UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04782

HSBC FUNDS

(Exact name of registrant as specified in charter)

452 FIFTH AVENUE

NEW YORK, NY 10018

(Address of principal executive offices) (Zip code)

STEFANO MICHELAGNOLI

PRESIDENT

452 FIFTH AVENUE

NEW YORK, NY 10018

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-782-8183

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

Explanatory Note: On January 5, 2024, HSBC Funds (the “Registrant”) timely filed its Form N-CSR for the fiscal year ending October 31, 2023, which included the Annual Shareholder Report dated October 31, 2023 for the HSBC Radiant U.S. Smaller Companies Fund (the “Fund”) and HSBC U.S. Smaller Companies Portfolio (the “Portfolio”), into which the Fund invests all of its assets.

However, the series and class identifier for the Portfolio (S000055061 and C000173143, respectively) was inadvertently excluded from the submission. The series and class identifiers for the Fund and the other series of the Registrant were appropriately included with the submission. The Registrant is re-filing its Form N-CSR for the fiscal year ending October 31, 2023 solely for the purpose of including the series and class identifier for the Portfolio. There are no changes being made to the Form N-CSR or the Annual Shareholder Report that was previously filed on behalf of the Registrant on January 5, 2024.

Item 1. Reports to Shareholders.

| (a) | The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”): |

HSBC Funds

Annual Report

October 31, 2023

| EQUITY FUND | | Class A | | Class I | |

| HSBC Radiant U.S. Smaller Companies Fund (formerly, HSBC RadiantESG U.S. Smaller Companies Fund) | | HSOAX | | RESCX | |

HSBC Family of Funds

Annual Report - October 31, 2023

Basis points (BPS) refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Gross Domestic Product (“GDP”) is the value of goods and services produced in a given country in a given year.

Russell 2500TM Growth Index is an index that measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500TM companies with higher price-to-book ratios and higher forecasted growth values.

Securities indices are unmanaged and assume reinvestment of all distributions and interest payments and do not take in account brokerage fees or expenses. Securities in the Fund do not match those in the indices and performance of the Fund will differ. Investors cannot invest directly in an index.

| Portfolio Reviews (Unaudited) |

HSBC Radiant U.S. Smaller Companies Fund

(Class A Shares and Class I Shares)

Investment decisions for the HSBC Radiant U.S. Smaller Companies Portfolio (the “Portfolio”) are made by the investment team at the Portfolio’s subadviser, Radiant Global Investors LLC (the “Subadviser”), which is led by Kathryn McDonald, co-founder and Head of Investments and Sustainability, and Harry Prabandham, Chief Investment Officer. Mr. Prabandham and Kevin Lin, CFA, Senior Portfolio Manager, are responsible for day-to-day management of the Portfolio. Ms. McDonald and Messrs. Prabandham and Lin have been portfolio managers of the Portfolio since June 2022.

The HSBC Radiant U.S. Smaller Companies Fund (the “Fund”) seeks long-term growth of capital by investing, under normal circumstances, at least 80% of its net assets, plus borrowings for investment purposes, in U.S. equity securities of small and mid-cap companies that meet the Subadviser’s fundamental and environmental, social, and governance (“ESG”) criteria (measured at the time of purchase). The Fund employs a two-tier structure, commonly referred to as a “master-feeder” structure, in which the Fund invests all of its investable assets in the Portfolio.

Investment Concerns

There is no assurance that the Fund will achieve its investment objective or will work under all market conditions. The value of investments may go down as well as up and you may not get back the amount originally invested. The Fund may be subject to certain additional risks, which should be considered carefully along with its investment objective and fees. Equity investments fluctuate in value based on changes to an individual company’s financial condition and overall market conditions. The Fund is also subject to market risk, which is the risk that the value of the Fund’s portfolio investments may decline due to changing market conditions. Market conditions may be negatively impacted by events such as war, acts of terrorism, social unrest, natural disasters, the spread of infectious illness, or other public health threats. Investing in smaller companies is more risky and volatile than investing in large companies. Growth investment style may fall out of favor in the marketplace and result in significant declines in the value of the Fund’s securities. Securities of companies considered growth investments may have rapid price swings in the event of earnings disappointments or during periods of market, political, regulatory, and economic uncertainty. Using ESG criteria will cause the Fund to forgo investment opportunities in certain companies and sectors that are available to other mutual funds that do not use these criteria, which could affect the Fund’s performance. The use of proprietary quantitative models in selecting investments could be adversely impacted by unforeseeable software or hardware malfunctions and other technological risks, and the data used in the models may cause the models to perform differently than expected.

For a complete description of these and other risks associated with investment in a mutual fund, please refer to the Fund’s prospectus.

Market Commentary

For the 12-month period ended October 31, 2023, the Fund returned 2.21% for its Class A shares (no load). That compared to a -4.80% return for the Russell 2500TM Growth Index, the Fund’s primary benchmark.

Portfolio Performance

U.S. equities ended the 12-month period in positive territory amid a general pivot toward a risk-on appetite among investors. The Federal Reserve raised interest rates multiple times throughout the period, which contributed to an increase in market volatility as equity investors sought to anticipate the effect of higher rates on the economy. The ongoing war in Ukraine and the emerging violence in the Middle East also contributed to bouts of volatility during the year, as did the banking crisis in March that was brought on by the failures of Silicon Valley Bank and Signature Bank, and the subsequent contagion to First Republic Bank. Large-cap stocks significantly outperformed their smaller cap peers for the period. On a sector basis, Information Technology, Communication and Consumer Discretionary companies outperformed while companies in the Utilities, Real Estate, and Healthcare sector underperformed.

The Fund outperformed its primary benchmark for the period under review. Stock selection, particularly within the Information Technology sector, was the main driver of the Fund’s outperformance, most notably holdings of a company that provides semiconductor equipment to chip manufacturers and a contract manufacturer for hardware companies. Both companies benefited from increased investment and growth in the semiconductor industry along with investor interest in artificial intelligence (AI). The Fund’s strategy of targeting companies with higher profitability and better earnings, stronger price momentum and lower price/earnings profiles also added to relative results. The Fund’s above-benchmark exposure to the Information Technology and Real Estate sectors also added to relative performance, as did its underweight exposure to the Industrials and Materials sectors.

The Fund’s above-benchmark exposure to companies with higher leverage dragged on relative results as those names generally underperformed as interest rates increased. The Fund’s overweight exposure to the Healthcare sector also negatively impacted relative results as that sector was one of the worst performing sectors for the period among U.S. smaller cap growth companies.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

| Portfolio Reviews (Unaudited) |

HSBC Radiant U.S. Smaller Companies Fund

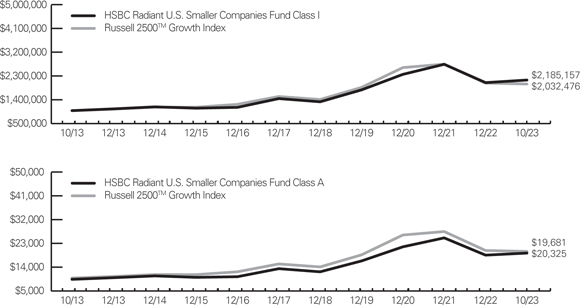

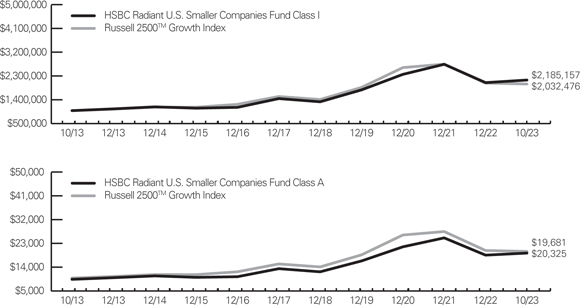

| Value of an Investment |

|

The charts above represent a historical 10-year performance comparison of a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

| Fund Performance | | | Average Annual

Total Returns (%)3 | | Expense

Ratio (%)4 | |

| As of October 31, 2023 | | Inception

Date | | 1 Year | | 5 Year | | 10 Year | | Gross | | Net | |

| HSBC Radiant U.S. Smaller Companies Fund Class A1 | | 9/23/96 | | –2.64 | | 6.44 | | 7.00 | | 8.07 | | 1.45 | |

| HSBC Radiant U.S. Smaller Companies Fund Class I† | | 9/3/96 | | 2.50 | | 8.14 | | 8.13 | | 6.79 | | 0.90 | |

| Russell 2500 GrowthTM Index2 | | — | | –4.80 | | 5.22 | | 7.35 | | N/A | | N/A | |

Past performance does not guarantee future results. The performance data quoted represents past performance (including prior to the date on which the Fund changed its name, principal investment strategies and sub-adviser) and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect the taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-782-8183.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers and/or expense reimbursements are in effect for the Fund through March 1, 2024.

