As filed with the Securities and Exchange Commission on May 21, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-4786

Ariel Investment Trust

(Exact name of registrant as specified in charter)

200 East Randolph Street

Suite 2900

Chicago, Illinois, 60601

(Address of principal executive offices) (Zip code)

Mareile Cusack

200 East Randolph Street

Suite 2900

Chicago, Illinois 60601

(Name and address of agent for service)

with a copy to:

Arthur Don, Esq.

Greenberg Traurig, LLP

77 West Wacker Drive

Suite 3100

Chicago, IL 60601

Registrant's telephone number, including area code: (312) 726-0140

Date of fiscal year end: September 30, 2015

Date of reporting period: March 31, 2015

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

The patient investor

| | | | | | |

| | | | | | |

| SEMI-ANNUAL REPORT: 03/31/15 |

| ● | Value | ● | Deep value | ● | Global |

| ● | Ariel Fund |

| ● | Ariel Appreciation Fund |

| ● | Ariel Focus Fund |

| ● | Ariel Discovery Fund |

| ● | Ariel International Fund |

| ● | |

Slow and steady wins the race.

One of Ariel Investments’ guiding principles is to communicate openly with our shareholders so they may gain a clear understanding of our investment philosophy, portfolio decisions and results, as well as our opinions on the underlying market. In reviewing the materials contained in The Patient Investor, please consider the information provided on this page. While our investment decisions are rooted in detailed analysis, it is important to point out that actual results can differ significantly from those we seek. We candidly discuss a number of individual companies. Our opinions are current as of the date they were written but are subject to change. We want to remind investors that the information in this report is not sufficient on which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security. Equity investments are affected by market conditions. The intrinsic value of the stocks in which the Funds invest may never be recognized by the broader market. Ariel Fund, Ariel Appreciation Fund, Ariel Focus Fund and Ariel Discovery Fund invest in small and/or midsized companies. Investing in small and mid-cap stocks is riskier and more volatile than investing in large cap stocks, in part because smaller companies may not have the scale, depth of resources and other assets of larger firms. Ariel Fund and Ariel Appreciation Fund often invest a significant portion of their assets in companies within the consumer discretionary and financial services sectors and their performance may suffer if these sectors underperform the overall stock market. Ariel Focus Fund invests primarily in equity securities of companies of any size and is a non-diversified fund, which means its investments are concentrated in fewer stocks than diversified funds. Ariel Focus Fund generally holds 20-30 stocks and therefore may be more volatile than a more diversified investment. Ariel International Fund and Ariel Global Fund invest in foreign securities and may use currency derivatives and ETFs. Investments in foreign securities may underperform and may be more volatile than comparable U.S. stocks because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. The use of currency derivatives and ETFs may increase investment losses and expenses and create more volatility. Investments in emerging and developing markets present additional risks, such as difficulties selling on a timely basis and at an acceptable price. Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for the Funds may be obtained by visiting our website, arielinvestments.com. Investors should consider carefully the investment objectives, risks, and charges and expenses before investing. For a current summary prospectus or full prospectus which contains this and other information about the Funds offered by Ariel Investment Trust, call us at 800.292.7435 or visit our website, arielinvestments.com. Please read the summary prospectus or full prospectus carefully before investing. Distributed by Ariel Distributors, LLC, a wholly owned subsidiary of Ariel Investments, LLC. Ariel Investment Trust c/o U.S. Bancorp Fund Services, LLC P.O. Box 701 Milwaukee, WI 53201-0701 800.292.7435 arielinvestments.com Follow us on Twitter @ArielFunds |

| | | |

| | Fund performance at a glance | AS OF 03/31/15 |

| | | |

| | | |

| | | | | | | | |

| | | | Annualized |

| | Quarter (%) | 1-year (%) | 3-year (%) | 5-year (%) | 10-year (%) | 20-year (%) | Since inception (%) |

| Small/mid cap value strategy | | | | | | | 11/06/86 |

| Ariel Fund–Investor Class | + 6.67 | +19.54 | + 21.60 | + 16.12 | + 7.89 | +11.68 | + 11.96 |

| Ariel Fund–Institutional Class | + 6.77 | +19.89 | + 21.99 | + 16.36 | + 8.00 | +11.74 | + 12.00 |

Russell 2500TM Value Index | + 3.02 | + 6.58 | + 16.29 | + 14.06 | + 8.46 | +11.72 | + 11.62 |

Russell 2000® Value Index | + 1.98 | + 4.43 | + 14.79 | + 12.54 | + 7.53 | +10.86 | + 10.86 |

S&P 500® Index | + 0.95 | +12.73 | + 16.11 | + 14.47 | + 8.01 | + 9.39 | + 10.29 |

| Mid cap value strategy | | | | | | | 12/01/89 |

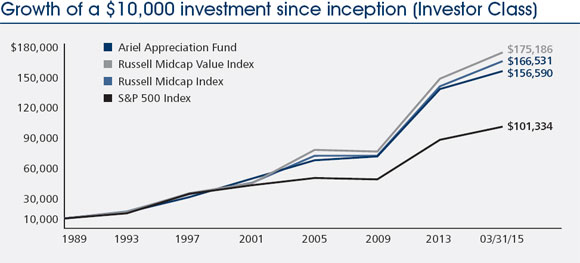

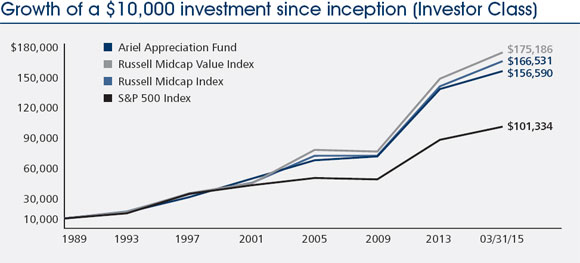

| Ariel Appreciation Fund–Investor Class | + 4.34 | +13.93 | + 19.21 | + 15.28 | + 9.32 | +12.15 | + 11.47 |

| Ariel Appreciation Fund–Institutional Class | + 4.41 | +14.32 | + 19.56 | + 15.51 | + 9.43 | +12.20 | + 11.52 |

Russell Midcap® Value Index | + 2.42 | +11.70 | + 18.60 | + 15.84 | + 9.61 | +12.13 | + 11.97 |

Russell Midcap® Index | + 3.95 | +13.68 | + 18.10 | + 16.16 | + 10.02 | +11.67 | + 11.74 |

S&P 500® Index | + 0.95 | +12.73 | + 16.11 | + 14.47 | + 8.01 | + 9.39 | + 9.57 |

| All cap value strategy | | | | | | | 06/30/05 |

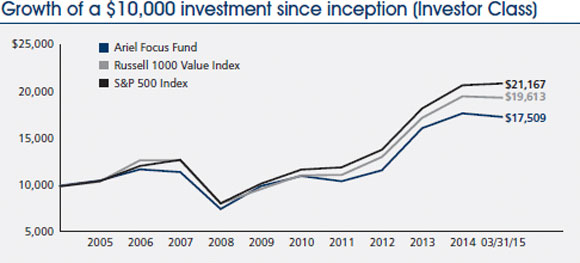

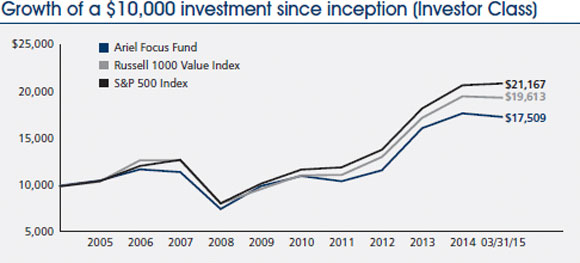

| Ariel Focus Fund–Investor Class | – 2.20 | + 5.28 | + 13.47 | + 10.77 | – | – | + 5.91 |

| Ariel Focus Fund–Institutional Class | – 2.13 | + 5.59 | + 13.75 | + 10.96 | – | – | + 6.00 |

Russell 1000® Value Index | – 0.72 | + 9.33 | + 16.44 | + 13.75 | – | – | + 7.22 |

