UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-4786 |

|

Ariel Investment Trust |

(Exact name of registrant as specified in charter) |

|

200 East Randolph Drive

Suite 2900

Chicago, Illinois | | 60601 |

(Address of principal executive offices) | | (Zip code) |

|

Sheldon R. Stein

200 East Randolph Drive

Suite 2900

Chicago, Illinois 60601 |

(Name and address of agent for service) |

|

with a copy to:

Arthur Don

Seyfarth Shaw LLP

131 South Dearborn Street

Suite 2400

Chicago, IL 60603 |

|

Registrant’s telephone number, including area code: | (312) 726-0140 | |

|

Date of fiscal year end: | September 30, 2007 | |

|

Date of reporting period: | March 31, 2008 | |

| | | | | | | |

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”) (17 CFR 270.30e-1).

One of Ariel’s guiding principles is to communicate openly with our shareholders so they may gain a clear understanding of our investment philosophy, portfolio decisions and results, as well as our opinions on the underlying market. In reviewing the materials contained in The Patient Investor and the Semi-Annual Report, please consider the information provided on this page. While our investment decisions are rooted in detailed analysis, it is important to point out that actual results can differ significantly from those we seek. We candidly discuss a number of individual companies. Our opinions are current as of the date they were written but are subject to change. We want to remind investors that the information in this report is not sufficient to base an investment decision and should not be considered a recommendation to purchase or sell any particular security.

The Funds invest primarily in small and mid-sized companies. Investing in small and mid-cap stocks is riskier and more volatile than investing in large cap stocks, in part because smaller companies may not have the scale, depth of resources and other assets of larger firms. Additionally, the Ariel Focus Fund is a non-diversified fund, which means its investments are concentrated in fewer names than diversified funds, such as Ariel Fund and Ariel Appreciation Fund. Ariel Focus Fund generally holds 20 stocks and therefore may be more volatile than a more diversified investment.

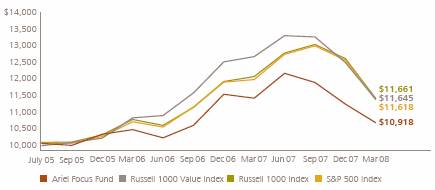

Performance data quoted is past performance and does not guarantee future results. The performance stated in this document assumes the reinvestment of dividends and capital gains. We caution shareholders that we can never predict or assure future returns on investments. The investment return and principal value of an investment with our Funds will fluctuate over time so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted in this report. For the period ended March 31, 2008, the average annual total returns for the one-, five- and ten-year periods for Ariel Fund and Ariel Appreciation Fund were -16.03%, 9.94% and 7.22%; and -12.18%, 10.25% and 7.05%, respectively. For the period ended March 31, 2008, the average annual total returns of Ariel Focus Fund for the one-year and since inception (June 30, 2005) periods were -6.45% and 3.24%. To access our performance data current to the most recent month-end, visit our website, arielinvestments.com.

As of September 30, 2007, Ariel Fund and Ariel Appreciation Fund had annual expense ratios of 1.03% and 1.12%, respectively. As of September 30, 2007, Ariel Focus Fund had an annual net expense ratio of 1.25% and a gross expense ratio of 1.63%. The Fund’s adviser, Ariel Investments, LLC is contractually obligated to waive fees or reimburse expenses in order to limit Ariel Focus Fund’s total annual operating expenses to 1.25% of net assets through the end of the fiscal year ending September 30, 2009. After that date, there is no assurance such expenses will be limited.

Investors should consider carefully the investment objectives, risks, and charges and expenses before investing. For a current prospectus which contains this and other information about the funds offered by Ariel Investment Trust, call Ariel Distributors, LLC at 800.292.7435 or visit our website, arielinvestments.com. Please read the prospectus carefully before investing. ©2008 Ariel Distributors, LLC.

ARIEL INVESTMENT TRUST

c/o U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701

800.292.7435

arielinvestments.com

| | CONTENTS |

| | |

2 | | The Patient Investor |

| | |

6 | | Company Spotlights |

| | |

9 | | Statistical Summaries |

| | |

13 | | Semi-Annual Report |

Turtle Talk with our Investment Specialists

I recently got married and now I need to change the registration on my Ariel account to include my husband as a joint account holder. Additionally, we received monetary wedding gifts which I want to invest in this account. Can you help us? —Erin R., Frankfort, IL

Shanita: Congratulations on your wedding! This is a very exciting time in your life and we are delighted you are already thinking about your financial future.

To change your name on your Ariel Investments account, simply download and complete the Name Change Form which is available at arielinvestments.com and mail it back to us along with an official copy of your marriage certificate.

To add your husband to the account, simply send us a brief letter of instruction and include the following:

1. Your existing account number

2. Your husband’s name and Social Security Number

3. Your husband’s date of birth

Please make sure both you and your husband sign this letter and obtain a Signature Guarantee from your commercial bank, savings bank, credit union or broker-dealer.

Investing your monetary wedding gifts is a great way to begin saving together. It only takes a moment to purchase additional shares of Ariel Investments. Call us Monday through Friday, 8am-7pm CT at 800.292.7435, option 3, and an Investment Specialist will be happy to assist you. Best wishes on a happy and financially secure future!

Not Part of the Semi-Annual Report | 25 years of patient investing |

Dear Fellow Shareholder: The first quarter of 2008 easily qualifies as one of the most volatile periods in our 25 years of patient investing. With extreme daily and weekly moves, we witnessed days like January 23rd when the Dow had its second-biggest intraday point swing ever: a nearly 250-point rout morphed into a nearly 300-point rally by the end of the day. Against this tumultuous backdrop, the quarter ended with domestic and international stock markets down sharply across the board—small companies, large companies, value and growth strategies—nothing was spared. Perhaps the environment was best summed up in Fortune by one Wall Street executive who said, “If you are on a beach and a tsunami hits, you’ll drown whether you are a small child or an Olympic swimmer.”1

Our portfolios, which have typically weathered some terrible storms, also felt the brunt of the market’s tsunami and did not provide the downside protection that history has taught us to expect. Although Ariel Fund has outperformed in 70% of the 23 down quarters that have occurred since its 1986 inception, we did not manage to do so this quarter. In fact, the small-to-mid sized holdings comprising Ariel Fund fell -11.2% while the Russell 2500 Value Index lost -7.2% and the Russell 2500 Index gave back -9.4%. As a means of comparison, even the bell-weather Standard & Poor’s 500 dropped -9.4% for the quarter. Meanwhile, Ariel Appreciation Fund fell -9.2% which was a bit worse than the Russell Midcap Value Index which lost -8.6% and slightly better than the -10.0% return posted by the Russell Midcap Index.

Ariel Focus was the bright spot. Its -5.0% three month return outperformed the Russell 1000 Value Index which lost -8.7% as well as the Russell 1000 Index which dropped -9.5%.

As fiercely competitive as Olympic swimmers, we are naturally disappointed in Ariel and Ariel Appreciation’s relative results during a down quarter. Our shortfalls are directly tied to difficulties in our favored sectors, more specifically consumer and financials. We have also underperformed because of unprecedented strength in commodities, which helped some of the stocks we avoid and hurt some of the stocks we own.

“The first quarter of 2008

easily qualifies as one of the most

volatile periods in our 25 years

of patient investing.”

Dodging Damage

Recessionary fears and protracted subprime induced credit crisis have temporarily spooked investors away from the consumer and financial sectors—core areas where we have significant exposure, deep expertise and

800.292.7435 | arielinvestments.com |

2

strong long-term confidence. Since December 2006, these have been the market’s two worst performing sectors. During the first quarter of this year, financials continued their dismal run with results falling close to the very bottom of the pack across all benchmarks. Although a long-standing bias towards consistent and predictable industries has driven our excellent long-term results, these sector weightings have detracted from recent returns.

“The performance of our

financial stocks... provides a

meaningful reminder that

focus has real benefits.”

The performance of our financial stocks, however, provides a meaningful reminder that focus has real benefits. Although the punishment of the financials has been broad and unrelenting, we have avoided much of the pain by being knowledgeable and choosy. That is, while our 30%+ percentage weightings in financial issuers are similar to the benchmarks’, our performance has been anything but. For example, while the Russell 2500 Value’s financial holdings have plummeted -24.18% since the beginning of last year, Ariel Fund’s financial names are down just -5.02% over the same 15 month period. Similarly, Appreciation’s financial stake is down

- -5.89% since December 2006 while the financial holdings in the Russell Midcap Value Index have tumbled -24.66% over the same period.

Bubble Trouble

Beyond consumer and financials, nearly every nook and cranny of the stock market has taken a beating since the New Year began. And yet the boom and bust commodity sector that we consciously avoid continues to touch new highs. As The New York Times recently noted, “Commodity investors have had a much easier time this year than people who have endured the white-knuckle ride of the stock market.”2 Although the indices may get a boost from their commodity exposure, an ever escalating cost of goods is wreaking havoc on consumers while dampening corporate profits. Globally, commodities ranging from gold to dairy have been on a price trajectory not seen in decades, if ever. Case in point, according to the Wall Street Journal, “Since the start of 2007, wheat futures are up +69%, soybeans have risen +92%, corn is up +49% and rice is up +131% on the Chicago Board of Trade.”3 Sugar is up more than +40% since December alone. And as we write, oil has just topped another record high of $119 a barrel—up +1,000% in a decade. We have seen surges like these before: Internet stocks in the late 1990s, an escalation of housing prices for much of this decade. In other words, just like the aforementioned debacles, we see growing evidence of a commodity bubble. As any child knows all too well, bubbles are fun to watch, but they inevitably burst! The Kiplinger Letter seems to agree noting, “Another bubble will burst soon... Commodities are unsustainably high... way out of whack with supply/demand dynamics. And the day of reckoning is not far off.”4

Now the commodity bulls will argue that global demand, especially in China and India, is causing a secular change that has re-set commodity prices at a permanently high plateau. They say current prices are not only justified but only the beginning of a prolonged, upward march. Our bearish counterargument starts with a basic point, best made by another money manager, Howard Marks, who recently wrote, “...’it’s different this time.’ Those four little words are always heard when the market swings to dangerously high levels...it’s not just a sign of an absurd condition, it is a prerequisite.” Second, let’s look to history as a guide. In an insightful article entitled “Commodities Handle with Care,” Bernstein Wealth Management Research reported, “Over the last 50 years, commodity prices have grown at an average of +2.5% a year, well below the rate of inflation.”5 Contrast this long-term return with recent commodity gains and one has to consider a reversion to the mean. Lastly, let’s not forget the speculators and their hand in the price madness. While everything from weather to war to growing demand can cause commodities to be in short supply, speculators also play an important role in surging prices. For example,

Not Part of the Semi-annual Report | 25 years of patient investing |

3

The Wall Street Journal points out, “...investors have poured roughly $175 to $200 billion into commodity-linked index funds since 2001.”6 Barron’s goes even further saying, “more than half of all bullish bets on commodities have been made by speculators, both big and small... [These] speculators’ bullishness may be way overdone, in the process lifting prices far above fair value.”7

So what might burst this commodities bubble? For one, even the slightest slowdown in the small but rapidly growing Asian economies. As Professor Bob Aliber of University of Chicago notes, “The world is dominated by extrapolators, failed engineers that tend to straight line growth rates.” Next, given that money has chased commodities because nothing else has worked lately, a rally in domestic or international stocks could cause assets to flow out of commodities and thereby deflate prices. Of course, a confirmation that the U.S. economy is in a bona fide recession could do it. Consumers tend to pull back on such news and consumption falls. Indeed, we have already seen U.S. gas usage drop 2% since the beginning of the year. Two percent may not sound like much, but since the U.S. guzzles one quarter of the world’s oil, small changes make a big difference. Longer term, there is the all important profit motive whereby big price movements encourage new players and new inventions that change the whole game.

