UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-04777

MFS SERIES TRUST I

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617)954-5000

Date of fiscal year end: August 31

Date of reporting period: February 28, 2019

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Semiannual Report

February 28, 2019

MFS® Core Equity Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the complete reports will be made available on the fund’s Web site (funds.mfs.com), and you will be notified by mail each time a report is posted and provided with a Web site link to access the report.

If you are already signed up to receive shareholder reports by email, you will not be affected by this change and you need not take any action. You may sign up to receive shareholder reports and other communications from the fund by email by contacting your financial intermediary (such as a broker-dealer or bank) or, if you hold your shares directly with the fund, by calling 1-800-225-2606 or by logging on to MFS Access at mfs.com.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. Contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the fund, you can call 1-800-225-2606 or send an email request to orderliterature@mfs.com to let the fund know that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the MFS fund complex if you invest directly.

RGI-SEM

MFS® Core Equity Fund

CONTENTS

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED• MAY LOSE VALUE• NO BANK GUARANTEE

LETTER FROM THE EXECUTIVE CHAIRMAN

Dear Shareholders:

Markets experienced a bout of volatility in late 2018 as a result of higher interest rates, international trade friction and geopolitical uncertainty surrounding issues such as

Brexit. But concern over those issues dissipated in the early months of 2019 due to a more dovish posture by the U.S. Federal Reserve, progress toward a trade pact between the United States and China, and a consensus forming in the British Parliament against ano-deal Brexit. Over the past year, U.S. equities have outperformed their global peers due in part to fiscal stimulus undertaken in late 2017 and early 2019, which helped maintain healthy levels of U.S. economic output against a backdrop of slowing global growth, though returns, on average, have been modest.

Globally, inflation remains largely subdued thanks in part to stable

oil prices, though tight labor markets are keeping investors on the lookout for its potential reappearance. Rising incomes in many developed and emerging markets are supportive of gains in consumption, though a challenging backdrop for global trade has weighed on manufacturing in most regions. Should the U.S. and China reach a comprehensive trade agreement, sentiment could improve later this year.

As a global investment manager with nearly a century of expertise, MFS® firmly believes active risk management offers downside mitigation and may help improve investment outcomes. We built our active investment platform with this belief in mind. Our long-term perspective influences nearly every aspect of our business, ensuring that our investment decisions align with the investing time horizons of our clients.

Respectfully,

Robert J. Manning

Executive Chairman

MFS Investment Management

April 16, 2019

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

PORTFOLIO COMPOSITION

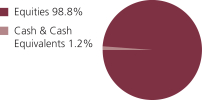

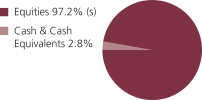

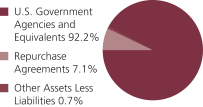

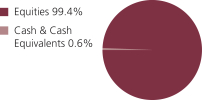

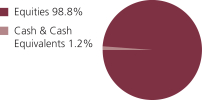

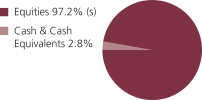

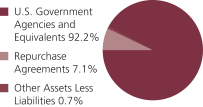

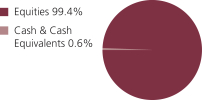

Portfolio structure

| | | | |

| Top ten holdings | | | | |

| Apple, Inc. | | | 3.7% | |

| Amazon.com, Inc. | | | 2.9% | |

| Alphabet, Inc., “A” | | | 2.9% | |

| Microsoft Corp. | | | 2.5% | |

| American Tower Corp., REIT | | | 2.1% | |

| Aon PLC | | | 2.0% | |

| Chevron Corp. | | | 2.0% | |

| Pfizer, Inc. | | | 1.8% | |

| Mastercard, Inc., “A” | | | 1.8% | |

| Salesforce.com, Inc. | | | 1.7% | |

| | | | |

| Global equity sectors (k) | | | | |

| Technology | | | 24.7% | |

| Financial Services | | | 18.2% | |

| Capital Goods | | | 13.6% | |

| Health Care (s) | | | 13.6% | |

| Consumer Cyclicals | | | 12.1% | |

| Energy | | | 8.0% | |

| Consumer Staples | | | 5.1% | |

| Telecommunications/Cable Television (s) | | | 3.4% | |

| (k) | The sectors set forth above and the associated portfolio composition are based on MFS’ own custom sector classification methodology. |

| (s) | Includes securities sold short. |

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of February 28, 2019.

The portfolio is actively managed and current holdings may be different.

2

EXPENSE TABLE

Fund expenses borne by the shareholders during the period, September 1, 2018 through February 28, 2019

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service(12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period September 1, 2018 through February 28, 2019.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

3

Expense Table – continued

| | | | | | | | | | | | | | | | | | |

Share

Class | | | | Annualized

Expense

Ratio | | | Beginning

Account Value

9/01/18 | | | Ending

Account Value

2/28/19 | | | Expenses

Paid During

Period (p)

9/01/18-2/28/19 | |

| A | | Actual | | | 0.97% | | | | $1,000.00 | | | | $979.23 | | | | $4.76 | |

| | Hypothetical (h) | | | 0.97% | | | | $1,000.00 | | | | $1,019.98 | | | | $4.86 | |

| B | | Actual | | | 1.72% | | | | $1,000.00 | | | | $975.56 | | | | $8.43 | |

| | Hypothetical (h) | | | 1.72% | | | | $1,000.00 | | | | $1,016.27 | | | | $8.60 | |

| C | | Actual | | | 1.73% | | | | $1,000.00 | | | | $975.61 | | | | $8.47 | |

| | Hypothetical (h) | | | 1.73% | | | | $1,000.00 | | | | $1,016.22 | | | | $8.65 | |

| I | | Actual | | | 0.73% | | | | $1,000.00 | | | | $980.32 | | | | $3.58 | |

| | Hypothetical (h) | | | 0.73% | | | | $1,000.00 | | | | $1,021.17 | | | | $3.66 | |

| R1 | | Actual | | | 1.73% | | | | $1,000.00 | | | | $975.60 | | | | $8.47 | |

| | Hypothetical (h) | | | 1.73% | | | | $1,000.00 | | | | $1,016.22 | | | | $8.65 | |

| R2 | | Actual | | | 1.22% | | | | $1,000.00 | | | | $977.73 | | | | $5.98 | |

| | Hypothetical (h) | | | 1.22% | | | | $1,000.00 | | | | $1,018.74 | | | | $6.11 | |

| R3 | | Actual | | | 0.98% | | | | $1,000.00 | | | | $978.80 | | | | $4.81 | |

| | Hypothetical (h) | | | 0.98% | | | | $1,000.00 | | | | $1,019.93 | | | | $4.91 | |

| R4 | | Actual | | | 0.73% | | | | $1,000.00 | | | | $980.25 | | | | $3.58 | |

| | Hypothetical (h) | | | 0.73% | | | | $1,000.00 | | | | $1,021.17 | | | | $3.66 | |

| R6 | | Actual | | | 0.65% | | | | $1,000.00 | | | | $980.87 | | | | $3.19 | |

| | Hypothetical (h) | | | 0.65% | | | | $1,000.00 | | | | $1,021.57 | | | | $3.26 | |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 181/365 (to reflect theone-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Notes to Expense Table

Expense ratios include 0.02% of investment related expenses from short sales (See Note 2 of the Notes to Financial Statements). Each class with a Rule12b-1 service fee is subject to a rebate of a portion of such fee. Such rebates are included in the expense ratios above. For Class A, Class B, and Class R2 shares, this rebate reduced the expense ratios above by 0.01%. See Note 3 in the Notes to Financial Statements for additional information.