S&P 500® Index | + 0.95 | +12.73 | + 16.11 | + 14.47 | – | – | + 8.07 |

| Small cap deep value strategy | | | | | | | 01/31/11 |

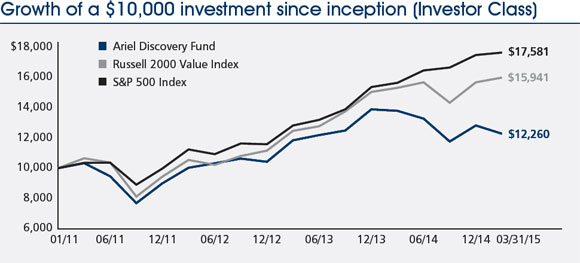

| Ariel Discovery Fund–Investor Class | – 4.18 | –10.93 | + 6.92 | – | – | – | + 5.02 |

| Ariel Discovery Fund–Institutional Class | – 4.15 | –10.77 | + 7.17 | – | – | – | + 5.25 |

Russell 2000® Value Index | + 1.98 | + 4.43 | + 14.79 | – | – | – | + 11.86 |

S&P 500® Index | + 0.95 | +12.73 | + 16.11 | – | – | – | + 14.52 |

| International all cap strategy | | | | | | | 12/30/11 |

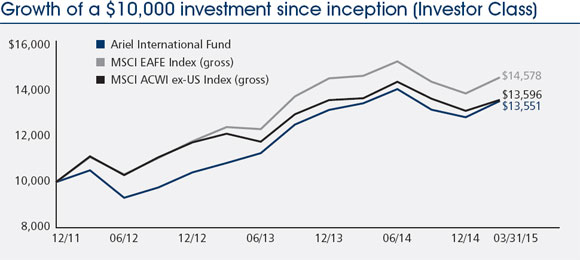

| Ariel International Fund–Investor Class | + 5.55 | + 0.78 | + 8.81 | – | – | – | + 9.79 |

| Ariel International Fund–Institutional Class | + 5.57 | + 0.99 | + 9.08 | – | – | – | + 10.05 |

MSCI EAFE® Index (gross) | + 5.00 | – 0.48 | + 9.52 | – | – | – | + 12.29 |

| MSCI ACWI ex-US Index (gross) | + 3.59 | – 0.57 | + 6.89 | – | – | – | + 9.91 |

| Global all cap strategy | | | | | | | 12/30/11 |

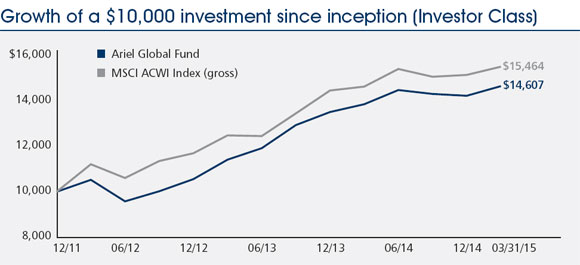

| Ariel Global Fund–Investor Class | + 2.91 | + 5.71 | + 11.56 | – | – | – | + 12.36 |

| Ariel Global Fund–Institutional Class | + 2.98 | + 6.00 | + 11.86 | – | – | – | + 12.67 |

MSCI ACWISM Index (gross) | + 2.44 | + 5.97 | + 11.35 | – | – | – | + 14.35 |

The inception date for the Institutional Class shares of all Funds is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of a Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of a Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of its Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. Descriptions for the indexes can be found in the individual fund summaries in the report. Any extraordinary performance shown for short-term periods may not be sustainable and is not representative of the performance over longer periods. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

| | | |

| TURTLE TALK | |

| | |

| | | |

| | Inside this issue | |

| | | |

| | Ariel Investments Chairman and CEO John W. Rogers, Jr. was recently profiled in the April edition of Ticker Magazine. In the interview “Contrarian and Disciplined,” John discusses Ariel Fund’s investment style and how he finds opportunities in the market. “We look for companies that we can own for years, and we feel confident that they will still be leaders in their industries with high returns on capital, high profit margins and consistent growth rates.” | |

| | | -John W. Rogers, Jr., Chairman and CEO | |

| | | |

Ariel Fund tops its Morningstar category since the market bottom

Six years ago, with panic at generational highs and expectations near all-time lows, the market bottomed on March 9, 2009. Given the extremely low valuations of stocks in early 2009, active managers had an opportunity to add value with savvy purchases and brave but rational conviction. Few managed the feat, as evidenced by results in Morningstar’s1 Mid-Cap Blend category, home to our flagship fund, Ariel Fund. In the six years from the March 9, 2009 market bottom through March 31, 2015, Ariel Fund ranked number one out of 259 funds in its category. While we are delighted with our performance since the market bottom, it is our current since inception ranking that matter most, number one out of 8 funds.

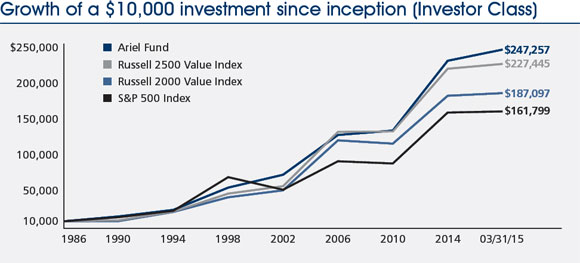

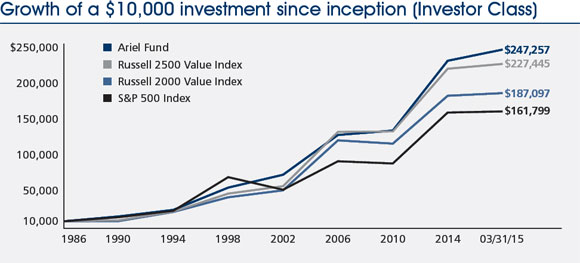

The key principle that underscores our work is our willingness to take a patient and long-term view. This patience has generated significant returns for our shareholders. For example, a $10,000 investment in Ariel Fund at its inception in 1986 is worth $247,257 today. This is nearly $20,000 higher than the Russell 2500 Value and over $85,000 higher than the S&P 500. While no one can guarantee future results, we remain committed to finding quality companies trading at attractive prices relative to their intrinsic value that can weather the storm.

We invite you to read the market commentary and the performance summary for Ariel Fund continuing on the pages that follow.

1 Performance data quoted represents past performance and does not guarantee future results. Performance shown assumes the reinvestment of dividends and capital gains, but it does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Fund may be obtained by visiting arielinvestments.com. Extraordinary performance for the short-term periods may not be sustainable and is not representative of the performance over longer periods. Morningstar, Inc. is a nationally recognized organization that reports performance and calculates rankings for mutual funds. Rankings are based on total returns. Morningstar ranks each fund relative to all funds in the same category. For the period ended March 31, 2015, the rankings of Ariel Fund for the 1-, 5-, 10-year, and since inception (November 6, 1986) periods were 4 out of 370 funds, 25 out of 268 funds, 118 out of 168 funds, and 1 out of 8 funds, respectively, among Morningstar Mid-Cap Blend funds. ©2015 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

ACTIVELY PATIENT

| Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Fund and Ariel Appreciation Fund may be obtained by visiting our website, arielinvestments.com. |

DEAR FELLOW SHAREHOLDER:

For the quarter ended March 31, 2015, Ariel Fund jumped +6.67% and finished ahead of the Russell 2500 Value Index’s +3.02% gain, as well as the +1.98% rise of the Russell 2000 Value Index. With producer durables representing the key soft spot in the portfolio, Ariel Fund was boosted by strong performance among our health-care and financial services names. Meanwhile, Ariel Appreciation Fund jumped +4.34%, ahead of the Russell Midcap Value Index’s +2.42% rise, as well as the +3.95% return of the Russell Midcap Index. For Ariel Appreciation, the strong performance of our financial services names was only marginally offset by weakness among our producer durable issues that had energy exposure. It is worth noting that the broad market, as measured by the Standard & Poor’s 500, weathered a volatile start of the year but ultimately managed to eke out a +0.95% three-month return. As Barron’s noted, “As the U.S. dollar continued to gain strength and the price of oil fell more than 10%…the index went negative in January before hitting a new high and then returning to the red in March.”1

ACTIVELY PATIENT

As most know, the debate about active versus passive (index) management is one that ebbs and flows. In recent years, passive investing has captured the lion’s share of investor attention—and assets—as some have become convinced that stock-pickers are a dying breed. We have been vocal in our unbridled support for true active management, and our results have certainly helped to reinforce our view. That said, when we speak of active management, we are most enthusiastic about the prospects of high-conviction managers who eschew following benchmarks in favor of optimizing returns. As we have been known to say, “The best way to beat a benchmark is not to follow it.” We know our views run counter to those who concern themselves with “tracking error,” which statistically shows how a manager’s performance diverges from a benchmark. In the case of tracking error, many believe less is more.

