As filed with the Securities and Exchange Commission on May 20, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-4786

Ariel Investment Trust

(Exact name of registrant as specified in charter)

200 East Randolph Street

Suite 2900

Chicago, Illinois, 60601

(Address of principal executive offices) (Zip code)

Mareile Cusack

200 East Randolph Street

Suite 2900

Chicago, Illinois 60601

(Name and address of agent for service)

with a copy to:

Arthur Don, Esq.

Greenberg Traurig, LLP

77 West Wacker Drive

Suite 3100

Chicago, IL 60601

Registrant's telephone number, including area code: (312) 726-0140

Date of fiscal year end: September 30, 2016

Date of reporting period: March 31, 2016

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the "Act") (17 CFR 270.30e-1)

The patient investor

| | | | | | |

| | | | | | |

| SEMI-ANNUAL REPORT: 03/31/16 |

| ● | Value | ● | Deep value | ● | Global |

| ● | Ariel Fund |

| ● | Ariel Appreciation Fund |

| ● | Ariel Focus Fund |

| ● | Ariel Discovery Fund |

| ● | Ariel International Fund |

| ● | Ariel Global Fund |

Slow and steady wins the race.

One of Ariel Investments’ guiding principles is to communicate openly with our shareholders so they may gain a clear understanding of our investment philosophy, portfolio decisions and results, as well as our opinions on the underlying market. In reviewing the materials contained in The Patient Investor, please consider the information provided on this page. While our investment decisions are rooted in detailed analysis, it is important to point out that actual results can differ significantly from those we seek. We candidly discuss a number of individual companies. Our opinions are current as of the date they were written but are subject to change. We want to remind investors that the information in this report is not sufficient on which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security. Equity investments are affected by market conditions. The intrinsic value of the stocks in which the Funds invest may never be recognized by the broader market. Ariel Fund, Ariel Appreciation Fund, Ariel Focus Fund and Ariel Discovery Fund invest in micro, small and/or mid-cap companies. Investing in micro, small and mid-cap stocks is riskier and more volatile than investing in large cap stocks, in part because smaller companies may not have the scale, depth of resources and other assets of larger firms. Ariel Fund and Ariel Appreciation Fund often invest a significant portion of their assets in companies within the consumer discretionary and financial services sectors and their performance may suffer if these sectors underperform the overall stock market. Ariel Focus Fund invests primarily in equity securities of companies of any size in order to provide investors access to superior opportunities in companies of all market capitalizations. Ariel Focus Fund is a non-diversified fund in that it generally holds only 20-30 stocks and therefore may be more volatile than a more diversified investment. Ariel International Fund and Ariel Global Fund invest in foreign securities and may use currency derivatives and ETFs. Investments in foreign securities may underperform and may be more volatile than comparable U.S. stocks because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. The use of currency derivatives and ETFs may increase investment losses and expenses and create more volatility. Investments in emerging markets present additional risks, such as difficulties selling on a timely basis and at an acceptable price. Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for the Funds may be obtained by visiting our website, arielinvestments.com. Investors should consider carefully the investment objectives, risks, and charges and expenses before investing. For a current summary prospectus or full prospectus which contains this and other information about the Funds offered by Ariel Investment Trust, call us at 800.292.7435 or visit our website, arielinvestments.com. Please read the summary prospectus or full prospectus carefully before investing. Distributed by Ariel Distributors, LLC, a wholly owned subsidiary of Ariel Investments, LLC. Ariel Investment Trust c/o U.S. Bancorp Fund Services, LLC P.O. Box 701 Milwaukee, WI 53201-0701 800.292.7435 • arielinvestments.com

• linkedin.com/company/ariel-investments

• twitter.com/ArielFunds

• facebook.com/ArielInvestments |

| | | |

| | Fund performance at a glance | AS OF 03/31/16 |

| | | |

| | | |

| | | | | | | | |

| | | | Annualized |

| | Quarter (%) | 1-year (%) | 3-year (%) | 5-year (%) | 10-year (%) | 20-year (%) | Since inception (%) |

| Small/mid cap value strategy | | | | | | | 11/06/86 |

| Ariel Fund–Investor Class | – 0.32 | –10.38 | + 9.85 | + 8.53 | + 5.75 | +10.26 | + 11.11 |

| Ariel Fund–Institutional Class | – 0.24 | –10.10 | + 10.19 | + 8.83 | + 5.90 | +10.34 | + 11.17 |

Russell 2500TM Value Index | + 3.33 | – 5.20 | + 7.15 | + 8.33 | + 5.80 | +10.07 | + 11.01 |

Russell 2000® Value Index | + 1.70 | – 7.72 | + 5.73 | + 6.66 | + 4.42 | + 9.12 | + 10.17 |

S&P 500® Index | + 1.35 | + 1.78 | + 11.82 | + 11.58 | + 7.01 | + 7.98 | + 9.99 |

| Mid cap value strategy | | | | | | | 12/01/89 |

| Ariel Appreciation Fund–Investor Class | + 1.09 | – 9.14 | + 9.06 | + 9.15 | + 7.48 | +10.62 | + 10.61 |

| Ariel Appreciation Fund–Institutional Class | + 1.20 | – 8.82 | + 9.43 | + 9.44 | + 7.62 | +10.70 | + 10.67 |

Russell Midcap® Value Index | + 3.92 | – 3.39 | + 9.88 | + 10.52 | + 7.23 | +10.50 | + 11.34 |

Russell Midcap® Index | + 2.24 | – 4.04 | + 10.45 | + 10.30 | + 7.45 | +10.02 | + 11.10 |

S&P 500® Index | + 1.35 | + 1.78 | + 11.82 | + 11.58 | + 7.01 | + 7.98 | + 9.27 |

| All cap value strategy | | | | | | | 06/30/05 |

| Ariel Focus Fund–Investor Class | + 1.62 | –12.08 | + 4.94 | + 5.89 | + 3.69 | – | + 4.09 |

| Ariel Focus Fund–Institutional Class | + 1.72 | –11.86 | + 5.21 | + 6.11 | + 3.80 | – | + 4.20 |

Russell 1000® Value Index | + 1.64 | – 1.54 | + 9.38 | + 10.25 | + 5.72 | – | + 6.37 |

S&P 500® Index | + 1.35 | + 1.78 | + 11.82 | + 11.58 | + 7.01 | – | + 7.47 |

| Small cap deep value strategy | | | | | | | 01/31/11 |

| Ariel Discovery Fund–Investor Class | + 2.20 | –21.90 | – 6.81 | – 1.51 | – | – | – 0.84 |

| Ariel Discovery Fund–Institutional Class | + 2.29 | –21.69 | – 6.58 | – 1.28 | – | – | – 0.61 |

Russell 2000® Value Index | + 1.70 | – 7.72 | + 5.73 | + 6.66 | – | – | + 7.76 |

S&P 500® Index | + 1.35 | + 1.78 | + 11.82 | + 11.58 | – | – | + 11.93 |

| International all cap strategy | | | | | | | 12/30/11 |

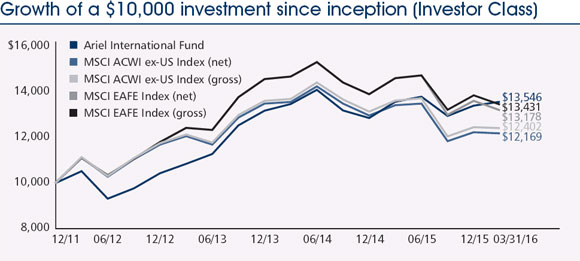

| Ariel International Fund–Investor Class | + 1.27 | – 0.04 | + 7.72 | – | – | – | + 7.40 |

| Ariel International Fund–Institutional Class | + 1.30 | + 0.18 | + 7.93 | – | – | – | + 7.64 |

| MSCI EAFE Index (net) | – 3.01 | – 8.27 | + 2.23 | – | – | – | + 6.71 |

| MSCI ACWI ex-US Index (net) | – 0.38 | – 9.19 | + 0.32 | – | – | – | + 4.73 |

| Global all cap strategy | | | | | | | 12/30/11 |

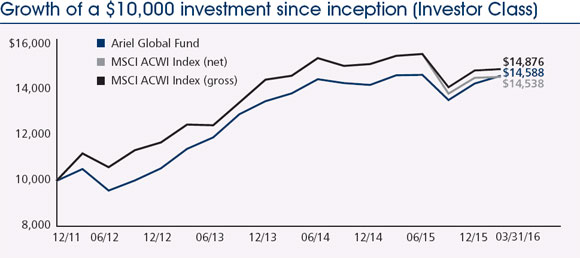

| Ariel Global Fund–Investor Class | + 2.41 | – 0.13 | + 8.57 | – | – | – | + 9.29 |

