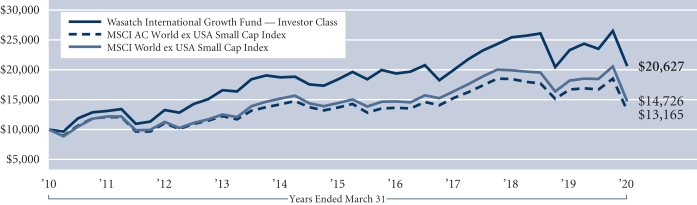

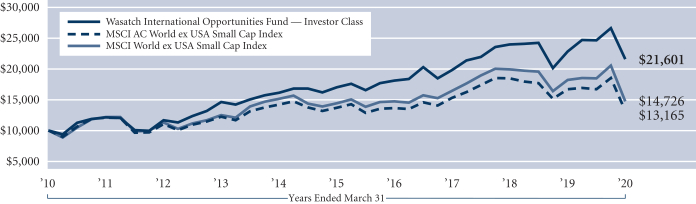

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-04920

WASATCH FUNDS TRUST

(Exact name of registrant as specified in charter)

505 Wakara Way, 3rd Floor

Salt Lake City, UT 84108

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Eric S. Bergeson Wasatch Advisors, Inc. 505 Wakara Way, 3rd Floor Salt Lake City, UT 84108 | | Eric F. Fess, Esq. Chapman & Cutler LLP 111 West Monroe Street Chicago, IL 60603 |

Registrant’s telephone number, including area code: (801)533-0777

Date of fiscal year end: September 30

Date of reporting period: March 31, 2020

| Item 1. | Report to Shareholders. |

WASATCHGLOBAL . COM MARCH 31, 2020 2020 Semi-Annual Report Fund Investor Institutional Name Class Class Wasatch Core Growth Fund WGROX WIGRX Wasatch Emerging India Fund WAINX WIINX Wasatch Emerging Markets Select Fund WAESX WIESX Wasatch Emerging Markets Small Cap Fund WAEMX WIEMX Wasatch Frontier Emerging Small Countries Fund WAFMX WIFMX Wasatch Global Opportunities Fund WAGOX WIGOX Wasatch Global Select Fund WAGSX WGGSX Wasatch Global Value Fund FMIEX WILCX Wasatch International Growth Fund WAIGX WIIGX Fund Investor Institutional Name Class Class Wasatch International Opportunities Fund WAIOX WIIOX Wasatch International Select Fund WAISX WGISX Wasatch Micro Cap Fund WMICX WGICX Wasatch Micro Cap Value Fund WAMVX WGMVX Wasatch Small Cap Growth Fund WAAEX WIAEX Wasatch Small Cap Value Fund WMCVX WICVX Wasatch Ultra Growth Fund WAMCX WGMCX Wasatch-Hoisington U.S. Treasury Fund WHOSX Beginning January 31, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of Wasatch Funds shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from Wasatch Funds or from your financial intermediary, (such as a broker-dealer or bank). Instead, reports will be made available on Wasatch Funds’ website wasatchglobal.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from Wasatch Funds electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, for Fund shares held directly with Wasatch Funds, by calling 800.551.1700 or by enrolling in “eDelivery” by logging into your account at https://wasatchfunds.olaccess.com. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue receiving paper copies of your shareholder reports. If you invest directly with Wasatch Funds, you can call 800.551.1700 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Wasatch Funds held in your account if you invest through a financial intermediary or all Wasatch Funds held with the fund complex if you invest directly with Wasatch Funds.

WASATCH FUNDS

Salt Lake City, Utah

wasatchglobal.com

800.551.1700

This material must be accompanied or preceded by a prospectus.

Please read the prospectus carefully before you invest.

Wasatch Funds are distributed by ALPS Distributors, Inc.

1

| | |

| LETTERTO SHAREHOLDERS — TRUSTING OUR INSTRUMENTS | | |

|

|

|

| | | | |

JB Taylor CEO, Portfolio Manager and Head of U.S. Small Cap Investing | |

Ajay Krishnan, CFA Portfolio Manager and Head of Emerging Markets Investing | | DEAR FELLOW SHAREHOLDERS: If you Google “trust your…,” some of the most-frequent entries you will see are “trust your gut,” “trust your instincts” and “trust your intuition.” While these are important considerations during the current health and economic crisis, we think they must be balanced with the equally important “trust your instruments” — a fundamental principle in the field of aviation. A pilot initially learns to navigate using visual reference points on the ground. But at higher altitude, especially under stormy conditions, reference points outside the cockpit mostly disappear. For these circumstances, a pilot is taught to override the body’s physical senses — and instead pay close attention to the instrument display panel. In fact, a pilot flying when visibility is poor must rely almost exclusively on the display indicators. |

In our investment process, we benefit from both subjective analysis and our version of “trusting our instruments.” As we steer through the current environment characterized by extreme stock-market volatility and a particularly uncertain future, the objectivity of our instruments has become increasingly valuable. Indeed, our instruments indicate that our funds are on course — invested in what we believe are strong companies at appropriate position sizes.

A BATTLEOF EXPONENTIAL FORCES

For stocks, the quarter ended March 31, 2020 included one of the worst periods on record. Stocks of companies — large and small, around the world and across all sectors — fell in a synchronous fashion. What was staggering, beyond the magnitude of the declines, was the speed at which stocks fell. Nearly all equity indexes declined between-30% and-40% over the four-week period between February 20 and March 20.

For a pilot, this would be the equivalent of flying through sunny, cloudless skies in one moment and through a Category 5 hurricane in the next. With unthinkable speed, we dove from record employment numbers in the U.S. to a probable global recession. The sad reality of the attempt to limit the spread of the novel coronavirus is a massive coordinated global slowdown in human interaction and commerce, with most businesses in every sector taking punishment in the storm.

The unprecedented uncertainty is due to the coronavirus’s exponential infection rate among the world’s population. However, we remain hopeful based on global responses. Medical responses include the fast-track development of potential vaccines and antiviral drugs. Economic responses consist of unprecedented monetary and fiscal measures. To paraphraseNew York Times columnist Thomas Friedman, we are in a battle of exponential forces. Globally, citizens are working to counterCovid-19’s negative exponential force with an overwhelmingly positive exponential force.

The current crisis is the equivalent of a massive slowdown in the global “income statement,” figuratively speaking, compared to the2008-09 global financial crisis, which saw a sudden evaporation of the global “balance sheet” due to enormous levels of bad credit. A struggling income statement can recover, provided the balance sheet is strong. It’s encouraging that the monetary and fiscal measures enacted — cash payments for workers, accessiblelow-interest loans for small businesses and massive influxes of banking liquidity — seem properly focused on preventing the current “income statement” problem from becoming a larger “balance sheet” issue.

Once the crisis has abated, we expect that our funds will be well-positioned with investments in companies benefiting from the renewed economic upturn — and not only in the U.S. Other countries have been just as diligent, or even more so, with their own medical and economic responses to the virus. And because world-wide economies had been relatively strong before the outbreak, we believe our companies will pick up not too far from where they had left off — even if there are hiccups along the way.

THE WASATCH RESPONSE

Our response during a typical market correction is generally to hold steady. After all, if we liked our companies going into the selloff, we should still like them afterwards — especially at the resulting less-expensive prices.

Therefore, even though this has not been a typical market correction, we are making very few changes to our growth-oriented funds. We generally invest in companies that we consider high quality. We have found that during market downturns, investors tend to prefer high-quality names — even those considered somewhat expensive.

Many of Wasatch’s long-term, alpha-producing track records have been generated by outperforming in down markets, and true to form, our funds have generally outperformed in the current downturn. During the past few years, it has been especially gratifying to see our growth-oriented funds generate benchmark-beating returns on both the downside and the upside.

Looking forward, it’s impossible to predict short-term performance, especially under the current“anything-but-normal” conditions. But we think our funds are well-situated compared to their benchmarks. Generally speaking, our companies have long records of stronger sales and earnings growth, higher returns on capital, better cash flows and, importantly, much healthier balance sheets.

Sometimes the hardest thing to do in investing is to not do anything. Because we have navigated severe market volatility many times before, we know what tends to work and we understand the value of keeping our emotions in check. These experiences, in turn, have given us the courage to trust the research we have already done. The overwhelming majority of our investments are in companies that we believe are built to withstand harsh economic shocks.

2

| | |

| | MARCH 31, 2020 (UNAUDITED) |

|

|

|

To be prepared for scenarios in which the current crisis becomes longer and deeper than we expect, the Wasatch research team hasre-analyzed and stress-tested every company we own for balance-sheet strength and the ability to endure relatively long-term hits to sales and earnings. We have adjusted weightings in companies for which we see increased or decreased potential, and we have sold a few names where our outlook for their long-term growth prospects has changed (which may not necessarily be due to recent events). As always, we continue to assess new opportunities — especially since many companies on our wish lists have fallen toonce-in-a-decade valuations.

