UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-2 |

COST PLUS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

COST PLUS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held June 18, 2009

To our Shareholders:

NOTICE IS HEREBY GIVEN that the 2009 Annual Meeting of Shareholders (the “Annual Meeting”) of Cost Plus, Inc. (the “Company” or “Cost Plus”), a California corporation, will be held on June 18, 2009 at 2:00 p.m., Pacific time, at Cost Plus’ corporate headquarters located at 200 4th Street, Oakland, California 94607, for the following purposes:

| | (1) | To elect eight directors to serve until the 2010 Annual Meeting of Shareholders or until their successors are elected. |

| | (2) | To approve an amendment to the Company’s 2004 Stock Plan to increase the number of shares of Common Stock reserved for issuance under the plan by 1,500,000 shares, including the approval of the material terms and performance goals of the plan for purposes of Internal Revenue Code Section 162(m). |

| | (3) | To approve an amendment to the Company’s 1996 Director Option Plan to increase the number of shares of Common Stock reserved for issuance under the plan by 300,000 shares. |

| | (4) | To ratify and approve the appointment of Deloitte & Touche LLP as Cost Plus’ independent registered public accounting firm for the fiscal year ending January 30, 2010. |

| | (5) | To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

Only shareholders of record at the close of business on April 24, 2009 are entitled to notice of and to vote at the Annual Meeting.

All shareholders are cordially invited to attend the Annual Meeting in person. However, to assure your representation at the Annual Meeting, you are urged to mark, sign and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose or submit your proxy electronically via the Internet or by telephone by following the enclosed instructions. Any shareholder of record attending the Annual Meeting may vote in person even if he or she returned a proxy.

By Order of the Board of Directors

Barry J. Feld

President and Chief Executive Officer

Oakland, California

May 18, 2009

YOUR VOTE IS IMPORTANT

IN ORDER TO ENSURE THAT YOUR SHARES WILL BE REPRESENTED AT THE ANNUAL MEETING, IN THE EVENT YOU ARE NOT PERSONALLY PRESENT, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT IN THE POSTAGE-PAID ENVELOPE PROVIDED OR SUBMIT YOUR PROXY ELECTRONICALLY VIA THE INTERNET OR BY TELEPHONE BY FOLLOWING THE ENCLOSED INSTRUCTIONS.

|

IMPORTANT NOTICE REGARDING THE PROXY MATERIALSFORTHE SHAREHOLDER MEETINGTOBEHELDON JUNE 18, 2009: The Proxy Statement and Annual Report to Shareholders for the fiscal year ended January 31, 2009 are available free of charge at http://materials.proxyvote.com/221485 |

TABLE OF CONTENTS

TABLE OF CONTENTS

(continued)

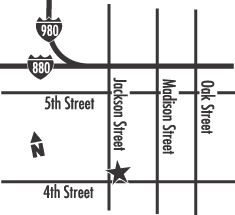

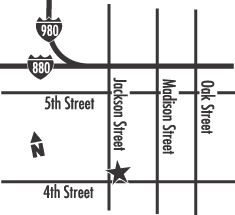

DIRECTIONS TO COST PLUS, INC.’S

CORPORATE HEADQUARTERS

Cost Plus, Inc.

200 4th Street

Oakland, California 94607

(510) 893-7300

Directions from San Francisco

Take the Bay Bridge to Interstate 580 East, to Interstate 980 (Downtown Oakland), which turns into Interstate 880, to Jackson Street. Exit Jackson Street and take a right onto Jackson Street and a left on 4th Street. The corporate headquarters are located at the corner of Jackson and 4th Streets.

Directions from Oakland Airport (and from the south)

Take Interstate 880 North to Oak Street Exit. Exit Oak Street and go straight ahead for two blocks and turn left on Jackson Street. Go two blocks and turn left on 4th Street. The corporate headquarters are located on the corner of Jackson and 4th Streets.

COST PLUS, INC.

ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of our Board of Directors for use at the 2009 Annual Meeting of Shareholders to be held June 18, 2009 at 2:00 p.m., Pacific time, or at any adjournment or postponement thereof, for the purposes set forth in this proxy statement and in the accompanying Notice of Annual Meeting of Shareholders. Our Annual Meeting will be held at our corporate headquarters located at 200 4th Street, Oakland, California 94607. Our telephone number at that location is (510) 893-7300.

These proxy solicitation materials were mailed on or about May 18, 2009 to all shareholders entitled to vote at the Annual Meeting.

Record Date and Voting Securities

Only shareholders of record at the close of business on April 24, 2009 are entitled to notice of and to vote at the Annual Meeting. As of April 24, 2009, there were 22,087,113 shares of our Common Stock issued and outstanding.

Each shareholder is entitled to one vote for each share of Common Stock on all matters presented at the Annual Meeting. Shareholders do not have the right to cumulate their votes in the election of directors.

Methods of Voting

Voting by Proxy—By signing and returning the proxy card according to the enclosed instructions, you are enabling our President and Chief Executive Officer, Barry J. Feld, and our Executive Vice President and Chief Financial Officer, Jane L. Baughman, who are named on the proxy card as “proxies or attorneys-in-fact,” to vote your shares at the meeting in the manner you indicate. We encourage you to sign and return the proxy card even if you plan to attend the meeting. In this way, your shares will be voted even if you are unable to attend the meeting.

Your shares will be voted in accordance with the instructions you indicate on the proxy card. If you submit the proxy card but do not indicate your voting instructions, your shares will be voted as follows:

| | • | | FOR the election of the nominees for director identified in Proposal One; |

| | • | | FOR the approval of the amendment of our 2004 Stock Plan to increase the number of shares of Common Stock authorized for issuance under the plan by 1,500,000 shares, including the approval of the material terms and performance goals of the plan for purposes of Internal Revenue Code Section 162(m) (Proposal Two); |

| | • | | FOR the approval of the amendment of our 1996 Director Option Plan to increase the number of shares of Common Stock reserved for issuance under the plan by 300,000 shares (Proposal Three); and |

| | • | | FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 30, 2010 (Proposal Four). |

1

Voting in Person at the Meeting—If you plan to attend the Annual Meeting and vote in person, we will provide you with a ballot at the meeting. If your shares are registered directly in your name, you are considered the shareholder of record and have the right to vote in person at the meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in your name, but if you wish to vote at the meeting you will need to bring a legal proxy from your broker or other nominee authorizing you to vote these shares.

If you hold shares through a bank, broker, or other record holder, you may vote your shares by following the instructions they have provided to you.

Voting By Telephone or Internet—Instructions for voting by telephone or over the Internet are included in the enclosed proxy card.

How to access the Notice of Annual Meeting, Proxy Statement, and Annual Report on Form 10-K on the Internet.

The Notice of Annual Meeting of Shareholders, Proxy Statement and 2008 Annual Report are available online at http://materials.proxyvote.com/221485. At this website, you will find directions as to how you may access and review all of the important information you need.

Revoking Your Proxy

You may revoke your proxy at any time before it is voted at the Annual Meeting. In order to do this, you must:

| | • | | sign and return another proxy bearing a later date before the beginning of the Annual Meeting; |

| | • | | provide written notice of the revocation to: |

Inspector of Elections

Cost Plus, Inc.

200 4th Street

Oakland, CA 94607

prior to the time we take the vote at the Annual Meeting; or

| | • | | attend the Annual Meeting and request that your proxy be revoked (attendance at the meeting will not by itself revoke a previously granted proxy). |

Solicitation of Votes

We will bear the cost of soliciting proxies. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Solicitation of proxies by mail may be supplemented by telephone, facsimile or personal solicitation by our directors, officers or regular employees. No additional compensation will be paid to such persons for such services. In addition, we have retained Georgeson Shareholder to assist in the solicitation of proxies at an estimated fee of $8,000, plus reimbursement of reasonable out-of-pocket expenses.

