UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4854

The Oberweis Funds

(Exact name of registrant as specified in charter)

3333 Warrenville Road, Suite 500, Lisle, IL 60532

(Address of principal executive offices) (Zip code)

James W. Oberweis | Copy to: James A. Arpaia |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 323-6166

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Annual Reports for the period 01/01/23 through 12/31/23 is filed herewith

ANNUAL REPORT | ||||||||

INVESTOR | INSTITUTIONAL | |||||||

Oberweis Micro-Cap Fund | OBMCX | OMCIX | ||||||

Oberweis Small-Cap Opportunities Fund | OBSOX | OBSIX | ||||||

Oberweis Global Opportunities Fund | OBEGX | OBGIX | ||||||

Oberweis China Opportunities Fund | OBCHX | OCHIX | ||||||

Oberweis Emerging Markets Fund | OBEMX | OIEMX | ||||||

Oberweis International Opportunities Fund | OBIOX | OBIIX | ||||||

Oberweis Focused International Growth Fund | — | OFIGX | ||||||

December 31, 2023 | ||||||||

oberweisfunds.com | ||||||||

TABLE OF CONTENTS

1 | ||

4 | ||

Schedule of Investments | ||

17 | ||

21 | ||

25 | ||

28 | ||

31 | ||

35 | ||

38 | ||

Statements of Assets and Liabilities | ||

40 | ||

40 | ||

40 | ||

41 | ||

41 | ||

42 | ||

42 | ||

Statements of Operations | ||

43 | ||

43 | ||

44 | ||

44 | ||

44 | ||

45 | ||

45 | ||

Statements of Changes in Net Assets | ||

46 | ||

47 | ||

48 | ||

49 | ||

50 | ||

51 | ||

52 | ||

53 | ||

Financial Highlights | ||

64 | ||

66 | ||

68 | ||

70 | ||

72 | ||

74 | ||

76 | ||

77 | ||

78 | ||

80 |

PRESIDENT’S LETTER (unaudited)

Dear Fellow Oberweis Funds Shareholder,

2023 Performance in REVIEW

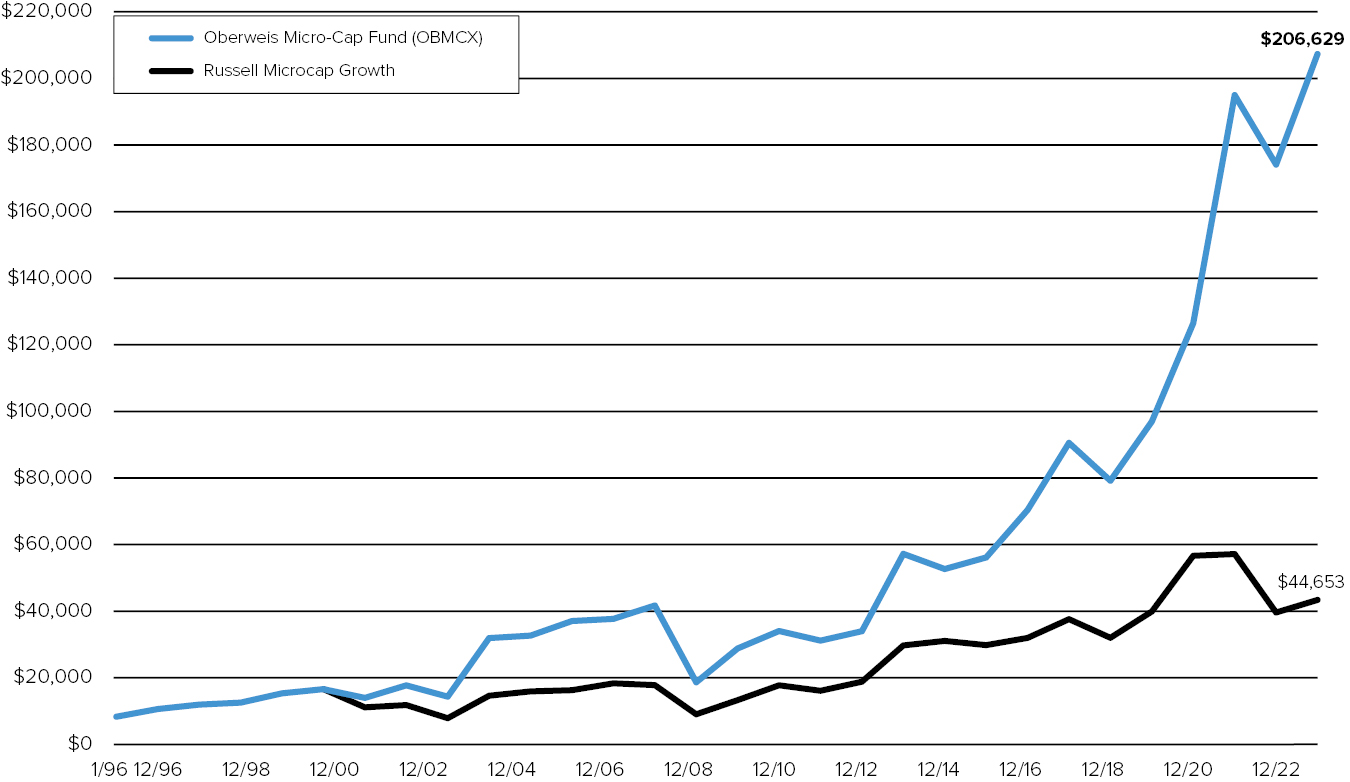

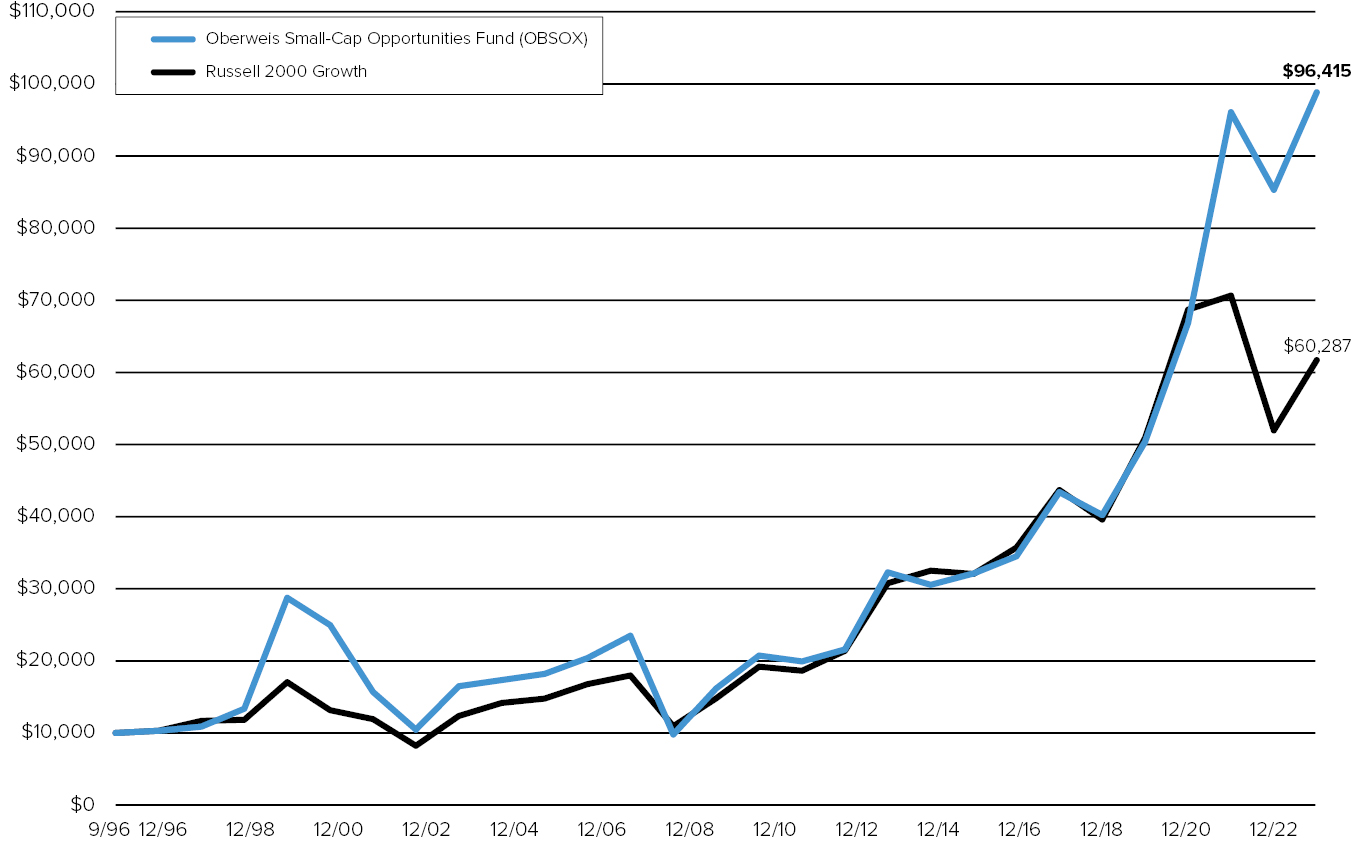

2023 was a mixed year for our funds. The Micro-Cap Fund performed very well, with an 18.87% (based on investor-class returns) compared to 9.11% for the Russell Micro-Cap Growth Index. The Small-Cap Opportunities Fund returned 15.81% versus 18.66% for the Russell 2000 Growth Index. These two U.S.-focused funds have performed exceptionally well over multi-year periods, outperforming their benchmark returns by a wide margin over the trailing 3-, 5-, 10-, and 15-year measurement periods.

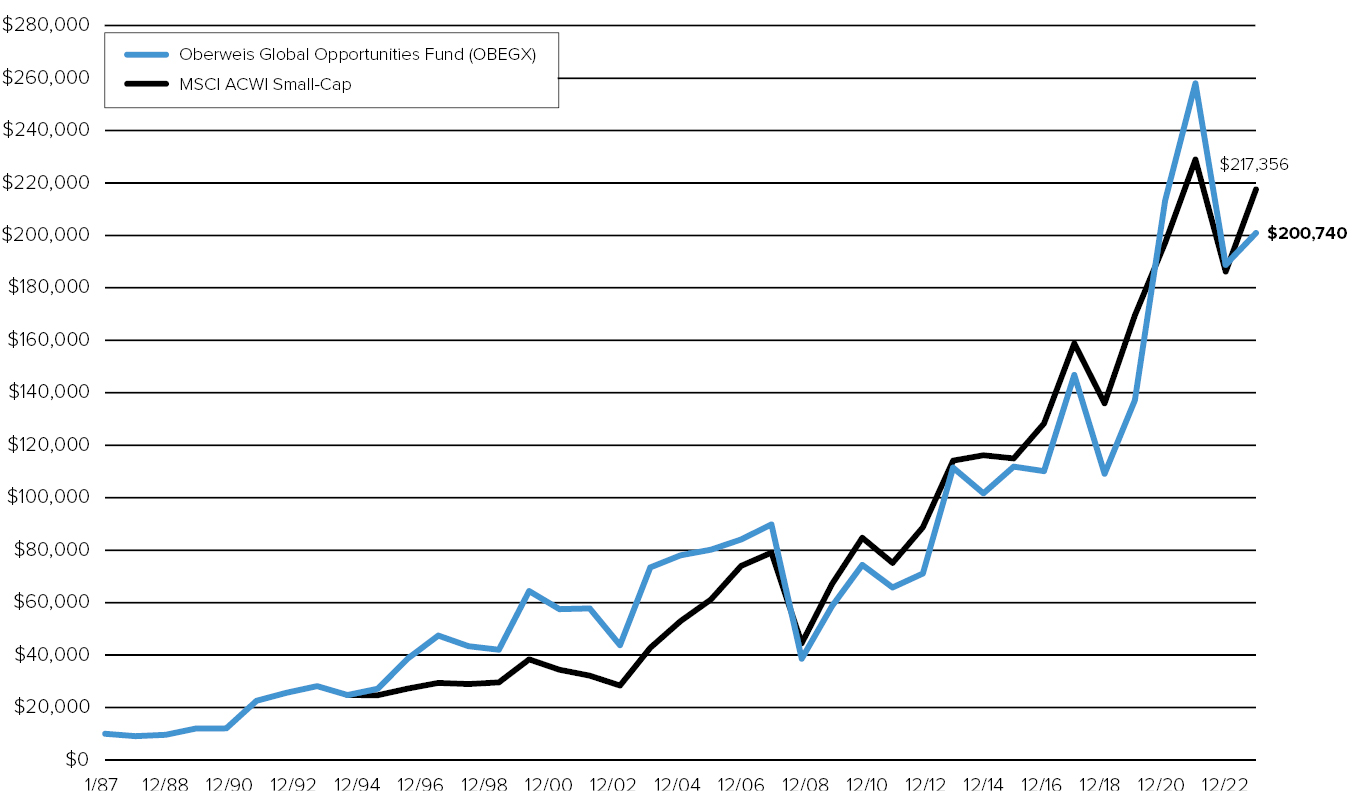

The year was more difficult for our international-focused funds. The China Opportunities Fund returned -7.70% compared to -11.20% for the MSCI China Index. Although the China Opportunities Fund has exceeded its benchmark over the trailing 1-,3-,5-, 10- and 15-year periods, the broader decline in Chinese equities has yielded unfavorable absolute returns in recent years. International Opportunities returned 4.89% compared to 10.57% for the MSCI World ex-US SCG Net Index. Global Opportunities gained 6.40% versus 16.84% for the MSCI ACWI Small-Cap Index. The Emerging Markets Fund returned 15.02% versus 23.92% for the MSCI EM Small-Cap Index. The Focused International Growth Fund returned 16.60% versus 18.24% for the MSCI EAFE Index.

