UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 4932

John Hancock World Fund

(Exact name of registrant as specified in charter)

601 Congress Street, Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Alfred P. Ouellette

Senior Attorney and Assistant Secretary

601 Congress Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-663-4324

| Date of fiscal year end: | October 31 | |

| | | |

| Date of reporting period: | October 31, 2006 | |

ITEM 1. REPORT TO SHAREHOLDERS.

| TABLE OF CONTENTS |

|

| |

| Your fund at a glance |

| page 1 |

|

| |

| Manager’s report |

| page 2 |

|

| |

| A look at performance |

| page 6 |

|

| |

| Your expenses |

| page 8 |

|

| |

| Fund’s investments |

| page 1 0 |

|

| |

| Financial statements |

| page 1 4 |

|

| |

| Notes to financial |

| statements |

| page 2 0 |

|

| |

| Trustees and officers |

| page 3 1 |

|

| |

| For more information |

| page 3 6 |

|

CEO corner

To Our Shareholders,

The future has arrived at John Hancock Funds.

We have always been firm believers in the powerful role the Internet can play in providing fund information to our shareholders and prospective investors. Recently, we launched a redesigned, completely overhauled Web site that is more visually pleasing, easier to navigate and, most importantly, provides more fund information and learning tools without overwhelming the user.

Not long after we embarked on this major project, a study was released by the Investment Company Institute, the mutual fund industry’s main trade group, which found that an overwhelming majority of shareholders consider the Internet the “wave of the future” for accessing fund information.

Our new site sports fresher and faster ways to access account information. New innovations allow investors to view funds by risk level, track the performance of the John Hancock funds of their choice or sort funds by Morningstar, Inc.’s star ratings. Investors who own a John Hancock fund through a qualified retirement plan and don’t pay sales charges when making a purchase have the option of sorting by a “Load Waived” Morningstar Rating, thereby creating an apples-to-apples comparison with no-load funds that may also be available in their retirement plan.

The new site also has more educational tools and interactive modules to educate and assist investors with their financial goals, from college savings to retirement planning. A new “I want to…” feature allows investors to check performance, invest more money, update personal information or download prospectuses and forms quickly and easily.

In another of our ongoing efforts to provide our shareholders with top-notch service, we also redesigned our shareholder reports, as you may have noticed with this report. We hope the larger size, more colorful cover and redesigned presentation of the commentary and data tables will draw you in and make them easier to read.

After you’ve read your shareholder report, we encourage you to visit our new Web site — www.jhfunds.com — and take a tour. It’s easy, fast and fun and allows you to be in control of what you see and do. In short, it’s the wave of the future!

Sincerely,

Keith F. Hartstein,

President and Chief Executive Officer

This commentary reflects the CEO’s views as of October 31, 2006. They are subject to change at any time.

Your fund at a glance

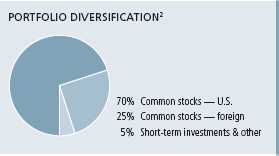

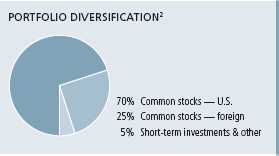

The Fund seeks long-term growth of capital by normally investing at least 80% of its assets in stocks of U.S. and foreign health sciences companies.

Over the last twelve months

► Health care stocks posted solid results for the period, although the sector lagged the broader stock market.

► Several biotech holdings boosted the Fund’s results, but its underweighting in large drug companies worked against it relative to its benchmark.

► Advantageous stock selection also lifted the Fund’s returns.

| Top 10 holdings | | | |

| Aveta, Inc. | 5.1% | Acorda Therapeutics, Inc. | 2.8% |

|

| Shire Plc | 3.5% | Nektar Therapeutics | 2.5% |

|

| Novartis AG, ADR | 3.5% | Aetna, Inc. | 2.5% |

|

| Bayer AG | 3.5% | AstraZeneca Plc | 2.3% |

|

| Roche Holding AG | 3.1% | Inverness Medical Innovations, Inc. | 2.3% |

|

As a percentage of net assets on October 31, 2006.

Manager’s report

John Hancock

Health Sciences Fund

Health care stocks posted solid returns for the 12-month period ended October 31, 2006, although the sector lagged the broader stock market during that time span. In the first half of the period, health care stocks, like the stock market overall, were buoyed by the resurgent U.S. and global economies in an era characterized by historically low, albeit rising, interest rates and muted inflation. But health care underperformed the overall market due to investors’ preference for stocks from more economically sensitive sectors. More recently, health care stocks were spurred by a stock-market rally prompted by the Federal Reserve Board’s decision to hold interest rates steady at its August, September and October policy meetings and by a pullback in the prices of crude oil and other commodity prices, which ultimately assuaged inflation concerns. After lagging the overall market during the prior three years, health care stocks started to benefit in the late summer and early fall from investors’ growing appetite for attractively valued companies in sectors that historically have proven defensive in slowing economic environments.

Performance

For the 12 months ended October 31, 2006, John Hancock Health Sciences Fund’s Class A, Class B and Class C shares posted total returns of 6.61%, 5.82% and 5.85%, respectively, at net asset value. During the same 12-month period, the Russell 3000 Healthcare Index returned 10.61%, the average Morningstar specialty/health fund had a total

SCORECARD

| INVESTMENT | | PERIOD’S PERFORMANCE... AND WHAT’S BEHIND THE NUMBERS |

| Acorda Therapeutics | ▲ | Excitement over clinical trial for MS treatment |

| Sirna Therapeutics | ▲ | Stock spikes on news that company will be acquired |

| Nektar Therapeutics | ▼ | Company delays launch of inhaled insulin product |

2

Portfolio Manager, MFC Global Investment Management (U.S.), LLC

Robert C. Junkin, CPA

return of 8.44% 1 and the Standard & Poor’s 500 Index returned 16.34% . The primary reason the Fund lagged the Russell index was our comparatively light weighting in large pharmaceutical companies and a relatively large weighting in biotech, during a period when drug companies outpaced biotech concerns. Keep in mind that your net asset value return will be different from the Fund’s performance if you were not invested in the Fund for the entire period and did not reinvest all distributions. See pages six and seven for historical performance results.

Leaders

Some of our biotech holdings were our best performers for the 12-month period. We enjoyed strong gains from biotech company Acorda Therapeutics, Inc., which was buoyed by its announcement that the company’s multiple sclerosis treatment succeeded in improving patients’ walking ability in a late-stage clinical trial. Our stake in Sirna Therapeutics, Inc. also worked in our favor. Its stock virtually doubled in price on the last trading day of the period on the announcement that Merck would acquire the company, which develops therapeutics using RNA interference, which aims to treat diseases by disrupting the expression of disease-causing genes. Celgene Corp. also experienced strong gains. Investors cheered the Food and Drug Administration’s approval of the company’s drug for use in patients with a cancer of the bone marrow, as well as Celgene’s ability to aggressively price the trea tment. FDA approval of a drug to treat HIV infection that combines three widely used medications into one pill helped propel the stock of Gilead Sciences, Inc.

“Health care stocks posted

solid returns for the 12-month

period ended October 31, 2006,

although the sector lagged the

broader stock market during that

time span. “

Health Sciences Fund

3

Beyond the biotech segment, our biggest contributors were an eclectic bunch. Shire Plc posted strong financial results following the success of its newly launched patch treatment for Attention Deficit Hyperactivity Disorder (ADHD). Magellan Health Services, Inc. was another winner, surging as its financial results flew past the consensus estimates of Wall Street analysts. Health insurer Aetna, Inc. also scored highly, rebounding when it announced that earlier reported financial results weren’t as bad as the company had initially calculated. Bayer AG also did well in response to investors’ placing a higher value on the company as it transformed from a chemical company into an integrated pharmaceutical concern with its early-2006 purchase of drug maker Schering.

