UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-04878

SEI Institutional Managed Trust

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

c/o CT Corporation

155 Federal Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-342-5734

Date of fiscal year end: September 30, 2017

Date of reporting period: March 31, 2017

| Item 1. | Reports to Stockholders. |

March 31, 2017

SEMI-ANNUAL REPORT

SEI Institutional Managed Trust

➤ Large Cap Fund

➤ Large Cap Value Fund

➤ Large Cap Growth Fund

➤ Tax-Managed Large Cap Fund

➤ S&P 500 Index Fund

➤ Small Cap Fund

➤ Small Cap Value Fund

➤ Small Cap Growth Fund

➤ Tax-Managed Small/Mid Cap Fund

➤ Mid-Cap Fund

➤ U.S. Managed Volatility Fund

➤ Global Managed Volatility Fund

➤ Tax-Managed Managed Volatility Fund

➤ Tax-Managed International Managed Volatility Fund

➤ Real Estate Fund

➤ Enhanced Income Fund

➤ Core Fixed Income Fund

➤ U.S. Fixed Income Fund

➤ High Yield Bond Fund

➤ Conservative Income Fund

➤ Tax-Free Conservative Income Fund

➤ Real Return Fund

➤ Dynamic Asset Allocation Fund

➤ Multi-Strategy Alternative Fund

➤ Multi-Asset Accumulation Fund

➤ Multi-Asset Income Fund

➤ Multi-Asset Inflation Managed Fund

➤ Multi-Asset Capital Stability Fund

➤ Long/Short Alternative Fund

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarter of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

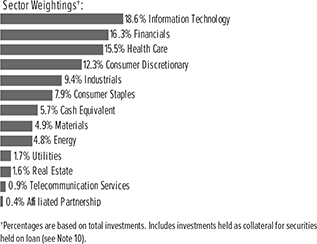

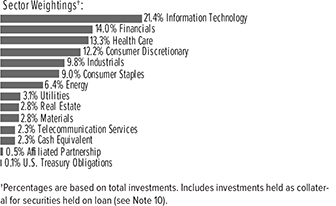

Large Cap Fund

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK — 94.3% |

| |||||||||||

Consumer Discretionary — 12.4% |

| |||||||||||

Amazon.com, Cl A* | 1.1 | % | 28,263 | $ | 25,056 | |||||||

Dollar General | 0.9 | 308,946 | 21,543 | |||||||||

General Motors | 0.7 | 484,804 | 17,143 | |||||||||

Home Depot | 0.6 | 99,393 | 14,594 | |||||||||

Lear | 0.6 | 94,223 | 13,340 | |||||||||

Lowe’s | 1.2 | 344,579 | 28,328 | |||||||||

Nike, Cl B | 0.9 | 387,182 | 21,578 | |||||||||

TJX | 1.0 | 307,346 | 24,305 | |||||||||

Other Securities | 5.4 | 123,338 | ||||||||||

|

| |||||||||||

| 289,225 | ||||||||||||

|

| |||||||||||

Consumer Staples — 7.9% |

| |||||||||||

CVS Health | 1.3 | 385,359 | 30,251 | |||||||||

JM Smucker | 0.6 | 111,999 | 14,681 | |||||||||

Kroger | 0.6 | 463,813 | 13,678 | |||||||||

Wal-Mart Stores | 0.7 | 218,181 | 15,726 | |||||||||

Other Securities (A) | 4.7 | 110,742 | ||||||||||

|

| |||||||||||

| 185,078 | ||||||||||||

|

| |||||||||||

Energy — 4.8% |

| |||||||||||

Other Securities (A) | 4.8 | 113,242 | ||||||||||

|

| |||||||||||

Financials — 16.4% |

| |||||||||||

Aflac | 0.7 | 237,030 | 17,166 | |||||||||

Allstate | 0.7 | 207,732 | 16,928 | |||||||||

Bank of America | 0.8 | 839,072 | 19,794 | |||||||||

Berkshire Hathaway, Cl B* | 0.7 | 95,167 | 15,862 | |||||||||

Citigroup | 1.1 | 427,385 | 25,566 | |||||||||

JPMorgan Chase | 1.1 | 285,284 | 25,059 | |||||||||

Moody’s | 0.8 | 173,656 | 19,456 | |||||||||

State Street | 0.6 | 171,397 | 13,645 | |||||||||

SunTrust Banks | 0.6 | 247,259 | 13,673 | |||||||||

Travelers | 0.7 | 137,264 | 16,546 | |||||||||

Other Securities‡ (A) (B) | 8.6 | 200,655 | ||||||||||

|

| |||||||||||

| 384,350 | ||||||||||||

|

| |||||||||||

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK(continued) |

| |||||||||||

Health Care — 15.5% |

| |||||||||||

Amgen, Cl A | 0.6 | % | 86,920 | $ | 14,261 | |||||||

Becton Dickinson | 1.8 | 224,138 | 41,116 | |||||||||

Biogen* | 1.1 | 98,305 | 26,878 | |||||||||

Gilead Sciences | 0.6 | 219,826 | 14,931 | |||||||||

Johnson & Johnson | 2.2 | 405,377 | 50,490 | |||||||||

Mettler Toledo International* | 1.0 | 47,126 | 22,569 | |||||||||

Pfizer | 0.6 | 417,434 | 14,280 | |||||||||

UnitedHealth Group | 2.4 | 340,674 | 55,874 | |||||||||

Other Securities | 5.2 | 122,868 | ||||||||||

|

| |||||||||||

| 363,267 | ||||||||||||

|

| |||||||||||

Industrials — 9.5% |

| |||||||||||

3M | 1.2 | 143,159 | 27,391 | |||||||||

Delta Air Lines, Cl A | 0.9 | 461,272 | 21,200 | |||||||||

Graco | 0.6 | 150,604 | 14,178 | |||||||||

Other Securities (A) | 6.8 | 158,961 | ||||||||||

|

| |||||||||||

| 221,730 | ||||||||||||

|

| |||||||||||

Information Technology — 18.7% |

| |||||||||||

Alphabet, Cl A* | 1.2 | 33,402 | 28,318 | |||||||||

Alphabet, Cl C* | 0.4 | 11,792 | 9,782 | |||||||||

Apple | 0.8 | 131,653 | 18,913 | |||||||||

Applied Materials | 0.9 | 511,790 | 19,909 | |||||||||

Cisco Systems | 0.8 | 539,163 | 18,224 | |||||||||

Facebook, Cl A* | 0.7 | 113,750 | 16,158 | |||||||||

HP | 0.6 | 746,230 | 13,343 | |||||||||

Intel | 0.8 | 514,638 | 18,563 | |||||||||

International Business Machines | 0.6 | 78,683 | 13,702 | |||||||||

Intuit | 0.6 | 123,143 | 14,283 | |||||||||

MasterCard, Cl A | 0.8 | 174,423 | 19,617 | |||||||||

Microsoft | 1.6 | 563,040 | 37,082 | |||||||||

Qualcomm | 0.6 | 253,021 | 14,508 | |||||||||

Visa, Cl A | 1.0 | 263,388 | 23,407 | |||||||||

Other Securities (A) | 7.3 | 170,577 | ||||||||||

|

| |||||||||||

| 436,386 | ||||||||||||

|

| |||||||||||

Materials — 4.9% |

| |||||||||||

Eastman Chemical | 0.7 | 193,748 | 15,655 | |||||||||

LyondellBasell Industries, Cl A | 0.6 | 148,123 | 13,507 | |||||||||

Sherwin-Williams, Cl A | 1.3 | 97,419 | 30,218 | |||||||||

Other Securities | 2.3 | 55,077 | ||||||||||

|

| |||||||||||

| 114,457 | ||||||||||||

|

| |||||||||||

Real Estate — 1.6% |

| |||||||||||

Other Securities‡ (A) | 1.6 | 37,897 | ||||||||||

|

| |||||||||||

Telecommunication Services — 0.9% |

| |||||||||||

Verizon Communications | 0.9 | 414,110 | 20,188 | |||||||||

|

| |||||||||||

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 | 1 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

Large Cap Fund (Concluded)

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK (continued) |

| |||||||||||

Utilities — 1.7% |

| |||||||||||

Other Securities | 1.7 | % | $ | 40,404 | ||||||||

|

| |||||||||||

Total Common Stock | 2,206,224 | |||||||||||

|

| |||||||||||

AFFILIATED PARTNERSHIP — 0.4% |

| |||||||||||

SEI Liquidity Fund, L.P. | ||||||||||||

0.870%**† (C) | 0.4 | 10,441,084 | 10,441 | |||||||||

|

| |||||||||||

Total Affiliated Partnership (Cost $10,431) ($ Thousands) | 10,441 | |||||||||||

|

| |||||||||||

CASH EQUIVALENT — 5.7% |

| |||||||||||

SEI Daily Income Trust, | 5.7 | 133,918,973 | 133,919 | |||||||||

|

| |||||||||||

Total Cash Equivalent | 133,919 | |||||||||||

|

| |||||||||||

Total Investments — 100.4% | $ | 2,350,584 | ||||||||||

|

| |||||||||||

A list of the open futures contracts held by the Fund at March 31, 2017 is as follows:

| Type of Contract | Number of Contracts Long | Expiration Date | Unrealized Appreciation ($ Thousands) | |||||||||

S&P 500 Index E-MINI | 32 | Jun-2017 | $ | 33 | ||||||||

S&P Mid Cap 400 Index E-MINI | 2 | Jun-2017 | 6 | |||||||||

|

| |||||||||||

| $ | 39 | |||||||||||

|

| |||||||||||

Percentages are based on a Net Assets of $2,340,557 ($ Thousands).

| * | Non-income producing security. |

| ** | The rate reported is the 7-day effective yield as of March 31, 2017. |

| † | Investment in Affiliated Security (see Note 6). |

| ‡ | Real Estate Investment Trust. |

| (A) | Certain securities or partial positions of certain securities are on loan at March 31, 2017 (see Note 10). The total market value of securities on loan at March 31, 2017, was $10,190 ($ Thousands). |

| (B) | Security is a Master Limited Partnership. At March 31, 2017, such securities amounted to $7,062 ($ Thousands), or 0.30% of Net Assets (see Note 2). |

| (C) | This security was purchased with cash collateral held from securities on loan (see Note 10). The total market value of such securities as of March 31, 2017 was $10,441 ($ Thousands). |

Cl — Class

L.P. — Limited Partnership

S&P — Standard & Poor’s

The Summary Schedule of Investments does not reflect the complete portfolio holdings. It includes the Fund’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Fund’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). In certain instances, securities for which footnotes listed above may otherwise apply are included in the Other Securities caption. The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 342-5734; and (ii) on the SEC’s website at http://www.sec.gov.

