As filed with the Securities and Exchange Commission on 7/8/2009

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 W. 57th Street, 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt, President

The Tocqueville Trust

40 W. 57th Street, 19th Floor

New York, NY 10019

(Name and address of agent for service)

212-698-0800

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: April 30, 2009

Item 1. Report to Stockholders.

SEMI-ANNUAL REPORT

April 30, 2009

The Tocqueville Trust

Mutual Funds

The Tocqueville Fund

The Tocqueville Small Cap Fund

The Tocqueville International Value Fund

The Tocqueville Gold Fund

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of The Tocqueville Trust. Please call 1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @ www.tocquevillefunds.com

Dear Fellow Shareholder,

After a timid recovery following the freefall experienced by practically all markets in October and November of 2008, a number of indices made minor new lows in March (for example the S&P 500 index), while others (such as the un-weighted Value Line Arithmetic index) merely revisited their November lows.

As of June 12, the S&P 500 index has now rebounded almost 42% from its March 6 low. The advance was broad-based as illustrated by the fact that on an equally-weighted basis, the stocks making up the index were up almost 61% on average.

It is important to remember that percentage gains or losses depend to a large extent on the level one uses as a base. For example, a stock that has declined 50% from $100 to $50 needs to gain 100% (e.g. to double) to return to its starting price of $100.

Thus, the S&P 500 lost 57.7% from its peak of 1576 on October 11, 2007 to its low of 667 on March 6 2009. It then gained 42% from that low but, at 946 on June 12 2009, that still leaves the index 40% below its peak of 2007. With various degrees of volatility, most global stock markets have followed similar patterns, as have most commodities.

We tend to think that the recovery to-date essentially erases the anomaly of October and November, when panic and forced sales resulted in a chaotic and indiscriminate collapse of stock prices: when one is forced to sell, one does not necessarily sell the stocks that most deserve to be sold, but rather those that can be sold. We also tend to think that the rebound has been and will continue to be just as indiscriminate as the liquidation of October and November.

Once we have rebounded to the levels preceding the October and November capitulation—somewhere between 1,000 and 1,100 on the S&P 500—some correction would not be too surprising and the real work will begin: to identify the potential leaders of the next major advance in global stock prices.

Faithfully Yours,

François Sicart

Chairman

The Tocqueville Fund

Dear Fellow Shareholder,

For the six month period ended April 30, 2009 which marks the first half of our fiscal year, the Tocqueville Fund generated a return of negative 4.09%. This compares with a negative return of 8.53% for the S&P 500, the index against which we are most often compared. These results, though gratifying, hardly begin to tell the story of the past six months.

The period began with the November election of Barack Obama, a truly historic event which was quickly followed by steep declines in the equity markets. A respite in December was offset the following month when the worst single month January decline in stock market history was followed by a nearly equal decline in February. By February’s end, the S&P 500 had declined by 26% since the election and this on top of an 18% decline in the two month period leading up to the election.

From these extremely depressed levels, the S&P 500 staged a rebound of 19% in the last two months of the period, a rebound that continues through this writing. By any measure this was an extraordinarily volatile period in market history, perhaps the most volatile, or certainly close to it. Managing a mutual fund in a period like this was no easy task.

Notwithstanding the difficulties, some themes began to emerge and some opportunities presented themselves. Government policies to address the financial and economic crises became more explicit. Among other things, it became clear that the level of government involvement in the economy, government regulations and government expense, in the form of higher taxes, are to be increased dramatically. It has also become abundantly clear that the government is prepared to use heretofore unheard of sums of deficit financing, as well as money creation, to achieve its goals. The long term effects of these policies seem certain to be much slower sustainable growth rates in the U.S. and rising inflationary and interest rate pressures, as well as a weaker dollar.

Shorter term, however, we would expect the economy to have a normal, if subdued, rebound from the steep declines of the past several quarters, and, thus, we have not been surprised by the rally of the past few months. Stock prices reached levels which suggested depression era extremes, and we do not believe that this represents the most likely outcome. While we are in for a possibly very long period of transition, perhaps along the lines of the Japanese experience since 1990, policy makers have not made the mistakes that were made in the 1930’s, at least not yet.

Our investment approach during this period has been to take advantage of the very low stock prices, especially in commodity oriented names, and in higher quality growth names, particularly those with global franchises. We have also began to research and position companies which would benefit from a rebound in housing activity, although we believe this remains quite a ways off. We have continued to avoid most areas of financial exposure, believing that the future for most financial institutions is fraught with challenges, even if the worst has past. Here especially, the heavy presence of the Federal Government is likely to restrict returns for some time, certainly over our investment time horizon.

Broad themes aside, our contrarian and value style of investing focuses on individual companies and fundamental research. Even in the most difficult of times, good investment opportunities can present themselves when investor psychology becomes more negative than the realities on the ground. That certainly seemed to be the case earlier in the calendar year, particularly just after the announcement of President Obama’s 2010 budget proposals. We will continue to look for opportunities to invest your funds in quality names at bargain prices and will try to use the swings in investor psychology to our advantage. For the foreseeable future, we believe this will remain a stock picker’s market and that the key to acceptable returns will be good stock selection.

As a large shareholder of the Tocqueville Fund, as well as its manager, I want to take this opportunity to thank each of you for your continued interest in and support of the fund.

Sincerely,

Robert W. Kleinschmidt

Portfolio Manager

The Tocqueville Fund

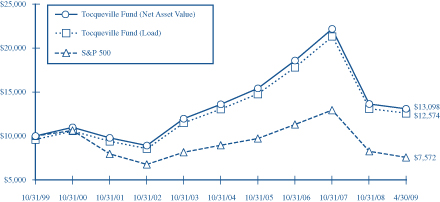

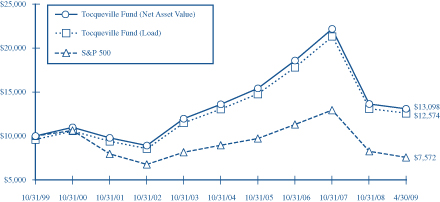

This chart assumes an initial gross investment of $10,000 made on 10/31/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2009

| | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

Tocqueville Fund—Net Asset Value | | -35.23% | | -10.55% | | 0.26% | | 2.21% |

Tocqueville Fund—Load* | | -35.23% | | -10.55% | | 0.26% | | 1.79% |

Standard & Poor’s 500 Stock Index | | -35.31% | | -10.76% | | -2.70% | | -2.48% |

| * | Effective February 1, 2000, the Fund eliminated its sales load. |

The Tocqueville Small Cap Fund

Dear Fellow Shareholder,

The first six months of our fiscal year ended April 30, 2009 were difficult for small cap stocks, with the Russell 2000 Index down 8.40%. The Tocqueville Small Cap Fund was down 2.52% over the same period. The Fund’s outperformance of its benchmark during the period resulted from an absence of financial stocks which did very poorly as cyclical credit issues started to emerge for smaller banks. Financials represented almost half of the negative contribution to performance for the Russell 2000 Index. Our energy holdings were market leaders and generated significant positive returns for the Fund. Unfortunately, this was not enough to get us to positive territory.

The pain experienced by investors over the past year will take a long time to heal but the first step is to find a market bottom. Unfortunately, this is not a singular event but a process. Many pieces of the puzzle need to come together before investors, consumers and businesses will think about a return to “normal.” Fortunately, we believe this may be happening.

Liquidity in the short term money markets has been restored. Healthy corporations are accessing capital in the bond market at reasonable rates. Mortgages have been available for refinancing at historic low rates and credit is available to qualified borrowers for home purchases. Real estate prices in California have shown signs of a turn, a result of lower prices and mortgage rates which have attracted new buyers. Banks have attained healthy profitability due to the low cost of deposits and have cut dividends thus allowing many to earn their way out of this situation without having to raise capital under duress. Retail sales have been firm in certain areas while consumers have already taken their saving rates to 5% from zero two years ago. They are beginning to restore their balance sheets by selling unwanted assets, paying down debt and refinancing mortgages at lower rates. Lower gasoline prices helped for a while. Anecdotal evidence suggests that China is back on a growth path again while oil prices may be signaling that global growth is being restored. Lastly, the recent recovery in share prices has helped to build consumer confidence which should spill over to business spending at some point. In summary, a lot of positive fundamental and psychological news has emerged which should restore investor confidence thus giving us hope that a bottom has been reached. The next step will be a revival of business momentum. No recovery can be expected to be a straight line so it may take several more quarters before signs of growth can emerge.

We expect that there will be lots of volatility, disappointment and missed expectations during this time that will cause markets to back and fill as they crawl their way back. Historically, however, companies that become the best performers in the next cycle begin to show themselves early, outperforming others in restoring business momentum during the ups and downs of the healing process as the energy stocks did over the past six months. This will be a fertile time for opportunistic stock picking strategies like ours. Hence, we continue to look to the future with great optimism.

