UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 4932

John Hancock World Fund

(Exact name of registrant as specified in charter)

601 Congress Street, Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Alfred P. Ouellette

Senior Attorney and Assistant Secretary

601 Congress Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-663-4324

Date of fiscal year end: October 31

Date of reporting period: October 31, 2005

ITEM 1. REPORT TO SHAREHOLDERS.

|

| Table of contents |

|

| Your fund at a glance |

| page 1 |

|

| Manager’s report |

| page 2 |

|

| A look at performance |

| page 6 |

|

| Growth of $10,000 |

| page 7 |

|

| Your expenses |

| page 8 |

|

| Fund’s investments |

| page 10 |

|

| Financial statements |

| page 14 |

|

| Trustees & officers |

| page 32 |

|

| For more information |

| page 37 |

|

To Our Shareholders,

I am pleased to be writing to you as the new President and Chief Executive Officer of John Hancock Funds, LLC, following the departure of James A. Shepherdson to pursue other opportunities. In addition, on July 25, 2005, your fund’s Board of Trustees appointed me to the roles of President and Chief Executive Officer of your fund.

As a means of introduction, I have been involved in the mutual fund industry since 1985. I have been with John Hancock Funds for the last 15 years, most recently as executive vice president of retail sales and marketing and a member of the company’s executive and investment committees. In my former capacity, I was responsible for all aspects of the distribution and marketing of John Hancock Funds’ open-end and closed-end funds. Outside of John Hancock, I have served as Chairman of the Investment Company Institute (ICI) Sales Force Marketing Committee since September 2003.

It is an exciting time to be at John Hancock Funds, and I am grateful for the opportunity to lead and shape its future growth. With the acquisition of John Hancock by Manulife Financial Corporation in April 2004, we are receiving broad support toward the goal of providing our shareholders with excellent investment opportunities and a more complete lineup of choices for the discerning investor.

For one example, we have recently added five “Lifestyle Portfolio” funds-of-funds that blend multiple fund offerings from internal and external money managers to create a broadly diversified asset allocation portfolio. Look for more information about these exciting additions to the John Hancock family of funds in the near future.

Although there has been a change in executive-level management, rest assured that the one thing that never wavers is John Hancock Funds’ commitment to placing the needs of shareholders above all else. We are all dedicated to the task of working with you and your financial advisors to help you reach your long-term financial goals.

Sincerely,

Keith F. Hartstein,

President and Chief Executive Officer

This commentary reflects the CEO’s views as of October 31, 2005. They are subject to change at any time.

YOUR FUND

AT A GLANCE

The Fund seeks

long-term growth of

capital by normally

investing at least

80% of its assets in

stocks of U.S. and

foreign health

sciences companies.

|

| | Over the last twelve months |

| |

▪ | Health care stocks outpaced the broader market, although |

| | performance among subsectors diverged. |

| |

▪ | The Fund’s strong performance stemmed from sector allocations |

| | and good stock selection. |

| |

▪ | Biotech stocks provided the Fund with some of its best and |

| | worst performers. |

Total returns for the Fund are at net asset value with all distributions reinvested. These

returns do not reflect the deduction of the maximum sales charge, which would

reduce the performance shown above.

|

| Top 10 holdings |

| 5.4% | Amgen, Inc. |

| 4.9% | Medtronic, Inc. |

| 4.7% | Genentech, Inc. |

| 3.4% | Abbot Laboratories |

| 3.3% | Caremark Rx, Inc. |

| 3.1% | WellPoint, Inc. |

| 2.9% | UnitedHealth Group, Inc. |

| 2.9% | Genzyme Corp. |

| 2.9% | Gilead Sciences, Inc. |

| 2.8% | Hospira, Inc. |

| As a percentage of net assets on October 31, 2005. |

1

BY ROBERT C. JUNKIN, CPA, PORTFOLIO MANAGER

JOHN HANCOCK

Health Sciences Fund

|

Health care stocks as a group posted strong gains for the 12 months ended October 31, 2005 and substantially outpaced the broader stock market. In the initial months of the period, virtually every subsector that makes up the health care group staged an impressive “relief” rally, buoyed by investors’ optimism that the re-election of President Bush would preclude onerous new regulation, increased competition from generic drug makers and price curbs, among other things.

But the performance of various industries that make up the broader health care segment began to diverge in 2005. Rising interest rates and a cautious economic outlook sent investors to seek safety among many types of health care stocks -- including HMOs, hospitals, medical device and technology and services sectors --which traditionally are considered good defensive bets during times of economic and financial markets uncertainty. However, large pharmaceutical companies persistently underperformed, dragged lower by anemic drug pipelines and the onslaught of stiff competition from generic drug makers. After disappointing investors in early 2005, biotechnology stocks started to outperform again, thanks in part to a number of scientific meetings that have shed light on new products, new product approvals and increasing merger and acquisition activity.

“Health care stocks as a group

posted strong gains for the 12

months ended October 31, 2005

and substantially outpaced the

broader stock market.”

Performance

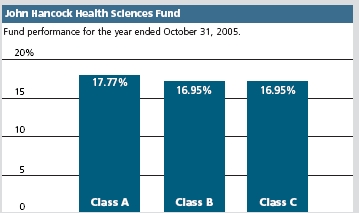

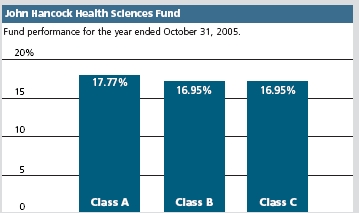

For the 12 months ended October 31, 2005, John Hancock Health Sciences Fund’s Class A, Class B and Class C shares posted total returns of 17.77%, 16.95% and 16.95%, respectively, at net asset value. During the same 12-month period, the Russell 3000 Healthcare Index returned 12.06% and the average health/biotechnology fund had a total return of 15.03%, according to Lipper, Inc.,1 while the Standard & Poor’s 500 Index returned 8.72% . Keep in mind that your net asset value return will be different from the Fund’s performance if you were not invested in the Fund for

2

the entire period and did not reinvest all distributions. See pages six and seven for historical performance results.

Performance explained

We believe that our outperformance relative to the index and the Lipper average was the result of advantageous sector allocation and good security selection. In terms of sector allocation, the biggest positive contributions resulted from our decisions to underweight the beleaguered pharmaceutical sector while maintaining an overweight position in strong-performing biotechnology stocks. As for stock selection, our preference for foreign pharmaceutical companies rather than U.S.-based concerns significantly aided returns. For example, Swiss drug makers Roche Holding AG and Novartis AG posted strong gains and were among our top performers during the period, thanks to their solid drug pipelines and fewer expiring patents versus many of their U.S. counterparts. Also within the pharmaceutical area we enjoyed good results from some specialty players such as IVAX Corp., maker of generic drugs respiratory treatments and products, and Alcon, Inc., which produces drugs, equipment and devices to treat eye diseases and disorders, and generic drug provider Teva Pharmaceutical Industries Ltd.

“...outperformance relative to the

index and the Lipper average

was the result of advantageous

sector allocation and good

security selection...”

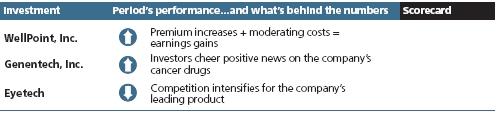

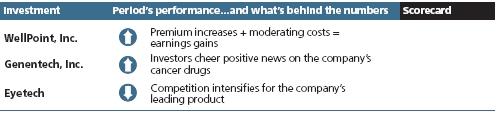

|

Biotech mixed

A number of biotechnology companies also topped our best performers list. Our holdings in the world’s largest biotech company Genentech, Inc. worked out very well. It reported strong growth in profits and revenues as sales of its new cancer drug Avastin continued to expand. The company’s stock continued to surge after it announced in mid April that Avastin helped some of the sickest breast cancer patients live longer than expected. Shareholders also cheered the late-period news that the drug Herceptin, an older cancer therapy from Genentech, helped prevent the recurrence of breast cancer following tumor surgery. Another biotech winner included Vicuron, a specialist in drugs to treat bacterial and fungal infections, which got a big lift when it was purchased by Pzifer, Inc. Celgene Corp. also performed quite well, propelled in large part by investors’ enthusiasm over the company’s experimental drug to treat multiple myeloma.

