UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04980

TCW Strategic Income Fund, Inc.

(Exact name of registrant as specified in charter)

865 South Figueroa Street, Suite 1800, Los Angeles, CA 90017

(Address of principal executive offices)

Patrick W. Dennis, Esq.

Vice President and Assistant Secretary

865 South Figueroa Street, Suite 1800

Los Angeles, CA 90017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (213) 244-0000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2021

| Item 1. | Reports to Stockholders. |

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”): |

TCW Strategic Income Fund, Inc.

Paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.tcw.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. You can call 1-800-FUND-TCW (1-800-386-3829), if you invest directly with the Fund, or contact your financial intermediary, if you invest though a financial intermediary, to inform the Fund or the financial intermediary that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held directly with TCW or through your financial intermediary.

| | |

To Our Valued Shareholders | | |

| | |

| | David Lippman President, Chief Executive Officer and Director |

To the shareholders of the TCW Strategic Income Fund, Inc.:

Executive Summary

TCW is pleased to present the 2021 semi-annual report for the TCW Strategic Income Fund, Inc. (“TSI” or the “Fund”). TSI is a multi-asset class closed-end fund managed by TCW Investment Management Company and is listed on the New York Stock Exchange under the ticker TSI. For the first half of 2021, the market price of TSI shares increased by 6.04% while the Fund’s net asset value (i.e., returns of the underlying assets) grew by 3.44%. For reference, TSI’s customized benchmark, a construct that is 25% high yield, 15% equities, 15% convertible bonds, and 45% U.S. Aggregate Bond Index, gained 3.40% over the same period. While the underlying assets performed largely in line with the benchmark, the Fund’s six-month price-based return was higher than the NAV-based return due to a decrease in the discount between NAV and share price from 2.7% at the beginning of the year to 0.3% by June 30, 2021. For the since inception period, annualized NAV-based and price-based returns both remain ahead of the Fund’s benchmark.

Over the past four quarters, the Fund paid quarterly dividends of 5.50, 5.50, 3.82, and 6.50 cents per share. This represents an annualized rate of approximately 21 cents per share, contributing to a realized 12-month trailing yield of 3.60% as of 6/30/2021. As yield is a function of a number of parameters, the go-forward yield of TSI will likely differ from the trailing figure.

Fund Performance (%)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Annualized Total Return as of June 30, 2021 | |

| | | YTD | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

3/1/06(2) | | | Since

3/5/87(3) | |

Price-Based Return | | | 6.04 | | | | 12.55 | | | | 8.92 | | | | 7.86 | | | | 8.47 | | | | 10.04 | | | | 8.25 | |

NAV-Based Return | | | 3.44 | | | | 9.62 | | | | 6.67 | | | | 6.18 | | | | 7.40 | | | | 8.69 | | | | 8.37 | |

Custom Benchmark(1) | | | 3.40 | | | | 15.65 | | | | 10.41 | | | | 8.67 | | | | 7.36 | | | | 6.99 | | | | N/A | |

| (1) | Custom Benchmark Index: 15% S&P 500 with Income, 15% Merrill Lynch Convertible Index, 45% Bloomberg Barclays Capital U.S. Aggregate Bond Index, 25% Citi High Yield Cash Pay Index. |

| (2) | The date on which the Fund’s investment objective changed to a multi-asset class fund. Prior to this date, the Fund primarily invested in convertible securities. |

| (3) | Inception date of the Fund. |

Past performance is no guarantee of future results. Current performance may be lower or higher than that quoted. The market value and net asset value of the Fund’s shares will fluctuate with market conditions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions. You should not draw any conclusions about the Fund’s performance from the amount of the quarterly distribution or from the terms of the Fund’s distribution policy.

Management Commentary

TCW manages the Fund according to a full cycle discipline. Effectively, this means that our management style opportunistically increases the level of risk taken in the early stages of an asset price/credit cycle. In the latter stages of the cycle, our proclivity is to reduce risk, which naturally also has the tendency to pull down the overall yield of the portfolio.

This discipline proved particularly beneficial throughout 2020 as market volatility picked up dramatically given a massive reduction in risk exposure as a result of the pandemic, leading to abundant opportunities for value investors to deploy liquidity at attractive valuations. With the remediation in subsequent months on an implied Fed backstop and optimism surrounding the rollout of a COVID vaccine, these additions made earlier in the year were then opportunistically trimmed on strength. Markets have continued to improve through the first half of 2021, with fixed income spreads compressing to pre-COVID levels, and the team has continued to take a prudent approach to positioning in the credit space, de-risking exposure by moving up the quality spectrum (given tight A/BBB relationships), reducing tight commodity-exposed names/sectors, swapping into shorter-dated maturities (where curves are flat), and enhancing liquidity. The focus remains on sectors that offer more stability in times of volatility (such as consumer non-cyclicals and communications) and on idiosyncratic opportunities where wider spreads offer more compelling value. Additionally, the allocation to municipal debt was significantly reduced given higher valuations in that sector. Other notable changes included a continued increase in exposure to current (low) coupon agency mortgage-backed securities (MBS) via the to-be-announced (TBA) market as increased Fed buying of agency mortgages has enhanced the implied carry of TBAs, while among asset-backed securities (ABS), positons backed by senior government-guaranteed FFELP student loans were trimmed in favor of mostly high quality collateralized loan obligations (CLOs).

COVID-19 and the associated disruptions delivered an unprecedented shock to the U.S. economy and the recovery has proceeded in fits and starts. With no historical corollary to reference, economic forecasting is particularly difficult. The impact of government stimulus efforts has clearly been substantial, while the impact on consumer finances and overall demand as that stimulus fades in the coming months is uncertain. All of this

1

implies that asset prices at all-time highs supported by relentlessly optimistic economic outlooks do not fully account for the myriad risks confronting the economy today. Those downside risks include the potential for slowing growth in the U.S. or China later this year, as well as policymakers’ significant challenge of engineering a smooth exit from policy support or shifting to a more hawkish policy stance in the face of rising price pressures. Given prevailing conditions, the strategy maintains a defensive position and ample levels of liquidity to respond to potential volatility. The duration profile of the Fund remains relatively short at 2.2 years against a backdrop of historically low rates that are likely to remain anchored with accommodative central bank policy for the foreseeable future. Corporate credit is viewed as generally expensive and positioning remains largely defensive as noted above, with an emphasis on communications and consumer non-cyclicals, while exposure to vulnerable issuers and industries is minimized. Within securitized, the strategy continues to prefer current coupon agency MBS TBAs which remain attractive given relatively high carry of TBAs versus specified pools; the sector continues to benefit from the significant tailwind of Fed sponsorship as well as money center banks. Legacy non-agency MBS remains attractive from a collateral perspective, with the added benefit of having largely floating rate coupons, and the strategy will seek to add new exposure at favorable valuations. In commercial mortgage-backed securities (CMBS), though current holdings continue to focus on top-of the-capital structure exposures in single asset, single borrower (SASB) AAA-rated issues, opportunities are beginning to present in AA- and A-rated collateral with good loan-to-value (LTV) ratios, i.e., protection, and good spread compensation. A similar strategy applies to CLOs, with possible additions on well-collateralized AA-rated issues offering good yields, while remaining ABS exposure continues to be made up largely of government-guaranteed FFELP student loan collateral.

Portfolio Positioning

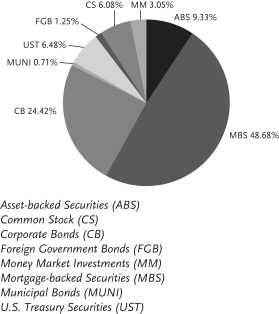

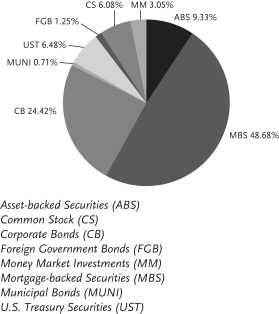

SECTOR ALLOCATION

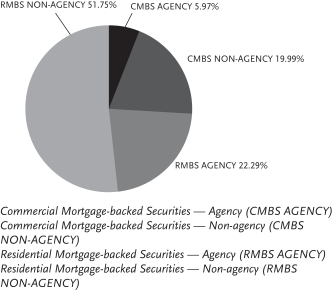

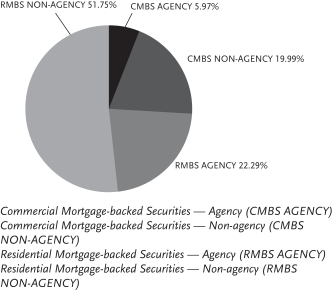

MBS ALLOCATION

Modest leverage can be utilized by TSI through a Line of Credit facility, though the Fund does not currently use any of the available $70 million commitment. Leverage may return to the Fund when market opportunity is more abundant and management deems the use of leverage is accretive to returns.

We greatly appreciate your investment in the Fund and your continuing support of TCW. If you have any additional questions or comments, we invite you to visit our website at www.tcw.com or contact our shareholder services department at 1-866-227-8179, or contact@tcw.com.

Sincerely,

David Lippman

President, Chief Executive Officer and Director

The views expressed in this report reflect those of the Fund’s Advisor as of the date this is written and may not reflect its views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding the Fund’s investment methodology and do not constitute investment advice. This report may contain discussions about investments that may or may not be held by the Fund as of the date of this report. All current and future holdings are subject to risk and to change. To the extent this report contains forward looking statements, unforeseen circumstances may cause actual results to differ materially from the views expressed as of the date this is written.

2

TCW Strategic Income Fund, Inc.

Schedule of Investments (Unaudited)