We remain overweighed in Healthcare, Technology, Energy and Producer Durables. We are building positions opportunistically in consumer stocks and may even purchase financials once we believe the worst of their cyclical credit issues are evident, later this year. Our focus continues on companies most likely to generate positive business momentum over the next twelve months in spite of a lackluster economic environment.

| | | | |

| Sincerely, | | | | |

| | |

| |  | |  |

| P. Drew Rankin | | Allen Huang | | Douglas Adams |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

The Tocqueville Small Cap Fund

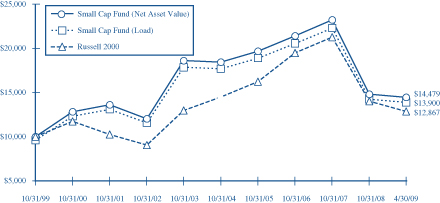

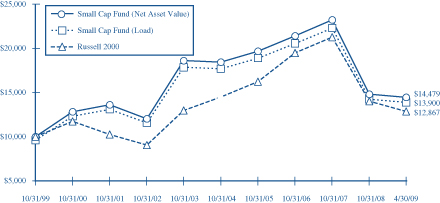

This chart assumes an initial gross investment of $10,000 made on 10/31/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Russell 2000 Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2009

| | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

Tocqueville Small Cap Fund—Net Asset Value | | -24.78% | | -13.23% | | -7.16% | | 5.20% |

Tocqueville Small Cap Fund—Load* | | -24.78% | | -13.23% | | -7.16% | | 4.77% |

Russell 2000 Index | | -30.74% | | -12.72% | | -1.45% | | 2.53% |

| * | Effective February 1, 2000, the Fund eliminated its sales load. |

The Tocqueville International Value Fund

Dear Fellow Shareholder,

For the six months ended April 30, 2009, global equity markets declined through mid-February as the global economy continued its sharp deceleration and credit markets remained frozen. Markets then rallied through the end of April in the wake of massive monetary and fiscal stimulus, various initiatives aimed at repairing financial institution balance sheets, and stabilizing credit markets. The Tocqueville International Value Fund’s total U.S. dollar return for the period was a gain of 2.71%. In the same period, the Morgan Stanley EAFE Index, the benchmark against which we are most often compared, had a total U.S. dollar loss of 2.35%.

During the six months, the European BE 500 index decreased by 8.06% in local currency terms, the Japanese Nikkei 225 increased by 4.00% in local currency terms, the Morgan Stanley Far East Index increased by 12.68%. Commodity prices generally reached their nadir in November and then slowly recovered as producers exercised supply discipline and investors and central banks sought hard asset inflationary hedges in the face of unprecedented money creation. Oil and gold in particular experienced substantial price increases. Most equity markets decreased during the period. The major exceptions were Brazil and Russia, which bottomed in November and moved up with commodity prices, and China and several Asian markets, which responded favorably to China’s announced fiscal stimulus plan. In terms of sectors, technology services, machinery, energy, chemicals, and mining were up, while real estate, financials, pharmaceuticals and autos were down, among others. The Japanese Yen strengthened while the Euro and most other currencies weakened against the U.S. dollar during the periods of rising risk aversion. This reversed as investors took more risk in March and April.

During the six-month period, most of our positions produced positive returns. Our strategy during the depths of the market turmoil has been to maintain a large exposure to highly cash generative, non-economically sensitive shares, while increasing our exposure to high quality, pro-cyclical companies with strong balance sheets in industrials, resources and technology as exceptional values emerged. During the period, we had healthy contributions from gold, metals and oil producers, like Newmont Mining, Freeport-McMoran and Petrobras; from European and Japanese industrial shares, like Belgian radial tire cord producer Beckaert, German construction machinery maker Wacker, and Japanese robotics maker Fanuc. Our losses were concentrated in consumer staple shares, like Unilever and Nestle, which had heretofore retained their value. We managed to avoid large losses in financials and real estate as we retain a limited exposure to those sectors.

While our pro-cyclical and pro-reflationary viewpoint has gone from being very contrarian in January to more accepted by the consensus today, we nonetheless continue to find exceptional values among well-positioned, financially-sound cyclical companies. During the period, we took positions in Umicore, a Belgian producer of automotive catalysts and other specialty materials; in French outdoor advertising leader JC Decaux; and in the convertible bonds of Mexican telecom provider NIHD. We also added to our positions in Cadbury plc, the UK candy maker, a terrific brand with a plan to improve profitability and returns. We sold our position in Taiwan’s Chunghwa Telecom, which had performed well during the market downturn and reached our valuation objective.

We find that the investment environment has stabilized in recent months. Financial institutions are generally being recapitalized, credit markets are beginning to function, and the economy is beginning to find its footing. With companies globally having implemented radical inventory and cost reductions, the stage is set for a recovery in corporate profits, notwithstanding the headwind from broad-based deleveraging in the U.S. While we are mindful of near term risks, we continue to seek out compelling long term investment opportunities in securities with favorable risk/reward profiles that are out of favor and cheap to intrinsic value. As noted, the current environment has us busy looking at a plethora of opportunities.

Respectfully,

| | | | |

| | |

| | | |  |

| James Hunt | | | | Francois Sicart |

| Portfolio Manager | | | | Portfolio Manager |

The Tocqueville International Value Fund

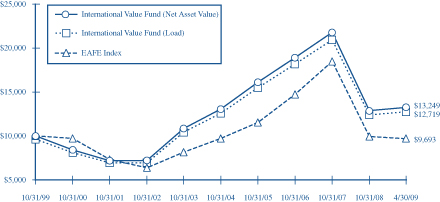

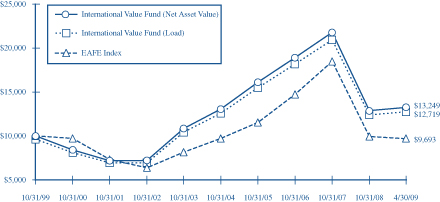

This chart assumes an initial gross investment of $10,000 made on 10/31/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Morgan Stanley EAFE Index is an unmanaged market-capitalization-weighted index composed of companies representative of the market structure of 21 Developed Market Countries in Europe, Australia, Asia and the Far East.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2009

| | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | | 10 Year |

Tocqueville International Value Fund—Net Asset Value | | -33.34% | | -12.08% | | 1.77 | % | | 3.45% |

Tocqueville International Value Fund—Load* | | -33.34% | | -12.08% | | 1.77 | % | | 3.03% |

Morgan Stanley EAFE Index | | -42.42% | | -11.91% | | 1.12 | % | | 0.35% |

| * | Effective February 1, 2000, the Fund eliminated its sales load. |

The Tocqueville Gold Fund

Dear Fellow Shareholder,

The prospect of yawning U.S. fiscal deficits has triggered renewed dollar weakness against the Euro. In the six months ended April 30, 2009, the dollar lost 4% against the euro. At the same time, Chinese central bankers have openly worried about their huge exposure to the U.S. dollar and suggested replacing the dollar as a reserve currency. Many other nations with large dollar reserves share these worries, in our view, but have been less vocal on the subject. There is a real possibility that a rout of the U.S. dollar will be the price paid for unprecedented monetary and fiscal stimulus to stabilize the slide in the U.S. economy. While credit spreads have narrowed, allowing the equity market to recover somewhat, serious dollar weakness will present a new set of policy problems which cannot be solved by more stimulus, because it will only exacerbate dollar weakness. We are concerned that the only way to contain dollar weakness may be a sharp rise in interest rates, which in turn would destabilize the economy. Yet, it seems unlikely there would be any political tolerance for higher interest rates. The policy reflex to this dilemma would most likely be a new round of monetary stimulus and debt monetization by the Federal Reserve. In so doing, economic policy would turn overtly to a weak dollar stance. We believe this would risk a cycle of dollar dumping by those who currently hold large dollar reserves and a flow of central bank capital into gold. We also believe that gold is beginning to discount this sort of scenario. Should events play out in this manner, the stage would be set for the metal to trade permanently above $1000. This in turn should breathe new life into the gold share sector, which in our opinion, would be rerated higher, and provide investment returns substantially in excess of the metal itself. While gold shares have provided good returns on a year to date basis, they have not yet returned to valuation levels that prevailed before the implosion of credit in the second half of 2008. The combination of a dynamic rise in the gold price and a return to historical valuation levels by the gold shares would seem to be a compelling investment proposition.

Sincerely,

John C. Hathaway

Portfolio Manager

The Tocqueville Gold Fund

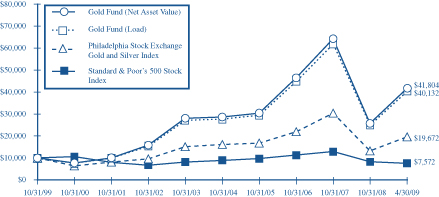

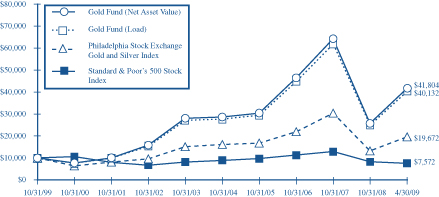

This chart assumes an initial gross investment of $10,000 made on 10/31/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

In 2003 and 2006, the performance of The Tocqueville Gold Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2009

| | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

Tocqueville Gold Fund—Net Asset Value | | -24.69% | | -6.35% | | 11.84% | | 15.85% |

Tocqueville Gold Fund—Load* | | -24.69% | | -6.35% | | 11.84% | | 15.04% |

Philadelphia Stock Exchange Gold and Silver Index | | -29.19% | | -7.80% | | 9.10% | | 6.56% |

Standard & Poor’s 500 Stock Index | | -35.31% | | -10.76% | | -2.70% | | -2.48% |

| * | Effective February 1, 2000, the Fund eliminated its sales load. |

Expense Example—April 30, 2009

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (November 1, 2008-April 30, 2009).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example Tables

The Tocqueville Fund

| | | | | | | | | |

| | | Beginning

Account Value

November 1, 2008 | | Ending

Account Value

April 30, 2009 | | Expenses Paid

During Period*

November 1, 2008 -

April 30, 2009 |

Actual | | $ | 1,000.00 | | $ | 959.10 | | $ | 6.07 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1018.60 | | | 6.26 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.25%, mutiplied by the average account value over the period, muliplied by 181/365 to reflect the one-half year period. |

