UNITED STATES

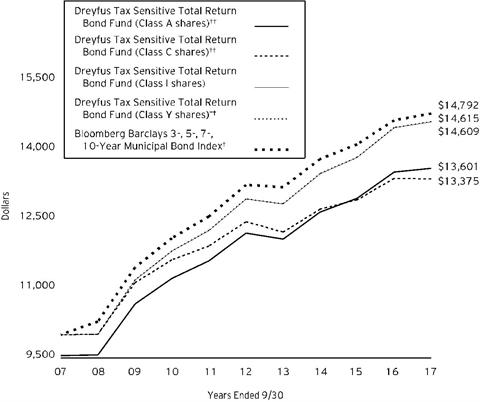

SECURITIES AND EXCHANGE COMMISSION

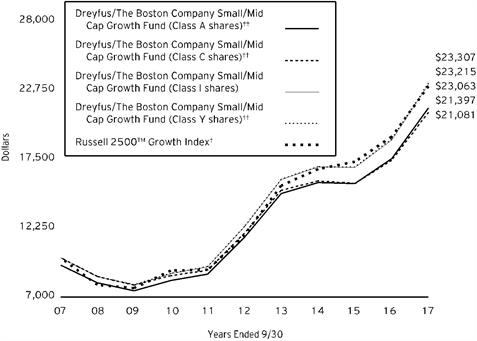

Washington, D.C. 20549

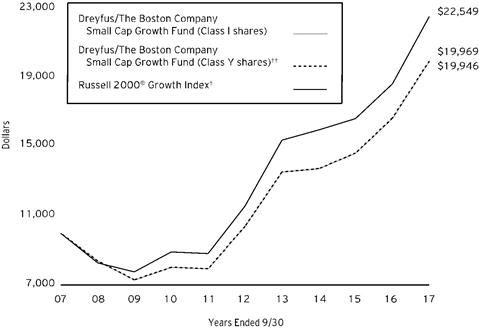

FORM N-CSR

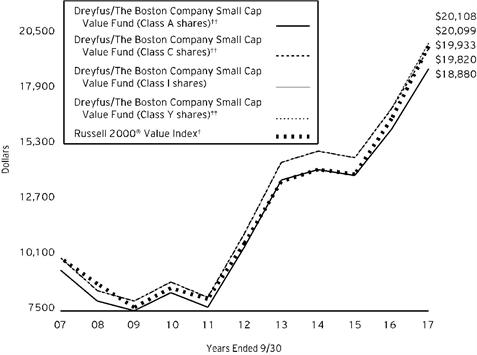

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-04813 |

| |

| Dreyfus Investment Funds | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett A. MacDougall, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6400 |

| |

Date of fiscal year end: | 09/30 | |

Date of reporting period: | 09/30/2017 | |

| | | | | | | |

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

Dreyfus Diversified Emerging Markets Fund

Dreyfus/Newton International Equity Fund

Dreyfus Tax Sensitive Total Return Bond Fund

Dreyfus/The Boston Company Small/Mid Cap Growth Fund

Dreyfus/The Boston Company Small Cap Growth Fund

Dreyfus/The Boston Company Small Cap Value Fund

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus Diversified Emerging Markets Fund

| | | |

| | ANNUAL REPORT September 30, 2017 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

| | | | |

| |

Dreyfus Diversified Emerging Markets Fund

| | The Fund |

A LETTER FROM THE CEO OF DREYFUS

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Diversified Emerging Markets Fund, covering the 12-month period from October 1, 2016 through September 30, 2017. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Stocks set a series of new record highs and bonds produced mixed results over the past year in response to changing economic and political conditions. Financial markets during the final months of 2016 were dominated by the election of a new U.S. presidential administration. Equities and corporate-backed bonds surged higher in anticipation of more business-friendly regulatory, tax, and fiscal policies, but high-quality bonds generally lost value due to expectations of rising interest rates and accelerating inflation in a stronger economy. Despite a series of short-term interest rate hikes, bonds recovered most or all of their previous losses over the first nine months of 2017 when it became clearer that pro-growth legislation would take time and political capital to enact. U.S. and international stocks continued to rally as corporate earnings grew and global economic conditions improved.

The markets’ recent strong performance has been supported by solid underlying fundamentals. While we currently expect these favorable conditions to persist, we remain watchful for economic and political developments that could derail the rallies. As always, we encourage you to discuss the risks and opportunities of today’s investment environment with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Mark D. Santero

Chief Executive Officer

The Dreyfus Corporation

October 16, 2017

2

DISCUSSION OF FUND PERFORMANCE

For the period from October 1, 2016 through September 30, 2017, as provided by portfolio managers Elizabeth Slover, Michelle Y. Chan, CFA, and Julianne McHugh of The Boston Company, Sub-Investment Adviser; C. Wesley Boggs, William S. Cazalet, CAIA, Ronald P. Gala, CFA, Peter D. Goslin, CFA, and Syed A. Zamil, CFA, of Mellon Capital Management Corporation, Sub-Investment Adviser

Market and Fund Performance Overview

For the 12-month period ended September 30, 2017, Dreyfus Diversified Emerging Markets Fund’s Class A shares produced a total return of 21.48%, Class C shares returned 20.39%, Class I shares returned 22.05%, and Class Y shares returned 22.06%.1 In comparison, the fund’s benchmark, the MSCI Emerging Markets Index (the “Index”), produced a total return of 22.46% for the same period.2

Emerging market equities rose sharply during the reporting period, largely in response to improving commodity prices, favorable currency movements, and accelerating corporate earnings growth. The fund mildly lagged the Index, mainly due to sector allocation shortfalls in one of its underlying funds, Dreyfus Global Emerging Markets Fund.

The Fund’s Investment Approach

The fund seeks long-term capital growth. To pursue its goal, the fund invests at least 80% of its assets in equity securities (or other instruments with similar economic characteristics) of companies located, organized, or with a majority of assets or business in countries considered to be emerging markets, including other investment companies that invest in such securities.

The fund uses a “manager-of-managers” approach by selecting one or more experienced investment managers to serve as subadvisers to the fund. The fund also uses a “fund-of-funds” approach by investing in one or more underlying funds. The fund currently allocates its assets among emerging market equity strategies of The Boston Company Asset Management, LLC (the TBCAM Strategy) and Mellon Capital Management Corporation (the Mellon Capital Strategy), each an affiliate of Dreyfus, and two affiliated underlying funds, Dreyfus Global Emerging Markets Fund, which is sub-advised by Newton Investment Management (North America) Limited (the Newton Fund) and Dreyfus Strategic Beta Emerging Markets Equity Fund, which is sub-advised by Mellon Capital Management Corporation (the Mellon Capital Fund). Dreyfus determines the investment strategies and sets the target allocations.

Emerging Markets Rebounded in 2017

The reporting period began with lackluster market performance due to uncertainties regarding the impact of the upcoming U.S. presidential election on global trade and currency exchange rates. However, after the U.S. presidential election in November, many emerging markets responded positively to rebounding energy and commodity prices. While stocks in Mexico and China initially lagged market averages amid concerns regarding possible detrimental U.S. trade policy shifts, they recovered when those worries waned.

3

DISCUSSION OF FUND PERFORMANCE (continued)

The remainder of the reporting period saw significant gains for most emerging market equities, which were supported by corporate earnings growth, a weakening U.S. dollar, and improving global and local economic conditions. China experienced explosive growth in the value of Internet-related stocks, while India, which briefly suffered in response to an unexpected demonetization in November 2016, rebounded sharply in the ensuing months. Consequently, after lagging their developed market counterparts early in the reporting period, emerging markets significantly outpaced developed market averages for the reporting period overall.