It’s important to emphasize that market cycles consist of two phases. One phase is the downturn, during which Wasatch has performed admirably in the current cycle. The other is the ensuing recovery, the start of which can only be determined in hindsight.

Because the stocks that hold up better during a significant downturn are sometimes the same ones that performed relatively well before the downturn, portfolio adjustments may not be necessary. But a recovery rally off the market bottom can be trickier to navigate. That’s not to say a static portfolio will necessarily perform poorly during a recovery rally. It’s just that moderate alterations to the portfolio can often improve performance.

For example, our historical research and firsthand insights — which are our versions of “flight-control instruments” — indicate that some of our biggest decliners during the downturn may also be some of our largest winners during the recovery. So, rather than selling these positions based on what might look like deteriorating fundamentals, we may prudently add to current weights at lower prices.

The idea is that, unlikerun-of-the-mill market corrections, crisis-induced precipitous declines often warrant increasing weights in what seem like “higher-risk” holdings. To be prepared, we havere-analyzed all our fund holdings and watch-list names. This continues to give us the conviction to increase position sizes and make incremental investments in companies whose stocks get punished particularly unfairly in our view.

MAINTAINING OUR LONG-TERM PERSPECTIVE

We think patience is our most-important asset. We remain steadfast in ourbottom-up research process. Above all, we are long-term investors focused on paying reasonable prices for high-quality companies. We think quality is especially important during a crisis because exceptional companies often increase their competitive advantages in times of stress, even when short-term sales and earnings decline on an absolute basis. After the crisis, these companies are particularly well-positioned to grow and take even more market share over the long term.

In closing, we would like to note that we as a firm believe it’s important to support public-health officials in containingCovid-19. As such, Wasatch has temporarily halted business travel. And members of our team have redoubled their efforts to minimize the impact on our operations.

For example, many of our scheduledin-person research meetings have been converted into technology-enabled “virtual visits.” Moreover, we have been impressed that the companies we own and those that we are considering for investment have been universally accommodative, so we have been able to get the information we need to do our jobs with remarkably few impediments.

Finally, out of an abundance of caution for the safety of our staff and the broader community, most of our employees are working from home. Please note that all business functions are fully operational and all lines of communication with Wasatch remain open.

With sincere thanks for your continuing investment and for your trust,

| | |

| |

|

JB Taylor | | Ajay Krishnan |

Information in this report regarding market or economic trends, or the factors influencing historical or future performance, reflects the opinions of management as of the date of this report. These statements should not be relied upon for any other purpose. Past performance is no guarantee of future results, and there is no guarantee that the market forecasts discussed will be realized.

CFA® is a trademark owned by the CFA Institute.

Wasatch Global Investors is the investment advisor to Wasatch Funds.

Wasatch Funds are distributed by ALPS Distributors, Inc. (ADI). ADI is not affiliated with Wasatch Global Investors.

Definitions of financial terms and index descriptions and disclosures begin on page 38.

3

| | |

| WASATCH CORE GROWTH FUND(WGROX / WIGRX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Core Growth Fund is managed by a team of Wasatch portfolio managers led by JB Taylor, Paul Lambert and Mike Valentine.

| | | | |

JB Taylor Lead Portfolio Manager | |

Paul Lambert Portfolio Manager | |

Mike Valentine Portfolio Manager |

OVERVIEW

Equity prices of small growth companiessee-sawed from gains to coronavirus-induced losses before partially rebounding near the end of the quarter ended March 31, 2020. Small-company stocks generally declined more than large-company names, and the benchmark Russell 2000 Index dropped-30.61% for the quarter. Meanwhile, the Russell 2000 Growth Index lost-25.76%. Declining less than these indexes, the Wasatch Core Growth Fund — Investor Class fell -23.93%.

Given the magnitude ofCovid-19 repercussions, pundits have drawn comparisons to the 2008-09 global financial crisis (GFC). For our part, we see a distinction in that the current crisis is the equivalent of a massive slowdown in the global “income statement,” whereas the GFC entailed a sudden evaporation of the global “balance sheet” due to enormous levels of bad credit. A struggling income statement can recover, provided the balance sheet is strong. It’s encouraging that the monetary and fiscal measures enacted seem properly focused on preventing the current “income statement” problem from becoming a larger “balance sheet” issue.

DETAILSOFTHE QUARTER

By sector, stock picking in consumer discretionary, information technology and real estate aided the Fund’s performance relative to its Russell 2000 benchmark. We also benefited from not having exposure to energy, by far the weakest area of the market. The industrials sector subtracted the most from the Fund’s return. Our industrial companies held up better than their Index peers, but our overweight position detracted from performance relative to the benchmark.

The top contributor to Fund performance was Five9, Inc., a provider of contact-center software that’s managed and hosted from the cloud. The company offers real-time and historical reporting, quality monitoring, and workforce and customer-relationship-management integrations. The superiority of cloud-based software has become especially evident during the pandemic. On a longer-term basis, Five9 has competitive advantages that make it the dominant growth company in its industry.

Another contributor was DocuSign, Inc. The company’se-signature software enables businesses to digitally prepare and execute agreements. DocuSign has been experiencing rapid sales gains and improved growth prospects. With the pandemic scattering corporate operations to home offices

and curtailing travel, DocuSign is positioned to benefit as more companies sign contracts over the internet.

The largest detractor from performance was Euronet Worldwide, Inc., a provider of electronic solutions for financial transactions in the U.S., Europe and Asia. Euronet’s offerings include financial-payment middleware, financial-network gateways, outsourcing and consulting. The stock fell due to the anticipateddrop-off in financial transactions amid a global economic slowdown. Over the long term, we think Euronet is well-positioned for double-digit annual sales growth and meaningfully improved earnings.

An additional detractor was Monro, Inc., which operates a chain of shops for automotive repairs and tires. These shops provide a broad range of services and parts related to brakes, mufflers, exhaust systems, steering mechanisms, drive trains, suspensions, wheel alignments and routine maintenance. At the current stock price, we like Monro based on our expectations that the company will increase revenues, margins and free cash flows.

OUTLOOK

Wasatch’s core expertise is the fundamental analysis of individual companies. In this regard, we liked our portfolio companies going into the selloff and we still like them now.

Compared to the benchmark, our companies generally have long records of stronger sales and earnings growth, higher returns on capital, better cash flows and, importantly, much healthier balance sheets. The Wasatch research team spent several weeksre-analyzing every company we own and scanning for new opportunities. We’ve adjusted company weightings where we see increased potential or weakness, and we’ve sold a handful of names for which we viewed upside potential as inadequate.

Having outpaced our benchmark during the initial phases of theCovid-19 turmoil, we’re acutely aware that the race is never over. In market panics, extreme risk aversion can cause investors to unfairly punish the stocks of companies whose long-term businesses remain strong — but whose near-term prospects are much less certain, or perhaps even quite poor. Such panics sometimes do not burn themselves out until high-quality stocks with some perceived risk are beaten down to the point that they may actually be the least-risky names. To the extent that we believe risk has become mispriced, we’ll continue to seek opportunities to selectively take it on.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

4

| | |

| WASATCH CORE GROWTH FUND(WGROX / WIGRX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | 10 YEARS |

Core Growth (WGROX) — Investor | | | | -17.26% | | | | | -12.13% | | | | | 5.40% | | | | | 11.12% | |

Core Growth (WIGRX) — Institutional | | | | -17.22% | | | | | -12.02% | | | | | 5.53% | | | | | 11.22% | |

Russell 2000® Index | | | | -23.72% | | | | | -23.99% | | | | | -0.25% | | | | | 6.90% | |

Russell 2000® Growth Index | | | | -17.31% | | | | | -18.58% | | | | | 1.70% | | | | | 8.89% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recentmonth-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2020 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Core Growth Fund are Investor Class: 1.19% / Institutional Class — Gross: 1.09%, Net: 1.05%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 1/31/2012 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 1/31/2012 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| |

Trex Co., Inc. | | | 3.5% | |

| |

Tyler Technologies, Inc. | | | 3.4% | |

| |

ICON plc (Ireland) | | | 3.4% | |

| |

Pool Corp. | | | 3.3% | |

| |

Proofpoint, Inc. | | | 2.9% | |

| | | | |

| Company | | % of Net

Assets | |

| |

Five9, Inc. | | | 2.8% | |

| |

Balchem Corp. | | | 2.8% | |

| |

Monolithic Power Systems, Inc. | | | 2.7% | |

| |

RBC Bearings, Inc. | | | 2.7% | |

| |

Euronet Worldwide, Inc. | | | 2.6% | |

| ** | As of March 31, 2020, there were 53 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

