As filed with the Securities and Exchange Commission on May 18, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-4786

Ariel Investment Trust

(Exact name of registrant as specified in charter)

200 East Randolph Drive

Suite 2900

Chicago, Illinois, 60601

(Address of principal executive offices) (Zip code)

Mareile Cusack

200 East Randolph Drive

Suite 2900

Chicago, Illinois 60601

(Name and address of agent for service)

with a copy to:

Arthur Don, Esq.

Greenberg Traurig, LLP

77 West Wacker Drive

Suite 3100

Chicago, IL 60601

Registrant's telephone number, including area code: (312) 726-0140

Date of fiscal year end: September 30, 2012

Date of reporting period: March 31, 2012

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”) (17 CFR 270.30e-1)

| | One of Ariel Investments’ guiding principles is to communicate openly with our shareholders so they may gain a clear understanding of our investment philosophy, portfolio decisions and results, as well as our opinions on the underlying market. In reviewing the materials contained in The Patient Investor, please consider the information provided on this page. While our investment decisions are rooted in detailed analysis, it is important to point out that actual results can differ significantly from those we seek. We candidly discuss a number of individual companies. Our opinions are current as of the date they were written but are subject to change. We want to remind investors that the information in this report is not sufficient on which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security. Ariel Fund, Ariel Appreciation Fund and Ariel Discovery Fund invest primarily in small and/or midsized companies. Investing in small and mid-cap stocks is riskier and more volatile than investing in large cap stocks, in part because smaller companies may not have the scale, depth of resources and other assets of larger firms. Ariel Fund and Ariel Appreciation Fund often invest a significant portion of their assets in companies within the consumer discretionary and financial services sectors and their performance may suffer if these sectors underperform the overall stock market. Ariel Focus Fund invests in large-capitalization stocks and is a non-diversified fund, which means its investments are concentrated in fewer names than diversified funds. Ariel Focus Fund generally holds 25-30 stocks and therefore may be more volatile than a more diversified investment. Equity investments are affected by market conditions. Ariel International Equity Fund and Ariel Global Equity Fund invest in foreign securities and may use currency derivatives and ETFs. Investments in foreign securities may underperform and may be more volatile than comparable U.S. stocks because of the risks involving foreign economies and markets, foreign political systems, foreign regulatory standards, foreign currencies and taxes. The use of currency derivatives and ETFs may increase investment losses and expenses and create more volatility. Investments in emerging and developing markets present additional risks, such as difficulties selling on a timely basis and at an acceptable price. The Ariel International Equity Fund and the Ariel Global Equity Fund are new with no operating history and there can be no assurance that they will grow to economically viable sizes. Investors should consider carefully the investment objectives, risks, and charges and expenses before investing. For a current summary prospectus or full prospectus which contains this and other information about the Funds offered by Ariel Investment Trust, call us at 800.292.7435 or visit our website, arielinvestments.com. Please read the summary prospectus or full prospectus carefully before investing. Distributed by Ariel Distributors, LLC, a wholly owned subsidiary of Ariel Investments, LLC. ARIEL INVESTMENT TRUST

c/o U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701

800.292.7435 | arielinvestments.com | |

Turtle Talk Lipper ranks Ariel Fund #1 in the mid-cap core category*

2012 is off to a great start with our domestic portfolios strongly outperforming their benchmarks, landing well within the top 10% of their Lipper categories. Following a very difficult investment environment that began in 2008, we are pleased that Ariel Fund ranks #1 out of 268 funds in the mid-cap core category for the three-year period ending March 31, 2012. During the same period, Lipper ranks Ariel Appreciation Fund #5 out of 620 funds in the multi-cap core category, and Ariel Focus Fund ranks #34 out of 469 in the large-cap value category. While these short-term returns are encouraging, as patient investors we continue to focus on the long term. Therefore, it is rewarding to see that since its inception through March 31, 2012, Ariel Fund ranks #3 out of just 10 mid-cap core funds. With only 10 funds with histories long enough to date back to Ariel Fund’s November 6, 1986 inception, our position within this group is certainly a testament to our patient approach to investing.

*Past performance is no guarantee of future results. Lipper, Inc. is a nationally recognized organization that reports performance and calculates rankings for mutual funds. Each fund is ranked within a universe of funds with similar investment objectives. Ranking is based on total returns. The rankings above are for the Investor Class shares of Ariel Fund, Ariel Appreciation Fund and Ariel Focus Fund.

| | Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Fund and Ariel Appreciation Fund may be obtained by visiting arielinvestments.com. | |

Dear Fellow Shareholder: For the first quarter ended March 31, 2012, Ariel Fund (Investor Class) rose +14.57% versus +11.52% for the Russell 2500 Value Index, +11.59% for the Russell 2000 Value Index and +12.99% for the Russell 2500 Index. Ariel Appreciation Fund (Investor Class) surged 16.25% during the first quarter versus +11.41% for the Russell Midcap Value Index and +12.94% for the Russell Midcap Index. Across the board, stocks were strong as also evidenced by the broad market—the S&P 500 Index rose +12.59% during the three-month period. While some find the best first quarter in 14 years noteworthy, we are most struck by the fact that these returns come on the heels of an equally impressive fourth quarter when the S&P 500 Index jumped +11.82% and our own portfolios saw returns in the high teens.

Against this backdrop, the market has totally reversed course after the precipitous drop last Fall when fears of a double dip recession ensued following the U.S. debt downgrade and the 2.0 version of Europe’s sovereign debt crisis. As Barron’s wisely noted, “the first quarter’s resounding rally was really just a repudiation of last year’s recession fears…the 50 S&P 500 stocks that fared the worst in 2011 rebounded +23.8% in the first quarter, while the 50 that held up the best climbed just +10.5%…And the most heavily shorted posse jumped +18.1%, while the least-reviled group gained just +9.7%.”1 In Ariel Fund, our most downtrodden financial services names have morphed into our very best performers—not surprising since these high-quality gems were dramatically oversold six months ago. In Ariel Appreciation Fund, the health care and financial stocks that were indiscriminately punished are now leading the pack with stellar returns. And although consumer stocks were the top performers in the Russell 2000 Value and Russell 2500 Value indices and the second best performing group in the Russell Midcap Value Index during the first quarter, our consumer names were our weakest contributors—mostly because they held up better during last year’s market lows.

Triple Play

Recently, the Los Angeles Dodgers sold for an eye-popping $2 billion to a consortium including Magic Johnson. The final figure exceeded all expectations—more than double the price the Chicago Cubs fetched in 2009. At one point in time, that bid might have seemed like a huge stretch. But today it says a lot about the immense value of television rights. After all, the Dodgers auction came shortly after Matt Kemp appeared on the cover of Forbes in an article that connected his $160 million contract to a regional sports network deal likely to be worth $3.5 billion over 20 years. The relationship between money and sports has a storied history that is constantly shifting. Even though the business of sports inevitably attracts an abundance of attention given its larger-than-life athletes and wealthy owners, as value investors, we have been able to identify some unique investment opportunities (directly and indirectly related to sports) that play to our strengths and land squarely within our circle of competence.

| | | |

| The Patient Investor March 31, 2012 | 2 | Slow and Steady Wins the Race |

The key to our enthusiasm derives from the fact that sports sits in the sweet spot of technology, media and even real estate. While we have never professed any high-tech expertise, there is no question that recent breakthroughs have made sports more ubiquitous in the last few years. Television, cable and satellite mean more games are available than ever before. Not to mention, watching them in high definition (HD) vastly improves the product. At one time a simple score would suffice but with the proliferation of mobile devices like smart phones, tablets and laptops, devoted fans can now travel the world following their favorite teams live.

