UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-4786 |

|

Ariel Investment Trust |

(Exact name of registrant as specified in charter) |

|

200 East Randolph Drive Suite 2900 Chicago, Illinois | | 60601 |

(Address of principal executive offices) | | (Zip code) |

|

Mareile Cusack 200 East Randolph Drive Suite 2900 Chicago, Illinois 60601 |

(Name and address of agent for service) |

|

with a copy to: |

|

Arthur Don, Esq. Greenberg Traurig, LLP 77 West Wacker Drive Suite 3100 Chicago, IL 60601 |

|

Registrant’s telephone number, including area code: | (312) 726-0140 | |

|

Date of fiscal year end: | September 30, 2010 | |

|

Date of reporting period: | March 31, 2010 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”) (17 CFR 270.30e-1).

One of Ariel Investments’ guiding principles is to communicate openly with our shareholders so they may gain a clear understanding of our investment philosophy, portfolio decisions and results, as well as our opinions on the underlying market. In reviewing the materials contained in The Patient Investor, please consider the information provided on this page. While our investment decisions are rooted in detailed analysis, it is important to point out that actual results can differ significantly from those we seek. We candidly discuss a number of individual companies.

Our opinions are current as of the date they were written but are subject to change. We want to remind investors that the information in The Patient Investor is not sufficient on which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security. Ariel Fund and Ariel Appreciation Fund invest primarily in small and mid-sized companies. Investing in small and midcap stocks is riskier and more volatile than investing in large cap stocks, in part because smaller companies may not have the scale, depth of resources and other assets of larger firms. Additionally, Ariel Focus Fund invests in mid to large-cap stocks and is a non-diversified fund, which means its investments are concentrated in fewer names than diversified funds, such as Ariel Fund and Ariel Appreciation Fund. Ariel Focus Fund generally holds 20 stocks and therefore may be more volatile than a more diversified investment. Investing in equity stocks is risky and subject to the volatility of the markets.

Performance data quoted is past performance and does not guarantee future results. The performance stated in The Patient Investor assumes the reinvestment of dividends and capital gains. We caution shareholders that we can never predict or assure future returns on investments. The investment return and principal value of an investment with our Funds will fluctuate over time so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted in this report. For the period ended March 31, 2010, the average annual total returns for the one-, five- and ten-year periods for Ariel Fund and Ariel Appreciation Fund were 112.31%, 0.25% and 8.66%; and 98.15%, 3.67% and 8.30%, respectively. For the period ended March 31, 2010, the average annual total returns of Ariel Focus Fund for the one-year and since inception (June 30, 2005) periods were 66.06% and 1.03%. To access our performance data current to the most recent month-end, visit our website, arielinvestments.com.

As of September 30, 2009, Ariel Fund and Ariel Appreciation Fund had annual expense ratios of 1.14% and 1.25%, respectively. As of September 30, 2009, Ariel Focus Fund had an annual net expense ratio of 1.25% and a gross expense ratio of 1.87%. The Fund’s adviser, Ariel Investments, LLC, is contractually obligated to waive fees or reimburse expenses in order to limit Ariel Focus Fund’s total annual operating expenses to 1.25% of net assets through the end of the fiscal year ending September 30, 2011. After that date, there is no assurance such expenses will be limited.

Investors should consider carefully the investment objectives, risks, and charges and expenses before investing. For a current summary prospectus or full prospectus which contains this and other information about the funds offered by Ariel Investment Trust, call us at 800.292.7435 or visit our website, arielinvestments.com. Please read the summary prospectus or full prospectus carefully before investing. Distributed by Ariel Distributors, LLC, a wholly-owned subsidiary of Ariel Investments, LLC.

ARIEL INVESTMENT TRUST

c/o U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701

800.292.7435 | arielinvestments.com

| WANT TO GET YOUR RETIREMENT SAVINGS BACK ON TRACK? |

INVEST IN AN ARIEL IRA TODAY! |

| |

| Ariel Investments has extended its offer to waive the custodial fee for both existing and new IRA shareholders through June 30th. |

| |

| To take advantage of this offer, invest or rollover: |

· | $1,000 in an Ariel IRA and we will waive your annual fee of $15 in 2010. |

· | $5,000 in an Ariel IRA and we will waive the lifetime fee of $60, so your custodial fees will be covered for the life of the account with Ariel. |

Turtle Talk with our Investment Specialists

I recently attended a graduation party for my niece who is heading off to college in September. It made me wonder if I’ll have enough money saved to send my infant daughter to college. Can Ariel help?

—Renee, Atlanta, GA

Khoa: Over the past ten years, the cost of tuition has risen nearly 5% per year beyond general inflation at public four-year colleges. While it is hard to predict the actual cost of college education several years from now, one thing we do know for sure is that it is important to start saving early—and even small amounts invested over time can be meaningful. For example, investing just $100 a month for 18 years will generate $48,000 to go towards your daughter’s college education expenses.*

Ariel Investments offers two types of accounts which can be used for saving for education: Coverdell Education Savings Accounts (“Coverdell ESA”) and Uniform Gifts or Transfers to Minor Act (“UGMA” and “UTMA”) accounts. Both ESAs and UGMA/UTMAs are custodial accounts, meaning the account is controlled by an adult (or custodian) until the child reaches age of majority— which varies by state, but is usually 18 to 21 years old.

· Coverdell ESA: ESAs are designed to specifically save for postsecondary educational expenses—including the cost of college or vocational school—and in some cases, will even cover some elementary and secondary school expenses. You can contribute up to $2,000 a year and withdrawals are tax free so long as they are used for qualified expenses (e.g., enrollment fees, tuition, cost of books, etc.).

· UGMA/UTMA: With an UTMA/UGMA account, there are no restrictions on how withdrawals can be used and there are no contribution limits. However, the income from the account is taxed at the minor’s income tax rate.

To learn more about effective ways to save for education with Ariel Investments, visit arielinvestments.com or call one of our Investment Specialists at 800.292.7435.

P.S. If you are looking to invest in a 529 plan offering one of our mutual funds, consider Illinois’ Bright Directions College Savings Program which includes Ariel Fund.

* This example assumes an annual return of 8% . It is illustrative only and is not indicative of any specific return you may receive from a particular investment. Please contact your tax advisor for specific tax information regarding ESAs UGMA/UTMA accounts and the rules for 529 plans in your state before making any investment. This is not a recommendation for any particular 529 plan or any other education savings account. Investors should consider carefully the investment objectives, risks, and charges and expenses of the Bright Directions College Savings Program. This and other information is contained in the Bright Directions’ plan disclosure document, which is available from your financial advisor. Please read the document carefully before investing. For more information about Bright Directions, visit brightdirections.com.

Dear Fellow Shareholder: For the three months ended March 31, 2010, the smaller companies comprising Ariel Fund had another strong quarter posting a +9.00% gain. This return was closely in line with the Russell 2500 Value Index which rose +9.57% as well as the Russell 2500 Index, which earned +9.21%. The mid-cap stocks comprising Ariel Appreciation Fund rose +7.19%, which was certainly gratifying on an absolute basis, but this return fell short of the Russell Midcap Value Index’s +9.61% jump as well as the Russell Midcap Index, which earned +8.67%. In the case of both Ariel portfolios, our consumer, financial and producer durable stocks did not perform as well as the value benchmarks’ during a quarter when there was largely an absence of news. As is often the case in an economic recovery, small- and mid-sized companies are leading the way. During the quarter, the large stocks of the S&P 500 Index returned +5.39%, which was more in-line with the typical stock mutual fund which Barron’s says “tacked on +5.68% in the first quarter.”1

The returns of the last quarter underscore a unique moment in stock market history—a remarkable rebound the like of which has not occurred since the Depression. Almost exactly a year ago we were at an inflection point. A stock market free-fall that cut broad market asset values in half and impaled smaller company stocks, including those of our portfolios, started to reverse itself. A year later, the S&P 500 Index has gained +49.77%, the Russell 2500 Value Index +67.17% and the Russell Midcap Value Index +72.41%. Our own recovery—built on our contrarian investing strategy—is the best we have had in 27 years of investing. More specifically, over the last 12 months, Ariel Fund has surged +112.31%, which mutual fund tracker Lipper Inc. ranks in the second percentile of its peers. Meanwhile, Ariel Appreciation Fund has gained +98.15% which lands the Fund in the first percentile of other Lipper-tracked funds with a similar strategy.1

Great Expectations

According to Barron’s, “The stock market is essentially an argument over the future.”2 To this point, the market’s dramatic ascent from last year’s gut- wrenching lows has led many to debate if public company shares have gone too far too fast. Recent

Lipper, Inc. is a nationally recognized organization that reports performance and calculates rankings for mutual funds based on total returns. The rankings quoted reflect the trailing 1-year ranking of Ariel Fund within its fund category. Lipper classifies Ariel Fund as a Mid-Cap Core Fund. For the period ended March 31, 2010, the rankings of Ariel Fund for the one-, five- and ten-year periods were in the 2nd percentile (7 out of 404 funds), 90th percentile (248 out of 275 funds) and 6th percentile (7 out of 123 funds) among Mid-Cap Core Funds. The rankings quoted reflect the trailing 1-year ranking of Ariel Appreciation Fund within its fund category. Lipper classifies Ariel Appreciation Fund as a Multi-Cap Core Fund. For the period ended March 31, 2010, the rankings of Ariel Appreciation Fund for the one-, five- and ten-year periods were in the 1st percentile (4 out of 805 funds), 22nd percentile (116 out of 539 funds) and 2nd percentile (3 out of 234 funds) among Multi-Cap Core Funds.

Performance data quoted is past performance and does not guarantee future results. We caution shareholders that we can never predict or assure future returns on investments. The investment return and principal value of an investment with our Funds will fluctuate over time so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted in this report. To access our performance data current to the most recent month-end, visit our website, arielinvestments.com.

