| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

| |

Expires: | | September 30, 2007 |

|

Estimated average burden |

hours per response | | 19.4 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4854

The Oberweis Funds

(Exact name of registrant as specified in charter)

| | |

| 3333 Warrenville Road, Suite 500, Lisle, IL | | 60532 |

|

| (Address of principal executive offices) | | (Zip code) |

| | |

James W. Oberweis The Oberweis Funds 3333 Warrenville Road, Suite 500 Lisle, IL 60532 | | Copy to: James A. Arpaia Vedder, Price, Kaufman, & Kammholz, P.C. 222 North LaSalle Street, Suite 2600 Chicago, IL 60601 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 323-6166

Date of fiscal year end: December 31

Date of reporting period: December 31, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Annual Report to Stockholders Follows.

The

Oberweis

Funds

Annual Report

Audited

December 31, 2005

1-800-245-7311

www.oberweisfunds.com

| | |

| Trustees and Officers | | |

| James D. Oberweis | | Katherine Smith Dedrick |

| Trustee | | Trustee |

| |

| Gary D. McDaniel | | James G. Schmidt |

| Trustee | | Trustee |

| |

| James W. Oberweis | | Patrick B. Joyce |

| President | | Executive Vice President |

| | | Treasurer |

| |

| David I. Covas | | Martin L. Yokosawa |

| Vice President | | Senior Vice President |

| |

| Eric V. Hannemann | | |

| Secretary | | |

Manager and Investment Advisor

Oberweis Asset Management, Inc.

3333 Warrenville Road, Suite 500, Lisle, IL 60532

1-800-323-6166

www.oberweisfunds.com

Distributor

Oberweis Securities, Inc.

3333 Warrenville Road, Suite 500, Lisle, IL 60532

1-630-577-2300

www.oberweisfunds.com

Custodian

UMB Bank, n.a.

928 Grand Blvd., Kansas City, MO 64106

Transfer Agent

UMB Fund Services, Inc.

P.O. Box 711 Milwaukee, WI 53201-0711

1-800-245-7311

Counsel

Vedder, Price, Kaufman & Kammholz, P.C.

222 North LaSalle Street, Chicago, IL 60601

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

One North Wacker Drive, Chicago, IL 60606

The Oberweis Funds

Emerging Growth Fund

Micro-Cap Fund

Mid-Cap Fund

China Opportunities Fund

1-800-245-7311

www.oberweisfunds.com

PRESIDENT’S LETTER

Dear Fellow Oberweis Funds Shareholder:

I am pleased to report another year of positive returns for The Oberweis Funds. Among the U.S. funds, the Oberweis Micro-Cap Fund appreciated +12.72%, the Emerging Growth Fund appreciated +2.74%, and the Mid-Cap Fund appreciated +4.85%. In the same period, the Russell 2000 Growth Index returned +4.15%. As you may recall, we started a new fund in 2005. The China Opportunities Fund commenced operations on October 1, 2005. In its first quarter, this new fund appreciated +7.80%. For comparison, the MSCI China Index, in U.S. dollar terms, returned -0.36% in the final quarter of the year.

2005 will surely be remembered for its unpredictable events. Commodities, oil, and gold prices surged amid continued geopolitical uncertainties, increased demand in Asia, and supply disruptions associated with natural disasters in the U.S. The price of gold reached $544.50 an ounce on December 12th, a record high since 1983, while oil went to a record of more than $70/barrel. Hurricane Katrina wreaked havoc with the lives of many in New Orleans and the Mississippi Delta. In addition to costing Americans an estimated $200 billion for reconstruction, the hurricane fueled higher energy prices due to constriction of supply and refining capacity. Yet even in the face of adverse developments, global equity markets still eked out gains for the year, in part due to reasonable valuations and modest expectations going into the year.

Although many macroeconomic events are difficult to predict, we believe there remains an opportunity to achieve above-average returns through prudent individual stock selection. Our investment strategy remains steadfast in each of the four funds. We strive to identify companies which have exceptionally high growth potential, are not widely followed by institutional investors, and can be purchased at low valuations in relation to their expected rates of growth. With respect to the current valuation of the U.S. funds, the average forward P/E ratio as of year-end was 24.1 times for the Micro-Cap Fund, 23.6 times for the Emerging Growth Fund, and 24.6 times for the Mid-Cap Fund. Notably, each of the three average P/E ratios is somewhat lower than the comparable ratios listed in last year’s annual report. On a P/E basis, this suggests that the funds may be more attractively priced than at the beginning of 2005. However, stock prices (and therefore P/Es) also reflect investor expectations for future growth; thus lower P/Es may represent either more attractive investment opportunities or more modest expectations for future growth (or a combination of both). The average P/E based on latest twelve months earnings for the China Opportunities Fund was 23.2 times. Note that because many of our investment holdings in China do not have analyst estimates, we compute the average P/E using historical earnings rather than estimated future earnings. Therefore, the average P/E for the China Opportunities Fund is not comparable to the average P/Es of our other funds. (The P/E based on future earnings, for growth stocks, will generally be lower than the P/E based on historical earnings). At year-end, the weighted-average market cap for the Micro-Cap, Emerging Growth, Mid-Cap and China Opportunities Funds was $336 million, $853 million, $2.0 billion, and $983 million, respectively.

Although the Micro-Cap Fund is currently closed to new shareholders, the Emerging Growth Fund, Mid-Cap Fund, and China Opportunities Fund remain open. Shares may be purchased either directly through The Oberweis Funds or through one of our many brokerage firm partners. If you have any questions about your account, please call our shareholder services representatives at (800) 245-7311. You may also download a prospectus and purchase shares online at www.oberweisfunds.com. Thank you for investing with us in The Oberweis Funds.

Sincerely,

James W. Oberweis

President & Portfolio Manager

1

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION ON FUND PERFORMANCE

For the annual period ending December 31, 2005, The Oberweis Micro-Cap Fund appreciated +12.72% and the Emerging Growth Fund appreciated +2.74%. For comparison, the benchmark Russell 2000 Growth Index appreciated +4.15%. The Oberweis Mid-Cap Fund appreciated +4.85%. The Russell 2500 Growth Index appreciated +8.11%. The Oberweis China Opportunities Fund returned +7.80% since its inception on October 1, 2005 versus -0.36% for its benchmark, the MSCI China Index.

Three of the four Oberweis Funds invest primarily in United States stocks, namely Micro-Cap, Emerging Growth, and Mid-Cap. These three funds are positioned to take advantage of the long-term price appreciation that occurs when the market places an appropriately high value on fast growing, profitable companies primarily located in the United States. The China Opportunities Fund is positioned to take advantage of the long-term price appreciation that occurs when the market places an appropriately high value on China-related fast-growing, profitable companies.

In 2005, the U.S. small-cap equity market delivered modest results overall, with the Russell 2000 Index rising 4.55%. Large-cap equities slightly outperformed small-cap equities, with the S&P 500 Index rising 4.91% and the Russell 1000 appreciating 6.27%. Within the small-cap marketplace, value once again edged out growth for the year, with the Russell 2000 Value Index gaining 4.71% and the Russell 2000 Growth Index gaining 4.15%. Commodities, oil, and gold prices surged amid continued geopolitical uncertainties, increased demand in Asia, and supply disruptions associated with natural disasters in the U.S.

By all metrics, the Micro-Cap Fund experienced strong performance in 2005, finishing the year with a significantly better return than its benchmark, the Russell 2000 Growth Index. The Emerging Growth Fund and Mid-Cap Funds trailed their benchmark indices returns for the year (Russell 2000 Growth Index and Russell 2500 Growth Index, respectively), primarily due to significant weights in technology in the first quarter. Both the Emerging Growth and Mid-Cap funds performed well in the final nine months of the year, although the gains achieved in the final nine months did not lead to excess returns over the benchmark for the year. The China Opportunities Fund, in its first and only quarter, experienced exceptionally favorable gains and significantly exceeded the return of its benchmark, the MSCI China Index.

The Micro-Cap Fund particularly benefited from investments in Somanetics Corp., Quality Systems Inc., GMX Resources, Barrett Business Services, and Viropharma Inc. The Emerging Growth Fund derived significant gains from investments in aQuantive Inc., LCA-Vision Inc., Hansen Natural Corp., Carrizo Oil, and Focus Media Holdings LTD. The Mid-Cap Fund particularly benefited from investments in Intuitive Surgical Inc., Celgene Corp., Focus Media Holdings LTD, Ultra Petroleum Corp., and Akamai Technologies. The China Opportunities Fund benefited from investments in Bodisen Biotech, Raffles Education, Century Sunshine Ecological, Prime Success, and Fuji Food and Catering Services. The portfolio turnover rates were 76% rate for the Micro-Cap Fund, 75% for the Emerging Growth Fund, 119% for the Mid-Cap Fund, and 14% for the China Opportunities Fund. The net expense ratios of the four funds were 1.70% for Micro-Cap, 1.42% for Emerging Growth, 2.00% for Mid-Cap, and 2.49% for China Opportunities.

2

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION ON FUND PERFORMANCE

(cont’d.)

The SEC adopted a requirement that Funds present their portfolio holdings in a table, chart or graph format in their annual and semi-annual reports to shareholders, whether or not a schedule of investments is utilized. The following tables, which present portfolio holdings as a percentage of net assets, are provided in compliance with this requirement.

