UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | Investment Company Act file number | 811-4854 |

The Oberweis Funds

(Exact name of registrant as specified in charter)

3333 Warrenville Road, Suite 500, Lisle, IL 60532

(Address of principal executive offices) (Zip code)

James W. Oberweis

The Oberweis Funds

3333 Warrenville Road, Suite 500

Lisle, IL 60532 | | Copy to: James A. Arpaia

Vedder Price P.C.

222 North LaSalle Street, Suite 2600

Chicago, IL 60601 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 323-6166

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Annual Reports for the period 01/01/22 through 12/31/22 is filed herewith

| | ANNUAL REPORT | | | | |

| | | | | INVESTOR

CLASS | | INSTITUTIONAL

CLASS | | |

| | | Oberweis Micro-Cap Fund | | OBMCX | | OMCIX | | |

| | | Oberweis Small-Cap Opportunities Fund | | OBSOX | | OBSIX | | |

| | | Oberweis Global Opportunities Fund | | OBEGX | | OBGIX | | |

| | | Oberweis China Opportunities Fund | | OBCHX | | OCHIX | | |

| | | Oberweis International Opportunities Fund | | OBIOX | | — | | |

| | | Oberweis Emerging Markets Fund | | OBEMX | | OIEMX | | |

| | | December 31, 2022 | | | | | | |

| | | oberweisfunds.com | | | | | | |

PRESIDENT’S LETTER (unaudited)

Dear Fellow Shareholder,

2022 was an unusually rough year for investors. The Fed’s fight against inflation and Russia’s war in Ukraine were mostly to blame. Both stocks and bonds felt the scourge of rising interest rates. The US Fed, in an attempt to fight inflation, increased its target rate for Fed Funds by 400 bps from March to December, going from a target range of 0.25-0.5% to 4.25-4.50%. Except for China, major central banks around the world followed suit. The magnitude of this year’s increase in rates materially exceeded investor expectations.

Unanticipated large increases in interest rates are a double whammy for growth stock investors. Higher interest rates tend to slow economic growth and depress future earnings. Additionally, they also tend to compress valuation multiples for growth stocks, as a higher discount factor reduces the present value of future earnings. When viewed in that light, it’s not terribly surprising to see a sharp decline in stock prices, particularly for growth stocks.

The Fed’s quest to quell inflation was complicated by supply-side disruptions and an incredibly tight labor market. The war in Ukraine and China’s COVID-related production problems increased commodity prices and pressured global supply chains, which fueled price increases and exacerbated inflation. Further, a labor shortage put upward pressure on wages, further complicating the Fed’s anti-inflation campaign.

In terms of economic growth, the US economy fared better than Europe. Europe suffered through a period of sky-high natural gas prices, largely from its dependence on Russian supply. Non-US small caps lagged their US counterparts for the second year in a row. Japanese equities fared relatively well in local currency terms, but not in USD terms, which include the effect of the Yen’s decline versus the US dollar.

China was the most challenging geography. Between President Xi Jinping’s “Covid zero” and “shared prosperity” policies, the investment climate could only be described as decidedly unfriendly and highly unpredictable. This occurred amid a strengthening US dollar and weakening Chinese property market, typically not great signs for Chinese asset prices. Chinese markets crashed into the October National Congress of the Communist Party, when Xi doubled down on the same adverse policy rhetoric.

However, in recent months and into 2023, Chinese equities have rallied strongly. After his successful consolidation of power, Xi dramatically changed policy direction, essentially abandoning “Covid Zero” entirely. While a massive wave of Covid promptly ensued, cases in urban areas may already have peaked and we expect a return to more open times soon. Xi also showed signs of softening his stance on property market regulation and anti-monopoly investigations against Internet firms. This drove a 30% rally in China over the two months that followed the National Congress, but it was not enough to recover from the heavy losses earlier in the year.

2022 Performance in REVIEW

While nobody is happy with a negative return, the domestic funds fared exceptionally well relative to their benchmark indices and peers. The Micro-Cap Fund and Small-Cap Opportunities Fund returned -10.60% and -11.17%, respectively (compared to -29.76% and -26.36% for the Russell Micro-Cap Growth and Russell 2000 Growth indices). Among the international funds, the International Opportunities Fund returned -37.06% (versus -27.02% for the MSCI World ex-US SCG Index). The China Opportunities Fund returned -37.23% (compared to -21.93% for the MSCI China Index). The Global Opportunities Fund returned -26.80% (compared to -18.67% for the MSCI ACWI Small-Cap Index).

1

PRESIDENT’S Letter (unaudited) (continued)

It is entirely normal to have individual years deviate positively and negatively from the benchmark. Over the trailing ten years, the average annual returns of the Micro-Cap, Small-Cap, Global, International, and China Funds have all handily beaten their benchmarks. Similarly, although the Emerging Markets Fund underperformed this year, returning -24.31% (versus -18.02% for the MSCI EM Small Cap Index), the fund has markedly outperformed since its inception. In fact, the Emerging Markets Fund has generated 1,800 basis points of excess cumulative return, net of fees, since its inception on May 1, 2018.

When you measure our skill, we find the long-term track record to be far more indicative than any individual year. In fact, our experience has shown that some of the most attractive entry points often occur following periods of short-term underperformance.

THE YEAR AHEAD

A reader of the first page of this seemingly dreary commentary might conclude our outlook to be bearish. It is, in reality, quite the opposite. We believe that at current prices, the return potential for our funds is significantly above-average, particularly relative to the risks. Our research shows that valuations for global small-caps rival the incredible bargains last seen in the depths of the global financial crisis. That might seem surprising, as stock prices have not declined as much as they did in 2008-2009. However, price/earnings ratios for small-caps were not as expensive at the beginning of 2021 as they were in 2007 and earnings have not similarly declined.

Of course, earnings for our portfolios could be curtailed in 2023, but we don’t see that as the most likely outcome. First, while we expect recession as a base case in 2023, we believe a modest GDP contraction is unlikely to lead to an unhealthy level of unemployment. That is, with less leverage on both corporate and individual balance sheets and a tight labor market, we believe that the coming economic slowdown is likely to be less severe than that of 2008.

Second, and more importantly, our funds are less correlated to the broader economy than you might think. We tend to own “disruptive” niche-oriented companies growing much faster than the broader economy. Long-term growth for these companies tends to be much more correlated with product acceptance and market share gains than oscillations in GDP. While broad economic growth or contraction will influence many holdings to some degree, the real driver, especially over the long-term, tends to be company-specific product growth.

That said, during periods of rising risk-aversion, investors seek current cash flow versus the potential for future earnings growth. That’s why multiples compressed last year. But that has already happened, and buyers today are paying much lower multiples than historical averages. Multiple compression could continue in 2023 but multiples for small-cap growth stocks have already dropped to among the cheapest levels of the past two decades. It could get worse, but we doubt any further contraction will be persistent or material.

At some point, the recession will pass and valuation multiples are likely to revert back to more normal levels. We cannot predict when this will occur, but post-recessionary multiple expansion (which typically happens well before the economy reaches the end of a recession) have been the single best periods for the performance of our funds. Don’t miss it.

VALUATION RECAP

As of December 31, 2022, the price/earnings (P/E) ratio was 14.9 times for the Global Opportunities Fund (versus 13.0 last quarter), 13.0 times for the Small-Cap Opportunities Fund (versus 11.5 last quarter), 11.6 times for the Micro-Cap Fund (versus 10.5 last quarter), 15.2 times for the International Opportunities Fund (versus 12.9 last quarter), 18.9 times for the China Opportunities Fund (versus 18.6 last quarter), 18.2 times for the Emerging Markets

2

PRESIDENT’S Letter (unaudited) (continued)

Fund (versus 17.4 times last quarter). Each of these funds invests in companies with expected earnings growth rates that are higher than that of the broader market, and in companies expected to grow faster than current market expectations. As of December 31, 2022, the weighted-average market capitalization was $4.3 billion for the Global Opportunities Fund, $3.8 billion for the Small-Cap Opportunities Fund, $1.3 billion for the Micro-Cap Fund, $4.3 billion for the International Opportunities Fund, $3.9 billion for the Emerging Markets Fund, and $33.1 billion for the China Opportunities Fund.

We appreciate your investment in The Oberweis Funds and are grateful for the trust you have shown us with your valuable investments. If you have any questions about your account, please contact shareholder services at (800) 245-7311. Thank you for investing with us in The Oberweis Funds.

Sincerely,

James W. Oberweis, CFA

President & Portfolio Manager

3

Management discussion on fund performance

(unaudited)

MARKET ENVIRONMENT

Global equities returned -17.74% in 2022, as measured by the MSCI World Index. Global small-caps, as measured by the MSCI World Small-Cap Index, returned -18.41%, slightly underperforming large-capitalization stocks. International small-caps underperformed U.S. small-caps for the second year, as evidenced by the -20.59% return on the MSCI World ex-USA Small-Cap Index. Within the United States, small-cap growth stocks outperformed large-cap growth stocks by 278 basis points, as measured by the respective returns of the Russell 2000 Growth (-26.36%) and Russell 1000 Growth (-29.14%) indices. Value stocks sharply outperformed growth stocks in 2022. Within domestic small-cap, the Russell 2000 Value Index (-14.50%) outperforming the Russell 2000 Growth Index (-26.36%) by 1186 basis points for the year.

DISCUSSION OF THE OBERWEIS FUNDS

The International Opportunities Fund returned -37.06% versus -27.02% for the MSCI World ex-US Small Cap Growth Index. At the country level, the United Kingdom, Japan, and Canada detracted from portfolio return, partially offset by favorable performance in Denmark. At the sector level, the portfolio was negatively impacted by stock selection in consumer staples and consumer discretionary, partially offset by positive stock selection in industrials. At the stock level, Hexatronic (HTRO SS), D/S Norden (DNORD DC), and Aixtron (AIXA GY) were among the top contributors to performance; Future (FUTR LN), Nordic Semiconductor (NOD NO), and Food & Life Companies (3563 JP) were among the top detractors.

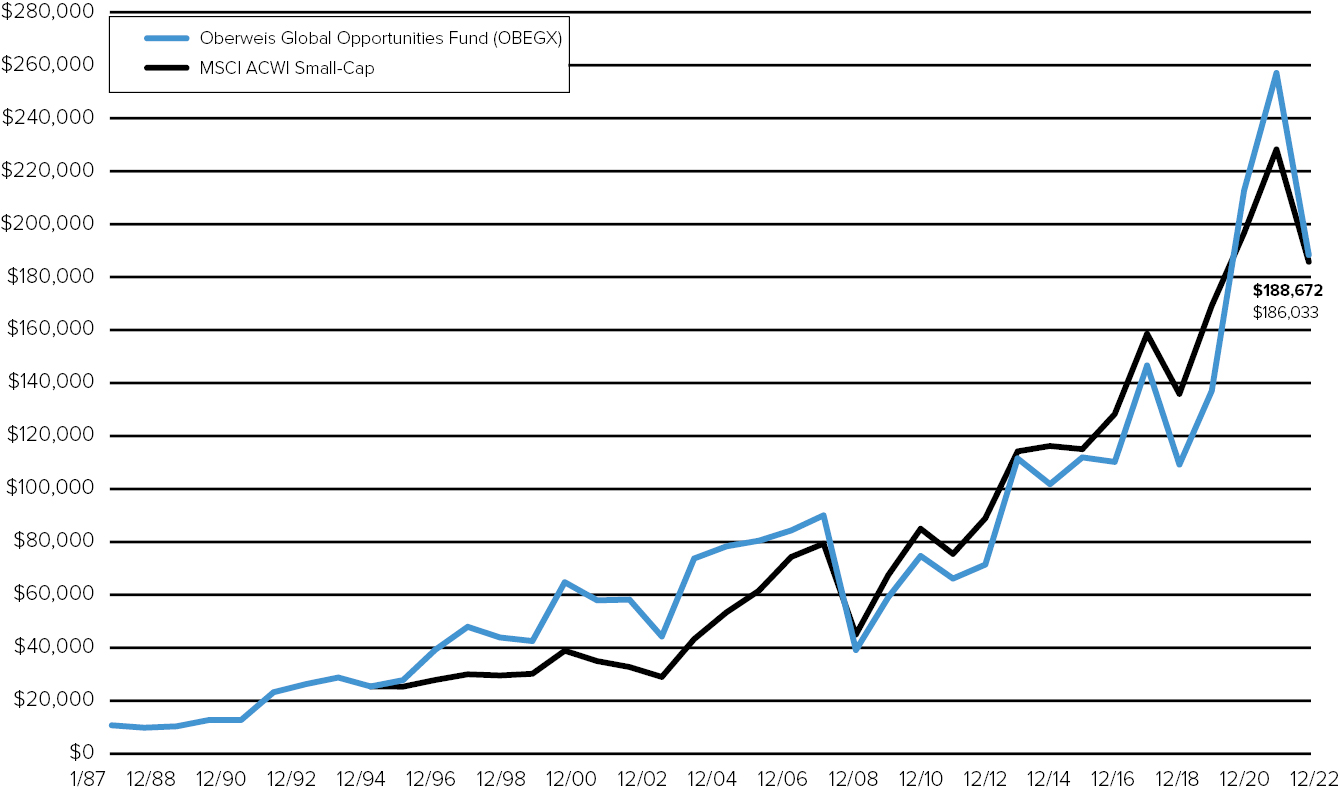

The Global Opportunities Fund returned -26.80% versus -18.67% for the MSCI AWCI Small-Cap Index. At the country level, stock selection in the United States, Taiwan, and Germany added to portfolio return, while Japan, the U.K., and China detracted from portfolio return. At the sector level, healthcare added to return, while information technology, consumer discretionary and financials detracted. At the stock level, Halozyme Therapeutics (HALO US), Acadia Healthcare (ACHC US), and Super Micro Computer (SMCI US) were among the top contributors to performance; Synaptics (SYNA US), Intermediate Capital Group (ICP LN) and Ultra Clean Holdings (UCTT US) were among the top detractors.

The China Opportunities Fund returned -37.23% versus -21.93% for the MSCI China Index. At the sector level, consumer discretionary added to return, while information technology, financials, and materials were top detractors. At the stock level, Pinduoduo (PDD US), Hygeia Healthcare (6078 HK), and Trip.com (9961 HK), were among the top contributors to performance; ACM Research (688082) and Longfor Group (960 HK) were among the top detractors.

The Emerging Markets Fund returned -24.31% versus -18.02% for the MSCI EM Small-Cap Index. At the country level, China, Mexico, and Turkey were the primary detractors while Indonesia was the top contributor. At the sector level, the fund was positively impacted by stock selection in consumer staples, while performance was adversely impacted by stock selection in industrials and information technology. At the stock level, Mitra Adiperkasa (MAPI IJ), Xiabuxiabu Catering Management (520 HK), and PT Sumber Alfaria Trijaya (AMRT IJ) were among the top contributors to performance; Aspeed Technology (5274 TT), Weimob (2013 HK), and Pan Jit International (2481 TT) were among the top detractors.

4

Management discussion on fund performance

(unaudited) (continued)

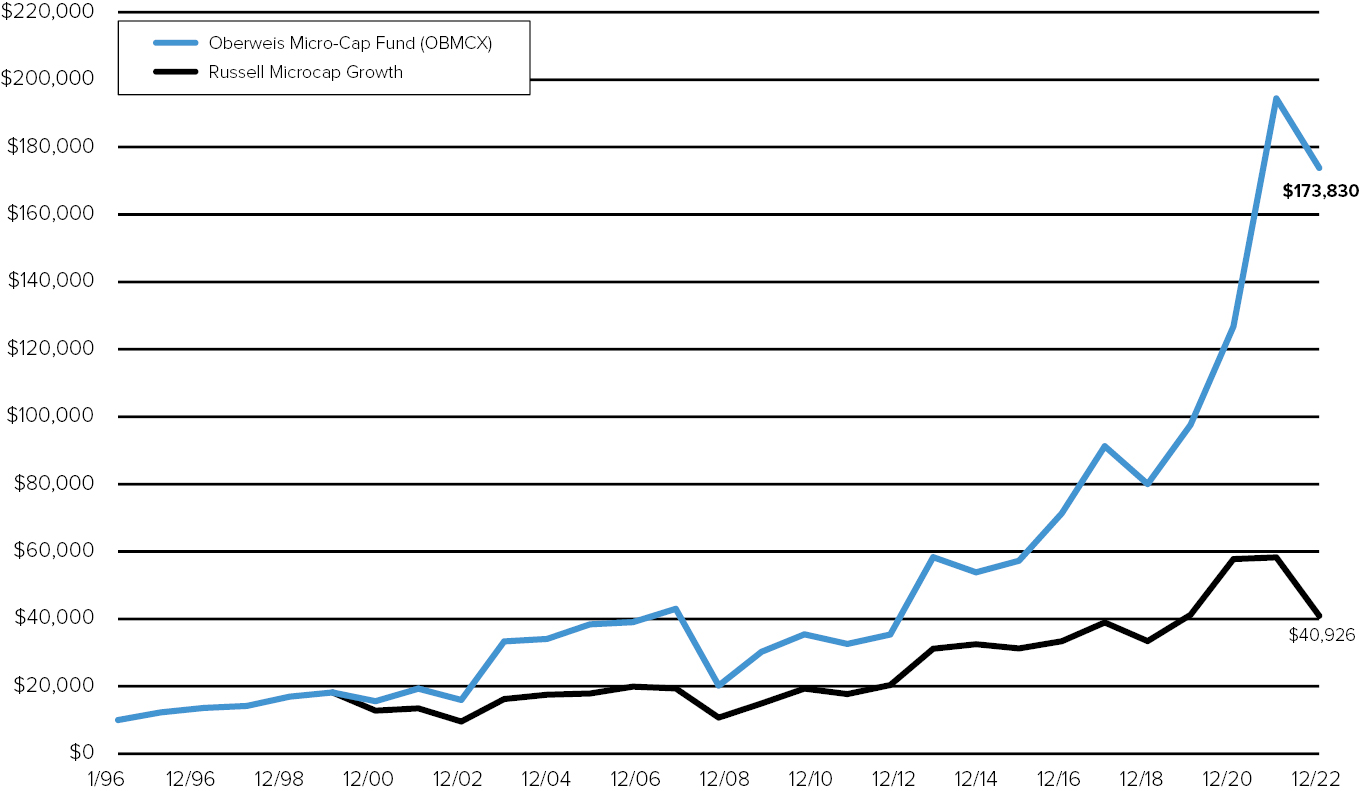

The Micro-Cap Fund returned -10.60% versus -29.76% for the Russell Micro-Cap Growth Index. The portfolio benefitted from favorable stock selection in technology, producer durables and healthcare. At the stock level, Lantheus (LNTH), Sierra Wireless (SWIR), and Bel Fuse (BELFB) were among the top contributors to performance. Alpha & Omega Semiconductor (AOSL), Boot Barn (BOOT), and Ultra Clean (UCTT) were among the top detractors.

