UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 West 57th Street, 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt

The Tocqueville Trust

40 West 57th Street, 19th Floor

New York, NY 10019

(Name and address of agent for service)

(212) 698-0800

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: April 30, 2013

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

April 30, 2013

The Tocqueville Trust

Mutual Funds

The Tocqueville Fund

The Tocqueville Opportunity Fund

The Tocqueville International Value Fund

The Tocqueville Gold Fund

The Delafield Fund

The Tocqueville Select Fund

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of The Tocqueville Trust. Please call 1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @ www.tocqueville.com/mutual-funds

Dear Fellow Shareholder,

The past year has witnessed the emergence of an economic myth that increasingly has been shaping the behavior of world stock markets. The reasons are clear, but the ultimate outcome is less so.

In recent years, to stimulate the U.S. economy with interest rates already close to zero, the Federal Reserve had initiated a new policy of “quantitative easing”. In effect, that policy promised to increase the nation’s supply of money and liquidity if further interest rate cuts alone would no longer be effective. This year, the Fed essentially promised quantitative easing ad infinitum—or at least until the economy gave clear signs of having resumed a lasting and self-sustaining growth pattern.

This policy allowed the United States to recover from the “Great Recession” faster than other large economies but, since the recovery still seemed fragile, quantitative easing has continued apace. Meanwhile, Japan also has embarked onto its own version of quantitative easing ad infinitum, apparently with some promising early results. And France is pushing hard for Europe to embark even more boldly on the easing path than it already has. In essence, quantitative easing has become global.

At first, massive increases in money supply into an economy that remains weak or hesitant after recession benefits mostly the financial markets. Growth of bank credit in the “real” economy remains subdued—either for lack of loan demand or because of bankers’ hesitancy to lend—so that banks use their excess reserves to purchase government bills and bonds and the new money eventually flows into the stock market as well.

This is a typical post-recession pattern, which normally fades when the real-economy recovers. However, in the aftermath of the recent global financial crisis, the recoveries in the United States, Europe and Japan have been less convincing than usual and the easing pattern has lasted longer. Among investors, this has engendered, if not euphoria, at least complacency that good economic news is good for the stock markets (because it will eventually translate into higher corporate profits), but that bad economic news is also good for the stock market (because it promises more liquidity injection from the central banks). That is the myth that pervades today’s investment scene.

However, this kind of win-win situation is seldom seen in real life for very long. To the extent that the belief in this golden equilibrium gains broad credence and is being reflected in heftier stock market valuations, therefore, investment risk has been and will be rising.

What complicates matters, in terms of how this situation will unwind, is that not all countries are aiming for the same goal. Japan, for example, is desperate to extract its economy from a deflationary spiral and has determined that this necessitated quantitative-type monetary easing. To the extent that this easing is causing weakness in the Japanese yen, this constitutes a welcome stimulus to exports, which were hurt by an overvalued yen. Europe, in spite of being still marred in recession, has paradoxically seen its currency (the Euro) recently appreciate strongly against the U.S. dollar, the Japanese yen and the Chinese renminbi, which is hurting its recovery potential.

In the “old” economies, inflation does not seem an imminent danger and, from a domestic point of view, they can afford policies of currency depreciation. But from an international perspective, the United States and Japan particularly must keep their currencies strong enough to sustain the global demand for their government debt.

Emerging economies have a different challenge: having suffered periodic inflation flare-ups and excessive and de-stabilizing capital inflows, they have welcomed the recent downward correction of several of their currencies. But inflation concerns have increased as a result.

As often, the United States and China will strongly influence the outcome of these global cross-currents. The United States needs to continue to attract capital to its bond markets and is also concerned about the long-term inflationary implications of its recent policies—and therefore about a new round of dollar weakness. Its patience with a sustained weakening of other major currencies might therefore quickly wear thin. In China, which has so far continued to accept and even encourage a slow appreciation of its currency, partly as an inflation-fighting tool, fast-rising wages have joined food commodities as an inflation concern and the renminbi is now overvalued in the opinion of many business people.

In a stock market environment which many investors view as a win/win proposition, uncertainty may come from the rise of new forms of mercantilist policies that are not yet factored in many economic models: less trade barriers, but more currency manipulation.

Respectfully,

François Sicart

Chairman

The Tocqueville Fund

Dear Fellow Shareholder,

It is said that a bull market climbs a wall of worry. The six months ended April 30, 2013 was no exception as investors overcame their myriad fears to drive equity markets to post crisis highs. The European sovereign debt crisis, the effects of U.S. Federal Government budget problems and sequestration, the so-called “hard landing” in China and various geopolitical hot spots each in turn have proven to be not as bad as advertised (so far) and, in any case, have been mitigated by accommodative monetary policies around the globe. In particular, quantitative easing in the U.S. and “Abenomics” in Japan has been supportive of not only their respective equity markets and economies but also those of their trading partners. While fear of what might happen once the Fed curtails its easy money policies likely remains atop investors’ list of concerns, the timing of an eventual tightening is still unknown.

Bearish arguments of future inflationary pressures remain unconfirmed and investors have shaken off weak economic data. For the present, it seems that the Fed’s monetary exertions have served merely to offset the decline in the velocity of money, as individuals and corporations appear content to sit on cash instead of spending or deploying it. Further evidence of this is that commodity markets remain benign and U.S. core inflation lies well below the Fed’s targets.

Still, fear has served to create at least one obvious bubble that of sovereign debt markets both in the U.S. and globally. In addition, the zero interest rate policy, or “ZIRP,” environment has created other distortions, pushing income seeking investors to take risk in terms of duration or credit quality to which they may not be accustomed and to bid up so called dividend yielding defensive equities to valuations that exceed historical precedent.

The true test for Fed Chairman Bernanke’s strategy and the equity markets will come when the economy has recovered sufficiently to lift inflation or at least expectation of it above the stated 2% threshold. Despite numerous suppositions in the financial and popular press, a change in course does not appear imminent. Meanwhile there are other sources for continued, cautious optimism. With Japan’s recent policy changes there is hope that a large but recently moribund sector of the world economy may become part of the global growth engine. In addition, recent academic studies have cast some doubt on the theoretical justification for the “austerity” measures that have dominated the European Central Bank’s prescribed approach to the region’s fiscal problems. If that provides policy makers in Europe the flexibility to change course it may be further, short-term support for the global economy, but only if coupled with local labor market reforms.

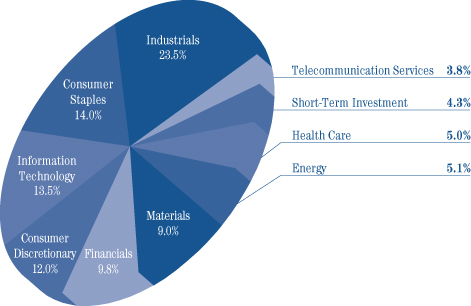

Over the period, the Tocqueville Fund returned 13.38% on a net of fees basis while the S&P 500, the index against which we are most often compared, gained 14.42%. Naturally, we would always prefer to exceed the “benchmark”, but it is absolute returns and capital preservation that we count as our highest priorities, so you won’t ever find us complaining about a 13% plus return over a six month period. Indeed, given our cautious approach and investment objectives, we are highly pleased to have kept as close to the market returns as we have since the start of the recovery in 2009. From the market bottom, roughly the end of February 2009, the S&P 500 climbed 141.73%, a 23.59% compound annual return. Over the same period, the Tocqueville Fund generated an annualized return of 21.61%. This is not a result we would have expected given our investment style and history. Normally, we would expect to lag very buoyant markets like this one by a far larger amount, while hopefully doing considerably better than the markets on the downside. Although that was not the case in the 2008 collapse; that has been our history. So, on balance, we are quite pleased with our recent and long term results, given the markets we have been in.

