As filed with the Securities and Exchange Commission on July 6, 2007

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 W. 57th Street, 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt, President

The Tocqueville Trust

40 W. 57th Street, 19th Floor

New York, NY 10019

(Name and address of agent for service)

212-698-0800

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: April 30, 2007

Item 1. Report to Stockholders.

S E M I - A N N U A L R E P O R T

April 30, 2007

The Tocqueville Trust

Mutual Funds

The Tocqueville Fund

The Tocqueville Small Cap Value Fund

The Tocqueville International Value Fund

The Tocqueville Gold Fund

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of The Tocqueville Trust.

Please call 1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @ www.tocquevillefunds.com

Dear Fellow Shareholder,

Times like these are testing for value investors—especially those with a memory of market cycles past. It is no secret that most of our fund managers have been worried about the global economic environment for some time. It also is no secret that finding true value in ebullient markets has become more and more of a challenge.

It is therefore a tribute to our bottom-up discipline that our funds have continued to perform satisfactorily.

In a word, we all have opinions about the outlook for the economies or the markets, but in the end, individual investment ideas, if compelling enough, will always supersede our “macro” views. This discipline prevented us from being grossly underinvested, as our instincts might have led us to be, during this year’s up legs of the global stock markets.

This is not to say that our portfolio managers have not become more defensive. But in fact, “raising” the proportion of cash in a portfolio is a somewhat illusory way to protect one’s portfolio against major market declines, unless one boosts that proportion to almost 100%. Historically, we have rather viewed cash as “dry powder” to be able to freely take advantage of opportunities created by large declines—in true contrarian-value fashion.

Another way of becoming defensive is in the selection of investments in each fund portfolio. For example, some companies’ shares may represent value only if the next economic cycle allows their profits to expand. If we feel that the economy may be entering a recession, we will probably delay this investment. This kind of screening, together with a somewhat stricter application of our value criteria, results in a more defensive portfolio, without having to make drastic bets on the stock market outlook.

By and large, this kind of prudence characterizes the attitude of our portfolio managers at this juncture and is coherent with our long-term mission to preserve the wealth of our shareholders.

Respectfully,

Dear Fellow Shareholder,

For the first six months of our fiscal year ended April 30, 2007, the Tocqueville Fund registered a gain of 9.40%. Over the same period the S&P 500 Index rose 8.60%. As we have often stated in past letters, six month returns don’t mean very much and relative returns even less. Still it is gratifying to have kept pace with a market that has had a strong upward move, particularly since we expect typically to underperform hot markets.

Our returns were aided by companies that can be characterized as special situations like W.R. Grace, for example, which is emerging from bankruptcy, and Cleveland Cliffs and Alcoa, two companies involved in possible takeover situations, and Weyerhaeuser, in the midst of a restructuring. Most of our technology positions, particularly Cisco and Juniper Networks performed very well in the period as well as our energy names, Murphy Oil and Schlumberger. More important than all of these however, was the fact that the Fund held very few positions that lost it any money in the first half of the fiscal year. Our mantra for many years has been, “The best way to make money in the stock market is to avoid losing it.” The wisdom of that approach was evident in the period.

That said, it does appear, to me, as well as to many others, that the equity markets have come too far too fast. The recent, though long expected, rise in interest rates represents a sea change for the equity markets. Of even greater importance is the impact I expect it will have on the residential housing market. After a wild run-up in home prices that finally peaked early last year, the residential real estate market has weakened considerably in most areas outside of Manhattan. This weakness has occurred within the context of a strong economy, rising employment, low unemployment, and until just recently very low interest rates. How much more downward pressure on home prices will result from the higher interest rates is not known, but I do not expect it to be slight. Nor will this have a salutary effect on consumer spending, as the wealth effect of housing is far greater than the one exerted by the equity markets.

In the near term, the Federal Reserve is probably powerless to fight the rising interest rate scenario, worried, as they are by resurgent inflation and the level of the dollar. No wonder concern over the level of the markets has surfaced in many quarters.

While it is not comforting for a contrarian to find himself in the consensus, it does happen from time to time. But, worrying about the market is my stock in trade. More to the point, it does not inform my investment approach which is to look for unloved shares of solid companies selling at a discount to their intrinsic value. Regardless of how I may feel about the market, I am going to buy stocks that fit that description and sell ones that don’t. Through-out my long career I have been right far more often about individual stocks than I have been about the direction of the markets. So I am determined to stick with what I know how to do.

As a major investor in the Tocqueville Fund, as well, as its manger, I thank you for your support and loyalty to the Fund and our investment approach.

Sincerely,

Robert W. Kleinschmidt

Portfolio Manager

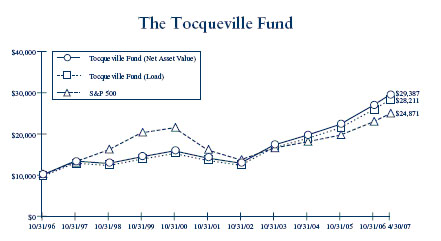

This chart assumes an initial gross investment of $10,000 made on 10/31/96. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2007

| | | | | |

| | 1 Year | 3 Year | 5 Year | 10 Year |

| Tocqueville Fund—Net Asset Value | 11.07% | 16.29% | 12.45% | 10.31% |

| Tocqueville Fund—Load* | 11.07% | 16.29% | 12.45% | 9.86% |

| Standard & Poor’s 500 Stock Index | 15.24% | 12.25% | 8.54% | 8.05% |

| * Effective February 1, 2000, the Fund eliminated its sales load. | | | | |

The Tocqueville Small Cap Value Fund

Dear Fellow Shareholder,

During the first half of this new fiscal year the Tocqueville Small Cap Value Fund posted a gain of 7.10% compared to the benchmark Russell 2000 Index return of 6.86%. Although many of the securities in the portfolio enjoyed modest gains, our returns were clearly driven by strong results in basic industries such as chemicals and energy related businesses. Looking back over the past two years these industrial companies have been the primary beneficiaries of a weak dollar and the expansion of the global economy.

When we examine the disarmingly persuasive argument that new found global prosperity will drive an unprecedented level of demand for the foreseeable future, we must ask ourselves if this is yet another new paradigm thesis packaged in a different, somewhat more fundamental, wrapper. Clearly communism has been discredited as an economically viable platform and China, Russia and the former Soviet Block countries have all embraced capitalism with unbridled enthusiasm creating millions of hungry new consumers. At the same time India and countries along the Pacific Rim have enhanced their standard of living by producing goods and services which can compete in the global marketplace. And, last but not least, the availability of capital and global liquidity have reached entirely new levels as commodity prices around the globe have enabled many emerging economies to recapitalize.

With all of this seemingly synchronized global growth taking place why should anyone be worried? Investors should be fully aware that even though it is currently fashionable to believe that the “new” global expansion will continue unabated for a very long time, I believe global expansion simply cannot continue without the active participation of the largest economic power in the world; the United States.

Although we acknowledge this global expansion may continue over the next several years we are quite cautious when it comes to the United States economy. Ignoring for the moment recent statements made by the esteemed Warren Buffet, we believe that the decline of the housing market will have a significant impact on the U.S. consumer and, in turn, retail spending. The immediate consequence of declining market values in residential real estate will be a de facto tightening of credit as banks move to eliminate secondary loans based on homeowner equity and restore order to the mortgage process. These factors alone should dampen the U.S. economy during 2007 and we look for consumer spending to slow considerably during the second half of the year.

Of course, the U.S. consumer has more to worry about than just housing. Energy prices remain stubbornly high, the dollar is down, Detroit is losing market share, medical insurance premiums continue to escalate, job growth has softened in recent months and we are still funding active military campaigns on two fronts. Thankfully for the American consumer global liquidity is extraordinarily high, U.S. interest rates have remained relatively low for the past five years and Federal Reserve Chairman Bernanke has not moved dramatically in his duty bound fight against inflation.

Given these economic realities we believe that the Tocqueville Small Cap Value Fund should be focused on securities that are less cyclical and less economically sensitive. During the first few months of 2007 we have increased our consumer staples positions and rebalanced our energy holdings while reducing our exposure to financial services companies and industrials. Over the long term we expect that our investments in health care, technology and bio-pharmaceuticals will produce positive results for the patient investor.

We will continue to employ our investment discipline in search of solid companies that are out of favor, under pressure for one reason or another or simply undiscovered by Wall Street. We greatly appreciate your continued support and thank you for your selection of the Tocqueville Small Cap Value Fund.

Sincerely,

Joseph Zock

Portfolio Manager

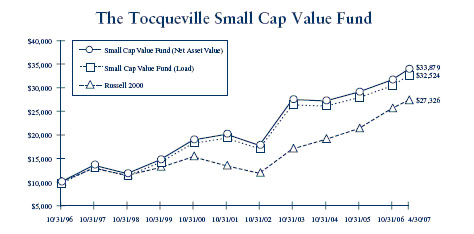

This chart assumes an initial gross investment of $10,000 made on 10/31/96. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost.

The Russell 2000 Index is an unmanaged index which measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2007

| | | | | |

| | 1 Year | 3 Year | 5 Year | 10 Year |

| Tocqueville Small Cap Value Fund—Net Asset Value | 3.71% | 3.07% | 7.04% | 12.60% |

| Tocqueville Small Cap Value Fund—Load* | 3.71% | 3.07% | 7.04% | 12.14% |

| Russell 2000 Index | 7.83% | 14.65% | 11.14% | 10.40% |

| * Effective February 1, 2000, the Fund eliminated its sales load. | | | | |

The Tocqueville International Value Fund

Dear Fellow Shareholder,

For the six months ended April 30th, 2007, the Tocqueville International Value Fund’s total U.S. dollar return was 10.67%. In the same period, the Morgan Stanley EAFE Index had a total U.S. dollar return of 15.68%.

