| Computed using average shares outstanding throughout the period. |

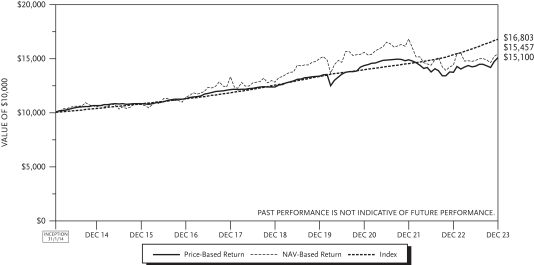

| Based on net asset value per share, adjusted for reinvestment of distributions. The Fund does not incur charges to investors for purchasing or selling shares. |

| Based on market price per share, adjusted for reinvestment of distributions. The Fund does not incur charges to investors for purchasing or selling shares. |

| The asset coverage ratio for a class of senior securities representing indebtedness is calculated as total assets, less all liabilities and indebtedness not represented by senior securities, divided by senior securities representing indebtedness. This asset coverage ratio is multiplied by one thousand to determine the asset coverage per share. |

See accompanying Notes to Financial Statements.

51

TCW Strategic Income Fund, Inc.

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Directors of

TCW Strategic Income Fund, Inc.

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of TCW Strategic Income Fund, Inc. (the “Fund”), including the schedule of investments, as of December 31, 2023, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2023, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended in conformity with accounting principles generally accepted in the United States of America.

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of December 31, 2023, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

Los Angeles, California

February 20, 2024

We have served as the auditor of one or more TCW/Metropolitan West Funds investment companies since 1990.

52

The TCW Group, Inc. and Subsidiaries

TCW Investment Management Company LLC

TCW Asset Management Company LLC

Metropolitan West Asset Management, LLC

| | | | |

TCW Funds, Inc. TCW Strategic Income Fund, Inc. Metropolitan West Funds | | Sepulveda Management LLC TCW Direct Lending LLC TCW Direct Lending VII LLC | | TCW Direct Lending VIII LLC TCW Star Direct Lending LLC TCW ETF TRUST |

Effective January 2024

At TCW, we recognize the importance of keeping information about you secure and confidential. We do not sell or share your nonpublic personal and financial information with marketers or others outside our affiliated group of companies.

We carefully manage information among our affiliated group of companies to safeguard your privacy and to provide you with consistently excellent service.

We are providing this notice to you to comply with the requirements of Regulation

S-P,

“Privacy of Consumer Financial information,” issued by the United States Securities and Exchange Commission.

We, The TCW Group, Inc. and its subsidiaries, the TCW Funds, Inc., TCW Strategic Income Fund, Inc., the Metropolitan West Funds, Sepulveda Management LLC, TCW Direct Lending LLC, TCW Direct Lending VII LLC, TCW Direct Lending VIII LLC, TCW Star Direct Lending LLC, and TCW ETF TRUST (collectively, “TCW”) are committed to protecting the nonpublic personal and financial information of our customers and consumers who obtain or seek to obtain financial products or services primarily for personal, family or household purposes. We fulfill our commitment by establishing and implementing policies and systems to protect the security and confidentiality of this information.

In our offices, we limit access to nonpublic personal and financial information about you to those TCW personnel who need to know the information in order to provide products or services to you. We maintain physical, electronic, and procedural safeguards to protect your nonpublic personal and financial information.

CATEGORIES OF INFORMATION WE COLLECT

We may collect the following types of nonpublic personal and financial information about you from the following sources:

| | ◾ | | Your name, address and identifying numbers, and other personal and financial information, from you and from identification cards and papers you submit to us, on applications, subscription agreements or other forms or communications. |

| | ◾ | | Information about your account balances and financial transactions with us, our affiliated entities, or nonaffiliated third parties, from our internal sources, from affiliated entities and from nonaffiliated third parties. |

| | ◾ | | Information about your account balances and financial transactions and other personal and financial information, from consumer credit reporting agencies or other nonaffiliated third parties, to verify information received from you or others. |

53

CATEGORIES OF INFORMATION WE DISCLOSE TO NONAFFILIATED THIRD PARTIES

We may disclose your name, address and account and other identifying numbers, as well as information about your pending or past transactions and other personal financial information, to nonaffiliated third parties, for our everyday business purposes such as necessary to execute, process, service and confirm your securities transactions and mutual fund transactions, to administer and service your account and commingled investment vehicles in which you are invested, to market our products and services through joint marketing arrangements or to respond to court orders and legal investigations.

