| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

Expires: | | August 31, 2010 |

Estimated average burden |

hours per response | | 18.9 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-4854 |

The Oberweis Funds

|

| (Exact name of registrant as specified in charter) |

| | |

| 3333 Warrenville Rd. Ste. 500, Lisle, IL | | 60532 |

| (Address of principal executive offices) | | (Zip code) |

James W. Oberweis,

The Oberweis Funds, 3333 Warrenville Road, Suite 500, Lisle, IL 60532

|

| (Name and address of agent for service) |

Copy To:

James A. Arpaia,

Vedder Price P.C. 222 North Lasalle Street, Suite 2600, Chicago, IL 60601

Registrant’s telephone number, including area code: (800) 323-6166

Date of fiscal year end: December 31

Date of reporting period: December 31, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Annual Report to Stockholders Follows.

The OBERWEIS FUNDS

A VISION FOR FUTURE GROWTH

ANNUAL REPORT

AUDITED

DECEMBER 31, 2007

| | • | | The Emerging Growth Fund |

| | • | | The China Opportunities Fund |

| | • | | The International Opportunities Fund |

1-800-245-7311

www.oberweisfunds.com

PRESIDENT’S LETTER

Dear Fellow Oberweis Funds Shareholder:

I am pleased to report a solid year for The Oberweis Funds. The China Opportunities Fund again delivered strong gains, appreciating +59.29%, following a gain of +81.17% in 2006. Our newest Fund, the International Opportunities Fund, returned +41.00% in 2007. Among our U.S.-focused Funds, the Micro-Cap Fund returned +10.17%, the Emerging Growth Fund returned +6.82%, and the Mid-Cap Fund returned +14.99%.

On a global basis, China was again a great place to invest in 2007. Despite governmental measures designed to slow the economy, growth in China continued at a rapid pace. Within the U.S., small-cap growth equities delivered good results, particularly when compared to their small-cap value brethren. After value stocks dominated the market from 2000-2006, the tables turned in 2007; the Russell 2000 Growth Index returned 7.1%, significantly better than the Russell 2000 Value Index return of -9.8%. On a capitalization basis, larger-cap stocks performed better than small-cap stocks during the year, with the Russell 1000 Growth Index (a large cap proxy) outperforming the Russell 2000 Growth Index by 470 basis points. Finally, in the international marketplace, the benchmark S&P/Citigroup EMI Growth World Ex-US Index returned +7.1% for the period February 1, 2007 through December 31, 2007. Our International Opportunities Fund performed much better, stemming from favorable stock selection in the industrial and consumer discretionary sectors.

While the year was a positive one, it looked much better prior to the fourth quarter. Gains were eroded in the final five months as investors reacted to the sub-prime mortgage crisis, looming $100 per barrel crude oil, accelerating inflation, and the prospect of a recession in 2008. After gaining almost 10% through late July, the S&P 500 Index dropped nearly 12% over the following four weeks as the magnitude of the housing market crisis became more apparent to the market. While the final tally on the S&P 500 Index produced a modest 5.5% gain for the year, stock volatility increased in the latter half of the year as investors reacted skittishly to news on the housing market, banking write-downs, and Federal Reserve moves (both speculated and actual). To stem a possible financial crisis, the Fed reduced interest rates three times late in the year and repeatedly injected liquidity into the system through open market operations. The correction has accelerated into January 2008. Due to the recent decline, stock valuations for smaller, high-growth companies, as measured by average P/E ratios as of the end of January 2008, are substantially lower than historical averages.

The average forward P/E ratio at the end of 2007 was 20.0 times for the Micro-Cap Fund, 24.3 times for the Emerging Growth Fund, 26.0 times for the Mid-Cap Fund, 33.5 times for the China Opportunities Fund, and 20.4 times for the International Opportunities Fund. As of 12/31/07, the weighted average market capitalization was $387 million for the Micro-Cap, $1.2 billion for the Emerging Growth, $3.4 billion for the Mid-Cap, $2.4 billion for International Opportunities and $5.9 billion for China Opportunities.

We are also proud to announce the launch of our sixth Fund, The Oberweis Asia Opportunities Fund (OBAOX), on February 1, 2008. Interested investors may obtain a prospectus at www.oberweisfunds.com. At present, all of The Oberweis Funds are open to new investors. If you have any questions about your account, please contact shareholder services at (800) 245-7311. Thank you for investing with us in The Oberweis Funds.

|

| Sincerely, |

|

|

James W. Oberweis, CFA President & Portfolio Manager |

2

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION

ON FUND PERFORMANCE

Market Environment

Global equities returned 7.11% in 2007, as measured by the S&P Citigroup BMI World Index. Emerging Asian countries including China led global returns. U.S. returns were more modest, with the S&P 500 returning 5.5% for the year. On a capitalization basis, larger-cap stocks performed better than small-cap stocks during the year, with the Russell 1000 Growth Index (a large cap proxy) outperforming the Russell 2000 Growth Index by 470 basis points. Domestic small-cap growth stocks outperformed small-cap value. After value stocks dominated the market from 2000-2006, the tables turned in 2007; the Russell 2000 Growth Index returned 7.1%, significantly better than the Russell 2000 Value Index return of -9.8%.

Gains were eroded in the final five months as investors reacted to the sub-prime mortgage crisis, looming $100 per barrel crude oil, accelerating inflation, and the prospect of a recession in 2008. Stock volatility increased in the latter half of the year as investors reacted skittishly to news on the housing market, banking write-downs, and Federal Reserve moves (both speculated and actual). To stem a possible financial crisis, the Fed reduced interest rates three times late in the year and repeatedly injected liquidity into the system through open market operations.

Discussion of The Oberweis Funds

For the year ending December 31, 2007, the Oberweis Micro-Cap Fund appreciated +10.17% and the Emerging Growth Fund appreciated +6.82%. For comparison, the benchmark Russell 2000 Growth Index appreciated +7.05%.

For the Micro-Cap Fund, the energy and technology sectors were the most important contributors to performance. The Fund’s holdings in these two sectors outperformed the corresponding sectors of the benchmark and the Fund benefited from higher relative weightings in these sectors as well. Healthcare was the greatest detractor to Fund performance. At the stock level, Vasco Data Security and Flotek Industries were among the top contributors to performance, while Kenexa and Vital Images were among the top detractors.

For the Emerging Growth Fund, financials and consumer discretionary were the most important contributing sectors compared to the benchmark. Stock selections in these two sectors significantly outperformed the benchmark sector returns. However, these gains were offset by the Fund’s healthcare and producer durables holdings, which underperformed and caused the Fund to slightly trail its benchmark for the year. At the stock level, Aquantive and Sigma Designs were among the top contributors to performance, while Heelys and Optium were among the top detractors.

The Oberweis Mid-Cap Fund appreciated +14.99%. For comparison, the Russell 2500 Growth Index appreciated +9.69% and the Russell Midcap Growth Index gained 11.43%. Favorable appreciation in the Fund’s consumer discretionary holdings helped performance. At the stock level, Intuitive Surgical and Baidu.com were among the top contributors to performance, while Heelys and Force Protection were among the top detractors.

3

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION

ON FUND PERFORMANCE (continued)

The Oberweis China Opportunities Fund returned +59.29% for the year ended December 31, 2007. The benchmark S&P/Citigroup EMI China Index returned +78.36%. Despite strong absolute gains, the Fund underperformed its benchmark for the year. The benchmark index includes larger capitalization issues as well as A-shares, neither of which have played a significant role in the Fund but both of which performed particularly well for the index in 2007. Baidu.com and China National Building Materials were among the top contributors; China Life Insurance and Pine Agritech were among the top detractors.

Since inception on 2/1/2007, the Oberweis International Opportunities Fund returned +41.00% versus +7.10% for the S&P/Citigroup EMI Growth World Ex-US Index. A higher relative weight and strong stock selection in industrials materially contributed to performance. Also, favorable stock selection in the consumer sector contributed. At the stock level, Meyer Burger Technology and Korea Line Corp were among the top contributors to performance; Moneysupermarket.com and Temenos Group AG were among the top detractors.

The annual portfolio turnover rates were 65% for the Micro-Cap Fund, 85% for the Emerging Growth Fund, 110% for the Mid-Cap Fund, and 68% for the China Opportunities Fund. For the period February 1, 2007 through December 31, 2007, the portfolio turnover rate was 126% for the International Opportunities Fund. The annual net expense ratios were 1.58% for Micro-Cap, 1.28% for Emerging Growth, 1.80% for Mid-Cap, 1.78% for China Opportunities. For the period February 1, 2007 through December 31, 2007, the annualized net expense ratio was 1.99% for International Opportunities.

4

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION

ON FUND PERFORMANCE (continued)

The SEC adopted a requirement that Funds present their portfolio holdings in a table, chart or graph format in their annual and semi-annual reports to shareholders, whether or not a schedule of investments is utilized. The following tables, which present portfolio holdings as a percentage of net assets, are provided in compliance with this requirement.

