UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 W. 57th Street, 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt, President

The Tocqueville Trust

40 W. 57th Street, 19th Floor

New York, NY 10019

(Name and address of agent for service)

212-698-0800

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: April 30, 2011

| Item 1. | Report to Stockholders. |

SEMI-ANNUAL REPORT

April 30, 2011

The Tocqueville Trust

Mutual Funds

The Tocqueville Fund

The Tocqueville Opportunity Fund

The Tocqueville International Value Fund

The Tocqueville Gold Fund

The Delafield Fund

The Tocqueville Select Fund

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of The Tocqueville Trust. Please call 1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @ www.tocquevillefunds.com

Dear Fellow Shareholder,

By and large, stock markets in recent months have followed the vagaries of popular perceptions about global economic and political affairs.

When public opinion was not worrying about snowballing deflation, it was concerned about signs of rising inflation. When the consensus stopped forecasting the unavoidable decline of the dollar, it began wondering if the European monetary union and its currency, the Euro, were not about to implode. The attention kept shifting between a watch for signs of slowdowns and a search for possible speculative bubbles in the making,

The U.S. economy did seem to confirm its recovery, but concerns remained about stubborn unemployment and inert housing activity. Despite strong profits (partly due to the translation into cheaper dollars of their foreign profits), industrial corporations have been reluctant to invest and hire permanent workers. Banks, also despite strong recovery profits, have been slow to write down their non-performing mortgage loans. This delays the disposal of distressed properties and thus the recovery that would normally ensue in homebuilding.

Practically every country was, at one time or another, the focus of investor worry. In China, for example, worries about inflation are narrowing the government’s margin for action if the economy should continue to (relatively) slow down. In the property sector, particularly, there has been simultaneous concern about a developing speculative bubble and overbuilding in high-priced projects and a shortage of some types of low-to-moderate income housing.

In individual sectors also, there are cross currents that may prove difficult to navigate. In computer hardware, software, networks and communications, for example, the fast emergence of cloud computing is casting doubt on the future of past and current industry leaders. Similarly the emergence of broad new social networks could be (in fact, is) changing the whole nature of marketing, sales, advertising, distribution and retailing, and even product design, as customers are aggregated into self-sustaining and self-promoting affinity groups.

The challenge for serious investors is that, in stock markets that are generally not as cheap as they historically have been just before strong, secular bull markets, it is the shares of reportedly vulnerable former leaders in maturing sectors that are statistically very cheap. Those of potential future leaders are hard to value until they can translate their initial successes into sustained and projectable growth in profits.

The surer way to losses over time in the stock market is to change strategies according to the current investing fashions. Rather, steadfastness and discipline are the key to success. At Tocqueville, we have assembled a group of fund managers whose disciplines differ somewhat depending on their definition of value and how far into the future they feel confident to project their portfolio companies’ recent growth trends. But they have in common that they all follow a discipline for selecting companies based on extensive fundamental research, and that they each follow their discipline strictly.

I have confidence that this approach will allow us to continue to report satisfactory performances over time.

Faithfully yours,

François Sicart

Chairman

The Tocqueville Fund

Dear Fellow Shareholders,

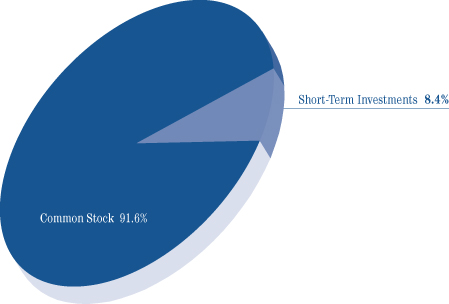

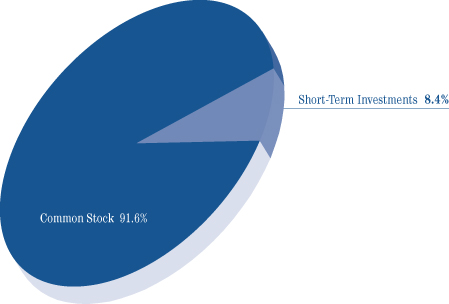

For the six months ended April 30, 2011, the first half of our fiscal year, the Tocqueville Fund generated a 14.72% rate of return. This compares with a 16.36% rate of return for the S&P 500 index, the benchmark against which we are often measured.

The period just ended commenced with an historic reordering of the political structure in the country, a mere two years after an equally historic election. These dramatic swings cannot help but impact policy initiatives as well as markets and equity valuations. Stock market prices commenced a long upswing in the early autumn when the expected election results were discounted, and resumed their climb shortly after the elections when the extent of the power reversal in Congress, the most dramatic change in almost eighty years, became clear. Markets responded not only to the likelihood that further Federal encroachment that had been the hallmark of the previous Congress, would be stymied, but also to the probability that Federal taxes, which had been scheduled to increase very dramatically, would remain unchanged. Even more important, as the period went on, it started to become increasingly evident that a consensus, of sorts, was emerging regarding the need to rein in government spending at all levels. Obviously, much political wrangling lies ahead, but both sides of the aisle seem to have come to grips with the unsustainability of the current fiscal situation, and given the alternatives, this is a hopeful development for the dollar, bond markets and equity valuations.

Given these developments, it is no surprise that markets lifted over this period, but there remain significant concerns. Chief among these are the rise in commodity prices, particularly oil prices, and the rising specter of global inflation, spurred by an unprecedented policy of easy money being pursued by the Federal Reserve for almost the past three years. European debt worries, the Japanese tsunami and nuclear disaster, the depressed housing market which cannot seem to regain its footing, and stubborn unemployment, all are significant impediments to a better near term economic outlook. That being said, corporate earnings have been generally strong, with some significant exceptions, including for some of our portfolio companies, and corporate balance sheets are in splendid condition.

Against this backdrop, the Fund’s results were satisfactory, in our view. General Electric, the largest position in the Fund, was also the name that had the most significant positive impact on Fund returns, followed closely by two commodity related names, Exxon and Cliffs Natural Resources, and by Pfizer, our second largest position. Rounding out the top five contributors to overall returns was Steelcase, a smaller capitalization equity security, which is consistent with our multicap approach. On the negative side of the ledger, only one position, Cisco Systems, registered a meaningful (more than 0.5%) impact on portfolio results. Indeed, as is often the case when returns are healthy, very few names generated any negative influence at all on the portfolio. Still, large capitalization technology names were weak contributors to results in the period. We remain attracted to the valuation parameters of many of these companies and are more likely to add to our positions than to give up on them. Trading activity during the period was relatively light, as usual, but we did institute a number of new positions, including Alkermes, a smaller capitalization pharmaceutical company with an attractive valuation and a promising drug pipeline, Briggs and Stratton, a small engine maker that dominates many of the markets it serves, and Plexus, a mid-cap electronic manufacturer with attractive financials and a significant upside potential. We also added to positions of larger names where we have been longtime holders, such as Microsoft, Johnson and Johnson, and Weyerhauser on an opportunistic basis. On the sell side, we liquidated positions in W.R. Grace, a chemical manufacturer, in 3M, American Express, and UPS and in Genzyme, the biotech giant, where prices met our objectives. Finally, we unloaded some disappointing performers like Nokia, Isis Pharmaceuticals, Wilmington Trust and The Washington Post, when we became disillusioned with the investment case we had constructed in purchasing these issues.

Going forward, we will continue to monitor the macro developments which exert such a large influence on investor behavior and stock prices, but we will focus the vast bulk of our efforts on individual companies where our fundamental analysis and unique contrarian point of view can add value.

Finally, as a substantial shareholder in your Fund myself, as well as being its portfolio manager, let me take this opportunity to express my gratitude for your loyalty to and support of the Tocqueville Fund.

Sincerely,

Robert W. Kleinschmidt

Portfolio Manager

The Tocqueville Fund

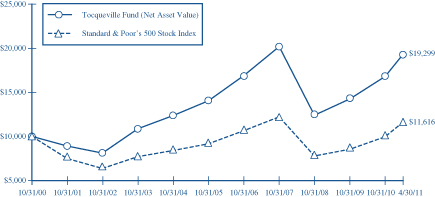

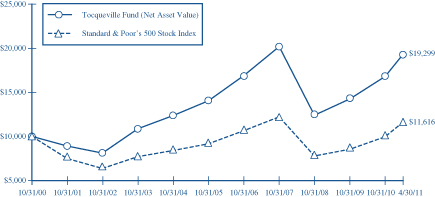

This chart assumes an initial gross investment of $10,000 made on 10/31/00. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held for 90 days or less.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Tocqueville Fund | | | 14.50% | | | | 1.61% | | | | 3.00% | | | | 6.36% | |

Standard & Poor’s 500 Stock Index | | | 17.22% | | | | 1.73% | | | | 2.95% | | | | 2.82% | |

The Tocqueville Opportunity Fund

Dear Fellow Shareholder,

U.S. equity markets advanced strongly during the six month period ended April 30, 2011, and performance was led by small and SMID (small and mid) capitalization issues. The larger capitalization Standard and Poor’s 500 Index rose 16.36% while the Russell 2000 and the SMID cap Russell 2500 indices rose 23.73% and 23.71% respectively. The Opportunity Fund increased 25.00% during the period. SMID growth oriented issues outperformed value biased issues and the Russell 2500 Growth Index increased 27.08% versus the Russell 2500 Value Index which rose 20.73%.

