UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04526 | |

Name of Registrant: | Vanguard Quantitative Funds | |

Address of Registrant: | P.O. Box 2600 | |

| Valley Forge, PA 19482 | ||

Name and address of agent for service: | Heidi Stam, Esquire | |

| P.O. Box 876 | ||

| Valley Forge, PA 19482 | ||

Registrant’s telephone number, including area code: (610) 669-1000 | ||

Date of fiscal year end: September 30 | ||

Date of reporting period: October 1, 2015 – March 31, 2016 | ||

Item 1: Reports to Shareholders | ||

Semiannual Report | March 31, 2016

Vanguard Growth and Income Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisors’ Report. | 7 |

| Fund Profile. | 11 |

| Performance Summary. | 12 |

| Financial Statements. | 13 |

| About Your Fund’s Expenses. | 33 |

| Glossary. | 35 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Pictured is a sailing block on the Brilliant, a 1932 schooner docked in Mystic, Connecticut. A type of pulley, the

sailing block helps coordinate the setting of the sails. At Vanguard, the intricate coordination of technology and people allows

us to help millions of clients around the world reach their financial goals.

Your Fund’s Total Returns

| Six Months Ended March 31, 2016 | |

| Total | |

| Returns | |

| Vanguard Growth and Income Fund | |

| Investor Shares | 8.07% |

| Admiral™ Shares | 8.12 |

| S&P 500 Index | 8.49 |

| Large-Cap Core Funds Average | 6.23 |

Large-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements.

Your Fund’s Performance at a Glance

September 30, 2015, Through March 31, 2016

| Distributions Per Share | ||||

| Starting | Ending | Income | Capital | |

| Share Price | Share Price | Dividends | Gains | |

| Vanguard Growth and Income Fund | ||||

| Investor Shares | $39.55 | $40.09 | $0.388 | $2.265 |

| Admiral Shares | 64.57 | 65.45 | 0.668 | 3.697 |

1

Chairman’s Letter

Dear Shareholder,

Despite a resurgence of volatility early in the second half of the period, U.S. stocks produced solid gains for the six months ended March 31, 2016. Stocks of larger-capitalization companies generally outpaced those of smaller firms.

Vanguard Growth and Income Fund, which focuses on mid- and large-cap stocks, returned about 8% for the period. It finished behind its benchmark, the Standard & Poor’s 500 Index, but ahead of the average return of its peers.

The fund posted gains in all ten industry sectors, with stocks of information technology, consumer staples, and industrials companies adding most to returns. However, the fund’s holdings in some of the top-performing sectors failed to keep pace with their counterparts in the index.

Stocks charted an uneven course en route to a favorable outcome

The broad U.S. stock market returned about 7% over the six months. The period began and ended strongly, with fluctuations in the middle as China’s economic slowdown and falling oil and commodity prices worried investors.

Stocks rallied in March as investors again seemed encouraged by news about monetary policy. The Federal Reserve indicated, after a mid-March meeting, that it would raise interest rates fewer times in 2016 than previously anticipated. And central

2

bankers in Europe and Asia kept up stimulus measures to combat weak growth and low inflation.

International stocks returned about 3% for the period after surging more than 8% in March. Stocks from emerging markets and from developed markets of the Pacific region outperformed European stocks, which were nearly flat.

Bonds produced gains following a subpar start

After posting weak results for the first three months of the period, bonds managed solid gains in the final three. The broad U.S. taxable bond market returned 2.44% for the fiscal half year.

With stocks volatile and the Fed proceeding cautiously with rate hikes, bonds proved attractive. The yield of the 10-year U.S. Treasury note closed at 1.77% at the end of March, down from 2.05% six months earlier. (Bond prices and yields move in opposite directions.)

Returns for money market funds and savings accounts remained limited by the Fed’s target rate of 0.25%–0.5%—still low despite rising a quarter percentage point in December.

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned 6.90%. International bonds got a boost as foreign currencies strengthened against the dollar, a turn-about from the trend of recent years.

| Market Barometer | |||

| Total Returns | |||

| Periods Ended March 31, 2016 | |||

| Six | One | Five Years | |

| Months | Year | (Annualized) | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 7.75% | 0.50% | 11.35% |

| Russell 2000 Index (Small-caps) | 2.02 | -9.76 | 7.20 |

| Russell 3000 Index (Broad U.S. market) | 7.30 | -0.34 | 11.01 |

| FTSE All-World ex US Index (International) | 3.09 | -8.53 | 0.70 |

| Bonds | |||

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 2.44% | 1.96% | 3.78% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 3.20 | 3.98 | 5.59 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.06 | 0.08 | 0.04 |

| CPI | |||

| Consumer Price Index | 0.08% | 0.85% | 1.28% |

3

Even without this currency benefit, however, international bond returns were solidly positive.

The fund delivered solid gains despite trailing its benchmark

The Growth and Income Fund provides broad exposure to the large- and mid-cap segments of the U.S. stock market. Each of the fund’s three advisors uses its own quantitative approach to screen stocks based on fundamental data such as earnings growth prospects and balance-sheet quality. All share the goal of outpacing the fund’s benchmark over the long term without taking on significant additional risk.

As I mentioned earlier in this letter, the fund produced positive results in all ten sectors for the most recent six months, with information technology, consumer staples, and industrials contributing most to overall performance. Together, the fund’s holdings in these three sectors accounted for almost 5 percentage points of its total return.

The fund’s underperformance relative to its benchmark can be attributed to its smaller returns in a handful of sectors. Although they notched impressive returns, the fund’s holdings in information technology and industrials failed to keep pace with their counterparts in the index. This was also true of energy, health care, and utilities.

| Expense Ratios | |||

| Your Fund Compared With Its Peer Group | |||

| Investor | Admiral | Peer Group | |

| Shares | Shares | Average | |

| Growth and Income Fund | 0.34% | 0.23% | 1.11% |

The fund expense ratios shown are from the prospectus dated January 26, 2016, and represent estimated costs for the current fiscal year. For

the six months ended March 31, 2016, the fund’s annualized expense ratios were 0.32% for Investor Shares and 0.21% for Admiral Shares.

The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures information through

year-end 2015.

Peer group: Large-Cap Core Funds.

4

Financials, which is one of the largest sectors, was also a relatively bright spot, as the fund’s holdings in this sector outpaced their benchmark counterparts by a wide margin. The fund also had a stronger showing than its benchmark in the lightly held materials sector.

For more about the advisors’ strategy and the Growth and Income Fund’s positioning during the six months, please see the Advisors’ Report that follows this letter.

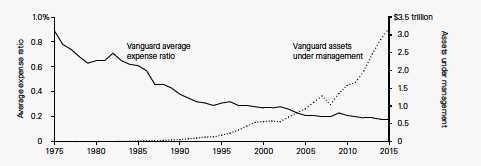

| Vanguard’s growth translates into lower costs for you |

| Research indicates that lower-cost investments have tended to outperform higher-cost ones. |

| So it’s little wonder that funds with lower expense ratios—including those at Vanguard—have |

| dominated the industry’s cash inflows in recent years. |

| Vanguard has long been a low-cost leader, with expenses well below those of many other |

| investment management companies. That cost difference remains a powerful advantage for |

| Vanguard clients. Why? Because a lower expense ratio allows a fund to pass along a greater |

| share of its returns to its investors. |

| What’s more, as you can see in the chart below, we’ve been able to lower our costs continually |

| as our assets under management have grown. Our steady growth has not been an explicit |

| business objective. Rather, we focus on putting our clients’ interests first at all times, and |

| giving them the best chance for investment success. But economies of scale—the cost |

| efficiencies that come with our growth—have allowed us to keep lowering our fund costs, |

| even as we invest in our people and technology. |

| The benefit of economies of scale |

| Note: Data are for U.S.-based Vanguard funds only. |

| Source: Vanguard. |

5

Consider rebalancing to manage your risk

Let’s say you’ve taken the time to carefully create an appropriate asset allocation for your investment portfolio. Your efforts have produced a diversified mix of stock, bond, and money market funds tailored to your goals, time horizon, and risk tolerance.

But what should you do when your portfolio drifts from its original asset allocation as the financial markets rise or fall? Consider rebalancing to bring it back to the proper mix.

Just one year of outsized returns can throw your allocation out of whack. Take 2013 as an example. That year, the broad stock market (as measured by the Russell 3000 Index) returned 33.55% and the broad taxable bond market (as measured by the Barclays U.S. Aggregate Bond Index) returned –2.02%. A hypothetical portfolio that tracked the broad domestic market indexes and started the year with 60% stocks and 40% bonds would have ended with a more aggressive mix of 67% stocks and 33% bonds.

Rebalancing to bring your portfolio back to its original targets would require you to shift assets away from areas that have been performing well toward those that have been falling behind. That isn’t easy or intuitive. It’s a way to minimize risk rather than maximize returns and to stick with your investment plan through different types of markets. (You can read more about our approach in Best Practices for Portfolio Rebalancing at vanguard.com/research.)

It’s not necessary to check your portfolio every day or every month, much less rebalance it that frequently. It may be more appropriate to monitor it annually or semiannually and rebalance when your allocation swings 5 percentage points or more from its target.

It’s important, of course, to be aware of the tax implications. You’ll want to consult with your tax advisor, but generally speaking, it may be a good idea to make any asset changes within a tax-advantaged retirement account or to direct new cash flows into the underweighted asset class.

However you go about it, keeping your asset allocation from drifting too far off target can help you stay on track with the investment plan you’ve crafted to meet your financial goals.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

April 12, 2016

6

Advisors’ Report

Vanguard Growth and Income Fund’s Investor Shares returned 8.07% for the six months ended March 31, 2016. The Admiral Shares returned 8.12%. The S&P 500 Index returned 8.49%, and the average return of large-capitalization core funds was 6.23%.

