| LOU HOLLAND |

| GROWTH FUND |

| |

| Letter to Shareholders |

| June, 2011 |

Dear Fellow Shareholder:

Thank you for your investment in the Lou Holland Growth Fund (the “Fund”).

Fund Results

The momentum that drove the domestic equity markets higher over the past two years continued through the first half of 2011. And while this momentum waned as we exited the second quarter, the major stock indexes were able to remain solidly in positive territory for the year-to-date period through June. In this environment, the Fund’s conservative high quality strategy generated a return of +7.46%, outpacing the +6.83% return of its style benchmark, the Russell 1000 Growth Index. The Fund’s return was also ahead of the +6.02% return of its secondary benchmark, the S&P 500 Index.

Fund Performance

Our bottom-up fundamental analysis resulted in favorable results during the year. Stock selection decisions were the driver of the Fund’s performance, with good performance in holdings across a number of sectors. Given that energy was one of the best performing market sectors, the Fund benefited from a combination of our long-standing overweight in the sector and solid performance of a number of energy holdings. Range Resources, a high quality gas focused exploration and production company, is among the Fund’s largest holdings and was a top contributor. In 2010, the stock was hurt by low natural gas prices and supplies that were high relative to demand. However, the stock has shown strength in 2011 as the supply situation, while not completely fixed, is now trending in the right direction. In addition, the company is making steady progress in their Marcellus shale play. Halliburton Company, which provides oil and gas exploration related services, also made a nice contribution. The pressure pumping market has been strong and the company seems to be in the middle of a long-term secular trend of increased service intensive drilling of both unconventional and conventional oil resources.

Citrix Systems, the Fund’s largest holding, extended its multi-year trend of strong results. It has recently performed very well due to a healthy earnings report and continuing penetration into new markets/verticals. The stock is one of the longest held positions.

Waters Corporation, a designer and manufacturer of high performance liquid chromatography and mass spectrometry instruments and systems, was also a top performer and contributor. The company continues to deliver excellent results through exceptionally strong top line growth and significant uptake of one of their key products. Fund performance was also aided by health care concern Covidien. The company has consistently beaten expectations that were laid out by management in the fall of 2010. Their medical device unit has had exceptionally strong performance and the company's gross margins continue to improve.

Other holdings making solid contributions to Fund performance include QUALCOMM and Yum! Brands. QUALCOMM experienced a solid return on new processor shipments for mobile phones and the company is also benefiting from generally positive trends in the industry and in average selling prices. Yum! Brands continues to report strong results in China. This segment of their business remains on a growth trajectory and should surpass $1 billion in profits during 2012.

| LOU HOLLAND |

| GROWTH FUND |

| |

| Letter to Shareholders |

| June, 2011 |

Several holdings showed weakness during the first half, which acted as a drag on Fund performance. Cisco Systems, despite its inexpensive valuation, remains in the doldrums due to the lack of specifics for a growth plan in this lackluster customer environment and a wait-and-see attitude of their current investor base. A lack of announcements on new M&A deals coupled with a lack of investor sponsorship has resulted in Greenhill & Co. being out of favor.

Fund Changes

We rely on our fundamental, bottom-up research to identify stocks that meet our long-term, fundamental, conservative investment criteria of double-digit earnings growth rates and reasonable valuations. Our focus is a three-to-five year investment horizon which generally results in low average turnover over long periods of time.

New additions to the Fund during the first six months of 2011 include Greenhill & Co., Advance Auto Parts, Hansen Natural, and MICROS Systems. Greenhill & Co. was purchased due to its focused business model, disciplined expense control, and the ability to benefit from trends in an improving mergers and acquisitions cycle. A position was also established in Advance Auto Parts, a defensive retailer that is benefiting from the current economic environment in which consumers defer car purchases and focus on maintaining their existing cars. Hansen Natural was added. The company is in the fast growing energy drink market and is experiencing strong volume growth in the U.S. as well as a strong international rollout. And finally, MICROS is a leading provider of Point of Sale software to the hospitality industry with a steady track record of achieving above average top line growth, increasing margins and converting over a significant amount of net income into free cash flow.

Stocks are generally sold when they no longer meet our investment criteria or when replaced with a better idea. Kohl’s Corporation, Wal-Mart Stores, and Diageo ADR were replaced with better ideas and Genzyme was sold after Sanofi-Aventis offered to purchase the company for $74 per share plus a contingent value right.