“...as patient investors we take a

contrary view and are encouraged

by the bevy of newfound

bargains coming to fore.”

Looking Forward

As James Stewart perfectly surmised in the April 2008 edition of SmartMoney magazine, “The mood is gloomy.” Indeed, smaller stocks have had three down quarters in a row for the first time since 1983, but as natural contrarians that leaves us feeling like the worst is behind us. Moreover, with obvious headwinds whip-sawing the market, a palpable undercurrent of fear, at times bordering on panic, has given way to some indiscriminate selling. While some might be unnerved by these price dislocations, as patient investors we take a contrary view and are encouraged by the bevy of newfound bargains coming to fore.

We appreciate the opportunity to serve you and welcome any questions or comments you might have. You can also contact us directly at email@arielinvestments.com.

Sincerely,

|

|

| |

John W. Rogers, Jr. | Mellody Hobson |

Chairman and CEO | President |

1 | McLean, Bethany. “The Man Who Must Keep Goldman Growing.” Fortune. 5 Mar. 2008. |

2 | Schultz, Abby. “Demand May Give Commodities a Long-Run Edge.” New York Times. 6 Apr. 2008. |

3 | Davis, Ann. “Call Goes Out to Rein In Grain Speculators.” Wall Street Journal. 22 Apr. 2008: A4. |

4 | The Kiplinger Washington Editors Letter. 4 Apr. 2008. |

5 | Bernstein Global Wealth Management. Bernstein Wealth Management Research Report-Commodities: Handle With Care. Sept. 2006. |

6 | Davis, Ann. “Call Goes Out to Rein In Grain Speculators.” Wall Street Journal. 22 Apr. 2008: A4. |

7 | Epstein, Gene. “Commodities: Who’s Behind the Boom?” Barron’s. 31 Mar. 2008. |

800.292.7435 | arielinvestments.com |

4

Patient investing has

a new name:

Ariel Investments

2008 MARKS THE 25TH ANNIVERSARY of Ariel Capital Management. As we enthusiastically anticipate our second quarter century, we have decided to re-brand our firm as clearly and concisely as our time-tested investment strategy. So, rather than using two names—Ariel Mutual Funds, representing the no-load funds we manage, and Ariel Capital Management, representing the institutional money management side of our firm—both aspects of our business will simply be known as Ariel Investments.

While our name is changing, our slow and steady approach remains the same and we continue to serve individuals, institutions and advisors. Unlike Aesop’s timeless fable, we realize the investment race has no finish line and we will continue to work hard on your behalf.

Not Part of the Semi-annual Report | | 25 years of patient investing |

5

| Ariel Fund | Ariel Appreciation Fund | |

| |

Company Spotlight | Ariel Focus Fund |

| Tiffany & Co. (NYSE: TIF) |

727 Fifth Avenue |

NewYork, NY 10022 |

800.843.3269 |

www.tiffany.com |

A Charmed Reputation

Established in 1837 in New York as a stationery and fancy goods purveyor, Tiffany & Co. has transformed itself into an international fine jeweler and specialty retailer. Its offerings include an extensive selection of jewelry, timepieces, sterling silver, china, crystal, fragrances and luxury accessories. From the very beginning, the firm has set itself apart by its relentless commitment to quality, an eye for detail and an incredible track record of innovation. Founder Charles Tiffany masterminded the company’s iconic blue box and launched the first national retail catalogue. The company also played an essential role in the adoption of the metric carat as a standard weight for gems. Lastly, Tiffany established a policy of non-negotiable pricing and has only had two sales in its 171 year history.

Tiffany’s Timelessness

In our view, Tiffany represents the quintessential retailer. The company boasts a number of competitive strengths, most notably its coveted brand. As just one example, a Tiffany diamond connotes an image of flawlessness, beauty and good taste. Beyond its signature items, every detail right down to the Tiffany bow creates a memorable customer experience, and as a result, consumers are willing to pay premium pricing to attain the Tiffany name. Despite concerns over a possible recession and pull-back in consumer spending, we believe the company’s customer base is more resilient than the average consumer. Additionally, an expansive geographic footprint is another strategic advantage—insulating the firm from a weakening U.S. dollar. Ironically, our declining currency has worked to Tiffany’s benefit by attracting an increase in international buyers to the company’s flagship Fifth Avenue store.

Holiday Stress

Tiffany’s share price took a beating early this year due to lighter than expected holiday sales and trimmed 2008 earnings estimates. This news, coupled with recession fears and concerns over a luxury slowdown, caused Tiffany’s stock to drop 26% in January—what we considered an exaggerated punishment. We took advantage of the price dislocation and initiated a position for each of our funds.

A Classic Ariel Holding

We view Tiffany as the crown jewel in the retail space. In fact, it is a name we have owned before, first purchasing shares in 2002 when luxury brands fell out of favor in the wake of the tech wreck. As the economy rebounded, so did Tiffany’s stock price and our discipline led us to sell in August 2003. As patient investors, we are watchful for the right time to own our favorite names again, and January afforded us this opportunity.

As of March 31, 2008, the company traded at $41.84, a compelling 29% discount to our $59 estimate of private market value.

800.292.7435 | arielinvestments.com |

6

Company Spotlight | Ariel Fund | Ariel Appreciation Fund |

| CB Richard Ellis Group, Inc. (NYSE: CBG) |

11150 Santa Monica Boulevard, Suite 1600 |

Los Angeles, CA 90025 |

310.405.8900 |

www.cbre.com |

CB Richard Ellis Group, Inc. is a leading global provider of commercial real estate services with an extensive list of offerings, including tenant representation; property leasing and sales; commercial property and facility management; valuation; and real estate investment management. Notably, it is the largest industry player in terms of revenues. Last year alone, CB Richard Ellis was responsible for $264 billion in real estate transactions and managed nearly two billion square feet of property and corporate facilities worldwide.

Global Strength

The company benefits significantly from its respected brand name and global suite of services. CB Richard Ellis was recognized again this year in the BusinessWeek 50 as a best-in-class business. And, in the Lipsey Company’s annual survey of commercial real estate brands, CB Richard Ellis has held onto the top spot for seven consecutive years—since the award’s inception. The firm’s global footprint is another key strength. CB Richard Ellis is one of only three firms capable of managing multi-national real estate portfolios on a worldwide scale, creating an important moat around its business. Moreover, its sophisticated capabilities have attracted an impressive client list, including 88 of the Fortune 100 companies.

Current Challenges

Unfortunately, chaos in the U.S. housing and credit markets has created panic about the future of companies exposed to real estate. In many cases, investors are taking a “guilty until proven innocent” viewpoint. Undeniably, current softening in CB Richard Ellis’ sales and leasing business will impact its bottom line, yet we believe Wall Street is underestimating the company’s diversification efforts and long-term prospects. Strength in its international operations should offset some weakness in the U.S. market and we see a long runway for growth, particularly in the Asia Pacific region. We are also confident in the strength of the company’s outsourcing services and believe more and more companies will turn to CB Richard Ellis to oversee their large-scale real estate portfolios.

Volatility Creates Opportunity

In response to market fears, we believe the investment community has severely discounted the company’s shares. By mid-January, the stock price was slashed by more than half from its July high. As the saying goes, the early bird gets the worm—and we saw excessive punishment as an opportunity to buy a top-shelf brand at a terrific price point. We have followed the company closely for many years through our ownership of industry peer, Jones Lang LaSalle. From our due diligence, we have faith in the franchise and its experienced management team.

As of March 31, 2008, the company traded at $21.64, a 38% discount to our $35 estimate of intrinsic worth.

Not Part of the Semi-Annual Report | 25 years of patient investing |

7

Company Spotlight | Ariel Focus Fund |

| JPMorgan Chase & Co. (NYSE: JPM) |

270 Park Avenue |

New York, NY 10017 |

212.270.6000 |

www.jpmorgan.com |

A leading diversified financial services firm, JPMorgan Chase & Co. was formed by the consolidation of multiple premier industry players, including J.P. Morgan, Chase Manhattan and Bank One. With a legacy spanning more than 200 years, today, the bank operates globally across six lines of business: investment banking; credit cards; retail banking; commercial banking; wealth management; and treasury and security services. JPMorgan is a formidable leader in many of its businesses—notably, investment banking, loan syndication and high yield debt.

Competitive and Dynamic Leadership

In our view, the bank’s long history of excellence is embodied in Chairman and CEO Jamie Dimon, a tour de force on Wall Street known for his ability to cut costs while simultaneously growing the business. Prior to his current role at JP Morgan Chase, Dimon was CEO of Bank One and the chief architect in the merger with J.P. Morgan. Additionally, he has held senior leadership positions at Citigroup and Salomon Smith Barney. As CEO of JPMorgan Chase, Dimon has done an exceptional job recruiting experienced chief lieutenants, many of whom are considered future CEO candidates in their own right.

Balance Sheet Obsession

In our view, this leadership team is an important reason JPMorgan has outperformed its peers during the ongoing credit crisis. In fact, JPMorgan Chase has emerged relatively unscathed from the sub-prime debacle. While other financial services firms experienced enormous write-downs—from $37 billion to $30 billion—JPMorgan’s losses were significantly smaller at $5 billion. We believe this is a direct correlation to management’s uncompromising standards with respect to balance sheet oversight. Notably, the leadership team meets weekly and the first topic on the agenda is a review of risk in all forms. This storm may not be over and we continue to keep a watchful eye.

