UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-04920

WASATCH FUNDS TRUST

(Exact name of registrant as specified in charter)

505 Wakara Way, 3rd Floor

Salt Lake City, UT 84108

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Eric S. Bergeson Wasatch Advisors, Inc. 505 Wakara Way, 3rd Floor Salt Lake City, UT 84108 | | Eric F. Fess, Esq. Chapman & Cutler LLP 111 West Monroe Street Chicago, IL 60603 |

Registrant’s telephone number, including area code: (801)533-0777

Date of fiscal year end: September 30

Date of reporting period: March 31, 2019

Item 1. Report to Shareholders.

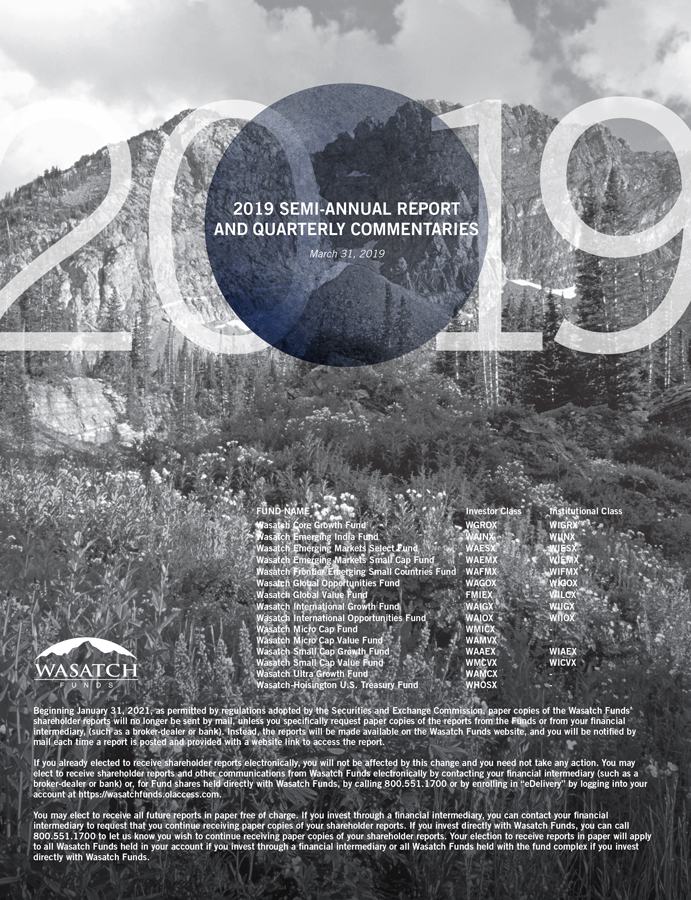

2019 SEMI-ANNUAL REPORT AND QUARTERLY COMMENTARIES March 31, 2019 FUND NAME Investor Class Institutional Class Wasatch Core Growth Fund WGROX WIGRX Wasatch Emerging India Fund WAINX WIINX Wasatch Emerging Markets Select Fund WAESX WIESX Wasatch Emerging Markets Small Cap Fund WAEMX WIEMX Wasatch Frontier Emerging Small Countries Fund WAFMX WIFMX Wasatch Global Opportunities Fund WAGOX WIGOX Wasatch Global Value Fund FMIEX WILCX Wasatch International Growth Fund WAIGX WIIGX Wasatch International Opportunities Fund WAIOX WIIOX Wasatch Micro Cap Fund WMICX — Wasatch Micro Cap Value Fund WAMVX — Wasatch Small Cap Growth Fund WAAEX WIAEX Wasatch Small Cap Value Fund WMCVX WICVX Wasatch Ultra Growth Fund WAMCX —Wasatch-Hoisington U.S. Treasury Fund WHOSX - Beginning January 31, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Wasatch Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, (such as a broker-dealer or bank). Instead, the reports will be made available on the Wasatch Funds website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from Wasatch Funds electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, for Fund shares held directly with Wasatch Funds, by calling 800.551.1700 or by enrolling in “eDelivery” by logging into your account at https://wasatchfunds.olaccess.com. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue receiving paper copies of your shareholder reports. If you invest directly with Wasatch Funds, you can call 800.551.1700 to let us know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Wasatch Funds held in your account if you invest through a financial intermediary or all Wasatch Funds held with the fund complex if you invest directly with Wasatch Funds.

WASATCH FUNDS

Salt Lake City, Utah

www.WasatchFunds.com

800.551.1700

This material must be accompanied or preceded by a prospectus.

Please read the prospectus carefully before you invest.

Wasatch Funds are distributed by ALPS Distributors, Inc.

1

| | |

| LETTERTO SHAREHOLDERS — GREAT COMPANIES FIND WAYSTO WIN OVERTHE LONG TERM | | |

|

|

|

| | | | |

Ken Applegate, CFA, CMT Portfolio Manager | |

Linda Lasater, CFA Portfolio Manager | | DEAR FELLOW SHAREHOLDERS: For this latest letter, we focus on a long-held Wasatch investment philosophy: Genuinely great companies are — as Warren Buffett has said — “rare gems” that prevail regardless of political climates, economic conditions or market events. This view is supported by an extensive quantitative study of corporate growth and survivorship undertaken by Patrick Viguerie and Sven Smit, researchers with consulting giant McKinsey & Company. In 2008, Viguerie and Smit, along with former McKinsey colleague Mehrdad Baghai, published their work in the Wiley business bestseller,The Granularity of Growth. In 2015, Smit revisited the book’s central thesis with another McKinsey colleague, Yuval Atsmon, to determine if the book’s findings still held true. Smit and Atsmon built abrand-new proprietary database to track company fundamentals across S&P 500 Index constituents over the30-year period from 1983 to 2013. The duo published their |

findings in a McKinsey research report entitledWhy It’s Still a World of ‘Grow or Go.’ The report found:

| | • | | For the three-decade period, nearly 60% of the S&P 500 companies that lagged their peers — in terms of growth and profit margins — were acquired. |

| | • | | More than 75% of the S&P 500 constituents that generatedtop-line growth and maintained or improved margins outperformed the Index over the period. |

| | • | | 56% of the companies that grew slowly but also aggressively distributed cash to shareholders outperformed the Index. |

| | • | | Companies with deteriorating margins underperformed, even if these companies were still growing at a significant clip. |

After revisiting the core tenets ofThe Granularity of Growth, Smit and Atsmon concluded that “outperforming the competition remains possible in all industries, even in sluggish economic times.” They added that high-performing companies “continually seek the kind of growth that generates real and sustainable value.”

Consistent with the principles described by the McKinsey researchers, we’d like to emphasize the following points:

| | • | | We’re repeatedly faced with challenges — the first quarter of 2019 presented its share, including the longest federal government shutdown in U.S. history, the continuation of the U.S.-China trade tensions and the U.K.’s wrangling over how to exit from the European Union. |

| | • | | Financial markets rebounded from sharp fourth-quarter declines. Despite the recent strong stock-market performance, we believe global economic growth is slowing. |

| | • | | While we’re on the lookout for potential challenges, having a large universe to pick from means we can always findhigh-quality, long-duration growth companies around the world and across market capitalizations. |

ECONOMY

In terms of economic news, we begin with the United States, the world’s largest economy. Real gross domestic product (GDP) in 2018’s fourth quarter rose at an annual rate of 2.2%, down from an earlier estimate of 2.6%. The retail-sales report from the U.S. Department of Commerce downwardly revised December’s percentage decline from-1.2% to-1.6%, further accentuating the worst month for retail sales since the global financial crisis. However, better news followed when it was reported that U.S. retail sales for January 2019 posted a significant 2.3% year-over-year increase. The U.S. Consumer Price Index also edged up recently, but a temporary drop in energy prices helped to hold down the Index on a year-over-year basis. With core inflation running at about a 2.1% annualized pace, the underlying trend remains in line with the Federal Reserve’s target of 2.0%.

Regarding China, the world’s second-largest economy, early data indicate continued deceleration in 2019. Nevertheless, China’s February retail sales rose more than 8% year-over-year, which was in line with forecasts. What’s more important to us, however, is that the selection of high-quality Chinese companies has doubled in the past three years. We continue to devote significanton-the-ground due diligence aimed at identifying emerging leaders in various industries. This research includes theA-share market of approximately 1,400 companies incorporated in mainland China.