Your fund is managed by three independent advisors, a strategy that enhances the fund’s diversification by providing exposure to distinct yet complementary investment approaches. It is not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The advisors, the percentage of fund assets each manages, and brief descriptions of their investment strategies are presented in the table below. The advisors have also prepared a discussion of the investment environment that existed during the fiscal half year and of how the portfolio’s positioning reflects this assessment. (Please note that Los Angeles Capital’s discussion refers to industry sectors as defined by Russell classifications, rather than by the Global Industry Classification Standard used elsewhere in this report.) These comments were prepared on April 18, 2016.

| Vanguard Growth and Income Fund Investment Advisors | |||

| Fund Assets Managed | |||

| Investment Advisor | % | $ Million | Investment Strategy |

| Los Angeles Capital | 33 | 2,049 | Employs a quantitative model that emphasizes stocks |

| with characteristics investors are currently seeking and | |||

| underweights stocks with characteristics investors are | |||

| currently avoiding. The portfolio’s sector weights, size, | |||

| and style characteristics may differ modestly from the | |||

| benchmark in a risk-controlled manner. | |||

| D. E. Shaw Investment | 33 | 2,042 | Employs quantitative models that seek to capture |

| Management, L.L.C. | predominantly “bottom up” stock-specific return | ||

| opportunities while aiming to keep the portfolio’s | |||

| sector weights, size, and style characteristics similar to | |||

| the benchmark. | |||

| Vanguard Quantitative Equity | 33 | 2,040 | Employs a quantitative fundamental management |

| Group | approach, using models that assess valuation, growth | ||

| prospects, management decisions, market sentiment, | |||

| and earnings and balance-sheet quality of companies | |||

| as compared with their peers. | |||

| Cash Investments | 1 | 129 | These short-term reserves are invested by Vanguard in |

| equity index products to simulate investments in | |||

| stocks. Each advisor also may maintain a modest cash | |||

| position. | |||

7

Los Angeles Capital

Portfolio Managers:

Thomas D. Stevens, CFA,

Chairman and Principal

Hal W. Reynolds, CFA,

Chief Investment Officer and Principal

The S&P 500 Index generated an 8.49% return for the six months ended March 31, 2016, as share prices recovered from January’s lows. Although falling equity volatility and rising energy prices eased credit concerns, investors remained concerned that earnings weakness could broaden outside of the energy and materials sectors.

The best-performing stocks over the six months were those with larger market capitalization and higher dividend yields. Stocks of companies with a large percentage of revenues outside the United States also performed well. These themes were driven by falling bond yields and a recent reversal in dollar strength. The high-yielding telecommunication services and utilities sectors outperformed and the internet subsector also posted strong gains. The biotechnology and financials segments lagged, with banks especially weak as low interest rates continued to impact net interest margins.

Over the six months, the portfolio maintained a bias towards lower-volatility stocks with strong analyst sentiment that contributed positively to returns. In addition, the portfolio’s tilt toward yield added value as investors sought stocks with higher payout ratios. Its bias toward

smaller-cap stocks and its underweighting of stocks with foreign revenues modestly detracted from results. In terms of sectors, lower exposure to utilities detracted, while overweighting consumer staples and materials contributed to returns.

Although the market continues to favor companies with strong profit margins, value-linked factors such as stronger earnings yield and stronger dividend yield are increasingly attractive. Investors are still penalizing volatile assets, along with riskier factors such as leverage and distress. The portfolio is tilted away from higher-growth segments of the market such as biotechnology, internet, and retail, and is tilted towards consumer staples.

D. E. Shaw Investment

Management, L.L.C.

Portfolio Managers:

Anne Dinning, Ph.D., Managing Director

and Chief Investment Officer

Philip Kearns, Ph.D., Managing Director

The S&P 500 Index fluctuated during the six months, but ended the period with a return of 8.5% after a strong rally in the final six weeks. After much anticipation, the Federal Reserve raised interest rates in mid-December. Possibly because it had been telegraphed well ahead of time, the move seemed to have little effect on equity markets. The price of crude oil fell during the period but showed some signs of life at the tail end; the oil component of the S&P GSCI Commodity Index, for example, dropped 40% through mid-February but finished down only 15%.

8

Global equity markets exhibited mixed performance, with the MSCI Pacific Index returning 4.9% and the MSCI Europe Index essentially flat. The Shanghai Composite Index had returned 20% as of the third week in December, but gave it all back after the People’s Bank of China cut the yuan fixing rate by nearly 1.5% over a period of eight days. European stocks fell in December after the European Central Bank (ECB) lowered its deposit rate to –0.3% and extended its bond purchase program by six months. The Eurostoxx 50 Index lost 9.5% in eight days following the ECB announcement.

While we actively monitor such market activity, we generally do not make portfolio decisions based on a subjective analysis of the investment environment, aside from attempting to mitigate newly emergent risk factors identified by the firm. There were no such occurrences during the half year.

Our quantitative equity investment process deploys alpha models that seek to forecast individual stock returns and deploys risk models that seek to mitigate active exposures to industries, sectors, and common risk factors. However, in constructing the equity portfolios, this process may result in small to moderate active exposures to industries, sectors, and risk factors as a by-product of our focus on bottom-up stock selection. We therefore generally attribute portfolio performance to three major sources: bottom-up stock selection; exposure to risk factors such as value, growth, and market capitalization; and exposure to industry groups.

Stock selection was the main reason for the underperformance of our portfolio, followed by exposure to certain industry groups. The largest drag on relative performance came from an overweight exposure to multiple segments of the pharmaceutical and energy sectors. Overall exposure to risk factors did not contribute materially to relative performance. Although underweight exposure to high-dividend-yield stocks and overweight exposure to high-volatility stocks detracted from relative performance, these were largely counterbalanced by underweight exposure to momentum stocks.

The three largest single-stock contributors were an underweight position in Bank of America, an overweight position in AT&T, and an underweight position in JP Morgan Chase & Co. The three largest single-stock detractors were underweight positions in Facebook and Verizon Communications and an overweight position in Williams.

The U.S. economy appears to be picking up strength, with unemployment remaining at or below 5% and the economy adding over 1.4 million nonfarm payroll jobs during the period. However, uncertainty and signs of weakness in various regions and sectors of the world economy could still dampen equity market returns. Japanese and core European five-year interest rates are currently negative, which may indicate troubled economic times ahead. In addition, China’s economy is still relatively weak, and the direction of oil prices remains uncertain. And while markets are generally anticipating that the Fed will raise interest rates again this year, there is much debate about the timing and size of the hike.

9

Vanguard Quantitative Equity Group

Portfolio Managers:

Michael R. Roach, CFA

James P. Stetler, Principal

Binbin Guo, Principal, Head of Equity

Research and Portfolio Strategies

Moving into 2016, the U.S. economy continued to grow, but at a slower pace. Fourth quarter 2015 real GDP grew 1.4%, down from 2.0% in the third quarter. The deceleration was mainly attributed to downturns in nonresidential fixed investment, exports, and state and local government spending. Corporate profits decreased 8.1%, reflecting the largest quarterly decline since the first quarter of 2011. The job market further improved, however. Total nonfarm payroll employment rose by 215,000 in March, while the unemployment rate was slightly changed at 5.0%.

In the first quarter of 2016, oil prices declined significantly but then recovered, increasing by more than 40% from mid-February’s bottom. This volatility spilled over into the global stock markets as they saw similar price action in the same quarter.

The U.S. Federal Reserve raised interest rates in December, after keeping rates near zero since 2008. Further gradual interest rate hikes are expected later this year, but they are dependent on the direction of global economic data. Even as the United States begins experiencing higher interest rates, several other central banks, including the European Central Bank and the Bank of Japan, are experimenting with negative interest rates in an attempt to spur economic growth.

Over the period, our growth and management models contributed positively to performance, but our sentiment, valuation, and quality models did not perform as expected. We were able to produce positive stock selection results in five of the ten sectors in the benchmark. Our strongest results were in consumer discretionary, telecommunication services, and financials. Our worst results were in energy and information technology.

At the individual stock level, the largest contributions came from overweight positions in PVH Corp, Leggett and Platt, and CenturyLink. In addition, when comparing the portfolio’s performance relative to its benchmark’s, we benefited from underweighting or avoiding poorly performing stocks such as Chipotle Mexican Grill, Staples, and Netflix.

Unfortunately, we were not able to avoid all bad performers. Overweight positions in Transocean Ltd, Marathon Petroleum Corporation, and Ensco Plc directly lowered performance. Also, underweighting companies that were not positively identified by the fundamentals in our model, such as Chevron Corporation and Facebook Inc., hurt our overall outperformance relative to the benchmark.

10

Growth and Income Fund

Fund Profile

As of March 31, 2016

| Share-Class Characteristics | ||

| Investor | Admiral | |

| Shares | Shares | |

| Ticker Symbol | VQNPX | VGIAX |

| Expense Ratio1 | 0.34% | 0.23% |

| 30-Day SEC Yield | 1.87% | 1.99% |

| Portfolio Characteristics | |||

| DJ | |||

| U.S. Total | |||

| S&P 500 | Market | ||

| Fund | Index | FA Index | |

| Number of Stocks | 949 | 504 | 3,900 |

| Median Market Cap | $52.6B | $79.4B | $52.5B |

| Price/Earnings Ratio | 18.6x | 20.5x | 21.8x |

| Price/Book Ratio | 2.8x | 2.8x | 2.7x |

| Return on Equity | 18.5% | 18.5% | 17.5% |

| Earnings Growth | |||

| Rate | 8.2% | 7.6% | 8.0% |

| Dividend Yield | 2.3% | 2.2% | 2.1% |

| Foreign Holdings | 0.2% | 0.0% | 0.0% |

| Turnover Rate | |||

| (Annualized) | 99% | — | — |

| Short-Term Reserves | 0.5% | — | — |

| Sector Diversification (% of equity exposure) | |||

| DJ | |||

| U.S. Total | |||

| S&P 500 | Market | ||

| Fund | Index FA Index | ||

| Consumer | |||

| Discretionary | 12.2% | 12.9% | 13.6% |

| Consumer Staples | 11.5 | 10.4 | 9.2 |

| Energy | 6.4 | 6.8 | 6.1 |

| Financials | 15.0 | 15.6 | 17.4 |

| Health Care | 14.5 | 14.3 | 13.7 |

| Industrials | 10.3 | 10.1 | 10.7 |

| Information | |||

| Technology | 20.1 | 20.8 | 20.1 |

| Materials | 3.7 | 2.8 | 3.2 |

| Telecommunication | |||

| Services | 3.0 | 2.8 | 2.5 |

| Utilities | 3.3 | 3.5 | 3.5 |

| Volatility Measures | ||

| DJ | ||

| U.S. Total | ||

| S&P 500 | Market | |

| Index | FA Index | |

| R-Squared | 0.99 | 0.99 |

| Beta | 0.98 | 0.96 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| Ten Largest Holdings (% of total net assets) | ||

| Apple Inc. | Technology | |

| Hardware, Storage & | ||

| Peripherals | 3.3% | |

| Johnson & Johnson | Pharmaceuticals | 2.3 |

| Microsoft Corp. | Systems Software | 2.0 |

| Exxon Mobil Corp. | Integrated Oil & Gas | 1.7 |

| AT&T Inc. | Integrated | |

| Telecommunication | ||

| Services | 1.6 | |

| Alphabet Inc. | Internet Software & | |

| Services | 1.6 | |

| Wells Fargo & Co. | Diversified Banks | 1.5 |

| Coca-Cola Co. | Soft Drinks | 1.2 |

| Amazon.com Inc. | Internet Retail | 1.2 |

| Altria Group Inc. | Tobacco | 1.1 |

| Top Ten | 17.5% | |

The holdings listed exclude any temporary cash investments and equity index products.

Investment Focus

1 The expense ratios shown are from the prospectus dated January 26, 2016, and represent estimated costs for the current fiscal year. For the six

months ended March 31, 2016, the annualized expense ratios were 0.32% for Investor Shares and 0.21% for Admiral Shares.