We may disclose nonpublic personal and financial information concerning you to law enforcement agencies, federal regulatory agencies, self-regulatory organizations or other nonaffiliated third parties, if required or requested to do so by a court order, judicial subpoena or regulatory inquiry.

We do not otherwise disclose your nonpublic personal and financial information to nonaffiliated third parties, except where we believe in good faith that disclosure is required or permitted by law. Because we do not disclose your nonpublic personal and financial information to nonaffiliated third parties, our Customer Privacy Policy does not contain

opt-out

provisions.

CATEGORIES OF INFORMATION WE DISCLOSE TO OUR AFFILIATED ENTITIES

| | ◾ | | We may disclose your name, address and account and other identifying numbers, account balances, information about your pending or past transactions and other personal financial information to our affiliated entities for any purpose. |

| | ◾ | | We regularly disclose your name, address and account and other identifying numbers, account balances and information about your pending or past transactions to our affiliates to execute, process and confirm securities transactions or mutual fund transactions for you, to administer and service your account and commingled investment vehicles in which you are invested, or to market our products and services to you. |

INFORMATION ABOUT FORMER CUSTOMERS

We do not disclose nonpublic personal and financial information about former customers to nonaffiliated third parties unless required or requested to do so by a court order, judicial subpoena or regulatory inquiry, or otherwise where we believe in good faith that disclosure is required or permitted by law.

Should you have any questions about our Customer Privacy Policy, please contact us by email or by regular mail at the address at the end of this policy.

REMINDER ABOUT TCW’S FINANCIAL PRODUCTS

Financial products offered by The TCW Group, Inc. and its subsidiaries, the TCW Funds, Inc., TCW Strategic Income Fund, Inc., the Metropolitan West Funds, Sepulveda Management LLC, TCW Direct Lending LLC, TCW Direct Lending VII LLC, TCW Direct Lending VIII LLC, TCW Star Direct Lending LLC, and TCW ETF TRUST.

| | ◾ | | Are not guaranteed by a bank; |

| | ◾ | | Are not obligations of The TCW Group, Inc. or of its subsidiaries; |

| | ◾ | | Are not insured by the Federal Deposit Insurance Corporation; and |

| | ◾ | | Are subject to investment risks, including possible loss of the principal amount committed or invested, and earnings thereon. |

| | | | |

TCW Funds, Inc. TCW Strategic Income Fund, Inc. Metropolitan West Funds | | Sepulveda Management LLC TCW Direct Lending LLC TCW Direct Lending VII LLC | | TCW Direct Lending VIII LLC TCW Star Direct Lending LLC TCW ETF TRUST |

Attention: Privacy Officer | 515 South Flower Street | Los Angeles, CA 90071 | email: privacy@tcw.com

54

TCW Strategic Income Fund, Inc.

Renewal of Investment Advisory and Management Agreement (Unaudited)

TCW Strategic Income Fund, Inc. (the “Fund”) and TCW Investment Management Company LLC (the “Advisor”) are parties to an Investment Advisory and Management Agreement (“Agreement”), pursuant to which the Advisor is responsible for managing the investments of the Fund. Unless terminated by either party, the Agreement continues in effect from year to year provided that the continuance is specifically approved at least annually by the vote of the holders of at least a majority of the outstanding shares of the Fund, or by the Board of Directors of the Fund (the “Board”), and, in either event, by a majority of the Directors who are not “interested persons” of the Fund as such term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “Independent Directors”), casting votes in person at a meeting called for that purpose.

