DONEGAL GROUP INC.

INDEX

TO FORM 10-K REPORT

| | | Page |

| PART I | | |

| Item 1. | | 1 |

| Item 1A. | | 27 |

| Item 1B. | | 41

|

| Item 1C. | | 41

|

| Item 2. | | 42

|

| Item 3. | | 42

|

| Item 4. | | 42

|

| | | |

| PART II | | |

| Item 5. | | 43

|

| Item 6. | | 44

|

| Item 7. | | 45

|

| Item 7A. | | 62

|

| Item 8. | | 64

|

| Item 9. | | 108

|

| Item 9A. | | 108

|

| Item 9B. | | 109

|

| | | |

| PART III | | |

| Item 10. | | 111

|

| Item 11. | | 111 |

| Item 12. | | 111 |

| Item 13. | | 111 |

| Item 14. | | 111 |

| | | |

| PART IV | | |

| Item 15. | | 112 |

| Item 16. | | 115 |

PART I

Introduction

Donegal Group Inc., or DGI, is an insurance holding company whose insurance subsidiaries and affiliates offer property and casualty insurance in 23 Mid-Atlantic, Midwestern, New England, Southern and Southwestern states. DGI has no significant business operations and is separate and distinct from its insurance subsidiaries. As used in this Form 10-K Report, the terms “we,” “us” and “our” refer to Donegal Group Inc. and its insurance subsidiaries. Our Class A common stock and our Class B common stock trade on the NASDAQ Global Select Market under the symbols “DGICA” and “DGICB,” respectively.

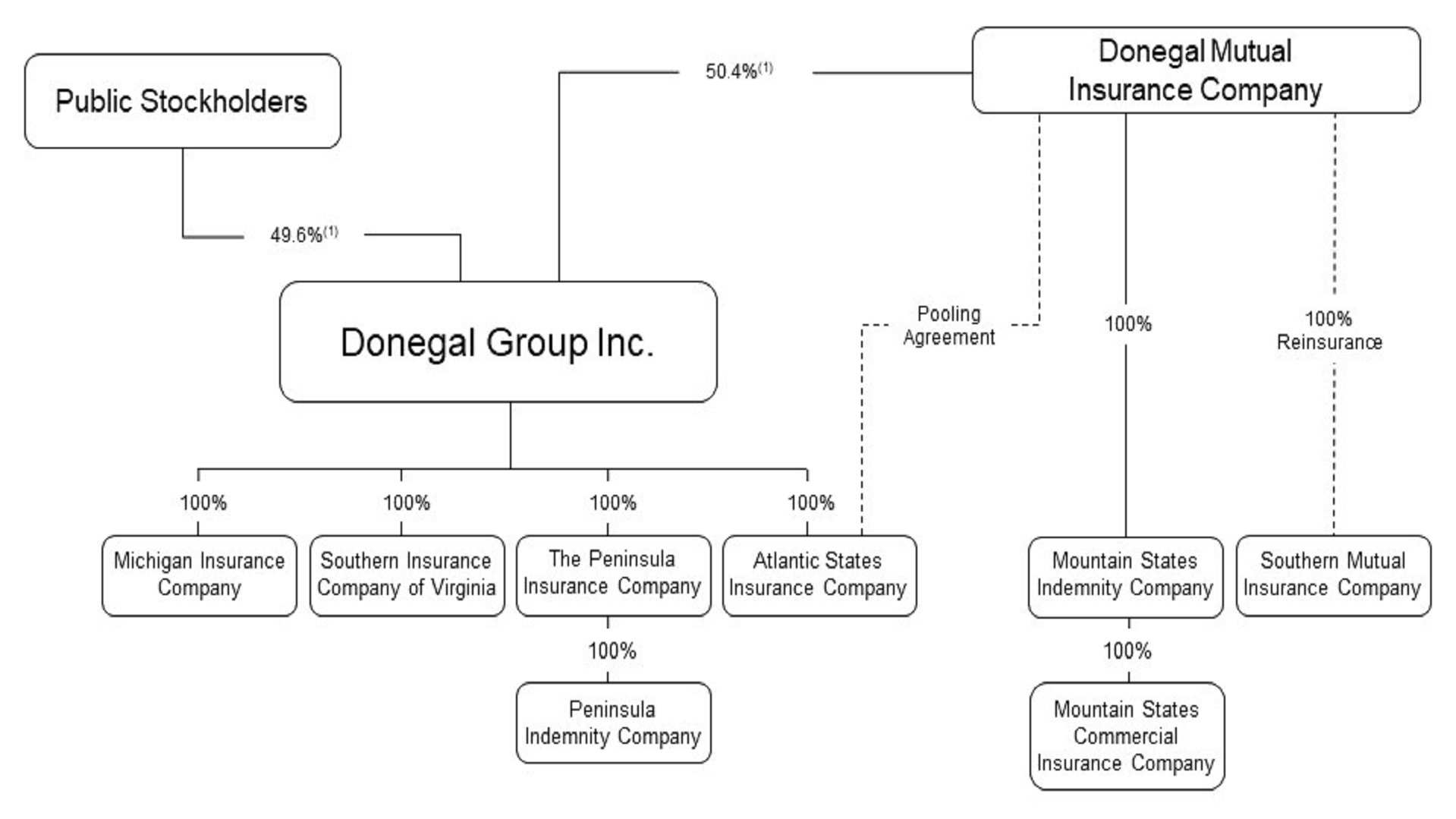

Donegal Mutual Insurance Company, or Donegal Mutual, organized us as an insurance holding company on August 26, 1986. At December 31, 2023, Donegal Mutual held approximately 44% of our outstanding Class A common stock and approximately 84% of our outstanding Class B common stock. Donegal Mutual’s ownership provides Donegal Mutual with approximately 71% of the combined voting power of our outstanding shares of Class A common stock and our outstanding shares of Class B common stock. Our insurance subsidiaries and Donegal Mutual have interrelated operations due to an intercompany pooling agreement and other intercompany agreements and transactions we describe in Note 3 of the Notes to Consolidated Financial Statements. While maintaining the separate corporate existence of each company, our insurance subsidiaries conduct business together with Donegal Mutual and its insurance subsidiaries as the Donegal Insurance Group. The Donegal Insurance Group is not a legal entity, is not an insurance company and does not issue or administer insurance policies. Rather, it is a trade name that refers to the group of insurance companies that are affiliated with Donegal Mutual.

At December 31, 2023, we had three segments: our investment function, our commercial lines of insurance and our personal lines of insurance. We set forth financial information about these segments in Note 19 of the Notes to Consolidated Financial Statements. The commercial lines products of our insurance subsidiaries consist primarily of commercial automobile, commercial multi-peril and workers’ compensation policies. The personal lines products of our insurance subsidiaries consist primarily of homeowners and private passenger automobile policies.

Our insurance subsidiaries and Donegal Mutual provide their policyholders with a selection of insurance products and pursue profitability by adhering to a strict underwriting discipline. Our insurance subsidiaries derive a substantial portion of their insurance business from smaller to mid-sized regional communities. We believe this focus provides our insurance subsidiaries with competitive advantages in terms of local market knowledge, marketing, underwriting, claims servicing and policyholder service. At the same time, we believe our insurance subsidiaries have cost advantages over many smaller regional insurers that result from economies of scale our insurance subsidiaries realize through centralized accounting, administrative, data processing, investment and other services.

We believe we have a substantial opportunity, as a well-capitalized regional insurance holding company with a solid business strategy, to grow profitably and compete effectively with larger national property and casualty insurers. Our downstream holding company structure, with Donegal Mutual holding approximately 71% of the combined voting power of our common stock, has proven its effectiveness and success over the 37 years of our existence. Over that time period, we have grown significantly in terms of revenue and financial strength, and the Donegal Insurance Group has developed an excellent reputation as a regional group of property and casualty insurers.

Since 1998, we and Donegal Mutual have completed seven transactions involving acquisitions of property and casualty insurance companies or participation in the business of property and casualty insurance companies through Donegal Mutual’s entry into quota-share reinsurance agreements with them. While we are currently placing less emphasis on pursuing acquisitions due to several ongoing major initiatives to enhance our technology infrastructure as well as our analytical and processing capabilities, we expect to continue to acquire other insurance companies to expand our business in a given region over time.