3

Industry

distribution2

Pharmaceuticals --

24%

Biotechnology --

23%

Health care

equipment -- 17%

Health care

services -- 15%

Managed health

care -- 8%

Health care

supplies -- 6%

Health care

facilities -- 3%

Agricultural

products -- 1%

Health care

distributors -- 1%

Life & health

insurance -- 1%

|

However, the biotech group also was the source of some of the period’s biggest disappointments. We eliminated holdings in Eyetech Pharmaceuticals, Inc., which performed poorly. Although it markets a product for macular degeneration that has good potential, Genentech recently released outstanding clinical trial data for a rival experimental drug. We also sold our holdings in Biogen Idec, Inc. after it suffered losses in response to news that the company was suspending sales of Tysabri following the death of several multiple sclerosis patients who were taking the drug and contracted a rare neurological disease. We trimmed our holdings in laggard Boston Scientific Corp. partly in response to a heightened competitive environment for its market-leading drug-eluting stent.

Our ongoing emphasis of managed care and pharmacy benefit managers (PBMs), also worked in the Fund’s favor over the last 12 months. Managed care companies continued to benefit from rising earnings, which resulted from health-care premium increases the companies passed onto their customers, compounded by moderating medical cost trends. For example, the stock price of

UnitedHealth Group, Inc. surged thanks to significant profit increases across its business units and WellPoint, Inc., the nation’s largest health insurance provider, rose substantially in response to strong profit and earnings growth. Among PBMs that design prescription plans and process pharmacy data claims for its business, health plan and government customers, the standout was CaremarkRx, Inc., which was boosted by bottom-line growth resulting from the strength of its mail-order pharmacy and also benefited from the company’s recent acquisition of rival AdvancePCS. Another

4

PBM, Medco Health Solutions, Inc. also benefited from strong volume growth from its mail-order prescription business.

Outlook

In our view, demographic trends, most notably the aging global population and new product and service innovations, support our bullish outlook for the health care sector over the longer term. But against this positive secular backdrop, the group may encounter some short-term challenges. Chief among them is the commencement of a Medicare drug benefit program that starts in January 2006. The estimated annual costs of the program have ballooned, and this fact, coupled with the massive U.S. federal budget deficit, may result in heightened concerns about future government intervention in the health care business in the form of price controls. Additionally, regulatory scrutiny has increased as the pace of new drug approvals has decelerated and investigations into company business practices have spread across the industry. However, if the economy slows, which we believe it will, many health care stocks may benefit from investors’ desire to seek investments that are defensive in nature. Regardless of the environment, we’ll continue to work to emphasize companies with exciting new product and service developments whose stocks are selling at compelling valuations.

“...demographic trends, most notably

the aging global population, and new

product and service innovation

support our bullish outlook for the

health care sector...”

|

This commentary reflects the views of the portfolio manager through the end of the Fund’s period discussed in this report. The manager’s statements reflect his own opinions. As such, they are in no way guarantees of future events, and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant. Sector investing is subject to greater risks than the market as a whole.1 Figures from Lipper, Inc. include reinvested dividends and do not take into account sales charges. Actual load-adjusted performance is lower.

2 As a percentage of net assets on October 31, 2005.

5

A LOOK AT

PERFORMANCE

For the period ended

October 31, 2005

|

| | | Class A | Class B | Class C |

| Inception date | | 10-1-91 | 3-7-94 | 3-1-99 |

|

| Average annual returns with maximum sales charge (POP) | |

| One year | | 11.89% | 11.95% | 15.95% |

|

| Five years | | 0.85 | 0.82 | 1.18 |

|

| Ten years | | 9.66 | 9.61 | -- |

|

| Since inception | | -- | -- | 6.12 |

|

| Cumulative total returns with maximum sales charge (POP) | |

| One year | | 11.89 | 11.95 | 15.95 |

|

| Five years | | 4.34 | 4.16 | 6.04 |

|

| Ten years | | 151.40 | 150.22 | -- |

|

| Since inception | | -- | -- | 48.57 |

|

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The returns for Class C shares have been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month-end, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

6

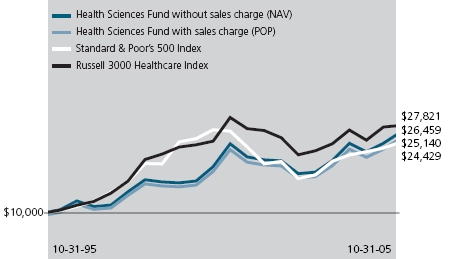

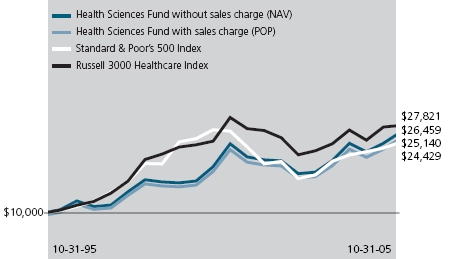

This chart shows what happened to a hypothetical $10,000 investment in Class A shares for the period indicated. For comparison, we’ve shown the same investment in two separate indexes.

| | Class B1 | Class C1 |

| Period beginning | 10-31-95 | 3-1-99 |

|

| Health Sciences Fund | $25,022 | $14,857 |

|

| Index 1 | 24,429 | 10,806 |

|

| Index 2 | 27,821 | 11,389 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B and Class C shares, respectively, as of October 31, 2005. The Class C shares investment with maximum sales charge has been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Standard & Poor’s 500 Index -- Index 1 -- is an unmanaged index that includes 500 widely traded common stocks.

Russell 3000 Healthcare Index -- Index 2 -- is a capitalization-weighted index composed of companies involved in medical services or health care.

It is not possible to invest directly in an index. Index figures do not reflect sales charges and would be lower if they did.

1 No contingent deferred sales charge applicable.

7

These examples are intended to help you understand your ongoing

operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

▪ Transaction costs which include sales charges (loads) on |

| purchases or redemptions (varies by share class), minimum |

| account fee charge, etc. |

▪ Ongoing operating expenses including management |

| fees, distribution and service fees (if applicable) and other |

| fund expenses. |

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on April 30, 2005, with the same investment held until October 31, 2005.

| Account value | | Expenses paid |

| $1,000.00 | Ending value | during period |

| on 4-30-05 | on 10-31-05 | ended 10-31-051 |

|

| Class A | $1,093.10 | $8.00 |

| Class B | 1,089.30 | 11.66 |

| Class C | 1,089.30 | 11.68 |

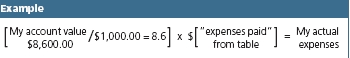

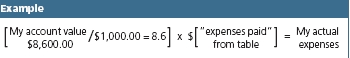

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at October 31, 2005 by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

8

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annual return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on April 30, 2005, with the same investment held until October 31, 2005. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| Account value | | Expenses paid |

| $1,000.00 | Ending value | during period |

| on 4-30-05 | on 10-31-05 | ended 10-31-051 |

|

| Class A | $1,017.56 | $7.71 |

| Class B | 1,014.05 | 11.24 |

| Class C | 1,014.02 | 11.26 |

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.52%, 2.21% and 2.22%, for Class A, Class B and Class C, respectively, multiplied by the average account value over the period, multiplied by number of days in most recent fiscal half-year/365 or 366 (to reflect the one-half year period).

