UNITED STATESSECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-Q

(Mark One)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2015

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission File Number 0-17325

(Exact name of registrant as specified in its charter)

| Colorado | | 88-0218499 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

5444 Westheimer Road

Suite1440

Houston, Texas 77056

(Address of principal executive offices, including zip code)

(713) 626-4700

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act") during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and, (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o |

Non-accelerated filer x | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date:

The number of shares of common stock, par value $0.0001 per share, outstanding as of April 30, 2015, was 1,339,487,881.

ERHC ENERGY INC.

| Part I. Financial Information | Page |

| | |

| Item 1. | | 5 |

| | | |

| | | 5 |

| | | |

| | | 6 |

| | | |

| | | 7 |

| | | |

| | | 8 |

| | | |

| | | 9 |

| | | |

| Item 2. | | 18 |

| | | |

| Item 3. | | 31 |

| | | |

| Item 4. | | 31 |

| | | |

| Part II. Other Information | |

| | | |

| Item 1. | | 32 |

| | | |

| Item 6. | | 34 |

| | | |

| | | 35 |

Forward-Looking Statements

ERHC Energy Inc. (also referred to as "ERHC" or the "Company" and denoted by the use of the pronouns "we," "our" and "us" as the case may be in this Report) or its representatives may, from time to time, make or incorporate by reference certain written or oral statements of historical fact, statements that include, but are not limited to, information concerning the Company's possible or assumed future business activities and results of operations and statements about the following subjects:

| | ● | future development of concessions, exploitation of assets and other business operations; |

| | ● | future market conditions and the effect of such conditions on the Company's future activities or results of operations; |

| | ● | future uses of and requirements for financial resources; |

| | ● | interest rate and foreign exchange risk; |

| | ● | future contractual obligations; |

| | ● | outcomes of legal proceedings including; |

| | ● | future operations outside the United States; |

| | ● | expected financial position; |

| | ● | future liquidity and sufficiency of capital resources; |

| | ● | budgets for capital and other expenditures; |

| | ● | plans and objectives of management; |

| | ● | compliance with applicable laws; and, |

| | ● | adequacy of insurance or indemnification. |

These types of statements and other forward-looking statements inherently are subject to a variety of assumptions, risks and uncertainties that could cause actual results, levels of activity, performance or achievements to differ materially from those expected, projected or expressed in forward-looking statements. These risks and uncertainties include, among others, the following:

| | ● | general economic and business conditions; |

| | ● | worldwide demand for oil and natural gas; |

| | ● | changes in foreign and domestic oil and gas exploration, development and production activity; |

| | ● | oil and natural gas price fluctuations and related market expectations; |

| | ● | termination, renegotiation or modification of existing contracts; |

| | ● | the ability of the Organization of Petroleum Exporting Countries, commonly referred to as "OPEC", to set and maintain production levels and pricing, and the level of production in non-OPEC countries; |

| | ● | policies of the various governments regarding exploration and development of oil and gas reserves; |

| | ● | advances in exploration and development technology; |

| | ● | the political environment of oil-producing regions; |

| | ● | political instability in the Democratic Republic of Săo Tomé and Príncipe ("DRSTP"), the Federal Republic of Nigeria, Republic of Kenya, and the Republic of Chad; |

| | ● | changes in foreign, political, social and economic conditions; |

| | ● | risks of international operations, compliance with foreign laws and taxation policies and expropriation or nationalization of equipment and assets; |

| | ● | risks of potential contractual liabilities; |

| | ● | foreign exchange and currency fluctuations and regulations, and the inability to repatriate income or capital; |

| | ● | risks of war, military operations, other armed hostilities, terrorist acts and embargoes; |

| | ● | regulatory initiatives and compliance with governmental regulations; |

| | ● | compliance with tax laws and regulations; |

| | ● | effects of litigation and governmental proceedings; |

| | ● | cost, availability and adequacy of insurance; |

| | ● | adequacy of the Company's sources of liquidity; |

| | ● | labor conditions and the availability of qualified personnel; and, |

| | ● | various other matters, many of which are beyond the Company's control. |

The risks and uncertainties included here are not exhaustive. Other sections of this report and the Company's other filings with the U.S. Securities and Exchange Commission ("SEC") include additional factors that could adversely affect the Company's business, results of operations and financial performance. Given these risks and uncertainties, investors should not place undue reliance on our statements concerning future intent. Our statements included in this report speak only as of the date of this report. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any of our statements to reflect any change in its expectations with regard to the statements or any change in events, conditions or circumstances on which any forward-looking statements are based.

| PART I. | FINANCIAL INFORMATION |

ERHC ENERGY INC. UNAUDITED CONSOLIDATED BALANCE SHEETS |

| | | March 31, 2015 | | | September 30, 2014 | |

| ASSETS | | | | | | |

| | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 1,496,658 | | | $ | 2,182,406 | |

| Investment in Oando Energy Resources | | | 430,656 | | | | 671,402 | |

| Deferred debt origination cost – short term | | | 141,905 | | | | 147,079 | |

| Prepaid expenses and other | | | 248,306 | | | | 246,922 | |

| | | | | | | | | |

| Total current assets | | | 2,317,525 | | | | 3,247,809 | |

| | | | | | | | | |

| Oil and gas concession fees | | | 6,052,528 | | | | 6,006,235 | |

| Furniture and equipment, net of accumulated depreciation of $407,303 and $368,587 at March 31, 2015 and September 30, 2014 | | | 170,178 | | | | 206,273 | |

| Deferred debt origination cost – long term | | | 26,373 | | | | 43,755 | |

| Income tax receivable | | | 2,018,533 | | | | 2,018,533 | |

| Prepaid expenses – long term | | | 57,000 | | | | 172,433 | |

| | | | | | | | | |

| Total assets | | $ | 10,642,137 | | | $ | 11,695,038 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | |

| | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable and accrued liabilities | | $ | 95,827 | | | $ | 379,639 | |

| Convertible note payable, net of discount – short term | | | 473,979 | | | | 625,533 | |

| Derivative liability – short term | | | 589,595 | | | | 751,404 | |

| | | | | | | | | |

| Total current liabilities | | | 1,159,401 | | | | 1,756,576 | |

| | | | | | | | | |

| Convertible note payable, net of discount – long term | | | 35,554 | | | | 38,076 | |

| Derivative liability – long term | | | 125,710 | | | | 270,538 | |

| | | | | | | | | |

| Total liabilities | | | 1,320,665 | | | | 2,065,190 | |

| Commitments and contingencies: | | | | | | | | |

| | | | | | | | | |

| Shareholders' equity: | | | | | | | | |

| Preferred stock, par value $0.0001; authorized 10,000,000 shares; none issued and outstanding | | | - | | | | - | |

| Common stock, par value $0.0001; authorized 3,000,000,000 shares; issued and outstanding 1,339,487,881 and 765,194,088 shares at March 31, 2015 and September 30, 2014 | | | 133,948 | | | | 76,520 | |

| Additional paid-in capital | | | 104,602,010 | | | | 101,080,306 | |

| Accumulated other comprehensive loss | | | (919,344 | ) | | | (678,598 | ) |

| Accumulated deficits | | | (94,495,142 | ) | | | (90,848,380 | ) |

| | | | | | | | | |

| Total shareholders' equity | | | 9,321,472 | | | | 9,629,848 | |

| | | | | | | | | |

| Total liabilities and shareholders' equity | | $ | 10,642,137 | | | $ | 11,695,038 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC. UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS |

| | | Three Months Ended March 31, | | | Six Months Ended March 31, | |

| | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

| Costs and expenses: | | | | | | | | | | | | |

| General and administrative | | $ | 520,695 | | | $ | 940,909 | | | $ | 1,349,168 | | | $ | 1,914,487 | |

| Exploration expenses | | | 1,926 | | | | 45,935 | | | | 447,914 | | | | 219,754 | |

| Depreciation | | | 19,380 | | | | 15,102 | | | | 38,716 | | | | 38,559 | |

| Gain on sale of partial interest in concessions | | | - | | | | (2,724,793 | ) | | | (239,515 | ) | | | (2,724,793 | ) |

| | | | | | | | | | | | | | | | | |

| Total costs and expenses | | | (542,001 | ) | | | 1,722,847 | | | | (1,596,283 | ) | | | 551,993 | |

| | | | | | | | | | | | | | | | | |

| Other income and (expenses): | | | | | | | | | | | | | | | | |

| Interest income | | | 208 | | | | 708 | | | | 913 | | | | 2,212 | |

| Gain (loss) on mark to market of derivative liabilities | | | (48,925 | ) | | | - | | | | 65,749 | | | | - | |

| Loss on embedded derivative | | | (727,072 | ) | | | - | | | | (1,259,260 | ) | | | - | |

| Gain from class-action settlement | | | 291,280 | | | | - | | | | 291,280 | | | | - | |

| Interest expense | | | (931,037 | ) | | | - | | | | (1,149,161 | ) | | | - | |

| | | | | | | | | | | | | | | | | |

| Total other income and (expense) | | | (1,415,546 | ) | | | 708 | | | | (2,050,479 | ) | | | 2,212 | |

| | | | | | | | | | | | | | | | | |

| Income (loss) before benefit (provision) for income taxes | | | (1,957,547 | ) | | | 1,723,555 | | | | (3,646,762 | ) | | | 554,205 | |

| | | | | | | | | | | | | | | | | |

| Benefit (provision) for income taxes: | | | | | | | | | | | | | | | | |

| Current | | | - | | | | - | | | | - | | | | - | |

| Deferred | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | |

| Total benefit (provision) for income taxes | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | (1,957,547 | ) | | $ | 1,723,555 | | | $ | (3,646,762 | ) | | $ | 554,205 | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) per common share - basic and diluted | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | |

| Weighted average number of common shares outstanding basic and diluted | | | 984,102,537 | | | | 764,849,260 | | | | 883,034,607 | | | | 764,849,260 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC. UNAUDITED CONSOLIDATED STATEMENTS OF OTHER COMPREHENSIVE INCOME (LOSS) |

| | | Three Months Ended March 31, | | | Six Months Ended March 31, | |

| | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

| | | | | | | | | |

| | | | | | | | | |

| Net income (loss) | | $ | (1,957,547 | ) | | $ | 1,723,555 | | | $ | (3,646,762 | ) | | $ | 554,205 | |

| Other comprehensive income (loss) on available for sale securities | | | (21,383 | ) | | | 26,172 | | | | (240,746 | ) | | | (54,834 | ) |

| | | | | | | | | | | | | | | | | |

| Other comprehensive loss | | $ | (1,978,930 | ) | | $ | 1,749,727 | | | $ | (3,887,508 | ) | | $ | 499,371 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements

ERHC ENERGY INC. UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| | | Six Months Ended March 31, | |

| | | 2015 | | | 2014 | |

| Cash Flows From Operating Activities: | | | | | | |

| Net income (loss) | | $ | (3,646,762 | ) | | $ | 554,205 | |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | | | | | | |

| Depreciation and depletion expense | | | 38,716 | | | | 38,559 | |

| Compensatory stock options | | | - | | | | 6,957 | |

| Loss on embedded derivative | | | 1,259,260 | | | | - | |

| Gain on change in fair value of derivative | | | (65,749 | ) | | | - | |

| Gain on sale of partial interest in Kenya concession | | | (239,515 | ) | | | (2,724,793 | ) |

| Amortization of convertible debt discount | | | 932,345 | | | | - | |

| Amortization of debt issuance cost | | | 71,082 | | | | - | |

| Stock issued for board compensation | | | 8,400 | | | | - | |

| Prepaid expenses and other current assets | | | 114,049 | | | | (242,040 | ) |

| Accounts payable and other accrued liabilities | | | (283,812 | ) | | | (2,360,857 | ) |

| | | | | | | | | |

| Net cash used in operating activities | | | (1,811,986 | ) | | | (4,727,969 | ) |

| | | | | | | | | |

| Cash Flows From Investing Activities: | | | | | | | | |

| Purchase of oil and gas concessions | | | (46,293 | ) | | | - | |

| Proceeds from sale of partial interest in Kenya concession | | | 239,515 | | | | 4,731,608 | |

| Proceeds from sale of restricted certificate of deposit | | | - | | | | 2,186,182 | |

| Purchase of furniture and equipment | | | (2,621 | ) | | | - | |

| | | | | | | | | |

| Net cash provided by (used in) investing activities | | | 190,601 | | | | 6,917,790 | |

| | | | | | | | | |

| Cash Flows From Financing Activities: | | | | | | | | |

| Proceeds from convertible debt | | | 935,637 | | | | - | |

| | | | | | | | | |

| Net cash provided by financing activities | | | 935,637 | | | | - | |

| | | | | | | | | |

| Net increase (decrease) in cash and cash equivalents | | | (685,748 | ) | | | 2,189,821 | |

| Cash and cash equivalents, beginning of period | | | 2,182,406 | | | | 1,184,204 | |

| Cash and cash equivalents, end of period | | $ | 1,496,658 | | | $ | 3,374,025 | |

| Non-cash investing and financing activities: | | | | | | | | |

| Unrealized loss on investment in Exile Resources | | $ | 240,746 | | | $ | 54,834 | |

| Discount from derivative | | $ | 592,860 | | | $ | - | |

| Conversion of note payable to common stock | | $ | 1,477,724 | | | $ | - | |

| Derivative liabilities extinguished on conversion | | $ | 2,093,008 | | | $ | - | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – BASIS OF PRESENTATION AND BUSINESS ORGANIZATION

The consolidated financial statements included herein, which have not been audited pursuant to the rules and regulations of the Securities and Exchange Commission, reflect all adjustments which, in the opinion of management, are necessary to present a fair statement of the results for the interim periods on a basis consistent with the annual audited financial statements. All such adjustments are of a normal recurring nature. The results of operations for the interim periods are not necessarily indicative of the results to be expected for an entire year. Certain information, accounting policies and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America, have been omitted pursuant to such rules and regulations, although ERHC Energy Inc. ("ERHC" or the "Company") believes that the disclosures are adequate to make the information presented not misleading. These financial statements should be read in conjunction with the Company's audited financial statements included in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2014.

Recent accounting pronouncements

There have been no recently issued accounting pronouncements that have had or are expected to have a material impact on the Company's consolidated financial statements.

NOTE 2 – FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company adopted new guidance as of October 1, 2008, related to the measurement of the fair value of certain of its financial assets required to be measured on a recurring basis. Under the new guidance, based on the observability of the inputs used in the valuation techniques, the Company is required to provide the following information according to the fair value hierarchy. The fair value hierarchy ranks the quality and reliability of the information used to determine fair values. Financial assets and liabilities carried at fair value will be classified and disclosed in one of the following three categories:

| | ● | Level 1 — Quoted prices in active markets for identical assets or liabilities. |

| | ● | Level 2 — Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or, other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. |

| | ● | Level 3 — Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. |

Interest income on cash and cash equivalents is recognized as earned on the accrual basis.

Investments are accounted for as available for sale securities and reported at fair value, determined based on the quoted prices in an active market for identical assets and classified as Level 1 under the ASC 820.

During the six months ended March 31, 2015, the Company's investment in the common stock and warrants of OER, a Canadian oil and gas company that trades on the Toronto Stock Exchange (TSX) decreased in value by $240,746. This decrease in value is included as a decrease in stockholders' equity in accumulated other comprehensive income.

During the six months ended March 31, 2015, the Company issued a number of convertible notes payable, and identified derivatives related to these notes. ERHC classifies its derivative liabilities as Level 3 and values them using the methods discussed in Note 5. While the Company believes that its valuation methods are appropriate and consistent with other market participants, it recognizes that the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different estimate of fair value at the reporting date. The primary assumptions that would significantly affect the fair values using the methods discussed in Note 5 are that of volatility and market price of the underlying common stock of the Company.

As of March 31, 2015, the Company did not have any derivative instruments that were designated as hedges.

The derivative liability as of March 31, 2015, in the amount of $715,305 has a level 3 classification.

The following table provides a summary of changes in fair value of the Company's Level 3 financial liabilities as of March 31, 2015:

| | | Derivative Liability | |

| | | | |

| Balance at September 30, 2014 | | $ | 1,021,942 | |

| Increase in derivative value due to issuances of convertible promissory notes | | | 592,860 | |

| Decrease in derivative value due to convertible promissory notes converted to common stocks | | | (2,093,008 | ) |

| Day 1 loss on derivative liabilities | | | 1,259,260 | |

| Change in fair market value of derivative liabilities on convertible notes due to the mark to market adjustment | | | (59,851 | ) |

| Change in fair market value of derivative liabilities on tainted warrants due to the mark to market adjustment | | | (5,898 | ) |

| | | | | |

| Balance at March 31, 2015 | | $ | 715,305 | |

NOTE 3 – OIL AND GAS CONCESSIONS

The following is an analysis of the cost of oil and gas concessions at March 31, 2015 and September 30, 2014:

| | | March 31, 2015 | | | September 30, 2014 | |

| | | | | | | |

| DRSTP concession | | $ | 3,113,795 | | | $ | 3,113,795 | |

| Chad concession | | | 2,827,615 | | | | 2,800,600 | |

| Pending concessions in other African countries | | | 111,118 | | | | 91,840 | |

| | | | | | | | | |

| | | $ | 6,052,528 | | | $ | 6,006,235 | |

In October, 2013, the Company entered into a farm-out agreement with CEPSA Kenya Limited, an affiliate of Compañía Española de Petróleos, S.A.U., an international oil and gas company ("CEPSA"). Under the terms of this agreement, the Company assigned and transferred 55% of its participating interest in Kenya Block 11A to CEPSA. In connection with this farm-out, the Company recognized a gain of $239,515 of reimbursement of exploration costs incurred during the six months ended March 31, 2015.

In exchange for the transferred rights, CEPSA will carry the Company's proportionate share of obligations and financial costs under the terms and conditions outlined in the farm-out agreement. The agreement was approved in January 2014 by the Kenyan Government and from February 2014, CEPSA took over from ERHC as operator under the production sharing contract ("PSC") for Kenya Block 11A.

NOTE 4 – CONVERTIBLE DEBT

The Company had the following convertible debt outstanding at March 31, 2015:

| Lender | | Date of Agreement | | Term (Months) | | | Annual Interest Rate | | | Face Value | | | Accrued Interest | | | Discount | | | Deferred Debt Origination Costs Due at Maturity | | | Net Convertible Note Payable | | | Note Derivative Liability | |

| Redwood Fund III | | 5/15/2014 | | 18 | | | | 7.85 | % | | $ | 40,000 | | | $ | 5,918 | | | $ | 15,867 | | | $ | - | | | $ | 30,051 | | | $ | 81,312 | |

| Iconic Holding, LLC | | 7/16/2014 | | 12 | | | | 10.00 | % | | | 3,456 | | | | 5,014 | | | | 5,034 | | | | - | | | | 3,436 | | | | 2,473 | |

| Vista Capital Investments #2 | | 8/26/2014 | | 24 | | | | 5.83 | % | | | 527 | | | | 324 | | | | 511 | | | | 2,777 | | | | 3,117 | | | | 486 | |

| JMJ Financial #2 | | 9/3/2014 | | 24 | | | | 5.83 | % | | | 9,020 | | | | 583 | | | | 13,305 | | | | 5,556 | | | | 1,854 | | | | 14,788 | |

| JSJ Investments #2 | | 9/8/2014 | | 6 | | | | 12.00 | % | | | 70,000 | | | | 10,637 | | | | - | | | | - | | | | 80,637 | | | | 143,306 | |

| Macallan Partners, LLC | | 9/9/2014 | | 12 | | | | 10.00 | % | | | 48,000 | | | | 4,405 | | | | 36,635 | | | | - | | | | 15,770 | | | | 43,162 | |

| Tonaquint, Inc #2 | | 10/7/2014 | | 12 | | | | 12.00 | % | | | 55,000 | | | | 3,914 | | | | 45,142 | | | | - | | | | 13,772 | | | | 79,567 | |

| Tonaquint, Inc #3 | | 10/7/2014 | | 12 | | | | 12.00 | % | | | 55,000 | | | | 3,914 | | | | 45,142 | | | | - | | | | 13,772 | | | | 79,567 | |

| JMJ Financial #3 | | 10/22/2014 | | 24 | | | | 5.83 | % | | | 50,000 | | | | 6,195 | | | | 52,323 | | | | - | | | | 3,872 | | | | 54,962 | |

| LG Capital #2 | | 10/23/2014 | | 12 | | | | 8.00 | % | | | 52,500 | | | | 1,036 | | | | 47,844 | | | | - | | | | 5,692 | | | | 81,543 | |

| KBM Worldwide #5 | | 10/23/2014 | | 9 | | | | 8.00 | % | | | 78,500 | | | | 3,648 | | | | - | | | | - | | | | 82,148 | | | | - | |

| Cardinal Capital Group | | 11/6/2014 | | 24 | | | | 12.00 | % | | | 50,000 | | | | 6,192 | | | | 51,760 | | | | - | | | | 4,432 | | | | 55,474 | |

