UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number 811- 4932

John Hancock World Fund

(Exact name of registrant as specified in charter)

|

601 Congress Street, Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

|

Alfred P. Ouellette

Senior Attorney and Assistant Secretary

|

601 Congress Street

Boston, Massachusetts 02210

(Name and address of agent for service)

|

Registrant's telephone number, including area code: 617-663-4324

| Date of fiscal year end: | October 31 |

| | |

| | |

| Date of reporting period: | April 30, 2006 |

ITEM 1. REPORT TO SHAREHOLDERS.

| Table of contents |

|

| Your fund at a glance |

| page 1 |

|

| Manager’s report |

| page 2 |

|

| A look at performance |

| page 6 |

|

| Growth of $10,000 |

| page 7 |

|

| Your expenses |

| page 8 |

|

| Fund’s investments |

| page 10 |

|

| Financial statements |

| page 14 |

|

| For more information |

| page 29 |

|

To Our Shareholders,

After producing modest returns in 2005, the stock market has advanced smartly in the first four months of 2006. The major indexes all advanced and produced four-month returns that were ahead of the market’s returns for all of 2005. For example, the Standard & Poor’s 500 Index returned 5.61% year-to-date through April 2006, versus 4.91% last year in total. Investors were encouraged by solid corporate earnings, a healthy economy and stable inflation, which suggested the Federal Reserve could be coming close to the end of its 18-month campaign of raising interest rates.

Despite the good results to date, it is anyone’s guess where the market will end 2006, especially given the wild cards of interest rate moves and record-high energy prices and their impact on corporate profits and the economy.

One thing we do know, however, is that the stock market’s pattern is one of extremes. Consider the last 10 years. From 1995 through 1999, we saw double-digit returns in excess of 20% per year, only to have 2000 through 2002 produce ever-increasing negative results, followed by another 20%-plus up year in 2004 and a less than 5% advance in 2005. Since 1926, the market, as measured by the Standard & Poor’s 500 Index, has produced average annual results of 10.4% . However, that “normal” return is rarely produced in any given year. In fact, calendar-year returns of 8% to 12% have occurred only five times in the 80 years since 1926.

Although the past in no way predicts the future, we have learned at least one lesson from history: Expect highs and lows in the short term, but always invest for the long term. Equally important: Work with your financial professional to maintain a diversified portfolio, spread out among not only different asset classes — stocks, bonds and cash — but also among various investment styles. It’s the best way we know of to benefit from, and weather, the market’s extremes.

Sincerely,

Keith F. Hartstein,

President and Chief Executive Officer

|

This commentary reflects the CEO’s views as of April 30, 2006. They are subject to change at any time.

YOUR FUND

AT A GLANCE

The Fund seeks long-term growth of capital by normally investing at least 80% of its assets in stocks of U.S. and foreign health sciences companies.

| | Over the last six months |

* | The stock market advanced smartly on solid economic and corporate |

| | earnings growth. |

* | Health care stocks produced positive results, but lagged the |

| | broad market. |

* | Advantageous stock selection was key to the Fund’s performance. |

Total returns for the Fund are at net asset value with all distributions reinvested. These returns do not reflect the deduction of the maximum sales charge, which would reduce the performance shown above.

| Top 10 holdings |

| 5.1% | Aveta, Inc. |

| 4.0% | Medtronic, Inc. |

| 3.2% | Nektar Therapeutics |

| 3.1% | Abbot Laboratories |

| 3.1% | Shire Pharmaceutical Group Plc |

| 3.1% | AstraZeneca Plc |

| 3.0% | Novartis AG |

| 2.9% | Hospira, Inc. |

| 2.8% | Amgen, Inc. |

| 2.5% | Roche Holding AG |

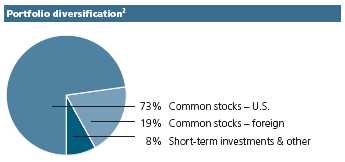

As a percentage of net assets on April 30, 2006.

1

BY ROBERT C. JUNKIN, CPA, FOR THE SOVEREIGN ASSET MANAGEMENT LLC

PORTFOLIO MANAGEMENT TEAM

|

JOHN HANCOCK

Health Sciences Fund

Health care stocks as a group posted gains for the six-month period ended April 30, 2006, although the sector’s returns signifi-cantly lagged the broader stock market. Like the stock market overall, health care stocks were buoyed by a pickup in U.S. and global economic growth. And despite repeated interest rate increases by the Federal Reserve Board, U.S. interest rates remained near historic lows, and inflation was contained. But health care stocks were constrained by slack demand as investors flocked to the stocks of more economically sensitive industry sectors, including energy and manufacturing companies.

The period was also characterized by a significant rotation away from biotech stocks, which slumped amid investors’ growing aversion to risk and their quest for more attractively valued securities, such as big drug stocks. The stage was set for drug stocks’ revival at the beginning of 2006; they were cited by many global money managers as one of the most undervalued industry sectors.

“Health care stocks as a group

posted gains for the six-month

period ended April 30, 2006,

although the sector’s returns

significantly lagged the broader

stock market.”

|

Performance

For the six months ended April 30, 2006, John Hancock Health Sciences Fund’s Class A, Class B and Class C shares posted total returns of 3.14%, 2.79% and 2.79%, respectively, at net asset value. During the same six-month period, the Russell 3000 Healthcare Index returned 3.43%, the average Morningstar specialty-health fund had a total return of 4.18% 1, and the Standard & Poor’s 500 Index returned 9.64% . Keep in mind that your net asset value return will be different from the Fund’s performance if you were not invested in the Fund for the entire period and did not reinvest all distributions. See pages six and seven for historical performance results.

2

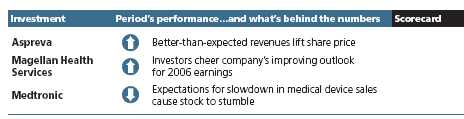

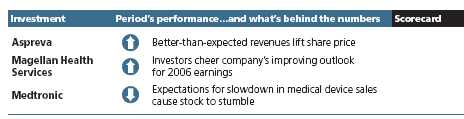

Leaders

Aiding the Fund’s performance was advantageous stock selection, with an eclectic group of holdings posting strong gains. One of the biggest contributors to the Fund’s return was Aspreva Pharmaceuticals Corp., which identifies, develops and commercializes new indications for approved drugs and late-stage drug candidates for patients living with less common diseases. Its stock more than doubled during the period, largely in response to better-than-expected revenues. The share price of managed behavioral health care company Magellan Health Services, Inc. was another winner, surging as its financial results flew past the consensus estimates of Wall Street analysts. Investors also cheered the company’s raising its outlook for earnings in 2006. We also scored well with Nektar Therapeutics. The stock roared after Exubera, the first inhalable insulin for adult diabetics developed by Nektar, Pfizer and French drug maker Sanofi-Aventis, received both U.S. and European approval. Gilead Sciences, Inc. also posted strong gains for the six-month period, driven higher by strong profit growth resulting from higher demand for its once-a-day pill to treat HIV, the virus that causes AIDS. The company also benefited from higher royalties from Tamiflu, a drug marketed by Roche Holding AG that is being stockpiled for a potential bird flu outbreak. Biotech concern Celgene Corp. also experienced strong gains. Sales are poised to beat expectations of the company’s new drug, Revlimid, which is approved to treat a group of blood disorders known as myelodysplastic syndromes and is expected to be approved for multiple myeloma.

