UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-4767

EAGLE GROWTH & INCOME FUND

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St. Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 573-3800

STEPHEN G. HILL, PRESIDENT

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

FRANCINE J. ROSENBERGER, ESQ.

K&L Gates, LLP

1601 K Street, NW

Washington, D.C. 20006

Date of fiscal year end: October 31

Date of reporting period: October 31, 2009

| Item 1. | Reports to Shareholders |

Annual Report

and Investment Performance Review

for the fiscal year ended October 31, 2009

Eagle Capital Appreciation Fund

Eagle Growth & Income Fund

Eagle International Equity Fund

Eagle Large Cap Core Fund

Eagle Mid Cap Growth Fund

Eagle Mid Cap Stock Fund

Eagle Small Cap Core Value Fund

Eagle Small Cap Growth Fund

| | | | |

| Go Paperless with eDelivery | | visit eagleasset.com/eDelivery | | For more information, see inside. |

Table of Contents

| | |

|

Visit eagleasset.com/eDelivery to receive shareholder communications including prospectuses and fund reports with a service that helps protect the environment:

Environmentally friendly. Go green with eDelivery by reducing the number of trees used to produce paper.

Efficient. Stop waiting on regular mail. Your documents will be sent via email as soon as they are available.

Easy. Download and save files using your home computer with a few clicks of a mouse.

President’s Letter

Dear Fellow Shareholders:

I am pleased to present the annual report and investment performance review of the Eagle mutual funds for the fiscal year ended October 31, 2009 (“reporting period”).

The reporting period was one of extremes for equity investors. We began with credit fears permeating the market, the economy in a severe recession and headlines filled with a barrage of negative economic data. These conditions led to a massive selloff phase that lasted through early March. The final step in this decline was based, in large part, on fears over the potential collapse of our banking system, an outcome that fortunately was avoided. This period was followed by a dramatic recovery phase that continued through the end of the reporting period. The recovery phase was fueled by massive financial stimulus and liquidity programs by governments worldwide. In this phase, profitable operations have returned to the large banks at the center of the credit crisis, credit markets have loosened and corporate earnings have improved.

As we begin to emerge from the longest recession in the post-World War II era, uncertainty still exists as to the strength and sustainability of the recovery. Many economists are expecting a modest recovery in gross domestic product over the next year and there is the potential for improving corporate profits. Concerns exist about the level of government debt resulting from the stimulus and other spending programs. Such debt levels have the potential to result eventually in higher taxes or inflation, neither of which is good for investors. Unemployment, which is slow to drop in a recovery, will likely remain high.

In light of the dramatic market volatility, we believe that a consistent and disciplined investing strategy is more important than ever.

In the commentaries that follow, each fund’s portfolio managers discuss the specific performance in their funds. While there can be no way to accurately predict short-term market movements, our portfolio managers hope to take advantage of investment opportunities that may arise during the current market. Our portfolio managers base their investment strategies on idea generation and proprietary research and avoid momentum-driven investments, risky bets and trendy market securities with unreasonable risk/return tradeoffs.

If you would like to begin receiving this report and other reports from the Eagle Family of Funds electronically, please visit our website, eagleasset.com and enroll for electronic delivery. Doing so will reduce the amount of paper we consume which saves the Funds (and their shareholders) money and will help the environment. Enrolling in this service will not affect the delivery of your account statements or other confidential communications.

To obtain a prospectus, which contains important information about the Eagle Family of Funds, contact your financial advisor, call us at 800.421.4184 or visit our website at eagleasset.com. Our website also has timely information about the funds, including performance and portfolio holdings. We are grateful for your continued support and confidence in the Eagle Family of Funds.

Sincerely,

Stephen G. Hill

President

December 8, 2009

| | |

| Performance Summary and Commentary |

| Eagle Capital Appreciation Fund | | |

Meet the managers | Steven M. Barry and David G. Shell, CFA are Chief Investment Officers and Senior Portfolio Managers at Goldman Sachs Asset Management L.P. and have been responsible for the day-to-day management of the Eagle Capital Appreciation Fund (the “Fund”) since 2002. Mr. Shell has been affiliated with the Fund since 1987 and has 22 years of investment experience; Mr. Barry joined the team in 1999 and has 23 years of investment experience.

Investment highlights | The Fund invests primarily in common stocks. The Fund’s portfolio management team believes that wealth is created through the long-term ownership of a growing business. They take a “bottom-up” approach to investing based on in-depth, fundamental research. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers use an intensive research process and each company is analyzed as if they were going to own and operate that company indefinitely. Key characteristics of the companies in which the Fund currently seeks to invest may include: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management.

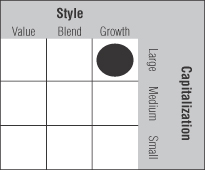

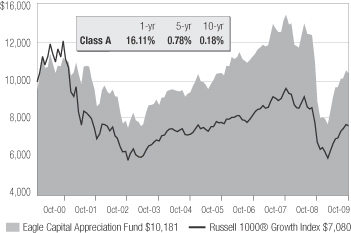

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2009 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

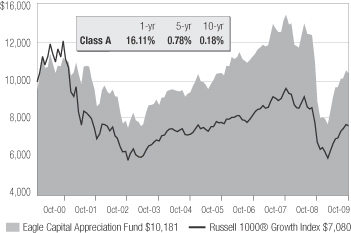

Performance summary | The Fund’s Class A shares returned 21.91% (excluding front-end sales charges) during the fiscal year ended October 31, 2009, outperforming its benchmark index, the Russell 1000® Growth Index, which returned 17.50%. The Russell 1000® Growth Index measures

performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values and is representative of U.S. securities exhibiting growth characteristics. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 11/1/99 to 10/31/09 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On November 30, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | The Fund experienced positive absolute returns in the information technology, telecommunications services and consumer discretionary sectors. Investments in these sectors were all strong leaders with double digit returns for the period. The healthcare sector hindered absolute performance as investments in this industry are generally defensive and are suffering from the ongoing national healthcare debate.

| | |

| Performance Summary and Commentary |

| Eagle Capital Appreciation Fund (cont’d) | | |

The Fund’s outperformance when compared to the benchmark index can be attributed to our consistent, bottom-up, research intensive approach to investing. In several instances, on both a stock and sector level, the Fund is meaningfully different from its benchmark, the Russell 1000® Growth Index, thus creating the potential for its performance to be materially higher or lower than the benchmark. For example, the Fund had a significant overweight in the telecommunication sector, coupled with strong selection, which led to material outperformance relative to the benchmark. Further, strong stock selection in the energy and financial services sectors contributed to relative outperformance. As for the laggards, although the Fund had approximately an equal weighting in information technology sector as the benchmark, poor stock selection in the well-performing sector hindered relative performance.

Top performers | Wireless tower company Crown Castle International contributed to performance as the volume of voice and data traffic on wireless networks continues to grow. In our view, Crown Castle is competitively well-positioned given its dominant market share in an industry with high barriers to entry. The Fund continues to hold the stock as we believe the wireless tower business is attractive, particularly in the current economic environment, as it provides a more predictable stream of revenue and recurring cash flow.