We turn now to Japan, the world’s third-largest economy and home to what we believe is one of the most excitingsmall-cap markets globally. Despite being supported by easy monetary policy, many economic indicators such as GDP growth are uninspiring. However, there are positive factors — such as Japan’s multi-decade low unemployment rate. With the country facing a labor shortage, we’re seeing some wage inflation, which can act as a tailwind for Japan’s domestic consumers. The tight labor market is also creating opportunities for companies that enable businesses to become more efficient and productive.

Continuing this review of developed nations, we land next on the United Kingdom, which remains in upheaval over Brexit. In April, Prime Minister Theresa May secured an extension from the European Council, which gives her until October 31st to work out a compromise deal with the fractious British Parliament. The uncertainty of Brexit has been clouding the British economy and markets since the referendum in 2016, and this haze is likely to persist until we know the outcome.

Among emerging markets, we see attractive company valuations coupled with bureaucratic reforms and stimulative government initiatives. In addition, investor sentiment has improved due to low inflation and reduced concerns over monetary policies in developed nations. These factors have also enhanced the prospects for emerging-market currency valuations. Moreover, country balance sheets have strengthened, as have international fund flows into emerging markets.

2

| | |

| | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Beyond China, we believe Latin America may offer good investment opportunities. The region’s political situation (although still highly imperfect) has become somewhat more stable, and the economic recovery seems to be getting back on track. In Brazil, we saw signs of improving consumer sentiment, and we think the country will make progress regarding deficit reduction and reining in corruption.

As for India,pro-business priorities and structural government-policy changes implemented over the past several years should pay economic dividends beyond the next decade. The government’s efforts — along with attractive demographics and a still rapidly growing economy — help make the country one of our most-fertile grounds for finding promising emerging-market investments.

MARKETS

We recently heard a great adage about investing: “The stock market is the only market where people head for the exit when things go on sale.” And considering what followed 2018’s stock-market rout, heading for the exit certainly wasn’t a wise move. As long-term investors, we prefer to use overall market weakness as an opportunity to increase our positions in exceptional businesses.

During the first quarter of 2019, the U.S.large-cap S&P 500® Index advanced 13.65%. The technology-heavy Nasdaq Composite Index gained 16.81%. The Russell 2000® Index of small caps rose 14.58%. And growth-oriented small caps performed extremely well, with the Russell 2000 Growth Index up 17.14%. Value-oriented small caps in the Russell 2000 Value Index were up 11.93%, as value stocks — including those across larger market capitalizations — generally trailed growth stocks. The outperformance of growth stocks relative to value names was a continuation of a trend we’ve seen for a number of years.

For the most part, international stocks also performed very well but generally lagged those in the U.S. The MSCI World ex USA Index rose 10.45% and the MSCI Emerging Markets Index gained 9.92% for the first quarter.

Intermediate- and long-term bond yields fell during the quarter as the inversion of the yield curve signaled subdued inflationary expectations. Because bond prices move in the opposite direction of yields, bond indexes posted positive returns. The Bloomberg Barclays US Aggregate Bond Index increased 2.94%. And the Bloomberg Barclays US 20+ Year Treasury Bond Index was up a solid 4.73%.

WASATCH

At Wasatch, we think the returns for stocks and bonds during the first quarter of 2019 were reminders of the difficulty of using macro events to try to predict asset prices. It appeared to us that the first-quarter rebound was triggered by investors feeling relieved by the pause in tightening of U.S. monetary policy and the outright accommodative monetary policies in Europe and Asia.

Stock investors seemed to ignore the inverted yield curve and the signs of slowing economic growth around the world. For our part, we believe it’s important to note that economic slowdowns and recessions aren’t all bad, as they can help correct excesses that build up during economic expansions. This underscores the importance of owning high-quality companies that are able to maneuver through challenging times. Truly exceptional companies focus on the long term — which provides the potential for investors like us to benefit from the power of compounding returns.

As we’ve said, forecasting macro events and how those events might affect stock prices over the short term isn’t our game. But we do recognize that macro events will sometimes create a tailwind for us, while at other times the wind will be in our faces. Through it all, we remain steadfastly focused on the long-term potential of individual stocks. In 2018, our investment team visited companies in 23 countries. Over the past two years, we’ve had over 1,500face-to-face meetings with management teams and made over 800on-site company visits. We believe that interactions with such a broad array of companies, combined with ourbottom-up quantitative screens, provide an even more robust view of business conditions and competitive dynamics.

With sincere thanks for your continuing investment and for your trust,

Ken Applegate and Linda Lasater

Information in this report regarding market or economic trends, or the factors influencing historical or future performance, reflects the opinions of management as of the date of this report. These statements should not be relied upon for any other purpose. Past performance is no guarantee of future results, and there is no guarantee that the market forecasts discussed will be realized.

CFA® is a trademark owned by CFA Institute.

Wasatch Advisors is the investment advisor to Wasatch Funds.

Wasatch Funds are distributed by ALPS Distributors, Inc. (ADI). ADI is not affiliated with Wasatch Advisors, Inc.

Definitions of financial terms and index descriptions and disclosures begin on page 34.

3

| | |

| WASATCH CORE GROWTH FUND(WGROX / WIGRX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Core Growth Fund is managed by a team of Wasatch portfolio managers led by JB Taylor, Paul Lambert and Mike Valentine.

| | | | |

JB Taylor Lead Portfolio Manager | |

Paul Lambert Portfolio Manager | |

Mike Valentine Portfolio Manager |

OVERVIEW

Stocks roared back in the first quarter of 2019. The Wasatch Core Growth Fund — Investor Class delivered a strong gain of 15.37% for the quarter, outperforming the 14.58% return of its primary benchmark, the Russell 2000 Index. The Fund slightly underperformed the Russell 2000 Growth Index, which rose 17.14%.

The past several quarters delivered a host of geopolitical, economic and technical market events — including the U.S. government shutdown, wrangling over Britain’s exit from the European Union and concerns of a “hard landing” for China’s economy. Two other highly publicized macro issues also stood out to us:

1. The wildup-and-down swings in stock prices over the past 15 months underscored, in our view, what may be a sustained increase in market volatility.

2. In late March 2019, the yield curve inverted for the first time since 2007, primarily due to the release of softer U.S. economic data, accommodative signals provided by Federal Reserve officials and bond investors believing interest-rate increases are over. Of course, many market pundits have opined that every American recession over the past 60 years has been preceded by an inverted yield curve. These same pundits have usually failed to mention, however, that a yield-curve inversion doesn’t predict the exact timing of a recession or how stocks will perform.

We raise these two macro issues — the significant increase in market volatility and the yield-curve inversion — not because our investment decisions rely heavily on macro conditions. Rather, we raise these issues because we think investors may have to get used to greater volatility in stock prices and because we want shareholders to be mindful that economic and market predictions aren’t as accurate as the headlines would have us believe.

DETAILSOFTHE QUARTER

The top contributor to performance for the first quarter was Euronet Worldwide, Inc., an electronic-payments business that operates ATMs, traditionalpoint-of-sale (POS) terminals, prepaid POS terminals and money-transfer networks. The company reported significant increases in operating income and adjusted earnings per share. As is often the

case with stronger-than-expected numbers, Euronet’s stock price soared after the report. We continue to be impressed with the company’s operating discipline — as 2018 was the sixth consecutive year that management delivered double-digit growth in adjusted earnings per share.

Another significant contributor was auto-repair chain Monro, Inc. The company started to see a turnaround in 2017 — after which we visited with Brett Ponton, Monro’s newly installed CEO. During this visit, we were encouraged by the company’s long-term growth prospects, along with Mr. Ponton’s strategic direction. In January 2019, Monro reported record revenue and a significant increase in net income. We remain pleased with Monro’s management team and believe the stock price has started to reflect the company’s progress.

The largest detractor from Fund performance was Metro Bank plc, one of theso-called “challenger banks” established in the U.K. after the global financial crisis. Despite Metro’s rapid growth, the stock plunged in January after the bank disclosed that it had applied an incorrectly low risk weighting to parts of its loan book. The stock fell again in February on news that Metro will have to raise additional equity in order to put more capital behind the misclassified loans. The bank now faces the prospect of having to issue stock at prices that are highly dilutive to the ownership stakes of existing shareholders.

Another major detractor was Cimpress N.V., a “mass-market customization” provider of printing, signage and packaging services. In January, the company reported a second consecutive quarter of disappointing earnings. Cimpress grew consolidated revenue just 8% compared to 32% for theyear-ago quarter, which disappointed Wall Street. We plan to monitor Cimpress closely to see if the steep decline in consolidated revenue was aone-time aberration or a more-meaningful trend.