“Aiding the Fund’s performance

was advantageous stock selection,

with an eclectic group of holdings

posting strong gains.”

|

LaggardsOn the flip side, we lost ground with Medtronic, Inc., the world’s largest maker of medical devices. It suffered from expectations that the company’s sales would slow, especially in light of the federal government’s proposed stiff cutbacks in Medicare reimbursements for implantable heart products and other medical devices. Despite posting solid earnings growth during the period, the nearly six-year bull run for U.S. health insurers came to a halt in the first quarter of 2006, as the leading companies that make up the group

3

| Industry | |

| distribution2 | |

|

| Pharmaceuticals |

| | 27% |

|

| Health care | |

| equipment | 19% |

|

| Health care | |

| services | 18% |

|

| Biotechnology | 15% |

|

| Managed | |

| health care | 6% |

|

| Agricultural | |

| products | 2% |

|

| Health care | |

| facilities | 2% |

|

| Health care | |

| supplies | 2% |

|

| Multi-utilities | |

| & unregulated | |

| power | 1% |

seemingly struggled under the weight of fears of rising medical costs, a tougher pricing climate and fewer new members. That trend hurt UnitedHealth Group, Inc., as did media and investor scrutiny of the company’s executive compensation program.

Three well-known biotech companies — Genzyme Corp., Genentech, Inc. and Amgen, Inc. — also were among our disappointments for the period, declining in value mainly due to the sector rotation away from the group into more attractively valued large pharmaceutical companies and other S&P industry groups. Simply put, Genzyme, Genentech and Amgen underperformed as many investors fled large-cap biotechs by cashing out after running up profits.

Outlook

Our outlook is contingent on whether the trends the health care sector experienced recently will prevail in coming months. One of the key questions is whether investors will continue to shun high-risk, highly valued sectors — namely biotech — and gravitate to more predictable, attractively valued groups such as drug stocks. Given the uncertainty over the future path of this trend, we plan to

maintain a more defensive stance, lowering our exposure to higher-volatility names and emphasizing more attractively valued companies with more predictable growth. From a top-down perspective, continued strong economic growth may prompt investors to continue to ignore the health care sector in search of faster-growing opportunities in economically cyclical industries. However, if the economy begins to show signs of slowing, health care stocks could

4

“...we plan to maintain a more defen-

sive stance, lowering our exposure to

higher-volatility names...”

|

be the market leaders. But over the longer term, our view is more bullish. Favorable demographic trends, most notably the aging global population, and new product and service innovations should support continued solid earnings growth for the health care group as a whole. Regardless of the environment, we’ll continue to look for companies with exciting new products and service developments whose stocks are selling at compelling valuations.

This commentary reflects the views of the manager through the end of the Fund’s period discussed in this report. The manager’s statements reflect his own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Sector investing is subject to greater risks than the market as a whole.

1 Figures from Morningstar, Inc. include reinvested dividends and do not take into account sales charges. Actual load-adjusted performance is lower.

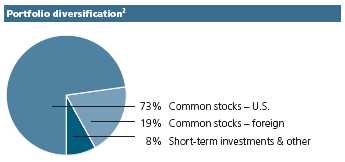

2 As a percentage of net assets on April 30, 2006.

5

A LOOK AT

PERFORMANCE

For the period ended

April 30, 2006

|

| | Class A | Class B | Class C |

| Inception date | 10-1-91 | 3-7-94 | 3-1-99 |

|

| Average annual returns with maximum sales charge (POP) | |

| One year | 7.11% | 6.98% | 10.97% |

|

| Five years | 3.89 | 3.89 | 4.23 |

|

| Ten years | 7.59 | 7.54 | — |

|

| Since inception | — | — | 6.09 |

|

| Cumulative total returns with maximum sales charge (POP) | |

| Six months | –2.01 | –1.79 | 1.87 |

|

| One year | 7.11 | 6.98 | 10.97 |

|

| Five years | 21.05 | 21.02 | 23.02 |

|

| Ten years | 107.90 | 106.91 | — |

|

| Since inception | — | — | 52.71 |

|

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The returns for Class C shares have been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month-end, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

6

This chart shows what happened to a hypothetical $10,000 investment in Class A shares for the period indicated. For comparison, we’ve shown the same investment in two separate indexes.

| | Class B1 | Class C1,2 |

| Period beginning | 4-30-96 | 3-1-99 |

|

| |

| Health Sciences Fund | $20,691 | $15,271 |

|

| Index 1 | 23,544 | 11,848 |

|

| Index 2 | 24,817 | 11,779 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B and Class C shares, respectively, as of April 30, 2006. The Class C shares investment with maximum sales charge has been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Standard & Poor’s 500 Index — Index 1 — is an unmanaged index that includes 500 widely traded common stocks.

Russell 3000 Healthcare Index — Index 2 — is a capitalization-weighted index composed of companies involved in medical services or health care.

It is not possible to invest directly in an index. Index figures do not reflect sales charges and would be lower if they did.

1 No contingent deferred sales charge applicable.

2 Index 2 as of February 28, 1999.

7

These examples are intended to help you understand your ongoing

operating expenses.

| Understanding fund expenses |

| As a shareholder of the Fund, you incur two types of costs: |

* | Transaction costs which include sales charges (loads) on |

| purchases or redemptions (varies by share class), minimum |

| account fee charge, etc. |

* | Ongoing operating expenses including management |

| fees, distribution and service fees (if applicable) and other |

| fund expenses. |

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on October 31, 2005, with the same investment held until April 30, 2006.

| Account value | | Expenses paid |

| $1,000.00 | Ending value | during period |

| on 10-31-05 | on 4-30-06 | ended 4-30-061 |

|

| Class A | $1,031.40 | $7.41 |

| Class B | 1,027.90 | 10.95 |

| Class C | 1,027.90 | 10.95 |

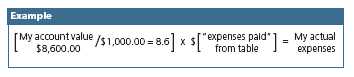

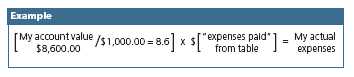

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at April 30, 2006 by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

8

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annual return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on October 31, 2005, with the same investment held until April 30, 2006. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| Account value | | Expenses paid |

| $1,000.00 | Ending value | during period |

| on 10-31-05 | on 4-30-06 | ended 4-30-061 |

|

| Class A | $1,017.50 | $7.36 |

| Class B | 1,014.00 | 10.88 |

| Class C | 1,014.00 | 10.88 |

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.47%, 2.17% and 2.17% for Class A, Class B and Class C, respectively, multiplied by the average account value over the period, multiplied by number of days in most recent fiscal half-year/365 or 366 (to reflect the one-half year period).

