UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04980

TCW Strategic Income Fund, Inc.

(Exact name of registrant as specified in charter)

865 South Figueroa Street, Suite 1800, Los Angeles, CA 90017

(Address of principal executive offices)

Patrick W. Dennis, Esq.

Vice President and Assistant Secretary

865 South Figueroa Street, Suite 1800

Los Angeles, CA 90017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (213) 244-0000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

| Item 1. | Reports to Stockholders. |

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”): |

Paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.tcw.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. You can call 1-800-FUND-TCW (1-800-386-3829), if you invest directly with the Fund, or contact your financial intermediary, if you invest though a financial intermediary, to inform the Fund or the financial intermediary that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held directly with TCW or through your financial intermediary.

| | |

To Our Valued Shareholders | | |

| | |

| | David Lippman President, Chief Executive Officer and Director |

To the shareholders of the TCW Strategic Income Fund:

Executive Summary

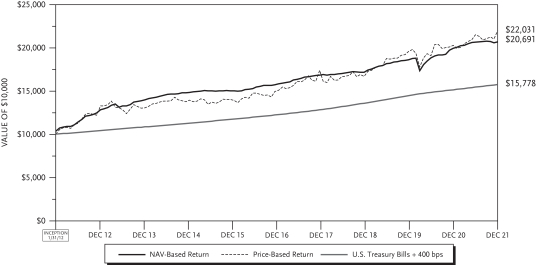

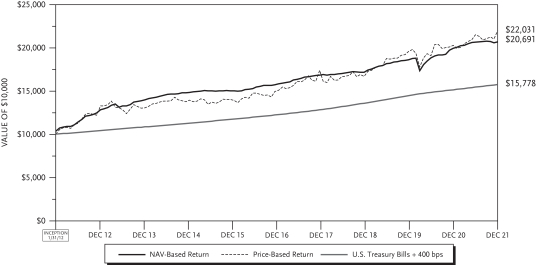

TCW is pleased to present the 2021 annual report for the TCW Strategic Income Fund (“TSI” or the “Fund”). TSI is a multi-asset class closed-end fund managed by TCW Investment Management Company and is listed on the New York Stock Exchange under the ticker TSI. For 2021, the price of TSI shares increased by 8.03% while the Fund’s net asset value (i.e., returns of the underlying assets) grew by 3.55%. For reference, TSI’s customized benchmark, a construct that is 25% high yield, 15% equities, 15% convertible bonds, and 45% U.S. Aggregate Bond Index, gained 5.60% in 2021. While the underlying assets trailed the benchmark, the Fund’s one-year price-based return was higher than the NAV-based return as the share price moved from a discount to NAV of 2.7% at the start of the year to a 1.4% premium by December 31, 2021. Since inception and 10 Year annualized NAV-based and price-based returns both remain ahead of the Fund’s benchmark.

Over the past four quarters, the Fund paid dividends of 5.5 cents per share each quarter, as well as a short- and a long-term capital gains distribution of 4.02 cents per share and 7.77 cents per share, respectively, and a special cash payment of 2.90 cents per share. This represents an annualized rate of approximately 37 cents per share, contributing to a realized 12-month trailing yield of approximately 6.4%, as of 12/31/2021. As yield is a function of a number of parameters, the go-forward yield of TSI will likely differ from the trailing figure.

TSI Benchmark Discussion

TSI’s existing blended benchmark1 dates back to the inception of the Fund when it was envisioned to be a (predominantly) convertibles fund. The management team believes that since TSI is now run as a multi-sector fund, primarily a fixed income fund, the original blended benchmark has lost its relevance. As such, TSI’s existing benchmark with be replaced effective March 1, 2022 with a benchmark that more closely aligns with its multi-sector fixed-income orientation, U.S. Treasury Bills + 400 basis points.

The table below shows TSI price-based and NAV-based returns historically compared to the existing blended benchmark and the proposed new benchmark of U.S. Treasury Bills + 400 basis points.

Fund Performance (%)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of December 31, 2021 | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

3/1/06(2) | | | Since

3/5/87(3) | |

Price-Based Return | | | 8.03 | | | | 9.50 | | | | 7.99 | | | | 8.20 | | | | 9.84 | | | | 8.18 | |

NAV-Based Return | | | 3.55 | | | | 6.37 | | | | 5.64 | | | | 7.54 | | | | 8.41 | | | | 8.25 | |

Custom Benchmark (1) | | | 5.60 | | | | 11.82 | | | | 8.48 | | | | 7.53 | | | | 6.91 | | | | N/A | |

U.S. Treasury Bills + 400 bps | | | 4.05 | | | | 5.04 | | | | 5.19 | | | | 4.67 | | | | 5.19 | | | | 7.21 | |

| (1) | Custom Benchmark Index: 15% S&P 500 with Income, 15% ICE BofA U.S. Convertibles Index, 45% Bloomberg U.S. Aggregate Bond Index, 25% FTSE High Yield Cash Pay Index. |

| (2) | The date on which the Fund’s investment objective changed to a multi-asset class fund. Prior to this date, the Fund primarily invested in convertible securities. |

| (3) | Inception date of the Fund. |

Past performance is no guarantee of future results. Current performance may be lower or higher than that quoted. The market value and net asset value of the Fund’s shares will fluctuate with market conditions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions. You should not draw any conclusions about the Fund’s performance from the amount of the quarterly distribution or from the terms of the Fund’s distribution policy.

1

Management Commentary

For everything that went on in between, in many ways the year finished much like it started — inflation as a headline risk, proving more lasting than expected, while COVID-19 once again dominated investor sentiment, this time with the Omicron variant. The persistence of inflation beyond a transitory post-vaccine surge was highlighted by a year-on-year 6.8% advance for headline Consumer Price Index (CPI) in November, its largest such increase in nearly 30 years. Against this backdrop, the Fed and elected officials are in rare accord over an aim to curb inflation. For its part, the Fed responded in December with an accelerated pace to its tapering of U.S. Treasury and agency mortgage-backed securities (MBS) purchases with expectations to segue hiking the funds rate from the zero bound. Fed funds futures now signal three hikes in 2022 to be followed by three in 2023 (a far cry from the March 2021 Federal Open Market Committee (FOMC) meeting, when the median dot reflected NO rate hikes through the end of 2023). Markets are currently rather sanguine about Chair Powell and the FOMC’s handle on the course of monetary policy, perhaps overly optimistic, as the last decade has been marked by seemingly unavoidable detours on the Fed’s road to a would-be terminal rate. This view is further motivated by the waning impact of (and lessened appetite for new) fiscal stimulus that might exacerbate inflationary leanings much beyond the short-intermediate term. Meanwhile, from a macroeconomic perspective, the traditional set of indicators used to evaluate the health of the economy all pointed in different directions throughout the year. Robust GDP growth and strong corporate earnings suggest the economy is in early cycle form, while high inflation, a flat yield curve, record equity market valuations, and tight credit spreads are all indicative of later cycle conditions. The labor market is similarly confounding — while unemployment levels have dropped dramatically from lockdown highs and workers seem to be finding some long-dormant pricing power, the participation rate remains lackluster, suggesting there are still millions of people who could be working but are not. To be sure, pandemic-related distortions are rampant, and uncertainty does not appear to be fading soon.

Equities proved ebullient despite a lack of much consistently good news, with the S&P 500 Index defying even the most confident early-year projections and rising to its 70th record close for the year as 2021 came to an end. The Index soared 11% in Q4, and over 28% for the year — a doubling since the pandemic low of March 2020! Fixed income markets, by contrast, were held back by rate volatility. The Bloomberg U.S. Aggregate Bond Index return was flat in the fourth quarter, and the sector trailed duration-matched Treasuries by 15 basis points (bps). Over the full year, a nearly 60 bps move higher for the 10-Year U.S. Treasury yield challenged fixed income total returns and the Bloomberg U.S. Aggregate Bond Index delivered a 1.5% loss, with Treasuries leading the decline by falling 2.3%, its first full-year loss since 2013, while

2

credit and mortgage-backed securities fell by approximately 1%. Nevertheless, yield premiums actually declined over the year and most sectors beat Treasuries on a duration-adjusted basis. The risk factors that led to rate volatility, such as the prospect of monetary tightening and increased inflation, did little to deter inflows and rattle corporate spreads against a relatively stable year of muted credit volatility, i.e., range-bound yield spreads in investment grade and high yield. Sectors linked to economic re-opening outperformed in 2021, notably airlines, lodging and energy. Lower quality credits were also outperformers on seemingly little stress, with the speculative universe posting a 0.7% return in 4Q and 5.3% for the year with a default rate under 0.5%, the slowest calendar year pace since 2007. Among securitized issues, returns were mixed, though legacy non-Agency MBS led on strong housing price appreciation and continued borrower profile improvements, while also benefitting from their floating rate structures. Conversely, agency MBS was victim not only to higher rates, but also to concerns over accelerated Fed tapering, though TBAs (To-Be-Announced) still profited from the Fed’s ongoing buys, especially lower coupons. The sector slipped 0.4% in the fourth quarter and 1.0% for the year (and lagged duration-matched Treasuries). Meanwhile, commercial MBS fell 0.6% in 4Q, and 1.2% in 2021, though non-agency issues outran agency-backed issues during the full year. Similarly, asset-backed securities (ABS) was down 0.6% for the quarter and 0.3% for the year, though the sector managed positive excess returns for the year.

The Economy and Market Ahead

As the end of the year demonstrated, markets are in a vulnerable position as economic momentum, which was positive coming into the final quarter of 2021, showed signs of subsiding. Market corrections can be anticipated in the coming months, particularly as valuations currently price in a “Goldilocks” environment of reasonable growth, controlled inflation, and solid earnings, none of which are guaranteed. In fact, risks to this outlook lean heavily negative, with potential drags from slower demand due to depleted consumer savings and significantly less direct fiscal support, rising inflation leading to higher interest rates, virus-related shutdowns, and ongoing labor shortages. Meanwhile, the risk of a policy error is heightened, as the Fed must negotiate the degree and pace of policy pullback at the same time that fiscal stimulus fades, particularly as growth prospects in the face of ongoing pandemic restrictions remain suspect. Remove accommodation too quickly, and the threat of deflation and recession rises, while too slow a withdrawal increases the possibility of higher inflation and meaningfully higher interest rates. Neither of those potential outcomes is priced into markets currently and, with economic cycle indicators still diverging greatly, expectations are for elevated volatility — with pinpoint forecasting of the sources less important than the volatility itself.

