As filed with the Securities and Exchange Commission on July 7, 2008

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 W. 57th Street, 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt, President

The Tocqueville Trust

40 W. 57th Street, 19th Floor

New York, NY 10019

(Name and address of agent for service)

212-698-0800

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: April 30, 2008

Item 1. Report to Stockholders.

S E M I - A N N U A L R E P O R T

April 30, 2008

The Tocqueville Trust

Mutual Funds

The Tocqueville Fund

The Tocqueville Small Cap Value Fund

The Tocqueville International Value Fund

The Tocqueville Gold Fund

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of The Tocqueville Trust. Please call 1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @ www.tocquevillefunds.com

Dear Fellow Shareholder,

The past eight months have been trying for investors, but not as damaging to portfolios as might have been expected.

On the backdrop of a developing financial crisis of historic proportions, the U.S. economy has been flirting with recession. Both Europe and Japan gave signs of slowing down as well, a trend which could only be aggravated by a U.S. downturn. In spite of recent talk about the “decoupling” of emerging economies from the developed ones, we doubt that these economies can resist recessions or near-recessions in the United States, Europe and Japan.

To add to current uncertainties, central banks have recently voiced their concern that inflation is accelerating, implying that their monetary policies would become more restrictive than they have recently been.

In spite of this mediocre economic outlook and although no one knows the ultimate size and scope of the losses that will eventually be triggered by the ongoing financial crisis, most global markets, after losing around 20%-25% between October and March, recovered strongly at the first sign that central banks were determined to prevent massive defaults.

Market losses have been somewhat larger in Europe, largely offset by the gains in the Euro against the U.S. dollar. In China, a much larger decline (around 50%) corrected only part of the speculative rise that preceded it.

Altogether, we do not feel that the market corrections to-date, though painful, are quite commensurate with the size of the problems that confront us. So there might remain risks in “the markets”. But, in the sectors that have been hurt the most—either financial companies themselves, or companies that use commodities, which have exploded in price—opportunities have likely surfaced.

Recognizing that market bottoms may not have been reached yet, we nevertheless believe that many individual stocks have grown worthy of our attention.

Thank you for your loyalty to the Tocqueville Funds,

Respectfully,

François Sicart

Dear Fellow Shareholders,

The first six months of the current fiscal year was a difficult time for equity investors. Indeed, for at least the past year equity investing has not been for the faint of heart. Ever since the first meltdown of Chinese stocks in February of 2007, when the Chinese market fell almost ten per cent in one day and sent ripples of worry through-out the global financial scene, equity investing has been a one step forward, two step back exercise. Promising rallies have been followed, and usually quite quickly, by punishing declines. Broad market returns, down 4.68% over the past year and down 9.64% over the past six months as measured by the S&P 500 mask the true extent of the damage. Financial stocks, in particular have been bludgeoned, with many down as much as ninety per cent from their highs less than eighteen months ago. The sharp decline in residential real estate values, after a long and ultimately unsustainable rise in home prices, and the sub-prime debacle which followed have exacted a heavy toll on financial and many non-financial companies through-out the world, resulting in widely publicized bankruptcies and bail-outs.

With a twelve month return of negative 0.53% and a six month decline, as of April 30, 2008, of 8.88%, your fund has managed these difficult times reasonably well though hardly as well as we would have hoped. Although we entered this period significantly underweighted in financial stocks, we began to add them to our portfolios as the crisis unfolded. In retrospect we were too early. While we remain convinced that the financials that we own will generate good returns over the next three to five years, we would have been wiser to restrain our enthusiasm until more of the dust settled. We do not try to pick bottoms in our stock selection, nor do we think it is even possible. But we do try to limit our downside risk, and in the financial stocks for the past year, that has been a tall task.

Financials were not the only names that hurt the portfolio over the last six months. Microsoft, one of our larger holdings declined significantly on the news of, what we viewed as, an ill considered takeover attempt, and has only recently began to recover. We continue to be a believer in the unique strengths of this company, although we, too, were shaken by the near waste of corporate resources a takeover of Yahoo! would have represented. And Pfizer, another large holding, continued its relentless decline. Now selling at nine times expected earnings and sporting a 6.5% yield, Pfizer, which once had the world’s largest market capitalization, is being priced as if it were a second rate electric utility or a deep cyclical selling at peak earnings. It is neither, and we believe the company represents outstanding value at current prices.

As one would expect, our returns were helped by our energy and commodity company holdings along with takeover names like Pharmion, a small cap drug company. Google, which we bought when the stock collapsed after a misunderstood earnings report also added to our results, as did a number of our foreign holdings, in particular an ETF which tracks the Japanese Yen, and Chunghwa Telephone, the leading Taiwanese phone company.

The credit crisis and more recently the oil price shock has pre-occupied equity investors to such an extent that we do not believe that the November elections have yet been reflected in share prices. This will surely come, and we do not view the current political landscape as being favorable for equity investing. This could change of course, and given this wild political year, probably will. But until uncertainty caused by the upcoming elections is resolved, and it may well be resolved before the elections themselves, it is difficult to see how the market can make much headway. That said, we are finding good values in the market and in our existing portfolio, so we have been adding to our positions. We continue to be long term investors with an investment time frame of three to five years. We believe the serious, but temporal issues facing the markets will be a distant memory by the time we are ready to sell most of the stocks in our portfolio, hopefully at much higher prices.

As one of the largest individual shareholders in the fund, as well as its manager, I have a considerably large stake as well as a firm belief in the wisdom of our long term contrarian, value orientation, and I appreciate your continued support of the Tocqueville Fund.

Sincerely,

Robert W. Kleinschmidt

Portfolio Manager

The Tocqueville Fund

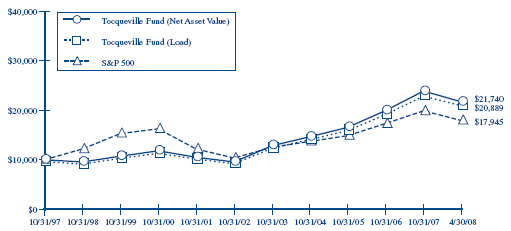

This chart assumes an initial gross investment of $10,000 made on 10/31/97. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2008

| | 1 Year | 3 Year | 5 Year | 10 Year |

| Tocqueville Fund—Net Asset Value | – 0.53% | 12.01% | 16.81% | 6.84% |

| Tocqueville Fund—Load* | – 0.53% | 12.01% | 16.81% | 6.41% |

| Standard & Poor’s 500 Stock Index | – 4.68% | 8.23% | 10.62% | 3.89% |

| * Effective February 1, 2000, the Fund eliminated its sales load. | | | | |

The Tocqueville Small Cap Value Fund

Dear Fellow Shareholders,

Since January 1, 2008 the Tocqueville Small Cap Value Fund has been managed by a new team. This team has been managing small cap separate accounts at Tocqueville Asset Management L.P. since 2000. We are very excited about the opportunity to manage your fund and look forward to a long and rewarding relationship with you.

During the first six months of our fiscal year ending on April 30, 2008, The Tocqueville Small Cap Value Fund declined by 17.28% compared to a decline of 12.92% for the Russell 2000 Index for that same period of time. This has been a very volatile time for small company shares.

Recently, our government instituted several dramatic actions in response to emerging financial difficulties, hoping to forestall an economic contraction. They may succeed short term but not, in our view, without extraordinary long term costs. Foreign holders of U.S. dollars no longer support our spendthrift ways. The recent tax rebates, opening the borrowing window to investment banks, and other measures to bail out over-extended borrowers has been, in our opinion, the “straw that broke the camel’s back”. In addition, the U.S. dollar has lost a significant amount of its value over the past few years. Thus it is understandable that these countries are giving up on us and accelerating their efforts to diversify their financial reserves. We believe the long term ramifications from this preference shift will be enormous for our capital markets.

The equity markets’ focus on recession risk has moderated corporate profit expectations. Over the next two quarters we expect these fears to dissipate. Once investor psychology rebounds from its current sour mood, opportunities should appear both from the continued economic growth plus overseas demand for equities. Selectivity will be essential, as usual, since the overall market could be trapped in a broad trading range because of gradually rising interest rates. So while hurdles remain, we believe significant opportunity awaits for those willing to dig for them. This is our style and we remain optimistic about the future.

It has been a difficult few quarters for small cap stocks. Fears surrounding the financial sector raised concerns about growth and profitability, both sensitive areas for small companies. Reduced liquidity increased volatility and this hurt stocks under $1 billion in market value the most. Steady growers did better than those struggling to improve operationally.

Our portfolio is concentrated in sectors sensitive to current economic concerns (technology and producer durables) plus companies under $1 billion in value. These factors negatively impacted our six-month return. Plus, our style focuses on firms attempting to restore profitability. This universe underperformed the benchmark. Disappointing returns from the industrial segment of the portfolio offset relative strength generated in the consumer, financial and healthcare sectors plus positive returns from energy. Fears of economic difficulties affected our selections in cyclically sensitive areas but this should reverse once growth prospects become more visible.