| Ariel Global Fund–Institutional Class | + 2.48 | + 0.08 | + 8.86 | – | – | – | + 9.57 |

| MSCI ACWI Index (net) | + 0.24 | – 4.34 | + 5.54 | – | – | – | + 9.20 |

The inception date for the Institutional Class shares of all Funds is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of a Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of a Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of its Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. Descriptions for the indexes can be found on page 65. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

| | | |

| TURTLE TALK | |

| | |

| | | |

| | Portfolio manager viewpoints | |

| | | |

| | “In the global markets, a volatile environment provided a wonderful opportunity for us to apply our contrarian intrinsic value investing strategy. We currently believe international valuations are attractive and ideal for bottom-up stock pickers like ourselves. Sharp moves tend to mean big shifts in valuation, and on the downside that can create opportunities.” | |

| | | |

| | | -Rupal J. Bhansali, Chief Investment Officer, Ariel Global Equites | |

| | | |

| | Please turn to page 17 to read Rupal Bhansali’s full letter to shareholders on year-to-date performance drivers, stocks and sectors. | |

| | | |

| A born investor | |

| | Rupal J. Bhansali,Portfolio Manager, Ariel International Fund & Ariel Global Fund |

Coming from a long line of bankers and brokers, Rupal Bhansali grew up on stock stories instead of fairy tales. Eager to enter the world of finance, she learned accounting by the age of 16 and began working in the field right out of high school. By age 24, she had edited prospectuses, calculated residual values on lease portfolios and learned how to trade foreign exchange.

During her college days, Rupal was known for challenging conventional wisdom. To break the cyclical habit of students job-hunting upon graduation, she encouraged them to consider entrepreneurship as a path to success by launching a competition called “Mind Your Own Business”.

Rupal learned the meaning of volatility firsthand, when she came to the United States to pursue her MBA at the University of Rochester in Rochester, N.Y., in 1991. The Indian rupee had just devalued by a massive 40%, and stock markets tumbled worldwide due to a global recession. Fortunately, she had earned a Rotary Foundation Scholarship that was not subject to currency risk or equity market fluctuations, which meant she could still fund her education. That formative shock lesson continues to guide her risk management philosophy today.

To hear Rupal’s whole story, visit arielinvestments.com/bhansali.

UTILITY FUTILITY

| Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Fund and Ariel Appreciation Fund may be obtained by visiting our website, arielinvestments.com. | |

DEAR FELLOW SHAREHOLDER:

Against the backdrop of an increasingly distant but still very relevant financial crisis, most investors have become accustomed to sharp downdrafts and steep recoveries. But even these days, it is rare to see a V-shaped market unfold in just one quarter. And yet, in the first six weeks of the year, stocks of all sizes and persuasions plummeted. And just as a bear market sentiment was taking root, they surged. After netting out some striking double-digit gains and losses, quarter-end results mask the extent of the volatility.

Amidst the frenzy, the smaller companies comprising Ariel Fund declined -0.32%, which fell short of the Russell 2000 Value Index’s +1.70% return but well below its primary Russell 2500 Value Index, which climbed +3.33%. And although Ariel Appreciation Fund managed to earn +1.09% during the first quarter, it underperformed the Russell Midcap Value Index as well as the Russell Midcap Index, which grew +3.92% and+2.24%, respectively.

Over the last three months Ariel Fund and Ariel Appreciation Fund have had similar performance experiences. Both benefited from select consumer discretionary names such as Mattel, Inc. (MAT) and certain producer durables holdings such as Kennametal Inc. (KMT). Separately, Ariel Fund’s sole, long-suffering energy holding, Contango Oil & Gas Co. (MCF) meaningfully recovered. Meanwhile, Ariel Appreciation Fund benefitted significantly from CBS Corp. (CBS) in the consumer discretionary sector. The greatest similarity, however, was both Funds were penalized for not owning utilities, which was far and away the best-performing sector over the three-month period—trouncing the other areas.

UTILITY FUTILITY?

There is little question that utilities provide much-needed products and services that make our daily lives possible. Electricity, water, gas, heat, telephones—all are considered basic necessities here in the U.S. When we turn on a faucet, flip a light switch, or adjust a thermometer, we expect it to work. And it is true, in most instances utility companies represent monopolies in their areas of service, which fends off competition completely. While many investors are attracted to their mostly-stable earnings and predictable dividends, American utility companies tend to lack the 10%-12% normalized growth rates we seek. Moreover, there is no such thing as branded electricity or trademarked natural gas. Not to mention, precisely because of the sheer magnitude of their importance, utilities are highly regulated—putting their rates and profits squarely under the control of government officials. If the aforementioned were not enough of an investment deterrent, it is worth noting that these businesses tend to be capital intensive with significant up-front and on-going costs often financed by debt.

Accordingly, in our more than three-decade history as professional investors, we have very rarely found attractive opportunities in the utilities sector. The economic shortcomings of these businesses ultimately come through in their market returns, as we show below in a look at the last 25 years. While utility gains of late underscore the truism that any stock or sector can have its “day in the sun,” the longer-term story is not so compelling. More specifically, risk-averse, yield-chasing investors piled headlong into the sector as soon as 2013 ended, and the numbers posted by both large- and small-cap utility issues are indeed quite stunning.

| 12/31/13–03/31/16 | | | | | | |

| | Cumulative return | Annualized return |

| Russell 2000 Value | – | 1.92 | % | – | 0.86 | % |

| Russell 2000 Value–Utilities | + | 29.66 | | + | 12.28 | |

| S&P 500 | + | 16.82 | | + | 7.15 | |

| S&P 500–Utilities | + | 41.83 | | + | 16.80 | |

Past performance does not guarantee future results.

As you can see below, the story was quite different for the first 22-plus years.

| 03/31/91–12/31/13 | | | | | | |

| | Cumulative return | Annualized return |

| Russell 2000 Value | + | 1226.84 | % | + | 12.03 | % |

| Russell 2000 Value–Utilities | + | 676.89 | | + | 9.43 | |

| S&P 500 | + | 687.50 | | + | 9.50 | |

| S&P 500–Utilities | + | 440.51 | | + | 7.70 | |

Past performance does not guarantee future results.

When considered together, the results of the last 25 years are meaningfully influenced by recent returns and thus more nuanced than one might surmise at a glance.

| 03/31/91–03/31/16 | | | | | | |

| | Cumulative return | Annualized return |

| Russell 2000 Value | + | 1203.95 | % | + | 10.81 | % |

| Russell 2000 Value–Utilities | + | 907.60 | | + | 9.67 | |

| S&P 500 | + | 819.92 | | + | 9.28 | |

| S&P 500–Utilities | + | 666.60 | | + | 8.49 | |

Past performance does not guarantee future results.

It reasonably follows, then, that our conscious decision to generally dodge utility stocks would boost our relative returns over the years. To show those results, we turn to our flagship mutual funds, Ariel Fund and Ariel Appreciation Fund, which have the best data over the very long term. Attribution analysis dating back to 1989 shows that by largely omitting the utilities sector, our flagship mutual fund Ariel Fund added +60.87%1 towards its outperformance of the primary Russell 2500 Value benchmark. In fact, for the 27-year period, our avoidance of utilities has contributed more than our ownership of any other sector. For the same period, the mid-cap Ariel Appreciation Fund has done even better. As a direct result of minimal investments in the sector, Ariel Appreciation Fund has contributed +88.13%1 towards the outperformance of its primary Russell Midcap Value Index. And, as for Ariel Fund, steering clear of the sector actually represents our number one sector contributor to returns over the period.

“Even these days, it is rare to see a V-shaped market unfold in just one quarter.”

