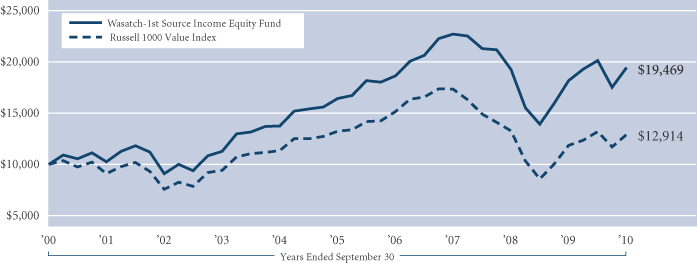

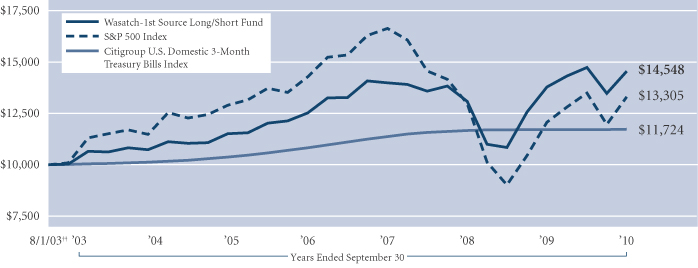

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04920

WASATCH FUNDS TRUST

(Exact name of registrant as specified in charter)

150 Social Hall Avenue

4th Floor

Salt Lake City, Utah 84111

(Address of principal executive offices)(Zip code)

| | |

(Name and Address of Agent for Service) | | Copy to: |

Samuel S. Stewart, Jr. Wasatch Funds Trust 150 Social Hall Avenue, 4th Floor Salt Lake City, Utah 84111 | | Eric F. Fess, Esq. Chapman & Cutler LLP 111 West Monroe Street Chicago, IL 60603 |

Registrant’s telephone number, including area code: (801) 533-0777

Date of fiscal year end: September 30

Date of reporting period: September 30, 2010

| Item 1: | Report to Shareholders. |

Annual Report & Commentaries

September 30, 2010-11-30

WASATCH

FUNDS

Deeper, Disciplined Investing

Wasatch Core Growth Fund

Wasatch Emerging Markets Small Cap Fund

Wasatch Global Opportunities Fund

Wasatch Global Science & Technology Fund

Wasatch Heritage Growth Fund

Wasatch International Growth Fund

Wasatch International Opportunities Fund

Wasatch Micro Cap Fund

Wasatch Micro Cap Value Fund

Wasatch Small Cap Growth Fund

Wasatch Small Cap Value Fund

Wasatch Strategic Income Fund

Wasatch Ultra Growth Fund

Wasatch-1st Source Income Equity Fund

Wasatch-1st Source Long/Short Fund

Wasatch-Hoisington U.S. Treasury Fund

Wasatch-1st Source Income Fund

EQUITY FUNDS

BOND FUNDS (SUB-ADVISED)

September 30, 2010

Annual Report &

Commentaries

Annual Report & Commentaries

September 30, 2010-11-30

WASATCH

FUNDS

Deeper, Disciplined Investing

Thank you for your investment in Wasatch Funds. We hope this report

will be helpful to you in understanding each of the funds within the Wasatch family.

As a reminder, manager commentaries can always be found on our website

www.WasatchFunds.com approximately three weeks after the end of each calendar

quarter.

Who we are.

We are a research driven, employee owned firm managing no-load mutual funds. Located at the foot of the Wasatch

Mountains in Salt Lake City, Utah, we are far away from Wall Street and its herd mentality. Our portfolio managers

are independent, yet collaborative, thinkers who bring substantial experience to their funds.

Where we came from.

Founded in 1975, by Dr. Sam Stewart, we initially focused on growth investing in small companies. Using a fundamental,

bottom up research method we looked for market inefficiencies relative to the long term growth potential of

lesser known companies. Investing in small, harder to find companies required a disciplined, rigorous and independent

research process. Over time, Wasatch added more research professionals and began applying the same successful

process to investing in micro, value, international, and larger companies.

What we believe.

We believe in common sense investing, involving deep due diligence, cross-team collaboration, and commitment to

discipline, as we follow our central investment philosophy of:

“Earnings Growth Drives Stock Prices Over the Long Term”

What we do.

We utilize a proven and repeatable process to uncover interesting companies. We look deeper to find and understand

each company. We leverage portfolio managers from across the firm to fully vet each investment idea. We stay true

to our investment style. We close funds before they get too large in order to protect shareholders. We seek to deliver

above-average returns over the long-term, and we strive in every way to earn the trust of our shareholders.

If your have any questions please visit our website www.WasatchFunds.com or feel free to call

us Monday through Friday 7am – 7pm CT at 1.800.551.1700.

Investing in small cap funds will be volatile and loss of principle could be greater than investing in large cap or

more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such

as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. An

investor should consider investment objectives, risks, charges and expenses carefully before investing. To obtain a

prospectus, which contains this and other information, visit www.wasatchfunds.com or call 800.551.1700. Please

read the prospectus carefully before investing. Wasatch Funds are distributed by ALPS Distributors, Inc.

What makes Wasatch different?

Deeper – We use an intensely thorough process to fully understand each investment.

Disciplined – We stick to our process and investment style regardless of market fads.

Collaborative – We work across portfolios to leverage valuable experience and research insights.

Independent – We do our own research to avoid getting caught in the herd.

Wasatch Funds

Salt Lake City, Utah

www.wasatchfunds.com

800.551.1700

This material must be accompanied or preceded by a prospectus.

Please read the prospectus carefully before you invest.

Wasatch Funds are distributed by ALPS Distributors, Inc.

1

| | |

| LETTERTO SHAREHOLDERS —“MOREOFTHE SAME” | | |

|

| |

| |

| | |

Samuel S. Stewart, Jr. PhD, CFA President of

Wasatch Funds | | DEAR FELLOW SHAREHOLDERS: ECONOMY Last year I used an analogy of crossing a white water river and then having to climb a steep riverbank to describe our economic situation. Well, we seem to have finally made it to the top of the riverbank. Unfortunately, what we can see from the top of the bank is that we have a long, dusty, uphill road still ahead to make it back to town. In my recent quarterly letters I have been discussing the long-term structural challenges that our economy faces — the most concerning being reduced access to credit, continuing high unemployment, and increasing government debt and regulatory burdens. Reflecting on these concerns, I would describe this quarter’s economic progress as just more of the same, as we have not seen a meaningful change in these metrics. I have expected them to be slow to improve, but for the moment it feels like we have paused at the top of the riverbank to catch our breath before beginning the long walk to town. There has been quite a bit of talk recently about a double-dip recession — sliding back down the riverbank. I am less concerned about such a risk and more focused on what it’s going to take to hike back to town. The |

government played an important role in keeping us from getting swept down the river at the height of the crisis, but now it is up to the people to get the economy restarted using our inherent ingenuity, entrepreneurial spirit, and hard work.

Outside of the U.S., I believe Europe is in an even tougher spot because the continent faces similar challenges to ours while also trying to tie disparate countries together with only a monetary union. It may be surprising to many, but emerging countries have best weathered the financial and economic storm and are positioned for continued growth. Although not considered “developed” economies, emerging countries were actually well ahead of the developed world in intelligent self-management — or perhaps more accurately, developed countries extended themselves beyond intelligent self-management.

Emerging economies are not getting everything right and have felt pain as well, but many are in better shape than developed countries. A recent Barron’s article noted that the U.K. and the U.S. have actually nationalized more companies during the financial crisis than were nationalized in Africa over the last nine years.1 Brazil’s and India’s banks have been solid throughout the financial crisis because those countries have regulations that limited the risk banks could undertake in the form of loan quality, leverage, and the like.

MARKET

The S&P 500 is up just over 10% for the past 12 months but, as market watchers know, it has not been a steady ride. Between February and April we saw the market rise almost 14% just to watch those gains and more vanish by the beginning of July. As people asked me about the falling market in May and June, I described the situation as “a change in perception, not a change in reality.” It appeared to me that the market had gotten ahead of the economic recovery as investors reacted to short-term data and chose not to acknowledge the longer-term challenges our economy faces. Events like the Greek financial crisis this spring caused investors to finally pause and at least temporarily consider these deeper issues.

Of the past year’s market gains, roughly 90% came in what was an unusually strong September — the S&P 500 gained about 9%. I am surprised to see just how momentum-driven the market remains. At times it feels to me like investors have failed to learn a lesson from the recent crisis, and that they remain incredibly shortsighted. As a result, the current market has created an interesting dichotomy — companies that are really doing well are getting all of the attention, while strong companies that are only firing on six of their eight cylinders are being overlooked. This makes it a good time to take some profits on stocks whose prices are moving up as well as to re-invest in forgotten companies that are well-positioned for the future but not yet firing on all cylinders.

We are also seeing a determined search for yield by investors, primarily through a continuing flight to bonds. This is partly driven by increased fear of the equity markets and partly by the investment needs of retiring baby boomers. As I’ve mentioned in recent quarters, I’m afraid that many of these bond investors are taking on more risk than they realize. Bond funds have been delivering unsustainably high returns as bond prices have been driven up by historically low interest rates and heavy demand. When interest rates begin to rise again we will likely see bond funds with negative returns.

In this quest for yield we are also seeing investors increasingly buying high yield bonds, perhaps without realizing the quality implications. I find this somewhat ironic since similar low-quality securities led to the financial crisis just two years ago. I’m concerned that new bond investors may not realize the risks they are accepting — interest rate risk and credit risk — because of the common misperception many investors have of all bonds being low risk by nature.

Meanwhile, blue chip stocks are being passed over despite offering attractive yields and trading at historically low valuations.

Given such incongruities, I expect that we will continue to experience a seesaw market, but overall I think the U.S. and European equity markets are likely to be sluggish over the next 12 months as we continue to work through our economic challenges.