Three of Four Strategies Outperformed the Index

Although the fund participated substantially in the Index’s gains, relative performance was dampened by the Newton Fund. Most notably, the Newton Fund struggled with overweighted exposure to the Philippines and underweighted positions in China and South Africa. The Newton Fund’s security selection strategy generally produced better results in South Korea, India, and Chile due to strong stock picks. From an industry group perspective, sector allocation shortfalls in the health care and industrials sectors offset favorable security selection results in the consumer discretionary, information technology, and materials sectors.

The fund achieved better relative results through the TBCAM Strategy, which achieved strong security selections in China, including high-flying Internet-related companies Alibaba Group Holding and Tencent Holdings. Investments in India and Brazil also supported the strategy’s returns. These winners more than offset relatively disappointing results in the Philippines and South Korea.

The fund’s quantitative investment strategies also fared relatively well. The Mellon Capital Strategy, which employs a composite alpha-ranking process, outperformed the Index due to strong results in India and South Korea. From an industry group perspective, the strategy fared especially well in the consumer discretionary, health care, financials, and materials sectors. The Mellon Capital Fund, which uses a strategic beta stock-ranking methodology, achieved especially strong results through favorable stock selections in Brazil, Russia, and South Korea, which more than made up for the adverse effects of underweighted exposure to China. Overweighted positions in the energy and materials sectors also added value, as did a focus on Chinese real estate developers.

Finding Ample Investment Opportunities

Despite the recent gains posted by emerging-market stocks, market valuations across the region have remained attractive compared to developed markets, particularly in light of forecasts of stronger economic growth. While each of the fund’s four underlying strategies employs its own distinctive approach to investing in emerging-market equities, all report that

4

they have continued to find opportunities that meet their investment criteria across a wide variety of markets and industry groups.

October 16, 2017

1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s returns reflect the absorption of certain fund expenses by The Dreyfus Corporation pursuant to an agreement in effect through February 1, 2019, at which time it may be extended, terminated, or modified. Had these expenses not been absorbed, the fund’s returns would have been lower.

2 Source: Lipper Inc. — Reflects reinvestment of net dividends and, where applicable, capital gain distributions. The MSCI Emerging Markets Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of emerging markets. Investors cannot invest directly in any index.

The fund’s performance will be influenced by political, social, and economic factors affecting investments in foreign companies. These special risks include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political instability, and differing auditing and legal standards. Investments in foreign currencies are subject to the risk that those currencies will decline in value relative to the U.S. dollar, or, in the case of hedged positions, that the U.S. dollar will decline relative to the currency being hedged.

Emerging markets tend to be more volatile than the markets of more mature economies and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. The securities of companies located in emerging markets are often subject to rapid and large changes in price. An investment in this fund should be considered only as a supplement to a complete investment program for those investors willing to accept the greater risks associated with investing in emerging market countries.

The ability of the fund to achieve its investment goal depends, in part, on the ability of Dreyfus to allocate effectively the fund’s assets among investment strategies, subadvisers, and underlying funds. There can be no assurance that the actual allocations will be effective in achieving the fund’s investment goal or that an investment strategy, subadviser or underlying fund will achieve its particular investment objective.

Each subadviser makes investment decisions independently, and it is possible that the investment styles of the subadvisers may not complement one another. As a result, the fund’s exposure to a given stock, industry, sector, market capitalization, geographic area, or investment style could unintentionally be greater or smaller than it would have been if the fund had a single adviser or investment strategy.

The risks of investing in other investment companies, including ETFs, typically reflect the risks associated with the types of instruments in which the investment companies and ETFs invest. When the fund or an underlying fund invests in another investment company or ETF, shareholders of the fund will bear indirectly their proportionate share of the expenses of the other investment company or ETF (including management fees) in addition to the expenses of the fund. ETFs are exchange-traded investment companies that are, in many cases, designed to provide investment results corresponding to an index. The value of the underlying securities can fluctuate in response to activities of individual companies or in response to general market and/or economic conditions.

5

FUND PERFORMANCE

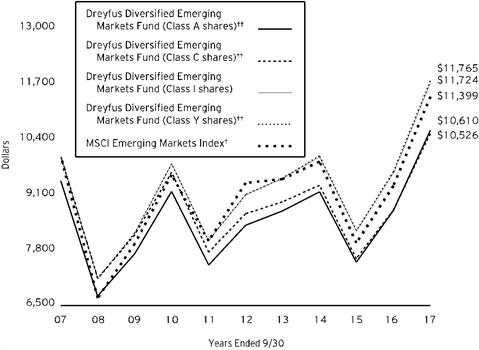

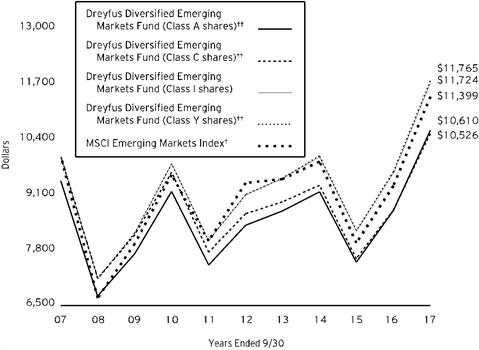

Comparison of change in value of $10,000 investment in Dreyfus Diversified Emerging Markets Fund Class A shares, Class C shares, Class I shares and Class Y shares and the MSCI Emerging Markets Index (the “Index”)

† Source: Lipper Inc.

†† The total return figures presented for Class A and Class C shares of the fund reflect the performance of the fund’s Class I shares for the period prior to 3/31/09 (the inception date for Class A and Class C shares), adjusted to reflect the applicable sales load for Class A shares.

The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class I shares for the period prior to 1/31/14 (the inception date for Class Y shares).

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class C, Class I and Class Y shares of Dreyfus Diversified Emerging Markets Fund on 9/30/07 to a $10,000 investment made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of emerging markets. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. These factors can contribute to the Index potentially outperforming the fund. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | |

Average Annual Total Returns as of 9/30/17 | | |

| Inception | 1 Year | 5 Years | 10 Years |

Date |

Class A shares | | | | |

with maximum sales charge (5.75%) | 3/31/09 | 14.47% | 3.59% | 0.59%†† |

without sales charge | 3/31/09 | 21.48% | 4.83% | 1.19%†† |

Class C shares | | | | |

with applicable redemption charge † | 3/31/09 | 19.39% | 3.99% | 0.51%†† |

without redemption | 3/31/09 | 20.39% | 3.99% | 0.51%†† |

Class I shares | 7/10/06 | 22.05% | 5.20% | 1.60% |

Class Y shares | 1/31/14 | 22.06% | 5.27%†† | 1.64%†† |

MSCI Emerging Markets Index | | 22.46% | 3.99% | 1.32% |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return performance figures presented for Class A and Class C shares of the fund reflect the performance of the fund’s Class I shares for the period prior to 3/31/09 (the inception date for Class A and Class C shares), adjusted to reflect the applicable sales load for Class A shares.

The total return performance figures presented for Class Y shares of the fund reflect the performance of the fund’s Class I shares for the period prior to 1/31/14 (the inception date for Class Y shares).