Low bond yields have driven the surge in the popularity of the utility sector in recent years. As the Federal Reserve slowly but surely raises interest rates from its current rock-bottom level of 0.25% toward its historical average of 5.00%, income substitutes will organically experience downward pressure. Investors are likely to trade equity risk for the safety of U.S. Treasuries. As such, while utilities have done well in the recent race to rock-bottom interest rates, their role as an income producer will become less potent as interest rates rise. That should bode well for investors who avoid the area as we do, whether it is hot or not.

PORTFOLIO COMINGS AND GOINGS

In the first quarter of the year, we added two positions and eliminated three positions in Ariel Fund. A current holding in Ariel Appreciation Fund, we purchased premier trust bank, Northern Trust Corp. (NTRS) as its market capitalization fell within the range of our small/mid fund. We also bought shares of educational services provider DeVry Education Group Inc. (DV). Investor concerns surrounding weak demand and government regulation at DeVry University has cast a cloud over the entire company. We think it obscures the combined value of the growing health care and international schools, a cash-rich balance sheet and the option-like value of the business and technology schools. We are confident this cloud will eventually pass and the company’s true value will shine through. We sold our shares of long-term holding and saw chain manufacturer Blount Intl, Inc. (BLT) after it agreed to be acquired by American Securities and P2 Capital Partners at $10 per share. In addition, we eliminated our positions in Media General Inc. (MEG) and Newell Rubbermaid Inc. (NWL) in order to pursue more compelling opportunities. “While utilities have done well in the recent race to rock-bottom interest rates, their role as an income producer will become less potent as interest rates rise.”

In Ariel Appreciation Fund, we added one position and eliminated two positions in. Global middle-market investment bank Houlihan Lokey, Inc. (HLI), a new firm-wide holding, homes in on mid-cap transactions and provides first class restructuring services. We believe the mid-cap focus and strength of the restructuring segment provide the company with greater protection relative to competitors during periods of decline in the M&A cycle. We sold our shares of Coach, Inc. (COH) and Janus Capital Group Inc. (JNS) in order to pursue more compelling opportunities.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

| | |

| Sincerely, | | |

| |  |

| John W. Rogers, Jr. | | Mellody Hobson |

| Chairman and CEO | | President |

| | | |

EVALUATING RISK EVALUATING RISK | |

| | | |

| | We recently asked our portfolio managers what they thought were the most important factors to consider when evaluating risk. Here’s how Timothy R. Fidler, CFA, Co-Portfolio Manager of Ariel Appreciation Fund and Director of Research, responded: “I focus on evaluating the strength of a business’s franchise. In my view, stable high quality businesses exhibit lower risk, thus our research effort evaluates every company’s competitive advantages and points of differentiation. Additionally, balance sheet strength can serve to lower risk as financial distress can harm even the most competitively advantaged businesses.” | |

1 These returns represent the opportunity cost of the investment decisions in a portfolio relative to the overall benchmark. The subpar performance of utilities was largely avoided by the Funds and thus represented a relative gain to the Funds versus their benchmarks. | | | |

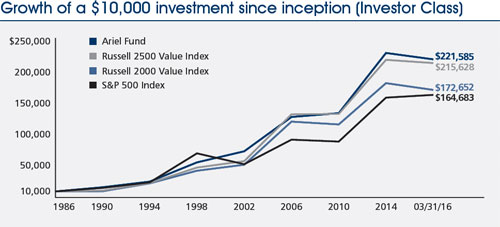

| Ariel Fund performance summary | INCEPTION: 11/06/86 |

| | | |

| | | |

| | | | | |

| |  | |  |

| John W. Rogers, Jr. | | John P. Miller, cfa | | Kenneth E. Kuhrt, cpa |

| Lead portfolio | | Portfolio | | Portfolio |

| manager | | manager | | manager |

Composition of equity holdings (%) | | | | |

| | | Ariel

Fund† | Russell

2500

Value

Index | Russell

2000

Value

Index | S&P

500

Index |

| | Consumer discretionary | 29.99 | 9.88 | 10.26 | 14.25 |

| | Financial services | 29.56 | 39.07 | 43.08 | 17.70 |

| | Producer durables | 18.98 | 12.94 | 12.26 | 10.61 |

| | Health care | 8.60 | 4.27 | 4.14 | 14.22 |

| | Materials & processing | 5.50 | 6.63 | 4.66 | 3.02 |

| | Technology | 3.12 | 8.31 | 9.79 | 17.88 |

| | Consumer staples | 3.11 | 2.73 | 3.16 | 9.30 |

| | Energy | 1.14 | 5.28 | 3.46 | 6.79 |

| | Utilities | 0.00 | 10.89 | 9.20 | 6.23 |

† Represents percentage of total equity holdings in the portfolio. |

| Average annual total returns (%) as of 03/31/16 |

| | | | | | | | | Since |

| | | Quarter | 1-year | 3-year | 5-year | 10-year | 20-year | inception |

| | Ariel Fund–Investor Class | – | 0.32 | – | 10.38 | + | 9.85 | + | 8.53 | + | 5.75 | + | 10.26 | + | 11.11 |

| | Ariel Fund–Institutional Class + | – | 0.24 | – | 10.10 | + | 10.19 | + | 8.83 | + | 5.90 | + | 10.34 | + | 11.17 |

| | Russell 2500TM Value Index | + | 3.33 | – | 5.20 | + | 7.15 | + | 8.33 | + | 5.80 | + | 10.07 | + | 11.01 |

| | Russell 2000® Value Index | + | 1.70 | – | 7.72 | + | 5.73 | + | 6.66 | + | 4.42 | + | 9.12 | + | 10.17 |

| | S&P 500® Index | + | 1.35 | + | 1.78 | + | 11.82 | + | 11.58 | + | 7.01 | + | 7.98 | + | 9.99 |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

Expense ratio (as of 9/30/15) | |

| Investor Class | 1.02% |

| Institutional Class | 0.72% |

Top ten equity holdings (% of net assets) |

| 1. | Lazard Ltd | 4.6 |

| 2. | KKR & Co. L.P. | 4.3 |

| 3. | TEGNA, Inc. | 4.0 |

| 4. | Brady Corp. | 3.7 |

| 5. | Kennametal Inc. | 3.7 |

| 6. | Interpublic Group of Cos., Inc. | 3.3 |

| 7. | Meredith Corp. | 3.3 |

| 8. | JLL | 3.2 |

| 9. | Janus Capital Group Inc. | 3.2 |

| 10. | Royal Caribbean Cruises Ltd. | 3.2 |

+ The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees.

Notes: The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94. See index descriptions on page 65.

| | | |

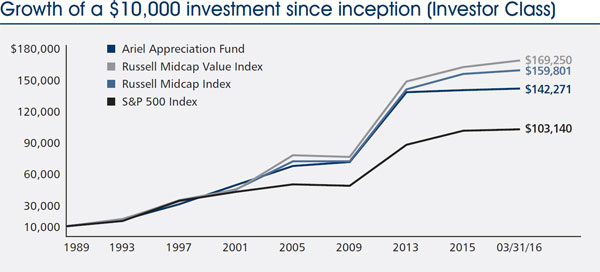

| | Ariel Appreciation Fund performance summary | INCEPTION: 12/01/89 |

| | | |

| | | |

| | | |

| |  |

John W. Rogers, Jr. Co-portfolio

manager | | Timothy R. Fidler, cfa Co-portfolio

manager |

Composition of equity holdings (%) | |

| | | Ariel | Russell | | |

| | | Apprec- | Midcap | Russell | S&P |

| | | iation | Value | Midcap | 500 |

| | | Fund† | Index | Index | Index |

| | Financial services | 33.81 | 33.43 | 25.05 | 17.70 |

| | Consumer discretionary | 24.17 | 9.11 | 17.64 | 14.25 |

| | Health care | 16.97 | 5.64 | 8.61 | 14.22 |

| | Producer durables | 16.76 | 9.06 | 12.12 | 10.61 |

| | Consumer staples | 3.41 | 4.36 | 6.31 | 9.30 |

| | Technology | 2.64 | 8.17 | 11.10 | 17.88 |

| | Energy | 2.24 | 8.59 | 4.78 | 6.79 |

| | Materials & processing | 0.00 | 6.96 | 6.82 | 3.02 |

| | Utilities | 0.00 | 14.68 | 7.57 | 6.23 |

† Represents percentage of total equity holdings in the portfolio. |

Average annual total returns (%) as of 03/31/16 | | |

| | | | | | | | | Since |

| | | Quarter | 1-year | 3-year | 5-year | 10-year | 20-year | inception |

| | Ariel Appreciation Fund–Investor Class | + | 1.09 | – | 9.14 | + | 9.06 | + | 9.15 | + | 7.48 | + | 10.62 | + | 10.61 |

| | Ariel Appreciation Fund–Institutional Class + | + | 1.20 | – | 8.82 | + | 9.43 | + | 9.44 | + | 7.62 | + | 10.70 | + | 10.67 |

| | Russell Midcap® Value Index | + | 3.92 | – | 3.39 | + | 9.88 | + | 10.52 | + | 7.23 | + | 10.50 | + | 11.34 |

| | Russell Midcap® Index | + | 2.24 | – | 4.04 | + | 10.45 | + | 10.30 | + | 7.45 | + | 10.02 | + | 11.10 |

| | S&P 500® Index | + | 1.35 | + | 1.78 | + | 11.82 | + | 11.58 | + | 7.01 | + | 7.98 | + | 9.27 |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

