UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4840

The Tocqueville Trust

(Exact name of registrant as specified in charter)

The Tocqueville Trust

40 West 57th Street, 19th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert W. Kleinschmidt

The Tocqueville Trust

40 West 57th Street, 19th Floor

New York, NY 10019

(Name and address of agent for service)

(212) 698-0800

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: April 30, 2015

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

April 30, 2015

The Tocqueville Trust

Mutual Funds

The Tocqueville Fund

The Tocqueville Opportunity Fund

The Tocqueville International Value Fund

The Tocqueville Gold Fund

The Delafield Fund

The Tocqueville Select Fund

The Tocqueville Alternative Strategies Fund

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of The Tocqueville Trust. Please call 1-800-697-FUND (3863) for a free prospectus. Read it carefully before you invest.

You are invited to visit our website @ www.tocqueville.com/mutual-funds

Dear Fellow Shareholder,

Since the U.S. stock market bottomed six years ago, the S&P 500 index has appreciated more than 200% (without dividends) and the NASDAQ Composite Index almost 300%. Other leading indices have not been idle. While a number of them started recovering a bit later, Japan’s Nikkei has now gained almost 180% and Germany’s DAX 200%. India has appreciated 220% as well, but many emerging markets or those sensitive to natural resources were not as buoyant: Russia rose only 67% and Brazil 44%, while China owed its 120% gain entirely to a speculative spike in recent months.

In theory, the age of a bull market has no import on its future direction. In most cases, however, valuation measures, while well below the recent peaks of 2000 or 2007, have merely retreated towards their long-term historical averages. So, I believe that while it cannot be argued that the current environment reflects the euphoria that often precedes major declines or corrections, neither can it be said that present conditions have bubble characteristics.

What is most striking in the current environment, in my view, is the prevailing and widespread complacency. Many of the world’s problems, which by historical standards are severe or even unprecedented, seem remote and relatively painless to the majority of investors, despite the sensational reporting in the media.

The United Nations reports that almost 60 million people were forcefully uprooted by conflict and persecution at the end of last year? This leaves more than 6 billion people largely unaffected (unless the displaced try to settle close by). U.S. unemployment rate is 5.5%? 94.5% of the labor force is working. The gross domestic products of major countries are hesitant or halting? This will motivate central banks to pour more money onto the financial markets, promising to push stocks higher.

Perhaps the most menacing headline I could imagine came out a few days ago:

Companies issue record levels of perpetual debt

Global issuance of corporate bonds that may never be redeemed has surged to record levels as companies lock in finance at historically low interest rates.

But one does not have to predict the future to perpetuity to imagine what might happen to a bond without a maturity date, issued when interest rates are historically very low. Without the prospect of redemption at par value upon maturity there is no price or time limit on the potential loss whenever interest rates rise again.

The first portfolios I worked on in the early 1970s on Wall Street were full of not perpetual, but very long-term bonds purchased in the 1940s and 1950s with coupons of 2% to 3%. By the 1970s, with interest rates at 6%-plus, these bonds were often selling at 50 cents on the issuance price dollar.

Today’s repeat of history, in my view, is a sign of the prevailing complacency and should serve as a reminder that it is dangerous in investing to assume that any condition may be perpetual.

Respectfully,

François Sicart

Chairman

The Tocqueville Fund

The six month period that ended April 30, 2015 was full of surprises for investors but, after suffering several bouts of volatility, global equity markets continued their upward trajectory. Throughout this period of time, investors seemed to focus their attention on commodities and currencies while choosing to overlook the worsening geopolitical situations in the Middle East, South China Sea and Ukraine. At the same time, investors continued to evidence their appetite for risk as U.S. equity markets advanced despite weakening economic data, signs of labor cost inflation and fears over the Federal Reserve’s eventual decision to raise interest rates. Only recently have investors begun to take pause in renewed worries of a Greek default and/or exit from the Euro and the possibility of higher borrowing costs.

Perhaps the biggest shock for investors over the period was the decline in energy and other commodity prices and the concomitant increase in the U.S. dollar exchange rate. For oil, while soft demand growth from the U.S. and Europe was part of the story and the end of China’s fixed investment boom another, investors significantly underestimated the disruption to the world’s energy supply-demand balance due to the impact of new technology in the U.S. energy production industry. The surge in the dollar was partly due to investors beginning to anticipate the Fed’s eventual tightening but also due to weakness in the rest of the world that transmitted dollar strength through the easy monetary policy of Europe, Japan and China. In addition, investors were slow to incorporate currency changes into their estimates and were caught off guard as companies began to report results during the period. In some ways, investors were either incorrect or early in their assumptions about the immediate benefits to consumer spending from lower energy prices, although on the latter point, it took longer than the period covered by this report to figure that out. Indeed, since bottoming in January, oil prices have rallied back by almost 30% and actual retail sales have yet to show any meaningful improvement.

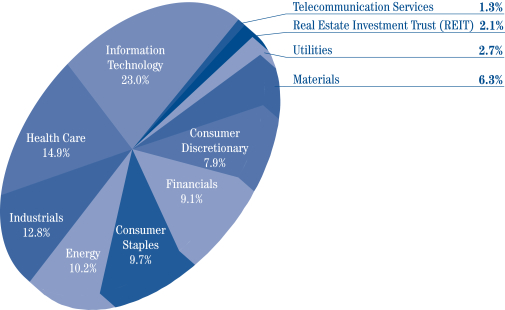

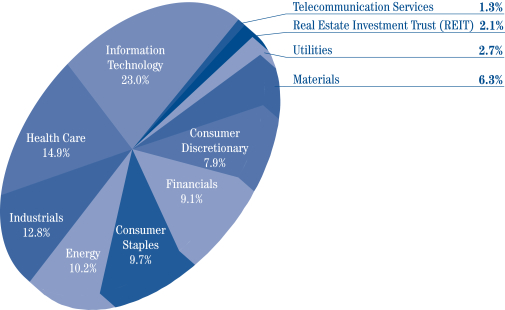

Over the six months ended April 30, 2015, the portfolio returned 3.31% while the S&P 500 gained 4.40%. This result is due largely to stock selection, particularly in technology which was a strong contributor for the market but where the Fund’s stocks greatly underperformed. In addition, being underweight in the consumer discretionary sector, which led the market, was a detriment as investors chased hope for improved retail spending. On the other hand, while the energy sector was the weakest for the market, the Fund’s positions in that sector fared better and it had strong performance from a few healthcare names.

The top performing sectors of the portfolio over the period were healthcare, industrials and financials while energy, consumer staples and technology were the laggards. The top individual contributors to performance in the portfolio were Isis Pharmaceuticals, which continues to show success in developing and partnering new products, Allergan, which was acquired by Actavis, and Amazon, which surprised investors by showing improved profits. The largest detractors were DeVry Education, a for-profit education provider that suffered from increased governmental scrutiny and regulation in the U.S. despite possessing a rapidly growing business in Brazil, Applied Materials, which had been hurt by a cyclical slowdown in semiconductor demand and Exxon Mobil, which was caught up in the energy decline.

With mid-year approaching, the outlook for equity markets seems mixed. In the U.S., the rise in buybacks, dividends and mergers & acquisitions has lately not been enough to overcome the specter of an eventual rate increase, the rise in the dollar, and weak economic growth. We believe that the greatest hope for U.S. equities lies in the consumer sector, which is the largest part of the domestic economy. Despite lower energy and commodity prices, rising labor rates and employment are signs that parts of the economy have normalized, consumer spending remains weak and household formation below trend. In our view, part of that is due to consumers repairing balance sheets and part of that is the misleading nature of the employment statistics which do not account for the decline in labor force participation and employees working fewer hours than they would like. We also believe that it is due to the hidden “taxes” of Obamacare that have siphoned off a larger portion of consumer budgets into healthcare. Still, we remain optimistic that consumer activity will improve from currently depressed levels in the second half of the year as further income gains take hold.

The Federal Reserve has a difficult decision coming up if the economy improves. In some ways, it may be an even more difficult one if it does not. We think the decision is obvious and that the oceans of liquidity and suppressed interest rates have in many ways hindered the recovery by skewing capital allocation. However, until the market sees how the economy reacts to higher interest rates, the Federal Reserve will likely to be range bound.