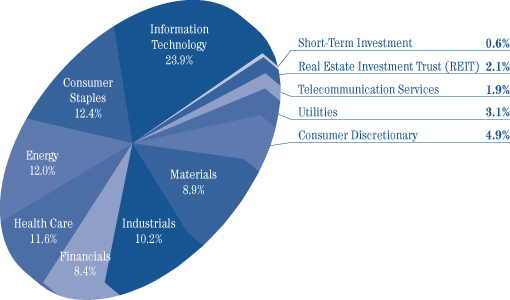

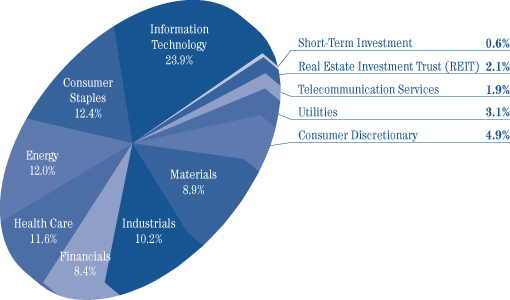

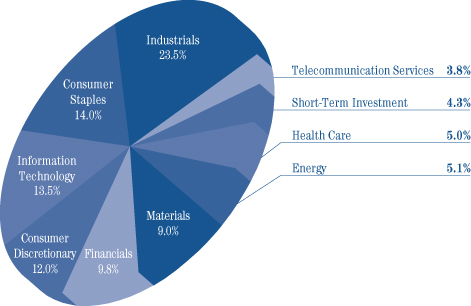

During the six month period, the top performing sectors of the Fund were health care, information technology and financials while materials, telecommunications and energy were the laggards. The top individual contributors to performance in the portfolio were Isis Pharmaceuticals, DuPont and Alkermes, while the largest detractors were Newmont Mining, VeriFone and Cliff Natural Resources.

Portfolio activity was again more concentrated on the sell side rather than the buy side as we monetized numerous positions in response to demand for investor liquidity. We also sold or trimmed positions as prices approached our targets

or in search of better opportunities (Campbell Soup, Fidelity National, NextEra, and Pfizer) and in a few cases as a result of a change in investment thesis such as Cliffs Natural Resources where we became disillusioned by management’s lack of capital discipline in the face of weak end markets. We initiated a number of new holdings during the period, the most notable of which is Apple, a name we had often been asked why it was not owned. The answer to that question lies at the heart of our contrarian investment philosophy. While in the past Apple was a statistically cheap stock, the price had not come under any significant pressure and sentiment was almost universally positive. However, following the decline from its peak, sentiment appeared to shift to concern that it had run out of growth prospects. We believe the company has tremendous balance sheet strength that gives it the flexibility to be more shareholder friendly with respect to financial engineering. We also added C.H. Robinson, an asset light, late cycle transportation and logistics business whose shares had traded below our estimate of intrinsic value due to disappointing quarterly results. Another new position is McDermott International, an engineering and construction firm whose shares are depressed due to poor execution on several large contracts and low utilization of its marine vessel fleet. In our view McDermott’s shares are trading at essentially liquidation value, despite a strong balance sheet and increased presence in the growing deep water arena, a combination we found attractive.

We have begun to see signs of a possible shift in investor sentiment away from the fixed income market and the so-called defensive equity trade as rates tick up slightly. However, we remain cautious because we have seen this happen before and many macro risks abound, particularly related to the uncharted waters of the Fed unwinding its monetary largesse. As the equity markets move higher finding broad contrarian themes becomes more challenging, though they still exist, and our efforts become more concentrated on idiosyncratic distressed and out of favor companies.

Thank you once again for your continued interest in our Fund.

Sincerely,

Robert W. Kleinschmidt

Portfolio Manager

The Tocqueville Fund

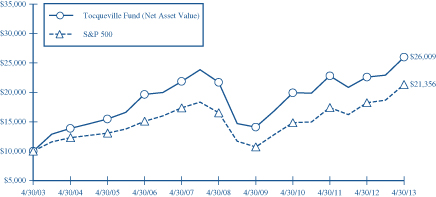

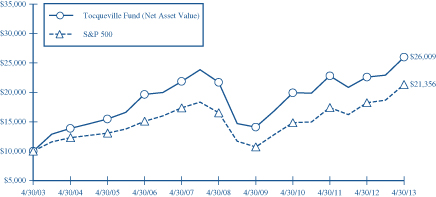

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/03. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held for 90 days or less.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2013

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Fund | | | 15.01% | | | | 9.29% | | | | 3.64% | | | | 10.03% | |

Standard & Poor’s 500 Stock Index | | | 16.89% | | | | 12.80% | | | | 5.21% | | | | 7.88% | |

The Tocqueville Opportunity Fund

Dear Fellow Shareholder,

U.S. equity markets appreciated significantly during the first half of the fiscal year ended April 30, 2013. The Tocqueville Opportunity Fund gained 13.96% versus an increase of 16.79% for its benchmark, the Russell 2500 Growth Index. In the SMID capitalization asset class, financial issues fueled returns and the financial heavy Russell 2500 Value Index led the Russell 2500 Growth Index with each advancing 18.83% and 16.79% respectively. Value has led growth for the past twelve month period by an even greater margin with the R2500 Value Index 22.25% versus the Growth Index 15.08% since April 30, 2012—driven by a significant turn in the performance of Financials and a low exposure to Technology issues. Moreover, while markets have moved to new highs, the leadership atypically has come from more defensive, higher yielding sectors, including the Utilities and Telecommunications sectors.

Over the past six months, we have significantly reduced investments in the Technology sector as visibility into the capital spending cycle has become considerably opaque – while some of the disruption has been attributed to end of the year (2012) jitters related to the “fiscal cliff” and “sequestration” effects, we believe that substitution effects and competition are impacting the sector. Cloud hosting of data and application solutions has introduced a considerably disruptive dynamic which appears to be significantly altering technology solutions and spending in unpredictable ways. While the Technology sector still ranks in the top four sector weights, we reduced holdings by more than one third over the period. New investments were directed primarily toward industrial, manufacturing, housing, transportation and auto related issues. We are currently over weighted in the Autos and Transportation, Materials and Processing, and Producer Durables sectors, and these three economy sensitive, cyclical sectors collectively represent the largest “sector” weighting of the Fund at approximately 26%. We have gained increased confidence in the economic and market outlook over the first half of the fiscal period due to a number of factors, including: reduced levels of global macro related volatility, safe navigation through the fiscal cliff period, and ongoing commitments to monetary accommodation. We believe that the sustained turns in housing prices and employment which have become apparent over the past several months are critical to improved consumer confidence and ultimately spending. Although the pace of domestic economic growth leaves most unimpressed, housing and employment trends are supportive of its continued positive bias.

Consumer and Healthcare sector investments comprised the #2 and #3 positions respectively with regard to investment weightings and represented nearly 45% of the Fund’s holdings. While we have continued to invest in new Healthcare issues, this sector also provided the best performance on both an absolute and relative basis for the period. Seven of the top 10 absolute price leaders and four of the Fund’s top 10 contributors were Healthcare investments; the price leaders included Aegerion Pharmaceutical (+100.4%), Vertex Pharmaceuticals (+83.7%), and BioMarin Pharmaceutical (+77.3%). From the perspective of the top 25 price leaders during the time period, 17 issues were Healthcare oriented! While we are pleased with the sector overall, there were a couple of significant disappointments, including Clovis Oncology (-45.6%) and Achillion Pharmaceuticals (-23.9%). The Materials sector provided the second best overall contribution to performance during the period; ironically this was due less to what we did own and more to what we did not own. This past December we began reducing the Fund’s investments in gold mining issues just as significant declines in the gold price and mining related issues commenced.