Certain returns shown include monies received by the HSBC Radiant U.S. Smaller Companies Portfolio (the “Portfolio”), in which the Fund invests, in respect of one-time class action settlements and monies received by the Fund from a one-time reimbursement from HSBC Global Asset Management (USA) Inc. (the “Adviser”) related to past marketing arrangements. As a result, the Fund’s total returns for those periods were higher than they would have been had the Portfolio and the Fund not received the payments.

| † | The Class I Shares are issued by a separate series of the HSBC Funds. |

| 1 | Reflects the maximum sales charge of 5.00% through October 29, 2023. Effective October 29, 2023, the sales charge was eliminated. |

| 2 | For additional information, please refer to the Glossary of Terms. |

| 3 | Reflects actual NAV at the end of the period. |

| 4 | Reflects the expense ratio as reported in the prospectus dated February 28, 2023, as supplemented to date. The Adviser has entered into a contractual expense limitation agreement with the Fund under which it will limit total expenses of the Fund (excluding interest, taxes, brokerage commissions, extraordinary expenses and estimated indirect expenses attributable to the Fund’s investments in investment companies other than the Portfolio) to an annual rate of 1.45% and 0.90% for Class A Shares and Class I Shares, respectively. The expense limitations shall be in effect until March 1, 2024. Additional information pertaining to the October 31, 2023 expense ratios can be found in the financial highlights. |

The Fund’s performance is measured against the Russell 2500TM Growth Index, an unmanaged index that measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. The performance for the index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index.

HSBC FAMILY OF FUNDS

Statements of Assets and Liabilities—as of October 31, 2023

| | | HSBC Radiant

U.S. Smaller

Companies Fund | | | HSBC Radiant

U.S. Smaller

Companies Fund

(Class I) | |

| Assets: | | | | | | | | |

| Investments in Affiliated Portfolio | | $ | 6,837,927 | | | $ | 12,749,551 | |

| Receivable from Investment Adviser | | | 45,639 | | | | 47,583 | |

| Prepaid expenses and other assets | | | 10,745 | | | | 14,757 | |

| Total Assets | | | 6,894,311 | | | | 12,811,891 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Accrued expenses and other liabilities: | | | | | | | | |

| Administrative Services | | | 61 | | | | 113 | |

| Distribution fees | | | 18 | | | | — | |

| Shareholder Servicing | | | 1,287 | | | | — | |

| Accounting | | | 4,600 | | | | 4,000 | |

| Compliance Services | | | 484 | | | | 484 | |

| Printing | | | 1,635 | | | | 2,516 | |

| Professional | | | 30,035 | | | | 30,035 | |

| Sub-Transfer Agent | | | 18,141 | | | | 12,326 | |

| Other | | | 164 | | | | 288 | |

| Total Liabilities | | | 56,425 | | | | 49,762 | |

| Commitments and contingent liabilities (Note 4) | | | — | | | | — | |

| Net Assets | | $ | 6,837,886 | | | $ | 12,762,129 | |

| | | | | | | | | |

| Composition of Net Assets: | | | | | | | | |

| Paid in Capital | | $ | 7,865,972 | | | $ | 15,934,858 | |

| Total distributable earnings/(loss) | | | (1,028,086 | ) | | | (3,172,729 | ) |

| Net Assets | | $ | 6,837,886 | | | $ | 12,762,129 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Class A Shares | | $ | 6,837,886 | | | $ | — | |

| Class I Shares | | | — | | | | 12,762,129 | |

| Total | | $ | 6,837,886 | | | $ | 12,762,129 | |

| | | | | | | | | |

| Shares Outstanding: | | | | | | | | |

| ($0.001 par value, unlimited number of shares authorized): | | | | | | | | |

| Class A Shares | | | 925,272 | | | | — | |

| Class I Shares | | | — | | | | 1,946,413 | |

| | | | | | | | | |

| Net Asset Value, Offering Price (Class A and Class I) and Redemption Price per share: | | | | | | | | |

| Class A Shares | | $ | 7.39 | | | $ | — | |

| Class I Shares | | $ | — | | | $ | 6.56 | |

Amounts designated as “—“ are $0.00 or have been rounded to $0.00.

| See notes to financial statements. | HSBC FAMILY OF FUNDS 5 |

HSBC FAMILY OF FUNDS

Statements of Operations - For the year ended October 31, 2023

| | | HSBC

Radiant

U.S. Smaller

Companies

Fund | | | HSBC

Radiant

U.S. Smaller

Companies

Fund (Class I) | |

| Net Investment Income/(Loss) Allocated from Affiliated Portfolio: | | | | | | | | |

| Investment income from Affiliated Portfolio | | $ | 68,510 | | | $ | 130,455 | |

| Expenses from Affiliated Portfolio(1) | | | (341,655 | ) | | | (658,916 | ) |

| Net Investment Income/(Loss) from Affiliated Portfolio | | | (273,145 | ) | | | (528,461 | ) |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Administrative Services: | | | | | | | | |

| Class A Shares | | | 776 | | | | — | |

| Class C Shares(2) | | | 3 | | | | — | |

| Class I Shares | | | — | | | | 1,502 | |

| Distribution: | | | | | | | | |

| Class C Shares(2) | | | 175 | | | | — | |

| Shareholder Servicing: | | | | | | | | |

| Class A Shares | | | 19,387 | | | | — | |

| Class C Shares(2) | | | 58 | | | | — | |

| Accounting | | | 8,106 | | | | 7,120 | |

| Compliance Services | | | 6,193 | | | | 6,193 | |

| Printing | | | 12,840 | | | | 20,577 | |

| Professional | | | 55,428 | | | | 55,432 | |

| Sub-Transfer Agent | | | 205,664 | | | | 133,428 | |

| Registration fees | | | 26,972 | | | | 23,500 | |

| Other | | | 11,397 | | | | 10,558 | |

| Total expenses before fee and expense reductions | | | 346,999 | | | | 258,310 | |

| Fees voluntarily reduced/reimbursed by Investment Adviser and/or Administrator | | | (7,784 | ) | | | — | |

| Fees contractually reduced/reimbursed by Investment Adviser | | | (575,609 | ) | | | (782,084 | ) |

| Net Expenses(1) | | | (236,394 | ) | | | (523,774 | ) |

| | | | | | | | | |

| Net Investment Income/(Loss) | | $ | (36,751 | ) | | $ | (4,687 | ) |

| | | | | | | | | |

| Realized/Unrealized Gains/(Losses) on Investments Allocated from Affiliated Portfolio: | | | | | | | | |

| Net realized gains/(losses) from Affiliated Portfolio | | | 759,926 | | | | 1,373,296 | |

| Change in unrealized appreciation/(depreciation) on investments from Affiliated Portfolio | | | (485,947 | ) | | | (818,279 | ) |

| | | | | | | | | |

| Net realized/unrealized gains/(losses) on investments from Affiliated Portfolio | | | 273,979 | | | | 555,017 | |

| Change in Net Assets Resulting from Operations | | $ | 237,228 | | | $ | 550,330 | |

| (1) | Total Net Fund expenses includes Expenses Allocated from Affiliated Portfolio and Net Expenses of the Fund. |

| (2) | Class C Shares are no longer offered by the Fund. Effective October 29, 2023, the then-existing Class C Shares converted to Class A Shares. |

Amounts designated as “—“ are $0.00 or have been rounded to $0.00.

