Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04920

WASATCH FUNDS TRUST

(Exact name of registrant as specified in charter)

505 Wakara Way, 3rd Floor

Salt Lake City, UT 84108

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: | |

Samuel S. Stewart, Jr. Wasatch Advisors, Inc. 505 Wakara Way, 3rd Floor Salt Lake City, UT 84108 | Eric F. Fess, Esq. Chapman & Cutler LLP 111 West Monroe Street Chicago, IL 60603 | |

Registrant’s telephone number, including area code: (801) 533-0777

Date of fiscal year end: September 30

Date of reporting period: March 31, 2015

Table of Contents

| Item 1: | Report to Shareholders. |

Table of Contents

Table of Contents

Wasatch Funds

Salt Lake City, Utah

www.WasatchFunds.com

800.551.1700

Table of Contents

| TABLEOF CONTENTS | ||

| ||

| ||

| 2 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

Wasatch Emerging Markets Small Cap Fund® Management Discussion | 10 | |||

| 11 | ||||

Wasatch Frontier Emerging Small Countries Fund® Management Discussion | 12 | |||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

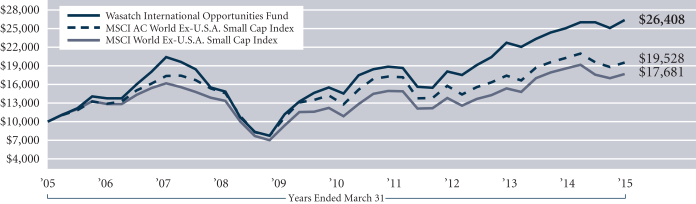

Wasatch International Opportunities Fund® Management Discussion | 20 | |||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

Wasatch-Hoisington U.S. Treasury Fund® Management Discussion | 42 | |||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 48 | ||||

| 92 | ||||

| 98 | ||||

| 104 | ||||

| 112 | ||||

| 118 | ||||

| 119 | ||||

| 137 | ||||

| 137 | ||||

| 138 | ||||

| 139 | ||||

| 139 | ||||

| 139 | ||||

| 146 | ||||

| 146 |

This material must be accompanied or preceded by a prospectus.

Please read the prospectus carefully before you invest.

Wasatch Funds are distributed by ALPS Distributors, Inc.

1

Table of Contents

| LETTERTO SHAREHOLDERS — HERE BE DRAGONS? | ||||

|

| |||

|

| |||

Samuel S. Stewart, Jr. PhD, CFA President of | DEAR FELLOW SHAREHOLDERS:

As the U.S. economic recovery approaches its sixth anniversary, prognosticators may want to borrow from the practice of medieval mapmakers. To depict areas beyond established frontiers, mapmakers drew colorful illustrations of dragons and other mythological creatures. The message was one of caution: No one knows what lies there. While today’s economic landscape may not be fraught with the perils of a months-long ocean voyage on a wind-powered vessel navigating in uncharted waters, the challenges facing investors are real. To be sure, there are many positive signs. Over the past year, the pace of the economic recovery in the U.S. has held relatively steady, the unemployment rate has continued to fall as new jobs have been created at a healthy clip, and most financial markets have stayed at elevated levels. At the same time, many economies around the globe are still struggling, short-term interest rates continue to hover near zero, the prices of various commodities have declined, energy prices in particular have plummeted, and the dollar has gained sharply against other world currencies. In numerous respects, the current situation is unlike that of any prior period. Similar to the explorers of old, we may be poised to discover whether or not there are dragons lurking beyond the horizon. |

ECONOMY

On the surface, the waters appear relatively calm and the wind is at our backs. Most financial markets have continued to hold their values or trend upward. U.S. economic data generally indicate that we’re still in a period of slow but steady growth.

The unemployment rate has resumed its decline, but the civilian labor force participation rate is somewhat concerning as it sits near its 37-year low. And new-job creation was disappointing in March. Nevertheless, for all of 2015, new jobs are expected to total more than three million, roughly the same as last year.

Inflation is expected to remain low, given the huge assist from declining energy prices, and is likely to stay below the U.S. Federal Reserve’s target of 2%. In addition, the housing market is expected to finish the year strong with gains in housing starts, rising sales of existing homes and a resurgence of first-time buyers.

The economies of Europe and Japan are more problematic despite ongoing monetary stimulus. The real gross domestic product (GDP) growth rate for the euro area is forecast to be just 1.3% this year. In Japan, neither Abenomics nor a deliberate devaluation of the Japanese yen has had the desired effect. On the other hand, China’s GDP growth looks impressive by comparison. Although many investors were unnerved by the deceleration in growth for 2014, China remains one of the fastest-growing countries in the world.

Beyond GDP growth rates, of all the economic factors that make investors pause, some of the most concerning to me are the levels of interest rates around the world. The yield on 10-year U.S. Treasury bonds is currently below 2%, down from about 4% five years ago. Three-year Treasury notes are currently yielding less than 1%, while one-year Treasury bills are yielding about 0.25%. As I’ve cautioned many times, investors seeking higher yields today are taking on considerable principal risks. Even small rate increases could result in substantial principal losses for longer-term bonds.

So are we headed for another period of financial stress? That’s the question many investors are asking. While current stock valuations are elevated, I don’t see an obvious economic parallel to the situation leading up to the global financial crisis that began in 2007.

During the global financial crisis of 2007 to 2009, not only did the stock market suffer, the entire economy was teetering. Appropriately, central bankers and policymakers came to the rescue. Today, I feel that the global economy is on reasonably sound footing — despite slow growth around the world. But it’s important to note that investors can experience losses even when the economy is relatively resilient. For example, during the tech bear market of 2000 to 2002, stock prices generally fell despite the fact that quarterly GDP growth was positive in 10 out of 12 quarters.

My main point is that we’re in a “high-degree-of-difficulty” environment. There are no easy answers. Take oil, for example, which recently fell below $50 per barrel. For those who think they know where oil is headed next, I’d ask how well they predicted oil’s price action in 2008 and 2009. Back then, oil had an even-more dramatic decline — only to recoup about two-thirds of its losses in relatively short order.

The same can be said about our ability to predict the consequences of other economic phenomena: Low, even negative, interest rates throughout the world. New rounds of monetary stimulus by the European Central Bank and the Bank of Japan. A significant rise in the value of the U.S. dollar. Intentional depreciation of the Japanese yen. And slow economic growth contributing to fears of deflation. Can all of these occur without a major disruption down the road? Maybe. But it wouldn’t be surprising if the economy did indeed encounter some dragons in the coming years.

MARKETS

Seemingly in defiance of the slow-growth economy, and in the face of potentially higher interest rates from the Federal Reserve, most stocks continued their advance during the first quarter of 2015. The S&P 500® Index rose 0.95%, its ninth straight quarterly increase. Repeating the pattern of the previous quarter, small caps, as measured by the Russell 2000® Index, performed even better with a rise of 4.32%. For the first time since the dot-com bubble burst in 2000, the Nasdaq Composite Index advanced past the 5,000 level, although the Index had settled a bit lower by quarter-end.

2

Table of Contents

| MARCH 31, 2015 (UNAUDITED) | ||

| ||

| ||

Moreover, the quarter’s gains were broad-based. Most sectors, market-cap ranges and style categories were in positive territory. Bond markets advanced as well. The intermediate-term Barclays Capital U.S. Aggregate Bond Index gained 1.61% and the long-term Barclays U.S. 20+ Year Treasury Bond Index rose 4.19%.

Overseas, European and Japanese stocks posted strong gains for the most part. Performance among emerging markets varied — China, India, Korea and Taiwan generally did well, while Latin America struggled. The strengthening U.S. dollar has had mixed impact internationally — boosting trade, but making dollar-denominated debt more expensive.

After several years of sharply rising stock prices and slow economic growth, there’s no question that valuations on most U.S. companies are high. Nor is there any denying that we’re now in a high-degree-of-difficulty environment, making the job of portfolio management more challenging.

In addition to the complicated risk/reward trade-offs of the current market environment, the S&P 500 Index has not had a correction of 10% or more for about three and a half years, which is two years longer than the average bull market. As a result, I believe now is a time for caution.