Donegal Mutual completed the merger of Mountain States Mutual Casualty Company, or Mountain States, with and into Donegal Mutual effective May 25, 2017. Donegal Mutual was the surviving company in the merger, and Mountain States’ insurance subsidiaries, Mountain States Indemnity Company and Mountain States Commercial Insurance Company (collectively, the “Mountain States insurance subsidiaries”), became insurance subsidiaries of Donegal Mutual upon completion of the merger. Upon completion of the merger, Donegal Mutual assumed all of the policy obligations of Mountain States and began to market its products together with the Mountain States insurance subsidiaries as the Mountain States Insurance Group in four Southwestern states. Donegal Mutual also entered into a 100% quota-share reinsurance agreement with the Mountain States insurance subsidiaries on the merger date. Beginning with policies effective in 2021, Donegal Mutual began to place the business of the Mountain States Insurance Group into the underwriting pool we describe in “History and Organizational Structure.”

Available Information

You may obtain our Annual Reports on Form 10-K, including this Form 10-K Report, our quarterly reports on Form 10-Q, our current reports on Form 8-K, our proxy statement and our other filings pursuant to the Securities Exchange Act of 1934, or the Exchange Act, without charge by viewing our website at www.donegalgroup.com. You may also view our Code of Business Conduct and Ethics and the charters of the executive committee, the audit committee, the compensation committee and the nominating committee of our board of directors on our website. Upon request to our corporate secretary, we will also provide printed copies of any of these documents to you without charge. We have provided the address of our website solely for the information of investors. We do not intend the reference to our website address to be an active link or to otherwise incorporate the contents of our website into this Form 10-K Report. In addition to our website, the Securities and Exchange Commission (the “SEC”) maintains an Internet site at www.sec.gov that contains our reports, proxy and information statements and other information that we electronically file with, or furnish to, the SEC.

History and Organizational Structure

In the mid-1980’s, Donegal Mutual, as a mutual insurance company, recognized the desirability of developing additional sources of capital and surplus so it could remain competitive, expand its business and ensure its long-term viability. Accordingly, Donegal Mutual determined that the implementation of a downstream holding company structure was a viable business strategy to accomplish that objective. Thus, in 1986, Donegal Mutual formed us as a downstream holding company, and we incorporated in the state of Delaware as Donegal Group Inc. After Donegal Mutual formed us, we in turn formed Atlantic States Insurance Company, or Atlantic States, as our wholly owned property and casualty insurance company subsidiary.

In connection with the formation of Atlantic States and the establishment of our downstream insurance holding company system, Donegal Mutual and Atlantic States entered into a proportional reinsurance agreement, or pooling agreement. Under the pooling agreement, Donegal Mutual and Atlantic States contribute substantially all of their respective premiums, losses and loss expenses to the underwriting pool, and the underwriting pool, acting through Donegal Mutual, then allocates 80% of the pooled business to Atlantic States. Thus, Donegal Mutual and Atlantic States share the underwriting results of the pooled business in proportion to their respective participation in the underwriting pool.

The member companies of the Donegal Insurance Group, which include our insurance subsidiaries, share a combined business plan to enhance market penetration and underwriting profitability objectives. We believe Donegal Mutual’s majority interest in the combined voting power of our Class A common stock and of our Class B common stock fosters our ability to implement our business philosophies, enjoy management continuity, maintain superior employee relations and provide a stable environment within which we can grow our businesses.

The products the member companies of the Donegal Insurance Group offer are generally complementary, which permits the Donegal Insurance Group to offer a broad range of products in a given market and to expand the Donegal Insurance Group’s ability to service an entire personal lines or commercial lines account. Distinctions within the products the member companies of the Donegal Insurance Group offer generally relate to specific risk profiles within similar classes of business, such as preferred tier products versus standard tier products. The member companies of the Donegal Insurance Group do not allocate all of the standard risk gradients to one company. As a result, the underwriting profitability of the business the individual companies write directly will vary. However, the underwriting pool homogenizes the risk characteristics of all business that Donegal Mutual and Atlantic States write directly and all business that Donegal Mutual assumes from its affiliates and places into the underwriting pool. The business Atlantic States derives from the underwriting pool represents a significant percentage of our total consolidated revenues.

As the capital of Atlantic States and our other insurance subsidiaries has increased, the underwriting capacity of our insurance subsidiaries has increased proportionately. The size of the underwriting pool has also increased substantially. Therefore, as we originally planned in the mid-1980s, Atlantic States has successfully raised the capital necessary to support the growth of its direct business as well as to accept increases in its allocation of business from the underwriting pool. The portion of the underwriting pool allocated to Atlantic States has increased from an initial allocation of 35% in 1986 to an 80% allocation since March 1, 2008. We do not anticipate any further change in the pooling agreement between Atlantic States and Donegal Mutual, including any change in the percentage participation of Atlantic States in the underwriting pool.

In addition to Atlantic States, our insurance subsidiaries are Michigan Insurance Company, or MICO, The Peninsula Insurance Company and its wholly owned subsidiary, Peninsula Indemnity Company, or collectively, Peninsula, and Southern Insurance Company of Virginia, or Southern. Donegal Mutual has a 100% quota-share reinsurance agreement with Southern Mutual Insurance Company, or Southern Mutual, and Donegal Mutual places its assumed business from Southern Mutual into the underwriting pool. Donegal Mutual wholly owns and has a 100% quota-share reinsurance agreement with the Mountain States insurance subsidiaries. Beginning with policies effective in 2021, Donegal Mutual places its assumed business from the Mountain States insurance subsidiaries into the underwriting pool.

The following chart depicts our organizational structure, including all of our property and casualty insurance subsidiaries and affiliates:

| | (1) | Because of the different relative voting power of our Class A common stock and our Class B common stock, our public stockholders hold approximately 29% of the combined voting power of our Class A common stock and our Class B common stock and Donegal Mutual holds approximately 71% of the combined voting power of our Class A common stock and our Class B common stock. |

Relationship with Donegal Mutual

Donegal Mutual provides facilities, management and other services to us and our insurance subsidiaries. In addition, Donegal Mutual purchases and maintains the information technology systems that support the business of Donegal Mutual and our insurance subsidiaries. Donegal Mutual allocates certain related expenses to Atlantic States in accordance with the relative participation of Donegal Mutual and Atlantic States in the pooling agreement. Our insurance subsidiaries other than Atlantic States reimburse Donegal Mutual for allocated costs of services Donegal Mutual provides on their behalf based on their proportion of the total direct premiums written of the Donegal Insurance Group and other metrics. Allocated expenses from Donegal Mutual for services it provided to Atlantic States and our other insurance subsidiaries totaled $219.0 million, $199.2 million and $186.6 million for 2023, 2022 and 2021, respectively.

Donegal Mutual is the employer of record for all personnel who provide services for our insurance subsidiaries. Donegal Mutual strives to maintain a culture that is based on integrity and respect, with an environment designed to facilitate excellent service to the agents and customers of the Donegal Insurance Group. At December 31, 2023, Donegal Mutual had 872 employees, of which 456 were based in its Marietta, Pennsylvania headquarters and 416 were based in regional offices or were permanent remote employees. There were 861 full-time employees and 11 part-time employees. Many of Donegal Mutual’s employees work remotely from their homes or follow a hybrid schedule that includes working several days in their assigned office to allow for enhanced collaboration and interaction with other employees. Donegal Mutual targets employee compensation that is competitive and consistent with an employee’s position, knowledge, experience and skill level. Donegal Mutual provides annual wage increases that are based on merit. Donegal Mutual provides an annual cash incentive plan for all of its employees that provides an opportunity for Donegal Mutual’s employees to earn a bonus as a percentage of their annual wages that varies based on the level of underwriting profit Donegal Insurance Group achieves for a calendar year. In addition, Donegal Mutual provides to its full-time employees a comprehensive employee benefits program, including medical, dental and vision insurance, paid time off, and a 401(k) retirement plan that includes company matching provisions. Donegal Mutual also provides substantial training, development and wellness programs and resources to its employees.