It is no secret: The academic community was skeptical of active management for a long time. Some professors concluded that active managers could not dependably outperform. While others acknowledged outperformance was possible, they concluded that identifying those who might do so in advance was quite difficult. We will be the first to admit how incredibly difficult it is to beat a benchmark over time. Over the last decade, K.J. Martijn Cremers, currently a professor of finance at the University of Notre Dame, working with various colleagues, has performed more in-depth studies of active management and in so doing, determined ways to predict which managers have a solid shot at beating passive benchmarks. Working with Antti Petajisto, then a professor of finance at the Yale School of Management, Cremers completed a paper in 2009 entitled, How Active Is Your Fund Manager? A New Measure That Predicts Performance. This groundbreaking measure known as “Active Share,” which quantifies how much a portfolio differs from a benchmark, proved to be simple and easy to understand. More specifically, a fund with 0% Active Share would be identical to the benchmark, while a fund with a 100% Active Share would have no overlapping exposure. The paper concluded that low Active Share portfolios, on average, were essentially destined to underperform, while high Active Share portfolios (of 80% or more) had a better shot at outperformance.

“We are most enthusiastic about the prospects of high-conviction managers who eschew following benchmarks in favor of optimizing returns.”

Cremers, now working with Ankur Pareek of Rutgers Business School, has a new paper, which is essentially a sequel to the first one, Patient Capital Outperformance: The Investment Skill of High Active Share Managers Who Trade Infrequently, a second draft of which was released last September. The very first line of this 72-page piece states that “among high Active Share portfolios—whose holdings differ substantially from the holdings of their benchmark—only those with patient investment strategies (i.e., with long stock holding durations of at least 2 years) outperform their benchmarks on average.”2 To paraphrase Jerry Maguire: They had us at hello! Before we read another line, we felt as if they could be talking about us. Then we came upon Panel A of Figure 3 and saw that our flagship Ariel Fund was one of just eight mutual funds used to illustrate the point after the authors studied “a large sample of actively managed all-equity U.S. retail mutual funds “ that have existed from 1995 through 2013, including “’dead,’ merged and delisted funds.” (They also analyzed the gross returns of institutional portfolios from 1986 through 2013. With the exception of slight performance differences related to gross and net returns, the conclusions drawn for mutual funds and institutional portfolios were largely the same.)

“High Active Share on its own is not enough to generate benchmark-beating results. Instead, the length of the holding period is the difference between success and mediocrity.”

Despite a dense paper complete with mathematical equations, their work can be boiled down to a few critical findings:

| | |

| ● | “A necessary condition for long-term outperformance is that the actively managed portfolio is substantially different than the benchmark.” |

| | |

| ● | “[A]mong high Active Share funds, patiently managed portfolios have been most likely to outperform. Patient funds are those which trade relatively infrequently, i.e., funds with long holding durations or low portfolio turnover.” |

| | |

| ● | “[F]unds with above 90% Active Share outperformed their benchmarks by about 1% a year, after fees were taken out.” |

After these facts were on the table, the paper goes into tremendous detail. More specifically, in order to prove their thesis, the authors work to disprove a number of binary points. For example, they demonstrate that high Active Share on its own is not enough to generate benchmark-beating results. Instead, the length of the holding period is the difference between success and mediocrity. On this point, they write, “We find no evidence that even the most active (i.e., high Active Share) mutual funds with short durations or frequent trading were able to outperform their benchmarks on average. Rather, we find that frequently trading mutual funds systematically underperformed their benchmarks, regardless of how different their holdings are relative to their benchmark.” The flip side is also true: A long holding period in and of itself does not drive outperformance. As the two professors note, “…the only portfolios with long Fund Duration that outperform are those that also contain high Active Share funds.”

Perhaps most interesting of all, once the authors moved passed the raw data analysis, they made two nuanced points that we would not normally associate with such a quantitative undertaking. First and foremost, they were perceptive in their view that to be a high Active Share/ low-turnover manager “requires a strong conviction on the part of the manager, as stock prices may initially move adversely before reversing any mispricing.” They also go on to say, “Similarly, it requires that investors are fairly patient in giving the manager time to see the strategy through, rather than evaluate the performance [after] relatively brief periods of time.” We live this day in and day out and wholeheartedly agree.

Additionally, the authors conclude, “The clear majority of the outperformance of the patient and active mutual fund managers seems due to their picking safe…, value…, and quality…stocks.” They underscore the thought by adding, “Our results thus suggest that Warren Buffett’s investment skill seems generally shared by mutual fund managers in the top Active Share and Fund Duration quintiles.” So there you have it: our strategy—value investing, with a long time horizon and more than 90% active share—and our hero—Warren Buffett—all in one academic paper about successful active management.

PORTFOLIO COMINGS AND GOINGS

During the quarter, we initiated one new position and eliminated two holdings in Ariel Fund. We added chainsaw chain maker Blount Intl, Inc. (BLT), a current holding in another of our portfolios. Blount produces saw chains, bars and sprockets, as well as outdoor equipment accessories and parts for the garden and landscape industry. It sells its products in more than 100 countries around the world. We sold our shares of City National Corp. (CYN) on the good news that it was being acquired by the Royal Bank of Canada (RY) for $5.4 billion, roughly half in cash and half in stock. We also sold our shares of Hospira, Inc. (HSP) when it entered a definitive merger agreement with Pfizer Inc., (PFE) an all-cash deal totaling about $17 billion.

In Ariel Appreciation Fund, we initiated one new position and eliminated two holdings during the quarter. We purchased shares in Anixter Intl Inc. (AXE), a current holding in some of our other portfolios. Anixter is a leading global supplier of communications and security products, electrical and electronic wire and cable, fasteners and other small components. Its innovative supply chain management services reduces the total cost of production and implementation for its customers. Ariel Appreciation Fund also exited City National Corp. and Hospira, Inc. due to their acquisitions.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

| | | |

| Sincerely, | | |

| |  |

| John W. Rogers, Jr. | | Mellody Hobson |

| Chairman and CEO | | President |

| | |

RESEARCH PROMOTIONS AND OTHER ARIEL NEWS RESEARCH PROMOTIONS AND OTHER ARIEL NEWS |

| | |

| | Recognizing and rewarding talent is the best way to keep great people engaged and inspired. To that end, we are delighted to announce promotions that reflect significant long-term contributions to Ariel. We invite you to read a special letter written by John W. Rogers, Jr. posted to arielinvestments.com. |

1 Michael Vallo, “Active Beats Passive in First Quarter,” Barron’s, April 6, 2015, L23.

2 Martijn Cremers and Ankur Pareek, Patient Capital Outperformance: The Investment Skill of High Active Share Managers Who Trade Infrequently, September 2014, 1.

| | | |

| | Ariel Fund performance summary | INCEPTION: 11/06/86 |

| | | |

| | | |

| | | | | |

| |  | |  |

| John W. Rogers, Jr. | | John P. Miller, cfa | | Kenneth E. Kuhrt, cpa |

| Lead portfolio | | Portfolio | | Portfolio |

| manager | | manager | | manager |

Composition of equity holdings (%) | | | | |

| | | | | | |

| | | Ariel

Fund† | Russell

2500

Value

Index | Russell

2000

Value

Index | S&P

500

Index |

| | Financial services | | | | 17.93 |

| | Consumer discretionary | 27.73 | 12.57 | 12.51 | 14.19 |

| | Producer durables | 19.38 | 12.86 | 13.24 | 10.65 |

| | Health care | 8.74 | 6.68 | 5.92 | 14.87 |

| | Materials & processing | 5.29 | 6.51 | 5.79 | 3.50 |

| | | 3.84 | 1.95 | 2.41 | 8.52 |

| | Technology | 3.46 | 7.72 | 8.72 | 16.95 |

| | Energy | 1.84 | 3.77 | 3.02 | 8.07 |

| | Utilities | 0.00 | 9.10 | 7.66 | 5.32 |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes. |