June 30, 2021

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

FIXED INCOME SECURITIES — 94.2% of Net Assets | |

|

| ASSET-BACKED SECURITIES — 10.4% | |

| |

321 Henderson Receivables LLC | | | | | |

| | | |

(17-1A-A) 3.99% (1) | | | 08/16/60 | | | $ | 210,336 | | | $ | 239,910 | |

| |

Aimco CLO, Ltd. (20-11A-A2) | | | | | |

| | | |

1.48% (3 mo. USD

LIBOR + 1.300%) (1)(2) | | | 10/15/31 | | | | 1,000,000 | | | | 1,000,942 | |

| |

Allegro CLO XII, Ltd. (20-1A-B) | | | | | |

| | | |

1.88% (3 mo. USD

LIBOR + 1.700%) (1)(2) | | | 01/21/32 | | | | 475,000 | | | | 475,475 | |

| |

Bayview Commercial Asset Trust (03-2-A) | | | | | |

| | | |

0.96% (1 mo. USD

LIBOR + 0.870%) (1)(2) | | | 12/25/33 | | | | 272,203 | | | | 268,264 | |

| |

Bayview Commercial Asset Trust (04-1-A) | | | | | |

| | | |

0.63% (1 mo. USD

LIBOR + 0.540%) (1)(2) | | | 04/25/34 | | | | 228,438 | | | | 228,533 | |

| |

Bayview Commercial Asset Trust (04-2-A) | | | | | |

| | | |

0.74% (1 mo. USD

LIBOR + 0.645%) (1)(2) | | | 08/25/34 | | | | 229,700 | | | | 228,084 | |

| |

Bayview Commercial Asset Trust (04-3-A1) | | | | | |

| | | |

0.46% (-1 mo. USD

LIBOR + 0.555%) (1)(2) | | | 01/25/35 | | | | 125,782 | | | | 124,091 | |

| |

Blackrock Rainier CLO VI, Ltd. (21-6A-A) | | | | | |

| | | |

1.89% (3 mo. USD

LIBOR + 1.700%) (1)(2) | | | 04/20/33 | | | | 700,000 | | | | 700,973 | |

| |

Brazos Higher Education Authority, Inc. (10-1-A2) | | | | | |

| | | |

1.35% (3 mo. USD

LIBOR + 1.200%) (2) | | | 02/25/35 | | | | 2,200,000 | | | | 2,234,928 | |

| |

Cedar Funding CLO, Ltd. (20-12A-A) | | | | | |

| | | |

1.45% (3 mo. USD

LIBOR + 1.270%) (1)(2) | | | 10/25/32 | | | | 1,375,000 | | | | 1,376,581 | |

| |

CIFC Funding, Ltd. (18-1A-SUB) | | | | | |

| | | |

1.00% (1)(3) | | | 04/18/31 | | | | 650,000 | | | | 490,978 | |

| |

CIT Education Loan Trust (07-1-A) | | | | | |

| | | |

0.24% (3 mo. USD

LIBOR + 0.090%) (1)(2) | | | 03/25/42 | | | | 571,359 | | | | 554,690 | |

| |

CoreVest American Finance Trust (19-1-XA) (I/O) | | | | | |

| | | |

2.34% (1)(3) | | | 03/15/52 | | | | 1,721,870 | | | | 112,200 | |

| |

CoreVest American Finance Trust (20-1-A2) | | | | | |

| | | |

2.30% (1) | | | 03/15/50 | | | | 470,000 | | | | 482,642 | |

| |

CoreVest American Finance Trust (20-3-XA) (I/O) | | | | | |

| | | |

3.80% (1)(3) | | | 08/15/53 | | | | 1,836,659 | | | | 280,276 | |

| |

CoreVest American Finance Trust (20-3-XB) (I/O) | | | | | |

| | | |

2.74% (1)(3) | | | 08/15/53 | | | | 1,650,000 | | | | 278,084 | |

| |

Dryden CLO, Ltd. (20-85A-A1) | | | | | |

| | | |

1.53% (3 mo. USD

LIBOR + 1.350%) (1)(2) | | | 10/15/32 | | | | 1,375,000 | | | | 1,376,744 | |

| |

Education Loan Asset-Backed Trust I (13-1-A2) | | | | | |

| | | |

0.89% (1 mo. USD

LIBOR + 0.800%) (1)(2) | | | 04/26/32 | | | | 1,130,959 | | | | 1,135,359 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| ASSET-BACKED SECURITIES (Continued) | |

| |

EFS Volunteer No 2 LLC (12-1-A2) | | | | | |

| | | |

1.44% (1 mo. USD

LIBOR + 1.350%) (1)(2) | | | 03/25/36 | | | $ | 1,088,936 | | | $ | 1,111,874 | |

| |

FORT CRE LLC (18-1A-A1) | | | | | |

| | | |

1.45% (1 mo. USD

LIBOR + 1.350%) (1)(2) | | | 11/16/35 | | | | 443,179 | | | | 443,761 | |

| |

Global SC Finance SRL (14-1A-A2) | | | | | |

| | | |

3.09% (1) | | | 07/17/29 | | | | 134,125 | | | | 135,393 | |

| |

Goal Capital Funding Trust (06-1-B) | | | | | |

| | | |

0.60% (3 mo. USD

LIBOR + 0.450%) (2) | | | 08/25/42 | | | | 195,991 | | | | 184,183 | |

| |

HPS Loan Management, Ltd. (0A-16-A1RR) | | | | | |

| | | |

1.23% (3 mo. USD

LIBOR + 1.140%) (1)(2) | | | 04/20/34 | | | | 875,000 | | | | 875,529 | |

| |

ITE Rail Fund Levered LP (21-1A-A) | | | | | |

| | | |

2.25% (1) | | | 02/28/51 | | | | 412,816 | | | | 414,299 | |

| |

LMREC Inc. (19-CRE3-A) | | | | | |

| | | |

1.49% (1 mo. USD

LIBOR + 1.400%) (1)(2) | | | 12/22/35 | | | | 890,000 | | | | 891,037 | |

| |

Magnetite VII, Ltd. (12-7A-A1R2) | | | | | |

| | | |

0.98% (3 mo. USD

LIBOR + 0.800%) (1)(2) | | | 01/15/28 | | | | 407,074 | | | | 406,687 | |

| |

Nelnet Student Loan Trust (14-4A-A2) | | | | | |

| | | |

1.04% (1 mo. USD

LIBOR + 0.950%) (1)(2) | | | 11/25/48 | | | | 575,000 | | | | 590,097 | |

| |

Neuberger Berman Loan Advisers CLO, Ltd. (21-43A-A) | | | | | |

| | | |

1.13% (3 mo. USD

LIBOR + 1.130%) (1)(2)(4) | | | 07/17/35 | | | | 800,000 | | | | 800,400 | |

| |

North Carolina State Education Assistance Authority (11-1-A3) | | | | | |

| | | |

1.08% (3 mo. USD

LIBOR + 0.900%) (2) | | | 10/25/41 | | | | 1,395,550 | | | | 1,398,376 | |

| |

OCP CLO, Ltd. (21-21A-B) | | | | | |

| | | |

1.83% (3 mo. USD

LIBOR + 1.700%) (1)(2) | | | 07/20/34 | | | | 400,000 | | | | 400,360 | |

| |

OHA Credit Funding, Ltd. (20-7A-A) | | | | | |

| | | |

1.44% (3 mo. USD

LIBOR + 1.250%) (1)(2) | | | 10/19/32 | | | | 1,400,000 | | | | 1,401,470 | |

| |

Palmer Square CLO, Ltd. (18-1A-A1) | | | | | |

| | | |

1.22% (3 mo. USD

LIBOR + 1.030%) (1)(2) | | | 04/18/31 | | | | 600,000 | | | | 599,910 | |

| |

Palmer Square Loan Funding Ltd. (20-2A-A2) | | | | | |

| | | |

1.74% (3 mo. USD

LIBOR + 1.550%) (1)(2) | | | 04/20/28 | | | | 350,000 | | | | 350,218 | |

| |

Park Avenue Institutional Advisers CLO, Ltd. (21-1A-A2) | | | | | |

| | | |

1.95% (3 mo. USD

LIBOR + 1.750%) (1)(2) | | | 01/20/34 | | | | 420,000 | | | | 421,302 | |

| |

Rockford Tower CLO, Ltd. (20-1A-D) | | | | | |

| | | |

4.00% (3 mo. USD

LIBOR + 3.750%) (1)(2) | | | 01/20/32 | | | | 900,000 | | | | 903,636 | |

See accompanying Notes to Financial Statements.

3

TCW Strategic Income Fund, Inc.

Schedule of Investments (Unaudited) (Continued)

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| ASSET-BACKED SECURITIES (Continued) | |

| |

Scholar Funding Trust (12-B-A2) | | | | | |

| | | |

1.20% (1 mo. USD

LIBOR + 1.100%) (1)(2) | | | 03/28/46 | | | $ | 630,316 | | | $ | 641,489 | |

| |

SLC Student Loan Trust (04-1-B) | | | | | |

| | | |

0.45% (3 mo. USD

LIBOR + 0.290%) (2) | | | 08/15/31 | | | | 258,829 | | | | 240,678 | |

| |

SLC Student Loan Trust (06-1-B) | | | | | |

| | | |

0.33% (3 mo. USD

LIBOR + 0.210%) (2) | | | 03/15/55 | | | | 352,524 | | | | 320,782 | |

| |

SLM Student Loan Trust (04-2-B) | | | | | |

| | | |

0.65% (3 mo. USD

LIBOR + 0.470%) (2) | | | 07/25/39 | | | | 299,567 | | | | 285,564 | |

| |

SLM Student Loan Trust (05-9-B) | | | | | |

| | | |

0.48% (3 mo. USD

LIBOR + 0.300%) (2) | | | 01/25/41 | | | | 363,759 | | | | 338,538 | |

| |

SLM Student Loan Trust (07-6-B) | | | | | |

| | | |

1.03% (3 mo. USD

LIBOR + 0.850%) (2) | | | 04/27/43 | | | | 126,205 | | | | 119,992 | |

| |

SLM Student Loan Trust (07-7-B) | | | | | |

| | | |

0.93% (3 mo. USD

LIBOR + 0.750%) (2) | | | 10/27/70 | | | | 150,000 | | | | 136,647 | |

| |

SLM Student Loan Trust (08-2-B) | | | | | |

| | | |

1.38% (3 mo. USD

LIBOR + 1.200%) (2) | | | 01/25/83 | | | | 225,000 | | | | 213,792 | |

| |

SLM Student Loan Trust (08-3-B) | | | | | |

| | | |

1.38% (3 mo. USD

LIBOR + 1.200%) (2) | | | 04/26/83 | | | | 225,000 | | | | 210,560 | |

| |

SLM Student Loan Trust (08-4-B) | | | | | |

| | | |

2.03% (3 mo. USD

LIBOR + 1.850%) (2) | | | 04/25/73 | | | | 515,000 | | | | 513,991 | |

| |

SLM Student Loan Trust (08-5-B) | | | | | |

| | | |

2.03% (3 mo. USD

LIBOR + 1.850%) (2) | | | 07/25/73 | | | | 260,000 | | | | 257,456 | |

| |

SLM Student Loan Trust (08-6-B) | | | | | |

| | | |

2.03% (3 mo. USD

LIBOR + 1.850%) (2) | | | 07/26/83 | | | | 225,000 | | | | 221,752 | |

| |

SLM Student Loan Trust (08-7-B) | | | | | |

| | | |

2.03% (3 mo. USD

LIBOR + 1.850%) (2) | | | 07/26/83 | | | | 305,000 | | | | 304,599 | |

| |

SLM Student Loan Trust (08-8-B) | | | | | |

| | | |

2.43% (3 mo. USD

LIBOR + 2.250%) (2) | | | 10/25/75 | | | | 260,000 | | | | 261,503 | |

| |

SLM Student Loan Trust (08-9-B) | | | | | |

| | | |

2.43% (3 mo. USD

LIBOR + 2.250%) (2) | | | 10/25/83 | | | | 260,000 | | | | 262,549 | |

| |

Structured Receivables Finance LLC (10-A-B) | | | | | |

| | | |

7.61% (1) | | | 01/16/46 | | | | 542,216 | | | | 613,782 | |

| |

Structured Receivables Finance LLC (10-B-B) | | | | | |

| | | |

7.97% (1) | | | 08/15/36 | | | | 339,563 | | | | 410,024 | |

| |

Student Loan Consolidation Center (02-2-B2) | | | | | |

| | | |

1.65% (28 day Auction Rate) (1)(2) | | | 07/01/42 | | | | 1,050,000 | | | | 969,280 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| ASSET-BACKED SECURITIES (Continued) | |