4

PORTFOLIO OF INVESTMENTS

2/28/19 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Common Stocks - 99.0% | | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Aerospace - 3.7% | | | | | | | | |

| Boeing Co. | | | 51,814 | | | $ | 22,796,088 | |

| CACI International, Inc., “A” (a) | | | 31,815 | | | | 5,798,602 | |

| Curtiss-Wright Corp. | | | 35,414 | | | | 4,366,192 | |

| FLIR Systems, Inc. | | | 36,416 | | | | 1,873,603 | |

| Honeywell International, Inc. | | | 134,756 | | | | 20,761,857 | |

| Northrop Grumman Corp. | | | 63,481 | | | | 18,406,951 | |

| United Technologies Corp. | | | 112,999 | | | | 14,200,584 | |

| | | | | | | | |

| | | | | | | $ | 88,203,877 | |

| Alcoholic Beverages - 0.4% | | | | | | | | |

| Constellation Brands, Inc., “A” | | | 51,943 | | | $ | 8,786,678 | |

| | |

| Apparel Manufacturers - 0.8% | | | | | | | | |

| NIKE, Inc., “B” | | | 137,310 | | | $ | 11,771,586 | |

| Skechers USA, Inc., “A” (a) | | | 181,209 | | | | 6,094,059 | |

| | | | | | | | |

| | | | | | | $ | 17,865,645 | |

| Automotive - 0.7% | | | | | | | | |

| Copart, Inc. (a) | | | 93,544 | | | $ | 5,488,227 | |

| Lear Corp. | | | 46,163 | | | | 7,020,007 | |

| Stoneridge, Inc. (a) | | | 119,687 | | | | 3,539,145 | |

| | | | | | | | |

| | | | | | | $ | 16,047,379 | |

| Biotechnology - 1.1% | | | | | | | | |

| Biogen, Inc. (a) | | | 60,353 | | | $ | 19,796,387 | |

| Illumina, Inc. (a) | | | 18,367 | | | | 5,744,647 | |

| | | | | | | | |

| | | | | | | $ | 25,541,034 | |

| Broadcasting - 0.4% | | | | | | | | |

| Netflix, Inc. (a) | | | 28,741 | | | $ | 10,292,152 | |

| | |

| Brokerage & Asset Managers - 2.4% | | | | | | | | |

| Blackstone Group LP | | | 391,652 | | | $ | 13,077,260 | |

| HealthEquity, Inc. (a) | | | 38,844 | | | | 3,126,165 | |

| Invesco Ltd. | | | 253,771 | | | | 4,910,469 | |

| TD Ameritrade Holding Corp. | | | 380,148 | | | | 21,413,737 | |

| TMX Group Ltd. | | | 218,295 | | | | 13,705,333 | |

| | | | | | | | |

| | | | | | | $ | 56,232,964 | |

5

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Business Services - 4.6% | | | | | | | | |

| Amdocs Ltd. | | | 86,287 | | | $ | 4,794,968 | |

| CarGurus, Inc. (a) | | | 218,915 | | | | 9,354,238 | |

| Cognizant Technology Solutions Corp., “A” | | | 148,415 | | | | 10,534,497 | |

| DXC Technology Co. | | | 130,748 | | | | 8,611,063 | |

| Equinix, Inc., REIT | | | 16,981 | | | | 7,191,453 | |

| Fidelity National Information Services, Inc. | | | 103,164 | | | | 11,157,187 | |

| First Data Corp. (a) | | | 215,255 | | | | 5,411,511 | |

| FleetCor Technologies, Inc. (a) | | | 58,911 | | | | 13,742,758 | |

| Global Payments, Inc. | | | 84,460 | | | | 11,011,895 | |

| Grand Canyon Education, Inc. (a) | | | 76,463 | | | | 8,845,240 | |

| Total System Services, Inc. | | | 62,461 | | | | 5,896,318 | |

| Verisk Analytics, Inc., “A” | | | 93,495 | | | | 11,820,573 | |

| | | | | | | | |

| | | | | | | $ | 108,371,701 | |

| Cable TV - 1.0% | | | | | | | | |

| Altice USA, Inc. | | | 605,599 | | | $ | 13,208,114 | |

| Comcast Corp., “A” | | | 255,709 | | | | 9,888,267 | |

| | | | | | | | |

| | | | | | | $ | 23,096,381 | |

| Chemicals - 2.0% | | | | | | | | |

| CF Industries Holdings, Inc. | | | 157,254 | | | $ | 6,636,119 | |

| DowDuPont, Inc. | | | 245,572 | | | | 13,071,797 | |

| FMC Corp. | | | 77,927 | | | | 6,974,466 | |

| Ingevity Corp. (a) | | | 42,844 | | | | 4,936,486 | |

| PPG Industries, Inc. | | | 144,277 | | | | 16,154,696 | |

| | | | | | | | |

| | | | | | | $ | 47,773,564 | |

| Computer Software - 6.6% | | | | | | | | |

| 8x8, Inc. (a) | | | 460,676 | | | $ | 9,061,497 | |

| Adobe Systems, Inc. (a) | | | 109,012 | | | | 28,615,650 | |

| Cadence Design Systems, Inc. (a) | | | 173,558 | | | | 9,936,196 | |

| DocuSign, Inc. (a) | | | 127,209 | | | | 7,015,576 | |

| Microsoft Corp. | | | 527,143 | | | | 59,055,830 | |

| Salesforce.com, Inc. (a) | | | 251,652 | | | | 41,182,850 | |

| | | | | | | | |

| | | | | | | $ | 154,867,599 | |

| Computer Software - Systems - 4.3% | | | | | | | | |

| Apple, Inc. (s) | | | 504,324 | | | $ | 87,323,701 | |

| Pluralsight, Inc., “A” (a) | | | 153,932 | | | | 5,004,329 | |

| Rapid7, Inc. (a) | | | 201,749 | | | | 9,286,506 | |

| | | | | | | | |

| | | | | | | $ | 101,614,536 | |

6

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Construction - 0.8% | | | | | | | | |

| Toll Brothers, Inc. | | | 225,197 | | | $ | 8,017,013 | |

| Vulcan Materials Co. | | | 98,936 | | | | 11,027,407 | |

| | | | | | | | |

| | | | | | | $ | 19,044,420 | |

| Consumer Products - 1.4% | | | | | | | | |

| Colgate-Palmolive Co. | | | 174,358 | | | $ | 11,484,962 | |

| Kimberly-Clark Corp. | | | 81,430 | | | | 9,513,467 | |

| Procter & Gamble Co. | | | 116,071 | | | | 11,438,797 | |

| | | | | | | | |

| | | | | | | $ | 32,437,226 | |

| Consumer Services - 1.1% | | | | | | | | |

| Bookings Holdings, Inc. (a) | | | 10,770 | | | $ | 18,277,121 | |

| Bright Horizons Family Solutions, Inc. (a) | | | 53,093 | | | | 6,583,532 | |

| | | | | | | | |

| | | | | | | $ | 24,860,653 | |

| Containers - 0.5% | | | | | | | | |

| Berry Global Group, Inc. (a) | | | 165,501 | | | $ | 8,683,837 | |

| Sealed Air Corp. | | | 96,964 | | | | 4,229,570 | |

| | | | | | | | |

| | | | | | | $ | 12,913,407 | |

| Electrical Equipment - 2.3% | | | | | | | | |

| AMETEK, Inc. | | | 227,745 | | | $ | 18,123,947 | |

| Fortive Corp. | | | 105,494 | | | | 8,605,146 | |

| HD Supply Holdings, Inc. (a) | | | 164,450 | | | | 7,072,994 | |

| Resideo Technologies, Inc. (a) | | | 21,565 | | | | 554,221 | |

| Sensata Technologies Holding PLC (a) | | | 186,835 | | | | 9,478,140 | |

| TE Connectivity Ltd. | | | 84,827 | | | | 6,963,448 | |

| WESCO International, Inc. (a) | | | 60,792 | | | | 3,310,124 | |

| | | | | | | | |

| | | | | | | $ | 54,108,020 | |

| Electronics - 3.2% | | | | | | | | |

| Analog Devices, Inc. | | | 232,832 | | | $ | 24,903,711 | |

| Applied Materials, Inc. | | | 59,135 | | | | 2,267,236 | |

| IPG Photonics Corp. (a) | | | 14,610 | | | | 2,264,988 | |

| Marvell Technology Group Ltd. | | | 488,197 | | | | 9,739,530 | |

| Mellanox Technologies Ltd. (a) | | | 29,671 | | | | 3,187,852 | |

| Monolithic Power Systems, Inc. | | | 16,475 | | | | 2,209,462 | |

| Silicon Laboratories, Inc. (a) | | | 39,581 | | | | 3,206,853 | |

| Texas Instruments, Inc. | | | 263,999 | | | | 27,925,814 | |

| | | | | | | | |

| | | | | | | $ | 75,705,446 | |

| Energy - Independent - 1.8% | | | | | | | | |

| Concho Resources, Inc. | | | 49,317 | | | $ | 5,424,870 | |

| Diamondback Energy, Inc. | | | 21,193 | | | | 2,181,395 | |

7

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Energy - Independent - continued | | | | | | | | |