On Offense for Opportunity

Its fortress-like balance sheet enabled JPMorgan to acquire Bear Stearns when it faced bankruptcy this March. With excess capital, the bank was able to negotiate a strategic acquisition which includes an unprecedented $30 billion in backing from the Federal Reserve on Bear’s riskier assets. The acquisition not only provides JPMorgan with a prime broker to strengthen its position against other investment banks, but also comes with premier office space in the heart of Manhattan. In our view, not only has JPMorgan adeptly navigated the pitfalls of the credit crisis, but it is emerging an early winner.

As of March 31, 2008, the company traded at $42.95, a compelling 37% discount to our private market value estimate of $68.

800.292.7435 | arielinvestments.com |

8

Ariel Fund Statistical Summary (ARGFX) | (unaudited) |

| | | | | | 52-Week Range | | Earnings per Share | | P/E Calendar | | | |

| | | | | | | | | | 2006 | | 2007 | | 2008 | | 2006 | | 2007 | | 2008 | | Market | |

| | Ticker | | Price | | | | | | Actual | | Actual | | Estimated | | Actual | | Actual | | Estimated | | Cap. | |

Company | | Symbol | | 3/31/08 | | Low | | High | | Calendar | | Calendar | | Calendar | | P/E | | P/E | | P/E | | ($MM) | |

| | | | | | | | | | | | | | | | | | | | | | | |

BearingPoint, Inc. | | BE | | 1.68 | | 1.50 | | 8.00 | | (1.01 | ) | (1.65 | ) | (0.11 | ) | NM | | NM | | NM | | 361 | |

Lee Enterprises, Inc. | | LEE | | 10.01 | | 9.26 | | 30.92 | | 1.90 | | 2.38 | | 2.01 | | 5.3 | | 4.2 | | 5.0 | | 467 | |

ACCO Brands Corp. | | ABD | | 13.57 | | 12.40 | | 26.09 | | 1.00 | | 1.37 | | 1.41 | | 13.6 | | 9.9 | | 9.6 | | 734 | |

McClatchy Co. | | MNI | | 10.70 | | 8.33 | | 34.32 | | 3.13 | | 1.62 | | 1.16 | | 3.4 | | 6.6 | | 9.2 | | 879 | |

Herman Miller, Inc. | | MLHR | | 24.57 | | 23.07 | | 37.56 | | 1.71 | | 2.27 | | 2.29 | | 14.4 | | 10.8 | | 10.7 | | 1,499 | |

Steelcase Inc. | | SCS | | 11.06 | | 11.03 | | 20.72 | | 0.72 | | 0.99 | | 0.95 | | 15.5 | | 11.2 | | 11.6 | | 1,564 | |

Brady Corp. | | BRC | | 33.43 | | 28.00 | | 44.46 | | 2.18 | | 2.47 | | 2.71 | | 15.3 | | 13.5 | | 12.3 | | 1,824 | |

Assured Guaranty Ltd. | | AGO | | 23.74 | | 13.34 | | 31.99 | | 2.12 | | 2.57 | | 2.81 | | 11.2 | | 9.2 | | 8.4 | | 1,898 | |

Sotheby’s | | BID | | 28.91 | | 25.30 | | 61.40 | | 1.73 | | 3.25 | | 2.66 | | 16.7 | | 8.9 | | 10.9 | | 1,924 | |

Jones Lang LaSalle Inc. | | JLL | | 77.34 | | 56.68 | | 124.99 | | 5.16 | | 7.64 | | 6.90 | | 15.0 | | 10.1 | | 11.2 | | 2,069 | |

Anixter International Inc. | | AXE | | 64.04 | | 52.26 | | 88.40 | | 4.23 | | 5.81 | | 6.52 | | 15.1 | | 11.0 | | 9.8 | | 2,327 | |

City National Corp. | | CYN | | 49.46 | | 48.00 | | 78.54 | | 4.66 | | 4.52 | | 3.73 | | 10.6 | | 10.9 | | 13.3 | | 2,366 | |

Bio-Rad Laboratories, Inc. | | BIO | | 88.95 | | 67.53 | | 115.23 | | 3.65 | | 4.19 | | 4.60 | | 24.4 | | 21.2 | | 19.3 | | 2,391 | |

IDEX Corp. | | IEX | | 30.69 | | 25.77 | | 44.99 | | 1.65 | | 1.98 | | 2.20 | | 18.6 | | 15.5 | | 14.0 | | 2,504 | |

HCC Insurance Holdings, Inc. | | HCC | | 22.69 | | 21.26 | | 34.45 | | 2.93 | | 3.38 | | 2.94 | | 7.7 | | 6.7 | | 7.7 | | 2,611 | |

J.M. Smucker Co. | | SJM | | 50.61 | | 42.75 | | 64.32 | | 2.73 | | 3.11 | | 3.38 | | 18.5 | | 16.3 | | 15.0 | | 2,829 | |

USG Corp. | | USG | | 36.82 | | 29.71 | | 52.75 | | 8.85 | | 1.06 | | (0.08 | ) | 4.2 | | 34.7 | | NM | | 3,647 | |

Constellation Brands, Inc. | | STZ | | 17.67 | | 17.21 | | 26.46 | | 1.65 | | 1.50 | | 1.65 | | 10.7 | | 11.8 | | 10.7 | | 3,810 | |

Janus Capital Group Inc. | | JNS | | 23.27 | | 20.76 | | 37.08 | | 0.66 | | 1.10 | | 1.29 | | 35.3 | | 21.2 | | 18.0 | | 3,870 | |

Interpublic Group of Cos., Inc. | | IPG | | 8.41 | | 7.22 | | 13.69 | | (0.19 | ) | 0.26 | | 0.46 | | NM | | 32.3 | | 18.3 | | 3,964 | |

IMS Health Inc. | | RX | | 21.01 | | 20.01 | | 33.12 | | 1.47 | | 1.60 | | 1.77 | | 14.3 | | 13.1 | | 11.9 | | 4,018 | |

Hewitt Associates, Inc. | | HEW | | 39.77 | | 28.42 | | 40.39 | | (0.36 | ) | 1.71 | | 2.16 | | NM | | 23.3 | | 18.4 | | 4,096 | |

Black & Decker Corp. | | BDK | | 66.10 | | 61.71 | | 97.01 | | 6.55 | | 6.03 | | 5.85 | | 10.1 | | 11.0 | | 11.3 | | 4,159 | |

CB Richard Ellis Group, Inc. | | CBG | | 21.64 | | 15.23 | | 42.74 | | 1.46 | | 2.11 | | 1.92 | | 14.8 | | 10.3 | | 11.3 | | 4,363 | |

Markel Corp. | | MKL | | 439.97 | | 394.99 | | 554.95 | | 34.87 | | 36.76 | | 29.94 | | 12.6 | | 12.0 | | 14.7 | | 4,381 | |

Equifax Inc. | | EFX | | 34.48 | | 31.49 | | 46.30 | | 2.01 | | 2.58 | | 2.77 | | 17.2 | | 13.4 | | 12.4 | | 4,472 | |

Mohawk Industries, Inc. | | MHK | | 71.61 | | 63.00 | | 108.00 | | 7.32 | | 7.35 | | 6.85 | | 9.8 | | 9.7 | | 10.5 | | 4,895 | |

Energizer Holdings, Inc. | | ENR | | 90.48 | | 84.68 | | 119.60 | | 4.63 | | 5.74 | | 6.99 | | 19.5 | | 15.8 | | 12.9 | | 5,199 | |

Tiffany & Co. | | TIF | | 41.84 | | 32.84 | | 57.34 | | 1.80 | | 2.17 | | 2.64 | | 23.2 | | 19.3 | | 15.8 | | 5,303 | |

Newell Rubbermaid Inc. | | NWL | | 22.87 | | 21.24 | | 32.19 | | 1.88 | | 1.82 | | 2.00 | | 12.2 | | 12.6 | | 11.4 | | 6,328 | |

Gannett Co., Inc. | | GCI | | 29.05 | | 27.77 | | 61.68 | | 4.90 | | 4.56 | | 4.27 | | 5.9 | | 6.4 | | 6.8 | | 6,687 | |

Royal Caribbean Cruises Ltd. | | RCL | | 32.90 | | 30.22 | | 45.17 | | 2.95 | | 2.82 | | 3.19 | | 11.2 | | 11.7 | | 10.3 | | 6,991 | |

Pitney Bowes Inc. | | PBI | | 35.02 | | 32.64 | | 49.70 | | 2.69 | | 2.72 | | 2.85 | | 13.0 | | 12.9 | | 12.3 | | 7,512 | |

Note: Holdings are as of March 31, 2008. All earnings per share numbers are fully diluted. Such numbers are from continuing operations and are adjusted for non-recurring items. All estimates of future earnings per share shown in this table are prepared by Ariel Investments research analysts as of March 31, 2008 and have not been updated to reflect any subsequent events. P/E ratios are based on earnings stated and March 31, 2008 stock price. NM=Not Meaningful.

