UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-4767

EAGLE GROWTH & INCOME FUND

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St. Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 567-8143

SUSAN L. WALZER, PRINCIPAL EXECUTIVE OFFICER

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

KATHY KRESCH INGBER, ESQ.

K&L Gates, LLP

1601 K Street, NW

Washington, D.C. 20006

Date of fiscal year end: October 31

Date of reporting period: October 31, 2015

Item 1. Reports to Shareholders

EAGLE MUTUAL FUNDS Annual Report and Investment Performance Review for the fiscal year ended October 31, 2015 Eagle Capital Appreciation Fund Eagle Growth & Income Fund Eagle International Stock Fund Eagle Investment Grade Bond Fund Eagle Mid Cap Growth Fund Eagle Mid Cap Stock Fund Eagle Small Cap Growth Fund Eagle Smaller Company Fund EAGLE | Family of Funds Go Paperless with eDelivery visit eagleasset.com/eDelivery For more information, see inside.

Table of Contents

Visit eagleasset.com/eDelivery to receive shareholder communications including prospectuses and fund reports with a service that helps protect the environment:

Environmentally friendly. Go green with eDelivery by reducing the number of trees used to produce paper.

Efficient. Stop waiting on regular mail. Your documents will be sent via email as soon as they are available.

Easy. Download and save files using your home computer with a few clicks of a mouse.

President’s Letter

Dear Fellow Shareholders:

I am pleased to present the annual report and investment-performance review of the Eagle Family of Funds for the fiscal year ended October 31, 2015 (the “reporting period”).

The current calendar year began with a market hiccup due to concerns about global growth, but investors quickly turned back to moving equity markets higher, which lasted until August. We believe that those global-growth concerns (particularly in China), as well as the second significant drop in energy prices in less than a year, sparked a long-anticipated market correction. The U.S. Federal Reserve Board (“the Fed”), which had said that domestic economic data would drive its decision regarding when to raise interest rates, in September stood pat on interest rates and indicated for the first time that global growth concerns were part of its decision-making process. Equity markets, long used to the Fed’s accommodative policy, subsequently popped back up nearly to the highs seen in late spring and early summer.

In sum, there have been—as there always are—many events that can impact the short-term direction of equity and bond markets. The Funds’ portfolio managers remain focused on striving to provide superior risk-adjusted returns over the long term.

I hope you will read the commentaries that follow in which our portfolio managers discuss their specific funds.

Here are just a few highlights from the reporting period:

| • | | The Eagle Mid Cap Growth Fund’s Class A Shares have an overall, three- and 10-year four-star rating from Morningstar.1,4* |

| • | | The Eagle Growth & Income Fund’s Class A Shares have a 10-year four-star rating from Morningstar.2,4* |

| • | | The Eagle Small Cap Growth Fund’s Class A Shares have a 10-year four-star rating from Morningstar.3,4* |

| • | | High-profile media outlets continue to seek Eagle managers. The Wall Street Journal and U.S. News & World Report have quoted James Camp, CFA®, co-portfolio manager of the Eagle Investment Grade Bond Fund. Chris Sassouni, DMD, an assistant portfolio manager of the Eagle Small Cap Growth and Eagle Mid Cap Growth fund, has been cited in Bloomberg Business. |

I would like to remind you that investing in any mutual fund carries certain risks. The principal risk factors for each fund are described at the end of this annual report. Carefully consider the investment objectives, risks, charges and expenses of any fund before you invest. Contact us at 800.421.4184 or eagleasset.com or your financial advisor for a prospectus, or a summary prospectus, which contains this and other important information about the Eagle Family of Funds. Read the prospectus, or summary prospectus, carefully before you invest or send money.

We are grateful for your continued support of, and confidence in, the Eagle Family of Funds.

Sincerely,

Richard J. Rossi

President

December 18, 2015

1 For the period ended Oct. 31, 2015, the Fund’s Class A shares are rated four stars for the three- and 10-year periods and overall and 3 stars for the five-year period among a total of 643, 437, 643 and 575 funds respectively, in the mid-cap growth category. Star ratings may be different for other share classes. Morningstar Rating® is based on risk-adjusted performance adjusted for fees and loads. Past performance is no guarantee of future results. Ratings are subject to change each month.

2 For the period ended Oct. 31, 2015, the Fund’s Class A shares are rated 4 stars for the 10-year, 3 stars for the overall and 2 stars for the five- and three-year periods among a total of 742, 1,197, 1,055 and 1,197 funds respectively, in the large-cap value category. Star ratings may be different for other share classes. Morningstar Rating® is based on risk-adjusted performance adjusted for fees and loads. Past performance is no guarantee of future results. Ratings are subject to change each month.

3 For the period ended Oct. 31, 2015, the Fund’s Class A shares are rated 4 stars for the 10-year, 3 stars for the five-year period and overall and 2 stars for the three-year period among a total of 416, 584, 658 and 658 funds respectively, in the small-cap growth category. Star ratings may be different for other share classes. Morningstar Rating® is based on risk-adjusted performance adjusted for fees and loads. Past performance is no guarantee of future results. Ratings are subject to change each month.

4 Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

* The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Funds with at least three years of performance history are assigned ratings from the fund’s three-, five- and 10-year average annual returns (when available) and a risk factor that reflects fund performance relative to three-month Treasury bill monthly returns. Fund returns are adjusted for fees and sales loads. Ten percent of the funds in an investment category receive five stars, 22.5% receive four stars, 35% receive three stars, 22.5% receive two stars and the bottom 10% receive one star. Investment return and principal value will vary so that investors have a gain or loss when shares are sold. Funds are rated for up to three time periods (three-, five-, and 10-years) and these ratings are combined to produce an overall rating. Ratings may vary among share classes and are based on past performance. Past performance does not guarantee future results.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Performance Summary and Commentary

| | |

| |

| | | |

| Eagle Capital Appreciation Fund | | |

Portfolio Managers | David J. Pavan, CFA®, C. Frank Feng, Ph.D., Ed Wagner, CFA®, and Stacey R. Nutt, Ph.D., of ClariVest Asset Management LLC (“ClariVest”), are Co-Portfolio Managers of the Eagle Capital Appreciation Fund (the “Fund”) and have been responsible for the day-to-day management of the Fund’s investment portfolio since June 2013.

Performance discussion | For the fiscal year ended October 31, 2015, the Fund’s Class A shares returned 10.29% (excluding front-end sales charges of 4.75%), outperforming its benchmark index, the Russell 1000® Growth Index, which returned 9.18%. The Fund posted positive absolute performance in all sectors for the period other than the relatively small materials and telecommunications services sectors for the period. Outperformance, relative to the benchmark, was led by the energy, industrials, and consumer staples sectors. In the energy sector, despite being hurt by an overweight position, strong security selection helped the Fund outperform the benchmark. In industrials and consumer staples, outperformance was also led by solid security selection. The Fund lost ground to the benchmark in the information technology and financials sectors, both due to weak stock selection. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

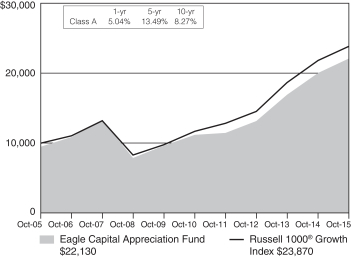

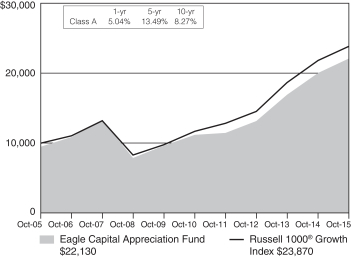

Growth of a $10,000 investment from 10/31/05 to 10/31/15 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Top performers | Apple Inc. designs, manufactures and markets mobile communication and media devices, personal computing products, and portable digital music players. The company continued beating earnings expectations on strong iPhone sales. Amazon. com, Inc. is the world’s largest online retailer,

offering a range of products including books, music, electronics, and household goods. Shares rose sharply on each of the company’s four quarterly earnings reports as the company, which was known for rapid sales growth but little profitability due to heavy investment spending, demonstrated it could also generate substantial profits. The company continued to gain share from traditional retailers, and achieved an estimated 44 million subscribers to its Prime membership program. NIKE, Inc. (Class B) designs, develops, and markets athletic footwear, apparel, equipment, and accessory products for men, women, and children. The company continued to beat earnings estimates and reported strong future orders even in the face of apparent foreign exchange headwinds and weak international economies. Northrop Grumman Corporation is a global security company which provides systems, products, and solutions in aerospace, electronics, information systems and technical services to government and commercial customers worldwide. The company appears to be using its ample free cash flow to repurchase shares, and defense multiples have increased as government budget concerns ease and conflicts rise in the Middle East. At the end of October, Northrop Grumman won a very large contract to build the U.S. Air Force’s next generation bomber (though this award is subject to appeal by the other bidders). Alphabet, Inc. (Class A and Class C) operates as a holding company. The company, through its subsidiaries including Google, provides web-based search, advertisements, maps, software applications, mobile operating systems, consumer content, enterprise solutions, commerce, and hardware products. The stock rose in the second half of the year as the company reported strong advertisement click growth and impressive cost control. The Fund continues to hold each of the securities noted above as “top performers.”

