Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04920

WASATCH FUNDS TRUST

(Exact name of registrant as specified in charter)

505 Wakara Way, 3rd Floor

Salt Lake City, UT 84108

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: | |

Eric S. Bergeson Wasatch Advisors, Inc. 505 Wakara Way, 3rd Floor Salt Lake City, UT 84108 | Eric F. Fess, Esq. Chapman & Cutler LLP 111 West Monroe Street Chicago, IL 60603 | |

Registrant’s telephone number, including area code: (801) 533-0777

Date of fiscal year end: September 30

Date of reporting period: March 31, 2018

Table of Contents

Item 1. Report to Shareholders.

Table of Contents

2018 SEMI-ANNUAL REPORT AND QUARTERLY COMMENTARIES

March 31, 2018

EQUITY FUNDS / Wasatch Core Growth Fund Wasatch Emerging India Fund Wasatch Emerging Markets Select Fund Wasatch Emerging Markets Small Cap Fund Wasatch Frontier Emerging Small Countries Fund Wasatch Global Opportunities Fund Wasatch Global Value Fund Wasatch International Growth Fund Wasatch International Opportunities Fund Wasatch Long/Short Fund Wasatch Micro Cap Fund Wasatch Micro Cap Value Fund Wasatch Small Cap Growth Fund Wasatch Small Cap Value Fund Wasatch Strategic Income Fund Wasatch Ultra Growth Fund Wasatch World Innovators Fund BOND FUNDS / Wasatch-1st Source Income Fund Wasatch-Hoisington U.S. Treasury Fund

Table of Contents

WASATCH FUNDS

Salt Lake City, Utah

www.WasatchFunds.com

800.551.1700

Table of Contents

| TABLEOF CONTENTS | ||

| ||

| ||

| 2 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

Wasatch Emerging Markets Small Cap Fund® Management Discussion | 10 | |||

| 11 | ||||

Wasatch Frontier Emerging Small Countries Fund® Management Discussion | 12 | |||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

Wasatch International Opportunities Fund® Management Discussion | 20 | |||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

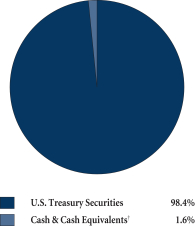

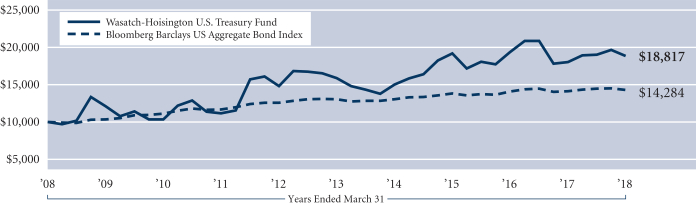

Wasatch-Hoisington U.S. Treasury Fund® Management Discussion | 40 | |||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| 47 | ||||

| 88 | ||||

| 94 | ||||

| 100 | ||||

| 108 | ||||

| 116 | ||||

| 118 | ||||

| 144 | ||||

| 144 | ||||

| 145 | ||||

| 145 | ||||

| 145 | ||||

Board Considerations for Advisory and Sub-Advisory Agreements of the Wasatch Funds | 146 | |||

| 156 | ||||

| 156 |

This material must be accompanied or preceded by a prospectus.

Please read the prospectus carefully before you invest.

Wasatch Funds are distributed by ALPS Distributors, Inc.

1

Table of Contents

| LETTERTO SHAREHOLDERS — DRIP, DRIP, DRIP | ||

| ||

| ||

Samuel S. Stewart, Jr. PhD, CFA President of | DEAR FELLOW SHAREHOLDERS:

Some bear markets can best be described as being like the maddening drip, drip, drip of water — often referred to as Chinese water torture. Inexplicably, stocks decline almost every day and they do so without regard to any significant relevant news. Our last bear market, now a decade in the past, was not like that. Yes, stocks went down on a near daily basis but bad news also arrived on an almost daily basis. It was easy for investors to understand why stocks were going down. During much of the past year, we were in — and perhaps still are in — what I call a “reverse Chinese water torture market.” That is, until the increased volatility of the first quarter, stocks had been going up on an almost daily basis but generally not based on any significant positive news. This led investors to suffer FOMO (fear of missing out). One-way markets, whether they’re moving down or up, provide investors with a quandary. The weakness of a one-way bear market leads investors to ask, “Is it too late to sell?” The strength of a one-way bull market leads investors to ask, “Is it too late to buy?” In both cases, the correct answer is initially “no,” but it’s important to remember that one-way markets demand that investors change their strategy at some point and so at some point the correct answer changes. Determining that point is difficult, but critical, |

since most one-way markets end in capitulation. Bears end in a final surge of selling until “everyone” has thrown in the towel. Bulls end in a final surge of buying until “everyone” is all in.

The notion of a one-way market suggests a market that’s somehow come loose from its more stable economic moorings. To be sure, the economy rises and falls but it almost always does so in a series of ebbs and flows, working its way higher or lower rather than moving “high” or “low” in a straight line. A useful way to determine how close a market is to the capitulation stage is to try to understand where the market is relative to the economy.

ECONOMY

In our one-way up market, the economy has generally been growing stronger with the cherry on top being the recent tax cuts. Now, however, there are signs of a shift.

| • | While stronger-than-expected economic indicators were the norm in the second half of 2017, this year economic indicators are coming in a bit softer. A recently revised estimate showed real gross domestic product (GDP) for the fourth quarter of 2017 increased at an annual rate of 2.9%, slower than the 3.2% reported for the third quarter. |

| • | Employment data was particularly strong for January and February, sparking fears of inflation. In contrast, March data was unexpectedly weak, showing only 103,000 jobs versus the expected 193,000 jobs. |

| • | The Federal Reserve raised interest rates in March and seems intent on doing so twice more this year, and three times instead of two times in 2019. That’s throwing sand into the gears of the economy and a reason to be more cautious on the market. |

While none of this suggests that an economic peak is imminent, it does suggest that the economy is transitioning from “accelerating” to “stabilizing.” If this is happening to the economy, it seems a distinct possibility that a shift in the market might also be forthcoming. Certainly the sharp selloffs in stocks we endured in recent months reminded us of what capitulation can look like. However, to the extent these corrections fade into the background and the market resumes “melt-up” behavior, I’d see it as a significant disconnect between the economy and the market.

That’s when investors can’t afford to lose their bearings — because the time of capitulation is likely approaching. At such a time, I believe the appropriate response is to emphasize quality in an investment portfolio. It’s no good to just step to the sidelines. How does one determine the right time to get back in? And the risk of missing out on long-term gains is too great. But one can make adjustments to one’s investment portfolio to emphasize characteristics that generally have been favorable through and after historical points of inflection. To me, that means a focus on quality first and foremost.

MARKETS

Taking the first quarter of 2018 as a whole, markets were flattish. Fading confidence in the near-term economic outlook dashed expectations of a surge in late-cycle value stocks. Instead, growth stocks outperformed value stocks across the market-capitalization spectrum. The uncertain environment favored Wasatch’s bottom-up investment approach, which seeks quality companies as evidenced by strong earnings growth, sustainable competitive advantages and experienced management teams.

In the U.S., newly announced tariffs on aluminum and steel — as well as separate measures directed specifically at China — hung over the market during March. Because smaller U.S. companies typically have less direct exposure to international trade, small-company stocks and micro caps outperformed large-cap issues during the quarter. Additionally, smaller U.S. companies currently tend to be valued more attractively than their larger peers, and smaller companies’ domestic focus leaves them well-positioned to benefit from a lower corporate tax rate.

In the U.S., the large-cap S&P 500® Index logged a three-month loss of -0.76%. The technology-heavy Nasdaq Composite Index fared better, up 2.59% for the quarter. The Russell 2000® Index of small caps was down -0.08% for the quarter.