WASATCH

Wasatch Funds had another successful year, with most of our funds outpacing their benchmark indices (please see individual fund performance on the following portfolio summary pages). I have been happy to report good years in 2009 and 2010, yet I can’t overlook the fact that we are still working to make up the ground lost in 2008. We have more work to do.

2

Our international team had a particularly strong year. All three international funds were ranked in the Top 1% of their respective Morningstar peer group based on total return for the year ended 9/30/10 (see chart below). The funds benefited from good stock picking, particularly in emerging markets, and an underweight position in Western Europe — where we simply hadn’t found as many interesting companies using our bottom-up investment process.

Time and again our portfolio managers return from trips abroad telling stories of small companies they visited which rarely, if ever, receive visits from U.S. investment firms. With decades of small cap experience and an expansive universe of relatively unknown small and micro cap companies around the world, we remain convinced that our hands-on deep due diligence approach gives Wasatch a significant investment advantage.

MORNINGSTAR TOTAL RETURN CATEGORY PEER RANKINGSASOF 9/30/10

| | | | | | |

| | | 1 Year | | 3 Year | | 5 Year |

Wasatch Emerging Markets Small Cap (WAEMX)

(Diversified Emerging Markets) | | Top 1%

(out of 379) | | Top 1%

(out of 268) | | n/a |

Wasatch International Growth (WAIGX)

(Foreign Small/Mid Growth) | | Top 1%

(out of 132) | | Top 12%

(out of 118) | | Top 29%

(out of 94) |

Wasatch International Opportunities (WAIOX)

(Foreign Small/Mid Growth) | | Top 1%

(out of 132) | | Top 9%

(out of 118) | | Top 3%

(out of 94) |

Past performance is not a guarantee of future results.

As I reflect on the past year, and look forward to the next, the Wasatch research commitment is as strong as ever, and I have seen continued progress across each of our key pillars:

| | Ÿ | | Deep Due Diligence — Someone is almost always on the road visiting companies. We increased our international travel this year. For example, team members returned from Brazil last week, others are in Canada this week, and another pair leaves for Malaysia and Indonesia next week. |

| | Ÿ | | Collaboration — Our collaborative culture is thriving. We continue to experiment with how best to integrate our domestic and international teams in order to tap into increasingly relevant global insights. |

| | Ÿ | | Discipline — Our research process remains consistent and I am pleased with the long-term perspective we have maintained through the recent short-term market swings. Our “high-end consulting” (a process of evaluating and critiquing each other’s portfolio) continues to be a great collaborative tool to help us tighten each fund’s adherence to its investment strategy “north star.” |

The Wasatch research team is comprised of bright and seasoned investors. Our success is driven by their passion, a proven investment approach, and our culture of collaboration. Our research teams are led by portfolio managers who understand and have a vested interest in how research works. For example, Roger Edgley, director of our international team, is a co-manager of all three international funds. Jeff Cardon, director of our domestic team, has been the portfolio manager on the Small Cap Growth Fund since its inception almost 24 years ago (he is also CEO of Wasatch Advisors, investment advisor to Wasatch Funds). In future letters, I think it would benefit shareholders to have greater exposure to the breadth and strength of our team. As such, I plan to ask others to join me in providing their perspectives on relevant topics. As a reminder, my quarterly letter, as well as a quarterly commentary from each portfolio manager, can be accessed online at www.WasatchFunds.com.

Thank you for the continued opportunity to manage your assets.

Sincerely,

Samuel S. Stewart, Jr.

President of Wasatch Funds

The investment objective of WAEMX, WAIGX, and WAIOX is long-term growth of capital.

The recent growth rate in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Information in this report regarding market or economic trends or the factors influencing historical or future performance reflects the opinions of management as of the date of this report. These statements should not be relied upon for any other purpose. Past performance is no guarantee of future results, and there is no guarantee that the market forecasts discussed will be realized.

The Morningstar percentile rank is the rank of a fund among its category peers, which rank is based on a comparison of a fund’s total return performance against its peers over a given time period. © 2010 Morningstar, Inc. All rights reserved. The information contained herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

CFA® is a trademark owned by CFA Institute.

1Barron’s, “The Final Frontier,” Vito J. Racanelli, 8/2/10.

3

| | |

| WASATCH CORE GROWTH FUND (WGROX) — Management Discussion | | SEPTEMBER 30, 2010 |

|

| |

| |

The Wasatch Core Growth Fund is managed by a team of Wasatch portfolio managers led by JB Taylor and Paul Lambert.

| | | | |

JB Taylor Portfolio Manager | |

Paul Lambert Portfolio Manager | | OVERVIEW The Wasatch Core Growth Fund gained 9.19% in what was its strongest quarter since the third quarter of 2009. The Russell 2000 Index also had its best quarter in a year, rising |

11.29%. It was not unexpected that the Fund trailed the Index given our tendency to lag in rapidly rising markets. The stable and consistent growth companies in the portfolio are rarely the stocks to lead the market when optimism and appetite for risk increase. We expect our stocks to keep pace in such markets, as they have done on a year-to-date basis, and then continue to grow and outperform in less robust markets.

DETAILSOFTHE QUARTER

Our economy emerged from recession in June 2009 but is expanding at a slower rate than is typical of post-recessionary periods. We think the economy will remain sluggish given high unemployment, unprecedented levels of U.S. debt and rising taxes needed to pay for government spending. In such an environment, we believe companies with true growth prospects will command a premium.

We are already seeing some signs of this narrowing in the market, as information technology stocks, which make up less than 20% of the Russell 2000 Index, accounted for nearly 30% of the Index’s return this quarter. Fast-growing companies in the areas of cloud computing, security software and Internet retailing were some of the best performers. While we are interested in the underlying themes behind these fast-growing companies, the lofty price-to-earnings (P/E) multiples and fast-changing dynamics in technology make them less appropriate for our style, which is focused on steady, consistent growth at a reasonable price. Nonetheless, the market’s focus on growth bodes well for our companies, as we believe they will continue to grow at rates faster than the overall economy.

One of our best-performing stocks this quarter was Herbalife Ltd., a global marketer of nutritional products. The company reported the best quarterly results in its history, including a 4.3% increase in operating margin and a 72% increase in earnings. Herbalife has shifted its strategy from traditional multi-level marketing, where customers order from distributors on a monthly basis, to more of a retail approach that emphasizes daily consumption. There are several advantages to the new model, such as expanding the market to customers that are not willing to commit to becoming Herbalife distributors but are still interested in purchasing the company’s weight-loss products. Obesity is a growing problem around the world, and we expect the sales

of Herbalife’s healthy products will continue to benefit as people try to slim down.

MSCI, Inc. is another name that performed especially well. The company provides equity market indices and investment analytics, and its indices are linked to more than 250 exchange-traded funds (ETFs). Its shares were weak in the second quarter when a decline in the global equity markets implied a decline in ETF revenues. This quarter, global equities rallied sharply, and so did MSCI. Despite the stock’s volatility, there has been no change in the company’s growth trajectory over the two-quarter period. The business is showing good momentum, supported by solid demand for ETFs and risk management analytics.

Health care was the only sector in the Fund that had a negative return, where veterinary company VCA Antech, Inc. was a big detractor. In this economy, consumers are cutting back on what they are willing to spend to take care of their pets — they may skip a routine test or wait for a sick pet to recover versus taking it right to the vet. Demand had shown signs of stabilizing earlier in the year, but investors were disappointed with VCA Antech’s most recent revenues and earnings, prompting a sell-off in the stock. Long term, we think the business is very stable given the trend toward increasing pet ownership and higher spending per pet. Current and future holdings are subject to risk.

DETAILSOFTHE YEAR

Our foreign stocks were a key driver of the Fund’s strong performance during the 12 months ended September 30. Positions in several Indian and Brazilian banks did especially well, as robust economic growth in these countries is stimulating loan demand. Top domestic performers included O’Reilly Automotive, Inc. and Monro Muffler Brake, Inc., companies with steady revenue streams that sell less “discretionary” goods. Health care was the Fund’s weakest sector against the backdrop of regulatory reform in the United States.

OUTLOOK

As we look ahead, one question we are asking ourselves is: Does the narrowing of the market that we saw in the third quarter continue, with just a small slice of high-growth, high-P/E stocks driving returns? While this is certainly possible, we are comfortable with our holdings and would never stray from our valuation discipline by chasing hot stocks in a frothy market. We think a likely scenario is that the challenges facing the economy will make investors less optimistic — and less likely to aggressively bid up any segment of the market to lofty valuations. Our portfolio of steadily growing companies that we believe are reasonably valued has the potential to do well in such an environment.

Thank you for the opportunity to manage your assets.

