Washington, D.C. 20549

Arthur Don, Esq.

Item 1. Reports to Stockholders.

The patient investor

| | | | | | |

| | | | | | |

| SEMI-ANNUAL REPORT: 03/31/14 |

| ● | Value | ● | Deep value | ● | Global |

| ● | Ariel Fund |

| ● | Ariel Appreciation Fund |

| ● | Ariel Focus Fund |

| ● | Ariel Discovery Fund |

| ● | Ariel International Fund |

| ● | |

Slow and steady wins the race.

One of Ariel Investments’ guiding principles is to communicate openly with our shareholders so they may gain a clear understanding of our investment philosophy, portfolio decisions and results, as well as our opinions on the underlying market. In reviewing the materials contained in The Patient Investor, please consider the information provided on this page. While our investment decisions are rooted in detailed analysis, it is important to point out that actual results can differ significantly from those we seek. We candidly discuss a number of individual companies. Our opinions are current as of the date they were written but are subject to change. We want to remind investors that the information in this report is not sufficient on which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security. Equity investments are affected by market conditions. The intrinsic value of the stocks in which the Funds invest may never be recognized by the broader market. Ariel Fund, Ariel Appreciation Fund, Ariel Focus Fund and Ariel Discovery Fund invest in small and/or midsized companies. Investing in small and mid-cap stocks is riskier and more volatile than investing in large cap stocks, in part because smaller companies may not have the scale, depth of resources and other assets of larger firms. Ariel Fund and Ariel Appreciation Fund often invest a significant portion of their assets in companies within the consumer discretionary and financial services sectors and their performance may suffer if these sectors underperform the overall stock market. Ariel Focus Fund invests primarily in equity securities of companies of any size and is a non-diversified fund, which means its investments are concentrated in fewer stocks than diversified funds. Ariel Focus Fund generally holds 25-30 stocks and therefore may be more volatile than a more diversified investment. Ariel International Fund and Ariel Global Fund invest in foreign securities and may use currency derivatives and ETFs. Investments in foreign securities may underperform and may be more volatile than comparable U.S. stocks because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. The use of currency derivatives and ETFs may increase investment losses and expenses and create more volatility. Investments in emerging and developing markets present additional risks, such as difficulties selling on a timely basis and at an acceptable price. Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for the Funds may be obtained by visiting our website, arielinvestments.com. Investors should consider carefully the investment objectives, risks, and charges and expenses before investing. For a current summary prospectus or full prospectus which contains this and other information about the Funds offered by Ariel Investment Trust, call us at 800.292.7435 or visit our website, arielinvestments.com. Please read the summary prospectus or full prospectus carefully before investing. Distributed by Ariel Distributors, LLC, a wholly owned subsidiary of Ariel Investments, LLC. Ariel Investment Trust c/o U.S. Bancorp Fund Services, LLC P.O. Box 701 Milwaukee, WI 53201-0701 800.292.7435 toll-free arielinvestments.com Follow us on Twitter @ArielFunds |

| | | |

| | Fund performance at a glance | AS OF 03/31/14 |

| | | |

| | | |

| | | | | | | | |

| | | | Annualized |

| | Quarter | 1-year | 3-year | 5-year | 10-year | 20-year | Since inception |

| Small/mid cap value strategy | | | | | | | 11/06/86 |

| Ariel Fund–Investor Class | – 0.99% | + 23.74% | + 12.02% | + 30.25% | + 7.37% | + 11.04% | + 11.69% |

| Ariel Fund – Institutional Class | – 0.90 | + 24.13 | + 12.29 | + 30.45 | + 7.45 | + 11.08 | + 11.72 |

Russell 2500TM Value Index | + 3.52 | + 21.76 | + 13.88 | + 24.81 | + 9.01 | + 11.72 | + 11.81 |

Russell 2000® Value Index | + 1.78 | + 22.65 | + 12.74 | + 23.33 | + 8.07 | + 10.81 | + 11.10 |

S&P 500® Index | + 1.81 | + 21.86 | + 14.66 | + 21.16 | + 7.42 | + 9.53 | + 10.21 |

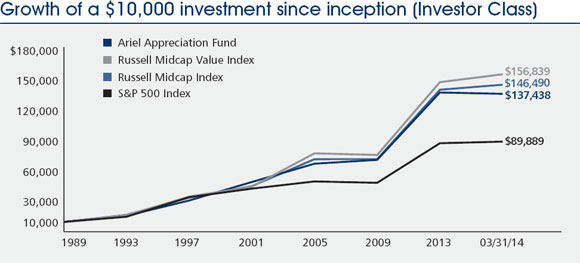

| Mid cap value strategy | | | | | | | 12/01/89 |

| Ariel Appreciation Fund–Investor Class | – 0.95% | + 25.33% | + 14.38% | + 28.77% | + 8.55% | + 11.59% | + 11.37% |

| Ariel Appreciation Fund – Institutional Class | – 0.86 | + 25.73 | + 14.63 | + 28.94 | + 8.62 | + 11.63 | + 11.40 |

Russell Midcap® Value Index | + 5.22 | + 22.95 | + 15.17 | + 26.35 | + 10.24 | + 12.09 | + 11.98 |

Russell Midcap® Index | + 3.53 | + 23.51 | + 14.39 | + 25.55 | + 10.05 | + 11.55 | + 11.66 |

S&P 500® Index | + 1.81 | + 21.86 | + 14.66 | + 21.16 | + 7.42 | + 9.53 | + 9.45 |

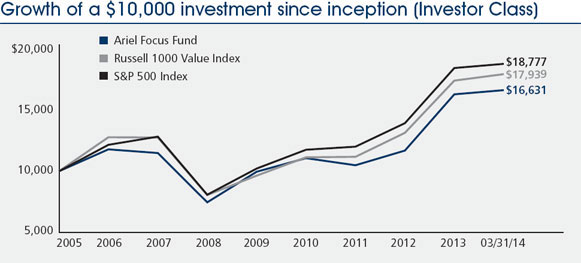

| All cap value strategy | | | | | | | 06/30/05 |

| Ariel Focus Fund–Investor Class | + 2.11% | + 24.86% | + 12.87% | + 21.34% | – | – | + 5.99% |

| Ariel Focus Fund – Institutional Class | + 2.11 | + 25.14 | + 13.07 | + 21.47 | – | – | + 6.05 |

Russell 1000® Value Index | + 3.02 | + 21.57 | + 14.80 | + 21.75 | – | – | + 6.98 |

S&P 500® Index | + 1.81 | + 21.86 | + 14.66 | + 21.16 | – | – | + 7.55 |

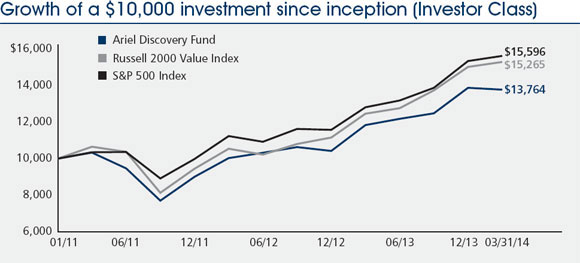

| Small cap deep value strategy | | | | | | | 01/31/11 |

| Ariel Discovery Fund–Investor Class | – 0.66% | + 16.35% | + 10.04% | – | – | – | + 10.63% |

| Ariel Discovery Fund– Institutional Class | – 0.51 | + 16.70 | + 10.31 | – | – | – | + 10.89 |

Russell 2000® Value Index | + 1.78 | + 22.65 | + 12.74 | – | – | – | + 14.32 |

S&P 500® Index | + 1.81 | + 21.86 | + 14.66 | – | – | – | + 15.09 |

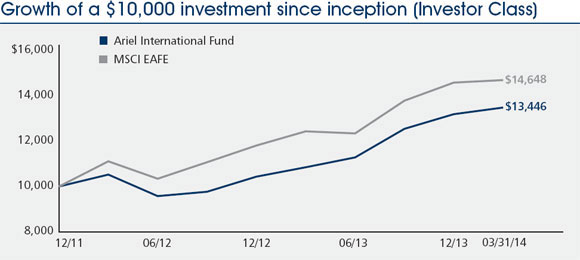

| International all cap strategy | | | | | | | 12/30/11 |

| Ariel International Fund–Investor Class | + 2.18% | + 24.07% | – | – | – | – | + 14.05% |

| Ariel International Fund – Institutional Class | + 2.29 | + 24.26 | – | – | – | – | + 14.33 |

