Table of Contents

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to (S)240.14a-12 |

COST PLUS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

COST PLUS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held June 19, 2008

To our Shareholders:

NOTICE IS HEREBY GIVEN that the 2008 Annual Meeting of Shareholders (the “Annual Meeting”) of Cost Plus, Inc. (the “Company” or “Cost Plus”), a California corporation, will be held on June 19, 2008 at 2:00 p.m., Pacific time, at Cost Plus’s corporate headquarters located at 200 4th Street, Oakland, California 94607, for the following purposes:

| (1) | To elect seven directors to serve until the 2009 Annual Meeting of Shareholders or until their successors are elected. |

| (2) | To ratify and approve the appointment of Deloitte & Touche LLP as Cost Plus’s independent registered public accounting firm for the fiscal year ending January 31, 2009. |

| (3) | To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

Only shareholders of record at the close of business on April 25, 2008 are entitled to notice of and to vote at the Annual Meeting.

All shareholders are cordially invited to attend the Annual Meeting in person. However, to assure your representation at the Annual Meeting, you are urged to mark, sign and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any shareholder of record attending the Annual Meeting may vote in person even if he or she returned a proxy.

By Order of the Board of Directors

Barry J. Feld

President and Chief Executive Officer

Oakland, California

May 14, 2008

YOUR VOTE IS IMPORTANT

To assure your representation at the Annual Meeting, you are requested to complete, sign and date the enclosed proxy as promptly as possible and return it in the enclosed envelope, which requires no postage if mailed in the United States.

Table of Contents

Table of Contents

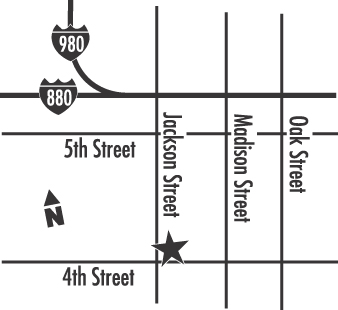

DIRECTIONS TO COST PLUS, INC.’S

CORPORATE HEADQUARTERS

Cost Plus, Inc.

200 4th Street

Oakland, California 94607

(510) 893-7300

Directions from San Francisco

Take the Bay Bridge to Interstate 580 East, to Interstate 980 (Downtown Oakland), which turns into Interstate 880, to Jackson Street. Exit Jackson Street and take a right onto Jackson Street and a left on 4th Street. The corporate headquarters are located at the corner of Jackson and 4th Streets.

Directions from Oakland Airport (and from the south)

Take Interstate 880 North to Oak Street Exit. Exit Oak Street and go straight ahead for two blocks and turn left on Jackson Street. Go two blocks and turn left on 4th Street. The corporate headquarters are located on the corner of Jackson and 4th Streets.

Table of Contents

COST PLUS, INC.

ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

The enclosed proxy is solicited on behalf of our Board of Directors for use at the 2008 Annual Meeting of Shareholders to be held June 19, 2008 at 2:00 p.m., Pacific time, or at any adjournment or postponement thereof, for the purposes set forth in this proxy statement and in the accompanying Notice of Annual Meeting of Shareholders. Our Annual Meeting will be held at our corporate headquarters located at 200 4th Street, Oakland, California 94607. Our telephone number at that location is (510) 893-7300.

These proxy solicitation materials were mailed on or about May 14, 2008 to all shareholders entitled to vote at the Annual Meeting.

Record Date and Voting Securities

Only shareholders of record at the close of business on April 25, 2008 are entitled to notice of and to vote at the Annual Meeting. As of April 25, 2008, there were 22,087,113 shares of our Common Stock issued and outstanding.

Each shareholder is entitled to one vote for each share of Common Stock on all matters presented at the Annual Meeting. Shareholders do not have the right to cumulate their votes in the election of directors.

Voting by Proxy—By signing and returning the proxy card according to the enclosed instructions, you are enabling our President and Chief Executive Officer, Barry J. Feld, and our Executive Vice President and Chief Financial Officer, Jane L. Baughman, who are named on the proxy card as “proxies or attorneys-in-fact,” to vote your shares at the meeting in the manner you indicate. We encourage you to sign and return the proxy card even if you plan to attend the meeting. In this way, your shares will be voted even if you are unable to attend the meeting.

Your shares will be voted in accordance with the instructions you indicate on the proxy card. If you submit the proxy card but do not indicate your voting instructions, your shares will be voted as follows:

| • | FOR the election of the nominees for director identified in Proposal One; and |

| • | FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2009. |

Voting in Person at the Meeting—If you plan to attend the Annual Meeting and vote in person, we will provide you with a ballot at the meeting. If your shares are registered directly in your name, you are considered the shareholder of record and have the right to vote in person at the meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in your name, but if you wish to vote at the meeting you will need to bring a legal proxy from your broker or other nominee authorizing you to vote these shares.

If you hold shares through a bank, broker, or other record holder, you may vote your shares by following the instructions they have provided to you.

1

Table of Contents

You may revoke your proxy at any time before it is voted at the Annual Meeting. In order to do this, you must:

| • | sign and return another proxy bearing a later date before the beginning of the Annual Meeting; |

| • | provide written notice of the revocation to: |

Inspector of Elections

Cost Plus, Inc.

200 4th Street

Oakland, CA 94607

prior to the time we take the vote at the Annual Meeting; or

| • | attend the Annual Meeting and request that your proxy be revoked (attendance at the meeting will not by itself revoke a previously granted proxy). |

We will bear the cost of soliciting proxies. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Solicitation of proxies by mail may be supplemented by telephone, facsimile or personal solicitation by our directors, officers or regular employees. No additional compensation will be paid to such persons for such services. In addition, we have retained Georgeson Shareholder to assist in the solicitation of proxies at an estimated fee of $8,000, plus reimbursement of reasonable out-of-pocket expenses.

Quorum Requirements, Abstentions and Broker Non-Votes

A quorum is necessary to hold a valid meeting. The required quorum for the transaction of business at the Annual Meeting is a majority of the votes eligible to be cast by holders of shares of our Common Stock, whether in person or by proxy, issued and outstanding on the record date.

Abstentions and broker non-votes are counted as present for establishing a quorum for the transaction of business at the Annual Meeting, but neither will be counted as votes cast. A “broker non-vote” occurs when a broker votes on some matters on the proxy card but not on others because the broker does not have authority to do so.

A properly executed proxy marked “Abstain” with respect to any such matter will not be voted. Accordingly, an abstention will have the effect of a negative vote.

Under the rules that govern brokers who have record ownership of shares that are held in “street name” for their clients, the beneficial owners of the shares, brokers have discretion to vote these shares on routine matters but not on non-routine matters. If you hold Common Stock through a broker and you have not given voting instructions to the broker, the broker may be prevented from voting shares on non-routine matters, resulting in a “broker non-vote.” Thus, if you do not otherwise instruct your broker, the broker may turn in a proxy card voting your shares “FOR” routine matters but expressly instructing that the broker is NOT voting on non-routine matters. Both Proposal One and Proposal Two contained in this proxy statement are considered routine matters.

Votes Required for Each Proposal

The vote required for the proposals to be considered at the Annual Meeting is as follows:

Proposal One—Election of Directors. The seven (7) director nominees receiving the highest number of votes, in person or by proxy, will be elected as directors.

2

Table of Contents

Proposal Two—Ratification of Deloitte & Touche LLP as our Independent Registered Public Accounting Firm. Ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2009 will require the affirmative vote of a majority of the shares present and entitled to vote at the Annual Meeting.

