Washington D.C. 20549

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act") during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and, (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date:

The number of shares of common stock, par value $0.0001 per share, outstanding as of January 31, 2015, was 884,519,152.

ERHC ENERGY INC.

ERHC Energy Inc. (also referred to as "ERHC" or the "Company" and denoted by the use of the pronouns "we," "our" and "us" as the case may be in this Report) or its representatives may, from time to time, make or incorporate by reference certain written or oral statements of historical fact, statements that include, but are not limited to, information concerning the Company's possible or assumed future business activities and results of operations and statements about the following subjects:

These types of statements and other forward-looking statements inherently are subject to a variety of assumptions, risks and uncertainties that could cause actual results, levels of activity, performance or achievements to differ materially from those expected, projected or expressed in forward-looking statements. These risks and uncertainties include, among others, the following:

The risks and uncertainties included here are not exhaustive. Other sections of this report and the Company's other filings with the U.S. Securities and Exchange Commission ("SEC") include additional factors that could adversely affect the Company's business, results of operations and financial performance. Given these risks and uncertainties, investors should not place undue reliance on our statements concerning future intent. Our statements included in this report speak only as of the date of this report. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any of our statements to reflect any change in its expectations with regard to the statements or any change in events, conditions or circumstances on which any forward-looking statements are based.

PART I. FINANCIAL INFORMATION

ERHC ENERGY INC.

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC.

The accompanying notes are an integral part of these unaudited consolidated financial statements.

ERHC ENERGY INC.

The accompanying notes are an integral part of these unaudited consolidated financial statements

The following table summarizes conversion terms of the notes outstanding at December 31, 2014:

As of December 31, 2014, Company recorded the following deferred origination costs related to the convertible notes:

As described in Notes 4 and 6, the Company has identified embedded derivatives in notes payables and outstanding warrants.

The fair value of the embedded derivatives related to the convertible notes payable, comprising conversion feature with the reset provisions and the default provisions, at issuance and December 31, 2014 was determined using the multinomial lattice models that value the derivative liability based on a probability weighted discounted cash flow model. These models are based on future projections of the various potential outcomes and utilize the following assumptions:

As discussed in Note 3, the Company issued convertible notes payable that provide for the issuance of convertible notes with variable conversion provisions. The conversion terms of the convertible notes are variable based on certain factors, such as the future price of the Company’s common stock. The number of shares of common stock to be issued is based on the future price of the Company’s common stock. The number of shares of common stock issuable upon conversion of the promissory note is indeterminate. Due to the fact that the number of shares of common stock issuable could exceed the Company’s authorized share limit, the equity environment is tainted and all additional convertible debentures and warrants are included in the value of the derivative. Pursuant to ASC 815-15 Embedded Derivatives, the fair values of the variable conversion option and warrants and shares to be issued were recorded as derivative liabilities on the issuance date.

The fair value of the embedded derivatives related to the tainted outstanding warrants, comprising exercise feature with the full ratchet reset, at December 31, 2014 was determined using the lattice models that value the derivative liability based on a probability weighted discounted cash flow model. These models are based on future projections of the various potential outcomes and utilize the following assumptions:

During the year ended December 31, 2014, the Company recorded an aggregate $114,674 gain on change in fair value of derivative liabilities and a $532,188 day 1 loss upon recognition of these derivatives. See Note 3 for more information.

During the three months ended December 31, 2014, the Company recognized compensation expense of $8,400 related to service granted to the Board of Directors in fiscal year 2014.

As of December 31, 2014, there are 4,150,000 options outstanding; none of which are exercisable. These options have a weighted average remaining term of six days and an intrinsic value of zero. Unamortized compensation cost related to these options amounted to $0.

During the three months ended December 31, 2014, there were no new warrants granted and none were exercised, cancelled or expired. As of December 31, 2014, the Company has 7,277,729 outstanding and exercisable warrants with a weighted average exercise price and remaining term of $0.32 per share and 1.0 years, respectively. As of December 31, 2014, these warrants have an intrinsic value of zero.

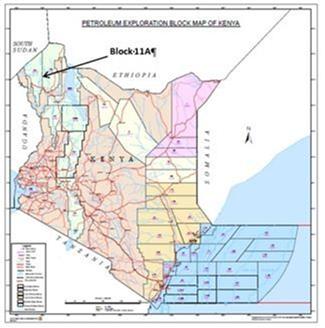

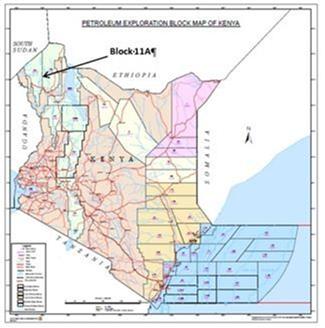

On June 28, 2012, ERHC entered into a production sharing contract ("PSC") with the Government of the Republic of Kenya for certain land based hydrocarbon exploration and production of Block 11A located in northwestern Kenya.

In October, 2013, the Company entered into a farm-out agreement with CEPSA Kenya Limited, an affiliate of Compañía Española de Petróleos, S.A.U., an international oil and gas company ("CEPSA"). Under the terms of this agreement, the Company assigned and transferred 55% of its participating interest in Kenya Block 11A to CEPSA. In exchange for the transferred rights, CEPSA will carry the Company's proportionate share of obligations and financial costs under the terms and conditions outlined in the farm-out agreement. The agreement was approved in January 2014 by the Kenyan Government and from February 2014, CEPSA took over from ERHC as operator under the production sharing contract ("PSC") for Kenya Block 11A.

Republic of Chad Concession Fees and Other Financial Commitments

On June 30, 2011, ERHC entered into a production sharing contract ("PSC") with Chad for certain onshore hydrocarbon exploration and development. In September 2013, the Ministry of Energy and Petroleum of Chad approved ERHC’s application to voluntarily relinquish two of the three Blocks covered by the PSC. The voluntary relinquishment proportionately reduces ERHC’s total signature-bonus obligations of $6,000,000 under the initial PSC to $2,000,000.

