UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-4767

EAGLE GROWTH & INCOME FUND

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St. Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 567-8143

SUSAN L. WALZER, PRINCIPAL EXECUTIVE OFFICER

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

KATHY KRESCH INGBER, ESQ.

K&L Gates, LLP

1601 K Street, NW

Washington, D.C. 20006

Date of fiscal year end: October 31

Date of reporting period: October 31, 2014

Item 1. Reports to Shareholders

| | | | |

| | Annual Report and Investment Performance Review for the fiscal year ended October 31, 2014 Eagle Capital Appreciation Fund Eagle Growth & Income Fund Eagle International Stock Fund Eagle Investment Grade Bond Fund Eagle Mid Cap Growth Fund Eagle Mid Cap Stock Fund Eagle Small Cap Growth Fund Eagle Small Cap Stock Fund Eagle Smaller Company Fund Privacy Notice Eagle Family of Funds | | |

| | | | |

| Go Paperless with eDelivery | | visit eagleasset.com/eDelivery | | For more information, see inside. |

Table of Contents

Visit eagleasset.com/eDelivery to receive shareholder communications including prospectuses and fund reports with a service that helps protect the environment:

Environmentally friendly. Go green with eDelivery by reducing the number of trees used to produce paper.

Efficient. Stop waiting on regular mail. Your documents will be sent via email as soon as they are available.

Easy. Download and save files using your home computer with a few clicks of a mouse.

President’s Letter

Dear Fellow Shareholders:

I am pleased to present the annual report and investment-performance review of the Eagle Family of Funds for the fiscal year that ended October 31, 2014 (the “reporting period”).

Volatility has returned to the equity markets, which, nevertheless, have mostly continued the winning ways of the last five years. Equity markets dropped a bit in January but then moved toward new nominal highs in February and March before taking a breather again in April. However, the market then resumed its upward path before repeating the same pattern again in the summer and mid-October. The specific events may change—this year’s Ukraine-Russia dust-up was last year’s Syrian revolution—but the market, which always has known and unknown issues to deal with, seems to keep “climbing the wall of worry.” The general consensus among our Portfolio Managers is that the U.S. economy is growing, albeit slowly, and the fundamentals of many companies are as strong as they’ve ever been.

On the fixed-income side, new U.S. Federal Reserve Board Chair Janet Yellen mostly has carried on the same dovish stance as her predecessor and short-term interest rates remain near 0 percent. However, the Fed ceased its third round of quantitative easing (commonly referred to as QEIII) and has said it is prepared to increase interest rates when inflationary pressures begin to mount. When that will happen—some data indicate the economy is growing in the 2 percent-3 percent range; meanwhile, fuel prices (often a major player in inflation) have fallen—is a topic of great debate.

Our Portfolio Managers at Eagle are aware of headlines but one of the hallmarks of Eagle over its more than 35 years has been the research our Portfolio Managers do in constructing portfolios. They strive to avoid getting caught up in today’s headlines and instead focus on identifying the individual companies that they believe will help their funds meet their investment objectives.

I hope you will read the commentaries that follow in which our Portfolio Managers discuss their specific funds.

Here are just a few highlights from this year:

| • | | The Eagle Growth & Income Fund finished the period with a 10-year five-star rating1,3 from Morningstar®. |

| • | | The Eagle Mid Cap Growth Fund finished the period with a 10-year and overall four-star rating2,3 from Morningstar®. |

| • | | Harald Hvideberg, CFA®, joined the Portfolio Management team of the Eagle Growth & Income Fund. Harald has nearly two decades of experience managing portfolios as well as analyzing companies that are important elements of the value- and dividend-focused benchmarks. On the research |

| | side, he specializes in the telecommunication services, information technology and utilities sectors. Harald earned bachelor’s degrees from the University of South Florida (one each in finance and business economics, 1993), a master’s degree from the University of Florida (1997) and his Chartered Financial Analyst designation (2000). |

| • | | Management of the Eagle Smaller Company Fund transferred in late October to portfolio co-managers Charles Schwartz, CFA®; Betsy Pecor, CFA®; and Matthew McGeary, CFA®. |

| • | | The Eagle Small Cap Stock Fund and Eagle International Stock Fund are approaching their second anniversaries early in 2015 and continue to perform as we would expect in current market situations.3 The Eagle Investment Grade Bond Fund has continued to perform as we expected of this core-type fixed-income fund: a non-correlated (to equities) piece of an investor’s well-allocated overall portfolio. |

| • | | High-profile media outlets continue to seek Eagle managers for input on current events and investing themes. James Camp, CFA®, who heads the Investment Grade Bond Fund, has been on Fox Business News and CNBC and was quoted in the Financial Times. Ed Cowart, CFA®, a co-manager of the Growth & Income Fund, was featured in a March edition of Barron’s. The magazine also has quoted Portfolio Co-manager Matt McGeary, CFA®, and analyst Matthew Spitznagle, CFA®, from the team that runs the Eagle Mid Cap Stock, Eagle Small Cap Stock and Eagle Smaller Company funds. |

I would like to remind you that investing in any mutual fund carries certain risks. The principal risk factors for each fund are described at the end of this report. Carefully consider the investment objectives, risks, charges and expenses of any fund before you invest. Contact us at 800.421.4184 or eagleasset.com or your financial advisor for a prospectus, which contains this and other important information about the Eagle Family of Funds. Read the prospectus carefully before you invest or send money.

We are grateful for your continued support of and confidence in the Eagle Family of Funds.

Sincerely,

Richard J. Rossi

President

December 18, 2014

1 For the period ended October 31, 2014, the Eagle Growth & Income Fund’s Class A shares are rated 5 stars for the 10-year period; 3 stars for the overall; and 2 stars for the three- and five-year periods among a total of 650, 1,101, 1,101 and 970 funds respectively, in the large-cap value category. Star ratings may be different for other share classes. Morningstar Rating® is based on risk-adjusted performance adjusted for fees and loads. Past performance is no guarantee of future results. Ratings are subject to change each month.

2 For the period ended October 31, 2014, the Eagle Mid Cap Growth Fund’s Class A shares are rated 4 stars for the overall and 10-year period; and 3 stars for the three- and five-year periods among a total of 644, 426, 644 and 587 funds respectively, in the mid-cap growth category. Star ratings may be different for other share classes. Morningstar Rating® is based on risk-adjusted performance adjusted for fees and loads. Past performance is no guarantee of future results. Ratings are subject to change each month.

3 Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Funds with at least three years of performance history are assigned ratings from the fund’s three-, five- and 10-year average annual returns (when available) and a risk factor that reflects fund performance relative to three-month Treasury bill monthly returns. Funds returns are adjusted for fees and sales loads. Ten percent of the funds in an investment category receive five stars, 22.5% receive four stars, 35% receive three stars, 22.5% receive two stars and the bottom 10% receive one star. Investment return and principal value will vary so that investors have a gain or loss when shares are sold. Funds are rated for up to three time periods (three-, five- and 10-years) and these ratings are combined to produce an overall rating. Ratings may vary among share classes and are based on past performance. Past performance does not guarantee future results.

Performance Summary and Commentary

| | |

| |

| | | |

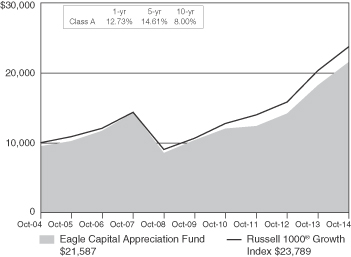

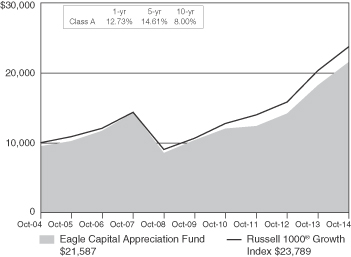

| Eagle Capital Appreciation Fund |

Portfolio Managers | David J. Pavan, CFA®, C. Frank Feng, Ph.D., Ed Wagner, CFA®, and Stacey R. Nutt, Ph.D., of ClariVest Asset Management LLC (“ClariVest”), are Co-Portfolio Managers of the Eagle Capital Appreciation Fund (the “Fund”) and have been responsible for the day-to-day management of the Fund’s investment portfolio since June 2013.