International stock markets were mixed. The MSCI World ex USA Index was down -2.04% for the quarter, while the MSCI Emerging Markets Index rose 1.42%.

2

Table of Contents

| MARCH 31, 2018 (UNAUDITED) | ||

| ||

| ||

Here I’ll circle back to my view that none of this means a significant market correction, or even just tepid performance, is close at hand. The U.S. economy is strong. Synchronous growth is still underway around the globe. U.S. tax-cut benefits have the potential to prompt companies to make meaningful capital investments. This is a time of growth.

It’s also a time to keep your wits about you because one-way markets, whether bear or bull, don’t stay one-way indefinitely. My suggestion, once again, is to remain focused on the quality of your investments.

WASATCH

It’s been 43 years since I founded Wasatch in 1975. Building this firm and serving you, our investors, has been the focus of my professional life and my great privilege. Later this year, I will depart Wasatch to join my sons Josh and Spence at Seven Canyons Advisors, an SEC-registered investment advisor recently founded by our family.

When I started Wasatch, one of my first tasks was to select an appropriate name. I wanted a name that would symbolize a firm built to outlast me — hence, Wasatch Advisors and not Stewart Advisors. I wanted to build not just a firm but also a culture that would endure irrespective of me. Together with the rest of the team at Wasatch, I’m proud that we’ve done just that.

As you may know, I stepped down from the role of CEO at Wasatch almost 10 years ago. Under the continuing leadership of CEO JB Taylor and my other colleagues, Wasatch will continue to serve you with the same commitment to excellence.

Like me, my son Josh is a portfolio manager here at Wasatch. The Wasatch Funds Board of Trustees approved a plan to merge the two funds he and I manage for Wasatch — the World Innovators Fund and the Strategic Income Fund — into two new funds with similar objectives and strategies that we’ll continue to manage at Seven Canyons. The timing of that potential transition is not yet clear, but we anticipate the merger will occur during the third quarter of 2018.

Apart from Josh and me, Wasatch’s global team of portfolio managers and analysts stands at 34 investment professionals. As always, the firm is still 100% employee-owned. To be part of this outstanding place — this outstanding group of people — has been the honor of a lifetime.

With sincere thanks for your continued investment and for your trust,

Sam Stewart

Information in this report regarding market or economic trends, or the factors influencing historical or future performance, reflects the opinions of management as of the date of this report. These statements should not be relied upon for any other purpose. Past performance is no guarantee of future results, and there is no guarantee that the market forecasts discussed will be realized.

CFA® is a trademark owned by CFA Institute.

The Wasatch Strategic Income Fund’s primary investment objective is to capture current income. A secondary objective is long-term growth of capital. The Wasatch World Innovators Fund’s investment objective is long-term growth of capital.

Wasatch Advisors is the investment advisor to Wasatch Funds.

Wasatch Funds are distributed by ALPS Distributors, Inc. (ADI). ADI is not affiliated with Wasatch Advisors, Inc. or Seven Canyons Advisors, LLC.

Wasatch Advisors, Inc. is not affiliated with Seven Canyons Advisors, LLC.

A bear market is generally defined as a drop of 20% or more in stock prices over at least a two-month period.

A bull market is defined as a prolonged period in which investment prices rise faster than their historical average. Bull markets can happen as the result of an economic recovery, an economic boom, or investor psychology.

Earnings growth is a measure of growth in a company’s net income over a specific period, often one year.

Gross domestic product (GDP) is a basic measure of a country’s economic performance and is the market value of all final goods and services made within the borders of a country in a year.

The Russell 2000 Index is an unmanaged total-return index of the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Russell 2000 is widely used in the industry to measure the performance of small-company stocks.

The Nasdaq Composite is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange.

The S&P 500 Index includes 500 of the United States’ largest stocks from a broad variety of industries. The Index is unmanaged and is a commonly used measure of common stock total return performance.

The MSCI Emerging Markets Index captures large and mid cap representation across 24 emerging market countries. With 839 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI World ex USA Index captures large and mid cap representation across 22 of 23 developed market countries — excluding the United States. With 1,020 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

You cannot invest directly in these or any indexes.

3

Table of Contents

| WASATCH CORE GROWTH FUND (WGROX / WIGRX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Management Discussion

The Wasatch Core Growth Fund is managed by a team of Wasatch portfolio managers led by JB Taylor, Paul Lambert and Mike Valentine.

JB Taylor Lead Portfolio Manager |

Paul Lambert Portfolio Manager |

Mike Valentine Portfolio Manager |

OVERVIEW

For the three-month period ended March 31, 2018, the Wasatch Core Growth Fund — Investor Class gained 4.13% compared to a -0.08% loss for its primary benchmark, the Russell 2000 Index. The Russell 2000 Growth Index advanced 2.30%.

In 2018’s first quarter, market volatility reemerged in rather dramatic fashion. After a relatively uneventful January, U.S. stocks sold off sharply in February. Robust employment and wage growth, rising bond yields and recently enacted tax cuts caused investors to worry about higher inflation and whether Federal Reserve (Fed) officials would act more aggressively to slow economic growth. Nevertheless, the Fed has been sticking to its plan for gradual increases with one interest-rate hike in March and two more scheduled this year. After February’s swoon, stocks partially recovered, only to fall again in the second half of March on somewhat softer economic indicators, turmoil in the tech world and fears of a trade war with China after the U.S. government proposed tariffs on steel and aluminum and specific Chinese products.

DETAILSOFTHE QUARTER

The Fund’s outperformance of the Russell 2000 Index during the first quarter of 2018 was primarily due to stock selection, which was especially beneficial in the health-care, industrials, consumer-discretionary and information-technology sectors.

In our view, the Fund’s outperformance in choppier markets underscores its bias toward high-quality companies, as evidenced by strong earnings growth, sustainable competitive advantages and experienced management teams. These characteristics are best measured on a company-specific basis — thus our intensive, bottom-up research process. In times of market stress, we generally expect investors to prefer sounder companies, and we see the Fund’s year-to-date performance relative to its benchmark as bearing that out.

Historically, the Fund has had a bias toward more-profitable companies, on average, than those that make up the Russell 2000 Index. For such highly profitable companies, tax reform may free up additional cash that could be

used for growing the business, providing higher compensation for employees, buying back shares or increasing shareholder dividends. As a result, we see the Fund as well-positioned with regard to tax reform.

Two of the Fund’s top contributors for the first quarter were repeats from 2017’s fourth quarter. First was Cimpress N.V., a U.S.-listed firm domiciled in the Netherlands. The company’s suite of “mass customization” brands includes Vistaprint. Cimpress operates three business segments, all of which are experiencing accelerating organic growth. Investors rewarded this growth — and the progress management has made in paying down debt and furthering restructuring initiatives — with over 25% share-price appreciation during the first quarter.

Second was Copart, Inc. This U.S. auto salvager has continued to impress us with both its growth and quality metrics. We held Copart for many months before its share price really took off. It’s a prime example of how we’re happy to be patient with companies we see as being high-quality with significant growth opportunities even though it may take some time to reap the potential rewards.

Healthcare Services Group, Inc., which provides housekeeping, food and other services to the health-care facilities industry, was the Fund’s largest detractor. The company’s quarterly reporting in February included notice of a one-time effect on net income as a result of tax reform. In addition, the process of bringing customers onboard has been more costly than previously anticipated. More broadly, though, the company has experienced growth in both the number of customers and the average number of services provided to customers. Here too, we’re willing to be patient given the company’s growth potential.

Another large detractor for the quarter was Altra Industrial Motion Corp. Revenue growth has been strong for this maker of mechanical power transmission components, but its margins have been negatively affected by transitory supply-chain issues and commodity price inflation. While many manufacturing companies are facing similar inflationary pressures, we are confident that Altra’s leading market position will allow it to pass on higher costs. We expect the company’s margins to improve going forward.