With U.S. equities near their recent highs, it is certainly more difficult to find broad sectors that appeal to us as contrarian value investors. However, there are always individual companies that fall out of favor for one reason or another and we will continue to search for these opportunities to purchase quality businesses at a substantial discount to intrinsic value.

Sincerely,

Robert W. Kleinschmidt

Portfolio Manager

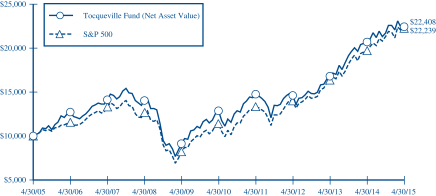

The Tocqueville Fund

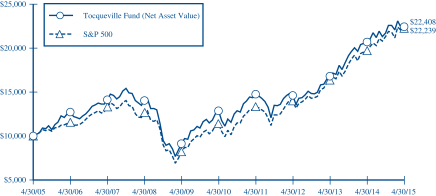

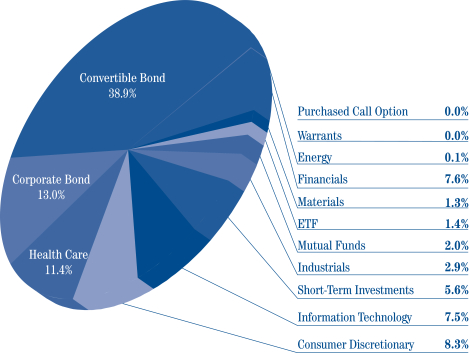

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/05. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held for 90 days or less.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2015

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Fund | | | 8.28% | | | | 15.32% | | | | 11.72% | | | | 8.40% | |

Standard & Poor’s 500 Stock Index | | | 12.98% | | | | 16.73% | | | | 14.33% | | | | 8.32% | |

The Tocqueville Opportunity Fund

As the first half of the 2015 fiscal year commenced this past November, small and mid-cap cap growth equities had struggled with a persistent volatility throughout most of 2014. Although the Russell 2500 Growth Index (SMID Growth benchmark) had appreciated nearly 4% through the end of October 2014, there were numerous swings in the index of 5% or more; and the Fund experienced a decline of nearly 14% during the March/April period and a pullback of nearly 10% during the July/October period. And while small and mid-cap’s had managed a gain (+4%) through the end of October, the gain significantly trailed the S&P 500 Index which had managed to appreciate nearly 11% over the same period as investors crowded into larger cap issues.

The past six months has delivered an altogether different pattern of performance as SMID growth issues have shaken away from the volatility bands of 2014 and moved on to achieve new highs and smartly outperformed their larger cap competitors—with the Russell 2500 Growth Index and the S&P 500 Index up 8.31% and up 4.40% respectively. However, the advance to new highs for the benchmarks only began in February 2015, and a look back over the past year and a half is revealing and important—in effect, small and mid-cap growth issues have traded sideways for nearly 17-18 months. The lows of this long period of consolidation had been set in late September 2013, and were tested in April and September 2014; the highs were established in March 2014 but could not be exceeded despite five solid runs at the prior high. We believe this long period of consolidation has several important implications: 1) it allowed the historical valuation premium of small and mid-cap caps to compress vis a vis large cap issues which were outperforming, 2) it demonstrated underlying strong support for SMID cap issues during periods of heightened volatility and sell-offs, 3) it provided reasonable evidence that volatility during the period was being driven by traders and market sentiment shifts as opposed to improving valuation and fundamentals.

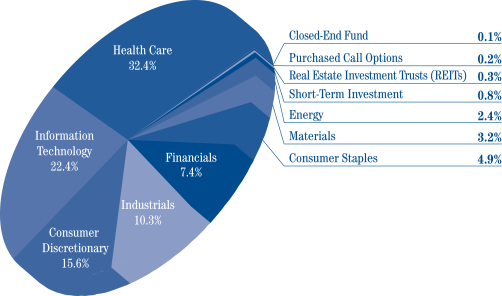

The Fund gained 12.99% through the six-month period ending April 30, 2015, versus an increase of 8.31% for the benchmark Russell 2500 Growth Index. Investment performance was driven by healthcare sector investments which accounted for one half of the Fund’s absolute performance despite representing less than one third of the Fund’s investments. Technology and consumer sector investments in order also posted strong absolute performance, and accounted for nearly two fifths of the Fund’s performance. The picture of the Fund’s near 6% excess relative performance (versus its benchmark) was similar in only certain respects—healthcare sector investments led and accounted for nearly half of the performance. While energy and financial sector investments provided the second and third leading boosts to relative performance. In both cases, the principal drivers of performance included security selection and significant underweighting of both sectors. On an overall basis, the Fund experienced positive sector performance on an absolute basis in all sectors but energy which declined 0.02%, on a relative basis, the Fund had positive performance in all sectors and outperformed the benchmark in all sectors (Consumer sectors combined basis).

Eight of the Fund’s portfolio holdings experienced takeovers during the period—seven healthcare issues and one financial holding. Several were significant holdings of the Fund, including: Auspex Pharmaceutical, Allergan, NPS Pharmaceutical, Pharmacyclics, Prosensa and Salix Pharmaceuticals. Eighteen issues appreciated greater than 50% during the period; while ten issues declined more than 30%. Auspex RX was the leading gainer (+271%) followed by Bluebird Bio (+217%); Stratasys Ltd (-69%) and OvaScience (-47%) were the two leading decliners but together their impact was less than 0.20% to the Fund’s performance due to the diversification strategy. On a relative basis, seven of the leading issues were healthcare investments (led by Pharmacyclics), and three were technology issues which included Palo Alto Networks and Manhattan Associates. Six of the leading relative underperformers were healthcare issues (led by Puma Biotechnology) and three were technology issues (including Workday and Netsuite). On an absolute basis, Pharmacyclics was the leading issue and accounted for more than ten percent of the Fund’s total return; Puma Bio was the worst, but only impacted the total return by 0.36%.

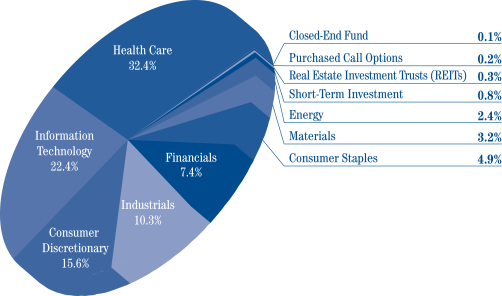

During the period, there were only minor shifts in sector allocations. Due to a the significant share of the Fund’s Healthcare issues which were taken over, we reinvested proceeds back into a number of smaller issues with promising technology and good trial results—the healthcare allocation rose to 32.6% of the Fund from the beginning of period weighting of 31.6%. Consumer investment allocation increased to approximately 21% from 19%; technology investments

declined just a bit to 22.5% from 23%. Shifts in the economy sensitive sectors were somewhat more significant and reflected a view that the U.S, economy has continued to face headwinds which do not favor accelerated, cyclical growth—financials were down 2.6% to just under 8%; materials were down 1% to just over 3%, and industrials were down over 1% to just above 10%. Two important changes in the Fund’s allocation included: 1) an increased energy exposure to nearly 2.5% of the portfolio from next to nothing in order to participate in any potential recovery due to an improved pricing environment and a more rational competitive industry structure (albeit this is still unclear), and 2) the beginning of a significant reduction in the exposure to airline investments as competitive issues with pricing and capacity and prospectively higher fuel costs may be signaling the end of the current cycle for the time being.

The Fund continues to be well diversified, and in fact is somewhat more diversified with newly initiated investments since the beginning of the period. This is most attributable to the fact that several big weighted names disappeared as a result of Mergers & Acquisitions. The top 50 issues represented 48.2% of the Fund at period end versus a prior 52.2% whereas the top 125 holdings represented 76.9% at the end of the period versus 82.2% at the beginning. Over time, we would expect and hope that recent, newly initiated investments should expand the concentration of weights in the top 125 names.