You may vote either “for” or “withhold” your vote for the director nominees. You may vote “for,” “against,” or “abstain” from voting on the proposal to ratify Deloitte & Touche LLP as our independent registered public accounting firm.

Shareholder Proposals for 2009 Annual Meeting of Shareholders

As a shareholder, you may be entitled to present proposals, including nominating directors to serve on our Board of Directors, for action at a forthcoming shareholder meeting. Pursuant to the rules of the Securities and Exchange Commission and our Bylaws, proposals that shareholders intend to present at our 2009 Annual Meeting of Shareholders and desire to have included in our proxy materials relating to such meeting must be received by us no later than January 14, 2009, which is 120 calendar days prior to the anniversary of this year’s proxy statement mailing date, and must be in compliance with our bylaws and with applicable laws and regulations (including the regulations of the Securities and Exchange Commission under Rule 14a-8). If the date of next year’s annual meeting is moved more than 30 days before or after the anniversary date of this year’s Annual Meeting, the deadline for inclusion of a proposal in our proxy statement is instead a reasonable time before we begin to print and mail our proxy materials. Proposals should be addressed to:

Corporate Secretary

Cost Plus, Inc.

200 4th Street

Oakland, California 94607

Shareholder proposals that are not intended to be included in the proxy materials for the 2009 Annual Meeting of Shareholders but that are to be presented by the shareholder from the floor are subject to the advance notice provisions contained in our bylaws. In order to be properly brought before the meeting, a proposal not intended for inclusion in our proxy materials must also be received by our corporate secretary at our principal executive offices no later than January14, 2009.

Shareholders Sharing the Same Address

We have adopted a procedure called “householding,” which has been approved by the Securities and Exchange Commission. Under this procedure, Cost Plus is delivering only one copy of the annual report and proxy statement to multiple shareholders who share the same address, unless we have received contrary instructions from an affected shareholder. This procedure reduces our printing costs, mailing costs, and fees. Shareholders who participate in householding will continue to receive separate proxy cards.

We will deliver, promptly upon written or oral request, a separate copy of the annual report and the proxy statement to any shareholder at a shared address to which a single copy of either of those documents was delivered. To receive a separate copy of the annual report or proxy statement, you may write or call us at the address above, telephone number (510) 893-7300. Any shareholders of record who share the same address and currently receive multiple copies of our annual report and proxy statement who wish to receive only one copy of these materials per household in the future, please contact us at the address or telephone number listed above to participate in the householding program.

A number of brokerage firms have instituted householding. If you hold your shares in “street name,” please contact your bank, broker, or other holder of record to request information about householding.

3

Table of Contents

We know of no other matters to be brought before the Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named in the enclosed proxy will vote the shares they represent as the Board of Directors may recommend.

4

Table of Contents

Board of Directors and Committee Meetings

Our Board of Directors held 12 meetings during the fiscal year ended February 2, 2008. Each of our directors attended at least 75% of the meetings of the Board of Directors and the committees on which he or she served during their respective periods of service in the fiscal year ended February 2, 2008. Our directors are expected, absent exceptional circumstances, to attend all Board meetings and meetings of committees on which they serve, and are also expected to attend our Annual Meeting of Shareholders. Six of the seven current Cost Plus directors attended the 2007 Annual Meeting of Shareholders.

Our Board of Directors has summarized its corporate governance practices in theCorporate Governance Guidelines for Cost Plus, Inc., a copy of which is available on the Corporate Governance page of the Investor Information section of our website athttp://www.worldmarket.com and is available in print upon request by any shareholder. Our Board of Directors currently has four committees: an Audit Committee, a Compensation Committee, a Nominating Committee and a Real Estate Committee. Other than the Real Estate Committee, each committee has a written charter approved by the Board of Directors outlining the principal responsibilities of the committee. These charters are also available on the Corporate Governance page of the Investor Information section of our website.

Audit Committee

The purpose of our Audit Committee is to oversee our accounting and financial reporting processes and audits of our financial statements and to assist the Board of Directors in the oversight and monitoring of (i) the integrity of our financial statements, (ii) Cost Plus’s accounting policies and procedures, (iii) our compliance with legal and regulatory requirements, (iv) our independent registered public accounting firm’s qualifications and independence, (v) our disclosure controls and procedures, and (vi) the performance of our internal audit function and our independent registered public accounting firm. In addition, the Audit Committee’s duties and responsibilities include reviewing and pre-approving any audit and non-audit services to be provided by our independent registered public accounting firm, reviewing, approving and monitoring our Code of Ethics for Principal Executive and Senior Financial Officers and establishing procedures for receiving, retaining and treating complaints regarding accounting, internal accounting controls or auditing matters. The report of the Audit Committee for the fiscal year ended February 2, 2008 is included in this proxy statement. The charter of the Audit Committee can be found in the Investor Information section of our website atwww.worldmarket.com/assets/corporate_files/audit_com_charter.pdf.

The Audit Committee currently consists of directors Coulombe, Robbins and Dodds and held 10 meetings in fiscal 2007. Directors Coulombe, Dodds and Robbins are independent within the meaning of the rules of the Securities and Exchange Commission and the listing standards of The Nasdaq Stock Market (the “Nasdaq Rules”). Mr. Dodds has been designated an “audit committee financial expert” within the meaning of the rules of the Securities and Exchange Commission, and the Board has determined that he has the accounting and related financial management expertise to satisfy the requirement that at least one member of the Audit Committee be financially sophisticated within the meaning of the Nasdaq Rules. Mr. Dodds is the Chairman of the Audit Committee.

Compensation Committee

The purpose of our Compensation Committee is to discharge the Board’s responsibilities for approving and evaluating officer compensation plans, policies and programs, to review and make recommendations regarding compensation for our employees and directors, and to administer our equity compensation plans. The report of the Compensation Committee for the fiscal year ended February 2, 2008 is included in this proxy statement. The Compensation Committee of the Board of Directors currently consists of directors Einstein, Robbins and

5

Table of Contents

Roberts, and held five meetings during the last fiscal year. Mr. Roberts serves as the Chairman of the Compensation Committee. Each member of the Compensation Committee is independent within the meaning of the Nasdaq Rules. The charter of the Compensation Committee can be found in the Investor Information section of our website athttp://www.worldmarket.com/assets/corporate_files/compensation_com_charter.pdf.

Nominating Committee

The purpose of our Nominating Committee is to assist the Board of Directors in identifying prospective director nominees and recommending director nominees for election to the Board of Directors and its committees. The Nominating Committee currently consists of directors Gurr and Robbins and held two meetings during the last fiscal year. Both members of the Nominating Committee are independent within the meaning of the Nasdaq Rules. Mr. Gurr serves as the Chairman of the Nominating Committee. The charter of the Nominating Committee can be found in the Investor Information section of our website athttp://www.worldmarket.com/assets/corporate_files/nominating_com_charter.pdf.

Real Estate Committee

The purpose of our Real Estate Committee is to assist the Board of Directors in reviewing, evaluating and approving or disapproving proposals by management for the opening, closing and moving of retail stores. The Real Estate Committee currently consists of directors Coulombe and Gurr and held two meetings during the last fiscal year. Mr. Coulombe serves as the Chairman of the Real Estate Committee.