4

| | |

| WASATCH CORE GROWTH FUND (WGROX) — Portfolio Summary | | SEPTEMBER 30, 2010 |

|

| |

| |

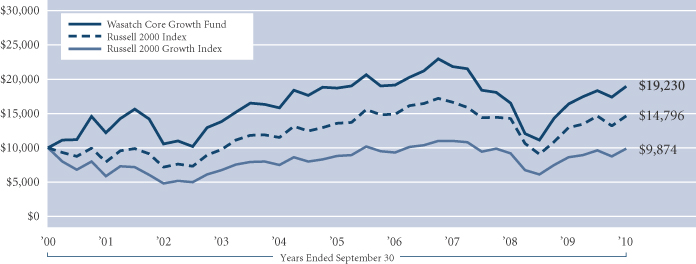

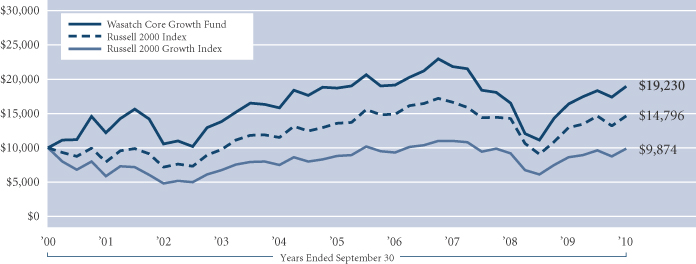

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | |

| | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Core Growth | | | 15.75% | | | | 0.28% | | | | 6.76% | |

Russell 2000 Index | | | 13.35% | | | | 1.60% | | | | 4.00% | |

Russell 2000 Growth Index | | | 14.79% | | | | 2.35% | | | | -0.13% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2010 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Core Growth Fund are 1.38%. The expense ratio shown elsewhere in this report may be different. Expenses include direct expenses paid to the Advisor as well as indirect expenses incurred by the Fund as a result of its investments in other investment companies (each an “Acquired Fund”), before any expense reimbursements by the Advisor. The Net Expense includes any reimbursement by the Advisor. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

TOP 10 EQUITY HOLDINGS*

| | | | |

| Company | | % of Net

Assets | |

| Copart, Inc. | | | 4.4% | |

| Life Time Fitness, Inc. | | | 3.8% | |

| Herbalife Ltd. | | | 3.6% | |

| Aaron’s, Inc. | | | 3.4% | |

| MEDNAX, Inc. | | | 3.2% | |

| | | | |

| Company | | % of Net

Assets | |

| LKQ Corp. | | | 3.1% | |

| O’Reilly Automotive, Inc. | | | 3.1% | |

| MSCI, Inc., Class A | | | 2.7% | |

| Alliance Data Systems Corp. | | | 2.7% | |

| IDEX Corp. | | | 2.5% | |

| * | As of September 30, 2010, there were 56 holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

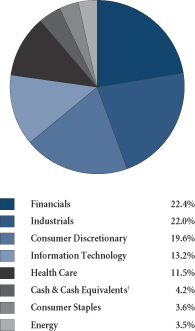

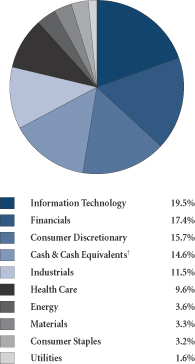

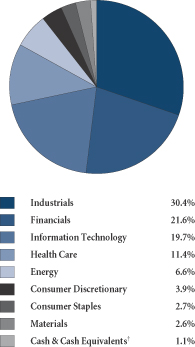

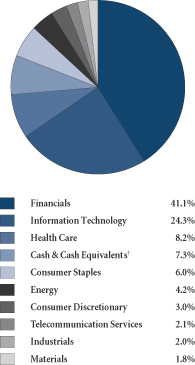

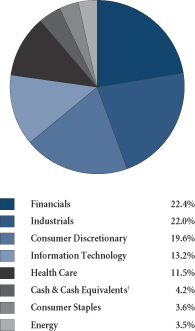

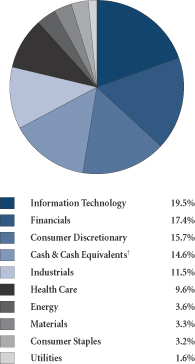

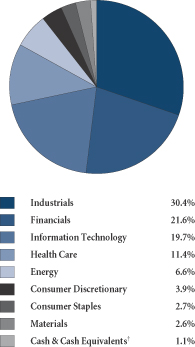

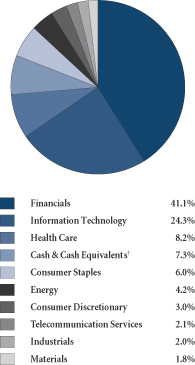

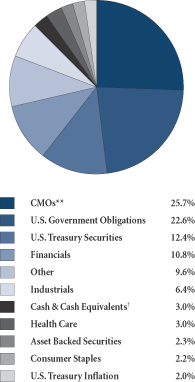

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and written options, if any. |

| † | Also includes Other Assets and Liabilities. |

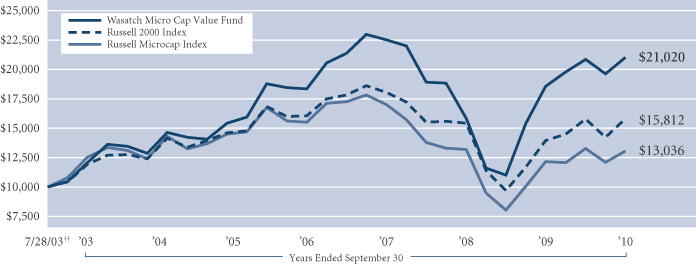

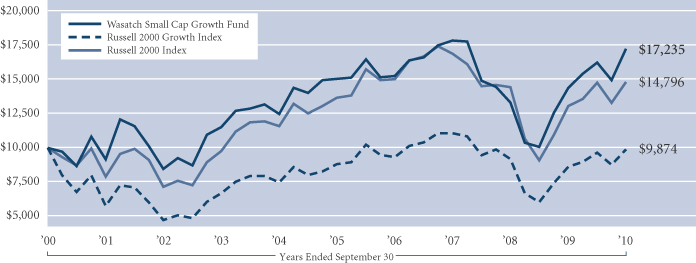

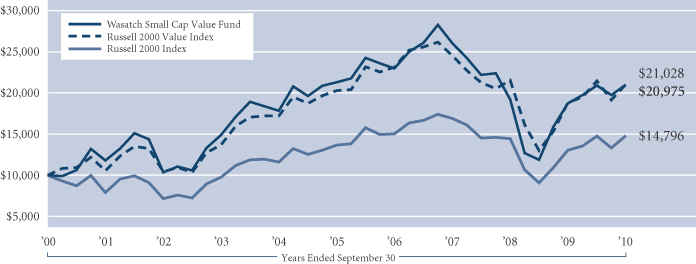

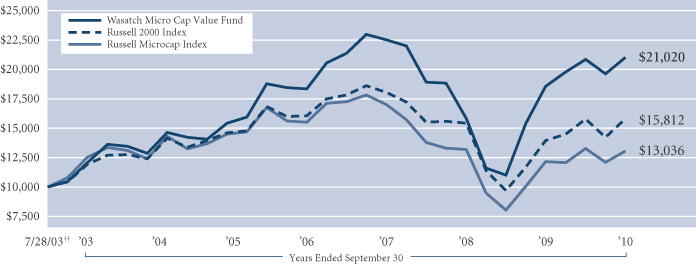

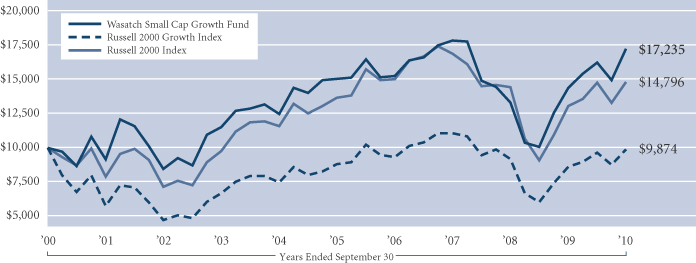

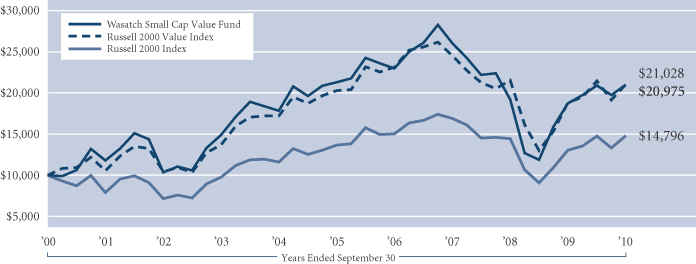

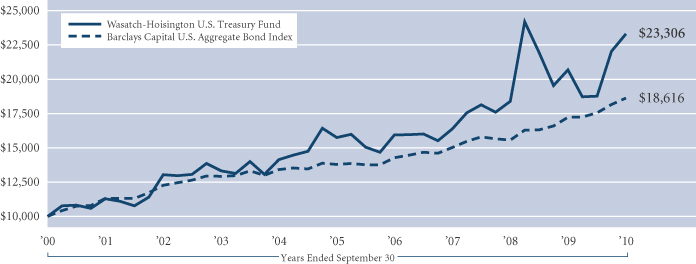

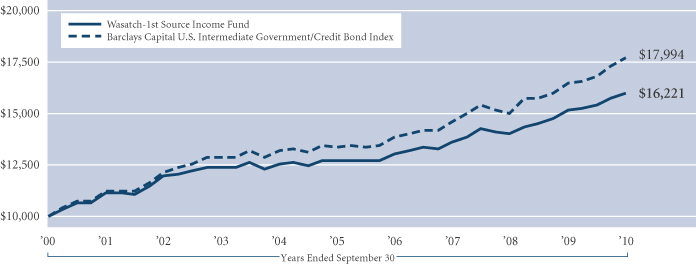

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. The Russell 2000 Index is an unmanaged total return index of the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Russell 2000 Index is widely regarded in the industry as accurately capturing the universe of small company stocks. The Russell 2000 Growth Index is an unmanaged total return index that measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values. You cannot invest directly in these or any indices.

5

| | |

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX) — Management Discussion | | SEPTEMBER 30, 2010 |

|

| |

| |

The Wasatch Emerging Markets Small Cap Fund is managed by a team of Wasatch portfolio managers led by Roger Edgley and Laura Geritz.

| | | | |

Roger D. Edgley, CFA Portfolio Manager | |

Laura Geritz, CFA Portfolio Manager | | OVERVIEW The Wasatch Emerging Markets Small Cap Fund gained 22.80% in the third quarter and outperformed the MSCI Emerging Markets Small Cap Index, which was up 20.48%. Performance for |

the quarter was strong as markets rebounded from a weaker second quarter. Overall, the gains within the Fund were broad based across markets, sectors and names. If there is a single element across the Fund’s top contributors this quarter, it is the presence of many consumer-oriented names.