While I don’t think that most investors can effectively move in and out of the markets, a somewhat higher-than-normal cash position might be warranted for more-conservative investors. And in an era of markets often dominated by speculative trend-following, I think it’s especially important for portfolio managers to really understand the companies in which they’re invested. This has always been our focus at Wasatch.

Regarding interest rates, I’ve said before that mild increases would help people at or near retirement who are currently unable to generate reasonable income on their lower-risk investments. Higher interest rates would also encourage a healthier credit environment — more borrowers would have access to capital and lenders would have the potential to receive fair returns.

Now that the Fed has signaled a rate hike for later this year, my outlook is for a reversion to normalcy. But again, the endgame is especially difficult to predict because we haven’t been here before and we don’t know the nature of the dragons that may appear.

WASATCH

Wasatch is celebrating its 40th anniversary this year. In some ways, today’s environment couldn’t be more different from when I founded the firm in 1975. Back then, 10-year U.S. Treasury bonds were yielding about 8%. Inflation was running at approximately 9%. Oil prices were spiking upward. And stock prices were low coming off of the 1973 to 1974 bear market.

What hasn’t changed is our focus on seeking to exploit opportunities in less-efficient areas of the markets. From the 1970s through the 1990s, most of our efforts were dedicated to researching U.S. small-cap companies that were able to rapidly grow their returns on capital. In 2000, we applied the same philosophy and process to international markets and launched our first international investment vehicle.

With sincere thanks for your continued investment and for your trust,

Sam Stewart

Information in this report regarding market or economic trends, or the factors influencing historical or future performance, reflects the opinions of management as of the date of this report. These statements should not be relied upon for any other purpose. Past performance is no guarantee of future results, and there is no guarantee that the market forecasts discussed will be realized.

CFA® is a trademark owned by CFA Institute.

Wasatch Advisors is the investment advisor to Wasatch Funds.

Abenomics refers to the economic policies advocated by Japanese prime minister Shinzo Abe after his December 2012 re-election to the post he last held in 2007.

A bear market is generally defined as a drop of 20% or more in stock prices over at least a two-month period.

A bull market is defined as a prolonged period in which investment prices rise faster than their historical average. Bull markets can happen as the result of an economic recovery, an economic boom or investor psychology.

Gross domestic product (GDP) is a basic measure of a country’s economic performance, and is the market value of all final goods and services made within the borders of a country in a year.

Valuation is the process of determining the current worth of an asset or company.

The S&P 500 Index includes 500 of the United States’ largest stocks from a broad variety of industries. The Index is unmanaged, but is a commonly used measure of common stock total-return performance.

The Russell 2000 Index is an unmanaged total-return index of the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Russell 2000 is widely used in the industry to measure the performance of small-company stocks.

The Barclays Capital U.S. Aggregate Bond Index covers the U.S. investment grade fixed rate bond market, including government and corporate securities, agency mortgage pass-through securities, and asset-backed securities.

The Barclays U.S. 20+ Year Treasury Bond Index measures the performance of U.S. Treasury securities that have remaining maturities of 20 or more years.

The Nasdaq Composite Index is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the Index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks.

You cannot invest directly in these or any indices.

3

Table of Contents

| WASATCH CORE GROWTH FUND (WGROX / WIGRX) — Management Discussion | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

The Wasatch Core Growth Fund is managed by a team of Wasatch portfolio managers led by JB Taylor and Paul Lambert.

JB Taylor Lead Portfolio Manager |

Paul Lambert Portfolio Manager | OVERVIEW

Small-cap stocks were strong in the first quarter of 2015. After a year of trailing the S&P 500® Index, small caps outperformed their larger-cap counterparts for the second quarter in a row. It was |

also another quarter in which the average small-cap manager underperformed. In this context, we were pleased that the Wasatch Core Growth Fund — Investor Class gained 7.30% and outperformed its benchmarks. The Russell 2000 Index advanced 4.32% and the Russell 2000 Growth Index returned 6.63%. We attribute our performance to solid stock-picking, which was strong across the Fund.

DETAILSOFTHE QUARTER

It’s impossible to discuss the current market environment without addressing the phenomenal performance of the biotechnology industry. The average biotechnology stock in the Russell 2000 Growth Index was up approximately 15% in the quarter, more than double the overall Index return. This has been an impressive run — in 13 of the last 16 quarters biotechnology stocks have outperformed.

The Fund’s minimal exposure to biotech companies has been a huge headwind. Most biotech companies go years without generating profits, and a company with great science may still fail to win Food and Drug Administration approval for its products. More biotech companies will fail than succeed, and the big winners heavily skew the industry’s performance.

We want to own profitable companies like Icon plc, which provides clinical-research services to the biotechnology industry. We call this a “picks and shovels” approach — selling goods and services to a well-capitalized group of risk-takers. In the first quarter, Icon was among our best contributors.

We will continue to execute our current strategy for the biotech industry, running a large underweight versus the benchmark, but occasionally rifle-shooting for a company with great science, a proven management team and a market valuation that is small relative to the company’s end-market potential.

The U.S. dollar continued to strengthen in the first quarter and the price of oil is still nearly 50% below the price last summer. Low-priced oil helps a company like our small-cap airline Allegiant Travel Co., where fuel is the largest single cost item in the income statement. Allegiant was the top contributor to the Fund’s performance in the first quarter.

Although the overall backdrop for small-cap fundamentals is the best we have seen in a long time, valuations remain high for U.S. small caps. The number of companies

trading with market valuations greater than 10 times revenues, a valuation metric we would consider “extreme,” remains close to an all-time high. A historically low number of companies today qualify as inexpensive (less than 1 times revenues). We believe we must stay disciplined with our valuations in such an elevated market. At quarter-end, the Fund’s price-to-earnings (P/E) multiple was roughly in line with both indices, but we have been capturing much better-than-average revenue and earnings growth rates.

It’s not customary for us to outperform in such a strong small-cap market. Our focus on high-quality companies typically has resulted in the Fund giving up some performance relative to the indices in the strongest markets, but it has often outperformed by a wide margin in choppier markets. To illustrate, on the 100 worst market days between December 31, 2012 and March 31, 2015, the Russell 2000 Growth Index was down, on average, -1.6%, and the Wasatch Core Growth Fund outperformed on 92% of those days. We attribute the Fund’s recent outperformance to the underlying fundamentals of our portfolio companies. For example, the Fund’s second-best contributor was Credit Acceptance Corp., a non-prime auto-finance company that we believe has an exceptional management team and a track record for prudently allocating capital.

Life Time Fitness, Inc. and Polypore International, Inc. announced that they were being acquired. Even though these two companies were top contributors for the quarter, we didn’t spend much time cheering. When they have been acquired, we’ll need to find businesses of comparable strength to replace them with.

From our first purchase in 2005 through the end of 2012, MSC Industrial Direct Co., Inc. executed superbly and continued to take profitable share in a large maintenance, repair and operations market. Since then, the company has had a difficult time turning investment spending on new initiatives into profitable growth.

Cornerstone OnDemand, Inc. posted a solid fourth quarter, but management gave disappointing guidance. With 30% of Cornerstone’s revenues generated outside the U.S., the strong dollar will make the company’s growth rate look lower in the short term. We like Cornerstone and believe it is one of the most attractively valued software-as-a-service (SaaS) businesses in the market.