Consistent with the Nasdaq listing standards and Securities and Exchange Commission rules regarding director independence, our Board of Directors has reviewed the independence of our directors and considered whether any director had any relationship with Cost Plus, Inc. or management that would compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. The Board considered the fact that Mr. Gurr served as interim President of Cost Plus in 2005 for approximately eight months while we conducted a search for a new Chief Executive Officer and received compensation of $60,000 for his services in that capacity. The Board concluded that this interim service did not affect his continued independence as a director under the applicable Nasdaq Rules or otherwise. The Board also considered the fact that Cost Plus has purchased from the publisher for sale in its stores copies of two collections of photographs taken by Mr. Roberts. The aggregate cost of these purchases, which occurred in 2005 and 2006, was approximately $74,000. The Board concluded that these transactions did not affect Mr. Roberts’s independence.

As a result of this review, our Board of Directors has affirmatively determined that directors Coulombe, Dodds, Einstein, Gurr, Roberts and Robbins are independent within the meaning of the Nasdaq Rules.

Shareholder Communications to Directors

Shareholders may communicate directly with our directors by sending a letter addressed to:

Fredric M. Roberts

Chairman of the Board of Directors

Cost Plus, Inc.

200 4th Street

Oakland, California 94607

email: Fred.Roberts@cpwm.com

Mr. Roberts will ensure that a summary of all received letters is provided to the Board of Directors at its regularly scheduled meetings. Where the nature of a communication warrants, Mr. Roberts may decide to obtain the more immediate attention of the appropriate committee of the Board of Directors or an individual director,

6

Table of Contents

management or independent advisors, as Mr. Roberts considers appropriate. Mr. Roberts may decide, in the exercise of his judgment, whether a response to any shareholder communication is necessary.

Policy for Director Recommendations and Nominations

The Nominating Committee considers candidates for Board membership suggested by Board members, management and our shareholders. It is the policy of the Nominating Committee to consider recommendations for candidates to the Board of Directors from any shareholder holding, as of the date the recommendation is submitted, not less than one percent (1%) of the then outstanding shares of our Common Stock continuously for at least 12 months prior to such date. The Nominating Committee will consider a director candidate recommended by our shareholders in the same manner as a nominee recommended by a Board member, management or other sources. In addition, a shareholder may nominate a person directly for election to the Board of Directors at an Annual Meeting of Shareholders provided the shareholder meets the requirements set forth in our Bylaws.

Where the Nominating Committee has either identified a prospective nominee or determines that an additional or replacement director is required, the Nominating Committee may take such measures that it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the Nominating Committee, the Board of Directors or management. In its evaluation of director candidates, including the members of the Board of Directors eligible for re-election, the Nominating Committee considers a number of factors, including:

| • | the current size and composition of the Board of Directors and the needs of the Board of Directors and the respective committees of the Board, and |

| • | such factors as judgment, independence, character and integrity, age, area of expertise, diversity of experience, length of service and potential conflicts of interest. |

The Nominating Committee has also specified the following minimum qualifications that it believes must be met by a nominee for a position on the Board:

| • | the highest personal and professional ethics and integrity, |

| • | proven achievement and competence in the nominee’s field and the ability to exercise sound business judgment, |

| • | skills that are complementary to those of the existing Board, |

| • | the ability to assist and support management and make significant contributions to our success, and |

| • | an understanding of the fiduciary responsibilities that is required of a member of the Board of Directors and the commitment of time and energy necessary to diligently carry out those responsibilities. |

After completing its evaluation, the Nominating Committee makes a recommendation to the full Board as to the persons who should be nominated to the Board, and the Board of Directors determines the nominees after considering the recommendation and report of the Nominating Committee.

Code of Business Conduct and Code of Ethics for Officers

Our Board of Directors has adopted aCode of Business Conduct and Ethics that is applicable to all of our employees, officers and directors. OurCode of Business Conduct and Ethics is intended to ensure that our employees act in accordance with the highest ethical standards based on respect for the dignity of each individual and a commitment to honesty and fairness. In addition, we have in place aCode of Ethics for Principal Executive

7

Table of Contents

and Senior Financial Officers, which applies to our Chief Executive Officer, Chief Financial Officer, and principal accounting officer. This code is intended to deter wrongdoing and promote ethical conduct among our executives and to ensure that all of our public disclosure is full, fair and accurate. TheCode of Business Conductand theCode of Ethics for Principal Executive and Senior Financial Officers are available on the Corporate Governance page of the Investor Information section of our website athttp://www.worldmarket.com.

Cash Compensation

Each of our non-employee directors receives an annual retainer of $30,000 for service on the Board and any committee of the Board, except for the Chairman, who receives an annual retainer of $75,000 in lieu of the standard annual retainer of $30,000 for his services in such capacity. In addition, each non-employee director receives a fee of $3,000 for each Board meeting attended in person, $1,500 for each committee meeting attended (in person or by telephone) and $1,500 for each telephonic Board meeting. Directors are also reimbursed for certain expenses they incur in connection with attendance at Board and committee meetings. The Chairmen of the Compensation and Real Estate Committees each receive additional annual compensation of $7,500 for their services in such capacities. The Chairman of the Audit Committee received $7,500 for his services as Chairman in fiscal 2007, and this amount has been increased to $10,000 in fiscal 2008.

Equity Compensation

Our 1996 Director Option Plan (the “Director Plan”) provides for our Board of Directors, in its discretion, to award options to purchase Common Stock to non-employee directors. The exercise price for all options granted under the Director Plan is 100% of the fair market value of the shares on the grant date. Assuming continued service on the Board, all options granted to non-employee directors become exercisable in four equal annual installments beginning one year after the date of grant. The options granted to the Board of Directors before fiscal year 2005 expire ten years after the date of grant and the options granted after fiscal year 2004 expire seven years after the date of grant. Vesting of options is accelerated in certain circumstances upon a change of control of Cost Plus.

On March 24, 2008, directors Coulombe, Dodds, Einstein, Gurr and Robbins each received grants under the Director Plan of options to purchase 12,000 shares of our Common Stock at an exercise price of $3.61. Mr. Roberts, in recognition of his added responsibilities as Chairman of the Board was granted an option to purchase 15,000 shares of our Common Stock at the same exercise price.

8

Table of Contents

The following table sets forth information concerning compensation paid or accrued for services rendered to Cost Plus in all capacities by the non-employee members of our Board of Directors for the fiscal year ended February 2, 2008.

Director Compensation Summary

For Fiscal Year 2007

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) (1)(2) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||

Joseph H. Coulombe | 81,000 | — | 58,480 | — | — | — | 139,480 | |||||||

Christopher V. Dodds | 79,500 | — | 28,709 | — | — | — | 108,209 | |||||||

Clifford J. Einstein | 48,500 | — | 2,120 | — | — | — | 50,620 | |||||||

Danny W. Gurr | 60,000 | — | 58,480 | — | — | — | 118,480 | |||||||

Kim D. Robbins | 81,000 | — | 58,480 | — | — | — | 139,480 | |||||||

Fredric M. Roberts | 116,750 | — | 59,641 | — | — | — | 176,391 |

| (1) | The amounts shown do not reflect compensation actually received. Instead, the amounts shown are the compensation costs recognized by Cost Plus for the fiscal year ended February 2, 2008 for stock option awards determined pursuant to Statement of Financial Accounting Standards No. 123 (revised 2004),Share-Based Payment (“SFAS 123(R)”), including amounts recognized with respect to options granted in fiscal 2007 and previous fiscal years. The grant date fair values of the stock options granted to the non-employee directors in fiscal 2007, computed in accordance with SFAS 123(R), were as follows: Mr. Coulombe, $31,200; Mr. Dodds, $31,200; Mr. Einstein, $28,480; Mr. Gurr, $31,200; Ms. Robbins, $31,200; and Mr. Roberts, $39,000. The fiscal 2007 option grants consisted of 8,000 shares to each non-employee director other than Mr. Roberts, who was granted an option to purchase 10,000 shares for serving as Chairman of the Board, and Mr. Einstein, who was granted an option to purchase 16,000 shares when he joined the Board. The assumptions used to calculate the value of option awards are set forth in Note 1 of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for fiscal 2007. |

| (2) | As of February 2, 2008, the non-employee directors held options to purchase the following shares of Common Stock, all of which were granted under the 1996 Director Option Plan: Mr. Coulombe, 67,013; Mr. Dodds, 24,000; Mr. Einstein, 16,000; Mr. Gurr, 85,975; Ms. Robbins, 67,585; and Mr. Roberts, 94,418. |