As of December 31, 2014, ERHC has paid or incurred:

| a. | $2,000,000 as the entire signature bonus |

| b. | $320,600 in advisers' and ancillary costs related to the PSC |

| c. | $480,000 as legal fees and costs for the drafting and negotiation of the PSC, as provided for in the PSC |

| d. | $190,872 as costs of Environmental Impact Study, as provided for in the PSC |

| e. | $385,500 on Aeromagnetic data acquisition survey |

OTHER FINANCIAL OBLIGATIONS:

| Ministry Training Fund | | $250,000 per annum during the exploration period |

| | | |

| | | $500,000 per annum during the exploitation period |

| | | |

Social Projects: | | None specified in the PSC |

| | | |

| Surface Rentals: | | $1/km2 per annum (Exploration Phase 1); $5/ km2 per annum (Exploration Phase 2); $10// km2 per annum (Extension) |

| | | |

| | | $100/ km2 per annum (Exploitation Phase 1); $150/ km2 per annum (Exploitation Phase 1) |

NOTE 8 – SUBSEQUENT EVENT

LEGAL PROCEEDINGS

JDZ Blocks 5 and 6

Lawsuit

The Company’s rights in JDZ Blocks 5 and 6 are currently the subject of legal proceedings at the London Court of International Arbitration and the Federal High Court in Abuja, Nigeria. The Company instituted both proceedings in November 2008 against the JDA and the Governments of Nigeria and Săo Tomé and Príncipe. The Company seeks legal clarification that its rights in the two Blocks remain intact.

The issue in contention is contractual. The Company was awarded a 15 percent working interest in each of the Blocks in a 2004/5 bid/licensing round conducted by the JDA following the Company’s exercise of preferential rights in the Blocks as guaranteed by contract and treaty. The JDA and the Government of STP contend that certain correspondence issued by a previous CEO/President of the Company in 2006 amount to a relinquishment of the Company’s rights in Blocks 5 and 6 under the Company’s contracts with STP which provide for the rights. The Company contends that no such relinquishment has occurred and has sought recourse to arbitration accordingly. It also filed the suit to prevent any tampering with its said rights in JDZ Blocks 5 and 6 pending the outcome of arbitration.

Proceedings on the suit and the arbitration are currently suspended while the Company pursues amicable settlement with the Governments of Nigeria and Săo Tomé & Príncipe.

Routine Claims

From time to time, ERHC may be subject to routine litigation, claims, or disputes in the ordinary course of business. ERHC intends to defend these matters vigorously. The Company cannot predict with certainty, however, the outcome or effect of any of the arbitration or litigation specifically described above or any other pending litigation or claims.

| Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion should be read in conjunction with the Company's unaudited consolidated financial statements (including the notes thereto) and Item 1A of Part II; "Risk Factors," included elsewhere in this report and the Company's audited consolidated financial statements and the notes thereto, Item 7; and "Management's Discussion and Analysis of Financial Condition and Plan of Operations" and Item 1A, "Risk Factors" included in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2014. The Company's historical results are not necessarily an indication of trends in operating results for any future period. References to "ERHC" or the "Company" mean ERHC Energy Inc., a Colorado corporation, and, unless expressly stated or the context otherwise requires, its wholly owned subsidiary.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

We are including the following cautionary statement to make applicable and take advantage of the safe harbor provision of the Private Securities Litigation Reform Act of 1995 for any forward-looking statements made by us, or on our behalf. This Quarterly Report on Form 10-Q contains forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, future events or performance and underlying assumptions and other statements which are other than statements of historical facts. Certain statements contained herein are forward-looking statements and, accordingly, involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. Our expectations, beliefs and projections are expressed in good faith and are believed by us to have a reasonable basis, including without limitations, management's examination of historical operating trends, data contained in our records and other data available from third parties, but there can be no assurance that management's expectations, beliefs or projections will result or be achieved or accomplished. In addition to other factors and matters discussed elsewhere herein, the following are important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements: geopolitical instability where we operate; our ability to meet our capital needs; our ability to raise sufficient capital and/or enter into one or more strategic relationships with one or more industry partners to execute our business plan; our ability and success in finding, developing and acquiring oil and gas reserves; our ability to respond to changes in the oil exploration and production environment, competition, and the availability of personnel in the future to support our activities.

Overview

ERHC Energy Inc., a Colorado corporation, ("ERHC" or the "Company") was incorporated in 1986. The Company is in the business of exploration for oil and gas resources in Africa. The Company's business includes working interests in exploration acreage in the Republic of Kenya ("Kenya"), the Republic of Chad ("Chad"), the Joint Development Zone ("JDZ") between the Democratic Republic of Săo Tomé and Príncipe ("STP"), the Federal Republic of Nigeria ("FRN" or "Nigeria"), and the exclusive economic zone of Săo Tomé and Príncipe (the "Exclusive Economic Zone" or "EEZ").

ERHC's strategy in Kenya and Chad is to perform exploration work and further establish the prospectivity of assets acquired through Production Sharing Contracts (PSCs) with the governments of both countries. ERHC found a farm-out partner for its interests in Kenya, and is currently seeking for a partner for its interests in Chad. ERHC expects that such farm-in arrangements, if entered into, might lower the risk and cost of the exploration programs to ERHC.

The Company's strategy in the JDZ and EEZ is to farm out its working interests to well established oil and gas operators for valuable consideration including upfront cash payments and being carried for ERHC's share of the exploration costs. This has already been done successfully on Blocks 2, 3 and 4 of the JDZ where ERHC has benefited from partnerships with Addax Petroleum and Sinopec Corporation, which have operated some of the license areas on behalf of ERHC.

Apart from its oil and gas exploration activities in Kenya, Chad, the JDZ and the EEZ, ERHC continues to pursue other oil and gas opportunities on the African continent. These opportunities also include the possible acquisition of significant equity stakes in other oil and gas exploration and production companies and the resulting indirect interest in the underlying exploration and production assets of such other companies.