Underperformers | Corning Inc. produces optical fiber, cable, and photonic components for the telecommunications industry, as well as manufactures glass panels, funnels, liquid crystal display glass and projection video lens assemblies for the information display industry. The stock declined over the year as end markets for its products appeared to weaken in personal computers globally and televisions in China. Kohl’s Corp. operates a chain of family-oriented department stores, featuring apparel, footwear and accessories for women, men and children; soft home products such as sheets and pillows; and housewares targeted to middle income customers. Shares of Kohl’s declined as a store refresh program failed to produce improving sales, and the expected consumer windfall from cheaper gasoline did not appear for many department store chains. American Express Co. is a global payment and travel company, offering charge and credit payment card products and travel-related services to consumers and businesses around the world. Shares dropped as the company lost its lucrative partnership for Costco credit cards. Micron Technology, Inc., through its subsidiaries, manufactures and markets dynamic random access memory chips (“DRAMs”), very fast static random access memory chips, flash memory, other semiconductor components, and memory modules. The stock declined on weak personal computer end market demand and DRAM pricing weakness. QUALCOMM, Inc. manufactures digital wireless communications equipment and licenses its wireless communications intellectual property to other manufacturers. Earnings declined as the company struggled to collect royalties in China and lost business as Samsung Electronics Co., Ltd. eliminated the company’s chips from its latest phone design. The Fund no longer holds the securities noted above as “underperformers.”

Performance Summary and Commentary

| | |

| |

| | | |

| Eagle Growth & Income Fund | | |

Portfolio Managers | Edmund Cowart, CFA®, David Blount, CFA®, CPA, Jeff Vancavage, CFA® and Harald Hvideberg, CFA®, are Co-Portfolio Managers of the Eagle Growth & Income Fund (the “Fund”). Messrs. Cowart and Blount have been responsible for the day-to-day management of the Fund’s investment portfolio since June 2011, Mr. Vancavage since July 2013, and Mr. Hvideberg since August 2014.

Performance discussion | For the fiscal year ended October 31, 2015, the Fund’s Class A shares returned (1.55)% (excluding front-end sales charges of 4.75%), underperforming its benchmark index, the S&P 500® Index, which returned 5.20%. Though the Portfolio Management team (“PM team”) was not satisfied with trailing the benchmark, the PM team was faced with a severe dividend yield headwind. During the fiscal year, dividend paying stocks returned 3.4%, while non-dividend paying stocks returned 16.7%. Furthermore, as part of the strategy’s mandate is to achieve a higher yield than the benchmark, returns on stocks with above median yields trailed their below median yield counterparts by 310 basis points. Investments in the telecommunications services and utilities sectors contributed positively to performance relative to the benchmark. The decision not to be invested in utilities for most of the year proved correct as the sector traded down. Investments in industrials, consumer discretionary, and information technology sectors all detracted. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

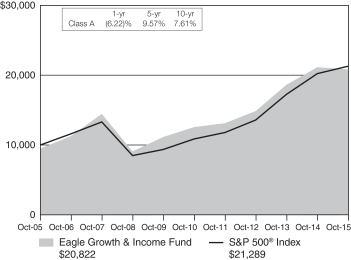

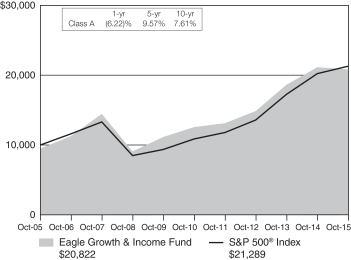

Growth of a $10,000 investment from 10/31/05 to 10/31/15 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | The PM team believes that The Bank of Montreal, a highly diversified financial services provider, struggled due to recession fears in Canada coupled with lower energy prices. Although the company recently reported positive 3Q15 results, from a fundamentals perspective, the PM team believes a deceleration in the Canadian economy is likely to hamper profitability

in the intermediate-term, and the decision was made to sell the security. The PM team believes that global growth concerns also caused Applied Materials, Inc., a global leader in materials engineering solutions, to trade lower. The company was forced to terminate its merger with Tokyo Electron Limited due to trouble gaining the support of the U.S. Department of Justice. The stock was negatively impacted and adjusted downward. Management of the company remains ambitious for the future, because this company has over $1 billion in its R&D budget, substantial resources that have been invested continue gaining market share, and it remains a trusted name among customers. The Fund continues to hold this security. Trending with oil prices, shares of ConocoPhillips, the third largest U.S. oil exploration and production company, traded down. Operationally, the company continues to perform well in a difficult environment. However, because management of the company has noted that maintaining the dividend is a top priority, the Fund continues to hold this security. Sluggish sales have continued to plague Eaton Corporation PLC, a power management company. The PM team believes that any major new initiatives are likely to be muted as the company will transition to a new CEO next year. Company management noted demand has been slower in several of its markets, and after a $1.2 billion negative impact from foreign exchange this year the Fund sold out of its position. Chevron Corporation, a leading integrated energy company, faced difficulty during the year as revenues declined by more than half from last year on lower oil prices. The company has been able to offset some of the losses by more than doubling income from its downstream business year-over-year. Management also announced that it will not raise its dividend. The Fund continues to hold this security.

Top performers | The Home Depot, Inc., a retailer of home improvement and construction products and services, has constantly reported higher-than-expected revenue and raised its earnings guidance for the balance of 2015. Sales in the interior home improvement category and the professional segment were major drivers for the positive performance. The company has benefited from a strong U.S. housing market with housing starts and household formations appearing to pick up. As the world’s largest cloud provider, Microsoft Corporation, the leading platform and productivity company, appeared to continue to find new ways to drive value for shareholders. Its newest operating system, Windows 10, is free for 1 year to certain non-enterprise users of older versions of Windows. The new version is expected to increase demand for the company’s cloud offerings. Microsoft also announced an update to its accounting standards to recognize Windows revenue over 3 years, rather than at initial purchase. The multinational pharmaceutical company, Pfizer Inc., performed well during the year announcing higher than expected sales and earnings-per-share. Particularly, their pneumococcal bacteria vaccine, Prevnar, and their breast cancer medicine, Ibrance, sold much more than expected. With better margins, management was able to raise guidance for the remainder of the year. The stock of Apple Inc., a consumer products and information technology company, continued to rise following the release of several new products. During the year, the company unveiled a new Apple watch, a new iPad, a new iPhone, new software updates to all of its products, and an enhanced subscription feature to iTunes. The impact of a new CEO at McDonald’s Corporation, the world’s leading global foodservice retailer, has already begun to show positive signs within the company’s operations. Progress is visible within the domestic and international markets as the company is working with franchisees on new menu initiatives. The PM team believes that franchisees will make the capital investments needed to further drive revenue growth. The Fund continues to hold each of the securities noted above as “top performers.”

Performance Summary and Commentary

| | |

| |

| | | |

| Eagle International Stock Fund | | |

Portfolio Managers | David V. Vaughn, CFA®, Stacey R. Nutt, Ph.D., and Alex Turner, CFA® are Co-Portfolio Managers of the Eagle International Stock Fund (the “Fund”). Mr. Vaughn has been responsible for the day-to-day management of the Fund’s investment portfolio since its inception in February 2013 and Dr. Nutt since June 2013. Mr. Turner has been a Co-Portfolio Manager of the Fund since March 2015 and previously served as Assistant Portfolio Manager of the Fund since its inception. Priyanshu Mutreja, CFA®, has served as Assistant Portfolio Manager of the Fund since March 2015.