9

Table of Contents

ELECTION OF DIRECTORS

Our Board of Directors currently consists of seven directors. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the seven nominees named below, all of whom are presently directors. If any of our nominees is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by the present Board of Directors to fill the vacancy. Our management has no reason to believe that any of the nominees will be unable or unwilling to serve if elected. The term of office of each person elected as a director will continue until the next Annual Meeting of Shareholders or until such person’s successor has been elected and qualified. Nominations of persons for election to our Board of Directors may be made by any shareholder of our company entitled to vote in the election of directors at the Annual Meeting who complies with the notice procedures set forth in our Bylaws.

The seven nominees receiving the highest number of affirmative votes of the holders of the shares of our Common Stock represented in person or by proxy and entitled to vote on the proposal shall be elected to the Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES LISTED BELOW.

The names of the nominees, their ages as of the date of this proxy statement and certain information about them are set forth below:

Name of Nominee | Age | Principal Occupation | Director | |||

Joseph H. Coulombe | 77 | Independent management consultant | 1995 | |||

Christopher V. Dodds | 48 | Retired Chief Financial Officer and Executive Vice President of Finance of The Charles Schwab Corporation | 2006 | |||

Clifford J. Einstein | 69 | Retired Chairman of Dailey and Associates | 2007 | |||

Barry J. Feld | 51 | Chief Executive Officer and President | 2001 | |||

Danny W. Gurr | 50 | Independent management consultant | 1995 | |||

Kim D. Robbins | 62 | Retired retail executive | 1999 | |||

Fredric M. Roberts | 65 | Retired investment banker | 1999 |

Except as set forth below, each of the nominees has been engaged in his or her principal occupation described above during the past five years. There is no family relationship between any director and executive officer of Cost Plus.

Mr. Coulombe has been engaged in independent management consulting since April 1995. Previously, he was employed in an executive capacity by several retailing and grocery businesses and as an independent business consultant. From February 1995 to April 1995, Mr. Coulombe served as President and Chief Executive Officer of Sport Chalet, Inc., a sporting goods retailer. From February 1994 to January 1995, Mr. Coulombe served as Chief Executive Officer of Provigo Corp., a wholesale and retail grocer. From November 1992 to February 1994, Mr. Coulombe was an independent business consultant. From March 1992 to October 1992, Mr. Coulombe served as Executive Vice President of Pacific Enterprises, with principal responsibility for Thrifty Corporation, an operator of drug and sporting goods chain stores. He also served as Co-Chairman of Thrifty Corporation during that time. From June 1989 through March 1992, Mr. Coulombe served as an independent

10

Table of Contents

business consultant. Mr. Coulombe is the founder of Trader Joe’s, a specialty food grocery chain, and he served as its Chief Executive Officer from 1957 to 1989. Mr. Coulombe currently serves as a director of True Religion Apparel, Inc., a manufacturer of high-end, contemporary, designer women’s and men’s jeans.

Mr. Dodds served at The Charles Schwab Corporation as Executive Vice President of Finance from December 1998 and then as Chief Financial Officer from July 1999 until his retirement in May 2007. Prior to his position as Chief Financial Officer, Mr. Dodds served as Corporate Controller at The Charles Schwab Corporation from November 1997 to March 1999 and as Treasurer from 1993 to 1997. He has also held a variety of financial positions at The Charles Schwab Corporation in treasury, financial planning and analysis and corporate development. Before joining The Charles Schwab Corporation in 1986, Mr. Dodds served in the treasury departments of Gulf Oil and Exxon.

Mr. Einstein served as Chairman of Dailey and Associates, an international advertising agency headquartered in West Hollywood, California, from 1994 until his retirement in 2006. Prior to his position as Chairman, Mr. Einstein served as President of Dailey and Associates from 1983 to 1994. He was Dailey and Associates’ original Executive Creative Director and served in that role as well for 35 years. Mr. Einstein currently serves as a director of Merchant House International, an Australian manufacturer of home textiles and footwear.

Mr. Feld was appointed Chief Executive Officer and President of Cost Plus, Inc. in October 2005. From August 1999 until October 2005, Mr. Feld was President, Chief Executive Officer and Chairman of the Board of Directors of PCA International, Inc., the largest North American operator of portrait studios focused on serving the discount retail market. From November 1998 to June 1999, Mr. Feld was President and Chief Operating Officer of Vista Eyecare, Inc., a specialty eyecare retailer. He joined Vista Eyecare as a result of its acquisition of New West Eyeworks, Inc., where he had been serving as President and a director since May 1991 and as Chief Executive Officer and a Director since February 1994. From 1987 to May 1991, Mr. Feld was with Frame-n-Lens Optical, Inc., where he served as its president prior to joining New West. Prior to that, he served in various senior management positions at Pearle Health Services for 10 years and, for a number of years, he served as an acquisition and turnaround specialist for optical retail groups acquired by Pearle. PCA International filed for protection under Chapter 11 of the federal Bankruptcy Code in August 2006.

Mr. Gurr served as Interim President and Chief Operating Officer of Cost Plus, Inc. from March 2005 until October 2005. Since September 2004, Mr. Gurr has also been serving as Director and President of Make Believe Ideas, Inc., a start-up publisher of children’s books. From January 2002 until July 2003, Mr. Gurr served as the President of Quarto Holdings, Inc., a leading international co-edition publisher. From April 1998 to July 2001, Mr. Gurr served as President and a director of Dorling Kindersley Publishing Inc., a publisher of illustrated books, videos and multi-media products. From September 1991 to February 1998, Mr. Gurr served as President and Chief Executive Officer of Lauriat’s Books, Inc., an operator of various bookstore chains. From November 1995 until June 1997, Mr. Gurr served as President and Chief Executive Officer of Chadwick Miller, Inc., an importer and wholesaler of housewares and gifts. Mr. Gurr is a director of Hastings Entertainment, Inc., a leading multimedia entertainment retailer.

Ms. Robbinsis a retired retail executive who worked in various department store and specialty store businesses. From 1997 to 2002, Ms. Robbins was the Director of Product Development for Jack Nadel, Inc., a direct response promotion agency specializing in creative marketing and merchandise solutions. From 1996 to 1997, she was the Executive Vice President and General Merchandise Manager of House of Fabrics, Inc., which operates sewing and craft stores throughout the United States. From 1995 to 1996, she was the Vice President of Merchandising for Sport Chalet Inc., a sporting goods retailer. From 1976 to 1993, Ms. Robbins served in capacities of increasing responsibility at Carter Hawley Hale, culminating in her appointment as Senior Vice President and General Merchandising Manager.