The Tocqueville Small Cap Fund

| | | | | | | | | |

| | | Beginning

Account Value

November 1, 2008 | | Ending

Account Value

April 30, 2009 | | Expenses Paid

During Period*

November 1, 2008 -

April 30, 2009 |

Actual | | $ | 1,000.00 | | $ | 974.80 | | $ | 6.95 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1017.75 | | | 7.10 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.42%, mutiplied by the average account value over the period, muliplied by 181/365 to reflect the one-half year period. |

The Tocqueville International Value Fund

| | | | | | | | | |

| | | Beginning

Account Value

November 1, 2008 | | Ending

Account Value

April 30, 2009 | | Expenses Paid

During Period*

November 1, 2008 -

April 30, 2009 |

Actual | | $ | 1,000.00 | | $ | 1,027.10 | | $ | 8.29 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,016.61 | | | 8.25 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.65%, mutiplied by the average account value over the period, muliplied by 181/365 to reflect the one-half year period. |

The Tocqueville Gold Fund

| | | | | | | | | |

| | | Beginning

Account Value

November 1, 2008 | | Ending

Account Value

April 30, 2009 | | Expenses Paid

During Period*

November 1, 2008 -

April 30, 2009 |

Actual | | $ | 1,000.00 | | $

| 1,623.40

| | $ | 10.21 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,017.01 | | | 7.85 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.57%, mutiplied by the average account value over the period, muliplied by 181/365 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating

performance

(For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2009 | | | Years Ended October 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 16.39 | | | $ | 28.93 | | | $ | 24.25 | | | $ | 22.17 | | | $ | 20.43 | | | $ | 17.99 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.19 | | | | 0.24 | | | | 0.18 | | | | 0.14 | | | | 0.15 | | | | 0.05 | |

Net realized and unrealized gain (loss) | | | (0.86 | ) | | | (10.56 | ) | | | 4.53 | | | | 4.33 | | | | 2.53 | | | | 2.41 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | (0.67 | ) | | | (10.32 | ) | | | 4.71 | | | | 4.47 | | | | 2.68 | | | | 2.46 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.29 | ) | | | (0.19 | ) | | | (0.03 | ) | | | (0.22 | ) | | | (0.12 | ) | | | (0.02 | ) |

Distributions from net realized gains | | | — | | | | (2.03 | ) | | | — | | | | (2.17 | ) | | | (0.82 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (0.29 | ) | | | (2.22 | ) | | | (0.03 | ) | | | (2.39 | ) | | | (0.94 | ) | | | (0.02 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | (0.96 | ) | | | (12.54 | ) | | | 4.68 | | | | 2.08 | | | | 1.74 | | | | 2.44 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 15.43 | | | $ | 16.39 | | | $ | 28.93 | | | $ | 24.25 | | | $ | 22.17 | | | $ | 20.43 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | (4.1 | )%(2) | | | (38.5 | )% | | | 19.4 | % | | | 20.5 | % | | | 13.4 | % | | | 13.7 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 288,766 | | | $ | 328,609 | | | $ | 523,878 | | | $ | 392,495 | | | $ | 175,791 | | | $ | 145,435 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.25 | %(3)(4) | | | 1.25 | %(3) | | | 1.25 | %(3) | | | 1.30 | % | | | 1.34 | % | | | 1.34 | % |

Net investment income | | | 2.34 | %(3)(4) | | | 0.94 | %(3) | | | 0.69 | %(3) | | | 0.68 | % | | | 0.68 | % | | | 0.25 | % |

Portfolio turnover rate | | | 15 | %(2) | | | 51 | % | | | 39 | % | | | 32 | % | | | 45 | % | | | 40 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.002, $0.009, $0.002, $0.002, $0.003 and $0.001 per share for the six months ended April 30, 2009 and the five years ended October 31, 2008, 2007, 2006, 2005, and 2004, respectively. |

| (3) | Net of fees waived amounting to 0.13%, 0.04% and 0.01% of average net assets for the six months ended April 30, 2009 and the two years ended October 31, 2008 and 2007, respectively. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Small Cap Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the

period) | | Six Months

Ended

April 30,

2009 | | | Years Ended October 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 9.77 | | | $ | 17.24 | | | $ | 18.04 | | | $ | 16.58 | | | $ | 16.11 | | | $ | 18.83 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.04 | ) | | | 0.02 | | | | 0.11 | | | | (0.07 | ) | | | (0.13 | ) | | | (0.11 | ) |

Net realized and unrealized gain (loss) | | | (0.22 | ) | | | (5.67 | ) | | | 1.26 | | | | 1.53 | | | | 1.26 | | | | 0.21 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | (0.26 | ) | | | (5.65 | ) | | | 1.37 | | | | 1.46 | | | | 1.13 | | | | 0.10 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.01 | ) | | | (0.12 | ) | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | (0.10 | ) | | | (1.70 | ) | | | (2.17 | ) | | | — | | | | (0.66 | ) | | | (2.82 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.11 | ) | | | (1.82 | ) | | | (2.17 | ) | | | — | | | | (0.66 | ) | | | (2.82 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | (0.37 | ) | | | (7.47 | ) | | | (0.80 | ) | | | 1.46 | | | | 0.47 | | | | (2.72 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 9.40 | | | $ | 9.77 | | | $ | 17.24 | | | $ | 18.04 | | | $ | 16.58 | | | $ | 16.11 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | (2.52 | )%(2) | | | (36.2 | )% | | | 8.4 | % | | | 8.8 | % | | | 6.8 | % | | | (1.0 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 31,389 | | | $ | 36,429 | | | $ | 49,543 | | | $ | 52,701 | | | $ | 57,576 | | | $ | 75,005 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.42 | %(3) | | | 1.35 | % | | | 1.32 | % | | | 1.34 | % | | | 1.39 | % | | | 1.41 | % |

Net investment income (loss) | | | (0.91 | )%(3) | | | 0.12 | % | | | 0.63 | % | | | (0.38 | )% | | | (0.67 | )% | | | (0.61 | )% |

Portfolio turnover rate | | | 34 | %(2) | | | 169 | % | | | 90 | % | | | 45 | % | | | 30 | % | | | 19 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.001, $0.005, $0.001, $0.015, $0.006 and $0.02 per share for six months ended April 30, 2009 and the five years ended October 31, 2008, 2007, 2006, 2005 and 2004 respectively. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville International Value Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2009 | | | Years Ended October 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 8.49 | | | $ | 16.48 | | | $ | 16.72 | | | $ | 16.06 | | | $ | 13.10 | | | $ | 10.90 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.04 | | | | 0.13 | | | | 0.08 | | | | 0.27 | | | | 0.04 | | | | 0.09 | |

Net realized and unrealized gain (loss) | | | 0.20 | | | | (6.09 | ) | | | 2.25 | | | | 2.30 | | | | 3.00 | | | | 2.15 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 0.24 | | | | (5.96 | ) | | | 2.33 | | | | 2.57 | | | | 3.04 | | | | 2.24 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.20 | ) | | | (0.10 | ) | | | (0.27 | ) | | | (0.05 | ) | | | (0.08 | ) | | | (0.04 | ) |

Distributions from net realized gains | | | (0.50 | ) | | | (1.93 | ) | | | (2.30 | ) | | | (1.86 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (0.70 | ) | | | (2.03 | ) | | | (2.57 | ) | | | (1.91 | ) | | | (0.08 | ) | | | (0.04 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | (0.46 | ) | | | (7.99 | ) | | | (0.24 | ) | | | 0.66 | | | | 2.96 | | | | 2.20 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 8.03 | | | $ | 8.49 | | | $ | 16.48 | | | $ | 16.72 | | | $ | 16.06 | | | $ | 13.10 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 2.7 | %(2) | | | (40.8 | )% | | | 15.3 | % | | | 17.4 | % | | | 23.3 | % | | | 20.6 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 102,168 | | | $ | 118,189 | | | $ | 219,220 | | | $ | 225,234 | | | $ | 215,711 | | | $ | 196,424 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.65 | %(3) | | | 1.56 | % | | | 1.59 | % | | | 1.61 | % | | | 1.66 | % | | | 1.71 | % |

Net investment income | | | 0.75 | %(3) | | | 1.07 | % | | | 0.49 | % | | | 1.49 | % | | | 0.29 | % | | | 0.85 | % |

Portfolio turnover rate | | | 16 | %(2) | | | 63 | % | | | 49 | % | | | 39 | % | | | 35 | % | | | 43 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.001, $0.001, $0.002, $0.011, $0.003 and $0.01 per share for the six months ended April 30, 2009 and the five years ended October 31, 2008, 2007, 2006, 2005 and 2004, respectively. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Gold Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2009 | | | Years Ended October 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 21.77 | | | $ | 64.36 | | | $ | 51.41 | | | $ | 35.51 | | | $ | 34.84 | | | $ | 34.71 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.18 | ) | | | (0.57 | ) | | | (0.30 | ) | | | (0.22 | ) | | | (0.33 | ) | | | (0.33 | ) |

Net realized and unrealized gain (loss) | | | 13.60 | | | | (33.24 | ) | | | 18.52 | | | | 18.21 | | | | 2.36 | | | | 1.04 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 13.42 | | | | (33.81 | ) | | | 18.22 | | | | 17.99 | | | | 2.03 | | | | 0.71 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | (0.46 | ) | | | (0.22 | ) | | | — | | | | — | | | | (0.03 | ) |