OUTLOOK

From where we sit, the operating environment for U.S. small-cap companies continues to improve and the average U.S. small-cap company’s fundamentals are accelerating. This has provided a good environment for us to execute our bottom-up selection process, as we focus on what we consider to be the highest-quality and best-managed long-duration growth companies. Our companies have consistently posted revenue and earnings growth rates that are higher than the average company. The ability to capture above-average earnings growth, compounded patiently over time, is at the center of our time-tested investment philosophy.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

4

Table of Contents

| WASATCH CORE GROWTH FUND (WGROX / WIGRX) — Portfolio Summary | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

AVERAGE ANNUAL TOTAL RETURNS

| SIX MONTHS* | 1 YEAR | 5 YEARS | 10 YEARS | |||||||||||||

Core Growth (WGROX) — Investor | 17.85% | 15.11% | 17.15% | 8.65% | ||||||||||||

Core Growth (WIGRX) — Institutional | 17.91% | 15.20% | 17.21% | 8.67% | ||||||||||||

Russell 2000® Index | 14.46% | 8.21% | 14.57% | 8.82% | ||||||||||||

Russell 2000® Growth Index | 17.36% | 12.06% | 16.58% | 10.02% | ||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2015 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Core Growth Fund are Investor Class: 1.18% / Institutional Class: 1.18%, Net: 1.12%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 1/31/2012 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 1/31/2012 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

| *Not | annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Net Assets | |||

| Allegiant Travel Co. | 4.3% | |||

| Cimpress N.V. | 3.4% | |||

| Life Time Fitness, Inc. | 3.3% | |||

| Spirit Airlines, Inc. | 2.9% | |||

| Credit Acceptance Corp. | 2.9% | |||

| Company | % of Net Assets | |||

| Polypore International, Inc. | 2.9% | |||

| MEDNAX, Inc. | 2.8% | |||

| Tyler Technologies, Inc. | 2.6% | |||

| Old Dominion Freight Line, Inc. | 2.5% | |||

| Dealertrack Technologies, Inc. | 2.4% | |||

| ** | As of March 31, 2015, there were 57 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

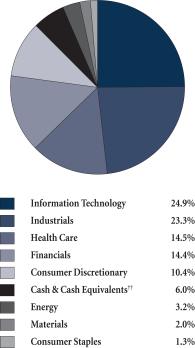

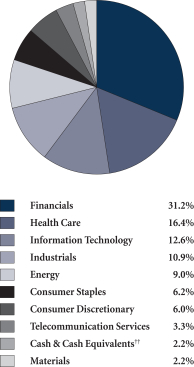

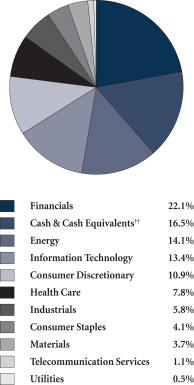

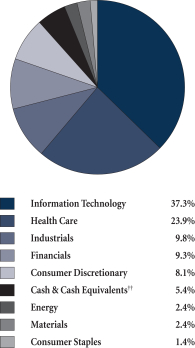

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

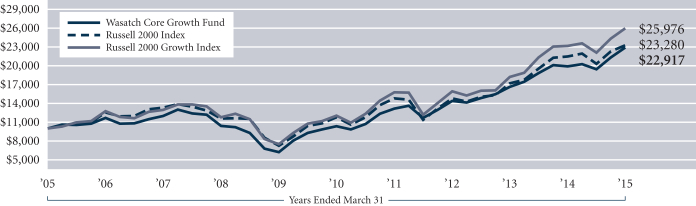

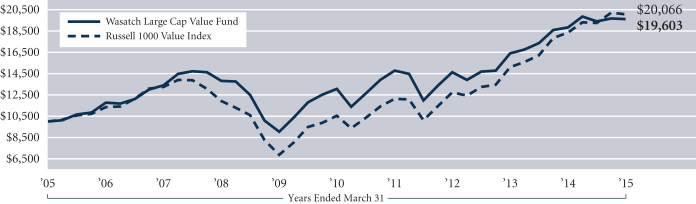

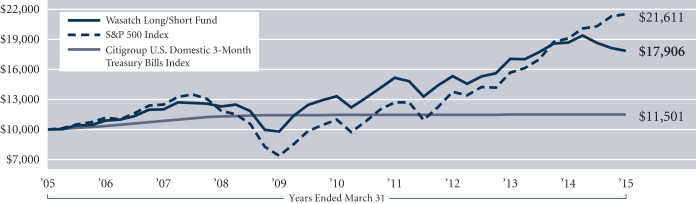

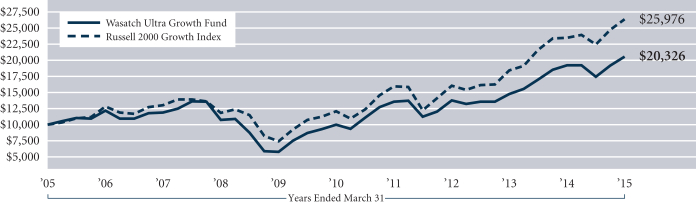

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. The Russell 2000 Index is an unmanaged total return index of the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Russell 2000 Index is widely regarded in the industry as accurately capturing the universe of small company stocks. The Russell 2000 Growth Index is an unmanaged total return index that measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values. You cannot invest directly in these or any indices.

5

Table of Contents

| WASATCH EMERGING INDIA FUND (WAINX) — Management Discussion | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

The Wasatch Emerging India Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan.

Ajay Krishnan, CFA Lead Portfolio Manager | OVERVIEW

In the first quarter of 2015, the Wasatch Emerging India Fund gained 5.76%. The Fund narrowly outpaced its benchmark, the MSCI India Investable Market Index, which rose 5.52%. India continued to benefit from lower oil prices. Because the country imports about 80% of its oil, Brent crude’s decline of 48% over the past year has brought down India’s current-account deficit and rate of inflation. Those developments, in |

turn, helped shore up the currency and boosted inflows of foreign capital. The improved backdrop enabled the Reserve Bank of India to cut interest rates twice during the first quarter to stimulate economic growth.

While falling energy and commodity prices have lowered production costs and boosted the profits of Indian companies, top-line growth has been uninspiring. In the first quarter, the consumer-staples sector was the Fund’s largest source of outperformance, as our companies benefited from margin expansion and persistent demand for their products. Our lack of investments in energy companies also helped the Fund by avoiding direct exposure to what proved to be the worst-performing sector of the Index.

DETAILSOFTHE QUARTER

Our two strongest contributors to Fund performance for the quarter were Lupin Ltd. and Natco Pharma Ltd. Both companies manufacture branded and generic pharmaceuticals and market them in India and other countries. Lupin is experiencing strong demand for its generic formulations and continues to execute well. The company also is benefiting from its excellent record with the U.S. Food and Drug Administration (FDA) and its significant number of new drugs completing registration and entering production.

Natco’s pipeline is impressive as well. The company has 34 applications for new drugs filed with the FDA and 22 more pending. It plans to launch its generic form of the multiple-sclerosis drug Copaxone later this year. Shares of Natco rose sharply in the first quarter on news it had won approval to market a generic version of Gilead’s new Hepatitis C drug, Sovaldi, in India and 90 other countries.

HCL Technologies Ltd. was our third-largest contributor. HCL is an information-technology (IT) company that provides infrastructure-management services in India, the U.S. and other countries. It has been especially successful at winning contracts that have come up for rebidding. Net income at the company jumped 28.0% in its most-recently reported quarter on 13.4% sales growth versus the same period a year ago. On a three-year horizon, we expect continued strong demand for its services to make HCL an ongoing holding in the Fund.

Our greatest detractor from performance for the quarter was India’s largest non-banking finance company, Mahindra

& Mahindra Financial Services Ltd. Through its network of branches, Mahindra finances purchases of tractors, utility vehicles, cars and homes, primarily in rural India. Although sales rose 11.3% year-over-year in the company’s most-recently reported quarter, earnings declined as weakness in southern India and a below-average monsoon season led to an uptick in non-performing loans. We view this as a temporary setback inherent in the uneven nature of the company’s business and continue to own the stock in the Fund.

Two other weak stocks in the Fund were La Opala RG Ltd. and TD Power Systems Ltd. Opala makes tableware, including opalware dinner sets and crystal. The company’s share price declined on investor concerns that top-line growth may be slowing. We think these fears are overdone, however, and remain optimistic about Opala’s long-term prospects.

TD Power manufactures and sells electric-power generators in India and internationally. Despite a 23.1% increase in sales, the company posted a small loss in its most-recently reported quarter compared to a small gain in the year-ago period. We believe this is a high-quality company positioned to make further inroads into European and Japanese markets, while also benefiting from planned upgrades to India’s railroad system and other infrastructure.

OUTLOOK

Even though the Indian government expects gross domestic product (GDP) to have increased 7.4% during the fiscal year ended March 31, pockets of weakness and lackluster sales growth have raised investor concerns. On the plus side, public finances have improved significantly, with the fiscal deficit over the same period projected to come in at 4.1% of GDP, the lowest in seven years. With recent auctions of coal licenses and mobile-telephone airwaves having added billions of dollars to government coffers, we believe the Modi government is likely to deliver on its ambitious plans for improving India’s roads, ports and power plants.