OUTLOOK

Although some economic indicators have been softening and the financial markets have been expressing investors’ nervousness, the environment is still positive overall. Having said that, we’re keeping an eye on the Fed’s action with regard to interest rates. While we haven’t positioned the Fund with any particular view on interest-rate policy, we’re cognizant of interest-rate risks — best seen as a tug of war between positive economic news and the Fed’s efforts to keep the economy from overheating.

As always, our focus remains on identifying companies with strong growth prospects. We believe the Fund is positioned with the potential to do well whether the economy keeps humming along or the Fed puts on the brakes.

Thank you for the opportunity to manage your assets.

| Current and future holdings are subject to risk. |

4

Table of Contents

| WASATCH CORE GROWTH FUND (WGROX / WIGRX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| SIX MONTHS* | 1 YEAR | 5 YEARS | 10 YEARS | |||||||||||||||||

Core Growth (WGROX) — Investor | 12.11% | 24.19% | 13.80% | 11.77% | ||||||||||||||||

Core Growth (WIGRX) — Institutional | 12.19% | 24.37% | 13.92% | 11.84% | ||||||||||||||||

Russell 2000® Index | 3.25% | 11.79% | 11.47% | 9.84% | ||||||||||||||||

Russell 2000® Growth Index | 6.99% | 18.63% | 12.90% | 10.95% | ||||||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2018 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Core Growth Fund are Investor Class: 1.21% / Institutional Class — Gross: 1.10%, Net: 1.05%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 1/31/2012 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 1/31/2012 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

| * | Not annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Net Assets | |||

Copart, Inc. | 3.4% | |||

ICON plc (Ireland) | 3.1% | |||

Cimpress N.V. | 2.9% | |||

Monro, Inc. | 2.9% | |||

Old Dominion Freight Line, Inc. | 2.8% | |||

| Company | % of Net Assets | |||

Pool Corp. | 2.7% | |||

Cantel Medical Corp. | 2.6% | |||

Tyler Technologies, Inc. | 2.6% | |||

Eagle Bancorp, Inc. | 2.6% | |||

Trex Co., Inc. | 2.5% | |||

| ** | As of March 31, 2018, there were 52 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

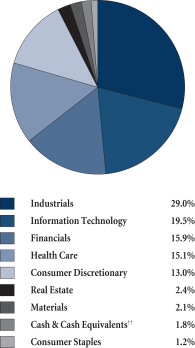

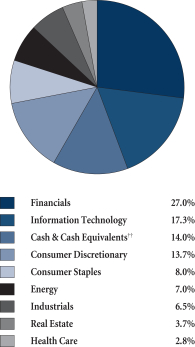

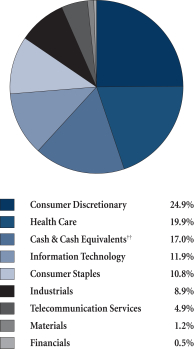

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

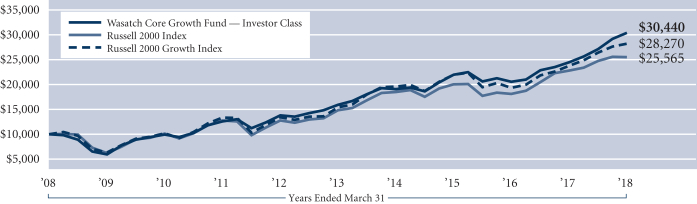

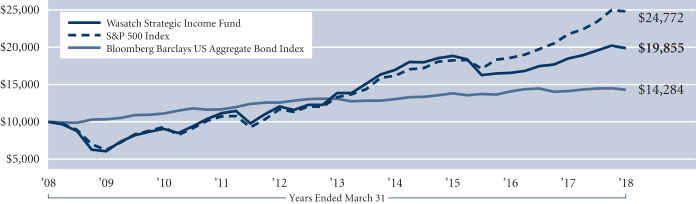

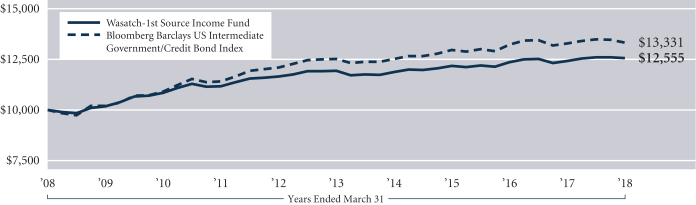

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. The Russell 2000 Index is an unmanaged total return index of the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Russell 2000 Index is widely regarded in the industry as accurately capturing the universe of small company stocks. The Russell 2000 Growth Index is an unmanaged total return index that measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values. You cannot invest directly in these or any indexes.

5

Table of Contents

| WASATCH EMERGING INDIA FUND (WAINX / WIINX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Management Discussion

The Wasatch Emerging India Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan and Matthew Dreith.

Ajay Krishnan, CFA Lead Portfolio Manager |

Matthew Dreith, CFA Associate Portfolio Manager | OVERVIEW

The benchmark MSCI India Investable Market Index (IMI) fell -8.02% during what was an up-and-down first quarter of the year for Indian equities. Outperforming its benchmark, the Wasatch Emerging |

India Fund — Investor Class declined -4.70%.

India’s stock market began the quarter in rally mode, as last year’s advance continued unabated during the first four weeks of 2018. In late January, however, global stock-market jitters and concerns about an international trade war sent Indian stocks lower. Worries that lower-than-expected tax revenues might lead India’s government to impose a capital-gains tax contributed to early skittishness. Later, news of a $2 billion fraud centered at one of the country’s state-owned banks rocked investor confidence.

Rising interest rates also weighed on sentiment. Rates had been on the rise in India since mid-2017, as bond investors mulled a likely surge in government spending ahead of next year’s elections. The Modi government’s funding requirements created an excess supply of government debt that continued to push bond yields higher during the first quarter.

DETAILSOFTHE QUARTER

The consumer-discretionary sector was the Fund’s greatest source of outperformance relative to the benchmark. Although the benchmark’s consumer-discretionary positions posted a double-digit percentage loss as a group, the Fund’s holdings in the sector ended the quarter with a modest gain. Amid the broad weakness in Indian equities, the information-technology sector was the only sector of the Index to generate a positive first-quarter return. Our significantly underweight allocation to this top-performing sector was a headwind to performance and the Fund’s largest source of weakness against the benchmark.

The strongest contributor to Fund performance for the quarter was V-Mart Retail Ltd. The company operates department stores specializing in apparel. V-Mart also sells a wide range of general merchandise and fast-moving consumer goods. Because V-Mart operates primarily in rural areas of India, the company stands to benefit as the Modi government seeks to create jobs and appeal to voters ahead of national elections in 2019.

MakeMyTrip Ltd. was the second-largest contributor. The company operates the leading online travel agency (OTA) in India. Shares of MakeMyTrip had languished over the previous three quarters on concerns that increased competition might impact the company’s profitability. Those worries

eased in February after MakeMyTrip announced a partnership with OYO, the largest hospitality company in India.

Third-largest contributor Godrej Consumer Products Ltd. is a consumer-goods company. Godrej sells soaps, hair colors, toiletries and household goods in India and internationally. Consolidated net profit rose 22.1% year-over-year in the company’s most-recent quarter on an 8.5% increase in comparable sales. Management cited strong volume growth in India, especially in rural areas of the country.

Industrial companies accounted for four of the Fund’s five largest detractors from performance during the quarter. Among them, the greatest detractor was Elgi Equipments Ltd. Elgi manufactures and sells air compressors in India and internationally. The company currently receives about half its revenue from outside India and approximately 60% of its international revenue from the U.S. and Europe. Elgi’s shares declined on concerns that U.S. protectionist trade policies might derail plans for further inroads into the U.S. market.