With markets optimistically pricing in a seamless transition from the end of taper to the start of a hiking regime a month later, duration positioning remains somewhat defensive versus the broader fixed income market, owing to inflationary expectations persisting into 2022 and consequent reactions in rates. Discipline will dictate the portfolio management team’s response with tactical adjustments to overall duration and yield curve positioning predicated on the reaction to policy action (or lack of) in the form of steepening or flattening. On the credit side of things, the biggest obstacle to prospective performance is valuations. As such, the team worked throughout the year to de-risk among credit holdings — reducing exposure (especially tight cyclical exposure while rotating into less cyclical sectors like banks and select technology companies), trimming spread duration, and maintaining liquidity in order to be prepared for the next bout of volatility. Municipal debt was also trimmed early in the year as valuations improved. Exposure to high yield credit was also taken modestly lower in a disciplined fashion. Emerging market debt remains a small position, as potentially raising rates and risks of slowing global growth make relative value unattractive in most cases, and was reduced slightly over the year. Within securitized, legacy non-agency MBS remains attractive from a collateral perspective, with the added benefit of having largely floating rate coupons, and the Fund will continue sourcing exposure at favorable valuations. The position in current coupon agency MBS TBAs was increased early in the year, then trimmed as valuations improved, but maintained an emphasis on current (low) coupon TBAs with attractive financing rates given the Fed’s sizable (albeit declining)

3

buying. In commercial mortgage-backed securities (CMBS), though current holdings continue to focus on top-of-the-capital structure exposures in single asset, single borrower (SASB) AAA-rated issues, opportunities are beginning to present in AA- and A-rated collateral with good loan-to-value (LTV) ratios, i.e., protection, and good spread compensation. A similar strategy applies to collateralized loan obligations (CLOs), with additions of well-collateralized AA-rated issues offering good yields alongside solid liquidity, while other ABS exposure includes government-guaranteed FFELP student loans.

Portfolio Positioning

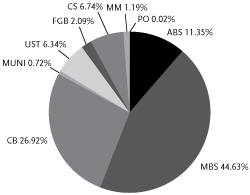

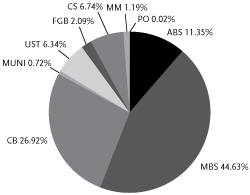

SECTOR ALLOCATION

| Asset-backed | Securities (ABS) |

| Foreign | Government Bonds (FGB) |

| Money | Market Investments (MM) |

| Mortgage-backed | Securities (MBS) |

U.S. Treasury Securities (UST)

MBS ALLOCATION

| Commercial | Mortgage-Backed Securities (CMBS) |

| Residential | Mortgage-Backed Securities (RMBS) |

Modest leverage can be utilized by the Fund through a Line of Credit facility, though the Fund does not currently use any of the available $70 million commitment. Leverage may return to the Fund when market opportunity is more abundant and management deems the use of leverage is accretive to returns.

We greatly appreciate your investment in the Fund and your continuing support of TCW. If you have any additional questions or comments, we invite you to visit our website at www.tcw.com or contact our shareholder services department at 1-866-227-8179, or contact@tcw.com.

Sincerely,

David Lippman

President, Chief Executive Officer and Director

The views expressed in this report reflect those of the Fund’s Advisor as of the date this is written and may not reflect its views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding the Fund’s investment methodology and do not constitute investment advice. This report may contain discussions about investments that may or may not be held by the Fund as of the date of this report. All current and future holdings are subject to risk and to change. To the extent this report contains forward-looking statements, unforeseen circumstances may cause actual results to differ materially from the views expressed as of the date this is written.

4

TCW Strategic Income Fund, Inc.

Management Discussion

The TCW Strategic Income Fund gained 3.55% (NAV-based return), trailing the TSI Custom Benchmark by just over 200 bps. Underperformance relative to the benchmark can almost entirely be attributed to the Fund’s lower allocation to “plus” sectors — equities, convertibles and high yield corporates, all of which posted strong returns in 2021. An overweight to investment grade credit and the allocation to securitized credit products helped to offset underperformance. Throughout the year, the Fund maintained its sizable position in non-agency residential MBS (absent in the benchmark) and the sector gained more than 6%, supported by a solid U.S. housing backdrop with prices rising and loan-to-value ratios improving. Finally, the allocation to CMBS and ABS also added marginally to returns as non-agency CMBS outpaced Treasuries by over 140 bps while ABS was supported (more-so during the first half of the year) by policy that helped keep the consumer afloat. Finally, the moderate allocation to agency MBS (predominantly TBAs) had a mild positive net contribution to return as additional roll carry helped offset spread widening in the sector.

Dividend Distribution Discussion

Over time, the manner in which the Fund’s quarterly distribution is determined has evolved. Prior to 2014, the Fund had a managed distribution policy whereby dividends for the upcoming year were estimated at the beginning of the year and dividends were held constant throughout the given calendar year. The Fund approached over-distribution, a return of capital, in 2013 due to volatility in income and corresponding tax adjustments on Non-Agency MBS bonds. This resulted in switching to a “pass-through” distribution policy in 2014, essentially distributing all income to shareholders. In 2020, the dispersion of quarterly dividend amounts under the “pass-through” distribution policy was very high, due to interest rate volatility associated with the onset of the pandemic and the corresponding impact of tax adjustments to distributable income. The dividend dispersion led to a re-evaluation of the distribution policy and adjustments to the methods being used to project distributable income summarized in this memo.

The goal of the Fund’s distribution policy is to maintain a stable payout without having to return capital to investors. A stable dividend policy will inevitably result in income surplus or deficit at the end of the year given it is impossible to estimate the Fund’s distributable income with 100% precision. Income from MBS securities, real estate mortgage investment conduits (REMIC), are also subject to tax adjustments. REMIC adjustments represent differences between distributable income recognized for tax purposes and income per GAAP accounting records maintained by State Street Bank. Fluctuating interest rates tend to impact the magnitude of REMIC adjustments and hence, the distributable income. The Fund will aim to improve its estimate of distributable income by increasing the frequency of REMIC adjustment analysis performed by KPMG from twice a year to at least four times a year to match the Fund’s dividend distribution frequency. TCW will also furnish KPMG with cash flow projections for securitized bonds held in TSI based on internal modeling in order to further improve projections of distributable income. Finally, the Fund will also maintain a modest reserve balance such that an income surplus remains at the end of the year as opposed to a shortfall.

This new approach was applied beginning in 2021 and the results were satisfactory. The fund maintained a 5.5 cent quarterly dividend throughout the year with a modest income surplus of 3.1 cents at year-end of which 2.9 cents was paid out as a special year-end dividend. TCW will continue to monitor the Fund’s income reserve for increases in surplus or shortfall and make adjustments to the quarterly dividend as warranted, with the goal of minimizing the dispersion of the quarterly dividend amounts and maintaining the dividend’s stability.

5

TCW Strategic Income Fund, Inc.

Management Discussions (Continued)

Rule 8b-16 Disclosure

Rule 8b-16 under the Investment Company Act of 1940, as amended, requires that we disclose certain information to stockholders in our annual report. That disclosure is included in this report as follows: (1) information about our dividend investment plan is included on page 60. (2) information about our investment objectives and policies is included on pages 43-44, and (3) information regarding the principal risk factors associated with investment in the Fund is included on pages 44-46. During the fiscal year ended December 31, 2021, there were no changes to our charter or by-laws that were not approved by stockholders that delay or prevent a change of control, nor were there changes to persons who are primarily responsible for the day-to-day management of the Company’s investment portfolio other than the retirement of Tad Rivelle effective as of December 31, 2021. After the retirement of Mr. Rivelle, Laird R. Landmann, Stephen M. Kane, Bryan T. Whalen and Mitch Flack continue to be jointly and primarily responsible for the day-to-day management of the Fund’s assets. The foregoing information is a summary of certain changes since the date the Fund’s annual report for the fiscal year ended December 31, 2020. This information may not reflect all of the changes that have occurred since you purchased shares of the Fund.

6

TCW Strategic Income Fund, Inc.

Schedule of Investments | December 31, 2021 |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

FIXED INCOME SECURITIES — 96.2% of Net Assets | |

|

| ASSET-BACKED SECURITIES — 12.9% | |

| |

321 Henderson Receivables LLC (17-1A-A) | | | | | |

| | | |

3.99% (1) | | | 08/16/60 | | | $ | 203,591 | | | $ | 228,341 | |

| |

Allegro CLO XII, Ltd. (20-1A-B) | | | | | |

| | | |

1.83% (3 mo. USD

LIBOR + 1.700%) (1)(2) | | | 01/21/32 | | | | 475,000 | | | | 474,952 | |

| |

AMSR Trust (20-SFR1-I) | | | | | |

| | | |

8.19% (1) | | | 04/17/37 | | | | 685,000 | | | | 724,573 | |

| |

Apidos CLO (21-37A-B) | | | | | |

| | | |

1.73% (3 mo. USD

LIBOR + 1.600%) (1)(2) | | | 10/22/34 | | | | 725,000 | | | | 721,032 | |

| |

Bayview Commercial Asset Trust (03-2-A) | | | | | |

| | | |

0.97% (1 mo. USD

LIBOR + 0.870%) (1)(2) | | | 12/25/33 | | | | 222,217 | | | | 219,188 | |

| |

Bayview Commercial Asset Trust (04-2-A) | | | | | |

| | | |

0.75% (1 mo. USD

LIBOR + 0.645%) (1)(2) | | | 08/25/34 | | | | 210,414 | | | | 209,976 | |

| |

Bayview Commercial Asset Trust (04-3-A1) | | | | | |

| | | |

0.66% (1 mo. USD

LIBOR + 0.555%) (1)(2) | | | 01/25/35 | | | | 106,871 | | | | 106,027 | |

| |

Blackrock Rainier CLO VI, Ltd. (21-6A-A) | | | | | |

| | | |

1.83% (3 mo. USD

LIBOR + 1.700%) (1)(2) | | | 04/20/33 | | | | 700,000 | | | | 701,993 | |

| |

BMO SBA COOF Trust (19-1-A) (I/O) | | | | | |

| | | |

1.57% (1)(3) | | | 10/25/45 | | | | 7,808,422 | | | | 450,831 | |

| |

Brazos Higher Education Authority, Inc. (10-1-A2) | | | | | |

| | | |

1.38% (3 mo. USD

LIBOR + 1.200%) (2) | | | 02/25/35 | | | | 2,200,000 | | | | 2,239,669 | |

| |

Carvana Auto Receivables Trust 2020-P1

(20-P1-R) | | | | | |

| | | |

0.00% (1)(4) | | | 09/08/27 | | | | 2,000 | | | | 595,000 | |

| |

Carvana Auto Receivables Trust 2021-N3

(21-N3-R) | | | | | |

| | | |

0.00% (1)(4) | | | 06/12/28 | | | | 2,200 | | | | 862,656 | |

| |

Cedar Funding XII CLO, Ltd. (20-12A-A1R) | | | | | |

| | | |

1.26% (3 mo. USD

LIBOR + 1.130%) (1)(2) | | | 10/25/34 | | | | 1,375,000 | | | | 1,372,627 | |

| |

CIFC Funding, Ltd. (18-1A-SUB) | | | | | |

| | | |

1.00% (1)(3) | | | 04/18/31 | | | | 650,000 | | | | 480,894 | |

| |

CIT Education Loan Trust (07-1-A) | | | | | |

| | | |

0.31% (3 mo. USD

LIBOR + 0.090%) (1)(2) | | | 03/25/42 | | | | 526,723 | | | | 506,937 | |

| |

COOF Securitization Trust II (15-2-A1) (I/O) | | | | | |

| | | |

2.44% (1)(3) | | | 08/25/41 | | | | 3,484,019 | | | | 240,027 | |

| |

CoreVest American Finance Trust (19-1-XA) (I/O) | | | | | |

| | | |

2.16% (1)(3) | | | 03/15/52 | | | | 1,512,627 | | | | 80,014 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| ASSET-BACKED SECURITIES (Continued) | |

