UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04892

Templeton Growth Fund, Inc.

(Exact name of registrant as specified in charter)

500 East Broward Blvd., Suite 2100, Fort Lauderdale, FL 33394-3091

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: (954) 527-7500_

Date of fiscal year end: _8/31__

Date of reporting period: 8/31/10_

Item 1. Reports to Stockholders.

TEMPLETON GROWTH FUND, INC.

SPECIALIZED EXPERTISE

TRUE DIVERSIFICATION

RELIABILITY YOU CAN TRUST

MUTUAL FUNDS |

Franklin Templeton Investments

Gain From Our Perspective®

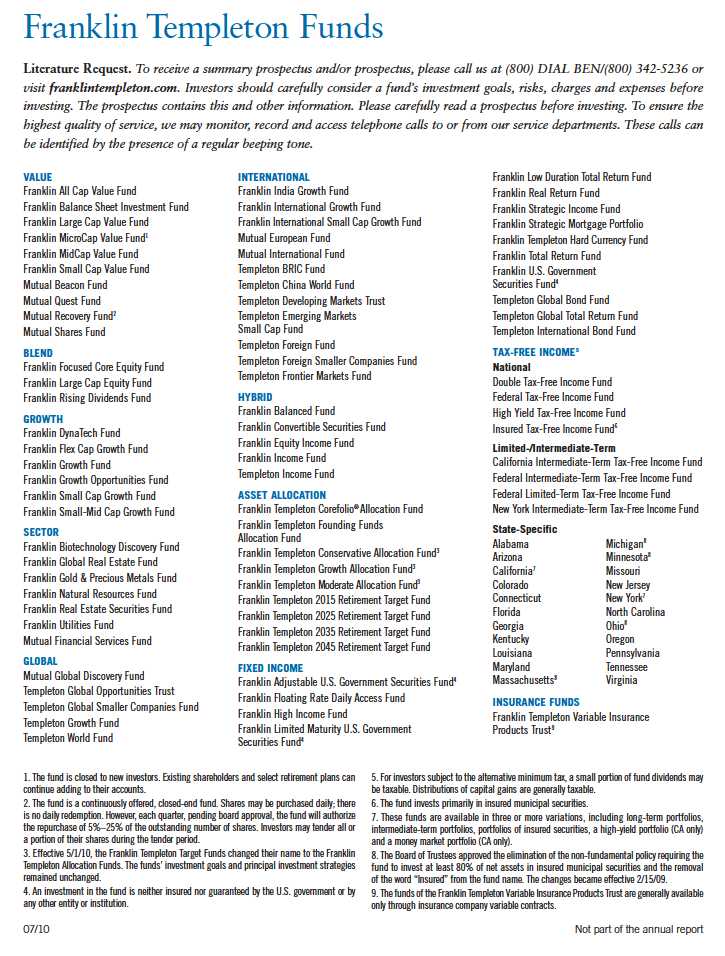

Franklin Templeton’s distinct multi-manager structure combines the specialized expertise of three world-class investment management groups—Franklin, Templeton and Mutual Series.

Each of our portfolio management groups operates autonomously, relying on its own research and staying true to the unique investment disciplines that underlie its success.

Franklin. Founded in 1947, Franklin is a recognized leader in fixed income investing and also brings expertise in growth- and value-style U.S. equity investing.

Templeton. Founded in 1940, Templeton pioneered international investing and, in 1954, launched what has become the industry’s oldest global fund. Today, with offices in over 25 countries, Templeton offers investors a truly global perspective.

Mutual Series. Founded in 1949, Mutual Series is dedicated to a unique style of value investing, searching aggressively for opportunity among what it believes are undervalued stocks, as well as arbitrage situations and distressed securities.

Because our management groups work independently and adhere to different investment approaches, Franklin, Templeton and Mutual Series funds typically have distinct portfolios. That’s why our funds can be used to build truly diversified allocation plans covering every major asset class.

At Franklin Templeton Investments, we seek to consistently provide investors with exceptional risk-adjusted returns over the long term, as well as the reliable, accurate and personal service that has helped us become one of the most trusted names in financial services.

RETIREMENT PLANS | 529 COLLEGE SAVINGS PLANS | SEPARATE ACCOUNTS

| Not part of the annual report |

Templeton Growth Fund, Inc.

Your Fund’s Goal and Main Investments: Templeton Growth Fund seeks long-term

capital growth. Under normal market conditions, the Fund invests primarily in equity securities of

companies located anywhere in the world, including emerging markets.

This annual report for Templeton Growth Fund covers the fiscal year ended August 31, 2010.

Performance Overview

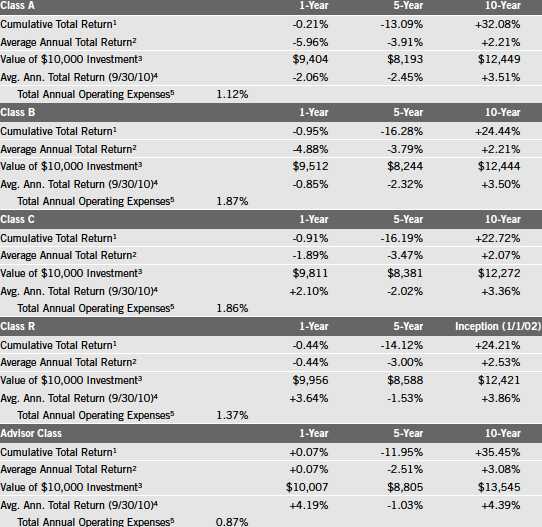

Templeton Growth Fund – Class A had a -0.21% cumulative total return for the 12 months under review. The Fund underperformed its benchmark, the Morgan Stanley Capital International (MSCI) World Index, which had a +2.07% total return for the same period.1 In line with our long-term investment strategy, we are pleased with our long-term results, as shown in the

1. Source: © 2010 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The MSCI World Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance in global developed markets. As of 8/31/10, the Fund’s Class A 10-year average annual total return not including the maximum sales charge was +2.82%, compared with the -0.16% 10-year average annual total return of the MSCI World Index. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