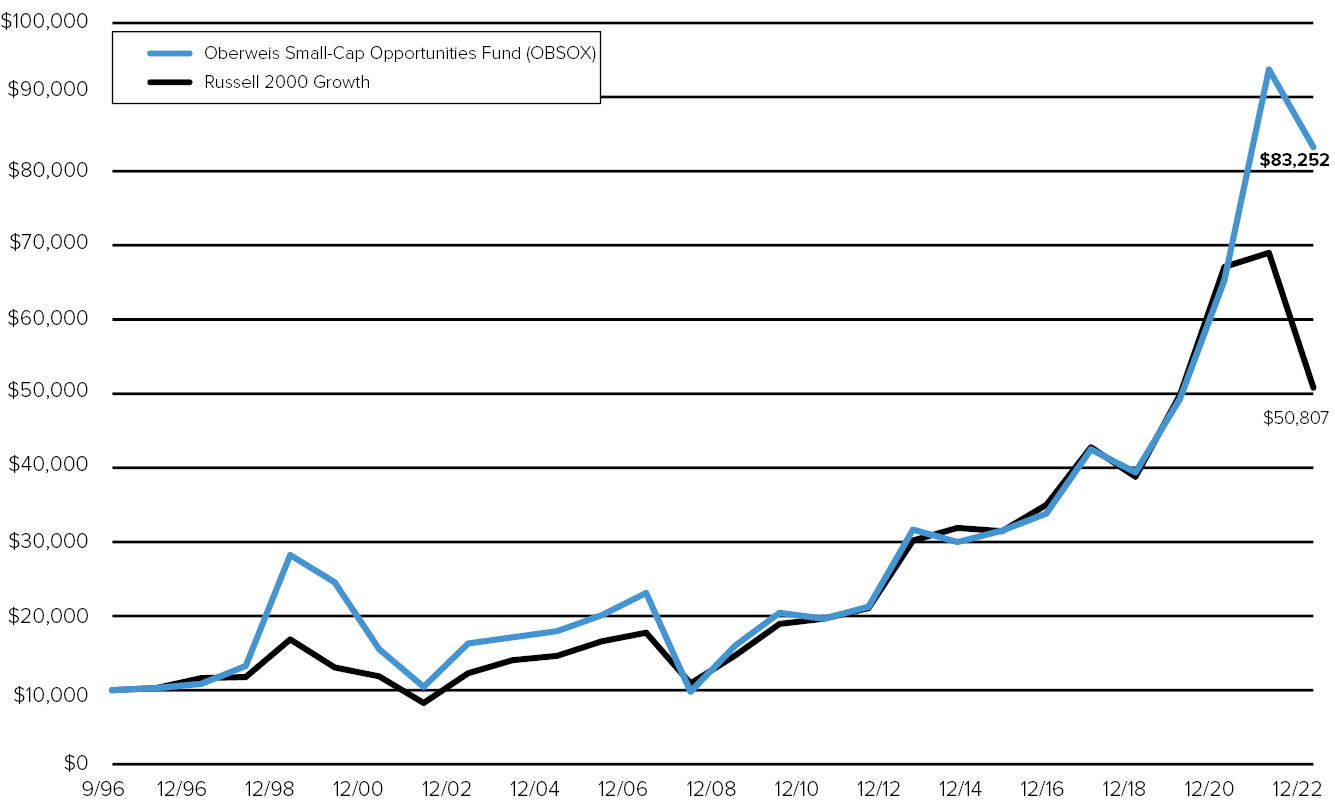

The Small-Cap Opportunities Fund returned -11.17% versus -26.36% for the Russell 2000 Growth Index. The portfolio benefitted from favorable stock selection in healthcare, technology, and producer durables. Lantheus (LNTH), Clearfield (CLFD), and Sierra Wireless (SWIR) were among the top contributors to performance. Synaptics (SYNA), Crocs (CROX), and Ultra Clean (UCTT) were among the top detractors.

For current performance information, please visit www.oberweisfunds.com.

5

MANAGEMENT DISCUSSION ON FUND PERFORMANCE

(unaudited) (continued)

Oberweis Micro-Cap Fund

At December 31, 2022

Asset Allocation (% of Net Assets) | | |

Equities | | 96.5 |

Other Assets less Liabilities | | 3.5 |

| | | |

Top Ten Holdings (% of Net Assets) |

Axcelis Technologies, Inc. | | 4.1 |

Aehr Test Systems | | 3.8 |

Veritiv Corp. | | 2.8 |

Lantheus Hldgs., Inc. | | 2.2 |

Clearfield, Inc. | | 2.1 |

Perion Network Ltd. | | 2.0 |

Model N, Inc. | | 2.0 |

Bel Fuse, Inc. | | 1.8 |

Impinj, Inc. | | 1.7 |

Extreme Networks, Inc. | | 1.6 |

| | | |

Top Ten Industries (% of Net Assets) |

Production Technology

Equipment | | 12.1 |

Communications Technology | | 8.0 |

Computer Services Software & Systems | | 6.0 |

Biotechnology | | 4.8 |

Specialty Retail | | 4.7 |

Medical & Dental Instruments & Supplies | | 4.3 |

Oil Well Equipment & Services | | 4.3 |

Medical Equipment | | 3.6 |

Back Office Support, Human Resources & Consulting | | 3.6 |

Consumer

Services – Miscellaneous | | 3.4 |

Oberweis Small-Cap Opportunities Fund

At December 31, 2022

Asset Allocation (% of Net Assets) | | |

Equities | | 95.9 |

Other Assets less Liabilities | | 4.1 |

| | | |

Top Ten Holdings (% of Net Assets) |

Axcelis Technologies, Inc. | | 4.0 |

Aehr Test Systems | | 3.7 |

Clean Harbors, Inc. | | 2.3 |

Crocs, Inc. | | 2.2 |

Impinj, Inc. | | 2.2 |

Allegro MicroSystems, Inc. | | 2.2 |

Clearfield, Inc. | | 2.1 |

Belden, Inc. | | 2.0 |

Fabrinet | | 1.9 |

Deckers Outdoor Corp. | | 1.9 |

| | | |

Top Ten Industries (% of Net Assets) |

Production Technology

Equipment | | 10.3 |

Diversified Manufacturing Operations | | 5.1 |

Medical & Dental Instruments & Supplies | | 4.7 |

Textiles Apparel & Shoes | | 4.1 |

Oil Crude Producer | | 4.0 |

Medical Equipment | | 3.9 |

Semiconductors & Components | | 3.8 |

Leisure Time | | 3.6 |

Healthcare Services | | 3.5 |

Back Office Support, Human Resources, & Consulting | | 3.2 |

6

Management discussion on fund performance

(unaudited) (continued)

Oberweis Global Opportunities Fund

At December 31, 2022

Asset Allocation (% of Net Assets) | | |

Equities | | 100.0 |

Other Liabilities less Assets | | 0.0 |

| | | |

Top Ten Holdings (% of Net Assets) |

Halozyme Therapeutics, Inc. | | 6.3 |

Impinj, Inc. | | 4.6 |

Crocs, Inc. | | 4.0 |

Axcelis Technologies, Inc. | | 3.9 |

Belden, Inc. | | 3.4 |

Ashtead Technology Hldgs. PLC | | 3.4 |

Super Micro Computer, Inc. | | 3.4 |

Deckers Outdoor Corp. | | 3.3 |

Intermediate Capital Group PLC | | 2.8 |

BayCurrent Consulting, Inc. | | 2.8 |

| | | |

Top Ten Industries (% of Net Assets) |

Semiconductors & Semiconductor Equipment | | 21.9 |

Textiles, Apparel & Luxury

Goods | | 8.3 |

Electronic Equipment, Instruments & Components | | 7.1 |

Biotechnology | | 6.3 |

Trading Co. & Distribution | | 5.4 |

Healthcare Equipment &

Supplies | | 5.4 |

Software | | 4.6 |

Professional Services | | 4.0 |

Communications Equipment | | 3.6 |

Healthcare Providers & Services | | 3.6 |

Oberweis China Opportunities Fund

At December 31, 2022

Asset Allocation (% of Net Assets) | | |

Equities | | 99.2 |

Other Assets less Liabilities | | 0.8 |

| | | |

Top Ten Holdings (% of Net Assets) |

Pinduoduo, Inc. ADS | | 5.1 |

Alibaba Group Hldg. Ltd. | | 3.7 |

Trip.com Group Ltd. | | 3.4 |

JD.com, Inc. | | 3.3 |

Meituan | | 3.2 |

New Oriental Education & Technology Group, Inc. | | 3.0 |

Hygeia Healthcare Hldgs. Co. Ltd. | | 2.7 |

Tencent Music Entertainment

Group ADS | | 2.6 |

Li Ning Co. Ltd. | | 2.5 |

Wuxi Biologics (Cayman), Inc. | | 2.5 |

| | | |

Top Ten Industries (% of Net Assets) |

Internet & Direct Marketing

Retail | | 19.9 |

Hotels, Restaurants & Leisure | | 12.0 |

Entertainment | | 7.0 |

Real Estate Management & Development | | 6.2 |

Healthcare Equipment &

Supplies | | 5.6 |

Diversified Consumer Services | | 4.1 |

Semiconductors & Semiconductor Equipment | | 3.1 |

Healthcare Providers & Services | | 2.7 |

Beverages | | 2.7 |

Textiles, Apparel & Luxury

Goods | | 2.5 |

7

MANAGEMENT DISCUSSION ON FUND PERFORMANCE

(unaudited) (continued)

Oberweis International Opportunities Fund

At December 31, 2022

Asset Allocation (% of Net Assets) | | |

Equities | | 99.7 |

Other Assets less Liabilities | | 0.3 |

| | | |

Top Ten Holdings (% of Net Assets) |

BayCurrent Consulting, Inc. | | 4.4 |

Nordic Semiconductor ASA | | 3.9 |

Rexel SA | | 3.7 |

Hexatronic Group AB | | 3.6 |

AIXTRON SE | | 3.2 |

Constellium SE | | 3.0 |

Edenred SA | | 2.7 |

ATS Corp. | | 2.7 |

Daiwa Securities Group, Inc. | | 2.4 |

Aritzia, Inc. | | 2.3 |

| | | |

Top Ten Industries (% of Net Assets) |

Machinery | | 12.0 |

Information Technology Services | | 8.9 |

Electrical Equipment | | 8.2 |

Semiconductors & Semiconductor Equipment | | 8.1 |

Capital Markets | | 7.6 |

Trading Co. & Distribution | | 7.4 |

Professional Services | | 6.0 |

Specialty Retail | | 4.4 |

Metals & Mining | | 4.3 |

Insurance | | 3.7 |

Oberweis Emerging Markets Fund

At December 31, 2022

Asset Allocation (% of Net Assets) | | |

Equities | | 96.1 |

Other Assets less Liabilities | | 3.9 |

| | | |

Top Ten Holdings (% of Net Assets) |

Dada Nexus Ltd. ADS | | 5.1 |

LEENO Industrial, Inc. | | 2.5 |

Kingdee International Software Group Co. Ltd. | | 2.5 |

Classys, Inc. | | 2.5 |

Chongqing Brewery Co. Ltd. | | 2.3 |

Petro Rio SA | | 2.3 |

Afya Ltd. | | 2.1 |

PT Sumber Alfaria Trijaya Tbk | | 2.0 |

Chailease Hldg. Co. Ltd. | | 2.0 |

POSCO Chemical Co. Ltd. | | 2.0 |

| | | |

Top Ten Industries (% of Net Assets) |

Electronic Equipment, Instruments & Components | | 9.6 |

Software | | 9.3 |

Internet & Direct Marketing

Retail | | 6.7 |

Beverages | | 6.4 |

Semiconductors & Semiconductor Equipment | | 5.9 |

Hotels, Restaurants & Leisure | | 5.2 |

Pharmaceuticals | | 4.7 |

Food & Staples Retailing | | 4.4 |

Healthcare Equipment &

Supplies | | 4.3 |

Diversified Consumer Services | | 4.1 |

8

Management discussion on fund performance

(unaudited) (continued)

Average Annual Total Returns1 (for the Periods Ended December 31, 2022)

| | 1 YR

(%) | | 5 YR (%) | | 10 YR (%) | | SINCE

INCEPTION2

(%) | | EXPENSE

RATIO3

(%) |

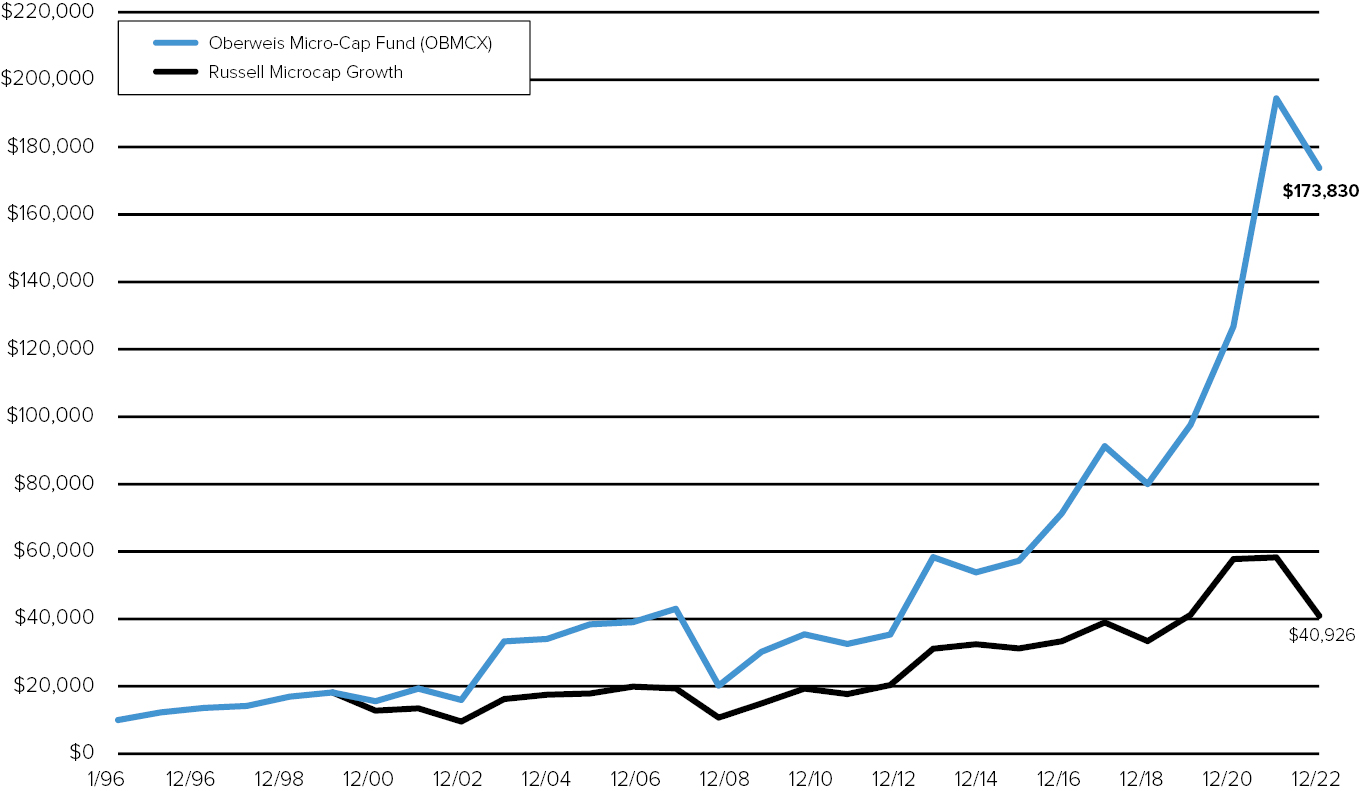

OBMCX | | (10.60) | | 13.76 | | 17.26 | | 11.16 | | 1.52 |

OMCIX4 | | (10.39) | | 14.03 | | 17.55 | | 11.43 | | 1.27 |

Russell Microcap Growth | | (29.76) | | 1.00 | | 7.22 | | N/A5 | | |

Growth of a $10,000 Investment (from January 1, 1996 to December 31, 2022)