When we invest, we are constantly looking for businesses with wide moats that make it hard for new competition to break in. This is where we get excited since sports are somewhat insulated from the disruptive forces that have made some media cash cows less profitable. In television, the DVR has wreaked havoc on traditional advertising. Instead of watching commercial after commercial during our favorite shows, we fast forward through the ads with remote in hand. This phenomenon does not exist with sports because fans prefer to watch games live. Also, while many turn to the Internet to get free news and entertainment—people are willing to pay for sports. We buy pricey tickets to see games in person and are even willing to pay to watch athletes play on TV. For example, it is hard to see National Hockey League games without a pay television service. Similarly, with Monday Night Football on ESPN, viewers pay a charge on their cable or satellite TV bills. Escalating television sports contracts underscore this point. In December 2011, for instance, the National Football League signed a new 9-year deal with CBS Corp. (CBS), Fox and NBC that represents a 60% revenue increase over the current $4 billion annual take.

Herein lies the opportunity for our portfolios. As seasoned media investors, our deep knowledge of their revenue streams as well as their recent challenges puts us in a unique position to assess the opportunities at hand. This hard-learned media expertise has given us insight into the value of those assets that maintain or increase revenues in a world where the top line is often volatile and sometimes sliding. We are also employing the knowledge we have gained in real estate from companies such as Jones Lang LaSalle Inc. (JLL) and CBRE Group, Inc. (CBG). Real estate is an unusual asset because it can be tricky to estimate its current value, and also because savvy managers can wring far more value out of it than others can.

For all these reasons, we bought shares of one of the world’s most famous sports venues last year—Madison Square Garden Co. (MSG). One part of our attraction was the fact that so few realize that it recently became a publicly traded company. Having been spun off from Cablevision Systems Corp. (CVC) in 2010, MSG includes the Garden, two regional sports networks, as well as the New York Knicks, the New York Rangers, and a variety of other venues and businesses. One of the main overhangs on the stock is the admittedly huge cost related to a massive upgrade of Madison Square Garden itself. With estimates running as high as $1 billion, the market is skeptical, but a tour of the under-construction facilities more than convinced us the dollars represent money well spent. The facilities will be spectacular when all is said and done. We are further reassured about the expense when one considers that even in the worst economic downturn, fans continued to pay for premium tickets to live sporting events. Additionally, there is no better moat since the scale of the Garden simply cannot be duplicated in Manhattan today. Even though it gained nearly +20% in the past quarter, we think it still trades at a 21% discount to intrinsic value today.

3

CBS and Gannett Co., Inc. (GCI) represent more of a back-door sports play. CBS, a holding in Ariel Appreciation Fund, currently has five of the top-10 rated shows in the country, the most of any network—as well as a topnotch sports franchise. Among other offerings, it currently hosts the NFL, PGA golf, the NCAA basketball tournament, and SEC (Southeastern Conference) college football. Moreover, the network has successfully made itself synonymous with watching these premier events on television. Even though it has gained more than 25% in the last quarter, we estimate it still trades at a double-digit discount to intrinsic value. While many continue to think Gannett, a holding in Ariel Fund and Ariel Appreciation Fund, is limited to USA Today, it is truly a diversified media company. A few of us recently attended their analyst day, where their small-town papers got a lot of play because Americans love their small-town sports and read the local paper to get the best coverage of these events. Additionally, the company’s 23 television stations carry live sports.

As a forward-thinking company, Gannett is working hard to monetize other parts of the sports craze. For instance, it recently devoted a chunk of its free cash flow to buy BaseballHQ.com, a fantasy sports website. Gannett trades at just 7x consensus 2012 earnings, which we think remains quite a bargain.

For us, the sports theme feels like a triple-play: the trend is clear in the social and entertainment world, remains unappreciated—and thus undervalued—in the investing world, and falls right in the center of our circle of competence.

Portfolio comings and goings

We did not purchase any new holdings in Ariel Fund during the quarter, but we eliminated our position in Herman Miller, Inc. (MLHR) in order to pursue more compelling opportunities. In Ariel Appreciation Fund, we did not purchase any new holdings during the quarter, but we eliminated our position in Mattel, Inc. (MAT) in order to pursue more compelling opportunities.

We appreciate the opportunity to serve you and welcome your questions or comments. Feel free to contact us at email@arielinvestments.com. Lastly, we recently posted new videos to our website featuring our investment team and hope you enjoy them.

1 Barron’s, April 16, 2012, page 13.

| | | |

| arielinvestments.com | 4 | 800.292.7435 |

| | |

| Ariel Fund Performance Summary | Inception: November 6, 1986 |

| | ABOUT THE FUND |

| | The Fund pursues long-term capital appreciation by investing in small- to medium-sized companies. |

| | |

| | |

| | |

| | |

AVERAGE ANNUAL TOTAL RETURNS as of March 31, 2012 | |

| | | 1st Quarter | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | 15 Year | | Life of Fund | |

| Ariel Fund | | | | | | | | | | | | | | | | | | | | | | |

| Investor Class | | | 14.57% | | | -6.56% | | | 35.58% | | | 0.46% | | | 5.00% | | | 8.93% | | | 10.87% | |

Institutional Class+ | | | 14.66% | | | -6.49% | | | 35.62% | | | 0.48% | | | 5.01% | | | 8.93% | | | 10.88% | |

Russell 2500TM Value Index | | | 11.52% | | | 0.09% | | | 27.09% | | | 1.00% | | | 7.46% | | | 9.46% | | | 11.08% | |

Russell 2000® Value Index* | | | 11.59% | | | -1.07% | | | 25.36% | | | 0.01% | | | 6.59% | | | 8.79% | | | 10.40% | |

Russell 2500TM Index | | | 12.99% | | | 1.33% | | | 28.42% | | | 3.03% | | | 7.49% | | | 8.94% | | | 10.44% | |

S&P 500® Index | | | 12.59% | | | 8.54% | | | 23.42% | | | 2.01% | | | 4.12% | | | 6.10% | | | 9.63% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com.

*One of the Fund’s benchmarks has changed from the Russell 2500 Index to the Russell 2000 Value Index as the Adviser believes this new index is more indicative of the market capitalization and style profile of the Fund.

| COMPOSITION OF EQUITY HOLDINGS (%) |

| | | Russell | Russell | |

| | | 2500 | 2000 | S&P |

| | Ariel | Value | Value | 500 |

| | Fund† | Index | Index | Index |

| | | | | |

| Consumer discretionary | 35.95 | 13.66 | 12.48 | 12.73 |

| | | | | |

| Financial services | 29.98 | 34.54 | 37.55 | 16.08 |

| | | | | |

| Health care | 14.18 | 5.44 | 5.14 | 11.24 |

| | | | | |

| Producer durables | 7.30 | 13.96 | 14.56 | 10.89 |

| | | | | |

| Consumer staples | 4.92 | 2.93 | 2.83 | 9.44 |

| | | | | |

| Materials & processing | 4.51 | 7.06 | 7.02 | 3.82 |

| | | | | |

| Energy | 3.16 | 3.47 | 3.71 | 11.25 |

| | | | | |

| Technology | 0.00 | 8.51 | 9.70 | 18.48 |

| | | | | |

| Utilities | 0.00 | 10.42 | 7.01 | 6.08 |

| † | Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes. |

| | | | | |

| Expense Ratio | | | | |

| Investor Class | | | 1.04 % |

| Institutional Class | | | 0.79 % |

| As of 9/30/11 (Investor Class). The expense ratio for the Institutional Class is based on estimated expenses for the current fiscal year. |

| | | | | | | | | | | | |

| TOP TEN EQUITY HOLDINGS | |

| | | | | | | | | | | | |

| 1 | Gannett Co., Inc. | | 4.0 | % | | 6 | | Jones Lang LaSalle Inc. | | 3.7 | % |

| 2 | Charles River Laboratories Intl Inc. | | 3.9 | % | | 7 | | Fair Isaac Corp. | | 3.7 | % |

| 3 | Janus Capital Group Inc. | | 3.9 | % | | 8 | | International Game Technology | | 3.6 | % |

| 4 | Interpublic Group of Cos., Inc. | | 3.8 | % | | 9 | | First American Financial Corp. | | 3.6 | % |

| 5 | Lazard Ltd | | 3.8 | % | | 10 | | Zimmer Holdings, Inc. | | 3.5 | % |

+The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. Notes: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 2500TM Value Index measures the performance of small to mid-cap value companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2500TM Index measures the performance of small to mid-cap companies. The S&P 500® is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