Outlook

Investor enthusiasm about the economic recovery was a key driver of the stock market’s strong performance in the early part of 2011. However, investors became concerned in May and June due to weak economic data and confirmation by the Federal Reserve that the economy is recovering at a pace more slowly than expected. In addition, events such as the impact of the crisis in Japan, the end of QE2 in June, and the European debt problems increased anxiety among investors. And while bits-and-pieces of better economic data and near-term action to fix Greece’s specific debt situation led to improved stock market action exiting the 2nd quarter, it is clear that investors remain suspicious of the numerous headwinds and concerns that could impact the recovery. For instance, housing, which tends to contribute significantly to economic recoveries, remains weak. Oil and gasoline prices, while dropping recently, are still challenging consumers. Unemployment is still stubbornly high and job gains remain anemic. Companies are cautious of hiring and spending and are hoarding cash because of uncertainty about the future, and the political debate on the debt ceiling and how to reduce the deficit either through spending cuts or raising taxes or a combination of the two continues to cause uncertainty.

| LOU HOLLAND |

| GROWTH FUND |

| |

| Letter to Shareholders |

| June, 2011 |

We do not attempt to predict the direction of the stock market, economic growth, or interest rates, nor the outcome of geopolitical events or activity. However, given the confluence of events and near-term headwinds that the economy continues to face, we believe the recovery will be slow and uneven at best. Given this dynamic, we would expect stock market action to remain reactive as evidence of the pace and sustainability of economic growth continues to evolve.

We understand that corporate profitability and earnings are affected by the pace of economic growth. Thus, we remain focused on using thorough, high quality, bottom-up research to identify companies that best meet our long-term fundamental investment criteria. We remain favorable toward companies with exposure to faster-growing products or markets, companies that are market share gainers, those with pricing power, and companies whose bottom lines can still leverage increased demand as the economy recovers. We continue to focus on high quality companies, with solid balance sheets and strong free cash flow and are committed to a portfolio positioned to participate in sustained rising market environments and protect in extended market downtrends.

In general, we believe that as the economy further recovers and corporate earnings growth normalizes, investors will become more cautious of lower quality stocks whose valuations are not supported by lower quality or unsustainable earnings. Rather, we expect investors to shift their focus toward stocks of high quality companies with strong balance sheets and good managements, and with the ability to generate high quality, sustainable earnings with achievable estimates, metrics consistent with our bottom-up fundamental investment criteria.

We believe that our extensive investment experience and our conservative growth strategy will produce superior results for long-term investors.

Sincerely,

Monica L. Walker Carl R. Bhathena

CEO & Chief Investment Officer – Equity Co-Portfolio Manager - Equity

| LOU HOLLAND |

| GROWTH FUND |

| |

| Performance Chart and Analysis |

| June 30, 2011 |

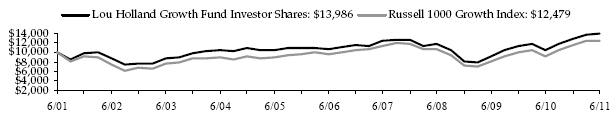

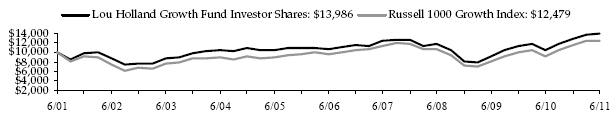

The following chart reflects the change in the value of a hypothetical $10,000 investment in Investor Shares, including reinvested dividends and distributions, in the Lou Holland Growth Fund (the “Fund”) compared with the performance of the benchmark, the Russell 1000 Growth Index, over the past ten fiscal years. The Russell 1000 Growth Index is an unmanaged index which measures the performance of a subset of approximately 622 of those Russell 1000 companies (that is, the 1,000 largest U.S. companies in terms of market capitalization) with higher price-to-book ratios and higher forecasted growth values. The total return of the Fund's classes includes the maximum sales charge of 5.75% (A Shares only) and operating expenses that reduce returns, while the total return of the Russell 1000 Growth Index does not include the effect of sales charges and expenses. A Shares are subject to a 1.00% contingent deferred sales charge on shares purchased without an initial sales charge and redeemed less than one year after purchase. The total return of the Russell 1000 Growth Index includes reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the Russell 1000 Growth Index does not include expenses. The Fund is professionally managed while the Russell 1000 Growth Index is unmanaged and is not available for investment.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please visit the website of the Fund's investment adviser at www.hollandcap.com. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Investor Shares, Institutional Shares and A Shares are 1.79%, 1.91%, and 42.81%, respectively. However, the Fund's adviser has agreed to contractually waive a portion of its fees and to reimburse expenses such that total operating expenses do not exceed 1.35% for Investor Shares through May 1, 2013, and 1.20% and 1.40% for Institutional Shares and A Shares, respectively through May 1, 2012. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

Performance for Investor Shares for periods prior to February 1, 2010, reflects performance and expenses of Lou Holland Growth Fund, a series of the Lou Holland Trust.

| |

| Average Annual Rate of Return for the Six Months Ended June 30, 2011 |

| | | | | | | | | |

| Lou Holland Growth Fund | | Year-to-Date | | 1 Year | | 5 Years | | 10 Years |

| Investor Shares | | 7.46 | % | | 31.97 | % | | 5.55 | % | | 3.41 | % |

| Institutional Shares* | | 7.50 | % | | 32.14 | % | | 5.59 | % | | 3.43 | % |

A Shares (with sales charge)* | | 2.51 | % | | 24.33 | % | | 4.30 | % | | 2.80 | % |

| Russell 1000 Growth Index | | 6.83 | % | | 35.01 | % | | 5.33 | % | | 2.24 | % |

| | *For the Institutional Shares and the A Shares, performance for the above periods are blended average annual returns which include the returns of the Investor Shares prior to February 1, 2010, the commencement of operations of the Institutional Shares and A Shares. |