Oberweis Emerging Growth Fund

At December 31, 2007

| | | |

Asset Allocation | | | |

Common Stocks | | 95.9 | % |

Commercial Paper | | 3.1 | % |

Warrants | | 0.3 | % |

Other Assets in excess of Liabilities | | 0.7 | % |

| | | |

| | 100.0 | % |

| |

Top Holdings | | | |

Focus Media Hldg. Ltd. | | 3.9 | % |

Sigma Designs, Inc. | | 3.2 | % |

Vasco Data Security Intl., Inc. | | 2.6 | % |

eHealth, Inc. | | 2.5 | % |

Synaptics, Inc. | | 2.4 | % |

Carrizo Oil & Gas, Inc. | | 2.4 | % |

Synchronoss Technologies, Inc. | | 2.3 | % |

Omrix Biopharmaceuticals, Inc. | | 2.1 | % |

Shoretel, Inc. | | 2.0 | % |

Zoltek Companies, Inc. | | 2.0 | % |

Other Holdings | | 74.6 | % |

| | | |

| | 100.0 | % |

| |

Top Industries | | | |

Computer Services Software & Systems | | 19.4 | % |

Communication Technology | | 7.9 | % |

Oil Crude Producer | | 6.0 | % |

Electronics Semi-Conductors | | 5.8 | % |

Advertising Agency | | 5.5 | % |

Computer Technology | | 5.2 | % |

Service Commercial | | 4.0 | % |

Healthcare Management Services | | 3.8 | % |

Drugs & Pharmaceuticals | | 3.6 | % |

Electronic Medical Systems | | 3.6 | % |

Other Industries | | 35.2 | % |

| | | |

| | 100.0 | % |

Oberweis Micro-Cap Fund

At December 31, 2007

| | | |

Asset Allocation | | | |

Common Stocks | | 98.9 | % |

Commercial Paper | | 1.7 | % |

Warrants | | 0.5 | % |

Other Liabilities in excess of Assets | | (1.1 | )% |

| | | |

| | 100.0 | % |

| |

Top Holdings | | | |

Double-Take Software, Inc. | | 3.5 | % |

Omrix Biopharmaceuticals, Inc. | | 3.2 | % |

LSB Industries, Inc. | | 2.9 | % |

Vocus, Inc. | | 2.8 | % |

T-3 Energy Services, Inc. | | 2.7 | % |

Vasco Data Security Intl., Inc. | | 2.6 | % |

Astronics Corp. | | 2.6 | % |

Cybersource Corp. | | 2.6 | % |

Sigma Designs, Inc. | | 2.5 | % |

Perficient, Inc. | | 2.5 | % |

Other Holdings | | 72.1 | % |

| | | |

| | 100.0 | % |

| |

Top Industries | | | |

Computer Services Software & Systems | | 23.4 | % |

Machine Oilwell Equipment | | 8.2 | % |

Service Commercial | | 7.9 | % |

Chemicals | | 5.8 | % |

Biotechnology | | 4.9 | % |

Electronic Semi-Conductors | | 4.2 | % |

Communication Technology | | 3.7 | % |

Electronic Medical Systems | | 3.4 | % |

Metal Fabricating | | 3.1 | % |

Technology Misc. | | 2.8 | % |

Other Industries | | 32.6 | % |

| | | |

| | 100.0 | % |

5

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION

ON FUND PERFORMANCE (continued)

Oberweis Mid-Cap Fund

At December 31, 2007

| | | |

Asset Allocation | | | |

Common Stocks | | 99.0 | % |

Other Assets in excess of Liabilities | | 1.0 | % |

| | | |

| | 100.0 | % |

| |

Top Holdings | | | |

Illumina, Inc. | | 4.5 | % |

Intuitive Surgical, Inc. | | 4.5 | % |

Omrix Biopharmaceutical, Inc. | | 3.9 | % |

FLIR Systems, Inc. | | 3.7 | % |

Nuance Communications, Inc. | | 3.2 | % |

Hologic, Inc. | | 3.2 | % |

BE Aerospace, Inc. | | 2.9 | % |

Cubist Pharmaceuticals, Inc. | | 2.5 | % |

Chipotle Mexican Grill, Inc. | | 2.4 | % |

Vasco Data Security Intl., Inc. | | 2.4 | % |

Other Holdings | | 66.8 | % |

| | | |

| | 100.0 | % |

| |

Top Industries | | | |

Computer Services Software & Systems | | 16.7 | % |

Electronic Medical Systems | | 13.9 | % |

Biotech Research & Production | | 8.4 | % |

Machine Oilwell | | 6.9 | % |

Health Care Management Services | | 4.7 | % |

Retail | | 4.5 | % |

Communication Technology | | 4.0 | % |

Electronics | | 3.7 | % |

Textile-Apparel Manufacturer | | 3.6 | % |

Electronics Semi-Conductors | | 3.2 | % |

Other Industries | | 30.4 | % |

| | | |

| | 100.0 | % |

Oberweis China Opportunities Fund

At December 31, 2007

| | | |

Asset Allocation | | | |

Common Stocks | | 98.8 | % |

Commercial Paper | | 1.7 | % |

Warrants | | 0.1 | % |

Other Liabilities in excess of Assets | | (0.6 | )% |

| | | |

| | 100.0 | % |

| |

Top Holdings | | | |

Suntech Power Hldgs. Co. Ltd | | 3.3 | % |

Lee Man Paper Manufacturing Ltd | | 3.2 | % |

Baidu.com, Inc. ADR | | 2.9 | % |

Focus Media Hldgs. Ltd | | 2.8 | % |

China National Building Material Co. Ltd | | 2.8 | % |

Ezra Hldgs. Ltd | | 2.4 | % |

Raffles Education Corp. Ltd | | 2.3 | % |

Li Ning Co. Ltd | | 2.2 | % |

China Resources Power Hldgs. Co. | | 2.0 | % |

Parkson Retail Group Ltd | | 2.0 | % |

Other Holdings | | 74.1 | % |

| | | |

| | 100.0 | % |

| |

Top Industries | | | |

Internet Software & Services | | 7.5 | % |

Textile, Apparel & Luxury Goods | | 7.0 | % |

Electrical Equipment | | 6.7 | % |

Paper & Forest Products | | 6.6 | % |

Hotels Restaurants & Leisure | | 5.5 | % |

Energy Equipment & Services | | 4.9 | % |

Media | | 4.8 | % |

Machinery | | 4.5 | % |

Multiline Retail | | 4.1 | % |

Diversified Consumer Services | | 4.1 | % |

Other Industries | | 44.3 | % |

| | | |

| | 100.0 | % |

6

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION

ON FUND PERFORMANCE (continued)

Oberweis International Opportunities Fund

At December 31, 2007

| | | |

Asset Allocation | | | |

Common Stocks | | 92.2 | % |

Commercial Paper | | 5.7 | % |

Other Assets in excess of Liabilities | | 2.1 | % |

| | | |

| | 100.0 | % |

| |

Top Holdings | | | |

Game Group | | 3.8 | % |

Wellstream Hldgs. PLC | | 3.6 | % |

Flsmidth & Co. AS | | 3.5 | % |

Roth & Rau AG | | 3.0 | % |

Hellenic Exchanges | | 2.8 | % |

Meyer Burger Technology AG | | 2.7 | % |

Boskalis Westminster | | 2.7 | % |

Aixtron AG | | 2.5 | % |

Schoeller-Bleckmann Oilfield | | 2.4 | % |

Tradus PLC | | 2.2 | % |

Other Holdings | | 70.8 | % |

| | | |

| | 100.0 | % |

| |

Top Industries | | | |

Machinery | | 18.4 | % |

Construction & Engineering | | 12.2 | % |

Energy Equipment & Services | | 9.4 | % |

Specialty Retail | | 5.8 | % |

Software | | 4.2 | % |

Textile, Apparel & Luxury Goods | | 3.4 | % |

Capital Markets | | 3.1 | % |

Electronic Equipment & Instruments | | 3.0 | % |

Diversified Financial Services | | 2.8 | % |

Commercial Service & Supply | | 2.7 | % |

Other Industries | | 35.0 | % |

| | | |

| | 100.0 | % |

7

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION

ON FUND PERFORMANCE (continued)

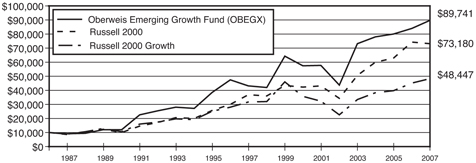

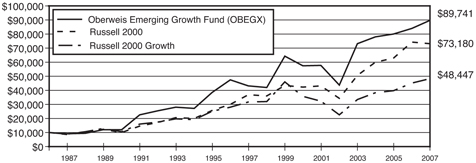

Average Annual Total Returns (1)

Periods ended 12/31/07

| | | | | | | | | | | | | | | |

| | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception

1/7/87 | | | Expense

Ratio (2) | |

OBEGX | | +6.82 | % | | +15.45 | % | | +7.55 | % | | +11.02 | % | | 1.29 | % |

Russell 2000 Growth | | +7.05 | % | | +16.50 | % | | +4.32 | % | | +7.81 | % | | | |

Russell 2000 | | -1.57 | % | | +16.25 | % | | +7.08 | % | | +9.95 | % | | | |

Growth of an Assumed $10,000 Investment

from January 7, 1987 to December 31, 2007

(1) | Performance data represents past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting www.oberweisfunds.com. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. There is no guarantee that the portfolios can achieve their objectives. |

The Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted earnings growth rates. The Russell 2000 Index measures the performance of 2000 companies with small-market capitalizations. The Russell indices are unmanaged and are not available for investment. A sales load of 4% was charged on the Oberweis Emerging Growth Fund until December 31, 1991 and is not reflected in the total return figures or graph above.

(2) | Expense ratio is the total annual fund operating expense ratio gross of any fee waivers or expense reimbursement. |

8

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION

ON FUND PERFORMANCE (continued)

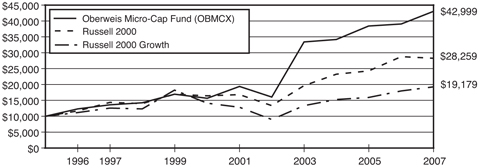

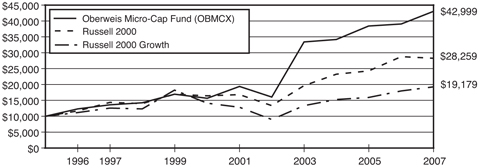

Average Annual Total Returns (1)

Periods ended 12/31/07

| | | | | | | | | | | | | | | |

| | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception

1/1/96 | | | Expense

Ratio (2) | |

OBMCX | | +10.17 | % | | +21.93 | % | | +12.21 | % | | +12.92 | % | | 1.59 | % |

Russell 2000 Growth | | +7.05 | % | | +16.50 | % | | +4.32 | % | | +5.58 | % | | | |

Russell 2000 | | -1.57 | % | | +16.25 | % | | +7.08 | % | | +9.04 | % | | | |

Growth of an Assumed $10,000 Investment

from January 1, 1996 to December 31, 2007

(1) | Performance data represents past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting www.oberweisfunds.com. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. There is no guarantee that the portfolios can achieve their objectives. |

The Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted earnings growth rates. The Russell 2000 Index measures the performance of 2000 companies with small-market capitalizations. The Russell indices are unmanaged and are not available for investment.

