UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-4767

EAGLE GROWTH & INCOME FUND

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St. Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 567-8143

RICHARD J. ROSSI, PRESIDENT

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

FRANCINE J. ROSENBERGER, ESQ.

K&L Gates, LLP

1601 K Street, NW

Washington, D.C. 20006

Date of fiscal year end: October 31

Date of reporting period: October 31, 2011

Item 1. Reports to Shareholders

| | |

Annual Report and Investment Performance Review for the fiscal year ended October 31, 2011 Eagle Capital Appreciation Fund Eagle Growth & Income Fund Eagle International Equity Fund Eagle Investment Grade Bond Fund Eagle Large Cap Core Fund Eagle Mid Cap Growth Fund Eagle Mid Cap Stock Fund Eagle Small Cap Core Value Fund Eagle Small Cap Growth Fund Privacy Notice Eagle Family of Funds | | |

| | | | |

| Go Paperless with eDelivery | | visit eagleasset.com/eDelivery | | For more information, see inside. |

Table of Contents

Visit eagleasset.com/eDelivery to receive shareholder communications including prospectuses and fund reports with a service that helps protect the environment:

Environmentally friendly. Go green with eDelivery by reducing the number of trees used to produce paper.

Efficient. Stop waiting on regular mail. Your documents will be sent via email as soon as they are available.

Easy. Download and save files using your home computer with a few clicks of a mouse.

President’s Letter

Dear Fellow Shareholders:

I am pleased to present the annual report and investment-performance review of the Eagle Family of Funds for the fiscal year that ended October 31, 2011 (the “reporting period”).

This has been an eventful year. Equity markets rallied through the spring but have pulled back since then on a seemingly relentless stream of mixed headlines, from both here in the United States and abroad. Political gridlock in Washington, D.C., created a great deal of uncertainty over the summer and, we believe, was the primary reason Standard & Poor’s downgraded U.S. debt in August. Meanwhile, political instability around the Mediterranean—specifically, debt issues in southern Europe and the “Arab Spring” democracy movements that spread into the fall—has left markets on edge.

The fixed-income environment has had its challenges, too. The New Year brought with it concerns that long-term low interest rates inevitably would lead to near-term inflation. And the summer’s rancorous federal budget debate, and the succeeding S&P downgrade, left some wondering who would buy U.S. Treasuries. We believe that a clearly slow-recovering global economy has allayed fears of the former for now while Europe’s issues have cast U.S. debt as relatively stable.

Our managers at Eagle are aware of headlines but one of the hallmarks of Eagle over its 35 years has been the fundamental research our managers do in constructing portfolios. Our goal here is to provide superior risk-adjusted returns for our long-term clients. Producing the desired results means avoiding getting caught up in today’s headlines (consider how many times in the last month, for example, the news has said Europe is “fixed,” only to hear a few days later it is not fixed at all) and focusing on individual companies that the managers believe have the characteristics necessary to make money for investors.

I hope you will read the commentaries that follow in which our portfolio managers discuss their specific funds. The general consensus among the managers seems to be that we likely face a slow-growth environment for some time and that the

volatility we have seen will continue. That said, volatility can create opportunities for long-term investors and there are

companies that show the promise of stability and growth, even in a challenging macroeconomic environment.

Here are just a few highlights from this year:

| • | | The Eagle Growth & Income Fund currently has an overall five-star rating from Morningstar.1 It is not surprising to us that the investing world suddenly has “woken up” to the idea of dividend-focused investing. In addition, shareholders have been notified that, effective January 20, 2012, the Eagle Large Cap Core Fund will be reorganized into the Eagle Growth & Income Fund. |

| • | | The Eagle Small Cap Core Value Fund (which we will be renaming the Eagle Smaller Company Fund) is now three years old and has produced for its long-term investors a solid track record.2 |

| • | | High-profile publications increasingly seek the insight of our managers. One example is a recent Barron’s article that featured the Eagle Mid Cap Growth Fund and manager Bert Boksen, CFA®, who also manages the Eagle Small Cap Growth Fund. |

I would like to remind you that investing in any mutual fund carries certain risks. The principal risk factors for each fund are described at the end of this report. Carefully consider the investment objectives, charges and expenses of any fund before you invest. Contact us at 800.421.4184 or eagleasset.com or your financial advisor for a prospectus, which contains this and other important information about the Eagle Family of Funds.

We are grateful for your continued support of, and confidence in, the Eagle Family of Funds.

Sincerely,

Richard J. Rossi

President

December 19, 2011

1 For the period ended September 30, 2011, the fund’s Class A shares are rated 5 stars for the overall, three- and five-year periods and 4 stars for the 10-year period among a total of 1,114, 1,114, 964 and 545 funds respectively, in the large-cap value category. Star ratings may be different for other share classes. Morningstar Rating® is based on risk-adjusted performance adjusted for fees and loads. Past performance is no guarantee of future results. Ratings are subject to change each month. 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Funds with at least three years of performance history are assigned ratings from the fund’s three-, five- and 10-year average annual returns (when available) and a risk factor that reflects fund performance relative to three-month Treasury bill monthly returns. Funds returns are adjusted for fees and sales loads. Ten percent of the funds in an investment category receive five stars, 22.5% receive four stars, 35% receive three stars, 22.5% receive two stars and the bottom 10% receive one star. Investment return and principal value will vary so that investors have a gain or loss when shares are sold. Funds are rated for up to three time periods (three-, five-, and 10-years) and these ratings are combined to produce an overall rating. Ratings may vary among share classes and are based on past performance. Past performance does not guarantee future results.

2 Returns for class A shares as of September 30, 2011 were -3.15% for the 1-year period and 9.90% since inception (inception date: November 3, 2008). Returns represent past performance and do not guarantee future results. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance reflects a maximum front-end sales charge of 4.75% applied with dividends and capital gains reinvested. The expense ratio is 1.71%. Current performance may be lower or higher than the performance data quoted and will differ for other share classes. To obtain more current performance data as of the most recent month-end, you may call 800.421.4184 or visit our website at eagleasset.com.

| | |

| Performance Summary and Commentary |

| Eagle Capital Appreciation Fund | | |

Meet the managers | Steven M. Barry, David G. Shell, CFA®, and Timothy M. Leahy, CFA®, are Portfolio Managers of Goldman Sachs Asset Management, LP’s (“GSAM”) “Growth Team.” Messrs. Barry and Shell are Chief Investment Officers and have been responsible for the day-to-day management of the Eagle Capital Appreciation Fund (the “Fund”) since 2002. Mr. Leahy joined GSAM as a Managing Director in 2005, and has been responsible for the day-to-day management of the Fund’s investment portfolio since February 2011.

Effective December 31, 2011, David G. Shell, CFA®, of GSAM, will retire and will no longer have portfolio management responsibilities for the Fund. Steven M. Barry and Timothy M. Leahy, CFA®, will remain with the fund as Chief Investment Officer and Portfolio Manager, respectively. Joseph B. Hudepohl, CFA®, will become a Portfolio Manager and, along with Messrs. Barry and Leahy, assume day-to-day management of the fund. Mr. Hudepohl has been a member of GSAM’s Growth Team since 1999.