The Fund’s investment in LinkedIn was the #1 relative contributor to performance as the name appreciated nearly 80%, and it was one of the Fund’s top weightings. Hanesbrands’ and Abercrombie & Fitch’s shares each rose nearly 50% during the period, and the pair ranked #5 in overall contribution to performance! This past December we increased the investment in Core Laboratories which had fallen precipitously in October due to an earnings report—CLB did not disappoint on its latest report and was one of the leading performers for the period! There were several significant upsets during the period all unexpected. The Fund’s worst performer was one of its former stars. Although Apple’s share price decline of 23.3% did not rank in the top 10 worst declines, a large relative weighting caused an unfortunate performance impact. Apple and the impact of an investment in chip supplier Cirrus Logic together accounted for much of the Fund’s lagging performance during the period. Although Apple has contributed to the Fund over longer time periods, we moved to the sidelines in the face of increased competition and declining profitability. We were blindsided by rapid changes in the share prices of The Fresh Market (TFM) and Netflix (NFLX). Weighting was the culprit as sellers amassed and drove

TFM’s share price down nearly 40% due to an earnings miss and a management shakeup. And Netflix shocked short sellers with spectacular subscriber gains and a share price that tripled during the first half period—the Fund had not held NFLX at the beginning of the period and performance was impacted by an unprecedented 65% two day price move!

The top 50 holdings of the Fund comprised 42% of the Fund at April 30, 2013 versus 49% at the beginning of the fiscal year. Over the past six months we have broadened the Fund’s diversification in order to accommodate a number of earlier stage smaller capitalization issues, particularly in biotechnology given the increasing record of approval successes. And increased weightings in the Financials, Auto/Transportation, Materials and Durables sectors have resulted from investment in new names and increases in existing names. We continue to believe the Fund is concentrated and nearly every holding is significantly active from a risk perspective.

Although we have witnessed solid and positive trending equity markets over the past six months, it is too soon to lose sight of our risk compass. China related commodities weakness, the rapid decline in the gold price, and the Cyprus bank fiasco are quick reminders that change is swift and constant. As the debate on the impact and relevance of the Federal Reserve’s quantitative easing efforts on asset prices (equities, housing, and commodities) continues, we fully expect that any changes in policy may introduce new volatility into markets. At this time, we believe that any moves to less accommodation may be initially disruptive to liquidity but we are optimistic that this disturbance will be offset by sustainable growth in the underlying economy and employment. As always, we greatly appreciate your continued confidence in our efforts for the shareholders of the Tocqueville Opportunity Fund.

Sincerely,

Thomas R. Vandeventer

Portfolio Manager

The Tocqueville Opportunity Fund

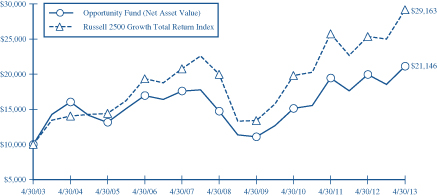

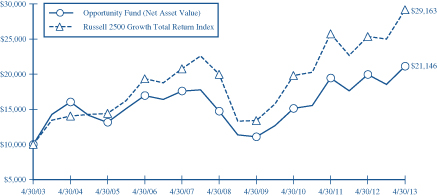

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/03. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held for 90 days or less.

The Russell 2500 Growth Total Return Index is an unmanaged index that measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forcasted growth values. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2013

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Opportunity Fund | | | 5.96% | | | | 11.78% | | | | 7.52% | | | | 7.78% | |

Russell 2500 Growth Total Return Index | | | 15.08% | | | | 13.77% | | | | 7.83% | | | | 11.30% | |

The Tocqueville International Value Fund

Dear Fellow Shareholder,

For the six months ended April 30, 2013, global equity markets advanced, driven by incrementally positive economic and political news from Japan and China, continuing stability in the Eurozone, an abatement of fears regarding the U.S. fiscal cliff, coupled with persistent expansive monetary policy and low interest rates. China’s once in a decade political transition went smoothly in November, temporarily removing an important source of uncertainty in the international markets. At around the same time in Japan, it became evident that a change of government would result in policies designed to promote growth and weaken the Yen, a positive for corporate profits. Subsequently, new Prime Minister Abe has followed through with aggressive policy statements and prescriptions. Despite a weak economy, Europe remained quiet for the most part, for the moment taking in stride a failed election in Italy and a banking crisis in Cyprus. The Euro remained stable versus the U.S. dollar, reflecting the tension between economic recession in the Eurozone, a negative for the Euro, and persistent efforts by the U.S. monetary authorities to devalue the U.S. dollar. In contrast, the Yen declined sharply against the U.S. dollar in response to government policy noted above. The CRB Index of commodities declined modestly, with industrial metals faring poorly and gold declining precipitously. Most equity markets advanced high single digits, with Japan producing the largest gains among developed economies, while Brazil declined due to disappointing economic results there. In terms of sectors, advances were led by financials, real estate, transport, machinery, consumer products, pharmaceuticals, furnishings, paper and construction materials, while steel, mining and energy stocks were notable laggards.

The Tocqueville International Fund’s total U.S. dollar return for the period was a gain of 14.64%. In the same period, the Morgan Stanley EAFE Index, the benchmark against we are most often compared, had a total U.S. dollar return of 17.18%. We had meaningful gains in our Japanese holdings, notably tire producer Bridgestone, industrial automation and test equipment concern Omron, household products company Kao, semiconductor manufacturing equipment producer Disco, financial Mitsubishi UFJ, pneumatic equipment producer SMC, and industrial conglomerate Hitachi. We also had significant profits in French logistics-focused holding company Bollore, Hong Kong financial and real estate conglomerate Guoco Group, subject of a going private offer by its controlling shareholder, Hong Kong-based China outdoor advertising company Clear Media, UK fuel distribution concern DCC, and Swiss drug maker Novartis. Our losses were concentrated in the shares of mining companies IAMGold, Newmont Mining and Freeport McMoran, as well as Telecom Italia, where post-election politics hurt investor sentiment.

During the period, we exited our positions in Bridgestone, Japanese power tool maker Makita, Japanese office equipment and camera maker Canon, Japanese chemical maker Asahi Kasei, Japanese auto parts maker Takata, UK auto parts retailer Halfords, UK based telecom services provider Vodafone, and mining conglomerate BHP Billiton, as they approached our estimates of intrinsic value. We also sold German steel distribution concern Kloeckner and gold producer IAMGold, in both cases because management failed to execute on operational and cost objectives. We took new positions in Japanese financials Mitsubishi UFJ and Sumitomo Mitsui, both of which hold strong market positions, trade at a discount to tangible book value, and should benefit from increasing consumer lending activity in Japan and corporate lending in Asia, particularly as European banks reduce their activities in Asia as they work to shore up their capital adequacy; in UK retailer Tesco, which is cash generative, rich in real estate, and where a new returns-oriented management team is in the process of divesting underperforming assets; in Japanese household products company Kao, a market leader with a substantial business in growth markets in Asia, that trades a single digit multiple of cash flow and a deep discount to its global peers; in Cameco Corp, the largest publicly traded producer of uranium, which is depressed along with negative sentiment toward nuclear power generation and is well positioned to benefit from an eventual improvement in demand for uranium; in UK emergency home repair insurer Homeserve, a cash generative business with operational challenges we deem temporary; in Telecom Italia, which is depressed due to investor concerns about growth in its home market and generates a high teens percentage free cash flow yield and has the potential for a corporate event that would be value enhancing; in Dutch company Fugro, the global leader in geological testing and mapping services for the oil industry, which has a strong niche position in its markets, produces significant free cash flow, and has an under-levered balance sheet; and in Dutch mail and logistics company TNT Express, when the price collapsed after a proposed acquisition by UPS was scuttled by anti-trust authorities, enabling us to pick up shares at a substantial discount to intrinsic

value. We also added to positions in Infineon, Hitachi, Beckaert, Akzo Nobel, Itau Unibanco, Nexans, Freeport McMoran, Sogefi, Orkla, and Groupe Bruxelles Lambert.