(2) | Expense ratio is the total annual fund operating expense ratio gross of any fee waivers or expense reimbursement. |

9

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION

ON FUND PERFORMANCE (continued)

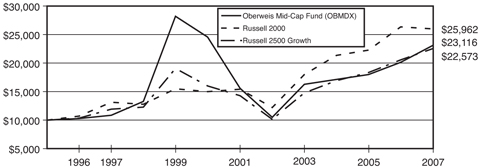

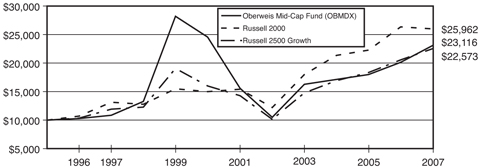

Average Annual Total Returns (1)

Period ended 12/31/07

| | | | | | | | | | | | | | | |

| | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception

9/15/96 | | | Expense

Ratio (2) | |

OBMDX | | +14.99 | % | | +17.20 | % | | +7.86 | % | | +7.70 | % | | 1.83 | % |

Russell 2500 Growth | | +9.69 | % | | +17.43 | % | | +6.63 | % | | +7.47 | % | | | |

Russell 2000 | | -1.57 | % | | +16.25 | % | | +7.08 | % | | +8.81 | % | | | |

Growth of an Assumed $10,000 Investment

from September 15, 1996 to December 31, 2007

(1) | Performance data represents past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting www.oberweisfunds.com. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. There is no guarantee that the portfolios can achieve their objectives. |

The Russell 2000 Index measures the performance of 2000 companies with small-market capitalizations. The Russell 2500 Growth Index measures the performance of Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values. The Russell indices are unmanaged and are not available for investment.

(2) | Expense ratio is the total annual fund operating expense ratio gross of any fee waivers or expense reimbursement. |

10

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION

ON FUND PERFORMANCE (continued)

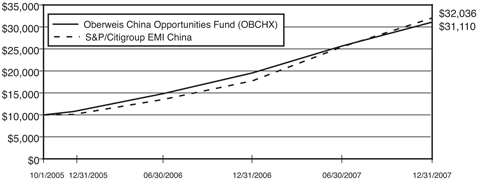

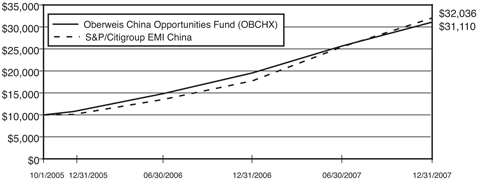

Average Annual Total Returns (1)

Periods ended 12/31/07

| | | | | | | | | |

| | | One

Year | | | Since

Inception

10/1/05 | | | Expense

Ratio (2) | |

OBCHX | | +59.29 | % | | +65.64 | % | | 1.78 | % |

S&P/Citigroup EMI China | | +78.36 | % | | +67.81 | % | | | |

Growth of an Assumed $10,000 Investment

from October 1, 2005 to December 31, 2007

(1) | Performance data represents past performance, which is no guarantee of future results. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting www.oberweisfunds.com. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. There is no guarantee that the portfolios can achieve their objectives. |

The S&P/Citigroup EMI China Index represents the smallest 20% of companies, ranked by total market capitalization, which qualify for inclusion in the S&P/Citigroup BMI China Index, which is an unmanaged broad market index of the universe of institutionally investable securities in China.

(2) | Expense ratio is the total annual fund operating expense ratio gross of any fee waivers or expense reimbursement. |

11

THE OBERWEIS FUNDS

MANAGEMENT DISCUSSION

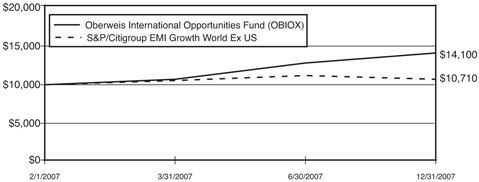

ON FUND PERFORMANCE (continued)

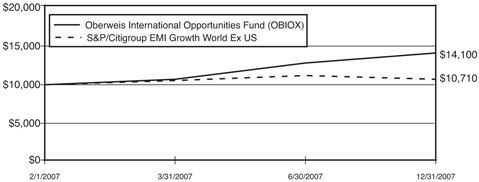

Average Annual Total Returns (1)

Periods ended 12/31/07

| | | | | | |

| | | Since

Inception

2/1/07 | | | Expense

Ratio (2) | |

OBIOX | | +41.00 | % | | 2.00 | % (3) |

S&P/Citigroup EMI Growth World EX US | | +7.10 | % | | | |

Growth of an Assumed $10,000 Investment

from February 1, 2007 to December 31, 2007

(1) | Performance data represents past performance, which is no guarantee of future results. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting www.oberweisfunds.com. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. There is no guarantee that the portfolios can achieve their objectives. |

The S&P/Citigroup EMI Growth World Ex-US Index captures the bottom 20% of institutionally investable capital of developed countries selected by the index sponsor, outside the United States.

(2) | Expense ratio is the total annual fund operating expense ratio gross of any fee waivers or expense reimbursement. |

12

OBERWEIS EMERGING GROWTH FUND

Schedule of Investments

December 31, 2007

| | | | | |

| | | Shares | | Value |

EQUITIES - 95.9% | | | | | |

Advertising Agency - 5.5% | | | | | |

Focus Media Hldg. Ltd. ADR * | | 149,978 | | $ | 8,520,250 |

inVentiv Health, Inc.* | | 40,750 | | | 1,261,620 |

ValueClick, Inc.* | | 101,500 | | | 2,222,850 |

| | | | | |

| | | | | 12,004,720 |

| | | | | |

Auto Trucks & Parts - 0.8% | | | | | |

Spartan Motors, Inc. | | 234,400 | | | 1,790,816 |

| | | | | |

Banks - 0.4% | | | | | |

Pinnacle Financial Partners, Inc.* | | 33,300 | | | 846,486 |

| | | | | |

Biotechnology - 2.1% | | | | | |

Omrix Biopharmaceuticals, Inc.* | | 130,100 | | | 4,519,674 |

| | | | | |

Building Materials - 2.0% | | | | | |

Zoltek Companies, Inc.* | | 100,000 | | | 4,287,000 |

| | | | | |

Commercial Information Service - 0.6% | | | | | |

LoopNet, Inc.* | | 93,500 | | | 1,313,675 |

| | | | | |

Communication Technology - 7.9% | | | | | |

Acme Packet, Inc.* | | 152,864 | | | 1,924,558 |

Atheros Communications, Inc.* | | 127,300 | | | 3,887,742 |

Geoeye, Inc.* | | 21,297 | | | 716,644 |

Globecom Systems, Inc.* | | 134,600 | | | 1,574,820 |

Novatel Wireless, Inc.* | | 154,700 | | | 2,506,140 |

Shoretel, Inc.* | | 319,650 | | | 4,465,510 |

Sierra Wireless, Inc.* | | 145,600 | | | 2,162,160 |

| | | | | |

| | | | | 17,237,574 |

| | | | | |

Computer Services Software & Systems - 19.4% | | | | | |

Chordiant Software, Inc.* | | 214,500 | | | 1,833,975 |

Concur Technologies, Inc.* | | 81,600 | | | 2,954,736 |

DealerTrack Hldgs., Inc.* | | 102,200 | | | 3,420,634 |

Double-Take Software Inc.* | | 149,800 | | | 3,253,656 |

Interactive Intelligence, Inc.* | | 154,100 | | | 4,060,535 |

Kenexa Corp.* | | 68,600 | | | 1,332,212 |

PROS Hldgs., Inc.* | | 128,600 | | | 2,523,132 |

Sapient Corp.* | | 180,100 | | | 1,586,681 |

Sigma Designs, Inc.* | | 128,508 | | | 7,093,642 |

Stanley, Inc.* | | 120,500 | | | 3,858,410 |

Synchronoss Technologies, Inc.* | | 141,000 | | | 4,997,040 |

Vasco Data Security International, Inc.* | | 201,600 | | | 5,628,672 |

| | | | | |

| | | | | 42,543,325 |

| | | | | |

See accompanying notes to the financial statements.

13

OBERWEIS EMERGING GROWTH FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Computer Technology - 5.2% | | | | | |

Advanced Analogic Technologies, Inc.* | | 146,800 | | $ | 1,655,904 |

Falconstor Software, Inc.* | | 258,900 | | | 2,915,214 |

Phoenix Technologies Ltd.* | | 112,000 | | | 1,442,560 |

Synaptics, Inc.* | | 129,400 | | | 5,326,104 |

| | | | | |

| | | | | 11,339,782 |

| | | | | |

Drugs & Pharmaceuticals- 3.6% | | | | | |

Caraco Pharmaceutical Laboratories, Ltd. * | | 46,800 | | | 802,620 |

Obagi Medical Products, Inc.* | | 231,400 | | | 4,232,306 |

Salix Pharmaceuticals Ltd.* | | 5,766 | | | 45,436 |

Sciele Pharma, Inc.* | | 137,467 | | | 2,811,200 |

| | | | | |

| | | | | 7,891,562 |

| | | | | |

Electrical - 0.6% | | | | | |

Axsys Technologies, Inc.* | | 11,990 | | | 439,434 |

Orion Energy Systems, Inc.* | | 42,100 | | | 785,586 |

| | | | | |

| | | | | 1,225,020 |

| | | | | |

Electronics - Instruments - 0.4% | | | | | |

Virtual Radiologic Corp.* | | 39,000 | | | 790,920 |

| | | | | |

Electronic Medical Systems - 3.6% | | | | | |

Accuray, Inc.* | | 276,800 | | | 4,212,896 |

Cynosure, Inc.* | | 86,600 | | | 2,291,436 |

Natus Medical, Inc.* | | 66,800 | | | 1,292,580 |

| | | | | |

| | | | | 7,796,912 |

| | | | | |

Electronics Semi-Conductors - 5.8% | | | | | |

Anadigics, Inc.* | | 133,300 | | | 1,542,281 |

AuthenTec, Inc.* | | 24,800 | | | 360,344 |

IPG Photonics Corp.* | | 128,400 | | | 2,566,716 |

Mellanox Technologies Ltd.* | | 83,500 | | | 1,521,370 |

O2Micro International Ltd. ADR * | | 241,600 | | | 2,788,064 |

Tessera Technologies, Inc.* | | 97,103 | | | 4,039,485 |

| | | | | |

| | | | | 12,818,260 |

| | | | | |

Energy Misc. - 0.8% | | | | | |

Dawson Geophysical Co.* | | 25,200 | | | 1,800,792 |

| | | | | |

Finance Companies - 0.8% | | | | | |

Life Partners Hldgs., Inc | | 67,200 | | | 1,861,440 |

| | | | | |

Financial Data Product Services - 2.7% | | | | | |

CyberSource Corp.* | | 148,000 | | | 2,629,960 |

Exlservice Hldgs., Inc.* | | 145,500 | | | 3,358,140 |

| | | | | |

| | | | | 5,988,100 |

| | | | | |

See accompanying notes to the financial statements.

