UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04526 | |

Name of Registrant: | Vanguard Quantitative Funds | |

Address of Registrant: | P.O. Box 2600 | |

| Valley Forge, PA 19482 | ||

Name and address of agent for service: | Heidi Stam, Esquire | |

| P.O. Box 876 | ||

| Valley Forge, PA 19482 | ||

Registrant’s telephone number, including area code: | (610) 669-1000 | |

Date of fiscal year end: September 30 | ||

Date of reporting period: October 1, 2014 – March 31, 2015 | ||

| Item 1: Reports to Shareholders | ||

Semiannual Report | March 31, 2015

Vanguard Growth and Income Fund

The mission continues

On May 1, 1975, Vanguard began operations, a fledgling company based on the simple but revolutionary idea that a mutual fund company should be managed solely in the interest of its investors.

Four decades later, that revolutionary spirit continues to animate the enterprise. Vanguard remains on a mission to give investors the best chance of investment success.

As we mark our 40th anniversary, we thank you for entrusting your assets to Vanguard and giving us the opportunity to help you reach your financial goals in the decades to come.

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisors’ Report. | 8 |

| Fund Profile. | 13 |

| Performance Summary. | 15 |

| Financial Statements. | 16 |

| About Your Fund’s Expenses. | 34 |

| Glossary. | 36 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Since our founding, Vanguard has drawn inspiration from the enterprise and valor demonstrated by British naval hero Horatio Nelson and his command at the Battle of the Nile in 1798. The photograph displays a replica of a merchant ship from the same era as Nelson’s flagship, the HMS Vanguard.

Your Fund’s Total Returns

| Six Months Ended March 31, 2015 | |

| Total | |

| Returns | |

| Vanguard Growth and Income Fund | |

| Investor Shares | 6.41% |

| Admiral™ Shares | 6.46 |

| S&P 500 Index | 5.93 |

| Large-Cap Core Funds Average | 5.21 |

| Large-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements. |

| Your Fund’s Performance at a Glance | ||||

| September 30, 2014, Through March 31, 2015 | ||||

| Distributions Per Share | ||||

| Starting | Ending | Income | Capital | |

| Share Price | Share Price | Dividends | Gains | |

| Vanguard Growth and Income Fund | ||||

| Investor Shares | $42.69 | $42.34 | $0.372 | $2.604 |

| Admiral Shares | 69.71 | 69.13 | 0.647 | 4.251 |

1

Chairman’s Letter

Dear Shareholder,

Although U.S. stocks produced solid returns for the six months ended March 31, 2015, they traced a choppy path upward. A strong U.S. dollar, the prospect of rising interest rates, and tepid growth abroad contributed to some retrenchment at times, but stocks were buoyed by other factors, including the improving labor market, growing consumer confidence, and patience from the Federal Reserve in holding rates low.

For the half year, Vanguard Growth and Income Fund returned 6.41% for Investor Shares and 6.46% for Admiral Shares. The fund achieved its objective of outpacing its benchmark, the Standard and Poor’s 500 Index, which returned 5.93%. It also bested the average return of 5.21% for its peer group.

The fund’s gains were fairly broad-based, with seven of its ten market sectors producing positive returns. Health care and consumer discretionary both made double-digit advances, while energy posted a double-digit decline. The fund’s outperformance of its benchmark was largely driven by superior returns in energy, health care, industrials, and information technology.

The Fed’s cautious approach was favorable for U.S. stocks

The broad U.S. stock market returned about 7% for the six months. Stocks were resilient after declining markedly at the start of the period and enduring bouts of turmoil in subsequent months.

2

Investors’ concerns included the strength of the dollar and how that would affect the profits of U.S.-based multinational corporations.

Overall, stocks responded favorably to both the Fed’s cautious approach to raising short-term interest rates and the monetary stimulus efforts of other central banks. A strong rebound in February, when the broad market notched its largest monthly gain since October 2011, helped lift returns for the period.

International stocks had a slightly negative return as the dollar’s strength against many foreign currencies hurt results. Without this currency effect, stocks outside the United States generally advanced. The developed markets of the Pacific, particularly Japan, were especially strong.

Global central bank stimulus helped drive up bond prices

Bond prices, too, were supported by accommodative monetary policies from central banks and by investors who sought safe-haven assets amid turbulence in the stock market. The broad U.S. taxable bond market returned 3.43%. The yield of the 10-year Treasury note ended March at 1.95%, down from 2.48% six months earlier. (Bond prices and yields move in opposite directions.)

| Market Barometer | |||

| Total Returns | |||

| Periods Ended March 31, 2015 | |||

| Six | One | Five Years | |

| Months | Year | (Annualized) | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 6.55% | 12.73% | 14.73% |

| Russell 2000 Index (Small-caps) | 14.46 | 8.21 | 14.57 |

| Russell 3000 Index (Broad U.S. market) | 7.13 | 12.37 | 14.71 |

| FTSE All-World ex US Index (International) | -0.08 | -0.21 | 5.19 |

| Bonds | |||

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 3.43% | 5.72% | 4.41% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 2.40 | 6.62 | 5.11 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.00 | 0.03 | 0.06 |

| CPI | |||

| Consumer Price Index | -0.80% | -0.07% | 1.64% |

3

Municipal bonds returned 2.40%, though results faded later in the period as more bonds were issued.

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned –7.49%, a reflection of foreign currencies’ weakness relative to the dollar. International bonds hedged to eliminate the effect of currency exchange rates produced positive returns.

The Fed’s target of 0%–0.25% for short-term interest rates continued to cap returns for money market funds and savings accounts.

Stepping away from the benchmark boosted the fund for the period

Each of the three advisors at the helm of the Growth and Income Fund uses its own proprietary computer model to screen stocks based on fundamental data such as earnings growth prospects and balance-sheet quality. As a result, each advisor holds a different selection of stocks but with a shared goal of outpacing the fund’s benchmark over the long term without taking on significant additional risk.

For the six months, health care was the strongest sector in the index. Mergers and acquisitions ran high as many biotechnology and pharmaceutical

| Expense Ratios | |||

| Your Fund Compared With Its Peer Group | |||

| Investor | Admiral | Peer Group | |

| Shares | Shares | Average | |

| Growth and Income Fund | 0.37% | 0.26% | 1.12% |

| The fund expense ratios shown are from the prospectus dated January 26, 2015, and represent estimated costs for the current fiscal year. For the six months ended March 31, 2015, the fund’s annualized expense ratios were 0.35% for Investor Shares and 0.24% for Admiral Shares. The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures information through year-end 2014. | |||

| Peer group: Large-Cap Core Funds. | |||

4

companies looked for opportunities to grow faster and become more efficient. New drugs moving closer to market also fueled investor interest. An outsized allocation to health care, and to some top-performing providers in particular, played to the fund’s advantage.

At the other end of the performance spectrum, energy slumped, but less for the fund than for the index. The advisors’ outperformance was mostly due to a lighter-than-benchmark allocation to companies whose business models were most affected by the sharp drop in the price of oil. These included oil and gas

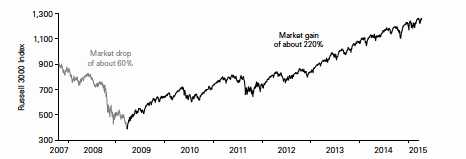

| Marking the sixth anniversary of the bull market |

| There’s been a long and steep climb in the U.S. stock market in the six years since the worst |

| of the financial crisis. |

| The dark line in the chart below traces the rise in the Russell 3000 Index from a low of 390 |

| on March 9, 2009, to 1,241 on March 9, 2015—an increase of roughly 220% in 72 months. |

| The robustness and duration of the advance defied the predictions of some market pundits. |

| Of course, the financial crisis caught many of them off guard as well. The lighter line below |

| charts the drop of about 60% in the index in 17 months, from its pre-crisis peak of 908 on |

| October 9, 2007. |

| These sharp and unexpected movements illustrate the challenge of trying to time the markets. |

| Instead of trying to guess which way the wind will blow (and for how long), investors are |

| generally better off staying committed to their investment plan through market ups and downs. |

| Rebalancing your portfolio from time to time will help keep market movements from pushing |

| your allocation to stocks and bonds off target. |

| The performance of the U.S. stock market since the start of the financial crisis |

Sources: Vanguard, based on data for the Russell 3000 Index.

5

exploration and production companies along with their equipment and service providers. The fund also got a small boost from its holdings among oil refiners. Stocks of these companies, whose profit margins tend to go up when oil prices fall because of oversupply, advanced by double digits.

More modest relative contributions came from the fund’s industrial-sector holdings in aerospace, defense, and machinery stocks and from internet and software stocks within information technology.

Improvements in the job market and growing consumer confidence translated into a good half year for consumer discretionary stocks. Retailers’ shares climbed, with home improvement, clothing, and automotive store chains doing especially well. The fund’s return for the sector roughly matched the index’s.

The advisors’ models disappointed in a few sectors, however. In consumer staples, the fund’s light holdings among some food producers, personal-care companies and drugstore chains lowered returns, as did its exposure to real estate investment trusts in financials.

More information about the advisors’ management of the fund can be found in the Advisors’ Report that follows this letter.

Our focus on balanced investing has roots going back many decades

On May 1, Vanguard will celebrate its 40th anniversary. Although many things have changed since 1975, our investment philosophy has not. From the start, we’ve focused on four timeless, straightforward principles that we believe help give clients the best chance for investment success:

• Goals. Create clear, appropriate investment goals.

• Balance. Develop a suitable asset allocation using broadly diversified funds.

• Cost. Minimize cost.

• Discipline. Maintain perspective and long-term discipline.

Although Vanguard has followed all these principles since its founding, one—the focus on balanced investing—is in the company’s DNA. That’s because our predecessor company, Wellington Management, was a pioneer in this respect, launching a fund in 1929 that included both stocks and bonds.

The Wellington™ Fund got its start on the eve of the Great Depression, but it thrived over the long term, thanks in large part to its balancing of stocks and bonds. And this strategy continues to define the fund, now one of the nation’s largest balanced funds.