| |

TCI-Flatiron CLO, Ltd. (16-1A-BR2) | | | | | |

| | | |

1.79% (3 mo. USD

LIBOR + 1.600%) (1)(2) | | | 01/17/32 | | | $ | 280,000 | | | $ | 280,232 | |

| | | | | | | | | | | | |

| | |

Total Asset-backed Securities | | | | | | | | | |

| | |

(Cost: $28,791,012) | | | | | | | | 29,520,496 | |

| | | | | | | | | | | | |

|

MORTGAGE-BACKED SECURITIES — 54.3% | |

|

| Commercial Mortgage-backed Securities — Agency — 3.2% | |

| |

BMO SBA COOF Trust (19-1-A) (I/O) | | | | | |

| | | |

1.87% (1)(3) | | | 10/25/45 | | | | 8,648,064 | | | | 517,933 | |

| |

COOF Securitization Trust II (15-2-A1) (I/O) | | | | | |

| | | |

2.80% (1)(3) | | | 08/25/41 | | | | 4,733,150 | | | | 358,998 | |

| |

Fannie Mae, Pool #464398 | | | | | |

| | | |

5.97% | | | 01/01/40 | | | | 551,744 | | | | 636,983 | |

| |

Fannie Mae, Pool #464400 | | | | | |

| | | |

5.97% | | | 01/01/40 | | | | 417,988 | | | | 482,563 | |

| |

Fannie Mae, Pool #AN3542 | | | | | |

| | | |

3.41% | | | 11/01/46 | | | | 1,122,536 | | | | 1,246,627 | |

| |

Fannie Mae (11-M5-A2) (ACES) (I/O) | | | | | |

| | | |

1.13% (3) | | | 07/25/21 | | | | 576,995 | | | | 14 | |

| |

Fannie Mae (16-M11-X2) (ACES) (I/O) | | | | | |

| | | |

2.95% (3) | | | 07/25/39 | | | | 1,639,320 | | | | 62,385 | |

| |

Fannie Mae (19-M29-X4) (ACES) (I/O) | | | | | |

| | | |

0.70% (3) | | | 03/25/29 | | | | 7,900,000 | | | | 326,132 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (K023-X3) (I/O) | | | | | |

| | | |

1.75% (3) | | | 10/25/40 | | | | 12,555,000 | | | | 230,520 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (K032-X3) (I/O) | | | | | |

| | | |

1.71% (3) | | | 10/25/41 | | | | 4,020,000 | | | | 128,413 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (K039-X3) (I/O) | | | | | |

| | | |

2.18% (3) | | | 08/25/42 | | | | 3,110,000 | | | | 218,617 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (K057-X1) (I/O) | | | | | |

| | | |

1.31% (3) | | | 07/25/26 | | | | 5,244,864 | | | | 266,624 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (K722-X1) (I/O) | | | | | |

| | | |

1.44% (3) | | | 03/25/23 | | | | 15,547,970 | | | | 245,244 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (K735-X3) (I/O) | | | | | |

| | | |

2.23% (3) | | | 05/25/47 | | | | 3,750,000 | | | | 352,958 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (Q013-XPT2) (I/O) | | | | | |

| | | |

1.81% | | | 05/25/27 | | | | 4,119,231 | | | | 157,817 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (19-P002-X) (I/O) | | | | | |

| | | |

1.14% (3) | | | 07/25/33 | | | | 1,295,000 | | | | 141,583 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K015-X3) (I/O) | | | | | |

| | | |

2.88% (3) | | | 08/25/39 | | | | 4,000,000 | | | | 5,697 | |

See accompanying Notes to Financial Statements.

4

TCW Strategic Income Fund, Inc.

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Commercial Mortgage-backed Securities — Agency (Continued) | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K021-X3) (I/O) | | | | | |

| | | |

2.03% (3) | | | 07/25/40 | | | $ | 3,475,000 | | | $ | 64,968 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K022-X3) (I/O) | | | | | |

| | | |

1.87% (3) | | | 08/25/40 | | | | 2,500,000 | | | | 48,580 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K025-X3) (I/O) | | | | | |

| | | |

1.81% (3) | | | 11/25/40 | | | | 5,400,000 | | | | 118,847 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K027-X3) (I/O) | | | | | |

| | | |

1.76% (3) | | | 01/25/41 | | | | 4,095,000 | | | | 102,535 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K031-X1) (I/O) | | | | | |

| | | |

0.31% (3) | | | 04/25/23 | | | | 55,708,098 | | | | 193,572 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K031-X3) (I/O) | | | | | |

| | | |

1.72% (3) | | | 07/25/41 | | | | 4,500,000 | | | | 130,102 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K034-X1) (I/O) | | | | | |

| | | |

0.20% (3) | | | 07/25/23 | | | | 26,739,988 | | | | 50,822 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K040-X3) (I/O) | | | | | |

| | | |

2.10% (3) | | | 11/25/42 | | | | 4,875,000 | | | | 305,029 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K049-X3) (I/O) | | | | | |

| | | |

1.60% (3) | | | 10/25/43 | | | | 2,330,000 | | | | 132,625 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K060-X3) (I/O) | | | | | |

| | | |

1.96% (3) | | | 12/25/44 | | | | 2,500,000 | | | | 224,915 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K726-X1) (I/O) | | | | | |

| | | |

1.02% (3) | | | 04/25/24 | | | | 12,792,690 | | | | 242,614 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K728-X3) (I/O) | | | | | |

| | | |

2.02% (3) | | | 11/25/45 | | | | 3,455,000 | | | | 202,555 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K732-X3) (I/O) | | | | | |

| | | |

2.25% (3) | | | 05/25/46 | | | | 2,400,000 | | | | 191,828 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (KC05-X1) (I/O) | | | | | |

| | | |

1.34% (3) | | | 06/25/27 | | | | 7,974,130 | | | | 401,140 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (KIR1-X) (I/O) | | | | | |

| | | |

1.20% (3) | | | 03/25/26 | | | | 8,506,872 | | | | 358,775 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (KLU2-X1) (I/O) | | | | | |

| | | |

1.17% (3) | | | 08/25/29 | | | | 4,963,199 | | | | 350,896 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (KS11-XFX) (I/O) | | | | | |

| | | |

1.76% (3) | | | 06/25/29 | | | | 2,290,000 | | | | 234,121 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Commercial Mortgage-backed Securities — Agency (Continued) | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (KW01-X3) (I/O) | | | | | |

| | | |

4.22% (3) | | | 03/25/29 | | | $ | 690,000 | | | $ | 111,597 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (Q010-XPT2) (I/O) | | | | | |

| | | |

0.36% | | | 08/25/24 | | | | 4,949,983 | | | | 32,135 | |

|

Ginnie Mae (12-139-IO) (I/O) | |

| | | |

0.69% (3) | | | 02/16/53 | | | | 3,308,312 | | | | 84,755 | |

|

Ginnie Mae (13-52-IO) (I/O) | |

| | | |

0.28% (3) | | | 02/16/55 | | | | 8,206,754 | | | | 46,944 | |

|

Ginnie Mae (09-114-IO) (I/O) | |

| | | |

0.03% (3) | | | 10/16/49 | | | | 5,213,050 | | | | 557 | |

|

Ginnie Mae (10-148-IO) (I/O) | |

| | | |

0.29% (3) | | | 09/16/50 | | | | 5,541,237 | | | | 64,337 | |

|

Ginnie Mae (11-105-IO) (I/O) | |

| | | |

0.00% (3)(5) | | | 09/16/51 | | | | 5,502,878 | | | | 1,142 | |

|

Ginnie Mae (11-152-IO) (I/O) | |

| | | |

0.06% (3) | | | 08/16/51 | | | | 2,329,475 | | | | 2,367 | |

|

Ginnie Mae (11-42-IO) (I/O) | |

| | | |

0.00% (3)(5) | | | 08/16/50 | | | | 2,293,626 | | | | 129 | |

|

Ginnie Mae (12-4-IO) (I/O) | |

| | | |

0.04% (3) | | | 05/16/52 | | | | 7,136,136 | | | | 8,373 | |

|

Ginnie Mae (14-103-IO) (I/O) | |

| | | |

0.18% (3) | | | 05/16/55 | | | | 2,872,185 | | | | 38,500 | |

| |

Ginnie Mae (14-125-IO) (I/O) | | | | | |

| | | |

0.88% (3) | | | 11/16/54 | | | | 1,976,791 | | | | 73,636 | |

| | | | | | | | | | | | |

| | |

Total Commercial Mortgage-backed

Securities — Agency | | | | | | | | | |

| | |

(Cost: $13,009,633) | | | | | | | | 9,197,504 | |

| | | | | | | | | | | | |

|

| Commercial Mortgage-backed Securities — Non-Agency — 10.9% | |

| |

BAMLL Commercial Mortgage Securities Trust (18-PARK-A) | | | | | |

| | | |

4.23% (1)(3) | | | 08/10/38 | | | | 590,000 | | | | 677,093 | |

|

BBCMS Mortgage Trust (17-C1-XA) (I/O) | |

| | | |

1.62% (3) | | | 02/15/50 | | | | 3,894,902 | | | | 250,891 | |

|

BBCMS Mortgage Trust (18-C2-A5) | |

| | | |

4.31% | | | 12/15/51 | | | | 430,000 | | | | 500,625 | |

|

Benchmark Mortgage Trust (19-B10-3CCB) | |

| | | |

4.03% (1)(3) | | | 03/15/62 | | | | 435,000 | | | | 428,575 | |

|

Benchmark Mortgage Trust (19-B14-225D) | |

| | | |

3.40% (1)(3) | | | 12/15/62 | | | | 535,000 | | | | 508,762 | |

|

Benchmark Mortgage Trust (20-B17-A5) | |

| | | |

2.29% | | | 03/15/53 | | | | 1,040,000 | | | | 1,067,416 | |

|

Benchmark Mortgage Trust (20-IG3-BXC) | |

| | | |

3.65% (1)(3) | | | 09/15/48 | | | | 555,000 | | | | 544,952 | |

|

BF Mortgage Trust (19-NYT-E) | |

| | | |

2.57% (1 mo. USD

LIBOR + 2.500%)(1)(2) | | | 12/15/35 | | | | 525,000 | | | | 516,636 | |

|

BX Commercial Mortgage Trust (18-IND-G) | |

| | | |

2.12% (1 mo. USD

LIBOR + 2.050%) (1)(2) | | | 11/15/35 | | | | 360,500 | | | | 360,980 | |

See accompanying Notes to Financial Statements.

5

TCW Strategic Income Fund, Inc.