Detractors

On the flip side, our holdings in Aspreva Pharmaceuticals Corp, which identifies, develops and commercializes new indications for approved drugs and late-stage drug candidates, declined sharply amid worries about the patent expiration of the company’s sole product. Another disappointment was Boston Scientific, which became the world’s largest cardiovascular device maker with its April acquisition of troubled Guidant Corp. The company failed to convince analysts and investors that it would achieve significant earnings and sales growth. Nektar Therapeutics performed poorly as investors expressed frustration when the company delayed the launch of its new inhaled insulin product. Neurocrine Biosciences plunged due to a number of setbacks, including the FDA’s decision not to approve the extended-release version of the company’s insomnia drug. Rotech Healthcare Inc., which leases medical equipment to home-bound patients, decli ned after the centers for Medicare and Medicaid Services suggested cutting reimbursement rates for stationary oxygen suppliers for 2007.

Outlook

We’re increasingly optimistic as we head into year-end. We believe that a slowing economy will be beneficial for health care stocks. Additionally, the late spring and summer market sell offs provided attractive entry points for the Fund. One of the key issues remains whether investors will return to more highly valued sectors — namely biotech — as opposed to the more attractively valued groups, such as drug stocks, in light of the

| INDUSTRY DISTRIBUTION2 |

| Pharmaceuticals | 30% |

| Health care services | 19% |

| Biotechnology | 17% |

| Health care equipment | 12% |

| Health care supplies | 5% |

| Diversified chemicals | 4% |

| Managed health care | 3% |

| Agricultural products | 2% |

| Health care distributors | 1% |

| Multi-utilities | 1% |

| Health care facilities | 1% |

Health Sciences Fund

4

events of the past two quarters of 2006. From a top-down perspective, the upward pressure on global interest rates, despite that recent halt in prior Fed policy, could lead to an economic deceleration. This scenario could lead investors back into more defensive growth sectors, such as health care, through the end of 2006 and into 2007. As far as the political climate, we believe there’s likely to be little or no federal legislation that would negatively affect health care companies in the near term. That’s based on our view that even if Democrats, who support an array of policies that could hurt some health-care sectors, assume control of both houses of the U.S. Congress, the executive branch will remain in Republican control under President Bush, making it likely that gridlock will result.

“Some of our biotech holdings

were our best performers for the

12-month period.”

This commentary reflects the views of the manager through the end of the Fund’s period discussed in this report. The manager’s statements reflect his own opinions. As such, they are in no way guarantees of future events, and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Sector investing is subject to greater risks than the market as a whole. International investing involves special risks such as political, economic and currency risks and differences in accounting standards and financial reporting.

1 Figures from Morningstar include reinvested dividends and do not take into account sales charges. Actual load-adjusted performance is lower.

2 As a percentage of net assets on October 31, 2006.

Health Sciences Fund

5

A look at performance

| For the periods ending October 31, 2006 | | | | | |

| |

| | | Average annual returns | | Cumulative total returns | | |

| | | with maximum sales charge (POP) | with maximum sales charge (POP) | |

| | Inception | | | | Since | | | | Since |

| Class | date | 1-year | 5-year | 10-year | inception | 1-year | 5-year | 10-year | inception |

|

| A | 10-1-91 | 1.28% | 5.17% | 9.00% | — | 1.28% | 28.67% | 136.66% | — |

|

| B | 3-7-94 | 1.11 | 5.18 | 8.95 | — | 1.11 | 28.75 | 135.58 | — |

|

| C | 3-1-99 | 4.91 | 5.51 | — | 6.08% | 4.91 | 30.78 | — | 57.26% |

|

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The returns for Class C shares have been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month-end, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

Health Sciences Fund

6

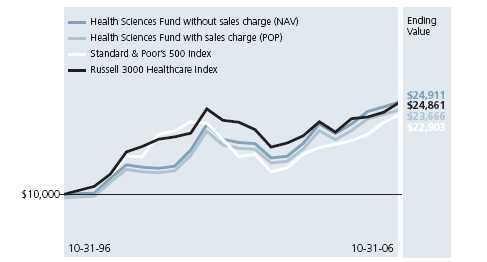

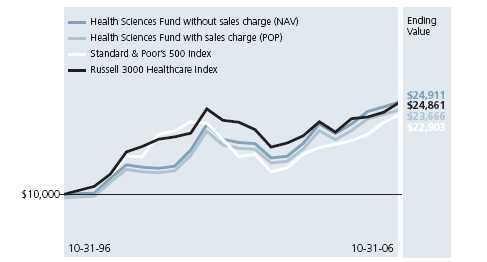

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in Class A shares

for the period indicated. For comparison, we’ve shown the same investment in two

separate indexes.

| | | Without sales | With maximum | | |

| Class | Period beginning | charge | sales charge | Index 1 | Index 2 |

|

| B1 | 10-31-96 | $23,558 | $23,558 | $22,903 | $24,861 |

|

| C1,2 | 3-1-99 | 15,726 | 15,726 | 12,572 | 12,597 |

|

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B and Class C shares, respectively, as of October 31, 2006. The Class C shares investment with maximum sales charge has been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Standard & Poor’s 500 Index — Index 1 — is an unmanaged index that includes 500 widely traded common stocks.

Russell 3000 Healthcare Index — Index 2 — is a capitalization-weighted index composed of companies involved in medical services or health care.

It is not possible to invest directly in an index. Index figures do not reflect sales charges which would have resulted in lower values if they did.

1 No contingent deferred sales charge applicable.

2 Index 2 as of February 28, 1999.

Health Sciences Fund

7

Your expenses

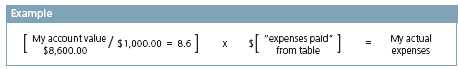

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc. n

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable) and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on May 1, 2006, with the same investment held until October 31, 2006.

| | Account value | Ending value | Expenses paid during period |

| | on 5-1-06 | on 10-31-06 | ended 10-31-061 |

|

| Class A | $1,000.00 | $1,033.60 | $8.01 |

|

| Class B | 1,000.00 | 1,029.50 | 11.67 |

|

| Class C | 1,000.00 | 1,029.80 | 11.62 |

|

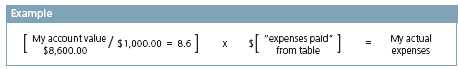

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at October 31, 2006 by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

Health Sciences Fund

8

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annual return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on May 1, 2006, with the same investment held until October 31, 2006. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | Account value | Ending value | Expenses paid during period |

| | on 5-1-06 | on 10-31-06 | ended 10-31-061 |

|

| Class A | $1,000.00 | $1,017.33 | $7.94 |

|

| Class B | 1,000.00 | 1,013.70 | 11.58 |

|

| Class C | 1,000.00 | 1,013.76 | 11.53 |

|

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.56%, 2.28% and 2.27% for Class A, Class B and Class C, respectively, multiplied by the average account value over the period, multiplied by number of days in most recent fiscal half-year/365 or 366 (to reflect the one-half year period).