Small cap stocks should respond favorably to better growth expectations for late 2008. Dollar weakness is stimulating export activity, a new phenomena for small firms. The shifting mix of technology spending toward small projects that enhance existing infrastructure is opening new doors. Plus, a surge in new healthcare products is emerging, many in small niches. These new trends should enhance investor interest in small companies in technology and healthcare, sectors long ignored, regardless of the economic environment. We remain concentrated in these opportunities and excited about the outlook for our portfolio.

| | | |

| P. Drew Rankin | Allen Huang | Douglas Adams |

The Tocqueville Small Cap Value Fund

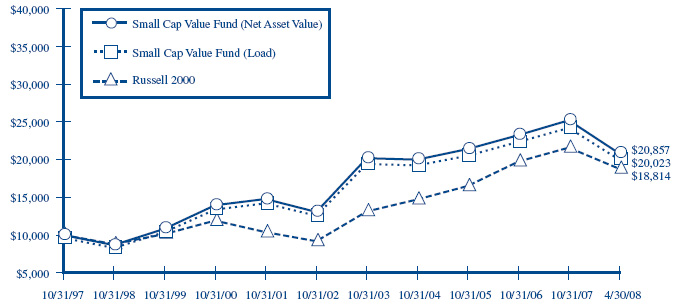

This chart assumes an initial gross investment of $10,000 made on 10/31/97. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Russell 2000 Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2008

| | 1 Year | 3 Year | 5 Year | 10 Year |

| Tocqueville Small Cap Value Fund—Net Asset Value | – 16.26% | 3.87% | 8.03% | 6.45% |

| Tocqueville Small Cap Value Fund—Load* | – 16.26% | 3.87% | 8.03% | 6.02% |

| Russell 2000 Index | – 10.96% | 8.62% | 13.76% | 5.33% |

| * Effective February 1, 2000, the Fund eliminated its sales load. | | | | |

The Tocqueville International Value Fund

Dear Fellow Shareholder,

For the six months ended April 30th, 2008, global equity markets declined sharply through March as investors digested the breadth of the global financial crisis and the likelihood of an economic slowdown. The Tocqueville International Value Fund’s total U.S. dollar return for the period was a loss of 8.83%. In the same period, the Morgan Stanley EAFE Index had a total U.S. dollar return loss of 8.91%.

During those same six months, the European BE 500 index decreased by 14.66% in local currency terms, the Japanese Nikkei 225 decreased by 16.57% in local currency terms, the Morgan Stanley Far East Index decreased by 15.93%. Commodity prices, and particularly energy and food prices, moved up despite the probability of an economic slowdown, due in part to persistently tight supply conditions and in part to an accelerating flow of speculative money into the asset class. Most equity markets decreased during the period. The greatest losses were suffered by markets that had been the subject of excessive investor enthusiasm, like China, India and Vietnam. Positive returns were earned in Brazil and certain markets in Africa and the Middle East, all net exporters of food or energy. In terms of sectors, energy, chemicals, and steel and other metals were up, while retail, travel, media, and financials were down sharply. The U.S. dollar declined in value versus most currencies, falling by 7.80% against the Euro and 9.97% against the Japanese Yen, as growth in the U.S. slowed and interest rates declined.

During the period, several positions produced positive returns, including Taiwanese telecom service provider Chunghwa, Mexican beer producer FEMSA, Japanese electronics concern Matsushita and logistics concern Nippon Express, and global oil service provider Schlumberger. We managed to avoid large losses in the financials as we retain a limited exposure to the sector. We lost money in industrials globally, like French aerospace concern Safran and UK heat treatment service provider Bodycote, in consumer discretionary shares in Europe, like French TV concern M6, and in telecom equipment and auto parts shares, like Nokia and Sogefi. These are businesses with good long term fundamentals and cheap valuations. Our performance relative to the index was handicapped by our limited exposure to materials and energy, areas which in our view are subject to excessive investor enthusiasm and whose valuations, despite good long term fundamentals, do not provide an adequate margin of safety.

Several of the concerns that we have articulated in previous letters have made themselves known to the broader investment community during these six months, namely: the risk associated with profligate U.S. mortgage financing, the likelihood of economic slowdown in the U.S. and the attendant probability of a global slowdown, incipient inflation, and the negative impact on corporate margins from rising commodity and labor costs. None of these issues has gone away, and in fact they could conceivably lead to further declines in the overall equity market. Having said that, compared with a year ago, when the markets were oblivious to risk, the investment community has adopted a more cautious stance and more risk has been priced into equities. More importantly, the general decline in equity markets and the steep declines in certain sectors has created opportunities to buy individual stocks at the kind of cheap valuation we have not seen since the early part of the decade. From our standpoint as contrarian, value oriented investors, the markets have become more attractive.

In terms of our activity and positioning, we continue to seek and find opportunities in Japan among world class industrials, like SMC Corp, and companies with substantial excess investments and real estate, like Nippon Express. We have taken the opportunity offered by market turbulence to purchase certain great global franchises, like Toyota and Nestle, as investor concerns drive prices down to valuations we deem attractive. The fear surrounding financials has made them attractive from a sentiment standpoint and in valuation terms relative to long term earnings power, and we have begun to build positions in European financial firms, like U.K. credit information firm Experian. Importantly, some of the great small and mid-sized European companies in which we have earned attractive returns in prior cycles have declined substantially in value. We are refreshing our understanding of the businesses with the expectation of building positions in the coming quarters. Overall, we have a limited exposure to emerging markets, other than in attractively valued consumer shares, like Mexican beverage concern FEMSA, and restructuring or recapitalization candidates, like Taiwan’s Chunghwa Telecom. We retain a limited exposure to materials and energy for reasons articulated above. Our industrial exposure is oriented to companies like Hitachi that have technology and a substantial exposure to global spending on infrastructure.

We continue to employ our investment discipline, seeking to discover fundamentally attractive companies that are out of favor and undervalued, and to provide our shareholders with above average returns with below average risk.

Sincerely,

| James Hunt | Francois Sicart |

| Portfolio Manager | Portfolio Manager |

The Tocqueville International Value Fund

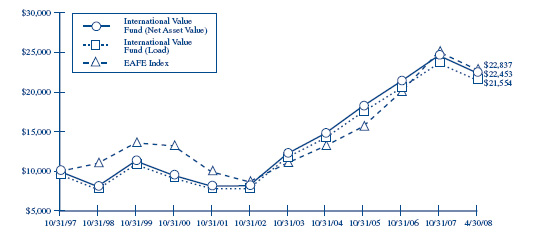

This chart assumes an initial gross investment of $10,000 made on 10/31/97. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Morgan Stanley EAFE Index is an unmanaged market-capitalization-weighted index composed of companies representative of the market structure of 20 Developed Market Countries in Europe, Australia, Asia and the Far East.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2008

| | 1 Year | 3 Year | 5 Year | 10 Year |

| Tocqueville International Value Fund—Net Asset Value | – 5.02% | 11.78% | 21.38% | 8.40% |

| Tocqueville International Value Fund—Load* | – 5.02% | 11.78% | 21.38% | 7.96% |

| Morgan Stanley EAFE Index | – 1.31% | 16.74% | 20.92% | 7.05% |

| * Effective February 1, 2000, the Fund eliminated its sales load. | | | | |

The Tocqueville Gold Fund

Dear Fellow Shareholder,

During the fiscal half year ending April 30, 2008, the Tocqueville Gold Fund returned (13.72)% vs. (8.64)% for the benchmark XAU (Philadelphia Stock Exchange index of gold and silver shares) and (9.64)% for the S&P 500.

During the past six months, the Federal Reserve and other world central banks have had to resort to unprecedented measures to prevent a total meltdown of global credit. The Fed, for example, has exchanged high quality treasury bonds held on their balance sheet for much lower quality debt instruments including mortgage backed securities and other difficult to value paper in order to provide liquidity to banks and brokerage houses. The European Central Bank and the Bank of England have undertaken similar initiatives. Financial market confidence remains fragile despite these extraordinary measures and the premiums for risk taking remain high. In short, we believe the environment for gold remains excellent.

In the hours before the dramatic Fed bailout of Bear Stearns and their counterparties in derivatives trades, gold briefly exceeded $1000/oz. Since then, it has been in a corrective mode and in our opinion, is attempting to establish a new base from which can launch to new highs. Shares of companies that are engaged in mining or processing gold (“Gold Shares”) have also entered this corrective phase and appear to be awaiting leadership from the metal before moving higher. However, major gold producers are enjoying significantly higher prices than a year ago and as a result should report favorable earnings comparisons over the next few quarters. The anticipated positive earnings reports will contrast starkly with likely negative earnings comparisons being reported by large segments of the economy including finance, housing and retail. This contrast alone could prove to be the catalyst necessary to attract improved investment interest.

Small and mid cap stocks which represent a significant exposure in the Fund’s portfolio continue to dramatically underperform large cap mining stocks. The reason in our opinion is that generalist investors for the time being prefer the liquidity of large cap Gold Shares despite the superior values offered by the small cap sector. We have no way of knowing how long this valuation disparity will last. However, based on history, the differential ultimately narrows so that smaller cap stocks ultimately provide superior relative performance.

While financial commentary obsesses over the high price of oil, few appear to understand that the strength of oil and other commodity prices in large part reflect the loss of value of the U.S. dollar. A sharp correction in commodity prices, in our opinion, will only come because of what has been dubbed as “demand destruction.” Few seem to realize that demand destruction in the short run is the equivalent of a more serious economic downturn than markets now appear to envision. Under that scenario, U.S. dollar weakness could accelerate because the Fed would be powerless to raise interest rates sufficiently to defend the currency. It seems to us that the Fed’s best option to avoid a prolonged and deep recession would be to validate high commodity prices via inflation, as it did in the 1970’s. Under those circumstances, the upside for gold and Gold Shares should be substantial.