9

F I N A N C I A L S TAT E M E N T S

FUND’S

INVESTMENTS

Securities owned

by the Fund on

October 31, 2005

|

This schedule is divided into three main categories: common stocks, warrants and short-term investments. Common stocks and warrants are further broken down by industry group. Short-term investments, which represent the Fund’s cash position, are listed last.| Issuer | Shares | Value |

|

| Common stocks 99.21% | | $287,596,102 |

| (Cost $195,348,180) | | |

Agricultural Products 1.27% | | 3,690,550 |

|

| Corn Products International, Inc. | 155,000 | 3,690,550 |

Biotechnology 23.25% | | 67,393,303 |

|

| Abgenix, Inc. (I) | 32,000 | 332,800 |

|

| Alkermes, Inc. (I) | 10,000 | 162,900 |

|

| Amgen, Inc. (I) | 204,800 | 15,515,648 |

|

| Applera Corp.-Celera Genomics Group (I) | 30,000 | 356,400 |

|

| Celgene Corp. (I)(L) | 35,000 | 1,963,500 |

|

| Cephalon, Inc. (I) | 5,000 | 227,950 |

|

| Genentech, Inc. (I)(L) | 150,000 | 13,590,000 |

|

| Genzyme Corp. (I) | 116,000 | 8,386,800 |

|

| Gilead Sciences, Inc. (I) | 177,000 | 8,363,250 |

|

| Human Genome Sciences, Inc. (I)(L) | 105,000 | 876,750 |

|

| Invitrogen Corp. (I)(L) | 22,000 | 1,398,980 |

|

| Life Sciences Research, Inc. (I) | 15,000 | 183,750 |

|

| Medarex, Inc. (I) | 32,500 | 284,050 |

|

| Nabi Biopharmaceuticals (I) | 29,900 | 384,215 |

|

| Neurocrine Biosciences, Inc. (I)(L) | 56,000 | 2,957,920 |

|

| OSI Pharmaceuticals, Inc. (I)(L) | 144,000 | 3,355,200 |

|

| Protein Design Labs, Inc. (I)(L) | 153,000 | 4,287,060 |

|

| Sepracor, Inc. (I)(L) | 51,000 | 2,868,750 |

|

| Telik, Inc. (I)(L) | 127,000 | 1,897,380 |

Health Care Distributors 0.95% | | 2,754,850 |

|

| Cardinal Health, Inc. | 15,000 | 937,650 |

|

| McKesson Corp. | 40,000 | 1,817,200 |

See notes to financial statements.

10

| | F I N A N C I A L | S TAT E M E N T S |

| |

| |

| |

| |

| Issuer | Shares | Value |

Health Care Equipment 16.42% | | $47,586,135 |

|

| American Medical Systems Holdings, Inc. (I) | 150,000 | 2,452,500 |

|

| ArthroCare Corp. (I)(L) | 110,000 | 4,040,300 |

|

| Biomet, Inc. (L) | 82,500 | 2,873,475 |

|

| Boston Scientific Corp. (I) | 66,350 | 1,666,712 |

|

| Caliper Life Sciences, Inc. (I) | 50,000 | 326,000 |

|

| CryoCor, Inc. (I) | 141,000 | 865,740 |

|

| Electro-Optical Sciences, Inc. (I) | 350,000 | 2,208,500 |

|

| Fisher Scientific International, Inc. (I)(L) | 73,500 | 4,152,750 |

|

| HemoSense, Inc. (I) | 150,000 | 1,065,000 |

|

| Hospira, Inc. (A)(I) | 204,150 | 8,135,378 |

|

| Medtronic, Inc. | 250,000 | 14,165,000 |

|

| Stryker Corp. (L) | 54,000 | 2,217,780 |

|

| Varian Medical Systems, Inc. (I)(L) | 75,000 | 3,417,000 |

Health Care Facilities 2.87% | | 8,327,250 |

|

| Community Health Systems, Inc. (I)(L) | 125,000 | 4,638,750 |

|

| DaVita, Inc. (I) | 75,000 | 3,688,500 |

Health Care Services 15.23% | | 44,133,348 |

|

| Advisory Board Co. (The) (I)(L) | 70,000 | 3,377,500 |

|

| Caremark Rx, Inc. (A)(I) | 180,000 | 9,432,000 |

|

| Covance, Inc. (I)(L) | 90,000 | 4,378,500 |

|

| Cytokinetics, Inc. (I) | 17,000 | 132,515 |

|

| Emdeon Corp. (A)(I) | 100,000 | 920,000 |

|

| ICON Plc, American Depositary Receipt (ADR) (Ireland) (I) | 65,000 | 2,614,950 |

