UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04777

MFS SERIES TRUST I

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: August 31

Date of reporting period: February 28, 2015

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

SEMIANNUAL REPORT

February 28, 2015

MFS® CORE EQUITY FUND

RGI-SEM

MFS® CORE EQUITY FUND

CONTENTS

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

LETTER FROM THE CHAIRMAN

Dear Shareholders:

Lower oil prices continue to influence markets in different ways. Among those economies hurt, oil-exporters such as Russia and Venezuela have been hit particularly hard, along with U.S. regions that have close oil industry ties.

The U.S. economic recovery remains solid. The labor market is strong, interest rates are historically low and reduced energy prices have helped to stimulate consumer spending.

Economic reports early in 2015 indicate that the eurozone is on a more solid footing, with confidence boosted by the launch of European Central Bank quantitative easing.

In Asia, the Chinese economy continues to raise concerns, with the People’s Bank of China implementing stimulus programs to counter a steady decline in growth rates.

As always, active risk management is integral to how we at MFS® manage your investments. We use a collaborative process, sharing insights across asset classes, regions and economic sectors. Our global investment team uses a diversified, multidisciplined, long-term approach.

Applying proven principles, such as asset allocation and diversification, can best serve investors over the long term. We are confident that this approach can help you as you work with your financial advisors to reach your goals in the years ahead.

Respectfully,

Robert J. Manning

Chairman

MFS Investment Management

April 14, 2015

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

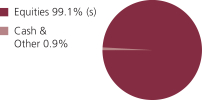

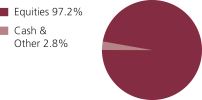

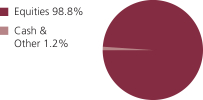

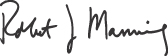

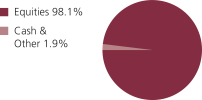

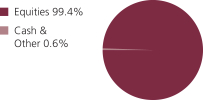

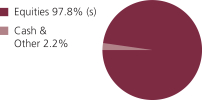

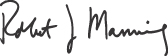

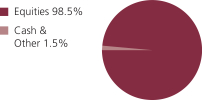

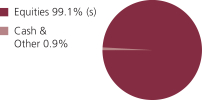

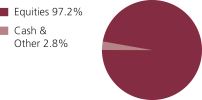

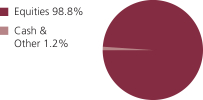

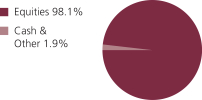

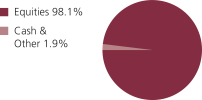

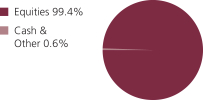

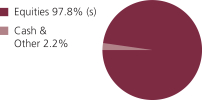

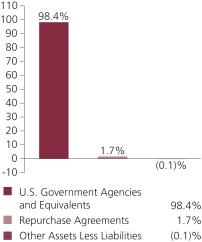

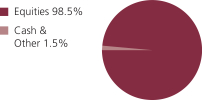

PORTFOLIO COMPOSITION

Portfolio structure

| | | | |

| Top ten holdings | | | | |

| Apple, Inc. | | | 2.9% | |

| Hess Corp. | | | 1.8% | |

| Actavis PLC | | | 1.7% | |

| JPMorgan Chase & Co. | | | 1.6% | |

| Visa, Inc., “A” | | | 1.6% | |

| Wells Fargo & Co. | | | 1.6% | |

| American International Group, Inc. | | | 1.6% | |

| Twenty-First Century Fox, Inc. | | | 1.2% | |

| CVS Health Corp. | | | 1.2% | |

| Honeywell International, Inc. | | | 1.2% | |

| | | | |

| Equity sectors | | | | |

| Financial Services | | | 17.5% | |

| Technology | | | 15.9% | |

| Health Care | | | 14.7% | |

| Industrial Goods & Services | | | 7.6% | |

| Retailing | | | 7.3% | |

| Energy | | | 6.9% | |

| Consumer Staples | | | 6.6% | |

| Utilities & Communications | | | 5.4% | |

| Leisure (s) | | | 4.9% | |

| Basic Materials | | | 4.4% | |

| Special Products & Services | | | 4.1% | |

| Transportation | | | 2.1% | |

| Autos & Housing | | | 1.7% | |

| (s) | Includes securities sold short. |

Cash & Other can include cash, other assets less liabilities, offsets to derivative positions, and short-term securities.

Percentages are based on net assets as of 2/28/15.

The portfolio is actively managed and current holdings may be different.

2

EXPENSE TABLE

Fund expenses borne by the shareholders during the period, September 1, 2014 through February 28, 2015

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period September 1, 2014 through February 28, 2015.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

3

Expense Table – continued

| | | | | | | | | | | | | | | | | | |

Share

Class | | | | Annualized Expense Ratio | | | Beginning Account Value 9/01/14 | | | Ending Account Value 2/28/15 | | | Expenses Paid During Period (p) 9/01/14-2/28/15 | |

| A | | Actual | | | 1.04% | | | | $1,000.00 | | | | $1,062.93 | | | | $5.32 | |

| | Hypothetical (h) | | | 1.04% | | | | $1,000.00 | | | | $1,019.64 | | | | $5.21 | |

| B | | Actual | | | 1.80% | | | | $1,000.00 | | | | $1,058.97 | | | | $9.19 | |

| | Hypothetical (h) | | | 1.80% | | | | $1,000.00 | | | | $1,015.87 | | | | $9.00 | |

| C | | Actual | | | 1.79% | | | | $1,000.00 | | | | $1,059.11 | | | | $9.14 | |

| | Hypothetical (h) | | | 1.79% | | | | $1,000.00 | | | | $1,015.92 | | | | $8.95 | |

| I | | Actual | | | 0.80% | | | | $1,000.00 | | | | $1,064.27 | | | | $4.09 | |

| | Hypothetical (h) | | | 0.80% | | | | $1,000.00 | | | | $1,020.83 | | | | $4.01 | |

| R1 | | Actual | | | 1.80% | | | | $1,000.00 | | | | $1,058.76 | | | | $9.19 | |

| | Hypothetical (h) | | | 1.80% | | | | $1,000.00 | | | | $1,015.87 | | | | $9.00 | |

| R2 | | Actual | | | 1.30% | | | | $1,000.00 | | | | $1,061.66 | | | | $6.65 | |

| | Hypothetical (h) | | | 1.30% | | | | $1,000.00 | | | | $1,018.35 | | | | $6.51 | |

| R3 | | Actual | | | 1.05% | | | | $1,000.00 | | | | $1,062.80 | | | | $5.37 | |

| | Hypothetical (h) | | | 1.05% | | | | $1,000.00 | | | | $1,019.59 | | | | $5.26 | |

| R4 | | Actual | | | 0.80% | | | | $1,000.00 | | | | $1,063.96 | | | | $4.09 | |

| | Hypothetical (h) | | | 0.80% | | | | $1,000.00 | | | | $1,020.83 | | | | $4.01 | |

| R5 | | Actual | | | 0.70% | | | | $1,000.00 | | | | $1,064.63 | | | | $3.58 | |

| | Hypothetical (h) | | | 0.70% | | | | $1,000.00 | | | | $1,021.32 | | | | $3.51 | |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Notes to Expense Table

Each class with a Rule 12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above. For Class A shares, this rebate reduced the expense ratio above by 0.01%. See Note 3 in the Notes to Financial Statements for additional information.