Consumer electronics manufacturer Apple Inc. contributed to performance as the company reported strong results behind sales of its iPod and iPhone products. We continue to believe the iPhone represents significant upside potential for global sales. In our view, Apple’s smart phone will likely continue to gain market share worldwide as Apple enters into new partnerships with additional telecommunications service providers. In addition, we believe the App Store, which provides users with on-demand access to iPhone applications, will continue to build a strong customer base. As a result, consumers will be willing to pay more for the Apps service, which will give Apple pricing leverage with carriers. The Fund continues to hold the stock in its portfolio.

Marriott International Inc., a hotel operator and franchisor, contributed to performance during the period as lodging stocks rallied on anticipation of an economic recovery. We continue to believe that Marriott is better positioned than competitors in the current economic environment given its dominant franchise and strong capital base. In our view, smaller, independent hotel operators will struggle to survive through the current downturn which could provide opportunities for Marriott to gain market share. Furthermore, difficulties in the credit markets have

made borrowing more expensive, thereby reducing the number of new hotels being constructed. We believe the constraint in lodging supply will create a potentially strong pricing environment for existing hotels in the future, reducing the number of new hotels being constructed.

Coach, a luxury goods producer, contributed to performance. Shares benefited from increased traffic in its factory stores, which was driven by price cuts. In addition, the company showed improved inventory levels which gave the market confidence that the company could sustain its very high margins over time. The Fund exited its position in Coach to fund higher conviction investment ideas.

Shares of CME Group, the world’s largest futures and options exchange, contributed to performance. We continue to believe CME has significant upside potential given its diverse product portfolio, superior clearing house platform, and strong free cash flow generation. In our view, CME’s over-the-counter clearing house business, Clearport, is a significant growth opportunity as it meets its customers’ demands for more transparency and less counterparty risk.

Under performers | Entravision Communications, a Spanish-language media company, detracted from performance during the period as economic headwinds and the company’s outstanding debt concerned investors. The Fund sold out of its position in the stock.

Merck & Company’s share price traded down after reporting first quarter results that fell short of analysts’ expectations. Sales for the first quarter declined compared to the same period last year as a challenging economic environment and adverse currency exchange rates negatively impacted results. Sales of Merck’s cervical cancer vaccine, Gardasil, disappointed. While we continue to believe Gardasil to be an important long-term growth driver for the company, we decided to exit the position for other investment opportunities.

Video game publisher Activision detracted from performance. Video game sales in the U.S. have experienced weakness over the first half of 2009 and we believe that retail trends will remain challenging as consumers continue to be financially-stretched. Due to the high-price point of the company’s games, we believe Activision will face near term sales pressure during the holiday season, which led us to sell out of the Fund’s position.

Personal computer maker Dell Inc. detracted from performance. We continue to believe that Dell’s management has initiated a successful plan to re-establish the company, but that turnaround strategy is being overshadowed by weak

| | |

| Performance Summary and Commentary |

| Eagle Capital Appreciation Fund (cont’d) | | |

macro-economic conditions and concerns around information technology spending. Given this additional uncertainty, we decided to sell the Fund’s position in Dell.

Shares of the video game publisher Electronic Arts Inc. detracted from performance as U.S. videogame sales have been challenged this year. The stock declined due to fears that this weakness could extend to one of the company’s top game franchises, Madden NFL. While not immune, we believe

Electronic Arts’ strong portfolio of “must-own” franchises has partially mitigated these industry headwinds. In addition, Sony and Microsoft announced price cuts on their respective gaming consoles, the Playstation 3 and Xbox 360. In our view, these price cuts will provide a catalyst for increasing console and game sales. We continue to hold Electronic Arts in the Fund as we maintain our thesis of long-term secular growth in the video game industry.

| | |

| Performance Summary and Commentary |

| Eagle Growth & Income Fund | | |

Meet the managers | William V. Fries, CFA, Managing Director, and Cliff Remily, CFA, of Thornburg Investment Management, Inc. are Co-Portfolio Managers of the Eagle Growth & Income Fund (the “Fund”). Mr. Fries has more than 33 years of investment experience and has been Co-Portfolio Manager since 2001. Mr. Remily was named Co-Portfolio Manager in January 2009 and has over 9 years of industry experience.

Investment highlights | The Fund invests primarily in domestic equity securities (primarily common stocks). The Fund’s portfolio managers look for promising investments that can be purchased at a discount to their estimate of each investment’s intrinsic value. They seek investments that deliver a competitive total return over multiple time horizons. Holdings are classified in three categories: basic value, consistent earners and emerging franchises as a means of structuring diversification. Dividends and dividend growth are a consideration in stock selection and may include stocks outside the traditional dividend paying areas.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s Class A shares returned 22.88% (excluding front-end sales charges) during the fiscal year ended October 31, 2009, outperforming the Fund’s benchmark index, which returned 9.80% during the same period. The Fund’s benchmark index, the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”), is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 11/1/99 to 10/31/09 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On November 13, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | The Fund had both impressive absolute and relative returns. Our flexible approach to value investing served the Fund well in this environment as multiple sectors including financials, information technology, and telecommunication services companies all contributed to the Fund’s strong performance. A year after the collapse of Lehman Brothers, financial institutions are now operating in a more stable environment; investors have grown more confident as visibility towards future profits has improved. Many financial services companies were beneficiaries of tighter spreads in the corporate bond market over the past six months. We believe that the financials sector has been a great area in which to invest. Fear is rampant, and valuations are selectively very attractive. Yields are unsustainably low, but financial stocks are priced as though the current interest rate environment will

| | |

| Performance Summary and Commentary |

| Eagle Growth & Income Fund (cont’d) | | |

persist forever; we believe this creates an opportunity to invest in companies that will benefit as interest rates rise. In the telecommunications sector, many of the Fund’s investments benefited from sizable dividends and the Fund continues to have a large weighting in the cash generative telecommunication service providers. Stock selection in the financials, telecommunication services, and consumer staples sectors helped contribute to our outperformance of the benchmark. Laggards to relative performance were the energy and consumer discretionary sectors due to poor stock selection.

The Fund’s fixed income exposure was another positive contributor to performance. These investments provided an opportunity for a strong return over the reporting period. As with any potential investment in the strategy, we analyze fixed income investments on an individual basis, weighing risk and reward. In some cases we have “moved up the capital structure,” trimming or selling an equity stake in a company as we have added fixed income exposure for the Fund. In other cases we have added to an overall investment with a particular issuer. Many of the investments in bonds have hit price targets and been sold. In general, we continue to see strong price appreciation in the bonds in the Fund’s portfolio and will continue to make the transition away from fixed income back into more attractive equities that are uncovered through our fundamental, bottom-up research process.

Top performers | Baidu Inc., the leader in Chinese language internet searches, contributed to the performance of the Fund as internet traffic in China continues to be strong.

U.S. Bancorp, a commercial bank, gained market share in traditional business and consumer lending in the regional Midwest markets through organic growth, and more recently, small acquisitions of failed competitors.

Global telecommunications company Telefonica SA, continues to be a large holding in the Fund due to its strong fundamentals including high cash generation, low valuation, attractive dividend yield, and exposure to growing markets.

