UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-4786 |

|

Ariel Investment Trust |

(Exact name of registrant as specified in charter) |

|

200 East Randolph Drive

Suite 2900

Chicago, Illinois | | 60601 |

(Address of principal executive offices) | | (Zip code) |

|

Sheldon R. Stein or Erik D. Ojala

200 East Randolph Drive

Suite 2900

Chicago, Illinois 60601 |

(Name and address of agent for service) |

|

with a copy to:

Arthur Don

Seyfarth Shaw LLP

131 South Dearborn Street

Suite 2400

Chicago, IL 60603 |

|

Registrant’s telephone number, including area code: | (312) 726-0140 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | March 31, 2007 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”) (17 CFR 270.30e-1)

Investing in small and mid-cap stocks is more risky and more volatile than investing in large cap stocks. For the period ended March 31, 2007, the average annual total returns of Ariel Fund and Ariel Appreciation Fund for the one-, five- and ten-year periods were +6.09%, +9.75% and +13.42%; and +11.01%, +7.32% and +13.01%, respectively. For the period ended March 31, 2007, the average annual total returns of Ariel Focus Fund for the one-year and since inception (June 30, 2005) periods were +8.96% and +9.21%. All performance assumes reinvestment of dividends and capital gains. Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by visiting our web site, arielmutualfunds.com. Ariel Focus Fund is a non-diversified fund and therefore may be subject to greater volatility than a more diversified investment. The performance of Ariel Focus Fund may differ from that of Ariel Fund and Ariel Appreciation Fund due to its status as a non-diversified fund and different portfolio managers.

This report candidly discusses a number of individual companies. Our opinions are current as of the date of this report but are subject to change. The information provided in this report is not reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell a particular security.

For a current prospectus which includes the investment objectives, risks, management fees, charges and expenses as well as other information, call 800-292-7435. Please read the prospectus and consider this information carefully before investing. ©2007, Ariel Distributors, LLC.

Ariel Investment Trust

P.O. Box 219121

Kansas City, Missouri 64121-9121

800-292-7435

arielmutualfunds.com

Table of Contents

Turtle Talk with our Investment Specialists

I recently received my tax refund of $1,600. This year, my New Year’s resolution is to save more, so I put it in my Ariel IRA instead of spending it like I usually do. I’d like to maximize my IRA contribution, but right now I don’t have another $2,400 to reach the $4,000 limit for 2007. Any suggestions?

-Chris R., Evanston, IL

Stephanie: It can be hard to save with so many day-to-day responsibilities, but with compounding, even just a few extra dollars can really add up. Personally, I’m a big fan of automatic investment programs because you can put your savings on autopilot, making it easier to stick to your goals.

With this type of program, you designate a specific dollar amount you want automatically withdrawn from either a paycheck or bank account. You have up until April 15, 2008 to make your 2007 IRA contribution. So, if you start in May and contribute $200 a month through next April, you'll reach your goal. If this seems like a stretch, you can start with as little as $50 each month. Then down the road, you can increase the amount at any time. To enroll in this convenient plan, log onto arielmutualfunds.com.*

As a shareholder services representative, I am excited to introduce a new feature on our web site. In early May, Ariel is updating the account login feature so that you can access your Ariel account with a username you create instead of your Social Security number. We are adding this function based on shareholder feedback and our commitment to providing the best possible security features for investors. For more information, visit arielmutualfunds.com/username/ or call us at 800.292.7435, option 4.

* | Please note, if your banking information is not already on file with Ariel, you will need to complete and mail in our banking instructions and automatic investment form. You can access this form on arielmutualfunds.com. |

MARCH 31, 2007 | | SLOW AND STEADY WINS THE RACE |

“ ...our conservative, high quality holdings with their strong financial shells should provide needed protection as lower quality, cyclical issues descend from their lofty heights.”

Dear Fellow Shareholder: Lower-quality cyclical and commodity issues had a surprising comeback during the quarter ended March 31, 2007. Surprising because after a prolonged and remarkable ascent built on feeble fundamentals, these unlikely stock market darlings had finally begun to experience some comeuppance last fall after the Federal Reserve Board stopped raising interest rates in a clear nod to a slowing economy. But it seems the New Year brought with it a hearty appetite for risk perhaps best summed up by a recent Wall Street Journal headline which declared, “Investors Regain Their Risk Hunger.” As The Journal put it, “Investors aren’t just dipping their toes in the water. They’re diving in head first, making high-stakes bets on everything...”

Much to our delight, Ariel Fund was able to overcome these headwinds and beat both of its benchmarks during the quarter. More specifically, the portfolio’s +3.9% gain outpaced the +3.1% return posted by the Russell 2500 Value Index as well as the +3.6% advance of the Russell 2500 Index. The Fund’s results are noteworthy because low-quality rallies generally do not offer ideal market conditions for our kind of stocks. But one by-product of current investor bias is that both financial and strategic buyers, with more cash on hand then ever, have begun to re-focus on some of the wonderful, branded businesses that have largely been ignored. Accordingly, three names in Ariel Fund announced transactions during the quarter: Investors Financial Services Corp. is being bought by State Street Corp. at a +38% premium, while ServiceMaster Co. and Tribune Co. are both being taken private. Shares of ServiceMaster are up +29.3% since the company announced it would explore strategic alternatives last fall. And although we believe the famed real estate investor, Sam Zell, is getting Tribune for a bargain in buying the company for less than our private market value estimate, his $34 price is still at a +25.5% premium to the stock’s 2006 low when we were actively acquiring more shares.

Although Ariel Appreciation Fund’s first quarter performance was also helped by the ServiceMaster and Tribune transactions, as well as the continued re-bound of other contrarian picks, our gains fell short of the ever skyrocketing mid-cap indices propelled to new heights by lower quality holdings producing what we now fear to be “bubble-like” returns. Finance theory says investors should be rewarded for accepting additional risk. As such, small caps should outperform mid-caps, which should outpace large caps over time. Conversely, during those periods when a more conservative approach is being rewarded, one would expect less risky large caps to outperform their higher octane small cap siblings—with

ARIELMUTUALFUNDS.COM

2

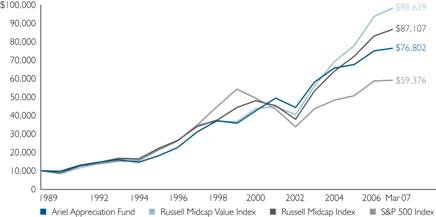

mid-cap performance somewhere in between. And yet, in keeping with the last five years, the first quarter advances of the Russell Midcap Value Index and the Russell Midcap Index continue to defy logic—having trounced both the Russell 2000 Value Index as well as the Russell 1000 Value Index as shown in the following chart. In fact, according to Lipper data, the Russell Midcap Value Index outperformed 89% of all domestic managers for the quarter and 98% of that same group over the last five-years. This, too, is noteworthy since a benchmark is expected to fall in the middle of the pack. As Smart Money columnist, James B. Stewart, recently explained in the April 2007 issue, “[The] whole point [of index funds] is to be ‘average,’ nothing more and nothing less.” Against this unusual backdrop, Ariel Appreciation Fund’s +1.9% return outpaced the broader market, but could not catch the Russell Midcap Value Index which surged +4.9% or the Russell Midcap Index’s +4.4% jump.

Not surprisingly, with low quality companies’ stellar rise, the conservative brands Ariel Focus Fund favors sat out this rally. Additionally, a few names in our concentrated portfolio struggled, weighing down results over the quarter. As such, Ariel Focus Fund returned -1.0%, trailing its benchmarks, which were up only slightly. Specifically, the S&P 500 Index gained +0.6%, while

the Russell 1000 Value Index and Russell 1000 Index both rose +1.2%.

Where has all the value gone?

Value is expensive. All of the signs are there. One would think that as value managers we would relish this period. But we don’t because the category is now picked over— making value’s seven-year run feel more like one encore too many at a concert with our favorite band. Barron’s Alan Abelson agrees and recently commented, “Stocks are anything but cheap [and] forces are making it

tougher to find, well, good value in these value days.”

“ …the category is now picked over—

making value’s seven-year run feel

more like one encore too many at a

concert with our favorite band.”

According to an updated white paper entitled “Has Growth Become Value—Reprise” by Dennis J. Trittin of the Frank Russell Company, “Value has outpaced Growth by +15.0% on an annualized basis...since the June 30, 2000 Growth stock peak.” Moreover, “not only is the magnitude of this style advantage to Value unprecedented since the inception of the Russell indexes, but also the duration is the longest on record.” In fact, although hard to imagine when one recalls those heady dot com days, he writes, “...the Value move in the ‘post-Bubble’ market has now overwhelmed the Growth rally in the speculative period that preceded it!”

It is not surprising then that the money has flowed hand over fist into the value style, making for a self-fulfilling prophesy that has less and less to do with the fundamentals of the underlying companies. For example, for the three years through 2000 when growth stocks were on fire, mid-cap value mutual funds experienced $6.9 billion in net redemptions. Large cap value had it even worse—

NOT PART OF THE SEMI-ANNUAL REPORT

3

$64 billion of the category’s assets ran for the door. All of these dollars and then some rushed to large cap growth funds which were inundated with $222 billion in net new assets. As you may recall, during this period, the Standard & Poor’s 500 Index garnered the highest “A” rating from The Wall Street Journal for its 1-, 3- and 5-year results placing it in the top 10% of all managers. Fast forward to today and one sees a striking contrast for the three years ending 2006. Mid-cap value took in $33 billion in new assets. Large cap value did even better with $76 billion in new flows. Meanwhile, large cap growth experienced $32 billion in redemptions.* As such, it is not hard to comprehend why Trittin believes “...market valuations have again become historically compressed...making growth companies... cheaper than normal and value companies ...more expensive than normal.” In further explaining value’s richness, he surmises that “during extended profit recoveries, investors often pay ‘growth stock multiples’ for what are ultimately shown to be cyclicals.”

“...we are convinced current

conditions are precarious, the

pendulum has just swung too far,

and some valuation ‘normalcy’ will

re-emerge as the economy slows.”

Against this backdrop, we are convinced current conditions are precarious—the pendulum has just swung too far—and some valuation ‘normalcy’ will re-emerge as the economy slows. Although market declines are never fun, we are comforted in knowing our conservative, high quality holdings with their strong financial shells should provide needed protection as lower quality, cyclical issues descend from their lofty heights. The reason being, our names generally have low expectations built into their prices and therefore have less far to fall in tough times. As such, we remain confident that when the inevitable correction does occur (this bull turns 5 years old this fall!), more bargains will be at hand.