4

PORTFOLIO OF INVESTMENTS

2/28/15 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Common Stocks - 99.3% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Aerospace - 3.6% | | | | | | | | |

| Honeywell International, Inc. | | | 154,688 | | | $ | 15,898,833 | |

| Northrop Grumman Corp. | | | 62,066 | | | | 10,284,957 | |

| Precision Castparts Corp. | | | 21,980 | | | | 4,754,274 | |

| Textron, Inc. | | | 55,069 | | | | 2,440,107 | |

| United Technologies Corp. | | | 125,451 | | | | 15,293,731 | |

| | | | | | | | |

| | | | | | | $ | 48,671,902 | |

| Alcoholic Beverages - 0.3% | | | | | | | | |

| Constellation Brands, Inc., “A” (a) | | | 35,941 | | | $ | 4,123,152 | |

| | |

| Apparel Manufacturers - 0.5% | | | | | | | | |

| PVH Corp. | | | 41,364 | | | $ | 4,406,507 | |

| VF Corp. | | | 33,207 | | | | 2,545,649 | |

| | | | | | | | |

| | | | | | | $ | 6,952,156 | |

| Automotive - 0.8% | | | | | | | | |

| Delphi Automotive PLC | | | 67,355 | | | $ | 5,310,268 | |

| Harley-Davidson, Inc. | | | 78,639 | | | | 4,999,081 | |

| | | | | | | | |

| | | | | | | $ | 10,309,349 | |

| Biotechnology - 2.4% | | | | | | | | |

| Alexion Pharmaceuticals, Inc. (a) | | | 49,380 | | | $ | 8,906,671 | |

| AMAG Pharmaceuticals, Inc. (a) | | | 131,800 | | | | 6,488,514 | |

| Biogen Idec, Inc. (a) | | | 29,389 | | | | 12,037,441 | |

| Exact Sciences Corp. (a)(l) | | | 25,454 | | | | 571,951 | |

| Illumina, Inc. (a) | | | 3,350 | | | | 654,791 | |

| MiMedx Group, Inc. (a) | | | 76,132 | | | | 787,966 | |

| Puma Biotechnology, Inc. (a) | | | 16,356 | | | | 3,483,992 | |

| | | | | | | | |

| | | | | | | $ | 32,931,326 | |

| Broadcasting - 2.0% | | | | | | | | |

| Time Warner, Inc. | | | 137,542 | | | $ | 11,259,188 | |

| Twenty-First Century Fox, Inc. | | | 465,917 | | | | 16,307,095 | |

| | | | | | | | |

| | | | | | | $ | 27,566,283 | |

| Brokerage & Asset Managers - 2.4% | | | | | | | | |

| Affiliated Managers Group, Inc. (a) | | | 13,060 | | | $ | 2,826,445 | |

| BlackRock, Inc. | | | 33,348 | | | | 12,386,114 | |

| Franklin Resources, Inc. | | | 180,909 | | | | 9,738,331 | |

| NASDAQ OMX Group, Inc. | | | 156,176 | | | | 7,833,788 | |

| | | | | | | | |

| | | | | | | $ | 32,784,678 | |

5

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Common Stocks - continued | | | | | | | | |

| Business Services - 2.6% | | | | | | | | |

| Accenture PLC, “A” | | | 56,421 | | | $ | 5,079,583 | |

| Bright Horizons Family Solutions, Inc. (a) | | | 160,148 | | | | 8,119,504 | |

| Equifax, Inc. | | | 31,849 | | | | 2,973,741 | |

| Fidelity National Information Services, Inc. | | | 98,172 | | | | 6,635,445 | |

| FleetCor Technologies, Inc. (a) | | | 17,524 | | | | 2,688,707 | |

| Gartner, Inc. (a) | | | 82,833 | | | | 6,884,251 | |

| Global Payments, Inc. | | | 26,242 | | | | 2,410,590 | |

| | | | | | | | |

| | | | | | | $ | 34,791,821 | |

| Cable TV - 1.3% | | | | | | | | |

| Charter Communications, Inc., “A” (a) | | | 32,991 | | | $ | 5,958,175 | |

| Comcast Corp., “Special A” | | | 68,562 | | | | 4,041,387 | |

| Time Warner Cable, Inc. | | | 46,740 | | | | 7,200,297 | |

| | | | | | | | |

| | | | | | | $ | 17,199,859 | |

| Chemicals - 1.5% | | | | | | | | |

| Agrium, Inc. | | | 41,368 | | | $ | 4,777,787 | |

| E.I. du Pont de Nemours & Co. | | | 124,282 | | | | 9,675,354 | |

| LyondellBasell Industries N.V., “A” | | | 66,253 | | | | 5,691,795 | |

| | | | | | | | |

| | | | | | | $ | 20,144,936 | |

| Computer Software - 3.7% | | | | | | | | |

| Adobe Systems, Inc. (a) | | | 115,428 | | | $ | 9,130,355 | |

| Check Point Software Technologies Ltd. (a) | | | 80,903 | | | | 6,754,591 | |

| Intuit, Inc. | | | 38,886 | | | | 3,796,440 | |

| Oracle Corp. | | | 234,456 | | | | 10,273,862 | |

| Qlik Technologies, Inc. (a) | | | 172,362 | | | | 5,591,423 | |

| Salesforce.com, Inc. (a) | | | 217,906 | | | | 15,118,318 | |

| | | | | | | | |

| | | | | | | $ | 50,664,989 | |

| Computer Software - Systems - 4.8% | | | | | | | | |

| Apple, Inc. (s) | | | 306,294 | | | $ | 39,346,527 | |

| EMC Corp. | | | 434,008 | | | | 12,560,192 | |

| Hewlett-Packard Co. | | | 70,164 | | | | 2,444,514 | |

| NCR Corp. (a) | | | 132,717 | | | | 3,903,207 | |

| Sabre Corp. | | | 130,249 | | | | 2,834,218 | |

| SS&C Technologies Holdings, Inc. | | | 72,893 | | | | 4,423,147 | |

| | | | | | | | |

| | | | | | | $ | 65,511,805 | |

| Construction - 1.0% | | | | | | | | |

| Fortune Brands Home & Security, Inc. | | | 124,836 | | | $ | 5,782,404 | |

| Pool Corp. | | | 7,213 | | | | 498,923 | |

| Sherwin-Williams Co. | | | 23,887 | | | | 6,812,572 | |

| | | | | | | | |

| | | | | | | $ | 13,093,899 | |

6

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Common Stocks - continued | | | | | | | | |

| Consumer Products - 2.2% | | | | | | | | |

| Colgate-Palmolive Co. | | | 124,021 | | | $ | 8,783,167 | |

| Estee Lauder Cos., Inc., “A” | | | 36,336 | | | | 3,003,897 | |

| Newell Rubbermaid, Inc. | | | 152,609 | | | | 5,996,008 | |

| Procter & Gamble Co. | | | 146,222 | | | | 12,447,879 | |

| | | | | | | | |

| | | | | | | $ | 30,230,951 | |

| Consumer Services - 1.5% | | | | | | | | |

| Nord Anglia Education, Inc. (a) | | | 290,309 | | | $ | 6,215,516 | |

| Priceline Group, Inc. (a) | | | 11,681 | | | | 14,455,004 | |

| | | | | | | | |

| | | | | | | $ | 20,670,520 | |

| Containers - 0.1% | | | | | | | | |

| Crown Holdings, Inc. (a) | | | 34,913 | | | $ | 1,850,389 | |

| | |

| Electrical Equipment - 2.1% | | | | | | | | |

| Advanced Drainage Systems, Inc. | | | 211,830 | | | $ | 5,751,185 | |

| AMETEK, Inc. | | | 138,219 | | | | 7,344,958 | |

| Danaher Corp. | | | 140,959 | | | | 12,302,902 | |

| W.W. Grainger, Inc. | | | 12,696 | | | | 3,007,809 | |

| | | | | | | | |

| | | | | | | $ | 28,406,854 | |

| Electronics - 3.7% | | | | | | | | |

| Avago Technologies Ltd. | | | 93,315 | | | $ | 11,908,860 | |

| Broadcom Corp., “A” | | | 151,570 | | | | 6,855,511 | |

| Freescale Semiconductor Ltd. (a) | | | 57,791 | | | | 2,086,833 | |

| KLA-Tencor Corp. | | | 58,266 | | | | 3,784,668 | |

| Mellanox Technologies Ltd. (a) | | | 91,587 | | | | 4,363,205 | |

| Rubicon Technology, Inc. (a)(l) | | | 233,726 | | | | 1,019,045 | |

| Skyworks Solutions, Inc. | | | 45,105 | | | | 3,957,964 | |

| Texas Instruments, Inc. | | | 249,257 | | | | 14,656,312 | |

| Ultratech, Inc. (a) | | | 88,502 | | | | 1,596,576 | |

| | | | | | | | |

| | | | | | | $ | 50,228,974 | |

| Energy - Independent - 3.3% | | | | | | | | |

| Anadarko Petroleum Corp. | | | 71,624 | | | $ | 6,032,890 | |

| Concho Resources, Inc. (a) | | | 16,404 | | | | 1,786,724 | |

| Energy XXI (Bermuda) Ltd. (l) | | | 80,076 | | | | 380,361 | |

| EOG Resources, Inc. | | | 65,372 | | | | 5,865,176 | |

| Goodrich Petroleum Corp. (a)(l) | | | 130,695 | | | | 585,514 | |

| Memorial Resource Development Corp. (a) | | | 155,791 | | | | 3,195,273 | |

| Noble Energy, Inc. | | | 56,350 | | | | 2,661,411 | |

| PDC Energy, Inc. (a) | | | 14,771 | | | | 763,365 | |

| Pioneer Natural Resources Co. | | | 18,913 | | | | 2,884,611 | |

| Rice Energy, Inc. (a) | | | 45,600 | | | | 892,848 | |

7

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Common Stocks - continued | | | | | | | | |