The macro environment last year posed challenges for our investment style. First, our strategies generally focus on smaller companies with misunderstood growth potential. To find them, most of our funds begin with the universe of firms reporting positive earnings surprises and/or positive earnings revisions. On average, these types of companies tend to outperform the market, but in 2023 small-caps with the largest negative earnings surprises broadly beat those with the largest positive surprises. Additionally, tighter monetary policy, particularly by the U.S. Federal Reserve, was another headwind and rising rates tend to adversely affect valuations of small-cap growth stocks. Further, since the average growth rate of companies in our funds tends to be higher than those of their respective benchmarks, our funds tend to underperform in a rising interest rate environment. Lastly, rising international risks and slower growth abroad relative to the U.S. made investing outside of the U.S. particularly challenging.

Of course, we aim to deliver long-term results for our shareholders, and over the long-term, the funds have fared well. Over the trailing fifteen years, the Micro-Cap, Small-Cap Opportunities, Global Opportunities, and International Opportunities funds have all beaten their benchmark returns (net of fees). Results have been exceptional for the U.S. funds. The Emerging Markets Fund, which eclipsed its 5-year anniversary in 2023, is well ahead of its benchmark since its inception in 2018.

With respect to the International Opportunities Fund, despite a strong 15-year track record, the fund has underperformed more recently. In our experience, some of the best buying opportunities have occurred after such periods, when valuations tend to be attractive. For example, the International Opportunities Fund lagged in 2018-2019, but then rocketed back with a 63% gain in 2020. Similarly, following a tough year in 2008, the fund rebounded 110% from 2009-2010, well ahead of its benchmark. Although no one can predict the future, we believe it’s worth studying patterns of the past.

Globally, the U.S. economy continues to lead the developed world in terms of economic growth, though valuations of its large-cap stocks are also the highest in the world. Developed markets outside of America face more difficult challenges, but slower growth and geopolitical risks appear to be already factored into less expensive equity valuations. Emerging markets, which one might expect to lag in a year in which rates soared, have outperformed. We attribute this both to greater economic resiliency than in past cycles as well as lower valuations going

1

PRESIDENT’S Letter (unaudited) (continued)

into 2023. Emerging markets, particularly China, continue to trade at a steep discount to the developed world. A shift in political posture, such as a significant stimulus program in China, has the potential to catalyze emerging market stocks.

THE YEAR AHEAD

We believe that the current environment presents a significantly better-than-average risk/reward opportunity for our small-cap strategies. Small-cap companies are trading for some of the cheapest valuations in recent history, both in the U.S. and in international markets. Also, the valuation gap between U.S. small- and large-cap stocks ranks among the widest in nearly 30 years. This comes after a prolonged multi-year cycle of small-cap underperformance, accentuated by one of the fastest and sharpest cycles of rising interest rates in history. It’s easy to forget that longer cycles favoring large- or small-caps have occurred regularly throughout history. Rising interest rate expectations and increasing recession fears have been two of the classic signposts of a cycle favoring large-cap stocks, but that cycle may have already concluded.

Those with long investment tenure or an affinity for market history will recognize that leadership changes invariably occur when a rising interest rate cycle is expected to conclude, which seems to match the present time. While we cannot pinpoint such a shift to a specific quarter or even a year, the pivot from a rising interest rate environment to a declining one has historically favored small-caps. Generally, after a period of rising interest rates, the market discounts both a higher cost of capital and a likelihood for slower economic conditions. When the cycle comes to an end, the bursts for small-caps can be quite dramatic. In fact, if asked for the ideal conditions to buy our strategies, our answer would be the inflection point of change when the small-caps shift course from depressed valuations, which is typically around the emergence from recession and/or the end of an interest rate cycle. We have not had a recession, and may not have one, but the interest rate cycle has seemingly already shifted. Other variables matter as well, such as investor risk-tolerance, economic growth and global military conflicts. But our experience lends one clear lesson: return potential for small-caps tends to be skewed to the upside when valuations are very low and marginal confidence in the asset class begins to improve. We believe this environment is likely to drive mean reversion of valuation multiples for small-cap stocks over the next few years, though the precise timing is hard to predict.

VALUATION RECAP

As of December 31, 2023, the price/earnings (P/E) ratio was 13.8 times for the Global Opportunities Fund (versus 11.8 last quarter), 17.7 times for the Small-Cap Opportunities Fund (versus 17.0 last quarter), 14.1 times for the Micro-Cap Fund (versus 14.4 last quarter), 16.5 times for the International Opportunities Fund (versus 15.6 last quarter), 14.9 times for the China Opportunities Fund (versus 13.5 last quarter), 21.3 times for the Emerging Markets Fund (versus 16.4 times last quarter), and 14.6 times for the Focused International Growth Fund (versus 14.3 last quarter). Each of these funds invests in companies with expected earnings growth rates that are higher than that of the broader market, and in companies expected to grow faster than current market expectations. As of December 31, 2023, the weighted-average market capitalization was $5.2 billion for the Global Opportunities Fund, $5.0 billion for the Small-Cap Opportunities Fund, $1.5 billion for the Micro-Cap Fund, $6.8 billion for the International Opportunities Fund, $3.6 billion for the Emerging Markets Fund, $79.4 billion for the China Opportunities Fund, and $136.0 billion for the Focused International Growth Fund.

2

PRESIDENT’S Letter (unaudited) (continued)

We appreciate your investment in The Oberweis Funds and are grateful for the trust you have shown us with your valuable investments. If you have any questions about your account, please contact shareholder services at (800) 245-7311. Thank you for investing with us in The Oberweis Funds.

Sincerely,

James W. Oberweis, CFA

President & Portfolio Manager

3

Management discussion on fund performance

(unaudited)

Market environment

Global equities returned 24.39% in 2023, as measured by the MSCI World Index. Global small-caps, as measured by the MSCI World Small-Cap Index, returned 16.32%, underperforming large-capitalization stocks. International small-caps underperformed U.S. small-caps for the third year, as evidenced by the 10.57% return on the MSCI World ex-USA Small-Cap Index. Within the United States, small-cap growth stocks underperformed large-cap growth stocks by 2,404 basis points, as measured by the respective returns of the Russell 2000 Growth (18.66%) and Russell 1000 Growth (42.67%) indices. Growth stocks significantly outperformed value stocks globally in 2023, with the MSCI World Growth Index (37.31%) returning 2,494 basis points more than the MSCI World Value Index (12.37%). Similarly, small-cap growth stocks outperformed small-cap value stocks, with the MSCI World Small-Cap Growth Index returning 16.45% versus 11.14% for the MSCI World Small-Cap Value Index. Within domestic small-cap, the Russell 2000 Growth Index (18.66%) outperformed the Russell 2000 Value Index (14.58%) by 408 basis points for the year.

Discussion of The Oberweis funds

The Micro-Cap Fund returned 18.87% versus 9.11% for the Russell Micro-Cap Growth Index. The portfolio benefitted from favorable stock selection in technology, industrials, and consumer discretionary while healthcare detracted from relative performance, primarily due to our underweight position in the sector. At the stock level, Axcelis (ACLS), Camtek (CAMT), and Applied Optoelectronics (AAOI) were among the top contributors to performance. Treace Medical Concepts (TMCI), Model N (MODN), and Nine Energy Service (NINE) were among the top detractors.

The Small-Cap Opportunities Fund returned 15.81% versus 18.66% for the Russell 2000 Growth Index. The portfolio benefitted from favorable stock selection in industrials, energy, and materials. Axcelis (ACLS), Aehr Test Systems (AEHR), and Vertiv (VRT) were among the top contributors to performance. Halozyme (HALO), Amylyx (AMLX), and 2U (TWOU) were among the top detractors.

The International Opportunities Fund returned 4.89% versus 10.57% for the MSCI World ex-US Small Cap Growth Index. At the country level, the Netherlands, Hong Kong, and Israel were the leading contributors to portfolio performance while Japan, the U.K., and Norway were the leading detractors. At the sector level, the portfolio was negatively impacted by stock selection in information technology and industrials, partially offset by positive stock selection in materials and healthcare. At the stock level, Be Semiconductor (BESI NA), Sage Group (SGE LN), and Daiwa Securities (8601 JP) were among the top contributors to performance; M&A Capital Partners (6080 JP), Oxford Instruments (OXIG LN), and Verallia (VRLA FP) were among the top detractors.

The Global Opportunities Fund returned 6.40% versus 16.84% for the MSCI AWCI Small-Cap Index. At the country level, stock selection in the United Kingdom, Taiwan, and China added to portfolio return, while the United States, Japan, and Brazil detracted from portfolio return. At the sector level, industrials, real estate, and financials added to return, while information technology, healthcare, and consumer staples detracted. At the stock level, Ashtead (AHT LN), Axcelis (ACLS US), M31 Technology (6643 TT) were among the top contributors to performance; Halozyme Therapeutics (HALO US), Extreme Networks (EXTR US), and Impinj (PI US) were among the top detractors.

4

Management discussion on fund performance

(unaudited) (continued)

The China Opportunities Fund returned -7.70% versus -11.20% for the MSCI China Index. At the sector level, technology and consumer discretionary contributed to performance while healthcare, communication services, and financials were top detractors. At the stock level, Pinduoduo (PDD US), Wistron (3231 TT), and Alchip Technologies (3661 TT), were among the top contributors to performance; Meituan (3690 HK), Wuxi Biologics (2269 HK), and Longfor (960 HK) were among the top detractors.

The Emerging Markets Fund returned 15.02% versus 23.92% for the MSCI EM Small-Cap Index. At the country level, China, Brazil, and Indonesia were the primary detractors while Thailand, South Korea, and South Africa were the top contributors. At the sector level, the fund was positively impacted by stock selection in consumer discretionary and real estate, while performance was adversely impacted by stock selection in consumer staples and materials. At the stock level, Alchip Technologies (3661 TT), M31 Technology (6643 HK), and KPIT Technologies (KPITTECH IN) were among the top contributors to performance; Chongqing Brewery (600132 CH), OPT Machine Vision (688686 CH), and Hangzhou Robam Appliances (002508 CH) were among the top detractors.

The Focused International Growth Fund returned 16.60% versus 18.24% for the MSCI EAFE Index. At the country level, the U.S., China, and Italy were the top contributors, while the Netherlands, Switzerland, and the U.K. detracted from portfolio return. At the sector level, technology, financials, and healthcare added to return, while materials, consumer staples, and industrials detracted. At the stock level, Cadence Design (CDNS US), Schneider Electric (SU FP), and Sony (6758 JP) were among the top contributors to performance; Adyen (ADYEN NA), Anglo American (AAL LN) and Alcon (ALC SW) were among the top detractors.