Our insurance subsidiaries have a catastrophe reinsurance agreement with Donegal Mutual, pursuant to which Donegal Mutual provides coverage for losses related to any catastrophic occurrence over a set retention of $3.0 million ($2.0 million for 2022 and 2021) for each participating insurance subsidiary, with a combined retention of $6.0 million ($5.0 million for 2022 and 2021) for a catastrophe involving a combination of participating insurance subsidiaries, up to the amount Donegal Mutual and our insurance subsidiaries retain under catastrophe reinsurance agreements with unaffiliated reinsurers. The purpose of the catastrophe reinsurance agreement is to lessen the effects of an accumulation of losses arising from one event to levels that are appropriate given each subsidiary’s size, underwriting profile and surplus.

Donegal Mutual had a quota-share reinsurance agreement with MICO for policies effective through December 31, 2021. The purpose of the quota-share reinsurance agreement with MICO was to transfer to Donegal Mutual 25% of the premiums and losses related to MICO’s business. Donegal Mutual placed its assumed business from MICO into the underwriting pool. Donegal Mutual and MICO terminated this reinsurance agreement on a run-off basis effective January 1, 2022. As a result, MICO retains 100% of its net premiums and losses beginning with policies effective as of that date.

Donegal Mutual had a quota-share reinsurance agreement with Peninsula for policies effective through December 31, 2021. The purpose of the quota-share reinsurance agreement with Peninsula was to transfer to Donegal Mutual 100% of the premiums and losses related to the workers’ compensation product line of Peninsula in certain states. Donegal Mutual placed its assumed business from Peninsula into the underwriting pool. Donegal Mutual and Peninsula terminated this reinsurance agreement on a run-off basis effective January 1, 2022. As a result, Peninsula retains 100% of its net workers’ compensation premiums and losses beginning with policies effective as of that date.

We and Donegal Mutual have maintained a coordinating committee since our formation in 1986. The coordinating committee consists of two members of our board of directors, neither of whom is a member of Donegal Mutual’s board of directors, and two members of Donegal Mutual’s board of directors, neither of whom is a member of our board of directors. The purpose of the coordinating committee is to establish and maintain a process for an ongoing evaluation of the transactions between Donegal Mutual, our insurance subsidiaries and us. The coordinating committee considers the fairness of each intercompany transaction to Donegal Mutual and its policyholders and to us and our stockholders.

A new agreement or any change to a previously approved agreement must receive coordinating committee approval. The approval process for a new agreement between Donegal Mutual and us or one of our insurance subsidiaries or a change in such an agreement is as follows:

| • | both of our members on the coordinating committee must determine that the new agreement or the change in an existing agreement is fair and equitable to us and in the best interests of our stockholders; |

| • | both of Donegal Mutual’s members on the coordinating committee must determine that the new agreement or the change in an existing agreement is fair and equitable to Donegal Mutual and in the best interests of its policyholders; |

| • | our board of directors must approve the new agreement or the change in an existing agreement; and |

| • | Donegal Mutual’s board of directors must approve the new agreement or the change in an existing agreement. |

The coordinating committee also meets annually to review each existing agreement between Donegal Mutual and us or our insurance subsidiaries, including all reinsurance agreements between Donegal Mutual and our insurance subsidiaries. The purpose of this annual review is to examine the results of the agreements over the past year and, in the case of reinsurance agreements, over several years and to determine if the results of the existing agreements remain fair and equitable to us and our stockholders and fair and equitable to Donegal Mutual and its policyholders or if Donegal Mutual and we should mutually agree to certain adjustments to the terms of the agreements. In the case of reinsurance agreements, the annual adjustments typically relate to the reinsurance premiums and loss retention amounts. These agreements are ongoing in nature and will continue in effect throughout 2024 in the ordinary course of our business.

Our members on the coordinating committee, as of the date of this Form 10-K Report, are Barry C. Huber and Richard D. Wampler, II. Donegal Mutual’s members on the coordinating committee as of such date are Michael W. Brubaker and Michael K. Callahan, who replaced Cyril J. Greenya in January 2024. We refer to our proxy statement for our annual meeting of stockholders to be held on April 18, 2024 for further information about the members of the coordinating committee.

We believe our relationships with Donegal Mutual offer us and our insurance subsidiaries a number of competitive advantages, including the following:

| • | enabling our stable management, the consistent underwriting discipline of our insurance subsidiaries, external growth, long-term profitability and financial strength; |

| • | creating operational and expense synergies from the combination of resources and integrated operations of the Donegal Insurance Group; |

| • | producing more stable and uniform underwriting results for our insurance subsidiaries over extended periods of time than we could achieve without our relationship with Donegal Mutual; |

| • | providing opportunities for growth because of the ability of Donegal Mutual to affiliate and enter into reinsurance agreements with, or otherwise acquire control of, mutual insurance companies and place the business it assumes into the underwriting pool; and |

| • | providing Atlantic States with a significantly larger underwriting capacity because of the underwriting pool Donegal Mutual and Atlantic States have maintained since 1986. |

In the first quarter of 2024, our board of directors and the board of directors of Donegal Mutual each undertook a review of the relationships between Donegal Mutual and DGI and determined that continuing the current relationships and the current corporate structure of Donegal Mutual and DGI is in the best interests of DGI and its various constituencies.

Business Strategy

We and Donegal Mutual are focused on several primary strategies, including achieving sustained excellent financial performance, strategically modernizing our operations and processes to transform our business, capitalizing on opportunities to grow profitably and delivering a superior experience to our agents and policyholders. Our strategies are designed to provide value to the policyholders of Donegal Mutual and our respective insurance subsidiaries and, ultimately, to provide value to our stockholders. The annual net premiums earned of our insurance subsidiaries have increased from $301.5 million in 2006 to $882.1 million in 2023, a compound annual growth rate of 6.5%.

The combined ratio of our insurance subsidiaries and that of the United States property and casualty insurance industry as computed using United States generally accepted accounting principles, or GAAP, and statutory accounting principles, or SAP, for the years 2019 through 2023 are shown in the following table:

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| Our GAAP combined ratio | | | 104.4 | % | | | 103.3 | % | | | 101.0 | % | | | 96.0 | % | | | 99.5 | % |

| Our SAP combined ratio | | | 104.2 | | | | 103.3 | | | | 100.8 | | | | 95.4 | | | | 98.7 | |

Industry SAP combined ratio (1) | | | 103.7 | | | | 103.1 | | | | 99.6 | | | | 98.4 | | | | 98.9 | |

| (1) | As reported (projected for 2023) by A.M. Best Company. |

We and Donegal Mutual believe we can continue to expand our insurance operations over time through organic growth and acquisitions of, or affiliations with, other insurance companies. Our insurance subsidiaries and Donegal Mutual seek to increase their premium base by making quality independent agency appointments, enhancing their competitive position within each agency, introducing new and enhanced insurance products and developing and maintaining automated systems to improve service, communications and efficiency.

A detailed review of our business strategies follows:

| • | Achieving sustained excellent financial performance. |

Our insurance subsidiaries seek to achieve consistent underwriting profitability. Underwriting profitability is a fundamental component of our long-term financial strength because it allows our insurance subsidiaries to generate profits without relying exclusively on their investment income for profitability.

Our insurance subsidiaries seek to enhance their underwriting results by:

| • | carefully selecting the product lines they underwrite; |

| • | carefully selecting the individual risks they underwrite; |

| • | utilizing data analytics and predictive modeling tools to inform risk selection and pricing decisions; |

| • | managing their property exposures in catastrophe-prone areas; and |

| • | evaluating their claims history on a regular basis to ensure the adequacy of their underwriting guidelines and product pricing. |

Our insurance subsidiaries maintain discipline in their pricing by effecting rate increases to sustain or improve their underwriting results without unduly affecting their customer retention. In addition to appropriate pricing, our insurance subsidiaries seek to ensure that their premium rates are adequate relative to the risk exposures they insure. Our insurance subsidiaries review loss trends on a regular basis to identify changes in the frequency and severity of their claims and to assess the adequacy of their rates and underwriting standards. Our insurance subsidiaries also carefully monitor and audit the information they use to price their policies for the purpose of enabling them to receive an adequate level of premiums for the risk they assume. For example, our insurance subsidiaries audit the payroll data of their workers’ compensation customers to verify that the assumptions used to price a particular policy were accurate. By implementing appropriate rate increases and understanding the risks our insurance subsidiaries agree to insure, our insurance subsidiaries seek to achieve consistent underwriting profitability.