| Energy - Independent - continued | | | | | | | | |

| Rosetta Resources, Inc. (a) | | | 39,246 | | | $ | 695,832 | |

| Sanchez Energy Corp. (a)(l) | | | 39,475 | | | | 528,965 | |

| Targa Resources Corp. | | | 22,960 | | | | 2,286,357 | |

| Valero Energy Corp. | | | 256,910 | | | | 15,848,778 | |

| | | | | | | | |

| | | | | | | $ | 44,408,105 | |

| Energy - Integrated - 2.5% | | | | | | | | |

| Chevron Corp. (s) | | | 82,960 | | | $ | 8,850,173 | |

| Hess Corp. (s) | | | 329,550 | | | | 24,742,614 | |

| | | | | | | | |

| | | | | | | $ | 33,592,787 | |

| Food & Beverages - 2.9% | | | | | | | | |

| Coca-Cola Co. | | | 328,349 | | | $ | 14,217,512 | |

| General Mills, Inc. | | | 106,745 | | | | 5,741,814 | |

| Mondelez International, Inc. | | | 201,009 | | | | 7,424,267 | |

| Pinnacle Foods, Inc. | | | 109,212 | | | | 3,964,396 | |

| Snyders-Lance, Inc. | | | 90,017 | | | | 2,777,024 | |

| WhiteWave Foods Co., “A” (a) | | | 120,062 | | | | 4,916,539 | |

| | | | | | | | |

| | | | | | | $ | 39,041,552 | |

| Food & Drug Stores - 1.3% | | | | | | | | |

| CVS Health Corp. | | | 156,746 | | | $ | 16,281,207 | |

| Fairway Group Holdings Corp. (a)(l) | | | 367,443 | | | | 2,046,658 | |

| | | | | | | | |

| | | | | | | $ | 18,327,865 | |

| Gaming & Lodging - 0.8% | | | | | | | | |

| La Quinta Holdings, Inc. (a) | | | 107,826 | | | $ | 2,394,815 | |

| Wynn Resorts Ltd. | | | 59,491 | | | | 8,477,468 | |

| | | | | | | | |

| | | | | | | $ | 10,872,283 | |

| General Merchandise - 1.4% | | | | | | | | |

| Dollar Tree, Inc. (a) | | | 52,032 | | | $ | 4,145,910 | |

| Five Below, Inc. (a) | | | 93,897 | | | | 2,979,821 | |

| Kohl’s Corp. | | | 81,482 | | | | 6,013,372 | |

| Target Corp. | | | 67,850 | | | | 5,212,916 | |

| | | | | | | | |

| | | | | | | $ | 18,352,019 | |

| Health Maintenance Organizations - 1.2% | | | | | | | | |

| UnitedHealth Group, Inc. | | | 137,715 | | | $ | 15,648,555 | |

| | |

| Insurance - 2.5% | | | | | | | | |

| American International Group, Inc. | | | 384,742 | | | $ | 21,287,775 | |

| MetLife, Inc. | | | 252,465 | | | | 12,832,796 | |

| | | | | | | | |

| | | | | | | $ | 34,120,571 | |

8

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Common Stocks - continued | | | | | | | | |

| Internet - 3.0% | | | | | | | | |

| Facebook, Inc., “A “ (a) | | | 139,494 | | | $ | 11,015,841 | |

| Google, Inc., “A” (a) | | | 25,406 | | | | 14,294,178 | |

| Google, Inc., “C” (a) | | | 18,694 | | | | 10,438,730 | |

| LinkedIn Corp., “A” (a) | | | 20,980 | | | | 5,605,856 | |

| | | | | | | | |

| | | | | | | $ | 41,354,605 | |

| Machinery & Tools - 1.9% | | | | | | | | |

| Colfax Corp. (a) | | | 100,094 | | | $ | 5,272,952 | |

| IPG Photonics Corp. (a) | | | 51,361 | | | | 4,925,520 | |

| Joy Global, Inc. | | | 70,306 | | | | 3,115,962 | |

| Roper Industries, Inc. | | | 73,965 | | | | 12,394,315 | |

| | | | | | | | |

| | | | | | | $ | 25,708,749 | |

| Major Banks - 4.1% | | | | | | | | |

| Goldman Sachs Group, Inc. | | | 63,196 | | | $ | 11,993,969 | |

| JPMorgan Chase & Co. | | | 361,955 | | | | 22,180,602 | |

| Wells Fargo & Co. | | | 391,471 | | | | 21,448,696 | |

| | | | | | | | |

| | | | | | | $ | 55,623,267 | |

| Medical & Health Technology & Services - 1.1% | | | | | | | | |

| Cerner Corp. (a) | | | 28,479 | | | $ | 2,052,197 | |

| Express Scripts Holding Co. (a) | | | 66,371 | | | | 5,627,597 | |

| Healthcare Services Group, Inc. | | | 72,870 | | | | 2,446,246 | |

| McKesson Corp. | | | 21,011 | | | | 4,805,216 | |

| | | | | | | | |

| | | | | | | $ | 14,931,256 | |

| Medical Equipment - 4.3% | | | | | | | | |

| Abbott Laboratories | | | 225,751 | | | $ | 10,693,825 | |

| AtriCure, Inc. (a) | | | 89,720 | | | | 1,586,250 | |

| Cepheid, Inc. (a) | | | 31,261 | | | | 1,776,875 | |

| Cooper Cos., Inc. | | | 33,946 | | | | 5,566,126 | |

| DENTSPLY International, Inc. | | | 47,076 | | | | 2,495,499 | |

| DexCom, Inc. (a) | | | 25,666 | | | | 1,558,953 | |

| Heartware International, Inc. (a) | | | 9,293 | | | | 792,042 | |

| Inovalon Holdings, Inc., “A” (a) | | | 4,070 | | | | 126,414 | |

| Medtronic PLC | | | 189,707 | | | | 14,719,366 | |

| OraSure Technologies, Inc. (a) | | | 75,737 | | | | 542,277 | |

| STERIS Corp. | | | 15,178 | | | | 979,285 | |

| Stryker Corp. | | | 123,350 | | | | 11,687,413 | |

| TearLab Corp. (a)(l) | | | 289,159 | | | | 751,813 | |

| Thermo Fisher Scientific, Inc. | | | 39,243 | | | | 5,101,590 | |

| | | | | | | | |

| | | | | | | $ | 58,377,728 | |

9

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Common Stocks - continued | | | | | | | | |

| Metals & Mining - 0.3% | | | | | | | | |

| First Quantum Minerals Ltd. | | | 124,679 | | | $ | 1,580,803 | |

| Lundin Mining Corp. (a) | | | 531,117 | | | | 2,315,485 | |

| | | | | | | | |

| | | | | | | $ | 3,896,288 | |

| Natural Gas - Pipeline - 0.5% | | | | | | | | |

| Williams Cos., Inc. | | | 88,793 | | | $ | 4,354,409 | |

| Williams Partners LP | | | 50,629 | | | | 2,589,167 | |

| | | | | | | | |

| | | | | | | $ | 6,943,576 | |

| Network & Telecom - 0.6% | | | | | | | | |

| Cisco Systems, Inc. | | | 228,259 | | | $ | 6,735,923 | |

| Ixia (a) | | | 178,290 | | | | 2,028,940 | |

| | | | | | | | |

| | | | | | | $ | 8,764,863 | |

| Oil Services - 1.1% | | | | | | | | |

| Forum Energy Technologies, Inc. (a) | | | 33,435 | | | $ | 652,986 | |

| Halliburton Co. | | | 65,958 | | | | 2,832,237 | |

| Schlumberger Ltd. | | | 138,525 | | | | 11,658,264 | |

| | | | | | | | |

| | | | | | | $ | 15,143,487 | |

| Other Banks & Diversified Financials - 5.0% | | | | | | | | |

| American Express Co. | | | 180,203 | | | $ | 14,702,763 | |

| BB&T Corp. | | | 113,481 | | | | 4,317,952 | |

| Discover Financial Services | | | 249,152 | | | | 15,193,289 | |

| EuroDekania Ltd. | | | 580,280 | | | | 211,043 | |

| PrivateBancorp, Inc. | | | 191,778 | | | | 6,660,450 | |

| Texas Capital Bancshares, Inc. (a) | | | 92,500 | | | | 4,294,775 | |

| Visa, Inc., “A” | | | 81,660 | | | | 22,155,175 | |

| | | | | | | | |

| | | | | | | $ | 67,535,447 | |

| Pharmaceuticals - 5.7% | | | | | | | | |

| Actavis PLC (a) | | | 77,466 | | | $ | 22,570,494 | |

| Bristol-Myers Squibb Co. | | | 210,016 | | | | 12,794,175 | |

| Eli Lilly & Co. | | | 149,535 | | | | 10,492,871 | |

| Endo International PLC (a) | | | 105,692 | | | | 9,047,235 | |

| Merck & Co., Inc. | | | 111,328 | | | | 6,517,141 | |

| Valeant Pharmaceuticals International, Inc. (a) | | | 79,301 | | | | 15,660,361 | |