The rally in global equity markets that began last June continued nearly uninterrupted during the six month period, driven by a powerful combination of corporate earnings growth, low interest rates, heated mergers and acquisitions activity, and corporate share repurchases. Liquidity remained abundant, with loose monetary policy and petrodollars creating a tsunami of money looking for investable assets. Global equity markets corrected in late February in response to a government-engineered sell-off in China and growing concerns regarding the U.S. sub-prime lending market, but recovered quickly during March. Toward the end of the period, the volume of carry trades—where investors borrow low yielding currencies to buy risk assets—grew substantially, suggesting a return to high investor risk tolerance.

During the six months, the European BE 500 Index increased by 10.88% in local currency terms, the Japanese Nikkei 225 Index increased by 6.67% in local currency terms and the Morgan Stanley Far East Index increased by

15.01%. The best performing sectors during the period included autos and auto parts, machinery, steel and other materials. Commodity dependent markets like Brazil and Indonesia were strong. India lagged as incipient inflation led the Central Bank to raise interest rates in an attempt to slow growth. The Euro increased by 6.94% against the U.S. dollar as growth prospects there continued to improve, and the Japanese Yen decreased by 2.11% as Japanese sold Yen to buy foreign assets and carry traders sold Yen short to borrow.

We had substantial gains in Finnish telecom equipment provider Nokia, whose operating and financial performance improved markedly and exceeded consensus expectations; in UK heat treatment company Bodycote, which was the subject of a takeover bid; in Anglo-Dutch consumer products company Unilever, which continued to benefit from productivity improvement measures and growth in emerging markets; in Malaysian REIT KLCC, whose prime real estate assets continue to increase in value; in Thai media company BEC World, which was re-rated as its market share of advertising dollars improved; in Japanese conglomerate Hitachi, which announced value-enhancing restructuring measures; and in Tokyo Broadcasting, where takeover rumors forced the realization of intrinsic value. We gave back gains in the Japanese game software stocks, which faded from investor focus after strong run-ups around the 2006 Christmas season, and in British Energy, as warm winter weather caused electricity prices to decline.

During the period, we initiated a new position in French radio operator NRJ, which we believe is overcapitalized, generates ample free cash flow, and trades at a discount to the intrinsic value of the French radio operation, offering the TV, international radio and mobile telecom operations for free. We also took a position in Israeli agricultural chemical producer Makhteshim-Agan, the leading global producer of generic crop protection products, which in our opinion has strong growth prospects and trades at low multiple of cash flow. We reduced our positions in Italian hydraulics manufacturer Interpump and Dutch animal feed maker Nutreco, both of which reached our valuation objectives. We also exited our positions in Dutch bakery ingredients maker CSM, a turnaround situation that had achieved our operational and valuation objectives, and Nintendo, where the success of the new Wii console produced a valuation premium in the stock.

We expect that many of the favorable conditions that have been driving equity market performance will persist. Global growth and improving corporate productivity will support earnings growth and mergers and acquisitions activity will support valuations. That said, there are signs of cost inflation, which could serve to slow earnings growth and eventually cause interest rates to rise, which would be negative for equities. Further, as we have noted in the past, the high level of risk tolerance among investors and low level of risk premium incorporated into equity valuations causes equities to be vulnerable to negative external shocks. We continue to focus our efforts on finding value in individual stocks that have fallen out of favor with investors due to short term operational and financial problems. We recently are finding opportunities in France, where we believe that a more market friendly government under new President Sarkozy will give companies wider scope to grow intrinsic value; in media companies, which generally remain out of favor with their traditional growth investor constituencies and are cheap on a cash flow basis; in Japan, in companies that are restructuring their operations to improve efficiency; and, in infrastructure related companies, that we expect to enjoy a multi-year cycle of growth in demand.

Over the long term, we expect the non-U.S. markets to benefit from improving corporate governance and management practices, the development of local equity cultures and positive capital flows. Against this background, inefficient pricing of equities, particularly among small and mid-cap companies, can provide exceptional opportunities. We continue to employ our investment discipline, seeking to discover fundamentally attractive companies that are out of favor and undervalued, and to provide our shareholders with above average returns with below average risk.

| James Hunt | Francois Sicart |

| Portfolio Manager | Portfolio Manager |

This chart assumes an initial gross investment of $10,000 made on 10/31/96. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost.

The Morgan Stanley EAFE Index is an unmanaged market-capitalization-weighted index composed of companies representative of the market structure of 20 Developed Market Countries in Europe, Australia, Asia and the Far East.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2007

| | | | | |

| | 1 Year | 3 Year | 5 Year | 10 Year |

| Tocqueville International Value Fund—Net Asset Value | 7.34% | 19.91% | 17.16% | 5.91% |

| Tocqueville International Value Fund—Load* | 7.34% | 19.91% | 17.16% | 5.47% |

| Morgan Stanley EAFE Index | 20.32% | 23.00% | 17.10% | 9.09% |

| * Effective February 1, 2000, the Fund eliminated its sales load. | | | | |

The Tocqueville Gold Fund

Dear Fellow Shareholder,

Gold has been in a consolidating pattern for the past year. It reached an intraday high of $723/oz. on May 11, 2006 and has been range bound since then. The current gold price of $670/oz. is approximately 8.5% below its 26 year high of a year ago. Gold shares also peaked on the same date and have also been range bound since then. The benchmark XAU Index of Gold and Silver Shares reached 171 on that date and is now trading around 140 or 18% below that peak. Some would say the gold sector has gone to sleep. We suggest that the year long consolidation has provided a powerful base for the next advance.

The catalyst for the next move will be, in our opinion, a broad shift in the pricing of risk by the financial markets. Historically tight credit spreads and low volatility, speculation marked by the private equity boom, and cross currency carry trades funded by a weak Japanese yen are just a few suggestions of the gross mispricing of risk. The truth of the matter is that neither we nor anyone else can predict the timing of a future avalanche in financial asset valuations, but for anyone who cares to look, the mountain peaks are covered with unstable snow packs of leverage, speculation, careless research, and greed. (For more, please refer to our recent web site article, Today’s Avalanche Forecast, at www.tocqueville.com.) The buildup of systemic risk prior to the 2000 dot-com bust looks like a blip by comparison.

The recent decisions by the governments of Kuwait and Syria to abandon their dollar pegs could turn out to be little more than an obscure footnote in the annals of monetary matters. More likely, in our opinion, these actions will be remembered as the beginning of a move to exits by foreign holders of dollar assets. What motivated the managers of these otherwise insignificant currencies to jump ship is rampant local inflation caused by the overvaluation of the U.S. dollar. The accumulation of dollar reserves forces host countries to print local currency, which, in turn leads to (surprise) inflation. The phenomenon has affected not only these tiny countries but the entire Gulf region, bloated with U.S. dollars because of oil exports. In almost all other corners of the globe, major economies including Brazil, Russia, China and India, and others too numerous to mention, face similar issues.

To date, the loss of shelf space by the dollar has been gradual. It is still regarded as the world’s supreme reserve currency. A quickening pace of erosion would rattle the markets. On the other hand, a slower pace might not disturb investor somnolence for a while more. However, the dollar’s decline in status, from senior reserve currency, to something less seems irreversible. The process will be salutary for gold. The time to accumulate the metal is when the alarm bells are silent. In our opinion, gold purchased at anything less than $1000/oz. will seem like a bargain within a few years.

Sincerely,

John C. Hathaway

Portfolio Manager

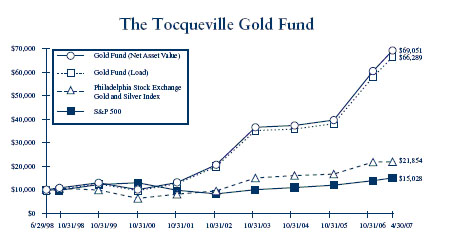

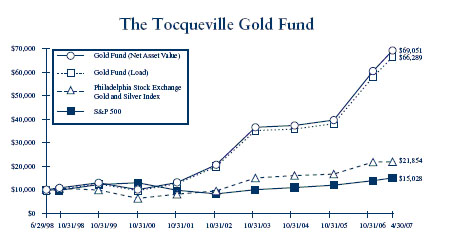

This chart assumes an initial gross investment of $10,000 made on 6/29/98 (commencement of operations). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost.

In 2003 and 2006, the performance of The Tocqueville Gold Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2007

| | | | | |

| | | | | Since inception |

| | 1 Year | 3 Year | 5 Year | 6/29/1998 |

| Tocqueville Gold Fund—Net Asset Value | 4.59% | 30.60% | 26.39% | 24.44% |

| Tocqueville Gold Fund—Load* | 4.59% | 30.60% | 26.39% | 23.85% |

| Philadelphia Stock Exchange Gold and Silver Index | (12.15)% | 20.14% | 14.66% | 9.25% |

| Standard & Poor’s 500 Stock Index | 15.24% | 12.25% | 8.54% | 4.67% |

| * Effective February 1, 2000, the Fund eliminated its sales load. | | | | |

Legend Related to Shareholder Letters

Past performance does not guarantee future results. The investment returns and principal value will fluctuate and the investor’s share, when redeemed, may be worth more or less than their original cost. You should consider the investment objectives, risks, charges and expenses of each Fund before investing. The Prospectus contains this and other information about The Tocqueville Trust and you should read it carefully before investing.

Each Fund’s holdings are also subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any mentioned security. The securities mentioned in the articles are not representative of each Fund’s entire portfolio.

There are special risks associated with investing in small cap and mid cap stocks, including: small and mid cap companies rely on limited product lines, financial resources and business activities that may make them more susceptible than larger companies to setbacks or downturns; and small and mid cap companies are less liquid and more thinly traded which make them more volatile than stocks of larger companies.

There are special risks associated with investing in foreign securities, including: the value of foreign currencies may decline relative to the US dollar; a foreign government may expropriate a Fund’s assets; and political, social or economic instability in a foreign country in which a Fund invests may cause the value of the Fund’s investments to decline.