Our insurance subsidiaries monitor the performance of the product lines they underwrite and the geographies in which they offer their insurance products. Our insurance subsidiaries take specific actions to remediate underperforming product lines or geographies that include pricing increases, underwriting adjustments, reunderwriting initiatives as well as discontinuing a given product or withdrawing from a geography when our insurance subsidiaries determine they cannot reasonably expect to generate targeted profitability over time. For example, our insurance subsidiaries ceased writing new commercial lines policies and began non-renewing all existing commercial lines accounts in the states of Georgia and Alabama during 2023. Our insurance subsidiaries took this action after determining that they could not reasonably expect to generate targeted profitability within a reasonable period of time for commercial lines of business in those states.

Our insurance subsidiaries have no material exposures to asbestos or environmental liabilities. Our insurance subsidiaries seek to provide more than one policy to a given personal lines or commercial lines customer because this “account selling” strategy diversifies their risk and has historically improved their underwriting results. Our insurance subsidiaries also use reinsurance to manage their exposure and limit their maximum net loss from large single risks or risks in concentrated areas.

Our insurance subsidiaries maintain stringent expense controls under direct supervision of their senior management. We centralize the processing and administrative activities of our insurance subsidiaries to realize operating synergies and better expense control. Our insurance subsidiaries utilize technology to automate much of their underwriting, claims and billing processes and to facilitate agency and policyholder communications on an efficient, timely and cost-effective basis. Our insurance subsidiaries have increased their annual premium per employee, a measure of efficiency that our insurance subsidiaries use to evaluate their operations, from approximately $470,000 in 1999 to approximately $1.2 million in 2023.

Return on invested assets is an important element of the financial results of our insurance subsidiaries. The investment strategy of our insurance subsidiaries is to generate an appropriate amount of after-tax income on invested assets while limiting the potential impact of equity market volatility and minimizing credit risk through investments in high-quality securities. As a result, our insurance subsidiaries seek to invest a high percentage of their assets in diversified, highly rated and marketable fixed-maturity instruments. The fixed-maturity portfolios of our insurance subsidiaries consist of both taxable and tax-exempt securities. Our insurance subsidiaries maintain a portion of their portfolios in short-term securities to provide liquidity for the payment of claims and operation of their respective businesses. Our insurance subsidiaries maintain a small percentage (2.0% at December 31, 2023) of their portfolios in equity securities that have a history of paying cash dividends or that our insurance subsidiaries expect will appreciate in value over time.

| • | Strategically modernizing our operations and processes to transform our business. |

In 2018, Donegal Mutual initiated a multi-year systems modernization project to replace its remaining legacy systems, streamline business processes and workflows and enhance data analytics and modeling capabilities. In February 2020, Donegal Mutual implemented the first release of new systems related to the project, and our insurance subsidiaries began to issue workers’ compensation policies from the new systems in the second quarter of 2020. In August 2021, Donegal Mutual implemented the second release of new systems related to the project, including a new agency portal and the rating, underwriting and policy issuance capabilities necessary to support the launch of new personal lines products, and our insurance subsidiaries began to issue new personal lines products from the new systems in the fourth quarter of 2021. In 2023, Donegal Mutual implemented two additional major releases of new systems, which included three commercial lines of business with enhanced straight-through-processing capabilities as well as dwelling fire and conversion of legacy homeowners renewal policies in two initial states. Over the next two years, Donegal Mutual expects to implement new systems for the remaining lines of business the Donegal Insurance Group issues currently and for the conversion of remaining legacy renewal policies of the Donegal Insurance Group.

We have an enterprise analytics department that is focused on integrating data and analytics into strategy and decision-making at all levels of our organization. The enterprise analytics team is responsible for core functions of rate-making, predictive analytics, data management and business intelligence. These responsibilities include the development and expansion of risk-based pricing segmentation, analytical innovation, predictive modeling solutions, formal data strategies, performance monitoring and enhanced reporting mechanisms. We developed and began executing a pricing and analytics roadmap that will continue to deliver data-driven insights to our underwriters. This roadmap includes ongoing development and enhancement of quality tools that allow us to operationalize pricing and underwriting predictive models, integrate internal and external data for better-informed pricing and underwriting decisions and enhance the automation and precision of our rate indication methodology. Our enterprise analytics team is continuing to develop new tools and solutions that are enhancing our product portfolio management capabilities, competitive intelligence, pricing sophistication and utilization of data to monitor and manage our operations. The team also generates reporting and analyses that enable us to draw business insights from data that drive actions to improve performance.

We are focused on process excellence and have prepared a multi-year roadmap for addressing those opportunities. We are also expanding our data management personnel and capabilities to continually ensure the data upon which we rely for our business decisions and financial reporting is complete, accurate and secure. We have assigned an innovation task force the responsibility to research emerging technologies and identify potential technology solutions that might assist us in achieving our business strategies.

| • | Capitalizing on opportunities to grow profitably. |

Continued expansion of our insurance subsidiaries within their existing markets will be a key source of their continued premium growth, and maintaining an effective network of independent agencies is integral to this expansion. Our insurance subsidiaries seek to be among the top three insurers within each of the independent agencies for the lines of business our insurance subsidiaries write by providing a consistent, competitive and stable market for their products. We believe that the consistency of the product offerings of our insurance subsidiaries enables our insurance subsidiaries to compete effectively for independent agents with other insurers whose product offerings may fluctuate based on industry conditions. Our insurance subsidiaries offer a competitive compensation program to their independent agents that rewards them for producing profitable growth and maintaining profitable books of business with our insurance subsidiaries.

Our insurance subsidiaries execute a combined annual business plan with Donegal Mutual and its insurance subsidiaries. Within the past several years, we enhanced the annual planning process to ensure that we are directing efforts and resources toward geographic regions, market segments, product lines and classes of business that will give us the best opportunities to achieve sustained growth and profitability. As part of the planning process, we perform a detailed analysis of internal and external data with respect to each state within our operating regions. We assess state-specific marketing dynamics and opportunities, including an evaluation of the historical experience of our insurance subsidiaries. We then assign a strategic posture for each state and develop action plans to execute state-specific strategies for growth or reduction of premiums, agency distribution and enhanced profit generation over the next several years. As part of our property exposure management, we implemented tools that have allowed us to assign a strategic posture at a county level within each state. Our insurance subsidiaries utilize these tools to further manage and refine their concentrations of property risk exposure and to enhance their geographic risk diversification. We expect this strategy will reduce over time the overall impact of losses from severe weather events to the results of our insurance subsidiaries.

In recent years, the consolidation of independent agencies has accelerated, resulting in the acquisition of independent agencies from which our insurance subsidiaries and Donegal Mutual currently receive business by national cluster groups and aggregators. We have expanded our national accounts team that is responsible for the management and expansion of our relationships with these national agency groups. The national accounts team serves as a centralized point of contact for these groups and works directly with our regional sales and marketing teams to support and develop relationships with independent agents affiliated with national agency groups. We believe our relationships with existing and emerging national agency groups will continue to expand and that these groups represent a significant opportunity for profitable future growth.

| • | Delivering a superior experience to our agents and policyholders. |

Donegal Mutual and our insurance subsidiaries strive to maintain technology comparable to that of their larger competitors. “Ease of doing business” is a critically important component of an insurer’s value to an independent agency. Our insurance subsidiaries provide fully automated underwriting and policy issuance portals that substantially ease data entry and facilitate the quoting and issuance of policies for the independent agents of our insurance subsidiaries. As a result, applications of the independent agents for our insurance subsidiaries can result in policy issuance without further re-entry of information. These systems also interface with the agency management systems of the independent agents of our insurance subsidiaries. In addition, we continue to explore and implement new agency relationship management solutions to expand the abilities of our insurance subsidiaries to manage their agency relationships and enhance their agency communications and interactions.