| | | | | | | | |

| | | | | | | $ | 77,082,277 | |

| Railroad & Shipping - 1.5% | | | | | | | | |

| Canadian Pacific Railway Ltd. | | | 43,021 | | | $ | 8,071,600 | |

| Union Pacific Corp. | | | 101,574 | | | | 12,215,289 | |

| | | | | | | | |

| | | | | | | $ | 20,286,889 | |

10

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Common Stocks - continued | | | | | | | | |

| Real Estate - 3.5% | | | | | | | | |

| Equity Lifestyle Properties, Inc., REIT | | | 140,730 | | | $ | 7,581,125 | |

| Gramercy Property Trust, Inc., REIT | | | 650,891 | | | | 4,588,782 | |

| Medical Properties Trust, Inc., REIT | | | 542,183 | | | | 8,208,651 | |

| Mid-America Apartment Communities, Inc., REIT | | | 134,668 | | | | 9,759,390 | |

| Plum Creek Timber Co. Inc., REIT | | | 191,270 | | | | 8,308,769 | |

| Tanger Factory Outlet Centers, Inc., REIT | | | 244,741 | | | | 8,676,068 | |

| | | | | | | | |

| | | | | | | $ | 47,122,785 | |

| Restaurants - 1.0% | | | | | | | | |

| Domino’s Pizza, Inc. | | | 40,159 | | | $ | 4,077,343 | |

| YUM! Brands, Inc. | | | 121,021 | | | | 9,816,013 | |

| | | | | | | | |

| | | | | | | $ | 13,893,356 | |

| Specialty Chemicals - 2.5% | | | | | | | | |

| Albemarle Corp. | | | 132,656 | | | $ | 7,504,350 | |

| Amira Nature Foods Ltd. (a)(l) | | | 72,290 | | | | 748,924 | |

| Axalta Coating Systems Ltd. (a) | | | 291,858 | | | | 8,288,767 | |

| Ecolab, Inc. | | | 89,953 | | | | 10,393,170 | |

| W.R. Grace & Co. (a) | | | 71,446 | | | | 7,083,871 | |

| | | | | | | | |

| | | | | | | $ | 34,019,082 | |

| Specialty Stores - 4.1% | | | | | | | | |

| American Eagle Outfitters, Inc. | | | 364,689 | | | $ | 5,459,394 | |

| AutoZone, Inc. (a) | | | 9,790 | | | | 6,291,837 | |

| Bed Bath & Beyond, Inc. (a) | | | 96,229 | | | | 7,184,457 | |

| Burlington Stores, Inc. (a) | | | 140,302 | | | | 7,796,582 | |

| Express, Inc. (a) | | | 269,133 | | | | 3,719,418 | |

| L Brands, Inc. | | | 56,032 | | | | 5,147,100 | |

| Ross Stores, Inc. | | | 78,822 | | | | 8,340,156 | |

| Sally Beauty Holdings, Inc. (a) | | | 122,801 | | | | 4,116,290 | |

| Urban Outfitters, Inc. (a) | | | 192,763 | | | | 7,510,046 | |

| | | | | | | | |

| | | | | | | $ | 55,565,280 | |

| Telecommunications - Wireless - 1.4% | | | | | | | | |

| American Tower Corp., REIT | | | 150,098 | | | $ | 14,880,716 | |

| SBA Communications Corp. (a) | | | 34,562 | | | | 4,310,227 | |

| | | | | | | | |

| | | | | | | $ | 19,190,943 | |

| Telephone Services - 0.9% | | | | | | | | |

| RigNet, Inc. (a) | | | 93,716 | | | $ | 2,963,300 | |

| Verizon Communications, Inc. | | | 176,863 | | | | 8,745,875 | |

| | | | | | | | |

| | | | | | | $ | 11,709,175 | |

11

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| Common Stocks - continued | | | | | | | | |

| Tobacco - 1.2% | | | | | | | | |

| Altria Group, Inc. | | | 148,317 | | | $ | 8,348,764 | |

| Philip Morris International, Inc. | | | 96,505 | | | | 8,006,055 | |

| | | | | | | | |

| | | | | | | $ | 16,354,819 | |

| Trucking - 0.6% | | | | | | | | |

| Swift Transportation Co. (a) | | | 276,914 | | | $ | 7,831,128 | |

| | |

| Utilities - Electric Power - 2.6% | | | | | | | | |

| American Electric Power Co., Inc. | | | 89,289 | | | $ | 5,141,261 | |

| Calpine Corp. (a) | | | 153,376 | | | | 3,251,571 | |

| CMS Energy Corp. | | | 159,241 | | | | 5,594,136 | |

| Dominion Resources, Inc. | | | 47,722 | | | | 3,440,279 | |

| Edison International | | | 72,111 | | | | 4,633,132 | |

| Exelon Corp. | | | 123,469 | | | | 4,188,060 | |

| NextEra Energy, Inc. | | | 41,065 | | | | 4,248,585 | |

| NRG Energy, Inc. | | | 86,965 | | | | 2,085,421 | |

| Pattern Energy Group, Inc. | | | 87,741 | | | | 2,440,955 | |

| | | | | | | | |

| | | | | | | $ | 35,023,400 | |

| Total Common Stocks (Identified Cost, $1,026,839,472) | | | | | | $ | 1,346,855,980 | |

| | |

| Money Market Funds - 0.7% | | | | | | | | |

MFS Institutional Money Market Portfolio, 0.1%,

at Cost and Net Asset Value (v) | | | 9,385,602 | | | $ | 9,385,602 | |

| | |

| Collateral for Securities Loaned - 0.2% | | | | | | | | |

Navigator Securities Lending Prime Portfolio, 0.17%,

at Cost and Net Asset Value (j) | | | 3,001,002 | | | $ | 3,001,002 | |

| Total Investments (Identified Cost, $1,039,226,076) | | | | | | $ | 1,359,242,584 | |

| | |

| Securities Sold Short - (0.2)% | | | | | | | | |

| Gaming & Lodging - (0.2)% | | | | | | | | |

| Marriott International, Inc., “A” (Proceeds Received $2,063,501) | | | (30,725 | ) | | $ | (2,553,248 | ) |

| | |

| Other Assets, Less Liabilities - (0.0)% | | | | | | | (151,581 | ) |

| Net Assets - 100.0% | | | | | | $ | 1,356,537,755 | |

| (a) | Non-income producing security. |

| (j) | The rate quoted is the annualized seven-day yield of the fund at period end. |

| (l) | A portion of this security is on loan. |

| (s) | Security or a portion of the security was pledged to cover collateral requirements for securities sold short and certain derivative transactions. |

| (v) | Underlying affiliated fund that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

12

Portfolio of Investments (unaudited) – continued

At February 28, 2015, the fund had cash collateral of $7,548 and other liquid securities with an aggregate value of $4,654,836 to cover any commitments for securities sold short and/or certain derivative contracts. Cash collateral is comprised of “Deposits with brokers” on the Statement of Assets and Liabilities.