9

Management discussion on fund performance

(unaudited) (continued)

Average Annual Total Returns1 (for the Periods Ended December 31, 2022)

| | 1 YR

(%) | | 5 YR (%) | | 10 YR (%) | | SINCE

INCEPTION2

(%) | | EXPENSE

RATIO3

(%) |

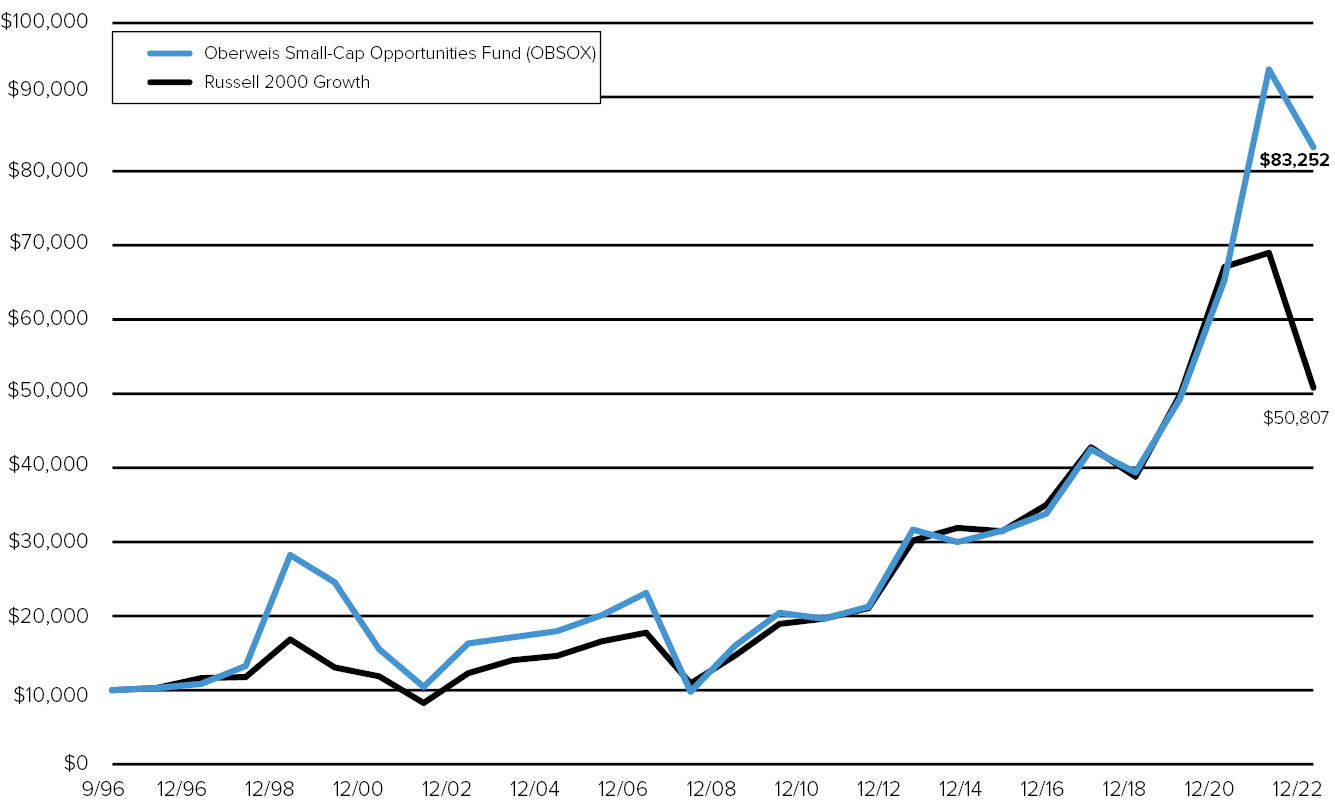

OBSOX | | (11.17) | | 14.41 | | 14.62 | | 8.39 | | 1.25 |

OBSIX4 | | (10.93) | | 14.69 | | 14.92 | | 8.67 | | 1.00 |

Russell 2000 Growth | | (26.36) | | 3.51 | | 9.20 | | 6.38 | | |

Growth of a $10,000 Investment (from September 15, 1996 to December 31, 2022)

10

Management discussion on fund performance

(unaudited) (continued)

Average Annual Total Returns1 (for the Periods Ended December 31, 2022)

| | 1 YR

(%) | | 5 YR (%) | | 10 YR (%) | | SINCE

INCEPTION2

(%) | | EXPENSE

RATIO3

(%) |

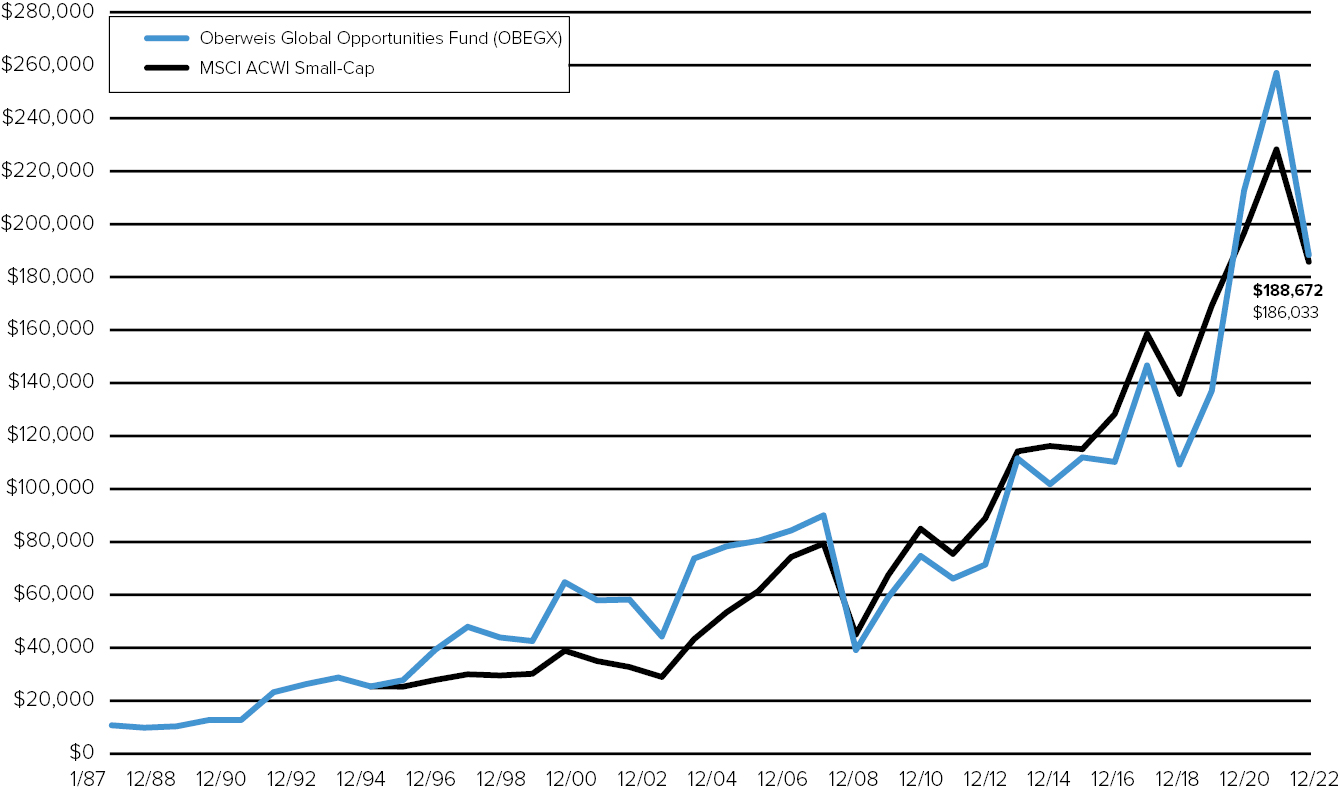

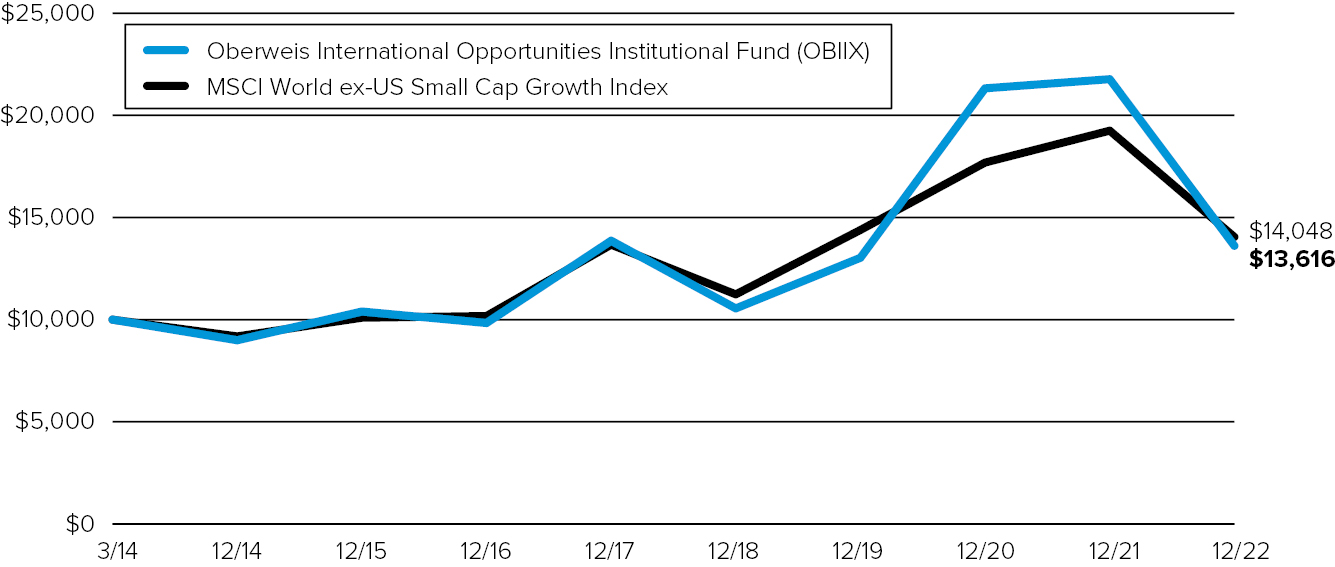

OBEGX | | (26.80) | | 5.16 | | 10.26 | | 8.51 | | 1.51 |

OBGIX4 | | (26.61) | | 5.43 | | 10.53 | | 8.78 | | 1.27 |

MSCI ACWI Small-Cap | | (18.67) | | 3.23 | | 7.69 | | N/A5 | | |

Growth of a $10,000 Investment (from January 7, 1987 to December 31, 2022)

11

Management discussion on fund performance

(unaudited) (continued)

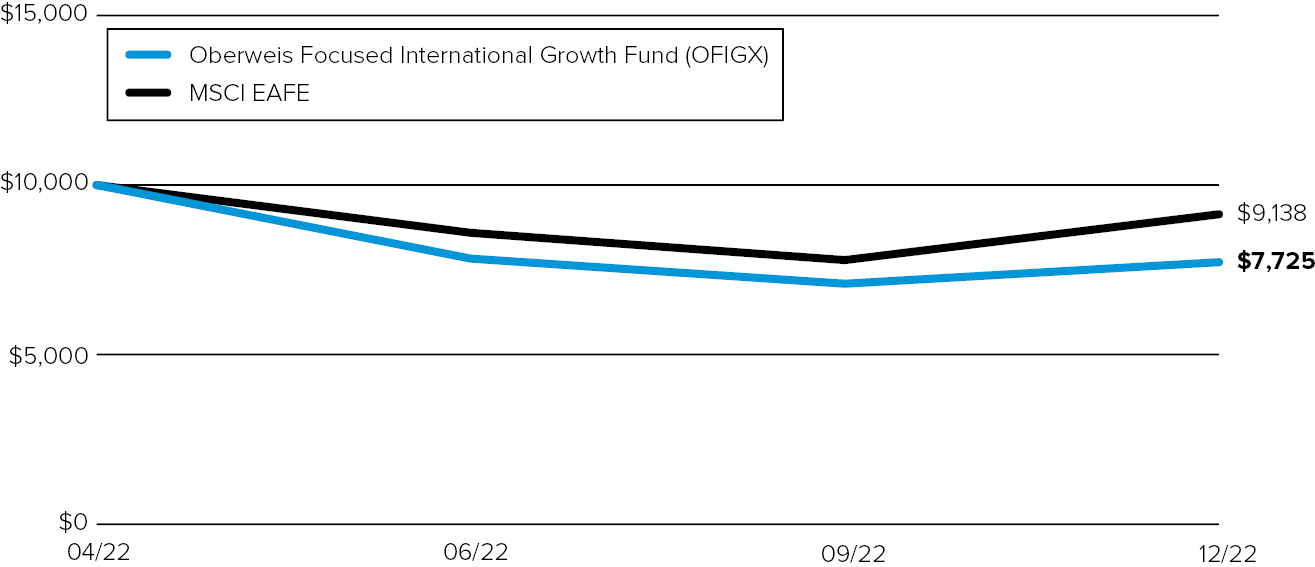

Average Annual Total Returns1 (for the Periods Ended December 31, 2022)

| | 1 YR

(%) | | 5 YR (%) | | 10 YR (%) | | SINCE

INCEPTION2

(%) | | EXPENSE

RATIO3

(%) |

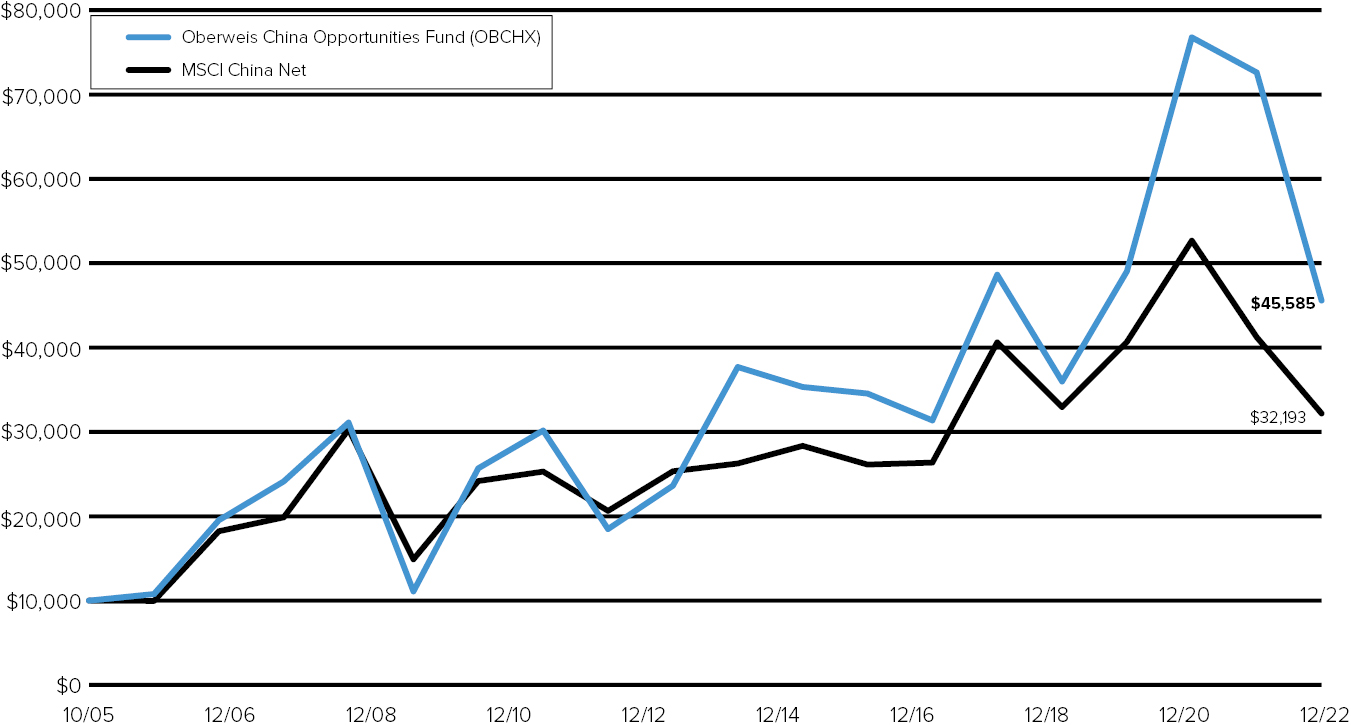

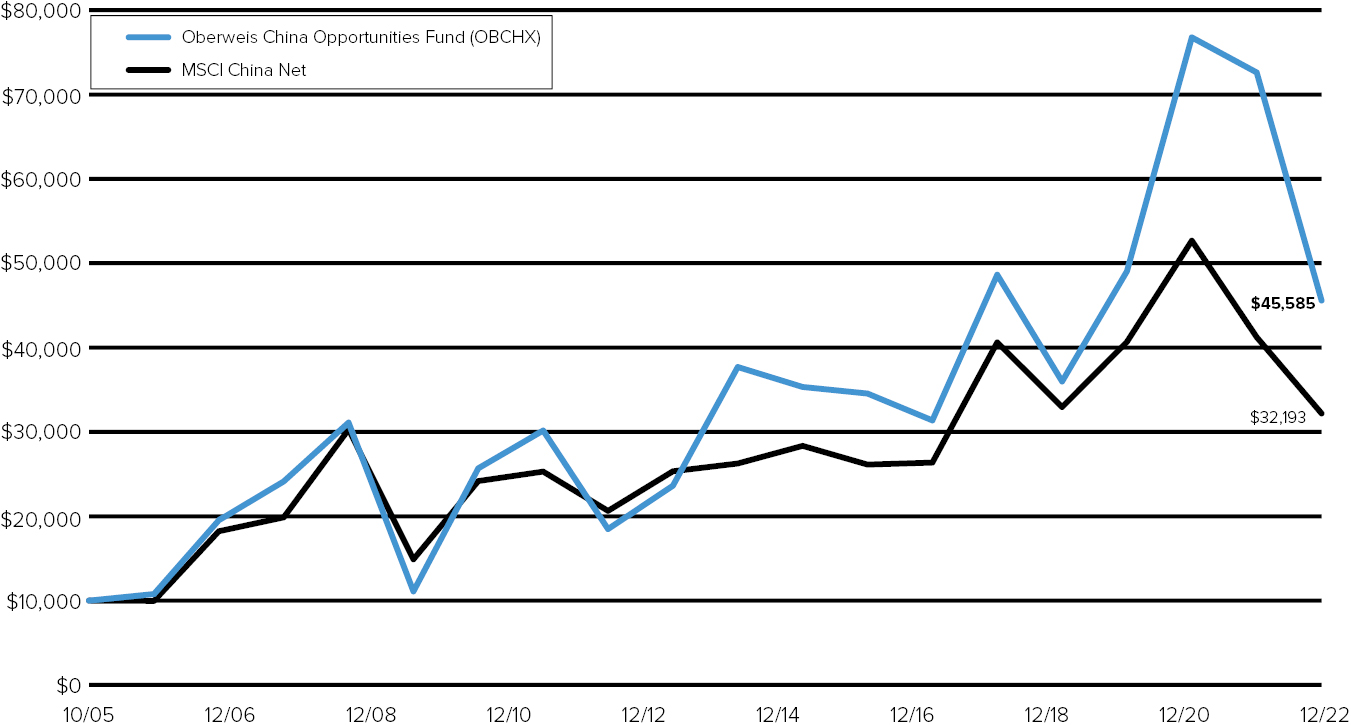

OBCHX | | (37.23) | | (1.29) | | 6.79 | | 9.20 | | 2.03 |

OCHIX4 | | (36.97) | | (1.02) | | 7.07 | | 9.47 | | 1.78 |

MSCI China Net | | (21.93) | | (4.54) | | 2.43 | | 7.01 | | |

Growth of a $10,000 Investment (from October 1, 2005 to December 31, 2022)