Quorum Requirements, Abstentions and Broker Non-Votes

A quorum is necessary to hold a valid meeting. The required quorum for the transaction of business at the Annual Meeting is a majority of the votes eligible to be cast by holders of shares of our Common Stock, whether in person or by proxy, issued and outstanding on the record date.

Abstentions and broker non-votes are counted as present for establishing a quorum for the transaction of business at the Annual Meeting, but neither will be counted as votes cast. A “broker non-vote” occurs when a broker votes on some matters on the proxy card but not on others because the broker does not have authority to do so.

2

A properly executed proxy marked “Abstain” with respect to any such matter will not be voted. Accordingly, an abstention will have the effect of a negative vote.

Under the rules that govern brokers who have record ownership of shares that are held in “street name” for their clients, the beneficial owners of the shares, brokers have discretion to vote these shares on routine matters but not on non-routine matters. If you hold Common Stock through a broker and you have not given voting instructions to the broker, the broker may be prevented from voting shares on non-routine matters, resulting in a “broker non-vote.” Thus, if you do not otherwise instruct your broker, the broker may turn in a proxy card voting your shares “FOR” routine matters but expressly instructing that the broker is NOT voting on non-routine matters. Proposals One and Four contained in this proxy statement are considered routine matters. However, Proposals Two and Three are not considered routine matters.

Votes Required for Each Proposal

The vote required and method of calculation for the proposals to be considered at the Annual Meeting are as follows:

Proposal One—Election of Directors. If a quorum is present, the eight (8) director nominees receiving the highest number of votes, in person or by proxy, will be elected to the board of directors.

You may vote either “for” or “withhold” your vote for the director nominees. A properly executed proxy marked “withhold” with respect to the election of the directors will not be voted with respect to the directors and will not affect the outcome of the election, although it will be counted for purposes of determining whether there is a quorum.

Proposal Two—The amendment and approval of the Cost Plus, Inc. 2004 Stock Plan. The amendment to the Cost Plus, Inc. 2004 Stock Plan will require the affirmative vote of a majority of the shares present and entitled to vote at the Annual Meeting.

You may vote “for,” “against,” or “abstain” from voting on this proposal. If you abstain from voting on this matter, your shares will be counted as present and entitled to vote on the matter for purposes of establishing a quorum, and the abstention will have the same effect as a vote against this proposal.

Proposal Three—The amendment and approval of the Cost Plus, Inc. 1996 Director Stock Plan. The approval of the amendment to the Cost Plus, Inc. 1996 Director Stock Plan will require the affirmative vote of a majority of the shares present and entitled to vote at the Annual Meeting.

You may vote “for,” “against,” or “abstain” from voting on this proposal. If you abstain from voting on this matter, your shares will be counted as present and entitled to vote on the matter for purposes of establishing a quorum, and the abstention will have the same effect as a vote against this proposal.

Proposal Four—Ratification of Deloitte & Touche LLP as our Independent Registered Public Accounting Firm. Ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 30, 2010 will require the affirmative vote of a majority of the shares present and entitled to vote at the Annual Meeting.

You may vote “for,” “against,” or “abstain” from voting on this proposal. If you abstain from voting on this matter, your shares will be counted as present and entitled to vote on the matter for purposes of establishing a quorum, and the abstention will have the same effect as a vote against this proposal.

Shareholder Proposals for 2010 Annual Meeting of Shareholders

As a shareholder, you may be entitled to present proposals, including nominating directors to serve on our Board of Directors, for action at a forthcoming shareholder meeting. Pursuant to the rules of the Securities and

3

Exchange Commission and our Bylaws, proposals that shareholders intend to present at our 2010 Annual Meeting of Shareholders and desire to have included in our proxy materials relating to such meeting must be received by us no later than January 18, 2010, which is 120 calendar days prior to the anniversary of this year’s proxy statement mailing date, and must be in compliance with our bylaws and with applicable laws and regulations (including the regulations of the Securities and Exchange Commission under Rule 14a-8). If the date of next year’s annual meeting is moved more than 30 days before or after the anniversary date of this year’s Annual Meeting, the deadline for inclusion of a proposal in our proxy statement is instead a reasonable time before we begin to print and mail our proxy materials. Proposals should be addressed to:

Corporate Secretary

Cost Plus, Inc.

200 4th Street

Oakland, California 94607

Shareholder proposals that are not intended to be included in the proxy materials for the 2010 Annual Meeting of Shareholders but that are to be presented by the shareholder from the floor are subject to the advance notice provisions contained in our bylaws. In order to be properly brought before the meeting, a proposal not intended for inclusion in our proxy materials must also be received by our corporate secretary at our principal executive offices no later than January 18, 2010.

Shareholders Sharing the Same Address

We have adopted a procedure called “householding,” which has been approved by the Securities and Exchange Commission. Under this procedure, Cost Plus is delivering only one copy of the annual report and proxy statement to multiple shareholders who share the same address, unless we have received contrary instructions from an affected shareholder. This procedure reduces our printing costs, mailing costs, and fees. Shareholders who participate in householding will continue to receive separate proxy cards.

We will deliver, promptly upon written or oral request, a separate copy of the annual report and the proxy statement to any shareholder at a shared address to which a single copy of either of those documents was delivered. To receive a separate copy of the annual report or proxy statement, you may write or call us at the address above, telephone number (510) 893-7300. Any shareholders of record who share the same address and currently receive multiple copies of our annual report and proxy statement who wish to receive only one copy of these materials per household in the future, please contact us at the address or telephone number listed above to participate in the householding program.

A number of brokerage firms have instituted householding. If you hold your shares in “street name,” please contact your bank, broker, or other holder of record to request information about householding.

Other Matters

We know of no other matters to be brought before the Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named in the enclosed proxy will vote the shares they represent as the Board of Directors may recommend.

4

CORPORATE GOVERNANCE

Board of Directors and Committee Meetings

Our Board of Directors held nine meetings during the fiscal year ended January 31, 2009. Each of our directors attended at least 75% of the meetings of the Board of Directors and the committees on which he or she served during their respective periods of service in the fiscal year ended January 31, 2009. Our directors are expected, absent exceptional circumstances, to attend all Board meetings and meetings of committees on which they serve, and are also expected to attend our Annual Meeting of Shareholders. All of our directors who were serving on the Board at the time of the 2008 Annual Meeting attended the meeting.

Our Board of Directors has summarized its corporate governance practices in theCorporate Governance Guidelines for Cost Plus, Inc., a copy of which is available on the Corporate Governance page of the Investor Information section of our website athttp://www.worldmarket.com and is available in print upon request by any shareholder. Our Board of Directors has established four committees: an Audit Committee, a Compensation Committee, a Nominating Committee and a Real Estate Committee. Other than the Real Estate Committee, each committee has a written charter approved by the Board of Directors outlining the principal responsibilities of the committee. These charters are also available on the Corporate Governance page of the Investor Information section of our website.