Expense ratio (as of 9/30/15) | |

| Investor Class | 1.12% |

| Institutional Class | 0.79% |

Top ten equity holdings (% of net assets) |

| 1. | Zimmer Biomet Holdings, Inc. | 4.8 |

| 2. | AFLAC Inc. | 4.4 |

| 3. | Kennametal Inc. | 4.1 |

| 4. | Northern Trust Corp. | 4.1 |

| 5. | Stanley Black & Decker, Inc. | 4.0 |

| 6. | Laboratory Corp. of America Holdings | 4.0 |

| 7. | First American Financial Corp. | 3.9 |

| 8. | Omnicom Group Inc. | 3.9 |

| 9. | Interpublic Group of Cos., Inc. | 3.7 |

| 10. | Lazard Ltd | 3.6 |

+ The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees.

Notes: The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94. See index descriptions on page 65.

IS THE DOLLAR REALLY ALMIGHTY

| |

| Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Focus Fund may be obtained by visiting our website, arielinvestments.com. |

DEAR FELLOW SHAREHOLDER:

Ariel Focus Fund returned +1.62% in the first quarter of 2016. It modestly lagged its primary benchmark the Russell 1000 Value Index, which gained +1.64%, as well as the S&P 500 Index, which increased +1.35%. In 2015, many of our worst-performing companies were commodity-related. Most of these turned positive in the first quarter, some dramatically so. Similarly, our home-furnishing retailers and sole for-profit education holding were oversold last year but recovered some of those losses in the first quarter. Our contrarian investments in “old tech” (companies like Western Union Co. (WU) and Oracle Corp. (ORCL)) boosted our performance in the quarter. Our only noteworthy disappointment was Hanger, Inc. (HNGR), which uncovered accounting irregularities and saw its shares delisted.

Past letters have focused on the woeful performance of companies with exposures to commodities such as oil and gas, copper and gold. Commodity returns have been so poor for so long that the shares of many quality commodity-related companies now trade well below the value of their assets and investments, according to our estimates. This quarter, the market finally began to recognize some of that value. Barrick Gold Corp. (ABX) saw its stock increase +84.28% in the quarter. Plus Kennametal Inc. (KMT), Exxon Mobil Corp. (XOM) and Apache Corp. (APA) all contributed to performance in the quarter.

I believe the market is finally acknowledging the risk of future inflation we have discussed frequently in prior letters. Recent government data shows that the core U.S. inflation rate is at or even exceeds the Fed’s 2% target. The anti-inflationary effects of high unemployment, a strong dollar and weak commodity prices are giving way to tighter job markets, a weaker dollar and a recovery in oil. I claim no particular skill in predicting short-term fluctuations in these macroeconomic inputs, of course. But the U.S. government has 19 trillion reasons to reduce the value of the U.S. dollar. $19 trillion is the current size of the U.S. Federal debt, and that figure does not include the value of debt owed by state and local governments. Inflation reduces the economic value of debt, a strong motivation for the government to take actions which increase inflation. In addition, more inflation should reduce the value of the dollar versus other currencies, improving the competitive position of U.S. manufacturers. I acknowledge inflation has taken longer to return than I expected. But I continue to believe increasing inflation (and a resulting increase in nominal interest rates) will be a dominant investment theme of the next three to five years.

Although the data shows increasing inflation, interest rates have stayed annoyingly low. “Annoyingly” because the investment thesis around many of our financial holdings is based on interest rates returning to their historic averages. Morgan Stanley (MS), Goldman Sachs Group, Inc. (GS), JPMorgan Chase & Co. (JPM), and Bank of New York Mellon Corp. (BK) will all generate higher profits when they are able to invest their capital in higher-earning fixed-income assets. All four of these companies saw their stocks decline in the quarter when interest rates did not increase, as we and many others had predicted.

Let me take a moment to focus on Morgan Stanley, whose shares fell -20.91% in the quarter to a breathtaking 30% below book value. For generations, bankers and traders competed to become partners at Morgan Stanley so they could have the right (!) to buy stock in the company at book value. At today’s stock price anyone can buy shares in Morgan Stanley below the price a partner once had to pay. As the graph below shows, since 1993 it has only traded at this current discount to book value on three occasions: in late 2008 during the Financial Crisis; in 2011 during the European sovereign debt crisis; and today.

Past performance does not guarantee future results.

We sometimes hear a justification for Morgan Stanley’s low price-to-book: it reportedly has “anemic” returns on equity. In 2015 Morgan Stanley earned “only” 8.40% return on equity (ROE). Admittedly, this return is a far cry from 2006 when the company posted a 23% ROE. But is 8.40% really that bad today? Morgan Stanley’s assets and resulting book value consist almost entirely of stocks, bonds and other financial instruments. In 2015, the S&P 500 gained +1.38%. The broad bond market posted low single-digit returns. Commodities lost money. As such, if you owned a portfolio of financial assets last year, would you have been disappointed with an +8.40% return? I bet you would have been thrilled. If a closed-end mutual fund with a diversified portfolio of stocks and bonds returned +8.40% in 2015, would you think that fund should trade at a discount to the value of its holdings? No, you would probably be willing to pay a premium if you thought it could repeat that performance in the future. And we would argue Morgan Stanley’s 2015 earnings and resulting ROE are artificially and temporarily below normalized rates. When interest rates return to normal levels, we think Morgan Stanley will again be able to charge its wealth management clients fees on their cash holdings, after years of foregoing these high margin fees. A normal, positively-sloped yield curve will improve the profitability of Morgan Stanley’s beleaguered Fixed Income, Commodities and Currencies (“FICC”) group. We view the opportunity to purchase Morgan Stanley shares at a 30% discount to book value as a “fat pitch.”

“The anti-inflationary effects of high unemployment, a strong dollar, and weak commodity prices are giving way to tighter job markets, a weaker dollar and a recovery in oil.”

PORTFOLIO COMINGS AND GOINGS

In the first quarter we made significant progress in “working out” of some of our troubled holdings. We sold all of our shares in Apollo Education Group, Inc. (APOL) when the company negotiated a transaction to go private at $9.50 per share. The stock returned +12.13% in the quarter supporting our decision to hold our shares as “too cheap to sell” despite headwinds facing the for-profit education industry. We were wrong in viewing Washington D.C. political pressures as a temporary phenomenon. Likewise, we have worked down our position in troubled natural gas company Chesapeake Energy Corp. (CHK) to less than 1% of our holdings. As we write, Chesapeake has jumped more than +40% year-to-date. We would not expect to remain holders of Chesapeake at year end. In addition, we sold our positions in Baxter International Inc. (BAX) and Newell Rubbermaid Inc. (NWL) in order to pursue more compelling opportunities.

We added two new names to Ariel Focus Fund in the first quarter. We purchased our first shares in BorgWarner Inc. (BWA) in February after the company’s stock tumbled almost -50% on concerns about the auto supplier’s largest customer, Volkswagen. BorgWarner is a leading manufacturer of drivetrain and engine components and systems. We think the company will continue to benefit from increased demand for fuel-saving and emission-controlling technology that helps car manufacturers comply with increasing stringent regulations. We have followed BorgWarner closely for many years and consider it one of the highest quality companies in the industry. We initiated our position at approximately 10x our calculation of next year’s earnings, near a 10-year low for BorgWarner. To read more about BorgWarner and our investment thesis, see our company spotlight on page 21.