|

| IDX Systems Corp. (I) | 80,000 | 3,471,200 |

|

| Magellan Health Services, Inc. (I) | 160,000 | 4,756,800 |

|

| Medco Health Solutions, Inc. (I)(L) | 94,910 | 5,362,415 |

|

| Nektar Therapeutics (I) | 22,000 | 331,320 |

|

| Onyx Pharmaceuticals, Inc. (I) | 119,200 | 3,062,248 |

|

| Quest Diagnostics, Inc. | 30,000 | 1,401,300 |

|

| Stericycle, Inc. (I)(L) | 85,000 | 4,892,600 |

Health Care Supplies 6.24% | | 18,096,792 |

|

| Alcon, Inc. (Switzerland) | 30,000 | 3,987,000 |

|

| Bioenvision, Inc. (I)(L) | 185,000 | 1,134,050 |

|

| ev3, Inc. (I)(L) | 76,500 | 1,146,735 |

|

| Gen-Probe, Inc. (I)(L) | 95,000 | 3,879,800 |

|

| Healthcare Acquisition Corp. (I) | 150,000 | 1,042,500 |

|

| Inhibitex, Inc. (I)(B) | 300,000 | 2,697,300 |

|

| OrthoLogic Corp. (I) | 2,145 | 6,907 |

| |

See notes to

financial statements. |

|

11

| F I N A N C I A L S TAT E M E N T S | | |

| |

| |

| Issuer | Shares | Value |

Health Care Supplies (continued) | | |

|

| Retractable Technologies, Inc. (I) | 50,000 | $202,500 |

|

| Rotech Healthcare, Inc. (I) | 200,000 | 4,000,000 |

Life & Health Insurance 0.66% | | 1,924,000 |

|

| Universal American Financial Corp. (I)(L) | 130,000 | 1,924,000 |

Managed Health Care 8.37% | | 24,266,162 |

|

| CIGNA Corp. | 30,000 | 3,476,100 |

|

| PacifiCare Health Systems, Inc. (A)(I) | 41,700 | 3,434,412 |

|

| UnitedHealth Group, Inc. (L) | 145,000 | 8,394,050 |

|

| WellPoint, Inc. (I) | 120,000 | 8,961,600 |

Pharmaceuticals 23.95% | | 69,423,712 |

|

| Abbot Laboratories | 230,000 | 9,901,500 |

|

| Andrx Corp. (I) | 160,000 | 2,475,200 |

|

| ARIAD Pharmaceuticals, Inc. (I)(L) | 100,000 | 696,000 |

|

| Aspreva Pharmaceuticals Corp. (Canada) (I)(L) | 80,000 | 1,113,600 |

|

| Connetics Corp. (I) | 5,000 | 65,200 |

|

| Cubist Pharmaceuticals, Inc. (I) | 100,000 | 2,021,000 |

|

| ICOS Corp. (I) | 5,000 | 134,900 |

|

| ImClone Systems, Inc. (I) | 85,500 | 2,966,850 |

|

| IVAX Corp. (I) | 179,400 | 5,121,870 |

|

| Johnson & Johnson | 120,000 | 7,514,400 |

|

| Medicines Co. (The) (I)(L) | 210,000 | 3,599,400 |

|

| MGI Pharma, Inc. (I)(L) | 115,000 | 2,157,400 |

|

| Novartis AG, (ADR) (Switzerland) | 145,000 | 7,803,900 |

|

| Pfizer, Inc. | 158,800 | 3,452,312 |

|

| Pharmion Corp. (I) | 5,000 | 94,450 |

|

| Progenics Pharmaceuticals, Inc. (I)(L) | 130,000 | 3,060,200 |

|

| Rigel Pharmaceuticals, Inc. (I) | 15,000 | 336,750 |

|

| Roche Holding AG (Switzerland) | 45,000 | 6,712,880 |

|

| Salix Pharmaceuticals, Ltd. (I) | 7,000 | 125,580 |

|

| Shire Pharmaceutical Group Plc, (ADR) (United Kingdom) | 181,000 | 6,487,040 |

|

| Teva Pharmaceutical Industries Ltd., (ADR) (Israel) | 94,000 | 3,583,280 |

| |

Issuer | Shares | Value |

|

Warrants 0.05% | | $151,500 |

| (Cost $142,500) | | |

Health Care Supplies 0.05% | | 151,500 |

|

| Healthcare Acquisition Corp. (I) | 150,000 | 151,500 |

| |

| See notes to | | |

| financial statements. | | |

12

| | | | F I N A N C I A L | S TAT E M E N T S |

| |

| |

| |

| | | Interest | Par value | |

| Issuer, description, maturity date | | rate | (000) | Value |

|

| Short-term investments 23.33% | | | $67,625,088 |

| (Cost $67,625,088) | | | | |

Joint Repurchase Agreement 2.79% | | | 8,072,000 |

|

| Investment in a joint repurchase agreement transaction | | | |

| with Barclays Capital, Inc. -- Dated 10-31-05 | | | |

| due 11-1-05 (secured by U.S. Treasury Inflation | | | |

| Indexed Notes 0.875% due 4-15-10 and 1.875% | | | |

| due 7-15-13) | | 3.94% | $8,072 | 8,072,000 |

| |

| | | | Shares | |

| Cash Equivalents 20.54% | | | | 59,553,088 |

|

| AIM Cash Investment Trust (T) | | | 59,553,088 | 59,553,088 |

|

| Total investments 122.59% | | | | $355,372,690 |

|

| |

| Other assets and liabilities, net (22.59%) | | | ($65,479,845) |

|

| |

| Total net assets 100.00% | | | | $289,892,845 |

| |

| | | | Shares | Value |

|

| Investments sold short | | | | $4,494,200 |

| (Proceeds $4,176,479) | | | | |

Health Care Equipment | | | | 3,549,200 |

|

| Intuitive Surgical, Inc. (I) | | | 40,000 | 3,549,200 |

Health Care Services | | | | 945,000 |

|

| WellCare Health Plans, Inc. (I) | | | 30,000 | 945,000 |

| (A) | These securities have been segregated by the Fund’s custodian bank to secure the Fund’s outstanding short sale positions. |

| |

| (B) | This security is fair valued in good faith under procedures established by the Board of Trustees. |

| |

| (I) | Non-income-producing security. |

| |

| (L) | All or a portion of this security is on loan as of October 31, 2005. |

| |

| (T) | Represents investment of securities lending collateral. |

| |

| | Parenthetical disclosure of a foreign country in the security description represents country of a foreign issuer. The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund. |

| |

See notes to

financial statements.

|

13

F I N A N C I A L S TAT E M E N T S

ASSETS AND

LIABILITIES

October 31, 2005

This Statement

of Assets and

Liabilities is the

Fund’s balance

sheet. It shows

the value of

what the Fund

owns, is due

and owes. You’ll

also find the net

asset value and

the maximum

offering price

per share.

|

| Assets | |

| Investments, at value (cost $263,115,768) | |

| including $58,383,620 of securities loaned | $355,372,690 |

| Cash | 1,743,770 |

| Receivable for shares sold | 205,451 |

| Dividends and interest receivable | 83,985 |

| Other assets | 16,474 |

| Total assets | 357,422,370 |

|

| Liabilities | |

| Payable for investments purchased | 2,131,024 |

| Payable for shares repurchased | 507,826 |

| Payable upon return of securities loaned | 59,553,088 |

| Payable for investments sold short, at value | |

| (proceeds $4,176,479) | 4,494,200 |

| Payable to affiliates | |

| Management fees | 613,787 |

| Distribution and service fees | 25,181 |

| Other | 98,729 |

| Other payables and accrued expenses | 105,690 |

| Total liabilities | 67,529,525 |

|

| Net assets | |

| Capital paid-in | 173,112,659 |

| Accumulated net realized gain on investments | |

| and foreign currency transactions | 24,849,972 |

| Net unrealized appreciation of investments | |

| and translation of assets and liabilities | |

| in foreign currencies | 91,937,864 |

| Accumulated net investment loss | (7,650) |

| Net assets | $289,892,845 |

|

| Net asset value per share | |

| Based on net asset values and shares outstanding -- | |

| the Fund has an unlimited number of shares | |

| authorized with no par value | |

| Class A ($149,164,018 ÷ 3,038,607 shares) | $49.09 |

| Class B ($124,102,014 ÷ 2,772,694 shares) | $44.76 |

| Class C ($16,626,813 ÷ 371,453 shares) | $44.76 |

|

| Maximum offering price per share | |

| Class A1 ($49.09 ÷ 95%) | $51.67 |

| 1 | On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced. |

| |

See notes to financial statements.

14

F I N A N C I A L S TAT E M E N T S

OPERATIONS

For the year ended

October 31, 2005

This Statement

of Operations

summarizes the

Fund’s investment

income earned and

expenses incurred

in operating the

Fund. It also

shows net gains

(losses) for the

period stated.

|

| Investment income | |

| Dividends (net of foreign withholding taxes of $42,842) | $1,000,803 |

| Interest | 328,566 |

| Securities lending | 80,184 |

| Total investment income | 1,409,553 |

|

Expenses | |

| Investment management fees | 2,177,111 |

| Class A distribution and service fees | 416,419 |

| Class B distribution and service fees | 1,292,698 |

| Class C distribution and service fees | 143,683 |

| Transfer agent fees | 1,033,736 |

| Printing | 105,074 |

| Custodian fees | 67,977 |

| Accounting and legal services fees | 67,023 |

| Registration and filing fees | 41,936 |

| Professional fees | 41,525 |

| Miscellaneous | 24,245 |

| Trustees’ fees | 14,287 |

| Interest | 12,144 |

| Compliance fees | 5,242 |

| Securities lending fees | 3,809 |

| Total expenses | 5,446,909 |

| Less expense reductions | (47,478) |

| Net expenses | 5,399,431 |

| Net investment loss | (3,989,878) |

|

Realized and unrealized gain (loss) | |

| Net realized gain (loss) on | |

| Investments | 37,080,982 |

| Foreign currency transactions | (1,926) |

| Change in net unrealized appreciation (depreciation) of | |

| Investments | 12,234,465 |

| Investments sold short | (317,721) |

| Translation of assets and liabilities in foreign currencies | (1,663) |

| Net realized and unrealized gain | 48,994,137 |

| Increase in net assets from operations | $45,004,259 |

See notes to financial statements.

15

F I N A N C I A L S TAT E M E N T S

CHANGES IN

NET ASSETS

These Statements

of Changes in Net

Assets show how

the value of the

Fund’s net assets

has changed

during the last

two periods. The

difference reflects

earnings less

expenses, any

investment

gains and losses,

distributions, if

any, paid to

shareholders and

the net of Fund

share transactions.

|

| | Year | Year |

| | ended | ended |

| | 10-31-04 | 10-31-05 |

|

| Increase (decrease) in net assets | | |

| From operations | | |

| Net investment loss | ($4,377,016) | ($3,989,878) |

| Net realized gain | 22,478,975 | 37,079,056 |

| Change in net unrealized | | |

| appreciation (depreciation) | 5,299,222 | 11,915,081 |

| Increase in net assets resulting | | |

| from operations | 23,401,181 | 45,004,259 |

| Distributions to shareholders | | |

| From net realized gain | | |

| Class A | -- | (4,490,378) |

| Class B | -- | (5,195,070) |

| Class C | -- | (513,947) |

| | -- | (10,199,395) |

| From Fund share transactions | (35,461,797) | (16,812,190) |

|

| |

| Net assets | | |

| Beginning of period | 283,960,787 | 271,900,171 |

| End of period1 | $271,900,171 | $289,892,845 |

| 1 | Includes accumulated net investment loss of $6,874 and $7,650, respectively. |

| |

See notes to financial statements.