Finally, as indicated in our discussion of sector based allocation, we anticipate that growth oriented issues should continue to lead Fund based returns until it becomes a bit clearer how and when industrial and cyclical demand becomes recharged. The U.S. economy continues along its steady but slow path of growth with intermittent periods of strength and weakness; we are encouraged by the steadiness and resiliency but less impressed with the degree of growth. Nevertheless, we are alert to the benefit of ongoing accommodation to the business cycle and look forward to a period of accelerated growth in the future—we believe such anticipated growth would lead us to expand our commitments in these economy sensitive areas, led by the financials and industrial sectors.

As always, we appreciate your confidence in our efforts on behalf of shareholders of the Opportunity Fund and we remain committed to its ongoing successes.

Sincerely,

Thomas R. Vandeventer

Portfolio Manager

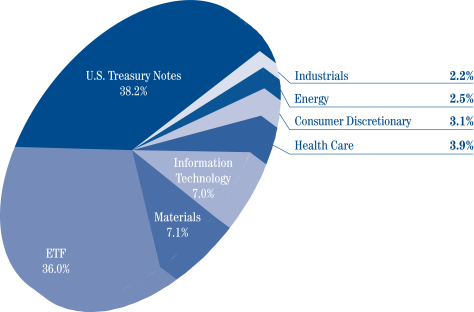

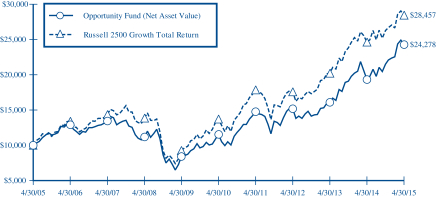

The Tocqueville Opportunity Fund

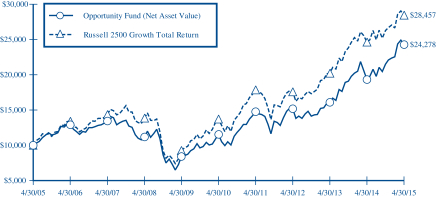

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/05. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held for 90 days or less.

The chart and table include The Opportunity Fund’s performance achieved prior to the changes effected in 2010 to its investment strategy.

The Russell 2500 Growth Total Return Index is an unmanaged index that measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. Returns assume the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2015

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Opportunity Fund | | | 25.74% | | | | 16.90% | | | | 16.05% | | | | 9.28% | |

Russell 2500 Growth Total Return Index | | | 15.54% | | | | 17.42% | | | | 15.68% | | | | 11.02% | |

The Tocqueville International Value Fund

Dear Fellow Shareholder,

For the six months ended April 30, 2015, global equity markets generally rose in the context of cross currents and bouts of volatility. At 2014 calendar year-end, markets declined in response to concerns about Chinese growth, the possibility of a Greek default, and the uncertainty deriving from a sharp decline in oil prices and a sharp increase in the value of the U.S. dollar. Then in January 2015, markets rallied in reaction to improving economic data and aggressive monetary easing in Europe, and an improvement of corporate earnings and corporate governance in Japan. The U.S. dollar increased in value against most currencies, amplifying a decline in commodity prices, which led to declines in the currencies and equity markets of commodity producing nations. Japan, Germany and Hong Kong were among the best performing markets globally, while commodity dependent Brazil and Mexico were among the worst. In terms of sectors, auto and auto related, paper and forest products, travel and leisure, and rubber products were among the best performers, while oil and gas and mining stocks were among the worst.

The Fund’s total U.S. dollar return for the six-month period was a gain of 11.63%. In the same period, the Morgan Stanley EAFE Index, the benchmark against which we are most often compared, had a total U.S. dollar return of 6.81%.

During the period, the Fund had gains in a diverse group of stocks. Notable contributors to profits were Japanese semiconductor manufacturing toolmaker Disco, Japanese mega bank Mitsubishi UFJ, Ireland based construction products maker CRH, Japanese industrial products distributor Misumi, French wire and cable producer Nexans, German compact construction equipment maker Wacker Neuson, and German semiconductor maker Infineon. Meaningful losses were limited to companies related to the commodity complex, notably global copper and energy concern Freeport McMoRan and oil country tubular goods producer Vallourec.

The Fund exited positions in Japanese imaging technology company Fujifilm and Swedish building products company Lindab as they approached our estimates of fair value. The Fund also exited Freeport McMoRan and Vallourec as our estimates of medium-term earnings power were undercut by the steep decline in oil prices. A new position in Danish facilities management company ISS was established, a quality business with strong and recurring cash flow generation trading at an attractive valuation due to a stock overhang. The Fund purchased French information technology concern Sopra, whose earnings power is misunderstood and underestimated by the market following its combination with competitor Steria. The Fund bought Japanese power tool maker Makita, a leading global franchise trading at an attractive valuation due to investor concerns about its European exposure. Another new position is Ireland-based drug maker Shire, which has several interesting products in its pipeline and in our judgment, stands to benefit from industry consolidation either as an acquirer or an acquisition target. Finally, the Fund purchased UK design software concern Aveva, a unique and defensible business franchise, when it became oversold due to exaggerated concerns about its business exposure to oil and gas producers. The Actavis, Amano, CRH, Greatview Aseptic Packaging, Ipsos, Saint Gobain, Sanofi and Shiseido positions were increased.

During the period, there was a decrease of the Fund’s exposure to Japan and an increase in the Fund’s exposure to Europe and Asia. Cash reserves remained steady at approximately 7%.

In developed markets outside the U.S., we believe the combination of monetary stimulus, more competitive foreign exchange rates and lower oil prices provides a more constructive macro backdrop for stock picking. In Europe, economic indicators such as bank lending, retail sales and employment have shown improvement; while in Japan strong machinery orders and consumer confidence indicate a strengthening economy. Against this backdrop, we believe valuations are reasonable in absolute terms and in general there exists a significant opportunity to grow corporate earnings via increased operating efficiency. Better capital allocation practices are also being adopted in Japan and should boost returns. Increased shareholder activism is helping to ensure that these operating and capital allocations improvements will be realized. We remain vigilant regarding the pace of economic growth in the U.S. and its potential impact on nascent recoveries in Japan and Europe.

In our effort to help protect and grow your capital, we continue to seek out companies that have defensible business franchises, pricing power, free cash generation, limited financial leverage and sound capital allocation practices, and which trade at a discount to intrinsic value based on future cash flows in a conservative economic growth scenario.

Respectfully,

James Hunt

Portfolio Manager

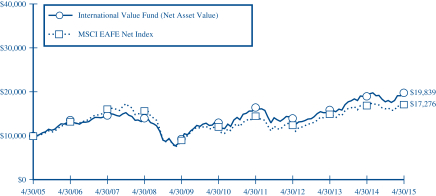

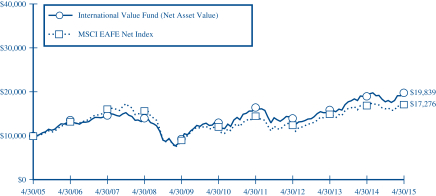

The Tocqueville International Value Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/05. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The MSCI EAFE Index is an unmanaged market-capitalization-weighted index composed of companies representative of the market structure of 21 Developed Market Countries in Europe, Australia, Asia and the Far East.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2015

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville International Value Fund | | | 4.08% | | | | 12.38% | | | | 8.72% | | | | 7.09% | |

MSCI EAFE Net Index | | | 1.66% | | | | 11.22% | | | | 7.40% | | | | 5.62% | |

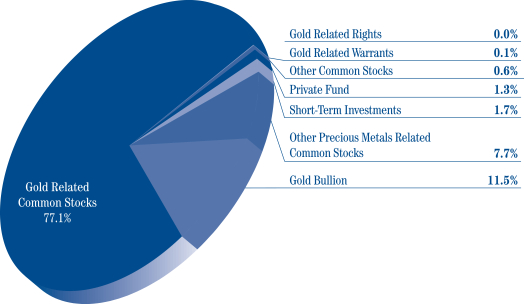

The Tocqueville Gold Fund

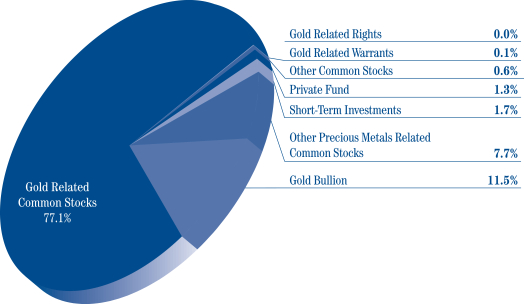

The Fund rose 6.7% during the six month period ended April 30, 2015, while the Philadelphia Gold and Silver index was up 13.0%, and the gold bullion price increased 0.9% to finish April at $1,182.40 per ounce.