The following abbreviations are used in this report and are defined:

| PLC | | Public Limited Company |

| REIT | | Real Estate Investment Trust |

See notes to financial statements

13

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 2/28/15 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | |

| Assets | | | | |

Investments- | | | | |

Non-affiliated issuers, at value (identified cost, $1,029,840,474) | | | $1,349,856,982 | |

Underlying affiliated funds, at cost and value | | | 9,385,602 | |

Total investments, at value, including $2,917,816 of securities on loan

(identified cost, $1,039,226,076) | | | $1,359,242,584 | |

Cash | | | 53 | |

Deposits with brokers | | | 7,548 | |

Receivables for | | | | |

Investments sold | | | 17,378,908 | |

Fund shares sold | | | 1,326,209 | |

Interest and dividends | | | 1,847,050 | |

Other assets | | | 6,627 | |

Total assets | | | $1,379,808,979 | |

| Liabilities | | | | |

Payables for | | | | |

Dividends on securities sold short | | | $6,145 | |

Securities sold short, at value (proceeds received, $2,063,501) | | | 2,553,248 | |

Investments purchased | | | 15,465,125 | |

Fund shares reacquired | | | 1,505,961 | |

Collateral for securities loaned, at value | | | 3,001,002 | |

Payable to affiliates | | | | |

Investment adviser | | | 60,285 | |

Shareholder servicing costs | | | 499,998 | |

Distribution and service fees | | | 30,205 | |

Payable for independent Trustees’ compensation | | | 84,660 | |

Accrued expenses and other liabilities | | | 64,595 | |

Total liabilities | | | $23,271,224 | |

Net assets | | | $1,356,537,755 | |

| Net assets consist of | | | | |

Paid-in capital | | | $970,720,899 | |

Unrealized appreciation (depreciation) on investments and translation of assets and liabilities in foreign currencies | | | 319,526,761 | |

Accumulated net realized gain (loss) on investments and foreign currency | | | 62,536,766 | |

Undistributed net investment income | | | 3,753,329 | |

Net assets | | | $1,356,537,755 | |

Shares of beneficial interest outstanding | | | 47,841,961 | |

14

Statement of Assets and Liabilities (unaudited) – continued

| | | | | | | | | | | | |

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share (a) | |

Class A | | | $1,049,597,394 | | | | 36,678,634 | | | | $28.62 | |

Class B | | | 39,318,229 | | | | 1,507,079 | | | | 26.09 | |

Class C | | | 93,990,731 | | | | 3,636,652 | | | | 25.85 | |

Class I | | | 52,490,570 | | | | 1,755,802 | | | | 29.90 | |

Class R1 | | | 4,500,047 | | | | 174,210 | | | | 25.83 | |

Class R2 | | | 19,057,382 | | | | 679,343 | | | | 28.05 | |

Class R3 | | | 73,716,433 | | | | 2,584,579 | | | | 28.52 | |

Class R4 | | | 21,396,708 | | | | 743,122 | | | | 28.79 | |

Class R5 | | | 2,470,261 | | | | 82,540 | | | | 29.93 | |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $30.37 [100 / 94.25 x $28.62]. On sales of $50,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R5. |

See notes to financial statements

15

Financial Statements

STATEMENT OF OPERATIONS

Six months ended 2/28/15 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | |

| Net investment income | | | | |

Income | | | | |

Dividends | | | $10,772,536 | |

Interest | | | 169,875 | |

Dividends from underlying affiliated funds | | | 7,564 | |

Foreign taxes withheld | | | (12,981 | ) |

Total investment income | | | $10,936,994 | |

Expenses | | | | |

Management fee | | | $3,759,130 | |

Distribution and service fees | | | 2,023,710 | |

Shareholder servicing costs | | | 990,265 | |

Administrative services fee | | | 108,381 | |

Independent Trustees’ compensation | | | 17,191 | |

Custodian fee | | | 60,603 | |

Shareholder communications | | | 50,305 | |

Audit and tax fees | | | 26,663 | |

Legal fees | | | 5,586 | |

Dividend and interest expense on securities sold short | | | 24,386 | |

Miscellaneous | | | 86,031 | |

Total expenses | | | $7,152,251 | |

Fees paid indirectly | | | (24 | ) |

Reduction of expenses by investment adviser and distributor | | | (69,163 | ) |

Net expenses | | | $7,083,064 | |

Net investment income | | | $3,853,930 | |

| Realized and unrealized gain (loss) on investments and foreign currency | | | | |

Realized gain (loss) (identified cost basis) | | | | |

Investments | | | $70,691,093 | |

Securities sold short | | | (51,451 | ) |

Foreign currency | | | (813 | ) |

Net realized gain (loss) on investments and foreign currency | | | $70,638,829 | |

Change in unrealized appreciation (depreciation) | | | | |

Investments | | | $5,801,151 | |

Securities sold short | | | (405,761 | ) |

Translation of assets and liabilities in foreign currencies | | | (39 | ) |

Net unrealized gain (loss) on investments and foreign currency translation | | | $5,395,351 | |

Net realized and unrealized gain (loss) on investments and foreign currency | | | $76,034,180 | |

Change in net assets from operations | | | $79,888,110 | |

See notes to financial statements

16

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | | | |

| Change in net assets | | Six months ended

2/28/15

(unaudited) | | | Year ended

8/31/14 | |

| From operations | | | | | | | | |

Net investment income | | | $3,853,930 | | | | $5,110,168 | |

Net realized gain (loss) on investments and foreign currency | | | 70,638,829 | | | | 105,521,459 | |

Net unrealized gain (loss) on investments and foreign currency translation | | | 5,395,351 | | | | 142,264,064 | |

Change in net assets from operations | | | $79,888,110 | | | | $252,895,691 | |

| Distributions declared to shareholders | | | | | | | | |

From net investment income | | | $(5,098,135 | ) | | | $(7,149,277 | ) |

From net realized gain on investments | | | (95,270,510 | ) | | | — | |

Total distributions declared to shareholders | | | $(100,368,645 | ) | | | $(7,149,277 | ) |

Change in net assets from fund share transactions | | | $84,920,626 | | | | $(64,001,160 | ) |

Total change in net assets | | | $64,440,091 | | | | $181,745,254 | |

| Net assets | | | | | | | | |

At beginning of period | | | 1,292,097,664 | | | | 1,110,352,410 | |

At end of period (including undistributed net investment income of $3,753,329 and $4,997,534, respectively) | | | $1,356,537,755 | | | | $1,292,097,664 | |

See notes to financial statements

17

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/15

(unaudited) | | | Years ended 8/31 | |

| Class A | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | | $29.19 | | | | $23.82 | | | | $19.68 | | | | $17.20 | | | | $14.62 | | | | $13.87 | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (d) | | | $0.09 | | | | $0.13 | | | | $0.18 | | | | $0.11 | | | | $0.11 | | | | $0.10 | |

Net realized and unrealized

gain (loss) on investments

and foreign currency | | | 1.62 | | | | 5.41 | | | | 4.07 | | | | 2.47 | | | | 2.58 | | | | 0.77 | |

Total from investment operations | | | $1.71 | | | | $5.54 | | | | $4.25 | | | | $2.58 | | | | $2.69 | | | | $0.87 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | |

From net investment income | | | $(0.13 | ) | | | $(0.17 | ) | | | $(0.11 | ) | | | $(0.10 | ) | | | $(0.11 | ) | | | $(0.12 | ) |

From net realized gain on

investments | | | (2.15 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $(2.28 | ) | | | $(0.17 | ) | | | $(0.11 | ) | | | $(0.10 | ) | | | $(0.11 | ) | | | $(0.12 | ) |

Net asset value, end of period (x) | | | $28.62 | | | | $29.19 | | | | $23.82 | | | | $19.68 | | | | $17.20 | | | | $14.62 | |

Total return (%) (r)(s)(t)(x) | | | 6.29 | (n) | | | 23.33 | | | | 21.69 | | | | 15.10 | | | | 18.39 | | | | 6.27 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.05 | (a) | | | 1.05 | | | | 1.11 | | | | 1.15 | | | | 1.18 | | | | 1.24 | |

Expenses after expense

reductions (f) | | | 1.04 | (a) | | | 1.04 | | | | 1.11 | | | | 1.15 | | | | 1.18 | | | | 1.23 | |

Net investment income | | | 0.67 | (a) | | | 0.49 | | | | 0.81 | | | | 0.61 | | | | 0.60 | | | | 0.68 | |

Portfolio turnover | | | 31 | (n) | | | 48 | | | | 58 | | | | 65 | | | | 66 | | | | 77 | |

Net assets at end of period

(000 omitted) | | | $1,049,597 | | | | $1,002,028 | | | | $873,139 | | | | $686,616 | | | | $612,504 | | | | $547,296 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | |

Ratio of expenses to average

net assets after expense

reductions excluding short sale

dividend and interest expense (f) | | | 1.04 | (a) | | | 1.04 | | | | 1.10 | | | | 1.15 | | | | 1.17 | | | | 1.22 | |

See notes to financial statements

18

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/15 (unaudited) | | | Years ended 8/31 | |

| Class B | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | | $26.78 | | | | $21.88 | | | | $18.11 | | | | $15.86 | | | | $13.50 | | | | $12.80 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.01 | ) | | | $(0.06 | ) | | | $0.01 | | | | $(0.02 | ) | | | $(0.02 | ) | | | $(0.01 | ) |