The Patient Investor March 31, 2010 | | Slow and Steady Wins the Race |

2

headlines tell the story with The New York Times asking, “Are We Flying Too High Again?” and Morningstar.com pondering, “The Recovery No One Wants to Believe In.”3 This skepticism is not surprising since behavioral finance reminds us to expect people to anchor in the past and to be slow to adapt to changing information. In contrast to some prevailing views, we think the economic recovery is real and this bull market has legs. As we wrote in our December 2009 letter, low Wall Street expectations anchored in 2008 crisis conditions as well as our unique, patient investing lens heighten our optimism. We are also encouraged by the number of new ideas populating our investment pipeline. Lastly and perhaps most importantly of all, we are enthusiastic about our prospects based on our belief that our battle-tested investment team is stronger than ever, precisely because of the financial crisis.

“The returns of the last quarter

underscore a unique moment in

stock market history—a remarkable

rebound the like of which has not

occurred since the Depression.”

Crisis Reveals

As many know, trial by fire is when you learn the most about others—be it a teammate, a spouse or a friend. Having watched a great deal of NCAA basketball in the last few weeks, we have come to liken our crisis revelations of the last two years to what one learns about athletes at crunch time. We would argue that as a hard-fought tournament unfolds and the inevitable ups and downs occur, a coach becomes more familiar with the strengths and weaknesses of the players than at any time during the regular season. He gains a good sense of who should take the shot with seconds on the clock; who should guard the toughest player on the opposing team; who is the least phased by jeering fans. While it was hard not to root for the underdogs from Butler University during the NCAA finals, Duke University confirmed why they win time and time again: the legendary Coach K, Mike Krzyzewski, brings confidence and calm to every game and has a formula for success based on study, accumulated knowledge and experience. Moreover, his players know their roles and get even better as the pressure builds. There is no scrambling.

“...we are enthusiastic about our

prospects based on our belief that

our battle-tested investment team

is stronger than ever, precisely

because of the financial crisis.”

As Martin Luther King, Jr. once wrote, “The ultimate measure of a man is not where he stands in moments of comfort and convenience, but where he stands at times of challenge and controversy.”4 To that point, as the market cratered, the economy froze and fear reigned, we were able to assess our own investment team more completely and holistically than ever before. During the ensuing moments of truth, those members of our investment committee with the keenest insights were able to determine how an unprecedented credit crunch would affect corporate balance sheets. Those with deep industry expertise could advocate for building larger positions at fire-sale prices while many professional investors were uncomfortable and waiting for the dust to settle. Those with the courage of their convictions could take a long-term view and ignore the short-term insanity. Those with vision could see what others did not see. Interestingly, like a team that excels during a full-court press, our skills were sharpened and our roles were even more clearly defined around individual areas of strength during what proved to be our playoffs. And while there have been a number of playoffs in our 27-year history—from the crash of ‘87 to 9/11—this was our toughest series yet.

3

In investing as in basketball, when success matters most, great teams harness individual strengths to win together. Although the crisis challenged us like nothing before, it has led our team to work even more effectively and productively, which should serve us well, come what may.

“In investing as in basketball,

when success matters most,

great teams harness individual

strengths to win together.”

Portfolio Comings and Goings

In the first quarter, we purchased Herman Miller, Inc. (MLHR) in Ariel Fund. Currently, the office furniture industry is facing declines because corporations have pulled back during the Great Recession. We believe Herman Miller is poised for the inevitable recovery, especially given the company’s new manufacturing efficiencies, diversified end-market strategy and the ability to pass through raw material costs through price increases. In addition to Herman Miller, we also bought shares of DeVry Inc. (DV) (See page 7 for a special feature on DeVry), a national for- profit education provider. We have owned it on and off from 1991 through 2007. The company specializes in career-oriented training in management, technology, health care and finance. The evidence shows DeVry graduates are able to get better jobs or expand their responsibilities. With unemployment hovering around 10%, we believe many people will go back to school to learn new skills and bolster existing knowledge which should continue to boost enrollment at DeVry.

In Ariel Appreciation Fund, we purchased Lazard Ltd (LAZ), a current holding in Ariel Fund, when the international financial advisory and asset management firm’s market capitalization rose to fit the parameters of this product. We did not exit any positions in either fund during the quarter.

As always, we appreciate the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

Sincerely,

|

|

| |

John W. Rogers, Jr. | Mellody Hobson |

Chairman and CEO | President |

1 Barron’s, April 12, 2010.

2 Barron’s, March 1, 2010.

3 The New York Times, April 9, 2010. Morningstar.com, March 30, 2010.

4 Martin Luther King, Jr., Strength to Love. (Minneapolis, MN: Fortress Press, 2010), p. 26.

arielinvestments.com | 800.292.7435 |

4

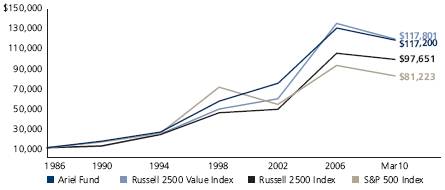

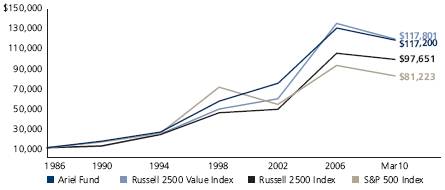

Ariel Fund Performance Summary | | Inception: November 6, 1986 |

ABOUT THE FUND

The no-load Ariel Fund pursues long-term capital appreciation by investing in undervalued companies that show strong potential for growth. The Fund primarily invests in companies with market capitalizations between $1 billion and $5 billion.

AVERAGE ANNUAL TOTAL RETURNS as of March 31, 2010

| | 1st Quarter | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Life of Fund | |

Ariel Fund | | 9.00 | % | 112.31 | % | -4.47 | % | 0.25 | % | 8.66 | % | 11.09 | % |

Russell 2500 Value Index | | 9.57 | % | 67.17 | % | -5.06 | % | 3.14 | % | 8.67 | % | 11.12 | % |

Russell 2500 Index | | 9.21 | % | 65.71 | % | -3.16 | % | 4.05 | % | 4.83 | % | 10.23 | % |

S&P 500 Index | | 5.39 | % | 49.77 | % | -4.17 | % | 1.92 | % | -0.65 | % | 9.36 | % |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit our website, arielinvestments.com.

COMPOSITION OF EQUITY HOLDINGS

| | Ariel

Fund† | | Russell

2500

Value

Index | | Russell

2500

Index | | S&P

500

Index | |

Consumer discretionary & services | | 36.84 | % | 13.77 | % | 15.88 | % | 12.06 | % |

Financial services | | 30.35 | % | 31.67 | % | 22.00 | % | 17.37 | % |

Producer durables | | 12.50 | % | 11.87 | % | 13.35 | % | 10.75 | % |

Consumer staples | | 8.93 | % | 2.69 | % | 3.38 | % | 9.67 | % |

Health care | | 7.05 | % | 5.30 | % | 12.06 | % | 12.09 | % |

Materials & processing | | 2.32 | % | 10.14 | % | 7.94 | % | 3.82 | % |

Technology | | 2.01 | % | 8.03 | % | 13.26 | % | 17.21 | % |

Utilities | | 0.00 | % | 10.97 | % | 6.81 | % | 6.04 | % |

Energy | | 0.00 | % | 5.56 | % | 5.31 | % | 10.99 | % |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

Portfolio Composition

Equity | | 98.6 | % |

Cash, Other Assets & Liabilities | | 1.4 | % |

Expense Ratio

THE VALUE OF A $10,000 INVESTMENT IN ARIEL FUND

| TOP TEN EQUITY HOLDINGS | | | |

| | | | |

1 | Hewitt Associates, Inc.

Leading human resources outsourcing and consulting firm | | 4.2 | % |

| | | | |

2 | Gannett Co., Inc.

Largest U.S. newspaper company and publisher of USA Today | | 4.2 | % |

| | | | |

3 | Jones Lang LaSalle Inc.

Leading commercial real estate services firm | | 4.2 | % |

| | | | |

4 | Interpublic Group of Cos., Inc.

Global advertising and marketing services conglomerate | | 4.0 | % |

| | | | |

5 | CB Richard Ellis Group, Inc.

World’s largest commercial real estate services firm | | 3.9 | % |

| | | | |

6 | Hospira, Inc.

Diversified health care company | | 3.8 | % |

| | | | |

7 | Janus Capital Group Inc.

Investment management company | | 3.4 | % |

| | | | |

8 | CBS Corp.

Mass media company | | 3.3 | % |

| | | | |

9 | Lazard Ltd

International financial advisory and asset management firm | | 3.2 | % |

| | | | |

10 | Bio-Rad Laboratories, Inc.

Leading manufacturer of laboratory equipment and biological testing products | | 3.1 | % |

Note: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 2500TM Value Index measures the performance of small to mid-cap value companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2500TM Index measures the performance of small to mid-cap companies. The S&P 500 is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

5

Ariel Fund Statistical Summary | (unaudited) |

| | | | | | 52-Week Range | | Earnings per Share | | P/E Calendar | | | |

Company | | Ticker

Symbol | | Price

3/31/10 | | Low | | High | | 2008

Actual

Calendar | | 2009

Actual

Calendar | | 2010

Estimated

Calendar | | 2008

Actual

P/E | | 2009

Actual

P/E | | 2010

Estimated

P/E | | Market

Cap.