Dividends from net realized gains | | | (0.88 | ) | | | (8.32 | ) | | | (5.05 | ) | | | (2.09 | ) | | | (1.36 | ) | | | (0.55 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.88 | ) | | | (8.78 | ) | | | (5.27 | ) | | | (2.09 | ) | | | (1.36 | ) | | | (0.58 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 12.54 | | | | (42.59 | ) | | | 12.95 | | | | 15.90 | | | | 0.67 | | | | 0.13 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 34.31 | | | $ | 21.77 | | | $ | 64.36 | | | $ | 51.41 | | | $ | 35.51 | | | $ | 34.84 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 62.3 | %(2) | | | (60.0 | )% | | | 38.4 | % | | | 52.5 | % | | | 6.2 | % | | | 2.0 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 624,073 | | | $ | 410,857 | | | $ | 1,231,475 | | | $ | 833,254 | | | $ | 538,492 | | | $ | 539,190 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.57 | %(3) | | | 1.43 | % | | | 1.42 | % | | | 1.50 | % | | | 1.59 | % | | | 1.58 | % |

Net investment income (loss) | | | (1.20 | )%(3) | | | (1.07 | )% | | | (0.81 | )% | | | (0.51 | )% | | | (0.97 | )% | | | (1.11 | )% |

Portfolio turnover rate | | | 7 | %(2) | | | 28 | % | | | 26 | % | | | 30 | % | | | 27 | % | | | 24 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.014, $0.027, $0.028, $0.06, $0.02 and $0.09 per share for the six months ended April 30, 2009 and the five years ended October 31, 2008, 2007, 2006, 2005 and 2004, respectively. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Fund

Schedule of Investments as of April 30, 2009

(Unaudited)

| | | | | |

| Common Stocks—95.4% | | Shares | | Value |

Aerospace & Defense—1.4% | | | | | |

The Boeing Co. | | 100,000 | | $ | 4,005,000 |

Air Freight & Logistics—1.8% | | | | | |

United Parcel Service, Inc. | | 100,000 | | | 5,234,000 |

Automobiles—2.1% | | | | | |

Toyota Motor Corp.—ADR (b) | | 75,000 | | | 5,937,000 |

Beverages—2.2% | | | | | |

The Coca-Cola Co. | | 150,000 | | | 6,457,500 |

Biotechnology—3.0% | | | | | |

Amgen, Inc. (a) | | 100,000 | | | 4,847,000 |

Isis Pharmaceuticals, Inc. (a) | | 250,000 | | | 3,920,000 |

| | | | | | 8,767,000 |

Building Products—0.9% | | | | | |

Masco Corp. | | 300,000 | | | 2,658,000 |

Capital Markets—1.4% | | | | | |

The Bank of New York Mellon Corp. | | 75,000 | | | 1,911,000 |

Lazard Ltd. (b) | | 75,000 | | | 2,047,500 |

| | | | | | 3,958,500 |

Chemicals—3.7% | | | | | |

EI Du Pont de Nemours & Co. | | 300,000 | | | 8,370,000 |

W.R. Grace & Co. (a) | | 250,000 | | | 2,207,500 |

| | | | | | 10,577,500 |

Commercial Banks—2.6% | | | | | |

East West Bancorp, Inc. | | 300,000 | | | 2,049,000 |

Mitsubishi UFJ Financial Group, Inc.—ADR (b) | | 1,000,000 | | | 5,420,000 |

| | | | | | 7,469,000 |

Commercial Services & Supplies—1.5% | | | |

Steelcase, Inc. | | 948,000 | | | 4,294,440 |

Communications Equipment—8.0% | | | |

Cisco Systems, Inc. (a) | | 524,000 | | | 10,123,680 |

Corning, Inc. | | 500,000 | | | 7,310,000 |

Nokia OYJ—ADR (b) | | 400,000 | | | 5,656,000 |

| | | | | | 23,089,680 |

Computers & Peripherals—1.1% | | | | | |

EMC Corp. (a) | | 250,000 | | | 3,132,500 |

Consumer Finance—1.3% | | | | | |

American Express Co. | | 150,000 | | | 3,783,000 |

Containers & Packaging—1.7% | | | | | |

Sonoco Products Co. | | 200,000 | | | 4,882,000 |

Diversified Telecommunication Services—3.6% |

Alaska Communications Systems Group, Inc. (c) | | 701,800 | | | 4,231,854 |

Verizon Communications, Inc. | | 200,000 | | | 6,068,000 |

| | | | | | 10,299,854 |

| | | | | |

| Common Stocks (continued) | | Shares | | Value |

Electric Utilities—4.2% | | | | | |

FPL Group, Inc. | | 225,000 | | $ | 12,102,750 |

Electrical Equipment—0.5% | | | | | |

Rockwell Automation, Inc. | | 50,000 | | | 1,579,500 |

Energy Equipment & Services—2.5% | | | |

Schlumberger Ltd. (b) | | 150,000 | | | 7,348,500 |

Food Products—4.2% | | | | | |

Campbell Soup Co. | | 200,000 | | | 5,144,000 |

Kraft Foods, Inc. | | 300,000 | | | 7,020,000 |

| | | | | | 12,164,000 |

Household Products—4.6% | | | | | |

Colgate-Palmolive Co. | | 100,000 | | | 5,900,000 |

Kimberly-Clark Corp. | | 150,000 | | | 7,371,000 |

| | | | | | 13,271,000 |

Industrial Conglomerates—3.5% | | | | | |

3M Co. | | 75,000 | | | 4,320,000 |

General Electric Co. | | 450,000 | | | 5,692,500 |

| | | | | | 10,012,500 |

Internet Software & Services—2.6% | | | |

eBay, Inc. (a) | | 100,000 | | | 1,647,000 |

Google, Inc. (a) | | 15,000 | | | 5,939,550 |

| | | | | | 7,586,550 |

IT Services—3.3% | | | | | |

Automatic Data Processing, Inc. | | 150,000 | | | 5,280,000 |

The Western Union Co. | | 250,000 | | | 4,187,500 |

| | | | | | 9,467,500 |

Machinery—1.7% | | | | | |

Illinois Tool Works, Inc. | | 150,000 | | | 4,920,000 |

Metals & Mining—7.9% | | | | | |

Alcoa, Inc. | | 210,000 | | | 1,904,700 |

BHP Billiton Ltd.—ADR (b) | | 65,000 | | | 3,129,100 |

Cliffs Natural Resources, Inc. | | 250,000 | | | 5,765,000 |

Newmont Mining Corp. | | 300,000 | | | 12,072,000 |

| | | | | | 22,870,800 |

Multi Utilities—0.6% | | | | | |

PNM Resources, Inc. | | 200,000 | | | 1,704,000 |

Multiline Retail—1.0% | | | | | |

Kohl’s Corp. (a) | | 62,500 | | | 2,834,375 |

Oil, Gas & Consumable Fuels—4.7% | | | |

Anadarko Petroleum Corp. | | 50,000 | | | 2,153,000 |

Chesapeake Energy Corp. | | 100,000 | | | 1,971,000 |

Murphy Oil Corp. | | 200,000 | | | 9,542,000 |

| | | | | | 13,666,000 |

Paper & Forest Products—0.5% | | | | | |

Weyerhaeuser Co. | | 42,000 | | | 1,480,920 |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Fund

Schedule of Investments as of April 30, 2009

(Unaudited)

| | | | | | |

| Common Stocks (continued) | | Shares | | Value |

Pharmaceuticals—6.1% | | | | | | |

Bristol-Myers Squibb Co. | | | 300,000 | | $ | 5,760,000 |

Johnson & Johnson | | | 100,000 | | | 5,236,000 |

Pfizer, Inc. | | | 500,000 | | | 6,680,000 |

| | | | | | | 17,676,000 |

Semiconductors & Semiconductor Equipment—4.9% |

Applied Materials, Inc. | | | 500,000 | | | 6,105,000 |

Emcore Corp. (a) | | | 225,000 | | | 279,000 |

Intel Corp. | | | 500,000 | | | 7,890,000 |

| | | | | | | 14,274,000 |

Software—5.2% | | | | | | |

Adobe Systems, Inc. (a) | | | 175,000 | | | 4,786,250 |

Bio-key International,

Inc. (a)(d)(e)(f) | | | 47,090 | | | 0 |

Microsoft Corp. | | | 500,000 | | | 10,130,000 |

| | | | | | | 14,916,250 |

Specialty Retail—1.1% | | | | | | |

Home Depot, Inc. | | | 120,000 | | | 3,158,400 |

Total Common Stocks (Cost $350,630,855) | | | | | | 275,578,019 |

Exchange-Traded Fund—1.5% | | | | | | |

SPDR Gold Trust (a) | | | 50,000 | | | 4,363,500 |

Total Exchange-Traded fund (Cost $4,229,919) | | | | | | 4,363,500 |

Warrants—0.0% | | | | | | |

Emcore Corp. $15.06 exercise price, expires 2/19/13 (a)(e) | | | 39,375 | | | — |

Raytheon Co. $37.50 exercise price, expires 6/16/11 (a) | | | 1,581 | | | 16,759 |

Total Warrants

(Cost $0) | | | | | | 16,759 |

| Corporate Bonds—1.8% | |

| Principal

Amount | | | |

Oil, Gas & Consumable Fuels—0.7% | | | |

Chesapeake Energy Corp. 9.500%, 2/15/2015 | | $ | 2,000,000 | | | 2,030,000 |

Paper & Forest Products—1.1% | | | |

Weyerhaeuser Co.