“Interest rates have stayed annoyingly low. ‘Annoyingly’ because the investment thesis around many of our financial holdings is based on interest rates returning to their historic averages.”

Finally, we initiated a new position in Zebra Technologies Corp. (ZBRA), the manufacturer of bar code printers and scanners used to track inventory and supplies. In 2014 Zebra purchased the bar code scanning business known as Motorola Solutions, Inc. (MSI). The company went from a printing scanner equipment manager to a systems designer able to deliver a complete solution to large retailers such as Wal-Mart Stores, Inc. (WMT) and Amazon.com, Inc. (AMZN). Zebra’s stock initially performed quite well after the acquisition, but was hit hard when costs of combining the two businesses exceeded management’s initial estimates. We purchased our first shares in Zebra at less than 10x our estimate of forward earnings, a very attractive price for a well-positioned supplier with good growth prospects both near and long term.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

Sincerely,

Charles K. Bobrinskoy

Portfolio manager

| | | | |

| EVALUATING RISK | |

| | | | |

| | We recently asked our portfolio managers what they thought were the most important factors to consider when evaluating risk. | |

| | | |

| | Here’s how Charles K. Bobrinskoy, Portfolio Manager of Ariel Focus Fund, responded: | |

| | | |

| | “I believe that certainty of underlying asset value is the most important factor to consider when evaluating risk. In addition, management can make a decision that leads to permanent impairment of capital. Thus we focus on identifying companies with strong, properly incentivized leadership.” | |

| | | |

| | | |

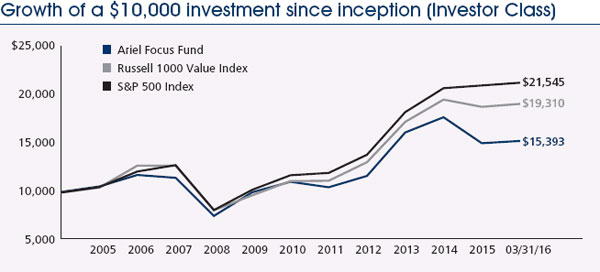

| | Ariel Focus Fund performance summary | INCEPTION: 06/30/05 |

| | | |

| | | |

| |

|

Charles K. Bobrinskoy Portfolio manager |

| Composition of equity holdings (%) | | | |

| | | | | |

| | Financial services | 25.59 | 28.50 | 17.70 |

| | Technology | 16.60 | 11.10 | 17.88 |

| | Health care | 16.35 | 11.66 | 14.22 |

| | Producer durables | 14.98 | 10.26 | 10.61 |

| | Energy | 10.30 | 12.83 | 6.79 |

| | Consumer discretionary | 8.48 | 6.50 | 14.25 |

| | Materials & processing | 7.70 | 3.10 | 3.02 |

| | Consumer staples | 0.00 | 6.24 | 9.30 |

| | Utilities | 0.00 | 9.81 | 6.23 |

† Represents percentage of total equity holdings in the portfolio.

| Average annual total returns (%) as of 03/31/16 | | | |

| | | | | | | | Since |

| | | Quarter | 1-year | 3-year | 5-year | 10-year | inception |

| | Ariel Focus Fund–Investor Class | + 1.62 | – 12.08 | + 4.94 | + 5.89 | + 3.69 | + 4.09 |

| | Ariel Focus Fund–Institutional Class+ | + 1.72 | – 11.86 | + 5.21 | + 6.11 | + 3.80 | + 4.20 |

| | Russell 1000® Value Index | + 1.64 | – 1.54 | + 9.38 | +10.25 | + 5.72 | + 6.37 |

| | S&P 500® Index | + 1.35 | + 1.78 | +11.82 | +11.58 | + 7.01 | + 7.47 |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

Expense ratio (as of 9/30/15) 1 | | Net | | Gross |

| Investor Class | | 1.00% | | 1.37% |

| Institutional Class | | 0.75% | | 1.07% |

Top ten equity holdings (% of net assets) | |

| 1. | Western Union Co. | 5.7 |

| 2. | Oracle Corp. | 5.6 |

| 3. | Intl Business Machines Corp. | 5.6 |

| 4. | Stanley Black & Decker, Inc. | 5.5 |

| 5. | Lockheed Martin Corp. | 5.1 |

| 6. | Zimmer Biomet Holdings, Inc. | 4.5 |

| 7. | Laboratory Corp. of America Holdings | 4.4 |

| 8. | Exxon Mobil Corp. | 3.9 |

| 9. | Mosaic Co. | 3.9 |

| 10. | Barrick Gold Corp. | 3.8 |

+The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees.

1 Effective February 1, 2014, Ariel Investments, LLC, the Adviser, has contractually agreed to waive fees and reimburse expenses in order to limit Ariel Focus Fund’s total annual operating expenses to 1.00% of net assets for the Investor Class and 0.75% of net assets for the Institutional Class through the end of the fiscal year ending September 30, 2017. Through January 31, 2014, the Expense Cap was 1.25% for the Investor Class and 1.00% for the Institutional Class. Notes: The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. See index descriptions on page 65.

ROSETTA STONE: A DIAMOND IN THE ROUGH

| Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Discovery Fund may be obtained by visiting our website, arielinvestments.com. |

DEAR FELLOW SHAREHOLDER:

Average annual total returns as of 03/31/16

| | | | 1Q16 | | 1-year | | 3-year | | 5-year | | Since inception* |

| Ariel Discovery Fund | | | + 2.20 | % | | | – 21.90 | % | | | – 6.81 | % | | | – 1.51 | % | | | – 0.84 | % |

Russell 2000® Value Index | | | + 1.70 | | | | – 7.72 | | | | + 5.73 | | | | + 6.66 | | | | + 7.76 | |

S&P 500® Index | | | + 1.35 | | | | + 1.78 | | | | + 11.82 | | | | + 11.58 | | | | + 11.93 | |

| * | The inception date for Ariel Discovery Fund is 01/31/11. |

The first quarter of 2016 showed improved relative performance after a tough 2015. And, while it looks as if little occurred based on rather flat absolute returns, the quarter was anything but uneventful. By February 10th Ariel Discovery Fund was down nearly 14% year-to-date, but was generally in line with a broad-based market selloff. Then sentiment quickly turned, partly driven by a bounce in energy prices, and we participated in a sharp move off the bottom through quarter-end.

This early-year volatility provided some terrific buying opportunities in Ariel Discovery Fund. Several quality companies fell into our low price-to-book world, and we took advantage of the brief but intense move to add seven new names. They replaced holdings that were taken over, merged into another holding, had become even too small for us, or in one case where we had lost confidence. The seven new holdings were initially purchased at an average price-to-book ratio of .96x. Six of the seven have net cash positions. All seven have positive EBITDA, and six of the seven had positive GAAP earnings in 2015 and are expected to this year as well. The individual names are discussed at the end of the letter.

Top performers during the quarter included Contango Oil & Gas Co. (MCF), which surged +83.93% as energy prices recovered during the quarter. Real Industry Inc. (RELY), a new position, gained +45.00% since our initial purchase in February. Finally, ORBCOMM, Inc. (ORBC), one of our best performers last year after its successful satellite launch, continued its momentum with a gain of +39.92%. As one of our largest holdings, ORBCOMM was easily the biggest contributor to our year-to-date results.

On the downside were two very small holdings: Rentech, Inc. (RTK), down -36.93%, and Rubicon Technology, Inc. (RBCN), which lost -35.96%. In addition, Orion Energy Systems, Inc. (OESX) fell -35.94%.

12 ARIELINVESTMENTS.COM

IF WE COULD OWN JUST ONE STOCK, WHAT WOULD IT BE

Since 2011, we have been using our first quarter letter to respond to this question, as we believe a deep dive into our favorite stock at a given point in time effectively illustrates the characteristics we seek in our portfolio holdings.

As deep value investors, we look for underfollowed and misunderstood companies trading at prices we believe can help mitigate a permanent loss of capital. Specifically, we seek companies selling at deep discounts to their intrinsic worth that have fortress balance sheets and excess cash. We also want to be invested alongside talented and incentivized leadership, and we look to identify upside potential from underappreciated opportunities, overlooked assets, or preferably both.