($MM) | |

| | | | | | | | | | | | | | | | | | | | | | | |

Interface, Inc. | | IFSIA | | 11.58 | | 2.90 | | 11.90 | | 0.82 | | 0.28 | | 0.55 | | 14.1 | | 41.4 | | 21.1 | | 733 | |

Private Bancorp, Inc. | | PVTB | | 13.70 | | 8.33 | | 29.11 | | (3.11 | ) | (0.95 | ) | 0.25 | | NM | | NM | | 54.8 | | 929 | |

Herman Miller, Inc. | | MLHR | | 18.06 | | 10.21 | | 20.59 | | 2.59 | | 0.83 | | 1.00 | | 7.0 | | 21.8 | | 18.1 | | 1,010 | |

Fair Isaac Corp. | | FICO | | 25.34 | | 13.58 | | 27.00 | | 1.66 | | 1.34 | | 1.50 | | 15.3 | | 18.9 | | 16.9 | | 1,179 | |

Brink’s Co. | | BCO | | 28.23 | | 22.23 | | 31.28 | | 2.91 | | 1.76 | | 1.85 | | 9.7 | | 16.0 | | 15.3 | | 1,352 | |

Meredith Corp. | | MDP | | 34.41 | | 16.40 | | 35.08 | | 2.72 | | 1.78 | | 2.47 | | 12.7 | | 19.3 | | 13.9 | | 1,560 | |

Anixter Intl Inc. | | AXE | | 46.85 | | 29.04 | | 48.85 | | 5.80 | | (0.83 | ) | 3.00 | | 8.1 | | NM | | 15.6 | | 1,626 | |

Brady Corp. | | BRC | | 31.12 | | 17.02 | | 33.10 | | 2.22 | | 2.01 | | 2.15 | | 14.0 | | 15.5 | | 14.5 | | 1,631 | |

Sotheby’s | | BID | | 31.09 | | 8.54 | | 32.23 | | 0.51 | | 0.22 | | 1.05 | | 61.0 | | 141.3 | | 29.6 | | 2,088 | |

Janus Capital Group Inc. | | JNS | | 14.29 | | 6.12 | | 16.06 | | 0.86 | | 0.45 | | 0.78 | | 16.6 | | 31.8 | | 18.3 | | 2,601 | |

IDEX Corp. | | IEX | | 33.10 | | 19.67 | | 33.66 | | 1.67 | | 1.51 | | 1.85 | | 19.8 | | 21.9 | | 17.9 | | 2,680 | |

City National Corp. | | CYN | | 53.97 | | 31.02 | | 55.66 | | 2.11 | | 0.50 | | 1.50 | | 25.6 | | 107.9 | | 36.0 | | 2,781 | |

Bio-Rad Laboratories, Inc. | | BIO | | 103.52 | | 63.31 | | 104.44 | | 5.40 | | 6.09 | | 6.21 | | 19.2 | | 17.0 | | 16.7 | | 2,849 | |

Jones Lang LaSalle Inc. | | JLL | | 72.89 | | 22.24 | | 74.59 | | 3.24 | | 1.82 | | 3.02 | | 22.5 | | 40.0 | | 24.1 | | 3,050 | |

Lazard Ltd | | LAZ | | 35.70 | | 25.20 | | 44.62 | | 0.06 | | (1.68 | ) | 2.32 | | 595.0 | | NM | | 15.4 | | 3,081 | |

HCC Insurance Holdings, Inc. | | HCC | | 27.60 | | 23.02 | | 29.01 | | 2.81 | | 3.11 | | 3.00 | | 9.8 | | 8.9 | | 9.2 | | 3,148 | |

Constellation Brands, Inc. | | STZ | | 16.44 | | 10.72 | | 17.56 | | 1.68 | | 1.66 | | 1.75 | | 9.8 | | 9.9 | | 9.4 | | 3,648 | |

Markel Corp. | | MKL | | 374.66 | | 255.37 | | 379.05 | | 22.10 | | 20.52 | | 21.92 | | 17.0 | | 18.3 | | 17.1 | | 3,679 | |

Mohawk Industries, Inc. | | MHK | | 54.38 | | 28.98 | | 55.52 | | 4.42 | | 2.61 | | 3.89 | | 12.3 | | 20.8 | | 14.0 | | 3,724 | |

Hewitt Associates, Inc. | | HEW | | 39.78 | | 27.92 | | 43.85 | | 2.03 | | 2.81 | | 3.08 | | 19.6 | | 14.2 | | 12.9 | | 3,740 | |

Dun & Bradstreet Corp. | | DNB | | 74.42 | | 69.10 | | 84.95 | | 5.60 | | 5.99 | | 5.50 | | 13.3 | | 12.4 | | 13.5 | | 3,810 | |

Gannett Co., Inc. | | GCI | | 16.52 | | 2.10 | | 17.33 | | 3.16 | | 1.75 | | 2.11 | | 5.2 | | 9.4 | | 7.8 | | 3,918 | |

Interpublic Group of Cos., Inc. | | IPG | | 8.32 | | 4.03 | | 8.87 | | 0.52 | | 0.28 | | 0.44 | | 16.0 | | 29.7 | | 18.9 | | 4,044 | |

Newell Rubbermaid Inc. | | NWL | | 15.20 | | 6.20 | | 16.10 | | 1.24 | | 1.30 | | 1.54 | | 12.3 | | 11.7 | | 9.9 | | 4,223 | |

Energizer Holdings, Inc. | | ENR | | 62.76 | | 47.90 | | 69.11 | | 5.98 | | 5.12 | | 5.41 | | 10.5 | | 12.3 | | 11.6 | | 4,382 | |

Equifax Inc. | | EFX | | 35.80 | | 24.00 | | 36.63 | | 2.09 | | 1.83 | | 2.50 | | 17.1 | | 19.6 | | 14.3 | | 4,518 | |

Stanley Black & Decker, Inc. | | SWK | | 57.41 | | 28.32 | | 59.98 | | 3.41 | | 2.69 | | 2.96 | | 16.8 | | 21.3 | | 19.4 | | 4,620 | |

DeVry Inc. | | DV | | 65.20 | | 38.19 | | 68.42 | | 2.07 | | 3.00 | | 4.15 | | 31.5 | | 21.7 | | 15.7 | | 4,636 | |

McCormick & Co., Inc. | | MKC | | 38.36 | | 28.08 | | 39.71 | | 2.32 | | 2.36 | | 2.56 | | 16.5 | | 16.3 | | 15.0 | | 5,082 | |

CB Richard Ellis Group, Inc. | | CBG | | 15.85 | | 3.66 | | 16.22 | | 0.74 | | 0.18 | | 0.53 | | 21.4 | | 88.1 | | 29.9 | | 5,100 | |

International Game Technology | | IGT | | 18.45 | | 8.94 | | 23.30 | | 1.12 | | 0.91 | | 1.00 | | 16.5 | | 20.3 | | 18.5 | | 5,472 | |

Tiffany & Co. | | TIF | | 47.49 | | 20.78 | | 48.38 | | 1.74 | | 2.00 | | 2.60 | | 27.3 | | 23.7 | | 18.3 | | 5,999 | |

Royal Caribbean Cruises Ltd. | | RCL | | 32.99 | | 7.75 | | 33.93 | | 2.68 | | 0.71 | | 1.78 | | 12.3 | | 46.5 | | 18.5 | | 7,058 | |

J.M. Smucker Co. | | SJM | | 60.26 | | 36.60 | | 63.00 | | 3.48 | | 3.86 | | 4.42 | | 17.3 | | 15.6 | | 13.6 | | 7,178 | |

Nordstrom, Inc. | | JWN | | 40.85 | | 15.84 | | 42.20 | | 1.83 | | 1.90 | | 2.60 | | 22.3 | | 21.5 | | 15.7 | | 8,893 | |

Hospira, Inc. | | HSP | | 56.65 | | 29.86 | | 57.67 | | 2.53 | | 3.11 | | 3.40 | | 22.4 | | 18.2 | | 16.7 | | 9,262 | |

CBS Corp. | | CBS | | 13.94 | | 3.65 | | 14.95 | | 1.91 | | 0.65 | | 1.21 | | 7.3 | | 21.4 | | 11.5 | | 9,407 | |

Note: Holdings are as of March 31, 2010. All earnings per share numbers are fully diluted. Such numbers are from continuing operations and are adjusted for non-recurring items. All estimates of future earnings per share shown in this table are prepared by Ariel Investments research analysts as of March 31, 2010. P/E ratios are based on earnings stated and March 31, 2010 stock price. NM=Not Meaningful.

arielinvestments.com | 800.292.7435 |

6

Company Spotlight

| DeVry Inc. (NYSE: DV) |

3005 Highland Parkway |

Downers Grove, IL 60515 |

800.733.3879 |

devryinc.com |

Founded in Chicago in 1931, DeVry, held in Ariel Fund, has consistently delivered on its promise to provide strong, career-oriented educations to enrich its students’ job skills. Currently approximately 100,000 students attend its five separate colleges with training in technology, science, business, the arts and management. For instance, the Chamberlain School of Nursing helps fill the ever-expanding need for health care workers. Meanwhile, DeVry University’s technology curriculum teaches working adults to thrive in an increasingly complex information age. The company maintains a laser-like focus on its goal of improving lives through education.

Growth through Downturns

Adults return to DeVry during economic downturns to boost their skills. The Great Recession has been no exception; DeVry’s revenue is growing six to seven times faster than the overall economy. Meanwhile, the company is now benefitting from management’s past strategic moves. After the educational downturn in 2003, the company grew brick and mortar capacity, diversified by acquiring institutions with different specialties, and invested in online curriculums.

Customer Oriented

For-profit educators have long served non-traditional students better than public and private universities have. So while it is true DeVry’s core constituents are the working adults trying to expand on skills they already have, that is not the whole story. The company also developed an edge educating minority and immigrant students as well as those who are the first in their family to attend college. These groups are well- served: since 1975, 90 percent of DeVry’s graduates were active in their field within six months.

Growing Market

Currently more than 18 million students attend colleges and universities—one in three of them at community colleges. With most states suffering from declining revenues and increased operating expenses, it seems very likely that state legislatures will have to cut budgets broadly—and possibly deeply—at these schools. DeVry is a natural competitor to community colleges, and thus a probable beneficiary from this unfortunate situation.

Compelling Opportunity

Although DeVry competes against government-funded schools, its students still get much of their financing from the government. This has led Wall Street investors to fear any changes in Department of Education regulations. Recently investors have been concerned the “rules of the game” would be altered and hurt for-profit colleges. The market assumes any changes will slow the company down, but we disagree, believing DeVry will compete effectively because it provides a cost-effective service that people need.

Valuation

With its shares trading at 13x 2011 earnings estimates, our confidence that the market had become overly pessimistic regarding regulatory changes made us ready to pounce. As of March 31, 2010, shares traded at $65.20, a 23% discount to our private market value of $84.76.

7

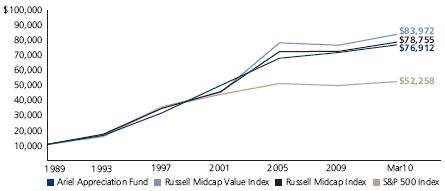

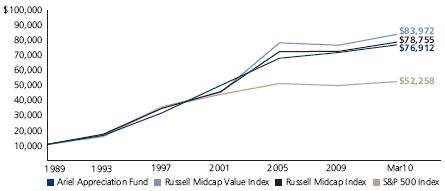

Ariel Appreciation Fund Performance Summary | Inception: December 1, 1989 |

ABOUT THE FUND

The no-load Ariel Appreciation Fund pursues long-term capital appreciation by investing in undervalued companies that show strong potential for growth. The Fund primarily invests in companies with market capitalizations between $2.5 billion and $15 billion.