Sincerely,

John C. Hathaway

Portfolio Manager

The Tocqueville Gold Fund

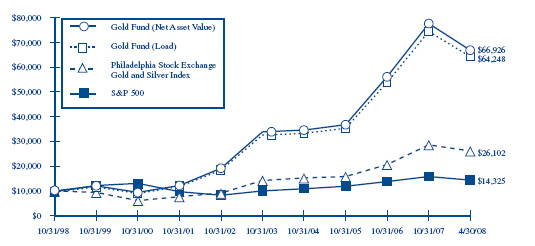

This chart assumes an initial gross investment of $10,000 made on 6/29/98 (commencement of operations). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

In 2003 and 2006, the performance of The Tocqueville Gold Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2008

| | | | | Since inception |

| | 1 Year | 3 Year | 5 Year | 6/29/1998 |

| Tocqueville Gold Fund—Net Asset Value | 4.29% | 29.78% | 26.12% | 22.23% |

| Tocqueville Gold Fund—Load* | 4.29% | 29.78% | 26.12% | 21.70% |

| Philadelphia Stock Exchange Gold and Silver Index | 25.91% | 28.34% | 22.59% | 10.83% |

| Standard & Poor’s 500 Stock Index | – 4.68% | 8.23% | 10.62% | 3.72% |

| * Effective February 1, 2000, the Fund eliminated its sales load. | | | | |

Expense Example—April 30, 2008

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (November 1, 2007-April 30, 2008).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example Tables

The Tocqueville Fund

| | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period* |

| | Account Value | | Account Value | | November 1, 2007 - |

| | November 1, 2007 | | April 30, 2008 | | April 30, 2008 |

| Actual | $ 1,000.00 | | $ 911.20 | | $ 5.94 |

| Hypothetical (5% return before expenses) | 1,000.00 | | 1,018.65 | | 6.27 |

| | | | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.25%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

The Tocqueville Small Cap Value Fund

| | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period* |

| | Account Value | | Account Value | | November 1, 2007 - |

| | November 1, 2007 | | April 30, 2008 | | April 30, 2008 |

| Actual | $ 1,000.00 | | $ 827.20 | | $ 6.09 |

| Hypothetical (5% return before expenses) | 1,000.00 | | 1,018.20 | | 6.72 |

| | | | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.34%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

The Tocqueville International Value Fund

| | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period* |

| | Account Value | | Account Value | | November 1, 2007 - |

| | November 1, 2007 | | April 30, 2008 | | April 30, 2008 |

| Actual | $ 1,000.00 | | $ 911.70 | | $ 7.51 |

| Hypothetical (5% return before expenses) | 1,000.00 | | 1,017.01 | | 7.92 |

| | | | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.58%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

The Tocqueville Gold Fund

| | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period* |

| | Account Value | | Account Value | | November 1, 2007 - |

| | November 1, 2007 | | April 30, 2008 | | April 30, 2008 |

| Actual | $ 1,000.00 | | $ 862.80 | | $ 6.39 |

| Hypothetical (5% return before expenses) | 1,000.00 | | 1,018.00 | | 6.92 |

| | | | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.38%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | |

| | | Six Months | | | | | | | | | | | | | | | | |

| Per share operating performance | | Ended | | | | | | | | | | | | | | | | |

(For a share outstanding throughout the | | April 30, | | | Years Ended October 31, | |

| | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 28.93 | | | $ | 24.25 | | | $ | 22.17 | | | $ | 20.43 | | | $ | 17.99 | | | $ | 13.42 | |

| Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.10 | | | | 0.18 | | | | 0.14 | | | | 0.15 | | | | 0.05 | | | | 0.02 | |

| Net realized and unrealized gain (loss) | | | (2.54) | | | | 4.53 | | | | 4.33 | | | | 2.53 | | | | 2.41 | | | | 4.55 | |

| Total from investment operations (1) | | | (2.44) | | | | 4.71 | | | | 4.47 | | | | 2.68 | | | | 2.46 | | | | 4.57 | |

| Dividends and distributions to | | | | | | | | | | | | | | | | | | | | | | | | |

| shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.19) | | | | (0.03) | | | | (0.22) | | | | (0.12) | | | | (0.02) | | | | — | |

| Distributions from net realized gains | | | (2.03) | | | | — | | | | (2.17) | | | | (0.82) | | | | — | | | | — | |

| Total dividends and distributions | | | (2.22) | | | | (0.03) | | | | (2.39) | | | | (0.94) | | | | (0.02) | | | | — | |

| Change in net asset value for the period | | | (4.66) | | | | 4.68 | | | | 2.08 | | | | 1.74 | | | | 2.44 | | | | 4.57 | |

| Net asset value, end of period | | $ | 24.27 | | | $ | 28.93 | | | $ | 24.25 | | | $ | 22.17 | | | $ | 20.43 | | | $ | 17.99 | |

| Total return | | | (8.9) | %(2) | | | 19.4 | % | | | 20.5 | % | | | 13.4 | % | | | 13.7 | % | | | 34.1 | % |

| Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | | $ | 567,354 | | | $ | 523,878 | | | $ | 392,495 | | | $ | 175,791 | | | $ | 145,435 | | | $ | 149,497 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses (3) | | | 1.25 | %(4) | | | 1.25 | % | | | 1.30 | % | | | 1.34 | % | | | 1.34 | % | | | 1.40 | % |

| Net investment income (3) | | | 0.84 | %(4) | | | 0.69 | % | | | 0.68 | % | | | 0.68 | % | | | 0.25 | % | | | 0.17 | % |

| Portfolio turnover rate | | | 22 | %(2) | | | 39 | % | | | 32 | % | | | 45 | % | | | 40 | % | | | 32 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Total from investment operations per share includes redemption fees of $0.006, $0.002, $0.002, $0.003, $0.001 and $0.000 per share for the six months ended April 30, 2008 and the five years ended October 31, 2007, 2006, 2005, 2004, and 2003, respectively. |

| (2) | Not annualized. | | | | | | | | | | | | |

| (3) | Net of fees waived amounting to 0.01%, 0.01% and 0.07% of average net assets for the six months ended April 30, 2008 and the two years ended October 31, 2007 and 2003, respectively. |

| (4) | Annualized. | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Small Cap Value Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | |

| | | Six Months | | | | | | | | | | | | | | | | |

| Per share operating performance | | Ended | | | | | | | | | | | | | | | | |

(For a share outstanding throughout the | | April 30, | | | Years Ended October 31, | |

| | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 17.24 | | | $ | 18.04 | | | $ | 16.58 | | | $ | 16.11 | | | $ | 18.83 | | | $ | 12.18 | |

| Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.03) | | | | 0.11 | | | | (0.07) | | | | (0.13) | | | | (0.11) | | | | (0.08) | |

| Net realized and unrealized gain (loss) | | | (2.73) | | | | 1.26 | | | | 1.53 | | | | 1.26 | | | | 0.21 | | | | 6.73 | |

| Total from investment operations (1) | | | (2.76) | | | | 1.37 | | | | 1.46 | | | | 1.13 | | | | 0.10 | | | | 6.65 | |

| Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.12) | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Distributions from net realized gains | | | (1.70) | | | | (2.17) | | | | — | | | | (0.66) | | | | (2.82) | | | | — | |

| Total distributions | | | (1.82) | | | | (2.17) | | | | — | | | | (0.66) | | | | (2.82) | | | | — | |

| Change in net asset value for the period | | | (4.58) | | | | (0.80) | | | | 1.46 | | | | 0.47 | | | | (2.72) | | | | 6.65 | |

| Net asset value, end of period | | $ | 12.66 | | | $ | 17.24 | | | $ | 18.04 | | | $ | 16.58 | | | $ | 16.11 | | | $ | 18.83 | |

| Total return | | | (17.3) | %(2) | | | 8.4 | % | | | 8.8 | % | | | 6.8 | % | | | (1.0) | % | | | 54.6 | % |

| Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | | $ | 36,259 | | | $ | 49,543 | | | $ | 52,701 | | | $ | 57,576 | | | $ | 75,005 | | | $ | 73,518 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses | | | 1.34 | %(3) | | | 1.32 | % | | | 1.34 | % | | | 1.39 | % | | | 1.41 | % | | | 1.36 | % |

| Net investment income (loss) | | | (0.59) | %(3) | | | 0.63 | % | | | (0.38) | % | | | (0.67) | % | | | (0.61) | % | | | (0.48) | % |

| Portfolio turnover rate | | | 116 | %(2) | | | 90 | % | | | 45 | % | | | 30 | % | | | 19 | % | | | 65 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Total from investment operations per share includes redemption fees of $0.002, $0.001, $0.015, $0.006, $0.02 and $0.03 per share for the six months ended April 30,2008 and the five years ended October 31, 2007, 2006, 2005, 2004 and 2003 respectively. |

| (2) | Not annualized. | | | | | | | | | | | |

| (3) | Annualized. | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville International Value Fund

Financial Highlights

| | | | | | | |

| | | Six Months | | | | |

| Per share operating performance | | Ended | | | | |

(For a share outstanding throughout | | April 30, | | | Years Ended October 31, | |

| the period) | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 16.48 | | | $ | 16.72 | | | $ | 16.06 | | | $ | 13.10 | | | $ | 10.90 | | | $ | 7.27 | |

| Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.05 | | | | 0.08 | | | | 0.27 | | | | 0.04 | | | | 0.09 | | | | 0.06 | |

| Net realized and unrealized gain (loss) | | | (1.40) | | | | 2.25 | | | | 2.30 | | | | 3.00 | | | | 2.15 | | | | 3.58 | |

| Total from investment operations (1) | | | (1.35) | | | | 2.33 | | | | 2.57 | | | | 3.04 | | | | 2.24 | | | | 3.64 | |

| Dividends and distributions to | | | | | | | | | | | | | | | | | | | | | | | | |

| shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.10) | | | | (0.27) | | | | (0.05) | | | | (0.08) | | | | (0.04) | | | | (0.01) | |

| Distributions from net realized gains | | | (1.94) | | | | (2.30) | | | | (1.86) | | | | — | | | | — | | | | — | |

| Total dividends and distributions | | | (2.04) | | | | (2.57) | | | | (1.91) | | | | (0.08) | | | | (0.04) | | | | (0.01) | |

| Change in net asset value for the period | | | (3.39) | | | | (0.24) | | | | 0.66 | | | | 2.96 | | | | 2.20 | | | | 3.63 | |

| Net asset value, end of period | | $ | 13.09 | | | $ | 16.48 | | | $ | 16.72 | | | $ | 16.06 | | | $ | 13.10 | | | $ | 10.90 | |

| Total return | | | (8.8) | %(2) | | | 15.3 | % | | | 17.4 | % | | | 23.3 | % | | | 20.6 | % | | | 50.1 | % |

| Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | | $ | 186,791 | | | $ | 219,220 | | | $ | 225,234 | | | $ | 215,711 | | | $ | 196,424 | | | $ | 129,875 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses | | | 1.58 | %(3) | | | 1.59 | % | | | 1.61 | % | | | 1.66 | % | | | 1.71 | % | | | 1.77 | % |

| Net investment income | | | 0.69 | %(3) | | | 0.49 | % | | | 1.49 | % | | | 0.29 | % | | | 0.85 | % | | | 0.72 | % |

| Portfolio turnover rate | | | 37 | %(2) | | | 49 | % | | | 39 | % | | | 35 | % | | | 43 | % | | | 55 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Total from investment operations per share includes redemption fees of $0.000, $0.002, $0.011, $0.003, $0.010 and $0.005 per share for the six months ended April 30, 2008 and the five years ended October 31, 2007, 2006, 2005, 2004 and 2003, respectively. |

| (2) | Not Annualized. | | | | | | | | | | | | |

| (3) | Annualized. | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Gold Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | |

| | | Six Months | | | | |

| Per share operating performance | | Ended | | | Years Ended October 31, | |

| (For a share outstanding | | April 30, | | | | | | | | | | | | | | | | |

| throughout the period) | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 64.36 | | | $ | 51.41 | | | $ | 35.51 | | | $ | 34.84 | | | $ | 34.71 | | | $ | 20.49 | |

| Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.13) | | | | (0.30) | | | | (0.22) | | | | (0.33) | | | | (0.33) | | | | (0.14) | |

| Net realized and unrealized gain | | | | | | | | | | | | | | | | | | | | | | | | |

| (loss) | | | (8.51) | | | | 18.52 | | | | 18.21 | | | | 2.36 | | | | 1.04 | | | | 15.41 | |

| Total from investment operations (1) | | | (8.64) | | | | 18.22 | | | | 17.99 | | | | 2.03 | | | | 0.71 | | | | 15.27 | |

| Dividends and distributions to | | | | | | | | | | | | | | | | | | | | | | | | |

| shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment | | | | | | | | | | | | | | | | | | | | | | | | |

| income | | | (0.46) | | | | (0.22) | | | | — | | | | — | | | | (0.03) | | | | — | |

| Dividends from net realized gains | | | (8.32) | | | | (5.05) | | | | (2.09) | | | | (1.36) | | | | (0.55) | | | | (1.05) | |

| Total distributions | | | (8.78) | | | | (5.27) | | | | (2.09) | | | | (1.36) | | | | (0.58) | | | | (1.05) | |

| Change in net asset value for the | | | | | | | | | | | | | | | | | | | | | | | | |

| period | | | (17.42) | | | | 12.95 | | | | 15.90 | | | | 0.67 | | | | 0.13 | | | | 14.22 | |

| Net asset value, end of period | | $ | 46.94 | | | $ | 64.36 | | | $ | 51.41 | | | $ | 35.51 | | | $ | 34.84 | | | $ | 34.71 | |

| Total return | | | (13.7) | %(2) | | | 38.4 | % | | | 52.5 | % | | | 6.2 | % | | | 2.0 | % | | | 77.3 | % |

| Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000) | | $ | 998,611 | | | $ | 1,231,475 | | | $ | 833,254 | | | $ | 538,492 | | | $ | 539,190 | | | $ | 433,554 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses | | | 1.38 | %(3) | | | 1.42 | % | | | 1.50 | % | | | 1.59 | % | | | 1.58 | % | | | 1.68 | % |

| Net investment income (loss) | | | (1.03) | %(3) | | | (0.81) | % | | | (0.51) | % | | | (0.97) | % | | | (1.11) | % | | | (0.77) | % |

| Portfolio turnover rate | | | 15 | %(2) | | | 26 | % | | | 30 | % | | | 27 | % | | | 24 | % | | | 40 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Total from investment operations per share includes redemption fees of $0.017, $0.028, $0.06, $0.02, $0.09 and $0.05 per share for the six months ended April 30, 2008 and the five years ended October 31, 2007, 2006, 2005, 2004 and 2003 , respectively. |

| (2) | Not Annualized. | | | | | | | | | | | | |

| (3) | Annualized. | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Fund

Schedule of Investments as of April 30, 2008

(Unaudited)

| Common Stocks—88.1% | Shares | Value |

| Aerospace & Defense—0.7% | | |

| European Aeronautic Defense and | | |

| Space Co. (a)(b) | 150,000 | $ 3,782,615 |

| Air Freight & Logistics—1.3% | | |

| United Parcel Service, Inc. | 100,000 | 7,241,000 |

| Automobiles—1.3% | | |

| Toyota Motor Corp.—ADR (b) | 75,000 | 7,612,500 |

| Beverages—3.6% | | |

| Anheuser-Busch Companies, Inc. | 300,000 | 14,760,000 |

| The Coca-Cola Co. | 100,000 | 5,887,000 |

| | | 20,647,000 |

| Biotechnology—1.9% | | |

| Amgen, Inc. (a) | 200,000 | 8,374,000 |

| Isis Pharmaceuticals, Inc. (a) | 200,000 | 2,356,000 |

| | | 10,730,000 |

| Capital Markets—1.1% | | |

| UBS AG (a)(b) | 189,000 | 6,348,510 |

| Chemicals—4.9% | | |

| EI Du Pont de Nemours & Co. | 325,000 | 15,895,750 |

| W.R. Grace & Co. (a) | 250,000 | 6,340,000 |

| Zoltek Companies, Inc. (a) | 200,000 | 5,334,000 |

| | | 27,569,750 |

| Commercial Banks—3.7% | | |

| East West Bancorp, Inc. | 500,000 | 7,120,000 |

| HSBC Holdings PLC—ADR (b) | 30,958 | 2,686,845 |

| Mitsubishi Ufj Financial Group, | | |

| Inc.—ADR (b) | 1,000,000 | 10,990,000 |

| | | 20,796,845 |

| Commercial Services & Supplies—2.4% | | |

| Avery Dennison Corp. | 70,000 | 3,373,300 |

| Cintas Corp. | 100,000 | 2,961,000 |

| Sotheby’s Holdings | 100,000 | 2,770,000 |

| Steelcase, Inc. | 400,000 | 4,432,000 |

| | | 13,536,300 |

| Communications Equipment—6.4% | | |

| Cisco Systems, Inc. (a) | 500,000 | 12,820,000 |

| Corning, Inc. | 400,000 | 10,684,000 |

| Juniper Networks, Inc. (a) | 200,000 | 5,524,000 |

| Nokia Corp.—ADR (b) | 250,000 | 7,517,500 |

| | | 36,545,500 |

| Computers & Peripherals—0.7% | | |

| EMC Corp. (a) | 250,000 | 3,850,000 |

| Construction Materials—0.6% | | |

| Cemex S.A. de C.V.—ADR (a)(b) | 115,600 | 3,196,340 |

| Containers & Packaging—1.2% | | |

| Sonoco Products Co. | 200,000 | 6,590,000 |

| Common Stocks (continued) | Shares | Value |

| Diversified Financial Services—1.8% | | |

| CIT Group, Inc. | 350,000 | $ 3,811,500 |

| Moody’s Corp. | 175,000 | 6,468,000 |

| | | 10,279,500 |

| Diversified Telecommunication Services—3.1% | | |

| Alaska Communications Systems | | |

| Group, Inc. (c) | 500,000 | 5,590,000 |

| Chunghwa Telecom Co., Ltd.— | | |

| ADR (b) | 250,000 | 6,377,500 |

| Verizon Communications, Inc. | 150,000 | 5,772,000 |

| | | 17,739,500 |

| Electric Utilities—3.1% | | |

| FPL Group, Inc. | 200,000 | 13,258,000 |

| Korea Electric Power Corp.— | | |

| ADR (b) | 120,000 | 1,971,600 |

| PNM Resources, Inc. | 150,000 | 2,173,500 |

| | | 17,403,100 |

| Electrical Appliances, Television And Radio Sets—0.6% | | |

| Samsung Electronics Co., Ltd.— | | |

| ADR (b) | 9,300 | 3,297,411 |

| Energy Equipment & Services—2.7% | | |

| Schlumberger, Ltd. | 150,000 | 15,082,500 |

| Food Products—2.9% | | |

| Campbell Soup Co. | 200,000 | 6,960,000 |

| Kraft Foods, Inc. | 300,000 | 9,489,000 |

| | | 16,449,000 |

| Gaming—0.5% | | |

| Scientific Games Corp.—Class A (a) | 100,000 | 2,816,000 |

| Health Care Equipment & Supplies—0.6% | | |

| Thoratec Corp. (a) | 220,000 | 3,517,800 |

| Household Products—2.9% | | |

| Colgate-Palmolive Co. | 100,000 | 7,070,000 |

| Kimberly-Clark Corp. | 150,000 | 9,598,500 |

| | | 16,668,500 |

| Industrial Conglomerates—3.9% | | |

| 3M Co. | 75,000 | 5,767,500 |

| General Electric Co. | 500,000 | 16,350,000 |

| | | 22,117,500 |

| Insurance—2.8% | | |

| American International Group, Inc. | 350,000 | 16,170,000 |

| Internet Software & Services—1.0% | | |

| Google, Inc. (a) | 10,200 | 5,857,758 |

| IT Services—2.2% | | |

| Automatic Data Processing, Inc. | 150,000 | 6,630,000 |

| Western Union Co. | 250,000 | 5,750,000 |

| | | 12,380,000 |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Fund

Schedule of Investments as of April 30, 2008

(Unaudited)