The Tocqueville Gold Fund is subject to special risks associated with investing in gold and other precious metals, including: the price of gold/precious metals may be subject to wide fluctuations; the market for gold/precious metals is relatively limited; the sources of gold/precious metals are concentrated in countries that have the potential for instability; and the market for gold/precious metals is unregulated.

This commentary is not an advertisement or solicitation to subscribe to The Tocqueville Trust, which may only be made by Prospectus. This material must be preceded or accompanied by the Trust’s Prospectus.

The Tocqueville Trust Mutual Funds are distributed by Lepercq, de Neuflize/Tocqueville Securities L.P.

Expense Example—April 30, 2007

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (November 1, 2006-April 30, 2007).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The Tocqueville Fund | | | | | | | | | | | |

| | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period* |

| | Account Value | | Account Value | | November 1, 2006 - |

| | November 1, 2006 | | April 30, 2007 | | April 30, 2007 |

| Actual | | $1,000.00 | | | | $1,094.00 | | | | $6.49 | |

| Hypothetical (5% return before expenses) | | 1,000.00 | | | | 1,018.60 | | | | 6.26 | |

| | | | | | | | | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.25%, mutiplied by the average account value over the period, muliplied by 181/365 to reflect the one-half year period. |

The Tocqueville Small Cap Value Fund | | | | | | | | | | | |

| | | | | | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period* |

| | Account Value | | Account Value | | November 1, 2006 - |

| | November 1, 2006 | | April 30, 2007 | | April 30, 2007 |

| Actual | | $1,000.00 | | | | $1,071.00 | | | | $6.78 | |

| Hypothetical (5% return before expenses) | | 1,000.00 | | | | 1,018.25 | | | | 6.61 | |

| | | | | | | | | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.32%, mutiplied by the average account value over the period, muliplied by 181/365 to reflect the one-half year period. |

The Tocqueville International Value Fund | | | | | | | | | | | |

| | | | | | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period* |

| | Account Value | | Account Value | | November 1, 2006 - |

| | November 1, 2006 | | April 30, 2007 | | April 30, 2007 |

| Actual | | $1,000.00 | | | | $1,106.70 | | | | $8.36 | |

| Hypothetical (5% return before expenses) | | 1,000.00 | | | | 1,016.86 | | | | 8.00 | |

| | | | | | | | | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.60%, mutiplied by the average account value over the period, muliplied by 181/365 to reflect the one-half year period. |

The Tocqueville Gold Fund | | | | | | | | | | | |

| | | | | | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period* |

| | Account Value | | Account Value | | November 1, 2006 - |

| | November 1, 2006 | | April 30, 2007 | | April 30, 2007 |

| Actual | | $1,000.00 | | | | $1,144.60 | | | | $7.60 | |

| Hypothetical (5% return before expenses) | | 1,000.00 | | | | 1,017.70 | | | | 7.15 | |

| | | | | | | | | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.43%, mutiplied by the average account value over the period, muliplied by 181/365 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | Six Months | | | | | | | | | | | | | | | |

Per share operating performance | Ended | | | | | | | | | | | | | | | |

(For a share outstanding throughout the | April 30, | | Years Ended October 31, | |

period) | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | (unaudited) | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 24.25 | | $ | 22.17 | | $ | 20.43 | | $ | 17.99 | | $ | 13.42 | | $ | 14.99 | |

| Operations: | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | 0.07 | | | 0.14 | | | 0.15 | | | 0.05 | | | 0.02 | | | (0.01 | ) |

| Net realized and unrealized gain (loss) | | 2.21 | | | 4.33 | | | 2.53 | | | 2.41 | | | 4.55 | | | (1.28 | ) |

| Total from investment operations (1) | | 2.28 | | | 4.47 | | | 2.68 | | | 2.46 | | | 4.57 | | | (1.29 | ) |

| Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | (0.03 | ) | | (0.22 | ) | | (0.12 | ) | | (0.02 | ) | | — | | | (0.01 | ) |

| Distributions from net realized gains | | — | | | (2.17 | ) | | (0.82 | ) | | — | | | — | | | (0.27 | ) |

| Total dividends and distributions | | (0.03 | ) | | (2.39 | ) | | (0.94 | ) | | (0.02 | ) | | — | | | (0.28 | ) |

| Change in net asset value for the period | | 2.25 | | | 2.08 | | | 1.74 | | | 2.44 | | | 4.57 | | | (1.57 | ) |

| Net asset value, end of period | $ | 26.50 | | $ | 24.25 | | $ | 22.17 | | $ | 20.43 | | $ | 17.99 | | $ | 13.42 | |

| Total return | | 9.4 | %(2) | | 20.5 | % | | 13.4 | % | | 13.7 | % | | 34.1 | % | | (8.9 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | $ | 470,768 | | $ | 392,495 | | $ | 175,791 | | $ | 145,435 | | $ | 149,497 | | $ | 70,134 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | |

| | 1.25 | %(4) | | 1.30 | % | | 1.34 | % | | 1.34 | | | 1.40 | | | 1.40 | % |

| Net investment income (loss) (3) | | 0.58 | %(4) | | 0.68 | % | | 0.68 | % | | 0.25 | % | | 0.17 | % | | (0.06 | )% |

| Portfolio turnover rate | | 16 | %(2) | | 32 | % | | 45 | % | | 40 | % | | 32 | % | | 62 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.000, $0.002, $0.003, $0.001 and $0.000 per share for the six months ended April 30, 2007 and the four years ended October 31, 2006, 2005, 2004, and 2003, respectively. |

| (3) | Net of fees waived amounting to 0.01%, 0.07% and 0.01% of average net assets for the six months ended April 30, 2007 and the two years ended October 31, 2003 and 2002, respectively. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Small Cap Value Fund

Financial Highlights

| | Six Months | | | | | | | | | | | | | | | |

Per share operating performance | Ended | | | | | | | | | | | | | | | |

(For a share outstanding throughout the | April 30, | | Years Ended October 31, | |

period) | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | (unaudited) | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 18.04 | | $ | 16.58 | | $ | 16.11 | | $ | | | $ | 12.18 | | $ | 15.09 | |

| Operations: | | | | | | | | | | | | | | | | | | |

| Net investment loss | | (0.03 | ) | | (0.07 | ) | | (0.13 | ) | | (0.11 | ) | | (0.08 | ) | | (0.08 | ) |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | | | ) |

| Total from investment operations (1) | | | | | | | | | | | | | | | | | (1.53 | ) |

| Distributions to shareholders: | | | | | | | | | | | | | | | | | | |

| Distributions from net realized gains | | (2.17 | ) | | | | | (0.66 | ) | | (2.82 | ) | | | | | (1.38 | ) |

| Total distributions | | (2.17 | ) | | | | | (0.66 | ) | | (2.82 | ) | | | | | (1.38 | ) |

| Change in net asset value for the period | | (1.01 | ) | | | | | | | | (2.72 | ) | | | | | (2.91 | ) |

| Net asset value, end of period | $ | 17.03 | | $ | 18.04 | | $ | 16.58 | | $ | | | $ | 18.83 | | $ | 12.18 | |

| Total return | | | %(2) | | 8.8 | % | | 6.8 | % | | (1.0 | )% | | 54.6 | % | | (11.7 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | $ | 50,502 | | $ | 52,701 | | $ | 57,576 | | $ | 75,005 | | $ | 73,518 | | $ | 50,879 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | |

| | 1.32 | | | 1.34 | % | | 1.39 | % | | 1.41 | | | 1.36 | | | 1.44 | % |

| Net investment loss | | (0.33 | | | (0.38 | )% | | (0.67 | )% | | (0.61 | )% | | (0.48 | )% | | (0.62 | )% |

| Portfolio turnover rate | | 50 | | | 45 | % | | 30 | % | | 19 | % | | 65 | % | | 25 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.000, $0.015, $0.006, $0.02 and $0.03 per share for the |

| | six months ended April 30, 2007 and the four years ended October 31, 2006, 2005, 2004 and 2003 respectively. |

| (2) | Not annualized. |

| (3) | Annualized. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville International Value Fund

Financial Highlights

| | Six Months | | | | | | | | | | | | | | | |

Per share operating performance | Ended | | | | | | | | | | | | | | | |

(For a share outstanding throughout the | April 30, | | Years Ended October 31, | |

period) | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | (unaudited) | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 16.72 | | $ | | | $ | 13.10 | | $ | 10.90 | | $ | 7.27 | | $ | | |

| Operations: | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | | | | | |

| Net realized and unrealized gain | | | | | | | | | | | | | | | | | | |

| Total from investment operations (1) | | | | | | | | | | | | | | | | | | |

| Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | (0.27 | ) | | (0.05 | | | (0.08 | ) | | (0.04 | ) | | (0.01 | ) | | | |

| Distributions from net realized gains | | (2.30 | ) | | (1.86 | ) | | | | | | | | | | | | |

| Total dividends and distributions | | | ) | | (1.91 | ) | | (0.08 | ) | | (0.04 | ) | | (0.01 | ) | | | |

| Change in net asset value for the period | | (0.90 | ) | | | | | | | | | | | | | | | |

| Net asset value, end of period | $ | 15.82 | | $ | | | $ | 16.06 | | $ | 13.10 | | $ | 10.90 | | $ | | |

| Total return | | 10.7 | | | 17.4 | | | 23.3 | | | 20.6 | | | 50.1 | | | 0.4 | |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | $ | 229,439 | | $ | 225,234 | | $ | 215,711 | | $ | 196,424 | | $ | 129,875 | | $ | 78,951 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | |

| | 1.60 | | | 1.61 | | | 1.66 | | | 1.71 | | | 1.77 | | | 1.73 | |

| Net investment income | | 0.19 | | | 1.49 | | | 0.29 | | | 0.85 | | | 0.72 | | | 0.16 | |

| Portfolio turnover rate | | 20 | | | 39 | | | 35 | | | 43 | | | 55 | | | 61 | |

| (1) | Total from investment operations per share includes redemption fees of $0.001, $0.011, $0.003, $0.01, $0.005 and $0.03 per |

| | share for the six months ended April 30, 2007 and the five years ended October 31, 2006, 2005, 2004, 2003 and 2002, |

| | respectively. |

| (2) | Not annualized. |

| (3) | Annualized. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Gold Fund