AVERAGE ANNUAL TOTAL RETURNS as of March 31, 2010

| | 1st Quarter | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Life of Fund | |

Ariel Appreciation Fund | | 7.19 | % | 98.15 | % | 0.05 | % | 3.67 | % | 8.30 | % | 10.55 | % |

Russell Midcap Value Index | | 9.61 | % | 72.41 | % | -5.22 | % | 3.71 | % | 8.46 | % | 11.03 | % |

Russell Midcap Index | | 8.67 | % | 67.71 | % | -3.30 | % | 4.20 | % | 4.84 | % | 10.68 | % |

S&P 500 Index | | 5.39 | % | 49.77 | % | -4.17 | % | 1.92 | % | -0.65 | % | 8.47 | % |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit our website, arielinvestments.com.

COMPOSITION OF EQUITY HOLDINGS

| | Ariel

Appreciation

Fund† | | Russell

Midcap

Value

Index | | Russell

Midcap

Index | | S&P

500

Index | |

Consumer discretionary & services | | 33.16 | % | 13.81 | % | 16.46 | % | 12.06 | % |

Financial services | | 30.68 | % | 29.21 | % | 20.63 | % | 17.37 | % |

Health care | | 14.95 | % | 4.15 | % | 8.68 | % | 12.09 | % |

Consumer staples | | 8.75 | % | 6.35 | % | 6.09 | % | 9.67 | % |

Producer durables | | 8.66 | % | 11.00 | % | 13.31 | % | 10.75 | % |

Technology | | 3.80 | % | 5.78 | % | 12.04 | % | 17.21 | % |

Utilities | | 0.00 | % | 12.85 | % | 8.02 | % | 6.04 | % |

Materials & processing | | 0.00 | % | 8.58 | % | 7.61 | % | 3.82 | % |

Energy | | 0.00 | % | 8.27 | % | 7.15 | % | 10.99 | % |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

Portfolio Composition

Equity | | 99.3 | % |

Cash, Other Assets & Liabilities | | 0.7 | % |

Expense Ratio

THE VALUE OF A $10,000 INVESTMENT IN ARIEL APPRECIATION FUND

| TOP TEN EQUITY HOLDINGS | | | |

| | | | |

1 | Gannett Co., Inc.

Largest U.S. newspaper company and publisher of USA Today | | 4.0 | % |

| | | | |

2 | Jones Lang LaSalle Inc.

Leading commercial real estate services firm | | 3.9 | % |

| | | | |

3 | Northern Trust Corp.

Premier trust bank focused on asset management, asset custodianship and private banking | | 3.7 | % |

| | | | |

4 | Viacom, Inc.

Cable network and film production company | | 3.7 | % |

| | | | |

5 | Accenture plc

Global management consultant specializing in technology and outsourcing | | 3.6 | % |

| | | | |

6 | Hewitt Associates, Inc.

Leading human resources outsourcing and consulting firm | | 3.6 | % |

| | | | |

7 | AFLAC Inc.

Leading provider of supplemental health and life insurance products in the U.S. and Japan | | 3.4 | % |

| | | | |

8 | Interpublic Group of Cos., Inc.

Global advertising and marketing services conglomerate | | 3.3 | % |

| | | | |

9 | CB Richard Ellis Group, Inc.

World’s largest commercial real estate services firm | | 3.2 | % |

| | | | |

10 | CBS Corp.

Mass media company | | 3.2 | % |

Note: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell Midcap® Value Index measures the performance of mid-cap value companies with lower price-to-book ratios and lower forecasted growth values. The Russell Midcap® Index measures the performance of mid-cap companies. The S&P 500 is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

arielinvestments.com | 800.292.7435 |

8

Ariel Appreciation Fund Statistical Summary | (unaudited) |

| | | | | | 52-Week Range | | Earnings per Share | | P/E Calendar | | | |

| | | | | | | | | | 2008 | | 2009 | | 2010 | | 2008 | | 2009 | | 2010 | | Market | |

| | Ticker | | Price | | | | | | Actual | | Actual | | Estimated | | Actual | | Actual | | Estimated | | Cap. | |

Company | | Symbol | | 3/31/10 | | Low | | High | | Calendar | | Calendar | | Calendar | | P/E | | P/E | | P/E | | ($MM) | |

Anixter Intl Inc. | | AXE | | 46.85 | | 29.04 | | 48.85 | | 5.80 | | (0.83 | ) | 3.00 | | 8.1 | | NM | | 15.6 | | 1,626 | |

Sotheby’s | | BID | | 31.09 | | 8.54 | | 32.23 | | 0.51 | | 0.22 | | 1.05 | | 61.0 | | 141.3 | | 29.6 | | 2.088 | |

Janus Capital Group Inc. | | JNS | | 14.29 | | 6.12 | | 16.06 | | 0.86 | | 0.45 | | 0.78 | | 16.6 | | 31.8 | | 18.3 | | 2,601 | |

City National Corp. | | CYN | | 53.97 | | 31.02 | | 55.66 | | 2.11 | | 0.50 | | 1.50 | | 25.6 | | 107.9 | | 36.0 | | 2,781 | |

Bio-Rad Laboratories, Inc. | | BIO | | 103.52 | | 63.31 | | 104.44 | | 5.40 | | 6.09 | | 6.21 | | 19.2 | | 17.0 | | 16.7 | | 2,849 | |

Jones Lang LaSalle Inc. | | JLL | | 72.89 | | 22.24 | | 74.59 | | 3.24 | | 1.82 | | 3.02 | | 22.5 | | 40.0 | | 24.1 | | 3,050 | |

Lazard Ltd | | LAZ | | 35.70 | | 25.20 | | 44.62 | | 0.06 | | (1.68 | ) | 2.32 | | 595.0 | | NM | | 15.4 | | 3,081 | |

Constellation Brands, Inc. | | STZ | | 16.44 | | 10.72 | | 17.56 | | 1.68 | | 1.66 | | 1.75 | | 9.8 | | 9.9 | | 9.4 | | 3,648 | |

Markel Corp. | | MKL | | 374.66 | | 255.37 | | 379.05 | | 22.10 | | 20.52 | | 21.92 | | 17.0 | | 18.3 | | 17.1 | | 3,679 | |

Mohawk Industries, Inc. | | MHK | | 54.38 | | 28.98 | | 55.52 | | 4.42 | | 2.61 | | 3.89 | | 12.3 | | 20.8 | | 14.0 | | 3,724 | |

Hewitt Associates, Inc. | | HEW | | 39.78 | | 27.92 | | 43.85 | | 2.03 | | 2.81 | | 3.08 | | 19.6 | | 14.2 | | 12.9 | | 3,740 | |

Dun & Bradstreet Corp. | | DNB | | 74.42 | | 69.10 | | 84.95 | | 5.60 | | 5.99 | | 5.50 | | 13.3 | | 12.4 | | 13.5 | | 3,810 | |

Gannett Co., Inc. | | GCI | | 16.52 | | 2.10 | | 17.33 | | 3.16 | | 1.75 | | 2.11 | | 5.2 | | 9.4 | | 7.8 | | 3,918 | |

Interpublic Group of Cos., Inc. | | IPG | | 8.32 | | 4.03 | | 8.87 | | 0.52 | | 0.28 | | 0.44 | | 16.0 | | 29.7 | | 18.9 | | 4,044 | |

Energizer Holdings, Inc. | | ENR | | 62.76 | | 47.90 | | 69.11 | | 5.98 | | 5.12 | | 5.41 | | 10.5 | | 12.3 | | 11.6 | | 4,382 | |

Equifax Inc. | | EFX | | 35.80 | | 24.00 | | 36.63 | | 2.09 | | 1.83 | | 2.50 | | 17.1 | | 19.6 | | 14.3 | | 4,518 | |

Stanley Black & Decker, Inc. | | SWK | | 57.41 | | 28.32 | | 59.98 | | 3.41 | | 2.69 | | 2.96 | | 16.8 | | 21.3 | | 19.4 | | 4,620 | |

McCormick & Co., Inc. | | MKC | | 38.36 | | 28.08 | | 39.71 | | 2.32 | | 2.36 | | 2.56 | | 16.5 | | 16.3 | | 15.0 | | 5,082 | |

CB Richard Ellis Group, Inc. | | CBG | | 15.85 | | 3.66 | | 16.22 | | 0.74 | | 0.18 | | 0.53 | | 21.4 | | 88.1 | | 29.9 | | 5,100 | |

International Game Technology | | IGT | | 18.45 | | 8.94 | | 23.30 | | 1.12 | | 0.91 | | 1.00 | | 16.5 | | 20.3 | | 18.5 | | 5,472 | |

Tiffany & Co. | | TIF | | 47.49 | | 20.78 | | 48.38 | | 1.74 | | 2.00 | | 2.60 | | 27.3 | | 23.7 | | 18.3 | | 5,999 | |

J.M. Smucker Co. | | SJM | | 60.26 | | 36.60 | | 63.00 | | 3.48 | | 3.86 | | 4.42 | | 17.3 | | 15.6 | | 13.6 | | 7,178 | |

Laboratory Corp. of America | | LH | | 75.71 | | 57.08 | | 77.09 | | 4.99 | | 5.28 | | 5.83 | | 15.2 | | 14.3 | | 13.0 | | 7,972 | |

Nordstrom, Inc. | | JWN | | 40.85 | | 15.84 | | 42.20 | | 1.83 | | 1.90 | | 2.60 | | 22.3 | | 21.5 | | 15.7 | | 8,893 | |

Clorox Co. | | CLX | | 64.14 | | 50.31 | | 65.18 | | 3.37 | | 4.16 | | 4.49 | | 19.0 | | 15.4 | | 14.3 | | 8,995 | |

CBS Corp. | | CBS | | 13.94 | | 3.65 | | 14.95 | | 1.91 | | 0.65 | | 1.21 | | 7.3 | | 21.4 | | 11.5 | | 9,407 | |