| EOG Resources, Inc. | | | 139,269 | | | $ | 13,091,286 | |

| Hess Corp. | | | 147,616 | | | | 8,539,586 | |

| Marathon Petroleum Corp. | | | 180,169 | | | | 11,172,280 | |

| Parsley Energy, Inc., “A” (a) | | | 96,282 | | | | 1,746,555 | |

| | | | | | | | |

| | | | | | | $ | 42,155,972 | |

| Energy - Integrated - 2.0% | | | | | | | | |

| Chevron Corp. | | | 384,867 | | | $ | 46,022,396 | |

| | |

| Engineering - Construction - 0.2% | | | | | | | | |

| KBR, Inc. | | | 218,467 | | | $ | 4,316,908 | |

| | |

| Food & Beverages - 2.7% | | | | | | | | |

| Archer Daniels Midland Co. | | | 107,010 | | | $ | 4,547,925 | |

| Coca-Cola Co. | | | 221,063 | | | | 10,022,996 | |

| Hostess Brands, Inc. (a) | | | 413,313 | | | | 5,017,620 | |

| J.M. Smucker Co. | | | 41,845 | | | | 4,431,804 | |

| Mondelez International, Inc. | | | 332,853 | | | | 15,697,347 | |

| PepsiCo, Inc. | | | 199,023 | | | | 23,015,020 | |

| | | | | | | | |

| | | | | | | $ | 62,732,712 | |

| Gaming & Lodging - 0.9% | | | | | | | | |

| Hilton Worldwide Holdings, Inc. | | | 195,591 | | | $ | 16,253,612 | |

| Marriott International, Inc., “A” | | | 32,318 | | | | 4,048,476 | |

| | | | | | | | |

| | | | | | | $ | 20,302,088 | |

| General Merchandise - 1.3% | | | | | | | | |

| Dollar General Corp. | | | 142,194 | | | $ | 16,844,301 | |

| Dollar Tree, Inc. (a) | | | 141,479 | | | | 13,628,672 | |

| | | | | | | | |

| | | | | | | $ | 30,472,973 | |

| Health Maintenance Organizations - 1.6% | | | | | | | | |

| Cigna Corp. | | | 120,859 | | | $ | 21,082,644 | |

| Humana Inc. | | | 57,336 | | | | 16,343,053 | |

| | | | | | | | |

| | | | | | | $ | 37,425,697 | |

| Insurance - 4.3% | | | | | | | | |

| Aon PLC | | | 274,797 | | | $ | 47,135,930 | |

| Assurant, Inc. | | | 87,559 | | | | 9,017,701 | |

| Athene Holding Ltd. (a) | | | 107,022 | | | | 4,767,830 | |

| Chubb Ltd. | | | 157,108 | | | | 21,036,761 | |

| Everest Re Group Ltd. | | | 18,889 | | | | 4,270,992 | |

| Hartford Financial Services Group, Inc. | | | 325,478 | | | | 16,065,594 | |

| | | | | | | | |

| | | | | | | $ | 102,294,808 | |

8

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Internet - 4.5% | | | | | | | | |

| Alphabet, Inc., “A” (a)(s) | | | 60,475 | | | $ | 68,128,111 | |

| Facebook, Inc., “A” (a) | | | 242,647 | | | | 39,175,358 | |

| | | | | | | | |

| | | | | | | $ | 107,303,469 | |

| Leisure & Toys - 0.9% | | | | | | | | |

| Brunswick Corp. | | | 97,714 | | | $ | 5,153,436 | |

| Electronic Arts, Inc. (a) | | | 165,418 | | | | 15,843,736 | |

| | | | | | | | |

| | | | | | | $ | 20,997,172 | |

| Machinery & Tools - 1.3% | | | | | | | | |

| Flowserve Corp. | | | 158,927 | | | $ | 7,057,948 | |

| IDEX Corp. | | | 32,134 | | | | 4,630,509 | |

| ITT, Inc. | | | 79,138 | | | | 4,571,011 | |

| Roper Technologies, Inc. | | | 42,421 | | | | 13,729,557 | |

| | | | | | | | |

| | | | | | | $ | 29,989,025 | |

| Major Banks - 2.0% | | | | | | | | |

| Goldman Sachs Group, Inc. | | | 131,885 | | | $ | 25,941,779 | |

| PNC Financial Services Group, Inc. | | | 104,593 | | | | 13,180,810 | |

| State Street Corp. | | | 109,792 | | | | 7,890,751 | |

| | | | | | | | |

| | | | | | | $ | 47,013,340 | |

| Medical & Health Technology & Services - 1.5% | | | | | | | | |

| Guardant Health, Inc. (a) | | | 21,203 | | | $ | 1,412,968 | |

| HCA Healthcare, Inc. | | | 85,645 | | | | 11,908,081 | |

| ICON PLC (a) | | | 37,312 | | | | 5,222,934 | |

| IDEXX Laboratories, Inc. (a) | | | 18,075 | | | | 3,814,367 | |

| McKesson Corp. | | | 55,384 | | | | 7,042,629 | |

| Walgreens Boots Alliance, Inc. | | | 97,069 | | | | 6,910,342 | |

| | | | | | | | |

| | | | | | | $ | 36,311,321 | |

| Medical Equipment - 3.4% | | | | | | | | |

| Boston Scientific Corp. (a) | | | 362,420 | | | $ | 14,540,290 | |

| Danaher Corp. | | | 74,338 | | | | 9,442,413 | |

| Medtronic PLC | | | 304,560 | | | | 27,562,680 | |

| PerkinElmer, Inc. | | | 121,903 | | | | 11,478,386 | |

| STERIS PLC | | | 96,987 | | | | 11,731,548 | |

| West Pharmaceutical Services, Inc. | | | 59,749 | | | | 6,258,708 | |

| | | | | | | | |

| | | | | | | $ | 81,014,025 | |

| Metals & Mining - 0.2% | | | | | | | | |

| Teck Resources Ltd., “B” | | | 160,534 | | | $ | 3,602,383 | |

9

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Natural Gas - Pipeline - 0.4% | | | | | | | | |

| Enterprise Products Partners LP | | | 231,262 | | | $ | 6,394,395 | |

| Equitrans Midstream Corp. | | | 202,402 | | | | 3,570,371 | |

| | | | | | | | |

| | | | | | | $ | 9,964,766 | |

| Network & Telecom - 1.4% | | | | | | | | |

| Cisco Systems, Inc. | | | 578,254 | | | $ | 29,936,210 | |

| Interxion Holding N.V. (a) | | | 56,744 | | | | 3,716,732 | |

| | | | | | | | |

| | | | | | | $ | 33,652,942 | |

| Oil Services - 0.7% | | | | | | | | |

| Apergy Corp. (a) | | | 80,048 | | | $ | 3,360,415 | |

| Cactus, Inc., “A” (a) | | | 115,315 | | | | 4,181,322 | |

| Core Laboratories N.V. | | | 44,611 | | | | 2,891,239 | |

| Patterson-UTI Energy, Inc. | | | 326,609 | | | | 4,330,835 | |

| Schlumberger Ltd. | | | 56,964 | | | | 2,509,834 | |

| | | | | | | | |

| | | | | | | $ | 17,273,645 | |

| Other Banks & Diversified Financials - 6.8% | | | | | | | | |

| Bank OZK | | | 283,211 | | | $ | 9,289,321 | |

| BB&T Corp. | | | 375,928 | | | | 19,161,050 | |

| Citigroup, Inc. | | | 533,108 | | | | 34,108,250 | |

| EuroDekania Ltd. (u) | | | 580,280 | | | | 69,304 | |

| Mastercard, Inc., “A” | | | 189,398 | | | | 42,570,988 | |

| Prosperity Bancshares, Inc. | | | 40,578 | | | | 3,021,032 | |

| Signature Bank | | | 115,767 | | | | 15,716,528 | |

| U.S. Bancorp | | | 493,462 | | | | 25,507,051 | |

| Wintrust Financial Corp. | | | 146,718 | | | | 10,808,715 | |

| | | | | | | | |

| | | | | | | $ | 160,252,239 | |

| Pharmaceuticals - 6.1% | | | | | | | | |

| Elanco Animal Health, Inc. (a)(l) | | | 601,517 | | | $ | 18,189,874 | |

| Eli Lilly & Co. | | | 151,871 | | | | 19,179,789 | |

| Johnson & Johnson | | | 274,284 | | | | 37,478,166 | |

| Pfizer, Inc. | | | 987,963 | | | | 42,828,196 | |

| Zoetis, Inc. | | | 279,119 | | | | 26,301,383 | |

| | | | | | | | |

| | | | | | | $ | 143,977,408 | |

| Pollution Control - 0.4% | | | | | | | | |

| Evoqua Water Technologies LLC (a) | | | 304,797 | | | $ | 4,139,144 | |

| Waste Connections, Inc. | | | 76,138 | | | | 6,349,909 | |

| | | | | | | | |

| | | | | | | $ | 10,489,053 | |

10

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Railroad & Shipping - 1.3% | | | | | | | | |