Performance discussion | For the fiscal year ended October 31, 2014, the Fund’s Class A shares returned 18.34% (excluding front-end sales charges of 4.75%) outperforming its benchmark index, the Russell 1000® Growth Index, which returned 17.11%. The Fund posted positive absolute performance in all sectors for the period. Outperformance, relative to the benchmark, was led by the consumer discretionary, consumer staples, and information technology sectors. In the consumer discretionary sector, despite being hurt by an overweight position, strong security selection helped the Fund outperform the benchmark. In consumer staples, outperformance was led by solid security selection. In information technology, an overweight position coupled with solid security selection helped bolster returns. The Fund lost ground to the benchmark in both the health care and energy sectors due to weak stock selection. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 10/31/04 to 10/31/14 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Top performers | Apple Inc. designs, manufactures and markets mobile communication and media devices, personal computing products, and portable digital music players. The Portfolio Management team (“PM team”) believes that shares of the company rose throughout the second half of the year, first in anticipation of the iPhone 6 launch and then on its record sales results. Marriott International, Inc. (Class A) is a worldwide operator and franchiser of hotels heavily concentrated in the North American market. The PM team believes that the company’s development plan indicates strong future growth in rooms available, and share repurchases continue to reduce share count. The company also appeared to benefit from speculation of further consolidation in the industry, potentially including a merger with French hotel giant Accor. Gilead Sciences, Inc. is a biotech pharmaceutical company with a number of drugs on the market including several in the areas of HIV treatment and Hepatitis C treatment. The company’s shares rose throughout the year on the launch and blockbuster sales of its Hepatitis C treatment, Sovaldi. CBRE Group, Inc. (Class A) is a global commercial real estate services firm. Earnings expectations declined in February on weaker mortgage brokerage results and higher depreciation, but then rose through the rest of the year as low interest rates and an improving economy drove increasing commercial real estate transactions. CBRE’s European operations appeared to benefit from the acquisition of UK engineering services firm Norland Managed Services Ltd. on top of double-digit organic growth. Microsoft Corp. develops and sells software products including operating system software, server application software and business and consumer applications. The company announced a restructuring, including layoffs of up to 18,000 employees, or 14% of its workforce. Analysts were positive on Microsoft’s shift in focus toward cloud computing, as well as its aggressive cost-cutting. The improving sentiment on the company led to a price-to-earnings (P/E) multiple expansion from 12 times to 16 times expected 2015 earnings. The Fund continues to hold each of the securities noted above as “top performers.”

Underperformers | Amazon.com Inc. is the world’s largest online retailer, offering a range of products including books, music, electronics, and household goods. The company’s shares fell in January as earnings missed estimates due to higher shipping costs, and again in April when the company forecast continued heavy investment spending that would forestall near-term profitability. Juniper Networks, Inc. provides internet infrastructure solutions to internet service providers and other telecommunications service providers. The stock fell in October as third-quarter results missed estimates. The company cited soft telecom carrier spending and a competitive pricing environment as the reasons for the missed estimates. Anadarko Petroleum Corp. is an international oil and gas exploration and production company. The company’s stock declined in December of last year on a ruling that it could be liable for up to $14 billion in environmental cleanup and health costs due to claims against a former chemical subsidiary obtained as part of the acquisition of Kerr-McGee Corp. Biotechnology company Vertex Pharmaceuticals Inc. discovers and develops novel small-molecule pharmaceuticals in the areas of viral diseases, cancer, inflammatory and autoimmune diseases, and neurodegenerative diseases. The company’s shares continued to decline in early November 2013, as analysts cited risks of weaker adoption of its cystic fibrosis drug Kalydeco. Pioneer Natural Resources Co. is an independent oil and gas exploration and production company. Shares declined in November of last year when the company warned that severe weather in Texas had significantly impacted the company’s production and drilling operations. The Fund no longer holds any of the securities noted above as “underperformers.”

Performance Summary and Commentary

| | |

|

| |

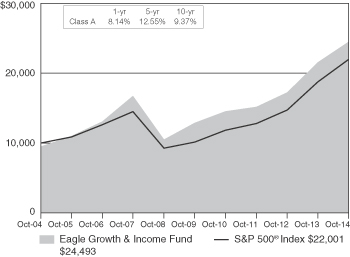

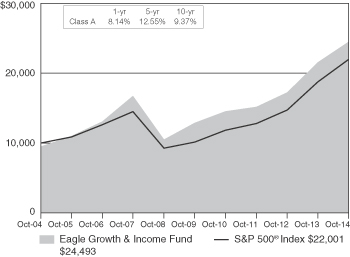

| Eagle Growth & Income Fund | | |

Portfolio Managers | Edmund Cowart, CFA®, David Blount, CFA®, CPA, John Pandtle, CFA®, Jeff Vancavage, CFA® and Harald Hvideberg, CFA®, are Co-Portfolio Managers of the Eagle Growth & Income Fund (the “Fund”). Messrs. Cowart, Blount, and Pandtle have been responsible for the day-to-day management of the Fund’s investment portfolio since June 2011, Mr. Vancavage since July 2013, and Mr. Hvideberg since August 2014.

Performance discussion | For the fiscal year ended October 31, 2014, the Fund’s Class A shares returned 13.52% (excluding front-end sales charges of 4.75%) underperforming its benchmark index, the S&P 500® Index, which returned 17.27%. The Fund’s underperformance was attributed to sector allocation relative to the benchmark. While an overweight position in the consumer discretionary sector benefited relative performance, the Fund being underweight in the information technology and health care sectors detracted much more from relative performance. Additionally, the Fund’s modest cash position, strictly a result of the investment process and averaging a little over 2% during the period, explains nearly 20% of the Fund’s gross underperformance. When the market appreciates as strongly as it did during the past year, even a small cash position can affect relative performance versus a benchmark index with no cash position. Individual stock selection also played a part in the Fund’s underperformance during the period, accounting for nearly 20% of gross underperformance. While the stock selections in the information technology sector strongly outperformed those in the benchmark, the selections in the health care and industrials sectors underperformed. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 10/31/04 to 10/31/14 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | Mattel, Inc. is a dominant toy company with a worldwide footprint. The stock initially suffered due to a poor holiday season in 2013, which led to a few quarters of inventory liquidation. The company has an improving cost structure, a culture of innovation and global capabilities. The Portfolio Management team (“PM team”) believes that it is attractively valued with a high dividend, and that management has taken the proper steps to position the company for a favorable 2014 holiday season. The Fund continues to hold this security. Eaton Corp. PLC is a diversified power management company. Investors speculated that a spin-off of Eaton’s vehicle segment would create value for the company; however, management ended the speculation due to the potential for unfavorable tax consequences. The PM team believes that Eaton is seeing solid growth, strong demand and the company is taking aggressive action on the cost side. The Fund continues to hold this security. Occidental Petroleum Corp., an oil & gas drilling company, had been performing well for much of the year as it made progress in unlocking value through the divestiture of riskier, capital intensive assets. However, a drop in oil prices late in the year led to questions about the company’s ability to complete the restructuring, which would allow the company the flexibility needed to execute even in a weaker oil price environment. Additionally, the company is set to execute a spin-off of a significant portion of its California business. The Fund continues to hold this security. CenturyLink, Inc., an integrated telecommunications company, surprised investors last year with the announcement of a major shift in the company’s capital allocation plan, which included a dividend cut. As a result, the Fund no longer holds the security. Telecommunications giant, AT&T Inc., saw its stock appreciate during the period. However, due to the depth of positive performance in the Fund, it was one of the Fund’s worst-performing stocks. The sector as a whole was the second-worst performing in the benchmark and AT&T performed in-line with its large telecommunications services peers. The Fund continues to hold this security.