| Common Stocks (continued) | Shares | Value |

| Machinery—1.6% | | |

| Albany International Group, Inc. | 100,000 | $3,630,000 |

| Illinois Tool Works, Inc. | 100,000 | 5,229,000 |

| | | 8,859,000 |

| Media—0.3% | | |

| Lee Enterprises, Inc. | 225,000 | 1,739,250 |

| Metals & Mining—5.8% | | |

| Alcoa, Inc. | 200,000 | 6,956,000 |

| Cleveland-Cliffs, Inc. | 80,000 | 12,832,000 |

| Newmont Mining Corp. | 300,000 | 13,263,000 |

| | | 33,051,000 |

| Multi-Utilities—0.6% | | |

| Veolia Environnement—ADR (b) | 45,000 | 3,260,250 |

| Oil & Gas—4.4% | | |

| Murphy Oil Corp. | 250,000 | 22,585,000 |

| Total SA—ADR (b) | 30,000 | 2,520,000 |

| | | 25,105,000 |

| Personal Products—1.0% | | |

| Avon Products, Inc. | 150,000 | 5,853,000 |

| Pharmaceuticals—5.0% | | |

| Bristol-Myers Squibb Co. | 300,000 | 6,591,000 |

| Johnson & Johnson | 100,000 | 6,709,000 |

| Pfizer, Inc. | 750,000 | 15,082,500 |

| | | 28,382,500 |

| Prepackaged Software—0.0% | | |

| Bio-key International, | | |

| Inc. (a)(b)(d)(e)(f) | 47,090 | — |

| Semiconductor & Semiconductor Equipment—4.2% | | |

| Applied Materials, Inc. | 500,000 | 9,330,000 |

| Emcore Corp. (a) | 557,000 | 3,442,260 |

| Intel Corp. | 500,000 | 11,130,000 |

| | | 23,902,260 |

| Software—2.5% | | |

| Microsoft Corp. | 500,000 | 14,260,000 |

| Telecommunications—0.8% | | |

| Fairpoint Communications, Inc. | 2,828 | 26,046 |

| NII Holdings, Inc. (a) | 100,000 | 4,574,000 |

| | | 4,600,046 |

| Thrifts & Mortgage Finance—3.8% | | |

| Fannie Mae | 300,000 | 8,490,000 |

| MGIC Investment Corp. | 1,000,000 | 13,030,000 |

| | | 21,520,000 |

| Water Supply—0.2% | | |

| Purecycle Corp. (a) | 200,000 | 1,314,000 |

| Total Common Stocks (Cost $455,316,463) | | 500,071,235 |

| Exchange Traded Funds—3.6% | Shares | Value |

| CurrencyShares Japanese Yen | | |

| Trust (a)(b) | 150,000 | $ 14,392,500 |

| Horizons BetaPro Oil Bear | | |

| ETF (a)(b) | 175,000 | 1,968,772 |

| Streetracks Gold Trust (a) | 50,000 | 4,339,500 |

| Total Exchange Traded Funds | | |

| (Cost $18,210,023) | | 20,700,772 |

| Warrants—0.0% | | |

| Bio-key Warrants, $1.00 strike | | |

| price, expires 4/14/09 (a)(e) | 262,500 | — |

| Emcore Corp. Warrants, $15.06 | | |

| strike price, expires | | |

| 2/15/13 (a)(e) | 39,375 | — |

| Raytheon Co. Warrants, $37.50 | | |

| strike price, expires | | |

| 6/16/11 (a) | 1,581 | 43,556 |

| Total Warrants (Cost $0) | | 43,556 |

| Short-Term | Principal | |

| Investments—8.2% | Amount | |

| Repurchase Agreement—2.9% | | |

| Repurchase Agreement with | | |

| U.S. Bank, N.A., 1.65%, | | |

| dated 4/30/08, due 5/1/08, | | |

| collateralized by a Freddie | | |

| Mac Giant 30-Year (Pool # | | |

| G01762) valued at | | |

| $16,592,858. Repurchase | | |

| proceeds of $16,267,746. | | |

| (Cost 16,267,000) | $16,267,000 | 16,267,000 |

| U.S. Treasury Bills—5.3% | | |

| 1.40%, 05/29/2008 (g) | 10,000,000 | 9,985,273 |

| 1.88%, 07/03/2008 (g) | 10,000,000 | 9,978,120 |

| 1.92%, 08/28/2008 (g) | 10,000,000 | 9,953,890 |

| (Cost $29,889,867) | | 29,917,283 |

| Total Short-Term Investments | | |

| (Cost $46,156,867) | | 46,184,283 |

| Total Investments | | |

| (Cost $519,683,353)—99.9% | | 566,999,846 |

| Other Assets in Excess of Liabilities—0.1% | | 353,659 |

| Total Net Assets—100.0% | | $567,353,505 |

The accompanying notes are an integral part of these Financial Statements.

The Tocqueville Fund

Schedule of Investments as of April 30, 2008

(Unaudited)

| Percentages are stated as a percent of net assets. |

| ADR American Depository Receipt |

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Foreign concentration was as |

| | follows: Canada 0.3%; Finland 1.3%; France 1.0%; Japan |

| | 5.8%; Mexico 0.6%; Netherlands 0.7%; South Korea |

| | 0.9%; Switzerland 1.1%; Taiwan 1.1%; United Kingdom |

| | 0.5%. |

| (c) | Affiliated company, see Note 9. |

| (d) | Denotes security is fully or partially restricted as to resale. |

| | The aggregate value of restricted securities at April 30, |

| | 2008 was $0, which represented 0.0% of net assets. |

| (e) | Fair valued security. The aggregate value of fair valued |

| | securities at April 30, 2008 was $0. Which represented |

| | 0.0% of net assets. |

| (f) | Security is considered illiquid and may be difficult to sell. |

| (g) | Rates shown are the effective yields based on the purchase |

| | price. The calculation assumes the security is held to |

| | maturity. |

The accompanying notes are an integral part of these Financial Statements.

The Tocqueville Small Cap Value Fund

Schedule of Investments as of April 30, 2008

(Unaudited)

| Common Stocks—95.5% | Shares | Value |

| Biotechnology—6.5% | | |

| Alkermes, Inc. (a) | 57,400 | $713,482 |

| Martek Biosciences Corp. (a) | 46,500 | 1,639,590 |

| | | 2,353,072 |

| Chemicals—1.5% | | |

| Landec Corp. (a) | 21,000 | 170,310 |

| Symyx Technologies (a)(b) | 48,700 | 365,737 |

| | | 536,047 |

| Commercial Services & Supplies—1.2% | | |

| ABM Industries, Inc. | 20,000 | 418,800 |

| Communications Equipment—1.1% | | |

| Powerwave Technologies, Inc. (a) | 148,500 | 405,405 |

| Computer Programming Services—0.5% | | |

| Perficient, Inc. (a) | 21,000 | 192,780 |

| Electrical Equipment—2.9% | | |

| Baldor Electric Co. | 33,000 | 1,069,200 |

| Electronic Equipment & Instruments—3.5% | | |

| Electro Scientific Industries, Inc. (a) | 46,500 | 763,065 |

| Gsi Group, Inc. (a) | 62,500 | 509,375 |

| | | 1,272,440 |

| Energy Equipment & Services—4.7% | | |

| Oceaneering International, Inc. (a) | 7,500 | 500,850 |

| Tetra Technologies, Inc. (a) | 73,500 | 1,195,110 |

| | | 1,695,960 |

| Food Products—2.6% | | |

| Hain Celestial Group, Inc. (a) | 19,500 | 481,260 |

| Sanderson Farms, Inc. | 11,500 | 479,205 |

| | | 960,465 |

| Health Care Equipment & Supplies—11.5% | | |

| Analogic Corp. | 24,500 | 1,410,955 |

| Greatbatch, Inc. (a) | 19,000 | 345,420 |

| Thoratec Corp. (a)(b) | 88,000 | 1,407,120 |

| Wright Medical Group, Inc. (a) | 36,600 | 1,021,872 |

| | | 4,185,367 |

| Health Care Providers & Services—1.8% | | |

| Centene Corp. (a) | 35,000 | 642,950 |

| Hotels Restaurants & Leisure—1.4% | | |

| Ambassadors Group, Inc. | 26,000 | 505,960 |

| Internet & Catalog Retail—2.1% | | |

| 1-800-FLOWERS.COM, Inc. (a)(b) | 85,000 | 749,700 |

| Internet Software & Services—6.2% | | |

| Interwoven, Inc. (a) | 81,500 | 917,690 |

| RealNetworks, Inc. (a) | 109,000 | 671,440 |

| Vignette Corp. (a) | 57,800 | 667,590 |

| | | 2,256,720 |

| Common Stocks (continued) | Shares | Value |

| IT Services—1.7% | | |

| Lionbridge Technologies (a)(b) | 206,500 | $609,175 |

| Machinery—2.1% | | |

| Astec Industries, Inc. (a) | 21,000 | 769,650 |

| Metals & Mining—1.7% | | |

| Brush Engineered Materials, Inc. (a) | 19,500 | 604,695 |

| Multiline Retail—0.7% | | |

| Tuesday Morning Corp. (a) | 45,700 | 248,608 |

| Paper & Forest Products—3.6% | | |

| Glatfelter | 89,000 | 1,298,510 |

| Pharmaceuticals—6.3% | | |

| Medicines Co. (a)(b) | 67,500 | 1,333,125 |

| Salix Pharmaceuticals, Ltd. (a) | 133,000 | 933,660 |

| | | 2,266,785 |

| Semiconductor & Semiconductor Equipment—16.5% | | |

| Emcore Corp. (a)(b) | 151,500 | 936,270 |

| Exar Corp. (a) | 114,500 | 965,235 |

| FEI Co. (a) | 45,500 | 995,085 |

| Kopin Corp. (a)(b) | 291,000 | 867,180 |

| Silicon Image, Inc. (a) | 155,500 | 928,335 |

| Ultratech, Inc. (a)(b) | 90,000 | 1,283,400 |

| | | 5,975,505 |

| Software—13.0% | | |

| Aspen Technology, Inc. (a) | 103,000 | 1,415,220 |

| Epicor Software Corp. (a) | 76,000 | 608,000 |

| Mentor Graphics Corp. (a) | 56,500 | 568,955 |

| Parametric Technology Corp. (a) | 42,000 | 732,060 |

| Secure Computing Corp. (a) | 127,000 | 840,740 |

| TIBCO Software, Inc. (a) | 73,100 | 560,677 |

| | | 4,725,652 |

| Specialty Retail—0.9% | | |

| Bebe Stores, Inc. | 32,000 | 319,680 |

| Textiles, Apparel & Luxury Goods—1.5% | | |

| Columbia Sportswear Co. | 13,000 | 545,480 |

| Total Common Stocks (Cost $38,714,313) | | 34,608,606 |

| Exchange Traded Fund—1.9% | | |

| iShares Russell 2000 Index Fund | 9,700 | 692,483 |

| Total Exchange Traded Fund | | |

| (Cost $661,086) | | 692,483 |

The accompanying notes are an integral part of these Financial Statements.