Schedule of Investments (Unaudited) (Continued)

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Commercial Mortgage-backed Securities — Non-Agency (Continued) | |

| |

BX Commercial Mortgage Trust (20-FOX-E) | | | | | |

| | | |

3.67% (1 mo. USD

LIBOR + 3.600%) (1)(2) | | | 11/15/32 | | | $ | 893,994 | | | $ | 900,141 | |

| |

BX Trust (19-OC11-A) | | | | | |

| | | |

3.20% (1) | | | 12/09/41 | | | | 265,000 | | | | 286,214 | |

| |

CALI Mortgage Trust (19-101C-A) | | | | | |

| | | |

3.96% (1) | | | 03/10/39 | | | | 680,000 | | | | 777,635 | |

| |

CALI Mortgage Trust (19-101C-E) | | | | | |

| | | |

4.47% (1)(3) | | | 03/10/39 | | | | 315,000 | | | | 319,918 | |

|

Citigroup Commercial Mortgage Trust (12-GC8-XA) (I/O) | |

| | | |

1.90% (1)(3)(6) | | | 09/10/45 | | | | 2,924,426 | | | | 40,752 | |

|

Citigroup Commercial Mortgage Trust (14-GC21-XD) (I/O) | |

| | | |

1.52% (1)(3) | | | 05/10/47 | | | | 4,703,442 | | | | 154,101 | |

|

Citigroup Commercial Mortgage Trust (15-GC35-XA) (I/O) | |

| | | |

0.93% (3) | | | 11/10/48 | | | | 6,466,773 | | | | 174,563 | |

|

Citigroup Commercial Mortgage Trust (19-PRM-X) (I/O) | |

| | | |

1.33% (1)(3) | | | 05/10/36 | | | | 14,000,000 | | | | 395,541 | |

| |

COMM Mortgage Trust (12-LC4-XB) (I/O) | | | | | |

| | | |

0.64% (1)(3) | | | 12/10/44 | | | | 18,671,016 | | | | 58,737 | |

| |

COMM Mortgage Trust (13-CR11-XA) (I/O) | | | | | |

| | | |

1.08% (3) | | | 08/10/50 | | | | 9,683,629 | | | | 178,496 | |

| |

COMM Mortgage Trust (13-CR12-XA) (I/O) | | | | | |

| | | |

1.28% (3) | | | 10/10/46 | | | | 9,194,850 | | | | 202,512 | |

| |

COMM Mortgage Trust (13-LC13-XA) (I/O) | | | | | |

| | | |

1.18% (3) | | | 08/10/46 | | | | 6,169,889 | | | | 112,528 | |

|

COMM Mortgage Trust (14-CR18-XA) (I/O) | |

| | | |

1.17% (3) | | | 07/15/47 | | | | 6,368,782 | | | | 161,777 | |

|

COMM Mortgage Trust (14-CR21-XA) (I/O) | |

| | | |

1.00% (3) | | | 12/10/47 | | | | 17,159,187 | | | | 424,053 | |

|

COMM Mortgage Trust (20-CBM-XCP) (I/O) | |

| | | |

0.72% (1)(3) | | | 02/10/37 | | | | 5,644,863 | | | | 116,552 | |

|

COMM Mortgage Trust (20-CX-E) | |

| | | |

2.77% (1)(3) | | | 11/10/46 | | | | 370,000 | | | | 353,014 | |

| |

CPT Mortgage Trust (19-CPT-A) | | | | | |

| | | |

2.87% (1) | | | 11/13/39 | | | | 1,165,000 | | | | 1,243,951 | |

| |

DBGS Mortgage Trust (18-5BP-E) | | | | | |

| | | |

2.12% (1 mo. USD

LIBOR + 1.900%) (1)(2) | | | 06/15/33 | | | | 685,000 | | | | 679,660 | |

| |

DBWF Mortgage Trust (16-85T-A) | | | | | |

| | | |

3.79% (1) | | | 12/10/36 | | | | 615,000 | | | | 681,544 | |

| |

DC Office Trust (19-MTC-A) | | | | | |

| | | |

2.97% (1) | | | 09/15/45 | | | | 550,000 | | | | 588,794 | |

| |

Grace Trust (20-GRCE-A) | | | | | |

| | | |

2.35% (1) | | | 12/10/40 | | | | 1,350,000 | | | | 1,379,469 | |

| |

Grace Trust (20-GRCE-D) | | | | | |

| | | |

2.77% (1)(3) | | | 12/10/40 | | | | 1,249,000 | | | | 1,240,954 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Commercial Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Grace Trust (20-GRCE-F) | | | | | |

| | | |

2.77% (1)(3) | | | 12/10/40 | | | $ | 376,000 | | | $ | 344,054 | |

| |

Grace Trust (20-GRCE-X) (I/O) | | | | | |

| | | |

0.39% (1)(3) | | | 12/10/40 | | | | 10,620,000 | | | | 284,166 | |

|

GS Mortgage Securities Corp. Trust (20-UPTN-XA) (I/O) | |

| | | |

0.45% (1)(3) | | | 02/10/37 | | | | 3,150,000 | | | | 38,970 | |

| |

GS Mortgage Securities Trust (11-GC3-X) (I/O) | | | | | |

| | | |

0.42% (1)(3) | | | 03/10/44 | | | | 2,701,548 | | | | 8,210 | |

| |

GS Mortgage Securities Trust (12-GC6-XB) (I/O) | | | | | |

| | | |

0.26% (1)(3)(6) | | | 01/10/45 | | | | 17,386,264 | | | | 22,908 | |

| |

GS Mortgage Securities Trust (12-GCJ7-XB) (I/O) | | | | | |

| | | |

0.54% (1)(3) | | | 05/10/45 | | | | 34,082,467 | | | | 98,318 | |

| |

GS Mortgage Securities Trust (14-GC18-XB) (I/O) | | | | | |

| | | |

0.27% (3) | | | 01/10/47 | | | | 66,563,000 | | | | 273,667 | |

| |

GS Mortgage Securities Trust (16-GS2-XA) (I/O) | | | | | |

| | | |

1.90% (3) | | | 05/10/49 | | | | 4,200,099 | | | | 298,255 | |

| |

Hudson Yards Mortgage Trust (19-30HY-A) | | | | | |

| | | |

3.23% (1) | | | 07/10/39 | | | | 560,000 | | | | 611,071 | |

| |

Hudson Yards Mortgage Trust (19-55HY-A) | | | | | |

| | | |

3.04% (1)(3) | | | 12/10/41 | | | | 550,000 | | | | 593,502 | |

| |

Hudson Yards Mortgage Trust (19-55HY-F) | | | | | |

| | | |

3.04% (1)(3) | | | 12/10/41 | | | | 150,000 | | | | 144,295 | |

| |

ILPT Trust (19-SURF-A) | | | | | |

| | | |

4.15% (1) | | | 02/11/41 | | | | 240,000 | | | | 275,690 | |

| |

JPMBB Commercial Mortgage Securities Trust (14-C24-XA) (I/O) | | | | | |

| | | |

1.06% (3) | | | 11/15/47 | | | | 7,860,603 | | | | 176,015 | |

| |

JPMBB Commercial Mortgage Securities Trust (14-C21-XA) (I/O) | | | | | |

| | | |

1.13% (3) | | | 08/15/47 | | | | 1,714,247 | | | | 44,719 | |

| |

JPMBB Commercial Mortgage Securities Trust (14-C23-XA) (I/O) | | | | | |

| | | |

0.76% (3) | | | 09/15/47 | | | | 9,671,856 | | | | 167,016 | |

| |

JPMBB Commercial Mortgage Securities Trust (15-C29-XD) (I/O) | | | | | |

| | | |

0.50% (1)(3) | | | 05/15/48 | | | | 26,458,000 | | | | 473,376 | |

| |

JPMCC Commercial Mortgage Securities Trust (17-JP5-XA) (I/O) | | | | | |

| | | |

1.16% (3) | | | 03/15/50 | | | | 13,466,080 | | | | 555,063 | |

| |

JPMorgan Chase Commercial Mortgage Securities Trust (11-C3-XB) (I/O) | | | | | |

| | | |

0.51% (1)(3) | | | 02/15/46 | | | | 52,560,935 | | | | 635,995 | |

| |

JPMorgan Chase Commercial Mortgage Securities Trust (12-HSBC-XA) (I/O) | | | | | |

| | | |

1.58% (1)(3)(6) | | | 07/05/32 | | | | 4,293,041 | | | | 47,220 | |

| |

JPMorgan Chase Commercial Mortgage Securities Trust (12-LC9-XA) (I/O) | | | | | |

| | | |

1.63% (3) | | | 12/15/47 | | | | 6,611,551 | | | | 107,523 | |

See accompanying Notes to Financial Statements.

6

TCW Strategic Income Fund, Inc.

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Commercial Mortgage-backed Securities — Non-Agency (Continued) | |

| |

JPMorgan Chase Commercial Mortgage Securities Trust (13-LC11-XA) (I/O) | | | | | |

| | | |

1.38% (3) | | | 04/15/46 | | | $ | 22,030,185 | | | $ | 386,428 | |

| |

JPMorgan Chase Commercial Mortgage Securities Trust (19-OSB-A) | | | | | |

| | | |

3.40% (1) | | | 06/05/39 | | | | 585,000 | | | | 647,451 | |

| |

JPMorgan Chase Commercial Mortgage Securities Trust (19-OSB-C) | | | | | |

| | | |

3.75% (1)(3) | | | 06/05/39 | | | | 150,000 | | | | 163,519 | |

| |

Manhattan West Mortgage Trust (20-1MW-A) | | | | | |

| | | |

2.13% (1) | | | 09/10/39 | | | | 695,000 | | | | 711,112 | |

| |

MFT Mortgage Trust (20-B6-C) | | | | | |

| | | |

3.39% (1)(3) | | | 08/10/40 | | | | 220,000 | | | | 221,030 | |

| |

MFT Trust (20-ABC-C) | | | | | |

| | | |

3.59% (1)(3) | | | 02/10/42 | | | | 175,000 | | | | 175,561 | |

| |

MFT Trust (20-ABC-D) | | | | | |

| | | |

3.59% (1)(3) | | | 02/10/42 | | | | 180,000 | | | | 175,383 | |

| |

MKT Mortgage Trust (20-525M-A) | | | | | |

| | | |

2.69% (1) | | | 02/12/40 | | | | 335,000 | | | | 352,364 | |

| |

Morgan Stanley Bank of America Merrill Lynch Trust (15-C22-XA) (I/O) | | | | | |

| | | |

1.17% (3) | | | 04/15/48 | | | | 8,731,215 | | | | 254,792 | |

| |

Morgan Stanley Bank of America Merrill Lynch Trust (15-C24-XA) (I/O) | | | | | |

| | | |

0.86% (3) | | | 05/15/48 | | | | 9,877,330 | | | | 250,762 | |

| |

Morgan Stanley Bank of America Merrill Lynch Trust (16-C31-XA) (I/O) | | | | | |

| | | |

1.47% (3) | | | 11/15/49 | | | | 7,277,467 | | | | 383,682 | |

| |

Morgan Stanley Capital I Trust (12-C4-XA) (I/O) | | | | | |

| | | |

2.23% (1)(3)(6) | | | 03/15/45 | | | | 3,989,114 | | | | 18,237 | |

| |

Morgan Stanley Capital I Trust (19-L2-A3) | | | | | |

| | | |

3.81% | | | 03/15/52 | | | | 460,000 | | | | 510,684 | |

| |

Morgan Stanley Capital I Trust (19-L2-A4) | | | | | |

| | | |

4.07% | | | 03/15/52 | | | | 980,000 | | | | 1,126,783 | |

| |

Morgan Stanley Capital I Trust (20-CNP-A) | | | | | |

| | | |

2.51% (1)(3) | | | 04/05/42 | | | | 650,000 | | | | 671,080 | |

| |

One Bryant Park Trust (19-OBP-A) | | | | | |

| | | |

2.52% (1) | | | 09/15/54 | | | | 1,295,000 | | | | 1,346,296 | |

| |

SFAVE Commercial Mortgage Securities Trust (15-5AVE-A2A) | | | | | |

| | | |

3.66% (1)(3) | | | 01/05/43 | | | | 805,000 | | | | 892,038 | |

| |

SFAVE Commercial Mortgage Securities Trust (15-5AVE-A2B) | | | | | |

| | | |

4.14% (1)(3) | | | 01/05/43 | | | | 65,000 | | | | 71,434 | |

| |

SFAVE Commercial Mortgage Securities Trust (15-5AVE-D) | | | | | |

| | | |

4.53% (1)(3) | | | 01/05/43 | | | | 880,000 | | | | 723,754 | |

| |

UBS Commercial Mortgage Trust (12-C1-XA) (I/O) | | | | | |

| | | |

2.24% (1)(3)(6) | | | 05/10/45 | | | | 4,444,487 | | | | 38,284 | |

| |

UBS Commercial Mortgage Trust (17-C5-XA) (I/O) | | | | | |

| | | |

1.14% (3) | | | 11/15/50 | | | | 7,198,984 | | | | 323,450 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Commercial Mortgage-backed Securities — Non-Agency (Continued) | |