Farewell to a good friend

Franklin Morton, a 15-year Ariel veteran, recently announced he plans to retire on June 1, 2007. Franklin has served as a long-time member of the Investment Committee with a specialty in the consumer products and financial services arenas. He has been a wonderful and valued member of Ariel’s team—always willing to go above and beyond to get any job done for our clients and shareholders. We sincerely appreciate all that he has done to help us get where we are today, and we wish him all the very best in the years to come.

As always, we appreciate the opportunity to serve you and welcome any questions or comments that you might have. You can contact us directly at email@arielmutualfunds.com.

Sincerely,

| |

|

| | |

| | |

John W. Rogers, Jr. | | Mellody Hobson |

Chairman and CEO | | President |

* According to Strategic Insight

800-292-7435

4

Company Spotlight | | [Ariel Fund] |

Investors Financial Services Corp. (NASDAQ: IFIN)

200 Clarendon Street

Boston, MA 02116

617-937-6700

www.ibtco.com

Investors Financial Services Corp. is the holding company for Investors Bank & Trust—a global provider of administrative and back-office services for asset managers such as mutual fund complexes, investment advisors, hedge funds, banks and insurance companies. More specifically, the company assists its clients with global custody, multi-currency accounting, fund administration, securities lending and other value-added services.

Admirable Franchise

Prior to initiating our purchase in July 2005, Ariel’s investment team had tracked the firm for a number of years, admiring its quality franchise, unique business niche and obsession for customer service. Unlike its larger competitors, Investors Financial targets smaller asset managers, which creates an important competitive advantage. By providing world-class customer service, the company has successfully grown along with its clients, today servicing over $2.3 trillion in assets. Particularly noteworthy is the fact that Investors Financial has been rated #1 in client service for four years by Global Investor—a tribute to management’s laser-like focus on accuracy and high-touch service. Of additional significance is the firm’s early advocacy of Exchange Traded Funds (ETFs), a rapidly-growing segment in the investment arena. In 2001, the company inked a deal with Barclays Global Investors which has emerged as the largest ETF manager, creating an important partnership for Investors Financial.

Buying Opportunity

We saw a wonderful buying opportunity in 2005, when two issues dragged down the company’s stock price. First, the Barclay’s contract was coming up for renewal. Wall Street worried Investors Financial was overly concentrated in one client and pondered doomsday scenarios over the loss of a major account. Second, the investment community was pessimistic over an inverted yield curve and its potential impact on the company. Historically, Investors Financial boosted profits by investing clients’ cash at higher long-term maturities. As the gap between long-term and short-term yields narrowed, a nice profit stream for the company weakened.

Slow and Steady

As the company was encountering these headwinds, Ariel initiated its position. Our investment team had conducted years of extensive due diligence on the firm’s fundamentals as well as deep quantitative analysis on the impact of the changing yield curve and the possible loss of the Barclay’s account. Additionally, we leveraged our network of peers and even other Investors Financial clients to verify the strength of its business. Our analysis dismissed Wall Street concerns as overblown and confirmed our thesis that this quality company was selling at a bargain. As such, we built the bulk of our position in 2005. We were pleasantly surprised when State Street Corporation announced in February its intention to acquire the company at a premium of 38%. On the good news of the merger, we sold our shares in March and the merger is expected to close this July.

NOT PART OF THE SEMI-ANNUAL REPORT

5

Company Spotlight | | [Ariel Fund] |

| | [Ariel Appreciation Fund] |

Mohawk Industries, Inc. (NYSE: MHK)

160 South Industrial Boulevard

Calhoun, GA 30701

706-629-7721

www.mohawkind.com

Founded in 1878 as a carpet manufacturer, Mohawk Industries is the oldest and largest company in its industry—and today competes across all major flooring categories including carpet, rugs, hardwood, laminate, ceramic tile, stone and vinyl flooring. The company markets and manufactures products to both residential and commercial customers under a number of well-known brands such as Mohawk, Aladdin, Ralph Lauren, Custom Weave, Karastan, Lees, Dal-Tile and American Olean.

Magic Carpet Ride

Beyond an impressive stable of brands, the company boasts a number of competitive advantages. Specifically, Mohawk sets itself apart from its peers through a relentless commitment to dealer relationships and premium servicing—both of which are critical in terms of filling orders, ensuring prompt delivery, achieving customer satisfaction and cultivating repeat business. Additionally, the company maintains an extensive distribution network of more than 300 locations and has its own trucking fleet.

Over the years, management has made several well-calculated acquisitions, providing complementary product offerings for customers. For example, its 2005 purchase of Unilin added an important proprietary product line to Mohawk’s portfolio, laminates. As Mohawk has folded Unilin into its distribution channel and extended this line across the pricing spectrum, the Unilin name has gained greater strength and appeal among retailers, increasing Mohawk’s revenues by 15%.

Current Headwinds

Unfortunately, over the past several months, the flooring industry has suffered from softness in new residential construction and replacement sales. As expected, Mohawk’s stock price has declined in sympathy. In our opinion, investors have exaggerated new construction’s impact on Mohawk, when in fact, the company has a robust commercial construction exposure which remains strong and helps offset some of the weakness in residential construction. Another stumbling block has been rising raw material prices—particularly petroleum, a key flooring component—which has pressured Mohawk’s earnings downward.

Looking Ahead

We believe these issues are temporary tough spots and that investor concerns are inflated. The industry historically has passed raw material increases to consumers and we see no reason why Mohawk will not be able to continue this trend. Furthermore, we expect its replacement business to regain momentum as buyers who postponed a new home consider smaller home improvements. We also believe Mohawk’s strong long-term track record dating back nearly 130 years speaks for itself. The company has a deep bench of management talent with significant industry expertise, and we have every confidence Mohawk will weather the current storm.

As of March 31, 2007, shares traded at $82.05, a 31% discount to our $119 estimate of private market value.

ARIELMUTUALFUNDS.COM

6

Company Spotlight | | [Ariel Focus Fund] |

Johnson & Johnson (NYSE: JNJ)

One Johnson & Johnson Plaza

New Brunswick, NJ 08933

732-524-0400

www.jnj.com

Johnson & Johnson is one of the largest and most diversified consumer health care companies in the world. Its more than 200 operating companies develop a broad spectrum of products spanning baby care, first aid, pharmaceuticals, medical devices and diagnostics to products relating to family planning, dermatology and feminine hygiene.

Industry Pioneers

With over 54,000 U.S. and international patents, Johnson & Johnson has a formidable track record of innovation with breakthroughs like baby powder, the first antiseptic surgical dressings and the Pap smear. In fact, Johnson’s Baby Powder was introduced in 1893 and over a century later, remains a favorite brand. Other popular household names from Johnson & Johnson include Band-Aid, Neutrogena, Tylenol, Visine, Benadryl and Reach, just to name a few. This level of brand strength is a significant advantage and hard to match. Additionally, Johnson & Johnson’s financial flexibility allows the company to explore revolutionary product ideas and take risks with research and development dollars. Equally important, Johnson & Johnson’s premier reputation as an iconic health care

company is invaluable to attracting and retaining world-class scientists and management talent.

Strategic Growth

Led by Chairman and CEO William Weldon, leadership continues to enhance its market strength through a number of strategic acquisitions. Most recently, the company purchased Pfizer Consumer Healthcare creating new market opportunities with consumer health care brands like Listerine, Rogaine and Sudafed. For example, the addition of Listerine more than triples Johnson & Johnson’s oral health franchise. Management also has made important acquisitions in its Medical Devices & Diagnostics division strengthening its therapies and product pipeline.

Current Pressures Create a Bargain

Lately, the blue-chip company’s stock has been pressured by a few product challenges. Specifically, investors fret over select pharmaceuticals losing patent protection in the next three years and the resulting increase in generic competition. Additionally, Johnson & Johnson’s stock slid further after controversial studies led to negative headlines regarding its heart stents, which are tiny wires used to open heart arteries. As one of the biggest players in the health care industry, Johnson & Johnson is a natural lightening rod for negative press. However, we have watched the company skillfully navigate past challenges and expect leadership to address current concerns with the same level of success.

In our view, short-term setbacks made this high-quality, blue-chip company an incredibly attractive value. In fact, Johnson & Johnson is selling at one of the lowest multiples in years. As such, we initiated our position in February and remain confident in the firm’s reputation, highly demanded products, diversification and enormous free cash flow. As of March 31, 2007, the company traded at $60.26, a 43% discount to our $105 value of intrinsic worth.

NOT PART OF THE SEMI-ANNUAL REPORT

7

Ariel Fund Statistical Summary (ARGFX)

| | | | | | 52-Week Range | | Earnings Per Share | | P/E Calendar | | | |

| | | | | | | | | | 2005 | | 2006 | | 2007 | | 2005 | | 2006 | | 2007 | | Market | |

| | Ticker | | Price | | | | | | Actual | | Actual | | Estimated | | Actual | | Actual | | Estimated | | Cap. | |

Company | | Symbol | | 3/31/07 | | Low | | High | | Calendar | | Calendar | | Calendar | | P/E | | P/E | | P/E | | ($MM) | |

| | | | | | | | | | | | | | | | | | | | | | | |

Invacare Corp. | | IVC | | 17.44 | | 17.24 | | 31.38 | | 1.86 | | 1.45 | | 1.42 | | 9.4 | | 12.0 | | 12.3 | | 558 | |

ACCO Brands Corp. | | ABD | | 24.09 | | 17.95 | | 27.45 | | 1.03 | | 1.00 | | 1.51 | | 23.4 | | 24.1 | | 16.0 | | 1,295 | |

Chittenden Corp. | | CHZ | | 30.19 | | 24.60 | | 31.96 | | 1.77 | | 1.83 | | 1.97 | | 17.1 | | 16.5 | | 15.3 | | 1,369 | |

Lee Enterprises, Inc. | | LEE | | 30.05 | | 22.98 | | 35.65 | | 2.11 | | 1.90 | | 2.72 | | 14.2 | | 15.8 | | 11.0 | | 1,384 | |

BearingPoint, Inc. | | BE | | 7.66 | | 7.33 | | 9.59 | | 0.17 | | (0.03 | )(e) | 0.32 | | 45.1 | | NM | | 23.9 | | 1,544 | |