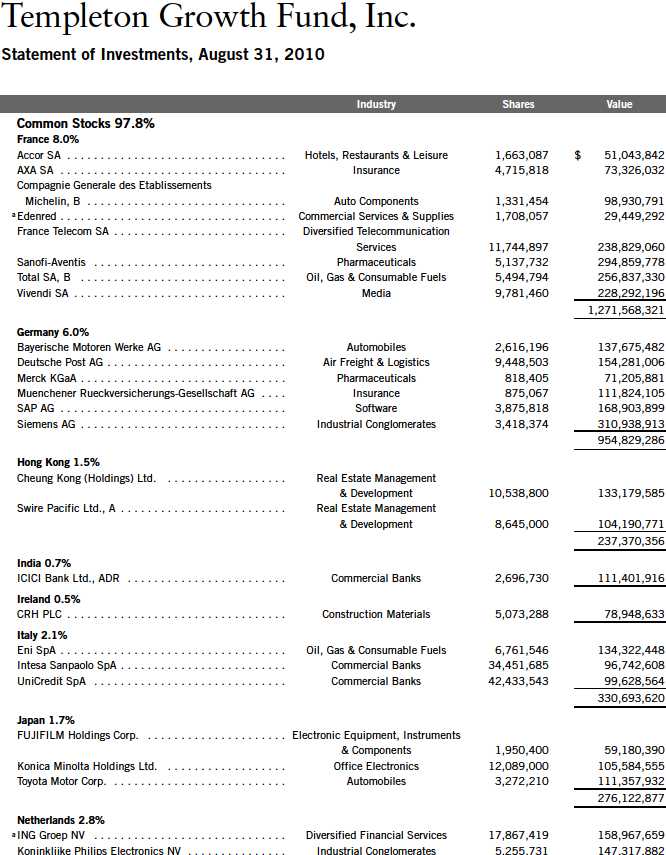

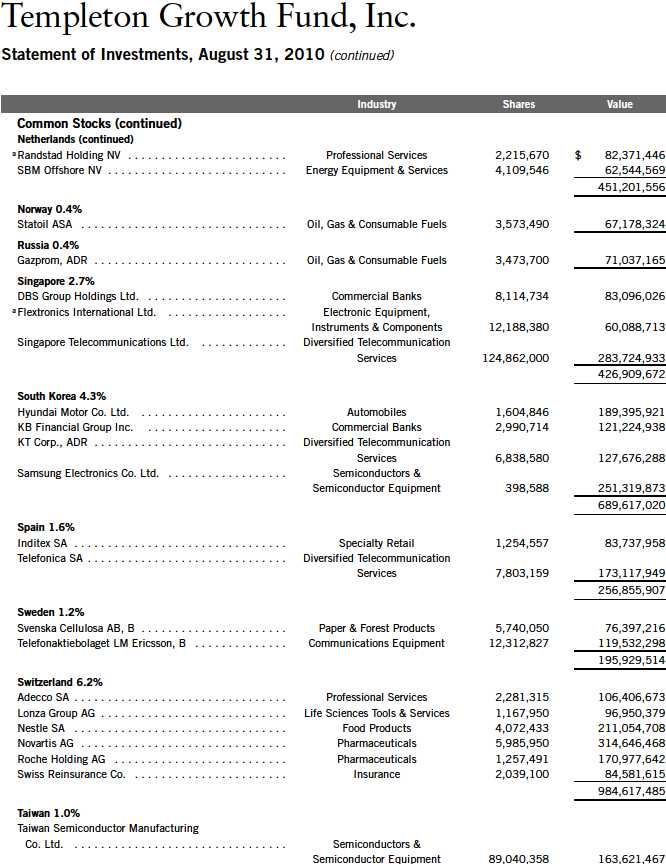

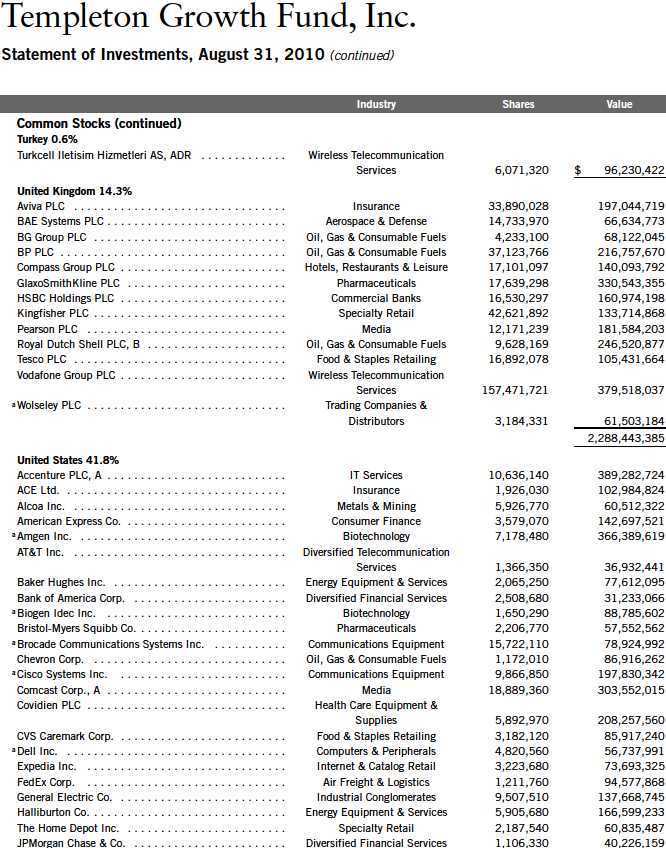

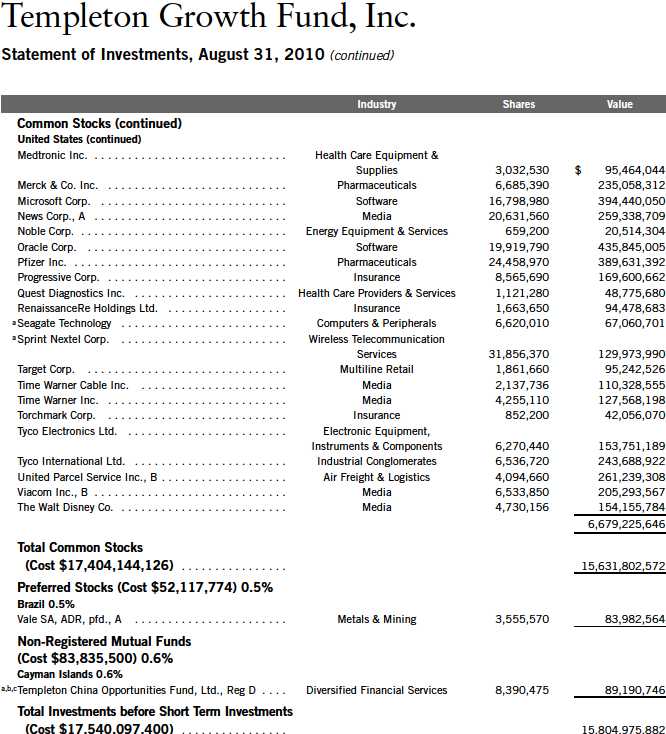

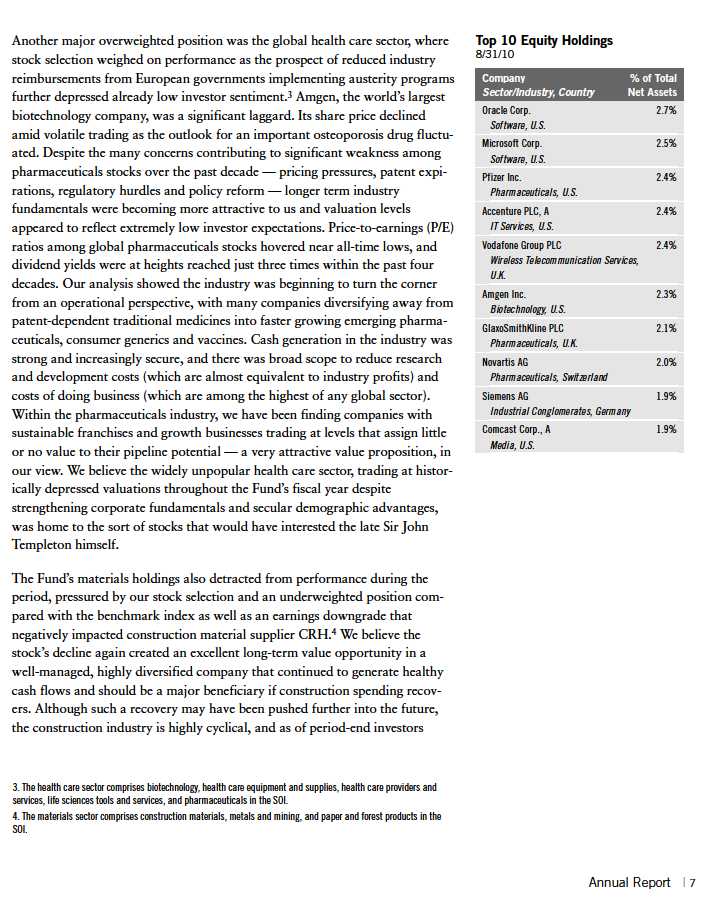

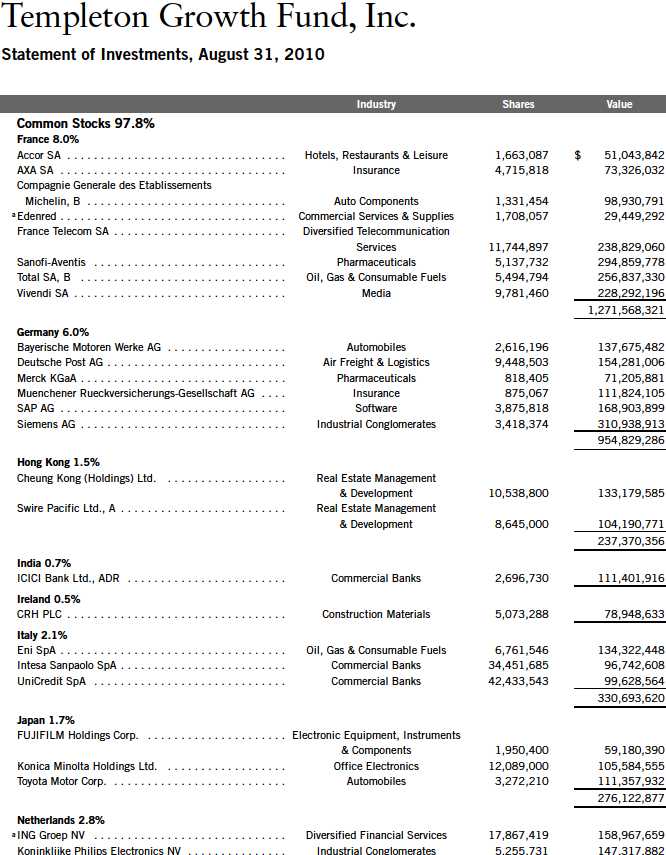

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 23.

What is a carry trade?

A carry trade is a strategy in which an investor sells a certain currency with a relatively low interest rate and uses the funds to purchase a different currency yielding a higher interest rate. A trader using this strategy attempts to capture the difference between the rates.

Performance Summary beginning on page 11. For the 10-year period ended August 31, 2010, Templeton Growth Fund – Class A delivered a +32.08% cumulative total return, compared with the MSCI World Index’s -1.59% cumulative total return for the same period.1 Please note that index performance information is provided for reference and that we do not attempt to track the index, but rather undertake investments on the basis of fundamental research. You can find more performance data in the Performance Summary.

Economic and Market Overview

The 12-month period under review captured the end of the 2009 market surge when global equities recovered from their financial crisis depths, as well as a period of renewed economic anxiety and range-bound trading that defined the market’s behavior throughout most of 2010. By the onset of the review period, an aggressive policy response by governments around the world had stabilized the global financial system and provided stimulus for growth. Emerging markets in particular continued to expand, attracting capital inflows as investors pinned their recovery hopes on new sources of demand in the developing world. Global financial institutions proceeded with necessary deleveraging, and a robust economic recovery supported investors’ renewed risk taking, driving up the prices of virtually all asset classes in practically every region around the globe. This positive momentum carried into 2010 as corporate earnings and economic indicators continued to recover. However, the rally soon sputtered as concerns became more pronounced about the state of sovereign finances in Europe and the ability of policymak-ers to engineer a sustainable global recovery. Despite corporate strength and vigilant policy support in the developed world, including a 750 billion euro pledge to forestall European sovereign debt defaults, sentiment trended significantly lower and many investors capitulated to the growing consensus that the year-long equity rally had run its course.

As the reporting period drew to a close, the market’s major concerns included fiscal imbalances in Europe (where several weaker countries had their credit ratings slashed) and fears of a renewed economic downturn. Currency movements reflected these concerns — the euro continued its protracted depreciation and the Japanese yen strengthened as risk-averse investors sought safer currencies or unwound carry trades. And although economic data remained generally mixed, news reports tended to focus on negative data in developed and emerging markets toward the end of the 12-month review period. Corporate profitability remained a bright spot in the global financial landscape. The majority of companies reported better-than-expected earnings, though outlooks became notably cautious as the period progressed. An increase in merger and acquisition activity over the summer also supported equity markets, and many

4 | Annual Report

companies that had cut costs and repaired balance sheets during the downturn emerged as strategic buyers in an environment of historically depressed valuations. Yet, individual investors remained largely unconvinced, and at period-end global investment capital continued to flow from equities into fixed income securities offering investors unusually low yields.

Investment Strategy

Our investment strategy employs a bottom-up, value-oriented, long-term approach. We focus on the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. As we look worldwide, we consider specific companies, rather than sectors or countries, while doing in-depth research to construct a bargain list from which we buy. Before we make a purchase, we look at the company’s price/earnings ratio, price/cash flow ratio, profit margins and liquidation value.

Manager’s Discussion

Sir John Templeton observed, “Too many investors focus on outlook and trend. Therefore, more profit is made by focusing on value.” Over the course of the past 12 months, and to an even greater degree than historical norms, the equity market focused squarely on the global economic outlook and near-term corporate earnings trends, with investors showing limited interest in long-term values at the individual security level. After the meltdown of virtually every sector and asset class during the market fallout of 2008, and the reflexive rebound of all sectors and asset classes in the recovery rally of 2009, equity trading through the first eight months of 2010 was extremely volatile but largely range-bound. Investors generally remained risk averse while continuing to commit funds to low-yielding bonds as they nervously contemplated the possibility of double-dip recession, sovereign debt crises, rising unemployment an d the like. Such an impressionable market is inherently misaligned with Templeton’s long-term, value-oriented approach. Yet, as Sir John knew well, a market driven by angst and worry over outlooks and trends can create excellent opportunities for investors focused on value. Throughout the period, we found such opportunities among stocks whose prices were depressed to levels we believed greatly understated the long-term earnings power, asset growth potential and cash-flow generating capacities of the underlying businesses.

In such an environment, we continued to uncover value opportunities according to our time-tested investment strategy, across sectors and geographies, and most notably among globally oriented industry leaders with defensible franchises, strong balance sheets and good future earnings and cash flow growth prospects that were selling at multi-year low valuation

Annual Report | 5

6 | Annual Report

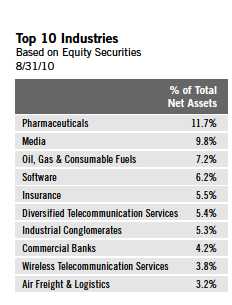

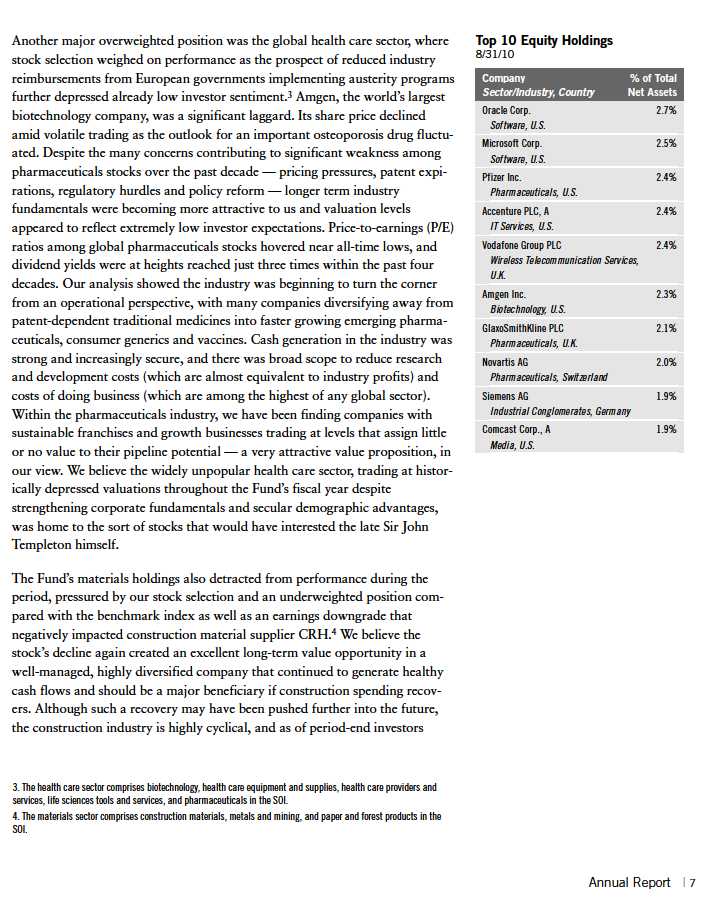

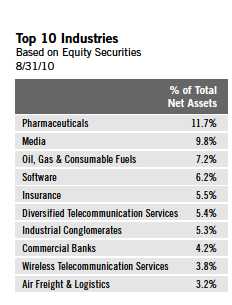

levels. A number of these companies hailed from the high-flying sectors of a decade ago: information technology, media and telecommunication services.2 The euphoric expectations that drove valuations to extremes in these sectors during the dot-com bubble diminished by 2009-2010, while many of the businesses themselves compounded value with solid earnings growth over the decade, allowing us to find many trading at a fraction of their bubble-level multiples. The Fund’s overweighting in media-related holdings was particularly productive during the fiscal year, delivering strong absolute and relative results. Investor concerns about the vulnerability of advertising revenues and the ability of “old” media companies to compete in the Internet age receded as industry prof itability, cash flow and asset values generally expanded. For example, U.S. cable operators Comcast and Time Warner Cable used their vast broadband networks to meet rising demand for high-speed Internet access and continued to make inroads into telephony, while content providers News Corp., Viacom and Disney benefited from shifting brand management strategies and an improving advertising cycle.

The Fund’s overweighted telecommunication services sector allocation also aided relative performance, with the U.K.’s Vodafone Group benefiting from solid growth in underpenetrated emerging markets and global demand growth for data-intensive smartphone services. In our view, telecommunications companies offered an increasingly essential “utility-like” service to consumers, yet valuations remained undemanding, and at period-end the sector traded at a steep discount to historical valuations and offered investors substantially higher yields than even the longest-dated Treasury securities.

Select information technology stocks also offered investors what we considered compelling values, but the Fund’s holdings underperformed the benchmark during the period as the cyclical recovery in the tech hardware industry stalled. Cyclical concerns aside, technology sector companies as a whole maintained the strongest overall balance sheet profile of any global sector as of period-end. We believe such low debt levels should allow for the productive allocation of cash flows, while elevated exposure to fast-growing emerging market demand (two-fifths of handset demand and nearly a third of PC demand originate in emerging Asian countries) could provide further solid growth within the sector. Despite such favorable fundamentals, the global technology sector at large traded at a substantial discount to its historical average (excluding the aforementioned bubble period) on forward earnings and generated a weighted average free cash flow yield of around 13% at fiscal year-end.

2. The information technology sector comprises communications equipment; computers and peripherals; electronic equipment, instruments and components; IT services; office electronics; semiconductors and semiconductor equipment; and software in the SOI. The telecommunication services sector comprises diversified telecommunication services and wireless telecommunication services in the SOI.

could buy shares of this beaten-down industry leader at 20-year low valuations, including a significant discount to book value, a single-digit multiple on normalized earnings and a dividend yield of about 5%.

The Fund’s underweighted consumer staples position also hindered relative performance in a period when a weakening economic outlook buoyed this typically defensive (non-cyclical) sector.5 However, we found few new long-term values among consumer staples companies whose capacity for profit-enhancing price hikes has been substantially reduced in the face of rising input costs and increasing pressures from private label competition.