Top performers | Apple Inc., a consumer products and information technology company, was the Fund’s strongest performing holding during the period. The PM team believes that the stock experienced a strong surge during the months of April and May as earnings results suggested that iPhone sales growth was not slowing at the rate some feared. Later in the year, the company unveiled and successfully launched the iPhone 6 as well as some other products, which led to more positive performance. The stock of software giant Microsoft Corp. appreciated steadily throughout the period. Earnings results showed some stabilization in the commercial PC department, and the company made headway into its plan to focus on cloud and mobile segments under new CEO Satya Nadella, while streamlining and restructuring the management of the company in alignment with those goals. The PM team believes that the stock of pharmaceutical company Merck & Co., Inc. benefited from the initiation of a submission for a new immune-oncology therapy. The implication of the announcement was that the product could come online as early as 2015, a year ahead of market expectations. The decline in the company’s Januvia franchise also stabilized during the year, and the company announced and closed the sale of its consumer business to Bayer AG. Applied Materials, Inc. is a dominant player in its core business providing semiconductor fabrication tools to chipmakers. The company had previously announced a well-received merger with Tokyo Electron. The market received better clarity on the timeline and potential synergies involved with the merger during the year, benefiting the stock. Earnings also continued strong, showing a strong order pipeline driven by foundry and memory demand. The stock of consumer and industrial technology company 3M Co. initially surged on the announcement of a significant raise in dividends as well as increased stock buyback authorizations. For the period, the company continued to produce peer-leading margins and strong execution despite headwinds. 3M also provided solid core growth in its businesses and completed several meaningful merger and acquisition deals during the period. The Fund continues to hold each of the securities noted above as “top performers.”

Performance Summary and Commentary

| | |

| |

| | | |

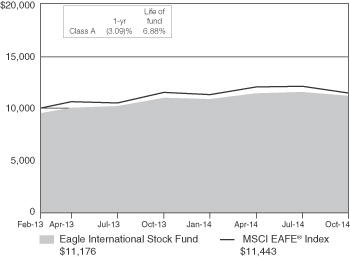

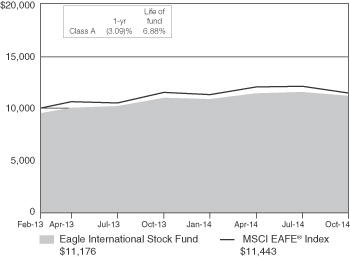

| Eagle International Stock Fund |

Portfolio Managers | David R. Vaughn, CFA®, and Stacey R. Nutt, Ph.D., are Co-Portfolio Managers of the Eagle International Stock Fund (the “Fund”). Mr. Vaughn has been responsible for the day-to-day management of the Fund’s investment portfolio since its inception in February 2013 and Dr. Nutt since June 2013. Alex Turner, CFA®, has served as Assistant Portfolio Manager of the Fund since its inception.

Performance discussion | For the fiscal year ended October 31, 2014, the Fund’s Class A shares returned 1.73% (excluding front-end sales charges of 4.75%) outperforming its benchmark index, the MSCI EAFE® Index, which returned (0.60)%. Sector selection was flat for the Fund. The Fund’s performance, relative to the benchmark, benefited from an underweight in the materials sector and an overweight in the health care sector. The Fund was negatively impacted by an overweight in the consumer discretionary sector and an underweight in the utilities sector. Country selection was flat. An overweight in Israel helped performance and an underweight in Switzerland hurt performance. Value and growth measures were solid across the globe, while momentum struggled in Asia. Overall factor performance was positive during the period. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 2/28/13 to 10/31/14 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Top performers | Ireland company Shire PLC, one of the world’s leading pharmaceutical companies, helped performance by making strategic acquisitions which diversified its product portfolio to include treatments of certain rare diseases and from receiving buyout offers from U.S. pharmaceutical firms. Late in the year, the Portfolio Management team (“PM team”) felt that there appeared to be more potential for downside than upside following the announcement of the AbbVie-Shire acquisition deal, so the Fund sold the position. The stock fell sharply after it was sold, which the PM team believes mainly was a result of the offer being withdrawn. Japanese company Minebea Co. Ltd., a manufacturer of electronic devices and machinery components, boosted performance as the company continued to surprise the market by reporting higher than expected earnings driven by improving sales of ball bearings and motors. The company also benefitted from LCD backlight sales to smartphone makers, despite concerns about the profitability of the backlight business in light of expanding production. The Fund decided to sell this security as the Fund was overweight in Japan and other more attractive opportunities presented themselves. Israeli company Teva Pharmaceutical Industries Ltd., a leading generic and specialty drug manufacturer, benefitted from a higher than expected rate of conversion to an improved version of its drug to treat Multiple Sclerosis. The Fund continues to hold this security. Australian company CSR Ltd., a building products manufacturer and supplier, gained from higher building activity in Australia as a result of increased housing starts due to low mortgage rates and strong housing price increases. Analysts began to downgrade the security when it appeared that the cyclical recovery in housing prices in Australia was reflected in the market, and leading indicators pointed to a potential softening in housing prices, so the Fund decided to sell this security when better investment opportunities presented themselves. Japanese company Nippon Telegraph and Telephone Corp., a provider of telephone and internet services, boosted performance as the company reported an extensive restructuring of its fee structure from flat-rate to usage-based data plans. The Fund continues to hold this security.

Underperformers | German company, Deutsche Lufthansa AG, an aviation group with global operations, hurt performance as the PM team believes that the company fell victim to the excess capacity and price competition affecting the industry. The company’s plan to start a low cost airline was delayed as the pilots went on a strike. Japanese company, Toyota Motor Corp., is the global manufacturer known for manufacturing Toyota and Lexus cars. The stock detracted from performance as the severe cold weather in the U.S., the company’s largest market, hurt sales. Three Japan-based trading companies, Marubeni Corp., Sojitz Corp., and Sumitomo Corp., with significant exposure to commodities and the tumbling Japanese yen, detracted from performance during the period. Sumitomo Corp., a trading company, significantly lowered guidance and wrote down the value of its U.S. shale oil development and Australian coal mining operations citing difficulty in extracting resources efficiently while facing weakening commodity prices. Similarly, Sojitz, a general trading company, detracted from performance as the company’s shares fell over the period. The PM team believes this was a result of the waning commodity prices and increased risks from its machineries segment. Marubeni Corp, a general trading company, also traded down due to what appeared to be concerns of falling commodity prices. The Fund continues to hold each of the securities noted above as “underperformers.”

Performance Summary and Commentary

| | |

|

| |

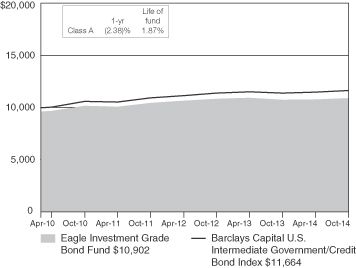

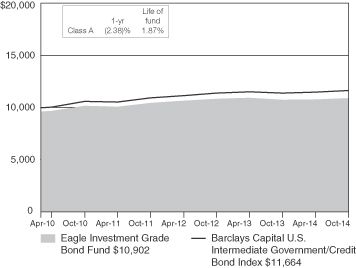

| Eagle Investment Grade Bond Fund |

Portfolio Managers | James C. Camp, CFA®, and Joseph Jackson, CFA®, are Co-Portfolio Managers of the Eagle Investment Grade Bond Fund (the “Fund”) and have been responsible for the day-to-day management of the Fund’s investment portfolio since its inception in March 2010.