Health Sciences Fund

9

Fund’s investments

F I N A N C I A L S T A T E M E N T S

Securities owned by the Fund on 10-31-06

This schedule is divided into four main categories: common stocks, units, warrants and short-term investments. Common stocks, units and warrants are further broken down by industry group. Short-term investments, which represent the Fund’s cash position, are listed last.

| Issuer | Shares | Value |

|

| Common stocks 94.55% | | $238,662,582 |

| (Cost $194,881,763) | | |

| Agricultural Products 1.84% | | 4,653,100 |

|

| Bunge Ltd. (Bermuda) | 50,000 | 3,205,500 |

|

| Corn Products International, Inc. | 40,000 | 1,447,600 |

| Biotechnology 16.59% | | 41,877,709 |

|

| Acorda Therapeutics, Inc. (I)(L) | 400,000 | 7,116,000 |

|

| Adeza Biomedical Corp. (I) | 100,000 | 1,394,000 |

|

| Advanced Magnetics, Inc. (I) | 30,000 | 1,245,000 |

|

| Amgen, Inc. (I) | 59,550 | 4,520,440 |

|

| Celgene Corp. (I)(L) | 70,000 | 3,740,800 |

|

| Exelixis, Inc. (I) | 43,200 | 419,040 |

|

| Gilead Sciences, Inc. (I)(V) | 67,000 | 4,616,300 |

|

| Invitrogen Corp. (I)(L) | 65,500 | 3,799,655 |

|

| Medarex, Inc. (I)(L) | 275,700 | 3,562,044 |

|

| OSI Pharmaceuticals, Inc. (I)(V) | 60,000 | 2,296,800 |

|

| Regeneration Technologies, Inc. (I) | 355,000 | 2,261,350 |

|

| Sirna Therapeutics, Inc. (I)(L) | 249,900 | 3,156,237 |

|

| Theratechnologies, Inc. (Canada) (I) | 235,000 | 604,043 |

|

| Theravance, Inc. (I) | 100,000 | 3,146,000 |

| Diversified Chemicals 3.49% | | 8,805,419 |

|

| Bayer AG (Germany) (C) | 175,500 | 8,805,419 |

| Health Care Distributors 1.43% | | 3,599,750 |

|

| Cardinal Health, Inc. | 55,000 | 3,599,750 |

| Health Care Equipment 12.33% | | 31,129,550 |

|

| ABIOMED, Inc. (I)(L) | 120,000 | 1,704,000 |

|

| ArthroCare Corp. (I)(L) | 75,000 | 3,030,750 |

|

| Baxter International, Inc. | 116,000 | 5,332,520 |

|

| Cardica, Inc. (I)(L) | 125,000 | 540,000 |

|

| Electro-Optical Sciences, Inc. (I) | 250,000 | 1,420,000 |

|

| Electro-Optical Sciences, Inc. (I)(K) | 43,860 | 252,634 |

|

| Haemonetics Corp. (I) | 47,500 | 2,166,000 |

|

| Hospira, Inc. (I) | 100,000 | 3,635,000 |

|

| NMT Medical, Inc. (I)(L) | 83,800 | 1,333,258 |

See notes to financial statements

Health Sciences Fund

10

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

| Health Care Equipment (continued) | | |

|

| SonoSite, Inc. (I)(L) | 85,000 | $2,422,500 |

|

| Stereotaxis, Inc. (I)(L) | 305,600 | 3,661,088 |

|

| Thoratec Corp. (I) | 166,000 | 2,614,500 |

|

| Varian Medical Systems, Inc. (I)(L) | 55,000 | 3,017,300 |

| Health Care Facilities 1.10% | | 2,781,500 |

|

| DaVita, Inc. (I) | 50,000 | 2,781,500 |

| Health Care Services 19.05% | | 48,079,176 |

|

| AnorMED, Inc. (Canada) (I) | 136,000 | 1,831,621 |

|

| Aveta, Inc. (I)(S) | 752,790 | 12,797,430 |

|

| Cerner Corp. (I)(L) | 73,500 | 3,550,785 |

|

| Digene Corp. (I) | 52,000 | 2,414,360 |

|

| Magellan Health Services, Inc. (I) | 80,000 | 3,491,200 |

|

| Medco Health Solutions, Inc. (I)(L) | 94,110 | 5,034,885 |

|

| Nektar Therapeutics (I)(L) | 442,000 | 6,378,060 |

|

| Omnicare, Inc. | 75,000 | 2,841,000 |

|

| OXiGENE, Inc. (I) | 200,000 | 790,000 |

|

| PDL BioPharma, Inc. (I)(L) | 178,000 | 3,761,140 |

|

| Santarus, Inc. (I)(L) | 439,350 | 3,378,602 |

|

| Systems Xcellence, Inc. (Canada) (I) | 110,170 | 1,810,093 |

| Health Care Supplies 4.54% | | 11,463,727 |

|

| Bioenvision, Inc. (I)(L) | 185,000 | 950,900 |

|

| Healthcare Acquisition Corp. (I) | 150,000 | 1,087,500 |

|

| Inverness Medical Innovations, Inc. (I)(K) | 152,000 | 5,728,880 |

|

| Minrad International, Inc. (I)(L) | 156,810 | 580,197 |

|

| PolyMedica Corp. (L) | 75,000 | 3,116,250 |

| Managed Health Care 2.52% | | 6,356,124 |

|

| Aetna, Inc. | 154,200 | 6,356,124 |

| Multi Utilities 1.29% | | 3,248,095 |

|

| British Energy Group Plc (United Kingdom) (I) | 405,000 | 3,248,095 |

| Pharmaceuticals 30.37% | | 76,668,432 |

|

| Allergan, Inc. | 30,000 | 3,465,000 |

|

| Anesiva, Inc. (I) | 450,000 | 3,325,500 |

|

| Aspreva Pharmaceuticals Corp. (Canada) (I) | 143,800 | 2,615,722 |

|

| Astellas Pharma, Inc. (Japan) | 105,150 | 4,729,977 |

|

| AstraZeneca Plc (United Kingdom) | 100,000 | 5,870,000 |

|

| Auxilium Pharmaceuticals, Inc. (I) | 344,000 | 4,334,400 |

|

| Barr Pharmaceuticals, Inc. (I)(V) | 55,000 | 2,880,350 |

|

| Cubist Pharmaceuticals, Inc. (I)(L) | 100,000 | 2,227,000 |

|

| Johnson & Johnson (V) | 50,000 | 3,370,000 |

|

| Labopharm, Inc. (Canada) (I)(L) | 202,240 | 1,031,424 |

|

| MGI Pharma, Inc. (I)(L) | 191,000 | 3,634,730 |

|

| Nastech Pharmaceutical Co., Inc. (I)(L) | 102,266 | 1,798,859 |

|

| Novartis AG, American Depositary Reciept (ADR) (Switzerland) (L) | 145,000 | 8,805,850 |