12

Management discussion on fund performance

(unaudited) (continued)

Average Annual Total Returns1 (for the Periods Ended December 31, 2022)

| | 1 YR

(%) | | 5 YR (%) | | 10 YR (%) | | SINCE

INCEPTION2

(%) | | EXPENSE

RATIO3

(%) |

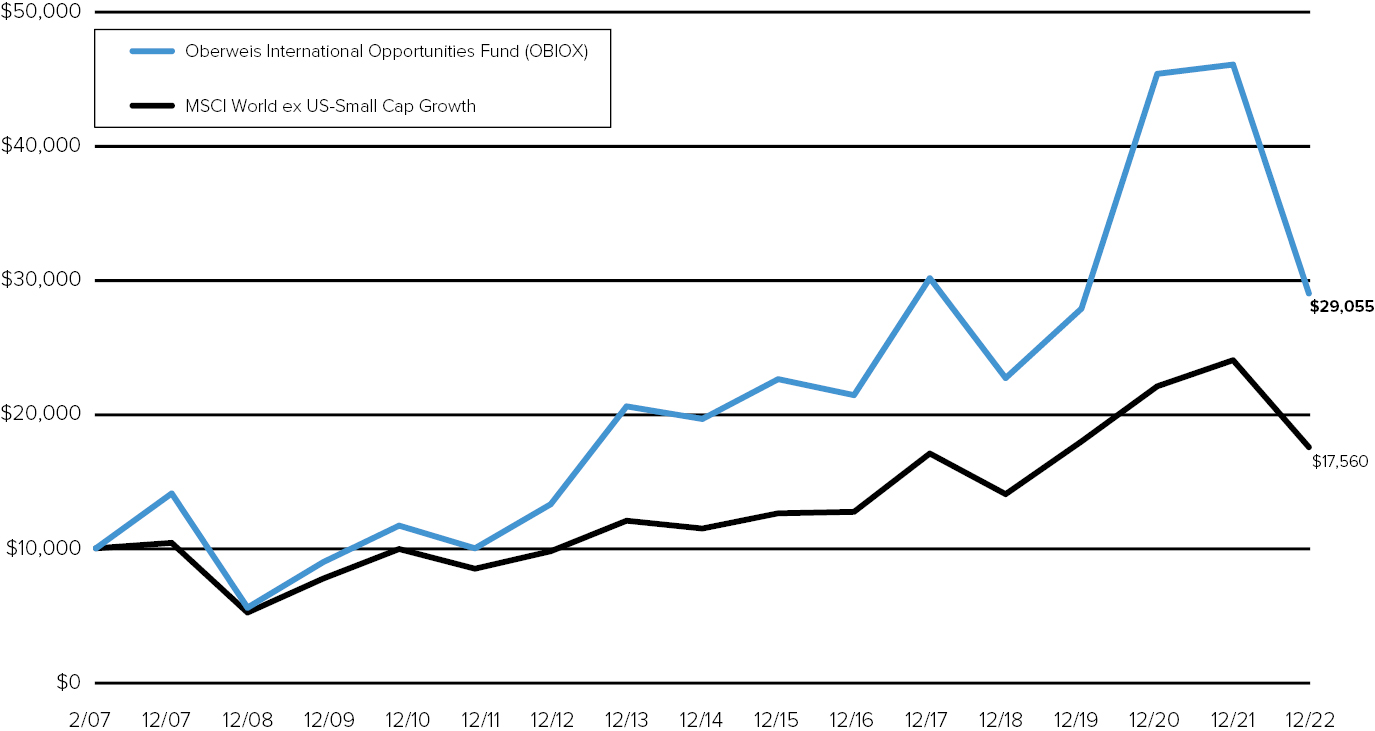

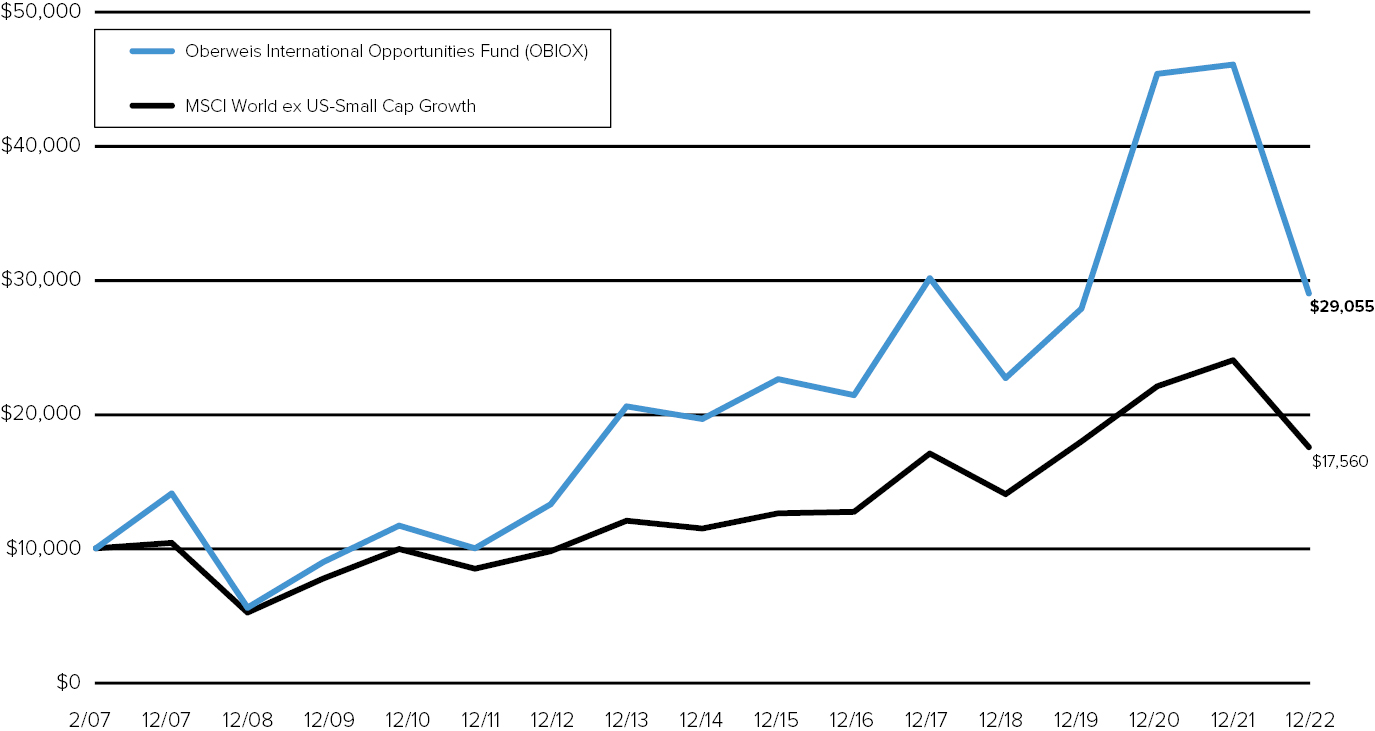

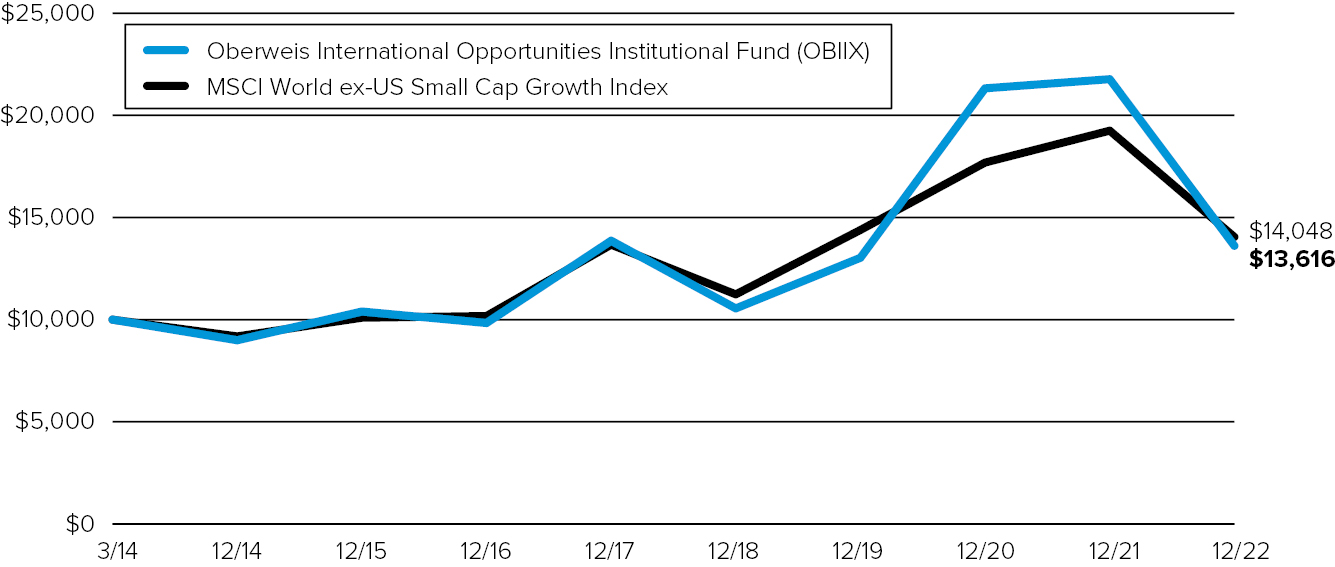

OBIOX | | (37.06) | | (0.76) | | 8.13 | | 6.93 | | 1.60 |

MSCI World ex-US Small Cap Growth | | (27.02) | | 0.55 | | 6.03 | | 3.68 | | |

Growth of a $10,000 Investment (from February 1, 2007 to December 31, 2022)

13

Management discussion on fund performance

(unaudited) (continued)

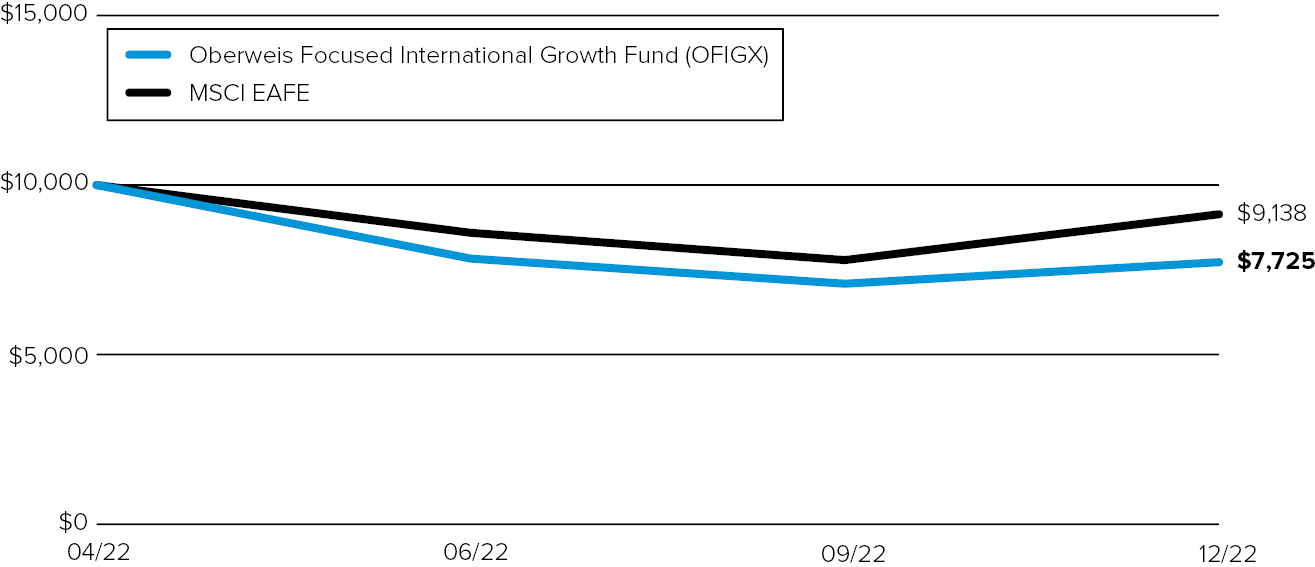

Average Annual Total Returns1 (for the Periods Ended December 31, 2022)