14

OBERWEIS EMERGING GROWTH FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Foods - 0.5% | | | | | |

Sunopta, Inc.* | | 90,000 | | $ | 1,201,500 |

| | | | | |

Forms & Bulk Print - 1.9% | | | | | |

InnerWorkings, Inc.* | | 240,600 | | | 4,152,756 |

| | | | | |

Health Care Management Services - 3.8% | | | | | |

Allscripts Healthcare, Inc.* | | 185,518 | | | 3,602,759 |

HealthExtras, Inc.* | | 93,000 | | | 2,425,440 |

Omnicell, Inc.* | | 90,300 | | | 2,431,779 |

| | | | | |

| | | | | 8,459,978 |

| | | | | |

Health Care Services - 2.5% | | | | | |

Healthways, Inc.* | | 42,766 | | | 2,499,245 |

Nighthawk Radiology Hldgs., Inc.* | | 146,800 | | | 3,090,140 |

| | | | | |

| | | | | 5,589,385 |

| | | | | |

Insurance - 2.5% | | | | | |

eHealth, Inc.* | | 173,100 | | | 5,558,241 |

| | | | | |

Machine Oilwell Equipment - 2.0% | | | | | |

Dril-Quip, Inc.* | | 42,600 | | | 2,371,116 |

Flotek Industries Inc.* | | 34,100 | | | 1,228,964 |

T-3 Energy Services, Inc.* | | 19,400 | | | 911,994 |

| | | | | |

| | | | | 4,512,074 |

| | | | | |

Machinery Specialty - 0.2% | | | | | |

TurboChef Technologies, Inc.* | | 30,900 | | | 509,850 |

| | | | | |

Materials & Commodities Misc. - 0.3% | | | | | |

Ceradyne, Inc.* | | 13,102 | | | 614,877 |

| | | | | |

Medical &Dental Services - 0.9% | | | | | |

Genoptix, Inc.* | | 9,600 | | | 294,720 |

Lifecell Corp.* | | 37,100 | | | 1,599,381 |

| | | | | |

| | | | | 1,894,101 |

| | | | | |

Metal Fabricating - 1.5% | | | | | |

Dynamic Materials Corp | | 57,600 | | | 3,392,640 |

| | | | | |

Oil Crude Producer - 6.0% | | | | | |

Arena Resources, Inc.* | | 91,200 | | | 3,803,952 |

Carrizo Oil & Gas, Inc.* | | 97,001 | | | 5,310,805 |

Gulfport Energy Corp.* | | 96,400 | | | 1,760,264 |

Warren Resources, Inc.* | | 164,500 | | | 2,324,385 |

| | | | | |

| | | | | 13,199,406 |

| | | | | |

Production Technology Equipment - 0.5% | | | | | |

Fei Co.* | | 42,800 | | | 1,062,724 |

| | | | | |

See accompanying notes to the financial statements.

15

OBERWEIS EMERGING GROWTH FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Restaurants - 0.9% | | | | | |

BJ’s Restaurants, Inc.* | | 118,500 | | $ | 1,926,810 |

| | | | | |

Retail - 1.6% | | | | | |

Volcom, Inc.* | | 75,003 | | | 1,652,316 |

Zumiez, Inc.* | | 76,600 | | | 1,865,976 |

| | | | | |

| | | | | 3,518,292 |

| | | | | |

Service Commercial- 4.0% | | | | | |

G-Market, Inc. ADR * | | 123,200 | | | 3,067,680 |

Liquidity Services, Inc.* | | 164,800 | | | 2,125,920 |

Perficient, Inc.* | | 120,800 | | | 1,901,392 |

The Knot, Inc.* | | 104,900 | | | 1,672,106 |

| | | | | |

| | | | | 8,767,098 |

| | | | | |

Shoes - 1.2% | | | | | |

Iconix Brand Group, Inc.* | | 130,200 | | | 2,559,732 |

| | | | | |

Technology Misc.- 0.4% | | | | | |

Dice Hldgs., Inc.* | | 97,100 | | | 775,829 |

| | | | | |

Telecommunications - 0.8% | | | | | |

Opnext, Inc.* | | 208,800 | | | 1,847,880 |

| | | | | |

Textile-Apparel Manufacturer - 0.3% | | | | | |

Lululemon Athletica * | | 11,900 | | | 563,703 |

| | | | | |

Wholesale & International Trade - 1.9% | | | | | |

Central European Distribution Corp.* | | 73,350 | | | 4,260,168 |

| | | | | |

Total Equities

(Cost: $169,122,792) | | | | $ | 210,423,102 |

| | | | | |

| | |

| | | Face Amount | | Value |

Commercial Paper - 3.1% | | | | | |

HSBC Financial Corp | | 4,500,000 | | | |

4.45%, due 01/03/2008 | | | | $ | 4,500,000 |

Toyota Motor Credit Corp | | 400,000 | | | |

4.18%, due 01/03/2008 | | | | | 400,000 |

Toyota Motor Credit Corp | | 2,000,000 | | | |

3.50%, due 01/03/2008 | | | | | 2,000,000 |

| | | | | |

Total Commercial Paper -

(Cost: $6,900,000) | | | | $ | 6,900,000 |

| | | | | |

See accompanying notes to the financial statements.

16

OBERWEIS EMERGING GROWTH FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Units | | Value |

Warrants - 0.3% | | | | | |

Internet Software & Systems | | | | | |

Think Partnership, Inc. ($2.50, expires 04/03/11)† | | 540,000 | | $ | 374,946 |

Think Partnership, Inc. ($3.05, expires 12/05/11)† | | 170,043 | | | 122,127 |

Think Partnership, Inc. ($4.00, expires 12/05/11)† | | 85,022 | | | 53,899 |

| | | | | |

Total Warrants

(Cost: $0) | | | | $ | 550,972 |

| | | | | |

Total Investments - 99.3%

(Cost: $176,022,792) | | | | $ | 217,874,074 |

Other Assets less Liabilities 0.7% | | | | | 1,449,196 |

| | | | | |

Net Assets - 100% | | | | $ | 219,323,270 |

| | | | | |

Based on the cost of investments of $176,279,086 for federal income tax purposes at December 31, 2007, the aggregate gross unrealized appreciation was $56,791,839 the aggregate gross unrealized depreciation was $15,196,851 and the net unrealized appreciation of investments was $41,594,988.

| * | Non-Income producing security during the year ended December 31, 2007. |

ADR American Depositary Receipt

See accompanying notes to the financial statements.

17

OBERWEIS MICRO-CAP FUND

Schedule of Investments

December 31, 2007

| | | | | |

| | | Shares | | Value |

EQUITIES - 98.9% | | | | | |

Air Transport - 0.7% | | | | | |

Edac Technologies Co.* | | 35,000 | | $ | 342,300 |

| | | | | |

Banks - 1.1% | | | | | |

Alliance Bankshares Corp.* | | 11,800 | | | 77,762 |

Silver State Bancorp * | | 34,450 | | | 485,745 |

| | | | | |

| | | | | 563,507 |

| | | | | |

Biotechnology - 4.9% | | | | | |

Omrix Biopharmaceuticals, Inc.* | | 46,300 | | | 1,608,462 |

Repligen Corp.* | | 137,400 | | | 899,970 |

| | | | | |

| | | | | 2,508,432 |

| | | | | |

Casinos & Gambling - 0.3% | | | | | |

Century Casinos, Inc.* | | 21,400 | | | 137,816 |

| | | | | |

Chemicals - 5.8% | | | | | |

KMG Chemicals, Inc | | 16,300 | | | 235,698 |

LSB Industries, Inc.* | | 51,700 | | | 1,458,974 |

Ultralife Batteries, Inc.* | | 61,900 | | | 1,247,285 |

| | | | | |

| | | | | 2,941,957 |

| | | | | |

Commercial Information System - 1.1% | | | | | |

Internet Gold-Golden Lines Ltd.* | | 48,000 | | | 571,200 |

| | | | | |

Communication Technology - 3.7% | | | | | |

Ceragon Networks Ltd.* | | 94,500 | | | 934,605 |

Chyron Corp.* | | 20,300 | | | 110,635 |

Network Equipment Technologies, Inc. * | | 59,200 | | | 498,464 |

Telular Corp.* | | 50,275 | | | 344,384 |

| | | | | |

| | | | | 1,888,088 |

| | | | | |

Computer Services Software & Systems - 23.4% | | | | | |

Bitstream, Inc.* | | 41,300 | | | 264,320 |

ClickSoftware Technologies Ltd.* | | 203,600 | | | 822,544 |

Document Sciences Co.* | | 21,000 | | | 304,290 |

Double-Take Software, Inc.* | | 82,500 | | | 1,791,900 |

Ebix, Inc.* | | 8,800 | | | 636,680 |

Edgewater Technology, Inc.* | | 24,800 | | | 181,040 |

Global Med Technologies, Inc.* | | 68,300 | | | 73,764 |

GlobalScape, Inc.* | | 110,200 | | | 608,304 |

GSE Systems, Inc.* | | 62,800 | | | 643,072 |

Guidance Software Inc.* | | 23,000 | | | 320,620 |

Innodata Isogen, Inc.* | | 51,300 | | | 274,455 |

Kenexa Corp.* | | 63,532 | | | 1,233,792 |

NetSol Technologies, Inc.* | | 155,900 | | | 375,719 |

Sigma Designs, Inc.* | | 23,400 | | | 1,291,680 |

See accompanying notes to the financial statements.