REPUBLIC OF KENYA

ERHC Kenya Acreage

In June 2012, after months of negotiations between ERHC and the Government of Kenya, the Government awarded Block 11A for oil and gas exploration and development in Kenya to the Company. On June 28, 2012, the Company announced that it had signed a Production Sharing Contract (PSC) on Block 11A with the Government of Kenya. A PSC is an agreement that governs the relationship between ERHC (and any future joint-venture partners) and the Government of Kenya in respect of exploration and production in the Block awarded to the Company. The PSC details, among other things, the work commitments (including acquisition of data, drilling of wells, social projects, etc.), the time frame for completion of the work commitments, production sharing between the parties and the Government, and how the costs of exploration, development and production will be recovered.

By virtue of the PSC, the Company holds a 90% interest in Block 11A, which encompasses 11,950.06 square kilometers or 2.95 million square acres. The Government of Kenya has a 10% carried participating interest up to the declaration of commerciality and may thereafter acquire an additional 10% interest in the PSC in which case the total Government participation would rise to 20%.

Circle Oil Limited (www.circleoilandgas.com) ("Circle") acted as finder in ERHC's acquisition of the Block by facilitating ERHC's entry into Kenya, including the introduction of Dr. Peter Thuo, ERHC's Kenya-based geoscientist and technical adviser who provided liaison services in the pursuit of ERHC's application. Circle's involvement provided significant efficiencies, including substantial cost savings, in ERHC's application process. By virtue of the terms of the business finder's agreement reached between Circle and ERHC, Circle is entitled to receive a 5% payment on the value of the acquisition accruing resulting to ERHC from the application. Circle has opted to receive this fee in the form of a carried 5% of ERHC's total interest in Block 11A.

In October, 2013, ERHC entered into a farm-out agreement with CEPSA Kenya Limited, an affiliate of Compañía Española de Petróleos, S.A.U., an international oil and gas company ("CEPSA"). The farm-out agreement was approved by the Government of the Republic of Kenya during the quarter ended March 31, 2014. Under terms of the agreement, ERHC transferred majority of its interest in Kenya Block 11A as well as operatorship to CEPSA. The farm-out agreement includes a carry and other considerations.

Kenya Operations Update

In October, 2013, ERHC entered into a farm-out agreement with CEPSA Kenya Limited, an affiliate of Compañía Española de Petróleos, S.A.U., an international oil and gas company ("CEPSA"). The farm-out agreement was approved by the Government of the Republic of Kenya during the quarter ended March 31, 2014. Under terms of the agreement, ERHC transferred majority of its interest in Kenya Block 11A as well as operatorship to CEPSA. The farm-out agreement includes a carry and other considerations.

Key Provisions of the ERHC’s PSC on Block 11A

KENYA BLOCK 11A |

| | | |

LICENSE: | | PSC with the Government of Kenya (effective September 2012) |

| | | |

PARTIES: | | ERHC (35%); CEPSA (55%); Government of Kenya (10%)1 |

WORK PROGRAM:

Phase 1 (2 years – September 2012 to September 2014)

| Minimum Work | | Minimum Expenditure | | Status |

| Acquire and interpret 1,000 square kilometers of gravity and magnetic data | | $ | 250,000 | | Completed: 14,943.8 line kilometers of FTG data acquired by January 2014 at an estimated total cost of $2,700,000. |

| Acquire and interpret 1,000 kilometers of 2D seismic data | | $ | 10,000,000 | | Completed: 1,086.6 line kilometers of 2D seismic data acquired by August 2014 at an estimated total cost of $28,300,000 |

Phase 2 (2 years – September 2014 to September 2016)

| Minimum Work | | Minimum Expenditure | | Status |

Acquire 750 square kilometers of 3D seismic data | | $ | 30,000,000 | | Decision taken not to acquire 3D seismic but to proceed to drilling based on FTG and 2D seismic |

OR | | OR | | |

| Drill one (1) well to a minimum depth of 3,000m | | $ | 30,000,000 | | Preparation underway for drilling exploration well in Q4 2015 or Q1 2016 |

Phase 3 (2 years – September 2016 to September 2018)

| Minimum Work | | Minimum Expenditure | | Status |

| Drill one (1) well to a minimum depth of 3,000m | | $ | 30,000,000 | | Not yet arisen |

OTHER FINANCIAL OBLIGATIONS:

| Ministry Training Fund | | $175,000 per annum during the exploration period |

| | | |

| | | $200,000 per annum (minimum) from adoption of first development plan |

| | | |

Social Projects: | | $50,000 per annum (minimum) |

| | | |

| Surface Rentals: | | $5/km2 per annum (exploration phase 1); $10/km2 per annum (exploration phase 2); $15/km2 per annum (exploration phase 3) |

| | | |

| | | $100/km2 per annum (development and production period) |

| Cost Recovery: |

| | | |

| Cost Oil | | Up to 60% of Cost Oil each fiscal year |

Profit Oil

| Incremental Production Tranches | | Government Share | | | Contractor Share | |

| 0-30,000 barrels per day | | | 50 | % | | | 50 | % |

| Next 25,000 barrels per day | | | 60 | % | | | 40 | % |

| Next 25,000 barrels per day | | | 65 | % | | | 35 | % |

| Next 20,000 barrels per day | | | 70 | % | | | 30 | % |

| Above 100,000 barrels per day | | | 78 | % | | | 22 | % |

1 CEPSA is carrying ERHC’s proportionate share of exploration costs except for the first exploration well where ERHC is expected to contribute 25% of its proportionate (35%) share of costs of the well.

As of December 2014, the exploration team is making steady progress toward drilling during the current “First Additional Phase” of exploration. 2D seismic mapping has been completed. To date, over a dozen structural prospects have been identified and supported. The parties' technical team is working to finalize volumetrics for identified prospects in the Block, which will help determine the location of the first well.

Our 2015 work program includes securing the requisite drilling rig, determining the location for drilling the first exploration well, completing an Environmental Impact Assessment for the drilling location and developing the well design. The work program is underway with lead items for well operations already under order.