Other weak industrials in the Fund included Somany Ceramics Ltd. and Kajaria Ceramics Ltd. — two large producers of ceramic tiles for walls and floors. A reduction in India’s goods-and-services tax (GST) last November caused customers to delay purchases until the new, lower tax rate had taken effect. An uptick in gas prices also hurt profitability, resulting in lower-than-expected quarterly earnings at the companies compared to the same period a year ago.

OUTLOOK

Although a rising supply of government debt has driven Indian bond yields higher since July of last year, there are signs that interest-rate pressures in India may be easing. In late March, the Indian government announced a borrowing plan for the first half of its fiscal year that is lower than in previous years. In an attempt to further encourage bond investors, India will issue inflation-indexed bonds and shorter-maturity debt. The Modi government also is seeking to increase purchase limits for foreign investors in government securities.

Another factor that contributed to general first-quarter malaise in Indian stocks was fading optimism about the prospects of Prime Minister Narendra Modi’s Bharatiya Janata Party (BJP) in upcoming state polls this year and general elections in 2019. While a strong showing from the BJP would help further Mr. Modi’s pro-business agenda, we seek to invest in companies whose business prospects do not depend on a particular political outcome.

Despite the slight deterioration we saw in the first quarter, we believe India’s macro situation still looks solid. As for our portfolio companies, we have been seeing accelerating earnings growth that we have been capturing in the Fund. For the most-recent quarter, we calculated that the Fund’s holdings, on average, turned in 27% earnings growth. We continue to have confidence in India as an attractive place to invest and in the long-term growth potential of our portfolio companies.

Thank you for the opportunity to manage your assets.

| Current and future holdings are subject to risk. |

6

Table of Contents

| WASATCH EMERGING INDIA FUND (WAINX / WIINX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

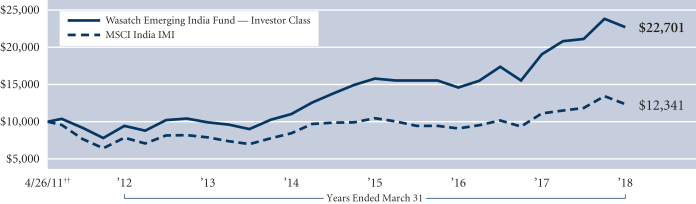

| SIX MONTHS* | 1 YEAR | 5 YEARS | SINCE INCEPTION 4/26/11 | |||||||||||||||||

Emerging India (WAINX) — Investor | 7.50% | 19.18% | 18.07% | 12.55% | ||||||||||||||||

Emerging India (WIINX) — Institutional | 7.45% | 19.07% | 18.18% | 12.62% | ||||||||||||||||

MSCI India IMI | 4.31% | 11.22% | 9.44% | 3.08% | ||||||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2018 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging India Fund are Investor Class: 1.73% / Institutional Class — Gross: 1.67%, Net: 1.50%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as unstable currencies, highly volatile securities markets and political and social instability, which are described in more detail in the prospectus.

| * | Not annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Net Assets | |||

| V-Mart Retail Ltd. (India) | 5.0% | |||

| Bajaj Finance Ltd. (India) | 5.0% | |||

| Housing Development Finance Corp. Ltd. (India) | 4.7% | |||

| Endurance Technologies Ltd. (India) | 4.6% | |||

| Amara Raja Batteries Ltd. (India) | 4.6% | |||

| Company | % of Net Assets | |||

| MakeMyTrip Ltd. (India) | 4.5% | |||

| Divi’s Laboratories Ltd. (India) | 4.4% | |||

| Quess Corp. Ltd. (India) | 4.2% | |||

| Page Industries Ltd. (India) | 4.1% | |||

| Pidilite Industries Ltd. (India) | 3.9% | |||

| ** | As of March 31, 2018, there were 42 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

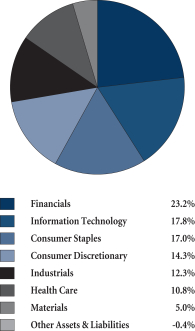

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ††Inception: April 26, 2011. The MSCI India IMI (Investable Market Index) is designed to measure the performance of the large-, mid- and small-cap segments of the Indian market. The Index covers approximately 99% of the free-float adjusted market capitalization of the Indian equity universe. You cannot invest directly in this or any index.

7

Table of Contents

| WASATCH EMERGING MARKETS SELECT FUND (WAESX / WIESX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Management Discussion

The Wasatch Emerging Markets Select Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan, Roger Edgley, Scott Thomas and Matthew Dreith.

Ajay Krishnan, CFA Lead Portfolio Manager

Scott Thomas, CFA Associate Portfolio |

Roger Edgley, CFA Portfolio Manager

Matthew Dreith, CFA Associate Portfolio Manager | OVERVIEW

A global selloff triggered by prospects of a trade war rocked emerging-market equities during the first quarter. The benchmark MSCI Emerging Markets Index surrendered most of an early double-digit percentage gain to finish up 1.42% for the quarter. The Wasatch Emerging Markets Select Fund — World equity markets kicked off 2018 with a strong January rally, before |

rising U.S. interest rates disrupted the advance during the final sessions of the month. Later, concerns about global trade moved to the forefront when the White House announced tariffs on imported aluminum and steel.

DETAILSOFTHE QUARTER

Korea was the Fund’s greatest source of outperformance relative to the benchmark. Though Korean stocks were weak during the quarter, an outsized gain in a single stock enabled the Fund’s Korean holdings to generate a positive return as a group.

The Fund’s largest source of weakness against the benchmark was Brazil, where investors appeared to rotate away from the higher-quality companies we seek to own in the Fund. With investor sentiment on the upswing in Brazil, the most defensive of our Brazilian holdings became less appealing to investors.

India, the most-heavily weighted country in the Fund, was among many poorly performing countries in the Index. However, the Fund’s Indian stocks declined significantly less than those in the Index, helping performance relative to the benchmark.

The strongest contributor to Fund performance for the quarter was Medytox, Inc. Based in Korea, the company manufactures injectable neurotoxins for cosmetic applications and the treatment of muscular disorders. Shares of Medytox surged as investors factored positive future developments into the company’s stock price.

Second-best contributor NMC Health plc provides health-care services in the United Arab Emirates and other countries in the Middle East. NMC saw its stock price rise on news that the company had landed a contract to manage two hospitals in Egypt.

Positive underlying fundamentals and healthy earnings growth helped our Chinese holdings outgain their benchmark counterparts during the first quarter. Top contributors included 51job, Inc., the leading online job search and recruitment site in China.

The greatest detractor from Fund performance for the quarter was BGF Retail Co. Ltd. The company operates convenience stores in Korea. Shares of BGF declined on concerns about the impact of the recent increase in Korea’s minimum wage.

Raia Drogasil S.A., the second-largest detractor, operates a leading drug-store chain in Brazil. The upturn in Brazil’s economy has made defensive issues such as Raia Drogasil less appealing to investors and has increased access to capital for the company’s competitors.

Another weak stock in the Fund was Page Industries Ltd. The company makes and sells undergarments under the Jockey brand in India. We have no fundamental news to relate concerning Page and attribute the stock’s weakness to general first-quarter malaise in Indian equities.

OUTLOOK

To the extent that global factors continue to create volatility for emerging-market equities, we expect the Fund’s relative performance to benefit from our greater emphasis on long-term growth stories tied to secular increases in domestic demand. By focusing on companies and countries with their own unique growth drivers, we seek to make the Fund less subject to whims of the global economy and more reflective of the long-term potential of emerging markets.