Investment highlights | The Fund invests primarily in common stocks. The Fund’s portfolio management team believes that wealth is created through the long-term ownership of a growing business. They take a “bottom-up” approach to investing based on in-depth, fundamental research. A bottom-up method of analysis typically emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers use an intensive research process and each company is analyzed as if they were going to own and operate that company indefinitely. Key characteristics of the companies in which the Fund currently seeks to invest may include: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

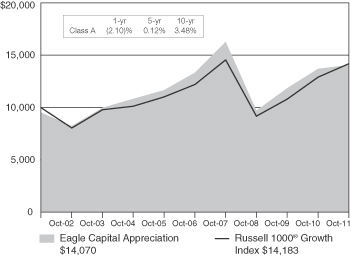

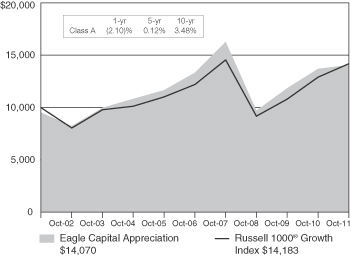

Performance summary | The Fund’s Class A shares returned 2.78% (excluding front-end sales charges) during the fiscal year ended October 31, 2011, underperforming its benchmark index, the Russell 1000® Growth Index, which returned 9.92%. The Russell 1000® Growth Index measures performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values and is representative of U.S. securities exhibiting growth characteristics. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 11/1/01 to 10/31/11 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | Both the Fund and the Russell 1000® Growth Index delivered positive returns during the Fund’s fiscal

| | |

| Performance Summary and Commentary |

| Eagle Capital Appreciation Fund (cont’d) | | |

year as the U.S. economy emerged from a recession and U.S. companies have been reporting earnings above market expectations. Strong returns from U.S. equities over the period reflected optimism on improving trends in labor, housing, manufacturing, and consumer confidence. Utilities and energy were the top performing sectors in both the Fund and the Index, while the telecommunication services and materials sectors lagged.

The Fund delivered positive absolute performance during the reporting period. Stock selection in the information technology and materials sectors and an underweight to the Industrials sector all contributed positively to the Fund’s performance relative to the benchmark. However, the Fund trailed its benchmark, the Russell 1000® Growth Index, during the period. Weakness in select consumer staples, health care and consumer discretionary names detracted from the Fund’s return.

Underperformers | Shares of Teva Pharmaceutical Industries Ltd. ADR, a leading manufacturer of generic drugs, declined during the period. This decline was due to competitive pressures and an ongoing infringement trial related to Copaxone, the company’s best-selling branded product and the top multiple sclerosis drug in the world by revenue. Despite these pressures, we continue to believe that Teva is competitively well positioned in the generics industry given its ability to launch earlier than other generics and its expanding global footprint. Furthermore, Teva’s large size and historically high free cash flow enables the company to keep costs low and remain financially flexible. Finally, Teva produces about half of its own active ingredients, which is an additional cost savings that it would otherwise pay to suppliers. The Fund continues to hold this position as we have conviction in Teva and believe it is gaining market share in a growing industry.

Staples, Inc., the office supply chain store, detracted from performance during the period after the company reported earnings that were below consensus estimates and lowered guidance for 2011. While we continue to see a long-term opportunity for the company, we sold out of the position as we believe ongoing cyclical challenges and macroeconomic headwinds may weigh on the business for a more extended period of time than we previously believed. We felt it was prudent to exit our position and reallocate the capital to higher conviction ideas in the Fund.

Shares of Devon Energy Corporation, one of the largest independent oil and gas exploration and production companies, detracted from relative performance during the period. Shares

declined due to macroeconomic headwinds and commodity pressures that have affected the energy sector at large. In addition, during the second quarter the company announced an increase in the capital expenditures budget, reflecting the acquisition of liquids-rich acreage and the acceleration of drilling in its existing Permian Basin, in New Mexico, and Canadian County, Oklahoma operations. In our view, the market had overly discounted the announcement and overlooked the potential of the exploratory plays. We also view the company’s announcement that it is looking for a partner in all five of its new venture plays very positively. We continue to have conviction in Devon given its deep inventory of liquids-rich growth plays, as well as its significant exposure to oil assets in Canada and various U.S. plays, and the Fund continues to hold this position.

Within consumer staples, Avon Products Inc. detracted from performance during the period. Avon’s earnings have been impacted by disappointing sales and softer margins due to higher input costs. In addition, management lowered its sales guidance for calendar year 2011. We continue to believe Avon is poised to deliver higher operating margins over the next few years as its broad geographic footprint, particularly in Latin America, provides exposure to numerous growing markets. However, we decided to trim our position during the period and allocated capital to higher conviction ideas in the Fund.

During the period, Northern Trust Corporation, the international financial services company, detracted from relative performance. Shares have recently come under pressure due to the low interest rate environment, regulatory uncertainty and macroeconomic headwinds. Despite these challenges, we believe Northern Trust remains a high quality franchise focused on expanding its business in core markets. In our view, the company has a solid balance sheet and cash position, and we believe that management is focused on rationalizing expenses and carefully managing risk (particularly their European exposure) which we view positively in the current environment. The Fund continues to hold this position.

Top performers | MasterCard Inc. (Class A) was a top contributor to performance during the period. The company has benefitted from better-than-expected purchase volume, the number of processed transactions and cross-border volume growth, as well as the positive impact from the announcement by the Federal Reserve on their final decision regarding debit interchange rates (charges on debit card transactions) as part of the last minute amendment to the Dodd-Frank Act of 2010, known as the Durbin amendment, which was more favorable

| | |

| Performance Summary and Commentary |

| Eagle Capital Appreciation Fund (cont’d) | | |

for the company than the market anticipated. Long-term, we believe the company’s large payment network and robust global footprint will allow it to benefit from the secular growth in cash-less payments and transaction volume growth.

Within the consumer staples sector, shares of Costco Wholesale Corporation, the largest membership warehouse club chain in the U.S., contributed to performance. During the period, the company reported strong revenue growth driven by rising gasoline prices, an increase in membership fees, solid membership renewal rates, and increased operations in global markets. In our view, Costco has a unique recurring revenue business model with higher barriers-to-entry than other retail franchises. We continue to believe accelerated customer traffic and an uptick in membership renewal rates should drive earnings growth. In addition, Costco has proven its ability to open profitable international units, which supports a long store growth runway.

Shares of NIKE, Inc. (Class B), a sportswear and equipment supplier, contributed to performance during the period. In the first quarter of 2011, unexpected pricing pressure from the rising cost of cotton negatively impacted quarterly earnings and the position detracted from relative performance. However, we believed that rising input costs would have only a transient effect on earnings, and we were confident that an improving operating environment coupled with our conviction in NIKE’s strong brand name and pricing power would allow it to pass on rising costs to consumers. We chose to add to our position on this weakness. Shares subsequently rose after the company announced strong sales acceleration in its key North American market in the second quarter of this year and raised its long-term revenue guidance. We believe that Nike has a leading product and innovation cycle, robust supply chain and strong balance sheet which should allow the company to continue to benefit from growing global demand for its products.