The members of the committees are identified below:

| | | | | | |

Audit Committee | | Compensation Committee | | Nominating Committee | | Real Estate Committee |

Christopher V. Dodds, Chair | | Kim D. Robbins, Chair | | Danny W. Gurr, Chair | | Joseph H. Coulombe, Chair |

Joseph H. Coulombe | | Clifford J. Einstein | | Kim D. Robbins | | Danny W. Gurr |

Kenneth T. Stevens* | | Fredric M. Roberts | | | | |

Danny W. Gurr | | | | | | |

Fredric M. Roberts | | | | | | |

| * | Mr. Stevens is expected to become chair of the Audit Committee immediately following the Annual Meeting. Mr. Dodds is currently the chair of the committee and will continue to serve in such capacity until the Annual Meeting. |

Audit Committee

The purpose of our Audit Committee is to oversee our accounting and financial reporting processes and audits of our financial statements and to assist the Board of Directors in the oversight and monitoring of (i) the integrity of our financial statements, (ii) Cost Plus’ accounting policies and procedures, (iii) our compliance with legal and regulatory requirements, (iv) our independent registered public accounting firm’s qualifications and independence, (v) our disclosure controls and procedures, and (vi) the performance of our internal audit function and our independent registered public accounting firm. In addition, the Audit Committee’s duties and responsibilities include reviewing and pre-approving any audit and non-audit services to be provided by our independent registered public accounting firm, reviewing, approving and monitoring our Code of Ethics for Principal Executive and Senior Financial Officers and establishing procedures for receiving, retaining and treating complaints regarding accounting, internal accounting controls or auditing matters. The report of the Audit Committee for the fiscal year ended January 31, 2009 is included in this proxy statement under the caption “Report of the Audit Committee.” The charter of the Audit Committee can be found in the Investor Information section of our website atwww.worldmarket.com/assets/corporate_files/audit_com_charter.pdf.

Our Audit Committee held eight meetings in fiscal 2008. Our Audit Committee consisted of directors Christopher V. Dodds, Joseph H. Coulombe and Kim D. Robbins until June 19, 2008 when Messrs. Roberts and Gurr were appointed to the committee. In addition, Mr. Stevens replaced Ms. Robbins on the committee on March 4, 2009. Directors Coulombe, Dodds, Gurr, Roberts and Stevens are independent within the meaning of

5

the rules of the Securities and Exchange Commission and the listing standards of The Nasdaq Stock Market (the “Nasdaq Rules”). Mr. Dodds is currently the Chairman of the Audit Committee and will continue to serve in such capacity until the Annual Meeting. Another director, Kenneth T. Stevens is expected to become Chairman of the Audit Committee immediately following the Annual Meeting. Mr. Dodds has been designated an “audit committee financial expert” within the meaning of the rules of the Securities and Exchange Commission, and the Board has determined that he has the accounting and related financial management expertise to satisfy the requirement that at least one member of the Audit Committee be financially sophisticated within the meaning of the Nasdaq Rules.

Compensation Committee

The purpose of our Compensation Committee is to discharge the Board’s responsibilities for approving and evaluating officer compensation plans, policies and programs, to review and make recommendations regarding compensation for our employees and directors, and to administer our equity compensation plans. The report of the Compensation Committee for the fiscal year ended January 31, 2009 is included in this proxy statement under the caption “Report of the Compensation Committee.” The Compensation Committee of the Board of Directors currently consists of directors Einstein, Robbins and Roberts. The Compensation Committee held five meetings in fiscal 2008. Mr. Roberts served as the Chairman of the Compensation Committee until June 19, 2008, when Ms. Robbins became Chairman of the committee. Each member of the Compensation Committee is independent within the meaning of the Nasdaq Rules. The charter of the Compensation Committee can be found in the Investor Information section of our website athttp://www.worldmarket.com/assets/corporate_files/compensation_com_charter.pdf.

Nominating Committee

The purpose of our Nominating Committee is to assist the Board of Directors in identifying prospective director nominees and recommending director nominees for election to the Board of Directors and its committees. The Nominating Committee currently consists of directors Gurr and Robbins. The Nominating Committee did not hold a meeting in fiscal 2008. Both members of the Nominating Committee are independent within the meaning of the Nasdaq Rules. Mr. Gurr serves as the Chairman of the Nominating Committee. The charter of the Nominating Committee can be found in the Investor Information section of our website athttp://www.worldmarket.com/assets/corporate_files/nominating_com_charter.pdf.

Real Estate Committee

The purpose of our Real Estate Committee is to assist the Board of Directors in reviewing, evaluating and approving or disapproving proposals by management for the opening, closing and moving of retail stores. The Real Estate Committee currently consists of directors Coulombe and Gurr. Our Real Estate Committee held one meeting in fiscal 2008. Mr. Coulombe serves as the Chairman of the Real Estate Committee.

Director Independence

Consistent with the Nasdaq listing standards and Securities and Exchange Commission rules regarding director independence, our Board of Directors has reviewed the independence of our directors and considered whether any director had any relationship with Cost Plus, Inc. or management that would compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities.

As a result of this review, our Board of Directors has affirmatively determined that all of our directors with the exception of Mr. Feld are independent within the meaning of the Nasdaq Rules.

6

Shareholder Communications to Directors

Shareholders may communicate directly with our directors by sending a letter addressed to:

Fredric M. Roberts

Chairman of the Board of Directors

Cost Plus, Inc.

200 4th Street

Oakland, California 94607

email: Fred.Roberts@cpwm.com

Mr. Roberts will ensure that a summary of all received letters is provided to the Board of Directors at its regularly scheduled meetings. Where the nature of a communication warrants, Mr. Roberts may decide to obtain the more immediate attention of the appropriate committee of the Board of Directors or an individual director, management or independent advisors, as Mr. Roberts considers appropriate. Mr. Roberts may decide, in the exercise of his judgment, whether a response to any shareholder communication is necessary.

Policy for Director Recommendations and Nominations

The Nominating Committee considers candidates for Board membership suggested by Board members, management and our shareholders. It is the policy of the Nominating Committee to consider recommendations for candidates to the Board of Directors from any shareholder holding, as of the date the recommendation is submitted, not less than one percent (1%) of the then outstanding shares of our Common Stock continuously for at least 12 months prior to such date. The Nominating Committee will consider a director candidate recommended by our shareholders in the same manner as a nominee recommended by a Board member, management or other sources. In addition, a shareholder may nominate a person directly for election to the Board of Directors at an Annual Meeting of Shareholders provided the shareholder meets the requirements set forth in our Bylaws.

Where the Nominating Committee has either identified a prospective nominee or determines that an additional or replacement director is required, the Nominating Committee may take such measures that it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the Nominating Committee, the Board of Directors or management. In its evaluation of director candidates, including the members of the Board of Directors eligible for re-election, the Nominating Committee considers a number of factors, including:

| | • | | the current size and composition of the Board of Directors and the needs of the Board of Directors and the respective committees of the Board, and |

| | • | | such factors as judgment, independence, character and integrity, age, area of expertise, diversity of experience, length of service and potential conflicts of interest. |

The Nominating Committee has also specified the following minimum qualifications that it believes must be met by a nominee for a position on the Board:

| | • | | the highest personal and professional ethics and integrity, |

| | • | | proven achievement and competence in the nominee’s field and the ability to exercise sound business judgment, |

| | • | | skills that are complementary to those of the existing Board, |

| | • | | the ability to assist and support management and make significant contributions to our success, and |

| | • | | an understanding of the fiduciary responsibilities that is required of a member of the Board of Directors and the commitment of time and energy necessary to diligently carry out those responsibilities. |

7

After completing its evaluation, the Nominating Committee makes a recommendation to the full Board as to the persons who should be nominated to the Board, and the Board of Directors determines the nominees after considering the recommendation and report of the Nominating Committee.

Code of Business Conduct and Code of Ethics for Officers

Our Board of Directors has adopted aCode of Business Conduct and Ethics that is applicable to all of our employees, officers and directors. OurCode of Business Conduct and Ethics is intended to ensure that our employees act in accordance with the highest ethical standards based on respect for the dignity of each individual and a commitment to honesty and fairness. In addition, we have in place aCode of Ethics for Principal Executive and Senior Financial Officers, which applies to our Chief Executive Officer, Chief Financial Officer, and principal accounting officer. This code is intended to deter wrongdoing and promote ethical conduct among our executives and to ensure that all of our public disclosure is full, fair and accurate. TheCode of Business Conduct and the Code of Ethics for Principal Executive and Senior Financial Officers are available on the Corporate Governance page of the Investor Information section of our website athttp://www.worldmarket.com.