| Canadian Pacific Railway Ltd. | | | 77,229 | | | $ | 15,946,244 | |

| Kansas City Southern Co. | | | 128,990 | | | | 14,013,474 | |

| | | | | | | | |

| | | | | | | $ | 29,959,718 | |

| Real Estate - 2.7% | | | | | | | | |

| Industrial Logistics Properties Trust, REIT | | | 465,357 | | | $ | 9,707,347 | |

| Life Storage, Inc., REIT | | | 22,842 | | | | 2,229,379 | |

| Medical Properties Trust, Inc., REIT | | | 1,373,065 | | | | 25,030,975 | |

| STORE Capital Corp., REIT | | | 334,143 | | | | 10,849,623 | |

| Sun Communities, Inc., REIT | | | 31,155 | | | | 3,538,274 | |

| W.P. Carey, Inc., REIT | | | 170,147 | | | | 12,568,759 | |

| | | | | | | | |

| | | | | | | $ | 63,924,357 | |

| Restaurants - 1.5% | | | | | | | | |

| Aramark | | | 186,206 | | | $ | 5,642,042 | |

| Starbucks Corp. | | | 336,870 | | | | 23,668,486 | |

| U.S. Foods Holding Corp. (a) | | | 184,100 | | | | 6,487,684 | |

| | | | | | | | |

| | | | | | | $ | 35,798,212 | |

| Specialty Chemicals - 0.2% | | | | | | | | |

| Univar, Inc. (a) | | | 203,842 | | | $ | 4,608,868 | |

| | |

| Specialty Stores - 5.2% | | | | | | | | |

| Amazon.com, Inc. (a)(s) | | | 42,212 | | | $ | 69,220,504 | |

| Costco Wholesale Corp. | | | 85,191 | | | | 18,634,679 | |

| Floor & Decor Holdings, Inc. (a) | | | 251,600 | | | | 9,354,488 | |

| Ross Stores, Inc. | | | 181,018 | | | | 17,165,937 | |

| Tractor Supply Co. | | | 98,222 | | | | 9,365,468 | |

| | | | | | | | |

| | | | | | | $ | 123,741,076 | |

| Telecommunications - Wireless - 2.1% | | | | | | | | |

| American Tower Corp., REIT | | | 276,655 | | | $ | 48,732,778 | |

| | |

| Telephone Services - 0.6% | | | | | | | | |

| Verizon Communications, Inc. | | | 249,551 | | | $ | 14,204,443 | |

| | |

| Tobacco - 0.6% | | | | | | | | |

| Philip Morris International, Inc. | | | 174,432 | | | $ | 15,165,118 | |

| | |

| Utilities - Electric Power - 3.1% | | | | | | | | |

| American Electric Power Co., Inc. | | | 129,627 | | | $ | 10,519,231 | |

| Avangrid, Inc. | | | 99,376 | | | | 4,804,830 | |

| CenterPoint Energy, Inc. | | | 226,115 | | | | 6,815,106 | |

| CMS Energy Corp. | | | 157,800 | | | | 8,584,320 | |

11

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Utilities - Electric Power - continued | | | | | | | | |

| Evergy, Inc. | | | 129,882 | | | $ | 7,261,703 | |

| Exelon Corp. | | | 223,436 | | | | 10,856,755 | |

| NextEra Energy, Inc. | | | 75,626 | | | | 14,196,513 | |

| Xcel Energy, Inc. | | | 170,618 | | | | 9,360,103 | |

| | | | | | | | |

| | | | | | | $ | 72,398,561 | |

| Total Common Stocks (Identified Cost, $1,880,983,457) | | | $ | 2,333,860,155 | |

| | |

| Convertible Preferred Stocks - 0.1% | | | | | | | | |

| Natural Gas - Distribution - 0.1% | | | | | | | | |

| South Jersey Industries, Inc. (Identified Cost, $1,879,350) | | | 37,587 | | | $ | 1,822,969 | |

| | |

| Investment Companies (h) - 0.8% | | | | | | | | |

| Money Market Funds - 0.8% | | | | | | | | |

MFS Institutional Money Market Portfolio, 2.49% (v)

(Identified Cost, $19,795,559) | | | 19,797,011 | | | $ | 19,797,011 | |

| | |

| Collateral for Securities Loaned - 0.7% | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio, 2.43% (j) (Identified Cost, $15,537,524) | | | 15,537,524 | | | $ | 15,537,524 | |

| | |

| Securities Sold Short - (0.4)% | | | | | | | | |

| Medical & Health Technology & Services - (0.2)% | | | | | | | | |

| Healthcare Services Group, Inc. | | | (85,694 | ) | | $ | (3,271,797 | ) |

| | |

| Telecommunications - Wireless - (0.2)% | | | | | | | | |

| Crown Castle International Corp., REIT | | | (44,300 | ) | | $ | (5,260,625 | ) |

Total Securities Sold Short

(Proceeds Received, $7,128,701) | | | | | | $ | (8,532,422 | ) |

| | |

| Other Assets, Less Liabilities - (0.2)% | | | | | | | (4,601,686 | ) |

| Net Assets - 100.0% | | | | | | $ | 2,357,883,551 | |

| (a) | Non-income producing security. |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund’s investments in affiliated issuers and in unaffiliated issuers were $19,797,011 and $2,351,220,648, respectively. |

| (j) | The rate quoted is the annualizedseven-day yield of the fund at period end. |

| (l) | A portion of this security is on loan. See Note 2 for additional information. |

| (s) | Security or a portion of the security was pledged to cover collateral requirements for securities sold short. |

| (u) | The security was valued using significant unobservable inputs and is considered level 3 under the fair value hierarchy. For further information about the fund’s level 3 holdings, please see Note 2 in the Notes to Financial Statements. |

12

Portfolio of Investments (unaudited) – continued

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualizedseven-day yield of the fund at period end. |

The following abbreviations are used in this report and are defined:

| PLC | | Public Limited Company |

| REIT | | Real Estate Investment Trust |

At February 28, 2019, the fund had cash collateral of $3,474,344 and other liquid securities with an aggregate value of $10,168,175 to cover any collateral or margin obligations for securities sold short. Restricted cash and/or deposits with brokers in the Statement of Assets and Liabilities are comprised of cash collateral.