Not Part of the Semi-Annual Report | 25 years of patient investing |

9

Ariel Appreciation Fund Statistical Summary (CAAPX) | (unaudited) |

| | | | | | 52-Week Range | | Earnings per Share | | P/E Calendar | | | |

| | | | | | | | | | 2006 | | 2007 | | 2008 | | 2006 | | 2007 | | 2008 | | Market | |

| | Ticker | | Price | | | | | | Actual | | Actual | | Estimated | | Actual | | Actual | | Estimated | | Cap. | |

Company | | Symbol | | 3/31/08 | | Low | | High | | Calendar | | Calendar | | Calendar | | P/E | | P/E | | P/E | | ($MM) | |

| | | | | | | | | | | | | | | | | | | | | | | |

McClatchy Co. | | MNI | | 10.70 | | 8.33 | | 34.32 | | 3.13 | | 1.62 | | 1.16 | | 3.4 | | 6.6 | | 9.2 | | 879 | |

Sotheby’s | | BID | | 28.91 | | 25.30 | | 61.40 | | 1.73 | | 3.25 | | 2.66 | | 16.7 | | 8.9 | | 10.9 | | 1,924 | |

Jones Lang LaSalle Inc. | | JLL | | 77.34 | | 56.68 | | 124.99 | | 5.16 | | 7.64 | | 6.90 | | 15.0 | | 10.1 | | 11.2 | | 2,069 | |

Anixter International Inc. | | AXE | | 64.04 | | 52.26 | | 88.40 | | 4.23 | | 5.81 | | 6.52 | | 15.1 | | 11.0 | | 9.8 | | 2,327 | |

City National Corp. | | CYN | | 49.46 | | 48.00 | | 78.54 | | 4.66 | | 4.52 | | 3.73 | | 10.6 | | 10.9 | | 13.3 | | 2,366 | |

HCC Insurance Holdings, Inc. | | HCC | | 22.69 | | 21.26 | | 34.45 | | 2.93 | | 3.38 | | 2.94 | | 7.7 | | 6.7 | | 7.7 | | 2,611 | |

Constellation Brands, Inc. | | STZ | | 17.67 | | 17.21 | | 26.46 | | 1.65 | | 1.50 | | 1.65 | | 10.7 | | 11.8 | | 10.7 | | 3,810 | |

Janus Capital Group Inc. | | JNS | | 23.27 | | 20.76 | | 37.08 | | 0.66 | | 1.10 | | 1.29 | | 35.3 | | 21.2 | | 18.0 | | 3,870 | |

Interpublic Group of Cos., Inc. | | IPG | | 8.41 | | 7.22 | | 13.69 | | (0.19 | ) | 0.26 | | 0.46 | | NM | | 32.3 | | 18.3 | | 3,964 | |

IMS Health Inc. | | RX | | 21.01 | | 20.01 | | 33.12 | | 1.47 | | 1.60 | | 1.77 | | 14.3 | | 13.1 | | 11.9 | | 4,018 | |

Hewitt Associates, Inc. | | HEW | | 39.77 | | 28.42 | | 40.39 | | (0.36 | ) | 1.71 | | 2.16 | | NM | | 23.3 | | 18.4 | | 4,096 | |

Black & Decker Corp. | | BDK | | 66.10 | | 61.71 | | 97.01 | | 6.55 | | 6.03 | | 5.85 | | 10.1 | | 11.0 | | 11.3 | | 4,159 | |

CB Richard Ellis Group, Inc. | | CBG | | 21.64 | | 15.23 | | 42.74 | | 1.46 | | 2.11 | | 1.92 | | 14.8 | | 10.3 | | 11.3 | | 4,363 | |

Equifax Inc. | | EFX | | 34.48 | | 31.49 | | 46.30 | | 2.01 | | 2.58 | | 2.77 | | 17.2 | | 13.4 | | 12.4 | | 4,472 | |

Dun & Bradstreet Corp. | | DNB | | 81.38 | | 79.02 | | 108.45 | | 3.97 | | 4.70 | | 5.31 | | 20.5 | | 17.3 | | 15.3 | | 4,622 | |

Mohawk Industries, Inc. | | MHK | | 71.61 | | 63.00 | | 108.00 | | 7.32 | | 7.35 | | 6.85 | | 9.8 | | 9.7 | | 10.5 | | 4,895 | |

Energizer Holdings, Inc. | | ENR | | 90.48 | | 84.68 | | 119.60 | | 4.63 | | 5.74 | | 6.99 | | 19.5 | | 15.8 | | 12.9 | | 5,199 | |

Tiffany & Co. | | TIF | | 41.84 | | 32.84 | | 57.34 | | 1.80 | | 2.17 | | 2.64 | | 23.2 | | 19.3 | | 15.8 | | 5,303 | |

Gannett Co., Inc. | | GCI | | 29.05 | | 27.77 | | 61.68 | | 4.90 | | 4.56 | | 4.27 | | 5.9 | | 6.4 | | 6.8 | | 6,687 | |

Pitney Bowes Inc. | | PBI | | 35.02 | | 32.64 | | 49.70 | | 2.69 | | 2.72 | | 2.85 | | 13.0 | | 12.9 | | 12.3 | | 7,512 | |

Clorox Co. | | CLX | | 56.64 | | 55.37 | | 69.36 | | 3.12 | | 3.32 | | 3.49 | | 18.2 | | 17.1 | | 16.2 | | 7,865 | |

Moody’s Corp. | | MCO | | 34.83 | | 31.14 | | 73.69 | | 2.58 | | 2.58 | | 1.81 | | 13.5 | | 13.5 | | 19.2 | | 8,757 | |

T. Rowe Price Group, Inc. | | TROW | | 50.00 | | 43.00 | | 65.46 | | 1.90 | | 2.40 | | 2.49 | | 26.3 | | 20.8 | | 20.1 | | 13,230 | |

Omnicom Group Inc. | | OMC | | 44.18 | | 40.86 | | 55.45 | | 2.57 | | 2.95 | | 3.32 | | 17.2 | | 15.0 | | 13.3 | | 14,270 | |

Northern Trust Corp. | | NTRS | | 66.47 | | 58.73 | | 83.17 | | 3.00 | | 3.24 | | 4.19 | | 22.2 | | 20.5 | | 15.9 | | 14,632 | |

CBS Corp. | | CBS | | 22.08 | | 21.00 | | 35.75 | | 1.80 | | 1.98 | | 2.03 | | 12.3 | | 11.2 | | 10.9 | | 14,836 | |

Yum! Brands, Inc. | | YUM | | 37.21 | | 28.37 | | 40.60 | | 1.46 | | 1.70 | | 1.89 | | 25.5 | | 21.9 | | 19.7 | | 18,568 | |

Accenture Ltd | | ACN | | 35.17 | | 31.91 | | 44.03 | | 1.73 | | 2.17 | | 2.62 | | 20.3 | | 16.2 | | 13.4 | | 20,789 | |

Franklin Resources, Inc. | | BEN | | 96.99 | | 83.27 | | 145.59 | | 5.87 | | 7.15 | | 7.42 | | 16.5 | | 13.6 | | 13.1 | | 23,251 | |

Thermo Fisher Scientific Inc. | | TMO | | 56.84 | | 45.89 | | 62.02 | | 1.90 | | 2.65 | | 3.10 | | 29.9 | | 21.4 | | 18.3 | | 23,602 | |

Illinois Tool Works Inc. | | ITW | | 48.23 | | 45.02 | | 60.00 | | 3.01 | | 3.43 | | 3.64 | | 16.0 | | 14.1 | | 13.3 | | 25,567 | |

Aflac Inc. | | AFL | | 64.95 | | 46.57 | | 67.00 | | 2.85 | | 3.27 | | 3.85 | | 22.8 | | 19.9 | | 16.9 | | 31,600 | |

Carnival Corp. | | CCL | | 40.48 | | 36.10 | | 52.10 | | 2.79 | | 2.98 | | 3.09 | | 14.5 | | 13.6 | | 13.1 | | 31,817 | |

Baxter International Inc. | | BAX | | 57.82 | | 49.30 | | 65.20 | | 2.30 | | 2.86 | | 3.22 | | 25.1 | | 20.2 | | 18.0 | | 36,637 | |

Note: Holdings are as of March 31, 2008. All earnings per share numbers are fully diluted. Such numbers are from continuing operations and are adjusted for non-recurring items. All estimates of future earnings per share shown in this table are prepared by Ariel Investments research analysts as of March 31, 2008 and have not been updated to reflect any subsequent events. P/E ratios are based on earnings stated and March 31, 2008 stock price. NM=Not Meaningful.

800.292.7435 | arielinvestments.com |

10

Ariel Focus Fund Statistical Summary (ARFFX) | (unaudited) |

| | | | | | 52-Week Range | | Earnings per Share | | P/E Calendar | | | |

| | | | | | | | | | 2006 | | 2007 | | 2008 | | 2006 | | 2007 | | 2008 | | Market | |

| | Ticker | | Price | | | | | | Actual | | Actual | | Estimated | | Actual | | Actual | | Estimated | | Cap. | |

Company | | Symbol | | 3/31/08 | | Low | | High | | Calendar | | Calendar | | Calendar | | P/E | | P/E | | P/E | | ($MM) | |

| | | | | | | | | | | | | | | | | | | | | | | |

USG Corp. | | USG | | 36.82 | | 29.71 | | 52.75 | | 8.85 | | 1.06 | | (0.08 | ) | 4.2 | | 34.7 | | NM | | 3,647 | |

IMS Health Inc. | | RX | | 21.01 | | 20.01 | | 33.12 | | 1.47 | | 1.60 | | 1.77 | | 14.3 | | 13.1 | | 11.9 | | 4,018 | |

Hewitt Associates, Inc. | | HEW | | 39.77 | | 28.42 | | 40.39 | | (0.36 | ) | 1.71 | | 2.16 | | NM | | 23.3 | | 18.4 | | 4,096 | |

Black & Decker Corp. | | BDK | | 66.10 | | 61.71 | | 97.01 | | 6.55 | | 6.03 | | 5.85 | | 10.1 | | 11.0 | | 11.3 | | 4,159 | |

Tiffany & Co. | | TIF | | 41.84 | | 32.84 | | 57.34 | | 1.80 | | 2.17 | | 2.64 | | 23.2 | | 19.3 | | 15.8 | | 5,303 | |

Omnicom Group Inc. | | OMC | | 44.18 | | 40.86 | | 55.45 | | 2.57 | | 2.95 | | 3.32 | | 17.2 | | 15.0 | | 13.3 | | 14,270 | |

Accenture Ltd | | ACN | | 35.17 | | 31.91 | | 44.03 | | 1.73 | | 2.17 | | 2.62 | | 20.3 | | 16.2 | | 13.4 | | 20,789 | |

Tyco International Ltd.* | | TYC | | 44.05 | | 31.01 | | 137.92 | | NA | | 2.15 | | 2.84 | | NA | | 20.5 | | 15.5 | | 21,641 | |

Covidien Ltd. | | COV | | 44.25 | | 36.90 | | 49.70 | | 3.17 | | 2.70 | | 2.70 | | 14.0 | | 16.4 | | 16.4 | | 22,049 | |

Illinois Tool Works Inc. | | ITW | | 48.23 | | 45.02 | | 60.00 | | 3.01 | | 3.43 | | 3.64 | | 16.0 | | 14.1 | | 13.3 | | 25,567 | |

Aflac Inc. | | AFL | | 64.95 | | 46.57 | | 67.00 | | 2.85 | | 3.27 | | 3.85 | | 22.8 | | 19.9 | | 16.9 | | 31,600 | |

Carnival Corp. | | CCL | | 40.48 | | 36.10 | | 52.10 | | 2.79 | | 2.98 | | 3.09 | | 14.5 | | 13.6 | | 13.1 | | 31,817 | |

Lowe’s Cos., Inc. | | LOW | | 22.94 | | 19.94 | | 33.19 | | 1.99 | | 1.86 | | 1.59 | | 11.5 | | 12.3 | | 14.4 | | 33,447 | |