The following is a list of the level of inputs used as of March 31, 2017, in valuing the Fund’s investments and other financial instruments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stock | $ | 2,206,224 | $ | — | $ | — | $ | 2,206,224 | ||||||||

Affiliated Partnership | — | 10,441 | — | 10,441 | ||||||||||||

Cash Equivalent | 133,919 | — | — | 133,919 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total Investments in Securities | $ | 2,340,143 | $ | 10,441 | $ | — | $ | 2,350,584 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| Other Financial Instruments | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Futures Contracts* | ||||||||||||||||

Unrealized Appreciation | $ | 39 | $ | — | $ | — | $ | 39 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Total Other Financial Instruments | $ | 39 | $ | — | $ | — | $ | 39 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| * | Futures contracts are valued at the unrealized appreciation on the instrument. |

For the period ended March 31, 2017, there were no transfers between Level 1 and Level 2 assets and liabilities.

For the period ended March 31, 2017, there were no transfers between Level 2 and Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 2 | SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

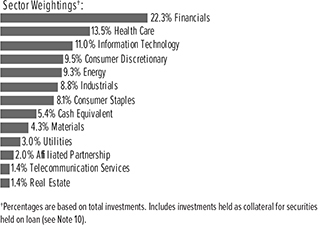

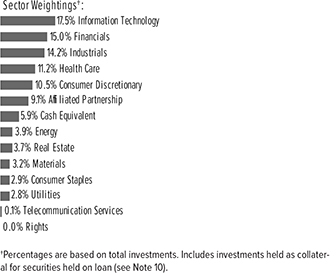

Large Cap Value Fund

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK — 94.7% |

| |||||||||||

Consumer Discretionary — 9.7% |

| |||||||||||

Dollar General | 0.7 | % | 139,112 | $ | 9,700 | |||||||

General Motors | 1.3 | 508,462 | 17,979 | |||||||||

Lowe’s | 0.9 | 153,153 | 12,591 | |||||||||

Norwegian Cruise Line Holdings* | 0.8 | 224,074 | 11,367 | |||||||||

Omnicom Group | 1.0 | 161,348 | 13,910 | |||||||||

Other Securities (A) | 5.0 | 68,811 | ||||||||||

|

| |||||||||||

| 134,358 | ||||||||||||

|

| |||||||||||

Consumer Staples — 8.3% |

| |||||||||||

CVS Health | 1.7 | 299,247 | 23,491 | |||||||||

JM Smucker | 1.3 | 132,332 | 17,346 | |||||||||

Kroger | 0.7 | 346,174 | 10,209 | |||||||||

Philip Morris International | 1.2 | 147,564 | 16,660 | |||||||||

Reynolds American | 0.8 | 182,206 | 11,483 | |||||||||

Other Securities | 2.6 | 35,822 | ||||||||||

|

| |||||||||||

| 115,011 | ||||||||||||

|

| |||||||||||

Energy — 9.5% |

| |||||||||||

BP ADR | 0.9 | 378,113 | 13,052 | |||||||||

Chevron | 1.3 | 164,816 | 17,696 | |||||||||

ExxonMobil | 0.9 | 146,681 | 12,029 | |||||||||

Occidental Petroleum | 1.1 | 235,634 | 14,930 | |||||||||

Valero Energy | 0.7 | 148,387 | 9,837 | |||||||||

Other Securities (A) | 4.6 | 64,354 | ||||||||||

|

| |||||||||||

| 131,898 | ||||||||||||

|

| |||||||||||

Financials — 22.8% |

| |||||||||||

Aflac | 1.1 | 210,468 | 15,242 | |||||||||

Allstate | 0.9 | 148,345 | 12,089 | |||||||||

Bank of America | 2.4 | 1,414,804 | 33,375 | |||||||||

Citigroup | 2.0 | 469,349 | 28,076 | |||||||||

Discover Financial Services | 0.7 | 148,304 | 10,142 | |||||||||

JPMorgan Chase | 2.5 | 388,370 | 34,114 | |||||||||

MetLife | 1.3 | 339,161 | 17,914 | |||||||||

State Street | 1.2 | 216,328 | 17,222 | |||||||||

SunTrust Banks | 0.9 | 220,296 | 12,182 | |||||||||

Synchrony Financial | 0.7 | 284,307 | 9,752 | |||||||||

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK (continued) |

| |||||||||||

Voya Financial | 0.9 | % | 345,475 | $ | 13,114 | |||||||

Other Securities‡ (B) | 8.2 | 113,978 | ||||||||||

|

| |||||||||||

| 317,200 | ||||||||||||

|

| |||||||||||

Health Care — 13.8% |

| |||||||||||

Abbott Laboratories | 0.8 | 259,647 | 11,531 | |||||||||

Aetna, Cl A | 0.8 | 91,657 | 11,691 | |||||||||

Amgen, Cl A | 1.7 | 140,865 | 23,112 | |||||||||

Anthem | 1.0 | 82,914 | 13,712 | |||||||||

Johnson & Johnson | 1.9 | 210,112 | 26,169 | |||||||||

Merck | 0.9 | 198,524 | 12,614 | |||||||||

Pfizer | 1.2 | 472,266 | 16,156 | |||||||||

Other Securities | 5.5 | 77,206 | ||||||||||

|

| |||||||||||

| 192,191 | ||||||||||||

|

| |||||||||||

Industrials — 9.0% |

| |||||||||||

Delta Air Lines, Cl A | 1.1 | 329,176 | 15,129 | |||||||||

Eaton | 0.8 | 141,548 | 10,496 | |||||||||

Illinois Tool Works | 0.8 | 87,772 | 11,627 | |||||||||

WW Grainger (A) | 0.8 | 45,832 | 10,668 | |||||||||

Other Securities (A) | 5.5 | 76,855 | ||||||||||

|

| |||||||||||

| 124,775 | ||||||||||||

|

| |||||||||||

Information Technology — 11.2% |

| |||||||||||

Applied Materials | 0.7 | 258,833 | 10,069 | |||||||||

Automatic Data Processing | 0.9 | 118,314 | 12,114 | |||||||||

Cisco Systems | 1.3 | 528,718 | 17,871 | |||||||||

Hewlett Packard Enterprise | 1.1 | 658,594 | 15,609 | |||||||||

Intel | 0.7 | 273,499 | 9,865 | |||||||||

Microchip Technology (A) | 0.8 | 141,564 | 10,445 | |||||||||

Qualcomm | 0.8 | 191,311 | 10,970 | |||||||||

Skyworks Solutions | 0.7 | 103,343 | 10,125 | |||||||||

Other Securities (A) | 4.2 | 58,262 | ||||||||||

|

| |||||||||||

| 155,330 | ||||||||||||

|

| |||||||||||

Materials — 4.4% |

| |||||||||||

Eastman Chemical | 0.8 | 146,559 | 11,842 | |||||||||

International Paper | 1.0 | 264,266 | 13,420 | |||||||||

LyondellBasell Industries, Cl A | 0.7 | 106,570 | 9,718 | |||||||||

Other Securities | 1.9 | 26,479 | ||||||||||

|

| |||||||||||

| 61,459 | ||||||||||||

|

| |||||||||||

Real Estate — 1.4% |

| |||||||||||

Other Securities‡ | 1.4 | 20,141 | ||||||||||

|

| |||||||||||

Telecommunication Services — 1.5% |

| |||||||||||

Verizon Communications | 0.9 | 243,135 | 11,853 | |||||||||

Other Securities | 0.6 | 8,344 | ||||||||||

|

| |||||||||||

| 20,197 | ||||||||||||

|

| |||||||||||

Utilities — 3.1% |

| |||||||||||

FirstEnergy | 0.7 | 331,180 | 10,538 | |||||||||

Other Securities | 2.4 | 32,055 | ||||||||||

|

| |||||||||||

| 42,593 | ||||||||||||

|

| |||||||||||

Total Common Stock |

| 1,315,153 | ||||||||||

|

| |||||||||||

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 | 3 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

Large Cap Value Fund (Concluded)

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

AFFILIATED PARTNERSHIP — 2.1% |

| |||||||||||

SEI Liquidity Fund, L.P. 0.870%**† (C) | 2.1 | % | 28,891,414 | $ | 28,890 | |||||||

|

| |||||||||||

Total Affiliated Partnership |

| 28,890 | ||||||||||

|

| |||||||||||

CASH EQUIVALENT — 5.5% |

| |||||||||||

SEI Daily Income Trust, Government Fund, Cl F 0.530%**† | 5.5 | 76,059,351 | 76,059 | |||||||||

|

| |||||||||||

Total Cash Equivalent |

| 76,059 | ||||||||||

|

| |||||||||||

Total Investments — 102.3% |

| $ | 1,420,102 | |||||||||

|

| |||||||||||

Percentages are based on a Net Assets of $1,388,247 ($ Thousands).

| * | Non-income producing security. |

| ** | The rate reported is the 7-day effective yield as of March 31, 2017. |

| † | Investment in Affiliated Security (see Note 6). |

| ‡ | Real Estate Investment Trust. |

| (A) | Certain securities or partial positions of certain securities are on loan at March 31, 2017 (see Note 10). The total market value of securities on loan at March 31, 2017, was $28,205 ($ Thousands). |

| (B) | Security is a Master Limited Partnership. At March 31, 2017, such securities amounted to $10,182 ($ Thousands), or 0.73% of Net Assets (see Note 2). |

| (C) | This security was purchased with cash collateral held from securities on loan (see Note 10). The total market value of such securities as of March 31, 2017 was $28,890 ($ Thousands). |

ADR — American Depositary Receipt

Cl — Class

L.P. — Limited Partnership

The Summary Schedule of Investments does not reflect the complete portfolio holdings. It includes the Fund’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Fund’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). In certain instances, securities for which footnotes listed above may otherwise apply are included in the Other Securities caption. The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 342-5734; and (ii) on the SEC’s website at http://www.sec.gov.