Our baseline macro scenario has not changed markedly since the last writing, and that is: Europe and the Euro survive, but it remains a growth challenged region; China averts a hard landing and consumer led growth settles at a lower but still enviable level; the U.S. continues to grow albeit below potential as fiscal adjustments take hold; inflation is more probable in light of serial monetary easing; and “Abenomics” is likely to have a stimulating effect in Japan for a period. One important change in the making is that European policy makers seem to have moved away from their insistence on fiscal austerity and toward a more growth oriented stance. Against this backdrop, the market has become more optimistic: today, with several of last year’s major macro risks seemingly having abated, interest rates at multi-year lows, and aggressive monetary policy being pursued throughout the developed world, investors are taking on more risk. Market gains have occurred despite only modest gains in corporate profits, abetted by cheap money and a reduction in risk premium. As the market becomes more complacent, we become more concerned about potential risks, including unrest in the Middle East, inflation, corporate profit margins, and the unknowable consequences of unprecedented expansionary monetary policy.

Despite the recent run-up in stock prices in Japan, the market is still attractively valued on a price/book value basis. Investors have been focused on the impact of government stimulus and a declining Yen, which as we have noted is very important for corporate profitability. Less discussed and potentially more important is the fact that more management teams are focusing on improving corporate profitability and capital allocation from a relatively weak starting point. If this dynamic continues, as we hope and expect, it will help create value for several years. Our due diligence of new investment ideas in Japan is focused on this criterion. The value of our Japanese holdings has increased meaningfully, though U.S. dollar returns have been impacted by the decline in the Yen. Europe is a mixed bag. Economic recession notwithstanding, or perhaps because of it, we are finding value in economically sensitive companies, and “special situations” where managements are creating shareholder value via restructuring and other means of self-improvement. On the other hand, it is more challenging to find value in “quality” stocks characterized by less economic sensitivity and more consistent cash flows. We continue to hold the view that developed markets offer better value than emerging markets, though following several quarters of poor performance; emerging markets are becoming more attractive. In the aggregate, we have reduced our overall exposure to Japan as our stocks have arrived at our estimated of intrinsic value faster than we have been able to replace them. Meanwhile, we have increased our overall exposure to Europe, which continues to be out of favor and underweighted in investor portfolios.

To protect and grow your capital, we continue to seek out companies that have defensible business franchises, pricing power, limited financial leverage and the ability to return cash to shareholders, and which trade at a discount to intrinsic value based on future cash flows in a conservative economic growth scenario.

Respectfully,

James Hunt

Portfolio Manager

The Tocqueville International Value Fund

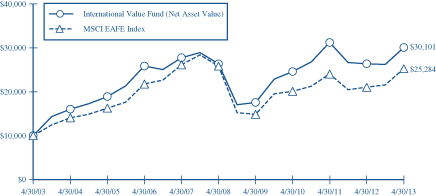

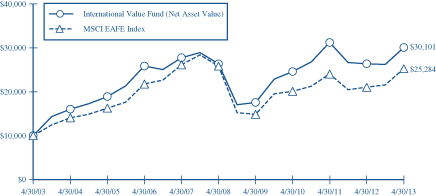

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/03. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The MSCI EAFE Index is an unmanaged market-capitalization-weighted index composed of companies representative of the market structure of 20 Developed Market Countries in Europe, Australia, Asia and the Far East.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2013

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville International Value Fund | | | 14.15% | | | | 6.89% | | | | 2.70% | | | | 11.65% | |

MSCI EAFE Index | | | 19.96% | | | | 7.96% | | | | -0.44% | | | | 9.72% | |

The Tocqueville Gold Fund

Dear Fellow Shareholder,

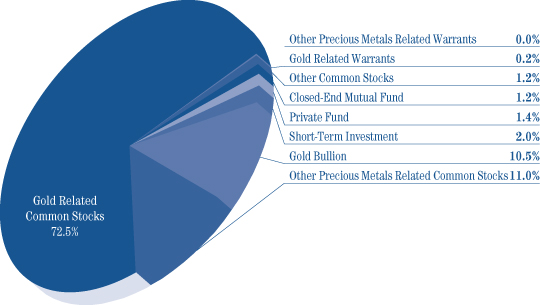

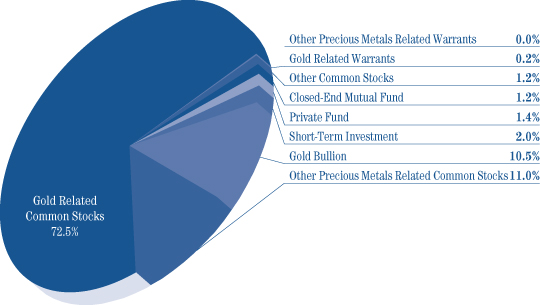

During the reporting period, from November 2012 through April 2013, the Fund was down 38.4% which compares to the Philadelphia Gold and Silver Index which was down 41.4% and the S&P 500 Index which was up 14.4 %.

In response to the downward trend in gold, we reduced exposure to higher cost operating companies and those with limited capital access, whose management teams struggled to execute a faulty strategy. We emphasized those investments that have superior assets and a quality management team that we judge and ability to deliver excess returns. Mining equities suffered across the board declines, because of their leverage to the gold price, while the Fund’s physical gold position fared better on a relative basis, despite the fact that gold prices were down about -17% during the period. Three developing companies—Tahoe Resources, Primero Gold Mines, and Turquoise Hill Resources declined less that the overall group; while those companies initiating start-ups—such as Detour Gold and Banro Corporation suffered from operational set-backs and tighter capital markets.

We believe the premise for investing in gold and gold mining shares remains sound, despite the steep correction over the past six months. Paper currencies appear to us to be more at risk of losing their purchasing power than at any time since the commencement of the gold bull market in 1999. As global economies stagnate, the accumulation of sovereign debt burdens since the credit crisis of 2008 will, in our opinion, ultimately leave policy makers no other choice than to resort to overt inflation.

Gold, to us, is as contrarian today as when we first launched the Tocqueville Gold Fund in 1998. We believe that the combination of extremely negative sentiment and compelling macroeconomic fundamentals suggest that we are approaching the commencement of a powerful new upward leg in the secular bull market for gold.

The bear raid during mid-April was an orchestrated attempt to break the gold market. It resulted in waves of panic selling by frightened investors. We believe it will be remembered as the final capitulation of the lengthy correction that commenced in August of 2011 when gold peaked briefly above $1900/oz. The net result is that bullion banks and other commercial interests used the panic to cover longstanding short positions. The net position of these commercial interests is strongly bullish and similar to where it stood at the end of 2008 when gold finished the year at $875/oz. prior to its two year ascent to all-time highs.

Gold mining shares, in our opinion, represent compelling values. Should the gold price advance strongly as we expect in the months ahead, mining shares should deliver more than satisfactory performance. As was the case at year end 2008, subsequent gains more than offset the drawdowns prior to the bottom.

Over the past few years, positive returns from equities, treasuries, and junk bonds have provided stiff competition for gold and precious metals shares. Should an extended correction in equity and bond markets take place, we expect investment flows would return to precious metals. While the possibility of such a correction is simply a speculation at the moment, we do believe that coordinated central bank policies designed to inflate asset prices is on the verge of obvious failure. The turmoil in the Japanese equity and bond markets, where the most extreme form of quantitative easing has been implemented, hints at the limits of radical monetary experimentation. To the extent that investors come to view quantitative easing as impotent in terms of stimulating economic activity through the inflation of asset prices, we believe that a crisis of confidence could ensue, not only in those policies but also in the value and utility of paper currency. We think this would provide the fuel for gold to trade at new all-time highs.

Extremism in monetary policy has never ended well. The massive buildup of debt on central bank balance sheets has no historical precedent. The secondary effects of this buildup have yet to appear but they will more than likely have a negative impact on capital markets and it is perhaps such an outcome that is in the early stages of being discounted.