18

OBERWEIS MICRO-CAP FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Silverstar Hldgs. Ltd.* | | 274,300 | | $ | 485,511 |

Simulations Plus, Inc.* | | 200,000 | | | 766,020 |

Unica Corp.* | | 10,700 | | | 98,975 |

Vasco Data Security International, Inc.* | | 48,008 | | | 1,340,383 |

Website Pros, Inc.* | | 34,900 | | | 405,189 |

| | | | | |

| | | | | 11,918,258 |

| | | | | |

Computer Technology - 2.7% | | | | | |

NCI, Inc.* | | 37,000 | | | 633,070 |

Silicom Ltd.* | | 51,600 | | | 720,852 |

| | | | | |

| | | | | 1,353,922 |

| | | | | |

Control & Filter Devices - 0.6% | | | | | |

K-Tron International, Inc.* | | 2,500 | | | 298,125 |

| | | | | |

Diversified Production - 2.6% | | | | | |

Astronics Corp.* | | 31,500 | | | 1,338,750 |

| | | | | |

Drugs & Pharmaceuticals - 0.8% | | | | | |

Questcor Pharmaceuticals, Inc.* | | 68,700 | | | 396,399 |

| | | | | |

Education Services - 1.1% | | | | | |

GP Strategies Corp.* | | 51,800 | | | 551,670 |

| | | | | |

Electronic Instruments - 1.1% | | | | | |

Perceptron, Inc.* | | 55,900 | | | 590,863 |

| | | | | |

Electronic Medical Systems - 3.4% | | | | | |

Somanetics Corp.* | | 41,722 | | | 986,725 |

Visicu, Inc.* | | 65,100 | | | 772,737 |

| | | | | |

| | | | | 1,759,462 |

| | | | | |

Electronics Semi-Conductors - 4.2% | | | | | |

Alliance Fiber Optic Products, Inc.* | | 57,300 | | | 114,600 |

AXT, Inc.* | | 149,700 | | | 928,140 |

Catalyst Semiconductor, Inc.* | | 97,600 | | | 453,840 |

NVE Corp.* | | 23,900 | | | 587,940 |

Simtek Corp.* | | 14,708 | | | 33,975 |

| | | | | |

| | | | | 2,118,495 |

| | | | | |

Engineering & Construction Services - 1.8% | | | | | |

Versar, Inc.* | | 49,100 | | | 318,168 |

VSE Corp | | 11,900 | | | 581,196 |

| | | | | |

| | | | | 899,364 |

| | | | | |

Equipment Misc. - 0.2% | | | | | |

MFRI, Inc.* | | 7,900 | | | 84,293 |

| | | | | |

See accompanying notes to the financial statements.

19

OBERWEIS MICRO-CAP FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Financial Data Product Services - 2.6% | | | | | |

Cybersource Corp.* | | 73,929 | | $ | 1,313,718 |

| | | | | |

Financial Information Services - 0.7% | | | | | |

TheStreet.com, Inc. | | 22,500 | | | 358,200 |

| | | | | |

Health Care Facilities - 1.2% | | | | | |

Almost Family, Inc.* | | 31,700 | | | 613,712 |

| | | | | |

Health Care Misc. - 0.3% | | | | | |

American Caresource Hldgs., Inc.* | | 50,100 | | | 160,320 |

| | | | | |

Machine Oilwell Equipment - 8.2% | | | | | |

Allis-Chalmers Energy, Inc.* | | 41,600 | | | 613,600 |

Bolt Technology Corp.* | | 25,200 | | | 957,096 |

Flotek Industries, Inc.* | | 35,000 | | | 1,261,400 |

T-3 Energy Services, Inc.* | | 28,900 | | | 1,358,589 |

| | | | | |

| | | | | 4,190,685 |

| | | | | |

Machinery - Construction - 0.1% | | | | | |

Paragon Technologies, Inc.* | | 9,900 | | | 67,815 |

| | | | | |

Machinery & Engineering - 0.4% | | | | | |

Peerless Mfg. Co.* | | 4,500 | | | 185,355 |

| | | | | |

Machine Tools - 0.9% | | | | | |

Hurco Companies, Inc.* | | 10,378 | | | 453,000 |

| | | | | |

Medical & Dental Instruments & Supply - 2.7% | | | | | |

Rochester Medical Corp.* | | 19,299 | | | 214,991 |

Span-America Medical Systems, Inc | | 2,900 | | | 32,799 |

Synovis Life Technologies, Inc.* | | 32,100 | | | 627,555 |

Transcend Services, Inc.* | | 31,000 | | | 503,750 |

| | | | | |

| | | | | 1,379,095 |

| | | | | |

Medical & Dental Services - 0.6% | | | | | |

Tutogen Medical, Inc.* | | 31,900 | | | 329,208 |

| | | | | |

Metal Fabricating - 3.1% | | | | | |

Dynamic Materials Corp | | 21,202 | | | 1,248,798 |

Graham Corp | | 6,300 | | | 330,120 |

| | | | | |

| | | | | 1,578,918 |

| | | | | |

Oil Crude Producer - 1.4% | | | | | |

Geokinetics, Inc.* | | 35,700 | | | 694,365 |

| | | | | |

Oil Integrated Domestic - 1.0% | | | | | |

GMX Resources, Inc.* | | 16,000 | | | 516,480 |

| | | | | |

See accompanying notes to the financial statements.

20

OBERWEIS MICRO-CAP FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Pollution & Environmental Service - 1.7% | | | | | |

Fuel - Tech N.V.* | | 38,600 | | $ | 874,290 |

| | | | | |

Retail - 0.5% | | | | | |

Appliance Recycling Centers of America, Inc.* | | 26,400 | | | 236,280 |

| | | | | |

Service Commercial - 7.9% | | | | | |

Bidz.com, Inc.* | | 72,300 | | | 648,531 |

CRM Hldgs. Ltd.* | | 93,800 | | | 735,392 |

ICF International, Inc.* | | 26,500 | | | 669,390 |

Inx, Inc.* | | 15,500 | | | 161,975 |

Perficient, Inc.* | | 80,618 | | | 1,268,927 |

Rainmaker Systems, Inc.* | | 88,134 | | | 569,346 |

| | | | | |

| | | | | 4,053,561 |

| | | | | |

Technology Misc. - 2.8% | | | | | |

Vocus, Inc.* | | 41,700 | | | 1,439,901 |

| | | | | |

Telecommunications - 0.9% | | | | | |

Numerex Corp.* | | 27,700 | | | 228,525 |

Vicon Industries, Inc.* | | 25,700 | | | 246,720 |

| | | | | |

| | | | | 475,245 |

| | | | | |

Tires & Rubber - 0.4% | | | | | |

Female Health Co.* | | 88,700 | | | 226,185 |

| | | | | |

Utilities Telecommunication - 1.9% | | | | | |

Commtouch Software Ltd.* | | 264,200 | | | 533,684 |

RRSAT Global Communication Network Ltd.* | | 22,500 | | | 443,025 |

| | | | | |

| | | | | 976,709 |

| | | | | |

Wholesalers - 0.1% | | | | | |

Clean Diesel Technologies, Inc.* | | 1,700 | | | 38,981 |

| | | | | |

Total Equities

(Cost: $ 39,313,748) | | | | $ | 50,424,924 |

| | | | | |

| | |

| | | Face Amount | | Value |

Commercial Paper - 1.7% | | | | | |

HSBC Financial Corp | | 900,000 | | | |

4.45%, due 01/03/2008 | | | | $ | 900,000 |

| | | | | |

Total Commercial Paper -

(Cost: $ 900,000) | | | | $ | 900,000 |

| | | | | |

See accompanying notes to the financial statements.

21

OBERWEIS MICRO-CAP FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | | |

| | | Units | | Value | |

Warrants - 0.5% | | | | | | |

Internet Software & Systems | | | | | | |

Think Partnership, Inc. ($2.50, expires 04/03/11)† | | 260,000 | | $ | 180,529 | |

Think Partnership, Inc. ($3.05, expires 12/05/11)† | | 81,873 | | | 58,802 | |

Think Partnership, Inc. ($4.00, expires 12/05/11)† | | 40,937 | | | 25,952 | |

| | | | | | |

Total Warrants

(Cost: $0) | | | | $ | 265,283 | |

| | | | | | |

Total Investments - 101.1%

(Cost: $40,213,748) | | | | $ | 51,590,207 | |

Other Liabilities less Assets - (1.1%) | | | | | (586,103 | ) |

| | | | | | |

Net Assets - 100% | | | | $ | 51,004,104 | |

| | | | | | |

Based on the cost of investments of $40,272,832 for federal income tax purposes at December 31, 2007, the aggregate gross unrealized appreciation was $14,510,512 the aggregate gross unrealized depreciation was $3,193,137 and the net unrealized appreciation of investments was $11,317,375.

| * | Non-Income producing security during the year ended December 31, 2007. |

See accompanying notes to the financial statements.

22

OBERWEIS MID-CAP FUND

Schedule of Investments

December 31, 2007

| | | | | |

| | | Shares | | Value |

EQUITIES - 99.0% | | | | | |

Advertising Agency - 1.9% | | | | | |

Focus Media Hldg. Ltd. ADR * | | 3,800 | | $ | 215,878 |

| | | | | |

Auto Trucks & Parts - 0.8% | | | | | |

Spartan Motors, Inc | | 12,100 | | | 92,444 |

| | | | | |

Beverage - Brewers Wine - 0.9% | | | | | |

Vina Concha y Toro S.A. ADR | | 2,400 | | | 101,952 |

| | | | | |

Biotech Research & Production - 8.4% | | | | | |

Cubist Pharmaceuticals, Inc.* | | 14,200 | | | 291,242 |

Icon Plc. ADR * | | 3,600 | | | 222,696 |

Omrix Biopharmaceutical, Inc.* | | 12,900 | | | 448,146 |

| | | | | |

| | | | | 962,084 |

| | | | | |

Building Materials - 1.9% | | | | | |

Zoltek Companies Inc.* | | 5,100 | | | 218,637 |

| | | | | |

Business & Consumers Discretionary Misc. - 0.4% | | | | | |

Ulta Salon, Cosmetics, and Fragrance, Inc.* | | 2,500 | | | 42,875 |

| | | | | |

Commercial Information Service - 1.7% | | | | | |

Baidu.com, Inc. ADR * | | 500 | | | 194,900 |

| | | | | |

Communication Technology - 4.0% | | | | | |

Aruba Networks, Inc.* | | 1,800 | | | 26,838 |

Atheros Communications, Inc.* | | 3,800 | | | 116,052 |

Ciena Corp.* | | 3,600 | | | 122,796 |

Netgear, Inc.* | | 5,200 | | | 185,484 |

| | | | | |

| | | | | 451,170 |

| | | | | |

Computer Services Software & Systems - 16.7% | | | | | |

Chordiant Software, Inc.* | | 13,100 | | | 112,005 |

Commvault Systems, Inc.* | | 9,400 | | | 199,092 |

Dealertrack Hldgs., Inc.* | | 6,000 | | | 200,820 |

Kenxa Corp.* | | 5,200 | | | 100,984 |

Nuance Communications, Inc.* | | 19,900 | | | 371,732 |

Omniture, Inc.* | | 8,000 | | | 266,320 |

Sapient Corp.* | | 17,500 | | | 154,175 |

Synchronoss Technologies, Inc.* | | 6,800 | | | 240,992 |

Vasco Data Security International, Inc.* | | 9,800 | | | 273,616 |

| | | | | |

| | | | | 1,919,736 |

| | | | | |

Computer Technology - 2.8% | | | | | |

Riverbed Technology, Inc.* | | 2,500 | | | 66,850 |

Synaptics, Inc.* | | 6,200 | | | 255,192 |

| | | | | |

| | | | | 322,042 |

| | | | | |

See accompanying notes to the financial statements.