While rising U.S. Treasury yields appear to have spooked world stock markets during the first quarter, the dynamics underlying the current interest-rate cycle are likely very different from those of the so-called “Taper Tantrum” of 2013. Of particular note is the U.S. dollar’s depreciation against a basket of rival currencies over the past six months — even as the yield on the 10-year Treasury note increased. With interest rates stabilizing in Europe and already on the rise in China, a scenario in which rising rates in the U.S. significantly underpin the dollar seems much less likely this time around.

Several other factors also appear to be at play. We suspect the worsening U.S. fiscal situation has given international investors less reason to fear a surge in the greenback. Additionally, the recent pickup in global growth has made it much more difficult for the U.S. to outgrow the rest of the world. Compared to developed markets, we believe the faster growth rates and more-attractive valuations of emerging markets should continue to merit favorable attention from investors.

Thank you for the opportunity to manage your assets.

| Current and future holdings are subject to risk. |

8

Table of Contents

| WASATCH EMERGING MARKETS SELECT FUND (WAESX / WIESX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Portfolio Summary

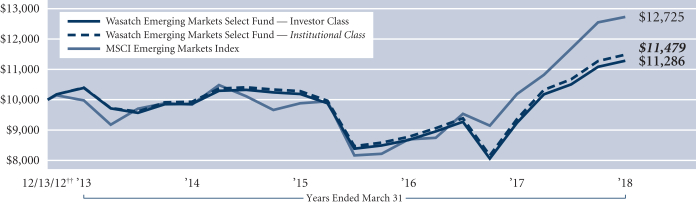

AVERAGE ANNUAL TOTAL RETURNS

| SIX MONTHS* | 1 YEAR | 5 YEARS | SINCE INCEPTION 12/13/12 | |||||||||||||||||

Emerging Markets Select (WAESX) — Investor | 7.46% | 22.17% | 1.67% | 2.31% | ||||||||||||||||

Emerging Markets Select (WIESX) — Institutional | 7.55% | 22.58% | 1.99% | 2.64% | ||||||||||||||||

MSCI Emerging Markets Index | 8.96% | 24.93% | 4.99% | 4.65% | ||||||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2018 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Select Fund are Investor Class — Gross: 1.90%, Net: 1.51% / Institutional Class — Gross: 1.52%, Net: 1.21%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

| * | Not annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Net Assets | |||

Alibaba Group Holding Ltd. ADR (China) | 5.4% | |||

Bajaj Finance Ltd. (India) | 5.4% | |||

Medytox, Inc. (Korea) | 5.2% | |||

Tencent Holdings Ltd. (China) | 5.1% | |||

NMC Health plc (United Arab Emirates) | 4.5% | |||

| Company | % of Net Assets | |||

Ctrip.com International Ltd. ADR (China) | 4.0% | |||

Raia Drogasil S.A. (Brazil) | 3.8% | |||

HDFC Bank Ltd. (India) | 3.6% | |||

Silergy Corp. (Taiwan) | 3.5% | |||

MakeMyTrip Ltd. (India) | 3.4% | |||

| ** | As of March 31, 2018, there were 36 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

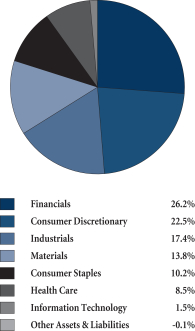

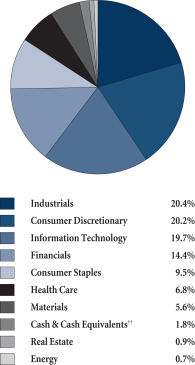

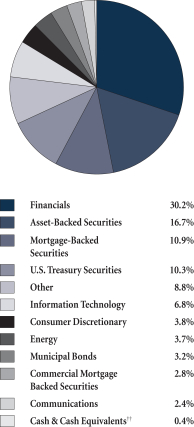

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ††Inception: December 13, 2012. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index designed to measure the equity market performance of emerging markets. You cannot invest directly in this or any index.

9

Table of Contents

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX / WIEMX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Management Discussion

The Wasatch Emerging Markets Small Cap Fund is managed by a team of Wasatch portfolio managers led by Roger Edgley, Andrey Kutuzov, Scott Thomas and Kevin Unger.

Roger Edgley, CFA Lead Portfolio Manager

Scott Thomas, CFA Associate Portfolio Manager |

Andrey Kutuzov, CFA Associate Portfolio Manager

Kevin Unger, CFA Associate Portfolio Manager | OVERVIEW

For the three months ended March 31, 2018, the Wasatch Emerging Markets Small Cap Fund — Investor Class gained 0.31% and slightly outperformed its benchmark, the MSCI Emerging Markets Small Cap Index, which returned 0.17%. Following an extremely strong year in 2017, world equity markets kicked off 2018 with a strong January rally, before rising U.S. interest rates disrupted the advance during the final sessions of |

the month. Later, concerns about global trade moved to the forefront when the White House announced tariffs on imported aluminum and steel and separate measures directed specifically at China. While markets have been volatile and some uncertainty has surfaced, our outlook is still upbeat given the investment opportunities we have been seeing.

We believe the Fund’s focus on companies tied to secular demand growth in their home countries served our investors well during the first quarter.

DETAILSOFTHE QUARTER

South Korea added the most to the Fund’s return and outperformance of the benchmark for the first quarter. The Fund’s top individual contributor was Medytox, Inc. Based in Korea, the company manufactures neurotoxins for cosmetic applications and the treatment of muscular disorders. Shares of Medytox surged on the potential approval of Medytox products in China in 2019, as well as a previously announced licensing deal.

The common thread with several of our Korean holdings is that they have made new technological advances and have strong returns on capital to help drive their research and the growth of their businesses. In our view, Korea’s strong base of an educated population and manufacturing know-how drives a world-class ecosystem for small Korean companies.

The Fund remains structurally underweight in China. While we are conscious of the many risks, our assessment of

China’s investment backdrop has moved from negative to more neutral. We’ve been increasing our weight as we’ve been finding more interesting companies that meet our quality standards and have long-duration growth potential.

51job, Inc., the leading online job search and recruitment site in China, was the Fund’s second-best contributor for the quarter. The company has been leveraging its relationships with employers to sell additional adjacent services that human resource (HR) departments need. In online recruitment and other HR business segments 51job has posted robust results.

One of the Fund’s largest sources of weakness was Brazil. Brazilian stocks soared to record highs after an appeals court upheld a corruption conviction against former President Luiz Inacio Lula da Silva. With investor sentiment on the upswing in Brazil, our most defensive Brazilian holdings became less appealing to investors.

An example is EcoRodovias Infraestrutura e Logistica S.A., the second-largest toll-road operator in Brazil. Although EcoRodovias was the Fund’s largest first-quarter detractor, we like the company’s prospects. The toll-road industry in Brazil appears solid, with rational competition, more projects coming up for bid and a recovering economy.

Indian equities fell amid concerns about interest rates and inflation. Investors also became more concerned with policy continuity after Prime Minister Narendra Modi’s Bharatiya Janata Party’s weaker-than-expected showing in recent state elections. During the quarter, the decline in the Fund’s Indian stocks subtracted just over a point from its return, but our holdings outperformed the Indian positions in the benchmark.

Kajaria Ceramics Ltd., a leading manufacturer of ceramic tiles in India, was a notable detractor. Indian tile manufacturers had a difficult January due to one-off factors including a second round of goods-and-services tax (GST) reforms and rising input costs. However, we believe growth may soon return. The GST rate on tiles was lowered as of November 2017 and there has been an uptick in housing construction, a strong market for tiles.

OUTLOOK

The backdrop for international small-cap equities remains constructive. However, financial volatility in developed countries spread to emerging markets in the first quarter as concerns about accelerating fiscal deficits and inflation in the U.S. fanned fears of higher global interest rates.