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to Dreyfus.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Diversified Emerging Markets Fund from April 1, 2017 to September 30, 2017. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming actual returns for the six months ended September 30, 2017 |

| | | | | | | | |

| | | | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000† | | $7.19 | | $12.40 | | $5.20 | | $4.71 |

Ending value (after expenses) | | $1,156.40 | | $1,151.10 | | $1,159.50 | | $1,159.30 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming a hypothetical 5% annualized return for the six months ended September 30, 2017 |

| | | | | | | | |

| | | | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000† | | $6.73 | | $11.61 | | $4.86 | | $4.41 |

Ending value (after expenses) | | $1,018.40 | | $1,013.54 | | $1,020.26 | | $1,020.71 |

† Expenses are equal to the fund’s annualized expense ratio of 1.33% for Class A, 2.30% for Class C, .96% for Class I and .87% for Class Y, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

8

STATEMENT OF INVESTMENTS

September 30, 2017

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 53.0% | | | | | |

Brazil - 3.5% | | | | | |

Banco Bradesco | | | | 7,250 | | 76,457 | |

Banco BTG Pactual | | | | 88,200 | | 524,942 | |

Banco do Brasil | | | | 67,500 | | 743,808 | |

BR Malls Participacoes | | | | 4,335 | | 19,258 | |

CCR | | | | 42,600 | | 238,210 | |

Cia de Saneamento Basico do Estado de Sao Paulo | | | | 89,900 | | 944,657 | |

EcoRodovias Infraestrutura e Logistica | | | | 202,500 | | 729,528 | |

EDP - Energias do Brasil | | | | 126,500 | | 604,711 | |

Hypermarcas | | | | 58,200 | | 591,712 | |

Petroleo Brasileiro, ADR | | | | 91,941 | a | 888,150 | |

Petroleo Brasileiro, ADR | | | | 19,009 | a | 190,850 | |

Qualicorp | | | | 97,600 | | 1,167,940 | |

Vale | | | | 87,441 | | 879,890 | |

| | | | | 7,600,113 | |

Canada - .1% | | | | | |

Gran Tierra Energy | | | | 121,722 | a,b | 277,526 | |

Chile - .7% | | | | | |

Aguas Andinas, Cl. A | | | | 164,900 | | 104,343 | |

Empresa Nacional de Telecomunicaciones | | | | 40,673 | | 421,562 | |

Enel Generacion Chile | | | | 568,400 | | 497,222 | |

Itau CorpBanca | | | | 61,140,090 | | 575,914 | |

| | | | | 1,599,041 | |

China - 16.4% | | | | | |

Air China, Cl. H | | | | 326,000 | | 270,846 | |

Alibaba Group Holding, ADR | | | | 34,698 | a | 5,992,692 | |

Anhui Conch Cement, Cl. H | | | | 266,000 | | 1,060,717 | |

ANTA Sports Products | | | | 114,000 | | 479,402 | |

Baidu, ADR | | | | 950 | a | 235,305 | |

Bank of China, Cl. H | | | | 2,534,000 | | 1,248,899 | |

Beijing Capital International Airport, Cl. H | | | | 317,956 | | 473,784 | |

BYD, Cl. H | | | | 52,500 | | 486,920 | |

China Communications Services, Cl. H | | | | 766,000 | | 394,198 | |

China Construction Bank, Cl. H | | | | 2,730,000 | | 2,264,632 | |

China Evergrande Group | | | | 44,000 | a | 153,490 | |

China Huarong Asset Management, Cl. H | | | | 877,000 | c | 391,819 | |

China Life Insurance, Cl. H | | | | 235,000 | | 699,441 | |

China Lodging Group, ADR | | | | 7,666 | a | 910,874 | |

China Medical System Holdings | | | | 101,000 | | 176,358 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 53.0% (continued) | | | | | |

China - 16.4% (continued) | | | | | |

China Petroleum & Chemical, Cl. H | | | | 142,000 | | 106,342 | |

China Shenhua Energy, Cl. H | | | | 235,000 | | 552,332 | |

China Southern Airlines, Cl. H | | | | 136,000 | | 93,666 | |

China Telecom, Cl. H | | | | 1,080,000 | | 553,024 | |

China Vanke, Cl. H | | | | 11,700 | | 38,493 | |

Chongqing Rural Commercial Bank, Cl. H | | | | 1,471,000 | | 932,133 | |

CNOOC | | | | 601,000 | | 775,524 | |

Country Garden Holdings | | | | 30,000 | | 47,698 | |

Geely Automobile Holdings | | | | 240,000 | | 675,918 | |

Guangzhou Automobile Group, Cl. H | | | | 182,000 | | 421,240 | |

Huaneng Renewables, Cl. H | | | | 832,000 | | 274,791 | |

Industrial & Commercial Bank of China, Cl. H | | | | 833,000 | | 618,490 | |

Jiangsu Expressway, Cl. H | | | | 216,000 | | 330,708 | |

Longfor Properties | | | | 7,500 | | 18,914 | |

New Oriental Education & Technology Group, ADR | | | | 7,633 | | 673,689 | |

People's Insurance Company Group of China, Cl. H | | | | 812,000 | | 362,778 | |

PICC Property & Casualty, Cl. H | | | | 206,000 | | 363,393 | |

Ping An Insurance Group Company of China, Cl. H | | | | 208,000 | | 1,596,293 | |

Shanghai Pharmaceuticals Holding, Cl. H | | | | 273,900 | | 669,007 | |

Sino-Ocean Group Holding | | | | 23,500 | | 15,673 | |

Sinopec Shanghai Petrochemical, Cl. H | | | | 266,000 | | 158,341 | |

Sinopharm Group, Cl. H | | | | 73,600 | | 324,113 | |

Sunny Optical Technology Group | | | | 68,000 | | 1,081,161 | |

Tencent Holdings | | | | 185,200 | | 7,970,741 | |

Zhejiang Expressway, Cl. H | | | | 720,000 | | 894,977 | |

ZTE, Cl. H | | | | 288,600 | a | 943,946 | |

| | | | | 35,732,762 | |

Colombia - .1% | | | | | |

Ecopetrol | | | | 335,100 | | 159,755 | |

Interconexion Electrica | | | | 27,800 | | 129,504 | |

| | | | | 289,259 | |

Hong Kong - 1.0% | | | | | |

China Everbright International | | | | 479,000 | | 600,927 | |

China Overseas Land & Investment | | | | 30,000 | | 97,547 | |

China Resources Land | | | | 20,000 | | 61,191 | |

China Unicom Hong Kong | | | | 346,000 | a | 481,023 | |

Haier Electronics Group | | | | 181,000 | a | 441,170 | |

Shanghai Industrial Holdings | | | | 161,000 | | 487,435 | |

Shimao Property Holdings | | | | 10,500 | | 22,770 | |

| | | | | 2,192,063 | |

10

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 53.0% (continued) | | | | | |