Performance discussion | For the fiscal year ended October 31, 2015, the Fund’s Class A shares returned 3.63% (excluding front-end sales charges of 4.75%), outperforming its benchmark index, the MSCI-EAFE Index, which returned (0.07)%. The Fund’s performance, relative to the benchmark, was modestly positive due to sector selection, where an overweight in the consumer discretionary sector and an underweight in the materials sector added to performance. On the other hand, being underweight in the consumer staples sector detracted from the Fund’s performance. Country selection was positive as well; being overweight in Japan and an underweight in Australia helped performance. Conversely, being underweight in France was a marginal detractor. Stock selection within countries and sectors was somewhat stronger than the corresponding allocation effects. Growth and momentum measures were strong across the globe, whereas valuation was flat. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

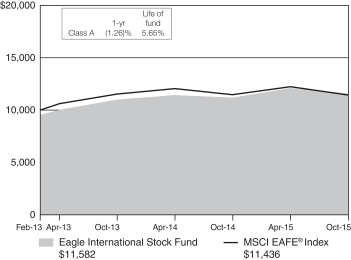

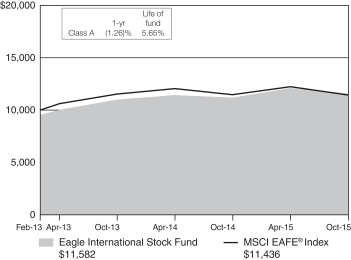

Growth of a $10,000 investment from 2/28/13 to 10/31/15 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Top performers | Qantas Airways Limited, the flag carrier airline of Australia, added to performance during the reporting period as the company posted its strongest profit in years, appeared to be helped by a recovery in passenger traffic, falling oil prices, and a major cost-cutting program implemented over the previous year. The Fund continues to hold this security. Central Japan Railway Co., a Japanese railway company operating between Tokyo and Osaka, contributed to performance as it reported an increase in profits, helped by an increase in ridership and a disciplined cost control program. The Fund no longer holds this position. The British tobacco company, Imperial Tobacco Group PLC, added to performance as it reported stable sales growth and gained market share from other tobacco brands. Fresenius SE & Co. KGaA, a German diversified health care company that provides products and services for dialysis, added to performance. This appeared to be, in part, due to strength in its North American Kabi segment, which, the Portfolio Management team (“PM team”) believes, benefitted from persistent U.S. drug shortages and new product launches. Taylor Wimpey PLC, one of the largest British based house building companies, contributed to performance as the company reported strong earnings growth apparently helped by a strong housing market amidst an improving economy. The Fund continues to hold the remaining securities listed as top performers.

Underperformers | Australian company, Western Areas Limited, a leading nickel producer, hurt performance despite strong production as nickel prices trended downward for most of the year. The PM team believes the stock price of Australia & New Zealand Banking Group Ltd., an Australian bank, fell due to exposure to Australia’s commodity-driven economy, as well as on concerns that the bank would need to do further capital raising. Volkswagen AG, the German car manufacturer, detracted from performance as the group appeared to face harsh conditions in Brazil and Russia, slowing growth in China and the company’s admission that it had falsified diesel emissions tests in the United States. A.P. Moller-Maersk A/S (Class B), the largest container shipper based in Denmark, detracted from performance as the company reported a lackluster first quarter apparently driven by weak freight rates and volumes, offsetting any gains from lower fuel costs. The Fund no longer holds any of the aforementioned underperformers. Royal Dutch Shell PLC (Class B), an integrated oil and gas company headquartered in the Netherlands, traded lower during the year, as it appeared to be hurt by declining oil prices. The Fund continues to hold the security.

Performance Summary and Commentary

| | |

| |

| | | |

| Eagle Investment Grade Bond Fund | | |

Portfolio Managers | James C. Camp, CFA®, and Joseph Jackson, CFA®, are Co-Portfolio Managers of the Eagle Investment Grade Bond Fund (the “Fund”) and have been responsible for the day-to-day management of the Fund’s investment portfolio since its inception in March 2010.

Performance discussion | For the fiscal year ended October 31, 2015, the Fund’s Class A shares returned 1.46% (excluding front-end sales charges of 3.75%), underperforming its benchmark index, the Barclays Capital U.S. Intermediate Government/Credit Bond Index, which returned 1.86%. The Portfolio Management team (“PM team”) believes that factors such as commodity deflation, geopolitical issues, brinksmanship between Greece and the Eurozone, and global economic concerns steming from China caused interest rates to finish the fiscal year lower. Angst over whether the U.S. Federal Reserve Board (“Fed”) would finally raise the Fed funds rate at each approaching Federal Open Market Committe meeting appeared to contribute to volatility throughout the fiscal year. The Portfolio Management team (“PM team”) believes that the uncertainty regarding the Fed’s decision, along with macro level concerns, drove a flattening in the yield curve causing outperformance in ten-year bonds. The main factors in the performance, relative to the benchmark, for the Fund during the period were the allocation to asset-backed securities and the underperformance of corporate utility sector holdings. The Fund earned positive relative returns in the corporate bonds sector due largely to a high quality bias. An allocation to mortgage-backed securities (“MBS”), which outperformed duration-matched U.S. Treasuries, as well as an allocation to longer-dated U.S. Treasuries, as compared to the benchmark, also added to the Fund’s performance. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

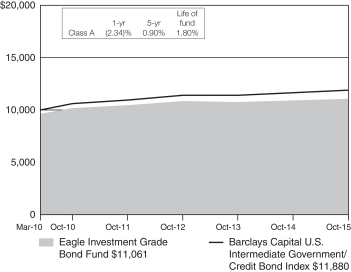

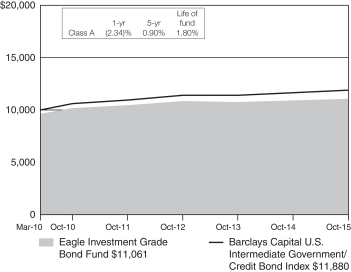

Growth of a $10,000 investment from 3/1/10 to 10/31/15 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 3.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | The corporate bond, issued by Time Warner Cable, 4.13%, 02/15/21, which is a provider of video, high-speed data, and voice services over broadband cable systems, was bought as a merger arbitrage play when Charter Communications, Inc. announced that definitive merger agreement had been reached between the two companies. When the deal did not pass regulatory approval and the investment thesis was no longer in effect, the Fund exited its position. The corporate bond, issued by Petrobras Global Finance BV, 2.00%, 05/20/16, which is the financial services arm of Petroleo Brasiliero SA, a globally integrated oil company detracted from performance. Issues with money laundering and bribery changed the PM team’s outlook on the credit profile of the company. The Fund no longer holds this security. U.S. Treasury Note, 2.00%, 02/15/25, was an “underperformer” due mainly to timing as the security was sold to manage the Fund’s sector and duration characteristics even though longer-dated U.S. Treasuries performed well for the period due to various global and economic concerns, especially after rates peaked in June. The corporate bond, issued by Harris Corp., 2.70%, 04/27/20, which is an international communications equipment company focused on product, system, and service solutions to government and commercial customers also detracted from performance. The Fund sold out of this position when the Fund was shedding corporate bond exposure. The corporate bond, issued by Enable Midstream Partners LP, 144A, 2.40%, 05/15/19, which is a mid-stream oil and gas services provider, including gathering, processing, transporting, and storing detracted from performance. The security appears to have come under pressure as the entire lower BBB rated energy space underperformed the broader market. The Fund continues to hold this security as the PM team continues to favor the “toll road” business model as compared to exploration and production.