At an

in-person

meeting on September 11, 2023, the Board approved the renewal of the Agreement for an additional

one-year

term from February 6, 2024 through February 5, 2025. The renewal of the Agreement was approved by the Board (including by a majority of the Independent Directors) upon the recommendation of the Independent Directors. The Independent Directors also met by videoconference in a working session on August 30, 2023 to hear presentations by representatives of the Advisor, to ask related questions, to review and discuss materials provided by the Advisor for their consideration, and to meet separately with their independent legal counsel. On September 11, 2023 they also met separately with their independent legal counsel to discuss the information that had been requested on their behalf by their independent legal counsel and presented by the Advisor. The information, material facts, and conclusions that formed the basis for the Independent Directors’ recommendation and the Board’s subsequent approval are described below.

— During the course of each year, the Directors receive a wide variety of materials relating to the services provided by the Advisor, including reports on the Advisor’s investment processes, as well as on the Fund’s investment results, portfolio composition, portfolio trading practices, compliance monitoring, shareholder services, and other information relating to the nature, extent, and quality of services provided by the Advisor to the Fund. In addition, the Board reviewed information furnished to the Independent Directors in response to a detailed request sent to the Advisor on their behalf. The information in the Advisor’s responses included extensive materials regarding the Fund’s investment results, advisory fee comparisons to advisory fees charged by the Advisor to its institutional clients, financial and profitability information regarding the Advisor, descriptions of various services provided to the Fund and to other advisory and

sub-advisory

clients, descriptions of functions such as compliance monitoring and portfolio trading practices, and information about the personnel providing investment management services to the Fund. The Directors also considered information provided by an independent data provider, Broadridge, comparing the investment performance and the fee and expense levels of the Fund to those of appropriate peer groups of funds selected by Broadridge. After reviewing this information, the Directors requested additional financial, profitability and service information from the Advisor, which the Advisor provided and the Directors considered.

The Directors’ determinations were made on the basis of each Director’s business judgment after consideration of all the information presented. The Independent Directors were advised by their independent legal counsel throughout the renewal process and received and reviewed advice from their independent legal counsel regarding legal and industry standards applicable to the renewal of the Agreement, including a legal memorandum from their independent legal counsel discussing their fiduciary

55

TCW Strategic Income Fund, Inc.

Renewal of Investment Advisory and Management Agreement (Unaudited) (Continued)

duties related to their approval of the continuation of the Agreement. The Independent Directors also discussed the renewal of the Agreement with the Advisor’s representatives and in private sessions at which no representatives of the Advisor were present. In deciding to recommend the renewal of the Agreement with respect to the Fund, the Independent Directors did not identify any single piece of information or particular factor that, in isolation, was the controlling factor. Each Independent Director may also have weighed factors differently. This summary describes the most important, but not all, of the factors considered by the Board and the Independent Directors.

2. Nature, extent, and quality of services provided by the Advisor

The Board and the Independent Directors considered the depth and quality of the Advisor’s investment management process, including its research and strong analytical capabilities; the experience, capability, and integrity of its senior management and other personnel; the advance planning and transition arrangements put in place with respect to the changes in key portfolio management and other personnel; the overall resources available to the Advisor; and the ability of its organizational structure to address the fluctuations in assets that have been experienced over the past several years. The Board and the Independent Directors considered the Advisor’s continued commitment and ability to attract and retain well-qualified investment professionals, noting in particular the Advisor’s hiring of professionals in various areas over the past several years, including recruiting and hiring a highly qualified President and Chief Executive Officer to replace the outgoing head of The TCW Group, Inc., the parent company of the Advisor (“TCW”), continued upgrading of resources in its middle office and back office operations and other areas, as well as a continuing and extensive program of infrastructure and systems enhancements, including business continuity and cyber security, as well as budgeting for certain future initiatives. The Board and the Independent Directors also considered that the Advisor made available to its investment professionals a variety of resources and systems relating to investment management, compliance, trading, operations, administration, research, portfolio accounting and legal matters. They noted the substantial additional resources made available by TCW. The Board and the Independent Directors examined and discussed a detailed description of the extensive additional services provided to the Fund to support its operations and compliance, as compared to the much narrower range of services provided to the Advisor’s institutional and