See Notes to Financial Statements

13

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 2/28/19 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | |

| Assets | | | | |

Investments in unaffiliated issuers, at value, including $15,405,072 of securities on loan (identified cost, $1,898,400,331) | | | $2,351,220,648 | |

Investments in affiliated issuers, at value (identified cost, $19,795,559) | | | 19,797,011 | |

Deposits with brokers for | | | | |

Securities sold short | | | 3,474,344 | |

Receivables for | | | | |

Investments sold | | | 13,078,501 | |

Fund shares sold | | | 8,032,390 | |

Interest and dividends | | | 3,878,509 | |

Other assets | | | 7,997 | |

Total assets | | | $2,399,489,400 | |

| |

| Liabilities | | | | |

Payable to custodian | | | $6,300 | |

Payables for | | | | |

Dividends on securities sold short | | | 16,817 | |

Securities sold short, at value (proceeds received, $7,128,701) | | | 8,532,422 | |

Investments purchased | | | 15,705,882 | |

Fund shares reacquired | | | 1,149,628 | |

Collateral for securities loaned, at value | | | 15,537,524 | |

Payable to affiliates | | | | |

Investment adviser | | | 74,525 | |

Shareholder servicing costs | | | 477,701 | |

Distribution and service fees | | | 16,397 | |

Payable for independent Trustees’ compensation | | | 10,451 | |

Accrued expenses and other liabilities | | | 78,202 | |

Total liabilities | | | $41,605,849 | |

Net assets | | | $2,357,883,551 | |

| |

| Net assets consist of | | | | |

Paid-in capital | | | $1,878,852,963 | |

Total distributable earnings (loss) | | | 479,030,588 | |

Net assets | | | $2,357,883,551 | |

Shares of beneficial interest outstanding | | | 76,462,116 | |

14

Statement of Assets and Liabilities (unaudited) – continued

| | | | | | | | | | | | |

| | | |

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share (a) | |

Class A | | | $1,209,405,757 | | | | 39,943,806 | | | | $30.28 | |

Class B | | | 24,569,766 | | | | 929,266 | | | | 26.44 | |

Class C | | | 64,495,915 | | | | 2,471,562 | | | | 26.10 | |

Class I | | | 342,839,071 | | | | 10,671,714 | | | | 32.13 | |

Class R1 | | | 3,043,826 | | | | 116,726 | | | | 26.08 | |

Class R2 | | | 13,019,173 | | | | 440,884 | | | | 29.53 | |

Class R3 | | | 40,215,584 | | | | 1,331,900 | | | | 30.19 | |

Class R4 | | | 24,117,641 | | | | 789,908 | | | | 30.53 | |

Class R6 | | | 636,176,818 | | | | 19,766,350 | | | | 32.18 | |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $32.13 [100 / 94.25 x $30.28]. On sales of $50,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R6. |

See Notes to Financial Statements

15

Financial Statements

STATEMENT OF OPERATIONS

Six months ended 2/28/19 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | |

| Net investment income (loss) | | | | |

Income | | | | |

Dividends | | | $18,719,606 | |

Dividends from affiliated issuers | | | 416,399 | |

Other | | | 120,989 | |

Income on securities loaned | | | 111,457 | |

Foreign taxes withheld | | | (46,590 | ) |

Total investment income | | | $19,321,861 | |

Expenses | | | | |

Management fee | | | $6,122,526 | |

Distribution and service fees | | | 1,916,578 | |

Shareholder servicing costs | | | 929,803 | |

Administrative services fee | | | 146,166 | |

Independent Trustees’ compensation | | | 10,138 | |

Custodian fee | | | 50,775 | |

Shareholder communications | | | 55,538 | |

Audit and tax fees | | | 28,586 | |

Legal fees | | | 8,259 | |

Dividend and interest expense on securities sold short | | | 189,426 | |

Interest expense and fees | | | 6,078 | |

Miscellaneous | | | 129,919 | |

Total expenses | | | $9,593,792 | |

Reduction of expenses by investment adviser and distributor | | | (144,928 | ) |

Net expenses | | | $9,448,864 | |

Net investment income (loss) | | | $9,872,997 | |

| |

| Realized and unrealized gain (loss) | | | | |

Realized gain (loss) (identified cost basis) | | | | |

Unaffiliated issuers | | | $20,732,230 | |

Affiliated issuers | | | (9,437 | ) |

Foreign currency | | | 151 | |

Net realized gain (loss) | | | $20,722,944 | |

Change in unrealized appreciation or depreciation | | | | |

Unaffiliated issuers | | | $(67,058,694 | ) |

Affiliated issuers | | | (2,318 | ) |

Securities sold short | | | (30,384 | ) |

Translation of assets and liabilities in foreign currencies | | | 115 | |

Net unrealized gain (loss) | | | $(67,091,281 | ) |

Net realized and unrealized gain (loss) | | | $(46,368,337 | ) |

Change in net assets from operations | | | $(36,495,340 | ) |

See Notes to Financial Statements

16

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | | | |

| Change in net assets | | Six months ended

2/28/19

(unaudited) | | | Year ended

8/31/18 | |

| | |

| From operations | | | | | | | | |

Net investment income (loss) | | | $9,872,997 | | | | $12,999,055 | |

Net realized gain (loss) | | | 20,722,944 | | | | 202,361,180 | |

Net unrealized gain (loss) | | | (67,091,281 | ) | | | 132,966,174 | |

Change in net assets from operations | | | $(36,495,340 | ) | | | $348,326,409 | |

Total distributions to shareholders (a) | | | $(199,800,134 | ) | | | $(118,520,157 | ) |

Change in net assets from fund share transactions | | | $420,157,187 | | | | $249,008,217 | |

Total change in net assets | | | $183,861,713 | | | | $478,814,469 | |

| | |

| Net assets | | | | | | | | |

At beginning of period | | | 2,174,021,838 | | | | 1,695,207,369 | |

At end of period (b) | | | $2,357,883,551 | | | | $2,174,021,838 | |

| (a) | Distributions from net investment income and from net realized gain are no longer required to be separately disclosed. See Note 2. For the year ended August 31, 2018, distributions from net investment income and from net realized gain were $10,130,006 and $108,390,151, respectively. |

| (b) | Parenthetical disclosure of undistributed net investment income is no longer required. See Note 2. For the year ended August 31, 2018, end of period net assets included undistributed net investment income of $12,453,901. |

See Notes to Financial Statements

17

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/19 | | | Year ended | |

| Class A | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $34.18 | | | | $30.46 | | | | $26.72 | | | | $27.19 | | | | $29.19 | | | | $23.82 | |

| | | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.13 | | | | $0.20 | | | | $0.18 | (c) | | | $0.18 | | | | $0.15 | | | | $0.13 | |

Net realized and unrealized

gain (loss) | | | (1.05 | ) | | | 5.63 | | | | 4.53 | | | | 2.08 | | | | 0.13 | | | | 5.41 | |

Total from investment operations | | | $(0.92 | ) | | | $5.83 | | | | $4.71 | | | | $2.26 | | | | $0.28 | | | | $5.54 | |

| | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | |

From net investment income | | | $(0.16 | ) | | | $(0.17 | ) | | | $(0.16 | ) | | | $(0.14 | ) | | | $(0.13 | ) | | | $(0.17 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | |

Total distributions declared to

shareholders | | | $(2.98 | ) | | | $(2.11 | ) | | | $(0.97 | ) | | | $(2.73 | ) | | | $(2.28 | ) | | | $(0.17 | ) |

Net asset value, end of period (x) | | | $30.28 | | | | $34.18 | | | | $30.46 | | | | $26.72 | | | | $27.19 | | | | $29.19 | |

Total return (%) (r)(s)(t)(x) | | | (2.08 | )(n) | | | 19.89 | | | | 18.11 | (c) | | | 9.09 | | | | 0.98 | | | | 23.33 | |

| | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 0.99 | (a) | | | 1.00 | | | | 1.03 | (c) | | | 1.07 | | | | 1.05 | | | | 1.05 | |

Expenses after expense

reductions (f) | | | 0.97 | (a) | | | 0.99 | | | | 1.01 | (c) | | | 1.05 | | | | 1.04 | | | | 1.04 | |

Net investment income (loss) | | | 0.83 | (a) | | | 0.62 | | | | 0.63 | (c) | | | 0.70 | | | | 0.52 | | | | 0.49 | |

Portfolio turnover | | | 24 | (n) | | | 42 | | | | 46 | | | | 68 | | | | 53 | | | | 48 | |

Net assets at end of period

(000 omitted) | | | $1,209,406 | | | | $1,184,976 | | | | $992,736 | | | | $959,812 | | | | $963,167 | | | | $1,002,028 | |

| | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | |

Ratio of expenses to average net

assets after expense reductions

excluding short sale expenses

and interest expense and fees (f) | | | 0.96 | (a) | | | 0.97 | | | | 1.00 | (c) | | | 1.04 | | | | 1.03 | | | | 1.04 | |

See Notes to Financial Statements

18

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/19 | | | Year ended | |

| Class B | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $30.19 | | | | $27.17 | | | | $23.96 | | | | $24.70 | | | | $26.78 | | | | $21.88 | |

| | | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.01 | | | | $(0.04 | ) | | | $(0.03 | )(c) | | | $(0.02 | ) | | | $(0.06 | ) | | | $(0.06 | ) |