| 6 HSBC FAMILY OF FUNDS | See notes to financial statements. |

HSBC FAMILY OF FUNDS

Statements of Changes in Net Assets

| | | HSBC Radiant U.S. Smaller

Companies Fund | | | HSBC Radiant U.S. Smaller

Companies Fund (Class I) | |

| | | Year Ended

October 31, 2023 | | | Year Ended

October 31, 2022 | | | Year Ended

October 31, 2023 | | | Year Ended

October 31, 2022 | |

| Investment Activities: | | | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | | | |

| Net investment loss | | $ | (36,751 | ) | | $ | (65,170 | ) | | $ | (4,687 | ) | | $ | (99,271 | ) |

| Net realized gains/(losses) from investments | | | 759,926 | | | | (1,486,716 | ) | | | 1,373,296 | | | | (4,652,078 | ) |

| Change in unrealized appreciation/(depreciation) on investments | | | (485,947 | ) | | | (1,648,501 | ) | | | (818,279 | ) | | | (18,029,576 | ) |

| Change in net assets resulting from operations | | | 237,228 | | | | (3,200,387 | ) | | | 550,330 | | | | (22,780,925 | ) |

| | | | | | | | | | | | | | | | | |

| Distributions to shareholders: | | | | | | | | | | | | | | | | |

| Class A Shares | | | — | | | | (3,766,491 | ) | | | — | | | | — | |

| Class C Shares | | | — | | | | (27,849 | ) | | | — | | | | — | |

| Class I Shares | | | — | | | | — | | | | — | | | | (45,436,904 | ) |

| Change in net assets resulting from distributions to shareholders: | | | — | | | | (3,794,340 | ) | | | — | | | | (45,436,904 | ) |

| Change in net assets resulting from capital transactions(1) | | | (1,617,732 | ) | | | 2,654,398 | | | | (4,782,072 | ) | | | (3,597,262 | ) |

| Change in net assets | | | (1,380,504 | ) | | | (4,340,329 | ) | | | (4,231,742 | ) | | | (71,815,091 | ) |

| | | | | | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | | | | | |

| Beginning of period | | | 8,218,390 | | | | 12,558,719 | | | | 16,993,871 | | | | 88,808,962 | |

| End of period | | $ | 6,837,886 | | | $ | 8,218,390 | | | $ | 12,762,129 | | | $ | 16,993,871 | |

| | | | | | | | | | | | | | | | | |

| CAPITAL TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Class A Shares: | | | | | | | | | | | | | | | | |

| Proceeds from shares issued | | $ | 117,904 | | | $ | 1,230,933 | | | $ | — | | | $ | — | |

| Dividends reinvested | | | — | | | | 3,689,980 | | | | — | | | | — | |

| Value of shares converted from Class C | | | 18,933 | | | | — | | | | — | | | | — | |

| Value of shares redeemed | | | (1,737,431 | ) | | | (2,282,301 | ) | | | — | | | | — | |

| Class A Shares capital transactions | | | (1,600,594 | ) | | | 2,638,612 | | | | — | | | | — | |

| Class C Shares: | | | | | | | | | | | | | | | | |

| Proceeds from shares issued | | $ | 13,100 | | | $ | — | | | $ | — | | | $ | — | |

| Dividends reinvested | | | — | | | | 27,849 | | | | — | | | | — | |

| Value of shares converted to Class A | | | (18,933 | ) | | | — | | | | — | | | | — | |

| Value of shares redeemed | | | (11,305 | ) | | | (12,063 | ) | | | — | | | | — | |

| Class C Shares capital transactions | | | (17,138 | ) | | | 15,786 | | | | — | | | | — | |

| Class I Shares: | | | | | | | | | | | | | | | | |

| Proceeds from shares issued | | $ | — | | | $ | — | | | $ | 523,276 | | | $ | 13,910,403 | |

| Dividends reinvested | | | — | | | | — | | | | — | | | | 44,902,419 | |

| Value of shares redeemed | | | — | | | | — | | | | (5,305,348 | ) | | | (62,410,084 | ) |

| Class I Shares capital transactions | | | — | | | | — | | | | (4,782,072 | ) | | | (3,597,262 | ) |

| Change in net assets resulting from capital transactions(1) | | $ | (1,617,732 | ) | | $ | 2,654,398 | | | $ | (4,782,072 | ) | | $ | (3,597,262 | ) |

| | | | | | | | | | | | | | | | | |

| SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Class A Shares: | | | | | | | | | | | | | | | | |

| Issued | | | 14,905 | | | | 153,638 | | | | — | | | | — | |

| Reinvested | | | — | | | | 407,733 | | | | — | | | | — | |

| Converted from Class C Shares | | | 2,599 | | | | — | | | | — | | | | — | |

| Redeemed | | | (226,078 | ) | | | (291,396 | ) | | | — | | | | — | |

| Change in Class A Shares | | | (208,574 | ) | | | 269,975 | | | | — | | | | — | |

| Class C Shares: | | | | | | | | | | | | | | | | |

| Issued | | | 8,973 | | | | — | | | | — | | | | — | |

| Reinvested | | | — | | | | 17,967 | | | | — | | | | — | |

| Converted to Class A Shares | | | (15,341 | ) | | | — | | | | — | | | | — | |

| Redeemed | | | (8,973 | ) | | | (8,944 | ) | | | — | | | | — | |

| Change in Class C Shares | | | (15,341 | ) | | | 9,023 | | | | — | | | | — | |

| Class I Shares: | | | | | | | | | | | | | | | | |

| Issued | | | — | | | | — | | | | 76,163 | | | | 2,222,072 | |

| Reinvested | | | — | | | | — | | | | — | | | | 5,676,665 | |

| Redeemed | | | — | | | | — | | | | (785,593 | ) | | | (9,876,855 | ) |

| Change in Class I Shares | | | — | | | | — | | | | (709,430 | ) | | | (1,978,118 | ) |

| (1) | Includes the conversion of Class C Shares to Class A Shares at the close of business on October 29, 2023. |

Amounts designated as “—“ are $0.00 or have been rounded to $0.00.

| See notes to financial statements. | HSBC FAMILY OF FUNDS 7 |

| HSBC RADIANT U.S. SMALLER COMPANIES FUND |

Financial Highlights

Selected data for a share outstanding throughout the periods indicated.*

| | | | | Investment Activities | | Distributions | | | | | Ratios/Supplementary Data |

| | | Net Asset

Value,

Beginning

of Period | | Net

Investment

Loss

(a) | | Net

Realized

and

Unrealized

Gains/

(Losses)

from

Investments | | Total from

Investment

Activities | | Net

Investment

Income | | Net Realized

Gains from

Investment

Transactions | | Total

Distributions | | Net Asset

Value, End

of Period | | Total Return

(b) | | Net

Assets at

Value,

End of

Period

(000’s) | | Ratio

of Net

Expense

to Average

Net Assets | | Ratio of

Net

Investment

Income to

Average

Net Assets | | Ratio of

Expenses

to Average

Net Assets

(Excluding

Fee

Reductions) | | Portfolio

Turnover

(c) |

| Class A Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended October 31, 2023 | | $7.23 | | $(0.04) | | $0.20 | | $0.16 | | $— | | $— | | $— | | $7.39 | | 2.21% | | $6,838 | | 1.35% | | (0.47)% | | 8.84% | | 103% |

| Year Ended October 31, 2022 | | 14.49 | | (0.05)(d) | | (2.80) | | (2.85) | | — | | (4.41) | | (4.41) | | 7.23(e) | | (25.80)% | | 8,200 | | 1.49%(f) | | (0.65)%(d) | | 6.47% | | 120% |

| Year Ended October 31, 2021 | | 10.71 | | (0.11) | | 4.57 | | 4.46 | | — | | (0.68) | | (0.68) | | 14.49 | | 42.81% | | 12,518 | | 1.55% | | (0.83)% | | 7.00% | | 78% |

| Year Ended October 31, 2020 | | 9.42 | | (0.09) | | 2.10 | | 2.01 | | — | | (0.72) | | (0.72) | | 10.71 | | 22.05% | | 9,224 | | 1.55% | | (0.91)% | | 7.29% | | 94% |

| Year Ended October 31, 2019 | | 10.70 | | (0.07) | | 0.59 | | 0.52 | | — | | (1.80) | | (1.80) | | 9.42 | | 8.77% | | 8,449 | | 1.55% | | (0.79)% | | 5.77% | | 81% |

| * | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the HSBC Radiant U.S. Smaller Companies Portfolio (the “Portfolio”). |

| (a) | Calculated based on average shares outstanding. |

| (b) | Total return calculations do not include any sales or redemption charges. |

| (c) | Portfolio turnover rate is calculated on the basis of the Portfolio, in which the Fund invests all of its investable assets. Portfolio turnover is calculated on the basis of the Portfolio as a whole without distinguishing between the classes of shares issued. |

| (d) | Reflects special dividends paid out during the year by several of the Portfolio’s holdings. Had the Portfolio, in which the Fund invests all of its investable assets, not received the special dividends, the net investment income/(loss) per share would have been $(0.08) and the net investment income/(loss) ratio would have been (0.97)%. |

| (e) | The net asset value per share (“NAV”) for financial reporting purposes differs from the NAV reported due to adjustments made in accordance with accounting principles generally accepted in the United States of America. |

| (f) | The net expense ratio shown for the period reflects the expense limitation agreement in effect as of June 28, 2022 and the higher limit in effect prior to that date. |