Net realized and unrealized

gain (loss) on investments

and foreign currency | | | 1.47 | | | | 4.96 | | | | 3.76 | | | | 2.27 | | | | 2.38 | | | | 0.71 | |

Total from investment operations | | | $1.46 | | | | $4.90 | | | | $3.77 | | | | $2.25 | | | | $2.36 | | | | $0.70 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $— | | | | $— | | | | $— | | | | $— | | | | $(0.00 | )(w) |

From net realized gain on

investments | | | (2.15 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $(2.15 | ) | | | $— | | | | $— | | | | $— | | | | $— | | | | $(0.00 | )(w) |

Net asset value, end of period (x) | | | $26.09 | | | | $26.78 | | | | $21.88 | | | | $18.11 | | | | $15.86 | | | | $13.50 | |

Total return (%) (r)(s)(t)(x) | | | 5.90 | (n) | | | 22.39 | | | | 20.82 | | | | 14.19 | | | | 17.48 | | | | 5.49 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.80 | (a) | | | 1.80 | | | | 1.86 | | | | 1.91 | | | | 1.93 | | | | 1.99 | |

Expenses after expense

reductions (f) | | | 1.80 | (a) | | | 1.80 | | | | 1.86 | | | | 1.90 | | | | 1.93 | | | | 1.98 | |

Net investment income (loss) | | | (0.09 | )(a) | | | (0.26 | ) | | | 0.07 | | | | (0.14 | ) | | | (0.15 | ) | | | (0.06 | ) |

Portfolio turnover | | | 31 | (n) | | | 48 | | | | 58 | | | | 65 | | | | 66 | | | | 77 | |

Net assets at end of period

(000 omitted) | | | $39,318 | | | | $40,536 | | | | $40,495 | | | | $43,320 | | | | $49,181 | | | | $55,327 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average

net assets after expense

reductions excluding short sale

dividend and interest expense (f) | | | 1.79 | (a) | | | 1.80 | | | | 1.86 | | | | 1.90 | | | | 1.92 | | | | 1.97 | |

See notes to financial statements

19

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/15

(unaudited) | | | Years ended 8/31 | |

| Class C | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | | $26.55 | | | | $21.72 | | | | $17.98 | | | | $15.74 | | | | $13.39 | | | | $12.75 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.01 | ) | | | $(0.06 | ) | | | $0.01 | | | | $(0.02 | ) | | | $(0.02 | ) | | | $(0.01 | ) |

Net realized and unrealized

gain (loss) on investments

and foreign currency | | | 1.46 | | | | 4.92 | | | | 3.73 | | | | 2.26 | | | | 2.37 | | | | 0.70 | |

Total from investment operations | | | $1.45 | | | | $4.86 | | | | $3.74 | | | | $2.24 | | | | $2.35 | | | | $0.69 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $(0.03 | ) | | | $— | | | | $— | | | | $— | | | | $(0.05 | ) |

From net realized gain on

investments | | | (2.15 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $(2.15 | ) | | | $(0.03 | ) | | | $— | | | | $— | | | | $— | | | | $(0.05 | ) |

Net asset value, end of period (x) | | | $25.85 | | | | $26.55 | | | | $21.72 | | | | $17.98 | | | | $15.74 | | | | $13.39 | |

Total return (%) (r)(s)(t)(x) | | | 5.91 | (n) | | | 22.38 | | | | 20.80 | | | | 14.23 | | | | 17.55 | | | | 5.40 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.80 | (a) | | | 1.80 | | | | 1.86 | | | | 1.90 | | | | 1.93 | | | | 1.99 | |

Expenses after expense

reductions (f) | | | 1.79 | (a) | | | 1.80 | | | | 1.86 | | | | 1.90 | | | | 1.93 | | | | 1.98 | |

Net investment income (loss) | | | (0.08 | )(a) | | | (0.26 | ) | | | 0.06 | | | | (0.14 | ) | | | (0.15 | ) | | | (0.07 | ) |

Portfolio turnover | | | 31 | (n) | | | 48 | | | | 58 | | | | 65 | | | | 66 | | | | 77 | |

Net assets at end of period

(000 omitted) | | | $93,991 | | | | $89,702 | | | | $78,777 | | | | $64,258 | | | | $62,249 | | | | $59,265 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average

net assets after expense

reductions excluding short sale

dividend and interest expense (f) | | | 1. | 79(a) | | | 1.80 | | | | 1.86 | | | | 1.90 | | | | 1.92 | | | | 1.97 | |

See notes to financial statements

20

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/15

(unaudited) | | | Years ended 8/31 | |

| Class I | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | | $30.43 | | | | $24.82 | | | | $20.49 | | | | $17.91 | | | | $15.21 | | | | $14.43 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.13 | | | | $0.21 | | | | $0.24 | | | | $0.16 | | | | $0.15 | | | | $0.15 | |

Net realized and unrealized

gain (loss) on investments

and foreign currency | | | 1.69 | | | | 5.62 | | | | 4.25 | | | | 2.57 | | | | 2.70 | | | | 0.79 | |

Total from investment operations | | | $1.82 | | | | $5.83 | | | | $4.49 | | | | $2.73 | | | | $2.85 | | | | $0.94 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.20 | ) | | | $(0.22 | ) | | | $(0.16 | ) | | | $(0.15 | ) | | | $(0.15 | ) | | | $(0.16 | ) |

From net realized gain on

investments | | | (2.15 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $(2.35 | ) | | | $(0.22 | ) | | | $(0.16 | ) | | | $(0.15 | ) | | | $(0.15 | ) | | | $(0.16 | ) |

Net asset value, end of period (x) | | | $29.90 | | | | $30.43 | | | | $24.82 | | | | $20.49 | | | | $17.91 | | | | $15.21 | |

Total return (%) (r)(s)(x) | | | 6.43 | (n) | | | 23.61 | | | | 22.03 | | | | 15.36 | | | | 18.73 | | | | 6.47 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 0.80 | (a) | | | 0.80 | | | | 0.86 | | | | 0.90 | | | | 0.93 | | | | 0.99 | |

Expenses after expense

reductions (f) | | | 0.80 | (a) | | | 0.80 | | | | 0.86 | | | | 0.90 | | | | 0.93 | | | | 0.98 | |

Net investment income | | | 0.92 | (a) | | | 0.73 | | | | 1.05 | | | | 0.86 | | | | 0.83 | | | | 0.93 | |

Portfolio turnover | | | 31 | (n) | | | 48 | | | | 58 | | | | 65 | | | | 66 | | | | 77 | |

Net assets at end of period

(000 omitted) | | | $52,491 | | | | $45,089 | | | | $29,812 | | | | $20,441 | | | | $17,250 | | | | $16,291 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | |

Ratio of expenses to average

net assets after expense

reductions excluding short sale

dividend and interest expense (f) | | | 0.79 | (a) | | | 0.80 | | | | 0.86 | | | | 0.90 | | | | 0.92 | | | | 0.97 | |

See notes to financial statements

21

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/15

(unaudited) | | | Years ended 8/31 | |

| Class R1 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | | $26.54 | | | | $21.69 | | | | $17.95 | | | | $15.72 | | | | $13.38 | | | | $12.75 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.01 | ) | | | $(0.06 | ) | | | $0.02 | | | | $(0.02 | ) | | | $(0.02 | ) | | | $(0.01 | ) |

Net realized and unrealized

gain (loss) on investments

and foreign currency | | | 1.45 | | | | 4.91 | | | | 3.72 | | | | 2.25 | | | | 2.37 | | | | 0.70 | |

Total from investment operations | | | $1.44 | | | | $4.85 | | | | $3.74 | | | | $2.23 | | | | $2.35 | | | | $0.69 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $(0.00 | )(w) | | | $— | | | | $— | | | | $(0.01 | ) | | | $(0.06 | ) |

From net realized gain on

investments | | | (2.15 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $(2.15 | ) | | | $(0.00 | )(w) | | | $— | | | | $— | | | | $(0.01 | ) | | | $(0.06 | ) |

Net asset value, end of period (x) | | | $25.83 | | | | $26.54 | | | | $21.69 | | | | $17.95 | | | | $15.72 | | | | $13.38 | |

Total return (%) (r)(s)(x) | | | 5.88 | (n) | | | 22.38 | | | | 20.84 | | | | 14.19 | | | | 17.56 | | | | 5.43 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.80 | (a) | | | 1.80 | | | | 1.86 | | | | 1.90 | | | | 1.93 | | | | 1.99 | |