The financials sector was another area where we found few values, as reflected by our underweighted allocation.6 Yet, unlike materials and consumer staples, the Fund’s financials underweighting proved to be a major contributor to relative performance during the 12-month period, as the sector underperformed all others. Although this diverse sector generally rebuilt its capital levels after a severe downturn, regulatory requirements became increasingly onerous in the aftermath of the credit crisis, ultimately forcing changes in business models and capital requirements. Much of the world continued to experience a lengthy and ongoing deleveraging cycle that curtailed loan growth in many developed economies, while profit growth was being sustained by lower provisioning and low funding costs subsidized by mo netary policy. The sector’s myriad uncertainties complicated our fundamental analysis, and though we continued to find selective values among adequately capitalized insurers and banks, we remained largely underweighted in financials relative to the benchmark.

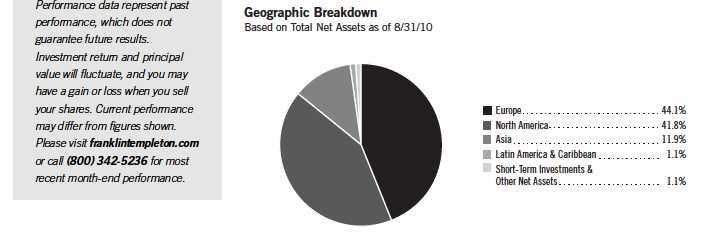

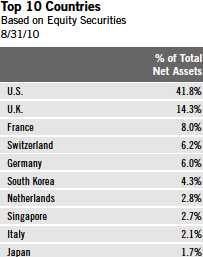

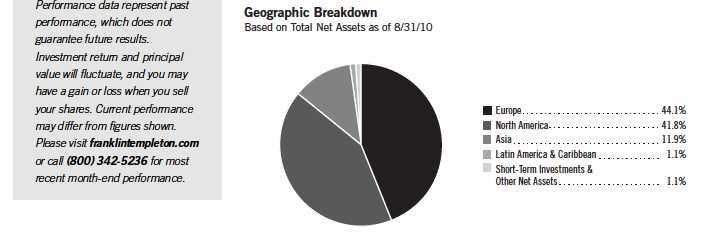

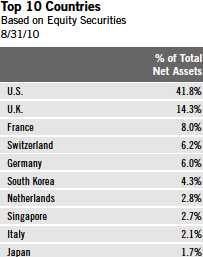

From a regional perspective, the Fund’s Asian holdings led relative performance, with an underweighted position in economically stagnant and politically turbulent Japan and overweighted positions in some higher growth emerging market regions serving as the primary drivers of returns. Conversely, European stocks were major detractors, largely due to the Fund’s stock selection and overweighted position in Europe during a period when sovereign debt problems and economic growth concerns roiled regional markets. Still, we

5. The consumer staples sector comprises food and staples retailing, and food products in the SOI.

6. The financials sector comprises commercial banks, consumer finance, diversified financial services, insurance, and real estate management and development in the SOI.

8 | Annual Report

continued to identify excellent bargain opportunities among European multinationals with strong fundamentals and globally recognized brands trading at what we viewed to be discounted valuations. We believed the debt crisis in Greece had been broadly projected onto the rest of Europe despite the fact that overall indebtedness in the region was less than in the U.S., the U.K. and Japan, while the average savings rate was six times that of the U.S.

Incidentally, Sir John Templeton’s first major investment success was his foray into Europe on the eve of World War II, at the height of concern over regional prospects. Over the course of his career, Sir John advised investors to go not where the outlook was best, but where it was “most miserable.” To him, and to us still today, outlook only matters insofar as it affects stock prices in relation to their intrinsic values. If the outlook is bad enough to depress stock prices well below their intrinsic values, then pervasive pessimism can be used to our advantage. We believe the anxious and uncertain outlook throughout the Fund’s fiscal year created attractive long-term investment opportunities at the security level, particularly among industry-leading businesses that we believe were indiscriminately downgraded. Rarely have we witnessed a market assign such low multiples to such high-quality companies. Furthermore, corporate funda mentals at period-end were generally in very good shape, particularly among global industry leaders that have emerged from the financial crisis stronger, leaner and more competitive. Although outlooks and trends could continue to unduly influence equities in the intermediate term, we believe rare opportunities exist for long-term investors who focus on value.

Annual Report | 9

Thank you for your continued participation in Templeton Growth Fund.

We look forward to serving your future investment needs.

Tucker Scott, CFA

Portfolio Management Team

Templeton Growth Fund, Inc. |

The foregoing information reflects our analysis, opinions and portfolio holdings as of August 31, 2010, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

10 | Annual Report

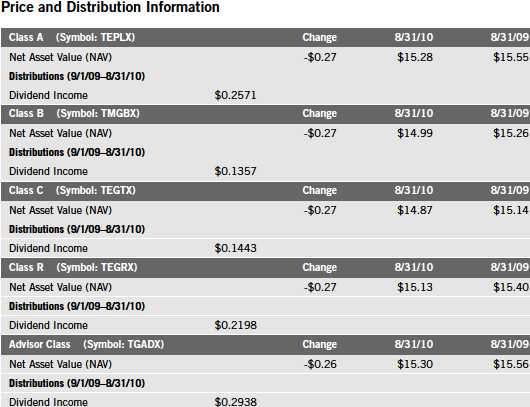

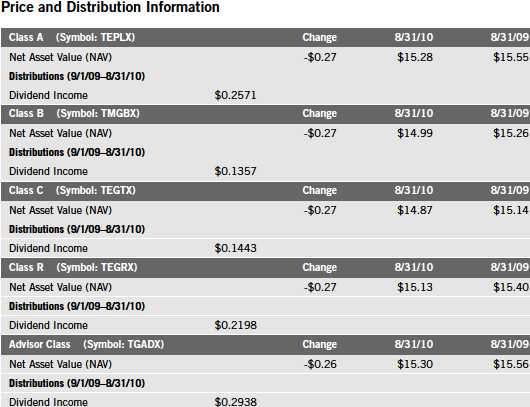

Performance Summary as of 8/31/10

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Annual Report | 11

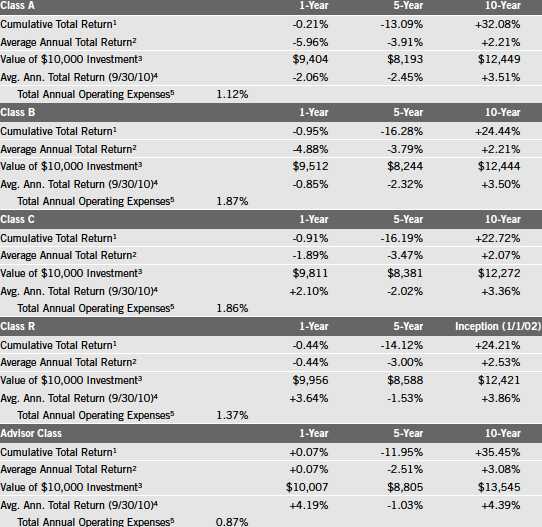

Performance Summary (continued)

Performance

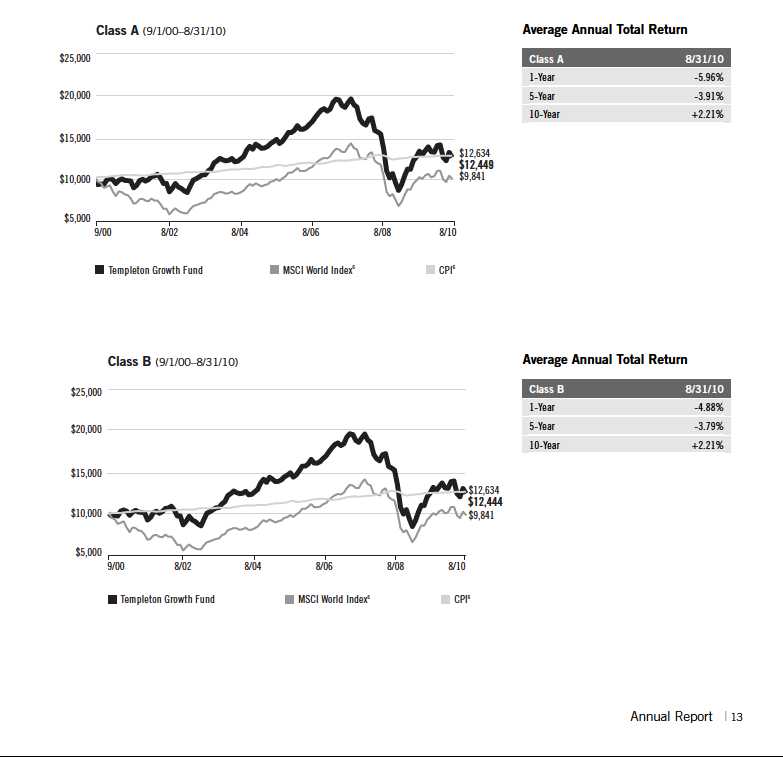

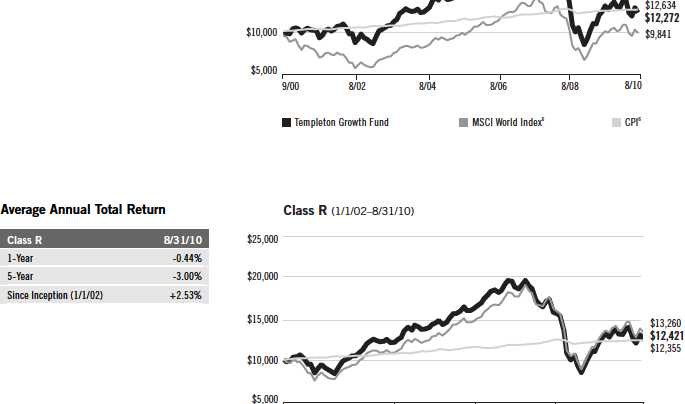

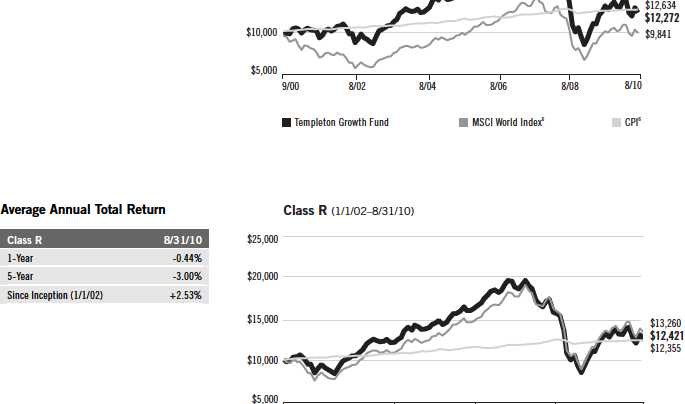

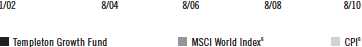

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charges; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

12 | Annual Report

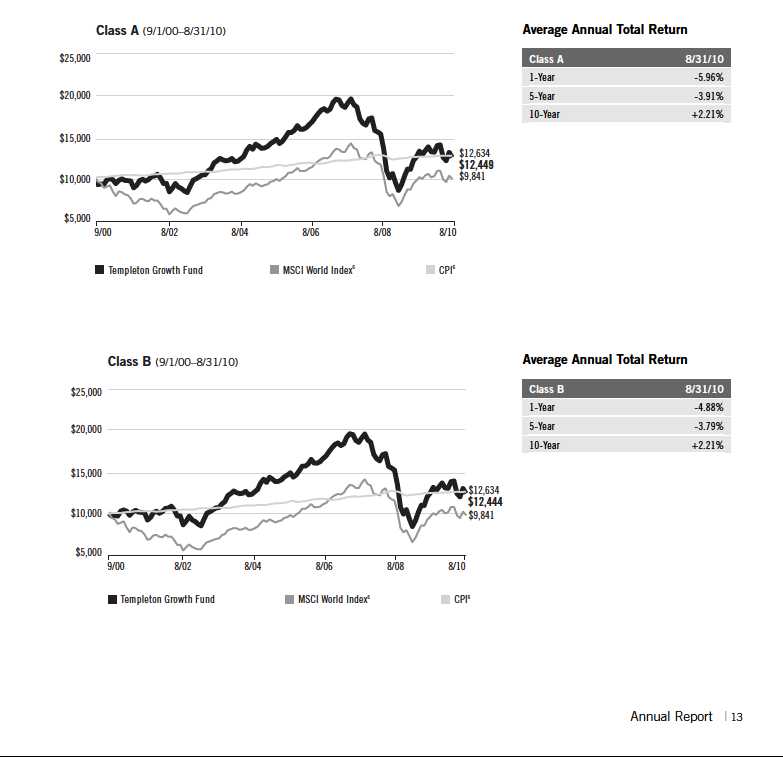

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any current, applicable, maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Performance Summary (continued)

14 | Annual Report

Endnotes

Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in developing markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

6. Source: © 2010 Morningstar. The MSCI World Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance in global developed markets. The Consumer Price Index (CPI), calculated by the U.S. Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