23

OBERWEIS MID-CAP FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Diverse Financial Services - 2.8% | | | | | |

Euronet Worldwide, Inc.* | | 5,600 | | $ | 168,000 |

NASDAQ Stock Market, Inc.* | | 3,200 | | | 158,368 |

| | | | | |

| | | | | 326,368 |

| | | | | |

Drugs & Pharmaceuticals - 2.8% | | | | | |

Adams Respiratory Therapeutics, Inc.* | | 900 | | | 53,766 |

Sciele Pharmaceutical, Inc.* | | 7,000 | | | 143,150 |

United Therapeutics Corp.* | | 1,300 | | | 126,945 |

| | | | | |

| | | | | 323,861 |

| | | | | |

Electronic Medical Systems - 13.9% | | | | | |

Accuray, Inc.* | | 13,700 | | | 208,514 |

Hologic, Inc.* | | 5,300 | | | 363,792 |

Illumina, Inc.* | | 8,700 | | | 515,562 |

Intuitive Surgical, Inc.* | | 1,591 | | | 513,893 |

| | | | | |

| | | | | 1,601,761 |

| | | | | |

Electronics - 3.7% | | | | | |

FLIR Systems, Inc.* | | 13,400 | | | 419,420 |

| | | | | |

Electronics Semi-Conductors - 3.2% | | | | | |

SunTech Power Hldgs. Co. Ltd. ADR * | | 2,200 | | | 181,104 |

Tessera Technologies, Inc.* | | 4,400 | | | 183,040 |

| | | | | |

| | | | | 364,144 |

| | | | | |

Forms & Bulk Print - 1.6% | | | | | |

InnerWorkings, Inc.* | | 10,800 | | | 186,408 |

| | | | | |

Health Care Management Services - 4.7% | | | | | |

Allscripts Healthcare Solutions, Inc.* | | 6,400 | | | 124,288 |

Amerigroup Corp.* | | 5,000 | | | 182,250 |

HealthExtras, Inc.* | | 4,100 | | | 106,928 |

Phase Forward, Inc.* | | 5,900 | | | 128,325 |

| | | | | |

| | | | | 541,791 |

| | | | | |

Leisure Time - 1.4% | | | | | |

Life Time Fitness, Inc.* | | 3,200 | | | 158,976 |

| | | | | |

Machine Oilwell - 6.9% | | | | | |

Flotek Industries, Inc.* | | 7,100 | | | 255,884 |

Oceaneering International, Inc.* | | 4,000 | | | 269,400 |

W-H Energy Services, Inc.* | | 2,800 | | | 157,388 |

Willbros Group, Inc.* | | 3,000 | | | 114,870 |

| | | | | |

| | | | | 797,542 |

| | | | | |

See accompanying notes to the financial statements.

24

OBERWEIS MID-CAP FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Oil Crude Producer - 2.9% | | | | | |

ATP Oil & Gas Corp.* | | 3,500 | | $ | 176,890 |

Gulfport Energy Corp.* | | 8,500 | | | 155,210 |

| | | | | |

| | | | | 332,100 |

| | | | | |

Producer Durables Misc. - 2.9% | | | | | |

BE Aerospace, Inc.* | | 6,200 | | | 327,980 |

| | | | | |

Restaurants - 2.4% | | | | | |

Chipotle Mexican Grill, Inc.* | | 1,900 | | | 279,433 |

| | | | | |

Retail - 4.5% | | | | | |

Gamestop Corp.* | | 3,000 | | | 186,330 |

Priceline.com, Inc.* | | 1,800 | | | 206,748 |

Zumiez, Inc.* | | 5,200 | | | 126,672 |

| | | | | |

| | | | | 519,750 |

| | | | | |

Textile - Apparel Manufacturer - 3.6% | | | | | |

Guess?, Inc* | | 6,300 | | | 238,707 |

Under Armour, Inc.* | | 4,000 | | | 174,680 |

| | | | | |

| | | | | 413,387 |

| | | | | |

Wholesale and International Trade - 2.2% | | | | | |

Central European Distribution Corp.* | | 4,352 | | | 252,764 |

| | | | | |

Total Equities

(Cost: $9,491,852) | | | | $ | 11,367,403 |

| | | | | |

Total Investments - 99.0%

(Cost: $9,491,852) | | | | $ | 11,367,403 |

Other Assets less Liabilities - 1.0% | | | | | 116,414 |

| | | | | |

Net Assets - 100% | | | | $ | 11,483,817 |

| | | | | |

Based on the cost of investments of $9,551,254 for federal income tax purposes at December 31, 2007, the aggregate gross unrealized appreciation was $2,504,703 the aggregate gross unrealized depreciation was $688,554 and the net unrealized appreciation of investments was $1,816,149.

| * | Non-Income producing security during the year ended December 31, 2007. |

ADR American Depositary Receipt

See accompanying notes to the financial statements.

25

OBERWEIS CHINA OPPORTUNITIES FUND

Schedule of Investments

December 31, 2007

| | | | | |

| | | Shares | | Value |

EQUITIES - 98.8% | | | | | |

Auto Components - 3.1% | | | | | |

Minth Group Ltd.† | | 7,949,100 | | $ | 11,663,791 |

Xinyi Glass Hldg. Co. Ltd.† | | 10,866,900 | | | 10,433,333 |

Zhejiang Glass Co.†* | | 7,705,400 | | | 7,157,443 |

| | | | | |

| | | | | 29,254,567 |

| | | | | |

Chemicals - 0.7% | | | | | |

Jiutian Chemical Group Ltd† | | 20,909,600 | | | 6,795,311 |

| | | | | |

Commercial Service & Supply - 0.3% | | | | | |

Asia Environment Hldgs. Ltd.† | | 5,341,900 | | | 3,039,738 |

| | | | | |

Communications Equipment - 0.9% | | | | | |

China Auto Electronics Group†* | | 8,336,600 | | | 3,433,212 |

Comtech Group, Inc.* | | 292,800 | | | 4,717,008 |

| | | | | |

| | | | | 8,150,220 |

| | | | | |

Computers & Peripherals - 0.8% | | | | | |

China Digital TV Hldg. ADR* | | 268,600 | | | 7,246,828 |

| | | | | |

Construction & Engineering - 1.0% | | | | | |

China Communications Construction Co.† | | 3,497,800 | | | 9,042,764 |

| | | | | |

Construction Materials - 3.0% | | | | | |

China National Building Material Co. Ltd.† | | 6,859,700 | | | 25,987,226 |

China National Materials Co.* | | 1,527,600 | | | 1,861,159 |

| | | | | |

| | | | | 27,848,385 |

| | | | | |

Containers & Packaging - 0.7% | | | | | |

AMVIG Hldgs. Ltd.† | | 5,020,200 | | | 7,019,807 |

| | | | | |

Distributors - 2.4% | | | | | |

Huabao International Hldgs. Ltd.† | | 12,573,000 | | | 12,449,486 |

Li & Fung Ltd.† | | 2,528,800 | | | 10,081,601 |

| | | | | |

| | | | | 22,531,087 |

| | | | | |

Diversified Consumer Services - 4.1% | | | | | |

Hartford Education Corp | | 2,567,050 | | | 312,087 |

New Oriental Education & Technology Group, Inc ADR* | | 205,700 | | | 16,577,363 |

Raffles Education Corp. Ltd.† | | 10,444,900 | | | 21,917,274 |

| | | | | |

| | | | | 38,806,724 |

| | | | | |

Diversified Financial Services - 1.6% | | | | | |

Hong Kong Exchanges & Clearing† | | 541,700 | | | 15,185,899 |

| | | | | |

See accompanying notes to the financial statements.

26

OBERWEIS CHINA OPPORTUNITIES FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Electrical Equipment - 6.7% | | | | | |

China High Speed Transmission†* | | 6,115,700 | | $ | 16,034,595 |

Dongfang Electrical Machinery Ltd.† | | 1,518,100 | | | 12,686,397 |

Neo-Neon Hldgs. Ltd.†* | | 3,858,500 | | | 3,809,807 |

Suntech Power Hldgs. Co., Ltd ADR * | | 376,300 | | | 30,977,016 |

| | | | | |

| | | | | 63,507,815 |

| | | | | |

Electronic Equipment & Instruments - 1.3% | | | | | |

Kingboard Chemicals Hldgs. Ltd.† | | 2,085,600 | | | 12,321,126 |

| | | | | |

Energy Equipment & Services - 4.9% | | | | | |

China Oilfield Services Ltd.† | | 7,533,100 | | | 16,823,640 |

Emer International Group Ltd.†* | | 6,611,800 | | | 4,531,356 |

Ezra Hldgs. Ltd.† | | 9,890,800 | | | 22,584,377 |

Shandong Molong Petroleum Co., Ltd.† | | 13,581,500 | | | 2,629,593 |

| | | | | |

| | | | | 46,568,966 |

| | | | | |

Food Products - 2.0% | | | | | |

China Mengniu Dairy Co.† | | 3,581,900 | | | 12,995,378 |

Synear Food Hldgs. Ltd.† | | 5,429,200 | | | 6,276,894 |

| | | | | |

| | | | | 19,272,272 |

| | | | | |

Food & Staples Retailing - 0.4% | | | | | |

Olam International Ltd.† | | 2,162,000 | | | 4,252,807 |

| | | | | |

Gas Utilities - 1.2% | | | | | |

China Gas Hldgs. Ltd.† | | 7,744,500 | | | 3,328,862 |

Xinao Gas Hldgs. Ltd.† | | 4,185,400 | | | 8,275,363 |

| | | | | |

| | | | | 11,604,225 |

| | | | | |

Health Care Equipment Supplies - 3.1% | | | | | |

Mindray Medical International Ltd. ADR* | | 345,300 | | | 14,837,541 |

Shandong Weigao Group† | | 6,141,600 | | | 14,065,488 |

| | | | | |

| | | | | 28,903,029 |

| | | | | |

Hotels Restaurants & Leisure - 5.5% | | | | | |

Ajisen China Hldgs. Ltd.†* | | 3,716,900 | | | 6,590,497 |

Banyan Tree Hldgs. Ltd.† | | 3,876,600 | | | 5,477,251 |

Ctrip.com International Ltd. ADR* | | 316,300 | | | 18,177,761 |

Fu Ji Food & Catering Services Hldgs. Ltd.† | | 3,581,600 | | | 8,193,759 |

Home Inns & Hotels Mgmt. Inc. ADR * | | 369,800 | | | 13,179,672 |

| | | | | |

| | | | | 51,618,940 |

| | | | | |

Household Durables - 0.4% | | | | | |

China Water Affairs Group.†* | | 5,682,000 | | | 3,448,594 |

| | | | | |

See accompanying notes to the financial statements.