sub-advised

clients, as well as the Advisor’s oversight and coordination of numerous outside service providers to the Fund. They further noted the high level of regular communication between the Advisor and the Independent Directors. The Advisor explained its responsibility to supervise the activities of the Fund’s various service providers, as well as supporting the Independent Directors and their meetings, regulatory filings, and various operational personnel, and the related costs.

The Board and the Independent Directors concluded that the nature, extent, and quality of the services provided by the Advisor are of a high quality and have benefited and should continue to benefit the Fund and its shareholders.

The Board and the Independent Directors considered the investment results of the Fund in light of its investment objective and principal investment strategies. They compared the Fund’s total returns with the total returns of other funds in peer group reports prepared by Broadridge with respect to various longer and more recent periods all ended May 31, 2023. The Board and the Independent Directors reviewed information as to a peer group selection presented by Broadridge and discussed the methodology for the selection with Broadridge. In reviewing the Fund’s relative performance, the Board and the Independent

56

TCW Strategic Income Fund, Inc.

Directors took into account the Fund’s investment strategies, distinct characteristics, asset size and diversification.

The Board and the Independent Directors noted that the Fund’s performance was in the fifth quintile for the

ten-year

period, the second quintile for the five- and three-year periods and the first quintile for the

one-year

period. The Board and the Independent Directors also considered that the Fund experienced significantly less volatility than the other funds in the peer group.

The Board and the Independent Directors concluded that the Advisor was implementing the Fund’s investment objective and that the Advisor’s record in managing the Fund indicated that its continued management should benefit the Fund and its shareholders over the long term.

4. Advisory fees and total expenses

The Board and the Independent Directors compared the management fees (which Broadridge defines to include the advisory fee and the administrative fee) and total expenses of the Fund (as a percentage of average net assets) with the median management fee and operating expense level of the other funds in the Broadridge peer group. These comparisons assisted the Board and the Independent Directors by providing a reasonable statistical measure to assess the Fund’s fees relative to its relevant peers. The Board and the Independent Directors observed that the Fund’s management fee was below and total expenses were at the median of the peer group funds. The Board and the Independent Directors concluded that the competitive fee charged by the Advisor, and competitive expense ratio, should continue to benefit the Fund and its shareholders.

The Board and the Independent Directors also reviewed information regarding the advisory fees charged by the Advisor to its institutional and

sub-advisory

clients with similar investment mandates. The Board and the Independent Directors concluded that, although the fees paid by those clients generally were lower than advisory fees paid by the Fund, the differences appropriately reflected the more extensive services provided by the Advisor to the Fund and the Advisor’s significantly greater responsibilities and expenses with respect to the Fund, including the additional risks of managing a pool of assets for public investors, administrative burdens, daily pricing and valuation responsibilities, the supervision of vendors and service providers, and the costs of additional infrastructure and operational resources and personnel and of complying with and supporting the more comprehensive regulatory and governance regime applicable to registered investment companies with shares listed on a stock exchange.

5. The Advisor’s costs, level of profits, and economies of scale

The Board and the Independent Directors reviewed information regarding the Advisor’s costs of providing services to the Fund, as well as the resulting level of profits to the Advisor. They reviewed the Advisor’s stated assumptions and methods of allocating certain costs, such as personnel costs, which constitute the Advisor’s largest operating cost. The Board and the Independent Directors recognized that the Advisor should be entitled to earn a reasonable level of profits for the services that it provides to the Fund. The Board and the Independent Directors also reviewed a comparison of the Advisor’s profitability with respect to the Fund to the profitability of certain unaffiliated publicly traded asset managers, which the Advisor believed supported its view that the Advisor’s profitability was reasonable. Based on their review, the Board and the Independent Directors concluded that they were satisfied that the Advisor’s level of profitability from its relationship with the Fund was not unreasonable or excessive.