Market extremes such as the one we are witnessing in gold right now almost always represent historically outstanding opportunities. This was the case at the bottom in 2008, and there are many parallels in different markets over the decades. Nevertheless, it takes a clear mind and a strong constitution to capitalize on such moments.

The gold mining industry has been undergoing a period of soul searching and introspection, brought on by poor share performance and investor criticism. We are beginning to see heightened responsiveness to shareholder interests, and we at Tocqueville are among the most vocal critics. Nearly 1/3 of CEO’s have been replaced over the past year. Expensive and risky capital expenditure programs are being curtailed, making the way for a new emphasis on higher dividend payouts. In the context of an improving picture for gold prices, we believe that investors will be favorably surprised by the transformation underway within the mining industry.

We appreciate your support through what has been a difficult period for performance and look forward to the unfolding of events in what we believe will be most favorable for our strategy.

Thank you for your continued support.

Sincerely,

| | |

| |  |

| John C. Hathaway | | Douglas B. Groh |

| Portfolio Manager | | Portfolio Manager |

The Tocqueville Gold Fund

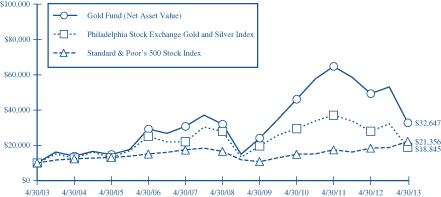

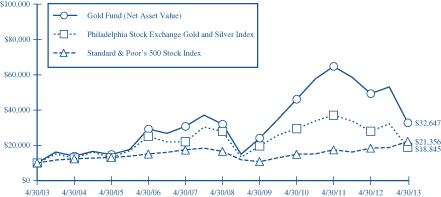

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/03. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2003, 2006, 2009, and 2010 the performance of The Tocqueville Gold Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2013

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Gold Fund | | | -33.74% | | | | -10.91% | | | | 0.45% | | | | 12.56% | |

Philadelphia Stock Exchange Gold and Silver Index | | | -32.50% | | | | -13.85% | | | | -7.43% | | | | 6.54% | |

Standard & Poor’s 500 Stock Index | | | 16.89% | | | | 12.80% | | | | 5.21% | | | | 7.88% | |

The Delafield Fund

Dear Fellow Shareholder,

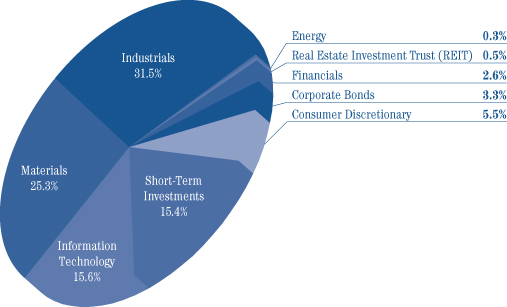

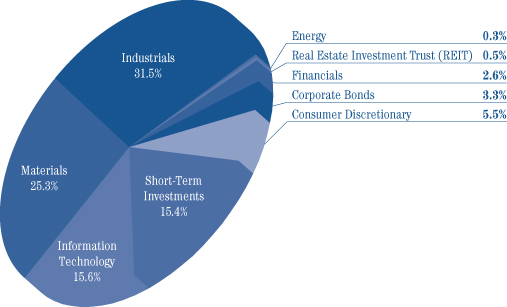

For the six months ended April 30, 2013, the Fund’s net asset value increased 15.25% versus an increase of 16.58% for the Russell 2000 Index (“Russell 2000”) and 14.42% for the Standard & Poor’s 500 Index (“S&P 500”), each on a total return basis. The Fund’s net asset value as of April 30, 2013 was $32.40 per share. The net asset value amounted to $1,528,882,122 of which 81.3% was invested in equities, and the balance in cash and equivalents and fixed income securities.

While an uncertain global economic and political environment remained a concern for the first half of the current fiscal year, domestic equity markets were blissfully unaware and rallied for virtually the entire six month period. Despite the uncertain outcome of the U.S. presidential election early in the period, worries regarding the European sovereign debt crisis throughout, and the fiscal cliff standoff, the Russell 2000 and the S&P 500 returned 10.63% and 6.75%, respectively for the first quarter of the fiscal year. Buoyed by the last minute (albeit temporary) fiscal cliff compromise, as well as improved domestic housing and jobs market reports, equity markets in the U.S. continued to rise during the second fiscal quarter.

Despite the uncertain macro-economic environment, our strategy remained constant throughout the period. We are fully committed to our bottom-up investment philosophy and believe that the portfolio is generally composed of companies where managements are taking actions to position their businesses for the long term. However, during the six month period, we were more inclined to reduce equity exposure, as some of our holdings became more fully valued. While our reserves hurt our performance on a relative basis, we remain content to use the cash as a hedge against volatility in the near term and ultimately, we will employ these cash reserves to seize upon attractive and appropriately priced investment opportunities as we uncover them.

Sector weighting is a by-product of our company by company investment approach. However, we had little to no exposure to consumer discretionary, financials or health care stocks during the six month period. This negatively impacted our relative performance, as they were the top three performing categories within the Russell 2000. In contrast, our relatively heavy weighting in the industrials space was a benefit, owing to the sector’s strong showing in both the Russell 2000 and the outperformance of our industrials holdings.

Stock selection contributed favorably to our return during the six month period. Investments in industrials, materials and information technology stocks, which represented about 70% of our portfolio during the first half of the fiscal year, contributed positively to our return on both an absolute and relative basis. With respect to individual stocks, TruBlue, Inc. was the largest positive contributor to the portfolio’s performance, followed by Sealed Air Corporation, Owens-Illinois, Inc. and Avery Dennison Corporation. In contrast, Carpenter Technology Corp., Molycorp, Inc., Acco Brands Corp., Maidenform Brands, Inc. and Allegheny Technologies, Inc. were the largest detractors to our performance during the period.

With respect to movement within the portfolio over the last six months, our most substantial addition was Ascena Retail Group, Inc. The company is a girls’ and women’s specialty retailer and had come under pressure following disappointing same-store sales results and a subsequent earnings shortfall. Though we believe the near-term could remain challenging, we also believe the shares are a compelling value given a number of opportunities for improved earnings power in the future. During the first half of the fiscal year we also exited a long-term holding, Thermo Fisher Scientific Inc, which had been a successful investment, but with shares appearing more fully valued to us, we sold our holdings.

Sincerely,

| | |

| |  |

| |

| J. Dennis Delafield | | Vincent Sellecchia |

| Portfolio Manager | | Portfolio Manager |

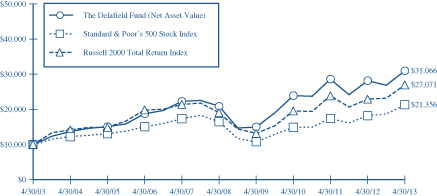

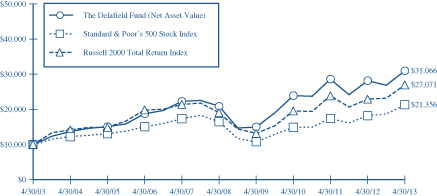

The Delafield Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/03. Since the Delafield Fund did not commence operations until 9/28/09, returns prior to that date are those of the Predecessor Fund. The Delafield Fund assumed the net asset value and performance history of the Predecessor Fund (See Footnote 1 to the Financial Statements). Returns shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee wiaviers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 8% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2013

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Delafield Fund | | | 10.00% | | | | 9.01% | | | | 8.14% | | | | 12.00% | |

Standard & Poor’s 500 Stock Index | | | 16.89% | | | | 12.80% | | | | 5.21% | | | | 7.88% | |

Russell 2000 Total Return Index | | | 17.69% | | | | 11.25% | | | | 7.27% | | | | 10.47% | |