Our insurance subsidiaries also provide their independent agents with ongoing support to enable them to better attract and service customers, including:

| • | availability of a personal lines service center that provides comprehensive service for our personal lines policyholders; |

| • | availability of a commercial lines small business unit to monitor straight-through processing results and enhance turnaround time for responses to agents for less complicated commercial risks; |

| • | availability of a commercial lines service center, which is an optional service enhancement for agencies who prefer that we interact directly with their customers for mid-term policy coverage changes and other service requests; and |

| • | accessibility to and regular interactions with marketing and underwriting personnel and senior management of our insurance subsidiaries. |

Our insurance subsidiaries appoint independent agencies with a strong underwriting and growth track record. We believe that our insurance subsidiaries will drive continued long-term growth by carefully selecting, motivating and supporting their independent agencies.

We believe that excellent policyholder service is important in attracting new policyholders and retaining existing policyholders. Our insurance subsidiaries work closely with their independent agents to provide a consistently responsive level of claims service, underwriting and customer support. Our insurance subsidiaries seek to respond expeditiously and effectively to address customer and independent agent inquiries in a number of ways, including:

| • | availability of a customer call center, secure website and mobile application for claims reporting; |

| • | availability of a secure website and mobile application for access to policy information and documents, payment processing and other features; |

| • | timely replies to information requests and policy submissions; and |

| • | prompt responses to, and processing of, claims. |

Our insurance subsidiaries periodically conduct policyholder surveys to evaluate the effectiveness of their service to policyholders. The management of our insurance subsidiaries meets on a regular basis with the personnel of the independent insurance agents our insurance subsidiaries appoint to seek service improvement recommendations, react to service issues and better understand local market conditions.

| • | Acquiring property and casualty insurance companies to augment the organic growth of our insurance subsidiaries. |

We have been an effective consolidator of smaller “main street” property and casualty insurance companies. While we are currently placing less emphasis on pursuing acquisitions due to several ongoing major initiatives to enhance our technology infrastructure as well as our analytical and processing capabilities, we expect to continue to acquire other insurance companies to expand our business in a given region over time.

Since 1998, we and Donegal Mutual have completed seven transactions involving acquisitions of property and casualty insurance companies or participation in the business of property and casualty insurance companies through Donegal Mutual’s entry into quota-share reinsurance agreements with them. We and Donegal Mutual intend to continue our growth by pursuing affiliations and acquisitions that meet our criteria. Our primary criteria are:

| • | location in regions where our insurance subsidiaries and Donegal Mutual are currently conducting business or that offer an attractive opportunity to conduct profitable business; |

| • | a mix of business similar to the mix of business of our insurance subsidiaries and Donegal Mutual; |

| • | annual premium volume between $50.0 million to $100.0 million; and |

| • | fair and reasonable transaction terms. |

We believe that our relationship with Donegal Mutual assists us in pursuing affiliations with, and subsequent acquisitions of, mutual insurance companies because, through Donegal Mutual, we understand the concerns and issues that mutual insurance companies face. In particular, Donegal Mutual has had success affiliating with underperforming mutual insurance companies that were operating at a competitive disadvantage due to lack of economies of scale compared to other industry participants, and we have either acquired them following their conversion to a stock company or benefited from their underwriting results as a result of Donegal Mutual’s entry into a 100% quota-share reinsurance agreement with them and placement of that assumed business into the pooling agreement. We evaluate a number of areas for operational synergies when considering acquisitions, including product underwriting, expenses, the cost of reinsurance and technology.

We believe that our ability to make direct acquisitions of stock insurance companies and to make indirect acquisitions of mutual insurance companies through Donegal Mutual provides us with flexibility that is a competitive advantage in making acquisitions. We also believe our historic record demonstrates our ability to acquire control of an underperforming insurance company utilizing a number of different acquisition structures and affiliation strategies, re-underwrite its book of business, reduce its cost structure and return it to sustained profitability.

While Donegal Mutual and we generally engage in preliminary discussions with potential direct or indirect acquisition candidates from time to time, neither Donegal Mutual nor we make any public disclosure regarding a proposed acquisition until Donegal Mutual or we have entered into a definitive acquisition agreement.

The following table highlights our and Donegal Mutual’s history of insurance company acquisitions and affiliations since 1998:

| Company Name | | State of Domicile | | Year Control Acquired | | Method of Acquisition/Affiliation |

Southern Heritage Insurance Company (1) | | Georgia | | 1998 | | Purchase of stock by us in 1998. |

| | | | | | | |

Le Mars Mutual Insurance Company of Iowa and then Le Mars Insurance Company (1) | | Iowa | | 2002 | | Surplus note investment by Donegal Mutual in 2002; conversion to stock company in 2004; acquisition of stock by us in 2004. |

| | | | | | | |

Peninsula Insurance Group | | Maryland | | 2004 | | Purchase of stock by us in 2004. |

| | | | | | | |

Sheboygan Falls Mutual Insurance Company and then Sheboygan Falls Insurance Company (1) | | Wisconsin | | 2007 | | Contribution note investment by Donegal Mutual in 2007; conversion to stock company in 2008; acquisition of stock by us in 2008. |

| | | | | | | |

Southern Mutual Insurance Company (2) | | Georgia | | 2009 | | Surplus note investment by Donegal Mutual and quota-share reinsurance in 2009. |

| | | | | | | |

Michigan Insurance Company | | Michigan | | 2010 | | Purchase of stock by us in 2010. |

| | | | | | | |

Mountain States Mutual Casualty Company(3) | | New Mexico | | 2017 | | Merger with and into Donegal Mutual in 2017. |

| | (1) | To reduce administrative and compliance costs and expenses, these subsidiaries subsequently merged into one of our existing insurance subsidiaries. |

| (2) | Control acquired by Donegal Mutual. |

| (3) | Donegal Mutual completed the merger of Mountain States with and into Donegal Mutual effective May 25, 2017. Donegal Mutual was the surviving company in the merger, and Mountain States insurance subsidiaries became insurance subsidiaries of Donegal Mutual upon completion of the merger. Donegal Mutual also entered into a 100% quota-share reinsurance agreement with the Mountain States insurance subsidiaries on the merger date. Beginning with policies effective in 2021, Donegal Mutual places the business of the Mountain States Insurance Group into the underwriting pool. |

Competition

The property and casualty insurance industry is highly competitive on the basis of both price and service. Numerous companies compete for business in the geographic areas where our insurance subsidiaries operate. Many of these other insurance companies are substantially larger and have greater financial resources than those of our insurance subsidiaries. In addition, because our insurance subsidiaries and Donegal Mutual market their respective insurance products exclusively through independent insurance agencies, most of which represent more than one insurance company, our insurance subsidiaries face competition within agencies, as well as competition to retain qualified independent agents. Insurance companies that are substantially larger than our insurance subsidiaries are likely to benefit from certain cost synergies, and insurance companies that market their products directly to end consumers are likely to incur lower relative acquisition costs compared to those of our insurance subsidiaries.

Products and Underwriting

We report the results of our insurance operations in two segments: commercial lines of insurance and personal lines of insurance. The commercial lines our insurance subsidiaries write consist primarily of commercial automobile, commercial multi-peril and workers’ compensation insurance. The personal lines our insurance subsidiaries write consist primarily of private passenger automobile and homeowners insurance. We describe these lines of insurance in greater detail below:

Commercial

| • | Commercial automobile — policies that provide protection against liability for bodily injury and property damage arising from automobile accidents and protection against loss from damage to automobiles owned by the insured. |

| • | Commercial multi-peril — policies that provide protection to businesses against many perils, usually combining liability and physical damage coverages. |

| • | Workers’ compensation — policies employers purchase to provide benefits to employees for injuries sustained during employment. The workers’ compensation laws of each state determine the extent of the coverage we provide. |

Personal

| • | Private passenger automobile — policies that provide protection against liability for bodily injury and property damage arising from automobile accidents and protection against loss from damage to automobiles owned by the insured. |

| • | Homeowners — policies that provide coverage for damage to residences and their contents from a broad range of perils, including fire, lightning, windstorm and theft. These policies also cover liability of the insured arising from injury to other persons or their property while on the insured’s property and under other specified conditions. |