5

| | |

| Ariel Appreciation Fund Performance Summary | Inception: December 1, 1989 |

| | ABOUT THE FUND |

| | The Fund pursues long-term capital appreciation by investing in medium-sized companies. |

| | |

| | |

| | |

| | |

| | | | | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS as of March 31, 2012 | |

| | | 1st Quarter | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | 15 Year | | Life of Fund | |

| Ariel Appreciation Fund | | | | | | | | | | | | | | | | | | | | | | |

| Investor Class | | | 16.25% | | | 0.66% | | | 33.54% | | | 3.78% | | | 5.53% | | | 9.85% | | | 10.47% | |

Institutional Class+ | | | 16.36% | | | 0.75% | | | 33.58% | | | 3.79% | | | 5.54% | | | 9.85% | | | 10.48% | |

Russell Midcap® Value Index | | | 11.41% | | | 2.28% | | | 29.18% | | | 1.26% | | | 8.02% | | | 9.58% | | | 11.10% | |

Russell Midcap® Index | | | 12.94% | | | 3.31% | | | 29.13% | | | 3.03% | | | 7.85% | | | 9.38% | | | 10.92% | |

S&P 500® Index | | | 12.59% | | | 8.54% | | | 23.42% | | | 2.01% | | | 4.12% | | | 6.10% | | | 8.72% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com.

| COMPOSITION OF EQUITY HOLDINGS (%) | | |

| | | Russell | | |

| | Ariel | Midcap | Russell | S&P |

| | Appreciation | Value | Midcap | 500 |

| | Fund† | Index | Index | Index |

| | | | | |

| Consumer discretionary | 37.95 | 12.68 | 17.08 | 12.73 |

| | | | | |

| Financial services | 34.48 | 33.05 | 21.07 | 16.08 |

| | | | | |

| Health care | 13.66 | 6.13 | 9.05 | 11.24 |

| | | | | |

| Producer durables | 4.51 | 10.18 | 12.87 | 10.89 |

| | | | | |

| Technology | 3.99 | 6.91 | 11.72 | 18.48 |

| | | | | |

| Energy | 3.16 | 5.65 | 7.39 | 11.25 |

| | | | | |

| Consumer staples | 2.25 | 6.65 | 6.06 | 9.44 |

| | | | | |

| Materials & processing | 0.00 | 5.00 | 7.44 | 3.82 |

| | | | | |

| Utilities | 0.00 | 13.75 | 7.31 | 6.08 |

| † | Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes. |

| | | | |

| Expense Ratio | | | | |

| Investor Class | | | 1.15 % |

| Institutional Class | | | 0.90 % |

| As of 9/30/11 (Investor Class). The expense ratio for the Institutional Class is based on estimated expenses for the current fiscal year. |

| TOP TEN EQUITY HOLDINGS | |

| | | | | | | | | | | | | |

| 1 | Northern Trust Corp. | | | 4.1 | % | | 6 | First American Financial Corp. | | | 3.6 | % |

| 2 | AFLAC Inc. | | | 4.0 | % | | 7 | Lazard Ltd | | | 3.6 | % |

| 3 | CBS Corp. | | | 4.0 | % | | 8 | Jones Lang LaSalle Inc. | | | 3.4 | % |

| 4 | Dell Inc. | | | 3.9 | % | | 9 | Thermo Fisher Scientific Inc. | | | 3.3 | % |

| 5 | Viacom, Inc. | | | 3.7 | % | | 10 | Interpublic Group of Cos., Inc. | | | 3.3 | % |

+The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees. Notes: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell Midcap® Value Index measures the performance of mid-cap value companies with lower price-to-book ratios and lower forecasted growth values. The Russell Midcap® Index measures the performance of mid-cap companies. The S&P 500® is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

| arielinvestments.com | 6 | 800.292.7435 |

| | Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Focus Fund may be obtained by visiting arielinvestments.com. | |

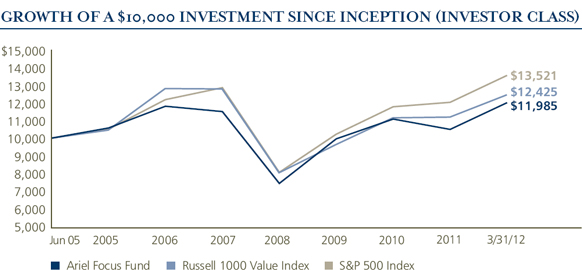

Dear Fellow Shareholder: Ariel Focus Fund posted strong results in the first quarter of 2012 on both an absolute and a relative basis. During the quarter ended March 31, 2012, Ariel Focus Fund (Investor Class) rose +14.26% versus an increase of +11.12% for its primary benchmark the Russell 1000 Value Index and +12.59% for the S&P 500 Index.

In this year’s first quarter, our large bank stocks performed particularly well, although over the full holding period for the portfolio they remain laggards. We have discussed in previous letters that certain financial stocks, in particular the investment banks, were trading at attractive valuations. Morgan Stanley (MS), Goldman, Sachs & Co. (GS), Citigroup Inc. (C) and JPMorgan Chase & Co. (JPM) all ended 2011 trading at discounts to their book values: in the extreme cases of Morgan Stanley and Citigroup, substantial discounts of more than 40%. During the first quarter, all four of these companies’ stock prices surged between +30% to +40%. The general explanation for the strong performance of financial services stocks so far this year has been the relatively benign developments around the European sovereign debt crisis. However, we believe strong negative sentiment around these companies provided an opportunity. The phrase “crowded trade” has been coined to describe situations where many institutional investors buy into the same investment thesis and purchase the same stocks. Late last year being bullish on the investment banks was just the opposite—a “lonely trade.”

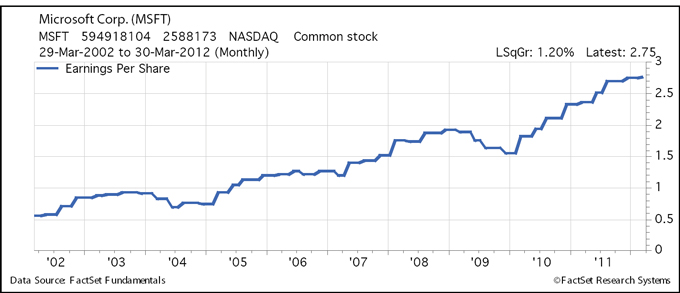

The second important theme that worked for us was our technology position. One way to describe our strategy in technology is “unloved tech.” We own several large technology companies with the following defining characteristics: they are highly profitable and growing, yet they trade at low multiples relative to their earnings. Microsoft Corp. (MSFT), our largest position at year end, rose +25% during the quarter. Microsoft continues to be a company and stock that many love to hate. The common perception is that the company has been ‘dead money’ with a bleak future to match its past stock performance. From our vantage point, the dead money perception works to our advantage as investors overlook the underlying growth of the business.

On the following page is a chart of Microsoft ’s earnings per share over the last 10 years, a period in which the company has faced tough competition from new form factors and technologies. Trailing 12-month EPS has grown from $0.53 in 2002 to $2.76 for the latest 12 months, a compound annual growth rate of approximately 18%. Taken as a whole, there has been nothing wrong with Microsoft ’s performance as a business over the last decade. The stock price went nowhere for much of the past 10 years because it was overvalued in our opinion. It was not overvalued when we bought it in Ariel Focus Fund in September 2010, and it is not overvalued today trading at nearly 11x our estimate of forward EPS of $2.86. Furthermore, when one adjusts for the more than $5.50 of net cash per share on the balance sheet, we believe the company is trading at roughly 9x forward earnings, well below the market multiple of over 12x.