For current performance information, please visit www.oberweisfunds.com.

5

Management discussion on fund performance

(unaudited) (continued)

Oberweis Micro-Cap Fund

At December 31, 2023

Asset Allocation (% of Net Assets) | ||

Equities | 97.3 | |

Other Assets less Liabilities | 2.7 | |

Top Ten Holdings (% of Net Assets) | ||

Applied Optoelectronics, Inc. | 3.6 | |

Aehr Test Systems | 3.1 | |

ADMA Biologics, Inc. | 2.7 | |

Camtek Ltd. | 2.7 | |

CECO Environmental Corp. | 1.9 | |

Amphastar Pharmaceuticals, Inc. | 1.9 | |

Ultra Clean Hldgs., Inc. | 1.9 | |

TransMedics Group, Inc. | 1.7 | |

Photronics, Inc. | 1.7 | |

Navitas Semiconductor Corp. | 1.7 | |

Top Ten Industries (% of Net Assets) | ||

Semiconductors & Semiconductor Equipment | 17.0 | |

Biotechnology | 7.9 | |

Healthcare Equipment & | 7.2 | |

Communications Equipment | 4.5 | |

Machinery | 4.3 | |

Commercial Services & Supplies | 4.3 | |

Construction & Engineering | 4.2 | |

Hotels, Restaurants & Leisure | 3.8 | |

Banks | 3.4 | |

Pharmaceuticals | 3.2 | |

Oberweis Small-Cap Opportunities Fund

At December 31, 2023

Asset Allocation (% of Net Assets) | ||

Equities | 95.9 | |

Other Assets less Liabilities | 4.1 | |

Top Ten Holdings (% of Net Assets) | ||

Axcelis Technologies, Inc. | 2.7 | |

Weatherford International PLC | 2.7 | |

Aehr Test Systems | 2.7 | |

Universal Display Corp. | 2.1 | |

Amphastar Pharmaceuticals, Inc. | 2.0 | |

Frontdoor, Inc. | 1.8 | |

TransMedics Group, Inc. | 1.7 | |

Oshkosh Corp. | 1.7 | |

Encompass Health Corp. | 1.7 | |

AeroVironment, Inc. | 1.7 | |

Top Ten Industries (% of Net Assets) | ||

Semiconductors & Semiconductor Equipment | 12.2 | |

Healthcare Equipment & | 10.4 | |

Machinery | 7.6 | |

Software | 7.1 | |

Healthcare Providers & Services | 5.4 | |

Energy Equipment & Services | 3.8 | |

Building Products | 3.8 | |

Professional Services | 3.6 | |

Aerospace & Defense | 3.1 | |

Diversified Consumer Services | 3.0 | |

6

Management discussion on fund performance

(unaudited) (continued)

Oberweis Global Opportunities Fund

At December 31, 2023

Asset Allocation (% of Net Assets) | ||

Equities | 94.7 | |

Other Assets less Liabilities | 5.3 | |

Top Ten Holdings (% of Net Assets) | ||

Ashtead Technology Hldgs. PLC | 6.8 | |

Alphatec Hldgs., Inc. | 5.0 | |

Weatherford International PLC | 4.8 | |

Axcelis Technologies, Inc. | 4.2 | |

Veracyte, Inc. | 3.5 | |

Vertiv Hldgs. Co. | 3.3 | |

Fuji Electric Co. Ltd. | 3.3 | |

Whitbread PLC | 3.2 | |

Bel Fuse, Inc. | 3.1 | |

Clean Harbors, Inc. | 2.6 | |

Top Ten Industries (% of Net Assets) | ||

Semiconductors & Semiconductor Equipment | 14.6 | |

Healthcare Equipment & Supplies | 8.6 | |

Electrical Equipment | 8.5 | |

Trading Co. & Distribution | 8.3 | |

Energy Equipment & Services | 6.9 | |

Commercial Services & Supplies | 4.7 | |

Electronic Equipment, Instruments & Components | 4.2 | |

Biotechnology | 3.5 | |

Machinery | 3.3 | |

Hotels, Restaurants & Leisure | 3.2 | |

Oberweis China Opportunities Fund

At December 31, 2023

Asset Allocation (% of Net Assets) | ||

Equities | 99.9 | |

Rights | 0.0 | |

Other Assets less Liabilities | 0.1 | |

Top Ten Holdings (% of Net Assets) | ||

PDD Hldgs. ADS | 8.1 | |

Alibaba Group Hldg. Ltd. | 4.9 | |

Tencent Hldgs. Ltd. | 4.6 | |

New Oriental Education & Technology Group, Inc. | 4.5 | |

Alchip Technologies Ltd. | 4.2 | |

Taiwan Semiconductor Manufacturing Co. Ltd. ADS | 3.9 | |

NetEase, Inc. | 3.6 | |

Baidu, Inc. | 3.0 | |

Trip.com Group Ltd. | 2.7 | |

Li Auto, Inc. ADS | 2.7 | |

Top Ten Industries (% of Net Assets) | ||

Semiconductors & Semiconductor Equipment | 18.6 | |

Broadline Retail | 14.8 | |

Interactive Media & Services | 7.5 | |

Electronic Equipment, Instruments & Components | 6.8 | |

Hotels, Restaurants & Leisure | 6.3 | |

Diversified Consumer Services | 6.0 | |

Automobile Components | 4.7 | |

Machinery | 4.2 | |

Entertainment | 3.8 | |

Technology Hardware, Storage & Peripherals | 3.7 | |

7

Management discussion on fund performance

(unaudited) (continued)

Oberweis Emerging Markets Fund

At December 31, 2023

Asset Allocation (% of Net Assets) | ||

Equities | 89.8 | |

Short-Term Investments | 0.1 | |

Other Assets less Liabilities | 10.1 | |

Top Ten Holdings (% of Net Assets) | ||

eMemory Technology, Inc. | 2.2 | |

Arcos Dorados Hldgs., Inc. | 2.1 | |

Arabian Contracting Services Co. | 1.9 | |

Control Print Ltd. | 1.9 | |

Alsea, S.A.B. de CV | 1.8 | |

Park Systems Corp. | 1.8 | |

PT Sumber Alfaria Trijaya Tbk | 1.8 | |

VTEX | 1.8 | |

Unimicron Technology Corp. | 1.8 | |

Alchip Technologies Ltd. | 1.8 | |

Top Ten Industries (% of Net Assets) | ||

Semiconductors & Semiconductor Equipment | 11.1 | |

Electronic Equipment, Instruments & Components | 7.6 | |

Software | 6.7 | |

Hotels, Restaurants & Leisure | 6.3 | |

Consumer Staples Distribution & Retail | 4.9 | |

Oil, Gas & Consumable Fuels | 3.6 | |

Banks | 3.3 | |

Beverages | 3.3 | |

Media | 3.2 | |

Pharmaceuticals | 3.1 | |

Oberweis International Opportunities Fund

At December 31, 2023

Asset Allocation (% of Net Assets) | ||

Equities | 98.6 | |

Other Assets less Liabilities | 1.4 | |

Top Ten Holdings (% of Net Assets) | ||

BE Semiconductor Industries NV | 3.4 | |

James Hardie Industries PLC | 3.4 | |

Daiwa Securities Group, Inc. | 3.2 | |

ASM International NV | 3.0 | |

Marks and Spencer Group PLC | 3.0 | |

The Sage Group PLC | 2.9 | |

Element Fleet Management Corp. | 2.8 | |

Stantec, Inc. | 2.6 | |

Fuji Electric Co. Ltd. | 2.4 | |

CTS Eventim AG & Co. | 2.3 | |

Top Ten Industries (% of Net Assets) | ||

Food Products | 8.3 | |

Trading Co. & Distribution | 7.2 | |

Machinery | 7.1 | |

Semiconductors & Semiconductor Equipment | 6.4 | |

Electrical Equipment | 5.4 | |

Consumer Staples Distribution & Retail | 5.1 | |

Capital Markets | 5.1 | |

Specialty Retail | 4.4 | |

Commercial Services & Supplies | 3.8 | |

Pharmaceuticals | 3.7 | |

8

Management discussion on fund performance

(unaudited) (continued)

Oberweis Focused International Growth Fund

At December 31, 2023

Asset Allocation (% of Net Assets) | ||

Equities | 98.7 | |

Short-Term Investments | 1.5 | |

Other Liabilities less Assets | (0.2) | |

Top Ten Holdings (% of Net Assets) | ||

Sony Group Corp. | 8.7 | |

Schneider Electric SE | 5.7 | |

Zurich Insurance Group AG | 5.2 | |

LVMH Moet Hennessy Louis Vuitton SE | 4.6 | |

Cadence Design Systems, Inc. | 4.5 | |

Novo Nordisk A/S | 3.9 | |

Partners Group Hldg. AG | 3.6 | |

Dollarama, Inc. | 3.5 | |

Hitachi Ltd. | 3.3 | |

SAP SE | 3.3 | |

Top Ten Industries (% of Net Assets) | ||

Pharmaceuticals | 9.6 | |

Capital Markets | 9.3 | |

Household Durables | 8.7 | |

Banks | 8.3 | |

Software | 7.8 | |

Electrical Equipment | 5.7 | |

Insurance | 5.2 | |

Oil, Gas & Consumable Fuels | 4.7 | |

Textiles, Apparel & Luxury Goods | 4.6 | |

Automobiles | 4.5 | |

9

MANAGEMENT DISCUSSION ON FUND PERFORMANCE

(unaudited) (continued)

Average Annual Total Returns1 (for the Periods Ended December 31, 2023)

1 YR (%) | 5 YR (%) | 10 YR (%) | SINCE | EXPENSE (%) | |

OBMCX | 18.87 | 20.89 | 13.48 | 11.42 | 1.53 |

OMCIX4 | 19.19 | 21.18 | 13.76 | 11.70 | 1.28 |

Russell Microcap Growth | 9.11 | 5.97 | 3.67 | N/A5 |

Growth of a $10,000 Investment (from January 1, 1996 to December 31, 2023)

1 Performance data represents past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting oberweisfunds.com. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. There is no guarantee that the portfolios can achieve their objectives.

The Russell Microcap Growth Index measures the performance of those Russell microcap companies with higher price-to-book ratios and higher forecasted growth values. The Russell Microcap Growth Index is represented by the smallest 1,000 securities in the small cap Russell 2000 Index plus the next 1,000 securities. The Russell Index is unmanaged and is not available for investment.

2 Since Inception returns are from commencement of operations on 01/01/96 for the Fund.

3 Expense ratio is the total annual net fund operating expense ratio as of 12/31/23. The expense ratio gross of any fee waivers or expense reimbursement was 1.53% and 1.28% for the Investor Class and Institutional Class, respectively.

4 The Institutional share class (OMCIX) began on May 1, 2017, returns for prior periods represent synthetic returns.

5 The Russell Microcap Growth Index began on July 3, 2000, and the line graph for the Index begins at the same value as the Fund on that date.

10

Management discussion on fund performance

(unaudited) (continued)

Average Annual Total Returns1 (for the Periods Ended December 31, 2023)

1 YR | 5 YR | 10 YR | SINCE | EXPENSE | ||||||

OBSOX | 15.81 | 19.60 | 11.78 | 8.66 | 1.25 | |||||

OBSIX4 | 16.06 | 19.90 | 12.06 | 8.93 | 1.00 | |||||

Russell 2000 Growth | 18.66 | 9.22 | 7.16 | 6.80 |

Growth of a $10,000 Investment (from September 15, 1996 to December 31, 2023)

1 Performance data represents past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting oberweisfunds.com. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. There is no guarantee that the portfolios can achieve their objectives.

The Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted earnings growth rates. The Russell Index is unmanaged and is not available for investment.

2 Since Inception returns are from commencement of operations on 09/15/96 for the Fund.

3 Expense ratio is the total annual net fund operating expense ratio as of 12/31/23. The expense ratio gross of any fee waivers or expense reimbursement was 1.32% and 1.07% for the Investor Class and Institutional Class, respectively.