Oberweis Emerging Growth Fund

| | | |

| Asset Allocation | | | |

| Common Stocks | | 99.0% | |

| Commercial Paper | | 1.7% | |

| Other Liabilities in excess of Assets | | (0.7% | ) |

| | |

|

|

| | | 100.0% | |

| | |

| Top Holdings | | |

| Ceradyne, Inc. | | 3.5% |

| Focus Media Hldg. Ltd. | | 3.1% |

| Kos Pharmaceuticals, Inc. | | 2.7% |

| aQuantive, Inc. | | 2.5% |

| Carrizo Oil & Gas, Inc. | | 2.3% |

| Euronet Worldwide, Inc. | | 2.1% |

| LifeCell Corp. | | 2.1% |

| A.S.V., Inc. | | 2.0% |

| Trident Microsystems, Inc. | | 2.0% |

| United Therapeutics Corp. | | 1.9% |

| Other Holdings | | 75.8% |

| | |

|

| | | 100.0% |

| | |

| Top Industries | | |

| Technology - Computer Services Software & Systems | | 12.0% |

| Healthcare - Drugs & Pharmaceuticals | | 9.3% |

| Consumer Discretionary - Advertising Agency | | 8.3% |

| Healthcare - Medical & Dental Services | | 7.8% |

| Other Energy - Oil Crude Producer | | 7.2% |

| Technology - Communication Technology | | 5.6% |

| Technology - Computer Technology | | 5.1% |

| Materials & Production - Misc. Materials & Commodities | | 4.1% |

| Healthcare - Biotechnology | | 3.5% |

| Healthcare - Electronic Medical Systems | | 2.8% |

| Other Industries | | 34.3% |

| | |

|

| | | 100.0% |

Oberweis Micro-Cap Fund

| | | |

| Asset Allocation | | | |

| Common Stocks | | 93.8% | |

| Commercial Paper | | 8.3% | |

| Other Liabilities in excess of Assets | | (2.1% | ) |

| | |

|

|

| | | 100.0% | |

| | |

| Top Holdings | | |

| Somanetics Corp. | | 3.9% |

| Palomar Medical Technologies, Inc. | | 3.7% |

| I.D. Systems, Inc. | | 3.3% |

| GMX Resources, Inc. | | 2.5% |

| Vasco Data Security International, Inc. | | 2.5% |

| Health Grades, Inc. | | 2.5% |

| Quality Systems, Inc. | | 2.4% |

| Barrett Business Services, Inc. | | 2.4% |

| Aldila, Inc. | | 2.3% |

| Merge Technologies, Inc. | | 2.1% |

| Other Holdings | | 72.4% |

| | |

|

| | | 100.0% |

| | |

| Top Industries | | |

| Technology - Computer Service Software & System | | 13.4% |

| Other Energy - Oil Crude Producer | | 8.0% |

| Health Care - Electronic Medical Systems | | 7.5% |

| Technology - Computer Technology | | 5.8% |

| Consumer Discretionary - Misc. | | 5.4% |

| Health Care - Medical & Dental | | 5.3% |

| Health Care - Facilities | | 5.3% |

| Producer Durables - Electronics | | 4.7% |

| Consumer Discretionary - Service Commercial | | 4.6% |

| Consumer Discretionary - Wholesale | | 3.8% |

| Other Industries | | 36.2% |

| | |

|

| | | 100.0% |

3

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION ON FUND PERFORMANCE

(cont’d.)

Oberweis Mid-Cap Fund

| | |

| Asset Allocation | | |

| Common Stocks | | 98.9% |

| Other Assets in excess of Liabilities | | 1.1% |

| | |

|

| | | 100.0% |

| | |

| Top Holdings | | |

| Focus Media Hldg. Ltd. | | 4.4% |

| Intuitive Surgical, Inc. | | 3.2% |

| Ceradyne, Inc. | | 3.2% |

| Trident Microsystems, Inc. | | 3.0% |

| Irobot Corp. | | 2.9% |

| A.S.V., Inc. | | 2.7% |

| Kos Pharmaceuticals, Inc. | | 2.7% |

| HealthExtras, Inc. | | 2.5% |

| Helmerich & Payne | | 2.5% |

| Ultra Petroleum Corp. | | 2.3% |

| Other Holdings | | 70.6% |

| | |

|

| | | 100.0% |

| | |

| Top Industries | | |

| Technology - Computer Service Software & Systems | | 11.6% |

| Technology - Computer Technology | | 7.6% |

| Other Energy - Machine Oilwell | | 7.6% |

| Consumer Discretionary - Advertising Agency | | 6.9% |

| Healthcare - Drugs & Pharmaceuticals | | 6.0% |

| Other Energy Crude Oil Producer | | 4.9% |

| Healthcare - Biotech Research & Production | | 4.8% |

Healthcare - Medical & Dental

Instruments / Supplies | | 4.4% |

| Consumer Discretionary - Retail | | 4.4% |

| Producer Durables - Machinery Construction | | 4.3% |

| Other Industries | | 37.5% |

| | |

|

| | | 100.0% |

Oberweis China Opportunities Fund

| | |

| Asset Allocation | | |

| Common Stocks | | 97.7% |

| Other Assets in excess of Liabilities | | 2.3% |

| | |

|

| | | 100.0% |

| | |

| Top Holdings | | |

Century Sunshine Ecological

Technology Ltd. | | 4.7% |

| Lee & Man Paper Manufacturing Ltd. | | 4.5% |

| Focus Media Hldg. Ltd. ADR | | 4.5% |

| Li Ning Co., Ltd. | | 4.2% |

| Raffles Education Corp. Ltd. | | 4.0% |

Fu Ji Food & Catering Services

Holding Ltd. | | 3.9% |

| AsiaPharma Group Ltd. | | 3.2% |

| Pearl Energy Ltd. | | 3.1% |

| Golden Meditech Co., Ltd. | | 3.1% |

| Guangzhou R&F Properties Co., Ltd. | | 2.8% |

| Other Holdings | | 62.0% |

| | |

|

| | | 100.0% |

| | |

| Top Industries | | |

Financials - Real Estate

Operations / Development | | 6.3% |

Consumer Non-Cyclical - Food

Misc / Diversified | | 5.0% |

| Basic Materials - Agriculture Chemicals | | 4.7% |

| Communications - Advertising Sales | | 4.4% |

| Basic Materials - Paper & Related Products | | 4.4% |

| Consumer Cyclical - Leisure and Recreational Products | | 4.2% |

| Consumer Non-Cyclical - Schools | | 3.9% |

| Communications - Web Portals/ISP | | 3.3% |

| Consumer Non-Cyclical - Medical Drugs | | 3.1% |

| Energy - Oil Comp-Exploration & Production | | 3.1% |

| Other Industries | | 57.6% |

| | |

|

| | | 100.0% |

4

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

(cont’d.)

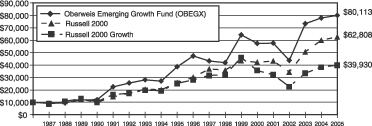

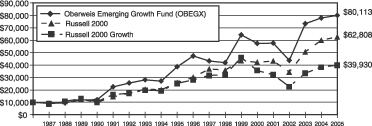

Average Annual Total Returns(1)

Periods ended 12/31/05

| | | | | | | | |

| | | One

Year | | Five

Years | | Ten

Years | | Since

Inception

1/7/87 |

| | |

|

OBEGX | | +2.74% | | +6.87% | | +7.54% | | +11.58% |

Russell 2000 Growth | | +4.15% | | +2.28% | | +4.69% | | +7.56% |

Russell 2000 | | +4.55% | | +8.22% | | +9.26% | | +10.16% |

Growth of an Assumed $10,000 Investment

from January 7, 1987 to December 31, 2005

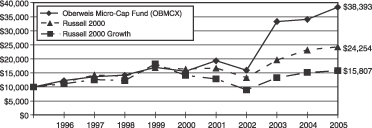

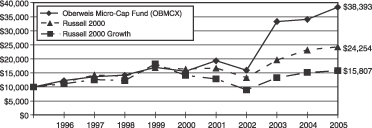

Average Annual Total Returns(1)

Periods ended 12/31/05

| | | | | | | | |

| | | One Year | | Five

Years | | Ten

Years | | Since

Inception

1/1/96 |

| | |

|

OBMCX | | +12.72% | | +19.75% | | +14.40% | | +14.40% |

Russell 2000 Growth | | +4.15% | | +2.28% | | +4.69% | | +4.69% |

Russell 2000 | | +4.55% | | +8.22% | | +9.26% | | +9.26% |

Growth of an Assumed $10,000 Investment

from January 1, 1996 to December 31, 2005

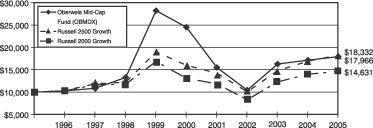

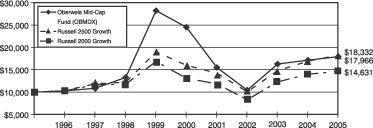

Average Annual Total Returns(1)

Periods ended 12/31/05

| | | | | | |

| | | One

Year | | Five

Years | | Since

Inception

9/15/96 |

| | |

|

OBMDX | | +4.85% | | -6.05% | | +6.51% |

Russell 2500 Growth | | +8.17% | | +2.78% | | +6.73% |

Russell 2000 Growth | | +4.15% | | +2.28% | | +4.18% |

Growth of an Assumed $10,000 Investment

from September 15, 1996 to December 31, 2005

| (1) | | Performance data represents past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting www.oberweisfunds.com. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. There is no guarantee that the portfolios can achieve their objectives. The Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted earnings growth rates. The Russell 2000 Index measures the performance of 2000 companies with small-market capitalizations. The Russell 2500 Growth Index measures the performance of Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values. The Russell indices are unmanaged and are not available for investment. A sales load of 4% was charged on the Oberweis Emerging Growth Fund until December 31, 1991 and is not reflected in the total return figures or graph above. |

5

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

(cont’d.)