Over the past six months, we have continued to shift both sector and issue weightings to reflect a broadened investment strategy. From a sector perspective, we have increased commitments to more cyclically exposed issues with additions to the Consumer Discretionary, Technology, and Producer Durable sectors. At the beginning of the period, the Healthcare sector was the largest in the Fund, but we have significantly reduced its position to fourth in the Fund by cutting exposure from 19.5% to 11.6%. The Technology and Consumer Discretionary sectors are now the dominant investments at 22% and 19% respectively. Nearly half of the Fund’s strong performance was led by investment contributions from Technology and Consumer Discretionary issues since the beginning of the fiscal period. While all sectors provided positive performance during the period, the best absolute performance was achieved, surprisingly, from the Consumer Staples sector due to large underlying price increases in several issues: Green Mountain Coffee Roasters, Herbalife, Hain Celestial, and Boston Beer. While we have shifted the composition of the top three sectors, the overall investment commitment to the top three was relatively unchanged at 54%-55% of the Fund.

We have proceeded to diversify the Fund by reducing individual overweighted investments and by adding new investments. The top ten security positions (excluding index ETF’s) were 15.6% of the Fund at the end of the period versus 21.7% six months ago. Only one issue, TIBCO Software, exceeded a 2% weighting in the Fund versus six investments greater than 2% at the beginning of the period. The significant increase in diversification and reduction in commitments to overweighted investments has been implemented in order to reduce risk exposure to any single name or issue. Although this diversification strategy will reduce the “homerun” potential of any successful, large investment, it should mitigate the “strike out” impact of an unexpected, ugly surprise. We have revised the “top ten” holdings to include six new names as well: Baidu, Brigham Exploration, lululemon athletica, Herbalife, Chipotle Mexican Grill, and Apple. We invested in Apple recently when news broke that its Chairman would take a second leave of absence from daily management for health purposes. We believe that Apple’s leading position in the current evolution of mobile and tablet computing was undervalued and represented a unique investment opportunity.

As experienced investors have learned, a critical tenet of successful investing is having the good fortune of being overweighted in issues that rise and being underweighted or not invested in issues that decline. The past six months have provided plenty of excitement, and the Fund had a number of investment standouts: lululelemon (+125.7%), Acme Packet (+108.9%), Ceradyne (+96.6%), Carbo Ceramics (+92.7%), and Tempur Pedic (+82%). Several of these names not only appreciated impressively, but also were among the top ten in overall contribution to the Fund’s performance. We were pleased that a number of the Fund’s investments were boosted by unexpected takeover bids: Fronteer Gold, Graham Packaging, King Pharmaceutical, Pride International, and Sonic Solutions. While we managed to hold most drawdowns to less than a third of a percentage point, the Fund gave up nearly one percent on its investment in Inspire Pharmaceutical; the company made a disappointing announcement on its developmental drug for cystic fibrosis on the first business day of the new year.

While U.S. markets have performed well since their pre-election lift early this past fall, news flow has continued to weigh on sentiment and valuation. A year has gone by since the first demonstrations against austerity measures in Athens previewed the still unresolved issues challenging the European fiscal, monetary and currency systems. Investors continue to be mesmerized by the litany of issues which threaten the rate and sustainability of economic expansion: the Japanese tsunami, the Mid East revolts, the monetary tightenings in China and other emerging market nations, the rise of commodity prices, the moribund real estate market, and the expanding fiscal deficit. Against these headwinds, corporate earnings have exceeded expectations across many sectors of the market. We find reasons to be optimistic that valuations will continue to be supported despite intermittent periods of heightened volatility. We believe smaller capitalization issues should benefit from any increased allocation to U.S. equity from cash and fixed income allocations. While some investors believe they have already missed the best price gains, most significant price moves have been justified by large, positive earnings surprises – and we continue to believe that valuations are attractive and reasonable. Moreover, we expect that those companies which are able to exhibit increased capital returns, market shares, and growth will garner the greatest interest of investors seeking to find investments in companies capable of increasing and sustaining shareholder returns. While investors seek to “go global” in search of growth to diversify away from the “mature” U.S. economy, there are plenty of excellent opportunities to invest for growth in technology, healthcare, energy, and new consumer oriented companies domestically. We look forward to continuing our search for companies which are truly differentiated in their competitive advantage, executive management and vision. We are optimistic that this search and a disciplined approach to risk management will contribute to the success of the shareholders of the Opportunity Fund, and we appreciate your ongoing confidence in our efforts.

Sincerely,

Thomas R. Vandeventer

Portfolio Manager

The Tocqueville Opportunity Fund

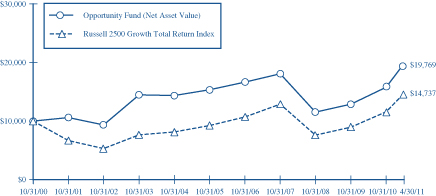

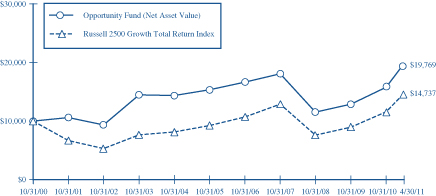

This chart assumes an initial gross investment of $10,000 made on 10/31/00. On July 1, 2010, a new portfolio management team assumed management of The Tocqueville Small Cap Fund and the Fund’s name and investment strategy changed as of October 12, 2010 (See Footnote 1 to the Financial Statements). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held for 90 days or less.

The Russell 2500 Growth Total Return Index is an unmanaged index that measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forcasted growth values. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Tocqueville Opportunity Fund | | | 28.30% | | | | 9.71% | | | | 2.78% | | | | 6.00% | |

Russell 2500 Growth Total Return Index | | | 30.07% | | | | 8.79% | | | | 5.91% | | | | 6.39% | |

The Tocqueville International Value Fund

Dear Fellow Shareholder,

For the six months ended April 30, 2011, global equity markets generally advanced in spite of geopolitical turmoil in the Middle East, fiscal problems in southern Europe and natural disaster in Japan. Developed markets in the U.S., Europe and Japan rose as corporate earnings continued to improve, interest rates remained low and liquidity abundant. Markets experienced a brief setback in March following the tsunami and nuclear accident in Japan, and then recovered much or all of what they had lost. The Tocqueville International Value Fund’s total U.S. dollar return for the period was a gain of 16.45%. In the same period, the Morgan Stanley EAFE Index, the benchmark against which we are most often compared, had a total U.S. dollar return of 12.95%.

During the six months, the European BE 500 Index increased by 7.87% in local currency terms, the Japanese Nikkei 225 increased by 8.12% in local currency terms, and the MSCI Asia Pacific ex-Japan Index increased by 5.00% in U.S. dollar currency terms. The CRB Index of commodity prices increased by 23%, with WTI (West Texas Intermediate) crude rising by 35% on the back of improving economic data and turmoil in the Middle East, gold increasing 13% as most central banks persisted with lax monetary policy, industrial metals rising and agricultural commodities mixed. Most developed economy equity markets increased in local currency terms and developed markets generally outperformed emerging markets. While Eastern European markets reversed previous years’ losses, emerging markets in the Middle East declined in reaction to the uncertainty engendered by the so called “Arab Spring”, and markets in Brazil, India and China all declined as their respective Central Banks raised interest rates to prevent economic overheating and combat inflation. In terms of sectors, building materials, machinery, chemicals and energy led advances, while transport and travel and leisure performed less well, in part responding to higher oil prices. The U.S. dollar declined in value against the Euro, Yen and most other currencies and the Federal Reserve continued its quantitative easing to help the economy.

Most of our positions produced positive returns, and we managed to avoid any meaningful losses. Our best results came from our European construction materials and machinery shares. Standout contributors included French aerial platform maker Haulotte Group, Italian hydraulic equipment producer Interpump, German steel distributor Kloeckner, French building products concern Saint Gobain and Belgian chemical producer Solvay. We had meaningful contributions from Japanese pneumatic equipment maker SMC, power tool producer Makita, and conglomerate Hitachi, as well as UK managed services concern Interserve, Spain based hotel concern Sol Melia, and energy related shares Total and Schlumberger. During the period, we had small losses in gold producer Newmont Mining, Italian conglomerate CIR and Telekom Indonesia.