To the extent that global factors continue to create volatility, we expect the Fund’s relative performance to benefit from our greater emphasis on companies with long-term growth stories tied to secular increases in domestic demand. By focusing on companies and countries with their own unique growth drivers, we seek to make the Fund less subject to whims of the global economy and more reflective of long-term potential. Despite this increased volatility, our overall positive outlook remains unchanged.

Thank you for the opportunity to manage your assets.

| Current and future holdings are subject to risk. |

10

Table of Contents

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX / WIEMX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| SIX MONTHS* | 1 YEAR | 5 YEARS | 10 YEARS | |||||||||||||||||

Emerging Markets Small Cap (WAEMX) — Investor | 8.03% | 25.68% | 2.38% | 7.13% | ||||||||||||||||

Emerging Markets Small Cap (WIEMX) — Institutional | 8.00% | 26.07% | 2.44% | 7.16% | ||||||||||||||||

MSCI Emerging Markets Small Cap Index | 9.41% | 18.62% | 4.58% | 4.36% | ||||||||||||||||

MSCI Emerging Markets Index | 8.96% | 24.93% | 4.99% | 3.02% | ||||||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2018 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Small Cap Fund are Investor Class — Gross: 2.02%, Net: 1.96% / Institutional Class: 1.88%, Net: 1.81%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

| * | Not annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Net Assets | |||

51job, Inc. ADR (China) | 3.5% | |||

Medytox, Inc. (Korea) | 3.3% | |||

Magazine Luiza S.A. (Brazil) | 2.5% | |||

ASPEED Technology, Inc. (Taiwan) | 2.2% | |||

Clicks Group Ltd. (South Africa) | 2.2% | |||

| Company | % of Net Assets | |||

Koh Young Technology, Inc. (Korea) | 2.0% | |||

Win Semiconductors Corp. (Taiwan) | 2.0% | |||

Silergy Corp. (Taiwan) | 2.0% | |||

TCS Group Holding plc GDR (Russia) | 2.0% | |||

Ennoconn Corp. (Taiwan) | 1.9% | |||

| ** | As of March 31, 2018, there were 83 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

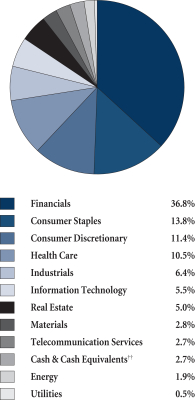

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

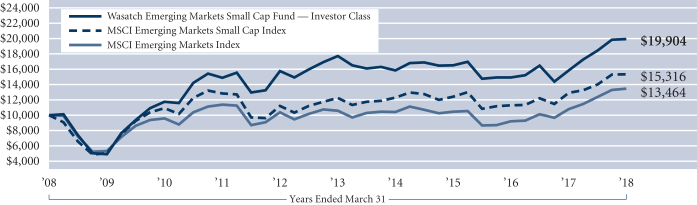

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. The MSCI Emerging Markets and Emerging Markets Small Cap indexes are free float-adjusted market capitalization indexes designed to measure the equity market performance of emerging markets. You cannot invest directly in these or any indexes.

11

Table of Contents

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND (WAFMX / WIFMX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Management Discussion

The Wasatch Frontier Emerging Small Countries Fund is managed by a team of Wasatch portfolio managers led by Roger Edgley, Jared Whatcott and Scott Thomas.

Roger Edgley, CFA Lead Portfolio Manager |

Jared Whatcott, CFA Portfolio Manager |

Scott Thomas, CFA Portfolio Manager |

OVERVIEW

The Wasatch Frontier Emerging Small Countries Fund — Investor Class returned 1.71% and slightly outperformed the 1.60% return of its benchmark, the MSCI Frontier Emerging Markets Index.

Over the past year, we have become increasingly optimistic regarding the prospects of frontier markets and emerging small countries. For the first quarter of 2018, frontier equity markets benefited from strong performance compared to their larger, more developed counterparts around the globe.

DETAILSOFTHE QUARTER

Vietnam, one of our largest country exposures, was the top contributor to the Fund’s return for the quarter. However, we underperformed the benchmark in Vietnam as our overweight position was offset by the lagging performance of our holdings in a strong market.

We recently spent a considerable amount of time on the ground in Vietnam and, despite seemingly rich valuations in some parts of the market, we came away with incrementally higher conviction in the country and in the prospects of its companies.

An example is Phu Nhuan Jewelry JSC, a top contributor for the quarter. The company has been increasing the number of its jewelry stores at an annual rate of 15%, while still achieving double-digit same-store-sales growth. At the same time, management has been investing in technology and inventory-management software, allowing Phu Nhuan to stay ahead of its competitors.

NMC Health plc, a United Arab Emirates (UAE)- based hospital operator, ended the quarter as the Fund’s top-contributing holding. The company recently reported revenue growth of over 31% for 2017, and the number of patients served grew 34%. NMC Health also recently entered Saudi Arabia — a much larger market of 30 million people that has been chronically underserved in specialized health-care services. Within the UAE, NMC Health has spent the past few years building out its hospital network, and we’re now beginning to see those efforts bear fruit.

Second-largest contributor Safaricom plc has been a long-time core holding of the Fund. Despite macro challenges in

Kenya, the company has continued to grow at a double-digit rate, leveraging its wide telecom-infrastructure network and its M-Pesa mobile-payment system, which now contributes 26% of Safaricom’s total revenues.

We took a trip to Egypt at the start of the year to assess opportunities and more closely examine the underlying economic environment. Although we have visited Egypt multiple times over the past several years, on this trip we came away the most optimistic yet on the country’s outlook and have been increasing our exposure.

We saw Ibnsina Pharma, a pharmaceutical-distribution firm managed by two brothers who are deeply passionate about the business. They have grown it to be the number-two player in the market over a short period of time. Supported by the double-digit growth of the pharmaceutical industry in Egypt, we believe Ibnsina Pharma can grow even faster. The company was recently listed and has raised equity to continue building out its distribution facilities. We added a position in Ibnsina Pharma.

Cleopatra Hospital, another holding based in Egypt, saw its share price wobble following a potentially delayed acquisition of a target hospital, but we aren’t too concerned. The company is developing Egypt’s first private-hospital network. In addition to strong organic growth, Cleopatra’s management team has been successfully acquiring hospitals and turning them around to increased profitability. Given the need for hospital services in Egypt, we believe Cleopatra has a long runway for growth.

Ayala Corp., one of the strongest conglomerates in the Philippines, was also among the Fund’s detractors in the quarter. The company has been increasing its recurring revenue stream with good results from energy investments. Despite Ayala’s fundamental strength, however, the stock fell due to selling by foreign institutional investors, led largely by Mitsubishi Corp. of Japan reducing its stake in Ayala as part of its portfolio rebalancing and not on business concerns.

OUTLOOK

Wasatch is increasingly optimistic regarding the outlook for frontier and emerging small countries where we see improving macro conditions after a multi-year period of difficult adjustments. The major externalities that had been overwhelming many of these markets such as the strong U.S. dollar, weakening commodity prices and external imbalances have largely turned neutral to positive. Many frontier and emerging small countries have been addressing structural issues, which has created a more stable and positive growth outlook. What’s more, domestic demand seems to have troughed and many economies appear poised for a continued cyclical recovery. Most importantly, we have seen significant improvement in the outlook for our portfolio companies and we are starting to see a rebound in earnings growth. Accelerating growth, reasonable valuations and low correlations with more developed global markets continue to give us confidence in the Fund’s holdings.