Last years’ pick, RealNetworks, Inc. (RNWK), along with Cowen Group, Inc. (COWN), from 2014, continue to represent extraordinary value, and either could still qualify as a favorite holding. Right up with them, especially given its lackluster stock performance in the face of very positive fundamental developments, is language learning expert Rosetta Stone, Inc. (RST).

Rosetta Stone is different from previous favorites in that our thesis has changed over time. We are the largest shareholder, and we have supported management to make changes that we believe will ultimately benefit investors. One constant has been the remarkable effectiveness of Rosetta Stone’s immersive language software and the extraordinary value of its brand.

Based in Arlington, Virginia, Rosetta Stone has long been known for the yellow boxes at airport kiosks, book stores, and other locations promising to teach any of a multitude of languages. We initially bought the stock in December 2011 at just over $7.00 per share. At the time, we believed the company would ultimately make a successful transition in its consumer-based business to a digital delivery model; the company also held more than $5.00 per share in cash.

Our original thesis played out nicely for a time, as management did a good job of cutting costs and improving distribution. By mid-2013 the stock had traded as high as $18.30, and we had trimmed back our position as the stock approached fair value. Shortly thereafter the shares began a two-year decline, as a series of poor earnings reports combined with a perception that free language apps would destroy Rosetta’s value. From peak to trough the stock lost nearly 65% of its value, touching $6.17 this January. As natural contrarians, we have gradually added to our position over time. As of March 31, 2016, the stock traded at $6.71, or a market capitalization of $147 million.

Light blue arrow = Ariel purchase Dark blue arrow = Ariel sale

Past performance does not guarantee future results.

During this period, our investment thesis changed from one dependent on the consumer business to an ultimately more powerful story built primarily on the institutional, or Enterprise & Education (E&E), business. Rosetta Stone was not a broken thesis. Instead, it evolved from a good thesis into an even better one.

Surely along the way there were poor results, an outcome of a management team attempting to build the consumer and enterprise businesses simultaneously. That ultimately meant overspending on a declining consumer business at the expense of the vast potential of the E&E franchise. A healthy dose of constructive activism, in our opinion, turned the tide.

Beginning in 2014, The D3 Family Funds and Osmium Partners, led by David Nierenberg and John Lewis, respectively, began to publicly voice their strong belief in the value of the company and their concern about its current direction and lack of focus. We had similar beliefs and privately expressed our concern to management and the board. With ownership of more than 30% of outstanding shares speaking independently—but with a common message—the board responded and the company made several significant changes:

800.292.7435 13

| • | A greatly improved Board of Directors. David Nierenberg joined, as did John Hass after an introduction by John Lewis. |

| • | A decision to focus the company on the E&E business and to vastly streamline the consumer side in pursuit of only serious learners. |

| • | John Hass appointed as Interim CEO in March 2015, and recently appointed as permanent CEO and Chair. |

| • | Engagement of renowned turnaround consultant Al Angrisani. |

The result of these moves and improved focus is a much better company that investors continue to ignore:

| • | $65 million in annual costs were taken out last year, and another $19 million are expected on an annualized basis. A leaner, more efficient company has emerged. |

| • | The decision to stop the bleeding on the consumer side may have been the single most important decision made by the board. Not only was the division in decline, the constant price cutting needed to entice the casual user was cannibalizing the institutional business. A powerful brand built over decades was in danger of becoming irrelevant. The contribution margin has more than doubled in a year to 25% in the fourth quarter. |

| • | Lexia Learning is now the crown jewel of Rosetta Stone. Purchased in 2013 for $22.5 million, this software focuses on first-language literacy, not learning additional languages. It has renewal rates of more than 90%. As a true Software as a Service (SaaS) business fulfilling a vital need to the nation’s schools, we believe it alone is worth more than the current RST enterprise value of just less than $100 million. Bookings of more than $30 million and a sustainable 30%+ growth rate should garner a price/ sales multiple of at least 3x and perhaps as much as 5x. |

| • | The institutional language business, under the leadership of Judy Verses, will soon launch its next-generation Language Learning Suite. Its core markets of enterprise and K12 digital learning are more than $1 billion in size. While it has struggled awaiting the launch of a cohesive platform, this is a solid business with high renewal rates. Even at only 1x revenue, it would be worth $70 million. |

| • | This collection of valuable assets is bolstered by a debt-free balance sheet with nearly $2 per share in cash. |

A sum-of-the parts valuation using what we believe to be very conservative multiples leads to a number of roughly twice the current price.

As John Lewis noted in a recent interview in Value Investor Insight, the market is clearly tired of this story1. The perception that Rosetta Stone is a broken consumer stock persists. But like Lewis, I find this to be one of my highest conviction holdings. The most likely scenario, in our opinion, is that the heavily incentivized leadership team will sell all or part of the company to one or more of several potential suitors. In particular, Lexia would be worth much more as part of a larger digital education company. Meanwhile, the foreign language businesses have tremendous franchise value. On the other hand, continued successful execution of the now highly-disciplined plan could lead to a fair value of 3-4 times the current price in as little as two years. We are enthusiastic owners, believing we stand to benefit from either outcome.

PORTFOLIO COMINGS AND GOINGS

As mentioned earlier, we took advantage of early-year market volatility to make some significant changes to the portfolio. The names eliminated included:

| • | Furmanite Corp. (FRM)– acquired by Team, Inc. (TISI), a current portfolio favorite. |

| • | CSW Industrials, Inc. (CSWI)– we believe the spinoff from Capital Southwest Corp. (CSWC) reached full value. |

| • | LeapFrog Enterprises, Inc. (LF)– agreed to be acquired by VTech for cash. |

| • | Broadwind Energy, Inc. (BWEN)– we had initiated a small position last year, but lost confidence in the company’s ability to avoid losses and protect its asset base. |

| • | Rentech, Inc., Rubicon Technology, Inc., Vical Inc. (VICL)– we believe each is deeply discounted, however, as discussed earlier, their very small market capitalizations and the opportunity to add the somewhat larger names below at similarly attractive valuations led us to eliminate these from this portfolio (note: the first two were still in the process of being sold at quarter-end, but are completed as of this writing). |

14 ARIELINVESTMENTS.COM

The new holdings, each of which we were very excited to add, are as follows:

| • | ArcBest Corp. (ARCB)– This well-managed freight transportation and logistics company trades below book value despite being solidly profitable. Macro-economic concerns provided us with an opportunity to purchase a company with potential to achieve higher returns as it grows its asset-light logistics business. |

| • | CRA International, Inc. (CRAI)– CRA International is a global consulting firm that offers litigation, regulatory, and financial consulting, as well as management consulting services. Trading below book value and with approximately 25% of the market cap in cash, we believe our investment has sizable downside protection. In addition, CRA International consistently generates cash and has solid long-term growth prospects. |

| • | Digi International Inc. (DGII)– Headquartered in Minnetonka, Minnesota, Digi International is a machine-to-machine (M2M) hardware provider in transition. The new management team is working strategically to reposition the company for sustainable long-term growth. DGII currently trades well below book value and has approximately 50% of its market cap in cash. |

| • | Movado Group Inc. (MOV)– Movado Group is a watch retailer and wholesaler with an international presence that operates through its iconic brands, along with six licensed brands. The company has a clean balance sheet with a sizable cash balance. Outstanding leadership has enabled the company to generate solid returns in a very challenging environment. Undemanding valuation multiples add to our enthusiasm. |

| • | Real Industry Inc.– Real Industry is a holding company based in Southern California backed by notable investors, including Sam Zell. With over $800 million in federal net operating losses (NOLs), management plans to acquire cash generating, stand-alone businesses that can utilize the NOL asset. Its first major purchase was Real Alloy, an aluminum recycling company. We believe the value of Real Alloy alone is more than the current market capitalization of Real Industry. With the value of the NOLs, we see an asymmetric risk/reward opportunity. |

| • | STRATTEC Security Corp. (STRT)– Headquartered in Milwaukee, STRATTEC Security designs, manufactures, and sells automotive access control products. The company has a clean balance sheet and trades near tangible book value. Additionally, advancement in automated cars should provide a tailwind, driving demand for STRATTEC products. |

| • | West Marine, Inc. (WMAR)– West Marine operates retail stores for boating supplies and accessories. It trades at a sizable discount to book value despite being profitable, and has a clean balance sheet with no debt and excess cash. West Marine is positioned to take advantage of an ongoing recovery in the boating industry. |