Hungary - .5% | | | | | |

OTP Bank | | | | 7,500 | | 281,398 | |

Richter Gedeon | | | | 32,716 | | 812,541 | |

| | | | | 1,093,939 | |

India - 3.4% | | | | | |

Aurobindo Pharma | | | | 37,184 | | 393,728 | |

Axis Bank | | | | 75,240 | | 582,414 | |

Bajaj Finance | | | | 14,800 | | 416,460 | |

Bharat Petroleum | | | | 29,808 | | 215,072 | |

Bharti Infratel | | | | 62,400 | | 370,835 | |

Hero MotoCorp | | | | 6,800 | | 392,942 | |

Hindustan Petroleum | | | | 76,350 | | 483,144 | |

ICICI Bank | | | | 118,282 | | 500,849 | |

Indiabulls Housing Finance | | | | 31,259 | | 577,492 | |

Indian Oil | | | | 67,316 | | 412,738 | |

Infosys | | | | 8,020 | | 110,490 | |

ITC | | | | 122,048 | | 482,624 | |

Mahindra & Mahindra | | | | 17,368 | | 333,494 | |

NTPC | | | | 157,311 | | 403,272 | |

Power Finance | | | | 136,686 | | 255,083 | |

Tata Consultancy Services | | | | 2,375 | | 88,524 | |

Tata Power | | | | 198,400 | | 236,306 | |

UPL | | | | 60,374 | | 719,552 | |

Vedanta | | | | 101,250 | | 484,389 | |

| | | | | 7,459,408 | |

Indonesia - 1.4% | | | | | |

Bank Mandiri | | | | 1,459,800 | | 728,870 | |

Bank Negara Indonesia | | | | 597,600 | | 328,327 | |

Bank Rakyat Indonesia | | | | 353,100 | | 400,446 | |

Bumi Serpong Damai | | | | 3,317,700 | | 435,988 | |

Indofood Sukses Makmur | | | | 641,700 | | 401,390 | |

Telekomunikasi Indonesia | | | | 911,100 | | 316,575 | |

United Tractors | | | | 174,600 | | 414,819 | |

| | | | | 3,026,415 | |

Malaysia - .4% | | | | | |

AirAsia | | | | 337,600 | | 275,837 | |

Genting | | | | 189,600 | | 428,817 | |

Public Bank | | | | 37,200 | | 180,075 | |

| | | | | 884,729 | |

Mexico - 1.1% | | | | | |

Arca Continental | | | | 100,700 | | 687,425 | |

Coca-Cola Femsa, Ser. L | | | | 15,100 | | 116,612 | |

El Puerto de Liverpool, Ser. C1 | | | | 50,000 | | 403,817 | |

Fibra Uno Administracion | | | | 13,100 | | 22,100 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 53.0% (continued) | | | | | |

Mexico - 1.1% (continued) | | | | | |

Fomento Economico Mexicano | | | | 62,600 | | 597,742 | |

Grupo Aeroportuario del Sureste, Cl. B | | | | 12,900 | | 246,028 | |

Grupo Bimbo, Ser. A | | | | 52,000 | | 125,845 | |

Wal-Mart de Mexico | | | | 70,800 | | 162,129 | |

| | | | | 2,361,698 | |

Panama - .4% | | | | | |

Copa Holdings, Cl. A | | | | 5,983 | | 745,063 | |

Philippines - .5% | | | | | |

Ayala Land | | | | 43,100 | | 36,907 | |

DMCI Holdings | | | | 1,605,100 | | 492,910 | |

Globe Telecom | | | | 2,295 | | 92,614 | |

Metropolitan Bank & Trust | | | | 231,160 | | 393,613 | |

SM Prime Holdings | | | | 46,300 | | 31,399 | |

| | | | | 1,047,443 | |

Poland - .8% | | | | | |

KGHM Polska Miedz | | | | 9,625 | | 309,667 | |

Polskie Gornictwo Naftowe i Gazownictwo | | | | 151,686 | | 282,255 | |

Powszechna Kasa Oszczednosci Bank Polski | | | | 43,646 | a | 422,585 | |

Powszechny Zaklad Ubezpieczen | | | | 51,780 | | 652,749 | |

| | | | | 1,667,256 | |

Qatar - .0% | | | | | |

Qatar National Bank | | | | 814 | | 27,305 | |

Russia - 1.4% | | | | | |

Gazprom, ADR | | | | 46,113 | | 193,213 | |

Lukoil, ADR | | | | 4,647 | | 245,966 | |

MMC Norilsk Nickel, ADR | | | | 4,700 | | 80,911 | |

Rosneft Oil Co., GDR | | | | 88,349 | | 490,779 | |

Sberbank of Russia, ADR | | | | 120,083 | | 1,709,382 | |

Sistema, GDR | | | | 6,159 | | 29,563 | |

Surgutneftegas, ADR | | | | 12,760 | | 64,566 | |

Tatneft, ADR | | | | 7,450 | | 318,115 | |

| | | | | 3,132,495 | |

South Africa - 1.6% | | | | | |

Barclays Africa Group | | | | 25,800 | | 264,884 | |

Clicks Group | | | | 50,893 | | 594,044 | |

FirstRand | | | | 157,407 | | 604,922 | |

Growthpoint Properties | | | | 17,287 | | 31,028 | |

Investec | | | | 12,200 | | 88,309 | |

Mondi | | | | 5,400 | | 144,178 | |

Naspers, Cl. N | | | | 3,400 | | 733,303 | |

Redefine Properties | | | | 20,861 | | 16,472 | |

12

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 53.0% (continued) | | | | | |

South Africa - 1.6% (continued) | | | | | |

Resilient REIT | | | | 2,384 | | 23,434 | |

Sappi | | | | 64,800 | | 440,623 | |

Standard Bank Group | | | | 14,200 | | 165,518 | |

Telkom | | | | 80,873 | | 354,166 | |

| | | | | 3,460,881 | |

South Korea - 8.6% | | | | | |

Coway | | | | 5,134 | | 421,352 | |

Dongbu Insurance | | | | 4,900 | | 312,306 | |

E-MART | | | | 2,333 | | 424,700 | |

GS Holdings | | | | 5,100 | | 292,103 | |

Hana Financial Group | | | | 17,918 | | 740,749 | |

Hanwha | | | | 7,400 | | 284,280 | |

Hanwha Life Insurance | | | | 54,500 | | 325,948 | |

Hyosung | | | | 933 | | 118,524 | |

Hyundai Marine & Fire Insurance | | | | 7,100 | | 280,814 | |

Hyundai Mobis | | | | 2,142 | | 448,841 | |

ING Life Insurance Korea | | | | 11,109 | c | 460,228 | |

KB Financial Group | | | | 3,220 | | 157,718 | |

KIWOOM Securities | | | | 6,243 | | 394,633 | |

KT | | | | 6,996 | | 178,053 | |

KT&G | | | | 5,172 | | 476,401 | |

LG | | | | 1,300 | | 91,483 | |

LG Chem | | | | 2,348 | | 803,611 | |

LG Electronics | | | | 5,600 | | 402,881 | |

LG Innotek | | | | 3,986 | | 535,944 | |

Lotte Chemical | | | | 1,006 | | 332,010 | |

NH Investment & Securities | | | | 6,900 | | 81,931 | |

POSCO | | | | 4,507 | | 1,247,408 | |

Samsung Electronics | | | | 2,968 | | 6,644,215 | |

Samsung SDI | | | | 5,262 | | 911,954 | |

Shinhan Financial Group | | | | 12,129 | | 532,666 | |

SK Holdings | | | | 890 | | 223,792 | |

SK Hynix | | | | 8,400 | | 607,989 | |

SK Telecom | | | | 1,840 | | 409,656 | |

Woori Bank | | | | 30,800 | | 480,010 | |

| | | | | 18,622,200 | |

Taiwan - 5.1% | | | | | |

Airtac International Group | | | | 51,189 | | 705,613 | |

Cathay Financial Holding | | | | 370,000 | | 588,115 | |

Chailease Holding | | | | 96,000 | | 231,421 | |

First Financial Holding | | | | 500,723 | | 321,167 | |

Formosa Chemicals & Fibre | | | | 188,000 | | 571,613 | |

Fubon Financial Holding | | | | 418,000 | | 652,005 | |

13

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 53.0% (continued) | | | | | |