|

UBS-Barclays Commercial Mortgage Trust (12-C3-XA) (I/O) | |

| | | |

1.98% (1)(3) | | | 08/10/49 | | | $ | 12,300,291 | | | $ | 195,634 | |

|

UBS-Barclays Commercial Mortgage Trust (13-C5-XA) (I/O) | |

| | | |

1.04% (1)(3) | | | 03/10/46 | | | | 12,420,743 | | | | 125,730 | |

| |

Wells Fargo Commercial Mortgage Trust (12-LC5-XA) (I/O) | | | | | |

| | | |

1.89% (1)(3) | | | 10/15/45 | | | | 4,988,779 | | | | 76,750 | |

| |

WFRBS Commercial Mortgage Trust (12-C8-XA) (I/O) | | | | | |

| | | |

1.94% (1)(3)(6) | | | 08/15/45 | | | | 4,124,437 | | | | 42,255 | |

| |

WFRBS Commercial Mortgage Trust (12-C9-XA) (I/O) | | | | | |

| | | |

2.03% (1)(3) | | | 11/15/45 | | | | 2,431,126 | | | | 41,681 | |

| |

WFRBS Commercial Mortgage Trust (13-C14-XA) (I/O) | | | | | |

| | | |

0.81% (3) | | | 06/15/46 | | | | 7,093,218 | | | | 66,569 | |

| |

WFRBS Commercial Mortgage Trust (13-C16-XA) (I/O) | | | | | |

| | | |

0.80% (3) | | | 09/15/46 | | | | 11,459,772 | | | | 133,844 | |

| |

WFRBS Commercial Mortgage Trust (14-C24-XA) (I/O) | | | | | |

| | | |

1.00% (3) | | | 11/15/47 | | | | 5,293,712 | | | | 130,530 | |

| | | | | | | | | | | | |

| | |

Total Commercial Mortgage-backed

Securities — Non-Agency | | | | | | | | | |

| | |

(Cost: $35,466,361) | | | | | | | | 30,783,986 | |

| | | | | | | | | | | | |

|

| Residential Mortgage-backed Securities — Agency — 12.1% | |

| |

Fannie Mae (04-53-QV) (I/O) (I/F) | | | | | |

| | | |

1.59% (3) | | | 02/25/34 | | | | 114,556 | | | | 359 | |

| |

Fannie Mae (07-42-SE) (I/O) (I/F) | | | | | |

| | | |

6.02% (-1 mo. USD

LIBOR + 6.110%) (2) | | | 05/25/37 | | | | 70,388 | | | | 9,519 | |

| |

Fannie Mae (07-48-SD) (I/O) (I/F) | | | | | |

| | | |

6.01% (-1 mo. USD

LIBOR + 6.100%) (2) | | | 05/25/37 | | | | 1,068,968 | | | | 187,025 | |

| |

Fannie Mae (09-69-CS) (I/O) (I/F) | | | | | |

| | | |

6.66% (-1 mo. USD

LIBOR + 6.750%) (2) | | | 09/25/39 | | | | 218,905 | | | | 34,387 | |

| |

Freddie Mac (1673-SD) (I/F) (PAC) | | | | | |

| | | |

15.86% (-2.15 x T10Y + 19.391%) (2) | | | 02/15/24 | | | | 28,852 | | | | 32,732 | |

| |

Freddie Mac (1760-ZD) | | | | | |

| | | |

1.14% (1 x T10Y -

0.500%) (2) | | | 02/15/24 | | | | 62,300 | | | | 62,467 | |

| |

Freddie Mac (2990-JK) (I/F) | | | | | |

| | | |

21.71% (-1 mo. USD

LIBOR + 22.004%) (2) | | | 03/15/35 | | | | 63,995 | | | | 73,848 | |

| |

Freddie Mac (3122-SG) (I/O) (I/F) (TAC) (P AC) | | | | | |

| | | |

5.56% (-1 mo. USD

LIBOR + 5.630%) (2) | | | 03/15/36 | | | | 1,839,626 | | | | 331,904 | |

| |

Freddie Mac (3239-SI) (I/O) (I/F) (PAC) | | | | | |

| | | |

6.58% (-1 mo. USD

LIBOR + 6.650%) (2) | | | 11/15/36 | | | | 420,907 | | | | 93,273 | |

See accompanying Notes to Financial Statements.

7

TCW Strategic Income Fund, Inc.

Schedule of Investments (Unaudited) (Continued)

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Agency (Continued) | |

| |

Freddie Mac (3323-SA) (I/O) (I/F) | | | | | |

| | | |

6.04% (-1 mo. USD

LIBOR + 6.110%) (2) | | | 05/15/37 | | | $ | 91,856 | | | $ | 10,860 | |

| |

Freddie Mac (3459-JS) (I/O) (I/F) | | | | | |

| | | |

6.18% (-1 mo. USD

LIBOR + 6.250%) (2) | | | 06/15/38 | | | | 129,216 | | | | 24,016 | |

| |

Freddie Mac (4030-HS) (I/O) (I/F) | | | | | |

| | | |

6.54% (-1 mo. USD

LIBOR + 6.610% ) (2) | | | 04/15/42 | | | | 808,018 | | | | 168,076 | |

|

Ginnie Mae (06-35-SA) (I/O) (I/F) | |

| | | |

6.51% (-1 mo. USD

LIBOR + 6.600%) (2) | | | 07/20/36 | | | | 1,168,630 | | | | 254,857 | |

| |

Ginnie Mae (06-61-SA) (I/O) (I/F) (TAC) | | | | | |

| | | |

4.66% (-1 mo. USD

LIBOR + 4.750%) (2) | | | 11/20/36 | | | | 1,921,882 | | | | 222,986 | |

| |

Ginnie Mae (08-58-TS) (I/O) (I/F) (TAC) | | | | | |

| | | |

6.31% (-1 mo. USD

LIBOR + 6.400%) (2) | | | 05/20/38 | | | | 896,032 | | | | 84,574 | |

| |

Ginnie Mae (16-153-IO) (I/O) | | | | | |

| | | |

3.50% | | | 11/20/46 | | | | 2,305,914 | | | | 300,707 | |

|

Uniform Mortgage-Backed Securities TBA, 30 Year | |

| | | |

2.00% (7) | | | 08/12/51 | | | | 14,700,000 | | | | 14,814,844 | |

| |

Uniform Mortgage-Backed Securities TBA, 30 Year | | | | | |

| | | |

2.50% (7) | | | 08/12/51 | | | | 17,075,000 | | | | 17,628,604 | |

| | | | | | | | | | | | |

| | |

Total Residential Mortgage-backed Securities — Agency | | | | | | | | | |

| |

(Cost: $33,559,531) | | | | 34,335,038 | |

| | | | | | | | | | | | |

|

| Residential Mortgage-backed Securities — Non-Agency — 28.1% | |

|

ACE Securities Corp. (04-IN1-A1) | |

| | | |

0.73% (1 mo. USD

LIBOR + 0.640%) (2) | | | 05/25/34 | | | | 418,249 | | | | 410,066 | |

|

ACE Securities Corp. (07-ASP1-A2C) | |

| | | |

0.35% (1 mo. USD

LIBOR + 0.260%) (2) | | | 03/25/37 | | | | 1,365,667 | | | | 835,675 | |

|

Adjustable Rate Mortgage Trust (05-4-6A22) | |

| | | |

2.86% (3)(8) | | | 08/25/35 | | | | 497,699 | | | | 330,447 | |

|

Adjustable Rate Mortgage Trust (06-1-2A1) | |

| | | |

3.48% (3)(8) | | | 03/25/36 | | | | 361,509 | | | | 253,205 | |

|

Ajax Mortgage Loan Trust (19-F-A2) | |

| | | |

3.50% (1) | | | 07/25/59 | | | | 1,300,000 | | | | 1,309,375 | |

|

Alternative Loan Trust (05-46CB-A20)(TAC) | |

| | | |

5.50% | | | 10/25/35 | | | | 709,299 | | | | 657,896 | |

|

Asset-Backed Funding Certificates (07-NC1-A2) | |

| | | |

0.39% (1 mo. USD

LIBOR + 0.300%) (1)(2) | | | 05/25/37 | | | | 1,150,612 | | | | 1,109,793 | |

|

Asset-Backed Securities Corp. Home Equity (06-HE3-A5) | |

| | | |

0.36% (1 mo. USD

LIBOR + 0.270%) (2) | | | 03/25/36 | | | | 1,425,000 | | | | 1,430,444 | |

|

Asset-Backed Securities Corp. Home Equity (07-HE1-A1B) | |

| | | |

0.24% (1 mo. USD

LIBOR + 0.150%) (2) | | | 12/25/36 | | | | 449,037 | | | | 437,943 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