We eliminated our positions in Dutch animal feed concern Nutreco, French water utility Veolia Environnement and Brazilian iron ore producer Vale as they arrived at our valuation objectives, and in Telekom Indonesia, where our investment thesis was undercut by a change in competitive conditions that produced pricing and margins pressures. We took new positions in Spanish information technology concern Indra Systems, which is depressed due to concerns about its government contracts, has a high free cash flow yield and growth opportunities in Latin America; in French pharma concern Ipsen, which trades at a discount to the net present value of cash flows from its existing portfolio of drugs and gives no value to the pipeline of new products; in Australian facilities management and food services concern Spotless Group, which has a strong market position and attractive cash flow characteristics, and is restructuring certain underperforming assets to improve financial performance; in Belgian telecom services provider Mobistar, which has a double digit free cash flow yield and would represent an accretive acquisition for controlling shareholder France Telecom; in French wire and cable producer Nexans, which is implementing a meaningful cost reduction program to enhance margins; and in Greek building materials producer Titan Cement, which serves growing markets in Egypt and the Balkans and continues to produce meaningful free cash flow despite weak conditions in its Greek and U.S. markets, which we expect will improve with time.

As we look forward, we are focused on a number of potential risks, including instability in the Middle East, fallout from U.S. fiscal profligacy, the impact on global growth of tightening credit conditions in BRIC countries, and the potentially destabilizing force of weak sovereign credits in southern Europe and elsewhere. More concretely, the cocktail of economic growth, productivity improvements and low interest rates we have enjoyed in developed economies since mid-2009 is unlikely to last. Growth will likely continue, and perhaps exceed expectations. However, with employment beginning to recover, commodity prices high, and financing costs likely to increase as monetary stimulus abates; we believe productivity and corporate profit margins will face headwinds. As a result, we remain vigilant with respect to the valuations and operating performance of our existing portfolio holdings, and demanding with respect to new ideas. Nonetheless, we are finding numerous attractive opportunities.

We continue to employ our investment discipline, seeking to discover fundamentally attractive companies that are out of favor and undervalued, and to provide our shareholders with above average returns with below average risk over the course of an economic cycle.

Respectfully,

|

|

|

|

| James Hunt |

| Portfolio Manager |

The Tocqueville International Value Fund

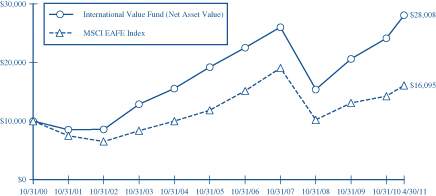

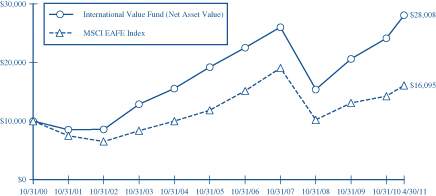

This chart assumes an initial gross investment of $10,000 made on 10/31/00. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The MSCI EAFE Index is an unmanaged market-capitalization-weighted index composed of companies representative of the market structure of 20 Developed Market Countries in Europe, Australia, Asia and the Far East.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Tocqueville International Value Fund | | | 26.69% | | | | 5.82% | | | | 3.85% | | | | 11.09% | |

MSCI EAFE Index | | | 19.70% | | | | -2.37% | | | | 2.02% | | | | 5.74% | |

The Tocqueville Gold Fund

Dear Fellow Shareholder,

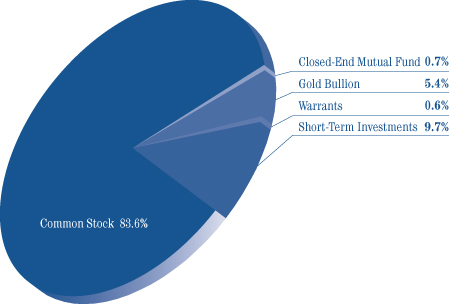

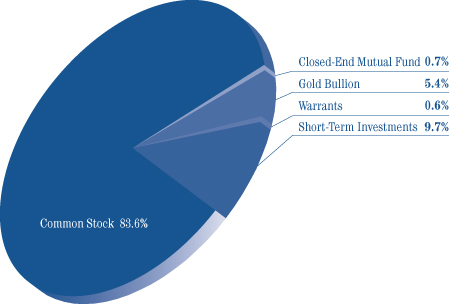

During the first six months of the 2011 fiscal year, the Tocqueville Gold Fund appreciated 12.52% vs. 9.51% for the XAU (Philadelphia Stock Exchange Gold/Silver Index) and 16.36% for the S&P 500. The price of gold rose 15.03% during the period and this provided a strong underpinning for gold shares. The Fund’s position in physical gold is 5.4% of its net assets and the balance is in shares of mining or processing companies whose principal business is the production of gold and other precious metals and cash equivalents.

The last six months have been eventful for gold as it marched to new highs of $1500 per ounce. Headlines for much of the start of the year were captivated by the unrest and social upheaval in Northern Africa, and later by the tragic, natural disaster in Japan. Such headlines highlighted the safe haven nature of gold. However, in our opinion, in the context of the investment case for gold, such headlines act as noise to the fundamental rationale for investment, which rests primarily upon monetary debasement. As gathering inflationary forces mount, it will be increasingly difficult to explain it away as short term, and the theoretically unsustainable result of volatility in food and energy. Meanwhile, in Washington, the Federal Reserve maintains that it will ease the markets out of QE2 on June 30th and partisan politics have forestalled efforts at a credible fiscal plan.

Against this backdrop, the Fund performed well during this period. The top contributors over this period included Gold Resources, Silver Wheaton, and Richfield Ventures which appreciated 43.9%, 41.4%, and 276.7% respectively. Notable among these was the performance by Richfield, which was the subject of an acquisition offer. This is another example of our strategy of investing in earlier stage companies that create value through exploration and development, and may eventually be acquired by a producing company. In contrast, our portfolio also had its share of disappointments during the period. The most notable were Semafo, Romarco, and Buenaventura, which declined 28.9%, 29.0%, and 20.3% respectively. Despite the lackluster performance, we continue to believe that these companies will be able to deliver shareholder value over time.

For all the excitement thus far this year, the next two months seem to have the market waiting with bated breath as to ongoing developments on the macroeconomic front. We have our own opinions as to the potential outcomes of these series of events but will also watch with anticipation as they unfold. In the interim, we continue to remain vigilant for investment opportunities in gold mining shares.

Sincerely,

John C. Hathaway

Portfolio Manager

The Tocqueville Gold Fund

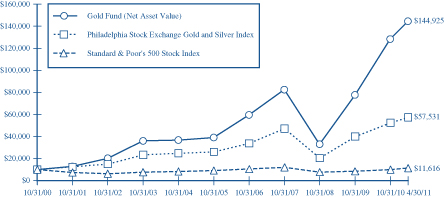

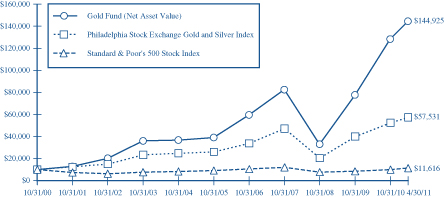

This chart assumes an initial gross investment of $10,000 made on 10/31/00. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2003, 2006, 2009, and 2010 the performance of The Tocqueville Gold Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Tocqueville Gold Fund | | | 40.22% | | | | 26.59% | | | | 17.22% | | | | 28.35% | |

Philadelphia Stock Exchange Gold and Silver Index | | | 25.50% | | | | 10.10% | | | | 8.09% | | | | 16.30% | |

Standard & Poor’s 500 Stock Index | | | 17.22% | | | | 1.73% | | | | 2.95% | | | | 2.82% | |

The Delafield Fund

Dear Fellow Shareholder,

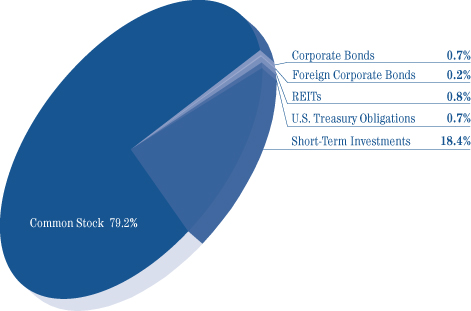

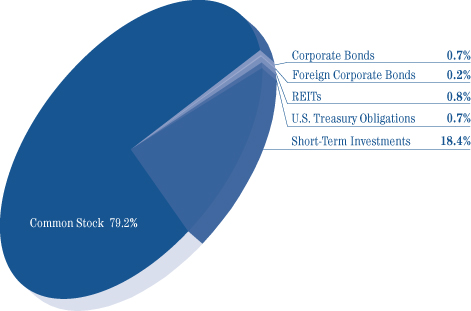

For the six months ended April 30, 2011, the Fund’s net asset value increased 20.49% versus an increase of 23.73% for the Russell 2000 Index (“Russell 2000”) and 16.36% for the Standard & Poor’s 500 Index (“S&P 500”), each on a total return basis. The Fund’s net asset value as of April 30, 2011 was $32.11 per share. The net asset value amounted to $1,442,420,909 of which 79.6% was invested in equities, 1.6% in fixed income, and the balance held in cash reserves.