Mr. Roberts is retired and was appointed Chairman of the Board in March 2005. Mr. Roberts served as President of F.M. Roberts & Company, Inc., an investment-banking firm he established in 1980, for more than 20

11

Table of Contents

years. Mr. Roberts has over 30 years of investment banking experience, including executive corporate finance positions with Lehman Brothers, Loeb, Rhoades & Co., E.F. Hutton & Co. and Cantor, Fitzgerald & Co., Inc. Mr. Roberts served as 1993 Chairman of the Board of Governors of the National Association of Securities Dealers, which at that time owned and operated The Nasdaq Stock Market. From 1994 to 1996, he was a member of the Nasdaq Board of Directors and its Executive Committee. Mr. Roberts also serves as a director and Chairman of the Compensation Committee of Tween Brands, Inc, a specialty retailer of branded apparel and lifestyle products for girls.

12

Table of Contents

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board of Directors has selected Deloitte & Touche LLP as our independent registered public accounting firm to audit the financial statements of our company for the current fiscal year ending January 31, 2009 and recommends that the shareholders ratify this selection. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection. Representatives of Deloitte & Touche LLP are expected to attend the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

Audit and Related Fees for Fiscal Years 2007 and 2006

The aggregate professional fees billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively “Deloitte”) for the audit of our annual financial statements for fiscal 2007 and 2006 and fees billed or to be billed for audit related services, tax services and all other services rendered by Deloitte for these periods were as follows:

| 2007 | 2006 | ||||||

Audit fees (1) | $ | 1,027,161 | (2) | $ | 1,022,706 | ||

Audit-related fees (3) | 28,310 | 35,570 | |||||

Tax fees (4) | — | — | |||||

All other fees | — | — | |||||

Total Fees: | $ | 1,055,471 | $ | 1,058,276 | |||

| (1) | Audit Fees—These are fees for professional services performed by Deloitte and include the audit of our annual financial statements, the audit of management’s assessment of our internal control over financial reporting and Deloitte’s own audit of our internal control over financial reporting, the review of financial statements included in our Quarterly Reports on Form 10-Q and for services that are normally provided in connection with statutory and regulatory filings or engagements. |

| (2) | The audit fees for the fiscal year 2007 audit are preliminary. |

| (3) | Audit-related Fees—These are fees for the assurance and related services performed by Deloitte that are reasonably related to the performance of the audit or review of our financial statements. Audit related services consist of consultation on various accounting matters. |

| (4) | Tax Fees—These are fees for professional services performed by Deloitte with respect to tax compliance, tax advice and tax planning. Deloitte performed no such services for us in fiscal 2006 or 2007. |

The Audit Committee pre-approved all audit services, audit related services and other services and concluded that the provision of such services by Deloitte was compatible with maintaining auditor independence. The Audit Committee’s current practice is to consider and approve in advance all proposed audit and non-audit services to be provided by our independent registered public accounting firm.

The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm requires the affirmative vote of the holders of a majority of the shares of our Common Stock represented in person or by proxy and entitled to vote on the proposal, which shares voting affirmatively must also constitute a majority of the required quorum.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

13

Table of Contents

The following is the Audit Committee’s report submitted to the Board of Directors for the fiscal year ended February 2, 2008.

The Audit Committee assists the Board of Directors in fulfilling its responsibilities for general oversight of the integrity of Cost Plus’s financial statements, its accounting policies and procedures, its compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications and independence, the performance of Cost Plus’s internal audit function and independent registered public accounting firm, disclosure controls and procedures and risk assessment and risk management. The Audit Committee manages Cost Plus’s relationship with its independent registered public accounting firm (who report directly to the Audit Committee). The Audit Committee has the authority to obtain advice and assistance from outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties and receive appropriate funding, as determined by the Audit Committee, from Cost Plus for such advice and assistance.

The Company’s management has primary responsibility for preparing Cost Plus’s financial statements and for its financial reporting process. Our independent registered public accounting firm, Deloitte & Touche LLP, is responsible for expressing an opinion on the conformity of Cost Plus’s audited financial statements with accounting principles generally accepted in the United States. We monitor and review these processes, as well as the integrity of Cost Plus’s consolidated financial statements and its system of internal controls. However, we are not professionally engaged in the practice of accounting or auditing and we are not experts in the fields of accounting or auditing, including with respect to auditor independence. We rely, without independent verification, on the information provided to us and on the representations made by management and the independent registered public accounting firm.

In this context, we:

| • | reviewed and discussed Cost Plus’s audited consolidated financial statements for the fiscal year ended February 2, 2008 with management and Deloitte & Touche LLP; |

| • | discussed with Deloitte & Touche LLP the matters required to be discussed by Statement on Auditing Standards No. 114, (The Auditor’s Communication With Those Charged With Governance); |

| • | received and reviewed the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standards No. 1 (Independence Discussions with Audit Committees) and discussed with Deloitte & Touche LLP their independence from Cost Plus; and |

| • | reviewed management’s report on internal controls as well as the independent registered public accounting firm’s report to Cost Plus as to its review of the effectiveness of Cost Plus’s internal controls as required under Section 404 of the Sarbanes-Oxley Act. |

Based on our review and these meetings, discussions and reports, and subject to the limitations on our role and responsibilities referred to above and in the Audit Committee Charter, we recommended to the Board of Directors that Cost Plus’s audited consolidated financial statements for the fiscal year ended February 2, 2008 be included in Cost Plus’s Annual Report on Form 10-K.

Respectfully submitted by:

THE AUDIT COMMITTEE

Christopher V. Dodds, Chairman

Joseph H. Coulombe

Kim D. Robbins

14

Table of Contents

REPORT OF THE COMPENSATION COMMITTEE

The information in the following report shall not be deemed to be “soliciting material” or to be filed with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that Cost Plus specifically incorporates it by reference into such filing.

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis for the fiscal year ended February 2, 2008 with management. In reliance on the reviews and discussions referred to above, the Compensation Committee recommended to the Board and the Board has approved, that the Compensation Discussion and Analysis be included in the proxy statement for the fiscal year ended February 2, 2008 for filing with the Securities and Exchange Commission.

Respectfully submitted by:

THE COMPENSATION COMMITTEE

Frederic M. Roberts, Chairman

Clifford J. Einstein

Kim D. Robbins

Compensation Committee Interlocks and Insider Participation

During fiscal 2007, no member of the Compensation Committee was an officer or employee or former officer or employee of Cost Plus or any of its subsidiaries. No member of the Compensation Committee or executive officer of Cost Plus served as a member of the Board of Directors or Compensation Committee of any entity that has an executive officer serving as a member of our Board of Directors or Compensation Committee. Finally, no member of the Compensation Committee had any other relationship requiring disclosure in this section.

15

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

AND EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview

Cost Plus, Inc. is a leading specialty retailer of casual home furnishings and entertaining products. Our business strategy is to differentiate our stores by offering a large and ever-changing selection of unique products, many of which are imported, at value prices in an exciting shopping environment. We compete against a diverse group of retailers ranging from specialty stores to department stores and discounters. We compete with these and other retailers for customers, suitable retail locations and talented employees and leaders.

We seek to develop and implement compensation programs that will attract, retain, and reward employees and leaders who are key to our successful growth. Our executive compensation program is designed to reward key leaders for high levels of performance and to align compensation with Cost Plus’s performance in meeting both short-term and long-term business objectives.

The Compensation Committee of our Board of Directors oversees our executive compensation program. The Compensation Committee currently consists of independent directors Fredric Roberts, Chairman, Kim Robbins, and Clifford Einstein The Committee is responsible to the Board of Directors for reviewing and approving executive compensation program elements, salary levels, incentive compensation and benefit plans for our Chief Executive Officer and our other executive officers. The Charter of the Compensation Committee is posted on our website athttp://www.worldmarket.com/assets/corporate_files/compensation_com_charter.pdf.