| | 1 YR

(%) | | SINCE

INCEPTION2

(%) | | EXPENSE

RATIO3

(%) |

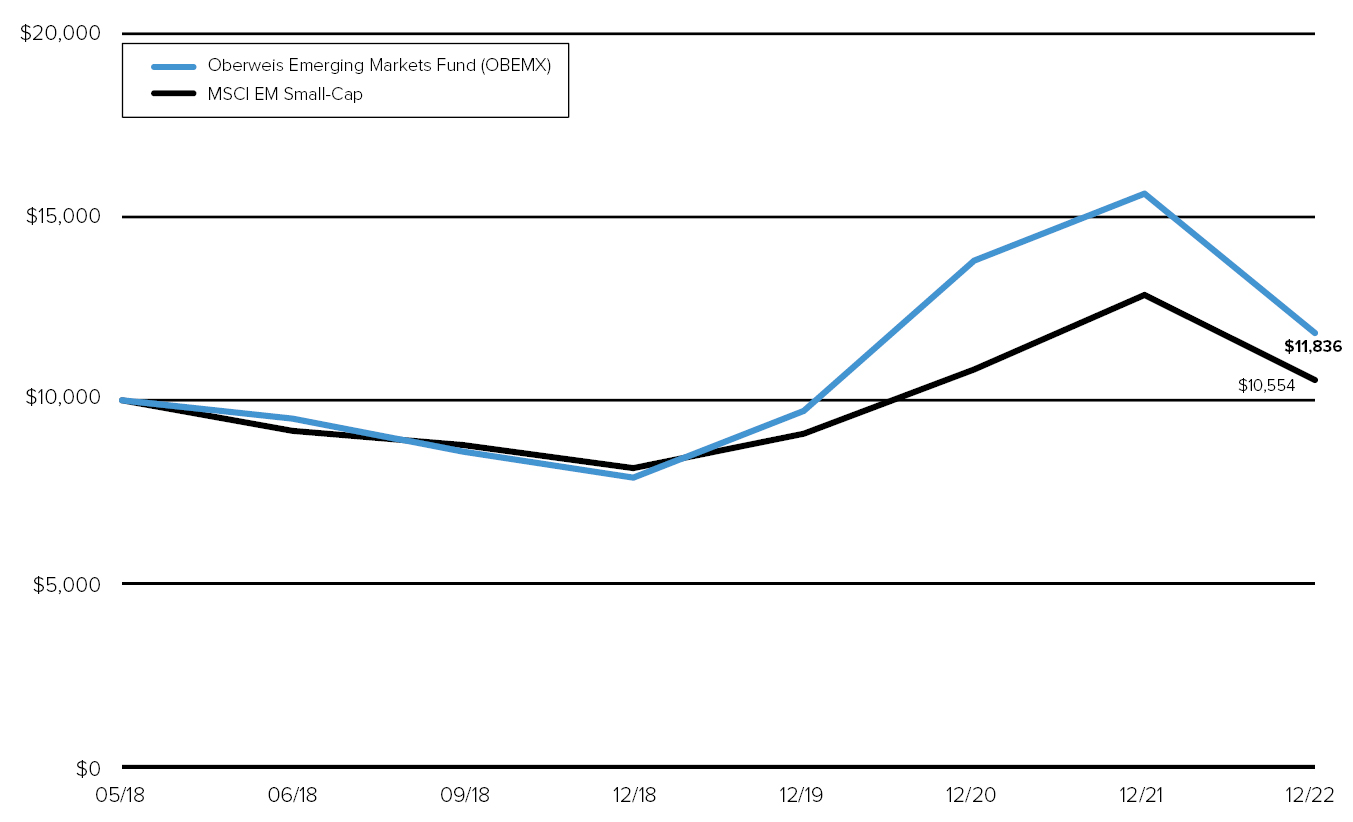

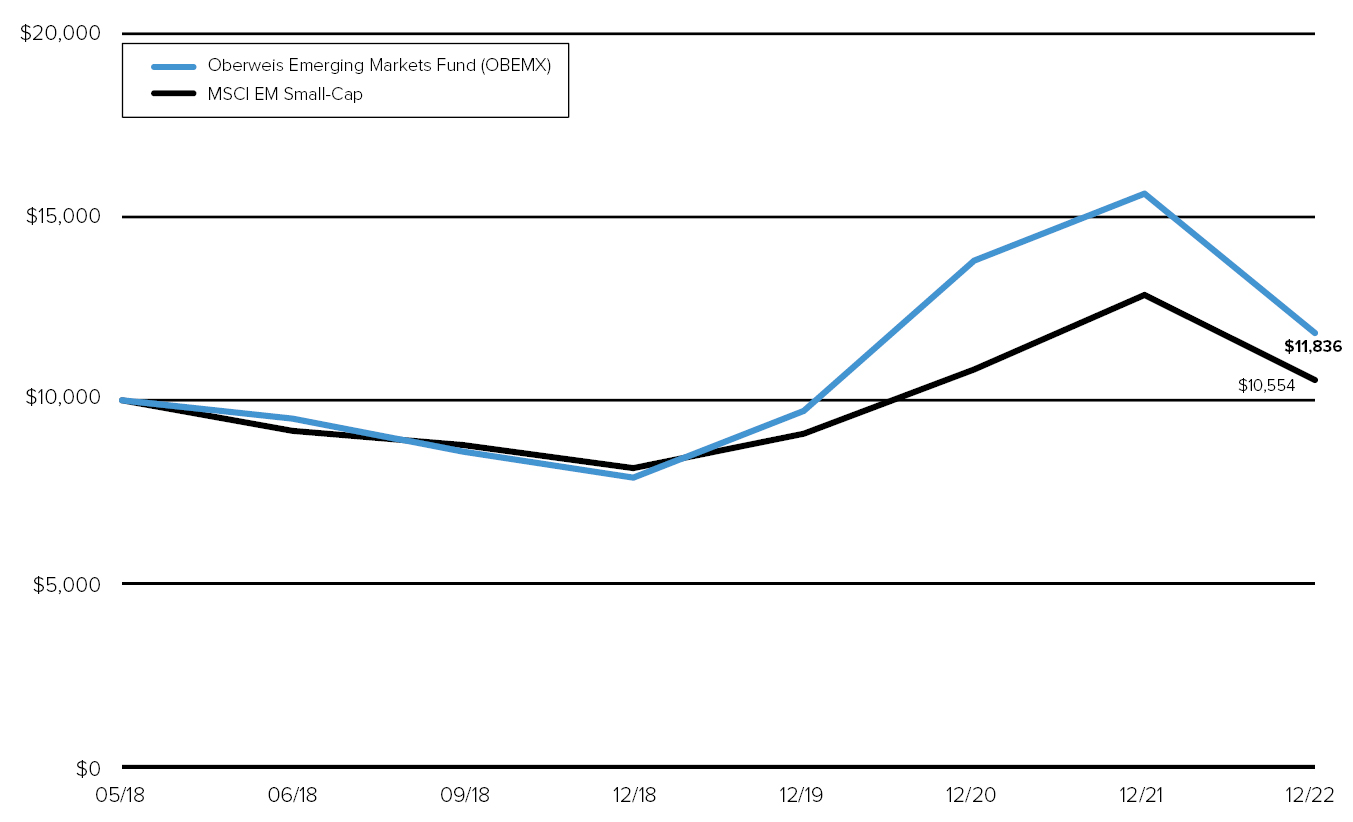

OBEMX | | (24.31) | | 3.68 | | 1.75 |

OIEMX | | (24.10) | | 3.94 | | 1.50 |

MSCI EM Small-Cap | | (18.02) | | 1.12 | | |

Growth of a $10,000 Investment (from May 1, 2018 to December 31, 2022)

14

OBERWEIS MICRO-CAP FUND

Schedule of Investments December 31, 2022

| | SHARES | | VALUE |

Equities – 96.5% | | | | | |

| | | | | | |

Advertising Agencies – 0.7% | | | | | |

Viad Corp.* | | 51,100 | | $ | 1,246,329 |

| | | | | | |

Aerospace – 2.0% | | | | | |

V2X, Inc.* | | 50,100 | | | 2,068,629 |

VSE Corp. | | 26,100 | | | 1,223,569 |

| | | | | | 3,292,198 |

| | | | | | |

Back Office Support, Human Resources & Consulting – 3.6% | | | | | |

Cross Country Healthcare, Inc.* | | 60,600 | | | 1,610,142 |

Franklin Covey Co.* | | 46,300 | | | 2,165,451 |

ICF International, Inc. | | 23,600 | | | 2,337,580 |

| | | | | | 6,113,173 |

| | | | | | |

Banks – Diversified – 1.8% | | | | | |

Mercantile Bank Corp. | | 25,700 | | | 860,436 |

Preferred Bank* | | 30,200 | | | 2,253,524 |

| | | | | | 3,113,960 |

| | | | | | |

Banks – Savings, Thrifts & Mortgage Lending – 2.0% | | | | | |

Brookline Bancorp, Inc.* | | 121,700 | | | 1,722,055 |

Heritage Financial Corp.* | | 55,400 | | | 1,697,456 |

| | | | | | 3,419,511 |

| | | | | | |

Biotechnology – 4.8% | | | | | |

ADMA Biologics, Inc.* | | 536,900 | | | 2,083,172 |

Catalyst Pharmaceuticals, Inc.* | | 96,600 | | | 1,796,760 |

Dynavax Technologies Corp.* | | 183,700 | | | 1,954,568 |

Veracyte, Inc.* | | 92,400 | | | 2,192,652 |

| | | | | | 8,027,152 |

| | | | | | |

Casinos & Gambling – 1.0% | | | | | |

Full House Resorts, Inc.* | | 221,743 | | | 1,667,507 |

| | | | | | |

Commercial Services – Rental & Leasing – 1.3% | | | | | |

H&E Equipment Services, Inc. | | 50,100 | | | 2,274,540 |

| | | | | | |

Commercial Vehicles & Parts – 1.0% | | | | | |

Modine Manufacturing Co.* | | 86,500 | | | 1,717,890 |

| | | | | | |

See accompanying notes to the financial statements.

15

OBERWEIS MICRO-CAP FUND (continued)

Schedule of Investments December 31, 2022

| | SHARES | | VALUE |

Communications Technology – 8.0% | | | | | |

ADTRAN, Inc. | | 116,400 | | $ | 2,187,156 |

Aviat Networks, Inc.* | | 83,307 | | | 2,598,345 |

Bel Fuse, Inc. | | 89,800 | | | 2,956,216 |

Extreme Networks, Inc.* | | 150,100 | | | 2,748,331 |

Harmonic, Inc.* | | 99,800 | | | 1,307,380 |

KVH Industries, Inc.* | | 88,000 | | | 899,360 |

Ooma, Inc.* | | 61,000 | | | 830,820 |

| | | | | | 13,527,608 |

| | | | | | |

COMPUTER SERVICES SOFTWARE & SYSTEMS – 6.0% | | | | | |

A10 Networks, Inc. | | 131,200 | | | 2,181,856 |

Avid Technology, Inc.* | | 52,200 | | | 1,387,998 |

Model N, Inc.* | | 82,400 | | | 3,342,144 |

OneSpan, Inc.* | | 216,900 | | | 2,427,111 |

PDF Solutions, Inc.* | | 30,100 | | | 858,452 |

| | | | | | 10,197,561 |

| | | | | | |

Computer Technology – 0.8% | | | | | |

ScanSource, Inc.* | | 46,800 | | | 1,367,496 |

| | | | | | |

Consumer Lending – 1.3% | | | | | |

EZCORP, Inc.* | | 262,000 | | | 2,135,300 |

| | | | | | |

Consumer Services – Miscellaneous – 3.4% | | | | | |

Perion Network Ltd.* | | 136,500 | | | 3,453,450 |

SP Plus Corp.* | | 67,600 | | | 2,347,072 |

| | | | | | 5,800,522 |

| | | | | | |

Containers & Packaging – 2.8% | | | | | |

Veritiv Corp. | | 39,400 | | | 4,795,374 |

| | | | | | |

Construction – 1.6% | | | | | |

Sterling Construction Co. Inc.* | | 80,600 | | | 2,643,680 |

| | | | | | |

Diversified Manufacturing Operations – 2.1% | | | | | |

NerdWallet, Inc.* | | 175,900 | | | 1,688,640 |

Playa Hotels & Resorts NV* | | 284,100 | | | 1,855,173 |

| | | | | | 3,543,813 |

| | | | | | |

Electronic Entertainment – 1.2% | | | | | |

Everi Hldgs. Inc.* | | 135,900 | | | 1,950,165 |

| | | | | | |

Energy Equipment – 1.5% | | | | | |

Ameresco, Inc.* | | 45,508 | | | 2,600,327 |

| | | | | | |

Financial Data & Systems – 0.9% | | | | | |

International Money Express, Inc.* | | 63,500 | | | 1,547,495 |

See accompanying notes to the financial statements.

16

OBERWEIS MICRO-CAP FUND (continued)

Schedule of Investments December 31, 2022

| | SHARES | | VALUE |

Food – 2.6% | | | | | |

SunOpta, Inc.* | | 262,600 | | $ | 2,216,344 |

The Chefs’ Warehouse, Inc.* | | 66,900 | | | 2,226,432 |

| | | | | | 4,442,776 |

| | | | | | |

Home Building – 0.8% | | | | | |

M/I Homes, Inc.* | | 30,000 | | | 1,385,400 |

| | | | | | |

Insurance – Property Casualty – 1.0% | | | | | |

Employers Hldgs., Inc. | | 38,500 | | | 1,660,505 |

| | | | | | |

Machinery – Agriculture – 2.2% | | | | | |

Titan International, Inc.* | | 145,100 | | | 2,222,932 |

Titan Machinery, Inc.* | | 39,600 | | | 1,573,308 |

| | | | | | 3,796,240 |

| | | | | | |

Machinery – Industrial – 1.2% | | | | | |

EnPro Industries, Inc. | | 19,300 | | | 2,097,717 |

| | | | | | |

Medical & Dental Instruments & Supplies – 4.3% | | | | | |

Alphatec Hldgs., Inc.* | | 212,900 | | | 2,629,315 |

Cerus Corp.* | | 283,900 | | | 1,036,235 |

LeMaitre Vascular, Inc. | | 21,600 | | | 994,032 |

TransMedics Group, Inc.* | | 42,400 | | | 2,616,928 |

| | | | | | 7,276,510 |

| | | | | | |

Medical Equipment – 3.6% | | | | | |

Lantheus Hldgs., Inc.* | | 74,000 | | | 3,771,040 |

Tactile Systems Technology, Inc.* | | 204,200 | | | 2,344,216 |

| | | | | | 6,115,256 |

| | | | | | |

Metal Fabricating – 0.9% | | | | | |

Haynes International, Inc. | | 33,500 | | | 1,530,615 |

| | | | | | |

Oil Crude Producer – 1.1% | | | | | |

Earthstone Energy, Inc.* | | 128,800 | | | 1,832,824 |

| | | | | | |

Oil Well Equipment & Services – 4.3% | | | | | |

MRC Global, Inc.* | | 119,900 | | | 1,388,442 |

Nine Energy Service, Inc.* | | 99,100 | | | 1,439,923 |

Patterson-UTI Energy, Inc. | | 139,100 | | | 2,342,444 |

RPC, Inc. | | 233,600 | | | 2,076,704 |

| | | | | | 7,247,513 |

| | | | | | |

Pharmaceuticals – 1.3% | | | | | |

Amphastar Pharmaceuticals, Inc.* | | 77,100 | | | 2,160,342 |

See accompanying notes to the financial statements.

17

OBERWEIS MICRO-CAP FUND (continued)

Schedule of Investments December 31, 2022

| | SHARES | | VALUE |

Production Technology Equipment – 12.1% | | | | | |

Aehr Test Systems* | | 318,400 | | $ | 6,399,840 |

Axcelis Technologies, Inc.* | | 87,100 | | | 6,912,256 |

Impinj, Inc.* | | 26,800 | | | 2,926,024 |

Photronics, Inc.* | | 116,800 | | | 1,965,744 |

Ultra Clean Hldgs., Inc.* | | 67,900 | | | 2,250,885 |

| | | | | | 20,454,749 |

| | | | | | |

Scientific Instruments – Electrical – 1.1% | | | | | |

Allied Motion Technologies, Inc. | | 46,400 | | | 1,615,184 |

RF Industries Ltd.* | | 63,100 | | | 321,810 |

| | | | | | 1,936,994 |

| | | | | | |

Scientific Instruments – Gauges & Meters – 1.0% | | | |

Vishay Precision Group, Inc.* | | 43,600 | | | 1,685,140 |

| | | | | | |

Scientific Instruments – Pollution Control – 1.3% | | | |

CECO Environmental Corp.* | | 182,100 | | | 2,126,928 |

| | | | | | |

Semiconductors & Components – 0.5% | | | | | |

Amtech Systems, Inc.* | | 113,900 | | | 865,640 |

| | | | | | |

Specialty Retail – 4.7% | | | | | |

Alta Equipment Group, Inc. | | 93,600 | | | 1,234,584 |

Boot Barn Hldgs., Inc.* | | 27,900 | | | 1,744,308 |

Caleres, Inc. | | 37,600 | | | 837,728 |

Destination XL Group, Inc.* | | 338,100 | | | 2,282,175 |

Guess’, Inc. | | 86,800 | | | 1,795,892 |

| | | | | | 7,894,687 |

| | | | | | |

Technology – Miscellaneous – 0.9% | | | | | |

Camtek Ltd.* | | 59,180 | | | 1,299,593 |

| | | | | | |

Telecommunications Equipment – 2.2% | | | | | |

Clearfield, Inc.* | | 37,700 | | | 3,549,078 |

| | | | | | |

Textiles Apparel & Shoes – 1.6% | | | | | |

Oxford Industries, Inc. | | 17,500 | | | 1,630,650 |

Rocky Brands, Inc. | | 36,000 | | | 850,320 |

| | | | | | 2,480,970 |

| | | | | | |

Total Equities | | | | | |

(Cost: $137,803,008) | | | | $ | 162,821,078 |

| | | | | | |

Total Investments – 96.5% | | | | | |

(Cost: $137,803,008) | | | | $ | 162,821,078 |

| | | | | | |

Other Assets Less Liabilities – 3.5% | | | | | 5,966,770 |

| | | | | | |

Net Assets – 100% | | | | $ | 168,787,848 |

See accompanying notes to the financial statements.

18

OBERWEIS SMALL-CAP OPPORTUNITIES FUND

Schedule of Investments December 31, 2022

| | SHARES | | VALUE |

Equities – 95.9% | | | | | |

| | | | | | |

AEROSPACE – 1.1% | | | | | |

ATI, Inc.* | | 57,200 | | $ | 1,707,992 |

| | | | | | |

AUTO PARTS – 1.5% | | | | | |

Visteon Corp.* | | 17,800 | | | 2,328,774 |

| | | | | | |

BACK OFFICE SUPPORT, HUMAN RESOURCES & CONSULTING – 3.2% | | | | | |

ICF International, Inc. | | 19,800 | | | 1,961,190 |

Insperity, Inc. | | 13,700 | | | 1,556,320 |

NV5 Global, Inc.* | | 11,800 | | | 1,561,376 |

| | | | | | 5,078,886 |

| | | | | | |

BANKS – DIVERSIFIED – 1.6% | | | | | |

First Merchants Corp. | | 25,300 | | | 1,040,083 |

Washington Federal, Inc. | | 43,200 | | | 1,449,359 |

| | | | | | 2,489,442 |

| | | | | | |

BEVERAGE – BREWERS & DISTILLERS – 1.2% | | | | | |

MGP Ingredients, Inc. | | 18,100 | | | 1,925,478 |

| | | | | | |

BIOTECHNOLOGY – 1.9% | | | | | |

Halozyme Therapeutics, Inc.* | | 52,200 | | | 2,970,180 |

| | | | | | |

CASINOS & GAMBLING – 1.0% | | | | | |

Monarch Casino and Resort, Inc.* | | 20,100 | | | 1,545,489 |

| | | | | | |

CHEMICALS – DIVERSIFIED – 2.1% | | | | | |

Cabot Corp. | | 24,200 | | | 1,617,528 |

Univar Solutions, Inc.* | | 54,300 | | | 1,726,740 |

| | | | | | 3,344,268 |

| | | | | | |

CHEMICALS – SPECIALTY – 1.2% | | | | | |

Quaker Chemical Corp. | | 11,600 | | | 1,936,040 |

| | | | | | |

COMMERCIAL VEHICLES & PARTS – 1.7% | | | | | |

Federal Signal Corp. | | 57,100 | | | 2,653,437 |

| | | | | | |

COMMUNICATIONS TECHNOLOGY – 3.0% | | | | | |

Calix, Inc.* | | 37,900 | | | 2,593,497 |

Ciena Corp.* | | 42,800 | | | 2,181,944 |

| | | | | | 4,775,441 |

| | | | | | |

COMPUTER TECHNOLOGY – 2.5% | | | | | |

Super Micro Computer, Inc.* | | 25,700 | | | 2,109,970 |

Synaptics, Inc.* | | 19,400 | | | 1,846,104 |

| | | | | | 3,956,074 |

See accompanying notes to the financial statements.