9

F I N A N C I A L S TAT E M E N T S

Securities owned

by the Fund on

April 30, 2006

(unaudited)

|

This schedule is divided into three main categories: common stocks, warrants and short-term investments. Common stocks and warrants are further broken down by industry group. Short-term investments, which represent the Fund’s cash position, are listed last.

| Issuer | Shares | Value |

|

| Common stocks 91.94% | | $253,081,570 |

| (Cost $193,569,125) | | |

Agricultural Products 1.52% | | 4,200,000 |

|

| Corn Products International, Inc. | 150,000 | 4,200,000 |

Biotechnology 15.44% | | 42,500,470 |

|

| Acorda Therapeutics, Inc. (I) | 400,000 | 1,960,000 |

|

| Amgen, Inc. (A)(I) | 113,550 | 7,687,335 |

|

| Celgene Corp. (I)(L) | 70,000 | 2,951,200 |

|

| Genentech, Inc. (I)(L) | 65,450 | 5,217,020 |

|

| Genzyme Corp. (I) | 90,000 | 5,504,400 |

|

| Gilead Sciences, Inc. (I) | 97,000 | 5,577,500 |

|

| Human Genome Sciences, Inc. (I)(L) | 105,000 | 1,198,050 |

|

| Medarex, Inc. (I)(L) | 332,500 | 3,993,325 |

|

| Neurocrine Biosciences, Inc. (I)(L) | 56,000 | 3,212,160 |

|

| OSI Pharmaceuticals, Inc. (I) | 144,000 | 3,826,080 |

|

| Regeneration Technologies, Inc. (I) | 180,000 | 1,373,400 |

Health Care Equipment 19.25% | | 52,978,020 |

|

| ABIOMED, Inc. (I)(L) | 100,000 | 1,293,000 |

|

| ArthroCare Corp. (I)(L) | 75,000 | 3,399,750 |

|

| Boston Scientific Corp. (A)(I) | 250,345 | 5,818,018 |

|

| Cardica, Inc. (I) | 125,000 | 991,250 |

|

| Cooper Companies, Inc. (The) (L) | 75,000 | 4,111,500 |

|

| Electro-Optical Sciences, Inc. (I) | 250,000 | 1,450,000 |

|

| Fisher Scientific International, Inc. (I) | 73,500 | 5,185,425 |

|

| Hospira, Inc. (A)(I) | 204,150 | 7,869,983 |

|

| Medtronic, Inc. (A) | 222,300 | 11,141,676 |

|

| St. Jude Medical, Inc. (I) | 142,850 | 5,639,718 |

|

| Stereotaxis, Inc. (I)(L) | 270,000 | 3,196,800 |

|

| Varian Medical Systems, Inc. (I)(L) | 55,000 | 2,880,900 |

See notes to

financial statements.

|

10

F I N A N C I A L S TAT E M E N T S

| Issuer | Shares | Value |

Health Care Facilities 2.07% | | $5,694,080 |

|

| Community Health Systems, Inc. (I) | 79,500 | 2,881,080 |

|

| DaVita, Inc. (I) | 50,000 | 2,813,000 |

Health Care Services 17.49% | | 48,150,450 |

|

| AnorMED, Inc. (Canada) (I) | 500,000 | 3,391,192 |

|

| Aveta, Inc. (I)(S) | 862,790 | 14,020,337 |

|

| Hythiam, Inc. (I)(L) | 100,000 | 894,000 |

|

| Magellan Health Services, Inc. (I) | 160,000 | 6,504,000 |

|

| Medco Health Solutions, Inc. (I) | 74,910 | 3,987,459 |

|

| Nektar Therapeutics (I)(L) | 412,000 | 8,862,120 |

|

| Onyx Pharmaceuticals, Inc. (I) | 119,200 | 2,783,320 |

|

| OXiGENE, Inc. (I)(L) | 200,000 | 864,000 |

|

| PDL BioPharma, Inc. (I)(L) | 128,000 | 3,683,840 |

|

| Santarus, Inc. (I)(L) | 409,350 | 3,160,182 |

Health Care Supplies 1.91% | | 5,246,370 |

|

| Bioenvision, Inc. (I)(L) | 185,000 | 1,208,050 |

|

| Healthcare Acquisition Corp. (I) | 150,000 | 1,245,000 |

|

| Inhibitex, Inc. (I) | 300,000 | 600,000 |

|

| Oracle Healthcare Acquisition Corp. (I) | 138,000 | 1,261,320 |

|

| Rotech Healthcare, Inc. (I) | 200,000 | 932,000 |

Managed Health Care 6.06% | | 16,676,852 |

|

| CIGNA Corp. | 30,000 | 3,210,000 |

|

| UnitedHealth Group, Inc. (A) | 133,070 | 6,618,902 |

|

| WellPoint, Inc. (I) | 96,450 | 6,847,950 |

Multi-Utilities & Unregulated Power 1.31% | | 3,609,852 |

|

| British Energy Group Plc (United Kingdom) (I) | 300,000 | 3,609,852 |

Pharmaceuticals 26.89% | | 74,025,476 |

|

| Abbot Laboratories (A) | 200,700 | 8,577,918 |

|

| Acadia Pharmaceuticals, Inc. (I) | 175,000 | 2,024,750 |

|

| Aspreva Pharmaceuticals Corp. (Canada) (I) | 155,000 | 5,270,000 |

|

| AstraZeneca Plc (United Kingdom) | 155,000 | 8,545,150 |

|

| Corgentech, Inc. (I) | 450,000 | 3,645,000 |

|

| Cubist Pharmaceuticals, Inc. (I)(L) | 100,000 | 2,267,000 |

|

| DUSA Pharmaceuticals, Inc. (I)(L) | 200,000 | 1,402,000 |

|

| Labopharm, Inc. (Canada) (I) | 340,000 | 2,992,000 |

|

| Medicines Co. (The) (I)(L) | 160,000 | 3,075,200 |

|

| MGI Pharma, Inc. (I)(L) | 115,000 | 2,148,200 |

|

| Nastech Pharmaceutical Co., Inc. (I)(L) | 225,000 | 3,413,250 |

See notes to

financial statements.