Top performers | Federal agency MBS, Freddie Mac Gold Pool, Series 13368, Class G, 6.00%, 11/01/23, is a well-seasoned, high coupon MBS that performed well despite the flattening yield curve. The Fund continues to hold this security. The corporate bond, issued by Medtronic, Inc., 3.15%, 03/15/22, which develops therapeutic and diagnostic medical products, was a top performer during the period due to attractive pricing in the primary market. The Fund continues to hold this position. The corporate bond, issued by Hospira, Inc., 6.05%, 03/30/17, which is a global pharmaceutical and medication delivery company that develops, manufactures, and markets products, had a strong total return apparently as a result of the company’s merger into higher credit-rated Pfizer, Inc. After the merger was complete, the PM team decided that valuation levels warranted selling this position and purchasing another security that offered a better risk/reward profile. Therefore, the Fund sold its position. The corporate bond, issued by Oracle Corp., 2.50%, 10/15/22, which is a provider of enterprise software and computer hardware products and services contributed to performance. The security is a high quality, longer-dated holding that appears to have benefited from the interest rate curve movement. The Fund continues to hold this position. The corporate bond, issued by Expedia, Inc., 4.50%, 08/15/24, which is an internet-based travel services provider for leisure and small business travelers, outperformed similarly low BBB rated peers. Extensive credit research on the company led the PM team to believe that it was valued attractively within the low BBB space at the time the corporate bond was purchased in August 2014. The Fund no longer holds the security as the PM team believed it reached an attractive valuation to sell.

Performance Summary and Commentary

| | |

| |

| | | |

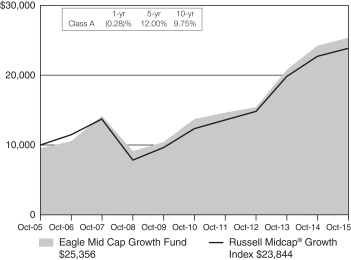

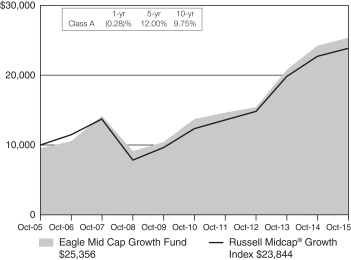

| Eagle Mid Cap Growth Fund | | |

Portfolio Managers | Bert L. Boksen, CFA®, and Eric Mintz, CFA®, are Co-Portfolio Managers of the Eagle Mid Cap Growth Fund (the “Fund”). Mr. Boksen has been responsible for the day-to-day management of the Fund’s investment portfolio since its inception in August 1998. Mr. Mintz has been a Co-Portfolio Manager of the Fund since March 2011, and had previously served as Assistant Portfolio Manager since 2008. Christopher Sassouni, D.M.D., has served as Assistant Portfolio Manager of the Fund since January 2006.

Performance discussion | For the fiscal year ended October 31, 2015, the Fund’s Class A shares returned 4.70% (excluding front-end sales charges of 4.75%), underperforming its benchmark index, the Russell Midcap® Growth Index, which returned 4.94%. The Fund underperformed, relative to the benchmark, primarily due to stock selection in the materials and financials sectors. Within these sectors, the Fund was also hurt by being underweight in each. In contrast, outperformnace in the consumer staples and industrials sectors largely offset the Fund’s underperformance as these sectors performed better than the benchmark while the fund maintained a slightly overweight position in consumer staples and in-line position in industrials. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 10/31/05 to 10/31/15 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | Michael Kors Holdings Ltd. offers affordable luxury handbags and accessories. Prospects for a rebound from weakness early in the period appeared to further deteriorate as the company reported declining year-over-year sales results. The Fund sold out of its position in the stock. Genworth Financial, Inc. (Class A), a provider of insurance, wealth-management and investment solutions, encountered difficulty early in the period as the claims reserve pool for its long-term care unit was deemed severely underfunded as a result of a Securities and Exchange Commission review. The fund no longer maintains a position in this stock. Huntsman Corporation, a manufacturer of adhesives and coatings used in a myriad of industries, appeared to encounter some near-term pricing environment weakness within its polyurethanes and pigments segments, which led customers to delay orders during the period. The Portfolio Management team (“PM team”) believes eventual stabilization of the pricing environment is likely to support re-acceleration of customer order growth going forward. The Fund continues to hold this stock. Memorial Resource Development Corporation is an energy exploration & production (“E&P”) company operating primarily in northern Louisiana and eastern Texas. In the midst of a very difficult pricing environment for E&P companies, Memorial Resource Development encountered less-than-stellar oil well results that failed to prove the viability of its acreage outside of its core position, which the PM team believes tempered growth prospects as a result. The Fund no longer holds this position. Envision Healthcare Holdings, Inc., which provides clinical human capital management and related support for processes outsourced by hospitals, saw shares decline. The PM team believes this was due to weaker-than-anticipated patient volumes within its emergency department segment EmCare, some initial underperformance by a handful of recently-entered hospital contracts as well as elevated insurance claims reserves weighed on the stock toward the end of the reporting period. Despite the near-term difficulties, the PM team believes Envision Healthcare’s business model possesses a strong value proposition, which, in our opinion, is well-revered by its hospital and community customers. The Fund continues to hold this position.

Top Performers | Monster Beverage Corporation, a producer of energy drinks, has continued to execute well as its flagship Monster product line has experienced meaningful market-share gains. This product line also appears to be benefitting from The Coca-Cola Company’s global distribution opportunities as it is gaining better access to international markets and enhanced profitability. Constellation Brands, Inc. (Class A), which owns a variety of wine, beer and spirits brands (e.g., Robert Mondavi, Arbor Mist, Corona and Svedka), has performed well as a result of efficient distribution and a popular product portfolio. Cruise line operator Royal Caribbean Cruises, Ltd. appears to have performed well primarily as a result of disciplined cost-control efforts in addition to lower fuel costs during the period. Palo Alto Networks, Inc., a provider of next-generation network security platforms, appears to have benefitted from positive trends within cybersecurity as companies increasingly look to address and enhance the safety of their data networks and customer data. Acuity Brands, Inc., a designer and producer of LED lighting fixtures largely used in commercial applications, performed well as a result of positive trends in non-residential construction during the period. The Fund continues to hold each of the securities noted above as “top performers.”

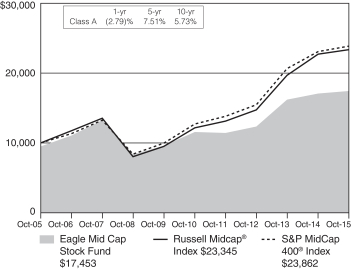

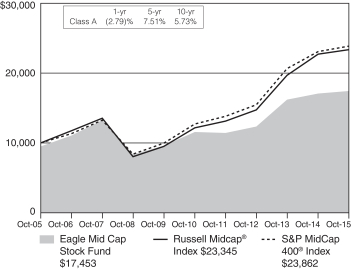

Performance Summary and Commentary

Portfolio Managers | Charles Schwartz, CFA®, Betsy Pecor, CFA®, and Matthew McGeary, CFA®, are Co-Portfolio Managers of the Eagle Mid Cap Stock Fund (the “Fund”) and have been responsible for the day-to-day management of the Fund’s investment portfolio since October 2012.

Performance discussion | For the fiscal year ended October 31, 2015, the Fund’s Class A shares returned 2.07% (excluding front-end sales charges of 4.75%), underperforming both benchmark indices, the Russell Midcap® Index and, secondarily, the S&P MidCap 400® Index, which returned 2.77% and 3.42%, respectively. The Fund’s performance, relative to the benchmarks, benefitted from positive absolute performance in the consumer staples and information technology sectors. The financials and industrials sectors returned in-line relative results for the period. Healthcare posted positive returns but slightly lagged the benchmark for the period. Consumer discretionary stocks showed positive returns but underperformed the benchmark; while stock selections in the energy and utility sectors had negative returns while also underperforming the benchmark. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 10/31/05 to 10/31/15 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | Whiting Petroleum Corporation, an oil and gas exploration and production (E&P) company with primary exposure in the Bakken shale region, decreased in value along with most of its energy-sector peers. The Fund sold its position in this stock. Quanta Services, Inc. is a leading engineering and construction company focused on the electric power transmission and pipeline industries. The company’s shares have decreased in value recently apparently due to some contract delays and operating inefficiencies. The Portfolio Management team (“PM team”) continues to like the outlook for Quanta and, therefore, the Fund is maintaining its position in the security. Range Resources Corp. is an oil and gas company focused primarily in the Marcellus shale in Pennsylvania. Company shares have been weak apparently due to softness in the underlying commodities. The Fund continues to hold this position as the PM team sees long term growth opportunities in the company. NRG Energy, Inc. is an independent power producer that has several diverse businesses—retail, solar and clean energy technologies. The company’s underperformance appears to have been driven by lower hedged power prices for 2016, the absence of a tangible exit strategy for the company’s negative cash flow generating GreenCo business, and the absence of aggressive share repurchases. The Fund no longer holds this position. BorgWarner Inc. (“BorgWarner”) is a manufacturer and supplier of engineered automotive systems and components. The company’s stock price underperformance appears to have been driven by weaker light passenger vehicle sales in China and concerns over the company’s exposure to Volkswagen. The Fund continues to hold a position as the PM team believes BorgWarner is the best-positioned supplier to benefit from growing global regulatory requirements to improve fuel efficiency of vehicles.