| KBM Worldwide #6 | | 12/8/2014 | | 9 | | | | 8.00 | % | | | 53,500 | | | | 1,767 | | | | - | | | | - | | | | 55,267 | | | | - | |

| KBM Worldwide #7 | | 1/13/2015 | | 9 | | | | 8.00 | % | | | 54,000 | | | | 1,215 | | | | - | | | | - | | | | 55,215 | | | | - | |

| Rock Capital | | 2/6/2015 | | 12 | | | | 10.00 | % | | | 34,500 | | | | 501 | | | | - | | | | - | | | | 35,001 | | | | - | |

| Union Capital #3 | | 2/17/2015 | | 12 | | | | 8.00 | % | | | 34,500 | | | | 318 | | | | - | | | | - | | | | 34,818 | | | | - | |

| Adar Bay #2 | | 2/19/2015 | | 12 | | | | 8.00 | % | | | 42,000 | | | | 368 | | | | - | | | | - | | | | 42,368 | | | | - | |

| Vista Capital Investments #3 | | 3/3/2015 | | 24 | | | | 5.83 | % | | | 25,000 | | | | 56 | | | | - | | | | - | | | | 25,056 | | | | - | |

| LG Capital #3 | | 3/10/2015 | | 12 | | | | 8.00 | % | | | 52,500 | | | | 242 | | | | 49,487 | | | | - | | | | 3,255 | | | | 78,666 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | $ | 808,003 | | | $ | 56,247 | | | $ | 363,050 | | | $ | 8,333 | | | $ | 509,533 | | | $ | 715,305 | |

During the six months ended March 31, 2015, the Company issued an aggregate of 574,083,793 shares of common stock for conversion of convertible debts of $1,477,724 and decrease in derivative value due to conversion of $2,093,008.

The Company issued convertible notes payable that provide for the issuance of convertible notes with variable conversion provisions. Pursuant to ASC 815-15 Embedded Derivatives, the fair values of the variable conversion option and warrants and shares to be issued were recorded as derivative liabilities once the note becomes convertible on the 180 days after the effective date.

The following table summarizes conversion terms of the notes outstanding at March 31, 2015:

| Lender | | Date of Agreement | | Conversion Rate | | Calculation Period | | Eligible for Conversion |

| JMJ Financial | | September 3 and October 27, 2014 | | Lesser of $0.06 or 60% | | 25 trading days prior to conversion | | 180 after the effective dates |

| KBM Worldwide | | October 23 and December 8, 2014, January 13, 2015 | | 61% | | 10 trading days prior to conversion | | 180 after the effective dates |

| Adar Bay | | 19-Feb-15 | | 50% | | 20 trading days prior to conversion | | 180 after the effective date |

| Redwood Fund III | | 15-May-14 | | 55% | | 20 trading days prior to conversion | | 180 after the effective date |

| Vista Capital Investments | | August 26, 2014, March 2, 2015 | | Lesser of $0.075 or 60% | | 25 trading days prior to conversion | | 180 after the effective dates |

| Tonaquint, Inc | | 7-Oct-14 | | 65% | | 25 trading days prior to conversion | | 180 after the effective date |

| Union Capital | | 17-Feb-15 | | 55% | | 20 trading days prior to conversion | | 180 after the effective date |

| Iconic Holding, LLC | | 16-Jul-14 | | Lesser of $0.085 or 60% | | 20 trading days prior to conversion | | 180 after the effective date |

| JSJ Investments | | 8-Sep-14 | | 60% | | 20 trading days prior to conversion | | 180 after the effective date |

| Macallan Partners, LLC | | 9-Sep-14 | | 55% | | 20 trading days prior to conversion | | 180 after the effective date |

| LG Capital #2 | | 23-Oct-14 | | 60% | | 20 trading days prior to conversion | | 180 after the effective date |

| Cardinal Capital Group | | 6-Nov-14 | | Lesser of $0.05 or 60% | | 25 trading days prior to conversion | | 180 after the effective dates |

| Rock Capital | | 6-Feb-15 | | 55% | | 20 trading days prior to conversion | | 180 after the effective date |

| LG Capital #3 | | 10-Mar-15 | | 60% | | 20 trading days prior to conversion | | 180 after the effective date |

As of March 31, 2015 Company recorded the following deferred origination costs related to the convertible notes:

| Lender | | Date of Agreement | | Transaction Costs | | | Deferred Debt Origination Costs Due at Maturity | | | Legal and Other Debt Origination Costs | | | Initial Deferred Origination Costs | | | Amortization | | | Net Deferred Debt Origination Costs | |

| Redwood Fund III | | 5/15/2014 | | $ | 10,000 | | | $ | - | | | $ | - | | | $ | 10,000 | | | $ | 5,104 | | | $ | 4,896 | |

| Various | | Various | | | - | | | | - | | | | 52,500 | | | | 52,500 | | | | 11,809 | | | | 40,691 | |

| Iconic Holding, LLC | | 7/16/2014 | | | 6,750 | | | | - | | | | 7,500 | | | | 14,250 | | | | - | | | | 14,250 | |

| Vista Capital Investments | | 8/26/2014 | | | 2,500 | | | | 2,777 | | | | - | | | | 5,277 | | | | - | | | | 5,277 | |

| JMJ Financial | | 9/3/2014 | | | 5,000 | | | | 5,556 | | | | - | | | | 10,556 | | | | 4,348 | | | | 6,208 | |

| JSJ Investments | | 9/8/2014 | | | 10,000 | | | | - | | | | 2,000 | | | | 12,000 | | | | 1,256 | | | | 10,744 | |

| Macallan Partners, LLC | | 9/9/2014 | | | - | | | | - | | | | 12,000 | | | | 12,000 | | | | - | | | | 12,000 | |

| Tonaquint, Inc #2 | | 10/7/2014 | | | 5,000 | | | | - | | | | 5,000 | | | | 10,000 | | | | 573 | | | | 9,427 | |

| Tonaquint, Inc #3 | | 10/7/2014 | | | 5,000 | | | | - | | | | 5,000 | | | | 10,000 | | | | 573 | | | | 9,427 | |

| JMJ Financial #3 | | 10/22/2014 | | | 5,000 | | | | - | | | | - | | | | 5,000 | | | | - | | | | 5,000 | |

| LG Capital #2 | | 10/23/2014 | | | 5,000 | | | | - | | | | 2,500 | | | | 7,500 | | | | 1,323 | | | | 6,177 | |

| KBM Worldwide #5 | | 10/23/2014 | | | 7,500 | | | | - | | | | 3,500 | | | | 11,000 | | | | 1,890 | | | | 9,110 | |

| Cardinal Capital Group | | 11/6/2014 | | | 5,000 | | | | - | | | | 5,000 | | | | 10,000 | | | | 112 | | | | 9,888 | |

| KBM Worldwide #6 | | 12/8/2014 | | | 5,000 | | | | - | | | | 3,500 | | | | 8,500 | | | | 2,064 | | | | 6,436 | |

| KBM Worldwide #7 | | 1/13/2015 | | | 3,000 | | | | - | | | | 1,500 | | | | 4,500 | | | | 506 | | | | 3,994 | |

| Rock Capital | | 2/6/2015 | | | 4,500 | | | | - | | | | 1,000 | | | | 5,500 | | | | 189 | | | | 5,311 | |

| Union Capital #3 | | 2/17/2015 | | | 4,500 | | | | - | | | | 1,500 | | | | 6,000 | | | | 849 | | | | 5,151 | |

| Adar Bay #2 | | 2/19/2015 | | | 2,000 | | | | - | | | | 1,500 | | | | 3,500 | | | | 197 | | | | 3,303 | |

| LG Capital #3 | | 3/10/2015 | | | 2,500 | | | | - | | | | 1,500 | | | | 4,000 | | | | 3,012 | | | | 988 | |

| | | | | $ | 88,250 | | | $ | 8,333 | | | $ | 105,500 | | | $ | 202,083 | | | $ | 33,805 | | | $ | 168,278 | |

NOTE 5 – DERIVATIVE LIABILITIES

As described in Notes 4 and 6, the Company has identified embedded derivatives in notes payables and outstanding warrants.

The fair value of the embedded derivatives related to the convertible notes payable, comprising conversion feature with the reset provisions and the default provisions, at issuance and March 31, 2015 was determined using the multinomial lattice models that value the derivative liability based on a probability weighted discounted cash flow model. These models are based on future projections of the various potential outcomes and utilize the following assumptions:

| | · | The stock price would fluctuate with the Company projected volatility; |

| | · | The Derivative Convertible Notes (held by JMJ Financial, LG Capital, Adar Bay, Vista Capital Investment, Tonaquint Inc., KBM Worldwide, JSJ Investments, Iconic Holding LLC, Macallan Partners LLC, Union Capital, Auctus Private, Redwood Fund III, Cardinal Capital Group, Inc. and Chrome Oil Service Limited ) convert at 40% to 60% of the market prices; |

| | · | An event of default would occur initially 0% of the time, increasing 1.00% per month until it reaches 10%; |

| | · | The projected volatility curve for each valuation period was based on the historical volatility of the Company, ranging between 101% and 108%; |

| | · | The Company would redeem the notes initially 0% of the time, and increase monthly by 1.00% to a maximum of 5.00%; |

| | · | The holders of the notes would automatically convert the notes at the maximum of two times the conversion price if the Company is not in default, with the target conversion price dropping as maturity approaches; and |

| | · | The Holder would convert the note early after 0-90-180 days and at maturity if the registration was effective and the Company was not in default. |

As discussed in Note 3, the Company issued convertible notes payable that provide for the issuance of convertible notes with variable conversion provisions. The conversion terms of the convertible notes are variable based on certain factors, such as the future price of the Company's common stock. The number of shares of common stock to be issued is based on the future price of the Company's common stock. The number of shares of common stock issuable upon conversion of the promissory note is indeterminate. Due to the fact that the number of shares of common stock issuable could exceed the Company's authorized share limit, all additional convertible debentures and warrants are included in the value of the derivative. Pursuant to ASC 815-15 Embedded Derivatives, the fair values of the variable conversion option and warrants and shares to be issued were recorded as derivative liabilities on the issuance date.