Some of the better performing stocks in the Fund during the six month period were the larger and better capitalized mining companies positioned to take advantage of the trending gold market. We believe that Randgold should now benefit from robust cash flow generation after the capital spending and mine building it undertook the past five years. Agnico Eagle continues to have good success adding to its resource base by acquisition and discovery. Detour Gold has been resolving start-up issues and by de-risking its mine it is now enjoying a better valuation. Newmont’s restructuring efforts, cost focus and debt reduction, are attributable for the positive re-rating its stock is receiving. The same is beginning to occur for Newcrest, which was added to the portfolio during the period. We continued to add to GoGold, which is establishing low cost operations with modest capital budgets in Mexico. A couple of stocks that hurt performance were subject to financial distress from Guatemala, which imposed additional royalties in the case of Tahoe Resources; and from Greece with its issues, in the case of Eldorado.

Lower valuations in the sector and tight capital markets for mining finance have encouraged more merger and acquisition activity, with companies such as Goldcorp acquiring resources through its acquisition of Probe Mines. Semafo added to its resource position in western Africa through an acquisition during the period. Tahoe Resources acquired Peruvian assets that should diversify its risk away from one mine, one country exposure. Agnico Eagle made numerous small strategic investments in junior mining or exploration companies that are unable to access capital in a traditional way. Premier Gold is finding partners to do joint ventures with as a way to diversify risk and establish North American production.

We predicted the flourishing of mergers & acquisitions activity in this sector well over a year ago. That has certainly been the case over the past six months. Larger companies such as Newmont, Barrick, and AngloGold Ashanti have divested quality assets to repair balance sheets and streamline operations. In this atmosphere of depressed valuations, these transactions could prove to be a win/win situation for both buyers and sellers. We believe a more efficient and better industry structure should result. This sort of cleansing is typically characteristic of an industry response at the bottom of a price cycle.

Operating costs continue to improve due to lower oil prices and weaker local currencies for those with non-U.S. operations. Gold producers are reporting those benefits and we believe that the favorable trend should continue well into the year. The industry’s all-in-cost of production is holding steady at around $1,100 per ounce, and we believe may even begin to decline slightly.

We added to the gold bullion position during the period as gold prices sold off in late 2014, recognizing the attractive gold price level and that the bottoming process the industry has been going through will limit supply in the future, as some higher cost operators close or sell down mining assets. We believe that the supply of newly mined gold is near a peak that will not be surpassed for many years.

We continue to favor precious metals royalty companies, such as Royal Gold, Osisko Royalties, Franco Nevada, and Silver Wheaton which provide capital for mining operations and offer investors an attractive business model combined with exposure to rising gold prices. Royalty companies are highly diversified geographically, offer easily understandable growth prospects, and generate high returns on capital.

By our assessment, sector managements have responded appropriately to the current gold price environment and, in particular, portfolio companies are in a much better position to make the most of rising gold prices. However, this is not fully appreciated by the broader market and we think that significant valuation expansion lies ahead.

We attempt to provide maximum exposure to a potential rise in precious metals prices, whether through exploration and discovery, mine development, precious metal production and/or astute mergers & acquisitions; while protecting

against downside exposure by investing only in those companies that are well managed. We believe that a significant rise in the gold price is simply a matter of time, and will occur when the financial markets recognize that the efforts of quantitative easing have succeeded only in inflating the value of financial assets while doing little, if anything, for economic growth.

We appreciate your continued interest and support as Tocqueville Gold Fund investors.

Sincerely,

| | |

| |  |

| |

John C. Hathaway Portfolio Manager | | Douglas B. Groh Portfolio Manager |

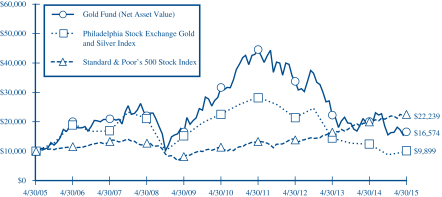

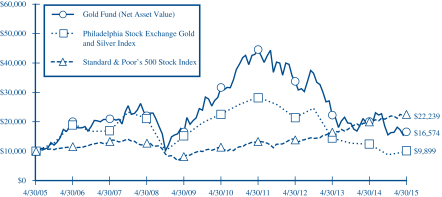

The Tocqueville Gold Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/05. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2006, 2009, and 2010 the performance of The Tocqueville Gold Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia Stock Exchange Gold and Silver Index is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver. Returns include the reinvestment of all dividends.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2015

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Gold Fund | | | -17.68% | | | | -21.10% | | | | -12.12% | | | | 5.18% | |

Philadelphia Stock Exchange Gold and Silver Index | | | -20.12% | | | | -22.54% | | | | -15.13% | | | | -0.10% | |

Standard & Poor’s 500 Stock Index | | | 12.98% | | | | 16.73% | | | | 14.33% | | | | 8.32% | |

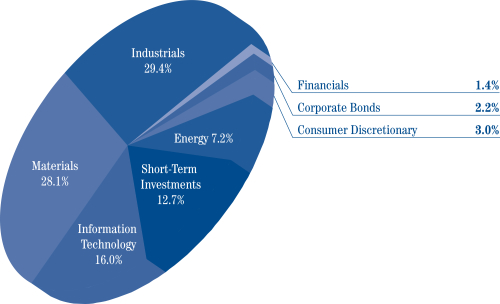

The Delafield Fund

Dear Fellow Shareholder,

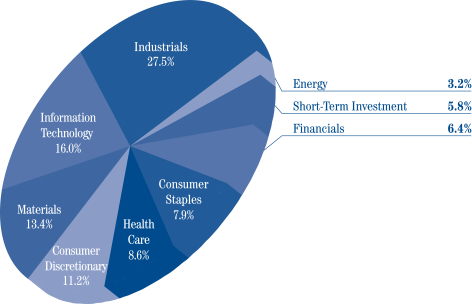

For the six months ended April 30, 2015, the Fund’s net asset value increased 0.56% versus an increase of 4.65% for the Russell 2000 Index (“Russell 2000”) and 4.40% for the Standard & Poor’s 500 Index (“S&P 500”), each on a total return basis. Owing to the smaller average market capitalization of companies in the Russell 2000, we view it as the more appropriate of the two comparative indices. The Fund’s net asset value as of April 30, 2015, was $32.83 per share. The net asset value amounted to $985,113,139, of which 84.6% was invested in equities, and the balance in cash and equivalents and fixed income securities.

Despite the Federal Reserve’s October 2014 decision to effectively end the Quantitative Easing program, investors were seemingly encouraged by continued signs of strength in the U.S. economy as well as solid third quarter earnings and drove continued gains in the major indices to close out the 2014 calendar year. Markets experienced a new year’s hangover, tumbling in January 2015 on the continued drop in oil prices, the surge in the U.S. dollar and renewed worries about international economic activity, particularly in China. Optimism returned, however, for the balance of the first calendar quarter and into the second quarter, with fundamental economic and corporate data supporting indices just shy of record highs.

The Fund’s performance during this time period was out of step with the market overall. In fact, it was very much a tale of two halves for the Fund. The fiscal first quarter performance was disappointing, with the previously mentioned drop in oil prices and foreign exchange rate volatility combining to create market uncertainty in a number of our holdings. In the fiscal second quarter, with a resumption of stability in macro factors, including oil prices, external concerns were mitigated. The Fund’s investments outperformed in this second half of the period as their earnings exhibited signs of operational strength.