Average annual total returns (%) as of 03/31/15 |

| | | | | | | | |

| | | Quarter | 1-year | 3-year | 5-year | 10-year | Since inception |

| | Ariel Fund–Investor Class | + | 6.67 | + 19.54 | + 21.60 | + 16.12 | + | 7.89 | + 11.96 |

| | Ariel Fund–Institutional Class+ | | 6.77 | + 19.89 | + 21.99 | + 16.36 | + | 8.00 | + 12.00 |

| | Russell 2500TM Value Index | + | 3.02 | + 6.58 | + 16.29 | + 14.06 | + | 8.46 | + 11.62 |

| | Russell 2000® Value Index | + | 1.98 | + 4.43 | + 14.79 | + 12.54 | + | 7.53 | + 10.86 |

| | S&P 500® Index | + | 0.95 | + 12.73 | + 16.11 | + 14.47 | + | 8.01 | + 10.29 |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000. |

Expense ratio (as of 09/30/14) | |

| Investor Class | 1.03% |

| Institutional Class | 0.72% |

Top ten equity holdings (% of net assets) |

| 1. | | 4.3 |

| 2. | | 3.4 |

| 3. | | 3.3 |

| 4. | International Speedway Corp. | 3.3 |

| 5. | | 3.3 |

| 6. | | 3.3 |

| 7. | | 3.2 |

| 8. | | 3.1 |

| 9. | | 3.1 |

| 10. | | 3.1 |

+The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. Notes: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 2500TM Value Index measures the performance of small to mid-cap value companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. Russell® is a trademark of Russell Investment Group, which is the source and owner of the Russell Indexes’ trademarks, service marks and copyrights. The S&P 500® is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

| | | |

| | Ariel Appreciation Fund performance summary | INCEPTION: 12/01/89 |

| | | |

| | | |

| | | |

| |  |

John W. Rogers, Jr. Co-portfolio

manager | | Timothy R. Fidler, cfa Co-portfolio

manager |

Composition of equity holdings (%) | | | | |

| | | | | | |

| | | | | | S&P

500

Index |

| | Financial services | | | | 17.93 |

| | Consumer discretionary | 25.70 | 11.52 | 18.27 | 14.19 |

| | Producer durables | 19.35 | 8.81 | 11.96 | 10.65 |

| | Health care | 13.37 | 10.24 | 12.15 | 14.87 |

| | | 3.81 | 3.08 | 5.71 | 8.52 |

| | | 2.54 | 3.80 | 4.33 | 8.07 |

| | Technology | 1.32 | 8.87 | 11.75 | 16.95 |

| | Materials & processing | 0.00 | 7.35 | 6.68 | 3.50 |

| | Utilities | 0.00 | 12.02 | 6.10 | 5.32 |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes. |

Average annual total returns (%) as of 03/31/15 |

| | | | | | | | |

| | | Quarter | 1-year | 3-year | 5-year | 10-year | Since inception |

| | Ariel Appreciation Fund–Investor Class | + | 4.34 | + 13.93 | + 19.21 | + 15.28 | + | 9.32 | + 11.47 |

| | Ariel Appreciation Fund–Institutional Class+ | | 4.41 | + 14.32 | + 19.56 | + 15.51 | + | 9.43 | + 11.52 |

| | Russell Midcap® Value Index | + | 2.42 | + 11.70 | + 18.60 | + 15.84 | + | 9.61 | + 11.97 |

| | | + | 3.95 | + 13.68 | + 18.10 | + 16.16 | + | 10.02 | + 11.74 |

| | S&P 500® Index | + | 0.95 | + 12.73 | + 16.11 | + 14.47 | + | 8.01 | + 9.57 |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000. |

Expense ratio (as of 09/30/14) | |

| Investor Class | 1.12% |

| Institutional Class | 0.79% |

Top ten equity holdings (% of net assets) |

| 1. | Stanley Black & Decker, Inc. | 4.6 |

| 2. | | 4.6 |

| 3. | | 4.1 |

| 4. | First American Financial Corp. | 4.0 |

| 5. | | 3.8 |

| 6. | | 3.7 |

| 7. | | 3.7 |

| 8. | | 3.6 |

| 9. | Interpublic Group of Cos., Inc. | 3.6 |

| 10. | | 3.5 |

+The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. Notes: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell Midcap® Value Index measures the performance of mid-cap value companies with lower price-to-book ratios and lower forecasted growth values. The Russell Midcap® Index measures the performance of mid-cap companies. Russell® is a trademark of Russell Investment Group, which is the source and owner of the Russell Indexes’ trademarks, service marks and copyrights. The S&P 500® is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

LEVERAGE: A TAILWIND, UNTIL IT’S NOT

| |

| Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Focus Fund may be obtained by visiting our website, arielinvestments.com. |

DEAR FELLOW SHAREHOLDER:

In the first quarter of 2015, Ariel Focus Fund trailed both its primary benchmark and the broad market, declining -2.20% versus a fall of -0.72% for the Russell 1000 Value Index and a rise of +0.95% for the S&P 500. Declining oil prices hurt the performance of many of our energy holdings, including National Oilwell Varco (NOV), which declined -23.01% in the quarter. It remains one of our favorite companies. Apollo Education Group, Inc. (APOL) continued to struggle in the first quarter, declining -44.53%. Fortunately, we had sold most of our position in Apollo. In hindsight, we should have sold it all. On the positive side, our largest position, Western Union Co. (WU), continues to see good stock and operating performance, increasing +17.12% in the quarter. In our view, Western Union remains a very inexpensive stock, trading at approximately 12x forward earnings. Equity analysts continue to underestimate the regulatory hurdles to using smartphones to transfer money across borders.

“Give me a long enough lever,” said Archimedes, “and I shall move the world.” In today’s investment climate, many companies and even entire asset classes have updated this saying to: “Give me enough debt leverage, and I shall move mediocre results into outperformance.” Last quarter, I discussed the disparate impact of falling interest rates on debt-laden versus strong balance sheet companies. Under the category of “no good deed goes unpunished,” I showed how, when interest rates fall, weak balance sheet companies with high levels of debt can see their stock prices increase much faster than the stock prices of strong balance sheet companies. In this letter, I will discuss how debt leverage can drive outperformance and underperformance, even holding interest rates constant. In my view, this power of leverage is not well understood, even by sophisticated investors. Alternative asset classes such as private equity, hedge funds and real estate in general employ much more leverage than long-only equity managers.

Full disclosure: I am not spending two quarterly letters on the topic of debt and leverage with purely altruistic motives. Ariel Focus Fund has a dog in this fight. The Fund invests in stocks with much stronger balance sheets than those in our primary benchmark. It had an average interest coverage ratio1 of 13.4x at quarter-end, compared with 6.3x for the Russell 1000 Value index and 9.0x for the S&P 500. It is my contention that these stronger, lower-leveraged balance sheets have been a recent headwind to our performance as interest rates have fallen. I expect this wind to shift if and when interest rates rise.

Suppose you serve on the investment committee of a local charity, perhaps your church, a hospital or your alma mater. You have just finished a year in which both markets and the economy were modestly up. Returns were nothing spectacular, but almost everyone has more money than they did the year before. At year-end, the professionals who manage money for your endowment present their results. One group has outperformed its benchmarks, showing strong absolute and relative returns. Another group showed positive returns but lagged its benchmark and the first group. In my opinion, this is the first question that should be asked: “How much leverage did the first (outperforming) group employ versus the second (underperforming)?” In my experience, that question almost never gets asked.