7

Besides Microsoft, our other tech stocks also performed well in the quarter. Accenture plc (ACN), International Business Machines Corp. (IBM) and Dell Inc. (DELL) were up +21.17%, +13.91% and +13.43% respectively, all ahead of the market.

The area that hurt performance most during the quarter was for-profit education. Both Apollo Group, Inc. (APOL) and DeVry Inc. (DV) traded down sharply, -28.27% and -11.93%, respectively. A year ago, the industry was suffering from severe negative publicity arising from proposed new federal regulations and changes in methods that schools could use to measure their recruiters productivity. Coming into this year, we believed these companies had turned an important corner and would start showing increases in student enrollment.

Unfortunately, this expectation has not been met. Prolonged high unemployment combined with a sluggish economic recovery has potential students postponing decisions to attain post-secondary education. Both Apollo and DeVry reported a continued decline in student starts in the first quarter.

In addition, the operating leverage which works so well when enrollments are growing has the opposite effect when the number of students is declining. The modest additional cost of adding “a student to the back of a class room” materially boosts margins with each additional student but provides a major headwind to operating profitability when student counts fall.

The for-profit education industry has always been subject to cyclicality, both in terms of investor sentiment and actual operating results. However, the core positives for the business remain intact. The number of people attending college has grown steadily and will continue to do so. Non-traditional college students (e.g., working adults, members of the military returning to civilian life, etc.) are growing as a percentage of college students and for-profit schools have always enjoyed a high market share in this category. Finally, government support for state schools and community colleges will continue to be pressured resulting in higher tuition rates for the main for-profit competitors. These are highly profitable businesses that we believe will be larger five years from now than they are today. It may be bumpy between now and then, but we are in the business of being patient.

| | | |

| arielinvestments.com | 8 | 800.292.7435 |

Portfolio Comings and Goings

During the quarter, we initiated a new position in Snap-on Inc. (SNA). Snap-on is a leading manufacturer of tools and diagnostic equipment for independent car repair centers and mechanics. Snap-on has many of the attributes we look for in a company and a stock. First, it has a great brand and reputation with its customers producing a leading market share position. Second, it demonstrates positive industry growth characteristics as independent repair shops gain share from the increasing average life of cars. Finally, we prefer to buy stocks that temporarily trade at a sharp discount to intrinsic value due to bad short-term news.

In the case of Snap-on, the company was forced to bring its financing operations onto its own books when its finance partner had difficulties in 2009. As a result, Snap-on’s results have been affected by this new finance business. We have spent significant time with management and believe the finance operations are strong and do not represent a significant risk to shareholder value. We are very excited about Snap-on and believe it will be a “sneaky grower” over the next five to 10 years, posting better operating results than the market expects.

We exited our position in Carnival Corp. (CCL) during the quarter. We have held Carnival since 2005, the year we launched Ariel Focus Fund. Carnival undeniably remains the industry leader, but within a tightly focused portfolio such as this one, we believed other companies offered greater opportunities.

We appreciate the opportunity to serve you and welcome your questions or comments. Feel free to contact us at email@arielinvestments.com. Lastly, we recently posted new videos to our website featuring our investment team and hope you enjoy them.

9

| | |

| Ariel Focus Fund Performance Summary | Inception: June 30, 2005 |

| | ABOUT THE FUND |

| | The Fund pursues long-term capital appreciation by investing in medium-to large-sized companies. |

| | |

| | |

| | |

| | |

| | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS as of March 31, 2012 | |

| | | | 1st Quarter | | | 1 Year | | | 3 Year | | | 5 Year | | | Life of Fund | |

| Ariel Focus Fund | | | | | | | | | | | | | | | | |

| Investor Class | | | 14.26% | | | 3.63% | | | 23.77% | | | 0.53% | | | 2.72% | |

Institutional Class+ | | | 14.36% | | | 3.72% | | | 23.80% | | | 0.55% | | | 2.73% | |

Russell 1000® Value Index | | | 11.12% | | | 4.79% | | | 22.82% | | | -0.81% | | | 3.36% | |

S&P 500® Index | | | 12.59% | | | 8.54% | | | 23.42% | | | 2.01% | | | 4.68% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com.

| | | | |

| COMPOSITION OF EQUITY HOLDINGS (%) |

| | | Russell | |

| | Ariel | 1000 | S&P |

| | Focus | Value | 500 |

| | Fund† | Index | Index |

| | | | |

| Financial services | 29.08 | 27.73 | 16.08 |

| | | | |

| Consumer discretionary | 16.14 | 10.11 | 12.73 |

| | | | |

| Technology | 15.62 | 7.75 | 18.48 |

| | | | |

| Health care | 15.00 | 12.32 | 11.24 |

| | | | |

| Producer durables | 12.24 | 9.06 | 10.89 |

| | | | |

| Energy | 8.64 | 11.53 | 11.25 |

| | | | |

| Consumer staples | 3.28 | 7.33 | 9.44 |

| | | | |

| Materials & processing | 0.00 | 2.73 | 3.82 |

| | | | |

| Utilities | 0.00 | 11.45 | 6.08 |

| † | Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes. |

| | | | | | | |

| Expense Ratio* | Investor Class | | Institutional Class |

| Net | | 1.25% | | | 1.00% | |

| Gross | | 1.51% | | | 1.26% | |

| As of 9/30/11 (Investor Class). The expense ratio for the Institutional Class is based on estimated expenses for the current fiscal year. |

| TOP TEN EQUITY HOLDINGS | |

| | | | | | | | | | | | | |

| 1 | Microsoft Corp. | | | 6.4 | % | | 6 | Exxon Mobil Corp. | | | 4.4 | % |

| 2 | Target Corp. | | | 5.7 | % | | 7 | Tyco Intl Ltd. | | | 4.4 | % |

| 3 | Dell Inc. | | | 5.5 | % | | 8 | Omnicom Group Inc. | | | 4.2 | % |

| 4 | Zimmer Holdings, Inc. | | | 4.7 | % | | 9 | Goldman, Sachs & Co. | | | 4.1 | % |

| 5 | Lockheed Martin Corp. | | | 4.5 | % | | 10 | Johnson & Johnson | | | 4.0 | % |

+ The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees.

*Ariel Investments, LLC, the Adviser, is contractually obligated to waive fees and reimburse expenses in order to limit Ariel Focus Fund’s total annual operating expenses to 1.25% of net assets for the Investor Class and 1.00% of net assets for the Institutional Class through the end of the fiscal year ending September 30, 2013.

Notes: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 1000® Value Index measures the performance of large-cap value companies with lower price-to-book ratios and lower expected growth values. The S&P 500® is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Ariel Focus Fund is a non-diversified fund and therefore may be subject to greater volatility than a more diversified investment.

| | | |

| arielinvestments.com | 10 | 800.292.7435 |

| | Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel Discovery Fund may be obtained by visiting arielinvestments.com. | |

Dear Fellow Shareholder: After a volatile 2011, U.S. stocks pulled out a strong and steady opening quarter of 2012, with the S&P 500 Index’s +12.59% return representing its best first quarter since 1998. Small-cap value stocks had similar gains, with the Russell 2000 Value Index gaining +11.59%. Our deep value portfolio did a bit better than we would expect in such a torrid market, with our gain of +11.32%—falling just slightly short of that benchmark.

Since inception on January 31, 2011 the Investor Class has an annual return of +0.26%, compared to +4.63% for the Russell 2000 Value Index and +10.50% for the S&P 500 Index. As discussed in earlier letters, we lagged the benchmark by some 5 percentage points during the first month of the fund’s existence, and have been working to overcome that deficit for the past year or so.