See notes to financial statements

Health Sciences Fund

11

F I N A N C I A L S T A T E M E N T S

| Issuer | | Shares | Value |

| Pharmaceuticals (continued) | | | |

|

| Roche Holding AG (Switzerland) | | 45,000 | $7,875,950 |

|

| Schering-Plough Corp. | | 240,000 | 5,313,600 |

|

| Shire Plc, (ADR) (United Kingdom) | | 161,000 | 8,830,850 |

|

| Spectrum Pharmaceuticals, Inc. (I) | | 95,060 | 516,176 |

|

| Warner Chilcott Ltd. (Class A) (Bermuda) (I)(L) | | 48,020 | 633,864 |

|

| Wyeth | | 106,000 | 5,409,180 |

| | | |

| Issuer | | Shares | Value |

|

| Units 0.45% | | | $1,138,500 |

| (Cost $1,104,000) | | | |

| Health Care Supplies 0.45% | | | 1,138,500 |

|

| Oracle Healthcare Acquisition Corp. (I) | | 138,000 | 1,138,500 |

| | | |

| Issuer | | Shares | Value |

|

| Warrants 0.06% | | | $135,000 |

| (Cost $142,500) | | | |

| Health Care Equipment 0.00% | | | 0 |

|

| Electro-Optical Sciences, Inc. (B) | | 6,579 | 0 |

| Health Care Supplies 0.06% | | | 135,000 |

|

| Healthcare Acquisition Corp. | | 150,000 | 135,000 |

| | | |

| | Interest | Par value | |

| Issuer, description, maturity date | rate | (000) | Value |

|

| Short-term investments 28.75% | | | $72,573,094 |

| (Cost $72,573,094) | | | |

| Joint Repurchase Agreement 7.07% | | | 17,857,000 |

|

| Investment in a joint repurchase agreement transaction | | | |

| with Morgan Stanley — Dated 10-31-06, due 11-1-06 | | | |

| (secured by U.S. Treasury Inflation Indexed Bond | | | |

| 3.375% due 4-15-32). | | | |

| Maturity value: $17,859,614 | 5.270% | $17,857 | 17,857,000 |

| | | |

| | | Shares | |

| Cash Equivalents 21.68% | | | 54,716,094 |

|

| AIM Cash Investment Trust (T) | | 54,716,094 | 54,716,094 |

|

| Total investments (cost $268,701,357) 123.81% | | | $312,509,176 |

|

| Other assets and liabilities, net (23.81%) | | | ($60,095,990) |

|

| Total net assets 100.00% | | | $252,413,186 |

See notes to financial statements

Health Sciences Fund

12

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

|

| Investments sold short | | $3,031,800 |

| (Proceeds $2,708,413) | | |

| Pharmaceuticals | | 3,031,800 |

|

| Bradley Pharmaceuticals, Inc. (I) | 85,000 | 1,479,000 |

|

| Sepracor, Inc. (I) | 30,000 | 1,552,800 |

(B) This security is fair valued in good faith under procedures established by the Board of Trustees. These securities amounted to $0 or 0% of the Fund’s net assets as of October 31, 2006.

(C) Parenthetical disclosure of a country in the security description represents country of issuer; however, the security is euro-denominated.

(I) Non-income-producing security.

(K) Direct placement securities are restricted to resale. They have been fair valued in accordance with procedures approved by the Trustees after consideration of restrictions as to resale, financial condition and prospects of the issuer, general market conditions and pertinent information in accordance with the Fund’s bylaws and the Investment Company Act of 1940, as amended. The Fund has limited rights to registration under the Securities Act of 1933 with respect to these restricted securities.

| | | | Value as a | |

| | | | percentage | |

| | Acquisition | Acquisition | of Fund's | Value as of |

| Issuer, description | date | cost | net assets | October 31, 2006 |

|

| Electro Optical Sciences, Inc. | 10-31-06 | $250,002 | 0.10% | $252,634 |

|

| Inverness Medical Innovations, Inc. | 8-17-06 | 4,598,000 | 2.27 | 5,728,880 |

|

| Total | | | 2.37% | $5,981,514 |

(L) All of a portion of this security is on loan as of October 31, 2006.

(S) This security is exempt from registration under Rule 144A of the Securities Act of 1933. Such security may be resold, normally to qualified institutional buyers, in transactions exempt from registration. Rule 144A securities amounted to $12,797,430 or 5.07% of the Fund’s net assets as of October 31, 2006.

(T) Represents investment of securities lending collateral.

(V) All or a portion of these securities have been segregated by the Fund’s custodian bank to secure the Fund’s outstanding short sale positions.

Parenthetical disclosure of a foreign country in the security description represents country of a foreign issuer.

The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund.

See notes to financial statements

Health Sciences Fund

13

Financial statements

F I N A N C I A L S T A T E M E N T S

Statement of assets and liabilities 10-31-06

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| Assets | |

| Investments, at value (cost $268,701,357) including $55,417,237 | |

| of securities loaned | $312,509,176 |

| Cash | 153,178 |

| Receivable for investments sold | 698,076 |

| Receivable for shares sold | 26,979 |

| Dividends and interest receivable | 68,562 |

| Other assets | 16,474 |

| Total assets | 313,472,445 |

|

| |

| Liabilities | |

| Payable for investments purchased | 2,226,560 |

| Payable for shares repurchased | 382,438 |

| Payable upon return of securities loaned | 54,716,094 |

| Payable for investments sold short, at value (proceeds $2,708,413) | 3,031,800 |

| Payable to affiliates | |

| Management fees | 518,163 |

| Distribution and service fees | 19,383 |

| Other | 63,541 |

| Other payables and accrued expenses | 101,280 |

| Total liabilities | 61,059,259 |

|

| |

| Net assets | |

| Capital paid-in | 158,295,144 |

| Accumulated net realized gain on investments and foreign currency transactions | 50,642,309 |

| Net unrealized appreciation of investments and translation of assets and | |

| liabilities in foreign currencies | 43,483,383 |

| Accumulated net investment loss | (7,650) |

| Net assets | $252,413,186 |

|

| |

| Net asset value per share | |

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($158,227,908 ÷ 3,359,701 shares) | $47.10 |

| Class B ($80,122,813 ÷ 1,899,755 shares) | $42.181 |

| Class C ($14,062,465 ÷ 333,382 shares) | $42.18 |

|

| |

| Maximum offering price per share | |

| Class A2 ($47.10 ÷ 95%) | $49.58 |

1 Net assets and shares outstanding have been rounded for presentation purpose. The net asset value is as reported on October 31, 2006.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

See notes to financial statements

Health Sciences Fund

14

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 10-31-06.

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| Investment income | |

| Dividends (net of foreign withholding taxes of $38,912) | $892,928 |

| Interest | 828,036 |

| Securities lending | 268,597 |

| Total investment income | 1,989,561 |

|

| Expenses | |

| Investment management fees (Note 2) | 2,100,118 |

| Distribution and service fees (Note 2) | 1,642,523 |

| Transfer agent fees (Note 2) | 886,723 |

| Accounting and legal services fees (Note 2) | 49,084 |

| Compliance fees | 8,364 |

| Printing fees | 63,606 |

| Blue sky fees | 54,434 |

| Custodian fees | 52,662 |

| Professional fees | 33,284 |

| Interest | 33,225 |

| Trustees’ fees | 14,652 |

| Securities lending fees | 10,444 |

| Miscellaneous | 16,997 |

| Total expenses | 4,966,116 |

| Less expense reductions (Note 2) | (23,107) |

| Net expenses | 4,943,009 |

| Net investment loss | (2,953,448) |

|

| Realized and unrealized gain (loss) | |

| Net realized gain (loss) on | |

| Investments | 67,339,160 |

| Foreign currency transactions | (112,058) |

| Change in net unrealized appreciation (depreciation) of | |

| Investments | (48,449,103) |

| Investments sold short | (5,666) |

| Translation of assets and liabilities in foreign currencies | 288 |

| Net realized and unrealized gain | 18,772,621 |

| Increase in net assets from operations | $15,819,173 |

See notes to financial statements

Health Sciences Fund

15

F I N A N C I A L S T A T E M E N T S

Statement of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | Year | Year |

| | ended | ended |

| | 10-31-05 | 10-31-06 |

|

| Increase (decrease) in net assets | | |

| From operations | | |

| Net investment loss | ($3,989,878) | ($2,953,448) |

| Net realized gain | 37,079,056 | 67,227,102 |

| Change in net unrealized appreciation (depreciation) | 11,915,081 | (48,454,481) |

| Increase in net assets resulting from operations | 45,004,259 | 15,819,173 |

| Distributions to shareholders | | |

| From net realized gain | | |

| Class A | (4,490,378) | (15,429,832) |

| Class B | (5,195,070) | (13,896,965) |

| Class C | (513,947) | (1,898,067) |

| | (10,199,395) | (31,224,864) |

| From Fund share transactions | (16,812,190) | (22,073,968) |

|

| Net assets | | |

| Beginning of period | 271,900,171 | 289,892,845 |

| End of period1 | $289,892,845 | $252,413,186 |

1 Includes accumulated net investment loss of $7,650 and $7,650, respectively.

See notes to financial statements

Health Sciences Fund

16

F I N A N C I A L S T A T E M E N T S

Financial highlights

The Financial highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| CLASS A SHARES | | | | | |