Taiwan - 5.1% (continued) | | | | | |

Hon Hai Precision Industry | | | | 192,250 | | 665,686 | |

Innolux | | | | 343,000 | | 160,053 | |

Lite-On Technology | | | | 265,000 | | 378,397 | |

Micro-Star International | | | | 136,000 | | 292,415 | |

Phison Electronics | | | | 39,000 | | 463,000 | |

Powertech Technology | | | | 286,659 | | 826,210 | |

Taiwan Semiconductor Manufacturing | | | | 639,600 | | 4,566,462 | |

Uni-President Enterprises | | | | 98,000 | | 205,217 | |

Wistron | | | | 587,586 | | 469,891 | |

| | | | | 11,097,265 | |

Thailand - 1.1% | | | | | |

Glow Energy | | | | 75,900 | | 203,121 | |

Indorama Ventures | | | | 219,100 | | 277,570 | |

PTT | | | | 43,300 | | 529,727 | |

PTT, NVDR | | | | 7,800 | | 95,424 | |

Siam Cement | | | | 17,850 | | 268,687 | |

Thai Beverage | | | | 851,100 | | 564,702 | |

Thai Oil | | | | 178,700 | | 495,645 | |

| | | | | 2,434,876 | |

Turkey - 1.3% | | | | | |

Akbank | | | | 82,700 | | 218,184 | |

Arcelik | | | | 49,230 | | 313,927 | |

Emlak Konut Gayrimenkul Yatirim Ortakligi | | | | 14,944 | a | 11,241 | |

Enka Insaat ve Sanayi | | | | 1 | | 1 | |

Ford Otomotiv Sanayi | | | | 30,300 | | 387,791 | |

KOC Holding | | | | 78,400 | | 359,769 | |

Tupras Turkiye Petrol Rafinerileri | | | | 15,282 | | 521,560 | |

Turkiye Garanti Bankasi | | | | 289,290 | | 785,957 | |

Turkiye Is Bankasi, Cl. C | | | | 54,100 | | 102,948 | |

Turkiye Vakiflar Bankasi, Cl. D | | | | 109,300 | | 192,344 | |

| | | | | 2,893,722 | |

United Arab Emirates - .5% | | | | | |

Dubai Islamic Bank | | | | 203,647 | | 336,306 | |

Emaar Properties | | | | 304,181 | | 703,179 | |

| | | | | 1,039,485 | |

United States - 3.1% | | | | | |

iShares MSCI All Peru Capped ETF | | | | 35,040 | b | 1,359,202 | |

iShares MSCI Emerging Markets ETF | | | | 56,526 | b | 2,532,930 | |

iShares MSCI Philippines ETF | | | | 28,257 | b | 1,044,661 | |

iShares MSCI South Korea Capped ETF | | | | 25,564 | | 1,765,450 | |

14

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 53.0% (continued) | | | | | |

United States - 3.1% (continued) | | | | | |

Vanguard FTSE Emerging Markets ETF | | | | 100 | | 4,357 | |

| | | | | 6,706,600 | |

Total Common Stocks (cost $90,792,988) | | | | 115,391,544 | |

| | | Preferred Dividend Yield % | | | | | |

Preferred Stocks - 1.9% | | | | | |

Brazil - 1.5% | | | | | |

Banco Bradesco | | 2.03 | | 45,283 | | 501,135 | |

Banco do Estado do Rio Grande do Sul, Cl. B | | 5.35 | | 114,400 | | 637,171 | |

Cia Energetica de Minas Gerais | | 7.89 | | 228,600 | | 575,984 | |

Cia Paranaense de Energia | | 8.35 | | 28,400 | | 253,140 | |

Itau Unibanco Holding | | 4.39 | | 59,729 | | 817,534 | |

Suzano Papel e Celulose, Cl. A | | 1.66 | | 88,000 | | 508,748 | |

| | | | | 3,293,712 | |

Colombia - .1% | | | | | |

Grupo Aval Acciones y Valores | | 4.67 | | 130,123 | | 58,933 | |

South Korea - .3% | | | | | |

Samsung Electronics | | 1.26 | | 369 | | 664,319 | |

Taiwan - .0% | | | | | |

Cathay Financial Holding | | 0.24 | | 23,923 | | 48,834 | |

Total Preferred Stocks (cost $3,082,764) | | | | 4,065,798 | |

| | | | | | | | |

Registered Investment Companies - 43.0% | | | | | |

United States - 43.0% | | | | | |

Dreyfus Global Emerging Markets Fund, Cl. Y | | | | 4,341,049 | d,e | 76,142,000 | |

Dreyfus Strategic Beta Emerging Markets Equity Fund, Cl. Y | | | | 1,310,281 | e | 17,636,388 | |

Total Registered Investment Companies (cost $71,842,857) | | | | 93,778,388 | |

15

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Investment of Cash Collateral for Securities Loaned - 1.3% | | | | | |

Registered Investment Company; | | | | | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares

(cost $2,813,104) | | | | 2,813,104 | f | 2,813,104 | |

Total Investments (cost $168,531,713) | | 99.2% | | 216,048,834 | |

Cash and Receivables (Net) | | .8% | | 1,827,131 | |

Net Assets | | 100.0% | | 217,875,965 | |

ADR—American Depository Receipt

ETF—Exchange-Traded Fund

GDR—Global Depository Receipt

NVDR—Non-Voting Depository Receipt

REIT—Real Estate Investment Trust

aNon-income producing security.

b Security, or portion thereof, on loan. At September 30, 2017, the value of the fund’s securities on loan was $2,776,002 and the value of the collateral held by the fund was $2,813,104.

c Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At September 30, 2017, these securities were valued at $852,047 or .39% of net assets.

d The fund’s investment in the Dreyfus Global Emerging Markets Fund, Cl. Y represents 34.9% of the fund’s net assets. The Dreyfus Global Emerging Markets Fund, Cl. Y seeks to provide long-term capital appreciation.

e Investment in affiliated mutual fund.

fInvestment in affiliated money market mutual fund.

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Mutual Fund: Foreign | 43.0 |

Information Technology | 15.4 |

Financials | 13.0 |

Consumer Discretionary | 3.9 |

Materials | 3.9 |

Energy | 3.7 |

Industrials | 3.4 |

Exchange-Traded Funds | 3.1 |

Consumer Staples | 2.2 |

Utilities | 1.9 |

Health Care | 1.9 |

Telecommunications | 1.7 |

Money Market Investment | 1.3 |

Real Estate | .8 |

| | 99.2 |

† Based on net assets.

See notes to financial statements.

16

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

| | | | | | |

Registered Investment Companies | | Value

9/30/2016 ($) | Purchases ($)† | Sales ($) | Net Realized

Gain (Loss) ($) |

Dreyfus Global Emerging Markets Fund, Cl. Y | | 54,484,482 | 14,326,630 | 3,994,767 | (86,501) |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares | | — | 22,241,957 | 19,428,853 | — |

Dreyfus Strategic Beta Emerging Markets Equity Fund, Cl. Y | | 12,259,823 | 3,826,096 | 998,692 | 36,108 |

Total | | 66,744,305 | 40,394,683 | 24,422,312 | (50,393) |

| | | | | | |

Registered Investment Companies | | Change in Net

Unrealized

Appreciation

(Depreciation) ($) | Value

9/30/2017 ($) | Net

Assets (%) | Dividends/

Distributions ($) |

Dreyfus Global Emerging Markets Fund, Cl. Y | | 11,412,156 | 76,142,000 | 34.9 | 17,516 |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares | | — | 2,813,104 | 1.3 | — |

Dreyfus Strategic Beta Emerging Markets Equity Fund, Cl. Y | | 2,513,053 | 17,636,388 | 8.1 | 248,819 |

Total | | 13,925,209 | 96,591,492 | 44.3 | 266,335 |

† Includes reinvested dividends/distributions.

See notes to financial statements.