OUTLOOK

As we’ve sifted through a multitude of sales and earnings reports over the past few months, we’ve tried to determine whether or not our long-term holdings remain on track. For the most part, we’ve been very pleased with our companies’ progress — which has led to remarkably little turnover in the Fund.

Going forward, we expect the relatively low turnover to continue. We think about it this way: U.S.small-cap stocks are roughly trading atyear-ago levels, but there’s been quite a lot of volatility along the way. Meanwhile, our companies have grown their sales and earnings at double-digit rates overall. We think our companies may have improved their competitive positions in the past year because great businesses tend to strengthen during times of slower economic growth, while lesser businesses tend to weaken.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

4

| | |

| WASATCH CORE GROWTH FUND(WGROX / WIGRX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | 10 YEARS |

Core Growth (WGROX) — Investor | | | | -6.18% | | | | | 6.83% | | | | | 11.25% | | | | | 18.45% | |

Core Growth (WIGRX) — Institutional | | | | -6.11% | | | | | 6.97% | | | | | 11.38% | | | | | 18.54% | |

Russell 2000® Index | | | | -8.56% | | | | | 2.05% | | | | | 7.05% | | | | | 15.36% | |

Russell 2000® Growth Index | | | | -8.22% | | | | | 3.85% | | | | | 8.41% | | | | | 16.52% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2019 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Core Growth Fund are Investor Class: 1.18% / Institutional Class — Gross: 1.08%, Net: 1.06%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 1/31/2012 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 1/31/2012 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| |

| Euronet Worldwide, Inc. | | | 4.2% | |

| |

| Monro, Inc. | | | 3.4% | |

| |

| Pool Corp. | | | 3.2% | |

| |

| Copart, Inc. | | | 2.9% | |

| |

| ICON plc(Ireland) | | | 2.8% | |

| | | | |

| Company | | % of Net

Assets | |

| |

| Balchem Corp. | | | 2.8% | |

| |

| Trex Co., Inc. | | | 2.8% | |

| |

| Guidewire Software, Inc. | | | 2.7% | |

| |

| EPAM Systems, Inc. | | | 2.7% | |

| |

| Tyler Technologies, Inc. | | | 2.6% | |

| ** | As of March 31, 2019, there were 53 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

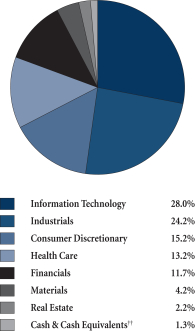

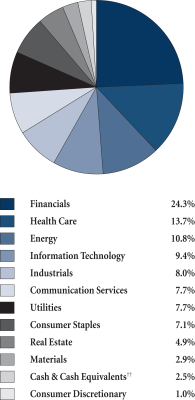

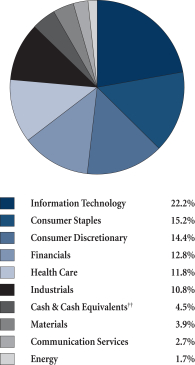

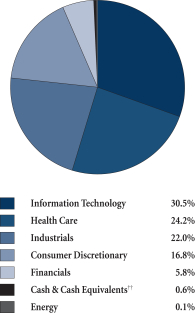

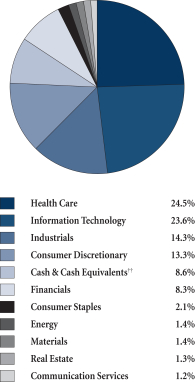

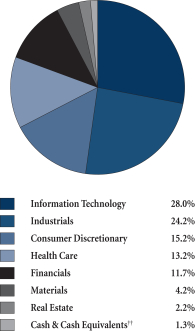

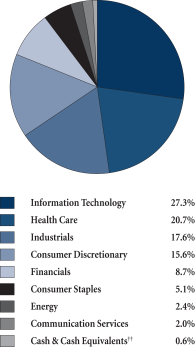

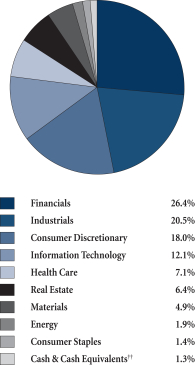

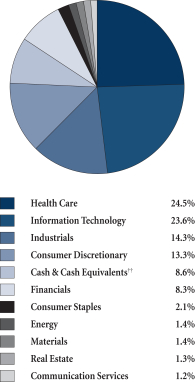

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

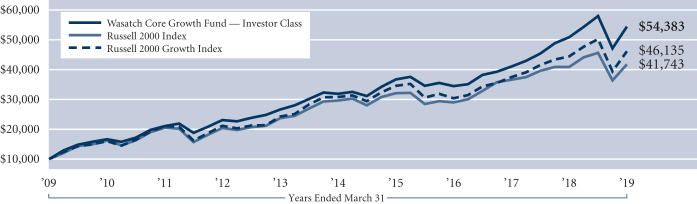

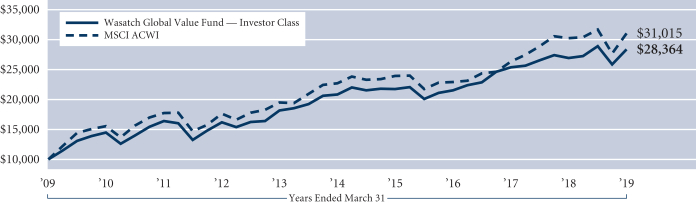

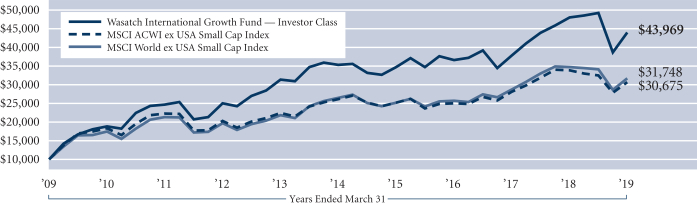

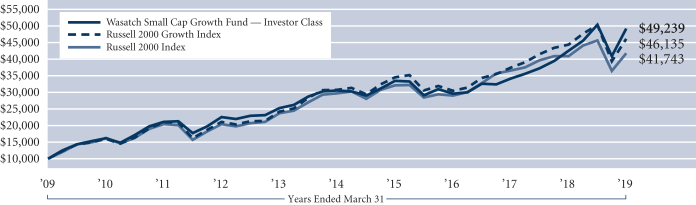

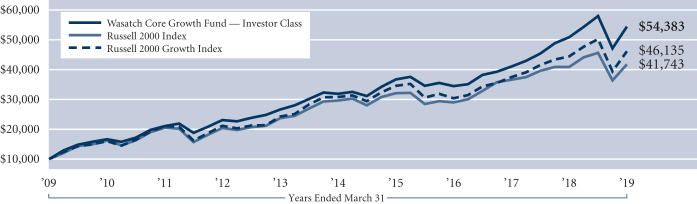

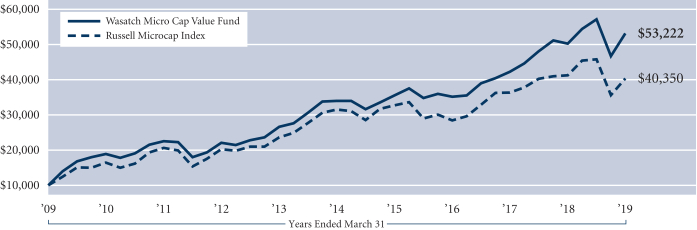

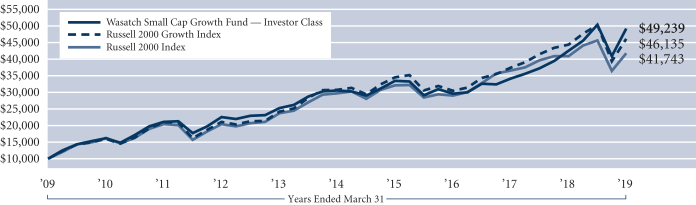

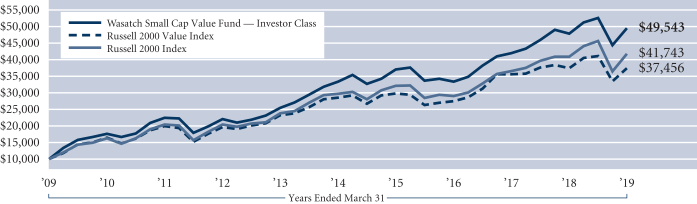

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. TheRussell 2000 Index is an unmanaged total return index of the smallest 2,000 companies in the Russell 3000 Index, as ranked by total market capitalization. The Russell 2000 Index is widely regarded in the industry as accurately capturing the universe of small company stocks. TheRussell 2000 Growth Index is an unmanaged total return index that measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values.You cannot invest directly in these or any indexes.