We’ll begin with an illustration based on an activist investor who recommends that a company “take advantage of its debt capacity” by paying a large special dividend of $9.5 billion to its shareholders and then financing that dividend with debt.

| Table 1: Financing a Special Dividend with Debt | | | | | | |

Dollars in millions, except per share | | Strong Balance Sheet Company A | | | Weak Balance Sheet Company B | |

| Total Debt | | | $500 | | | | $10,000 | |

| Borrowing Cost | | | 5.00% | | | | 8.00% | |

| Sales | | | $10,000 | | | | $10,000 | |

| Operating Margin | | | 20.00% | | | | 20.00% | |

| Operating Income | | | 2,000 | | | | 2,000 | |

| Interest Expense | | | 25 | | | | 800 | |

| Pretax Income | | | 1,975 | | | | 1,200 | |

| Taxes (35%) | | | 691 | | | | 420 | |

| Net Income | | | 1,284 | | | | 780 | |

| Shares Outstanding | | | 1,000 | | | | 1,000 | |

| EPS | | | $1.28 | | | | $0.78 | |

| P/E Multiple | | | 15.0 | | | | 15.0 | |

| Stock Price | | | $19.26 | | | | $11.70 | |

| | | | | | | $11.70 + $9.50 special dividend = $21.20 | |

Note: These examples are intended to show the potential general effect of interest rates on the stock price of a company with low debt versus a company with high debt. All information shown is hypothetical except for the stock price, which is purely a calculation of the earnings per share (EPS) multiplied by the price/earnings multiple (P/E multiple). Examples are illustrative only and are not indicative of any specific return an investor may receive from a particular investment. The underlying assumptions are not predictive of the effect of future interest rates on any particular company.

The new “restructured” company has exactly the same operating results as the old company: the same $10 billion in sales, the same 20% operating margin and the same operating income of $2 billion. But because the new leveraged company has a lot more debt than the old, it has a lot more interest expense—$800 million versus $25 million, in this illustration. As a result, net income will be lower, as will earnings per share. No surprises so far. But watch what happens to the stock price, assuming the same price/earnings (P/E) ratio: The stock price goes down by only $7.56, far less than the $9.50 dividend. New shareholders then have $9.50 in their pockets plus a stock trading at $11.70, for a total of $21.20. The activist has created an increase in shareholder value of almost 10% without improving the operating performance of the company—all through the power of leverage.

But the story doesn’t end there. Let’s assume we see modest economic growth (sales up by 5%), as well as modest increases in operating margins (from 20% to 21%). How do these companies perform? From an operating perspective, they are still identical. Both see operating income increase to $2.205 billion.

| Table 2: Operating Leverage | | | | | | | | | | | | |

Dollars in millions, except per share | | Strong Balance Sheet Company A | | | Weak Balance Sheet Company B | |

| Total Debt | | | $500 | | | | $500 | | | | $10,000 | | | | $10,000 | |

| Borrowing Cost | | | 5.00% | | | | 5.00% | | | | 8.00% | | | | 8.00% | |

| Sales | | | $10,000 | | | | $10,500 | | | | $10,000 | | | | $10,500 | |

| Operating Margin | | | 20.00% | | | | 21.00% | | | | 20.00% | | | | 21.00% | |

| Operating Income | | | 2,000 | | | | 2,205 | | | | 2,000 | | | | 2,205 | |

| Interest Expense | | | 25 | | | | 25 | | | | 800 | | | | 800 | |

| Net Income | | | 1,284 | | | | 1,417 | | | | 780 | | | | 913 | |

| EPS | | | $1.28 | | | | $1.42 | | | | $0.78 | | | | $0.91 | |

| P/E Multiple | | | 15.0 | | | | 15.0 | | | | 15.0 | | | | 15.0 | |

| Stock Price | | | $19.26 | | | | $21.26 | | | | $11.70 | | | | $13.70 | |

| Change in Stock Price | | | | | | | 10.38% | | | | | | | | 17.08% | |

Note: These examples are intended to show the potential general effect of interest rates on the stock price of a company with low debt versus a company with high debt. All information shown is hypothetical except for the stock price, which is purely a calculation of the earnings per share (EPS) multiplied by the price/earnings multiple (P/E multiple). Examples are illustrative only and are not indicative of any specific return an investor may receive from a particular investment. The underlying assumptions are not predictive of the effect of future interest rates on any particular company.

The shares of the highly leveraged company increase by more than 17%, while the shares of the strong balance sheet company grow by only 10%. Finally, consider the effect of declining interest rates, which I described in detail last quarter. So far, the examples used in this letter assume “normal” interest rates. To be specific, I have assumed a 10-year Treasury rate of 4.00% with a 1.00% incremental credit spread for a Strong Balance Sheet Company, resulting in a 5.00% borrowing cost, and a 4.00% increment credit spread for a Weak Balance Sheet Company, resulting in an 8.00% borrowing cost. But recently, interest rates have been anything but normal. Ten-year Treasury rates have dropped below 2%, near their lowest level in 140 years.

Now, let’s examine what happens to the stock prices of our two theoretical companies when we combine the operating leverage from Table 2 with lower borrowing costs.

Table 3: Lower Borrowing Costs | | | | | | | | | | | | |

Dollars in millions, except per share | | Strong Balance Sheet Company A | | | Weak Balance Sheet Company B | |

| Total Debt | | | $500 | | | | $500 | | | | $10,000 | | | | $10,000 | |

| Borrowing Cost | | | 5.00% | | | | 2.50% | | | | 8.00% | | | | 5.50% | |

| Sales | | | $10,000 | | | | $10,500 | | | | $10,000 | | | | $10,500 | |

| Operating Margin | | | 20.00% | | | | 21.00% | | | | 20.00% | | | | 21.00% | |

| Operating Income | | | 2,000 | | | | 2,205 | | | | 2,000 | | | | 2,205 | |

| Interest Expense | | | 25 | | | | 13 | | | | 800 | | | | 550 | |

| Net Income | | | 1,284 | | | | 1,425 | | | | 780 | | | | 1,075 | |

| EPS | | | $1.28 | | | | $1.43 | | | | $0.78 | | | | $1.08 | |

| P/E Multiple | | | 15.0 | | | | 17.0 | | | | 15.0 | | | | 17.0 | |

| Stock Price | | | $19.26 | | | | $24.23 | | | | $11.70 | | | | $18.29 | |

| Change in Stock Price | | | | | | | 25.81% | | | | | | | | 56.31% | |

Note: These examples are intended to show the potential general effect of interest rates on the stock price of a company with low debt versus a company with high debt. All information shown is hypothetical except for the stock price, which is purely a calculation of the earnings per share (EPS) multiplied by the price/earnings multiple (P/E multiple). Examples are illustrative only and are not indicative of any specific return an investor may receive from a particular investment. The underlying assumptions are not predictive of the effect of future interest rates on any particular company.

The combination of these effects (greater leverage to an improving economy and greater benefit from declining interest rates) produces more than 3,000 basis points of outperformance for the leveraged company versus the unleveraged company: a +56% return versus a roughly +26% return. (Note: I have increased the P/E ratio for both companies in the declining interest rate scenario. When interest rates fall, required returns fall, and investors will pay a higher price for a given stream of earnings—at least in theory.)

I contend that that this leverage effect explains relative returns of various investment asset classes. Private equity, leveraged buyouts and hedge funds employ far more debt leverage, on average, than long-only mutual funds. Real estate and many “hard asset” investment vehicles use leverage to improve returns above that of the underlying asset. Since 1981, interest rates have declined in a very steep, if bumpy, trajectory, providing a consistent tailwind to these leveraged asset classes and individual stocks. Which brings us back to Ariel Focus Fund. If the benefits of leverage are so powerful, why does Ariel Focus Fund insist on investing in stocks with significantly higher interest coverage than our benchmark and the S&P 500? In short, the answer is that all of the effects of leverage discussed in this letter work both ways. If the economy turns down, corporate profitability declines, P/E multiples contract and, most importantly, interest rates eventually head higher, then all of these effects should reverse, and unleveraged stocks and less-leveraged asset classes should outperform, as shown in Table 4.