Omnicom Group Inc. | | OMC | | 38.81 | | 23.00 | | 40.29 | | 3.17 | | 2.65 | | 2.78 | | 12.2 | | 14.6 | | 14.0 | | 11,969 | |

Zimmer Holdings, Inc. | | ZMH | | 59.20 | | 35.36 | | 64.77 | | 4.24 | | 4.13 | | 4.52 | | 14.0 | | 14.3 | | 13.1 | | 12,089 | |

St. Jude Medical, Inc. | | STJ | | 41.05 | | 31.66 | | 41.96 | | 2.41 | | 2.55 | | 2.92 | | 17.0 | | 16.1 | | 14.1 | | 13,322 | |

Northern Trust Corp. | | NTRS | | 55.26 | | 46.72 | | 66.08 | | 3.47 | | 3.16 | | 3.50 | | 15.9 | | 17.5 | | 15.8 | | 13,355 | |

T. Rowe Price Group, Inc. | | TROW | | 54.93 | | 27.42 | | 56.25 | | 1.82 | | 1.65 | | 2.59 | | 30.2 | | 33.3 | | 21.2 | | 14,212 | |

Viacom, Inc. | | VIA.B | | 34.38 | | 17.04 | | 34.78 | | 2.13 | | 2.43 | | 2.90 | | 16.1 | | 14.1 | | 11.9 | | 20,882 | |

Thermo Fisher Scientific Inc. | | TMO | | 51.44 | | 30.83 | | 52.39 | | 3.16 | | 3.05 | | 3.43 | | 16.3 | | 16.9 | | 15.0 | | 21,055 | |

Illinois Tool Works Inc. | | ITW | | 47.36 | | 29.69 | | 51.16 | | 3.08 | | 1.95 | | 2.77 | | 15.4 | | 24.3 | | 17.1 | | 23,791 | |

Franklin Resources, Inc. | | BEN | | 110.90 | | 51.33 | | 116.39 | | 5.97 | | 4.45 | | 6.40 | | 18.6 | | 24.9 | | 17.3 | | 25,308 | |

AFLAC Inc. | | AFL | | 54.29 | | 17.25 | | 55.20 | | 3.92 | | 4.85 | | 5.22 | | 13.8 | | 11.2 | | 10.4 | | 25,439 | |

Accenture plc | | ACN | | 41.95 | | 26.33 | | 43.89 | | 2.65 | | 2.79 | | 2.70 | | 15.8 | | 15.0 | | 15.5 | | 26,705 | |

Dell Inc. | | DELL | | 15.01 | | 9.22 | | 17.26 | | 1.35 | | 0.96 | | 1.25 | | 11.1 | | 15.6 | | 12.0 | | 29,394 | |

Carnival Corp. & plc | | CCL | | 38.88 | | 21.14 | | 39.35 | | 2.84 | | 2.24 | | 2.41 | | 13.7 | | 17.4 | | 16.1 | | 30,676 | |

Baxter Intl Inc. | | BAX | | 58.20 | | 45.46 | | 61.88 | | 3.45 | | 3.88 | | 4.33 | | 16.9 | | 15.0 | | 13.4 | | 34,977 | |

Note: Holdings are as of March 31, 2010. All earnings per share numbers are fully diluted. Such numbers are from continuing operations and are adjusted for non-recurring items. All estimates of future earnings per share shown in this table are prepared by Ariel Investments research analysts as of March 31, 2010. P/E ratios are based on earnings stated and March 31, 2010 stock price. NM=Not Meaningful.

9

Company Spotlight

| Mohawk Industries, Inc. (NYSE: MHK) |

160 South Industrial Boulevard |

Calhoun, GA 30701 |

800.241.4494 |

mohawkind.com |

Mohawk Industries, held in Ariel Fund and Ariel Appreciation Fund, is the leading manufacturer and distributor of floorcovering in the United States. Founded in 1878 as a carpet manufacturer, Mohawk is the oldest and largest company in the floorcovering industry—competing in all major categories including carpet, hardwood, laminate, and ceramic tile. The company markets and manufactures under a number of premier brand names such as Mohawk, Karastan, Lees, Dal-Tile, Unilin and American Olean.

A League of its Own

Mohawk maintains strong competitive advantages through an extensive distribution network of 300 locations, its own trucking fleet, low-cost manufacturing and brand recognition. Furthermore, the company has a strong commitment to its dealer relationships and premium service levels—both of which are critical in filling orders, ensuring prompt delivery, and achieving customer satisfaction.

Solid Strategic Acquirer

Over the years, Mohawk has completed several strategic acquisitions, rounding out its product portfolio. The company’s most recent acquisition, Columbia Wood, has provided the company with a proprietary hardwood product line. Even during the extreme downturn, management expanded the breadth of the hardwood product portfolio to raise prices and extend its distribution. Once the market rebounds, Mohawk’s hardwood division is poised to expand faster than the overall market due to the steps the company has taken during tough times.

An Industry in a Depression

During the Great Recession, the floorcovering industry did not face a recession—it faced a severe depression. This was the longest and deepest downturn lasting about three-and-a-half years and declining approximately 35%. In addition to the collapse of the housing market, the recession also slashed cash outlays for the residential replacement floorcovering business. Exacerbating this further was the capital freeze among corporate America on the commercial floorcovering business. We believe there is a shining silver lining for the floorcovering marketplace. Given the pullback in the market, we believe there is a huge amount of pent-up demand for floorcovering products. As existing home sales stabilize and improve, those neglected and foreclosed houses will require new floorcoverings. The typical homebuyer today is not as stretched for cash given the strict requirements by banks to have high credit scores, along with solid down payments. The purchasers today are in better shape financially than homebuyers during the bubble peak. Mohawk has a strong recurring replacement floor covering business which is more profitable than bulk purchases from home builders for new residences.

Slick Pricing

Another issue pressuring the stock is Mohawk’s exposure to raw material price increases (primarily petroleum-related products). Generally the industry has passed raw material price increases along to the end-consumer. During the Great Recession, however, the industry struggled to fully pass through price increases as the consumer shifted to the lower-priced products. In response, Mohawk has concentrated its research efforts in recycling, less expensive products, and non-nylon carpets.

As of March 31, 2010, Mohawk shares traded at $54.38, a 40% discount to our private market value of $89.98. We believe Wall Street does not fully appreciate the underlying pent-up demand within the floorcovering market and the operating margin expansion the company will exhibit as volumes increase.

arielinvestments.com | 800.292.7435 |

10

Dear Fellow Shareholder: In the first quarter of 2010 Ariel Focus Fund performed in line with the market, slightly underperforming the Russell 1000 Value Index and modestly outperforming the broad market as measured by the S&P 500 Index. For the quarter ended March 31, 2010, Ariel Focus Fund rose +5.43% versus +6.78% for the Russell 1000 Value Index, and +5.39% for the S&P 500 Index. For the last twelve months, the Fund gained +66.06% versus +53.56% for the Russell 1000 Value Index, and +49.77% for the S&P 500 Index.

Before taking a look at the stocks that helped and hurt performance in the quarter, we thought we would update our outlook for the rest of 2010 and for the market in general. You may recall our last letter called for “A Return to Normalcy” with outperformance coming primarily from superior stock selection rather than positioning for major market moves. In this type of market we expected broad equity returns in the high single or low double-digits rather than the +25% annual moves we have seen recently. We said we thought high-quality companies with steady earnings growth and robust cash flow offered the best risk/reward opportunity. Our portfolio at year-end reflected this quality bias with Johnson & Johnson (JNJ), Accenture plc (ACN), Omnicom Group Inc. (OMC) and Berkshire Hathaway Inc. (BRK.B) representing our four largest holdings.

At Ariel we do not profess to be able to predict short-term trends in the market; indeed, our forecast that higher-quality issues would outperform did not come true in the first quarter. Risk premiums continued to shrink in the quarter with lower-quality, higher- leveraged, deeper-cyclical companies on average outperforming higher-quality, less-leveraged, less-cyclical names. Overall equity returns in the quarter continued their recent trend of above-normal returns, reflecting the investment community’s continued appetite for risk. Of our four largest high-quality names, three (Johnson & Johnson, Omnicom and Accenture) underperformed the market. Only Berkshire Hathaway outperformed.

We continue to position Ariel Focus Fund to be heavily weighted toward higher-quality holdings. In short, we believe market participants are currently not being sufficiently compensated for taking risk. Usually there are trade-offs between quality, earnings growth, and valuation. As Milton Friedman would say, “There is no such thing as a free lunch.” But at quarter-end, Ariel Focus Fund had projected earnings growth estimates well above the broad market but traded at a forward PE multiple below the market. As of March 31, the forward PE for Ariel Focus Fund was 13.7x versus 14.4x for the S&P 500. Based on third-party (IBES) projected estimates, the stocks in our portfolio are growing

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month –end, visit our website, arielinvestments.com.

11

earnings 20% faster than those in the S&P 500 over the next five years. And Ariel Focus Fund holds high-quality companies with much better balance sheet strength as measured by interest coverage (9.7x versus 6.8x). While there may be no free lunches, we think Ariel Focus Fund is currently buying sirloin steaks at hamburger prices.

“While there may be no

free lunches, we think

Ariel Focus Fund is

currently buying sirloin steaks

at hamburger prices.”

In the first quarter, Berkshire Hathaway was the second largest contributor to performance, with a gain of +23.66%. What has occurred with Berkshire over the last six months is a wonderful illustration of many of Ariel’s core value investing principles in action. In mid-2009, Berkshire was a company with sustainable competitive advantages trading at a discount to our calculation of intrinsic value. Berkshire’s competitive advantages include the world’s greatest investor at the helm and a reputation as the place to go when good companies need money in a hurry. In 2008-2009, Warren Buffett was offered the opportunity to make investments in Goldman Sachs Group, Inc. (GS), General Electric Co. (GE), and Tiffany & Co. (TIF), all on terms other institutional investors could only dream of. Those investments, along with the strong performance of Berkshire’s existing divisions such as GEICO and Gen Re, increased our calculation of the intrinsic value of Berkshire to about $3,674 per share1, 26% above our initial 2005 purchase price. But for most of 2009 Berkshire traded between $2,500 and $3,250, a substantial discount to Ariel’s calculation of private market value. The stock had traded poorly, in part, due to concerns over equity put options Buffett had sold in 2008 as well as credit default insurance Berkshire had written against certain municipal bonds.