6

As we embark on our fifth decade, we’ll continue to emphasize the importance of balanced, diversified investing. How investors allocate assets between stocks and bonds has an enormous effect on the risks and returns of their portfolios. And broad diversification reduces exposure to specific risks, while providing opportunities to benefit from the market’s current leaders. (You can read more in Vanguard’s Principles for Investing Success, available at vanguard.com/research.)

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

April 14, 2015

Advisors’ Report

Vanguard Growth and Income Fund’s Investor Shares returned 6.41% for the six months ended March 31, 2015. The Admiral Shares returned 6.46%. The Standard & Poor’s 500 Index returned 5.93%, and the average return of large-capitalization core funds was 5.21%.

Your fund is managed by three independent advisors, a strategy that enhances the fund’s diversification by providing exposure to distinct yet complementary investment approaches. It is not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The advisors, the percentage of fund assets each manages, and brief descriptions of their investment strategies are presented in the table below. The advisors have also prepared a discussion of the investment environment that existed during the fiscal half year and of how the portfolio’s positioning reflects this assessment. (Please note that Los Angeles Capital’s discussion refers to industry sectors as defined by Russell classifications, rather than by the Global Industry Classification Standard used elsewhere in this report.) These comments were prepared on April 21, 2015.

| Vanguard Growth and Income Fund Investment Advisors | ||||

| Fund Assets Managed | ||||

| Investment Advisor | % | $ Million | Investment Strategy | |

| Los Angeles Capital | 32 | 2,049 | Employs a quantitative model that emphasizes stocks | |

| with characteristics investors are currently seeking and | ||||

| underweights stocks with characteristics investors are | ||||

| currently avoiding. The portfolio’s sector weights, size, | ||||

| and style characteristics may differ modestly from the | ||||

| benchmark in a risk-controlled manner. | ||||

| D. E. Shaw Investment | 32 | 2,047 | Employs quantitative models that seek to capture | |

| Management, L.L.C. | predominantly “bottom up” stock-specific return | |||

| opportunities while aiming to keep the portfolio’s | ||||

| sector weights, size, and style characteristics similar to | ||||

| the benchmark. | ||||

| Vanguard Equity Investment | 32 | 2,045 | Employs a quantitative fundamental management | |

| Group | approach, using models that assess valuation, growth | |||

| prospects, management decisions, market sentiment, | ||||

| and earnings and balance-sheet quality of companies | ||||

| as compared with their peers. | ||||

| Cash Investments | 4 | 190 | These short-term reserves are invested by Vanguard in | |

| equity index products to simulate investments in | ||||

| stocks. Each advisor also may maintain a modest cash | ||||

| position. | ||||

8

Los Angeles Capital

Portfolio Managers:

Thomas D. Stevens, CFA,

Chairman and Principal

Hal W. Reynolds, CFA,

Chief Investment Officer and Principal

The S&P 500 Index generated a 5.93% return for the six months. A meaningful pullback in March, however, suggested concerns about corporate profits and broader economic growth. Following last year’s gains, the outlook for earnings has been lowered given declining oil prices and a stronger dollar. Along with energy, utility stocks, which had a high relative valuation coming into 2015, have been penalized in recent months.

The best-performing stocks over the six months had strong analyst sentiment and lower volatility. Companies with weaker balance sheets trading at low multiples to book value generally underperformed. Energy was by far the worst-performing sector, while growth segments of the economy such as health care, retail, consumer cyclicals, and biotechnology generated strong returns.

After six years of near-zero interest rates, the Federal Reserve’s cautious optimism about the economy suggests that rates are likely to begin to rise later this year.

Over the six months, the portfolio maintained a bias toward smaller-cap stocks with strong analyst sentiment that contributed positively to returns. In addition, as companies with robust foreign revenues underperformed given the strengthening dollar and the relative robustness of the U.S. economy, the portfolio’s underweighting of such companies added value. An overweighting of companies with strong earnings quality detracted slightly. Among sectors, underweighting energy contributed significantly to returns as earnings estimates continued to fall, with Brent crude oil prices ranging from $46 to $62 per barrel.

Although the market continues to favor companies with strong analyst sentiment, stable growth assets are increasingly attractive. Companies with high book values relative to their market caps continue to be penalized as investors favor higher-quality assets with sustainable growth. In addition to the underweighting of energy, the portfolio is tilted away from finance and technology and toward health care and retail.

D. E. Shaw Investment

Management, L.L.C.

Portfolio Managers:

Anne Dinning, Ph.D., Managing Director

and Chief Investment Officer

Philip Kearns, Ph.D., Managing Director

In our view, the primary themes driving equity market valuations during the reporting period were strong U.S. corporate earnings, macroeconomic developments, and central bank policy actions in the United States, Europe, Japan, and emerging markets. In particular, equity markets appeared to be sensitive to falling crude oil

9

prices, declining interest rates and inflation, and the strengthening U.S. dollar. In the United States, stronger-than-expected employment and GDP data appeared to propel equity markets higher, as the S&P 500 Index broke through 2,100 for the first time. The Federal Reserve, while poised to raise its federal funds rate in the near future, signaled that rates would not rise as high or as quickly as many observers had anticipated. The European Central Bank initiated a quantitative easing program, and the Bank of Japan expanded its own, while the People’s Bank of China cut interest rates. Geopolitical tensions in Ukraine subsided, while military conflict in the Middle East spread to Yemen.

Unusually large moves in individual stocks in the first two weeks of October were a challenge for the portfolio. That challenge was generally offset by stronger relative performance in the first quarter of 2015, as risk-taking returned to the markets. We generally attribute portfolio performance to three major sources: bottom-up stock selection; exposure to common risk factors such as value, growth, and market cap; and exposure to industry groups. During the period, stock selection disappointed. The three largest single-stock detractors to relative return were overweight positions in LyondellBasell Industries, Occidental Petroleum, and Netflix. The three largest contributors were an underweight position in Microsoft and overweight positions in Constellation Brands and Boston Scientific.

Common risk factors positively affected our portfolio’s return. In particular, it benefited from modest exposures to small-cap and low-dollar-volume stocks, while modest exposures to high volatility and high-turnover stocks detracted from relative performance. Sector and industry deviations from benchmark weights boosted the portfolio’s relative return.

Over the last five years, the U.S. equity market has performed strongly, outpacing global equity markets and a number of other asset classes. Rising U.S. stock valuations have been supported by impressive growth in corporate earnings. The dollar’s recent strengthening dampened earnings growth, and future dollar moves—whether positive or negative—could spark volatility in the stock market. In addition, downside shocks on the macroeconomic or political front in the United States, Europe, or China, as well as unexpected interest rate moves by the Fed, could hurt U.S. stock market valuations and increase volatility.

Vanguard Equity Investment Group

Portfolio Managers:

James D. Troyer, CFA, Principal

James P. Stetler, Principal

Michael R. Roach, CFA

For the fiscal half year, equities continued to produce strong returns. The broad U.S. equity market was up about 7%. Large-cap stocks in the fund’s benchmark, the S&P 500 Index, gained 5.93%, while small-caps outpaced the rest of the market, rising more than 14%. Value-oriented equities were widely outpaced by growth stocks. Globally, the U.S. equity market generated the lion’s share of returns, with other

countries down slightly. Emerging markets, which declined more than 2%, were a large contributor to that result.

Performance within the benchmark was mixed as three sectors declined. Results were best in health care, consumer discretionary, and consumer staples. Telecommunication services, energy, and materials stocks were all negative.

As the U.S. economy moved into 2015, it built on its positive momentum. Fourth-quarter GDP growth came in at an annual rate of 2.2%. This was down from 5% in the third quarter but still encouraging. Although job growth slowed in March, the unemployment level has declined to 5.5%, and the country appears to be approaching full employment.

The past six months have not been without challenges. The harsh winter in many parts of the country is believed to have hurt first-quarter 2015 growth, and tepid sales have boosted wholesale inventory levels, leaving little motivation to restock warehouses. It remains uncertain when and to what extent the Fed will begin raising interest rates. In addition, the dollar’s strength has increased the price of exports by as much as 20%, challenging the revenue and profit results of multinational companies.

Although it’s important to understand how our overall performance is affected by the macro factors we’ve described, our approach to investing focuses on specific fundamentals—not on technical analysis of stock price movements. We compare all stocks in our investment universe within the same industry groups to identify those with characteristics that we believe will outperform over the long run.

To do this, we use a strict quantitative process that systematically focuses on several key fundamental factors. We believe that attractive stocks exhibit five key themes: 1) high quality—healthy balance sheets and consistent cash-flow generation; 2) effective use of capital—sound investment policies that prefer internal to external funding; 3) consistent earnings growth—a demonstrated ability to grow earnings year after year; 4) strong market sentiment—market confirmation of our view; and 5) reasonable valuation—avoidance of overpriced stocks.

Using these five themes, we generate a composite expected return for all the stocks in our universe each day—seeking to capitalize on investor biases across the market. We then monitor our portfolio, based on those scores, and adjust when appropriate to maximize expected return while minimizing exposure to risks that our research indicates do not improve returns (such as industry selection and other risks relative to our benchmark).

For the half year, our growth and management decisions models were positive contributors to performance. However, our sentiment, valuation, and quality models did not perform as expected. The models’ effectiveness across sectors was pleasing, as stock selection was positive in five of the ten sectors, close to neutral in four, and negative in one. Our strongest results

11

were in energy, information technology, and consumer discretionary. We underperformed in materials.

Among individual stocks, the largest contributors came from overweight positions in Electronic Arts, O’Reilly Automotive, and Edwards Lifesciences. And compared with the benchmark, we benefited from underweighting or avoiding poor performers such as Halliburton and Freeport-McMoRan.

Unfortunately, we were not able to avoid all bad performers. Overweight positions in Nabors Industries, National Oilwell Varco, and UnitedHealth Group directly lowered performance. Also, underweighting Walgreens Boots Alliance and Kraft Foods Group, companies that were not positively identified by the fundamentals in our model, hurt our overall outperformance.

We continue to believe that constructing a portfolio that focuses on the key fundamentals described earlier will benefit investors over the long term, even as we recognize that risk can reward or punish us in the near term. We look forward to the rest of the fiscal year; we believe that the fund offers a strong mix of stocks with attractive valuation and growth characteristics relative to the benchmark.