19

OBERWEIS SMALL-CAP OPPORTUNITIES FUND (continued)

Schedule of Investments December 31, 2022

| | SHARES | | VALUE |

CONSUMER LENDING – 1.0% | | | | | |

FirstCash Hldgs., Inc. | | 17,900 | | $ | 1,555,689 |

| | | | | | |

CONSUMER SERVICES – MISCELLANEOUS – 1.8% | | | | | |

Perion Network Ltd.* | | 110,900 | | | 2,805,770 |

| | | | | | |

CONTAINERS & PACKAGING – 2.9% | | | | | |

O-I Glass, Inc.* | | 103,400 | | | 1,713,338 |

Veritiv Corp. | | 22,742 | | | 2,767,929 |

| | | | | | 4,481,267 |

| | | | | | |

COSMETICS – 1.4% | | | | | |

Inter Parfums, Inc. | | 22,100 | | | 2,133,092 |

| | | | | | |

DIVERSIFIED MANUFACTURING OPERATIONS – 5.1% | | | | | |

Allegro MicroSystems, Inc.* | | 115,200 | | | 3,458,304 |

Inmode Ltd.* | | 59,500 | | | 2,124,150 |

Janus International Group, Inc.* | | 130,300 | | | 1,240,456 |

MP Materials Corp.* | | 48,000 | | | 1,165,440 |

| | | | | | 7,988,350 |

| | | | | | |

ELECTRONIC ENTERTAINMENT – 0.8% | | | | | |

Everi Hldgs., Inc.* | | 88,900 | | | 1,275,715 |

| | | | | | |

ENERGY EQUIPMENT – 1.5% | | | | | |

Ameresco, Inc.* | | 40,700 | | | 2,325,598 |

| | | | | | |

ENVIRONMENTAL, MAINTENANCE & SECURITY SERVICES – 1.3% | | | | | |

ABM Industries, Inc. | | 44,500 | | | 1,976,690 |

| | | | | | |

FOREST PRODUCTS – 0.7% | | | | | |

UFP Industries, Inc. | | 14,700 | | | 1,164,975 |

| | | | | | |

HEALTHCARE MANAGEMENT SERVICES – 1.3% | | | | | |

Option Care Health, Inc.* | | 65,500 | | | 1,970,895 |

| | | | | | |

HEALTHCARE SERVICES – 3.5% | | | | | |

Acadia Healthcare Co., Inc.* | | 18,900 | | | 1,555,848 |

AMN Healthcare Services, Inc.* | | 15,200 | | | 1,562,864 |

Evolent Health, Inc.* | | 81,900 | | | 2,299,752 |

| | | | | | 5,418,464 |

| | | | | | |

INSURANCE – LIFE – 0.8% | | | | | |

Unum Group | | 29,000 | | | 1,189,870 |

| | | | | | |

LEISURE TIME – 3.6% | | | | | |

Fox Factory Hldg. Corp.* | | 21,100 | | | 1,924,953 |

SeaWorld Entertainment, Inc.* | | 39,500 | | | 2,113,645 |

Topgolf Callaway Brands Corp.* | | 83,800 | | | 1,655,050 |

| | | | | | 5,693,648 |

See accompanying notes to the financial statements.

20

OBERWEIS SMALL-CAP OPPORTUNITIES FUND (continued)

Schedule of Investments December 31, 2022

| | SHARES | | VALUE |

MACHINERY – AGRICULTURE – 0.8% | | | | | |

Titan International, Inc.* | | 80,100 | | $ | 1,227,132 |

| | | | | | |

MACHINERY – INDUSTRIAL – 2.7% | | | | | |

Applied Industrial Technologies, Inc. | | 16,600 | | | 2,092,098 |

Franklin Electric Co., Inc. | | 26,600 | | | 2,121,350 |

| | | | | | 4,213,448 |

| | | | | | |

MEDICAL & DENTAL INSTRUMENTS & SUPPLIES – 4.7% | | | | | |

Alphatec Hldgs., Inc.* | | 188,700 | | | 2,330,445 |

Merit Medical Systems, Inc.* | | 35,600 | | | 2,514,072 |

TransMedics Group, Inc.* | | 40,000 | | | 2,468,800 |

| | | | | | 7,313,317 |

| | | | | | |

MEDICAL EQUIPMENT – 3.9% | | | | | |

Haemonetics Corp.* | | 19,700 | | | 1,549,405 |

Inspire Medical Systems, Inc.* | | 3,850 | | | 969,738 |

Lantheus Hldgs., Inc.* | | 50,800 | | | 2,588,768 |

Shockwave Medical, Inc.* | | 5,150 | | | 1,058,892 |

| | | | | | 6,166,803 |

| | | | | | |

OIL CRUDE PRODUCER – 4.0% | | | | | |

Comstock Resources, Inc. | | 114,000 | | | 1,562,940 |

Magnolia Oil & Gas Corp. | | 67,100 | | | 1,573,495 |

Matador Resources Co. | | 30,300 | | | 1,734,372 |

PDC Energy, Inc. | | 22,200 | | | 1,409,256 |

| | | | | | 6,280,063 |

| | | | | | |

OIL WELL EQUIPMENT & SERVICES – 1.9% | | | | | |

Liberty Energy, Inc. | | 84,100 | | | 1,346,441 |

NOV, Inc. | | 80,800 | | | 1,687,912 |

| | | | | | 3,034,353 |

| | | | | | |

PAPER – 1.0% | | | | | |

Clearwater Paper Corp.* | | 41,800 | | | 1,580,458 |

| | | | | | |

PHARMACEUTICALS – 1.0% | | | | | |

Amphastar Pharmaceuticals, Inc.* | | 56,900 | | | 1,594,338 |

| | | | | | |

POWER TRANSMISSION EQUIPMENT – 2.0% | | | | | |

Belden, Inc. | | 42,900 | | | 3,084,510 |

| | | | | | |

PRODUCTION TECHNOLOGY EQUIPMENT – 10.3% | | | | | |

Aehr Test Systems* | | 289,208 | | | 5,813,081 |

Axcelis Technologies, Inc.* | | 78,800 | | | 6,253,568 |

Impinj, Inc.* | | 32,000 | | | 3,493,760 |

Novanta, Inc.* | | 4,900 | | | 665,763 |

| | | | | | 16,226,172 |

See accompanying notes to the financial statements.

21

OBERWEIS SMALL-CAP OPPORTUNITIES FUND (continued)

Schedule of Investments December 31, 2022

| | SHARES | | VALUE |

RESTAURANTS – 0.6% | | | | | |

Texas Roadhouse, Inc. | | 9,500 | | $ | 864,025 |

| | | | | | |

SCIENTIFIC INSTRUMENTS – POLLUTION CONTROL – 2.3% | | | | | |

Clean Harbors, Inc.* | | 31,300 | | | 3,571,956 |

| | | | | | |

SEMICONDUCTORS & COMPONENTS – 3.8% | | | | | |

MACOM Technology Solutions Hldgs., Inc.* | | 38,400 | | | 2,418,432 |

MaxLinear, Inc.* | | 58,500 | | | 1,986,075 |

Silicon Laboratories, Inc.* | | 11,650 | | | 1,580,556 |

| | | | | | 5,985,063 |

| | | | | | |

SPECIALTY RETAIL – 0.5% | | | | | |

Murphy USA, Inc. | | 2,900 | | | 810,666 |

| | | | | | |

TECHNOLOGY – MISCELLANEOUS – 1.9% | | | | | |

Fabrinet* | | 23,700 | | | 3,038,814 |

| | | | | | |

TELECOMMUNICATIONS EQUIPMENT – 2.1% | | | | | |

Clearfield, Inc.* | | 34,800 | | | 3,276,072 |

| | | | | | |

TEXTILES, APPAREL & SHOES – 4.1% | | | | | |

Crocs, Inc.* | | 32,300 | | | 3,502,289 |

Deckers Outdoor Corp.* | | 7,500 | | | 2,993,700 |

| | | | | | 6,495,989 |

| | | | | | |

TRUCKERS – 0.6% | | | | | |

Forward Air Corp. | | 9,800 | | | 1,027,922 |

| | | | | | |

Total Equities | | | | | |

(Cost: $143,070,392) | | | | $ | 150,482,625 |

| | | | | | |

Total Investments – 95.9% | | | | | |

(Cost: $143,070,392) | | | | $ | 150,482,625 |

Other Assets Less Liabilities – 4.1% | | | | | 6,403,729 |

Net Assets – 100% | | | | $ | 156,886,354 |

* Non-income producing security during the period ended December 31, 2022

See accompanying notes to the financial statements.

22

OBERWEIS GLOBAL OPPORTUNITIES FUND

Schedule of Investmentsa December 31, 2022

| | SHARES | | VALUE |

Equities – 100.0% | | | | | |

| | | | | | |

AUSTRALIA – 1.2% | | | | | |

IDP Education Ltd. | | 35,000 | | $ | 645,003 |

| | | | | | |

BRAZIL – 1.1% | | | | | |

TOTVS SA | | 110,000 | | | 575,438 |

| | | | | | |

CANADA – 5.2% | | | | | |

Aritzia, Inc.* | | 32,600 | | | 1,140,037 |

ATS Corp.* | | 25,000 | | | 777,142 |

TFI International, Inc. | | 7,800 | | | 781,210 |

| | | | | | 2,698,389 |

| | | | | | |

CHINA – 5.7% | | | | | |

Dada Nexus Ltd. ADS* | | 173,342 | | | 1,208,194 |

Li Ning Co. Ltd. | | 61,500 | | | 528,835 |

Shanghai Weaver Network Co. Ltd. | | 75,000 | | | 541,690 |

YTO Express Group Co. Ltd. | | 225,000 | | | 649,188 |

| | | | | | 2,927,907 |

| | | | | | |

FRANCE – 2.1% | | | | | |

Rexel SA | | 29,700 | | | 587,413 |

Soitec SA* | | 3,000 | | | 492,403 |

| | | | | | 1,079,816 |

| | | | | | |

GERMANY – 1.7% | | | | | |

AIXTRON SE | | 30,000 | | | 863,186 |

| | | | | | |

ISRAEL – 1.3% | | | | | |

Inmode Ltd.* | | 19,400 | | | 692,580 |

| | | | | | |

JAPAN – 7.4% | | | | | |

BayCurrent Consulting, Inc. | | 46,000 | | | 1,431,980 |

Fuji Electric Co. Ltd. | | 31,000 | | | 1,169,918 |

Future Corp. | | 44,400 | | | 552,340 |

Visional, Inc.* | | 10,000 | | | 662,384 |

| | | | | | 3,816,622 |

| | | | | | |

NORWAY – 2.2% | | | | | |

Nordic Semiconductor ASA* | | 66,900 | | | 1,121,392 |

| | | | | | |

SOUTH KOREA – 1.2% | | | | | |

LEENO Industrial, Inc. | | 5,000 | | | 617,851 |

| | | | | | |

SWITZERLAND – 2.5% | | | | | |

u-blox Hldg. AG | | 11,000 | | | 1,313,010 |

| | | | | | |

TAIWAN – 2.2% | | | | | |

M31 Technology Corp. | | 72,000 | | | 1,067,006 |

See accompanying notes to the financial statements.

23

OBERWEIS GLOBAL OPPORTUNITIES FUND (continued)

Schedule of Investmentsa December 31, 2022

| | | SHARES | | | VALUE | |

UNITED KINGDOM – 10.9% | | | | | | |

Ashtead Technology Hldgs. PLC* | | 459,400 | | $ | 1,749,408 | |

Intermediate Capital Group PLC | | 105,100 | | | 1,451,071 | |

Oxford Instruments PLC | | 19,200 | | | 524,565 | |

RS GROUP PLC | | 41,900 | | | 451,124 | |

VIDENDUM PLC | | 31,800 | | | 414,698 | |

Wise PLC* | | 158,800 | | | 1,075,797 | |

| | | | | | 5,666,663 | |

| | | | | | | |

UNITED STATES OF AMERICA – 55.3% | | | | | | |

Acadia Healthcare Co., Inc.* | | 16,900 | | | 1,391,208 | |

Alphatec Hldgs., Inc.* | | 85,300 | | | 1,053,455 | |

Axcelis Technologies, Inc.* | | 25,149 | | | 1,995,825 | |

Bel Fuse, Inc. | | 25,000 | | | 823,000 | |

Belden, Inc. | | 24,500 | | | 1,761,550 | |

Cabot Corp. | | 8,400 | | | 561,456 | |

Ciena Corp.* | | 15,000 | | | 764,700 | |

Clean Harbors, Inc.* | | 7,900 | | | 901,548 | |

Clearfield, Inc.* | | 11,700 | | | 1,101,438 | |

Comstock Resources, Inc. | | 28,800 | | | 394,847 | |

Crocs, Inc.* | | 18,900 | | | 2,049,327 | |

Cross Country Healthcare, Inc.* | | 17,100 | | | 454,347 | |

Deckers Outdoor Corp.* | | 4,300 | | | 1,716,388 | |

Evolent Health, Inc.* | | 29,600 | | | 831,168 | |

Fabrinet* | | 4,300 | | | 551,346 | |

Halozyme Therapeutics, Inc.* | | 57,200 | | | 3,254,680 | |

Impinj, Inc.* | | 21,700 | | | 2,369,206 | |

Lantheus Hldgs., Inc.* | | 20,300 | | | 1,034,488 | |

MaxLinear, Inc.* | | 20,100 | | | 682,395 | |

MGP Ingredients, Inc. | | 5,600 | | | 595,728 | |

Model N, Inc.* | | 31,200 | | | 1,265,472 | |

Super Micro Computer, Inc.* | | 21,300 | | | 1,748,730 | |

Synaptics, Inc.* | | 8,600 | | | 818,376 | |

Visteon Corp.* | | 4,600 | | | 601,818 | |

| | | | | | 28,722,496 | |

| | | | | | | |

Total Equities | | | | | | |

(Cost: $46,889,562) | | | | $ | 51,807,359 | |

| | | | | | | |

Total Investments 100.0% | | | | | | |

(Cost: $46,889,562) | | | | $ | 51,807,359 | |

Other Liabilities Less Assets – 0.0% | | | | | (2,739 | ) |

Net Assets – 100% | | | | $ | 51,804,620 | |

a Certain securities were fair valued under the discretion of the Board of Trustees

* Non-income producing security during the period ended December 31, 2022

ADS—American depositary share

See accompanying notes to the financial statements.

24

OBERWEIS GLOBAL OPPORTUNITIES FUND (continued)

Schedule of Investmentsa December 31, 2022

SECTOR ALLOCATIONS (As A Percentage of Net Assets) (unaudited) | | |

Consumer Discretionary | | 16.0 | % |

Consumer Staples | | 1.1 | % |

Energy | | 0.8 | % |

Financials | | 2.8 | % |

Healthcare | | 16.8 | % |

Industrials | | 17.7 | % |

Information Technology | | 43.7 | % |

Materials | | 1.1 | % |

See accompanying notes to the financial statements.

25

OBERWEIS CHINA OPPORTUNITIES FUND

Schedule of Investments December 31, 2022

| | SHARES | | VALUE |

Equities – 99.2% | | | | | |

| | | | | | |

AIR FREIGHT & LOGISTICS – 2.3% | | | | | |

Milkyway Chemical Supply Chain Service Co. Ltd. | | 25,000 | | $ | 419,538 |

YTO Express Group Co. Ltd. | | 300,032 | | | 867,076 |

| | | | | | 1,286,614 |

| | | | | | |

AIRLINES – 1.1% | | | | | |

Cathay Pacific Airways Ltd.* | | 550,000 | | | 600,346 |

| | | | | | |

BEVERAGES – 2.7% | | | | | |

China Resources Beer Hldgs. Co. Ltd. | | 100,000 | | | 698,866 |

Luzhou Laojiao Co. Ltd. | | 25,000 | | | 806,565 |

| | | | | | 1,505,431 |

| | | | | | |

BIOTECHNOLOGY – 2.4% | | | | | |

BeiGene Ltd.* | | 80,000 | | | 1,375,440 |

| | | | | | |

CAPITAL MARKETS – 1.4% | | | | | |

Futu Hldgs. Ltd. ADS* | | 20,000 | | | 813,000 |

| | | | | | |

CHEMICALS – 2.5% | | | | | |

Nanjing Cosmos Chemical Co. Ltd.* | | 85,000 | | | 637,650 |

Rianlon Corp.* | | 94,929 | | | 745,181 |

| | | | | | 1,382,831 |

| | | | | | |

DIVERSIFIED CONSUMER SERVICES – 4.1% | | | | | |

New Oriental Education & Technology Group, Inc.* | | 455,000 | | | 1,661,329 |

TAL Education Group ADS* | | 95,000 | | | 669,750 |

| | | | | | 2,331,079 |

| | | | | | |

ELECTRICAL EQUIPMENT – 1.8% | | | | | |

Shenzhen Kstar Science And Technology Co. Ltd.* | | 120,000 | | | 994,289 |

| | | | | | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS – 2.3% | | | | | |

BOE Varitronix Ltd. | | 50,000 | | | 95,061 |

Cowell e Hldgs., Inc.* | | 350,000 | | | 486,964 |

Suzhou Dongshan Precision Manufacturing Co. Ltd.* | | 200,000 | | | 711,481 |

| | | | | | 1,293,506 |

| | | | | | |

ENTERTAINMENT – 7.0% | | | | | |

Bilibili, Inc.* | | 50,000 | | | 1,196,592 |

NetEase, Inc. | | 90,000 | | | 1,320,223 |

Tencent Music Entertainment Group ADS* | | 175,000 | | | 1,449,000 |

| | | | | | 3,965,815 |

See accompanying notes to the financial statements.