|

11

F I N A N C I A L S TAT E M E N T S

| Issuer | | Shares | Value |

Pharmaceuticals (continued) | | | |

|

| Novartis AG, American Depositary Receipt (ADR) (Switzerland) | 145,000 | $8,338,950 |

|

| Progenics Pharmaceuticals, Inc. (I)(L) | | 130,000 | 3,047,200 |

|

| Roche Holding AG (Switzerland) | | 45,000 | 6,899,698 |

|

| Shire Pharmaceutical Group Plc, (ADR) (United Kingdom) | 181,000 | 8,572,160 |

|

| Teva Pharmaceutical Industries Ltd., (ADR) (Israel) | | 94,000 | 3,807,000 |

| |

| Issuer | | Shares | Value |

|

Warrants 0.10% | | | $285,000 |

| (Cost $142,500) | | | |

Health Care Supplies 0.10% | | | 285,000 |

|

| Healthcare Acquisition Corp. (I) | | 150,000 | 285,000 |

| |

| | Interest | Par value | |

| Issuer, description, maturity date | rate | (000) | Value |

|

| Short-term investments 31.23% | | | $85,964,609 |

| (Cost $85,964,609) | | | |

| Joint Repurchase Agreement 9.06% | | | 24,925,000 |

|

| Investment in a joint repurchase agreement transaction | | | |

| with Barclays — Dated 4-28-06, due 5-1-06 | | | |

| (Secured by U.S. Treasury Inflation Indexed Bond | | | |

| 3.875%, due 4-15-29 and U.S. Treasury Inflation | | | |

| Indexed Note 2.375%, due 4-15-11) | 4.710% | $24,925 | 24,925,000 |

| |

| | | Shares | |

Cash Equivalents 22.17% | | | 61,039,609 |

|

| AIM Cash Investment Trust (T) | | 61,039,609 | 61,039,609 |

|

| Total investments 123.27% | | | $339,331,179 |

|

| |

| Other assets and liabilities, net (23.27%) | | | ($64,064,139) |

|

| |

| Total net assets 100.00% | | | $275,267,040 |

See notes to

financial statements.

|

12

F I N A N C I A L S TAT E M E N T S

| | Shares | Value |

|

| Investments sold short | | $1,256,400 |

| (Proceeds $1,055,806) | | |

| Health Care Services | | 1,256,400 |

|

| WellCare Health Plans, Inc. (I) | 30,000 | 1,256,400 |

(A) All or a portion of these securities have been segregated by the Fund’s custodian bank to secure the Fund’s outstanding short sale positions.

(I) Non-income-producing security.

(L) All or a portion of this security is on loan as of April 30, 2006.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration. Rule 144A securities amounted to $14,020,337 or 5.09% of the Fund’s net assets as of April 30, 2006.

(T) Represents investment of securities lending collateral.

Parenthetical disclosure of a foreign country in the security description represents country of a foreign issuer; however, security is U.S. dollar-denominated.

The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund.

See notes to

financial statements.

|

13

F I N A N C I A L S TAT E M E N T S

ASSETS AND

LIABILITIES

April 30, 2006 (unaudited)

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| Assets | |

|

| Investments at value (cost $279,676,234) | |

| including $60,398,796 of securities loaned | $339,331,179 |

| Cash | 1,853 |

| Receivable for investments sold | 8,334,685 |

| Receivable for shares sold | 135,688 |

| Dividends and interest receivable | 116,303 |

| Other assets | 16,474 |

| Total assets | 347,936,182 |

|

| Liabilities | |

|

| Payable for investments purchased | 8,835,297 |

| Payable for shares repurchased | 849,139 |

| Payable upon return of securities loaned | 61,039,609 |

| Payable for investments sold short, at value | |

| (proceeds $1,055,806) | 1,256,400 |

| Payable to affiliates | |

| Management fees | 569,614 |

| Distribution and service fees | 22,714 |

| Other | 41,455 |

| Other payables and accrued expenses | 54,914 |

| Total liabilities | 72,669,142 |

|

| Net assets | |

|

| Capital paid-in | 180,851,410 |

| Accumulated net realized gain on investments | |

| and foreign currency transactions | 36,526,503 |

| Net unrealized appreciation of investments | |

| and translation of assets and liabilities | |

| in foreign currencies | 59,454,415 |

| Accumulated net investment loss | (1,565,288) |

| Net assets | $275,267,040 |

|

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — | |

| the Fund has an unlimited number of shares | |

| authorized with no par value | |

| Class A ($155,457,459 ÷ 3,411,668 shares) | $45.57 |

| Class B ($104,266,257 ÷ 2,545,860 shares) | $40.96 |

| Class C ($15,543,324 ÷ 379,492 shares) | $40.96 |

|

| Maximum offering price per share | |

|

| Class A1 ($45.57 ÷ 95%) | $47.97 |

1 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

See notes to

financial statements.

|

14

F I N A N C I A L S TAT E M E N T S

OPERATIONS

For the period ended April 30, 2006 (unaudited)1

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| Investment income | |

|

| Dividends (net of foreign withholding taxes of $34,799) | $606,764 |

| Interest | 353,771 |

| Securities lending | 73,542 |

| Total investment income | 1,034,077 |

|

| Expenses | |

|

| Investment management fees | 1,109,845 |

| Class A distribution and service fees | 231,285 |

| Class B distribution and service fees | 590,420 |

| Class C distribution and service fees | 82,441 |

| Transfer agent fees | 428,530 |

| Printing | 31,341 |

| Accounting and legal services fees | 31,041 |

| Custodian fees | 25,320 |

| Registration and filing fees | 19,931 |

| Professional fees | 15,129 |

| Interest | 12,706 |

| Miscellaneous | 11,368 |

| Trustees’ fees | 7,419 |

| Compliance fees | 3,752 |

| Securities lending fees | 2,813 |

Total expenses | 2,603,341 |

| Less expense reductions | (11,626) |

Net expenses | 2,591,715 |

Net investment loss | (1,557,638) |

|

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments | 42,920,601 |

| Foreign currency transactions | (19,206) |

Change in net unrealized appreciation (depreciation) of | |

| Investments | (32,601,977) |

| Investments sold short | 117,127 |

| Translation of assets and liabilities in foreign currencies | 1,401 |

Net realized and unrealized gain | 10,417,946 |

Increase in net assets from operations | $8,860,308 |

1 Semiannual period from 11-1-05 through 4-30-06.

See notes to

financial statements.

|

15

F I N A N C I A L S TAT E M E N T S

CHANGES IN

NET ASSETS

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | Year | Period |

| | ended | ended |

| | 10-31-05 | 4-30-061 |

|

| |

| Increase (decrease) in net assets | | |

From operations | | |

| Net investment loss | ($3,989,878) | ($1,557,638) |

| Net realized gain | 37,079,056 | 42,901,395 |

| Change in net unrealized | | |

| appreciation (depreciation) | 11,915,081 | (32,483,449) |

Increase in net assets resulting | | |

| from operations | 45,004,259 | 8,860,308 |

Distributions to shareholders | | |

| From net realized gain | | |

| Class A | (4,490,378) | (15,429,831) |

| Class B | (5,195,070) | (13,896,965) |

| Class C | (513,947) | (1,898,068) |

| | (10,199,395) | (31,224,864) |

| From Fund share transactions | (16,812,190) | 7,738,751 |

|

| |

| Net assets | | |

| Beginning of period | 271,900,171 | 289,892,845 |

| End of period2 | $289,892,845 | $275,267,040 |

1 Semiannual period from 11-1-05 through 4-30-06. Unaudited.

2 Includes accumulated net investment loss of $7,650 and $1,565,288, respectively.

See notes to

financial statements.