57

TCW Strategic Income Fund, Inc.

Renewal of Investment Advisory and Management Agreement (Unaudited) (Continued)

The Board and the Independent Directors considered the extent to which potential economies of scale could be realized as the Fund grows and whether the advisory fee reflects those potential economies of scale. They noted the breakpoint under the Agreement, which results in a lower advisory fee rate as the Fund grows larger. They recognized the Advisor’s view that the advisory fee compares favorably to peer group fees, and that expenses remain competitive even at higher asset levels and that the relatively low advisory fees reflect the potential economies of scale. The Board and the Independent Directors recognized the benefits of the Advisor’s substantial past and ongoing investment in the advisory business, such as successfully recruiting and retaining key professional talent, systems and technology upgrades, added resources dedicated to legal, compliance, risk management and cybersecurity programs, and improvements to the overall firm infrastructure, as well as the financial pressures of competing against much larger firms and passive investment products. The Board and the Independent Directors also recognized that the Fund benefits from receiving investment advice from an organization with other types of advisory clients in addition to investment companies. The Board and the Independent Directors concluded that the Advisor was satisfactorily sharing potential economies of scale with the Fund through low fees and expenses, and through reinvesting in its capabilities for serving the Fund and its shareholders.

The Board and the Independent Directors also considered ancillary benefits received or to be received by the Advisor and its affiliates as a result of the relationship of the Advisor with the Fund. The Board and the Independent Directors concluded that any potential benefits to be received or to be derived by the Advisor from its relationships with the Fund are reasonably related to the services provided by the Advisor to the Fund.

Based on their overall review, including their consideration of each of the factors referred to above (and others), the Board and the Independent Directors concluded that the Agreement is fair and reasonable to the Fund and its shareholders, that the Fund’s shareholders received reasonable value in return for the advisory fees and other amounts paid to the Advisor by the Fund, and that the renewal of the Agreement was in the best interests of the Fund and its shareholders.

58

TCW Strategic Income Fund, Inc.

Supplemental Information

Proxy Voting Guidelines

The policies and procedures that the Fund uses to determine how to vote proxies are available without charge. The Board of the Fund has delegated the Fund’s proxy voting authority to the Advisor.

Disclosure of Proxy Voting Guidelines

The proxy voting guidelines of the Advisor are available:

| | 1. | By calling to obtain a hard copy; or |

| | 2. | By going to the SEC website at http://www.sec.gov. |

When the Fund receives a request for a description of the Advisor’s proxy voting guidelines, it will deliver the description that is disclosed in the Fund’s Statement of Additional Information. This information will be sent out via first class mail (or other means designed to ensure equally prompt delivery) within three business days of receiving the request.

The Advisor, on behalf of the Fund, prepares and files Form

N-PX

with the SEC not later than August 31 of each year, which must include the Fund’s proxy voting record for the most recent twelve-month period ended June 30 of that year. The Fund’s proxy voting record for the most recent twelve-month period ended June 30 is available without charge:

| | 1. By | calling to obtain a hard copy; or |

| | 2. By | going to the SEC website at http://www.sec.gov. |

When the Fund receives a request for the Fund’s proxy voting record, it will send the information disclosed in the Fund’s most recently filed report on Form

N-PX

via first class mail (or other means designed to ensure equally prompt delivery) within three business days of receiving the request.

The Fund also discloses its proxy voting record on its website as soon as is reasonably practicable after its report on Form

N-PX

is filed with the SEC.

Availability of Quarterly Portfolio Schedule

The Fund files a complete schedule of its portfolio holdings with the SEC for the first and third quarters of its fiscal year on Form

NPORT-P.