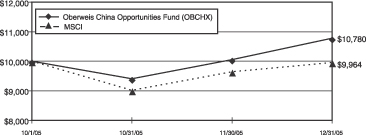

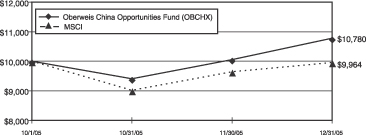

Average Annual Total Returns(1)

Periods ended 12/31/05

| | |

| | | Since

Inception

10/1/05 |

| | |

|

OBCHX | | +7.80% |

MSCI | | -0.36% |

Growth of an Assumed $10,000 Investment

from October 1, 2005 to December 31, 2005

| (1) | | Performance data represents past performance, which is no guarantee of future results. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting www.oberweisfunds.com. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. There is no guarantee that the portfolios can achieve their objectives. |

| | | The MSCI China Index is a free float-adjusted market capitalization-weighted index of Chinese equities that includes Red Chips and H shares listed on the Hong Kong exchange, and B shares listed on the Shanghai and Shenzhen exchanges. Investors cannot invest directly in market indexes. |

6

OBERWEIS EMERGING GROWTH FUND

Portfolio of Investments

December 31, 2005 (value in thousands)

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | COMMON STOCK - 99.0% | | | |

| | | Consumer Discretionary - Advertising

Agency - 8.3% | | | |

| 178,174 | | aQuantive, Inc. @ 25.24 | | $ | 4,497 |

| 166,100 | | Focus Media Hldg. Ltd. @ 33.77 | | | 5,609 |

| 176,600 | | ValueClick, Inc. @ 18.11 | | | 3,198 |

| 81,750 | | Ventiv Health, Inc. @ 23.62 | | | 1,931 |

| | | | |

|

|

| | | | | | 15,235 |

| | | | |

|

|

| | | Consumer Discretionary - Commercial Information Service - 1.0% | | | |

| 109,594 | | Lecg Corp. @ 17.38 | | | 1,905 |

| | | | |

|

|

| | | Consumer Discretionary - Consumer Electronics - 2.8% | | | |

| 101,500 | | iVillage, Inc. @ 8.02 | | | 814 |

| 92,493 | | Jamdat Mobile, Inc. @ 26.58 | | | 2,458 |

| 97,800 | | WebSideStory, Inc. @ 18.13 | | | 1,773 |

| | | | |

|

|

| | | | | | 5,045 |

| | | | |

|

|

| | | Consumer Discretionary - Consumer

Products - 0.7% | | | |

| 36,265 | | USANA Health Sciences, Inc. @ 38.36 | | | 1,391 |

| | | | |

|

|

| | | Consumer Discretionary - Cosmetics - 0.7% | | | |

| 43,782 | | Parlux Fragrances, Inc. @ 30.53 | | | 1,337 |

| | | | |

|

|

| | | Consumer Discretionary - Retail - 2.1% | | | |

| 82,649 | | Stamps.com, Inc. @ 22.96 | | | 1,898 |

| 56,967 | | Volcom, Inc. @ 34.01 | | | 1,937 |

| | | | |

|

|

| | | | | | 3,835 |

| | | | |

|

|

| | | Consumer Discretionary - Service

Commercial - 1.8% | | | |

| 39,265 | | CRA International, Inc. @ 47.69 | | | 1,873 |

| 23,546 | | Ctrip.com International Ltd. @ 57.75 | | | 1,360 |

| | | | |

|

|

| | | | | | 3,233 |

| | | | |

|

|

| | | Consumer Discretionary - Wholesale - 1.7% | | | |

| 76,000 | | Central European Distribution Corp. @ 40.14 | | | 3,051 |

| | | | |

|

|

| | | Financial Services - Banks - 0.4% | | | |

| 19,158 | | *Mercantile Bank Corp. @ 38.50 | | | 738 |

| | | | |

|

|

| | | Financial Services - Diverse - 2.1% | | | |

| 141,968 | | Euronet Worldwide, Inc. @ 27.80 | | | 3,947 |

| | | | |

|

|

| | | Financial Services - Financial Data Product Services - 1.2% | | | |

| 172,400 | | Tradestation Group, Inc. @ 12.38 | | | 2,134 |

| | | | |

|

|

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | Financial Services - Insurance - 1.2% | | | |

| 90,100 | | HealthExtras, Inc. @ 25.10 | | $ | 2,262 |

| | | | |

|

|

| | | Health Care - Biotechnology - 3.5% | | | |

| 124,531 | | Adeza Biomedical Corp. @ 21.05 | | | 2,621 |

| 25,209 | | Anika Therapeutics, Inc. @ 11.69 | | | 295 |

| 73,124 | | ArthroCare Corp. @ 42.14 | | | 3,081 |

| 51,260 | | Vnus Medical Technologies, Inc. @ 8.38 | | | 430 |

| | | | |

|

|

| | | | | | 6,427 |

| | | | |

|

|

| | | Health Care - Drugs &

Pharmaceuticals - 9.3% | | | |

| 82,900 | | Adams Respiratory Therapeutics, Inc. @ 40.66 | | | 3,370 |

| 84,500 | | Aspreva Pharmaceuticals Corp. @ 15.72 | | | 1,328 |

| 83,567 | | First Horizon Pharmaceutical Corp. @ 17.25 | | | 1,442 |

| 94,798 | | Kos Pharmaceuticals, Inc. @ 51.73 | | | 4,904 |

| 72,600 | | Quidel Corp. @ 10.76 | | | 781 |

| 98,669 | | Salix Pharmaceuticals Ltd. @ 17.58 | | | 1,735 |

| 49,991 | | United Therapeutics Corp. @ 69.12 | | | 3,455 |

| | | | |

|

|

| | | | | | 17,015 |

| | | | |

|

|

| | | Health Care - Electronic Medical

Systems - 2.8% | | | |

| 57,871 | | Aspect Medical Systems, Inc. @ 34.35 | | | 1,988 |

| 62,114 | | IntraLase Corp. @ 17.83 | | | 1,107 |

| 63,382 | | Syneron Medical Ltd. @ 31.75 | | | 2,012 |

| | | | |

|

|

| | | | | | 5,107 |

| | | | |

|

|

| | | Health Care - Facilities - 2.8% | | | |

| 39,666 | | American Healthways, Inc. @ 45.25 | | | 1,795 |

| 71,705 | | *LCA-Vision, Inc. @ 47.51 | | | 3,407 |

| | | | |

|

|

| | | | | | 5,202 |

| | | | |

|

|

| | | Health Care - Management Services - 0.5% | | | |

| 36,319 | | Centene Corp. @ 26.29 | | | 955 |

| | | | |

|

|

| | | Health Care - Medical & Dental

Services - 7.8% | | | |

| 33,688 | | American Science & Engineering, Inc. @ 62.37 | | | 2,101 |

| 60,000 | | ICU Medical, Inc. @ 39.21 | | | 2,353 |

| 82,500 | | Kyphon, Inc. @ 40.83 | | | 3,368 |

| 32,200 | | Laserscope, Inc. @ 22.46 | | | 723 |

| 204,614 | | LifeCell Corp. @ 19.04 | | | 3,895 |

| 54,000 | | Palomar Medical Technologies, Inc. @ 35.04 | | | 1,892 |

| | | | |

|

|

| | | | | | 14,332 |

| | | | |

|

|

See accompanying notes to financial statements.

7

OBERWEIS EMERGING GROWTH FUND

Portfolio of Investments (cont’d.)

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | Health Care - Services - 0.5% | | | |

| 53,347 | | LHC Group, Inc. @ 17.43 | | $ | 930 |

| | | | |

|

|

| | | Materials & Production - Misc. Materials & Commodities - 4.1% | | | |

| 147,350 | | Ceradyne, Inc. @ 43.80 | | | 6,454 |

| 58,295 | | Charles & Colvard Ltd. @ 20.20 | | | 1,178 |

| | | | |

|

|

| | | | | | 7,632 |

| | | | |

|

|

| | | Other Energy - Machine Oilwell

Equipment - 2.2% | | | |

| 41,900 | | Dril Quip, Inc. @ 47.20 | | | 1,978 |

| 40,400 | | Lufkin Industries, Inc. @ 49.87 | | | 2,015 |

| | | | |

|

|

| | | | | | 3,993 |

| | | | |

|

|

| | | Other Energy - Misc. - 1.0% | | | |

| 53,675 | | Veritas DGC, Inc. @ 35.49 | | | 1,905 |

| | | | |

|

|

| | | Other Energy - Oil Crude Producer - 7.2% | | | |

| 80,791 | | ATP Oil & Gas Corp. @ 37.01 | | | 2,990 |

| 116,300 | | Bronco Drilling Company, Inc. @ 23.01 | | | 2,676 |

| 174,543 | | Carrizo Oil & Gas, Inc. @ 24.70 | | | 4,311 |

| 68,900 | | Petrohawk Energy Corp. @ 13.22 | | | 911 |

| 50,800 | | Pioneer Drilling Co. @ 17.93 | | | 911 |

| 36,622 | | Whiting Petroleum Corp. @ 40.00 | | | 1,465 |

| | | | |

|

|

| | | | | | 13,264 |

| | | | |

|

|

| | | Producer Durables - Homebuilding - 1.0% | | | |

| 59,455 | | Desarrolladora Homex S.A. Development Corp. @ 30.68 | | | 1,824 |

| | | | |

|

|

| | | Producer Durables - Machinery - Construction - 2.0% | | | |

| 150,026 | | A.S.V., Inc. @ 24.98 | | | 3,748 |

| | | | |

|

|

| | | Producer Durables - Misc. - 2.5% | | | |

| 44,900 | | Bucyrus International, Inc. @ 52.70 | | | 2,366 |

| 154,245 | | Turbochef Technologies, Inc. @ 14.36 | | | 2,215 |

| | | | |

|

|

| | | | | | 4,581 |

| | | | |

|

|

| | | Technology - Communication

Technology - 5.6% | | | |

| 179,270 | | Audicodes Ltd. @ 11.10 | | | 1,990 |

| 43,085 | | Comtech Telecommunications Corp. @ 30.55 | | | 1,316 |

| 409,211 | | Glenayre Technologies, Inc. @ 3.25 | | | 1,330 |

| 104,741 | | Ixia @ 14.80 | | | 1,550 |

| 90,547 | | Orckit Communications Ltd. @ 24.38 | | | 2,208 |

| 43,053 | | Talx Corp. @ 45.71 | | | 1,968 |

| | | | |

|

|

| | | | | | 10,362 |

| | | | |

|

|

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | Technology - Computer Services Software & Systems - 12.0% | | | |