Financial Highlights

| Six Months | | | | | | | | | | | | | | | |

Per share operating performance | Ended | | | | | | | | | | | | | | | |

(For a share outstanding throughout the | April 30, | | Years Ended October 31, | |

period) | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | (unaudited) | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | | | $ | 35.51 | | $ | 34.84 | | $ | | | $ | 20.49 | | $ | | |

| Operations: | | | | | | | | | | | | | | | | | | |

| Net investment loss | | (0.09 | ) | | (0.22 | ) | | (0.33 | ) | | (0.33 | ) | | (0.14 | ) | | (0.08 | ) |

| Net realized and unrealized gain | | | | | | | | | | | | | | | | | | |

| Total from investment operations (1) | | | | | | | | | | | | | | | | | | |

| Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | (0.22 | ) | | | | | | | | (0.03 | ) | | | | | | |

| Distributions from net realized gains | | (5.05 | ) | | (2.09 | ) | | (1.36 | ) | | (0.55 | ) | | (1.05 | ) | | (0.06 | ) |

| Total distributions | | (5.27 | ) | | (2.09 | ) | | (1.36 | ) | | (0.58 | ) | | (1.05 | ) | | (0.06 | ) |

| Change in net asset value for the period | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | $ | | | $ | 51.41 | | $ | 35.51 | | $ | | | $ | 34.71 | | $ | | |

| Total return | | 14.5 | %(2) | | 52.5 | % | | 6.2 | % | | 2.0 | % | | 77.3 | % | | 57.2 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | $ | 1,006,828 | | $ | 833,254 | | $ | 538,492 | | $ | 539,190 | | $ | 433,554 | | $ | 137,210 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | |

| | 1.43 | | | 1.50 | % | | 1.59 | % | | 1.58 | | | 1.68 | | | 1.68 | % |

| Net investment income (loss) | | (0.80 | | | (0.51 | )% | | (0.97 | )% | | (1.11 | )% | | (0.77 | )% | | (0.61 | )% |

| Portfolio turnover rate | | 11 | | | 30 | % | | 27 | % | | 24 | % | | 40 | % | | 72 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.016, $0.06, $0.02, $0.09, $0.05 and $0.09 per share |

| | for the six months ended April 30, 2007 and the five years ended October 31, 2006, 2005, 2004, 2003 and 2002, respectively. |

| (2) | Not annualized. |

| (3) | Annualized. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Fund

Schedule of Investments as of April 30, 2007

(Unaudited)

| | | | | | | |

Common Stocks—95.0% | Shares | Value | | Common Stocks (continued) | Shares | Value |

Aerospace & Defense—1.0% | | | | Computers & Peripherals—0.8% | | |

| Boeing Co. | 50,000 | $ 4,650,000 | | EMC Corp. (a) | 250,000 | $ 3,795,000 |

Air Freight & Logistics—0.4% | | | | Construction Materials—0.8% | | |

| United Parcel Service, Inc. | 30,000 | 2,112,900 | | Cemex S.A. de C.V. ADR (a)(b) | 112,832 | 3,667,040 |

Airlines—0.6% | | | | Containers & Packaging—0.7% | | |

| SkyWest, Inc. | 112,000 | 3,047,520 | | Sonoco Products Co. | 75,000 | 3,198,000 |

Automobiles—0.8% | | | | Discount—0.4% | | |

| Tata Motors Ltd. ADR (b) | 200,000 | 3,656,000 | | Home Depot, Inc. | 50,000 | 1,893,500 |

Beverages—3.6% | | | | Diversified Financial Services—1.1% | | |

| Anheuser-Busch Companies, Inc. | 200,000 | 9,838,000 | | Citigroup, Inc. | 100,000 | 5,362,000 |

| The Coca-Cola Co. | 100,000 | 5,219,000 | | Diversified Telecommunication Services—3.7% | | |

Koninklijke Grolsch N.V. (b) | | 1,837,737 | | Alaska Communications Systems | | |

| | | | | Group, Inc. | 421,000 | |

Biotechnology—2.2% | | | | Chunghwa Telecom Company Ltd. | | |

| Amgen, Inc. (a) | 75,000 | 4,810,500 | | ADR (b) | 250,000 | 4,975,000 |

| Pharmion Corp. (a) | 190,000 | 5,755,100 | | Verizon Communications, Inc. | 150,000 | 5,727,000 |

| | | 10,565,600 | | | | 17,395,900 |

Capital Markets—0.9% | | | | Electric Utilities—2.6% | | |

| The Bank of New York Co., Inc. | 100,000 | 4,048,000 | | FPL Group, Inc. | 150,000 | 9,655,500 |

Chemicals—4.1% | | | | Korea Electric Power Corp. ADR (b) | 120,000 | 2,481,600 |

| Bayer AG (b) | 25,000 | 1,718,091 | | | | 12,137,100 |

| EI Du Pont de Nemours & Co. | 225,000 | 11,063,250 | | Electrical Appliances, Television And Radio Sets—0.6% | |

| | 6,650,000 | | Samsung Electronics Co., Ltd. | | |

| | | 19,431,341 | | GDR (b) | 9,300 | 2,868,457 |

Commercial Banks—4.4% | | | | Electronic Computers—0.4% | | |

| East West Bancorp, Inc. | 50,000 | 1,993,000 | | Hitachi, Ltd. ADR (b) | 25,000 | 1,898,500 |

| First Midwest Bancorp Inc/IL | 41,200 | 1,480,728 | | Electronic Equipment & Instruments—0.6% | | |

| HSBC Holdings PLC ADR (b) | 24,730 | 2,284,063 | | Molex, Inc. | 100,000 | 2,988,000 |

| M&T Bank Corp. | 10,000 | 1,113,400 | | Energy Equipment & Services—2.0% | | |

| Marshall & Ilsley Corp. | 35,000 | 1,680,700 | | | 125,000 | 9,228,750 |

| Mitsubishi Ufj Financial Group, Inc. | | | | Food & Staples Retailing—1.4% | | |

| ADR (b) | 1,000,000 | 10,450,000 | | | 50,000 | 1,637,000 |

| Wilmington Trust Corp. | 40,000 | 1,618,400 | | | | |

| | | 20,620,291 | | | | |

Commercial Services & Supplies—3.4% | | | | Food Products—2.0% | | |

| Avery Dennison Corp. | 60,000 | 3,732,000 | | | 300,000 | 4,923,000 |

| DeVry, Inc. | 115,000 | 3,793,850 | | | | |

| H&R Block, Inc. | 150,000 | 3,391,500 | | | | |

| Pico Holdings, Inc. (a) | 20,000 | 893,400 | | Health Care Equipment & Supplies—1.7% | | |

| | 4,177,280 | | Medtronic, Inc. | 40,000 | |

| | | | | | | |

Communications Equipment—5.6% | | | | | | |

| Cisco Systems, Inc. (a) | 400,000 | 10,696,000 | | | | |

| Cisco Systems, Inc. (a) | 200,000 | 4,744,000 | | Household Durables—0.3% | | |

| Juniper Networks, Inc. (a) | 225,000 | 5,031,000 | | | 45,000 | |

| Nokia Oyj ADR (b) | 150,000 | 3,787,500 | | | | |

| Nortel Networks Corp. (a)(b) | 100,000 | 2,288,000 | | | | |

| | | 26,546,500 | | | | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Fund

Schedule of Investments as of April 30, 2007

(Unaudited)

| | | | | | | |

Common Stocks (continued) | Shares | Value | | Common Stocks (continued) | Shares | Value |

Household Products—1.5% | | | | Oil Drilling, Equipment & Services—1.1% | | |

| Colgate-Palmolive Co. | 25,000 | $ 1,693,500 | | Devon Energy Corp. | 71,880 | $ 5,237,895 |

| Kimberly-Clark Corp. | 75,000 | 5,337,750 | | Paper & Forest Products—1.9% | | |

| | | 7,031,250 | | Weyerhaeuser Co. | 110,000 | 8,714,200 |

Industrial Conglomerates—4.7% | | | | Personal Products—0.8% | | |

| 3M Co. | 75,000 | 6,207,750 | | Avon Products, Inc. | 100,000 | 3,980,000 |

| General Electric Co. | 300,100 | 11,061,686 | | Pharmaceuticals—5.0% | | |

| Tyco International Ltd. (b) | 150,000 | 4,894,500 | | Bristol-Myers Squibb Co. | 250,000 | 7,215,000 |

| | | 22,163,936 | | Johnson & Johnson | 40,000 | 2,568,800 |

Insurance—4.5% | | | | Novartis AG ADR (b) | 30,000 | 1,742,700 |

| American International Group, Inc. | 150,000 | 10,486,500 | | Pfizer, Inc. | 400,000 | 10,584,000 |

| Hannover Rueckverscherung AG (b) | 60,000 | 3,066,363 | | Sepracor, Inc. (a) | 25,000 | 1,342,000 |

| IPC Holdings Ltd. (b) | 250,000 | 7,495,000 | | | | 23,452,500 |

| | | 21,047,863 | | Prepackaged Software—0.0% | | |

Internet Software & Services—0.9% | | | | Bio-key International, | | |

| Yahoo!, Inc. (a) | 150,000 | 4,206,000 | | Inc. (a)(c)(e)(f) | 47,090 | — |

IT Services—2.1% | | | | Semiconductor & Semiconductor Equipment—4.6% | |

| Automatic Data Processing, Inc. | 100,000 | 4,476,000 | | Applied Materials, Inc. | 350,000 | 6,727,000 |