Top performers | Skyworks Solutions, Inc., which sells analog semiconductors with a focus on wireless-connectivity solutions, continues to post solid financial results and offer encouraging earnings guidance. The PM team remains positive on the shares due to multiple growth drivers, increasing dollar content per device, and its current valuation. The Fund continues to hold the security but has reduced the position in recent months. NICE-Systems Ltd., Sponsored ADR, a leading cybersecurity and software company, has reported strong recent results and raised future guidance based on an uptick in cyber-crime. The Fund continues to hold this position. HCC Insurance Holdings, Inc., a diversified specialty insurance company, announced that it agreed to be acquired by Tokio Marine Holdings Inc. for a 38% premium. The Fund subsequently sold its position in the stock prior to the completion of the acquisition. SolarWinds, Inc., a provider of infrastructure management software to IT professionals, recently announced that it had entered into an agreement to be acquired by a private equity technology investment firm. The Fund continues to hold this position. Ulta Salon, Cosmetics & Fragrance, Inc. (“Ulta”), a cosmetics and fragrance specialty retailer, continues to post strong financial results as the PM team believes that fundamentals in the beauty category remain very strong. Further, the company is gaining significant market share as consumers appear to increasingly shop at specialty retailers rather than department stores for their beauty needs. The PM team continues to like the company’s growth opportunities and, as such, the Fund continues to maintain a position in Ulta.

Performance Summary and Commentary

| | |

| |

| | | |

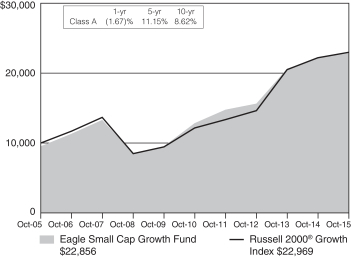

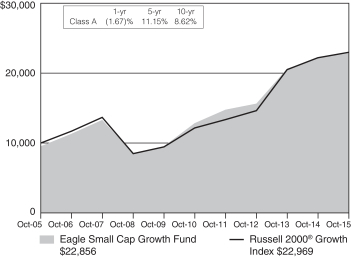

| Eagle Small Cap Growth Fund | | |

Portfolio Managers | Bert L. Boksen, CFA®, and Eric Mintz, CFA®, are Co-Portfolio Managers of the Eagle Small Cap Growth Fund (the “Fund”). Mr. Boksen has been responsible for the day-to-day management of the Fund’s investment portfolio since August 1995 and Mr. Mintz since March 2011. Christopher Sassouni, D.M.D., has served as Assistant Portfolio Manager of the Fund since March 2015.

Performance discussion | For the fiscal year ended October 31, 2015, the Fund’s Class A shares returned 3.23% (excluding front-end sales charges of 4.75%), underperforming its benchmark index, the Russell 2000® Growth Index, which returned 3.52%. The Fund underperformed, relative to the benchmark, principally due to the consumer discretionary and information technology sectors. Within these sectors, the Fund was hurt by weak stock selection, while maintaining a slight underweight in the consumer discretionary sector and an in-line weight in the information technology sector. In contrast, the health care and industrials sectors were bright spots for the Fund, with solid absolute and relative performance generated in both sectors, while being slightly underweight in each. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 10/31/05 to 10/31/15 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | Vitamin Shoppe, Inc. (“Vitamin Shoppe”) is a specialty retailer of vitamins, sports nutrition, and health and beauty-aid products. The company encountered weaker-than-expected same-store-sales growth while also modestly tempering guidance, which weighed on shares during the period. The Portfolio Management team (“PM team”) believes secular tailwinds supporting the vitamins and supplements industry (e.g., an aging U.S. baby boomer population and increasing public health awareness) continue to exist, which should ultimately bode well for Vitamin Shoppe. The Fund continues to hold this position. Huntsman Corporation manufactures adhesives and coatings used in a myriad of industries. The company encountered headwinds associated with a subdued pricing environment within its polyurethanes and pigments segments, which appeared to lead some customers to delay orders during the period. The PM team believes eventual stabilization of the pricing environment is likely to support re-acceleration of customer order growth going forward. The Fund continues to hold this position. Veeco Instruments, Inc. (“Veeco”) produces light-emitting diode products and systems used in a variety of applications. Share prices waned toward the end of the period as near-term weakness within the company’s Chinese segment appeared to weigh on the stock. Despite the near-term challenges, the PM team believes Veeco remains a dominant player in a key industry expected to see growth in the form of a multi-year upgrade cycle as general lighting applications transition to LED bulbs. The Fund continues to hold this position. Colfax Corporation (“Colfax”) manufactures fluid and gas-handling technology serving the petrochemical, oil, and gas industries. The end-market (e.g., China) appeared to temper the company’s results in the midst of a challenging capital expenditure environment. The PM team believes that when the energy markets re-find their footing, growth prospects for Colfax should re-emerge as capital expenditure conditions improve. The Fund continues to hold this stock. Vince Holding Corp., an apparel and accessories company, encountered sustained weakness within its wholesale segment while the unexpected departure of its CFO appeared to cloud the market perspective on the company’s near- to mid-term strategic direction. The Fund sold its position in this stock.

Top performers | Anacor Pharmaceuticals, Inc. is a company that focuses on therapies used to treat skin-related conditions. Share prices jumped as the company reported positive phase-3 results for a potential eczema-treatment compound. The Fund continues to hold this position. JetBlue Airways Corporation, a leading airline carrier, appears to be benefitting from a more disciplined and rational competitive environment as well as lower fuel prices. The Fund continues to hold this position. Thoratec Corporation is a developer of medical devices used to support patients with failing hearts. The company agreed to be acquired by St. Jude Medical Inc., during the period at a sizeable premium. The Fund held the position through the acquisition close. Proofpoint, Inc. provides software-as-a-service based comprehensive email security solutions for enterprise users. The PM team believes the company has benefitted from a strong product offering as well as associated tailwinds in cybersecurity as companies increasingly look to address and enhance the safety of their data networks. The Fund continues to hold this stock. Receptos, Inc., a developer of drug treatments for conditions such as multiple sclerosis, ulcerative colitis, and irritable-bowel syndrome, agreed to be acquired by Celgene Corp. during the period at a substantial premium. The Fund held the position through the acquisition close.

Performance Summary and Commentary

| | |

| |

| | | |

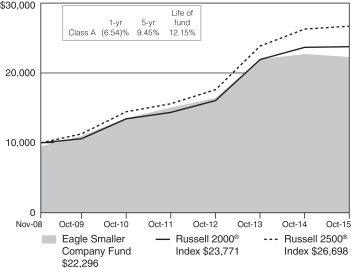

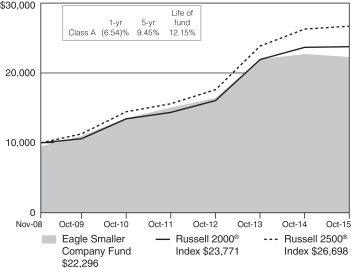

| Eagle Smaller Company Fund | | |

Portfolio Managers | Charles Schwartz, CFA®, Betsy Pecor, CFA®, and Matthew McGeary, CFA®, are Co-Portfolio Managers of the Eagle Smaller Company Fund (the “Fund”) and have been responsible for the day-to-day management of the Fund’s investment portfolio since its October 2014.

Performance discussion | For the fiscal year ended October 31, 2015, the Fund’s Class A shares returned (1.88)% (excluding front-end sales charges of 4.75%), underperforming both benchmark indices, the Russell 2000® Index and, secondarily, the Russell 2500® Index, which returned 0.34% and 1.50%, respectively. The Fund’s performance, relative to the benchmarks, benefited from strong performance in the health care sector due to strong stock selection in health care providers and a lack of exposure to biotechnology. In addition, the Fund was slightly overweight in the materials sector where stock selection in the metals and mining industry benefited the Fund. In contrast, the Fund’s holdings in the consumer discretionary sector underperformed the benchmark which the Portfolio Management team (“PM team”) believes is due to negative news about several companies. Furthermore, the Fund’s relative performance suffered due to lower allocations to highly defensive and high-yielding sectors, including utilities and telecommunications. Please keep in mind that an index is not available for direct investment; therefore its performance does not reflect the expenses associated with the active management of an actual portfolio.