The fair value of the embedded derivatives related to the tainted outstanding warrants, comprising exercise feature with the full ratchet reset, at March 31, 2015 was determined using the lattice models that value the derivative liability based on a probability weighted discounted cash flow model. These models are based on future projections of the various potential outcomes and utilize the following assumptions:

| | · | The stock price would fluctuate with the Company projected volatility; |

| | · | The stock price would fluctuate with an annual volatility. The projected volatility curve for each valuation period was based on the historical volatility of the Company, ranging between 101% and 103%; |

| | · | The Holder would exercise the warrant as they become exercisable at target prices of two times the higher of the projected reset price or stock price; |

| | · | The Warrants with the $0.355; $0.28; and $0.275 exercise prices are fixed and not projected to adjust; and |

| | · | The Feltang Warrants have expired in the period ending December 31, 2014 without being exercised. |

The accounting treatment of derivative financial instruments requires that the Company record fair value of the derivatives as of the inception date and to fair value as of each subsequent reporting date which at March 31, 2014 was an aggregate of $715,305.

During six months ended March 31, 2015, the Company recorded an aggregate $65,749 gain on change in fair value of derivative liabilities and a $1,259,260 day 1 loss upon recognition of these derivatives. See Note 3 for more information.

NOTE 6 - STOCKHOLDERS' EQUITY

During the six months ended March 31, 2015, the Company recognized compensation expense of $8,400 related to service granted to the Board of Directors in fiscal year 2014.

During the six months ended March 31, 2015, the Company issued an aggregate of 574,083,793 shares of common stock for conversion of convertible debt with total valued at $3,570,732.

As of March 31, 2015, there are 4,150,000 options outstanding; none of which are exercisable. These options have a weighted average remaining term of six days and an intrinsic value of zero. Unamortized compensation cost related to these options amounted to $0.

During the six months ended March 31, 2015, there were no new warrants granted and none were exercised, cancelled or expired. As of March 31, 2015, the Company has 7,277,729 outstanding and exercisable warrants with a weighted average exercise price and remaining term of $0.32 per share and 1.0 years, respectively. As of March 31, 2015, these warrants have an intrinsic value of zero.

NOTE 7 – COMMITMENTS AND CONTINGENCIES

COMMITMENTS UNDER PRODUCTION SHARE CONTRACTS

Republic of Kenya Concession Fees and Other Financial Commitments

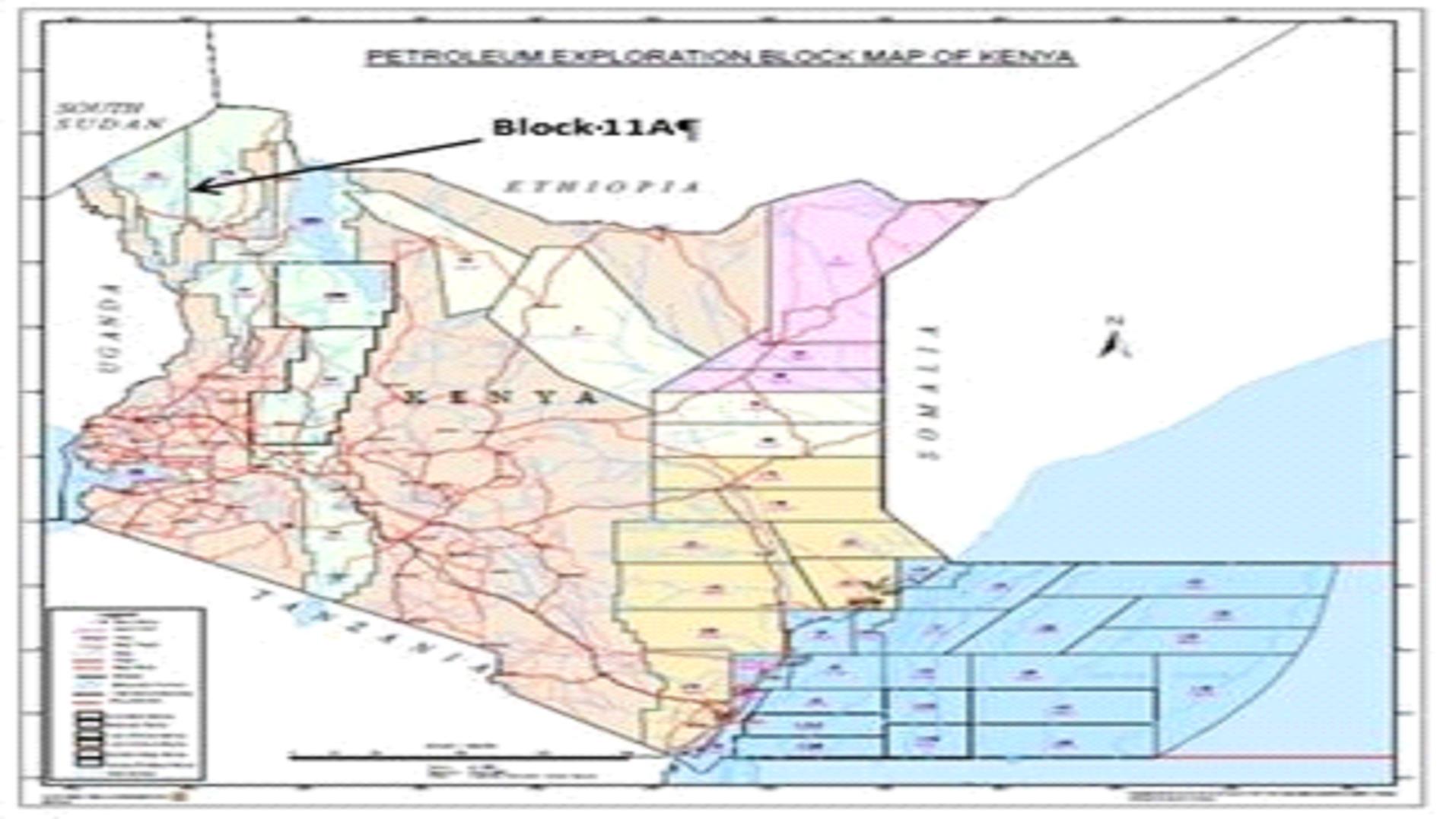

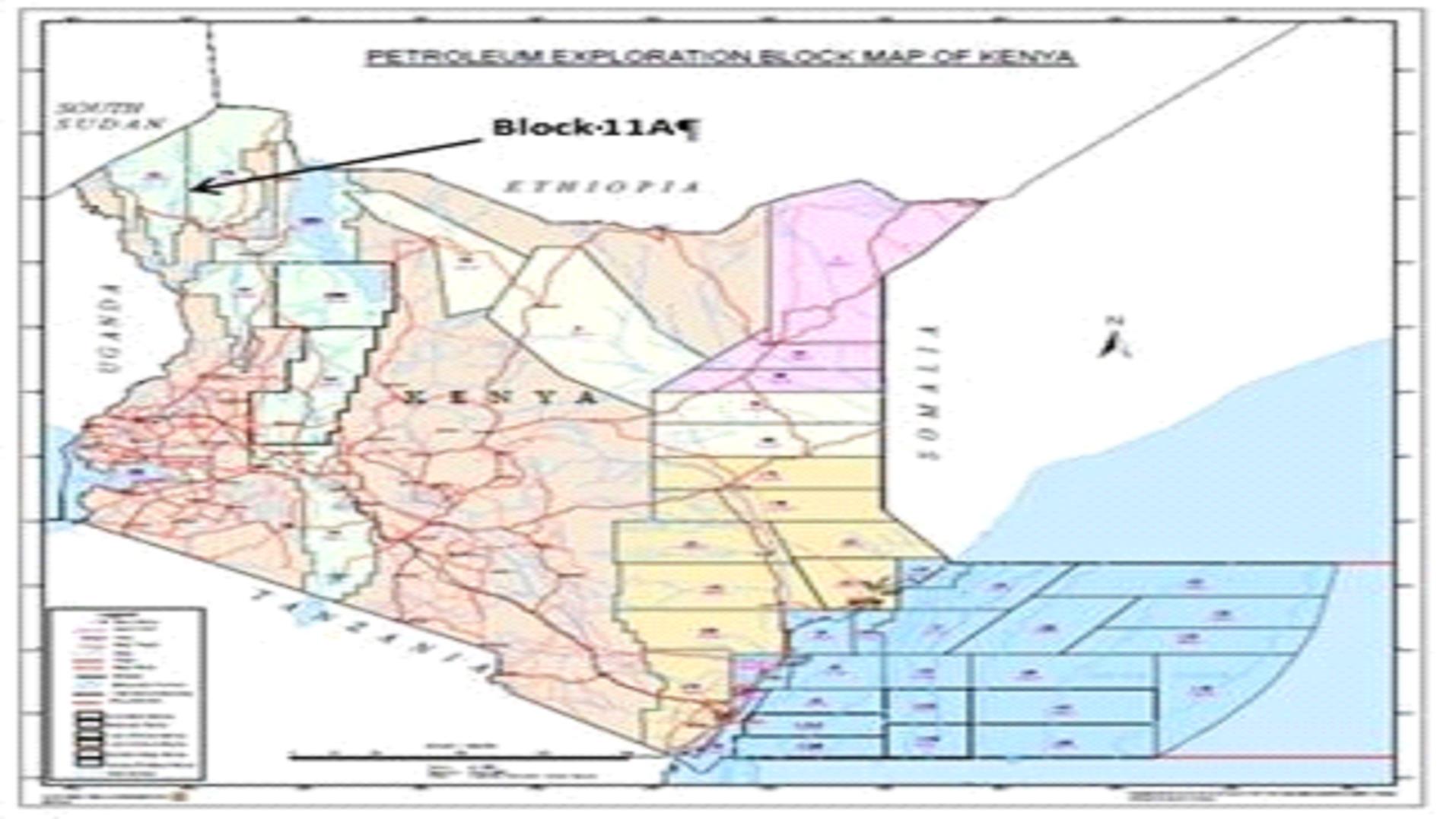

On June 28, 2012, ERHC entered into a production sharing contract ("PSC") with the Government of the Republic of Kenya for certain land based hydrocarbon exploration and production of Block 11A located in northwestern Kenya.

In October, 2013, the Company entered into a farm-out agreement with CEPSA Kenya Limited, an affiliate of Compañía Española de Petróleos, S.A.U., an international oil and gas company ("CEPSA"). Under the terms of this agreement, the Company assigned and transferred 55% of its participating interest in Kenya Block 11A to CEPSA. In exchange for the transferred rights, CEPSA will carry the Company's proportionate share of obligations and financial costs under the terms and conditions outlined in the farm-out agreement. The agreement was approved in January 2014 by the Kenyan Government and from February 2014, CEPSA took over from ERHC as operator under the production sharing contract ("PSC") for Kenya Block 11A.