Streamlining India’s bureaucracy may prove more difficult, especially given its contentious political culture and decentralized system of government. Even so, such reforms are crucial for economic development. The maze of regulations, taxes and fees imposed by the country’s 29 states have dropped India to 142 out of 189 countries on the World Bank’s latest Ease of Doing Business Index. In areas such as contract enforcement and construction permits, India ranks even lower.

One initiative in which the government is making significant headway involves using biometric-enhanced ID cards to reduce fraud in its welfare system and provide benefits more efficiently to hundreds of millions of poor people. Other encouraging signs include progress on a proposed national sales tax. Known as the “goods-and-services tax,” the measure would transform India into a single market for the first time and pave the way for further expansions in commerce and manufacturing.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

6

Table of Contents

| WASATCH EMERGING INDIA FUND (WAINX) — Portfolio Summary | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

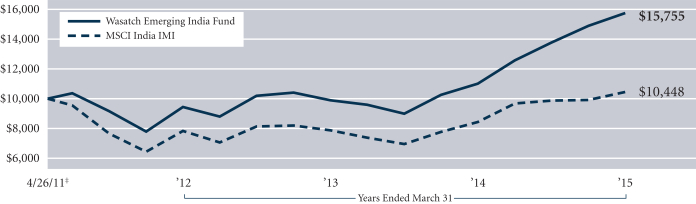

AVERAGE ANNUAL TOTAL RETURNS

| SIX MONTHS* | 1 YEAR | 5 YEARS | SINCE INCEPTION 4/26/11 | |||||||||||||||||

Emerging India | 14.35% | 43.20% | N/A | 12.26% | ||||||||||||||||

MSCI India IMI | 5.93% | 24.14% | N/A | 1.12% | ||||||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2015 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging India Fund are 2.57%. The Net Expenses are 1.95%. The expense ratio shown elsewhere in this report may be different. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

| *Not | annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Net Assets | |||

| Cognizant Technology Solutions Corp., Class A | 3.2% | |||

| Natco Pharma Ltd. (India) | 3.2% | |||

| HCL Technologies Ltd. (India) | 3.0% | |||

| Glenmark Pharmaceuticals Ltd. (India) | 2.9% | |||

| MakeMyTrip Ltd. (India) | 2.6% | |||

| Company | % of Net Assets | |||

| Marksans Pharma Ltd. (India) | 2.6% | |||

| Axis Bank Ltd. (India) | 2.6% | |||

| Repco Home Finance Ltd. (India) | 2.5% | |||

| Lupin Ltd. (India) | 2.5% | |||

| Bajaj Finance Ltd. (India) | 2.2% | |||

| ** | As of March 31, 2015, there were 84 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

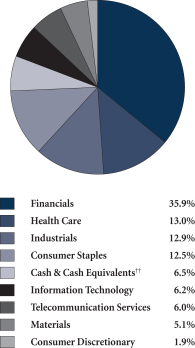

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ‡Inception: April 26, 2011. The MSCI India IMI (Investable Market Index) is designed to measure the performance of the large-, mid- and small-cap segments of the Indian market. The Index covers approximately 99% of the free-float adjusted market capitalization of the Indian equity universe. You cannot invest directly in this or any index.

7

Table of Contents

| WASATCH EMERGING MARKETS SELECT FUND (WAESX / WIESX) — Management Discussion | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

The Wasatch Emerging Markets Select Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan and Roger Edgley.

Ajay Krishnan, CFA Lead Portfolio Manager |

Roger Edgley, CFA Portfolio Manager | OVERVIEW

In the first quarter of 2015, the Wasatch Emerging Markets Select Fund — Investor Class fell |

which gained 2.24%. Emerging-market equities generally rose as the prospect of further policy easing in China lifted Asian shares and firmer oil prices boosted energy stocks.

Comments from Central Bank Governor Zhou Xiaochuan that China’s growth had slowed “too much” raised expectations for new measures to support the Chinese economy. While China, Hong Kong, Korea and Taiwan all posted gains that helped the Index, our minimal positions in those markets were headwinds for the Fund.

Our lack of investments in Russia also hurt the Fund’s performance relative to the Index. Russian stocks surged during the quarter following a cease-fire in Ukraine and a rebound in the price of Brent crude. The benchmark’s holdings in Russia also benefited from modest appreciation of the ruble against the U.S. dollar.

Most other emerging-market currencies fell against the greenback. In Turkey, Brazil and Colombia, currency depreciation produced what were the Fund’s three largest sources of underperformance. Meanwhile, the dollar’s strength helped the big exporters that make up a significant share of the Index. The capitalization effect favoring large- and mega-cap stocks was an additional headwind for the Fund, which generally has significant holdings in smaller-cap companies.

India was the Fund’s top-performing country. In India, our stocks outgained the benchmark’s holdings and made significant contributions to Fund performance. Together with healthy gains in the Philippines and Thailand, our strong showing in India helped the Fund offset much of its underperformance in other countries.

DETAILSOFTHE QUARTER

India accounted for seven of the 10 strongest contributors to Fund performance for the quarter, including Lupin Ltd. and HCL Technologies Ltd. Lupin, our top contributor, markets its branded and generic pharmaceuticals primarily in India, the U.S. and Japan. The company is experiencing strong demand for its products and continues to execute well. Lupin also has benefited from its excellent record of compliance with U.S. Food and Drug Administration regulations.

HCL is an information-technology company that provides infrastructure-management services in India, the U.S. and other countries. It has been especially successful at winning

contracts that have come up for rebidding. On a three-year horizon, we expect continued strong demand for its services to make HCL an ongoing holding in the Fund.

Another strong stock in the Fund was Metropolitan Bank & Trust. Metrobank offers a full range of banking services to business and retail customers in the Philippines. We believe its extensive branch network leaves the bank well-positioned to benefit from growing demand in the Philippines for consumer lending and financial services.

Our greatest detractor from performance for the quarter was Qualicorp S.A. The company offers insurance and benefits packages to corporations and affinity groups in Brazil. Its share price slumped on speculation that Brazil’s government is considering measures to stimulate sales of individual health-insurance plans. In addition, weakness in the Brazilian currency reduced the stock’s value in U.S. dollars.

Coca-Cola Icecek A.S. was the Fund’s second-largest detractor. Serving markets in Turkey, Pakistan, Central Asia and the Middle East, this Turkish company is a major bottler in the Coca-Cola system. Over the past two years, Coca-Cola Icecek has encountered a series of setbacks including the Taksim Gezi Park disturbances and the war against Islamic State in Iraq. In the first quarter, currency weakness in the Turkish lira also impacted the stock. Even so, with per-capita consumption of soft drinks in its markets still low compared to other countries, we think this top-tier bottler is well-situated for future growth.

Our third-largest detractor was Colombian cement company, Cemex Latam Holdings S.A. Strength in the Colombian currency had hurt Cemex by making it economical for a competitor to import cement from outside the country. That situation has now reversed and, over the longer term, we expect the company to benefit from Colombia’s significant infrastructure needs.

OUTLOOK

During the past four years, the MSCI Emerging Markets Index has made little headway — even as the earnings of its underlying companies have increased. As a result, the broad emerging-market universe has become more attractively valued. In addition, the U.S. dollar’s recent climb to multi-year highs has made emerging-market equities less costly for dollar-based investors.

We expect lower oil prices to benefit emerging markets in several ways. First, we believe the lower cost of imported oil will improve current-account deficits and help support the currencies of energy-importing countries. Second, reduced government outlays for fuel subsidies will improve fiscal accounts. Third, the lower cost of energy should put downward pressure on inflation. We believe these factors will help make developing nations more appealing to foreign investors and help emerging markets attract the capital they need to grow.