| Western Union Co. | 250,000 | 5,262,500 | | Intel Corp. | 500,000 | 10,750,000 |

| | | 9,738,500 | | Ultratech, Inc. (a) | 300,000 | 4,155,000 |

Machinery—2.1% | | | | | | 21,632,000 |

Albany International Corp. | 26,200 | 1,003,460 | | Software—5.4% | | |

Illinois Tool Works, Inc. | | | | | 200,000 | 4,000,000 |

| | | | Electronic Arts, Inc. (a) | | |

| | | | | Mentor Graphics Corp. (a) | | |

| | | | | | | |

| | | | | | | |

Media—3.1% | | | | | | |

| Dow Jones & Co, Inc. | 250,000 | 9,082,500 | | | | |

| Getty Images, Inc. (a) | 35,000 | 1,820,000 | | Specialty Retail—0.3% | | |

| John Wiley & Sons, Inc. | 44,000 | 1,647,800 | | | 65,000 | 1,372,150 |

| Time Warner, Inc. | 100,000 | 2,063,000 | | Thrifts & Mortgage Finance—0.5% | | |

| | | 14,613,300 | | | 40,000 | 2,356,800 |

Metals & Mining—5.4% | | | | | | |

| Alcoa, Inc. | 225,000 | 7,985,250 | | | | 701,000 |

| Cleveland-Cliffs, Inc. | 100,000 | 6,929,000 | | Total Common Stocks (Cost $354,906,123) | | |

| Newmont Mining Corp. | 250,000 | 10,425,000 | | Exchange Traded Fund—0.7% | | |

| | | 25,339,250 | | StreetTRACKS Gold Trust (a) | 50,000 | |

Multiline Retail—0.3% | | | | Total Exchange Traded Fund | | |

| Conn’s, Inc. (a) | 50,000 | 1,297,500 | | | | |

Multi-Utilities & Unregulated Power—0.6% | | | | Preferred Stock—0.1% | | |

| Suez SA (b) | 50,000 | 2,864,395 | | | | |

National Commercial Banks—0.3% | | | | Zymequest, Inc. (a)(c)(e)(f) | 400,000 | 560,000 |

| Hang Seng Bank Ltd. ADR (b) | 100,000 | 1,410,260 | | Total Prefered Stock (Cost $960,000) | | |

Oil & Gas—3.7% | | | | | | |

| Murphy Oil Corp. | 275,000 | 15,246,000 | | | | |

| Total SA ADR (b) | 30,000 | 2,210,700 | | | | |

| | | 17,456,700 | | | | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Fund

Schedule of Investments as of April 30, 2007

(Unaudited)

| | | | | |

Warrants—0.0% | Shares | Value | | (d) | Security is a “step-up” bond where the coupon rate increases or |

| Bio-key Warrants, $1.00 strike | | | | | steps up at a predetermined rate. Rate shown reflects the original |

| price, expires 4/14/09 (a)(e) | 262,500 | $ — | | | rate. |

| Raytheon Co. Warrants, $37.50 | | | | (e) | Fair valued security. The aggregate value of fair valued securities |

| strike price, expires 6/16/11 (a) | 1,581 | 28,411 | | | at April 30, 2007 was $560,000 which represents 0.1% of net |

| Total Warrants (Cost $0) | | 28,411 | | | assets. |

U.S. Government Agency | Principal | | | (f) | Security is considered illiquid and may be difficult to sell. |

Bonds—0.9% | Amount | | | | |

| Freddie Mac, 3.70%, 8/25/09 (d) | $2,000,000 | 1,984,904 | | | |

| Freddie Mac, 3.90%, 8/27/09 (d) | 2,000,000 | 1,983,422 | | | |

| Total U.S. Government Agency Bonds | | | | | |

| (Cost $4,048,424) | | 3,968,326 | | | |

Short-Term Investments—3.2% | | | | | |

Repurchase Agreement—0.7% | | | | | |

| Repurchase Agreement with U.S. | | | | | |

| Bank, N.A., 5.00%, dated | | | | | |

| 4/30/07, due 5/1/07, | | | | | |

| collateralized by a Freddie Mac | | | | | |

| 15-Year Fixed (Pool # 4622) | | | | | |

| valued at $3,503,875. | | | | | |

| Repurchase proceeds of | | | | | |

| $3,435,477. | | | | | |

| (Cost $3,435,000) | 3,435,000 | 3,435,000 | | | |

U.S. Treasury Bills—2.5% | | | | | |

| 5.06%, 5/03/07 | 4,000,000 | 3,998,906 | | | |

| 4.93%, 6/21/07 | 4,000,000 | 3,972,233 | | | |

| 4.91%, 7/05/07 | 4,000,000 | 3,965,696 | | | |

| Total U.S. Treasury Bills (Cost $11,935,641) | | 11,936,835 | | | |

| Total Short-Term Investments | | | | | |

| (Cost $15,370,641) | | 15,371,835 | | | |

Total Investments | | | | | |

(Cost $378,099,648)—99.9% | | 470,458,037 | | | |

Other Assets in Excess of Liabilities—0.1% | | 309,491 | | | |

Total Net Assets—100.0% | | $470,767,528 | | | |

| | | | | | |

| Percentages are stated as a percent of net assets. | | | | | |

| ADR American Depository Receipt | | | | | |

| GDR Gobal Depository Receipt | | | | | |

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Foreign concentration was as follows: |

| | Bermuda 2.6%; Canada 0.5%; Finland 0.8%; France 1.1%; |

| | Germany 1.0%; Hong Kong 0.3%; India 0.8%; Japan 2.6%; |

| | Mexico 0.8%; Netherlands 3.3%; South Korea 1.1%; Switzerland |

| | 0.4%; Taiwan 1.1%; United Kingdom 0.5%. |

| (c) | Denotes security is fully or partially restricted as to resale. The |

| | aggregate value of restricted securities at April 30, 2007 was |

| | $560,000 which represented 0.1% of net assets. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Small Cap Value Fund

Schedule of Investments as of April 30, 2007

(Unaudited)

| | | | | | | |

| | | | Common Stocks (continued) | Shares | Value |

| | | | | | |

| Constellation Brands, Inc. (a) | 60,000 | $1,344,600 | | Ceridian Corp. (a) | 45,000 | $ 1,519,200 |

Biotechnology—2.4% | | | | Convergys Corp. (a) | 50,000 | 1,263,000 |

| Pharmion Corp. (a) | 40,000 | 1,211,600 | | | | 2,782,200 |

Chemicals—12.1% | | | | Machinery—4.8% | | |

| Arch Chemicals, Inc. | 39,000 | 1,178,580 | | Federal Signal Corp. | 80,000 | 1,263,200 |

| Cambrex Corp. | 35,000 | 849,100 | | Mueller Water Products, Inc. | 80,000 | 1,146,400 |

| Hercules, Inc. (a) | 70,000 | 1,318,800 | | | | 2,409,600 |

| Olin Corp. | 70,000 | 1,199,800 | | Oil & Gas—1.9% | | |

| Sensient Technologies Corp. | 60,000 | 1,570,800 | | Syntroleum Corp. (a) | 300,000 | 939,000 |

| | | 6,117,080 | | Pharmaceuticals—8.2% | | |

Commercial Physical And Biological Research—2.0% | | | DepoMed, Inc. (a) | 350,000 | 1,204,000 |

| Crucell NV ADR (a)(b) | 40,000 | 1,013,600 | | Perrigo Co. | 80,000 | 1,520,000 |

Commercial Services & Supplies—5.4% | | | | Salix Pharmaceuticals, Ltd. (a) | 110,000 | 1,432,200 |

| ABM Industries, Inc. | 55,000 | 1,547,700 | | | | 4,156,200 |

| FTI Consulting, Inc. (a) | 32,000 | 1,176,640 | | Real Estate Investment Trust—2.4% | | |

| | | 2,724,340 | | National Retail Properties, Inc. | 50,000 | 1,197,500 |

Communications Equipment—2.2% | | | | Semiconductor & Semiconductor Equipment—5.7% | |

| Powerwave Technologies, Inc. (a) | 180,000 | 1,121,400 | | FEI Co. (a) | 40,000 | 1,488,000 |

Computers & Peripherals—1.8% | | | | Ultratech, Inc. (a) | 102,000 | 1,412,700 |

| Presstek, Inc. (a) | 150,000 | 915,000 | | | | 2,900,700 |

Electrical Equipment—3.1% | | | | Software—2.4% | | |

| Baldor Electric Co. | 40,000 | 1,575,600 | | Mentor Graphics Corp. (a) | 75,000 | 1,213,500 |

Electronic Equipment & Instruments—4.8% | | | | Trading Companies & Distributors—2.6% | | |

| Avnet, Inc. (a) | 30,000 | 1,227,000 | | Watsco, Inc. | 25,000 | 1,329,250 |

| Veeco Instruments, Inc. (a) | 65,000 | 1,188,200 | | Total Common Stocks (Cost $41,690,581) | | 48,487,940 |

| | | 2,415,200 | | Short-Term Investments—3.8% | | |

Energy Equipment & Services—8.5% | | | | Repurchase Agreement—3.8% | | |

| Cameron International Corp. (a) | 20,000 | 1,291,400 | | Repurchase Agreement with U.S. | | |

| Hornbeck Offshore Services, Inc. (a) | 50,000 | 1,581,500 | | Bank, N.A., 5.00%, dated | | |

| Input/Output, Inc. (a) | 100,000 | 1,399,000 | | 4/30/07, due 5/1/07, collateralized | | |

| | | 4,271,900 | | by a Freddie Mac 15-Year Fixed | | |

Food & Staples Retailing—2.5% | | | | (Pool # 4622) valued at | | |

| Performance Food Group Co. (a) | 40,000 | 1,250,000 | | $1,926,050. Repurchase proceeds | | |