Our philosophy is to invest broadly across the countries and sectors that are within its remit. It is important to note that the opportunities we favor go well beyond the BRIC countries (Brazil, Russia, India and China) — to countries like South Africa, Peru, Thailand, Egypt and Indonesia amongst others. Our job is to go where many do not — to invest in underfollowed countries and companies. Many of the countries that did well in the quarter were smaller ones that were well represented in the Fund. The top five contributors for the quarter were from the following countries: Brazil, India, Indonesia, Thailand and China.

DETAILSOFTHE QUARTER

Some interesting new names we added include Clicks Group Ltd. (South Africa), Diagnosticos da America S.A. (DASA) (Brazil), and Marisa Lojas S.A. (Brazil). Although emerging market small caps have had a year of strong returns, we are still able to find names that we believe have excellent long term prospects — companies that are well managed, financially well structured, and able to take advantage of the important changes in their economies. Clicks Group is a South African based retailer that includes a leading pharmacy chain and brand name stores like The Body Shop. We feel it is well placed with South African consumers and the pharmacy business should benefit as it takes market share from smaller “mom and pop” operators.

Two members of Wasatch’s team were in Brazil in September visiting companies including DASA and Marisa mentioned above. DASA is the largest clinical diagnostics and imaging laboratory group in Brazil (it would rate as one of the top five in the world). Health care trends in Brazil include a push toward efficiency as more members of the population enter private health care plans and increasing government spending.

Marisa is an apparel store chain with a focus on female buyers and “middle” consumers. We might compare Marisa to Old Navy or the Gap in the U.S. It has different kinds of formats so it is not just tied to malls, which have seen strong

growth in Brazil, but has street fronts, one of which we visited in Rio de Janeiro. Marisa has seen strong, same-store growth and sees attractive opportunities in other areas of Brazil.

Names that made significant contributions in the quarter included Cia. Hering (Brazil), LIC Housing Finance Ltd. (India), O-Net Communications Group Ltd. (China), and PT Jasa Marga (Indonesia). In terms of losers for the quarter, there were no significant “torpedoes”—the worst performing name was down about 25% and just 12 stocks had negative returns.

One of the most important trends we see across emerging economies is the growth of consumer spending as incomes and wealth grow significantly. This continues to be an important theme that cuts across many areas ranging from mortgage finance growth to health care spending to higher spending on apparel.

We have seen increased merger and acquisition activity and we expect to see more in the coming months. Two companies in the portfolio were impacted during the quarter. Another company purchased a controlling stake in Tivit Terceirizacao de Processos Servicos e Tecnologia S.A. (Brazil) and Dufry Group (Switzerland) acquired the assets of a South American company held in the portfolio. We sold both positions. A long-term holding we sold was Kingdee International Software Group Co. Ltd. (China), a Chinese software company, as its stock price reached a level we believed to be fully valued. Current and future holdings are subject to risk.

DETAILSOFTHE YEAR

The Wasatch Emerging Markets Small Cap Fund gained 51.69% over the past 12 months and outperformed the MSCI Emerging Markets Small Cap Index, which gained 32.32%. The top contributing countries were India, Indonesia, Brazil, China, Thailand and South Africa. Overall, our individual investments performed well for the year. There were few detractors. The top contributors came from a broad range of countries and sectors and included Cia. Hering, LIC Housing Finance Ltd., KPJ Healthcare Berhad (Malaysia) and PT Mayora Indah Tbk (Indonesia).

OUTLOOK

This has been a strong year of performance for small caps in emerging markets backed by strong asset flows from investors. We have some concern regarding global investors crowding into this segment of emerging markets with valuation levels looking — in some sectors and countries — closer to fair value. However, we still see attractive opportunities — it is a broad universe.

We remain grateful for the faith shown in us by our shareholders and we will continue to work hard to justify it. Emerging markets small caps are an exciting segment for us as an investment team and we possess long-term faith in its opportunities.

Thank you for the opportunity to manage your assets.

| | CFA® is a trademark owned by CFA Institute. |

6

| | |

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX) — Portfolio Summary | | SEPTEMBER 30, 2010 |

|

| |

| |

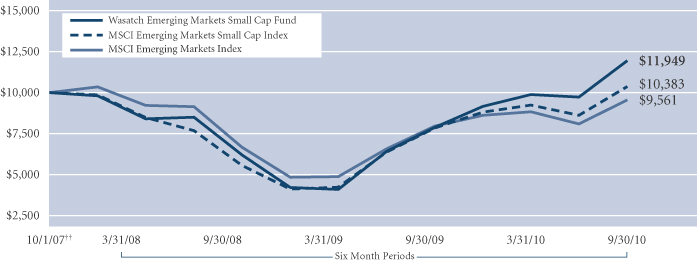

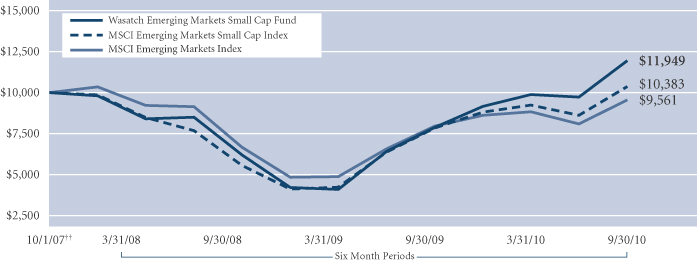

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | |

| | | 1 YEAR | | | 5 YEARS | | SINCE INCEPTION

10/1/07 | |

Emerging Markets Small Cap | | | 51.69% | | | N/A | | | 6.11% | |

MSCI Emerging Markets Small Cap Index | | | 32.32% | | | N/A | | | 1.26% | |

MSCI Emerging Markets Index | | | 20.22% | | | N/A | | | -1.48% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2010 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Small Cap Fund are 3.03%. The Net Expenses are 2.05%. The expense ratio shown elsewhere in this report may be different. Expenses include direct expenses paid to the Advisor as well as indirect expenses incurred by the Fund as a result of its investments in other investment companies (each an “Acquired Fund”), before any expense reimbursements by the Advisor. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the securities of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| | | | |

| Company | | % of Net

Assets | |

| LIC Housing Finance Ltd. (India) | | | 2.2% | |

| Mr Price Group Ltd. (South Africa) | | | 2.0% | |

| Bata India Ltd. (India) | | | 2.0% | |

| Exide Industries Ltd. (India) | | | 1.9% | |

| Mahindra & Mahindra Financial Services Ltd. (India) | | | 1.9% | |

| | | | |

| Company | | % of Net

Assets | |

| PT Holcim Indonesia Tbk (Indonesia) | | | 1.8% | |

| Cia. Hering (Brazil) | | | 1.7% | |

| Globaltrans Investment plc GDR (Russia) | | | 1.6% | |

| Allahabad Bank Ltd. (India) | | | 1.5% | |

| CETIP S.A. (Brazil) | | | 1.5% | |

| * | As of September 30, 2010, there were 164 holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

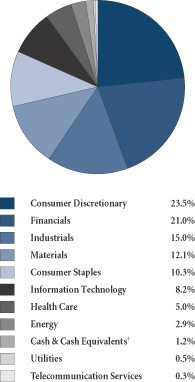

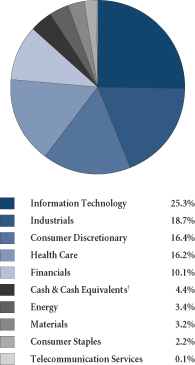

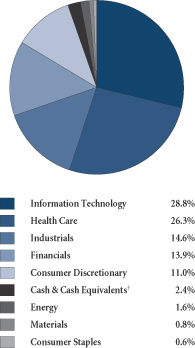

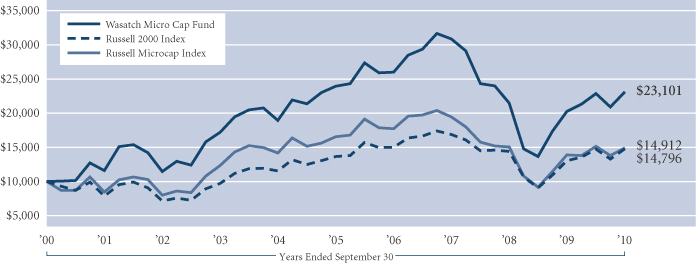

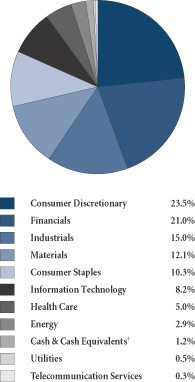

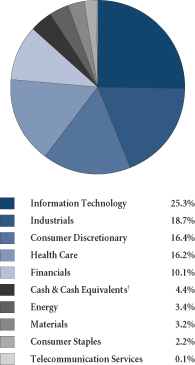

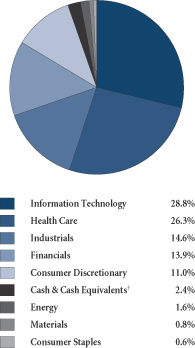

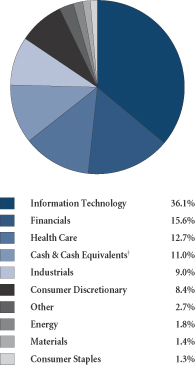

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and written options, if any. |

| † | Also includes Other Assets and Liabilities. |

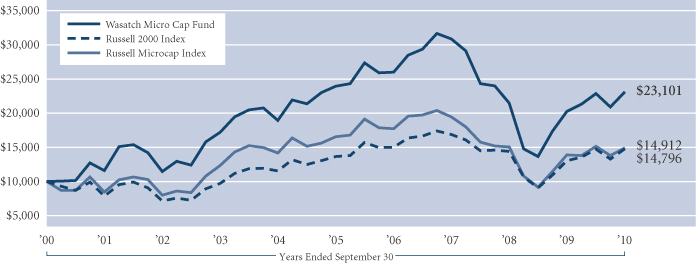

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ††Inception: October 1, 2007. The MSCI Emerging Markets and Small Cap indices are free float-adjusted market capitalization indices that are designed to measure equity market performance in the global emerging markets. You cannot invest directly in these or any indices.