17

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2017

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $2,776,002)—Note 1(c): | | | |

Unaffiliated issuers | | 93,875,752 | | 119,457,342 | |

Affiliated issuers | | 74,655,961 | | 96,591,492 | |

Cash | | | | | 3,395,315 | |

Cash denominated in foreign currency | | | 1,390,455 | | 1,381,337 | |

Receivable for shares of Beneficial Interest subscribed | | | | | 144,500 | |

Dividends and securities lending income receivable | | | | | 139,405 | |

Receivable for investment securities sold | | | | | 28,228 | |

Prepaid expenses | | | | | 27,230 | |

| | | | | 221,164,849 | |

Liabilities ($): | | | | |

Due to The Dreyfus Corporation and affiliates—Note 3(c) | | | | | 171,385 | |

Liability for securities on loan—Note 1(c) | | | | | 2,813,104 | |

Payable for shares of Beneficial Interest redeemed | | | | | 244,096 | |

Accrued expenses | | | | | 60,299 | |

| | | | | 3,288,884 | |

Net Assets ($) | | | 217,875,965 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 195,226,204 | |

Accumulated undistributed investment income—net | | | | | 595,545 | |

Accumulated net realized gain (loss) on investments | | | | | (25,454,317) | |

Accumulated net unrealized appreciation (depreciation)

on investments and foreign currency transactions | | | | 47,508,533 | |

Net Assets ($) | | | 217,875,965 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 900,787 | 27,963 | 3,550,081 | 213,397,134 | |

Shares Outstanding | 37,247 | 1,224 | 147,153 | 8,832,995 | |

Net Asset Value Per Share ($) | 24.18 | 22.85 | 24.13 | 24.16 | |

| | | | | | |

See notes to financial statements. | | | | | |

18

STATEMENT OF OPERATIONS

Year Ended September 30, 2017

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $292,712 foreign taxes withheld at source): | |

Unaffiliated issuers | | | 2,205,261 | |

Affiliated issuers | | | 266,335 | |

Income from securities lending—Note 1(c) | | | 7,982 | |

Total Income | | | 2,479,578 | |

Expenses: | | | | |

Investment advisory fee—Note 3(a) | | | 1,011,998 | |

Professional fees | | | 98,021 | |

Administration fee—Note 3(a) | | | 92,007 | |

Custodian fees—Note 3(c) | | | 91,129 | |

Registration fees | | | 66,262 | |

Trustees’ fees and expenses—Note 3(d) | | | 12,057 | |

Prospectus and shareholders’ reports | | | 11,319 | |

Shareholder servicing costs—Note 3(c) | | | 6,826 | |

Loan commitment fees—Note 2 | | | 4,076 | |

Distribution fees—Note 3(b) | | | 355 | |

Miscellaneous | | | 67,290 | |

Total Expenses | | | 1,461,340 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (28) | |

Less—reduction in fees due to earnings credits—Note 3(c) | | | (9,436) | |

Net Expenses | | | 1,451,876 | |

Investment Income—Net | | | 1,027,702 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions: | | |

Unaffiliated issuers | | | | 4,836,079 | |

Affiliated issuers | | | | (50,393) | |

Net realized gain (loss) on forward foreign currency exchange contracts | (47,765) | |

Net Realized Gain (Loss) | | | 4,737,921 | |

Net unrealized appreciation (depreciation) on investments

and foreign currency transactions: | | | | |

Unaffiliated issuers | | | | 15,432,906 | |

Affiliated issuers | | | | 13,925,209 | |

Net Unrealized Appreciation (Depreciation) | | | 29,358,115 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 34,096,036 | |

Net Increase in Net Assets Resulting from Operations | | 35,123,738 | |

| | | | | | | |

See notes to financial statements. | | | | | |

19

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended September 30, |

| | | | 2017 | | 2016 | |

Operations ($): | | | | | | | | |

Investment income—net | | | 1,027,702 | | | | 612,182 | |

Net realized gain (loss) on investments | | 4,737,921 | | | | (18,430,537) | |

Net unrealized appreciation (depreciation)

on investments | | 29,358,115 | | | | 39,348,620 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 35,123,738 | | | | 21,530,265 | |

Distributions to Shareholders from ($): | |

Investment income—net: | | | | | | | | |

Class A | | | (706) | | | | (5,152) | |

Class I | | | (6,480) | | | | (5,449) | |

Class Y | | | (714,061) | | | | (1,057,347) | |

Total Distributions | | | (721,247) | | | | (1,067,948) | |

Beneficial Interest Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 537,581 | | | | 319,297 | |

Class C | | | - | | | | 23,636 | |

Class I | | | 4,376,821 | | | | 1,075,725 | |

Class Y | | | 60,760,200 | | | | 65,099,939 | |

Distributions reinvested: | | | | | | | | |

Class A | | | 706 | | | | 5,152 | |

Class I | | | 5,849 | | | | 4,990 | |

Class Y | | | 112,993 | | | | 170,335 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (747,230) | | | | (676,922) | |

Class C | | | (44,160) | | | | (274,249) | |

Class I | | | (2,523,767) | | | | (2,949,941) | |

Class Y | | | (29,151,205) | | | | (121,057,786) | |

Increase (Decrease) in Net Assets

from Beneficial Interest Transactions | 33,327,788 | | | | (58,259,824) | |

Total Increase (Decrease) in Net Assets | 67,730,279 | | | | (37,797,507) | |

Net Assets ($): | |

Beginning of Period | | | 150,145,686 | | | | 187,943,193 | |

End of Period | | | 217,875,965 | | | | 150,145,686 | |

Undistributed investment income—net | 595,545 | | | | 477,060 | |

20

| | | | | | | | | | |

| | | | Year Ended September 30, |

| | | | 2017 | | 2016 | |

Capital Share Transactions (Shares): | |

Class A | | | | | | | | |

Shares sold | | | 24,924 | | | | 18,059 | |

Shares issued for distributions reinvested | | | 38 | | | | 296 | |

Shares redeemed | | | (35,348) | | | | (37,669) | |

Net Increase (Decrease) in Shares Outstanding | (10,386) | | | | (19,314) | |

Class C | | | | | | | | |

Shares sold | | | - | | | | 1,450 | |

Shares redeemed | | | (2,173) | | | | (15,716) | |

Net Increase (Decrease) in Shares Outstanding | (2,173) | | | | (14,266) | |

Class Ia | | | | | | | | |

Shares sold | | | 208,888 | | | | 59,285 | |

Shares issued for distributions reinvested | | | 317 | | | | 289 | |

Shares redeemed | | | (122,804) | | | | (164,331) | |

Net Increase (Decrease) in Shares Outstanding | 86,401 | | | | (104,757) | |

Class Ya | | | | | | | | |

Shares sold | | | 2,831,224 | | | | 3,702,351 | |

Shares issued for distributions reinvested | | | 6,111 | | | | 9,840 | |

Shares redeemed | | | (1,438,486) | | | | (6,966,813) | |

Net Increase (Decrease) in Shares Outstanding | 1,398,849 | | | | (3,254,622) | |

| | | | | | | | | | |

aDuring the period ended September 30, 2017, 150,737 Class Y shares representing $3,124,374 were exchanged for 150,938 Class I shares and during the period ended September 30, 2016, 51,105 Class Y shares representing $928,807 were exchanged for 51,169 Class I shares. | |

See notes to financial statements. | | | | | | | | |

21

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements.

| | | | | | | | | |

| | | | |

| | | |

| | | Year Ended September 30, |

Class A Shares | | 2017 | 2016 | 2015 | 2014 | 2013 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 19.92 | 17.23 | 21.34 | 20.58 | 19.78 |