Food Products—2.7% | | | | of $1,888,262. | | |

| Del Monte Foods Co. | 120,000 | 1,392,000 | | Total Short-Term Investments | | |

Health Care Equipment & Supplies—5.4% | | | | (Cost $1,888,000) | 1,888,000 | 1,888,000 |

| Datascope Corp. | 35,000 | 1,296,750 | | Total Investments | | |

| Wright Medical Group, Inc. (a) | 60,000 | 1,417,200 | | (Cost $43,578,581)—99.8% | | 50,375,940 |

| | | 2,713,950 | | Other Assets in Excess of Liabilities—0.2% | | 125,672 |

Hotels Restaurants & Leisure—5.1% | | | | Total Net Assets—100.0% | | $50,501,612 |

| Bob Evans Farms, Inc. | 35,000 | 1,284,500 | | | | |

| | | | Percentages are stated as a percent of net assets. | | |

| | | | ADR American Depository Receipt | | |

Internet & Catalog Retail—1.8% | | | | (a) | Non-income producing security. |

| Insight Enterprises, Inc. (a) | 46,000 | | | (b) | Foreign issued security. Foreign concentration was as follows: |

| | | | | | |

| | | | | | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville International Value Fund

Schedule of Investments as of April 30, 2007

(Unaudited)

| | | | | | | |

Common Stocks—89.4% | Shares | Value | | Common Stocks (continued) | Shares | Value |

Canada—2.5% | | | | Mexico—2.3% | | |

| Alcan, Inc. | 96,208 | $ 5,673,258 | | Cemex S.A. de C.V. ADR (a) | 161,032 | $ 5,233,540 |

Finland—5.6% | | | | Netherlands—3.1% | | |

| Nokia Oyj ADR | 290,000 | 7,322,500 | | European Aeronautic Defense and | | |

| UPM-Kymmene Oyj | 226,700 | 5,624,266 | | Space Co. | 45,000 | 1,456,625 |

| | | 12,946,766 | | Unilever NV ADR | 185,000 | 5,642,500 |

France—11.9% | | | | | | 7,099,125 |

| M6 Metropole Television | 190,000 | 6,777,658 | | Singapore—1.5% | | |

| NRJ Group | 132,450 | 2,400,327 | | GP Industries | 9,775,949 | 3,378,228 |

| Safran SA | 245,000 | 5,951,227 | | South Korea—4.5% | | |

| Sanofi-Aventis | 75,000 | 6,906,481 | | Halla Climate Control | 385,000 | 3,991,030 |

| Vivendi SA | 125,000 | 5,182,249 | | Samsung Electronics Co., Ltd. | 12,000 | 5,678,376 |

| | | 27,217,942 | | SK Telecom Co., Ltd. ADR | 23,000 | 571,090 |

Germany—1.7% | | | | | | 10,240,496 |

| Siemens AG | 32,600 | 3,953,842 | | Switzerland—5.0% | | |

Greece—1.2% | | | | Ciba Specialty Chemicals AG | 80,800 | 5,355,446 |

| Titan Cement Co., SA | 50,000 | 2,865,760 | | Kudelski SA | 156,000 | 6,032,043 |

Indonesia—1.4% | | | | | | 11,387,489 |

| PT Tempo Scan Pacific Tbk | 34,380,000 | 3,217,329 | | Taiwan—5.0% | | |

Israel—1.5% | | | | Chunghwa Telecom Co., Ltd. ADR | 326,400 | 6,495,360 |

| Makhteshim-Agan Industries, Ltd. | 487,000 | 3,553,686 | | Merrill Taiwan Secom Co., Ltd. | 2,889,977 | 4,982,031 |

Italy—3.4% | | | | | | 11,477,391 |

| Guala Closures SpA | 24,000 | 186,029 | | Thailand—4.8% | | |

| Interpump SpA | 303,300 | 3,588,492 | | Airports of Thailand Public | | |

| Sogefi SpA | 409,500 | 3,928,526 | | Company Ltd. | 1,550,000 | 2,652,049 |

| | | 7,703,047 | | BEC World Pcl | 9,287,200 | 6,276,037 |

Japan—25.7% | | | | TPI Polene Public Company, Ltd. | 6,100,000 | 2,210,209 |

| Aderans Company, Ltd. | 68,000 | 1,525,212 | | | | 11,138,295 |

| Amano Corp. | 330,000 | 4,355,442 | | United Kingdom—4.4% | | |

| Capcom Co., Ltd. | 205,000 | 3,134,578 | | Bodycote International | 641,250 | 3,795,593 |

| Fuji Photo Film Co., Ltd. | 140,000 | 5,835,042 | | GlaxoSmithKline Plc ADR | 107,100 | 6,188,238 |

| Hitachi, Ltd. | 983,000 | 7,519,454 | | | | 9,983,831 |

| | | | | United States—1.6% | | |

| Matsushita Electric Industrial Co., | | | | Freeport-McMoRan Copper & | | |

| Ltd. ADR | 200,000 | 3,886,000 | | | 56,200 | 3,774,392 |

| Mitsubishi Tokyo Financial Group, | | | | Total Common Stocks (Cost $149,750,429) | | 205,100,414 |

| Inc. ADR | 396,000 | 4,138,200 | | Exchange Traded Fund—0.3% | | |

| Nippon Tv Network | 35,100 | 5,804,712 | | CurrencyShares Japanese Yen | | |

| Omron Corp. | 220,000 | 5,947,190 | | | 9,800 | 820,162 |

| SANKYO CO., LTD. | 114,000 | 5,018,538 | | Total Exchange Traded Fund (Cost $833,256) | | 820,162 |

| Secom Co., Ltd. | 77,000 | 3,492,823 | | | | |

| Square Enix Co., Ltd. | 150,000 | 3,841,486 | | | | |

| Tecmo Ltd. | 513,100 | 4,483,211 | | | | |

| | | 58,981,888 | | | | |

Malaysia—2.3% | | | | | | |

| KLCC Property Holdings Berhad | 4,700,000 | 5,274,109 | | | | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville International Value Fund

Schedule of Investments as of April 30, 2007

(Unaudited)

| | | | | | |

Short-Term | Principal | | | | | |

| Amount | Value | | | | |

Variable Rate Demand Notes—7.0% | | | | | | |

| JP Morgan Chase Demand | | | | | | |

| Deposits, 2.00% | $15,973,919 | $ 15,973,919 | | | | |

| Total Short-Term Investments | | | | | | |

| (Cost $15,973,919) | | 15,973,919 | | | | |

Total Investments | | | | | | |

(Cost $166,557,604)—96.7% | | 221,894,495 | | | | |

Other Assets in Excess of Liabilities—3.3% | | 7,544,225 | | | | |

Total Net Assets—100.0% | | $229,438,720 | | | | |

| | | | | | | |

| Percentages are stated as a percent of net assets. | | | | | | |

| ADR American Depository Receipt | | | | | | |

| (a) | Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Gold Fund

Schedule of Investments as of April 30, 2007

(Unaudited)

| | | | | | | |

Common Stocks—87.6% | Shares | Value | | Common Stocks (continued) | Shares | Value |

Gold & Gold Related—73.4% | | | | Semafo, Inc. (a)(b) | 4,900,000 | $ 8,476,439 |

| Agnico-Eagle Mines Ltd. (b) | 402,000 | $14,182,560 | | Shore Gold, Inc. (a)(b) | 2,207,800 | 10,960,427 |

| Alamos Gold, Inc. (a)(b) | 2,615,100 | 15,715,575 | | Sino Gold Ltd. (a)(b) | 2,941,500 | 14,731,686 |

| Almaden Minerals Ltd. (a)(b) | 800,000 | 2,025,408 | | SouthernEra Diamonds, | | |

| Apollo Gold Corp. (a)(b) | 733,000 | 336,814 | | Inc. (a)(b) | 225,000 | 87,170 |

| Aquiline Resources, Inc. (a)(b) | 1,333,333 | 9,754,630 | | Strongbow Exploration, | | |

| Aurelian Resources, Inc. (a)(b) | 189,000 | 5,866,339 | | Inc. (a)(b) | 1,800,000 | 2,254,257 |

| Aurizon Mines Ltd. (a)(b) | 600,000 | 2,054,239 | | Sunridge Gold Corp. (a)(b) | 500,000 | 991,080 |

| Banro Corp. (a)(b) | 631,400 | 6,251,992 | | SXR Uranium One, Inc. (a)(b) | 1,802,500 | 27,039,936 |

| Centamin Egypt Ltd. (a)(b) | 7,830,000 | 7,066,106 | | Troy Resources NL (b)(f) | 3,413,000 | 8,504,012 |

| Cia de Minas Buenaventura SA | | | | U.S. Gold Corp. (a) | 223,000 | 1,340,130 |

| ADR (b) | 563,800 | 18,368,604 | | Wesdome Gold Mines Ltd. (a)(b) | 627,250 | 870,317 |

| Cluff Gold Ltd. (a)(b) | 2,450,000 | 3,796,893 | | Yamana Gold, Inc. (b) | 3,541,532 | 49,330,647 |

| Comaplex Minerals Corp. (a)(b) | 1,918,000 | 8,145,840 | | Zijin Mining Group Co., Ltd. (b) | 37,500,000 | 22,052,056 |

| Crystallex International Corp. (a)(b) | 2,555,600 | 10,196,844 | | | | 738,777,111 |

| Eldorado Gold Corporation | | | | Precious Metals & Related—14.2% | | |

| Ltd. (a)(b) | 1,000,000 | 5,793,315 | | Aber Diamond Corp. (b) | 100,000 | 3,624,000 |

| Euro Ressources S.A. (a)(b)(f) | 2,900,000 | 4,432,375 | | Apex Silver Mines Ltd. (a) | 1,111,800 | 16,665,882 |

| FNX Mining Co, Inc. (a)(b) | 300,000 | 7,189,837 | | Brilliant Mining Corp. (a)(b) | 1,875,000 | 3,665,871 |