|

16

F I N A N C I A L H I G H L I G H T S

CLASS A SHARES

The Financial Highlights show how the Fund’s net asset value for a

share has changed since the end of the previous period.

| Period ended | 10-31-01 | 10-31-02 | 10-31-03 | 10-31-04 | 10-31-05 | 4-30-061 |

|

| Per share operating performance | | | | | | |

| Net asset value, | | | | | | |

| beginning of period | $49.99 | $40.06 | $34.67 | $39.79 | $43.22 | $49.09 |

| Net investment loss2 | (0.37) | (0.41) | (0.38) | (0.47) | (0.49) | (0.17) |

| Net realized and unrealized | | | | | | |

| gain (loss) on investments | (5.99) | (4.98) | 5.50 | 3.90 | 7.93 | 1.73 |

| Total from | | | | | | |

| investment operations | (6.36) | (5.39) | 5.12 | 3.43 | 7.44 | 1.56 |

| Less distributions | | | | | | |

| From net realized gain | (3.57) | — | — | — | (1.57) | (5.08) |

| Net asset value, | | | | | | |

| end of period | $40.06 | $34.67 | $39.79 | $43.22 | $49.09 | $45.57 |

| Total return3 (%) | (13.56) | (13.45) | 14.77 | 8.62 | 17.774 | 3.144,5 |

|

| Ratios and supplemental data | | | | | | |

| Net assets, end of period | | | | | | |

| (in millions) | $145 | $110 | $117 | $125 | $149 | $155 |

| Ratio of expenses | | | | | | |

| to average net assets (%) | 1.50 | 1.59 | 1.67 | 1.57 | 1.56 | 1.476 |

| Ratio of gross expenses | | | | | | |

| to average net assets7 (%) | — | — | — | — | 1.58 | 1.486 |

| Ratio of net investment loss | | | | | | |

| to average net assets (%) | (0.87) | (1.06) | (1.04) | (1.08) | (1.06) | (0.75)6 |

| Portfolio turnover (%) | 91 | 85 | 95 | 54 | 508 | 44 |

See notes to

financial statements.

|

17

F I N A N C I A L H I G H L I G H T S

CLASS B SHARES

| Period ended | 10-31-01 | 10-31-02 | 10-31-03 | 10-31-04 | 10-31-05 | 4-30-061 |

|

| Per share operating performance | | | | | | |

| Net asset value, | | | | | | |

| beginning of period | $47.55 | $37.68 | $32.39 | $36.91 | $39.81 | $44.76 |

| Net investment loss2 | (0.63) | (0.63) | (0.59) | (0.72) | (0.75) | (0.31) |

| Net realized and unrealized | | | | | | |

| gain (loss) on investments | (5.67) | (4.66) | 5.11 | 3.62 | 7.27 | 1.59 |

| Total from | | | | | | |

| investment operations | (6.30) | (5.29) | 4.52 | 2.90 | 6.52 | 1.28 |

| Less distributions | | | | | | |

| From net realized gain | (3.57) | — | — | — | (1.57) | (5.08) |

| Net asset value, | | | | | | |

| end of period | $37.68 | $32.39 | $36.91 | $39.81 | $44.76 | $40.96 |

| Total return3 (%) | (14.18) | (14.04) | 13.95 | 7.86 | 16.954 | 2.794,5 |

|

| Ratios and supplemental data | | | | | | |

| Net assets, end of period | | | | | | |

| (in millions) | $231 | $162 | $154 | $134 | $124 | $104 |

| Ratio of expenses | | | | | | |

| to average net assets (%) | 2.20 | 2.29 | 2.37 | 2.27 | 2.26 | 2.176 |

| Ratio of gross expenses | | | | | | |

| to average net assets7 (%) | — | — | — | — | 2.28 | 2.186 |

| Ratio of net investment loss | | | | | | |

| to average net assets (%) | (1.57) | (1.76) | (1.74) | (1.77) | (1.76) | (1.46)6 |

| Portfolio turnover (%) | 91 | 85 | 95 | 54 | 508 | 44 |

See notes to

financial statements.

|

18

F I N A N C I A L H I G H L I G H T S

CLASS C SHARES

| Period ended | 10-31-01 | 10-31-02 | 10-31-03 | 10-31-04 | 10-31-05 | 4-30-061 |

|

| Per share operating performance | | | | | | |

| Net asset value, | | | | | | |

| beginning of period | $47.55 | $37.68 | $32.39 | $36.91 | $39.81 | $44.76 |

| Net investment loss2 | (0.63) | (0.63) | (0.59) | (0.72) | (0.75) | (0.30) |

| Net realized and unrealized | | | | | | |

| gain (loss) on investments | (5.67) | (4.66) | 5.11 | 3.62 | 7.27 | 1.58 |

| Total from | | | | | | |

| investment operations | (6.30) | (5.29) | 4.52 | 2.90 | 6.52 | 1.28 |

| Less distributions | | | | | | |

| From net realized gain | (3.57) | — | — | — | (1.57) | (5.08) |

| Net asset value, | | | | | | |

| end of period | $37.68 | $32.39 | $36.91 | $39.81 | $44.76 | $40.96 |

| Total return3 (%) | (14.18) | (14.04) | 13.95 | 7.86 | 16.954 | 2.794,5 |

|

| Ratios and supplemental data | | | | | | |

| Net assets, end of period | | | | | | |

| (in millions) | $15 | $12 | $13 | $13 | $17 | $16 |

| Ratio of expenses | | | | | | |

| to average net assets (%) | 2.20 | 2.29 | 2.37 | 2.27 | 2.26 | 2.176 |

| Ratio of gross expenses | | | | | | |

| to average net assets7 (%) | — | — | — | — | 2.28 | 2.186 |

| Ratio of net investment loss | | | | | | |

| to average net assets (%) | (1.58) | (1.76) | (1.73) | (1.78) | (1.76) | (1.45)6 |

| Portfolio turnover (%) | 91 | 85 | 95 | 54 | 508 | 44 |

1 Semiannual period from 11-1-05 through 4-30-06. Unaudited.

2 Based on the average of the shares outstanding.

3 Assumes dividend reinvestment and does not reflect the effect of sales charges.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Annualized.

7 Does not take into consideration expense reductions during the periods shown.

8 Excludes merger activity.

|

See notes to

financial statements.

|

19

NOTES TO

STATEMENTS

Unaudited

|

Note A

Accounting policiesJohn Hancock Health Sciences Fund (the “Fund”) is a non-diver-sified series of John Hancock World Fund (the “Trust”), an open-end management investment company registered under the Investment Company Act of 1940. The investment objective of the Fund is to achieve long-term growth of capital.

The Trustees have authorized the issuance of multiple classes of shares of the Fund, designated as Class A, Class B and Class C shares. The shares of each class represent an interest in the same portfolio of investments of the Fund and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission and the Internal Revenue Service. Shareholders of a class that bears distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan.