The Tocqueville Select Fund

Dear Fellow Shareholder,

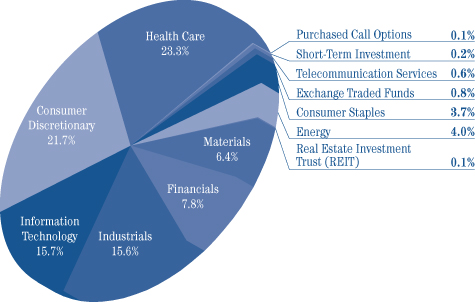

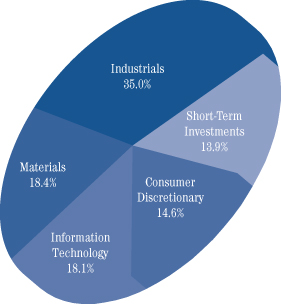

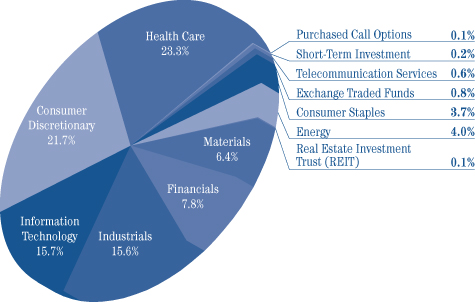

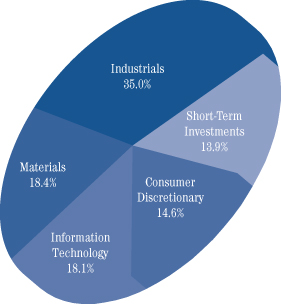

For the six months ended April 30, 2013, the Fund’s net asset value increased 19.34% versus an increase of 17.94% for the Russell 2500 Index (“Russell 2500”) and 16.58% for the Russell 2000 Index (“Russell 2000”), each on a total return basis. The Fund’s net asset value as of April 30, 2013 was $12.98 per share. The net asset value amounted to $87,473,141 of which 85.8% was invested in equities, and the balance in cash and equivalents.

Despite the uncertain outcome of the U.S. presidential election early in the period, worries regarding the European sovereign debt crisis throughout, and the fiscal cliff standoff, the Russell 2500 and Russell 2000 indices rallied through the first quarter of the fiscal year. During the second fiscal quarter, equity markets in the U.S. continued to rise, buoyed by the last minute (albeit temporary) fiscal cliff compromise, as well as improved domestic housing and jobs market reports.

We remained committed to our investment strategy, where utilizing a strictly bottom-up approach we search for companies that we believe are selling at prices which seem modest in relation to the company’s intrinsic value and where something may change which will alter that company’s future for the better. To that end, our most significant additions to the portfolio during the six month period were Carpenter Technology Corp. (“CRS”) and RPX Corporation (“RPXC”). CRS is a leader in specialty metals for niche aerospace, energy, power and medical markets. We anticipate a significant ramp in earnings power and free cash flow generation in the next eighteen months as the company completes the integration of an acquisition and the startup of a large forging operation. RPXC purchases patents from owners, and offers its entire patent portfolio on a subscription basis to its corporate customer base. With the patent troll epidemic growing, we believe that RPXC is well positioned to show strong revenue and earnings growth. During the first half of the fiscal year we also sold out of our holdings in Harris Corporation after the shares had run up and the valuation appeared to be full.

Sector weighting is a by-product of our company by company investment approach. However, we had no exposure to health care, financials or utilities stocks during the six month period. This negatively impacted our relative performance, as these categories, in aggregate, represented nearly 30% of the Russell 2500 during the period and were among the top performing sectors.

Overall, stock selection drove our performance during the six month period, though selection was mixed by sector. Our holdings in the information technology sector were most beneficial on both an absolute and relative basis, followed by our materials stocks. In contrast, our industrials names underperformed relative to the Russell 2500. With respect to individual stocks, Monotype Imaging Holdings, Universal Electronics, Summer Infant, Inc., Checkpoint Systems, Inc. and J2 Global Inc were the largest positive contributors to the portfolio’s performance. In contrast, Carpenter Technology Corp., Maidenform Brands, Inc., Acco Brands Corp., XO Group, Inc. and Foot Locker Inc. were the largest detractors to our performance during period.

| | | | |

Sincerely, | | | | |

| |  | |  |

| | |

| J. Dennis Delafield | | Vincent Sellecchia | | Donald Wang |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

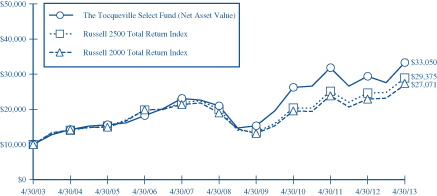

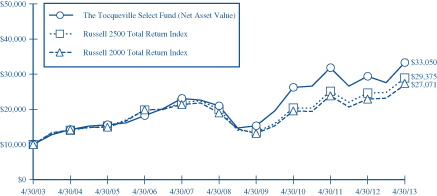

The Tocqueville Select Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/03. Since The Tocqueville Select Fund did not commence operations until 9/28/09, returns from the period from September 29, 2008 to September 27, 2009 are those of the Class Y Shares of the Predecessor Fund (See Footnote 1 to the Financial Statements). Prior to that period, returns shown are those of a limited partnership managed by the adviser. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The Russel 2500 Total Return Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2013

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Select Fund | | | 11.85% | | | | 7.88% | | | | 9.43% | | | | 12.70% | |

Russell 2500 Total Return Index | | | 18.96% | | | | 12.95% | | | | 7.95% | | | | 11.38% | |

Russell 2000 Total Return Index | | | 17.69% | | | | 11.25% | | | | 7.27% | | | | 10.47% | |

Expense Example—April 30, 2013 (Unaudited)

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (November 1, 2012-April 30, 2013).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example Tables (Unaudited)

| | | | | | | | | | | | |

| The Tocqueville Fund | | Beginning

Account Value

November 1, 2012 | | | Ending

Account Value

April 30, 2013 | | | Expenses Paid

During Period*

November 1, 2012 -

April 30, 2013 | |

Actual | | $ | 1,000.00 | | | $ | 1,133.80 | | | $ | 6.67 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.55 | | | | 6.31 | |

| | | |

| The Tocqueville Opportunity Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,139.60 | | | $ | 6.95 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.30 | | | | 6.56 | |

| | | |

| The Tocqueville International Value Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,146.40 | | | $ | 7.18 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.10 | | | | 6.76 | |

| | | |

| The Tocqueville Gold Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 615.90 | | | $ | 5.25 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.30 | | | | 6.56 | |

| | | |

| The Delafield Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,152.50 | | | $ | 6.51 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.74 | | | | 6.11 | |

| | | |

| The Tocqueville Select Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,193.40 | | | $ | 7.40 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.05 | | | | 6.80 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including extraordinary expenses) of 1.26%, 1.31%, 1.35%, 1.31%, 1.22% and 1.36% for The Tocqueville Fund, Opportunity Fund, International Value Fund, Gold Fund, Delafield Fund, and Select Fund, respectively, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding throughout

the period) | | Six Months

Ended

April 30,

2013 | | | Years Ended October 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 24.11 | | | $ | 22.23 | | | $ | 21.53 | | | $ | 18.47 | | | $ | 16.39 | | | $ | 28.93 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.21 | | | | 0.40 | | | | 0.23 | | | | 0.32 | | | | 0.28 | | | | 0.24 | |