Our best performers during the quarter included AV Homes, Inc. (AVHI), formerly Avatar Holdings, returning +69.64% after a difficult 2011. Littelfuse, Inc. (LFUS), purchased in the fourth quarter of 2011, gained +46.38%, and Rosetta Stone Inc. (RST), also a late 2011 addition to the portfolio, was up +35.26%. On the downside were RadioShack Corp. (RSH), which lost -34.73%, Vical Inc. (VICL), down -22.90% after more than doubling in 2011, and Orion Energy Systems, Inc. (OESX), falling -19.32%.

If we could own just one stock, what would it be? A popular investment website asks managers this question, and our answer at this time last year was Force Protection, Inc. Since the company was acquired last fall by General Dynamics Corp. (GD), we thought this would be a good time to address this theme again. While we would of course never put all of our eggs in one basket, answering this question periodically is a great way to illustrate the characteristics we seek.

As deep value investors, we look for underfollowed and misunderstood companies trading at prices that provide a “margin of safety”1 to buyers. We seek protection in asset values, with an emphasis on cash-rich, debt-free balance sheets. We also strongly favor talented and properly incentivized leadership, and we look to identify upside potential from underappreciated opportunities. Today, the stock that best embodies the combination of these traits is Pervasive software Inc. (PVSW).

Based in Austin, Texas, Pervasive is a software company focused on data innovation. The company describes its business as “software to manage, integrate and analyze data, in the cloud or on-premises, throughout the entire data life cycle.” With the explosion of data across the globe, and the need for businesses to process and analyze this data in a cost-effective, timely manner, Pervasive software operates in a truly exciting place.

| | |

| 1 | Attempting to purchase with a margin of safety on price cannot protect investors from the volatility associated with stocks, incorrect assumptions or estimations on our part, declining fundamentals or external forces. |

11

We believe Pervasive’s stock currently represents an extraordinary investment opportunity with low downside risk. With a cash-rich balance sheet, a legacy database business generating significant cash, and growth opportunities in big data – one of the hottest areas in technology – we have made Pervasive one of our largest positions. Our confidence is further enhanced by the executive team of CEO John Farr and CTO Mike Hoskins, talented leaders who also are clearly motivated by their combined 16% ownership stake.

Founded in 1982 and public since 1997, Pervasive has established a solid presence with its embedded database product, PSQL. Used by tens of thousands of customers globally, the product is sold to independent software vendors (ISVs) that embed a relational database feature in their software products. A typical customer is The Sage Group plc (SGE.L), which provides business software to small and medium-sized businesses. This is a mature business line with little growth potential but one which produces significant and dependable cash for Pervasive and has led to 44 consecutive quarters of profitability.

Revenue from this legacy division has been consistently in the range of $26 million to $29 million per year, representing nearly 60% of the company’s current sales. The strong cash flow has allowed the company to repurchase shares opportunistically, invest heavily in R&D and generate consistent profitability. We calculate the legacy business combined with the company’s $41 million cash balance is worth at least the $97 million market capitalization of the entire company, which was trading at $5.99 per share as of March 31, 2012.

With Pervasive’s balance sheet and legacy business providing our desired “margin of safety,” we believe the remaining 40% of the company’s business provides enormous upside potential. We agree with John Farr’s assertion that software markets are going through “rapid and destructive change, brought on by the emergence and mainstreaming of cloud-based2 infrastructure and applications, and the explosion of data volumes (Big Data3).”

To capitalize on these trends, Pervasive has reinvested 25% of its annual revenues in R&D, well above industry norms. Pervasive Data Integrator is the largest product in Pervasive’s Data and Application Integration segment. This product has shown consistent growth, even during the financial crisis, and 70% of its revenues are now recurring, i.e., subscription4, support and maintenance. The Gartner Group has recognized Data Integrator in its “Visionary” quadrant for data integration tools. Pervasive DataProfiler and Pervasive Business XChange are related and successful products.

Cloud and big data innovation products are potentially the most exciting and underappreciated opportunities at Pervasive. Pervasive DataCloud is being employed by Intuit to integrate QuickBooks with Salesforce.com in a partnership with excellent potential. CTO Mike Hoskins has taken on the role of General Manager of Pervasive Big Data Products and Solutions, working to apply Pervasive DataRush to problems which are labeled “Extreme Information Management” by thought leaders such as Gartner and Forrester.

We believe that, due to its small size, investors are overlooking the value in these growth businesses—in our view assigning them no value. Current annual revenue run rates for the Integration and Innovation lines total roughly $20 million. The importance of cloud-based integration and big data capability has led to acquisitions, such as Dell Inc.’s (DELL) purchase of Boomi and the International Business Machines Corp. (IBM) acquisition of Cast Iron, at multiples of up to 10x revenue. Yet Pervasive’s current EV/Sales multiple is just 1.1x—a low figure even for the legacy embedded database. In our calculation of intrinsic value, we estimate the current share price fully values the legacy business plus the cash; if we apply a conservative multiple of 5x revenue on the growth businesses, that would lead to a share price above $12.00. In the intermediate term, we can envision an economically rational strategic takeout well above that level.

| | | |

| arielinvestments.com | 12 | 800.292.7435 |

Finally, a word about leadership, which is so crucial in our world. Management’s incentives, which we discussed at length in our fourth quarter 2011 letter, are completely aligned with shareholders. The management team owns 21% of the company and have modest salaries. CEO John Farr has a financial background, and in our multiple conversations, clearly demonstrated he grasps the importance of capital allocation. He has spent $45.1 million to repurchase roughly 10.3 million shares over the past six years, sharply reducing the share count while maintaining a large cash reserve. CTO Mike Hoskins is responsible for the innovation taking place at Pervasive and remains the company’s largest single shareholder. Management’s heavy equity ownership has been crucial in giving us the comfort needed to become major investors in Pervasive stock.

Portfolio Comings and Goings

We eliminated one holding during the quarter. InfoSpace, Inc. (INSP) was sold as the company approached our estimates of fair value after executing well on its long-term plan. We added two new positions during the quarter, thereby ending the first quarter with 35 companies in Ariel Discovery Fund:

Rentech, Inc. (RTK) — Rentech presents an unusual special situation opportunity. While cutting back drastically on its investment in its clean energy projects, the company recently spun off its hugely profitable nitrogen fertilizer facility in the form of a limited partnership. Rentech’s 60.9% remaining stake in publicly traded Rentech Nitrogen Partners alone is worth some $650 million, significantly more than the $475 million market value of Rentech Inc. On top of that, the company has nearly $140 million in net cash on its balance sheet – implying a negative value of more than $300 million for the legacy business.

Brink’s Co. (BCO) — Based in Richmond, Virginia, Brink’s has been held in other Ariel portfolios since 2009. The company is a global provider of secure transportation, cash logistics and other security-related services. Investors are focused on near-term challenges in the company’s U.S. and European operations, while in our opinion undervaluing the strength of the Brink’s brand as well as its robust emerging market opportunities.