4 The Institutional share class (OBSIX) began on May 1, 2017, returns for prior periods represent synthetic returns.

11

Management discussion on fund performance

(unaudited) (continued)

Average Annual Total Returns1 (for the Periods Ended December 31, 2023)

1 YR | 5 YR | 10 YR | SINCE | EXPENSE | ||||||

OBEGX | 6.40 | 12.98 | 6.07 | 8.45 | 1.50 | |||||

OBGIX4 | 6.67 | 13.26 | 6.34 | 8.72 | 1.25 | |||||

MSCI ACWI Small-Cap | 16.84 | 9.85 | 6.66 | N/A5 |

Growth of a $10,000 Investment (from January 7, 1987 to December 31, 2023)

1 Performance data represents past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting oberweisfunds.com. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. There is no guarantee that the portfolios can achieve their objectives.

The MSCI ACWI Small-Cap Index (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of small cap developed and emerging markets with dividends reinvested net of withholding tax. A sales load of 4% was charged on the Oberweis Global Opportunities Fund until 12/31/91 and is not reflected in the total return figures or graph above.

2 Since Inception returns are from commencement of operations on 01/07/87 for the Fund.

3 Expense ratio is the total annual net fund operating expense ratio as of 12/31/23. The expense ratio gross of any fee waivers or expense reimbursement was 1.51% and 1.25% for Investor Class and Institutional Class, respectively.

4 The Institutional share class (OBGIX) began on May 1, 2017, returns for prior periods represent synthetic returns.

5 The MSCI ACWI Small-Cap Index began on May 31, 1994, and the line graph for the index begins at the same value as the Fund on that date.

12

Management discussion on fund performance

(unaudited) (continued)

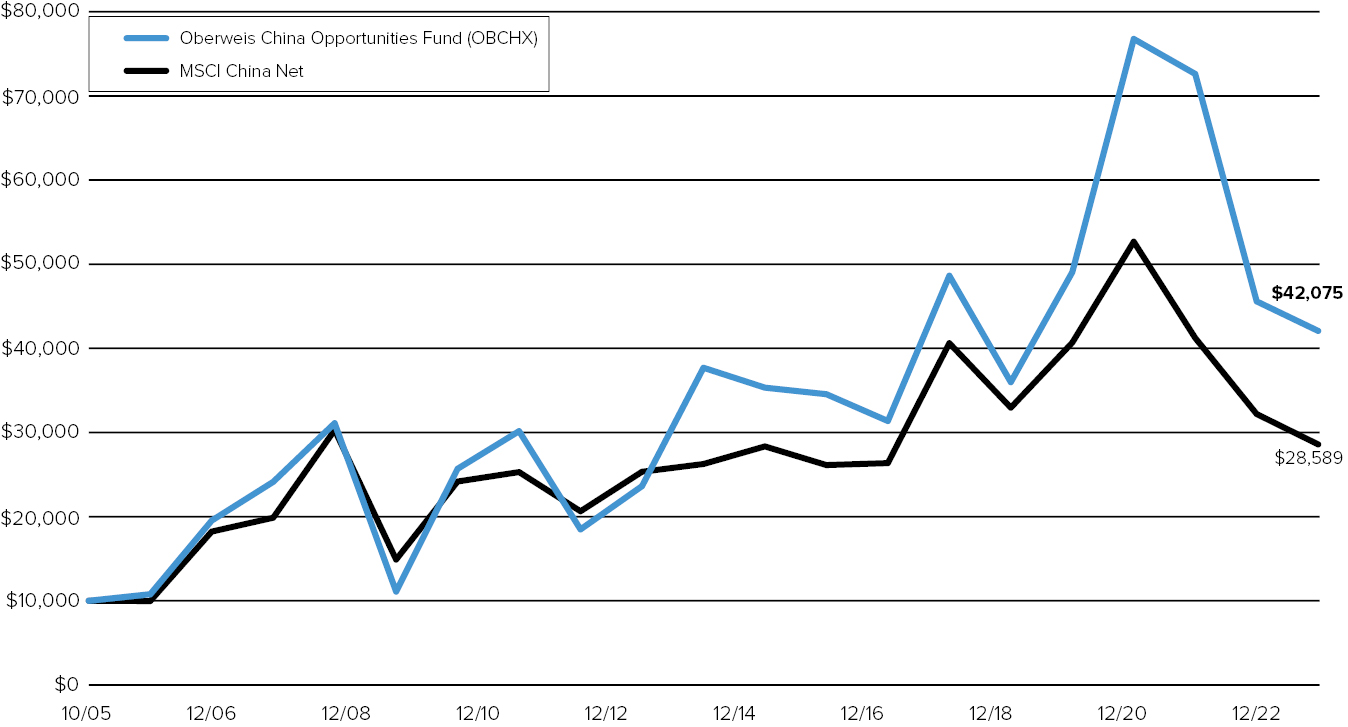

Average Annual Total Returns1 (for the Periods Ended December 31, 2023)

1 YR | 5 YR | 10 YR | SINCE | EXPENSE | ||||||

OBCHX | (7.70) | 3.18 | 1.11 | 8.19 | 2.15 | |||||

OCHIX4 | (7.58) | 3.44 | 1.35 | 8.46 | 1.90 | |||||

MSCI China Net | (11.20) | (2.80) | 0.85 | 5.92 |

Growth of a $10,000 Investment (from October 1, 2005 to December 31, 2023)

1 Performance data represents past performance, which is no guarantee of future results. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting oberweisfunds.com. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. There is no guarantee that the portfolios can achieve their objectives.

The MSCI China Net Index is a free float-adjusted market capitalization-weighted Index of Chinese equities that include China-affiliated corporations and H shares listed on the Hong Kong Exchange, and B shares listed on the Shanghai and Shenzhen exchanges and P chips and foreign listings with minimum dividends reinvested net of withholding tax. The MSCI China net index is unmanaged and is not available for investment.

2 Since Inception returns are from commencement of operations on 10/01/05 for the Fund.

3 Expense ratio is the total annual net fund operating expense ratio as of 12/31/23. The expense ratio gross of any fee waivers or expense reimbursement was 2.16% and 1.90% for Investor Class and Institutional Class, respectively.

4 The Institutional share class (OCHIX) began on May 1, 2017, returns for prior periods represent synthetic returns.

13

Management discussion on fund performance

(unaudited) (continued)

Average Annual Total Returns1 (for the Periods Ended December 31, 2023)

1 YR | 5 YR | SINCE | EXPENSE | |||||

OBEMX | 15.02 | 11.53 | 5.59 | 1.75 | ||||

OIEMX | 15.29 | 11.81 | 5.85 | 1.50 | ||||

MSCI EM Small-Cap | 23.92 | 9.92 | 4.82 |

Growth of a $10,000 Investment (from May 1, 2018 to December 31, 2023)

1 Performance data represents past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting oberweisfunds.com. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. There is no guarantee that the portfolios can achieve their objectives.

The MSCI EM Small-Cap Index (Net) is a free float-adjusted market capitalization weighted index that measures the performance of Small-Cap stocks in 24 emerging markets.

2 Since Inception returns are from commencement of operations on 05/01/2018 for the Fund.

3 Expense ratio is the total annual net fund operating expense ratio as of 12/31/23. The expense ratio gross of any fee waivers or expense reimbursement was 2.71% and 2.46% for Investor Class and Institutional Class, respectively.

14

Management discussion on fund performance

(unaudited) (continued)

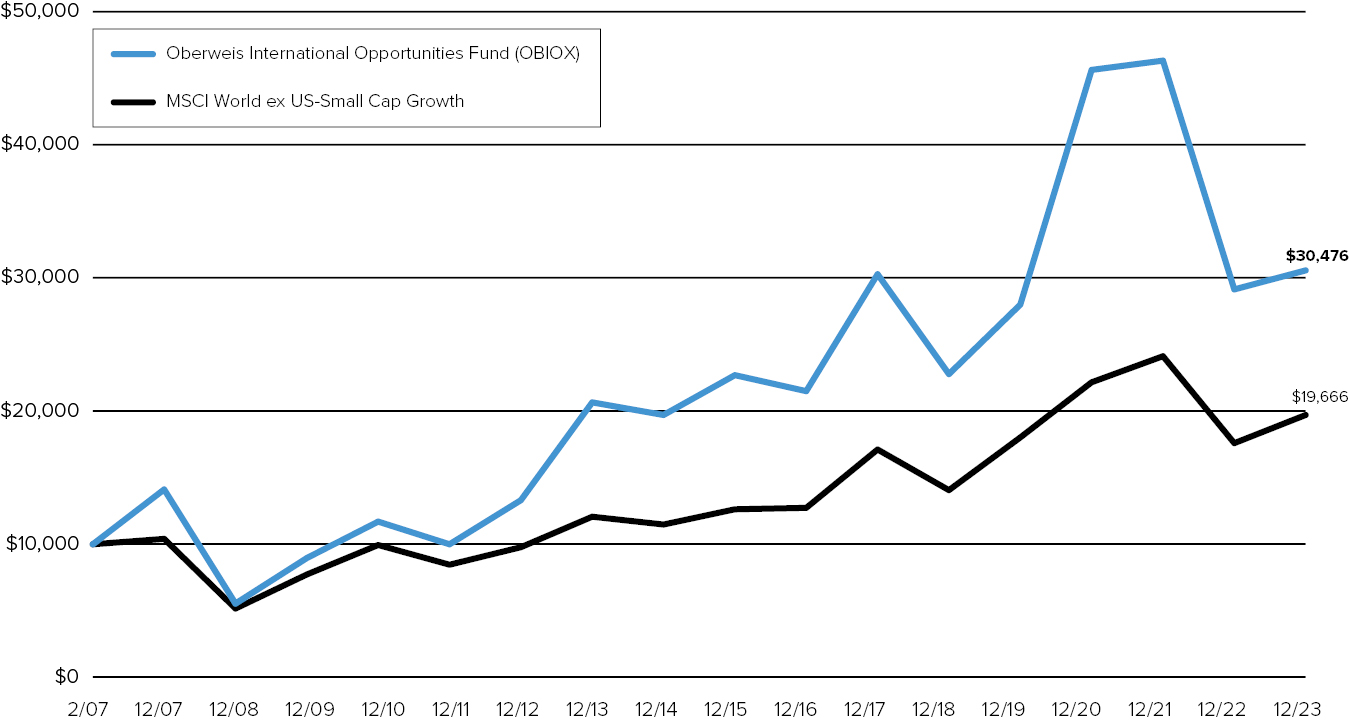

Average Annual Total Returns1 (for the Periods Ended December 31, 2023)

1 YR | 5 YR | 10 YR | SINCE | EXPENSE | ||||||

OBIOX | 4.89 | 6.05 | 3.99 | 6.81 | 1.59 | |||||

OBIIX4 | 5.23 | 6.33 | 4.26 | 7.08 | 1.09 | |||||

MSCI World ex-US Small Cap Growth | 10.57 | 6.69 | 4.88 | 4.07 |

Growth of a $10,000 Investment (from February 1, 2007 to December 31, 2023)

1 Performance data represents past performance, which is no guarantee of future results. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting oberweisfunds.com. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. There is no guarantee that the portfolios can achieve their objectives.

The MSCI World ex-US Small Cap Growth Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of small cap growth developed and emerging markets excluding the U.S., with minimum dividends reinvested net of withholding tax.

2 Since Inception returns are from commencement of operations on 02/01/07 for the Fund.

3 Expense ratio is the total annual net fund operating expense ratio as of 12/31/23. The expense ratio gross of any fee waivers or expense reimbursement was 1.92% and 1.10% for Investor Class and Institutional Class, respectively.

4 The Institutional share class (OBIIX) began on December 23, 2023, returns for prior periods represent synthetic returns.