Executive Compensation Program Objectives and Philosophy

The objectives of our executive compensation program are:

| • | To align compensation with company performance in meeting both short-term and long-term business objectives and with the interests of our shareholders; |

| • | To enable us to attract, retain and reward leaders who are key to our continued successful growth; and |

| • | To reward high levels of performance, with pay-at-risk increasing at higher levels of the organization. |

Our compensation philosophy is to set base salary ranges at approximately the competitive market median and to provide annual cash bonus incentive opportunities and long-term, equity-based incentive opportunities at median levels, with increasing upside potential for exceeding targets. We do not have a set policy or target for the allocation between either cash and non-cash or short-term and long-term incentive compensation. The appropriate levels and mix of compensation are reviewed annually by our Compensation Committee based on information provided by its compensation consultant and on other factors described below. Our objectives are to ensure competitive base compensation to attract and retain executive talent, to reward performance on an annual basis in the form of cash incentives for performance exceeding specific short-term goals, and to provide equity compensation to reward performance exceeding specific long-term goals to maximize long-term value for Cost Plus and its shareholders.

Executive Compensation Process

At the beginning of each fiscal year, the Compensation Committee reviews the compensation of the Chief Executive Officer and senior executives. Typically, the Chief Executive Officer makes compensation recommendations to the Compensation Committee with respect to the executive officers who report to him. The executive officers are not present during these discussions. The Chairman of the Committee then makes compensation recommendations to the Compensation Committee regarding the Chief Executive Officer, who is not present at this time.

16

Table of Contents

In making compensation recommendations and decisions for the officers, the Committee considers a number of factors, including market data provided by its outside consultant, an internal review of each executive’s compensation, both individually and relative to other officers, individual performance and expected future contributions, retention needs and Cost Plus’s performance.

Compensation Consultant and Benchmark Group

Mercer (US) Inc. (‘Mercer’) is directly retained by the Compensation Committee to review the competitiveness of our executive compensation program for our Chief Executive Officer and other senior executives, including the officers listed in the Summary Compensation Table, whom we refer to as our Named Executive Officers. In fiscal 2007 Mercer evaluated the competitiveness of the total executive compensation we provided in fiscal 2006, including base salary, target annual cash incentive opportunity, long-term incentives, equity usage and market trends. In assessing the competitive market, Mercer used two data sources: a peer group of comparable companies and national published surveys. The peer group for fiscal 2007 consisted of the following seven companies: Bed Bath & Beyond Inc.; Williams-Sonoma, Inc.; Pier 1 Imports, Inc.; The Bombay Company, Inc.; Restoration Hardware, Inc.; Kirkland’s, Inc.; and Tuesday Morning Corporation. The median revenue size for the peer group is approximately $1.0 billion, closely aligned with our revenue.

The Compensation Committee requests information and recommendations from Mercer as it deems appropriate in order to assist it in structuring and evaluating our executive compensation programs, plans, and practices. The Committee’s decisions about the executive compensation program, including the specific amounts paid to executive officers, are its own and may reflect factors and considerations other than the information and recommendations provided by Mercer.

Components of Executive Compensation

Base Salary

The Compensation Committee determines base salary ranges annually for each executive based on the competitive market and the other factors described above.

For fiscal 2007, due to the fact that although Cost Plus had made progress in its turnaround but still had not achieved its financial turnaround goals, we made no general adjustment to the base salaries of our executive officers. The only Named Executive Officers who received base salary increases in fiscal 2007 were Mr. Whitley, our Senior Vice President, Supply Chain, whose base salary was increased from $275,000 to $300,000 in April 2007 in view of the highly competitive market for supply chain executives, and Ms. Baughman, whose base salary was increased from $250,000 to $325,000 in connection with her promotion to Executive Vice President and Chief Financial Officer in August 2007.

Management Incentive Plan

Our Management Incentive Plan (cash incentive program) is a key element of our philosophy to pay our executives for actual performance. The Plan rewards executives for the achievement of short-term goals established by the Compensation Committee near the beginning of each fiscal year.

For fiscal 2007, target incentive percentages for executive officers ranged from 30% of base salary to 70% in the case of our Chief Executive Officer. Depending on Cost Plus’s performance against pre-determined goals, actual cash incentive payments could vary from no cash incentive if Cost Plus’s performance was below minimum levels to 150% of the target incentive amount for exceptional performance by Cost Plus. The Committee seeks to design target incentive awards, in combination with base salaries, to provide total cash compensation opportunities at approximately median competitive levels if incentive plan goals are achieved at target levels. Actual incentive payments will be above median levels for performance by Cost Plus that exceeds

17

Table of Contents

target levels and will be below median levels for performance below target levels. The amounts that could have been earned by our Named Executive Officers in fiscal 2007 at various performance levels are furnished in the table entitled “Grants of Plan-Based Awards” below.

For fiscal 2007, as we continued our turnaround efforts, our Compensation Committee and management agreed that the incentive plan should focus on two financial measures: earnings before interest, taxes, depreciation and amortization (EBITDA) and comparable store sales, weighted equally. The two measures are among the most commonly used performance measures in the retail industry, and the Committee believed that achievement of the established goals would represent significantly improved performance by Cost Plus.

When the performance measures were adopted, the Committee and management felt that, although it would require significant effort and success by management to achieve the target levels, the targets were achievable. However, Cost Plus did not attain either of the minimum fiscal 2007 performance targets, and, therefore, as for fiscal 2006, no cash incentives were paid to our executive officers for fiscal 2007.

Long-term Incentive Program

Our Compensation Committee believes that long-term, equity-based incentive compensation programs align the interests of management, employees and our shareholders in creating long-term shareholder value. Our 2004 Stock Plan provides for the grant of options to purchase shares of our Common Stock as well as for grants of full value awards, such as restricted stock, restricted stock units, performance shares and performance units. Prior to fiscal 2006, the only types of awards that had been made under the Plan were stock options.

The Committee considers various factors, such as share dilution levels, individual performance, retention concerns, the value of outstanding grants held by executives and the practices of peer group companies in determining the size and type of equity-based awards to Named Executive Officers. Beginning in fiscal 2006, the Committee also determined that including a performance share award component in the long-term incentive program would strengthen the alignment of the executive compensation program with corporate performance, help control the rate at which shares of Common Stock are utilized under the 2004 Stock Plan, and would assist in managing the higher accounting charges associated with stock options.

The fiscal 2007 annual stock option grants to our Named Executive Officers ranged from 12,000 shares to 50,000 shares. All of these options have terms of seven years and become vested at the rate of 25% of the shares subject to the option each year. Performance shares were awarded to 19 executives at the Vice President level and higher (including the Chief Executive Officer and Named Executive Officers). The performance targets established by the Compensation Committee were specified levels of comparable stores sales growth and income from operations, equally weighted, with threshold, target, and maximum award levels. The performance period for the awards of performance shares was fiscal year 2007, but the shares, if earned, would only be issued at the end of the third year following the award and only if the participating executive remained continuously employed by Cost Plus through the three-year period (subject to exceptions for death and disability). The total target awards for our Named Executive Officers ranged from 2,500 to 12,500 shares. If maximum performance targets were achieved, the awards would be double those amounts and would range from 5,000 to 25,000 shares. At the time the goals were established, the Committee believed that the goals were achievable at target levels and would require substantial effort to reach maximum levels. However, for the fiscal year 2007 performance period the targets were not met, and thus no performance shares will be issued in connection with the fiscal 2007 awards.