7

| | |

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX) — Management Discussion | | SEPTEMBER 30, 2010 |

|

| |

| |

The Wasatch Global Opportunities Fund is managed by a team of Wasatch portfolio managers led by Robert Gardiner and Blake Walker.

| | | | |

Robert Gardiner, CFA Portfolio Manager | |

Blake H. Walker Portfolio Manager | | OVERVIEW The Global Opportunities Fund posted a strong gain during the third quarter in what was a positive environment for stock investing. Developed and emerging markets rallied as data |

coming out of the United States suggested the world’s largest economy would avoid a double-dip recession. Moreover, the Federal Reserve indicated that it was prepared to take additional steps to revive the U.S. economy, if needed.

Returns in the Fund were strong across geographies and sectors. We are pleased by the breadth of the good performance, since the Fund’s mandate gives us the flexibility to invest in companies of any size, in any country and in any type of business. That said, we are disappointed that we lagged the market indices. Our goal is to keep up with the market when stock prices are rising and provide the potential to outperform when they are falling.

DETAILSOFTHE QUARTER

Western Europe was a key area of strength in the Fund, and our investments in the region gained approximately 25%. Two of our best-performing stocks were Melexis N.V. (Belgium) and Wirecard AG (Germany), which are top-weighted holdings. Melexis designs semiconductors used in automotive electronics, and the company announced record revenues and earnings in July. Melexis is benefiting from Asia’s booming auto market and the rising chip content in cars, as high-tech features like adaptive cruise control become more prevalent. Wirecard is the leading processor of online payment transactions in Europe. The company has a history of strong growth — growing even throughout the recession — and should continue to thrive as it adds customers and expands geographically. Wirecard is one of several names in the Fund that is capitalizing on the migration from traditional “bricks and mortar” retailing to Internet retailing.

We also did well in emerging markets, including China, India and Brazil. Similar to last quarter, a number of our Chinese consumer stocks and Indian banks had substantial gains — names like Anta Sports Products Ltd. (China) and Allahabad Bank Ltd. (India). Strength in Brazil was driven by companies in a broad group of industries, from health care services to machinery to personal care products. We are excited about the growth we are seeing in emerging countries, but these markets have gotten a bit expensive.

Our U.S. holdings produced a strong gain but lagged the international piece of the portfolio. Major detractors included several semiconductor, business services and health

care companies whose operating performance and/or growth outlooks disappointed investors. For example, revenues for Supertex, Inc., a semiconductor manufacturer, came in below expectations due to a shortage in test and assembly capacity. CRA International, Inc., a consulting firm, beat second-quarter estimates but gave a cautious outlook for the rest of the year. Management cited the reluctance of corporations to spend on consulting services in the weak economy.

We faced some sector and industry headwinds in the quarter. Our big weighting in health care was a negative, as government reform in the United States has clouded the outlook for many health care companies. In addition, Americans are cutting back on medical services, as jobs losses lead to lost health insurance, and as more people opt for high-deductible plans. Our relatively low exposure to energy and metals and mining stocks also hurt performance. These areas of the market did especially well on rising commodity prices.

DETAILSOFTHE YEAR

Our investments in emerging markets gained more than 50% during the 12 months ended September 30. India was one of the best-performing countries in the Fund, where the list of top contributors was dominated by financial services companies. Although returns were positive in most developed markets, Australia was a notable exception. We have been upgrading the quality of our holdings in Australia following a recent trip to the country.

Performance was strong in most sectors, with consumer discretionary and information technology making the largest contributions to return. Top-performing holdings included ASOS plc (United Kingdom), an Internet retailer, and OPNET Technologies, Inc., a developer of network management software. The generally weak performance of our construction and engineering stocks limited gains in the industrials sector.

OUTLOOK

The U.S. recovery remains fragile, and investors are waiting to see if the Federal Reserve will step in to provide support. The outcome of the November U.S. elections is also of intense interest given its implications for taxes and regulation. Overseas, many emerging economies are growing rapidly but, like the United States, developed European countries are struggling with public deficits.

While uncertainty abounds, we aren’t spending our time trying to figure out if the economic and political landscape is going to get better or worse. Our job is to identify great companies whose individual characteristics should allow them to do well regardless of what is happening in the macro environment. If we can find these types of companies, and pay reasonable prices for them, we believe we can deliver strong results over time.

Thank you for the opportunity to manage your assets.

| | CFA® is a trademark owned by CFA Institute. |

8

| | |

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX) — Portfolio Summary | | SEPTEMBER 30, 2010 |

|

| |

| |

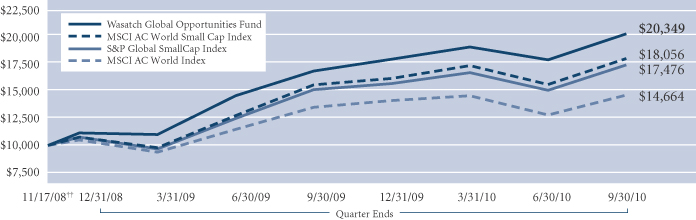

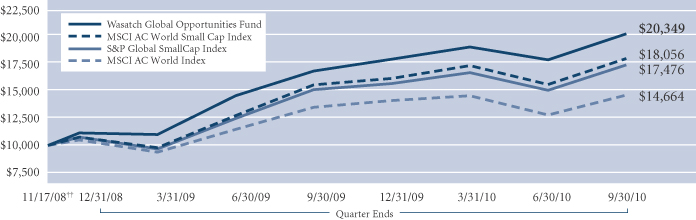

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | |

| | | 1 YEAR | | | 5 YEARS | | SINCE INCEPTION

11/17/08 | |

Global Opportunities | | | 20.41% | | | N/A | | | 46.18% | |

MSCI AC World Small Cap Index | | | 15.70% | | | N/A | | | 37.13% | |

S&P Global SmallCap Index | | | 15.18% | | | N/A | | | 34.76% | |

MSCI AC World Index | | | 8.42% | | | N/A | | | 22.70% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2010 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Opportunities Fund are 2.61%. The Net Expenses are 2.25%. The expense ratio shown elsewhere in this report may be different. Expenses include direct expenses paid to the Advisor as well as indirect expenses incurred by the Fund as a result of its investments in other investment companies (each an “Acquired Fund”), before any expense reimbursements by the Advisor. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small and micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Being non-diversified, the Fund can invest a larger portion of its assets in the securities of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

TOP 10 EQUITY HOLDINGS*

| | | | |

| Company | | % of Net

Assets | |

| Melexis N.V. (Belgium) | | | 1.9% | |

| Wirecard AG (Germany) | | | 1.7% | |

| Dollar Tree, Inc. | | | 1.4% | |

| Ted Baker plc (United Kingdom) | | | 1.2% | |

| EPS Co. Ltd. (Japan) | | | 1.2% | |

| | | | |

| Company | | % of Net

Assets | |

| Power Integrations, Inc. | | | 1.1% | |

| Resources Connection, Inc. | | | 1.1% | |

| Richelieu Hardware Ltd. (Canada) | | | 1.0% | |

| O2Micro International Ltd. ADR (China) | | | 1.0% | |

| Indutrade AB (Sweden) | | | 0.9% | |

| * | As of September 30, 2010, there were 356 holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

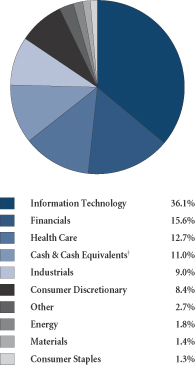

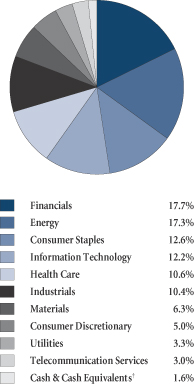

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and written options, if any. |

| † | Also includes Other Assets and Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ††Inception: November 17, 2008. The MSCI AC World Small Cap Index is an unmanaged index and includes reinvestment of all dividends of issuers located in countries throughout the world representing developed and emerging markets, including securities of U.S. issuers, with market capitalizations between US $200 million and $1.5 billion. The S&P Global SmallCap Index is an unmanaged index and includes reinvestment of all dividends of issuers located across developed and emerging markets, including the United States, who fall in the bottom 15% of their country’s market cap range. The MSCI AC World Index is an unmanaged index and includes reinvestment of all dividends of issuers located in countries throughout the world representing developed and emerging markets, including securities of U.S. issuers, of all capitalizations. You cannot invest directly in these or any indices.

9

| | |

| WASATCH GLOBAL SCIENCE & TECHNOLOGY FUND (WAGTX) — Management Discussion | | SEPTEMBER 30, 2010 |

|

| |

| |

The Wasatch Global Science & Technology Fund is managed by a team of Wasatch portfolio managers led by Sam Stewart.

| | |

Samuel S. Stewart, Jr. PhD, CFA Portfolio Manager | | OVERVIEW The Wasatch Global Science & Technology Fund returned 13.94% in the quarter, bringing its 12-month return to 22.91%. The companies we own in the Fund reported sales and earnings growth of 24% and 46%, respectively, significantly above the broader market average. DETAILSOFTHE QUARTER We made further progress toward reducing the number of portfolio hold- |

ings during the past three months. Fewer holdings will allow us to get more wood behind the arrow of our best ideas. A related goal was increasing the percentage of the portfolio invested in our highest conviction ideas. We are happy to report that our top 10 holdings now represent about 27% of the portfolio, up from approximately 19% at the beginning of the year. We believe that running a more concentrated portfolio will allow us to use our knowledge base more effectively for the benefit of our shareholders.