5

| | |

| WASATCH EMERGING INDIA FUND(WAINX / WIINX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Emerging India Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan and Matthew Dreith.

| | | | |

Ajay Krishnan, CFA Lead Portfolio Manager | |

Matthew Dreith, CFA Portfolio Manager | | OVERVIEW Indian equities registered solid gains during the first quarter of the year, with the benchmark MSCI India Investable Market Index (IMI) rising 6.65%. Trailing the benchmark |

somewhat, the Wasatch Emerging India Fund — Investor Class returned 5.32%.

Apprehension surrounding India’s upcoming general election helped keep stock-market gains in check during January and February. Investors feared populist measures designed to enhance the ruling coalition’s approval with voters might strain India’s finances. Rising oil prices also raised concerns in a country that imports about 80% of the oil it uses. Sentiment improved in March after war was averted in the conflict with Pakistan along India’s northern border.

Energy stocks led India’s equity market higher as the price of Brent crude surged 25% during the first three months of the year. Energy was thetop-performing sector of the Index, and the Fund’s lack of investments in energy stocks was the primary reason the Fund lagged its benchmark. Information-technology (IT) stocks also were strong performers, as the IT component of the Index posted a double-digit percentage gain during the quarter. As with energy, however, the Fund’s significantly underweight position in IT hurt performance relative to the Index.

Consumer discretionary was one of the poorest-performing sectors after a lackluster festival season in 2018 fanned concerns that India’s economy may be slowing. Although the Fund’s consumer-discretionary stocks outperformed their benchmark peers, our overweight position in the sector offset that advantage. Health care and communication services were the Fund’s greatest sources of strength against the benchmark. In both of these sectors, our stocks appreciably surpassed their counterparts in the Index and helped Fund performance.

DETAILSOFTHE QUARTER

Financials accounted for a number of the Fund’s best performers. These included the two top contributors for the quarter, ICICI Lombard General Insurance Co. Ltd. and Bajaj Finance Ltd. ICICI Lombard is one of the largest private-sector general insurers in India. The company offers motor-vehicle, health, home, travel and other types of insurance coverage. An upswing in India’s insurance cycle continued to benefit ICICI Lombard and other insurance companies.

Anon-bank financial company, Bajaj Finance is the lending arm of the Bajaj Group — a well-regarded Indian industrial house founded in 1926. The company is experiencing secular

demand growth driven by increased financialization, favorable demographics and a cultural shift away from extended-family living arrangements. We believe the company is creating significant headroom for future growth through its innovative use of technology to expand the markets it serves.

The greatest detractor from Fund performance for the quarter was Godrej Consumer Products Ltd. Operating in India and internationally, Godrej is one of the leading manufacturers of household insecticides in India. As consumers seek new forms of protection from mosquito-borne diseases, illegally manufactured mosquito-repellent incense sticks have captured a growing share of India’s household-insecticide market. Now that Godrej has launched its own mosquito-repellent incense stick under the flagship Goodknight brand, we expect the competitive situation to improve.

Other weak stocks in the Fund included GRUH Finance Ltd. and Bandhan Bank Ltd. GRUH provides a range of home loans and insurance products through a network of offices in India. Bandhan is a commercial bank offering traditional and internet-banking services. Investors reacted negatively to news that Bandhan was acquiring GRUH in a stock-swap deal. The stock prices of both companies fell on the news, as the shareholders of both firms were unhappy with the details of the transaction. We liquidated the Fund’s positions in both companies to seek better opportunities elsewhere.

OUTLOOK

According to official government data released in February, India’s year-over-year gross domestic product growth slowed to 6.6% during the fourth quarter of last year — down from a revised 7% in the previous quarter and the weakest reading in six quarters. For a variety of reasons, we don’t view this report as a significant cause for concern.

First, our investment approach isn’t driven by economic forecasts. Although we take macroeconomic factors into account, most of our analysis focuses on the growth prospects of individual companies. And recent financial results from the companies we own in the Fund have generally been positive, with strongtop-line growth in a number of our consumer-related businesses.

Second, part of the recent slowdown resulted from sluggish sales of passenger cars andtwo-wheeled vehicles. Much of this can be attributed to higher financing costs and a shortage of loans during the fourth quarter as India’s shadow-banking system recovered from the default of a major player. But the tighter liquidity conditions are helping the Fund’snon-bank financial companies gain market share as weaker competitors struggle to obtain capital.

Third, a benign inflationary environment has allowed India’s central bank to take a more-accommodative stance with respect to monetary policy. The Reserve Bank of India (RBI) cut interest rates in February to spur economic growth, and new RBI Governor Shaktikanta Das has signaled the possibility of future cuts.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

6

| | |

| WASATCH EMERGING INDIA FUND(WAINX / WIINX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | SINCE INCEPTION

4/26/11 |

Emerging India (WAINX) — Investor | | | | 12.62% | | | | | 4.43% | | | | | 16.59% | | | | | 11.49% | |

Emerging India (WIINX) — Institutional | | | | 12.81% | | | | | 4.64% | | | | | 16.74% | | | | | 11.58% | |

MSCI India IMI | | | | 10.06% | | | | | 2.98% | | | | | 8.59% | | | | | 3.07% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2019 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging India Fund are Investor Class: 1.70% / Institutional Class — Gross: 1.60%, Net: 1.51%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as unstable currencies, highly volatile securities markets and political and social instability, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| |

| Bajaj Finance Ltd.(India) | | | 7.8% | |

| |

| ICICI Lombard General Insurance Co. Ltd. (India) | | | 6.1% | |

| |

| V-Mart Retail Ltd.(India) | | | 5.6% | |

| |

| HDFC Bank Ltd.(India) | | | 5.2% | |

| |

| Housing Development Finance Corp. Ltd. (India) | | | 4.9% | |

| | | | |

| Company | | % of Net

Assets | |

| |

| Divi’s Laboratories Ltd.(India) | | | 4.6% | |

| |

| Pidilite Industries Ltd.(India) | | | 4.4% | |

| |

| Dr. Lal PathLabs Ltd.(India) | | | 4.2% | |

| |

| Amara Raja Batteries Ltd.(India) | | | 4.1% | |

| |

| AU Small Finance Bank Ltd.(India) | | | 3.6% | |

| ** | As of March 31, 2019, there were 35 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

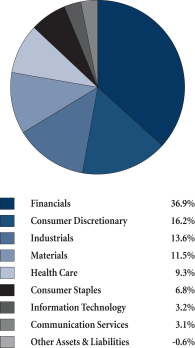

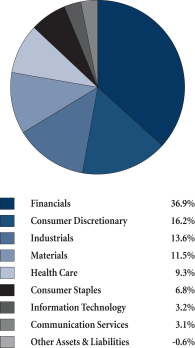

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.‡Inception: April 26, 2011.The MSCI India IMI (Investable Market Index)is designed to measure the performance of the large-, mid- and small-cap segments of the Indian market. The Index covers approximately 99% of the free-float adjusted market capitalization of the Indian equity universe.You cannot invest directly in this or any index.

7

| | |

| WASATCH EMERGING MARKETS SELECT FUND(WAESX / WIESX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Emerging Markets Select Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan, Roger Edgley, Scott Thomas and Matthew Dreith.

| | | | |

Ajay Krishnan, CFA Lead Portfolio Manager

Scott Thomas, CFA Associate Portfolio

Manager | |

Roger Edgley, CFA Portfolio Manager

Matthew Dreith, CFA Associate Portfolio Manager | | OVERVIEW Emerging-market equities got off to a strong start in 2019, helped by a dovish shift in U.S. monetary policy and the prospect of additional economic stimulus in China. The benchmark MSCI Emerging Markets Index rose 9.92% during first quarter of the year. Outpacing the benchmark, the Wasatch Emerging Markets Select Fund — Investor Class gained 13.20%. After signaling a “patient” approach to raising interest rates in January, the U.S. Federal |

Reserve (Fed) pleased investors again in March by projecting no further rate hikes this year. The central bank also downgraded its outlook for U.S. economic growth and said it would stop shrinking its balance sheet in September. Taken together, the Fed’s moves undercut the U.S. dollar, making riskier investments in emerging markets more attractive to investors.