12

Growth and Income Fund

Fund Profile

As of March 31, 2015

| Share-Class Characteristics | ||

| Investor | Admiral | |

| Shares | Shares | |

| Ticker Symbol | VQNPX | VGIAX |

| Expense Ratio1 | 0.37% | 0.26% |

| 30-Day SEC Yield | 1.67% | 1.78% |

| Portfolio Characteristics | |||

| DJ | |||

| U.S. Total | |||

| S&P 500 | Market | ||

| Fund | Index | FA Index | |

| Number of Stocks | 714 | 502 | 3,757 |

| Median Market Cap | $59.1B | $79.3B | $46.5B |

| Price/Earnings Ratio | 19.5x | 19.8x | 21.4x |

| Price/Book Ratio | 3.1x | 2.9x | 2.8x |

| Return on Equity | 18.5% | 18.7% | 17.5% |

| Earnings Growth | |||

| Rate | 13.2% | 13.4% | 13.5% |

| Dividend Yield | 2.0% | 2.0% | 1.9% |

| Foreign Holdings | 0.3% | 0.0% | 0.0% |

| Turnover Rate | |||

| (Annualized) | 116% | — | — |

| Short-Term Reserves | 0.3% | — | — |

| Volatility Measures | ||

| DJ | ||

| U.S. Total | ||

| S&P 500 | Market | |

| Index | FA Index | |

| R-Squared | 0.99 | 0.98 |

| Beta | 1.00 | 0.97 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. | ||

| Ten Largest Holdings (% of total net assets) | ||

| Apple Inc. | Technology | |

| Hardware, Storage & | ||

| Peripherals | 4.3% | |

| Johnson & Johnson | Pharmaceuticals | 2.1 |

| Exxon Mobil Corp. | Integrated Oil & Gas | 1.7 |

| General Electric Co. | Industrial | |

| Conglomerates | 1.5 | |

| Wells Fargo & Co. | Diversified Banks | 1.4 |

| Merck & Co. Inc. | Pharmaceuticals | 1.3 |

| Procter & Gamble Co. | Household Products | 1.1 |

| Home Depot Inc. | Home Improvement | |

| Retail | 1.1 | |

| AT&T Inc. | Integrated | |

| Telecommunication | ||

| Services | 1.1 | |

| JPMorgan Chase & Co. | Diversified Banks | 1.0 |

| Top Ten | 16.6% | |

| The holdings listed exclude any temporary cash investments and equity index products. | ||

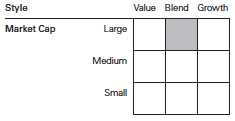

Investment Focus

1 The expense ratios shown are from the prospectus dated January 26, 2015, and represent estimated costs for the current fiscal year. For the six months ended March 31, 2015, the annualized expense ratios were 0.35% for Investor Shares and 0.24% for Admiral Shares.

13

Growth and Income Fund

| Sector Diversification (% of equity exposure) | |||

| DJ | |||

| U.S. Total | |||

| S&P 500 | Market | ||

| Fund | Index FA Index | ||

| Consumer | |||

| Discretionary | 12.4% | 12.6% | 13.4% |

| Consumer Staples | 9.9 | 9.7 | 8.4 |

| Energy | 6.6 | 8.0 | 7.3 |

| Financials | 15.2 | 16.2 | 17.6 |

| Health Care | 16.8 | 14.9 | 14.6 |

| Industrials | 12.3 | 10.4 | 11.1 |

| Information | |||

| Technology | 17.9 | 19.7 | 19.0 |

| Materials | 4.0 | 3.2 | 3.5 |

| Telecommunication | |||

| Services | 2.3 | 2.3 | 2.0 |

| Utilities | 2.6 | 3.0 | 3.1 |

14

Growth and Income Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

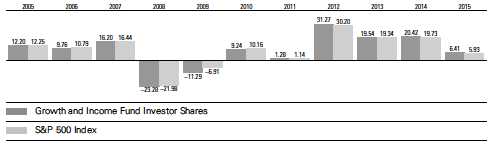

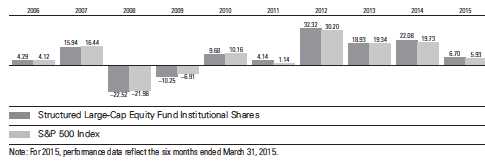

Fiscal-Year Total Returns (%): September 30, 2004, Through March 31, 2015

| Average Annual Total Returns: Periods Ended March 31, 2015 | ||||

| Inception | One | Five | Ten | |

| Date | Year | Years | Years | |

| Investor Shares | 12/10/1986 | 13.83% | 14.77% | 7.25% |

| Admiral Shares | 5/14/2001 | 13.95 | 14.90 | 7.38 |

See Financial Highlights for dividend and capital gains information.

15

Growth and Income Fund

Financial Statements (unaudited)

Statement of Net Assets

As of March 31, 2015

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Common Stocks (96.7%)1 | |||

| Consumer Discretionary (11.9%) | |||

| Home Depot Inc. | 616,124 | 69,998 | |

| Comcast Corp. Class A | 774,170 | 43,717 | |

| Walt Disney Co. | 408,775 | 42,876 | |

| Lowe’s Cos. Inc. | 561,810 | 41,793 | |

| Wyndham Worldwide Corp. | 424,250 | 38,382 | |

| Time Warner Cable Inc. | 216,065 | 32,384 | |

| * | O’Reilly Automotive Inc. | 108,530 | 23,469 |

| * | Amazon.com Inc. | 58,770 | 21,868 |

| Cablevision Systems Corp. | |||

| Class A | 1,178,450 | 21,566 | |

| L Brands Inc. | 224,327 | 21,152 | |

| NIKE Inc. Class B | 183,100 | 18,370 | |

| Expedia Inc. | 181,587 | 17,093 | |

| Delphi Automotive plc | 202,350 | 16,135 | |

| Viacom Inc. Class B | 235,230 | 16,066 | |

| * | Under Armour Inc. Class A | 192,880 | 15,575 |

| Staples Inc. | 935,052 | 15,227 | |

| Time Warner Inc. | 172,015 | 14,525 | |

| * | Priceline Group Inc. | 11,800 | 13,737 |

| Kohl’s Corp. | 175,400 | 13,725 | |

| H&R Block Inc. | 410,700 | 13,171 | |

| Marriott International Inc. | |||

| Class A | 159,300 | 12,795 | |

| Royal Caribbean | |||

| Cruises Ltd. | 153,090 | 12,530 | |

| TJX Cos. Inc. | 173,480 | 12,152 | |

| Best Buy Co. Inc. | 309,900 | 11,711 | |

| Harman International | |||

| Industries Inc. | 80,700 | 10,784 | |

| * | Netflix Inc. | 23,380 | 9,742 |

| * | DIRECTV | 112,477 | 9,572 |

| Interpublic Group of | |||

| Cos. Inc. | 394,685 | 8,730 | |

| Ross Stores Inc. | 79,730 | 8,400 | |

| Omnicom Group Inc. | 105,323 | 8,213 | |

| Leggett & Platt Inc. | 169,990 | 7,835 | |

| Ford Motor Co. | 459,220 | 7,412 | |

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Graham Holdings Co. | |||

| Class B | 6,708 | 7,041 | |

| General Motors Co. | 179,900 | 6,746 | |

| Gap Inc. | 143,296 | 6,209 | |

| * | Chipotle Mexican Grill Inc. | ||

| Class A | 8,450 | 5,497 | |

| Genuine Parts Co. | 57,690 | 5,376 | |

| * | Dollar General Corp. | 68,000 | 5,126 |

| Goodyear Tire & Rubber Co. | 179,800 | 4,869 | |

| * | Fossil Group Inc. | 59,000 | 4,865 |

| Darden Restaurants Inc. | 69,529 | 4,821 | |

| * | AutoZone Inc. | 6,958 | 4,746 |

| Target Corp. | 52,560 | 4,314 | |

| Macy’s Inc. | 63,570 | 4,126 | |

| * | AutoNation Inc. | 63,320 | 4,073 |

| * | Ulta Salon Cosmetics & | ||

| Fragrance Inc. | 26,200 | 3,952 | |

| * | Mohawk Industries Inc. | 19,310 | 3,587 |

| Whirlpool Corp. | 16,866 | 3,408 | |

| Tractor Supply Co. | 39,000 | 3,317 | |

| * | Liberty Global plc | 66,511 | 3,313 |

| Nordstrom Inc. | 38,890 | 3,124 | |

| * | CarMax Inc. | 41,940 | 2,894 |

| * | Michael Kors Holdings Ltd. | 43,797 | 2,880 |

| * | Charter Communications | ||

| Inc. Class A | 14,300 | 2,761 | |

| Starbucks Corp. | 28,229 | 2,673 | |

| Newell Rubbermaid Inc. | 65,780 | 2,570 | |

| Johnson Controls Inc. | 48,633 | 2,453 | |

| * | NVR Inc. | 1,800 | 2,392 |

| * | Liberty Media Corp. | 49,000 | 1,872 |

| * | TripAdvisor Inc. | 21,908 | 1,822 |

| Hasbro Inc. | 28,517 | 1,803 | |

| * | Discovery | ||

| Communications Inc. | 39,940 | 1,177 | |

| * | Liberty Ventures Class A | 27,400 | 1,151 |

| PVH Corp. | 8,700 | 927 | |

| Mattel Inc. | 36,943 | 844 | |

| * | Discovery Communications | ||

| Inc. Class A | 23,099 | 711 |

16

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Gannett Co. Inc. | 18,960 | 703 | |