Xilinx, Inc., a semiconductor chip company that is a leader in programmable logic devices (“PLDs”), contributed to relative

returns during the period. The company reported better-than-expected third quarter 2011 earnings as well as improved gross margins. The company issued a positive outlook on its competitive positioning for the next product cycle and announced a number of new innovations in the pipeline that we believe will drive long-term growth. We maintain our conviction that Xilinx will benefit from the long-term secular trends of PLDs taking share from application-specific integrated circuits (“ASICs”), an alternative semiconductor chip. In our view, the addressable market for PLDs will continue to expand as they offer significant benefits over ASICs such as lower development costs, shorter development time, and upgradability.

Apple Inc., a designer and marketer of consumer electronics, computer software, and personal computers, contributed to the portfolio during the period. The company reported strong quarterly earnings driven by better-than-expected iPhone and iPad sales. We believe the iPhone will continue to gain market share worldwide as Apple continues to build out its business in emerging and developing markets such as China, Brazil and Mexico. We also believe the iPad has joined the iPhone as a key Apple product that will help the company increase market share and build brand awareness as new customers are exposed to the company’s product offerings. In August, Steve Jobs resigned as CEO of the firm and was succeeded by COO Tim Cook. In our view, Mr. Jobs’ resignation did not change the long-term fundamentals of the company. We believe Apple’s platform is now stronger than ever and can be successfully managed by Mr. Cook and Apple’s seasoned management team, following Mr. Jobs’ passing. We believe Apple’s increasing competitive momentum and compelling new products will drive continued outperformance in the stock.

The Fund continues to hold each of the securities noted above as “top performers.”

| | |

| Performance Summary and Commentary |

| Eagle Growth & Income Fund | | |

Meet the managers | Edmund Cowart, CFA®, David Blount, CFA®, and John Pandtle, CFA® are Co-Portfolio Managers of the Eagle Growth & Income Fund (the “Fund”), and have been jointly responsible for the day-to-day management of the Fund’s investment portfolio since June 2011. Prior to June 2011, the portfolio was managed by William V. Fries, CFA®, Managing Director, and Cliff Remily, CFA®, of Thornburg Investment Management, Inc.

The performance discussion, including underperformers and top performers, covers the period since Eagle assumed management of the Fund in June 2011.

Investment highlights | The Fund invests primarily in domestic equity securities (predominantly common stocks) that the portfolio managers believe are high-quality, financially strong companies that pay above-market dividends, have cash resources (i.e. free cash flow) and a history of raising dividends. The Fund’s portfolio managers select companies based in part upon their belief that those companies have the following characteristics: (1) yield or dividend growth at or above the S&P 500® Index; (2) potential for growth; and (3) stock price below its estimated intrinsic value. The fund can also own a variety of other securities, including fixed income securities, which, in the opinion of the fund’s portfolio managers, offer prospects for meeting the fund’s investment goals.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

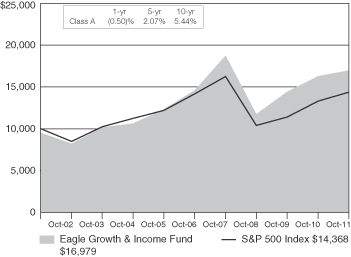

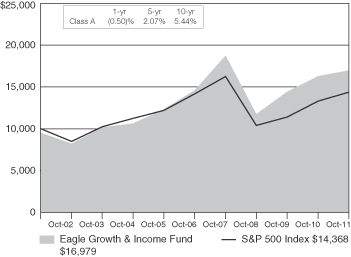

Performance summary | The Fund’s Class A shares returned 4.46% (excluding front-end sales charges) during the fiscal year ended October 31, 2011, underperforming its benchmark index, the S&P 500® Index which returned 8.09%. The

S&P 500® Index is an unmanaged index of 500 U.S stocks and gives a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 11/1/01 to 10/31/11 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | During the period of time in which Eagle managed the Fund through October 31, 2011, the market was mostly characterized by cautious investment and fear selling, bracketed by a pair of equity market rallies. Late in June, investor confidence sparked a late quarter rally. A rebound in June’s ISM Manufacturing Index appeared to indicate that a manufacturing dislocation caused by Japan’s natural disasters was healing. The Federal Reserve’s quantitative easing (QE2) program ended with a whimper, not a bang. In Europe, the Greek parliament approved additional austerity measures likely to facilitate receiving additional bailout funds. However, the rally came to a sudden and dramatic end early in the third quarter. Renewed fears and further distress in

| | |

| Performance Summary and Commentary |

| Eagle Growth & Income Fund (cont’d) | | |

the euro zone sovereign debt market fueled a substantial increase in volatility in the back half of the quarter. There was additional stress due to the rancorous debate over the U.S. federal debt ceiling, culminating in Standard & Poor’s first ever downgrade of U.S. debt. The subsequent October equity market rally was not enough to bring the S&P 500® Index out of negative territory for the five-month period.

Along with the broad market, the Fund’s performance since June 2011 was negative. The Fund did not have any one sector perform in the negative double-digits; however, seven of the nine economic sectors in which the Fund participated suffered negative returns. Sector allocation during the period did not benefit the Fund relative to the S&P 500® Index. This is mostly due to the Fund’s lack of participation in the information technology sector where it had trouble finding companies that met its investment mandate. This sector was essentially flat in the benchmark during the period; however, this made it one of the more attractive sectors in which to be invested during the period June 2011 through October 2011. On the other hand, stock selection for the Fund was positive relative to the index in eight of the nine economic sectors in which the Fund participated. The Fund benefited from the market’s preference for quality and stability during a period characterized by economic uncertainty.

Underperformers | Cooper Industries PLC, a producer of transformers, tools and electrical equipment, was one of the more economically cyclical holdings and was affected strongly by global macroeconomic trends. The Fund sold the stock as it opted for a less cyclical, more defensive name in the current slow growth setting.

JPMorgan Chase & Co., a leading global financial services firm, traded down during the period along with the financials sector in general. However, the stock was not down as much as most other diversified financial services stocks. The Fund continues to own the stock.

3M Company, the American multinational conglomerate corporation, traded down along with the rest of the industrial

conglomerates on global macroeconomic fears. The stock’s return over the period roughly matched the returns of its peers.

Investors were disappointed as amortization costs related to CenturyLink, Inc.’s acquisition of Qwest Communications International Inc. proved to be higher than expected. Fund management does not believe that this increase will affect the company’s cash flow and the Fund continues to own the provider of high speed internet, phone and TV service’s stock.

Food inflation provided a headwind for Sysco Corporation’s stock during the period, making it difficult for the marketer and distributor of foodservice products to perform above market expectations. The Fund continues to own the stock.

Top performers | McDonald’s Corporation, a global restaurant, has enjoyed strong top-line performance, showing a consistent ability to overcome difficult macro conditions and keep growing their business while managing margin pressures.

Regal Entertainment Group, a leading motion picture exhibitor, reported strong cinema attendance growth trends and good quarterly results which pushed the stock price up significantly during the period.

Simon Property Group, Inc., a commercial and real estate company, proved to be a good defensive pick during a period of economic uncertainty. The company’s core regional mall and outlet platform continued to show positive momentum.

Abbott Laboratories, a diversified pharmaceutical and health care product company, showed increasing visibility and solid revenue growth above market expectations. Due to these factors, the stock price benefited.

The stock of global broadband and telecommunications company Verizon Communications, Inc. held steady during the period of macroeconomic uncertainty, with earnings results that have come in at market expectations. The company is ahead of schedule on builds of their Long Term Evolution, a standard for wireless communication of high speed data.