Annual Report | 15

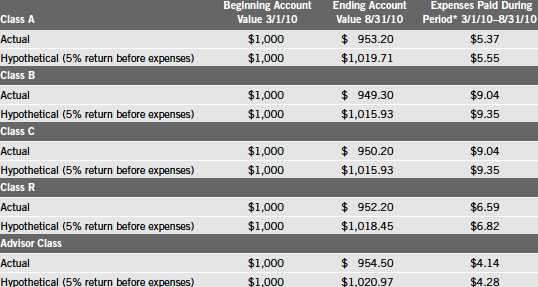

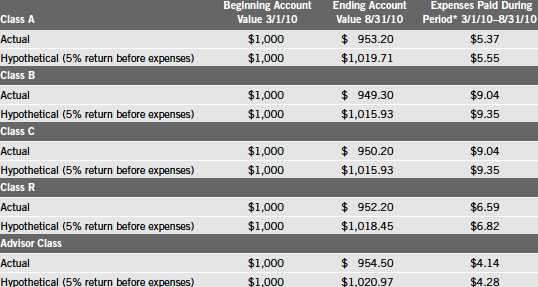

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

Transaction costs, including sales charges (loads) on Fund purchases; and

Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

16 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.09%; B: 1.84%; C: 1.84%; R: 1.34%; and Advisor: 0.84%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

Annual Report | 17

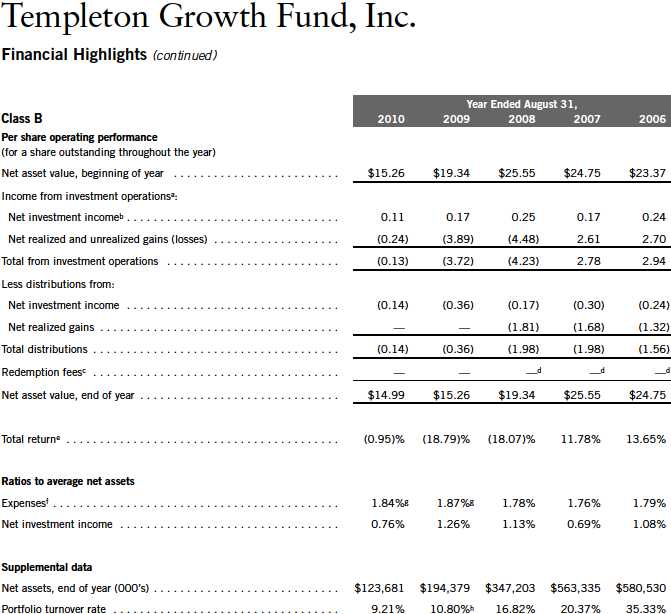

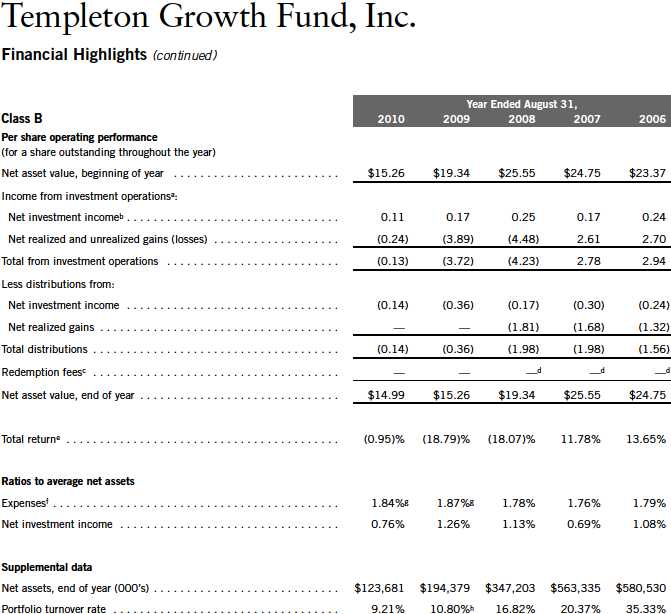

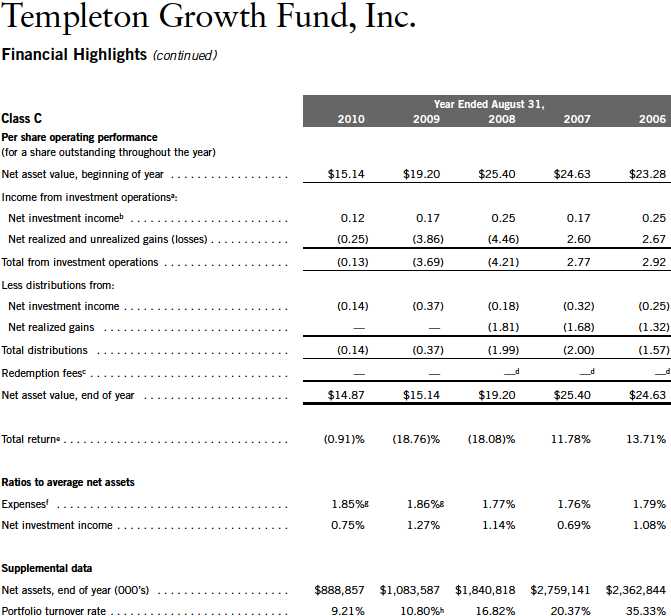

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fBenefit of expense reduction rounds to less than 0.01%.

gBenefit of waiver and payment by affiliate rounds to less than 0.01%.

hExcludes the value of portfolio securities delivered as a result of redemptions in-kind.

18 | The accompanying notes are an integral part of these financial statements. | Annual Report

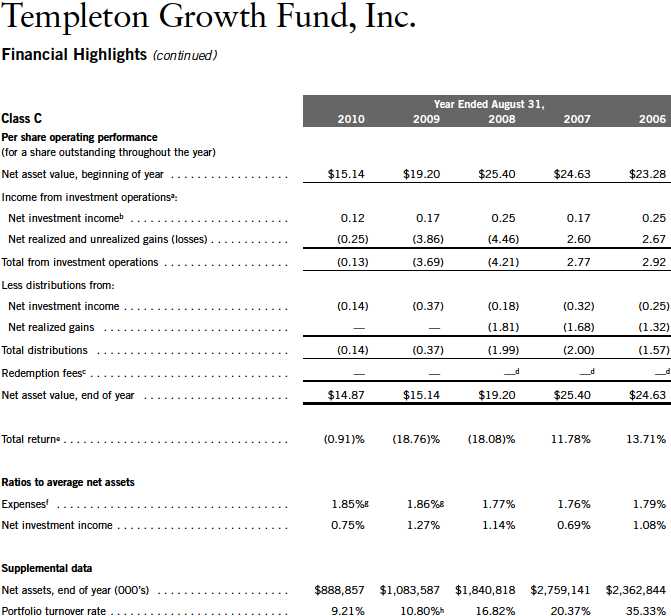

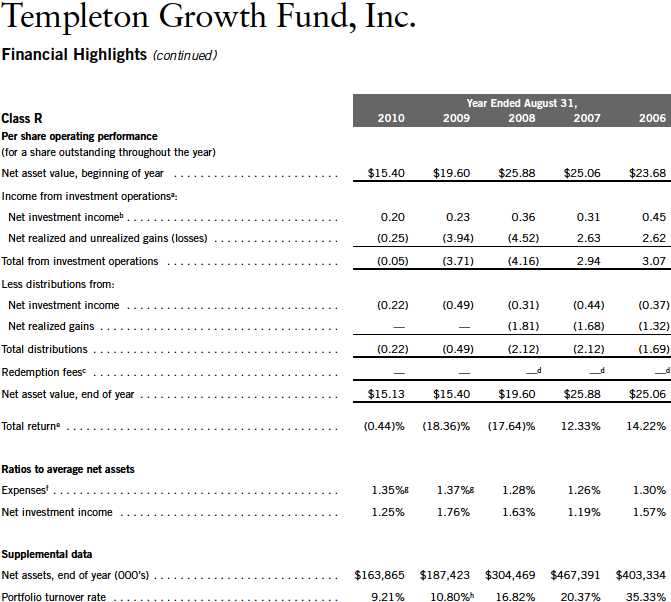

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fBenefit of expense reduction rounds to less than 0.01%.

gBenefit of waiver and payment by affiliate rounds to less than 0.01%.

hExcludes the value of portfolio securities delivered as a result of redemptions in-kind.

Annual Report | The accompanying notes are an integral part of these financial statements. | 19

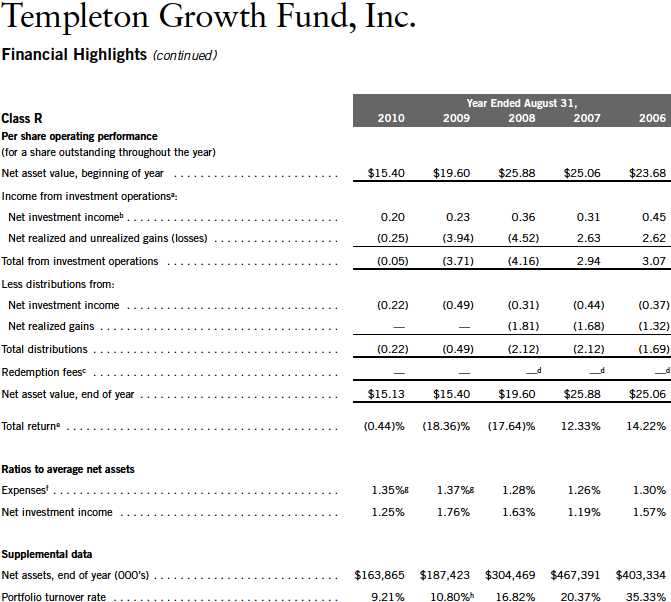

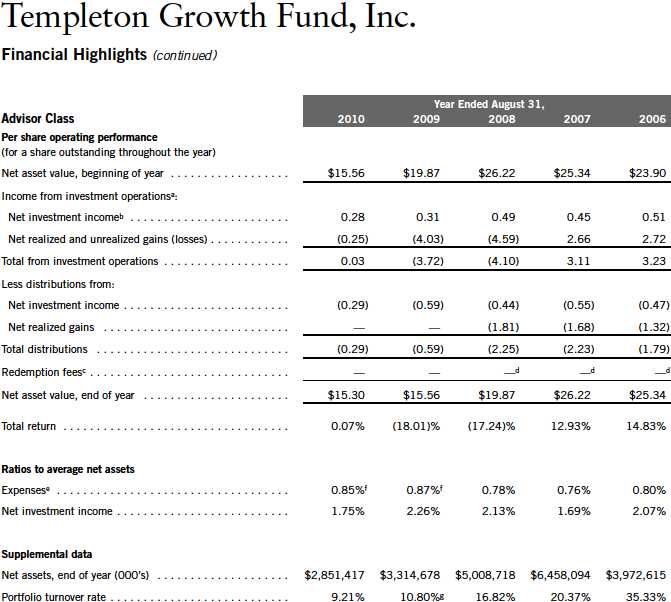

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fBenefit of expense reduction rounds to less than 0.01%.

gBenefit of waiver and payment by affiliate rounds to less than 0.01%.

hExcludes the value of portfolio securities delivered as a result of redemptions in-kind.

20 | The accompanying notes are an integral part of these financial statements. | Annual Report

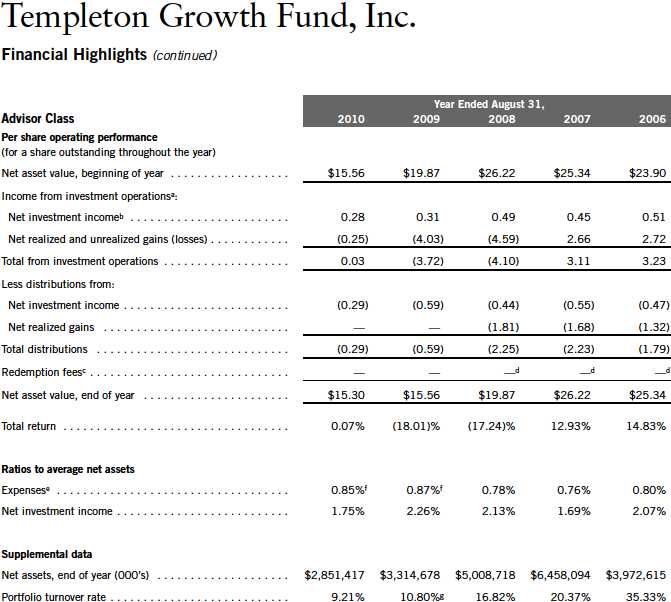

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fBenefit of expense reduction rounds to less than 0.01%.

gBenefit of waiver and payment by affiliate rounds to less than 0.01%.

hExcludes the value of portfolio securities delivered as a result of redemptions in-kind.

Annual Report | The accompanying notes are an integral part of these financial statements. | 21

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payment by affiliate rounds to less than 0.01%.

gExcludes the value of portfolio securities delivered as a result of redemptions in-kind.

22 | The accompanying notes are an integral part of these financial statements. | Annual Report

Annual Report | 23

24 | Annual Report

Annual Report | 25

26 | Annual Report

Templeton Growth Fund, Inc.