16

F I N A N C I A L H I G H L I G H T S

CLASS A SHARESThe Financial Highlights show how the Fund’s net asset value for a

share has changed since the end of the previous period.

| Period ended | 10-31-01 | 10-31-02 | 10-31-03 | 10-31-04 | 10-31-05 |

|

| Per share operating performance | | | | | |

| Net asset value, | | | | | |

| beginning of period | $49.99 | $40.06 | $34.67 | $39.79 | $43.22 |

| Net investment loss1 | (0.37) | (0.41) | (0.38) | (0.47) | (0.49) |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | (5.99) | (4.98) | 5.50 | 3.90 | 7.93 |

| Total from | | | | | |

| investment operations | (6.36) | (5.39) | 5.12 | 3.43 | 7.44 |

| Less distributions | | | | | |

| From net realized gain | (3.57) | -- | -- | -- | (1.57) |

| Net asset value, | | | | | |

| end of period | $40.06 | $34.67 | $39.79 | $43.22 | $49.09 |

| Total return2 (%) | (13.56) | (13.45) | 14.77 | 8.62 | 17.773 |

|

| Ratios and supplemental data | | | | | |

| Net assets, end of period | | | | | |

| (in millions) | $145 | $110 | $117 | $125 | $149 |

| Ratio of expenses | | | | | |

| to average net assets (%) | 1.50 | 1.59 | 1.67 | 1.57 | 1.56 |

| Ratio of adjusted expenses | | | | | |

| to average net assets4 (%) | -- | -- | -- | -- | 1.58 |

| Ratio of net investment loss | | | | | |

| to average net assets (%) | (0.87) | (1.06) | (1.04) | (1.08) | (1.06) |

| Portfolio turnover (%) | 91 | 85 | 95 | 54 | 505 |

See notes to financial statements.

17

F I N A N C I A L H I G H L I G H T S

CLASS B SHARES

| Period ended | 10-31-01 | 10-31-02 | 10-31-03 | 10-31-04 | 10-31-05 |

|

| Per share operating performance | | | | | |

| Net asset value, | | | | | |

| beginning of period | $47.55 | $37.68 | $32.39 | $36.91 | $39.81 |

| Net investment loss1 | (0.63) | (0.63) | (0.59) | (0.72) | (0.75) |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | (5.67) | (4.66) | 5.11 | 3.62 | 7.27 |

| Total from | | | | | |

| investment operations | (6.30) | (5.29) | 4.52 | 2.90 | 6.52 |

| Less distributions | | | | | |

| From net realized gain | (3.57) | -- | -- | -- | (1.57) |

| Net asset value, | | | | | |

| end of period | $37.68 | $32.39 | $36.91 | $39.81 | $44.76 |

| Total return2 (%) | (14.18) | (14.04) | 13.95 | 7.86 | 16.953 |

|

| Ratios and supplemental data | | | | | |

| Net assets, end of period | | | | | |

| (in millions) | $231 | $162 | $154 | $134 | $124 |

| Ratio of expenses | | | | | |

| to average net assets (%) | 2.20 | 2.29 | 2.37 | 2.27 | 2.26 |

| Ratio of adjusted expenses | | | | | |

| to average net assets4 (%) | -- | -- | -- | -- | 2.28 |

| Ratio of net investment loss | | | | | |

| to average net assets (%) | (1.57) | (1.76) | (1.74) | (1.77) | (1.76) |

| Portfolio turnover (%) | 91 | 85 | 95 | 54 | 505 |

See notes to financial statements.

18

F I N A N C I A L H I G H L I G H T S

CLASS C SHARES

| Period ended | 10-31-01 | 10-31-02 | 10-31-03 | 10-31-04 | 10-31-05 |

|

| Per share operating performance | | | | | |

| Net asset value, | | | | | |

| beginning of period | $47.55 | $37.68 | $32.39 | $36.91 | $39.81 |

| Net investment loss1 | (0.63) | (0.63) | (0.59) | (0.72) | (0.75) |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | (5.67) | (4.66) | 5.11 | 3.62 | 7.27 |

| Total from | | | | | |

| investment operations | (6.30) | (5.29) | 4.52 | 2.90 | 6.52 |

| Less distributions | | | | | |

| From net realized gain | (3.57) | -- | -- | -- | (1.57) |

| Net asset value, | | | | | |

| end of period | $37.68 | $32.39 | $36.91 | $39.81 | $44.76 |

| Total return2 (%) | (14.18) | (14.04) | 13.95 | 7.86 | 16.953 |

|

| Ratios and supplemental data | | | | | |

| Net assets, end of period | | | | | |

| (in millions) | $15 | $12 | $13 | $13 | $17 |

| Ratio of expenses | | | | | |

| to average net assets (%) | 2.20 | 2.29 | 2.37 | 2.27 | 2.26 |

| Ratio of adjusted expenses | | | | | |

| to average net assets4 (%) | -- | -- | -- | -- | 2.28 |

| Ratio of net investment loss | | | | | |

| to average net assets (%) | (1.58) | (1.76) | (1.73) | (1.78) | (1.76) |

| Portfolio turnover (%) | 91 | 85 | 95 | 54 | 505 |

| 1 | Based on the average of the shares outstanding. |

| |

| 2 | Assumes dividend reinvestment and does not reflect the effect of sales charges. |

| |

| 3 | Total returns would have been lower had certain expenses not been reduced during the period shown. |

| |

| 4 | Does not take into consideration expense reductions during the period shown. |

| |

| 5 | Excludes merger activity. |

| |

See notes to financial statements.

19

Note A

Accounting policies

John Hancock Health Sciences Fund (the “Fund”) is a non-diver-sified series of John Hancock World Fund, an open-end management investment company registered under the Investment Company Act of 1940. The investment objective of the Fund is to achieve long-term growth of capital.

The Trustees have authorized the issuance of multiple classes of shares of the Fund, designated as Class A, Class B and Class C shares. The shares of each class represent an interest in the same portfolio of investments of the Fund and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission and the Internal Revenue Service. Shareholders of a class that bears distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan.

Significant accounting policies

of the Fund are as follows:

Valuation of investments

Securities in the Fund’s portfolio are valued on the basis of market quotations, valuations provided by independent pricing services or, if quotations are not readily available, or the value has been materially affected by events occurring after the close of a foreign market, at fair value as determined in good faith in accordance with procedures approved by the Trustees. Short-term debt investments which have a remaining maturity of 60 days or less may be valued at amortized cost, which approximates market value. Investments in AIM Cash Investment Trust are valued at their net asset value each business day. All portfolio transactions initially expressed in terms of foreign currencies have been translated into U.S. dollars as described in “Foreign currency translation” below.

Joint repurchase agreement

Pursuant to an exemptive order issued by the Securities and Exchange Commission, the Fund, along with other registered investment companies having a management contract with John Hancock Advisers, LLC (the “Adviser”), a wholly owned subsidiary of John Hancock Financial Services, Inc., may participate in a joint repurchase agreement transaction. Aggregate cash balances are invested in one or more large repurchase agreements, whose underlying securities are obligations of the U.S. government and/or its agencies. The Fund’s custodian bank receives delivery of the underlying securities for the joint account on the Fund’s behalf. The Adviser is responsible for ensuring that the agreement is fully collateralized at all times.

20

Foreign currency

translation

All assets or liabilities initially expressed in terms of foreign currencies are translated into U.S. dollars based on London currency exchange quotations as of 4:00 P.M., London time, on the date of any determination of the net asset value of the Fund. Transactions affecting statement of operations accounts and net realized gain (loss) on investments are translated at the rates prevailing at the dates of the transactions.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign currency exchange gains or losses arise from sales of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency exchange gains and losses arise from changes in the value of assets and liabilities, other than investments in securities, resulting from changes in the exchange rates.

Investment transactions

Investment transactions are recorded as of the date of purchase, sale or maturity. Net realized gains and losses on sales of investments are determined on the identified cost basis. Capital gains realized on some foreign securities are subject to foreign taxes, which are accrued as applicable.

Class allocations

Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the appropriate net asset value of the respective classes. Distribution and service fees, if any, are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rate(s) applicable to each class.

Expenses

The majority of expenses are directly identifiable to an individual fund. Expenses that are not readily identifi-able to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative sizes of the funds.

Bank borrowings

The Fund is permitted to have bank borrowings for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The Fund has entered into a syndicated line of credit agreement with various banks. This agreement enables the Fund to participate, with other funds managed by the Adviser, in an unsecured line of credit with banks, which permits borrowings of up to $250 million, collectively. Interest is charged to each fund based on its borrowing. In addition, a commitment fee is charged to each fund based on the average daily unused portion of the line of credit, and is allocated among the participating funds. The Fund had no borrowing activity under the line of credit during the year ended October 31, 2005.