Dell Inc. | | DELL | | 19.92 | | 18.87 | | 30.77 | | 1.17 | | 1.30 | | 1.57 | | 17.0 | | 15.3 | | 12.7 | | 41,035 | |

Morgan Stanley | | MS | | 45.70 | | 33.56 | | 90.95 | | 7.09 | | 2.37 | | 5.33 | | 6.4 | | 19.3 | | 8.6 | | 50,512 | |

UBS AG | | UBS | | 28.80 | | 22.19 | | 66.26 | | 4.45 | | (3.23 | ) | (1.03 | ) | 6.5 | | NM | | NM | | 55,052 | |

Walt Disney Co. | | DIS | | 31.38 | | 26.30 | | 36.79 | | 1.69 | | 2.01 | | 2.30 | | 18.6 | | 15.6 | | 13.6 | | 60,595 | |

Citigroup Inc. | | C | | 21.42 | | 17.99 | | 55.55 | | 4.25 | | 0.72 | | 1.09 | | 5.0 | | 29.8 | | 19.7 | | 106,984 | |

JPMorgan Chase & Co. | | JPM | | 42.95 | | 36.01 | | 53.25 | | 3.86 | | 4.38 | | 3.47 | | 11.1 | | 9.8 | | 12.4 | | 144,630 | |

International Business Machines Corp. | | IBM | | 115.14 | | 93.57 | | 121.46 | | 6.23 | | 7.13 | | 8.25 | | 18.5 | | 16.1 | | 14.0 | | 159,496 | |

Toyota Motor Corp. | | TM | | 100.89 | | 91.21 | | 129.19 | | 8.17 | | 10.17 | | 10.30 | | 12.3 | | 9.9 | | 9.8 | | 160,651 | |

Johnson & Johnson | | JNJ | | 64.87 | | 59.72 | | 68.85 | | 3.76 | | 4.35 | | 4.65 | | 17.3 | | 14.9 | | 14.0 | | 184,245 | |

Berkshire Hathaway Inc. | | BRK.B | | 4,472.90 | | 3,538.00 | | 5,059.00 | | 199.86 | | 207.73 | | 202.85 | | 22.4 | | 21.5 | | 22.1 | | 206,503 | |

Note: Holdings are as of March 31, 2008. All earnings per share numbers are fully diluted. Such numbers are from continuing operations and are adjusted for non-recurring items. All estimates of future earnings per share shown in this table are prepared by Ariel Investments research analysts as of March 31, 2008 and have not been updated to reflect any subsequent events. P/E ratios are based on earnings stated and March 31, 2008 stock price. NM=Not Meaningful. NA=Not Applicable.

*On 7/2/07, Tyco International Ltd. divided into three companies (Tyco International, Tyco Electronics and Covidien Ltd.) and completed a 1-for-4 stock split. Therefore, 2006 earnings figures do not exist for the individual segments of the original company.

Not Part of the Semi-Annual Report | 25 years of patient investing |

11

Celebrating 25 years of

patient investing

AT ARIEL INVESTMENTS, WE HAVE LEARNED

that one of life’s greatest lessons also holds

true when investing: slow and steady wins the race.

Just like Aesop’s fabled Tortoise, the symbol

of our firm, we value patience and persistence over the

fleeting and the flashy. More than an adage,

patience sums up our way of evaluating companies,

making investment decisions and even

running our firm.

| | CONTENTS |

| | |

| | Ariel Fund |

16 | | Portfolio Management Discussion |

17 | | Performance Summary |

18 | | Schedule of Investments |

| | |

| | Ariel Appreciation Fund |

20 | | Portfolio Management Discussion |

21 | | Performance Summary |

22 | | Schedule of Investments |

| | |

| | Ariel Focus Fund |

24 | | Portfolio Management Discussion |

25 | | Performance Summary |

26 | | Schedule of Investments |

| | |

28 | | Statements of Assets & Liabilities |

| | |

29 | | Statements of Operations |

| | |

30 | | Statements of Changes in Net Assets |

| | |

32 | | Financial Highlights |

| | |

35 | | Notes to the Financial Statements |

| | |

38 | | Fund Expense Example |

| | |

39 | | Important Supplemental Information |

| | |

42 | | Board of Trustees |

| | |

44 | | Officers |

Ariel Fund Portfolio Management Discussion (ARGFX)

Fund Results

For the quarter ended March 31, 2008, Ariel Fund declined -11.21%. By comparison, the Russell 2500 Value Index retreated -7.22%, while the Russell 2500 Index gave back -9.37%. For the six months ended March 31, 2008, Ariel Fund posted a -17.18% return. Over the same timeframe, the Russell 2500 Value Index declined -13.69%, in line with the - -13.28% loss of the Russell 2500 Index.

Performance Drivers

Over the past six months, two primary factors significantly influenced Ariel Fund’s underperformance. First, we do not invest in energy stocks due to their connection to unpredictable commodities. The only sectors in the Russell 2500 Value Index to post gains during the period were energy-related. Second, investor pessimism was especially negative on the future of corporate spending. Noticeably, a number of our consumer names—like furniture manufacturers Herman Miller and Steelcase along with office products maker Acco Brands—sold off sharply during the period, although they did not report any significant bad news.

During the past two quarters, some of our stocks struggled. Technology consultant BearingPoint tumbled -58.5% largely on CEO Harry You’s December departure, marking the end of the firm’s attempts to shed underperforming businesses. Despite a changing of the guard, we remain convinced that the value of BearingPoint’s government business alone more than justifies its current stock price. Alcohol beverage distributor Constellation Brands shed -27.0%. Fear over consumer belt-tightening is the main cause for the stock’s swoon. From our vantage point, alcohol consumption tends to be fairly stable in all environments and we believe Constellation will benefit from wine’s increasing worldwide popularity.

Over the past six months, HR consulting firm Hewitt Associates rose +13.5%, demonstrating consistent performance since mid-2006. Moreover Hewitt’s first quarter 2008 earnings were almost 50% higher than Wall Street’s consensus estimate and in our view, the Street is not giving Hewitt full credit for its improving results. Commercial real estate firm CB Richard Ellis (featured on page 7) gained +7.9% during the period. In the fourth quarter of 2007, the stock sold off sharply as investors feared anything related to real estate was risky due to the housing crisis. In 2008, however, the market seems to be paying closer attention to the impressive fundamentals that the company continues to show.

Comings & Goings

During the quarter, we purchased shares of Gannett Co., Inc., the country’s largest newspaper company and publisher of USA TODAY. We also added Pitney Bowes Inc., a leading outsourcer of mailroom services along with Tiffany & Co. (featured on page 6). Conversely, we exited H&R Block after the company announced the sale of its mortgage servicing business, which caused a run up in the company’s stock price. We also parted with direct marketing company Harte-Hanks, Inc. on concerns it has lost its niche stronghold, as well as Invacare Corp. on our increased caution about changes in the home medical product industry.

The Patient Investor

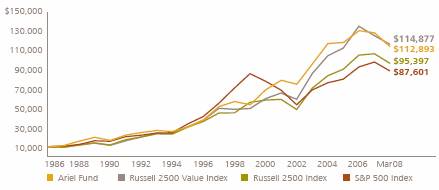

Reflecting on the longer time horizon, Ariel Fund posted a +7.22% ten-year average annual total return, just shy of the Russell 2500 Value Index’s +7.86 rise and surpassing the +6.89% rise by the Russell 2500 Index over the same period. We believe the Fund’s long-term performance is driven by our disciplined investment approach, stock selection across industries in which Ariel has experience, and our commitment to investing in quality companies we believe are selling at excellent values.

arielinvestments.com

16

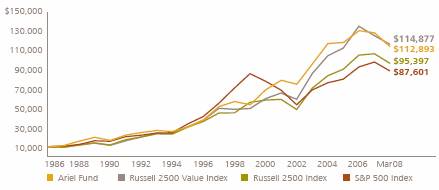

Ariel Fund Performance Summary | | Inception: November 6, 1986 |

ABOUT THE FUND

The no-load Ariel Fund pursues long-term capital appreciation by investing in undervalued companies that show strong potential for growth. The Fund primarily invests in companies with market capitalizations between $1 billion and $5 billion.

COMPOSITION OF EQUITY HOLDINGS

| | Ariel

Fund† | | Russell

2500

Value

Index | | Russell

2500

Index | | S&P

500

Index | |

Financial services | | 30.7 | % | 32.5 | % | 21.0 | % | 17.6 | % |

Consumer discretionary & services | | 28.1 | % | 10.8 | % | 16.2 | % | 11.1 | % |

Producer durables | | 10.3 | % | 5.2 | % | 7.6 | % | 5.0 | % |

Materials & processing | | 9.3 | % | 12.9 | % | 11.7 | % | 4.3 | % |

Consumer staples | | 7.8 | % | 3.6 | % | 2.5 | % | 8.6 | % |

Health care | | 7.7 | % | 4.6 | % | 11.0 | % | 12.0 | % |

Technology | | 6.1 | % | 7.5 | % | 11.2 | % | 13.3 | % |

Utilities | | 0.0 | % | 11.8 | % | 6.3 | % | 7.5 | % |

Other energy | | 0.0 | % | 5.8 | % | 7.3 | % | 5.5 | % |

Autos & transportation | | 0.0 | % | 3.7 | % | 4.0 | % | 2.6 | % |

Other | | 0.0 | % | 1.4 | % | 1.0 | % | 4.8 | % |

Integrated oils | | 0.0 | % | 0.0 | % | 0.1 | % | 7.7 | % |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

Portfolio Composition

Equity | | 98.2 | % |

Cash, Other Assets & Liabilities | | 1.8 | % |

Expense Ratio

AVERAGE ANNUAL TOTAL RETURNS as of March 31, 2008

| | 1st

Quarter | | 1

Year | | 3

Year | | 5

Year | | 10

Year | | Life

of Fund | |

Ariel Fund | | -11.21 | % | -16.03 | % | -0.84 | % | 9.94 | % | 7.22 | % | 11.99 | % |

Russell 2500 Value Index | | -7.22 | % | -16.54 | % | 4.41 | % | 15.56 | % | 7.86 | % | 12.07 | % |

Russell 2500 Index | | -9.37 | % | -11.27 | % | 6.01 | % | 15.67 | % | 6.89 | % | 11.10 | % |

S&P 500 Index | | -9.44 | % | -5.08 | % | 5.85 | % | 11.32 | % | 3.50 | % | 10.66 | % |

Past performance does not guarantee future results.