Significant accounting policies

of the Fund are as follows:

Valuation of investments

Securities in the Fund’s portfolio are valued on the basis of market quotations, valuations provided by independent pricing services or, if quotations are not readily available, or the value has been materially affected by events occurring after the close of a foreign market, at fair value as determined in good faith in accordance with procedures approved by the Trustees. Short-term debt investments which have a remaining maturity of 60 days or less may be valued at amortized cost, which approximates market value. Investments in AIM Cash Investment Trust are valued at their net asset value each business day. All portfolio transactions initially expressed in terms of foreign currencies have been translated into U.S. dollars as described in “Foreign currency translation” below.

Joint repurchase agreement

Pursuant to an exemptive order issued by the Securities and Exchange Commission, the Fund, along with other registered investment companies having a management contract with John Hancock Advisers, LLC (the “Adviser”), a wholly owned subsidiary of John Hancock Financial Services, Inc., a subsidiary of Manulife Financial Corporation (“MFC”), may participate in a joint repurchase agreement transaction. Aggregate cash balances are invested in one or more large repurchase agreements, whose underlying securities are obligations of the U.S. government and/or its agencies. The Fund’s custodian bank receives delivery of the underlying securities for the joint account on the Fund’s behalf. The Adviser is responsible for ensuring that the agreement is

20

fully collateralized at all times.

Foreign currency

translation

All assets or liabilities initially expressed in terms of foreign currencies are translated into U.S. dollars based on London currency exchange quotations as of 4:00 P.M., London time, on the date of any determination of the net asset value of the Fund. Transactions affecting statement of operations accounts and net realized gain (loss) on investments are translated at the rates prevailing at the dates of the transactions.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctua-tions are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign currency exchange gains or losses arise from sales of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency exchange gains and losses arise from changes in the value of assets and liabilities, other than investments in securities, resulting from changes in the exchange rates.

Investment transactions

Investment transactions are recorded as of the date of purchase, sale or maturity. Net realized gains and losses on sales of investments are determined on the identified cost basis. Capital gains realized on some foreign securities are subject to foreign taxes, which are accrued as applicable.

Class allocations

Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the appropriate net asset value of the respective classes. Distribution and service fees, if any, are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rate(s) applicable to each class.

Expenses

The majority of expenses are directly identifiable to an individual fund. Expenses that are not readily identifi-able to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative sizes of the funds.

Bank borrowings

The Fund is permitted to have bank borrowings for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The Fund has entered into a syndicated line of credit agreement with various banks. This agreement enables the Fund to participate, with other funds managed by the Adviser, in an unsecured line of credit with banks, which permits borrowings of up to $150 million, collectively. Interest is charged to each fund based on its borrowing. In addition, a commitment fee is charged to each fund based on the average daily unused portion of the line of credit and is allocated among the participating funds. The Fund had no borrowing activity under the line of credit during the period ended April 30, 2006.

Securities lending

The Fund may lend securities to certain qualified brokers who pay the Fund negotiated lender fees. The loans are collateralized at all times with cash or securities with a market value at least equal to the market value of the securities on loan. As with other extensions of credit, the Fund may bear the risk of delay of the loaned securities in recovery or even loss of rights in the collateral, should the borrower of the securities fail financially. On April 30,

21

2006, the Fund loaned securities having a market value of $60,398,796, collateralized by cash in the amount of $61,039,609. The cash collateral was invested in a short-term instrument. Securities lending expenses are paid by the Fund to the Adviser.

Short sales

The Fund, in “selling short,” sells borrowed securities, which must at some date be repurchased and returned to the lender. The risk associated with this practice is that, if the market value of securities sold short increases, the Fund may realize losses upon repurchase at prices that may exceed the prices used in determining the liability on the Fund’s Statement of Assets and Liabilities. Further, in unusual circumstances, the Fund may be unable to repurchase securities to close its short positions except at prices above those previously quoted in the market.

Forward foreign currency

exchange contracts

The Fund may enter into forward foreign currency exchange contracts as a hedge against the effect of fluctuations in currency exchange rates. A forward foreign currency exchange contract involves an obligation to purchase or sell a specific currency at a future date at a set price. The aggregate principal amounts of the contracts are marked to market daily at the applicable foreign currency exchange rates. Any resulting unrealized gains and losses are included in the determination of the Fund’s daily net asset value. The Fund records realized gains and losses at the time the forward foreign currency exchange contracts are closed out. Risks may arise upon entering these contracts from the potential inability of counterparties to meet the terms of the contracts and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar. These contracts involve market or credit risk in excess of the unrealized gain or loss reflected in the Fund’s Statement of Assets and Liabilities.

The Fund may also purchase and sell forward contracts to facilitate the settlement of foreign currency denominated portfolio transactions, under which it intends to take delivery of the foreign currency. Such contracts normally involve no market risk if they are offset by the currency amount of the underlying transactions.

The Fund had no open forward foreign currency exchange contracts on April 30, 2006.

Federal income taxes

The Fund qualifies as a “regulated investment company” by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required. For federal income tax purposes, the Fund has $3,694,388 of a capital loss carryforward available, to the extent provided by regulations, to offset future net realized capital gains. To the extent that such carryforward is used by the Fund, no capital gain distributions will be made. The loss carryforward expires as follows: October 31, 2009 — $2,309,251 and October 31, 2010 —$1,385,137. Availability of a certain amount of the carry-forwards that were acquired on June 10, 2005 in a merger with John Hancock Biotech-nology Fund may be limited in a given year.

Dividends, interest

and distributions

Dividend income on investment securities is recorded on the ex-dividend date or, in the case of some foreign securities, on the date thereafter when the Fund identifies the dividend. Interest income on investment securities is recorded on the accrual basis. Foreign income may be subject to foreign withholding taxes, which are accrued as applicable.

The Fund records distributions to shareholders from net investment income and

22

net realized gains, if any, on the ex-dividend date. During the year ended October 31, 2005, the tax character of distributions paid was as follows: long-term capital gains $10,199,395. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Use of estimates

The preparation of these financial statements, in accordance with accounting principles generally accepted in the United States of America, incorporates estimates made by management in determining the reported amount of assets, liabilities, revenues and expenses of the Fund. Actual results could differ from these estimates.

Note B

Management fee and

transactions with

affiliates and others

The Fund has an investment management contract with the Adviser. Under the investment management contract, the Fund pays a quarterly management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.80% of the first $200,000,000 of the Fund’s average daily net asset value and (b) 0.70% of the Fund’s daily average net asset value in excess of $200,000,000.

Effective December 31, 2005, the investment management teams of the Adviser were reorganized into Sovereign Asset Management LLC (“Sovereign”), a wholly owned indirect subsidiary of John Hancock Life Insurance Company (“JHLICo”), a subsidiary of MFC. The Adviser remains the principal advisor on the Fund, and Sovereign acts as subadviser under the supervision of the Adviser. The restructuring did not have an impact on the Fund, which continues to be managed using the same investment philosophy and process. The Fund is not responsible for payment of the subadvisory fees.