Strong gains in China and Brazil were the main reasons the Fund surpassed its benchmark. The Chinese government vowed to continue supporting the nation’s economy by cutting taxes and fees. In Brazil, new president Jair Bolsonaro faces the difficult tasks of reforming Brazil’s ailing pension system and reviving the economy, but we believe the companies we own there represent enduring, high-quality businesses with attractive prospects for long-term growth.

The Fund’s overweight position in India hurt performance, as apprehension ahead of upcoming elections kept Indian equities in check. A 25% increase in the U.S.-dollar price of Brent crude during the quarter also impacted sentiment toward India, which imports about 80% of the oil it uses.

DETAILSOFTHE QUARTER

Chinese stocks were some of the strongest contributors to Fund performance. Among these was Ctrip.com International Ltd., which soared after the online travel agent reported better-than-expected earnings and revenues in its most-recent quarter. Management cited the company’s customer-centric initiatives and platform improvements, as well as Ctrip’s expansion into lower-tier cities through localized product and

service offerings. Longer term, the company stands to benefit from rising urbanization rates and the transformation of China’s economy from manufacturing and investment to service and consumption.

MercadoLibre, Inc. was another large contributor. The company operatese-commerce platforms in Brazil and other Latin American countries. MercadoLibre’s payment solution, MercadoPago, is driving strong growth at the company as an increasing number ofe-commerce sites andbrick-and-mortar retailers adopt MercadoPago as a preferred payment method.

The greatest detractor from Fund performance for the quarter was Godrej Consumer Products Ltd. Operating in India and internationally, Godrej is one of India’s leading manufacturers of household insecticides. As Indian consumers seek new forms of protection from mosquito-borne diseases, illegally manufactured mosquito-repellent incense sticks have captured a significant share of the household-insecticide market. Now that Godrej has launched its own mosquito-repellent incense stick under the flagship Goodknight brand, we expect the competitive situation to improve as informal players exit the market.

Second-largest detractor Discovery Ltd. provides insurance products and services in South Africa and other countries. Higher-than-expected mortality experience impacted Discovery’s life-insurance business in the company’s most-recent quarter. Increased spending in Discovery’s new businesses, which include a bank in South Africa and a health-insurance venture in China, also hampered profitability. Given the expected growth in these new areas, however, we think the investments make sense.

OUTLOOK

Part of the reason for the Fund’s recent outperformance is the type of companies we own. Of particular interest to us are stable businesses tied to secular growth in domestic demand from an expanding middle class. We’re less interested in exporters and commodity producers, which are often subject to the whims of the global economy. During the first quarter, heightened concerns about the pace of global growth boosted the appeal of our high-quality, long-duration businesses.

Given recent structural reforms in India, we’re comfortable carrying an above-benchmark weighting in Indian stocks. Although the uncertainty surrounding India’s upcoming general election kept a lid on stock prices for most of the quarter, March was a month of strong gains for Indian equities.

In China, we continue to devote significant research attention to theA-share market, which consists of the stocks of approximately 1,400 companies incorporated in mainland China. Quoted in Chinese renminbi,A-shares are traded on China’s Shanghai or Shenzhen stock exchanges. Identifying long-duration growth opportunities of the type we favor has proven particularly difficult in China. The task is complicated by the need to invest in Chinese companies whose businesses align with the goals of the Chinese government.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

8

| | |

| WASATCH EMERGING MARKETS SELECT FUND (WAESX / WIESX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | | | | | |

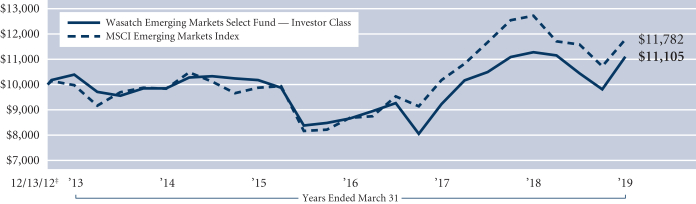

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | SINCE INCEPTION 12/13/12 |

Emerging Markets Select (WAESX) — Investor | | | | 6.35% | | | | | -1.60% | | | | | 2.41% | | | | | 1.68% | |

Emerging Markets Select (WIESX) — Institutional | | | | 6.53% | | | | | -1.32% | | | | | 2.67% | | | | | 2.00% | |

MSCI Emerging Markets Index | | | | 1.71% | | | | | -7.41% | | | | | 3.68% | | | | | 2.64% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2019 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Select Fund are Investor Class — Gross: 1.76%, Net: 1.51% / Institutional Class — Gross:1.45%, Net: 1.21%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| |

| Bajaj Finance Ltd.(India) | | | 7.7% | |

| |

| Alibaba Group Holding Ltd. ADR(China) | | | 5.0% | |

| |

| Ctrip.com International Ltd. ADR(China) | | | 4.3% | |

| |

| Tencent Holdings Ltd.(China) | | | 4.2% | |

| |

| BGF Retail Co. Ltd.(Korea) | | | 4.1% | |

| | | | |

| Company | | % of Net

Assets | |

| |

| HDFC Bank Ltd.(India) | | | 4.0% | |

| |

| Vitasoy International Holdings Ltd.(China) | | | 4.0% | |

| |

| Medytox, Inc.(Korea) | | | 3.8% | |

| |

| Raia Drogasil S.A.(Brazil) | | | 3.4% | |

| |

| ICICI Lombard General Insurance Co. Ltd. (India) | | | 3.3% | |

| ** | As of March 31, 2019, there were 35 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

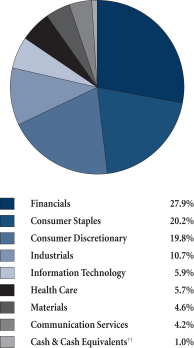

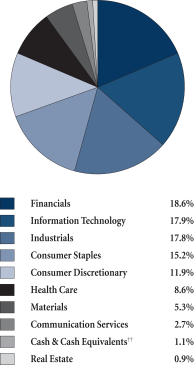

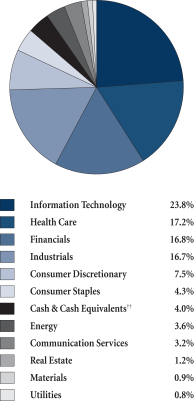

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

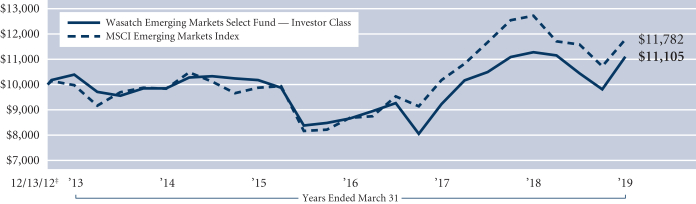

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.‡Inception: December 13, 2012. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index designed to measure the equity market performance of emerging markets.You cannot invest directly in this or any index.

9

| | |

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX / WIEMX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Emerging Markets Small Cap Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan, Dan Chace, Roger Edgley, Andrey Kutuzov, Scott Thomas and Kevin Unger.

| | | | |

Ajay Krishnan, CFA Lead Portfolio Manager | |

Dan Chace, CFA Portfolio Manager | |

Roger Edgley, CFA Portfolio Manager |

| | | | |

Andrey Kutuzov, CFA Associate Portfolio Manager | |

Scott Thomas, CFA Associate Portfolio Manager | |

Kevin Unger, CFA Associate Portfolio Manager |

OVERVIEW

The Wasatch Emerging Markets Small Cap Fund — Investor Class gained 10.39% for the three months ended March 31, 2019 and outperformed the MSCI Emerging Markets Small Cap Index, which gained 7.76%.

A dovish shift in U.S. monetary policy and the prospect of additional economic stimulus in China helped emerging-market equities get off to a strong start in 2019. While we take macroeconomic factors into account, our primary focus is on analyzing the growth prospects of individual companies in emerging markets. We look for stable businesses benefiting from secular trends tied to a country’s long-term development. We believe the Fund’s holdings are high-quality businesses capable of long-duration growth.