The broad market recovery that began two years ago continued during the first half of our fiscal year. The strength was driven by the market’s belief in a sustainable recovery in the global financial system and in worldwide governments’ efforts to stimulate their economies. Additionally, strong corporate earnings reports during the six month period drove stock gains. While we recognize the fundamental improvements that have driven this remarkable comeback, we do worry that investors are not fully discounting some of the underlying global political and economic uncertainties that remain. These include continued weakness in domestic housing values and unemployment rates, the viability of some European banks, soaring energy prices and supply bumps following the Japanese disaster.

By most industry standards we are underinvested, but that does not concern us. In the volatile markets which have developed over the last 15 to 20 years, we have come to believe that the long-term investor’s best hedge against volatility is to have cash with which to invest in equities when prices seem unduly depressed. Thus, we will increase our equity exposure when we believe we have uncovered attractive opportunities.

The Fund portfolio is built using a bottom-up approach. We remain focused on identifying companies where our analytical insight suggests a largely unanticipated improvement in operations. We focus intently on valuation and analyze cash flows and attempt to invest at prices that we believe undervalue the underlying franchise. This is the strategy we consistently employ, that we believe is the best way to increase wealth over time and which drives the performance of the Fund.

The Fund’s portfolio is not constructed with industry allocation targets. However, we were overweight in the industrials sector as a result of investment opportunities that we uncovered in that area, which benefited performance. Our underweight position in financials detracted from performance. Virtually all of our holdings experienced positive returns during the six month period. The largest contributors to our six month performance were Fairchild Semiconductor International Inc, Eastman Chemical Company and Collective Brands, Inc. In contrast, Flextronics International Ltd. was the largest detractor.

Sincerely,

| | |

| |  |

| |

| J. Dennis Delafield | | Vincent Sellecchia |

| Portfolio Manager | | Portfolio Manager |

The Delafield Fund

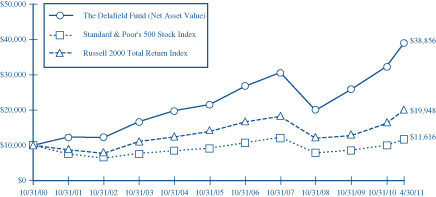

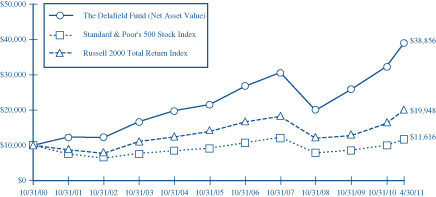

This chart assumes an initial gross investment of $10,000 made on 10/31/00. Since the Delafield Fund did not commence operations until 9/28/09, returns prior to that date are those of the Predecessor Fund. The Delafield Fund assumed the net asset value and performance history of the Predecessor Fund (See Footnote 1 to the Financial Statements). Returns shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee wiaviers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 8% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Delafield Fund | | | 19.55% | | | | 10.92% | | | | 8.78% | | | | 12.51% | |

Standard & Poor’s 500 Stock Index | | | 17.22% | | | | 1.73% | | | | 2.95% | | | | 2.82% | |

Russell 2000 Total Return Index | | | 22.20% | | | | 8.03% | | | | 3.89% | | | | 7.34% | |

The Tocqueville Select Fund

Dear Fellow Shareholder,

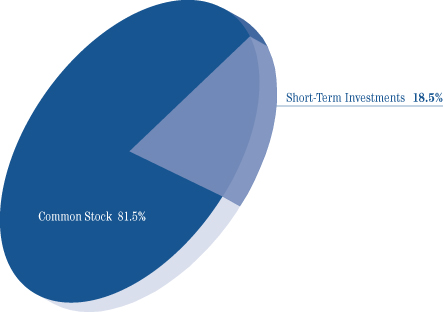

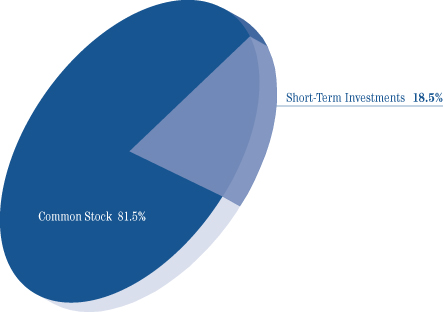

For the six months ended April 30, 2011, the Fund’s net asset value increased 19.69% versus an increase of 23.71% for the Russell 2500 Index (“Russell 2500”) and 23.73% for the Russell 2000 Index (“Russell 2000”), each on a total return basis. The Fund’s net asset value as of April 30, 2011 was $13.25 per share. The net asset value amounted to $86,794,054 of which 81.1% was invested in equities with the balance held in cash reserves.

The broad market recovery that began two years ago continued during the first half of our fiscal year. The strength was driven by the market’s belief in a sustainable recovery in the global financial system and in worldwide governments’ efforts to stimulate their economies. Additionally, strong corporate earnings reports during the six month period drove stock gains. While we recognize the fundamental improvements that have driven this remarkable comeback, we do worry that investors are not fully discounting some of the underlying global political and economic uncertainties that remain. These include continued weakness in domestic housing values and unemployment rates, the viability of some European banks, soaring energy prices and supply bumps following the Japanese disaster.

The Fund portfolio is built using a bottom-up approach. We remain focused on identifying companies where our analytical insight suggests a largely unanticipated improvement in operations. We focus intently on valuation and analyze cash flows and attempt to invest at prices that we believe undervalue the underlying franchise. This is the strategy we consistently employ, that we believe is the best way to increase wealth over time and which drives the performance of the Fund.

The Fund’s portfolio is not constructed with industry allocation targets. However, we were overweight in the industrials sector as a result of investment opportunities that we uncovered in that area, which benefited performance. Our underweight position in energy detracted from performance. Virtually all of our holdings experienced positive returns during the six month period. The largest contributors to our six month performance were TriMas Corporation and Ethan Allen Interiors Inc., while Ruby Tuesday, Inc. and Flextronics International Ltd. were the primary detractors.

| | | | |

| Sincerely, | | | | |

| | |

| |  | |  |

| | |

| J. Dennis Delafield | | Vincent Sellecchia | | Donald Wang |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

The Tocqueville Select Fund

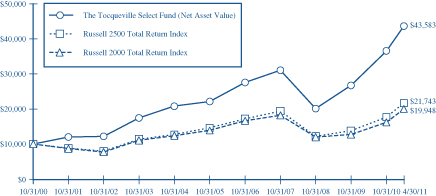

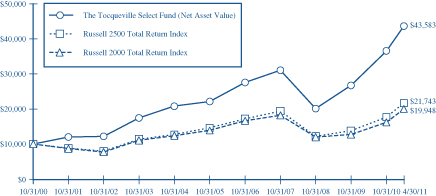

This chart assumes an initial gross investment of $10,000 made on 10/31/00. Since The Tocqueville Select Fund did not commence operations until 9/28/09, returns from the period from September 29, 2008 to September 27, 2009 are those of the Class Y Shares of the Predecessor Fund (See Footnote 1 to the Financial Statements). Prior to that period, returns shown are those of a limited partnership managed by the adviser. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The Russel 2500 Total Return Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2011

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Select Fund | | | 21.58% | | | | 14.97% | | | | 11.90% | | | | 13.93% | |

Russell 2500 Total Return Index | | | 23.89% | | | | 8.02% | | | | 4.91% | | | | 8.24% | |

Russell 2000 Total Return Index | | | 22.20% | | | | 8.03% | | | | 3.89% | | | | 7.34% | |

Expense Example—April 30, 2011 (Unaudited)