The Trust has a Distribution Agreement with John Hancock Funds, LLC (“JH Funds”), a wholly owned subsidiary of the Adviser. The Fund has adopted Distribution Plans with respect to Class A, Class B and Class C, pursuant to Rule 12b-1 under the Investment Company Act of 1940, to reimburse JH Funds for the services it provides as distributor of shares of the Fund. Accordingly, the Fund makes monthly payments to JH Funds at an annual rate not to exceed 0.30%, 1.00% and 1.00% of average daily net asset value of Class A, Class B and Class C, respectively. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of the National Association of Securities Dealers. Under the Conduct Rules, curtailment of a portion of the Fund’s 12b-1 payments could occur under certain circumstances.

Class A shares are assessed up-front sales charges. During the period ended April 30, 2006, JH Funds received net up-front sales charges of $170,312 with regard to sales of Class A shares. Of this amount, $26,071 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $129,965 was paid as sales commissions to unrelated broker-dealers and $14,276 was paid as sales commissions to sales personnel of Signator Investors, Inc. (“Signator Investors”), a related broker-dealer. The Adviser’s indirect parent, JHLICo, is the indirect sole shareholder of Signator Investors.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales

23

charge (“CDSC”) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from the CDSCs are paid to JH Funds and are used, in whole or in part, to defray its expenses for providing distribution-related services to the Fund in connection with the sale of Class B and Class C shares. During the period ended April 30, 2006, CDSCs received by JH Funds amounted to $99,868 for Class B shares and $1,279 for Class C shares.

The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (“Signature Services”), an indirect subsidiary of JHLICo. The Fund pays a monthly transfer agent fee at an annual rate of 0.05% of each class’s average daily net asset values, plus a fee based on the number of shareholder accounts and reimbursement for certain out-of-pocket expenses, aggregated and allocated to each class on the basis of its relative net asset value. Signature Services agreed to voluntarily reduce the Fund’s asset-based portion of the transfer agent fee if the total transfer agent fee exceeds the Lipper, Inc. median transfer agency fee for comparable mutual funds by greater than 0.05% . Accordingly, the transfer agent expense for Class A, Class B and Class C shares was reduced by $11,626 for the period ended April 30, 2006. Signature Services reserves the right to terminate this limitation at any time.

The Fund has an agreement with the Adviser and affiliates to perform necessary tax, accounting and legal services for the Fund. The compensation for the period amounted to $31,041. The Fund also paid the adviser the amount of $1,248 for certain publishing services, included in the printing fees. The Fund also reimbursed JHLICo for certain compliance costs, included in the Fund’s Statement of Operations.

Mr. James R. Boyle is Chairman of the Adviser, as well as affiliated Trustee of the Fund, and is compensated by the Adviser and/or its affiliates. The compensation of unaffiliated Trustees is borne by the Fund. The unaffiliated Trustees may elect to defer, for tax purposes, their receipt of this compensation under the John Hancock Group of Funds Deferred Compensation Plan. The Fund makes investments into other John Hancock funds, as applicable, to cover its liability for the deferred compensation. Investments to cover the Fund’s deferred compensation liability are recorded on the Fund’s books as another asset. The deferred compensation liability and the related other asset are always equal and are marked to market on a periodic basis to reflect any income earned by the investments, as well as any unrealized gains or losses. The Deferred Compensation Plan investments had no impact on the operations of the Fund.

24

Note C

Fund share transactions

This listing illustrates the number of Fund shares sold, issued in reorganization, reinvested and repurchased during the last two periods, along with the corresponding dollar value.

| | Year ended 10-31-05 | Period ended 4-30-06 1 |

| | Shares | Amount | Shares | Amount |

|

| Class A shares | | | | |

| Sold | 680,605 | $31,548,459 | 459,376 | $21,490,409 |

| Issued in reorganization | 134,447 | 6,204,667 | — | — |

| Distributions reinvested | 100,940 | 4,292,992 | 321,186 | 14,697,455 |

| Repurchased | (772,658) | (35,802,443) | (407,501) | (19,009,201) |

| Net increase | 143,334 | $6,243,675 | 373,061 | $17,178,663 |

|

| |

| Class B shares | | | | |

| Sold | 258,383 | $11,089,162 | 93,459 | $3,939,434 |

| Issued in reorganization | 162,701 | 6,864,958 | — | — |

| Distributions reinvested | 125,964 | 4,916,350 | 318,638 | 13,147,022 |

| Repurchased | (1,129,243) | (47,633,095) | (638,931) | (26,861,889) |

| Net decrease | (582,195) | ($24,762,625) | (226,834) | ($9,775,433) |

|

| |

| Class C shares | | | | |

| Sold | 61,221 | $2,630,110 | 30,585 | $1,290,778 |

| Issued in reorganization | 62,469 | 2,635,984 | — | — |

| Distributions reinvested | 11,660 | 455,107 | 42,275 | 1,744,277 |

| Repurchased | (96,007) | (4,014,441) | (64,821) | (2,699,534) |

| Net increase | 39,343 | $1,706,760 | 8,039 | $335,521 |

|

| |

| Net increase (decrease) | (399,518) | ($16,812,190) | 154,266 | $7,738,751 |

1 Semiannual period from 11-1-05 through 4-30-06. Unaudited.

Note D

Investment

transactions

|

Purchases and proceeds from sales or maturities of securities, other than short-term securities and obligations of the U.S. government, during the period ended April 30, 2006 aggregated $121,202,973 and $162,781,956, respectively.The cost of investments owned on April 30, 2006, including short-term investments, for federal income tax purposes, was $280,237,329. Gross unrealized appreciation and depreciation of investments aggregated $69,461,515 and $10,367,665, respectively, resulting in net unrealized appreciation of $59,093,850. The difference between book basis and tax basis net unrealized appreciation of investments is attributable primarily to the tax deferral of losses on certain sales of securities.

On June 8, 2005, the shareholders of the John Hancock Biotechnology Fund (“Biotechnology Fund”) approved an Agreement and Plan of Reorganization, which provided for the transfer of substantially all of the assets and liabilities of the Biotechnology Fund in exchange for Class A, Class B and Class C shares of the Fund. The acquisition was accounted for as a tax-free exchange of 134,447 Class A shares, 162,701 Class B shares and 62,469 Class C25

shares of the Fund for the net assets of the Biotechnology Fund, which amounted to $6,204,667, $6,864,958 and $2,635,984 for Class A, Class B and Class C shares of the Biotechnology Fund, including $2,020,906 of unrealized appreciation of investments, after the close of business on June 10, 2005.