The Fund continues to hold each of the securities noted above as “top performers.”

| | |

| Performance Summary and Commentary |

| Eagle International Equity Fund | | |

Meet the managers | Richard C. Pell is Chief Executive Officer at Artio Global Investors Inc. and Chief Investment Officer at its affiliate, Artio Global Management LLC (“Artio Global”). Rudolph-Riad Younes, CFA®, is Head of International Equities at Artio Global. Messrs. Pell and Younes have managed the Eagle International Equity Fund (the “Fund”) since 2002.

Investment highlights | The Fund invests primarily in foreign equity securities. The Fund’s portfolio managers seek investment opportunities within the developed and emerging markets. In the developed markets, a “bottom-up” approach is adopted. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. In the emerging markets, a “top-down” assessment consisting of currency/interest rate risks, political environments/leadership assessment, growth rates, structural reforms and risk (liquidity) is applied. A top-down method of analysis emphasizes the significance of economy and market cycles. In Japan, given the highly segmented nature of this market comprised of both strong global competitors and protected domestic industries, a hybrid approach encompassing both bottom-up and top-down analyses is conducted.

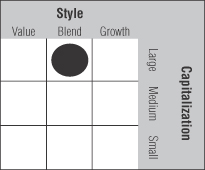

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

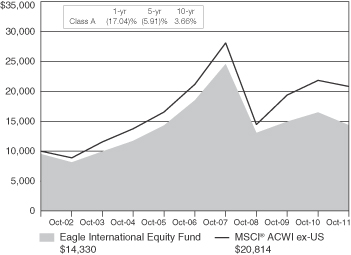

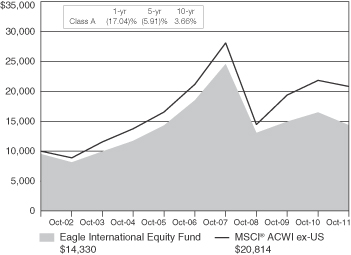

Performance summary | The Fund’s Class A shares returned -12.90% (excluding front-end sales charges) during the fiscal year ended October 31, 2011, underperforming its benchmark index, which returned -4.66%. The Fund’s benchmark index, the Morgan Stanley Capital International® All Country World Index ex-US (“MSCI® ACWI ex-US”), is a free float-adjusted market capitalization index that is designed to measure equity

market performance in the global developed and emerging markets. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 11/1/01 to 10/31/11 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | During the fiscal year ended October 31, 2011, we witnessed an extraordinary number of major events affecting both global economies and markets, and, more importantly, the lives of citizens in both earthquake- and tsunami-ravaged Japan as well as the large populations of individuals living through the events of the Arab Spring. On top of these human events was the worsening of the sovereign debt crisis in Europe, which continues largely to dictate the trajectory of markets. Fears over a Greek default and contagion to the periphery countries in Europe contributed to major declines in markets during the months of August and September, coupled with high levels of market volatility. The markets also were impacted by S&P’s decision to cut its AAA rating on U.S. government debt to AA+, as well as renewed

| | |

| Performance Summary and Commentary |

| Eagle International Equity Fund (cont’d) | | |

fears that the fragile global economy may be sliding back toward a possible recession. Emerging markets underperformed the developed world as there was generally a “risk off” move by investors against the negative backdrop for most of the period under review. From a sector perspective, looking across both developed and emerging markets, the worst hit were utilities (impact of Japan’s nuclear disaster following the tsunami) and, not surprisingly, financials given the unraveling sovereign debt debacle in Europe. The best performing sectors were consumer staples and health care (fears over weakening global growth which favored non-discretionary, consumer-oriented companies), as well as energy.

In an environment which tended to favor more of a “risk off” bias, the Fund’s positioning within emerging markets relative to the MSCI® ACWI ex-US benchmark largely explained the underperformance for the period. Despite these challenges, the Fund remains committed to the emerging world, particularly in Asia, where we continue to see attractive, long-term opportunities for shareholders. During the period, the Fund’s overweight position in China detracted from the Fund’s relative performance. Fears shifted from worries about possible economic overheating in China to fears at the opposite end of the spectrum that the economy would experience a hard landing. The overweight position and stock selection within India also detracted from the Fund’s relative performance, with a number of infrastructure-related stocks underperforming. Stock selection in Russia and Brazil also had a negative impact amid concerns over slowing global growth. On a positive note, stock selection in Taiwan contributed to results given the Fund’s position in a smartphone company. Within developed markets, the Fund underperformed due primarily to a few stock-specific issues. Currency hedging also detracted for the period.

Underperformers | A combination of fears over rising inflation earlier in the reporting period, as well as concerns over slowing global growth, negatively impacted India and other emerging markets. Larsen & Toubro Ltd. GDR, India’s largest engineering company, was not immune to this backdrop. The Fund continues to hold this position.

VTB Bank OJSC GDR, Russia’s second largest bank, underperformed against concerns the economy is slowing, potentially affecting the outlook for loans within the industry. Although it underperformed, the Fund continues to hold this position.

Hang Lung Properties Ltd., a real estate developer based in Hong Kong, underperformed as concerns over a possible hard landing for the Chinese economy impacted property-related companies. The Fund continues to hold this position.

Sberbank, Russia’s largest lender, underperformed against fears of an economic slowdown and the impact on loan growth in the country. The Fund continues to hold this position.

Erste Group Bank AG, active in Eastern Europe, underperformed amidst difficulties surrounding foreign currency loans made in Hungary, which announced plans to impose mortgage losses on lenders. The Fund sold its position.

Top performers | Baidu Inc./China ADR, a Chinese internet search engine company, outperformed during the period. The shares received a particular tailwind toward the end of the period amid strong third quarter earnings and a growing belief the country will begin to ease measures designed to cool inflationary pressures. The Fund continues to hold this position.

Against higher oil prices, robust demand for gas and stronger refining margins, Netherland’s based Royal Dutch Shell PLC (Class A), Europe’s largest oil company by market value, outperformed. Despite sluggish economic growth in Europe and the U.S., world oil demand continues to grow in China, India and other developing countries. The Fund continues to hold this position.

The Fund’s position in HTC Corporation, a Taiwanese manufacturer of smartphones, was sold for several reasons, including profit taking, continued uncertainty behind Apple Inc. patent lawsuits, increasing strength of Samsung products and Google’s acquisition of Motorola (a direct competitor).

Dragon Oil PLC, the international oil and gas exploration, development and production company, with primary operations in Turkmenistan, outperformed for the period. The shares were supported by the company’s expectations that its rate of production growth would be maintained with prospects for increases in coming years. The Fund continues to hold this position.

First Quantum Minerals Ltd., Canada’s second-largest publicly traded copper producer, outperformed. After wide outperformance versus its sector and peers, the Fund sold it and took the profits on the position given more modest expectations for further upside potential.

| | |

| Performance Summary and Commentary |

| Eagle Investment Grade Bond Fund | | |

Meet the managers | James C. Camp, CFA®, a Managing Director at Eagle Asset Management (“Eagle”) and Joseph Jackson, CFA®, are Co-Portfolio Managers of the Eagle Investment Grade Bond Fund (the “Fund”) and have been jointly responsible for the day-to-day management of the Fund’s investment portfolio since the Fund’s inception.