The Tocqueville Small Cap Value Fund

Schedule of Investments as of April 30, 2008

(Unaudited)

| | Principal | |

| Short-Term Investments—2.9% | Amount | Value |

| Repurchase Agreement—2.9% | | |

| Repurchase Agreement with U.S. | | |

| Bank, N.A., 1.65%, dated | | |

| 4/30/08, due 5/1/08, | | |

| collateralized by a Freddie Mac | | |

| Giant 30-Year (Pool # G0514) | | |

| valued at $1,087,579. | | |

| Repurchase proceeds of | | |

| $1,066,049. | $1,066,000 | $ 1,066,000 |

| Total Short-Term Investments | | |

| (Cost $1,066,000) | | 1,066,000 |

| Total Investments | | |

| (Cost $40,441,399)—100.3% | | 36,367,089 |

| Liabilities in Excess of Other Assets—(0.3%) | | (108,506) |

| Total Net Assets—100.0% | | $36,258,583 |

| | | |

| | | |

| Percentages are stated as a percent of net assets. | | |

| (a) Non-income producing security. | | |

| (b) Affiliated company, see Note 9. | | |

The accompanying notes are an integral part of these Financial Statements.

The Tocqueville International Value Fund

Schedule of Investments as of April 30, 2008

(Unaudited)

| Common Stocks—89.5% | Shares | Value |

| Belgium—0.4% | | |

| Solvay SA | 5,000 | $737,161 |

| Bermuda—1.0% | | |

| Celestial NutriFoods, Ltd. | 3,500,000 | 1,884,149 |

| Brazil—1.0% | | |

| Companhia Vale do Rio Doce— | | |

| ADR | 50,000 | 1,954,000 |

| Finland—3.7% | | |

| Nokia Corp.—ADR | 130,000 | 3,909,100 |

| UPM-Kymmene Oyj | 157,700 | 3,058,311 |

| | | 6,967,411 |

| France—14.5% | | |

| Carbone Lorraine | 30,381 | 1,670,307 |

| LVMH Moet Hennessy Louis | | |

| Vuitton SA | 8,000 | 917,134 |

| M6 Metropole Television | 160,000 | 3,715,004 |

| Manitou BF SA | 51,500 | 1,584,170 |

| Safran SA | 155,000 | 3,272,177 |

| Sanofi-Aventis | 60,000 | 4,698,406 |

| Total SA—ADR | 40,000 | 3,360,000 |

| Veolia Environnement | 38,000 | 2,761,457 |

| Vivendi SA | 125,000 | 5,088,378 |

| | | 27,067,033 |

| Germany—2.2% | | |

| Siemens AG—ADR | 34,600 | 4,098,370 |

| Greece—0.8% | | |

| Titan Cement Co. SA | 35,000 | 1,567,384 |

| Indonesia—2.1% | | |

| Telekomunikasi Indonesia Tbk | | |

| PT—ADR | 49,000 | 1,902,180 |

| Tempo Scan Pacific Tbk PT | 34,380,000 | 1,938,582 |

| | | 3,840,762 |

| Ireland—1.8% | | |

| Allied Irish Banks PLC—ADR | 40,000 | 1,705,200 |

| Experian Group, Ltd. | 233,500 | 1,766,547 |

| | | 3,471,747 |

| Israel—1.7% | | |

| Makhteshim-Agan Industries, Ltd. | 350,000 | 3,229,193 |

| Italy—4.1% | | |

| C.I.R.—Compagnie Industriali | | |

| Riunite SpA | 1,000,000 | 2,615,430 |

| Interpump Group SpA | 146,828 | 1,304,516 |

| Sogefi SpA | 161,650 | 807,708 |

| Unicredito Italiano SpA | 375,000 | 2,857,455 |

| | | 7,585,109 |

| Common Stocks (continued) | Shares | Value |

| Japan—21.7% | | |

| Bridgestone Corp. | 50,000 | $913,112 |

| Canon, Inc.—ADR (a) | 4,700 | 234,859 |

| Capcom Co., Ltd. | 75,000 | 2,250,324 |

| Fuji Photo Film Co., Ltd. | 100,000 | 3,837,092 |

| Hitachi, Ltd. | 700,000 | 4,718,950 |

| Kyoto Kimono Yuzen Co., Ltd. | 3,600 | 3,372,025 |

| Matsushita Electric Industrial Co., | | |

| Ltd.—ADR | 165,000 | 3,856,050 |

| Mitsubishi UFJ Financial Group, | | |

| Inc.—ADR | 345,000 | 3,791,550 |

| Nippon Express Co., Ltd. | 700,000 | 3,864,019 |

| Omron Corp. | 162,000 | 3,365,101 |

| Secom Co., Ltd. | 77,000 | 3,583,978 |

| Tecmo Ltd. | 365,000 | 3,885,705 |

| Toyota Motor Corp.—ADR | 27,500 | 2,791,250 |

| | | 40,464,015 |

| Mexico—4.1% | | |

| Cemex S.A.B. de C.V.—ADR (a) | 104,983 | 2,902,780 |

| Fomento Economico Mexicano | | |

| S.A.B. de C.V.—ADR | 108,000 | 4,692,600 |

| | | 7,595,380 |

| Netherlands—5.2% | | |

| ING Groep NV—ADR | 45,000 | 1,709,550 |

| Schlumberger Ltd. | 36,000 | 3,619,800 |

| Unilever NV—ADR | 130,000 | 4,360,200 |

| | | 9,689,550 |

| Singapore—1.5% | | |

| GP Industries | 8,389,241 | 2,876,735 |

| South Korea—1.4% | | |

| Dongyang Mechatro | 334,100 | 2,555,774 |

| Spain—0.9% | | |

| Sol Melia SA | 125,000 | 1,760,536 |

| Sweden—2.7% | | |

| Saab AB | 150,000 | 4,259,300 |

| Sandvik AB | 50,000 | 770,432 |

| | | 5,029,732 |

| Switzerland—4.5% | | |

| Kudelski SA | 170,000 | 2,697,293 |

| Nestle SA | 4,200 | 2,014,573 |

| UBS AG (a) | 110,250 | 3,703,298 |

| | | 8,415,164 |

The accompanying notes are an integral part of these Financial Statements.

The Tocqueville International Value Fund

Schedule of Investments as of April 30, 2008

(Unaudited)

| Common Stocks (continued) | Shares | Value |

| Taiwan—2.4% | | |

| Chunghwa Telecom Co., Ltd.— | | |

| ADR | 174,095 | $4,441,163 |

| Thailand—3.5% | | |

| Bangkok Bank Public Co., Ltd. | 900,000 | 3,973,510 |

| BEC World Pcl | 3,000,100 | 2,625,442 |

| | | 6,598,952 |

| United Kingdom—4.0% | | |

| Bodycote International | 766,250 | 3,683,162 |

| BP PLC—ADR | 28,000 | 2,038,120 |

| Invensys PLC (a) | 275,000 | 1,634,887 |

| | | 7,356,169 |

| United States—4.3% | | |

| Newmont Mining Corp. | 70,000 | 3,094,700 |

| NII Holdings, Inc. (a) | 105,800 | 4,839,292 |

| | | 7,933,992 |

| Total Common Stocks (Cost $149,087,566) | | 167,119,481 |

| Short-Term | Principal | |

| Investments—6.1% | Amount | |

| Variable Rate Demand Notes—6.1% | | |

| JP Morgan Chase Demand | | |

| Deposits 2.000% | $11,407,846 | 11,407,846 |

| Total Short-Term Investments | | |

| (Cost $11,407,846) | | 11,407,846 |

| Total Investments | | |

| (Cost $160,495,412)—95.6% | | 178,527,327 |

| Other Assets in Excess of Liabilities—4.4% | | 8,263,891 |

| Total Net Assets—100.0% | | $186,791,218 |

| | | |

| | | |

| Percentages are stated as a percent of net assets. | |

| ADR American Depository Receipt | |

| (a) Non-income producing security. | |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Gold Fund