| |

CoreVest American Finance Trust (20-1-A2) | | | | | |

| | | |

2.30% (1) | | | 03/15/50 | | | $ | 470,000 | | | $ | 472,293 | |

| |

CoreVest American Finance Trust (20-3-XA) (I/O) | | | | | |

| | | |

3.67% (1)(3) | | | 08/15/53 | | | | 1,552,292 | | | | 223,776 | |

| |

CoreVest American Finance Trust (20-3-XB) (I/O) | | | | | |

| | | |

2.61% (1)(3) | | | 08/15/53 | | | | 1,650,000 | | | | 275,644 | |

| |

Dryden CLO, Ltd. (20-85A-AR) | | | | | |

| | | |

1.27% (3 mo. USD

LIBOR +

1.150%) (1)(2) | | | 10/15/35 | | | | 1,375,000 | | | | 1,375,929 | |

| |

Eaton Vance CLO, Ltd. (20-1A-AR) | | | | | |

| | | |

1.29% (3 mo. USD

LIBOR +

1.170%) (1)(2) | | | 10/15/34 | | | | 850,000 | | | | 850,878 | |

| |

Education Loan Asset-Backed Trust I (13-1-A2) | | | | | |

| | | |

0.90% (1 mo. USD

LIBOR +

0.800%) (1)(2)(5) | | | 04/26/32 | | | | 999,241 | | | | 1,000,090 | |

| |

EFS Volunteer No 2 LLC (12-1-A2) | | | | | |

| | | |

1.45% (1 mo. USD

LIBOR +

1.350%) (1)(2) | | | 03/25/36 | | | | 964,487 | | | | 977,299 | |

| |

Global SC Finance SRL (14-1A-A2) | | | | | |

| | | |

3.09% (1) | | | 07/17/29 | | | | 112,375 | | | | 113,076 | |

| |

Goal Capital Funding Trust (06-1-B) | | | | | |

| | | |

0.63% (3 mo. USD

LIBOR + 0.450%) (2) | | | 08/25/42 | | | | 184,194 | | | | 173,864 | |

| |

Harvest Commercial Capital Loan Trust (19-1-A) | | | | | |

| | | |

3.29% (1)(3) | | | 09/25/46 | | | | 573,110 | | | | 575,523 | |

| |

HPS Loan Management, Ltd. (0A-16-A1RR) | | | | | |

| | | |

1.27% (3 mo. USD

LIBOR +

1.140%) (1)(2) | | | 04/20/34 | | | | 875,000 | | | | 873,922 | |

| |

ITE Rail Fund Levered LP (21-1A-A) | | | | | |

| | | |

2.25% (1) | | | 02/28/51 | | | | 403,106 | | | | 403,025 | |

| |

LMREC Inc. (19-CRE3-A) | | | | | |

| | | |

1.50% (1 mo. USD

LIBOR +

1.400%) (1)(2) | | | 12/22/35 | | | | 890,000 | | | | 889,040 | |

| |

Magnetite VII, Ltd. (12-7A-A1R2) | | | | | |

| | | |

0.92% (3 mo. USD

LIBOR +

0.800%) (1)(2) | | | 01/15/28 | | | | 402,030 | | | | 401,206 | |

| |

Nelnet Student Loan Trust (14-4A-A2) | | | | | |

| | | |

1.05% (1 mo. USD

LIBOR +

0.950%) (1)(2) | | | 11/25/48 | | | | 575,000 | | | | 578,271 | |

| |

Neuberger Berman Loan Advisers CLO, Ltd. (21-43A-A) | | | | | |

| | | |

1.24% (3 mo. USD

LIBOR +

1.130%) (1)(2) | | | 07/17/35 | | | | 800,000 | | | | 800,098 | |

See accompanying Notes to Financial Statements.

7

TCW Strategic Income Fund, Inc.

Schedule of Investments (Continued)

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| ASSET-BACKED SECURITIES (Continued) | |

| |

North Carolina State Education Assistance Authority (11-1-A3) | | | | | |

| | | |

1.02% (3 mo. USD

LIBOR + 0.900%) (2) | | | 10/25/41 | | | $ | 1,287,237 | | | $ | 1,285,891 | |

| |

OCP CLO, Ltd. (21-21A-B) | | | | | |

| | | |

1.83% (3 mo. USD

LIBOR + 1.700%) (1)(2) | | | 07/20/34 | | | | 400,000 | | | | 398,917 | |

| |

OHA Credit Funding, Ltd. (20-7A-A) | | | | | |

| | | |

1.37% (3 mo. USD

LIBOR + 1.250%) (1)(2) | | | 10/19/32 | | | | 1,400,000 | | | | 1,400,210 | |

| |

Palmer Square CLO, Ltd. (18-1A-A1) | | | | | |

| | | |

1.15% (3 mo. USD

LIBOR + 1.030%) (1)(2) | | | 04/18/31 | | | | 600,000 | | | | 599,622 | |

| |

Palmer Square Loan Funding Ltd. (20-2A-A2) | | | | | |

| | | |

1.68% (3 mo. USD

LIBOR + 1.550%) (1)(2) | | | 04/20/28 | | | | 350,000 | | | | 350,075 | |

| |

Park Avenue Institutional Advisers CLO, Ltd.

(21-1A-A2) | | | | | |

| | | |

1.88% (3 mo. USD

LIBOR + 1.750%) (1)(2) | | | 01/20/34 | | | | 420,000 | | | | 419,924 | |

| |

Regata XII Funding, Ltd. (19-1A-BR) | | | | | |

| | | |

1.68% (3 mo. USD

LIBOR + 1.600%) (1)(2) | | | 10/15/32 | | | | 725,000 | | | | 724,420 | |

| |

Rockford Tower CLO, Ltd. (20-1A-D) | | | | | |

| | | |

3.88% (3 mo. USD

LIBOR + 3.750%) (1)(2) | | | 01/20/32 | | | | 900,000 | | | | 900,316 | |

| |

Scholar Funding Trust (12-B-A2) | | | | | |

| | | |

1.20% (1 mo. USD

LIBOR + 1.100%) (1)(2) | | | 03/28/46 | | | | 605,993 | | | | 615,675 | |

| |

SLC Student Loan Trust (04-1-B) | | | | | |

| | | |

0.44% (3 mo. USD

LIBOR + 0.290%) (2) | | | 08/15/31 | | | | 240,798 | | | | 224,230 | |

| |

SLC Student Loan Trust (06-1-B) | | | | | |

| | | |

0.41% (3 mo. USD

LIBOR +

0.210%) (2) | | | 03/15/55 | | | | 329,348 | | | | 304,468 | |

| |

SLM Student Loan Trust (04-2-B) | | | | | |

| | | |

0.59% (3 mo. USD

LIBOR + 0.470%) (2) | | | 07/25/39 | | | | 282,809 | | | | 270,294 | |

| |

SLM Student Loan Trust (05-9-B) | | | | | |

| | | |

0.42% (3 mo. USD

LIBOR + 0.300%) (2) | | | 01/25/41 | | | | 344,801 | | | | 326,484 | |

| |

SLM Student Loan Trust (07-6-B) | | | | | |

| | | |

0.97% (3 mo. USD

LIBOR + 0.850%) (2) | | | 04/27/43 | | | | 126,205 | | | | 121,457 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| ASSET-BACKED SECURITIES (Continued) | |

| |

SLM Student Loan Trust (07-7-B) | | | | | |

| | | |

0.87% (3 mo. USD

LIBOR + 0.750%) (2) | | | 10/27/70 | | | $ | 150,000 | | | $ | 140,420 | |

| |

SLM Student Loan Trust (08-2-B) | | | | | |

| | | |

1.32% (3 mo. USD

LIBOR + 1.200%) (2) | | | 01/25/83 | | | | 225,000 | | | | 216,376 | |

| |

SLM Student Loan Trust (08-3-B) | | | | | |

| | | |

1.32% (3 mo. USD

LIBOR + 1.200%) (2) | | | 04/26/83 | | | | 225,000 | | | | 211,439 | |

| |

SLM Student Loan Trust (08-4-B) | | | | | |

| | | |

1.97% (3 mo. USD

LIBOR + 1.850%) (2) | | | 04/25/73 | | | | 515,000 | | | | 517,577 | |

| |

SLM Student Loan Trust (08-5-B) | | | | | |

| | | |

1.97% (3 mo. USD

LIBOR + 1.850%) (2) | | | 07/25/73 | | | | 260,000 | | | | 260,527 | |

| |

SLM Student Loan Trust (08-6-B) | | | | | |

| | | |

1.97% (3 mo. USD

LIBOR + 1.850%) (2) | | | 07/26/83 | | | | 225,000 | | | | 227,027 | |

| |

SLM Student Loan Trust (08-7-B) | | | | | |

| | | |

1.97% (3 mo. USD

LIBOR + 1.850%) (2) | | | 07/26/83 | | | | 305,000 | | | | 306,907 | |

| |

SLM Student Loan Trust (08-8-B) | | | | | |

| | | |

2.37% (3 mo. USD

LIBOR + 2.250%) (2) | | | 10/25/75 | | | | 260,000 | | | | 261,326 | |

| |

SLM Student Loan Trust (08-9-B) | | | | | |

| | | |

2.37% (3 mo. USD

LIBOR + 2.250%) (2) | | | 10/25/83 | | | | 260,000 | | | | 262,471 | |

| |

SLM Student Loan Trust (13-M1-M1R) | | | | | |

| | | |

0.00% (1)(4) | | | 10/28/29 | | | | 1,000 | | | | 940,330 | |

| |

Stratus CLO, Ltd. (21-3A) | | | | | |

| | | |

1.00% (1)(3) | | | 12/29/29 | | | | 750,000 | | | | 716,247 | |

| |

Structured Receivables Finance LLC (10-A-B) | | | | | |

| | | |

7.61% (1) | | | 01/16/46 | | | | 522,005 | | | | 575,313 | |

| |

Structured Receivables Finance LLC (10-B-B) | | | | | |

| | | |

7.97% (1) | | | 08/15/36 | | | | 332,949 | | | | 390,770 | |

| |

Student Loan Consolidation Center (02-2-B2) | | | | | |

| | | |

1.65% (28 day Auction

Rate) (1)(2) | | | 07/01/42 | | | | 1,050,000 | | | | 968,161 | |

| |

TCI-Flatiron CLO, Ltd. (16-1A-BR2) | | | | | |

| | | |

1.72% (3 mo. USD LIBOR +

1.600%) (1)(2) | | | 01/17/32 | | | | 280,000 | | | | 280,000 | |

| |

TRESTLES CLO V, Ltd. (21-5A-A1) | | | | | |

| | | |

1.34% (3 mo. USD

LIBOR + 1.170%) (1)(2) | | | 10/20/34 | | | | 525,000 | | | | 525,359 | |

| | | | | | | | | | | | |

| | |

Total Asset-backed Securities | | | | | | | | | |

| | | |

(Cost: $34,492,877) | | | | | | | | | | | 34,940,904 | |

| | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

8

TCW Strategic Income Fund, Inc.