11

Growth and Income Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

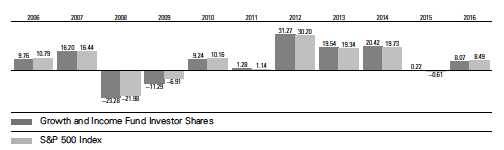

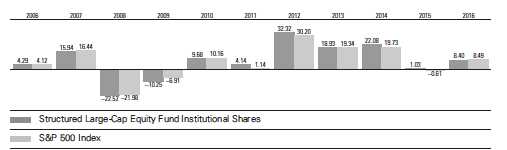

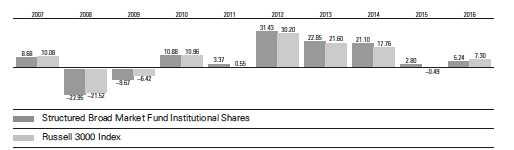

Fiscal-Year Total Returns (%): September 30, 2005, Through March 31, 2016

Average Annual Total Returns: Periods Ended March 31, 2016

| Inception | One | Five | Ten | |

| Date | Year | Years | Years | |

| Investor Shares | 12/10/1986 | 1.75% | 11.98% | 6.31% |

| Admiral Shares | 5/14/2001 | 1.88 | 12.10 | 6.44 |

See Financial Highlights for dividend and capital gains information.

12

Growth and Income Fund

Financial Statements (unaudited)

Statement of Net Assets

As of March 31, 2016

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Common Stocks (97.6%)1 | |||

| Consumer Discretionary (11.9%) | |||

| * | Amazon.com Inc. | 122,581 | 72,769 |

| Home Depot Inc. | 471,519 | 62,915 | |

| Walt Disney Co. | 464,223 | 46,102 | |

| McDonald’s Corp. | 278,970 | 35,061 | |

| Target Corp. | 377,623 | 31,071 | |

| Comcast Corp. Class A | 475,170 | 29,023 | |

| Time Warner Cable Inc. | 123,026 | 25,174 | |

| Lowe’s Cos. Inc. | 322,852 | 24,456 | |

| Omnicom Group Inc. | 270,032 | 22,475 | |

| Darden Restaurants Inc. | 334,609 | 22,185 | |

| Leggett & Platt Inc. | 438,340 | 21,216 | |

| * | Priceline Group Inc. | 15,600 | 20,108 |

| L Brands Inc. | 210,780 | 18,509 | |

| Time Warner Inc. | 254,205 | 18,443 | |

| Interpublic Group of Cos. | |||

| Inc. | 783,716 | 17,986 | |

| Carnival Corp. | 324,256 | 17,111 | |

| General Motors Co. | 474,041 | 14,899 | |

| NIKE Inc. Class B | 239,700 | 14,734 | |

| Wyndham Worldwide Corp. | 192,650 | 14,724 | |

| PVH Corp. | 142,150 | 14,081 | |

| Best Buy Co. Inc. | 423,670 | 13,744 | |

| * | O’Reilly Automotive Inc. | 50,013 | 13,687 |

| Marriott International Inc. | |||

| Class A | 175,600 | 12,499 | |

| Goodyear Tire & Rubber | |||

| Co. | 374,218 | 12,342 | |

| ^ | Nordstrom Inc. | 192,518 | 11,014 |

| GameStop Corp. Class A | 329,500 | 10,455 | |

| * | Netflix Inc. | 97,100 | 9,927 |

| News Corp. Class B | 749,142 | 9,926 | |

| * | Discovery Communications | ||

| Inc. Class A | 329,393 | 9,430 | |

| VF Corp. | 123,300 | 7,985 | |

| Staples Inc. | 528,733 | 5,832 | |

| * | AutoZone Inc. | 7,118 | 5,671 |

| Twenty-First Century Fox | |||

| Inc. Class A | 200,554 | 5,591 | |

| * | Liberty Global plc | 132,800 | 4,988 |

| * | Michael Kors Holdings Ltd. | 85,840 | 4,889 |

| Viacom Inc. Class B | 111,800 | 4,615 | |

| Johnson Controls Inc. | 112,740 | 4,393 | |

| * | Mohawk Industries Inc. | 19,820 | 3,784 |

| Hanesbrands Inc. | 133,100 | 3,772 | |

| * | AutoNation Inc. | 75,800 | 3,538 |

| TEGNA Inc. | 140,475 | 3,296 | |

| Kohl’s Corp. | 64,470 | 3,005 | |

| DR Horton Inc. | 85,054 | 2,571 | |

| Tiffany & Co. | 34,700 | 2,546 | |

| * | Ulta Salon Cosmetics & | ||

| Fragrance Inc. | 12,700 | 2,460 | |

| * | Discovery Communications | ||

| Inc. | 78,302 | 2,114 | |

| * | DISH Network Corp. | ||

| Class A | 42,566 | 1,969 | |

| Aramark | 49,800 | 1,649 | |

| Hasbro Inc. | 19,727 | 1,580 | |

| Hilton Worldwide Holdings | |||

| Inc. | 65,857 | 1,483 | |

| Restaurant Brands | |||

| International Inc. | 35,960 | 1,396 | |

| Bloomin’ Brands Inc. | 71,337 | 1,203 | |

| Graham Holdings Co. | |||

| Class B | 2,354 | 1,130 | |

| News Corp. Class A | 82,820 | 1,058 | |

| * | Liberty Ventures Class A | 24,700 | 966 |

| Cable One Inc. | 2,155 | 942 | |

| Royal Caribbean Cruises | |||

| Ltd. | 10,585 | 870 | |

| Service Corp. International | 35,000 | 864 | |

| Gannett Co. Inc. | 54,195 | 820 | |

| * | TripAdvisor Inc. | 12,200 | 811 |

| * | Sirius XM Holdings Inc. | 199,800 | 789 |

| * | Vista Outdoor Inc. | 14,100 | 732 |

| * | Sally Beauty Holdings Inc. | 21,200 | 686 |

| TJX Cos. Inc. | 8,269 | 648 | |

| Twenty-First Century Fox | |||

| Inc. | 21,400 | 603 |

13

Growth and Income Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | Liberty Global plc Class A | 15,600 | 601 |