| |

| Period ended | 10-31-02 | 10-31-03 | 10-31-04 | 10-31-05 | 10-31-06 |

|

| Per share operating performance | | | | | |

| Net asset value, beginning of period | $40.06 | $34.67 | $39.79 | $43.22 | $49.09 |

| Net investment loss1 | (0.41) | (0.38) | (0.47) | (0.49) | (0.35) |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | (4.98) | 5.50 | 3.90 | 7.93 | 3.44 |

| Total from investment operations | (5.39) | 5.12 | 3.43 | 7.44 | 3.09 |

| Less distributions | | | | | |

| From net realized gain | — | — | — | (1.57) | (5.08) |

| Net asset value, end of period | $34.67 | $39.79 | $43.22 | $49.09 | $47.10 |

| Total return2 (%) | (13.45) | 14.77 | 8.62 | 17.773 | 6.613 |

|

| Ratios and supplemental data | | | | | |

| Net assets, end of period | | | | | |

| (in millions) | $110 | $117 | $125 | $149 | $158 |

| Ratio of expenses to average | | | | | |

| net assets (%) | 1.59 | 1.67 | 1.57 | 1.56 | 1.52 |

| Ratio of gross expenses to average | | | | | |

| net assets (%) | 1.59 | 1.67 | 1.57 | 1.584 | 1.534 |

| Ratio of net investment loss | | | | | |

| to average net assets (%) | (1.06) | (1.04) | (1.08) | (1.06) | (0.78) |

| Portfolio turnover (%) | 85 | 95 | 54 | 505 | 93 |

See notes to financial statements

Health Sciences Fund

17

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS B SHARES | | | | | |

| |

| Period ended | 10-31-02 | 10-31-03 | 10-31-04 | 10-31-05 | 10-31-06 |

|

| Per share operating performance | | | | | |

| Net asset value, beginning of period | $37.68 | $32.39 | $36.91 | $39.81 | $44.76 |

| Net investment loss1 | (0.63) | (0.59) | (0.72) | (0.75) | (0.61) |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | (4.66) | 5.11 | 3.62 | 7.27 | 3.11 |

| Total from investment operations | (5.29) | 4.52 | 2.90 | 6.52 | 2.50 |

| Less distributions | | | | | |

| From net realized gain | — | — | — | (1.57) | (5.08) |

| Net asset value, end of period | $32.39 | $36.91 | $39.81 | $44.76 | $42.18 |

| Total return2 (%) | (14.04) | 13.95 | 7.86 | 16.953 | 5.823 |

|

| Ratios and supplemental data | | | | | |

| Net assets, end of period | | | | | |

| (in millions) | $162 | $154 | $134 | $124 | $80 |

| Ratio of expenses to average | | | | | |

| net assets (%) | 2.29 | 2.37 | 2.27 | 2.26 | 2.22 |

| Ratio of gross expenses to average | | | | | |

| net assets (%) | 2.29 | 2.37 | 2.27 | 2.284 | 2.234 |

| Ratio of net investment loss | | | | | |

| to average net assets (%) | (1.76) | (1.74) | (1.77) | (1.76) | (1.49) |

| Portfolio turnover (%) | 85 | 95 | 54 | 505 | 93 |

See notes to financial statements

Health Sciences Fund

18

F I N A N C I A L S T A T E M E N T S

Financial highlights

| CLASS C SHARES | | | | | |

| |

| Period ended | 10-31-02 | 10-31-03 | 10-31-04 | 10-31-05 | 10-31-06 |

|

| Per share operating performance | | | | | |

| Net asset value, beginning of period | $37.68 | $32.39 | $36.91 | $39.81 | $44.76 |

| Net investment loss1 | (0.63) | (0.59) | (0.72) | (0.75) | (0.61) |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | (4.66) | 5.11 | 3.62 | 7.27 | 3.11 |

| Total from investment operations | (5.29) | 4.52 | 2.90 | 6.52 | 2.50 |

| Less distributions | | | | | |

| From net realized gain | — | — | — | (1.57) | (5.08) |

| Net asset value, end of period | $32.39 | $36.91 | $39.81 | $44.76 | $42.18 |

| Total return2 (%) | (14.04) | 13.95 | 7.86 | 16.953 | 5.853 |

|

| Ratios and supplemental data | | | | | |

| Net assets, end of period | | | | | |

| (in millions) | $12 | $13 | $13 | $17 | $14 |

| Ratio of expenses to average | | | | | |

| net assets (%) | 2.29 | 2.37 | 2.27 | 2.26 | 2.22 |

| Ratio of gross expenses to average | | | | | |

| net assets (%) | 2.29 | 2.37 | 2.27 | 2.284 | 2.234 |

| Ratio of net investment loss | | | | | |

| to average net assets (%) | (1.76) | (1.73) | (1.78) | (1.76) | (1.49) |

| Portfolio turnover (%) | 85 | 95 | 54 | 505 | 93 |

1 Based on the average of the shares outstanding.

2 Assumes dividend reinvestment and does not reflect the effect of sales charges.

3 Total returns would have been lower had certain expenses not been reduced during the period shown.

4 Does not take into consideration expense reductions during the period shown.

5 Excludes merger activity.

See notes to financial statements

Health Sciences Fund

19

Notes to financial statements

Note 1

Accounting policies

John Hancock Health Sciences Fund (the “Fund”) is a non-diversified series of John Hancock World Fund (the “Trust”), an open-end management investment company registered under the Investment Company Act of 1940 (the “1940 Act”), as amended. The investment objective of the Fund is to achieve long-term growth of capital.

The Trustees have authorized the issuance of multiple classes of shares of the Fund, designated as Class A, Class B and Class C shares. The shares of each class represent an interest in the same portfolio of investments of the Fund and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission and the Internal Revenue Service. Shareholders of a class that bears distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan. Class B shares will convert to Class A shares eight years after purchase.

Significant accounting policies of the Fund are as follows:

Valuation of investments

Securities in the Fund’s portfolio are valued on the basis of market quotations, valuations provided by independent pricing services or, if quotations are not readily available, or the value has been materially affected by events occurring after the close of a foreign market, at fair value as determined in good faith in accordance with procedures approved by the Trustees. Short-term debt investments which have a remaining maturity of 60 days or less may be valued at amortized cost, which approximates market value. Investments in AIM Cash Investment Trust are valued at their net asset value each business day. All portfolio transactions initially expressed in terms of foreign currencies have been translated into U.S. dollars as described in “Foreign currency translation” below.

Joint repurchase agreement

Pursuant to an exemptive order issued by the Securities and Exchange Commission, the Fund, along with other registered investment companies having a management contract with John Hancock Advisers, LLC (the “Adviser”), a wholly owned subsidiary of John Hancock Financial Services, Inc., a subsidiary of Manulife Financial Corporation (“MFC”), may participate in a joint repurchase agreement transaction. Aggregate cash balances are invested in one or more large repurchase agreements, whose underlying securities are obligations of the U.S. government and/or its agencies. The Fund’s custodian bank receives delivery of the underlying securities for the joint account on the Fund’s behalf. The Adviser is responsible for ensuring that the agreement is fully collateralized at all times.

Foreign currency translation

All assets or liabilities initially expressed in terms of foreign currencies are translated into U.S. dollars based on London currency exchange quotations as of 4:00 p.m., London time, on the date of any determination of the net asset value of the Fund. Transactions affecting statement of operations accounts and net realized gain (loss) on investments are translated at the rates prevailing at the dates of the transactions.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Health Sciences Fund

20

Reported net realized foreign currency exchange gains or losses arise from sales of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency exchange gains and losses arise from changes in the value of assets and liabilities, other than investments in securities, resulting from changes in the exchange rates.

Investment transactions

Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Net realized gains and losses on sales of investments are determined on the identified cost basis. Capital gains realized on some foreign securities are subject to foreign taxes, which are accrued as applicable.