| Freeport-McMoRan Copper & Gold, | | | | Cameco Corp. (b) | 236,000 | 11,002,320 |

| Inc. | 150,000 | 10,074,000 | | Impala Platinum Holdings Ltd. | | |

| Fury Explorations Ltd. (a)(b)(f) | 1,500,000 | 1,216,326 | | ADR (b) | 450,000 | 14,708,070 |

| Gabriel Resources Ltd. (a)(b) | 3,300,000 | 11,625,372 | | Impala Platinum Holdings Ltd. | 640,000 | 20,858,722 |

| Gammon Lake Resources, | | | | Ivanhoe Nickel & Platinum | | |

| Inc. (a)(b) | 2,192,100 | 35,452,018 | | Ltd. (a)(b)(c)(d)(e) | 458,333 | 3,666,664 |

| GBS Gold International, Inc. (a)(b) | 2,164,300 | 5,654,987 | | Mvelaphanda Resources | | |

| Gold Eagle Mines Ltd. (a)(b) | 200,000 | 1,538,878 | | Ltd. (a)(b) | 350,000 | 2,866,657 |

| Gold Fields Ltd. (b) | 166,249 | 3,015,663 | | Peru Copper, Inc. (a)(b) | 1,365,000 | 6,247,590 |

| Gold Fields Ltd. ADR (b) | 2,361,500 | 42,436,155 | | Sabina Silver Corp. (a)(b) | 900,000 | 2,473,196 |

| Goldcorp, Inc. (b) | 1,343,950 | 32,711,743 | | Silver Standard Resources, | | |

| Golden Star Resources Ltd. (a) | 5,589,000 | 24,518,532 | | Inc. (a)(b) | 557,000 | 20,291,510 |

| Great Basin Gold Ltd. (a)(b) | 1,000,000 | 2,288,494 | | Silver Wheaton Corp. (a)(b) | 1,687,400 | 18,761,278 |

| Harmony Gold Mining Co., | | | | Stornoway Diamond Corp. (a)(b) | 1,950,000 | 1,686,638 |

| Ltd. (a)(b) | 106,667 | 1,707,549 | | Trade Winds Ventures, Inc. (a)(b) | 1,100,000 | 322,101 |

| Harmony Gold Mining Co., Ltd. | | | | Uramin, Inc. (a)(b) | 2,776,600 | 16,679,767 |

| ADR (a)(b) | 784,400 | 12,456,272 | | | | 143,520,266 |

| Iamgold Corp. (b) | 1,805,700 | 14,645,702 | | Total Common Stocks (Cost $512,210,000) | | 882,297,377 |

| Ivanhoe Mines Ltd. (a)(b) | 4,467,000 | 55,339,445 | | Gold Bullion—6.6% | Ounces | |

| Lundin Mining Corp. (a)(b) | 300,000 | 3,678,710 | | | | 66,413,325 |

| Meridian Gold, Inc. (a)(b) | 550,531 | 13,888,484 | | Total Gold Bullion (Cost $44,609,241) | | |

| Minefinders Corp. (a)(b) | 663,000 | 7,437,021 | | | Shares | |

| Miramar Mining Corp. (a)(b) | 4,331,306 | 18,581,303 | | Gold & Gold Related—0.6% | | |

| New Gold, Inc. (a)(b)(f) | 1,518,500 | 11,172,835 | | Nevsun Resources Ltd. (a)(b)(d) | 202,125 | — |

| Newmont Mining Corp. | 419,800 | 17,505,661 | | Northern Orion Resources, | | |

| NovaGold Resources, Inc. (a)(b) | 880,500 | 12,478,840 | | | | |

| Orezone Resources, Inc. (a)(b) | 5,563,700 | 10,426,611 | | NovaGold Resources, Inc. (a)(b) | 75,000 | 610,190 |

| Osisko Exploration Ltd. (a)(b) | 1,673,200 | 16,136,607 | | Osisko Exploration (a)(b)(d) | | |

| Oxiana Ltd. (b) | 5,000,000 | 12,624,375 | | | | |

| Polyus Gold ADR (a)(b) | 851,616 | 38,748,528 | | Great Basin Gold Ltd. (a) | | |

| Radius Gold, Inc. (a)(b) | 1,329,544 | 634,885 | | | | |

Randgold Resources Ltd. ADR (b) | | | | | | |

| Royal Gold, Inc. | 447,765 | 13,132,947 | | | | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Gold Fund

Schedule of Investments as of April 30, 2007

(Unaudited)

| | | | | |

Warrants (continued) | Shares | Value | | Percentages are stated as a percent of net assets. |

Precious Metals & Related—0.2% | | | | ADR American Depository Receipt |

| Brilliant Mining (a)(b)(d) | 937,500 | | | (a) | Non-income producing security. |

| PAN American Silver | | | | (b) | Foreign issued security. Foreign concentration was as follows: |

| Corp. (a)(b) | 61,536 | 1,090,560 | | | Australia 4.9%; Canada 51.8%; China 2.2%; France 0.4%; Peru |

| | | 1,705,480 | | | 1.8%; Russia 3.9%; South Africa 11.8%; United Kingdom 4.3%. |

| Total Warrants (Cost $86,900) | | 8,059,936 | | (c) | Denotes security is fully or partially restricted to resale. The |

| | | | | | aggregate value of restricted securities at April 30, 2007 was |

| | Principal | | | | $3,666,664 which represented 0.4% of net assets. |

Corporate Bond—0.3% | Amount | | | (d) | Fair valued security. The aggregate value of fair valued securities |

Gold & Gold Related—0.3% | | | | | at April 30, 2007 was $6,567,858 which represented 0.7% of net |

| Crystallex Intl. Corp. | | | | | assets. |

| 9.375%, 12/30/11 (b) | $ 4,100,000 | 3,280,000 | | (e) | Security is considered illiquid and may be difficult to sell. |

| Total Corporate Bond (Cost $4,100,000) | | 3,280,000 | | (f) | Affiliated company. See Note 8 in Notes to the Financial |

Convertible Bond—0.7% | | | | | Statements. |

Gold & Gold Related—0.7% | | | | | |

| Sino Gold Ltd. | | | | | |

| 5.75%, 3/17/12 (b) | 3,000,000 | 6,732,000 | | | |

| Total Convertible Bond (Cost $3,000,000) | | 6,732,000 | | | |

Exchange Traded Fund—1.7% | | | | | |

| iShares Silver Trust (a) | 131,000 | 17,468,850 | | | |

| Total Exchange Traded Fund | | | | | |

| (Cost $12,982,561) | | 17,468,850 | | | |

Short-Term Investments—2.3% | | | | | |

| Repurchase Agreement with | | | | | |

| U.S. Bank, N.A., 5.00%, | | | | | |

| dated 4/30/07, due 5/1/07, | | | | | |

| collateralized by a Freddie | | | | | |

| Mac 15-Year Fixed (Pool | | | | | |

| #4622) valued at | | | | | |

| $23,310,450. Repurchase | | | | | |

| proceeds of 22,856,174. | | | | | |

| (Cost $22,853,000) | 22,853,000 | 22,853,000 | | | |

| Total Short-Term Investments | | | | | |

| (Cost $22,853,000) | | 22,853,000 | | | |

Total Investments | | | | | |

(Cost $599,841,702)—100.0% | | 1,007,104,488 | | | |

Liabilities in Excess of Other Assets—0.0% | | (276,824) | | | |

Total Net Assets—100.0% | | | | | |

The accompanying notes are an integral part of these financial statements.

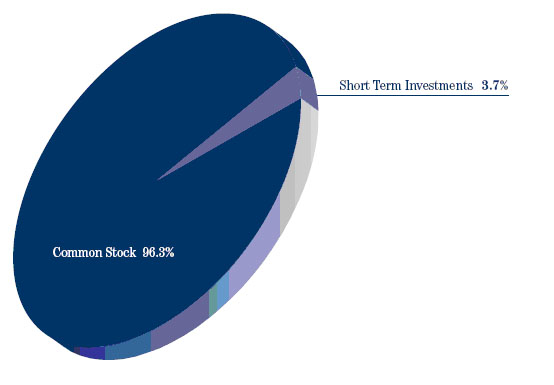

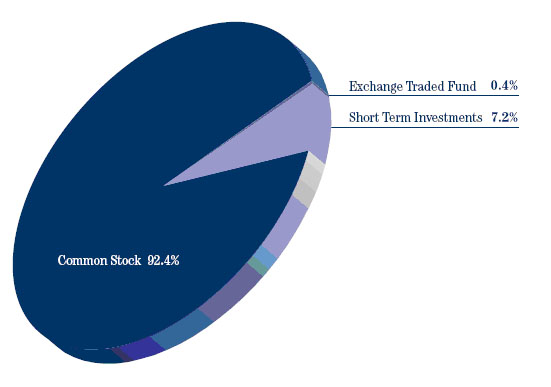

Percent of Total Investments

The Tocqueville Fund

Allocation of Portfolio Holdings

April 30, 2007

The Tocqueville Small Cap Value Fund

Allocation of Portfolio Holdings

April 30, 2007

Percent of Total Investments

The Tocqueville International Value Fund

Allocation of Portfolio Holdings

April 30, 2007

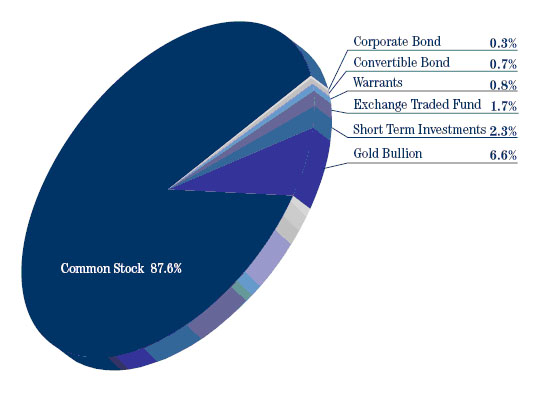

The Tocqueville Gold Fund

Allocation of Portfolio Holdings

April 30, 2007

The Tocqueville Trust

Statements of Assets and Liabilities

April 30, 2007

(Unaudited)

| | | The | | | Small Cap | | | International | | | | |

| | | Tocqueville | | | Value | | | Value | | | Gold | |

| | | Fund | | | Fund | | | Fund | | | Fund | |

Assets | | | | | | | | | | | | |

| Investments, at value (1) | | | | | | | | | | | | |

| Unaffiliated issuers | | $ | 470,458,037 | | | $ | 50,375,940 | | | $ | 221,894,495 | | | $ | 981,778,940 | |

| Affiliated issuers | | | — | | | | — | | | | — | | | | 25,325,548 | |

| Foreign currencies (2) | | | 1,629 | | | | — | | | | 8,955,562 | | | | — | |

| Cash | | | 1,150,599 | | | | 153 | | | | — | | | | — | |

| Receivable for fund shares sold | | | 1,984,244 | | | | 158,056 | | | | 135,690 | | | | 1,821,846 | |

| Dividends, interest and other receivables | | | 378,525 | | | | 29,150 | | | | 650,564 | | | | 760,871 | |

| Prepaid assets | | | 30,582 | | | | 12,180 | | | | 13,790 | | | | 37,212 | |

| Total Assets | | | 474,003,616 | | | | 50,575,479 | | | | 231,650,101 | | | | 1,009,724,417 | |