Investment highlights | The Fund invests primarily in investment grade fixed income securities. Investment grade is defined as securities rated BBB- or better by Standard & Poor’s Rating Services or an equivalent rating by at least one other nationally recognized statistical rating organization or, for unrated securities, those that are determined to be of equivalent quality by the Fund’s Portfolio Manager. The average portfolio duration of the Fund is expected to vary and may generally range anywhere from two to seven years based upon economic and market conditions. The Fund expects to invest in a variety of fixed income securities including, but not limited to, corporate debt securities of U.S. and non-U.S. issuers, including corporate commercial paper; bank certificates of deposit; debt securities issued by states or local governments and their agencies; obligations of non-U.S. Governments and their subdivisions, agencies and government sponsored enterprises; obligations of international agencies or supranational entities (such as the European Union); obligations issued or guaranteed by the U.S. Government and its agencies; mortgage-backed securities and asset-backed securities; commercial real estate securities; and floating rate instruments.

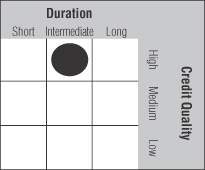

This Morningstar Style Box™ shows the duration and credit quality of bonds held in the Fund. Duration and credit quality are two main components of bond performance. The assessment reflects the fund’s portfolio as of the date reported and is not a precise indication of risk or performance—past, present or future. Definitions of style assessments: Duration: Short, up to 3.5 years; Intermediate, more than 3.5 years to less than six years; Long, six years or greater. Credit quality: High, AA or better; Medium, A or BBB; Low, BB or lower as

rated by Standard & Poor’s or its equivalent, as reported to Morningstar. Source: Morningstar, Inc.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

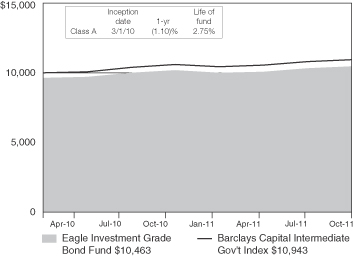

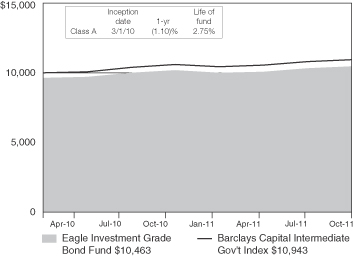

Performance summary | The Fund’s Class A shares returned 2.75% (excluding front-end sales charges) during the fiscal year ended October 31, 2011, underperforming its benchmark index, which returned 3.22%. The Fund’s benchmark index, the Barclays Intermediate Government/Credit Bond Index, includes U.S. government and investment grade credit securities that have a greater than or equal to one year and less than ten years remaining to maturity and have $250 million or more of outstanding face value. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 3/1/10 to 10/31/11 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 3.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

| | |

| Performance Summary and Commentary |

| Eagle Investment Grade Bond Fund (cont’d) | | |

Performance discussion | The past twelve months in the fixed income market could be best described as long periods of quiet nervousness punctuated by short periods of extreme panic. 2011 proved a continuation of 2010 in Europe—just with more concerning signs. The problems in Greece, as feared, spread to Spain, Portugal and Italy, swiftly creating downward pressure on Treasury yields. The ever-changing tone out of the euro zone was the most persistent and impactful storyline during the year. We expect this to continue into 2012 until some sort of sprawling resolution encompassing the entire Euro area is reached. Domestically the story garnering the most media coverage was the S&P downgrade of U.S. debt. It would be difficult to discern the real impact of the downgrade, considering that modern era low interest rates on U.S. Treasuries were reached after the downgrade. The items of note that caused more market reaction are concerns over the mortgage market which persist and, more importantly, fraudulent foreclosure practices that have presented potentially devastating legal liabilities for some primary financial institutions. This is an unresolved issue for many banks heavily involved in home loans before the credit crisis and will require close monitoring in 2012.

In the twelve-month period ended October 31, 2011, the Fund underperformed the Barclays Intermediate Government/Credit Bond Index by 47 basis points. The biggest contributor to the Fund’s performance, relative to its benchmark, was its positioning in corporate credit. The Fund was overweight high quality industrials as riskier issues underperformed. In terms of total return, financial institution holdings (as a sector) led all sub-sectors of the Fund. The corporate sector overall was the best performing sector of the Fund, outpacing Treasuries by a slim margin. The Fund’s mortgage backed securities, covered bond and government-related holdings also earned positive total returns despite lagging corporate credit and Treasuries. The utilities sub-sector lagged all others in the Fund, but also earned a positive total return.

Underperformers | The American internet consumer-to-consumer corporation eBay, 1.63%, 10/15/15, underperformed higher beta securities during the quarter as investors sought high-yielding investments. The Fund sold this security.

Both General Mills Inc., 5.65%, 02/15/19 and PepsiCo Inc., 7.90%, 11/01/18, and consumer products companies in general, were hurt by rising inflation and tightening margins due to the recent run-up in commodity prices. The Fund sold both of these securities.

Kreditanstalt fuer Wiederaufbau, 2.75%, 9/08/20, the German government-owned development bank, underperformed during the period due to renewed concerns over the European banking system. The Fund no longer owns this security.

American telecommunications company AT&T Corporation, 7.30%, 11/15/11, along with other short-duration issues, underperformed during the period as recession fears peaked. This issue has called.

Top performers | Intermediate-Long Treasuries, specifically U.S. Treasury Notes, 2.00%, 04/30/16 and 2.38%, 07/31/17, rallied during the period thanks to fears of recession locally and in Europe. The Fund continues to own both securities.

Investors preferred non-money center financial institutions, such as CME Group Index Services LLC, 144A, 4.40% 03/15/18 and US Bancorp, 4.13%, 5/24/21, during times of stress in 2011. The Fund sold CME Group during the period once it reached its price target. The Fund continues to own US Bancorp.

The Fund owns Google Inc., 3.63%, 05/19/21, an American multinational public corporation invested in internet search, cloud computing and advertising technologies. High quality, cash flow-rich tech companies, such as Google, outperformed riskier issuers late in the year. The Fund continues to own this position.

| | |

| Performance Summary and Commentary |

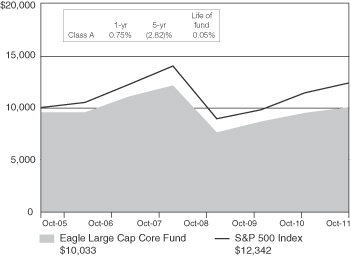

| Eagle Large Cap Core Fund | | |

Meet the managers | Richard Skeppstrom, John “Jay” Jordan, CFA®, Craig Dauer, CFA®, and Robert Marshall at Eagle Asset Management, Inc. (“Eagle”) have been Co-Portfolio Managers of the Eagle Large Cap Core Fund (the “Fund”) since inception. Mr. Skeppstrom is a Managing Director at Eagle.

Investment highlights | The Fund invests primarily in common stocks. When identifying investments for the Fund, the portfolio managers use a “bottom-up” research process that is combined with a proprietary relative-valuation discipline. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. In general, the portfolio managers seek to select securities that, at the time of purchase, have above-average expected returns and at least one of the following characteristics: projected earnings growth rate at or above the benchmark index, above-average earnings quality and stability, or a price-to-earnings ratio comparable to the benchmark index.