Table 4: Higher Interest Rates | | | | | | | | | | | | |

Dollars in millions, except per share | | Strong Balance Sheet Company A | | | Weak Balance Sheet Company B | |

| Total Debt | | | $500 | | | | $500 | | | | $10,000 | | | | $10,000 | |

| Borrowing Cost | | | 2.50% | | | | 6.00% | | | | 5.50% | | | | 9.00% | |

| Sales | | | $10,500 | | | | $9,500 | | | | $10,500 | | | | $9,500 | |

| Operating Margin | | | 21.00% | | | | 19.00% | | | | 21.00% | | | | 19.00% | |

| Operating Income | | | 2,205 | | | | 1,805 | | | | 2,205 | | | | 1,805 | |

| Interest Expense | | | 13 | | | | 30 | | | | 550 | | | | 900 | |

| Net Income | | | 1,425 | | | | 1,154 | | | | 1,075 | | | | 588 | |

| EPS | | | $1.43 | | | | $1.15 | | | | $1.08 | | | | $0.59 | |

| P/E Multiple | | | 17.0 | | | | 14.0 | | | | 17.0 | | | | 14.0 | |

| Stock Price | | | $24.23 | | | | $16.15 | | | | $18.29 | | | | $8.24 | |

| Change in Stock Price | | | | | | | –33.33% | | | | | | | | –54.97% | |

Note: These examples are intended to show the potential general effect of interest rates on the stock price of a company with low debt versus a company with high debt. All information shown is hypothetical except for the stock price, which is purely a calculation of the earnings per share (EPS) multiplied by the price/earnings multiple (P/E multiple). Examples are illustrative only and are not indicative of any specific return an investor may receive from a particular investment. The underlying assumptions are not predictive of the effect of future interest rates on any particular company.

The outperformances of leveraged companies and asset classes have been relative headwinds for Ariel Focus Fund. I am managing the portfolio to benefit when and if those winds change direction.

PORTFOLIO COMINGS AND GOINGS

During the quarter, we initiated three new positions and exited three in Ariel Focus Fund. We purchased shares in Anixter Intl Inc. (AXE), a current holding in some of our other portfolios. Anixter is a leading global supplier of communications and security products, electrical and electronic wire and cable, fasteners, and other small components. We purchased Bio-Rad Laboratories, Inc. (BIO), also a current holding in some of our other portfolios. This company has remained at the center of scientific discovery for more than 50 years, manufacturing and distributing a broad range of products for the life science research and clinical diagnostic markets. We also bought shares of St. Jude Medical, Inc. (STJ), a current holding in our mid cap value portfolio. This company develops medical technology and services to treat cardiac, neurological and chronic pain patients worldwide. We sold International Game Technology (IGT), which is being acquired by GTECH SpA (GTKYY) for $6.4 billion. Lastly, we sold our shares in Target Corp. (TGT) and Snap-on Inc. (SNA) in order to pursue more compelling opportunities.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

Sincerely,

Charles K. Bobrinskoy

Portfolio manager

| | |

| 1 | The interest coverage ratio shows how easily a company can pay interest on its debt. It divides a company’s earnings before interest and taxes (EBIT) by the company’s interest expenses. The lower the ratio, the higher the debt burden. |

| | This commentary contains the writer’s beliefs relating to future interest rates and the general effect of interest rates on companies with differing debt ratings. The underlying assumptions the writer uses are for illustration purposes only. The beliefs expressed are not predictive of future interest rates and are not representative of the effects of future interest rates on any particular company. |

| | A REIT (real estate investment trust) is a security that invests in real estate. REITs receive special tax considerations, have potentially high yields, and offer a liquid method of investing in real estate. Risks include interest rate and overdevelopment risk. Utility stocks are known as defensive stocks because they historically provide higher-than-average returns in a declining market. In addition, utility companies may return dividends that are likely to offset declines in the company’s stock prices. Risks of utility companies include the reduced potential for capital gain and the risk that the stocks may decline in value resulting in a loss. |

| | | |

| | Ariel Focus Fund performance summary | INCEPTION: 06/30/05 |

| | | |

| | | |

| |

|

Charles K. Bobrinskoy Portfolio manager |

Composition of equity holdings (%) | | | |

| | | | | |

| | | | | |

| | | | | |

| | | 18.16 | | |

| | | 14.51 | 8.42 | |

| | | 14.29 | | |

| | | | | 8.07 |

| | | | 8.18 | |

| | Materials & processing | 6.28 | 3.30 | |

| | | 4.63 | 5.97 | |

| | | 0.00 | | |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes. |

Average annual total returns (%) as of 03/31/15 |

| | | | | | | |

| | | | 1-year | 3-year | | Since inception |

| | Ariel Focus Fund–Investor Class | | + 5.28 | + 13.47 | + | 10.77 | + 5.91 |

| | Ariel Focus Fund–Institutional Class+ | | + 5.59 | + 13.75 | + | 10.96 | + 6.00 |

| | Russell 1000® Value Index | | + 9.33 | + 16.44 | + | 13.75 | + 7.22 |

| | | + 0.95 | + 12.73 | + 16.11 | + | 14.47 | + 8.07 |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000. |

Expense ratio (as of 09/30/14)1 | | Net | | Gross | | Expense Cap |

| Investor Class | | 1.08% | | 1.40% | | 1.00% |

| Institutional Class | | 0.83% | | 1.06% | | 0.75% |

Top ten equity holdings (% of net assets) |

| 1. | Western Union Co. | 6.2 |

| 2. | Stanley Black & Decker, Inc. | 6.0 |

| 3. | Oracle Corp. | 5.2 |

| 4. | Lockheed Martin Corp. | 5.0 |

| 5. | International Business Machines Corp. | 4.6 |

| 6. | CVS Health Corp. | 4.6 |

| 7. | National Oilwell Varco | 4.3 |

| 8. | Mosaic Co. | 4.0 |

| 9. | Newell Rubbermaid Inc. | 3.9 |

| 10. | Exxon Mobil Corp. | 3.9 |

+The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees.

1 Effective February 1, 2014, Ariel Investments, LLC, the Adviser, has contractually agreed to waive fees and reimburse expenses (the “Expense Cap”) in order to limit Ariel Focus Fund’s total annual operating expenses to 1.00% of net assets for the Investor Class and 0.75% of net assets for the Institutional Class through the end of the fiscal year ending September 30, 2016. Through January 31, 2014, the Expense Cap was 1.25% for the Investor Class and 1.00% for the Institutional Class.

Notes: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 1000® Value Index measures the performance of large-cap value companies with lower price-to-book ratios and lower expected growth values. Russell® is a trademark of Russell Investment Group, which is the source and owner of the Russell Indexes’ trademarks, service marks and copyrights. The S&P 500® is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index.

HIDDEN IN PLAIN SIGHT

| Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Discovery Fund may be obtained by visiting our website, arielinvestments.com. |

DEAR FELLOW SHAREHOLDER:

Our deep value portfolios had a difficult first quarter, as the market continued to give little credit for our generally cash-rich, low price-to-book holdings. The best-performing stocks in the period were high-octane, small-growth names, as evidenced by the +7.44% gain in the Russell 2500 Growth Index.

Despite the underperformance, however, we believe that, on average, our portfolio companies did quite well fundamentally. That is, business results were solid and in many cases improving. This led us to increase our estimates of fair value in most cases, thereby giving us even greater conviction in the attractiveness of our micro-cap and small cap deep value portfolios.

Average annual total returns as of 03/31/15

| | | | | | | | | | | | | | | | |

| | | Quarter | | 1-year | | 3-year | | | Since inception* | |

| Ariel Discovery Fund | | | | % | | | % | | + 6.92 | % | | | | % | |

Russell 2000® Value Index | | | | | | + 4.43 | | | + 14.79 | | | | + 11.86 | | |

S&P 500® Index | | | + 0.95 | | | + 12.73 | | | + 16.11 | | | | + 14.52 | | |

* The inception date for Ariel Discovery Fund is 01/31/11.

As long-term deep value investors, we know our style is often out of favor, and the prolonged disconnect can be frustrating. However, at many of our portfolio companies, significant changes have occurred, are in the process of happening or are extremely likely. Therefore, we believe that we may very well be at a fundamental inflection point.