| Magna International Inc. | 12,900 | 554 | |

| Wendy’s Co. | 48,200 | 525 | |

| Whirlpool Corp. | 2,557 | 461 | |

| Starbucks Corp. | 6,600 | 394 | |

| ^ | Lions Gate Entertainment | ||

| Corp. | 18,000 | 393 | |

| * | Michaels Cos. Inc. | 13,800 | 386 |

| Fiat Chrysler Automobiles | |||

| NV | 46,600 | 376 | |

| CST Brands Inc. | 9,600 | 368 | |

| * | Liberty Media Corp. | 9,447 | 360 |

| * | LKQ Corp. | 10,800 | 345 |

| Rent-A-Center Inc. | 20,100 | 319 | |

| * | Denny’s Corp. | 23,600 | 244 |

| * | Houghton Mifflin Harcourt | ||

| Co. | 11,100 | 221 | |

| * | Liberty Media Corp. Class A | 5,400 | 209 |

| * | Restoration Hardware | ||

| Holdings Inc. | 4,700 | 197 | |

| Newell Rubbermaid Inc. | 4,167 | 185 | |

| PulteGroup Inc. | 8,800 | 165 | |

| Time Inc. | 9,700 | 150 | |

| DeVry Education Group Inc. | 7,000 | 121 | |

| * | NVR Inc. | 60 | 104 |

| Churchill Downs Inc. | 682 | 101 | |

| * | La Quinta Holdings Inc. | 8,042 | 101 |

| * | Isle of Capri Casinos Inc. | 6,527 | 91 |

| Cheesecake Factory Inc. | 1,700 | 90 | |

| Marriott Vacations | |||

| Worldwide Corp. | 1,331 | 90 | |

| * | New York & Co. Inc. | 19,273 | 76 |

| Libbey Inc. | 3,900 | 73 | |

| Nutrisystem Inc. | 3,000 | 63 | |

| Gentex Corp. | 3,900 | 61 | |

| * | Bed Bath & Beyond Inc. | 1,070 | 53 |

| Aaron’s Inc. | 2,000 | 50 | |

| Sonic Automotive Inc. | |||

| Class A | 2,400 | 44 | |

| Barnes & Noble Inc. | 3,400 | 42 | |

| La-Z-Boy Inc. | 1,500 | 40 | |

| * | TopBuild Corp. | 1,300 | 39 |

| * | Murphy USA Inc. | 600 | 37 |

| * | Party City Holdco Inc. | 2,340 | 35 |

| * | Liberty TripAdvisor Holdings | ||

| Inc. Class A | 1,500 | 33 | |

| Chico’s FAS Inc. | 2,500 | 33 | |

| * | Bojangles’ Inc. | 1,900 | 32 |

| Gap Inc. | 1,080 | 32 | |

| Citi Trends Inc. | 1,596 | 28 | |

| Cato Corp. Class A | 700 | 27 | |

| Texas Roadhouse Inc. Class A | 600 | 26 | |

| * | Townsquare Media Inc. | ||

| Class A | 2,302 | 26 | |

| ClubCorp Holdings Inc. | 1,764 | 25 |

| * | Sears Holdings Corp. | 1,590 | 24 | |

| * | Liberty Broadband Corp. | 400 | 23 | |

| Carter’s Inc. | 200 | 21 | ||

| * | Live Nation Entertainment | |||

| Inc. | 900 | 20 | ||

| Genuine Parts Co. | 200 | 20 | ||

| Journal Media Group Inc. | 1,600 | 19 | ||

| * | Lee Enterprises Inc. | 9,597 | 17 | |

| Yum! Brands Inc. | 200 | 16 | ||

| * | Chegg Inc. | 3,500 | 16 | |

| * | Express Inc. | 700 | 15 | |

| * | Ruby Tuesday Inc. | 2,670 | 14 | |

| * | Biglari Holdings Inc. | 34 | 13 | |

| Signet Jewelers Ltd. | 100 | 12 | ||

| * | Nautilus Inc. | 600 | 12 | |

| Ross Stores Inc. | 200 | 12 | ||

| * | ServiceMaster Global | |||

| Holdings Inc. | 300 | 11 | ||

| Williams-Sonoma Inc. | 200 | 11 | ||

| * | Tumi Holdings Inc. | 400 | 11 | |

| * | Starz | 400 | 11 | |

| Lennar Corp. Class A | 200 | 10 | ||

| Wolverine World Wide Inc. | 500 | 9 | ||

| * | Regis Corp. | 600 | 9 | |

| * | Container Store Group Inc. | 1,400 | 8 | |

| * | Liberty Interactive Corp. | |||

| QVC Group Class A | 300 | 8 | ||

| * | Barnes & Noble Education Inc. | 700 | 7 | |

| * | Carrols Restaurant Group Inc. | 454 | 7 | |

| Haverty Furniture Cos. Inc. | 300 | 6 | ||

| International Game | ||||

| Technology plc | 335 | 6 | ||

| * | MGM Resorts International | 234 | 5 | |

| * | Caesars Entertainment Corp. | 700 | 5 | |

| * | Mattress Firm Holding Corp. | 100 | 4 | |

| * | J Alexander’s Holdings Inc. | 365 | 4 | |

| * | Cherokee Inc. | 200 | 4 | |

| * | Perry Ellis International Inc. | 107 | 2 | |

| 745,733 | ||||

| Consumer Staples (11.2%) | ||||

| Coca-Cola Co. | 1,674,904 | 77,699 | ||

| Altria Group Inc. | 1,108,712 | 69,472 | ||

| Procter & Gamble Co. | 805,141 | 66,271 | ||

| Wal-Mart Stores Inc. | 877,877 | 60,126 | ||

| PepsiCo Inc. | 497,178 | 50,951 | ||

| Philip Morris International | ||||

| Inc. | 402,921 | 39,531 | ||

| General Mills Inc. | 499,098 | 31,618 | ||

| Kimberly-Clark Corp. | 234,890 | 31,595 | ||

| Dr Pepper Snapple Group | ||||

| Inc. | 318,006 | 28,436 | ||

| CVS Health Corp. | 246,099 | 25,528 | ||

| Kroger Co. | 614,159 | 23,492 | ||

| Clorox Co. | 183,844 | 23,175 | ||

| ConAgra Foods Inc. | 455,115 | 20,307 | ||

14

Growth and Income Fund

| Market | ||||

| Value• | ||||

| Shares | ($000) | |||

| Campbell Soup Co. | 271,544 | 17,322 | ||

| Colgate-Palmolive Co. | 208,160 | 14,706 | ||

| Mondelez International Inc. | ||||

| Class A | 361,800 | 14,515 | ||

| Sysco Corp. | 278,139 | 12,997 | ||

| Hershey Co. | 140,205 | 12,911 | ||

| Tyson Foods Inc. Class A | 188,735 | 12,581 | ||

| Coca-Cola Enterprises Inc. | 240,810 | 12,219 | ||

| Kraft Heinz Co. | 149,300 | 11,729 | ||

| Archer-Daniels-Midland Co. | 261,437 | 9,493 | ||

| Kellogg Co. | 116,323 | 8,905 | ||

| Constellation Brands Inc. | ||||

| Class A | 44,700 | 6,754 | ||

| Bunge Ltd. | 73,800 | 4,182 | ||

| Church & Dwight Co. Inc. | 40,082 | 3,695 | ||

| Mead Johnson Nutrition Co. | 41,200 | 3,501 | ||

| Walgreens Boots Alliance | ||||

| Inc. | 40,000 | 3,370 | ||

| Whole Foods Market Inc. | 90,100 | 2,803 | ||

| Costco Wholesale Corp. | 15,320 | 2,414 | ||

| Molson Coors Brewing Co. | ||||

| Class B | 5,500 | 529 | ||

| Hormel Foods Corp. | 10,079 | 436 | ||

| *,^ | Pilgrim’s Pride Corp. | 16,400 | 417 | |

| Spectrum Brands Holdings | ||||

| Inc. | 3,600 | 393 | ||

| * | Edgewell Personal Care Co. | 4,800 | 387 | |

| McCormick & Co. Inc. | 1,390 | 138 | ||

| Reynolds American Inc. | 2,203 | 111 | ||

| * | Adecoagro SA | 6,100 | 70 | |

| Brown-Forman Corp. Class B | 700 | 69 | ||

| * | Sprouts Farmers Market Inc. | 1,700 | 49 | |

| * | Hain Celestial Group Inc. | 900 | 37 | |

| Lancaster Colony Corp. | 300 | 33 | ||

| JM Smucker Co. | 221 | 29 | ||

| Dean Foods Co. | 1,300 | 22 | ||

| Flowers Foods Inc. | 800 | 15 | ||

| * | SunOpta Inc. | 3,200 | 14 | |

| * | USANA Health Sciences Inc. | 100 | 12 | |

| 705,059 | ||||

| Energy (6.2%) | ||||

| Exxon Mobil Corp. | 1,247,902 | 104,312 | ||

| Schlumberger Ltd. | 498,693 | 36,779 | ||

| Phillips 66 | 309,140 | 26,768 | ||

| Valero Energy Corp. | 416,150 | 26,692 | ||

| Tesoro Corp. | 293,192 | 25,217 | ||

| Chevron Corp. | 256,768 | 24,496 | ||

| Marathon Petroleum Corp. | 488,380 | 18,158 | ||

| * | FMC Technologies Inc. | 607,764 | 16,628 | |

| Ensco plc Class A | 1,258,796 | 13,054 | ||

| Anadarko Petroleum Corp. | 233,913 | 10,893 | ||

| Occidental Petroleum Corp. | 149,483 | 10,229 | ||

| Kinder Morgan Inc. | 532,300 | 9,507 | ||

| ^ | Transocean Ltd. | 974,592 | 8,908 | |

| National Oilwell Varco Inc. | 270,072 | 8,399 | ||

| Noble Corp. plc | 751,100 | 7,774 | ||

| * | Cameron International Corp. | 101,521 | 6,807 |

| EOG Resources Inc. | 93,125 | 6,759 | |

| Williams Cos. Inc. | 398,500 | 6,404 | |

| ConocoPhillips | 115,601 | 4,655 | |

| Devon Energy Corp. | 161,617 | 4,435 | |

| Marathon Oil Corp. | 234,812 | 2,616 | |

| Apache Corp. | 40,654 | 1,984 | |

| *,^ | Southwestern Energy Co. | 146,440 | 1,182 |

| Cabot Oil & Gas Corp. | 35,900 | 815 | |

| Columbia Pipeline Group Inc. | 31,950 | 802 | |

| ONEOK Inc. | 24,116 | 720 | |

| Energen Corp. | 16,530 | 605 | |

| *,^ | Seadrill Ltd. | 158,100 | 522 |

| * | Newfield Exploration Co. | 12,806 | 426 |

| ^ | Cameco Corp. | 31,100 | 399 |

| EQT Corp. | 4,400 | 296 | |

| Golar LNG Ltd. | 12,100 | 217 | |

| Encana Corp. | 18,500 | 113 | |

| Golar LNG Partners LP | 6,580 | 97 | |

| * | Memorial Resource | ||

| Development Corp. | 8,780 | 89 | |

| US Silica Holdings Inc. | 3,900 | 89 | |

| CVR Energy Inc. | 3,100 | 81 | |

| Euronav NV | 6,245 | 64 | |

| * | Cobalt International Energy | ||

| Inc. | 21,400 | 64 | |

| * | Oasis Petroleum Inc. | 8,000 | 58 |

| Halliburton Co. | 1,570 | 56 | |

| * | Harvest Natural Resources | ||

| Inc. | 79,000 | 48 | |

| Frank’s International NV | 2,582 | 43 | |

| EnLink Midstream LLC | 3,600 | 40 | |

| * | Kosmos Energy Ltd. | 6,900 | 40 |

| * | TETRA Technologies Inc. | 4,900 | 31 |

| * | Laredo Petroleum Inc. | 3,500 | 28 |

| Aegean Marine Petroleum | |||

| Network Inc. | 3,260 | 25 | |

| Teekay Corp. | 2,800 | 24 | |

| Plains GP Holdings LP | |||

| Class A | 2,600 | 23 | |

| * | InterOil Corp. | 600 | 19 |

| * | Forum Energy | ||

| Technologies Inc. | 1,386 | 18 | |

| Baker Hughes Inc. | 348 | 15 | |

| SemGroup Corp. Class A | 400 | 9 | |

| * | TransAtlantic Petroleum Ltd. | 8,887 | 7 |

| * | Natural Gas Services Group | ||

| Inc. | 300 | 6 | |

| * | Gener8 Maritime Inc. | 800 | 6 |

| Atwood Oceanics Inc. | 600 | 5 | |

| * | Pacific Drilling SA | 9,240 | 5 |

| * | Weatherford International plc | 400 | 3 |

| * | Willbros Group Inc. | 1,447 | 3 |

| California Resources Corp. | 2,349 | 2 | |

| 388,569 |

15

Growth and Income Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Financials (14.6%) | |||