MSCI EAFE® Index | + 0.77 | + 18.06 | – | – | – | – | + 18.47 |

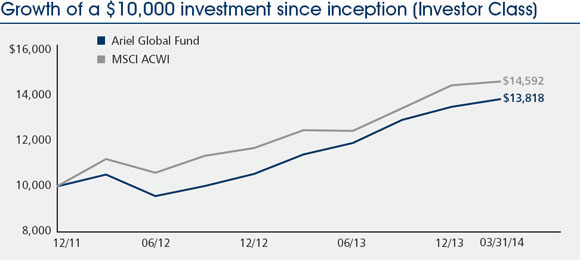

| Global all cap strategy | | | | | | | 12/30/11 |

| Ariel Global Fund–Investor Class | + 2.50% | + 21.21% | – | – | – | – | + 15.44% |

| Ariel Global Fund – Institutional Class | + 2.54 | + 21.62 | – | – | – | – | + 15.76 |

MSCI ACWISM Index | + 1.21 | + 17.17 | – | – | – | – | + 18.27 |

The inception date for the Institutional Class shares of all Funds is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of a Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of a Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of its Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. Descriptions for the indexes can be found in the individual fund summaries in the report. The extraordinary performance shown for the recent short-term periods may not be sustainable and is not representative of the performance over longer periods.

| | | |

| TURTLE TALK | |

| | |

| | | |

| | Portfolio manager viewpoints | |

| | | |

| | Chairman and CEO, John W. Rogers, Jr. and Vice Chairman and Director of Research, Charles K. Bobrinskoy recently participated in a webinar hosted by InvestmentNews and moderated by Conseulo Mack. In this webcast, John and Charlie discuss how investors can re-think standard sources of returns by challenging the categories of conventional investing using behavioral finance theories. To hear John and Charlie’s webcast on behavioral finance or to read John’s recent Forbes column on “Behavioral Bias”, please visit arielinvestments.com. | |

| | | |

Retirement do’s and don’t’s

Making sure you have enough saved to last throughout your retirement can be overwhelming. Use these friendly guidelines to keep yourself on track.

| | |

| DO |

| ● | Maximize your contributions. For 2014, you can contribute up to $5,500 ($6,500 if you’re age 50 or older) to your IRA and $17,500 to your 401k ($23,000 if you’re age 50 or older). |

| | |

| ● | Consider how much you’ll need in retirement. With medical advances, more Americans are expected to live healthier and long lives. |

| | |

| ● | Seize opportunities. When short-term fluctuations in the market occur, these can be opportunities to invest when stocks are selling at a discount. |

| | |

| DON’T |

| ● | Take an early distribution. If you’re not 59½ years old, you may be faced with both a 10% penalty and income taxes. |

| | |

| ● | Lose track of old retirement plans. If you change employers, think about moving your retirement plan(s) into a Rollover IRA so nothing gets lost in the shuffle. |

| | |

| ● | Invest in only your employer’s stock. Manage your overall risk with a well-diversified portfolio. |

For more information regarding your retirement options, call 800.292.7435.

Past performance does not guarantee future results. Investing involves risk, including the possible loss of principal. Consider your financial ability to continue to invest in both up and down markets. This information is not personalized investment or tax advice. Consult a licensed tax professional for tax ramifications.

MUCH ADO

Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Fund and Ariel Appreciation Fund may be obtained by visiting our website, arielinvestments.com. The extraordinary performance shown for the recent short-term periods may not be sustainable and is not representative of the performance over longer periods. |

DEAR FELLOW SHAREHOLDER:

For the first quarter ended March 31, 2014, Ariel Fund fell –0.99% during a time when its primary benchmark, the Russell 2500 Value Index, gained +3.52% and the Russell 2000 Value Index rose +1.78%. Ariel Appreciation Fund’s –0.95% loss paled in comparison to the robust +5.22% gain for the Russell Midcap Value Index and +3.53% rise of the Russell Midcap Index. Keep in mind, 2013 was a strong performance year for our Funds before this reversal, which we discuss below in detail. Specifically, Ariel Fund surged +44.68%, topping the Russell 2500 Value Index’s +33.32% gain, and the Russell 2000 Value Index’s +34.52% rise. Meanwhile, Ariel Appreciation Fund leapt +46.21%, outdistancing the Russell Midcap Value Index’s +33.46% return and the Russell Midcap Index’s +34.76% move.

A Wall Street Journal headline characterized overall market returns as “A Restrained Start to 2014.”1 Our small losses accentuate this point. Not to mention, the striking similarity in the Funds’ returns underscores a style-driven result.

Before we drill down on the most recent quarter’s returns, we would be remiss if we failed to mention that, after the worst financial crisis since the Great Depression, the market hit bottom almost exactly five years ago. Since March 31, 2009, our flagship Ariel Fund ranked number one in the Morningstar Mid-Cap Blend category out of 311 funds that have been in existence over the 60-month period.* While we are pleased with this outcome, we are even more pleased Ariel Fund ranked number one in that same Morningstar database since the Fund’s inception on November 6, 1986—the longer time frame being more statistically significant as a measure of skill over luck. Also worth noting, only 11 Mid-Cap Blend funds have track records dating back as far.

* Past performance does not guarantee future results. For the period ended March 31, 2014, the rankings of Ariel Fund for the one-, five-, ten-year and since inception periods were 138 out of 390 funds, 1 out of 311 funds, 139 out of 192 funds and 1 out of 11 funds, respectively, among Morningstar Mid-Cap Blend funds. Morningstar, Inc. is a nationally recognized organization that reports performance and calculates rankings for mutual funds. Rankings are based on total returns. Morningstar ranks each fund relative to all funds in the same category.

MUCH ADO

According to Institutional Investor, “William Shakespeare’s Macbeth once observed that life is ‘full of sound and fury, signifying nothing.’”2 That’s how we feel about the first three months of 2014. More specifically, our post mortem on the quarter illustrates that most of our biggest winners last year were our biggest losers this year—and yet, there was little in the way of meaningful news to drive this outcome. For example, the top-10 performers in Ariel Fund in 2013 posted one-year gains ranging from Graham Holdings Co. (GHC), which surged +81.6%, on the high end to Lazard Ltd (LAZ), which gained +51.9%, on the low end. By contrast, the first quarter of 2014 exhibited a distinct reversal of fortune, whereby eight of those same top-10 performers experienced an average drop of –8.0% for the period, with losses ranging from –19.1% to –0.6%. The returns of Ariel Appreciation Fund’s holdings are similar. In 2013 its top stock, Towers Watson (TW), surged a whopping +127.0%. The tenth best performer, City National Corp. (CYN), racked up a +60.0% return. Meanwhile, seven of last year’s top-10 mid-cap performers have fallen on average –4.9% through March 31, with Towers Watson coming in at the bottom of the pack with a –10.6% first quarter loss.

Typically, underperformance results from deteriorating fundamentals, which often comes in the form of negative earnings revisions. As we look into 2014 and beyond, we are actually quite optimistic about our portfolios precisely because the reversal of some of our best performers is not supported by weakening fundamentals. For example, in Ariel Fund, Gannett Co., Inc. (GCI) had its earnings revised down just –1% during the quarter, yet the stock fell –6.7% over the period. Mohawk Industries, Inc. (MHK) experienced the same negligible revision, but its shares experienced an even worse outcome, dropping –8.7%. In Ariel Appreciation Fund, CBS Corp. (CBS) had no earnings revision at all, but the stock still fell –3.0%.

“…most of our biggest winners last year were our biggest losers this year—and yet, there was little in the way of meaningful news to drive this outcome.”