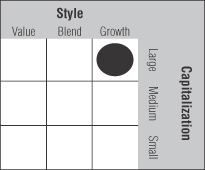

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

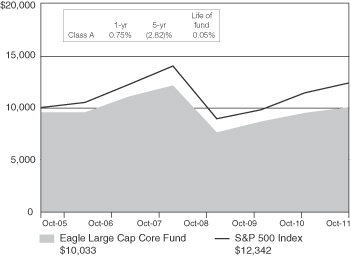

Performance summary | The Fund’s Class A shares returned 5.78% (excluding front-end sales charges) during the fiscal year ended October 31, 2011, underperforming its benchmark index, the S&P 500® Index which returned 8.09%. The S&P 500® Index is an unmanaged index of 500 U.S stocks and gives a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 5/2/05 to 10/31/11 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | Major stock market indexes posted satisfactory returns during the 12-month reporting period, supported by continued Federal Reserve accommodation, strong corporate earnings growth and an expanding economy. Significant volatility occurred, however. Following a strong first quarter when the equity market overcame significant shocks of widespread Middle East turmoil and a devastating earthquake and tsunami in Japan which impacted supply chains, major stock indexes were mixed in the second quarter. Strong earnings carried the market higher through April, but equity prices lost their upward momentum in May as weaker economic data, euro-zone sovereign debt concerns and the imminent June conclusion of the Federal Reserve’s quantitative easing (QE2) program prompted investors into a more cautious stance. Stocks finally rallied in late June after the Greek Parliament approved a five-year austerity plan demanded by international creditors, but the rally was short-lived.

A seemingly relentless stream of negative developments sent stock prices sharply lower during the third quarter, ending with

| | |

| Performance Summary and Commentary |

| Eagle Large Cap Core Fund (cont’d) | | |

the fifth consecutive monthly decline for major indexes as investors reacted to: deepening concerns over the European sovereign debt crisis; partisan intransigence in raising the federal debt ceiling; S&P’s downgrade of U.S. credit, weakening global economic data that raised the possibility of a double-dip recession domestically; negative growth potential in the euro-zone; no growth in Japan; and at least a significant slowdown in China. Investor sentiment turned positive in October as stock prices rebounded, fueled strongly by the growing optimism of European efforts to resolve its debt crisis, eased domestic recession concerns and mostly upbeat third quarter earnings reports.

The S&P 500® Index performance during the period was led by energy, utilities, consumer discretionary, consumer staples, health care and information technology sectors. The Fund captured the performance in those sectors with particularly strong absolute returns from utilities, energy, health care, industrials, information technology and consumer staples. Weaker-performing sectors included telecommunication services, financials, consumer discretionary and materials.

Underperformers | Sprint Nextel Corporation, a global provider of voice, data and internet services, reacted to negative commentary regarding potential liquidity issues following its commitment to Apple Inc. for the iPhone and media misinterpretation/poor CFO communication regarding future capital market needs. Sprint later reported third quarter earnings above expectations with much greater detail regarding both the costs associated with the iPhone as well as the Network Vision plan. Fund management believes that this sets up the stock for several potential positive catalysts in the intermediate term. The Fund continues to hold this position.

The Walt Disney Company, a diversified worldwide entertainment company, saw a negative stock price reaction due to lowered earnings estimates by a couple of percentage points due to sluggish ad trends and slightly slower-than-expected park attendance trends. This was certainly exacerbated by recession fears. The Fund continues to hold this position.

Staples, Inc., the office supply chain store, tumbled after reporting first quarter 2011 earnings that were shy of Street estimates. European margins were hurt by capital spending for revenue growth that didn’t occur due to the macro slowdown and, as a result, guidance was trimmed for the year. Corrective actions have been taken and the stock’s weakness has created a compelling relative valuation. The Fund continues to hold this position.

Apache Corporation, an American independent oil and gas corporation, along with the energy sector in general, came

under pressure in August and September on declining energy/commodity prices as global economic growth concerns were heightened by the European sovereign debt crisis. The Fund continues to hold this position.

Adobe Systems Inc., an American computer software company, experienced underperformance that was mostly due to worries centered around the European credit crisis and the potential for further budget cuts. While the company posted better-than-expected second quarter results, along with better-than-expected Japanese sales, Europe was slightly below expectations. Europe comprises 31% of Adobe’s revenue. The position was sold in August.

Top performers | Apple Inc., designer and marketer of consumer electronics, computer software, and personal computers, posted exceptional June quarter results paced by strong sales of both iPhones and iPads and expectations for the upcoming iPhone5 which Fund management believes will helps support continued sales momentum.

UnitedHealth Group Incorporated, a provider of health services and benefits, performed well as investors become increasingly comfortable that managed care companies can successfully navigate U.S. healthcare reform, reflected by rising earnings estimate revisions.

Tyco International Ltd., a leading provider of electronic security products and services, was a top performer as Schneider National Inc. held exploratory discussions with bankers regarding a potential acquisition of Tyco. While we believe the magnitude and complexity of the transaction made a deal unlikely, Schneider’s interest highlighted the strong free cash flow yield at Tyco as well as the improving business trends and operating leverage at ADT North America, a division of Tyco.

Bed Bath & Beyond Inc., a chain of domestic merchandise retail stores, produced a significant positive earnings surprise in February of $1.12 versus a consensus of $0.97 and management’s $0.91-$0.95 guidance. Additionally, management provided 2011 guidance at the low end of what was slightly above consensus.

Exxon Mobil Corporation, and the energy sector in general, benefited from the increasing intensity of internal conflicts in the Middle East earlier this year, which sharply boosted oil prices on supply concerns. While oil prices remain below most theoretical estimates of demand destruction levels, rising energy prices bear attention as to their potential impact on global economic growth.

The Fund continues to hold each of the securities noted above as “top performers.”

| | |

| Performance Summary and Commentary |

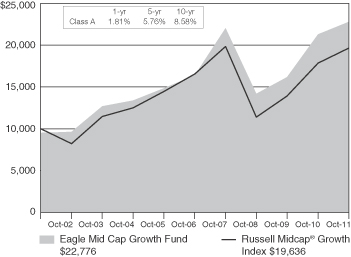

| Eagle Mid Cap Growth Fund | | |

Meet the managers | Bert L. Boksen, CFA®, a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”), is the Portfolio Manager of the Eagle Mid Cap Growth Fund (the “Fund”), and has managed the Fund since its inception. Eric Mintz, CFA®, has been Co-Portfolio Manager since 2011, and Christopher Sassouni, DMD, has served as Assistant Portfolio Manager of the Fund since 2006. Mr. Mintz served as Assistant Portfolio Manager from 2008 through 2011.