|

Banc of America Alternative Loan Trust (05-10-1CB1) | |

| | | |

0.49% (1 mo. USD

LIBOR + 0.400%) (2)(8) | | | 11/25/35 | | | $ | 489,574 | | | $ | 417,091 | |

|

Banc of America Funding Corp. (15-R3-6A2) | |

| | | |

0.26% (1)(3) | | | 05/27/36 | | | | 1,848,180 | | | | 1,741,072 | |

|

Banc of America Funding Trust (06-3-4A14) | |

| | | |

6.00% | | | 03/25/36 | | | | 260,630 | | | | 261,784 | |

|

Banc of America Funding Trust (06-3-5A3) | |

| | | |

5.50% (8) | | | 03/25/36 | | | | 157,355 | | | | 157,016 | |

|

Banc of America Funding Trust (14-R5-1A1) | |

| | | |

1.68% (6 mo. USD

LIBOR + 1.500%) (1)(2) | | | 09/26/45 | | | | 470,355 | | | | 467,516 | |

|

Banc of America Funding Trust (15-R4-2A1) | |

| | | |

0.30% (1 mo. USD

LIBOR + 0.205%) (1)(2) | | | 02/25/37 | | | | 685,203 | | | | 672,561 | |

|

BCMSC Trust (00-A-A4) | |

| | | |

8.29% (3) | | | 06/15/30 | | | | 3,316,690 | | | | 831,896 | |

|

Bear Stearns Adjustable Rate Mortgage Trust (03-7-9A) | |

| | | |

2.78% (3) | | | 10/25/33 | | | | 287,238 | | | | 291,126 | |

|

Bear Stearns Adjustable Rate Mortgage Trust (05-9-A1) | |

| | | |

2.41% (1 year Treasury Constant Maturity

Rate + 2.300%) (2) | | | 10/25/35 | | | | 171,475 | | | | 175,039 | |

|

Bear Stearns Adjustable Rate Mortgage Trust (07-4-22A1) | |

| | | |

3.34% (3)(8) | | | 06/25/47 | | | | 840,989 | | | | 842,164 | |

|

Bear Stearns ALT-A Trust (05-3-4A3) | |

| | | |

2.50% (3) | | | 04/25/35 | | | | 449,054 | | | | 456,659 | |

|

Bear Stearns Asset-Backed Securities Trust (05-AC6-1A3) | |

| | | |

5.50% (3) | | | 09/25/35 | | | | 407,118 | | | | 412,372 | |

|

Bear Stearns Asset-Backed Securities Trust (06-IM1-A1) | |

| | | |

0.55% (1 mo. USD

LIBOR + 0.460%) (2) | | | 04/25/36 | | | | 213,612 | | | | 327,253 | |

|

Bear Stearns Mortgage Funding Trust (07-AR3-1X) | |

| | | |

(I/O) 0.50% (9) | | | 03/25/37 | | | | 31,937,321 | | | | 874,160 | |

|

Centex Home Equity Loan Trust (05-A-AF5) | |

| | | |

5.78% | | | 01/25/35 | | | | 42,175 | | | | 42,160 | |

|

CIM Trust (19-R1-A) | |

| | | |

3.25% (1)(3) | | | 10/25/58 | | | | 1,014,400 | | | | 945,325 | |

|

CIM Trust (21-NR3-A1) | |

| | | |

2.57% (1) | | | 06/25/57 | | | | 567,952 | | | | 569,204 | |

|

CIM Trust (21-R3-A1A) | |

| | | |

1.95% (1)(3) | | | 06/25/57 | | | | 1,329,778 | | | | 1,346,356 | |

|

CIM Trust (21-R4-A1A) | |

| | | |

2.00% (1)(3) | | | 05/01/61 | | | | 1,300,000 | | | | 1,306,503 | |

|

Citigroup Mortgage Loan Trust, Inc. (05-11-A2A) | |

| | | |

2.53% (1 year Treasury Constant Maturity Rate + 2.400%) (2) | | | 10/25/35 | | | | 259,325 | | | | 266,952 | |

|

Citigroup Mortgage Loan Trust, Inc. (05-8-1A1A) | |

| | | |

2.59% (3)(8) | | | 10/25/35 | | | | 599,625 | | | | 550,418 | |

See accompanying Notes to Financial Statements.

8

TCW Strategic Income Fund, Inc.

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Citigroup Mortgage Loan Trust, Inc. (14-10-2A2) | | | | | |

| | | |

0.34% (1 mo. USD

LIBOR + 0.250%) (1)(2) | | | 07/25/37 | | | $ | 1,348,873 | | | $ | 1,318,121 | |

| |

CitiMortgage Alternative Loan Trust (06-A3-1A7) | | | | | |

| | | |

6.00% (8) | | | 07/25/36 | | | | 810,824 | | | | 819,988 | |

| |

CitiMortgage Alternative Loan Trust (06-A5-1A8) | | | | | |

| | | |

6.00% (8) | | | 10/25/36 | | | | 724,801 | | | | 722,019 | |

| |

Conseco Finance Securitizations Corp. (99-6-A1) | | | | | |

| | | |

7.36% (1)(3) | | | 06/01/30 | | | | 1,396,057 | | | | 746,367 | |

| |

Conseco Financial Corp. (96-6-M1) | | | | | |

| | | |

7.95% (3) | | | 09/15/27 | | | | 116,002 | | | | 122,414 | |

| |

Conseco Financial Corp. (96-7-M1) | | | | | |

| | | |

7.70% (3) | | | 09/15/26 | | | | 92,641 | | | | 93,603 | |

| |

Conseco Financial Corp. (98-3-A6) | | | | | |

| | | |

6.76% (3) | | | 03/01/30 | | | | 9,158 | | | | 9,163 | |

| |

Conseco Financial Corp. (98-4-A5) | | | | | |

| | | |

6.18% | | | 04/01/30 | | | | 57,734 | | | | 57,757 | |

| |

Conseco Financial Corp. (98-4-A6) | | | | | |

| | | |

6.53% (3) | | | 04/01/30 | | | | 35,123 | | | | 35,477 | |

| |

Conseco Financial Corp. (98-4-A7) | | | | | |

| | | |

6.87% (3) | | | 04/01/30 | | | | 37,191 | | | | 37,604 | |

| |

Countrywide Alternative Loan Trust (05-20CB-4A1) (I/F) | | | | | |

| | | |

5.25% | | | 07/25/20 | | | | 683 | | | | 673 | |

| |

Countrywide Alternative Loan Trust (06-8T1-1A2) | | | | | |

| | | |

(I/O) 5.41% (-1 mo. USD

LIBOR + 5.500%) (2)(9) | | | 04/25/36 | | | | 5,470,932 | | | | 1,237,234 | |

| |

Countrywide Asset-Backed Certificates (07-13-2A1) | | | | | |

| | | |

0.99% (1 mo. USD

LIBOR + 0.900%) (2) | | | 10/25/47 | | | | 573,462 | | | | 571,583 | |

| |

Countrywide Home Loans (04-HYB4-B1) | | | | | |

| | | |

2.93% (3) | | | 09/20/34 | | | | 564,015 | | | | 267,621 | |

| |

Countrywide Home Loans (06-14-X) (I/O) | | | | | |

| | | |

0.15% (3)(9) | | | 09/25/36 | | | | 12,519,875 | | | | 52,257 | |

| |

Countrywide Home Loans (06-HYB2-1A1) | | | | | |

| | | |

3.18% (3)(8) | | | 04/20/36 | | | | 773,198 | | | | 590,780 | |

| |

Credit Suisse First Boston Mortgage Securities Corp. (04-AR5-11A2) | | | | | |

| | | |

0.83% (1 mo. USD

LIBOR + 0.740%) (2) | | | 06/25/34 | | | | 117,051 | | | | 117,545 | |

| |

Credit Suisse First Boston Mortgage Securities Corp. (05-12-1A1) | | | | | |

| | | |

6.50% (8) | | | 01/25/36 | | | | 1,029,148 | | | | 458,682 | |

| |

Credit Suisse Mortgage Capital Certificates (06-6-1A8) | | | | | |

| | | |

6.00% (8) | | | 07/25/36 | | | | 553,285 | | | | 428,600 | |

| |

Credit-Based Asset Servicing and Securitization LLC (03-CB3-AF1) | | | | | |

| | | |

3.38% | | | 12/25/32 | | | | 416,592 | | | | 416,114 | |

| |

Credit-Based Asset Servicing and Securitization LLC (06-CB1-AF2) | | | | | |

| | | |

3.01% | | | 01/25/36 | | | | 1,103,441 | | | | 902,168 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Credit-Based Asset Servicing and Securitization LLC (06-CB2-AF2) | | | | | |

| | | |

3.11% | | | 12/25/36 | | | $ | 2,145,369 | | | $ | 2,122,234 | |

| |

Credit-Based Asset Servicing and Securitization LLC (07-CB2-A2B) | | | | | |

| | | |

3.74% | | | 02/25/37 | | | | 967,479 | | | | 781,524 | |

| |

Credit-Based Asset Servicing and Securitization LLC (07-CB2-A2C) | | | | | |

| | | |

3.74% | | | 02/25/37 | | | | 950,560 | | | | 767,767 | |

| |

Credit-Based Asset Servicing and Securitization LLC (07-CB3-A3) | | | | | |

| | | |

3.46% | | | 03/25/37 | | | | 1,294,317 | | | | 661,103 | |

| |

Deutsche Alt-A Securities, Inc. Mortgage Loan Trust (06-AB2-A2) | | | | | |

| | | |

4.91% (3)(8) | | | 06/25/36 | | | | 1,315,921 | | | | 1,308,016 | |

| |

Deutsche Alt-A Securities, Inc. Mortgage Loan Trust (06-AR6-A6) | | | | | |

| | | |

0.47% (1 mo. USD

LIBOR + 0.380%) (2) | | | 02/25/37 | | | | 437,943 | | | | 424,987 | |

| |

DSLA Mortgage Loan Trust (06-AR2-2A1A) | | | | | |

| | | |

0.29% (1 mo. USD

LIBOR + 0.200%) (2) | | | 10/19/36 | | | | 398,330 | | | | 342,525 | |

| |

First Franklin Mortgage Loan Asset-Backed Certificates (06-FF11-2A3) | | | | | |

| | | |

0.39% (1 mo. USD

LIBOR + 0.300%)(2) | | | 08/25/36 | | | | 841,508 | | | | 825,896 | |

| |

First Franklin Mortgage Loan Asset-Backed Certificates (06-FF13-A2C) | | | | | |

| | | |

0.41% (1 mo. USD

LIBOR + 0.320%) (2) | | | 10/25/36 | | | | 750,693 | | | | 611,122 | |

| |

First Franklin Mortgage Loan Asset-Backed Certificates (06-FF18-A2D) | | | | | |

| | | |

0.30% (1 mo. USD

LIBOR + 0.210%) (2) | | | 12/25/37 | | | | 696,825 | | | | 652,572 | |

| |

First Horizon Alternative Mortgage Securities Trust (05-AA10-2A1) | | | | | |

| | | |

2.37% (3)(8) | | | 12/25/35 | | | | 306,284 | | | | 265,196 | |

| |

Greenpoint Manufactured Housing (00-1-A4) | | | | | |

| | | |

8.14% (3) | | | 03/20/30 | | | | 600,364 | | | | 525,214 | |

| |

GSAA Home Equity Trust (06-13-AF6) | | | | | |

| | | |

6.54% | | | 07/25/36 | | | | 1,291,465 | | | | 583,347 | |

| |

GSC Capital Corp. Mortgage Trust (06-2-A1) | | | | | |

| | | |

0.45% (1 mo. USD

LIBOR + 0.360%) (2) | | | 05/25/36 | | | | 260,218 | | | | 255,196 | |

| |

GSR Mortgage Loan Trust (05-AR3-6A1) | | | | | |

| | | |

2.87% (3) | | | 05/25/35 | | | | 206,294 | | | | 187,362 | |

| |

HSI Asset Loan Obligation Trust (07-2-2A12) | | | | | |

| | | |

6.00% | | | 09/25/37 | | | | 382,571 | | | | 359,957 | |

| |

Indymac INDX Mortgage Loan Trust (04-AR6-5A1) | | | | | |

| | | |

3.01% (3) | | | 10/25/34 | | | | 350,804 | | | | 356,449 | |

| |

Indymac INDX Mortgage Loan Trust (05-AR19-A1) | | | | | |

| | | |

2.79% (3) | | | 10/25/35 | | | | 483,369 | | | | 419,898 | |

See accompanying Notes to Financial Statements.

9

TCW Strategic Income Fund, Inc.