15

Management discussion on fund performance

(unaudited) (continued)

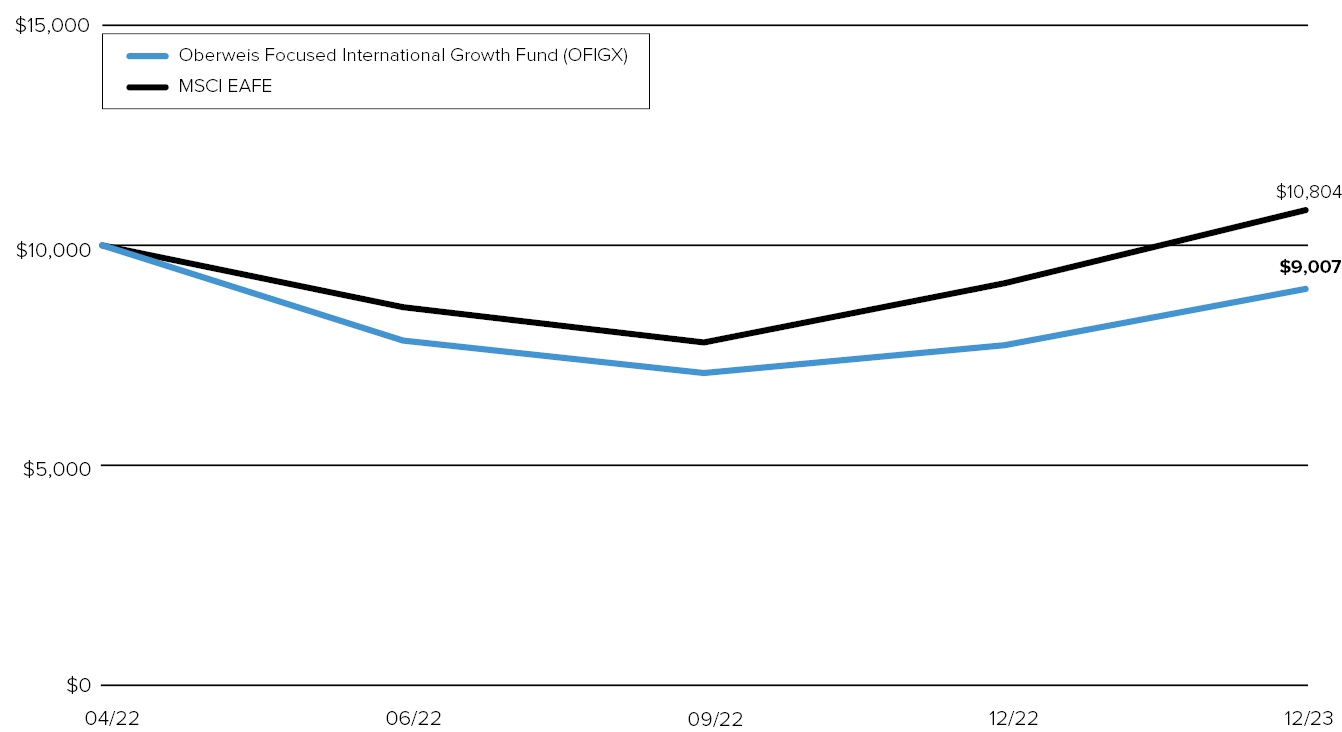

Average Annual Total Returns1 (for the Periods Ended December 31, 2023)

1 YR | SINCE | EXPENSE | ||||

OFIGX | 16.60 | (5.80) | 0.95 | |||

MSCI EAFE | 18.24 | 4.22 |

Growth of a $10,000 Investment (from April 1, 2022 to December 31, 2023)

1 Performance data represents past performance, which is no guarantee of future results. Returns are historical and include changes in share price and reinvestment of dividends and capital gains. Current performance may be higher or lower than the performance shown. You can obtain performance data current to the most recent month by visiting oberweisfunds.com. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares. The Oberweis Funds invest in rapidly growing smaller and medium sized companies, which may offer greater return potential. However, these investments often involve greater risks and volatility. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. There is no guarantee that the portfolios can achieve their objectives.

The MSCI EAFE Index is an equity index that captures large and mid-cap representation across 21 developed markets countries around the world, excluding the U.S. and Canada. The index is comprehensive, covering approximately 85% of the free-float-adjusted market capitalization in each country with minimum dividends reinvested net of withholding tax.

2 Since Inception returns are from commencement of operations on 04/01/22 for the Fund.

3 Expense ratio is the total annual net fund operating expense ratio as of 12/31/23. The expense ratio gross of any fee waivers, earnings credit or expense reimbursement was 2.51%.

16

Schedule of Investments December 31, 2023

SHARES | VALUE | ||||

Equities – 97.3% |

| ||||

| |||||

Aerospace & Defense – 1.8% |

| ||||

Cadre Hldgs., Inc. | 102,400 | $ | 3,367,936 | ||

V2X, Inc.* | 100,700 |

| 4,676,508 | ||

| 8,044,444 | ||||

| |||||

Automobile Components – 1.1% |

| ||||

Modine Manufacturing Co.* | 86,500 |

| 5,164,050 | ||

| |||||

Banks – 3.4% |

| ||||

1st Source Corp. | 60,000 |

| 3,297,000 | ||

Heritage Financial Corp. | 140,400 |

| 3,003,156 | ||

Mercantile Bank Corp. | 61,800 |

| 2,495,484 | ||

Preferred Bank | 89,600 |

| 6,545,280 | ||

| 15,340,920 | ||||

| |||||

Beverages – 0.6% |

| ||||

The Vita Coco Co., Inc.* | 106,600 |

| 2,734,290 | ||

| |||||

Biotechnology – 7.9% |

| ||||

ADMA Biologics, Inc.* | 2,710,700 |

| 12,252,364 | ||

Catalyst Pharmaceuticals, Inc.* | 348,600 |

| 5,859,966 | ||

Dynavax Technologies Corp.* | 417,400 |

| 5,835,252 | ||

MannKind Corp.* | 722,800 |

| 2,630,992 | ||

Mirum Pharmaceuticals, Inc.* | 77,400 |

| 2,284,848 | ||

Veracyte, Inc.* | 264,400 |

| 7,273,644 | ||

| 36,137,066 | ||||

| |||||

Building Products – 1.1% |

| ||||

JELD WEN Hldg., Inc.* | 260,200 |

| 4,912,576 | ||

| |||||

Chemicals – 0.6% |

| ||||

Hawkins, Inc. | 37,500 |

| 2,640,750 | ||

| |||||

Commercial Services & Supplies – 4.3% |

| ||||

CECO Environmental Corp.* | 426,700 |

| 8,653,476 | ||

HNI Corp. | 154,800 |

| 6,475,284 | ||

VSE Corp. | 66,300 |

| 4,283,643 | ||

| 19,412,403 | ||||

| |||||

Communications Equipment – 4.5% |

| ||||

Applied Optoelectronics, Inc.* | 849,615 |

| 16,414,562 | ||

Aviat Networks, Inc.* | 129,207 |

| 4,219,901 | ||

| 20,634,463 | ||||

| |||||

Construction & Engineering – 4.2% |

| ||||

Limbach Hldgs., Inc.* | 99,494 |

| 4,523,992 | ||

Primoris Services Corp. | 209,900 |

| 6,970,779 | ||

Sterling Construction Co. Inc.* | 88,000 |

| 7,737,840 | ||

| 19,232,611 | ||||

See accompanying notes to the financial statements.

17

OBERWEIS MICRO-CAP FUND (continued)

Schedule of Investments December 31, 2023

SHARES | VALUE | ||||

Consumer Finance – 1.3% |

| ||||

EZCORP, Inc.* | 655,500 | $ | 5,729,070 | ||

| |||||

Diversified Consumer Services – 3.0% |

| ||||

Adtalem Global Education, Inc.* | 86,500 |

| 5,099,175 | ||

OneSpaWorld Hldgs. Ltd.* | 248,400 |

| 3,502,440 | ||

Rover Group, Inc.* | 466,200 |

| 5,072,256 | ||

| 13,673,871 | ||||

| |||||

Electrical Equipment – 2.8% |

| ||||

American Superconductor Corp.* | 375,800 |

| 4,186,412 | ||

Powell Industries, Inc. | 28,600 |

| 2,528,240 | ||

Thermon Group Hldgs., Inc.* | 190,700 |

| 6,211,099 | ||

| 12,925,751 | ||||

| |||||

Electronic Equipment, Instruments & Components – 2.0% |

| ||||

Bel Fuse, Inc. | 99,300 |

| 6,630,261 | ||

ePlus, Inc.* | 33,300 |

| 2,658,672 | ||

| 9,288,933 | ||||

| |||||

Energy Equipment & Services – 2.5% |

| ||||

Helix Energy Solutions Group, Inc.* | 357,400 |

| 3,674,072 | ||

Precision Drilling Corp.* | 59,700 |

| 3,241,113 | ||

RPC, Inc. | 627,700 |

| 4,569,656 | ||

| 11,484,841 | ||||

| |||||

Healthcare Equipment & Supplies – 7.2% |

| ||||

Alphatec Hldgs., Inc.* | 494,200 |

| 7,467,362 | ||

Artivion, Inc.* | 258,000 |

| 4,613,040 | ||

LeMaitre Vascular, Inc. | 65,300 |

| 3,706,428 | ||

RxSight, Inc.* | 83,100 |

| 3,350,592 | ||

SI BONE, Inc.* | 287,100 |

| 6,026,229 | ||

TransMedics Group, Inc.* | 99,000 |

| 7,814,070 | ||

| 32,977,721 | ||||

| |||||

Healthcare Providers & Services – 1.3% |

| ||||

PetIQ, Inc.* | 304,400 |

| 6,011,900 | ||

| |||||

Hotels, Restaurants & Leisure – 3.8% |

| ||||

BJ’s Restaurants, Inc.* | 148,600 |

| 5,351,086 | ||

Carrols Restaurant Group, Inc. | 623,500 |

| 4,913,180 | ||

Full House Resorts, Inc.* | 223,143 |

| 1,198,278 | ||

Playa Hotels & Resorts NV* | 701,500 |

| 6,067,975 | ||

| 17,530,519 | ||||

| |||||

Household Durables – 1.5% |

| ||||

M/I Homes, Inc.* | 48,800 |

| 6,721,712 | ||

See accompanying notes to the financial statements.

18

OBERWEIS MICRO-CAP FUND (continued)

Schedule of Investments December 31, 2023

SHARES | VALUE | ||||

Insurance – 1.3% |

| ||||

Employers Hldgs., Inc. | 82,500 | $ | 3,250,500 | ||

Skyward Specialty Insurance Group, Inc.* | 81,800 |

| 2,771,384 | ||

| 6,021,884 | ||||

| |||||

Life Sciences Tools & Services – 0.5% |

| ||||

Quanterix Corp.* | 87,800 |

| 2,400,452 | ||

| |||||

Machinery – 4.3% |

| ||||

Blue Bird Corp.* | 286,700 |

| 7,729,432 | ||

Enerpac Tool Group Corp.* | 71,300 |

| 2,216,717 | ||

Proto Labs, Inc.* | 117,400 |

| 4,573,904 | ||

REV Group, Inc. | 151,700 |

| 2,756,389 | ||

The Gorman-Rupp Corp. | 68,900 |

| 2,448,017 | ||

| 19,724,459 | ||||

| |||||

Media – 1.4% |

| ||||

Perion Network Ltd.* | 205,400 |

| 6,340,698 | ||

| |||||

Oil, Gas & Consumable Fuels 1.6% |

| ||||

Dorian LPG Ltd.* | 65,500 |

| 2,873,485 | ||

Vital Energy, Inc.* | 99,700 |

| 4,535,353 | ||

| 7,408,838 | ||||

| |||||

Paper & Forest Products – 0.8% |

| ||||

Clearwater Paper Corp.* | 103,900 |

| 3,752,868 | ||

| |||||

Passenger Airlines – 1.0% |

| ||||

Sun Country Airlines Hldgs., Inc.* | 297,700 |

| 4,682,821 | ||

| |||||

Pharmaceuticals – 3.2% |

| ||||

Amphastar Pharmaceuticals, Inc.* | 136,400 |

| 8,436,340 | ||

ANI Pharmaceuticals, Inc.* | 43,500 |

| 2,398,590 | ||

Evolus, Inc.* | 371,400 |

| 3,910,842 | ||

| 14,745,772 | ||||

| |||||

Professional Services – 3.2% |

| ||||

Huron Consulting Group, Inc.* | 47,500 |

| 4,883,000 | ||

ICF International, Inc. | 27,800 |

| 3,727,702 | ||

Upwork, Inc.* | 396,900 |

| 5,901,903 | ||

| 14,512,605 | ||||

| |||||

See accompanying notes to the financial statements.