THE VALUE OF A $10,000 INVESTMENT IN ARIEL FUND

| TOP TEN EQUITY HOLDINGS | | | |

| | | | |

1 | Markel Corp. | | 5.3 | % |

| Specialty insurance provider | | | |

| | | | |

2 | Hewitt Associates, Inc. | | 5.2 | % |

| Human resources outsourcing and consulting firm | | | |

| | | | |

3 | Anixter International Inc. | | 4.9 | % |

| Global distributor of communication products, wire, cable and fasteners | | | |

| | | | |

4 | J.M. Smucker Co. | | 4.3 | % |

| Manufacturer of fruit spreads, peanut butter and other food products | | | |

| | | | |

5 | Brady Corp. | | 4.2 | % |

| Global manufacturer of industrial identification and specialty coated products | | | |

| | | | |

6 | Jones Lang LaSalle Inc. | | 4.0 | % |

| Real estate services and money management firm | | | |

| | | | |

7 | Equifax Inc. | | 4.0 | % |

| Provider of consumer and commercial credit information | | | |

| | | | |

8 | Energizer Holdings, Inc. | | 3.9 | % |

| Consumer battery and razor manufacturer | | | |

| | | | |

9 | IDEX Corp. | | 3.9 | % |

| Industrial product manufacturer | | | |

| | | | |

10 | CB Richard Ellis Group, Inc. | | 3.8 | % |

| Global commercial real estate services company | | | |

Note: All performance assumes the reinvestment of dividends and capital gains. The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 2500® Value Index measures the performance of small and mid-sized, value-oriented companies with lower price-to-earnings ratios. The Russell 2500® Index measures the performance of small and mid-sized companies. The S&P 500 is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Total return does

not reflect a maximum 4.75% sales load charged prior to 7/15/94.

800.292.7435

17

Ariel Fund Schedule of Investments

Number of Shares | | COMMON STOCKS—98.17% | | Cost | | Market Value | |

| | | | | | | |

| | Consumer Discretionary & Services—27.60% | | | | | |

1,500,475 | | Black & Decker Corp. | | $ | 121,537,818 | | $ | 99,181,397 | |

1,431,900 | | Gannett Co., Inc. | | 43,037,070 | | 41,596,695 | |

3,742,450 | | Hewitt Associates, Inc., Class A(a) | | 90,780,346 | | 148,837,236 | |

8,178,400 | | Interpublic Group of Cos., Inc.(a) | | 88,115,203 | | 68,780,344 | |

3,753,400 | | Lee Enterprises, Inc. | | 128,523,058 | | 37,571,534 | |

4,962,300 | | McClatchy Co., Class A | | 217,503,439 | | 53,096,610 | |

1,450,900 | | Mohawk Industries, Inc.(a) | | 103,061,829 | | 103,898,949 | |

3,516,300 | | Newell Rubbermaid Inc. | | 89,952,722 | | 80,417,781 | |

3,236,575 | | Royal Caribbean Cruises Ltd. | | 135,809,325 | | 106,483,318 | |

1,297,300 | | Tiffany & Co. | | 49,284,759 | | 54,279,032 | |

| | | | 1,067,605,569 | | 794,142,896 | |

| | Consumer Staples—7.68% | | | | | |

5,577,425 | | Constellation Brands, Inc.(a) | | 120,129,733 | | 98,553,100 | |

2,418,953 | | J.M. Smucker Co. | | 96,648,892 | | 122,423,211 | |

| | | | 216,778,625 | | 220,976,311 | |

| | Financial Services—30.14% | | | | | |

1,172,350 | | Assured Guaranty Ltd. | | 22,080,467 | | 27,831,589 | |

5,103,100 | | CB Richard Ellis Group, Inc.(a) | | 104,626,750 | | 110,431,084 | |

2,132,500 | | City National Corp. | | 154,868,542 | | 105,473,450 | |

3,330,000 | | Equifax Inc. | | 126,918,180 | | 114,818,400 | |

3,938,150 | | HCC Insurance Holdings, Inc. | | 68,404,887 | | 89,356,624 | |

4,085,600 | | Janus Capital Group Inc. | | 50,319,644 | | 95,071,912 | |

1,500,500 | | Jones Lang LaSalle Inc. | | 23,634,203 | | 116,048,670 | |

345,125 | | Markel Corp.(a) | | 73,225,835 | | 151,844,646 | |

1,957,400 | | Sotheby’s | | 66,436,739 | | 56,588,434 | |

| | | | 690,515,247 | | 867,464,809 | |

| | Health Care—7.56% | | | | | |

1,212,300 | | Bio-Rad Laboratories, Inc., Class A(a) | | 74,732,433 | | 107,834,085 | |

5,223,175 | | IMS Health Inc. | | 121,784,313 | | 109,738,907 | |

| | | | 196,516,746 | | 217,572,992 | |

| | Materials & Processing—9.15% | | | | | |

3,615,710 | | Brady Corp., Class A | | 69,842,870 | | 120,873,185 | |

1,253,250 | | Energizer Holdings, Inc.(a) | | 25,864,606 | | 113,394,060 | |

792,500 | | USG Corp.(a) | | 30,982,477 | | 29,179,850 | |

| | | | 126,689,953 | | 263,447,095 | |

| | Producer Durables—10.07% | | | | | |

3,408,000 | | ACCO Brands Corp.(a)(b) | | 76,759,532 | | 46,246,560 | |

1,836,750 | | Herman Miller, Inc. | | 33,636,406 | | 45,128,947 | |

3,661,000 | | IDEX Corp. | | 50,153,152 | | 112,356,090 | |

1,199,900 | | Pitney Bowes Inc. | | 42,186,050 | | 42,020,498 | |

3,988,575 | | Steelcase Inc., Class A | | 47,724,289 | | 44,113,640 | |

| | | | 250,459,429 | | 289,865,735 | |

| | | | | | | | | |

arielinvestments.com

18

March 31, 2008 (unaudited)

Number of Shares | | COMMON STOCKS—98.17% (cont’d) | | Cost | | Market Value | |

| | | | | | | |

| | Technology—5.97% | | | | | |

2,218,775 | | Anixter International Inc.(a)(b) | | $ | 58,438,417 | | $ | 142,090,351 | |

17,620,950 | | BearingPoint, Inc.(a)(b) | | 139,455,233 | | 29,603,196 | |

| | | | 197,893,650 | | 171,693,547 | |

| | | | | | | |

| | Total Common Stocks | | 2,746,459,219 | | 2,825,163,385 | |

| | | | | | | | | |

Principal Amount | | REPURCHASE AGREEMENT—2.11% | | Cost | | Market Value | |

| | | | | | | | | | |

$ | 60,810,118 | | Fixed Income Clearing Corporation, 1.40%, dated 3/31/2008, due 4/1/2008, repurchase price $60,812,482, (collateralized by Federal Home Loan Mortgage Corp., 3.625% due 9/15/2008) | | $ | 60,810,118 | | $ | 60,810,118 | |

| | Total Investments—100.28% | | $ | 2,807,269,337 | | 2,885,973,503 | |

| | Liabilities less Other Assets—(0.28%) | | | | (8,131,080 | ) |

| | NET ASSETS—100% | | | | $ | 2,877,842,423 | |

(a) | Non-income producing. |

(b) | Affiliated company (See Note Five). |

A category may contain multiple industries as defined by the Standard Industrial Classification system.

The accompanying notes are an integral part of the financial statements.

800.292.7435

19

Ariel Appreciation Fund Portfolio Management Discussion (CAAPX)

Fund Results

For the quarter ended March 31, 2008, Ariel Appreciation Fund declined -9.22% edging out the Russell Midcap benchmark’s -9.98% loss but trailing the Russell Midcap Value Index’s -8.64% posting. For the six month period ended March 31, 2008, Ariel Appreciation Fund retreated -14.59%. Its benchmarks fared a bit better—the Russell Midcap Value Index declined -14.09% and the Russell Midcap Index fell -13.17%.

Performance Drivers

Our six month performance was weighed down by a lack of energy-related holdings—the only sectors with positive returns in the Russell Midcap Value Index. There was also general pessimism toward consumer stocks. It is worth noting that solid stock selection was crucial for us, as our heaviest weightings were in two of the hardest hit sectors: consumer discretionary and financial services. The Fund’s holdings in these segments outperformed the Russell Midcap Value benchmark by roughly six percentage points in each sector.

Notably, shares of HR consulting firm Hewitt Associates were up +13.5% during the six month period. Performance has been solid since mid-2006, and the firm’s first quarter 2008 earnings were 50% higher than Wall Street’s consensus estimate. In our view, the Street has yet to fully appreciate the firm’s improving business fundamentals. Supplemental insurer Aflac Inc. gained +14.7% as investors flocked to the conservative financial firm which has a rock-solid balance sheet and highly transparent cash-flows. It also helps that Aflac’s extensive Japanese business counter-balanced weakness in the U.S. economy.

In this tough period, some stocks suffered. IMS Health, the leading pharmaceutical data provider lost -31.3%. Most of that slide occurred on the heels of a bleak third quarter 2007 earnings report. Margins fell, management lowered guidance and earnings disappointed the Street. We too were dissatisfied, but our analysis suggests the company’s business remains intact as drug firms simply need IMS data. USA TODAY publisher Gannett Co. slid -31.9%. The news about newspaper firms remains negative as ad revenues wane from competition of new media platforms and a softening economy. We believe content is king and creators of content will reap rewards on paper and over the Internet. Moreover, Gannett is one of only two publicly traded newspaper companies with an investment grade credit rating, meaning its financial strength is better than its peers.

Comings & Goings

During the quarter, we added fine jeweler Tiffany & Co. (featured on page 6) to the portfolio. Tiffany is a name Ariel admires and has held before. When weak 2007 holiday sales created what we viewed as a temporary price dislocation, we initiated a position once again. Conversely, we sold H&R Block on the announced sale of its mortgage servicing business, which consequently resulted in a run up of the company’s stock. We also parted with USG Corp., a dominant manufacturer of gypsum wallboard, on continued uncertainty regarding an end to the housing downturn.

The Patient Investor

Reflecting on the longer time horizon, Ariel Appreciation Fund posted a +7.05% ten-year average annual total return. By comparison, the Russell Midcap Value Index gained +8.16% and the Russell Midcap Index returned 7.65% over this time horizon. We believe the Fund’s long-term performance is driven by our disciplined investment approach, stock selection across industries in which Ariel has experience, and our commitment to investing in quality companies we believe are selling at excellent values.

arielinvestments.com

20

Ariel Appreciation Fund Performance Summary | | Inception: December 1, 1989 |

ABOUT THE FUND

The no-load Ariel Appreciation Fund pursues long-term capital appreciation by investing in undervalued companies that show strong potential for growth. The Fund primarily invests in companies with market capitalizations between $2.5 billion and $15 billion.