Performance discussion | For the fiscal year ended October 31, 2014, the Fund’s Class A shares returned 1.42% (excluding front-end sales charges of 3.75%) underperforming its benchmark index, the Barclays Capital U.S. Intermediate Government/Credit Bond Index, which returned 2.28%. The Portfolio Management team (“PM team”) believes that the combination of a substantial rally on the long end of the yield curve and declining credit spreads drove market performance during the period. At the same time, the intermediate (three- to seven-year) bucket of the curve experienced rising yields and lagging total returns. This ‘bull flattening’ (when declines in long term interest rates outpace those of intermediate term) environment was the largest detractor from relative performance for the Fund during the period. The Fund’s positions in U.S. Treasuries were the largest contributor to relative performance due to the relative duration of these securities to those of the benchmark. The Fund earned positive relative returns in the corporate sector due largely to its underweight in the seven- and ten-year duration buckets within the sector. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 3/1/10 to 10/31/14 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 3.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | Federal agency MBS, Freddie Mac, REMIC, Series 4097, Class BG, 2.00%, 12/15/41, was a low coupon CMO, which underperformed relative to other mortgage-backed securities, as interest rates moved above coupon rates. The PM team believes that the negative convexity inherent with this type of security caused the duration of the bond to extend as rates increased, compounding the problem. Corporate bond, Allergan Inc., 3.38%, 09/15/20, one of the world’s leading specialty pharmaceutical companies, generated negative absolute returns and underperformance relative to the industrial sector. This was mainly due to multiple takeover offers made by Valeant Pharmaceuticals International, which threatened a deterioration in the credit quality of Allergan. Corporate bond, eBay Inc., 2.20%, 08/01/19, a global commerce and payments leader, generated negative absolute returns and underperformance relative to its sector due to the announcement of its plan to spin off its PayPal unit. Corporate bond, Actavis Funding SCS, 144A, 2.45%, 06/15/19, a global, integrated specialty pharmaceutical company, generated negative absolute and relative returns due to rumors of its intention to bid on specialty pharmaceutical company Allergan. Corporate bond, International Game Technology, 7.50%, 06/15/19, a global gaming company specializing in the design, manufacture, and marketing of electronic gaming equipment and system products, generated negative absolute and relative returns as it agreed to be purchased by Gtech SpA, a lower-rated company. The Fund no longer holds any of the securities noted above as “underperformers.”

Top performers | Corporate bonds, Microsoft Corp., 3.63%, 12/15/23, the world’s leading enterprise software company, and Comcast Corp., 3.60%, 03/01/24, the nation’s largest video, high-speed internet and phone provider, were leading performers during the reporting period thanks to curve positioning. The Fund continues to own both securities. Corporate bond, Broadridge Financial Solutions, Inc., 3.95%, 09/01/20, is a leading global provider of investor communications and technology-driven solutions to banks, broker-dealers, mutual funds and corporate issuers. The security generated high returns, which the PM team also believes is due to curve positioning. The Fund continues to own this security. Corporate bond, Juniper Networks, Inc., 4.50%, 03/15/24, a company that delivers innovation across routing, switching and security, outperformed the benchmark index during the period. The Fund bought the security at an attractive price in the primary market and sold it when it reached what the PM team believed to be an internally generated fair value price. Corporate bond, Gilead Sciences, Inc., 4.50%, 04/01/21, a large biopharmaceutical company that delivers, develops and commercializes innovation therapeutics in areas of unmet medical need, outperformed the benchmark index as the company generated financial results above market expectations and avoided transformational merger and acquisition (M&A) headlines that dominated the health care sector during the period. The Fund continues to hold this security.

Performance Summary and Commentary

| | |

| |

| | | |

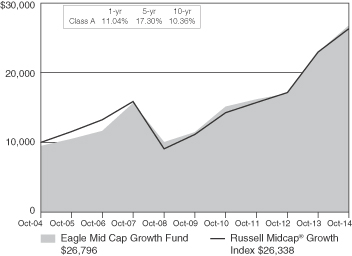

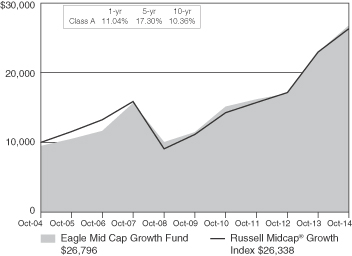

| Eagle Mid Cap Growth Fund | | |

Portfolio Managers | Bert L. Boksen, CFA®, and Eric Mintz, CFA®, are Co-Portfolio Managers of the Eagle Mid Cap Growth Fund (the “Fund”). Mr. Boksen has been responsible for the day-to-day management of the Fund’s investment portfolio since its inception in August 1998. Mr. Mintz has been a Co-Portfolio Manager of the Fund since March 2011, and had previously served as Assistant Portfolio Manager since 2008. Christopher Sassouni, D.M.D., has served as Assistant Portfolio Manager of the Fund since January 2006.

Performance discussion | For the fiscal year ended October 31, 2014, the Fund’s Class A shares returned 16.58% (excluding front-end sales charges of 4.75%) outperforming its benchmark index, the Russell Midcap® Growth Index, which returned 14.59%. The Fund’s outperformance was driven by strong absolute and relative performance in the information technology and consumer staples sectors, while reflecting in-line and slightly underweight positioning respectively. In contrast, underperformance in the health care sector somewhat tempered the Fund’s performance as, despite solid absolute returns, sector results failed to keep up with those of the benchmark on a relative basis. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 10/31/04 to 10/31/14 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Top performers | Monster Beverage Corp. sells a variety of energy drinks and sodas as well as teas and juices. Shares benefited from an announced partnership with The Coca-Cola Company, which is expected to improve distribution and profitability while enabling better access to international markets. Royal Caribbean Cruises Ltd. has benefited from better-than-expected improvement within its European and Asian markets, where ticket revenues—as well as on-board revenues—have been generally strong. Further, tempered oil prices provided additional propulsion for the shares near the period end. Ameriprise Financial, Inc. offers asset-management and insurance products through a substantial financial-advisor network. The stock has performed consistently well in recent quarters as fundamentals remain solid across the company’s core business segments. The Portfolio Management team (“PM team”) believes that rising interest rates are likely to provide further upside as the company continues to increase its focus on asset-management offerings. Harman International Industries, Inc., a leader in the car-audio and infotainment-systems industry, continued its strong run by leveraging the strength and versatility of its core infotainment segment which has seen robust results in recent periods. Delta Air Lines, Inc., a domestic and international passenger and cargo air transportation company, appeared to benefit from favorable trends in air-traffic growth as well as a solid pricing environment within an airline industry that the PM team believes will continue to improve as a result of substantial consolidation. The Fund continues to hold each of the securities noted above as “top performers.”