In short, we believe investment opportunities in emerging markets are more attractive now than at any time in the past several years. We are excited about emerging markets and their expanding role in the global economy.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

8

Table of Contents

| WASATCH EMERGING MARKETS SELECT FUND (WAESX / WIESX) — Portfolio Summary | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

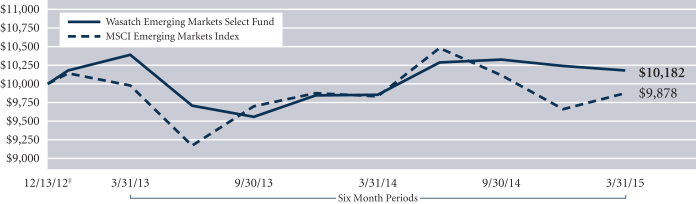

AVERAGE ANNUAL TOTAL RETURNS

| SIX MONTHS* | 1 YEAR | 5 YEARS | SINCE INCEPTION 12/13/12 | |||||||||||

Emerging Markets Select (WAESX) — Investor | -1.41% | 3.30% | N/A | 0.79% | ||||||||||

Emerging Markets Select (WIESX) — Institutional | -1.26% | 3.52% | N/A | 1.21% | ||||||||||

MSCI Emerging Markets Index | -2.37% | 0.44% | N/A | -0.53% | ||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2015 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Select Fund are Investor Class — Gross: 1.88%, Net: 1.69% / Institutional Class — Gross: 1.71%, Net: 1.51%. The expense ratio shown elsewhere in this report may be different. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Being non-diversified, the Fund can invest a larger portion of its assets in the securities of a limited number of companies than a diversified fund. Non-diversification increases the risk of loss to the Fund if the values of these securities decline.

| * | Not annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Net Assets | |||

| Lupin Ltd. (India) | 3.9% | |||

| International Container Terminal Services, Inc. (Philippines) | 3.6% | |||

| PT Tower Bersama Infrastructure Tbk (Indonesia) | 3.6% | |||

| Kasikornbank Public Co. Ltd. (Thailand) | 3.5% | |||

| IndusInd Bank Ltd. (India) | 3.4% | |||

| Company | % of Net Assets | |||

| HCL Technologies Ltd. (India) | 3.3% | |||

| Universal Robina Corp. (Philippines) | 3.2% | |||

| Metropolitan Bank & Trust (Philippines) | 3.2% | |||

| Axis Bank Ltd. (India) | 3.1% | |||

| PT Jasa Marga Persero Tbk (Indonesia) | 3.0% | |||

| ** | As of March 31, 2015, there were 38 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

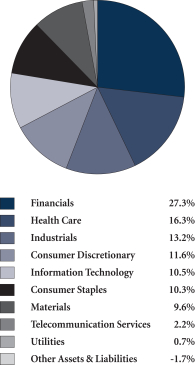

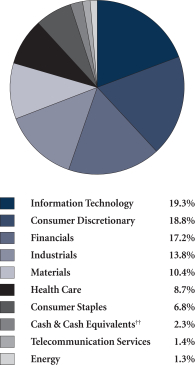

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ‡Inception: December 13, 2012. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index designed to measure the equity market performance of emerging markets. You cannot invest directly in this or any index.

9

Table of Contents

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX) — Management Discussion | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

The Wasatch Emerging Markets Small Cap Fund is managed by a team of Wasatch portfolio managers led by Roger Edgley, Andrey Kutuzov and Scott Thomas.

Roger Edgley, CFA Lead Portfolio Manager |

Andrey Kutuzov, CFA Associate Portfolio |

Scott Thomas, CFA Associate Portfolio |

OVERVIEW

In the first quarter of 2015, the Wasatch Emerging Markets Small Cap Fund gained 0.37% but underperformed its benchmark, the MSCI Emerging Markets Small Cap Index, which gained 3.59%. Emerging-market equity returns were mixed but generally rose as the prospect of further policy easing in China lifted Asian shares.

Comments from Central Bank Governor Zhou Xiaochuan that China’s growth had slowed “too much” raised expectations for new measures to support the Chinese economy. China and Korea posted gains that helped the Index. Our underweighting in those markets and the underperformance of our holdings were headwinds for the Fund. Taiwan was also a positive market. The Fund’s weight in Taiwan was approximately equal to that of the benchmark and our holdings outperformed those in the Index.

Several emerging-market currencies fell relative to the U.S. dollar during the quarter. In Turkey, Brazil and Colombia, currency depreciation impacted stock performance in the benchmark and the Fund. Meanwhile, the dollar’s strength helped the big exporting markets. India continued to provide positive performance.

DETAILSOFTHE QUARTER

It is worth commenting on China and the changes in equity markets there, as well as the implications for emerging-market investors. China is a significant part of the emerging-market indices and it is likely to get much larger given the size of the domestic Chinese equity market as well as U.S.-listed Chinese names. While the Fund remains significantly underweighted in China, we expect to increase our Chinese holdings over time.

The difficulty for equity investors in China has been to find high-quality names that are not state-owned enterprises (SOEs) or connected to or controlled by SOEs (the capitalization of SOEs is well over 70% of the market). That is part of the reason China is a value market, though reforming SOEs — which seems part of the Chinese government’s agenda — may help to improve their valuations. The performance of emerging-market SOEs has been substantially worse than the market since 2008. At the present time, China is opening up its equity market and the currency is

becoming liberalized. This is not a small market opening up. The market capitalization of the domestic Chinese market is over US$4 trillion.

For us as small-cap investors, our challenges in China have been lack of scale in companies we see (in a large-scale economy), hyper-competition, corporate governance and unclear strategy. These challenges will not go away. However, over time we believe companies and managements will improve. We see progress in the “new areas” of the economy (Internet, health care, technology). In addition to investing in companies based in mainland China, we also expect to invest in companies based in Hong Kong and Taiwan that have shown they can be successful in China.

Elsewhere, India continued to see strength and the Fund continued to be structurally overweight in India. Natco Pharma Ltd. was one of the Fund’s top contributors. Natco’s share price rose sharply in the first quarter on news it had won approval to market a generic version of Gilead’s new Hepatitis C drug, Sovaldi, in India and 90 other countries.

The Fund is still underweight in Korea, but we are increasingly finding more attractive opportunities as dividends increase, government regulation improves and labor productivity gets better. Nevertheless, Korea was a source of underperformance in the first quarter as our companies overall did not keep pace with those in the benchmark. Hanssem Co. Ltd., a manufacturer of kitchen and bath cabinetry, was up over 50% and was the Fund’s top contributor to performance. On the other hand, i-SENS, Inc. was down over 20% and detracted from performance. i-SENS, one of the world’s leading manufacturers of blood-glucose monitoring systems, has one of the lowest costs of manufacturing for blood-glucose strips. The company also has a strong research and development pipeline.

Another large detractor was Qualicorp S.A., a firm offering insurance and benefits packages to corporations and affinity groups in Brazil. Qualicorp’s shares slumped on speculation that the government is considering measures to stimulate sales of individual health-insurance plans, which could increase competition in Qualicorp’s industry.

OUTLOOK

Overall, we see a much better tone in emerging markets. While gross domestic product (GDP) growth has been slowing and U.S. dollar-denominated debt levels remain a concern, we’re optimistic regarding the prospects for lower interest rates and SOE reforms.

The outlook is clearly improving in the developed regions of Europe and Japan. Emerging markets may be lagging, but over time they may also benefit from the improvement in developed markets. During the past four years, the MSCI Emerging Markets Small Cap Index has essentially moved sideways even as the earnings of its underlying companies have increased. As a result, the broad emerging-market universe has become more attractively valued. In addition, the U.S. dollar’s recent climb to multi-year highs has made emerging-market equities less costly for dollar-based investors. Going forward, we anticipate lower oil prices will also benefit many emerging markets.

We appreciate the support that shareholders have shown us.

Current and future holdings are subject to risk.