Such filings occur no later than 60 days after the end of the Fund’s first and third quarters and are available on the SEC’s website at www.sec.gov.

Corporate Governance Listing Standards

In accordance with Section 303A.12 (a) of the New York Stock Exchange Listed Company Manual, the Fund submitted the Annual CEO Certification certifying compliance with NYSE’s Corporate Governance Listing Standards on October 6, 2023 as part of its Annual Written Affirmation. In accordance with Section 303A.12(c) of the New York Stock Exchange Listed Company Manual, the Fund submitted the Annual Written Affirmation on October 6, 2023 and Interim Written Affirmations on March 1, 2023 and January 8, 2024. In accordance with Section 303A.14(d) of the New York Stock Exchange Listed Company Manual, the Fund submitted the Recovery Policy Affirmation on December 26, 2023.

59

TCW Strategic Income Fund, Inc.

Report of Annual Meeting of Shareholders

The annual meeting of shareholders (the “Annual Meeting”) of the Fund was held on September 12, 2023. At the Annual Meeting, the following matters were submitted to a shareholder vote:

| | 1) | — the shareholders of the Fund elected the following Directors to serve on the Board of Directors until their successors have been duly elected and qualified. |

| | | | | | | | |

| | | | | | |

| Samuel P. Bell* | | | 29,818,637 | | | | 4,187,831 | |

| Patrick C. Haden | | | 29,882,702 | | | | 4,123,767 | |

| Kathryn Koch** | | | 29,529,167 | | | | 4,477,303 | |

| Peter McMillan | | | 29,686,296 | | | | 4,320,175 | |

| Victoria B. Rogers | | | 29,626,361 | | | | 4,380,111 | |

| Andrew Tarica | | | 29,692,488 | | | | 4,313,981 | |

| | 2) | Ratification of Selection of Independent Registered Public Accounting Firm — the shareholders of the Fund approved the ratification of the selection of Deloitte & Touche LLP as the independent registered public accounting firm for the Fund for the fiscal year ended December 31, 2023. |

| | | | |

| | | | |

| 20,351,631 | | 132,289 | | 237,782 |

| Retired from the Board effective December 31, 2023. |

| Resigned from the Board effective December 31, 2023. |

60

TCW Strategic Income Fund, Inc.

Dividend Reinvestment Plan

Shareholders who wish to add to their investment may do so by making an election to participate in the Dividend Reinvestment Plan (the “Plan”). Under the Plan, your dividend is used to purchase Fund shares on the open market whenever shares, including the related sales commission, are selling below the Fund’s net asset value per share. You will be charged a

pro-rata

portion of brokerage commissions on open-market purchases under the Plan. If the market price, including commission, of Fund shares is above the Fund’s net asset value per share, you will receive shares at a price equal to the higher of the Fund’s net asset value per share on the payment date or 95% of the closing market price of Fund shares on the payment date. Generally, for tax purposes, shareholders participating in the Plan will be treated as having received a distribution from the Fund in cash equal to the value of the shares purchased from them under the Plan.

To enroll in the Plan, if your shares are registered in your name, write to Computershare, P.O. Box 43078, Providence, RI 02940-3078, or call toll free at (866)

227-8179.

If your shares are held by a brokerage firm, please call your broker. If you participate in the Plan through a broker, you may not be able to transfer your shares to another broker and continue to participate in the Plan if your new broker does not permit such participation. If you no longer want to participate in the Plan, please contact Computershare or your broker. You may elect to continue to hold shares previously purchased on your behalf or to sell your shares and receive the proceeds, net of any brokerage commissions. If you need additional information or assistance, please call our investor relations department at (877)

829-4768

or visit our website at www.tcw.com. As always, we would be pleased to accommodate your investment needs.

The Fund has a net investment income-based distribution policy. The policy is to pay quarterly distributions out of the Fund’s accumulated undistributed net investment income and/or other sources subject to the requirements of the 1940 Act and Sub-chapter M of the Code.