The following is a list of the level of inputs used as of March 31, 2017, in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stock | $ | 1,315,153 | $ | — | $ | — | $ | 1,315,153 | ||||||||

Affiliated Partnership | — | 28,890 | — | 28,890 | ||||||||||||

Cash Equivalent | 76,059 | — | — | 76,059 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total Investments in Securities | $ | 1,391,212 | $ | 28,890 | $ | — | $ | 1,420,102 | ||||||||

|

|

|

|

|

|

|

| |||||||||

For the period ended March 31, 2017, there were no transfers between Level 1 and Level 2 assets and liabilities.

For the period ended March 31, 2017, there were no transfers between Level 2 and Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 4 | SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

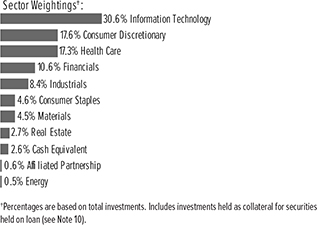

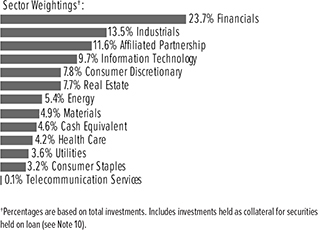

Large Cap Growth Fund

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK — 97.5% |

| |||||||||||

Consumer Discretionary — 17.7% |

| |||||||||||

Amazon.com, Cl A* | 2.9 | % | 46,452 | $ | 41,182 | |||||||

Autozone* | 0.9 | 16,845 | 12,180 | |||||||||

Home Depot | 1.2 | 112,101 | 16,460 | |||||||||

Lowe’s | 1.4 | 246,892 | 20,297 | |||||||||

NetFlix* | 1.0 | 94,764 | 14,007 | |||||||||

Nike, Cl B | 2.2 | 555,242 | 30,944 | |||||||||

Priceline Group* | 1.4 | 10,811 | 19,243 | |||||||||

TJX | 1.7 | 311,851 | 24,661 | |||||||||

Tractor Supply | 0.8 | 164,061 | 11,315 | |||||||||

Other Securities (A) | 4.2 | 59,882 | ||||||||||

|

| |||||||||||

| 250,171 | ||||||||||||

|

| |||||||||||

Consumer Staples — 4.7% |

| |||||||||||

Colgate-Palmolive | 1.1 | 209,349 | 15,322 | |||||||||

Constellation Brands, Cl A | 1.0 | 82,655 | 13,396 | |||||||||

PepsiCo | 1.6 | 206,469 | 23,096 | |||||||||

Other Securities | 1.0 | �� | 13,843 | |||||||||

|

| |||||||||||

| 65,657 | ||||||||||||

|

| |||||||||||

Energy — 0.5% |

| |||||||||||

Other Securities | 0.5 | 6,522 | ||||||||||

|

| |||||||||||

Financials — 10.7% |

| |||||||||||

Berkshire Hathaway, Cl B* | 0.9 | 73,613 | 12,270 | |||||||||

Citigroup | 0.8 | 174,515 | 10,439 | |||||||||

Moody’s | 2.0 | 250,210 | 28,033 | |||||||||

MSCI, Cl A | 1.0 | 146,922 | 14,279 | |||||||||

US Bancorp | 0.8 | 227,159 | 11,699 | |||||||||

Wells Fargo | 1.5 | 362,802 | 20,194 | |||||||||

Other Securities | 3.7 | 53,557 | ||||||||||

|

| |||||||||||

| 150,471 | ||||||||||||

|

| |||||||||||

Health Care — 17.4% |

| |||||||||||

Alexion Pharmaceuticals* | 0.9 | 106,365 | 12,896 | |||||||||

Becton Dickinson | 2.3 | 177,785 | 32,613 | |||||||||

Biogen* | 1.9 | 96,641 | 26,424 | |||||||||

Celgene, Cl A* | 1.3 | 151,599 | 18,863 | |||||||||

Johnson & Johnson | 1.5 | 174,678 | 21,756 | |||||||||

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK (continued) |

| |||||||||||

Mettler Toledo International* | 1.7 | % | 49,199 | $ | 23,562 | |||||||

Quintiles Transnational* | 0.9 | 166,807 | 13,433 | |||||||||

UnitedHealth Group | 3.5 | 296,815 | 48,681 | |||||||||

Varian Medical Systems* | 0.8 | 125,145 | 11,404 | |||||||||

Other Securities | 2.6 | 35,603 | ||||||||||

|

| |||||||||||

| 245,235 | ||||||||||||

|

| |||||||||||

Industrials — 8.5% |

| |||||||||||

3M | 0.8 | 61,707 | 11,806 | |||||||||

Equifax | 0.9 | 95,137 | 13,009 | |||||||||

Graco | 1.3 | 189,591 | 17,848 | |||||||||

United Technologies | 0.7 | 93,235 | 10,462 | |||||||||

Other Securities (A) | 4.8 | 66,201 | ||||||||||

|

| |||||||||||

| 119,326 | ||||||||||||

|

| |||||||||||

Information Technology — 30.8% |

| |||||||||||

Alphabet, Cl A* | 2.8 | 45,781 | 38,813 | |||||||||

Alphabet, Cl C* | 1.2 | 20,792 | 17,248 | |||||||||

Apple | 1.5 | 148,310 | 21,306 | |||||||||

ASML Holding, Cl G | 1.0 | 109,218 | 14,504 | |||||||||

Cognizant Technology Solutions, Cl A* | 0.8 | 196,853 | 11,717 | |||||||||

Electronic Arts* | 1.0 | 159,649 | 14,292 | |||||||||

Facebook, Cl A* | 2.0 | 197,066 | 27,993 | |||||||||

Intuit | 0.9 | 108,893 | 12,630 | |||||||||

MasterCard, Cl A | 2.5 | 313,933 | 35,308 | |||||||||

Microsoft | 3.7 | 784,564 | 51,671 | |||||||||

PayPal Holdings* | 0.8 | 271,180 | 11,666 | |||||||||

Qualcomm | 0.7 | 175,349 | 10,055 | |||||||||

Vantiv, Cl A* | 1.0 | 212,581 | 13,631 | |||||||||

Visa, Cl A | 2.4 | 379,643 | 33,739 | |||||||||

Other Securities | 8.5 | 119,706 | ||||||||||

|

| |||||||||||

| 434,279 | ||||||||||||

|

| |||||||||||

Materials — 4.5% |

| |||||||||||

Praxair | 0.9 | 101,704 | 12,062 | |||||||||

Sherwin-Williams, Cl A | 2.3 | 103,162 | 32,000 | |||||||||

Other Securities | 1.3 | 20,121 | ||||||||||

|

| |||||||||||

| 64,183 | ||||||||||||

|

| |||||||||||

Real Estate — 2.7% |

| |||||||||||

Crown Castle International‡ | 0.7 | 109,140 | 10,309 | |||||||||

Equinix‡ | 1.1 | 38,182 | 15,287 | |||||||||

SBA Communications, Cl A*‡ | 0.9 | 100,376 | 12,082 | |||||||||

|

| |||||||||||

| 37,678 | ||||||||||||

|

| |||||||||||

Total Common Stock |

| 1,373,522 | ||||||||||

|

| |||||||||||

AFFILIATED PARTNERSHIP — 0.6% |

| |||||||||||

SEI Liquidity Fund, L.P. | 0.6 | 8,772,972 | 8,772 | |||||||||

|

| |||||||||||

Total Affiliated Partnership |

| 8,772 | ||||||||||

|

| |||||||||||

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 | 5 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

Large Cap Growth Fund (Concluded)

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

CASH EQUIVALENT — 2.6% |

| |||||||||||

SEI Daily Income Trust, Government Fund, Cl F 0.530%**† | 2.6 | % | 36,133,195 | $ | 36,133 | |||||||

|

| |||||||||||

Total Cash Equivalent |

| 36,133 | ||||||||||

|

| |||||||||||

Total Investments — 100.7% |

| $ | 1,418,427 | |||||||||

|

| |||||||||||

Percentages are based on a Net Assets of $1,408,733 ($ Thousands).

| * | Non-income producing security. |

| ** | The rate reported is the 7-day effective yield as of March 31, 2017. |

| † | Investment in Affiliated Security (see Note 6). |

| ‡ | Real Estate Investment Trust. |

| (A) | Certain securities or partial positions of certain securities are on loan at March 31, 2017 (see Note 10). The total market value of securities on loan at March 31, 2017, was $8,598 ($ Thousands). |

| (B) | This security was purchased with cash collateral held from securities on loan (see Note 10). The total market value of such securities as of March 31, 2017 was $8,772 ($ Thousands). |

Cl — Class

L.P. — Limited Partnership

MSCI — Morgan Stanley Capital International

The Summary Schedule of Investments does not reflect the complete portfolio holdings. It includes the Fund’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Fund’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). In certain instances, securities for which footnotes listed above may otherwise apply are included in the Other Securities caption. The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 342-5734; and (ii) on the SEC’s website at http://www.sec.gov.