December 31, 2021

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

MORTGAGE-BACKED SECURITIES — 50.6% | |

|

| Commercial Mortgage-backed Securities — Agency — 2.6% | |

| |

Fannie Mae, Pool #464398 | | | | | |

| | | |

5.97% | | | 01/01/40 | | | $ | 544,628 | | | $ | 609,160 | |

| | | |

Fannie Mae, Pool #464400 | | | | | | | | | | | | |

| | | |

5.97% | | | 01/01/40 | | | | 412,597 | | | | 461,485 | |

| |

Fannie Mae, Pool #AN3542 | | | | | |

| | | |

3.41% | | | 11/01/46 | | | | 1,110,787 | | | | 1,235,511 | |

| |

Fannie Mae (16-M11-X2) (ACES) (I/O) | | | | | |

| | | |

2.93% (3) | | | 07/25/39 | | | | 1,399,494 | | | | 42,951 | |

| |

Fannie Mae (19-M29-X4) (ACES) (I/O) | | | | | |

| | | |

0.70% (3) | | | 03/25/29 | | | | 7,900,000 | | | | 305,694 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (K023-X3) (I/O) | | | | | |

| | | |

1.69% (3) | | | 10/25/40 | | | | 12,555,000 | | | | 124,108 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (K032-X3) (I/O) | | | | | |

| | | |

1.66% (3) | | | 10/25/41 | | | | 4,020,000 | | | | 95,709 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (K039-X3) (I/O) | | | | | |

| | | |

2.11% (3) | | | 08/25/42 | | | | 3,110,000 | | | | 184,680 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (K057-X1) (I/O) | | | | | |

| | | |

1.17% (3) | | | 07/25/26 | | | | 5,202,424 | | | | 234,942 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (K722-X1) (I/O) | | | | | |

| | | |

1.31% (3) | | | 03/25/23 | | | | 14,695,130 | | | | 151,332 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (K735-X3) (I/O) | | | | | |

| | | |

2.15% (3) | | | 05/25/47 | | | | 3,750,000 | | | | 315,960 | |

| |

Freddie Mac Multifamily Structured Pass Through Certificates (Q013-XPT2) (I/O) | | | | | |

| | | |

1.81% | | | 05/25/27 | | | | 3,868,479 | | | | 135,411 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (19-P002-X) (I/O) | | | | | |

| | | |

1.01% (3) | | | 07/25/33 | | | | 1,295,000 | | | | 134,493 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K021-X3) (I/O) | | | | | |

| | | |

1.97% (3) | | | 07/25/40 | | | | 3,475,000 | | | | 32,307 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K022-X3) (I/O) | | | | | |

| | | |

1.81% (3) | | | 08/25/40 | | | | 2,500,000 | | | | 25,970 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K025-X3) (I/O) | | | | | |

| | | |

1.75% (3) | | | 11/25/40 | | | | 5,400,000 | | | | 71,259 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K027-X3) (I/O) | | | | | |

| | | |

1.71% (3) | | | 01/25/41 | | | | 4,095,000 | | | | 68,178 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K031-X1) (I/O) | | | | | |

| | | |

0.19% (3) | | | 04/25/23 | | | | 54,774,456 | | | | 125,800 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Commercial Mortgage-backed Securities — Agency (Continued) | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K031-X3) (I/O) | | | | | |

| | | |

1.66% (3) | | | 07/25/41 | | | $ | 4,500,000 | | | $ | 93,222 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K034-X1) (I/O) | | | | | |

| | | |

0.06% (3) | | | 07/25/23 | | | | 26,239,840 | | | | 31,965 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K040-X3) (I/O) | | | | | |

| | | |

2.04% (3) | | | 11/25/42 | | | | 4,875,000 | | | | 258,916 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K049-X3) (I/O) | | | | | |

| | | |

1.55% (3) | | | 10/25/43 | | | | 2,330,000 | | | | 115,389 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K060-X3) (I/O) | | | | | |

| | | |

1.89% (3) | | | 12/25/44 | | | | 2,500,000 | | | | 207,593 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K726-X1) (I/O) | | | | | |

| | | |

0.89% (3) | | | 04/25/24 | | | | 11,730,396 | | | | 195,273 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K728-X3) (I/O) | | | | | |

| | | |

1.95% (3) | | | 11/25/45 | | | | 3,455,000 | | | | 178,474 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (K732-X3) (I/O) | | | | | |

| | | |

2.17% (3) | | | 05/25/46 | | | | 2,400,000 | | | | 167,692 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (KC05-X1) (I/O) | | | | | |

| | | |

1.20% (3) | | | 06/25/27 | | | | 7,957,875 | | | | 352,198 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (KIR1-X) (I/O) | | | | | |

| | | |

1.05% (3) | | | 03/25/26 | | | | 8,413,726 | | | | 314,664 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (KLU2-X1) (I/O) | | | | | |

| | | |

1.04% (3) | | | 08/25/29 | | | | 4,419,888 | | | | 257,218 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (KS11-XFX) (I/O) | | | | | |

| | | |

1.60% (3) | | | 06/25/29 | | | | 2,290,000 | | | | 217,937 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (KW01-X3) (I/O) | | | | | |

| | | |

4.08% (3) | | | 03/25/29 | | | | 690,000 | | | | 99,370 | |

| |

Freddie Mac Multifamily Structured Pass-Through Certificates (Q010-XPT2) (I/O) | | | | | |

| | | |

0.36% | | | 08/25/24 | | | | 3,471,473 | | | | 18,524 | |

| |

Ginnie Mae (12-139-IO) (I/O) | | | | | |

| | | |

0.73% (3) | | | 02/16/53 | | | | 2,472,612 | | | | 63,568 | |

| |

Ginnie Mae (13-52-IO) (I/O) | | | | | |

| | | |

0.14% (3) | | | 02/16/55 | | | | 7,355,815 | | | | 28,465 | |

| |

Ginnie Mae (09-114-IO) (I/O) | | | | | |

| | | |

0.02% (3) | | | 10/16/49 | | | | 5,144,548 | | | | 483 | |

| |

Ginnie Mae (10-148-IO) (I/O) | | | | | |

| | | |

0.29% (3) | | | 09/16/50 | | | | 5,219,597 | | | | 57,962 | |

See accompanying Notes to Financial Statements.

9

TCW Strategic Income Fund, Inc.

Schedule of Investments (Continued)

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Commercial Mortgage-backed Securities — Agency (Continued) | |

| |

Ginnie Mae (11-105-IO) (I/O) | | | | | |

| | | |

0.00% (3) | | | 09/16/51 | | | $ | 4,427,142 | | | $ | 7 | |

| |

Ginnie Mae (11-152-IO) (I/O) | | | | | |

| | | |

0.04% (3) | | | 08/16/51 | | | | 1,628,302 | | | | 546 | |

| |

Ginnie Mae (11-42-IO) (I/O) | | | | | |

| | | |

0.00% (3) | | | 08/16/50 | | | | 2,068,944 | | | | 10 | |

| |

Ginnie Mae (12-4-IO) (I/O) | | | | | |

| | | |

0.00% (3) | | | 05/16/52 | | | | 4,443,591 | | | | 44 | |

| |

Ginnie Mae (14-103-IO) (I/O) | | | | | |

| | | |

0.28% (3) | | | 05/16/55 | | | | 2,358,682 | | | | 28,826 | |

| |

Ginnie Mae (14-125-IO) (I/O) | | | | | |

| | | |

0.92% (3) | | | 11/16/54 | | | | 1,760,187 | | | | 62,137 | |

| | | | | | | | | | | | |

| | |

Total Commercial Mortgage-backed Securities — Agency | | | | | | | | | |

| | |

(Cost: $11,393,262) | | | | | | | | 7,105,433 | |

| | | | | | | | | | | | |

|

| Commercial Mortgage-backed Securities — Non-Agency — 10.1% | |

| |

BAMLL Commercial Mortgage Securities Trust (18-PARK-A) | | | | | |

| | | |

4.09% (1)(3) | | | 08/10/38 | | | | 590,000 | | | | 659,295 | |

| |

BBCMS Mortgage Trust (17-C1-XA) (I/O) | | | | | |

| | | |

1.44% (3) | | | 02/15/50 | | | | 3,829,919 | | | | 226,387 | |

| |

BBCMS Mortgage Trust (20-BID-D) | | | | | |

| | | |

4.74% (1 mo. USD

LIBOR + 4.630%) (1)(2) | | | 10/15/37 | | | | 705,000 | | | | 708,508 | |

| |

BCRR Trust (16-FRR3-E) | | | | | |

| | | |

2.02% (-1 mo. USD

LIBOR + 18.348%) (1)(2) | | | 05/26/26 | | | | 695,789 | | | | 636,619 | |

| |

Benchmark Mortgage Trust (19-B14-225D) | | | | | |

| | | |

3.29% (1)(3) | | | 12/15/62 | | | | 535,000 | | | | 504,564 | |

| |

Benchmark Mortgage Trust (20-B17-A5) | | | | | |

| | | |

2.29% | | | 03/15/53 | | | | 1,040,000 | | | | 1,050,956 | |

| |

Benchmark Mortgage Trust (20-IG3-BXC) | | | | | |

| | | |

3.54% (1)(3) | | | 09/15/48 | | | | 555,000 | | | | 537,676 | |

| |

BF Mortgage Trust (19-NYT-E) | | | | | |

| | | |

2.61% (1 mo. USD

LIBOR + 2.500%) (1)(2) | | | 12/15/35 | | | | 525,000 | | | | 521,020 | |

| |

BX Commercial Mortgage Trust (18-IND-G) | | | | | |

| | | |

2.16% (1 mo. USD

LIBOR + 2.050%) (1)(2) | | | 11/15/35 | | | | 360,500 | | | | 359,721 | |

| |

BX Commercial Mortgage Trust (20-FOX-E) | | | | | |

| | | |

3.71% (1 mo. USD

LIBOR + 3.600%) (1)(2) | | | 11/15/32 | | | | 766,951 | | | | 768,630 | |

| |

BX Commercial Mortgage Trust (20-FOX-G) | | | | | |

| | | |

4.86% (1 mo. USD

LIBOR + 4.750%) (1)(2) | | | 11/15/32 | | | | 994,508 | | | | 1,001,859 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Commercial Mortgage-backed Securities — Non-Agency (Continued) | |