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (November 1, 2010-April 30, 2011).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example Tables (Unaudited)

| | | | | | | | | | | | |

The Tocqueville Fund | | Beginning

Account Value

November 1, 2010 | | | Ending

Account Value

April 30, 2011 | | | Expenses Paid

During Period*

November 1, 2010 -

April 30, 2011 | |

Actual | | $ | 1,000.00 | | | $ | 1,147.20 | | | $ | 6.65 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.60 | | | | 6.26 | |

| | | |

| The Tocqueville Opportunity Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,250.00 | | | $ | 7.42 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.20 | | | | 6.66 | |

| | | |

| The Tocqueville International Value Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,164.50 | | | $ | 8.26 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.16 | | | | 7.70 | |

| | | |

| The Tocqueville Gold Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,125.20 | | | $ | 6.48 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.70 | | | | 6.16 | |

| | | |

| The Delafield Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,204.90 | | | $ | 6.62 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.79 | | | | 6.06 | |

| | | |

| The Tocqueville Select Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,196.90 | | | $ | 7.19 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.25 | | | | 6.61 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.25%, 1.33%, 1.54%, 1.23%, 1.21% and 1.32% for The Tocqueville Fund, Opportunity Fund, International Value Fund, Gold Fund, Delafield Fund, and Select Fund, respectively, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout

the period) | | Six Months

Ended

April 30,

2011 | | | Years Ended October 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 21.53 | | | $ | 18.47 | | | $ | 16.39 | | | $ | 28.93 | | | $ | 24.25 | | | $ | 22.17 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.11 | | | | 0.32 | | | | 0.28 | | | | 0.24 | | | | 0.18 | | | | 0.14 | |

Net realized and unrealized gain (loss) | | | 3.03 | | | | 2.97 | | | | 2.09 | | | | (10.56 | ) | | | 4.53 | | | | 4.33 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 3.14 | | | | 3.29 | | | | 2.37 | | | | (10.32 | ) | | | 4.71 | | | | 4.47 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.33 | ) | | | (0.23 | ) | | | (0.29 | ) | | | (0.19 | ) | | | (0.03 | ) | | | (0.22 | ) |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | (2.03 | ) | | | — | | | | (2.17 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (0.33 | ) | | | (0.23 | ) | | | (0.29 | ) | | | (2.22 | ) | | | (0.03 | ) | | | (2.39 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 2.81 | | | | 3.06 | | | | 2.08 | | | | (12.54 | ) | | | 4.68 | | | | 2.08 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 24.34 | | | $ | 21.53 | | | $ | 18.47 | | | $ | 16.39 | | | $ | 28.93 | | | $ | 24.25 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 14.7 | %(3) | | | 18.0 | % | | | 14.8 | % | | | (38.5 | )% | | | 19.4 | % | | | 20.5 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 566,163 | | | $ | 489,670 | | | $ | 383,470 | | | $ | 328,609 | | | $ | 523,878 | | | $ | 392,495 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.25 | %(4)(2) | | | 1.25 | %(2) | | | 1.25 | %(2) | | | 1.25 | %(2) | | | 1.25 | %(2) | | | 1.30 | % |

Net investment income | | | 0.94 | %(4)(2) | | | 1.66 | %(2) | | | 1.68 | %(2) | | | 0.94 | %(2) | | | 0.69 | %(2) | | | 0.68 | % |

Portfolio turnover rate | | | 12 | %(3) | | | 23 | % | | | 32 | % | | | 51 | % | | | 39 | % | | | 32 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.001 for the six months ended April 30, 2011 and $0.002, $0.004, $0.009, $ 0.002 and $0.002 per share for the five years ended October 31, 2010, 2009, 2008, 2007 and 2006, respectively. |

| (2) | Net of fees waived amounting to 0.01%, 0.08%, 0.04%, and 0.01% of average net assets for the four years ended October 31, 2010, 2009, 2008 and 2007, respectively. The amount of fees waived for the six months ended April 30, 2011 was less than 0.01%. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Opportunity Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the

period) | | Six Months

Ended

April 30,

2011 | | | Years Ended October 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 13.20 | | | $ | 10.78 | | | $ | 9.77 | | | $ | 17.24 | | | $ | 18.04 | | | $ | 16.58 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.07 | ) | | | (0.12 | ) | | | (0.11 | ) | | | 0.02 | | | | 0.11 | | | | (0.07 | ) |

Net realized and unrealized gain (loss) | | | 3.37 | | | | 2.54 | | | | 1.23 | | | | (5.67 | ) | | | 1.26 | | | | 1.53 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 3.30 | | | | 2.42 | | | | 1.12 | | | | (5.65 | ) | | | 1.37 | | | | 1.46 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | (0.01 | ) | | | (0.12 | ) | | | — | | | | — | |

Distributions from net realized gains | | | — | | | | — | | | | (0.10 | ) | | | (1.70 | ) | | | (2.17 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | — | | | | (0.11 | ) | | | (1.82 | ) | | | (2.17 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 3.30 | | | | 2.42 | | | | 1.01 | | | | (7.47 | ) | | | (0.80 | ) | | | 1.46 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 16.50 | | | $ | 13.20 | | | $ | 10.78 | | | $ | 9.77 | | | $ | 17.24 | | | $ | 18.04 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 25.0 | %(2) | | | 22.6 | % | | | 11.7 | % | | | (36.2 | )% | | | 8.4 | % | | | 8.8 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 46,207 | | | $ | 32,863 | | | $ | 30,498 | | | $ | 36,429 | | | $ | 49,543 | | | $ | 52,701 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.33 | %(3) | | | 1.41 | % | | | 1.41 | % | | | 1.35 | % | | | 1.32 | % | | | 1.34 | % |

Net investment income (loss) | | | (1.02 | )%(3) | | | (1.08 | )% | | | (0.97 | )% | | | 0.12 | % | | | 0.63 | % | | | (0.38 | )% |

Portfolio turnover rate | | | 57 | %(2) | | | 104 | % | | | 62 | % | | | 169 | % | | | 90 | % | | | 45 | % |

| (1) | Total from investment operations per share includes redemption fees of less than $0.001 for the six months ended April 30, 2011 and $0.001, $0.001, $0.005, $0.001 and $0.015 per share for the years ended October 31, 2010, 2009, 2008, 2007 and 2006, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville International Value Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout

the period) | | Six Months

Ended

April 30,

2011 | | | Years Ended October 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 12.12 | | | $ | 10.48 | | | $ | 8.49 | | | $ | 16.48 | | | $ | 16.72 | | | $ | 16.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.03 | | | | 0.11 | | | | 0.10 | | | | 0.13 | | | | 0.08 | | | | 0.27 | |

Net realized and unrealized gain (loss) | | | 1.96 | | | | 1.65 | | | | 2.59 | | | | (6.09 | ) | | | 2.25 | | | | 2.30 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 1.99 | | | | 1.76 | | | | 2.69 | | | | (5.96 | ) | | | 2.33 | | | | 2.57 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.07 | ) | | | (0.12 | ) | | | (0.20 | ) | | | (0.10 | ) | | | (0.27 | ) | | | (0.05 | ) |

Distributions from net realized gains | | | — | | | | — | | | | (0.50 | ) | | | (1.93 | ) | | | (2.30 | ) | | | (1.86 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (0.07 | ) | | | (0.12 | ) | | | (0.70 | ) | | | (2.03 | ) | | | (2.57 | ) | | | (1.91 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 1.92 | | | | 1.64 | | | | 1.99 | | | | (7.99 | ) | | | (0.24 | ) | | | 0.66 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 14.04 | | | $ | 12.12 | | | $ | 10.48 | | | $ | 8.49 | | | $ | 16.48 | | | $ | 16.72 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 16.5 | %(2) | | | 17.0 | % | | | 34.0 | % | | | (40.8 | )% | | | 15.3 | % | | | 17.4 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 193,083 | | | $ | 150,103 | | | $ | 131,613 | | | $ | 118,189 | | | $ | 219,220 | | | $ | 225,234 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.54 | %(3) | | | 1.56 | % | | | 1.62 | % | | | 1.56 | % | | | 1.59 | % | | | 1.61 | % |

Net investment income | | | 0.54 | %(3) | | | 1.03 | % | | | 0.96 | % | | | 1.07 | % | | | 0.49 | % | | | 1.49 | % |

Portfolio turnover rate | | | 12 | %(2) | | | 27 | % | | | 27 | % | | | 63 | % | | | 49 | % | | | 39 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.001 for the six months ended April 30, 2011 and $0.002, $0.001, $0.001, $0.002 and $0.011 per share for the five years ended October 31, 2010, 2009, 2008, 2007 and 2006, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Gold Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2011 | | | Years Ended October 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 82.00 | | | $ | 49.71 | | | $ | 21.77 | | | $ | 64.36 | | | $ | 51.41 | | | $ | 35.51 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.33 | ) | | | (0.58 | ) | | | (0.45 | ) | | | (0.57 | ) | | | (0.30 | ) | | | (0.22 | ) |

Net realized and unrealized gain (loss) | | | 10.51 | | | | 32.96 | | | | 29.28 | | | | (33.24 | ) | | | 18.52 | | | | 18.21 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 10.18 | | | | 32.38 | | | | 28.83 | | | | (33.81 | ) | | | 18.22 | | | | 17.99 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | (0.46 | ) | | | (0.22 | ) | | | — | |