Expenses after expense

reductions (f) | | | 1.80 | (a) | | | 1.80 | | | | 1.86 | | | | 1.90 | | | | 1.93 | | | | 1.98 | |

Net investment income (loss) | | | (0.09 | )(a) | | | (0.26 | ) | | | 0.08 | | | | (0.14 | ) | | | (0.15 | ) | | | (0.07 | ) |

Portfolio turnover | | | 31 | (n) | | | 48 | | | | 58 | | | | 65 | | | | 66 | | | | 77 | |

Net assets at end of period

(000 omitted) | | | $4,500 | | | | $4,132 | | | | $3,839 | | | | $4,098 | | | | $3,904 | | | | $3,688 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average

net assets after expense

reductions excluding short sale

dividend and interest expense (f) | | | 1.79 | (a) | | | 1.80 | | | | 1.85 | | | | 1.90 | | | | 1.92 | | | | 1.97 | |

See notes to financial statements

22

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/15

(unaudited) | | | Years ended 8/31 | |

| Class R2 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | | $28.59 | | | | $23.35 | | | | $19.28 | | | | $16.86 | | | | $14.33 | | | | $13.62 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.06 | | | | $0.06 | | | | $0.12 | | | | $0.06 | | | | $0.06 | | | | $0.06 | |

Net realized and unrealized

gain (loss) on investments

and foreign currency | | | 1.58 | | | | 5.29 | | | | 4.00 | | | | 2.42 | | | | 2.54 | | | | 0.75 | |

Total from investment operations | | | $1.64 | | | | $5.35 | | | | $4.12 | | | | $2.48 | | | | $2.60 | | | | $0.81 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.03 | ) | | | $(0.11 | ) | | | $(0.05 | ) | | | $(0.06 | ) | | | $(0.07 | ) | | | $(0.10 | ) |

From net realized gain on

investments | | | (2.15 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $(2.18 | ) | | | $(0.11 | ) | | | $(0.05 | ) | | | $(0.06 | ) | | | $(0.07 | ) | | | $(0.10 | ) |

Net asset value, end of period (x) | | | $28.05 | | | | $28.59 | | | | $23.35 | | | | $19.28 | | | | $16.86 | | | | $14.33 | |

Total return (%) (r)(s)(x) | | | 6.17 | (n) | | | 22.96 | | | | 21.44 | | | | 14.74 | | | | 18.14 | | | | 5.97 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.30 | (a) | | | 1.30 | | | | 1.36 | | | | 1.40 | | | | 1.43 | | | | 1.49 | |

Expenses after expense

reductions (f) | | | 1.30 | (a) | | | 1.30 | | | | 1.36 | | | | 1.40 | | | | 1.43 | | | | 1.48 | |

Net investment income | | | 0.41 | (a) | | | 0.24 | | | | 0.56 | | | | 0.36 | | | | 0.35 | | | | 0.43 | |

Portfolio turnover | | | 31 | (n) | | | 48 | | | | 58 | | | | 65 | | | | 66 | | | | 77 | |

Net assets at end of period

(000 omitted) | | | $19,057 | | | | $19,434 | | | | $19,625 | | | | $17,369 | | | | $16,424 | | | | $14,013 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average

net assets after expense

reductions excluding short sale

dividend and interest expense (f) | | | 1.29 | (a) | | | 1.30 | | | | 1.36 | | | | 1.40 | | | | 1.42 | | | | 1.47 | |

See notes to financial statements

23

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/15

(unaudited) | | | Years ended 8/31 | |

| Class R3 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | | $29.10 | | | | $23.75 | | | | $19.63 | | | | $17.16 | | | | $14.59 | | | | $13.85 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.09 | | | | $0.13 | | | | $0.18 | | | | $0.11 | | | | $0.11 | | | | $0.10 | |

Net realized and unrealized

gain (loss) on investments

and foreign currency | | | 1.61 | | | | 5.39 | | | | 4.05 | | | | 2.47 | | | | 2.57 | | | | 0.77 | |

Total from investment operations | | | $1.70 | | | | $5.52 | | | | $4.23 | | | | $2.58 | | | | $2.68 | | | | $0.87 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.13 | ) | | | $(0.17 | ) | | | $(0.11 | ) | | | $(0.11 | ) | | | $(0.11 | ) | | | $(0.13 | ) |

From net realized gain on

investments | | | (2.15 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $(2.28 | ) | | | $(0.17 | ) | | | $(0.11 | ) | | | $(0.11 | ) | | | $(0.11 | ) | | | $(0.13 | ) |

Net asset value, end of period (x) | | | $28.52 | | | | $29.10 | | | | $23.75 | | | | $19.63 | | | | $17.16 | | | | $14.59 | |

Total return (%) (r)(s)(x) | | | 6.28 | (n) | | | 23.32 | | | | 21.68 | | | | 15.12 | | | | 18.38 | | | | 6.25 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.05 | (a) | | | 1.05 | | | | 1.11 | | | | 1.15 | | | | 1.18 | | | | 1.24 | |

Expenses after expense

reductions (f) | | | 1.05 | (a) | | | 1.05 | | | | 1.11 | | | | 1.15 | | | | 1.18 | | | | 1.23 | |

Net investment income | | | 0.67 | (a) | | | 0.49 | | | | 0.81 | | | | 0.61 | | | | 0.60 | | | | 0.68 | |

Portfolio turnover | | | 31 | (n) | | | 48 | | | | 58 | | | | 65 | | | | 66 | | | | 77 | |

Net assets at end of period

(000 omitted) | | | $73,716 | | | | $68,977 | | | | $58,381 | | | | $46,833 | | | | $32,277 | | | | $26,573 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | |

Ratio of expenses to average

net assets after expense

reductions excluding short sale

dividend and interest expense (f) | | | 1.04 | (a) | | | 1.05 | | | | 1.10 | | | | 1.15 | | | | 1.17 | | | | 1.22 | |

See notes to financial statements

24

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/15

(unaudited) | | | Years ended 8/31 | |

| Class R4 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning

of period | | | $29.40 | | | | $23.99 | | | | $19.81 | | | | $17.32 | | | | $14.72 | | | | $13.98 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.13 | | | | $0.20 | | | | $0.23 | | | | $0.16 | | | | $0.13 | | | | $0.14 | |

Net realized and unrealized

gain (loss) on investments

and foreign currency | | | 1.61 | | | | 5.44 | | | | 4.11 | | | | 2.48 | | | | 2.62 | | | | 0.76 | |

Total from investment operations | | | $1.74 | | | | $5.64 | | | | $4.34 | | | | $2.64 | | | | $2.75 | | | | $0.90 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.20 | ) | | | $(0.23 | ) | | | $(0.16 | ) | | | $(0.15 | ) | | | $(0.15 | ) | | | $(0.16 | ) |

From net realized gain on

investments | | | (2.15 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions declared to

shareholders | | | $(2.35 | ) | | | $(0.23 | ) | | | $(0.16 | ) | | | $(0.15 | ) | | | $(0.15 | ) | | | $(0.16 | ) |

Net asset value, end of period (x) | | | $28.79 | | | | $29.40 | | | | $23.99 | | | | $19.81 | | | | $17.32 | | | | $14.72 | |

Total return (%) (r)(s)(x) | | | 6.40 | (n) | | | 23.62 | | | | 22.03 | | | | 15.36 | | | | 18.68 | | | | 6.40 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 0.80 | (a) | | | 0.81 | | | | 0.86 | | | | 0.91 | | | | 0.92 | | | | 0.98 | |

Expenses after expense

reductions (f) | | | 0.80 | (a) | | | 0.80 | | | | 0.86 | | | | 0.90 | | | | 0.92 | | | | 0.97 | |

Net investment income | | | 0.92 | (a) | | | 0.72 | | | | 1.04 | | | | 0.86 | | | | 0.75 | | | | 0.92 | |

Portfolio turnover | | | 31 | (n) | | | 48 | | | | 58 | | | | 65 | | | | 66 | | | | 77 | |

Net assets at end of period

(000 omitted) | | | $21,397 | | | | $19,706 | | | | $6,165 | | | | $1,871 | | | | $1,367 | | | | $408 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | |

Ratio of expenses to average

net assets after expense

reductions excluding short sale

dividend and interest expense (f) | | | 0.79(a | ) | | | 0.80 | | | | 0.86 | | | | 0.90 | | | | 0.91 | | | | 0.97 | |