A core goal of value investing is to buy companies at a discount to their intrinsic value without necessarily needing to identify the “catalyst” that will close this gap in the future. In fact, the absence of an identifiable catalyst is often necessary for a stock to trade at a discount. Investors focused on the short-term outlook may avoid a stock with long-term value if there is nothing in the near-term that will move a stock higher. At Ariel we are perfectly comfortable owning a great company like Berkshire at a discount, participating in the intrinsic growth of the business and waiting patiently for shorter-term clouds over the company to dissipate.

“...Berkshire Hathaway was the

second largest contributor to

performance, with a gain of

+23.66%. What has occurred with

Berkshire over the last six months

is a wonderful illustration of many

of Ariel’s core value investing

principles in action.”

In early 2010, Berkshire acquired railroad Burlington Northern Santa Fe Corporation. It was also added to the S&P 500 Index, which increased its share price. Additionally, Berkshire has enjoyed a recovery in the value of its large equity holdings as well as improved operating company performance, which contributed to the strong price movement. Considering that the shares trade near our calculation of intrinsic value and much of the “dry powder” of excess capital has been deployed in the recent correction, we sold half of our position in the quarter. We have a bias toward

arielinvestments.com | 800.292.7435 |

12

a complete exit in the near-term given our discipline of selling stocks trading above our estimate of private market value. We bought Berkshire for Ariel Focus Fund at an average cost of $2,911 because we thought it a great company trading at a discount to a carefully calculated intrinsic value. In the first quarter, we sold half of our shares when the valuation gap closed. We do not claim to be able to see the future. But we do believe if we purchase stocks at prices that incorporate a margin of safety; the market will eventually “weigh” the cash flows owned by the company and assign a price more consistent with their underlying values. That is value investing in a nutshell.

“A core goal of value investing

is to buy companies at a

discount to their intrinsic value

without necessarily needing to

identify the “catalyst” that will

close this gap in the future.”

Stocks having a negative effect on performance were generally less interesting than Berkshire, with no stock declining by more than

-6%. Many of our companies providing services to corporations underperformed modestly in the quarter. Hewitt Associates, Inc. (HEW) (see page 16 for a special feature on Hewitt) declined -5.9% and Omnicom declined -0.3%, both due to lack of investor enthusiasm with new estimates of 2010 profitability. In general, business services spending has earned its reputation as “late cycle”. Revenue for these companies has only met or even slightly missed expectations. Given the flood of negative headlines regarding Toyota Motor Corp. (TM), its worldwide recall and pending fines, it is actually encouraging that Toyota’s stock price declined only

-4.4% in the quarter.

Portfolio comings and goings

In the first quarter of 2010, we purchased Interpublic Group of Cos., Inc. (IPG), a current holding in Ariel Fund and Ariel Appreciation Fund. This advertising and marketing services firm rose to fit the parameters of this product and had a compelling valuation given its growth prospects in the recovery. Meanwhile, we exited Waste Management, Inc. (WM) during the quarter as the stock price approached our estimate of its private market value.

We appreciate your consideration and the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

Sincerely, | | |

| |

|

Charles K. Bobrinskoy | | Timothy Fidler |

Vice Chairman & Director of Research | | Senior Vice President, |

Co-Portfolio Manager | | Investment Committee |

| | Co-Portfolio Manager |

1 On January 20, 2010, Berkshire Hathaway Inc. shareholders approved a 50-for-1 split of its class B common stock. As of March 31, 2010 the stock traded at $81.27.

13

Ariel Focus Fund Performance Summary | Inception: June 30, 2005 |

ABOUT THE FUND

The no-load Ariel Focus Fund pursues long-term capital appreciation by investing in undervalued companies that show strong potential for growth. The Fund primarily invests in companies with market capitalizations in excess of $10 billion. Ariel Focus Fund is a non-diversified fund and holds approximately 20 securities.

AVERAGE ANNUAL TOTAL RETURNS as of March 31, 2010

| | 1st Quarter | | 1 Year | | 3 Year | | Life of Fund | |

Ariel Focus Fund | | 5.43 | % | 66.06 | % | -3.47 | % | 1.03 | % |

Russell 1000 Value Index | | 6.78 | % | 53.56 | % | -7.33 | % | 0.62 | % |

S&P 500 Index | | 5.39 | % | 49.77 | % | -4.17 | % | 1.58 | % |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To access performance data current to the most recent month-end, visit our website, arielinvestments.com.

COMPOSITION OF EQUITY HOLDINGS

| | | | Russell | | | |

| | Ariel | | 1000 | | S&P | |

| | Focus | | Value | | 500 | |

| | Fund† | | Index | | Index | |

Consumer discretionary & services | | 25.97 | % | 11.07 | % | 12.06 | % |

Financial services | | 20.44 | % | 26.24 | % | 17.37 | % |

Producer durables | | 18.69 | % | 10.98 | % | 10.75 | % |

Health care | | 16.91 | % | 8.68 | % | 12.09 | % |

Technology | | 9.50 | % | 4.36 | % | 17.21 | % |

Energy | | 8.49 | % | 17.44 | % | 10.99 | % |

Utilities | | 0.00 | % | 11.42 | % | 6.04 | % |

Consumer staples | | 0.00 | % | 5.49 | % | 9.67 | % |

Materials & processing | | 0.00 | % | 4.31 | % | 3.82 | % |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

Portfolio Composition

Equity | | 96.9 | % |

Cash, Other Assets & Liabilities | | 3.1 | % |

Expense Ratio

THE VALUE OF A $10,000 INVESTMENT IN ARIEL FOCUS FUND

| TOP TEN EQUITY HOLDINGS | | | |

| | | | |

1 | Johnson & Johnson

Diversified health care and consumer products company | | 5.6 | % |

| | | | |

2 | Omnicom Group Inc.

Leading global advertising and marketing services company | | 5.2 | % |

| | | | |

3 | Accenture plc

Global management consultant specializing in technology and outsourcing | | 5.0 | % |

| | | | |

4 | Tyco Intl Ltd.

Diversified manufacturing conglomerate | | 4.8 | % |

| | | | |

5 | Apollo Group, Inc.

Nationwide private education provider specializing in online courses | | 4.8 | % |

| | | | |

6 | AFLAC Inc.

Leading provider of supplemental health and life insurance products in the U.S. and Japan | | 4.8 | % |

| | | | |

7 | International Business Machines Corp.

World’s top provider of computer products and services | | 4.7 | % |

| | | | |

8 | Dell Inc.

Global personal computer manufacturer and technology provider | | 4.5 | % |

| | | | |

9 | Morgan Stanley

Leading global financial services firm | | 4.5 | % |

| | | | |

10 | Walt Disney Co.

Global media and theme park company | | 4.4 | % |

*As of 9/30/09 Ariel Investments, LLC, the Adviser to the Funds, is contractually obligated to waive fees and reimburse expenses in order to limit Ariel Focus Fund’s total annual operating expenses to 1.25% of net assets through the end of the fiscal year ending September 30, 2011.

Note: The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 1000® Value Index measures the performance of large-cap value companies with lower price-to-book ratios and lower expected growth values. The S&P 500 is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Ariel Focus Fund is a non-diversified fund and therefore may be subject to greater volatility than a more diversified investment.

arielinvestments.com | 800.292.7435 |

14

Ariel Focus Fund Statistical Summary | (unaudited) |

| | | | | | 52-Week Range | | Earnings per Share | | P/E Calendar | | | |

| | | | | | | | | | 2008 | | 2009 | | 2010 | | 2008 | | 2009 | | 2010 | | Market | |

| | Ticker | | Price | | | | | | Actual | | Actual | | Estimated | | Actual | | Actual | | Estimated | | Cap. | |

Company | | Symbol | | 3/31/10 | | Low | | High | | Calendar | | Calendar | | Calendar | | P/E | | P/E | | P/E | | ($MM) | |

Hewitt Associates, Inc. | | HEW | | 39.78 | | 27.92 | | 43.85 | | 2.03 | | 2.81 | | 3.08 | | 19.6 | | 14.2 | | 12.9 | | 3,740 | |

Interpublic Group of Cos., Inc. | | IPG | | 8.32 | | 4.03 | | 8.87 | | 0.52 | | 0.28 | | 0.44 | | 16.0 | | 29.7 | | 18.9 | | 4,044 | |

Apollo Group, Inc. | | APOL | | 61.29 | | 52.79 | | 81.20 | | 3.25 | | 4.51 | | 5.39 | | 18.9 | | 13.6 | | 11.4 | | 9,291 | |

Omnicom Group Inc. | | OMC | | 38.81 | | 23.00 | | 40.29 | | 3.17 | | 2.65 | | 2.78 | | 12.2 | | 14.6 | | 14.0 | | 11,969 | |

Tyco Intl Ltd. | | TYC | | 38.25 | | 18.70 | | 38.88 | | 2.97 | | 2.51 | | 2.62 | | 12.9 | | 15.2 | | 14.6 | | 18,174 | |

Hess Corp. | | HES | | 62.55 | | 46.33 | | 69.74 | | 7.28 | | 1.98 | | 4.05 | | 8.6 | | 31.6 | | 15.4 | | 20,468 | |

Covidien plc | | COV | | 50.28 | | 30.55 | | 52.40 | | 2.81 | | 3.20 | | 3.65 | | 17.9 | | 15.7 | | 13.8 | | 25,141 | |

AFLAC Inc. | | AFL | | 54.29 | | 17.25 | | 55.20 | | 3.92 | | 4.85 | | 5.22 | | 13.8 | | 11.2 | | 10.4 | | 25,439 | |

Accenture plc | | ACN | | 41.95 | | 26.33 | | 43.89 | | 2.65 | | 2.79 | | 2.70 | | 15.8 | | 15.0 | | 15.5 | | 26,705 | |

Dell Inc. | | DELL | | 15.01 | | 9.22 | | 17.26 | | 1.35 | | 0.96 | | 1.25 | | 11.1 | | 15.6 | | 12.0 | | 29,394 | |