Investment Operations: | | | | | | |

Investment income—neta | | .02 | .02 | .09 | .05 | .23 |

Net realized and unrealized

gain (loss) on investments | | 4.26 | 2.72 | (3.88) | .98 | .57 |

Total from Investment Operations | | 4.28 | 2.74 | (3.79) | 1.03 | .80 |

Distributions: | | | | | | |

Dividends from investment

income—net | | (.02) | (.08) | (.13) | (.28) | – |

Dividends from net realized gain

on investments | | — | — | (.20) | — | — |

Total Distributions | | (.02) | (.08) | (.33) | (.28) | — |

Proceeds from redemption

fees—Note 3(e) | | .00b | .03 | .01 | .01 | — |

Net asset value, end of period | | 24.18 | 19.92 | 17.23 | 21.34 | 20.58 |

Total Return (%)c | | 21.48 | 16.20 | (18.00) | 5.14 | 3.99 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.28d | 1.39d | 1.42d | 4.80d | 6.20 |

Ratio of net expenses

to average net assets | | 1.27d | 1.39d | 1.42d | 1.60d | 1.60 |

Ratio of net investment income

to average net assets | | .08d | .10d | .47d | .22d | 1.10 |

Portfolio Turnover Rate | | 50.35 | 62.91 | 78.32 | 128.76 | 67.74 |

Net Assets, end of period ($ x 1,000) | | 901 | 949 | 1,153 | 209 | 130 |

a Based on average shares outstanding.

b Amount represents less than $.01 per share.

c Exclusive of sales charge.

d Amount does not include the expenses of the underlying funds.

See notes to financial statements.

22

| | | | | | | | |

| | | | |

| | | |

| | | Year Ended September 30, |

Class C Shares | | 2017 | 2016 | 2015 | 2014 | 2013 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 18.98 | 16.50 | 20.44 | 19.60 | 18.98 |

Investment Operations: | | | | | | |

Investment income (loss)—neta | | (.16) | (.13) | .04 | (.16) | .04 |

Net realized and unrealized

gain (loss) on investments | | 4.03 | 2.58 | (3.79) | .99 | .58 |

Total from Investment Operations | | 3.87 | 2.45 | (3.75) | .83 | .62 |

Distributions: | | | | | | |

Dividends from net realized gain

on investments | | — | — | (.20) | — | — |

Proceeds from redemption

fees—Note 3(e) | | .00b | .03 | .01 | .01 | — |

Net asset value, end of period | | 22.85 | 18.98 | 16.50 | 20.44 | 19.60 |

Total Return (%)c | | 20.39 | 15.03 | (18.44) | 4.34 | 3.21 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 2.32d | 2.23d | 2.08d | 6.10d | 6.62 |

Ratio of net expenses

to average net assets | | 2.25d | 2.23d | 2.08d | 2.35d | 2.35 |

Ratio of net investment income (loss)

to average net assets | | (.83)d | (.74)d | .22d | (.77)d | .22 |

Portfolio Turnover Rate | | 50.35 | 62.91 | 78.32 | 128.76 | 67.74 |

Net Assets, end of period ($ x 1,000) | | 28 | 64 | 291 | 69 | 76 |

a Based on average shares outstanding.

b Amount represents less than $.01 per share.

c Exclusive of sales charge.

d Amount does not include the expenses of the underlying funds.

See notes to financial statements.

23

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | |

| | | |

| | | |

| | | Year Ended September 30, |

Class I Shares | | 2017 | 2016 | 2015 | 2014 | 2013 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 19.86 | 17.16 | 21.16 | 20.45 | 19.60 |

Investment Operations: | | | | | | |

Investment income (loss)—neta | | .13 | .02 | .16 | (.30) | .26 |

Net realized and unrealized

gain (loss) on investments | | 4.22 | 2.75 | (3.79) | 1.34 | .59 |

Total from Investment Operations | | 4.35 | 2.77 | (3.63) | 1.04 | .85 |

Distributions: | | | | | | |

Dividends from investment

income—net | | (.08) | (.10) | (.18) | (.34) | — |

Dividends from net realized gain

on investments | | — | — | (.20) | — | — |

Total Distributions | | (.08) | (.10) | (.38) | (.34) | — |

Proceeds from redemption

fees—Note 3(e) | | .00b | .03 | .01 | .01 | — |

Net asset value, end of period | | 24.13 | 19.86 | 17.16 | 21.16 | 20.45 |

Total Return (%) | | 22.05 | 16.45 | (17.44) | 5.32 | 4.23 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | .95c | 1.11c | .99c | 3.57c | 5.39 |

Ratio of net expenses

to average net assets | | .94c | 1.11c | .99c | 1.35c | 1.35 |

Ratio of net investment income (loss)

to average net assets | | .57c | .12c | .83c | (.63)c | 1.27 |

Portfolio Turnover Rate | | 50.35 | 62.91 | 78.32 | 128.76 | 67.74 |

Net Assets, end of period ($ x 1,000) | | 3,550 | 1,207 | 2,840 | 748 | 3,359 |

a Based on average shares outstanding.

b Amount represents less than $.01 per share.

c Amount does not include the expenses of the underlying funds.

See notes to financial statements.

24

| | | | | | | | | | |

| | | |

| | | | | | |

| | | | Year Ended September 30, |

Class Y Shares | | | 2017 | 2016 | 2015 | 2014a |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | | 19.90 | 17.18 | 21.20 | 19.03 |

Investment Operations: | | | | | | |

Investment income—netb | | | .13 | .07 | .17 | .14 |

Net realized and unrealized gain (loss)

on investments | | | 4.23 | 2.74 | (3.82) | 2.02 |

Total from Investment Operations | | | 4.36 | 2.81 | (3.65) | 2.16 |

Distributions: | | | | | | |

Dividends from investment income—net | | | (.10) | (.12) | (.18) | — |

Dividends from net realized gain

on investments | | | — | — | (.20) | — |

Total Distributions | | | (.10) | (.12) | (.38) | — |

Proceeds from redemption fees—Note 3(e) | | | .00c | .03 | .01 | .01 |

Net asset value, end of period | | | 24.16 | 19.90 | 17.18 | 21.20 |

Total Return (%) | | | 22.06 | 16.64 | (17.44) | 11.40d |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assetse | | | .86 | 1.01 | .93 | 1.29f |

Ratio of net expenses to average net assetse | | | .85 | 1.01 | .93 | 1.29f |

Ratio of net investment income

to average net assetse | | | .61 | .42 | .84 | 1.03f |

Portfolio Turnover Rate | | | 50.35 | 62.91 | 78.32 | 128.76 |

Net Assets, end of period ($ x 1,000) | | | 213,397 | 147,926 | 183,659 | 187,879 |

a From the close of business on January 31, 2014 (commencement of initial offering) to September 30, 2014.

b Based on average shares outstanding.

c Amount represents less than $.01 per share.

d Not annualized.

e Amount does not include the expenses of the underlying funds.

f Annualized.

See notes to financial statements.

25

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Diversified Emerging Markets Fund (the “fund”) is a separate diversified series of Dreyfus Investment Funds (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering seven series, including the fund. The fund’s investment objective is to seek long-term growth of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Mellon Capital Management Corporation (“Mellon Capital”) and The Boston Company Asset Management, LLC (“TBCAM”), each a wholly-owned subsidiary of BNY Mellon and an affiliate of Dreyfus, serve as the fund’s sub-investment advisers.