DETAILSOFTHE QUARTER

For the quarter, the Fund’s holdings in India substantially outperformed their benchmark counterparts. India is the Fund’s largest country weighting, and the Fund is significantly overweight versus the Index. Info Edge India Ltd., a leader in online classified advertising, was a top contributor to Fund performance. We believe the company has substantial headroom for growth as the Indian market is in the early stages of shifting from print to online advertising. In other markets, we have seen dominant providers of online classified ads demonstrate consistent growth and they are extremely difficult for competitors to dislodge.

The Fund’s holdings in China significantly outperformed those in the benchmark for the quarter led by top overall contributor Vitasoy International Holdings Ltd. This Chinese company offers soy milk, tofu, rice milk, tea, juices and relatedfood-and-beverage products in over 40 countries. Vitasoy reported strong earnings citing improved manufacturing efficiency and favorable trends in commodity prices, particularly sugar and milk powder.

Taiwan was another large contributor to performance led by Win Semiconductors Corp. Win manufactures gallium arsenide (GaAs) wafers, the dominant semiconductor technology for mobile devices. Win is expected to benefit from the deployment of 5G user equipment and network infrastructure. Win also provides optoelectronic device fabrication services for optical communication and 3D sensing applications. Strong demand for 3D sensing has been increasing and diversifying the company’s growth profile.

The Fund’s largest detractor was Douzone Bizon Co. Ltd., the leading accounting software and enterprise-resource planning (ERP) provider in Korea. The company has been transitioning from desktop to cloud software products, which has led to a pickup in growth, margins and returns on capital. Douzone’s ERP business has been more volatile than expected and earnings were below expectations, but we expect the ERP segment to become more consistent over time.

Magazine Luiza S.A., the Fund’s top contributor for 2018, detracted for the first quarter of 2019. The company operates consumer-electronic stores in Brazil. Strong information-technology infrastructure drives itse-commerce business, and its stores act as showrooms and mini-distribution centers.

Muangthai Capital Public Co. Ltd., a provider of lending services in Thailand, was the third-largest detractor. Uncertainty around pending regulation ofnon-bank financial companies in Thailand and the effect it might have on current interest rates and fees has been substantially resolved.

OUTLOOK

Positive factors that could help emerging markets in 2019 include the U.S. Federal Reserve’s lowered projections for future interest-rate hikes, the potential for a trade deal between the U.S. and China, and the inexpensive prices of emerging-market stocks compared to those in developed markets. Moreover, many emerging-market currencies have stabilized against the U.S. dollar. Lower inflation is supportive of domestic consumers in emerging-market countries.

In India, we expect that when the upcoming national elections are complete, investors will be better able to focus on the strong business momentum and fundamentals that we see every day as we research individual Indian companies.

The emerging-market universe is becoming more diverse across sectors. We are seeing more knowledge-based companies and companies with valuable intellectual property. These and other positive factors support the future of emerging-market equity investing and the long-term growth of companies in these markets.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

10

| | |

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX / WIEMX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | | | | | |

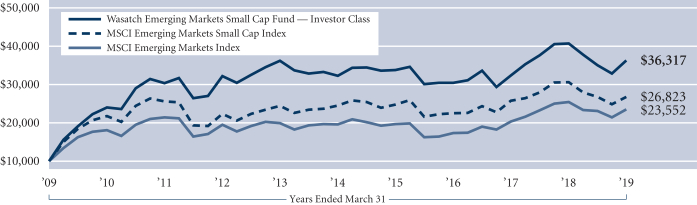

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | 10 YEARS |

Emerging Markets Small Cap (WAEMX) — Investor | | | | 3.63% | | | | | -10.81% | | | | | 2.34% | | | | | 13.77% | |

Emerging Markets Small Cap (WIEMX) — Institutional | | | | 4.01% | | | | | -10.43% | | | | | 2.49% | | | | | 13.85% | |

MSCI Emerging Markets Small Cap Index | | | | 0.03% | | | | | -12.42% | | | | | 1.76% | | | | | 10.37% | |

MSCI Emerging Markets Index | | | | 1.71% | | | | | -7.41% | | | | | 3.68% | | | | | 8.94% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2019 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Small Cap Fund are Investor Class — Gross: 1.97%, Net: 1.95% /Institutional Class — Gross: 1.83%, Net: 1.81%. The expense ratio shown elsewhere in this report may be different. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| |

| Vitasoy International Holdings Ltd.(China) | | | 3.5% | |

| |

| ICICI Lombard General Insurance Co. Ltd. (India) | | | 3.3% | |

| |

| Medytox, Inc.(Korea) | | | 3.2% | |

| |

| ASPEED Technology, Inc.(Taiwan) | | | 3.2% | |

| |

| 51job, Inc. ADR(China) | | | 2.9% | |

| | | | |

| Company | | % of Net

Assets | |

| |

| Bajaj Finance Ltd.(India) | | | 2.8% | |

| |

| Magazine Luiza S.A.(Brazil) | | | 2.7% | |

| |

| Info Edge India Ltd.(India) | | | 2.7% | |

| |

| Silergy Corp.(Taiwan) | | | 2.5% | |

| |

| Globant S.A.(Argentina) | | | 2.3% | |

| ** | As of March 31, 2019, there were 61 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

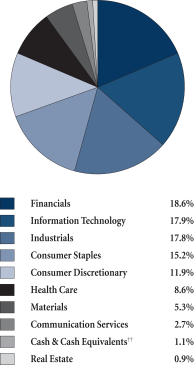

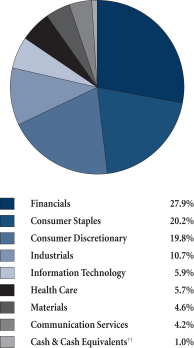

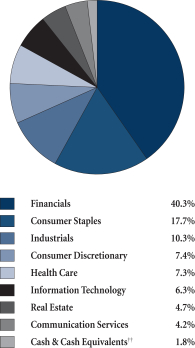

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

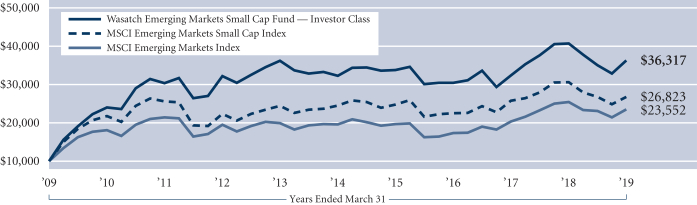

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. TheMSCI Emerging Markets andEmerging Markets Small Cap indexes are free float-adjusted market capitalization indexes designed to measure the equity market performance of emerging markets.You cannot invest directly in these or any indexes.

11

| | |

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND (WAFMX / WIFMX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Frontier Emerging Small Countries Fund is managed by a team of Wasatch portfolio managers led by Scott Thomas and Jared Whatcott.

| | | | |

Scott Thomas, CFA Lead Portfolio Manager | |

Jared Whatcott, CFA Portfolio Manager | | OVERVIEW The first quarter of 2019 saw global equity markets rebound from fourth-quarter weakness. In the frontier and emerging small countries universe, the MSCI Frontier Emerging Markets |

Index rose 9.44% and the Wasatch Frontier Emerging Small Countries Fund — Investor Class gained 9.66%.

The strength of the U.S. dollar, which has been a persistent headwind for frontier markets and many small emerging-market countries, continued to abate in the first quarter as the U.S. Federal Reserve signaled a “patient” approach to raising interest rates in January and again in March by projecting no further rate hikes this year. What’s more, perceived progress on U.S.-China trade negotiations, however slight, and a recovery in oil prices, after hitting recent lows in December 2018, helped to improve investors’ sentiment on the frontier asset class.

DETAILSOFTHE QUARTER

Egypt was the largest contributor to Fund performance for the first quarter. After a difficult period of adjustment and foreign currency liberalization in 2016, the country is now witnessing strong and ameliorating fundamentals such as improving external balances, healthy foreign exchange reserves, inflation normalization, and positive fiscal-reform initiatives. These factors along with high domestic bond yields have attracted asset inflows into the country’s equity and debt markets. Cleopatra Hospital, the largest private hospital operator in Egypt, was a top contributor for the Fund. Cleopatra is at the forefront of consolidating a fragmented and underdeveloped hospital market. With Egypt’s population of 100 million people, a significant undersupply of hospital beds, and one of the lowest levels of health-care spending per capita in the region, we believe demand for Cleopatra’s services is set to grow at a rapid pace.

Two Latin American companies — MercadoLibre, Inc. and Globant S.A. — were the top contributors to Fund performance for the quarter. MercadoLibre operatese-commerce platforms in Brazil and other Latin American countries. The company’s most-recent report highlighted continued strength in sales growth across key markets such as Brazil and Argentina.