Hartford Financial Services Group Inc., an insurance company, has approximately one third of its assets in fixed income investments. During the reporting period, the spreads in the corporate bond market tightened and increased the value of their assets, along with other assets such as loans, some mortgages, and other fixed income investments.

Level 3 Communications is a diversified telecommunication company who lowered the debt on its balance sheet as it successfully refinanced some of its near-term debt during the fourth quarter 2008. In addition, the company reported operating cash flow growth of 7% while guiding to lower capital expenditures for 2009.

The Fund continues to hold all of these top performing securities.

Under performers | Swiss Reinsurance Co., an insurance provider, suffered accelerated balance sheet impairments in the near term which lead to the need for more capital infusions and a reshuffling of management. The Fund sold out of the stock as this was a clear sign of a stressed business model in this environment.

Despite poor short-term performance, the Fund continues to hold Canadian Oil Sands Trust, an oil, gas and consumable fuels provider. The company experienced escalating operating costs in its synthetic crude projects. The Fund sold out of the position earlier in the reporting period but repurchased it in the third quarter as we believe the company remains an attractive long-term investment.

KKR Financial Holdings LLC, a financial services company, harmed Fund performance as it suffered impairments on its balance sheet large enough to impede additional sources of funding. Management also will be limited in any new deal-making potential in the leverage loan market. The Fund sold out of the stock.

Oil, gas and consumable fuels provider ConocoPhillips suffered from a litany of items including lower oil and gas prices, Russian market risk (through its stake in Lukoil), and poor refining and marketing margins. All of these events led to a temporary suspension of their share buyback program. The Fund trimmed its position in the stock during the year.

Diamond Offshore Drilling Inc. produces energy equipment and services. Despite its long-term contracts, competition is forcing Diamond to renew expired contracts at lower rates. We reduced some of the Fund’s exposure in the stock but still hold the position as we continue to find the company an attractive investment.

| | |

| Performance Summary and Commentary |

| Eagle International Equity Fund | | |

Meet the managers | Richard C. Pell is Chief Executive Officer at Artio Global Investors Inc. and Chief Investment Officer at its affiliate, Artio Global Management LLC (“Artio Global”). Rudolph-Riad Younes, CFA, is Head of International Equities at Artio Global. Messrs. Pell and Younes have managed the Eagle International Equity Fund (the “Fund”) since 2002.

Investment highlights | The Fund invests primarily in foreign equity securities. The Fund’s portfolio managers seek investment opportunities within the developed and emerging markets. In the developed markets, a “bottom-up” approach is adopted. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. In the emerging markets, a “top-down” assessment consisting of currency/interest rate risks, political environments/leadership assessment, growth rates, structural reforms and risk (liquidity) is applied. A top-down method of analysis emphasizes the significance of economy and market cycles. In Japan, given the highly segmented nature of this market comprised of both strong global competitors and protected domestic industries, a hybrid approach encompassing both bottom-up and top-down analyses is conducted.

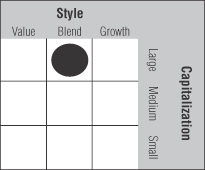

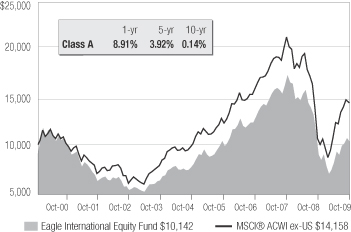

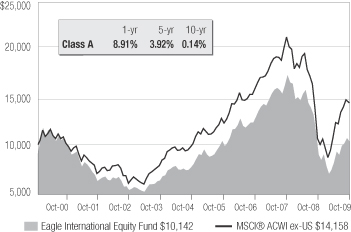

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s Class A shares returned 14.34% (excluding front-end sales charges) during the fiscal year ended October 31, 2009, underperforming the Fund’s benchmark index, which returned 34.10% during the same period. The Fund’s benchmark index, the Morgan Stanley Capital International® All Country World Index ex-US (“MSCI® ACWI ex- US”), is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 11/1/99 to 10/31/09 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On November 6, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | During the period, the Eagle International Equity Fund underperformed its benchmark. Our defensive positioning, which was initially supportive to relative results, led the Fund to underperform as markets suddenly advanced. In early March, negative sentiment previously targeted at the banking sector and other areas quickly began to turn more hopeful. A sudden and dramatic move forward in financials, emerging markets and more cyclical industries led the Fund to underperform given its underrepresentation and allocation within many of these sectors as well as a focus on companies that we deemed as having higher-quality balance sheets. As fundamentals improved, we moved to reduce the defensive positioning between the Fund and the benchmark, but the speed and magnitude at which markets turned left a negative imprint on relative results.

| | |

| Performance Summary and Commentary |

| Eagle International Equity Fund (cont’d) | | |

For the first two months of the reporting period, the Fund’s more defensive stance proved beneficial to results versus its benchmark. Specifically, the higher than normal cash position and large underweight to financials in the developed markets (many of which we deemed as technically insolvent) supported returns over this period despite declines in banks held in Central and Eastern Europe. Moving into 2009, markets resumed their dramatic declines amid a highly uncertain economic environment up until early March. While the Fund’s defensive positioning with respect to cash holdings and an underweight to developed market financials continued to be of benefit, these effects were negated by an underweight to emerging Asia and Latin America (in particular Brazil) which outperformed the benchmark, as well as underperformance in Central and Eastern Europe.

Most of the underperformance versus the benchmark for the reporting period occurred from early March through the end of June. Beginning on March 10, markets began a massive rally amid better news on the financial sector front. The United States Treasury Department announced plans to remove toxic assets from banks’ balance sheets and investors awaited impending changes in mark-to-market rules from the Financial Accounting Standards Board. Against this backdrop, the financials sector staged a powerful rally and the Fund’s underweight to this sector, as well as its quality bias, proved costly to the Fund’s performance as the environment suddenly shifted toward risk-seeking versus risk-aversion. Although the Fund had purchased companies which were more cyclical in nature with solid franchises (e.g. materials, select industrials) ahead of and during the market turnaround, banks far outperformed such companies due to the very generous government handouts and dramatic short-covering in these names, which far exaggerated the magnitude and speed of the moves. The underweight to emerging markets in Asia and Brazil also detracted from the Fund’s performance over this period. On a positive note, stock selection within the materials sector, particularly in metals and mining companies in Australia, Canada and the United Kingdom contributed to results amid expectations that stimulus efforts would begin to take hold, leading to increased demand for raw materials. Additionally, Central and Eastern Europe began to rebound as credit and liquidity concerns began to ease.

During the final four months of the reporting period, performance began to stabilize versus the benchmark as the Fund reduced its defensive positioning. Specifically, the Fund increased exposure to emerging markets in Asia and Latin America as the cyclicality of these regions geared to the global recovery are likely to continue to gain momentum amid massive stimulus efforts worldwide. The Fund also increased its exposure to developed market banks preferring to participate through the purchase of larger companies across several markets, affording us the opportunity to quickly reposition if necessary. The headwinds that plagued the financial sector during the market upheaval have abated. The steep yield curve environment has improved profitability prospects for banks and increases in the overall level of capital in the system have improved the sector’s overall health. The Fund also reduced holdings in defensive-type companies with stretched valuations and began purchasing firms we believe have not participated in the rally to the same degree.