The Company continue to work with Deloitte Corporate Finance LLC (DCF) on a further farm-down of our interest in the Block to help raise funds for the company.

REPUBLIC OF CHAD

ERHC's Chad Acreage

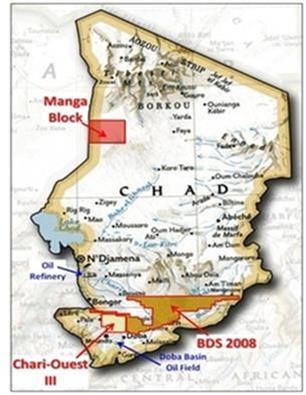

On July 6, 2011, the Company announced that it had signed a Production Sharing Contract (PSC) on the three oil blocks with the Government of Chad. A PSC is an agreement that governs the relationship between ERHC (and any future joint-venture partners) and the Government of Chad in respect of exploration and production in the Blocks awarded to the Company. The initial period of exploration commenced on July 12, 2012 with the publication, in Chadian Government’s Gazette Principal, of the Exclusive Exploration Authorization, granted to ERHC by the Government of Chad.

During the quarter ended March 31, 2014, the Company received the arrêté (decree) of the President of Chad giving presidential seal of approval to the Company’s request to obtain oil exploration Block BDS 2008 and its voluntary relinquishment of the Manga and Chari-Ouest III Blocks.

Chad Operations Update

ERHC has completed the Environmental Impact Assessment ("EIA") as a mandatory pre-condition to commencing data acquisition and the rest of the work program. In addition, ERHC completed the Environmental Impact Study ("EIS") and submitted the results of EIS to the Government of Chad for review, as required under the PSC. The EIA has been completed and approved, and ERHC is advancing to the next step in its oil and gas exploration work program: an aero gravity/magnetic survey of BDS2008. The Company awarded the contract for this survey to Bridgeporth, Ltd (“Bridgeporth”) in June 2014, and the survey will commence during the third quarter of 2014, upon obtaining of the administrative approvals necessary for Bridgeporth to begin work.

Focus Areas

ERHC's exploration focus is on Block BDS 2008 which measures 41,800 square kilometers or 10,329,000 acres. Within this block, two focus areas have been identified:

- North of Esso’s Tega and Maku discoveries in the Doseo basin; and

- East of and on trend with OPIC’s Benoy-1 margin discovery in the Doba basin.

.

Key Provisions of ERHC's Production Sharing Contract (PSC) in Chad

CHAD BLOCK BDS 2008

LICENSE: | | PSC with the Government of Chad signed June 20112 |

| | | |

PARTIES: | | ERHC (100%) |

WORK PROGRAM:

Phase 1 (5 years – June 2012 to June 2017)3

| Minimum Work | Minimum Expenditure | Status |

| Unspecified: annual work program to be proposed yearly by contractor | $15,000,000 in total for the exploration phase | EIA completed; |

| | | Aero gravity and magnetic survey completed; |

| | | · | 4,720 line kilometers of high precision gravity and magnetic data acquired by November 2014; |

| | | · | Three leads identified; |

| | | |

| | | Seismic in preparation; |

| | | · | 2D seismic on focus areas planned for 2015-16 |

2 PSC originally covered thee Blocks; ERHC voluntarily relinquished two Blocks in 2013, retaining only BDS 2008. Relinquishment and retention approved by Presidential Decree as provided for in PSC.

3 PSC provides for exploration period to run from date of grant of Exclusive Exploration Authorization (“EEA”). EEA granted to ERHC in June 2012.

Phase 2 (3 years)

| Minimum Work | | Minimum Expenditure | | Status |

| Unspecified: annual work program to be proposed yearly by contractor | | $ | 1,000,000 | | Not yet arisen; ERHC proposes an exploration well in this period if Phase 1 G&G studies justify |

OTHER FINANCIAL OBLIGATIONS: |

| | | |

| Ministry Training Fund | | $250,000 per annum during the exploration period |

| | | |

| | | $500,000 per annum during the exploitation period |

| | | |

Social Projects: | | None specified in the PSC |

| | | |

| Surface Rentals | | $1/km2 per annum (Exploration Phase 1); $5/ km2 per annum (Exploration Phase 2); $10// km2 per annum (Extension) |

| | | |

| | | $100/ km2 per annum (Exploitation Phase 1); $150/ km2 per annum (Exploitation Phase 1) |

| COST RECOVERY AND PRODUCTION SHARING: |

| | | |

| Royalty | | 14.25% for crude oil |

| | | |

| | | 5% for natural gas |

| | | |

| Cost Oil | | Up to 70% of net production after deduction of royalty |

Profit Oil

R-Factor, as defined by the PSC4 | | Less than or equal to 2.25 | | | Between 2.25 and 3 | | | Greater than 3 | |

| Contractor’s share of profit oil | | | 60 | % | | | 50 | % | | | 40 | % |

| State’s share of profit oil | | | 40 | % | | | 50 | % | | | 60 | % |

4 R-factor is based on a formula defined in the PSC.

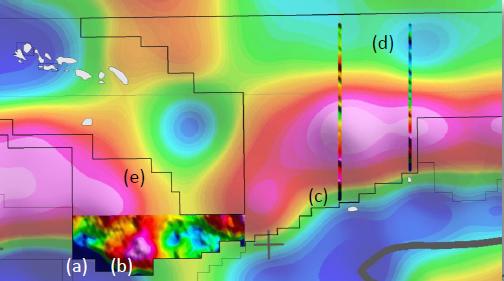

As of December 2014, ERHC’s exploration team has commenced planning toward 2-D seismic acquisition. The information gathered through an airborne gravity/magnetic survey of the Block in Southern Chad proved to be a significant improvement on current data resolution. ERHC's sub-contractor, Bridgeporth Ltd., a specialist geosciences company, completed the survey during the fourth quarter of 2014, confirming the preliminary leads and revealing additional targets. The main conclusions of the study are as follows:

a) The Graben edge is clearly visible in the southwest corner of the Bridgeporth survey.

b) The data can be used to target seismic acquisition over possible rift associated structures.

c) It appears that the Graben edge will enter into the ERHC block northeast of the Bridgeporth survey.

d) Regional profile data acquired by Bridgeporth suggests that the gravity low to the north of BDS 2008 could indeed be a rifted section.

e) The saddle feature in the west central portion of the Block should be investigated.