Effective March 31, 2017, the fund authorized the issuance of Class T shares, but, as of the date of this report, the fund did not offer Class T shares for purchase.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Class A, Class C, Class I, Class T and Class Y. Class A, Class C and Class T shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A and Class T shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I shares are sold primarily to bank trust departments and other financial service providers (including The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class I and Class Y shares are offered without a front-end sales charge or CDSC. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific

26

class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Trust accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

27

NOTES TO FINANCIAL STATEMENTS (continued)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Trust’s Board of Trustees (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

28

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

Forward foreign currency exchange contracts (“forward contracts”) are valued at the forward rate and are generally categorized within Level 2 of the fair value hierarchy.

The following is a summary of the inputs used as of September 30, 2017 in valuing the fund’s investments:

| | | | | | |

| | Level 1 - Unadjusted Quoted Prices | Level 2 - Other Significant Observable Inputs | | Level 3 - Significant Unobservable Inputs | Total |

Assets ($) | | | |

Investments in Securities: | | | |

Equity Securities – Foreign

Common Stocks† | 107,796,794 | — | | — | 107,796,794 |

Equity Securities - Foreign

Preferred Stocks† | 4,953,948 | — | | — | 4,953,948 |

Exchange-Traded Funds | 6,706,600 | — | | — | 6,706,600 |

Registered Investment Companies | 96,591,492 | — | | — | 96,591,492 |

† See Statement of Investments for additional detailed categorizations.

At September 30, 2016, $74,667,823 of exchange traded foreign equity securities were classified within Level 2 of the fair value hierarchy pursuant to the fund’s fair valuation procedures. It is the fund’s policy to recognize transfers between levels at the end of the reporting period.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments

29

NOTES TO FINANCIAL STATEMENTS (continued)

resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by Dreyfus, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, The Bank of New York Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending transactions are on an overnight and continuous basis. During the period ended September 30, 2017, The Bank of New York Mellon earned $1,269 from lending portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” under the Act.

(e) Risk: Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S. These risks include revaluation of currencies, high rates of inflation, repatriation restrictions on income and capital, and adverse political and economic developments. Moreover, securities issued in these markets may be less liquid, subject to government ownership controls and delayed settlements, and their prices may be more volatile than those of comparable securities in the U.S.

30

(f) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended September 30, 2017, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended September 30, 2017, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended September 30, 2017 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At September 30, 2017, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $940,040, accumulated capital losses $23,427,564 and unrealized appreciation $45,137,285.

Under the Regulated Investment Company Modernization Act of 2010, the fund is permitted to carry forward capital losses for an unlimited period. Furthermore, capital loss carryovers retain their character as either short-term or long-term capital losses.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if any, realized subsequent to September 30, 2017. The fund has $11,640,865 of short-term capital losses and $11,786,699 of long-term capital losses which can be carried forward for an unlimited period.

The tax character of distributions paid to shareholders during the fiscal periods ended September 30, 2017 and September 30, 2016 were as follows: ordinary income $721,247 and $1,067,948, respectively.

31

NOTES TO FINANCIAL STATEMENTS (continued)

During the period ended September 30, 2017, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign currency gains and losses, foreign capital gains taxes and passive foreign investment companies, the fund decreased accumulated undistributed investment income-net by $187,970 and increased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in an $810 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to October 5, 2016, the unsecured credit facility with Citibank, N.A. was $555 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended September 30, 2017, the fund did not borrow under the Facilities.

NOTE 3—Investment Advisory Fee, Sub-Investment Advisory Fee, Administration Fee and Other Transactions with Affiliates:

(a) Pursuant to an investment advisory agreement with Dreyfus, the fund has agreed to pay an investment advisory fee at the annual rate of 1.10% of the value of the fund’s average daily net assets other than assets allocated to investments in other investment companies (other underlying funds, which may consist of affiliated funds, mutual funds and exchange traded funds) and is payable monthly. Therefore the fund’s investment advisory fee will fluctuate based on the fund’s allocation between underlying and direct investments. Dreyfus had contractually agreed, from October 1, 2016 through February 1, 2017, to waive receipt of its fees and/or assume the direct expenses of the fund, so that the expenses of Class A, C, I and Y shares (excluding Rule 12b-1 Distribution Plan fees, Shareholder Services Plan fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings, acquired fund fees and expenses of the underlying fund and extraordinary expenses) did not exceed 1.35%, 1.35%, 1.35% and 1.30% of the value of the respective class’ average daily net assets. Dreyfus has also contractually agreed, from February 2, 2017 through February 1, 2019, to waive receipt of its fees and/or assume the expenses of the fund, so that the expenses of Class A, Class C, Class I and Class Y shares (excluding certain expenses as described above) do not exceed 1.30% of the value of the fund’s average daily net assets. The reduction in expenses,

32

pursuant to the undertaking, amounted to $28 during the period ended September 30, 2017.

Pursuant to separate sub-investment advisory agreements between Dreyfus, TBCAM and Mellon Capital, each serves as the fund’s sub-investment adviser responsible for the day-to-day management of a portion of the fund’s portfolio. Dreyfus pays each sub-investment adviser a monthly fee at an annual percentage of the value of the fund’s average daily net assets. Dreyfus has obtained an exemptive order from the SEC (the “Order”), upon which the fund may rely, to use a manager of managers approach that permits Dreyfus, subject to certain conditions and approval by the Board, to enter into and materially amend sub-investment advisory agreements with one or more sub-investment advisers who are either unaffiliated with Dreyfus or are wholly-owned subsidiaries (as defined under the Act) of Dreyfus’ ultimate parent company, BNY Mellon, without obtaining shareholder approval. The Order also allows the fund to disclose the sub-investment advisory fee paid by Dreyfus to any unaffiliated sub-investment adviser in the aggregate with other unaffiliated sub-investment advisers in documents filed with the SEC and provided to shareholders. In addition, pursuant to the Order, it is not necessary to disclose the sub-investment advisory fee payable by Dreyfus separately to a sub-investment adviser that is a wholly-owned subsidiary of BNY Mellon in documents filed with the SEC and provided to shareholders; such fees are to be aggregated with fees payable to Dreyfus. Dreyfus has ultimate responsibility (subject to oversight by the Board) to supervise any sub-investment adviser and recommend the hiring, termination, and replacement of any sub-investment adviser to the Board.

The fund has a Fund Accounting and Administrative Services Agreement (the “Administration Agreement”) with Dreyfus, whereby Dreyfus performs administrative, accounting and recordkeeping services for the fund. The fund has agreed to compensate Dreyfus for providing accounting and recordkeeping services, administration, compliance monitoring, regulatory and shareholder reporting, as well as related facilities, equipment and clerical help. The fee is based on the fund’s average daily net assets and computed at the following annual rates: .10% of the first $500 million, .065% of the next $500 million and .02% in excess of $1 billion.

In addition, after applying any expense limitations or fee waivers that reduce the fees paid to Dreyfus for this service, Dreyfus has contractually agreed in writing to waive any remaining fees for this service to the extent that they exceed both Dreyfus’ costs in providing these services and a reasonable allocation of the costs incurred by Dreyfus and its affiliates

33

NOTES TO FINANCIAL STATEMENTS (continued)

related to the support and oversight of these services. The fund also reimburses Dreyfus for the out-of-pocket expenses incurred in performing this service for the fund. Pursuant to the Administration Agreement, the fund was charged $92,007 during the period ended September 30, 2017.

During the period ended September 30, 2017, the Distributor retained $966 from commissions earned on sales of the fund’s Class A shares.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. During the period ended September 30, 2017, Class C shares were charged $355 pursuant to the Distribution Plan.