Securities lending

The Fund may lend securities to certain qualified brokers who pay the Fund negotiated lender fees. The loans are collateralized at all times with cash or securities with a market value at least equal to the market value of the securities on loan. As with other extensions of credit, the Fund may bear the risk of delay of the loaned securities in recovery or even loss of rights in the collateral, should the borrower of the securities fail financially. On October 31, 2005, the Fund loaned securities having a market value of $58,383,620

21

collateralized by cash in the amount of $59,553,088 collateral was invested in a short-term instrument. Securities lending expenses are paid by the Fund to the Adviser.

Short sales

The Fund, in “selling short”, sells borrowed securities, which must at some date be repurchased and returned to the lender. The risk associated with this practice is that, if the market value of securities sold short increases, the Fund may realize losses upon repurchase at prices which may exceed the prices used in determining the liability on the Fund’s Statement of Assets and Liabilities. Further, in unusual circumstances, the Fund may be unable to repurchase securities to close its short positions except at prices above those previously quoted in the market.

Forward foreign currency

exchange contracts

The Fund may enter into forward foreign currency exchange contracts as a hedge against the effect of fluctuations in currency exchange rates. A forward foreign currency exchange contract involves an obligation to purchase or sell a specific currency at a future date at a set price. The aggregate principal amounts of the contracts are marked to market daily at the applicable foreign currency exchange rates. Any resulting unrealized gains and losses are included in the determination of the Fund’s daily net asset value. The Fund records realized gains and losses at the time the forward foreign currency exchange contracts are closed out. Risks may arise upon entering these contracts from the potential inability of counterparties to meet the terms of the contracts and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar. These contracts involve market or credit risk in excess of the unrealized gain or loss reflected in the Fund’s Statement of Assets and Liabilities.

The Fund may also purchase and sell forward contracts to facilitate the settlement of foreign currency denominated portfolio transactions, under which it intends to take delivery of the foreign currency. Such contracts normally involve no market risk if they are offset by the currency amount of the underlying transactions.

The Fund had no open forward foreign currency exchange contracts on October 31, 2005.

Federal income taxes

The Fund qualifies as a “regulated investment company” by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required. For federal income tax purposes, the Fund has $3,694,388 of a capital loss carryforward available, to the extent provided by regulations, to offset future net realized capital gains. To the extent that such carryforward is used by the Fund, no capital gain distributions will be made. The loss carryforward expires as follows: October 31, 2009 - --$2,309,251 and October 31, 2010 -- $1,385,137. Availability of a certain amount of the carryforwards which were acquired on June 10, 2005 in a merger with John Hancock Biotechnology Fund may be limited in a given year.

Dividends, interest

and distributions

Dividend income on investment securities is recorded on the ex-dividend date or, in the case of some foreign securities, on the date thereafter when the Fund identifies the dividend. Interest income on investment securities is recorded on the accrual basis. Foreign income may be subject to foreign withholding taxes, which are accrued as applicable.

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. During the year ended October 31, 2004, there

22

were no distributions. During the year ended October 31, 2005, the tax character of distributions paid was as follows: long-term capital gain $10,199,395. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

As of October 31, 2005, the components of distributable earnings on a tax basis included $31,224,870 of undistributed long-term gain.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Use of estimates

The preparation of these financial statements, in accordance with accounting principles generally accepted in the United States of America, incorporates estimates made by management in determining the reported amount of assets, liabilities, revenues and expenses of the Fund. Actual results could differ from these estimates.

Note B

Management fee

and transactions with

affiliates and others

The Fund has an investment management contract with the Adviser. Under the investment management contract, the Fund pays a quarterly management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.80% of the first $200,000,000 of the Fund’s average daily net asset value and (b) 0.70% of the Fund’s daily average net asset value in excess of $200,000,000.

The Fund has Distribution Plans with John Hancock Funds, LLC (“JH Funds”), a wholly owned subsidiary of the Adviser. The Fund has adopted Distribution Plans with respect to Class A, Class B and Class C, pursuant to Rule 12b-1 under the Investment Company Act of 1940, to reimburse JH Funds for the services it provides as distributor of shares of the Fund. Accordingly, the Fund makes monthly payments to JH Funds at an annual rate not to exceed 0.30% of Class A average daily net asset value and 1.00% of Class B and Class C average daily net asset value. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of the National Association of Securities Dealers. Under the Conduct Rules, curtailment of a portion of the Fund’s 12b-1 payments could occur under certain circumstances.

Class A shares are assessed up-front sales charges. During the year ended October 31, 2005, JH Funds received net up-front sales charges of $167,420 with regard to sales of Class A shares. Of this amount, $24,041 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $116,394 was paid as sales commissions to unrelated broker-dealers and $26,985 was paid as sales commissions to sales personnel of Signator Investors, Inc. (“Signator Investors”), a related broker-dealer. The Adviser’s indirect parent, John Hancock Life Insurance Company (“JHLICo”), is the indirect sole shareholder of Signator Investors.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (“CDSC”) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from the CDSCs are paid to JH Funds and are used, in whole or in part, to defray its expenses for providing

23

distribution-related services to the Fund in connection with the sale of Class B and Class C shares. During the year ended October 31, 2005, CDSCs received by JH Funds amounted to $236,630 for Class B shares and $986 for Class C shares.

The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (“Signature Services”), an indirect subsidiary of JHLICo. The Fund pays a monthly transfer agent fee at an annual rate of 0.05% of each class’s average daily net asset values, plus a fee based on the number of shareholder accounts and reimbursement for certain out-of-pocket expenses, aggregated and allocated to each class on the basis of its relative net asset value. Signature Services agreed to voluntarily reduce the Fund’s asset-based portion of the transfer agent fee if the total transfer agent fee exceeds the Lipper, Inc. median transfer agency fee for comparable mutual funds by 0.05% . Accordingly, the transfer agent expense for Class A, Class B and Class C shares was reduced by $47,478 for the year ended October 31, 2005. Signature Services reserves the right to terminate this limitation at any time.

The Fund has an agreement with the Adviser to perform necessary tax, accounting and legal services for the Fund. The compensation for the year amounted to $67,023. The Fund also paid the Adviser the amount of $788 for certain publishing services, included in the printing fees. The Fund also reimbursed JHLICo for certain compliance costs, included in the Fund’s Statement of Operations.

Mr. James R. Boyle is an officer of certain affiliates of the Adviser, as well as affiliated Trustee of the Fund, and is compensated by the Adviser and/or its affiliates. The compensation of other unaffiliated Trustees is borne by the Fund. The unaffiliated Trustees may elect to defer, for tax purposes, their receipt of this compensation under the John Hancock Group of Funds Deferred Compensation Plan. The Fund makes investments into other John Hancock funds, as applicable, to cover its liability for the deferred compensation. Investments to cover the Fund’s deferred compensation liability are recorded on the Fund’s books as an other asset. The deferred compensation liability and the related other asset are always equal and are marked to market on a periodic basis to reflect any income earned by the investments, as well as any unrealized gains or losses. The Deferred Compensation Plan investments had no impact on the operations of the Fund.

24

Note C

Fund share transactions

This listing illustrates the number of Fund shares sold, issued in reorganization, reinvested and repurchased during the last two periods, along with the corresponding dollar value.

| | Year ended 10-31-04 | Year ended 10-31-05 |

| | Shares | Amount | Shares | Amount |

|

| Class A shares | | | | |

| Sold | 838,297 | $37,031,926 | 680,605 | $31,548,459 |

| Issued in reorganization | -- | -- | 134,447 | 6,204,667 |

| Distributions reinvested | -- | -- | 100,940 | 4,292,992 |

| Repurchased | (881,741) | (38,668,127) | (772,658) | (35,802,443) |

| Net increase (decrease) | (43,444) | ($1,636,201) | 143,334 | $6,243,675 |

|

| |

| Class B shares | | | | |

| Sold | 570,109 | $22,972,932 | 258,383 | $11,089,162 |

| Issued in reorganization | -- | -- | 162,701 | 6,864,958 |

| Distributions reinvested | -- | -- | 125,964 | 4,916,350 |

| Repurchased | (1,396,371) | (56,382,735) | (1,129,243) | (47,633,095) |

| Net decrease | (826,262) | ($33,409,803) | (582,195) | ($24,762,625) |

|

| |

| Class C shares | | | | |

| Sold | 92,939 | $3,788,765 | 61,221 | $2,630,110 |

| Issued in reorganization | -- | -- | 62,469 | 2,635,984 |

| Distributions reinvested | -- | -- | 11,660 | 455,107 |

| Repurchased | (105,002) | (4,204,558) | (96,007) | (4,014,441) |

| Net increase (decrease) | (12,063) | ($415,793) | 39,343 | $1,706,760 |

|

| |

| Net decrease | (881,769) | ($35,461,797) | (399,518) | ($16,812,190) |

Note D

Investment transactions

Purchases and proceeds from sales or maturities of securities, other than short-term securities and obligations of the U.S. government, during the year ended October 31, 2005, aggregated $137,339,986 and $167,232,991, respectively.