In recent years, we have taken actions to shift our business mix to a higher proportion of commercial business, where we believe we will continue to have opportunities to achieve profitable, sustainable long-term growth. Due to our decision to exit the commercial lines markets in Georgia and Alabama that reduced commercial lines premiums and the significant personal lines rate increases we implemented to restore profitability while maintaining strong policy retention rates that increased personal lines premiums, our 2023 business mix did not reflect this strategic shift that we expect will resume as we concentrate on profitable commercial growth opportunities in the future. We are executing state-specific strategies that include accelerating growth in states where we see opportunities for profitable growth and reducing exposures in states we have targeted for profit improvement. While we expect to place greater emphasis on commercial growth for the foreseeable future, we desire to maintain a profitable book of personal business to provide enhanced stability across our product portfolio and increase our brand value to our independent agents. Donegal Mutual and our insurance subsidiaries offer personal lines products in ten states through a modern, user-friendly online agency portal. These products feature comprehensive coverage options, modernized rating methodology, enhanced pricing segmentation, application of predictive analytical models and utilization of third-party data to augment pricing and risk selection. Due to ongoing inflationary pressures on loss costs, we carefully managed personal lines exposure growth in 2023, while implementing premium rate increases throughout the year. In 2024, we plan to continue implementing premium rate increases and managing exposures to restore the profitability of our personal lines segment.

The following table sets forth the net premiums written of our insurance subsidiaries by line of insurance for the periods indicated:

| | | Year Ended December 31, | |

| | | 2023 | | | 2022 | | | 2021 | |

| (dollars in thousands) | | Amount | | | % | | | Amount | | | % | | | Amount | | | % | |

| Commercial lines: | | | | | | | | | | | | | | | | | | |

| Automobile | | $ | 174,741 | | | | 19.5 | % | | $ | 167,774 | | | | 19.9 | % | | $ | 161,947 | | | | 20.1 | % |

| Workers’ compensation | | | 107,598 | | | | 12.0 | | | | 111,892 | | | | 13.3 | | | | 113,256 | | | | 14.1 | |

| Commercial multi-peril | | | 195,632 | | | | 21.8 | | | | 200,045 | | | | 23.7 | | | | 188,242 | | | | 23.4 | |

| Other | | | 50,458 | | | | 5.7 | | | | 51,135 | | | | 6.0 | | | | 49,229 | | | | 6.1 | |

| Total commercial lines | | | 528,429 | | | | 59.0 | | | | 530,846 | | | | 62.9 | | | | 512,674 | | | | 63.7 | |

| Personal lines: | | | | | | | | | | | | | | | | | | | | | | | | |

| Automobile | | | 215,957 | | | | 24.1 | | | | 181,129 | | | | 21.5 | | | | 170,578 | | | | 21.2 | |

| Homeowners | | | 139,688 | | | | 15.6 | | | | 120,087 | | | | 14.2 | | | | 109,974 | | | | 13.7 | |

| Other | | | 11,623 | | | | 1.3 | | | | 11,468 | | | | 1.4 | | | | 11,041 | | | | 1.4 | |

| Total personal lines | | | 367,268 | | | | 41.0 | | | | 312,684 | | | | 37.1 | | | | 291,593 | | | | 36.3 | |

| Total business | | $ | 895,697 | | | | 100.0 | % | | $ | 843,530 | | | | 100.0 | % | | $ | 804,267 | | | | 100.0 | % |

The commercial lines and personal lines underwriting departments of our insurance subsidiaries evaluate and select those risks that they believe will enable our insurance subsidiaries to achieve an underwriting profit. Within each of the underwriting departments, our insurance subsidiaries have dedicated product development and management teams responsible for the development of quality products at competitive prices to promote growth and profitability as well as the enhancement of our current products to meet targeted customer needs.

In order to achieve underwriting profitability on a consistent basis, our insurance subsidiaries:

| • | assess and select primarily standard and preferred risks; |

| • | adhere to disciplined underwriting guidelines; |

| • | seek to price risks appropriately based on exposure, risk characteristics, utilization of predictive models and application of underwriting judgment; and |

| • | utilize various types of risk management and loss control services. |

Our insurance subsidiaries also review their existing portfolio of insured accounts to determine whether certain risks or classes of business continue to meet their underwriting guidelines and margin expectations. If a given account or class of business no longer meets those underwriting guidelines or margin expectations, our insurance subsidiaries will take appropriate action regarding that account or class of business, including raising premium rates or non-renewing policies to the extent applicable laws and regulations permit.

As part of the effort of our insurance subsidiaries to maintain acceptable underwriting results, they conduct annual reviews of agencies that have failed to meet their underwriting profitability criteria. The review process includes an analysis of the underwriting and re-underwriting practices of the agency, the completeness and accuracy of the applications the agency submits, the adequacy of the training of the agency’s staff and the agency’s record of adherence to the underwriting guidelines and service standards of our insurance subsidiaries. Based on the results of this review process, the marketing and underwriting personnel of our insurance subsidiaries develop, together with the agency, a plan to improve its underwriting profitability. Our insurance subsidiaries monitor the agency’s compliance with the plan and take other measures as required in the judgment of our insurance subsidiaries, including the termination, to the extent applicable laws and regulations permit, of agencies that are unable to achieve acceptable underwriting profitability.

Distribution

Our insurance subsidiaries market their products primarily in the Mid-Atlantic, Midwestern, New England, Southern and Southwestern regions through approximately 2,200 independent insurance agencies. At December 31, 2023, the Donegal Insurance Group actively wrote business in 23 states (Arizona, Colorado, Delaware, Georgia, Illinois, Indiana, Iowa, Maine, Maryland, Michigan, Nebraska, New Hampshire, New Mexico, North Carolina, Ohio, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, and Wisconsin). Donegal Mutual includes the business it writes directly and assumes from the Mountain States insurance subsidiaries in five Southwestern states (Arizona, Colorado, New Mexico, Texas and Utah) in the pooling agreement between Donegal Mutual and Atlantic States. We believe the relationships of our insurance subsidiaries with their independent agents are valuable in identifying, obtaining and retaining profitable business. Our insurance subsidiaries maintain a stringent agency selection procedure that emphasizes appointing agencies with proven marketing strategies for the development of profitable business, and our insurance subsidiaries only appoint agencies with a strong underwriting history and potential growth capabilities. Our insurance subsidiaries also regularly evaluate the independent agencies that represent them based on their profitability and performance in relation to the objectives of our insurance subsidiaries. Our insurance subsidiaries seek to be among the top three insurers within each of their agencies for the lines of business our insurance subsidiaries write.

The following table sets forth the percentage of direct premiums our insurance subsidiaries write, including 80% of the direct premiums Donegal Mutual and Atlantic States include in the underwriting pool, in each of the states where they conducted a significant portion of their business in 2023:

| Pennsylvania | | | 36.7 | % |

| Michigan | | | 15.9 | |

| Maryland | | | 8.7 | |

| Delaware | | | 6.6 | |

| Virginia | | | 6.3 | |

| Ohio | | | 3.9 | |

| Georgia | | | 3.2 | |

| Wisconsin | | | 3.2 | |

| Indiana | | | 2.8 | |

| North Carolina | | | 2.4 | |

| Tennessee | | | 1.7 | |

| Other | | | 8.6 | |

| Total | | | 100.0 | % |

Our insurance subsidiaries employ a number of policies and procedures that we believe enable them to attract, retain and motivate their independent agents. We believe that the consistency of the product offerings of our insurance subsidiaries enables our insurance subsidiaries to compete effectively for independent agents with other insurers whose product offerings may fluctuate based upon industry conditions. Our multi-year systems modernization project is further enhancing the ability of our insurance subsidiaries to conduct business with their independent agents and to develop and implement new products. Our insurance subsidiaries have a competitive compensation program for their independent agents that includes base commissions, growth incentive plans and a profit-sharing plan, consistent with applicable state laws and regulations, under which the independent agents may earn additional commissions based upon the volume of premiums produced and the profitability of the business our insurance subsidiaries receive from that agency. We have an agency stock purchase plan that allows our independent agents to purchase our Class A common stock at a discount to market prices to further align the interests of our independent agents with the interests of our stockholders.