| 54,543 | | Blue Coat Systems, Inc. @ 45.72 | | $ | 2,494 |

| 140,800 | | Concur Technologies, Inc. @ 12.89 | | | 1,815 |

| 98,484 | | Jupitermedia Corp. @ 14.78 | | | 1,456 |

| 90,613 | | Merge Technologies, Inc. @ 25.04 | | | 2,268 |

| 197,862 | | Online Resources, Inc. @ 11.05 | | | 2,186 |

| 143,491 | | Openwave Systems, Inc. @ 17.47 | | | 2,507 |

| 115,135 | | PDF Solutions, Inc. @ 16.25 | | | 1,871 |

| 115,955 | | Rightnow Technologies, Inc. @ 18.46 | | | 2,141 |

| 37,000 | | Retalix Ltd. @ 24.46 | | | 905 |

| 57,382 | | Safenet, Inc. @ 32.22 | | | 1,849 |

| 164,900 | | VASCO Data Security International, Inc. @ 9.86 | | | 1,626 |

| 59,100 | | Zoran Corp. @ 16.21 | | | 958 |

| | | | |

|

|

| | | | | | 22,076 |

| | | | |

|

|

| | | Technology - Computer Technology - 5.1% | | | |

| 57,244 | | M-Systems Flash Disk Pioneers Ltd.@ 33.12 | | | 1,896 |

| 77,000 | | Rackable Systems, Inc. @ 28.48 | | | 2,192 |

| 139,300 | | Silicon Motion Technology Corp. @ 12.00 | | | 1,672 |

| 202,000 | | Trident Microsystems, Inc. @ 18.00 | | | 3,636 |

| | | | |

|

|

| | | | | | 9,396 |

| | | | |

|

|

| | | Technology - Electronics - 0.6% | | | |

| 23,800 | | Supertex, Inc. @ 44.25 | | | 1,053 |

| | | | |

|

|

| | | Technology - Electronics

Semi-Conductors - 2.4% | | | |

| 63,100 | | Ikanos Communications @ 14.74 | | | 930 |

| 66,900 | | Saifun Semiconductor Ltd. @ 31.47 | | | 2,105 |

| 53,203 | | Tessera Technologies, Inc. @ 25.85 | | | 1,375 |

| | | | |

|

|

| | | | | | 4,410 |

| | | | |

|

|

| | | Technology - Electronics Technology - 0.6% | | | |

| 68,900 | | Essex Corp. @ 17.05 | | | 1,175 |

| | | | |

|

|

| | | Technology - Misc. Technology - 1.5% | | | |

| 80,600 | | iRobot Corp. @ 33.33 | | | 2,686 |

| | | | |

|

|

| | | Total Common Stocks

(Cost: $134,888,000) | | $ | 182,186 |

| | | | |

|

|

See accompanying notes to financial statements.

8

OBERWEIS EMERGING GROWTH FUND

Portfolio of Investments (cont’d.)

| | | | | | | |

Face

Amount | | Company (Closing Price) | | Value | |

| | | | | | | | |

| | | | COMMERCIAL PAPER - 1.7% | | | | |

| $ | 3,200,000 | | General Electric Capital Corporation

4.18%, due 01-03-06 | | $ | 3,200 | |

| | | | | |

|

|

|

| | |

| | | | Total Commercial Paper

(Cost: $3,200,000) | | | 3,200 | |

| | | | | |

|

|

|

| | |

| | | | Total Investments - 100.7%

(Cost: $138,088,000) | | | 185,386 | |

| | |

| | | | Other Liabilities less Assets (0.7%) | | | (1,407 | ) |

| | | | | |

|

|

|

| | |

| | | | NET ASSETS - 100% | | $ | 183,979 | |

| | | | | |

|

|

|

Notes to Portfolio of Investments

| * | Income producing security during the year ended December 31, 2005. |

Based on the cost of investments of $138,106,000 for federal income tax purposes at December 31, 2005, the aggregate gross unrealized appreciation was $52,061,000, the aggregate gross unrealized depreciation was $4,781,000 and the net unrealized appreciation of investments was $47,280,000.

See accompanying notes to financial statements.

9

OBERWEIS MICRO-CAP FUND

Portfolio of Investments

December 31, 2005 (value in thousands)

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | COMMON STOCK - 93.8% | | | |

| | | Auto & Transport - Auto Parts - 0.4% | | | |

| 37,600 | | Hoku Scientific, Inc. @ 7.59 | | $ | 285 |

| | | | |

|

|

| | | Consumer Discretionary - Casinos & Gambling - 0.5% | | | |

| 27,788 | | Gaming Partners International Corp. @11.18 | | | 311 |

| | | | |

|

|

| | | Consumer Discretionary - Commercial Information Service - 0.8% | | | |

| 104,800 | | Traffix, Inc. @ 5.12 | | | 537 |

| | | | |

|

|

| | | Consumer Discretionary - Consumer Electronics - 2.9% | | | |

| 27,875 | | Rimage Corp. @ 28.98 | | | 808 |

| 62,731 | | WebSideStory, Inc. @ 18.13 | | | 1,137 |

| | | | |

|

|

| | | | | | 1,945 |

| | | | |

|

|

| | | Consumer Discretionary - Education Services - 0.3% | | | |

| 44,883 | | Competitive Technology, Inc. @ 3.91 | | | 175 |

| | | | |

|

|

| | | Consumer Discretionary - Leisure Time - 2.2% | | | |

| 60,115 | | *Aldila, Inc. @ 25.43 | | | 1,529 |

| | | | |

|

|

| | | Consumer Discretionary - Misc. - 5.4% | | | |

| 65,406 | | Barrett Business Services, Inc. @ 24.99 | | | 1,634 |

| 150,400 | | Home Solutions of America, Inc. @ 4.48 | | | 674 |

| 64,932 | | Kenexa Corp. @ 21.10 | | | 1,370 |

| | | | |

|

|

| | | | | | 3,678 |

| | | | |

|

|

| | | Consumer Discretionary - Retail - 0.2% | | | |

| 11,275 | | Celebrate Express, Inc. @ 13.50 | | | 152 |

| 400 | | Golf Galaxy @ 19.15 | | | 8 |

| | | | |

|

|

| | | | | | 160 |

| | | | |

|

|

| | | Consumer Discretionary - Service

Commercial - 4.6% | | | |

| 97,200 | | Bodisen Biotech, Inc. @ 14.00 | | | 1,361 |

| 115,328 | | eDiets.com @ 6.12 | | | 706 |

| 40,413 | | First Advantage Corp. @ 26.71 | | | 1,079 |

| | | | |

|

|

| | | | | | 3,146 |

| | | | |

|

|

| | | Consumer Discretionary - Wholesale - 3.8% | | | |

| 54,940 | | Allion Healthcare, Inc. @ 11.65 | | | 640 |

| 30,193 | | Central European Distribution Corp. @ 40.14 | | | 1,212 |

| 35,100 | | Infosonics Corp. @ 16.24 | | | 570 |

| 22,394 | | Lazare Kaplan International, Inc. @ 7.87 | | | 176 |

| | | | |

|

|

| | | | | | 2,598 |

| | | | |

|

|

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | Consumer Staples - Foods - 0.5% | | | |

| 60,000 | | Medifast, Inc. @ 5.24 | | $ | 314 |

| | | | |

|

|

| | | Financial Services - Banks - 2.2% | | | |

| 13,135 | | Dearborn Bankcorp, Inc. @ 24.75 | | | 325 |

| 15,162 | | St. Joseph Capital Corp. @ 29.78 | | | 452 |

| 20,400 | | Valley Bancorp, Inc. @ 34.69 | | | 708 |

| | | | |

|

|

| | | | | | 1,485 |

| | | | |

|

|

| | | Financial Services - Financial Data Product Services - 0.9% | | | |

| 89,729 | | Cybersource Corp. @ 6.60 | | | 592 |

| | | | |

|

|

| | | Financial Services - Insurance - 1.2% | | | |

| 33,859 | | HealthExtras, Inc. @ 25.10 | | | 850 |

| | | | |

|

|

| | | Health Care - Biotechnology - 0.4% | | | |

| 24,408 | | Anika Therapeutics, Inc. @ 11.69 | | | 285 |

| | | | |

|

|

| | | Health Care - Drugs &

Pharmaceuticals - 3.0% | | | |

| 50,243 | | Bentley Pharmaceuticals, Inc. @ 16.41 | | | 825 |

| 68,052 | | ViroPharma, Inc. @ 18.50 | | | 1,259 |

| | | | |

|

|

| | | | | | 2,084 |

| | | | |

|

|

| | | Health Care - Electronic Medical

Systems - 7.5% | | | |

| 42,500 | | Criticare Systems, Inc. @ 4.96 | | | 211 |

| 41,240 | | Healthtronics, Inc. @ 7.65 | | | 315 |

| 33,600 | | Q-Med, Inc. @ 9.67 | | | 325 |

| 21,300 | | Quality Systems, Inc. @ 76.76 | | | 1,635 |

| 82,622 | | Somanetics Corp. @ 32.00 | | | 2,644 |

| | | | |

|

|

| | | | | | 5,130 |

| | | | |

|

|

| | | Health Care - Facilities - 5.3% | | | |

| 263,772 | | Health Grades, Inc. @ 6.32 | | | 1,667 |

| 217,211 | | Paincare Holdings, Inc. @ 3.26 | | | 708 |

| 21,337 | | Psychiatric Solutions, Inc. @ 58.74 | | | 1,253 |

| | | | |

|

|

| | | | | | 3,628 |

| | | | |

|

|

| | | Health Care - Management Services - 1.9% | | | |

| 50,389 | | Vital Images, Inc. @ 26.15 | | | 1,318 |

| | | | |

|

|

| | | Health Care - Medical & Dental - 5.3% | | | |

| 191,800 | | Alpha Pro Tech Ltd. @ 2.30 | | | 441 |

| 31,900 | | Intricon Corp. @ 4.11 | | | 131 |

| 71,291 | | Palomar Medical Technologies, Inc. @ 35.04 | | | 2,498 |

| 74,427 | | Vascular Solutions, Inc. @ 7.56 | | | 563 |

| | | | |

|

|

| | | | | | 3,633 |

| | | | |

|

|

See accompanying notes to financial statements.

10

OBERWEIS MICRO-CAP FUND

Portfolio of Investments (cont’d.)