We appreciate the opportunity to serve you and welcome your questions or comments. Feel free to contact us at email@arielinvestments.com. Lastly, we recently posted new videos to our website featuring our investment team and hope you enjoy them.

| | |

| 2 | PCMag.com defines cloud computing as “Using the Web server facilities of a provider on the Internet (the “cloud”) to run applications.” |

| | |

| 3 | PCMag.com defines Big Data as “the massive amounts of data that collect over time that are difficult to analyze and handle using common database management tools. Big data may be any type, such as business transactions, photos or surveillance videos. Scientific research data from logs and sensors can reach mammoth proportions over time, and big data also includes unstructured text posted on the Web, such as blogs and social media.” |

| | |

| 4 | Software as a Subscription, or SaaS, has become the most favorable model for delivering software to customers. Revenues are recognized periodically, leading to more stable and predictable streams. |

13

| | |

| Ariel Discovery Fund Performance Summary | Inception: January 31, 2011 |

| | ABOUT THE FUND |

| | The Fund pursues long-term capital appreciation and searches for a margin of safety1 by investing in small companies trading at significant discounts to their instrinsic values. |

| | |

| | |

| | |

| | |

AVERAGE ANNUAL TOTAL RETURNS as of March 31, 2012 | |

| | | 1st Quarter | | 1 Year | | Life of Fund | |

| Ariel Discovery Fund | | | | | | | | | | |

| Investor Class | | | 11.32% | | | -2.90% | | | 0.26% | |

Institutional Class+ | | | 11.54% | | | -2.71% | | | 0.43% | |

Russell 2000® Value Index | | | 11.59% | | | -1.07% | | | 4.63% | |

S&P 500® Index | | | 12.59% | | | 8.54% | | | 10.50% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com.

| | | | |

| COMPOSITION OF EQUITY HOLDINGS (%) |

| | | Russell | |

| | Ariel | 2000 | S&P |

| | Discovery | Value | 500 |

| | Fund † | Index | Index |

| | | | |

| Financial services | 21.42 | 37.55 | 16.08 |

| | | | |

| Technology | 19.92 | 9.70 | 18.48 |

| | | | |

| Consumer discretionary | 19.69 | 12.48 | 12.73 |

| | | | |

| Producer durables | 13.55 | 14.56 | 10.89 |

| | | | |

| Materials & processing | 11.57 | 7.02 | 3.82 |

| | | | |

| Energy | 9.05 | 3.71 | 11.25 |

| | | | |

| Health care | 4.80 | 5.14 | 11.24 |

| | | | |

| Consumer staples | 0.00 | 2.83 | 9.44 |

| | | | |

| Utilities | 0.00 | 7.01 | 6.08 |

| † | Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes. |

| | | | | | |

| Expense Ratio* | | Investor Class | | Institutional Class |

| Net | | 1.50% | | 1.25% | |

| Gross | | 6.75% | | 6.50% | |

| As of 9/30/11 (Investor Class). The expense ratio for the Institutional Class is based on estimated expenses for the current fiscal year. |

| | | | | | | | | | | | | |

| TOP TEN EQUITY HOLDINGS | |

| | | | | | | | | | | | | |

| 1 | Market Leader, Inc. | | | 5.9 | % | | 6 | Team, Inc. | | | 3.9 | % |

| 2 | First American Financial Corp. | | | 5.2 | % | | 7 | Contango Oil & Gas Co. | | | 3.7 | % |

| 3 | Mitcham Industries, Inc. | | | 5.0 | % | | 8 | Ballantyne Strong, Inc. | | | 3.7 | % |

| 4 | Madison Square Garden Co. | | | 4.7 | % | | 9 | Vical Inc. | | | 3.4 | % |

| 5 | Pervasive Software Inc. | | | 4.6 | % | | 10 | PCTEL, Inc. | | | 3.4 | % |

+ The inception date for the Institutional Class shares is December 30, 2011. Performance information for the Institutional Class prior to that date reflects the actual performance of the Fund’s Investor Class (and uses the actual expenses of the Fund’s Investor Class, for such period of time), without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses, which are primarily differences in distribution and service fees.

1 Attempting to purchase with a margin of safety on price cannot protect investors from the volatility associated with stocks, incorrect assumptions or estimations on our part, declining fundamentals or external forces.

* Ariel Investments, LLC, the Adviser, is contractually obligated to waive fees or reimburse expenses in order to limit Ariel Discovery Fund’s total annual operating expenses to 1.50% of net assets for the Investor Class and 1.25% for the Institutional Class through the end of the fiscal year ending September 30, 2014.

Notes: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. The S&P 500® is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index.

| | | |

| arielinvestments.com | 14 | 800.292.7435 |

| | Performance data quoted represents past performance. Past performance does not guarantee future results. All performance assumes the reinvestment of dividends and capital gains. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end for Ariel International Equity Fund and Ariel Global Equity Fund may be obtained by visiting arielinvestments.com. | |

Dear Fellow Shareholder: As I write this debut letter to introduce myself and our investment discipline to a new client base, it is an opportune moment to reflect on the 21 years I have spent honing my craft. It has been an unusual journey with unusual results.

I started out in the Eastern hemisphere covering emerging markets, then moved West to cover developed markets, while the world shifted in the opposite direction. I entered the profession at a time when merely having access to information was a source of alpha1. Today, given the proliferation of the Internet, I believe access to infinite information creates a huge amount of noise that actually detracts from alpha. In the first half of my career, investors fell in love with equities. In the latter half, they have wanted very little to do with them. In the early half, the U.S. was the favorite investment destination; in the latter half, everyone clamors to go overseas! So yes, much has changed and yet much remains unchanged.

My home is new but my investment discipline remains the same. At Ariel, I found a kindred spirit and an investment philosophy that resonated with my own. There is an additional benefit to the complementary nature of the relationship—I can lean on the domestic research team, and in turn they can lean on me for international perspectives. Recognizing that investors could benefit from not just broader research insights but broader product offerings as well, we launched two flagship funds–Ariel International Equity Fund and Ariel Global Equity Fund.

These funds are managed using an investment process custom-designed to achieve compelling absolute returns and superior relative returns over the long-term.

Unlike other disciplines that focus solely on “return management,” our process pays equal attention to “risk management.” Simply put, we pay attention to both capital appreciation and capital preservation. In practice this means we do not simply estimate a stock’s upside potential should everything go well, but we also carefully evaluate how much we stand to lose should things go wrong.

We simplify and focus. We find that the intrinsic quality of a business and the valuations we pay to own it are the most relevant factors in determining the risk and reward of the investment. As such, the bulk of our research is designed to understand these two components of the investment decision.

15

Lastly, we seek to optimize not maximize. Many managers buy stocks they think will go up the most; we instead seek to buy those that will post reasonable gains if all goes well but are unlikely to crater if things go wrong. In other words, the stocks in our portfolio are not the cheapest, the most popular or even the ones most likely to have the biggest gains—they are the ones, in our judgment, whose balance of risk and reward make them likely to withstand the test of time in different market environments—good and bad.

Finally, we are independent thinkers. We pick stocks, not styles. We buy and sell against the crowd, not with it. We own companies based on risk and reward, not their benchmark weights or geographies. We believe investing is more like Le Mans (endurance test) than a NASCAR race (speed test).

Performance Update

Globally, stocks rallied strongly in the first quarter of 2012, sending the MSCI EAFE and the MSCI ACWI Indices up +10.98% and +12.02%, respectively. Over the same time period, Ariel International Equity Fund (Investor Class) and Ariel Global Equity Fund (Investor Class) each gained +5.20%.

Underperformance in this sharp rally was predictable for several reasons. First and foremost, it was the portfolios’ first three months of existence, so we were still accumulating our full positions. Cash was significantly higher than it would be in almost any other environment. This especially hurt when markets jumped +2% on the day of the portfolio’s inception. We see this effect as a one-time occurrence. Also, our generally risk-averse, contrarian strategy tends to lag when the markets run hot. Finally, our portfolios had a lower relative weighting in financial services firms—a top-performing sector for the quarter.

While market participants displayed an ample risk appetite during the quarter, we remain risk-aware. We think significant economic and fiscal challenges are unresolved in both the public and private spheres. Our policy is to remain vigilant about such risks but to appreciate the opportunities they sometimes present for those building high-conviction portfolios designed to carefully balance risk and reward.

