UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-04813 |

| |

| Dreyfus Investment Funds | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett A. MacDougall, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6400 |

| |

Date of fiscal year end: | 09/30 | |

Date of reporting period: | 09/30/18 | |

| | | | | | | |

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

Dreyfus Diversified Emerging Markets Fund

Dreyfus/Newton International Equity Fund

Dreyfus Tax Sensitive Total Return Bond Fund

Dreyfus/The Boston Company Small/Mid Cap Growth Fund

Dreyfus/The Boston Company Small Cap Growth Fund

Dreyfus/The Boston Company Small Cap Value Fund

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus Diversified Emerging Markets Fund

| | | |

| | ANNUAL REPORT

September 30, 2018 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

| | | | |

| |

Dreyfus Diversified Emerging Markets Fund

| | The Fund |

A LETTER FROM THE PRESIDENT OF DREYFUS

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Diversified Emerging Markets Fund, covering the 12-month period from October 1, 2017 through September 30, 2018. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

The 12-month period started on solid footing which gave way to a shifting landscape. Through February 2018, major global economies appeared to be in lockstep as they moved towards less accommodative monetary policy and concurrent growth. In the equity markets, both U.S. and non-U.S. markets enjoyed upward progression across sectors and market capitalizations. Interest rates rose across the curve, thus putting pressure on bond prices, but sectors such as investment grade and high yield corporates, non-U.S. dollar-denominated bonds, and emerging market debt, were able to outperform like-duration U.S. Treasuries.

In February, global economic growth and monetary policy paths began to diverge. Volatility disrupted equity markets until April, when pressure eased. Backed by strong economic growth, U.S. equity indices rebounded quickly and posted double-digit gains for the period. While some non-U.S. markets made it back into the black by year-end, continued difficulties in the Eurozone and in emerging markets weighed on global returns. The rising rate environment and a flattening yield curve caused some fixed income instruments to struggle during the second half of the period.

Despite concerns regarding trade, U.S. inflationary pressures, and global growth, we are optimistic that U.S. consumer spending, corporate earnings, and economic data will remain strong in the near term. However, we will stay attentive to signs that indicate potential changes on the horizon. As always, we encourage you to discuss the risks and opportunities of today’s investment environment with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Renee Laroche-Morris

President

The Dreyfus Corporation

October 15, 2018

2

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from October 1, 2017 through September 30, 2018, as provided by portfolio managers Elizabeth Slover, Michelle Y. Chan, CFA, Julianne McHugh, C. Wesley Boggs, William S. Cazalet, CAIA, Peter D. Goslin, CFA, and Syed A. Zamil, CFA, of BNY Mellon Asset Management North America Corporation, Sub-Investment Adviser

Market and Fund Performance Overview

For the 12-month period ended September 30, 2018, Dreyfus Diversified Emerging Markets Fund’s Class A shares produced a total return of -5.50%, Class C shares returned -6.48%, Class I shares returned -5.10%, and Class Y shares returned -5.06%.1 In comparison, the fund’s benchmark, the MSCI Emerging Markets Index (the “Index”), produced a return of -0.81% for the same period.2

Stocks in the emerging markets lost ground during the reporting period, largely in response to developed markets’ tightening monetary policies and geopolitical unrest. The fund lagged the Index due to shortfalls in one of the fund’s underlying funds, Dreyfus Global Emerging Markets Fund, and one of the fund’s underlying investment strategies, referred to below as the Mellon Capital Strategy.

The Fund’s Investment Approach

The fund seeks long-term capital growth. To pursue its goal, the fund invests at least 80% of its assets, plus any borrowings for investment purposes, in equity securities (or other instruments with similar economic characteristics) of companies located, organized, or with a majority of assets or business in countries considered to be emerging markets, including other investment companies that invest in such securities.

The fund uses a “manager-of-managers” approach by selecting one or more experienced investment managers to serve as sub-advisers to the fund. The fund also uses a “fund-of-funds” approach by investing in one or more underlying funds. The fund currently allocates its assets among two emerging-market equity strategies by BNY Mellon Asset Management North America Corporation (the “Sub-adviser,” an affiliate of Dreyfus (the Mellon Capital Strategy and the TBCAM Strategy), and two affiliated underlying funds, Dreyfus Global Emerging Markets Fund, which is sub-advised by Newton Investment Management (North America) Limited (the Newton Fund), and Dreyfus Strategic Beta Emerging Markets Equity Fund, which is sub-advised by the Sub-adviser (the Mellon Capital Fund). The Mellon Capital Strategy is through the Mellon Capital Management active equity portfolio management team and the TBCAM Strategy is through The Boston Company Asset Management global research portfolio team, each at the Sub-adviser. Dreyfus determines the investment strategies and sets the target allocations.

Emerging Markets Rebound, Then Reverse Course

Emerging-market equities benefited broadly from positive global economic trends during the first four months of the reporting period. Corporate earnings growth gained momentum across most industry groups and geographic regions. Strengthening global demand for commodities bolstered markets that export raw materials and energy, such as Russia and

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

Brazil. Strong information technology and financials sector performance drove gains in China. South Korea benefited from easing regional political tensions.

Global equity markets, including most emerging markets, dipped sharply in February 2018 in response to concerns about renewed inflationary pressures in the United States. In March, the prospect of potential U.S. trade restrictions sparked additional market declines. Markets steadied after the initial sell-off, but as U.S. rates and yields resumed their upward trend in April alongside a rising oil price, the heightened inflation expectations resulted in the U.S. dollar strengthening. This was a headwind for all emerging-market currencies to varying degrees, particularly Argentina and Turkey, whose currencies depreciated significantly. Further weighing on sentiment has been the rising U.S./China trade tensions, and political and economic difficulties in parts of South America.

Underlying Strategies Produced Mixed Results

The fund’s performance compared to the Index was constrained by shortfalls posted by one of the four underlying strategies and one of the underlying funds. Most notably, the Newton Fund was undermined by underweighted exposure to banks and a lack of holdings in the rallying energy sector. Exposure to Mexico-based micro-finance company Gentera weighed on returns, as did a position in India-based finance company Edelweiss Financial Services. We have since exited our position in Gentera. Indian software and retail service company Vakrangee was among the largest individual detractors from performance. These detractors more than offset positive results from stock selection in industrials and a lack of exposure to communication services and real estate.

The Mellon Capital Strategy also trailed the Index, in part due to disappointing security selection in the health care and utilities sectors. Stock decisions in Turkey and India also weighed on results. More successful stock picks in the communication services and consumer staples sectors, as well as positions in Colombia- and Mexico-based companies, were not enough to make up for shortfalls in other areas.

Dreyfus Strategic Beta Emerging Markets Equity Fund fared better than the Index on the strength of favorable stock selections in the energy and consumer discretionary sectors. A position in Russian energy company Lukoil was among the largest contributors. From a country perspective, the fund achieved positive relative results in China and Russia. This performance compensated for relatively weak results in the financials and information technology sectors, as well as in Poland- and South Korea-based companies.

The TBCAM Strategy outperformed the Index as a result of strongly positive contributions from investments in South Africa, China, and Mexico. Industry groups that supported relative performance included the materials and financials sectors. Positive performance in these areas negated the effects of relative weakness in India, Taiwan, and Turkey as well as the industrials and health care sectors.

Finding Ample Opportunities in the Emerging Markets

While recent threats of new U.S. tariffs have raised concerns regarding stock market volatility and the stability of international trade relations, we believe that fundamental economic trends portend well for continued growth in the emerging markets. Each of the fund’s underlying strategies and underlying funds employs its own distinctive approach to

4

investing in emerging-market equities, and all report that they have continued to find opportunities that meet their investment criteria across a wide variety of markets and industry groups.