Carnival Corp. & plc | | CCL | | 38.88 | | 21.14 | | 39.35 | | 2.84 | | 2.24 | | 2.41 | | 13.7 | | 17.4 | | 16.1 | | 30,676 | |

Lockheed Martin Corp. | | LMT | | 83.22 | | 65.21 | | 87.19 | | 7.96 | | 7.58 | | 7.41 | | 10.5 | | 11.0 | | 11.2 | | 31,041 | |

Baxter Intl Inc. | | BAX | | 58.20 | | 45.46 | | 61.88 | | 3.45 | | 3.88 | | 4.33 | | 16.9 | | 15.0 | | 13.4 | | 34,977 | |

Bank of New York Mellon Corp. | | BK | | 30.88 | | 23.75 | | 33.62 | | 1.22 | | (0.93 | ) | 2.40 | | 25.3 | | NM | | 12.9 | | 37,298 | |

Morgan Stanley | | MS | | 29.29 | | 20.69 | | 35.78 | | 3.51 | | (0.93 | ) | 2.84 | | 8.3 | | NM | | 10.3 | | 39,852 | |

Walt Disney Co. | | DIS | | 34.91 | | 17.82 | | 35.60 | | 2.10 | | 1.82 | | 2.11 | | 16.6 | | 19.2 | | 16.5 | | 65,488 | |

Merck & Co., Inc. | | MRK | | 37.35 | | 22.33 | | 41.56 | | 3.52 | | 3.34 | | 3.45 | | 10.6 | | 11.2 | | 10.8 | | 116,092 | |

Toyota Motor Corp. | | TM | | 80.42 | | 63.14 | | 91.97 | | 0.52 | | (5.95 | ) | 2.08 | | 154.7 | | NM | | 38.7 | | 126,099 | |

International Business Machines Corp. | | IBM | | 128.25 | | 94.85 | | 134.25 | | 8.89 | | 9.88 | | 11.05 | | 14.4 | | 13.0 | | 11.6 | | 167,409 | |

JPMorgan Chase & Co. | | JPM | | 44.75 | | 24.85 | | 47.47 | | 1.37 | | 2.24 | | 3.40 | | 32.7 | | 20.0 | | 13.2 | | 176,403 | |

Johnson & Johnson | | JNJ | | 65.20 | | 50.12 | | 65.95 | | 4.75 | | 4.81 | | 5.12 | | 13.7 | | 13.6 | | 12.7 | | 179,582 | |

Berkshire Hathaway Inc. | | BRK.B | | 81.27 | | 54.66 | | 83.57 | | 4.14 | | 3.46 | | 3.80 | | 19.6 | | 23.5 | | 21.4 | | 189,197 | |

Exxon Mobil Corp. | | XOM | | 66.98 | | 63.56 | | 76.54 | | 8.47 | | 3.95 | | 5.53 | | 7.9 | | 17.0 | | 12.1 | | 316,614 | |

Note: Holdings are as of March 31, 2010. All earnings per share numbers are fully diluted. Such numbers are from continuing operations and are adjusted for non-recurring items. All estimates of future earnings per share shown in this table are prepared by Ariel Investments research analysts as of March 31, 2010. P/E ratios are based on earnings stated and March 31, 2010 stock price. NM=Not Meaningful.

15

Company Spotlight

| Hewitt Associates (NYSE: HEW)

100 Half Day Road

Lincolnshire, IL 60069

847.295.5000

hewitt.com |

A Wonderful Franchise

Hewitt Associates, held in Ariel Fund, Ariel Appreciation Fund and Ariel Focus Fund, offers its clients a complete range of human capital management services, including: Human Resources (HR), Payroll, and Benefits Consulting & Outsourcing, Health Care, Retirement, and Financial Management Consulting, and Talent and Organizational Change Consulting. Hewitt’s competitive strength lies with its extensive experience in human resources and its blue chip client base. Currently more than half of the Fortune 500 companies are Hewitt clients and the company has retention rates of over 90% in its core benefits outsourcing business. Hewitt has a powerful brand and is a clear leader with scope and scale in the HR market. The company operates a growing business requiring low capital requirements, high operating margins and returns on invested capital as well as high client retention rates.

Hewitt continues to put up solid results in a difficult environment and is gaining increasing attention from the investment community now that the HR Business Process Outsourcing (BPO) segment has been stabilized. Hewitt is one the rare turnarounds that actually ‘turned’ and is demonstrating earnings growth and strong financial health in this toughest of periods. Furthermore, Hewitt is the type of investment Ariel thrives on: a conservatively, well-run company with an established world-class franchise and solid long-term growth prospects, available at very attractive valuation levels on both an absolute and relative basis.

Economic Sensitivity

As with almost every other company in this tough market, investors are highly focused on how Hewitt will perform in a recessionary environment. The headline here is that the company will exhibit modest cyclicality in revenues and profitability but is well-protected by strong free cash flow generation, a solid balance sheet and a high percentage of recurring revenue business.

The consulting business enjoys a largely recurring book of business from its pension and actuarial practice as well as a moderately stable project flow in other practice areas. The outsourcing business is directly affected by client employment levels, but although it is more cyclical than the other Hewitt units, we think the market is overly concerned. Benefit plan participant counts do not tightly match changes in overall employment, and we do not believe the employment outlook is as grim as analysts are anticipating over the next few years. One of our core tenets at Ariel is patience, and we intend to ride out the economic bumps as Hewitt has excellent growth potential once the economy has substantially recovered.

HR/BPO Contracts

Uncertainty around Hewitt’s HR BPO business has been a significant drag on the company’s share price over the past few years. Management has successfully stabilized the business; losses have fallen consistently, and the contract portfolio may even become profitable this year. Chief Executive Officer Russ Fradin has made the decision to narrow the types of HR BPO contracts that Hewitt is willing to pursue, while previous management focused on gaining market share.

Hewitt is now focused on HR BPO contracts that involve processes that offer one-to-many capabilities which drive scale in geographies the company knows well and require limited customization. What is most encouraging to us, however, is that while market opinion is focused on when the business achieves sustainable profitability, we believe investors are overlooking the potential for HR BPO to evolve into a growing, attractively profitable niche for Hewitt going forward.

As of March 31, 2010, shares traded at $39.78, a 29% discount to our steadily growing private market value of $56.28.

arielinvestments.com | | 800.292.7435 |

16

Ariel Fund Schedule of Investments | | March 31, 2010 (unaudited) |

Number of Shares | | Common Stocks—98.61% | | Cost | | Market Value | |

| | | | | | | |

| | Consumer discretionary & services—36.33% | | | | | |

5,130,200 | | CBS Corp., Class B | | $ | 24,505,203 | | $ | 71,514,988 | |

300,600 | | DeVry Inc. | | 17,738,885 | | 19,599,120 | |

5,471,339 | | Gannett Co., Inc. | | 13,461,475 | | 90,386,520 | |

3,303,625 | | International Game Technology | | 38,027,450 | | 60,951,881 | |

10,405,972 | | Interpublic Group of Cos., Inc.(a) | | 73,827,572 | | 86,577,687 | |

1,160,071 | | Meredith Corp. | | 24,852,975 | | 39,918,043 | |

1,112,148 | | Mohawk Industries, Inc.(a) | | 56,034,949 | | 60,478,608 | |

4,343,257 | | Newell Rubbermaid Inc. | | 83,215,102 | | 66,017,506 | |

1,418,075 | | Nordstrom, Inc. | | 20,132,272 | | 57,928,364 | |

2,004,356 | | Royal Caribbean Cruises Ltd.(a) | | 18,252,968 | | 66,123,704 | |

1,264,567 | | Sotheby’s | | 24,677,315 | | 39,315,388 | |

1,106,795 | | Stanley Black & Decker, Inc. | | 28,874,113 | | 63,541,101 | |

1,266,806 | | Tiffany & Co. | | 45,115,866 | | 60,160,617 | |

| | | | 468,716,145 | | 782,513,527 | |

| | Consumer staples—8.81% | | | | | |

2,181,738 | | Constellation Brands, Inc., Class A(a) | | 29,957,540 | | 35,867,773 | |

657,054 | | Energizer Holdings, Inc.(a) | | 16,529,522 | | 41,236,709 | |

1,033,238 | | J.M. Smucker Co. | | 36,511,651 | | 62,262,922 | |

1,313,325 | | McCormick & Co., Inc. | | 46,516,963 | | 50,379,147 | |

| | | | 129,515,676 | | 189,746,551 | |

| | Financial services—29.93% | | | | | |

5,292,457 | | CB Richard Ellis Group, Inc.(a) | | 29,043,371 | | 83,885,444 | |

964,326 | | City National Corp. | | 47,566,633 | | 52,044,674 | |

722,100 | | Dun & Bradstreet Corp. | . | 57,173,652 | | 53,738,682 | |

1,403,955 | | Equifax Inc. | | 48,536,697 | | 50,261,589 | |

972,600 | | Fair Isaac Corp. | | 20,548,195 | | 24,645,684 | |

1,794,065 | | HCC Insurance Holdings, Inc. | | 35,586,221 | | 49,516,194 | |

5,163,978 | | Janus Capital Group Inc. | | 45,288,053 | | 73,793,246 | |

1,232,073 | | Jones Lang LaSalle Inc. | | 18,949,825 | | 89,805,801 | |

1,938,400 | | Lazard Ltd, Class A | | 69,211,850 | | 69,200,880 | |

127,816 | | Markel Corp.(a) | | 30,017,212 | | 47,887,543 | |

3,647,457 | | PrivateBancorp, Inc.(b) | | 47,769,149 | | 49,970,161 | |

| | | | 449,690,858 | | 644,749,898 | |

| | Health care—6.95% | | | | | |

653,534 | | Bio-Rad Laboratories, Inc., Class A(a) | | 38,619,433 | | 67,653,840 | |