The cost of investments owned on October 31, 2005, including short-term investments, for federal income tax purposes, was $265,796,278. Gross unrealized appreciation and depreciation of investments aggregated $96,902,462 and $7,326,050, respectively, resulting in net unrealized appreciation of $89,576,412. The difference between book basis and tax basis net unrealized appreciation of investments is attributable primarily to the tax deferral of losses certain sales of securities.

Note E

Reclassification

of accounts

During the year ended October 31, 2005, the Fund reclassified amounts to reflect a decrease in accumulated net realized gain on investments of $8,205,438, a decrease in accumulated net investment loss of $3,989,102 and an increase in capital paid-in of $4,216,336. This represents the amounts necessary to report these balances on a tax basis, excluding certain temporary differences, as of October 31, 2005. Additional adjustments may be needed in subsequent reporting periods. These reclassifications, which have no impact on the net asset value of the Fund, are primarily attributable to certain differences in the computation of distributable income and capital gains under federal tax rules versus

25

accounting principles generally accepted in the United States of America, book and tax differences in accounting for net operating loss, deferred compensation and certain foreign currency adjustments. The calculation of net investment loss per share in the Fund’s Financial Highlights excludes these adjustments.

Note F

Reorganization

On June 8, 2005, the shareholders of the John Hancock Biotechnology Fund (“Biotechnology Fund”) approved an Agreement and Plan of Reorganization, which provided for the transfer of substantially all of the assets and liabilities of the Biotechnology Fund in exchange for Class A, Class B and Class C shares of the Fund. The acquisition was accounted for as a tax-free exchange of 134,447 Class A shares, 162,701 Class B shares and 62,469 Class C shares of the Fund for the net assets of the Biotechnology Fund, which amounted to $6,204,667, $6,864,958 and $2,635,984 for Class A, Class B and Class C shares of the Biotechnology Fund, including $2,020,906 of unrealized appreciation of investments, after the close of business on June 10, 2005.

Shareholder meeting (unaudited)

On December 1, 2004, a Special Meeting of shareholders of the Fund was held to elect nine Trustees effective January 1, 2005.

Proxies covering 5,416,269 shares of beneficial interest were voted at the meeting.

The shareholders elected the following Trustees to serve until their respective successors are duly elected and qualified, with the votes tabulated as follows:

| | | W I T H H E L D |

| | F O R | A U T H O R I T Y |

|

| James F. Carlin | 5,298,019 | 118,250 |

| Richard P. Chapman, Jr. | 5,292,095 | 124,174 |

| William H. Cunningham | 5,292,069 | 124,200 |

| Ronald R. Dion | 5,296,819 | 119,450 |

| Charles L. Ladner | 5,293,897 | 122,372 |

| Dr. John A. Moore | 5,293,818 | 122,451 |

| Patti McGill Peterson | 5,291,747 | 124,522 |

| Steven R. Pruchansky | 5,294,370 | 121,899 |

| James A. Shepherdson* | 5,293,700 | 122,569 |

| * Mr. James A. Shepherdson resigned effective July 15, 2005. | |

26

AUDITORS’

REPORT

Report of

Independent

Registered Public

Accounting Firm |

To the Board of Trustees and Shareholders of John Hancock

Health Sciences Fund,

|

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock Health Sciences Fund (the “Fund”) at October 31, 2005, the results of its operations, the changes in its net assets and the financial highlights for the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2005 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.PricewaterhouseCoopers LLP

Boston, Massachusetts

December 14, 2005

|

27

For federal income tax purposes, the following information is furnished with respect to the distributions of the Fund, if any, paid during its taxable year ended October 31, 2005.

The Fund designated distributions to shareholders of $10,199,395 as capital gain dividends.

The Fund hereby designates the maximum amount allowable of its net taxable income as qualified dividend income as provided in the Jobs and Growth Tax Relief Reconciliation Act of 2003. This amount will be reflected on Form 1099-DIV for the calendar year 2005.

Shareholders will be mailed a 2005 U.S. Treasury Department Form 1099-DIV in January 2006. This will reflect the total of all distributions that are taxable for calendar year 2005.

28

Board Consideration

of and Continuation

of Investment

Advisory Agreement:

John Hancock Health

Sciences Fund

Section 15(c) of the Investment Company Act of 1940 (the “1940 Act”) requires the Board of Trustees (the “Board”) of John Hancock World Fund (the “Trust”), including a majority of the Trustees who have no direct or indirect interest in the investment advisory agreement and are not “interested persons” of the Trust, as defined in the 1940 Act (the “Independent Trustees”), annually to review and consider the continuation of the investment advisory agreement (the “Advisory Agreement”) with John Hancock Advisers, LLC (the “Adviser”) for the John Hancock Health Sciences Fund (the “Fund”).

At meetings held on May 19-20 and June 6-7, 2005, the Board, including the Independent Trustees, considered the factors and reached the conclusions described below relating to the selection of the Adviser and the continuation of the Advisory Agreement. During such meetings, the Board’s Contracts/Operations Committee and the Independent Trustees also met in executive sessions with their independent legal counsel. In evaluating the Advisory Agreement, the Board, including the Contracts/Operations Committee and the Independent Trustees, reviewed a broad range of information requested for this purpose by the Independent Trustees, including but not limited to the following: (i) the investment performance of the Fund and a broader universe of relevant funds (the “Universe”) selected by Lipper Inc. (“Lipper”), an independent provider of investment company data, for a range of periods, (ii) advisory and other fees incurred by, and the expense ratios of, the Fund and a peer group of comparable funds selected by Lipper (the “Peer Group”), (iii) the advisory fees of comparable portfolios of other clients of the Adviser, (iv) the Adviser’s financial results and condition, including its and certain of its affiliates’ profitability from services performed for the Fund, (v) breakpoints in the Fund’s and the Peer Group’s fees and a study undertaken at the direction of the Independent Trustees as to the allocation of the benefits of economies of scale between the Fund and the Adviser, (vi) the Adviser’s record of compliance with applicable laws and regulations, with the Fund’s investment policies and restrictions, and with the Fund’s Code of Ethics and the structure and responsibilities of the Adviser’s compliance department, (vii) the background and experience of senior management and investment professionals, and (viii) the nature, cost and character of advisory and non-investment management services provided by the Adviser and its affiliates.

Nature, extent and quality

of services

The Board considered the ability of the Adviser, based on its resources, reputation and other attributes, to attract and retain qualified investment professionals, including research, advisory, and supervisory personnel. The Board further considered the compliance programs and compliance records of the Adviser. In addition, the Board took into account the administrative services provided to the Fund by the Adviser and its affiliates.

Based on the above factors, together with those referenced below, the Board concluded that, within the context of its full deliberations, the nature, extent and quality of the investment advisory services provided to the Fund by the Adviser were sufficient to support renewal of the Advisory Agreement.

Fund performance

The Board considered the performance results for the Fund over various time periods. The Board also considered these results in comparison to the performance of the Universe, as well as the Fund’s benchmark

29

indexes. Lipper determined the Universe for the Fund. The Board reviewed with a representative of Lipper the methodology used by Lipper to select the funds in the Universe and the Peer Group.