October 15, 2018

1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s returns reflect the absorption of certain fund expenses by The Dreyfus Corporation pursuant to an agreement in effect through February 1, 2020, at which time it may be extended, terminated, or modified. Had these expenses not been absorbed, the fund’s returns would have been lower.

2 Source: Lipper Inc. — The MSCI Emerging Markets Index is a free float-adjusted, market capitalization-weighted index that is designed to measure equity market performance of emerging markets. It reflects reinvestment of net dividends and, where applicable, capital gain distributions. Investors cannot invest directly in any index.

The fund’s performance will be influenced by political, social, and economic factors affecting investments in foreign companies. These special risks include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political instability, and differing auditing and legal standards. Investments in foreign currencies are subject to the risk that those currencies will decline in value relative to the U.S. dollar, or, in the case of hedged positions, that the U.S. dollar will decline relative to the currency being hedged.

Emerging markets tend to be more volatile than the markets of more mature economies and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. The securities of companies located in emerging markets are often subject to rapid and large changes in price. An investment in this fund should be considered only as a supplement to a complete investment program for those investors willing to accept the greater risks associated with investing in emerging-market countries.

The ability of the fund to achieve its investment goal depends, in part, on the ability of Dreyfus to allocate effectively the fund’s assets among investment strategies, sub-advisers, and underlying funds. There can be no assurance that the actual allocations will be effective in achieving the fund’s investment goal or that an investment strategy, sub-adviser or underlying fund will achieve its particular investment objective.

Each strategy of the Sub-adviser makes investment decisions independently, and it is possible that the investment styles of the individual strategies of the Sub-adviser may not complement one another. As a result, the fund’s exposure to a given stock, industry, sector, market capitalization, geographic area, or investment style could unintentionally be greater or smaller than it would have been if the fund had a single investment strategy.

The risks of investing in other investment companies, including ETFs, typically reflect the risks associated with the types of instruments in which the investment companies and ETFs invest. When the fund or an underlying fund invests in another investment company or ETF, shareholders of the fund will bear indirectly their proportionate share of the expenses of the other investment company or ETF (including management fees) in addition to the expenses of the fund. ETFs are exchange-traded investment companies that are, in many cases, designed to provide investment results corresponding to an index. The value of the underlying securities can fluctuate in response to activities of individual companies or in response to general market and/or economic conditions.

5

FUND PERFORMANCE (Unaudited)

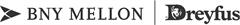

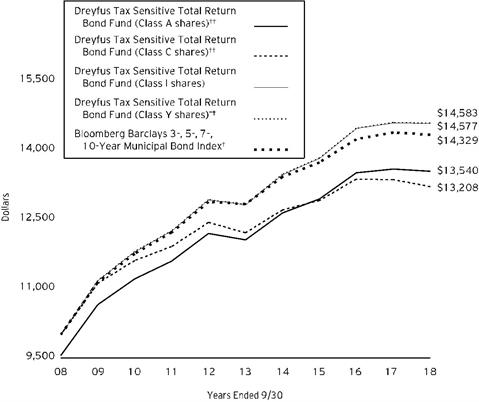

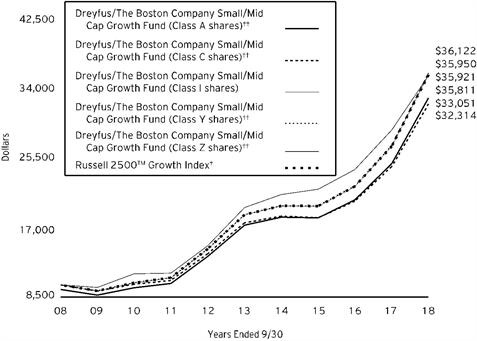

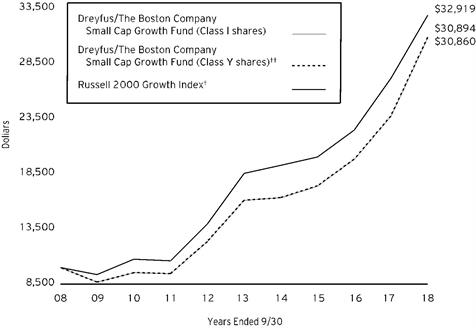

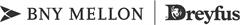

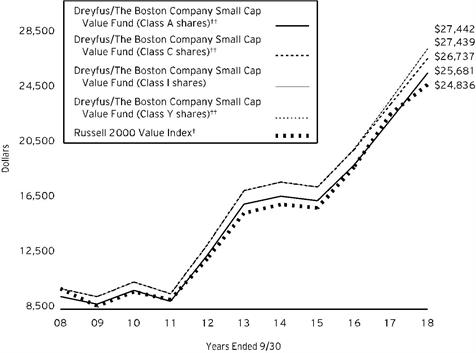

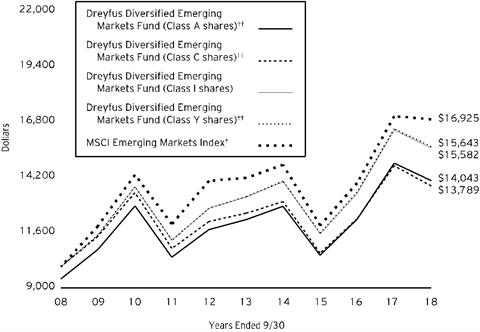

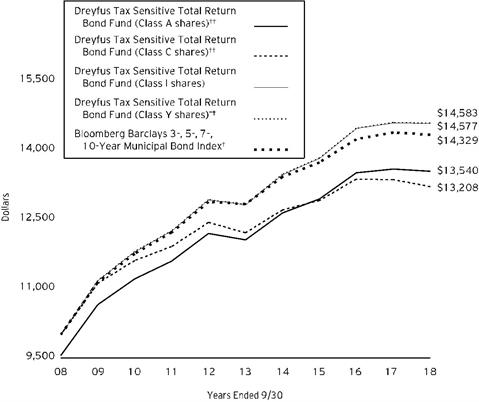

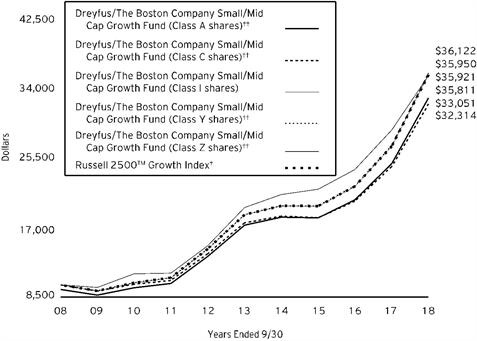

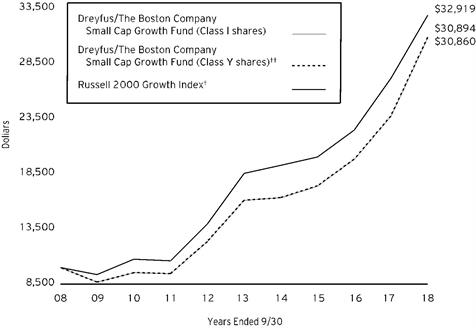

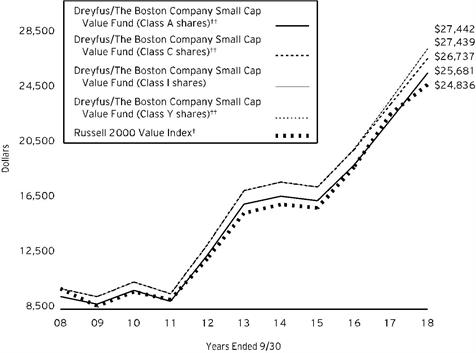

Comparison of change in value of $10,000 investment in Dreyfus Diversified Emerging Markets Fund Class A shares, Class C shares, Class I shares and Class Y shares and the MSCI Emerging Markets Index (the “Index”)

† Source: Lipper Inc.