Director Compensation

Cash Compensation

Each of our non-employee directors receives an annual retainer of $30,000 for service on the Board and any committee of the Board, except for the Chairman of the Board, who receives an annual retainer of $75,000 in lieu of the standard annual retainer of $30,000 for his services in such capacity. In addition, each non-employee director receives a fee of $3,000 for each Board meeting attended in person, $1,500 for each committee meeting attended (in person or by telephone) and $1,500 for each telephonic Board meeting. Directors are also reimbursed for certain expenses they incur in connection with attendance at Board and committee meetings. The Chairmen of the Compensation and Real Estate Committees each received additional annual compensation of $7,500 in fiscal 2008 for their services in such capacities. The Chairman of the Audit Committee received $10,000 for his services as Chairman of the audit committee in fiscal 2008. Mr. Coulombe, Chairman of our Real Estate Committee, has agreed to a decrease in his annual compensation related to services rendered in his capacity as Chairman of the Real Estate Committee, from $7,500 to $5,000 for fiscal 2009 due to decreased real estate activity.

Equity Compensation

Our 1996 Director Option Plan (the “Director Plan”) provides for our Board of Directors, in its discretion, to award options to purchase Common Stock to non-employee directors. The current practice of our Board of Directors is to approve the grant of an option to purchase 16,000 shares of our Common Stock upon the initial election or appointment to the Board of individuals who are not Company employees (an “Initial Option”). The exercise price for all options granted under the Director Plan is 100% of the fair market value of the shares on the grant date. Assuming continued service on the Board, options granted to non-employee directors prior to 2009 become exercisable in four equal annual installments beginning one year after the date of grant, however, commencing in 2009, options granted to non-employee directors will become exercisable on the two year anniversary after the date of grant. The options granted to the Board of Directors before fiscal year 2005 expire ten years after the date of grant but the options granted after fiscal year 2005 expire seven years after the date of grant. Vesting of options is accelerated in certain circumstances upon a change of control of Cost Plus.

On March 24, 2008, directors Coulombe, Dodds, Einstein, Gurr and Robbins were each granted an option under the Director Plan to purchase 12,000 shares of our Common Stock at an exercise price of $3.61 per share, while Mr. Roberts, as Chairman of the Board, was granted an option to purchase 15,000 shares of our Common Stock at the same exercise price.

8

In connection with their appointment to our Board of Directors during fiscal 2008, Messrs. Mesdag and Stevens were each granted an Initial Option to purchase 16,000 shares of our Common Stock at an exercise price of $0.85 and $1.23 per share, respectively. In addition, in recognition of Mr. Roberts’ extensive responsibilities and duties as Chairman of the Board during fiscal 2008, the Board approved a one-time grant of a fully-vested option to purchase 50,000 shares of our Common Stock at an exercise price of $1.23 per share.

On March 23, 2009, directors Einstein, Coulombe, Robbins, Gurr, Dodds, Stevens, Mesdag and Roberts were each granted an option under the Director Plan to purchase 1,500 shares of our Common Stock at an exercise price of $0.89 per share. Due to the insufficient number of authorized shares currently available under the 1996 Director Option Plan, the Compensation Committee did not approve the full customary annual option grants to our directors under the Director Plan. However, the Compensation Committee expects to approve the grant of additional options in June 2009, subject to approval by shareholders of additional shares increasing the number of shares reserved for issuance under the 1996 Director Option Plan, as described in Proposal Three on page 20 of this proxy statement.

The following table sets forth information concerning compensation paid or accrued for services rendered to Cost Plus in all capacities by the non-employee members of our Board of Directors for the fiscal year ended January 31, 2009.

Director Compensation Summary

For Fiscal Year 2008

| | | | | | | | | | | | | | |

Name | | Fees

Earned or

Paid in

Cash ($) | | Stock

Awards ($) | | Option

Awards

($) (1)(2) | | Non-Equity

Incentive Plan

Compensation

($) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($) | | All Other

Compensation

($) | | Total ($) |

Joseph H. Coulombe | | 78,000 | | — | | 66,832 | | — | | — | | — | | 144,832 |

Christopher V. Dodds | | 77,500 | | — | | 32,584 | | — | | — | | — | | 110,084 |

Clifford J. Einstein | | 52,500 | | — | | 9,458 | | — | | — | | — | | 61,958 |

Danny W. Gurr | | 63,000 | | — | | 66,832 | | — | | — | | — | | 129,832 |

Kim D. Robbins | | 79,500 | | — | | 66,832 | | — | | — | | — | | 146,332 |

Fredric M. Roberts | | 109,500 | | — | | 130,833 | | — | | — | | — | | 240,333 |

Kenneth T. Stevens | | 19,500 | | — | | 885 | | — | | — | | — | | 20,385 |

Willem Mesdag | | 13,500 | | — | | 348 | | — | | — | | — | | 13,848 |

| (1) | The amounts shown do not reflect compensation actually received. Instead, the amounts shown are the compensation costs recognized by Cost Plus for the fiscal year ended January 31, 2009 for stock option awards determined pursuant to Statement of Financial Accounting Standards No. 123 (revised 2004),Share-Based Payment (“SFAS 123(R)”), including amounts recognized with respect to options granted in fiscal 2008 and previous fiscal years. The grant date fair values of the stock options granted to the non-employee directors in fiscal 2008, computed in accordance with SFAS 123(R), were as follows: Mr. Coulombe, $21,120; Mr. Dodds, $21,120; Mr. Einstein, $21,120; Mr. Gurr, $21,120; Ms. Robbins, $21,120; Mr. Stevens, $10,880; Mr. Mesdag, $7,480; and Mr. Roberts, $87,900. The fiscal 2008 option grants consisted of 12,000 shares to each non-employee director other than Mr. Roberts, who was granted options to purchase a total of 65,000 shares for serving as Chairman of the Board, and Messrs. Stevens and Mesdag who were each granted an option to purchase 16,000 shares when they joined the Board. The assumptions used to calculate the value of option awards are set forth in Note 1 of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for fiscal 2008. |

| (2) | As of January 31, 2009, the non-employee directors held options to purchase the following shares of Common Stock, all of which were granted under the 1996 Director Option Plan: Mr. Coulombe, 79,013; Mr. Dodds, 36,000; Mr. Einstein, 28,000; Mr. Gurr, 93,475; Ms. Robbins, 79,585; Mr. Stevens, 16,000; Mr. Mesdag, 16,000 and Mr. Roberts, 159,418. |

9

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

Our Board of Directors currently consists of nine directors. Mr. Dodds will not stand for re-election to our Board of Directors and the authorized number of directors will be reduced to eight concurrently with the Annual Meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the eight nominees named below, all of whom are presently directors. If any of our nominees is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by the present Board of Directors to fill the vacancy. Our management has no reason to believe that any of the nominees will be unable or unwilling to serve if elected. The term of office of each person elected as a director will continue until the next Annual Meeting of Shareholders or until such person’s successor has been elected and qualified. Nominations of persons for election to our Board of Directors may be made by any shareholder of our Company entitled to vote in the election of directors at the Annual Meeting who complies with the notice procedures set forth in our Bylaws.

Vote Required

The eight nominees receiving the highest number of affirmative votes of the holders of the shares of our Common Stock represented in person or by proxy and entitled to vote on the proposal shall be elected to the Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES LISTED BELOW.