19

OBERWEIS MICRO-CAP FUND (continued)

Schedule of Investments December 31, 2023

SHARES | VALUE | ||||

Semiconductors & Semiconductor Equipment – 17.0% |

| ||||

ACM Research, Inc.* | 393,400 | $ | 7,687,036 | ||

Aehr Test Systems* | 534,400 |

| 14,177,632 | ||

Axcelis Technologies, Inc.* | 41,400 |

| 5,369,166 | ||

Camtek Ltd.* | 174,480 |

| 12,105,422 | ||

Navitas Semiconductor Corp.* | 959,100 |

| 7,739,937 | ||

PDF Solutions, Inc.* | 69,500 |

| 2,233,730 | ||

Photronics, Inc.* | 247,500 |

| 7,764,075 | ||

Silicon Motion Technology Corp. ADS | 76,400 |

| 4,681,028 | ||

Ultra Clean Hldgs., Inc.* | 247,100 |

| 8,435,994 | ||

Veeco Instruments, Inc.* | 240,000 |

| 7,447,200 | ||

| 77,641,220 | ||||

| |||||

Software – 2.0% |

| ||||

AvePoint, Inc.* | 241,100 |

| 1,979,431 | ||

Weave Communications, Inc.* | 609,400 |

| 6,989,818 | ||

| 8,969,249 | ||||

| |||||

Specialty Retail – 2.0% |

| ||||

Boot Barn Hldgs., Inc.* | 51,600 |

| 3,960,816 | ||

Caleres, Inc. | 88,400 |

| 2,716,532 | ||

Hibbett, Inc. | 34,100 |

| 2,455,882 | ||

| 9,133,230 | ||||

| |||||

Textiles, Apparel & Luxury Goods – 2.3% |

| ||||

G-III Apparel Group Ltd.* | 196,600 |

| 6,680,468 | ||

Oxford Industries, Inc. | 31,500 |

| 3,150,000 | ||

| 9,830,468 | ||||

| |||||

Trading Co. & Distribution – 1.8% |

| ||||

H&E Equipment Services, Inc. | 98,900 |

| 5,174,448 | ||

Transcat, Inc.* | 21,800 |

| 2,383,394 | ||

| 7,557,842 | ||||

| |||||

Total Equities |

| ||||

(Cost: $363,327,334) | $ | 443,320,297 | |||

| |||||

Total Investments – 97.3% |

| ||||

(Cost: $363,327,334) | $ | 443,320,297 | |||

| |||||

Other Assets Less Liabilities 2.7% |

| 12,346,663 | |||

| |||||

Net Assets – 100% | $ | 455,666,960 | |||

* Non-income producing security during the period ended December 31, 2023

ADS—American depositary share

See accompanying notes to the financial statements.

20

OBERWEIS SMALL-CAP OPPORTUNITIES FUND

Schedule of Investments December 31, 2023

SHARES | VALUE | ||||

Equities – 95.9% |

| ||||

| |||||

Aerospace & Defense – 3.1% |

| ||||

AeroVironment, Inc.* | 69,800 | $ | 8,797,592 | ||

Woodward, Inc. | 52,000 |

| 7,078,760 | ||

| 15,876,352 | ||||

| |||||

Automobile Components – 1.0% |

| ||||

Visteon Corp.* | 39,800 |

| 4,971,020 | ||

| |||||

Banks – 0.6% |

| ||||

First Merchants Corp. | 79,200 |

| 2,936,736 | ||

| |||||

Beverages – 1.9% |

| ||||

MGP Ingredients, Inc. | 64,300 |

| 6,334,836 | ||

Primo Water Corp. | 240,800 |

| 3,624,040 | ||

| 9,958,876 | ||||

| |||||

Biotechnology – 2.2% |

| ||||

Halozyme Therapeutics, Inc.* | 96,300 |

| 3,559,248 | ||

Veracyte, Inc.* | 280,600 |

| 7,719,306 | ||

| 11,278,554 | ||||

| |||||

Building Products – 3.8% |

| ||||

AAON, Inc. | 36,300 |

| 2,681,481 | ||

Gibraltar Industries, Inc.* | 43,300 |

| 3,419,834 | ||

Janus International Group, Inc.* | 528,400 |

| 6,895,620 | ||

Simpson Manufacturing Co., Inc. | 16,800 |

| 3,326,064 | ||

Trex Co., Inc.* | 40,100 |

| 3,319,879 | ||

| 19,642,878 | ||||

| |||||

Chemicals – 1.1% |

| ||||

Quaker Chemical Corp. | 27,000 |

| 5,762,340 | ||

| |||||

Commercial Services & Supplies – 2.2% |

| ||||

Clean Harbors, Inc.* | 39,000 |

| 6,805,890 | ||

MSA Safety, Inc. | 28,100 |

| 4,744,123 | ||

| 11,550,013 | ||||

| |||||

Construction & Engineering – 1.2% |

| ||||

Comfort Systems USA, Inc. | 17,700 |

| 3,640,359 | ||

Dycom Industries, Inc.* | 23,000 |

| 2,647,070 | ||

| 6,287,429 | ||||

| |||||

Consumer Finance – 1.6% |

| ||||

FirstCash Hldgs., Inc. | 74,200 |

| 8,042,538 | ||

| |||||

Consumer Staples Distribution & Retail – 0.7% |

| ||||

Grocery Outlet Hldg. Corp.* | 139,200 |

| 3,752,832 | ||

See accompanying notes to the financial statements.

21

OBERWEIS SMALL-CAP OPPORTUNITIES FUND (continued)

Schedule of Investments December 31, 2023

SHARES | VALUE | ||||

Diversified Consumer Services – 3.0% |

| ||||

Frontdoor, Inc.* | 268,000 | $ | 9,438,960 | ||

Grand Canyon Education, Inc.* | 26,800 |

| 3,538,672 | ||

Stride, Inc.* | 42,500 |

| 2,523,225 | ||

| 15,500,857 | ||||

| |||||

Electrical Equipment – 2.5% |

| ||||

NEXTracker, Inc.* | 103,200 |

| 4,834,920 | ||

Vertiv Hldgs. Co. | 173,900 |

| 8,352,417 | ||

| 13,187,337 | ||||

| |||||

Electronic Equipment, Instruments & Components – 2.1% |

| ||||

Fabrinet* | 33,200 |

| 6,318,956 | ||

OSI Systems, Inc.* | 35,300 |

| 4,555,465 | ||

| 10,874,421 | ||||

| |||||

Energy Equipment & Services – 3.8% |

| ||||

Liberty Energy, Inc. | 137,400 |

| 2,492,436 | ||

NOV, Inc. | 156,900 |

| 3,181,932 | ||

Weatherford International PLC* | 143,700 |

| 14,058,171 | ||

| 19,732,539 | ||||

| |||||

Healthcare Equipment & Supplies – 10.4% |

| ||||

Alphatec Hldgs., Inc.* | 515,500 |

| 7,789,205 | ||

AtriCure, Inc.* | 69,100 |

| 2,466,179 | ||

Axonics, Inc.* | 133,300 |

| 8,295,259 | ||

Haemonetics Corp.* | 96,700 |

| 8,268,817 | ||

Integer Hldgs. Corp.* | 71,000 |

| 7,034,680 | ||

LivaNova PLC* | 74,200 |

| 3,839,108 | ||

Merit Medical Systems, Inc.* | 90,800 |

| 6,897,168 | ||

TransMedics Group, Inc.* | 113,900 |

| 8,990,127 | ||

| 53,580,543 | ||||

| |||||

Healthcare Providers & Services – 5.4% |

| ||||

Acadia Healthcare Co., Inc.* | 82,600 |

| 6,422,976 | ||

Encompass Health Corp. | 133,900 |

| 8,933,808 | ||

HealthEquity, Inc.* | 38,700 |

| 2,565,810 | ||

NeoGenomics, Inc.* | 392,700 |

| 6,353,886 | ||

Option Care Health, Inc.* | 113,700 |

| 3,830,553 | ||

| 28,107,033 | ||||

| |||||

Healthcare Technology – 1.0% |

| ||||

Evolent Health, Inc.* | 159,000 |

| 5,251,770 | ||

| |||||

See accompanying notes to the financial statements.

22

OBERWEIS SMALL-CAP OPPORTUNITIES FUND (continued)

Schedule of Investments December 31, 2023

SHARES | VALUE | ||||

Hotels, Restaurants & Leisure – 2.0% |

| ||||

Light & Wonder, Inc.* | 30,100 | $ | 2,471,511 | ||

Monarch Casino and Resort, Inc. | 58,500 |

| 4,045,275 | ||

Wingstop, Inc. | 15,900 |

| 4,079,622 | ||

| 10,596,408 | ||||

| |||||

Information Technology Services – 0.9% |

| ||||

Fastly, Inc.* | 249,800 |

| 4,446,440 | ||

| |||||

Insurance – 1.0% |

| ||||

Assurant, Inc. | 30,700 |

| 5,172,643 | ||

| |||||

Machinery – 7.6% |

| ||||

Esab Corp. | 79,100 |

| 6,851,642 | ||

Federal Signal Corp. | 98,700 |

| 7,574,238 | ||

Flowserve Corp. | 209,800 |

| 8,647,956 | ||

Oshkosh Corp. | 82,800 |

| 8,976,348 | ||

SPX Technologies, Inc.* | 73,000 |

| 7,373,730 | ||

| 39,423,914 | ||||

| |||||

Media – 1.0% |

| ||||

Perion Network Ltd.* | 169,600 |

| 5,235,552 | ||

| |||||

Metals & Mining – 1.4% |

| ||||

ATI, Inc.* | 102,500 |

| 4,660,675 | ||

Carpenter Technology Corp.* | 35,700 |

| 2,527,560 | ||

| 7,188,235 | ||||

| |||||

Oil, Gas & Consumable Fuels – 1.9% |

| ||||

International Seaways, Inc. | 94,600 |

| 4,302,408 | ||

Magnolia Oil & Gas Corp. | 117,200 |

| 2,495,188 | ||

Matador Resources Co. | 52,800 |

| 3,002,208 | ||

| 9,799,804 | ||||

| |||||

Passenger Airlines – 1.3% |

| ||||

SkyWest, Inc.* | 133,700 |

| 6,979,140 | ||

| |||||

Personal Care Products – 2.1% |

| ||||

elf Beauty, Inc.* | 28,500 |

| 4,113,690 | ||

Inter Parfums, Inc. | 48,400 |

| 6,970,084 | ||

| 11,083,774 | ||||

| |||||

Pharmaceuticals – 2.0% |

| ||||

Amphastar Pharmaceuticals, Inc.* | 168,700 |

| 10,434,095 | ||

| |||||

Professional Services – 3.6% |

| ||||

ICF International, Inc. | 38,300 |

| 5,135,647 | ||

Maximus, Inc. | 60,400 |

| 5,065,144 | ||

Parsons Corp.* | 133,000 |

| 8,340,430 | ||

| 18,541,221 | ||||

See accompanying notes to the financial statements.