26

OBERWEIS CHINA OPPORTUNITIES FUND (continued)

Schedule of Investments December 31, 2022

| | SHARES | | VALUE |

HEALTHCARE EQUIPMENT & SUPPLIES – 5.6% | | | | | |

Acotec Scientific Hldgs. Ltd.* | | 400,000 | | $ | 880,405 |

AK Medical Hldgs. Ltd.* | | 1,000,000 | | | 1,254,244 |

Angelalign Technology, Inc.* | | 25,000 | | | 393,953 |

Sonoscape Medical Corp.* | | 80,000 | | | 630,982 |

| | | | | | 3,159,584 |

| | | | | | |

HEALTHCARE PROVIDERS & SERVICES – 2.7% | | | | | |

Hygeia Healthcare Hldgs. Co. Ltd.* | | 210,000 | | | 1,506,630 |

| | | | | | |

HOTELS, RESTAURANTS & LEISURE – 12.0% | | | | | |

H World Group Ltd. | | 300,000 | | | 1,293,319 |

Helens International Hldgs. Co. Ltd.* | | 350,000 | | | 664,531 |

Jiumaojiu International Hldgs. Ltd. | | 430,000 | | | 1,148,613 |

Sands China Ltd.* | | 350,000 | | | 1,161,361 |

Trip.com Group Ltd.* | | 55,000 | | | 1,927,871 |

Yum China Hldgs., Inc. | | 10,500 | | | 573,825 |

| | | | | | 6,769,520 |

| | | | | | |

INSURANCE – 1.8% | | | | | |

China Life Insurance Co. Ltd.* | | 600,000 | | | 1,030,043 |

| | | | | | |

INTERACTIVE MEDIA & SERVICES – 1.4% | | | | | |

Kuaishou Technology* | | 85,000 | | | 773,717 |

| | | | | | |

INTERNET & DIRECT MARKETING RETAIL – 19.9% | | | | | |

Alibaba Group Hldg. Ltd.* | | 190,000 | | | 2,099,481 |

Alibaba Health Information Technology Ltd.* | | 1,000,000 | | | 851,963 |

Dada Nexus Ltd. ADS* | | 150,000 | | | 1,045,500 |

JD.com, Inc. | | 65,000 | | | 1,833,707 |

Maoyan Entertainment* | | 650,000 | | | 750,304 |

Meituan* | | 80,000 | | | 1,790,532 |

Pinduoduo, Inc. ADS* | | 35,000 | | | 2,854,250 |

| | | | | | 11,225,737 |

| | | | | | |

LIFE SCIENCES TOOLS & SERVICES – 2.5% | | | | | |

Wuxi Biologics (Cayman), Inc.* | | 185,000 | | | 1,418,519 |

| | | | | | |

MACHINERY – 2.0% | | | | | |

Morimatsu International Hldgs. Co. Ltd.* | | 500,000 | | | 555,378 |

Ningbo Haitian Precision Machinery Co. Ltd.* | | 150,000 | | | 565,329 |

| | | | | | 1,120,707 |

| | | | | | |

MULTILINE RETAIL – 1.7% | | | | | |

MINISO Group Hldg. Ltd. ADS* | | 90,000 | | | 965,700 |

| | | | | | |

PAPER & FOREST PRODUCTS – 0.6% | | | | | |

Nine Dragons Paper Hldgs. Ltd.* | | 400,000 | | | 364,871 |

| | | | | | |

PHARMACEUTICALS – 1.4% | | | | | |

Lotus Pharmaceutical Co. Ltd.* | | 100,000.00 | | | 800,377 |

See accompanying notes to the financial statements.

27

OBERWEIS CHINA OPPORTUNITIES FUND (continued)

Schedule of Investments December 31, 2022

| | SHARES | | VALUE |

PROFESSIONAL SERVICES – 0.3% | | | | | |

Centre Testing International Group Co. Ltd. | | 50,050 | | $ | 160,553 |

| | | | | | |

REAL ESTATE MANAGEMENT & DEVELOPMENT 6.2% | | | | | |

China Resources Mixc Lifestyle Services Ltd. | | 251,538 | | | 1,277,751 |

Country Garden Services Hldgs. Co. Ltd.* | | 450,000 | | | 1,120,748 |

Longfor Group Hldgs. Ltd. | | 350,000 | | | 1,089,616 |

| | | | | | 3,488,115 |

| | | | | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT – 3.1% | | | | | |

Jentech Precision Industrial Co. Ltd.* | | 75,000 | | | 918,726 |

M31 Technology Corp.* | | 55,000 | | | 817,784 |

| | | | | | 1,736,510 |

| | | | | | |

SPECIALTY RETAIL – 1.4% | | | | | |

China Tourism Group Duty Free Corp. Ltd. | | 25,000 | | | 776,896 |

| | | | | | |

TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS – 1.3% | | | | | |

Ninestar Corp. | | 100,016 | | | 746,556 |

| | | | | | |

TEXTILES, APPAREL & LUXURY GOODS – 2.5% | | | | | |

Li Ning Co. Ltd. | | 165,000 | | | 1,432,163 |

| | | | | | |

TOBACCO – 1.7% | | | | | |

Smoore International Hldgs. Ltd.* | | 600,000 | | | 931,651 |

| | | | | | |

TRANSPORTATION INFRASTRUCTURE – 2.1% | | | | | |

Shanghai International Airport Co. Ltd.* | | 140,000 | | | 1,162,219 |

| | | | | | |

UTILITIES – GAS – 1.4% | | | | | |

China Resources Gas Group Ltd. | | 200,000 | | | 750,753 |

| | | | | | |

Total Equities | | | | | |

(Cost: $51,390,311) | | | | $ | 55,869,172 |

| | | | | | |

Total Investments – 99.2% | | | | | |

(Cost: $51,390,311) | | | | $ | 55,869,172 |

Other Assets Less Liabilities – 0.8% | | | | | 447,050 |

Net Assets – 100% | | | | $ | 56,316,222 |

* Non-income producing security during the period ended December 31, 2022

ADS—American depositary share

COUNTRY ALLOCATION (As a Percentage of Net Assets) (unaudited) | | |

China (Includes the People’s Republic of China,

Taiwan and Hong Kong) | | 99.2 | % |

See accompanying notes to the financial statements.

28

OBERWEIS INTERNATIONAL OPPORTUNITIES FUND

Schedule of Investmentsa December 31, 2022

| | SHARES | | VALUE |

Equities – 99.7% | | | | | |

| | | | | | |

AUSTRALIA – 8.9% | | | | | |

Computershare Ltd. | | 166,100 | | $ | 2,925,929 |

Elders Ltd. | | 320,600 | | | 2,200,611 |

GrainCorp Ltd. | | 479,100 | | | 2,415,332 |

IDP Education Ltd. | | 161,000 | | | 2,967,013 |

JB Hi-Fi Ltd. | | 81,600 | | | 2,325,667 |

| | | | | | 12,834,552 |

| | | | | | |

AUSTRIA – 2.4% | | | | | |

ANDRITZ AG* | | 53,400 | | | 3,056,684 |

AT & S Austria Technologie & Systemtechnik AG | | 14,300 | | | 490,476 |

| | | | | | 3,547,160 |

| | | | | | |

BELGIUM – 1.1% | | | | | |

Barco NV* | | 66,200 | | | 1,640,005 |

| | | | | | |

CANADA – 18.0% | | | | | |

Aritzia, Inc.* | | 95,500 | | | 3,339,679 |

ATS Corp.* | | 127,700 | | | 3,969,640 |

BRP, Inc. | | 24,600 | | | 1,875,523 |

Element Fleet Management Corp. | | 241,800 | | | 3,294,838 |

Finning International, Inc. | | 98,400 | | | 2,446,192 |

Gildan Activewear, Inc. | | 26,000 | | | 712,024 |

International Petroleum Corp.* | | 200,900 | | | 2,256,853 |

Parex Resources, Inc. | | 120,724 | | | 1,796,594 |

Sleep Country Canada Hldgs., Inc. | | 39,400 | | | 668,694 |

TFI International, Inc. | | 16,000 | | | 1,602,482 |

Toromont Industries Ltd. | | 20,800 | | | 1,501,010 |

Trisura Group Ltd.* | | 77,900 | | | 2,605,680 |

| | | | | | 26,069,209 |

| | | | | | |

DENMARK – 1.5% | | | | | |

D/S Norden A/S | | 36,600 | | | 2,205,692 |

| | | | | | |

FINLAND – 5.2% | | | | | |

Cargotec Oyj* | | 58,100 | | | 2,577,060 |

Metso Outotec Oyj | | 297,100 | | | 3,059,348 |

Outokumpu Oyj | | 385,000 | | | 1,953,931 |

| | | | | | 7,590,339 |

| | | | | | |

FRANCE – 7.4% | | | | | |

Edenred SA* | | 73,100 | | | 3,978,441 |

Nexans SA* | | 15,350 | | | 1,389,298 |

Rexel SA | | 271,000 | | | 5,359,894 |

| | | | | | 10,727,633 |

See accompanying notes to the financial statements.

29

OBERWEIS INTERNATIONAL OPPORTUNITIES FUND (continued)

Schedule of Investmentsa December 31, 2022

| | SHARES | | VALUE |

GERMANY – 5.1% | | | | | |

AIXTRON SE | | 160,600 | | $ | 4,620,920 |

Aurelius Equity Opportunities SE | | 37,923 | | | 739,401 |

Krones AG* | | 14,200 | | | 1,586,732 |

Sixt SE | | 5,372 | | | 491,813 |

| | | | | | 7,438,866 |

| | | | | | |

ITALY – 1.0% | | | | | |

Brunello Cucinelli SpA* | | 20,400 | | | 1,509,395 |

| | | | | | |

JAPAN – 15.9% | | | | | |

BayCurrent Consulting, Inc. | | 205,200 | | | 6,387,876 |

Daiwa Securities Group, Inc. | | 779,400 | | | 3,444,017 |

Fuji Electric Co. Ltd. | | 81,100 | | | 3,060,656 |

Future Corp. | | 198,800 | | | 2,473,092 |

M&A Capital Partners Co. Ltd.* | | 72,900 | | | 2,543,563 |

Toyo Suisan Kaisha Ltd.* | | 73,600 | | | 2,835,511 |

Visional, Inc.* | | 35,100 | | | 2,324,968 |

| | | | | | 23,069,683 |

| | | | | | |

NETHERLANDS – 7.1% | | | | | |

Aalberts NV | | 59,000 | | | 2,298,158 |

Alfen NV* | | 24,000 | | | 2,172,881 |

ASM International NV* | | 5,700 | | | 1,446,267 |

Constellium SE* | | 366,300 | | | 4,333,329 |

| | | | | | 10,250,635 |

| | | | | | |

NORWAY – 5.9% | | | | | |

Aker Solutions ASA | | 450,300 | | | 1,734,322 |

Nordic Semiconductor ASA* | | 334,800 | | | 5,611,987 |

Wallenius Wilhelmsen ASA | | 124,900 | | | 1,230,093 |

| | | | | | 8,576,402 |

| | | | | | |

SWEDEN – 4.5% | | | | | |

Hexatronic Group AB | | 383,600 | | | 5,225,847 |

Munters Group AB* | | 120,700 | | | 1,189,945 |

| | | | | | 6,415,792 |

See accompanying notes to the financial statements.

30

OBERWEIS INTERNATIONAL OPPORTUNITIES FUND (continued)

Schedule of Investmentsa December 31, 2022

| | SHARES | | VALUE |

UNITED KINGDOM – 15.7% | | | | | |

Beazley PLC* | | 333,000 | | $ | 2,723,298 |

Future PLC | | 82,800 | | | 1,262,009 |

IMI PLC | | 54,200 | | | 846,449 |

Indivior PLC* | | 69,600 | | | 1,557,468 |

Intermediate Capital Group PLC | | 162,500 | | | 2,243,569 |

Keywords Studios PLC* | | 45,300 | | | 1,486,521 |

Man Group PLC | | 786,300 | | | 2,022,973 |

Morgan Sindall Group PLC | | 35,400 | | | 658,157 |

Redrow PLC | | 129,500 | | | 709,620 |

RS GROUP PLC | | 125,900 | | | 1,355,525 |

Taylor Wimpey PLC | | 546,700 | | | 669,496 |

Telecom Plus PLC | | 119,700 | | | 3,168,389 |

The Sage Group PLC | | 208,400 | | | 1,876,507 |

Wise PLC* | | 309,600 | | | 2,097,398 |

| | | | | | 22,677,379 |

| | | | | | |

Total Equities | | | | | |

(Cost: $139,985,092) | | | | $ | 144,552,742 |

| | | | | | |

Total Investments – 99.7% | | | | | |

(Cost: $139,985,092) | | | | $ | 144,552,742 |

| | | | | | |

Other Assets Less Liabilities – 0.3% | | | | | 417,202 |

Net Assets – 100% | | | | $ | 144,969,944 |

SECTOR ALLOCATIONS (As a Percentage of Net Assets) (unaudited) | | |

Communication Services | | 0.9 | % |

Consumer Discretionary | | 10.2 | % |

Consumer Staples | | 5.1 | % |

Energy | | 4.0 | % |

Financials | | 13.5 | % |

Healthcare | | 1.1 | % |

Industrials | | 38.6 | % |

Information Technology | | 19.8 | % |

Materials | | 4.3 | % |

Utilities | | 2.2 | % |

See accompanying notes to the financial statements.

31

OBERWEIS EMERGING MARKETS FUND

Schedule of Investmentsa December 31, 2022

| | SHARES | | VALUE |

Equities – 96.1% | | | | | |

| | | | | | |

ARGENTINA – 0.5% | | | | | |

Despegar.com Corp.* | | 11,600 | | $ | 59,508 |

| | | | | | |

AUSTRALIA – 2.0% | | | | | |

IDP Education Ltd. | | 13,300 | | | 246,115 |

| | | | | | |

BRAZIL – 6.8% | | | | | |

Afya Ltd.* | | 17,000 | | | 265,540 |

LOG Commercial Properties e Participacoes SA | | 25,000 | | | 76,329 |

Petro Rio SA* | | 40,400 | | | 284,724 |

TOTVS SA | | 44,200 | | | 231,222 |

| | | | | | 857,815 |

| | | | | | |

CHINA – 23.3% | | | | | |

AK Medical Hldgs. Ltd.* | | 182,000 | | | 228,272 |

Chongqing Brewery Co. Ltd. | | 16,100 | | | 295,010 |

Dada Nexus Ltd. ADS* | | 92,600 | | | 645,422 |

Glodon Co. Ltd.* | | 12,000 | | | 103,485 |

Hangzhou Robam Appliances Co. Ltd. | | 50,500 | | | 201,660 |

Kingdee International Software Group Co. Ltd.* | | 149,000 | | | 319,552 |

Sichuan Swellfun Co. Ltd.* | | 14,000 | | | 170,013 |

Thunder Software Technology Co. Ltd.* | | 7,000 | | | 100,997 |

Weimob, Inc.* | | 204,000 | | | 174,062 |

Wolong Electric Group Co. Ltd. | | 64,500 | | | 115,608 |

Xiabuxiabu Catering Management China Hldgs. Co. Ltd. | | 194,000 | | | 220,706 |

Yantai Jereh Oilfield Services Group Co. Ltd. | | 42,700 | | | 171,434 |

Zhejiang Shuanghuan Driveline Co. Ltd.* | | 52,016 | | | 190,429 |

| | | | | | 2,936,650 |

| | | | | | |

FRANCE – 1.3% | | | | | |

Gaztransport & Technigaz SA | | 1,550 | | | 165,586 |

| | | | | | |

GREECE – 1.6% | | | | | |

Greek Organization of Football Prognostics SA | | 14,500 | | | 205,347 |

| | | | | | |

HUNGARY – 1.3% | | | | | |

Richter Gedeon Nyrt | | 7,200 | | | 160,216 |

| | | | | | |

INDIA – 13.7% | | | | | |

Affle India Ltd.* | | 12,100 | | | 158,362 |

AMI Organics Ltd.* | | 10,300 | | | 120,187 |

Cera Sanitaryware Ltd.* | | 2,200 | | | 138,475 |

Computer Age Management Services Ltd. | | 4,100 | | | 110,102 |

Container Corp. of India Ltd. | | 12,300 | | | 109,842 |

Federal Bank Ltd.* | | 146,000 | | | 245,392 |

See accompanying notes to the financial statements.