| |

BX Trust (19-OC11-A) | | | | | |

| | | |

3.20% (1) | | | 12/09/41 | | | $ | 265,000 | | | $ | 279,596 | |

| |

CALI Mortgage Trust (19-101C-A) | | | | | |

| | | |

3.96% (1) | | | 03/10/39 | | | | 680,000 | | | | 755,921 | |

| |

Citigroup Commercial Mortgage Trust

(12-GC8-XA) (I/O) | | | | | |

| | | |

1.72% (1)(3)(6) | | | 09/10/45 | | | | 2,873,422 | | | | 13,819 | |

| |

Citigroup Commercial Mortgage Trust

(14-GC21-XD) (I/O) | | | | | |

| | | |

1.35% (1)(3) | | | 05/10/47 | | | | 4,702,111 | | | | 128,446 | |

| |

Citigroup Commercial Mortgage Trust

(15-GC35-XA) (I/O) | | | | | |

| | | |

0.72% (3) | | | 11/10/48 | | | | 6,443,850 | | | | 155,830 | |

| |

Citigroup Commercial Mortgage Trust

(19-PRM-X) (I/O) | | | | | |

| | | |

1.18% (1)(3) | | | 05/10/36 | | | | 14,000,000 | | | | 314,926 | |

| |

COMM Mortgage Trust (12-LC4-XB) (I/O) | | | | | |

| | | |

0.55% (1)(3) | | | 12/10/44 | | | | 18,671,016 | | | | 187 | |

| |

COMM Mortgage Trust (13-CR11-XA) (I/O) | | | | | |

| | | |

0.91% (3) | | | 08/10/50 | | | | 9,591,925 | | | | 122,825 | |

| |

COMM Mortgage Trust (13-CR12-XA) (I/O) | | | | | |

| | | |

1.11% (3) | | | 10/10/46 | | | | 8,927,965 | | | | 144,303 | |

| |

COMM Mortgage Trust (13-LC13-XA) (I/O) | | | | | |

| | | |

1.00% (3) | | | 08/10/46 | | | | 6,051,210 | | | | 80,638 | |

| |

COMM Mortgage Trust (14-CR18-XA) (I/O) | | | | | |

| | | |

1.00% (3) | | | 07/15/47 | | | | 6,269,051 | | | | 128,505 | |

| |

COMM Mortgage Trust (14-CR21-XA) (I/O) | | | | | |

| | | |

0.85% (3) | | | 12/10/47 | | | | 16,972,529 | | | | 353,385 | |

| |

COMM Mortgage Trust (20-CBM-XCP) (I/O) | | | | | |

| | | |

0.60% (1)(3) | | | 02/10/37 | | | | 5,644,863 | | | | 98,151 | |

| |

COMM Mortgage Trust (20-CX-E) | | | | | |

| | | |

2.68% (1)(3) | | | 11/10/46 | | | | 370,000 | | | | 347,303 | |

| |

CPT Mortgage Trust (19-CPT-A) | | | | | |

| | | |

2.87% (1) | | | 11/13/39 | | | | 510,000 | | | | 531,727 | |

| |

CSMC (20-FACT-F) | | | | | |

| | | |

6.27% (1 mo. USD

LIBOR + 6.157%) (1)(2) | | | 10/15/37 | | | | 1,017,000 | | | | 1,027,830 | |

| |

DBGS Mortgage Trust (18-5BP-E) | | | | | |

| | | |

2.16% (1 mo. USD

LIBOR + 2.050%) (1)(2) | | | 06/15/33 | | | | 685,000 | | | | 665,493 | |

| |

DBWF Mortgage Trust (16-85T-A) | | | | | |

| | | |

3.79% (1) | | | 12/10/36 | | | | 615,000 | | | | 664,294 | |

| |

DC Office Trust (19-MTC-A) | | | | | |

| | | |

2.97% (1) | | | 09/15/45 | | | | 550,000 | | | | 574,445 | |

| |

Grace Trust (20-GRCE-A) | | | | | |

| | | |

2.35% (1) | | | 12/10/40 | | | | 1,350,000 | | | | 1,350,838 | |

| |

Grace Trust (20-GRCE-D) | | | | | |

| | | |

2.68% (1)(3) | | | 12/10/40 | | | | 1,249,000 | | | | 1,192,640 | |

See accompanying Notes to Financial Statements.

10

TCW Strategic Income Fund, Inc.

December 31, 2021

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Commercial Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Grace Trust (20-GRCE-F) | | | | | |

| | | |

2.68% (1)(3) | | | 12/10/40 | | | $ | 376,000 | | | $ | 339,175 | |

| |

Grace Trust (20-GRCE-X) (I/O) | | | | | |

| | | |

0.30% (1)(3) | | | 12/10/40 | | | | 10,620,000 | | | | 266,140 | |

| |

GS Mortgage Securities Corp. Trust

(20-UPTN-XA) (I/O) | | | | | |

| | | |

0.35% (1)(3) | | | 02/10/37 | | | | 3,150,000 | | | | 32,813 | |

| |

GS Mortgage Securities Trust (11-GC3-X) (I/O) | | | | | |

| | | |

0.00% (1)(3) | | | 03/10/44 | | | | 706,439 | | | | 7 | |

| |

GS Mortgage Securities Trust (12-GC6-XB) (I/O) | | | | | |

| | | |

0.52% (1)(3)(6) | | | 01/10/45 | | | | 6,186,622 | | | | 62 | |

| |

GS Mortgage Securities Trust (12-GCJ7-XB) (I/O) | | | | | |

| | | |

0.40% (1)(3) | | | 05/10/45 | | | | 30,442,756 | | | | 28,714 | |

| |

GS Mortgage Securities Trust (14-GC18-XB) (I/O) | | | | | |

| | | |

0.09% (3) | | | 01/10/47 | | | | 66,563,000 | | | | 197,492 | |

| |

GS Mortgage Securities Trust (16-GS2-XA) (I/O) | | | | | |

| | | |

1.74% (3) | | | 05/10/49 | | | | 4,176,872 | | | | 262,322 | |

| |

Hudson Yards Mortgage Trust (19-55HY-A) | | | | | |

| | | |

2.94% (1)(3) | | | 12/10/41 | | | | 550,000 | | | | 576,456 | |

| |

Hudson Yards Mortgage Trust (19-55HY-F) | | | | | |

| | | |

2.94% (1)(3) | | | 12/10/41 | | | | 150,000 | | | | 139,379 | |

| |

ILPT Trust (19-SURF-A) | | | | | |

| | | |

4.15% (1) | | | 02/11/41 | | | | 240,000 | | | | 266,769 | |

| |

JPMBB Commercial Mortgage Securities Trust (14-C24-XA) (I/O) | | | | | |

| | | |

0.86% (3) | | | 11/15/47 | | | | 7,459,652 | | | | 140,195 | |

| |

JPMBB Commercial Mortgage Securities Trust

(14-C21-XA) (I/O) | | | | | |

| | | |

0.96% (3) | | | 08/15/47 | | | | 1,681,766 | | | | 35,367 | |

| |

JPMBB Commercial Mortgage Securities Trust

(14-C23-XA) (I/O) | | | | | |

| | | |

0.60% (3) | | | 09/15/47 | | | | 9,416,049 | | | | 129,348 | |

| |

JPMBB Commercial Mortgage Securities Trust

(15-C29-XD) (I/O) | | | | | |

| | | |

0.50% (1)(3) | | | 05/15/48 | | | | 26,458,000 | | | | 398,513 | |

| |

JPMCC Commercial Mortgage Securities Trust (17-JP5-XA) (I/O) | | | | | |

| | | |

0.96% (3) | | | 03/15/50 | | | | 12,416,208 | | | | 471,546 | |

| |

JPMorgan Chase Commercial Mortgage Securities Trust (11-C3-XB) (I/O) | | | | | |

| | | |

0.39% (1)(3) | | | 02/15/46 | | | | 51,987,800 | | | | 467,251 | |

| |

JPMorgan Chase Commercial Mortgage Securities Trust (12-HSBC-XA) (I/O) | | | | | |

| | | |

1.43% (1)(3)(6) | | | 07/05/32 | | | | 4,228,801 | | | | 15,492 | |

| |

JPMorgan Chase Commercial Mortgage Securities Trust (12-LC9-XA) (I/O) | | | | | |

| | | |

1.39% (3) | | | 12/15/47 | | | | 5,517,462 | | | | 48,427 | |

| |

JPMorgan Chase Commercial Mortgage Securities Trust (13-LC11-XA) (I/O) | | | | | |

| | | |

1.23% (3) | | | 04/15/46 | | | | 21,467,842 | | | | 242,353 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Commercial Mortgage-backed Securities — Non-Agency (Continued) | |