We have transitioned the Fund to take advantage of sectors and companies which may benefit from the dynamics unfolding in the Asian emerging markets. This has led us to favor companies and countries linked to the commodity/materials sector given continued stimulus spending in the emerging markets. We also favor industrial companies such as airports and seaports which we have long viewed as quasi-monopolies. In addition, we find the cement industry attractive from a valuation perspective.

Over the longer term, we continue to view emerging markets in Asia and Latin America as closely linked to global imbalances (i.e. overspending in the U.S.), creating market vulnerabilities. However, the cyclicality of these regions may continue to support investments there. In China, we increased the Fund’s weighting to the banking sector in order to benefit from a recovery of the local economy as well as attractive valuations. The government is taking steps to move the country from one that is export oriented to a more consumer-driven model, but this monumental process should take years.

| | |

| Performance Summary and Commentary |

| Eagle Large Cap Core Fund | | |

Meet the managers | Richard Skeppstrom, John “Jay” Jordan, CFA, Craig Dauer, CFA, and Robert Marshall at Eagle Asset Management, Inc. (“Eagle”) have been Co-Portfolio Managers of the Eagle Large Cap Core Fund (the “Fund”) since inception. Mr. Skeppstrom is a Managing Director at Eagle and has 18 years of investment experience. Mr. Jordan, Mr. Dauer and Mr. Marshall have 18, 15 and 22 years of investment experience, respectively.

Investment highlights | The Fund invests primarily in common stocks. When identifying investments for the Fund, the portfolio managers use a “bottom-up” research process that is combined with a proprietary relative-valuation discipline. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. In general, the portfolio managers seek to select securities, that, at the time of purchase, have above-average expected returns and at least one of the following characteristics: projected earnings growth rate at or above the benchmark index, above-average earnings quality and stability, or a price-to-earnings ratio comparable to the benchmark index.

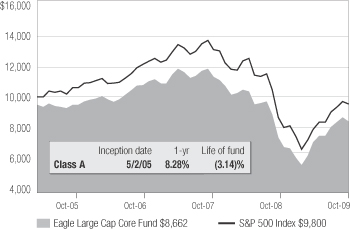

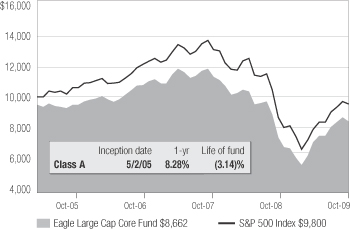

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s Class A shares returned 13.68% (excluding front-end sales charges) during the fiscal year ended October 31, 2009, outperforming the Fund’s benchmark index, which returned 9.80% during the same period. The Fund’s benchmark index, the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”), is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 5/2/05 to 10/31/09 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On November 13, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | The Fund benefited from strong absolute returns in the information technology and consumer discretionary sectors. Companies in these sectors benefited from improved earnings in the early phases of the recovery cycle. In addition, the Fund realized a strong return from a single telecommunication services holding which was purchased during the reporting period and later sold for a significant gain.

Relative to the Fund’s benchmark, the financials sector was the strongest performer reflecting excellent stock selection and timing of trades. Since the recession was triggered by housing price declines and sub-prime mortgage losses that spread to the credit markets in general, the financial sector bore the brunt of the declines through early March. As investor sentiment turned positive, the sector rebounded above the benchmark.

| | |

| Performance Summary and Commentary |

| Eagle Large Cap Core Fund (cont’d) | | |

Positive stock selection and a significant overweight position in the outperforming consumer discretionary sector contributed to the Fund’s relative outperformance of the benchmark. Telecommunication services outperformed the benchmark due to the timing of trades in certain stocks.

The only sector detracting from absolute and relative Fund returns was the healthcare sector as these stocks are impacted by the continued healthcare debate. The materials sector underperformed relative to the benchmark due to a lack of exposure to a strong benchmark sector. Finally, cash reserves relative to the strong market performance detracted from the Fund’s return.

Top performers | Sprint Nextel, a communication service provider to a wide range of consumers and business, boosted the Fund’s returns during the reporting period. After increasing the Fund’s position at the beginning of the period at depressed values, the Fund sold off a portion of its position later in the year after the stock price more than doubled.

In February, the Fund added retailer Macy’s to the portfolio. The stock performed well as it benefited from positive management earnings guidance and the attraction of consumer cyclicals in a strong market anticipating economic recovery. The Fund continues to invest in the company.

Performance in Tyco International, a security services company, was helped by recurring revenue businesses in a difficult environment. In addition, strong cost controls by management made this stock an attractive investment and the Fund continued to add to its position during the year.

The Fund benefited from a strong performance in Adobe Systems, a software developer. The stock was sold after it reached our valuation goals.

Shares in investment bank Morgan Stanley were purchased in October 2008 at the height of the investment bank panic. At the time, the stock was extremely undervalued by all measures, especially given its relatively limited exposure to the worst of the toxic assets. The Fund sold the position later in the year after the stock price rebounded, posting a healthy gain.

Under performers | Industrial, media and financial services conglomerate General Electric Company hindered Fund performance. The combination of credit fears at subsidiary General Electric Capital Corporation coupled with lower earnings out of the industrial businesses due to a global economic slowdown drove both earnings and valuations lower. The Fund still holds the position as we believe the stock appears undervalued in relation to the company’s earning power and as industrial and credit markets gradually improve.

Genzyme Corporation, a biotechnology company, reported lower than expected third quarter earnings. The stock price suffered on news that an important drug patent was delayed along with the shutdown of one of its major production plants. The Fund still holds the position as we believe the company has made progress on getting its Cerezyme and Fabrazyme products back on the market following the plant shutdown.

Along with other banks, Bank of America Corporation got caught up in the banking sector collapse. Its stock price also suffered after its acquisition of Merrill Lynch, which significantly impaired its capital. The Fund sold the stock in April following the company’s disconcerting first quarter report, and repurchased it at a compelling price in May after the company raised the majority of the required capital.

Investment bank JP Morgan Chase & Company’s share price suffered in the global banking sector collapse and experienced extreme selling pressure through February. The Fund continues to hold this stock as we consider the company the strongest-positioned bank to participate in the gradual banking recovery as the global economy strengthens.

Like the finance sector in general, SunTrust Banks, Inc. experienced extreme selling pressure through February as credit conditions continued to deteriorate and job losses mounted during the depth of the recession. Finance sector prices began to recover during March in anticipation of gradual economic stabilization. The Fund held the position through the end of the reporting period.

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Growth Fund | | |

Meet the managers | Bert L. Boksen, CFA, a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”), is the Portfolio Manager of the Eagle Mid Cap Growth Fund (the “Fund”). Mr. Boksen has 32 years of investment experience. Christopher Sassouni, DMD, with 20 years of investment experience and Eric Mintz, CFA, with 14 years of investment experience, have been Assistant Portfolio Managers since 2006 and 2008, respectively.