1,449,601 | | Hospira, Inc.(a) | | 50,879,418 | | 82,119,897 | |

| | | | 89,498,851 | | 149,773,737 | |

| | Materials & processing—2.29% | | | | | |

4,250,258 | | Interface, Inc., Class A(b) | | 42,423,952 | | 49,217,988 | |

| | | | | | | | | |

arielinvestments.com | | Semi-Annual Report |

17

Ariel Fund Schedule of Investments (continued) | | March 31, 2010 (unaudited) |

Number of Shares | | Common Stocks—98.61% | | Cost | | Market Value | |

| | | | | | | |

| | Producer durables—12.32% | | | | | |

1,648,603 | | Brady Corp., Class A | | $ | 23,936,272 | | $ | 51,304,525 | |

1,557,600 | | Brink’s Co. | | 38,884,487 | | 43,971,048 | |

1,970,590 | | Herman Miller, Inc. | | 34,594,947 | | 35,588,855 | |

2,289,113 | | Hewitt Associates, Inc., Class A(a) | | 62,451,405 | | 91,060,915 | |

1,315,811 | | IDEX Corp. | | 15,542,024 | | 43,553,344 | |

| | | | 175,409,135 | | 265,478,687 | |

| | Technology—1.98% | | | | | |

911,950 | | Anixter Intl Inc.(a) | | 20,242,635 | | 42,724,858 | |

| | | | | | | |

| | Total common stocks | | 1,375,497,252 | | 2,124,205,246 | |

| | | | | | | |

Principal Amount | | Repurchase Agreement—1.67% | | Cost | | Market Value | |

| | | | | | | | | | |

$ | 36,002,291 | | Fixed Income Clearing Corporation, 0.00%, dated 3/31/2010, due 4/1/2010, repurchase price $36,002,291, (collateralized by Federal Farm Credit Bank, 5.05%, due 9/9/2039, and Federal Home Loan Bank, 5.50%, due 7/15/2036, and Federal National Mortgage Assoc., 4.15% - 5.80%, due 12/17/2018 - 2/9/2026) | | $ | 36,002,291 | | $ | 36,002,291 | |

| | Total Investments—100.28% | | $ | 1,411,499,543 | | 2,160,207,537 | |

| | Liabilities less Other Assets��(0.28%) | | | | (6,060,544 | ) |

| | Net Assets—100.00% | | | | $ | 2,154,146,993 | |

(a) Non-income producing.

(b) Affiliated company (See Note Five).

A category may contain multiple industries as defined by the Global Industry Classification Standards.

The accompanying notes are an integral part of the financial statements.

Semi-Annual Report | | 800.292.7435 |

18

Ariel Appreciation Fund Schedule of Investments | | March 31, 2010 (unaudited) |

Number of Shares | | Common Stocks—99.32% | | Cost | | Market Value | |

| | | | | | | |

| | Consumer discretionary & services—32.93% | | | | | |

1,194,150 | | Carnival Corp. & plc | | $ | 34,487,581 | | $ | 46,428,552 | |

3,582,800 | | CBS Corp., Class B | | 24,487,329 | | 49,944,232 | |

3,747,000 | | Gannett Co., Inc. | | 8,270,245 | | 61,900,440 | |

2,023,500 | | International Game Technology | | 27,043,611 | | 37,333,575 | |

6,112,375 | | Interpublic Group of Cos., Inc.(a) | | 36,893,417 | | 50,854,960 | |

838,975 | | Mohawk Industries, Inc.(a) | | 38,084,790 | | 45,623,460 | |

667,500 | | Nordstrom, Inc. | | 8,374,245 | | 27,267,375 | |

1,205,900 | | Omnicom Group Inc. | | 36,525,508 | | 46,800,979 | |

494,800 | | Sotheby’s | | 9,412,000 | | 15,383,332 | |

663,199 | | Stanley Black & Decker, Inc. | | 14,108,688 | | 38,074,255 | |

773,100 | | Tiffany & Co. | | 25,369,849 | | 36,714,519 | |

1,686,500 | | Viacom, Inc.(a) | | 42,077,361 | | 57,981,870 | |

| | | | 305,134,624 | | 514,307,549 | |

| | Consumer staples—8.70% | | | | | |

322,047 | | Clorox Co. | | 14,119,343 | | 20,656,095 | |

1,695,500 | | Constellation Brands, Inc., Class A(a) | | 23,312,580 | | 27,874,020 | |

448,100 | | Energizer Holdings, Inc.(a) | | 21,561,708 | | 28,122,756 | |

532,675 | | J.M. Smucker Co. | | 27,256,513 | | 32,098,995 | |

704,725 | | McCormick & Co., Inc. | | 25,031,244 | | 27,033,251 | |

| | | | 111,281,388 | | 135,785,117 | |

| | Financial services—30.47% | | | | | |

981,000 | | AFLAC Inc. | | 21,343,572 | | 53,258,490 | |

3,173,750 | | CB Richard Ellis Group, Inc.(a) | | 11,953,634 | | 50,303,937 | |

626,700 | | City National Corp. | | 36,050,180 | | 33,822,999 | |

403,122 | | Dun & Bradstreet Corp. | | 19,517,536 | | 30,000,339 | |

682,400 | | Equifax Inc. | | 12,861,012 | | 24,429,920 | |

332,100 | | Franklin Resources, Inc. | | 10,904,455 | | 36,829,890 | |

3,244,075 | | Janus Capital Group Inc. | | 24,345,358 | | 46,357,832 | |

840,500 | | Jones Lang LaSalle Inc. | | 52,779,034 | | 61,264,045 | |

588,850 | | Lazard Ltd, Class A | | 22,025,040 | | 21,021,945 | |

74,800 | | Markel Corp.(a) | | 25,016,727 | | 28,024,568 | |

1,061,400 | | Northern Trust Corp. | | 42,639,405 | | 58,652,964 | |

579,900 | | T. Rowe Price Group, Inc. | | 12,554,880 | | 31,853,907 | |

| | | | 291,990,833 | | 475,820,836 | |

| | Health care—14.85% | | | | | |

629,050 | | Baxter Intl Inc. | | 18,985,460 | | 36,610,710 | |

280,525 | | Bio-Rad Laboratories, Inc., Class A(a) | | 19,179,773 | | 29,039,948 | |

471,000 | | Laboratory Corp. of America(a) | | 31,986,016 | | 35,659,410 | |

949,300 | | St. Jude Medical, Inc.(a) | | 35,511,568 | | 38,968,765 | |

851,854 | | Thermo Fisher Scientific Inc.(a) | | 17,046,087 | | 43,819,370 | |

807,300 | | Zimmer Holdings, Inc.(a) | | 37,117,537 | | 47,792,160 | |

| | | | 159,826,441 | | 231,890,363 | |

| | | | | | | | | |

arielinvestments.com | | Semi-Annual Report |

19

Ariel Appreciation Fund Schedule of Investments (continued) | | March 31, 2010 (unaudited) |

Number of Shares | | Common Stocks—99.32% | | Cost | | Market Value | |

| | | | | | | |

| | Producer durables—8.60% | | | | | |

1,354,100 | | Accenture plc, Class A | | $ | 25,609,266 | | $ | 56,804,495 | |

1,410,700 | | Hewitt Associates, Inc., Class A(a) | | 38,554,216 | | 56,117,646 | |

451,550 | | Illinois Tool Works Inc. | | 21,793,488 | | 21,385,408 | |

| | | | 85,956,970 | | 134,307,549 | |

| | Technology—3.77% | | | | | |

527,400 | | Anixter Intl Inc.(a) | | 31,724,407 | | 24,708,690 | |

2,279,800 | | Dell Inc.(a) | | 23,270,366 | | 34,219,798 | |

| | | | 54,994,773 | | 58,928,488 | |

| | | | | | | |

| | Total common stocks | | 1,009,185,029 | | 1,551,039,902 | |

| | | | | | | |

Principal Amount | | Repurchase Agreement—0.86% | | Cost | | Market Value | |

| | | | | | | |

$ | 13,463,000 | | Fixed Income Clearing Corporation, 0.00%, dated 3/31/2010, due 4/1/2010, repurchase price $13,463,000, (collateralized by Federal National Mortgage Assoc., 4.15%, due 12/17/2018) | | $ | 13,463,000 | | $ | 13,463,000 | |

| | Total Investments—100.18% | | $ | 1,022,648,029 | | 1,564,502,902 | |

| | Liabilities less Other Assets—(0.18%) | | | | (2,872,592 | ) |

| | Net Assets—100.00% | | | | $ | 1,561,630,310 | |

| | | | | | | | | | |

(a) Non-income producing.

A category may contain multiple industries as defined by the Global Industry Classification Standards.

The accompanying notes are an integral part of the financial statements.

Semi-Annual Report | 800.292.7435 |

20

Ariel Focus Fund Schedule of Investments | | March 31, 2010 (unaudited) |

Number of Shares | | Common Stocks—96.86% | | Cost | | Market Value | |

| | | | | | | |

| | Consumer discretionary & services—25.15% | | | | | |

32,000 | | Apollo Group, Inc.(a) | | $ | 2,019,175 | | $ | 1,961,280 | |

40,900 | | Carnival Corp. & plc | | 1,562,840 | | 1,590,192 | |

183,100 | | Interpublic Group of Cos., Inc.(a) | | 1,207,259 | | 1,523,392 | |

55,000 | | Omnicom Group Inc. | | 2,242,373 | | 2,134,550 | |

16,000 | | Toyota Motor Corp., ADR | | 1,380,901 | | 1,286,720 | |

51,900 | | Walt Disney Co. | | 1,393,306 | | 1,811,829 | |

| | | | 9,805,854 | | 10,307,963 | |

| | Energy—8.22% | | | | | |

26,300 | | Exxon Mobil Corp. | | 1,940,214 | | 1,761,574 | |

25,700 | | Hess Corp. | | 1,381,326 | | 1,607,535 | |

| | | | 3,321,540 | | 3,369,109 | |

| | Financial services—19.80% | | | | | |

36,100 | | AFLAC Inc. | | 1,428,472 | | 1,959,869 | |

58,200 | | Bank of New York Mellon Corp. | | 1,578,790 | | 1,797,216 | |

14,250 | | Berkshire Hathaway Inc., Class B(a) | | 829,587 | | 1,158,097 | |

29,900 | | JPMorgan Chase & Co. | | 1,186,580 | | 1,338,025 | |

63,450 | | Morgan Stanley | | 1,873,122 | | 1,858,451 | |

| | | | 6,896,551 | | 8,111,658 | |