| |

JPMorgan Chase Commercial Mortgage Securities Trust (19-OSB-A) | | | | | |

| | | |

3.40% (1) | | | 06/05/39 | | | $ | 585,000 | | | $ | 631,807 | |

| |

JPMorgan Chase Commercial Mortgage Securities Trust (19-OSB-C) | | | | | |

| | | |

3.75% (1)(3) | | | 06/05/39 | | | | 150,000 | | | | 159,130 | |

| |

Manhattan West Mortgage Trust (20-1MW-A) | | | | | |

| | | |

2.13% (1) | | | 09/10/39 | | | | 695,000 | | | | 694,485 | |

| |

Med Trust 2021-MDLN (21-MDLN-G) | | | | | |

| | | |

5.36% (1 mo. USD LIBOR +

5.250%) (1)(2) | | | 11/15/38 | | | | 670,000 | | | | 667,711 | |

| |

MFT Mortgage Trust (20-B6-C) | | | | | |

| | | |

3.28% (1)(3) | | | 08/10/40 | | | | 220,000 | | | | 206,482 | |

| |

MFT Trust (20-ABC-C) | | | | | |

| | | |

3.48% (1)(3) | | | 02/10/42 | | | | 175,000 | | | | 167,797 | |

| |

MFT Trust (20-ABC-D) | | | | | |

| | | |

3.48% (1)(3) | | | 02/10/42 | | | | 180,000 | | | | 168,828 | |

| |

Morgan Stanley Bank of America Merrill Lynch Trust (15-C22-XA) (I/O) | | | | | |

| | | |

1.02% (3) | | | 04/15/48 | | | | 8,633,971 | | | | 215,971 | |

| |

Morgan Stanley Bank of America Merrill Lynch Trust (15-C24-XA) (I/O) | | | | | |

| | | |

0.72% (3) | | | 05/15/48 | | | | 9,771,414 | | | | 212,753 | |

| |

Morgan Stanley Bank of America Merrill Lynch Trust (16-C31-XA) (I/O) | | | | | |

| | | |

1.29% (3) | | | 11/15/49 | | | | 6,866,920 | | | | 338,683 | |

| |

Morgan Stanley Capital I Trust (12-C4-XA) (I/O) | | | | | |

| | | |

1.78% (1)(3)(6) | | | 03/15/45 | | | | 552,945 | | | | 6 | |

| |

Morgan Stanley Capital I Trust (19-L2-A3) | | | | | |

| | | |

3.81% | | | 03/15/52 | | | | 230,000 | | | | 250,230 | |

| |

One Bryant Park Trust (19-OBP-A) | | | | | |

| | | |

2.52% (1) | | | 09/15/54 | | | | 1,295,000 | | | | 1,311,888 | |

| |

SFAVE Commercial Mortgage Securities Trust (15-5AVE-A2A) | | | | | |

| | | |

3.66% (1)(3) | | | 01/05/43 | | | | 805,000 | | | | 875,408 | |

| |

SFAVE Commercial Mortgage Securities Trust (15-5AVE-A2B) | | | | | |

| | | |

4.14% (1)(3) | | | 01/05/43 | | | | 65,000 | | | | 70,786 | |

| |

SFAVE Commercial Mortgage Securities Trust (15-5AVE-D) | | | | | |

| | | |

4.39% (1)(3) | | | 01/05/43 | | | | 880,000 | | | | 720,830 | |

| |

UBS Commercial Mortgage Trust (12-C1-XA) (I/O) | | | | | |

| | | |

1.85% (1)(3)(6) | | | 05/10/45 | | | | 856,081 | | | | 36 | |

| |

UBS Commercial Mortgage Trust (17-C5-XA) (I/O) | | | | | |

| | | |

0.99% (3) | | | 11/15/50 | | | | 7,159,448 | | | | 289,978 | |

| |

UBS-Barclays Commercial Mortgage Trust (12-C3-XA) (I/O) | | | | | |

| | | |

1.81% (1)(3) | | | 08/10/49 | | | | 11,346,907 | | | | 80,944 | |

| |

UBS-Barclays Commercial Mortgage Trust (13-C5-XA) (I/O) | | | | | |

| | | |

0.90% (1)(3) | | | 03/10/46 | | | | 12,264,709 | | | | 69,464 | |

See accompanying Notes to Financial Statements.

11

TCW Strategic Income Fund, Inc.

Schedule of Investments (Continued)

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Commercial Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Wells Fargo Commercial Mortgage Trust

(12-LC5-XA) (I/O) | | | | | |

| | | |

1.72% (1)(3) | | | 10/15/45 | | | $ | 4,904,598 | | | $ | 33,445 | |

| |

WFRBS Commercial Mortgage Trust (12-C8-XA) (I/O) | | | | | |

| | | |

1.76% (1)(3)(6) | | | 08/15/45 | | | | 3,127,046 | | | | 10,631 | |

| |

WFRBS Commercial Mortgage Trust (12-C9-XA) (I/O) | | | | | |

| | | |

1.85% (1)(3) | | | 11/15/45 | | | | 2,334,654 | | | | 19,460 | |

| |

WFRBS Commercial Mortgage Trust (13-C14-XA) (I/O) | | | | | |

| | | |

0.66% (3) | | | 06/15/46 | | | | 6,896,076 | | | | 46,085 | |

| |

WFRBS Commercial Mortgage Trust (13-C16-XA) (I/O) | | | | | |

| | | |

0.62% (3) | | | 09/15/46 | | | | 11,281,922 | | | | 95,051 | |

| |

WFRBS Commercial Mortgage Trust (14-C24-XA) (I/O) | | | | | |

| | | |

0.85% (3) | | | 11/15/47 | | | | 5,215,494 | | | | 105,824 | |

| | | | | | | | | | | | |

| | |

Total Commercial Mortgage-backed Securities — Non-Agency | | | | | | | | | |

| | | |

(Cost: $33,555,041) | | | | | | | | | | | 27,407,871 | |

| | | | | | | | | | | | |

|

| Residential Mortgage-backed Securities — Agency — 11.6% | |

| |

Fannie Mae (07-42-SE) (I/O) (I/F) | | | | | |

| | | |

6.01% (-1 mo. USD

LIBOR + 6.110%) (2) | | | 05/25/37 | | | | 62,855 | | | | 7,819 | |

| |

Fannie Mae (07-48-SD) (I/O) (I/F) | | | | | |

| | | |

6.00% (-1 mo. USD

LIBOR + 6.100%) (2) | | | 05/25/37 | | | | 1,003,041 | | | | 164,733 | |

| |

Fannie Mae (09-69-CS) (I/O) (I/F) | | | | | |

| | | |

6.65% (-1 mo. USD

LIBOR + 6.750%) (2) | | | 09/25/39 | | | | 185,233 | | | | 27,805 | |

| |

Freddie Mac (1673-SD) (I/F) (PAC) | | | | | |

| | | |

15.94% (-2.15 x T10Y + 19.391%) (2) | | | 02/15/24 | | | | 19,904 | | | | 22,028 | |

| |

Freddie Mac (1760-ZD) | | | | | |

| | | |

1.10% (1 x T10Y -0.500%) (2) | | | 02/15/24 | | | | 42,978 | | | | 43,069 | |

| |

Freddie Mac (2990-JK) (I/F) | | | | | |

| | | |

21.57% (-1 mo. USD

LIBOR + 22.004%) (2) | | | 03/15/35 | | | | 55,310 | | | | 60,353 | |

| |

Freddie Mac (3122-SG) (I/O) (I/F) (TAC) (PAC) | | | | | |

| | | |

5.52% (-1 mo. USD

LIBOR + 5.630%) (2) | | | 03/15/36 | | | | 1,644,871 | | | | 276,521 | |

| |

Freddie Mac (3239-SI) (I/O) (I/F) (PAC) | | | | | |

| | | |

6.54% (-1 mo. USD

LIBOR + 6.650%) (2) | | | 11/15/36 | | | | 379,398 | | | | 79,719 | |

| |

Freddie Mac (3323-SA) (I/O) (I/F) | | | | | |

| | | |

6.00% (-1 mo. USD

LIBOR + 6.110%) (2) | | | 05/15/37 | | | | 82,173 | | | | 8,784 | |

| |

Freddie Mac (3459-JS) (I/O) (I/F) | | | | | |

| | | |

6.14% (-1 mo. USD

LIBOR + 6.250%) (2) | | | 06/15/38 | | | | 109,396 | | | | 20,166 | |

| |

Freddie Mac (4030-HS) (I/O) (I/F) | | | | | |

| | | |

6.50% (-1 mo. USD

LIBOR + 6.610%) (2) | | | 04/15/42 | | | | 699,321 | | | | 137,625 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Agency (Continued) | |

| |

Ginnie Mae (06-35-SA) (I/O) (I/F) | | | | | |

| | | |

6.50% (-1 mo. USD

LIBOR + 6.600%) (2) | | | 07/20/36 | | | $ | 1,037,781 | | | $ | 211,770 | |

| |

Ginnie Mae (06-61-SA) (I/O) (I/F) (TAC) | | | | | |

| | | |

4.65% (-1 mo. USD

LIBOR + 4.750%) (2) | | | 11/20/36 | | | | 1,669,765 | | | | 168,534 | |

| |

Ginnie Mae (08-58-TS) (I/O) (I/F) (TAC) | | | | | |

| | | |

6.30% (-1 mo. USD

LIBOR + 6.400%) (2) | | | 05/20/38 | | | | 760,271 | | | | 60,771 | |

| |

Ginnie Mae (16-153-IO) (I/O) | | | | | |

| | | |

3.50% | | | 11/20/46 | | | | 1,881,127 | | | | 255,234 | |

| |

Uniform Mortgage-Backed Securities TBA, 30 Year | | | | | |

| | | |

2.00% (7) | | | 07/01/51 | | | | 13,625,000 | | | | 13,553,747 | |

| |

Uniform Mortgage-Backed Securities TBA, 30 Year | | | | | |

| | | |

2.50% (7) | | | 07/01/51 | | | | 16,050,000 | | | | 16,347,338 | |

| | | | | | | | | | | | |

| | |

Total Residential Mortgage-backed Securities — Agency | | | | | | | | | |

| | |

(Cost: $30,856,965) | | | | | | | | 31,446,016 | |

| | | | | | | | | | | | |

|

| Residential Mortgage-backed Securities — Non-Agency — 26.3% | |

| |

ACE Securities Corp. (04-IN1-A1) | | | | | |

| | | |

0.74% (1 mo. USD

LIBOR + 0.640%) (2) | | | 05/25/34 | | | | 375,567 | | | | 367,990 | |

| |

ACE Securities Corp. (07-ASP1-A2C) | | | | | |

| | | |

0.36% (1 mo. USD

LIBOR + 0.260%) (2) | | | 03/25/37 | | | | 1,286,553 | | | | 748,772 | |

| |

Adjustable Rate Mortgage Trust (05-4-6A22) | | | | | |

| | | |

2.86% (3)(5) | | | 08/25/35 | | | | 433,846 | | | | 381,375 | |

| |

Adjustable Rate Mortgage Trust (06-1-2A1) | | | | | |

| | | |

3.46% (3)(5) | | | 03/25/36 | | | | 358,558 | | | | 247,688 | |

| |

Ajax Mortgage Loan Trust (19-F-A2) | | | | | |

| | | |

3.50% (1) | | | 07/25/59 | | | | 1,300,000 | | | | 1,288,730 | |

| |

Alternative Loan Trust (05-46CB-A20) (TAC) | | | | | |

| | | |

5.50% (5) | | | 10/25/35 | | | | 642,400 | | | | 582,990 | |

| |

Asset-Backed Funding Certificates (07-NC1-A2) | | | | | |

| | | |

0.40% (1 mo. USD

LIBOR + 0.300%) (1)(2) | | | 05/25/37 | | | | 1,075,504 | | | | 1,036,748 | |

| |

Asset-Backed Securities Corp. Home Equity (06-HE3-A5) | | | | | |

| | | |

0.64% (1 mo. USD

LIBOR + 0.540%) (2) | | | 03/25/36 | | | | 1,227,075 | | | | 1,224,797 | |

| |

Asset-Backed Securities Corp. Home Equity (07-HE1-A1B) | | | | | |

| | | |

0.25% (1 mo. USD

LIBOR + 0.150%) (2) | | | 12/25/36 | | | | 413,101 | | | | 403,609 | |

| |

Banc of America Alternative Loan Trust (05-10-1CB1) | | | | | |

| | | |

0.50% (1 mo. USD

LIBOR + 0.400%) (2)(5) | | | 11/25/35 | | | | 401,626 | | | | 345,368 | |

| |

Banc of America Funding Corp. (15-R3-6A2) | | | | | |

| | | |

0.26% (1)(3) | | | 05/27/36 | | | | 1,574,462 | | | | 1,491,802 | |

See accompanying Notes to Financial Statements.