Net realized and unrealized

gain (loss) | | | (0.94 | ) | | | 5.00 | | | | 4.05 | | | | 1.87 | | | | 0.13 | | | | 4.96 | |

Total from investment operations | | | $(0.93 | ) | | | $4.96 | | | | $4.02 | | | | $1.85 | | | | $0.07 | | | | $4.90 | |

| | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $— | | | | $— | | | | $— | | | | $— | | | | $— | |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | |

Total distributions declared to

shareholders | | | $(2.82 | ) | | | $(1.94 | ) | | | $(0.81 | ) | | | $(2.59 | ) | | | $(2.15 | ) | | | $— | |

Net asset value, end of period (x) | | | $26.44 | | | | $30.19 | | | | $27.17 | | | | $23.96 | | | | $24.70 | | | | $26.78 | |

Total return (%) (r)(s)(t)(x) | | | (2.44 | )(n) | | | 19.01 | | | | 17.21 | (c) | | | 8.24 | | | | 0.25 | | | | 22.39 | |

| | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.74 | (a) | | | 1.75 | | | | 1.78 | (c) | | | 1.82 | | | | 1.80 | | | | 1.80 | |

Expenses after expense

reductions (f) | | | 1.72 | (a) | | | 1.74 | | | | 1.77 | (c) | | | 1.81 | | | | 1.80 | | | | 1.80 | |

Net investment income (loss) | | | 0.06 | (a) | | | (0.14 | ) | | | (0.12 | )(c) | | | (0.07 | ) | | | (0.23 | ) | | | (0.26 | ) |

Portfolio turnover | | | 24 | (n) | | | 42 | | | | 46 | | | | 68 | | | | 53 | | | | 48 | |

Net assets at end of period

(000 omitted) | | | $24,570 | | | | $26,993 | | | | $27,139 | | | | $30,324 | | | | $34,126 | | | | $40,536 | |

| | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | |

Ratio of expenses to average net

assets after expense reductions

excluding short sale expenses

and interest expense and fees (f) | | | 1.71 | (a) | | | 1.72 | | | | 1.75 | (c) | | | 1.79 | | | | 1.79 | | | | 1.80 | |

See Notes to Financial Statements

19

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/19 | | | Year ended | |

| Class C | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $29.84 | | | | $26.88 | | | | $23.71 | | | | $24.47 | | | | $26.55 | | | | $21.72 | |

| | | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.01 | | | | $(0.05 | ) | | | $(0.03 | )(c) | | | $(0.01 | ) | | | $(0.06 | ) | | | $(0.06 | ) |

Net realized and unrealized

gain (loss) | | | (0.93 | ) | | | 4.95 | | | | 4.01 | | | | 1.84 | | | | 0.13 | | | | 4.92 | |

Total from investment operations | | | $(0.92 | ) | | | $4.90 | | | | $3.98 | | | | $1.83 | | | | $0.07 | | | | $4.86 | |

| | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $— | | | | $— | | | | $— | | | | $— | | | | $(0.03 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | |

Total distributions declared to

shareholders | | | $(2.82 | ) | | | $(1.94 | ) | | | $(0.81 | ) | | | $(2.59 | ) | | | $(2.15 | ) | | | $(0.03 | ) |

Net asset value, end of period (x) | | | $26.10 | | | | $29.84 | | | | $26.88 | | | | $23.71 | | | | $24.47 | | | | $26.55 | |

Total return (%) (r)(s)(t)(x) | | | (2.44 | )(n) | | | 18.98 | | | | 17.22 | (c) | | | 8.24 | | | | 0.26 | | | | 22.38 | |

| | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.74 | (a) | | | 1.75 | | | | 1.78 | (c) | | | 1.82 | | | | 1.80 | | | | 1.80 | |

Expenses after expense

reductions (f) | | | 1.73 | (a) | | | 1.74 | | | | 1.77 | (c) | | | 1.81 | | | | 1.80 | | | | 1.80 | |

Net investment income (loss) | | | 0.09 | (a) | | | (0.17 | ) | | | (0.12 | )(c) | | | (0.05 | ) | | | (0.23 | ) | | | (0.26 | ) |

Portfolio turnover | | | 24 | (n) | | | 42 | | | | 46 | | | | 68 | | | | 53 | | | | 48 | |

Net assets at end of period

(000 omitted) | | | $64,496 | | | | $56,413 | | | | $89,946 | | | | $89,160 | | | | $88,020 | | | | $89,702 | |

| | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | |

Ratio of expenses to average net

assets after expense reductions

excluding short sale expenses

and interest expense and fees (f) | | | 1.71 | (a) | | | 1.72 | | | | 1.75 | (c) | | | 1.79 | | | | 1.79 | | | | 1.80 | |

See Notes to Financial Statements

20

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/19 | | | Year ended | |

| Class I | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $36.12 | | | | $32.07 | | | | $28.10 | | | | $28.44 | | | | $30.43 | | | | $24.82 | |

| | | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.18 | | | | $0.30 | | | | $0.26 | (c) | | | $0.29 | | | | $0.23 | | | | $0.21 | |

Net realized and unrealized

gain (loss) | | | (1.11 | ) | | | 5.93 | | | | 4.76 | | | | 2.15 | | | | 0.13 | | | | 5.62 | |

Total from investment operations | | | $(0.93 | ) | | | $6.23 | | | | $5.02 | | | | $2.44 | | | | $0.36 | | | | $5.83 | |

| | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | |

From net investment income | | | $(0.24 | ) | | | $(0.24 | ) | | | $(0.24 | ) | | | $(0.19 | ) | | | $(0.20 | ) | | | $(0.22 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | |

Total distributions declared to

shareholders | | | $(3.06 | ) | | | $(2.18 | ) | | | $(1.05 | ) | | | $(2.78 | ) | | | $(2.35 | ) | | | $(0.22 | ) |

Net asset value, end of period (x) | | | $32.13 | | | | $36.12 | | | | $32.07 | | | | $28.10 | | | | $28.44 | | | | $30.43 | |

Total return (%) (r)(s)(t)(x) | | | (1.97 | )(n) | | | 20.21 | | | | 18.38 | (c) | | | 9.36 | | | | 1.23 | | | | 23.61 | |

| | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 0.74 | (a) | | | 0.75 | | | | 0.78 | (c) | | | 0.81 | | | | 0.80 | | | | 0.80 | |

Expenses after expense

reductions (f) | | | 0.73 | (a) | | | 0.74 | | | | 0.77 | (c) | | | 0.80 | | | | 0.80 | | | | 0.80 | |

Net investment income (loss) | | | 1.11 | (a) | | | 0.88 | | | | 0.88 | (c) | | | 1.07 | | | | 0.77 | | | | 0.73 | |

Portfolio turnover | | | 24 | (n) | | | 42 | | | | 46 | | | | 68 | | | | 53 | | | | 48 | |

Net assets at end of period

(000 omitted) | | | $342,839 | | | | $246,779 | | | | $122,055 | | | | $61,739 | | | | $49,768 | | | | $45,089 | |

| | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | |

Ratio of expenses to average net

assets after expense reductions

excluding short sale expenses

and interest expense and fees (f) | | | 0.71 | (a) | | | 0.73 | | | | 0.75 | (c) | | | 0.79 | | | | 0.79 | | | | 0.80 | |

See Notes to Financial Statements

21

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/19 | | | Year ended | |

| Class R1 | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $29.82 | | | | $26.86 | | | | $23.70 | | | | $24.45 | | | | $26.54 | | | | $21.69 | |

| | | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.01 | | | | $(0.04 | ) | | | $(0.03 | )(c) | | | $(0.02 | ) | | | $(0.06 | ) | | | $(0.06 | ) |

Net realized and unrealized

gain (loss) | | | (0.93 | ) | | | 4.94 | | | | 4.00 | | | | 1.86 | | | | 0.12 | | | | 4.91 | |

Total from investment operations | | | $(0.92 | ) | | | $4.90 | | | | $3.97 | | | | $1.84 | | | | $0.06 | | | | $4.85 | |

| | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | |

From net investment income | | | $— | | | | $— | | | | $— | | | | $— | | | | $— | | | | $(0.00 | )(w) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | |

Total distributions declared to

shareholders | | | $(2.82 | ) | | | $(1.94 | ) | | | $(0.81 | ) | | | $(2.59 | ) | | | $(2.15 | ) | | | $(0.00 | )(w) |

Net asset value, end of period (x) | | | $26.08 | | | | $29.82 | | | | $26.86 | | | | $23.70 | | | | $24.45 | | | | $26.54 | |

Total return (%) (r)(s)(t)(x) | | | (2.44 | )(n) | | | 19.00 | | | | 17.19 | (c) | | | 8.29 | | | | 0.22 | | | | 22.38 | |

| | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.74 | (a) | | | 1.75 | | | | 1.78 | (c) | | | 1.82 | | | | 1.80 | | | | 1.80 | |

Expenses after expense

reductions (f) | | | 1.73 | (a) | | | 1.74 | | | | 1.77 | (c) | | | 1.81 | | | | 1.80 | | | | 1.80 | |

Net investment income (loss) | | | 0.06 | (a) | | | (0.14 | ) | | | (0.13 | )(c) | | | (0.09 | ) | | | (0.23 | ) | | | (0.26 | ) |

Portfolio turnover | | | 24 | (n) | | | 42 | | | | 46 | | | | 68 | | | | 53 | | | | 48 | |

Net assets at end of period

(000 omitted) | | | $3,044 | | | | $3,448 | | | | $3,103 | | | | $2,935 | | | | $3,625 | | | | $4,132 | |

| | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | |

Ratio of expenses to average net

assets after expense reductions

excluding short sale expenses

and interest expense and fees (f) | | | 1.71 | (a) | | | 1.73 | | | | 1.75 | (c) | | | 1.80 | | | | 1.79 | | | | 1.80 | |

See Notes to Financial Statements

22

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/19 | | | Year ended | |

| Class R2 | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $33.33 | | | | $29.75 | | | | $26.12 | | | | $26.62 | | | | $28.59 | | | | $23.35 | |

| | | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.08 | | | | $0.11 | | | | $0.10 | (c) | | | $0.11 | | | | $0.07 | | | | $0.06 | |

Net realized and unrealized

gain (loss) | | | (1.02 | ) | | | 5.50 | | | | 4.43 | | | | 2.04 | | | | 0.14 | | | | 5.29 | |

Total from investment operations | | | $(0.94 | ) | | | $5.61 | | | | $4.53 | | | | $2.15 | | | | $0.21 | | | | $5.35 | |

| | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | |

From net investment income | | | $(0.04 | ) | | | $(0.09 | ) | | | $(0.09 | ) | | | $(0.06 | ) | | | $(0.03 | ) | | | $(0.11 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | |

Total distributions declared to

shareholders | | | $(2.86 | ) | | | $(2.03 | ) | | | $(0.90 | ) | | | $(2.65 | ) | | | $(2.18 | ) | | | $(0.11 | ) |

Net asset value, end of period (x) | | | $29.53 | | | | $33.33 | | | | $29.75 | | | | $26.12 | | | | $26.62 | | | | $28.59 | |

Total return (%) (r)(s)(t)(x) | | | (2.23 | )(n) | | | 19.61 | | | | 17.80 | (c) | | | 8.82 | | | | 0.75 | | | | 22.96 | |

| | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 1.24 | (a) | | | 1.25 | | | | 1.28 | (c) | | | 1.32 | | | | 1.30 | | | | 1.30 | |

Expenses after expense

reductions (f) | | | 1.22 | (a) | | | 1.24 | | | | 1.27 | (c) | | | 1.31 | | | | 1.30 | | | | 1.30 | |

Net investment income (loss) | | | 0.56 | (a) | | | 0.35 | | | | 0.38 | (c) | | | 0.46 | | | | 0.27 | | | | 0.24 | |

Portfolio turnover | | | 24 | (n) | | | 42 | | | | 46 | | | | 68 | | | | 53 | | | | 48 | |

Net assets at end of period

(000 omitted) | | | $13,019 | | | | $15,202 | | | | $16,508 | | | | $15,932 | | | | $16,332 | | | | $19,434 | |

| | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | |

Ratio of expenses to average net

assets after expense reductions

excluding short sale expenses

and interest expense and fees (f) | | | 1.21 | (a) | | | 1.22 | | | | 1.25 | (c) | | | 1.29 | | | | 1.29 | | | | 1.30 | |

See Notes to Financial Statements

23

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/19 | | | Year ended | |

| Class R3 | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $34.11 | | | | $30.33 | | | | $26.61 | | | | $27.10 | | | | $29.10 | | | | $23.75 | |

| | | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.12 | | | | $0.20 | | | | $0.17 | (c) | | | $0.18 | | | | $0.15 | | | | $0.13 | |

Net realized and unrealized

gain (loss) | | | (1.05 | ) | | | 5.61 | | | | 4.52 | | | | 2.06 | | | | 0.13 | | | | 5.39 | |

Total from investment operations | | | $(0.93 | ) | | | $5.81 | | | | $4.69 | | | | $2.24 | | | | $0.28 | | | | $5.52 | |

| | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | |

From net investment income | | | $(0.17 | ) | | | $(0.09 | ) | | | $(0.16 | ) | | | $(0.14 | ) | | | $(0.13 | ) | | | $(0.17 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | |

Total distributions declared to

shareholders | | | $(2.99 | ) | | | $(2.03 | ) | | | $(0.97 | ) | | | $(2.73 | ) | | | $(2.28 | ) | | | $(0.17 | ) |

Net asset value, end of period (x) | | | $30.19 | | | | $34.11 | | | | $30.33 | | | | $26.61 | | | | $27.10 | | | | $29.10 | |

Total return (%) (r)(s)(t)(x) | | | (2.12 | )(n) | | | 19.91 | | | | 18.10 | (c) | | | 9.06 | | | | 0.99 | | | | 23.32 | |

| | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 0.99 | (a) | | | 1.00 | | | | 1.02 | (c) | | | 1.07 | | | | 1.05 | | | | 1.05 | |

Expenses after expense

reductions (f) | | | 0.98 | (a) | | | 0.99 | | | | 1.02 | (c) | | | 1.06 | | | | 1.05 | | | | 1.05 | |

Net investment income (loss) | | | 0.83 | (a) | | | 0.61 | | | | 0.62 | (c) | | | 0.71 | | | | 0.52 | | | | 0.49 | |

Portfolio turnover | | | 24 | (n) | | | 42 | | | | 46 | | | | 68 | | | | 53 | | | | 48 | |

Net assets at end of period

(000 omitted) | | | $40,216 | | | | $34,916 | | | | $28,075 | | | | $77,217 | | | | $65,775 | | | | $68,977 | |

| | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | |

Ratio of expenses to average net

assets after expense reductions

excluding short sale expenses

and interest expense and fees (f) | | | 0.96 | (a) | | | 0.98 | | | | 1.00 | (c) | | | 1.04 | | | | 1.04 | | | | 1.05 | |

See Notes to Financial Statements

24

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/19 | | | Year ended | |

| Class R4 | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $34.48 | | | | $30.71 | | | | $26.93 | | | | $27.39 | | | | $29.40 | | | | $23.99 | |

| | | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.16 | | | | $0.28 | | | | $0.25 | (c) | | | $0.23 | | | | $0.22 | | | | $0.20 | |

Net realized and unrealized

gain (loss) | | | (1.06 | ) | | | 5.67 | | | | 4.57 | | | | 2.11 | | | | 0.12 | | | | 5.44 | |

Total from investment operations | | | $(0.90 | ) | | | $5.95 | | | | $4.82 | | | | $2.34 | | | | $0.34 | | | | $5.64 | |

| | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | |

From net investment income | | | $(0.23 | ) | | | $(0.24 | ) | | | $(0.23 | ) | | | $(0.21 | ) | | | $(0.20 | ) | | | $(0.23 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | |

Total distributions declared to

shareholders | | | $(3.05 | ) | | | $(2.18 | ) | | | $(1.04 | ) | | | $(2.80 | ) | | | $(2.35 | ) | | | $(0.23 | ) |

Net asset value, end of period (x) | | | $30.53 | | | | $34.48 | | | | $30.71 | | | | $26.93 | | | | $27.39 | | | | $29.40 | |