| * | News Corp. Class A | 37,720 | 604 |

| * | Liberty Broadband Corp. | 10,350 | 586 |

| Time Inc. | 23,021 | 517 | |

| CBS Corp. Class B | 7,790 | 472 | |

| * | Hilton Worldwide | ||

| Holdings Inc. | 13,100 | 388 | |

| * | Murphy USA Inc. | 5,300 | 384 |

| * | Liberty TripAdvisor | ||

| Holdings Inc. Class A | 12,000 | 382 | |

| * | Liberty Media Corp. Class A | 9,700 | 374 |

| * | Isle of Capri Casinos Inc. | 26,500 | 372 |

| GNC Holdings Inc. Class A | 7,184 | 353 | |

| * | Michaels Cos. Inc. | 12,500 | 338 |

| GameStop Corp. Class A | 8,900 | 338 | |

| * | Sears Holdings Corp. | 7,900 | 327 |

| * | Apollo Education Group Inc. | 15,990 | 303 |

| VF Corp. | 2,640 | 199 | |

| PulteGroup Inc. | 8,860 | 197 | |

| Bloomin’ Brands Inc. | 7,600 | 185 | |

| SeaWorld Entertainment Inc. | 9,175 | 177 | |

| * | ITT Educational Services Inc. | 25,400 | 172 |

| * | Lee Enterprises Inc. | 38,010 | 121 |

| Scripps Networks | |||

| Interactive Inc. Class A | 1,706 | 117 | |

| * | Ascena Retail Group Inc. | 7,300 | 106 |

| * | TRI Pointe Homes Inc. | 6,800 | 105 |

| CST Brands Inc. | 1,689 | 74 | |

| * | Townsquare Media Inc. | ||

| Class A | 5,000 | 64 | |

| DeVry Education Group Inc. | 1,700 | 57 | |

| * | New York & Co. Inc. | 22,498 | 56 |

| * | Sally Beauty Holdings Inc. | 1,248 | 43 |

| Harte-Hanks Inc. | 3,300 | 26 | |

| * | Citi Trends Inc. | 800 | 22 |

| * | Tower International Inc. | 800 | 21 |

| * | Blyth Inc. | 2,798 | 21 |

| * | Cooper-Standard Holding Inc. | 300 | 18 |

| * | Wayfair Inc. | 500 | 16 |

| * | Biglari Holdings Inc. | 34 | 14 |

| * | Build-A-Bear Workshop Inc. | 700 | 14 |

| * | Aeropostale Inc. | 3,900 | 14 |

| * | ZAGG Inc. | 1,500 | 13 |

| John Wiley & Sons Inc. | |||

| Class A | 200 | 12 | |

| BorgWarner Inc. | 200 | 12 | |

| * | Dollar Tree Inc. | 100 | 8 |

| Service Corp. International | 300 | 8 | |

| Nutrisystem Inc. | 300 | 6 | |

| Universal Technical | |||

| Institute Inc. | 500 | 5 | |

| * | Journal Communications | ||

| Inc. Class A | 200 | 3 | |

| * | Boyd Gaming Corp. | 208 | 3 |

| * | MGM Resorts International | 100 | 2 |

| 756,497 |

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Consumer Staples (9.5%) | |||

| Procter & Gamble Co. | 863,020 | 70,716 | |

| PepsiCo Inc. | 677,481 | 64,781 | |

| Wal-Mart Stores Inc. | 582,869 | 47,941 | |

| Kroger Co. | 580,053 | 44,467 | |

| Coca-Cola Co. | 1,071,062 | 43,432 | |

| CVS Health Corp. | 388,891 | 40,137 | |

| Altria Group Inc. | 748,438 | 37,437 | |

| * | Constellation Brands Inc. | ||

| Class A | 246,761 | 28,676 | |

| Costco Wholesale Corp. | 153,100 | 23,194 | |

| Dr Pepper Snapple | |||

| Group Inc. | 263,871 | 20,709 | |

| Reynolds American Inc. | 297,300 | 20,487 | |

| Sysco Corp. | 542,169 | 20,456 | |

| Clorox Co. | 162,790 | 17,970 | |

| Archer-Daniels-Midland Co. | 366,960 | 17,394 | |

| Walgreens Boots | |||

| Alliance Inc. | 176,890 | 14,979 | |

| Mondelez International Inc. | |||

| Class A | 394,640 | 14,243 | |

| * | Monster Beverage Corp. | 91,800 | 12,705 |

| Coca-Cola Enterprises Inc. | 221,640 | 9,796 | |

| Kraft Foods Group Inc. | 98,884 | 8,614 | |

| ConAgra Foods Inc. | 193,300 | 7,061 | |

| General Mills Inc. | 113,032 | 6,398 | |

| Philip Morris | |||

| International Inc. | 82,619 | 6,224 | |

| Hershey Co. | 53,255 | 5,374 | |

| JM Smucker Co. | 38,314 | 4,434 | |

| Tyson Foods Inc. Class A | 79,777 | 3,055 | |

| Colgate-Palmolive Co. | 39,700 | 2,753 | |

| Avon Products Inc. | 339,430 | 2,712 | |

| Campbell Soup Co. | 55,020 | 2,561 | |

| Whole Foods Market Inc. | 44,500 | 2,318 | |

| Kimberly-Clark Corp. | 16,031 | 1,717 | |

| Pilgrim’s Pride Corp. | 14,100 | 318 | |

| * | Herbalife Ltd. | 6,200 | 265 |

| * | Adecoagro SA | 10,656 | 109 |

| Mead Johnson Nutrition Co. | 1,000 | 101 | |

| * | SunOpta Inc. | 6,396 | 68 |

| * | Rite Aid Corp. | 3,600 | 31 |

| Hormel Foods Corp. | 200 | 11 | |

| 603,644 | |||

| Energy (6.3%) | |||

| Exxon Mobil Corp. | 1,251,357 | 106,365 | |

| Anadarko Petroleum Corp. | 395,800 | 32,776 | |

| Chevron Corp. | 284,426 | 29,859 | |

| Occidental Petroleum Corp. | 393,222 | 28,705 | |

| Tesoro Corp. | 312,920 | 28,567 | |

| Schlumberger Ltd. | 328,669 | 27,424 | |

| Valero Energy Corp. | 380,170 | 24,186 | |

| National Oilwell Varco Inc. | 374,700 | 18,731 | |

| * | Newfield Exploration Co. | 385,600 | 13,531 |

| EOG Resources Inc. | 146,800 | 13,460 | |

| Phillips 66 | 166,900 | 13,118 | |

17

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Marathon Petroleum Corp. | 124,310 | 12,728 | |