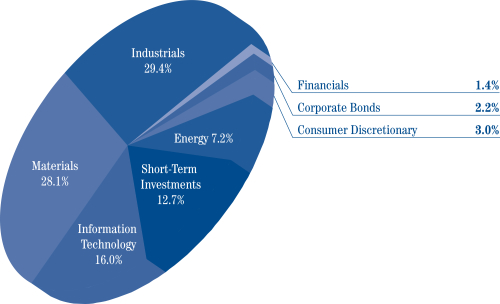

For the six month period, the Fund’s exposure to the rapid decline in oil prices was particularly painful on an absolute and relative basis. The Fund’s direct energy sector holdings declined about 7% during the period, which was favorable relative to the energy component of the Russell 2000, but detracted from the absolute return. However, the tangential exposure in the portfolio to energy was material and the resulting consequences unanticipated. A number of the Fund’s holdings in the industrials and materials sectors experienced declines related to energy prices; some, like Dover Corporation and WESCO International., Inc. as a result of end market exposure, others, like Eastman Chemical Corporation, as a function of energy related input cost variations. In the aggregate, we estimate that energy related weakness impacted relative performance by about 200 basis points during the period, with the indirect impact most felt in the industrials and materials holdings.

During the entire period, the market, as defined by the Russell 2000, also favored large over small and health care and high tech over basic industry. Activist involvement as well as merger & acquisitions activity was also focused in these areas. Unfortunately, we were not participants in those areas, which further contributed to the Fund’s lag. For example, the health care component of the Russell 2000 represented about 15% of its holdings and was the strongest contributor, generating a return in excess of 13%. In contrast, the Fund had strong performance in the consumer discretionary space, with those stocks increasing about 12% in the aggregate, but it was underweight the Russell 2000 Index, and so the relative performance there was essentially in line.

Ryerson Inc. (materials) was the largest individual detractor from the six month performance, with the shares down on weak earnings and depressed metal prices driving expectations for continued sluggish demand. Conversely, Fairchild Semiconductor International (information technology) was the largest contributor. The stock benefited from good earnings results, evidence of the company’s manufacturing consolidation progressing and expectations that they will continue to utilize free cash flow for substantial share repurchases.

Despite the difficult period we experienced, we remain confident in both the investment approach and the portfolio. We believe that the special situation stocks remain largely on track with their respective internal improvement strategies

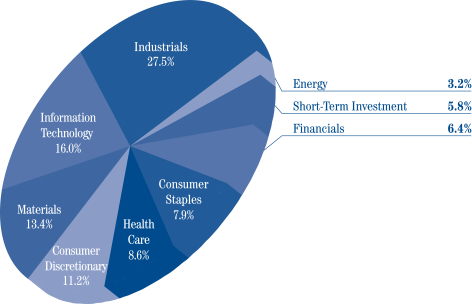

and that as their progress begins to be reflected in their financial results, our patience will be rewarded. Lastly, the opportunities presented to us through our bottom-up and value investment approach have resulted in a portfolio with heavy exposure to the industrials and materials sectors. As already discussed, these sectors were out of favor in recent quarters, but we believe are also most likely to eventually benefit from the continuing, albeit gradual, improvement in the U.S. economy as well as signs of stabilization in China and Europe.

Sincerely,

| | |

| |  |

| |

J. Dennis Delafield Portfolio Manager | | Vincent Sellecchia Portfolio Manager |

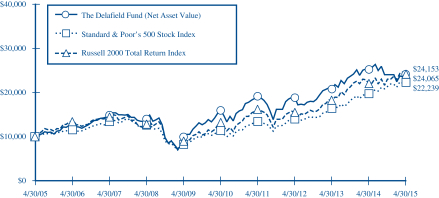

The Delafield Fund

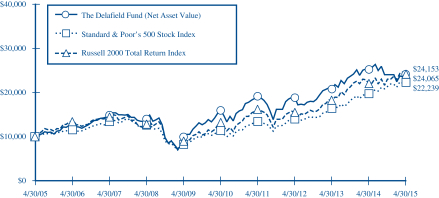

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/05. Since the Delafield Fund did not commence operations until 9/28/09, returns prior to that date are those of the Predecessor Fund. The Delafield Fund assumed the net asset value and performance history of the Predecessor Fund (See Footnote 1 to the Financial Statements). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 10% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2015

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Delafield Fund | | | -3.98% | | | | 8.79% | | | | 8.68% | | | | 9.22% | |

Standard & Poor’s 500 Stock Index | | | 12.98% | | | | 16.73% | | | | 14.33% | | | | 8.32% | |

Russell 2000 Total Return Index | | | 9.71% | | | | 15.87% | | | | 12.73% | | | | 9.18% | |

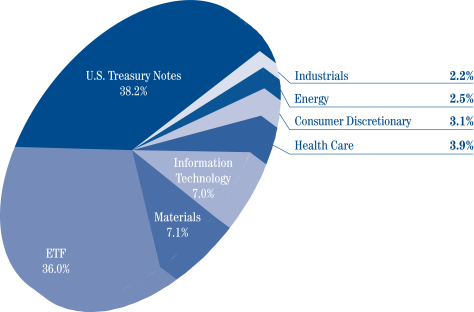

The Tocqueville Select Fund

Dear Fellow Shareholder,

For the six months ended April 30, 2015, the Fund’s net asset value increased 3.54% versus an increase of 5.64% for the Russell 2500 Index (“Russell 2500”) and 4.65% for the Russell 2000 Index (“Russell 2000”), each on a total return basis. The net asset value as of April 30, 2015 was $13.59 per share. The net asset value amounted to $98,477,499 of which 94.9% was invested in equities, and the balance in cash and cash equivalents.

The final calendar quarter of 2014 was marked by continued gains in the major indices on continued signs of strength in the U.S. economy as well as solid third quarter earnings. However, the new year brought renewed volatility. Markets tumbled in January 2015 on worries over a continued drop in oil prices, the surge in the U.S. dollar and sluggish international economic activity, particularly in China. Optimism returned, however, for the balance of the first calendar quarter and into the second quarter, with fundamental economic and corporate data supporting indices just shy of record highs.

The Fund’s fiscal first quarter performance was disappointing. Macro events, including the previously mentioned drop in oil prices and foreign exchange rate volatility, clouded the market’s forecast for a number of the Fund’s holdings. Performance in the fiscal second quarter was very strong on both an absolute and relative basis, but not enough to entirely offset the fiscal first quarter shortfall. The Fund’s investments outperformed in the second half of the period as their earnings exhibited signs of operational strength in a more stable macro environment.

For the six month period ended April 30, 2015, the Fund’s exposure to the rapid decline in oil prices was painful on an absolute and relative basis. Direct energy sector holdings declined about 17% during the period, detracting from the absolute return by about 115 basis points, but only slightly underperforming the energy component of the Russell 2500. However, the tangential exposure in the portfolio to energy was material and the resulting consequences unanticipated. A number of the Fund’s holdings in the industrials sector experienced declines related to energy prices owing to end market exposure. These included Dover Corporation, WESCO International, Civeo Corp, Harsco Corporation and MRC Global Inc. Combined these accounted for about a 70 basis point absolute negative return and, close to 130 basis points of relative underperformance.

During the period, the market, as defined by the Russell 2500, also continued to favor health care and high tech over basic industry. As always, sector weighting remains a by-product of our company by company investment approach. However, the Fund had no exposure to health care, which was the strongest component of the Russell 2500, contributing nearly 185 basis points to its return. In contrast, we had strong performance in the consumer discretionary and information technology sectors. The Fund’s holdings in these sectors experienced aggregate gains of about 21% and 14%, respectively. The Fund was overweight in both sectors and they contributed about 250 basis points to the relative performance.

With respect to individual stocks selection, Staples Inc. (consumer discretionary) was the largest contributor to the Fund’s six month performance, followed by EPAM Systems and J2 Global Inc. In contrast, Harsco Corporation (industrials) was the largest detractor, with Oil States International Inc. and Stantec Inc. following.