Brady Corp. | | BRC | | 31.20 | | 30.85 | | 42.79 | | 1.85 | | 2.08 | | 2.33 | | 16.9 | | 15.0 | | 13.4 | | 1,683 | |

Assured Guaranty Ltd. | | AGO | | 27.32 | | 23.50 | | 28.40 | | 2.61 | | 2.12 | | 2.32 | | 10.5 | | 12.9 | | 11.8 | | 1,845 | |

Bio-Rad Laboratories, Inc. | | BIO | | 69.84 | | 60.91 | | 88.54 | | 3.51 | | 3.65 | | 3.27 | | 19.9 | | 19.1 | | 21.4 | | 1,851 | |

Harte-Hanks, Inc. | | HHS | | 27.59 | | 22.35 | | 28.78 | | 1.34 | | 1.39 | | 1.51 | | 20.6 | | 19.8 | | 18.3 | | 2,075 | |

Herman Miller, Inc. | | MLHR | | 33.49 | | 25.77 | | 40.79 | | 1.27 | | 1.76 | | 2.20 | | 26.4 | | 19.0 | | 15.2 | | 2,155 | |

McClatchy Co. | | MNI | | 31.61 | | 31.25 | | 50.64 | | 3.44 | | 3.13 | | 2.55 | | 9.2 | | 10.1 | | 12.4 | | 2,589 | |

Anixter International Inc. | | AXE | | 65.94 | | 44.42 | | 67.44 | | 2.43 | | 4.23 | | 4.98 | | 27.1 | | 15.6 | | 13.2 | | 2,605 | |

IDEX Corp. | | IEX | | 50.88 | | 39.00 | | 53.48 | | 2.09 | | 2.48 | | 2.98 | | 24.3 | | 20.5 | | 17.1 | | 2,732 | |

Career Education Corp. | | CECO | | 30.50 | | 17.60 | | 42.59 | | 2.32 | | 1.55 | | 1.36 | | 13.1 | | 19.7 | | 22.4 | | 2,934 | |

Steelcase Inc. | | SCS | | 19.89 | | 13.22 | | 20.54 | | 0.45 | | 0.72 | | 1.03 | | 44.2 | | 27.8 | | 19.3 | | 2,953 | |

J.M. Smucker Co. | | SJM | | 53.32 | | 38.75 | | 53.99 | | 2.55 | | 2.73 | | 3.16 | | 20.9 | | 19.5 | | 16.9 | | 3,027 | |

Hewitt Associates, Inc. | | HEW | | 29.23 | | 19.01 | | 30.77 | | 1.29 | | (0.47 | ) | 1.44 | | 22.7 | | NM | | 20.3 | | 3,242 | |

Jones Lang LaSalle Inc. | | JLL | | 104.28 | | 70.55 | | 110.02 | | 3.12 | | 5.16 | | 5.23 | | 33.4 | | 20.2 | | 19.9 | | 3,321 | |

HCC Insurance Holdings, Inc. | | HCC | | 30.80 | | 28.51 | | 35.15 | | 1.76 | | 2.93 | | 3.21 | | 17.5 | | 10.5 | | 9.6 | | 3,441 | |

City National Corp. | | CYN | | 73.60 | | 60.02 | | 78.25 | | 4.60 | | 4.66 | | 4.85 | | 16.0 | | 15.8 | | 15.2 | | 3,524 | |

Janus Capital Group Inc. | | JNS | | 20.91 | | 15.50 | | 24.20 | | 0.52 | | 0.66 | | 0.99 | | 40.2 | | 31.7 | | 21.1 | | 4,046 | |

USG Corp. | | USG | | 46.68 | | 43.68 | | 94.24 | | 6.67 | | 8.81 | | 3.87 | | 7.0 | | 5.3 | | 12.1 | | 4,195 | |

ServiceMaster Co. | | SVM | | 15.39 | | 9.66 | | 15.42 | | 0.64 | | 0.64 | | 0.69 | | 24.0 | | 24.0 | | 22.3 | | 4,490 | |

Equifax Inc. | | EFX | | 36.45 | | 30.15 | | 42.00 | | 1.79 | | 2.01 | | 2.23 | | 20.4 | | 18.1 | | 16.3 | | 4,545 | |

Energizer Holdings, Inc. | | ENR | | 85.33 | | 49.19 | | 88.34 | | 4.07 | | 4.53 | | 5.21 | | 21.0 | | 18.8 | | 16.4 | | 4,789 | |

Markel Corp. | | MKL | | 484.83 | | 325.00 | | 505.89 | | 12.57 | | 34.87 | | 34.05 | | 38.6 | | 13.9 | | 14.2 | | 4,845 | |

Constellation Brands, Inc. | | STZ | | 21.18 | | 18.83 | | 29.17 | | 1.55 | | 1.65 | | 1.45 | | 13.7 | | 12.8 | | 14.6 | | 4,949 | |

A.G. Edwards, Inc. | | AGE | | 69.18 | | 47.77 | | 70.10 | | 3.06 | | 3.02 | | 4.62 | | 22.6 | | 22.9 | | 15.0 | | 5,210 | |

Black & Decker Corp. | | BDK | | 81.62 | | 66.04 | | 94.90 | | 6.90 | | 6.55 | | 6.50 | | 11.8 | | 12.5 | | 12.6 | | 5,447 | |

800-292-7435

8

(Unaudited)

| | | | | | 52-Week Range | | Earnings Per Share | | P/E Calendar | | | |

| | | | | | | | | | 2005 | | 2006 | | 2007 | | 2005 | | 2006 | | 2007 | | Market | |

| | Ticker | | Price | | | | | | Actual | | Actual | | Estimated | | Actual | | Actual | | Estimated | | Cap. | |

Company | | Symbol | | 3/31/07 | | Low | | High | | Calendar | | Calendar | | Calendar | | P/E | | P/E | | P/E | | ($MM) | |

| | | | | | | | | | | | | | | | | | | | | | | |

Mohawk Industries, Inc. | | MHK | | 82.05 | | 62.80 | | 94.35 | | 5.78 | | 7.32 | | 7.68 | | 14.2 | | 11.2 | | 10.7 | | 5,560 | |

Interpublic Group of Cos., Inc. | | IPG | | 12.31 | | 7.79 | | 13.94 | | (0.69 | ) | (0.19 | ) | 0.28 | | NM | | NM | | 44.0 | | 5,768 | |

IMS Health Inc. | | RX | | 29.66 | | 25.68 | | 30.13 | | 1.42 | | 1.47 | | 1.64 | | 20.9 | | 20.2 | | 18.1 | | 5,952 | |

H&R Block, Inc. | | HRB | | 21.04 | | 18.31 | | 24.95 | | 1.71 | | 1.32 | | 1.60 | | 12.3 | | 15.9 | | 13.2 | | 6,792 | |

Tribune Co. | | TRB | | 32.11 | | 27.09 | | 34.28 | | 2.08 | | 2.04 | | 2.02 | | 15.4 | | 15.7 | | 15.9 | | 7,681 | |

Note: All earnings per share numbers are fully diluted. Such numbers are from continuing operations and are adjusted for non-recurring items. All estimates of future earnings per share shown in this table are prepared by Ariel Capital Management, LLC research analysts as of March 31, 2007 and have not been updated to reflect any subsequent events. P/E ratios are based on earnings stated and March 31, 2007 stock price. NM=Not Meaningful.

(e) Ariel Capital Management, LLC estimates are used for companies that had not reported 2006 earnings by 3/31/07.

NOT PART OF THE SEMI-ANNUAL REPORT

9

Ariel Appreciation Fund Statistical Summary (CAAPX) | (Unaudited) |

| | | | | | 52-Week Range | | Earnings Per Share | | P/E Calendar | | | |

| | | | | | | | | | 2005 | | 2006 | | 2007 | | 2005 | | 2006 | | 2007 | | Market | |

| | Ticker | | Price | | | | | | Actual | | Actual | | Estimated | | Actual | | Actual | | Estimated | | Cap. | |

Company | | Symbol | | 3/31/07 | | Low | | High | | Calendar | | Calendar | | Calendar | | P/E | | P/E | | P/E | | ($MM) | |

| | | | | | | | | | | | | | | | | | | | | | | |

Harte-Hanks, Inc. | | HHS | | 27.59 | | 22.35 | | 28.78 | | 1.34 | | 1.39 | | 1.51 | | 20.6 | | 19.8 | | 18.3 | | 2,075 | |

McClatchy Co. | | MNI | | 31.61 | | 31.25 | | 50.64 | | 3.44 | | 3.13 | | 2.55 | | 9.2 | | 10.1 | | 12.4 | | 2,589 | |

Anixter International Inc. | | AXE | | 65.94 | | 44.42 | | 67.44 | | 2.43 | | 4.23 | | 4.98 | | 27.1 | | 15.6 | | 13.2 | | 2,605 | |

Career Education Corp. | | CECO | | 30.50 | | 17.60 | | 42.59 | | 2.32 | | 1.55 | | 1.36 | | 13.1 | | 19.7 | | 22.4 | | 2,934 | |

Hewitt Associates, Inc. | | HEW | | 29.23 | | 19.01 | | 30.77 | | 1.29 | | (0.47 | ) | 1.44 | | 22.7 | | NM | | 20.3 | | 3,242 | |

HCC Insurance Holdings, Inc. | | HCC | | 30.80 | | 28.51 | | 35.15 | | 1.76 | | 2.93 | | 3.21 | | 17.5 | | 10.5 | | 9.6 | | 3,441 | |

City National Corp. | | CYN | | 73.60 | | 60.02 | | 78.25 | | 4.60 | | 4.66 | | 4.85 | | 16.0 | | 15.8 | | 15.2 | | 3,524 | |

Janus Capital Group Inc. | | JNS | | 20.91 | | 15.50 | | 24.20 | | 0.52 | | 0.66 | | 0.99 | | 40.2 | | 31.7 | | 21.1 | | 4,046 | |

USG Corp. | | USG | | 46.68 | | 43.68 | | 94.24 | | 6.67 | | 8.81 | | 3.87 | | 7.0 | | 5.3 | | 12.1 | | 4,195 | |

Equifax Inc. | | EFX | | 36.45 | | 30.15 | | 42.00 | | 1.79 | | 2.01 | | 2.23 | | 20.4 | | 18.1 | | 16.3 | | 4,545 | |

Energizer Holdings, Inc. | | ENR | | 85.33 | | 49.19 | | 88.34 | | 4.07 | | 4.53 | | 5.21 | | 21.0 | | 18.8 | | 16.4 | | 4,789 | |