Underperformers | The Fresh Market, Inc. is a premium food retailer operating specialty grocery stores. The company encountered some growing pains in light of aggressive new store expansion beyond the core Southeast U.S. market, with new store productivity metrics moderating in recent periods. Electronic Arts Inc. is a premier global gaming software company, generating titles such as Battlefield, SimCity and Madden NFL. The company encountered execution (glitch) issues associated with the release of Battlefield 4 as well as Madden NFL in the midst of new gaming console rollouts by Xbox and PlayStation, which, in turn, appeared to drive some investors to the sideline. Antero Resources Corp. is an energy E&P company with a core focus on the Marcellus and Utica Shale formations within the Appalachian region of the United States. Shares traded off because the company significantly increased its capital expenditures to accommodate its robust growth targets. Although the PM team views these targets as achievable, the PM team believes that the targets have placed substantial pressure on margins in the foreseeable future. Stratasys Ltd. produces 3D printers used in a variety of applications such as building initial models for manufacturing and design processes. 3D printing continues to become more cost competitive when compared to traditional manufacturing and Stratasys remains a strong leader. However, the company encountered margin compression during the period, which resulted in further weakness in the near- to mid-term as the company continued to boost expenditures significantly in order to capitalize on the opportunity. Ally Financial, Inc. operates as a bank holding company with a primary focus on automotive financing products and services. In the PM team’s opinion, the company, which went public earlier in the year, was poised to show meaningful improvement in fundamentals after a period of repositioning. Unfortunately, from the PM team’s perspective, Ally struggled to gain sufficient traction in recent quarters since going public. The Fund no longer holds any of the securities noted above as “underperformers.”

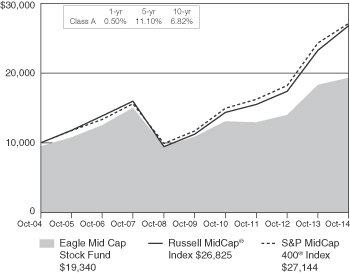

Performance Summary and Commentary

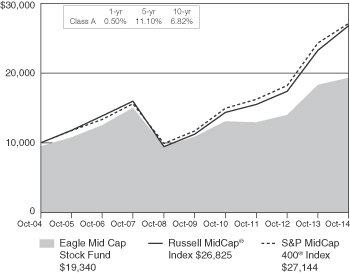

Portfolio Managers | Charles Schwartz, CFA®, Betsy Pecor, CFA®, and Matthew McGeary, CFA®, are Co-Portfolio Managers of the Eagle Mid Cap Stock Fund (the “Fund”) and have been responsible for the day-to-day management of the Fund’s investment portfolio since October 2012.

Performance discussion | For the fiscal year ended October 31, 2014, the Fund’s Class A shares returned 5.51% (excluding front-end sales charges of 4.75%), underperforming both benchmark indices, the Russell Midcap® Index and, secondarily, the S&P MidCap 400® Index, which returned 15.32% and 11.65%, respectively. The Fund’s performance, relative to the benchmarks, benefitted from positive absolute performance in all but the energy sector. Most returns were greater than 10%, with the materials and telecommunication services sectors delivering over 20%. The Fund’s relative performance against the benchmarks benefitted from solid performance in the materials and telecommunications services sectors. The financials, utilities, consumer staples, consumer discretionary, health care, industrials, and information technology sectors put up positive returns but lagged the benchmarks for the period. In the energy sector, the Fund was negatively impacted by lagging stock selection results in oil, gas, and consumable fuels, along with being overweight in the sector. The industrials sector was hurt by stock selection mainly in transportation industries. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 10/31/04 to 10/31/14 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | CommVault Systems, Inc. sells software for data-management applications. The company delivered financial results that were below expectations; further, it had some sales-execution issues in the North American region. The company is trying to bring the revenue-growth rate back to historical levels, but the Portfolio Management team (“PM team”) believes that spending is likely to impact results for several more quarters. The PM team continues to believe in the company’s products and management team, and the Fund added to its position. NeuStar, Inc. (Class A), a provider of real-time information services and analytics, was meaningfully impacted due to what the PM team believes was uncertainty regarding the company’s largest contract. After successfully winning and executing on the contract for the last 17 years, the PM team believes that continued delays in the renewal process and news that a recommendation in favor of a competitor for the contract has caused significant investor concern. The PM team believes NeuStar has a number of attractive businesses, and the loss of the contract is largely reflected in the current share price. The Fund continues to hold this security. Oasis Petroleum, Inc. is an energy exploration-and-production company with operations focused solely in the Williston Basin. The company experienced weather-related production slowdowns and concerns about increasing costs in the basin. The PM team remains optimistic about the long-term prospects for this company. The Fund continues to hold this security. SM Energy Co. performed poorly after it indicated in an earnings release that it was reviewing its reserve assumptions for an area within its Eagleford (Texas) acreage. The company didn’t issue a final report of the review but the market appeared to assume the worst and the stock price suffered. The Fund continues to hold this security because the PM team believes the market overreacted, and they continue to believe SM Energy remains a compelling opportunity. Noble Corp. PLC is an offshore contract driller. The company performed poorly after it (and other industry participants) warned investors that near-term deep-water drilling activity may be soft given slow demand trends and increased industry capacity. The Fund sold the security.

Top performers | Edwards Lifesciences Corp., which sells heart-valve products, had superior across-the-board third quarter results. Edwards currently has three major product launches in the U.S., Europe and Japan that appear to be intended to compete with Medtronic’s product line. The Fund no longer holds this security. Hanesbrands Inc. manufactures a broad range of apparel through brands that include Hanes, Champion, Playtex, Bali and Maidenform. The company saw stronger-than-expected sales, better gross margins and lower expenses. Additionally, the company recently announced that it was acquiring DBApparel, which will give it a significant footprint in Europe. The Fund still holds the security. Skyworks Solutions, Inc. makes analog semiconductors with a focus on wireless-connectivity applications. The company has among the best operating and financial metrics of its peer group. The PM team believes it will benefit from several meaningful growth drivers that will also help further diversify its business lines. The company reported solid financial results and gave very strong guidance in the middle of the year. The Fund still holds this security. Steel Dynamics, Inc., a diversified steel producer and metals recycler, performed well due largely to the company’s announced acquisition of a steel mill—one of the newest and technologically advanced mini-mills in North America. The PM team believes the deal will be beneficial to Steel Dynamics’ financials and is likely to increase its exposure to attractive growth markets in the southern U.S. and Mexico. Further, the company pre-announced its latest quarterly results due to stronger volumes, better capacity utilization and solid pricing. The Fund continues to hold the security. Illumina, Inc. is a leader in the genetic-analysis tools space. The Fund owned Illumina at the end of last year but sold it after Roche Holdings made a purchase offer that drove the stock price higher. Roche subsequently dropped its offer and the stock fell by approximately 10%. All the while, the company continued to execute and maintain its leadership position in the industry. The PM team believed the company’s valuation looked compelling at the lower levels. Consequently, the Fund repurchased the stock, and the company beat their fourth-quarter expectations. The Fund sold the security when it reached the Fund’s price target.

Performance Summary and Commentary

| | |

| |

| | | |

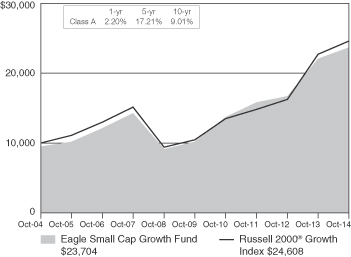

| Eagle Small Cap Growth Fund |

Portfolio Managers | Bert L. Boksen, CFA®, and Eric Mintz, CFA®, are Co-Portfolio Managers of the Eagle Small Cap Growth Fund (the “Fund”). Mr. Boksen has been responsible for the day-to-day management of the Fund’s investment portfolio since August 1995 and Mr. Mintz since March 2011.