10

Table of Contents

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX) — Portfolio Summary | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

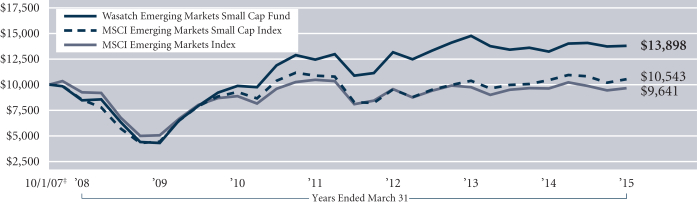

AVERAGE ANNUAL TOTAL RETURNS

| SIX MONTHS* | 1 YEAR | 5 YEARS | SINCE INCEPTION 10/1/07 | |||||||||||||

Emerging Markets Small Cap | -2.06% | 4.42% | 7.06% | 4.49% | ||||||||||||

MSCI Emerging Markets Small Cap Index | -2.65% | 1.06% | 2.64% | 0.71% | ||||||||||||

MSCI Emerging Markets Index | -2.37% | 0.44% | 1.75% | -0.49% | ||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2015 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Small Cap Fund are 2.02%. The Net Expenses are 1.95%. The expense ratio shown elsewhere in this report may be different. Net Expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

| * | Not annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Net Assets | |||

| D&L Industries, Inc. (Philippines) | 2.0% | |||

| Hermes Microvision, Inc. (Taiwan) | 2.0% | |||

| Security Bank Corp. (Philippines) | 2.0% | |||

| Pidilite Industries Ltd. (India) | 1.8% | |||

| Giant Manufacturing Co. Ltd. (Taiwan) | 1.7% | |||

| Company | % of Net Assets | |||

| Koh Young Technology, Inc. (Korea) | 1.7% | |||

| Merida Industry Co. Ltd. (Taiwan) | 1.7% | |||

| Minor International Public Co. Ltd. (Thailand) | 1.7% | |||

| Poya Co. Ltd. (Taiwan) | 1.6% | |||

| Hotel Shilla Co. Ltd. (Korea) | 1.6% | |||

| ** | As of March 31, 2015, there were 111 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

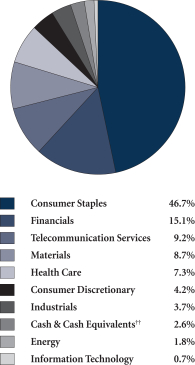

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ‡Inception: October 1, 2007. The MSCI Emerging Markets and Emerging Markets Small Cap indices are free float-adjusted market capitalization indices designed to measure the equity market performance of emerging markets. You cannot invest directly in these or any indices.

11

Table of Contents

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND (WAFMX) — Management Discussion | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

The Wasatch Frontier Emerging Small Countries Fund is managed by a team of Wasatch portfolio managers led by Laura Geritz.

Laura Geritz, CFA Lead Portfolio Manager | OVERVIEW

The Wasatch Frontier Emerging Small Countries Fund fell -4.52% in a disappointing first quarter of 2015. The Fund also underperformed the MSCI Frontier Emerging Markets Index, which lost -2.42%. The first quarter was a difficult time for frontier markets. Lower oil prices continued to weigh on net exporters of oil and hurt performance in Nigeria, Colombia and Kuwait. Nevertheless, |

many frontier markets remain bright spots of positive change and growth in a growth-challenged world.

I think the pullback in frontier markets has been overdone and has been driven by sharply lower oil prices, which have had collateral effects on more domestically oriented companies in various countries. With the retrenchment in the equity markets, frontier stocks look attractively valued.

DETAILSOFTHE QUARTER

In his latest quarterly message, Wasatch Funds’ President, Sam Stewart, speaks of dragons as metaphors for uncertainty in today’s investment environment. The Frontier Emerging Small Countries Fund ventures into places relatively unexplored on the map, where dragons illustrate boundaries not yet crossed by most investors.

Given a number of weak quarters in a row for frontier markets and media headlines suggesting something might be wrong with the economies where we invest, my team and I rolled up our sleeves and went out in an attempt to slay the dragons — to find out if negative movements in the markets had much justification based on the fundamentals. We traveled to Vietnam, Cambodia, Laos, Turkey, Sri Lanka, the United Arab Emirates, Qatar, Egypt, Tunisia and South Korea.

We met scores of management teams and spent hours with central bankers, journalists, economists and other experts in each country. This was one of the most-grueling explorations of frontier markets since the launch of the Fund. When stocks go down, I always fear I’m missing something. However, I walked away from this trip with even stronger conviction that the frontier story remains as good as, if not better than, ever.

It had been roughly a year since I last touched down in Vietnam and about three years since I had been to Cambodia and Laos. The changes underway are stunning. These countries, with dynamic, young and educated labor pools, appear perfectly positioned to benefit from the movement of jobs from China. In addition to low-end jobs, high-tech jobs are moving here as well.

Vietnam is targeting hundreds of initial public offerings (IPOs). Cambodia is introducing companies as well, though custody is still a bottleneck. Laos is behind the curve, but has plenty of funding from regional governments that see placing money here as having the potential for great returns

on investment. We can gain access to this market through regional players with a strong footprint in Laos. So why isn’t the Vietnamese stock market raging? From our deep due diligence, it’s nothing fundamental. Our analysis concluded that for most constituents of the frontier asset class, the best is yet to come.

I made my first visit to Tunisia. This is the country where the Arab Spring was ignited. Surely, this would be a terrifying place — filled with dragons. My view from the airplane was one of verdant hills covered in olives and grapes, a sparkling sea, and modern roads and buildings. After a day of meetings and a lunch at the last remaining caravan hotel in the city, it was crystal clear to me that the reason the Arab Spring started in this nation was that it could. While Tunisia is a small market, its companies have a long history of regional success and significant growth rates. In addition, attractive IPOs are springing up in the country.

SECTORAND COUNTRY REVIEW

The consumer-staples sector detracted the most from the Fund’s absolute performance in the first quarter. We believe consumer-staples companies continue to offer the most attractive exposure to frontier markets with the best risk-to-return profile, which explains why over 40% of the Fund is in this sector. During the first quarter, our consumer-staples holdings declined, but not as much as those in the benchmark.

Several of the Fund’s biggest detractors for the quarter came from the consumer-staples sector, including food-products manufacturer and distributor Nestlé Nigeria plc, Nigerian Breweries and food processor Grupo Nutresa S.A. (Colombia). However, six of the Fund’s top 10 contributors to performance were consumer-staples companies including British American Tobacco Bangladesh Co. Ltd.; Universal Robina Corp., the largest food and beverage company in the Philippines; and Agthia Group PJSC, a UAE agribusiness and consumer-foods company.

Our holdings in Nigeria and Pakistan, traditionally strong markets for the Fund, were significant sources of weakness for the quarter. Bangladesh and the Philippines were the largest contributors to the Fund’s absolute performance. Kenya was the Fund’s rare outperformer in sub-Saharan Africa, helped by our investment in telecommunications company Safaricom Ltd., our top contributor for the quarter.

OUTLOOK

While I’m comfortable with our investments, I’ve had the privilege of personally venturing to frontier markets to see the opportunities firsthand. My hope is that investors trust me as a dragonslayer. I take my fiduciary duty with the utmost seriousness and invest my assets alongside the Fund’s shareholders. My fear is that without confronting the dragons firsthand, investors will confuse falling stock prices with weak fundamentals. I hope I��ve convinced you otherwise. I remain confident and excited about the long-term prospects of frontier markets in general, and the Fund in particular.

Thank you very much for your investment.

Current and future holdings are subject to risk.