Our insurance subsidiaries encourage their independent agents to focus on “account selling,” or serving all of a particular insured’s property and casualty insurance needs, which our insurance subsidiaries believe generally results in more favorable loss experience than covering a single risk for an individual insured.

Technology

Donegal Mutual owns and manages the technology that our insurance subsidiaries utilize on a daily basis. The technology is comprised of highly integrated agency-facing and back-end processing systems that operate within an advanced, modernized infrastructure that provides high service levels for performance, reliability, security and availability. Donegal Mutual maintains disaster recovery and backup systems and tests these systems on a regular basis. Our insurance subsidiaries bear their proportionate share of information services expenses based on their respective percentage of the total net premiums written of the Donegal Insurance Group.

The business strategy and ultimate success of our insurance subsidiaries depends on the effectiveness of efficient and integrated business systems and technology infrastructure. These systems enable our insurance subsidiaries to provide quality service to agents and policyholders by processing business in a timely and dependable manner, communicate and share data with agents and provide a variety of methods for the payment of premiums. These systems also allow for the accumulation and analysis of data and information for the management of our insurance subsidiaries. Donegal Mutual is currently in the midst of a multi-year effort to modernize certain of its key infrastructure and applications systems we describe in more detail under “Business - Business Strategy - Strategically modernizing our operations and processes to transform our business.”

The modernized proficiency of these integrated technology systems facilitates high service levels for the agents and policyholders of our insurance subsidiaries, increased efficiencies in processing the business of our insurance subsidiaries and lower operating costs. Key components of these technology systems include agency interface systems, automated policy management systems, a claims processing system and a billing administration system. The agency interface systems provide our insurance subsidiaries with a comprehensive single source to facilitate data sharing both to and from agents’ systems and also provides agents with an integrated means of processing new business. The automated policy management systems provide agents with the ability to generate underwritten quotes and automatically issue policies that meet the underwriting guidelines of our insurance subsidiaries with limited or no intervention by their personnel. The claims processing system allows our insurance subsidiaries to process claims efficiently and in an automated environment. The billing administration system allows our insurance subsidiaries to process premium billing and collection efficiently and in an automated environment.

We believe Donegal Mutual’s agency-facing technology systems compare well against those of many national property and casualty insurance carriers in terms of feature capabilities and service levels. Donegal Mutual maintains a regular interactive forum with its independent agents to be proactive in identifying opportunities for continued automation and technology enhancements.

Claims

The management of claims is a critical component of the philosophy of our insurance subsidiaries to achieve underwriting profitability on a consistent basis and is fundamental to the successful operations of our insurance subsidiaries and their dedication to excellent service. Our senior claims management oversees the claims processing units of each of our insurance subsidiaries to assure consistency in the claims settlement process. The field office staff of our insurance subsidiaries receives support from home office technical, litigation, material damage, subrogation and medical audit personnel.

The claims departments of our insurance subsidiaries rigorously manage claims to assure that they settle legitimate claims quickly and fairly and that they identify questionable claims for defense. In the majority of cases, the personnel of our insurance subsidiaries, who have significant experience in the property and casualty insurance industry and know the service philosophy of our insurance subsidiaries, adjust claims. Our insurance subsidiaries provide various means of claims reporting on a 24-hours a day, seven-days a week basis, including toll-free numbers and electronic reporting through our website and mobile application. Our insurance subsidiaries strive to respond to notifications of claims promptly, generally within the day reported. Our insurance subsidiaries believe that, by responding promptly to claims, they provide quality customer service and minimize the ultimate cost of the claims. Our insurance subsidiaries engage independent adjusters as needed to handle claims in areas in which the volume of claims is not sufficient to justify the hiring of internal claims adjusters by our insurance subsidiaries. Our insurance subsidiaries also employ independent adjusters and private investigators, structural experts and outside legal counsel to supplement their internal staff and to assist in the investigation of claims. Our insurance subsidiaries have a special investigative unit primarily staffed by former law enforcement officers that attempts to identify and prevent fraud and abuse and to investigate questionable claims.

The management of the claims departments of our insurance subsidiaries develops and implements policies and procedures for the establishment of adequate claim reserves. Our insurance subsidiaries employ an actuarial staff that regularly reviews their reserves for incurred but not reported claims. The management and staff of the claims departments resolve policy coverage issues, manage and process reinsurance recoveries and handle salvage and subrogation matters. The litigation and personal injury sections of our insurance subsidiaries manage all claims litigation. Branch office claims above certain thresholds require home office review and settlement authorization. Our insurance subsidiaries provide their claims adjusters reserving and settlement authority based upon their experience and demonstrated abilities. Larger or more complicated claims require consultation and approval of senior claims department management.

Liabilities for Losses and Loss Expenses

Liabilities for losses and loss expenses are estimates at a given point in time of the amounts an insurer expects to pay with respect to incurred policyholder claims based on facts and circumstances the insurer knows at that point in time. For example, legislative, judicial and regulatory actions may expand coverage definitions, retroactively mandate coverage or otherwise require our insurance subsidiaries to pay losses for damages that their policies explicitly excluded or did not intend to cover. At the time of establishing its estimates, an insurer recognizes that its ultimate liability for losses and loss expenses will exceed or be less than such estimates. Our insurance subsidiaries base their estimates of liabilities for losses and loss expenses on assumptions as to future loss trends, expected claims severity, judicial theories of liability and other factors. However, during the loss adjustment period, our insurance subsidiaries may learn additional facts regarding individual claims, and, consequently, it often becomes necessary for our insurance subsidiaries to refine and adjust their estimates for these liabilities. We reflect any adjustments to the liabilities for losses and loss expenses of our insurance subsidiaries in our consolidated results of operations in the period in which our insurance subsidiaries make adjustments to their estimates.

Our insurance subsidiaries maintain liabilities for the payment of losses and loss expenses with respect to both reported and unreported claims. Our insurance subsidiaries establish these liabilities for the purpose of covering the ultimate costs of settling all losses, including investigation and litigation costs. Our insurance subsidiaries base the amount of their liability for reported losses primarily upon a case-by-case evaluation of the type of risk involved, knowledge of the circumstances surrounding each claim and the insurance policy provisions relating to the type of loss the policyholder incurred. Our insurance subsidiaries determine the amount of their liability for unreported claims and loss expenses on the basis of historical information by line of insurance. Our insurance subsidiaries account for inflation in the reserving function through analysis of costs and trends and reviews of historical reserving results. Our insurance subsidiaries monitor their liabilities closely and recompute them periodically using new information on reported claims and a variety of statistical techniques. Our insurance subsidiaries do not discount their liabilities for losses and loss expenses.

Reserve estimates can change over time because of unexpected changes in assumptions related to our insurance subsidiaries’ external environment and, to a lesser extent, assumptions related to our insurance subsidiaries’ internal operations. For example, our insurance subsidiaries have experienced an increase in claims severity and a lengthening of the claim settlement periods on bodily injury claims during the past several years. In addition, the COVID-19 pandemic and related government mandates and restrictions resulted in various changes from historical claims reporting and settlement trends during 2020 and resulted in significant increases in loss costs in 2022 and 2023 due to a number of factors, including supply chain disruption, higher new and used automobile values, increases in the cost of replacement automobile parts and rising labor rates. While these trend changes have begun to normalize, they caused significant disruption to historical loss patterns and give rise to greater uncertainty as to the pattern of future loss settlements. Related uncertainties regarding future trends include social inflation, availability and cost of replacement automobile parts and building materials, availability of skilled labor, the rate of plaintiff attorney involvement in claims and the cost of medical technologies and procedures. Assumptions related to our insurance subsidiaries’ external environment include the absence of significant changes in tort law and the legal environment that increase liability exposure, consistency in judicial interpretations of insurance coverage and policy provisions and the rate of loss cost inflation. Internal assumptions include consistency in the recording of premium and loss statistics, consistency in the recording of claims, payment and case reserving methodology, accurate measurement of the impact of rate changes and changes in policy provisions, consistency in the quality and characteristics of business written within a given line of business and consistency in reinsurance coverage and collectability of reinsured losses, among other items. To the extent our insurance subsidiaries determine that underlying factors impacting their assumptions have changed, our insurance subsidiaries make adjustments in their reserves that they consider appropriate for such changes. Accordingly, our insurance subsidiaries’ ultimate liability for unpaid losses and loss expenses will likely differ from the amount recorded at December 31, 2023. For every 1% change in our insurance subsidiaries’ loss and loss expense reserves, net of reinsurance recoverable, the effect on our pre-tax results of operations would be approximately $6.9 million.

The establishment of appropriate liabilities is an inherently uncertain process and we can provide no assurance that our insurance subsidiaries’ ultimate liability will not exceed our insurance subsidiaries’ loss and loss expense reserves and have an adverse effect on our results of operations and financial condition. Furthermore, we cannot predict the timing, frequency and extent of adjustments to our insurance subsidiaries’ estimated future liabilities, because the historical conditions and events that serve as a basis for our insurance subsidiaries’ estimates of ultimate claim costs may change. As is the case for substantially all property and casualty insurance companies, our insurance subsidiaries have found it necessary in the past to increase their estimated future liabilities for losses and loss expenses in certain periods and, in other periods, their estimated future liabilities for losses and loss expenses have exceeded their actual liabilities for losses and loss expenses. Changes in our insurance subsidiaries’ estimates of their liability for losses and loss expenses generally reflect actual payments and their evaluation of information received subsequent to the prior reporting period. Our insurance subsidiaries recognized a decrease in their liability for losses and loss expenses of prior years of $16.7 million, $44.8 million and $31.2 million in 2023, 2022 and 2021, respectively. Our insurance subsidiaries made no significant changes in their reserving philosophy or claims management personnel, and they have made no significant offsetting changes in estimates that increased or decreased their loss and loss expense reserves in those years. The 2023 development represented 2.5% of the December 31, 2022 net carried reserves and resulted primarily from lower-than-expected loss emergence in the personal automobile and commercial automobile lines of business for accident years prior to 2023. The majority of the 2023 development related to decreases in the liability for losses and loss expenses of prior years for Atlantic States and MICO. The 2022 development represented 7.2% of the December 31, 2021 net carried reserves and resulted primarily from lower-than-expected loss emergence in the personal automobile and commercial automobile lines of business for accident years prior to 2022. The majority of the 2022 development related to decreases in the liability for losses and loss expenses of prior years for Atlantic States and MICO. The 2021 development represented 5.6% of the December 31, 2020 net carried reserves and resulted primarily from lower-than-expected loss emergence in the personal automobile, workers’ compensation and commercial automobile lines of business for accident years prior to 2021. The majority of the 2021 development related to decreases in the liability for losses and loss expenses of prior years for Atlantic States and MICO.

Excluding the impact of severe weather events and the COVID-19 pandemic, our insurance subsidiaries have noted stable amounts in the number of claims incurred and the number of claims outstanding at period ends relative to their premium base in recent years across most of their lines of business. However, the amount of the average claim outstanding has increased gradually over the past several years due to various factors such as increased property and automobile repair and replacement costs, rising medical loss costs and increased litigation trends. We have also experienced a general slowing of settlement rates in litigated claims and lengthening of repair completion times for property and automobile claims. Our insurance subsidiaries could have to make further adjustments to their estimates in the future. However, on the basis of our insurance subsidiaries’ internal procedures, which analyze, among other things, their prior assumptions, their experience with similar cases and historical trends such as reserving patterns, loss payments, pending levels of unpaid claims and product mix, as well as court decisions, economic conditions and public attitudes, we believe that our insurance subsidiaries have made adequate provision for their liability for losses and loss expenses.

Atlantic States’ participation in the underwriting pool with Donegal Mutual exposes Atlantic States to adverse loss development on the business that Donegal Mutual contributes to the underwriting pool. However, pooled business represents the predominant percentage of the net underwriting activity of both companies, and Donegal Mutual and Atlantic States share proportionately any adverse risk development relating to the pooled business. The business in the underwriting pool is homogeneous, and each company has a pro-rata share of the entire underwriting pool. Since the predominant percentage of the business of Atlantic States and Donegal Mutual is pooled and the results shared by each company according to its participation level under the terms of the pooling agreement, the intent of the underwriting pool is to produce a more uniform and stable underwriting result from year to year for each company than either would experience individually and to spread the risk of loss between the companies.

Differences between liabilities reported in our financial statements prepared on a GAAP basis and our insurance subsidiaries’ financial statements prepared on a SAP basis result from anticipating salvage and subrogation recoveries for GAAP but not for SAP. These differences amounted to $32.4 million, $28.7 million and $23.5 million at December 31, 2023, 2022 and 2021, respectively.

The following table sets forth a reconciliation of the beginning and ending GAAP net liability of our insurance subsidiaries for unpaid losses and loss expenses for the periods indicated:

| | | Year Ended December 31, | |

| (in thousands) | | 2023 | | | 2022 | | | 2021 | |

| Gross liability for unpaid losses and loss expenses at beginning of year | | $ | 1,121,046 | | | $ | 1,077,620 | | | $ | 962,007 | |

| Less reinsurance recoverable | | | 451,184 | | | | 451,261 | | | | 404,818 | |

| Cumulative effect of adoption of updated accounting guidance for credit losses at January 1 | | | 1,132 | | | | — | | | | — | |

| Net liability for unpaid losses and loss expenses at beginning of year | | | 670,994 | | | | 626,359 | | | | 557,189 | |

Provision for net losses and loss expenses for claims incurred in the current year | | | 625,831 | | | | 608,900 | | | | 551,918 | |

Change in provision for estimated net losses and loss expenses for claims incurred in prior years | | | (16,653 | ) | | | (44,821 | ) | | | (31,208 | ) |

| Total incurred | | | 609,178 | | | | 564,079 | | | | 520,710 | |

| Net losses and loss expense payments for claims incurred during: | | | | | | | | | | | | |

| The current year | | | 330,290 | | | | 302,272 | | | | 269,317 | |

| Prior years | | | 260,739 | | | | 218,304 | | | | 182,223 | |

| Total paid | | | 591,029 | | | | 520,576 | | | | 451,540 | |

| Net liability for unpaid losses and loss expenses at end of year | | | 689,143 | | | | 669,862 | | | | 626,359 | |

| Plus reinsurance recoverable | | | 437,014 | | | | 451,184 | | | | 451,261 | |

| Gross liability for unpaid losses and loss expenses at end of year | | $ | 1,126,157 | | | $ | 1,121,046 | | | $ | 1,077,620 | |

The following table sets forth the development of the liability for net unpaid losses and loss expenses of our insurance subsidiaries from 2013 to 2023. Loss data in the table includes business Atlantic States received from the underwriting pool.

“Net liability at end of year for unpaid losses and loss expenses” sets forth the estimated liability for net unpaid losses and loss expenses recorded at the balance sheet date for each of the indicated years. This liability represents the estimated amount of net losses and loss expenses for claims arising in the current and all prior years that are unpaid at the balance sheet date, including losses incurred but not reported.

The “Net liability re-estimated as of” portion of the table shows the re-estimated amount of the previously recorded liability based on experience for each succeeding year. The estimate increases or decreases as payments are made and more information becomes known about the severity of the remaining unpaid claims. For example, the 2013 liability has developed a deficiency after ten years because we expect the re-estimated net losses and loss expenses to be $23.7 million more than the estimated liability we initially established in 2013 of $265.6 million.

The “Cumulative deficiency (excess)” shows the cumulative deficiency or excess at December 31, 2023 of the liability estimate shown on the top line of the corresponding column. A deficiency in liability means that the liability established in prior years was less than the amount of actual payments and currently re-estimated remaining unpaid liability. An excess in liability means that the liability established in prior years exceeded the amount of actual payments and currently re-estimated unpaid liability remaining.

The “Cumulative amount of liability paid through” portion of the table shows the cumulative net losses and loss expense payments made in succeeding years for net losses incurred prior to the balance sheet date. For example, the 2013 column indicates that at December 31, 2023 payments equal to $282.0 million of the currently re-estimated ultimate liability for net losses and loss expenses of $289.3 million had been made.

| | | Year Ended December 31, | |

| (in thousands) | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | | | 2019 | | | 2020 | | | 2021 | | | 2022 | | | 2023 | |