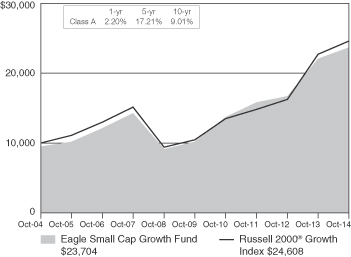

Performance discussion | For the fiscal year ended October 31, 2014, the Fund’s Class A shares returned 7.30% (excluding front-end sales charges of 4.75%), underperforming its benchmark index, the Russell 2000® Growth Index, which returned 8.26%. The Fund underperformed most in the health care sector, as well as, to a lesser extent, the energy sector. In the health care sector, the Fund was hurt by weak stock selection, while being slightly overweight. The Fund’s energy holdings generated below-benchmark returns during the period, while reflecting an in-line sector weighting. In contrast, the consumer discretionary and information technology sectors were bright spots for the Fund, with solid relative performance generated in both sectors, while reflecting in-line and slightly underweight positioning relative to the benchmark respectively. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 10/31/04 to 10/31/14 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | Geospace Technologies Corp. makes seismic instruments used in monitoring oil and natural-gas reserves. The Portfolio Management team (“PM team”) believes that contract-timing issues have continued to plague the stock in recent periods; nevertheless, the PM team believes Geospace continues to have strong prospects for its innovative seismic-recording systems. The Fund continues to hold the security. Medidata Solutions Inc. sells technology used to enhance its customers’ efficiency in clinical-development and research processes. The company’s shares gave back some ground as a correction of many high-flying software-as-a-service names reigned in valuations earlier in the period to more reasonable levels. The Fund continues to hold the security. Thoratec Corp. develops medical devices used to support patients with failing hearts. The company dramatically lowered guidance, which pressured the stock. The PM team believes that weak results were due to a dramatic slowdown in the market as the pace of patient referrals declined. The PM team continues to believe that the potential market for these devices is substantial with few therapeutic options available to the huge number of patients with congestive heart failure. The Fund continues to hold the security. Chart Industries, Inc. manufactures equipment used primarily in the production and storage of liquid natural gas (“LNG”). Strong orders and record backlogs were tempered by news of the company’s revenue-guidance reduction early in the period in light of a handful of customer-order schedule delays. The PM team continues to like Chart’s positioning to benefit from the ongoing build-out of LNG export terminals in North America and a progressing shift to natural-gas-powered trucks. The Fund continues to hold the security. Aegerion Pharmaceuticals, Inc. focuses on treatments for severe lipid (cholesterol) disorders. Competitor, Amgen Inc., continues to develop a high-cholesterol treatment that will compete with Aegerion’s products. Aegerion’s growth outlook was tempered further due to lighter-than-expected traction of its ongoing Juxtapid launch. Accordingly, the security was sold.

Top performers | Puma Biotechnology, Inc. develops drugs such as Neratinib, which is designed to treat several mutations of metastatic breast cancer. The company’s shares nearly tripled during the quarter in response to substantially positive phase-three clinical trial data. The Fund continues to hold the security. Receptos, Inc. is engaged in the development of drug therapies for use in the treatment of multiple sclerosis (“MS”) and irritable-bowel syndrome. The shares benefitted from largely positive phase-two clinical trial data, which further distinguished the efficacy and safety profiles of its MS-treatment candidate. The Fund continues to hold the security. Texas Industries, Inc., a supplier of cement construction products, was acquired by Martin Marietta Materials, Inc. in an all-stock transaction. The Fund continues to hold the resulting position of Marietta Materials as it provides the Fund exposure to the U.S. non-residential construction cycle which has begun to show signs of recovery. The WhiteWave Foods Co. manufactures food products such as Silk and International Delight. The company continues to execute well in an expanding natural and organic-foods industry, leveraging strong brand awareness to take market share. The Fund continues to hold the security. OpenTable, Inc. provides an electronic-reservation booking service for restaurants via cloud-based computers or smartphone applications. Shares jumped during the period as online travel- and leisure-planning firm Priceline Group announced it would acquire OpenTable at a substantial premium. The Fund sold the security post-announcement after the premium became priced in its valuation.

Performance Summary and Commentary

| | |

|

| |

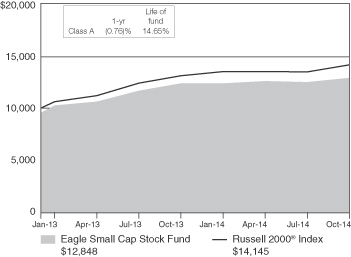

| Eagle Small Cap Stock Fund | | |

Portfolio Managers | Charles Schwartz, CFA®, Betsy Pecor, CFA®, and Matthew McGeary, CFA®, are Co-Portfolio Managers of the Eagle Small Cap Stock Fund (the “Fund”) and have been responsible for the day-to-day management of the Fund’s investment portfolio since its inception in December 2012.

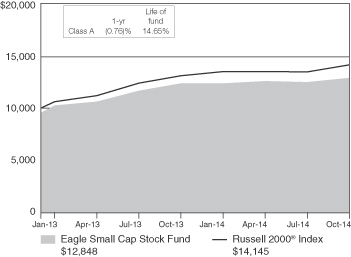

Performance discussion | For the fiscal year ended October 31, 2014, the Fund’s Class A shares returned of 4.17% (excluding front-end sales charges of 4.75%) underperforming its benchmark index, the Russell 2000® Index, which returned 8.06%. The Fund’s performance, relative to the benchmark, benefitted from solid performance in the materials, consumer staples, financials, and industrials sectors. The performance in the information technology, health care, energy, consumer discretionary, and utilities sectors lagged the benchmark for the period. The Fund’s holdings in the Information technology sector was hurt by stock selection in the semiconductor and software & services industry groups. In the health care sector, the Fund was negatively impacted by stock selection results in health care equipment and services, but did benefit from its allocation in the sector as a whole. The Fund’s stock selection in the oil, gas & consumable fuels industry led to the Fund’s overall underperformance in that sector. By contrast, materials was a source of relative outperformance due to solid stock selection in the chemicals and metals & mining industries. Additionally, consumer staples was an outperforming sector for the Fund due to solid stock performance in the food & beverage industry group. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 12/31/12 to 10/31/14 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | Emerald Oil, Inc. is an exploration and production company with operations focused in the Bakken Shale region. In the past year, the company has executed some asset divestitures, new property leases and a secondary stock offering. Emerald now sits with a debt-free balance sheet, a large cash position and a solid set of drilling locations. Despite the recent sell-off in the energy sector, the Fund continues to hold its positon in Emerald as the Portfolio Management team (“PM team”) likes the long-term prospects. Shares of Energy XXI Bermuda Ltd., an independent oil and gas exploration-and-production company, performed poorly after the company missed consensus earnings expectations due to numerous cost overruns. The PM team had been hopeful that the company had addressed these issues and after the company’s most recent earnings miss, the Fund sold the security. NeuStar, Inc. (Class A), a provider of real-time information services and analytics, was meaningfully impacted due to what the PM team believes was uncertainty regarding the company’s largest contract. After successfully winning and executing on the contract for the last 17 years, the PM team believed that continued delays in the renewal process and news that a recommendation in favor of a competitor for the contract caused significant investor concern. The PM team believes NeuStar has a number of attractive businesses, and the loss of the contract is largely reflected in the current share price. The Fund continues to hold the security. CommVault Systems, Inc., a seller of software for data-management applications, delivered financial results that were below expectations. The company is trying to bring the revenue-growth rate back to historical levels but the PM team believes that spending is likely to impact results for several more quarters. The PM team continues to believe in the company’s products and management team and the Fund added to its position. CARBO Ceramics Inc. manufactures parts used in the completion process for oil and gas wells. The PM team believes that the stock performed poorly as concerns arose regarding some of its customers switching from ceramics to lower-cost sand in some wells. In the past, when customers have reduced their consumption of ceramics, near-term results were impacted negatively for a short time. The PM team is watching the situation carefully but is confident in the company’s products, market position and business plan. The Fund continues to hold the security.