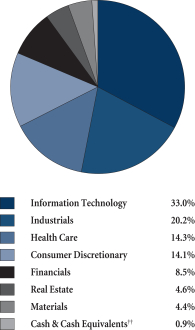

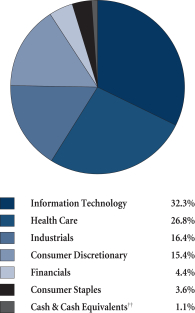

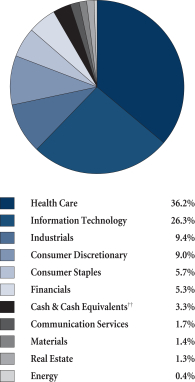

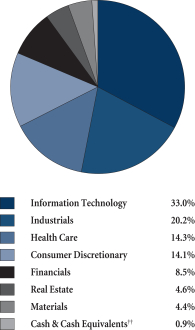

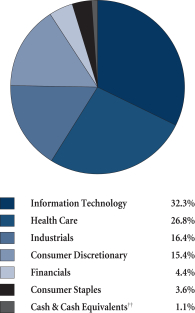

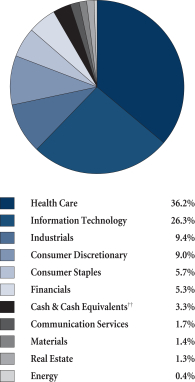

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

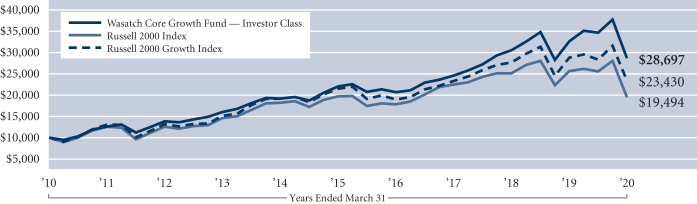

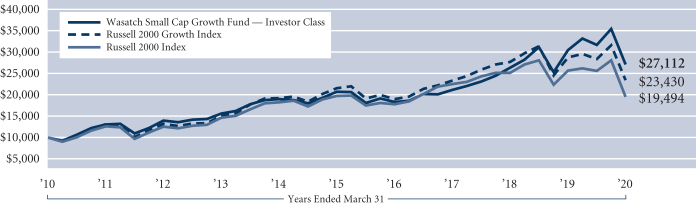

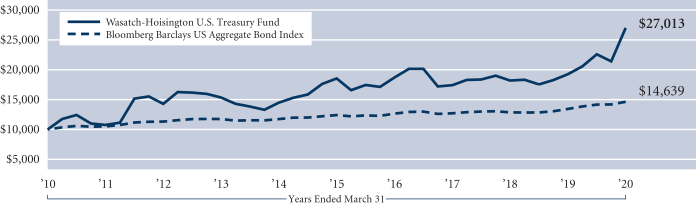

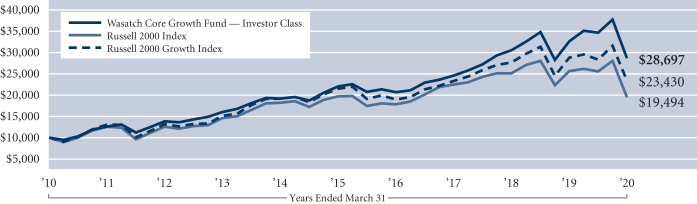

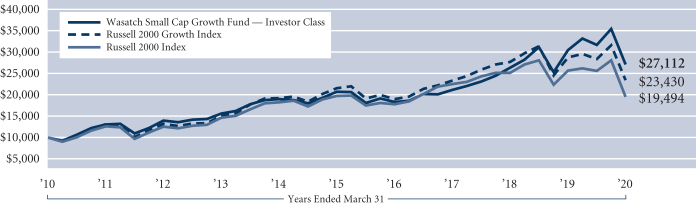

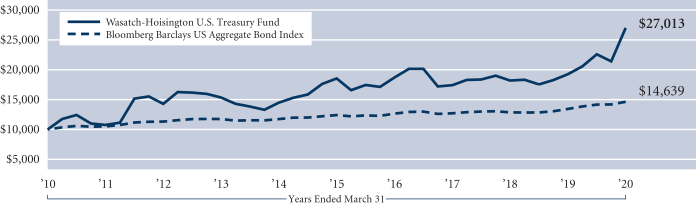

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

5

| | |

| WASATCH EMERGING INDIA FUND(WAINX / WIINX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Emerging India Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan and Matthew Dreith.

| | | | |

Ajay Krishnan, CFA Lead Portfolio Manager | |

Matthew Dreith, CFA Portfolio Manager | | OVERVIEW Stocks in India posted steep losses during the quarter ended March 31, 2020 as the nation went into a lockdown to halt the spread ofCovid-19. |

The Wasatch Emerging India Fund — Investor Class slipped-28.12% for the quarter. The Fund declined less than its benchmark, the MSCI India Investable Market Index (IMI), which fell-31.79%.

Although the spread ofCovid-19 in India appeared to be slow, Prime Minister Narendra Modi announced a three-week lockdown designed to replicate China’s success in containing the outbreak. To cushion the impact on the nation and the economy, the national government announced $22.6 billion in spending aimed primarily at the poor. In addition, state governments implemented relief programs of their own. India’s central bank slashed interest rates and pledged to inject up to $50 billion of cash into the country’s financial system.

DETAILSOFTHE QUARTER

The coronavirus lockdown is likely to hinder the ability of households and businesses to repay debt, which added to the woes of Indian financial stocks during the quarter. Our financials declined less than the financials in the Index, providing a source of strength for the Fund relative to its benchmark. The Fund’s largest sources of outperformance were materials and health care, respectively. In these sectors as well, the Fund’s holdings held up substantially better than the corresponding positions in the benchmark.

During a quarter in which defensive investments tended to perform better, our underweight position in consumer staples was a headwind for the Fund. The consumer-staples sector was the best-performing sector of the Index and one of the few areas in which the Fund’s holdings posted steeper declines than the benchmark’s positions.

The Fund’s position in Divi’s Laboratories Ltd. held up well during the quarter. The company produces active pharmaceutical ingredients and intermediates. Divi’s has benefited as international manufacturers of pharmaceuticals shift supply chains out of China or seek secondary sources of supply.

Trent Ltd. is a relatively new position in the Fund. The company operates a chain of retail stores that sell fashion apparel, cosmetics, perfumes and toiletries. We think Trent has the potential to become the “Zara of India.” (Zara, based in Spain, is an apparel retailer that specializes in fast fashion and is one of the largest international retail companies.) We expect Trent to be a strong beneficiary of the formalization of India’s retail landscape, where close to 90% of the industry is dominated by small informal retailers.

Financial companies accounted for many of the Fund’s greatest detractors for the quarter. Among these were Bajaj Finance Ltd., AU Small Finance Bank Ltd. and Aavas Financiers Ltd. Bajaj is anon-bank financial company (NBFC) offering a broad spectrum of lending services. AU is a small finance bank that primarily targets unbanked and underbankedlow- and middle-income individuals and small businesses. Aavas is an NBFC specializing in housing loans tolow- and middle-income customers in semi-urban and rural areas of India.

After having spoken with the management teams of all three of these companies and making our own analyses based on potential worst-case outcomes, we believe they have ample capital buffers and we expect them to emerge from theCovid-19 crisis even stronger. We have used the sharp declines in their share prices to add selectively to our positions.

OUTLOOK

When the pandemic subsides, India will set about resuming the political and economic progress that has brought steady improvement to the lives of its people since long before the arrival of the coronavirus. Our optimism is based in part on a confluence of factors that have been driving a virtuous circle of progress.

The first such factor is the market-friendly reforms that have been enacted in India. Although the current government tends to receive most of the credit for these reforms, some were in the works before the Modi coalition came into power. Second is India’s young and growing population. Because India is home to one of the youngest populations in the world, a large cohort of Indians will be reaching their peak-productivity, peak-consumption years at roughly the same time. The third key factor is having the world’s lowest prices for mobile-telecommunications data, which have enabled the large-scale digitalization of banking and commerce in India.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

6

| | |

| WASATCH EMERGING INDIA FUND(WAINX / WIINX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | SINCE INCEPTION

4/26/11 |

Emerging India (WAINX) — Investor | | | | -23.99% | | | | | -22.35% | | | | | 3.16% | | | | | 7.07% | |

Emerging India (WIINX) — Institutional | | | | -23.82% | | | | | -22.19% | | | | | 3.34% | | | | | 7.17% | |