Amounts designated as “—” are $0.00 or have been rounded to $0.00.

| 8 HSBC FAMILY OF FUNDS | See notes to financial statements. |

| HSBC RADIANT U.S. SMALLER COMPANIES FUND (CLASS I) |

Financial Highlights

Selected data for a share outstanding throughout the periods indicated.*

| | | | | Investment Activities | | Distributions | | | | | | Ratios/Supplementary Data |

| | | Net Asset

Value,

Beginning

of Period | | Net

Investment

Loss

(a) | | Net

Realized

and Unrealized

Gains/

(Losses)

from

Investments | | Total from

Investment

Activities | | Net

Investment

Income | | Net Realized

Gains from

Investment

Transactions | | Total

Distributions | | Net Asset

Value, End

of Period | | Total Return

(b) | | Net

Assets at Value,

End of

Period

(000's) | | Ratio

of Net

Expense

to Average

Net Assets | | Ratio of

Net

Investment

Income to

Average

Net Assets | | Ratio of

Expenses

to Average

Net Assets

(Excluding

Fee

Reductions) | | Portfolio

Turnover

(c) |

| Class I Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended October 31, 2023 | | $6.40 | | $(0.00) | | $0.16 | | $0.16 | | $— | | $— | | $— | | $6.56 | | 2.50% | | $12,762 | | 0.90% | | (0.03)% | | 6.11% | | 103% |

| Year Ended October 31, 2022 | | 19.16 | | (0.02)(d) | | (2.84) | | (2.86) | | — | | (9.90) | | (9.90) | | 6.40(e) | | (24.77)% | | 16,993 | | 1.07%(f) | | (0.19)%(d) | | 3.02% | | 120% |

| Year Ended October 31, 2021 | | 14.67 | | (0.07) | | 6.13 | | 6.06 | | — | | (1.57) | | (1.57) | | 19.16(e) | | 43.23% | | 88,809 | | 1.10% | | (0.39)% | | 1.88% | | 78% |

| Year Ended October 31, 2020 | | 12.79 | | (0.06) | | 2.85 | | 2.79 | | — | | (0.91) | | (0.91) | | 14.67 | | 22.58% | | 121,959 | | 1.10% | | (0.46)% | | 1.63% | | 94% |

| Year Ended October 31, 2019 | | 14.38 | | (0.04) | | 0.81 | | 0.77 | | — | | (2.36) | | (2.36) | | 12.79 | | 9.25% | | 115,924 | | 1.10% | | (0.34)% | | 1.44% | | 81% |

| * | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the HSBC Radiant U.S. Smaller Companies Portfolio (the “Portfolio”). |

| (a) | Calculated based on average shares outstanding. |

| (b) | Total return calculations do not include any sales or redemption charges. |

| (c) | Portfolio turnover rate is calculated on the basis of the Portfolio, in which the Fund invests all of its investable assets. Portfolio turnover is calculated on the basis of the Portfolio as a whole without distinguishing between the classes of shares issued. |

| (d) | Reflects special dividends paid out during the year by several of the Portfolio’s holdings. Had the Portfolio, in which the Fund invests all of its investable assets, not received the special dividends, the net investment income/(loss) per share would have been $(0.05) and the net investment income/(loss) ratio would have been (0.59)%. |

| (e) | The net asset value per share (“NAV”) for financial reporting purposes differs from the NAV reported due to adjustments made in accordance with accounting principles generally accepted in the United States of America. |

| (f) | The net expense ratio shown for the period reflects the expense limitation agreement in effect as of June 28, 2022 and the higher limit in effect prior to that date. |

Amounts designated as “—” are $0.00 or have been rounded to $0.00.

| See notes to financial statements. | HSBC FAMILY OF FUNDS 9 |

Notes to Financial Statements—October 31, 2023

The HSBC Funds (the “Trust”), a Delaware statutory trust organized on March 2, 2016, is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. As of October 31, 2023, the Trust is comprised of 5 separate operational funds, each a series of the HSBC Family of Funds. The accompanying financial statements are presented for the following two diversified funds (individually a “Fund”, collectively the “Funds”) of the Trust. The Funds changed their names on October 27, 2023.

| Fund | Short Name |

HSBC Radiant U.S. Smaller Companies Fund

(formerly, HSBC RadiantESG U.S. Smaller Companies Fund) | Radiant U.S. Smaller Companies Fund |

| HSBC Radiant U.S. Smaller Companies Fund (Class I) (formerly, HSBC RadiantESG U.S. Smaller Companies Fund (Class I)) | Radiant U.S. Smaller Companies Fund (Class I) |

Financial statements for all other series of the Trust are published separately.

Each Fund is a feeder fund in a master-feeder fund structure and seeks to achieve its investment objective by investing all of its investable assets in the HSBC Radiant U.S. Smaller Companies Portfolio (formerly, HSBC RadiantESG U.S. Smaller Companies Portfolio) (the “Portfolio”), which is a diversified series of the Trust with the same investment objective as the Funds. The Portfolio operates as the master fund in a master-feeder arrangement in which the feeder funds invest all or part of their investable assets in the Portfolio. The Funds’ proportionate ownership of the Portfolio as of the date of this report was as follows:

| Fund | Proportionate

Ownership

Interest on

October 31, 2023

(%) |

| Radiant U.S. Smaller Companies Fund | 34.9 |

| Radiant U.S. Smaller Companies Fund (Class I) | 65.1 |

The financial statements of the Portfolio, including the Schedule of Portfolio Investments, are included elsewhere in this report. The financial statements of the Portfolio should be read in conjunction with the financial statements of the Funds.

The Funds are authorized to issue an unlimited number of shares of beneficial interest with a par value of $0.001 per share. The Radiant U.S. Smaller Companies Fund offers one class of shares: Class A Shares. The Radiant U.S. Smaller Companies Fund (Class I) also offers one class of shares: Class I Shares. Effective October 29, 2023, Class A Shares of Radiant U.S. Smaller Companies Fund are offered with no sales charge. Prior to October 29, 2023, Class A Shares had a maximum sales charge of 5.00% as a percentage of the offering price. The Fund previously offered Class C Shares, which the Fund no longer offers. After the close of business on October 29, 2023, Class C Shares of HSBC Radiant U.S. Smaller Companies Fund converted into Class A Shares (without a contingent deferred sales charge or other charge). No sales charges are assessed with respect to Class I Shares of the Radiant U.S. Smaller Companies Fund (Class I). Each class of shares in the Funds has identical rights and privileges except with respect to arrangements pertaining to shareholder servicing and/or distribution, class-related expenses, voting rights on matters affecting a single class of shares, and exchange privileges of each class of shares.

Under the Trust’s organizational documents, the Trust’s officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Funds. In addition, in the normal course of business, the Trust enters into contracts with its service providers, which also provide for indemnifications by the Funds. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds. However, based on experience, the Trust believes the risk of loss to be remote.

Notes to Financial Statements—October 31, 2023 (continued)

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services-Investment Companies.”

| 2. | Significant Accounting Policies: |

The following is a summary of the significant accounting policies followed by the Funds in the preparation of their financial statements. The policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”). The preparation of financial statements requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Securities Valuation:

The Funds record their investments in the Portfolio at fair value, which represents their proportionate ownership of the value of the Portfolio’s net assets. The notes to the Portfolio’s financial statements included elsewhere in this report provide information about the Portfolio’s valuation policy and its period-end security valuations.

Investment Transactions and Related Income:

The Funds record investments in the Portfolio on a trade date basis. The Funds record daily their proportionate share of income, expenses, changes in unrealized appreciation and depreciation and realized gains and losses derived from the Portfolio. In addition, the Funds accrue their own expenses daily as incurred.

Foreign Currency Translation:

The accounting records of the Funds are maintained in U.S. dollars. Foreign currency amounts, if any, are translated into U.S. dollars at the current rate of exchange to determine the value of investments, assets and liabilities at the close of each business day. Purchases and sales of securities, and income and expenses, are, as applicable, translated at the prevailing rate of exchange on the respective dates of such transactions. The Funds do not isolate the portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuations arising from changes in market prices of securities held. If applicable, any such fluctuations are included with the net realized and unrealized gain or loss from investments in securities and foreign currency translations.