†† The total return figures presented for Class A and Class C shares of the fund reflect the performance of the fund’s Class I shares for the period prior to 3/31/09 (the inception date for Class A and Class C shares), adjusted to reflect the applicable sales load for Class A shares.

The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class I shares for the period prior to 1/31/14 (the inception date for Class Y shares).

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class C, Class I and Class Y shares of Dreyfus Diversified Emerging Markets Fund on 9/30/08 to a $10,000 investment made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of emerging markets. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. These factors can contribute to the Index potentially outperforming the fund. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | |

Average Annual Total Returns as of 9/30/18 | | |

| Inception | 1 Year | 5 Years | 10 Years |

Date |

Class A shares | | | | |

with maximum sales charge (5.75%) | 3/31/09 | -10.95% | 1.63% | 3.45%†† |

without sales charge | 3/31/09 | -5.50% | 2.84% | 4.07%†† |

Class C shares | | | | |

with applicable redemption charge † | 3/31/09 | -7.41% | 1.96% | 3.27%†† |

without redemption | 3/31/09 | -6.48% | 1.96% | 3.27%†† |

Class I shares | 7/10/06 | -5.10% | 3.24% | 4.54% |

Class Y shares | 1/31/14 | -5.06% | 3.32%†† | 4.58%†† |

MSCI Emerging Markets Index | | -0.81% | 3.61% | 5.40% |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return performance figures presented for Class A and Class C shares of the fund reflect the performance of the fund’s Class I shares for the period prior to 3/31/09 (the inception date for Class A and Class C shares), adjusted to reflect the applicable sales load for Class A shares.

The total return performance figures presented for Class Y shares of the fund reflect the performance of the fund’s Class I shares for the period prior to 1/31/14 (the inception date for Class Y shares).

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to Dreyfus.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Diversified Emerging Markets Fund from April 1, 2018 to September 30, 2018. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming actual returns for the six months ended September 30, 2018 |

| | | | | | | | |

| | | | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000† | | $6.48 | | $10.66 | | $4.45 | | $4.02 |

Ending value (after expenses) | | $886.00 | | $882.30 | | $888.60 | | $888.40 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming a hypothetical 5% annualized return for the six months ended September 30, 2018 |

| | | | | | | | |

| | | | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000† | $ | $6.93 | | $11.41 | | $4.76 | | $4.31 |

Ending value (after expenses) | $ | $1,018.20 | | $1,013.74 | | $1,020.36 | | $1,020.81 |

† Expenses are equal to the fund’s annualized expense ratio of 1.37% for Class A, 2.26% for Class C, .94% for Class I and 85% for Class Y, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

8

STATEMENT OF INVESTMENTS

September 30, 2018

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 51.7% | | | | | |

Brazil - 2.0% | | | | | |

Banco Bradesco | | | | 7,975 | | 50,434 | |

Banco do Brasil | | | | 93,800 | | 682,617 | |

BR Malls Participacoes | | | | 4,335 | a | 10,358 | |

Cia de Saneamento Basico do Estado de Sao Paulo | | | | 60,100 | | 352,098 | |

EDP - Energias do Brasil | | | | 158,400 | | 503,218 | |

Hypermarcas | | | | 58,200 | | 410,573 | |

JBS | | | | 197,400 | | 457,018 | |

Suzano Papel e Celulose | | | | 71,200 | | 846,068 | |

Vale | | | | 87,441 | | 1,293,682 | |

| | | | | 4,606,066 | |

Canada - .2% | | | | | |

Gran Tierra Energy | | | | 121,722 | a,b | 464,978 | |

Chile - .4% | | | | | |

Aguas Andinas, Cl. A | | | | 164,900 | | 91,262 | |

Empresa Nacional de Electricidad | | | | 568,400 | | 398,749 | |

Empresa Nacional de Telecomunicaciones | | | | 57,150 | | 485,810 | |

| | | | | 975,821 | |

China - 15.5% | | | | | |

Alibaba Group Holding, ADR | | | | 35,898 | a | 5,914,555 | |

Angang Steel | | | | 118,000 | | 105,514 | |

Anhui Conch Cement, Cl. H | | | | 242,000 | | 1,460,652 | |

ANTA Sports Products | | | | 114,000 | | 546,820 | |

BAIC Motor | | | | 691,000 | c | 553,446 | |

Baidu | | | | 2,150 | a | 491,662 | |

Bank of China, Cl. H | | | | 372,000 | | 165,368 | |

Beijing Capital International Airport, Cl. H | | | | 317,956 | | 386,258 | |

China Coal Energy, Cl. H | | | | 971,000 | | 409,320 | |

China Communications Services, Cl. H | | | | 850,000 | | 782,860 | |

China Construction Bank, Cl. H | | | | 3,159,000 | | 2,760,168 | |

China Medical System Holdings | | | | 380,000 | | 528,132 | |

China National Building Material, Cl. H | | | | 560,000 | | 497,167 | |

China Petroleum & Chemical, Cl. H | | | | 1,244,000 | | 1,245,851 | |

China Railway Group, Cl. H | | | | 782,000 | | 775,172 | |

China Shenhua Energy, Cl. H | | | | 235,000 | | 536,741 | |

China Vanke, Cl. H | | | | 11,700 | | 38,709 | |

Chongqing Rural Commercial Bank, Cl. H | | | | 610,000 | | 333,506 | |

CNOOC | | | | 624,000 | | 1,235,509 | |

Country Garden Holdings | | | | 30,000 | | 37,824 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 51.7% (continued) | | | | | |

China - 15.5% (continued) | | | | | |

Country Garden Services Holdings | | | | 3,448 | a | 5,858 | |

Evergrande Real Estate Group | | | | 44,000 | | 123,372 | |

Geely Automobile Holdings | | | | 202,000 | | 402,537 | |

Guangzhou Automobile Group, Cl. H | | | | 440,000 | | 487,306 | |

Huaneng Renewables, Cl. H | | | | 1,578,000 | | 469,670 | |

Huazhu Group | | | | 16,388 | | 529,332 | |

Industrial & Commercial Bank of China, Cl. H | | | | 833,000 | | 608,654 | |

Longfor Properties | | | | 7,500 | | 19,353 | |

New Oriental Education & Technology Group, ADR | | | | 7,633 | a | 564,918 | |

PICC Property & Casualty, Cl. H | | | | 309,000 | | 364,721 | |

Ping An Insurance Group Company of China, Cl. H | | | | 289,500 | | 2,939,988 | |

Shanghai Pharmaceuticals Holding, Cl. H | | | | 273,900 | | 684,370 | |

Sino-Ocean Land Holdings | | | | 23,500 | | 10,357 | |

Sinopec Shanghai Petrochemical, Cl. H | | | | 266,000 | | 162,420 | |

Tencent Holdings | | | | 190,900 | | 7,881,467 | |

Weibo, ADR | | | | 7,132 | a | 521,563 | |

Weichai Power, Cl. H | | | | 473,000 | | 586,088 | |

Yanzhou Coal Mining, Cl. H | | | | 472,000 | | 546,864 | |

| | | | | 35,714,072 | |

Colombia - .6% | | | | | |

Bancolombia, ADR | | | | 12,101 | | 504,854 | |

Ecopetrol | | | | 552,400 | | 751,374 | |

Interconexion Electrica | | | | 27,800 | | 125,545 | |

| | | | | 1,381,773 | |

Czech Republic - .4% | | | | | |

Moneta Money Bank | | | | 231,833 | c | 853,497 | |

Hong Kong - 1.7% | | | | | |

China Mobile | | | | 23,000 | | 226,670 | |

China Overseas Land & Investment | | | | 30,000 | | 93,890 | |

China Resources Cement Holdings | | | | 234,000 | | 272,310 | |

China Resources Gas Group | | | | 174,000 | | 707,927 | |

China Resources Land | | | | 20,000 | | 70,002 | |

China Unicom Hong Kong | | | | 498,000 | | 586,530 | |

Haier Electronics | | | | 83,000 | a | 225,303 | |

Lee & Man Paper Manufacturing | | | | 537,000 | | 498,013 | |

Shanghai Industrial Holdings | | | | 227,000 | | 502,811 | |

Shimao Property Holdings | | | | 271,000 | | 675,739 | |

| | | | | 3,859,195 | |

Hungary - .2% | | | | | |

OTP Bank | | | | 13,525 | | 501,243 | |

10

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 51.7% (continued) | | | | | |