| Chesapeake Energy Corp. | 820,700 | 11,621 | |

| Kinder Morgan Inc. | 151,490 | 6,372 | |

| ConocoPhillips | 96,790 | 6,026 | |

| Williams Cos. Inc. | 92,110 | 4,660 | |

| * | FMC Technologies Inc. | 118,500 | 4,386 |

| * | Southwestern Energy Co. | 157,508 | 3,653 |

| Baker Hughes Inc. | 49,800 | 3,166 | |

| ONEOK Inc. | 38,810 | 1,872 | |

| Spectra Energy Corp. | 35,700 | 1,291 | |

| * | Cameron International Corp. | 27,500 | 1,241 |

| EQT Corp. | 10,800 | 895 | |

| EnLink Midstream LLC | 23,200 | 755 | |

| California Resources Corp. | 93,798 | 714 | |

| Apache Corp. | 11,800 | 712 | |

| * | Laredo Petroleum Inc. | 37,900 | 494 |

| * | WPX Energy Inc. | 37,176 | 406 |

| QEP Resources Inc. | 13,900 | 290 | |

| * | SEACOR Holdings Inc. | 3,600 | 251 |

| * | Penn Virginia Corp. | 29,800 | 193 |

| * | Pacific Drilling SA | 38,400 | 149 |

| Delek US Holdings Inc. | 3,200 | 127 | |

| Tsakos Energy Navigation Ltd. | 11,510 | 94 | |

| Ensco plc Class A | 3,474 | 73 | |

| * | Rosetta Resources Inc. | 3,700 | 63 |

| * | FMSA Holdings Inc. | 8,400 | 61 |

| * | EP Energy Corp. Class A | 5,400 | 57 |

| * | Stone Energy Corp. | 3,800 | 56 |

| * | Goodrich Petroleum Corp. | 14,900 | 53 |

| * | Willbros Group Inc. | 15,300 | 51 |

| * | TransAtlantic Petroleum Ltd. | 9,187 | 49 |

| * | InterOil Corp. | 1,000 | 46 |

| Noble Corp. plc | 2,400 | 34 | |

| * | Memorial Resource | ||

| Development Corp. | 1,700 | 30 | |

| * | Rex Energy Corp. | 6,800 | 25 |

| Frank’s International NV | 1,300 | 24 | |

| * | Harvest Natural | ||

| Resources Inc. | 52,777 | 24 | |

| * | Callon Petroleum Co. | 2,800 | 21 |

| Aegean Marine Petroleum | |||

| Network Inc. | 1,036 | 15 | |

| Ocean Rig UDW Inc. | 2,142 | 14 | |

| Seadrill Ltd. | 1,500 | 14 | |

| Marathon Oil Corp. | 300 | 8 | |

| PBF Energy Inc. Class A | 200 | 7 | |

| Exterran Holdings Inc. | 200 | 7 | |

| Plains GP Holdings LP Class A | 200 | 6 | |

| * | ION Geophysical Corp. | 2,400 | 5 |

| Western Refining Inc. | 100 | 5 | |

| * | Gulfport Energy Corp. | 100 | 5 |

| * | Era Group Inc. | 214 | 4 |

| North American Energy | |||

| Partners Inc. | 1,300 | 4 | |

| * | Kosmos Energy Ltd. | 400 | 3 |

| 399,582 |

| Market | ||

| Value | ||

| Shares | ($000) | |

| Financials (14.7%) | ||

| Wells Fargo & Co. | 1,653,716 | 89,962 |

| JPMorgan Chase & Co. | 1,096,208 | 66,408 |

| * Berkshire Hathaway Inc. | ||

| Class B | 411,304 | 59,359 |

| Citigroup Inc. | 962,325 | 49,579 |

| Goldman Sachs Group Inc. | 164,285 | 30,881 |

| Capital One Financial Corp. | 383,400 | 30,220 |

| Host Hotels & Resorts Inc. | 1,436,810 | 28,995 |

| Weyerhaeuser Co. | 791,453 | 26,237 |

| Public Storage | 132,371 | 26,096 |

| American International | ||

| Group Inc. | 461,000 | 25,258 |

| Ameriprise Financial Inc. | 186,004 | 24,337 |

| Morgan Stanley | 604,350 | 21,569 |

| Allstate Corp. | 302,530 | 21,531 |

| Navient Corp. | 1,038,700 | 21,117 |

| Travelers Cos. Inc. | 182,426 | 19,726 |

| PNC Financial Services | ||

| Group Inc. | 183,400 | 17,100 |

| Progressive Corp. | 620,173 | 16,869 |

| US Bancorp | 383,194 | 16,734 |

| Aon plc | 168,560 | 16,202 |

| Bank of America Corp. | 1,050,310 | 16,164 |

| General Growth | ||

| Properties Inc. | 526,724 | 15,565 |

| Simon Property Group Inc. | 77,207 | 15,105 |

| McGraw Hill Financial Inc. | 144,000 | 14,890 |

| Legg Mason Inc. | 262,696 | 14,501 |

| Crown Castle | ||

| International Corp. | 165,530 | 13,663 |

| American Express Co. | 174,343 | 13,620 |

| Assurant Inc. | 217,860 | 13,379 |

| Ventas Inc. | 171,659 | 12,535 |

| Moody’s Corp. | 119,080 | 12,360 |

| Prologis Inc. | 252,229 | 10,987 |

| Marsh & McLennan | ||

| Cos. Inc. | 195,840 | 10,985 |

| Intercontinental | ||

| Exchange Inc. | 45,900 | 10,707 |

| BlackRock Inc. | 26,690 | 9,764 |

| Bank of New York | ||

| Mellon Corp. | 229,465 | 9,234 |

| Lincoln National Corp. | 154,005 | 8,849 |

| Health Care REIT Inc. | 110,410 | 8,541 |

| Chubb Corp. | 76,869 | 7,771 |

| CME Group Inc. | 78,600 | 7,444 |

| AvalonBay Communities Inc. | 40,900 | 7,127 |

| ACE Ltd. | 63,200 | 7,046 |

| Regions Financial Corp. | 704,800 | 6,660 |

| Iron Mountain Inc. | 176,630 | 6,443 |

| SunTrust Banks Inc. | 154,400 | 6,344 |

| Aflac Inc. | 85,500 | 5,473 |

| HCP Inc. | 84,900 | 3,669 |

| Principal Financial Group Inc. | 70,800 | 3,637 |

| Equity Residential | 46,120 | 3,591 |

18

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Invesco Ltd. | 90,460 | 3,590 | |

| People’s United | |||

| Financial Inc. | 231,042 | 3,512 | |

| Plum Creek Timber Co. Inc. | 79,842 | 3,469 | |

| Prudential Financial Inc. | 41,000 | 3,293 | |

| Apartment Investment & | |||

| Management Co. | 68,440 | 2,694 | |

| Equity LifeStyle | |||

| Properties Inc. | 48,900 | 2,687 | |

| First Horizon National Corp. | 178,470 | 2,550 | |

| Northern Trust Corp. | 32,980 | 2,297 | |

| Cincinnati Financial Corp. | 41,980 | 2,237 | |

| Hartford Financial | |||

| Services Group Inc. | 50,000 | 2,091 | |

| Discover Financial Services | 33,241 | 1,873 | |

| NASDAQ OMX Group Inc. | 33,660 | 1,715 | |

| Kimco Realty Corp. | 42,510 | 1,141 | |

| Excel Trust Inc. | 79,195 | 1,110 | |

| XL Group plc Class A | 28,540 | 1,050 | |

| Brixmor Property Group Inc. | 37,400 | 993 | |

| * | Realogy Holdings Corp. | 21,500 | 978 |

| Torchmark Corp. | 15,090 | 829 | |

| * | CBRE Group Inc. Class A | 20,871 | 808 |

| Voya Financial Inc. | 14,100 | 608 | |

| American Tower Corporation | 6,050 | 570 | |

| Retail Properties of | |||

| America Inc. | 33,800 | 542 | |

| Loews Corp. | 11,600 | 474 | |

| Leucadia National Corp. | 16,800 | 374 | |

| BankUnited Inc. | 10,800 | 354 | |

| Chimera Investment Corp. | 107,000 | 336 | |

| * | Forest City Enterprises Inc. | ||

| Class A | 10,400 | 265 | |

| Parkway Properties Inc. | 15,200 | 264 | |

| * | Equity Commonwealth | 8,900 | 236 |

| CIT Group Inc. | 4,800 | 217 | |

| * | SLM Corp. | 21,400 | 199 |

| * | NewStar Financial Inc. | 14,083 | 165 |

| WP GLIMCHER Inc. | 9,583 | 159 | |

| Columbia Property Trust Inc. | 5,600 | 151 | |

| Old Republic | |||

| International Corp. | 7,300 | 109 | |

| ZAIS Financial Corp. | 5,800 | 103 | |

| Aspen Insurance | |||

| Holdings Ltd. | 2,100 | 99 | |

| Symetra Financial Corp. | 4,100 | 96 | |

| Healthcare Realty Trust Inc. | 3,400 | 94 | |

| MVC Capital Inc. | 9,327 | 88 | |

| T. Rowe Price Group Inc. | 1,060 | 86 | |

| Erie Indemnity Co. Class A | 900 | 79 | |

| AG Mortgage Investment | |||

| Trust Inc. | 3,800 | 72 | |

| Digital Realty Trust Inc. | 1,000 | 66 | |

| * | Ladder Capital Corp. | 3,000 | 56 |

| Unum Group | 1,600 | 54 |

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Assured Guaranty Ltd. | 1,900 | 50 | |