The stocks we sold during the quarter fell into three main categories. First were those where we thought the market had more than priced in strong business prospects, such as F5 Networks, Inc., Techne Corp., and NetLogic Microsystems, Inc. The second group included companies that became subject to new regulatory risk, including MEDNAX, Inc. and Korean company MegaStudy Co. Ltd. While these are great companies, we think the discounts offered in the stock prices are not enough to justify the current level of risk. We would love to come back to the stocks in these two groups sometime down the road if their prices become more reasonable. The final group is companies that we deemed good but not great. In most cases, we based our decision on some combination of the stocks’ lower-quality business models and less attractive end markets.

One of the clear highlights from the quarter was the first major payoff from our improved focus on our best ideas. Our top holding going into the quarter — Wirecard AG, a German company that provides payment services for online transactions — was also our top contributor thanks to its large position size and 59% price increase. Early in the year, Wirecard was one of our larger holdings with a 2% weighting. When an Internet rumor dragged down its stock price, our discussions with company management, several industry experts, and our own experienced research team gave us the confidence to add to our position. As a result, we came into the third quarter with a 4% weighting in the stock. While we have taken some profits following its strong rally, Wirecard remains our top pick based on our belief that it is an attractively priced way to ride the tailwind as more and more retail transactions occur online.

Another large holding that generated a strong return was Abcam plc, the Cambridge, England-based online antibody distributor. We’ve owned Abcam for years and consider it to

be similar to Amazon.com, except focused on supplies used in lab research. Abcam, which has been rapidly taking market share from the traditional paper-based catalogs in the industry, has generated high sales growth before, during, and after the recession. Abcam’s shares rose nearly 50% in the quarter.

Another recurring theme was our purchase of stocks that Wasatch owns currently or has owned at some point in the past, including NuVasive, Inc., Copart, Inc., VistaPrint N.V., and Japanese e-commerce company Start Today Co. Ltd. We love it when the market gives us a chance to buy companies we know well at discounted prices. Our long history with these companies means we are way up the information curve on day one of ownership, and we’ve already built up relationships and trust in senior management.

A key detractor was ICON plc, an Ireland-based contract research organization that reduced its earnings guidance to the low end of the previous range. Also weighing on performance were our holdings in Japanese software company Simplex Technology, Inc., veterinary services provider VCA Antech, Inc., and technology equipment company Intevac, Inc. Current and future holdings are subject to risk.

DETAILSOFTHE YEAR

The Fund’s one-year return of 22.91% is also an indication of the fundamental strengths of the underlying companies we have held in the portfolio. For the year, our companies generated 16% year-over-year sales growth and 39% growth in bottom-line earnings. A substantial contribution to performance came from our investments overseas, where on average about half of the Fund’s assets were invested. China and Brazil proved to be fertile ground for growth investments. Among U.S.-based companies, Akamai Technologies, Inc. and F5 Networks made the largest contributions to performance. The most significant detractors were Intevac and CVS Group plc (United Kingdom).

OUTLOOK

As the financial crisis and ensuing recession move further into the rear view mirror, we believe the market will value real growth above growth pretenders (companies enjoying high year-over-year growth mostly due to easy earnings comparisons). We continue to tune out most of the macroeconomic noise in order to spend our time in pursuit of under-appreciated growth companies. We are gratified that quarterly and annual data show that our portfolio holdings are achieving earnings growth and higher valuations — a potentially powerful combination.

As we continue the process of pruning the Fund’s holdings, we are increasingly satisfied that we have a portfolio of companies offering under-appreciated growth. Even as the market recognizes some of this growth potential, we continue to find ample opportunities for investing in attractively valued growth companies.

Thank you for the opportunity to manage your assets.

| | CFA® is a trademark owned by CFA Institute. |

10

| | |

| WASATCH GLOBAL SCIENCE & TECHNOLOGY FUND (WAGTX) — Portfolio Summary | | SEPTEMBER 30, 2010 |

|

| |

| |

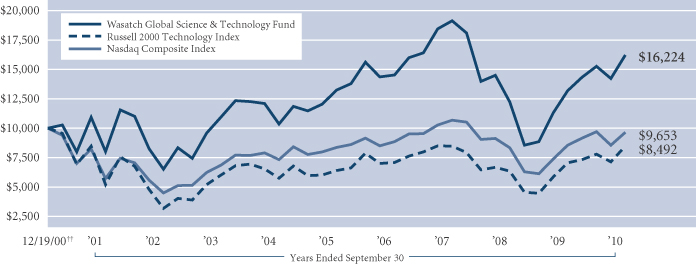

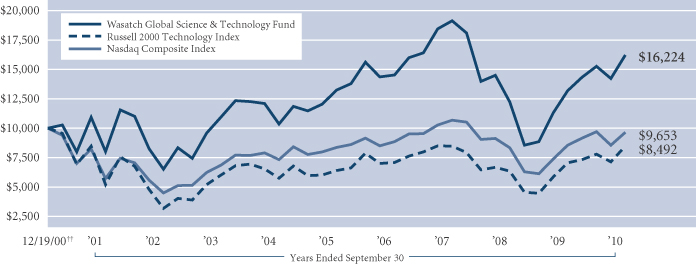

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | |

| | | 1 YEAR | | | 5 YEARS | | | SINCE INCEPTION 12/19/00 | |

Global Science & Technology | | | 22.91% | | | | 4.14% | | | | 5.07% | |

Russell 2000 Technology Index | | | 20.41% | | | | 5.77% | | | | -1.66% | |

Nasdaq Composite Index | | | 12.74% | | | | 2.86% | | | | -0.36% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2010 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Science & Technology Fund are 2.15%. The Net Expenses are 1.96%. The expense ratio shown elsewhere in this report may be different. Expenses include direct expenses paid to the Advisor as well as indirect expenses incurred by the Fund as a result of its investments in other investment companies (each an “Acquired Fund”), before any expense reimbursements by the Advisor. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in concentrated funds will be more volatile and loss of principal could be greater than investing in more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS*

| | | | |

| Company | | % of Net

Assets | |

Wirecard AG (Germany) | | | 4.8% | |

DiaSorin S.p.A. (Italy) | | | 3.3% | |

Google, Inc., Class A | | | 2.8% | |

CVS Group plc (United Kingdom) | | | 2.7% | |

Xilinx, Inc. | | | 2.6% | |

| | | | |

| Company | | % of Net

Assets | |

| Altera Corp. | | | 2.5% | |

| International Business Machines Corp. | | | 2.4% | |

| Alliance Data Systems Corp. | | | 2.2% | |

| Pegasystems, Inc. | | | 2.1% | |

| Create SD Holdings Co. Ltd. (Japan) | | | 2.1% | |

| * | As of September 30, 2010, there were 77 holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and written options, if any. |

| †Also | includes Other Assets and Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ††Inception: December 19, 2000. The Russell 2000 Technology Index is a capitalization-weighted index of companies that serve the electronics and computer industries or that manufacture products based on the latest applied science. The Nasdaq Composite Index is unmanaged and measures all Nasdaq domestic and non-U.S. based common stocks listed on The Nasdaq Stock Market. The Index is market-value weighted. This means each company’s security affects the Index in proportion to its market value. The market value, the last sale price multiplied by total shares outstanding, is calculated throughout the trading day, and is related to the total value of the Index. Due to their number and size, technology stocks tend to dominate the direction of the Index. You cannot invest directly in these or any indices.

11

| | |

| WASATCH HERITAGE GROWTH FUND (WAHGX) — Management Discussion | | SEPTEMBER 30, 2010 |

|

| |

| |

The Wasatch Heritage Growth Fund is managed by a team of Wasatch portfolio managers led by Chris Bowen and Ryan Snow.

| | | | |

Chris Bowen Portfolio Manager | |

Ryan Snow Portfolio Manager | | OVERVIEW Even in the face of a tepid economic environment, it was a rare September to remember for stocks. The market — as gauged by the S&P 500 Index — hadn’t closed a third quarter with a monthly gain this |

large (8.92%) since 1939. As investors latched onto the hope of a strengthening recovery, the Fund’s benchmark, the Russell Midcap Growth Index turned in a strong gain, led by consumer discretionary and economically sensitive producer durable stocks. Primarily due to its lower weights in cyclical stocks and the consumer-driven retail segment, the Fund trailed the benchmark for the quarter.

The Fund was unable to keep pace in a frothy environment after outperforming the benchmark during second quarter weakness. In particular, our cautiousness regarding consumers tempered our returns. Both high unemployment and excess valuations in the space have made it difficult to find attractively valued consumer oriented stocks.

We believe the quality of the Fund’s holdings constrained returns a bit as well, as investors bid up shares of many companies with volatile earnings as economic murkiness dissipated slightly. By and large, our companies were able to weather the challenges of the last two years reasonably well. As many formerly profitable companies saw earnings turn negative, even at the worst, many of our holdings at least sustained their level of earnings. This then transformed into fairly robust growth over the last several quarters, which we project will normalize in the future.

While we ideally would outperform the market during rallies, given the quality of our holdings, it is not surprising that the Fund would only keep pace or trail slightly during extremely bullish environments. Rallies are typically fueled by speculation, which tends to bode well for volatile companies that can showcase what are often temporary fundamental surprises or those stocks that have been beaten down the most in prior market declines.

DETAILSOFTHE QUARTER

Although we’ve always been diligent about investing in companies that meet our exacting standards, we’ve never been more pleased about the Fund’s composition than we are now. We have made an even more concerted effort to ensure that every company held in the Fund meets each appendage of what we call the three-legged stool — quality, valuation and momentum.

As our companies hopefully continue to perform steadily, meeting or exceeding our hurdle growth rate of 15%, we believe they will be rewarded in the market over the long-term.

The Fund’s performance was buoyed by strength in the information technology sector, where Cognizant Technology Solutions Corp., Altera Corp. and Amphenol Corp. were the highest contributors to performance.

Outside of technology, Herbalife Ltd., a provider of health foods primarily focused on weight management and nutritional supplements, was one of our top-performing stocks.

Copart, Inc. and Covance, Inc. both suffered what we believe to be temporary setbacks detracting from the quarter’s performance. They are both debt-free and hold significant amounts of cash, which should allow them flexibility as they focus on future business opportunities. Current and future holdings are subject to risk.