As the Company did with the JDZ and Kenya Block 11A, ERHC continues to explore a farm-out to spread risk. The Chad acreage is also within the scope of Deloitte Corporation Finance LLC (DCF)’s engagement and we continue to work with them to find suitable farm-out or joint venture partners.

NIGERIA – SAO TOME AND PRINCIPE JOINT DEVELOPMENT ZONE ("JDZ")

Background of the JDZ

In the spring of 2001, Sao Tome & Principe and Nigeria signed a treaty establishing a JDZ for the joint development of petroleum and other resources in the overlapping area of their respective maritime boundaries. The treaty also established an administrative body, the Joint Development Authority ("JDA"), to administer the treaty and all activities in the JDZ. Revenues derived from the JDZ will be shared 60:40 between the governments of Nigeria and Săo Tomé & Príncipe, respectively. The JDZ lies approximately 180 kilometers south of Nigeria, in the Gulf of Guinea, one of the most prolific hydrocarbon regions of the world.

ERHC's Rights in the JDZ

In April 2003, the Company and STP entered into an Option Agreement (the "2003 Option Agreement") in which the Company relinquished significant prior legal rights and financial interests in the Joint Development Zone ("JDZ") in exchange for preferential exploration rights in the JDZ. Following the exercise of ERHC's rights as set forth in the 2003 Option Agreement, the JDA confirmed the award in 2004 of participating interests ("Original Participating Interest") in each of JDZ Blocks 2, 3, 4, 5, 6 and 9 of the JDZ during the 2004/5 licensing round conducted by the JDA. ERHC also jointly bid with internationally recognized technical partners for additional participating interests in the JDZ during the 2004/5 licensing round. As a result of the joint bid, ERHC won additional participating interests ("Joint Bid Participating Interest") in Blocks 2, 3 and 4. The following is a tabulation of ERHC's participating interests in the JDZ.

| JDZ Block | | ERHC Original Participating Interest | | | ERHC Joint Bid Participating Interest | | | Participating Interest(s) Assigned | | | Current ERHC Retained Participating Interest | |

| | | | | | | | | | | | | |

| 2 | | 30.00% | | | 35.00% | | | 43.00% | | | 22.00% | |

| 3 | | 20.00% | | | 5.00% | | | 15.00% | | | 10.00% | |

| 4 | | 25.00% | | | 35.00% | | | 40.50% | | | 19.50% | |

| 5 | | 15.00% | | | - | | | - | | | 15.00% (in arbitration) | |

| 6 | | 15.00% | | | - | | | - | | | 15.00% (in arbitration ) | |

| 9 | | 20.00% | | | - | | | - | | | 20.00% | |

ERHC's Participating Agreements in the JDZ

The following are the particulars of the Participating Agreements by which ERHC assigned some of its participating interests in JDZ Blocks 2, 3 and 4 to technical partners so that the technical partners would operate the Blocks and carry ERHC's proportionate share of costs in the Blocks until production, if any, commenced from the Blocks:

Date of Participation Agreement | Party(ies) to the Participation Agreement | | Participating Interest(s) Assigned | | | Participating Interest Assigned Price | |

| | | | | | | | |

| JDZ Block 2 - Participation Agreement - ERHC Retained Interest of 22.00% | | | | |

| | | | | | | | |

| March 2, 2006 | Sinopec International Petroleum Exploration Production Co. Nigeria Ltd - a subsidiary of Sinopec International Petroleum and Production Corporation | | | 28.67 | % | | $ | 13,600,000 | |

| | | | | | | | | | |

| Addax Energy Nigeria Limited - an Addax Petroleum Corporation subsidiary | | | 14.33 | % | | $ | 6,800,000 | |

| | | | | | | | | | |

| JDZ Block 3 - Participation Agreement - ERHC Retained Interest of 10.00% | | | | | |

| | | | | | | | | | |

| February 15, 2006 | Addax Petroleum Resources Nigeria Limited - a subsidiary of Addax Petroleum Corporation | | | 15.00 | % | | $ | 7,500,000 | |

| | | | | | | | | | |

| JDZ Block 4 - Participation Agreement - ERHC Retained Interest of 19.50% | | | | | |

| | | | | | | | | | |

| November 15, 2005 | Addax Petroleum Nigeria (Offshore 2) Limited - a subsidiary of Addax Petroleum Corporation | | | 40.50 | % | | $ | 18,000,000 | |

Under the terms of the Participation Agreements Sinopec and Addax agreed to pay all of ERHC's future costs for petroleum operations ("the carried costs") in respect of ERHC's retained interests in the blocks. Additionally, Sinopec and Addax are entitled to 100% of ERHC's allocation of cost oil plus up to 50% of ERHC's allocation of profit oil from the retained interests on individual blocks until Sinopec and Addax Sub recover 100% of ERHC's carried costs.

On or about October 2, 2009, Sinopec International Petroleum Exploration and Production Corporation acquired all of the outstanding shares of Addax Petroleum Corporation.

ERHC's JDZ Acreage

ERHC has working interests in six of the nine Blocks in the JDZ, as follows:

| | ● | JDZ Block 5: 15.0% (in arbitration) |

| | ● | JDZ Block 6: 15.0% (in arbitration) |

The working interest percentages represent ERHC's share of all the hydrocarbon production from the blocks and obligates ERHC to pay a corresponding percentage of the costs of drilling, production and operating the blocks. Through Exploration Phase 1 in blocks 2, 3 and 4, these costs have been carried by the operators. The operators can only recover their costs by carrying ERHC until production whereupon the operators will recover their costs from production revenues.