Allocations:

Expenses directly attributable to a Fund are charged to that Fund. Expenses not directly attributable to a Fund are allocated among the applicable series within the Trust equally to each series, in relation to its net assets, or another appropriate basis. Because the Funds operate in a master-feeder structure, in which the Funds invest all of their investable assets in the Portfolio, certain expenses are allocated solely to the Portfolio rather than the Funds. Class specific expenses are charged directly to the class incurring the expense. In addition, income, expenses (other than class specific expenses), and unrealized and realized gains and losses are allocated to each class based on relative net assets on a daily basis.

Distributions to Shareholders:

Dividends distributed to shareholders of the Funds from net investment income, if any, are declared and distributed semiannually.

Distributions from net realized gains, if any, are declared and paid at least annually by the Funds. Additional distributions are also made to the Funds’ shareholders to the extent necessary to avoid the federal excise tax on certain undistributed income and net realized gains of regulated investment companies.

Notes to Financial Statements—October 31, 2023 (continued)

Federal Income Taxes:

Each Fund is a separate taxable entity for federal income tax purposes. Each Fund has qualified and intends to continue to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code, as amended, and to distribute substantially all of its taxable net investment income and net realized gains, if any, to its shareholders. Accordingly, no provision for federal income or excise tax is required for the Funds, although shareholders may be taxed on distributions they receive.

Management of the Funds has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last four tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken. Management’s conclusions may be subject to future review based on changes in, or interpretation of, accounting standards or tax laws and regulations.

| 3. | Investment Valuation Summary |

The valuation techniques employed by the Funds, as described below, maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The Funds’ investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs used for valuing the Funds’ investments are summarized in the three broad levels listed below:

| ● | Level 1—quoted prices (unadjusted) in active markets for identical assets |

| ● | Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayments speeds, credit risk, etc.) |

| ● | Level 3—significant unobservable inputs (including the Investment Adviser’s own assumptions in determining the fair value of investments) |

Changes in valuation techniques may result in transfers in or out of an assigned level within the fair value hierarchy. The inputs or methodology used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

The Funds record their investments in the Portfolio at fair value, which represents their proportionate ownership of the value of the Portfolio’s net assets. These investments are typically categorized as Level 2 in the fair value hierarchy. The underlying securities of the Portfolio are recorded at fair value, as discussed more fully in the Notes to Financial Statements of the Portfolio included in the attached financial statements.

As of October 31, 2023, all investments by the Funds were categorized as Level 2 in the fair value hierarchy.

| 4. | Related Party Transactions and Other Agreements and Plans: |

Investment Management:

HSBC Global Asset Management (USA) Inc. (“HSBC” or the “Investment Adviser”), a wholly-owned subsidiary of HSBC USA, Inc., a registered bank holding company under the laws of the United States, acts as Investment Adviser to the Portfolio pursuant to an Investment Advisory Contract. As Investment Adviser, HSBC manages the investments of the Portfolio and continuously reviews, supervises, and administers the Portfolio’s investments. The Adviser has retained Radiant Global Investors LLC (“Radiant” or the “Subadviser”) to provide day-to-day management of the Portfolio. The Funds are not directly charged any investment management fees, but rather share proportionately in the investment management fees charged to the Portfolio.

Notes to Financial Statements—October 31, 2023 (continued)

Administration, Fund Accounting and Other Services:

HSBC also serves the Funds as Administrator. Effective November 7, 2022, under the terms of the Amended and Restated Administration Services Agreement, HSBC receives from the Funds (as well as other series of the Trust combined) a fee, accrued daily and paid monthly, at an annual rate of two basis points (0.02%) of average daily net assets. The fee rate is determined on the basis of the aggregate average daily net assets of the Trust. The total administration fee paid to HSBC is allocated to each series based upon its proportionate share of the aggregate net assets of the Trust subject to certain allocations in cases where one series invests some or all of its assets in another series of the Trust (for example, the Funds). For assets invested in the Portfolio by the Funds, the Portfolio pays half of the administration fee and the Funds pay the remaining half, for a combination of the total fee rate set forth above.

Prior to November 7, 2022, HSBC received, as Administrator to the Funds, a fee, accrued daily and paid monthly, at an annual rate based on the aggregate average daily net assets of the Trust, based on the breakpoints set forth below. A portion of such fees was paid by HSBC to the Funds’ former Sub-Administrator, Citi Fund Services Ohio, Inc. (“Citi”).

| Based on Average Daily Net Assets of the Trust | | Fee Rate (%) |

| Up to $10 billion | | 0.0400 |

| In excess of $10 billion but not exceeding $20 billion | | 0.0350 |

| In excess of $20 billion but not exceeding $50 billion | | 0.0265 |

| In excess of $50 billion | | 0.0245 |

Effective as of November 7, 2022, State Street Bank and Trust Company (“State Street”) serves as Sub-Administrator to the Funds and provides fund accounting, custody, fund administration, regulatory administration and certain other services to the Funds pursuant to a Master Services Agreement with the Trust. For its services, State Street is entitled to a fee, payable by the Funds, based on a Fund’s net assets, subject to per Fund fees, miscellaneous fees and reimbursements of certain expenses.

Effective as of November 7, 2022, under a Fund PFO/Treasurer, CCO, Secretary and AMLO Agreement between Foreside Fund Officer Services, LLC (“Foreside”) and the Trust, Foreside makes individuals available to serve as the Trust’s Chief Compliance Officer, Anti-Money Laundering Officer, Treasurer and Secretary. For the services provided under that agreement, the Trust paid Foreside $200,146 for the year ended October 31, 2023, plus reimbursement of certain out-of-pocket expenses. Compliance services fees incurred by each Fund are reflected on the Statements of Operations as “Compliance Services” and the other services fees are included in “Other” on the Statements of Operations. Foreside pays the salary and other compensation earned by individuals performing these services. Prior to November 7, 2022, Citi provided these officer services.

Distribution Arrangements:

Foreside Distribution Services, L.P. (“Foreside” or the “Distributor”) serves the Trust as Distributor. The Trust, on behalf of the Radiant U.S. Smaller Companies Fund, has adopted a non-compensatory Distribution Plan and Agreement (the “Distribution Plan”) pursuant to Rule 12b-1 of the Act. The Distribution Plan provides for reimbursement of expenses incurred by the Distributor related to distribution and marketing, at a rate not to exceed 0.25% and 1.00% of the average daily net assets of Class A Shares (currently not being charged) and Class C Shares (charged 0.75% until October 29, 2023 when Class C Shares converted to Class A Shares and ceased operations) of the Fund, respectively. For the year ended October 31, 2023, Foreside received $175 in commissions from sales of the Trust.

Notes to Financial Statements—October 31, 2023 (continued)

Shareholder Servicing:

The Trust has adopted a Shareholder Services Plan, which provides for payments to shareholder servicing agents for providing various shareholder services. For performing these services, the shareholder servicing agents receive a fee that is computed daily and paid monthly up to 0.25% of the average daily net assets of Class A Shares of the Radiant U.S. Smaller Companies Fund. The fees paid to the Distributor pursuant to the Distribution Plan and to shareholder servicing agents pursuant to the Shareholder Services Plan may not exceed in the aggregate 0.50% annually of the average daily net assets of Class A Shares and for Class C shares was 1.00% of the average daily net assets.

The Trust has entered into shareholder services contracts with affiliated and unaffiliated financial intermediaries who provide shareholder services and other related services to their clients or customers who invest in the Funds under which the Funds will pay all or a portion of such fees earned to financial intermediaries for performing such services.

Transfer Agency:

Effective as of November 7, 2022, State Street replaced SS&C Global Investor and Distribution Solutions, Inc. (formerly, DST Asset Manager Solutions, Inc.) (“SS&C”) as the transfer agent for each Fund, although State Street has delegated its responsibilities to SS&C and SS&C continues to provide transfer agency services to the Funds. As sub-transfer agent, SS&C receives a fee based on the number of funds and shareholder accounts, subject to certain minimums, and reimbursement of certain expenses.

Independent Trustees:

The Trust pays an annual retainer to each Independent Trustee, plus additional annual retainers to each Committee Chair and the Chairman of the Board of Trustees (the “Board”). The Independent Trustees also receive a fee for each regular, special, and informational meeting of the Board attended. The aggregate amount of the fees and expenses of the Independent Trustees are allocated among all the series in the Trust (except that these fees and expenses are allocated to the Portfolio rather than the Funds).