32

OBERWEIS EMERGING MARKETS FUND (continued)

Schedule of Investmentsa December 31, 2022

| | SHARES | | VALUE |

KPIT Technologies Ltd. | | 18,500 | | $ | 157,484 |

L&T Technology Services Ltd. | | 2,700 | | | 120,217 |

Linde India Ltd. | | 3,000 | | | 124,553 |

Tube Investments of India Ltd.* | | 3,500 | | | 117,423 |

Varun Beverages Ltd. | | 13,018 | | | 208,110 |

Vinati Organics Ltd. | | 4,700 | | | 113,333 |

| | | | | | 1,723,480 |

| | | | | | |

INDONESIA – 6.2% | | | | | |

PT Indofood CBP Sukses Makmur Tbk | | 200,000 | | | 128,473 |

PT Kalbe Farma Tbk* | | 1,453,000 | | | 195,071 |

PT Mitra Adiperkasa Tbk* | | 2,282,900 | | | 211,902 |

PT Sumber Alfaria Trijaya Tbk | | 1,476,500 | | | 251,339 |

| | | | | | 786,785 |

| | | | | | |

MALAYSIA – 4.2% | | | | | |

Carlsberg Brewery Malaysia Bhd | | 25,000 | | | 129,852 |

My E.G. Services Bhd | | 1,032,000 | | | 203,823 |

Telekom Malaysia Bhd* | | 158,000 | | | 193,689 |

| | | | | | 527,364 |

| | | | | | |

MEXICO – 2.3% | | | | | |

Alsea, S.A.B. de CV* | | 88,300 | | | 167,025 |

Controladora Vuela Compania de Aviacion, S.A.B de CV ADS* | | 14,000 | | | 117,040 |

| | | | | | 284,065 |

| | | | | | |

PHILIPPINES – 1.5% | | | | | |

Wilcon Depot, Inc. | | 360,800 | | | 191,269 |

| | | | | | |

POLAND – 1.4% | | | | | |

Dino Polska SA* | | 2,100 | | | 179,881 |

| | | | | | |

SOUTH AFRICA – 1.7% | | | | | |

Clicks Group Ltd. | | 7,680 | | | 122,075 |

Karooooo Ltd. | | 3,700 | | | 87,801 |

| | | | | | 209,876 |

| | | | | | |

SOUTH KOREA – 10.5% | | | | | |

Classys, Inc. | | 21,727 | | | 316,776 |

LEENO Industrial, Inc. | | 2,588 | | | 319,799 |

LG Innotek Co. Ltd. | | 949 | | | 191,393 |

Park Systems Corp. | | 1,500 | | | 135,917 |

POSCO Chemical Co. Ltd. | | 1,730 | | | 247,144 |

SaraminHR Co. Ltd. | | 5,500 | | | 115,114 |

| | | | | | 1,326,143 |

| | | | | | |

SWITZERLAND – 0.9% | | | | | |

Wizz Air Hldgs. PLC* | | 4,809 | | | 110,720 |

See accompanying notes to the financial statements.

33

OBERWEIS EMERGING MARKETS FUND (continued)

Schedule of Investmentsa December 31, 2022

| | SHARES | | VALUE |

TAIWAN – 15.0% | | | | | |

ASPEED Technology, Inc. | | 4,400 | | $ | 241,219 |

Chailease Hldg. Co. Ltd. | | 35,499 | | | 250,631 |

Chroma ATE, Inc.* | | 30,000 | | | 176,669 |

Genius Electronic Optical Co. Ltd.* | | 16,000 | | | 174,651 |

Innodisk Corp. | | 23,881 | | | 144,131 |

momo.com, Inc. | | 9,440 | | | 197,182 |

Pan Jit International, Inc. | | 98,000 | | | 184,614 |

Sinbon Electronics Co. Ltd. | | 21,000 | | | 187,893 |

Unimicron Technology Corp.* | | 24,000 | | | 93,703 |

Yageo Corp. | | 16,551 | | | 242,863 |

| | | | | | 1,893,556 |

| | | | | | |

THAILAND – 0.9% | | | | | |

Mega Lifesciences PCL | | 87,000 | | | 117,432 |

| | | | | | |

VIETNAM – 1.0% | | | | | |

Masan Group Corp. | | 28,800 | | | 113,612 |

| | | | | | |

Total Equities | | | | | |

(Cost: $11,717,517) | | | | $ | 12,095,420 |

| | | | | | |

Total Investments – 96.1% | | | | | |

(Cost: $11,717,517) | | | | $ | 12,095,420 |

| | | | | | |

Other Assets Less Liabilities – 3.9% | | | | | 495,056 |

Net Assets – 100% | | | | $ | 12,590,476 |

SECTOR ALLOCATIONS (As a Percentage of Net Assets) (unaudited) | | |

Communication Services | | 2.8 | % |

Consumer Discretionary | | 23.2 | % |

Consumer Staples | | 12.7 | % |

Energy | | 4.9 | % |

Financials | | 3.9 | % |

Healthcare | | 9.0 | % |

Industrials | | 6.6 | % |

Information Technology | | 28.4 | % |

Materials | | 3.9 | % |

Real Estate | | 0.7 | % |

See accompanying notes to the financial statements.

34

THE OBERWEIS FUNDS

Statements of Assets and Liabilities December 31, 2022

| | | Micro-Cap

Fund | | Small-Cap

Opportunities

Fund | | Global

Opportunities

Fund | |

| | | ASSETS | | | | | | | | | | |

| | | Investment securities at valuea | $ | 162,821,078 | | $ | 150,482,625 | | $ | 51,807,359 | | |

| | | Cash | | 5,989,381 | | | 7,041,412 | | | 7,575 | | |

| | | Receivable from fund shares sold | | 220,476 | | | 2,153,497 | | | 5,500 | | |

| | | Dividends and interest receivable | | 5,474 | | | 4,076 | | | 63,901 | | |

| | | Prepaid expenses | | 36,019 | | | 35,677 | | | 16,429 | | |

| | | Total Assets | | 169,072,428 | | | 159,717,287 | | | 51,900,764 | | |

| | | | | | | | | | | | | |

| | | LIABILITIES | | | | | | | | | | |

| | | Payable for fund shares redeemed | | 57,329 | | | 161,681 | | | — | | |

| | | Payable for securities purchased | | — | | | 2,507,811 | | | — | | |

| | | Payable to advisor (see note 3) | | 140,458 | | | 79,686 | | | 38,709 | | |

| | | Payable to distributor | | 19,575 | | | 19,915 | | | 7,604 | | |

| | | Accrued expenses | | 67,218 | | | 61,840 | | | 49,831 | | |

| | | Total Liabilities | | 284,580 | | | 2,830,933 | | | 96,144 | | |

| | | NET ASSETS | $ | 168,787,848 | | $ | 156,886,354 | | $ | 51,804,620 | | |

| | | | | | | | | | | | | |

| | | NET ASSETS | | | | | | | | | | |

| | | Investor Class | $ | 96,280,538 | | $ | 94,109,831 | | $ | 34,967,751 | | |

| | | Institutional Class | | 72,507,310 | | | 62,776,523 | | | 16,836,869 | | |

| | | Total | $ | 168,787,848 | | $ | 156,886,354 | | $ | 51,804,620 | | |

| | | | | | | | | | | | | |

| | | SHARES OUTSTANDING | | | | | | | | | | |

| | | (shares of beneficial interest issued and outstanding, respectively, unlimited number of shares authorized with no par value) | | | | | | | | | | |

| | | Investor Class | | 3,043,395 | | | 4,926,864 | | | 1,389,238 | | |

| | | Institutional Class | | 2,251,076 | | | 3,221,622 | | | 656,682 | | |

| | | Total | | 5,294,471 | | | 8,148,486 | | | 2,045,920 | | |

| | | | | | | | | | | | | |

| | | NET ASSET VALUE | | | | | | | | | | |

| | | Investor Class, offering price and redemption price | $ | 31.64 | | $ | 19.10 | | $ | 25.17 | | |

| | | Institutional Class, offering price and redemption price | $ | 32.21 | | $ | 19.49 | | $ | 25.64 | | |

| | | | | | | | | | | | | |

| | | ANALYSIS OF NET ASSETS | | | | | | | | | | |

| | | Capital | $ | 146,329,230 | | $ | 153,427,688 | | $ | 52,580,657 | | |

| | | Accumulated earnings (losses) | | 22,458,618 | | | 3,458,666 | | | (776,037 | ) | |

| | | Net assets | $ | 168,787,848 | | $ | 156,886,354 | | $ | 51,804,620 | | |

| | | | | | | | | | | | | |

| | | a Investment securities at cost | $ | 137,803,008 | | $ | 143,070,392 | | $ | 46,889,562 | | |

See accompanying notes to the financial statements.

35

THE OBERWEIS FUNDS

Statements of Assets and Liabilities December 31, 2022 (continued)

| | | China

Opportunities

Fund | | International

Opportunities

Fund | | Emerging

Markets

Fund | |

| | | ASSETS | | | | | | | | | | | | |

| | | Investment securities at valuea | $ | 55,869,172 | | | $ | 144,552,742 | | | $ | 12,095,420 | | |

| | | Cash | | 34,047 | | | | 107,140 | | | | 556,508 | | |

| | | Foreign Currencyb | | 889,200 | | | | 19,276 | | | | 1,717 | | |

| | | Receivable from fund shares sold | | 105,650 | | | | 120,772 | | | | 9,000 | | |

| | | Dividends and interest receivable | | 11,538 | | | | 874,074 | | | | 12,455 | | |

| | | Prepaid expenses | | 18,385 | | | | 33,755 | | | | 7,392 | | |

| | | Other Assets | | 2,036 | | | | — | | | | — | | |

| | | Total Assets | | 56,930,028 | | | | 145,707,759 | | | | 12,682,492 | | |

| | | | | | | | | | | | | | | |

| | | LIABILITIES | | | | | | | | | | | | |

| | | Payable for fund shares redeemed | | 107,193 | | | | 477,673 | | | | — | | |

| | | Payable for securities purchased | | 372,107 | | | | — | | | | — | | |

| | | Payable to advisor (see note 3) | | 59,697 | | | | 136,619 | | | | 3,532 | | |

| | | Deferred foreign capital gains tax liability (see note 2) | | — | | | | — | | | | 44,211 | | |

| | | Payable to distributor | | 9,752 | | | | 31,776 | | | | 324 | | |

| | | Accrued expenses | | 65,057 | | | | 91,747 | | | | 43,949 | | |

| | | Total Liabilities | | 613,806 | | | | 737,815 | | | | 92,016 | | |

| | | NET ASSETS | $ | 56,316,222 | | | $ | 144,969,944 | | | $ | 12,590,476 | | |

| | | | | | | | | | | | | | | |

| | | NET ASSETS | | | | | | | | | | | | |

| | | Investor Class | $ | 45,803,317 | | | $ | 144,969,944 | | | $ | 1,578,092 | | |

| | | Institutional Class | | 10,512,905 | | | | — | | | | 11,012,384 | | |

| | | Total | $ | 56,316,222 | | | $ | 144,969,944 | | | $ | 12,590,476 | | |

| | | | | | | | | | | | | | | |

| | | SHARES OUTSTANDING | | | | | | | | | | | | |

| | | (shares of beneficial interest issued and outstanding, respectively, unlimited number of shares authorized with no par value) | | | | | | | | | | | | |

| | | Investor Class | | 6,410,949 | | | | 8,692,126 | | | | 157,125 | | |

| | | Institutional Class | | 1,446,690 | | | | — | | | | 1,083,930 | | |

| | | Total | | 7,857,639 | | | | 8,692,126 | | | | 1,241,055 | | |

| | | | | | | | | | | | | | | |

| | | NET ASSET VALUE | | | | | | | | | | | | |

| | | Investor Class, offering price and redemption price | $ | 7.14 | | | $ | 16.68 | | | $ | 10.04 | | |

| | | Institutional Class, offering price and redemption price | $ | 7.27 | | | $ | — | | | $ | 10.16 | | |

| | | | | | | | | | | | | | | |

| | | ANALYSIS OF NET ASSETS | | | | | | | | | | | | |

| | | Capital | $ | 77,136,077 | | | $ | 184,245,844 | | | $ | 13,471,040 | | |

| | | Accumulated losses | | (20,819,855 | ) | | | (39,275,900 | ) | | | (880,564 | ) | |

| | | Net assets | $ | 56,316,222 | | | $ | 144,969,944 | | | $ | 12,590,476 | | |

| | | | | | | | | | | | | | | |

| | | a Investment securities at cost | $ | 51,390,311 | | | $ | 139,985,092 | | | $ | 11,717,517 | | |

| | | b Foreign currency at cost | $ | 874,971 | | | $ | 19,274 | | | $ | 1,627 | | |

See accompanying notes to the financial statements.

36

THE OBERWEIS FUNDS

Statements of Operations Year Ended December 31, 2022

| | | Micro-Cap

Fund | | Small-Cap

Opportunities

Fund | |

| | | INVESTMENT INCOME | | | | | | | | |

| | | Dividends | $ | 691,911 | | | $ | 282,600 | | |

| | | Total investment income | | 691,911 | | | | 282,600 | | |

| | | | | | | | | | | |

| | | EXPENSES | | | | | | | | |

| | | Investment advisory fees (see note 3) | | 824,982 | | | | 267,948 | | |

| | | Management fees (see note 3) | | 549,988 | | | | 267,948 | | |

| | | Distribution fees and shareholder services

(see note 3) | | 199,062 | | | | 111,863 | | |

| | | Transfer agent fees and expenses | | 153,307 | | | | 115,703 | | |

| | | Custodian fees and expenses | | 23,908 | | | | 14,423 | | |

| | | Accounting services fees | | 60,112 | | | | 37,368 | | |

| | | Other | | 142,710 | | | | 97,713 | | |

| | | Total expenses before reimbursed expenses | | 1,954,069 | | | | 912,966 | | |

| | | Earnings credit (see note 6) | | (9,830 | ) | | | (14,355 | ) | |

| | | Expense reimbursement (see note 3) | | — | | | | (116,878 | ) | |

| | | Total expenses | | 1,944,239 | | | | 781,733 | | |

| | | NET INVESTMENT LOSS | | (1,252,328 | ) | | | (499,133 | ) | |

| | | | | | | | | | | |

| | | NET REALIZED AND UNREALIZED GAINS (LOSSES) FROM INVESTMENTS | | |

| | | Net realized gains (losses) on investment

transactions | | 440,411 | | | | (3,923,184 | ) | |

| | | Change in net unrealized appreciation/depreciation

on investments | | (16,127,343 | ) | | | 450,435 | | |

| | | Net realized/unrealized losses on investments | | (15,686,932 | ) | | | (3,472,749 | ) | |

| | | NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (16,939,260 | ) | | $ | (3,971,882 | ) | |

See accompanying notes to the financial statements.

37

THE OBERWEIS FUNDS

Statements of Operations Year Ended December 31, 2022 (continued)

| | | Global

Opportunities

Fund | China

Opportunities

Fund | International

Opportunities

Fund | Emerging

Markets

Fund | |

| | | INVESTMENT INCOME | | | | | | | | | | | | | |

| | | Dividendsa | $ | 446,853 | | $ | 724,787 | | $ | 4,248,957 | | $ | 170,210 | | |

| | | Interest | | — | | | 58 | | | — | | | — | | |

| | | Total investment income | | 446,853 | | | 724,845 | | | 4,248,957 | | | 170,210 | | |

| | | | | | | | | | | | | | | | |

| | | EXPENSES | | | | | | | | | | | | | |

| | | Investment advisory fees (see note 3) | | 248,998 | | | 845,056 | | | 2,411,314 | | | 162,225 | | |

| | | Management fees (see note 3) | | 223,998 | | | — | | | — | | | — | | |

| | | Distribution fees and shareholder services (see note 3) | | 92,818 | | | 136,592 | | | 482,263 | | | 4,214 | | |

| | | Transfer agent fees and expenses | | 62,311 | | | 109,746 | | | 333,403 | | | 32,593 | | |

| | | Custodian fees and expenses | | 48,535 | | | 111,425 | | | 118,247 | | | 52,532 | | |

| | | Accounting services fees | | 35,634 | | | 44,491 | | | 83,382 | | | 24,964 | | |

| | | Federal and state registration fees | | 32,101 | | | 36,538 | | | 36,120 | | | 33,864 | | |

| | | Audit fees | | 21,792 | | | 21,792 | | | 21,794 | | | 21,792 | | |

| | | Other | | 40,486 | | | 48,827 | | | 123,277 | | | 16,000 | | |

| | | Total expenses before reimbursed expenses | | 806,673 | | | 1,354,467 | | | 3,609,800 | | | 348,184 | | |

| | | Earnings credit (see note 6) | | (6,551 | ) | | (17,348 | ) | | (24,474 | ) | | (8,598 | ) | |

| | | Expense reimbursement (see note 3) | | — | | | — | | | (498,844 | ) | | (140,702 | ) | |

| | | Total Expenses | | 800,122 | | | 1,337,119 | | | 3,086,482 | | | 198,884 | | |

| | | NET INVESTMENT INCOME (LOSS) | | (353,269 | ) | | (612,274 | ) | | 1,162,475 | | | (28,674 | ) | |

| | | | | | | | |

| | | NET REALIZED AND UNREALIZED LOSSES FROM INVESTMENTS | | | | | |