Award Grant Process

The Compensation Committee has adopted a formal policy for administering grants of awards under our 2004 Stock Plan and 1996 Director Option Plan. Under this policy, all awards under both Plans must be approved by the Committee. The policy provides that the exercise price of stock options will be the closing price of the Common Stock on the date of the meeting or the effective date of an action by the written consent of the

18

Table of Contents

Committee members unless a future grant date is specified by the Committee. The policy provides that the Committee may not make awards to officers or directors with a grant date occurring during the restricted trading periods observed by Cost Plus pending the release of financial results. Grants that are authorized during these periods must specify a specific future grant date, which will typically be at the end of the second full day of trading following the public release of financial results.

Perquisites and Other Benefits

Our executives receive no perquisites or benefits that are not also available to other eligible employees in the company.

We have a 401(k) plan with matching contributions from Cost Plus. All of our executives and eligible employees may participate in the plan. We provide a 100% matching contribution for participants up to 3% of their salaries and a 50% matching contribution up to an additional 2% of their salaries.

Employment and Severance Agreements; Change in Control Arrangements

Other than the employment agreement with our Chief Executive Officer, Barry J. Feld, that we entered into when he commenced employment with Cost Plus in October 2005 and that we amended in March 2008, we do not have employment agreements with our executive officers. The terms of Mr. Feld’s agreement are discussed below and under the heading “Employment and Related Agreements; Change in Control Arrangements.”

We have entered into severance agreements with our executive officers and certain other officers. These agreements, as well as Mr. Feld’s employment agreement, provide for payments to the officers in certain circumstances upon their involuntary termination, including termination following a change of control (as these terms are defined in the agreements).

Late in fiscal 2007, our Board of Directors and our Compensation Committee became concerned that Cost Plus faced an increased risk of losing its executives to competitors and requested its compensation consultant to review the existing severance provisions for our executives. Mercer delivered its report to the Committee in February 2008 and made various recommendations regarding Cost Plus’s severance arrangements designed to align the Company’s severance structure more closely with its peer group. These included recommendations to add benefits continuation provisions to the agreements and to extend the agreements to certain executives deeper in the organization. Mercer also recommended certain amendments to Mr. Feld’s employment agreement, including an increase in his base salary, which had not been adjusted since he joined Cost Plus, an increase in his target cash incentive to 100% of base salary, an increased stock option grant and enhancements to his severance pay, continuation of benefits following an involuntary termination of employment for the COBRA period (up to 18 months) and an extension of his contract term. Following further consideration of these recommendations by the Committee and consultation with the Board of Directors, Cost Plus entered into an amended employment agreement with Mr. Feld in March 2008. The existing employment severance agreements with the Named Executive Officers and certain other executives were amended in May 2008, and Cost Plus entered into severance agreements with certain other executives who had not previously had such agreements.

Additional information regarding Mr. Feld’s employment agreement and the severance agreements with other executives is presented below under the heading “Employment and Related Agreements; Change in Control Arrangements.”

Our 2004 Stock Plan provides that in the event of a change of control of Cost Plus, as that term is defined in the 2004 Stock Plan, outstanding stock awards granted under the 2004 Stock Plan shall become fully vested. We may also elect to take certain other actions in the event of a change of control, including accelerating, terminating and canceling outstanding awards in exchange for a per share payment for each share subject to the outstanding awards equal to the number (or amount) and kind of stock, securities, cash, property or other consideration that

19

Table of Contents

each holder of a share was entitled to receive in connection with the change of control, reduced in some cases by the per share strike price. We may also elect to have deferred stock units assumed by the acquirer for distribution according to their existing distribution schedule.

Our Board and the Compensation Committee believe the interests of shareholders will be best served if the interests of our senior management are aligned with them, and providing change-in-control severance benefits should eliminate, or at least reduce, any reluctance or bias on the part of senior management to pursue potential change-in-control transactions that may be in the best interests of shareholders, while simultaneously preserving their neutrality in the negotiation and execution of a transaction favorable to shareholders. In addition, the security of competitive change-in-control severance arrangements serves to eliminate distraction caused by uncertainty about personal financial circumstances during a period in which Cost Plus requires focused and thoughtful leadership to ensure a successful outcome.

Tax and Accounting Considerations

In designing our compensation programs, we generally take into consideration the accounting and tax effect that each element will or may have on us and the executive officers and other employees as a group. We aim to keep the expense related to our compensation programs as a whole within reasonable affordability levels.

Section 162(m) of the Internal Revenue Code limits the federal income tax deductibility of compensation paid to our Chief Executive Officer and to each of our four other most highly compensated executive officers. Under Section 162(m), Cost Plus may deduct such compensation with respect to any of these individuals only to the extent that during any fiscal year such compensation does not exceed $1 million or meets certain other conditions (such as qualification of the compensation as “performance-based compensation” under Section 162(m)).

The cash compensation (base salary and cash incentive) paid to our Chief Executive Officer and our four other most highly compensated executive officers for fiscal 2007 was fully deductible for federal income tax purposes because it was less than $1 million per officer. Our Management Incentive Plan, which provides executives the opportunity to receive cash incentive payments, is currently not considered “performance-based” under Section 162(m). Accordingly, if the total of base salary, cash incentive payments and other non-performance-based compensation paid to these executives should exceed $1 million to an executive the amounts over that level would be non-deductible for federal income tax purposes.

We believe that each stock option granted to our Chief Executive Officer and each of our four other most highly compensated executive officers in fiscal 2007 should qualify as performance-based compensation under Section 162(m) and therefore should be fully deductible by us. The performance shares granted to these executives in fiscal 2007 were intended to qualify as performance-based compensation under Section 162(m) and should also have been fully deductible had they been earned.

In designing our compensation programs, we also take into consideration the impact of Section 409A of the Internal Revenue Code. Section 409A imposes additional significant taxes in the event that an executive officer, director or service provider receives “deferred compensation” that does not satisfy the requirements of Section 409A. Consequently, we terminated our nonqualified deferred compensation plan effective March 1, 2006 due to the complexities and restrictions of Section 409A. In addition, we structured our employment severance agreements and our equity awards in a manner intended either to avoid the application of Section 409A or to comply with its requirements.

Also of consideration is Section 280G and related Internal Revenue Code sections, which provide that executive officers, directors who hold significant shareholder interests and certain other service providers could be subject to significant additional taxes if they receive payments or benefits in connection with our change in control that exceeds certain limits, and that we or our successor could lose a deduction on the amounts subject to

20

Table of Contents

the additional tax. Although our employment agreement with our Chief Executive Officer provides a gross-up for tax amounts he might pay pursuant to Section 280G, we have not provided any other executive officer or director with a gross-up or other reimbursement amount for Section 280G-related taxes.