Net realized and unrealized gain (loss) | | | 2.98 | | | | 1.81 | | | | 0.80 | | | | 2.97 | | | | 2.09 | | | | (10.56 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (2) | | | 3.19 | | | | 2.21 | | | | 1.03 | | | | 3.29 | | | | 2.37 | | | | (10.32 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.35 | ) | | | (0.33 | ) | | | (0.33 | ) | | | (0.23 | ) | | | (0.29 | ) | | | (0.19 | ) |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | (2.03 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.35 | ) | | | (0.33 | ) | | | (0.33 | ) | | | (0.23 | ) | | | (0.29 | ) | | | (2.22 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 2.84 | | | | 1.88 | | | | 0.70 | | | | 3.06 | | | | 2.08 | | | | (12.54 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 26.95 | | | $ | 24.11 | | | $ | 22.23 | | | $ | 21.53 | | | $ | 18.47 | | | $ | 16.39 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return | | | 13.4 | %(4) | | | 10.1 | % | | | 4.8 | % | | | 18.0 | % | | | 14.8 | % | | | (38.5 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 360,334 | | | $ | 366,025 | | | $ | 491,541 | | | $ | 489,670 | | | $ | 383,470 | | | $ | 328,609 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense (3) | | | 1.26 | %(5)(6) | | | 1.26 | %(5) | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

Net investment income (3) | | | 1.55 | %(6) | | | 1.33 | % | | | 0.98 | % | | | 1.66 | % | | | 1.68 | % | | | 0.94 | % |

Portfolio turnover rate | | | 8 | %(4) | | | 17 | % | | | 28 | % | | | 23 | % | | | 32 | % | | | 51 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Total from investment operations per share includes redemption fees of $0.001 for the six months ended April 30, 2013 and $0.002, $0.002, $0.002, $0.004, and $0.009 per share for the fiscal years ended October 31, 2012, 2011, 2010, 2009, and 2008, respectively. |

| (3) | Net of fees waived amounting to 0.03% for the six months ended April 30, 2013 and 0.03%, 0.01%, 0.01%, 0.08%, and 0.04% of average net assets for the fiscal years ended October 31, 2012, 2011, 2010, 2009, and 2008, respectively. |

| (5) | Includes 0.01% of interest expense which is not included in the Fund’s operating expense cap. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Opportunity Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding throughout

the period) | | Six Months

Ended

April 30,

2013 | | | Years Ended October 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 15.76 | | | $ | 14.96 | | | $ | 13.20 | | | $ | 10.78 | | | $ | 9.77 | | | $ | 17.24 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (1) | | | (0.07 | ) | | | (0.11 | ) | | | (0.13 | ) | | | (0.12 | ) | | | (0.11 | ) | | | 0.02 | |

Net realized and unrealized gain (loss) | | | 2.27 | | | | 0.91 | | | | 1.89 | | | | 2.54 | | | | 1.23 | | | | (5.67 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (2) | | | 2.20 | | | | 0.80 | | | | 1.76 | | | | 2.42 | | | | 1.12 | | | | (5.65 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.01 | ) | | | (0.12 | ) |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.10 | ) | | | (1.70 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | — | | | | — | | | | — | | | | (0.11 | ) | | | (1.82 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 2.20 | | | | 0.80 | | | | 1.76 | | | | 2.42 | | | | 1.01 | | | | (7.47 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 17.96 | | | $ | 15.76 | | | $ | 14.96 | | | $ | 13.20 | | | $ | 10.78 | | | $ | 9.77 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return | | | 14.0 | %(3) | | | 5.4 | % | | | 13.3 | % | | | 22.6 | % | | | 11.7 | % | | | (36.2 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 70,801 | | | $ | 65,455 | | | $ | 46,963 | | | $ | 32,863 | | | $ | 30,498 | | | $ | 36,429 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.31 | %(4) | | | 1.32 | % | | | 1.36 | % | | | 1.41 | % | | | 1.41 | % | | | 1.35 | % |

Net investment income (loss) | | | (0.74 | )%(4) | | | (0.76 | )% | | | (1.04 | )% | | | (1.08 | )% | | | (0.97 | )% | | | 0.12 | % |

Portfolio turnover rate | | | 54 | %(3) | | | 77 | % | | | 110 | % | | | 104 | % | | | 62 | % | | | 169 | % |

| (1) | Net investment income (loss) per share is calculated using the ending balances prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Total from investment operations per share includes redemption fees of less than $0.001 for the six months ended April 30, 2013 and $0.004, $0.001, and $0.005 for the fiscal years ended October 31, 2012, 2009, and 2008, respectively and less than $0.001 for the fiscal years ended October 31, 2011 and 2010. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville International Value Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding throughout

the period) | | Six Months

Ended

April 30,

2013 | | | Years Ended October 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 11.68 | | | $ | 12.00 | | | $ | 12.12 | | | $ | 10.48 | | | $ | 8.49 | | | $ | 16.48 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.09 | | | | 0.17 | | | | 0.11 | | | | 0.11 | | | | 0.10 | | | | 0.13 | |

Net realized and unrealized gain (loss) | | | 1.61 | | | | (0.37 | ) | | | (0.16 | ) | | | 1.65 | | | | 2.59 | | | | (6.09 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (2) | | | 1.70 | | | | (0.20 | ) | | | (0.05 | ) | | | 1.76 | | | | 2.69 | | | | (5.96 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.18 | ) | | | (0.12 | ) | | | (0.07 | ) | | | (0.12 | ) | | | (0.20 | ) | | | (0.10 | ) |

Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.50 | ) | | | (1.93 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.18 | ) | | | (0.12 | ) | | | (0.07 | ) | | | (0.12 | ) | | | (0.70 | ) | | | (2.03 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 1.52 | | | | (0.32 | ) | | | (0.12 | ) | | | 1.64 | | | | 1.99 | | | | (7.99 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 13.20 | | | $ | 11.68 | | | $ | 12.00 | | | $ | 12.12 | | | $ | 10.48 | | | $ | 8.49 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return | | | 14.6 | %(3) | | | (1.6 | )% | | | (0.5 | )% | | | 17.0 | % | | | 34.0 | % | | | (40.8 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 238,360 | | | $ | 218,793 | | | $ | 199,848 | | | $ | 150,103 | | | $ | 131,613 | | | $ | 118,189 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.35 | %(4)(5) | | | 1.56 | % | | | 1.56 | % | | | 1.56 | % | | | 1.62 | % | | | 1.56 | % |

Net investment income | | | 1.43 | %(4)(5) | | | 1.53 | % | | | 0.99 | % | | | 1.03 | % | | | 0.96 | % | | | 1.07 | % |

Portfolio turnover rate | | | 25 | %(3) | | | 38 | % | | | 30 | % | | | 27 | % | | | 27 | % | | | 63 | % |

| (1) | Net investment income per shares is calculated using the ending balances prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Total from investment operations per share includes redemption fees of less than $0.001 for the six months ended April 30, 2013 and $0.001, $0.010, $0.002, $0.001, and $0.001 for the fiscal years ended October 31, 2012, 2011, 2010, 2009, and 2008, respectively. |

| (4) | Net of fees waived amounting to 0.19% of average net assets for the six months ended April 30, 2013. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Gold Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding throughout

the period) | | Six Months

Ended

April 30,

2013 | | | Years Ended October 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 72.82 | | | $ | 81.97 | | | $ | 82.00 | | | $ | 49.71 | | | $ | 21.77 | | | $ | 64.36 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.17 | ) | | | (0.35 | ) | | | (0.67 | ) | | | (0.58 | ) | | | (0.45 | ) | | | (0.57 | ) |

Net realized and unrealized gain (loss) | | | (27.32 | ) | | | (7.47 | ) | | | 2.25 | | | | 32.96 | | | | 29.28 | | | | (33.24 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (2) | | | (27.49 | ) | | | (7.82 | ) | | | 1.58 | | | | 32.38 | | | | 28.83 | | | | (33.81 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.46 | ) |