Liabilities | | | | | | | | | | | | | | | | |

| Payable for investments purchased | | | 2,158,365 | | | | — | | | | 1,507,465 | | | | — | |

| Payable for fund shares redeemed | | | 547,835 | | | | 12,959 | | | | 163,255 | | | | 1,674,779 | |

| Payable to Adviser | | | 284,182 | | | | 31,178 | | | | 190,827 | | | | 733,944 | |

| Due to custodian | | | — | | | | — | | | | 153,649 | | | | 8,743 | |

| Accrued distribution fee | | | 50,471 | | | | 7,291 | | | | 37,043 | | | | 45,501 | |

| Accrued expenses and other liabilities | | | 195,235 | | | | 22,439 | | | | 159,142 | | | | 433,786 | |

| Total Liabilities | | | 3,236,088 | | | | 73,867 | | | | 2,211,381 | | | | 2,896,753 | |

| Net Assets | | $ | 470,767,528 | | | $ | 50,501,612 | | | $ | 229,438,720 | | | $ | 1,006,827,664 | |

Net assets consist of: | | | | | | | | | | | | | | | | |

| Paid in capital | | | 374,022,569 | | | | 39,378,407 | | | | 161,303,744 | | | | 570,392,058 | |

| Accumulated net investment income (loss) | | | 812,847 | | | | (83,401 | ) | | | (211,322 | ) | | | (16,374,034 | ) |

| Accumulated net realized gain | | | 3,572,959 | | | | 4,409,247 | | | | 13,040,859 | | | | 45,545,971 | |

| Net unrealized appreciation on: | | | | | | | | | | | | | | | | |

| Investments and foreign currency related items | | | 92,359,153 | | | | 6,797,359 | | | | 55,305,439 | | | | 407,263,669 | |

| Net assets | | $ | 470,767,528 | | | $ | 50,501,612 | | | $ | 229,438,720 | | | $ | 1,006,827,664 | |

| Shares of beneficial interest outstanding | | | | | | | | | | | | | | | | |

| (unlimited shares of $0.01 par value authorized) | | | 17,763,508 | | | | 2,964,757 | | | | 14,502,059 | | | | 18,899,222 | |

| Net asset value and redemption price per share | | $ | 26.50 | | | $ | 17.03 | | | $ | 15.82 | | | $ | 53.27 | |

| Maximum offering price per share | | $ | 26.50 | | | $ | 17.03 | | | $ | 15.82 | | | $ | 53.27 | |

| (1) Cost of Investments | | | | | | | | | | | | | | | | |

| Unafilliated issuers | | $ | 378,099,648 | | | $ | 43,578,581 | | | $ | 166,557,604 | | | $ | 576,136,686 | |

| Affiliated issuers | | $ | — | | | $ | — | | | $ | — | | | $ | 23,705,016 | |

| (2) Cost of Foreign Currencies | | $ | 1,516 | | | $ | — | | | $ | 8,995,471 | | | $ | — | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Trust

Statements of Operations

For the Six Months Ended April 30, 2007

(Unaudited)

| | | The | | | Small Cap | | | International | | | | |

| | | Tocqueville | | | Value | | | Value | | | Gold | |

| | | Fund | | | Fund | | | Fund | | | Fund | |

Investment Income: | | | | | | | | | | | | |

| Dividends* | | | | | | | | | | | | |

| Unaffiliated issuers | | $ | 3,339,137 | | | $ | 198,988 | | | $ | 1,819,217 | | | $ | 2,359,845 | |

| Interest | | | 640,640 | | | | 49,621 | | | | 228,046 | | | | 573,479 | |

| | | | 3,979,777 | | | | 248,609 | | | | 2,047,263 | | | | 2,933,324 | |

Expenses: | | | | | | | | | | | | | | | | |

| Investment Adviser’s fee (See Note 4) | | | 1,627,326 | | | | 188,818 | | | | 1,142,120 | | | | 4,105,704 | |

| Distribution fees (See Note 4) | | | 542,442 | | | | 62,939 | | | | 285,530 | | | | 1,162,794 | |

| Administration fee (See Note 4) | | | 325,465 | | | | 37,763 | | | | 171,318 | | | | 697,676 | |

| Transfer agent and shareholder services fees | | | 74,737 | | | | 10,211 | | | | 44,917 | | | | 185,776 | |

| Professional fees | | | 42,129 | | | | 6,022 | | | | 32,533 | | | | 121,043 | |

| Fund accounting fees | | | 25,313 | | | | 3,496 | | | | 22,074 | | | | 54,084 | |

| Custody fees | | | 21,478 | | | | 5,334 | | | | 78,332 | | | | 113,264 | |

| Registration fees | | | 17,247 | | | | 11,690 | | | | 17,842 | | | | 42,128 | |

| Printing and mailing expense | | | 16,947 | | | | 1,144 | | | | 5,989 | | | | 36,906 | |

| Trustee fees and expenses | | | 13,351 | | | | 1,144 | | | | 11,609 | | | | 46,230 | |

| Insurance expense | | | 6,233 | | | | 1,546 | | | | 6,697 | | | | 23,526 | |

| Other expenses | | | 15,847 | | | | 1,903 | | | | 7,849 | | | | 44,670 | |

| Total expenses before waiver | | | 2,728,515 | | | | 332,010 | | | | 1,826,810 | | | | 6,633,801 | |

| Less: Fees waived (See Note 4) | | | (16,305 | ) | | | — | | | | — | | | | — | |

| Net expenses | | | 2,712,210 | | | | 332,010 | | | | 1,826,810 | | | | 6,633,801 | |

Net Investment Income (Loss) | | | 1,267,567 | | | | (83,401 | ) | | | 220,453 | | | | (3,700,477 | ) |

Realized and Unrealized Gain (Loss): | | | | | | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | | | | | | |

| Investments | | | | | | | | | | | | | | | | |

| Unaffiliated issuers | | | 17,706,134 | | | | 4,465,732 | | | | 12,733,085 | | | | 46,110,235 | |

| Foreign currency translation | | | (7,593 | ) | | | — | | | | 303,680 | | | | (6,995 | ) |

| | | | 17,698,541 | | | | 4,465,732 | | | | 13,036,765 | | | | 46,103,240 | |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | |

| Investments | | | 19,478,019 | | | | (905,191 | ) | | | 10,207,119 | | | | 79,004,712 | |

| Foreign currency translation | | | 301 | | | | — | | | | (136,834 | ) | | | — | |

| | | | 19,478,320 | | | | (905,191 | ) | | | 10,070,285 | | | | 79,004,712 | |

| Net gain on investments and foreign currency | | | 37,176,861 | | | | 3,560,541 | | | | 23,107,050 | | | | 125,107,952 | |

Net Increase in Net Assets Resulting from Operations | | $ | 38,444,428 | | | $ | 3,477,140 | | | $ | 23,327,503 | | | $ | 121,407,475 | |

| * Net of foreign taxes withheld | | $ | 53,793 | | | $ | — | | | $ | 247,290 | | | $ | 137,266 | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Trust

Statements of Changes in Net Assets

| | | | |

| | | The Tocqueville Fund | |

| | | For the | | | | |

| | | Six Months | | | For the | |

| | | Ended | | | Year Ended | |

| | | April 30, | | | October 31, | |

| | | 2007 | | | 2006 | |

| | | (Unaudited) | | | | |

Operations: | | | | | | |

| Net investment income (loss) | | $ | 1,267,567 | | | $ | 1,593,038 | |

| Net realized gain on investments and foreign currency | | | 17,698,541 | | | | 26,821,512 | |

| Net change in unrealized appreciation/(depreciation) | | | 19,478,320 | | | | 34,202,302 | |

| Net increase in net assets resulting from operations | | | 38,444,428 | | | | 62,616,852 | |

Dividends and distributions to shareholders: | | | | | | | | |

| Net investment income | | | (454,720 | ) | | | (2,189,946 | ) |

| Net realized gains | | | — | | | | (23,608,046 | ) |

| Total dividends and distributions | | | (454,720 | ) | | | (25,797,992 | ) |

Fund share transactions: | | | | | | | | |

| Shares sold | | | 72,179,546 | | | | 115,739,773 | |

| Shares issued in merger (See Note 7) | | | — | | | | 65,466,749 | |

| Shares issued to holders in reinvestment of dividends | | | 367,310 | | | | 22,804,475 | |

| Shares redeemed* | | | (32,263,985 | ) | | | (24,126,165 | ) |