A number of new CEOs for our holdings are making significant impact at their respective companies, usually after strong boards acted in shareholders’ interests to improve leadership. Activists have driven constructive change in other cases, most clearly at Rosetta Stone Inc. (RST), the well-known language and literacy company. Three new outside directors, a plan to focus on the rapidly growing educational and enterprise business, a new CEO, and engagement of an experienced turnaround consultant give us great confidence in improved results and an unlocking of significant value. And finally, there are situations where activist investors have launched proxy fights to replace ineffective board members and may successfully take control of underutilized assets.

Since its early 2011 inception and over the past three years, Ariel Discovery Fund’s returns are positive but well short of our benchmark. The difficult period after the fund’s launch, combined with the softness since year-end 2013 leaves our +5.02% return since inception behind the +11.86% gain in the Russell 2000 Value Index. Again, the relative weakness in the portfolio despite solid fundamentals leads us to believe our portfolio represents exceptional value at this point in time. Top performers during the quarter included Multi-Fineline Electronix, Inc. (MFLX), which gained +63.67% prior to our sale; Capital Southwest Corp. (CSWC), up +22.45%; and Telenav Inc. (TNAV), which rose +18.74%. On the downside, Erickson Inc. (EAC) fell by -48.20% as investors continued to punish the stock for a weak 2014. Orion Energy Systems, Inc. (OESX) dropped -42.91%, and Contango Oil & Gas Co. (MCF) lost -24.76% as low commodity prices continued to take a toll on energy stocks.

IF WE COULD OWN JUST ONE STOCK, WHAT WOULD IT BE?

A number of investment websites and magazines ask managers this question. Since 2011, we have been using our first-quarter letter to respond. While we would never recommend investing in only one stock, a detailed answer effectively illustrates the characteristics we seek in our portfolio holdings.

“As long-term deep value investors, we know our style is often out of favor, and the prolonged disconnect can be frustrating.”

As deep value investors, we look for underfollowed and misunderstood companies trading at prices that we believe provide a potential margin of safety* to buyers. Specifically, we refer to the difference between price and our significantly higher estimate of a company’s intrinsic value. We seek stocks that have value largely substantiated by tangible assets, with an emphasis on pristine balance sheets. We also want to be invested alongside talented and properly incentivized leadership, and we look to identify upside potential from underappreciated opportunities and/ or overlooked assets. This year, the company that best embodies these traits is RealNetworks, Inc. (RNWK).

“Putting a precise valuation on Rhapsody is difficult, but as RealNetworks’ stake is an investment requiring no ongoing capital, we believe any meaningful value is a windfall for shareowners.”

Based in Seattle, RealNetworks is best known for its RealPlayer media player software, which is downloaded onto millions of computers. The company invented the streaming media category in 1995 with the introduction of RealAudio. After trading at more than 50 times its current level during the Internet bubble, the company fell on hard times following the retirement of founder Rob Glaser. With a 36% ownership stake, he returned as interim CEO in 2012 and took on the role last year on a permanent basis. We are impressed with his reorganization and cost-cutting, along with the reinvigoration of RealNetworks’ product lines.

The company’s most important business is the RealPlayer Group. As sales of its legacy products have diminished, the company has developed RealPlayer Cloud, a cloud- and mobile-centric video storage and sharing platform. The service has grown from 500,000 to more than 10 million users in a year, and is approaching levels where we believe it will become a meaningful source of value for RealNetworks.

The other two businesses are Mobile Entertainment, a software as a service (SaaS) line that includes the LISTEN ringback app and Games, which holds both Zylom and the Slingo social casino brand, GameHouse. These two business lines have potential, especially because each has added strong leadership over the past year or two. Still, we ascribe only modest value to them in assessing RealNetworks’ intrinsic value.

With a current market capitalization of just more than $240 million, no debt and more than $160 million in cash, the market is currently ascribing very little value to the company’s business (based on a 3/31/15 share price of $6.73). Even assuming significant cash burn in the near future and applying a modest multiple to revenues, which we think should return to growth later this year, we come up with a valuation roughly 15% above current levels.

However, this valuation completely ignores an overlooked and potentially extremely valuable asset. Hidden in plain sight is RealNetworks’ 43% stake in privately held Rhapsody, the pioneer of the music streaming business. RealNetworks has made it clear it intends to monetize this investment. Carried on RealNetworks’ books at just $10 million, we believe that the 43% holding is worth at least $5.00 per share and could be worth multiples of that.

Although surpassed in size and notoriety by Spotify and Pandora, Rhapsody has found its footing and is growing rapidly. It reached 2.5 million paid subscribers by year-end 2014, up 60% year-over-year. Carrier partnerships such as UnRadio with T-Mobile are helping drive this subscriber growth. Through Napster, Rhapsody’s international brand, music is now available in more than 30 countries, up from only three countries just two years ago. A global partnership with Telefonica has shown significant growth, and the company has also expanded into auto partnerships. Finally, Rhapsody and Twitter, Inc. (TWTR) announced a partnership just weeks ago, giving Rhapsody access to a massive user base.

Putting a precise valuation on Rhapsody is difficult, but as RealNetworks’ stake is an investment requiring no ongoing capital, we believe any meaningful value is a windfall for shareowners, especially given that we estimate the rest of RealNetworks is worth more than the current quote.

Privately held Spotify can provide some clues based on reports of capital raised. With 15 million paid subscribers, it is six times the size of Rhapsody. Arguably, its acquisition costs have been much higher than Rhapsody’s, as much of Rhapsody’s success has come from carrier partnerships. Margin data is not available, but it is not unreasonable to assign similar multiples on a per-subscriber basis.

Reports are that Spotify is earning a value of nearly $600 per subscriber. At the high end, if Rhapsody reaches 3 million subscribers by mid-year, a 43% stake would be worth nearly $775 million, or more than $21.00 per share. While we use a heavily discounted version of that calculation to be conservative, we arrive at a sum-of-the parts valuation for RealNetworks of more than twice the current share price.

PORTFOLIO COMINGS AND GOINGS

There was one deletion from the Fund during the quarter. Multi-Fineline Electronix, Inc. (MFLX) was sold as it approached our estimate of fair value. We added one new position, SeaChange Int’l Inc. (SEAC), the market share leader in video on demand (VOD) software for cable and telecom companies. Trading at a very modest premium-to-book value, with nearly half of its market capitalization in cash, we believe the company’s growth potential from new software products is overlooked. Recently appointed CEO Jay Samit has a terrific reputation as a digital media innovator, and his shareholder-friendly compensation package adds to our confidence.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

Sincerely,

David M. Maley

Lead portfolio manager

| | | | |

| DAVID MALEY NAMED

MICROCAP SUPERSTAR | |

| | | | |

| | | In Dave Gentry’s new book, Microcap Superstars: The Movers and Shakers in Small Stocks and Big Money, Portfolio Manager David Maley is listed as a MicroCap Superstar among an elite group of investment professionals. To learn more about David’s strategy, visit arielinvestments.com. | |

* Attempting to purchase with a margin of safety on price cannot protect investors from the volatility associated with stocks, incorrect assumptions or estimations on our part, declining fundamentals or external forces.

| | | |

| | Ariel Discovery Fund performance summary | |

| | | |

| | | |

|  |

| David M. Maley | |

Lead portfolio

manager | Portfolio

manager |

Composition of equity holdings (%) | | | | | | | |

| | | | | |

| | Ariel Discovery | Russell 2000 Value Index | | S&P 500 Index |

| Technology | | | 8.72 | | | | |

| Financial services | | | | | | | |

| | | | | | | |

| Utilities | | | | | | | |

| Materials & processing | | | | | | 3.50 | |

| Producer durables | 10.69 | | 13.24 | | | 10.65 | |

| | | | | | | |

| Health care | | | | | | | |

| Consumer staples | | | | | | 8.52 | |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

Average annual total returns (%) as of 03/31/15 |

| | | | | |

| | | | | Since |

| | Quarter | 1-year | 3-year | inception |

Ariel Discovery Fund–Investor Class | | | | |

Ariel Discovery Fund–Institutional Class+ | | | | |

Russell 2000® Value Index | + 1.98 | | | |

| + 0.95 | | | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. The minimum initial investment for Investor Class shares is $1,000; the minimum for Institutional Class shares is $1,000,000.