Sincerely,

| | | | |

| |  | |  |

| | |

J. Dennis Delafield Portfolio Manager | | Vincent Sellecchia Portfolio Manager | | Donald Wang Portfolio Manager |

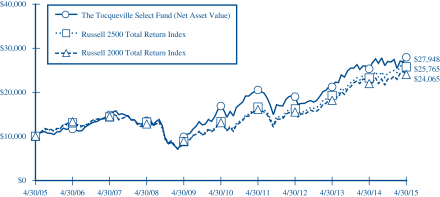

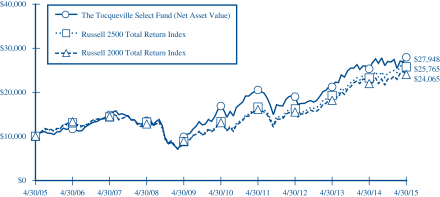

The Tocqueville Select Fund

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 4/30/05. Since The Tocqueville Select Fund did not commence operations until 9/28/09, returns from the period from September 29, 2008 to September 27, 2009 are those of the Class Y Shares of the Predecessor Fund (See Footnote 1 to the Financial Statements). Prior to that period, returns shown are those of a limited partnership managed by the adviser. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2013 the performance of The Tocqueville Select Fund was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Russell 2500 Total Return Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000 Index. Returns include the reinvestment of all dividends.

The Russell 2000 Total Return Index is an unmanaged index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. Returns include the reinvestment of all dividends.

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2015

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

The Tocqueville Select Fund | | | 10.51% | | | | 13.82% | | | | 10.60% | | | | 10.82% | |

Russell 2500 Total Return Index | | | 10.70% | | | | 16.73% | | | | 14.01% | | | | 9.93% | |

Russell 2000 Total Return Index | | | 9.71% | | | | 15.87% | | | | 12.73% | | | | 9.18% | |

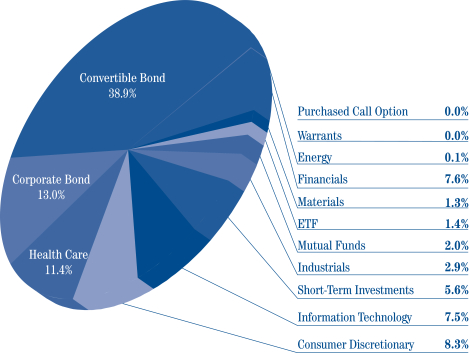

The Tocqueville Alternative Strategies Fund

Over the six month period ending April 30, 2015, the Fund generated a total return of 4.23% versus a total return of 4.40% for the S&P 500 and a 0.49% gain for the Hedge Fund Research North America Index (HFRXNA).

Of the 423 basis points (or 4.23%) the Fund gained in the period, Amazon (AMZN), a long equity trade and the Fund’s largest equity holding, accounted for 133 basis points of positive performance. We have a high degree of confidence that Amazon’s management will continue to achieve growth rates above its peer group and we are excited about the investments they continue to redeploy in their new business segments, most notably, Amazon Web Services (AWS).

The Fund did hold a handful of poorly performing positions, including Freeport McMoRan Copper (“FCX”), whose ill-timed acquisition of Plains Exploration & Production put stress on the balance sheet ahead of steep commodity price declines that reduced future cash flow outlook. As a result, FCX significantly reduced its dividend and is seeking to sell some non-core assets to reduce leverage. Consequently, we have closed our position.

The Fund’s four main strategy classifications, Convertible Arbitrage, Fixed Income, Special Situations and Long Equity contributed approximately +47 basis points, -22 basis points, +243 basis points and +269 basis points, respectively. In addition, the portfolio gave up approximately 114 basis points in its portfolio hedges, primarily as a result of index hedges that hurt the portfolio as stock markets performed well.

We have been actively integrating Tocqueville research ideas into our long only and hedged investments since June 2014. In the last few months, we have continued to add exposure to health care equity names (including biotech) and we have added a number of diversified convertible bond positions, both hedged and unhedged. Over the coming months, we expect interest rates to rise, although quite slowly, thanks to a cautious Federal Reserve, even though we believe rates should already be higher. As a result, our team has been fairly aggressive about hedging the interest rate exposure in the portfolio.

The portfolio remains only minimally exposed to energy companies. Although we have been looking for an entry point to increase the Fund’s exposure to energy, most market participants’ view on oil appears to be too bullish from our perspective, because there is still a glut of oil and because production continues to increase (thanks to productivity improvements) despite the higher cost of capital for U.S. oil companies.

With the depth of Tocqueville research, our idea generation tools, our experienced team and our ability to go anywhere in the capital structure, we believe that we have a sustainable process which will serve us well in any market environment, including today’s. Thank you for investing with us.

Sincerely,

Kenneth Lee

Portfolio Manager

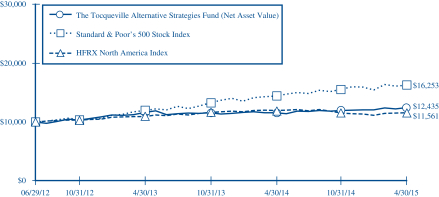

The Tocqueville Alternative Strategies Fund

(Unaudited)

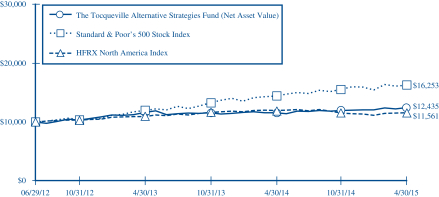

This chart assumes an initial gross investment of $10,000 made on June 29, 2012. Since the Tocqueville Alternative Strategies Fund did not commence operations until June 30, 2014, returns prior to that date are those of the Predecessor Fund (See Footnote 1 to the Financial Statements). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held for 90 days or less.

The Standard & Poor’s 500 Stock Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends.

The HFRX North America Index is designed to reflect the performance of the North American region of the hedge fund universe. Regional Investment Focus is designed to reflect the primary focus of the Fund’s strategic exposure, over various market cycles, independent of the investment manager’s physical location or the domiciled registration location of the fund. Fund investing in North America typically have greater than 50% exposure in North America. Returns include the reinvestment of all dividends

AVERAGE ANNUAL RATE OF RETURN (%)

FOR PERIODS ENDED APRIL 30, 2015

| | | | | | | | |

| | | 1 Year | | | Inception(1) | |

The Tocqueville Alternative Strategies Fund | | | 7.38% | | | | 7.99% | |

Standard & Poor’s 500 Stock Index | | | 12.98% | | | | 18.68% | |

HFRX North America Index | | | -3.34% | | | | 5.25% | |

| (1) | Inception of the Predecessor Fund was June 29, 2012. |

Expense Example—April 30, 2015 (Unaudited)

As a shareholder of The Tocqueville Trust (the “Funds”), you incur ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (November 1, 2014-April 30, 2015).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Example Tables (Unaudited)

| | | | | | | | | | | | |

| The Tocqueville Fund | | Beginning

Account Value

November 1, 2014 | | | Ending

Account Value

April 30, 2015 | | | Expenses Paid

During Period*

November 1, 2014 -

April 30, 2015 | |

Actual | | $ | 1,000.00 | | | $ | 1,033.10 | | | $ | 6.30 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.60 | | | | 6.26 | |

| | | |

| The Tocqueville Opportunity Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,129.90 | | | $ | 6.87 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.35 | | | | 6.51 | |

| | | |

| The Tocqueville International Value Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,116.30 | | | $ | 6.56 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.60 | | | | 6.26 | |

| | | |

| The Tocqueville Gold Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,066.50 | | | $ | 7.12 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.90 | | | | 6.95 | |

| | | |

| The Delafield Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,005.60 | | | $ | 6.17 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.65 | | | | 6.21 | |

| | | |

| The Tocqueville Select Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,035.40 | | | $ | 6.76 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,018.15 | | | | 6.71 | |

| | | |

| The Tocqueville Alternative Strategies Fund | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,042.30 | | | $ | 14.53 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,010.56 | | | | 14.31 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio (including interest expense and dividends and interest expense on short sales) of 1.25%, 1.30%, 1.25%, 1.39%, 1.24%, 1.34%, 2.87% for The Tocqueville Fund, Opportunity Fund, International Value Fund, Gold Fund, Delafield Fund, Select Fund, and Alternative Strategies Fund respectively, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