In 2009, Sinopec and Addax, ERHC's technical partners and operators in Blocks 2, 3 and 4 undertook an exploratory drilling campaign across the three blocks that was completed in January 2010.

Biogenic gas was discovered in each block and discussions continue between the Joint Development Authority and the parties, including ERHC, that hold interests in JDZ Blocks 2, 3 and 4, regarding drilling results. The meetings with the JDA are aimed at reaching a definitive agreement on how to proceed with the next stage of exploration in the Blocks following the expiration of Exploration Phase I in March 2012.

JDZ Operations Update

The JDZ partnership is currently assessing the data for possible new exploration play concepts in this area.

SAO TOME AND PRINCIPE EXCLUSIVE ECONOMIC ZONE ("EEZ")

Overview of ERHC's EEZ Blocks

The Săo Tomé and Príncipe EEZ is delineated over an expanse of waters offshore Sao Tome and Principe that covers approximately 160,000 square kilometers. In terms of hydrocarbon exploration and exploitation, the EEZ is a frontier region that sits south of the Niger Delta and west of the Gabon salt basin, retaining similarities with each of those prolific hydrocarbon regions. The regional seismic database comprises approximately 12,000 kilometers of seismic data. Interpretation of that seismic data shows numerous structures in the EEZ that have similar characteristics to known hydrocarbon accumulations in the area.

ERHC's Rights in the EEZ

Under a 2001 agreement with the Government of Sao Tome and Principe ("STP"), ERHC was vested with the rights to participate in exploration and production activities in the EEZ. These rights included (a) the right to receive up to 100% of two blocks of ERHC's choice and (b) the option to acquire up to a 15% paid working interest in each of two additional blocks of ERHC's choice in the EEZ. In 2010, ERHC exercised its rights to receive up to 100% of two blocks of ERHC's choice in the EEZ and was duly awarded Blocks 4 and 11 of the EEZ by the Government of STP.

EEZ Block 4 is 5,808 square kilometers, situated directly east of the island of Príncipe.

EEZ Block 11 totals 8,941 square kilometers, situated directly east of the island of Săo Tomé and abuts the territorial waters of Gabon. The southern area of the EEZ, where EEZ Block 11 is situated, contains parts of the Ascension and Fang Fracture Zones.

ERHC will decide whether to take up the option to acquire up to a 15% paid working interest in each of two additional blocks of the EEZ when called upon to exercise the option by the Government of STP in accordance with the agreements which provide for the rights and option.

PSC for the EEZ

In July 2014, ERHC and the National Petroleum Agency of São Tomé and Príncipe (ANP-STP) announced the conclusion of final terms for the Production Sharing Contract for EEZ Block 11.

A PSC is an agreement that governs the relationship between the Company (and its joint venture partners) and the Government of Săo Tomé and Príncipe in respect of exploration and production in any Block awarded to the Company. The PSC spells out, among other things, the work commitments (including acquisition of data, drilling of wells, social projects, etc.), the time frames for accomplishing the work commitments, how production will be shared between the parties and the government, and how the costs of exploration, development and production will be recovered.

EEZ Operations Update

SAO TOME & PRINCIPE EEZ BLOCK 11 |

| | | |

| LICENSE | | PSC with the Government of STP signed July 2014 |

| | | |

| PARTIES | | ERHC (85%); Government of STP (15%)5 |

WORK PROGRAM

Phase 1 (4 years)

| Minimum Work | Minimum Expenditure | Status |

| Purchase and reprocess all existing 2D seismic on the Block | $2,500,000 for the entire exploration phase | Not yet commenced; budgeting for first year being discussed with ANP-STP |

| Geological and Geophysical studies (including AVO, geochemical studies and sequence stratigraphy) | | |

| EIA | | |

| Magnetic and gravity surveys | | |

| Acquire, process and interpret 2,500km 2D seismic | | |

| Handover all data and an evaluation report to ANP-STP at least 3 months to end of phase | | |

5 Contractor to carry the Government’s 15% to production and be entitled to 100% of Cost Oil to recover the carry

Phase 2 (2 years)

| Minimum Work | | Minimum Expenditure | | Status |

| EIA | | $ | 40,000,000 | | Not yet arisen |

| Acquire, process and interpret 1,100 square kilometers 3D seismic | | | | | |

| Drill one exploration well | | | | | |

| Evaluate discoveries and remaining prospectivity | | | | | |

Phase 3 (2 years)

| Minimum Work | | Minimum Expenditure | | Status |

| EIA | | $ | 40,000,000 | | Not yet arisen |

| Drill one exploration well | | | | | |

| Evaluate discoveries | | | | | |

| OTHER FINANCIAL OBLIGATIONS |

| | | |

| Signature Bonus | | None payable |

| | | |

| Training | | Between $100,000 (min) and $250,000 (max) per calendar year during the exploration period |

| | | |

| | | $550,000 per annum during the production period |

| | | |

| Social Projects | | Exploration Phase 1: $300,000 per annum (minimum) |

| | | |

| | | Exploration Phase 2: $500,000 per annum (minimum) |

| | | |

| | | Exploration Phase 3: $400,000 per annum (minimum) |

| | | |

| | | On production, $2million worth of projects if cumulative production is 20mmboe, $4million if 40mmboe and $6m if 60mmboe |

| COST RECOVERY AND PRODUCTION SHARING |

| | | |

| Royalty | | 2% (first charge on production) |

| | | |

| Cost Oil | | Up to 80% of available crude after deduction of royalty oil in any accounting period |

Profit Oil

Contractor’s Rate of Return6 for Contract Area (% per annum) | | Government Share | | | Contractor Share | |

| <16% | | 0% | | | 100% | |

| >=16%<19% | | 10% | | | 90% | |

| >=19%<23% | | 20% | | | 80% | |

| >=23%<26% | | 40% | | | 60% | |

| >=26% | | 50% | | | 50% | |

As was the case in Kenya and earlier in the Joint Development Zone, management's intention is to bring a technically and financially capable operating partner onboard. The Company's discussions continue with several international oil companies about partnerships in EEZ Block 11. Some of those discussions are on the possibility of a 'right-to-earn' partnership where the operator commits to carrying only one aspect of the work program in return for a pre-determined interest in the PSC if the results of that aspect convince the operator to commit to the rest of the work program.