COMPOSITION OF EQUITY HOLDINGS

| | | | Russell | | | | | |

| | Ariel | | Midcap | | Russell | | S&P | |

| | Appreciation | | Value | | Midcap | | 500 | |

| | Fund† | | Index | | Index | | Index | |

Financial services | | 36.7 | % | 29.4 | % | 19.5 | % | 17.6 | % |

Consumer discretionary & services | | 34.3 | % | 9.9 | % | 15.0 | % | 11.1 | % |

Health care | | 11.1 | % | 1.8 | % | 7.4 | % | 12.0 | % |

Consumer staples | | 6.3 | % | 6.4 | % | 4.7 | % | 8.6 | % |

Producer durables | | 5.6 | % | 5.8 | % | 7.5 | % | 5.0 | % |

Materials & processing | | 3.0 | % | 9.6 | % | 9.4 | % | 4.3 | % |

Technology | | 3.0 | % | 5.9 | % | 10.2 | % | 13.3 | % |

Utilities | | 0.0 | % | 16.1 | % | 9.1 | % | 7.5 | % |

Other energy | | 0.0 | % | 6.1 | % | 10.3 | % | 5.5 | % |

Autos & transportation | | 0.0 | % | 3.9 | % | 3.8 | % | 2.6 | % |

Other | | 0.0 | % | 2.7 | % | 1.9 | % | 4.8 | % |

Integrated oils | | 0.0 | % | 2.5 | % | 1.1 | % | 7.7 | % |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

Portfolio Composition

Equity | | 99.7 | % |

Cash, Other Assets & Liabilities | | 0.3 | % |

Expense Ratio

AVERAGE ANNUAL TOTAL RETURNS as of March 31, 2008

| | 1st | | 1 | | 3 | | 5 | | 10 | | Life | |

| | Quarter | | Year | | Year | | Year | | Year | | of Fund | |

Ariel Appreciation Fund | | -9.22 | % | -12.18 | % | 1.65 | % | 10.25 | % | 7.05 | % | 10.97 | % |

Russell MidCap Value Index | | -8.64 | % | -14.12 | % | 6.56 | % | 16.77 | % | 8.16 | % | 12.35 | % |

Russell MidCap Index | | -9.98 | % | -8.92 | % | 7.36 | % | 16.31 | % | 7.65 | % | 11.95 | % |

S&P 500 Index | | -9.44 | % | -5.08 | % | 5.85 | % | 11.32 | % | 3.50 | % | 9.88 | % |

Past performance does not guarantee future results.

THE VALUE OF A $10,000 INVESTMENT IN ARIEL APPRECIATION FUND

| TOP TEN EQUITY HOLDINGS | | | |

| | | | |

1 | Accenture Ltd | | 4.8 | % |

| Global management consulting, technology services and outsourcing firm | | | |

| | | | |

2 | Thermo Fisher Scientific Inc. | | 3.9 | % |

| Distributor of scientific equipment and instruments | | | |

| | | | |

3 | Equifax Inc. | | 3.9 | % |

| Provider of consumer and commercial credit information | | | |

| | | | |

4 | CBS Corp. | | 3.8 | % |

| Mass media company | | | |

| | | | |

5 | Hewitt Associates, Inc. | | 3.8 | % |

| Human resources outsourcing and consulting firm | | | |

| | | | |

6 | Pitney Bowes Inc. | | 3.7 | % |

| Manufacturer of mailing equipment | | | |

| | | | |

7 | IMS Health Inc. | | 3.7 | % |

| Provider of health care data | | | |

| | | | |

8 | Baxter International Inc. | | 3.5 | % |

| Diversified health care manufacturer | | | |

| | | | |

9 | Northern Trust Corp. | | 3.5 | % |

| Global private wealth and institutional trust company | | | |

| | | | |

10 | Carnival Corp. | | 3.4 | % |

| Worldwide cruise company | | | |

Note: All performance assumes the reinvestment of dividends and capital gains. The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell Midcap® Value Index measures the performance of mid-sized, value-oriented companies with lower price-to-earnings ratios. The Russell Midcap® Index measures the performance of mid-sized companies. The S&P 500 is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

800.292.7435

21

Ariel Appreciation Fund Schedule of Investments

Number of Shares | | COMMON STOCKS—99.73% | | Cost | | Market Value | |

| | | | | | | |

| | Consumer Discretionary & Services—34.21% | | | | | |

2,474,600 | | Accenture Ltd, Class A | | $ | 37,718,556 | | $ | 87,031,682 | |

735,600 | | Black & Decker Corp. | | 27,179,544 | | 48,623,160 | |

1,517,550 | | Carnival Corp. | | 49,723,470 | | 61,430,424 | |

3,143,600 | | CBS Corp., Class B | | 77,462,472 | | 69,410,688 | |

1,935,750 | | Gannett Co., Inc. | | 109,108,067 | | 56,233,538 | |

1,728,100 | | Hewitt Associates, Inc., Class A(a) | | 47,443,870 | | 68,726,537 | |

4,373,475 | | Interpublic Group of Cos., Inc.(a) | | 36,241,351 | | 36,780,925 | |

2,211,000 | | McClatchy Co., Class A | | 98,174,435 | | 23,657,700 | |

675,400 | | Mohawk Industries, Inc.(a) | | 47,701,140 | | 48,365,394 | |

1,137,300 | | Omnicom Group Inc. | | 33,438,172 | | 50,245,914 | |

817,300 | | Tiffany & Co. | | 31,052,750 | | 34,195,832 | |

933,500 | | Yum! Brands, Inc. | | 10,416,470 | | 34,735,535 | |

| | | | 605,660,297 | | 619,437,329 | |

| | Consumer Staples—6.24% | | | | | |

951,672 | | Clorox Co. | | 37,327,203 | | 53,902,702 | |

3,341,200 | | Constellation Brands, Inc.(a) | | 70,862,041 | | 59,039,004 | |

| | | | 108,189,244 | | 112,941,706 | |

| | Financial Services—36.65% | | | | | |

345,400 | | Aß ac Inc. | | 15,462,034 | | 22,433,730 | |

2,766,075 | | CB Richard Ellis Group, Inc.(a) | | 69,023,447 | | 59,857,863 | |

1,204,200 | | City National Corp. | | 86,459,629 | | 59,559,732 | |

698,322 | | Dun & Bradstreet Corp. | | 17,041,841 | | 56,829,444 | |

2,024,000 | | Equifax Inc. | | 46,485,471 | | 69,787,520 | |

537,100 | | Franklin Resources, Inc. | | 20,777,883 | | 52,093,329 | |

1,464,700 | | HCC Insurance Holdings, Inc. | | 44,748,815 | | 33,234,043 | |

2,359,500 | | Janus Capital Group Inc. | | 27,432,245 | | 54,905,565 | |

789,400 | | Jones Lang LaSalle Inc. | | 68,978,776 | | 61,052,196 | |

1,276,800 | | Moody’s Corp. | | 55,578,218 | | 44,470,944 | |

944,000 | | Northern Trust Corp. | | 28,384,032 | | 62,747,680 | |

1,239,700 | | Sotheby’s | | 42,155,856 | | 35,839,727 | |

1,016,800 | | T. Rowe Price Group, Inc. | | 17,478,661 | | 50,840,000 | |

| | | | 540,006,908 | | 663,651,773 | |

| | Healthcare—11.09% | | | | | |

1,092,150 | | Baxter International Inc. | | 22,562,673 | | 63,148,113 | |

3,180,060 | | IMS Health Inc. | | 51,370,367 | | 66,813,061 | |

1,245,354 | | Thermo Fisher Scientific Inc.(a) | | 18,747,995 | | 70,785,921 | |

| | | | 92,681,035 | | 200,747,095 | |

| | Materials & Processing—2.98% | | | | | |

597,500 | | Energizer Holdings, Inc.(a) | | 47,817,008 | | 54,061,800 | |

| | | | | | | |

| | Producer Durables—5.57% | | | | | |

707,800 | | Illinois Tool Works Inc. | | 38,063,057 | | 34,137,194 | |

1,908,075 | | Pitney Bowes Inc. | | 68,185,224 | | 66,820,787 | |

| | | | 106,248,281 | | 100,957,981 | |

| | | | | | | | | |

arielinvestments.com

22

March 31, 2008 (unaudited)

Number of Shares | | COMMON STOCKS—99.73% (cont’d) | | Cost | | Market Value | |

| | | | | | | |

| | Technology—2.99% | | | | | |

844,900 | | Anixter International Inc.(a) | | $ | 53,531,300 | | $ | 54,107,396 | |

| | | | | | | |

| | Total Common Stocks | | 1,554,134,073 | | 1,805,905,080 | |

| | | | | | | | | |

Principal Amount | | REPURCHASE AGREEMENT—0.30% | | Cost | | Market Value | |

| | | | | | | |

$ | 5,467,186 | | Fixed Income Clearing Corporation, 1.40%, dated 3/31/2008, due 4/1/2008, repurchase price $5,467,399, (collateralized by Federal Home Loan Mortgage Corp., 3.625% due 9/15/2008) | | $ | 5,467,186 | | $ | 5,467,186 | |

| | Total Investments—100.03% | | $ | 1,559,601,259 | | 1,811,372,266 | |

| | Liabilities less Other Assets—(0.03%) | | | | (610,346 | ) |

| | NET ASSETS—100% | | | | $ | 1,810,761,920 | |

| | | | | | | | | | |

A category may contain multiple industries as defined by the Standard Industrial Classification system.

The accompanying notes are an integral part of the financial statements.

800.292.7435

23

Ariel Focus Fund Portfolio Management Discussion (ARFFX)

Fund Results

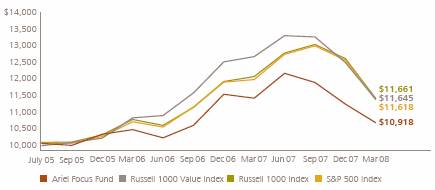

For the three months ended March 31, 2008, Ariel Focus Fund declined -5.01%, surpassing each of its benchmarks. The Russell 1000 Value Index retreated -8.72% and the Russell 1000 Index declined - -9.48%. During the quarter, the S&P 500 Index gave back -9.44%. For the six month period ended March 31, 2008, Ariel Focus Fund posted a -10.14% return, again, better than the -14.01% and

- -12.41% losses of the Russell 1000 Value and the Russell 1000 Indexes and ahead of the S&P 500 Index’s -12.46% decline.