India - 3.6% | | | | | |

Bajaj Finance | | | | 5,400 | | 161,312 | |

Bharat Petroleum | | | | 29,808 | | 152,810 | |

Bharti Infratel | | | | 62,400 | | 224,171 | |

Hero MotoCorp | | | | 6,800 | | 274,920 | |

Hindalco Industries | | | | 155,000 | | 485,632 | |

Hindustan Petroleum | | | | 142,150 | | 488,120 | |

Housing Development Finance | | | | 37,817 | | 913,978 | |

ICICI Bank | | | | 165,870 | | 693,362 | |

Indiabulls Housing Finance | | | | 31,259 | | 368,398 | |

Infosys | | | | 51,840 | | 520,273 | |

ITC | | | | 122,048 | | 497,047 | |

Larsen & Toubro | | | | 46,794 | | 819,536 | |

Mahindra & Mahindra | | | | 41,180 | | 487,649 | |

Tata Consultancy Services | | | | 4,750 | | 142,924 | |

Tata Power | | | | 198,400 | | 173,300 | |

Tech Mahindra | | | | 133,531 | | 1,368,594 | |

UPL | | | | 21,500 | | 196,276 | |

Vedanta | | | | 133,250 | | 422,358 | |

| | | | | 8,390,660 | |

Indonesia - .9% | | | | | |

Bank Mandiri | | | | 1,459,800 | | 658,803 | |

Bank Negara Indonesia | | | | 597,600 | | 296,765 | |

Telekomunikasi Indonesia | | | | 4,212,700 | | 1,029,039 | |

| | | | | 1,984,607 | |

Luxembourg - .2% | | | | | |

Tenaris | | | | 12,573 | | 421,447 | |

Malaysia - .7% | | | | | |

Genting | | | | 134,900 | | 254,578 | |

Hong Leong Financial Group | | | | 129,700 | | 604,859 | |

Malaysia Airports Holdings | | | | 338,000 | | 726,882 | |

| | | | | 1,586,319 | |

Mexico - 1.3% | | | | | |

America Movil, Ser. L | | | | 259,800 | | 208,934 | |

Arca Continental | | | | 100,700 | | 649,917 | |

Fibra Uno Administracion | | | | 13,100 | | 17,325 | |

Gentera | | | | 1,099,500 | | 1,112,191 | |

Grupo Aeroportuario del Sureste, Cl. B | | | | 12,900 | | 263,597 | |

Wal-Mart de Mexico | | | | 283,500 | | 860,014 | |

| | | | | 3,111,978 | |

Philippines - .8% | | | | | |

Ayala Land | | | | 743,400 | | 551,049 | |

DMCI Holdings | | | | 1,605,100 | | 338,072 | |

Globe Telecom | | | | 2,295 | | 93,448 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 51.7% (continued) | | | | | |

Philippines - .8% (continued) | | | | | |

Metro Pacific Investments | | | | 1,906,000 | | 167,564 | |

Puregold Price Club | | | | 841,350 | | 700,736 | |

SM Prime Holdings | | | | 46,300 | | 30,978 | |

| | | | | 1,881,847 | |

Poland - .3% | | | | | |

Jastrzebska Spolka Weglowa | | | | 13,600 | a | 244,201 | |

Powszechna Kasa Oszczednosci Bank Polski | | | | 43,646 | | 507,870 | |

| | | | | 752,071 | |

Qatar - .0% | | | | | |

Qatar National Bank | | | | 814 | | 39,571 | |

Russia - 2.2% | | | | | |

Gazprom, ADR | | | | 230,501 | | 1,152,505 | |

Lukoil, ADR | | | | 22,240 | | 1,705,808 | |

MMC Norilsk Nickel, ADR | | | | 4,700 | | 81,310 | |

Rosneft, GDR | | | | 12,313 | | 92,446 | |

Sberbank of Russia, ADR | | | | 106,609 | | 1,351,802 | |

Sistema, GDR | | | | 6,159 | | 16,186 | |

Surgutneftegas, ADR | | | | 12,760 | | 52,826 | |

Tatneft, ADR | | | | 7,450 | | 569,925 | |

| | | | | 5,022,808 | |

South Africa - 2.4% | | | | | |

Absa Group | | | | 25,800 | | 277,097 | |

Clicks Group | | | | 50,893 | | 629,808 | |

FirstRand | | | | 138,069 | | 662,653 | |

Growthpoint Properties | | | | 17,287 | | 28,398 | |

Investec | | | | 61,200 | | 430,742 | |

Kumba Iron Ore | | | | 5,900 | | 133,911 | |

Naspers, Cl. N | | | | 5,110 | | 1,102,723 | |

Nedbank Group | | | | 28,995 | | 542,593 | |

Redefine Properties | | | | 20,861 | | 14,781 | |

Resilient REIT | | | | 2,384 | | 9,800 | |

Sappi | | | | 63,800 | | 400,407 | |

Sasol | | | | 22,141 | | 857,269 | |

Standard Bank Group | | | | 14,200 | | 175,727 | |

Telkom | | | | 60,973 | | 222,743 | |

| | | | | 5,488,652 | |

South Korea - 9.6% | | | | | |

Daelim Industrial | | | | 8,200 | | 610,611 | |

Dongbu Insurance | | | | 7,100 | | 465,973 | |

E-MART | | | | 2,333 | | 436,419 | |

GS Engineering & Construction | | | | 18,919 | | 892,011 | |

Hana Financial Group | | | | 17,918 | | 719,628 | |

12

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 51.7% (continued) | | | | | |

South Korea - 9.6% (continued) | | | | | |

Hankook Tire | | | | 9,278 | | 419,047 | |

Hyundai Heavy Industries | | | | 7,646 | a | 927,101 | |

Hyundai Marine & Fire Insurance | | | | 17,300 | | 654,257 | |

Hyundai Mobis | | | | 2,939 | | 604,095 | |

KB Financial | | | | 13,520 | | 660,612 | |

KIWOOM Securities | | | | 5,762 | | 506,464 | |

KT | | | | 6,996 | | 190,155 | |

KT&G | | | | 6,800 | | 637,548 | |

Kumho Petrochemical | | | | 8,646 | | 767,754 | |

LG Electronics | | | | 3,329 | | 213,080 | |

NH Investment & Securities | | | | 40,900 | | 527,266 | |

POSCO | | | | 4,167 | | 1,106,316 | |

Samsung Electro-Mechanics | | | | 6,674 | | 836,318 | |

Samsung Electronics | | | | 160,850 | | 6,735,616 | |

Samsung SDI | | | | 3,597 | | 838,246 | |

Shinhan Financial Group | | | | 18,326 | | 743,448 | |

SK Holdings | | | | 2,280 | | 589,912 | |

SK Hynix | | | | 12,800 | | 843,525 | |

SK Telecom | | | | 2,330 | | 592,346 | |

S-Oil | | | | 4,141 | | 511,442 | |

Woori Bank | | | | 10,000 | | 152,355 | |

| | | | | 22,181,545 | |

Taiwan - 6.4% | | | | | |

Cathay Financial Holding | | | | 578,000 | | 993,843 | |

Chailease Holding | | | | 239,920 | | 840,777 | |

China Life Insurance | | | | 157,940 | | 158,804 | |

EVA Airways | | | | 1,014,300 | | 493,314 | |

Formosa Chemicals & Fibre | | | | 188,000 | | 788,131 | |

Fubon Financial Holding | | | | 418,000 | | 709,147 | |

Innolux | | | | 701,000 | | 243,363 | |

Largan Precision | | | | 7,000 | | 833,361 | |

Powertech Technology | | | | 166,000 | | 452,881 | |

Shin Kong Financial Holding | | | | 439,235 | | 171,908 | |

Synnex Technology International | | | | 403,000 | | 514,095 | |

Taiwan Semiconductor Manufacturing | | | | 682,600 | | 5,868,486 | |

TCI | | | | 52,870 | | 850,200 | |

Transcend Information | | | | 78,000 | | 178,823 | |

Uni-President Enterprises | | | | 334,000 | | 871,837 | |

Wistron | | | | 604,842 | | 394,208 | |

Yageo | | | | 24,773 | | 372,410 | |

| | | | | 14,735,588 | |

Thailand - 1.5% | | | | | |

Advanced Info Service | | | | 180,900 | | 1,124,332 | |

13

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 51.7% (continued) | | | | | |