Growth of a $10,000 investment from 11/3/08 to 10/31/15 (a)

(a) The Fund’s values and returns reflect the maximum front-end sales charge of 4.75%, fund expenses and the reinvestment of dividends; however, they do not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

Underperformers | Helix Energy Solutions Group, Inc., a specialized service provider to the offshore oil and gas industry, underperformed during the reporting period apparently due to the decline in the price of crude oil. In response to weak commodity prices, oil and gas producers appear to have radically reduced capital spending in order to preserve liquidity. Platform Specialty Products Corp., a producer of specialty chemicals for the electronics and agricultural markets, has grown rapidly through an acquisition over the past year. However, the stock has underperformed due to what the PM team believes are increasing concerns about the near-term health of its agricultural business and its exposure to weak currencies such as the Brazilian Real. LifeLock, Inc. is a provider of identity theft and fraud services. The company’s shares underperformed as the Company entered into litigation with the Federal Trade Commission and management reduced its fiscal 2015 guidance to reflect the likelihood of negative publicity. Tangoe, Inc., a provider of software solutions to help organizations manage and optimize their complex array of communications services and assets, reported lackluster financial results during the year, which appeared to cause some investors to question the organic growth rate of the business. The PM team decided to move to the sidelines on this stock until better execution and an accelerating organic growth rate are apparent. Iconix Brand Group, Inc. owns, licenses, and markets a growing portfolio of consumer brands. The company underperformed after the departures of the chief operating officer and chief financial officer following a period of weak operating results. The Fund no longer holds any of the securities noted above as “underperformers.”

Top performers | NICE-Systems Ltd., Sponsored ADR, a leading cyber security and software company, has reported strong recent results and raised future guidance based on an uptick in cyber-crime. The Fund continues to hold this position. SolarWinds, Inc., a provider of infrastructure management software to IT professionals, recently announced it had entered into an agreement to be acquired by a private equity technology investment firm. The Fund continues to hold this position. ICU Medical, Inc., which manufactures disposable products used in intravenous therapies, posted strong recent financial results. The PM team believes that the company has improved its manufacturing processes, bolstered product development and created strong financial-reporting communication to investors. The Fund continues to maintain a position in the security. Prestige Brands Holdings, Inc. is a leading provider of over-the-counter drug products. The company has delivered strong financial results which appeared to be driven by healthy organic sales growth and tight cost controls. The PM team likes how this company is positioned in the market and believes the management team is executing well. The Fund continues to maintain a position in the security. AmTrust Financial Services Inc., a specialty property and casualty insurance company, performed well recently apparently due to better than expected earnings growth driven by upside in net earned premium, service and fee income, and book value per share growth. The PM team elected to exit the Fund’s position due to valuation concerns.

Description of Indices

The Barclays Capital U.S. Intermediate Government/Credit Bond Index includes U.S. government and investment grade credit securities that have a greater than or equal to one year and less than ten years remaining to maturity and have $250,000,000 or more of outstanding face value. The returns of the index do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The MSCI EAFE® Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of December 31, 2013, the index consisted of 21 developed market country indices. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell 2500TM Index measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500 is a subset of the Russell 3000® Index. It includes approximately 2,500 of the smallest securities based on a combination of their market cap and current index membership. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 Index companies with higher price-to-value ratios and higher forecasted growth values. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The Russell Midcap® Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The S&P 500® Index is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

The S&P MidCap 400® Index is an unmanaged index that measures the performance of the mid-sized company segment of the U.S. market. Its returns do not include the effect of any sales charges. That means that actual returns would be lower if they included the effect of sales charges.