Class allocations

Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the appropriate net asset value of the respective classes. Distribution and service fees, if any, are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rate(s) applicable to each class.

Expenses

The majority of expenses are directly identifiable to an individual fund. Expenses that are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

Bank borrowings

The Fund is permitted to have bank borrowings for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The Fund has entered into a syndicated line of credit agreement with various banks. This agreement enables the Fund to participate, with other funds managed by the Adviser, in an unsecured line of credit with banks, which permits borrowings of up to $150 million, collectively. Interest is charged to each fund based on its borrowing. In addition, a commitment fee is charged to each fund based on the average daily unused portion of the line of credit, and is allocated among the participating funds. The Fund had no borrowing activity under the line of credit during the year ended October 31, 2006.

Securities lending

The Fund may lend securities to certain qualified brokers who pay the Fund negotiated lender fees. The loans are collateralized at all times with cash or securities with a market value at least equal to the market value of the securities on loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. As with other extensions of credit, the Fund may bear the risk of delay of the loaned securities in recovery or even loss of rights in the collateral, should the borrower of the securities fail financially. At October 31, 2006, the Fund loaned securities having a market value of $55,417,237 collateralized by securities in the amount of $54,716,094. The cash collateral was invested in a short-term instrument. Securities lending expenses are paid by the Fund to the Adviser.

Short sales

The Fund, in “selling short”, sells borrowed securities, which must at some date be repurchased and returned to the lender. The risk associated with this practice is that, if the market value of securities sold short increases, the Fund may realize losses upon repurchase at prices which may exceed the prices used in determining the liability on the Fund’s Statement of Assets and Liabilities. Further, in unusual circumstances, the Fund may be unable to repurchase securities to close its short positions except at prices above those previously quoted in the market.

Health Sciences Fund

21

Forward foreign currency exchange contracts

The Fund may enter into forward foreign currency exchange contracts as a hedge against the effect of fluctuations in currency exchange rates. A forward foreign currency exchange contract involves an obligation to purchase or sell a specific currency at a future date at a set price. The aggregate principal amounts of the contracts are marked to market daily at the applicable foreign currency exchange rates. Any resulting unrealized gains and losses are included in the determination of the Fund’s daily net asset value. The Fund records realized gains and losses at the time the forward foreign currency exchange contracts are closed out. Risks may arise upon entering these contracts from the potential inability of counterparties to meet the terms of the contracts and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar. These contracts involve market or credit risk in excess of the unrealized gain or loss reflected in the Fund’ ;s Statement of Assets and Liabilities.

The Fund may also purchase and sell forward contracts to facilitate the settlement of foreign currency denominated portfolio transactions, under which it intends to take delivery of the foreign currency. Such contracts normally involve no market risk if they are offset by the currency amount of the underlying transactions. The Fund had no open forward foreign currency exchange contracts on October 31, 2006.

Federal income taxes

The Fund qualifies as a “regulated investment company” by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required. For federal income tax purposes, the Fund has $2,745,340 of a capital loss carryforward available, to the extent provided by regulations, to offset future net realized capital gains. To the extent that such carryforward is used by the Fund, no capital gain distributions will be made. The loss carryforward expires as follows: October 31, 2009 — $1,622,916 and October 31, 2010 — $1,122,424. Capital loss carryforward utilized for the year ended October 31, 2006 amounted to $686,335. Availability of a certain amount of the carryforwards which were acquired on June 10, 2005 in a merger with John Hancock Biotechnology Fund may be limited in a given year.

New accounting pronouncements

In June 2006, Financial Accounting Standards Board (“FASB”) Interpretation No. 48, Accounting for Uncertainty in Income Taxes (the “Interpretation”) was issued, and is effective for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. The Interpretation prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return, and requires certain expanded disclosures. Management is currently evaluating the application of the Interpretation to the Fund, and has not at this time quantified the impact, if any, resulting from the adoption of the Interpretation on the Fund’s financial statements.

In September 2006, FASB Standard No. 157, Fair Value Measurements (“FAS 157”) was issued, and is effective for fiscal years beginning after November 15, 2007. FAS 157 defines fair value, establishing a framework for measuring fair value and expands disclosure about fair value measurements. Management is currently evaluating the application of FAS 157 to the Fund, and its impact, if any, resulting from the adoption of FAS 157 on the Fund’s financial statements.

Dividends, interest and distributions

Dividend income on investment securities is recorded on the ex-dividend date or, in the case of some foreign securities, on the date thereafter when the Fund identifies the dividend. Interest income on investment securities is recorded on the accrual basis. Foreign income may be subject to foreign withholding taxes, which are accrued as applicable.

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. During the year ended October 31, 2005, the tax character of distributions paid was as follows: long-term capital gain $10,199,395. During the year ended October 31, 2006, the tax character of distributions paid was as

Health Sciences Fund

22

follows: long-term capital gain $31,224,864. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

As of October 31, 2006, the components of distributable earnings on a tax basis included $53,654,117 of undistributed long-term gain.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Use of estimates

The preparation of these financial statements, in accordance with accounting principles generally accepted in the United States of America, incorporates estimates made by management in determining the reported amount of assets, liabilities, revenues and expenses of the Fund. Actual results could differ from these estimates.

Note 2

Management fee and transactions with

affiliates and others

The Fund has an investment management contract with the Adviser. Under the investment management contract, the Fund pays a quarterly management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.80% of the first $200,000,000 of the Fund’s average daily net asset value and (b) 0.70% of the Fund’s daily average net asset value in excess of $200,000,000.

Effective December 31, 2005, the investment management teams of the Adviser were reorganized into Sovereign Asset Management LLC (“Sovereign”), a wholly owned indirect subsidiary of John Hancock Life Insurance Company (“JHLICO”), a subsidiary of MFC. The Adviser remains the principal advisor on the Fund and Sovereign acts as subadviser under the supervision of the Adviser. The restructuring did not have an impact on the Fund, which continues to be managed using the same investment philosophy and process. The Fund is not responsible for payment of the subadvisory fees.

Effective October 1, 2006, Sovereign changed its name to MFC Global Investment Management (U.S.), LLC.

The Fund has a Distribution Agreement with John Hancock Funds, LLC (“JH Funds”), a wholly owned subsidiary of the Adviser. The Fund has adopted Distribution Plans with respect to Class A, Class B and Class C, pursuant to Rule 12b-1 under the 1940 Act, as amended, to reimburse JH Funds for the services it provides as distributor of shares of the Fund. Accordingly, the Fund makes monthly payments to JH Funds at an annual rate not to exceed 0.30%, 1.00% and 1.00% of the average daily net asset value of Class A, Class B and Class C, respectively. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of the National Association of Securities Dealers. Under the Conduct Rules, curtailment of a portion of the Fund’s 12b-1 payments could occur under certain circumstances.

Class A shares are assessed up-front sales charges. During the year ended October 31, 2006, JH Funds received net up-front sales charges of $280,179 with regard to sales of Class A shares. Of this amount, $43,560 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $212,929 was paid as sales commissions to unrelated broker-dealers and $23,690 was paid as sales commissions to sales personnel of Signator Investors, Inc. (“Signator Investors”), a related broker-dealer. The Adviser’s indirect parent JHLICO, is the indirect sole shareholder of Signator Investors.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (“CDSC”) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase

Health Sciences Fund

23

cost of the shares being redeemed. Proceeds from the CDSCs are paid to JH Funds and are used, in whole or in part, to defray its expenses for providing distribution-related services to the Fund in connection with the sale of Class B and Class C shares. During the year ended October 31, 2006, CDSCs received by JH Funds amounted to $168,929 for Class B shares and $2,903 for Class C shares.