Distributions from net realized gains | |

| (1.61

| )

| | | (0.09 | ) | | | (0.89 | ) | | | (8.32 | ) | | | (5.05 | ) | | | (2.09 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.61 | ) | | | (0.09 | ) | | | (0.89 | ) | | | (8.78 | ) | | | (5.27 | ) | | | (2.09 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 8.57 | | | | 32.29 | | | | 27.94 | | | | (42.59 | ) | | | 12.95 | | | | 15.90 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 90.57 | | | $ | 82.00 | | | $ | 49.71 | | | $ | 21.77 | | | $ | 64.36 | | | $ | 51.41 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 12.5 | %(2) | | | 65.2 | % | | | 135.2 | % | | | (60.0 | )% | | | 38.4 | % | | | 52.5 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 2,860,970 | | | $ | 2,199,603 | | | $ | 937,492 | | | $ | 410,857 | | | $ | 1,231,475 | | | $ | 833,254 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.23 | %(3) | | | 1.34 | % | | | 1.50 | % | | | 1.43 | % | | | 1.42 | % | | | 1.50 | % |

Net investment income (loss) | | | (0.89 | )%(3) | | | (1.11 | )% | | | (1.25 | )% | | | (1.07 | )% | | | (0.81 | )% | | | (0.51 | )% |

Portfolio turnover rate | | | 1 | %(2) | | | 9 | % | | | 9 | % | | | 28 | % | | | 26 | % | | | 30 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.065 for the six months ended April 30, 2011 and $0.056, $0.025, $0.027, $0.028, and $0.060 per share for the five years ended October 31, 2010, 2009, 2008, 2007 and 2006, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Delafield Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating

performance

(For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2011 | | | Year

Ended

October 31,

2010 | | | January 1,

2009

through

October 31,

2009 | | | Years Ended December 31, | |

| | | | | 2008 | | | 2007 | | | 2006 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 26.65 | | | $ | 21.35 | | | $ | 15.10 | | | $ | 24.33 | | | $ | 25.64 | | | $ | 23.63 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.04 | ) | | | (0.00 | )(2) | | | 0.03 | | | | 0.07 | | | | 0.17 | | | | 0.19 | |

Net realized and unrealized gain (loss) | | | 5.50 | | | | 5.32 | | | | 6.25 | | | | (9.23 | ) | | | 1.10 | | | | 4.64 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 5.46 | | | | 5.32 | | | | 6.28 | | | | (9.16 | ) | | | 1.27 | | | | 4.83 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | (0.03 | ) | | | (0.07 | ) | | | (0.16 | ) | | | (0.19 | ) |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | (0.00 | )(2) | | | (2.42 | ) | | | (2.63 | ) |

Return of Capital | | | — | | | | (0.02 | ) | | | (0.00 | )(2) | | | (0.00 | )(2) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | (0.02 | ) | | | (0.03 | ) | | | (0.07 | ) | | | (2.58 | ) | | | (2.82 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 5.46 | | | | 5.30 | | | | 6.25 | | | | (9.23 | ) | | | (1.31 | ) | | | 2.01 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 32.11 | | | $ | 26.65 | | | $ | 21.35 | | | $ | 15.10 | | | $ | 24.33 | | | $ | 25.64 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 20.5 | %(3) | | | 25.0 | % | | | 41.6 | %(3) | | | (37.6 | )% | | | 4.9 | % | | | 20.4 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 1,442,421 | | | $ | 933,674 | | | $ | 636,548 | | | $ | 404,860 | | | $ | 656,999 | | | $ | 532,108 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.21 | %(4) | | | 1.27 | % | | | 1.38 | %(4) | | | 1.34 | %(5) | | | 1.28 | %(5) | | | 1.32 | %(5) |

Net investment income (loss) | | | (0.30 | )%(4) | | | (0.02 | )% | | | 0.21 | %(4) | | | 0.35 | %(5) | | | 0.57 | %(5) | | | 0.82 | %(5) |

Portfolio turnover rate | | | 18 | %(3) | | | 30 | % | | | 46 | %(3) | | | 81 | % | | | 61 | % | | | 72 | % |

| (1) | Total from investment operations per share includes redemption fees of $0.002 for the six months ended April 30, 2011, $0.006 per share for the year ended October 31, 2010, $0.008 per share for the period ended October 31, 2009, $0.01 per share for the fiscal year ended December 31, 2007 and less than $0.01 per share for the fiscal years ended December 31, 2008 and 2006. |

| (2) | Represents less than $0.01. |

| (5) | Net of fees waived amounting to 0.06%, 0.05%, and 0.08% for the fiscal years ended December 31, 2008, 2007, and 2006, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Select Fund

Financial Highlights

| | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout the period) | | Six Months

Ended

April 30,

2011 | | | Year

Ended

October 31,

2010 | | | January 1,

2009

through

October 31,

2009 | | | Period from

September 29,

2008 (2)

through

December 31,

2008 | |

| | | (Unaudited) | | | | | | | | | | |

Net asset value, beginning of period | | $ | 11.54 | | | $ | 8.46 | | | $ | 5.77 | | | $ | 8.74 | |

| | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.03 | ) | | | (0.03 | ) | | | (0.00 | )(3) | | | 0.01 | |

Net realized and unrealized gain (loss) | | | 2.27 | | | | 3.12 | | | | 2.70 | | | | (2.97 | ) |

| | | | | | | | | | | | | | | | |

Total from investment operations (1) | | | 2.24 | | | | 3.09 | | | | 2.70 | | | | (2.96 | ) |

| | | | | | | | | | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | (0.01 | ) | | | (0.00 | )(3) | | | (0.01 | ) |

Distributions from net realized gains | | | (0.53 | ) | | | — | | | | — | | | | — | |

Return of Capital | | | — | | | | — | | | | (0.01 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.53 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 1.71 | | | | 3.08 | | | | 2.69 | | | | (2.97 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 13.25 | | | $ | 11.54 | | | $ | 8.46 | | | $ | 5.77 | |

| | | | | | | | | | | | | | | | |

Total return | | | 19.7 | %(4) | | | 36.6 | % | | | 46.7 | %(4) | | | (33.9 | )%(4) |

Ratios/supplemental data | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 86,794 | | | $ | 41,788 | | | $ | 24,681 | | | $ | 9,226 | |

Ratios to average net assets: | | | | | | | | | | | | | | | | |

Expenses | | | 1.32 | %(5) | | | 1.38 | % | | | 1.26 | %(5)(6) | | | 1.15 | %(5)(6) |

Net investment income (loss) | | | (0.75 | )%(5) | | | (0.43 | )% | | | (0.16 | )%(5)(6) | | | 0.29 | %(5)(6) |

Portfolio turnover rate | | | 9 | %(4) | | | 40 | % | | | 24 | %(4) | | | 29 | %(4) |

| (1) | Total from investment operations per share includes redemption fees of $0.005 for the six months ended April 30, 2011 and $0.007 per share for the year ended October 31, 2010. |

| (3) | Represents less than $0.01 per share. |

| (6) | Net of fees waived amounting to 0.77% and 2.32% for the periods ended October 31, 2009 and December 31, 2008, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Fund

Schedule of Investments as of April 30, 2011

(Unaudited)