| * | E*TRADE Financial Corp. | 1,690 | 48 |

| Arbor Realty Trust Inc. | 6,463 | 45 | |

| Armada Hoffler | |||

| Properties Inc. | 4,200 | 45 | |

| * | PHH Corp. | 1,700 | 41 |

| WP Carey Inc. | 600 | 41 | |

| Gain Capital Holdings Inc. | 4,000 | 39 | |

| * | Signature Bank | 300 | 39 |

| Apollo Commercial Real | |||

| Estate Finance Inc. | 2,200 | 38 | |

| Reinsurance Group of | |||

| America Inc. Class A | 400 | 37 | |

| BB&T Corp. | 800 | 31 | |

| * | Meridian Bancorp Inc. | 2,200 | 29 |

| Endurance Specialty | |||

| Holdings Ltd. | 300 | 18 | |

| * | Cascade Bancorp | 3,422 | 16 |

| * | Western Alliance Bancorp | 473 | 14 |

| * | Genworth Financial Inc. | ||

| Class A | 1,700 | 12 | |

| CorEnergy Infrastructure | |||

| Trust Inc. | 1,708 | 12 | |

| National Penn | |||

| Bancshares Inc. | 844 | 9 | |

| * | Flagstar Bancorp Inc. | 617 | 9 |

| Allied World Assurance Co. | |||

| Holdings AG | 200 | 8 | |

| LaSalle Hotel Properties | 200 | 8 | |

| Liberty Property Trust | 100 | 4 | |

| Zions Bancorporation | 118 | 3 | |

| Chatham Lodging Trust | 100 | 3 | |

| Suffolk Bancorp | 100 | 2 | |

| National Bank Holdings | |||

| Corp. Class A | 111 | 2 | |

| 929,670 | |||

| Health Care (16.3%) | |||

| Johnson & Johnson | 1,294,786 | 130,255 | |

| Merck & Co. Inc. | 1,386,076 | 79,672 | |

| Pfizer Inc. | 1,785,582 | 62,120 | |

| * | Gilead Sciences Inc. | 537,705 | 52,765 |

| Anthem Inc. | 306,200 | 47,280 | |

| * | Express Scripts Holding Co. | 527,489 | 45,770 |

| Eli Lilly & Co. | 585,855 | 42,562 | |

| AbbVie Inc. | 725,823 | 42,490 | |

| * | Biogen Inc. | 99,140 | 41,861 |

| Cardinal Health Inc. | 392,580 | 35,438 | |

| Amgen Inc. | 217,158 | 34,713 | |

| Bristol-Myers Squibb Co. | 532,432 | 34,342 | |

| UnitedHealth Group Inc. | 282,728 | 33,444 | |

| AmerisourceBergen Corp. | |||

| Class A | 252,662 | 28,720 | |

| * | Boston Scientific Corp. | 1,440,639 | 25,571 |

| Cigna Corp. | 191,450 | 24,781 | |

19

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| * | Regeneron | ||

| Pharmaceuticals Inc. | 43,330 | 19,563 | |

| * | Vertex Pharmaceuticals Inc. | 143,856 | 16,971 |

| Aetna Inc. | 135,730 | 14,459 | |

| * | Edwards Lifesciences Corp. | 99,618 | 14,192 |

| * | HCA Holdings Inc. | 186,880 | 14,059 |

| McKesson Corp. | 61,600 | 13,934 | |

| * | Laboratory Corp. of | ||

| America Holdings | 105,920 | 13,355 | |

| * | DaVita HealthCare | ||

| Partners Inc. | 162,972 | 13,246 | |

| Abbott Laboratories | 272,693 | 12,634 | |

| * | Valeant Pharmaceuticals | ||

| International Inc. | 61,104 | 12,136 | |

| * | Actavis plc | 39,832 | 11,855 |

| * | Mylan NV | 197,090 | 11,697 |

| * | Celgene Corp. | 100,480 | 11,583 |

| Baxter International Inc. | 153,058 | 10,484 | |

| Medtronic plc | 94,783 | 7,392 | |

| Quest Diagnostics Inc. | 86,210 | 6,625 | |

| Agilent Technologies Inc. | 154,895 | 6,436 | |

| * | Tenet Healthcare Corp. | 119,490 | 5,916 |

| Thermo Fisher Scientific Inc. | 43,287 | 5,815 | |

| Humana Inc. | 25,310 | 4,506 | |

| Zoetis Inc. | 87,681 | 4,059 | |

| * | Endo International plc | 44,680 | 4,008 |

| Becton Dickinson and Co. | 27,882 | 4,004 | |

| Universal Health | |||

| Services Inc. Class B | 34,010 | 4,003 | |

| Stryker Corp. | 42,850 | 3,953 | |

| * | Hospira Inc. | 37,040 | 3,254 |

| * | VCA Inc. | 56,400 | 3,092 |

| PerkinElmer Inc. | 49,910 | 2,552 | |

| * | Intuitive Surgical Inc. | 3,810 | 1,924 |

| * | Mallinckrodt plc | 13,700 | 1,735 |

| * | Medivation Inc. | 10,800 | 1,394 |

| Zimmer Holdings Inc. | 10,984 | 1,291 | |

| Perrigo Co. plc | 7,600 | 1,258 | |

| * | Health Net Inc. | 14,900 | 901 |

| * | Cerner Corp. | 12,030 | 881 |

| * | Illumina Inc. | 3,900 | 724 |

| * | BioTelemetry Inc. | 69,772 | 617 |

| * | Neurocrine Biosciences Inc. | 15,364 | 610 |

| * | Arena Pharmaceuticals Inc. | 92,903 | 406 |

| * | Alnylam | ||

| Pharmaceuticals Inc. | 3,600 | 376 | |

| * | TESARO Inc. | 6,100 | 350 |

| * | Geron Corp. | 85,600 | 323 |

| * | Vanda Pharmaceuticals Inc. | 33,700 | 313 |

| Theravance Inc. | 17,400 | 274 | |

| * | BioCryst | ||

| Pharmaceuticals Inc. | 25,400 | 229 | |

| * | Horizon Pharma plc | 8,700 | 226 |

| STERIS Corp. | 3,100 | 218 | |

| CR Bard Inc. | 1,170 | 196 | |

| * | Dyax Corp. | 9,700 | 163 |

| Market | |||

| Value | |||

| Shares | ($000) | ||

| * | Pain Therapeutics Inc. | 78,492 | 148 |

| * | OvaScience Inc. | 3,900 | 135 |

| * | Rigel Pharmaceuticals Inc. | 33,901 | 121 |

| * | Puma Biotechnology Inc. | 500 | 118 |

| * | ANI Pharmaceuticals Inc. | 1,850 | 116 |

| * | Halyard Health Inc. | 2,003 | 99 |

| * | Insmed Inc. | 4,412 | 92 |

| * | SciClone | ||

| Pharmaceuticals Inc. | 9,590 | 85 | |

| * | Endocyte Inc. | 13,400 | 84 |

| * | Omeros Corp. | 3,800 | 84 |

| * | Dynavax Technologies Corp. | 2,800 | 62 |

| * | Momenta | ||

| Pharmaceuticals Inc. | 5,000 | 76 | |

| * | Genocea Biosciences Inc. | 5,523 | 66 |

| * | XenoPort Inc. | 8,499 | 61 |

| Omnicare Inc. | 700 | 54 | |

| * | Oncothyreon Inc. | 30,765 | 50 |

| * | Cytokinetics Inc. | 7,200 | 49 |

| * | Progenics | ||

| Pharmaceuticals Inc. | 8,000 | 48 | |

| * | Amicus Therapeutics Inc. | 4,200 | 46 |

| * | Arrowhead Research Corp. | 6,300 | 43 |

| * | Quintiles Transnational | ||

| Holdings Inc. | 500 | 34 | |

| * | Affymetrix Inc. | 2,100 | 26 |

| * | ARIAD Pharmaceuticals Inc. | 2,700 | 22 |

| * | ArQule Inc. | 8,649 | 19 |

| * | China Biologic Products Inc. | 200 | 19 |

| * | Receptos Inc. | 100 | 17 |

| * | Five Prime Therapeutics Inc. | 600 | 14 |

| * | Zeltiq Aesthetics Inc. | 400 | 12 |

| * | Targacept Inc. | 3,152 | 9 |

| * | Hyperion Therapeutics Inc. | 200 | 9 |

| * | Vical Inc. | 9,342 | 9 |

| * | AcelRx Pharmaceuticals Inc. | 2,200 | 9 |

| * | Regado Biosciences Inc. | 6,365 | 8 |

| * | Ligand Pharmaceuticals Inc. | 100 | 8 |

| HealthSouth Corp. | 154 | 7 | |

| * | Pacific Biosciences of | ||

| California Inc. | 1,000 | 6 | |

| * | ImmunoGen Inc. | 478 | 4 |

| * | La Jolla Pharmaceutical Co. | 200 | 4 |

| * | GTx Inc. | 4,487 | 3 |

| * | Inovio Pharmaceuticals Inc. | 300 | 2 |

| * | Trupanion Inc. | 272 | 2 |

| * | KaloBios | ||

| Pharmaceuticals Inc. | 625 | — | |

| 1,033,856 | |||

| Industrials (11.9%) | |||

| General Electric Co. | 3,834,980 | 95,146 | |

| General Dynamics Corp. | 417,663 | 56,689 | |

| Lockheed Martin Corp. | 250,034 | 50,747 | |

| Boeing Co. | 288,830 | 43,348 | |

| Union Pacific Corp. | 395,350 | 42,820 | |

| Northrop Grumman Corp. | 201,050 | 32,361 | |

20

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| 3M Co. | 176,040 | 29,038 | |

| Southwest Airlines Co. | 617,186 | 27,341 | |

| Illinois Tool Works Inc. | 238,000 | 23,119 | |

| Waste Management Inc. | 404,580 | 21,940 | |

| Delta Air Lines Inc. | 444,790 | 19,998 | |

| Cintas Corp. | 243,200 | 19,852 | |

| Danaher Corp. | 229,300 | 19,468 | |

| United Parcel Service Inc. | |||

| Class B | 162,957 | 15,797 | |

| FedEx Corp. | 93,502 | 15,470 | |

| * | Spirit AeroSystems | ||

| Holdings Inc. Class A | 289,300 | 15,104 | |

| Tyco International plc | 341,986 | 14,726 | |

| United Technologies Corp. | 117,632 | 13,786 | |

| Republic Services Inc. | |||

| Class A | 335,117 | 13,592 | |

| ADT Corp. | 323,996 | 13,452 | |

| Pitney Bowes Inc. | 532,937 | 12,428 | |

| Robert Half | |||

| International Inc. | 197,673 | 11,963 | |

| Honeywell International Inc. | 102,900 | 10,734 | |

| Snap-on Inc. | 69,600 | 10,235 | |

| * | United Rentals Inc. | 110,300 | 10,055 |

| CSX Corp. | 283,587 | 9,392 | |

| Equifax Inc. | 77,580 | 7,215 | |

| Ingersoll-Rand plc | 105,360 | 7,173 | |

| Stanley Black & Decker Inc. | 73,290 | 6,989 | |

| PACCAR Inc. | 103,900 | 6,560 | |

| Raytheon Co. | 57,320 | 6,262 | |

| Expeditors International of | |||

| Washington Inc. | 128,862 | 6,209 | |

| * | Stericycle Inc. | 43,590 | 6,121 |

| Pentair plc | 96,400 | 6,063 | |

| Allegion plc | 82,986 | 5,076 | |

| L-3 Communications | |||

| Holdings Inc. | 39,925 | 5,022 | |

| Allison Transmission | |||

| Holdings Inc. | 142,100 | 4,539 | |

| Dun & Bradstreet Corp. | 33,330 | 4,278 | |

| AMETEK Inc. | 79,700 | 4,187 | |

| CH Robinson | |||

| Worldwide Inc. | 54,490 | 3,990 | |

| Precision Castparts Corp. | 15,800 | 3,318 | |

| * | AerCap Holdings NV | 69,600 | 3,038 |

| Roper Industries Inc. | 16,400 | 2,821 | |

| Caterpillar Inc. | 34,100 | 2,729 | |

| Emerson Electric Co. | 39,393 | 2,230 | |

| KAR Auction Services Inc. | 58,500 | 2,219 | |

| Deere & Co. | 24,652 | 2,162 | |

| Norfolk Southern Corp. | 13,260 | 1,365 | |

| * | Verisk Analytics Inc. | ||

| Class A | 16,100 | 1,150 | |

| Dover Corp. | 14,000 | 968 | |

| Huntington Ingalls | |||

| Industries Inc. | 6,700 | 939 |

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Masco Corp. | 29,500 | 788 | |

| American Airlines | |||

| Group Inc. | 11,100 | 586 | |

| * | RPX Corp. | 40,306 | 580 |

| * | ARC Document | ||

| Solutions Inc. | 35,200 | 325 | |

| Con-way Inc. | 5,700 | 252 | |

| Babcock & Wilcox Co. | 7,600 | 244 | |

| * | IHS Inc. Class A | 1,555 | 177 |

| Nielsen NV | 3,425 | 153 | |

| * | Old Dominion Freight | ||

| Line Inc. | 1,500 | 116 | |

| MFC Industrial Ltd. | 24,012 | 98 | |

| * | MRC Global Inc. | 7,900 | 94 |

| Hubbell Inc. Class B | 800 | 88 | |

| Federal Signal Corp. | 5,200 | 82 | |

| * | Rexnord Corp. | 2,900 | 77 |

| Fluor Corp. | 1,000 | 57 | |

| Toro Co. | 600 | 42 | |

| * | Quanta Services Inc. | 1,300 | 37 |

| Knoll Inc. | 1,000 | 23 | |

| Regal-Beloit Corp. | 283 | 23 | |

| Insperity Inc. | 400 | 21 | |

| Barnes Group Inc. | 500 | 20 | |

| Actuant Corp. Class A | 800 | 19 | |

| * | Navigant Consulting Inc. | 1,100 | 14 |

| * | ACCO Brands Corp. | 1,600 | 13 |

| * | Norcraft Cos. Inc. | 500 | 13 |

| * | WABCO Holdings Inc. | 100 | 12 |

| * | GrafTech International Ltd. | 2,950 | 12 |

| Kennametal Inc. | 300 | 10 | |

| Advanced Drainage | |||

| Systems Inc. | 200 | 6 | |

| Trinity Industries Inc. | 100 | 4 | |

| * | Energy Recovery Inc. | 500 | 1 |

| 755,211 | |||

| Information Technology (17.3%) | |||

| Apple Inc. | 2,190,521 | 272,567 | |

| Microsoft Corp. | 1,545,308 | 62,825 | |

| International Business | |||

| Machines Corp. | 390,100 | 62,611 | |

| Intel Corp. | 1,975,419 | 61,771 | |

| Hewlett-Packard Co. | 1,590,330 | 49,555 | |

| * | Google Inc. Class A | 76,941 | 42,679 |

| * | Facebook Inc. Class A | 397,710 | 32,698 |

| Visa Inc. Class A | 425,100 | 27,806 | |

| Computer Sciences Corp. | 420,940 | 27,479 | |

| Western Union Co. | 1,303,572 | 27,127 | |

| * | Google Inc. Class C | 41,766 | 22,888 |

| Fidelity National | |||

| Information Services Inc. | 333,480 | 22,697 | |

| Texas Instruments Inc. | 344,397 | 19,694 | |

| * | Fiserv Inc. | 242,775 | 19,276 |

| Symantec Corp. | 788,984 | 18,435 | |

| Accenture plc Class A | 194,730 | 18,244 | |

21

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| MasterCard Inc. Class A | 206,180 | 17,812 | |