Distribution policies are a matter of Board discretion and may be modified or terminated at any time without prior notice. Any such change or termination may have an adverse effect on the market price for the Fund’s shares.

You should not draw any conclusions about the Fund’s investment performance from the amount of the quarterly distribution or from the terms of the Fund’s distribution policy.

61

TCW Strategic Income Fund, Inc.

Tax Information Notice (Unaudited)

Under Section 854(b)(2) of the Code, the Fund designates 1.93% of the dividend paid as qualified dividends for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended December 31, 2023.

The dividend received deduction percentage for the Fund’s corporate shareholders was 1.67% for the fiscal year ended December 31, 2023.

This information is given to meet certain requirements of the Code and should not be used by shareholders for preparing their income tax returns. Shareholders should refer to the Form

1099-DIV

provided by Computershare or your broker for tax filing purposes. Shareholders are advised to check with their tax advisors for information on the treatment of these amounts on their individual tax returns.

62

TCW Strategic Income Fund, Inc.

Directors and Officers

A board of four directors is responsible for overseeing the operations of the TCW Strategic Income Fund, Inc. (the “Fund”). The directors of the Fund, their business addresses and their principal occupations for the last five years are set forth below.

| | | | | | |

| | | | | | |

Chairman of the Board | | Mr. Haden has served as a director of the Fund since May 2001. | | President (since 2003), Wilson Ave. Consulting (business consulting firm). | | Auto Club (affiliate of AAA); Metropolitan West Funds (mutual fund); TCW Funds, Inc. (mutual fund); TCW ETF Trust (exchange-traded fund). |

| | Mr. McMillan has served as a director of the Fund since August 2010. | | Co-founder (since 2019), Pacific Oak Capital Advisors (investment advisory firm);Co-founder, Managing Partner and Chief Investment Officer (since May 2013), Temescal Canyon Partners (investment advisory firm);Co-founder and Executive Vice President (2005-2019), KBS Capital Advisors (a manager of real estate investment trusts). | | Pacific Oak Strategic Opportunity REIT (real estate investments); Keppel Pacific Oak U.S. REIT (real estate investments); Pacific Oak Residential Trust (real estate investments); Metropolitan West Funds (mutual fund); TCW DL VII Financing LLC (private fund); TCW Funds, Inc. (mutual fund); TCW ETF Trust (exchange-traded fund). |

Victoria B. Rogers (1961) | | Ms. Rogers has served as a director of the Fund since October 2011. | | President and Chief Executive Officer (since 1996), The Rose Hills Foundation (charitable foundation). | | Norton Simon Museum (art museum); Causeway Capital Management Trust (mutual fund); The Rose Hills Foundation (charitable foundation); Saint John’s Health Center Foundation (charitable foundation); TCW Funds, Inc. (mutual fund); Metropolitan West Funds (mutual fund); TCW ETF Trust (exchange-traded fund). |

| | Mr. Tarica has served as a director of the Fund since March 2012. | | Director of Fixed Income (since February 2022), Forest Road Securities (broker-dealer); Chief Executive Officer (since February 2001), Meadowbrook Capital Management (asset management company); and Employee (2003 – January 2022), Cowen Prime Services (broker-dealer). | | Metropolitan West Funds (mutual fund); TCW Funds, Inc. (mutual fund); TCW Direct Lending VII, LLC (business development company); TCW Direct Lending VIII, LLC (business development company); TCW Star Direct Lending, LLC (business development company); TCW ETF Trust (exchange-traded fund). |

| The address of each Independent Director is c/o Morgan, Lewis & Bockius LLP, Counsel to the Independent Directors, 300 South Grand Avenue, Los Angeles, CA 90071. |

| Position with company may have changed over time. |

63

TCW Strategic Income Fund, Inc.