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | Health Care - Misc. - 1.5% | | | |

| 128,200 | | A.D.A.M., INC. @ 8.06 | | $ | 1,033 |

| | | | |

|

|

| | | Materials & Products - Chemicals - 0.1% | | | |

| 19,458 | | Flexible Solutions International, Inc. @ 2.90 | | | 56 |

| | | | |

|

|

| | | Medical Products - Engineering & Contracting Services - 1.8% | | | |

| 29,860 | | *VSE Corp. @ 42.09 | | | 1,257 |

| | | | |

|

|

| | | Other Energy - Oil Crude Producer - 8.0% | | | |

| 31,000 | | Arena Resources, Inc. @ 27.60 | | | 856 |

| 42,090 | | Dawson Geophysical Co. @ 30.82 | | | 1,297 |

| 42,992 | | Edge Petroleum Corp. @ 24.91 | | | 1,071 |

| 47,000 | | GMX Resources, Inc. @ 36.00 | | | 1,692 |

| 132,603 | | Vaalco Energy, Inc. @ 4.24 | | | 562 |

| | | | |

|

|

| | | | | | 5,478 |

| | | | |

|

|

| | | Other Energy - Misc. - 2.2% | | | |

| 106,800 | | ENGlobal Corp. @ 8.42 | | | 899 |

| 33,700 | | Flotek Industries, Inc. @ 18.65 | | | 628 |

| | | | |

|

|

| | | | | | 1,527 |

| | | | |

|

|

| | | Producer Durables - Control & Filter

Devices - 2.3% | | | |

| 33,778 | | Hurco Companies, Inc. @ 30.82 | | | 1,041 |

| 91,400 | | International Displayworks, Inc. @ 5.94 | | | 543 |

| | | | |

|

|

| | | | | | 1,584 |

| | | | |

|

|

| | | Producer Durables - Electronics - 4.7% | | | |

| 93,194 | | I.D. Systems, Inc. @ 23.85 | | | 2,223 |

| 46,421 | | Iris International, Inc. @ 21.86 | | | 1,015 |

| | | | |

|

|

| | | | | | 3,238 |

| | | | |

|

|

| | | Producer Durables - Machinery

Construction - 0.3% | | | |

| 19,800 | | Paragon Technologies, Inc. @ 9.95 | | | 197 |

| | | | |

|

|

| | | Producer Durables - Metal Fabricating - 0.1% | | | |

| 3,400 | | Graham Corp. @ 22.50 | | | 76 |

| | | | |

|

|

| | | Producer Durables - Misc. - 1.7% | | | |

| 13,102 | | Dynamic Materials Corp. @ 30.02 | | | 393 |

| 56,900 | | Fuel Tech N.V. @ 9.07 | | | 516 |

| 58,800 | | Henry Bros Electronics, Inc. @ 4.48 | | | 263 |

| | | | |

|

|

| | | | | | 1,172 |

| | | | |

|

|

| | | Producer Durables -

Telecommunications - 0.1% | | | |

| 7,100 | | Scopus Video Network Ltd. @ 6.00 | | | 43 |

| | | | |

|

|

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | Technology - Communication - 1.9% | | | |

| 16,200 | | Comarco, Inc.@ 9.98 | | $ | 162 |

| 14,900 | | Optelecom, Inc. @ 13.40 | | | 200 |

| 34,000 | | Radyne Corp. @ 14.57 | | | 495 |

| 56,600 | | Relm Wireles Corp. @ 7.31 | | | 414 |

| | | | |

|

|

| | | | | | 1,271 |

| | | | |

|

|

| | | Technology - Computer Service Software & System - 13.2% | | | |

| 100,900 | | Applix, Inc. @ 7.30 | | | 737 |

| 37,666 | | Astea International, Inc. @ 14.17 | | | 534 |

| 86,278 | | Datatrak International, Inc. @ 9.99 | | | 862 |

| 23,500 | | Edgewater Technology, Inc. @ 5.90 | | | 139 |

| 28,400 | | Fundtech Ltd. @ 10.23 | | | 291 |

| 54,718 | | Merge Technologies, Inc. @ 25.04 | | | 1,370 |

| 3,380 | | Moldflow Corp. @ 13.94 | | | 47 |

| 74,131 | | Pacificnet, Inc. @ 6.77 | | | 502 |

| 90,370 | | Perficient, Inc. @ 8.91 | | | 805 |

| 25,968 | | SI International, Inc. @ 30.57 | | | 794 |

| 138,493 | | Youbet.com, Inc. @ 4.73 | | | 655 |

| 169,608 | | Vasco Data Security International, Inc. @ 9.86 | | | 1,671 |

| 59,200 | | Vocus, Inc.@ 10.39 | | | 615 |

| | | | |

|

|

| | | | | | 9,022 |

| | | | |

|

|

| | | Technology - Computer Technology - 5.8% | | | |

| 231,696 | | ACE Communications Corp. @ 3.14 | | | 728 |

| 73,700 | | LanVision System, Inc. @ 5.75 | | | 424 |

| 30,600 | | Neoware Systems, Inc. @ 23.30 | | | 713 |

| 145,992 | | Peerless Systems, Inc. @ 8.43 | | | 1,231 |

| 30,600 | | Rackable Systems, Inc. @ 28.48 | | | 871 |

| | | | |

|

|

| | | | | | 3,967 |

| | | | |

|

|

| | | Technology Electronics - 0.6% | | | |

| 31,500 | | Micronetics, Inc. @ 12.02 | | | 379 |

| | | | |

|

|

| | | Utilities - Utilities Misc. - 0.2% | | | |

| 71,400 | | Hudson Technologies, Inc. @ 1.73 | | | 124 |

| | | | |

|

|

| | |

| | | Total Common Stocks

(Cost $45,994,000) | | $ | 64,107 |

| | | | |

|

|

See accompanying notes to financial statements.

11

OBERWEIS MICRO-CAP FUND

Portfolio of Investments (cont’d.)

| | | | | | | |

Face

Amount | | Company (Closing Price) | | Value | |

| | | | | | | | |

| | | | COMMERCIAL PAPER - 8.3% | | | | |

| $ | 3,300,000 | | American Express 4.00%, due 01-03-06 | | $ | 3,300 | |

| | 300,000 | | GE Capital Corp. 3.88%, due 01-06-06 | | | 300 | |

| | 1,000,000 | | GE Capital Corp. 4.26%, due 01-05-06 | | | 1,000 | |

| | 1,100,000 | | GE Capital Corp. 4.26%, due 01-03-06 | | | 1,100 | |

| | | | | |

|

|

|

| | |

| | | | Total Commercial Paper

(Cost: $5,700,000) | | | 5,700 | |

| | | | | |

|

|

|

| | |

| | | | Total Investments - 102.1%

(Cost: $51,694,000) | | | 69,807 | |

| | |

| | | | Other Liabilities less Assets - (2.1%) | | | (1,452 | ) |

| | | | | |

|

|

|

| | |

| | | | NET ASSETS - 100.0% | | $ | 68,355 | |

| | | | | |

|

|

|

Notes to Portfolio of Investments

| * | Income producing security during the year ended December 31, 2005. |

Based on the cost of investments of $51,698,000 for federal income tax purposes at December 31, 2005, the aggregate gross unrealized appreciation was $20,413,000, the aggregate gross unrealized depreciation was $2,304,000 and the net unrealized appreciation of investments was $18,109,000.

See accompanying notes to financial statements.

12

OBERWEIS MID-CAP FUND

Portfolio of Investments

December 31, 2005 (value in thousands)

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | COMMON STOCKS - 98.8% | | | |

| | | Consumer Discretionary - Advertising

Agency - 6.9% | | | |

| 4,631 | | aQuantive, Inc. @ 25.24 | | $ | 117 |

| 11,500 | | Focus Media Hldg. Ltd. @ 33.77 | | | 388 |

| 5,581 | | ValueClick, Inc. @ 18.11 | | | 101 |

| | | | |

|

|

| | | | | | 606 |

| | | | |

|

|

| | | Consumer Discretionary - Restaurants - 3.7% | | | |

| 2,548 | | Panera Bread Co. @ 65.68 | | | 167 |

| 4,332 | | The Cheesecake Factory, Inc. @ 37.39 | | | 162 |

| | | | |

|

|

| | | | | | 329 |

| | | | |

|

|

| | | Consumer Discretionary - Retail - 4.4% | | | |

| 6,200 | | Coldwater Creek, Inc. @ 30.53 | | | 189 |

| 3,646 | | Urban Outfitters, Inc. @ 25.31 | | | 93 |

| 3,100 | | Volcom, Inc. @ 34.01 | | | 105 |

| | | | |

|

|

| | | | | | 387 |

| | | | |

|

|

| | | Consumer Discretionary - Service

Commercial - 3.0% | | | |

| 2,051 | | Ctrip.com International Ltd. @ 57.75 | | | 118 |

| 3,072 | | CRA International, Inc. @ 47.69 | | | 147 |

| | | | |

|

|

| | | | | | 265 |

| | | | |

|

|

| | | Consumer Discretionary - Wholesale - 2.0% | | | |

| 4,335 | | Central European Distribution Corp. @ 40.14 | | | 174 |

| | | | |

|

|

| | | Financial Services - Diverse Financial

Services - 1.6% | | | |

| 5,061 | | Euronet Worldwide, Inc. @ 27.80 | | | 141 |

| | | | |

|

|

| | | Financial Services - Insurance - 2.5% | | | |

| 8,700 | | HealthExtras, Inc. @ 25.10 | | | 218 |

| | | | |

|

|

| | | Health Care - Biotech Research &

Production - 4.8% | | | |

| 4,574 | | Arthrocare Corp. @ 42.14 | | | 193 |

| 1,794 | | Celgene Corp. @ 64.80 | | | 116 |

| 3,060 | | Integra Lifesciences Holdings Corp. @ 35.46 | | | 109 |

| | | | |

|

|

| | | | | | 418 |

| | | | |

|

|

| | | Health Care - Drugs & Pharmaceuticals - 6.0% | | | |

| 3,156 | | Adams Respiratory Therapeutics, Inc. @ 40.66 | | | 128 |

| 4,508 | | Kos Pharmaceuticals, Inc. @ 51.73 | | | 233 |

| 2,376 | | United Therapeutics Corp. @ 69.12 | | | 164 |

| | | | |

|

|

| | | | | | 525 |

| | | | |

|

|

| | | Health Care - Electrical Medical Systems - 3.2% | | | |

| 2,391 | | Intuitive Surgical, Inc. @ 117.27 | | | 280 |

| | | | |

|

|

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | Health Care - Facilities - 3.7% | | | |