We will be the first to admit that all is not perfect in our portfolios; just like baseball batting averages, it never is. Take the worst revision among Ariel Fund’s top performers last year, Dun & Bradstreet Corp. (DNB). In 2013, DNB was up +56.1%. In the first quarter, consensus expectations for the company’s 2014 earnings were revised down –11.0%. The stock plummeted –19.1%, a painful outcome for sure. That said, we believe the new CEO’s cloud-based strategy, coupled with investment spending aimed at long-term growth should reward investors over time. Another stock that was problematic is slot machine manufacturer, International Game Technology (IGT), which fell –22.6% this year and is the worst-performing company in both funds. During a time of industry-wide compression, a bumpy acquisition integration, poor stock buy-back timing and eroding market share have led to a rough-and-tumble period for IGT. Despite these meaningful headwinds, we believe the business remains a good one, even as management’s recent actions have tried our patience.

“…we are actually quite optimistic about our portfolios precisely because the reversal of some of our best performers is not supported by weakening fundamentals.”

It is important to note that in keeping with our contrarian approach, we pared back our exposure to certain big winners as their stock prices soared in recent years. Mind you, when we sell after a stock runs hard, we do not sell haphazardly or automatically. Rather, we carefully examine our original thesis, thoroughly update our financial models based on new information and rigorously debate its future prospects. When we believe the gap between value and price has disappeared, we liquidate; when we think it has narrowed, we pare back. We have recently liquidated a few stocks and pared back on a larger number, but remain keen on the prospects of the great franchises we still own, many of which are moderately cheap rather than breathtaking bargains. Note, however, that we have added to other positions where we thought the difference between value and price had expanded or remained wide.

We will end this letter by comparing our own activities to what we think happened to some of our stocks during the quarter. When stocks we know well sell off on minor news (or no news!), we consider it a conundrum. As you know, we believe behavioral economics explains many market mysteries, so we offer a possible explanation for what we have described in detail above. One of the more arcane topics in behavioral finance is the disposition effect, first identified by Hersh Shefrin and Meir Statman in 1985. The disposition effect is the tendency for investors to sell rising securities too soon and to hold assets that fall too long. Those falling prey to this inclination often say they are “capturing profits” or “cashing in their chips,” which is fine if they are using careful analysis. Those simply selling based on price are ignoring half of the equation: value. Ultimately we think many investors who owned 2013’s hottest stocks simply sold, even when they lacked a truly solid rationale to do so. People tend to think of market returns in calendar years, so it makes sense that the disposition effect would kick in during the first quarter following a torrid market year such as 2013. We know of no other way to rigorously test our thesis, but we find it a reasonable explanation for actions that strike us as unwarranted.

���Ultimately we think many investors who owned 2013’s hottest stocks simply sold, even when they lacked a truly solid rationale to do so.”

PORTFOLIO COMINGS AND GOINGS

During the quarter we added two new positions to Ariel Fund. We purchased Bally Technologies Inc. (BYI) in our small/mid cap value fund. With an estimated $1.2 billion in fiscal year 2014 revenues, Bally Technologies has become one of the larger gaming equipment and systems companies in the world. At this time, we believe the investment community is too focused on what we consider to be short-term issues, such as disappointing attendance and play at regional casino operators. We are confident that Bally is poised to benefit from gaming growth, both domestically and internationally. We also added a previous Ariel holding, Laboratory Corp. of America Holdings (LH). LabCorp maintains a leading market position in an industry that continues to show promising growth potential due to technological advances, aging demographics, health-care cost containment, and preventative medicine. LabCorp maintains a solid balance sheet, generates a significant amount of free cash flow, and has been returning value to shareholders through share repurchases. The company operates with an experienced management team that is conservative yet willing to take slight risks in order to grow the business long-term. We did not eliminate any positions this quarter.

We also purchased LabCorp in Ariel Appreciation Fund and exited our position in Apollo Education Group, Inc. (APOL) in order to pursue more compelling opportunities.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

| | | |

| Sincerely, | | |

| |  |

| John W. Rogers, Jr. | | Mellody Hobson |

| Chairman and CEO | | President |

| | | |

MORNINGSTAR INVESTMENT CONFERENCE MORNINGSTAR INVESTMENT CONFERENCE | |

| | | |

| | John W. Rogers, Jr. will discuss wide moat investing at this year’s Morningstar Investment Conference in Chicago. If you have registered to attend, please join him on June 19 at 1:40pm and again at 2:40pm. Then stop by and meet John at the Ariel booth #322 from 3:30-4:30pm. We hope to see you there. | |

1 The Wall Street Journal, April 7, 2014, page R2.

2 Institutional Investor, December 2012/January 2013, page 78.

| | | |

| | Ariel Fund performance summary | INCEPTION: 11/06/86 |

| | | |

| | | |

| | | | | |

| |  | |  |

| John W. Rogers, Jr. | | John P. Miller, cfa | | Kenneth E. Kuhrt, cpa |

| Lead portfolio | | Portfolio | | Portfolio |

| manager | | manager | | manager |

Composition of equity holdings (%) | | | | |

| | | | | | |

| | | Ariel

Fund† | Russell

2500

Value

Index | Russell

2000

Value

Index | S&P

500

Index |

| | Financial services | 31.60 | 37.99 | 39.65 | 17.85 |

| | Consumer discretionary | 30.60 | 10.90 | 10.39 | 13.81 |

| | Producer durables | 12.47 | 13.68 | 14.31 | 10.98 |

| | Health care | 10.18 | 5.00 | 4.83 | 13.20 |

| | Materials & processing | 6.48 | 6.53 | 5.40 | 3.93 |

| | | 3.17 | 1.54 | 2.11 | 8.49 |

| | Technology | 3.01 | 8.51 | 9.76 | 16.04 |

| | Energy | 2.49 | 6.84 | 6.69 | 10.18 |

| | Utilities | 0.00 | 9.01 | 6.86 | 5.52 |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes. |

Average annual total returns as of 03/31/14 |

| | | | | | | | | |

| | | Quarter | 1-year | 3-year | 5-year | 10-year | 20-year | Since inception |

| | Ariel Fund– Investor Class | – | 0.99% | + 23.74% | + 12.02% | + 30.25% | + | 7.37% | + | 11.04% | + 11.69% |

| | Ariel Fund– Institutional Class+ | | 0.90 | + 24.13 | + 12.29 | + 30.45 | + | 7.45 | + | 11.08 | + 11.72 |

| | Russell 2500TM Value Index | + | 3.52 | + 21.76 | + 13.88 | + 24.81 | + | 9.01 | + | 11.72 | + 11.81 |

| | Russell 2000® Value Index | + | 1.78 | + 22.65 | + 12.74 | + 23.33 | + | 8.07 | + | 10.81 | + 11.10 |

| | S&P 500® Index | + | 1.81 | + 21.86 | + 14.66 | + 21.16 | + | 7.42 | + | 9.53 | + 10.21 |

| Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. |

| Expense ratio (as of 09/30/13) | |

| Investor Class | 1.03% |

| Institutional Class | 0.72% |

Top ten equity holdings (% of net assets) |

| 1. | KKR & Co. L.P. | 3.9 |

| 2. | Lazard Ltd | 3.8 |

| 3. | | 3.8 |

| 4. | Royal Caribbean Cruises Ltd. | 3.7 |

| 5. | | 3.6 |

| 6. | U.S. Silica Holdings Inc. | 3.2 |

| 7. | | 3.1 |

| 8. | | 3.1 |

| 9. | | 3.1 |

| 10. | | 3.0 |

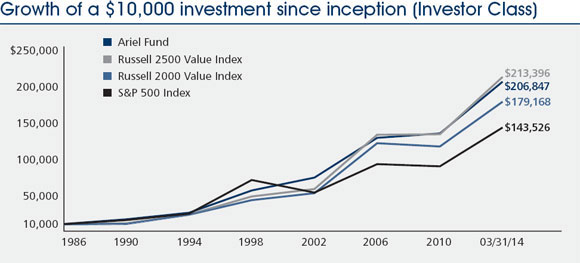

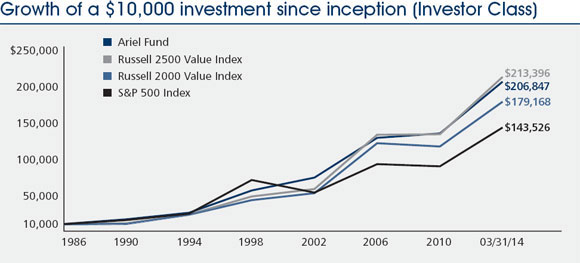

+The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. Notes: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 2500TM Value Index measures the performance of small to mid-cap value companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. Russell® is a trademark of Russell Investment Group, which is the source and owner of the Russell Indexes’ trademarks, service marks and copyrights. The S&P 500® is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