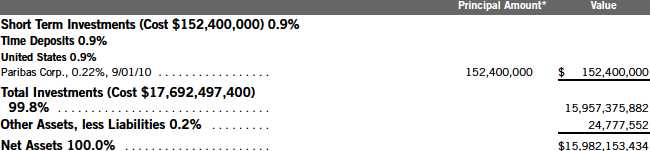

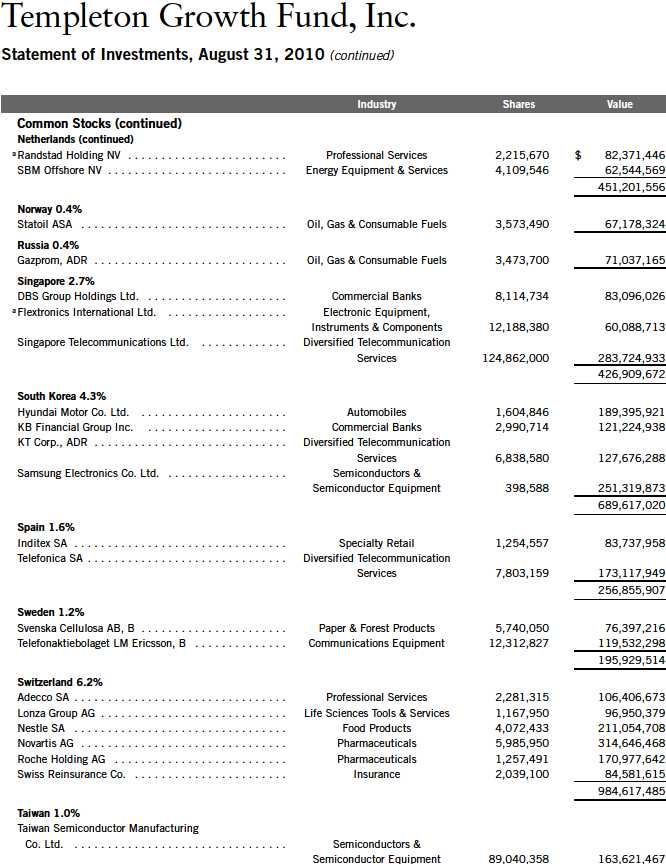

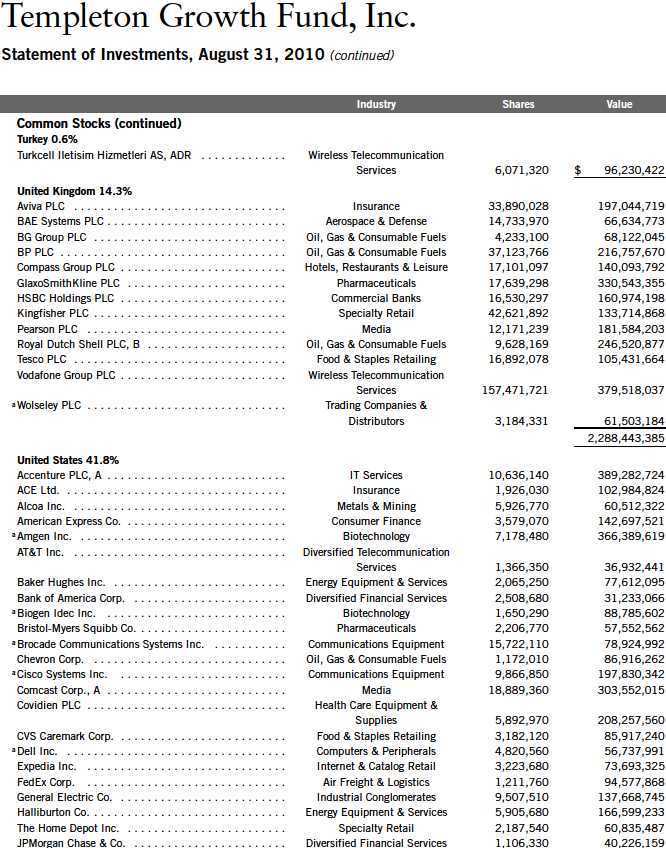

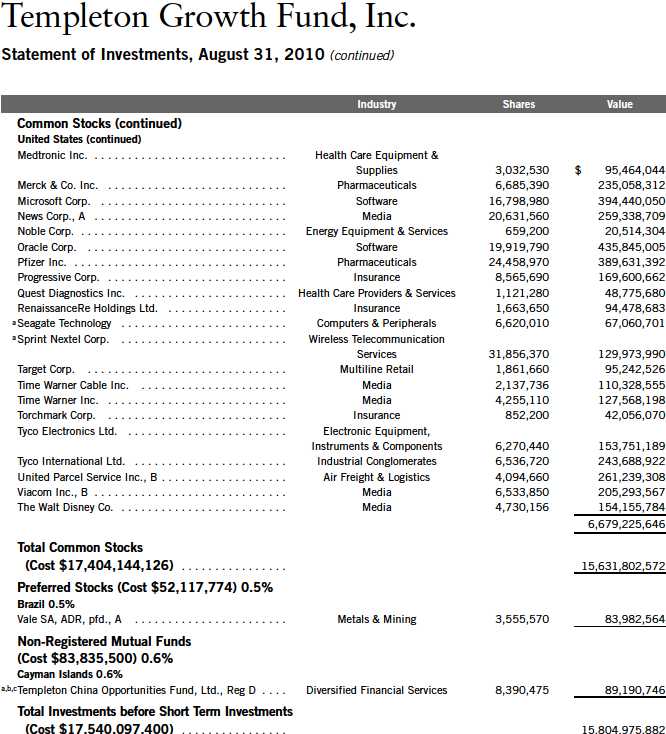

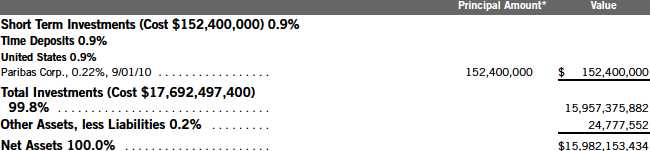

Statement of Investments, August 31, 2010 (continued)

| | See Abbreviations on page 43. |

| * | The principal amount is stated in U.S. dollars unless otherwise indicated. |

| a | Non-income producing. |

| b | See Note 1(c) regarding investment in Templeton China Opportunities Fund, Ltd. |

| c | See Note 9 regarding holdings of 5% voting securities. |

Annual Report | The accompanying notes are an integral part of these financial statements. | 27

28 | The accompanying notes are an integral part of these financial statements. | Annual Report

Annual Report | The accompanying notes are an integral part of these financial statements. | 29

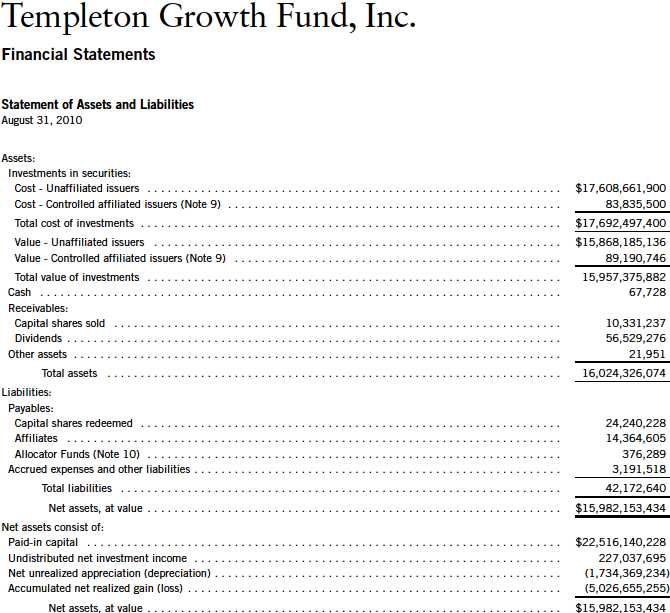

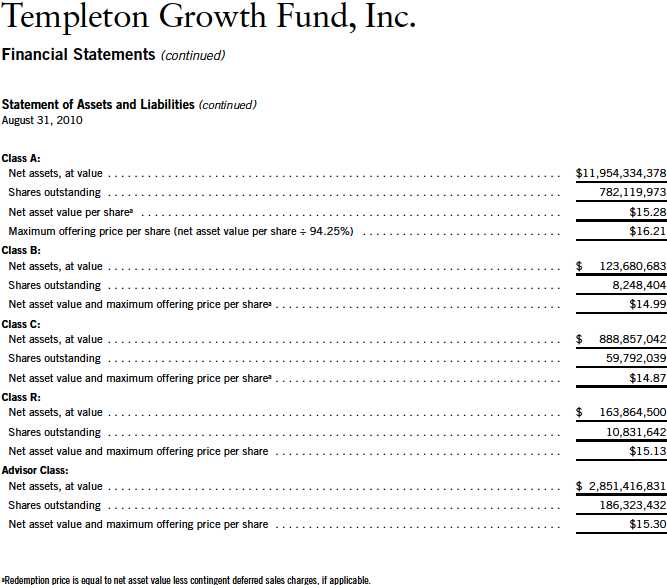

Templeton Growth Fund, Inc.

Financial Statements (continued)

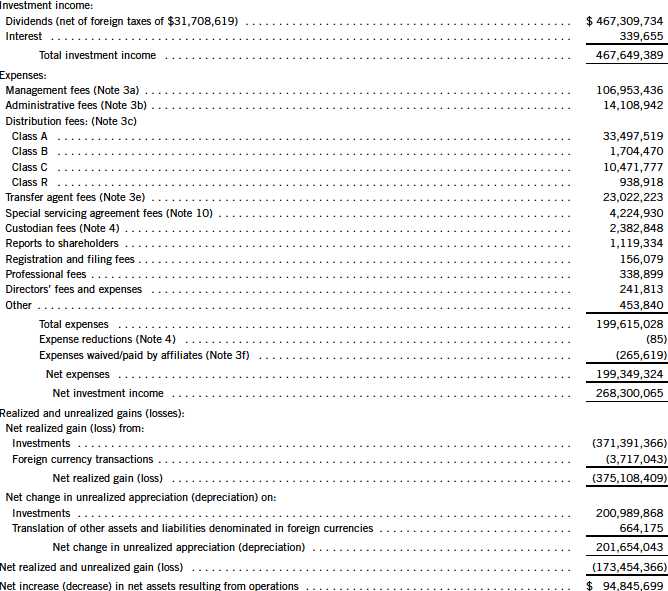

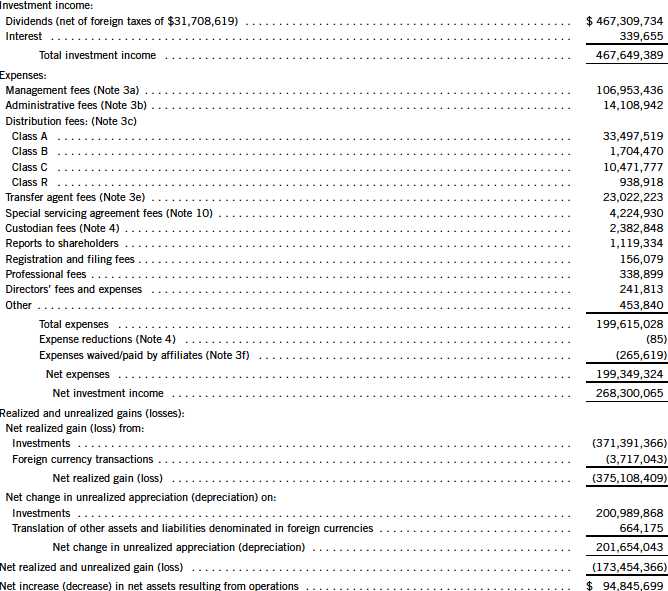

Statement of Operations

for the year ended August 31, 2010 |

30 | The accompanying notes are an integral part of these financial statements. | Annual Report

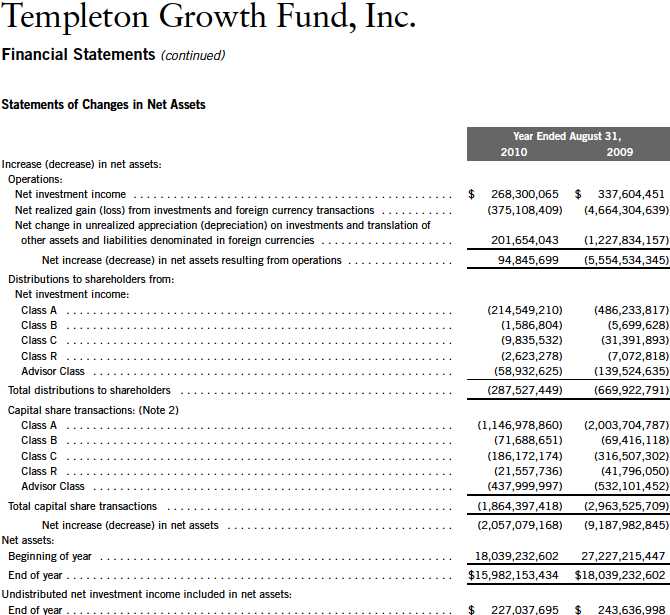

Annual Report | The accompanying notes are an integral part of these financial statements. | 31

Templeton Growth Fund, Inc.