See notes to financial statements

25

Financial Highlights – continued

| | | | | | | | | | | | |

| | | Six months

ended

2/28/15

(unaudited) | | | Years ended 8/31 | |

| Class R5 | | | 2014 | | | 2013 (i) | |

| | | | | | | | | |

Net asset value, beginning of period | | | $30.47 | | | | $24.84 | | | | $21.02 | |

| Income (loss) from investment operations | | | | | | | | | | | | |

Net investment income (d) | | | $0.15 | | | | $0.23 | | | | $0.22 | |

Net realized and unrealized gain (loss) on investments

and foreign currency | | | 1.68 | | | | 5.64 | | | | 3.60 | |

Total from investment operations | | | $1.83 | | | | $5.87 | | | | $3.82 | |

| Less distributions declared to shareholders | | | | | | | | | | | | |

From net investment income | | | $(0.22 | ) | | | $(0.24 | ) | | | $— | |

From net realized gain on investments | | | (2.15 | ) | | | — | | | | — | |

Total distributions declared to shareholders | | | $(2.37 | ) | | | $(0.24 | ) | | | $— | |

Net asset value, end of period (x) | | | $29.93 | | | | $30.47 | | | | $24.84 | |

Total return (%) (r)(s)(x) | | | 6.46 | (n) | | | 23.73 | | | | 18.17 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.71 | (a) | | | 0.71 | | | | 0.76 | (a) |

Expenses after expense reductions (f) | | | 0.70 | (a) | | | 0.71 | | | | 0.76 | (a) |

Net investment income | | | 1.01 | (a) | | | 0.80 | | | | 1.39 | (a) |

Portfolio turnover | | | 31 | (n) | | | 48 | | | | 58 | |

Net assets at end of period (000 omitted) | | | $2,470 | | | | $2,492 | | | | $119 | |

| Supplemental Ratios (%): | | | | | | | | | | | | |

Ratio of expenses to average net assets after expense

reductions excluding short sale dividend and interest

expense (f) | | | 0.70 | (a) | | | 0.71 | | | | 0.75 | (a) |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (i) | For the period from the class inception, January 2, 2013, through the stated period end. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (t) | Total returns do not include any applicable sales charges. |

| (w) | Per share amount was less than $0.01. |

| (x) | The net asset values per share and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See notes to financial statements

26

NOTES TO FINANCIAL STATEMENTS

(unaudited)

(1) Business and Organization

MFS Core Equity Fund (the fund) is a diversified series of MFS Series Trust I (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

(2) Significant Accounting Policies

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued.

In June 2014, FASB issued Accounting Standards Update 2014-11, Transfers and Servicing (Topic 860) – Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures (“ASU 2014-11”). ASU 2014-11 changes the accounting for repurchase-to-maturity transactions (i.e., repurchase agreements that settle at the same time as the maturity of the transferred financial asset) and enhances the required disclosures for repurchase agreements and other similar transactions. Although still evaluating the potential impacts of ASU 2014-11 to the fund, management expects that the impact of the fund’s adoption will be limited to additional financial statement disclosures which would first be effective for interim reporting periods beginning after March 15, 2015.

Balance Sheet Offsetting – The fund’s accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund’s right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’s in-scope financial instruments and transactions.

Investment Valuations – Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price as provided by a third-party

27

Notes to Financial Statements (unaudited) – continued

pricing service on the market or exchange on which they are primarily traded. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation as provided by a third-party pricing service on the market or exchange on which such securities are primarily traded. Equity securities held short, for which there were no sales reported for that day, are generally valued at the last quoted daily ask quotation as provided by a third-party pricing service on the market or exchange on which such securities are primarily traded. Short-term instruments with a maturity at issuance of 60 days or less may be valued at amortized cost, which approximates market value. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. Values obtained from third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur on a frequent basis after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that

28

Notes to Financial Statements (unaudited) – continued

the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

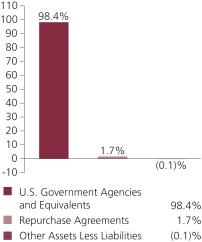

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. The following is a summary of the levels used as of February 28, 2015 in valuing the fund’s assets or liabilities:

| | | | | | | | | | | | | | | | |

| Investments at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Equity Securities: | | | | | | | | | | | | | | | | |

United States | | | $1,300,519,870 | | | | $— | | | | $— | | | | $1,300,519,870 | |

Canada | | | 32,406,036 | | | | — | | | | — | | | | 32,406,036 | |

Israel | | | 6,754,591 | | | | — | | | | — | | | | 6,754,591 | |

Hong Kong | | | 6,215,516 | | | | — | | | | — | | | | 6,215,516 | |

United Arab Emirates | | | 748,924 | | | | — | | | | — | | | | 748,924 | |

Cayman Islands | | | — | | | | — | | | | 211,043 | | | | 211,043 | |

| Mutual Funds | | | 12,386,604 | | | | — | | | | — | | | | 12,386,604 | |

| Total Investments | | | $1,359,031,541 | | | | $— | | | | $211,043 | | | | $1,359,242,584 | |

| Short Sales | | | $(2,553,248 | ) | | | $— | | | | $— | | | | $(2,553,248 | ) |

For further information regarding security characteristics, see the Portfolio of Investments.

The following is a reconciliation of level 3 assets for which significant unobservable inputs were used to determine fair value. The fund’s policy is to recognize transfers between the levels as of the end of the period. The table presents the activity of level 3 securities held at the beginning and the end of the period.

| | | | |

| | | Equity Securities | |

| Balance as of 8/31/14 | | | $274,485 | |

Change in unrealized appreciation (depreciation) | | | (63,442 | ) |

| Balance as of 2/28/15 | | | $211,043 | |

The net change in unrealized appreciation (depreciation) from investments still held as level 3 at February 28, 2015 is $(63,442). At February 28, 2015, the fund held one level 3 security.

Foreign Currency Translation – Purchases and sales of foreign investments, income, and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions or on the reporting date for foreign denominated receivables and payables. Gains and losses attributable to foreign currency exchange rates on sales of securities are recorded for financial statement

29

Notes to Financial Statements (unaudited) – continued

purposes as net realized gains and losses on investments. Gains and losses attributable to foreign exchange rate movements on receivables, payables, income and expenses are recorded for financial statement purposes as foreign currency transaction gains and losses. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

Short Sales – The fund entered into short sales whereby it sells a security it does not own in anticipation of a decline in the value of that security. The fund will realize a gain if the security price decreases and a loss if the security price increases between the date of the short sale and the date on which the fund replaces the borrowed security. Losses from short sales can exceed the proceeds of the security sold; and they can also exceed the potential loss from an ordinary buy and sell transaction. The amount of any premium, dividends, or interest the fund may be required to pay in connection with a short sale will be recognized as a fund expense. During the six months ended February 28, 2015, this expense amounted to $24,386. The fund segregates cash or marketable securities in an amount that, when combined with the amount of proceeds from the short sale deposited with the broker, at least equals the current market value of the security sold short.

Security Loans – Under its Securities Lending Agency Agreement with the fund, State Street Bank and Trust Company (“State Street”), as lending agent, loans the securities of the fund to certain qualified institutions (the “Borrowers”) approved by the fund. The loans are collateralized by cash and/or U.S. Treasury and federal agency obligations in an amount typically at least equal to the market value of the securities loaned. On loans collateralized by cash, the cash collateral is invested in a money market fund. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. State Street provides the fund with indemnification against Borrower default. In the event of Borrower default, State Street will for the benefit of the fund either purchase securities identical to those loaned or, when such purchase is commercially impracticable, pay the fund the market value of the loaned securities. In return, State Street assumes the fund’s rights to the related collateral. If the collateral value is less than the cost to purchase identical securities, State Street is responsible for the shortfall, but only to the extent that such shortfall is not due to a decline in collateral value resulting from collateral reinvestment for which the fund bears the risk of loss. At period end, the fund had investment securities on loan with a fair value of $2,917,816 and a related liability of $3,001,002 for cash collateral received on securities loaned, both of which are presented gross in the Statement of Assets and Liabilities. The collateral received on securities loaned exceeded the value of securities on loan at period end. The liability for cash collateral for securities loaned is carried at fair value, which is categorized as level 2 within the fair value hierarchy. A portion of the income generated upon investment of the collateral is remitted to the Borrowers, and the remainder is allocated between the fund and the lending agent. On loans collateralized by U.S. Treasury and/or federal agency obligations, a fee is received from the Borrower, and is allocated between the fund and the lending agent. Income from securities

30

Notes to Financial Statements (unaudited) – continued