The following table presents information concerning the total compensation of Cost Plus’s Chief Executive Officer, Chief Financial Officer, the three other most highly compensated executive officers, and a former executive officer (the “Named Executive Officers”) for services rendered to Cost Plus in all capacities for the fiscal year ended February 2, 2008:

Summary Compensation Table

Name and Principal | Fiscal Year | Salary ($) (1) | Discretionary Non-Plan Based Bonus ($) | Stock Awards ($) | Option Awards ($) (2) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) (3) | All Other Compensation ($) (4) (5) | Total ($) | ||||||||||

Barry J. Feld | 2007 | 675,000 | — | — | 354,721 | — | — | 6,812 | 1,036,533 | ||||||||||

President and Chief Executive Officer | 2006 | 675,000 | — | — | 657,207 | — | — | 106,018 | 1,438,225 | ||||||||||

Jane L. Baughman | 2007 | 281,731 | — | — | 60,901 | — | — | 10,061 | 352,693 | ||||||||||

Executive Vice President, Chief Financial Officer and Corporate Secretary | 2006 | 201,058 | — | — | 102,873 | — | — | 7,749 | 311,680 | ||||||||||

Michael J. Allen | 2007 | 375,000 | — | — | 101,887 | — | — | 8,775 | 485,662 | ||||||||||

Executive Vice President, Store Operations | 2006 | 402,734 | — | — | 184,004 | — | — | 7,008 | 593,746 | ||||||||||

Rayford K. Whitley | 2007 | 296,154 | — | — | 85,632 | — | — | 9,826 | 391,612 | ||||||||||

Senior Vice President, Supply Chain | 2006 | 275,000 | — | — | 115,582 | — | — | 1,523 | 392,105 | ||||||||||

George K. Whitney | 2007 | 325,000 | — | — | 27,875 | — | — | 855 | 353,730 | ||||||||||

Senior Vice President, Merchandising | 2006 | 56,250 | 3,407 | 100 | 59,757 | ||||||||||||||

Thomas D. Willardson | 2007 | 237,000 | — | — | — | — | — | 380,977 | 617,977 | ||||||||||

Former Executive Vice President, Chief Financial Officer and Assistant Secretary | 2006 | 375,000 | — | — | (34,586 | ) | — | — | 143,532 | 483,946 | |||||||||

| (1) | The 2006 amount for Mr. Allen includes an accrued vacation payout of $39,272, and the 2007 amount for Mr. Willardson includes an accrued vacation payout of $13,541. |

| (2) | The amounts shown do not reflect compensation actually received. Instead, the amounts shown are the compensation costs recognized by Cost Plus in fiscal 2007 and 2006 for stock option awards granted during and prior to those years as determined pursuant to SFAS 123(R). The assumptions used to calculate the value of option awards are set forth in Note 1 of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for fiscal 2007. The award amounts shown for Mr. Feld include $34,694 and $89,624 in fiscal 2007 and 2006, respectively, for options granted to him in his capacity as a director before he became Chief Executive Officer. |

| (3) | Cost Plus terminated its deferred compensation plan effective March 1, 2006. |

| (4) | Consists of matching contributions made by Cost Plus under its tax-qualified 401(k) Plan and life insurance premiums paid by Cost Plus, except that the 2006 amount for Mr. Feld includes a relocation allowance of $104,461, and the 2006 amount for Mr. Willardson consists of a relocation allowance of $143,532. |

| (5) | The 2007 amount for Mr. Willardson includes $375,000 in severance payments, which were accrued when his employment with the Company terminated on August 24, 2007. Pursuant to a severance agreement described more fully under the heading “Employment and Related Agreements; Change in Control Arrangements” section, he is continuing to receive this amount, which is his base compensation for one year, on a salary continuation basis. The balance of Mr. Willardson’s 2007 amount consists of life insurance premiums and premiums for Mr. Willardson to continue participation in the Cost Plus health, dental and vision insurance plans after his termination. |

21

Table of Contents

The following table presents information concerning grants of plan-based awards to each of the Named Executive Officers during the fiscal year ended February 2, 2008.

Grants of Plan-Based Awards

For Fiscal Year 2007

Name | Grant Date | Approval Date | Estimated Possible Payouts Under Non-Equity Incentive Plan Awards (1) | Estimated Possible Payouts Under Equity Incentive Plan Awards (2) | All Other Stock Awards: Number of Shares of Stock or Units (#) | All Other Option Awards: Number of Securities Underlying Options (#) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards ($) | ||||||||||||||||

| Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | |||||||||||||||||||

Barry J. Feld | 236,250 | 472,500 | 708,750 | — | — | — | — | — | — | — | ||||||||||||||

| 5/7/2007 | 4/6/2007 | — | — | — | — | — | — | — | 50,000 | 9.38 | 195,000 | |||||||||||||

| 5/7/2007 | 5/1/2007 | — | — | — | 6,250 | 12,500 | 25,000 | — | — | — | — | |||||||||||||

Jane L. Baughman | 65,000 | 130,000 | 195,000 | — | — | — | — | — | — | — | ||||||||||||||

| 5/7/2007 | 4/6/2007 | — | — | — | — | — | — | — | 10,000 | 9.38 | 39,000 | |||||||||||||

| 5/7/2007 | 5/1/2007 | — | — | — | 1,250 | 2,500 | 5,000 | — | — | — | — | |||||||||||||

| 9/5/2007 | 9/5/2007 | — | — | — | — | — | — | — | 30,000 | 4.10 | 51,600 | |||||||||||||

Michael J. Allen | 75,000 | 150,000 | 225,000 | — | — | — | — | — | — | — | ||||||||||||||

| 5/7/2007 | 4/6/2007 | — | — | — | — | — | — | — | 12,000 | 9.38 | 46,800 | |||||||||||||

| 5/7/2007 | 5/1/2007 | — | — | — | 1,750 | 3,500 | 7,000 | — | — | — | — | |||||||||||||

Rayford K. Whitley | 45,000 | 90,000 | 135,000 | — | — | — | — | |||||||||||||||||

| 5/7/2007 | 4/6/2007 | — | — | — | — | — | — | — | 12,000 | 9.38 | 46,800 | |||||||||||||

| 5/7/2007 | 5/1/2007 | — | — | — | 1,250 | 2,500 | 5,000 | — | — | — | — | |||||||||||||

George K. Whitney | 65,000 | 130,000 | 195,000 | — | — | — | — | — | — | — | ||||||||||||||

| 5/7/2007 | 4/6/2007 | — | — | — | — | — | — | — | 12,000 | 9.38 | 46,800 | |||||||||||||

| 5/7/2007 | 5/1/2007 | — | — | — | 1,250 | 2,500 | 5,000 | — | — | — | — | |||||||||||||

Thomas D. Willardson (3) | 93,750 | 187,500 | 281,250 | — | — | — | — | — | — | — | ||||||||||||||

| 5/7/2007 | 4/6/2007 | — | — | — | — | — | — | — | 12,000 | 9.38 | 46,800 | |||||||||||||

| 5/7/2007 | 5/1/2007 | — | — | — | 1,750 | 3,500 | 7,000 | — | — | — | — | |||||||||||||

| (1) | These columns show the range of potential payouts under the Cost Plus Fiscal 2007 Management Incentive Plan as described under the heading “Management Incentive Plan” in the Compensation Discussion and Analysis. The minimum performance targets were not met in fiscal 2007, and no bonus payments were made under the plan. |

| (2) | These columns show the range of payouts targeted for performance share awards granted under the 2004 Stock Plan as described under the heading “Long Term Incentive Program” in the Compensation Discussion and Analysis. The minimum performance targets were not met in fiscal 2007, and no stock will be issued under these awards. |

| (3) | Mr. Willardson’s employment with the Company terminated on August 24, 2007. |

22

Table of Contents

The following table presents certain information concerning equity awards held by the Named Executive Officers at the end of the fiscal year ended February 2, 2008.

Outstanding Equity Awards

at Fiscal 2007 Year-End

| Option Awards | Stock Awards | |||||||||||||||||||

Name | Number of Securities Underlying Unexercised Options (#) (1) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |||||||||||

Barry J. Feld | 4,000 | (2) | — | — | 24.00 | 2/28/2011 | — | — | — | — | ||||||||||

| 5,000 | (2) | — | — | 20.00 | 11/05/2011 | — | — | — | — | |||||||||||

| 4,500 | (2) | — | — | 21.80 | 7/22/2012 | — | — | — | — | |||||||||||

| 6,000 | (2) | — | — | 22.96 | 2/26/2013 | — | — | — | — | |||||||||||