We appreciate the opportunity to serve you and welcome your questions or comments. Feel free to contact us at email@arielinvestments.com. Lastly, we recently posted new videos to our website featuring our investment team and hope you enjoy them.

| | |

| 1 | Alpha is a measure of performance on a risk-adjusted basis. Alpha takes the volatility of an investment and compares its risk-adjusted performance to a benchmark index. The excess return of the investment relative to the return of the benchmark index is an investment’s alpha. |

| arielinvestments.com | 16 | 800.292.7435 |

| | Rupal J. Bhansali Portfolio Manager Rupal is the portfolio manager for Ariel’s international and global strategies and oversees the entire research effort of these offerings. She joined Ariel after spending 10 years with MacKay Shields where she was senior managing director, portfolio manager and head of international equities. During her tenure, Rupal successfully managed both institutional and retail portfolios. Prior to joining MacKay Shields, Rupal was portfolio manager and co-head of international equities at Oppenheimer Capital where she co-managed international and global equity portfolios. She has also held various roles at other investment firms since she began her career in 1989, including Soros Fund Management. Fluent in several Indian languages including Hindi, Rupal earned a Bachelor of Commerce in accounting and finance, and a Master of Commerce in international finance and banking from the University of Mumbai, as well as an MBA in finance from the University of Rochester where she was a Rotary Foundation Scholar. | |

17

| Ariel International Equity Fund Performance Summary | Inception: December 30, 2011 |

| | ABOUT THE FUND |

| | The Fund pursues long-term capital appreciation by investing primarily in companies outside the U.S. in developed international markets. |

| | |

| | |

| | |

| | |

AVERAGE ANNUAL TOTAL RETURNS as of March 31, 2012

| | 1st Quarter | Life of Fund |

| Ariel International Equity Fund | | |

| Investor Class | 5.20% | 5.20% |

| Institutional Class | 5.20% | 5.20% |

MSCI EAFE® Index | 10.98% | 10.98% |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com.

| COMPOSITION OF EQUITY HOLDINGS (%) |

| | Ariel | |

| | International | MSCI |

| | Equity | EAFE |

| | Fund† | Index |

| | | |

| Financials | 22.25 | 22.61 |

| | | |

| Information technology | 19.36 | 4.83 |

| | | |

| Consumer staples | 15.66 | 11.22 |

| | | |

| Consumer discretionary | 13.36 | 10.83 |

| | | |

| Industrials | 9.20 | 12.72 |

| | | |

| Telecommunication services | 7.07 | 5.44 |

| | | |

| Health care | 6.88 | 9.32 |

| | | |

| Utilities | 3.86 | 4.33 |

| | | |

| Energy | 2.36 | 8.53 |

| | | |

| Materials | 0.00 | 10.18 |

| † | Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes. |

| COUNTRY WEIGHTINGS (%) | |

| | |

| Japan | 24.96 |

| | |

| U.K. | 14.77 |

| | |

| Switzerland | 12.44 |

| | |

| Spain | 8.00 |

| | |

| France | 6.15 |

| | |

| Germany | 5.91 |

| | |

| Italy | 4.93 |

| | |

| Finland | 4.79 |

| | |

| Ireland | 4.77 |

| | |

| Canada | 4.31 |

| | |

| Netherlands | 4.25 |

| | |

| Belgium | 2.51 |

| | |

| Hong Kong | 1.60 |

| | |

| Norway | 0.61 |

| TOP TEN COMPANIES |

| 1 | Tesco plc | 4.9% |

| 2 | Roche Holding AG | 4.8% |

| 3 | Nokia Corp. | 3.9% |

| 4 | Ryanair Holdings plc | 3.9% |

| 5 | Nintendo Co., Ltd | 3.8% |

| 6 | NTT DOCOMO, Inc. | 3.7% |

| 7 | Koninklijke Ahold NV | 3.4% |

| 8 | Nestle SA | 3.3% |

| 9 | Bouygues SA | 3.3% |

| 10 | Deutsche Boerse AG | 3.1% |

| For the purpose of determining the Fund’s top ten companies, securities of the same issuer are aggregated. |

| Expense Ratio* | Investor Class | | Institutional Class |

| Net | 1.40% | | 1.15% |

| Gross | 2.49% | | 2.24% |

*Based on estimated expenses for the current year. Ariel Investments, LLC, the Adviser, is contractually obligated to waive fees or reimburse expenses in order to limit Ariel International Equity Fund’s total annual operating expenses to 1.40% of net assets for the Investor Class, and 1.15% of net assets for the Institutional Class, through the end of the fiscal year ending September 30, 2015.

Notes: The performance table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. MSCI EAFE® Index is an unmanaged, market weighted index of companies in developed markets, excluding the U.S. and Canada.

| arielinvestments.com | 18 | 800.292.7435 |

| Ariel Global Equity Fund Performance Summary | Inception: December 30, 2011 |

| | ABOUT THE FUND |

| | The Fund pursues long-term capital appreciation by investing primarily in companies both within and outside the U.S., in countries with developed or emerging markets. |

| | |

| | |

| | |

| | |

AVERAGE ANNUAL TOTAL RETURNS as of March 31, 2012

| | 1st Quarter | Life of Fund |

| Ariel Global Equity Fund | | |

| Investor Class | 5.20% | 5.20% |

| Institutional Class | 5.30% | 5.30% |

MSCI AC World IndexSM | 12.02% | 12.02% |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit arielinvestments.com.

| COMPOSITION OF EQUITY HOLDINGS (%) |

| | Ariel | |

| | Global | MSCI |

| | Equity | AC World |

| | Fund † | Index |

| | | |

| Information technology | 22.05 | 13.05 |

| | | |

| Financials | 18.04 | 19.52 |

| | | |

| Health care | 17.80 | 8.89 |

| | | |

| Consumer staples | 12.85 | 10.22 |

| | | |

| Consumer discretionary | 11.30 | 10.46 |

| | | |

| Industrials | 8.02 | 10.51 |

| | | |

| Telecommunication services | 5.43 | 4.45 |

| | | |

| Utilities | 2.71 | 3.65 |

| | | |

| Energy | 1.80 | 11.35 |

| | | |

| Materials | 0.00 | 7.90 |

| † | Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes. |

| COUNTRY WEIGHTINGS (%) |

| | |

| U.S. | 25.59 |

| | |

| Japan | 18.21 |

| | |

| U.K. | 11.95 |

| | |

| Switzerland | 8.97 |

| | |

| Spain | 6.11 |

| | |

| France | 4.79 |

| | |

| Italy | 3.89 |

| | |

| Finland | 3.77 |

| | |

| Netherlands | 3.41 |

| | |

| Ireland | 3.37 |

| | |

| Germany | 3.33 |

| | |

| Canada | 2.93 |

| | |

| Belgium | 1.82 |

| | |

| Hong Kong | 1.47 |

| | |

| Norway | 0.39 |

| TOP TEN COMPANIES |

| 1 | Tesco plc | 4.8% |

| 2 | Roche Holding AG | 4.7% |

| 3 | Johnson & Johnson | 4.3% |

| 4 | Nokia Corp. | 3.1% |

| 5 | NTT DOCOMO, Inc. | 3.0% |

| 6 | Koninklijke Ahold NV | 2.8% |

| 7 | Bouygues SA | 2.8% |

| 8 | Ryanair Holdings plc | 2.8% |

| 9 | Deutsche Boerse AG | 2.7% |

| 10 | Nintendo Co., Ltd | 2.7% |

| For the purpose of determining the Fund’s top ten companies, securities of the same issuer are aggregated. |

| Expense Ratio* | Investor Class | Institutional Class |

| Net | 1.40% | 1.15% |

| Gross | 2.49% | 2.24% |

*Based on estimated expenses for the current year. Ariel Investments, LLC, the Adviser, is contractually obligated to waive fees or reimburse expenses in order to limit Ariel Global Equity Fund’s total annual operating expenses to 1.40% of net assets for the Investor Class, and 1.15% of net assets for the Institutional Class, through the end of the fiscal year ending September 30, 2015.

Notes: The performance table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. MSCI ACWI (All Country World Index) IndexSM is an unmanaged, market weighted index of global developed and emerging markets.