12

TCW Strategic Income Fund, Inc.

December 31, 2021

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Banc of America Funding Trust (06-3-4A14) | | | | | |

| | | |

6.00% | | | 03/25/36 | | | $ | 185,619 | | | $ | 183,203 | |

| |

Banc of America Funding Trust (06-3-5A3) | | | | | |

| | | |

5.50% (5) | | | 03/25/36 | | | | 133,203 | | | | 132,584 | |

| |

Banc of America Funding Trust (14-R5-1A1) | | | | | |

| | | |

1.75% (6 mo. USD

LIBOR + 1.500%) (1)(2) | | | 09/26/45 | | | | 247,845 | | | | 247,866 | |

| |

Banc of America Funding Trust (15-R4-2A1) | | | | | |

| | | |

0.30% (1 mo. USD

LIBOR + 0.205%) (1)(2) | | | 02/25/37 | | | | 552,905 | | | | 546,053 | |

| |

BCMSC Trust (00-A-A4) | | | | | |

| | | |

8.29% (3) | | | 06/15/30 | | | | 3,316,690 | | | | 777,078 | |

| |

Bear Stearns Adjustable Rate Mortgage Trust (03-7-9A) | | | | | |

| | | |

2.62% (3) | | | 10/25/33 | | | | 277,807 | | | | 282,387 | |

| |

Bear Stearns Adjustable Rate Mortgage Trust (05-9-A1) | | | | | |

| | | |

2.38% (1 year Treasury Constant Maturity Rate + 2.300%) (2) | | | 10/25/35 | | | | 135,708 | | | | 139,006 | |

| |

Bear Stearns Adjustable Rate Mortgage Trust (07-4-22A1) | | | | | |

| | | |

3.27% (3)(5) | | | 06/25/47 | | | | 738,881 | | | | 738,508 | |

| |

Bear Stearns ALT-A Trust (05-3-4A3) | | | | | |

| | | |

2.41% (3) | | | 04/25/35 | | | | 368,062 | | | | 375,300 | |

| |

Bear Stearns Asset-Backed Securities Trust (05-AC6-1A3) | | | | | |

| | | |

5.50% (3) | | | 09/25/35 | | | | 387,976 | | | | 392,387 | |

| |

Bear Stearns Asset-Backed Securities Trust (06-IM1-A1) | | | | | |

| | | |

0.56% (1 mo. USD

LIBOR + 0.460%) (2) | | | 04/25/36 | | | | 181,835 | | | | 303,372 | |

| |

Bear Stearns Mortgage Funding Trust (07-AR3-1X) (I/O) | | | | | |

| | | |

0.50% (8) | | | 03/25/37 | | | | 29,967,474 | | | | 712,685 | |

| |

CIM Trust (19-R1-A) | | | | | |

| | | |

3.25% (1)(3) | | | 10/25/58 | | | | 897,427 | | | | 838,969 | |

| |

CIM Trust (21-NR3-A1) | | | | | |

| | | |

2.57% (1)(5) | | | 06/25/57 | | | | 491,697 | | | | 492,281 | |

| |

CIM Trust (21-R3-A1A) | | | | | |

| | | |

1.95% (1)(3) | | | 06/25/57 | | | | 1,125,788 | | | | 1,121,924 | |

| |

CIM Trust (21-R4-A1A) | | | | | |

| | | |

2.00% (1)(3) | | | 05/01/61 | | | | 1,112,399 | | | | 1,106,664 | |

| |

CIM Trust (21-R5-A1B) | | | | | |

| | | |

2.00% (1)(3) | | | 08/25/61 | | | | 1,096,000 | | | | 981,669 | |

| |

Citigroup Mortgage Loan Trust, Inc. (05-11-A2A) | | | | | |

| | | |

2.47% (1 year Treasury Constant Maturity Rate + 2.400%) (2) | | | 10/25/35 | | | | 224,596 | | | | 231,170 | |

| |

Citigroup Mortgage Loan Trust, Inc. (05-8-1A1A) | | | | | |

| | | |

2.50% (3)(5) | | | 10/25/35 | | | | 487,907 | | | | 438,444 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Citigroup Mortgage Loan Trust, Inc. (14-10-2A2) | | | | | |

| | | |

0.34% (1 mo. USD

LIBOR + 0.250%) (1)(2) | | | 07/25/37 | | | $ | 913,854 | | | $ | 900,758 | |

| |

CitiMortgage Alternative Loan Trust (06-A3-1A7) | | | | | |

| | | |

6.00% (5) | | | 07/25/36 | | | | 719,464 | | | | 717,562 | |

| |

CitiMortgage Alternative Loan Trust (06-A5-1A8) | | | | | |

| | | |

6.00% (5) | | | 10/25/36 | | | | 632,100 | | | | 630,358 | |

| |

Conseco Finance Securitizations Corp. (99-6-A1) | | | | | |

| | | |

7.36% (1)(3)(5) | | | 06/01/30 | | | | 1,350,847 | | | | 684,224 | |

| |

Conseco Financial Corp. (96-6-M1) | | | | | |

| | | |

7.95% (3) | | | 09/15/27 | | | | 87,012 | | | | 90,419 | |

| |

Countrywide Alternative Loan Trust

(05-20CB-4A1) (I/F) | | | | | |

| | | |

5.25% | | | 07/25/20 | | | | 808 | | | | 796 | |

| |

Countrywide Alternative Loan Trust (06-8T1-1A2) (I/O) | | | | | |

| | | |

5.40% (-1 mo. USD LIBOR +

5.500%) (2)(8) | | | 04/25/36 | | | | 5,130,077 | | | | 994,929 | |

| |

Countrywide Asset-Backed Certificates (07-13-2A1) | | | | | |

| | | |

1.00% (1 mo. USD LIBOR + 0.900%) (2) | | | 10/25/47 | | | | 520,291 | | | | 520,236 | |

| |

Countrywide Home Loans (04-HYB4-B1) | | | | | |

| | | |

2.87% (3) | | | 09/20/34 | | | | 540,885 | | | | 274,702 | |

| |

Countrywide Home Loans (06-14-X) (I/O) | | | | | |

| | | |

0.17% (3)(8) | | | 09/25/36 | | | | 10,443,088 | | | | 44,680 | |

| |

Countrywide Home Loans (06-HYB2-1A1) | | | | | |

| | | |

3.16% (3)(5) | | | 04/20/36 | | | | 735,401 | | | | 572,359 | |

| |

Credit Suisse First Boston Mortgage Securities Corp. (04-AR5-11A2) | | | | | |

| | | |

0.84% (1 mo. USD

LIBOR + 0.740%) (2) | | | 06/25/34 | | | | 117,051 | | | | 117,972 | |

| |

Credit Suisse First Boston Mortgage Securities Corp. (05-12-1A1) | | | | | |

| | | |

6.50% (5) | | | 01/25/36 | | | | 962,332 | | | | 347,301 | |

| |

Credit Suisse Mortgage Capital Certificates (06-6-1A8) | | | | | |

| | | |

6.00%(5) | | | 07/25/36 | | | | 526,413 | | | | 372,740 | |

| |

Credit-Based Asset Servicing and Securitization LLC (03-CB3-AF1) | | | | | |

| | | |

3.38% | | | 12/25/32 | | | | 377,868 | | | | 371,929 | |

| |

Credit-Based Asset Servicing and Securitization LLC (06-CB1-AF2) | | | | | |

| | | |

2.92% | | | 01/25/36 | | | | 1,052,724 | | | | 858,489 | |

| |

Credit-Based Asset Servicing and Securitization LLC (06-CB2-AF2) | | | | | |

| | | |

3.07% | | | 12/25/36 | | | | 2,039,310 | | | | 2,029,629 | |

| |

Credit-Based Asset Servicing and Securitization LLC (07-CB2-A2B) | | | | | |

| | | |

3.63% | | | 02/25/37 | | | | 902,207 | | | | 710,332 | |

See accompanying Notes to Financial Statements.

13

TCW Strategic Income Fund, Inc.

Schedule of Investments (Continued)

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | �� | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Credit-Based Asset Servicing and Securitization LLC (07-CB2-A2C) | | | | | |