Investment highlights | The Fund invests primarily in stocks of mid-capitalization companies. The Fund’s portfolio managers seek to capture the significant long-term capital appreciation potential of mid-cap, rapidly growing companies. The portfolio managers use a “bottom-up” investment approach through a proprietary research strategy that emphasizes the selection of mid-cap growth stocks that are reasonably priced. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The Fund’s portfolio managers believe that conducting extensive research on mid cap companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

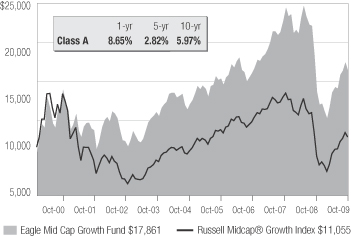

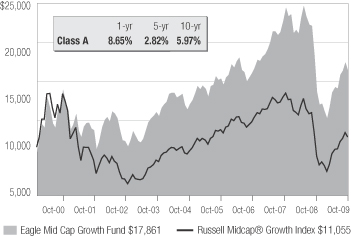

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s Class A shares returned 14.06% (excluding front-end sales charges) during the fiscal year ended October 31, 2009, underperforming the Fund’s benchmark index, which returned 22.48% during the same period. The Fund’s benchmark index, the Russell Midcap® Growth Index, measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 11/1/99 to 10/31/09 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On November 6, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | The Fund underperformed its benchmark index during the reporting period. Investments in the information technology (“IT”), industrials, healthcare and materials sectors trailed the benchmark. In the IT sector, relative returns were damaged by the Fund’s investments in IT services and semiconductors, which were the weaker industries in the sector. Investments in the construction and engineering industry along with the commercial services and supplies industry had detrimental performance on an absolute basis and pulled down overall industrials returns as investors remained concerned about the severity of the housing crisis. The Fund’s overweight position in the underperforming biotechnology industry hurt returns in the healthcare sector. Underperformance of the Fund’s investments in the chemicals industry damaged relative returns in the materials sector.

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Growth Fund (cont’d) |

Investments that showed positive absolute and relative returns were in the consumer discretionary, energy and financials sectors. The Fund’s investments in the luxury goods, internet and catalog retail industries, along with hotel, restaurant and leisure industries were strong performers despite continued high unemployment, depressed housing prices and tight credit. Energy equipment and services companies rallied with the price of oil, while the Fund’s overweight position in financials benefited from improvements in the capital markets.

Under performers | Biotechnology company Celgene Corporation underperformed expectations during the period as concerns about increasing unemployment affecting prescription volume and healthcare reform caused the stock to decline. The Fund continues to hold the position as the company provides a lifesaving therapy for a difficult to treat form of cancer and this product is in the early stages of international expansion.

CF Industries Holdings is a manufacturer of fertilizer products. The stock declined dramatically during the financial meltdown that occurred during the last quarter of the 2008 calendar year on fears of slower global growth prospects. The Fund sold out of the position.

Cliffs Natural Resources, a producer of iron ore, was sold out of the portfolio during the period. The stock’s price reflected continued concerns about muted growth expectations as the expense outlook for 2009 was not favorable.

The Fund sold out of its position in Corrections Corporation of America which owns, operates and manages prisons and other correctional facilities. The company announced lower-than-expected earnings guidance for 2009.

Eclipsys Corporation, a healthcare IT company, was sold out of the Fund when pre-announced fourth quarter revenue and earnings were lower than expected and the company set lower than expected 2009 revenue and earnings guidance due to challenging macroeconomic conditions.

Top performers | Freeport-McMoRan Copper and Gold is a mining company. During the period, the stock price appreciated due to a more positive outlook for copper prices.

Netflix is an online DVD rental service who beat earnings and revenue expectations. The company continues to increase its market share as consumers seem to favor renting versus buying DVDs.

Luxury goods producer Coach Inc. contributed to positive returns for the Fund as the company implemented cost cutting initiatives and, as a result, exceeded earnings expectations. The company has learned to adjust its strategy to the changing economic environment. We believe that it continues to remain an appealing investment going forward.

Online retail broker TD Ameritrade Holding Corporation performed well as it was able to retain clients and increase assets despite the tough macro conditions.

Bally Technologies manufactures gaming equipment and systems. This company is in the consumer discretionary sector and is capturing domestic market share, growing its international presence, and expanding its margins. As economic conditions improve, we believe the company is in a position to accelerate its earnings.

The Fund continues to hold all of these top performers.

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Stock Fund | | |

Meet the managers | Todd L. McCallister, Ph.D., CFA, is a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”) and Co-Portfolio Manager of the Eagle Mid Cap Stock Fund (the “Fund”). Mr. McCallister has 22 years of investment experience and has managed the Fund since its inception. Stacey Serafini Thomas, CFA, is a Vice President at Eagle and served as Assistant Portfolio Manager to the Fund from 2000 to 2005, before being named Co-Portfolio Manager. Ms. Thomas has more than 12 years of investment experience.

Investment highlights | The Fund invests primarily in stocks of mid-capitalization companies. The portfolio managers of the Fund employ a “bottom-up” stock-selection process to identify growing, mid-cap companies that are reasonably priced. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers seek to gain a comprehensive understanding of a company’s management, business plan, financials, real rate of growth and competitive threats and advantages.

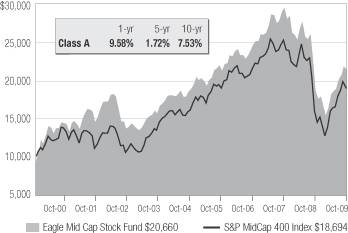

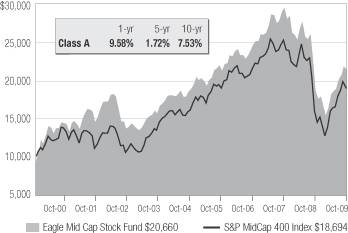

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s Class A shares returned 15.05% (excluding front-end sales charges) during the fiscal year ended October 31, 2009, underperforming the Fund’s benchmark index, which returned 18.18% during the same period. The Fund’s benchmark index, the Standard & Poor’s MidCap 400 Index (“S&P MidCap 400”), is an unmanaged index that measures the performance of the mid-sized company segment of the U.S. market. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 11/1/99 to 10/31/09 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On November 16, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | During the reporting period, the Fund underperformed its benchmark index. The strong market rebound off its March 2009 lows was led by low market-cap, low returns on equity, low prices and non-earning stocks. This behavior is typical of economic recoveries and resembles the stock-return patterns we witnessed in 2003 when the economy last experienced a recovery. As in 2003, the Fund had a difficult time keeping up with the indices in this type of market rally.

The Fund posted its best absolute returns in the materials and information technology sectors. In materials, signs of a market recovery encouraged investors into more cyclical investments which should benefit from a restocking of inventories. In information technology, the communications equipment and software industries performed best.

On a relative basis, the Fund’s holdings in the poor-performing financials sector strongly outperformed the benchmark as we

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Stock Fund (cont’d) |

invested in diversified financial services companies and avoided banks during the financial crisis. The Fund’s bank and thrift holdings were added in the spring and were purchased for less than book value while reporting considerably lower losses than their peers. The Fund’s underweight position and positive stock selection in the underperforming utilities sector also led to relative outperformance.