Directors and Officers (Continued)

The officers of the Fund who are not directors of the Fund are:

| | | | |

| | | | |

| | President and Principal Executive Officer | | Group Managing Director (since July 2023), the Advisor, The TCW Group, Inc., TCW LLC, Metropolitan West Asset Management, LLC and TCW Asset Management Company LLC. |

| | Executive Vice President | | Executive Vice President, General Counsel and Secretary (since September 2023), the Advisor, Metropolitan West Asset Management, LLC, The TCW Group, Inc., TCW Asset Management Company LLC, TCW LLC; Chief Operating Officer (August 2021 – September 2023) Western Asset Management Company; Executive Vice President and General Counsel (March 2020 – February 2021); and Senior Vice President and General Counsel (May 2015 – March 2020), Jackson Financial Inc. |

| | Assistant Treasurer | | Managing Director of Fund Operations (since November 2006), Metropolitan West Asset Management, LLC and (since 2009), the Advisor, TCW Asset Management Company LLC and TCW LLC; Assistant Treasurer, Metropolitan West Funds (since 2010) and TCW Funds, Inc. (since 2009). Mr. Chan is a Certified Public Accountant |

| | Vice President and Secretary | | Senior Vice President, Associate General Counsel and Assistant Secretary (since July 2022), the Advisor, Metropolitan West Asset Management, LLC, TCW Asset Management Company LLC, TCW LLC; Vice President and Secretary (since September 2022 and December 2023, respectively), Metropolitan West Funds and TCW Funds, Inc.; Assistant Secretary of TCW Funds, Inc. and Metropolitan West Funds (September 2022 – December 2023); Assistant General Counsel – Investment Products and Advisory Services (2020 – July 2022), The Northwestern Mutual Life Insurance Company; Associate General Counsel (2019 – August 2020), Resolute Investment Managers; Assistant General Counsel (2003 – October 2019), Invesco Ltd. |

64

TCW Strategic Income Fund, Inc.

| | | | |

| | | | |

| | Tax Officer | | Tax Officer (since December 2016), Metropolitan West Funds and TCW Funds, Inc.; Managing Director and Director of Tax (since August 2016), TCW, LLC. |

| | Treasurer, Principal Financial Officer and Principal Accounting Officer | | Executive Vice President, Chief Financial Officer and Assistant Secretary (since January 2016), TCW LLC and (since July 2008), the Advisor, Metropolitan West Asset Management, LLC, The TCW Group, Inc., and TCW Asset Management Company LLC; Treasurer, Principal Financial Officer and Principal Accounting Officer (since February 2014), TCW Funds, Inc. and (since February 2021) Metropolitan West Funds. |

| | Chief Compliance Officer and AML Officer | | Chief Compliance Officer and AML Officer (since January 2021), TCW Funds, Inc. and Metropolitan West Funds; Group Managing Director and Global Chief Compliance Officer (since January 2021), TCW LLC, the Advisor, Metropolitan West Asset Management, LLC, and TCW Asset Management Company LLC; Global Chief Compliance Officer (since January 2021), The TCW Group, Inc.; Senior Vice President (February 2015 – December 2020), TCW LLC, the Advisor, Metropolitan West Asset Management, LLC, and TCW Asset Management Company LLC. |

| The address of each officer is c/o the TCW Group, Inc., 515 South Flower Street, Los Angeles, CA 90071. |

| Positions with The TCW Group, Inc. and its affiliates may have changed over time. |

65

TCW Strategic Income Fund, Inc.

Los Angeles, California 90071

TCW Investment Management Company LLC

Los Angeles, California 90071

TRANSFER AGENT, DIVIDEND REINVESTMENT AND DISBURSEMENT AGENT AND REGISTRAR

Providence, RI 02940-3078

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Los Angeles, California 90013

CUSTODIAN & ADMINISTRATOR

State Street Bank & Trust Company

One Congress Street, Suite 1

Boston, Massachusetts 02114-2016

101 California Street, 48th Floor

San Francisco, California 94111

President and Principal Executive Officer

Treasurer and Principal Financial and Accounting Officer

and Anti-Money Laundering Officer

Vice President and Secretary

TSIart9445 12/31/21