| Wells Fargo & Co. | 1,883,368 | 91,080 | |

| JPMorgan Chase & Co. | 982,280 | 58,171 | |

| Citigroup Inc. | 1,370,873 | 57,234 | |

| * | Berkshire Hathaway Inc. | ||

| Class B | 381,002 | 54,057 | |

| Bank of New York Mellon | |||

| Corp. | 860,399 | 31,688 | |

| Travelers Cos. Inc. | 261,597 | 30,531 | |

| Hartford Financial Services | |||

| Group Inc. | 622,160 | 28,669 | |

| Prologis Inc. | 599,735 | 26,496 | |

| Crown Castle International | |||

| Corp. | 296,290 | 25,629 | |

| Bank of America Corp. | 1,750,366 | 23,665 | |

| Aon plc | 200,980 | 20,992 | |

| AvalonBay Communities | |||

| Inc. | 103,410 | 19,669 | |

| McGraw Hill Financial Inc. | 179,237 | 17,741 | |

| Prudential Financial Inc. | 223,411 | 16,135 | |

| Navient Corp. | 1,266,200 | 15,156 | |

| Capital One Financial Corp. | 215,763 | 14,955 | |

| Kimco Realty Corp. | 482,864 | 13,897 | |

| Progressive Corp. | 370,173 | 13,008 | |

| Huntington Bancshares | |||

| Inc. | 1,359,367 | 12,968 | |

| Discover Financial | |||

| Services | 253,927 | 12,930 | |

| Ameriprise Financial Inc. | 135,708 | 12,758 | |

| American Express Co. | 207,500 | 12,740 | |

| People’s United Financial | |||

| Inc. | 768,752 | 12,246 | |

| SunTrust Banks Inc. | 337,726 | 12,185 | |

| Public Storage | 42,769 | 11,797 | |

| Nasdaq Inc. | 174,862 | 11,607 | |

| Fifth Third Bancorp | 678,518 | 11,324 | |

| CME Group Inc. | 115,000 | 11,046 | |

| Equinix Inc. | 32,161 | 10,636 | |

| Macerich Co. | 119,636 | 9,480 | |

| Moody’s Corp. | 96,000 | 9,270 | |

| Allstate Corp. | 135,704 | 9,142 | |

| Chubb Ltd. | 75,217 | 8,962 | |

| Northern Trust Corp. | 134,981 | 8,797 | |

| BlackRock Inc. | 24,980 | 8,507 | |

| Aflac Inc. | 127,785 | 8,068 | |

| US Bancorp | 191,180 | 7,760 | |

| Extra Space Storage Inc. | 77,970 | 7,287 | |

| Unum Group | 224,671 | 6,947 | |

| Cincinnati Financial Corp. | 102,416 | 6,694 | |

| * | Synchrony Financial | 232,983 | 6,677 |

| Realty Income Corp. | 105,198 | 6,576 | |

| Simon Property Group Inc. | 30,618 | 6,359 | |

| Marsh & McLennan Cos. | |||

| Inc. | 101,980 | 6,199 | |

| Willis Towers Watson plc | 50,101 | 5,945 | |

| Weyerhaeuser Co. | 177,745 | 5,507 | |

| Intercontinental Exchange | |||

| Inc. | 22,440 | 5,277 | |

| Principal Financial Group | |||

| Inc. | 132,930 | 5,244 | |

| Welltower Inc. | 74,424 | 5,161 | |

| Equity LifeStyle Properties | |||

| Inc. | 66,738 | 4,854 | |

| Voya Financial Inc. | 160,600 | 4,781 | |

| First Horizon National Corp. | 335,670 | 4,397 | |

| Lincoln National Corp. | 109,651 | 4,298 | |

| General Growth Properties | |||

| Inc. | 135,130 | 4,017 | |

| * | Realogy Holdings Corp. | 91,000 | 3,286 |

| Goldman Sachs Group Inc. | 19,961 | 3,133 | |

| Torchmark Corp. | 55,212 | 2,990 | |

| HCP Inc. | 91,672 | 2,987 | |

| Regions Financial Corp. | 371,847 | 2,919 | |

| Comerica Inc. | 76,100 | 2,882 | |

| MetLife Inc. | 65,472 | 2,877 | |

| Vornado Realty Trust | 21,690 | 2,048 | |

| American International | |||

| Group Inc. | 36,700 | 1,984 | |

| Zions Bancorporation | 75,950 | 1,839 | |

| Host Hotels & Resorts Inc. | 109,233 | 1,824 | |

| Equity Residential | 23,428 | 1,758 | |

| PNC Financial Services | |||

| Group Inc. | 20,100 | 1,700 | |

| State Street Corp. | 25,980 | 1,520 | |

| Boston Properties Inc. | 11,400 | 1,449 | |

| Apartment Investment & | |||

| Management Co. | 34,420 | 1,439 | |

| East West Bancorp Inc. | 43,100 | 1,400 | |

| Four Corners Property Trust | |||

| Inc. | 76,404 | 1,371 | |

| Ventas Inc. | 19,693 | 1,240 | |

| Charles Schwab Corp. | 39,600 | 1,110 | |

| FNF Group | 27,800 | 942 | |

| Synovus Financial Corp. | 32,500 | 940 | |

| Essex Property Trust Inc. | 3,427 | 801 | |

| Retail Properties of America | |||

| Inc. | 40,700 | 645 | |

| Radian Group Inc. | 46,200 | 573 | |

| * | Equity Commonwealth | 19,800 | 559 |

| Umpqua Holdings Corp. | 31,596 | 501 | |

| * | Santander Consumer USA | ||

| Holdings Inc. | 45,500 | 477 | |

| Franklin Resources Inc. | 12,173 | 475 | |

| FNB Corp. | 35,600 | 463 | |

| * | E*TRADE Financial Corp. | 17,500 | 429 |

| Citizens Financial Group Inc. | 19,500 | 409 | |

| Great Western Bancorp Inc. | 14,800 | 404 | |

| KeyCorp | 36,085 | 398 | |

| Axis Capital Holdings Ltd. | 7,100 | 394 | |

| * | MGIC Investment Corp. | 50,800 | 390 |

16

Growth and Income Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Assured Guaranty Ltd. | 15,000 | 379 | |