MSCI India IMI | | | | -28.20% | | | | | -32.64% | | | | | -3.91% | | | | | -1.72% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recentmonth-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2020 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging India Fund are Investor Class: 1.68%/ Institutional Class: 1.49%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as unstable currencies, highly volatile securities markets and political and social instability, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| |

| Divi’s Laboratories Ltd.(India) | | | 6.5% | |

| |

| Dr. Lal PathLabs Ltd.(India) | | | 6.1% | |

| |

| Bajaj Finance Ltd.(India) | | | 6.1% | |

| |

| Pidilite Industries Ltd.(India) | | | 5.9% | |

| |

| ICICI Lombard General Insurance Co. Ltd. (India) | | | 5.9% | |

| | | | |

| Company | | % of Net

Assets | |

| |

| Berger Paints India Ltd.(India) | | | 5.0% | |

| |

| Britannia Industries Ltd.(India) | | | 5.0% | |

| |

| HDFC Bank Ltd.(India) | | | 4.9% | |

| |

| AU Small Finance Bank Ltd.(India) | | | 4.8% | |

| |

| Mindtree Ltd.(India) | | | 4.7% | |

| ** | As of March 31, 2020, there were 32 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

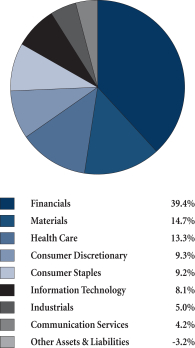

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

††Inception: April 26, 2011.Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

7

| | |

| WASATCH EMERGING MARKETS SELECT FUND(WAESX / WIESX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Emerging Markets Select Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan, Scott Thomas and Matthew Dreith.

| | | | |

Ajay Krishnan, CFA Lead Portfolio Manager | |

Scott Thomas, CFA Associate Portfolio

Manager | |

Matthew Dreith, CFA Associate Portfolio

Manager |

OVERVIEW

Worries tied to the coronavirus pandemic sent stock prices in emerging markets sharply lower during the quarter ended March 31, 2020. The Wasatch Emerging Markets Select Fund — Investor Class lost-23.42% compared to a decline of-23.60% for its benchmark, the MSCI Emerging Markets Index. Growing fears about the impact ofCovid-19 on global demand, supply chains, corporate profits and economic growth jolted financial markets around the world.

In the wake of this crisis, the Wasatch international team spent several weeksre-analyzing every company we own and scanning our investment universe for new opportunities. As expected, our analysis showed that the Fund’s companies have stronger earnings growth, higher returns on equity and returns on assets, and less debt than the average company in the benchmark. We adjusted company weightings where we saw an improvement in the risk/reward potential and sold a few holdings for which we viewed upside potential as inadequate.

DETAILSOFTHE QUARTER

Taiwan and Brazil were the Fund’s largest sources of outperformance relative to the benchmark. Taiwan was one of thetop-performing emerging markets during the quarter. Its early response and effective containment measures have resulted in fewer cases ofCovid-19 compared to most neighboring countries. Brazil was the worst performer in the Index amid mounting concerns about the government’s handling of the crisis and growing tensions between the president and the Congress.

India was the greatest source of weakness against the benchmark. Although the Indian stocks in the Fund fared only slightly worse than those in the benchmark, our overweight position in India was a headwind to performance.

The strongest contributor to Fund performance was Microport Scientific Corp. Based in Shanghai, China, the company manufactures interventional and minimally invasive devices for keyhole surgery. Reports that a well-respected, Asia-focused private-equity firm had acquired an ownership stake sent Microport’s stock price soaring in late February.

Taiwanese holdings Silergy Corp. and ASPEED Technology, Inc. were the second- and third-largest contributors, respectively. Silergy manufactures high-performance mixed-signal and analog integrated circuits used in a wide array of

electronic devices. The company reported strong revenues, which helped alleviate concerns that weak demand from China might lead to a protracted slowdown in Silergy’s growth. ASPEED is a fabless designer of integrated circuits specializing in areas that include server management and audio-visual extensions. The company has been benefiting as firms globally add capacity to their data centers to accommodate citizens waiting out the coronavirus under home confinement.

Two Indian financial companies — Bajaj Finance Ltd. and HDFC Bank Ltd. — were the largest and second-largest detractors, respectively. Bajaj is anon-bank financial company offering lending services that include vehicle loans, mortgage loans, consumer loans and commercial loans. HDFC is one of India’s leading private-sector banks. The share prices of both companies tumbled on fears that India’s three-week coronavirus lockdown may trigger a wave of loan defaults. While these concerns appear justified, we believe the stocks of Bajaj and HDFC have been unfairly punished, and we don’t think the long-term franchise of either company has been impaired.

Grupo Aeroportuario del Pacifico S.A.B. de C.V. was also a significant detractor. The company operates international airports in Mexico under contracts with the government. The stock fell sharply on concerns that coronavirus-related declines in airport traffic would significantly reduce the amount of tariff revenue the company collects.

OUTLOOK

While the new coronavirus will likely have broad,short- to medium-term earnings impacts on many businesses — particularly those connected to global supply chains — we don’t currently expect major impairments to the long-term competitive positions of the companies we own. We continue to assess the ability of our companies to weather a severe, prolonged downturn. Because our investment approach already emphasizes high-quality companies with little or no debt and strong cash flows, the results thus far have been favorable.

Moreover, our outreach to company management teams has indicated few changes to their secular outlooks for operations and capital investments. Although we have been forced to temporarily suspend international travel, the Wasatch team maintains an extensive network of contacts throughout the world. We feel confident that disruptions stemming from the pandemic won’t fundamentally threaten the long-term revenue and earnings power of companies owned in the Fund.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

8

| | |

| WASATCH EMERGING MARKETS SELECT FUND (WAESX / WIESX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | SINCE INCEPTION 12/13/12 |

Emerging Markets Select (WAESX) — Investor | | | | -15.37% | | | | | -13.38% | | | | | -1.13% | | | | | -0.53% | |

Emerging Markets Select (WIESX) — Institutional | | | | -15.26% | | | | | -13.16% | | | | | -0.88% | | | | | -0.22% | |

MSCI Emerging Markets Index | | | | -14.55% | | | | | -17.69% | | | | | -0.37% | | | | | -0.42% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recentmonth-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2020 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Select Fund are Investor Class — Gross: 1.97%, Net: 1.51% / Institutional Class — Gross:1.43%, Net: 1.21%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| |

Silergy Corp.(Taiwan) | | | 6.9% | |

| |

MercadoLibre, Inc. | | | 5.6% | |

| |

Bajaj Finance Ltd.(India) | | | 4.5% | |

| |

Raia Drogasil S.A.(Brazil) | | | 4.2% | |

| |

Globant S.A.(Argentina) | | | 3.9% | |

| |

HDFC Bank Ltd.(India) | | | 3.7% | |

| | | | |

| Company | | % of Net

Assets | |

| |

ICICI Lombard General Insurance Co. Ltd. (India) | | | 3.6% | |

| |

Vitasoy International Holdings Ltd.(Hong Kong) | | | 3.6% | |

| |

Voltronic Power Technology Corp.(Taiwan) | | | 3.4% | |

| |

Tencent Holdings Ltd.(China) | | | 3.3% | |

| ** | As of March 31, 2020, there were 39 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

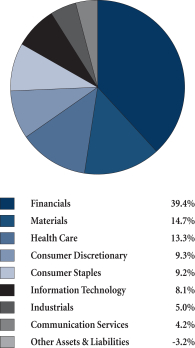

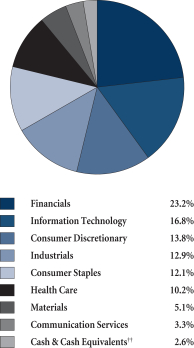

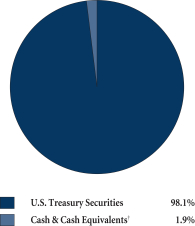

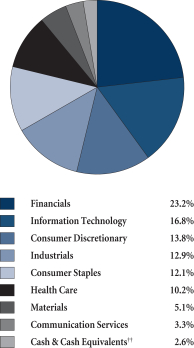

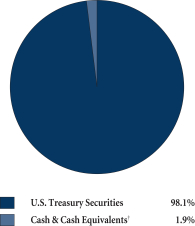

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

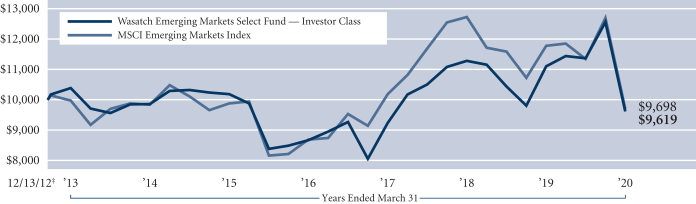

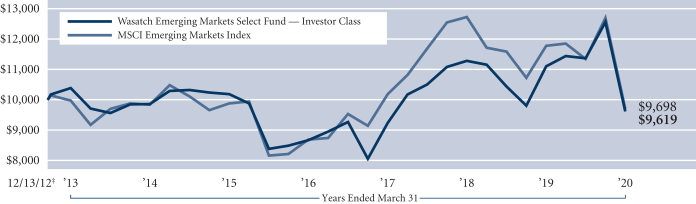

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

‡Inception: December 13, 2012. Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

9

| | |

| WASATCH EMERGING MARKETS SMALL CAP FUND(WAEMX / WIEMX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Emerging Markets Small Cap Fund is managed by a team of Wasatch portfolio managers led by Ajay Krishnan, Dan Chace, Scott Thomas and Kevin Unger.

| | | | |

Ajay Krishnan, CFA Lead Portfolio Manager

Scott Thomas, CFA Associate Portfolio Manager | |

Dan Chace, CFA Portfolio Manager

Kevin Unger, CFA Associate Portfolio Manager | | OVERVIEW Growing fears about the impact of the coronavirus pandemic on global demand, supply chains, corporate profits and economic growth jolted financial markets and sent emerging-market stock prices plunging during the quarter ended March 31, 2020. The Wasatch Emerging Markets Small Cap Fund — Investor Class |

|

fell-23.74%, while the benchmark MSCI Emerging Markets Small Cap Index lost-31.37%.