Constellation Brands, Inc. | | STZ | | 21.18 | | 18.83 | | 29.17 | | 1.55 | | 1.65 | | 1.45 | | 13.7 | | 12.8 | | 14.6 | | 4,949 | |

Black & Decker Corp. | | BDK | | 81.62 | | 66.04 | | 94.90 | | 6.90 | | 6.55 | | 6.50 | | 11.8 | | 12.5 | | 12.6 | | 5,447 | |

Dun & Bradstreet Corp. | | DNB | | 91.20 | | 65.03 | | 91.72 | | 3.47 | | 3.97 | | 4.60 | | 26.3 | | 23.0 | | 19.8 | | 5,481 | |

Mohawk Industries, Inc. | | MHK | | 82.05 | | 62.80 | | 94.35 | | 5.78 | | 7.32 | | 7.68 | | 14.2 | | 11.2 | | 10.7 | | 5,560 | |

Interpublic Group of Cos., Inc. | | IPG | | 12.31 | | 7.79 | | 13.94 | | (0.69 | ) | (0.19 | ) | 0.28 | | NM | | NM | | 44.0 | | 5,768 | |

IMS Health Inc. | | RX | | 29.66 | | 25.68 | | 30.13 | | 1.42 | | 1.47 | | 1.64 | | 20.9 | | 20.2 | | 18.1 | | 5,952 | |

H&R Block, Inc. | | HRB | | 21.04 | | 18.31 | | 24.95 | | 1.71 | | 1.32 | | 1.60 | | 12.3 | | 15.9 | | 13.2 | | 6,792 | |

Tribune Co. | | TRB | | 32.11 | | 27.09 | | 34.28 | | 2.08 | | 2.04 | | 2.02 | | 15.4 | | 15.7 | | 15.9 | | 7,681 | |

Clorox Co. | | CLX | | 63.69 | | 56.17 | | 67.50 | | 2.72 | | 3.16 | | 3.47 | | 23.4 | | 20.2 | | 18.4 | | 9,633 | |

Pitney Bowes Inc. | | PBI | | 45.39 | | 40.18 | | 48.95 | | 2.46 | | 2.69 | | 2.97 | | 18.5 | | 16.9 | | 15.3 | | 10,014 | |

Mattel, Inc. | | MAT | | 27.57 | | 15.81 | | 29.00 | | 1.20 | | 1.41 | | 1.54 | | 23.0 | | 19.6 | | 17.9 | | 10,595 | |

T. Rowe Price Group, Inc. | | TROW | | 47.19 | | 34.87 | | 50.30 | | 1.58 | | 1.90 | | 2.38 | | 29.9 | | 24.8 | | 19.8 | | 12,503 | |

Northern Trust Corp. | | NTRS | | 60.14 | | 51.52 | | 63.49 | | 2.64 | | 3.00 | | 3.41 | | 22.8 | | 20.0 | | 17.6 | | 13,153 | |

Gannett Co., Inc. | | GCI | | 56.29 | | 51.65 | | 63.50 | | 4.99 | | 4.90 | | 4.80 | | 11.3 | | 11.5 | | 11.7 | | 13,214 | |

YUM! Brands, Inc. | | YUM | | 57.76 | | 44.21 | | 63.68 | | 2.63 | | 2.92 | | 3.26 | | 22.0 | | 19.8 | | 17.7 | | 15,306 | |

Omnicom Group Inc. | | OMC | | 102.38 | | 81.84 | | 106.90 | | 4.36 | | 4.99 | | 5.68 | | 23.5 | | 20.5 | | 18.0 | | 17,233 | |

Thermo Fisher Scientific Inc. | | TMO | | 46.75 | | 33.85 | | 49.90 | | 1.54 | | 1.82 | | 2.43 | | 30.4 | | 25.7 | | 19.2 | | 19,476 | |

Accenture Ltd | | ACN | | 38.54 | | 25.68 | | 39.25 | | 1.50 | | 1.71 | | 2.05 | | 25.7 | | 22.5 | | 18.8 | | 22,681 | |

Aflac Inc. | | AFL | | 47.06 | | 41.63 | | 49.37 | | 2.53 | | 2.85 | | 3.28 | | 18.6 | | 16.5 | | 14.3 | | 23,179 | |

CBS Corp. | | CBS | | 30.59 | | 23.97 | | 32.27 | | 1.59 | | 1.80 | | 1.87 | | 19.2 | | 17.0 | | 16.4 | | 23,505 | |

Franklin Resources, Inc. | | BEN | | 120.83 | | 80.16 | | 126.71 | | 4.47 | | 4.64 | | 6.59 | | 27.0 | | 26.0 | | 18.3 | | 30,637 | |

Baxter International Inc. | | BAX | | 52.67 | | 36.00 | | 53.53 | | 1.99 | | 2.30 | | 2.62 | | 26.5 | | 22.9 | | 20.1 | | 34,261 | |

Carnival Corp. | | CCL | | 46.86 | | 36.40 | | 52.73 | | 2.75 | | 2.79 | | 3.07 | | 17.0 | | 16.8 | | 15.3 | | 37,254 | |

Note: All earnings per share numbers are fully diluted. Such numbers are from continuing operations and are adjusted for non-recurring items. All estimates of future earnings per share shown in this table are prepared by Ariel Capital Management, LLC research analysts as of March 31, 2007 and have not been updated to reflect any subsequent events. P/E ratios are based on earnings stated and March 31, 2007 stock price. NM=Not Meaningful.

ARIELMUTUALFUNDS.COM

10

Ariel Focus Fund Statistical Summary (ARFFX) | | (Unaudited) |

| | | | | | 52-Week Range | | Earnings Per Share | | P/E Calendar | | | |

| | | | | | | | | | 2005 | | 2006 | | 2007 | | 2005 | | 2006 | | 2007 | | Market | |

| | Ticker | | Price | | | | | | Actual | | Actual | | Estimated | | Actual | | Actual | | Estimated | | Cap. | |

Company | | Symbol | | 3/31/07 | | Low | | High | | Calendar | | Calendar | | Calendar | | P/E | | P/E | | P/E | | ($MM) | |

| | | | | | | | | | | | | | | | | | | | | | | |

Hewitt Associates, Inc. | | HEW | | 29.23 | | 19.01 | | 30.77 | | 1.29 | | (0.47 | ) | 1.44 | | 22.7 | | NM | | 20.3 | | 3,242 | |

Constellation Brands, Inc. | | STZ | | 21.18 | | 18.83 | | 29.17 | | 1.55 | | 1.65 | | 1.45 | | 13.7 | | 12.8 | | 14.6 | | 4,949 | |

Black & Decker Corp. | | BDK | | 81.62 | | 66.04 | | 94.90 | | 6.90 | | 6.55 | | 6.50 | | 11.8 | | 12.5 | | 12.6 | | 5,447 | |

IMS Health Inc. | | RX | | 29.66 | | 25.68 | | 30.13 | | 1.42 | | 1.47 | | 1.64 | | 20.9 | | 20.2 | | 18.1 | | 5,952 | |

H&R Block, Inc. | | HRB | | 21.04 | | 18.31 | | 24.95 | | 1.71 | | 1.32 | | 1.60 | | 12.3 | | 15.9 | | 13.2 | | 6,792 | |

Omnicom Group Inc. | | OMC | | 102.38 | | 81.84 | | 106.90 | | 4.36 | | 4.99 | | 5.68 | | 23.5 | | 20.5 | | 18.0 | | 17,233 | |

Accenture Ltd | | ACN | | 38.54 | | 25.68 | | 39.25 | | 1.50 | | 1.71 | | 2.05 | | 25.7 | | 22.5 | | 18.8 | | 22,681 | |

Aflac Inc. | | AFL | | 47.06 | | 41.63 | | 49.37 | | 2.53 | | 2.85 | | 3.28 | | 18.6 | | 16.5 | | 14.3 | | 23,179 | |

Carnival Corp. | | CCL | | 46.86 | | 36.40 | | 52.73 | | 2.75 | | 2.79 | | 3.07 | | 17.0 | | 16.8 | | 15.3 | | 37,254 | |

Dell Inc. | | DELL | | 23.21 | | 18.95 | | 30.44 | | 1.29 | | 1.18 | (e) | 1.20 | | 18.0 | | 19.7 | | 19.3 | | 52,919 | |

Tyco International Ltd. | | TYC | | 31.55 | | 24.97 | | 33.29 | | 1.83 | | 1.88 | | 2.05 | | 17.2 | | 16.8 | | 15.4 | | 62,339 | |

Home Depot, Inc. | | HD | | 36.74 | | 32.85 | | 42.94 | | 2.58 | | 2.78 | | 2.68 | | 14.2 | | 13.2 | | 13.7 | | 72,378 | |

Morgan Stanley | | MS | | 78.76 | | 54.52 | | 84.66 | | 5.63 | | 7.50 | | 8.05 | | 14.0 | | 10.5 | | 9.8 | | 83,615 | |

International Business Machines Corp. | | IBM | | 94.26 | | 72.73 | | 100.90 | | 5.34 | | 6.06 | | 6.82 | | 17.7 | | 15.6 | | 13.8 | | 142,001 | |

JPMorgan Chase & Co. | | JPM | | 48.38 | | 39.33 | | 51.95 | | 2.95 | | 4.04 | | 4.16 | | 16.4 | | 12.0 | | 11.6 | | 167,476 | |

Berkshire Hathaway Inc. | | BRK.B | | 3,640.00 | | 2,839.00 | | 3,825.00 | | 185.00 | | 199.86 | | 196.41 | | 19.7 | | 18.2 | | 18.5 | | 168,172 | |

Johnson & Johnson | | JNJ | | 60.26 | | 57.32 | | 69.41 | | 3.39 | | 3.76 | | 4.13 | | 17.8 | | 16.0 | | 14.6 | | 174,346 | |

Pfizer Inc | | PFE | | 25.26 | | 22.16 | | 28.60 | | 2.03 | | 2.08 | | 2.14 | | 12.4 | | 12.1 | | 11.8 | | 179,952 | |

Toyota Motor Corp. | | TM | | 128.16 | | 94.52 | | 138.00 | | 6.91 | | 8.31 | | 9.04 | | 18.5 | | 15.4 | | 14.2 | | 206,086 | |

Citigroup Inc. | | C | | 51.34 | | 46.22 | | 57.00 | | 3.96 | | 4.25 | | 4.58 | | 13.0 | | 12.1 | | 11.2 | | 252,182 | |

Note: All earnings per share numbers are fully diluted. Such numbers are from continuing operations and are adjusted for non-recurring items. All estimates of future earnings per share shown in this table are prepared by Ariel Capital Management, LLC research analysts as of March 31, 2007 and have not been updated to reflect any subsequent events. P/E ratios are based on earnings stated and March 31, 2007 stock price. NM=Not Meaningful.