| | | |

| | Ariel Appreciation Fund performance summary | INCEPTION: 12/01/89 |

| | | |

| | | |

| | | |

| |  |

John W. Rogers, Jr. Co-portfolio

manager | | Timothy R. Fidler, cfa Co-portfolio

manager |

Composition of equity holdings (%)

| | | | | | |

| | | Ariel Apprec- iation Fund† | Russell Midcap Value Index | Russell Midcap Index | S&P 500 Index |

| | Financial services | 36.98 | 32.57 | 21.39 | 17.85 |

| | Consumer discretionary | 29.52 | 9.39 | 18.18 | 13.81 |

| | Health care | 15.08 | 8.08 | 10.63 | 13.20 |

| | Producer durables | 14.03 | 12.29 | 13.11 | 10.98 |

| | Consumer staples | 2.98 | 2.90 | 5.53 | 8.49 |

| | Energy | 1.41 | 6.96 | 6.66 | 10.18 |

| | | 0.00 | 5.81 | 6.65 | 3.93 |

| | Technology | 0.00 | 9.24 | 11.38 | 16.04 |

| | Utilities | 0.00 | 12.77 | 6.47 | 5.52 |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes. |

Average annual total returns as of 03/31/14

| | | | | | | | | | | | | |

| | | Quarter | 1-year | 3-year | 5-year | 10-year | 20-year | Since inception |

| | Ariel Appreciation Fund– Investor Class | – | 0.95% | + 25.33% | + 14.38% | + 28.77% | + | 8.55% | + | 11.59% | + | 11.37% |

| | Ariel Appreciation Fund– Institutional Class+ | – | 0.86 | + 25.73 | + 14.63 | + 28.94 | + | 8.62 | + | 11.63 | + | 11.40 |

| | Russell Midcap® Value Index | + | 5.22 | + 22.95 | + 15.17 | + 26.35 | + | 10.24 | + | 12.09 | + | 11.98 |

| | Russell Midcap® Index | + | 3.53 | + 23.51 | + 14.39 | + 25.55 | + | 10.05 | + | 11.55 | + | 11.66 |

| | S&P 500® Index | + | 1.81 | + 21.86 | + 14.66 | + 21.16 | + | 7.42 | + | 9.53 | + | 9.45 |

| Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com. |

| Expense ratio (as of 09/30/13) | |

| Investor Class | 1.13% |

| Institutional Class | 0.80% |

Top ten equity holdings (% of net assets)

| | 1. | Lazard Ltd | 4.5 |

| | 2. | | 4.4 |

| | 3. | First American Financial Corp. | 4.0 |

| | 4. | Stanley Black & Decker, Inc. | 3.5 |

| | 5. | | 3.5 |

| | 6. | Interpublic Group of Cos., Inc. | 3.3 |

| | 7. | | 3.3 |

| | 8. | International Game Technology | 3.2 |

| | 9. | | 3.2 |

| | 10. | AFLAC Inc. | 3.1 |

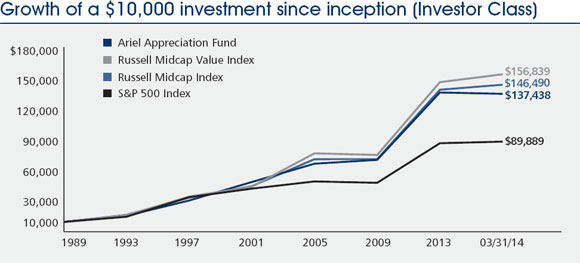

+The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. Notes: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell Midcap® Value Index measures the performance of mid-cap value companies with lower price-to-book ratios and lower forecasted growth values. The Russell Midcap® Index measures the performance of mid-cap companies. Russell® is a trademark of Russell Investment Group, which is the source and owner of the Russell Indexes’ trademarks, service marks and copyrights. The S&P 500® is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

INFLATION PREPARATION

| Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Focus Fund may be obtained by visiting our website, arielinvestments.com. |

DEAR FELLOW SHAREHOLDER:

For the first quarter ending March 31, 2014, Ariel Focus Fund had mixed performance. Specifically, it increased +2.11%, slightly behind the Russell 1000 Value Index’s +3.02% gain but just ahead of the broad market as measured by the S&P 500 Index’s +1.81% return. Positive contributions came from a broad array of names, with seven stocks increasing more than +7%. Only two stocks declined by more than –7%, namely International Game Technology (IGT) and Goldman Sachs Group, Inc. (GS), both of which will be discussed in this letter.

FIRST QUARTER PERFORMANCE

One pleasant surprise during the quarter was the strong absolute performance of our five health-care names: Johnson & Johnson (JNJ), Zimmer Holdings, Inc. (ZMH), Hospira, Inc. (HSP), Baxter Intl Inc. (BAX), and our newest holding, Laboratory Corp. of America Holdings (LH). The stock prices of these holdings increased an average of +5.44% during the quarter. Counterintuitively, uncertainty surrounding the Affordable Care Act seems to have boosted profits. Health-care management teams assert (and our independent research confirms) that concerns about the new law drove more patients into hospitals in the fourth quarter. Usually uncertainty decreases activity, but not this time. The result was significantly improved health-care fundamentals, including more orthopedic procedures such as hip and knee replacements.

Speaking of health care, one new name was added to the portfolio during the quarter, Laboratory Corp. of America Holdings. LabCorp is an operator of independent clinical laboratories performing health-care testing. Its testing facilities are located outside hospitals and boast a much lower cost structure than an in-house lab. Our investment thesis is simple: An aging population will require more medical tests. Meanwhile, curtailing health-care costs will continue to be of increasing importance. Our opportunity came when the first draft of the annual “Doc Fix” legislation, the law that sets Medicare reimbursement rates, called for big cuts in independent lab fees. LabCorp’s stock got hit, and we initiated a position.

A few of our holdings struggled during the quarter. Investment bank Goldman Sachs slid –7.25% during the quarter, largely because it had to revise its plan to return capital to shareholders. The Federal Reserve has instituted stress tests that limit Goldman’s ability to return capital to shareholders. In early 2014, it became apparent that the Fed would become even more strict than previously anticipated. Also, gaming manufacturer International Game Technology fell –22.00% after a subpar earnings report. Its revenue and earnings per share (EPS) both slid below consensus estimates. Specifically, revenues were 2% lower than Wall Street expected, while the (adjusted) EPS of $0.25 did not meet the $0.30 forecast. The miss came from weak regional gaming trends and higher-than-expected operating expenses.

POSITIONING FOR INFLATION

Given the relatively uneventful nature of the first quarter, the rest of this letter will address a subtle change in outlook. A core strategy of Ariel Focus Fund is to buy what others are selling. If, as portfolio manager, I believe investors are overly concerned with a particular risk, I often invest in companies whose stocks have been excessively punished. But I also invest in companies that stand to benefit from a risk that seems to be underestimated. Right now, a key underappreciated risk is inflation.

“One pleasant surprise during the quarter was the strong absolute performance of our five health-care names.”

I realize there are few signs of inflation today. In fact, new Federal Reserve Chair Janet Yellen says she is concerned about the opposite problem, deflation, since wage rates do not seem to be rising. Additionally, the U.S. manufacturing system currently has a great deal of capacity. Since the financial crisis, the Consumer Price Index has averaged +2.13%, or only half the long-term average since 1970. Finally, perhaps the best argument against being worried about inflation is that 10-year Treasury yields of 2.72% are near historic lows. I cannot imagine bond investors accepting that coupon rate if they were expecting inflation to rear its ugly head.