The following is a list of the level of inputs used as of March 31, 2017, in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stock | $ | 1,373,522 | $ | — | $ | — | $ | 1,373,522 | ||||||||

Affiliated Partnership | — | 8,772 | — | 8,772 | ||||||||||||

Cash Equivalent | 36,133 | — | — | 36,133 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total Investments in Securities | $ | 1,409,655 | $ | 8,772 | $ | — | $ | 1,418,427 | ||||||||

|

|

|

|

|

|

|

| |||||||||

For the period ended March 31, 2017, there were no transfers between Level 1 and Level 2 assets and liabilities.

For the period ended March 31, 2017, there were no transfers between Level 2 and Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 6 | SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

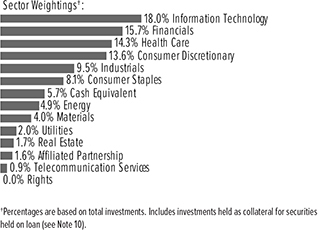

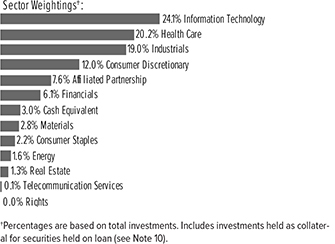

Tax-Managed Large Cap Fund

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK — 94.2% |

| |||||||||||

Consumer Discretionary — 13.8% |

| |||||||||||

Amazon.com, Cl A* | 1.1 | % | 43,128 | $ | 38,235 | |||||||

Autozone* | 0.6 | 28,750 | 20,788 | |||||||||

Dollar General | 0.9 | 450,186 | 31,391 | |||||||||

Home Depot | 0.5 | 118,848 | 17,450 | |||||||||

Lowe’s | 0.9 | 372,467 | 30,621 | |||||||||

Nike, Cl B | 0.7 | 445,778 | 24,843 | |||||||||

TJX | 0.6 | 282,625 | 22,350 | |||||||||

Other Securities (A) | 8.5 | 291,606 | ||||||||||

|

| |||||||||||

| 477,284 | ||||||||||||

|

| |||||||||||

Consumer Staples — 8.2% |

| |||||||||||

CVS Health | 1.0 | 421,911 | 33,120 | |||||||||

Kimberly-Clark | 0.5 | 125,774 | 16,556 | |||||||||

Philip Morris International | 0.7 | 209,277 | 23,627 | |||||||||

Tyson Foods, Cl A | 0.5 | 281,181 | 17,352 | |||||||||

Walgreens Boots Alliance | 0.5 | 219,542 | 18,233 | |||||||||

Other Securities | 5.0 | 176,514 | ||||||||||

|

| |||||||||||

| 285,402 | ||||||||||||

|

| |||||||||||

Energy — 5.0% |

| |||||||||||

Chevron | 0.7 | 213,036 | 22,874 | |||||||||

Other Securities (A) | 4.3 | 150,124 | ||||||||||

|

| |||||||||||

| 172,998 | ||||||||||||

|

| |||||||||||

Financials — 15.9% |

| |||||||||||

Bank of America | 1.3 | 1,841,396 | 43,439 | |||||||||

Citigroup | 0.7 | 379,987 | 22,731 | |||||||||

Discover Financial Services | 0.5 | 241,586 | 16,522 | |||||||||

JPMorgan Chase | 1.4 | 549,498 | 48,268 | |||||||||

Moody’s | 0.8 | 251,546 | 28,183 | |||||||||

Wells Fargo | 0.7 | 427,725 | 23,807 | |||||||||

Other Securities (A) (B) | 10.5 | 367,625 | ||||||||||

|

| |||||||||||

| 550,575 | ||||||||||||

|

| |||||||||||

Health Care — 14.5% |

| |||||||||||

Amgen, Cl A | 0.8 | 167,917 | 27,550 | |||||||||

Becton Dickinson | 1.0 | 192,791 | 35,366 | |||||||||

Biogen* | 0.9 | 118,701 | 32,455 | |||||||||

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK (continued) |

| |||||||||||

Celgene, Cl A* | 0.9 | % | 245,980 | $ | 30,607 | |||||||

Johnson & Johnson | 1.6 | 452,116 | 56,311 | |||||||||

Pfizer | 0.7 | 706,138 | 24,157 | |||||||||

UnitedHealth Group | 1.8 | 371,767 | 60,973 | |||||||||

Other Securities (A) | 6.8 | 235,561 | ||||||||||

|

| |||||||||||

| 502,980 | ||||||||||||

|

| |||||||||||

Industrials — 9.7% |

| |||||||||||

3M | 0.9 | 165,685 | 31,701 | |||||||||

Delta Air Lines, Cl A | 0.5 | 388,636 | 17,862 | |||||||||

Graco | 0.5 | 190,940 | 17,975 | |||||||||

Illinois Tool Works | 0.6 | 158,062 | 20,939 | |||||||||

Raytheon | 0.5 | 120,803 | 18,422 | |||||||||

Other Securities (A) | 6.7 | 227,214 | ||||||||||

|

| |||||||||||

| 334,113 | ||||||||||||

|

| |||||||||||

Information Technology — 18.3% |

| |||||||||||

Adobe Systems* | 0.5 | 137,412 | 17,881 | |||||||||

Alphabet, Cl A* | 0.7 | 27,622 | 23,418 | |||||||||

Alphabet, Cl C* | 0.6 | 26,751 | 22,192 | |||||||||

Apple | 1.3 | 321,205 | 46,144 | |||||||||

Applied Materials | 0.6 | 507,844 | 19,755 | |||||||||

Cisco Systems | 0.5 | 488,328 | 16,506 | |||||||||

Facebook, Cl A* | 0.9 | 209,203 | 29,717 | |||||||||

Intel | 0.6 | 570,596 | 20,581 | |||||||||

Intuit | 0.5 | 156,005 | 18,095 | |||||||||

MasterCard, Cl A | 1.2 | 372,740 | 41,922 | |||||||||

Microsoft | 1.3 | 660,683 | 43,513 | |||||||||

Qualcomm | 0.5 | 308,957 | 17,716 | |||||||||

Texas Instruments | 0.5 | 211,061 | 17,003 | |||||||||

Visa, Cl A | 1.1 | 425,642 | 37,827 | |||||||||

Other Securities (A) | 7.5 | 262,211 | ||||||||||

|

| |||||||||||

| 634,481 | ||||||||||||

|

| |||||||||||

Materials — 4.1% |

| |||||||||||

International Paper | 0.5 | 367,473 | 18,660 | |||||||||

Sherwin-Williams, Cl A | 0.8 | 90,944 | 28,210 | |||||||||

Other Securities | 2.8 | 94,149 | ||||||||||

|

| |||||||||||

| 141,019 | ||||||||||||

|

| |||||||||||

Real Estate — 1.7% |

| |||||||||||

Crown Castle International‡ | 0.5 | 198,875 | 18,784 | |||||||||

Equinix‡ | 0.5 | 41,936 | 16,790 | |||||||||

Other Securities‡ | 0.7 | 24,433 | ||||||||||

|

| |||||||||||

| 60,007 | ||||||||||||

|

| |||||||||||

Telecommunication Services — 1.0% |

| |||||||||||

Verizon Communications | 0.5 | 350,334 | 17,079 | |||||||||

Other Securities | 0.5 | 16,055 | ||||||||||

|

| |||||||||||

| 33,134 | ||||||||||||

|

| |||||||||||

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 | 7 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

Tax-Managed Large Cap Fund (Concluded)

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK (continued) |

| |||||||||||

Utilities — 2.0% |

| |||||||||||

Other Securities | 2.0 | % | $ | 68,849 | ||||||||

|

| |||||||||||

Total Common Stock |

| 3,260,842 | ||||||||||

|

| |||||||||||

RIGHTS* — 0.0% |

| |||||||||||

Other Securities | 0.0 | 115 | ||||||||||

|

| |||||||||||

Total Rights |

| 115 | ||||||||||

|

| |||||||||||

AFFILIATED PARTNERSHIP — 1.7% |

| |||||||||||

SEI Liquidity Fund, L.P. | 1.7 | 57,227,694 | 57,225 | |||||||||

|

| |||||||||||

Total Affiliated Partnership |

| 57,225 | ||||||||||

|

| |||||||||||

CASH EQUIVALENT — 5.7% |

| |||||||||||

SEI Daily Income Trust, Government Fund, Cl F 0.530%**† | 5.7 | 198,626,109 | 198,626 | |||||||||

|

| |||||||||||

Total Cash Equivalent |

| 198,626 | ||||||||||

|

| |||||||||||

Total Investments — 101.6% |

| $ | 3,516,808 | |||||||||

|

| |||||||||||

A list of the open futures contracts held by the Fund at March 31, 2017 is as follows:

| Type of Contract | Number of Contracts Long | Expiration Date | Unrealized Appreciation (Depreciation) ($ Thousands) | |||||||||

S&P 500 Index E-MINI | 62 | Jun-2017 | $ | (7 | ) | |||||||

S&P Mid Cap 400 Index E-MINI | 4 | Jun-2017 | 4 | |||||||||

|

| |||||||||||

| $ | (3 | ) | ||||||||||

|

| |||||||||||

For the period ended March 31, 2017, the total amount of all open futures contracts, as presented in the table above, are representative of activity for this derivative type during the year.

Percentages are based on a Net Assets of $3,461,119 ($ Thousands).

| * | Non-income producing security. |

| ** | The rate reported is the 7-day effective yield as of March 31, 2017. |

| † | Investment in Affiliated Security (see Note 6). |

| ‡ | Real Estate Investment Trust. |

| (A) | Certain securities or partial positions of certain securities are on loan at March 31, 2017 (see Note 10). The total market value of securities on loan at March 31, 2017, was $55,808 ($ Thousands). |

| (B) | Security is a Master Limited Partnership. At March 31, 2017, such securities amounted to $6,186 ($ Thousands), or 0.18% of Net Assets (See Note 2). |

| (C) | This security was purchased with cash collateral held from securities on loan (see Note 10). The total market value of such securities as of March 31, 2017 was $57,225 ($ Thousands). |

Cl — Class

L.P. — Limited Partnership

S&P— Standard & Poor’s

The Summary Schedule of Investments does not reflect the complete portfolio holdings. It includes the Fund’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Fund’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). In certain instances, securities for which footnotes listed above may otherwise apply are included in the Other Securities caption. The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 342-5734; and (ii) on the SEC’s website at http://www.sec.gov.

The following is a list of the level of inputs used as of March 31, 2017, in valuing the Fund’s investments and other financial instruments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stock | $ | 3,260,842 | $ | — | $ | — | $ | 3,260,842 | ||||||||

Rights | — | 115 | — | 115 | ||||||||||||

Affiliated Partnership | — | 57,225 | — | 57,225 | ||||||||||||

Cash Equivalent | 198,626 | — | — | 198,626 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total Investments in Securities | $ | 3,459,468 | $ | 57,340 | $ | – | $ | 3,516,808 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| Other Financial Instruments | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Futures Contracts* | ||||||||||||||||

Unrealized Appreciation | $ | 4 | $ | — | $ | — | $ | 4 | ||||||||

Unrealized Depreciation | (7 | ) | — | — | (7 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Total Other Financial Instruments | $ | (3 | ) | $ | — | $ | — | $ | (3 | ) | ||||||

|

|

|

|

|

|

|

| |||||||||

| * | Future contracts are valued at the unrealized appreciation/(depreciation) on the instrument. |

For the period ended March 31, 2017, there were no transfers between Level 1 and Level 2 assets and liabilities.

For the period ended March 31, 2017, there were no transfers between Level 2 and Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 8 | SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

S&P 500 Index Fund

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK — 97.7% |

| |||||||||||

Consumer Discretionary — 12.3% |

| |||||||||||

Amazon.com, Cl A* | 1.7 | % | 14,549 | $ | 12,898 | |||||||

Comcast, Cl A | 0.9 | 173,396 | 6,518 | |||||||||

Home Depot | 0.9 | 44,645 | 6,555 | |||||||||

McDonald’s | 0.5 | 30,017 | 3,891 | |||||||||

Priceline Group* | 0.4 | 1,806 | 3,215 | |||||||||

Starbucks | 0.4 | 53,434 | 3,120 | |||||||||

Walt Disney | 0.8 | 53,253 | 6,038 | |||||||||

Other Securities (A) | 6.7 | 50,875 | ||||||||||

|

| |||||||||||

| 93,110 | ||||||||||||

|

| |||||||||||

Consumer Staples — 9.1% |

| |||||||||||

Altria Group | 0.7 | 71,073 | 5,076 | |||||||||

Coca-Cola | 0.8 | 141,549 | 6,007 | |||||||||

PepsiCo | 0.8 | 52,215 | 5,841 | |||||||||

Philip Morris International | 0.8 | 56,787 | 6,411 | |||||||||

Procter & Gamble | 1.1 | 93,608 | 8,411 | |||||||||

Wal-Mart Stores | 0.5 | 55,161 | 3,976 | |||||||||

Other Securities | 4.4 | 33,379 | ||||||||||

|

| |||||||||||

| 69,101 | ||||||||||||

|

| |||||||||||

Energy — 6.4% |

| |||||||||||

Chevron | 1.0 | 69,323 | 7,443 | |||||||||

ExxonMobil | 1.6 | 151,946 | 12,461 | |||||||||

Schlumberger, Cl A | 0.5 | 51,000 | 3,983 | |||||||||

Other Securities (A) | 3.3 | 24,980 | ||||||||||

|

| |||||||||||

| 48,867 | ||||||||||||

|

| |||||||||||

Financials — 14.0% |

| |||||||||||

Bank of America | 1.1 | 367,245 | 8,663 | |||||||||

Berkshire Hathaway, Cl B* | 1.5 | 69,617 | 11,604 | |||||||||

Citigroup | 0.8 | 101,451 | 6,069 | |||||||||

JPMorgan Chase | 1.5 | 130,900 | 11,498 | |||||||||

Wells Fargo | 1.2 | 164,915 | 9,179 | |||||||||

Other Securities | 7.9 | 59,709 | ||||||||||

|

| |||||||||||

| 106,722 | ||||||||||||

|

| |||||||||||

Health Care — 13.3% |

| |||||||||||

AbbVie | 0.5 | 58,368 | 3,803 | |||||||||

Amgen, Cl A | 0.6 | 26,929 | 4,418 | |||||||||

Bristol-Myers Squibb | 0.4 | 61,292 | 3,333 | |||||||||

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK (continued) |

| |||||||||||

Celgene, Cl A* | 0.5 | % | 28,505 | $ | 3,547 | |||||||

Gilead Sciences | 0.4 | 47,766 | 3,244 | |||||||||

Johnson & Johnson | 1.6 | 99,354 | 12,375 | |||||||||

Medtronic | 0.5 | 50,072 | 4,034 | |||||||||

Merck | 0.8 | 100,574 | 6,390 | |||||||||

Pfizer | 1.0 | 218,056 | 7,460 | |||||||||

UnitedHealth Group | 0.8 | 35,228 | 5,778 | |||||||||

Other Securities (A) | 6.2 | 47,015 | ||||||||||

|

| |||||||||||

| 101,397 | ||||||||||||

|

| |||||||||||

Industrials — 9.9% |

| |||||||||||

3M | 0.5 | 21,801 | 4,171 | |||||||||

Boeing | 0.5 | 20,841 | 3,686 | |||||||||

General Electric | 1.3 | 319,609 | 9,524 | |||||||||

Honeywell International | 0.5 | 27,851 | 3,478 | |||||||||

Union Pacific | 0.4 | 29,793 | 3,156 | |||||||||

Other Securities (A) | 6.7 | 51,288 | ||||||||||

|

| |||||||||||

| 75,303 | ||||||||||||

|

| |||||||||||

Information Technology — 21.6% |

| |||||||||||

Alphabet, Cl A* | 1.2 | 10,846 | 9,195 | |||||||||

Alphabet, Cl C* | 1.2 | 10,870 | 9,017 | |||||||||

Apple | 3.6 | 192,182 | 27,609 | |||||||||

Broadcom, Cl A | 0.4 | 14,646 | 3,207 | |||||||||

Cisco Systems | 0.8 | 183,461 | 6,201 | |||||||||

Facebook, Cl A* | 1.6 | 86,309 | 12,260 | |||||||||

Intel | 0.8 | 173,163 | 6,246 | |||||||||

International Business Machines | 0.7 | 31,433 | 5,474 | |||||||||

MasterCard, Cl A | 0.5 | 34,517 | 3,882 | |||||||||

Microsoft | 2.5 | 283,089 | 18,644 | |||||||||

Oracle, Cl B | 0.6 | 109,823 | 4,899 | |||||||||

Visa, Cl A | 0.8 | 68,018 | 6,045 | |||||||||

Other Securities (A) | 6.9 | 51,321 | ||||||||||

|

| |||||||||||

| 164,000 | ||||||||||||

|

| |||||||||||

Materials — 2.8% |

| |||||||||||

Other Securities | 2.8 | 21,096 | ||||||||||

|

| |||||||||||

Real Estate — 2.9% |

| |||||||||||

Other Securities‡ | 2.9 | 21,807 | ||||||||||

|

| |||||||||||

Telecommunication Services — 2.3% |

| |||||||||||

AT&T | 1.2 | 224,959 | 9,347 | |||||||||

Verizon Communications | 0.9 | 149,296 | 7,278 | |||||||||

Other Securities (A) | 0.2 | 1,086 | ||||||||||

|

| |||||||||||

| 17,711 | ||||||||||||

|

| |||||||||||

Utilities — 3.1% |

| |||||||||||

Other Securities | 3.1 | 23,678 | ||||||||||

|

| |||||||||||

Total Common Stock |

| 742,792 | ||||||||||

|

| |||||||||||

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 | 9 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

S&P 500 Index Fund (Concluded)

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

U.S. TREASURY OBLIGATIONS — 0.1% |

| |||||||||||

Other Securities (B) | 0.1 | % | $ | 805 | ||||||||

|

| |||||||||||

Total U.S. Treasury Obligations |

| 805 | ||||||||||

|

| |||||||||||

AFFILIATED PARTNERSHIP — 0.5% |

| |||||||||||

SEI Liquidity Fund, L.P. | 0.5 | 3,491,979 | 3,492 | |||||||||

|

| |||||||||||

Total Affiliated Partnership |

| 3,492 | ||||||||||

|

| |||||||||||

CASH EQUIVALENT — 2.3% |

| |||||||||||

SEI Daily Income Trust, Government Fund, Cl F 0.530%**† | 2.3 | 17,403,458 | 17,403 | |||||||||

|

| |||||||||||

Total Cash Equivalent |

| 17,403 | ||||||||||

|

| |||||||||||

Total Investments — 100.6% |

| $ | 764,492 | |||||||||

|

| |||||||||||

A list of the open futures contracts held by the Fund at March 31, 2017 is as follows:

| Type of Contract | Number of Contracts Long | Expiration Date | Unrealized Depreciation ($ Thousands) | |||||||||

S&P 500 Index E-MINI | 143 | Jun-2017 | $ | (46 | ) | |||||||

|

| |||||||||||

Percentages are based on a Net Assets of $760,194 ($ Thousands).

| * | Non-income producing security. |

| ** | The rate reported is the 7-day effective yield as of March 31, 2017. |

| ‡ | Real Estate Investment Trust. |

| † | Investment in Affiliated Security (see Note 6). |

| †† | Narrow Industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting. |

| (A) | Certain securities or partial positions of certain securities are on loan at March 31, 2017 (see Note 10). The total market value of securities on loan at March 31, 2017, was $3,412 ($ Thousands). |

| (B) | Security, or portion thereof, has been pledged as collateral on open futures contracts. |

| (C) | This security was purchased with cash collateral held from securities on loan (see Note 10). The total market value of such securities as of March 31, 2017 was $3,492 ($ Thousands). |

Cl — Class

L.P.— Limited Partnership

S&P— Standard & Poor’s

The Summary Schedule of Investments does not reflect the complete portfolio holdings. It includes the Fund’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Fund’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). In certain instances, securities for which footnotes listed above may otherwise apply are included in the Other Securities caption. The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 342-5734; and (ii) on the SEC’s website at http://www.sec.gov.