Other:

The Funds pay fees to certain intermediaries or financial institutions for record keeping, sub-accounting services, transfer agency and other administrative services as reflected on the Statements of Operations as “Administrative Services.”

The Funds may use related party broker-dealers. For the year ended October 31, 2023, there were no brokerage commissions paid to broker-dealers affiliated with the Investment Adviser.

The Investment Adviser and its affiliates may have lending, banking, brokerage, underwriting, or other business relationships with the issuers of the securities in which the Portfolio invests.

Fee Reductions:

The Investment Adviser has agreed to contractually limit through March 1, 2024 the total annual expenses of the Funds, including the allocated expenses from the Portfolio, exclusive of interest, taxes, brokerage commissions, extraordinary expenses, and estimated indirect expenses attributable to the Funds’ investments in investment companies. Each Fund Class has its own expense limitations based on the average daily net assets for any full fiscal year as follows:

| | | Class | | Contractual

Expense

Limitations (%) |

| Radiant U.S. Smaller Companies Fund | | Class A Shares | | 1.45 |

| Radiant U.S. Smaller Companies Fund | | Class C Shares | | 2.20* |

| Radiant U.S. Smaller Companies Fund (Class I) | | Class I Shares | | 0.90 |

| * | Ceased to exist effective October 29, 2023. |

Notes to Financial Statements—October 31, 2023 (continued)

Any amounts contractually waived or reimbursed by the Investment Adviser will be subject to repayment by the respective Fund to the Investment Adviser within three years calculated monthly from when the waiver or reimbursement is recorded to the extent that the repayment will not cause the Fund’s operating expenses to exceed the contractual expense limit that was in effect at the time of such waiver or reimbursement. During the year ended October 31, 2023, the Investment Adviser did not recapture any of its prior contractual waivers or reimbursements. As of October 31, 2023, there was no contingent liability.

As of October 31, 2023, the repayments that may potentially be made by the Funds are as follows:

| | | Amount Eligible Through | |

| | | October 31,

2026 ($) | | | October 31,

2025 ($) | | | October 31,

2024 ($) | | | Total

($) | |

Radiant U.S. Smaller

Companies Fund | | 575,609 | | | 487,707 | | | 623,917 | | | 1,687,233 | |

Radiant U.S. Smaller

Companies Fund (Class I) | | 782,084 | | | 1,033,366 | | | 821,503 | | | 2,636,953 | |

In addition to the contractual expense limitation agreement with the Funds, HSBC, in its role as Investment Adviser and Administrator, may waive/reimburse additional fees at its discretion. Any voluntary fee waivers/reimbursements are not subject to repayment in subsequent fiscal periods. Voluntary waivers/reimbursements may be eliminated or changed at any time. Amounts waived/reimbursed by the Investment Adviser and/or Administrator are reported on the Statements of Operations, as applicable.

During the year ended October 31, 2023, the following amounts of expenses were voluntarily and/or contractually waived:

| | | Class A

($) | | | Class C

($) | | | Class I

($) | | | Total

($) | |

| Radiant U.S. Smaller Companies Fund | | 581,657 | | | 1,736 | | | — | | | 583,393 | |

| Radiant U.S. Smaller Companies Fund (Class I) | | — | | | — | | | 782,084 | | | 782,084 | |

| 5. | Affiliated Investment Transactions: |

A summary of each Fund’s investment in the Portfolio for the year ended October 31, 2023 is as follows:

| | | Value

10/31/2022

($) | | | Contributions

($) | | | Withdrawals

($) | | | Net

Realized

Gains/

(Losses)

($) | | | Change in

Unrealized

Appreciation/

Depreciation

($) | | | Net

Income/

(Loss)

($) | | | Value

10/31/2023

($) | |

Radiant U.S. Smaller

Companies Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

HSBC Radiant

U.S. Smaller Companies Portfolio | | | 8,175,190 | | | | 762,492 | | | | (2,100,589 | ) | | | 759,926 | | | | (485,947 | ) | | | (273,145 | ) | | | 6,837,927 | |

| Total | | | 8,175,190 | | | | 762,492 | | | | (2,100,589 | ) | | | 759,926 | | | | (485,947 | ) | | | (273,145 | ) | | | 6,837,927 | |

Radiant U.S. Smaller

Companies Fund

(Class I) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

HSBC Radiant U.S.

Smaller Companies Portfolio | | | 17,023,582 | | | | 1,401,491 | | | | (5,702,078 | ) | | | 1,373,296 | | | | (818,279 | ) | | | (528,461 | ) | | | 12,749,551 | |

| Total | | | 17,023,582 | | | | 1,401,491 | | | | (5,702,078 | ) | | | 1,373,296 | | | | (818,279 | ) | | | (528,461 | ) | | | 12,749,551 | |

Notes to Financial Statements—October 31, 2023 (continued)

The risks are presented in an order intended to facilitate readability, and their order does not imply that the realization of one risk is likely to occur more frequently than another risk, nor does it imply that the realization of one risk is likely to have a greater adverse impact than another risk.

Equity Securities Risk: The prices of equity securities fluctuate from time to time based on changes in a company’s financial condition or overall market and economic conditions. As a result, the value of equity securities may fluctuate drastically from day to day.

Market Risk: The value of the Portfolio’s investments may decline due to changing economic, political, social, regulatory or market conditions. Market risk may affect a single issuer, industry or sector of the economy or it may affect the economy as a whole. Moreover, the conditions in one country or geographic region could adversely affect the Portfolio’s investments in a different country or geographic region. Events such as war, acts of terrorism, social unrest, natural disasters, rapid changes in interest rates, the spread of infectious illness or other public health threats could also significantly impact the Portfolio and its investments.

Model and Data Risk: Radiant employs proprietary quantitative models in selecting investments for the Portfolio. Investments selected using these models may perform differently than expected as a result of the factors used in the models, the weight placed on each factor, changes in a factor’s historical trends, and technical issues in the construction, implementation, and maintenance of the models (including, for example, problems with data sourced by Radiant or supplied by third parties, software issues, or other types of errors). There are limitations inherent in every quantitative model and there is no guarantee that quantitative models will perform as expected or result in effective investment decisions for the Portfolio. Additionally, commonality of holdings across quantitative asset managers may amplify losses.

ESG Investing Risk: The incorporation of environmental, social and governance (“ESG”) criteria, including ESG and Impact scores and the identification of controversial business lines and other screens, into the investment process will cause the Portfolio to forgo investment opportunities available to other mutual funds that do not use these criteria, or to increase or decrease its exposure to certain sectors or certain types of companies. For example, the Portfolio will generally not seek to invest in companies that operate in, or derive a specific amount of revenue from, controversial business lines (e.g., tobacco, nuclear armaments and other controversial weapons, and thermal coal extraction), or companies with severe controversies (e.g., severe violators of human rights and liberties). As a result, the Portfolio could underperform or outperform other mutual funds that do not consider ESG criteria in their investment processes. In evaluating a company, Radiant is dependent upon third-party data that it believes to be reliable, but it does not guarantee the accuracy of such third-party data. ESG data from third-party data providers may be incomplete, inaccurate, or unavailable and may vary significantly from one third-party data provider to another, which could adversely affect the analysis of ESG criteria relevant to a particular company. Investing on the basis of ESG criteria is qualitative and subjective by nature and there can be no assurance that the process utilized by Radiant or any third-party research or data providers or any judgment exercised by Radiant will reflect the views of any particular investor. Radiant’s ESG criteria and ESG-related investment processes may be changed periodically without shareholder approval or notice.