Schedule of Investments (Unaudited) (Continued)

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Indymac INDX Mortgage Loan Trust (06-AR13-A4X) | | | | | |

| | | |

(I/O) 2.30% (3)(9) | | | 07/25/36 | | | $ | 212,168 | | | $ | 2,679 | |

| |

Indymac INDX Mortgage Loan Trust (06-AR9-1A1) | | | | | |

| | | |

3.07% (3) | | | 06/25/36 | | | | 638,518 | | | | 486,043 | |

| |

Indymac INDX Mortgage Loan Trust (07-AR5-2A1) | | | | | |

| | | |

3.02% (3) | | | 05/25/37 | | | | 828,885 | | | | 781,378 | |

| |

Indymac INDX Mortgage Loan Trust (07-FLX2-A1C) | | | | | |

| | | |

0.28% (1 mo. USD LIBOR + 0.190%) (2) | | | 04/25/37 | | | | 1,979,760 | | | | 1,888,596 | |

| |

JPMorgan Alternative Loan Trust (06-A2-5A1) | | | | | |

| | | |

2.99% (3)(8) | | | 05/25/36 | | | | 459,963 | | | | 332,044 | |

| |

JPMorgan Mortgage Acquisition Trust (06-WF1-A5) | | | | | |

| | | |

6.91% | | | 07/25/36 | | | | 2,148,956 | | | | 933,765 | |

| |

JPMorgan Mortgage Acquisition Trust (07-CH4-A4) | | | | | |

| | | |

0.25% (1 mo. USD LIBOR + 0.160%) (2) | | | 01/25/36 | | | | 17,883 | | | | 17,892 | |

| |

JPMorgan Mortgage Trust (04-A6-5A1) | | | | | |

| | | |

2.78% (3) | | | 12/25/34 | | | | 276,340 | | | | 278,170 | |

| |

JPMorgan Mortgage Trust (07-S2-1A1) | | | | | |

| | | |

5.00% | | | 06/25/37 | | | | 147,728 | | | | 89,883 | |

| |

JPMorgan Resecuritization Trust (15-4-1A5) | | | | | |

| | | |

0.28% (1 mo. USD

LIBOR + 0.190%) (1)(2) | | | 06/26/47 | | | | 1,863,000 | | | | 1,756,551 | |

| |

JPMorgan Resecuritization Trust (15-4-2A2) | | | | | |

| | | |

3.56% (1)(3)(8) | | | 06/26/47 | | | | 3,710,634 | | | | 2,192,538 | |

| |

Legacy Mortgage Asset Trust (19-GS4-A1) | | | | | |

| | | |

3.44% (1) | | | 05/25/59 | | | | 979,141 | | | | 981,040 | |

| |

Lehman Mortgage Trust (06-7-2A5) (I/O) (I/F) | | | | | |

| | | |

6.46% (-1 mo. USD

LIBOR + 6.550%) (2)(9) | | | 11/25/36 | | | | 3,099,601 | | | | 952,510 | |

| |

Lehman XS Trust (06-10N-1A3A) | | | | | |

| | | |

0.51% (1 mo. USD

LIBOR + 0.420%) (2) | | | 07/25/46 | | | | 576,162 | | | | 588,368 | |

| |

Lehman XS Trust (06-12N-A31A) | | | | | |

| | | |

0.49% (1 mo. USD

LIBOR + 0.400%) (2) | | | 08/25/46 | | | | 793,942 | | | | 787,340 | |

| |

Long Beach Mortgage Loan Trust (04-4-M1) | | | | | |

| | | |

0.99% (1 mo. USD

LIBOR + 0.900%) (2) | | | 10/25/34 | | | | 667,746 | | | | 663,599 | |

| |

MASTR Alternative Loan Trust (06-2-2A2) (I/O) (I/F) | | | | | |

| | | |

7.01% (-1 mo. USD

LIBOR + 7.100%) (2) | | | 03/25/36 | | | | 5,934,859 | | | | 1,471,905 | |

| |

MASTR Alternative Loans Trust (07-HF1-4A1) | | | | | |

| | | |

7.00% (8) | | | 10/25/47 | | | | 1,089,048 | | | | 712,381 | |

| |

MASTR Asset-Backed Securities Trust (07-HE1-A4) | | | | | |

| | | |

0.37% (1 mo. USD

LIBOR + 0.280%) (2) | | | 05/25/37 | | | | 2,000,000 | | | | 1,796,487 | |

| |

Merrill Lynch Alternative Note Asset Trust (07-OAR2-A2) | | | | | |

| | | |

0.51% (1 mo. USD

LIBOR + 0.420%) (2) | | | 04/25/37 | | | | 912,780 | | | | 862,197 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Merrill Lynch First Franklin Mortgage Loan Trust (07-3-A2B) | | | | | |

| | | |

0.22% (1 mo. USD

LIBOR + 0.130%) (2) | | | 06/25/37 | | | $ | 578,990 | | | $ | 428,502 | |

| |

Merrill Lynch First Franklin Mortgage Loan Trust (07-3-A2C) | | | | | |

| | | |

0.27% (1 mo. USD

LIBOR + 0.180%) (2) | | | 06/25/37 | | | | 1,182,284 | | | | 881,797 | |

| |

Merrill Lynch Mortgage-Backed Securities Trust (07-2-1A1) | | | | | |

| | | |

2.44% (1 year Treasury Constant Maturity Rate + 2.400%) (2)(8) | | | 08/25/36 | | | | 181,837 | | | | 173,025 | |

| |

Mid-State Trust (04-1-B) | | | | | |

| | | |

8.90% | | | 08/15/37 | | | | 194,651 | | | | 219,519 | |

| |

Mid-State Trust (04-1-M1) | | | | | |

| | | |

6.50% | | | 08/15/37 | | | | 194,651 | | | | 211,218 | |

| |

Morgan Stanley ABS Capital I, Inc. Trust (06-HE3-A1) | | | | | |

| | | |

0.37% (1 mo. USD

LIBOR + 0.280%) (2) | | | 04/25/36 | | | | 185,794 | | | | 181,293 | |

| |

Morgan Stanley ABS Capital I, Inc. Trust (07-15AR-4A1) | | | | | |

| | | |

2.88% (3) | | | 11/25/37 | | | | 377,731 | | | | 380,152 | |

| |

Nomura Asset Acceptance Corp. (06-AR1-1A) | | | | | |

| | | |

3.49% (3) | | | 02/25/36 | | | | 545,862 | | | | 515,291 | |

| |

Oakwood Mortgage Investors, Inc. (00-A-A4) | | | | | |

| | | |

8.15% (3) | | | 09/15/29 | | | | 1,755,843 | | | | 763,470 | |

| |

Oakwood Mortgage Investors, Inc. (00-D-A4) | | | | | |

| | | |

7.40% (3) | | | 07/15/30 | | | | 698,880 | | | | 270,926 | |

| |

Oakwood Mortgage Investors, Inc. (01-C-A3) | | | | | |

| | | |

6.61% (3) | | | 06/15/31 | | | | 1,671,028 | | | | 330,064 | |

| |

Oakwood Mortgage Investors, Inc. (01-D-A3) | | | | | |

| | | |

5.90% (3) | | | 09/15/22 | | | | 683,286 | | | | 490,645 | |

| |

Oakwood Mortgage Investors, Inc. (01-D-A4) | | | | | |

| | | |

6.93% (3) | | | 09/15/31 | | | | 395,881 | | | | 309,804 | |

| |

Oakwood Mortgage Investors, Inc. (02-A-A3) | | | | | |

| | | |

6.03% (3) | | | 05/15/24 | | | | 130,220 | | | | 133,029 | |

| |

Oakwood Mortgage Investors, Inc. (98-A-M) | | | | | |

| | | |

6.83% (3) | | | 05/15/28 | | | | 16,085 | | | | 16,111 | |

| |

Oakwood Mortgage Investors, Inc. (99-B-A4) | | | | | |

| | | |

6.99% | | | 12/15/26 | | | | 94,294 | | | | 95,506 | |

| |

Oakwood Mortgage Investors, Inc. (99-E-A1) | | | | | |

| | | |

7.61% (3) | | | 03/15/30 | | | | 737,075 | | | | 581,067 | |

| |

Popular ABS Mortgage Pass-Through Trust (05-6-A4) | | | | | |

| | | |

3.45% | | | 01/25/36 | | | | 162,293 | | | | 162,856 | |

| |

RALI Series Trust (06-QS13-1A2) (I/O) (I/F) | | | | | |

| | | |

7.07% (-1 mo. USD

LIBOR + 7.160%)(2)(9) | | | 09/25/36 | | | | 3,208,475 | | | | 589,038 | |

| |

RALI Series Trust (06-QS7-A2) | | | | | |

| | | |

6.00% (8) | | | 06/25/36 | | | | 433,079 | | | | 418,686 | |

See accompanying Notes to Financial Statements.

10

TCW Strategic Income Fund, Inc.