The Fund lagged its benchmark in the industrials and consumer discretionary sectors. Industrials saw weakness this year in commercial services and machinery. The Fund’s waste removal and machinery holdings performed defensively at the beginning of the reporting period but soon fell as investors looked for more speculative investments.

In consumer discretionary, the Fund underperformed the benchmark in the diversified consumer services, catalog retail and specialty retail industries. In the diversified consumer services industry, the Fund was hurt by stock selection. The Fund did not own any catalog retailers this year and missed a large jump there. In specialty retail, the Fund’s holdings, while showing positive absolute performance, underperformed the index.

Under performers | Pactiv Corporation, a containers and packaging manufacturer, suffered earlier in the reporting period due to concerns regarding sales and the company’s pension plan. Investors were worried about the potential need for significant future contributions to the plan in future years. The company’s packaging business has been in relatively good shape during 2009 and the stock mounted a comeback. The Fund sold the stock in August.

Service Corporation International, Inc. is the largest single provider of funeral, cremation and cemetery services in the country. Its stock price declined throughout the year despite its relatively stable business model. The Fund sold the position because we believe that pre-death purchases of cemetery plots and coffins will be significantly weaker and because of concerns related to the company’s debt load.

Insurance provider Unum Group traded down and was sold out of the Fund after an article was published in an accounting journal questioning the company’s reliance on its customer’s employment levels amid the deteriorating job market. Furthermore, the company’s chief financial officer stepped down at the time of the release of the company’s earnings. We felt that broader economic problems would hamper this company as they are reliant on employment levels for disability and group life insurance participants.

NCR Corporation is a technology firm that helps companies interact with their customers primarily through ATMs, point-of-sales systems, and self service kiosks. The Fund sold the

company’s stock after disappointing earnings were announced. The company continues to wrestle with a difficult economic environment for both the consumer and business.

Lincare Holdings, an oxygen provider, had been in a battle over Medicare reimbursements. The Fund sold the position to reduce our healthcare weighting, as we were worried about a worst-case scenario in which reimbursement cuts would slash $120 million to $150 million from earnings in the next year.

Top performers | Celanese Corporation is a chemicals producer that has a market leader position in most of the products that it sells. It is the world’s largest producer of acetyls, including acetic acid, vinyl acetate monomer and polyacetals. The company has a high free-cash-flow yield and was trading at a very cheap valuation before the Fund purchased it. The company had problems with inventory destocking at the end of last year, which seem to be over. The company’s end markets also are showing signs of improving. Two-thirds of sales are generated outside of North America. The Fund sold this stock for a gain.

IntercontinentalExchange, Inc. operates global commodity and financial products exchanges. The company saw marked improvement in commissions from energy futures in the past quarters and has seen growth in its credit-default swaps. In the middle of June, IntercontinentalExchange U.S. Trust LLC passed the $1 trillion mark of cleared credit-default swaps. The Fund continues to hold this stock.

TJX Companies retails off-price apparel and home fashions through its T.J. Maxx, Marshalls, Home Goods and A.J. Wright stores. The company has benefited in this slower economic environment as consumers have traded down and their new inventory costs have decreased. We continue to like the business model and management team and the Fund still owns the stock.

Adobe Systems has a very strong software franchise. The Fund purchased the stock in the spring when its price decrease lowered the company’s market value into the mid-cap range. This is a good example of a stock that has fallen into our range, yet, does not appear to be experiencing a fundamental problem with its business. The Fund sold Adobe Systems for a gain.

CME Group, the world’s largest derivatives exchange, rallied throughout the end of the reporting period as the volume of contracts has continued to trend up from the beginning of the year. While overall volume is down from last year, we are encouraged by the current build up in open interest, which tends to lead volume. In addition, Clearport, a clearing system for over-the-counter energy swaps, is growing at a tremendous pace (over 40% compared to last year) as counterparties are trying to mitigate bilateral risk. The Fund continues to hold the stock.

| | |

| Performance Summary and Commentary |

| Eagle Small Cap Core Value Fund | | |

Meet the managers | David M. Adams, CFA, Lead Portfolio Manager, and John “Jack” McPherson, CFA, Co-Portfolio Manager, are Managing Directors at Eagle Boston Investment Management, Inc. (“EBIM”) and have been responsible for the day-to-day management of the Eagle Small Cap Core Value Fund (the “Fund”) since its inception. Both Mr. Adams and Mr. McPherson have 19 years of investment experience.

Investment highlights | The Fund invests primarily in equity securities of small-capitalization companies. Using a value approach to investing, the Fund’s portfolio managers seek to capture capital growth by selecting securities that the portfolio managers believe are selling at a discount relative to their underlying value and then hold them until their market value reflects their intrinsic value. To assess value, a “bottom-up” method of analysis is utilized. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. Other factors that the portfolio managers may look for when selecting investments include: management with demonstrated ability and commitment to the company, above-average potential for earnings and revenue growth, low debt levels relative to total capitalization and strong industry fundamentals.

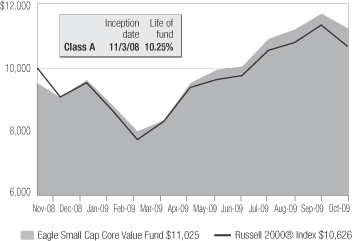

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

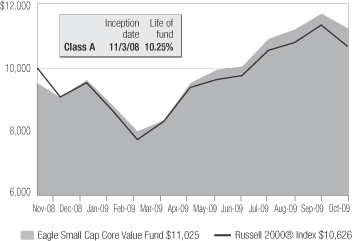

Performance summary | The Fund’s Class A shares returned 15.75% (excluding front-end sales charges) from November 3, 2008 (commencement of operations) to October 31, 2009, outperforming the Fund’s benchmark index, which returned 6.26% during the same period. The Fund’s benchmark index, the Russell 2000® Index, is an unmanaged index comprised of the 2,000 smallest companies in the Russell 3000® Index. The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 11/3/08 to 10/31/09 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On November 17, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | On an absolute basis, the positive performance for the reporting period was due to strong stock selection, primarily in the software and services area of the information technology sector. Energy also contributed as the Fund owned companies with a reliance on global oil markets in the oilfield service sector which benefited from a rebound in oil prices over the past year. Investments in the consumer discretionary and consumer staples sectors performed positively as many high-quality companies were significantly oversold at the end of calendar year 2008 as fears that a complete consumer slowdown and rising U.S. dollar would be a negative drag went well beyond what our companies eventually experienced. Lastly, the Fund benefitted in the materials sector with the strong performance of the precious metal group, driven significantly by the rise in the price of gold. The only sector causing a slight drag on performance from an absolute basis was the healthcare sector. The Fund’s holdings in pharmaceutical and biotechnology companies were down more

| | |

| Performance Summary and Commentary |

| Eagle Small Cap Core Value Fund (cont’d) |

significantly than the slight underperformance of our healthcare service holdings.