Republic of Chad Concession Fees and Other Financial Commitments

On June 30, 2011, ERHC entered into a production sharing contract ("PSC") with Chad for certain onshore hydrocarbon exploration and development. In September 2013, the Ministry of Energy and Petroleum of Chad approved ERHC's application to voluntarily relinquish two of the three Blocks covered by the PSC.

As of March 31, 2015, ERHC has paid or incurred:

| a. | $2,000,000 as the entire signature bonus |

| b. | $320,600 in advisers' and ancillary costs related to the PSC |

| c. | $480,000 as legal fees and costs for the drafting and negotiation of the PSC, as provided for in the PSC |

| d. | $190,872 as costs of Environmental Impact Study, as provided for in the PSC |

| e. | $448,000 on Aeromagnetic data acquisition survey, in fulfilment of work program obligations under the PSC |

LEGAL PROCEEDINGS

JDZ Blocks 5 and 6

Lawsuit

The Company's rights in JDZ Blocks 5 and 6 are currently the subject of legal proceedings at the London Court of International Arbitration and the Federal High Court in Abuja, Nigeria. The Company instituted both proceedings in November 2008 against the JDA and the Governments of Nigeria and Săo Tomé and Príncipe. The Company seeks legal clarification that its rights in the two Blocks remain intact.

The issue in contention is contractual. The Company was awarded a 15 percent working interest in each of the Blocks in a 2004/5 bid/licensing round conducted by the JDA following the Company's exercise of preferential rights in the Blocks as guaranteed by contract and treaty. The JDA and the Government of STP contend that certain correspondence issued by a previous CEO/President of the Company in 2006 amount to a relinquishment of the Company's rights in Blocks 5 and 6 under the Company's contracts with STP which provide for the rights. The Company contends that no such relinquishment has occurred and has sought recourse to arbitration accordingly. It also filed the suit to prevent any tampering with its said rights in JDZ Blocks 5 and 6 pending the outcome of arbitration.

Proceedings on the suit and the arbitration are currently suspended while the Company pursues amicable settlement with the Governments of Nigeria and Săo Tomé & Príncipe.

Routine Claims

From time to time, ERHC may be subject to routine litigation, claims, or disputes in the ordinary course of business. ERHC intends to defend these matters vigorously. The Company cannot predict with certainty, however, the outcome or effect of any of the arbitration or litigation specifically described above or any other pending litigation or claims.

| Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion should be read in conjunction with the Company's unaudited consolidated financial statements (including the notes thereto) and Item 1A of Part II; "Risk Factors," included elsewhere in this report and the Company's audited consolidated financial statements and the notes thereto, Item 7; and "Management's Discussion and Analysis of Financial Condition and Plan of Operations" and Item 1A, "Risk Factors" included in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2014. The Company's historical results are not necessarily an indication of trends in operating results for any future period. References to "ERHC" or the "Company" mean ERHC Energy Inc., a Colorado corporation, and, unless expressly stated or the context otherwise requires, its wholly owned subsidiary.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

We are including the following cautionary statement to make applicable and take advantage of the safe harbor provision of the Private Securities Litigation Reform Act of 1995 for any forward-looking statements made by us, or on our behalf. This Quarterly Report on Form 10-Q contains forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, future events or performance and underlying assumptions and other statements which are other than statements of historical facts. Certain statements contained herein are forward-looking statements and, accordingly, involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. Our expectations, beliefs and projections are expressed in good faith and are believed by us to have a reasonable basis, including without limitations, management's examination of historical operating trends, data contained in our records and other data available from third parties, but there can be no assurance that management's expectations, beliefs or projections will result or be achieved or accomplished. In addition to other factors and matters discussed elsewhere herein, the following are important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements: geopolitical instability where we operate; our ability to meet our capital needs; our ability to raise sufficient capital and/or enter into one or more strategic relationships with one or more industry partners to execute our business plan; our ability and success in finding, developing and acquiring oil and gas reserves; our ability to respond to changes in the oil exploration and production environment, competition, and the availability of personnel in the future to support our activities.

Overview

ERHC Energy Inc., a Colorado corporation, ("ERHC" or the "Company") was incorporated in 1986. The Company is in the business of exploration for oil and gas resources in Africa. The Company's business includes working interests in exploration acreage in the Republic of Kenya ("Kenya"), the Republic of Chad ("Chad"), the Joint Development Zone ("JDZ") between the Democratic Republic of Săo Tomé and Príncipe ("STP"), the Federal Republic of Nigeria ("FRN" or "Nigeria"), and the exclusive economic zone of Săo Tomé and Príncipe (the "Exclusive Economic Zone" or "EEZ").

ERHC's strategy in Kenya and Chad is to perform exploration work and further establish the prospectivity of assets acquired through Production Sharing Contracts (PSCs) with the governments of both countries. ERHC found a farm-out partner for its interests in Kenya, and is currently seeking for a partner for its interests in Chad. ERHC expects that such farm-in arrangements, if entered into, might lower the risk and cost of the exploration programs to ERHC.

The Company's strategy in the JDZ and EEZ is to farm out its working interests to well established oil and gas operators for valuable consideration including upfront cash payments and being carried for ERHC's share of the exploration costs. This has already been done successfully on Blocks 2, 3 and 4 of the JDZ where ERHC has benefited from partnerships with Addax Petroleum and Sinopec Corporation, which have operated some of the license areas on behalf of ERHC.

Apart from its oil and gas exploration activities in Kenya, Chad, the JDZ and the EEZ, ERHC continues to pursue other oil and gas opportunities on the African continent. These opportunities also include the possible acquisition of significant equity stakes in other oil and gas exploration and production companies and the resulting indirect interest in the underlying exploration and production assets of such other companies.

REPUBLIC OF KENYA

ERHC Kenya Acreage

In June 2012, after months of negotiations between ERHC and the Government of Kenya, the Government awarded Block 11A for oil and gas exploration and development in Kenya to the Company. On June 28, 2012, the Company announced that it had signed a Production Sharing Contract (PSC) on Block 11A with the Government of Kenya. A PSC is an agreement that governs the relationship between ERHC (and any future joint-venture partners) and the Government of Kenya in respect of exploration and production in the Block awarded to the Company. The PSC details, among other things, the work commitments (including acquisition of data, drilling of wells, social projects, etc.), the time frame for completion of the work commitments, production sharing between the parties and the Government, and how the costs of exploration, development and production will be recovered.

By virtue of the PSC, the Company acquired a 90% interest in Block 11A, which encompasses 11,950.06 square kilometers or 2.95 million square acres. The Government of Kenya has a 10% carried participating interest up to the declaration of commerciality and may thereafter acquire an additional 10% interest in the PSC in which case the total Government participation would rise to 20%.

Circle Oil Limited (www.circleoilandgas.com) ("Circle") acted as finder in ERHC's acquisition of the Block by facilitating ERHC's entry into Kenya, including the introduction of Dr. Peter Thuo, ERHC's Kenya-based geoscientist and technical adviser who provided liaison services in the pursuit of ERHC's application. Circle's involvement provided significant efficiencies, including substantial cost savings, in ERHC's application process. By virtue of the terms of the business finder's agreement reached between Circle and ERHC, Circle is entitled to receive a 5% payment on the value of the acquisition accruing resulting to ERHC from the application. Circle has opted to receive this fee in the form of a carried 5% of ERHC's total interest in Block 11A.

In October, 2013, ERHC entered into a farm-out agreement with CEPSA Kenya Limited, an affiliate of Compañía Española de Petróleos, S.A.U., an international oil and gas company ("CEPSA"). The farm-out agreement was approved by the Government of the Republic of Kenya during the quarter ended March 31, 2014. Under terms of the agreement, ERHC transferred a majority of its interest in Kenya Block 11A as well as operatorship to CEPSA. The farm-out agreement includes a carry and other considerations.

Key Provisions of the ERHC's PSC on Block 11A

KENYA BLOCK 11A |

| | | |

LICENSE: | | PSC with the Government of Kenya (effective September 2012) |

| | | |

PARTIES: | | ERHC (35%); CEPSA (55%); Government of Kenya (10%)1 |

WORK PROGRAM:

Phase 1 (2 years – September 2012 to September 2014)

| Minimum Work | | Minimum Expenditure | | Status |

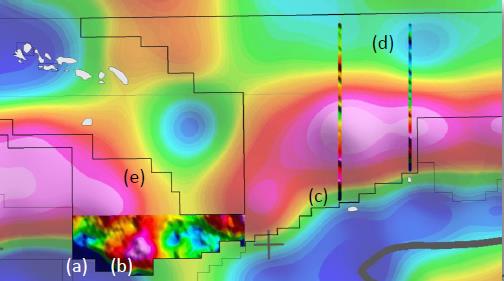

| Acquire and interpret 1,000 square kilometers of gravity and magnetic data | | $250,000 | | Completed: 12,714 square kilometers of FTG data acquired by January 2014 at a total cost of $2,070,780. |

| Acquire and interpret 1,000 kilometers of 2D seismic data | | $10,000,000 | | Completed: 1,086.6 line kilometers of 2D seismic data acquired by August 2014 at an estimated total cost of $28,300,000 |

Phase 2 (2 years – September 2014 to September 2016)

| Minimum Work | | Minimum Expenditure | | Status |

| Acquire 750 square kilometers of 3D seismic data | | $30,000,000 | | Decision taken not to acquire 3D seismic but to proceed to drilling based on FTG and 2D seismic |

OR | | OR | | |

| Drill one (1) well to a minimum depth of 3,000m | | $30,000,000 | | Preparation underway for drilling exploration well in Q1 2016 |

Phase 3 (2 years – September 2016 to September 2018)

| Minimum Work | | Minimum Expenditure | | Status |

| Drill one (1) well to a minimum depth of 3,000m | | $30,000,000 | | Not yet arisen |

OTHER FINANCIAL OBLIGATIONS:

| Ministry Training Fund | | $175,000 per annum during the exploration period |

| | | |

| | | $200,000 per annum (minimum) from adoption of first development plan |

| | | |

Social Projects: | | $50,000 per annum (minimum) |

| | | |

| Surface Rentals: | | $5/km2 per annum (exploration phase 1); $10/km2 per annum (exploration phase 2); $15/km2 per annum (exploration phase 3) |

| | | |

| | | $100/km2 per annum (development and production period) |

| Cost Recovery: |

| | | |

| Cost Oil | | Up to 60% of Cost Oil each fiscal year |

Profit Oil

| Incremental Production Tranches | Government Share | Contractor Share |

| 0-30,000 barrels per day | 50% | 50% |

| Next 25,000 barrels per day | 60% | 40% |

| Next 25,000 barrels per day | 65% | 35% |

| Next 20,000 barrels per day | 70% | 30% |

| Above 100,000 barrels per day | 78% | 22% |

1 CEPSA is carrying ERHC's proportionate share of exploration costs except for the first exploration well where ERHC is expected to contribute 25% of its proportionate (35%) share of costs..