19

Founded in 1889, First American Financial is a leading provider of title insurance and settlement services. The core title insurance business drives the majority of the company’s profits, providing essential policies in both the residential and commercial markets. Additionally, the company offers title plant management services, home warranty products, property and casualty insurance as well as trust and investment advisory services. With nearly 30% market share, the company has a distinct scale advantage in its network of offices and agencies and is poised to benefit from a housing market recovery. Yet investors remain fixated on the rearview mirror, paralyzed by the worst housing downturn in recent history.

Green Shoots Amidst the Wreckage

There is no denying that the recent housing downturn was severe. Mortgage originations plummeted, foreclosures spiked and refinancings remained elusive for all but for the most credit-worthy borrowers. In 2011, mortgage originations totaled just under $1.3 trillion, the lowest level in over a decade. Despite this reality, First American continues to weather the storm and remain profitable. Its high margin commercial business is thriving. Record low interest rates are driving periodic boosts in refinancing demand. More importantly, for the first time in a long while, the residential housing market is finally beginning to see some signs of stability.

A Lean, Mean, Centralized Machine

What investors are missing in this story is that once the residential housing market finally turns, First American is poised to emerge as a leaner, more efficient industry leader. Over the past few years, management has taken dramatic steps to enact permanent cost cuts to the tune of over $1 billion in annual savings. Claims centers have been reduced from 100 to 5. Accounting centers have been consolidated from 30 to just 3. And, regional managers have been cut from 16 to 3. Long gone are the days when every policy required onsite courthouse visits to inspect title. The new world in title insurance revolves around electronic data, automation and centralization and no one is better positioned than First American. Investors may worry that housing sales will never return to its peak levels, thus jeopardizing the future profitability of the company. But we take comfort that peak volumes are not necessary. In fact, with its cost-saving measures now implemented, First American can achieve prior peak operating margins on just half the number of real estate transactions required previously.

A Credit to Management

CEO Dennis Gilmore deserves credit for both the company’s success during the downturn as well as its current industry position. While competitors chose to either shift away from the title business or make short term staff reductions, Gilmore had the foresight to seize a rare opportunity to completely reshape the business. The company has over a $1.50 per share in excess cash, an efficient cost structure and a strong commercial business–all of which should help drive earnings per share this year to over $1.00.

A Long Term View

As long term investors, we believe the current housing market has created a tremendous opportunity to buy this rare diamond in the rough at a bargain price. Held in Ariel Fund, Ariel Appreciation Fund and Ariel Discovery Fund, First American Financial’s shares traded at $16.63 as of March 31, 2012, a 34% discount to our private market value of $25.21.

| arielinvestments.com | 20 | 800.292.7435 |

Snap-on is a leading manufacturer of tools and equipment as well as a provider of diagnostics, repair information and systems solutions for independent car repair centers. The company was founded in 1920 when Joseph Johnson and William Seidemann came up with the original idea of interchangeable sockets and wrench handles. The innovative spirit that characterized the company’s early beginnings along with a passion for producing high-quality products has led to the company’s dominant market position.

Franchisee Model

Snap-on uses a franchise structure in the sale and distribution of its products to vehicle repair centers. These franchisees carry their inventory in 4,800 customized vans and make weekly visits to customers and prospects. The vans usually sell products directly to the mechanics. The frequent interaction between the franchisee and mechanics has proven helpful in understanding their customers’ needs. Snap-on’s regular give-and-take with customers gives it an edge over other toolmakers.

Demand for New Tools

Demand for Snap-on tools is expected to grow due to multiple tailwinds. First, the company’s primary customers are independent automotive shops, which continue to gain share versus auto dealerships. This gain is the result of two major factors—an aging car fleet and higher labor costs per hour at dealerships. Older cars need more repairs after warranties expire, and the cheaper labor costs of independent shops have proven to be a solid alternative to returning to the dealer for the work. This trend should continue in the near term. Also, because independent shops work on a variety of vehicle brands, they often require multiple sets of tools. Finally, innovation in newer models can increase demand for new tools.

Financial Services Segment

In 2009, Snap-on ended its agreement with CIT Group to fund the assets of Snap-on Credit, a business that provides a broad range of financial services to the company’s franchisees and customers. Integrating the financial services business has created “lumpiness” in the company’s earnings, but this should stabilize once the transition is completed. We expect this segment to improve its profitability over the next few quarters and demonstrate the earnings power of the business.

Intriguing Valuation

The market is valuing the company as if it will no longer benefit from the aforementioned growth trends. Additionally, we believe the current market valuation reflects low expectations from the company’s financial services business. Overall, Snap-on stock is positioned to provide significant upside from current levels in the long run.

Held in Ariel Focus Fund, Snap-on’s shares traded at $60.97 as of March 31, 2012, a 32% discount to our steadily growing private market value of $89.16.

21

Symmetry Medical Inc. is a leading global source of innovative medical device solutions. The company supplies high-precision surgical instruments that focus on orthopedic applications like knee and hip reconstruction procedures. Symmetry also delivers a full line of cases and trays that are used in more than 25 different medical markets ranging from the orthopedics to the dental to the cardiovascular fields. The surgical instruments are typically combined into a case that is compatible with the specialized-sterilization procedures required between surgeries. Finally, the company has the ability to fully manufacture orthopedic implants from start to finish.

Growth in the Current Healthcare Cost Environment

We believe innovative, well-managed organizations can still thrive in this cost-conscious healthcare environment. First, Symmetry’s core products will benefit from the growth in orthopedic procedures due to aging global demographics. Second, the company directly benefits from new product launches by its core orthopedic partners. We believe innovative products that improve surgical outcomes, speed recovery times and decrease the probability of infection will continue to be highly desired. Third, as the restraints on healthcare costs impact medical device suppliers, they are re-engineering their business processes to focus on costs. One way to lower costs is to reduce the number of vendors manufacturing the company’s products, which results in more favorable pricing. At the same time, quality control cannot be sacrificed since recalls can be extremely costly. But Symmetry will benefit from vendor rationalization without jeopardizing its reputation for quality due to a strong track-record that is envied by its competitors. Finally, the company has a state-of-the-art facility in Malaysia that serves as a platform for expansion into overseas markets that are investing in better healthcare systems.

I Wish I Had It Done Sooner

Over the last three years, Symmetry has been under a cloud due to weak patient volume. The soft market is a consequence of higher insurance deductibles, higher co-payments and concerns about sick-time required for recuperation from surgery. Patients have not been willing to take extended sick-time for fear of losing their jobs in this high unemployment environment. We believe, as the economy continues to stabilize, those who have delayed orthopedic surgeries will return to the patient pool. In addition, as the economy recovers and unemployment declines, orthopedic surgery volumes should normalize. Although these procedures are considered elective, they are highly desired by the patient who wants to maintain an active lifestyle. After undergoing a hip or knee reconstruction procedure, doctors and family-members often hear “I wish I had it done sooner.”

On The Right Track

Symmetry Medical is under the new leadership of Tom Sullivan. Having joined the company in 2011, Sullivan brings a wealth of industry knowledge from his prior days at Johnson & Johnson. His previous roles enable him to understand what Symmetry’s customers need to navigate a changing healthcare environment. Under his leadership, we believe the company is focused on expanding its geographic footprint and product line. The company recently acquired an instrumentation business from Johnson & Johnson which added complimentary products to its portfolio. Although the company added debt to complete the acquisition, we remain confident management is laser-focused on right-sizing the balance sheet over the near-term. We believe the company is positioned for solid growth as the U.S. economy rebounds and the financial dynamics of the company improve. Held in Ariel Fund and Ariel Discovery Fund, Symmetry Medical’s shares traded at $7.07 as of March 31, 2012, a 54% discount to our PMV of $15.23.

| arielinvestments.com | 22 | 800.292.7435 |

| Ariel Fund Statistical Summary | (unaudited) |

| | | | 52-Week Range | | Earnings per Share | | P/E Calendar | | |