Investment Portfolios

| | | | | | | | | | |

| EAGLE CAPITAL APPRECIATION FUND | | | | | | | | |

| COMMON STOCKS—98.9% | | | | Shares | | | Value | |

| Aerospace & defense—4.9% | | | | | | | | | | |

General Dynamics Corp. | | | | | 24,400 | | | | $3,625,352 | |

Honeywell International, Inc. | | | | | 46,480 | | | | 4,800,455 | |

Northrop Grumman Corp. | | | | | 45,600 | | | | 8,561,400 | |

| | | |

| Airlines—2.4% | | | | | | | | | | |

Delta Air Lines, Inc. | | | | | 115,500 | | | | 5,872,020 | |

JetBlue Airways Corp.* | | | | | 97,600 | | | | 2,424,384 | |

| | | |

| Auto components—1.5% | | | | | | | | | | |

Lear Corp. | | | | | 42,800 | | | | 5,352,568 | |

| | | |

| Beverages—3.6% | | | | | | | | | | |

Molson Coors Brewing Co., Class B | | | | | 46,900 | | | | 4,131,890 | |

PepsiCo, Inc. | | | | | 83,321 | | | | 8,514,573 | |

| | | |

| Biotechnology—7.0% | | | | | | | | | | |

AbbVie, Inc. | | | | | 54,700 | | | | 3,257,385 | |

Amgen, Inc. | | | | | 43,700 | | | | 6,912,466 | |

Celgene Corp.* | | | | | 34,900 | | | | 4,282,579 | |

Gilead Sciences, Inc. | | | | | 91,000 | | | | 9,839,830 | |

| | | |

| Building products—0.8% | | | | | | | | | | |

Owens Corning | | | | | 62,700 | | | | 2,854,731 | |

| | | |

| Capital markets—1.3% | | | | | | | | | | |

The Goldman Sachs Group, Inc. | | | | | 23,600 | | | | 4,425,000 | |

| | | |

| Chemicals—2.0% | | | | | | | | | | |

LyondellBasell Industries N.V., Class A | | | | | 53,100 | | | | 4,933,521 | |

The Mosaic Co. | | | | | 55,300 | | | | 1,868,587 | |

| | | |

| Communications equipment—2.3% | | | | | | | | | | |

Harris Corp. | | | | | 38,800 | | | | 3,070,244 | |

Juniper Networks, Inc. | | | | | 163,400 | | | | 5,129,126 | |

| | | |

| Diversified telecommunication—2.7% | | | | | | | | | | |

AT&T, Inc. | | | | | 101,181 | | | | 3,390,575 | |

Verizon Communications, Inc. | | | | | 129,000 | | | | 6,047,520 | |

| | | |

| Food & staples retailing—3.6% | | | | | | | | | | |

CVS Health Corp. | | | | | 67,300 | | | | 6,647,894 | |

The Kroger Co. | | | | | 156,100 | | | | 5,900,580 | |

| | | |

| Food products—1.9% | | | | | | | | | | |

Archer-Daniels-Midland Co. | | | | | 87,100 | | | | 3,976,986 | |

Tyson Foods, Inc., Class A | | | | | 58,100 | | | | 2,577,316 | |

| | | |

| Health care equipment & supplies—1.9% | | | | | | | | | | |

Edwards Lifesciences Corp.* | | | | | 31,600 | | | | 4,965,940 | |

St. Jude Medical, Inc. | | | | | 25,800 | | | | 1,646,298 | |

| | | |

| Health care providers & services—7.9% | | | | | | | | | | |

Aetna, Inc. | | | | | 37,500 | | | | 4,304,250 | |

Cardinal Health, Inc. | | | | | 37,200 | | | | 3,057,840 | |

Cigna Corp. | | | | | 30,800 | | | | 4,128,432 | |

Laboratory Corp. of America Holdings* | | | | | 32,800 | | | | 4,025,872 | |

McKesson Corp. | | | | | 28,800 | | | | 5,149,440 | |

UnitedHealth Group, Inc. | | | | | 59,800 | | | | 7,043,244 | |

| | | |

| Hotels restaurants & leisure—1.4% | | | | | | | | | | |

Darden Restaurants, Inc. | | | | | 46,400 | | | | 2,871,696 | |

Marriott International, lnc., Class A | | | | | 25,495 | | | | 1,957,506 | |

| | | |

| Household durables—1.8% | | | | | | | | | | |

D.R. Horton, Inc. | | | | | 135,600 | | | | 3,992,064 | |

Mohawk Industries, Inc.* | | | | | 10,900 | | | | 2,130,950 | |

| | | | | | | | | | |

| | | |

| COMMON STOCKS—98.9% | | | | Shares | | | Value | |

| Insurance—1.3% | | | | | | | | | | |

FNF Group | | | | | 66,740 | | | | $2,354,587 | |

XL Group PLC | | | | | 57,500 | | | | 2,189,600 | |

| | | |

| Internet & catalog retail—2.8% | | | | | | | | | | |

Amazon.com, Inc.* | | | | | 15,600 | | | | 9,764,040 | |

| | | |

| Internet software & services—7.0% | | | | | | | | | | |

Alphabet, Inc., Class A* | | | | | 13,614 | | | | 10,038,827 | |

Alphabet, Inc., Class C* | | | | | 10,512 | | | | 7,472,035 | |

Facebook, Inc., Class A* | | | | | 67,700 | | | | 6,903,369 | |

| | | |

| IT services—7.2% | | | | | | | | | | |

Amdocs Ltd. | | | | | 54,000 | | | | 3,216,780 | |

Fiserv, Inc.* | | | | | 45,700 | | | | 4,410,507 | |

FleetCor Technologies, Inc.* | | | | | 13,800 | | | | 1,999,068 | |

International Business Machines Corp. | | | | | 11,200 | | | | 1,568,896 | |

MasterCard, Inc., Class A | | | | | 93,630 | | | | 9,268,434 | |

Vantiv, Inc., Class A* | | | | | 95,404 | | | | 4,784,510 | |

| | | |

| Life sciences tools & services—1.1% | | | | | | | | | | |

Thermo Fisher Scientific, Inc. | | | | | 30,600 | | | | 4,001,868 | |

| | | |

| Media—3.8% | | | | | | | | | | |

Comcast Corp., Class A | | | | | 65,200 | | | | 4,082,824 | |

The Walt Disney Co. | | | | | 56,500 | | | | 6,426,310 | |

Time Warner, Inc. | | | | | 34,400 | | | | 2,591,696 | |

| | | |

| Oil, gas & consumable fuels—2.5% | | | | | | | | | | |

Marathon Petroleum Corp. | | | | | 46,400 | | | | 2,403,520 | |

Tesoro Corp. | | | | | 31,700 | | | | 3,389,681 | |

Valero Energy Corp. | | | | | 46,500 | | | | 3,065,280 | |

| | | |

| Pharmaceuticals—0.7% | | | | | | | | | | |

Allergan PLC* | | | | | 7,863 | | | | 2,425,500 | |

| |

| Real estate management & development—1.1% | | | | | |

CBRE Group, Inc., Class A* | | | | | 105,047 | | | | 3,916,152 | |

| | | |

| Semiconductors & semiconductor equipment—1.9% | | | | | | | | | | |

Lam Research Corp. | | | | | 45,300 | | | | 3,469,527 | |

Skyworks Solutions, Inc. | | | | | 40,400 | | | | 3,120,496 | |

| | | |

| Software—6.8% | | | | | | | | | | |

Electronic Arts, Inc.* | | | | | 90,200 | | | | 6,500,714 | |

Microsoft Corp. | | | | | 185,000 | | | | 9,738,400 | |

Oracle Corp. | | | | | 112,000 | | | | 4,350,080 | |

Synopsys, Inc.* | | | | | 66,000 | | | | 3,298,680 | |

| | | |

| Specialty retail—5.2% | | | | | | | | | | |

Foot Locker, Inc. | | | | | 50,900 | | | | 3,448,475 | |

Lowe’s Cos., Inc. | | | | | 89,245 | | | | 6,588,958 | |

The Home Depot, Inc. | | | | | 65,000 | | | | 8,036,600 | |

| | | |

| Technology hardware, storage & peripherals—5.8% | | | | | | | | | | |

Apple, Inc. | | | | | 168,866 | | | | 20,179,487 | |

| | | |

| Textiles, apparel & luxury goods—2.5% | | | | | | | | | | |

NIKE, Inc., Class B | | | | | 65,452 | | | | 8,576,176 | |

| | | |

| Tobacco—2.2% | | | | | | | | | | |

Reynolds American, Inc. | | | | | 157,100 | | | | 7,591,072 | |

| Total common stocks (cost $234,186,056) | | | | | | | | | 344,842,663 | |

| | | | |

| The accompanying notes are an integral part of the financial statements. | | | 11 | |

Investment Portfolios

| | | | | | | | | | |

| EAGLE CAPITAL APPRECIATION FUND (cont’d) | | | | |

| MONEY MARKET FUNDS—1.0% | | | | Shares | | | Value | |

Fidelity Institutional Money Market Funds—Government Portfolio—Institutional Shares, 0.01% # | | | | | 3,338,352 | | | | $ 3,338,352 | |

| Total money market funds (cost $3,338,352) | | | | 3,338,352 | |

| |

| Total investment portfolio (cost $237,524,408) 99.9% ‡ | | | | 348,181,015 | |

| | | |

Other assets in excess of liabilities 0.1% | | | | | | | | | 503,002 | |

| | | |

| Total net assets 100.0% | | | | | | | | | $348,684,017 | |

* Non-income producing security

# Annualized seven-day yield as of October 31, 2015

‡ As of October 31, 2015, aggregate cost for federal income tax purposes was $237,946,938, Net unrealized appreciation (depreciation) on a tax-basis was $110,234,077, including aggregate gross unrealized appreciation and depreciation of $114,010,214 and $(3,776,137), respectively. The difference between book-basis and tax-basis unrealized appreciation (depreciation) was primarily attributable to deferral of losses from wash sales.