Thailand - 1.5% (continued) | | | | | |

Bangkok Bank | | | | 73,500 | | 495,455 | |

Glow Energy | | | | 93,000 | | 253,061 | |

Indorama Ventures | | | | 334,000 | | 609,338 | |

PTT, NVDR | | | | 78,000 | | 130,844 | |

Thai Beverage | | | | 851,100 | | 423,355 | |

Thai Oil | | | | 178,700 | | 489,021 | |

| | | | | 3,525,406 | |

Turkey - .2% | | | | | |

Akbank | | | | 6,200 | | 7,109 | |

Emlak Konut Gayrimenkul Yatirim Ortakligi | | | | 14,944 | | 4,432 | |

Eregli Demir ve Celik Fabrikalari | | | | 7,600 | | 13,890 | |

Ford Otomotiv Sanayi | | | | 23,642 | | 257,766 | |

Haci Omer Sabanci Holding | | | | 159,390 | | 201,512 | |

Tofas Turk Otomobil Fabrikasi | | | | 900 | | 3,188 | |

Turkiye Sise ve Cam Fabrikalari | | | | 28,100 | | 27,192 | |

Turkiye Vakiflar Bankasi, Cl. D | | | | 22,100 | | 13,879 | |

| | | | | 528,968 | |

United Arab Emirates - .6% | | | | | |

Abu Dhabi Commercial Bank | | | | 274,026 | | 591,622 | |

Dubai Islamic Bank | | | | 292,347 | | 429,009 | |

Emaar Properties | | | | 304,181 | | 409,936 | |

| | | | | 1,430,567 | |

Total Common Stocks (cost $102,566,852) | | | | 119,438,679 | |

| | | | | | | | |

Exchange-Traded Funds - 3.9% | | | | | |

United States - 3.9% | | | | | |

Global X MSCI Colombia ETF | | | | 150,311 | b | 1,503,110 | |

iShares MSCI Emerging Markets ETF | | | | 101,365 | b | 4,350,586 | |

iShares MSCI Indonesia ETF | | | | 71,436 | b | 1,640,885 | |

iShares MSCI South Africa ETF | | | | 23,702 | b | 1,271,612 | |

Vanguard FTSE Emerging Markets ETF | | | | 6,400 | | 262,400 | |

Total Exchange-Traded Funds (cost $9,288,952) | | | | 9,028,593 | |

| | | Preferred Dividend

Yield (%) | | | | | |

Preferred Stocks - .9% | | | | | |

Brazil - .4% | | | | | |

Banco Bradesco | | 3.62 | | 14,831 | | 104,956 | |

Banco do Estado do Rio Grande do Sul, Cl. B | | 5.89 | | 130,200 | | 479,398 | |

Cia Energetica de Minas Gerais | | 4.95 | | 258,416 | | 454,310 | |

| | | | | 1,038,664 | |

14

| | | | | | | | |

| |

Description | | Preferred Dividend

Yield (%) | | Shares | | Value ($) | |

Preferred Stocks - .9% (continued) | | | | | |

Chile - .2% | | | | | |

Embotelladora Andina, Cl. B | | 3.62 | | 111,048 | | 432,200 | |

South Korea - .3% | | | | | |

Samsung Electronics | | 3.29 | | 18,450 | | 629,554 | |

Taiwan - .0% | | | | | |

Cathay Financial Holding | | 3.59 | | 23,923 | | 49,361 | |

Total Preferred Stocks (cost $2,142,433) | | | | 2,149,779 | |

| | | | | | | | |

Investment Companies - 41.7% | | | | | |

Registered Investment Companies - 41.7% | | | | | |

Dreyfus Global Emerging Markets Fund, Cl. Y | | | | 4,853,271 | d | 76,633,153 | |

Dreyfus Strategic Beta Emerging Markets Equity Fund, Cl. Y | | | | 1,485,865 | d | 19,806,580 | |

Total Investment Companies (cost $83,320,799) | | | | 96,439,733 | |

| | | 7-Day

Yield (%) | | | | | |

Investment of Cash Collateral for Securities Loaned - .5% | | | | | |

Registered Investment Companies - .5% | | | | | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares

(cost $1,091,825) | | 1.97 | | 1,091,825 | d | 1,091,825 | |

Total Investments (cost $198,410,861) | | 98.7% | | 228,148,609 | |

Cash and Receivables (Net) | | 1.3% | | 2,958,595 | |

Net Assets | | 100.0% | | 231,107,204 | |

ADR—American Depository Receipt

ETF—Exchange-Traded Fund

GDR—Global Depository Receipt

NVDR—Non-Voting Depository Receipt

REIT—Real Estate Investment Trust

aNon-income producing security.

bSecurity, or portion thereof, on loan. At September 30, 2018, the value of the fund’s securities on loan was $4,676,546 and the value of the collateral held by the fund was $4,800,564, consisting of cash collateral of $1,091,825 and U.S. Government & Agency securities valued at $3,708,739.

cSecurity exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At September 30, 2018, these securities were valued at $1,406,943 or .61% of net assets.

dInvestment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the respective investment company’s prospectus.

15

STATEMENT OF INVESTMENTS (continued)

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Registered Investment Companies | 45.6 |

Banks | 7.5 |

Software & Services | 7.3 |

Technology Hardware & Equipment | 5.0 |

Materials | 4.9 |

Energy | 4.8 |

Semiconductors & Semiconductor Equipment | 3.1 |

Capital Goods | 2.6 |

Insurance | 2.5 |

Telecommunication Services | 2.5 |

Diversified Financials | 2.3 |

Food, Beverage & Tobacco | 1.7 |

Utilities | 1.5 |

Automobiles & Components | 1.5 |

Food & Staples Retailing | 1.1 |

Real Estate | .9 |

Transportation | .8 |

Consumer Services | .6 |

Media | .5 |

Investment Companies | .5 |

Consumer Durables & Apparel | .4 |

Pharmaceuticals Biotechnology & Life Sciences | .4 |

Household & Personal Products | .4 |

Health Care Equipment & Services | .3 |

Commercial & Professional Services | .0 |

| | 98.7 |

† Based on net assets.

See notes to financial statements.