| Cisco Systems Inc. | 642,727 | 17,691 | |

| Xerox Corp. | 1,375,520 | 17,675 | |

| Seagate Technology plc | 332,246 | 17,287 | |

| * | Electronic Arts Inc. | 277,470 | 16,319 |

| QUALCOMM Inc. | 224,600 | 15,574 | |

| Intuit Inc. | 146,452 | 14,200 | |

| Western Digital Corp. | 155,655 | 14,166 | |

| * | VeriSign Inc. | 202,797 | 13,581 |

| * | Citrix Systems Inc. | 157,802 | 10,079 |

| * | Cognizant Technology | ||

| Solutions Corp. Class A | 161,400 | 10,070 | |

| Harris Corp. | 118,930 | 9,367 | |

| * | Micron Technology Inc. | 339,750 | 9,217 |

| * | eBay Inc. | 158,250 | 9,128 |

| CA Inc. | 245,197 | 7,996 | |

| NetApp Inc. | 222,240 | 7,881 | |

| Corning Inc. | 302,275 | 6,856 | |

| * | F5 Networks Inc. | 55,600 | 6,391 |

| Paychex Inc. | 122,437 | 6,075 | |

| Xilinx Inc. | 141,900 | 6,002 | |

| Total System Services Inc. | 152,110 | 5,803 | |

| Oracle Corp. | 133,485 | 5,760 | |

| TE Connectivity Ltd. | 72,600 | 5,200 | |

| * | Adobe Systems Inc. | 68,700 | 5,080 |

| Broadcom Corp. Class A | 116,050 | 5,024 | |

| Skyworks Solutions Inc. | 40,780 | 4,008 | |

| Altera Corp. | 91,398 | 3,922 | |

| NVIDIA Corp. | 166,420 | 3,482 | |

| SanDisk Corp. | 52,100 | 3,315 | |

| EMC Corp. | 123,348 | 3,153 | |

| Avago Technologies Ltd. | |||

| Class A | 24,550 | 3,117 | |

| IAC/InterActiveCorp | 39,600 | 2,672 | |

| Automatic Data | |||

| Processing Inc. | 20,581 | 1,763 | |

| * | NCR Corp. | 57,900 | 1,709 |

| * | Teradata Corp. | 37,822 | 1,669 |

| Microchip Technology Inc. | 32,625 | 1,595 | |

| * | AOL Inc. | 38,500 | 1,525 |

| ^ | King Digital | ||

| Entertainment plc | 82,600 | 1,325 | |

| Marvell Technology | |||

| Group Ltd. | 81,300 | 1,195 | |

| Analog Devices Inc. | 18,500 | 1,166 | |

| * | Keysight Technologies Inc. | 29,946 | 1,112 |

| * | EchoStar Corp. Class A | 20,908 | 1,081 |

| FLIR Systems Inc. | 31,323 | 980 | |

| * | Genpact Ltd. | 40,100 | 932 |

| * | Flextronics International Ltd. | 65,700 | 833 |

| Juniper Networks Inc. | 32,038 | 723 | |

| * | Glu Mobile Inc. | 113,700 | 570 |

| KLA-Tencor Corp. | 9,300 | 542 | |

| Booz Allen Hamilton | |||

| Holding Corp. Class A | 12,100 | 350 |

| Market | |||

| Value | |||

| Shares | ($000) | ||

| * | Autodesk Inc. | 5,609 | 329 |

| * | Zillow Group Inc. Class A | 3,265 | 327 |

| * | Cimpress NV | 3,445 | 291 |

| * | CoreLogic Inc. | 7,000 | 247 |

| * | FleetCor Technologies Inc. | 1,600 | 241 |

| * | VMware Inc. Class A | 2,800 | 230 |

| * | Cirrus Logic Inc. | 5,500 | 183 |

| * | MoneyGram | ||

| International Inc. | 20,500 | 177 | |

| * | Blackhawk Network | ||

| Holdings Inc. Class B | 4,564 | 162 | |

| * | Polycom Inc. | 11,900 | 159 |

| Brocade Communications | |||

| Systems Inc. | 11,400 | 135 | |

| * | Mellanox Technologies Ltd. | 2,400 | 109 |

| * | First Solar Inc. | 1,610 | 96 |

| * | Zynga Inc. Class A | 33,300 | 95 |

| * | WebMD Health Corp. | 1,700 | 75 |

| PC-Tel Inc. | 9,160 | 73 | |

| Pegasystems Inc. | 3,196 | 70 | |

| * | TeleCommunication | ||

| Systems Inc. Class A | 12,500 | 48 | |

| Leidos Holdings Inc. | 1,100 | 46 | |

| * | Sigma Designs Inc. | 5,100 | 41 |

| * | Global Cash Access | ||

| Holdings Inc. | 5,300 | 40 | |

| Linear Technology Corp. | 840 | 39 | |

| * | Web.com Group Inc. | 2,000 | 38 |

| * | Ciber Inc. | 8,515 | 35 |

| * | Aspen Technology Inc. | 800 | 31 |

| * | CommScope Holding Co. Inc. | 1,000 | 29 |

| * | United Online Inc. | 1,608 | 26 |

| * | Pandora Media Inc. | 1,300 | 21 |

| Lam Research Corp. | 300 | 21 | |

| Checkpoint Systems Inc. | 1,500 | 16 | |

| * | XO Group Inc. | 800 | 14 |

| Motorola Solutions Inc. | 209 | 14 | |

| * | ShoreTel Inc. | 2,000 | 14 |

| Atmel Corp. | 1,600 | 13 | |

| * | Imation Corp. | 3,200 | 13 |

| * | Tremor Video Inc. | 5,338 | 12 |

| * | Bankrate Inc. | 1,100 | 12 |

| * | Intralinks Holdings Inc. | 1,000 | 10 |

| * | Rambus Inc. | 600 | 8 |

| CDW Corp. | 200 | 7 | |

| * | Veeco Instruments Inc. | 200 | 6 |

| Intersil Corp. Class A | 400 | 6 | |

| * | 3D Systems Corp. | 200 | 5 |

| * | Sonus Networks Inc. | 600 | 5 |

| * | Gigamon Inc. | 200 | 4 |

| * | EZchip Semiconductor Ltd. | 200 | 4 |

| * | Amkor Technology Inc. | 400 | 4 |

| 1,094,906 |

22

Growth and Income Fund

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Materials (3.9%) | |||

| Sherwin-Williams Co. | 142,980 | 40,678 | |

| Monsanto Co. | 259,100 | 29,159 | |

| PPG Industries Inc. | 100,255 | 22,612 | |

| Ball Corp. | 317,106 | 22,400 | |

| Dow Chemical Co. | 325,703 | 15,627 | |

| LyondellBasell Industries | |||

| NV Class A | 176,700 | 15,514 | |

| Avery Dennison Corp. | 247,870 | 13,115 | |

| Air Products & | |||

| Chemicals Inc. | 80,000 | 12,102 | |

| Alcoa Inc. | 865,800 | 11,186 | |

| Sealed Air Corp. | 241,020 | 10,981 | |

| Praxair Inc. | 67,397 | 8,138 | |

| Ecolab Inc. | 70,400 | 8,052 | |

| United States Steel Corp. | 252,300 | 6,156 | |

| Vulcan Materials Co. | 71,260 | 6,007 | |

| Mosaic Co. | 114,663 | 5,281 | |

| Bemis Co. Inc. | 89,170 | 4,130 | |

| International Paper Co. | 67,610 | 3,752 | |

| EI du Pont de Nemours | |||

| & Co. | 49,326 | 3,525 | |

| Eastman Chemical Co. | 24,090 | 1,669 | |

| Nucor Corp. | 33,180 | 1,577 | |

| Freeport-McMoRan Inc. | 78,800 | 1,493 | |

| * | Owens-Illinois Inc. | 56,100 | 1,308 |

| * | Berry Plastics Group Inc. | 23,000 | 832 |

| Valspar Corp. | 8,500 | 714 | |

| * | Constellium NV Class A | 20,756 | 422 |

| ^ | Mesabi Trust | 13,903 | 185 |

| Innophos Holdings Inc. | 2,400 | 135 | |

| CF Industries Holdings Inc. | 400 | 114 | |

| Cliffs Natural Resources Inc. | 17,600 | 85 | |

| Orion Engineered | |||

| Carbons SA | 4,200 | 76 | |

| FMC Corp. | 1,300 | 74 | |

| * | Platform Specialty | ||

| Products Corp. | 2,800 | 72 | |

| * | Mercer International Inc. | 3,500 | 54 |

| * | Vista Gold Corp. | 112,900 | 34 |

| Globe Specialty Metals Inc. | 1,700 | 32 | |

| Worthington Industries Inc. | 400 | 11 | |

| Greif Inc. Class A | 200 | 8 | |

| Gold Resource Corp. | 1,800 | 6 | |

| * | Chemtura Corp. | 200 | 5 |

| * | Kinross Gold Corp. | 1,800 | 4 |

| TimkenSteel Corp. | 100 | 3 | |

| Newmont Mining Corp. | 100 | 2 | |

| 247,330 | |||

| Other (0.2%) | |||

| SPDR S&P 500 ETF Trust | 47,272 | 9,758 | |

| * | Safeway Inc CVR (Casa Ley) | ||

| Exp. 01/30/2018 | 75,810 | 10 | |

| * | Safeway Inc CVR (PDC) | ||

| Exp. 01/30/2017 | 75,810 | 4 | |

| 9,772 | |||

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Telecommunication Services (2.2%) | |||