| 1,883 | | American Healthways, Inc.@ 45.25 | | $ | 85 |

| 3,067 | | Lca-vision, Inc. @ 47.51 | | | 146 |

| 1,600 | | Psychiatric Solutions, Inc. @ 58.74 | | | 94 |

| | | | |

|

|

| | | | | | 325 |

| | | | |

|

|

| | | Health Care - Medical & Dental Instruments / Supplies - 4.4% | | | |

| 5,431 | | Cytyc Corp. @ 28.33 | | | 153 |

| 3,681 | | Kyphon, Inc. @ 40.83 | | | 150 |

| 2,136 | | Resmed, Inc. @ 38.31 | | | 82 |

| | | | |

|

|

| | | | | | 385 |

| | | | |

|

|

| | | Material Producer - Misc. Materials & Commodities - 3.2% | | | |

| 6,387 | | Ceradyne, Inc. @ 43.80 | | | 280 |

| | | | |

|

|

| | | Other Energy - Machine Oilwell - 7.5% | | | |

| 2,900 | | Dril-Quip, Inc. @ 47.20 | | | 137 |

| 3,500 | | Helmerich & Payne, Inc. @ 61.91 | | | 217 |

| 2,033 | | Hydril Co. @ 62.60 | | | 127 |

| 3,500 | | Oceaneering International, Inc. @ 49.78 | | | 174 |

| | | | |

|

|

| | | | | | 655 |

| | | | |

|

|

| | | Other Energy - Misc. - 0.9% | | | |

| 2,299 | | Veritas DGC, Inc. @ 35.49 | | | 82 |

| | | | |

|

|

| | | Other Energy - Crude Oil Producer - 4.9% | | | |

| 7,200 | | Petrohawk Energy Corp. @ 13.22 | | | 95 |

| 7,500 | | Pioneer Drilling Co. @ 17.93 | | | 135 |

| 3,671 | | Ultra Petroleum Corp. @ 55.80 | | | 205 |

| | | | |

|

|

| | | | | | 435 |

| | | | |

|

|

| | | Producer Durables - Machinery -

Construction - 4.3% | | | |

| 4,300 | | Astec Industries, Inc. @ 32.66 | | | 140 |

| 9,368 | | A.S.V., Inc. @ 24.98 | | | 234 |

| | | | |

|

|

| | | | | | 374 |

| | | | |

|

|

| | | Producer Durables - Machinery

Industrial - 2.2% | | | |

| 4,833 | | Joy Global, Inc. @ 40.00 | | | 193 |

| | | | |

|

|

| | | Producer Durables - Machinery -

Specialty - 3.2% | | | |

| 2,201 | | *JLG Industries, Inc. @ 45.66 | | | 101 |

| 14,200 | | Powerwave Technologies, Inc. @ 12.57 | | | 179 |

| | | | |

|

|

| | | | | | 280 |

| | | | |

|

|

See accompanying notes to financial statements.

13

OBERWEIS MID-CAP FUND

Portfolio of Investments (cont’d.)

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | Technology - Communication

Technology - 3.1% | | | |

| 3,600 | | Comtech Telecommunications Corp. @ 30.55 | | $ | 110 |

| 3,778 | | J2 Global Communications, Inc. @ 42.74 | | | 162 |

| | | | |

|

|

| | | | | | 272 |

| | | | |

|

|

| | | Technology - Computer Service Software & Systems - 11.6% | | | |

| 8,585 | | Akamai Technologies, Inc. @ 19.93 | | | 171 |

| 2,800 | | F5 Networks, Inc. @ 57.19 | | | 160 |

| 2,954 | | Navteq Corp. @ 43.87 | | | 130 |

| 1,534 | | Netease.com, Inc. @ 56.16 | | | 86 |

| 10,556 | | Openwave Systems, Inc. @ 17.47 | | | 184 |

| 3,104 | | Sra International, Inc. @ 30.54 | | | 95 |

| 4,100 | | Tom On-Line Inc. @ 19.82 | | | 81 |

| 1,700 | | Websense, Inc. @ 65.64 | | | 112 |

| | | | |

|

|

| | | | | | 1,019 |

| | | | |

|

|

| | | Technology - Computer Technology - 7.6% | | | |

| 5,180 | | Cogent, Inc. @ 22.68 | | | 118 |

| 5,083 | | M-Systems Flash Disk Pioneers, Ltd. @ 33.12 | | | 168 |

| 3,343 | | Nvidia Corp. @ 36.56 | | | 122 |

| 14,428 | | Trident Microsystems, Inc. @ 18.00 | | | 260 |

| | | | |

|

|

| | | | | | 668 |

| | | | |

|

|

| | | Technology - Electronics

Semi-Conductors - 1.2% | | | |

| 3,600 | | Sift Technology Hldgs Inc. @ 29.80 | | | 107 |

| | | | |

|

|

| | | Technology - Misc. Technology - 2.9% | | | |

| 7,600 | | Irobot Corp. @ 33.33 | | | 253 |

| | | | |

|

|

| | |

| | | Total Common Stocks

(Cost: $7,110,000) | | $ | 8,671 |

| | | | |

|

|

| | |

| | | Total Investments - 98.8%

(Cost: $7,110,000) | | | 8,671 |

| | |

| | | Other Assets less Liabilities - 1.2% | | | 102 |

| | | | |

|

|

| | |

| | | NET ASSETS - 100.0% | | $ | 8,773 |

| | | | |

|

|

Notes to Portfolio of Investments

| * | Income producing security during the year ended December 31, 2005. |

Based on the cost of investments of $7,111,000 for federal income tax purposes at December 31, 2005, the aggregate gross unrealized appreciation was $1,637,000, the aggregate gross unrealized depreciation was $77,000 and the net unrealized appreciation of investments was $1,560,000.

See accompanying notes to financial statements.

14

OBERWEIS CHINA OPPORTUNITIES FUND

Portfolio of Investments

December 31, 2005 (value in thousands)

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | COMMON STOCKS - 97.7% | | | |

| | | Hong Kong - 66.9% | | | |

| | | Basic Materials - Agriculture

Chemicals - 4.7% | | | |

| 1,070,000 | | Century Sunshine Ecological Technology Holdings Ltd. @ 0.3256 | | $ | 348 |

| | | | |

|

|

| | | Basic Materials - Gold Mining - 1.6% | | | |

| 272,000 | | †Zijin Mining Group Co., Ltd. @ .4411 | | | 120 |

| | | | |

|

|

| | | Basic Materials - Paper & Related

Products - 4.5% | | | |

| 300,000 | | †Lee & Man Paper Manufacturing Ltd. @ 1.1073 | | | 332 |

| | | | |

|

|

| | | Basic Materials - PetroChemicals - 0.8% | | | |

| 170,000 | | †Jilin Chemical Industrial Co., Ltd. @ 0.3573 | | | 61 |

| | | | |

|

|

| | | Consumer Cyclical - Airlines - 2.2% | | | |

| 226,000 | | †Air China Ltd. @ 0.3187 | | | 72 |

| 462,000 | | †China National Aviation Co., Ltd. @ 0.1948 | | | 90 |

| | | | |

|

|

| | | | | | 162 |

| | | | |

|

|

| | | Consumer Cyclical - Apparel

Manufactures - 2.3% | | | |

| 147,000 | | †Ports Design Limited @ 1.1633 | | | 171 |

| | | | |

|

|

| | | Consumer Cyclical - Distribution /

Wholesale - 2.6% | | | |

| 100,000 | | †Li & Fung, Ltd. @ 1.9241 | | | 192 |

| | | | |

|

|

| | | Consumer Cyclical - Footwear & Related Apparel - 2.5% | | | |

| 372,000 | | †*Prime Success International Group Ltd. @ 0.5011 | | | 186 |

| | | | |

|

|

| | | Consumer Cyclical - Leisure & Recreational Products - 4.2% | | | |

| 440,000 | | Li Ning Co., Ltd. @ .7093 | | | 312 |

| | | | |

|

|

| | | Consumer Cyclical - Misc

Manufacturer - 2.4% | | | |

| 560,000 | | †Peace Mark Holdings Ltd. @ 0.3173 | | | 178 |

| | | | |

|

|

| | | Consumer Cyclical - Retail Consumer Electronics - 1.4% | | | |

| 300,000 | | China Paradise Electronics Retail Ltd. @ 0.3547 | | | 106 |

| | | | |

|

|

| | | Consumer Cyclical - Retail -

Hypermarkets - 1.8% | | | |

| 70,000 | | Wumart Stores, Inc. @ 1.9216 | | | 134 |

| | | | |

|

|

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | Consumer Cyclical - Retail - Major Department Stores - 0.8% | | | |