27

OBERWEIS CHINA OPPORTUNITIES FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Industrial Power Production/Energy Trade - 2.0% | | | | | |

China Resources Power Hldgs.Co.† | | 5,686,900 | | $ | 19,332,426 |

| | | | | |

Internet Software & Services - 7.5% | | | | | |

Alibaba.com Ltd.* | | 2,124,900 | | | 7,535,010 |

Baidu.com, Inc. ADR * | | 71,300 | | | 27,792,740 |

Sohu.com, Inc.* | | 335,700 | | | 18,302,364 |

Tencent Hldgs. Ltd.† | | 2,237,000 | | | 16,707,843 |

| | | | | |

| | | | | 70,337,957 |

| | | | | |

Leisure Equipment & Products - 2.2% | | | | | |

Li Ning Co. Ltd.† | | 5,589,100 | | | 20,580,194 |

| | | | | |

Life Sciences Tools & Services - 0.7% | | | | | |

Wuxi Pharmatech, Inc. ADR * | | 230,100 | | | 6,728,124 |

| | | | | |

Machinery - 4.5% | | | | | |

China Infrastructure Machinery Hldg.† | | 7,270,300 | | | 11,385,729 |

Enric Energy Equipment†* | | 3,215,300 | | | 3,715,322 |

Eva Precision Industrial Hldg.† | | 9,946,500 | | | 3,771,236 |

Guangzhou Shipyard International Co.†* | | 1,988,500 | | | 11,026,593 |

Yangzijiang Ship Building†* | | 9,062,200 | | | 12,405,478 |

| | | | | |

| | | | | 42,304,358 |

| | | | | |

Marine - 1.0% | | | | | |

China Shipping Development† | | 3,845,300 | | | 9,985,037 |

| | | | | |

Media - 4.8% | | | | | |

Air Media Group, Inc. ADR.* | | 560,400 | | | 12,541,752 |

Focus Media Hldgs. Ltd ADR.* | | 464,000 | | | 26,359,840 |

VisionChina Media, Inc. ADR.* | | 708,940 | | | 6,025,990 |

| | | | | |

| | | | | 44,927,582 |

| | | | | |

Metals & Mining - 1.8% | | | | | |

China Molybdenum Co.†* | | 4,269,100 | | | 7,684,150 |

Zijin Mining Group Co., Ltd.† | | 6,036,975 | | | 9,143,028 |

| | | | | |

| | | | | 16,827,178 |

| | | | | |

Multiline Retail - 4.1% | | | | | |

Golden Eagle Retail Group Ltd.† | | 6,861,464 | | | 7,106,447 |

Lifestyle, International Hldgs. Ltd.† | | 4,634,700 | | | 12,397,380 |

Parkson Retail Group Ltd.† | | 1,619,700 | | | 19,328,945 |

| | | | | |

| | | | | 38,832,772 |

| | | | | |

See accompanying notes to the financial statements.

28

OBERWEIS CHINA OPPORTUNITIES FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Paper & Forest Products - 6.6% | | | | | |

China Grand Forestry†* | | 64,177,200 | | $ | 13,409,277 |

Lee Man Paper Manufacturing Ltd.† | | 6,872,900 | | | 29,963,231 |

Nine Dragons Paper Hldgs. Ltd.† | | 7,705,000 | | | 19,257,954 |

| | | | | |

| | | | | 62,630,462 |

| | | | | |

Personal Products - 2.6% | | | | | |

China Flavors & Fragrances† | | 9,469,348 | | | 3,784,266 |

Ecogreen Fine Chemicals Group† | | 2,707,200 | | | 1,172,400 |

Hengan International Groups Co., Ltd.† | | 4,327,500 | | | 19,234,604 |

| | | | | |

| | | | | 24,191,270 |

| | | | | |

Real Estate Management & Development - 3.9% | | | | | |

E House China Hldgs. ADS | | 420,900 | | | 10,030,047 |

Guangzhou R&F Properties Co., Ltd.† | | 3,062,600 | | | 10,741,684 |

Hopson Develpment Hldgs. Ltd.† | | 1,572,200 | | | 4,287,992 |

Sino-Ocean Land Hldgs.* | | 2,258,500 | | | 2,797,998 |

Yanlord Land Group Ltd.† | | 3,863,300 | | | 8,827,793 |

| | | | | |

| | | | | 36,685,514 |

| | | | | |

Software - 1.0% | | | | | |

Longtop Financial Technologies Ltd. ADR * | | 330,525 | | | 7,826,832 |

VanceInfo Technologies, Inc. ADR * | | 218,130 | | | 1,963,170 |

| | | | | |

| | | | | 9,790,002 |

| | | | | |

Specialty Retail - 1.2% | | | | | |

Belle International Hldgs.† | | 7,533,700 | | | 11,270,695 |

| | | | | |

Semiconductors & Semi Equipment - 0.5% | | | | | |

Trina Solar Ltd. ADR * | | 95,200 | | | 5,121,760 |

| | | | | |

Textile, Apparel & Luxury Goods - 7.0% | | | | | |

Anta Sports Products Co. Ltd.†* | | 10,120,700 | | | 13,922,809 |

China Hongxing Sports Ltd.† | | 14,964,300 | | | 9,819,916 |

China Sky Chemical Fibre Co.† | | 9,766,300 | | | 14,861,304 |

Peace Mark Hldgs. Ltd.† | | 9,182,400 | | | 14,584,158 |

Ports Design Ltd.† | | 3,653,195 | | | 12,529,483 |

| | | | | |

| | | | | 65,717,670 |

| | | | | |

Trading Co. & Distribution - 1.4% | | | | | |

KS Energy Services Ltd.† | | 5,918,200 | | | 13,097,376 |

| | | | | |

Transport Infrastructure - 1.2% | | | | | |

Hong Kong Aircraft Engineering† | | 412,600 | | | 11,136,422 |

| | | | | |

See accompanying notes to the financial statements.

29

OBERWEIS CHINA OPPORTUNITIES FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | | |

| | | Shares | | Value | |

Water Utilities - 0.7% | | | | | | |

Epure International Ltd†* | | 4,839,500 | | $ | 7,004,827 | |

| | | | | | |

Total Equities (Cost: $596,075,047) | | | | $ | 932,920,730 | |

| | | | | | |

| | |

| | | Face

Amount | | Value | |

Commercial Paper - 1.7% | | | | | | |

Toyota Motor Credit | | 16,000,000 | | | | |

4.18%, due 01/03/2008 | | | | $ | 16,000,000 | |

| | | | | | |

Total Commercial Paper

(Cost: $16,000,000) | | | | $ | 16,000,000 | |

| | | | | | |

| | |

| | | Units | | Value | |

Warrants - 0.1% | | | | | | |

Chemicals | | | | | | |

Jiutian Chemical Group Ltd. ($0.80, expires 10/15/10) | | 4,587,700 | | $ | 478,068 | |

| | | | | | |

Total Warrants

(Cost: $0) | | | | $ | 478,068 | |

| | | | | | |

Total Investments - 100.6%

(Cost: $612,075,047) | | | | $ | 949,398,798 | |

Other Liabilities less Assets - (0.6%) | | | | | (5,574,024 | ) |

| | | | | | |

Net Assets - 100% | | | | $ | 943,824,774 | |

| | | | | | |

Based on the cost of investments of $615,633,764 for federal income tax purposes at December 31, 2007, the aggregate gross unrealized appreciation was $349,713,335, the aggregate gross unrealized depreciation was $15,948,301 and the net unrealized appreciation of investments was $333,765,034.

| * | Non-Income producing security during the year ended December 31, 2007. |

| | | |

ADR American Depositary Receipt | | | |

COUNTRY ALLOCATION (as a percentage of Net Assets) | | | |

China (Includes the People’s Republic of China and Hong Kong) | | 87.0 | % |

Taiwan | | 0.4 | % |

Singapore | | 11.4 | % |

See accompanying notes to the financial statements.

30

OBERWEIS INTERNATIONAL OPPORTUNITES FUND

Schedule of Investments

December 31, 2007

| | | | | |

| | | Shares | | Value |

EQUITIES - 92.2% | | | | | |

Australia - 8.8% | | | | | |

Ausenco Ltd. | | 100,000 | | $ | 1,336,389 |

Computershare Ltd. | | 105,000 | | | 910,887 |

JB HI-FI Ltd. | | 160,000 | | | 2,191,608 |

Leighton Hldgs. Ltd. | | 44,000 | | | 2,364,407 |

Monadelphous Group Ltd. | | 108,000 | | | 1,307,694 |

Tassal Group Ltd. | | 490,883 | | | 1,810,279 |

| | | | | |

| | | | | 9,921,264 |

| | | | | |

Austria - 2.4% | | | | | |

Schoeller-Bleckmann Oilfield† | | 30,000 | | | 2,691,188 |

| | | | | |

Canada - 2.0% | | | | | |

Absolute Software Corp.* | | 60,000 | | | 2,229,900 |

| | | | | |

Denmark - 3.5% | | | | | |

Flsmidth & Co. AS† | | 39,000 | | | 3,976,874 |

| | | | | |

Finland - 4.2% | | | | | |

Elisa Corp.† | | 21,000 | | | 642,220 |

Konecranes OYJ† | | 26,000 | | | 885,673 |

Outokumpu Technology† | | 28,000 | | | 1,518,141 |

Poyry OYJ† | | 64,000 | | | 1,622,237 |

| | | | | |

| | | | | 4,668,271 |

| | | | | |

France - 1.8% | | | | | |

Seloger.com * | | 35,000 | | | 2,057,108 |

| | | | | |

Germany - 6.6% | | | | | |

Aixtron AG†* | | 200,000 | | | 2,779,157 |

Roth & Rau AG†* | | 9,200 | | | 3,428,291 |

SGL Carbon AG†* | | 23,000 | | | 1,244,526 |

| | | | | |

| | | | | 7,451,974 |

| | | | | |

Greece - 6.4% | | | | | |

Hellenic Exchanges | | 90,000 | | | 3,158,033 |

Jumbo S.A | | 49,000 | | | 1,776,686 |

Sprider Stores S.A | | 300,000 | | | 2,280,802 |

| | | | | |

| | | | | 7,215,521 |

| | | | | |

HongKong - 3.9% | | | | | |

Pacific Basin Shipping Ltd. | | 100,000 | | | 161,336 |

Shandong Weigao Group Medical | | 671,900 | | | 1,551,055 |

Weichai Power Co. Ltd. | | 190,000 | | | 1,386,488 |

Xinyi Glass Hldg. Co. Ltd. | | 1,377,400 | | | 1,338,997 |

| | | | | |

| | | | | 4,437,876 |

| | | | | |

See accompanying notes to the financial statements.