23

OBERWEIS SMALL-CAP OPPORTUNITIES FUND (continued)

Schedule of Investments December 31, 2023

SHARES | VALUE | ||||

Semiconductors & Semiconductor Equipment – 12.2% |

| ||||

Aehr Test Systems* | 522,042 | $ | 13,849,774 | ||

Allegro MicroSystems, Inc.* | 148,600 |

| 4,498,122 | ||

Axcelis Technologies, Inc.* | 109,400 |

| 14,188,086 | ||

FormFactor, Inc.* | 159,200 |

| 6,640,232 | ||

Onto Innovation, Inc.* | 44,600 |

| 6,819,340 | ||

Power Integrations, Inc. | 77,300 |

| 6,347,103 | ||

Universal Display Corp. | 56,200 |

| 10,748,812 | ||

| 63,091,469 | ||||

| |||||

Software – 7.1% |

| ||||

ACI Worldwide, Inc.* | 144,262 |

| 4,414,417 | ||

Blackbaud, Inc.* | 30,100 |

| 2,609,670 | ||

Clear Secure, Inc. | 303,500 |

| 6,267,275 | ||

Informatica, Inc.* | 182,100 |

| 5,169,819 | ||

LiveRamp Hldgs., Inc.* | 139,000 |

| 5,265,320 | ||

Qualys, Inc.* | 17,600 |

| 3,454,528 | ||

Rapid7, Inc.* | 48,200 |

| 2,752,220 | ||

Zeta Global Hldgs. Corp.* | 778,800 |

| 6,869,016 | ||

| 36,802,265 | ||||

| |||||

Specialty Retail – 0.9% |

| ||||

Abercrombie & Fitch Co.* | 55,000 |

| 4,852,100 | ||

| |||||

Technology Hardware, Storage & Peripherals – 1.0% |

| ||||

Super Micro Computer, Inc.* | 19,100 |

| 5,429,366 | ||

| |||||

Textiles, Apparel & Luxury Goods – 1.6% |

| ||||

Crocs, Inc.* | 38,800 |

| 3,624,308 | ||

Deckers Outdoor Corp.* | 6,000 |

| 4,010,580 | ||

| 7,634,888 | ||||

| |||||

Trading Co. & Distribution – 0.7% |

| ||||

McGrath RentCorp. | 26,100 |

| 3,122,082 | ||

| |||||

Total Equities |

| ||||

(Cost: $436,956,368) | $ | 496,127,464 | |||

| |||||

Total Investments – 95.9% |

| ||||

(Cost: $436,956,368) | $ | 496,127,464 | |||

| |||||

Other Assets Less Liabilities 4.1% |

| 21,203,072 | |||

| |||||

Net Assets – 100% | $ | 517,330,536 | |||

* Non-income producing security during the period ended December 31, 2023

See accompanying notes to the financial statements.

24

OBERWEIS GLOBAL OPPORTUNITIES FUND

Schedule of Investments December 31, 2023

SHARES | VALUE | ||||

Equities – 94.7% |

| ||||

| |||||

Australia – 1.7% |

| ||||

James Hardie Industries PLC* | 24,100 | $ | 927,706 | ||

| |||||

Canada – 4.4% |

| ||||

ATS Corp.* | 13,100 |

| 564,592 | ||

Element Fleet Management Corp. | 68,600 |

| 1,116,154 | ||

Stantec, Inc. | 8,500 |

| 682,386 | ||

| 2,363,132 | ||||

| |||||

China – 3.5% |

| ||||

MINISO Group Hldg. Ltd. ADS | 38,600 |

| 787,440 | ||

New Oriental Education & Technology Group, Inc.* | 100,000 |

| 707,562 | ||

Zhejiang Shuanghuan Driveline Co. Ltd.* | 100,000 |

| 366,882 | ||

| 1,861,884 | ||||

| |||||

Finland – 1.3% |

| ||||

Kemira Oyj | 38,000 |

| 704,372 | ||

| |||||

France – 2.6% |

| ||||

Rexel SA | 29,700 |

| 812,176 | ||

Sopra Steria Group SA | 2,600 |

| 567,763 | ||

| 1,379,939 | ||||

| |||||

Germany – 1.0% |

| ||||

Gerresheimer AG | 5,000 |

| 520,810 | ||

| |||||

Indonesia – 0.9% |

| ||||

PT Sumber Alfaria Trijaya Tbk* | 2,600,000 |

| 494,772 | ||

| |||||

Israel – 2.5% |

| ||||

Perion Network Ltd.* | 43,200 |

| 1,333,584 | ||

| |||||

Japan – 5.0% |

| ||||

Asics Corp. | 14,100 |

| 441,800 | ||

Fuji Electric Co. Ltd. | 40,700 |

| 1,751,832 | ||

Yamazaki Baking Co. Ltd. | 21,000 |

| 478,979 | ||

| 2,672,611 | ||||

Netherlands – 2.0% |

| ||||

BE Semiconductor Industries NV* | 7,200 |

| 1,084,610 | ||

| |||||

Sweden – 1.1% |

| ||||

Saab AB | 10,000 |

| 602,413 | ||

| |||||

Switzerland – 1.9% |

| ||||

Accelleron Industries AG* | 31,600 |

| 986,584 | ||

| |||||

Taiwan – 3.7% |

| ||||

Alchip Technologies Ltd.* | 6,000 |

| 640,263 | ||

M31 Technology Corp. | 38,800 |

| 1,340,089 | ||

| 1,980,352 | ||||

See accompanying notes to the financial statements.

25

OBERWEIS GLOBAL OPPORTUNITIES FUND (continued)

Schedule of Investments December 31, 2023

SHARES | VALUE | ||||

United Kingdom – 13.6% |

| ||||

Ashtead Technology Hldgs. PLC | 459,400 | $ | 3,595,559 | ||

Cranswick PLC | 8,300 |

| 402,886 | ||

Games Workshop Group PLC* | 3,000 |

| 377,438 | ||

Marks & Spencer Group PLC* | 155,000 |

| 538,203 | ||

Oxford Instruments PLC | 19,200 |

| 561,683 | ||

Whitbread PLC | 36,200 |

| 1,687,026 | ||

| 7,162,795 | ||||

| |||||

United States of America – 49.5% |

| ||||

Acadia Healthcare Co., Inc.* | 7,600 |

| 590,976 | ||

Aehr Test Systems* | 12,900 |

| 342,238 | ||

Allegro MicroSystems, Inc.* | 25,000 |

| 756,750 | ||

Alphatec Hldgs., Inc.* | 175,800 |

| 2,656,338 | ||

Amphastar Pharmaceuticals, Inc.* | 13,400 |

| 828,790 | ||

Applied Optoelectronics, Inc.* | 38,100 |

| 736,092 | ||

Axcelis Technologies, Inc.* | 17,029 |

| 2,208,491 | ||

Axonics, Inc.* | 21,500 |

| 1,337,945 | ||

Bel Fuse, Inc. | 25,000 |

| 1,669,250 | ||

Clean Harbors, Inc.* | 7,900 |

| 1,378,629 | ||

Comstock Resources, Inc. | 64,900 |

| 574,365 | ||

Deckers Outdoor Corp.* | 1,200 |

| 802,116 | ||

Evolent Health, Inc.* | 29,600 |

| 977,688 | ||

Flowserve Corp. | 15,100 |

| 622,422 | ||

Merit Medical Systems, Inc.* | 7,500 |

| 569,700 | ||

Oshkosh Corp. | 5,100 |

| 552,891 | ||

Power Integrations, Inc. | 10,000 |

| 821,100 | ||

RPC, Inc. | 159,000 |

| 1,157,520 | ||

Universal Display Corp. | 3,100 |

| 592,906 | ||

Veracyte, Inc.* | 67,100 |

| 1,845,921 | ||

Vertiv Hldgs. Co. | 37,000 |

| 1,777,110 | ||

Visteon Corp.* | 3,600 |

| 449,640 | ||

Weatherford International PLC* | 25,900 |

| 2,533,797 | ||

Zeta Global Hldgs. Corp.* | 57,000 |

| 502,740 | ||

| 26,285,415 | ||||

| |||||

Total Equities |

| ||||

(Cost: $40,041,962) | $ | 50,360,979 | |||

| |||||

Total Investments – 94.7% |

| ||||

(Cost: $40,041,962) | $ | 50,360,979 | |||

| |||||

Other Assets Less Liabilities – 5.3% |

| 2,824,658 | |||

| |||||

Net Assets – 100% | $ | 53,185,637 | |||

* Non-income producing security during the period ended December 31, 2023

ADS—American depositary share

See accompanying notes to the financial statements.

26

OBERWEIS GLOBAL OPPORTUNITIES FUND (continued)

Schedule of Investments December 31, 2023

SECTOR ALLOCATIONS (As a Percentage of Net Assets) (unaudited) | |||

Communication Services | 2.5 | % | |

Consumer Discretionary | 10.6 | % | |

Consumer Staples | 3.6 | % | |

Energy | 8.0 | % | |

Healthcare | 17.5 | % | |

Industrials | 27.2 | % | |

Information Technology | 22.2 | % | |

Materials | 3.1 | % | |

See accompanying notes to the financial statements.

27

Oberweis China Opportunities Fund

Schedule of Investmentsa December 31, 2023

SHARES | VALUE | ||||

Equities – 99.9% |

| ||||

| |||||

Automobile Components – 4.7% |

| ||||

Cheng Shin Rubber Industry Co. Ltd.* | 350,000 | $ | 512,048 | ||

Shanghai Baolong Automotive Corp.* | 110,000 |

| 874,764 | ||

Tong Yang Industry Co. Ltd.* | 300,000 |

| 742,901 | ||

| 2,129,713 | ||||

| |||||

Automobiles – 2.7% |

| ||||

Li Auto, Inc. ADS* | 33,000 |

| 1,235,190 | ||

| |||||

Biotechnology – 2.1% |

| ||||

Legend Biotech Corp. ADS* | 16,000 |

| 962,720 | ||

| |||||

Broadline Retail – 14.8% |

| ||||

Alibaba Group Hldg. Ltd | 230,000 |

| 2,226,804 | ||

MINISO Group Hldg. Ltd. ADS | 40,000 |

| 816,000 | ||

PDD Hldgs. ADS* | 25,000 |

| 3,657,750 | ||

| 6,700,554 | ||||

| |||||

Capital Markets – 0.8% |

| ||||

Hong Kong Exchanges & Clearing Ltd.* | 10,000 |

| 343,216 | ||

| |||||

Chemicals – 1.8% |

| ||||

Nan Pao Resins Chemical Co. Ltd.* | 90,000 |

| 824,034 | ||

| |||||

Communications Equipment – 1.7% |

| ||||

BYD Electronic International Co. Ltd.* | 160,000 |

| 749,952 | ||

| |||||

Diversified Consumer Services – 6.0% |

| ||||

New Oriental Education & Technology Group, Inc.* | 285,000 |

| 2,016,552 | ||

TAL Education Group ADS* | 55,000 |

| 694,650 | ||

| 2,711,202 | ||||

| |||||

Electronic Equipment, Instruments & Components – 6.8% |

| ||||

Cowell e Hldgs., Inc.* | 280,000 |

| 826,535 | ||

Global Brands Manufacture Ltd | 240,000 |

| 504,391 | ||

Gold Circuit Electronics Ltd.* | 75,000 |

| 532,738 | ||

WT Microelectronics Co. Ltd.* | 140,000 |

| 513,188 | ||

Yageo Corp.* | 35,000 |

| 680,830 | ||

| 3,057,682 | ||||

| |||||

Entertainment – 3.8% |

| ||||

iQIYI, Inc. ADS* | 20,000 |

| 97,600 | ||

NetEase, Inc | 90,000 |

| 1,620,542 | ||

| 1,718,142 | ||||

See accompanying notes to the financial statements.