Schedule of Investments as of April 30, 2008

(Unaudited)

| Common Stocks—88.9% | Shares | Value |

| Gold & Gold Related—76.1% | | |

| Agnico-Eagle Mines Ltd. (a) | 377,000 | $23,543,650 |

| Alamos Gold, Inc. (a)(b) | 2,615,100 | 15,813,682 |

| Almaden Minerals Ltd. (a)(b) | 800,000 | 1,787,310 |

| Andean Resources (a)(b)(c ) | 15,771,500 | 23,808,733 |

| Aquiline Resources, Inc. (a)(b) | 1,333,333 | 10,181,045 |

| Aurelian Resources, Inc. (a)(b)(c) | 756,000 | 3,077,748 |

| Banro Corp. (a)(b) | 631,400 | 4,984,242 |

| Centamin Egypt Ltd. (a)(b) | 7,830,000 | 10,406,921 |

| Cia de Minas Buenaventura SA— | | |

| ADR (a) | 503,800 | 31,522,766 |

| Cluff Gold Ltd. (a)(b)(c) | 2,990,000 | 5,597,258 |

| Comaplex Minerals Corp. (a)(b) | 1,918,000 | 10,074,690 |

| Detour Gold Corporation (a)(b) | 280,000 | 4,759,972 |

| Eldorado Gold Corporation | | |

| Ltd. (a)(b) | 1,726,800 | 11,779,482 |

| Electrum Ltd. (b)(d)(e) | 1,047,776 | 5,752,290 |

| Euro Ressources S.A. (a)(b)(c) | 2,900,000 | 4,301,797 |

| European Goldfields Ltd. (a)(b) | 3,594,200 | 19,485,981 |

| Exeter Resource Corp. (a)(b)(e) | 570,000 | 2,307,394 |

| FNX Mining Co., Inc. (a)(b) | 300,000 | 6,896,038 |

| Franco Nevada Corp. (a)(b) | 1,405,900 | 24,988,194 |

| GBS Gold International, Inc. (a)(b) | 2,164,300 | 3,137,601 |

| Gold Eagle Mines Ltd. (a)(b) | 200,000 | 1,584,748 |

| Gold Fields Ltd. (a) | 166,249 | 2,198,552 |

| Gold Fields Ltd.—ADR (a) | 2,711,500 | 36,605,250 |

| Gold Resource Corp. (b)(c) | 2,129,700 | 9,988,293 |

| Goldcorp, Inc. (a) | 1,418,050 | 50,652,746 |

| Golden Star Resources Ltd. (b) | 5,589,000 | 18,757,641 |

| Great Basin Gold Ltd. (a)(b) | 3,864,137 | 11,510,685 |

| Iamgold Corp. (a) | 2,918,700 | 17,591,609 |

| Ivanhoe Mines Ltd. (a)(b) | 4,467,000 | 42,758,296 |

| KazakhGold Group, Ltd. (a)(b) | 434,000 | 9,634,800 |

| Kinross Gold Corp. (a) | 899,700 | 17,013,327 |

| Minefinders Corp. (a)(b) | 791,000 | 8,372,614 |

| New Gold, Inc. (a)(b)(c) | 1,518,500 | 11,579,863 |

| Newmont Mining Corp. | 813,800 | 35,978,099 |

| NovaGold Resources, Inc. (a)(b) | 880,500 | 6,478,508 |

| Orezone Resources, Inc. (a)(b) | 17,163,700 | 22,155,506 |

| Osisko Exploration Ltd. (a)(b)(c) | 3,891,900 | 16,423,965 |

| Oxiana Ltd. (a) | 6,681,485 | 20,677,125 |

| Polo Resources Ltd. (a)(b)(c) | 49,275,000 | 11,022,065 |

| Polyus Gold Co.—ADR (a) | 651,616 | 34,535,648 |

| Radius Gold, Inc. (a)(b) | 1,329,544 | 349,845 |

| Randgold Resources Ltd.— | | |

| ADR (a) | 1,663,200 | 75,708,864 |

| Red Back Mining, Inc. (a)(b) | 895,000 | 5,465,445 |

| Regent Pacific Group (a)(b) | 71,000,000 | 7,288,452 |

| Royal Gold, Inc. | 447,765 | 12,667,272 |

| Semafo, Inc. (a)(b) | 4,900,000 | 6,617,019 |

| Common Stocks (continued) | Shares | Value |

| Sino Gold Ltd. (a)(b) | 2,941,500 | $ 13,904,324 |

| Sunridge Gold Corp. (a)(b) | 500,000 | 397,180 |

| Troy Resources NL (a)(c) | 3,549,520 | 8,037,559 |

| Troy Resources NL Npv (a)(b)(c) | 100,000 | 211,498 |

| Wesdome Gold Mines Ltd. (a)(b) | 1,427,250 | 1,913,204 |

| Witwatersrand Consolidated Gold | | |

| Resources, Ltd. (a)(b) | 335,000 | 4,784,607 |

| Yukon-Nevada Gold Corp. (a)(b) | 8,350,000 | 11,939,231 |

| | | 759,010,634 |

| Oil, Gas & Consumable Fuels—1.5% | | |

| Uranium One, Inc. (a)(b) | 3,309,300 | 15,279,759 |

| Precious Metals & Related—11.3% | | |

| Apex Silver Mines Ltd. (a)(b) | 1,111,800 | 11,173,590 |

| Impala Platinum Holdings Ltd. (a) | 640,000 | 26,068,040 |

| Impala Platinum Holdings Ltd.— | | |

| ADR (a) | 450,000 | 18,362,475 |

| Ivanhoe Nickel & Platinum Ltd. | | |

| (a)(b)(d)(e) | 458,333 | 3,666,664 |

| PAN American Silver Corp. (a)(b) | 61,536 | 2,050,589 |

| PAN American Silver Corp.— | | |

| ADR (a)(b) | 130,967 | 4,387,395 |

| Silver Standard Resources, | | |

| Inc. (a)(b) | 557,000 | 14,320,470 |

| Silver Wheaton Corp. (a)(b) | 1,687,400 | 22,367,977 |

| Silverstone Resources Corp. (a)(b) | 5,000,000 | 10,723,861 |

| | | 113,121,061 |

| Total Common Stocks (Cost $663,816,120) | | 887,411,454 |

| Gold Bullion—8.6% | Ounces | |

| Gold Bullion (b) | 98,032 | 86,027,724 |

| Total Gold Bullion (Cost $44,609,241) | | 86,027,724 |

| Exchange Traded Fund—1.9% | Shares | |

| iShares Silver Trust (b) | 113,000 | 18,893,600 |

| Total Exchange Traded Fund | | |

| (Cost $11,125,879) | | 18,893,600 |

| Warrants—0.7% | | |

| Gold & Gold Related—0.7% | | |

| Electrum Ltd. Warrant (a)(b)(d) | 1,047,776 | 1,267,809 |

| Govi High Power Exploration Co. | | |

| Warrant (a)(b)(d) | 1,750,000 | 3,500,000 |

| Great Basin Gold Ltd. (a) | 500,000 | 263,132 |

| Nevsun Resources Ltd. (a)(b) | 202,125 | — |

| NovaGold Resources, Inc. (a)(b) | 75,000 | 114,685 |

| Osisko Exploration Ltd. (a)(c) | 1,155,000 | 1,677,279 |

| U.S. Gold Corp. (b) | 111,500 | 71,964 |

| Yukon-Nevada Gold Corp. (a) | 4,175,000 | — |

| | | 6,894,869 |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Gold Fund

Schedule of Investments as of April 30, 2008

(Unaudited)

| Warrants (continued) | Shares | Value |

| Precious Metals & Related—0.0% | | |

| Brilliant Mining (a)(e) | 937,500 | $54,457 |

| Total Warrants (Cost $0) | | 6,949,326 |

| Total Investments | | |

| (Cost $719,551,240)—100.1% | | 999,282,104 |

| Liabilities in Excess of Other Assets—(0.1)% | | (670,771) |

| Total Net Assets—100.0% | | $998,611,333 |

| Percentages are stated as a percent of net assets. | | |

| ADR American Depository Receipt | | | |

| (a) | Foreign issued security. Foreign concentration was as |

| | follows: Australia 7.7%, Canada 45.5%, Cayman Islands |

| | 1.1%, French Guiana 0.4%, Hong Kong 0.7%, Jersey |

| | 8.5%, Peru 3.2%, Russia 3.5%, South Africa 8.8%, United |

| | Kingdom 0.6%, Virgin Islands 1.1%. | | |

| (b) | Non-income producing security. | | | |

| (c) | Affiliated Company, see Note 9. | | | |

| (d) | Denotes security is fully or partially restricted to resale. |

| | The aggregate value of restricted securities as of April 30, |

| | 2008 was $14,186,763 which represented 1.4% of net |

| | assets. | | | |

| (e) | Security is considered illiquid and may be difficult to sell. |

The accompanying notes are an integral part of these Financial Statements.

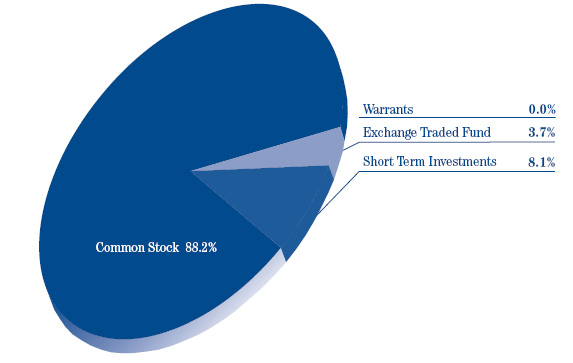

Percent of Total Investments

The Tocqueville Fund

Allocation of Portfolio Holdings

April 30, 2008

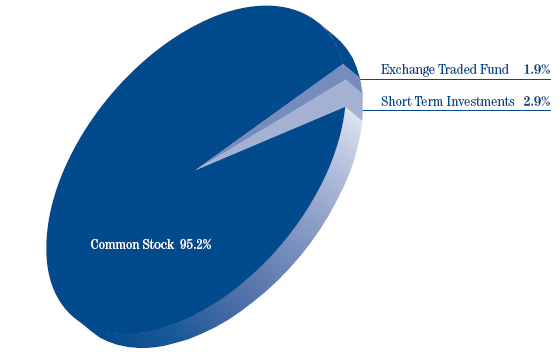

The Tocqueville Small Cap Value Fund

Allocation of Portfolio Holdings

April 30, 2008

Percent of Total Investments

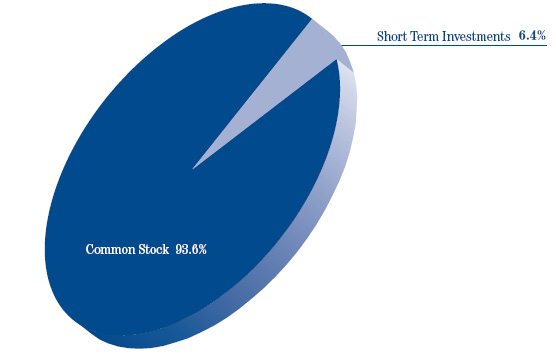

The Tocqueville International Value Fund

Allocation of Portfolio Holdings

April 30, 2008

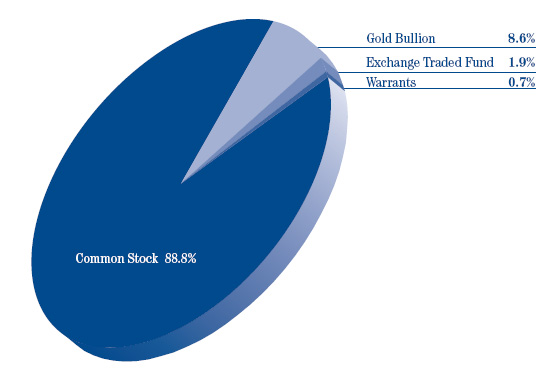

The Tocqueville Gold Fund

Allocation of Portfolio Holdings

April 30, 2008

The Tocqueville Trust

Statements of Assets and Liabilities

April 30, 2008

(Unaudited)

| | | | | | | | | | | | | |

| | | The | | | Small Cap | | | International | | | | |

| | | Tocqueville | | | Value | | | Value | | | Gold | |

| | | Fund | | | Fund | | | Fund | | | Fund | |

| Assets | | | | | | | | | | | | |

| Investments, at value (1) | | | | | | | | | | | | |

Unaffiliated issuers | | $ | 561,409,846 | | | $ | 29,214,847 | | | $ | 178,527,327 | | | $ | 903,556,046 | |