ERHC is currently working with the National Petroleum Agency of São Tomé and Príncipe (ANP-STP) to complete the budget for the first year of its exploration work program. A preliminary examination of available 2D seismic data indicates the possibility of commercially sizeable Cretaceous deep water tubidite fan existing in Block 11. While further investigation is in process, ERHC’s exploration team believes it has the potential for holding enormous hydrocarbon resources.

6 PSC provides for rate of return to be determined at the end of each quarter on the basis of accumulated compounded net cash flow for the contract area using a prescribed procedure.

INVESTMENT IN OANDO ENERGY RESOURCES (FORMERLY EXILE RESOURCES)

During the year ended September 30, 2011, ERHC invested $1,350,000 in Exile Resources Inc, a company listed on the Toronto Stock Exchange (Ventures Exchange) stock in open market purchases. ERHC’s intention was to gain an indirect interest in Exile’s underlying oil and gas exploration and production assets as well as the ability to participate in Exile’s decision making in respect of those assets. ERHC was particularly interested in Exile’s carried interest in the proven Akepo field in the Niger Delta.

In July 2011, Oando Petroleum and Exploration Company (“Oando Petroleum”) commenced a reverse takeover (“RTO”) of Exile Resources. In July 2012, Exile announced the completion of the RTO by Oando Petroleum and the change of name of the resultant company to Oando Energy Resources Inc, (“Oando Energy”). It also announced the listing of the company’s shares under the symbol “OER” on the Toronto Stock Exchange (TSX) and commencement of trading in the shares on the TSX from July 30, 2012.

As a result of the RTO, ERHC now holds 418,889 shares in the common stock of Oando Energy. ERHC also holds warrants for 418,889 common shares exercisable within 24 months of the closing of the RTO at Cdn$2.00 per share.

CURRENT PLANS FOR OPERATIONS

ERHC's principal assets are its interests in rights for exploration for hydrocarbons in Kenya, Chad, the JDZ and the EEZ. ERHC has no current sources of income from its operations. The Company plans to develop its business by the acquisition of other assets which may include revenue-producing assets in diverse geographical areas and the forging of strategic, new business partnerships and alliances. ERHC cannot currently predict the outcome of negotiations for acquisitions, or, if successful, their impact on the Company's operations.

PLANS FOR FUNDING OF POTENTIAL ACQUISITIONS

ERHC's future plans will depend on the Company's ability to attract new funding. The Company is implementing a series of steps to fund the geophysical work, including magnetic/gravity and seismic surveys, prior to securing potential farm-out on Chad acreage. Such funding steps include but are not limited to the issuance of a series of convertible notes, which the Company has commenced, issuance of shares of common stock through registered direct offerings, which the Company plans to commence shortly and farm-outs to potential partners on its assets in Africa. The fund raising might include:

| · | Farm-outs of part of the Company’s assets in Kenya, Chad and the Săo Tomé and Príncipe Exclusive Economic Zone |

| · | Issue shares of common stock through a registered direct offering |

| · | Convertible Loans and other debt instruments |

| · | Other available financing options |

During the quarter ended December 31, 2014, the Company retained the services of Deloitte Corporate Finance LLC (DCF) to advise on the Company's oil assets in the Republics of Chad and Kenya, and to seek new strategic investment into the company itself.

About Deloitte Corporate Finance LLC

Deloitte Corporate Finance LLC (DCF) provides strategic advisory services and M&A advice that help corporate, entrepreneurial and private equity clients create and act upon opportunities for liquidity, growth and long-term advantage. With an in-depth understanding of the marketplace and access to a global network of investment bankers, we help clients confidently pursue strategic transactions in both domestic and global markets. DCF, together with the Corporate Finance Advisory practices within the Deloitte Touche Tohmatsu Limited network of member firms, include in excess of 1,900 professionals, who work collaboratively across 150 international locations. With our significant experience providing investment banking services across key industries, we are able to offer our clients solutions that help them to achieve their strategic objectives.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The process of preparing financial statements requires that the Company make estimates and assumptions that affect the reported amounts of liabilities and stockholders' equity at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Such estimates primarily relate to realization of oil and gas concession assets and the valuation allowance related to deferred tax assets as of the date of the financial statements; accordingly, actual results may differ from estimated amounts. ERHC's estimates and assumptions are based on current facts, historical experience and various other factors we believe to be reasonable under the circumstances. The most significant estimates with regard to the financial statements included with this report relate to realization of oil and gas concession assets and the valuation allowance related to deferred tax assets.

These estimates and assumptions are reviewed periodically and, as adjustments become necessary, they are reported in earnings in the periods in which they become known.

RECENT ACCOUNTING PRONOUNCEMENTS

In preparing its financial statements and filings, the company considers recent guidance issued related to accounting principles generally accepted in the United States. The Company believes that there has been no new guidance since its most recent annual report on Form 10-K that have a significant impact on its financial statements.

RESULTS OF OPERATIONS

Three Months Ended December 31, 2014 Compared with the Three Months Ended December 31, 2013

General and administrative expenses varied slightly from $973,578 in the three months ended December 31, 2013 to $828,473 in the three months ended December 31, 2014. Both periods reflect a normal level of expenses.

During the three months ended December 31, 2014, the Company had a net loss of $1,698,215 compared with a net loss of $1,169,350 for the three months ended December 31, 2013. The increase in loss is primarily due to the exploration expenses incurred in relation to an airborne gravity/magnetic survey of the Block in Southern Chad; and loss on embedded derivative related to convertible promissory notes issued.

LIQUIDITY AND CAPITAL RESOURCES

As of December 31, 2014, the Company had $1,448,771 in cash and cash equivalents, and a working capital of $682,098. The Company is currently raising more funds through convertible debentures.