16

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

| | | | | | | |

Registered Investment Companies | | Value

9/30/2017 ($) | Purchases ($) | † | Sales ($) | Net Realized

Gain (Loss) ($) |

Dreyfus Global Emerging Markets Fund, Cl. Y | | 76,142,000 | 12,970,701 | | 3,583,485 | (314,680) |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares | | 2,813,104 | 97,586,318 | | 99,307,597 | — |

Dreyfus Strategic Beta Emerging Markets Equity Fund, Cl. Y | | 17,636,388 | 3,360,932 | | 895,871 | (59,653) |

Total | | 96,591,492 | 113,917,951 | | 103,786,953 | (374,333) |

| | | | | | | |

Registered Investment Companies | | Change in Net

Unrealized

Appreciation

(Depreciation) ($) | Value

9/30/2018 ($) | | Net

Assets (%) | Dividends/

Distributions ($) |

Dreyfus Global Emerging Markets Fund, Cl. Y | | (8,581,383) | 76,633,153 | | 33.1 | 1,023,087 |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares | | — | 1,091,825 | | .5 | — |

Dreyfus Strategic Beta Emerging Markets Equity Fund, Cl. Y | | (235,216) | 19,806,580 | | 8.6 | 374,029 |

Total | | (8,816,599) | 97,531,558 | | 42.2 | 1,397,116 |

† Includes reinvested dividends/distributions.

See notes to financial statements.

17

STATEMENT OF FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS September 30, 2018

| | | | | | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation (Depreciation)($) |

Credit Suisse International | | | |

Turkish Lira | 1,792,510 | United States Dollar | 294,739 | 10/1/18 | 1,626 |

Brazilian Real | 780,614 | United States Dollar | 192,848 | 10/1/18 | 393 |

United States Dollar | 395,094 | Brazilian Real | 1,599,261 | 10/1/18 | (804) |

Hungarian Forint | 36,662,913 | United States Dollar | 132,788 | 10/1/18 | (1,100) |

Hong Kong Dollar | 10,503,485 | United States Dollar | 1,344,825 | 10/2/18 | (3,044) |

United States Dollar | 260,071 | Hong Kong Dollar | 2,031,227 | 10/2/18 | 589 |

United States Dollar | 140,068 | South Korean Won | 156,329,781 | 10/2/18 | (881) |

Deutsche Bank | | | |

United States Dollar | 87,373 | Taiwan Dollar | 2,677,138 | 10/1/18 | (323) |

Merrill Lynch, Pierce, Fenner & Smith | | | |

United States Dollar | 246,931 | Thai Baht | 8,016,594 | 10/1/18 | (977) |

United States Dollar | 505,317 | Indonesian Rupiah | 7,541,857,685 | 10/2/18 | (574) |

Gross Unrealized Appreciation | | | 2,608 |

Gross Unrealized Depreciation | | | (7,703) |

See notes to financial statements.

18

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2018

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $4,676,546)—Note 1(c): | | | |

Unaffiliated issuers | 113,998,237 | | 130,617,051 | |

Affiliated issuers | | 84,412,624 | | 97,531,558 | |

Cash | | | | | 2,223,019 | |

Cash denominated in foreign currency | | | 2,099,590 | | 2,089,491 | |

Receivable for investment securities sold | | 1,638,378 | |

Receivable for shares of Beneficial Interest subscribed | | 529,382 | |

Dividends and securities lending income receivable | | 180,033 | |

Tax reclaim receivable | | 11,462 | |

Unrealized appreciation on foreign currency transactions | | 4,604 | |

Unrealized appreciation on forward foreign

currency exchange contracts—Note 4 | | 2,608 | |

Prepaid expenses | | | | | 25,867 | |

| | | | | 234,853,453 | |

Liabilities ($): | | | | |

Due to The Dreyfus Corporation and affiliates—Note 3(c) | | | | 188,195 | |

Payable for investment securities purchased | | 2,171,010 | |

Liability for securities on loan—Note 1(c) | | 1,091,825 | |

Payable for shares of Beneficial Interest redeemed | | 216,808 | |

Unrealized depreciation on forward foreign

currency exchange contracts—Note 4 | | 7,703 | |

Trustees fees and expenses payable | | 1,770 | |

Accrued expenses | | | | | 68,938 | |

| | | | | 3,746,249 | |

Net Assets ($) | | | 231,107,204 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 224,872,602 | |

Total distributable earnings (loss) | | | | | 6,234,602 | |

Net Assets ($) | | | 231,107,204 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 478,585 | 28,959 | 4,700,252 | 225,899,408 | |

Shares Outstanding | 21,089 | 1,355 | 207,444 | 9,955,854 | |

Net Asset Value Per Share ($) | 22.69 | 21.37 | 22.66 | 22.69 | |

| | | | | | |

See notes to financial statements. | | | | | |

19

STATEMENT OF OPERATIONS

Year Ended September 30, 2018

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $469,933 foreign taxes withheld at source): | |

Unaffiliated issuers | | | 3,513,622 | |

Affiliated issuers | | | 1,397,116 | |

Income from securities lending—Note 1(c) | | | 41,022 | |

Total Income | | | 4,951,760 | |

Expenses: | | | | |

Investment advisory fee—Note 3(a) | | | 1,434,576 | |

Custodian fees—Note 3(c) | | | 125,124 | |

Professional fees | | | 106,680 | |

Administration fee—Note 3(a) | | | 101,372 | |

Registration fees | | | 64,023 | |

Trustees’ fees and expenses—Note 3(d) | | | 17,723 | |

Prospectus and shareholders’ reports | | | 10,702 | |

Shareholder servicing costs—Note 3(c) | | | 9,486 | |

Loan commitment fees—Note 2 | | | 4,712 | |

Distribution fees—Note 3(b) | | | 207 | |

Miscellaneous | | | 77,835 | |

Total Expenses | | | 1,952,440 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (91) | |

Net Expenses | | | 1,952,349 | |

Investment Income—Net | | | 2,999,411 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions: | | |

Unaffiliated issuers | | | | 1,405,536 | |

Affiliated issuers | | | | (374,333) | |

Net realized gain (loss) on forward foreign currency exchange contracts | (61,384) | |

Net Realized Gain (Loss) | | | 969,819 | |

Net unrealized appreciation (depreciation) on investments

and foreign currency transactions: | | | | |

Unaffiliated issuers | | | | (8,959,680) | |

Affiliated issuers | | | | (8,816,599) | |

Net unrealized appreciation (depreciation) on

forward foreign currency exchange contracts | | | (5,095) | |

Net Unrealized Appreciation (Depreciation) | | | (17,781,374) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (16,811,555) | |

Net (Decrease) in Net Assets Resulting from Operations | | (13,812,144) | |

| | | | | | | |

See notes to financial statements. | | | | | |

20

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended September 30, |

| | | | 2018 | | 2017a | |

Operations ($): | | | | | | | | |

Investment income—net | | | 2,999,411 | | | | 1,027,702 | |

Net realized gain (loss) on investments | | 969,819 | | | | 4,737,921 | |

Net unrealized appreciation (depreciation)

on investments | | (17,781,374) | | | | 29,358,115 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | (13,812,144) | | | | 35,123,738 | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (6,659) | | | | (706) | |

Class I | | | (59,484) | | | | (6,480) | |

Class Y | | | (2,536,872) | | | | (714,061) | |

Total Distributions | | | (2,603,015) | | | | (721,247) | |

Beneficial Interest Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 436,160 | | | | 537,581 | |

Class C | | | 19,500 | | | | - | |

Class I | | | 5,503,868 | | | | 4,376,821 | |

Class Y | | | 53,816,816 | | | | 60,760,200 | |

Distributions reinvested: | | | | | | | | |

Class A | | | 6,600 | | | | 706 | |

Class I | | | 51,165 | | | | 5,849 | |

Class Y | | | 441,442 | | | | 112,993 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (798,235) | | | | (747,230) | |