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

| |

RBSSP Resecuritization Trust (12-6-4A2) | | | | | |

| | | |

0.75% (1 mo. USD

LIBOR + 0.330%)(1)(2) | | | 01/26/36 | | | $ | 1,494,216 | | | $ | 1,463,617 | |

| |

Residential Accredit Loans, Inc. (05-QA7-A1) | | | | | |

| | | |

3.30% (3)(8) | | | 07/25/35 | | | | 839,224 | | | | 726,790 | |

| |

Residential Accredit Loans, Inc. (05-QA8-CB21) | | | | | |

| | | |

3.57% (3)(8) | | | 07/25/35 | | | | 420,430 | | | | 306,152 | |

| |

Residential Accredit Loans, Inc. (06-QA10-A2) | | | | | |

| | | |

0.27% (1 mo. USD

LIBOR + 0.180%)(2) | | | 12/25/36 | | | | 575,604 | | | | 564,833 | |

| |

Residential Accredit Loans, Inc. (06-QS1-A3) (PAC) | | | | | |

| | | |

5.75% (8) | | | 01/25/36 | | | | 318,820 | | | | 312,114 | |

| |

Residential Accredit Loans, Inc. (06-QS11-AV) (I/O) | | | | | |

| | | |

0.36% (3)(9) | | | 08/25/36 | | | | 8,445,423 | | | | 112,099 | |

| |

Residential Accredit Loans, Inc. (06-QS6-1AV) (I/O) | | | | | |

| | | |

0.76% (3)(9) | | | 06/25/36 | | | | 3,729,257 | | | | 84,594 | |

| |

Residential Accredit Loans, Inc. (06-QS8-A3) | | | | | |

| | | |

6.00% (8) | | | 08/25/36 | | | | 705,781 | | | | 692,138 | |

| |

Residential Accredit Loans, Inc. (07-QS2-AV) (I/O) | | | | | |

| | | |

0.33% (3)(9) | | | 01/25/37 | | | | 9,533,747 | | | | 109,345 | |

| |

Residential Accredit Loans, Inc. (07-QS3-AV) (I/O) | | | | | |

| | | |

0.35% (3)(9) | | | 02/25/37 | | | | 10,199,916 | | | | 120,377 | |

| |

Residential Accredit Loans, Inc. (07-QS6-A62) (TAC) | | | | | |

| | | |

5.50% (8) | | | 04/25/37 | | | | 217,979 | | | | 207,705 | |

| |

Residential Asset Securitization Trust (05-A15-4A1) | | | | | |

| | | |

6.00% (8) | | | 02/25/36 | | | | 972,170 | | | | 491,859 | |

| |

Residential Asset Securitization Trust (07-A5-AX) (I/O) | | | | | |

| | | |

6.00% (9) | | | 05/25/37 | | | | 1,730,521 | | | | 342,422 | |

| |

Residential Funding Mortgage Securities (06-S9-AV) (I/O) | | | | | |

| | | |

0.34% (3)(9) | | | 09/25/36 | | | | 23,025,325 | | | | 272,659 | |

| |

Saxon Asset Securities Trust (07-3-2A4) | | | | | |

| | | |

0.58% (1 mo. USD

LIBOR + 0.490%)(2) | | | 09/25/47 | | | | 2,926,000 | | | | 2,637,984 | |

| |

Securitized Asset-Backed Receivables LLC Trust (07-NC2-A2C) | | | | | |

| | | |

0.31% (1 mo. USD

LIBOR + 0.220%)(2) | | | 01/25/37 | | | | 4,614,000 | | | | 3,362,518 | |

| |

Soundview Home Loan Trust (06-1-A4) | | | | | |

| | | |

0.69% (1 mo. USD

LIBOR + 0.600%)(2) | | | 02/25/36 | | | | 263,635 | | | | 263,897 | |

| |

Structured Adjustable Rate Mortgage Loan Trust (05-20-1A1) | | | | | |

| | | |

2.85% (3)(8) | | | 10/25/35 | | | | 140,582 | | | | 134,293 | |

| |

Structured Adjustable Rate Mortgage Loan Trust (07-9-2A1) | | | | | |

| | | |

3.21% (3)(8) | | | 10/25/47 | | | | 307,031 | | | | 261,448 | |

| |

Structured Asset Mortgage Investments II Trust (06-AR4-5A1) | | | | | |

| | | |

0.45% (1 mo. USD

LIBOR + 0.360%) (2) | | | 06/25/36 | | | | 853,902 | | | | 756,595 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

| |

WAMU Asset-Backed Certificates (07-HE1-2A3) | | | | | |

| | | |

0.24% (1 mo. USD LIBOR + 0.150%) (2) | | | 01/25/37 | | | $ | 1,835,182 | | | $ | 1,153,627 | |

| |

Wells Fargo Alternative Loan Trust (07-PA2-2A2) (I/O) (I/F) | | | | | |

| | | |

5.98% (-1 mo. USD LIBOR + 6.070%) (2)(9) | | | 06/25/37 | | | | 2,063,705 | | | | 240,864 | |

| |

Wells Fargo Mortgage-Backed Securities Trust (07-AR3-A4) | | | | | |

| | | |

2.68% (3)(8) | | | 04/25/37 | | | | 185,447 | | | | 177,316 | |

| | | | | | | | | | | | |

| | |

Total Residential Mortgage-backed Securities — Non-Agency | | | | | | | | | |

| |

(Cost: $73,232,036) | | | | 79,708,217 | |

| | | | | | | | | | | | |

| | |

Total Mortgage-backed Securities | | | | | | | | | |

| |

(Cost: $155,267,561) | | | | 154,024,745 | |

| | | | | | | | | | | | |

|

CORPORATE BONDS — 27.3% | |

|

| Advertising — 0.1% | |

| |

National CineMedia LLC | | | | | |

| | | |

5.88% (1) | | | 04/15/28 | | | | 225,000 | | | | 221,391 | |

| | | | | | | | | | | | |

| |

| Aerospace/Defense — 0.2% | | | | |

| | | |

Boeing Co. (The) | | | | | | | | | | | | |

| | | |

1.43% | | | 02/04/24 | | | | 705,000 | | | | 706,903 | |

| | | | | | | | | | | | |

| |

| Agriculture — 0.6% | | | | |

| |

BAT Capital Corp. | | | | | |

| | | |

2.73% | | | 03/25/31 | | | | 5,000 | | | | 4,928 | |

| | | |

4.54% | | | 08/15/47 | | | | 130,000 | | | | 138,502 | |

| |

Imperial Brands Finance PLC | | | | | |

| | | |

3.13% (1) | | | 07/26/24 | | | | 270,000 | | | | 284,318 | |

| |

Reynolds American, Inc. | | | | | |

| | | |

5.85% | | | 08/15/45 | | | | 975,000 | | | | 1,196,881 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 1,624,629 | |

| | | | | | | | | | | | |

|

| Airlines — 0.4% | |

| |

JetBlue Pass-Through Certificates (20-1A) | | | | | |

| | | |

4.00% | | | 05/15/34 | | | | 773,825 | | | | 853,135 | |

| |

US Airways Group, Inc. Pass-Through Certificates (10-1A) (EETC) | | | | | |

| | | |

6.25% | | | 10/22/24 | | | | 318,967 | | | | 327,917 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 1,181,052 | |

| | | | | | | | | | | | |

|

| Auto Manufacturers — 1.3% | |

| |

Daimler Finance North America LLC | | | | | |

| | | |

1.06% (3 mo. USD LIBOR + 0.900%)(1)(2) | | | 02/15/22 | | | | 350,000 | | | | 351,902 | |

| |

Ford Motor Credit Co. LLC | | | | | |

| | | |

1.42% (3 mo. USD LIBOR + 1.270%)(2) | | | 03/28/22 | | | | 345,000 | | | | 344,218 | |

| | | |

3.22% | | | 01/09/22 | | | | 1,150,000 | | | | 1,163,743 | |

| | | |

3.34% | | | 03/28/22 | | | | 645,000 | | | | 655,139 | |

See accompanying Notes to Financial Statements.

11

TCW Strategic Income Fund, Inc.

Schedule of Investments (Unaudited) (Continued)

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Auto Manufacturers (Continued) | |

| |

General Motors Co. | | | | | |

| | | |

4.88% | | | 10/02/23 | | | $ | 150,000 | | | $ | 163,458 | |

| |

General Motors Financial Co., Inc. | | | | | |

| | | |

3.15% | | | 06/30/22 | | | | 180,000 | | | | 184,523 | |

| | | |

3.45% | | | 04/10/22 | | | | 55,000 | | | | 56,017 | |

| | | |

4.38% | | | 09/25/21 | | | | 656,000 | | | | 662,137 | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | 3,581,137 | |

| | | | | | | | | | | | |

|

| Banks — 4.8% | |

| | | |

Bank of America Corp. | | | | | | | | | | | | |

| | | |

1.66% (SOFR + 0.910%)(2) | | | 03/11/27 | | | | 595,000 | | | | 599,645 | |

| | | |

1.73% (SOFR + 0.960%)(2) | | | 07/22/27 | | | | 590,000 | | | | 595,050 | |

| | | |

2.09% (SOFR + 1.060%)(2) | | | 06/14/29 | | | | 570,000 | | | | 574,799 | |

|

Citigroup, Inc. | |

| | | |

1.46% (SOFR+ 0.770%) (2) | | | 06/09/27 | | | | 430,000 | | | | 428,276 | |

| | | |

4.41% (SOFR + 3.914%) (2) | | | 03/31/31 | | | | 440,000 | | | | 514,281 | |

| |

Comerica, Inc. | | | | | |

| | | |

5.63% (U.S. 5 year Treasury Constant Maturity Rate + 5.291%) (2) | | | 12/31/99 | | | | 395,000 | | | | 438,450 | |

| |

Credit Suisse Group AG | | | | | |

| | | |

1.31% (SOFR + 0.980%) (1)(2) | | | 02/02/27 | | | | 190,000 | | | | 186,299 | |

| | | |

2.19% (SOFR + 2.044%) (1)(2) | | | 06/05/26 | | | | 425,000 | | | | 435,275 | |

| | | |

2.59% (SOFR + 1.560%) (1)(2) | | | 09/11/25 | | | | 55,000 | | | | 57,225 | |

| | | |

3.09% (SOFR + 1.730%) (1)(2) | | | 05/14/32 | | | | 270,000 | | | | 278,529 | |

| | | |

3.75% | | | 03/26/25 | | | | 330,000 | | | | 358,201 | |

| | | |

4.55% | | | 04/17/26 | | | | 75,000 | | | | 84,992 | |

| |

Goldman Sachs Group, Inc. (The) | | | | | |

| | | |

1.09% (SOFR + 0.789%) (2) | | | 12/09/26 | | | | 215,000 | | | | 211,801 | |

| | | |

1.43% (SOFR + 0.798%) (2) | | | 03/09/27 | | | | 425,000 | | | | 423,887 | |

| | | |

1.54% (SOFR + 0.818%) (2) | | | 09/10/27 | | | | 430,000 | | | | 428,830 | |

| |

HSBC Holdings PLC | | | | | |

| | | |

0.98% (SOFR + 0.708%) (2) | | | 05/24/25 | | | | 430,000 | | | | 429,888 | |

| | | |

1.59% (SOFR + 1.290%) (2) | | | 05/24/27 | | | | 285,000 | | | | 285,764 | |

| | | |

2.01% (SOFR + 1.732%) (2) | | | 09/22/28 | | | | 685,000 | | | | 687,740 | |

| |

JPMorgan Chase & Co | | | | | |

| | | |

. 0.97% (SOFR + 0.580%) (2) | | | 06/23/25 | | | | 350,000 | | | | 350,497 | |

| | | |

1.58% (SOFR + 0.885%) (2) | | | 04/22/27 | | | | 425,000 | | | | 427,423 | |

| | | |

2.01% (SOFR + 1.585%) (2) | | | 03/13/26 | | | | 505,000 | | | | 521,640 | |

| | | |

3.56% (3) | | | 04/23/24 | | | | 385,000 | | | | 406,051 | |

| |

Lloyds Banking Group PLC (United Kingdom) | | | | | |

| | | |

1.63% (U.S. 1 year Treasury Constant Maturity Rate + 0.850%) (2) | | | 05/11/27 | | | | 395,000 | | | | 395,616 | |

| | | |

2.86% (3 mo. USD LIBOR + 1.249%) (2) | | | 03/17/23 | | | | 275,000 | | | | 279,729 | |

| | | |

3.87% (1 year Treasury Constant Maturity Rate + 3.500%) (2) | | | 07/09/25 | | | | 285,000 | | | | 308,890 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Banks (Continued) | |

| |

Macquarie Group, Ltd. | | | | | |

| | | |

1.63% (SOFR + 0.910%)(1)(2) | | | 09/23/27 | | | $ | 430,000 | | | $ | 428,198 | |

| |

Morgan Stanley | | | | | |

| | | |

1.59% (SOFR + 0.879%)(2) | | | 05/04/27 | | | | 425,000 | | | | 428,047 | |

| |

NatWest Group PLC (United Kingdom) | | | | | |

| | | |

4.27% (3) | | | 03/22/25 | | | | 260,000 | | | | 282,199 | |

| |

Santander UK Group Holdings PLC (United Kingdom) | | | | | |

| | | |

1.09% (SOFR + 0.787%) (2) | | | 03/15/25 | | | | 565,000 | | | | 567,294 | |

| | | |

3.37% (3) | | | 01/05/24 | | | | 435,000 | | | | 453,010 | |

| | | |

4.80% (3) | | | 11/15/24 | | | | 335,000 | | | | 366,443 | |

|

Wells Fargo & Co. | |

| | | |

2.16% (3 mo. USD LIBOR + 0.750%) (2) | | | 02/11/26 | | | | 115,000 | | | | 119,433 | |

| | | |