(e) Ariel Capital Management, LLC estimates are used for companies that had not reported 2006 earnings by 3/31/07.

NOT PART OF THE SEMI-ANNUAL REPORT

11

A history of patient investing

At Ariel, patience serves as the core of our corporate philosophy. We believe that the most successful investors proceed, not by sudden leaps and bounds, but by the steady, painstaking work of research, stock selection and investment monitoring. More than an adage, patience sums up our way of evaluating companies, making investment decisions and even running our firm.

Semi-annual Report

March 31, 2007 (Unaudited)

Ariel Fund

Ariel Appreciation Fund

Ariel Focus Fund

Investing in small and mid-cap stocks is more risky and more volatile than investing in large cap stocks. For the period ended March 31, 2007, the average annual total returns of Ariel Fund and Ariel Appreciation Fund for the one-, five- and ten-year periods were +6.09%, +9.75% and +13.42%; and +11.01%, +7.32% and +13.01%, respectively. For the period ended March 31, 2007, the average annual total returns of Ariel Focus Fund for the one-year and since inception (June 30, 2005) periods were +8.96% and +9.21%. All performance assumes reinvestment of dividends and capital gains. Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained by visiting our web site, arielmutualfunds.com. Ariel Focus Fund is a non-diversified fund and therefore may be subject to greater volatility than a more diversified investment. The performance of Ariel Focus Fund may differ from that of Ariel Fund and Ariel Appreciation Fund due to its status as a non-diversified fund and different portfolio managers.

This report candidly discusses a number of individual companies. Our opinions are current as of the date of this report but are subject to change. The information provided in this report is not reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell a particular security.

For a current prospectus which includes the investment objectives, risks, management fees, charges and expenses as well as other information, call 800-292-7435. Please read the prospectus and consider this information carefully before investing. ©2007, Ariel Distributors, LLC.

Ariel Investment Trust

P.O. Box 219121

Kansas City, Missouri 64121-9121

800-292-7435

arielmutualfunds.com

Table of Contents

Ariel Fund | | |

Portfolio Management Discussion | | 16 |

Performance Summary | | 17 |

Schedule of Investments | | 18 |

| | |

Ariel Appreciation Fund | | |

Portfolio Management Discussion | | 20 |

Performance Summary | | 21 |

Schedule of Investments | | 22 |

| | |

Ariel Focus Fund | | |

Portfolio Management Discussion | | 24 |

Performance Summary | | 25 |

Schedule of Investments | | 26 |

| | |

Statements of Assets & Liabilities | | 27 |

| | |

Statements of Operations | | 28 |

| | |

Statements of Changes in Net Assets | | 29 |

| | |

Financial Highlights | | 31 |

| | |

Notes to the Financial Statements | | 33 |

| | |

Fund Expense Example | | 36 |

| | |

Important Supplemental Information | | 37 |

| | |

Board of Trustees | | 40 |

| | |

Officers | | 42 |

Ariel Fund Portfolio Management Discussion | | ARGFX |

Fund Results

During the first three months of 2007, Ariel Fund rose +3.94%, surpassing its benchmarks. By comparison, the Russell 2500 Value Index rose +3.08% while the Russell 2500 Index gained +3.55%. For the six-month period ended March 31, 2007, Ariel Fund rose a solid +10.44%, but trailed the +12.51% and +12.56% advances of the Russell 2500 Value and the Russell 2500 Indices, respectively.

Performance Drivers

After closing 2006 short of its benchmarks, we were pleased to see Ariel Fund pull ahead in the first quarter of the New Year. The value conscious portfolio’s advance is particularly noteworthy given a rising market when lower-quality cyclical issues typically outperform the conservative, defensive stocks Ariel favors. As patient investors with a consistent approach—the stocks impacting the Fund’s quarterly and six-month periods were similar.

Specifically, Ariel Fund’s results were lifted by transactions involving Investors Financial Services Corp. and ServiceMaster Co. During the quarter, Investors Financial (featured on page 5) soared +37% on the news State Street Corp. will acquire it. Additionally, ServiceMaster jumped +18% this quarter on news it will go private. Conversely, McClatchy Co. tumbled almost -27% over the three-month period on sluggish advertising and pessimism toward newspaper stocks. Yet, we remain confident in McClatchy’s management and the company’s attractive valuation. Industrial product manufacturer, Brady Corp. also suffered, tumbling -16% over the quarter. It fell on an earnings disappointment and softening demand for its labels by cell phone and disk drive manufacturers. We view these challenges as surmountable short-term setbacks.

Also noteworthy, was the April announcement that long-time holding, Tribune Co. will go private in an employee stock ownership plan backed by contrarian business maverick, Sam Zell. The takeout price was $34 per share.

From our vantage, the bull’s incredible run is showing signs of age. The market stumbled unexpectedly in February, sending a shockwave through global markets. Additionally, the economy is slowing with GDP clocking a mere 2.5% and corporate earnings pulling back to 7.3% from previous double-digit growth. Furthermore, a weakening U.S. housing market is likely to crimp consumer spending habits. As such, we continue to favor quality companies with strong brands that provide predictable, consistent returns. Although our conservative bias may sacrifice some short-term gains, we believe our patient approach and long-term focus provide shareholder value over the long-haul.

Comings & Goings

During the quarter, we purchased Constellation Brands, Inc., a producer and marketer of beverage alcohol brands; USG Corp., a leader in North America’s building materials industry and Equifax Inc., a provider of credit information. Conversely, we exited three financial holdings. We sold Sky Financial Group, Inc. and Investors Financial on the good news of their pending acquisitions. We also parted with TD Banknorth Inc. when majority owner, Toronto Dominion, announced it will purchase the company’s remaining shares.

The Patient Investor

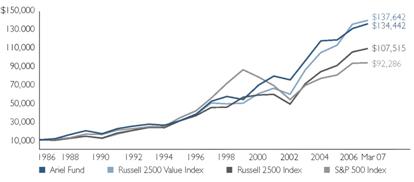

Reflecting on the longer time horizon, Ariel Fund posted a +13.42% ten-year average annual total return, in line with the Russell 2500 Value Index’s +13.95% rise and ahead of the +12.03% gain by the Russell 2500 Index over the same period. We believe the Fund’s long-term performance is driven by our disciplined investment approach, stock selection across industries in which Ariel has experience and our commitment to investing in quality companies we believe are selling at excellent values.

800-292-7435

16

Ariel Fund Performance Summary | | Inception: November 6, 1986 |

About the Fund

The no-load Ariel Fund pursues long-term capital appreciation by investing in undervalued companies that show strong potential for growth. The Fund primarily invests in companies with market capitalizations between $1 billion and $5 billion.

Composition of Equity Holdings

| | | | Russell | | | | | |

| | | | 2500 | | Russell | | S&P | |

| | Ariel | | Value | | 2500 | | 500 | |

| | Fund† | | Index | | Index | | Index | |

Financial Services | | 33.1 | % | 32.8 | % | 23.5 | % | 22.6 | % |

Consumer Discretionary & Services | | 29.6 | % | 15.0 | % | 18.3 | % | 12.3 | % |

Producer Durables | | 10.7 | % | 5.7 | % | 7.2 | % | 4.3 | % |

Materials & Processing | | 8.9 | % | 11.1 | % | 10.2 | % | 3.6 | % |

Technology | | 6.8 | % | 7.6 | % | 10.8 | % | 12.5 | % |

Health Care | | 6.5 | % | 3.9 | % | 10.5 | % | 12.1 | % |

Consumer Staples | | 4.4 | % | 3.9 | % | 2.6 | % | 7.4 | % |

Utilities | | 0.0 | % | 11.5 | % | 6.8 | % | 8.3 | % |

Other Energy | | 0.0 | % | 3.9 | % | 5.3 | % | 3.6 | % |

Autos & Transportation | | 0.0 | % | 3.6 | % | 3.8 | % | 2.4 | % |

Other | | 0.0 | % | 1.0 | % | 0.9 | % | 4.6 | % |

Integrated Oils | | 0.0 | % | 0.1 | % | 0.1 | % | 6.3 | % |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

Portfolio Composition | | | |

| | | |

Equity | | 97.9 | % |

Cash & Other | | 2.1 | % |

| | | |

Expense Ratio | | | |

| | | |

As of 9/30/06 | | 1.07 | % |

Average Annual Total Returns as of March 31, 2007

| | 1st Quarter | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Life of Fund | |

| | | | | | | | | | | | | |

Ariel Fund | | 3.94 | % | 6.09 | % | 9.77 | % | 9.75 | % | 13.42 | % | 13.59 | % |

| | | | | | | | | | | | | |

Russell 2500 Value Index | | 3.08 | % | 12.15 | % | 15.19 | % | 14.33 | % | 13.95 | % | 13.70 | % |

| | | | | | | | | | | | | |

Russell 2500 Index | | 3.55 | % | 8.23 | % | 13.26 | % | 12.15 | % | 12.03 | % | 12.33 | % |

| | | | | | | | | | | | | |

S&P 500 Index | | 0.64 | % | 11.83 | % | 10.04 | % | 6.27 | % | 8.20 | % | 11.49 | % |

Past performance does not guarantee future results.