Class C | | | (16,234) | | | | (44,160) | |

Class I | | | (3,999,456) | | | | (2,523,767) | |

Class Y | | | (25,815,228) | | | | (29,151,205) | |

Increase (Decrease) in Net Assets

from Beneficial Interest Transactions | 29,646,398 | | | | 33,327,788 | |

Total Increase (Decrease) in Net Assets | 13,231,239 | | | | 67,730,279 | |

Net Assets ($): | |

Beginning of Period | | | 217,875,965 | | | | 150,145,686 | |

End of Period | | | 231,107,204 | | | | 217,875,965 | |

21

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | | | | | | | | |

| | | | Year Ended September 30, |

| | | | 2018 | | 2017a | |

Capital Share Transactions (Shares): | |

Class Ab | | | | | | | | |

Shares sold | | | 16,816 | | | | 24,924 | |

Shares issued for distributions reinvested | | | 257 | | | | 38 | |

Shares redeemed | | | (33,231) | | | | (35,348) | |

Net Increase (Decrease) in Shares Outstanding | (16,158) | | | | (10,386) | |

Class Cb | | | | | | | | |

Shares sold | | | 833 | | | | - | |

Shares redeemed | | | (702) | | | | (2,173) | |

Net Increase (Decrease) in Shares Outstanding | 131 | | | | (2,173) | |

Class Ic | | | | | | | | |

Shares sold | | | 220,205 | | | | 208,888 | |

Shares issued for distributions reinvested | | | 2,001 | | | | 317 | |

Shares redeemed | | | (161,915) | | | | (122,804) | |

Net Increase (Decrease) in Shares Outstanding | 60,291 | | | | 86,401 | |

Class Yc | | | | | | | | |

Shares sold | | | 2,159,493 | | | | 2,831,224 | |

Shares issued for distributions reinvested | | | 17,243 | | | | 6,111 | |

Shares redeemed | | | (1,053,877) | | | | (1,438,486) | |

Net Increase (Decrease) in Shares Outstanding | 1,122,859 | | | | 1,398,849 | |

| | | | | | | | | | |

a Distributions to shareholders include only distributions from net investment income. Undistributed investment income—net was 595,545 in 2017 and is no longer presented as a result of the adoption of SEC’s Disclosure Update and Simplification Rule. | |

b During the period ended September 30, 2018, 339 Class C shares representing $8,029 were automatically converted for 319 Class A shares. | |

cDuring the period ended September 30, 2018, 107,970 Class Y shares representing $2,689,738 were exchanged for 108,116 Class I shares and during the period ended September 30, 2017, 150,737 Class Y shares representing $3,124,374 were exchanged for 150,938 Class I shares. | |

See notes to financial statements.

| | | | | | | | |

22

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements.

| | | | | | | | | |

| | | | |

| | |

| | Year Ended September 30, |

Class A Shares | | 2018 | 2017 | 2016 | 2015 | 2014 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 24.18 | 19.92 | 17.23 | 21.34 | 20.58 |

Investment Operations: | | | | | | |

Investment income—neta | | .19 | .02 | .02 | .09 | .05 |

Net realized and unrealized

gain (loss) on investments | | (1.50) | 4.26 | 2.72 | (3.88) | .98 |

Total from Investment Operations | | (1.31) | 4.28 | 2.74 | (3.79) | 1.03 |

Distributions: | | | | | | |

Dividends from investment

income—net | | (.18) | (.02) | (.08) | (.13) | (.28) |

Dividends from net realized gain

on investments | | — | — | — | (.20) | — |

Total Distributions | | (.18) | (.02) | (.08) | (.33) | (.28) |

Proceeds from redemption

fees—Note 3(e) | | .00b | .00b | .03 | .01 | .01 |

Net asset value, end of period | | 22.69 | 24.18 | 19.92 | 17.23 | 21.34 |

Total Return (%)c | | (5.50) | 21.48 | 16.20 | (18.00) | 5.14 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assetsd | | 1.26 | 1.28 | 1.39 | 1.42 | 4.80 |

Ratio of net expenses

to average net assetsd | | 1.26 | 1.27 | 1.39 | 1.42 | 1.60 |

Ratio of net investment income

to average net assetsd | | .77 | .08 | .10 | .47 | .22 |

Portfolio Turnover Rate | | 41.37 | 50.35 | 62.91 | 78.32 | 128.76 |

Net Assets, end of period ($ x 1,000) | | 479 | 901 | 949 | 1,153 | 209 |

a Based on average shares outstanding.

b Amount represents less than $.01 per share.

c Exclusive of sales charge.

d Amount does not include the expenses of the underlying funds

See notes to financial statements.

23

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | |

| | | | |

| | |

| | Year Ended September 30, |

Class C Shares | | 2018 | 2017 | 2016 | 2015 | 2014 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 22.85 | 18.98 | 16.50 | 20.44 | 19.60 |

Investment Operations: | | | | | | |

Investment income (loss)—neta | | (.11) | (.16) | (.13) | .04 | (.16) |

Net realized and unrealized

gain (loss) on investments | | (1.37) | 4.03 | 2.58 | (3.79) | .99 |

Total from Investment Operations | | (1.48) | 3.87 | 2.45 | (3.75) | .83 |

Distributions: | | | | | | |

Dividends from net realized gain

on investments | | — | — | — | (.20) | — |

Proceeds from redemption

fees—Note 3(e) | | .00b | .00b | .03 | .01 | .01 |

Net asset value, end of period | | 21.37 | 22.85 | 18.98 | 16.50 | 20.44 |

Total Return (%)c | | (6.48) | 20.39 | 15.03 | (18.44) | 4.34 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assetsd | | 2.59 | 2.32 | 2.23 | 2.08 | 6.10 |

Ratio of net expenses

to average net assetsd | | 2.26 | 2.25 | 2.23 | 2.08 | 2.35 |

Ratio of net investment income (loss)

to average net assetsd | | (.47) | (.83) | (.74) | .22 | (.77) |

Portfolio Turnover Rate | | 41.37 | 50.35 | 62.91 | 78.32 | 128.76 |

Net Assets, end of period ($ x 1,000) | | 29 | 28 | 64 | 291 | 69 |

a Based on average shares outstanding.

b Amount represents less than $.01 per share.

c Exclusive of sales charge.

d Amount does not include the expenses of the underlying funds.

See notes to financial statements.

24

| | | | | | | | |

| | | |

| | |

| | Year Ended September 30, |

Class I Shares | | 2018 | 2017 | 2016 | 2015 | 2014 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 24.13 | 19.86 | 17.16 | 21.16 | 20.45 |

Investment Operations: | | | | | | |

Investment income (loss)—neta | | .32 | .13 | .02 | .16 | (.30) |

Net realized and unrealized

gain (loss) on investments | | (1.52) | 4.22 | 2.75 | (3.79) | 1.34 |

Total from Investment Operations | | (1.20) | 4.35 | 2.77 | (3.63) | 1.04 |

Distributions: | | | | | | |

Dividends from investment

income—net | | (.27) | (.08) | (.10) | (.18) | (.34) |

Dividends from net realized gain

on investments | | — | — | — | (.20) | — |

Total Distributions | | (.27) | (.08) | (.10) | (.38) | (.34) |

Proceeds from redemption

fees—Note 3(e) | | .00b | .00b | .03 | .01 | .01 |

Net asset value, end of period | | 22.66 | 24.13 | 19.86 | 17.16 | 21.16 |

Total Return (%) | | (5.10) | 22.05 | 16.45 | (17.44) | 5.32 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assetsc | | .89 | .95 | 1.11 | .99 | 3.57 |

Ratio of net expenses

to average net assetsc | | .89 | .94 | 1.11 | .99 | 1.35 |

Ratio of net investment income (loss)

to average net assetsc | | 1.26 | .57 | .12 | .83 | (.63) |

Portfolio Turnover Rate | | 41.37 | 50.35 | 62.91 | 78.32 | 128.76 |

Net Assets, end of period ($ x 1,000) | | 4,700 | 3,550 | 1,207 | 2,840 | 748 |

a Based on average shares outstanding.

b Amount represents less than $.01 per share.

c Amount does not include the expenses of the underlying funds.

See notes to financial statements.