Globant, an information-technology services company based in Argentina, has been witnessing strong demand for its digital services and benefits from a portfolio of high-quality, blue-chip customers. Globant’s recently reported results were strong with revenue and margin guidance better

than we had expected driven mostly by the company’s ability to meet the needs of media and financial customers.

Colombia was the top-performing country within the Index, increasing nearly 25% for the quarter. As a result, our underweight exposure to Colombia detracted significantly from performance relative to the benchmark. Colombia’s economic indicators were surprisingly good, making evident a gradual firming of economic growth. The Colombian peso appreciated 1.9% in nominal terms versus the U.S. dollar, aided by higher oil prices, the country’s key export.

Our only holding in Colombia, Banco Davivienda S.A., a universal bank, gained nearly 25% during the quarter. The company has been benefiting from accelerating loan growth and improving credit-quality trends. Mortgages, a key lending segment for the bank, increased 16% from the same period a year ago. Banco Davivienda’s digital customers reached 1.4 million, up 62% from the year-ago period.

The largest detractor from Fund performance for the quarter was Discovery Ltd., a South Africa-based insurance company. The company reported worse-than-expected semi-annual results, citing higher investment spending on emerging businesses and a spike in mortality claims. While many investors appear concerned with the company’s elevated spending on what may seem to be initiatives with uncertain outcomes, we remain confident in Discovery’s long-term growth opportunities and see the stock-price weakness as a temporary overreaction.

Muangthai Capital Public Co. Ltd., a provider of lending services in Thailand, was also a large detractor. Uncertainty around pending regulation of non-bank financial companies in Thailand and the effect it might have on current interest rates and fees has been substantially resolved.

OUTLOOK

While specific externalities have been overwhelming many frontier and small emerging markets, including the strong U.S. dollar, others such as weakening commodity prices and external imbalances have largely turned neutral to positive. We believe that the difficult adjustments many frontier and emerging small countries are continuing to make will allow economic stability to continue to improve. Egypt is a good example of how structural reforms are now paying off with better stability and an environment that is more supportive of companies’ efforts to meet their long-term strategic goals.

By continually striving to position the Fund in what we regard as the highest-quality companies across frontier markets and small emerging-market countries, we believe we provide the Fund with the best chance of reaping the potential long-term rewards.

We believe that bottom-up analysis and travel to the regions in which we invest are critical, as economic growth, political structures and willingness to reform vary widely in developing countries. We continue to travel extensively and are excited about the future of frontier and emerging small countries and their expanding role in the global economy.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

12

| | |

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND (WAFMX / WIFMX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Portfolio Summary

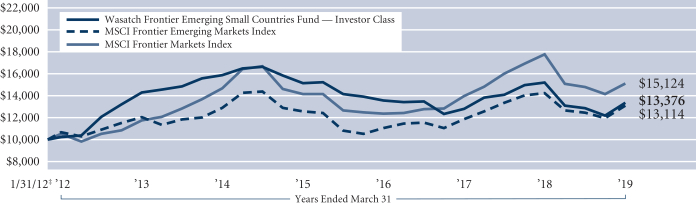

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | | | | | |

| | | SIX

MONTHS* | | 1 YEAR | | 5 YEARS | | SINCE INCEPTION 1/31/12 |

Frontier Emerging Small Countries (WAFMX) — Investor | | | | 3.98% | | | | | -12.12% | | | | | -3.39% | | | | | 4.14% | |

Frontier Emerging Small Countries (WIFMX) — Institutional | | | | 3.95% | | | | | -12.04% | | | | | -3.25% | | | | | 4.25% | |

MSCI Frontier Emerging Markets Index | | | | 5.08% | | | | | -8.00% | | | | | 0.31% | | | | | 3.86% | |

MSCI Frontier Markets Index | | | | 2.25% | | | | | -15.00% | | | | | 0.57% | | | | | 5.94% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2019 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Frontier Emerging Small Countries Fund are Investor Class — Gross: 2.31%, Net: 2.17%/Institutional Class — Gross: 2.07%, Net: 1.98%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in frontier and emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS**

| | | | |

Company | | % of Net

Assets | |

| |

| Globant S.A.(Argentina) | | | 4.5% | |

| |

| ASA International Group plc(United Kingdom) | | | 4.3% | |

| |

| Safaricom plc(Kenya) | | | 4.3% | |

| |

| PT Bank Central Asia Tbk(Indonesia) | | | 4.2% | |

| |

| Naspers Ltd., Class N(South Africa) | | | 4.0% | |

| | | | |

Company | | % of Net

Assets | |

| |

| Grupo Aeroportuario del Sureste S.A.B. de C.V., Class B(Mexico) | | | 4.0% | |

| |

| Raia Drogasil S.A.(Brazil) | | | 3.9% | |

| |

| Clicks Group Ltd.(South Africa) | | | 3.9% | |

| |

| Commercial International Bank S.A.E. (Egypt) | | | 3.9% | |

| |

| Cleopatra Hospital(Egypt) | | | 3.8% | |

| ** | As of March 31, 2019, there were 37 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

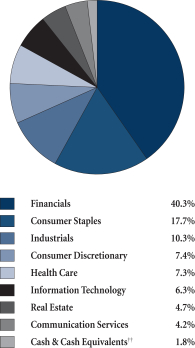

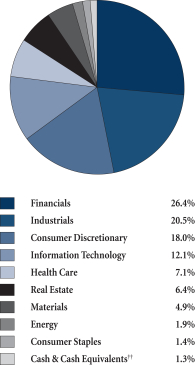

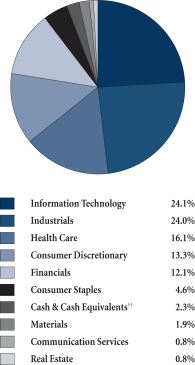

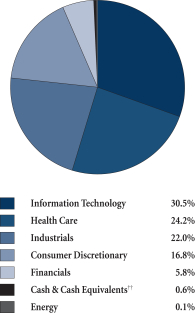

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

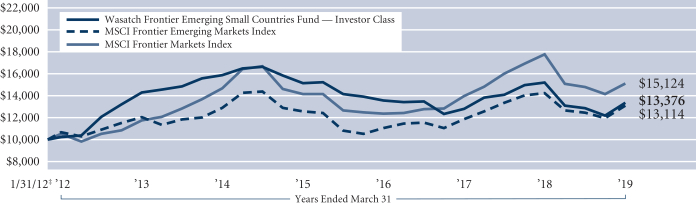

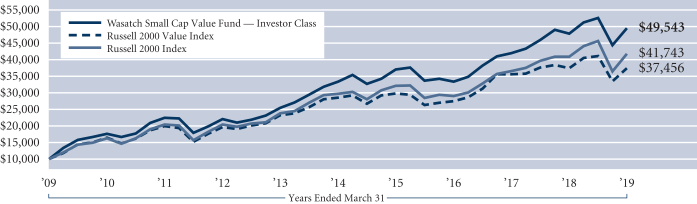

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.‡Inception: January 31, 2012. TheMSCI Frontier Emerging Markets andMSCI Frontier Markets indexes are free float-adjusted market capitalization indexes designed to measure the equity market performance of the global frontier and emerging markets.You cannot invest directly in these or any indexes.

13

| | |

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX / WIGOX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Global Opportunities Fund is managed by a team of Wasatch portfolio managers led by JB Taylor, Ajay Krishnan, Ken Applegate and Paul Lambert.

| | | | |

JB Taylor Lead Portfolio Manager | |

Lead Portfolio Manager Ajay Krishnan, CFA | | OVERVIEW Led by the U.S. — and growth stocks in particular — the MSCI ACWI Small Cap Index snapped back from its fourth-quarter swoon. The Index gained 13.10% for the first quarter of 2019, recouping a good portion of the losses from the prior period. The Wasatch Global Opportunities Fund — Investor Class outpaced its benchmark, advancing 16.78%. In our view, global equities were due for a recovery. We saw the fourth- |

Ken Applegate, CFA Portfolio Manager | |

Paul Lambert Portfolio Manager |

quarter selloff as the product of an event-driven market that didn’t reflect continuing fundamental business strength both in the U.S. and elsewhere.