The names of the nominees, their ages as of the date of this proxy statement and certain information about them are set forth below:

| | | | | | |

Name of Nominee | | Age | | Principal Occupation | | Director

Since |

Joseph H. Coulombe | | 78 | | Independent management consultant | | 1995 |

Clifford J. Einstein | | 70 | | Founding Partner, Dailey and Associates Advertising | | 2007 |

Barry J. Feld | | 52 | | Chief Executive Officer and President | | 2001 |

Danny W. Gurr | | 51 | | Independent management consultant | | 1995 |

Willem Mesdag | | 55 | | Partner, Red Mountain Capital Partners LLC | | 2008 |

Kim D. Robbins | | 63 | | Retired retail executive | | 1999 |

Fredric M. Roberts | | 66 | | Retired investment banker | | 1999 |

Kenneth T. Stevens | | 57 | | Retired President, Chief Operating Officer and Secretary of Tween Brands Inc | | 2008 |

Except as set forth below, each of the nominees has been engaged in his or her principal occupation described above during the past five years. There is no family relationship between any director and executive officer of Cost Plus.

Mr. Coulombe has been engaged in independent management consulting since April 1995. Previously, he was employed in an executive capacity by several retailing and grocery businesses and as an independent business consultant. From February 1995 to April 1995, Mr. Coulombe served as President and Chief Executive Officer of Sport Chalet, Inc., a sporting goods retailer. From February 1994 to January 1995, Mr. Coulombe served as Chief Executive Officer of Provigo Corp., a wholesale and retail grocer. From November 1992 to February 1994, Mr. Coulombe was an independent business consultant. From March 1992 to October 1992,

10

Mr. Coulombe served as Executive Vice President of Pacific Enterprises, with principal responsibility for Thrifty Corporation, an operator of drug and sporting goods chain stores. He also served as Co-Chairman of Thrifty Corporation during that time. From June 1989 through March 1992, Mr. Coulombe served as an independent business consultant. Mr. Coulombe is the founder of Trader Joe’s, a specialty food grocery chain, and he served as its Chief Executive Officer from 1957 to 1989. Mr. Coulombe currently serves as a director of True Religion Apparel, Inc., a manufacturer of high-end, contemporary, designer women’s and men’s jeans.

Mr. Einstein served as Chairman of Dailey and Associates, an international advertising agency headquartered in West Hollywood, California, from 1994 until his retirement in 2006. Prior to his position as Chairman, Mr. Einstein served as President of Dailey and Associates from 1983 to 1994. He was Dailey and Associates’ original Executive Creative Director and served in that role as well for 35 years. Mr. Einstein currently serves as a director of Merchant House International, an Australian manufacturer of home textiles and footwear.

Mr. Feld was appointed Chief Executive Officer and President of Cost Plus, Inc. in October 2005. From August 1999 until October 2005, Mr. Feld was President, Chief Executive Officer and Chairman of the Board of Directors of PCA International, Inc., the largest North American operator of portrait studios focused on serving the discount retail market. From November 1998 to June 1999, Mr. Feld was President and Chief Operating Officer of Vista Eyecare, Inc., a specialty eyecare retailer. He joined Vista Eyecare as a result of its acquisition of New West Eyeworks, Inc., where he had been serving as President and a director since May 1991 and as Chief Executive Officer and a Director since February 1994. From 1987 to May 1991, Mr. Feld was with Frame-n-Lens Optical, Inc., where he served as its president prior to joining New West. Prior to that, he served in various senior management positions at Pearle Health Services for 10 years and, for a number of years, he served as an acquisition and turnaround specialist for optical retail groups acquired by Pearle. PCA International filed for protection under Chapter 11 of the federal Bankruptcy Code in August 2006.

Mr. Gurr served as Interim President and Chief Operating Officer of Cost Plus, Inc. from March 2005 until October 2005. Since September 2004, Mr. Gurr has also been serving as Director and President of Make Believe Ideas, Inc., a publisher of children’s books. From January 2002 until July 2003, Mr. Gurr served as the President of Quarto Holdings, Inc., a leading international co-edition publisher. From April 1998 to July 2001, Mr. Gurr served as President and a director of Dorling Kindersley Publishing Inc., a publisher of illustrated books, videos and multi-media products. From September 1991 to February 1998, Mr. Gurr served as President and Chief Executive Officer of Lauriat’s Books, Inc., an operator of various bookstore chains. From November 1995 until June 1997, Mr. Gurr served as President and Chief Executive Officer of Chadwick Miller, Inc., an importer and wholesaler of housewares and gifts. Mr. Gurr is a director of Hastings Entertainment, Inc., a leading multimedia entertainment retailer.

Mr. Mesdaghas been a Partner of Red Mountain Capital Partners LLC, an investment firm, since January 2005. Mr. Mesdag also serves as a director of 3i Group plc, Encore Capital Group, Inc. and Davis Petroleum Corporation. Before establishing Red Mountain Capital Partners LLC, Mr. Mesdag was an investment banker at Goldman, Sachs & Co. Mr. Mesdag joined Goldman, Sachs & Co. in 1981 and became a General Partner in 1990.

Ms. Robbins is a retired retail executive who worked in various department store and specialty store businesses. From 1997 to 2002, Ms. Robbins was the Director of Product Development for Jack Nadel, Inc., a direct response promotion agency specializing in creative marketing and merchandise solutions. From 1996 to 1997, she was the Executive Vice President and General Merchandise Manager of House of Fabrics, Inc., which operates sewing and craft stores throughout the United States. From 1995 to 1996, she was the Vice President of Merchandising for Sport Chalet Inc., a sporting goods retailer. From 1976 to 1993, Ms. Robbins served in capacities of increasing responsibility at Carter Hawley Hale, culminating in her appointment as Senior Vice President and General Merchandising Manager.

11

Mr. Roberts is retired and was appointed Chairman of the Board in March 2005. Mr. Roberts served as President of F.M. Roberts & Company, Inc., an investment-banking firm he established in 1980, for more than 20 years. Mr. Roberts has over 30 years of investment banking experience, including executive corporate finance positions with Lehman Brothers, Loeb, Rhoades & Co., E.F. Hutton & Co. and Cantor, Fitzgerald & Co., Inc. Mr. Roberts served as 1993 Chairman of the Board of Governors of the National Association of Securities Dealers, which at that time owned and operated The Nasdaq Stock Market. From 1994 to 1996, he was a member of the Nasdaq Board of Directors and its Executive Committee. Mr. Roberts also serves as a director and Chairman of the Compensation Committee of Tween Brands, Inc, a specialty retailer of branded apparel and lifestyle products for girls.

Mr. Stevens was the president, chief operating officer and secretary of Tween Brands, Inc., a publicly traded retailer with 785 locations in the U.S, from 2006 through 2008. From 2002 until 2006, Mr. Stevens worked at Limited Brands, Inc., where he held various positions, the most recent of which was executive vice president and chief financial officer. Prior to working at Limited Brands, Inc., Mr. Stevens worked at several private and public companies, including Bank One Retail Group, PepsiCo, Inc. and General Mills, Inc. From 1983 to 1991, Mr. Stevens was a partner at McKinsey & Company, Inc. Mr. Stevens currently serves on the boards of Virgin Mobile USA, Inc. and Spartan Stores, Inc.

12

PROPOSAL TWO

AMENDMENT AND APPROVAL OF THE 2004 STOCK PLAN

The 2004 Stock Plan was adopted by our Board of Directors in May 2004 and approved by our shareholders in July 2004. An aggregate of 900,000 shares were initially reserved for issuance under the 2004 Stock Plan, plus up to 100,000 remaining shares available for grant under our 1995 Stock Option Plan, and up to 800,000 shares subject to outstanding options under our 1995 Stock Option Plan if they expire unexercised. The 2004 Stock Plan was amended in 2006 to increase the share reserve under the 2004 Stock Plan by an additional 1,000,000 shares.