| * | Arch Capital Group Ltd. | 5,100 | 363 |

| Annaly Capital Management | |||

| Inc. | 35,300 | 362 | |

| TCF Financial Corp. | 27,915 | 342 | |

| Empire State Realty Trust | |||

| Inc. | 18,400 | 323 | |

| ProAssurance Corp. | 6,100 | 309 | |

| WR Berkley Corp. | 5,400 | 303 | |

| * | Essent Group Ltd. | 12,000 | 250 |

| National Health Investors Inc. | 3,700 | 246 | |

| Post Properties Inc. | 4,003 | 239 | |

| American Capital Agency | |||

| Corp. | 11,600 | 216 | |

| United Bankshares Inc. | 5,288 | 194 | |

| Loews Corp. | 4,900 | 187 | |

| Legg Mason Inc. | 5,400 | 187 | |

| Wintrust Financial Corp. | 4,100 | 182 | |

| Liberty Property Trust | 5,400 | 181 | |

| Morgan Stanley | 7,046 | 176 | |

| RLJ Lodging Trust | 7,300 | 167 | |

| Ares Capital Corp. | 11,136 | 165 | |

| Allied World Assurance Co. | |||

| Holdings AG | 4,500 | 157 | |

| UMB Financial Corp. | 3,000 | 155 | |

| Prosperity Bancshares Inc. | 3,300 | 153 | |

| MFA Financial Inc. | 22,200 | 152 | |

| Aspen Insurance Holdings | |||

| Ltd. | 3,100 | 148 | |

| Care Capital Properties Inc. | 5,500 | 148 | |

| Two Harbors Investment | |||

| Corp. | 18,500 | 147 | |

| Old Republic International | |||

| Corp. | 7,200 | 132 | |

| Trustmark Corp. | 5,700 | 131 | |

| Hancock Holding Co. | 5,200 | 119 | |

| Forest City Realty Trust Inc. | |||

| Class A | 5,500 | 116 | |

| Invesco Ltd. | 3,706 | 114 | |

| * | CBRE Group Inc. Class A | 3,700 | 107 |

| * | Markit Ltd. | 2,824 | 100 |

| Washington Federal Inc. | 4,400 | 100 | |

| * | PHH Corp. | 7,600 | 95 |

| Hospitality Properties Trust | 3,500 | 93 | |

| Cathay General Bancorp | 3,200 | 91 | |

| BankUnited Inc. | 2,600 | 90 | |

| * | Stifel Financial Corp. | 3,000 | 89 |

| * | Flagstar Bancorp Inc. | 3,900 | 84 |

| Brookline Bancorp Inc. | 7,000 | 77 | |

| Camden Property Trust | 900 | 76 | |

| Columbia Property Trust Inc. | 3,400 | 75 | |

| Ryman Hospitality Properties | |||

| Inc. | 1,280 | 66 | |

| Blackstone Mortgage Trust | |||

| Inc. Class A | 2,000 | 54 |

| SEI Investments Co. | 1,200 | 52 | |

| * | Beneficial Bancorp Inc. | 3,480 | 48 |

| Erie Indemnity Co. Class A | 500 | 46 | |

| * | FNFV Group | 4,200 | 46 |

| Financial Engines Inc. | 1,400 | 44 | |

| Glacier Bancorp Inc. | 1,700 | 43 | |

| BancorpSouth Inc. | 2,000 | 43 | |

| Outfront Media Inc. | 1,900 | 40 | |

| * | Western Alliance Bancorp | 1,200 | 40 |

| * | Ocwen Financial Corp. | 15,000 | 37 |

| Old National Bancorp | 2,900 | 35 | |

| Iron Mountain Inc. | 1,000 | 34 | |

| * | NewStar Financial Inc. | 3,572 | 31 |

| Brixmor Property Group Inc. | 1,200 | 31 | |

| United Community Banks Inc. | 1,600 | 30 | |

| Greenhill & Co. Inc. | 1,200 | 27 | |

| First Financial Bancorp | 1,427 | 26 | |

| Meridian Bancorp Inc. | 1,800 | 25 | |

| Southwest Bancorp Inc. | 1,600 | 24 | |

| Monogram Residential Trust | |||

| Inc. | 2,400 | 24 | |

| Apollo Investment Corp. | 4,000 | 22 | |

| Government Properties | |||

| Income Trust | 1,200 | 21 | |

| Omega Healthcare Investors | |||

| Inc. | 600 | 21 | |

| American Tower Corporation | 200 | 20 | |

| Arbor Realty Trust Inc. | 2,800 | 19 | |

| AG Mortgage Investment | |||

| Trust Inc. | 1,405 | 18 | |

| * | Credit Acceptance Corp. | 100 | 18 |

| Columbia Banking System Inc. | 600 | 18 | |

| HFF Inc. Class A | 600 | 16 | |

| Argo Group International | |||

| Holdings Ltd. | 279 | 16 | |

| Anworth Mortgage Asset | |||

| Corp. | 3,400 | 16 | |

| Boston Private Financial | |||

| Holdings Inc. | 1,335 | 15 | |

| Ladder Capital Corp. | 1,200 | 15 | |

| First Republic Bank | 201 | 13 | |

| Credicorp Ltd. | 100 | 13 | |

| * | PRA Group Inc. | 400 | 12 |

| Valley National Bancorp | 1,200 | 11 | |

| SL Green Realty Corp. | 100 | 10 | |

| Raymond James Financial Inc. | 200 | 10 | |

| Associated Banc-Corp | 500 | 9 | |

| WP Carey Inc. | 141 | 9 | |

| Washington REIT | 300 | 9 | |

| American Equity Investment | |||

| Life Holding Co. | 500 | 8 | |

| Brown & Brown Inc. | 211 | 8 | |

| Alexander & Baldwin Inc. | 200 | 7 | |

| Brandywine Realty Trust | 500 | 7 | |

| Sierra Bancorp | 386 | 7 |

17

Growth and Income Fund

| Market | ||||

| Value• | ||||

| Shares | ($000) | |||

| Armada Hoffler Properties Inc. | 600 | 7 | ||

| West Bancorporation Inc. | 352 | 6 | ||

| Corrections Corp. of America | 200 | 6 | ||

| Hudson Pacific Properties Inc. | 221 | 6 | ||

| New Residential | ||||

| Investment Corp. | 500 | 6 | ||

| * | OneMain Holdings Inc. | |||

| Class A | 200 | 5 | ||

| THL Credit Inc. | 445 | 5 | ||

| Investors Bancorp Inc. | 400 | 5 | ||

| Banner Corp. | 100 | 4 | ||

| MVC Capital Inc. | 457 | 3 | ||

| * | SLM Corp. | 500 | 3 | |

| Artisan Partners Asset | ||||

| Management Inc. Class A | 100 | 3 | ||

| BB&T Corp. | 82 | 3 | ||

| CareTrust REIT Inc. | 200 | 3 | ||

| Suffolk Bancorp | 100 | 3 | ||

| FelCor Lodging Trust Inc. | 300 | 2 | ||

| 916,576 | ||||

| Health Care (14.1%) | ||||

| Johnson & Johnson | 1,313,633 | 142,135 | ||

| Merck & Co. Inc. | 1,186,200 | 62,762 | ||

| Pfizer Inc. | 1,967,361 | 58,313 | ||

| Amgen Inc. | 388,302 | 58,218 | ||

| Gilead Sciences Inc. | 540,006 | 49,605 | ||

| Eli Lilly & Co. | 633,075 | 45,588 | ||

| Bristol-Myers Squibb Co. | 619,692 | 39,586 | ||

| Anthem Inc. | 278,626 | 38,726 | ||

| * | Express Scripts Holding | |||

| Co. | 523,483 | 35,958 | ||

| AbbVie Inc. | 540,475 | 30,872 | ||

| Cardinal Health Inc. | 347,787 | 28,501 | ||

| AmerisourceBergen Corp. | ||||

| Class A | 241,530 | 20,904 | ||

| Abbott Laboratories | 492,213 | 20,589 | ||

| McKesson Corp. | 128,081 | 20,141 | ||

| * | Biogen Inc. | 73,165 | 19,046 | |

| UnitedHealth Group Inc. | 143,254 | 18,465 | ||

| * | Allergan plc | 63,132 | 16,921 | |

| * | HCA Holdings Inc. | 211,046 | 16,472 | |

| Medtronic plc | 204,548 | 15,341 | ||

| Aetna Inc. | 126,538 | 14,217 | ||

| Thermo Fisher Scientific | ||||

| Inc. | 99,770 | 14,126 | ||

| Agilent Technologies Inc. | 313,416 | 12,490 | ||

| Zoetis Inc. | 278,610 | 12,351 | ||

| Cigna Corp. | 78,292 | 10,745 | ||

| Zimmer Biomet Holdings | ||||

| Inc. | 77,500 | 8,264 | ||

| * | DaVita HealthCare Partners | |||

| Inc. | 109,400 | 8,028 | ||

| * | Boston Scientific Corp. | 400,790 | 7,539 | |

| * | Vertex Pharmaceuticals Inc. | 75,000 | 5,962 | |

| Patterson Cos. Inc. | 124,120 | 5,775 | ||

| * | Regeneron Pharmaceuticals | |||

| Inc. | 14,041 | 5,061 | ||

| Stryker Corp. | 42,850 | 4,597 | ||

| Baxter International Inc. | 109,531 | 4,500 | ||

| Baxalta Inc. | 102,118 | 4,126 | ||

| Becton Dickinson and Co. | 25,922 | 3,935 | ||

| Humana Inc. | 21,360 | 3,908 | ||

| CR Bard Inc. | 16,660 | 3,377 | ||

| * | Cerner Corp. | 50,453 | 2,672 | |

| Universal Health Services | ||||

| Inc. Class B | 20,095 | 2,506 | ||

| Perrigo Co. plc | 15,700 | 2,009 | ||

| St. Jude Medical Inc. | 32,797 | 1,804 | ||

| * | VCA Inc. | 22,800 | 1,315 | |

| Quest Diagnostics Inc. | 16,000 | 1,143 | ||

| * | United Therapeutics Corp. | 9,300 | 1,036 | |

| * | Hologic Inc. | 22,200 | 766 | |

| * | Intuitive Surgical Inc. | 1,000 | 601 | |

| * | Medivation Inc. | 12,900 | 593 | |

| * | Envision Healthcare | |||

| Holdings Inc. | 21,600 | 441 | ||

| PerkinElmer Inc. | 8,221 | 407 | ||

| DENTSPLY SIRONA Inc. | 6,241 | 385 | ||

| * | Community Health Systems | |||

| Inc. | 17,300 | 320 | ||

| * | VWR Corp. | 7,900 | 214 | |

| * | Myriad Genetics Inc. | 4,500 | 168 | |

| * | QIAGEN NV | 7,456 | 167 | |

| * | Pain Therapeutics Inc. | 66,692 | 149 | |

| * | Mallinckrodt plc | 2,300 | 141 | |

| * | Mylan NV | �� | 2,952 | 137 |

| * | IMS Health Holdings Inc. | 5,000 | 133 | |

| * | Rigel Pharmaceuticals Inc. | 52,910 | 110 | |

| * | Amicus Therapeutics Inc. | 10,300 | 87 | |

| * | Waters Corp. | 620 | 82 | |

| * | BioTelemetry Inc. | 4,800 | 56 | |

| * | AMAG Pharmaceuticals Inc. | 2,300 | 54 | |

| * | PAREXEL International Corp. | 800 | 50 | |

| * | Innoviva Inc. | 3,600 | 45 | |

| * | SciClone Pharmaceuticals Inc. | 3,300 | 36 | |

| * | Neurocrine Biosciences Inc. | 800 | 32 | |

| * | ARIAD Pharmaceuticals Inc. | 4,400 | 28 | |

| * | Triple-S Management Corp. | |||

| Class B | 1,065 | 26 | ||

| * | FibroGen Inc. | 1,205 | 26 | |

| * | BioCryst Pharmaceuticals Inc. | 8,600 | 24 | |

| * | Catalent Inc. | 900 | 24 | |

| * | Centene Corp. | 370 | 23 | |

| * | Imprivata Inc. | 1,700 | 21 | |

| * | Orthofix International NV | 500 | 21 | |

| * | OraSure Technologies Inc. | 2,000 | 14 | |

| * | Halyard Health Inc. | 500 | 14 | |

| * | ArQule Inc. | 8,649 | 14 | |

| * | Acorda Therapeutics Inc. | 500 | 13 | |

| *,^ | MannKind Corp. | 6,200 | 10 | |

18

Growth and Income Fund

| Market | ||||

| Value• | ||||

| Shares | ($000) | |||

| * | Corcept Therapeutics Inc. | 2,100 | 10 | |

| Bio-Techne Corp. | 100 | 9 | ||

| Bruker Corp. | 300 | 8 | ||

| * | INC Research Holdings Inc. | |||

| Class A | 200 | 8 | ||

| Owens & Minor Inc. | 200 | 8 | ||

| * | OPKO Health Inc. | 700 | 7 | |

| * | Lexicon Pharmaceuticals Inc. | 600 | 7 | |

| * | Genocea Biosciences Inc. | 923 | 7 | |

| * | Syneron Medical Ltd. | 899 | 7 | |

| * | Threshold Pharmaceuticals | |||

| Inc. | 14,000 | 6 | ||

| * | BioScrip Inc. | 2,800 | 6 | |

| * | Momenta Pharmaceuticals | |||

| Inc. | 600 | 6 | ||

| * | Nektar Therapeutics | 400 | 6 | |

| * | Exact Sciences Corp. | 800 | 5 | |

| Hill-Rom Holdings Inc. | 100 | 5 | ||

| * | Puma Biotechnology Inc. | 162 | 5 | |

| * | Select Medical Holdings Corp. | 400 | 5 | |

| * | HealthStream Inc. | 200 | 4 | |

| HealthSouth Corp. | 100 | 4 | ||

| * | GTx Inc. | 4,487 | 2 | |

| * | RTI Surgical Inc. | 400 | 2 | |

| 885,188 | ||||

| Industrials (10.1%) | ||||

| General Electric Co. | 1,971,808 | 62,684 | ||

| General Dynamics Corp. | 358,000 | 47,030 | ||

| Northrop Grumman Corp. | 159,763 | 31,617 | ||

| Lockheed Martin Corp. | 138,374 | 30,650 | ||

| Boeing Co. | 189,022 | 23,994 | ||

| Cintas Corp. | 246,355 | 22,125 | ||

| Southwest Airlines Co. | 491,554 | 22,022 | ||

| Stanley Black & Decker Inc. | 198,935 | 20,930 | ||

| United Parcel Service Inc. | ||||

| Class B | 168,417 | 17,763 | ||

| * | United Continental | |||

| Holdings Inc. | 274,125 | 16,409 | ||

| Masco Corp. | 518,000 | 16,291 | ||

| PACCAR Inc. | 271,492 | 14,848 | ||

| Republic Services Inc. | ||||

| Class A | 307,227 | 14,639 | ||

| Pitney Bowes Inc. | 648,770 | 13,975 | ||

| Raytheon Co. | 109,930 | 13,481 | ||

| Union Pacific Corp. | 163,400 | 12,999 | ||

| Illinois Tool Works Inc. | 123,550 | 12,656 | ||

| Equifax Inc. | 109,660 | 12,533 | ||

| Delta Air Lines Inc. | 252,248 | 12,279 | ||

| Ingersoll-Rand plc | 192,180 | 11,917 | ||

| 3M Co. | 70,818 | 11,800 | ||

| * | United Rentals Inc. | 189,259 | 11,770 | |

| Waste Management Inc. | 193,980 | 11,445 | ||

| * | Quanta Services Inc. | 506,486 | 11,426 | |

| FedEx Corp. | 69,600 | 11,325 | ||

| Caterpillar Inc. | 140,504 | 10,754 | ||

| Fluor Corp. | 200,263 | 10,754 | |

| American Airlines Group | |||

| Inc. | 251,369 | 10,309 | |

| Allison Transmission | |||

| Holdings Inc. | 373,520 | 10,078 | |

| Tyco International plc | 219,000 | 8,040 | |

| Honeywell International | |||

| Inc. | 67,900 | 7,608 | |

| * | Spirit AeroSystems | ||

| Holdings Inc. Class A | 147,000 | 6,668 | |

| Snap-on Inc. | 40,692 | 6,388 | |

| KAR Auction Services Inc. | 152,700 | 5,824 | |

| Rockwell Automation Inc. | 48,573 | 5,525 | |

| AMETEK Inc. | 92,900 | 4,643 | |

| ADT Corp. | 109,100 | 4,501 | |

| L-3 Communications | |||

| Holdings Inc. | 36,035 | 4,270 | |

| Dun & Bradstreet Corp. | 33,330 | 3,436 | |

| Nielsen Holdings plc | 63,570 | 3,348 | |

| CSX Corp. | 125,152 | 3,223 | |

| Cummins Inc. | 25,760 | 2,832 | |

| * | AerCap Holdings NV | 68,600 | 2,659 |

| Danaher Corp. | 27,692 | 2,627 | |

| United Technologies Corp. | 25,085 | 2,511 | |

| Allegion plc | 35,100 | 2,236 | |

| Deere & Co. | 27,994 | 2,155 | |

| Expeditors International of | |||

| Washington Inc. | 44,000 | 2,148 | |

| CH Robinson Worldwide Inc. | 27,200 | 2,019 | |

| * | IHS Inc. Class A | 15,259 | 1,895 |

| Textron Inc. | 48,883 | 1,782 | |

| Pentair plc | 27,100 | 1,470 | |

| Roper Technologies Inc. | 7,141 | 1,305 | |

| * | JetBlue Airways Corp. | 54,800 | 1,157 |

| Norfolk Southern Corp. | 11,300 | 941 | |

| Carlisle Cos. Inc. | 9,300 | 925 | |

| * | Armstrong World Industries | ||

| Inc. | 19,100 | 924 | |

| * | HD Supply Holdings Inc. | 26,800 | 886 |

| Covanta Holding Corp. | 47,300 | 798 | |

| BWX Technologies Inc. | 19,900 | 668 | |

| * | RPX Corp. | 53,900 | 607 |

| Dover Corp. | 8,237 | 530 | |

| Hubbell Inc. Class B | 4,769 | 505 | |

| * | Kirby Corp. | 5,280 | 318 |

| * | Continental Building | ||

| Products Inc. | 17,100 | 317 | |

| Kansas City Southern | 3,600 | 308 | |

| Huntington Ingalls Industries | |||

| Inc. | 2,200 | 301 | |

| Xylem Inc. | 7,000 | 286 | |

| Air Lease Corp. Class A | 6,900 | 222 | |

| Joy Global Inc. | 11,800 | 190 | |

| Nordson Corp. | 2,300 | 175 | |

| West Corp. | 7,011 | 160 |

19

Growth and Income Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Watsco Inc. | 1,100 | 148 | |