When many fear rising inflation, companies that benefit from higher prices see their shares spike. Obviously, given low concern regarding inflation, that has not happened in this market and, in fact, such companies have languished. Oil and gas companies have underperformed the market over the last 12 months. Fertilizer companies are trading as much as 40% below their early 2011 levels. Finally, the price of gold has dropped from more than $1,900 per ounce in 2011 to approximately $1,300 today, causing gold mining stocks to suffer.

“(We) invest in companies that stand to benefit from a risk that seems to be underestimated. Right now, a key underappreciated risk is inflation.”

As portfolio manager of Ariel Focus Fund, why am I now worried about inflation when the typical investor shows no concern? I was raised in Hyde Park, on the South Side of Chicago, where Nobel Prize–winning economist Milton Friedman was quoted as saying, “Inflation is always and everywhere a monetary phenomenon.” At the University of Chicago, he taught his students that inflation comes from a significant increase in the money supply. Moreover, a significant increase in the money supply always leads to inflation. Recently we have witnessed an unprecedented increase in the money supply through $3 trillion of Federal Reserve Quantitative Easing. Therefore, according to Friedman, inflation is coming—it is simply a matter of time.

“It would be one thing if the United States was the only country to have inflationary policies, but easy money is a global phenomenon.”

It would be one thing if the United States was the only country to have inflationary policies, but easy money is a global phenomenon. We seem to be witnessing a global currency devaluation competition in which three of the world’s largest economies (the United States, China and Japan) are racing to see which country can devalue its currency the most quickly. The European Union, anxious to reduce unemployment by increasing exports, stands to finish just out of the medals in these liquidity Olympics.

As Warren Buffett has counseled, be fearful when others are greedy and greedy only when others are fearful. Today, market participants have little fear over inflation, which makes me especially nervous in light of the inflationary policies noted above. In contrast, I remain cautiously optimistic about the economy. The portfolio reflects these views. More than 20% of Ariel Focus Fund assets are invested in companies that I believe stand to benefit directly from inflation. That is, 16% of the portfolio is invested in natural resources exploration and services companies. Fertilizer company Mosaic Co. (MOS) represents 3% of the portfolios’ assets. The newest holding (purchased in April) is Barrick Gold Corp. (ABX), the largest gold mining company in the world. All of the aforementioned names are leading companies with strong balance sheets that stand to have reasonable fundamentals if inflation remains low; conversely, I think they will outperform if inflation spikes.

“We seem to be witnessing a global currency devaluation competition in which three of the world’s largest economies are racing to see which country can devalue its currency the most quickly.”

PORTFOLIO COMINGS AND GOINGS

During the quarter, we added two new positions and eliminated two in Ariel Focus Fund. As mentioned above, we purchased a previous Ariel holding, LabCorp. We also initiated a position in Telephone & Data Systems, Inc. (TDS), a telecom company. Telephone & Data Systems provides telephone and television service to approximately 5.9 million customers nationwide, using both wireless and landline connections. We exited both DeVry Inc. (DV) and First American Financial Corp. (FAF) in order to pursue more compelling opportunities.

We appreciate your consideration and the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

| Sincerely, | |

| |

| |

| Portfolio manager | |

| | | |

TURTLE TIME WITH CHARLIE TURTLE TIME WITH CHARLIE | |

| | | |

| | Please join us on Tuesday, June 24, at 10am CST, as Charles K. Bobrinskoy responds to your investment questions in an hour-long Q&A session. Register now at arielinvestments.com/turtle-time. | |

| | | |

| | Ariel Focus Fund performance summary | |

| | | |

| | | |

Charles K. Bobrinskoy

Portfolio manager

Composition of equity holdings (%)

| | | | | | | |

| | | | | Russell | | |

| | | Ariel | | 1000 | | S&P |

| | | Focus | | Value | | 500 |

| | | Fund† | | Index | | Index |

| Energy | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Technology | | 14.11 | | 8.48 | | 16.04 |

Consumer staples | | 4.15 | | 5.40 | | 8.49 |

| Materials & processing | | 3.23 | | 3.07 | | 3.93 |

| Utilities | | 1.68 | | 8.60 | | 5.52 |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

Average annual total returns as of 03/31/14

| | | | | | |

| | | | | | Since |

| | | 1-year | 3-year | 5-year | inception |

Ariel Focus Fund–Investor Class | + 2.11% | + 24.86% | + 12.87% | + 21.34% | + 5.99% |

Ariel Focus Fund–Institutional Class+ | + 2.11 | + 25.14 | + 13.07 | + 21.47 | + 6.05 |

Russell 1000® Value Index | + 3.02 | + 21.57 | + 14.80 | + 21.75 | + 6.98 |

| + 1.81 | + 21.86 | + 14.66 | + 21.16 | + 7.55 |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com.

| | | |

| Expense ratio (as of 09/30/13)* | Investor Class | Institutional Class |

| Net | 1.25% | 1.00% |

| Gross | 1.54% | 1.19% |

Top ten equity holdings (% of net assets) |

| 1. | International Business Machines Corp. | |

| 2. | Microsoft Corp. | |

| 3. | Lockheed Martin Corp. | 5.2 |

| 4. | National Oilwell Varco | 5.0 |

| 5. | Western Union Co. | 4.8 |

| 6. | DIRECTV | 4.8 |

| 7. | Stanley Black & Decker, Inc. | 4.6 |

8. | Exxon Mobil Corp. | 4.3 |

| 9. | CVS Caremark Corp. | 4.0 |

| 10. | Johnson & Johnson | 3.7 |

+The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees.

*Effective February 1, 2014, Ariel Investments, LLC, the Adviser, has contractually agreed to waive fees and reimburse expenses in order to limit Ariel Focus Fund’s total annual operating expenses to 1.00% of net assets for the Investor Class and 0.75% of net assets for the Institutional Class through the end of the fiscal year ending September 30, 2016. Through January 31, 2014, the Expense Cap was 1.25% for the Investor Class and 1.00% for the Institutional Class.

Notes: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 1000® Value Index measures the performance of large-cap value companies with lower price-to-book ratios and lower expected growth values. Russell® is a trademark of Russell Investment Group, which is the source and owner of the Russell Indexes’ trademarks, service marks and copyrights. The S&P 500® is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index.

INCENTIVES DRIVE BEHAVIOR

| |

Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Discovery Fund may be obtained by visiting our website, arielinvestments.com. |

DEAR FELLOW SHAREHOLDER:

Ariel Discovery Fund essentially broke even in the first quarter of 2014, falling by -0.66% during a volatile period for U.S. equities. This result was 244 basis points behind that of our primary benchmark, the Russell 2000 Value Index, which gained +1.78%. That modest shortfall came roughly equally from the Energy and Producer Durables sectors, with no individual name having an outsized effect on performance in either direction.

Ariel Discovery Fund results ended December 31, 2014

| | | | | | | | | | | | | |

| | | | | | 1-year | | | 3-year | | | Since inception | |

| Ariel Discovery Fund | | - 0.66% | | | + 16.35% | | | + 10.04% | | | + 10.63% | |

Russell 2000® Value Index | | + 1.78 | | | + 22.65 | | | + 12.74 | | | + 14.32 | |

S&P 500® Index | | + 1.81 | | | + 21.86 | | | + 14.66 | | | + 15.09 | |

One point I would like to stress is that after 30 years in the business, I have come to understand that short-term results have almost no correlation with the value of the work done in that period. This is especially true, given that our expected holding period is minimally three to five years.

More importantly, the quality of work done by our team this quarter was the best ever. After such strong gains in 2013, I believed it critical to be even more on top of company fundamentals, and to re-double our communications with portfolio management teams. The number of in-person meetings this quarter was easily the highest in my career, and the rigorous debate among team members on existing and potential positions was the best yet. We expect this work to drive performance in the future.

During the quarter, the fund reached its three-year anniversary. The rocky start during the first few months of 2011 continues to weigh on our long-term relative results. Given our deep value strategy, which focuses on seeking a “margin of safety,”* we are not surprised to lag what has been a strong market with few exceptions since inception. We believe that the portfolio is well-positioned going forward, with a collection of attractive investments trading well below our average estimate of intrinsic value.