Expense ratio (as of 09/30/14) 1 | Net | Gross | Expense Cap |

| Investor Class | 1.33% | 1.93% | 1.25% |

| Institutional Class | 1.07% | 1.25% | 1.00% |

Top ten equity holdings (% of net assets) |

| 1. | | |

| 2. | | |

| 3. | | |

| 4. | | |

| 5. | | |

| 6. | | |

| 7. | | |

| 8. | | |

| 9. | | |

| 10. | | |

+ The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees.

1 Effective February 1, 2014, Ariel Investments, LLC, the Adviser, has contractually agreed to waive fees and reimburse expenses (the “Expense Cap”) in order to limit Ariel Discovery Fund’s total annual operating expenses to 1.25% of net assets for the Investor Class and 1.00% for the Institutional Class through the end of the fiscal year ending September 30, 2016. Through January 31, 2014, the Expense Cap was 1.50% for the Investor Class and 1.25% for the Institutional Class.

Notes: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. Russell® is a trademark of Russell Investment Group, which is the source and owner of the Russell Indexes’ trademarks, service marks and copyrights. The S&P 500® is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index.

THE INVESTING MARATHON

| Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel International Fund and Ariel Global Fund may be obtained by visiting our website, arielinvestments.com. |

DEAR FELLOW SHAREHOLDER:

International markets were up significantly in the first quarter of 2015, but performance in the U.S. market was more muted. Macroeconomic factors mainly drove the buoyant mood abroad. While the U.S. Federal Reserve has ended its quantitative easing (QE) program, the European Central Bank (ECB) just started one. This ECB action drove large moves in currency and equity markets, sending the Euro down -10% and Euro Stoxx 50 Index1 up +19% in local currency terms (although in U.S. dollars, the move was only +7%). The U.S. market was only up +1%, as a stronger dollar caused a weaker earnings outlook for America’s global firms.

Such an environment could have been a boon for a prognosticator who foresaw such forces. For instance, one could have concluded that QE would be the big factor in the first quarter of 2015 and surmised that it would drive European equities up—but not U.K. equities where the ECB stood by the sidelines—and then positioned the portfolio accordingly. We made no such macro calls, nor did we reposition our portfolios to benefit from such an environment. And yet, we outperformed. Specifically, Ariel International Fund gained +5.55%, topping the MSCI EAFE’s +5.00% gain and the MSCI ACWI ex-US Index’s +3.59% rise. Finally, Ariel Global Fund advanced +2.91%, outpacing the MSCI ACWI Index’s +2.44% return. To some, this may be a counterintuitive or unexpected outcome but not to us. We explore this below.

Many people often compare investing to a footrace; given our Aesop-inspired tortoise logo, we endorse the metaphor. That said, it is not perfect. First, race conditions are generally stable and, for big races, moderate. Second, in a footrace, the distance is clear. For instance, the Boston Marathon has a distance of 26.2 miles with slightly hilly terrain; the steepest grade (Heartbreak Hill) is about 3.3%. The weather changes yearly but is typically mild with temperatures in the upper 40s or lower 50s. The location does not shift from the Swiss Alps in January to the Sahara Desert in August, and it certainly does not change quickly from freezing to more than 100 degrees. Nobody cares who wins mile 3 or 10, and we doubt anybody strives to do so. It is the full 26.2 miles that matter.

When it comes to investing, some managers do try to compete in short-term cycles by positioning and repositioning the portfolio to suit the prevailing mood or momentum of the market. Put another way, they do focus on winning mile 3 or 10, often at the expense of winning the full 26.2 miles. We think it is very risky to attempt to predict the short-term environment and construct a portfolio to suit it. The market environment can shift from moderate to intense and from ebullient to harrowing in the space of weeks or even days, usually without notice, leaving such investors in the awkward position of chasing their own tails. Instead, we try to construct a portfolio in which superior bottom-up stock selection drives the performance. We believe while macro developments can create headwinds or tailwinds, and shift suddenly, a high-quality business drives its own destiny, especially over the long term. Indeed, many of our portfolio holdings recently showed this quality over the short term, enabling us to outperform for the quarter.

“In a marathon, nobody cares who wins mile 3 or 10, and we doubt anybody strives to do so. It is the full 26.2 miles that matter.”

Glaxo SmithKline plc, a U.K.-domiciled health-care company, was a key contributor, even though a weak Euro hurt its earnings. The same goes for another key contributor, Nintendo Co., Ltd., despite securing no benefit from the ECB’s actions. Simultaneously, our portfolio excluded important European exporters such as Volkswagen or BMW, which were key beneficiaries of a weak Euro; that detracted from performance. On balance, however, what we owned performed well enough to offset what we did not own.

We are not suggesting that superior stock-picking can always offset macro headwinds in the short run, but it often can. The past quarter was one such period. The difference between always and often is crucial, in our view. In the short run, a concentrated portfolio can perform idiosyncratically—sometimes performing well despite headwinds or performing poorly even with tailwinds. Given such varying outcomes, short-term performance, whether good or bad, is not a dependable measuring stick for the success of a strategy. For that, we believe one must examine the overall investment process and philosophy.

“Short-term performance, whether good or bad, is not a dependable measuring stick for the success of a strategy.”

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

Sincerely,

Rupal J. Bhansali

Portfolio manager

| | | | |

| TURTLE TIME WITH RUPAL BHANSALI | |

| | | | |

| | “Our investment process is trying to solve for two objectives, not just one. Most investment disciplines are designed to achieve capital appreciation in equities. We try to shoot for capital appreciation, with a focus on risk management. All of these things have led to our 5-star rating from Morningstar for Ariel International Fund.” | |

| | | |

| | – Rupal J. Bhansali

CIO, International & Global Equities

Portfolio Manager | |

| | | |

| | Portfolio Manager Rupal J. Bhansali answers your questions in the latest edition of Turtle Time. We invite you to read the in-depth interview on arielinvestments.com/turtle-time-rupal in June. | |

Ariel International Fund’s Overall Morningstar RatingTM was five stars as of 4/30/15 among 310 Foreign Large Value Funds and is derived only from the three-year rating of five stars among 310 Foreign Large Value Funds. Ariel International Fund’s inception date is 12/30/11 and therefore it does not yet have performance or a rating for the five- and ten-year periods. Morningstar Rating is for the Investor share class only; the Institutional share class may have different performance characteristics. Past performance is no guarantee of future results.

For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. These ratings change monthly. The top 10% of funds in an investment category receive five stars, the next 22.5% receive four stars, the next 35% receive three stars, the next 22.5% receive two stars, and the bottom 10% receive one star. The Overall Morningstar Rating for a fund is derived from a weighted average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. ©2015 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

1 The EURO STOXX 50 is a stock index of Eurozone stocks designed by STOXX, an index provider owned by Deutsche Börse Group and SIX Group.

| | | |

| | Ariel International Fund performance summary | |

| | | |

| | | |

Rupal J. Bhansali

Portfolio manager

Composition of equity holdings* (%)

| | | | | | | | | | |

| | | | | | | | | MSCI |

| | | Ariel | | MSCI | | ACWI |

| | | International | | EAFE | | ex-US |

| | | Fund† | | Index | | Index |

| Information technology | | 20.41 | | | 4.91 | | | 7.67 | |

| Financials | | 18.15 | | | 26.01 | | | 27.34 | |

| Telecommunication services | | 14.92 | | | 4.70 | | | 5.10 | |

| Consumer staples | | 13.56 | | | 11.02 | | | 9.95 | |

| Consumer discretionary | | 13.06 | | | 13.12 | | | 11.83 | |

| Health care | | 10.46 | | | 11.43 | | | 9.14 | |

| Energy | | 5.10 | | | 5.11 | | | 6.89 | |

| Industrials | | 3.45 | | | 12.68 | | | 11.12 | |

| Utilities | | 0.53 | | | 3.58 | | | 3.38 | |

| Materials | | 0.36 | | | 7.46 | | | 7.57 | |

| † | Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes. |