In most countries, our stocks held up better than those in the Index. On average, our companies have stronger earnings growth, higher returns on equity and returns on assets, and less debt than the average benchmark company. The Wasatch international team spent several weeksre-analyzing every company we own and scanning for new opportunities. We adjusted company weightings where we saw an improvement in the risk/reward potential and sold a few holdings for which we viewed upside potential as inadequate.

DETAILSOFTHE QUARTER

Brazil and Taiwan were the Fund’s largest sources of outperformance relative to the benchmark. Taiwan was atop-performing emerging market during the quarter. Its early response and effective containment measures have resulted in fewer cases ofCovid-19 compared to most neighboring countries. Brazil was one of the Index’s worst performers amid concerns about the government’s handling of the crisis and tensions between the president and the Congress.

Falling oil prices and coronavirus worries weighed on Mexican equities during the quarter. The Fund’s Mexican stocks declined more than their Index counterparts, and our overweight position in Mexico was a headwind to performance.

The strongest contributor to Fund performance for the quarter was Microport Scientific Corp. Based in Shanghai, China, the company manufactures interventional and minimally invasive devices for keyhole surgery. Reports that a well-respected, Asia-focused private-equity firm had acquired an ownership stake sent Microport’s stock price soaring in late February. We trimmed the Fund’s position to maintain its desired weight.

Taiwanese holdings Silergy Corp. and ASPEED Technology, Inc. were the second- and third-largest contributors, respectively.

Silergy manufactures high-performance mixed-signal and analog integrated circuits used in electronic devices. The company reported strong revenues, which helped alleviate concerns that weak demand from China might lead to a protracted slowdown in Silergy’s growth. ASPEED is a fabless designer of integrated circuits specializing in areas that include server management and audio-visual extensions. The company has been benefiting as firms globally add capacity to their data centers to accommodate citizens waiting out the coronavirus under home confinement.

Two Indian financial companies — Bajaj Finance Ltd. and AU Small Finance Bank Ltd. — were the Fund’s largest and second-largest detractors, respectively. Bajaj, anon-bank financial company, offers lending services that include vehicle loans, mortgage loans, consumer loans and commercial loans. AU primarily targets unbanked and underbankedlow- and middle-income individuals and small businesses. Both companies’ share prices tumbled on fears that India’s three-week coronavirus lockdown may trigger a wave of loan defaults. While these concerns appear justified, we believe the stocks of Bajaj and AU have been unfairly punished. In our analysis, both lenders are well-capitalized, and their long-term franchises are not impaired.

Grupo Aeroportuario del Centro Norte S.A.B. de C.V. was the third-largest detractor. The company operates international airports in the northern and central regions of Mexico. Its stock price fell sharply on concerns that coronavirus-related declines in airport traffic would significantly reduce tariff revenue.

OUTLOOK

WhileCovid-19 will likely have broad, short- to medium-term earnings impacts on many businesses — particularly those connected to global supply chains — we don’t currently expect major impairments to the long-term competitive positions of the Fund’s companies. The Wasatch international team continues to stress-test our companies to assess their ability to weather a severe, prolonged downturn. Because we already emphasize high-quality companies with little or no debt and strong cash flows, the results thus far have been favorable.

Moreover, our outreach to company management teams has indicated few changes to their secular outlooks for operations and capital investments. Although we have been forced to temporarily suspend international travel, the Wasatch team maintains an extensive network of contacts throughout the world. We feel confident that disruptions stemming from the pandemic won’t fundamentally threaten the long-term revenue and earnings power of companies owned in the Fund.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

10

| | |

| WASATCH EMERGING MARKETS SMALL CAP FUND (WAEMX / WIEMX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | 10 YEARS |

Emerging Markets Small Cap (WAEMX) — Investor | | | | -14.97% | | | | | -11.97% | | | | | -1.10% | | | | | 2.90% | |

Emerging Markets Small Cap (WIEMX) — Institutional | | | | -14.53% | | | | | -11.87% | | | | | -0.93% | | | | | 2.99% | |

MSCI Emerging Markets Small Cap Index | | | | -24.83% | | | | | -28.98% | | | | | -5.17% | | | | | -1.34% | |

MSCI Emerging Markets Index | | | | -14.55% | | | | | -17.69% | | | | | -0.37% | | | | | 0.68% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recentmonth-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2020 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Emerging Markets Small Cap Fund are Investor Class — Gross: 1.99%, Net: 1.97%/ Institutional Class — Gross:1.85%, Net: 1.82%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| |

Silergy Corp.(Taiwan) | | | 5.6% | |

| |

Voltronic Power Technology Corp.(Taiwan) | | | 4.8% | |

| |

Raia Drogasil S.A.(Brazil) | | | 3.9% | |

| |

Berger Paints India Ltd.(India) | | | 3.5% | |

| |

Magazine Luiza S.A.(Brazil) | | | 3.4% | |

| |

Globant S.A.(Argentina) | | | 3.3% | |

| | | | |

| Company | | % of Net

Assets | |

| |

Dr. Lal PathLabs Ltd.(India) | | | 3.3% | |

| |

ICICI Lombard General Insurance Co. Ltd. (India) | | | 3.3% | |

| |

ASPEED Technology, Inc.(Taiwan) | | | 3.1% | |

| |

Vitasoy International Holdings Ltd. (Hong Kong) | | | 2.9% | |

| ** | As of March 31, 2020, there were 51 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

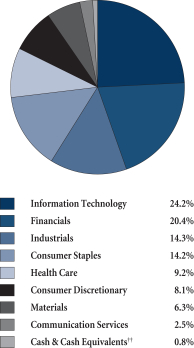

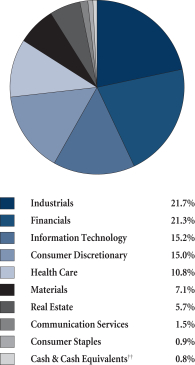

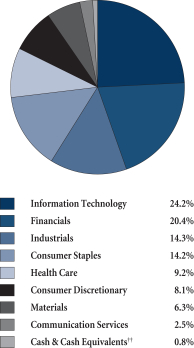

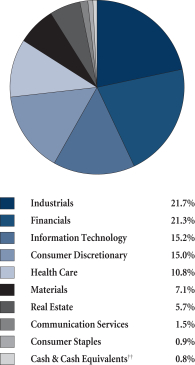

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

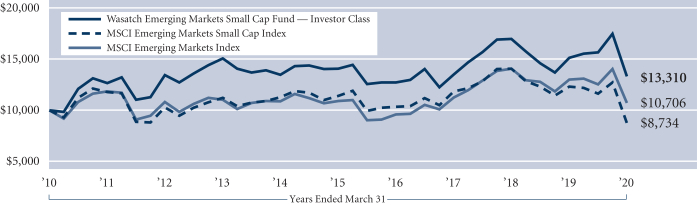

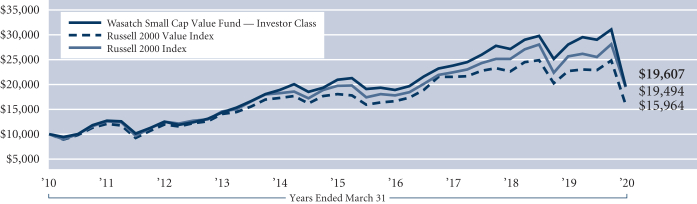

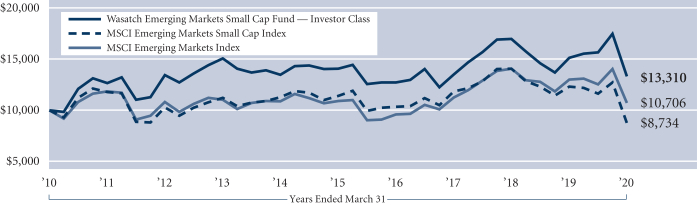

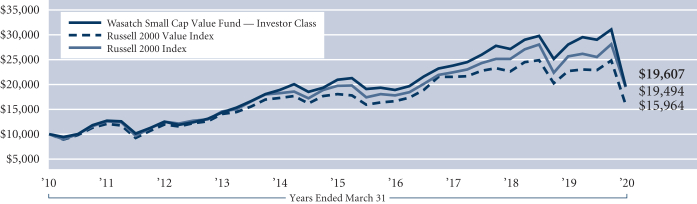

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

11

| | |

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND (WAFMX / WIFMX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Frontier Emerging Small Countries Fund is managed by a team of Wasatch portfolio managers led by Scott Thomas.

| | |

Scott Thomas, CFA Lead Portfolio Manager | | OVERVIEW The Wasatch Frontier Emerging Small Countries Fund — Investor Class finished the quarter ended March 31, 2020 down-31.23%, slightly outperforming its primary benchmark, the MSCI Frontier Emerging Markets Index, which finished the period down-31.56%. During the quarter, market panic sur- |

rounding theCovid-19 pandemic took a dramatic toll on global equity markets. Global governments and central banks have taken swift and unprecedented action. Broadly speaking, the overarching theme has been one of unpredictability as the rapid pace of breaking developments has led to historic market volatility, with drawdowns one day followed by historic rallies the next.