The following is a list of the level of inputs used as of March 31, 2017, in valuing the Fund’s investments and other financial instruments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stock | $ | 742,792 | $ | — | $ | — | $ | 742,792 | ||||||||

U.S. Treasury Obligations | — | 805 | — | 805 | ||||||||||||

Affiliated Partnership | — | 3,492 | — | 3,492 | ||||||||||||

Cash Equivalent | 17,403 | — | — | 17,403 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total Investments in Securities | $ | 760,195 | $ | 4,297 | $ | – | $ | 764,492 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| Other Financial Instruments | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Futures Contracts* | ||||||||||||||||

Unrealized Depreciation | $ | (46 | ) | $ | — | $ | — | $ | (46 | ) | ||||||

|

|

|

|

|

|

|

| |||||||||

Total Other Financial Instruments | $ | (46 | ) | $ | — | $ | — | $ | (46 | ) | ||||||

|

|

|

|

|

|

|

| |||||||||

| * | Futures contracts are valued at the unrealized depreciation on the instrument. |

For the period ended March 31, 2017, there were no transfers between Level 1 and Level 2 assets and liabilities.

For the period ended March 31, 2017, there were no transfers between Level 2 and Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 10 | SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

Small Cap Fund

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK — 93.5% |

| |||||||||||

Consumer Discretionary — 11.5% |

| |||||||||||

Big Lots(A) | 0.5 | % | 64,248 | $ | 3,128 | |||||||

Jack in the Box | 0.7 | 40,318 | 4,101 | |||||||||

Monro Muffler | 0.5 | 52,710 | 2,746 | |||||||||

Pool | 0.5 | 25,091 | 2,994 | |||||||||

William Lyon Homes, Cl A* (A) | 0.5 | 137,388 | 2,833 | |||||||||

Other Securities (A) | 8.8 | 52,399 | ||||||||||

|

| |||||||||||

| 68,201 | ||||||||||||

|

| |||||||||||

Consumer Staples — 3.2% |

| |||||||||||

Hostess Brands* | 0.6 | 216,121 | 3,430 | |||||||||

Snyder’s-Lance (A) | 0.8 | 113,955 | 4,594 | |||||||||

Other Securities (A) | 1.8 | 10,935 | ||||||||||

|

| |||||||||||

| 18,959 | ||||||||||||

|

| |||||||||||

Energy — 4.3% |

| |||||||||||

Gulfport Energy* | 0.5 | 184,651 | 3,174 | |||||||||

Other Securities (A) | 3.8 | 22,283 | ||||||||||

|

| |||||||||||

| 25,457 | ||||||||||||

|

| |||||||||||

Financials — 16.5% |

| |||||||||||

American Equity Investment Life Holding | 0.6 | 144,883 | 3,424 | |||||||||

Bank of the Ozarks (A) | 0.5 | 56,901 | 2,959 | |||||||||

Central Pacific Financial | 0.5 | 101,535 | 3,101 | |||||||||

FNB (Pennsylvania) | 0.9 | 347,445 | 5,166 | |||||||||

Fulton Financial | 0.5 | 168,505 | 3,008 | |||||||||

Green Dot, Cl A* | 0.5 | 85,397 | 2,849 | |||||||||

OFG Bancorp | 0.5 | 238,270 | 2,812 | |||||||||

Popular | 0.5 | 68,678 | 2,797 | |||||||||

Wintrust Financial | 0.8 | 68,633 | 4,744 | |||||||||

Other Securities‡ (A) | 11.2 | 67,023 | ||||||||||

|

| |||||||||||

| 97,883 | ||||||||||||

|

| |||||||||||

Health Care — 12.3% |

| |||||||||||

Acadia Healthcare, Cl A* (A) | 0.5 | 69,899 | 3,048 | |||||||||

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK (continued) |

| |||||||||||

AMN Healthcare Services* | 0.8 | % | 113,966 | $ | 4,627 | |||||||

Integra LifeSciences Holdings* | 0.7 | 93,265 | 3,929 | |||||||||

Lannett* (A) | 0.6 | 150,109 | 3,355 | |||||||||

Ligand Pharmaceuticals* (A) | 0.9 | 48,216 | 5,103 | |||||||||

Prestige Brands Holdings, Cl A* | 1.0 | 108,730 | 6,041 | |||||||||

Supernus Pharmaceuticals* | 0.5 | 100,563 | 3,148 | |||||||||

Other Securities (A) | 7.3 | 43,972 | ||||||||||

|

| |||||||||||

| 73,223 | ||||||||||||

|

| |||||||||||

Industrials — 15.6% |

| |||||||||||

Apogee Enterprises (A) | 0.8 | 84,159 | 5,017 | |||||||||

Deluxe (A) | 0.5 | 42,715 | 3,083 | |||||||||

Masonite International* | 0.7 | 52,734 | 4,179 | |||||||||

On Assignment* | 0.7 | 88,426 | 4,291 | |||||||||

Tetra Tech | 0.6 | 87,478 | 3,574 | |||||||||

WageWorks* | 0.5 | 40,357 | 2,918 | |||||||||

XPO Logistics* | 0.5 | 57,656 | 2,761 | |||||||||

Other Securities (A) | 11.3 | 66,855 | ||||||||||

|

| |||||||||||

| 92,678 | ||||||||||||

|

| |||||||||||

Information Technology — 19.3% |

| |||||||||||

Acxiom* | 0.7 | 154,212 | 4,390 | |||||||||

CalAmp* | 0.8 | 269,971 | 4,533 | |||||||||

Callidus Software* | 0.6 | 175,256 | 3,742 | |||||||||

Cavium* | 0.7 | 58,085 | 4,162 | |||||||||

Cornerstone OnDemand* | 0.5 | 75,167 | 2,923 | |||||||||

Criteo ADR* (A) | 0.6 | 67,858 | 3,392 | |||||||||

FireEye* (A) | 0.5 | 223,512 | 2,818 | |||||||||

Integrated Device Technology* | 0.5 | 114,707 | 2,715 | |||||||||

MAXIMUS | 0.9 | 87,508 | 5,443 | |||||||||

ON Semiconductor* | 0.6 | 209,456 | 3,244 | |||||||||

PDF Solutions* | 0.5 | 124,986 | 2,827 | |||||||||

Sanmina* | 0.6 | 82,159 | 3,336 | |||||||||

Stamps.com* (A) | 0.6 | 27,649 | 3,272 | |||||||||

Tech Data* | 0.5 | 33,632 | 3,158 | |||||||||

TrueCar* (A) | 0.6 | 209,323 | 3,238 | |||||||||

Other Securities (A) | 10.1 | 61,325 | ||||||||||

|

| |||||||||||

| 114,518 | ||||||||||||

|

| |||||||||||

Materials — 3.6% |

| |||||||||||

Ferroglobe Representation* | 0.0 | 56,257 | 6 | |||||||||

Other Securities (A) | 3.6 | 21,142 | ||||||||||

|

| |||||||||||

| 21,148 | ||||||||||||

|

| |||||||||||

Real Estate — 4.1% |

| |||||||||||

Colony Starwood Homes‡ (A) | 0.5 | 80,746 | 2,741 | |||||||||

Other Securities‡ (A) | 3.6 | 21,411 | ||||||||||

|

| |||||||||||

| 24,152 | ||||||||||||

|

| |||||||||||

Telecommunication Services — 0.0% |

| |||||||||||

Other Securities (A) | 0.0 | 304 | ||||||||||

|

| |||||||||||

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 | 11 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

Small Cap Fund (Concluded)

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK (continued) |

| |||||||||||

Utilities — 3.1% |

| |||||||||||

ALLETE | 0.5 | % | 40,656 | $ | 2,753 | |||||||

PNM Resources | 0.5 | 85,509 | 3,164 | |||||||||

Other Securities (A) | 2.1 | 12,351 | ||||||||||

|

| |||||||||||

| 18,268 | ||||||||||||

|

| |||||||||||

Total Common Stock |

| 554,791 | ||||||||||

|

| |||||||||||

RIGHTS* — 0.0% |

| |||||||||||

Other Securities | 0.0 | — | ||||||||||

|

| |||||||||||

Total Rights |

| — | ||||||||||

|

| |||||||||||

AFFILIATED PARTNERSHIP — 10.0% |

| |||||||||||

SEI Liquidity Fund, L.P. | 10.0 | 59,676,493 | 59,673 | |||||||||

|

| |||||||||||

Total Affiliated Partnership |

| 59,673 | ||||||||||

|

| |||||||||||

CASH EQUIVALENT — 6.5% |

| |||||||||||

SEI Daily Income Trust, Government Fund, Cl F | 6.5 | 38,414,296 | 38,414 | |||||||||

|

| |||||||||||

Total Cash Equivalent |

| 38,414 | ||||||||||

|

| |||||||||||

Total Investments — 110.0% |

| $ | 652,878 | |||||||||

|

| |||||||||||

A list of the open futures contracts held by the Fund at March 31, 2017 is as follows:

| Type of Contract | Number of Contracts Long | Expiration Date | Unrealized Appreciation ($ Thousands) | |||||||||

Russell 2000 Index E-MINI | 182 | Jun-2017 | $ | 181 | ||||||||

|

| |||||||||||

Percentages are based on a Net Assets of $593,387 ($ Thousands).

| * | Non-income producing security. |

| ** | The rate reported is the 7-day effective yield as of March 31, 2017. |

| † | Investment in Affiliated Security (See Note 6). |

| ‡ | Real Estate Investment Trust. |

| (A) | Certain securities or partial positions of certain securities are on loan at March 31, 2017 (see Note 10). The total market value of securities on loan at March 31, 2017, was $58,442 ($ Thousands). |

| (B) | This security was purchased with cash collateral held from securities on loan (see Note 10). The total market value of such securities as of March 31, 2017 was $59,673 ($ Thousands). |

ADR — American Depositary Receipt

Cl — Class

L.P. — Limited Partnership

The Summary Schedule of Investments does not reflect the complete portfolio holdings. It includes the Fund’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Fund’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). In certain instances, securities for which footnotes listed above may otherwise apply are included in the Other Securities caption. The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 342-5734; and (ii) on the SEC’s website at http://www.sec.gov.