As of March 31, 2015, the exploration team is making steady progress toward drilling during the current phase of exploration. 2D seismic mapping has been completed. To date, two basins, Tarach and Anam, in the eastern and western parts of the block respectively, have been identified. 12 drillable prospects have been mapped in the Tarach Basin alone. Volumetric calculations and risk analyses have been completed leading to a total mean resource estimate of 640 MMBO. The technical team agreed on drilling Tarach-1 as the first exploratory well with a mean resource estimate of 65.78 MMBO during the first quarter of 2016 if all conditions precedent are met. Seismic interpretation of the Anam Basin will start later in 2015.

The Company continues to work with Deloitte Corporate Finance LLC (DCF) on a further farm-down of our interest in the Block to help raise funds for the company.

REPUBLIC OF CHAD

ERHC's Chad Acreage

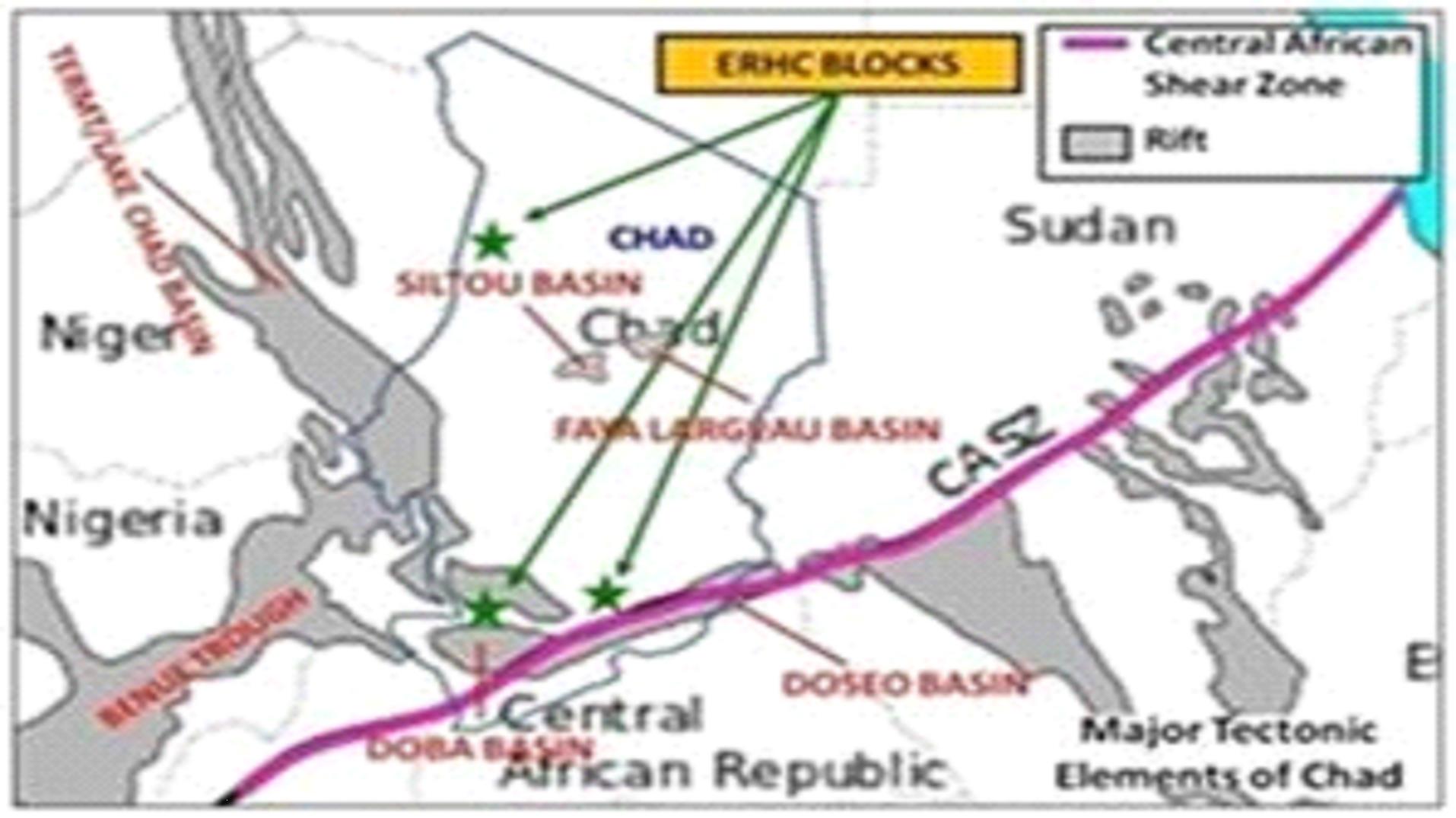

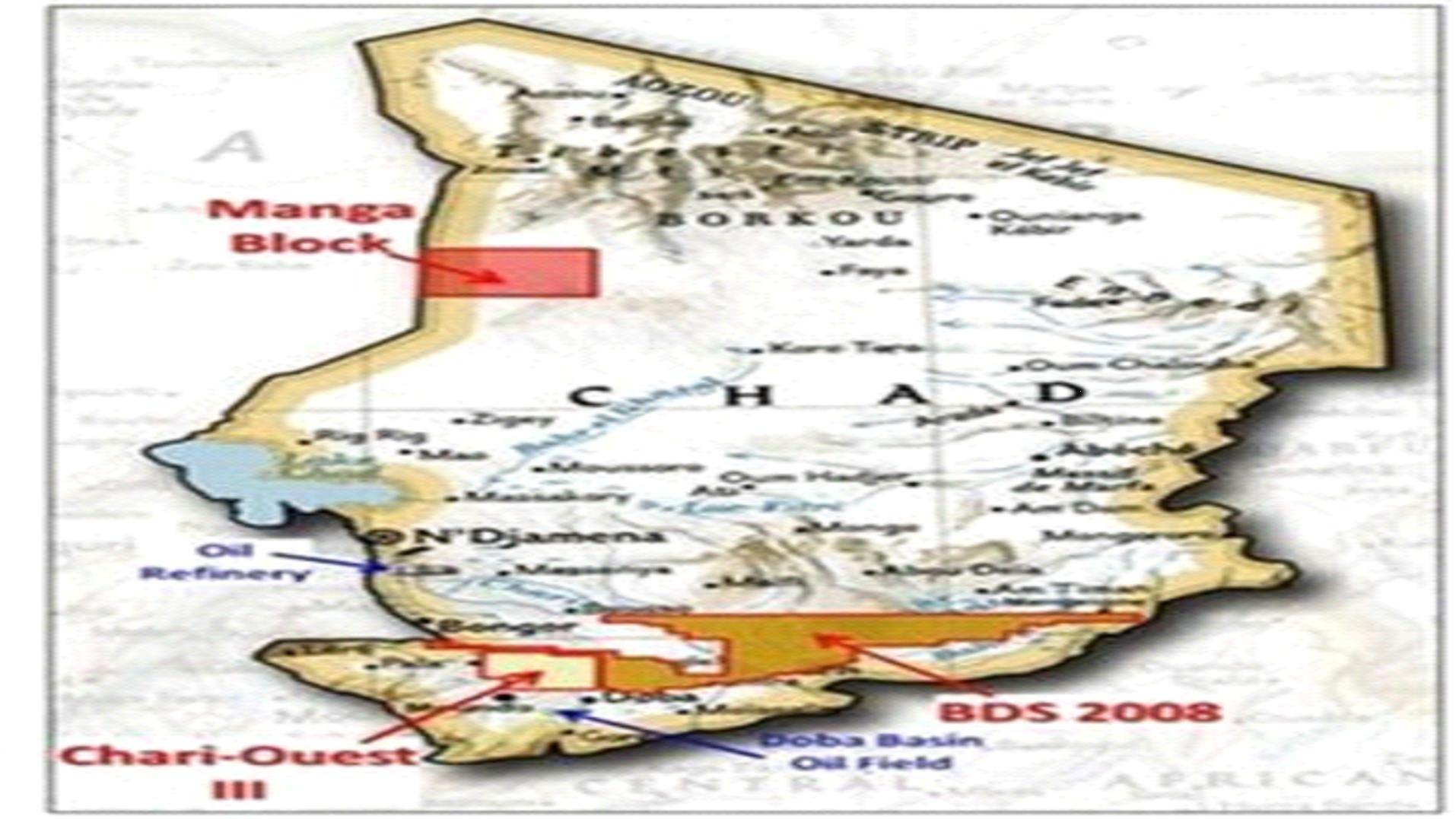

On July 6, 2011, the Company announced that it had signed a Production Sharing Contract (PSC) on the three oil blocks with the Government of Chad. A PSC is an agreement that governs the relationship between ERHC (and any future joint-venture partners) and the Government of Chad in respect of exploration and production in the Blocks awarded to the Company. The initial period of exploration commenced on July 12, 2012 with the publication, in Chadian Government's Gazette Principal, of the Exclusive Exploration Authorization, granted to ERHC by the Government of Chad.

During the quarter ended March 31, 2014, the Company received the arrêté (decree) of the President of Chad giving presidential seal of approval to the Company's request to obtain oil exploration Block BDS 2008 and its voluntary relinquishment of the Manga and Chari-Ouest III Blocks.

Focus Areas

Block BDS 2008 measures 41,800 square kilometers or 10,329,000 acres. ERHC's technical team has identified two focus areas within the Block:

- North of Esso's Tega and Maku discoveries in the Doseo basin; and

- East of and on trend with OPIC's Benoy-1 margin discovery in the Doba basin.

Key Provisions of ERHC's Production Sharing Contract (PSC) in Chad

CHAD BLOCK BDS 2008

LICENSE: | | PSC with the Government of Chad signed June 20112 |

| | | |

PARTIES: | | ERHC (100%) |

WORK PROGRAM:

Phase 1 (5 years – June 2012 to June 2017)3

| Minimum Work | Minimum Expenditure | Status |

| Unspecified: annual work program to be proposed yearly by contractor | $15,000,000 in total for the exploration phase | EIA completed; |

| | | Aero gravity and magnetic survey completed; |

| | | · | 4,720 line kilometers of high precision gravity and magnetic data acquired by November 2014; Processing and interpretation of the data were completed in January 2015. |

| | | · | Three leads identified; |

| | | |

| | | Seismic in preparation; |

| | | · | 2D seismic on focus areas planned for 2015-16 |

2 PSC originally covered thee Blocks; ERHC voluntarily relinquished two Blocks in 2013, retaining only BDS 2008. Relinquishment and retention approved by Presidential Decree as provided for in PSC.3 PSC provides for exploration period to run from date of grant of Exclusive Exploration Authorization ("EEA"). EEA granted to ERHC in June 2012.