26

|

| Equity | Balanced Fund |

| | Classic Value Fund |

| | Core Equity Fund |

| | Focused Equity Fund |

| | Growth Trends Fund |

| | Large Cap Equity Fund |

| | Large Cap Select Fund |

| | Mid Cap Equity Fund |

| | Mid Cap Growth Fund |

| | Multi Cap Growth Fund |

| | Small Cap Fund |

| | Small Cap Equity Fund |

| | Small Cap Intrinsic Value Fund |

| | Sovereign Investors Fund |

| | U.S. Global Leaders Growth Fund |

|

| |

| Asset Allocation and | Allocation Growth + Value Portfolio |

| Lifestyle Portfolios | Allocation Core Portfolio |

| | Lifestyle Aggressive Portfolio |

| | Lifestyle Growth Portfolio |

| | Lifestyle Balanced Portfolio |

| | Lifestyle Moderate Portfolio |

| | Lifestyle Conservative Portfolio |

|

| |

| Sector | Financial Industries Fund |

| | Health Sciences Fund |

| | Real Estate Fund |

| | Regional Bank Fund |

| | Technology Fund |

| | Technology Leaders Fund |

|

| |

| International | Greater China Opportunities Fund |

| | International Fund |

| | International Classic Value Fund |

|

| |

| Income | Bond Fund |

| | Government Income Fund |

| | High Yield Fund |

| | Investment Grade Bond Fund |

| | Strategic Income Fund |

|

| |

| Tax-Free Income | California Tax-Free Income Fund |

| | High Yield Municipal Bond Fund |

| | Massachusetts Tax-Free Income Fund |

| | New York Tax-Free Income Fund |

| | Tax-Free Bond Fund |

|

| |

| Money Market | Money Market Fund |

| | U.S. Government Cash Reserve |

|

For more complete information on any John Hancock Fund and a prospectus, which includes charges and expenses, call your financial professional, or John Hancock Funds at 1-800-225-5291. Please read the prospectus carefully before investing or sending money.

27

ELECTRONIC

DELIVERY

Now available from

John Hancock Funds

|

Instead of sending annual and semiannual reports and prospectuses through the U.S. mail, we’ll notify you by e-mail when these documents are available for online viewing.

How does electronic delivery benefit you?

| * | No more waiting for the mail to arrive; you’ll receive an |

| | e-mail notification as soon as the document is ready for |

| | online viewing. |

| |

| * | Reduces the amount of paper mail you receive from |

| | John Hancock Funds. |

| |

| * | Reduces costs associated with printing and mailing. |

Sign up for electronic delivery today at

www.jhfunds.com/edelivery

|

28

For more information

The Fund’s proxy voting policies, procedures and records are available without charge, upon request:

| By phone | On the Fund’s Web site | On the SEC’s Web site |

| 1-800-225-5291 | www.jhfunds.com/proxy | www.sec.gov |

|

| Trustees | Francis V. Knox, Jr. | Custodian |

| Ronald R. Dion, Chairman | Vice President and | The Bank of New York |

| James R. Boyle† | Chief Compliance Officer | One Wall Street |

| James F. Carlin | John G. Vrysen | New York, NY 10286 |

| Richard P. Chapman, Jr.* | Executive Vice President and | |

| William H. Cunningham | Chief Financial Officer | Transfer agent |

| Charles L. Ladner* | | John Hancock Signature |

| Dr. John A. Moore* | Investment adviser | Services, Inc. |

| Patti McGill Peterson* | John Hancock Advisers, LLC | 1 John Hancock Way, |

| Steven R. Pruchansky | 601 Congress Street | Suite 1000 |

| *Members of the Audit Committee | Boston, MA 02210-2805 | Boston, MA 02217-1000 |

| †Non-Independent Trustee | | |

| Subadviser | Legal counsel |

| Officers | Sovereign Asset | Wilmer Cutler Pickering |

| Keith F. Hartstein | Management LLC | Hale and Dorr LLP |

| President and | 101 Huntington Avenue | 60 State Street |

| Chief Executive Officer | Boston, MA 02199 | Boston, MA 02109-1803 |

| William H. King | | |

| Vice President and Treasurer | Principal distributor | |

| John Hancock Funds, LLC | |

| 601 Congress Street | |

| Boston, MA 02210-2805 | |

The Fund’s investment objective, risks, charges and expenses are included in the prospectus and should be considered carefully before investing. For a prospectus, call your financial professional, call John Hancock Funds at 1-800-225-5291, or visit the Fund’s Web site at www.jhfunds.com. Please read the prospectus carefully before investing or sending money.

A listing of month-end portfolio holdings is available on our Web site, www.jhfunds.com. A more detailed portfolio holdings summary is available on a quarterly basis 60 days after the fiscal quarter on our Web site or upon request by calling 1-800-225-5291, or on the Securities and Exchange Commission’s Web site, www.sec.gov.

29

1-800-225-5291

1-800-554-6713 (TDD)

1-800-338-8080 EASI-Line

www.jhfunds.com

|

Now available: electronic delivery

www.jhfunds.com/edelivery

|

This report is for the information of

the shareholders of John Hancock

Health Sciences Fund.

|

ITEM 2. CODE OF ETHICS.

As of the end of the period, April 30, 2006, the registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its Chief Executive Officer, Chief Financial Officer and Treasurer (respectively, the principal executive officer, the principal financial officer and the principal accounting officer, the “Senior Financial Officers”). A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

The code of ethics was amended effective February 1, 2005 to address new Rule 204A-1 under the Investment Advisers Act of 1940 and to make other related changes.

The most significant amendments were:

(a) Broadening of the General Principles of the code to cover compliance with all federal securities laws.

(b) Eliminating the interim requirements (since the first quarter of 2004) for access persons to preclear their personal trades of John Hancock mutual funds. This was replaced by post-trade reporting and a 30 day hold requirement for all employees.

(c) A new requirement for “heightened preclearance” with investment supervisors by any access person trading in a personal position worth $100,000 or more.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable at this time.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable at this time.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable at this time.

ITEM 6. SCHEDULE OF INVESTMENTS.

Not applicable.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END

MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT

COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT

INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

There were no material changes to previously disclosed John Hancock Funds - Administration Committee Charter and John Hancock Funds – Governance Committee Charter.

ITEM 11. CONTROLS AND PROCEDURES.

|

(a) Based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-CSR, the registrant's principal executive officer and principal financial officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) There were no changes in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal half-year (the registrant's second fiscal half-year in the case of an annual report) that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

(a)(1) Code of Ethics for Senior Financial Officers is attached.

(a)(2) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(b) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, and Rule 30a-2(b) under the Investment Company Act of 1940, are attached. The certifications furnished pursuant to this paragraph are not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section. Such certifications are not deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Registrant specifically incorporates them by reference.

(c) Contact person at the registrant.

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

By: /s/ Keith F. Hartstein

-------------------------------------

Keith F. Hartstein

President and Chief Executive Officer

Date: June 27, 2006

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: /s/ Keith F. Hartstein

-------------------------------------

Keith F. Hartstein

President and Chief Executive Officer

Date: June 27, 2006

|

By: /s/ John G. Vrysen

-------------------------------------

John G. Vrysen

Executive Vice President and Chief Financial Officer