* Attempting to purchase with a margin of safety on price cannot protect investors from the volatility associated with stocks, incorrect assumptions or estimations on our part, declining fundamentals or external forces.

Top performers for the quarter included Imation Corp. (IMN), gaining +23.29%, Callaway Golf Co. (ELY), which returned +19.60% before our sale, and Emergent BioSolutions Inc. (EBS), up +19.14% before it was also sold. On the downside, XO Group Inc. (XOXO) lost -31.76%, Spartan Motors Inc. (SPAR) fell by -23.28%, and Mitcham Industries, Inc. (MIND) was down -21.29%.

IF WE COULD OWN JUST ONE STOCK, WHAT WOULD IT BE?

A number of investment websites and magazines ask managers this question. Since 2011, we have been using our first-quarter letter to respond, because while we would never invest that way, a detailed answer effectively illustrates the characteristics we seek in our portfolio holdings.

As deep value investors, we look for underfollowed and misunderstood companies trading at prices that have the potential to provide a “margin of safety” to buyers. We seek protection in asset values, with an emphasis on strong balance sheets. We also want to be invested alongside talented and properly incentivized leadership, and we look to identify upside potential from underappreciated opportunities. Today, the holding that best embodies these traits is Cowen Group, Inc. (COWN).

“…we seek companies with significant and widespread insider ownership, pay packages that reward long-term value creation, and talented managers and strong boards.”

First of all, we believe this company with roughly a $500 million market capitalization is clearly ignored and misunderstood. Followed by only two sell-side analysts, Cowen is commonly thought of as a troubled, sub-scale investment bank and broker dealer. However, Cowen Group was actually formed when Cowen Holdings, a boutique investment bank, was purchased by then privately held asset manager Ramius LLC in 2009. The Cowen brand remains, but top management comes primarily from Ramius. Founded in 1994, Ramius is a highly respected alternative asset manager with nearly $10 billion in assets under management and an outstanding long-term track record.

When we uncover a potential deep value investment, the first step in our research process is to examine the corporate governance and insider ownership profile. We obviously favor talented leadership, but we also believe that incentives drive behavior. Therefore, we seek companies with significant and widespread insider ownership, pay packages that reward long-term value creation, and talented managers and strong boards.

Cowen fits this bill as well as any company we own, with extraordinary leadership starting at the top from CEO Peter Cohen, who led Shearson Lehman from 1983 to 1990. He and his team collectively own roughly 15% of the company, clearly aligning their incentives with ours. Ramius Chair and Cowen Group Vice Chair Thomas Strauss rose to President of Salomon Brothers in 1986. Jeff Solomon, an original Ramius executive, is now leading Cowen & Co., the investment bank and brokerage arm, while Michael Singer joined in 2012 from Third Avenue Management to lead Ramius. This is a savvy team with decades of experience on both sides of the business. We have been extraordinarily impressed with them in our series of meetings and calls over the past few years, as well as by the actions they have taken to build the business to maximize shareholder value.

Two recent decisions highlight this astute decision-making. The first was last year’s acquisition of Dahlman Rose, which added highly respected energy and resource expertise to the research and investment banking teams of Cowen & Co. The second was the hiring of Jake Walthour as Vice Chairman of New Business and Product Development for Ramius. Part of Jake’s mandate is to find emerging, minority and women-owned alternative managers to add to Ramius’s platform. Many pension plans, particularly in the public sector, have the desire and even the mandate to identify emerging managers. Recent studies show that such managers in the alternative world outperform their more established peers1, yet they are often limited by their ability to create the infrastructure needed to win significant business. Ramius is unique among its peers in that its platform is built perfectly to work with small, talented managers, providing them with operational, legal and marketing expertise, while allowing them to focus on their investment disciplines. Although we have not modeled in any value for this Diversity and Emerging Fund Platform, it could provide a nice addition to assets under management over time.

The combination of the two entities created a firm that now has three profit centers: asset management, a research-driven investment bank and invested firm capital. Ramius’s business model is highly scalable; it could manage at least $20 billion on its current platform. With product lines such as US Small-Cap Activism, Global Long/Short Credit, Healthcare Royalties, and Real Estate and Alternative Solutions, Ramius has an attractive and diverse platform. A very significant portion of the firm’s highly liquid balance sheet is invested alongside clients; since 1999, Ramius has generated a roughly 15% return on equity on internal capital. And finally, Cowen & Co. looks to have executed an impressive turnaround under Jeff Solomon’s leadership and is well-positioned to serve active investment managers and growth companies with a vastly improved cost structure and complete product offering.

“…short-term results have almost no correlation with the value of the work done in that period.”

Finally, we see significant upside potential in Cowen Group stock. We believe that the broker-dealer’s troubles prior to and during the financial crisis, and the tough decisions necessary to turn it around, have caused investors to lose sight of the intrinsic value of the rest of company. We value Cowen Group on a sum-of-the-parts basis, using a percentage of assets under management for Ramius and a multiple of tangible book value for the broker-dealer. On top of that, there is a deferred tax asset potentially worth more than $100 million from net operating loss carryforwards. Even if we assume no value for the tax asset, we arrive at an intrinsic value well above current quotes. As we now believe the firm is poised for consistent profitability, the value of the business should become evident, and the tax asset should also start to be realized.

Therefore, we believe Cowen Group offers terrific upside potential and meaningful asset-based downside protection. So, if we could only own one stock, today it would be Cowen Group.

PORTFOLIO COMINGS AND GOINGS

We eliminated three holdings during the quarter. Callaway Golf, Tessera Technologies Inc. (TSRA), and Emergent BioSolutions were each sold as they essentially reached our estimates of fair value. We also added two new positions, thereby ending the first quarter with 36 companies in Ariel Discovery Fund’s portfolio:

Orion Energy Systems, Inc. (OESX) – Based in Manitowoc, Wisconsin, Orion is a company we have owned in our micro-cap strategy since 2009, and one that we had previously owned in Ariel Discovery Fund. Under the leadership of John Scribante, appointed CEO in 2012, this maker of energy-efficient lighting has made dramatic improvements in both its cost structure and product lineup. With a clean balance sheet, an underutilized plant providing a runway for growth and a new market in the form of LED lighting to pursue, we are very optimistic about Orion’s prospects.

Century Casinos, Inc. (CNTY) – Based in Colorado Springs, Century is a regional operator of domestic and international casinos. Trading just above its book value, Century has significant earnings potential from its operations in Poland and an under-construction racino (horse racing track/casino combination) with a prime location in Calgary. Co-CEOs who have worked together effectively for years and who each own more than 5% of the company add to our enthusiasm for this new holding.

We appreciate your consideration and the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

Sincerely,

David M. Maley

Lead portfolio manager

1 Ramius; Barclays Hedge Fund Pulse, Affirmative Investing: Women and Minority Hedge Funds, June 2011; Rothstein Kass, Women in Alternative Investments, June 2013.

| | | |

| | Ariel Discovery Fund performance summary | |

| | | |

| | | |

|  |

| David M. Maley | |

Lead portfolio

manager | Portfolio

manager |

Composition of equity holdings (%) | | | | | | | |

| | | | | |

| | Ariel Discovery | Russell 2000 Value Index | | S&P 500 Index |

| Technology | | | 9.76 | | | | |

| Financial services | | | | | | | |

| Producer durables | | | | | | | |

| | | | | | | |

| Energy | | | | | | | |

| Materials & processing | | | | | | 3.93 | �� |

| | | | | | | |

| Health care | | | | | | | |

| Consumer staples | 0.00 | | | | | 8.49 | |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

| Average annual total returns as of 03/31/14 |

| | | | | |

| | | | | Since |

| | Quarter | 1-year | 3-year | inception |

Ariel Discovery Fund– Investor Class | | | | |

Ariel Discovery Fund– Institutional Class+ | | | | |

Russell 2000® Value Index | + 1.78 | | | |

| + 1.81 | | | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com.