12

Table of Contents

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND (WAFMX) — Portfolio Summary | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

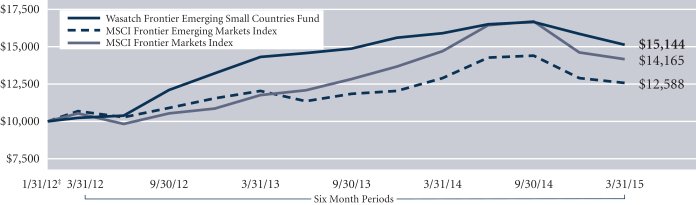

AVERAGE ANNUAL TOTAL RETURNS

| SIX MONTHS* | 1 YEAR | 5 YEARS | SINCE INCEPTION 1/31/12 | |||||||||||||||||

Frontier Emerging Small Countries | -9.04% | -4.74% | N/A | 14.01% | ||||||||||||||||

MSCI Frontier Emerging Markets Index | -12.58% | -2.50% | N/A | 7.54% | ||||||||||||||||

MSCI Frontier Markets Index | -15.18% | -3.62% | N/A | 11.63% | ||||||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2015 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Frontier Emerging Small Countries Fund are 2.24%. The expense ratio shown elsewhere in this report may be different. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in frontier and emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

| * | Not annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Net Assets | |||

| East African Breweries Ltd. (Kenya) | 3.2% | |||

| Commercial International Bank S.A.E. (Egypt) | 3.2% | |||

| GrameenPhone Ltd. (Bangladesh) | 2.9% | |||

| Safaricom Ltd. (Kenya) | 2.9% | |||

| Universal Robina Corp. (Philippines) | 2.5% | |||

| Company | % of Net Assets | |||

| Kuwait Foods Americana (Kuwait) | 2.5% | |||

| Square Pharmaceuticals Ltd. (Bangladesh) | 2.4% | |||

| Nestlé Nigeria plc (Nigeria) | 2.4% | |||

| Vietnam Dairy Products JSC (Vietnam) | 2.4% | |||

| Nigerian Breweries plc (Nigeria) | 2.2% | |||

| ** | As of March 31, 2015, there were 142 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

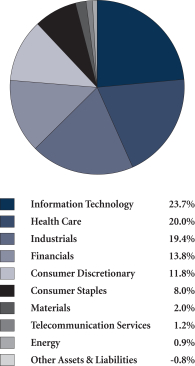

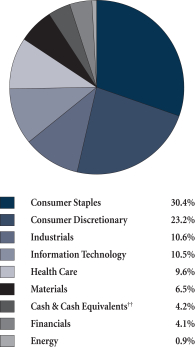

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ‡Inception: January 31, 2012. The MSCI Frontier Emerging Markets and MSCI Frontier Markets indices are free float-adjusted market capitalization indices designed to measure the equity market performance of the global frontier and emerging markets. You cannot invest directly in these or any indices.

13

Table of Contents

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX) — Management Discussion | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

The Wasatch Global Opportunities Fund is managed by a team of Wasatch portfolio managers led by JB Taylor and Ajay Krishnan.

JB Taylor Lead Portfolio Manager |

Ajay Krishnan, CFA Lead Portfolio Manager | OVERVIEW

The Wasatch Global Opportunities Fund was up 4.04% in the first quarter of 2015, roughly keeping pace with the benchmark MSCI AC World Small Cap Index, which returned 4.36%. |

Ongoing signs of strength in the domestic economy supported U.S. small-cap performance, as the employment backdrop continued to improve and consumers benefited from the recent decline in oil prices. At the same time, the U.S. Federal Reserve reiterated that the inevitable tightening of monetary policy would be measured, given an inflation rate that has remained below the target level.

Among other major developed markets, Japanese small caps performed extremely well. In addition, most eurozone stocks rebounded as the European Central Bank stepped up its commitment to quantitative easing. Within emerging markets, equity performance was less robust overall, weighed down by some of the commodity-exporting countries and several economies experiencing severe currency weakness.

Against this backdrop, stock selection within countries was the principal factor in the Fund’s performance. Selection within the United States, Japan and the United Kingdom was especially strong. In terms of sectors, selection within consumer discretionary and consumer staples helped relative performance, while selection within financials and health care underperformed the benchmark.

Although we believe our heavy allocation to emerging markets will pay off over the longer term, the allocation was a drag on the Fund’s return during the first quarter. In particular, Brazil, Colombia and Turkey underperformed.

DETAILSOFTHE QUARTER

India had a positive effect on the Fund during the first quarter. Our top-performing Indian stock was Lupin Ltd., which markets branded and generic pharmaceuticals primarily in India, the U.S. and Japan. The company is experiencing strong demand for its products and continues to execute well. Lupin also has benefited from its excellent record of compliance with the U.S. Food and Drug Administration.

Allegiant Travel Co. was another leading contributor to performance for the quarter. The airline has successfully pursued a low-cost, high-utilization business model in select underserved U.S. markets. Moreover, we believe that lower fuel costs will help boost margins and profits going forward.

Pigeon Corp. (Japan) benefited from solid revenue growth and improved sentiment on Japan’s economy. The company has the top market share of sales for baby and child-care products in Japan. Additionally, Pigeon’s overseas business

is expanding mainly due to sales in China.

Qualicorp S.A. detracted from Fund performance for the quarter. Qualicorp offers insurance and benefits packages to corporations and affinity groups in Brazil. The company’s shares slumped on speculation that the government is considering measures to stimulate sales of individual health-insurance plans, which could increase competition in Qualicorp’s industry. Additionally, weakness in the Brazilian real reduced the stock’s value when converted into U.S. dollars.

Information-technology firm Cornerstone OnDemand, Inc. also lagged. Cornerstone, which provides cloud-based human-resources software, saw its shares decline after management lowered revenue guidance for 2015. With its main competitors having been acquired by larger companies, we think Cornerstone is well-positioned to capture more of the growing human-resources software market.

Coca-Cola Icecek A.S., a major bottler in the Coca-Cola system serving markets in Turkey, Pakistan, Central Asia and the Middle East, was another detractor for the quarter. Over the past two years, Coca-Cola Icecek has encountered a series of setbacks including the Taksim Gezi Park disturbances and the war against Islamic State in Iraq. During the quarter, currency weakness in the Turkish lira also impacted the stock. Even so, with per-capita consumption of soft drinks in its markets still low compared to other countries, we think this top-tier bottler is well-situated for future growth.

OUTLOOK

Indications of economic health and employment in the U.S. are more favorable than in most parts of the world. Moreover, our U.S. companies have been reporting excellent sales and earnings growth rates — and margins remain high. However, valuations are generally quite elevated in the U.S. So we’re increasingly looking abroad to find companies with attractive growth opportunities at reasonable prices.

While the Fund’s current weighting in Japan is below that of the benchmark, we’re considering increasing our exposure, as Japan‘s efforts at fiscal stimulus and monetary easing are gradually being accompanied by structural reforms. And we’re increasingly finding well-managed small-cap growth companies in Japan.

European economies have not yet picked up the momentum we’d like to see. Nevertheless, we’re optimistic about the investing environment as we expect accommodative fiscal and monetary policies to take hold in coming quarters.

Although emerging-market stock performance has lagged the performance of developed markets over the past several years, we believe emerging markets now offer especially compelling valuations for companies that are poised to increase revenues and earnings at double-digit rates well into the future. In addition, we expect lower oil prices to benefit emerging markets. In short, the investment opportunities in emerging markets look more attractive to us now than at any time in the past several years.

We continue to look globally for small companies with market leadership, sustainable competitive advantages, strong financials and proven management teams.

Thank you for the opportunity to manage your assets.

Current and future holdings are subject to risk.

14

Table of Contents

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX) — Portfolio Summary | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

AVERAGE ANNUAL TOTAL RETURNS

| SIX MONTHS* | 1 YEAR | 5 YEARS | SINCE INCEPTION 11/17/08 | |||||||||||||||||

Global Opportunities | 5.71% | 5.71% | 12.01% | 21.02% | ||||||||||||||||

MSCI AC World Small Cap Index | 6.22% | 3.23% | 11.00% | 18.40% | ||||||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2015 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Opportunities Fund are 1.78%. The expense ratio shown elsewhere in this report may be different. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in small and micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

| * | Not annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Net Assets | |||

Allegiant Travel Co. | 2.5% | |||

| Wirecard AG (Germany) | 2.4% | |||

Knight Transportation, Inc. | 2.4% | |||

IPG Photonics Corp. | 2.1% | |||

Lupin Ltd. (India) | 2.0% | |||

Seattle Genetics, Inc. | 2.0% | |||

| Company | % of Net Assets | |||

| Medy-Tox, Inc. (Korea) | 1.9% | |||

| International Container Terminal Services, Inc. (Philippines) | | 1.8% | | |

| Calbee, Inc. (Japan) | 1.8% | |||

| MercadoLibre, Inc. (Brazil) | 1.8% | |||

| ** | As of March 31, 2015, there were 78 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

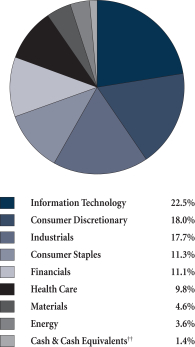

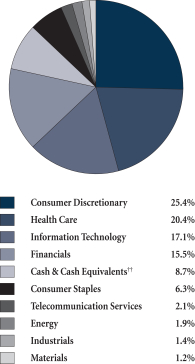

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

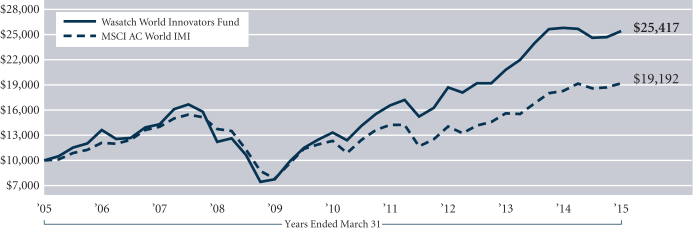

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ‡Inception: November 17, 2008. The MSCI AC (All Country) World Small Cap Index is a free float-adjusted market capitalization index designed to measure the performance of small capitalization securities in developed and emerging markets. You cannot invest directly in this or any index.