Our Board of Directors believes that long-term incentive compensation programs align the interests of management, employees and the shareholders to create long-term shareholder value. The Board believes that plans such as the 2004 Stock Plan increase the Company’s ability to achieve this objective by allowing for several different forms of long-term incentive awards, which the Board believes will help us recruit, reward, motivate and retain talented personnel. The 2004 Stock Plan provides for the grant of options to purchase shares of our common stock, stock appreciation rights (“SARs”), restricted stock, performance shares, performance units, and deferred stock units (each referred to as “awards”) to employees and consultants of Cost Plus. As of January 31, 2009, options to purchase 1,853,954 shares were issued and outstanding under the 2004 Stock Plan, no options to purchase shares of our common stock have been exercised, and options to purchase 950,046 shares remained available for future grants. As of January 31, 2009, the closing price of our common stock was $0.96 per share.

In April 2009, our Board of Directors approved a proposal to amend the 2004 Stock Plan, subject to shareholder approval, to increase the shares reserved for issuance thereunder by 1,500,000 shares and to provide that no more than 30% of the shares remaining under the 2004 Stock Plan as of the date of shareholder approval of this amendment, and shares subsequently added to the 2004 Stock Plan by virtue of options expiring under the 1995 Stock Option Plan, will be issued under awards with an exercise price or purchase price that is less than 100% of fair market value on the date of grant. We are seeking shareholder approval of this proposed amendment to the 2004 Stock Plan.

In addition, we are seeking shareholder approval of the material terms of the 2004 Stock Plan and the performance goals thereunder to enable us to continue to deduct in full for federal income tax purposes the compensation recognized by our executive officers in connection with certain awards granted under the 2004 Stock Plan. Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) (“Section 162(m)”), generally denies a corporate tax deduction for annual compensation exceeding $1,000,000 paid to the chief executive officer and other “covered employees” as determined under Section 162(m) and applicable guidance. However, certain types of compensation, including performance-based compensation, are generally excluded from this deductibility limit. To take advantage of Section 162(m)’s exception for performance-based compensation where the compensation committee has authority to change the targets under a performance goal (as is the case with the 2004 Stock Plan), the material terms of the performance goals must be disclosed to and reapproved by shareholders within 5 years of the previous shareholder approval. Our shareholders previously approved the material terms of the 2004 Plan in June 2004. To enable compensation in connection with awards granted under the 2004 Stock Plan to continue to qualify as “performance-based” within the meaning of Section 162(m), we are seeking shareholder approval of the material terms of the 2004 Stock Plan, including the eligible participants, performance goals, and limits to the number of shares that may be granted on an annual basis through individual awards.

13

Please see the summary of the 2004 Stock Plan below.

Summary of the 2004 Stock Plan (including proposed amendment to reserve an additional 1,500,000 shares for issuance)

The essential features of the 2004 Stock Plan are summarized below.

General. The purposes of the 2004 Stock Plan are to attract and retain the best available personnel for positions of substantial responsibility, provide additional incentive to our employees and consultants, and promote the success of our business.

Administration. The 2004 Stock Plan may be administered by our Board of Directors or a committee, which our Board of Directors may appoint from among its members (the “Administrator”). Subject to the provisions of the 2004 Stock Plan, the Administrator has the authority to: (i) determine the fair market value of our common stock; (ii) select the persons to whom awards are to be granted; (iii) determine whether and to what extent awards are granted; (iv) subject to individual fiscal year limits applicable to each type of award, determine the number of shares to be made subject to each award; (v) approve forms of agreement for use under the 2004 Stock Plan; (vi) determine the terms and conditions applicable to awards generally and of each individual award; (vii) construe and interpret the terms of the 2004 Stock Plan and each award; (viii) prescribe, amend or rescind rules and regulations relating to the 2004 Stock Plan; (ix) to modify or amend each award; (x) authorize any person to execute on behalf of the Company any instrument required to effect the grant of an option or SAR previously granted by the Administrator; (xi) allow participants to satisfy withholding tax obligations by electing to have the Company withhold from the shares or cash to be issued upon exercise, vesting of an award (or distribution of a deferred stock unit) that number of shares or cash having a fair market value equal to the minimum amount required to be withheld; (xii) determine the terms and restrictions applicable to awards; and (xiii) subject to certain limitations, take any other actions deemed necessary or advisable for the administration of the 2004 Stock Plan. All decisions, interpretations and other actions of the Administrator will be final and binding on all holders of options or rights and on all persons deriving their rights therefrom.

Reserved Shares. The maximum number of shares that may be subject to awards under the 2004 Stock Plan is 3,400,000 shares plus up to 100,000 shares which remain available for grant under our 1995 Stock Option Plan, and up to an additional 800,000 shares which are subject to outstanding options under our 1995 Stock Option Plan if they expire unexercised. However, no more than 30% of the shares available for issuance under the 2004 Stock Plan as of June 18, 2009, the date of shareholder approval, and shares subsequently added to the 2004 Stock Plan by virtue of options expiring under the 1995 Stock Option Plan may be granted pursuant to awards with an exercise price or purchase price that is less than 100% of fair market value on the date of grant.

Eligibility. The 2004 Stock Plan provides that awards may be granted to our employees and consultants. Incentive stock options may only be granted to employees.

Section 162(m). Section 162(m) of the Code places limits on the deductibility for federal income tax purposes of compensation paid to certain of our executive officers. We have designed the 2004 Stock Plan so that it permits us to issue awards that qualify as performance-based under Section 162(m) of the Code.

At the Administrator’s discretion, one or more of the following performance goals may apply:

14

| | • | | Total shareholder return |

The performance goals may differ from participant to participant and from award to award.

Options. The Administrator is able to grant nonstatutory stock options and incentive stock options under the 2004 Stock Plan. The Administrator determines the number of shares subject to each option, although the 2004 Stock Plan provides that a participant may not receive options and stock appreciation rights to purchase more than 300,000 shares in any fiscal year.

The Administrator determines the exercise price of options at the time the options are granted, provided the exercise price of incentive stock options and nonstatutory stock options that are intended to qualify as “performance-based compensation” within the meaning of Code Section 162(m) must be at least equal to the fair market value of our common stock on the date of grant. Other nonstatutory stock options must have an exercise price equal to no less than 25% of fair market value on the grant date. In addition, the exercise price of an incentive stock option granted to any participant who owns more than 10% of the total voting power of all classes of our outstanding stock must be at least 110% of the fair market value of the common stock on the grant date. No option granted under the 2004 Stock Plan may be repriced without shareholder approval, including by means of an exchange for another award.

The term of each option will be stated in the award agreement. The term of an option may not exceed 10 years, except that, with respect to any participant who owns 10% of the voting power of all classes of the Company’s outstanding capital stock, the term of an incentive stock option may not exceed 5 years.

After a termination of service with the Company, a participant will be able to exercise the vested portion of his or her option for the period of time stated in the award agreement. If no such period of time is stated in the participant’s award agreement, the participant will generally be able to exercise his or her option for (i) 30 days following his or her termination for reasons other than death or disability, and (ii) 12 months following his or her termination due to death or disability. In no event may an option be exercised later than the expiration of its term.

Stock Appreciation Rights. The Administrator will be able to grant stock appreciation rights, which are the rights to receive the appreciation in fair market value of Common Stock between the exercise date and the date of grant. The Company can pay the appreciation in either cash, or shares of our common stock, or a combination thereof. Stock appreciation rights will become exercisable at the times and on the terms established by the Administrator, subject to the terms of the 2004 Stock Plan. The Administrator, subject to the terms of the 2004 Stock Plan, will have complete discretion to determine the terms and conditions of stock appreciation rights granted under the 2004 Stock Plan, provided that the term of a stock appreciation right may not exceed 10 years and no stock appreciation right may be repriced without shareholder approval, including by means of an exchange for another award. The 2004 Stock Plan provides that a participant may not receive options and stock appreciation rights to purchase more than 300,000 shares in any fiscal year.