6.750%, 3/15/2012 | | | 3,000,000 | | | 2,995,824 |

Total Corporate Bonds (Cost $4,619,013) | | | | | | 5,025,824 |

| | | | | | | |

| Short-Term Investments—1.6% | | Principal

Amount | | Value | |

Repurchase Agreement—1.6% | | | | | | | |

Repurchase Agreement with U.S. Bank, N.A., 0.01%, dated 4/30/09, due 5/1/09, collateralized by: Fannie Mae Conventional Level Pay 15 Year Fixed (Pool #555745) valued at $4,815,705. Repurchase proceeds of $4,721,001. (Cost $4,721,000) | | $ | 4,721,000 | | $ | 4,721,000 | |

Total Short-Term Investments (Cost $4,721,000) | | | | | | 4,721,000 | |

Total Investments (Cost $364,200,787)—100.3% | | | | | | 289,705,102 | |

Liabilities in Excess of Other Assets—(0.3)% | | | (938,727 | ) |

Total Net Assets—100.0% | | | | | $ | 288,766,375 | |

| | | | | | | |

Percentages are stated as a percent of net assets.

ADR American Depository Receipt

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Foreign concentration was as follows: Australia 1.1%; Bermuda 0.7%; |

| | Finland 2.0%; Japan 3.9%; Netherlands Antilles 2.5% |

| (c) | Affiliated company. See footnote 8. |

| (d) | Denotes a security is either fully or partially restricted to resale. The aggregate value of restricted securities at April 30, 2009 was $0 which represented 0.0% of net assets. |

| (e) | Fair valued security. The aggregate value of fair valued securities as of April 30, 2009 was $0 which represented 0.0% of net assets. |

| (f) | Security is considered illiquid and may be difficult to sell. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Small Cap Fund

Schedule of Investments as of April 30, 2009

(Unaudited)

| | | | | |

| Common Stocks—98.2% | | Shares | | Value |

Biotechnology—2.8% | | | | | |

Alkermes, Inc. (a) | | 87,000 | | $ | 665,550 |

Martek Biosciences Corp. | | 12,000 | | | 218,640 |

| | | | | | 884,190 |

Chemicals—2.0% | | | | | |

Landec Corp. (a)(b) | | 49,600 | | | 335,296 |

Minerals Technologies, Inc. | | 8,000 | | | 297,520 |

| | | | | | 632,816 |

Commercial Services & Supplies—3.5% | | | |

EnergySolutions, Inc. | | 114,500 | | | 1,110,650 |

Diversified Financial Services—0.6% | | | | | |

CIT Group, Inc. | | 86,000 | | | 190,920 |

Electrical Equipment—1.4% | | | | | |

Baldor Electric Co. | | 19,000 | | | 440,800 |

Electronic Equipment & Instruments—1.5% |

Electro Scientific Industries, Inc. (a) | | 55,000 | | | 473,000 |

Energy Equipment & Services—8.7% | | | |

CARBO Ceramics, Inc. | | 12,700 | | | 390,017 |

Global Industries Ltd. (a) | | 113,500 | | | 734,345 |

Oceaneering International, Inc. (a) | | 23,500 | | | 1,070,895 |

Tetra Technologies, Inc. (a) | | 92,000 | | | 526,240 |

| | | | | | 2,721,497 |

Food Products—3.5% | | | | | |

The Hain Celestial Group, Inc. (a) | | 65,000 | | | 1,084,850 |

Health Care Equipment & Supplies—12.0% | | | |

Analogic Corp. | | 21,500 | | | 782,600 |

Greatbatch, Inc. (a) | | 42,000 | | | 883,680 |

ICU Medical, Inc. (a) | | 9,300 | | | 349,680 |

Thoratec Corp. (a) | | 32,000 | | | 929,920 |

Wright Medical Group, Inc. (a) | | 60,000 | | | 825,000 |

| | | | | | 3,770,880 |

Health Care Technology—5.1% | | | | | |

Allscripts- Misys Healthcare Solutions, Inc. | | 83,700 | | | 1,039,554 |

IMS Health, Inc. | | 44,500 | | | 558,920 |

| | | | | | 1,598,474 |

Household Products—2.0% | | | | | |

WD-40 Co. | | 23,000 | | | 622,380 |

Internet & Catalog Retail—1.3% | | | | | |

1-800-Flowers.com, Inc. (a)(b) | | 145,500 | | | 424,860 |

Internet Software & Services—5.4% | | | | | |

Perficient, Inc. (a) | | 57,500 | | | 400,775 |

RealNetworks, Inc. (a) | | 174,500 | | | 429,270 |

Valueclick, Inc. (a) | | 44,000 | | | 466,400 |

Websense, Inc. (a) | | 23,000 | | | 410,090 |

| | | | | | 1,706,535 |

| | | | | |

| Common Stocks (continued) | | Shares | | Value |

IT Services—1.1% | | | | | |

Lionbridge Technologies (a)(b) | | 245,500 | | $ | 331,425 |

Life Sciences Tools & Services—1.5% | | | |

Life Technologies Corp. (a) | | 12,300 | | | 458,790 |

Media—0.9% | | | | | |

DreamWorks Animation SKG, Inc. (a) | | 12,200 | | | 292,922 |

Metals & Mining—2.0% | | | | | |

Brush Engineered Materials, Inc. (a) | | 37,500 | | | 634,500 |

Pharmaceuticals—5.7% | | | | | |

King Pharmaceuticals, Inc. (a) | | 40,500 | | | 319,140 |

The Medicines Co. (a) | | 30,500 | | | 304,390 |

Perrigo Co. | | 12,000 | | | 311,040 |

Salix Pharmaceuticals Ltd. (a)(b) | | 77,200 | | | 849,200 |

| | | | | | 1,783,770 |

Real Estate—2.1% | | | | | |

The St Joe Co. (a) | | 26,500 | | | 659,320 |

Road & Rail—1.0% | | | | | |

Arkansas Best Corp. | | 13,500 | | | 311,580 |

Semiconductors & Semiconductor Equipment—13.2% |

Cymer, Inc. (a) | | 32,000 | | | 909,120 |

FEI Co. (a) | | 29,000 | | | 498,220 |

Kopin Corp. (a)(b) | | 193,000 | | | 530,750 |

Silicon Image, Inc. (a) | | 283,500 | | | 771,120 |

Ultratech, Inc. (a)(b) | | 105,000 | | | 1,419,600 |

| | | | | | 4,128,810 |

Software—15.7% | | | | | |

Aspen Technology, Inc. (a) | | 122,000 | | | 946,720 |

Epicor Software Corp. (a) | | 133,000 | | | 734,160 |

Fair Isaac Corp. | | 50,000 | | | 841,000 |

Parametric Technology Corp. (a) | | 84,000 | | | 936,600 |

Symyx Technologies (a)(b) | | 88,000 | | | 425,920 |

TIBCO Software, Inc. (a) | | 165,100 | | | 1,043,432 |

| | | | | | 4,927,832 |

Specialty Retail—4.3% | | | | | |

Bebe Stores, Inc. | | 89,000 | | | 818,800 |

Tractor Supply Co. (a) | | 12,800 | | | 516,864 |

| | | | | | 1,335,664 |

Textiles, Apparel & Luxury Goods—0.9% |

Columbia Sportswear Co. | | 9,500 | | | 291,840 |

Total Common Stocks (Cost $37,606,025) | | | | | 30,818,305 |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Small Cap Fund

Schedule of Investments as of April 30, 2009

(Unaudited)

| | | | | | |

| Short-Term Investments—0.6% | | Principal

Amount | | Value |

Repurchase Agreement—0.6% | | | | | | |

Repurchase Agreement with U.S. Bank, N.A., 0.01% dated 4/30/09, due 5/1/09, collateralized by: Fannie Mae Conventional Level Pay 15 Year Fixed (Pool #555745) valued at $180,721. Repurchase proceeds of $177,000.

(Cost $177,000) | | $ | 177,000 | | $ | 177,000 |

Total Short-term Investments

(Cost $177,000) | | | | | | 177,000 |

Total Investments (Cost $37,783,025)—98.8% | | | | | | 30,995,305 |

Other Assets in Excess of Liabilities—1.2% | | | 393,444 |

Total Net Assets—100.0% | | | | | $ | 31,388,749 |

| | | | | | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Affiliated company. See footnote 8. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville International Value Fund

Schedule of Investments as of April 30, 2009

(Unaudited)