Notes to Financial Statements—October 31, 2023 (continued)

| 7. | Federal Income Tax Information: |

As of the tax year ended October 31, 2023, the cost basis of investments for federal income tax purposes, gross unrealized appreciation, gross unrealized depreciation and net unrealized appreciation/(depreciation) were as follows:

| | | Tax Cost ($) | | | Tax Unrealized

Appreciation ($) | | | Tax Unrealized

Depreciation ($) | | | Net Unrealized

Appreciation/

(Depreciation) ($)* | |

| Radiant U.S. Smaller Companies Fund | | 6,937,686 | | | — | | | (99,759) | | | (99,759) | |

| Radiant U.S. Smaller Companies Fund (Class I) | | 12,631,916 | | | 117,635 | | | — | | | 117,635 | |

| * | The differences between book-basis and tax-basis unrealized appreciation/(depreciation) are attributable primarily to tax deferral of losses on wash sales. |

The tax character of distributions paid by the Funds for the tax year ended October 31, 2023, was as follows:

| | | | Distributions paid from | |

| | | | Ordinary Income ($) | | | | Total Taxable

Distributions ($) | | | | Total Distributions

Paid ($)(1) | |

| Radiant U.S. Smaller Companies Fund | | | — | | | | — | | | | — | |

| Radiant U.S. Smaller Companies Fund (Class I) | | | — | | | | — | | | | — | |

| (1) | Total distributions paid may differ from that disclosed in the Statements of Changes in Net Assets because distributions are recognized when actually paid for tax purposes. |

The tax character of distributions paid by the Funds for the tax year ended October 31, 2022, was as follows:

| | | Distributions paid from | |

| | | Ordinary Income ($) | | | Net Long-Term

Capital Gains ($) | | | Total Taxable

Distributions ($) | | | Total Distributions

Paid ($)(1) | |

| Radiant U.S. Smaller Companies Fund | | | 1,311,809 | | | | 2,482,531 | | | | 3,794,340 | | | | 3,794,340 | |

| Radiant U.S. Smaller Companies Fund (Class I) | | | 16,743,166 | | | | 28,693,738 | | | | 45,436,904 | | | | 45,436,904 | |

| (1) | Total distributions paid may differ from that disclosed in the Statements of Changes in Net Assets because distributions are recognized when actually paid for tax purposes. |

As of the tax year ended October 31, 2023, the components of accumulated earnings/(deficit) on a tax basis for the Funds were as follows:

| | | Accumulated

Capital and Other

Losses ($) | | | Unrealized Appreciation/

(Depreciation)

($)(1) | | | Total Accumulated

Earnings/

(Deficit) ($) | |

| Radiant U.S. Smaller Companies Fund | | (928,327) | | | (99,759) | | | (1,028,086) | |

| Radiant U.S. Smaller Companies Fund (Class I) | | (3,290,364) | | | 117,635 | | | (3,172,729) | |

| (1) | The differences between book-basis and tax-basis unrealized appreciation/depreciation are attributable primarily to tax deferral of losses on wash sales. |

Notes to Financial Statements—October 31, 2023 (continued)

As of the tax year ended October 31, 2023, the Funds had net capital loss carryforwards (“CLCFs”) not subject to expiration as summarized in the table below. The Board does not intend to authorize a distribution of any realized gain for the Funds until any applicable CLCF has been offset or expires.

| | | Short Term

Amount ($) | | | Long Term

Amount ($) | | | Total ($) | |

| Radiant U.S. Smaller Companies Fund | | 896,515 | | | — | | | 896,515 | |

| Radiant U.S. Smaller Companies Fund (Class I) | | 3,286,771 | | | — | | | 3,286,771 | |

The amount and character of net investment income and net realized gains distributed are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g., certain gain/loss and certain distributions), such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences (e.g., wash sale losses) do not require reclassification. To the extent distributions to shareholders from net investment income and net realized gains exceed net investment income and net realized gains for tax purposes, they are reported as distributions of capital.

On the Statements of Assets and Labilities, as a result of permanent book-to-tax differences, reclassification adjustments were made as follows:

| | | Accumulated Net

Investment Income/

(Distributions in Excess

of Net Investment

Income)

($)* | | | Accumulated

Net Realized

Gains/(Losses)

($)* | | | Paid in Capital

($) | |

| Radiant U.S. Smaller Companies Fund | | 64,910 | | | (103,899) | | | 38,989 | |

| Radiant U.S. Smaller Companies Fund (Class I) | | 100,365 | | | 103,899 | | | (204,264) | |

| * | These components of capital are presented together as “Total distributable earnings/(loss)” on the Statements of Assets and Liabilities. |

| 8. | Significant Shareholders: |

Shareholders, including other funds, individuals, and accounts, as well as each Fund’s investment manager(s) and/or investment personnel, may from time to time own (beneficially or of record) a significant percentage of the Fund’s shares and can be considered to “control” the Fund when that ownership exceeds 25% of the Fund’s assets (and which may differ from control as determined in accordance with GAAP).

The following list includes the Funds which had individual shareholder accounts with ownership of voting securities greater than 10% of the total outstanding voting securities but less than 25% and/or accounts with ownership of voting securities greater than 25% of the total outstanding voting securities. Significant transactions by these shareholder accounts may negatively impact the Funds’ performance.

| | | Number of

shareholders with

ownership of voting

securities of the Fund

greater than 10% and

less than 25% of the

total Fund’s

outstanding voting

securities | | | Percentage

owned

in aggregate

by 10% – 25%

shareholders (%) | | | Number of

shareholders with

ownership of

voting securities

of the Fund

greater than 25%

of the total Fund’s

outstanding

voting securities | | | Percentage owned

in aggregate by

greater than 25%

shareholders (%) | |

| Radiant U.S. Smaller Companies Fund | | — | | | — | | | 1 | | | 63 | |

| Radiant U.S. Smaller Companies Fund (Class I) | | 3 | | | 39 | | | 1 | | | 47 | |

Subsequent events occurring after the date of this report have been evaluated for potential impact, for purposes of recognition or disclosure in the financial statements, through the date the report was issued and no adjustments or additional disclosures were required to the financial statements.

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of HSBC Funds and Shareholders of HSBC Radiant U.S. Smaller Companies Fund and HSBC Radiant U.S. Smaller Companies Fund (Class I)

Opinions on the Financial Statements

We have audited the accompanying statements of assets and liabilities of HSBC Radiant U.S. Smaller Companies Fund and HSBC Radiant U.S. Smaller Companies Fund (Class I) (two of the funds constituting HSBC Funds, hereafter collectively referred to as the “Funds”) as of October 31, 2023, the related statements of operations for the year ended October 31, 2023, the statements of changes in net assets for each of the two years in the period ended October 31, 2023, including the related notes, and the financial highlights for each of the five years in the period ended October 31, 2023 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of October 31, 2023, the results of each of their operations for the year then ended, the changes in each of their net assets for each of the two years in the period ended October 31, 2023 and each of the financial highlights for each of the five years in the period ended October 31, 2023 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinions

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2023 by correspondence with the sub-administrator of the Funds. We believe that our audits provide a reasonable basis for our opinions.

/s/PricewaterhouseCoopers LLP

New York, New York

December 26, 2023

We have served as the auditor of one or more investment companies in the HSBC Funds since 2015.

Table of Shareholder Expenses—as of October 31, 2023 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including exchange fees (if any); and (2) ongoing costs, including management fees, distribution fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

Actual Expenses

The actual examples are based on an investment of $1,000 invested at the beginning of a six-month period beginning May 1, 2023 and held through the period ended October 31, 2023.

The columns below under the heading entitled “Actual” provide information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Actual Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The hypothetical expense examples are based on an investment of $1,000 invested at the beginning of a six-month period and held throughout the period ended October 31, 2023.

The columns below under the heading entitled “Hypothetical” provide information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the columns under the heading entitled “Hypothetical” are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | Actual | | | Hypothetical

(5% return before expenses) | |

| | | Annualized

Expense

Ratio During

Period | | | Beginning

Account

Value

5/1/23 | | | Ending

Account

Value

10/31/23 | | | Expenses

Paid During

Period(1) | | | Ending

Account

Value

10/31/23 | | | Expenses

Paid During

Period(1) | |

| Radiant U.S. Smaller Companies Fund – Class A Shares | | | 1.35% | | | | $1,000.00 | | | | $978.80 | | | | $6.73 | | | | $1,018.40 | | | | $6.87 | |

| Radiant U.S. Smaller Companies Fund (Class I) – Class I Shares | | | 0.90% | | | | 1,000.00 | | | | 982.00 | | | | 4.50 | | | | 1,020.70 | | | | 4.58 | |

| (1) | Expenses are equal to the average account value over the period multiplied by the Fund’s annualized expense ratio, multiplied by 184/365 (the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year.) |