Performance Drivers

Although never pleased when one of our mutual funds posts negative returns, we are satisfied that Ariel Focus Fund provided staunch downside protection compared to its benchmarks over the past two quarters. In some ways, the credit crisis was far more disruptive in the mid- and larger-cap universe than it was for smaller companies. Larger companies tend to invest in interconnected ways in securities related to the mortgages now defaulting, whereas smaller firms in general don’t have the same exposure to these types of complicated investments. A combination of a lighter weighting in the financial services sector than its primary benchmark—the Russell 1000 Value Benchmark—and generally good stock picking within this hard-hit arena drove most of the fund’s six-month outperformance.

The two best-performing stocks over this timeframe have a great deal in common. Insurance giant Berkshire Hathaway gained +13.2%, and supplemental health insurer Aflac Inc. climbed +14.7%. While Berkshire made headlines for starting up a bond insurer and acquiring 60% of conglomerate Marmon Group, Aflac had little surprising news. In both cases, we believe investors were seeking out conservative financial firms with strong balance sheets, steady cash flows and seasoned management—some of the key reasons we also admire these companies. Also notable, Aflac’s extensive Japanese business provided important diversification away from a weakening U.S. economy.

Unfortunately, the portfolio’s two worst performers also had multiple parallels which dragged down results. During the period, Citigroup fell -52.9% while Swiss banking giant UBS lost -45.9%. The credit crisis has been so broad and sweeping that it has been difficult for global financial firms such as Citigroup and UBS to emerge unscathed. Since the credit crisis began, Citigroup has had write-downs of $32 billion and UBS has taken a $37 billion hit. As a result, both have sought out multi-billion dollar capital infusions. Despite negative news, we remain confident in the long-term prospects of Citigroup and UBS. First, we believe most of the bad news is out and reflected in the stock prices, and at this point we see additional downside risk as minimal. Second, and even more important, we are confident that both Citigroup and UBS will survive and recover. Each has sizeable assets, established global brands and wide- ranging diversification.

Comings & Goings

During the quarter, we initiated a position in fine jeweler Tiffany & Co. (featured on page 6), as well as media and entertainment icon Walt Disney Co. after its stock traded down on falling consumer confidence and lower discretionary spending. We sold our stake in Home Depot and bought Lowe’s Cos., Inc., another home improvement retailer with higher margins and what we believe offers shareholders a brighter long-term outlook. Additionally, we sold our stake in Constellation Brands, a leading producer and distributor of alcohol beverages, to pursue other investment ideas, although we continue to hold Constellation in Ariel Fund and Ariel Appreciation Fund. Finally, we parted with tax preparation giant H&R Block after management announced the sale of its mortgage business, resulting in a nice run up in its stock price.

arielinvestments.com

24

Ariel Focus Fund Performance Summary | | Inception: June 30, 2005 |

ABOUT THE FUND

The no-load Ariel Focus Fund pursues long-term capital appreciation by investing in undervalued companies that show strong potential for growth. The Fund primarily invests in companies with market capitalizations in excess of $10 billion. Ariel Focus Fund is a non-diversified fund and generally will hold 20 securities.

COMPOSITION OF EQUITY HOLDINGS |

| | | | Russell | | | | | |

| | Ariel | | 1000 | | Russell | | S&P | |

| | Focus | | Value | | 1000 | | 500 | |

| | Fund† | | Index | | Index | | Index | |

Consumer discretionary & services | | 30.3 | % | 7.0 | % | 11.8 | % | 11.1 | % |

Financial services | | 17.9 | % | 28.0 | % | 17.8 | % | 17.6 | % |

Health care | | 15.2 | % | 7.6 | % | 11.8 | % | 12.0 | % |

Technology | | 12.2 | % | 3.4 | % | 12.9 | % | 13.3 | % |

Other | | 11.2 | % | 6.6 | % | 4.5 | % | 4.8 | % |

Autos & transportation | | 6.9 | % | 1.6 | % | 2.5 | % | 2.6 | % |

Producer durables | | 3.2 | % | 3.2 | % | 5.2 | % | 5.0 | % |

Materials & processing | | 3.1 | % | 5.4 | % | 5.2 | % | 4.3 | % |

Utilities | | 0.0 | % | 13.1 | % | 7.4 | % | 7.5 | % |

Integrated oils | | 0.0 | % | 12.9 | % | 6.9 | % | 7.7 | % |

Consumer staples | | 0.0 | % | 7.1 | % | 7.9 | % | 8.6 | % |

Other energy | | 0.0 | % | 3.9 | % | 6.0 | % | 5.5 | % |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

Portfolio Composition | | | |

| | | |

Equity | | 97.3 | % |

Cash, Other Assets & Liabilities | | 2.7 | % |

| | | |

Expense Ratio | | | |

| | | |

Net | | 1.25 | %* |

Gross | | 1.63 | %* |

*As of 9/30/07 Ariel Investments, the Adviser to the Funds, is contractually obligated to waive fees and reimburse expenses in order to limit Ariel Focus Fund’s total annual operating expenses to 1.25% of net assets through the end of the fiscal year ending September 30, 2009. After that date, there is no assurance that such expenses will be limited.

AVERAGE ANNUAL TOTAL RETURNS as of March 31, 2008

| | 1st | | 1 | | Life | |

| | Quarter | | Year | | of Fund | |

Ariel Focus Fund | | -5.01 | % | -6.45 | % | 3.24 | % |

Russell 1000 Value Index | | -8.72 | % | -9.99 | % | 5.68 | % |

Russell 1000 index | | -9.48 | % | -5.40 | % | 5.73 | % |

S&P 500 Index | | -9.44 | % | -5.08 | % | 5.59 | % |

Past performance does not guarantee future results.

THE VALUE OF A $10,000 INVESTMENT IN ARIEL FOCUS FUND

| | TOP TEN EQUITY HOLDINGS | | |

| | | | |

1 | | Berkshire Hathaway Inc. | | 7.4% |

| | Global insurance and investment firm | | |

| | | | |

2 | | International Business Machines Corp. | | 7.2% |

| | Worldwide provider of computer products and services | | |

| | | | |

3 | | Toyota Motor Corp. | | 6.7% |

| | Global auto manufacturer | | |

| | | | |

4 | | IMS Health Inc. | | 5.2% |

| | Provider of health care data | | |

| | | | |

5 | | Johnson & Johnson | | 5.1% |

| | Diversified health care and consumer products company | | |

| | | | |

6 | | Accenture Ltd | | 4.8% |

| | Global management consulting, technology services and outsourcing firm | | |

| | | | |

7 | | Dell Inc. | | 4.7% |

| | Global computer and technology provider | | |

| | | | |

8 | | JPMorgan Chase & Co. | | 4.4% |

| | Global financial services firm | | |

| | | | |

9 | | Aflac Inc. | | 4.4% |

| | Global insurance provider | | |

| | | | |

10 | | Covidien Ltd. | | 4.4% |

| | Global healthcare products company | | |

Note: All performance assumes the reinvestment of dividends and capital gains. The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 1000® Value Index measures the performance of large-sized, value-oriented companies with lower price-to-earnings ratios. The Russell 1000® Index measures the performance of large-sized companies. The S&P 500 is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Ariel Focus Fund is a non-diversified fund and therefore may be subject to greater volatility than a more diversified investment.

800.292.7435

25

Ariel Focus Fund Schedule of Investments

Number of Shares | | COMMON STOCKS—97.32% | | Cost | | Market Value | |

| | | | | | | |

| | Autos & Transportation—6.71% | | | | | |

26,900 | | Toyota Motor Corp., ADR | | $ | 2,793,369 | | $ | 2,713,941 | |

| | | | | | | |

| | Consumer Discretionary & Services—29.55% | | | | | |

55,000 | | Accenture Ltd, Class A | | 1,554,494 | | 1,934,350 | |

21,500 | | Black & Decker Corp. | | 1,838,786 | | 1,421,150 | |

43,800 | | Carnival Corp. | | 2,106,185 | | 1,773,024 | |

36,500 | | Hewitt Associates, Inc., Class A(a) | | 931,694 | | 1,451,605 | |

53,200 | | Lowe’s Cos., Inc. | | 1,305,723 | | 1,220,408 | |

37,400 | | Omnicom Group Inc. | | 1,733,937 | | 1,652,332 | |

30,900 | | Tiffany & Co. | | 1,137,950 | | 1,292,856 | |

38,700 | | Walt Disney Co. | | 1,081,589 | | 1,214,406 | |

| | | | 11,690,358 | | 11,960,131 | |

| | Financial Services—17.41% | | | | | |

27,500 | | Aflac Inc. | | 1,236,588 | | 1,786,125 | |

53,700 | | Citigroup Inc. | | 2,271,066 | | 1,150,254 | |

41,600 | | JPMorgan Chase & Co. | | 1,745,710 | | 1,786,720 | |

25,400 | | Morgan Stanley | | 1,255,628 | | 1,160,780 | |

40,400 | | UBS AG | | 2,427,899 | | 1,163,520 | |

| | | | 8,936,891 | | 7,047,399 | |

| | Health Care—14.77% | | | | | |

40,275 | | Covidien Ltd. | | 1,492,310 | | 1,782,168 | |

100,500 | | IMS Health Inc. | | 2,388,710 | | 2,111,505 | |

32,100 | | Johnson & Johnson | | 2,013,337 | | 2,082,327 | |

| | | | 5,894,357 | | 5,976,000 | |

| | Materials & Processing—2.98% | | | | | |

32,800 | | USG Corp.(a) | | 1,498,433 | | 1,207,696 | |

| | | | | | | |

| | Other—10.87% | | | | | |

671 | | Berkshire Hathaway Inc., Class B (a) | | 2,178,823 | | 3,001,316 | |

31,775 | | Tyco International Ltd. | | 1,316,147 | | 1,399,689 | |

| | | | 3,494,970 | | 4,401,005 | |

| | Producer Durables—3.16% | | | | | |

26,500 | | Illinois Tool Works Inc. | | 1,394,764 | | 1,278,095 | |

| | | | | | | | | |

arielinvestments.com

26

March 31, 2008 (unaudited)

Number of Shares | | COMMON STOCKS—97.32% | | Cost | | Market Value | |

| | | | | | | |

| | Technology—11.87% | | | | | |

95,000 | | Dell Inc.(a) | | $ | 2,305,224 | | $ | 1,892,400 | |

25,300 | | International Business Machines Corp. | | 2,048,580 | | 2,913,042 | |