| Landstar System Inc. | 2,100 | 136 | |

| Steelcase Inc. Class A | 8,173 | 122 | |

| * | Babcock & Wilcox | ||

| Enterprises Inc. | 5,100 | 109 | |

| Eaton Corp. plc | 1,330 | 83 | |

| Albany International Corp. | 2,100 | 79 | |

| SPX Corp. | 4,703 | 71 | |

| * | Rexnord Corp. | 3,400 | 69 |

| Barnes Group Inc. | 1,924 | 67 | |

| Kaman Corp. | 1,500 | 64 | |

| Woodward Inc. | 1,100 | 57 | |

| * | Hub Group Inc. Class A | 1,400 | 57 |

| Allegiant Travel Co. Class A | 300 | 53 | |

| * | NCI Building Systems Inc. | 3,600 | 51 |

| RR Donnelley & Sons Co. | 3,000 | 49 | |

| * | Moog Inc. Class A | 1,000 | 46 |

| Brady Corp. Class A | 1,700 | 46 | |

| * | ARC Document Solutions Inc. | 9,800 | 44 |

| * | Masonite International Corp. | 600 | 39 |

| * | MFC Bancorp Ltd. | 19,512 | 39 |

| JB Hunt Transport Services | |||

| Inc. | 440 | 37 | |

| * | Mistras Group Inc. | 1,487 | 37 |

| * | Atlas Air Worldwide Holdings | ||

| Inc. | 800 | 34 | |

| Knoll Inc. | 1,517 | 33 | |

| * | Jacobs Engineering Group Inc. | 700 | 31 |

| Matson Inc. | 600 | 24 | |

| Quad/Graphics Inc. | 1,800 | 23 | |

| Triumph Group Inc. | 700 | 22 | |

| Seaspan Corp. Class A | 1,200 | 22 | |

| * | Air Transport Services Group | ||

| Inc. | 1,300 | 20 | |

| Ennis Inc. | 1,000 | 20 | |

| * | Hertz Global Holdings Inc. | 1,700 | 18 |

| * | Huron Consulting Group Inc. | 300 | 17 |

| Hillenbrand Inc. | 400 | 12 | |

| Mueller Water Products Inc. | |||

| Class A | 1,100 | 11 | |

| Exponent Inc. | 200 | 10 | |

| * | Blount International Inc. | 1,012 | 10 |

| * | USG Corp. | 400 | 10 |

| Korn/Ferry International | 300 | 9 | |

| * | Navigant Consulting Inc. | 500 | 8 |

| IDEX Corp. | 78 | 6 | |

| EnPro Industries Inc. | 73 | 4 | |

| * | Saia Inc. | 143 | 4 |

| * | Roadrunner Transportation | ||

| Systems Inc. | 300 | 4 | |

| NN Inc. | 206 | 3 | |

| Costamare Inc. | 300 | 3 | |

| * | Accuride Corp. | 1,500 | 2 |

| 631,697 |

| Information Technology (19.6%) | |||

| Apple Inc. | 1,875,902 | 204,455 | |

| Microsoft Corp. | 2,198,413 | 121,418 | |

| Intel Corp. | 1,979,582 | 64,039 | |

| International Business | |||

| Machines Corp. | 420,129 | 63,629 | |

| * | Alphabet Inc. Class A | 81,400 | 62,100 |

| Visa Inc. Class A | 757,077 | 57,901 | |

| * | Alphabet Inc. Class C | 53,755 | 40,045 |

| Cisco Systems Inc. | 1,267,117 | 36,075 | |

| Accenture plc Class A | 297,748 | 34,360 | |

| Symantec Corp. | 1,663,056 | 30,567 | |

| Broadcom Ltd. | 158,144 | 24,433 | |

| Western Union Co. | 1,179,693 | 22,756 | |

| * | Facebook Inc. Class A | 199,039 | 22,710 |

| * | Citrix Systems Inc. | 264,510 | 20,785 |

| HP Inc. | 1,676,971 | 20,660 | |

| QUALCOMM Inc. | 394,960 | 20,198 | |

| Intuit Inc. | 188,629 | 19,619 | |

| Motorola Solutions Inc. | 256,693 | 19,432 | |

| * | Fiserv Inc. | 181,561 | 18,625 |

| CSRA Inc. | 667,231 | 17,949 | |

| MasterCard Inc. Class A | 184,236 | 17,410 | |

| Fidelity National | |||

| Information Services Inc. | 263,544 | 16,685 | |

| * | Electronic Arts Inc. | 248,548 | 16,432 |

| Total System Services Inc. | 332,768 | 15,833 | |

| Hewlett Packard | |||

| Enterprise Co. | 886,870 | 15,724 | |

| Xerox Corp. | 1,235,842 | 13,792 | |

| NVIDIA Corp. | 376,576 | 13,417 | |

| Juniper Networks Inc. | 519,294 | 13,247 | |

| * | VeriSign Inc. | 140,300 | 12,422 |

| Oracle Corp. | 282,153 | 11,543 | |

| Texas Instruments Inc. | 197,562 | 11,344 | |

| * | F5 Networks Inc. | 96,100 | 10,172 |

| Corning Inc. | 486,785 | 10,169 | |

| Paychex Inc. | 183,411 | 9,906 | |

| * | PayPal Holdings Inc. | 243,970 | 9,417 |

| TE Connectivity Ltd. | 141,500 | 8,762 | |

| Lam Research Corp. | 104,169 | 8,604 | |

| * | Teradata Corp. | 317,072 | 8,320 |

| Computer Sciences Corp. | 238,650 | 8,207 | |

| Harris Corp. | 91,950 | 7,159 | |

| Automatic Data | |||

| Processing Inc. | 75,500 | 6,773 | |

| Analog Devices Inc. | 78,900 | 4,670 | |

| EMC Corp. | 168,640 | 4,494 | |

| Applied Materials Inc. | 193,500 | 4,098 | |

| * | eBay Inc. | 167,400 | 3,994 |

| CA Inc. | 122,810 | 3,781 | |

| Seagate Technology plc | 106,127 | 3,656 | |

| * | Akamai Technologies Inc. | 58,400 | 3,245 |

| Western Digital Corp. | 59,100 | 2,792 | |

| * | LinkedIn Corp. Class A | 22,262 | 2,546 |

20

Growth and Income Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| IAC/InterActiveCorp | 35,700 | 1,681 | |