DETAILSOFTHE QUARTER

Although currency effects were significant headwinds during the quarter, beneficial stock selection in a number of countries, including Colombia, Peru, Egypt, the Philippines and Argentina, was enough to drive the Fund’s outperformance of its benchmark.

The impact of the coronavirus was broad and spared few markets or companies. Still, some companies weathered the storm relatively well. Among them were Fund holdings TQM Corp. and Delta Brac Housing Finance Corp. We think both companies have bright futures.

TQM is the leading insurance broker in Thailand. We believe the pandemic will have limited impact on TQM’s business. Our research has shown that the company has a pristine balance sheet with ample cash and no debt. We expect TQM to be able to continue gaining market share. Management just set an ambitious insurance-premium target of 50 billion Thai baht by 2026. That’s a compound annual growth rate of more than 21% from 2019.

Our sole holding at the moment in Bangladesh is Delta Brac Housing Finance. We see the company as having a major growth runway, as the penetration of mortgages in Bangladesh is among the lowest in the world. With strong backing from key institutional shareholders, Delta has consistently produced returns on equity of more than 20%. We expect the company to continue to compound earnings as demand for housing remains a long-term constant.

On a country basis, Mexico was the largest detractor from Fund performance versus the Index. Mexico is likely to face numerous challenges stemming from the pandemic. Some estimates project that the Mexican economy could contract by as much as 8%, at least in part due to the impact on the country’s tourism industry and decreased demand for Mexican exports. However, we believe Mexico may also benefit over the longer term, insofar as the crisis motivates organizations to look beyond China as a sole-source manufacturing provider.

The Fund’s largest detractor for the quarter was Qualitas Controladoras S.A.B. de C.V., a Mexican insurance company specializing in automotive insurance and related financial products. In our view, the decline in the company’s share price over the past three months provides a good example of the indiscriminate selling that has been commonplace during this market crisis. Judging from our analysis, Qualitas looks to be capable of weathering the current storm.

Colombia also suffered disproportionally and was one of the worst-performing frontier markets for the three-month period. This was driven in part by the steep decline in oil prices given the importance of oil to the Colombian government’s budget and the economy. Banco Davivienda S.A. detracted from Fund performance for the quarter. The bank, domiciled in Colombia, provides banking services to individuals, families, small andmedium-size enterprises and builders. Banco Davivienda is one of the largest lenders in Colombia. We think recent stock-price weakness presents an interesting buying opportunity, as the bank boasts a strong balance sheet and has little direct exposure to oil.

OUTLOOK

Without mincing words: we believe Wasatch is in good shape, as a firm. And we believe the Frontier Emerging Small Countries Fund is similarly well-positioned. As we assess frontier markets and emerging small countries, one thing is clear: We liked our companies going into the selloff, and we still like them now — especially at the current, less-expensive prices. We have conductedin-depth analyses of how our investments are positioned and feel confident that the majority of the Fund’s portfolio companies have much stronger balance sheets, generate stronger earnings growth and have higher returns on equity than the companies represented in the benchmark.

In many of our recent calls, our companies’ management teams have generally been optimistic, seeing the prospect for growth on the other side of the crisis. We believe these companies arewell-run and better poised to weather this environment than lower-quality competitors, who are less likely to have the organizational means to maintain operations and serve customers in this challenging time.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

12

| | |

| WASATCH FRONTIER EMERGING SMALL COUNTRIES FUND (WAFMX / WIFMX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Portfolio Summary

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | SINCE INCEPTION 1/31/12 |

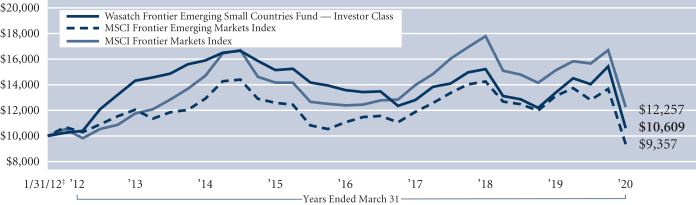

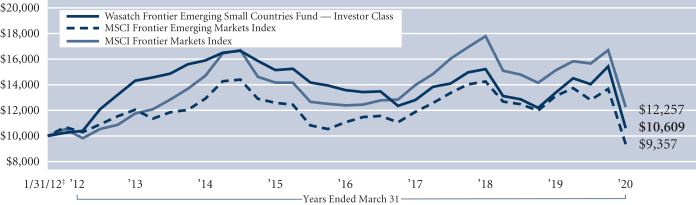

Frontier Emerging Small Countries (WAFMX) — Investor | | | | -24.45% | | | | | -20.69% | | | | | -6.87% | | | | | 0.73% | |

Frontier Emerging Small Countries (WIFMX) — Institutional | | | | -24.28% | | | | | -20.53% | | | | | -6.69% | | | | | 0.84% | |

MSCI Frontier Emerging Markets Index | | | | -26.95% | | | | | -28.65% | | | | | -5.76% | | | | | -0.81% | |

MSCI Frontier Markets Index | | | | -21.73% | | | | | -18.96% | | | | | -2.85% | | | | | 2.52% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recentmonth-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2020 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Frontier Emerging Small Countries Fund are Investor Class — Gross: 2.30%, Net: 2.20%/ Institutional Class — Gross:2.15%, Net: 2.00%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in frontier and emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| |

MercadoLibre, Inc. | | | 6.6% | |

| |

Cleopatra Hospital(Egypt) | | | 5.8% | |

| |

Raia Drogasil S.A.(Brazil) | | | 5.6% | |

| |

Philippine Seven Corp.(Philippines) | | | 5.5% | |

| |

Safaricom plc(Kenya) | | | 4.9% | |

| | | | |

| Company | | % of Net

Assets | |

| |

Qualitas Controladora S.A.B. de C.V.(Mexico) | | | 4.5% | |

| |

Globant S.A.(Argentina) | | | 4.3% | |

| |

Naspers Ltd., Class N(South Africa) | | | 3.9% | |

| |

Commercial International Bank S.A.E.(Egypt) | | | 3.9% | |

| |

FPT Corp.(Vietnam) | | | 3.7% | |

| ** | As of March 31, 2020, there were 38 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

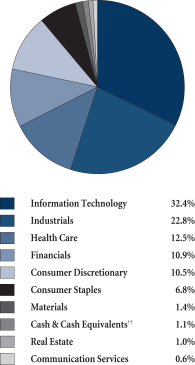

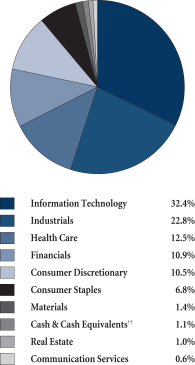

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

‡Inception: January 31, 2012. Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

13

| | |

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX / WIGOX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Global Opportunities Fund is managed by a team of Wasatch portfolio managers led by JB Taylor, Ajay Krishnan, Ken Applegate and Paul Lambert.

| | | | |

JB Taylor Lead Portfolio Manager

Ken Applegate, CFA Portfolio Manager | |

Ajay Krishnan, CFA Lead Portfolio Manager

Paul Lambert Portfolio Manager | | OVERVIEW The Wasatch Global Opportunities Fund —

Investor Class finished the quarter ended March 31, 2020 down-25.43% and outperformed the benchmark MSCI AC (All Country) World Small Cap Index, which finished the period down -30.19%. The quarter began on a positive note amid |

|

optimism that the trade conflict between the U.S. and China was finally nearing an end. News of a phase-one agreement, signed on January 15, raised hopes for a period of improving relations between the world’s two largest economies. By mid-February, large-cap U.S. stock indexes had pushed to all-time highs, with small caps not far behind. The joy was short-lived, however, as the outbreak of the novel-coronavirus disease in China began spreading to other countries.