Total return (%) (r)(s)(t)(x) | | | (1.98 | )(n) | | | 20.18 | | | | 18.40 | (c) | | | 9.36 | | | | 1.22 | | | | 23.62 | |

| | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 0.74 | (a) | | | 0.75 | | | | 0.78 | (c) | | | 0.82 | | | | 0.80 | | | | 0.81 | |

Expenses after expense

reductions (f) | | | 0.73 | (a) | | | 0.74 | | | | 0.77 | (c) | | | 0.81 | | | | 0.80 | | | | 0.80 | |

Net investment income (loss) | | | 1.05 | (a) | | | 0.86 | | | | 0.87 | (c) | | | 0.90 | | | | 0.76 | | | | 0.72 | |

Portfolio turnover | | | 24 | (n) | | | 42 | | | | 46 | | | | 68 | | | | 53 | | | | 48 | |

Net assets at end of period

(000 omitted) | | | $24,118 | | | | $27,707 | | | | $22,494 | | | | $15,799 | | | | $21,159 | | | | $19,706 | |

| | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | |

Ratio of expenses to average net

assets after expense reductions

excluding short sale expenses

and interest expense and fees (f) | | | 0.71 | (a) | | | 0.73 | | | | 0.76 | (c) | | | 0.79 | | | | 0.79 | | | | 0.80 | |

See Notes to Financial Statements

25

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended

2/28/19 | | | Year ended | |

| Class R6 | | 8/31/18 | | | 8/31/17 | | | 8/31/16 | | | 8/31/15 | | | 8/31/14 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $36.18 | | | | $32.12 | | | | $28.13 | | | | $28.49 | | | | $30.47 | | | | $24.84 | |

| | | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.19 | | | | $0.32 | | | | $0.29 | (c) | | | $0.58 | | | | $0.24 | | | | $0.23 | |

Net realized and unrealized

gain (loss) | | | (1.11 | ) | | | 5.95 | | | | 4.77 | | | | 1.89 | | | | 0.15 | | | | 5.64 | |

Total from investment operations | | | $(0.92 | ) | | | $6.27 | | | | $5.06 | | | | $2.47 | | | | $0.39 | | | | $5.87 | |

| | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | |

From net investment income | | | $(0.26 | ) | | | $(0.27 | ) | | | $(0.27 | ) | | | $(0.24 | ) | | | $(0.22 | ) | | | $(0.24 | ) |

From net realized gain | | | (2.82 | ) | | | (1.94 | ) | | | (0.81 | ) | | | (2.59 | ) | | | (2.15 | ) | | | — | |

Total distributions declared to

shareholders | | | $(3.08 | ) | | | $(2.21 | ) | | | $(1.07 | ) | | | $(2.83 | ) | | | $(2.37 | ) | | | $(0.24 | ) |

Net asset value, end of period (x) | | | $32.18 | | | | $36.18 | | | | $32.12 | | | | $28.13 | | | | $28.49 | | | | $30.47 | |

Total return (%) (r)(s)(t)(x) | | | (1.94 | )(n) | | | 20.29 | | | | 18.49 | (c) | | | 9.46 | | | | 1.34 | | | | 23.73 | |

| | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | | 0.66 | (a) | | | 0.67 | | | | 0.69 | (c) | | | 0.70 | | | | 0.71 | | | | 0.71 | |

Expenses after expense

reductions (f) | | | 0.65 | (a) | | | 0.66 | | | | 0.68 | (c) | | | 0.69 | | | | 0.70 | | | | 0.71 | |

Net investment income (loss) | | | 1.16 | (a) | | | 0.95 | | | | 0.97 | (c) | | | 2.10 | | | | 0.82 | | | | 0.80 | |

Portfolio turnover | | | 24 | (n) | | | 42 | | | | 46 | | | | 68 | | | | 53 | | | | 48 | |

Net assets at end of period

(000 omitted) | | | $636,177 | | | | $577,588 | | | | $393,153 | | | | $300,078 | | | | $6,198 | | | | $2,492 | |

| | | |

| Supplemental Ratios (%): | | | | | | | | | | | | | |

Ratio of expenses to average net

assets after expense reductions

excluding short sale expenses

and interest expense and fees (f) | | | 0.63 | (a) | | | 0.65 | | | | 0.66 | (c) | | | 0.68 | | | | 0.69 | | | | 0.71 | |

See Notes to Financial Statements

26

Financial Highlights – continued

| (c) | Amount reflects aone-time reimbursement of expenses by the custodian (or former custodian) without which net investment income and performance would be lower and expenses would be higher. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. Excluding the effect of the proceeds received from anon-recurring litigation settlement against Household International, Inc., the total return for the year ended August 31, 2017 would have been lower by approximately 0.85%. |

| (t) | Total returns do not include any applicable sales charges. |

| (w) | Per share amount was less than $0.01. |

| (x) | The net asset values and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

27

NOTES TO FINANCIAL STATEMENTS

(unaudited)

(1) Business and Organization

MFS Core Equity Fund (the fund) is a diversified series of MFS Series Trust I (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as anopen-end management investment company.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

(2) Significant Accounting Policies

General– The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued.

In August 2018, the Securities and Exchange Commission (SEC) released its Final Rule on Disclosure Update and Simplification (the “Final Rule”) which is intended to simplify an issuer’s disclosure compliance efforts by removing redundant or outdated disclosure requirements without significantly altering the mix of information provided to investors. Effective with the current reporting period, the fund adopted the Final Rule with the impacts being that the fund is no longer required to present the components of distributable earnings on the Statement of Assets and Liabilities or the sources of distributions to shareholders and the amount of undistributed net investment income on the Statements of Changes in Net Assets.

Balance Sheet Offsetting– The fund’s accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement, or similar agreement, does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund’s right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’sin-scope financial instruments and transactions.

Investment Valuations– Equity securities, including restricted equity securities and equity securities sold short, are generally valued at the last sale or official closing price on their primary market or exchange as provided by a third-party pricing service. Equity securities, for which there were no sales reported that day, are generally valued at the

28

Notes to Financial Statements (unaudited) – continued

last quoted daily bid quotation on their primary market or exchange as provided by a third-party pricing service. Equity securities sold short, for which there were no sales reported for that day, are generally valued at the last quoted daily ask quotation on their primary market or exchange as provided by a third-party pricing service.Short-term instruments with a maturity at issuance of 60 days or less may be valued at amortized cost, which approximates market value.Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. In determining values, third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur on a frequent basis after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

29

Notes to Financial Statements (unaudited) – continued

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. The following is a summary of the levels used as of February 28, 2019 in valuing the fund’s assets or liabilities:

| | | | | | | | | | | | | | | | |

| | | | |

| Financial Instruments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Equity Securities | | | $2,335,613,820 | | | | $— | | | | $69,304 | | | | $2,335,683,124 | |

| Mutual Funds | | | 35,334,535 | | | | — | | | | — | | | | 35,334,535 | |

| Total | | | $2,370,948,355 | | | | $— | | | | $69,304 | | | | $2,371,017,659 | |

| | | | |

| Short Sales | | | $(8,532,422 | ) | | | $— | | | | $— | | | | $(8,532,422 | ) |

For further information regarding security characteristics, see the Portfolio of Investments.

The following is a reconciliation of level 3 assets for which significant unobservable inputs were used to determine fair value. The table presents the activity of level 3 securities held at the beginning and the end of the period.

| | | | |

| |

| | | Equity Securities | |

| Balance as of 8/31/18 | | | $73,250 | |

Change in unrealized appreciation or depreciation | | | (3,946 | ) |

| Balance as of 2/28/19 | | | $69,304 | |

The net change in unrealized appreciation or depreciation from investments held as level 3 at February 28, 2019 is $(3,946). At February 28, 2019, the fund held one level 3 security.

Foreign Currency Translation– Purchases and sales of foreign investments, income, and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions or on the reporting date for foreign denominated receivables and payables. Gains and losses attributable to foreign currency exchange rates on sales of securities are recorded for financial statement purposes as net realized gains and losses on investments. Gains and losses attributable to foreign exchange rate movements on receivables, payables, income and expenses are recorded for financial statement purposes as foreign currency transaction gains and losses. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

Short Sales– The fund entered into short sales whereby it sells a security it does not own in anticipation of a decline in the value of that security. The fund will realize a gain

30

Notes to Financial Statements (unaudited) – continued