After termination of service with the Company, a participant will be able to exercise the vested portion of his or her stock appreciation right for the period of time stated in the award agreement. If no such period of time is stated in a participant’s award agreement, a participant will generally be able to exercise his or her stock appreciation right for (i) 30 days following his or her termination for reasons other than death or disability, and (ii) 12 months following his or her termination due to death or disability. In no event will a stock appreciation right be exercised later than the expiration of its term.

Restricted Stock. Awards of restricted stock are rights to acquire or purchase shares of our common stock, which vest in accordance with the terms and conditions established by the Administrator in its sole discretion.

15

Subject to the terms and conditions of the 2004 Stock Plan, restricted stock may be granted to our employees and consultants at any time and from time to time at the discretion of the Administrator. The Administrator will have complete discretion to determine (i) the number of shares subject to a restricted stock award granted to any participant and (ii) the conditions for grant or for vesting that must be satisfied, which typically will be based principally or solely on continued provision of services but may include a performance-based component. However, no participant will be granted more than 200,000 shares of restricted stock in any of Cost Plus’ fiscal years. Until the shares are issued, no right to vote or receive dividends or any other rights as a shareholder will exist with respect to the underlying shares. Each restricted stock grant will be evidenced by an agreement that will specify the purchase price (if any) and such other terms and conditions as the Administrator will determine;provided,however, that if the restricted stock grant has a purchase price, the purchase price must be paid no more than 10 years following the date of grant.

Performance Shares. The Administrator will be able to grant performance shares, which are awards that will result in a payment to a participant only if the performance goals or other vesting criteria the Administrator may establish are achieved or the awards otherwise vest. Subject to the terms and conditions of the 2004 Stock Plan, performance shares may be granted to our employees and consultants at any time and from time to time as will be determined at the discretion of the Administrator. The Administrator will have complete discretion to determine (i) the number of shares of our common stock subject to a performance share award granted to any service provider and (ii) the conditions that must be satisfied for grant or for vesting, which typically will be based principally or solely on achievement of performance milestones but may include a service-based component.However, no participant will be granted more than 200,000 units of performance shares in any of Costs Plus’ fiscal years. Each performance share grant will be evidenced by an agreement that will specify such other terms and conditions as the Administrator, in its sole discretion, will determine.

Performance Units. Performance units are similar to performance shares, except that they will be settled in cash equivalent to the fair market value of the underlying shares of our common stock, determined as of the vesting date. The shares available for issuance under the 2004 Stock Plan will not be diminished as a result of the settlement of a performance unit. Each performance unit grant will be evidenced by an agreement that will specify such terms and conditions as will be determined at the discretion of the Administrator. However, no participant will be granted performance units having an initial value greater than $1,000,000 in any of Cost Plus’ fiscal years, except that a newly hired participant may receive performance units with an initial value up to $2,000,000 in the year in which his or her service commences.

Deferred Stock Units. Deferred stock units consist of a restricted stock, performance share or performance unit award that the Administrator, in its sole discretion, permits to be paid out in installments or on a deferred basis, in accordance with rules and procedures established by the Administrator. Deferred stock units are subject to the individual annual limits that apply to each type of award.

Non-Transferability of Awards. Unless determined otherwise by the Administrator, an award granted under the 2004 Stock Plan may not be sold, pledged, assigned, hypothecated, transferred, or disposed of in any manner other than by will or by the laws of descent or distribution and may be exercised, during the lifetime of the recipient, only by the recipient. If the Administrator makes an award granted under the 2004 Stock Plan transferable, such award will contain such additional terms and conditions as the Administrator deems appropriate.

Acceleration upon Death. In the event that a participant dies while a service provider, 100% of his or her awards will immediately vest.

Change of Control. In the event of a change of control of the Company, each outstanding award granted under the 2004 Stock Plan will become fully vested. Cost Plus also may elect to take certain other actions in the event of our change of control, including accelerating, terminating and canceling outstanding awards in exchange for a per share payment for each share subject to the outstanding awards equal to the number (or amount) and kind of stock, securities, cash, property or other consideration that each holder of a share was entitled to receive in

16

connection with the change of control, reduced in some cases by the per share strike price. We may also elect to have deferred stock units assumed by the acquirer for distribution according to their existing distribution schedule.

Capitalization Changes. In the event that our capital stock is changed by reason of any stock split, reverse stock split, stock dividend, combination or recapitalization, or any other increase or decrease in the number of issued shares of common stock effected without receipt of consideration by the Company, appropriate proportional adjustments will be made in the number and class of shares of stock subject to the 2004 Stock Plan, the individual fiscal year limits applicable to awards, the number and class of shares of stock subject to any award outstanding under the 2004 Stock Plan, and the exercise price of any such outstanding option or SAR or other award. Any such adjustment will be made upon approval of the Compensation Committee of our Board of Directors, whose determination will be conclusive.

Amendment, Suspensions and Termination of the 2004 Stock Plan. Our Board of Directors may amend, alter, suspend or terminate the 2004 Stock Plan at any time, except that shareholder approval is required for any amendment to the 2004 Stock Plan to the extent required by any applicable laws. No amendment, alteration, suspension or termination of the 2004 Stock Plan will impair the rights of any participant, unless mutually agreed otherwise between the participant and the Administrator and which agreement must be in writing and signed by the participant and the Company. The 2004 Stock Plan will terminate in April 2014, unless our Board of Directors terminates it earlier.

Number of Awards Granted to Employees and Consultants

The number of awards that an employee or consultant may receive under the 2004 Stock Plan is in the discretion of the Administrator and therefore cannot be determined in advance. The following table sets forth (i) the aggregate number of shares of common stock subject to options granted under the 2004 Stock Plan from February 3, 2008, the beginning of our last fiscal year, to April 24, 2009, and (ii) the average per share exercise price of such options. No performance shares, stock appreciation rights, deferred stock units or restricted stock have been granted under the 2004 Stock Plan.

| | | | | |

Name of Individual or Group | | Number of

Options

Granted | | Average

Exercise

Price |

Barry J. Feld President and Chief Executive Officer | | 350,000 | | $ | 2.83 |

Jane L. Baughman Executive Vice President, Chief Financial Officer and Corporate Secretary | | 70,000 | | $ | 2.25 |

Joan S. Fujii Executive Vice President, Human Resources | | 70,000 | | $ | 2.25 |

Rayford K. Whitley Former Senior Vice President, Supply Chain | | 70,000 | | $ | 2.25 |

George K. Whitney Senor Vice President, Merchandising | | 70,000 | | $ | 2.25 |

Michael J. Allen Former Executive Vice President, Store Operations | | 35,000 | | $ | 3.61 |

All Named Executive Officers, as a group | | 665,000 | | $ | 2.63 |

All directors who are not Named Executive Officers, as a group | | 0 | | | — |

All employees who are not Named Executive Officers, as a group | | 921,500 | | $ | 2.09 |

Federal Tax Aspects

The following paragraphs are a summary of the general federal income tax consequences to U.S. taxpayers and us of Awards granted under the 2004 Stock Plan. Tax consequences for any particular individual may be different.

Nonstatutory Stock Options. No taxable income is reportable when a nonstatutory stock option with an exercise price equal to the fair market value of the underlying stock on the date of grant is granted to a

17

participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the excess of the fair market value (on the exercise date) of the shares purchased over the exercise price of the option. Any taxable income recognized in connection with an option exercise by an employee of the Company is subject to tax withholding by the Company. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss.