During the first quarter, the U.S. Federal Reserve (Fed), after signaling a “patient” approach to raising interest rates, projected no further rate hikes this year, downgraded its outlook for U.S. economic growth and said it would stop shrinking its balance sheet in September. The Fed’s moves undercut the U.S. dollar, making investments in international stocks outside the U.S. somewhat more attractive to investors. Hopes of a constructive solution to the U.S.-China trade dispute also buoyed the markets.

DETAILSOFTHE QUARTER

The U.S., aided in particular by strong results from information-technology companies, contributed the most to the Fund’s outperformance of the Index in the first quarter. Japan was the next-best country contributor.

The Fund’s top-contributing holding for the quarter was MercadoLibre, Inc., which operatese-commerce platforms in Brazil and other Latin American countries. MercadoLibre’s payment solution, MercadoPago, is driving strong growth at the company as an increasing number ofe-commerce sites andbrick-and-mortar retailers adopt MercadoPago as a preferred payment method.

The second-best contributor was U.S.-based financial transaction processing services provider Euronet Worldwide, Inc. All three segments of the business — Electronic Financial Transaction (EFT) Processing, Money Transfer and epay — showed double-digit operating-profit growth driven by margin expansion, with particular strength in epay.

Zendesk, Inc. was another top contributor from the U.S. information-technology sector. ThisSoftware-as-a-Service company focuses on providing customer service and engagement products that help organizations support their customers across various channels including phone, chat, email and social media. Zendesk continued to execute its growth plans.

The greatest detractor from Fund performance wasMetro Bank plc. This U.K. retail bank has been disrupting the high street banking industry and winning new customers with its customer-first, employee-empowered strategy and culture. During the quarter, an internal misclassification forced Metro to raise its risk weightings on certain commercial-property loans andbuy-to-let mortgages. This required a capital increase 12% higher than analysts had been expecting. Despite the volatility in Metro’s stock price and short-term uncertainties, we believe there is significant upside potential if the company can execute its business strategy.

Cimpress N.V., a “mass-market customization” printed-materials provider, also weighed on Fund performance. The company reported surprisingly disappointing results across its business lines, owing in part to higher customer-acquisitions costs. We’re looking into our concerns regarding the competitive environment.

Finally, the Fund’s position in Sangamo Therapeutics, Inc.was down for the quarter. A clinical-stage biopharmaceutical company, Sangamo specializes in the treatment and cure of gene disorders. Investors reacted negatively to interim results from an early-stage study using the company’szinc-finger editing technology for the treatment of Hurler syndrome. However, we think it’s too early to draw conclusions until results from the study’s high-dose subjects have been released.

OUTLOOK

After the swift snapback in stock prices that we’ve seen thus far in 2019, we’re remaining watchful of heightened equity valuations. Over the longer term, we believe that the fundamentals supporting the growth of the U.S. economy remain in place. While incoming data suggest softening of industrial-production numbers, businesses are generally cautiously optimistic. Bolstered by more accommodative Fed policy, stocks may have further room to appreciate in 2019, particularly if driven by positive economic political catalysts.

In Japan, where stocks generally experienced a difficult fourth quarter, valuations of many companies bounced back in the first quarter. We continue to see strong fundamentals among our Japanese holdings.

For stocks in the United Kingdom, uncertainty is the greatest problem caused by Brexit. As we have said before, many of the Fund’s U.K. holdings generate the majority of their earnings in foreign markets.

We continue to monitor global political and economic developments that could affect the Fund’s performance. At the same time, our primary focus remains, as ever, on investing in companies with solid fundamentals and strong long-term growth prospects.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

14

| | |

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX / WIGOX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Portfolio Summary

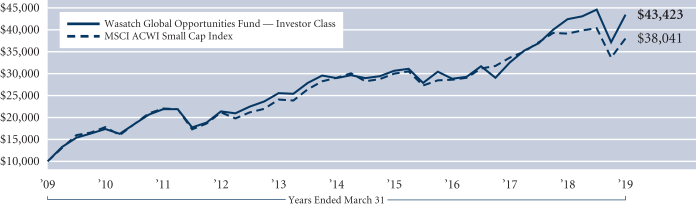

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | 10 YEARS |

Global Opportunities (WAGOX) — Investor | | | | -2.68% | | | | | 2.32% | | | | | 8.42% | | | | | 15.82% | |

Global Opportunities (WIGOX) — Institutional | | | | -2.68% | | | | | 2.57% | | | | | 8.53% | | | | | 15.88% | |

MSCI ACWI Small Cap Index | | | | -5.85% | | | | | -2.72% | | | | | 5.54% | | | | | 14.29% | |

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit www.WasatchFunds.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2019 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Opportunities Fund are Investor Class: 1.55% / Institutional Class — Gross: 1.66%, Net: 1.36%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small and micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| |

| Euronet Worldwide, Inc. | | | 3.1% | |

| |

| Ensign Group, Inc. (The) | | | 2.7% | |

| |

| Copart, Inc. | | | 2.7% | |

| |

| Zendesk, Inc. | | | 2.4% | |

| |

| Globant S.A.(Argentina) | | | 2.3% | |

| | | | |

| Company | | % of Net

Assets | |

| |

| Trex Co., Inc. | | | 2.2% | |

| |

| Monro, Inc. | | | 2.2% | |

| |

| Medytox, Inc.(Korea) | | | 2.2% | |

| |

| MercadoLibre, Inc.(Brazil) | | | 2.1% | |

| |

| HubSpot, Inc. | | | 2.0% | |

| ** | As of March 31, 2019, there were 74 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

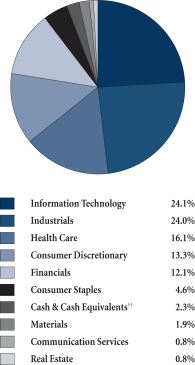

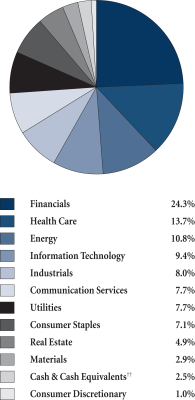

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

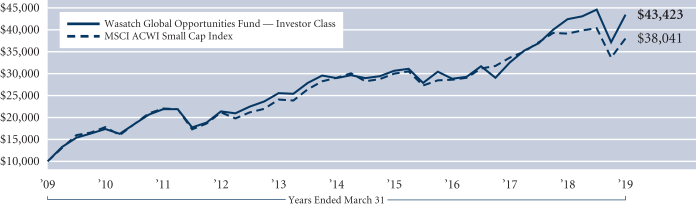

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees. TheMSCI ACWI (All Country World Index) Small Cap Index is a free float-adjusted market capitalization index designed to measure the performance of small capitalization securities in developed and emerging markets.You cannot invest directly in this or any index.

15

| | |

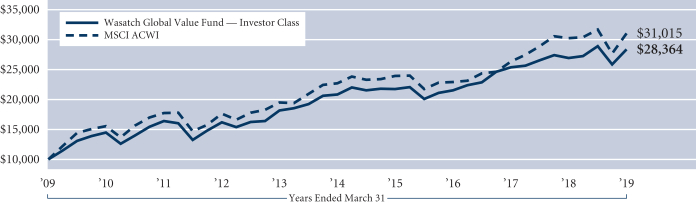

| WASATCH GLOBAL VALUE FUND (FMIEX / WILCX) | | MARCH 31, 2019 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Global Value Fund is managed by a team of Wasatch portfolio managers led by David Powers.

| | |

David Powers, CFA Lead Portfolio Manager | | OVERVIEW The Wasatch Global Value Fund —

Investor Class gained 9.64% in the first quarter of 2019, but underperformed the benchmark MSCI ACWI (All Country World Index), which returned 12.18%. Large-cap U.S. equities, as measured by the S&P 500® Index, returned 13.65% in the quarter compared to 9.98% for large- andmid-cap international equities as gauged by the MSCI |

EAFE Index. After the fourth-quarter 2018 rout in financial markets, the Federal Reserve (Fed) signaled a patient approach entering 2019 and eventually indicated it would likely hold interest rates steady throughyear-end. The European Central Bank and the People’s Bank of China also moved toward more-stimulative stances. Taken together with indications of progress toward resolving the U.S.-China trade dispute, the tenor of central-bank communications outweighed investor concerns about slowing global economic growth.

Within the global equity universe, information technology, real estate and energy were outperforming sectors, while health care and financials were underperforming sectors. The Fund benefited relative to its benchmark from stock selection in the energy, real-estate and materials sectors. While information technology was the leading contributor to the Fund’s return, our underweight position in the sector detracted from relative performance as did our selection of consumer-discretionary holdings.