25

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | | | |

| | | |

| | | | |

| | | Year Ended September 30, | |

Class Y Shares | | 2018 | 2017 | 2016 | 2015 | 2014a |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 24.16 | 19.90 | 17.18 | 21.20 | 19.03 |

Investment Operations: | | | | | | |

Investment income—netb | | .31 | .13 | .07 | .17 | .14 |

Net realized and unrealized

gain (loss) on investments | | (1.50) | 4.23 | 2.74 | (3.82) | 2.02 |

Total from Investment Operations | | 1.19 | 4.36 | 2.81 | (3.65) | 2.16 |

Distributions: | | | | | | |

Dividends from investment

income—net | | (.28) | (.10) | (.12) | (.18) | — |

Dividends from net realized gain

on investments | | — | — | — | (.20) | — |

Total Distributions | | (.28) | (.10) | (.12) | (.38) | — |

Proceeds from redemption

fees—Note 3(e) | | .00c | .00c | .03 | .01 | .01 |

Net asset value, end of period | | 22.69 | 24.16 | 19.90 | 17.18 | 21.20 |

Total Return (%) | | (5.06) | 22.06 | 16.64 | (17.44) | 11.40d |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assetse | | .80 | .86 | 1.01 | .93 | 1.29f |

Ratio of net expenses

to average net assetse | | .80 | .85 | 1.01 | .93 | 1.29f |

Ratio of net investment income

to average net assetse | | 1.24 | .61 | .42 | .84 | 1.03f |

Portfolio Turnover Rate | | 41.37 | 50.35 | 62.91 | 78.32 | 128.76 |

Net Assets, end of period ($ x 1,000) | | 225,899 | 213,397 | 147,926 | 183,659 | 187,879 |

a From the close of business on January 31, 2014 (commencement of initial offering) to September 30, 2014.

b Based on average shares outstanding.

c Amount represents less than $.01 per share.

d Not annualized.

e Amount does not include the expenses of the underlying funds.

f Annualized.

See notes to financial statements.

26

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Diversified Emerging Markets Fund (the “fund”) is a separate diversified series of Dreyfus Investment Funds (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering seven series, including the fund. The fund’s investment objective is to seek long-term growth of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Effective January 31, 2018, BNY Mellon Asset Management North America Corporation (the “sub adviser”), a wholly-owned subsidiary of BNY Mellon and an affiliate of Dreyfus, serves as the fund’s sub-investment adviser. The sub adviser is a specialist multi-asset investment manager formed by the combination of certain BNY Mellon affiliated investment management firms, including Mellon Capital Management Corporation and The Boston Company Asset Management Corporation, which they served as the fund’s sub-investment adviser prior to January 31, 2018.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares. The fund is authorized to issue an unlimited number of $.001 par value shares of Beneficial Interest in each of the following classes of shares: Class A, Class C, Class I, Class T and Class Y. Class A, Class C and Class T shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A and Class T shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class C shares automatically convert to Class A shares ten years after the date of purchase, without the imposition of a sales charge. Class I shares are sold primarily to bank trust departments and other financial service providers (including The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class I and Class Y shares are offered without a front-end sales charge or CDSC. As of the date of this report, the fund did not offer Class T shares for purchase. Other differences between the classes

27

NOTES TO FINANCIAL STATEMENTS (continued)

include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Trust accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

28

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Trust’s Board of Trustees (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

29

NOTES TO FINANCIAL STATEMENTS (continued)

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

Forward foreign currency exchange contracts (“forward contracts”) are valued at the forward rate and are generally categorized within Level 2 of the fair value hierarchy.

The following is a summary of the inputs used as of September 30, 2018 in valuing the fund’s investments:

| | | | | | |

| | Level 1 - Unadjusted Quoted Prices | Level 2 - Other Significant Observable Inputs | | Level 3 - Significant Unobservable Inputs | Total |

Assets ($) | | | |

Investments in Securities: | | | |

Equity Securities –

Common Stocks† | 119,438,679 | - | | - | 119,438,679 |

Equity Securities -

Preferred Stocks† | 2,149,779 | - | | - | 2,149,779 |

Exchange-Traded Funds | 9,028,593 | - | | - | 9,028,593 |

Investment Companies | 97,531,558 | - | | - | 97,531,558 |

Other Financials Instruments: | | | |

Forward Foreign Currency

Exchange Contracts†† | - | 2,608 | | - | 2,608 |

Liabilities ($) | | | |

Other Financials Instruments: | | | |

Forward Foreign Currency

Exchange Contracts†† | - | (7,703) | | - | (7,703) |

† See Statement of Investments for additional detailed categorizations.

†† Amount shown represents unrealized appreciation (depreciation) at period end, but only variation margin on exchanged traded and centrally cleared derivatives are reported in the Statement of Assets and Liabilities.

At September 30, 2018, there were no transfers between levels of the fair value hierarchy. It is the fund’s policy to recognize transfers between levels at the end of the reporting period.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions

30

between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by Dreyfus, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, The Bank of New York Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending transactions are on an overnight and continuous basis. During the period ended September 30, 2018, The Bank of New York Mellon earned $7,786 from lending portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” under the Act.

(e) Risk: Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S. These risks include revaluation of currencies, high rates of inflation, repatriation restrictions on income and capital, and adverse political and economic developments. Moreover, securities issued in these markets may be less

31

NOTES TO FINANCIAL STATEMENTS (continued)

liquid, subject to government ownership controls and delayed settlements, and their prices may be more volatile than those of comparable securities in the U.S.

(f) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended September 30, 2018, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended September 30, 2018, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended September 30, 2018 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At September 30, 2018, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $1,105,455, accumulated capital losses $22,300,538 and unrealized appreciation $27,429,685.

Under the Regulated Investment Company Modernization Act of 2010, the fund is permitted to carry forward capital losses for an unlimited period. Furthermore, capital loss carryovers retain their character as either short-term or long-term capital losses.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if any, realized subsequent to September 30, 2018. The fund has $14,366,725 of short-term capital losses and $7,933,813 of long-term capital losses which can be carried forward for an unlimited period.

32

The tax character of distributions paid to shareholders during the fiscal periods ended September 30, 2018 and September 30, 2017 were as follows: ordinary income $2,603,015 and $721,247, respectively.

During the period ended September 30, 2018, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign currency gains and losses, foreign capital gains taxes and passive foreign investment companies, the fund increased accumulated undistributed investment income-net by $84,501 and decreased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

(h) New Accounting Pronouncements: In August 2018, the FASB issued Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). The update provides guidance that eliminates, adds and modifies certain disclosure requirements for fair value measurements. ASU 2018-13 will be effective for annual periods beginning after December 15, 2019. Management is currently assessing the potential impact of these changes to future financial statements.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in an $830 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to October 4, 2017, the unsecured credit facility with Citibank, N.A. was $810 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended September 30, 2018, the fund did not borrow under the Facilities.

NOTE 3—Investment Advisory Fee, Sub-Investment Advisory Fee, Administration Fee and Other Transactions with Affiliates:

(a) Pursuant to an investment advisory agreement with Dreyfus, the fund has agreed to pay an investment advisory fee at the annual rate of 1.10% of the value of the fund’s average daily net assets other than assets allocated to investments in other investment companies (other underlying funds, which may consist of affiliated funds, mutual funds and exchange traded funds) and is payable monthly. Therefore the fund’s investment advisory fee will fluctuate based on the fund’s allocation between underlying and

33

NOTES TO FINANCIAL STATEMENTS (continued)

direct investments. Dreyfus has also contractually agreed, from October 1, 2017 through February 1, 2020, to waive receipt of its fees and/or assume the direct expenses of the fund, so that the expenses of Class A, Class C, Class I and Class Y shares (excluding Rule 12b-1 Distribution Plan fees, Shareholder Services Plan fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings, acquired fund fees and expenses of the underlying fund and extraordinary expenses) do not exceed 1.30% of the value of the fund’s average daily net assets. The reduction in expenses, pursuant to the undertaking, amounted to $91 during the period ended September 30, 2018.