Relative to the Russell® 2000 benchmark index, the Fund had significant outperformance in the financials sector. The Fund held an underweight position in banks and those positions significantly outperformed for the benchmark, which was down 35%. The Fund also benefited from an overweight position in the energy sector coupled with superior stock selection, primarily in oilfield service companies. In the information technology sector, the Fund was overweight and outperformed the benchmark on the basis of strong performance from the software and services industry. Finally, the Fund’s underweight position and strong stock selection in the lagging industrials sector helped relative performance, primarily due to appreciation of investments in capital goods related companies. Detracting from relative performance were investments in healthcare, largely due to underperformance and an underweight position in the pharmaceuticals, biotechnology and life sciences industries. The Fund also underperformed the benchmark in the consumer discretionary sector due largely to an overweight position in media companies that underperformed both the sector and media industry group for the year.

Top performers | IAMGOLD Corporation is in the precious metal (primarily gold) exploration and production business worldwide. The company’s turnaround continues as they have benefited from the rise in gold prices as well as some key acquisitions that should help grow their gold production over the next few years. The Fund continues to hold a position, but has scaled back its position at a profit.

URS Corporation is an engineering, construction and technical services firm serving many industries and government entities. They have won a significant number of new contracts. In addition, the stock valuation reflects the belief a the company should benefit through design work in conjunction with the Obama administration stimulus package’s focus on infrastructure. The Fund sold part of its position for a significant gain during the reporting period.

Oceaneering International, Inc., an oilfield equipment and services company, appreciated as a relatively strong operating fundamentals outlook offset negative investor sentiment towards energy stocks. We believe the company’s position in the deep offshore market, where contracts tend to be longer-term in nature, and less commodity price sensitive near-term, is particularly positive for the company. The Fund continues to own the stock.

Euronet Worldwide, Inc. provides payment solutions including middleware, outsourcing and consulting services. After a period of underperformance and negative earnings revisions during the height of the financial crisis, we believe the company is poised to return to growth in revenue and earnings. The Fund maintains a position.

SPSS Inc. is a software company that specializes in business intelligence systems, which provide customers with software tools to help them with predictive analytic solutions to develop models and prepare and report results. Over the past several years management had built a global business, which they sold for cash and at a greater than 40% premium to its stock price. The deal closed in October, and the Fund no longer owns shares.

Under performers | 1-800-Flowers.com Inc. operates as a gift retailer, primarily in the floral business through the internet. Like many consumer companies, 1-800-Flowers revenues have slowed dramatically, but the Fund continues to hold the position as we believe management’s ability to cut costs should allow the company to remain profitable through the trough of their business cycle.

Psychiatric Solutions Inc. is a provider of inpatient behavioral healthcare services. After reporting fourth quarter 2008 earnings, the company guided 2009 earnings per share down slightly, and investors sold the stock heavily. Similarly, upon reporting third quarter 2009 earnings, management disclosed a one-time incurred cost not anticipated by investors, causing another sell-off. The Fund added to its position in both cases, firmly believing the reaction was not commensurate with the company’s valuation and fundamentals.

Cubist Pharmaceuticals Inc. is a biopharmaceutical company with the drug Cubicin as its primary source of revenue, which is growing over 25% on a 2009 revenue estimate. Shares have come under pressure due to a patent infringement case Cubist has filed against TEVA Pharmaceuticals. We believe the fears surrounding the patent case are overdone and continue to maintain the stock in the Fund.

Cross Country Healthcare Inc. is a healthcare staffing company focused on traveling nurses and allied health workers, along with a national temporary physician staffing practice. The nursing and allied divisions have been very weak with placements, leading to revenue and earnings shortfalls over the past year. The Fund trimmed, but maintained, a position during the period.

Microsemi Corporation designs and manufactures analog, mixed-signal and discrete semiconductors. The company was negatively affected by the overall downturn in demand for semiconductors due to the economy. Microsemi Corporation maintained solid profitability due to its exposure in military and space applications. The Fund maintains a position in the company.

| | |

| Performance Summary and Commentary |

| Eagle Small Cap Growth Fund | | |

Meet the managers | Bert L. Boksen, CFA, a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”), has been responsible for the management of the Eagle Small Cap Growth Fund (the “Fund”) since 1995. Mr. Boksen has 32 years of investment experience. Eric Mintz, CFA, has 14 years of investment experience and has been Assistant Portfolio Manager since 2008.

Investment highlights | The Fund invests primarily in stocks of small-capitalization companies. Using a “bottom-up” approach, the Fund’s portfolio managers seek to capture the significant long-term capital appreciation potential of small, rapidly growing companies. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers also look for small-cap growth companies that are reasonably priced. Since small-cap companies often have narrower markets than large-cap companies, the portfolio managers believe that conducting extensive proprietary research on small-cap growth companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

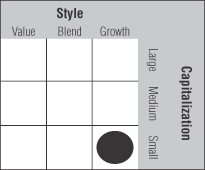

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

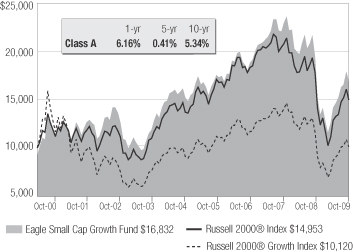

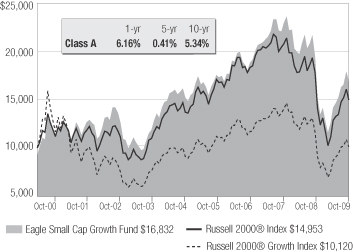

Performance summary | The Fund’s Class A shares returned 11.46% (excluding front-end sales charges) during the fiscal year ended October 31, 2009. The Fund outperformed its primary benchmark index, the Russell 2000® Growth Index, which returned 11.34% as well as its secondary benchmark index, the Russell 2000® Index, which returned 6.46% during the reporting period. Effective November 1, 2008, the Fund replaced its benchmark index, the Russell 2000® Index, with the Russell 2000® Growth Index. When evaluating long term performance, the Fund’s portfolio managers believe the Russell 2000® Growth Index better reflects the investment style of the Fund. The Russell 2000® Growth Index is an unmanaged index

comprised of Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000® Index is an unmanaged index comprised of the 2,000 smallest companies in the Russell 3000® Index. The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

Growth of a $10,000 Investment from 11/1/99 to 10/31/09 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On November 6, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | The Fund’s absolute performance was aided by its holdings in the information technology and consumer discretionary sectors. In information technology, the Fund outperformed on an absolute and relative basis as a result of its investments in software and semiconductor stocks, which rallied in anticipation of improving business conditions. In the consumer discretionary sector, the Fund’s holdings in the hotel, restaurant and leisure and luxury goods industries contributed to performance, despite continued high unemployment data, negative home equity and tightening of consumer credit.

| | |

| Performance Summary and Commentary |

| Eagle Small Cap Growth Fund (cont’d) | | |

The Fund also had strong performance relative to its primary benchmark in the energy, materials and industrials sectors. In energy, the Fund’s overweight position in equipment and services and underweight position in oil, gas and consumable fuels boosted relative performance. In the materials sector, we supported our constructive view on agriculture and cyclical business with an overweight position in the chemicals industry. The Fund benefited from an underweight position in the underperforming industrials sector, and specifically, avoiding the lagging industries in that sector.