| AT&T Inc. | 2,120,598 | 69,238 | |

| Verizon Communications | |||

| Inc. | 642,419 | 31,241 | |

| CenturyLink Inc. | 849,936 | 29,365 | |

| Frontier | |||

| Communications Corp. | 709,600 | 5,003 | |

| * | Level 3 | ||

| Communications Inc. | 91,000 | 4,899 | |

| Inteliquent Inc. | 11,563 | 182 | |

| * | T-Mobile US Inc. | 4,810 | 152 |

| * | Premiere Global | ||

| Services Inc. | 1,546 | 15 | |

| NTELOS Holdings Corp. | 2,600 | 13 | |

| * | Intelsat SA | 852 | 10 |

| * | Globalstar Inc. | 2,434 | 8 |

| 140,126 | |||

| Utilities (2.5%) | |||

| PG&E Corp. | 371,900 | 19,737 | |

| PPL Corp. | 573,905 | 19,318 | |

| NextEra Energy Inc. | 170,630 | 17,754 | |

| American Electric | |||

| Power Co. Inc. | 270,590 | 15,221 | |

| Public Service Enterprise | |||

| Group Inc. | 319,400 | 13,389 | |

| Entergy Corp. | 144,470 | 11,195 | |

| Ameren Corp. | 260,084 | 10,975 | |

| Edison International | 152,700 | 9,539 | |

| Sempra Energy | 78,801 | 8,591 | |

| Dominion Resources Inc. | 112,374 | 7,964 | |

| CenterPoint Energy Inc. | 343,370 | 7,008 | |

| Duke Energy Corp. | 77,740 | 5,969 | |

| Exelon Corp. | 156,700 | 5,267 | |

| DTE Energy Co. | 18,160 | 1,465 | |

| TECO Energy Inc. | 46,690 | 906 | |

| * | Dynegy Inc. | 21,300 | 669 |

| Atlantic Power Corp. | 53,304 | 150 | |

| AES Corp. | 9,339 | 120 | |

| Eversource Energy | 2,030 | 103 | |

| Xcel Energy Inc. | 1,220 | 42 | |

| * | Calpine Corp. | 1,100 | 25 |

| MDU Resources Group Inc. 1,100 | 23 | ||

| NRG Energy Inc. | 500 | 13 | |

| ITC Holdings Corp. | 300 | 11 | |

| 155,454 | |||

| Total Common Stocks | |||

| (Cost $5,021,977) | 6,126,048 | ||

| Temporary Cash Investments (3.4%)1 | |||

| Money Market Fund (3.2%) | |||

| 2,3 | Vanguard Market Liquidity | ||

| Fund, 0.128% | 201,282,090 | 201,282 | |

23

Growth and Income Fund

| Face | Market | ||

| Amount | Value | ||

| ($000) | ($000) | ||

| U.S. Government and Agency Obligations (0.2%) | |||

| 4,5 | Federal Home Loan | ||

| Bank Discount Notes, | |||

| 0.100%, 4/24/15 | 1,000 | 1,000 | |

| 4,5 | Federal Home Loan | ||

| Bank Discount Notes, | |||

| 0.080%, 5/8/15 | 2,000 | 2,000 | |

| 4,5 | Federal Home Loan | ||

| Bank Discount Notes, | |||

| 0.070%, 5/14/15 | 1,100 | 1,100 | |

| 4,5 | Federal Home Loan | ||

| Bank Discount Notes, | |||

| 0.133%, 7/31/15 | 200 | 200 | |

| 5,6 | Freddie Mac Discount | ||

| Notes, 0.090%, 4/6/15 | 3,700 | 3,700 | |

| 5,6 | Freddie Mac Discount | ||

| Notes, 0.118%, 7/31/15 | 4,400 | 4,398 | |

| 12,398 | |||

| Total Temporary Cash Investments | |||

| (Cost $213,680) | 213,680 | ||

| Total Investments (100.1%) | |||

| (Cost $5,235,657) | 6,339,728 | ||

| Other Assets and Liabilities (-0.1%) | |||

| Other Assets | 88,145 | ||

| Liabilities3 | (97,166) | ||

| (9,021) | |||

| Net Assets (100%) | 6,330,707 | ||

| At March 31, 2015, net assets consisted of: | |

| Amount | |

| ($000) | |

| Paid-in Capital | 5,046,486 |

| Undistributed Net Investment Income | 17,261 |

| Accumulated Net Realized Gains | 162,930 |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 1,104,071 |

| Futures Contracts | (41) |

| Net Assets | 6,330,707 |

| Investor Shares—Net Assets | |

| Applicable to 72,949,245 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 3,088,482 |

| Net Asset Value Per Share— | |

| Investor Shares | $42.34 |

| Admiral Shares—Net Assets | |

| Applicable to 46,901,381 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 3,242,225 |

| Net Asset Value Per Share— | |

| Admiral Shares | $69.13 |

See Note A in Notes to Financial Statements.

*Non-income-producing security.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $1,381,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 99.8% and 0.3%, respectively, of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 Includes $1,488,000 of collateral received for securities on loan.

4 The issuer operates under a congressional charter; its securities are generally neither guaranteed by the U.S. Treasury nor backed by the full faith and credit of the U.S. government.

5 Securities with a value of $8,899,000 have been segregated as initial margin for open futures contracts.

6 The issuer was placed under federal conservatorship in September 2008; since that time, its daily operations have been managed by the Federal Housing Finance Agency and it receives capital from the U.S. Treasury, as needed to maintain a positive net worth, in exchange for senior preferred stock.

REIT—Real Estate Investment Trust.

See accompanying Notes, which are an integral part of the Financial Statements.

24

Growth and Income Fund

Statement of Operations

| Six Months Ended | |

| March 31, 2015 | |

| ($000) | |

| Investment Income | |

| Income | |

| Dividends1 | 64,284 |

| Interest2 | 112 |

| Securities Lending | 80 |

| Total Income | 64,476 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 3,235 |

| Performance Adjustment | 83 |

| The Vanguard Group—Note C | |

| Management and Administrative—Investor Shares | 3,351 |

| Management and Administrative—Admiral Shares | 1,746 |

| Marketing and Distribution—Investor Shares | 220 |

| Marketing and Distribution—Admiral Shares | 204 |

| Custodian Fees | 120 |

| Shareholders’ Reports—Investor Shares | 18 |

| Shareholders’ Reports—Admiral Shares | 5 |

| Trustees’ Fees and Expenses | 6 |

| Total Expenses | 8,988 |

| Net Investment Income | 55,488 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 181,546 |

| Futures Contracts | 10,517 |

| Realized Net Gain (Loss) | 192,063 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 132,105 |

| Futures Contracts | 852 |

| Change in Unrealized Appreciation (Depreciation) | 132,957 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 380,508 |

| 1 Dividends are net of foreign withholding taxes of $8,000. | |

| 2 Interest income from an affiliated company of the fund was $108,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

25

Growth and Income Fund

Statement of Changes in Net Assets

| Six Months Ended | Year Ended | |

| March 31, | September 30, | |

| 2015 | 2014 | |

| ($000) | ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 55,488 | 95,797 |

| Realized Net Gain (Loss) | 192,063 | 660,609 |

| Change in Unrealized Appreciation (Depreciation) | 132,957 | 260,158 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 380,508 | 1,016,564 |

| Distributions | ||

| Net Investment Income | ||

| Investor Shares | (25,847) | (47,416) |

| Admiral Shares | (27,304) | (43,820) |

| Realized Capital Gain1 | ||

| Investor Shares | (180,933) | — |

| Admiral Shares | (179,398) | — |

| Total Distributions | (413,482) | (91,236) |

| Capital Share Transactions | ||

| Investor Shares | 125,709 | (393,996) |

| Admiral Shares | 341,537 | 338,592 |

| Net Increase (Decrease) from Capital Share Transactions | 467,246 | (55,404) |

| Total Increase (Decrease) | 434,272 | 869,924 |

| Net Assets | ||

| Beginning of Period | 5,896,435 | 5,026,511 |

| End of Period2 | 6,330,707 | 5,896,435 |

| 1 Includes fiscal 2015 short-term gain distributions totaling $830,000. Short-term gain distributions are treated as ordinary income dividends for tax purposes. 2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $17,261,000 and $14,924,000. | ||

See accompanying Notes, which are an integral part of the Financial Statements.

26

Growth and Income Fund

Financial Highlights

| Investor Shares | ||||||

| Six Months | ||||||

| Ended | ||||||

| For a Share Outstanding | March 31, | Year Ended September 30, | ||||

| Throughout Each Period | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

| Net Asset Value, Beginning of Period | $42.69 | $36.02 | $30.73 | $23.86 | $23.98 | $22.34 |

| Investment Operations | ||||||

| Net Investment Income | . 379 | . 671 | . 631 | . 549 | . 482 | . 418 |

| Net Realized and Unrealized Gain (Loss) | ||||||

| on Investments | 2.247 | 6.639 | 5.288 | 6.846 | (.124) | 1.630 |

| Total from Investment Operations | 2.626 | 7.310 | 5.919 | 7.395 | .358 | 2.048 |

| Distributions | ||||||

| Dividends from Net Investment Income | (. 372) | (. 640) | (. 629) | (. 525) | (. 478) | (. 408) |

| Distributions from Realized Capital Gains | (2.604) | — | — | — | — | — |

| Total Distributions | (2.976) | (. 640) | (. 629) | (. 525) | (. 478) | (. 408) |

| Net Asset Value, End of Period | $42.34 | $42.69 | $36.02 | $30.73 | $23.86 | $23.98 |

| Total Return1 | 6.41% | 20.42% | 19.54% | 31.27% | 1.28% | 9.24% |

| Ratios/Supplemental Data | ||||||

| Net Assets, End of Period (Millions) | $3,088 | $2,979 | $2,869 | $2,798 | $2,548 | $3,020 |

| Ratio of Total Expenses to | ||||||

| Average Net Assets2 | 0.35% | 0.37% | 0.36% | 0.36% | 0.32% | 0.32% |

| Ratio of Net Investment Income to | ||||||

| Average Net Assets | 1.76% | 1.67% | 1.90% | 1.94% | 1.78% | 1.74% |

| Portfolio Turnover Rate | 116% | 133% | 109% | 102% | 120% | 94% |

| The expense ratio, net income ratio, and turnover rate for the current period have been annualized. | ||||||

| 1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. 2 Includes performance-based investment advisory fee increases (decreases) of 0.00%, 0.02%, 0.01%, 0.01%, (0.04%), and (0.04%). | ||||||