Investor concerns about the potential impact of Covid-19 on economic growth and corporate earnings led to a precipitous drop in global markets. Financial markets rallied near the end of the quarter after the Federal Reserve embarked on an open-ended program of quantitative easing and the U.S. government enacted relief legislation of unprecedented scale.

DETAILSOFTHE QUARTER

Stock selection, particularly in the U.S., Japan, Australia and Taiwan, drove the Fund’s outperformance of the benchmark.

One of the areas that we think might bounce back quickly and for which we see a favorable tailwind is the information-technology (IT) sector, which was already overweight, comprising over 30% of the Fund versus less than 14% for the benchmark.

In keeping with our long-held optimism for the IT space, Five9, Inc. was the largest individual contributor to Fund performance during the quarter. The company is a cloud software provider for contact centers around the world. Five9’s products include a virtual contact center that acts as a hub for engagement between clients and customers. As industries have necessarily shifted toward remote-work arrangements, call centers, many of which run on Five9’s software, have become even more integral to the operations of many organizations. We believe the company’s long-term growth prospects remain strong.

ASPEED Technology, Inc. and Silergy Corp. were two other IT companies that contributed to the Fund’s return during

the quarter. ASPEED produces processors intended for server-management applications. Silergy manufactures integrated circuits for power management. Both companies are based in Taiwan. As the pandemic highlights the business risks inherent in sourcing supply from a single country, an increase in manufacturers seeking to diversify operations away from China may benefit countries like Taiwan and India.

In India, sharp selloffs hit the financials sector. AU Small Finance Bank Ltd. and Bajaj Finance Ltd., the Fund’s two most-significant individual detractors during the quarter, were among those impacted. As its name suggests, AU Small Finance Bank offers banking products focused on low- and middle-income individuals and small businesses, while Bajaj Finance specializes in wealth management, investments, and related financial services and products.

Generally, we continue to like the prospects of the Fund’s Indian holdings and we are overweight versus the benchmark in India. One development that could be favorable for India is diminished global demand for oil, which has led to lower oil prices. Because India imports approximately 80% of the petroleum it uses, cheaper oil typically improves the nation’s current-account balance, supports its currency and helps keep inflation in check. Investors hope this will give India’s central bank additional scope to pursue interest-rate cuts aimed at stimulating the country’s slowing economy.

OUTLOOK

We understand it is an alarming and uncertain time for investors. What we’ve found in times of uncertainty like we’re currently experiencing is that quality companies adapt. For precisely this reason, our commitment to a “bottom-up” approach focused on strong company fundamentals isn’t merely a flowery talking point. Rather, we feel firm conviction that the best places to be invested during difficult periods are in excellent companies whose capable management teams have positioned the businesses to grow for years. Such positioning includes reasonable preparation to weather unpredictable events in the interim between the present and our long-term investment horizon.

We believe the Fund’s demonstrated resilience through the first months of the coronavirus is evidentiary of the effectiveness of our long-term perspective.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

14

| | |

| WASATCH GLOBAL OPPORTUNITIES FUND (WAGOX / WIGOX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

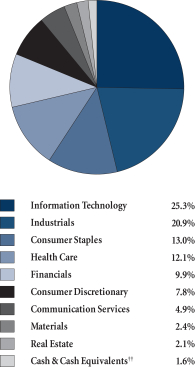

Portfolio Summary

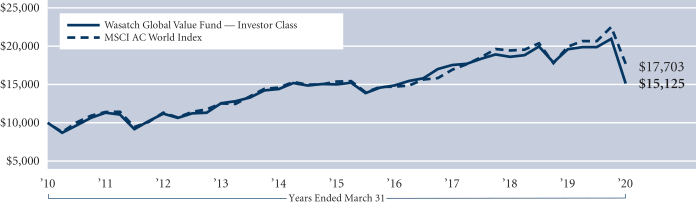

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS* | | 1 YEAR | | 5 YEARS | | 10 YEARS |

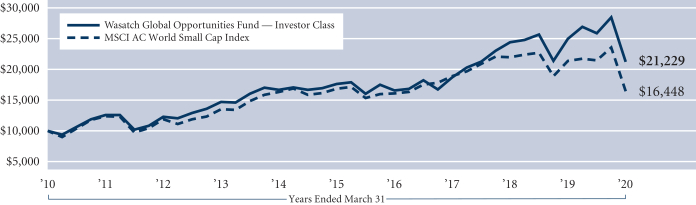

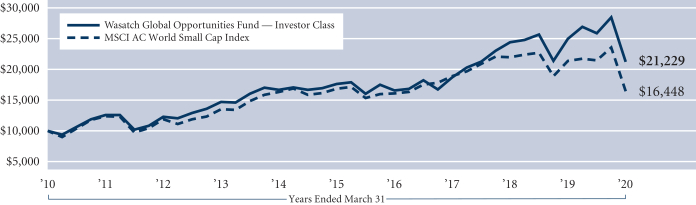

Global Opportunities (WAGOX) — Investor | | | | -17.97% | | | | | -15.03% | | | | | 3.79% | | | | | 7.82% | |

Global Opportunities (WIGOX) — Institutional | | | | -18.15% | | | | | -14.97% | | | | | 3.90% | | | | | 7.88% | |

MSCI AC World Small Cap Index | | | | -23.39% | | | | | -23.06% | | | | | -0.49% | | | | | 5.10% | |

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

As of the January 31, 2020 prospectus, the Total Annual Fund Operating Expenses for the Wasatch Global Opportunities Fund are Investor Class: 1.56% / Institutional Class — Gross: 1.57%, Net: 1.36%. The expense ratio shown elsewhere in this report may be different. Net expenses are based on Fund expenses, net of waivers and reimbursements. See the prospectus for additional information regarding Fund expenses.

Wasatch will deduct a 2.00% redemption fee on Fund shares held 60 days or less. Performance data do not reflect the deduction of fees, including sales charges, or the taxes you would pay on fund distributions or the redemption of fund shares. Fees and taxes, if reflected, would reduce the performance quoted. Wasatch does not charge any sales fees. For more complete information including charges, risks and expenses, read the prospectus carefully.

Performance for the Institutional Class prior to 2/1/2016 is based on the performance of the Investor Class. Performance of the Fund’s Institutional Class prior to 2/1/2016 uses the actual expenses of the Fund’s Investor Class without any adjustments. For any such period of time, the performance of the Fund’s Institutional Class would have been substantially similar to, yet higher than, the performance of the Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses.

Investing in small and micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities, especially in emerging markets, entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

TOP 10 EQUITY HOLDINGS**

| | | | |

| Company | | % of Net

Assets | |

| |

Trex Co., Inc. | | | 3.1% | |

| |

AU Small Finance Bank Ltd.(India) | | | 2.7% | |

| |

Monolithic Power Systems, Inc. | | | 2.6% | |

| |

Vitasoy International Holdings Ltd.(Hong Kong) | | | 2.6% | |

| |

Globant S.A.(Argentina) | | | 2.6% | |

| | | | |

| Company | | % of Net

Assets | |

| |

Silergy Corp.(Taiwan) | | | 2.5% | |

| |

Tyler Technologies, Inc. | | | 2.4% | |

| |

Five9, Inc. | | | 2.4% | |

| |

MercadoLibre, Inc. | | | 2.2% | |

| |

Ensign Group, Inc. (The) | | | 2.1% | |

| ** | As of March 31, 2020, there were 78 holdings in the Fund. Foreign currency contracts, written options and repurchase agreements, if any, are not included in the number of holdings. Portfolio holdings are subject to change at any time. References to specific securities should not be construed as recommendations by the Funds or their Advisor. Current and future holdings are subject to risk. |

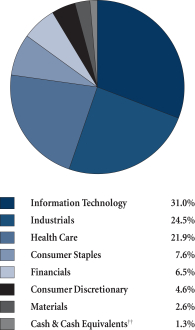

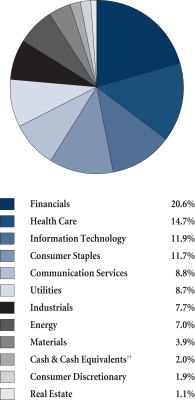

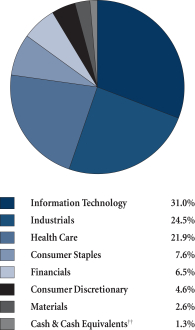

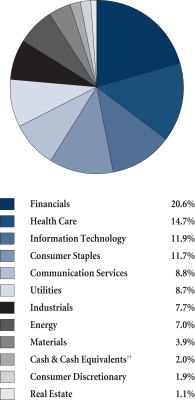

SECTOR BREAKDOWN†

| † | Excludes securities sold short and options written, if any. |

| †† | Also includes Other Assets & Liabilities. |

GROWTHOFA HYPOTHETICAL $10,000 INVESTMENT

Past performance does not predict future performance. The graph above does not reflect the deduction of fees, sales charges, or taxes that you would pay on fund distributions or the redemption of fund shares. Wasatch does not charge any sales fees.