The Fund’s investments in financials hurt performance during the year. In the financials sector, the stock prices of commercial banks declined and led to underperformance relative to the benchmark. Finally, the Fund’s investments in the healthcare providers and services industry led to underperformance relative to the benchmark in the healthcare sector.

Top performers | Rovi Corporation is a software company that, despite the economic downturn headwinds, posted growth in its core product and new product opportunities.

Shares in gaming equipment manufacturer Bally Technologies gained as the company is capturing domestic market share and growing its international presence. We feel that the stock is poised for accelerated earnings as market conditions improve.

Huntsman Corporation, a chemical manufacturer, settled its lawsuit with Hexion Specialty Chemicals, Inc. and now has enough cash to weather the economic storm. We believe the company should be able to produce strong returns in an economic recovery.

TIBCO Software, a provider of infrastructure software solutions, advanced as it has a strong recurring revenue model. Software maintenance requires its customers to make ongoing expenditures.

Quality Systems, Inc., which develops information processing systems for medical and dental practices, substantially exceeded its revenue and profit targets. Further, the company has benefited from positive investor sentiment following the passage of the stimulus act, which has funded initiatives to automate medical records.

The Fund still owns each of the above stocks.

Under performers | SVB Financial Group is a niche bank that disclosed information about a $69 million troubled loan with a venture capital client. The Fund sold the stock as this disclosure shook our belief about the level of troubled assets in their sub-prime loan portfolio.

Shares in prison operator Corrections Corporation of America fell as the company announced lower than expected earnings guidance for 2009. The Fund sold its shares in the company.

ICON PLC is a contract-research organization whose stock declined due to concerns that the financial crisis would hurt its biotechnology company customers. The Fund continues to hold the stock as the company has a stellar reputation for quality and we believe that the share price may have overestimated the company’s exposure to its cash-strapped customers.

Cliffs Natural Resources is a producer of iron ore that underperformed expectations. Its stock price was under pressure due to concerns about muted growth expectations resulting from an increased cost outlook in 2009. The Fund no longer owns the stock.

Quaker Chemical Corporation is a specialty chemical supplier to the steel, metalworking and aerospace industries. The tough economic climate and concerns over high raw material costs pushed the stock price lower and the Fund sold the stock.

Investment Portfolios

| | | | | | |

| EAGLE CAPITAL APPRECIATION FUND | | |

| Common stocks—99.2% (a) | | | | Shares | | Value |

| Advertising—0.9% | | | | | | |

| Lamar Advertising Company, Class A* | | | | 173,588 | | $4,218,188 |

| | | |

| Apparel—1.5% | | | | | | |

| Nike, Inc., Class B | | | | 118,700 | | 7,380,766 |

| | | |

| Banks—2.4% | | | | | | |

| Morgan Stanley | | | | 363,087 | | 11,662,354 |

| | | |

| Beverages—4.1% | | | | | | |

| PepsiCo, Inc. | | | | 331,809 | | 20,091,035 |

| | | |

| Biotechnology—1.9% | | | | | | |

| Gilead Sciences, Inc.* | | | | 215,877 | | 9,185,566 |

| | | |

| Commercial services—5.2% | | | | | | |

| The Western Union Company | | | | 661,128 | | 12,012,696 |

| Visa Inc., Class A | | | | 176,901 | | 13,402,020 |

| | | |

| Computers—4.4% | | | | | | |

| Apple, Inc.* | | | | 112,500 | | 21,206,250 |

| | | |

| Cosmetics/personal care—3.7% | | | | | | |

| The Procter & Gamble Company | | | | 313,439 | | 18,179,462 |

| | | |

| Electronics—2.2% | | | | | | |

| Thermo Fisher Scientific Inc.* | | | | 235,276 | | 10,587,420 |

| | | |

| Financial services—6.6% | | | | | | |

| CME Group Inc. | | | | 61,417 | | 18,585,398 |

| The Charles Schwab Corporation | | | | 778,129 | | 13,492,757 |

| | | |

| Healthcare products—9.8% | | | | | | |

| Baxter International Inc. | | | | 286,639 | | 15,495,704 |

| Johnson & Johnson | | | | 309,947 | | 18,302,370 |

| St. Jude Medical, Inc.* | | | | 413,800 | | 14,102,304 |

| | | |

| Internet—3.8% | | | | | | |

| Equinix Inc.* | | | | 219,195 | | 18,701,717 |

| | | |

| Lodging—1.6% | | | | | | |

| Marriott International, Inc., Class A | | | | 311,996 | | 7,818,620 |

| | | |

| Oil & gas—4.0% | | | | | | |

| EOG Resources Inc. | | | | 47,400 | | 3,870,684 |

| Occidental Petroleum Corporation | | | | 63,300 | | 4,803,204 |

| Suncor Energy Inc. | | | | 330,240 | | 10,904,525 |

| | | |

| Oil & gas services—3.8% | | | | | | |

| Schlumberger Ltd. | | | | 296,842 | | 18,463,572 |

| | | |

| Pharmaceuticals—5.4% | | | | | | |

| Express Scripts Inc.* | | | | 226,700 | | 18,117,864 |

| Teva Pharmaceutical Industries Ltd., Sponsored ADR | | | | 159,865 | | 8,069,985 |

| | | |

| Real estate—2.1% | | | | | | |

| CB Richard Ellis Group Inc., Class A* | | | | 990,632 | | 10,253,041 |

| | | |

| Retail—6.4% | | | | | | |

| Costco Wholesale Corporation | | | | 217,248 | | 12,350,549 |

| Lowe’s Companies, Inc. | | | | 348,137 | | 6,813,041 |

| Target Corporation | | | | 245,100 | | 11,870,193 |

| | | |

| Savings & loans—1.4% | | | | | | |

| People’s United Financial Inc. | | | | 435,500 | | 6,981,065 |

| | | |

| Semiconductors—3.0% | | | | | | |

| Broadcom Corporation, Class A* | | | | 542,700 | | 14,441,247 |

| | | |

| Software—8.9% | | | | | | |

| Electronic Arts Inc.* | | | | 338,378 | | 6,172,015 |

| Microsoft Corporation | | | | 668,950 | | 18,549,984 |

| Oracle Corporation | | | | 874,538 | | 18,452,752 |

| | | | | | |

| | | |

| Common stocks—99.2% (a) | | | | Shares | | Value |

| Telecommunications—16.1% | | | | | | |

| American Tower Corporation, Class A* | | | | 741,450 | | $27,300,189 |

| Crown Castle International Corporation* | | | | 962,028 | | 29,072,486 |

| QUALCOMM Inc. | | | | 528,040 | | 21,866,138 |

| Total common stocks (cost $410,571,400) | | | | | | 482,777,161 |

| | | |

| Repurchase agreement—0.8% (a) | | | | | | |

| Repurchase agreement with Fixed Income Clearing Corporation dated October 30, 2009 @ 0.01% to be repurchased at $3,633,003 on November 2, 2009, collateralized by $3,660,000 United States Treasury Notes, 1.75% due November 15, 2011 (market value $3,749,287 including interest) (cost $3,633,000) | | 3,633,000 |

| |

| Total investment portfolio (cost $414,204,400) 100.0% (a) | | $486,410,161 |

| |