| | | | | |

| Common Stocks—92.3% | | Shares | | Value |

Australia—1.4% | | | | | |

BHP Billiton Ltd.—ADR | | 30,000 | | $ | 1,444,200 |

Belgium—3.3% | | | | | |

Bekaert SA | | 15,000 | | | 1,392,008 |

Solvay SA | | 12,000 | | | 1,028,608 |

Umicore | | 50,000 | | | 979,916 |

| | | | | | 3,400,532 |

Brazil—3.5% | | | | | |

Petroleo Brasileiro SA—ADR | | 60,000 | | | 2,014,200 |

Vale SA—ADR | | 94,000 | | | 1,551,940 |

| | | | | | 3,566,140 |

Finland—2.4% | | | | | |

Nokia OYJ—ADR | | 170,000 | | | 2,403,800 |

France—16.5% | | | | | |

Cie de Saint-Gobain | | 55,927 | | | 2,006,409 |

JC Decaux SA | | 69,000 | | | 981,229 |

M6-Metropole Television | | 120,000 | | | 2,242,939 |

Manitou BF SA | | 56,353 | | | 357,244 |

Sanofi-Aventis SA | | 50,000 | | | 2,895,607 |

Total SA—ADR | | 51,200 | | | 2,545,664 |

Veolia Environnement | | 54,300 | | | 1,487,474 |

Veolia Environnement—ADR | | 50,000 | | | 1,365,500 |

Vivendi | | 110,000 | | | 2,957,799 |

| | | | | | 16,839,865 |

Germany—3.9% | | | | | |

Siemens AG—ADR | | 35,000 | | | 2,342,550 |

Wacker Neuson SE | | 180,000 | | | 1,643,292 |

| | | | | | 3,985,842 |

Indonesia—1.6% | | | | | |

Telekomunikasi Indonesia Tbk PT—ADR | | 58,000 | | | 1,666,920 |

Ireland—5.0% | | | | | |

DCC Plc | | 153,105 | | | 2,781,188 |

Experian Plc | | 354,413 | | | 2,333,689 |

| | | | | | 5,114,877 |

Italy—2.7% | | | | | |

C.I.R.—Compagnie Industriali Riunite SpA (a) | | 1,500,000 | | | 1,953,362 |

Interpump Group SpA (a) | | 194,128 | | | 826,445 |

| | | | | | 2,779,807 |

Japan—22.6% | | | | | |

Amada Co Ltd. | | 170,000 | | | 1,052,707 |

Bridgestone Corp. | | 90,000 | | | 1,341,525 |

Canon, Inc.—ADR | | 70,000 | | | 2,114,700 |

Fanuc Ltd. | | 20,000 | | | 1,443,245 |

Kyoto Kimono Yuzen Co. Ltd. | | 350,500 | | | 2,281,058 |

MISUMI Group, Inc. | | 92,500 | | | 1,248,927 |

| | | | | |

| Common Stocks (continued) | | Shares | | Value |

Mitsubishi UFJ Financial Group, Inc.—ADR | | 214,100 | | $ | 1,160,422 |

Nintendo Co., Ltd.—ADR | | 24,000 | | | 802,258 |

Nippon Express Co. Ltd. | | 500,500 | | | 1,784,928 |

Omron Corp. | | 162,000 | | | 2,421,273 |

Panasonic Corp.—ADR | | 150,000 | | | 2,187,000 |

SMC Corp. | | 24,000 | | | 2,354,321 |

Toyota Motor Corp.—ADR | | 37,000 | | | 2,928,920 |

| | | | | | 23,121,284 |

Luxembourg—0.9% | | | | | |

ArcelorMittal—ADR | | 40,000 | | | 943,200 |

Mexico—2.2% | | | | | |

Fomento Economico Mexicano S.A.B. de C.V.—ADR | | 80,000 | | | 2,264,800 |

Netherlands Antilles—2.2% | | | | | |

Schlumberger Ltd. | | 45,000 | | | 2,204,550 |

Netherlands—3.9% | | | | | |

Nutreco Holding NV | | 30,000 | | | 1,029,556 |

Unilever NV—ADR | | 147,500 | | | 2,919,025 |

| | | | | | 3,948,581 |

Singapore—1.5% | | | | | |

GP Industries Ltd. | | 7,788,241 | | | 1,578,517 |

Spain—1.2% | | | | | |

Sol Melia SA | | 245,000 | | | 1,205,758 |

Switzerland—5.7% | | | | | |

ABB Ltd.—ADR | | 75,000 | | | 1,066,500 |

Kudelski SA | | 170,000 | | | 2,429,561 |

Nestle SA | | 71,000 | | | 2,314,368 |

| | | | | | 5,810,429 |

Thailand—1.3% | | | | | |

BEC World PCL | | 2,365,100 | | | 1,323,119 |

United Kingdom—5.5% | | | | | |

Bodycote PLC | | 1 | | | 2 |

BP PLC—ADR | | 28,000 | | | 1,188,880 |

Cadbury PLC—ADR | | 31,600 | | | 950,844 |

Cadbury PLC | | 192,800 | | | 1,441,632 |

Invensys PLC (a) | | 687,400 | | | 2,007,484 |

| | | | | | 5,588,842 |

United States—5.0% | | | | | |

Freeport-McMoRan Copper & Gold, Inc. | | 30,000 | | | 1,279,500 |

Newmont Mining Corp. | | 70,000 | | | 2,816,800 |

NII Holdings, Inc. (a) | | 60,000 | | | 969,600 |

| | | | | | 5,065,900 |

Total Common Stocks (Cost $120,850,027) | | | | | 94,256,963 |

The accompanying notes are an integral part of these financial statements.

The Tocqueville International Value Fund

Schedule of Investments as of April 30, 2009

(Unaudited)

| | | | | | |

| Convertible Bonds—2.8% | | Principal

Amount | | Value |

Luxembourg—2.2% | | | | | | |

Kloeckner & Co Finance International SA

1.500%, 7/27/2012 | | $ | 3,050,000 | | $ | 2,272,880 |

United States—0.6% | | | | | | |

NII Holdings, Inc.

3.125%, 6/15/2012 | | | 825,000 | | | 606,375 |

Total Convertible Bonds (Cost $2,978,626) | | | | | | 2,879,255 |

Short Term Investments—1.4% | | | | | | |

Repurchase Agreement—1.4% | | | | | | |

Repurchase Agreement with U.S. Bank, N.A., 0.01% dated 4/30/09, due 5/1/09, collateralized by: Fannie Mae 15 Year Fixed (Pool #739797) valued at $1,534,115. Repurchase proceeds of $1,504,000. (Cost $1,504,000) | | | 1,504,000 | | | 1,504,000 |

Total Short Term Investments (Cost $1,504,000) | | | | | | 1,504,000 |

Total Investments (Cost $125,332,653)—96.5% | | | | | | 98,640,218 |

Other Assets in Excess of Liabilities—3.5% | | | 3,527,752 |

Total Net Assets—100.0% | | | | | $ | 102,167,970 |

| | | | | | |

Percentages are stated as a percent of net assets.

ADR American Depository Receipt

| (a) | Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Gold Fund

Schedule of Investments as of April 30, 2009

(Unaudited)

| | | | | |

| Common Stocks—84.6% | | Shares | | Value |

Financial Services—0.4% | | | | | |

Endeavour Financial Corp. (a) | | 2,000,000 | | $ | 2,396,715 |

Gold & Gold Related—78.7% | | | | | |

Agnico-Eagle Mines Ltd. (b) | | 252,000 | | | 11,115,720 |

Alamos Gold, Inc. (a)(b) | | 2,615,100 | | | 16,984,015 |

Allied Nevada Gold Corp. (a) | | 1,129,848 | | | 6,101,179 |

Andean Resources Ltd. (a)(b) | | 15,771,500 | | | 18,568,325 |

AngloGold Ashanti Ltd.—ADR (b) | | 200,000 | | | 6,160,000 |

Aquiline Resources, Inc. (a)(b) | | 1,333,333 | | | 2,670,465 |

Banro Corp. (a)(b) | | 631,400 | | | 925,962 |

Centamin Egypt Ltd. (a)(b) | | 7,830,000 | | | 6,374,558 |

Cia de Minas Buenaventura SA—ADR (b) | | 853,600 | | | 18,062,176 |

Comaplex Minerals Corp. (a)(b)(f) | | 2,839,000 | | | 7,494,218 |

Detour Gold Corp. (a)(b) | | 280,000 | | | 2,712,478 |

Eldorado Gold Corp. (a)(b) | | 2,026,800 | | | 16,101,621 |

Electrum Ltd. (a)(b)(c)(d)(e) | | 2,095,552 | | | 11,735,091 |

European Goldfields Ltd. (a)(b) | | 4,035,500 | | | 8,555,950 |

Franco-Nevada Corp. (b) | | 1,435,900 | | | 30,551,832 |

Gold Fields Ltd. (b) | | 166,249 | | | 1,734,644 |

Gold Fields Ltd.—ADR (b) | | 1,211,500 | | | 12,599,600 |

Gold Resource Corp. (a)(f) | | 2,300,797 | | | 9,134,164 |

Goldcorp, Inc.—ADR (b) | | 1,268,050 | | | 34,896,736 |

Govi Ex IP Holdings, Inc. (a)(c)(d)(e) | | 1,750,000 | | | 71,225 |

Harmony Gold Mining Co. Ltd. (a)(b) | | 1 | | | 9 |

IAMGOLD Corp. (b) | | 4,291,796 | | | 34,203,453 |

International Tower Hill Mines Ltd. (a)(b)(f) | | 1,993,100 | | | 5,010,727 |

Ivanhoe Australia Ltd. (a)(b) | | 6,464,000 | | | 8,878,669 |

Ivanhoe Mines Ltd. (a)(b) | | 4,467,000 | | | 28,674,449 |

Kinross Gold Corp. (b) | | 1,139,352 | | | 17,593,653 |

Minefinders Corp. (a)(b) | | 1,041,000 | | | 7,580,902 |

New Gold, Inc. (a)(b) | | 3,478,200 | | | 6,266,764 |

Newmont Mining Corp. | | 789,800 | | | 31,781,552 |

Orezone Gold Corp. (a)(b)(f) | | 2,145,463 | | | 575,336 |

Osisko Mining Corp. (a)(b) | | 5,470,000 | | | 25,669,991 |

Randgold Resources Ltd.—ADR (b) | | 858,200 | | | 41,536,880 |

Red Back Mining, Inc. (a)(b) | | 1,245,000 | | | 8,617,866 |

Royal Gold, Inc. | | 691,765 | | | 25,014,222 |

SEMAFO, Inc. (a)(b) | | 4,900,000 | | | 7,555,518 |

Sino Gold Mining Ltd. (a)(b) | | 3,333,700 | | | 13,204,068 |

Witwatersrand Consolidated Gold Resources Ltd. (a)(b) | | 335,000 | | | 2,200,694 |

Yukon-Nevada Gold Corp. (a)(b)(f) | | 8,350,000 | | | 804,701 |

| | | | | | 487,719,413 |

| | | | | |

| Common Stocks (continued) | | Shares | | Value |

Precious Metals & Related—5.5% | | | |

Brilliant Mining Corp. (a)(b) | | 937,500 | | $ | 121,774 |

GoviEx Uranium, Inc. (a)(b)(c)(d)(e) | | 1,750,000 | | | 3,428,775 |

Ivanhoe Nickel & Platinum Ltd. (a)(b)(c)(d)(e) | | 533,333 | | | 2,933,331 |

PAN American Silver Corp. (a)(b) | | 61,536 | | | 1,013,825 |

PAN American Silver Corp.—ADR (a)(b) | | 500,000 | | | 8,240,000 |

Silver Wheaton Corp. (a)(b) | | 1,687,400 | | | 12,938,666 |

Silverstone Resources Corp. (a)(b)(f) | | 6,635,000 | | | 9,229,951 |

| | | | | | 37,906,322 |

Total Common Stocks

(Cost $513,218,653) | | | | | 528,022,450 |

| Gold Billion—14.0% | | Ounces | | | |

Gold Billion (a) | | 98,032 | | | 87,071,761 |

Total Gold Billion

(Cost $44,609,241) | | | | | 87,071,761 |

| Warrants—0.6% | | Shares | | | |

Financial Services—0.1% | | | | | |

Endeavour Financial Corp.