| * | Flextronics International | ||

| Ltd. | 136,300 | 1,644 | |

| * | Red Hat Inc. | 22,060 | 1,644 |

| Amdocs Ltd. | 23,200 | 1,402 | |

| * | VMware Inc. Class A | 25,900 | 1,355 |

| * | Cadence Design Systems | ||

| Inc. | 53,927 | 1,272 | |

| * | Micron Technology Inc. | 109,908 | 1,151 |

| * | CoreLogic Inc. | 31,700 | 1,100 |

| FLIR Systems Inc. | 33,036 | 1,089 | |

| * | ANSYS Inc. | 10,700 | 957 |

| * | Twitter Inc. | 45,500 | 753 |

| Marvell Technology Group | |||

| Ltd. | 68,200 | 703 | |

| * | InterXion Holding NV | 16,300 | 564 |

| * | Genpact Ltd. | 20,400 | 555 |

| * | ON Semiconductor Corp. | 56,000 | 537 |

| * | Trimble Navigation Ltd. | 18,800 | 466 |

| * | Synopsys Inc. | 8,800 | 426 |

| * | WebMD Health Corp. | 6,200 | 388 |

| Teradyne Inc. | 15,900 | 343 | |

| * | MicroStrategy Inc. Class A | 1,900 | 341 |

| Tessera Technologies Inc. | 10,600 | 329 | |

| * | CommScope Holding Co. Inc. | 11,400 | 318 |

| * | Mellanox Technologies Ltd. | 5,000 | 272 |

| Brocade Communications | |||

| Systems Inc. | 25,200 | 267 | |

| * | Polycom Inc. | 22,500 | 251 |

| Sabre Corp. | 8,474 | 245 | |

| * | Pandora Media Inc. | 27,300 | 244 |

| * | Zebra Technologies Corp. | 3,500 | 242 |

| * | OSI Systems Inc. | 3,296 | 216 |

| * | Nuance Communications Inc. | 10,700 | 200 |

| * | Sohu.com Inc. | 4,000 | 198 |

| * | NCR Corp. | 6,300 | 189 |

| * | Keysight Technologies Inc. | 6,500 | 180 |

| NIC Inc. | 9,700 | 175 | |

| * | VeriFone Systems Inc. | 5,783 | 163 |

| * | Amkor Technology Inc. | 27,700 | 163 |

| * | Blackhawk Network | ||

| Holdings Inc. | 4,564 | 157 | |

| * | Calix Inc. | 21,824 | 155 |

| Leidos Holdings Inc. | 2,900 | 146 | |

| Jabil Circuit Inc. | 6,800 | 131 | |

| * | Zynga Inc. Class A | 51,500 | 117 |

| * | NetScout Systems Inc. | 4,500 | 103 |

| * | Bankrate Inc. | 11,132 | 102 |

| * | Cimpress NV | 1,100 | 100 |

| * | Rackspace Hosting Inc. | 4,400 | 95 |

| * | Qlik Technologies Inc. | 3,200 | 93 |

| Intersil Corp. Class A | 6,700 | 90 | |

| * | Net 1 UEPS Technologies | ||

| Inc. | 9,431 | 87 | |

| * | Rambus Inc. | 6,300 | 87 |

| * | RetailMeNot Inc. | 10,782 | 86 |

| * | Photronics Inc. | 8,200 | 85 |

| * | EchoStar Corp. Class A | 1,907 | 84 |

| SanDisk Corp. | 1,100 | 84 | |

| * | comScore Inc. | 2,600 | 78 |

| * | II-VI Inc. | 3,400 | 74 |

| * | QLogic Corp. | 5,200 | 70 |

| * | SPS Commerce Inc. | 1,600 | 69 |

| Cabot Microelectronics Corp. | 1,676 | 69 | |

| * | DHI Group Inc. | 7,700 | 62 |

| * | Angie’s List Inc. | 7,285 | 59 |

| Plantronics Inc. | 1,500 | 59 | |

| InterDigital Inc. | 910 | 51 | |

| * | Verint Systems Inc. | 1,200 | 40 |

| Mentor Graphics Corp. | 1,800 | 37 | |

| * | Silicon Laboratories Inc. | 800 | 36 |

| * | Semtech Corp. | 1,600 | 35 |

| * | SunEdison Semiconductor | ||

| Ltd. | 5,400 | 35 | |

| * | SunPower Corp. Class A | 1,500 | 34 |

| * | TechTarget Inc. | 4,200 | 31 |

| Activision Blizzard Inc. | 900 | 30 | |

| NVE Corp. | 530 | 30 | |

| * | XO Group Inc. | 1,821 | 29 |

| * | ShoreTel Inc. | 3,700 | 28 |

| * | Knowles Corp. | 2,000 | 26 |

| * | Celestica Inc. | 2,300 | 25 |

| * | Ixia | 2,000 | 25 |

| * | FormFactor Inc. | 3,360 | 24 |

| Belden Inc. | 394 | 24 | |

| * | Web.com Group Inc. | 1,200 | 24 |

| * | Alliance Data Systems Corp. | 100 | 22 |

| * | Progress Software Corp. | 900 | 22 |

| * | United Online Inc. | 1,500 | 17 |

| * | Blucora Inc. | 3,300 | 17 |

| * | Zix Corp. | 4,300 | 17 |

| EVERTEC Inc. | 1,200 | 17 | |

| MKS Instruments Inc. | 400 | 15 | |

| Microchip Technology Inc. | 300 | 14 | |

| * | Orbotech Ltd. | 600 | 14 |

| Xilinx Inc. | 300 | 14 | |

| NetApp Inc. | 500 | 14 | |

| * | ACI Worldwide Inc. | 600 | 12 |

| * | Cognizant Technology | ||

| Solutions Corp. Class A | 196 | 12 | |

| * | Endurance International | ||

| Group Holdings Inc. | 1,100 | 12 | |

| Amphenol Corp. Class A | 200 | 12 | |

| * | ARRIS International plc | 500 | 11 |

| * | Ultratech Inc. | 515 | 11 |

| * | VASCO Data Security | ||

| International Inc. | 700 | 11 | |

| * | Sigma Designs Inc. | 1,500 | 10 |

| * | Veeco Instruments Inc. | 500 | 10 |

| * | Quotient Technology Inc. | 800 | 9 |

| * | Entegris Inc. | 600 | 8 |

| * | Diodes Inc. | 400 | 8 |

Growth and Income Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | Monster Worldwide Inc. | 2,400 | 8 |

| * | Yandex NV Class A | 500 | 8 |

| Maxim Integrated Products | |||

| Inc. | 203 | 7 | |

| * | TTM Technologies Inc. | 968 | 6 |

| * | Ciber Inc. | 2,844 | 6 |

| * | BlackBerry Ltd. | 700 | 6 |

| * | Brightcove Inc. | 900 | 6 |

| * | Bazaarvoice Inc. | 1,700 | 5 |

| * | Anixter International Inc. | 100 | 5 |

| * | Zillow Group Inc. Class A | 200 | 5 |

| * | Infinera Corp. | 300 | 5 |

| * | Kemet Corp. | 2,000 | 4 |

| * | GoDaddy Inc. Class A | 100 | 3 |

| * | Fortinet Inc. | 100 | 3 |

| * | Advanced Micro Devices Inc. | 900 | 3 |

| * | Lionbridge Technologies Inc. | 500 | 3 |

| * | VirnetX Holding Corp. | 504 | 2 |

| 1,225,693 | |||

| Materials (3.6%) | |||

| Air Products & Chemicals | |||

| Inc. | 246,154 | 35,459 | |

| Sealed Air Corp. | 635,836 | 30,527 | |

| LyondellBasell Industries | |||

| NV Class A | 263,100 | 22,516 | |

| Sherwin-Williams Co. | 77,052 | 21,934 | |

| Dow Chemical Co. | 422,863 | 21,507 | |

| Avery Dennison Corp. | 263,864 | 19,027 | |

| Monsanto Co. | 150,520 | 13,207 | |

| Ball Corp. | 160,906 | 11,471 | |

| PPG Industries Inc. | 76,327 | 8,510 | |

| Mosaic Co. | 292,790 | 7,905 | |

| Praxair Inc. | 48,390 | 5,538 | |

| Eastman Chemical Co. | 63,801 | 4,608 | |

| Newmont Mining Corp. | 131,100 | 3,485 | |

| Ecolab Inc. | 26,100 | 2,911 | |

| Martin Marietta Materials | |||

| Inc. | 10,800 | 1,723 | |

| Freeport-McMoRan Inc. | 150,700 | 1,558 | |

| Vulcan Materials Co. | 14,200 | 1,499 | |

| Graphic Packaging Holding | |||

| Co. | 107,600 | 1,383 | |

| International Paper Co. | 32,956 | 1,353 | |

| Westlake Chemical Corp. | 22,900 | 1,060 | |

| Celanese Corp. Class A | 15,487 | 1,014 | |

| International Flavors & | |||

| Fragrances Inc. | 8,848 | 1,007 | |

| Nucor Corp. | 19,900 | 941 | |

| CF Industries Holdings Inc. | 26,185 | 821 | |

| * | Crown Holdings Inc. | 13,300 | 660 |

| Reliance Steel & Aluminum | |||

| Co. | 4,500 | 311 | |

| * | Berry Plastics Group Inc. | 7,811 | 282 |

| EI du Pont de Nemours & | |||

| Co. | 3,700 | 234 | |

| Potash Corp. of | ||||

| Saskatchewan Inc. | 11,200 | 191 | ||

| SunCoke Energy Inc. | 22,600 | 147 | ||

| Ferroglobe plc | 13,700 | 121 | ||

| * | Axalta Coating Systems Ltd. | 3,500 | 102 | |

| * | Headwaters Inc. | 5,000 | 99 | |

| * | Century Aluminum Co. | 13,600 | 96 | |

| Valspar Corp. | 807 | 86 | ||

| Materion Corp. | 2,900 | 77 | ||

| * | Constellium NV Class A | 13,300 | 69 | |

| * | Turquoise Hill Resources | |||

| Ltd. | 21,550 | 55 | ||

| * | Ferro Corp. | 3,700 | 44 | |

| * | Owens-Illinois Inc. | 2,500 | 40 | |

| Schweitzer-Mauduit | ||||

| International Inc. | 1,200 | 38 | ||

| Bemis Co. Inc. | 700 | 36 | ||

| Eldorado Gold Corp. | 10,400 | 33 | ||

| Orion Engineered Carbons | ||||

| SA | 2,088 | 29 | ||

| * | Boise Cascade Co. | 1,400 | 29 | |

| Mercer International Inc. | 2,800 | 26 | ||

| * | Novagold Resources Inc. | 4,400 | 22 | |

| Silgan Holdings Inc. | 400 | 21 | ||

| Allegheny Technologies Inc. | 1,200 | 20 | ||

| KMG Chemicals Inc. | 700 | 16 | ||

| PH Glatfelter Co. | 640 | 13 | ||

| Mesabi Trust | 2,015 | 12 | ||

| * | Flotek Industries Inc. | 1,600 | 12 | |

| Kaiser Aluminum Corp. | 100 | 8 | ||

| * | Intrepid Potash Inc. | 5,500 | 6 | |

| Sonoco Products Co. | 117 | 6 | ||

| Olin Corp. | 200 | 3 | ||

| * | Stillwater Mining Co. | 298 | 3 | |

| 223,911 | ||||

| Other (0.2%) | ||||

| SPDR S&P 500 ETF Trust | 55,572 | 11,423 | ||

| * | Safeway Inc. CVR (Casa Ley) | |||

| Exp. 01/30/2018 | 75,810 | 10 | ||

| * | Safeway Inc. CVR (PDC) | |||

| Exp. 01/30/2017 | 75,810 | 4 | ||

| * | Biosante Pharmaceutical | |||

| Inc. CVR | 4,189 | — | ||

| 11,437 | ||||

| Telecommunication Services (2.9%) | ||||

| AT&T Inc. | 2,634,359 | 103,188 | ||

| Verizon Communications | ||||

| Inc. | 1,038,048 | 56,138 | ||

| CenturyLink Inc. | 479,774 | 15,333 | ||

| * | Level 3 Communications | |||

| Inc. | 114,600 | 6,057 | ||

| Frontier Communications | ||||

| Corp. | 78,800 | 440 | ||

| Telephone & Data | ||||

| Systems Inc. | 9,800 | 295 | ||

22

Growth and Income Fund

| Market | ||||

| Value• | ||||

| Shares | ($000) | |||

| * | Sprint Corp. | 10,738 | 37 | |

| Inteliquent Inc. | 1,100 | 18 | ||

| * | Globalstar Inc. | 7,900 | 12 | |

| 181,518 | ||||

| Utilities (3.2%) | ||||

| American Electric Power | ||||

| Co. Inc. | 287,260 | 19,074 | ||

| Southern Co. | 354,870 | 18,357 | ||

| Entergy Corp. | 229,976 | 18,233 | ||

| FirstEnergy Corp. | 489,457 | 17,606 | ||

| Ameren Corp. | 314,425 | 15,753 | ||

| Exelon Corp. | 417,410 | 14,968 | ||

| PPL Corp. | 378,286 | 14,401 | ||

| Public Service Enterprise | ||||

| Group Inc. | 295,273 | 13,919 | ||

| Duke Energy Corp. | 160,390 | 12,940 | ||

| NextEra Energy Inc. | 84,240 | 9,969 | ||

| Sempra Energy | 80,610 | 8,387 | ||

| Consolidated Edison Inc. | 104,932 | 8,040 | ||

| CenterPoint Energy Inc. | 300,610 | 6,289 | ||

| Dominion Resources Inc. | 74,984 | 5,633 | ||

| PG&E Corp. | 62,985 | 3,761 | ||

| Pinnacle West Capital Corp. | 46,235 | 3,471 | ||

| DTE Energy Co. | 29,619 | 2,685 | ||

| SCANA Corp. | 23,800 | 1,670 | ||

| NiSource Inc. | 35,040 | 826 | ||

| * | Dynegy Inc. | 44,100 | 634 | |

| * | Calpine Corp. | 25,700 | 390 | |

| Edison International | 3,860 | 277 | ||

| Atlantic Power Corp. | 104,726 | 258 | ||

| Xcel Energy Inc. | 5,860 | 245 | ||

| Atmos Energy Corp. | 2,500 | 186 | ||