Portfolio Composition*

October 31, 2023 (Unaudited)

| HSBC Radiant U.S. Smaller Companies Portfolio |

| Investment Allocation | Percentage of Investments

at Value (%) |

| Software | 15.6 | |

| Health Care Equipment & Supplies | 12.3 | |

| Biotechnology | 8.3 | |

| Health Care Providers & Services | 6.8 | |

| Electronic Equipment, Instruments & Components | 5.3 | |

| Professional Services | 5.1 | |

| Diversified Consumer Services | 4.6 | |

| Building Products | 4.5 | |

| Household Durables | 3.8 | |

| Construction & Engineering | 3.2 | |

| Specialized REITs | 3.0 | |

| Capital Markets | 2.3 | |

| Technology Hardware, Storage & Peripherals | 2.2 | |

| Trading Companies & Distributors | 2.2 | |

| Textiles, Apparel & Luxury Goods | 2.1 | |

| Commercial Banks | 2.1 | |

| Electrical Equipment | 1.8 | |

| Communications Equipment | 1.6 | |

| Semiconductors & Semiconductor Equipment | 1.6 | |

| Financial Services | 1.4 | |

| Diversified Telecommunication Services | 1.4 | |

| Consumer Staples Distribution & Retail | 1.4 | |

| Insurance | 1.3 | |

| Health Care REITs | 1.3 | |

| Specialty Retail | 1.2 | |

| Metals & Mining | 1.1 | |

| Office REITs | 0.9 | |

| Health Care Technology | 0.8 | |

| Interactive Media & Services | 0.8 | |

| Total | 100.0 | |

* Portfolio composition is subject to change.

| HSBC RADIANT U.S. SMALLER COMPANIES PORTFOLIO |

Schedule of Portfolio Investments—as of October 31, 2023

| Common Stocks — 98.6% | | | | | | | | |

| | | | | | | | | |

| | | | Shares | | | | Value ($) | |

| Biotechnology — 8.2% | |

| Alkermes PLC (a) | | | 13,530 | | | | 327,291 | |

| Dynavax Technologies Corp. (a) | | | 16,340 | | | | 232,191 | |

| Exact Sciences Corp. (a) | | | 4,560 | | | | 280,850 | |

| Halozyme Therapeutics, Inc. (a) | | | 10,710 | | | | 362,748 | |

| Ironwood Pharmaceuticals, Inc. Class A(a) | | | 14,380 | | | | 128,989 | |

| MiMedx Group, Inc. (a) | | | 28,520 | | | | 187,091 | |

| Neurocrine Biosciences, Inc. (a) | | | 750 | | | | 83,205 | |

| | | | | | | | 1,602,365 | |

| Building Products — 4.5% | |

| Apogee Enterprises, Inc. | | | 2,900 | | | | 124,468 | |

| Griffon Corp. | | | 5,870 | | | | 234,448 | |

| JELD-WEN Holding, Inc. (a) | | | 3,500 | | | | 39,655 | |

| Owens Corning | | | 2,570 | | | | 291,361 | |

| Quanex Building Products Corp. | | | 7,030 | | | | 188,755 | |

| | | | | | | | 878,687 | |

| Capital Markets — 2.3% | |

| Donnelley Financial Solutions, Inc. (a) | | | 4,670 | | | | 254,188 | |

| Victory Capital Holdings, Inc. Class A | | | 6,710 | | | | 197,677 | |

| | | | | | | | 451,865 | |

| Commercial Banks — 2.1% | |

| Ameris Bancorp | | | 5,810 | | | | 216,713 | |

| SouthState Corp. | | | 2,980 | | | | 196,978 | |

| | | | | | | | 413,691 | |

| Communications Equipment — 1.6% | |

| Extreme Networks, Inc. (a) | | | 15,120 | | | | 311,774 | |

| Construction & Engineering — 3.1% | | | | | | | | |

| Sterling Infrastructure, Inc. (a) | | | 3,830 | | | | 279,015 | |

| WillScot Mobile Mini Holdings Corp. (a) | | | 8,460 | | | | 333,409 | |

| | | | | | | | 612,424 | |

| Consumer Staples Distribution & Retail — 1.3% | |

| Sprouts Farmers Market, Inc. (a) | | | 6,240 | | | | 262,205 | |

| Diversified Consumer Services — 4.6% | |

| Coursera, Inc. (a) | | | 16,360 | | | | 283,682 | |

| Frontdoor, Inc. (a) | | | 7,970 | | | | 230,572 | |

| H&R Block, Inc. | | | 9,250 | | | | 379,713 | |

| | | | | | | | 893,967 | |

| Diversified Telecommunication Services — 1.4% | |

| Iridium Communications, Inc. | | | 7,360 | | | | 272,688 | |

| Electrical Equipment — 1.8% | | | | | | | | |

| Atkore, Inc. (a) | | | 2,780 | | | | 345,498 | |

| Electronic Equipment, Instruments & Components — 5.3% | |

| Advanced Energy Industries, Inc. | | | 3,880 | | | | 338,569 | |

| Jabil, Inc. | | | 3,790 | | | | 465,412 | |

| Vontier Corp. | | | 7,790 | | | | 230,272 | |

| | | | | | | | 1,034,253 | |

| Financial Services — 1.4% | |

| WEX, Inc. (a) | | | 1,640 | | | | 273,027 | |

| Health Care Equipment & Supplies — 12.1% | |

| Alphatec Holdings, Inc. (a) | | | 18,750 | | | | 172,125 | |

| Artivion, Inc. (a) | | | 14,460 | | | | 184,220 | |

| AtriCure, Inc. (a) | | | 5,130 | | | | 177,703 | |

| CONMED Corp. | | | 3,000 | | | | 292,380 | |

| Glaukos Corp. (a) | | | 3,640 | | | | 248,248 | |

| Common Stocks, continued | | | | |

| | | | | |

| | | | Shares | | | | Value ($) | |

| Haemonetics Corp. (a) | | | 3,280 | | | | 279,554 | |

| Inari Medical, Inc. (a) | | | 4,290 | | | | 260,446 | |

| Inspire Medical Systems, Inc. (a) | | | 960 | | | | 141,274 | |

| Lantheus Holdings, Inc. (a) | | | 4,200 | | | | 271,320 | |

| Penumbra, Inc. (a) | | | 740 | | | | 141,451 | |

| Tactile Systems Technology, Inc. (a) | | | 8,680 | | | | 94,786 | |

| TransMedics Group, Inc. (a) | | | 2,970 | | | | 111,316 | |

| | | | | | | | 2,374,823 | |

| Health Care Providers & Services — 6.7% | |

| AMN Healthcare Services, Inc. (a) | | | 2,510 | | | | 190,409 | |

| Ensign Group, Inc. | | | 4,580 | | | | 442,428 | |

| Option Care Health, Inc. (a) | | | 9,260 | | | | 256,780 | |

| Progyny, Inc. (a) | | | 3,580 | | | | 110,479 | |

| RadNet, Inc. (a) | | | 7,500 | | | | 202,200 | |

| Select Medical Holdings Corp. | | | 4,850 | | | | 110,240 | |

| | | | | | | | 1,312,536 | |

| Health Care REITs — 1.3% | |

| Omega Healthcare Investors, Inc.REIT | | | 7,430 | | | | 245,933 | |

| Health Care Technology — 0.8% | |

| Health Catalyst, Inc. (a) | | | 19,860 | | | | 148,751 | |

| Household Durables — 3.8% | |

| Cavco Industries, Inc. (a) | | | 100 | | | | 24,951 | |

| Installed Building Products, Inc. | | | 3,250 | | | | 362,927 | |

| Tempur Sealy International, Inc. | | | 8,760 | | | | 349,787 | |

| | | | | | | | 737,665 | |

| Insurance — 1.3% | |

| Everest Group Ltd. | | | 640 | | | | 253,197 | |

| Interactive Media & Services — 0.7% | |

| Cars.com, Inc. (a) | | | 9,680 | | | | 147,426 | |

| Metals & Mining — 1.0% | |

| Constellium SE Class A(a) | | | 13,080 | | | | 206,664 | |

| Office REITs — 0.9% | | | | | | | | |

| Boston Properties, Inc.REIT | | | 3,390 | | | | 181,602 | |

| Professional Services — 5.0% | |

| Paylocity Holding Corp. (a) | | | 2,210 | | | | 396,474 | |

| TriNet Group, Inc. (a) | | | 2,650 | | | | 272,288 | |

| Verra Mobility Corp. Class A(a) | | | 15,870 | | | | 313,750 | |

| | | | | | | | 982,512 | |

| Semiconductors & Semiconductor Equipment — 1.6% | |

| Rambus, Inc. (a) | | | 5,700 | | | | 309,681 | |

| Software — 15.3% | |

| Elastic NV (a) | | | 4,020 | | | | 301,661 | |

| Gen Digital, Inc. | | | 20,200 | | | | 336,532 | |

| Manhattan Associates, Inc. (a) | | | 2,350 | | | | 458,203 | |

| Nutanix, Inc. Class A(a) | | | 11,890 | | | | 430,299 | |

| PROS Holdings, Inc. (a) | | | 7,730 | | | | 240,790 | |