The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (“Signature Services”), an indirect subsidiary of JHLICO. The Fund pays a monthly transfer agent fee at an annual rate of 0.05% of each class’s average daily net asset value, plus a fee based on the number of shareholder accounts and reimbursement for certain out-of-pocket expenses, aggregated and allocated to each class on the basis of its relative net asset value. Signature Services agreed to voluntarily reduce the Fund’s asset-based portion of the transfer agent fee for Class A, Class B and Class C shares if the total transfer agent fee exceeded the median transfer agency fee for comparable mutual funds by greater than 0.05% . Accordingly, the transfer agent expense for Class A, Class B and Class C shares was reduced by $23,107 for the year ended October 31, 2006. Signature Services terminated this reimbursement agreement June 30, 2006.

The Fund has an agreement with the Adviser and affiliates to perform necessary tax, accounting and legal services for the Fund. The compensation for the year amounted to $49,084. The Fund also paid the Adviser the amount of $1,248 for certain publishing services, included in the printing fees. The Fund reimbursed JHLICO for certain compliance costs, included in the Fund’s Statement of Operations.

Expenses under the agreements described above for the period ended October 31, 2006 were as follows:

| | Distribution and |

| Share Class | service fees |

|

| |

| Class A | $459,400 |

| Class B | 1,029,549 |

| Class C | 153,574 |

| Total | $1,642,523 |

The Fund has an independent advisory board composed of scientific and medical experts who provide the investment officers of the Fund with advice and consultation on health-care developments, for which the Fund pays the advisory board a fee.

Mr. James R. Boyle is Chairman of the Adviser, as well as affiliated Trustee of the Fund, and is compensated by the Adviser and/or its affiliates. The compensation of unaffiliated Trustees is borne by the Fund. The unaffiliated Trustees may elect to defer, for tax purposes, their receipt of this compensation under the John Hancock Group of Funds Deferred Compensation Plan. The Fund makes investments into other John Hancock funds, as applicable, to cover its liability for the deferred compensation. Investments to cover the Fund’s deferred compensation liability are recorded on the Fund’s books as an other asset. The deferred compensation liability and the related other asset are always equal and are marked to market on a periodic basis to reflect any income earned by the investments, as well as any unrealized gains or losses. The Deferred Compensation Plan investments had no impact on the operations of the Fund.

Health Sciences Fund

24

Note 3

Fund share transactions

This listing illustrates the number of Fund shares sold, issued in reorganization, reinvested and repurchased during the last two periods, along with the corresponding dollar value.

| | Year ended 10-31-05 | Year ended 10-31-06 |

| | Shares | Amount | Shares | Amount |

|

| Class A shares | | | | |

| Sold | 680,605 | $31,548,459 | 905,024 | $40,986,398 |

| Issued in reorganization | 134,447 | 6,204,667 | — | — |

| Distributions reinvested | 100,940 | 4,292,992 | 321,186 | 14,697,455 |

| Repurchased | (772,658) | (35,802,443) | (905,116) | (40,992,154) |

| Net increase | 143,334 | $6,243,675 | 321,094 | $14,691,699 |

|

| |

| Class B shares | | | | |

| Sold | 258,383 | $11,089,162 | 140,848 | $5,822,156 |

| Issued in reorganization | 162,701 | 6,864,958 | — | — |

| Distributions reinvested | 125,964 | 4,916,350 | 318,638 | 13,147,022 |

| Repurchased | (1,129,243) | (47,633,095) | (1,332,425) | (54,233,794) |

| Net decrease | (582,195) | ($24,762,625) | (872,939) | ($35,264,616) |

|

| |

| Class C shares | | | | |

| Sold | 61,221 | $2,630,110 | 40,990 | $1,704,023 |

| Issued in reorganization | 62,469 | 2,635,984 | | |

| Distributions reinvested | 11,660 | 455,107 | 42,275 | 1,744,277 |

| Repurchased�� | (96,007) | (4,014,441) | (121,336) | (4,949,351) |

| Net increase (decrease) | 39,343 | $1,706,760 | (38,071) | ($1,501,051) |

|

| |

| Net decrease | (399,518) | ($16,812,190) | (589,916) | ($22,073,968) |

Note 4

Investment transactions

Purchases and proceeds from sales or maturities of securities, other than short-term securities and obligations of the U.S. government, during the year ended October 31, 2006, aggregated $239,372,335 and $304,605,846, respectively.

The cost of investments owned on October 31, 2006, including short-term investments, for federal income tax purposes, was $268,967,825. Gross unrealized appreciation and depreciation of investments aggregated $52,080,792 and $8,539,441, respectively, resulting in net unrealized appreciation of $43,541,351. The difference between book basis and tax basis net unrealized appreciation of investments is attributable primarily to the tax deferral on certain sales of securities.

Note 5

Reclassification of accounts

During the year ended October 31, 2006, the Fund reclassified amounts to reflect a decrease in accumulated net realized gain on investments of $10,209,901, a decrease in accumulated net investment loss of $2,953,448 and an increase in capital paid-in of $7,256,453. This represents the amounts necessary to report these balances on a tax basis, excluding certain temporary differences, as of October 31, 2006. Additional adjustments may be needed in subsequent reporting periods. These reclassifications, which have no impact on the net asset value of the Fund, are primarily attributable to certain differences in the computation of distributable income and capital gains under federal tax rules versus accounting principles generally accepted in the United States of America, book and tax differences in accounting for certain foreign currency adjustments and equalization. The calculation of net investment loss per share in the Fund’s Financial Highlights excludes these adjustments.

Health Sciences Fund

25

Auditors’ report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of the John Hancock World Fund Trust and Shareholders of John Hancock Health Sciences Fund,

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock Health Sciences Fund (the “Fund”) at October 31, 2006, the results of its operations, the changes in its net assets and the financial highlights for the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2006 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

December 13, 2006

26

Tax information

Unaudited

For federal income tax purposes, the following information is furnished with respect to the distributions of the Fund, if any, paid during its taxable year ended October 31, 2006.

The Fund has designated distributions to shareholders of $41,809,531 as a long-term capital gain dividend.

The Fund hereby designates the maximum amount allowable of its net taxable income as qualified dividend income as provided in the Jobs and Growth Tax Relief Reconciliation Act of 2003. This amount will be reflected on Form 1099-DIV for the calendar year 2006.

Shareholders will be mailed a 2006 U.S. Treasury Department Form 1099-DIV in January 2007. This will reflect the total of all distributions that are taxable for calendar year 2006.

27

Board Consideration of and

Continuation of Investment

Advisory Agreement and Sub-Advisory

Agreement: John Hancock Health

Sciences Fund

The Investment Company Act of 1940 (the “1940 Act”) requires the Board of Trustees (the “Board”) of John Hancock World Fund (the “Trust”), including a majority of the Trustees who have no direct or indirect interest in the investment advisory agreement and are not “interested persons” of the Trust, as defined in the 1940 Act (the “Independent Trustees”), annually to review and consider the continuation of: (i) the investment advisory agreement (the “Advisory Agreement”) with John Hancock Advisers, LLC (the “Adviser”) and (ii) the investment sub-advisory agreement (the “Sub-Advisory Agreement”) with MFC Global Investment Management (U.S.), LLC (the “Sub-Adviser”) for the John Hancock Health Sciences Fund (the “Fund”). The Advisory Agreement and the Sub-Advisory Agreement are collectively referred to as the “Advisory Agreements.”

At meetings held on May 1-2 and June 5-6, 2006,1 the Board considered the factors and reached the conclusions described below relating to the selection of the Adviser and Sub-Adviser and the continuation of the Advisory Agreements. During such meetings, the Board’s Contracts/Operations Committee and the Independent Trustees also met in executive sessions with their independent legal counsel.