The Tocqueville Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance

(For a share outstanding throughout

the period) | | Six Months

Ended

April 30,

2015 | | | Years Ended October 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 34.18 | | | $ | 30.67 | | | $ | 24.11 | | | $ | 22.23 | | | $ | 21.53 | | | $ | 18.47 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.13 | | | | 0.28 | | | | 0.40 | | | | 0.40 | | | | 0.23 | | | | 0.32 | |

Net realized and unrealized gain | | | 0.97 | | | | 3.78 | | | | 6.51 | | | | 1.81 | | | | 0.80 | | | | 2.97 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations* | | | 1.10 | | | | 4.06 | | | | 6.91 | | | | 2.21 | | | | 1.03 | | | | 3.29 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.25 | ) | | | (0.30 | ) | | | (0.35 | ) | | | (0.33 | ) | | | (0.33 | ) | | | (0.23 | ) |

Distributions from net realized gains | | | (1.20 | ) | | | (0.25 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.45 | ) | | | (0.55 | ) | | | (0.35 | ) | | | (0.33 | ) | | | (0.33 | ) | | | (0.23 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | (0.35 | ) | | | 3.51 | | | | 6.56 | | | | 1.88 | | | | 0.70 | | | | 3.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 33.83 | | | $ | 34.18 | | | $ | 30.67 | | | $ | 24.11 | | | $ | 22.23 | | | $ | 21.53 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 3.3 | %(4) | | | 13.4 | % | | | 29.0 | % | | | 10.1 | % | | | 4.8 | % | | | 18.0 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 375,992 | | | $ | 380,561 | | | $ | 348,269 | | | $ | 366,025 | | | $ | 491,541 | | | $ | 489,670 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense before waiver/reimbursement | | | 1.25 | %(5) | | | 1.25 | % | | | 1.28 | % | | | 1.29 | % | | | 1.26 | % | | | 1.26 | % |

Expense after waiver/reimbursement | | | 1.25 | %(5) | | | 1.24 | % | | | 1.26 | %(3) | | | 1.26 | %(3) | | | 1.25 | % | | | 1.25 | % |

Net investment income before waiver/reimbursement | | | 0.74 | %(5) | | | 0.84 | % | | | 1.33 | % | | | 1.30 | % | | | 0.97 | % | | | 1.65 | % |

Net investment income after waiver/reimbursement | | | 0.74 | %(5) | | | 0.85 | % | | | 1.35 | % | | | 1.33 | % | | | 0.98 | % | | | 1.66 | % |

Portfolio turnover rate | | | 7 | %(4) | | | 19 | % | | | 16 | % | | | 17 | % | | | 28 | % | | | 23 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01 |

| (3) | Includes 0.01% of interest expense which is not included in the Fund’s operating expense cap. |

The Accompanying Footnotes are an Integral Part of these Financial Statements.

The Tocqueville Opportunity Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding throughout

the period) | | Six Months

Ended

April 30,

2015 | | | Years Ended October 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 22.78 | | | $ | 21.29 | | | $ | 15.76 | | | $ | 14.96 | | | $ | 13.20 | | | $ | 10.78 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.08 | ) | | | (0.22 | ) | | | (0.13 | ) | | | (0.11 | ) | | | (0.13 | ) | | | (0.12 | ) |

Net realized and unrealized gain | | | 2.68 | | | | 2.80 | | | | 5.66 | | | | 0.91 | | | | 1.89 | | | | 2.54 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations* | | | 2.60 | | | | 2.58 | | | | 5.53 | | | | 0.80 | | | | 1.76 | | | | 2.42 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | (3.20 | ) | | | (1.09 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (3.20 | ) | | | (1.09 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | (0.60 | ) | | | 1.49 | | | | 5.53 | | | | 0.80 | | | | 1.76 | | | | 2.42 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 22.18 | | | $ | 22.78 | | | $ | 21.29 | | | $ | 15.76 | | | $ | 14.96 | | | $ | 13.20 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) |

Total Return | | | 13.0 | %(3) | | | 12.6 | % | | | 35.1 | % | | | 5.4 | % | | | 13.3 | % | | | 22.6 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 102,603 | | | $ | 80,324 | | | $ | 80,609 | | | $ | 65,455 | | | $ | 46,963 | | | $ | 32,863 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.30 | %(4) | | | 1.30 | % | | | 1.30 | % | | | 1.32 | % | | | 1.36 | % | | | 1.41 | % |

Net investment loss | | | (0.91 | )%(4) | | | (0.90 | )% | | | (0.64 | )% | | | (0.76 | )% | | | (1.04 | )% | | | (1.08 | )% |

Portfolio turnover rate | | | 50 | %(3) | | | 92 | % | | | 100 | % | | | 77 | % | | | 110 | % | | | 104 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01 |

The Accompanying Footnotes are an Integral Part of these Financial Statements.

The Tocqueville International Value Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding throughout

the period) | | Six Months

Ended

April 30,

2015 | | | Years Ended October 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 14.48 | | | $ | 14.71 | | | $ | 11.68 | | | $ | 12.00 | | | $ | 12.12 | | | $ | 10.48 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (1) | | | 0.06 | | | | 0.15 | | | | 0.24 | | | | 0.17 | | | | 0.11 | | | | 0.11 | |

Net realized and unrealized gain (loss) | | | 1.50 | | | | (0.15 | ) | | | 2.97 | | | | (0.37 | ) | | | (0.16 | ) | | | 1.65 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations* | | | 1.56 | | | | — | | | | 3.21 | | | | (0.20 | ) | | | (0.05 | ) | | | 1.76 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.32 | ) | | | (0.23 | ) | | | (0.18 | ) | | | (0.12 | ) | | | (0.07 | ) | | | (0.12 | ) |

Distributions from net realized gains | | | (0.52 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.84 | ) | | | (0.23 | ) | | | (0.18 | ) | | | (0.12 | ) | | | (0.07 | ) | | | (0.12 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 0.72 | | | | (0.23 | ) | | | 3.03 | | | | (0.32 | ) | | | (0.12 | ) | | | 1.64 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 15.20 | | | $ | 14.48 | | | $ | 14.71 | | | $ | 11.68 | | | $ | 12.00 | | | $ | 12.12 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.01 | | | | 0.00 | (2) |

Total Return | | | 11.6 | %(4) | | | (0.0 | )% | | | 27.8 | % | | | (1.6 | )% | | | (0.5 | )% | | | 17.0 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 264,060 | | | $ | 237,051 | | | $ | 262,981 | | | $ | 218,793 | | | $ | 199,848 | | | $ | 150,103 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense before waiver/reimbursement | | | 1.56 | %(5) | | | 1.54 | % | | | 1.55 | % | | | 1.56 | % | | | 1.56 | % | | | 1.56 | % |

Expense after waiver/reimbursement | | | 1.25 | %(5) | | | 1.25 | % | | | 1.30 | %(3) | | | 1.56 | % | | | 1.56 | % | | | 1.56 | % |

Net investment income before waiver/reimbursement | | | 0.44 | %(5) | | | 0.62 | % | | | 1.55 | % | | | 1.53 | % | | | 0.99 | % | | | 1.03 | % |

Net investment income after waiver/reimbursement | | | 0.75 | %(5) | | | 0.91 | % | | | 1.80 | %(3) | | | 1.53 | % | | | 0.99 | % | | | 1.03 | % |

Portfolio turnover rate | | | 26 | %(4) | | | 31 | % | | | 37 | % | | | 38 | % | | | 30 | % | | | 27 | % |

| (1) | Net investment income per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01 |

| (3) | Expense cap of 1.25% was implemented on January 1, 2013. |

The Accompanying Footnotes are an Integral Part of these Financial Statements.