28

Oberweis China Opportunities Fund (continued)

Schedule of Investmentsa December 31, 2023

SHARES | VALUE | ||||

Healthcare Equipment & Supplies – 1.3% |

| ||||

Gan & Lee Pharmaceuticals Co. Ltd.* | 40,000 | $ | 296,946 | ||

Xiangyu Medical Co. Ltd.* | 40,000 |

| 300,556 | ||

| 597,502 | ||||

| |||||

Hotels, Restaurants & Leisure – 6.3% |

| ||||

H World Group Ltd | 240,000 |

| 806,813 | ||

Meituan* | 50,000 |

| 524,429 | ||

Sands China Ltd.* | 100,000 |

| 292,630 | ||

Trip.com Group Ltd.* | 35,000 |

| 1,244,285 | ||

| 2,868,157 | ||||

| |||||

Household Durables – 2.1% |

| ||||

Beijing Roborock Technology Co. Ltd | 13,060 |

| 521,041 | ||

Hisense Home Appliances Group Co. Ltd | 200,000 |

| 431,837 | ||

| 952,878 | ||||

| |||||

Interactive Media & Services – 7.5% |

| ||||

Baidu, Inc.* | 90,000 |

| 1,338,157 | ||

Tencent Hldgs. Ltd | 55,000 |

| 2,068,003 | ||

| 3,406,160 | ||||

| |||||

Machinery – 4.2% |

| ||||

Sinotruk Hong Kong Ltd.* | 250,000 |

| 490,491 | ||

Suzhou Secote Precision Electronic Co. Ltd.* | 65,000 |

| 665,012 | ||

Yangzijiang Shipbuilding Hldgs. Ltd.* | 650,000 |

| 733,823 | ||

| 1,889,326 | ||||

| |||||

Metals & Mining – 1.6% |

| ||||

Zijin Mining Group Co. Ltd | 450,000 |

| 733,046 | ||

| |||||

Oil, Gas & Consumable Fuels – 3.5% |

| ||||

China Shenhua Energy Co. Ltd.* | 170,000 |

| 582,378 | ||

PetroChina Co. Ltd | 1,500,000 |

| 991,228 | ||

| 1,573,606 | ||||

| |||||

Pharmaceuticlas – 1.1% |

| ||||

Hansoh Pharmaceutical Group Co. Ltd.* | 250,000 |

| 504,578 | ||

| |||||

Real Estate Management & Development – 2.9% |

| ||||

China Resources Mixc Lifestyle Services Ltd | 221,538 |

| 790,143 | ||

Longfor Group Hldgs. Ltd | 320,000 |

| 512,262 | ||

| 1,302,405 | ||||

| |||||

Retail REITs – 0.4% |

| ||||

Link REIT* | 35,000 |

| 196,549 | ||

See accompanying notes to the financial statements.

29

Oberweis China Opportunities Fund (continued)

Schedule of Investmentsa December 31, 2023

SHARES | VALUE | ||||

Semiconductors & Semiconductor Equipment – 18.6% |

| ||||

Alchip Technologies Ltd | 18,000 | $ | 1,920,790 | ||

AP Memory Technology Corp.* | 35,000 |

| 534,856 | ||

Elan Microelectronics Corp | 140,000 |

| 741,272 | ||

ITE Technology, Inc.* | 30,000 |

| 147,114 | ||

King Yuan Electronics Co. Ltd | 380,000 |

| 1,051,205 | ||

M31 Technology Corp | 29,500 |

| 1,018,882 | ||

MediaTek, Inc.* | 31,000 |

| 1,025,236 | ||

Powertech Technology, Inc.* | 50,000 |

| 229,713 | ||

Taiwan Semiconductor Manufacturing Co. Ltd. ADS | 17,000 |

| 1,768,000 | ||

| 8,437,068 | ||||

| |||||

Technology Hardware, Storage & Peripherals – 3.7% |

| ||||

Chicony Electronics Co. Ltd.* | 160,000 |

| 912,334 | ||

Xiaomi Corp.* | 370,000 |

| 739,194 | ||

| 1,651,528 | ||||

| |||||

Textiles, Apparel & Luxury Goods – 1.5% |

| ||||

ANTA Sports Products Ltd.* | 20,000 |

| 194,019 | ||

Makalot Industrial Co. Ltd.* | 40,000 |

| 462,032 | ||

| 656,051 | ||||

| |||||

Total Equities |

| ||||

(Cost: $40,473,099) | $ | 45,201,259 | |||

| |||||

Rights – 0.0% |

| ||||

| |||||

Electronic Equipment, Instruments & Components – 0.0% |

| ||||

WT Microelectronics Co. Ltd.* | 18,809 |

| 10,725 | ||

| |||||

Total Rights |

| ||||

(Cost: $0) | $ | 10,725 | |||

| |||||

Total Investments – 99.9% |

| ||||

(Cost: $40,473,099) | $ | 45,211,984 | |||

| |||||

Other Assets Less Liabilities – 0.1% |

| 61,474 | |||

| |||||

Net Assets – 100% | $ | 45,273,458 | |||

a Certain securities were fair valued under the discretion of the Board of Trustees

* Non-income producing security during the period ended December 31, 2023

ADS—American depositary share

COUNTRY ALLOCATION (As a Percentage of Net Assets) (unaudited) | |||

China ( Includes the People’s Republic of China, | 98.3 | % | |

Singapore | 1.6 | % | |

See accompanying notes to the financial statements.

30

SHARES | VALUE | ||||

Equities – 89.8% |

| ||||

| |||||

Argentina – 3.3% |

| ||||

Arcos Dorados Hldgs., Inc | 30,000 | $ | 380,700 | ||

Despegar.com Corp.* | 22,500 |

| 212,850 | ||

| 593,550 | ||||

| |||||

Brazil – 8.1% |

| ||||

GPS Participacoes e Empreendimentos SA* | 78,600 |

| 305,009 | ||

Hypera SA | 21,200 |

| 156,024 | ||

Petro Rio SA | 27,200 |

| 257,856 | ||

Santos Brasil Participacoes SA | 100,000 |

| 192,894 | ||

TOTVS SA | 34,200 |

| 237,195 | ||

VTEX* | 46,900 |

| 322,672 | ||

| 1,471,650 | ||||

| |||||

Chile – 0.9% |

| ||||

Embotelladora Andina SA | 66,700 |

| 165,802 | ||

| |||||

China – 7.8% |

| ||||

Chongqing Brewery Co. Ltd | 24,000 |

| 224,867 | ||

Dada Nexus Ltd. ADS* | 22,800 |

| 75,696 | ||

Haitian International Hldgs. Ltd.* | 84,000 |

| 207,835 | ||

Hangzhou Robam Appliances Co. Ltd | 95,400 |

| 292,971 | ||

Jiangsu Hengli Hydraulic Co. Ltd | 19,600 |

| 151,114 | ||

Kingdee International Software Group Co. Ltd.* | 117,000 |

| 170,514 | ||

Zhejiang Shuanghuan Driveline Co. Ltd | 80,516 |

| 295,399 | ||

| 1,418,396 | ||||

| |||||

France – 1.3% |

| ||||

Gaztransport & Technigaz SA | 1,750 |

| 231,646 | ||

| |||||

Greece – 1.2% |

| ||||

Greek Organization of Football Prognostics SA | 12,500 |

| 212,105 | ||

| |||||

Hungary – 1.3% |

| ||||

Richter Gedeon Nyrt | 9,200 |

| 232,046 | ||

| |||||

India – 19.5% |

| ||||

Affle India Ltd.* | 15,800 |

| 247,992 | ||

Angel One Ltd.* | 6,200 |

| 259,865 | ||

C.E. Info Systems Ltd | 9,200 |

| 215,059 | ||

Cera Sanitaryware Ltd | 1,463 |

| 137,965 | ||

Control Print Ltd.* | 28,000 |

| 337,105 | ||

CreditAccess Grameen Ltd.* | 7,500 |

| 143,896 | ||

Emudhra Ltd | 42,000 |

| 227,883 | ||

Federal Bank Ltd | 168,700 |

| 316,564 | ||

See accompanying notes to the financial statements.

31

Oberweis Emerging Markets Fund (continued)

Schedule of Investments December 31, 2023

SHARES | VALUE | ||||

Kaynes Technology India Ltd.* | 7,800 | $ | 244,698 | ||

KEI Industries Ltd.* | 6,698 |

| 261,553 | ||

KPIT Technologies Ltd | 11,500 |

| 209,211 | ||

Oracle Financial Services Software Ltd* | 4,600 |

| 232,881 | ||

Senco Gold Ltd.* | 26,500 |

| 221,853 | ||

TVS Motor Co. Ltd.* | 12,000 |

| 292,134 | ||

Varun Beverages Ltd | 13,736 |

| 204,174 | ||

| 3,552,833 | ||||

| |||||

Indonesia – 6.1% |

| ||||

PT Indofood CBP Sukses Makmur Tbk | 340,700 |

| 234,000 | ||

PT Mitra Adiperkasa Tbk | 2,158,900 |

| 250,986 | ||

PT Sumber Alfaria Trijaya Tbk | 1,724,300 |

| 328,129 | ||

PT Samator Indo Gas Tbk | 1,292,700 |

| 127,616 | ||

PT United Tractors Tbk | 112,000 |

| 164,578 | ||

| 1,105,309 | ||||

| |||||

Japan – 1.1% |

| ||||

RS Technologies Co. Ltd | 9,100 |

| 192,907 | ||

| |||||

Malaysia – 1.6% |

| ||||

CTOS Digital Bhd | 970,800 |

| 297,895 | ||

| |||||

Mexico – 5.0% |

| ||||

Alsea, S.A.B. de CV* | 88,300 |

| 333,627 | ||

Prologis Property Mexico SA de CV | 60,400 |

| 287,221 | ||

Regional SAB de CV | 30,200 |

| 288,590 | ||

| 909,438 | ||||

| |||||

Philippines – 1.4% |

| ||||

Wilcon Depot, Inc | 668,800 |

| 252,423 | ||

| |||||

Poland – 1.4% |

| ||||

Dino Polska SA* | 2,100 |

| 245,875 | ||

| |||||

Saudi Arabia – 1.9% |

| ||||

Arabian Contracting Services Co.* | 5,400 |

| 341,280 | ||

| |||||

South Africa – 1.4% |

| ||||

Clicks Group Ltd | 14,080 |

| 250,704 | ||

| |||||

South Korea – 11.9% |

| ||||

AfreecaTV Co. Ltd | 2,600 |

| 171,997 | ||

Chips & Media, Inc | 6,850 |

| 167,948 | ||

Classys, Inc | 9,627 |

| 280,879 | ||

Cosmax, Inc | 2,500 |

| 244,814 | ||

KINX, Inc | 3,100 |

| 239,310 | ||

See accompanying notes to the financial statements.

32

Oberweis Emerging Markets Fund (continued)

Schedule of Investments December 31, 2023

SHARES | VALUE | ||||

LEENO Industrial, Inc | 2,038 | $ | 318,957 | ||

Lunit, Inc.* | 2,800 |

| 177,067 | ||

Park Systems Corp | 2,456 |

| 329,527 | ||

Tokai Carbon Korea Co. Ltd | 2,850 |

| 245,356 | ||

| 2,175,855 | ||||

| |||||

Taiwan – 12.8% |

| ||||

91APP, Inc | 44,000 |

| 150,535 | ||

Alchip Technologies Ltd | 3,000 |

| 320,132 | ||

ASPEED Technology, Inc | 2,400 |

| 243,984 | ||

eMemory Technology, Inc.* | 5,000 |

| 399,146 | ||

Ennoconn Corp | 23,000 |

| 200,844 | ||

Innodisk Corp | 23,218 |

| 236,034 | ||

M31 Technology Corp | 8,800 |

| 303,938 | ||

Sinbon Electronics Co. Ltd | 16,000 |

| 155,879 | ||

Unimicron Technology Corp | 56,000 |

| 321,142 | ||

| 2,331,634 | ||||

| |||||

Thailand – 0.8% |

| ||||

Mega Lifesciences PCL | 145,300 |

| 171,174 | ||

| |||||

United Kingdom – 1.0% | �� | ||||

WAG Payment Solutions PLC* | 173,000 |

| 198,470 | ||

| |||||

Total Equities |

| ||||

(Cost: $13,931,393) | $ | 16,350,992 | |||

| |||||

Short-Term Investments – 0.1% |

| ||||

Fidelity Investments Money Market Government Portfolio Class I 5.25%a | 12,520 |

| 12,520 | ||

| |||||

Total Short-Term Investments |

| ||||

(Cost: $12,520) | $ | 12,520 | |||

| |||||

Total Investments – 89.9% |

| ||||

(Cost: $13,943,913) | $ | 16,363,512 | |||

| |||||

Other Assets Less Liabilities – 10.1% |

| 1,844,708 | |||

| |||||

Net Assets – 100% | $ | 18,208,220 | |||

a Annualized seven-day effective yield as of December 31, 2023

* Non-income producing security during the period ended December 31, 2023

ADS—American depositary share

See accompanying notes to the financial statements.

33