Expires 1/30/14, Exercise Price: CAD $2.50 (a) | | 1,000,000 | | | 410,626 |

Gold & Gold Related—0.5% | | | | | |

Kinross Gold Corp.

Expires 9/13/13, Exercise Price: CAD $32.00 (a)(b) | | 108,032 | | | 378,424 |

Minefinders Corp.

Expires 12/31/11, Exercise Price: CAD $5.00 (a)(b)(d) | | 125,000 | | | 258,055 |

Osisko Mining Corp.

Expires 5/10/09, Exercise Price: CAD $2.00 (a)(b)(d) | | 1,155,000 | | | 2,315,227 |

Osisko Mining Corp.

Expires 11/17/09, Exercise Price: CAD $5.45 (a)(b) | | 600,000 | | | 553,088 |

U.S. Gold Corp.

Expires 2/22/11, Exercise Price: $10.00 (a) | | 111,500 | | | 25,929 |

Yukon-Nevada Gold Corp.

Expires 5/30/12 Exercise Price: CAD $3.00 (a)(b)(d)(f) | | 4,175,000 | | | 0 |

| | | | | | 3,530,723 |

Total Warrants

(Cost $1,314,862) | | | | | 3,941,349 |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Gold Fund

Schedule of Investments as of April 30, 2009

(Unaudited)

| | | | | | |

| Short-Term Investments—0.8% | | Principal

Amount | | Value |

Repurchase Agreement—0.8% | | | | | | |

Repurchase Agreement with U.S. Bank, N.A., 0.01%, dated 4/30/09, due 5/1/09, collateralized by: Fannie Mae Conventional Level Pay 15 Year Fixed (Pool #254919) valued at $4,831,756. Repurchase proceeds of $4,737,001. (Cost $4,737,000) | | $ | 4,737,000 | | $ | 4,737,000 |

Total Short-Term Investments (Cost $4,737,000) | | | | | | 4,737,000 |

Total Investments

(Cost $563,879,756)—100.0% | | | 623,772,560 |

Other Assets in Excess of Liabilities—0.0% | | | 300,055 |

Total Net Assets—100.0% | | | | | $ | 624,072,615 |

| | | | | | |

Percentages are stated as a percent of net assets.

ADR American Depository Receipt

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Foreign concentration was as follows: Australia 7.5%; Canada 50.1%; |

| | France 1.9%; Peru 2.9%; South Africa 3.6%; United Kingdom 6.7% |

| (c) | Denotes a security is either fully or partially restricted to resale. The aggregate value of restricted securities at April 30, 2009 was $20,741,705 which represented 2.9% of net assets. |

| (d) | Fair valued security. The aggregate value of fair valued securities as of April 30, 2009 was $20,741,705 which represented 2.9% of net assets. |

| (e) | Security is considered illiquid and may be difficult to sell. |

| (f) | Affiliated company. See footnote 8. |

The accompanying notes are an integral part of these financial statements.

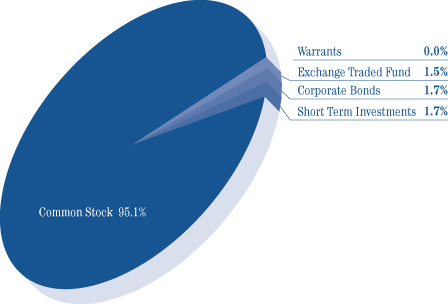

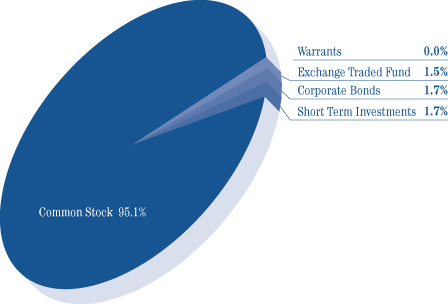

Percent of Total Investments

The Tocqueville Fund

Allocation of Portfolio Holdings

April 30, 2009

(Unaudited)

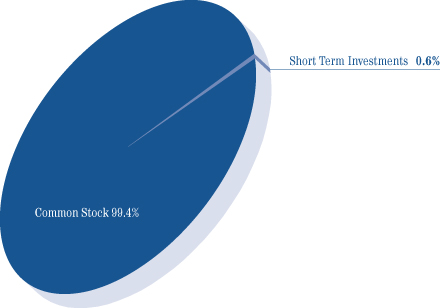

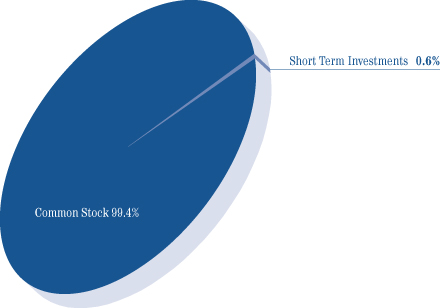

The Tocqueville Small Cap Fund

Allocation of Portfolio Holdings

April 30, 2009

(Unaudited)

Percent of Total Investments

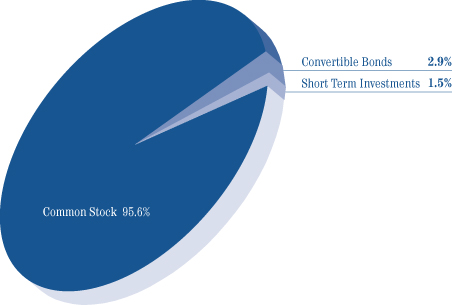

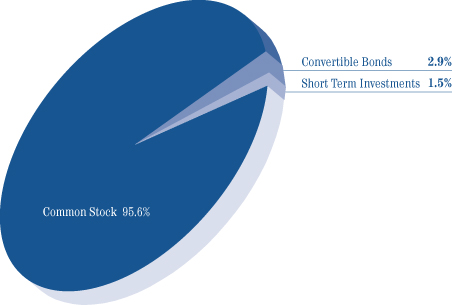

The Tocqueville International Value Fund

Allocation of Portfolio Holdings

April 30, 2009

(Unaudited)

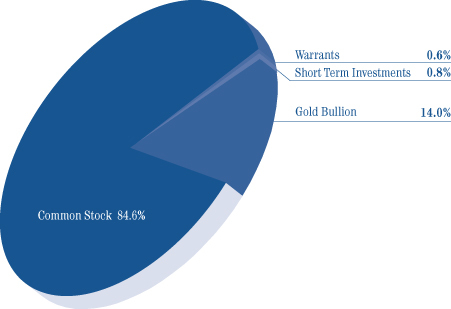

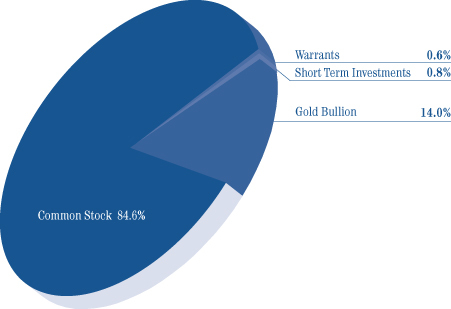

The Tocqueville Gold Fund

Allocation of Portfolio Holdings

April 30, 2009

(Unaudited)

The Tocqueville Trust

Statements of Assets and Liabilities

April 30, 2009

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | The

Tocqueville

Fund | | | Small Cap

Fund | | | International

Value

Fund | | | Gold

Fund | |

Assets | | | | | | | | | | | | | | | | |

Investments, at value (1) | | | | | | | | | | | | | | | | |

Unaffiliated issuers | | $ | 285,194,248 | | | $ | 26,678,254 | | | $ | 98,640,218 | | | $ | 591,523,463 | |

Affiliated issuers | | | 4,510,854 | | | | 4,317,051 | | | | — | | | $ | 32,249,097 | |

Foreign currencies (2) | | | — | | | | — | | | | 3,933,124 | | | | 806,743 | |

Cash | | | 460 | | | | 6,365 | | | | 57,825 | | | | 11,988 | |

Receivable for investments sold | | | — | | | | 570,338 | | | | 738,244 | | | | — | |

Receivable for fund shares sold | | | 279,828 | | | | 69 | | | | 9,527 | | | | 957,250 | |

Dividends, interest and other receivables | | | 722,450 | | | | 12,944 | | | | 751,904 | | | | 18,628 | |

Prepaid assets | | | 33,576 | | | | 12,334 | | | | 18,336 | | | | 52,955 | |

| | | | | | | | | | | | | | | | |

Total Assets | | | 290,741,416 | | | | 31,597,355 | | | | 104,149,178 | | | | 625,620,124 | |

| | | | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | |

Payable for investments purchased | | | 1,280,043 | | | | — | | | | 1,485,569 | | | | — | |