The Tocqueville Gold Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2015 | | | Years Ended October 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 30.38 | | | $ | 38.01 | | | $ | 72.82 | | | $ | 81.97 | | | $ | 82.00 | | | $ | 49.71 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.11 | ) | | | (0.08 | ) | | | (0.26 | ) | | | (0.35 | ) | | | (0.67 | ) | | | (0.58 | ) |

Net realized and unrealized gain (loss) | | | 2.13 | | | | (7.55 | ) | | | (32.93 | ) | | | (7.47 | ) | | | 2.25 | | | | 32.96 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations* | | | 2.02 | | | | (7.63 | ) | | | (33.19 | ) | | | (7.82 | ) | | | 1.58 | | | | 32.38 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | — | | | | — | | | | (1.62 | ) | | | (1.33 | ) | | | (1.61 | ) | | | (0.09 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | — | | | | (1.62 | ) | | | (1.33 | ) | | | (1.61 | ) | | | (0.09 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 2.02 | | | | (7.63 | ) | | | (34.81 | ) | | | (9.15 | ) | | | (0.03 | ) | | | 32.29 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 32.40 | | | $ | 30.38 | | | $ | 38.01 | | | $ | 72.82 | | | $ | 81.97 | | | $ | 82.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | 0.00 | (2) | | | 0.02 | | | | 0.02 | | | | 0.02 | | | | 0.10 | | | | 0.06 | |

Total Return | | | 6.7 | %(3) | | | (20.1 | )% | | | (46.4 | )% | | | (9.5 | )% | | | 1.8 | % | | | 65.2 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 1,235,076 | | | $ | 1,138,557 | | | $ | 1,215,081 | | | $ | 2,445,913 | | | $ | 2,647,078 | | | $ | 2,199,603 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.39 | %(4) | | | 1.36 | % | | | 1.34 | % | | | 1.28 | % | | | 1.25 | % | | | 1.34 | % |

Net investment loss | | | (0.73 | )%(4) | | | (0.78 | )% | | | (0.41 | )% | | | (0.56 | )% | | | (0.86 | )% | | | (1.11 | )% |

Portfolio turnover rate | | | 4 | %(3) | | | 10 | % | | | 14 | % | | | 11 | % | | | 3 | % | | | 9 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01 |

The Accompanying Footnotes are an Integral Part of these Financial Statements.

The Delafield Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding

throughout the period) | | Six Months

Ended

April 30,

2015 | | | Years Ended October 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 36.40 | | | $ | 37.13 | | | $ | 29.79 | | | $ | 27.21 | | | $ | 26.65 | | | $ | 21.35 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.07 | ) | | | (0.10 | ) | | | (0.05 | ) | | | (0.04 | ) | | | (0.08 | ) | | | (0.00 | )(2) |

Net realized and unrealized gain | | | 0.13 | | | | 0.70 | | | | 9.19 | | | | 2.99 | | | | 0.64 | | | | 5.32 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 0.06 | | | | 0.60 | | | | 9.14 | | | | 2.95 | | | | 0.56 | | | | 5.32 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Distributions from net realized gains | | | (3.63 | ) | | | (1.33 | ) | | | (1.80 | ) | | | (0.37 | ) | | | — | | | | — | |

Return of capital | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.02 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (3.63 | ) | | | (1.33 | ) | | | (1.80 | ) | | | (0.37 | ) | | | — | | | | (0.02 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | (3.57 | ) | | | (0.73 | ) | | | 7.34 | | | | 2.58 | | | | 0.56 | | | | 5.30 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 32.83 | | | $ | 36.40 | | | $ | 37.13 | | | $ | 29.79 | | | $ | 27.21 | | | $ | 26.65 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.01 | | | | 0.01 | |

Total Return | | | 0.6 | %(3) | | | 1.6 | % | | | 32.1 | % | | | 11.0 | % | | | 2.1 | % | | | 25.0 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 985,113 | | | $ | 1,475,139 | | | $ | 1,759,341 | | | $ | 1,346,273 | | | $ | 1,262,876 | | | $ | 933,674 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.24 | %(4) | | | 1.21 | % | | | 1.21 | % | | | 1.23 | % | | | 1.23 | % | | | 1.27 | % |

Net investment loss | | | (0.16 | )%(4) | | | (0.24 | )% | | | (0.15 | )% | | | (0.13 | )% | | | (0.30 | )% | | | (0.02 | )% |

Portfolio turnover rate | | | 7 | %(3) | | | 34 | % | | | 34 | % | | | 49 | % | | | 38 | % | | | 30 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01 |

The Accompanying Footnotes are an Integral Part of these Financial Statements.

The Tocqueville Select Fund

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding throughout

the period) | | Six Months

Ended

April 30,

2015 | | | Years Ended October 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 14.90 | | | $ | 15.57 | | | $ | 11.35 | | | $ | 11.06 | | | $ | 11.54 | | | $ | 8.46 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss (1) | | | (0.04 | ) | | | (0.07 | ) | | | (0.06 | ) | | | (0.04 | ) | | | (0.07 | ) | | | (0.03 | ) |

Net realized and unrealized gain | | | 0.47 | | | | 0.94 | | | | 4.79 | | | | 0.44 | | | | 0.12 | | | | 3.12 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations * | | | 0.43 | | | | 0.87 | | | | 4.73 | | | | 0.40 | | | | 0.05 | | | | 3.09 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.01 | ) |

Distributions from net realized gains | | | (1.74 | ) | | | (1.54 | ) | | | (0.51 | ) | | | (0.11 | ) | | | (0.53 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.74 | ) | | | (1.54 | ) | | | (0.51 | ) | | | (0.11 | ) | | | (0.53 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | (1.31 | ) | | | (0.67 | ) | | | 4.22 | | | | 0.29 | | | | (0.48 | ) | | | 3.08 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 13.59 | | | $ | 14.90 | | | $ | 15.57 | | | $ | 11.35 | | | $ | 11.06 | | | $ | 11.54 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.00 | (2) | | | 0.01 | | | | 0.01 | |

Total Return | | | 3.5 | %(3) | | | 6.1 | % | | | 43.2 | % | | | 3.7 | % | | | (0.1 | )% | | | 36.6 | % |

Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 98,477 | | | $ | 108,060 | | | $ | 99,888 | | | $ | 84,549 | | | $ | 71,554 | | | $ | 41,788 | |

Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expense | | | 1.34 | %(4) | | | 1.32 | % | | | 1.34 | % | | | 1.37 | % | | | 1.36 | % | | | 1.38 | % |

Net investment loss | | | (0.62 | )%(4) | | | (0.50 | )% | | | (0.39 | )% | | | (0.36 | )% | | | (0.67 | )% | | | (0.43 | )% |

Portfolio turnover rate | | | 20 | %(3) | | | 32 | % | | | 28 | % | | | 31 | % | | | 28 | % | | | 40 | % |

| (1) | Net investment loss per share is calculated using the ending balance prior to consideration or adjustment for permanent book-to-tax differences. |

| (2) | Represents less than $0.01 |

The Accompanying Footnotes are an Integral Part of these Financial Statements.

The Tocqueville Alternative Strategies Fund

Financial Highlights

| | | | | | | | | | | | | | | | |

Per share operating performance (For a share outstanding throughout the period) | | Six Months

Ended

April 30,

2015 | | | For the Period

January 1, 2014

to

October 31,

2014 | | | For the Period

June 1, 2013

to

December 31,

2013† | | | For the Period

June 29, 2012(3)

to

May 31,

2013† | |

| | | (unaudited) | | | | | | | | | | |

Net asset value, beginning of period | | $ | 27.26 | | | $ | 26.19 | | | $ | 29.06 | | | $ | 25.00 | |

| | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.04 | (1) | | | (0.20 | )(1) | | | (0.15 | )(2) | | | (0.04 | )(2) |

Net realized and unrealized gain (loss) | | | 1.09 | | | | 1.27 | | | | (0.98 | ) | | | 4.75 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.13 | | | | 1.07 | | | | (1.13 | ) | | | 4.71 | |

| | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | (0.11 | ) | | | (0.02 | ) |

Distributions from net realized gains | | | (0.58 | ) | | | — | | | | (1.63 | ) | | | (0.63 | ) |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.58 | ) | | | — | | | | (1.74 | ) | | | (0.65 | ) |

| | | | | | | | | | | | | | | | |

Change in net asset value for the period | | | 0.55 | | | | 1.07 | | | | (2.87 | ) | | | 4.06 | |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 27.81 | | | $ | 27.26 | | | $ | 26.19 | | | $ | 29.06 | |

| | | | | | | | | | | | | | | | |

* Includes redemption fees per share of | | | 0.00 | (4) | | | 0.00 | (4) | | | 0.00 | (4) | | | 0.00 | (4) |