Investment highlights | The Fund invests primarily in stocks of mid-capitalization companies. The Fund’s portfolio managers seek to capture the significant long-term capital appreciation potential of mid-cap, rapidly growing companies. The portfolio managers use a “bottom-up” investment approach through a proprietary research strategy that emphasizes the selection of mid-cap growth stocks that are reasonably priced. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The Fund’s portfolio managers believe that conducting extensive research on mid-cap companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

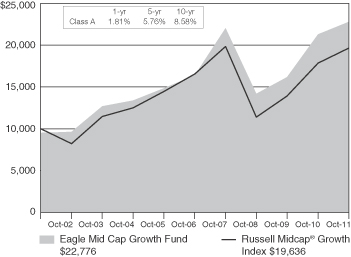

Performance summary | The Fund’s Class A shares returned 6.89% (excluding front-end sales charges) during the fiscal year ended October 31, 2011, underperforming its benchmark index, which returned 10.08%. The Fund’s benchmark index, the Russell Midcap® Growth Index, measures the performance of those Russell Midcap® companies with higher price-to-book ratios and higher forecasted growth values. Please keep in

mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 11/1/01 to 10/31/11 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | All but the telecommunication services sector posted positive returns for the Fund during the period. Consumer staples, energy and consumer discretionary posted the largest absolute returns while the telecommunication services sector slightly hindered the Fund’s performance relative to its benchmark for the period. In consumer staples, strong returns in the food and staples retailing and food products industries led sector performance for the period. The oil, gas and consumable fuels industry reflected strong returns to support solid performance in the energy sector. In consumer discretionary, the textiles apparel and luxury goods and multiline retail industries led with solid absolute returns. Within telecommunication services, the wireless telecommunication services industry dragged down returns for the reporting period.

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Growth Fund (cont’d) | | |

The Fund underperformed its benchmark index during the reporting period. The financials, industrials, energy, materials and information technology sectors pulled returns relative to the Fund’s benchmark down for the period. Weak performance in the real estate management and development and diversified financial services industries dragged down relative returns in financials. In industrials, a slight overweight along with underperformance in the machinery space and underperformance in the trading companies and distributors industry damaged sector returns. Soft results in the oil, gas and consumable fuels industry hurt relative returns in energy. In materials, an overweight position and underperformance in the metals and mining industry hurt returns for the period. Underperformance in the software and internet software and services industries negatively affected the information technology sector result. The Fund did perform well against the index within the consumer staples, consumer discretionary and health care sectors. An overweight position in an outperforming personal products industry boosted relative returns in consumer staples. Strong performance in the internet and catalog retail industry and a slight overweight and outperformance in the textiles apparel and luxury goods led to strong consumer discretionary relative returns. In health care, overweight positioning in the health care technology industry boosted sector returns for the period.

Underperformers | Akamai Technologies Inc. provides technologies that improve the delivery of content over the Internet. The firm saw lower-than-expected revenue growth as content delivery traffic was not substantial enough to offset continued price decreases.

Jones Lang LaSalle, Inc. is a provider of integrated real estate and investment management services. The firm experienced softer-than-expected leasing and sales rates during the period and encountered concerns related to exposure in European markets and the associated economic turmoil in the region.

Dril-Quip, Inc. is one of the world’s leading manufacturers of precision-engineered offshore drilling and production equipment. It specializes in deep water depths and harsh environments. The company is levered to deep-water drilling activity in the Gulf of Mexico and growth in its subsea business, for which permitting recently has begun to pick back up. Dril-Quip, along with the rest of the industry, saw increased scrutiny of its project specifications and testing procedures in

the wake of the BP oil spill, resulting in slightly extended completion timeframes in some instances.

WESCO International, Inc., a distributor of electrical supplies, tempered expectations in light of ongoing economic uncertainty as weaker-than-expected construction trends put pressure on the firm’s end markets.

Shares of Whiting Petroleum Corporation, a domestic oil and natural gas company, traded down due to spotty well-completion results earlier in the period.

The Fund sold out of each of the securities noted above as “underperformers.”

Top performers | ARM Holdings PLC ADR, a beneficiary of smartphone and tablet adoption, announced that a future version of the Windows operating system will run on ARM-based processors. This will enable the company to expand its addressable market to include Windows-based tablets and potentially servers, notebooks and desktop PCs.

Deckers Outdoor Corporation designs and markets performance and casual footwear, as well as outerwear and accessories. The stock has experienced substantial benefit from revenue growth in its UGG® footwear line as the assortment expansion increases the firm’s addressable market.

Herbalife Ltd. is a provider of nutritional supplements and personal care products with focus on weight management and wellness. The stock continues to benefit from an aging population and a general increase in the level of health awareness by consumers. In addition, Herbalife is making significant headway into China.

Dollar Tree Stores, Inc. operates discount stores across the United States. The stock has benefited from the current environment as consumers look to save money on household supplies and other everyday purchases.

Cerner Corporation, a provider of healthcare information technology solutions, is well-aligned with the federal Health Information Technology for Economic and Clinical Health (HITECH) Act and is seeing continued growth given the legislation’s focus on electronic health records security.

The Fund continues to hold each of the securities noted above as “top performers.”

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Stock Fund | | |

Meet the managers | Todd L. McCallister, Ph.D., CFA®, is a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”) and Co-Portfolio Manager of the Eagle Mid Cap Stock Fund (the “Fund”). Dr. McCallister has 24 years of investment experience and has managed the Fund since its inception. Scott Renner has been Co-Portfolio Manager since 2011. Stacey Serafini Thomas, CFA®, served as Assistant Portfolio Manager to the Fund from 2000 to 2005, before being named Co-Portfolio Manager in 2005.

Investment highlights | The Fund invests primarily in stocks of mid-capitalization companies. The portfolio managers of the Fund employ a “bottom-up” stock-selection process to identify growing, mid-cap companies that are reasonably priced. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers seek to gain a comprehensive understanding of a company’s management, business plan, financials, real rate of growth and competitive threats and advantages.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

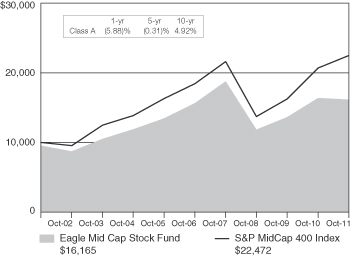

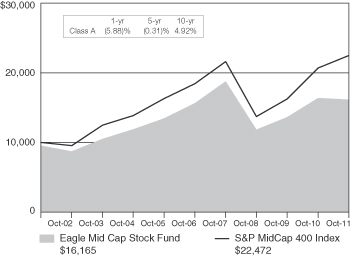

Performance summary | The Fund’s Class A shares returned -1.18% (excluding front-end sales charges) during the fiscal year ended October 31, 2011, underperforming its benchmark index, the S&P MidCap 400® which returned 8.55%. The S&P MidCap 400® is an unmanaged index that measures the performance of the mid-sized company segment of the U.S. market. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 11/1/01 to 10/31/11 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Performance discussion | During the fiscal year, stocks mostly traded together and idiosyncratic risk was small. In early 2011, many were surprised that the stock market continued to produce strong returns in spite of headline news difficult to overlook: select European bond yields were at all-time highs; the world’s third-largest economy suffered dual disasters; state and local cutbacks took place here in the United States; oil prices were at several-year highs; housing prices had fallen to a new post-bubble low; and developed nations continue to have high debt burdens. Then, during mid-2011, the S&P MidCap 400® Index dropped almost 20%. One might expect that several investment opportunities have developed in the past few months. However, economic risks are clearly heightened because global credit markets that are now reflecting the stresses in Europe, the economies of China, and emerging markets are slowing. In addition, there is a definite fiscal headwind here in the United States.

| | |

| Performance Summary and Commentary |

| Eagle Mid Cap Stock Fund (cont’d) | | |

The Fund underperformed its index benchmark, the S&P MidCap 400®, during the period. Relative to the Fund’s benchmark, the telecommunication services sector had the best performance while consumer discretionary, followed by industrials and staples, had the worst performance. For the period, the Fund was overweight in consumer discretionary, with most of that in media holdings. While the Fund’s media holdings outperformed the media in the index, its overweighting hurt the Fund’s allocation affect. Furthermore, the underweight in specialty retailers hurt the Fund, and its holdings were down slightly, while the retailers in the index were up. The Fund still maintains the underweight in retailers as it is a cyclical industry by nature that often does not meet the Fund’s investment criterion. Industrials were hurt as the Fund’s machinery holdings underperformed the index. The Fund underperformed while being underweight consumer staples as the sector became a safe haven trade for investors concerned with the economy.