| | | | | | | | |

| Common Stocks—95.5% | | Shares | | | Value | |

Automobiles & Components—1.0% | | | | | |

Toyota Motor Corp.—ADR | | | 72,000 | | | $ | 5,736,960 | |

Banks—2.9% | | | | | | | | |

Banco Santander SA—ADR | | | 500,000 | | | | 6,200,000 | |

East West Bancorp, Inc. | | | 250,000 | | | | 5,282,500 | |

Mitsubishi UFJ Financial Group, Inc.—ADR | | | 1,000,000 | | | | 4,770,000 | |

| | | | | | | | 16,252,500 | |

Capital Goods—10.9% | | | | | | | | |

The Boeing Co. | | | 75,000 | | | | 5,983,500 | |

Briggs & Stratton Corp. | | | 125,065 | | | | 2,950,283 | |

General Electric Co. | | | 1,000,000 | | | | 20,450,000 | |

Illinois Tool Works, Inc. | | | 150,000 | | | | 8,761,500 | |

ITT Corp. | | | 100,000 | | | | 5,779,000 | |

Masco Corp. | | | 500,000 | | | | 6,710,000 | |

Northrop Grumman Corp. | | | 100,000 | | | | 6,361,000 | |

Tyco International Ltd.(a) | | | 100,000 | | | | 4,874,000 | |

| | | | | | | | 61,869,283 | |

Commercial & Professional Services—2.0% | |

Steelcase, Inc. | | | 1,000,000 | | | | 11,550,000 | |

Consumer Services—1.0% | | | | | |

Yum! Brands, Inc. | | | 100,000 | | | | 5,364,000 | |

Diversified Financials—1.5% | | | | | |

The Bank of New York Mellon Corp. | | | 300,000 | | | | 8,688,000 | |

Energy—10.5% | | | | | | | | |

Anadarko Petroleum Corp. | | | 50,000 | | | | 3,947,000 | |

Cameco Corp.(a) | | | 150,000 | | | | 4,422,000 | |

Chesapeake Energy Corp. | | | 250,000 | | | | 8,417,500 | |

Exxon Mobil Corp. | | | 200,000 | | | | 17,600,000 | |

Murphy Oil Corp. | | | 150,000 | | | | 11,622,000 | |

Schlumberger Ltd.(a) | | | 150,000 | | | | 13,462,500 | |

| | | | | | | | 59,471,000 | |

Food & Staples Retailing—1.1% | | | | | |

Safeway, Inc. | | | 250,000 | | | | 6,077,500 | |

Food, Beverage & Tobacco—6.2% | |

Campbell Soup Co. | | | 250,000 | | | | 8,397,500 | |

The Coca-Cola Co. | | | 150,000 | | | | 10,119,000 | |

Kraft Foods, Inc. | | | 300,000 | | | | 10,074,000 | |

Unilever NV—ADR | | | 100,000 | | | | 3,300,000 | |

Zhongpin, Inc.(a)(b) | | | 204,100 | | | | 3,408,470 | |

| | | | | | | | 35,298,970 | |

Health Care Equipment & Services—1.2% | |

St. Jude Medical, Inc. | | | 125,000 | | | | 6,680,000 | |

Household & Personal Products—3.3% | |

Colgate-Palmolive Co. | | | 100,000 | | | | 8,435,000 | |

Kimberly-Clark Corp. | | | 150,000 | | | | 9,909,000 | |

| | | | | | | | 18,344,000 | |

| | | | | | | | |

| Common Stocks (continued) | | Shares | | | Value | |

Insurance—2.0% | |

Aflac, Inc. | | | 47,000 | | | $ | 2,640,930 | |

The Allstate Corp. | | | 75,000 | | | | 2,538,000 | |

Fidelity National Financial, Inc. | | | 400,000 | | | | 6,176,000 | |

| | | | | | | | 11,354,930 | |

Materials—12.7% | |

BHP Billiton Ltd.—ADR | | | 75,000 | | | | 7,593,000 | |

Cliffs Natural Resources, Inc. | | | 100,000 | | | | 9,372,000 | |

EI du Pont de Nemours & Co. | | | 300,000 | | | | 17,037,000 | |

Ferro Corp.(b) | | | 166,500 | | | | 2,497,500 | |

Newmont Mining Corp. | | | 300,000 | | | | 17,583,000 | |

Owens-Illinois, Inc.(b) | | | 250,000 | | | | 7,417,500 | |

Sonoco Products Co. | | | 200,000 | | | | 6,912,000 | |

Vulcan Materials Co. | | | 80,000 | | | | 3,616,000 | |

| | | | | | | | 72,028,000 | |

Pharmaceuticals, Biotechnology & Life Sciences—8.1% | |

Alkermes, Inc (b) | | | 145,000 | | | | 2,090,900 | |

Johnson & Johnson | | | 175,000 | | | | 11,501,000 | |

Merck & Co., Inc. | | | 200,000 | | | | 7,190,000 | |

Myriad Genetics, Inc.(b) | | | 300,000 | | | | 6,432,000 | �� |

Pfizer, Inc. | | | 900,000 | | | | 18,864,000 | |

| | | | | | | | 46,077,900 | |

Real Estate—2.3% | |

CB Richard Ellis Group, Inc.(b) | | | 200,000 | | | | 5,342,000 | |

Weyerhaeuser Co. | | | 320,000 | | | | 7,363,200 | |

| | | | | | | | 12,705,200 | |

Retailing—1.3% | |

Home Depot, Inc. | | | 200,000 | | | | 7,428,000 | |

Semiconductors & Semiconductor Equipment—5.1% | |

Applied Materials, Inc. | | | 750,000 | | | | 11,767,500 | |

Intel Corp. | | | 500,000 | | | | 11,595,000 | |

LSI Corp.(b) | | | 750,000 | | | | 5,497,500 | |

| | | | | | | | 28,860,000 | |

Software & Services—11.3% | |

Adobe Systems, Inc.(b) | | | 150,000 | | | | 5,032,500 | |

Automatic Data Processing, Inc. | | | 150,000 | | | | 8,152,500 | |

Bio-key International,

Inc.(b)(c)(d)(e) | | | 47,090 | | | | — | |

Google, Inc.(b) | | | 15,000 | | | | 8,161,500 | |

Mastercard, Inc. | | | 40,000 | | | | 11,035,600 | |

Microsoft Corp. | | | 650,000 | | | | 16,913,000 | |

Symantec Corp.(b) | | | 450,000 | | | | 8,842,500 | |

Total Systems Services, Inc. | | | 300,000 | | | | 5,655,000 | |

| | | | | | | | 63,792,600 | |

Technology Hardware & Equipment—6.1% | |

Canon, Inc.—ADR | | | 60,000 | | | | 2,830,200 | |

Cisco Systems, Inc. | | | 500,000 | | | | 8,780,000 | |

Corning, Inc. | | | 400,000 | | | | 8,376,000 | |

The Accompanying Footnotes are an Integral Part of these Financial Statements

The Tocqueville Fund

Schedule of Investments as of April 30, 2011

(Unaudited)

| | | | | | | | |

| Common Stocks (continued) | | Shares | | | Value | |

Hitachi Ltd.—ADR | | | 200,000 | | | $ | 10,892,000 | |

Plexus Corp.(b) | | | 100,000 | | | | 3,649,000 | |

| | | | | | | | 34,527,200 | |

Telecommunication Services—2.0% | |

Verizon Communications, Inc. | | | 150,000 | | | | 5,667,000 | |

Vodafone Group PLC—ADR | | | 200,000 | | | | 5,824,000 | |

| | | | | | | | 11,491,000 | |

Utilities—3.0% | |

NextEra Energy, Inc. | | | 300,000 | | | | 16,971,000 | |

Total Common Stocks

(Cost $456,700,220) | | | | | | | 540,568,043 | |

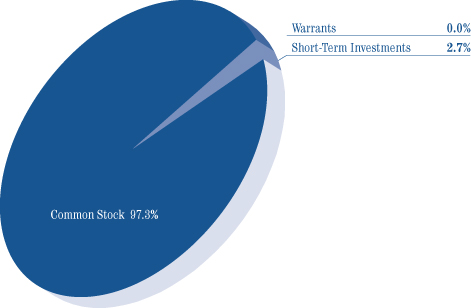

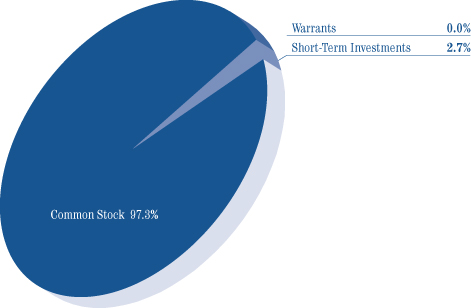

Warrants—0.0% | | | | | | | | |

Capital Goods—0.0% | | | | | | | | |

EMCORE Corp.

Expires: 02/19/13,

Exercise Price:

$15.06(b)(d) | | | 39,375 | | | | 20,269 | |

Raytheon Co.

Expires: 06/16/11,

Exercise Price: $37.50(b) | | | 1,581 | | | | 18,134 | |

Total Warrants

(Cost $0) | | | | | | | 38,403 | |

Short-Term

Investments—2.6% | |

| Principal

Amount |

| | | | |

Repurchase Agreement—2.6% | | | | | |

Repurchase Agreement with U.S. Bank, N.A., 0.01% dated 04/29/2011, due 05/02/2011, collateralized by: Freddie Mac Conventional 15 Year Fixed (Pool #E99837) valued at $1,189,046. Repurchase proceeds of $1,165,626. Freddie Mac 30 Year Variable (Pool #1B2052) valued at $1,972,456. Repurchase proceeds of $1,933,863. | | | | | | | | |

| | | | | | | | |

Short-Term Investments

(continued) | | Principal

Amount | | | Value | |

Fannie Mae Conventional Level Pay 15 Year Fixed (Pool #255494) valued at $11,604,956. Repurchase proceeds of $11,378,164. Freddie Mac 30 Year Fixed Mortgage Backed Securities (Pool #2694) valued at $597,059. Repurchase proceeds of $585,360. | | $ | 15,063,000 | | | $ | 15,063,000 | |

Total Short-Term Investments

(Cost $15,063,000) | | | | | | | 15,063,000 | |

Total Investments

(Cost $471,763,220)—98.1% | | | | 555,669,446 | |

Other Assets in Excess of

Liabilities—1.9% | | | | 10,493,468 | |

Total Net Assets—100.0% | | | $ | 566,162,914 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