Thank you for the opportunity to manage your assets.

| Current and future holdings are subject to risk. |

12

Table of Contents

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND (WAFMX / WIFMX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| SIX MONTHS* | 1 YEAR | 5 YEARS | SINCE INCEPTION 1/31/12 | |||||||||||||||||

Frontier Emerging Small Countries (WAFMX) — Investor | 8.00% | 18.80% | 1.23% | 7.05% | ||||||||||||||||

Frontier Emerging Small Countries (WIFMX) — Institutional | 8.33% | 19.12% | 1.37% | 7.17% | ||||||||||||||||

MSCI Frontier Emerging Markets Index | 6.72% | 19.93% | 3.42% | 5.92% | ||||||||||||||||

MSCI Frontier Markets Index | 10.99% | 27.26% | 8.64% | 9.80% | ||||||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2018 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Frontier Emerging Small Countries Fund are Investor Class — Gross: 2.36%, Net: 2.18% / Institutional Class —Gross: 2.07%, Net: 1.98%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in frontier and emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

| * | Not annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Net Assets | |||

| FPT Corp. (Vietnam) | 4.3% | |||

| NMC Health plc (United Arab Emirates) | 4.3% | |||

| Aramex PJSC (United Arab Emirates) | 4.3% | |||

| Grupo Financiero Galicia S.A. ADR (Argentina) | 4.1% | |||

| Philippine Seven Corp. (Philippines) | 3.7% | |||

| Company | % of Net Assets | |||

| Grupo Supervielle S.A. ADR (Argentina) | 3.7% | |||

| Vietnam Dairy Products JSC (Vietnam) | 3.5% | |||

| Naspers Ltd., Class N (South Africa) | 3.4% | |||

| Bolsas y Mercados Argentinos S.A. (Argentina) | 3.2% | |||

| Unifin Financiera S.A.B. de C.V. SOFOM ENR (Mexico) | 3.0% | |||

| **As | of March 31, 2018, there were 48 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ‡Inception: January 31, 2012. The MSCI Frontier Emerging Markets and MSCI Frontier Markets indexes are free float-adjusted market capitalization indexes designed to measure the equity market performance of the global frontier and emerging markets. You cannot invest directly in these or any indexes.

13

Table of Contents

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX / WIGOX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Management Discussion

The Wasatch Global Opportunities Fund is managed by a team of Wasatch portfolio managers led by JB Taylor and Ajay Krishnan.

JB Taylor Lead Portfolio Manager

|

Ajay Krishnan, CFA Lead Portfolio Manager

| OVERVIEW

Buoyed by continued synchronous global economic expansion, the Wasatch Global Opportunities Fund — Investor Class returned 5.99% for the quarter ended March 31, 2018, | ||

| outperforming the benchmark MSCI ACWI (All Country World Index) Small Cap Index, which declined -0.47%. | ||||

Passage by Congress of the tax-reform bill in December was a plus for U.S. stocks, as it was widely perceived that the significant reduction in the U.S. corporate tax rate would free up capital that companies could deploy to reinvest in their businesses, buy back stock, increase employee wages or pay higher dividends. Given our investments in profitable companies, we believe the Fund is well-positioned relative to tax reform.

Despite continued good economic news, volatility returned to the financial markets in the first three months of 2018. While January was relatively uneventful, investors grew concerned with the length of the current bull market in stocks and the prospect of rising inflation. February saw the U.S. market shed more than 10% of its peak January value before partially recovering. In March, a rate hike by the Federal Reserve and worries that tariffs proposed by the U.S. government would result in a trade war triggered a steep selloff in the equity markets.

DETAILSOFTHE QUARTER

Health care and information technology were the Fund’s top-contributing sectors for the first quarter, driven mainly by stock selection but also helped by being significantly overweight versus the benchmark. Among the sectors in which the Fund was invested, financials ceded the most ground to the benchmark.

The Fund benefited from investments in developed countries, led by outstanding contributions from the United States and Japan. Korea was the top-contributing emerging market, primarily due to the outsized return of one holding. India and Brazil were the countries that detracted the most from Fund’s performance. Following a particularly strong run in 2017, our investments in India produced mixed results over the past few months. Although India’s market was weak in the quarter, we believe the country’s economy is strong, and that given time, the reforms introduced by the Modi government will prove to be positive. We also see our holdings in India as having strong growth prospects, and we remain confident in their potential to benefit the Fund over the long term.

Medytox, Inc., a Korean manufacturer of injectable neurotoxins for cosmetic applications and the treatment of muscular disorders, was the leading contributor to the Fund’s first-quarter performance. Medytox shares rose during the quarter following reports that a competitor had encountered regulatory difficulties with the U.S. Food and Drug Administration. Already a leader in its industry, Medytox appears well-positioned in our view for further gains to the extent that stringent enforcement of quality standards weeds out weaker competitors.

Second-best contributor Nihon M&A Center, Inc. specializes in facilitating the purchase and sale of businesses. This Japanese company has been benefiting from a wave of consolidations affecting several industries throughout Japan, including the pharmaceutical industry, where the Fund also has investments. Nihon M&A has been successful matching small companies with potential buyers, which are usually larger companies seeking to expand.

India’s Somany Ceramics Ltd. manufactures ceramic and vitrified tiles used on walls and floors. We believe the company stands to benefit from the growth of India’s middle class, but Somany Ceramics was the Fund’s largest detractor during the quarter as India’s equity markets gave back some of the gains achieved last year.

Another significant detractor was EcoRodovias Infraestrutura e Logistica S.A., the second-largest toll-road operator in Brazil. The road network in Brazil is over-crowded and under-developed as is typical for emerging markets. The toll-road industry in Brazil appears solid, with rational competition, more projects coming up for bid and a recovering economy. In February, EcoRodovias agreed to buy Concessionaria de Rodovias Minas Gerais Goias (MGO), which manages a 271-mile highway in the Brazilian states of Goias and Minas Gerais, pending approval of regulators.

OUTLOOK

Five members of our investment team recently returned from a two-week trip to Japan, where they met with management teams from about 80 different companies. They came away with a lot of new ideas that the team will continue to research for possible inclusion in the Fund. Both their discussions with the companies they visited, and our observations of Japan generally, confirmed our view that wage growth, the tight employment market, economic improvement, corporate-governance reforms, and increased reinvestment in businesses are all continuing to add to the health of Japan’s economy. In addition, we see a wealth of high-quality companies and believe it’s still possible to find and exploit inefficiencies in the Japanese market.

While it wouldn’t surprise us if 2018 continues to be a volatile year for the U.S. markets, our long-term outlook hasn’t changed given that both company and economic fundamentals continue to be positive. As always, we’ll stay focused on pursuing our investment discipline to find growing companies that we believe have the potential to contribute to the long-term success of the Fund.

Thank you for the opportunity to manage your assets.

| Current and future holdings are subject to risk. |

14

Table of Contents

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX / WIGOX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| SIX MONTHS* | 1 YEAR | 5 YEARS | SINCE INCEPTION 11/17/08 | |||||||||||||||||

Global Opportunities (WAGOX) — Investor | 14.84% | 30.46% | 10.66% | 17.87% | ||||||||||||||||

Global Opportunities (WIGOX) — Institutional | 14.84% | 30.85% | 10.72% | 17.91% | ||||||||||||||||

MSCI ACWI Small Cap Index | 5.17% | 16.21% | 10.20% | 15.39% | ||||||||||||||||

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2018 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Opportunities Fund are Investor Class: 1.59% / Institutional Class — Gross: 1.93%, Net: 1.36%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small and micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

| * | Not annualized. |

TOP 10 EQUITY HOLDINGS**

| Company | % of Net Assets | |||

Medytox, Inc. (Korea) | 3.4% | |||

Copart, Inc. | 2.5% | |||

HealthEquity, Inc. | 2.5% | |||

Metro Bank plc (United Kingdom) | 2.4% | |||

MakeMyTrip Ltd. (India) | 2.2% | |||

Ollie’s Bargain Outlet Holdings, Inc. | 2.2% | |||

| Company | % of Net Assets | |||

Knight-Swift Transportation Holdings, Inc. | 2.1% | |||

Trex Co., Inc. | 2.1% | |||

Unifin Financiera S.A.B. de C.V. SOFOM ENR (Mexico) | 2.0% | |||

HubSpot, Inc. | 1.9% | |||

| ** | As of March 31, 2018, there were 79 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