DETAILSOFTHE YEAR

As it did during the third quarter, information technology drove the Fund’s performance for the year, with Altera, Cognizant and F5 Networks, Inc. leading the way. The Fund returned 16.06% and trailed the 18.27% return of the benchmark.

In a strong market environment, Apollo Group, Inc., a for-profit higher education provider, accounted for most of the performance gap as it faced stiff regulatory challenges concerning the availability of student aid. As unexpected headwinds continued to mount, we recently sold the Fund’s stake in this long-time holding.

We also concentrated the Fund and, in our opinion, increased its overall quality by focusing on our top tier companies. During the year, we trimmed the Fund’s holdings from 54 to 42 and feel that the Fund is now better positioned to perform well.

OUTLOOK

Even though the recession officially ended in June 2009, high unemployment and increasing levels of public debt continue to put a damper on economic activity. Although it’s clear that the path to a more normal economic environment will be long and arduous, it doesn’t dampen our enthusiasm about the Fund’s prospects. With the luxury of being able to invest in a small portion of existing public companies, we can be selective and pinpoint companies that we believe will do well in spite of macro challenges.

Though we are pleased with the Fund’s current composition, we continue to screen for additional investment opportunities and visit management teams of both existing and prospective companies. A large amount of insight that can’t be gleaned merely from reviewing financial statements — especially regarding corporate culture — is gained by meeting with management teams face-to-face. Even visits with companies that we ultimately choose not to invest in are an invaluable comparison tool that can help strengthen our conviction about the companies that are held in the Fund.

In our view, the three legs of the stool seem properly balanced. We feel extremely positive about the quality and the earnings growth momentum of the Fund and that valuations are low enough to allow for satisfactory returns over time.

Thank you for the opportunity to manage your assets.

12

| | |

| WASATCH HERITAGE GROWTH FUND (WAHGX) — Portfolio Summary | | SEPTEMBER 30, 2010 |

|

| |

| |

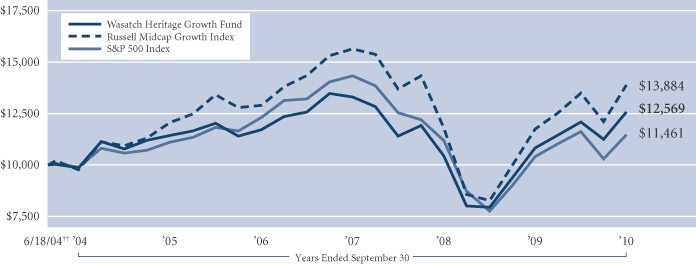

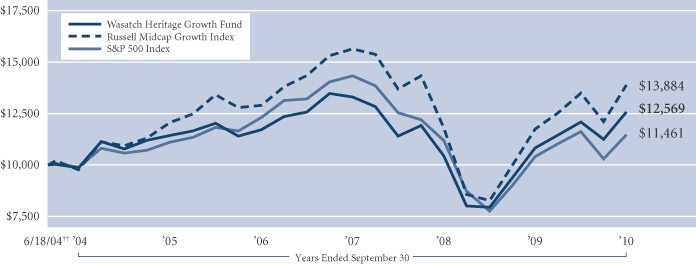

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | |

| | | 1 YEAR | | | 5 YEARS | | | SINCE INCEPTION

6/18/04 | |

Heritage Growth | | | 16.06% | | | | 1.91% | | | | 3.70% | |

Russell Midcap Growth Index | | | 18.27% | | | | 2.86% | | | | 5.36% | |

S&P 500 Index | | | 10.16% | | | | 0.64% | | | | 2.20% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2010 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Heritage Growth Fund are 1.21%. The Net Expenses are 0.95%. The expense ratio shown elsewhere in this report may be different. Expenses include direct expenses paid to the Advisor as well as indirect expenses incurred by the Fund as a result of its investments in other investment companies (each an “Acquired Fund”), before any expense reimbursements by the Advisor. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in mid cap funds will be more volatile and loss of principal could be greater than investing in large cap funds. Equity investing involves risks including potential loss of the principal amount invested.

TOP TEN EQUITY HOLDINGS*

| | | | |

| Company | | % of Net

Assets | |

| Altera Corp. | | | 6.0% | |

Cognizant Technology Solutions Corp., Class A | | | 4.8% | |

IHS, Inc., Class A | | | 4.1% | |

| Tim Hortons, Inc. (Canada) | | | 3.8% | |

| Ross Stores, Inc. | | | 3.7% | |

| | | | |

| Company | | % of Net

Assets | |

| Amphenol Corp., Class A | | | 3.7% | |

| Linear Technology Corp. | | | 3.7% | |

| Express Scripts, Inc. | | | 3.7% | |

| Copart, Inc. | | | 3.7% | |

| St. Jude Medical, Inc. | | | 3.4% | |

| * | As of September 30, 2010, there were 42 holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

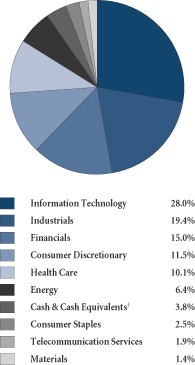

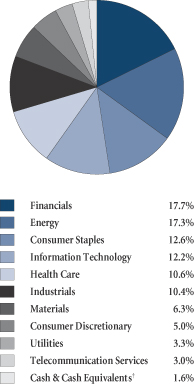

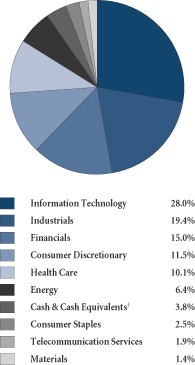

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and written options, if any. |

| † | Also includes Other Assets and Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ††Inception: June 18, 2004. The Russell Midcap Growth Index measures the performance of those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values. The stocks in the Russell Midcap Growth Index are also members of the Russell 1000 Growth Index. The S&P 500 Index represents 500 of the United States’ largest stocks from a broad variety of industries. The index is unmanaged, and a common measure of common stock total return performance. You cannot invest directly in these or any indices.

13

| | |

| WASATCH INTERNATIONAL GROWTH FUND (WAIGX) — Management Discussion | | SEPTEMBER 30, 2010 |

|

| |

| |

The Wasatch International Growth Fund is managed by a team of Wasatch portfolio managers led by Roger Edgley.

| | |

Roger D. Edgley, CFA Portfolio Manager | | OVERVIEW The Wasatch International Growth Fund returned 23.33% in the third quarter and outperformed the MSCI AC World Ex-U.S.A. Small Cap Index, which returned 18.43%. The Fund was helped by its exposure to Asia and Latin America, where markets performed well and economies are growing. In general, developed economies struggled in a more difficult credit and consumer environment against the |

more pro-growth emerging economies, and that is what is playing out today.

DETAILSOFTHE QUARTER

It is worth discussing in detail the top contributors for the quarter as they illustrate well our philosophy and some common elements across names. Among the top contributors to performance were Abcam plc (United Kingdom), Wirecard AG (Germany), Cia. Hering (Brazil) and Dah Chong Hong Holdings Ltd. (Hong Kong). All are companies we know well and that operate from a position of significant strength in their fields of business.

As a Cambridge-based online provider of antibodies for the research community worldwide, Abcam has been a big long-term winner for the Fund. We found Abcam when it was a tiny company. Now, its market capitalization is close to a billion dollars. We have cut back some of our position size owing to its weight in the Fund and valuation, but Abcam remains a prominent position.

Wirecard is a payment service provider in Europe, focused on enabling Internet payments and providing an extra layer of credit protection for merchants selling online. It therefore is a significant beneficiary of the growth of online transactions in Europe and is now starting to grow in Asia.

Cia. Hering is a brand name retailer in Brazil continuing to add stores in other regions. In a meeting with management (and a store visit) in the last few weeks, they stated that they believe it is possible to double the number of stores, with franchising being part of that growth. Our recent visit to Brazil reinforced our opinion of the opportunity there —Brazil to us seems to represent a combination of well-managed small companies within an economy showing highly supportive trends.

Dah Chong Hong (DCH) is a name we added that illustrates how we source our ideas in different ways. DCH has been the main distributor for Honda for 40 years. It is a company this portfolio manager learned about firsthand years ago when living in Hong Kong as the owner of a new Honda Civic bought from and serviced by a DCH dealer. At Wasatch, we were aware of DCH’s level of service and organization and knew that Honda chooses their distributors with care. Aside from representing some major car brands in Hong Kong, DCH has a growing portfolio of brands it represents in China. The stock is a relatively new listing, one

we thought was inexpensive — maybe being perceived as somewhat dull or just misunderstood. After good results were announced, with DCH’s China operations showing growth, the stock was significantly upgraded. The business has a long commercial history, so we think it can produce stable growth over a long period.

The worst performing names for the quarter generally had one thing in common: Japan. As an economy, Japan continues to struggle with deflation, low growth and a strong currency that makes it difficult for its exporters to remain competitive. Construction equipment firm Takeuchi Mfg. Co. Ltd. is one of our holdings that has been hurt by these factors. We have been underweight in Japan for a long time — we find it relatively unattractive from a bottom up stock perspective as well as from a top down economic view. Growing small companies thrive not only on growth in their own economies but from change — Japan in many areas is seeing little change and few opportunities. Zero-level interest rates indicate an economy ruled by continuing fears of deflation, lacking animal spirits. Current and future holdings are subject to risk.

DETAILSOFTHE YEAR

The Fund outperformed the Index over the past 12 months with strong performance from the United Kingdom, India, Brazil and Indonesia. Our U.K. investments in Abcam and online fashion retailer ASOS plc did especially well. We also had good results from our Indian financial companies, notably LIC Housing Finance Ltd. and Allahabad Bank Ltd. In Brazil, Cia. Hering was a top contributor as was cosmetics producer Natura Cosmeticos. Two cement producers, Semen Gresik and Indocement Tunggal Prakarsa, led the way in Indonesia. Japan was also weak over the 12-month period, with several Japanese holdings numbering among our largest detractors.