15

Table of Contents

| WASATCH HERITAGE GROWTH FUND (WAHGX) — Management Discussion | MARCH 31, 2015 (UNAUDITED) | |

| ||

| ||

The Wasatch Heritage Growth Fund was managed by a team of Wasatch portfolio managers led by Chris Bowen.

Chris Bowen Lead Portfolio Manager | SPECIAL NOTICE

The Wasatch Heritage Growth Fund ceased operations on April 30, 2015. Following official notice to shareholders, the Fund liquidated its holdings and moved to cash and cash equivalents during the first quarter of 2015. For more information, please call Wasatch Funds at 800.551.1700. Per the Special Notice above, the following comments reflect the partial period prior to the liquidation of the |

Fund’s holdings, although the Fund and index returns are for the full quarter.

OVERVIEW

As volatility re-emerged, the stock market as gauged by the S&P 500 Index eked out another gain during the first quarter, rising 0.95%, its ninth consecutive quarterly advance.

In contrast, paced by equities in the information-technology sector, the Wasatch Heritage Growth Fund gained 5.98% for the first quarter of 2015. The result exceeded the 5.38% return of the Fund’s primary benchmark, the Russell Midcap Growth Index.

The Fund’s performance during the quarter was broad-based, but was led by information-technology companies IPG Photonics Corp. and Cognizant Technology Solutions Corp. Another top contributor was health-care company Mallinckrodt plc along with Nu Skin Enterprises, Inc.

The stocks that detracted significantly from the Fund’s performance included F5 Networks, Inc., MSC Industrial Direct Co., Inc. and LKQ Corp. These companies suffered modest declines and, in aggregate, subtracted less than one percentage point from performance.

DETAILSOFTHE QUARTER

A few identifiable factors contributed to the Fund’s recent strong performance. Previously oversold stocks rebounded. Companies exceeded earnings expectations. Relative to historical patterns, we saw more of the Fund’s holdings get acquired at meaningful premiums.

During the quarter, several of the Fund’s larger holdings that didn’t perform well in mid-2014 continued to recover. In most cases, the pullbacks were temporary blips caused by the short-term outlook for each company. Combined with our analysis of individual company fundamentals, our core tenet — treating the investment process as a marathon rather than a sprint — helped us maintain our conviction.

Cognizant is a perfect example of this type of turnaround story. Cognizant’s stock retreated during the third quarter of 2014 due to the perception of slowing growth. We’ve owned the company for many years and feel like we understand it well. Our belief in the ability of Cognizant’s management team to execute its business plan, the company’s competitive and strategic positioning and an attractive long-run outlook

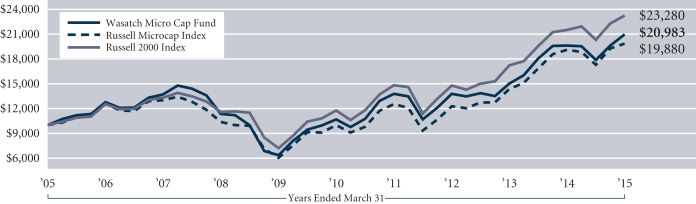

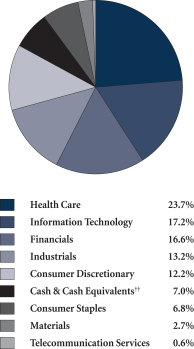

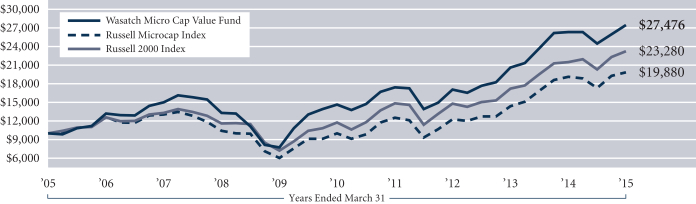

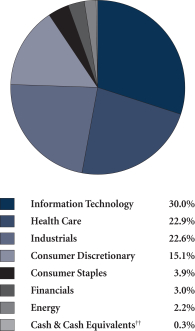

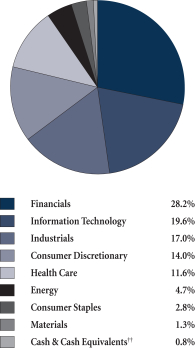

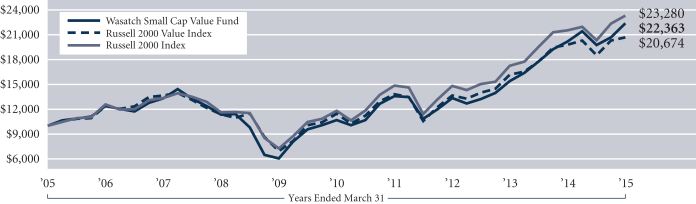

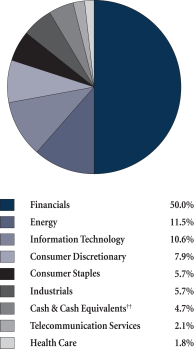

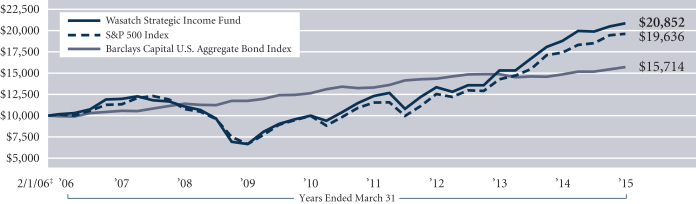

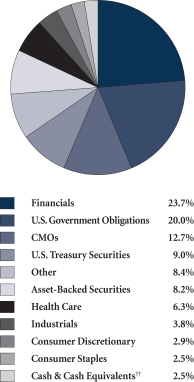

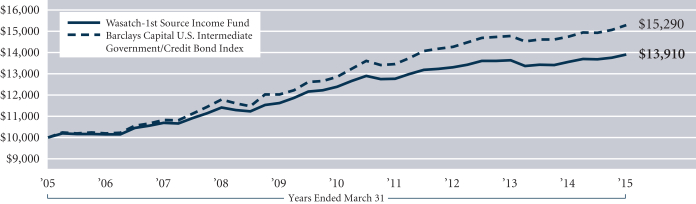

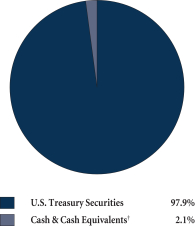

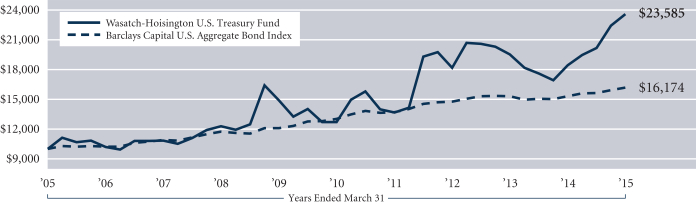

led us to ultimately make it one of the Fund’s largest holdings. Last year, Cognizant announced that big contracts would be coming through, but that earnings would be lumpy over the short term. We didn’t sell the stock in a panic, and more recently we saw evidence of the big contracts starting to flow through.