Phase 2 (3 years)

| Minimum Work | | Minimum Expenditure | | Status |

| Unspecified: annual work program to be proposed yearly by contractor | | $1,000,000 | | Not yet arisen; ERHC proposes an exploration well in this period if Phase 1 G&G studies justify |

OTHER FINANCIAL OBLIGATIONS: |

| | | |

| Ministry Training Fund | | $250,000 per annum during the exploration period |

| | | |

| | | $500,000 per annum during the exploitation period |

| | | |

Social Projects: | | None specified in the PSC |

| | | |

| Surface Rentals | | $1/km2 per annum (Exploration Phase 1); $5/ km2 per annum (Exploration Phase 2); $10// km2 per annum (Extension) |

| | | |

| | | $100/ km2 per annum (Exploitation Phase 1); $150/ km2 per annum (Exploitation Phase 1) |

| COST RECOVERY AND PRODUCTION SHARING: |

| | | |

| Royalty | | 14.25% for crude oil |

| | | |

| | | 5% for natural gas |

| | | |

| Cost Oil | | Up to 70% of net production after deduction of royalty |

Profit Oil

R-Factor, as defined by the PSC4 | Less than or equal to 2.25 | Between 2.25 and 3 | Greater than 3 |

| Contractor's share of profit oil | 60% | 50% | 40% |

| State's share of profit oil | 40% | 50% | 60% |

4 R-factor is based on a formula defined in the PSC.

As the Company did with the JDZ and Kenya Block 11A, ERHC continues to explore a farm-out to spread risk. The Chad acreage is also within the scope of Deloitte Corporation Finance LLC (DCF)'s engagement and ERHC continues to work with DCF to find suitable farm-out or joint venture partners.

NIGERIA – SAO TOME AND PRINCIPE JOINT DEVELOPMENT ZONE ("JDZ")

Background of the JDZ

In the spring of 2001, Sao Tome & Principe and Nigeria signed a treaty establishing a JDZ for the joint development of petroleum and other resources in the overlapping area of their respective maritime boundaries. The treaty also established an administrative body, the Joint Development Authority ("JDA"), to administer the treaty and all activities in the JDZ. Revenues derived from the JDZ will be shared 60:40 between the governments of Nigeria and Săo Tomé & Príncipe, respectively. The JDZ lies approximately 180 kilometers south of Nigeria, in the Gulf of Guinea, one of the most prolific hydrocarbon regions of the world.

ERHC's Rights in the JDZ

In April 2003, the Company and STP entered into an Option Agreement (the "2003 Option Agreement") in which the Company relinquished significant prior legal rights and financial interests in the Joint Development Zone ("JDZ") in exchange for preferential exploration rights in the JDZ. Following the exercise of ERHC's rights as set forth in the 2003 Option Agreement, the JDA confirmed the award in 2004 of participating interests ("Original Participating Interest") in each of JDZ Blocks 2, 3, 4, 5, 6 and 9 of the JDZ during the 2004/5 licensing round conducted by the JDA. ERHC also jointly bid with internationally recognized technical partners for additional participating interests in the JDZ during the 2004/5 licensing round. As a result of the joint bid, ERHC won additional participating interests ("Joint Bid Participating Interest") in Blocks 2, 3 and 4. The following is a tabulation of ERHC's participating interests in the JDZ.

| JDZ Block | | | ERHC Original Participating Interest | | | ERHC Joint Bid Participating Interest | | | Participating Interest(s) Assigned | | | Current ERHC Retained Participating Interest | |

| | | | | | | | | | | | | | |

| 2 | | | 30.00% | | | 35.00% | | | 43.00% | | | 22.00% | |

| 3 | | | 20.00% | | | 5.00% | | | 15.00% | | | 10.00% | |

| 4 | | | 25.00% | | | 35.00% | | | 40.50% | | | 19.50% | |

| 5 | | | 15.00% | | | - | | | - | | | 15.00% (in arbitration) | |

| 6 | | | 15.00% | | | - | | | - | | | 15.00% (in arbitration) | |

| 9 | | | 20.00% | | | - | | | - | | | 20.00% | |

ERHC's Participating Agreements in the JDZ

The following are the particulars of the Participating Agreements by which ERHC assigned some of its participating interests in JDZ Blocks 2, 3 and 4 to technical partners so that the technical partners would operate the Blocks and carry ERHC's proportionate share of costs in the Blocks until production, if any, commenced from the Blocks:

Date of Participation Agreement | Party(ies) to the Participation Agreement | | Participating Interest(s) Assigned | | | Participating Interest Assigned Price | |

| | | | | | | | |

| JDZ Block 2 - Participation Agreement - ERHC Retained Interest of 22.00% | | | | |

| | | | | | | | |

| March 2, 2006 | Sinopec International Petroleum Exploration Production Co. Nigeria Ltd - a subsidiary of Sinopec International Petroleum and Production Corporation | | | 28.67 | % | | $ | 13,600,000 | |

| | | | | | | | | | |

| Addax Energy Nigeria Limited - an Addax Petroleum Corporation subsidiary | | | 14.33 | % | | $ | 6,800,000 | |

| | | | | | | | | | |

| JDZ Block 3 - Participation Agreement - ERHC Retained Interest of 10.00% | | | | | | | | |

| | | | | | | | | | |

| February 15, 2006 | Addax Petroleum Resources Nigeria Limited - a subsidiary of Addax Petroleum Corporation | | | 15.00 | % | | $ | 7,500,000 | |

| | | | | | | | | | |

| JDZ Block 4 - Participation Agreement - ERHC Retained Interest of 19.50% | | | | | | | | |

| | | | | | | | | | |

| November 15, 2005 | Addax Petroleum Nigeria (Offshore 2) Limited - a subsidiary of Addax Petroleum Corporation | | | 40.50 | % | | $ | 18,000,000 | |

Under the terms of the Participation Agreements Sinopec and Addax agreed to pay all of ERHC's future costs for petroleum operations ("the carried costs") in respect of ERHC's retained interests in the blocks. Additionally, Sinopec and Addax are entitled to 100% of ERHC's allocation of cost oil plus up to 50% of ERHC's allocation of profit oil from the retained interests on individual blocks until Sinopec and Addax Sub recover 100% of ERHC's carried costs.

On or about October 2, 2009, Sinopec International Petroleum Exploration and Production Corporation acquired all of the outstanding shares of Addax Petroleum Corporation.

ERHC's JDZ Acreage

ERHC has working interests in six of the nine Blocks in the JDZ, as follows:

| | ● | JDZ Block 5: 15.0% (in arbitration) |

| | ● | JDZ Block 6: 15.0% (in arbitration) |

The working interest percentages represent ERHC's share of all the hydrocarbon production from the blocks and obligates ERHC to pay a corresponding percentage of the costs of drilling, production and operating the blocks. Through Exploration Phase 1 in blocks 2, 3 and 4, these costs have been carried by the operators. The operators can only recover their costs by carrying ERHC until production whereupon the operators will recover their costs from production revenues.

In 2009, Sinopec and Addax, ERHC's technical partners and operators in Blocks 2, 3 and 4 undertook an exploratory drilling campaign across the three blocks that was completed in January 2010.

Biogenic gas was discovered in each block and discussions continue between the Joint Development Authority and the parties, including ERHC, that hold interests in JDZ Blocks 2, 3 and 4, regarding drilling results. The meetings with the JDA are aimed at reaching a definitive agreement on how to proceed with the next stage of exploration in the Blocks following the expiration of Exploration Phase I in March 2012.

JDZ Operations Update

The JDZ partnership is currently assessing the data for possible new exploration play concepts in this area.

SAO TOME AND PRINCIPE EXCLUSIVE ECONOMIC ZONE ("EEZ")

Overview of ERHC's EEZ Blocks

The Săo Tomé and Príncipe EEZ is delineated over an expanse of waters offshore Sao Tome and Principe that covers approximately 160,000 square kilometers. In terms of hydrocarbon exploration and exploitation, the EEZ is a frontier region that sits south of the Niger Delta and west of the Gabon salt basin, retaining similarities with each of those prolific hydrocarbon regions. The regional seismic database comprises approximately 12,000 kilometers of seismic data. Interpretation of that seismic data shows numerous structures in the EEZ that have similar characteristics to known hydrocarbon accumulations in the area.

ERHC's Rights in the EEZ

Under a 2001 agreement with the Government of Sao Tome and Principe ("STP"), ERHC was vested with the rights to participate in exploration and production activities in the EEZ. These rights included (a) the right to receive up to 100% of two blocks of ERHC's choice and (b) the option to acquire up to a 15% paid working interest in each of two additional blocks of ERHC's choice in the EEZ. In 2010, ERHC exercised its rights to receive up to 100% of two blocks of ERHC's choice in the EEZ and was duly awarded Blocks 4 and 11 of the EEZ by the Government of STP.

EEZ Block 4 is 5,808 square kilometers, situated directly east of the island of Príncipe.

EEZ Block 11 totals 8,941 square kilometers, situated directly east of the island of Săo Tomé and abuts the territorial waters of Gabon. The southern area of the EEZ, where EEZ Block 11 is situated, contains parts of the Ascension and Fang Fracture Zones.

ERHC will decide whether to take up the option to acquire up to a 15% paid working interest in each of two additional blocks of the EEZ when called upon to exercise the option by the Government of STP in accordance with the agreements which provide for the rights and option.

PSC for the EEZ

In July 2014, ERHC and the National Petroleum Agency of São Tomé and Príncipe (ANP-STP) announced the conclusion of final terms for the Production Sharing Contract for EEZ Block 11.

A PSC is an agreement that governs the relationship between the Company (and its joint venture partners) and the Government of Săo Tomé and Príncipe in respect of exploration and production in any Block awarded to the Company. The PSC spells out, among other things, the work commitments (including acquisition of data, drilling of wells, social projects, etc.), the time frames for accomplishing the work commitments, how production will be shared between the parties and the government, and how the costs of exploration, development and production will be recovered.