Incentive Stock Options. No taxable income is reportable when an incentive stock option is granted or exercised (except for purposes of the alternative minimum tax, in which case taxation is the same as for nonstatutory stock options). If the participant exercises the option and then later sells or otherwise disposes of the shares more than two years after the grant date and more than one year after the exercise date, the difference between the sale price and the exercise price will be taxed as capital gain or loss. If the participant exercises the option and then later sells or otherwise disposes of the shares before the end of the two- or one-year holding periods described above, he or she generally will have ordinary income at the time of the sale equal to the fair market value of the shares on the exercise date (or the sale price, if less) minus the exercise price of the option.

Stock Appreciation Rights. No taxable income is reportable when a stock appreciation right with an exercise price equal to the fair market value of the underlying stock on the date of grant is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the amount of cash received and the fair market value of any shares received. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss.

Restricted Stock, Performance Units, Performance Shares, and Deferred Stock Units. A participant generally will not have taxable income at the time an award of restricted stock, performance shares, performance units, or deferred stock units are granted. Instead, he or she will recognize ordinary income in the first taxable year in which his or her interest in the shares underlying the Award becomes either (i) freely transferable, or (ii) no longer subject to substantial risk of forfeiture. However, the recipient of a restricted stock award may elect to recognize income at the time he or she receives the award in an amount equal to the fair market value of the shares underlying the award (less any cash paid for the shares) on the date the Award is granted.

Tax Effect for Us. We generally will be entitled to a tax deduction in connection with an award under the 2004 Stock Plan in an amount equal to the ordinary income realized by a participant and at the time the participant recognizes such income (for example, the exercise of a nonstatutory stock option). Special rules limit the deductibility of compensation paid to our Chief Executive Officer and to “covered employees” within the meaning of Section 162(m) of the Code. Under Section 162(m) of the Code, the annual compensation paid to any of these specified executives will be deductible only to the extent that it does not exceed $1,000,000. However, we can preserve the deductibility of certain compensation in excess of $1,000,000 if the conditions of Section 162(m) are met. These conditions include shareholder approval of the 2004 Stock Plan, setting limits on the number of awards that any individual may receive and for awards other than certain stock options, establishing performance criteria that must be met before the award actually will vest or be paid. The 2004 Stock Plan has been designed to permit the Administrator to grant awards that qualify as performance-based for purposes of satisfying the conditions of Section 162(m), thereby permitting us to continue to receive a federal income tax deduction in connection with such awards.

Section 409A. Section 409A of the Code, which was added by the American Jobs Creation Act of 2004, provides certain new requirements on non-qualified deferred compensation arrangements. These include new requirements with respect to an individual’s election to defer compensation and the individual’s selection of the timing and form of distribution of the deferred compensation. Section 409A also generally provides that distributions must be made on or following the occurrence of certain events (e.g., the individual’s separation from service, a predetermined date, or the individual’s death). Section 409A imposes restrictions on an individual’s ability to change his or her distribution timing or form after the compensation has been deferred. For certain individuals who are officers, Section 409A requires that such individual’s distribution commence no earlier than six months after such officer’s separation from service.

18

Awards granted under the 2004 Stock Plan with a deferral feature will be subject to the requirements of Section 409A. If an award is subject to and fails to satisfy the requirements of Section 409A, the recipient of that award will recognize ordinary income on the amounts deferred under the Award, to the extent vested, which may be prior to when the compensation is actually or constructively received. Also, if an award that is subject to Section 409A fails to comply with Section 409A’s provisions, Section 409A imposes an additional 20% federal income tax on compensation recognized as ordinary income, as well as possible interest charges and penalties. Certain states have enacted laws similar to Section 409A which impose additional taxes, interest and penalties on non-qualified deferred compensation arrangements. We will also have withholding and reporting requirements with respect to such amounts.

THE FOREGOING IS ONLY A SUMMARY OF THE EFFECT OF FEDERAL INCOME TAXATION UPON PARTICIPANTS AND THE COMPANY WITH RESPECT TO THE GRANT AND EXERCISE OF AWARDS UNDER THE 2004 STOCK PLAN. IT DOES NOT PURPORT TO BE COMPLETE, AND DOES NOT DISCUSS THE TAX CONSEQUENCES OF A PARTICIPANT’S DEATH OR THE PROVISIONS OF THE INCOME TAX LAWS OF ANY MUNICIPALITY, STATE OR FOREIGN COUNTRY IN WHICH THE PARTICIPANT MAY RESIDE.

Vote Required

Approval of the amendment to the 2004 Stock Plan and to meet the shareholder approval requirements of Section 162(m) requires the affirmative vote of holders of a majority of the shares of our Common Stock that are present in person or by proxy and entitled to vote at the Annual Meeting.

Our executive officers have an interest in this proposal as they may receive awards under the 2004 Stock Plan.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF THE AMENDMENT TO THE 2004 STOCK PLAN TO INCREASE THE SHARES RESERVED THEREUNDER BY 1,500,000 SHARES AND OF THE MATERIAL TERMS OF THE 2004 STOCK PLAN FOR SECTION 162(M) PURPOSES.

19

PROPOSAL THREE

AMENDMENT AND APPROVAL OF THE 1996 DIRECTOR OPTION PLAN

The 1996 Director Option Plan (the “Director Plan”) was adopted by our Board of Directors and approved by our shareholders in March 1996. Our Board of Directors believes that the Director Plan serves as an incentive to current Directors, helps align their interests with those of our shareholders, and is an important factor in attracting and retaining qualified persons willing to serve on our Board of Directors.

Under the terms of the Director Plan, the exercise price of each option is the market value of our common stock on the date of grant. In addition, these options have terms of 10 years but terminate earlier if the individual ceases to serve as a director. A cumulative total of 703,675 shares of our common stock have been reserved for issuance under the Director Plan prior to the amendment described in this Proposal Three. As of January 31, 2009 options to purchase 550,991 shares were issued and outstanding under the Director Plan, options to purchase 128,968 shares of our common stock had been exercised, and options to purchase 13,215 shares remained available for future grants. As of January 31, 2009, the closing price of our common stock was $0.96 per share.

In April 2009, our Board of Directors approved a proposal to amend the Director Plan to increase the shares reserved for issuance thereunder by 300,000 shares. We are seeking shareholder approval of the proposed amendment to the Director Plan.

Please see the summary of the Director Plan below.

Summary of the 1996 Director Option Plan (including proposed amendment to reserve an additional 300,000 shares for issuance)

The essential features of the Director Plan are summarized below.

Purpose. The purposes of the Director Plan are to attract and retain the best available individuals for service as non-employee directors of Cost Plus, to provide additional incentive to the non-employee directors and to encourage their continued service on our Board of Directors.

Administration. The Director Plan is administered by our Board of Directors or our Compensation Committee (the “Committee”). All grants of options under the Director Plan are subject to the discretion of the Committee pursuant to the terms of the Director Plan. All questions of interpretation or application of the Director Plan are determined by our Board of Directors, whose decisions are final and binding upon all participants.

Reserved Shares. The maximum number of shares that may be subject to option grants under the Director Plan is 1,003,675 shares, which includes 300,000 new shares.

Eligibility. Options under the Director Plan may be granted only to non-employee directors or, if a non-employee director represents an entity, directly to the entity employing the non-employee director. We currently have seven non-employee directors, all of whom have been nominated for election at our 2009 Annual Meeting of Shareholders.

Options. The Committee is able to grant nonstatutory stock options under the Director Plan. The specific terms of each option granted under the Director Plan are determined by the Committee. Each option granted under the Director Plan is evidenced by a written stock option agreement between the Company and the optionee. Each option term can only be up 10 years, and the exercise price of options will equal 100% of the fair market value per share of the Company’s common stock on the date of grant.

20