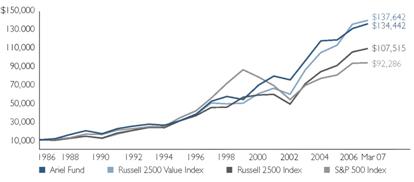

The Value of a $10,000 Investment in Ariel Fund

| | Top Ten Equity Holdings | | | |

1 | | Hewitt Associates, Inc. | | 5.3 | % |

| | Human resources outsourcing and consulting firm | | | |

| | | | | |

2 | | Markel Corp. | | 5.2 | % |

| | Specialty insurance provider | | | |

| | | | | |

3 | | Energizer Holdings, Inc. | | 4.8 | % |

| | Consumer battery and razor manufacturer | | | |

| | | | | |

4 | | Janus Capital Group Inc. | | 4.4 | % |

| | Mutual fund manager | | | |

| | | | | |

5 | | IDEX Corp. | | 3.9 | % |

| | Industrial product manufacturer | | | |

| | | | | |

6 | | Jones Lang LaSalle Inc. | | 3.8 | % |

| | Real estate services and money management firm | | | |

| | | | | |

7 | | Mohawk Industries, Inc. | | 3.8 | % |

| | Manufacturer and distributor of floor coverings | | | |

| | | | | |

8 | | Tribune Co. | | 3.7 | % |

| | Publishing and broadcasting company | | | |

| | | | | |

9 | | HCC Insurance Holdings, Inc. | | 3.6 | % |

| | Global provider of specialized property and casualty insurance | | | |

| | | | | |

10 | | Anixter International Inc. | | 3.6 | % |

| | Global distributor of communication products, wire, cable and fasteners | | | |

Note: All performance assumes the reinvestment of dividends and capital gains. The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 2500® Value Index measures the performance of small and mid-sized, value-oriented companies with lower price-to-earnings ratios. The Russell 2500® Index measures the performance of small and mid-sized companies. The S&P 500 is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

MARCH 31, 2007 SEMI-ANNUAL REPORT

17

Ariel Fund Schedule of Investments | |

Number of Shares | | COMMON STOCKS—97.86% | | Cost | | Market Value | |

| | | | | | | |

| | Consumer Discretionary & Services—28.96% | | | | | |

1,465,500 | | Black & Decker Corp. | | $ | 118,566,967 | | $ | 119,614,110 | |

2,433,650 | | Career Education Corp. * | | 73,461,595 | | 74,226,325 | |

3,812,500 | | Harte-Hanks, Inc. †† | | 92,171,127 | | 105,186,875 | |

7,496,050 | | Hewitt Associates, Inc., Class A *†† | | 192,863,559 | | 219,109,541 | |

7,406,800 | | Interpublic Group of Cos., Inc. * | | 81,206,219 | | 91,177,708 | |

3,658,900 | | Lee Enterprises, Inc. | | 126,721,405 | | 109,949,945 | |

3,190,100 | | McClatchy Co., Class A | | 171,045,441 | | 100,839,061 | |

1,905,700 | | Mohawk Industries, Inc. * | | 136,902,456 | | 156,362,685 | |

4,065,825 | | ServiceMaster Co. | | 43,508,502 | | 62,573,047 | |

4,711,500 | | Tribune Co. | | 132,358,461 | | 151,286,265 | |

| | | | 1,168,805,732 | | 1,190,325,562 | |

| | | | | | | |

| | Consumer Staples—4.27% | | | | | |

2,192,000 | | Constellation Brands, Inc. * | | 43,724,682 | | 46,426,560 | |

2,418,953 | | J.M. Smucker Co. | | 96,648,892 | | 128,978,574 | |

| | | | 140,373,574 | | 175,405,134 | |

| | | | | | | |

| | Financial Services—32.36% | | | | | |

1,982,100 | | A. G. Edwards, Inc. | | 69,247,985 | | 137,121,678 | |

3,962,450 | | Assured Guaranty Ltd. †† | | 81,579,508 | | 108,254,134 | |

2,173,750 | | Chittenden Corp. | | 60,176,026 | | 65,625,512 | |

1,566,400 | | City National Corp. | | 111,549,007 | | 115,287,040 | |

2,216,300 | | Equifax Inc. | | 82,387,086 | | 80,784,135 | |

5,924,600 | | H&R Block, Inc. | | 136,158,665 | | 124,653,584 | |

4,805,400 | | HCC Insurance Holdings, Inc. | | 89,202,304 | | 148,006,320 | |

8,632,900 | | Janus Capital Group Inc. | | 120,517,774 | | 180,513,939 | |

1,500,500 | | Jones Lang LaSalle Inc. | | 23,634,203 | | 156,472,140 | |

440,925 | | Markel Corp. * | | 102,045,666 | | 213,773,668 | |

| | | | 876,498,224 | | 1,330,492,150 | |

| | | | | | | |

| | Health Care—6.35% | | | | | |

1,085,500 | | Bio-Rad Laboratories, Inc., Class A * | | 64,939,669 | | 75,811,320 | |

4,915,575 | | IMS Health Inc. | | 114,603,686 | | 145,795,954 | |

2,268,875 | | Invacare Corp. †† | | 76,822,858 | | 39,569,180 | |

| | | | 256,366,213 | | 261,176,454 | |

| | | | | | | |

| | Materials & Processing—8.71% | | | | | |

3,268,610 | | Brady Corp., Class A | | 56,916,465 | | 101,980,632 | |

2,305,050 | | Energizer Holdings, Inc. * | | 76,476,687 | | 196,689,916 | |

1,275,100 | | USG Corp. * | | 62,585,663 | | 59,521,668 | |

| | | | 195,978,815 | | 358,192,216 | |

| | | | | | | | | |

ARIELMUTUALFUNDS.COM

18

March 31, 2007 (Unaudited)

Number of Shares | | COMMON STOCKS—97.86% (cont’d) | | Cost | | Market Value | |

| | | | | | | |

| | Producer Durables—10.51% | | | | | |

3,264,900 | | ACCO Brands Corp. *†† | | $ | 73,169,018 | | $ | 78,651,441 | |

2,566,100 | | Herman Miller, Inc. | | 50,873,913 | | 85,938,689 | |

3,151,450 | | IDEX Corp. †† | | 68,473,088 | | 160,345,776 | |

5,389,475 | | Steelcase Inc., Class A | | 67,272,241 | | 107,196,658 | |

| | | | 259,788,260 | | 432,132,564 | |

| | | | | | | |

| | Technology—6.70% | | | | | |

2,218,775 | | Anixter International Inc. *†† | | 58,438,417 | | 146,306,024 | |

16,828,050 | | BearingPoint, Inc. *†† | | 133,685,901 | | 128,902,863 | |

| | | | 192,124,318 | | 275,208,887 | |

| | | | | | | |

| | Total Common Stocks | | 3,089,935,136 | | 4,022,932,967 | |

| | | | | | | |

Principal Amount | | REPURCHASE AGREEMENT—3.99% | | Cost | | Market Value | |

| | | | | | | |

$ | 164,017,539 | | Fixed Income Clearing Corporation, 4.50%, dated 3/30/2007, | | | | | |

| | due 4/2/2007, repurchase price $164,079,046, | | | | | |

| | (collateralized by U.S. Treasury Note, 4.625%, | | | | | |

| | due 3/31/2008) | | 164,017,539 | | 164,017,539 | |

| | Total Investments—101.85% | | $ | 3,253,952,675 | | 4,186,950,506 | |

| | Liabilities less Other Assets—(1.85%) | | | | (75,905,673 | ) |

| | NET ASSETS—100.00% | | | | $ | 4,111,044,833 | |

| | | | | | | | | | |

* | Non-income producing. |

†† | Affiliated company (See Note Five). |

| A category may contain multiple industries as defined by the Standard Industrial Classification system. |

| The accompanying notes are an integral part of the financial statements. |

MARCH 31, 2007 SEMI-ANNUAL REPORT

19

Ariel Appreciation Fund Portfolio Management Discussion | | CAAPX |

Fund Results

During the quarter ended March 31, 2007, Ariel Appreciation Fund rose +1.92% trailing the +4.86% gain by the Russell Midcap Value Index and the +4.38% increase by the Russell Midcap Index. For the six-month period, the Fund posted a solid +9.02%, still behind the +13.77% and +12.38% advances of the Russell Midcap Value and Russell Midcap Indices.

Performance Drivers

During the quarter and the six-month period ended March 31, 2007, low quality stocks continued their stellar rise, fueling the Russell Midcap Value Index’s bubble-like performance. In fact, the Russell Midcap Value Index bested 89% of all domestic managers last quarter and 98% over the five-year period (universe rankings provided by Lipper). Against this unusual backdrop, Ariel Appreciation Fund’s return surpassed the broader market, but could not keep up with runaway returns of its benchmarks.

As patient investors with a consistent approach—the stocks impacting the portfolio were similar for the quarter and six-month periods. Notably, a few of our underdogs continued their rebounds. Career Education Corp. climbed +23% during the quarter as its regulatory outlook improved, allowing management to move forward with two campus expansions. Additionally, our conviction in ServiceMaster Co. was rewarded. ServiceMaster surged almost +18% this quarter on news it will go private. Conversely, some of our contrarian plays have not panned out yet. Specifically, McClatchy Co. tumbled almost -27% over the quarter on sluggish advertising sales and general pessimism toward newspaper stocks. Yet, we remain confident in McClatchy management and the company’s attractive valuation. H&R Block, Inc. also struggled, falling -8% over the quarter on concerns over its mortgage business and association with the sub-prime meltdown. We believe H&R Block’s iconic tax franchise continues to operate well, and that on its own is worth more than the current stock price.

Also noteworthy, was the April announcement that long-time holding, Tribune Co. will go private in an employee stock ownership plan backed by contrarian business maverick, Sam Zell. The takeout price was $34 per share.

While investors try to catch the last few waves of this remarkable ride, history has shown that eventually there will be a return to normalcy. Knowing the market moves through peaks and troughs, we consistently favor quality companies with strong brand franchises and predictable, stable returns. Although our conservative bias may appear to sacrifice some short-term gains, we believe our patient approach and long-term focus provide shareholder value over the long-haul.

Comings & Goings

During the quarter, we purchased six names: Anixter International Inc., a leading distributor of communication products and wiring systems; Constellation Brands, Inc., a producer and marketer of beverage alcohol brands; Energizer Holdings, Inc., a battery and razor manufacturer; HCC Insurance Holdings, Inc., a specialty insurer; Hewitt Associates, Inc., a leading human resources outsourcer and USG Corp., a leader in North America’s building materials industry. Conversely, we exited Realogy Corp. and ServiceMaster on the good news each will go private. We also parted with TD Banknorth Inc. when its majority owner, Toronto Dominion, announced its purchase of the company’s remaining shares.

The Patient Investor

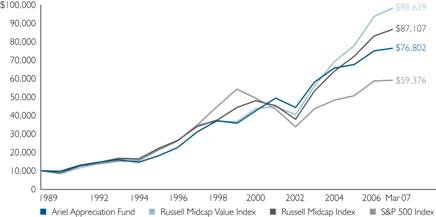

Reflecting on the longer time horizon, the Fund posted a solid +13.01% ten-year average annual total return while the Russell Midcap Value Index and the Russell Midcap Index gained +14.00% and +12.71%, respectively. We believe the portfolio’s long-term performance is driven by our disciplined investment approach, stock selection across industries in which Ariel has experience and commitment to investing in quality companies we believe are selling at excellent values.