Payable for fund shares redeemed | | | 284,163 | | | | 161,458 | | | | 326,738 | | | | 669,257 | |

Payable to Adviser | | | 154,895 | | | | 18,630 | | | | 80,863 | | | | 490,250 | |

Due to Custodian | | | — | | | | 6,000 | | | | — | | | | — | |

Accrued distribution fee | | | 40,829 | | | | 5,403 | | | | 17,904 | | | | 42,356 | |

Accrued expenses and other liabilities | | | 215,111 | | | | 17,115 | | | | 70,134 | | | | 345,646 | |

| | | | | | | | | | | | | | | | |

Total Liabilities | | | 1,975,041 | | | | 208,606 | | | | 1,981,208 | | | | 1,547,509 | |

| | | | | | | | | | | | | | | | |

Net Assets | | $ | 288,766,375 | | | $ | 31,388,749 | | | $ | 102,167,970 | | | $ | 624,072,615 | |

| | | | | | | | | | | | | | | | |

Net assets consist of: | | | | | | | | | | | | | | | | |

Paid in capital | | $ | 430,392,255 | | | $ | 46,192,075 | | | $ | 142,514,538 | | | $ | 556,909,057 | |

Accumulated net investment income (loss) | | | 1,695,911 | | | | (132,561 | ) | | | 198,200 | | | | (3,321,318 | ) |

Accumulated net realized gain (loss) | | | (68,827,027 | ) | | | (7,883,045 | ) | | | (13,790,507 | ) | | | 10,573,869 | |

Net unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | |

Investments and foreign currency related items | | | (74,494,764 | ) | | | (6,787,720 | ) | | | (26,754,261 | ) | | | 59,911,007 | |

| | | | | | | | | | | | | | | | |

Net assets | | $ | 288,766,375 | | | $ | 31,388,749 | | | $ | 102,167,970 | | | $ | 624,072,615 | |

| | | | | | | | | | | | | | | | |

Shares of beneficial interest outstanding

(unlimited shares of $0.01 par value authorized) | | | 18,714,008 | | | | 3,338,319 | | | | 12,719,658 | | | | 18,191,363 | |

Net asset value and redemption price per share | | $ | 15.43 | | | $ | 9.40 | | | $ | 8.03 | | | $ | 34.31 | |

| | | | | | | | | | | | | | | | |

Maximum offering price per share | | $ | 15.43 | | | $ | 9.40 | | | $ | 8.03 | | | $ | 34.31 | |

| | | | | | | | | | | | | | | | |

(1) Cost of Investments | | | | | | | | | | | | | | | | |

Unaffiliated issuers | | $ | 354,710,503 | | | $ | 32,193,855 | | | $ | 125,332,653 | | | $ | 505,169,275 | |

Affiliated issuers | | $ | 9,490,284 | | | $ | 5,589,170 | | | $ | — | | | $ | 58,710,481 | |

(2) Cost of Foreign Currencies | | $ | — | | | $ | — | | | $ | 4,001,210 | | | $ | 788,326 | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Trust

Statements of Operations

For the Six Months Ended April 30, 2009

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | The

Tocqueville

Fund | | | Small Cap

Fund | | | International

Value

Fund | | | Gold

Fund | |

Investment Income: | | | | | | | | | | | | | | | | |

Dividends* | | | | | | | | | | | | | | | | |

Unaffiliated issuers | | $ | 4,460,141 | | | $ | 72,535 | | | $ | 1,036,290 | | | $ | 939,068 | |

Affiliated issuers | | | 312,137 | | | | — | | | | — | | | | — | |

Interest | | | 161,979 | | | | 1,368 | | | | 174,465 | | | | 36,847 | |

| | | | | | | | | | | | | | | | |

| | | 4,934,257 | | | | 73,903 | | | | 1,210,755 | | | | 975,915 | |

| | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | |

Investment Adviser’s fee (See Note 5) | | | 1,029,820 | | | | 108,778 | | | | 505,442 | | | | 2,619,090 | |

Distribution fees (See Note 5) | | | 343,273 | | | | 36,259 | | | | 126,361 | | | | 674,666 | |

Administration fee (See Note 5) | | | 205,964 | | | | 21,756 | | | | 75,816 | | | | 404,799 | |

Transfer agent and shareholder services fees | | | 95,840 | | | | 6,724 | | | | 23,736 | | | | 158,005 | |

Professional fees | | | 54,325 | | | | 6,076 | | | | 20,543 | | | | 102,520 | |

Fund accounting fees | | | 25,304 | | | | 3,323 | | | | 20,963 | | | | 43,448 | |

Custody fees | | | 19,055 | | | | 4,713 | | | | 21,104 | | | | 31,188 | |

Registration fees | | | 19,945 | | | | 11,414 | | | | 10,294 | | | | 29,016 | |

Printing and mailing expense | | | 22,886 | | | | 2,008 | | | | 7,057 | | | | 53,117 | |

Trustee fees and expenses | | | 28,743 | | | | 3,258 | | | | 12,882 | | | | 47,500 | |

Insurance expense | | | 7,510 | | | | 643 | | | | 3,712 | | | | 18,489 | |

Other expenses | | | 44,486 | | | | 1,512 | | | | 5,198 | | | | 44,926 | |

| | | | | | | | | | | | | | | | |

Total expenses before waiver | | | 1,897,151 | | | | 206,464 | | | | 833,108 | | | | 4,226,764 | |

Less: Fees waived (See Note 5) | | | (180,784 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net expenses | | | 1,716,367 | | | | 206,464 | | | | 833,108 | | | | 4,226,766 | |

| | | | | | | | | | | | | | | | |

Net Investment Income (Loss) | | | 3,217,890 | | | | (132,561 | ) | | | 377,647 | | | | (3,250,849 | ) |

| | | | | | | | | | | | | | | | |

Realized and Unrealized Gain (Loss): | | | | | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | |

Unaffiliated issuers | | | (56,841,911 | ) | | | (4,960,286 | ) | | | (13,900,145 | ) | | | 16,753,818 | |

Affiliated issuers | | | (3,862,641 | ) | | | (2,593,868 | ) | | | — | | | | (6,273,923 | ) |

Foreign currency translation | | | — | | | | — | | | | 129,372 | | | | 23,509 | |

| | | | | | | | | | | | | | | | |

| | | (60,704,552 | ) | | | (7,554,154 | ) | | | (13,770,773 | ) | | | 10,503,404 | |

Net change in unrealized appreciation on: | | | | | | | | | | | | | | | | |

Investments | | | 41,740,662 | | | | 6,356,216 | | | | 14,975,258 | | | | 221,579,336 | |

Foreign currency translation | | | — | | | | — | | | | 816,284 | | | | 9,238,246 | |

| | | | | | | | | | | | | | | | |

| | | 41,740,662 | | | | 6,356,216 | | | | 15,791,542 | | | | 230,817,582 | |

Net gain (loss) on investments and foreign currency | | | (18,963,890 | ) | | | (1,197,938 | ) | | | 2,020,769 | | | | 241,320,986 | |

| | | | | | | | | | | | | | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | (15,746,000 | ) | | $ | (1,330,499 | ) | | $ | 2,398,416 | | | $ | 238,070,137 | |

| | | | | | | | | | | | | | | | |

* Net of foreign taxes withheld | | $ | 57,824 | | | $ | — | | | $ | 118,687 | | | $ | 91,220 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Trust

Statements of Changes in Net Assets

| | | | | | | | |

| | | The Tocqueville Fund | |

| | | For the

Six-Months

Ended

April 30,

2009 | | | For the

Year Ended

October 31,

2008 | |

| | | (Unaudited) | | | | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | 3,217,890 | | | $ | 4,739,815 | |

Net realized gain (loss) on investments and foreign currency | | | (60,704,552 | ) | | | 2,137,522 | |

Net change in unrealized appreciation (depreciation) | | | 41,740,662 | | | | (227,748,077 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (15,746,000 | ) | | | (220,870,740 | ) |

Dividends and distributions to shareholders: | | | | | | | | |

Net investment income | | | (5,443,842 | ) | | | (3,450,163 | ) |

Net realized gains | | | — | | | | (36,514,100 | ) |

| | | | | | | | |

Total dividends and distributions | | | (5,443,842 | ) | | | (39,964,263 | ) |

Fund share transactions: | | | | | | | | |

Shares sold | | | 42,181,383 | | | | 221,857,644 | |

Shares issued to holders in reinvestment of dividends | | | 4,443,262 | | | | 34,039,145 | |

Shares redeemed* | | | (65,277,678 | ) | | | (190,330,381 | ) |

| | | | | | | | |

Net increase (decrease) | | | (18,653,033 | ) | | | 65,566,408 | |

| | | | | | | | |

Net increase (decrease) in net assets | | | (39,842,875 | ) | | | (195,268,595 | ) |

Net Assets: | | | | | | | | |

Beginning of period | | | 328,609,250 | | | | 523,877,845 | |

| | | | | | | | |

End of period** | | | 288,766,375 | | | | 328,609,250 | |

| | | | | | | | |

* Net of redemption fees of: | | $ | 46,965 | | | $ | 198,509 | |

| | | | | | | | |

** Including undistributed net investment income (loss) of: | | $ | 1,695,911 | | | $ | 3,921,863 | |

| | | | | | | | |

Change in shares outstanding: | | | | | | | | |

Shares sold | | | 2,854,600 | | | | 9,218,902 | |

Shares issued to holders in reinvestment of dividends | | | 286,662 | | | | 1,316,286 | |

Shares redeemed | | | (4,471,012 | ) | | | (8,602,242 | ) |

| | | | | | | | |

Net increase (decrease) | | | (1,329,750 | ) | | | 1,932,946 | |

| | | | | | | | |