Expense ratio (as of 09/30/13)* | Investor Class | Institutional Class |

| Net | 1.50% | 1.25% |

| Gross | 2.90% | 1.93% |

Top ten equity holdings (% of net assets) |

| 1. | Contango Oil & Gas Co. | |

| 2. | | |

| 3. | | |

| 4. | First American Financial Corp. | |

| 5. | | |

| 6. | International Speedway Corp. | |

| 7. | | |

| 8. | | |

| 9. | | |

| 10. | | |

+The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees.

*Effective February 1, 2014, Ariel Investments, LLC, the Adviser, has contractually agreed to waive fees and reimburse expenses in order to limit Ariel Discovery Fund’s total annual operating expenses to 1.25% of net assets for the Investor Class and 1.00% for the Institutional Class through the end of the fiscal year ending September 30, 2016. Through January 31, 2014, the Expense Cap was 1.50% for the Investor Class and 1.25% for the Institutional Class.

Notes: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. Russell® is a trademark of Russell Investment Group, which is the source and owner of the Russell Indexes’ trademarks, service marks and copyrights. The S&P 500® is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index.

TODAY’S BARGAINS: TRADITIONAL TECHNOLOGY

| |

Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains and represents returns of the Investor Class shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel International Fund and Ariel Global Fund may be obtained by visiting our website, arielinvestments.com. |

DEAR FELLOW SHAREHOLDER:

Global equity markets slowed down in the first quarter of 2014, which was of some relief to us. As you know, we are independent thinkers who focus intently on valuation, so when strong 2012 returns became an ebullient 2013 campaign, we became more skeptical looking forward. We welcomed the deceleration, during which the broad global indexes gained less than 2%. Our portfolios outperformed. Specifically, Ariel International Fund returned +2.18%, nicely ahead of the MSCI EAFE Index, which moved +0.77%, while Ariel Global Fund gained +2.50%, topping the MSCI ACWI Index, which went up +1.21%.

Since our international and global portfolios debuted at the end of December 2011, I have had the opportunity to present our investment process and philosophy to investors in great detail. Building a track record for the long run takes patience and discipline. Previously, we have emphasized our commitment to bottom-up stock-picking but have noted that bargains often cluster—sometimes by country, sometimes by sector, and in other various ways. For instance, in the second quarter of 2013, we wrote about our relatively heavy investments in Japan, and the next quarter, we wrote about health-care stocks. This quarter, we are writing about the technology area, in which we currently have a significant weighting.

In technology stocks, we are not making a sector bet. Rather, we perceive a valuation bifurcation within the sector that we believe has produced heavy risk in some stocks and opportunities in others. At first glance, one might think this stance runs parallel to the one in health-care stocks (which persists). While there are similarities, we think the differences are greater and more important.

One clear similarity between our tech and health-care holdings nicely illustrates our philosophy: Overall, our weightings are quite substantial when compared to the benchmarks. Unlike many practitioners, we do not start with an index’s sector weightings and adjust them up and down based on macroeconomic factors. Rather, we buy specific stocks within a sector to an appropriate investment level—on a risk/reward basis—and only constrain once the weighting becomes quite heavy. For example, our health-care weightings fall between 11% in the developed market portfolio and 21% in the global portfolio. The global portfolio weighting is 10 percentage points higher than the benchmark or roughly twice as high. Meanwhile, our technology weights fall between 15% in the developed markets portfolio and 21% in the global portfolio, where the weighting is 8 percentage points higher than the benchmark. Although the absolute weighting in technology stocks is lowest in the developed markets portfolio, our weighting is more than triple the index’s exposure of less than 5%. While some view such positions as risky on a relative performance basis, we view them as prudent on an absolute risk/reward investment basis.

“…we perceive a valuation bifurcation within the sector that we believe has produced heavy risk in some stocks and opportunities in others.”

Another parallel between the technology and health-care areas is their historical association with growth investing. Health-care stocks have generally, although not currently, had heavier weightings in growth indexes than in value benchmarks. This is even more true of technology stocks. Over long periods, investors have expected faster growth from tech firms than companies in other areas such as utilities, energy and financial services. While we do admire future growth, we do not think our style is “drifting” with these exposures, since we view every opportunity as a mix of current valuation and future expected growth. Sometimes an area with strong secular growth prospects appears cheap on a valuation basis, while other times it seems expensive relative to its likely future. In the case of the former, we are happy to invest a significant amount; that does not mean, however, that we have changed our stripes or adopted a new philosophy.

That statement brings us to the most significant difference between our current interest in technology and health care. As detailed six months ago, the market broadly concluded health-care companies were not growing as swiftly as they once did, causing valuations to fall across the sector. Something very different has happened in the technology sector. That is, expectations for certain technology companies are extremely high, while other technology companies reflect low growth assumptions. In other words, sometimes we find opportunities when investors give up on a broad area; other times, we find opportunities when the crowd gravitates toward one industry and ignores similar ones.

“…we view every opportunity as a mix of current valuation and future expected growth.”

The market’s current darlings are the recently public social media firms. To be sure, Facebook Inc., Twitter Inc., LinkedIn Corp., and Yelp Inc. have been as remarkable and game-changing as the Internet blue chips from years past: Amazon. com, Inc., eBay Inc., and Google Inc. are obvious examples. Investors, however, have historically shown a suspect ability to separate such long-term winners from those that fail to live up to expectations. Remember Pets.com, theglobe.com, Inc., and Webvan? They, too, once traded at sky-high valuations along with the eventual Internet blue chips but did not pan out.

“When we see valuations spike on exciting but unproven companies, we become nervous.”

When we see valuations spike on exciting but unproven companies, we become nervous. Because some of today’s favorites are not yet profitable, we will use an Enterprise Value/Sales ratio1 to sketch their valuations: LinkedIn trades at 15.6x; Facebook at 16.3x, Yelp at 19.3x, and Twitter at a remarkable 51.5x. Were a larger company to acquire one of these companies at the market price, it would pay, on average, $22 for every $1 of revenue the company produced over the last year. Again, that is not $22 per every $1 of profit, but for every dollar of revenue. True, it is possible that such companies will grow fast and far enough to justify current valuations. That said, at those valuations, the risk/ reward tradeoff more closely resembles speculation than it does prudent investing.

The good news is that within the same broad technology area, other companies are trading very cheaply on the same metrics. Moreover, these are not new, unproven companies. Rather, they are global titans with robust cash flows, diversified product offerings, and strong market positions—names such as Microsoft Corp., Nokia Corp. and Broadcom Corp. These are the types of companies that compose the significant technology weightings in our portfolios. The companies listed on the following page, the technology companies in our global portfolio, have an average enterprise value/sales ratio of just 2.6x. Based on this one metric, they would cost a hypothetical acquirer roughly one tenth as much as the popular social media companies mentioned on the previous page:

Ariel global technology holdings as of March 31, 2014

| | | |

| Company | EV/Sales | |

| Canon Inc. | 0.8x | | |

| Nokia Corp. | 1.0x | | |

| QLogic Corp. | 1.2x | | |

| NVIDIA Corp. | 1.3x | | |

| Nintendo Co., Ltd | 1.4x | | |

| Tokyo Electron Ltd. | 1.7x | | |

| Broadcom Corp. | 1.7x | | |

| Dialog Semiconductor plc | 1.7x | | |

| EMC Corp. | 2.1x | | |

| Global Payments Inc. | 2.3x | | |

| Microsoft Corp. | 3.0x | | |

| TIBCO Software Inc. | 3.1x | | |

| Ruckus Wireless, Inc. | 3.8x | | |

| Baidu, Inc. | 11.2x | | |

| Average | 2.6x | | |

As investors who consider both risk and reward in assembling a portfolio, we strongly favor these time-tested companies with strong business models, defensible market positions and relatively low valuations to today’s high flyers. Moreover, we believe the near frenzy around today’s social media darlings has helped make traditional technology companies seem less interesting and exciting—and cheap. To be clear, however, we are not simply making a “bet” on established technology companies and eschewing the new ones. Rather, within the cheaper end of the technology space, we have found a fairly large number of specific companies that are good risk/reward tradeoffs at current valuations.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