The following is a list of the level of inputs used as of March 31, 2017, in valuing the Fund’s investments and other financial instruments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stock | $ | 554,791 | $ | — | $ | — | $ | 554,791 | ||||||||

Rights | — | — | — | — | ||||||||||||

Affiliated Partnership | — | 59,673 | — | 59,673 | ||||||||||||

Cash Equivalent | 38,414 | — | — | 38,414 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total Investments in Securities | $ | 593,205 | $ | 59,673 | $ | — | $ | 652,878 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| Other Financial Instruments | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Futures Contracts | ||||||||||||||||

* Unrealized Appreciation | $ | 181 | $ | — | $ | — | $ | 181 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Total Other Financial Instruments | $ | 181 | $ | — | $ | — | $ | 181 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| * | Futures contracts are valued at the unrealized appreciation on the instrument. |

For the period ended March 31, 2017, there were no transfers between Level 1 and Level 2 assets and liabilities.

For the period ended March 31, 2017, there were no transfers between Level 2 and Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 12 | SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

Small Cap Value Fund

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK — 94.7% |

| |||||||||||

Consumer Discretionary — 8.8% |

| |||||||||||

Big Lots (A) | 0.5 | % | 44,404 | $ | 2,162 | |||||||

Cooper-Standard Holdings* | 0.5 | 16,327 | 1,811 | |||||||||

Dana | 0.6 | 115,528 | 2,231 | |||||||||

Other Securities (A) | 7.2 | 28,775 | ||||||||||

|

| |||||||||||

| 34,979 | ||||||||||||

|

| |||||||||||

Consumer Staples — 3.6% |

| |||||||||||

Sanderson Farms (A) | 0.5 | 20,031 | 2,080 | |||||||||

Other Securities (A) | 3.1 | 12,316 | ||||||||||

|

| |||||||||||

| 14,396 | ||||||||||||

|

| |||||||||||

Energy — 6.1% |

| |||||||||||

Gulfport Energy* | 0.7 | 167,073 | 2,872 | |||||||||

Parsley Energy, Cl A* | 0.5 | 63,353 | 2,060 | |||||||||

PBF Energy, Cl A (A) | 0.6 | 100,508 | 2,228 | |||||||||

Other Securities (A) | 4.3 | 17,126 | ||||||||||

|

| |||||||||||

| 24,286 | ||||||||||||

|

| |||||||||||

Financials — 26.7% |

| |||||||||||

American Equity Investment Life Holding | 0.6 | 106,916 | 2,526 | |||||||||

Argo Group International Holdings | 0.5 | 31,177 | 2,114 | |||||||||

BGC Partners, Cl A | 0.5 | 166,087 | 1,887 | |||||||||

Central Pacific Financial | 0.7 | 92,461 | 2,824 | |||||||||

CNO Financial Group | 0.7 | 129,197 | 2,649 | |||||||||

Customers Bancorp* | 0.5 | 58,396 | 1,841 | |||||||||

First Commonwealth Financial | 0.7 | 220,259 | 2,921 | |||||||||

FNB (Pennsylvania) | 1.0 | 263,632 | 3,920 | |||||||||

Fulton Financial | 0.7 | 159,491 | 2,847 | |||||||||

Green Dot, Cl A* | 0.5 | 63,841 | 2,130 | |||||||||

Hanover Insurance Group, Cl A | 0.6 | 24,510 | 2,207 | |||||||||

IBERIABANK | 0.6 | 30,650 | 2,424 | |||||||||

Kemper, Cl A | 0.5 | 44,447 | 1,773 | |||||||||

Maiden Holdings (A) | 0.6 | 166,188 | 2,327 | |||||||||

Meridian Bancorp | 0.5 | 112,704 | 2,063 | |||||||||

OFG Bancorp | 0.6 | 206,561 | 2,437 | |||||||||

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK (continued) |

| |||||||||||

Old National Bancorp, Cl A | 0.6 | % | 144,844 | $ | 2,513 | |||||||

PacWest Bancorp | 0.6 | 41,971 | 2,235 | |||||||||

Popular | 0.7 | 68,331 | 2,783 | |||||||||

Starwood Property Trust‡ | 0.7 | 128,852 | 2,910 | |||||||||

United Community Banks | 0.5 | 69,000 | 1,911 | |||||||||

Other Securities‡ (A) | 13.8 | 54,464 | ||||||||||

|

| |||||||||||

| 105,706 | ||||||||||||

|

| |||||||||||

Health Care — 4.7% |

| |||||||||||

Lannett* (A) | 0.7 | 121,607 | 2,718 | |||||||||

Ligand Pharmaceuticals* (A) | 0.7 | 27,382 | 2,898 | |||||||||

Other Securities (A) | 3.3 | 12,879 | ||||||||||

|

| |||||||||||

| 18,495 | ||||||||||||

|

| |||||||||||

Industrials — 15.3% |

| |||||||||||

ACCO Brands* | 0.6 | 166,616 | 2,191 | |||||||||

Atlas Air Worldwide Holdings* | 0.5 | 38,787 | 2,151 | |||||||||

BWX Technologies, Cl W | 0.5 | 41,548 | 1,978 | |||||||||

Genesee & Wyoming, Cl A* | 0.5 | 29,661 | 2,013 | |||||||||

KAR Auction Services | 0.5 | 46,360 | 2,025 | |||||||||

Other Securities (A) | 12.7 | 50,034 | ||||||||||

|

| |||||||||||

| 60,392 | ||||||||||||

|

| |||||||||||

Information Technology — 10.9% |

| |||||||||||

Benchmark Electronics* | 0.5 | 67,860 | 2,158 | |||||||||

IAC* | 0.5 | 28,912 | 2,131 | |||||||||

Sanmina* | 0.9 | 84,584 | 3,434 | |||||||||

Tech Data* | 0.6 | 26,091 | 2,450 | |||||||||

Other Securities (A) | 8.4 | 32,970 | ||||||||||

|

| |||||||||||

| 43,143 | ||||||||||||

|

| |||||||||||

Materials — 5.6% |

| |||||||||||

Ferroglobe Representation* | 0.0 | 53,302 | 6 | |||||||||

FMC | 0.5 | 27,575 | 1,919 | |||||||||

Silgan Holdings | 0.6 | 39,167 | 2,325 | |||||||||

Other Securities (A) | 4.5 | 17,808 | ||||||||||

|

| |||||||||||

| 22,058 | ||||||||||||

|

| |||||||||||

Real Estate — 8.7% |

| |||||||||||

Colony Starwood Homes‡ (A) | 1.0 | 111,210 | 3,776 | |||||||||

Equity Commonwealth*‡ | 0.6 | 71,225 | 2,224 | |||||||||

Gramercy Property Trust‡ (A) | 0.5 | 74,522 | 1,960 | |||||||||

Howard Hughes* | 0.6 | 20,585 | 2,414 | |||||||||

Other Securities‡ (A) | 6.0 | 23,965 | ||||||||||

|

| |||||||||||

| 34,339 | ||||||||||||

|

| |||||||||||

Telecommunication Services — 0.2% |

| |||||||||||

Other Securities (A) | 0.2 | 601 | ||||||||||

|

| |||||||||||

Utilities — 4.1% |

| |||||||||||

ALLETE | 0.6 | 34,689 | 2,349 | |||||||||

PNM Resources | 0.6 | 59,679 | 2,208 | |||||||||

Portland General Electric | 0.6 | 54,437 | 2,418 | |||||||||

Southwest Gas | 0.6 | 27,969 | 2,319 | |||||||||

Spire | 0.5 | 27,070 | 1,827 | |||||||||

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 | 13 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

Small Cap Value Fund (Concluded)

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK (continued) |

| |||||||||||

Other Securities (A) | 1.2 | % | $ | 4,939 | ||||||||

|

| |||||||||||

| 16,060 | ||||||||||||

|

| |||||||||||

Total Common Stock |

| 374,455 | ||||||||||

|

| |||||||||||

AFFILIATED PARTNERSHIP — 13.1% |

| |||||||||||

SEI Liquidity Fund, L.P. | 13.1 | 51,675,206 | 51,673 | |||||||||

|

| |||||||||||

Total Affiliated Partnership |

| 51,673 | ||||||||||

|

| |||||||||||

CASH EQUIVALENT — 5.2% |

| |||||||||||

SEI Daily Income Trust, | 5.2 | 20,587,318 | 20,587 | |||||||||

|

| |||||||||||

Total Cash Equivalent |

| 20,587 | ||||||||||

|

| |||||||||||

Total Investments — 113.0% |

| $ | 446,715 | |||||||||

|

| |||||||||||

A list of the open futures contracts held by the Fund at March 31, 2017 is as follows:

| Type of Contract | Number of Contracts Long | Expiration Date | Unrealized Appreciation ($ Thousands) | |||||||||

Russell 2000 Index E-MINI | 52 | Jun-2017 | $ | 60 | ||||||||

|

| |||||||||||

Percentages are based on a Net Assets of $395,395 ($ Thousands).

| * | Non-income producing security. |

| ** | The rate reported is the 7-day effective yield as of March 31, 2017. |

| ‡ | Real Estate Investment Trust. |

| † | Investment in Affiliated Security (see Note 6). |

| (A) | Certain securities or partial positions of certain securities are on loan at March 31, 2017 (see Note 10). The total market value of securities on loan at March 31, 2017, was $50,922 ($ Thousands). |

| (B) | This security was purchased with cash collateral held from securities on loan (see Note 10). The total market value of such securities as of March 31, 2017 was $51,673 ($ Thousands). |

Cl — Class

L.P. — Limited Partnership

The Summary Schedule of Investments does not reflect the complete portfolio holdings. It includes the Fund’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Fund’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). In certain instances, securities for which footnotes listed above may otherwise apply are included in the Other Securities caption. The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 342-5734; and (ii) on the SEC’s website at http://www.sec.gov.