EEZ Operations Update

SAO TOME & PRINCIPE EEZ BLOCK 11 |

| | | |

| LICENSE | | PSC with the Government of STP signed July 2014 |

| | | |

| PARTIES | | ERHC (85%); Government of STP (15%)5 |

WORK PROGRAM

Phase 1 (4 years)

| Minimum Work | | Minimum Expenditure | | Status |

| Purchase and reprocess all existing 2D seismic on the Block | | $2,500,000 for the entire exploration phase | | Not yet commenced; budgeting for first year being discussed with ANP-STP |

| Geological and Geophysical studies (including AVO, geochemical studies and sequence stratigraphy) | | | | |

| EIA | | | | |

| Magnetic and gravity surveys | | | | |

| Acquire, process and interpret 2,500km 2D seismic | | | | |

| Handover all data and an evaluation report to ANP-STP at least 3 months to end of phase | | | | |

5 Contractor to carry the Government's 15% to production and be entitled to 100% of Cost Oil to recover the carry

Phase 2 (2 years)

| Minimum Work | | Minimum Expenditure | | Status |

| EIA | | $40,000,000 | | Not yet arisen |

| Acquire, process and interpret 1,100 square kilometers 3D seismic | | | | | |

| Drill one exploration well | | | | | |

| Evaluate discoveries and remaining prospectivity | | | | | |

Phase 3 (2 years)

| Minimum Work | | Minimum Expenditure | | Status |

| EIA | | $40,000,000 | | Not yet arisen |

| Drill one exploration well | | | | | |

| Evaluate discoveries | | | | | |

| OTHER FINANCIAL OBLIGATIONS |

| | | |

| Signature Bonus | | None payable |

| | | |

| Training | | Between $100,000 (min) and $250,000 (max) per calendar year during the exploration period |

| | | |

| | | $550,000 per annum during the production period |

| | | |

| Social Projects | | Exploration Phase 1: $300,000 per annum (minimum) |

| | | |

| | | Exploration Phase 2: $500,000 per annum (minimum) |

| | | |

| | | Exploration Phase 3: $400,000 per annum (minimum) |

| | | |

| | | On production, $2million worth of projects if cumulative production is 20mmboe, $4million if 40mmboe and $6m if 60mmboe |

| COST RECOVERY AND PRODUCTION SHARING |

| | | |

| Royalty | | 2% (first charge on production) |

| | | |

| Cost Oil | | Up to 80% of available crude after deduction of royalty oil in any accounting period |

Profit Oil

Contractor's Rate of Return6 for Contract Area (% per annum) | Government Share | Contractor Share |

| <16% | 0% | 100% |

| >=16%<19% | 10% | 90% |

| >=19%<23% | 20% | 80% |

| >=23%<26% | 40% | 60% |

| >=26% | 50% | 50% |

As was the case in Kenya and earlier in the Joint Development Zone, management's intention is to bring a technically and financially capable operating partner onboard. The Company's discussions continue with several international oil companies about partnerships in EEZ Block 11. Some of those discussions are on the possibility of a 'right-to-earn' partnership where the operator commits to carrying only one aspect of the work program in return for a pre-determined interest in the PSC if the results of that aspect convince the operator to commit to the rest of the work program.

ERHC is currently working with the National Petroleum Agency of São Tomé and Príncipe (ANP-STP) to complete the budget for the first year of its exploration work program. A preliminary examination of available 2D seismic data indicates the possibility of commercially sizeable Cretaceous deep water tubidite fan existing in Block 11. While further investigation is in process, ERHC's exploration team believes that the Block has the potential for holding enormous hydrocarbon resources.

6 PSC provides for rate of return to be determined at the end of each quarter on the basis of accumulated compounded net cash flow for the contract area using a prescribed procedure.

INVESTMENT IN OANDO ENERGY RESOURCES (FORMERLY EXILE RESOURCES)

During the year ended September 30, 2011, ERHC invested $1,350,000 in Exile Resources Inc, a company listed on the Toronto Stock Exchange (Ventures Exchange) stock in open market purchases. ERHC's intention was to gain an indirect interest in Exile's underlying oil and gas exploration and production assets as well as the ability to participate in Exile's decision making in respect of those assets. ERHC was particularly interested in Exile's carried interest in the proven Akepo field in the Niger Delta.

In July 2011, Oando Petroleum and Exploration Company ("Oando Petroleum") commenced a reverse takeover ("RTO") of Exile Resources. In July 2012, Exile announced the completion of the RTO by Oando Petroleum and the change of name of the resultant company to Oando Energy Resources Inc, ("Oando Energy"). It also announced the listing of the company's shares under the symbol "OER" on the Toronto Stock Exchange (TSX) and commencement of trading in the shares on the TSX from July 30, 2012.

As a result of the RTO, ERHC now holds 418,889 shares in the common stock of Oando Energy. ERHC also holds warrants for 418,889 common shares exercisable within 24 months of the closing of the RTO at Cdn$2.00 per share.

CURRENT PLANS FOR OPERATIONS

ERHC's principal assets are its interests in rights for exploration for hydrocarbons in Kenya, Chad, the JDZ and the EEZ. ERHC has no current sources of income from its operations. The Company plans to develop its business by the acquisition of other assets which may include revenue-producing assets in diverse geographical areas and the forging of strategic, new business partnerships and alliances. ERHC cannot currently predict the outcome of negotiations for acquisitions, or, if successful, their impact on the Company's operations.

PLANS FOR FUNDING OF POTENTIAL ACQUISITIONS

ERHC's future plans will depend on the Company's ability to attract new funding. The Company is implementing a series of steps to fund the geophysical work, including magnetic/gravity and seismic surveys, prior to securing potential farm-out on Chad acreage. The fund raising might include:

| | · | Farm-outs of part of the Company's assets in Kenya, Chad and the Săo Tomé and Príncipe Exclusive Economic Zone |

| | · | Issue shares of common stock through a registered direct offering |

| | · | Convertible loans and other debt instruments |

| | · | Other available financing options |

During the quarter ended December 31, 2014, the Company retained the services of Deloitte Corporate Finance LLC (DCF) to advise on the Company's oil assets in the Republics of Chad and Kenya.

About Deloitte Corporate Finance LLC

Deloitte Corporate Finance LLC (DCF) provides strategic advisory services and M&A advice that help corporate, entrepreneurial and private equity clients create and act upon opportunities for liquidity, growth and long-term advantage. With an in-depth understanding of the marketplace and access to a global network of investment bankers, DCF help clients confidently pursue strategic transactions in both domestic and global markets. DCF, together with the Corporate Finance Advisory practices within the Deloitte Touche Tohmatsu Limited network of member firms, include in excess of 1,900 professionals, who work collaboratively across 150 international locations. With significant experience providing investment banking services across key industries, DCF are able to offer clients solutions that help them to achieve their strategic objectives.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The process of preparing financial statements requires that the Company make estimates and assumptions that affect the reported amounts of liabilities and stockholders' equity at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Such estimates primarily relate to realization of oil and gas concession assets and the valuation allowance related to deferred tax assets as of the date of the financial statements; accordingly, actual results may differ from estimated amounts. ERHC's estimates and assumptions are based on current facts, historical experience and various other factors we believe to be reasonable under the circumstances. The most significant estimates with regard to the financial statements included with this report relate to realization of oil and gas concession assets and the valuation allowance related to deferred tax assets.

These estimates and assumptions are reviewed periodically and, as adjustments become necessary, they are reported in earnings in the periods in which they become known.

RECENT ACCOUNTING PRONOUNCEMENTS

In preparing its financial statements and filings, the company considers recent guidance issued related to accounting principles generally accepted in the United States. The Company believes that there has been no new guidance since its most recent annual report on Form 10-K that have a significant impact on its financial statements.

RESULTS OF OPERATIONS

Three Months Ended March 31, 2015 Compared with the Three Months Ended March 31, 2014

General and administrative expenses decreased from $940,909 in the three months ended March 31, 2014 to $520,695 in the three months ended March 31, 2015. The decrease was primarily due to decrease in general and administrative expenses as part of our cost savings plan.

During the three months ended March 31, 2015, the Company had a net loss of $1,957,547 compared with a net gain of $1,723,555 for the three months ended March 31, 2014. The increase in net loss was primarily due loss on embedded derivative of $727,072 and interest expenses of $931,037 related to our convertible debts compared with no convertible debt during the same period in 2014.

Six Months Ended March 31, 2015 Compared with the Six Months Ended March 31, 2014

General and administrative expenses decreased from $1,914,487 in the six months ended March 31, 2014 to $1,349,168 in the six months ended March 31, 2015. The decrease was primarily due to a decrease in general and administrative expenses as part of our cost savings plan.

During the six months ended March 31, 2015, the Company had a net loss of $3,646,762 compared with a net gain of $554,205 for the six months ended March 31, 2014. The increase in net loss was primarily due to loss on embedded derivative of $1,259,260 and interest expenses of $1,149,161 related to our convertible compared with no convertible debt during the same period in 2014.

LIQUIDITY AND CAPITAL RESOURCES

As of March 31, 2015, the Company had $1,496,658 in cash and cash equivalents, and a working capital of $1,158,124. The Company is currently raising more funds through convertible debentures.

OFF-BALANCE SHEET ARRANGEMENTS

At March 31, 2015, the Company had no off-balance sheet arrangements.

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk |

The Company's current focus is to exploit its primary assets, which are rights to working interests oil and gas exploration blocks in Kenya, Chad, the JDZ and EEZ under agreements with the governments of Kenya, Chad, the JDA and the government of STP respectively. The Company intends to continue to form relationships with other oil and gas companies with operational, technical and financial capabilities, to partner with the Company in leveraging its interests. The Company currently has no other operations.

As of March 31, 2015, all the Company's exploration and production acreages were located outside the United States. The Company's primary assets are agreements with Kenya, Chad, STP and the JDA which provide ERHC with rights to participate in exploration and production activities in Kenya, Chad, the EEZ and the JDZ in Africa. This geographic area of interest is controlled by foreign governments that have historically experienced volatility of which is out of management's control. The Company's operations and its ability to exploit its interests in the agreements in this area may be impacted by this circumstance.

The future success of the Company's international operations may also be adversely affected by risks associated with international activities that include financial, economic and labor conditions, political instability, risk of war, expropriation, renegotiation or modification of existing contracts, tax laws (including host-country import-export, excise and income taxes and United States taxes on foreign subsidiaries) and changes in the value of the U.S. dollar relative to the local currencies in which future oil and gas producing activities may be denominated. Furthermore, changes in exchange rates may adversely affect the Company's future results of operations and financial condition.

Market risks relating to the Company's operations result primarily from changes in interest rates as well as credit risk concentrations. The Company's interest expense is generally not sensitive to changes in the general level of interest rates in the United States, particularly because a substantial majority of its indebtedness is at fixed rates.