ADR—American Depository Receipt

| (a) | Foreign issued security. Foreign concentration (including ADRs) was as follows: Australia 1.3%; Britian 1.0%; Canada 0.8%; China 0.6%; Curacao 2.4%; Japan 4.3%; Netherlands 0.6%; Spain 1.1%; Switzerland 0.9% |

| (b) | Non-income producing security. |

| (c) | Denotes a security is either fully or partially restricted to resale. The aggregate value of restricted securities at April 30, 2011 was $0 which represented 0.0% of net assets. |

| (d) | Fair valued security. The aggregate value of fair valued securities as of April 30, 2011 was $20,269 which represented 0.0% of net assets. |

| (e) | Security is considered illiquid and may be difficult to sell. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The Accompanying Footnotes are an Integral Part of these Financial Statements

The Tocqueville Opportunity Fund

Schedule of Investments as of April 30, 2011

(Unaudited)

| | | | | | | | |

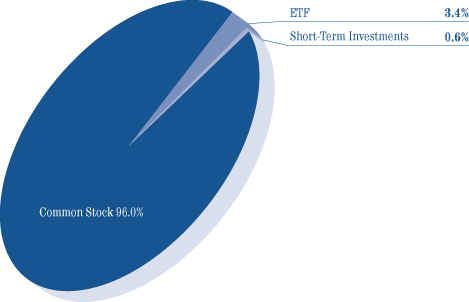

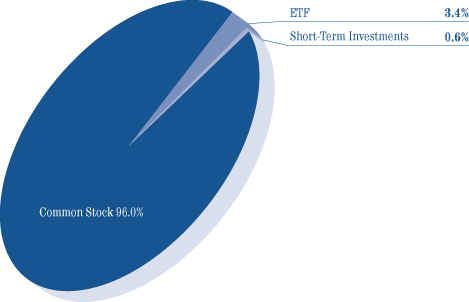

| Common Stocks—96.4% | | Shares | | | Value | |

Automobiles & Components—1.8% | | | | | | | | |

BorgWarner, Inc.(a) | | | 6,200 | | | $ | 478,888 | |

Gentex Corp. | | | 11,000 | | | | 344,850 | |

| | | | | | | | 823,738 | |

Banks—1.5% | |

BankUnited, Inc. | | | 3,500 | | | | 98,315 | |

Huntington Bancshares, Inc. | | | 23,300 | | | | 158,207 | |

Pinnacle Financial Partners, Inc.(a) | | | 6,000 | | | | 96,420 | |

Umpqua Holdings Corp. | | | 30,000 | | | | 348,300 | |

| | | | | | | | 701,242 | |

Capital Goods—5.8% | |

Alliant Techsystems, Inc. | | | 2,000 | | | | 141,300 | |

Ceradyne, Inc.(a) | | | 5,000 | | | | 234,300 | |

Citrix Systems, Inc.(a) | | | 3,100 | | | | 261,454 | |

Esterline Technologies Corp.(a) | | | 2,800 | | | | 201,040 | |

Gardner Denver, Inc. | | | 1,600 | | | | 138,256 | |

Harbin Electric, Inc.(a) | | | 11,500 | | | | 215,280 | |

ITT Corp. | | | 2,300 | | | | 132,917 | |

Joy Global, Inc. | | | 4,500 | | | | 454,275 | |

Polypore International, Inc.(a) | | | 2,500 | | | | 154,425 | |

RBC Bearings, Inc.(a) | | | 4,800 | | | | 188,448 | |

TAL International Group, Inc. | | | 4,900 | | | | 176,645 | |

The Toro Co. | | | 2,900 | | | | 196,939 | |

Valmont Industries, Inc. | | | 1,600 | | | | 168,480 | |

| | | | | | | | 2,663,759 | |

Commercial & Professional Services—0.8% | |

Clean Harbors, Inc.(a) | | | 3,500 | | | | 344,750 | |

Consumer Durables & Apparel—5.4% | | | | | |

Deckers Outdoor Corp.(a) | | | 3,500 | | | | 297,010 | |

Fossil, Inc.(a) | | | 3,300 | | | | 316,074 | |

Harman International Industries, Inc. | | | 4,800 | | | | 232,944 | |

Lululemon Athletica, Inc.(a) | | | 5,500 | | | | 550,165 | |

Polo Ralph Lauren Corp. | | | 1,700 | | | | 222,309 | |

Tempur-Pedic International, Inc.(a) | | | 7,000 | | | | 439,460 | |

Tupperware Brands Corp. | | | 6,800 | | | | 432,956 | |

| | | | | | | | 2,490,918 | |

Consumer Services—6.3% | |

China Lodging Group Ltd.—ADR(a) | | | 18,200 | | | | 398,398 | |

Chipotle Mexican Grill, Inc.(a) | | | 1,900 | | | | 506,901 | |

Ctrip.com International Ltd.—ADR(a) | | | 6,500 | | | | 316,680 | |

Gaylord Entertainment Co.(a) | | | 2,500 | | | | 89,675 | |

Hyatt Hotels Corp.(a) | | | 5,700 | | | | 252,567 | |

Intercontinental Hotels Group

PLC—ADR | | | 10,500 | | | | 231,525 | |

MGM Resorts International(a) | | | 9,500 | | | | 120,270 | |

Panera Bread Co.(a) | | | 1,000 | | | | 121,110 | |

Royal Caribbean Cruises Ltd.(a)(b) | | | 7,800 | | | | 310,596 | |

Sotheby’s | | | 5,800 | | | | 293,016 | |

| | | | | | | | |

| Common Stocks (continued) | | Shares | | | Value | |

Texas Roadhouse, Inc. | | | 9,600 | | | $ | 156,192 | |

Wyndham Worldwide Corp. | | | 2,800 | | | | 96,908 | |

| | | | | | | | 2,893,838 | |

Diversified Financials—3.9% | |

Blackstone Group LP | | | 18,400 | | | | 348,496 | |

KKR & Co. LP | | | 19,500 | | | | 369,720 | |

Lazard Ltd.(b) | | | 8,800 | | | | 360,800 | |

MSCI, Inc.(a) | | | 9,200 | | | | 326,324 | |

Netspend Holdings, Inc.(a) | | | 15,500 | | | | 179,955 | |

Portfolio Recovery Associates, Inc.(a) | | | 2,500 | | | | 225,650 | |

| | | | | | | | 1,810,945 | |

Energy—9.3% | |

Brigham Exploration Co.(a) | | | 16,500 | | | | 553,245 | |

Cameron International Corp.(a) | | | 2,800 | | | | 147,616 | |

CARBO Ceramics, Inc. | | | 3,000 | | | | 482,820 | |

Complete Production Services, Inc.(a) | | | 9,800 | | | | 332,612 | |

Concho Resources, Inc.(a) | | | 2,000 | | | | 213,700 | |

Continental Resources, Inc.(a) | | | 3,200 | | | | 219,776 | |

Core Laboratories NV(b) | | | 3,400 | | | | 326,332 | |

Dril-Quip, Inc.(a) | | | 6,500 | | | | 497,640 | |

Noble Corp.(b) | | | 2,000 | | | | 86,020 | |

Oceaneering International, Inc.(a) | | | 4,000 | | | | 349,680 | |

Petrohawk Energy Corp.(a) | | | 5,000 | | | | 135,050 | |

Pioneer Natural Resources Co. | | | 3,000 | | | | 306,690 | |

Rowan Companies., Inc.(a) | | | 5,100 | | | | 212,670 | |

SM Energy Co. | | | 3,000 | | | | 227,580 | |

Whiting Petroleum Corp.(a) | | | 3,100 | | | | 215,450 | |

| | | | | | | | 4,306,881 | |

Food & Staples Retailing—1.0% | |

The Fresh Market, Inc.(a) | | | 11,300 | | | | 472,566 | |

Food, Beverage & Tobacco—2.6% | | | | | | | | |

Boston Beer Co., Inc.(a) | | | 3,300 | | | | 311,058 | |

Green Mountain Coffee

Roasters, Inc.(a) | | | 6,800 | | | | 455,328 | |

The Hain Celestial Group, Inc.(a) | | | 13,100 | | | | 445,531 | |

| | | | | | | | 1,211,917 | |

Health Care Equipment & Services—5.3% | |

Allscripts Healthcare Solutions, Inc.(a) | | | 35,400 | | | | 762,516 | |

Bio-Reference Labs, Inc.(a) | | | 7,400 | | | | 186,554 | |

Greatbatch, Inc.(a) | | | 4,000 | | | | 108,280 | |

HMS Holdings Corp.(a) | | | 2,000 | | | | 157,420 | |

Hologic, Inc.(a) | | | 5,100 | | | | 112,302 | |

Magellan Health Services, Inc.(a) | | | 4,000 | | | | 208,080 | |