| 44,000 | | †Lifestlye International Holdings Ltd. @ 1.3914 | | $ | 61 |

| | | | |

|

|

| | | Consumer Cyclical - Textile Products - 2.1% | | | |

| 117,000 | | †Weiqiao Textile Co. Ltd. @ 1.3675 | | | 160 |

| | | | |

|

|

| | | Consumer Non-Cyclical - Food-

Misc / Diversified - 5.0% | | | |

| 160,000 | | China Yurun Food Group Ltd. @ 0.5578 | | | 89 |

| 174,000 | | †Fu Ji Food & Catering Services Holdings Ltd. @ 1.6379 | | | 285 |

| | | | |

|

|

| | | | | | 374 |

| | | | |

|

|

| | | Consumer Non-Cyclical - Food-Wholesale / Distribution - 1.8% | | | |

| 915,000 | | *Heng Tai Consumables Group Ltd. @ 0.1457 | | | 133 |

| | | | |

|

|

| | | Consumer Non-Cyclical - Medical

Instruments - 3.0% | | | |

| 944,000 | | Golden Meditech Co., Ltd. @ 0.2399 | | | 226 |

| | | | |

|

|

| | | Consumer Non-Cyclical -

Printing-Commercial - 1.5% | | | |

| 178,000 | | Vision Grande Group Holdings Ltd. @ .6417 | | | 114 |

| | | | |

|

|

| | | Consumer Non-Cyclical - Public

Thoroughfares - 1.6% | | | |

| 142,000 | | †Anhui Expressway Co., Ltd. @ 0.4832 | | | 69 |

| 76,000 | | †Zhejang Expressway Co., Ltd. @ 0.6176 | | | 47 |

| | | | |

|

|

| | | | | | 116 |

| | | | |

|

|

| | | Diversified - Diversified Operations - 0.4% | | | |

| 324,000 | | †China Resources Logic Ltd. @ 0.1004 | | | 33 |

| | | | |

|

|

| | | Energy - Oil Field Services - 1.8% | | | |

| 334,000 | | †China Oilfield Services Ltd. @ 0.4095 | | | 137 |

| | | | |

|

|

| | | Energy - Pipelines - 2.1% | | | |

| 836,000 | | †China Gas Holdings Ltd. @ 0.1870 | | | 156 |

| | | | |

|

|

| | | Financials - Real Estate Operations /

Development - 6.3% | | | |

| 60,000 | | Guangzhou R&F Properties Co., Ltd. @ 3.4822 | | | 209 |

| 212,000 | | †*Hopson Development Holdings Ltd. @ 1.2309 | | | 261 |

| | | | |

|

|

| | | | | | 470 |

| | | | |

|

|

| | | Industrial - Electronic Components-

Misc - 0.8% | | | |

| 46,000 | | Truly International Holdings Ltd. @ 1.2961 | | | 60 |

| | | | |

|

|

See accompanying notes to financial statements.

15

OBERWEIS CHINA OPPORTUNITIES FUND

Portfolio of Investments (cont’d.)

| | | | | | |

| Shares | | | Company (Closing Price) | | Value |

| | | | | | | |

| | | | Industrial - Machinery - Construction &

Mining - 1.4% | | | |

| 532,000 | | | China Infrastructure @ 0.1960 | | $ | 104 |

| | | | | |

|

|

| | | | Industrial - Metal Processors &

Fabrication - 0.8% | | | |

| 126,000 | | | †Jiangxi Copper Co. Ltd. @ 0.4734 | | | 60 |

| | | | | |

|

|

| | | | Industrial - Power Conversion / Supply

Equipment - 1.2% | | | |

| 86,000 | | | †Dongfang Electrical Machinery Ltd. @ 1.0194 | | | 88 |

| | | | | |

|

|

| | | | Technology - Computers-Integrated

Systems - 1.1% | | | |

| 522,000 | | | †Citic 21 Cn Co., Ltd. @ 0.1623 | | | 85 |

| | | | | |

|

|

| | | | Technology - Enterprise Software /

Services - 0.8% | | | |

| 560,000 | | | †Chinasoft International Ltd. @ 0.1098 | | | 61 |

| | | | | |

|

|

| | | | Technology Components-Integrated

Circuit - 1.3% | | | |

| 236,000 | | | †Solomon Systech International Ltd. @ 0.4141 | | | 98 |

| | | | | |

|

|

| | | | Utilities - Gas-Distribution - 2.1% | | | |

| 200,000 | | | Xinao Gas Holdings Ltd. @ 0.7932 | | | 159 |

| | | | | |

|

|

| | | | Singapore - 16.8% | | | |

| | | | Consumer Non-Cyclical - Agriculture

Bio-Tech - 2.4% | | | |

| 654,000 | | | †China Sun Bio-Chem Technology Group Co. @ 0.2756 | | | 180 |

| | | | | |

|

|

| | | | Consumer Non-Cyclical - Healthcare Safety Devices - 0.6% | | | |

| 46,000 | | | †Osim International Ltd. @ 0.9540 | | | 44 |

| | | | | |

|

|

| | | | Consumer Non-Cyclical - Medical

Drugs - 3.1% | | | |

| 622,000 | | | †AsiaPharma Group Ltd. @ 0.3751 | | | 233 |

| | | | | |

|

|

| | | | Consumer Non-Cyclical - Schools - 3.9% | | | |

| 288,000 | | | †*Raffles Education Corp. Ltd. @ 1.0099 | | | 291 |

| | | | | |

|

|

| | | | Energy - Oil Comp-Exploration &

Production - 3.1% | | | |

| 260,000 | | | †Pearl Energy Ltd. @ 0.8813 | | | 229 |

| | | | | |

|

|

| | | | Industrial - Transport-Marine - 2.4% | | | |

| 206,000 | | | †*Ezra Holdings Ltd. @ 0.8743 | | | 180 |

| | | | | |

|

|

| | | | Industrial - Water Treatment Systems - 1.3% | | | |

| 151,000 | | | †*Bio-Treat Technology Ltd. @ .6708 | | | 101 |

| | | | | |

|

|

| | | | | |

| Shares | | Company (Closing Price) | | Value |

| | | | | | |

| | | United States - 14.0% | | | |

| | | Communications - Advertising Sales - 4.4% | | | |

| 9,800 | | Focus Media Holdings Ltd. ADR @ 33.7700 | | $ | 331 |

| | | | |

|

|

| | | Communications - E-Commerce /

Services - 0.8% | | | |

| 1,100 | | Ctrip.com International Ltd. ADR @ 57.7500 | | | 64 |

| | | | |

|

|

| | | Communications - Web Portals / ISP - 3.3% | | | |

| 2,000 | | Netease.com, Inc. @ 56.1600 | | | 112 |

| 6,600 | | Tom On-Line Inc. ADR @ 19.8200 | | | 131 |

| | | | |

|

|

| | | | | | 243 |

| | | | |

|

|

| | | Consumer Non-Cyclical Agriculture

Bio-Tech - 2.8% | | | |

| 14,800 | | Bodisen Biotech, Inc. ADR @ 14.00 | | | 207 |

| | | | |

|

|

| | | Energy - Energy-Alternative Sources - 1.6% | | | |

| 4,300 | | Suntech Power Holdings Co., Ltd. ADR

@ 27.2500 | | | 117 |

| | | | |

|

|

| | | Technology - Electronic

Components-Semis - 1.1% | | | |

| 6,863 | | Silicon Motion Technology Corp. ADR

@ 12.0000 | | | 82 |

| | | | |

|

|

| | |

| | | Total Common Stocks

(Cost: $6,744,000) | | $ | 7,299 |

| | | | |

|

|

| | |

| | | Total Investments - 97.7%

(Cost: $6,744,000) | | | 7,299 |

| | |

| | | Other Assets less Liabilities - 2.3% | | | 172 |

| | | | |

|

|

| | |

| | | Net Assets - 100% | | $ | 7,471 |

| | | | |

|

|

Notes to Portfolio of Investments

| * | Income producing security during the year ended December 31, 2005. |

Based on the cost of investments of $6,744,000 for federal income tax purposes at December 31, 2005, the aggregate gross unrealized appreciation was $802,000, the aggregate gross unrealized depreciation was $247,000 and the net unrealized appreciation of investments was $555,000.

ADR American Depositary Receipt

See accompanying notes to financial statements.

16

THE OBERWEIS FUNDS

Statement of Assets and Liabilities

December 31, 2005 (in thousands, except pricing of shares)

| | | | | | | | | | | | | | |

| | | Emerging

Growth

Fund | | Micro-Cap

Fund | | Mid-Cap

Fund | | | China

Opportunities

Fund | |

| | | | |

| Assets: | | | | | | | | | | | | | | |

Investment securities at value | | $ | 185,386 | | $ | 69,807 | | $ | 8,671 | | | $ | 7,299 | |

(Cost: $138,088, $51,694, $7,110

and $6,744, respectively) | | | | | | | | | | | | | | |

Cash | | | 208 | | | 242 | | | — | | | | 93 | |

Receivable from fund shares sold | | | 320 | | | 540 | | | 17 | | | | 100 | |

Receivable from securities sold | | | 126 | | | 116 | | | 114 | | | | 51 | |

Dividends and interest receivable | | | 5 | | | 2 | | | __ | | | | 8 | |

Due from Advisor | | | — | | | — | | | — | | | | 14 | |

Prepaid expenses | | | 59 | | | 27 | | | 11 | | | | 20 | |

| | |

|

| |

|

| |

|

|

| |

|

|

|

Total Assets | | | 186,104 | | | 70,734 | | | 8,813 | | | | 7,585 | |

| | |

|

| |

|

| |

|

|

| |

|

|

|

| | | | |

| Liabilities: | | | | | | | | | | | | | | |

Payable to custodian bank | | | — | | | — | | | 11 | | | | — | |

Payable for fund shares redeemed | | | 260 | | | 201 | | | 2 | | | | — | |

Payable for securities purchased | | | 1,617 | | | 2,054 | | | — | | | | 89 | |

Payable to advisor (see note 2) | | | 130 | | | 54 | | | 8 | | | | 7 | |

Payable to distributor | | | 40 | | | 14 | | | 2 | | | | 1 | |

Accrued expenses | | | 78 | | | 56 | | | 17 | | | | 17 | |

| | |

|

| |

|

| |

|

|

| |

|

|

|

Total Liabilities | | | 2,125 | | | 2,379 | | | 40 | | | | 114 | |

| | |

|

| |

|

| |

|

|

| |

|

|

|

| Net Assets | | $ | 183,979 | | $ | 68,355 | | $ | 8,773 | | | $ | 7,471 | |

| | |

|

| |

|

| |

|

|

| |

|

|

|

| Analysis of net assets: | | | | | | | | | | | | | | |

Capital | | $ | 132,865 | | $ | 49,237 | | $ | 8,579 | | | $ | 6,930 | |

Accumulated net realized gains (losses) on investment and foreign currency transactions | | | 3,816 | |

| 1,005 | | | (1,367 | ) | | | (14 | ) |

Net unrealized appreciation of investments and translation of assets and liabilities denominated in foreign currencies. | | | 47,298 | |

| 18,113 | | | 1,561 | | | | 555 | |

| | |

|

| |

|

| |

|

|

| |

|

|

|

Net Assets | | $ | 183,979 | | $ | 68,355 | | $ | 8,773 | | | $ | 7,471 | |

| | |

|

| |

|

| |

|

|

| |

|

|

|

| The Pricing of Shares: | | | | | | | | | | | | | | |

Net asset value and offering price per share | | | | | | | | | | | | | | |

| Emerging Growth Fund: | | | | | | | | | | | | | | |

($183,978,669 divided by 6,825,650 shares outstanding) | | $ | 26.95 | | | | | | | | | | | |

| | |

|

| | | | | | | | | | | |

| Micro-Cap Fund: | | | | | | | | | | | | | | |

($68,355,223 divided by 3,949,878 shares outstanding) | | | | | $ | 17.31 | | | | | | | | |

| | | | | |

|

| | | | | | | | |

| Mid-Cap Fund: | | | | | | | | | | | | | | |

($8,772,695 divided by 700,302 shares outstanding) | | | | | | | | $ | 12.53 | | | | | |

| | | | | | | | |

|

|

| | | | |

| China Opportunities Fund: | | | | | | | | | | | | | | |

($7,470,732 divided by 692,899 shares outstanding) | | | | | | | | | | | | $ | 10.78 | |

| | | | | | | | | | | | |

|

|

|

See accompanying notes to financial statements.