The following is a list of the level of inputs used as of March 31, 2017, in valuing the Fund’s investments and other financial instruments carried at value ($ Thousands):

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stock | $ | 374,455 | $ | — | $ | — | $ | 374,455 | ||||||||

Affiliated Partnership | — | 51,673 | — | 51,673 | ||||||||||||

Cash Equivalent | 20,587 | — | — | 20,587 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total Investments in Securities | $ | 395,042 | $ | 51,673 | $ | — | $ | 446,715 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| Other Financial Instruments | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Futures Contracts* | ||||||||||||||||

Unrealized Appreciation | $ | 60 | $ | — | $ | — | $ | 60 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Total Other Financial Instruments | $ | 60 | $ | — | $ | — | $ | 60 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| * | Futures contracts are valued at the unrealized appreciation on the instrument. |

For the period ended March 31, 2017, there were no transfers between Level 1 and Level 2 assets and liabilities.

For the period ended March 31, 2017, there were no transfers between Level 2 and Level 3 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| 14 | SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

Small Cap Growth Fund

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK †† — 96.6% |

| |||||||||||

Consumer Discretionary — 12.9% |

| |||||||||||

Bright Horizons Family Solutions* | 1.0 | % | 45,102 | $ | 3,269 | |||||||

Dave & Buster’s Entertainment* | 0.6 | 31,750 | 1,940 | |||||||||

Five Below* | 0.5 | 41,796 | 1,810 | |||||||||

Grand Canyon Education* | 0.7 | 31,260 | 2,239 | |||||||||

Jack in the Box | 0.7 | 23,259 | 2,366 | |||||||||

National CineMedia | 0.6 | 151,530 | 1,914 | |||||||||

Planet Fitness, Cl A | 0.6 | 104,813 | 2,020 | |||||||||

Other Securities (A) | 8.2 | 27,302 | ||||||||||

|

| |||||||||||

| 42,860 | ||||||||||||

|

| |||||||||||

Consumer Staples — 2.4% |

| |||||||||||

Hostess Brands* | 0.6 | 115,386 | 1,831 | |||||||||

Other Securities (A) | 1.8 | 6,223 | ||||||||||

|

| |||||||||||

| 8,054 | ||||||||||||

|

| |||||||||||

Energy — 1.7% |

| |||||||||||

Other Securities (A) | 1.7 | 5,755 | ||||||||||

|

| |||||||||||

Financials — 6.6% |

| |||||||||||

Eagle Bancorp* | 0.7 | 36,275 | 2,166 | |||||||||

Evercore Partners, Cl A | 0.9 | 36,667 | 2,856 | |||||||||

Wintrust Financial | 0.9 | 43,435 | 3,002 | |||||||||

Other Securities (A) (B) (C) | 4.1 | 13,920 | ||||||||||

|

| |||||||||||

| 21,944 | ||||||||||||

|

| |||||||||||

Health Care — 21.8% |

| |||||||||||

AMAG Pharmaceuticals* | 0.5 | 77,061 | 1,738 | |||||||||

AMN Healthcare Services* | 1.1 | 90,440 | 3,672 | |||||||||

INC Research Holdings, Cl A* | 0.6 | 45,197 | 2,072 | |||||||||

Integra LifeSciences Holdings* | 0.7 | 56,260 | 2,370 | |||||||||

Nevro* | 0.6 | 21,758 | 2,039 | |||||||||

PRA Health Sciences* | 0.7 | 36,881 | 2,406 | |||||||||

Prestige Brands Holdings, Cl A* | 1.2 | 70,202 | 3,900 | |||||||||

Supernus Pharmaceuticals* | 0.8 | 87,211 | 2,730 | |||||||||

Vocera Communications* | 0.6 | 84,553 | 2,099 | |||||||||

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK (continued) |

| |||||||||||

Other Securities (A) | 15.0 | % | $ | 49,249 | ||||||||

|

| |||||||||||

| 72,275 | ||||||||||||

|

| |||||||||||

Industrials — 20.5% |

| |||||||||||

Apogee Enterprises | 1.1 | 62,006 | 3,696 | |||||||||

Astec Industries | 0.6 | 30,457 | 1,873 | |||||||||

Deluxe | 1.1 | 50,564 | 3,649 | |||||||||

John Bean Technologies, Cl A | 1.1 | 41,481 | 3,648 | |||||||||

Masonite International* | 0.7 | 29,481 | 2,336 | |||||||||

Mercury Systems* | 1.0 | 82,519 | 3,222 | |||||||||

On Assignment* | 0.8 | 54,226 | 2,632 | |||||||||

SP Plus* | 0.6 | 57,590 | 1,944 | |||||||||

Tennant | 0.5 | 23,944 | 1,739 | |||||||||

TriNet Group* | 0.6 | 69,193 | 2,000 | |||||||||

WageWorks* | 0.6 | 27,037 | 1,955 | |||||||||

Other Securities (A) | 11.8 | 39,445 | ||||||||||

|

| |||||||||||

| 68,139 | ||||||||||||

|

| |||||||||||

Information Technology — 26.0% |

| |||||||||||

2U* | 0.8 | 68,102 | 2,701 | |||||||||

Acxiom* | 0.7 | 78,734 | 2,242 | |||||||||

CalAmp* | 0.8 | 150,093 | 2,520 | |||||||||

Callidus Software* | 1.1 | 169,597 | 3,621 | |||||||||

Cavium* | 0.8 | 38,493 | 2,758 | |||||||||

Coherent* | 1.1 | 17,357 | 3,569 | |||||||||

Euronet Worldwide* | 0.6 | 22,470 | 1,922 | |||||||||

FireEye* (A) | 0.6 | 145,365 | 1,833 | |||||||||

Littelfuse | 1.0 | 21,395 | 3,421 | |||||||||

LogMeIn | 0.9 | 30,289 | 2,953 | |||||||||

MAXIMUS | 0.6 | 34,045 | 2,118 | |||||||||

Microsemi* | 0.7 | 44,008 | 2,268 | |||||||||

Monolithic Power Systems | 1.1 | 38,105 | 3,509 | |||||||||

PDF Solutions* | 0.7 | 95,513 | 2,160 | |||||||||

Proofpoint* (A) | 0.7 | 32,437 | 2,412 | |||||||||

TrueCar* (A) | 0.7 | 142,515 | 2,205 | |||||||||

Other Securities (A) | 13.1 | 44,040 | ||||||||||

|

| |||||||||||

| 86,252 | ||||||||||||

|

| |||||||||||

Materials — 3.1% |

| |||||||||||

Sensient Technologies | 0.6 | 25,375 | 2,011 | |||||||||

Summit Materials, Cl A* | 0.6 | 74,979 | 1,853 | |||||||||

Other Securities | 1.9 | 6,250 | ||||||||||

|

| |||||||||||

| 10,114 | ||||||||||||

|

| |||||||||||

Real Estate — 1.4% |

| |||||||||||

National Storage Affiliates Trust‡ | 0.6 | 83,885 | 2,005 | |||||||||

Other Securities‡ | 0.8 | 2,504 | ||||||||||

|

| |||||||||||

| 4,509 | ||||||||||||

|

| |||||||||||

| SEI Institutional Managed Trust / Semi-Annual Report / March 31, 2017 | 15 |

SUMMARY SCHEDULE OF INVESTMENTS (Unaudited)

March 31, 2017

Small Cap Growth Fund (Concluded)

| Description | Percentage of Net Assets (%) | Shares | Market Value ($ Thousands) | |||||||||

COMMON STOCK (continued) |

| |||||||||||

Telecommunication Services — 0.2% |

| |||||||||||

Other Securities | 0.2 | % | $ | 539 | ||||||||

|

| |||||||||||

Total Common Stock |

| 320,441 | ||||||||||

|

| |||||||||||

RIGHTS* — 0.0% |

| |||||||||||

Other Securities | 0.0 | — | ||||||||||

|

| |||||||||||

Total Rights |

| — | ||||||||||

|

| |||||||||||

AFFILIATED PARTNERSHIP — 8.2% |

| |||||||||||

SEI Liquidity Fund, L.P. | 8.2 | 27,190,111 | 27,189 | |||||||||

|

| |||||||||||

Total Affiliated Partnership |

| 27,189 | ||||||||||

|

| |||||||||||

CASH EQUIVALENT — 3.2% |

| |||||||||||

SEI Daily Income Trust, | 3.2 | 10,588,465 | 10,588 | |||||||||

|

| |||||||||||

Total Cash Equivalent |

| 10,588 | ||||||||||

|

| |||||||||||

Total Investments — 108.0% |

| $ | 358,218 | |||||||||

|

| |||||||||||

Percentages are based on a Net Assets of $331,743 ($ Thousands).

| * | Non-income producing security. |

| ** | The rate reported is the 7-day effective yield as of March 31, 2017. |

| ‡ | Real Estate Investment Trust. |

| † | Investment in Affiliated Security (see Note 6). |

| †† | Narrow Industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting. |