800-292-7435

20

Ariel Appreciation Fund Performance Summary | | Inception: December 1, 1989 |

About the Fund

The no-load Ariel Appreciation Fund pursues long-term capital appreciation by investing in undervalued companies that show strong potential for growth. The Fund primarily invests in companies with market capitalizations between $2.5 billion and $15 billion.

Composition of Equity Holdings

| | | | Russell | | | | | |

| | Ariel | | Midcap | | Russell | | S&P | |

| | Appreciation | | Value | | Midcap | | 500 | |

| | Fund† | | Index | | Index | | Index | |

Consumer Discretionary & Services | | 47.7 | % | 11.3 | % | 18.2 | % | 12.3 | % |

Financial Services | | 29.5 | % | 31.2 | % | 21.1 | % | 22.6 | % |

Health Care | | 10.5 | % | 2.6 | % | 8.9 | % | 12.1 | % |

Producer Durables | | 4.4 | % | 4.4 | % | 6.3 | % | 4.3 | % |

Materials & Processing | | 3.5 | % | 8.9 | % | 8.2 | % | 3.6 | % |

Consumer Staples | | 3.4 | % | 7.1 | % | 5.0 | % | 7.4 | % |

Technology | | 1.0 | % | 5.6 | % | 9.6 | % | 12.5 | % |

Utilities | | 0.0 | % | 17.7 | % | 10.1 | % | 8.3 | % |

Other Energy | | 0.0 | % | 4.3 | % | 6.2 | % | 3.6 | % |

Autos & Transportation | | 0.0 | % | 3.8 | % | 4.1 | % | 2.4 | % |

Other | | 0.0 | % | 1.9 | % | 1.6 | % | 4.6 | % |

Integrated Oils | | 0.0 | % | 1.3 | % | 0.6 | % | 6.3 | % |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

Portfolio Composition

Equity | | 98.8 | % |

Cash & Other | | 1.2 | % |

Expense Ratio

Average Annual Total Returns as of March 31, 2007

| | 1st Quarter | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Life of Fund | |

Ariel Appreciation Fund | | 1.92 | % | 11.01 | % | 8.27 | % | 7.32 | % | 13.01 | % | 12.48 | % |

Russell Midcap Value Index | | 4.86 | % | 17.13 | % | 18.58 | % | 15.22 | % | 14.00 | % | 14.11 | % |

Russell Midcap Index | | 4.38 | % | 11.79 | % | 15.72 | % | 12.91 | % | 12.71 | % | 13.29 | % |

S&P 500 Index | | 0.64 | % | 11.83 | % | 10.04 | % | 6.27 | % | 8.20 | % | 10.82 | % |

Past performance does not guarantee future results.

The Value of a $10,000 Investment in Ariel Appreciation Fund

| | Top Ten Equity Holdings | | | |

| | | | | |

1 | | Accenture Ltd | | 5.3 | % |

| | Global management consulting, technology services and outsourcing firm | | | |

| | | | | |

2 | | Tribune Co. | | 4.8 | % |

| | Publishing and broadcasting company | | | |

| | | | | |

3 | | Carnival Corp. | | 4.6 | % |

| | Worldwide cruise company | | | |

| | | | | |

4 | | Northern Trust Corp. | | 4.5 | % |

| | Personal and institutional trust company | | | |

| | | | | |

5 | | Pitney Bowes Inc. | | 4.3 | % |

| | Manufacturer of mailing equipment | | | |

| | | | | |

6 | | Mohawk Industries, Inc. | | 4.1 | % |

| | Manufacturer and distributor of floor coverings | | | |

| | | | | |

7 | | CBS Corp. | | 3.9 | % |

| | Mass media company | | | |

| | | | | |

8 | | Baxter International Inc. | | 3.8 | % |

| | Diversified health care manufacturer | | | |

| | | | | |

9 | | Gannett Co., Inc. | | 3.7 | % |

| | Diversified news and information company | | | |

| | | | | |

10 | | Janus Capital Group Inc. | | 3.4 | % |

| | Mutual fund manager | | | |

Note: All performance assumes the reinvestment of dividends and capital gains. The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell Midcap® Value Index measures the performance of mid-sized, value-oriented companies with lower price-to-earnings ratios. The Russell Midcap® Index measures the performance of mid-sized companies. The S&P 500 is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Total return does not reflect a maximum 4.75% sales load charged prior to 7/15/94.

MARCH 31, 2007 SEMI-ANNUAL REPORT

21

Ariel Appreciation Fund Schedule of Investments

Number of Shares | | COMMON STOCKS—98.77% | | Cost | | Market Value | |

| | | | | | | |

| | Consumer Discretionary & Services—47.11% | | | | | |

3,685,000 | | Accenture Ltd, Class A | | $ | 56,325,881 | | $ | 142,019,900 | |

1,102,300 | | Black & Decker Corp. | | 46,231,739 | | 89,969,726 | |

1,331,050 | | Career Education Corp. * | | 36,683,514 | | 40,597,025 | |

2,661,450 | | Carnival Corp. | | 104,482,844 | | 124,715,547 | |

3,418,600 | | CBS Corp., Class B | | 85,442,944 | | 104,574,974 | |

1,772,750 | | Gannett Co., Inc. | | 102,063,515 | | 99,788,097 | |

1,772,875 | | Harte-Hanks, Inc. | | 26,291,077 | | 48,913,621 | |

1,352,500 | | Hewitt Associates, Inc., Class A * | | 36,159,113 | | 39,533,575 | |

4,321,925 | | Interpublic Group of Cos., Inc. * | | 38,395,852 | | 53,202,897 | |

1,900,900 | | Mattel, Inc. | | 30,848,996 | | 52,407,813 | |

1,844,100 | | McClatchy Co., Class A | | 89,246,726 | | 58,292,001 | |

1,337,400 | | Mohawk Industries, Inc. * | | 99,343,670 | | 109,733,670 | |

879,100 | | Omnicom Group Inc. | | 56,838,256 | | 90,002,258 | |

4,046,450 | | Tribune Co. | | 155,544,548 | | 129,931,510 | |

1,467,300 | | YUM! Brands, Inc. | | 34,541,737 | | 84,751,248 | |

| | | | 998,440,412 | | 1,268,433,862 | |

| | Consumer Staples—3.32% | | | | | |

931,472 | | Clorox Co. | | 35,804,496 | | 59,325,452 | |

1,424,100 | | Constellation Brands, Inc. * | | 28,408,226 | | 30,162,438 | |

| | | | 64,212,722 | | 89,487,890 | |

| | Financial Services—29.15% | | | | | |

1,365,200 | | Aflac Inc. | | 61,815,706 | | 64,246,312 | |

1,030,000 | | City National Corp. | | 73,176,054 | | 75,808,000 | |

726,822 | | Dun & Bradstreet Corp. | | 18,040,486 | | 66,286,166 | |

1,888,800 | | Equifax Inc. | | 41,321,942 | | 68,846,760 | |

687,600 | | Franklin Resources, Inc. | | 24,818,844 | | 83,082,708 | |

3,839,500 | | H&R Block, Inc. | | 91,850,040 | | 80,783,080 | |

1,746,700 | | HCC Insurance Holdings, Inc. | | 53,848,775 | | 53,798,360 | |

4,412,800 | | Janus Capital Group Inc. | | 55,412,068 | | 92,271,648 | |

1,997,800 | | Northern Trust Corp. | | 65,826,514 | | 120,147,692 | |

1,684,800 | | T. Rowe Price Group, Inc. | | 30,041,105 | | 79,505,712 | |

| | | | 516,151,534 | | 784,776,438 | |

| | Health Care—10.33% | | | | | |

1,949,350 | | Baxter International Inc. | | 42,861,921 | | 102,672,264 | |

3,105,060 | | IMS Health Inc. | | 49,619,587 | | 92,096,080 | |

1,781,954 | | Thermo Fisher Scientific Inc. * | | 28,662,350 | | 83,306,350 | |

| | | | 121,143,858 | | 278,074,694 | |

| | Materials & Processing—3.49% | | | | | |

648,300 | | Energizer Holdings, Inc. * | | 52,145,998 | | 55,319,439 | |

829,600 | | USG Corp. * | | 40,660,906 | | 38,725,728 | |

| | | | 92,806,904 | | 94,045,167 | |

| | | | | | | | | |

ARIELMUTUALFUNDS.COM

22

March 31, 2007 (Unaudited)

Number of Shares | | COMMON STOCKS—98.77% (cont’d) | | Cost | | Market Value | |

| | | | | | | |

| | Producer Durables—4.34% | | | | | |

2,574,375 | | Pitney Bowes Inc. | | $ | 95,880,248 | | $ | 116,850,881 | |

| | | | | | | |

| | Technology—1.03% | | | | | |

418,100 | | Anixter International Inc. * | | 25,786,923 | | 27,569,514 | |

| | | | | | | |

| | Total Common Stocks | | 1,914,422,601 | | 2,659,238,446 | |

| | | | | | | |

Principal Amount | | REPURCHASE AGREEMENT—1.81% | | Cost | | Market Value | |

| | | | | | | |

$ | 48,551,719 | | Fixed Income Clearing Corporation, 4.50%, dated 3/30/2007, due 4/2/2007, repurchase price $48,569,926, (collateralized by U.S. Treasury Bond, 8.875%, due 2/15/2019) | | 48,551,719 | | 48,551,719 | |

| | Total Investments—100.58% | | $ | 1,962,974,320 | | 2,707,790,165 | |

| | Liabilities less Other Assets—(0.58%) | | | | (15,491,874 | ) |

| | NET ASSETS—100.00% | | | | $ | 2,692,298,291 | |

| | | | | | | | | | |

* Non-income producing.

A category may contain multiple industries as defined by the Standard Industrial Classification system.

The accompanying notes are an integral part of the financial statements.

MARCH 31, 2007 SEMI-ANNUAL REPORT

23

Ariel Focus Fund Portfolio Management Discussion | | ARFFX |

Fund Results

Ariel Focus Fund dipped -1.04% during the first quarter of 2007. By comparison, the Russell 1000 Value Index gained +1.24%, the Russell 1000 Index inched up +1.21% while the broader market as measured by the S&P 500 Index was up only a nominal +0.64%. For the six months ended March 31, 2007, Ariel Focus Fund increased a solid +7.63%, slightly ahead of the S&P 500’s rise of +7.38%. By comparison, over the same six-month period, the Russell 1000 Value and Russell 1000 Indices rose +9.34% and +8.25%, respectively.