15

| | |

| WASATCH GLOBAL SELECT FUND(WAGSX / WGGSX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Management Discussion

The Wasatch Global Select Fund is managed by a team of Wasatch portfolio managers led by Ken Applegate, Ken Korngiebel, Paul Lambert, Linda Lasater and Mike Valentine.

| | | | |

Ken Applegate, CFA Portfolio Manager | |

Ken Korngiebel, CFA Portfolio Manager | |

Paul Lambert Portfolio Manager |

| | |

Linda Lasater, CFA Portfolio Manager | |

Mike Valentine Portfolio Manager |

OVERVIEW

The Wasatch Global Select Fund — Investor Class declined-17.82% for the quarter ended March 31, 2020. The Fund outperformed the benchmark MSCI AC (All Country) World Index, which finished the period down -21.37%.

The quarter began on a positive note amid optimism that the trade conflict between the U.S. and China was finally nearing an end. News of a phase-one agreement, signed on January 15, raised hopes for a period of improving relations between the world’s two largest economies. By mid-February, large-cap U.S. stock indexes had pushed to all-time highs, with small caps not far behind. The joy was short-lived, however, as the outbreak of the novel-coronavirus disease in China began spreading to other countries.

DETAILSOFTHE QUARTER

Not all companies have been negatively impacted by this crisis. One of the areas that we think might bounce back quickly and for which we see a favorable tailwind is the information-technology (IT) sector, in which the Fund was already overweight, comprising over 31% of the portfolio versus approximately 18% for the benchmark.

In keeping with our long-held optimism for the IT space, DocuSign, Inc. was the top contributor to Fund performance for the quarter. The company offers e-signature software that enables businesses to digitally prepare and execute agreements. The company has been experiencing rapid sales gains and improved prospects for growth. With the pandemic scattering corporate operations to home offices and curtailing business travel, we think DocuSign is positioned to benefit as more companies sign contracts electronically over the internet.

Like IT, we have also been able to find companies with attractive quality and growth characteristics in the health-care space. The Fund is overweight in health care at about 22% of its portfolio compared to approximately 12% for the

benchmark. Veeva Systems, Inc. was a top health-care contributor. The company possesses many of the same attributes we see in our IT holdings. Veeva offers cloud solutions, including data and software solutions, targeted at streamlining operations for customers in the life sciences and biotechnology industries.

Tsuruha Holdings, Inc. from the consumer-staples sector also contributed. This Japan-based drugstore chain has continued to generate strong sales by supplying local citizens with daily necessities and pharmaceuticals.

The Fund’s largest individual detractor for the quarter was Bajaj Finance Ltd., a non-bank financial company offering a broad spectrum of lending services that includes vehicle loans, mortgage loans, consumer loans and commercial loans. Shares of Bajaj tumbled on fears that India’s three-week coronavirus lockdown may trigger a wave of loan defaults. While these concerns appear justified in our view, we believe the company’s stock has been unfairly punished. Bajaj focuses on India’s salaried class, whose loan payments are often made through automatic transfers from their bank accounts. We believe the company is well-capitalized and do not foresee impairment to its long-term business prospects from coronavirus effects.

Euronet Worldwide, Inc., a U.S.-based financial transaction processing services provider, was another detractor. The company has faced near-term pressure in its money-transfer business, in addition to market concerns surrounding the coronavirus. However, we continue to like Euronet and believe the company has strong growth potential in all three business segments — electronic funds transfer (EFT) processing, epay and money transfer.

OUTLOOK

While the pandemic will likely have broad, short- to medium-term earnings impacts on many companies, we don’t currently expect major impairments to the long-term competitive positions of the companies we own.

On average, our companies have stronger earnings growth, higher returns on equity and returns on assets, and less debt than the average company in the benchmark. The Wasatch research team spent several weeks re-analyzing every company we own and scanning for new opportunities. We’ve adjusted company weightings where we see increased potential or weakness, and we’ve sold a handful of names for which we viewed upside potential as inadequate. However, we currently do not see many new names that get us more excited than the ones we already own.

Thank you for the opportunity to manage your assets.

| | Current and future holdings are subject to risk. |

16

| | |

| WASATCH GLOBAL SELECT FUND(WAGSX / WGGSX) | | MARCH 31, 2020 (UNAUDITED) |

|

|

|

Portfolio Summary

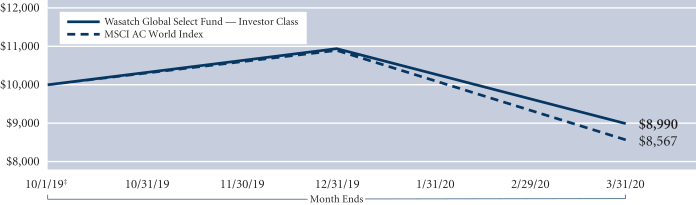

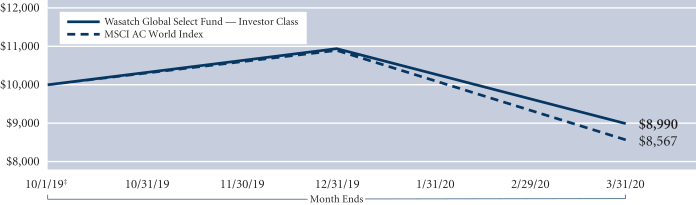

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | |

| | | SIX MONTHS* | | SINCE INCEPTION |

Global Select (WAGSX) — Investor | | | | -10.10% | | | | | -10.10% | |

Global Select (WGGSX) — Institutional | | | | -9.90% | | | | | -9.90% | |

MSCI AC World Index | | | | -14.33% | | | | | -14.33% | |

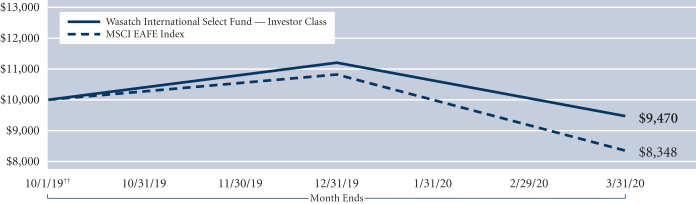

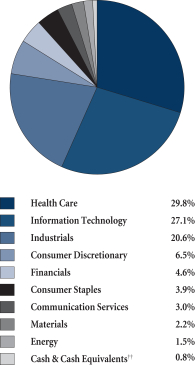

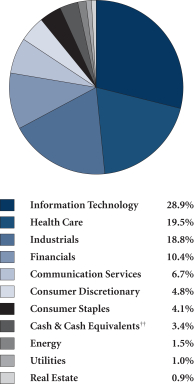

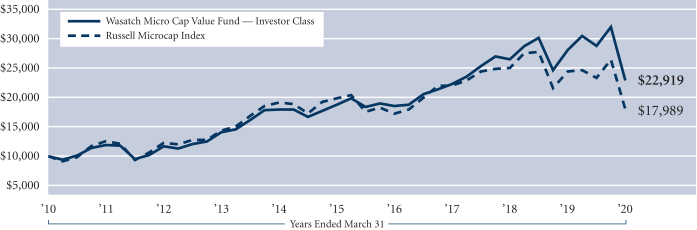

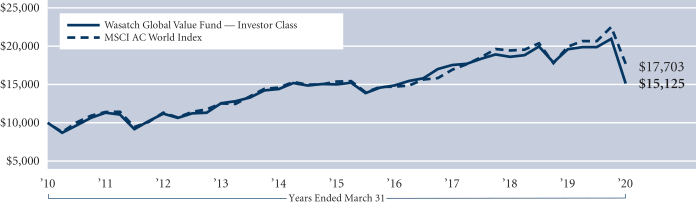

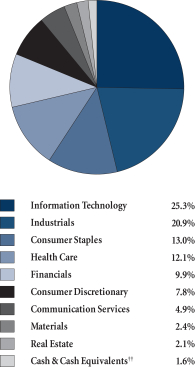

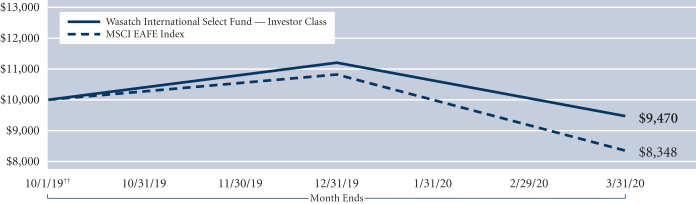

Data show past performance, which is not indicative of future performance. Current performance may be lower or higher than the performance quoted. To obtain the most recent month-end performance data available, please visit wasatchglobal.com. The Advisor may absorb certain Fund expenses, without which total returns would have been lower. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost.