Regulatory requirements, including RBC requirements, may impact our insurance subsidiaries’ ability to pay dividends. The amount of statutory capital and surplus necessary for our insurance subsidiaries to satisfy regulatory requirements, including RBC requirements, was not significant in relation to our insurance subsidiaries’ statutory capital and surplus at December 31, 2020. Generally, the maximum amount that one of our insurance subsidiaries may pay to us as ordinary dividends during any year after notice to, but without prior approval of, the insurance commissioner of its domiciliary state is limited to a stated percentage of that subsidiary’s statutory capital and surplus at December 31 of the preceding fiscal year or the net income of that subsidiary for its preceding fiscal year. Our insurance subsidiaries paid dividends to us of $14.0 million, $4.0 million and $11.0 million in 2020, 2019 and 2018, respectively. At December 31, 2020, the amount of ordinary dividends our insurance subsidiaries could pay to us during 2021, without the prior approval of their respective domiciliary insurance commissioners, is shown in the following table.

| | | | |

Name of Insurance Subsidiary | |

| |

| | $ | 27,979,670 | |

| | | 12,236,054 | |

| | | 10,907,098 | |

| | | 300,409 | |

| | | | |

| | $ | 51,423,231 | |

| | | | |

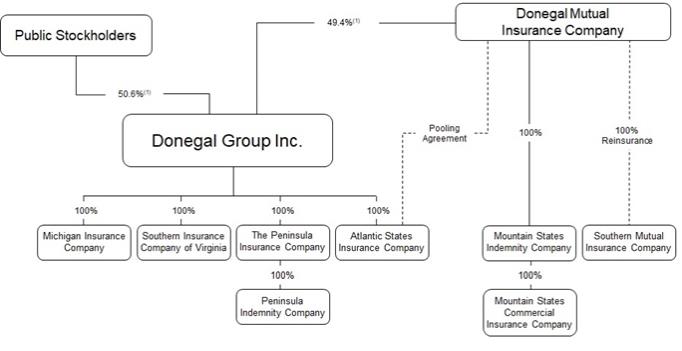

Donegal Mutual Insurance Company

Donegal Mutual organized as a mutual fire insurance company in Pennsylvania in 1889. At December 31, 2020, Donegal Mutual had admitted assets of $759.5 million and policyholders’ surplus of $319.4 million. At December 31, 2020, Donegal Mutual had total liabilities of $440.1 million, including reserves for net losses and loss expenses of $187.4 million and unearned premiums of $89.2 million. Donegal Mutual’s investment portfolio of $423.0 million at December 31, 2020 consisted primarily of investment-grade bonds of $183.0 million and its investment in our Class A common stock and our Class B common stock. At December 31, 2020, Donegal Mutual owned 10,267,692 shares, or approximately 42%, of our Class A common stock, which Donegal Mutual carried on its books at $146.7 million, and 4,654,339 shares, or approximately 84%, of our Class B common stock, which Donegal Mutual carried on its books at $66.5 million. We present Donegal Mutual’s financial information in accordance with SAP as the NAIC Accounting Practices and Procedures Manual requires. Donegal Mutual does not, nor is it required to, prepare financial statements in accordance with GAAP.

Cautionary Statement Regarding Forward-Looking Statements

This Form

10-K

Report and the documents we incorporate by reference in this Form

10-K

Report contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include certain discussions relating to underwriting, premium and investment income volumes, business strategies, reserves, profitability and business relationships and our other business activities during 2020 and beyond. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “objective,” “project,” “predict,” “potential,” “goal” and similar expressions. These forward-looking statements reflect our current views about future events and our current assumptions, and are subject to known and unknown risks and uncertainties that may cause our results, performance or achievements to differ materially from those we anticipate or imply by our forward-looking statements. We cannot control or predict many of the factors that could determine our future financial condition or results of operations. Such factors may include those we describe under “Risk Factors.” The forward-looking statements contained in this Form

10-K

Report reflect our views and assumptions only as of the date of this Form

10-K

Report. Except as required by law, we do not intend to update, and we assume no responsibility for updating, any forward-looking statements we have made. We qualify all of our forward-looking statements by these cautionary statements.