Distributions from net realized gains | | | (1.62 | ) | | | (1.33 | ) | | | (1.61 | ) | | | (0.09 | ) | | | (0.89 | ) | | | (8.32 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.62 | ) | | | (1.33 | ) | | | (1.61 | ) | | | (0.09 | ) | | | (0.89 | ) | | | (8.78 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | (29.11 | ) | | | (9.15 | ) | | | (0.03 | ) | | | 32.29 | | | | 27.94 | | | | (42.59 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 43.71 | | | $ | 72.82 | | | $ | 81.97 | | | $ | 82.00 | | | $ | 49.71 | | | $ | 21.77 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return | | | (38.4 | )%(3) | | | (9.5 | )% | | | 1.8 | % | | | 65.2 | % | | | 135.2 | % | | | (60.0 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 1,401,100 | | | $ | 2,445,913 | | | $ | 2,647,078 | | | $ | 2,199,603 | | | $ | 937,492 | | | $ | 410,857 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.31 | %(4) | | | 1.28 | % | | | 1.25 | % | | | 1.34 | % | | | 1.50 | % | | | 1.43 | % |

Net investment loss | | | (0.39 | )%(4) | | | (0.56 | )% | | | (0.86 | )% | | | (1.11 | )% | | | (1.25 | )% | | | (1.07 | )% |

Portfolio turnover rate | | | 3 | %(3) | | | 11 | % | | | 3 | % | | | 9 | % | | | 9 | % | | | 28 | % |

| (1) | Net investment loss per share is calculated using the ending balances prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Total from investment operations per share includes redemption fees of $0.010 for the six months ended April 30, 2013 and $0.021, $0.102, $0.056, $0.025, and $0.027 for the fiscal years ended October 31, 2012, 2011, 2010, 2009, and 2008, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Delafield Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2013 | | | Years Ended October 31, | | | January 1,

2009

through

October 31,

2009 | | | Year Ended

December 31,

2008 | |

| | | 2012 | | | 2011 | | | 2010 | | | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 29.79 | | | $ | 27.21 | | | $ | 26.65 | | | $ | 21.35 | | | $ | 15.10 | | | $ | 24.33 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (1) | | | (0.02 | ) | | | (0.04 | ) | | | (0.08 | ) | | | (0.00 | )(3) | | | 0.03 | | | | 0.07 | |

Net realized and unrealized gain (loss) | | | 4.44 | | | | 2.99 | | | | 0.64 | | | | 5.32 | | | | 6.25 | | | | (9.23 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (2) | | | 4.42 | | | | 2.95 | | | | 0.56 | | | | 5.32 | | | | 6.28 | | | | (9.16 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.03 | ) | | | (0.07 | ) |

Distributions from net realized gains | | | (1.81 | ) | | | (0.37 | ) | | | — | | | | — | | | | — | | | | (0.00 | )(3) |

Return of capital | | | — | | | | — | | | | — | | | | (0.02 | ) | | | (0.00 | )(3) | | | (0.00 | )(3) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.81 | ) | | | (0.37 | ) | | | — | | | | (0.02 | ) | | | (0.03 | ) | | | (0.07 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 2.61 | | | | 2.58 | | | | 0.56 | | | | 5.30 | | | | 6.25 | | | | (9.23 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 32.40 | | | $ | 29.79 | | | $ | 27.21 | | | $ | 26.65 | | | $ | 21.35 | | | $ | 15.10 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return | | | 15.3 | %(4) | | | 11.0 | % | | | 2.1 | % | | | 25.0 | % | | | 41.6 | %(4) | | | (37.6 | )% |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 1,528,882 | | | $ | 1,346,273 | | | $ | 1,262,876 | | | $ | 933,674 | | | $ | 636,548 | | | $ | 404,860 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.22 | %(5) | | | 1.23 | % | | | 1.23 | % | | | 1.27 | % | | | 1.38 | %(5) | | | 1.34 | %(6) |

Net investment income (loss) | | | (0.16 | )%(5) | | | (0.13 | )% | | | (0.30 | )% | | | (0.02 | )% | | | 0.21 | %(5) | | | 0.35 | %(6) |

Portfolio turnover rate | | | 18 | %(4) | | | 49 | % | | | 38 | % | | | 30 | % | | | 46 | %(4) | | | 81 | % |

| (1) | Net investment income (loss) per share is calculated using the ending balances prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Total from investment operations per share includes redemption fees of $0.001 for the six months ended April 30, 2013 and $0.003, $0.006, and $0.006 for the fiscal years ended October 31, 2012, 2011, and 2010, $0.008 per share for the period ended October 31, 2009, and less than $0.01 for the fiscal year ended December 31, 2008. |

| (3) | Represents less than $0.01. |

| (6) | Net of fees waived amounting to 0.06% and 0.05% for the fiscal years ended December 31, 2008, and 2007, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Select Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding throughout

the period) | | Six Months

Ended

April 30,

2013 | | | Years Ended October 31, | | | January 1,

2009

through

October 31,

2009 | | | Period from

September

2008 (3)

through

December 31,

2008 | |

| | | 2012 | | | 2011 | | | 2010 | | | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 11.35 | | | $ | 11.06 | | | $ | 11.54 | | | $ | 8.46 | | | $ | 5.77 | | | $ | 8.74 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (1) | | | (0.03 | ) | | | (0.04 | ) | | | (0.07 | ) | | | (0.03 | ) | | | (0.00 | )(4) | | | 0.01 | |

Net realized and unrealized gain (loss) | | | 2.17 | | | | 0.44 | | | | 0.12 | | | | 3.12 | | | | 2.70 | | | | (2.97 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations (2) | | | 2.14 | | | | 0.40 | | | | 0.05 | | | | 3.09 | | | | 2.70 | | | | (2.96 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | (0.01 | ) | | | (0.00 | )(4) | | | (0.01 | ) |

Distributions from net realized gains | | | (0.51 | ) | | | (0.11 | ) | | | (0.53 | ) | | | — | | | | — | | | | — | |

Return of Capital | | | — | | | | — | | | | — | | | | — | | | | (0.01 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.51 | ) | | | (0.11 | ) | | | (0.53 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 1.63 | | | | 0.29 | | | | (0.48 | ) | | | 3.08 | | | | 2.69 | | | | (2.97 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 12.98 | | | $ | 11.35 | | | $ | 11.06 | | | $ | 11.54 | | | $ | 8.46 | | | $ | 5.77 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return | | | 19.3 | %(5) | | | 3.7 | % | | | (0.1 | )% | | | 36.6 | % | | | 46.7 | %(5) | | | (33.9 | )%(5) |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 87,473 | | | $ | 84,549 | | | $ | 71,554 | | | $ | 41,788 | | | $ | 24,681 | | | $ | 9,226 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.36 | %(6) | | | 1.37 | % | | | 1.36 | % | | | 1.38 | % | | | 1.26 | %(6)(7) | | | 1.15 | %(6)(7) |

Net investment income (loss) | | | (0.35 | )%(6) | | | (0.36 | )% | | | (0.67 | )% | | | (0.43 | )% | | | (0.16 | )%(6)(7) | | | 0.29 | %(6)(7) |

Portfolio turnover rate | | | 13 | %(5) | | | 31 | % | | | 28 | % | | | 40 | % | | | 24 | %(5) | | | 29 | %(5) |

| (1) | Net investment income (loss) per share is calculated using the ending balances prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Total from investment operations per share includes redemption fees of less than $0.001 for the six months ended April 30, 2013 and $0.002, $0.008, and $0.007 for the fiscal years ended October 31, 2012, 2011, and 2010, respectively. |

| (4) | Represents less than $0.01. |

| (7) | Net of fees waived amounting to 0.77% and 2.32% for the fiscal periods ended October 31, 2009 and December 31, 2008, respectively. |

The Accompanying Notes are an Integral Part of these Financial Statements.

The Tocqueville Fund

Schedule of Investments as of April 30, 2013

(Unaudited)

| | | | | | | | |

| Common Stocks—97.2% | | Shares | | | Value | |

Automobiles & Components—2.7% | | | | | | | | |

Ford Motor Co. | | | 700,000 | | | $ | 9,597,000 | |

Banks—2.0% | | | | | | | | |

M&T Bank Corp. | | | 20,000 | | | | 2,004,000 | |

Mitsubishi UFJ Financial Group, Inc.—ADR | | | 750,000 | | | | 5,085,000 | |