Top performers | Akorn, Inc. is a pharmaceutical firm with two segments, prescription pharmaceuticals and consumer health. The PM team believes that the company has seen strong revenue growth from internally developed products, revived products and several strategic acquisitions. The PM team continues to like Akorn’s revenue prospects—including generic price inflation for a few key products, international manufacturing opportunities, and 93 new-drug applications filed with the government. The Fund continues to hold the security. SolarWinds, Inc., a leading provider of network-monitoring and management software for IT professionals, has executed well recently, and its management’s efforts to improve the sales and support organization appear to be on track. Investors appear to have embraced the good results, and the Fund continues to hold the security. Pebblebrook Hotel Trust is a real estate investment trust (“REIT”) which owns and invests in high-end full-service hotels primarily in major urban and resort markets. The company, which owns 28 hotels, has been able to identify under-capitalized or poorly managed assets and improve their per-room revenue and generate impressive margin expansion. The company has consistently delivered strong results over the past year and has traded up along with the overall REIT industry. The PM team continues to like the high-end nature and the overall portfolio of hotels. The Fund continues to hold the security. Esterline Technologies Corp. is a specialized manufacturing company principally serving aerospace and defense customers. The PM team believes that the company performed exceptionally well over the past year based on improving fundamentals, confidence in the cost savings plan implemented by the new management team, and the accretive acquisition of Joslyn Sunbank Company, LLC. After the solid performance, the Fund sold the security. Shares of Landstar System, Inc., a provider of integrated transportation-management solutions, performed well following the release of quarterly earnings which exceeded expectations. The Fund continues to hold the security.

Performance Summary and Commentary

| | |

| |

| | | |

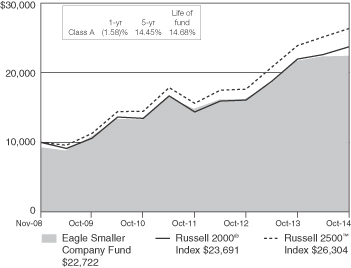

| Eagle Smaller Company Fund |

Portfolio Managers | Charles Schwartz, CFA®, Betsy Pecor, CFA®, and Matthew McGeary, CFA®, are Co-Portfolio Managers of the Eagle Smaller Company Fund (the “Fund”) and have been responsible for the day-to-day management of the Fund’s investment portfolio since October 2014.

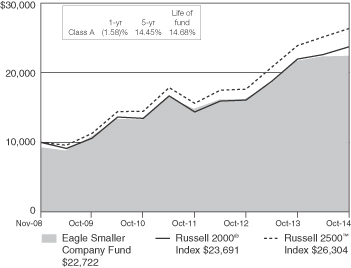

Performance discussion | The following commentary covers the fiscal year ended October 31, 2014. For the period November 1, 2013 through October 19, 2014, the Fund was subadvised by Eagle Boston Investment Management, Inc. Eagle Asset Management Inc. assumed responsibility of the day-to-day management of the Fund’s investment portfolio as of October 20, 2014 and managed the Fund through the fiscal year end.

For the fiscal year ended October 31, 2014, the Fund’s Class A shares returned 3.34% (excluding front-end sales charges of 4.75%) underperforming both benchmark indices, the Russell 2000® Index and, secondarily, the Russell 2500™ Index, which returned 8.06% and 10.23%, respectively. The Fund’s performance, relative to the benchmark, benefitted from positive absolute performance in all but three sectors, with the telecommunication services sector delivering returns of more than 50%. The Fund’s relative performance benefitted from solid performance in the consumer discretionary, energy, and telecommunications services sectors. However, the information technology, consumer staples, health care, financials, industrials, materials, and utilities sectors all lagged the benchmark for the period. In the information technology sector, the Fund’s stock returns did not keep pace with the performance of the benchmark, especially among technology hardware and semiconductor stocks. In the consumer staples sector, the Fund was negatively impacted by lagging stock selection results in the personal products industry. The Fund’s performance in the health care sector was hurt not only by stock selection in the biotechnology and pharmaceuticals industries, but also by the Fund’s overall underweight in those industries. In contrast, the consumer discretionary sector was a source of relative outperformance due to the solid stock selection in internet & catalog retail industry as well as an underweight in the sector as a whole. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 11/3/08 to 10/31/14 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | NCR Corp., a company which sells financial transaction machines (e.g., automatic teller machines and other point-of-sale devices), experienced disappointing sales results and, as a result, the Fund sold the security. Nu Skin Enterprises, Inc. (Class A), a multi-level marketer of primarily personal care products, fell on the announcement of a regulatory inquiry in China, which is one of Nu Skin’s largest and fastest-growing markets. The Fund no longer holds the security. Rosetta Resources Inc. is an independent oil and gas exploration company, which engages in the acquisition and development of onshore energy resources in the U.S. Shares of Rosetta traded lower as the price of oil dropped below $90 per barrel. Despite the recent sell-off in the energy sector, as a whole, the Portfolio Management team (“PM team”) likes the company’s long-term prospects. The Fund continues to hold the security. NeuStar, Inc. (Class A), a provider of real-time information services and analytics, was meaningfully impacted due to what the PM team believes was uncertainty regarding the company’s largest contract. After successfully winning and executing on the contract for the last 17 years, the PM team believes that continued delays in the renewal process and news that a recommendation in favor of a competitor for the contract caused significant investor concern. The PM team believes NeuStar has a number of attractive businesses and the loss of the contract is largely reflected in the current share price. As a result, the Fund continues to hold the security. The Bancorp, Inc., a Mid-Atlantic-based bank and provider of pre-paid and debit cards, announced an FDIC consent decree that will impede some of its operations while the company bolsters its compliance infrastructure. The Fund sold the security.

Top performers | AerCap Holdings N.V., a global leader in aircraft leasing, almost doubled this year as the company bought one of its larger competitors in a beneficial deal that added 931 owned planes to AerCap’s leasing business and more than 300 planes on order. AerCap is now the largest lessor of airplanes. Accordingly, the PM team believes that the Company may be able to recognize important purchasing economies of scale. The Fund no longer holds the security. Chemed Corp. is a company which conducts its business operations in two segments: a provider of hospice and palliative care services (VITAS Healthcare Corporation) and a provider of plumbing and drain cleaning services (Roto-Rooter). The company issued better than expected earnings guidance as a result of improving demand. The stock has more than rebalanced from a sharp price decline last year and demonstrated strong fundamental performance over the course of the past year. The Fund sold the stock toward the end of the year. Shares of The Hillshire Brands Co., a producer and marketer of meat-centric and bakery grocery products, rose after the Company agreed to be acquired by Tyson Foods for a sizeable premium following a bidding contest. The Fund no longer holds the security. Shares of Dresser-Rand Group, Inc., a global supplier of environmentally friendly technology platforms in distributed power generation for the oil and gas, industrial, institutional, and commercial industries, rose after the Company agreed to be acquired by Germany-based Siemens AG. The PM team felt that the acquisition price was fair and decided to sell the Fund’s position ahead of the acquisition. QTS Realty Trust, Inc. (Class A) is a real estate investment trust (“REIT”) that owns and operates data centers across the U.S. The company’s portfolio includes several properties with excess capacity, which the PM team believes may benefit from strong demand for data-center services. The Fund purchased the shares as part of its initial public offering because the PM team believed that the positive operating leverage associated with an increase in capacity utilization may drive above average cash flow growth. With the recent performance of the REIT industry, the PM team felt it was a good opportunity to exit the position toward the end of the year. The Fund no longer holds the security.