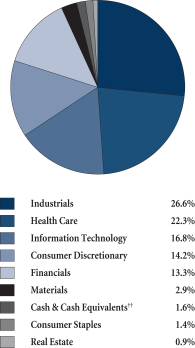

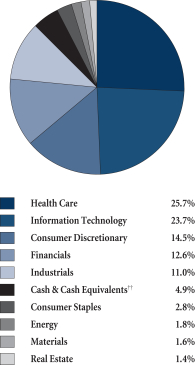

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

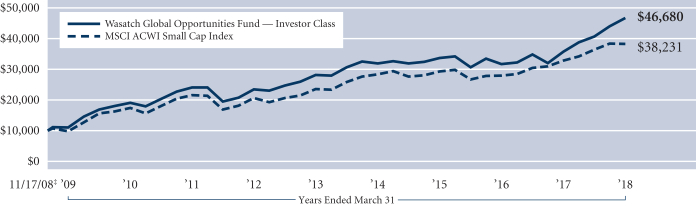

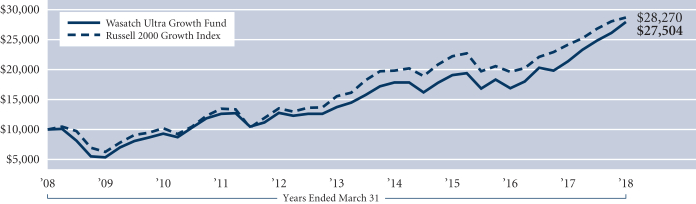

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. ‡Inception: November 17, 2008. The MSCI ACWI (All Country World Index) Small Cap Index is a free float-adjusted market capitalization index designed to measure the performance of small capitalization securities in developed and emerging markets. You cannot invest directly in this or any index.

15

Table of Contents

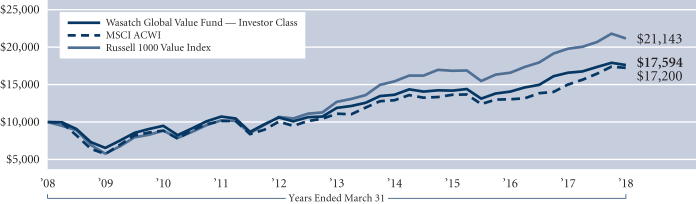

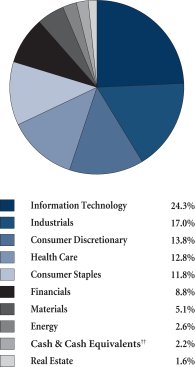

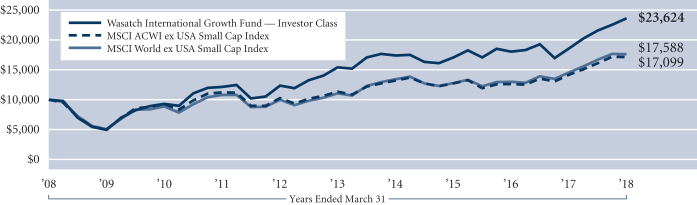

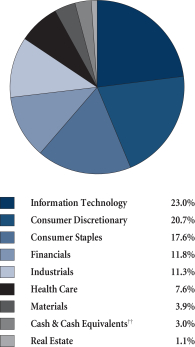

| WASATCH GLOBAL VALUE FUND (FMIEX / WILCX) | MARCH 31, 2018 (UNAUDITED) | |

| ||

| ||

Management Discussion —On October 31, 2017, the Fund changed its name from the Wasatch Large Cap Value Fund and its primary benchmark from the Russell 1000 Value Index.

The Wasatch Global Value Fund is managed by a team of Wasatch portfolio managers led by David Powers.

David Powers, CFA Lead Portfolio Manager | OVERVIEW

The Wasatch Global Value Fund —Investor Class declined -1.64%, lagging its benchmark, the MSCI ACWI (All Country World Index), which fell -0.96% in the first quarter of 2018. U.S. equities declined -0.76% in the first quarter of 2018 as measured by the S&P 500® Index, while international equities as gauged by the MSCI EAFE Index declined -1.53%. February saw stock prices dive on concerns over the | |

prospect of higher inflation and worries that central banks across the globe would accelerate the withdrawal of monetary support. After regaining much of the lost ground, stocks wavered again in March on speculation that the U.S. government’s proposed tariffs on Chinese imports would lead to a global trade war. | ||

Continuing the trend that was in place throughout 2017, stocks that typically do well in times of economic growth, including information technology and financial stocks, led the benchmark’s performance in the quarter. Conversely, more defensive, value-oriented stocks generally lagged. To illustrate the growth versus value split, consider that the MSCI ACWI Growth Index gained 0.67% while the MSCI ACWI Value Index lost -2.62%.

DETAILSOFTHE QUARTER

Our efforts to position the Fund more defensively, given what we see as an economy in the latter stages of the business cycle, hindered performance in the first quarter. The Fund’s performance relative to its benchmark was constrained by our investments in the consumer-staples, consumer-discretionary, energy and financials sectors. Conversely, stock selection within the materials, utilities and industrials sectors aided relative performance. The Fund’s U.S. holdings, about half of the portfolio, were down for the quarter, while our international holdings finished slightly positive. We continue to believe that our defensive-minded, globally diversified approach will be beneficial when late-cycle dynamics begin to take hold.

The Fund’s top contributor for the quarter was Ireland-based Smurfit Kappa Group plc, Europe’s largest corrugated-box manufacturer. The company’s share price moved higher on a buyout offer from U.S. rival International Paper.* We took advantage of the stock’s upward movement and sold our position.

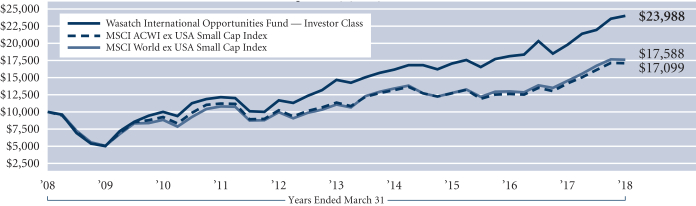

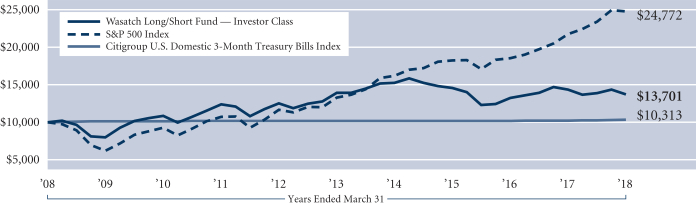

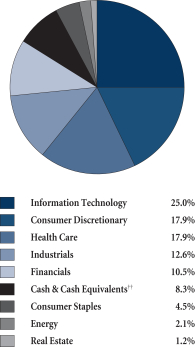

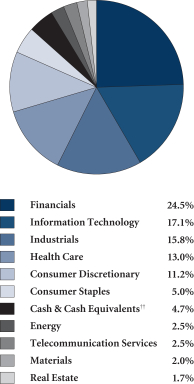

Technology company Cisco Systems, Inc. was the second-best contributor to performance. In 2017, Cisco’s revenues decreased as the company underwent an investment cycle. During the first quarter, management reported strong results that showed an increase in revenues and raised guidance for the upcoming quarter. Notably, Cisco has seen an increase in recurring revenue as it moves from selling hardware and networking services to a subscription-based business model. In addition, the company expects to benefit