Performance Drivers

During the quarter and the six-month period ended March 31, 2007, low quality stocks continued their stellar rise. The conservative brands that Ariel favors largely sat out this rally as investors chased performance. Compounding our avoidance of low-quality, a few names in our concentrated portfolio struggled, weighing down overall performance for the three- and six-month periods.

On a positive note, our conviction in Hewitt Associates, Inc. was rewarded this quarter. Hewitt rose almost +14% on improved earnings, management’s stock repurchase plans and stabilization in its Human Resources Business Processing Outsourcing segment. Unfortunately, some gains were given back on struggle stories like H&R Block, Inc. which fell -8%, on investor skittishness regarding a softening housing market and worry over rippling effects of a sub-prime meltdown. Wall Street further penalized the stock when mortgage lenders, HSBC and New Century Financial, experienced very large and public losses. Yet, H&R Block’s core business, its iconic tax franchise, continues to operate well. We believe the tax business alone is worth more than the current stock price.

Over the six month period, Accenture rose almost +23% on strong organic growth in its consulting and outsourcing businesses combined with management’s buyback of over a billion dollars worth of outstanding shares. A significant percentage of these gains were offset by poor performance of a few holdings. For example, pharmaceutical giant, Pfizer Inc, fell -9%, largely on its suspension of all Phase 3 torcetrapib trials because of safety concerns over the cholesterol drug. Despite this disappointment, we remain confident in Pfizer’s robust pipeline of early stage drugs, its track record of innovation and management’s continued commitment to cut costs and reallocate capital wisely.

This historic market rally now stands at four years, five months and counting. While investors try to catch the last few waves of this remarkable ride, history has shown that eventually there will be a return to normalcy. In fact, we see signs of challenges ahead. Specifically, the economy is slowing with GDP clocking a mere 2.5% and corporate earnings pulling back to 7.3% from previous double-digit growth. Furthermore, a weakening U.S. housing market is likely to crimp the spending habits of U.S. consumers. As such, we favor quality companies with strong brand franchises that provide relatively predictable, consistent returns. Although our conservative bias may appear to sacrifice some short-term gains, we believe our patient approach and long-term focus provide shareholder value over the long-haul.

Comings & Goings

During the quarter, we added two holdings to the portfolio. We purchased shares of consumer health care manufacturer, Johnson & Johnson, whose stable of brands includes popular names like Band-Aid, Tylenol, Reach and Listerine. Additionally, we added Constellation Brands, Inc., a leading producer and marketer of beverage alcohol brands. Conversely, we sold our position in Gannett Co., Inc. to pursue other opportunities.

800-292-7435

24

Ariel Focus Fund Performance Summary | | Inception: June 30, 2005 |

About the Fund

The no-load Ariel Focus Fund pursues long-term capital appreciation by investing in undervalued companies that show strong potential for growth. The Fund primarily invests in companies with market capitalizations in excess of $10 billion. Ariel Focus Fund is a non-diversified fund and generally will hold 20 securities.

Composition of Equity Holdings

| | | | Russell | | | | | |

| | Ariel | | 1000 | | Russell | | S&P | |

| | Focus | | Value | | 1000 | | 500 | |

| | Fund† | | Index | | Index | | Index | |

Consumer Discretionary & Services | | 26.2 | % | 7.5 | % | 13.3 | % | 12.3 | % |

Financial Services | | 23.2 | % | 35.3 | % | 22.7 | % | 22.6 | % |

Other | | 14.7 | % | 3.6 | % | 3.9 | % | 4.6 | % |

Technology | | 12.6 | % | 3.6 | % | 12.3 | % | 12.5 | % |

Health Care | | 11.9 | % | 6.7 | % | 12.3 | % | 12.1 | % |

Autos & Transportation | | 6.5 | % | 1.6 | % | 2.4 | % | 2.4 | % |

Consumer Staples | | 4.9 | % | 7.0 | % | 7.0 | % | 7.4 | % |

Utilities | | 0.0 | % | 14.0 | % | 8.3 | % | 8.3 | % |

Integrated Oils | | 0.0 | % | 11.1 | % | 5.7 | % | 6.3 | % |

Materials & Processing | | 0.0 | % | 4.6 | % | 4.3 | % | 3.6 | % |

Other Energy | | 0.0 | % | 2.9 | % | 3.3 | % | 3.6 | % |

Producer Durables | | 0.0 | % | 2.0 | % | 4.6 | % | 4.3 | % |

† Sector weightings are calculated based on equity holdings in the Fund and exclude cash in order to make a relevant comparison to the indexes.

Portfolio Composition

Equity | | 95.3 | % |

Cash & Other | | 4.7 | % |

Expense Ratio

* As of 9/30/06

Ariel Capital Management, LLC, the Adviser to the Ariel Mutual Funds, is contractually obligated to waive fees and reimburse expenses in order to limit Ariel Focus Fund’s total annual operating expenses to 1.25% of net assets through the end of the fiscal year ending September 30, 2008. After that date, there is no assurance that such expenses will be limited.

Average Annual Total Returns as of March 31, 2007

| | 1st Quarter | | 1 Year | | Life of Fund | |

Ariel Focus Fund | | -1.04 | % | 8.96 | % | 9.21 | % |

Russell 1000 Value Index | | 1.24 | % | 16.83 | % | 15.82 | % |

Russell 1000 Index | | 1.21 | % | 11.84 | % | 12.67 | % |

S&P 500 Index | | 0.64 | % | 11.83 | % | 12.22 | % |

Past performance does not guarantee future results.

The Value of a $10,000 Investment in Ariel Focus Fund

| | Top Ten Equity Holdings | | | |

| | | | | |

1 | | Berkshire Hathaway Inc. | | 7.6 | % |

| | Insurance and investment firm | | | |

| | | | | |

2 | | International Business Machines Corp. | | 6.8 | % |

| | Worldwide provider of computer products and services | | | |

| | | | | |

3 | | Tyco International Ltd. | | 6.4 | % |

| | Manufacturing conglomerate | | | |

| | | | | |

4 | | H&R Block, Inc. | | 6.3 | % |

| | Tax, investment and mortgage services provider | | | |

| | | | | |

5 | | Toyota Motor Corp. | | 6.2 | % |

| | Global auto manufacturer | | | |

| | | | | |

6 | | Dell Inc. | | 5.2 | % |

| | Global computer and technology provider | | | |

| | | | | |

7 | | Carnival Corp. | | 4.8 | % |

| | Worldwide cruise company | | | |

| | | | | |

8 | | Hewitt Associates, Inc. | | 4.7 | % |

| | Human resources outsourcing and consulting firm | | | |

| | | | | |

9 | | Black & Decker Corp. | | 4.7 | % |

| | Manufacturer of power tools and accessories | | | |

| | | | | |

10 | | Constellation Brands, Inc. | | 4.6 | % |

| | Leading producer of alcohol brands | | | |

Note: All performance assumes the reinvestment of dividends and capital gains. The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Russell 1000® Value Index measures the performance of large-sized, value-oriented companies with lower price-to-earnings ratios. The Russell 1000® Index measures the performance of large-sized companies. The S&P 500 is a broad market-weighted index dominated by blue-chip stocks. All indexes are unmanaged, and an investor cannot invest directly in an index. Ariel Focus Fund is a non-diversified fund and therefore may be subject to greater volatility than a more diversified investment. The performance of Ariel Focus Fund may differ from that of Ariel Fund and Ariel Appreciation Fund due to its status as a non-diversified fund and different portfolio managers.

MARCH 31, 2007 SEMI-ANNUAL REPORT

25

Ariel Focus Fund Schedule of Investments | | March 31, 2007 (Unaudited) |

Number of Shares | | COMMON STOCKS—95.28% | | Cost | | Market Value | |

| | | | | | | |

| | Autos & Transportation—6.24% | | | | | |

18,100 | | Toyota Motor Corp., ADR | | $ | 1,760,280 | | $ | 2,319,696 | |

| | | | | | | |

| | Consumer Discretionary & Services—24.97% | | | | | |

42,700 | | Accenture Ltd, Class A | | 1,073,642 | | 1,645,658 | |

21,500 | | Black & Decker Corp. | | 1,859,011 | | 1,754,830 | |

38,300 | | Carnival Corp. | | 1,854,480 | | 1,794,738 | |

60,200 | | Hewitt Associates, Inc., Class A * | | 1,526,283 | | 1,759,646 | |

43,100 | | Home Depot, Inc. | | 1,663,536 | | 1,583,494 | |

7,300 | | Omnicom Group Inc. | | 588,398 | | 747,374 | |

| | | | 8,565,350 | | 9,285,740 | |

| | Consumer Staples—4.65% | | | | | |

81,600 | | Constellation Brands, Inc.* | | 1,615,657 | | 1,728,288 | |

| | Financial Services—22.13% | | | | | |

32,500 | | Aflac Inc. | | 1,466,383 | | 1,529,450 | |

31,000 | | Citigroup Inc. | | 1,490,585 | | 1,591,540 | |

110,800 | | H&R Block, Inc. | | 2,641,490 | | 2,331,232 | |

35,000 | | JPMorgan Chase & Co. | | 1,449,606 | | 1,693,300 | |

13,800 | | Morgan Stanley | | 768,771 | | 1,086,888 | |

| | | | 7,816,835 | | 8,232,410 | |

| | Health Care—11.31% | | | | | |

47,900 | | IMS Health Inc. | | 1,182,080 | | 1,420,714 | |

27,900 | | Johnson & Johnson | | 1,742,847 | | 1,681,254 | |

43,700 | | Pfizer Inc | | 1,098,927 | | 1,103,862 | |

| | | | 4,023,854 | | 4,205,830 | |

| | Other—14.02% | | | | | |

781 | | Berkshire Hathaway Inc., Class B * | | 2,435,851 | | 2,842,840 | |

75,200 | | Tyco International Ltd. | | 2,002,640 | | 2,372,560 | |

| | | | 4,438,491 | | 5,215,400 | |

| | Technology—11.96% | | | | | |

82,800 | | Dell Inc. * | | 2,015,985 | | 1,921,788 | |

26,800 | | International Business Machines Corp. | | 2,194,320 | | 2,526,168 | |

| | | | 4,210,305 | | 4,447,956 | |