Notes to Financial Statements

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

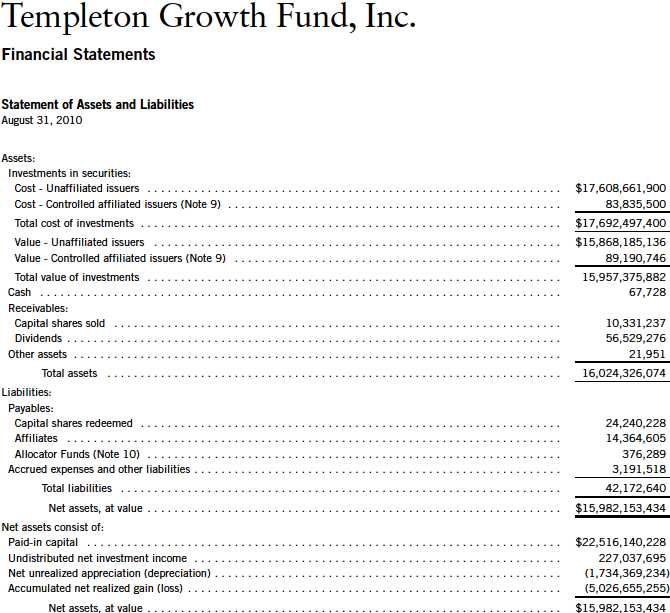

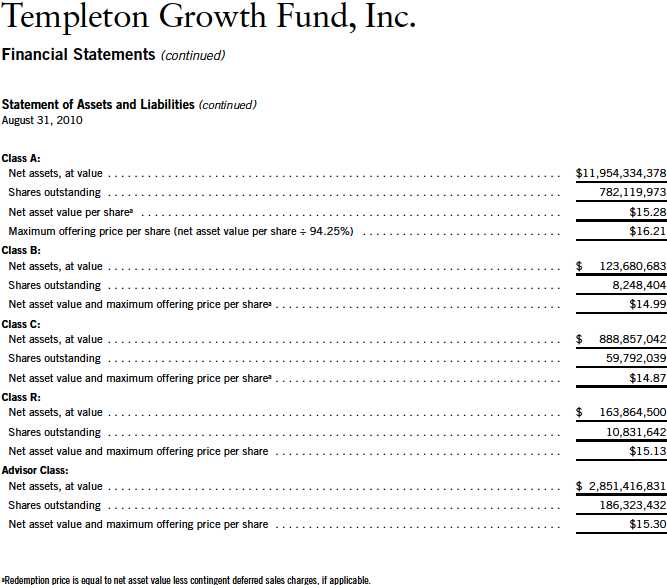

Templeton Growth Fund, Inc. (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company. The Fund offers five classes of shares: Class A, Class B, Class C, Class R, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund values its investments in securities and other assets and liabilities carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Fund’s Board of Directors, the Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in open-end mutual funds are valued at the closing net asset value. Time deposits are valued at cost, which approximates market value.

Debt and certain preferred securities generally trade in the over-the-counter market rather than on a securities exchange. The Fund’s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value. Securities denominated in a foreign curr ency are converted into their U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the date that the values of the foreign debt securities are determined.

32 | Annual Report

Templeton Growth Fund, Inc.

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

The Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

Trading in securities on foreign exchanges and over-the-counter markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the investment manager monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depository Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thres holds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Fund’s Board of Directors.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Annual Report | 33

Templeton Growth Fund, Inc.

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| b. | Foreign Currency Translation (continued) |

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

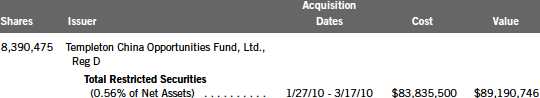

c. Investment in Templeton China Opportunities Fund, Ltd.

The Fund invests in Templeton China Opportunities Fund, Ltd. (China Fund), a private offering of unregistered shares in a Cayman Islands Exempt Company. The China Fund’s investment objective is to seek capital growth primarily through investments in A-shares of Chinese companies listed on the Shanghai and Shenzhen stock exchanges. Chinese A-shares are traded in Chinese Renminbi and are only available as an investment to domestic (Chinese) investors and holders of a Qualified Foreign Institutional Investors license. The China Fund is managed by Templeton Investment Counsel, LLC (an affiliate of the investment manager). No additional management or administrative fees are incurred on assets invested in the China Fund.

Currently, shares of the China Fund are subject to a restriction on redemption set to expire on approximately April 7, 2011. Additionally, the Fund may incur delays in redeeming its investment in the China Fund. The China Fund may be subject to certain restrictions and administrative processes relating to its ability to repatriate cash balances, investment proceeds and earnings associated with its investment, as such activities are subject to approval by agencies of the Chinese government. The Fund’s investment in the China Fund is valued based upon fair value of China Fund’s portfolio securities and other assets and liabilities. See Note 8 regarding restricted securities.

d. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code and to distribute to shareholders substantially all of its taxable income and net realized gains. As a result, no provision for U.S. federal income taxes is required. The Fund files U.S. income tax returns as well as tax returns in certain other jurisdictions. The Fund recognizes in its financial statements the effects including penalties and interest, if any, of a tax position taken on a tax return (or expected to be taken) when it’s more likely than not (a greater than 50% probability), based on the technical merits, that the tax position will be sustained upon examination by the tax authorities. As of August 31, 2010, and for all open tax years, the Fund has determined that no provision for income tax is required in the Fund’s financial statements. Open tax years are those that remain subject to examinati on and are based on each tax jurisdiction statute of limitation. The Fund is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax effects will significantly change in the next twelve months.

34 | Annual Report

Templeton Growth Fund, Inc.

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Income Taxes (continued) |

Foreign securities held by the Fund may be subject to foreign taxation on income received. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. The Fund may be subject to a tax imposed on net realized gains on securities of certain foreign currencies.

e. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their t ax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

f. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

g. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and directors are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

Annual Report | 35

Templeton Growth Fund, Inc.

Notes to Financial Statements (continued)

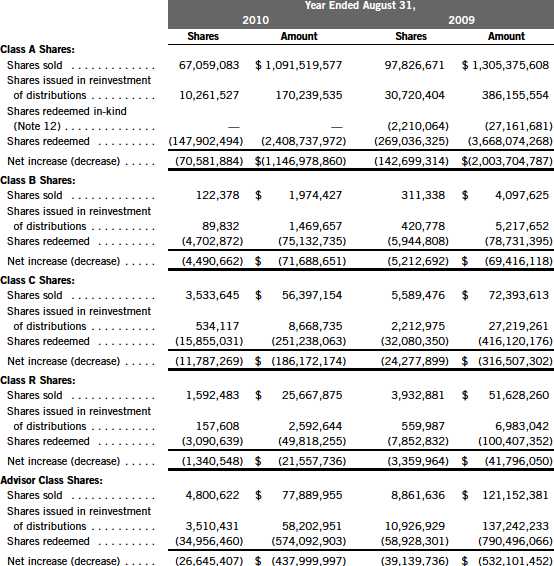

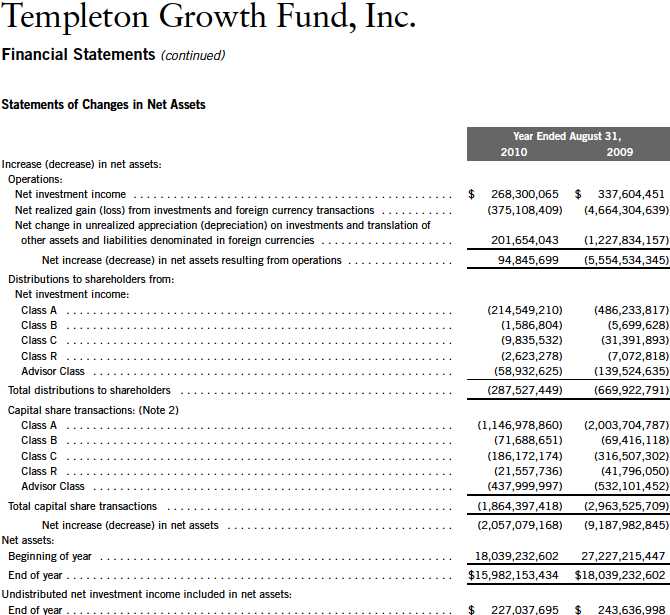

2. CAPITAL STOCK

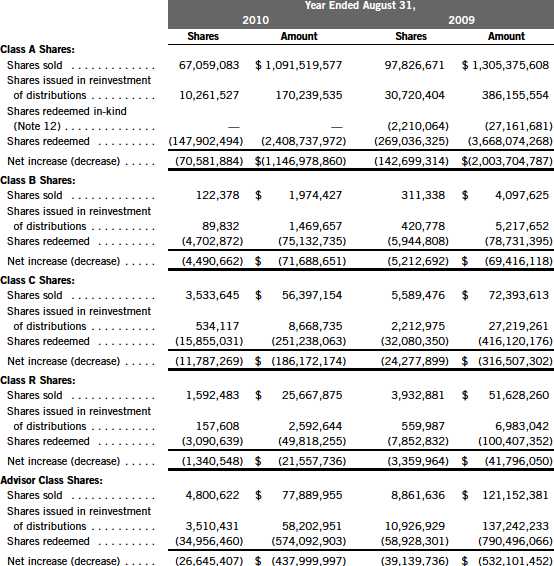

At August 31, 2010, there were 2.4 billion shares authorized ($0.01 par value). Transactions in the Fund’s shares were as follows:

36 | Annual Report

Templeton Growth Fund, Inc.

Notes to Financial Statements (continued)

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and directors of the Fund are also officers and/or directors of the following subsidiaries:

| |

Subsidiary Templeton Global Advisors Limited (TGAL) Franklin Templeton Services, LLC (FT Services) Franklin Templeton Distributors, Inc. (Distributors) Franklin Templeton Investor Services, LLC (Investor Services) | Affiliation Investment manager Administrative manager Principal underwriter Transfer agent |

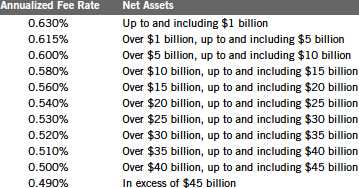

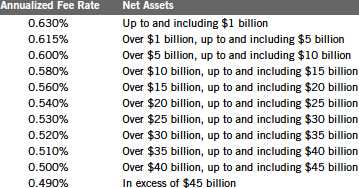

a. Management Fees

The Fund pays an investment management fee to TGAL based on the average daily net assets of the Fund as follows:

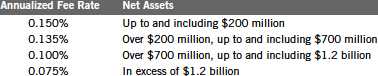

b. Administrative Fees

The Fund pays an administrative fee to FT Services based on the Fund’s average daily net assets as follows:

c. Distribution Fees

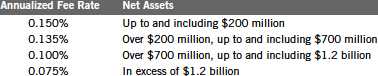

The Fund’s Board of Directors has adopted distribution plans for each share class, with the exception of Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods.

Annual Report | 37

Templeton Growth Fund, Inc.

Notes to Financial Statements (continued)

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| c. | Distribution Fees (continued) |

In addition, under the Fund’s Class B, C, and R compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate for each class.

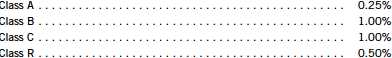

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

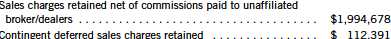

d. Sales Charges/Underwriting Agreements

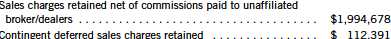

Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the year:

e. Transfer Agent Fees

For the year ended August 31, 2010, the Fund paid transfer agent fees of $23,022,223, of which $15,501,748 was retained by Investor Services.

f. Waiver and Expense Reimbursements

TGAL and FT Services had voluntarily agreed to limit the increase in the Fund’s net annual operating expense ratio that results from the implementation of the Special Servicing Agreement (SSA) to 0.02% through April 30, 2010. See Note 10 regarding the SSA.

4. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the year ended August 31, 2010, the custodian fees were reduced as noted in the Statement of Operations.

38 | Annual Report

Templeton Growth Fund, Inc.

Notes to Financial Statements (continued)

5. INCOME TAXES

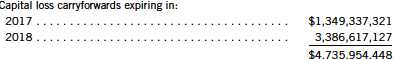

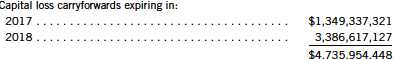

For tax purposes, capital losses may be carried over to offset future capital gains, if any.

At August 31, 2010, the capital loss carryforwards were as follows:

For tax purposes, realized capital losses occurring subsequent to October 31, may be deferred and treated as occurring on the first day of the following fiscal year. At August 31, 2010, the Fund deferred realized capital losses of $270,864,951.

The tax character of distributions paid during the years ended August 31, 2010 and 2009, was as follows:

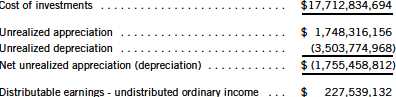

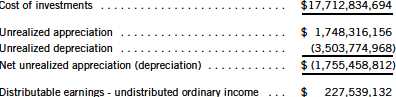

At August 31, 2010, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income for income tax purposes were as follows:

Net investment income differs for financial statement and tax purposes primarily due to differing treatments of foreign currency transactions, regulatory settlements, and bond discounts and premiums.

Net realized gains (losses) differ for financial statement and tax purposes primarily due to differing treatments of wash sales, foreign currency transactions, and bond discounts and premiums.

6. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short term securities) for the year ended August 31, 2010, aggregated $1,622,755,170 and $3,359,699,030, respectively.

Annual Report | 39

Templeton Growth Fund, Inc.

Notes to Financial Statements (continued)

7. CONCENTRATION OF RISK

Investing in foreign securities may include certain risks and considerations not typically associated with investing in U.S. securities, such as fluctuating currency values and changing local and regional economic, political and social conditions, which may result in greater market volatility. In addition, certain foreign securities may not be as liquid as U.S. securities.