| | | |

3.63% | | | 02/25/37 | | | $ | 886,429 | | | $ | 697,823 | |

| |

Credit-Based Asset Servicing and Securitization LLC (07-CB3-A3) | | | | | |

| | | |

3.31% | | | 03/25/37 | | | | 1,253,540 | | | | 646,288 | |

| |

Deutsche Alt-A Securities, Inc. Mortgage Loan Trust (06-AB2-A2) | | | | | |

| | | |

4.94% (3)(5) | | | 06/25/36 | | | | 1,158,312 | | | | 1,152,642 | |

| |

Deutsche Alt-A Securities, Inc. Mortgage Loan Trust (06-AR6-A6) | | | | | |

| | | |

0.48% (1 mo. USD

LIBOR + 0.380%) (2) | | | 02/25/37 | | | | 375,882 | | | | 369,922 | |

| |

DSLA Mortgage Loan Trust (06-AR2-2A1A) | | | | | |

| | | |

0.30% (1 mo. USD

LIBOR + 0.200%) (2) | | | 10/19/36 | | | | 375,808 | | | | 327,119 | |

| |

First Franklin Mortgage Loan Asset-Backed Certificates (06-FF11-2A3) | | | | | |

| | | |

0.40% (1 mo. USD

LIBOR + 0.300%) (2) | | | 08/25/36 | | | | 739,023 | | | | 725,025 | |

| |

First Franklin Mortgage Loan Asset-Backed Certificates (06-FF13-A2C) | | | | | |

| | | |

0.42% (1 mo. USD

LIBOR + 0.320%) (2) | | | 10/25/36 | | | | 679,357 | | | | 547,758 | |

| |

First Franklin Mortgage Loan Asset-Backed Certificates (06-FF18-A2D) | | | | | |

| | | |

0.31% (1 mo. USD

LIBOR + 0.210%) (2) | | | 12/25/37 | | | | 628,388 | | | | 602,434 | |

| |

First Horizon Alternative Mortgage Securities Trust (05-AA10-2A1) | | | | | |

| | | |

2.30% (3)(5) | | | 12/25/35 | | | | 271,083 | | | | 235,383 | |

| |

Greenpoint Manufactured Housing (00-1-A4) | | | | | |

| | | |

8.14% (3) | | | 03/20/30 | | | | 559,707 | | | | 476,569 | |

| |

GSAA Home Equity Trust (06-13-AF6) | | | | | |

| | | |

6.54% | | | 07/25/36 | | | | 1,243,892 | | | | 539,019 | |

| |

GSC Capital Corp. Mortgage Trust (06-2-A1) | | | | | |

| | | |

0.46% (1 mo. USD

LIBOR + 0.360%) (2) | | | 05/25/36 | | | | 242,782 | | | | 237,546 | |

| |

GSR Mortgage Loan Trust (05-AR3-6A1) | | | | | |

| | | |

2.85% (3) | | | 05/25/35 | | | | 177,564 | | | | 163,814 | |

| |

HSI Asset Loan Obligation Trust (07-2-2A12) | | | | | |

| | | |

6.00% | | | 09/25/37 | | | | 372,294 | | | | 342,655 | |

| |

Indymac INDX Mortgage Loan Trust (04-AR6-5A1) | | | | | |

| | | |

2.81% (3) | | | 10/25/34 | | | | 309,343 | | | | 314,296 | |

| |

Indymac INDX Mortgage Loan Trust (05-AR19-A1) | | | | | |

| | | |

2.74% (3) | | | 10/25/35 | | | | 445,346 | | | | 420,204 | |

| |

Indymac INDX Mortgage Loan Trust

(06-AR13-A4X) (I/O) | | | | | |

| | | |

1.65% (3)(8) | | | 07/25/36 | | | | 252,528 | | | | 3,068 | |

| |

Indymac INDX Mortgage Loan Trust

(06-AR9-1A1) | | | | | |

| | | |

2.94% (3) | | | 06/25/36 | | | | 566,082 | | | | 414,867 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Indymac INDX Mortgage Loan Trust (07-AR5-2A1) | | | | | |

| | | |

2.98% (3)(5) | | | 05/25/37 | | | $ | 752,325 | | | $ | 708,203 | |

| |

Indymac INDX Mortgage Loan Trust (07-FLX2-A1C) | | | | | |

| | | |

0.29% (1 mo. USD

LIBOR + 0.190%) (2) | | | 04/25/37 | | | | 1,686,303 | | | | 1,618,622 | |

| |

JPMorgan Alternative Loan Trust (06-A2-5A1) | | | | | |

| | | |

3.04% (3)(5) | | | 05/25/36 | | | | 401,980 | | | | 278,032 | |

| |

JPMorgan Mortgage Acquisition Trust (06-WF1-A5) | | | | | |

| | | |

6.91% | | | 07/25/36 | | | | 2,063,157 | | | | 825,130 | |

| |

JPMorgan Mortgage Trust (04-A6-5A1) | | | | | |

| | | |

2.43% (3) | | | 12/25/34 | | | | 200,935 | | | | 201,345 | |

| |

JPMorgan Mortgage Trust (07-S2-1A1) | | | | | |

| | | |

5.00% | | | 06/25/37 | | | | 146,981 | | | | 85,529 | |

| |

JPMorgan Resecuritization Trust (15-4-1A5) | | | | | |

| | | |

0.47% (1 mo. USD

LIBOR + 0.190%) (1)(2) | | | 06/26/47 | | | | 1,863,000 | | | | 1,808,416 | |

| |

JPMorgan Resecuritization Trust (15-4-2A2) | | | | | |

| | | |

3.65% (1)(3)(5) | | | 06/26/47 | | | | 3,346,557 | | | | 1,748,910 | |

| |

Legacy Mortgage Asset Trust (19-GS4-A1) | | | | | |

| | | |

3.44% (1) | | | 05/25/59 | | | | 861,561 | | | | 863,140 | |

| |

Lehman Mortgage Trust (06-7-2A5) (I/O) (I/F) | | | | | |

| | | |

6.45% (-1 mo. USD

LIBOR + 6.550%) (2)(8) | | | 11/25/36 | | | | 2,970,721 | | | | 712,345 | |

| |

Lehman XS Trust (06-10N-1A3A) | | | | | |

| | | |

0.52% (1 mo. USD

LIBOR + 0.420%) (2) | | | 07/25/46 | | | | 499,485 | | | | 519,471 | |

| |

Lehman XS Trust (06-12N-A31A) | | | | | |

| | | |

0.50% (1 mo. USD

LIBOR + 0.400%) (2) | | | 08/25/46 | | | | 664,778 | | | | 676,142 | |

| |

Long Beach Mortgage Loan Trust (04-4-M1) | | | | | |

| | | |

1.00% (1 mo. USD

LIBOR + 0.900%) (2) | | | 10/25/34 | | | | 562,390 | | | | 559,433 | |

| |

MASTR Alternative Loan Trust (06-2-2A2) (I/O) (I/F) | | | | | |

| | | |

7.00% (-1 mo. USD

LIBOR + 7.100%) (2)(8) | | | 03/25/36 | | | | 5,921,452 | | | | 1,046,768 | |

| |

MASTR Alternative Loans Trust (07-HF1-4A1) | | | | | |

| | | |

7.00% (5) | | | 10/25/47 | | | | 1,060,946 | | | | 676,121 | |

| |

MASTR Asset-Backed Securities Trust (07-HE1-A4) | | | | | |

| | | |

0.38% (1 mo. USD

LIBOR + 0.280%) (2) | | | 05/25/37 | | | | 2,000,000 | | | | 1,853,920 | |

| |

Merrill Lynch Alternative Note Asset Trust

(07-OAR2-A2) | | | | | |

| | | |

0.52% (1 mo. USD

LIBOR + 0.420%) (2) | | | 04/25/37 | | | | 781,474 | | | | 737,476 | |

| |

Merrill Lynch First Franklin Mortgage Loan Trust

(07-3-A2B) | | | | | |

| | | |

0.23% (1 mo. USD

LIBOR + 0.130%) (2) | | | 06/25/37 | | | | 537,959 | | | | 506,922 | |

See accompanying Notes to Financial Statements.

14

TCW Strategic Income Fund, Inc.

December 31, 2021

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Merrill Lynch First Franklin Mortgage Loan Trust

(07-3-A2C) | | | | | |

| | | |

0.28% (1 mo. USD

LIBOR + 0.180%) (2) | | | 06/25/37 | | | $ | 1,098,499 | | | $ | 1,040,052 | |

| |

Merrill Lynch Mortgage-Backed Securities Trust

(07-2-1A1) | | | | | |

| | | |

2.61% (1 year Treasury Constant Maturity Rate + 2.400%) (2)(5) | | | 08/25/36 | | | | 161,437 | | | | 157,503 | |

| |

Mid-State Trust (04-1-B) | | | | | |

| | | |

8.90% | | | 08/15/37 | | | | 152,819 | | | | 160,539 | |

| |

Mid-State Trust (04-1-M1) | | | | | |

| | | |

6.50% | | | 08/15/37 | | | | 152,819 | | | | 157,904 | |

| |

Morgan Stanley ABS Capital I, Inc. Trust (06-HE3-A1) | | | | | |

| | | |

0.38% (1 mo. USD

LIBOR + 0.280%) (2) | | | 04/25/36 | | | | 28,416 | | | | 28,399 | |

| |

Morgan Stanley ABS Capital I, Inc. Trust (07-15AR-4A1) | | | | | |

| | | |

2.83% (3) | | | 11/25/37 | | | | 334,560 | | | | 336,125 | |

| |

Nomura Asset Acceptance Corp. (06-AR1-1A) | | | | | |

| | | |

4.48% (3) | | | 02/25/36 | | | | 176,960 | | | | 152,390 | |

| |

Oakwood Mortgage Investors, Inc. (00-A-A4) | | | | | |

| | | |

8.15% (3) | | | 09/15/29 | | | | 1,741,180 | | | | 687,797 | |

| |

Oakwood Mortgage Investors, Inc. (00-D-A4) | | | | | |

| | | |

7.40% (3) | | | 07/15/30 | | | | 692,971 | | | | 248,980 | |

| |

Oakwood Mortgage Investors, Inc. (01-C-A3) | | | | | |

| | | |

6.61% (3) | | | 06/15/31 | | | | 1,671,028 | | | | 305,199 | |

| |

Oakwood Mortgage Investors, Inc. (01-D-A3) | | | | | |

| | | |

5.90% (3) | | | 09/15/22 | | | | 649,834 | | | | 447,354 | |

| |

Oakwood Mortgage Investors, Inc. (01-D-A4) | | | | | |

| | | |

6.93% (3) | | | 09/15/31 | | | | 376,500 | | | | 282,092 | |

| |

Oakwood Mortgage Investors, Inc. (02-A-A3) | | | | | |

| | | |

6.03% (3) | | | 05/15/24 | | | | 85,623 | | | | 87,010 | |

| |

Oakwood Mortgage Investors, Inc. (99-B-A4) | | | | | |

| | | |

6.99% | | | 12/15/26 | | | | 65,180 | | | | 65,747 | |

| |

Oakwood Mortgage Investors, Inc. (99-E-A1) | | | | | |

| | | |

7.61% (3) | | | 03/15/30 | | | | 695,185 | | | | 524,605 | |

| |

Popular ABS Mortgage Pass-Through Trust (05-6-A4) | | | | | |

| | | |

3.42% | | | 01/25/36 | | | | 41,524 | | | | 41,445 | |

| |

RALI Series Trust (06-QS13-1A2) (I/O) (I/F) | | | | | |

| | | |

7.06% (-1 mo. USD

LIBOR + 7.160%) (2)(8) | | | 09/25/36 | | | | 2,835,783 | | | | 484,530 | |

| |

RALI Series Trust (06-QS7-A2) | | | | | |

| | | |

6.00% (5) | | | 06/25/36 | | | | 371,018 | | | | 358,250 | |

| |

RBSSP Resecuritization Trust (12-6-4A2) | | | | | |

| | | |

0.75% (1 mo. USD

LIBOR + 0.330%) (1)(2) | | | 01/26/36 | | | | 927,851 | | | | 917,749 | |

| |

Residential Accredit Loans, Inc. (05-QA7-A1) | | | | | |

| | | |

3.35% (3)(5) | | | 07/25/35 | | | | 729,402 | | | | 614,549 | |

| | | | | | | | | | | | |

| Issues | | Maturity

Date | | | Principal

Amount | | | Value | |

|

| Residential Mortgage-backed Securities — Non-Agency (Continued) | |

| |

Residential Accredit Loans, Inc. (05-QA8-CB21) | | | | | |

| | | |

3.44% (3)(5) | | | 07/25/35 | | | $ | 384,726 | | | $ | 271,277 | |

| |

Residential Accredit Loans, Inc. (06-QA10-A2) | | | | | |

| | | |

0.46% (1 mo. USD

LIBOR + 0.360%) (2) | | | 12/25/36 | | | | 483,582 | | | | 486,950 | |

| |

Residential Accredit Loans, Inc. (06-QS1-A3) (PAC) | | | | | |

| | | |