OUTLOOK

As 2010 draws to a close, we remain aware of global economic and trade tensions and how these can disrupt markets. For many of the small, generally domestically-oriented companies we invest in, we believe that conditions are supportive with tighter capital flows helping the higher quality companies on which we focus. With over 10,000 companies in our investable universe, there continue to be companies that stand out to us as long-term benefactors of growth throughout the world. We are confident that we can continue to build a portfolio of companies that exhibit higher quality and better growth prospects than the markets in general. We remain very grateful for all the support shown by shareholders.

Thank you for the opportunity to manage your assets.

| | CFA® is a trademark owned by CFA Institute. |

14

| | |

| WASATCH INTERNATIONAL GROWTH FUND (WAIGX) — Portfolio Summary | | SEPTEMBER 30, 2010 |

|

| |

| |

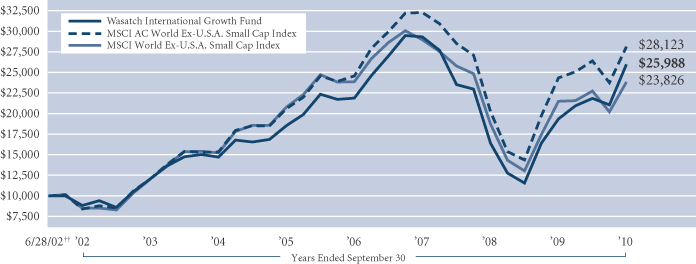

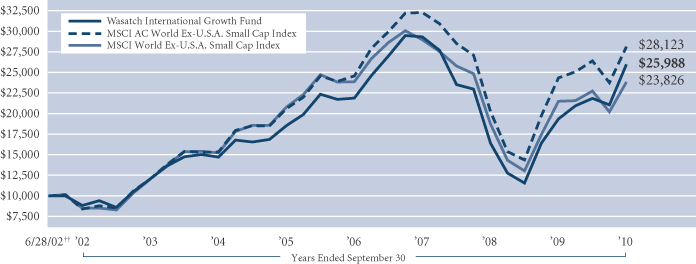

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | |

| | | 1 YEAR | | | 5 YEARS | | | SINCE INCEPTION

6/28/02 | |

International Growth | | | 34.15% | | | | 6.99% | | | | 12.26% | |

MSCI AC World Ex-U.S.A. Small Cap Index | | | 15.59% | | | | 6.42% | | | | 13.33% | |

MSCI World Ex-U.S.A. Small Cap Index | | | 10.86% | | | | 2.74% | | | | 11.08% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.wasatchfunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2010 prospectus, the Total Annual Fund Operating Expenses for the Wasatch International Growth Fund are 1.94%. The expense ratio shown elsewhere in this report may be different. Expenses include direct expenses paid to the Advisor as well as indirect expenses incurred by the Fund as a result of its investments in other investment companies (each an “Acquired Fund”), before any expense reimbursements by the Advisor. The Net Expense includes any reimbursement by the Advisor. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

TOP 10 EQUITY HOLDINGS*

| | | | |

| Company | | % of Net

Assets | |

| LIC Housing Finance Ltd. (India) | | | 2.4% | |

| Abcam plc (United Kingdom) | | | 2.4% | |

| Rotork plc (United Kingdom) | | | 2.4% | |

| SJM Holdings Ltd. (Hong Kong) | | | 2.2% | |

| DiaSorin S.p.A. (Italy) | | | 2.1% | |

| Cia. Hering (Brazil) | | | 2.0% | |

| | | | |

| Company | | % of Net

Assets | |

| Wirecard AG (Germany) | | | 1.9% | |

| Mahindra & Mahindra Financial Services Ltd. (India) | | | 1.8% | |

| Anta Sports Products Ltd. (China) | | | 1.8% | |

| Dah Chong Hong Holdings Ltd. (Hong Kong) | | | 1.8% | |

| * | As of September 30, 2010, there were 111 holdings in the Fund. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

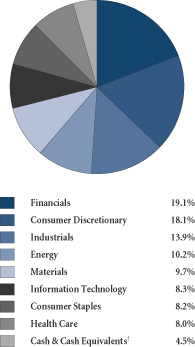

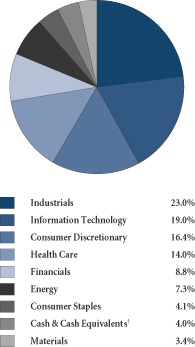

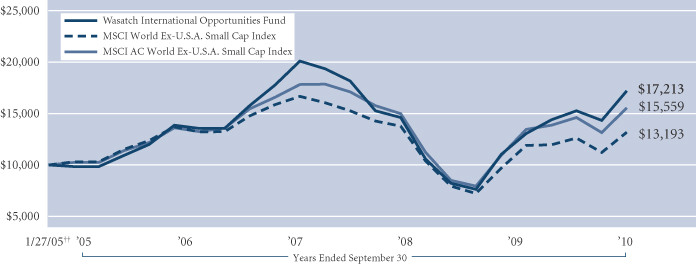

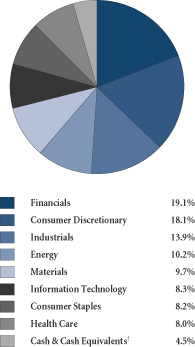

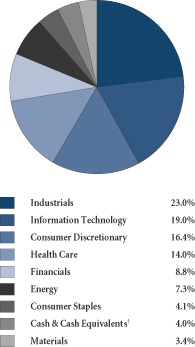

SECTOR BREAKDOWN**

| ** | Excludes securities sold short and written options, if any. |

| † | Also includes Other Assets and Liabilities. |

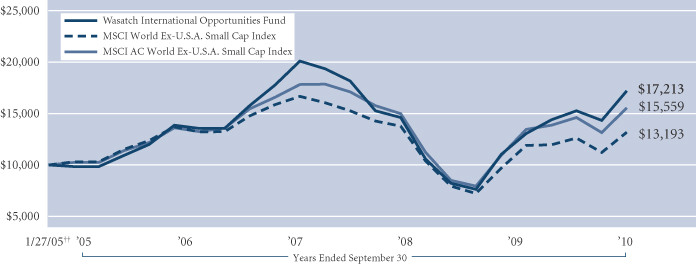

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance and the graph above does not reflect the deduction of taxes that you would pay on fund distributions or the redemption of fund shares. Performance shown in the chart above does not include any applicable sales charges and fees. Wasatch does not charge any sales fees. ††Inception: June 28, 2002. The MSCI AC World Ex-U.S.A. Small Cap Index is an unmanaged index and includes reinvestment of all dividends of issuers located in countries throughout the world representing developed and emerging markets, excluding securities of U.S. issuers. This index is a free float-adjusted market capitalization index designed to measure the performance of small capitalization securities. The MSCI World Ex-U.S.A. Small Cap Index is an unmanaged index that measures the performance of stocks with market capitalizations between U.S. $200 million and $1.5 billion across 22 developed markets, excluding the United States. You cannot invest directly in these or any indices.

15

| | |

| WASATCH INTERNATIONAL OPPORTUNITIES FUND (WAIOX) — Management Discussion | | SEPTEMBER 30, 2010 |

|

| |

| |

The Wasatch International Opportunities Fund is managed by a team of Wasatch portfolio managers led by Roger Edgley and Blake Walker.

| | | | |

Roger D. Edgley, CFA Portfolio Manager | |

Blake H. Walker Portfolio Manager | | OVERVIEW The third quarter saw global equities stage a bit of a comeback, though volatility remained very much in evidence. Consumers in most developed markets were still keeping a close |

watch on their spending, but those in China and other emerging markets spent at a more robust pace.

The Wasatch International Opportunities Fund returned 20.09% during the quarter, placing it comfortably ahead of its benchmark, the MSCI World Ex-U.S.A. Small Cap Index, which returned 17.75% over the same period. With no single theme or trend driving the market, our individual stock selection was the main factor in the Fund’s outperformance for the period.

DETAILSOFTHE QUARTER

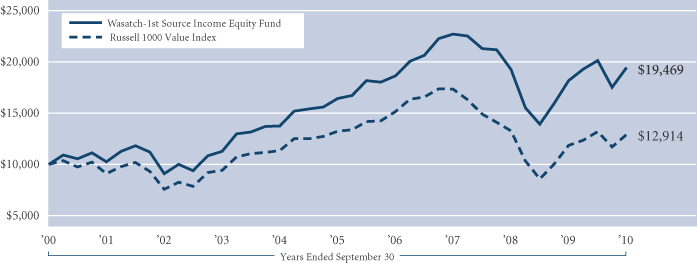

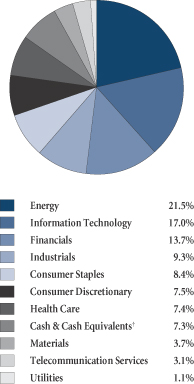

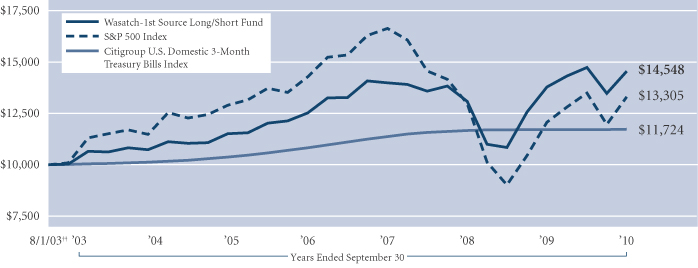

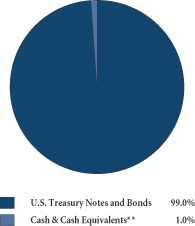

The absence of a single specific theme or trend driving the market is evident among our 10 top contributors to performance over the quarter, where nine different countries on four continents and 10 industries in four major market sectors were represented.