8. RESTRICTED SECURITIES

The Fund may invest in securities that are restricted under the Securities Act of 1933 (1933 Act) or which are subject to legal, contractual, or other agreed upon restrictions on resale. Restricted securities are often purchased in private placement transactions, and cannot be sold without prior registration unless the sale is pursuant to an exemption under the 1933 Act. Disposal of these securities may require greater effort and expense, and prompt sale at an acceptable price may be difficult. The Fund may have registration rights for restricted securities. The issuer generally incurs all registration costs.

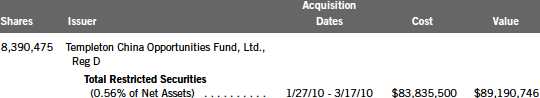

At August 31, 2010, the Fund held investments in restricted securities, excluding certain securities exempt from registration under the 1933 Act deemed to be liquid, as follows:

9. HOLDINGS OF 5% VOTING SECURITIES OF PORTFOLIO COMPANIES

The 1940 Act defines “affiliated companies” to include investments in portfolio companies in which a fund owns 5% or more of the outstanding voting securities. Investments in “affiliated companies” for the Fund for the year ended August 31, 2010, were as shown below.

40 | Annual Report

Templeton Growth Fund, Inc.

Notes to Financial Statements (continued)

10. SPECIAL SERVICING AGREEMENT

The Fund, which is an eligible underlying investment of one or more of the Franklin Templeton Fund Allocator Series Funds (Allocator Funds), participates in a SSA with the Allocator Funds and certain service providers of the Fund and the Allocator Funds. Under the SSA, the Fund may pay a portion of the Allocator Funds’ expenses (other than any asset allocation, administrative, and distribution fees) to the extent such payments are less than the amount of the benefits realized or expected to be realized by the Fund (e.g., due to reduced costs associated with servicing accounts) from the investment in the Fund by the Allocator Funds. The Allocator Funds are either managed by Franklin Advisers, Inc. or administered by FT Services, affiliates of TGAL. For the year ended August 31, 2010, the Fund was held by one or more of the Allocator Funds and was allocated expenses as noted in the Statement of Operations. At August 31 , 2010, 15.39% of the Fund’s outstanding shares was held by one or more of the Allocator Funds.

11. CREDIT FACILITY

The Fund, together with other U.S. registered and foreign investment funds (collectively “Borrowers”), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $750 million (Global Credit Facility) which matures on January 21, 2011. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.10% based upon the unused portion of the Global Credit Facility, which is reflected in other expenses on the Statement of Operations. During the year ended August 31, 2010, the Fund did not use the Global Credit Facility.

12. REDEMPTION IN-KIND

During the year ended August 31, 2009, the Fund realized $11,628,312 of net losses resulting from a redemption in-kind in which a shareholder redeemed fund shares for securities held by the Fund rather than for cash. Because such losses are not taxable to the Fund, and are not netted with capital gains that are distributed to remaining shareholders, they have been reclassified from accumulated net realized losses to paid-in capital.

Annual Report | 41

Templeton Growth Fund, Inc.

Notes to Financial Statements (continued)

13. REGULATORY AND LITIGATION MATTERS

During the year ended August 31, 2010, the Fund received $478,594 resulting from a settlement between the SEC and Franklin Advisers, Inc. (an affiliate of the investment manager) relating to market-timing activities, as previously reported in the Fund’s financial statements during the years ended August 31, 2004 through August 31, 2007. This payment is included in capital share transactions on the Statement of Changes in Net Assets.

14. FAIR VALUE MEASUREMENTS

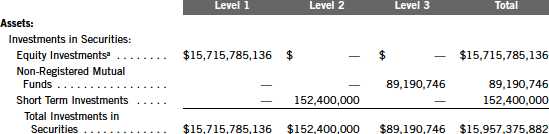

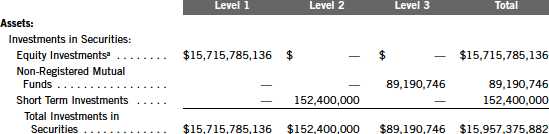

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

The following is a summary of the inputs used as of August 31, 2010, in valuing the Fund’s assets carried at fair value:

aIncludes common and preferred stocks. For detailed industry descriptions, see the accompanying Statement of Investments.

42 | Annual Report

Templeton Growth Fund, Inc.

Notes to Financial Statements (continued)

14. FAIR VALUE MEASUREMENTS (continued)

At August 31, 2010, the reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value, is as follows:

15. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

ABBREVIATIONS

Selected Portfolio

ADR - American Depository Receipt |

Annual Report | 43

Templeton Growth Fund, Inc.

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of Templeton Growth Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Templeton Growth Fund, Inc. (the “Fund”) at August 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted ou r audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at August 31, 2010 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

| | San Francisco, California

October 21, 2010 |

44 | Annual Report

Templeton Growth Fund, Inc.

Tax Designation (unaudited)

Under Section 854(b)(2) of the Internal Revenue Code (Code), the Fund designates 38.09% of the ordinary income dividends as income qualifying for the dividends received deduction for the fiscal year ended August 31, 2010.

Under Section 854(b)(2) of the Code, the Fund designates the maximum amount allowable but no less than $454,865,228 as qualified dividends for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended August 31, 2010. Distributions, including qualified dividend income, paid during calendar year 2010 will be reported to shareholders on Form 1099-DIV in January 2011. Shareholders are advised to check with their tax advisors for information on the treatment of these amounts on their individual income tax returns.

Under Section 871(k)(1)(C) of the Code, the Fund designates the maximum amount allowable but no less than $224,390 as interest related dividends for purposes of the tax imposed under Section 871(a)(1)(A) of the Code for the fiscal year ended August 31, 2010.

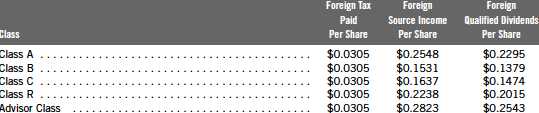

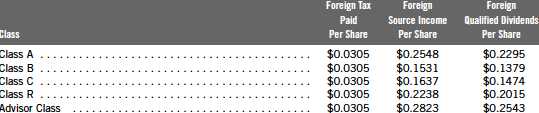

At August 31, 2009, more than 50% of the Fund’s total assets were invested in securities of foreign issuers. In most instances, foreign taxes were withheld from income paid to the Fund on these investments. As shown in the table below, the Fund designates to shareholders the foreign source income and foreign taxes paid, pursuant to Section 853 of the Code. This designation will allow shareholders of record on December 10, 2009, to treat their proportionate share of foreign taxes paid by the Fund as having been paid directly by them. The shareholder shall consider these amounts as foreign taxes paid in the tax year in which they receive the Fund distribution.

The following table provides a detailed analysis of foreign tax paid, foreign source income, and foreign qualified dividends as designated by the Fund, to Class A, Class B, Class C, Class R, and Advisor Class shareholders of record.

Foreign Tax Paid Per Share (Column 1) is the amount per share available to you, as a tax credit (assuming you held your shares in the Fund for a minimum of 16 days during the 31-day period beginning 15 days before the ex-dividend date of the Fund’s distribution to which the foreign taxes relate), or, as a tax deduction.

Annual Report | 45

Templeton Growth Fund, Inc.

Tax Designation (unaudited) (continued)

Foreign Source Income Per Share (Column 2) is the amount per share of income dividends paid to you that is attributable to foreign securities held by the Fund, plus any foreign taxes withheld on these dividends. The amounts reported include foreign source qualified dividends that have not been adjusted for the rate differential applicable to such dividend income.1

Foreign Qualified Dividends Per Share (Column 3) is the amount per share of foreign source qualified dividends the Fund paid to you, plus any foreign taxes withheld on these dividends. These amounts represent the portion of the Foreign Source Income reported to you in column 2 that were derived from qualified foreign securities held by the Fund.1

In January 2010, shareholders received Form 1099-DIV which included their share of taxes paid and foreign source income distributed during the calendar year 2009. The Foreign Source Income reported on Form 1099-DIV has not been adjusted for the rate differential on foreign source qualified dividend income. Shareholders are advised to check with their tax advisors for information on the treatment of these amounts on their 2009 individual income tax returns.

1Qualified dividends are taxed at reduced long term capital gain tax rates. In determining the amount of foreign tax credit that may be applied against the U.S. tax liability of individuals receiving foreign source qualified dividends, adjustments may be required to the foreign tax credit limitation calculation to reflect the rate differential applicable to such dividend income. The rules however permit certain individuals to elect not to apply the rate differential adjustments for capital gains and/or dividends for any taxable year. Please consult your tax advisor and the instructions to Form 1116 for more information.

46 | Annual Report

Templeton Growth Fund, Inc.

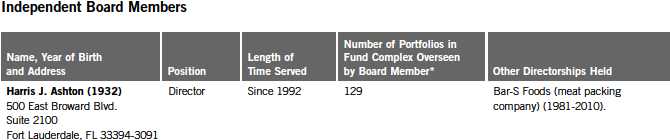

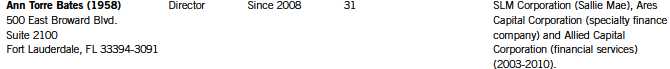

Board Members and Officers

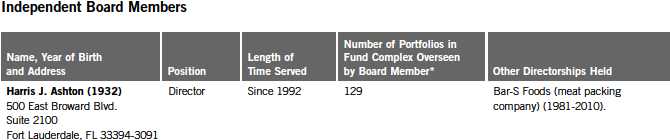

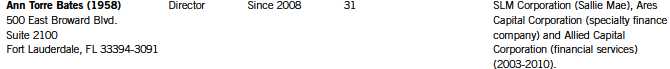

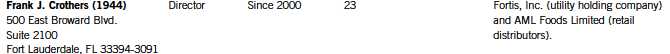

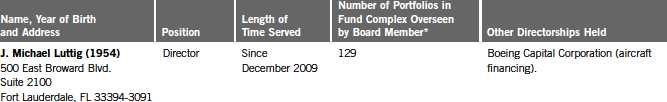

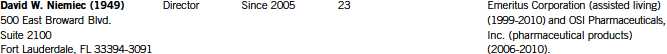

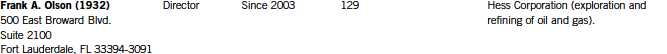

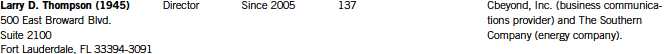

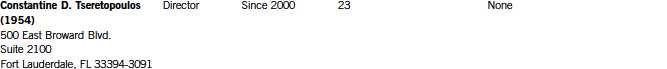

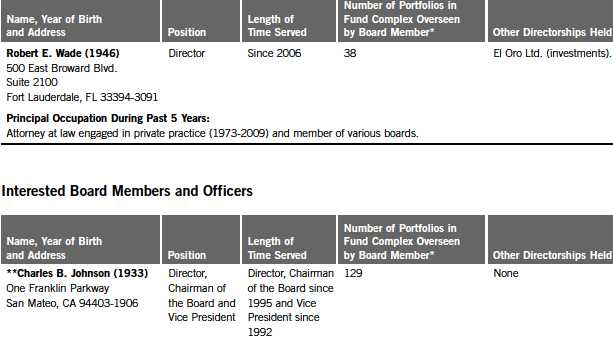

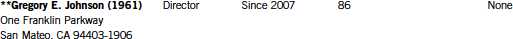

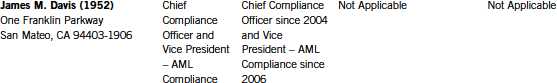

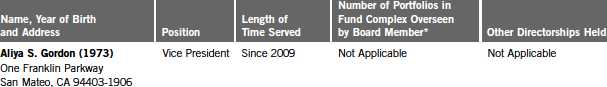

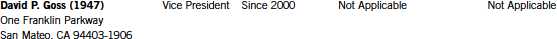

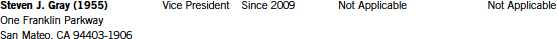

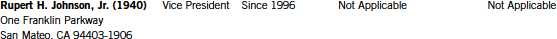

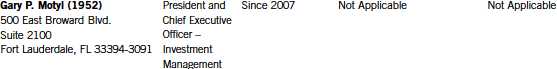

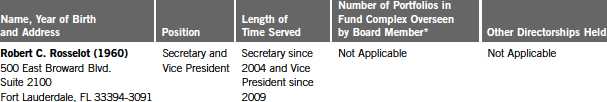

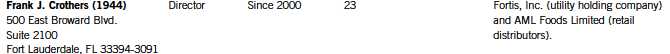

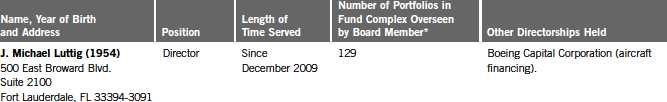

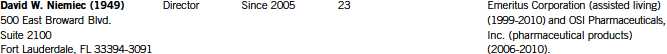

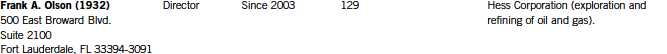

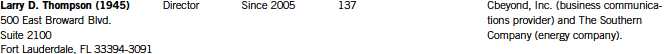

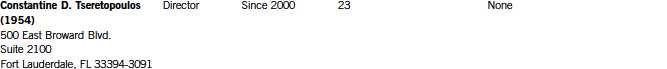

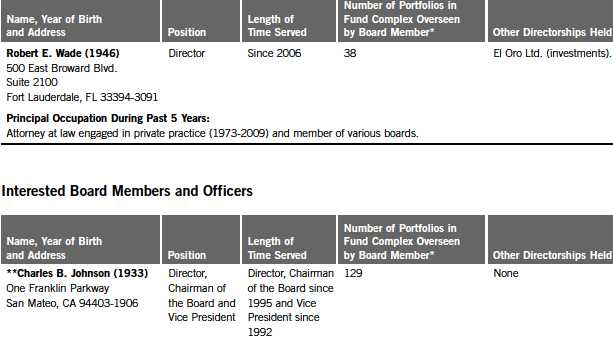

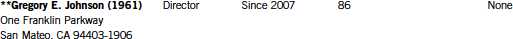

The name, year of birth and address of the officers and board members, as well as their affiliations, positions held with the Fund, principal occupations during the past five years and number of U.S. registered portfolios overseen in the Franklin Templeton Investments fund complex are shown below. Generally, each board member serves until that person’s successor is elected and qualified.