In evaluating the Advisory Agreements, the Board, including the Contracts/Operations Committee and the Independent Trustees, reviewed a broad range of information requested for this purpose by the Independent Trustees, including: (i) the investment performance of the Fund relative to a category of relevant funds (the “Category”) and a peer group of comparable funds (the “Peer Group”) each selected by Morningstar Inc. (“Morningstar”), an independent provider of investment company data, for a range of periods ended December 31, 2005; (ii) advisory and other fees incurred by, and the expense ratios of, the Fund relative to a Category and a Peer Group; (iii) the advisory fees of comparable portfolios of other clients of the Adviser and the Sub-Adviser; (iv) the Adviser’s financial results and condition, including its and certain of its affiliates’ profitability from services performed for the Fund; (v) br eakpoints in the Fund’s and the Peer Group’s fees, and information about economies of scale; (vi) the Adviser’s and Sub-Adviser’s record of compliance with applicable laws and regulations, with the Fund’s investment policies and restrictions and with the applicable Code of Ethics, and the structure and responsibilities of the Adviser’s and Sub-Adviser’s compliance department; (vii) the background and experience of senior management and investment professionals and (viii) the nature, cost and character of advisory and non-investment management services provided by the Adviser and its affiliates and by the Sub-Adviser.

The Board’s review and conclusions were based on a comprehensive consideration of all information presented to the Board and not the result of any single controlling factor. It was based on performance and other information as of December 31, 2005; facts may have changed between that date and the date of this shareholders report. The key factors considered by the Board and the conclusions reached are described below.

Nature, extent and quality of services

The Board considered the ability of the Adviser and the Sub-Adviser, based on their resources, reputation and other attributes, to attract and retain qualified investment professionals, including research, advisory and supervisory personnel. The Board further considered the compliance programs and compliance records of the Adviser and Sub-Adviser. In addition, the Board took into account the administrative services provided to the Fund by the Adviser and its affiliates.

Based on the above factors, together with those referenced below, the Board concluded that, within the context of its full deliberations, the nature, extent and quality of the investment advisory services provided to the Fund by the Adviser and Sub-Adviser were sufficient to support renewal of the Advisory Agreements.

Fund performance

The Board considered the performance results for the Fund over various time periods ended December 31, 2005. The Board also

28

considered these results in comparison to the performance of the Category, as well as the Fund’s Peer Group and benchmark index. Morningstar determined the Category and the Peer Group for the Fund. The Board reviewed, with a representative of Morningstar, the methodology used by Morningstar to select the funds in the Category and the Peer Group. The Board noted the imperfect comparability of the Peer Group.

The Board noted that the Fund’s performance during the 10-year period was equal to the performance of the Peer Group median and lower than the performance of the Category median, and its benchmark index — the Dow Jones Health Care Sector Index. The Board also noted that the performance of the Fund for the five-year period was higher than the median of its Category and Peer Group, and its benchmark index. The Board noted that, although the Fund’s performance was generally competitive with the performance of the Peer Group and Category medians during the more recent 1- and 3-year periods, the performance of the Fund was lower than the Peer Group and Category medians and higher than the performance of the benchmark index.

Investment advisory fee and sub-advisory fee rates and expenses

The Board reviewed and considered the contractual investment advisory fee rate payable by the Fund to the Adviser for investment advisory services (the “Advisory Agreement Rate”). The Board received and considered information comparing the Advisory Agreement Rate with the advisory fees for the Peer Group and Category. The Board noted that the Advisory Agreement Rate was lower than the median rate of the Peer Group and Category.

The Board received and considered expense information regarding the Fund’s various components, including advisory fees, distribution and fees other than advisory and distribution fees, including transfer agent fees, custodian fees and other miscellaneous fees (e.g., fees for accounting and legal services). The Board also considered peer-adjusted comparisons for the transfer agent fees. The Board considered comparisons of these expenses to the Peer Group median. The Board also received and considered expense information regarding the Fund’s total operating expense ratio (“Gross Expense Ratio”) and total operating expense ratio after taking the fee waiver arrangement applicable to the Advisory Agreement Rate into account (“Net Expense Ratio”). The Board received and considered information comparing the Gross Expense Ratio and Net Expense Ratio of the Fund to that of the Peer Group and Category medians. The Board noted that the Fund’s Gross and Net Expense Ratios were equal to the median of its Peer Group and not appreciably higher than median of the Category.

The Adviser also discussed the Morningstar data and rankings, and other relevant information, for the Fund. Based on the above-referenced considerations and other factors, the Board concluded that the Fund’s overall performance and expenses supported the re-approval of the Advisory Agreements.

The Board also received information about the investment sub-advisory fee rate (the “Sub-Advisory Agreement Rate”) payable by the Adviser to the Sub-Adviser for investment sub-advisory services. The Board concluded that the Sub-Advisory Agreement Rate was fair and equitable, based on its consideration of the factors described here.

Profitability

The Board received and considered a detailed profitability analysis of the Adviser based on the Advisory Agreements, as well as on other relationships between the Fund and the Adviser and its affiliates, including the Sub-Adviser. The Board concluded that, in light of the costs of providing investment management and other services to the Fund, the profits and other ancillary benefits reported by the Adviser were not unreasonable.

Economies of scale

The Board received and considered general information regarding economies of scale with respect to the management of the Fund, including the Fund’s ability to appropriately benefit from economies of scale under the Fund’s fee structure. The Board recognized the inherent limitations of any analysis of economies of scale, stemming largely from the Board’s understanding that most of the

29

Adviser’s costs are not specific to individual Funds, but rather are incurred across a variety of products and services.

To the extent the Board and the Adviser were able to identify actual or potential economies of scale from Fund-specific or allocated expenses, in order to ensure that any such economies continue to be reasonably shared with the Fund as its assets increase, the Adviser and the Board agreed to continue the existing breakpoints to the Advisory Agreement Rate.

Information about services to other clients

The Board also received information about the nature, extent and quality of services and fee rates offered by the Adviser and Sub-Adviser to their other clients, including other registered investment companies, institutional investors and separate accounts. The Board concluded that the Advisory Agreement Rate and the Sub-Advisory Agreement Rate were not unreasonable, taking into account fee rates offered to others by the Adviser and Sub-Adviser, respectively, after giving effect to differences in services.

Other benefits to the Adviser

The Board received information regarding potential “fall-out” or ancillary benefits received by the Adviser and its affiliates as a result of the Adviser’s relationship with the Fund. Such benefits could include, among others, benefits directly attributable to the relationship of the Adviser with the Fund and benefits potentially derived from an increase in the business of the Adviser as a result of its relationship with the Fund (such as the ability to market to shareholders other financial products offered by the Adviser and its affiliates).

The Board also considered the effectiveness of the Adviser’s, Sub-Adviser’s and Fund’s policies and procedures for complying with the requirements of the federal securities laws, including those relating to best execution of portfolio transactions and brokerage allocation.

Other factors and broader review

As discussed above, the Board reviewed detailed materials received from the Adviser and Sub-Adviser as part of the annual re-approval process. The Board also regularly reviews and assesses the quality of the services that the Fund receives throughout the year. In this regard, the Board reviews reports of the Adviser and Sub-Adviser at least quarterly, which include, among other things, fund performance reports and compliance reports. In addition, the Board meets with portfolio managers and senior investment officers at various times throughout the year.

After considering the above-described factors and based on its deliberations and its evaluation of the information described above, the Board concluded that approval of the continuation of the Advisory Agreements for the Fund was in the best interest of the Fund and its shareholders. Accordingly, the Board unanimously approved the continuation of the Advisory Agreements.

1 The Board previously considered information about the Sub-Advisory Agreement at the September and December 2005 Board meetings in connection with the Adviser’s reorganization.

30

Trustees and Officers

This chart provides information about the Trustees and Officers who oversee your John Hancock fund. Officers elected by the Trustees manage the day-to-day operations of the Fund and execute policies formulated by the Trustees.

| Independent Trustees | | |

| |

| Name, age | | Number of |