Sincerely,

Rupal J. Bhansali

Portfolio manager

1The Enterprise Value/Sales valuation ratio compares a company’s overall enterprise value (equity plus debt) to its sales (or revenues). The metric is quite useful when assessing a company’s valuation in the event of an acquisition. In a takeover, the acquirer would need to not only purchase the equity but also cover the debt. Sales or revenues are often used when a company is young or unprofitable.

| | | |

| | Ariel International Fund performance summary | |

| | | |

| | | |

Rupal J. Bhansali

Portfolio manager

Composition of equity holdings1 (%)

| | | | |

| | Ariel International Fund† | | MSCI EAFE Index |

| 18.80 | | | 25.56 | |

| Information technology | 16.40 | | | 4.53 | |

| Consumer discretionary | 16.12 | | | 11.76 | |

| Consumer staples | 13.50 | | | 10.99 | |

| Health care | 11.54 | | | 10.44 | |

| Telecommunication services | 8.43 | | | 4.96 | |

| Energy | 6.78 | | | 6.90 | |

| Utilities | 3.84 | | | 3.76 | |

| 2.85 | | | 12.95 | |

| Materials | 1.74 | | | 8.14 | |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

1 The sectors above are the Global Industry Classification Standard (“GICS”) sector classifications. GICS was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Ariel Investments, LLC. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

Average annual total returns as of 03/31/14

| | | | | | | | |

| | | | Quarter | | 1-year | | Since inception |

Ariel International Fund– Investor Class | | | + 2.18 | % | | + 24.07 | % | | + 14.05 | % |

Ariel International Fund– Institutional Class | | | + 2.29 | | | + 24.26 | | | + 14.33 | |

MSCI EAFE® Index | | | + 0.77 | | | + 18.06 | | | + 18.47 | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com.

Expense ratio (as of 09/30/13)* | Investor Class | Institutional Class |

| Net | 1.40% | 1.15% |

| Gross | 9.36% | 6.53% |

Top ten companies^ (% of net assets)

| 1. | | 4.9 |

| 2. | | 4.7 |

| 3. | | 4.6 |

| 4. | | 4.5 |

| 5. | | 3.6 |

| 6. | | 3.4 |

| 7. | | 3.2 |

| 8. | | 3.2 |

| 9. | | 3.1 |

| 10. | | 3.0 |

^For the purposes of determining the Fund’s top ten companies, securities of the same issuer are aggregated.

Country weightings (%)

| Japan | 18.43 | |

| U.K. | 18.18 | |

| Switzerland | 15.08 | |

| Germany | 9.25 | |

| 6.70 | |

| Netherlands | 5.27 | |

| 5.02 | |

| Italy | 5.00 | |

| U.S. | 3.72 | |

| Finland | 3.54 | |

| Ireland | 2.49 | |

| 1.45 | |

| 1.29 | |

| 1.08 | |

| 1.07 | |

| 0.76 | |

| 0.61 | |

| 0.41 | |

| 0.33 | |

| 0.17 | |

| Australia | 0.15 | |

*Effective February 1, 2014, Ariel Investments, LLC, the Adviser, has contractually agreed to waive fees and reimburse expenses in order to limit Ariel International Fund’s total annual operating expenses to 1.25% of net assets for the Investor Class and 1.00% for the Institutional Class through the end of the fiscal year ending September 30, 2016. Through January 31, 2014, the Expense Cap was 1.40% for the Investor Class and 1.15% for the Institutional Class.

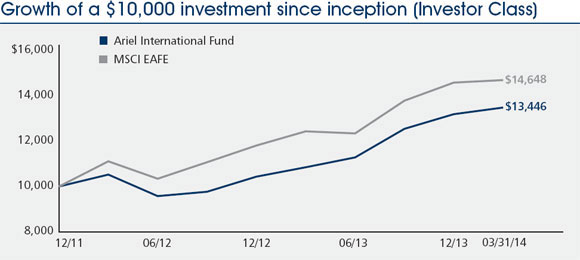

Notes: The performance table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. MSCI EAFE® Index is an unmanaged, market weighted index of companies in developed markets, excluding the U.S. and Canada. An investor cannot invest directly in an index.

| | | |

| | Ariel Global Fund performance summary | |

| | | |

| | | |

Rupal J. Bhansali

Portfolio manager

Composition of equity holdings1 (%)

| | | |

| | Ariel Global Fund† | MSCI ACWI Index |

| 21.72 | | 10.65 | |

| Information technology | 20.51 | | 12.67 | |

| Financials | 14.80 | | 21.53 | |

| Consumer discretionary | 12.82 | | 11.65 | |

| Consumer staples | 10.82 | | 9.69 | |

| Telecommunication services | 6.36 | | 3.90 | |

| Energy | 5.61 | | 9.66 | |

| Industrials | 3.69 | | 10.84 | |

| Materials | 1.92 | | 6.13 | |

| Utilities | 1.54 | | 3.29 | |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

1 The sectors above are the Global Industry Classification Standard (“GICS”) sector classifications. GICS was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by Ariel Investments, LLC. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

Average annual total returns as of 03/31/14

| | | | | | | | |

| | | | Quarter | | 1-year | | Since inception |

Ariel Global Fund–Investor Class | | | + 2.50 | % | | + 21.21 | % | | + 15.44 | % |

Ariel Global Fund–Institutional Class | | | + 2.54 | | | + 21.62 | | | + 15.76 | |

MSCI ACWISM Index | | | + 1.21 | | | + 17.17 | | | + 18.27 | |

Performance data quoted represents past performance and does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com.

| Expense ratio (as of 09/30/13)* | Investor Class | Institutional Class |

| Net | 1.40% | 1.15% |

| Gross | 5.37% | 2.51% |

Top ten companies^ (% of net assets)

| 1. | | 5.4 |

| 2. | | 4.9 |

| 3. | | 4.8 |

| 4. | | 4.8 |

| 5. | Harman Intl Industries Inc. | 3.8 |

| 6. | | 3.5 |

| 7. | | 3.5 |

| 8. | | 3.4 |

| 9. | | 3.2 |

| 10. | | 2.9 |

^ For the purposes of determining the Fund’s top ten companies, securities of the same issuer are aggregated.

Country weightings (%)

| U.S. | 44.53 | |

| U.K. | 11.06 | |

| Switzerland | 9.62 | |

| 9.43 | |

| Germany | 4.99 | |

| China | 4.55 | |

| Netherlands | 3.68 | |

| France | 3.41 | |

| 1.77 | |

| 1.75 | |

| Italy | 1.54 | |

| Spain | 1.14 | |

| Hong Kong | 0.65 | |

| 0.54 | |

| 0.38 | |

| 0.33 | |

| Sweden | 0.25 | |

| 0.20 | |

| 0.18 | |

*Effective February 1, 2014, Ariel Investments, LLC, the Adviser, has contractually agreed to waive fees and reimburse expenses in order to limit Ariel Global Fund’s total annual operating expenses to 1.25% of net assets for the Investor Class and 1.00% for the Institutional Class through the end of the fiscal year ending September 30, 2016. Through January 31, 2014, the Expense Cap was 1.40% for the Investor Class and 1.15% for the Institutional Class.

Notes: The performance table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. MSCI ACWI (All Country World Index) IndexSM is an unmanaged, market weighted index of global developed and emerging markets. An investor cannot invest directly in an index.

Coach, Inc. (NYSE: COH)

516 West 34th Street

New York, NY 10001

212.594.1850 | coach.com

Seventy-three years ago, Coach, Inc. (COH) began as a Manhattan-based family-operated producer of small handmade leather goods. It has since evolved into a leading, internationally-recognized, American designer of luxury leather bags, shoes, wallets and other accessories that are best known for their classic style, high quality, and excellent craftsmanship. Currently, Coach is undergoing a transformation from an international handbag and accessories brand into a global lifestyle brand, anchored in accessories—a brand that will encompass a full head-to-toe-expression of the Coach woman and man— which should invigorate the brand and bolster future sales.

PREMIUM LUXURY AT AFFORDABLE PRICES