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

Sincerely,

David M. Maley

Lead portfolio manager

| | | | |

| EVALUATING RISK | |

| | | | |

| | We recently asked our portfolio managers what they thought were the most important factors to consider when evaluating risk. | |

| | | |

| | Here’s how David M. Maley, Lead Portfolio Manager of Ariel Discovery Fund, responded: | |

| | | |

| | “One of the core beliefs that our Domestic Research Team shares is that certainty of underlying asset value is the most important factor to consider when evaluating risk. An additional consideration is that management can make a decision that leads to permanent impairment of capital. We therefore focus on identifying companies with strong, properly incentivized leadership.” | |

1 | “Investor Insight: Activism,” Value Investor Insight, March 31, 2016, 12-13. |

800.292.7435 15

| | | |

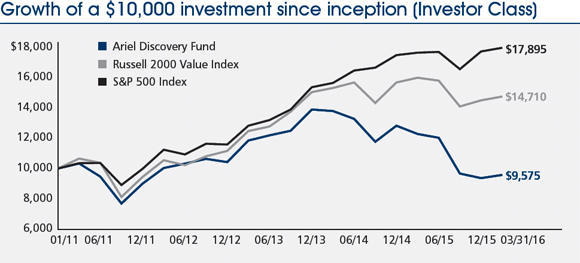

| | Ariel Discovery Fund performance summary | INCEPTION: 01/31/11 |

| | | |

| | | |

|  |

| David M. Maley | Kenneth E. Kuhrt, cpa |

Lead portfolio

manager | Portfolio

manager |

Composition of equity holdings (%) | | | | | | | |

| | Ariel Discovery Fund† | Russell 2000 Value Index | | S&P 500 Index |

Consumer discretionary | 24.39 | | 10.26 | | | 14.25 | |

| Technology | 21.30 | | 9.79 | | | 17.88 | |

| Producer durables | 17.68 | | 12.26 | | | 10.61 | |

| Financial services | 13.66 | | 43.08 | | | 17.70 | |

| Utilities | 9.29 | | 9.20 | | | 6.23 | |

| Materials & processing | 5.83 | | 4.66 | | | 3.02 | |

| Energy | 5.77 | | 3.46 | | | 6.79 | |

| Health care | 2.08 | | 4.14 | | | 14.22 | |

| Consumer staples | 0.00 | | 3.16 | | | 9.30 | |

† Represents percentage of total equity holdings in the portfolio.

Average annual total returns (%) as of 03/31/16 |

| | | | | | Since |

| | Quarter | 1-year | 3-year | 5-year | inception |

Ariel Discovery Fund–Investor Class | + 2.20 | – 21.90 | – 6.81 | – 1.51 | – 0.84 |

Ariel Discovery Fund–Institutional Class+ | + 2.29 | – 21.69 | – 6.58 | – 1.28 | – 0.61 |

Russell 2000®Value Index | + 1.70 | – 7.72 | + 5.73 | + 6.66 | + 7.76 |

S&P 500® Index | + 1.35 | + 1.78 | + 11.82 | + 11.58 | + 11.93 |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

Expense ratio (as of 9/30/15) 1 | Net | Gross |

| Investor Class | 1.25% | 2.10% |

| Institutional Class | 1.00% | 1.29% |

Top ten equity holdings (% of net assets) |

| 1. | ORBCOMM, Inc. | 6.2 |

| 2. | Cowen Group, Inc. | 6.0 |

| 3. | Team, Inc. | 4.8 |

| 4. | Gaiam, Inc. | 4.6 |

| 5. | Rosetta Stone Inc. | 4.4 |

| 6. | RealNetworks, Inc. | 4.1 |

| 7. | SeaChange Intl, Inc. | 3.7 |

| 8. | Telenav Inc. | 3.5 |

| 9. | XO Group Inc. | 3.4 |

| 10. | Bristow Group Inc. | 3.3 |

+ The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees.

1 Effective February 1, 2014, Ariel Investments, LLC, the Adviser, has contractually agreed to waive fees and reimburse expenses in order to limit Ariel Discovery Fund’s total annual operating expenses to 1.25% of net assets for the Investor Class and 1.00% for the Institutional Class through the end of the fiscal year ending September 30, 2017. Through January 31, 2014, the Expense Cap was 1.50% for the Investor Class and 1.25% for the Institutional Class. Notes: The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. See index descriptions on page 65.

EMBRACING VOLATILITY: OUR PHILOSOPHY IN ACTION

| Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel International Fund and Ariel Global Fund may be obtained by visiting our website, arielinvestments.com. |

DEAR FELLOW SHAREHOLDER:

Global equity markets followed a remarkably symmetrical v-shaped trajectory in the first quarter of 2016. The key indexes serving as benchmarks for our global portfolios were down double-digit percentages through mid-February, and regained most of the losses by quarter end.

As in 2015, our global portfolios had positive returns even though most of their benchmarks fell in the first quarter of 2016. Specifically, Ariel International Fund advanced +1.27%, topping the MSCI EAFE Index, which lost -3.01%, as well as the MSCI ACWI ex-US Index’s -0.38% drop. Meanwhile, Ariel Global Fund climbed +2.41%, as compared to the MSCI ACWI Index, which eked out a +0.24% gain.

As you will likely recall, our last quarterly letter addressed risk, stability and volatility. We noted that after the Great Financial Crisis of 2007-2009, investors sought “stable” stocks in the attempt to avoid harrowing losses like those from the crisis. Our key message from that letter was to be fearful when others are complacent—that is, to be vigilant when the crowd blithely assumes it can count on historical stability, volatility and risk profiles to remain fixed no matter the price.

In this letter we will discuss how that philosophy played out in the recent quarter—an environment that provided a wonderful opportunity to apply our strategy.

Specifically, when prices shift quickly and markedly, risks as well as opportunities appear. All else being equal, buying a volatile stock at a low price is better than buying a sedate stock at a high one. Indeed, far too many investors have so fully associated risk with volatility measurements—standard deviation, beta and so forth—that they have ignored price. In our view, the price you pay determines whether you are more exposed to risk or return. In other words, in equity investing you are ultimately paying for a share of a business’s profits. And future profits are never a sure thing. So the more you pay for supposedly stable earnings, the more exposed you are to risk—and the lower your likely returns.

We will use the current darlings of the world market, consumer staples stocks, as our example. Five years ago, the MSCI ACWI Index had a P/E ratio1 of 12.4x. Consumer staples stocks, however, sold at a premium, with a P/E ratio of 15.0x. Today, the index has a P/E ratio of 16.2x, which we would describe as toward the higher end of the normal range. Meanwhile, the consumer staples sector has a P/E ratio of 21.5x. Those embracing this love of consumer staples companies seem to believe they have a relatively predictable earnings pattern with a dearth of bad surprises; so they are worth a premium because they have low volatility. From our perspective, by contrast, when you pay $21.50 for each dollar of a consumer staples company’s present earnings, that’s a much higher price than the $16.20 you pay for a dollar of the broad market’s earnings. If those earnings fail to meet expectations, the price is likely to fall sharply—especially given that so many people are counting on those earnings to be on target.

Going into the quarter, we believed companies with relatively steady earnings were generally expensive—and therefore risky—while companies with more volatile earnings were more attractive. As the market sold off, investors fled to perceived safety, such as consumer staples fare. That meant we examined our portfolio and pared back on some of our more defensive names where the discount to our estimate of intrinsic value decreased. Specifically, we sold shares of tobacco-makers Philip Morris Intl, Inc. and Japan Tobacco Inc., utilities firms WEC Energy Group and Southern Co., and telecommunication and media firm Rogers Communications Inc.

Simultaneously, we added shares in our more volatile holdings where the discount to intrinsic value increased. In the broad technology and telecommunications area, we added to wireless expert Nokia Corp., integrated circuit-maker Dialog Semiconductor plc, and infotainment specialist Harman Intl Industries, Inc. We also bought more shares of French tire-maker Michelin (CDGE), whose stock trades in sympathy with the cyclical automobile industry. Finally, we increased our positions in energy companies EOG Resources Inc., Tenaris and Suncor Energy, Inc. as natural resources prices fluctuated considerably.