Affiliated issuers | | | 5,590,000 | | | | 7,152,242 | | | | — | | | | 95,726,058 | |

| Foreign currencies (2) | | | 5,607 | | | | — | | | | 7,151,595 | | | | (2,473 | ) |

| Cash | | | 269,268 | | | | 259 | | | | — | | | | 2,931,846 | |

| Receivable for investments sold | | | — | | | | 412,264 | | | | 1,552,816 | | | | 20,659,167 | |

| Receivable for fund shares sold | | | 822,990 | | | | 47,407 | | | | 4,583 | | | | 1,183,044 | |

| Dividends, interest and other receivables | | | 489,017 | | | | 10,510 | | | | 2,504,046 | | | | 110,911 | |

| Prepaid assets | | | 57,415 | | | | 11,625 | | | | 13,353 | | | | 69,779 | |

| Total Assets | | | 568,644,143 | | | | 36,849,154 | | | | 189,753,720 | | | | 1,024,234,378 | |

| Liabilities | | | | | | | | | | | | | | | | |

| Payable for investments purchased | | | 278,443 | | | | 536,475 | | | | 1,124,824 | | | | 12,991,946 | |

| Payable for fund shares redeemed | | | 462,878 | | | | 5,456 | | | | 124,394 | | | | 3,741,059 | |

| Payable to Adviser | | | 333,979 | | | | 21,911 | | | | 151,002 | | | | 759,353 | |

| Due to custodian | | | — | | | | — | | | | 49,190 | | | | — | |

| Accrued distribution fee | | | 37,666 | | | | 5,616 | | | | 32,433 | | | | 23,285 | |

| Accrued expenses and other liabilities | | | 177,672 | | | | 21,113 | | | | 1,480,659 | | | | 8,107,402 | |

| Total Liabilities | | | 1,290,638 | | | | 590,571 | | | | 2,962,502 | | | | 25,623,045 | |

| Net Assets | | $ | 567,353,505 | | | $ | 36,258,583 | | | $ | 186,791,218 | | | $ | 998,611,333 | |

| Net assets consist of: | | | | | | | | | | | | | | | | |

| Paid in capital | | $ | 517,694,668 | | | $ | 37,748,484 | | | $ | 156,102,440 | | | $ | 683,260,043 | |

| Accumulated net investment income (loss) | | | 1,533,244 | | | | (132,821 | ) | | | 423,733 | | | | (31,882,765 | ) |

| Accumulated net realized gain | | | 805,125 | | | | 2,717,230 | | | | 12,073,196 | | | | 67,503,238 | |

| Net unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | |

Investments and foreign currency related items | | | 47,320,468 | | | | (4,074,310 | ) | | | 18,191,849 | | | | 279,730,817 | |

| Net assets | | $ | 567,353,505 | | | $ | 36,258,583 | | | $ | 186,791,218 | | | $ | 998,611,333 | |

| Shares of beneficial interest outstanding | | | | | | | | | | | | | | | | |

(unlimited shares of $0.01 par value authorized) | | | 23,379,698 | | | | 2,863,943 | | | | 14,271,432 | | | | 21,274,026 | |

| Net asset value and redemption price per share | | $ | 24.27 | | | $ | 12.66 | | | $ | 13.09 | | | $ | 46.94 | |

| Maximum offering price per share | | $ | 24.27 | | | $ | 12.66 | | | $ | 13.09 | | | $ | 46.94 | |

| (1) Cost of Investments | | | | | | | | | | | | | | | | |

Unaffiliated issuers | | $ | 513,926,327 | | | $ | 31,385,573 | | | $ | 160,495,412 | | | $ | 643,854,261 | |

Affiliated issuers | | $ | 5,757,026 | | | $ | 9,055,826 | | | $ | — | | | $ | 75,696,979 | |

| (2) Cost of Foreign Currencies | | $ | 1,632 | | | $ | — | | | $ | 6,991,661 | | | $ | (2,426 | ) |

The accompanying notes are an integral part of these financial statements.

The Tocqueville Trust

Statements of Operations

For the Six Months Ended April 30, 2008

(Unaudited)

| | | The | | | Small Cap | | | International | | | | |

| | | Tocqueville | | | Value | | | Value | | | Gold | |

| | | Fund | | | Fund | | | Fund | | | Fund | |

| Investment Income: | | | | | | | | | | | | |

| Dividends* | | | | | | | | | | | | |

| Unaffiliated issuers | | $ | 4,873,230 | | | $ | 122,249 | | | $ | 2,007,939 | | | $ | 1,510,164 | |

| Affiliated issuers | | | 215,000 | | | | — | | | | — | | | | — | |

| Interest | | | 509,313 | | | | 26,572 | | | | 160,818 | | | | 432,102 | |

| | | | 5,597,543 | | | | 148,821 | | | | 2,168,757 | | | | 1,942,266 | |

| Expenses: | | | | | | | | | | | | | | | | |

| Investment Adviser’s fee (see Note 5) | | | 2,005,917 | | | | 147,750 | | | | 955,718 | | | | 4,748,295 | |

| Distribution fees (see Note 5) | | | 668,639 | | | | 49,250 | | | | 238,930 | | | | 1,396,049 | |

| Administration fee (see Note 5) | | | 401,183 | | | | 29,550 | | | | 143,358 | | | | 837,629 | |

| Transfer agent and shareholder services fees | | | 92,111 | | | | 6,141 | | | | 29,385 | | | | 204,132 | |

| Professional fees | | | 41,863 | | | | 5,274 | | | | 19,768 | | | | 91,814 | |

| Fund accounting fees | | | 30,105 | | | | 3,068 | | | | 20,576 | | | | 63,809 | |

| Custody fees | | | 36,931 | | | | 6,940 | | | | 61,154 | | | | 149,661 | |

| Registration fees | | | 24,660 | | | | 9,968 | | | | 9,502 | | | | 43,861 | |

| Printing and mailing expense | | | 22,798 | | | | 2,501 | | | | 6,613 | | | | 66,820 | |

| Trustee fees and expenses | | | 24,639 | | | | 1,817 | | | | 13,105 | | | | 58,079 | |

| Insurance expense | | | 13,796 | | | | 1,188 | | | | 4,896 | | | | 23,121 | |

| Other expenses | | | 10,777 | | | | 918 | | | | 4,328 | | | | 27,053 | |

| Total expenses before waiver | | | 3,373,419 | | | | 264,365 | | | | 1,507,333 | | | | 7,710,323 | |

| Less: Fees waived (see Note 5) | | | (32,759 | ) | | | — | | | | — | | | | — | |

| Net expenses | | | 3,340,660 | | | | 264,365 | | | | 1,507,333 | | | | 7,710,323 | |

| Net Investment Income (Loss) | | | 2,256,883 | | | | (115,544 | ) | | | 661,424 | | | | (5,768,057 | ) |

| Realized and Unrealized Gain (Loss): | | | | | | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | | | | | | |

| Investments | | | | | | | | | | | | | | | | |

| Unaffiliated issuers | | | 11,152,852 | | | | 2,910,552 | | | | 11,362,160 | | | | 67,137,556 | |

| Affiliated issuers | | | — | | | | (89,411 | ) | | | — | | | | (183,205 | ) |

| Foreign currency translation | | | 6,582 | | | | — | | | | 711,166 | | | | 549,105 | |

| | | | 11,159,434 | | | | 2,821,141 | | | | 12,073,326 | | | | 67,503,456 | |

| Net change in unrealized appreciation (depreciation) | | | | | | | | | | | | | | | | |

| on: | | | | | | | | | | | | | | | | |

| Investments | | | (63,304,427 | ) | | | (10,774,038 | ) | | | (36,067,057 | ) | | | (195,801,514 | ) |

| Foreign currency translation | | | (887,755 | ) | | | — | | | | 3,943,324 | | | | (31,530,521 | ) |

| | | | (64,192,182 | ) | | | (10,774,038 | ) | | | (32,123,733 | ) | | | (227,332,035 | ) |

| Net gain on investments and foreign currency | | | (53,032,748 | ) | | | (7,952,897 | ) | | | (20,050,407 | ) | | | (159,828,579 | ) |

| Net Increase in Net Assets Resulting from Operations | | $ | (50,775,865 | ) | | $ | (8,068,441 | ) | | $ | (19,388,983 | ) | | $ | (165,596,636 | ) |

| * Net of foreign taxes withheld | | $ | 30,348 | | | $ | — | | | $ | 208,598 | | | $ | 172,794 | |

The accompanying notes are an integral part of these financial statements.