The Board noted that the performance of the Fund was higher than the median and average performance of its Universe over the more recent time periods under review and one of its benchmark indexes, the Russell 3000 Health Index for all but the longest time period under review. The Board also noted that the performance of the Fund was higher than or not appreciably lower than the performance of its other benchmark index, the Lipper Health/Biotechnology Funds Index, for all of time periods under review. Although the Fund’s performance was slightly lower than the median and average performance of its Universe and the performance of its benchmark indexes over the longer-term periods under review, the Board favorably considered the Fund’s improved performance during the more recent years.

Investment advisory fee

rates and expenses

The Board reviewed and considered the contractual investment advisory fee rate payable by the Fund to the Adviser for investment advisory services (the “Advisory Agreement Rate”). The Board received and considered information comparing the Advisory Agreement Rate with the advisory fees for the Peer Group. The Board noted that the Advisory Agreement Rate was lower than the median rate of the Peer Group. The Board concluded that the Advisory Agreement Rate was reasonable in relation to the services provided.

The Board received and considered information regarding the Fund’s total operating expense ratio and its various components, including contractual advisory fees, actual advisory fees, non-management fees, Rule 12b-1 and non-Rule 12b-1 service fees, transfer agent fees and custodian fees, including and excluding Rule 12b-1 and non-Rule 12b-1 service fees. The Board also considered comparisons of these expenses to the expense information for the Peer Group and the Universe. The Board noted that the total operating expense ratio of the Fund was not appreciably higher than the Peer Group’s and Universe’s median total operating expense ratio.

The Adviser also discussed the Lipper data and rankings, and other relevant information, for the Fund. Based on the above-referenced considerations and other factors, the Board concluded that the Fund’s overall expense results and performance supported the re-approval of the Advisory Agreement.

Profitability

The Board received and considered a detailed profitability analysis of the Adviser based on the Advisory Agreement, as well as on other relationships between the Fund and the Adviser and its affiliates. The Board concluded that, in light of the costs of providing investment management and other services to the Fund, the profits and other ancillary benefits reported by the Adviser were not unreasonable.

Economies of scale

The Board received and considered general information regarding economies of scale with respect to the management of the Fund, including the Fund’s ability to appropriately benefit from economies of scale under the Fund’s fee structure. The Board recognized the inherent limitations of any analysis of economies of scale, stemming largely from the Board’s understanding that most of the Adviser’s costs are not specific to individual Funds, but rather are incurred across a variety of products and services.

To the extent the Board and the Adviser were able to identify actual or potential economies of scale from Fund-specific or allocated expenses, in order to ensure

30

that any such economies continue to be reasonably shared with the Fund as its assets increase, the Adviser and the Board agreed to continue the existing breakpoints.

Information about

services to other clients

The Board also received information about the nature, extent and quality of services and fee rates offered by the Adviser to its other clients, including other registered investment companies, institutional investors and separate accounts. The Board concluded that the Advisory Agreement Rate was not unreasonable, taking into account fee rates offered to others by the Adviser and giving effect to differences in services covered by such fee rates.

Other benefits to

the adviser

The Board received information regarding potential “fall-out” or ancillary benefits received by the Adviser and its affiliates as a result of the Adviser’s relationship with the Fund. Such benefits could include, among others, benefits directly attributable to the relationship of the Adviser with the Fund and benefits potentially derived from an increase in the business of the Adviser as a result of its relationship with the Fund (such as the ability to market to shareholders other financial products offered by the Adviser and its affiliates).

The Board also considered the effectiveness of the Adviser’s and the Fund’s policies and procedures for complying with the requirements of the federal securities laws, including those relating to best execution of portfolio transactions and brokerage allocation.

Other factors and

broader review

As discussed above, the Board reviewed detailed materials received from the Adviser as part of the annual re-approval process under Section 15(c) of the 1940 Act. The Board also regularly reviews and assesses the quality of the services that the Fund receives throughout the year. In this regard, the Board reviews reports of the Adviser at least quarterly, which include, among other things, a detailed portfolio review, detailed fund performance reports and compliance reports. In addition, the Board meets with portfolio managers and senior investment officers at various times throughout the year.

After considering the above-described factors and based on its deliberations and its evaluation of the information described above, the Board concluded that approval of the continuation of the Advisory Agreement for the Fund was in the best interest of the Fund and its shareholders. Accordingly, the Board unanimously approved the continuation of the Advisory Agreement.

31

This chart provides information about the Trustees and Officers who oversee your John Hancock fund. Officers elected by the Trustees manage the day-to-day operations of the Fund and execute policies formulated by the Trustees.

| Independent Trustees | | |

Name, age | | Number of |

| Position(s) held with Fund | Trustee | John Hancock |

| Principal occupation(s) and other | of Fund | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

|

| Ronald R. Dion, Born: 1946 | 2005 | 53 |

| Independent Chairman (since 2005); Chairman and Chief Executive Officer, | | |

| R.M. Bradley & Co., Inc.; Director, The New England Council and Massachusetts | |

| Roundtable; Trustee, North Shore Medical Center; Director, Boston Stock | | |

| Exchange; Director, BJ’s Wholesale Club, Inc. and a corporator of the Eastern | | |

| Bank; Trustee, Emmanuel College; Director, Boston Municipal Research Bureau; | |

| Member of the Advisory Board, Carroll Graduate School of Management at | | |

| Boston College. | | |

|

| |

| James F. Carlin, Born: 1940 | 2005 | 53 |

| Director and Treasurer, Alpha Analytical Inc. (analytical laboratory) (since 1985); | |

| Part Owner and Treasurer, Lawrence Carlin Insurance Agency, Inc. (since 1995); | |

| Part Owner and Vice President, Mone Lawrence Carlin Insurance Agency, Inc. | | |

| (since 1996); Director and Treasurer, Rizzo Associates (engineering) (until 2000); | |

| Chairman and CEO, Carlin Consolidated, Inc. (management/investments) (since | |

| 1987); Director and Partner, Proctor Carlin & Co., Inc. (until 1999); Trustee, | | |

| Massachusetts Health and Education Tax Exempt Trust (since 1993); Director of | |

| the following: Uno Restaurant Corp. (until 2001), Arbella Mutual (insurance) | | |

| (until 2000), HealthPlan Services, Inc. (until 1999), Flagship Healthcare, Inc. (until | |

| 1999), Carlin Insurance Agency, Inc. (until 1999); Chairman, Massachusetts | | |

| Board of Higher Education (until 1999). | | |

|

| |

| Richard P. Chapman, Jr.,2 Born: 1935 | 1991 | 53 |

| President and Chief Executive Officer, Brookline Bancorp Inc. (lending) | | |

| (since 1972); Director, Lumber Insurance Co. (insurance) (until 2000); | | |

| Chairman and Director, Northeast Retirement Services, Inc. (retirement | | |

| administration) (since 1998). | | |

|

| |

| William H. Cunningham, Born: 1944 | 2005 | 143 |

| Former Chancellor, University of Texas System and former President of the | | |

| University of Texas, Austin, Texas; Chairman and CEO, IBT Technologies | | |

| (until 2001); Director of the following: The University of Texas Investment | | |

| Management Company (until 2000), Hire.com (until 2004), STC Broadcasting, | | |

| Inc. and Sunrise Television Corp. (electronic manufacturing) (until 2001), | | |

| Symtx, Inc. (electronic manufacturing) (since 2001), Adorno/Rogers Technology, | |

| Inc. (until 2004), Pinnacle Foods Corporation (until 2003), rateGenius (Internet | | |

32

| Independent Trustees (continued) | | |

Name, age | | Number of |

| Position(s) held with Fund | Trustee | John Hancock |

| Principal occupation(s) and other | of Fund | funds overseen |

| directorships during past 5 years | since1 | by Trustee |

|

| William H. Cunningham, Born: 1944 (continued) | 2005 | 143 |

| service) (until 2003), Jefferson-Pilot Corporation (diversified life insurance | | |

| company) (since 1985), New Century Equity Holdings (formerly Billing Concepts) | |

| (until 2001), eCertain (until 2001), ClassMap.com (until 2001), Agile Ventures | | |

| (until 2001), LBJ Foundation (until 2000), Golfsmith International, Inc. | | |