Clearly, this quarter’s activities represent a portfolio adjustment, not an overhaul. And when the market becomes especially erratic, adjustments are appropriate. In line with our patient investing philosophy, we would not generally endorse a wave of mass selling, a huge shift from one area to another, or any radical attempt to time the market. That said, to stand flat-footed when some stocks’ valuations rise and other shares plummet strikes us as risky in the first case and lethargic in the other. Just as importantly, the actions we took this quarter are not likely to show through in the coming days and weeks but rather in months or years. That is by no means to say they were not important: small shifts can boost returns substantially whether the market hits an air pocket or soars. We look forward to those results.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

Sincerely,

Rupal J. Bhansali

Portfolio manager

| | | | |

| EVALUATING RISK | |

| | | | |

| | We recently asked our portfolio managers what they thought were the most important factors to consider when evaluating risk. | |

| | | |

| | Here’s how Rupal J. Bhansali, Portfolio Manager of Ariel International Fund and Ariel Global Fund, responded: | |

| | | |

| | “Both qualitative and quantitative factors should be considered when evaluating risk. Our qualitative risk assessment considers whether a company’s business model and strategy will stand the test of time, competitive threats, corporate governance matters, and capital allocation priorities. Quantitative risk factors incorporate an assessment of a company’s returns relative to its risk profile, balance sheet strength, and trading liquidity, among other factors.” | |

1 P/E, or price/earnings, is the ratio of a company’s share price to its per-share earnings.

Investing in equity stocks is risky and subject to the volatility of the markets. Bonds are fixed income securities in that at the time of the purchase of a bond, the amount of income and the timing of the payments are known. Risks of bonds include credit risk and interest rate risk, both of which may affect a bond’s investment value by resulting in lower bond prices or an eventual decrease in income. Treasury bonds are issued by the government of the United States. Payment of principal and interest is guaranteed by the full faith and credit of the U.S. government, and interest earned is exempt from state and local taxes.

| | | |

| Ariel International Fund performance summary | INCEPTION: 12/30/11 |

| | | |

| | | |

| |

| Rupal J. Bhansali | |

| Portfolio manager | |

Composition of equity holdings* (%) | | | | | | |

| | | Ariel

International

Fund† | | MSCI

EAFE

Index | | MSCI

ACWI

ex-US

Index |

| | Information technology | 20.43 | | | 5.25 | | 8.35 |

| | Financials | 17.36 | | | 23.78 | | 25.79 |

| | Telecommunication services | 15.21 | | | 5.11 | | 5.34 |

| | Consumer staples | 13.43 | | | 12.66 | | 11.23 |

| | Health care | 12.15 | | | 11.47 | | 8.86 |

| | Consumer discretionary | 11.87 | | | 13.17 | | 11.99 |

| | Energy | 3.56 | | | 4.67 | | 6.38 |

| | Industrials | 3.00 | | | 13.29 | | 11.54 |

| | Utilities | 2.60 | | | 3.88 | | 3.58 |

| | Materials | 0.39 | | | 6.73 | | 6.94 |

| * | The sectors above are the Global Industry Classification Standard (“GICS”) sector classifications. GICS was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Ariel Investments, LLC. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. |

Average annual total returns (%) as of 03/31/16 | | | | | | | | |

| | | Quarter | 1-year | 3-year | Since

inception |

| | Ariel International Fund–Investor Class | + | 1.27 | – | 0.04 | + | 7.72 | + | 7.40 |

| | Ariel International Fund–Institutional Class | + | 1.30 | + | 0.18 | + | 7.93 | + | 7.64 |

| | MSCI EAFE Index (gross) | – | 2.88 | – | 7.87 | + | 2.68 | + | 7.18 |

| | MSCI EAFE Index (net) | – | 3.01 | – | 8.27 | + | 2.23 | + | 6.71 |

| | MSCI ACWI ex-US Index (gross) | – | 0.26 | – | 8.78 | + | 0.76 | + | 5.19 |

| | MSCI ACWI ex-US Index (net) | – | 0.38 | – | 9.19 | + | 0.32 | + | 4.73 |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

Expense ratio (as of 9/30/15) 1 | | Net | | Gross |

| Investor Class | | 1.26% | | 3.49% |

| Institutional Class | | 1.01% | | 2.68% |

Top ten companies^ (% of net assets) | |

| | 1. | Deutsche Boerse AG | | 3.5 | | |

| | 2. | GlaxoSmithKline plc | | 3.2 | | |

| | 3. | China Mobile Ltd. | | 3.0 | | |

| | 4. | Roche Holding AG | | 3.0 | | |

| | 5. | Dialog Semiconductor plc | | 2.7 | | |

| | 6. | Ahold N.V. | | 2.7 | | |

| | 7. | Nokia Corp. | | 2.3 | | |

| | 8. | Reckitt Benckiser Group plc | | 2.2 | | |

| | 9. | Baidu, Inc. | | 2.0 | | |

| | 10. | Telefonica Deutschland GmbH & Co. | | 1.8 | | |

^For the purposes of determining the Fund’s top ten, securities of the same issuer are aggregated.

Country weightings† (%) | | | |

| | United Kingdom | | 18.07 | |

| | Germany | | 15.68 | |

| | Japan | | 15.22 | |

| | Switzerland | | 11.20 | |

| | China | | 9.91 | |

| | Netherlands | | 5.80 | |

| | France | | 5.14 | |

| | Finland | | 4.52 | |

| | United States | | 4.47 | |

| | Canada | | 2.58 | |

| | Spain | | 2.06 | |

| | Italy | | 1.35 | |

| | Ireland | | 0.90 | |

| | Hong Kong | | 0.73 | |

| | Luxembourg | | 0.62 | |

| | Israel | | 0.61 | |

| | Sweden | | 0.58 | |

| | Singapore | | 0.48 | |

| | United Arab Emirates | | 0.08 | |

1 | Effective February 1, 2014, Ariel Investments, LLC, the Adviser, has contractually agreed to waive fees and reimburse expenses in order to limit Ariel International Fund’s total annual operating expenses to 1.25% of net assets for the Investor Class and 1.00% for the Institutional Class through the end of the fiscal year ending September 30, 2017. For the year ended 9/30/15, the net expense ratios for both Classes of the Fund rounded above the expense caps due to interest expense which is excluded from the expense reimbursement. Through January 31, 2014, the Expense Cap was 1.40% for the Investor Class and 1.15% for the Institutional Class. |

| † | Sector and country weightings are calculated based on equity holdings in the Fund and exclude cash and ETFs in order to make a relevant comparison to the indexes. Notes: The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. See index descriptions on page 65. |

| | | |

| | Ariel Global Fund performance summary | INCEPTION: 12/30/11 |

| | | |

| | | |

| |

| Rupal J. Bhansali | |

| Portfolio manager | |

Composition of equity holdings* (%) | | | | | | |

| | | | Ariel

Global

Fund† | | MSCI

ACWI

Index |

| | Health care | | 24.77 | | | 11.72 | |

| | Information technology | | 21.20 | | | 15.01 | |

| | Telecommunication services | | 13.88 | | | 3.98 | |

| | Financials | | 13.19 | | | 20.38 | |

| | Consumer discretionary | | 12.53 | | | 12.91 | |

| | Utilities | | 4.99 | | | 3.47 | |

| | Consumer staples | | 4.68 | | | 10.67 | |

| | Energy | | 3.20 | | | 6.49 | |

| | Industrials | | 1.24 | | | 10.56 | |

| | Materials | | 0.32 | | | 4.81 | |

| * | The sectors above are the Global Industry Classification Standard (“GICS”) sector classifications. GICS was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Ariel Investments, LLC. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. |

| | | | | | | | | | |

Average annual total returns (%) as of 03/31/16 |

| | | Quarter | 1-year | 3-year | Since

inception |

| | Ariel Global Fund–Investor Class | + | 2.41 | – | 0.13 | + | 8.57 | + | 9.29 |

| | Ariel Global Fund–Institutional Class | + | 2.48 | + | 0.08 | + | 8.86 | + | 9.57 |

| | MSCI ACWI Index (gross) | + | 0.38 | – | 3.81 | + | 6.10 | + | 9.79 |