31

OBERWEIS INTERNATIONAL OPPORTUNITIES FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Italy - 2.1% | | | | | |

Ducati Motor Hldg.†* | | 1,100,000 | | $ | 2,313,800 |

| | | | | |

Japan - 5.1% | | | | | |

Hitachi Construction Machinery† | | 25,000 | | | 742,124 |

NGK Insulators Ltd.† | | 62,000 | | | 1,662,301 |

O-M Ltd.† | | 120,000 | | | 1,015,103 |

Shima Seiki Mfg. Ltd.† | | 38,000 | | | 1,742,729 |

Works Applications Co. Ltd.† | | 500 | | | 544,012 |

| | | | | |

| | | | | 5,706,269 |

| | | | | |

Netherlands - 4.3% | | | | | |

Boskalis Westminster | | 49,000 | | | 2,984,546 |

Smit International NV | | 18,000 | | | 1,842,186 |

| | | | | |

| | | | | 4,826,732 |

| | | | | |

Norway - 2.8% | | | | | |

Odim ASA†* | | 150,000 | | | 2,325,573 |

Tandberg ASA† | | 40,900 | | | 844,486 |

| | | | | |

| | | | | 3,170,059 |

| | | | | |

Russia- 0.5% | | | | | |

Wimm-Bill-Dann Foods OJSC ADR | | 4,500 | | | 589,680 |

| | | | | |

Singpore- 2.0% | | | | | |

China Hongxing Sports Ltd. | | 1,300,000 | | | 866,998 |

Tat Hong Hldgs. Ltd. | | 600,000 | | | 1,425,544 |

| | | | | |

| | | | | 2,292,542 |

| | | | | |

South Korea - 2.4% | | | | | |

Hyundai Mipo Dockyard† | | 3,500 | | | 1,062,457 |

Korea Line Corp.† | | 1,500 | | | 260,858 |

Taewoong Co. Ltd.† | | 15,000 | | | 1,415,680 |

| | | | | |

| | | | | 2,738,995 |

| | | | | |

Spain- 1.2% | | | | | |

Grifols SA† | | 54,000 | | | 1,212,179 |

| | | | | |

Sweden - 5.5% | | | | | |

Axis Communications AB† | | 77,100 | | | 1,886,481 |

Betsson AB† | | 160,000 | | | 2,020,842 |

Hagstromer & Qviberg AB† | | 58,000 | | | 1,558,445 |

Odd Molly International AB†* | | 25,000 | | | 678,811 |

| | | | | |

| | | | | 6,144,579 |

| | | | | |

See accompanying notes to the financial statements.

32

OBERWEIS INTERNATIONAL OPPORTUNITIES FUND

Schedule of Investments (continued)

December 31, 2007

| | | | | |

| | | Shares | | Value |

Switzerland - 6.4% | | | | | |

Burckhardt Compression Hldg.† | | 7,000 | | $ | 2,271,281 |

Meyer Burger Technology AG†* | | 8,200 | | | 3,018,767 |

Swissquote Group Hldgs† | | 35,000 | | | 1,944,564 |

| | | | | |

| | | | | 7,234,612 |

| | | | | |

United Kingdom - 20.3% | | | | | |

Aggreko | | 135,000 | | | 1,432,339 |

Aquarius Platinum | | 120,000 | | | 1,373,517 |

Aveva Group | | 100,000 | | | 1,921,929 |

Game Group | | 870,000 | | | 4,329,564 |

Lamprell PLC | | 200,000 | | | 1,711,920 |

MoneySupermarket.com * | | 30,000 | | | 83,605 |

Senior PLC | | 500,000 | | | 1,171,968 |

Severfield-Rowen | | 20,000 | | | 183,136 |

Tradus PLC * | | 69,679 | | | 2,486,951 |

Weir Group | | 125,000 | | | 2,014,243 |

Wellstream Hldgs. PLC * | | 190,000 | | | 4,096,067 |

Wood Group (John) PLC | | 240,000 | | | 2,068,636 |

| | | | | |

| | | | | 22,873,875 |

| | | | | |

Total Equities

(Cost: $81,958,559) | | | | $ | 103,753,298 |

| | | | | |

| | |

| | | Face Amount | | Value |

Commercial Paper - 5.7% | | | | | |

HSBC Financial Corp | | 1,900,000 | | | |

4.45%, due 01/03/2008 | | | | $ | 1,900,000 |

Toyota Motor Credit | | 4,500,000 | | | |

3.50%, due 01/03/2008 | | | | | 4,500,000 |

| | | | | |

Total Commercial Paper

(Cost: $6,400,000) | | | | $ | 6,400,000 |

| | | | | |

Total Investments - 97.9%

(Cost: $88,358,559) | | | | $ | 110,153,298 |

Other Assets less Liabilities - 2.1% | | | | | 2,316,674 |

| | | | | |

Net Assets - 100% | | | | $ | 112,469,972 |

| | | | | |

Based on the cost of investments of $89,040,277 for federal income tax purposes at December 31, 2007, the aggregate gross unrealized appreciation was $21,969,299 the aggregate gross unrealized depreciation was $856,278 and the net unrealized appreciation of investments was $21,113,021.

| * | Non-Income producing security during the year ended December 31, 2007. |

ADR American Depositary Receipt

See accompanying notes to the financial statements.

33

THE OBERWEIS FUNDS

Statement of Assets and Liabilities

December 31, 2007

| | | | | | | | | |

| | | Emerging

Growth Fund | | Micro-Cap

Fund | | Mid-Cap

Fund |

Assets: | | | | | | | | | |

Investment securities at value | | $ | 217,874,074 | | $ | 51,590,207 | | $ | 11,367,403 |

(Cost: $176,022,792, $40,213,748 and $9,491,852 respectively) | | | | | | | | | |

Cash | | | 249,817 | | | — | | | 95,899 |

Receivable from fund shares sold | | | 594,306 | | | 58,770 | | | 18,853 |

Receivable from securities sold | | | 2,396,014 | | | 43,908 | | | 15,414 |

Dividends and interest receivable | | | 3,792 | | | 875 | | | 661 |

Prepaid expenses | | | 14,131 | | | 12,602 | | | 5,842 |

| | | | | | | | | |

Total Assets | | | 221,132,134 | | | 51,706,362 | | | 11,504,072 |

| | | | | | | | | |

Liabilities: | | | | | | | | | |

Payable to custodian bank | | | — | | | 458,506 | | | — |

Payable for fund shares redeemed | | | 278,908 | | | 26,088 | | | 639 |

Payable for securities purchased | | | 1,266,018 | | | 138,480 | | | — |

Payable to advisor (see note 2) | | | 153,028 | | | 43,731 | | | 7,852 |

Payable to distributor | | | 47,158 | | | 10,933 | | | 2,454 |

Accrued expenses | | | 63,752 | | | 24,520 | | | 9,310 |

| | | | | | | | | |

Total Liabilities | | | 1,808,864 | | | 702,258 | | | 20,255 |

| | | | | | | | | |

Net Assets | | $ | 219,323,270 | | $ | 51,004,104 | | $ | 11,483,817 |

| | | | | | | | | |

Analysis of net assets: | | | | | | | | | |

Capital | | $ | 174,951,860 | | $ | 38,681,014 | | $ | 9,018,395 |

Undistributed net realized gains (losses) on investment and foreign currency transactions | | | 2,520,128 | | | 946,631 | | | 589,871 |

Net unrealized appreciation of investments and translation of assets and liabilities denominated in foreign currencies | | | 41,851,282 | | | 11,376,459 | | | 1,875,551 |

| | | | | | | | | |

Net Assets | | $ | 219,323,270 | | $ | 51,004,104 | | $ | 11,483,817 |

| | | | | | | | | |

The Pricing of Shares: | | | | | | | | | |

Net asset value and offering price per share | | | | | | | | | |

Emerging Growth Fund: | | | | | | | | | |

($219,323,270 divided by 8,501,501 shares outstanding) | | $ | 25.80 | | | | | | |

| | | | | | | | | |

Micro-Cap Fund: | | | | | | | | | |

($51,004,104 divided by 3,278,648 shares outstanding) | | | | | $ | 15.56 | | | |

| | | | | | | | | |

Mid-Cap Fund: | | | | | | | | | |

($11,483,817 divided by 738,419 shares outstanding) | | | | | | | | $ | 15.55 |

| | | | | | | | | |

See accompanying notes to the financial statements.

34

THE OBERWEIS FUNDS

Statement of Assets and Liabilities

December 31, 2007

| | | | | | | |

| | | China

Opportunities

Fund | | International

Opportunities

Fund | |

Assets: | | | | | | | |

Investment securities at value | | $ | 949,398,798 | | $ | 110,153,298 | |

(Cost: $612,075,047 and $88,358,559 respectively) | | | | | | | |

Cash | | | — | | | 570,348 | |

Receivable from fund shares sold | | | 1,334,077 | | | 241,776 | |

Receivable from securities sold | | | 6,596,445 | | | 6,487,783 | |

Receivable from foreign tax reclaims | | | — | | | 14,897 | |

Dividends and interest receivable | | | 304,189 | | | 24,539 | |

Prepaid expenses | | | 103,023 | | | 36,892 | |

| | | | | | | |

Total Assets | | | 957,736,532 | | | 117,529,533 | |

| | | | | | | |

Liabilities: | | | | | | | |

Payable to custodian bank | | | 5,294,457 | | | — | |

Payable for fund shares redeemed | | | 4,482,498 | | | 116,891 | |

Payable for securities purchased | | | 2,586,313 | | | 4,739,470 | |

Payable to advisor (see note 2) | | | 1,034,535 | | | 129,151 | |