Principal Occupation During Past 5 Years:

Director of various companies; and formerly, Director, RBC Holdings, Inc. (bank holding company) (until 2002); and President, Chief Executive Officer and Chairman of the Board, General Host Corporation (nursery and craft centers) (until 1998).

Principal Occupation During Past 5 Years:

Independent strategic and financial consultant; and formerly, Executive Vice President and Chief Financial Officer, NHP Incorporated (manager of multifamily housing) (1995-1997); and Vice President and Treasurer, US Airways, Inc. (until 1995).

Principal Occupation During Past 5 Years:

Director and Vice Chairman, Caribbean Utilities Company, Ltd.; director of various other private business and nonprofit organizations; and formerly, Chairman, Atlantic Equipment and Power Ltd. (1977-2003).

Principal Occupation During Past 5 Years:

Director or Trustee of various companies and trusts; and formerly, Assistant to the President of the United States and Secretary of the Cabinet (1990-1993); General Counsel to the United States Treasury Department (1989-1990); and Counselor to the Secretary and Assistant Secretary for Public Affairs and Public Liaison-United States Treasury Department (1988-1989).

Annual Report | 47

Principal Occupation During Past 5 Years:

Executive Vice President, General Counsel and member of Executive Council, The Boeing Company; and formerly, Federal Appeals Court Judge, U.S. Court of Appeals for the Fourth Circuit (1991-2006).

Principal Occupation During Past 5 Years:

Advisor, Saratoga Partners (private equity fund); and formerly, Managing Director, Saratoga Partners (1998-2001) and SBC Warburg Dillon Read (investment banking) (1997-1998); Vice Chairman, Dillon, Read & Co. Inc. (investment banking) (1991-1997); and Chief Financial Officer, Dillon, Read & Co. Inc. (1982-1997).

Principal Occupation During Past 5 Years:

Chairman Emeritus, The Hertz Corporation (car rental) (since 2000) (Chairman of the Board (1980-2000) and Chief Executive Officer (1977-1999)); and formerly, Chairman of the Board, President and Chief Executive Officer, UAL Corporation (airlines).

Principal Occupation During Past 5 Years:

Senior Vice President – Government Affairs, General Counsel and Secretary, PepsiCo, Inc. (consumer products); and formerly, Director, Delta Airlines (aviation) (2003-2005) and Providian Financial Corp. (credit card provider) (1997-2001); Senior Fellow of The Brookings Institution (2003-2004); Visiting Professor, University of Georgia School of Law (2004); and Deputy Attorney General, U.S. Department of Justice (2001-2003).

Principal Occupation During Past 5 Years:

Physician, Chief of Staff, owner and operator of the Lyford Cay Hospital (1987-present); director of various nonprofit organizations; and formerly, Cardiology Fellow, University of Maryland (1985-1987) and Internal Medicine Resident, Greater Baltimore Medical Center (1982-1985).

48 | Annual Report

Principal Occupation During Past 5 Years:

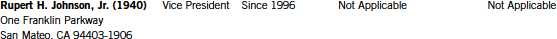

Chairman of the Board, Member – Office of the Chairman and Director, Franklin Resources, Inc.; and officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 41 of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

Director, President and Chief Executive Officer, Franklin Resources, Inc.; and officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 33 of the investment companies in Franklin Templeton Investments.

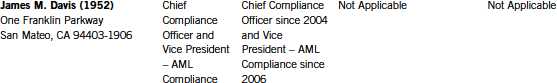

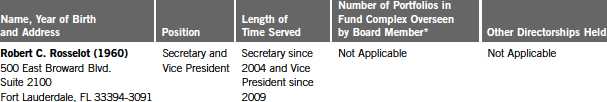

Principal Occupation During Past 5 Years:

Director, Global Compliance, Franklin Resources, Inc.; officer of some of the other subsidiaries of Franklin Resources, Inc. and of 45 of the investment companies in Franklin Templeton Investments; and formerly, Director of Compliance, Franklin Resources, Inc. (1994-2001).

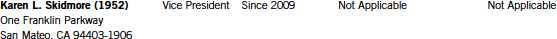

Principal Occupation During Past 5 Years:

Senior Vice President, Franklin Templeton Services, LLC; officer of 45 of the investment companies in Franklin Templeton Investments; and formerly, Director and member of Audit and Valuation Committees, Runkel Funds, Inc. (2003-2004); Assistant Treasurer of most of the investment companies in Franklin Templeton Investments (1997-2003); and Vice President, Franklin Templeton Services, LLC (1997-2003).

Annual Report | 49

Principal Occupation During Past 5 Years:

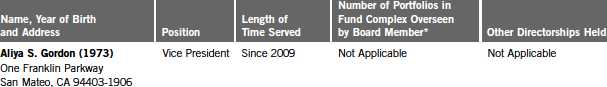

Associate General Counsel, Franklin Templeton Investments; officer of 45 of the investment companies in Franklin Templeton Investments; and formerly, Litigation Associate, Steefel, Levitt & Weiss, LLP (2000-2004).

Principal Occupation During Past 5 Years:

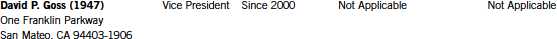

Senior Associate General Counsel, Franklin Templeton Investments; and officer and/or director, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 45 of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

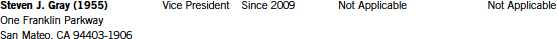

Senior Associate General Counsel, Franklin Templeton Investments; Vice President, Franklin Templeton Distributors, Inc.; and officer of 45 of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

Vice Chairman, Member – Office of the Chairman and Director, Franklin Resources, Inc.; Director, Franklin Advisers, Inc.; Senior Vice President, Franklin Advisory Services, LLC; and officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 25 of the investment companies in Franklin Templeton Investments.

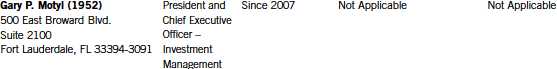

Principal Occupation During Past 5 Years:

President, Templeton Investment Counsel, LLC; Executive Vice President, Franklin Templeton Institutional, LLC; and officer and/or director of some of the other subsidiaries of Franklin Resources, Inc. and of six of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

Director, Global Fund Accounting Operations, Franklin Templeton Investments; and officer of 14 of the investment companies in Franklin Templeton Investments.

50 | Annual Report

Principal Occupation During Past 5 Years:

Senior Associate General Counsel, Franklin Templeton Investments; Assistant Secretary, Franklin Resources, Inc.; Vice President and Secretary, Templeton Investment Counsel, LLC; Vice President, Secretary and Trust Officer, Fiduciary Trust International of the South; and officer of 45 of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

Senior Associate General Counsel, Franklin Templeton Investments; and officer of 45 of the investment companies in Franklin Templeton Investments.

Principal Occupation During Past 5 Years:

General Counsel and Executive Vice President, Franklin Resources, Inc.; officer of some of the other subsidiaries of Franklin Resources, Inc. and of 45 of the investment companies in Franklin Templeton Investments; and formerly, Partner, Shearman & Sterling, LLP (2004-2005); and General Counsel, Investment Company Institute (ICI) (1997-2004).

*We base the number of portfolios on each separate series of the U.S. registered investment companies within the Franklin Templeton Investments fund complex. These portfolios have a common investment manager or affiliated investment managers.

**Charles B. Johnson is considered to be interested person of the Trust under the federal securities laws due to his position as officer and director and major shareholder of Franklin Resources, Inc. (Resources), which is the parent company of the Trust’s investment manager and distributor. Gregory E. Johnson is considered to be interested person of the Trust under the federal securities laws due to his position as officer and director Resources.

Note 1: Charles B. Johnson and Rupert H. Johnson, Jr. are brothers and the father and uncle, respectively, of Gregory E. Johnson.

Note 2: Officer information is current as of the date of this report. It is possible that after this date, information about officers may change.

The Sarbanes-Oxley Act of 2002 and Rules adopted by the U.S. Securities and Exchange Commission require the Fund to disclose whether the Fund’s Audit Committee includes at least one member who is an audit committee financial expert within the meaning of such Act and Rules. The Fund's Board has determined that there is at least one such financial expert on the Audit Committee and has designated each of Ann Torre Bates and David W. Niemiec as an audit committee financial expert. The Board believes that Ms. Bates and Mr. Niemiec qualify as such an expert in view of their extensive business background and experience. Ms. Bates has served as a member of the Fund Audit Committee since 2008. She currently serves as a director of SLM Corporation and Ares Capital Corporation and was formerly a director of Allied Capital Corporation from 2003 to 2010, Executive Vice President and Chief Financial Officer of NHP Incorporated and Vice Presi dent and Treasurer of US Airways, Inc. Mr. Niemiec has served as a member of the Fund Audit Committee since 2005, currently serves as an Advisor to Saratoga Partners and was formerly its Managing Director from 1998 to 2001. Mr. Niemiec is formerly a director of Emeritus Corporation from 1999 to 2010 and OSI Pharmaceuticals, Inc. from 2006 to 2010, Managing Director of SBC Warburg Dillon Read from 1997 to 1998, and was Vice Chairman from 1991 to 1997 and Chief Financial Officer from 1982 to 1997 of Dillon, Read & Co. Inc. As a result of such background and experience, the Board believes that Ms. Bates and Mr. Niemiec have each acquired an understanding of generally accepted accounting principles and financial statements, the general application of such principles in connection with the accounting estimates, accruals and reserves, and analyzing and evaluating financial statements that present a breadth and level of complexity of accounting issues generally comparable to those of the Fund, as well as an understanding of internal controls and procedures for financial reporting and an understanding of audit committee functions. Ms. Bates and Mr. Niemiec are independent Board members as that term is defined under the applicable U.S. Securities and Exchange Commission Rules and Releases.

The Statement of Additional Information (SAI) includes additional information about the board members and is available, without charge, upon request. Shareholders may call (800) DIAL BEN/(800) 342-5236 to request the SAI.

Annual Report | 51

Templeton Growth Fund, Inc.

Shareholder Information

Board Review of Investment Management Agreement

At a meeting held May 18, 2010, the Board of Directors (Board), including a majority of non-interested or independent Directors, approved renewal of the investment management agreement for the Fund. In reaching this decision, the Board took into account information furnished throughout the year at regular Board meetings, as well as information prepared specifically in connection with the annual renewal review process. Information furnished and discussed throughout the year included investment performance reports and related financial information for the Fund, as well as periodic reports on shareholder services, legal, compliance, pricing, brokerage commissions and execution and other services provided by the Investment Manager (Manager) and its affiliates. Information furnished specifically in connection with the renewal process included a report for the Fund prepared by Lipper, Inc. (Lipper), an independent organization, as well as additional mater ial, including a Fund profitability analysis report prepared by management. The Lipper report compared the Fund’s investment performance and expenses with those of other mutual funds deemed comparable to the Fund as selected by Lipper. The Fund profitability analysis report discussed the profitability to Franklin Templeton Investments from its overall U.S. fund operations, as well as on an individual fund-by-fund basis. Included with such profitability analysis report was information on a fund-by-fund basis listing portfolio managers and other accounts they manage, as well as information on management fees charged by the Manager and its affiliates to U.S. mutual funds and other accounts, including management’s explanation of differences where relevant and a three-year expense analysis with an explanation for any increase in expense ratios. Additional material accompanying such report was a memorandum prepared by management describing project initiatives and capital investments relating to the servi ces provided to the Fund by the Franklin Templeton Investments organization, as well as a memorandum relating to economies of scale and a comparative analysis concerning transfer agent fees charged the Fund.

In considering such materials, the independent Directors received assistance and advice from and met separately with independent counsel. In approving continuance of the investment management agreement for the Fund, the Board, including a majority of independent Directors, determined that the existing management fee structure was fair and reasonable and that continuance of the investment management agreement was in the best interests of the Fund and its shareholders. While attention was given to all information furnished, the following discusses some primary factors relevant to the Board’s decision.

NATURE, EXTENT AND QUALITY OF SERVICES. The Board was satisfied with the nature and quality of the overall services provided by the Manager and its affiliates to the Fund and its shareholders. In addition to investment performance and expenses discussed later, the Board’s opinion was based, in part, upon periodic reports furnished it showing that the investment policies and restrictions for the Fund were consistently complied with as well as other reports periodically furnished the Board covering matters such as the compliance of portfolio managers and other management personnel with the code of ethics adopted throughout the Franklin Templeton fund complex, the adherence to fair value pricing procedures established by the

52 | Annual Report

Templeton Growth Fund, Inc.

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)