OFF-BALANCE SHEET ARRANGEMENTS

At December 31, 2014, the Company had no off-balance sheet arrangements.

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk |

The Company's current focus is to exploit its primary assets, which are rights to working interests oil and gas exploration blocks in Kenya, Chad, the JDZ and EEZ under agreements with the governments of Kenya, Chad, the JDA and the government of STP respectively. The Company intends to continue to form relationships with other oil and gas companies with operational, technical and financial capabilities, to partner with the Company in leveraging its interests. The Company currently has no other operations.

As of December 31, 2014, all the Company's exploration and production acreages were located outside the United States. The Company's primary assets are agreements with Kenya, Chad, STP and the JDA which provide ERHC with rights to participate in exploration and production activities in Kenya, Chad, the EEZ and the JDZ in Africa. This geographic area of interest is controlled by foreign governments that have historically experienced volatility of which is out of management's control. The Company's operations and its ability to exploit its interests in the agreements in this area may be impacted by this circumstance.

The future success of the Company's international operations may also be adversely affected by risks associated with international activities that include financial, economic and labor conditions, political instability, risk of war, expropriation, renegotiation or modification of existing contracts, tax laws (including host-country import-export, excise and income taxes and United States taxes on foreign subsidiaries) and changes in the value of the U.S. dollar relative to the local currencies in which future oil and gas producing activities may be denominated. Furthermore, changes in exchange rates may adversely affect the Company's future results of operations and financial condition.

Market risks relating to the Company's operations result primarily from changes in interest rates as well as credit risk concentrations. The Company's interest expense is generally not sensitive to changes in the general level of interest rates in the United States, particularly because a substantial majority of its indebtedness is at fixed rates.

The Company holds no derivative financial or commodity instruments.

| Item 4. | Controls and Procedures |

The Company's Chief Executive Officer and Principal Accounting Officer participated in an evaluation by management regarding the effectiveness of the Company's disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of December 31, 2014. Based on their participation in that evaluation, the Company's Chief Executive Officer and Principal Accounting Officer concluded that as of December 31, 2014, our disclosure controls and procedures are effective and ensure that the information required to be disclosed in the reports that ERHC files or submits under the Exchange Act, is accumulated and communicated to our management; including our principal executive and principal financial officers, to allow timely decisions regarding required disclosure under the Exchange Act. ERHC officers also concluded on December 31, 2014 that our disclosure controls and procedures are effective in ensuring that information required to be disclosed in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC rules and forms.

There was no change in the Company's internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) that occurred during the fiscal quarter ended December 31, 2014 that has materially affected, or is reasonably likely to materially affect, the Company's internal control over financial reporting.

PART II. OTHER INFORMATION

LEGAL PROCEEDINGS

JDZ BLOCKS 5 AND 6

Arbitration and Lawsuit

The Company’s rights in JDZ Blocks 5 and 6 are currently the subject of legal proceedings at the London Court of International Arbitration and the Federal High Court in Abuja, Nigeria. The Company instituted both proceedings in November 2008 against the JDA and the Governments of Nigeria and Săo Tomé and Príncipe. The Company seeks legal clarification that its rights in the two Blocks remain intact.

The issue in contention is contractual. The Company was awarded a 15 percent working interest in each of the Blocks in a 2004/5 bid/licensing round conducted by the JDA following the Company’s exercise of preferential rights in the Blocks as guaranteed by contract and treaty. The JDA and the Government of STP contend that certain correspondence issued by a previous CEO/President of the Company in 2006 amount to a relinquishment of the Company’s rights in Blocks 5 and 6 under the Company’s contracts with STP which provide for the rights. The Company contends that no such relinquishment has occurred and has sought recourse to arbitration accordingly. It also filed the suit to prevent any tampering with its said rights in JDZ Blocks 5 and 6 pending the outcome of arbitration.

Suspension of Proceedings on the Arbitration and Lawsuit

Proceedings on the suit and the arbitration are currently suspended while the Company pursues amicable settlement with the Governments of Nigeria and Săo Tomé Príncipe.

ROUTINE CLAIMS AND OTHER MATTERS

From time to time, ERHC may be subject to routine litigation, claims, or disputes in the ordinary course of business. ERHC intends to defend these matters vigorously. The Company cannot predict with certainty, however, the outcome or effect of any of the arbitration or litigation specifically described above or any other pending litigation or claims.

Our operation and financial results are subject to various risks and uncertainties that could affect our business, financial condition, results of operations, and trading price of our common stock, including but not limited to, failing financial institutions. Please refer to our annual report on Form 10-K for fiscal year 2014 for additional information concerning these and other uncertainties that could negatively impact the Company.

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

None

| Item 3. | Defaults Upon Senior Securities |

None.

| Item 4. | Submission of Matters to A Vote of Security Holders |

None.

None

| | Signatures |

| | |

| Rule 13a-14(a) Certification of the Chief Executive Officer |

| | |

| Rule 13a-14(a) Certification of the Principal Accounting Officer |

| | |

| Certification Pursuant to 18 U.S.C. Section 1350, as adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, of the Chief Executive Officer |

| | |

| Certification Pursuant to 18 U.S.C. Section 1350, as adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, of the Principal Accounting Officer |

| | |

| 101.INS* | Instance Document |

| | |

| 101.SCH* | XBRL Taxonomy Extension Schema Document |

| | |

| 101.CAL* | XBRL Taxonomy Extension Calculation Linkbase Document |

| | |

| 101.LAB* | XBRL Taxonomy Extension Label Linkbase Document |

| | |

| 101.PRE* | XBRL Taxonomy Extension Presentation Linkbase Document |

| | |

| | * Filed or furnished herewith. |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

ERHC Energy Inc.

| Name | Title | Date |

| | | |

| /s/ Peter Ntephe | President | February 13, 2015 |

| Peter Ntephe | Chief Executive Officer | |

| | | |

| /s/ Sylvan Odobulu | Vice President (Admin) and Controller | February 13, 2015 |

| Sylvan Odobulu | Principal Accounting Officer | |