17

THE OBERWEIS FUNDS

Statement of Operations

Year Ended December 31, 2005 (in thousands)

| | | | | | | | | | | | | | | | |

| | | Emerging

Growth

Fund | | | Micro-Cap

Fund | | | Mid-Cap

Fund | | | China

Opportunities

Fund | |

| | | | |

| Investment Income: | | | | | | | | | | | | | | | | |

Interest | | $ | 156 | | | $ | 70 | | | $ | — | | | $ | 2 | |

Dividends | | | 94 | | | | 207 | | | | 9 | | | | 13 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Income | | | 250 | | | | 277 | | | | 9 | | | | 15 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | |

| Expenses: | | | | | | | | | | | | | | | | |

Investment advisory fees | | | 687 | | | | 277 | | | | 36 | | | | 16 | |

Management fees | | | 662 | | | | 185 | | | | 36 | | | | — | |

Distribution fees (see note 2) | | | 414 | | | | 116 | | | | 22 | | | | 3 | |

Transfer agent fees and expenses | | | 199 | | | | 69 | | | | 31 | | | | 6 | |

Professional fees | | | 103 | | | | 35 | | | | 8 | | | | 14 | |

Custodian fees and expenses | | | 91 | | | | 43 | | | | 34 | | | | 12 | |

Shareholder reports | | | 83 | | | | 16 | | | | 5 | | | | 1 | |

Federal and state registration fees | | | 48 | | | | 30 | | | | 16 | | | | 6 | |

Insurance | | | 28 | | | | 7 | | | | 2 | | | | — | |

Trustees’ fees | | | 23 | | | | 6 | | | | 1 | | | | — | |

Miscellaneous | | | 8 | | | | 2 | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total expenses before reimbursed expenses | | | 2,346 | | | | 786 | | | | 191 | | | | 58 | |

Earnings credit (see note 2) | | | (12 | ) | | | (9 | ) | | | (2 | ) | | | (2 | ) |

Expenses reimbursed (see note 2) | | | — | | | | — | | | | (11 | ) | | | (24 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Expenses | | | 2,334 | | | | 777 | | | | 178 | | | | 32 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net Investment Loss | | | (2,084 | ) | | | (500 | ) | | | (169 | ) | | | (17 | ) |

| | | | |

| Net Realized and Unrealized Gains (Losses) from Investments: | | | | | | | | | | | | | | | | |

| Net realized gains (losses) on investment transactions | | | 11,809 | | | | 4,865 | | | | 998 | | | | (14 | ) |

| Net realized gains (losses) on foreign currency transactions | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net realized gains (losses) on investment and foreign currency transactions | | | 11,809 | | | | 4,865 | | | | 998 | | | | (14 | ) |

| Increase (decrease) in unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | (5,371 | ) | | | 1,558 | | | | (487 | ) | | | 555 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net realized/unrealized gains (losses) on investments and foreign currencies | | | 6,438 | | | | 6,423 | | | | 511 | | | | 541 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net increase in net assets resulting from operations | | $ | 4,354 | | | $ | 5,923 | | | $ | 342 | | | $ | 524 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

See accompanying notes to financial statements.

18

THE OBERWEIS FUNDS

Statements of Changes in Net Assets (in thousands)

| | | | | | | | |

| | | Emerging Growth Fund

| |

| | | Year Ended

December 31, 2005 | | | Year Ended

December 31, 2004 | |

| | |

| |

| From Operations: | | | | | | | | |

Net investment loss | | $ | (2,084 | ) | | $ | (2,537 | ) |

Net realized gains on investments | | | 11,809 | | | | 18,699 | |

Decrease in net unrealized appreciation of investments | | | (5,371 | ) | | | (10,025 | ) |

| | |

|

|

| |

|

|

|

Net increase in net assets resulting from operations | | | 4,354 | | | | 6,137 | |

| | |

|

|

| |

|

|

|

| | |

| From Distributions: | | | | | | | | |

Distributions from net realized gains on investments | | | (11,084 | ) | | | (4,683 | ) |

| | |

|

|

| |

|

|

|

| | |

| From Capital Share Transactions: | | | | | | | | |

Net proceeds from sale of shares | | | 55,337 | | | | 86,918 | |

Proceeds from reinvestment of distributions | | | 10,521 | | | | 4,473 | |

Redemption of shares | | | (50,763 | ) | | | (159,926 | ) |

| | |

|

|

| |

|

|

|

Net increase (decrease) from capital share transactions | | | 15,095 | | | | (68,535 | ) |

| | |

|

|

| |

|

|

|

Total increase (decrease) in net assets | | | 8,365 | | | | (67,081 | ) |

| | |

| Net Assets: | | | | | | | | |

Beginning of year | | | 175,614 | | | | 242,695 | |

| | |

|

|

| |

|

|

|

End of year | | $ | 183,979 | | | $ | 175,614 | |

| | |

|

|

| |

|

|

|

| | |

| Accumulated Net Investment Gain | | $ | 3,816 | | | $ | 3,091 | |

| | |

|

|

| |

|

|

|

| | |

| Transactions in Shares: | | | | | | | | |

Shares sold | | | 2,071 | | | | 3,276 | |

Shares issued in reinvestment of dividends | | | 392 | | | | 174 | |

Less shares redeemed | | | (1,924 | ) | | | (6,136 | ) |

| | |

|

|

| |

|

|

|

Net increase (decrease) from capital share transactions | | | 539 | | | | (2,686 | ) |

| | |

|

|

| |

|

|

|

See accompanying notes to financial statements.

19

THE OBERWEIS FUNDS

Statements of Changes in Net Assets (in thousands)

| | | | | | | | |

| | | Micro-Cap Fund

| |

| | | Year Ended December 31, 2005 | | | Year Ended December 31, 2004 | |

| | |

| |

| From Operations: | | | | | | | | |

Net investment loss | | $ | (500 | ) | | $ | (929 | ) |

Net realized gains on investments | | | 4,865 | | | | 27,170 | |

Increase (decrease) in net unrealized appreciation of investments | | | 1,558 | | | | (28,225 | ) |

| | |

|

|

| |

|

|

|

Net increase (decrease) in net assets resulting from operations | | | 5,923 | | | | (1,984 | ) |

| | |

|

|

| |

|

|

|

| | |

| From Distributions: | | | | | | | | |

Distributions from net realized gains on investments | | | (6,356 | ) | | | (13,764 | ) |

| | |

|

|

| |

|

|

|

| | |

| From Capital Share Transactions: | | | | | | | | |

Net proceeds from sale of shares | | | 27,620 | | | | 15,331 | |

Proceeds from reinvestment of distributions | | | 6,110 | | | | 12,993 | |

Redemption of shares | | | (11,618 | ) | | | (65,446 | ) |

| | |

|

|

| |

|

|

|

Net increase (decrease) from capital share transactions | | | 22,112 | | | | (37,122 | ) |

| | |

|

|

| |

|

|

|

Total increase (decrease) in net assets | | | 21,679 | | | | (52,870 | ) |

| | |

| Net Assets: | | | | | | | | |

Beginning of year | | | 46,676 | | | | 99,546 | |

| | |

|

|

| |

|

|

|

End of year | | $ | 68,355 | | | $ | 46,676 | |

| | |

|

|

| |

|

|

|

| | |

| Accumulated Net Investment Gain | | $ | 1,005 | | | $ | 2,496 | |

| | |

|

|

| |

|

|

|

| | |

| Transactions in Shares: | | | | | | | | |

Shares sold | | | 1,598 | | | | 716 | |

Shares issued in reinvestment of dividends | | | 370 | | | | 877 | |

Less shares redeemed | | | (686 | ) | | | (2,716 | ) |

| | |

|

|

| |

|

|

|

Net increase (decrease) from capital share transactions | | | 1,282 | | | | (1,123 | ) |

| | |

|

|

| |

|

|

|

See accompanying notes to financial statements.

20

THE OBERWEIS FUNDS

Statements of Changes in Net Assets (in thousands)

| | | | | | | | |

| | | Mid-Cap Fund

| |

| | | Year Ended

December 31, 2005 | | | Year Ended

December 31, 2004 | |

| | |

| |

| From Operations: | | | | | | | | |

Net investment loss | | $ | (169 | ) | | $ | (166 | ) |

Net realized gains on investments | | | 998 | | | | 1,474 | |

Decrease in net unrealized appreciation of investments | | | (487 | ) | | | (1,073 | ) |

| | |

|

|

| |

|

|

|

Net increase in net assets resulting from operations | | | 342 | | | | 235 | |

| | |

|

|

| |

|

|

|

| | |

| From Capital Share Transactions: | | | | | | | | |

Net proceeds from sale of shares | | | 776 | | | | 4,520 | |

Redemption of shares | | | (2,771 | ) | | | (5,149 | ) |

| | |

|

|

| |

|

|

|

Net decrease from capital share transactions | | | (1,995 | ) | | | (629 | ) |

| | |

|

|

| |

|

|

|

Total decrease in net assets | | | (1,653 | ) | | | (394 | ) |

| | |