| | | | |

| |

| Sector allocation (unaudited) | | | |

| Sector | | Percent of net assets | |

| Information technology | | | 31.1% | |

| Consumer discretionary | | | 18.9% | |

| Health care | | | 18.7% | |

| Consumer staples | | | 11.3% | |

| Industrials | | | 8.1% | |

| Financials | | | 3.7% | |

| Telecommunication services | | | 2.7% | |

| Energy | | | 2.5% | |

| Materials | | | 1.9% | |

| Money market funds | | | 1.0% | |

| | | | | | | | | | |

| | | | |

| EAGLE GROWTH & INCOME FUND | | | | | | | | |

| COMMON STOCKS—99.5% | | | | Shares | | | Value | |

| Aerospace & defense—5.7% | | | | | | | | | | |

Honeywell International, Inc. | | | | | 184,487 | | | | $19,053,817 | |

United Technologies Corp. | | | | | 142,035 | | | | 13,977,664 | |

| | | |

| Banks—8.7% | | | | | | | | | | |

JPMorgan Chase & Co. | | | | | 195,203 | | | | 12,541,793 | |

The PNC Financial Services Group, Inc. | | | | | 209,827 | | | | 18,938,985 | |

Wells Fargo & Co. | | | | | 353,791 | | | | 19,154,245 | |

| | | |

| Beverages—5.3% | | | | | | | | | | |

PepsiCo, Inc. | | | | | 164,515 | | | | 16,811,788 | |

The Coca-Cola Co. | | | | | 332,881 | | | | 14,097,510 | |

| | | |

| Chemicals—2.2% | | | | | | | | | | |

E.I. du Pont de Nemours & Co. | | | | | 202,302 | | | | 12,825,947 | |

| | | |

| Commercial services & supplies—2.9% | | | | | | | | | | |

Tyco International PLC | | | | | 454,534 | | | | 16,563,219 | |

| | | |

| Communications equipment—2.8% | | | | | | | | | | |

Cisco Systems, Inc. | | | | | 564,666 | | | | 16,290,614 | |

| | | | | | | | | | |

| | | |

| COMMON STOCKS—99.5% | | | | Shares | | | Value | |

| Diversified telecommunication—2.0% | | | | | | | | | | |

AT&T, Inc. | | | | | 337,301 | | | | $11,302,957 | |

| | | |

| Food & staples retailing—2.7% | | | | | | | | | | |

Sysco Corp. | | | | | 380,646 | | | | 15,701,648 | |

| | | |

| Food products—2.3% | | | | | | | | | | |

General Mills, Inc. | | | | | 224,166 | | | | 13,026,286 | |

| | | |

| Health care equipment & supplies—6.2% | | | | | | | | | | |

Abbott Laboratories | | | | | 424,264 | | | | 19,007,027 | |

St. Jude Medical, Inc. | | | | | 267,125 | | | | 17,045,246 | |

| | | |

| Hotels restaurants & leisure—1.9% | | | | | | | | | | |

McDonald’s Corp. | | | | | 99,120 | | | | 11,126,220 | |

| | | |

| Household products—2.5% | | | | | | | | | | |

The Procter & Gamble Co. | | | | | 191,647 | | | | 14,637,998 | |

| | | |

| Industrial conglomerates—3.8% | | | | | | | | | | |

3M Co. | | | | | 141,030 | | | | 22,171,326 | |

| | | |

| Media—3.9% | | | | | | | | | | |

Regal Entertainment Group, Class A | | | | | 1,177,939 | | | | 22,828,458 | |

| | | |

| Multi-utilities—3.8% | | | | | | | | | | |

PG&E Corp. | | | | | 202,529 | | | | 10,815,049 | |

Sempra Energy | | | | | 111,676 | | | | 11,436,739 | |

| | | |

| Oil, gas & consumable fuels—8.6% | | | | | | | | | | |

Chevron Corp. | | | | | 136,918 | | | | 12,443,108 | |

ConocoPhillips | | | | | 240,602 | | | | 12,836,117 | |

Occidental Petroleum Corp. | | | | | 178,523 | | | | 13,307,104 | |

TOTAL S.A., Sponsored ADR | | | | | 238,914 | | | | 11,522,822 | |

| | | |

| Pharmaceuticals—10.8% | | | | | | | | | | |

Johnson & Johnson | | | | | 183,725 | | | | 18,561,737 | |

Merck & Co., Inc. | | | | | 370,044 | | | | 20,226,605 | |

Pfizer, Inc. | | | | | 711,340 | | | | 24,057,519 | |

| | | |

| Real estate investment trusts (REITs)—4.1% | | | | | | | | | | |

Camden Property Trust | | | | | 110,180 | | | | 8,130,182 | |

Prologis, Inc. | | | | | 196,553 | | | | 8,398,710 | |

Simon Property Group, Inc. | | | | | 35,241 | | | | 7,099,652 | |

| | | |

| Road & rail—2.5% | | | | | | | | | | |

Union Pacific Corp. | | | | | 164,014 | | | | 14,654,651 | |

| | | |

| Semiconductors & semiconductor equipment—2.8% | | | | | | | | | | |

Applied Materials, Inc. | | | | | 974,479 | | | | 16,342,013 | |

| | | |

| Software—4.7% | | | | | | | | | | |

Microsoft Corp. | | | | | 512,201 | | | | 26,962,261 | |

| | | |

| Specialty retail—3.0% | | | | | | | | | | |

The Home Depot, Inc. | | | | | 140,399 | | | | 17,358,932 | |

| | | |

| Technology hardware, storage & peripherals—4.1% | | | | | | | | | | |

Apple, Inc. | | | | | 201,253 | | | | 24,049,733 | |

| | | |

| Tobacco—2.2% | | | | | | | | | | |

Altria Group, Inc. | | | | | 207,345 | | | | 12,538,152 | |

| Total common stocks (cost $452,339,243) | | | | | | | | | 577,843,834 | |

| | |

| 12 | | The accompanying notes are an integral part of the financial statements. |

Investment Portfolios

| | | | | | | | | | |

| | | |

| EAGLE GROWTH & INCOME FUND (cont’d) | | | | | | | | |

| MONEY MARKET FUNDS—0.6% | | | | Shares | | | Value | |

Fidelity Institutional Money Market Funds—Government Portfolio—Institutional Shares, 0.01% # | | | | | 3,636,636 | | | | $3,636,636 | |

| Total money market funds (cost $3,636,636) | | | | 3,636,636 | |

| |

| Total investment portfolio (cost $455,975,879) 100.1% ‡ | | | | 581,480,470 | |

| | | |

Liabilities in excess of other assets (0.1)% | | | | | | | | | (570,602 | ) |

| | | |

| Total net assets 100.0% | | | | | | | | | $580,909,868 | |

# Annualized seven-day yield as of October 31, 2015.

‡ As of October 31, 2015, aggregate cost for federal income tax purposes was $455,039,136, Net unrealized appreciation (depreciation) on a tax-basis was $126,441,334, including aggregate gross unrealized appreciation and depreciation of $138,321,251 and $(11,879,917), respectively. The difference between book-basis and tax-basis unrealized appreciation (depreciation) was primarily attributable to deferral of losses from wash sales.

ADR—American depository receipt

| | | | |

| |

| Sector allocation (unaudited) | | | |

| Sector | | Percent of net assets | |

| Health care | | | 17.0% | |

| Consumer staples | | | 15.0% | |

| Industrials | | | 14.9% | |

| Information technology | | | 14.4% | |

| Financials | | | 12.8% | |

| Consumer discretionary | | | 8.8% | |

| Energy | | | 8.6% | |

| Utilities | | | 3.8% | |

| Materials | | | 2.2% | |

| Telecommunication services | | | 2.0% | |

| Money market funds | | | 0.6% | |

| | | | | | | | | | |

| | | | |

| EAGLE INTERNATIONAL STOCK FUND | | | | | | | | |

| COMMON STOCKS—97.5% | | | | Shares | | | Value | |

| Australia—4.9% | | | | | | | | | | |

Aristocrat Leisure Ltd. | | | | | 38,375 | | | | $253,310 | |

Dexus Property Group | | | | | 14,585 | | | | 80,062 | |

Macquarie Group Ltd. | | | | | 575 | | | | 34,816 | |

OZ Minerals Ltd. | | | | | 19,124 | | | | 58,687 | |

Qantas Airways Ltd.* | | | | | 52,539 | | | | 147,989 | |

Suncorp Group Ltd. | | | | | 10,171 | | | | 94,484 | |

Treasury Wine Estates Ltd. | | | | | 31,715 | | | | 158,735 | |

| | | |

| Austria—0.5% | | | | | | | | | | |

Erste Group Bank AG* | | | | | 3,029 | | | | 88,822 | |

| | | |

| Belgium—0.5% | | | | | | | | | | |

AGFA-Gevaert N.V.* | | | | | 12,898 | | | | 54,980 | |

Elia System Operator S.A. | | | | | 710 | | | | 34,344 | |

| | | |

| Denmark—2.0% | | | | | | | | | | |

Danske Bank A/S | | | | | 11,151 | | | | 306,805 | |

DFDS A/S | | | | | 1,306 | | | | 39,667 | |

| | | | | | | | | | |

| | | |

| COMMON STOCKS—97.5% | | | | Shares | | | Value | |

| Finland—0.4% | | | | | | | | | | |

UPM-Kymmene OYJ | | | | | 3,957 | | | | $74,079 | |

| | | |

| France—8.0% | | | | | | | | | | |

BNP Paribas S.A. | | | | | 4,520 | | | | 273,899 | |

Cap Gemini S.A. | | | | | 705 | | | | 62,686 | |

Cie de Saint-Gobain S.A. | | | | | 979 | | | | 40,982 | |

Cie Generale des Etablissements Michelin | | | | | 1,462 | | | | 145,434 | |

Credit Agricole S.A. | | | | | 11,542 | | | | 145,781 | |

Nexans S.A.* | | | | | 1,511 | | | | 60,064 | |

Orange S.A. | | | | | 12,039 | | | | 212,268 | |

Renault S.A. | | | | | 2,886 | | | | 271,931 | |

Societe Generale S.A. | | | | | 3,016 | | | | 140,073 | |

| | | |

| Germany—13.9% | | | | | | | | | | |

Allianz SE | | | | | 1,136 | | | | 198,877 | |

Bayer AG | | | | | 1,545 | | | | 206,003 | |

Commerzbank AG* | | | | | 8,918 | | | | 98,078 | |

Daimler AG | | | | | 4,583 | | | | 397,409 | |

Deutsche Bank AG | | | | | 3,134 | | | | 87,717 | |

Deutsche Lufthansa AG* | | | | | 5,415 | | | | 79,967 | |

E.ON SE | | | | | 19,098 | | | | 201,468 | |

Fresenius SE & Co. KGaA | | | | | 4,439 | | | | 326,188 | |

Gerresheimer AG | | | | | 1,564 | | | | 121,953 | |