Underperformers | The Fund purchased stock in Illumina, Inc., a global company that develops innovative array-based solutions for DNA, RNA and protein analysis, after the company missed estimates for earnings and revenue. It was thought that guidance was more achievable, yet the shares traded lower. For the remainder of the period, exposure to the National Institute of Health and the European Union hurt the stock. Aside from Europe, there were concerns that the National Institute of Health would be cutting its budget during the debate over the debt ceiling. The Fund sold this position.

DISH Network Corporation, the second largest pay TV provider in the U.S., experienced a sell-off this summer after it surprised the Street with subscriber churn in its satellite business. The Fund continues to own this position as we believe its inexpensive valuation should work in the long term.

Lazard Ltd., the world’s preeminent advisory investment bank, was purchased as an effort to own more mergers and acquisitions boutiques, because the Fund expected that business segment to return to a stronger pace. However, the stock experienced a sell-off as mergers and acquisitions were uneven across the globe due to weak CEO confidence levels. The Fund sold the holding as European and U.S. sovereign debt crises continued to erode CEO confidence, which is key to mergers and acquisitions.

General Cable Corporation, a manufacturer of copper, aluminum and fiber optic wire and cable products for the energy, industrial, specialty and communications markets, was lower on similar concerns of European exposure. General Cable also missed earnings due to delayed shipments and foreign currency translations. The Fund sold the holding as we felt it would be best to lower the Fund’s exposure to Europe.

Lam Research Corporation, a supplier of wafer fabrication equipment and services to the worldwide semiconductor industry, traded lower as it reported fewer revenues this quarter. The Fund continues to hold the position as it has large market shares in both etching and cleaning of circuit boards and over $1 billion in cash.

Top performers | National Oilwell Varco, Inc., a worldwide leader in providing major mechanical components for land and offshore drilling rigs, saw an uptick in inbound orders. The orders were lifted as there has been a large change in the sentiment for contract drillers, causing them to increase their orders for rigs. New orders for capital equipment jumped to $2 billion during this period, and it was the first time orders exceeded deliveries since 2008. The Fund sold National Oilwell Varco in the spring, as it grew out of the market cap range of the Fund.

Check Point Software Technologies Ltd., a leader in network security software, continues to cross-sell its products after it acquired Nokia’s appliances business. The company has had success migrating users to newer versions of the platform, and these newer versions have additional functionality and higher average selling prices. The Fund continues to own the stock.

Agilent Technologies Inc., a manufacturer of a wide range of analytical instrumentation relating to mass spectrometry, spectroscopy, chromatography and biotechnology, continued to execute well throughout the period. The company is the leader in measurement devices, with larger clients in the wireless communications and life-sciences industries. The Fund continues to hold this position.

Fossil, Inc., a designer and manufacturer of clothing and accessories, continues to do well as it is an example of one of the few specialty retailers that operates in a niche market with a solid brand as its barrier to entry. We believed the watch and accessories company was trading at a good value and that, going forward, the revenue growth was still going to be strong and gross margins would continue to be robust. The Fund sold the position when the security reached its target valuation.

LaSalle Hotel Properties is a hotel real estate investment trust (“REIT”) which owns 35 upscale hotels. LaSalle has relationships with lodging companies like Westin, Hilton and Hyatt Hotels. We purchased this holding toward the end of the fiscal year as the company traded lower when compared to other hotel REITs despite being in a much more enviable debt-to-equity ratio. Shortly after the Fund initiated a position, the stock traded higher following an announcement of a share repurchase valued at $100 million. The Fund continues to hold this position.

| | |

| Performance Summary and Commentary |

| Eagle Small Cap Core Value Fund | | |

Meet the managers | David M. Adams, CFA®, and John “Jack” McPherson, CFA®, Managing Directors at Eagle Boston Investment Management, Inc. (“EBIM”), are Co-Portfolio Managers of the Eagle Small Cap Core Value Fund (the “Fund”), and have been jointly responsible for the day-to-day management of the Fund’s investment portfolio since its inception.

Investment highlights | The Fund invests primarily in equity securities of small-capitalization companies. Using a valuation sensitive approach to investing, the Fund’s portfolio managers seek to capture capital growth by selecting securities that the portfolio managers believe are selling at a discount relative to their underlying value and then hold them until their market value reflects their intrinsic value. To assess value, a “bottom-up” method of analysis is utilized. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. Other factors that the portfolio managers may look for when selecting investments include: management with demonstrated ability and commitment to the company, above-average potential for earnings and revenue growth, low debt levels relative to total capitalization and strong industry fundamentals.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2011 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

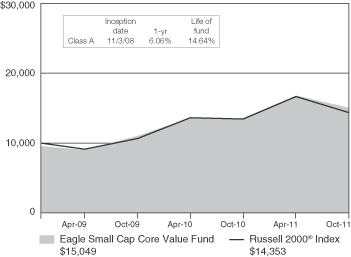

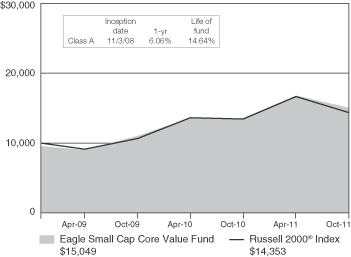

Performance summary | The Fund’s Class A shares returned 11.35% (excluding front-end sales charges) during the fiscal year ended October 31, 2011, outperforming both benchmark indices, the Russell 2000® Index and Russell 2500® Index, which returned 6.71% and 7.97%, respectively. The Russell 2000® Index is an unmanaged index comprised of the 2,000 smallest companies in the Russell 3000® Index, and the

Russell 2500® Index is a market cap weighted index that includes the smallest 2,500 companies in the Russell 3000® Index. The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 Investment from 11/3/08 to 10/31/11 (a)

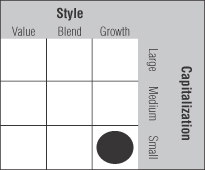

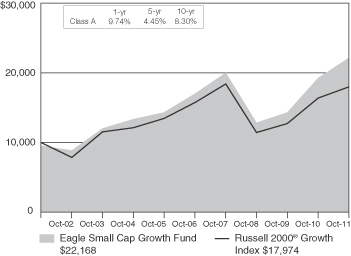

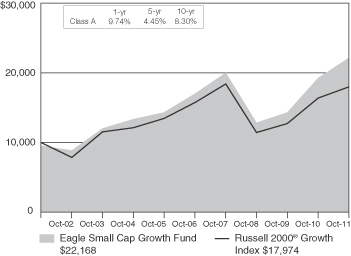

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.