Description of Indices

The Barclays Capital U.S. Intermediate Government/Credit Bond Index includes U.S. government and investment grade credit securities that have a greater than or equal to one year and less than ten years remaining to maturity and have $250,000,000 or more of outstanding face value. The returns of the index do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The MSCI EAFE® Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of December 31, 2013, the index consisted of 21 developed market country indices. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell 2500TM Index measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500 is a subset of the Russell 3000® Index. It includes approximately 2,500 of the smallest securities based on a combination of their market cap and current index membership. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 Index companies with higher price-to-value ratios and higher forecasted growth values. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell Midcap® Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The S&P 500® Index is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The S&P MidCap 400® Index is an unmanaged index that measures the performance of the mid-sized company segment of the U.S. market. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

Investment Portfolios

| | | | | | | | | | |

| EAGLE CAPITAL APPRECIATION FUND | | | | |

| COMMON STOCKS—99.6% | | | | Shares | | | Value | |

| Aerospace/defense—2.0% | | | | | | | | | | |

Northrop Grumman Corp. | | | | | 46,700 | | | | $6,442,732 | |

| | | |

| Agriculture—1.3% | | | | | | | | | | |

Archer-Daniels-Midland Co. | | | | | 89,300 | | | | 4,197,100 | |

| | | |

| Airlines—1.5% | | | | | | | | | | |

Delta Air Lines, Inc. | | | | | 119,100 | | | | 4,791,393 | |

| | | |

| Apparel—3.6% | | | | | | | | | | |

Hanesbrands, Inc. | | | | | 44,400 | | | | 4,689,084 | |

NIKE, Inc., Class B | | | | | 73,352 | | | | 6,819,535 | |

| | | |

| Auto parts & equipment—0.8% | | | | | | | | | | |

Lear Corp. | | | | | 26,500 | | | | 2,451,250 | |

| | | |

| Banks—0.8% | | | | | | | | | | |

The Goldman Sachs Group, Inc. | | | | | 13,000 | | | | 2,469,870 | |

| | | |

| Beverages—4.0% | | | | | | | | | | |

Molson Coors Brewing Co., Class B | | | | | 59,700 | | | | 4,440,486 | |

PepsiCo, Inc. | | | | | 85,421 | | | | 8,214,938 | |

| | | |

| Biotechnology—5.5% | | | | | | | | | | |

Amgen, Inc. | | | | | 29,300 | | | | 4,751,874 | |

Celgene Corp.* | | | | | 35,800 | | | | 3,833,822 | |

Gilead Sciences, Inc.* | | | | | 80,300 | | | | 8,993,600 | |

| | | |

| Chemicals—0.9% | | | | | | | | | | |

LyondellBasell Industries N.V., Class A | | | | | 32,700 | | | | 2,996,301 | |

| | | |

| Commercial services—3.2% | | | | | | | | | | |

FleetCor Technologies, Inc.* | | | | | 14,100 | | | | 2,122,896 | |

MasterCard, Inc., Class A | | | | | 95,930 | | | | 8,034,137 | |

| | | |

| Computers—8.2% | | | | | | | | | | |

Apple, Inc. | | | | | 202,566 | | | | 21,877,128 | |

International Business Machines Corp. | | | | | 11,400 | | | | 1,874,160 | |

Western Digital Corp. | | | | | 24,300 | | | | 2,390,391 | |

| | | |

| Distribution/wholesale—0.5% | | | | | | | | | | |

Ingram Micro, Inc., Class A* | | | | | 58,200 | | | | 1,562,088 | |

| | | |

| Diversified financial services—2.2% | | | | | | | | | | |

American Express Co. | | | | | 79,175 | | | | 7,121,791 | |

| | | |

| Electronics—2.8% | | | | | | | | | | |

Honeywell International, Inc. | | | | | 60,680 | | | | 5,832,562 | |

Thermo Fisher Scientific, Inc. | | | | | 27,400 | | | | 3,221,418 | |

| | | |

| Food—1.7% | | | | | | | | | | |

The Kroger Co. | | | | | 66,300 | | | | 3,693,573 | |

Tyson Foods, Inc., Class A | | | | | 40,300 | | | | 1,626,105 | |

| | | |

| Healthcare products—0.5% | | | | | | | | | | |

St. Jude Medical, Inc. | | | | | 26,400 | | | | 1,694,088 | |

| | | |

| Healthcare services—2.0% | | | | | | | | | | |

Aetna, Inc. | | | | | 39,000 | | | | 3,217,890 | |

Cigna Corp. | | | | | 31,600 | | | | 3,146,412 | |

| | | |

| Home furnishings—0.5% | | | | | | | | | | |

Whirlpool Corp. | | | | | 9,900 | | | | 1,703,295 | |

| | | |

| Internet—8.3% | | | | | | | | | | |

Facebook, Inc., Class A* | | | | | 69,400 | | | | 5,204,306 | |

Google, Inc., Class A* | | | | | 16,752 | | | | 9,512,958 | |

Google, Inc., Class C* | | | | | 16,752 | | | | 9,365,708 | |

The Priceline Group, Inc.* | | | | | 1,960 | | | | 2,364,172 | |

| | | |

| Lodging—2.9% | | | | | | | | | | |

Marriott International, Inc., Class A | | | | | 122,395 | | | | 9,271,421 | |

| | | | | | | | | | |

| | | | | | | | | |

| COMMON STOCKS—99.6% | | | | Shares | | | Value | |

| Machinery-construction & mining—0.6% | | | | | | | | | | |

Caterpillar, Inc. | | | | | 17,600 | | | | $1,784,816 | |

| | | |

| Media—2.4% | | | | | | | | | | |

Comcast Corp., Class A | | | | | 66,800 | | | | 3,697,380 | |

DIRECTV* | | | | | 26,100 | | | | 2,265,219 | |

Viacom, Inc., Class B | | | | | 22,000 | | | | 1,598,960 | |

| | | |

| Miscellaneous manufacturer—0.7% | | | | | | | | | | |

Trinity Industries, Inc. | | | | | 67,000 | | | | 2,392,570 | |

| | | |

| Oil & gas—2.1% | | | | | | | | | | |

EOG Resources, Inc. | | | | | 23,800 | | | | 2,262,190 | |

Marathon Petroleum Corp. | | | | | 23,800 | | | | 2,163,420 | |

Valero Energy Corp. | | | | | 47,700 | | | | 2,389,293 | |

| | | |

| Oil & gas services—2.2% | | | | | | | | | | |

Schlumberger Ltd. | | | | | 72,810 | | | | 7,183,435 | |

| | | |

| Pharmaceuticals—6.4% | | | | | | | | | | |

AbbVie, Inc. | | | | | 72,100 | | | | 4,575,466 | |

Actavis PLC* | | | | | 12,300 | | | | 2,985,702 | |

Cardinal Health, Inc. | | | | | 38,100 | | | | 2,990,088 | |

Johnson & Johnson | | | | | 33,800 | | | | 3,642,964 | |

McKesson Corp. | | | | | 30,100 | | | | 6,122,641 | |

| | | |

| Real estate—2.6% | | | | | | | | | | |

CBRE Group, Inc., Class A* | | | | | 256,547 | | | | 8,209,504 | |

| | | |

| Real estate investment trusts (REITs)—2.0% | | | | | | | | | | |

American Tower Corp. | | | | | 38,853 | | | | 3,788,167 | |

Crown Castle International Corp. | | | | | 34,197 | | | | 2,671,470 | |

| | | |

| Retail—10.6% | | | | | | | | | | |

Chipotle Mexican Grill, Inc.* | | | | | 11,335 | | | | 7,231,730 | |

Costco Wholesale Corp. | | | | | 45,902 | | | | 6,121,950 | |

CVS Health Corp. | | | | | 69,000 | | | | 5,920,890 | |

Foot Locker, Inc. | | | | | 44,700 | | | | 2,503,647 | |

Macy’s, Inc. | | | | | 52,700 | | | | 3,047,114 | |