| LOU HOLLAND |

| GROWTH FUND |

| |

| Schedule of Investments |

| June 30, 2011 |

| Shares | | Security Description | | Value | |

| Common Stock - 96.7% |

| Consumer Discretionary - 11.5% |

| | 11,600 | | Advance Auto Parts, Inc. | $ | 678,484 | |

| | 7,200 | | Amazon.com, Inc. (a) | | 1,472,328 | |

| | 9,350 | | Costco Wholesale Corp. | | 759,594 | |

| | 16,750 | | NIKE, Inc., Class B | | 1,507,165 | |

| | 13,050 | | The Walt Disney Co. | | 509,472 | |

| | 34,050 | | Yum! Brands, Inc. | | 1,880,922 | |

| | | 6,807,965 | |

| Consumer Staples - 6.3% |

| | 11,300 | | H.J. Heinz Co. | | 602,064 | |

| | 9,200 | | Hansen Natural Corp. (a) | | 744,740 | |

| | 12,800 | | Mead Johnson Nutrition Co. | | 864,640 | |

| | 14,250 | | PepsiCo, Inc. | | 1,003,628 | |

| | 7,700 | | The Procter & Gamble Co. | | 489,489 | |

| | | 3,704,561 | |

| Energy - 18.8% |

| | 26,759 | | Exxon Mobil Corp. | | 2,177,647 | |

| | 34,750 | | Halliburton Co. | | 1,772,250 | |

| | 13,950 | | Noble Corp. | | 549,770 | |

| | 18,600 | | Occidental Petroleum Corp. | | 1,935,144 | |

| | 19,300 | | QEP Resources, Inc. | | 807,319 | |

| | 45,750 | | Range Resources Corp. | | 2,539,125 | |

| | 30,400 | | Southwestern Energy Co. (a) | | 1,303,552 | |

| | | 11,084,807 | |

| Financial Services - 9.2% |

| | 19,490 | | Berkshire Hathaway, Inc., Class B (a) | | 1,508,331 | |

| | 3,700 | | BlackRock, Inc. | | 709,697 | |

| | 7,450 | | Greenhill & Co., Inc. | | 400,959 | |

| | 8,750 | | IHS, Inc., Class A (a) | | 729,925 | |

| | 42,000 | | TD Ameritrade Holding Corp. | | 819,420 | |

| | 15,300 | | Visa, Inc., Class A | | 1,289,178 | |

| | | 5,457,510 | |

| Health Care - 8.4% |

| | 44,400 | | Covidien PLC | | 2,363,412 | |

| | 18,150 | | Hospira, Inc. (a) | | 1,028,379 | |

| | 16,300 | | Laboratory Corp. of America Holdings (a) | | 1,577,677 | |

| | | 4,969,468 | |

| Materials & Processing - 2.2% |

| | 11,800 | | Praxair, Inc. | | 1,279,002 | |

| Producer Durables - 11.8% |

| | 9,250 | | Automatic Data Processing, Inc. | | 487,290 | |

| | 11,850 | | Expeditors International of Washington, Inc. | | 606,602 | |

| | 22,200 | | Honeywell International, Inc. | | 1,322,898 | |

| | 7,250 | | MSC Industrial Direct Co. | | 480,748 | |

| | 10,100 | | Roper Industries, Inc. | | 841,330 | |

| | 9,450 | | United Parcel Service, Inc., Class B | | 689,188 | |

| | 9,350 | | United Technologies Corp. | | 827,568 | |

| | 18,100 | | Waters Corp. (a) | | 1,732,894 | |

| | | 6,988,518 | |

| Technology - 28.5% |

| | 42,750 | | Adobe Systems, Inc. (a) | | 1,344,488 | |

| | 24,900 | | American Tower Corp., Class A (a) | | 1,302,270 | |

| | 7,650 | | Apple, Inc. (a) | | 2,567,875 | |

| | 104,350 | | Cisco Systems, Inc. | | 1,628,903 | |

| | 33,050 | | Citrix Systems, Inc. (a) | | 2,644,000 | |

| | 2,650 | | Google, Inc., Class A (a) | | 1,341,907 | |

| | 26,450 | | Intel Corp. | | 586,132 | |

| | 9,500 | | International Business Machines Corp. | | 1,629,725 | |

| | 15,950 | | MICROS Systems, Inc. (a) | | 792,875 | |

| | 29,050 | | Microsoft Corp. | | 755,300 | |

| | 39,700 | | QUALCOMM, Inc. | | 2,254,563 | |

| | | 16,848,038 | |

Total Common Stock (Cost $39,984,806) | | 57,139,869 | |

Total Investments - 96.7% (Cost $39,984,806)* | $ | 57,139,869 | |

| Other Assets & Liabilities, Net – 3.3% | | 1,944,993 | |

| Net Assets – 100.0% | $ | 59,084,862 | |

| | See Notes to Financial Statements | |

| | 5 | |

| LOU HOLLAND |

| GROWTH FUND |

| |

| Schedule of Investments |

| June 30, 2011 |

| PLC | Public Limited Company |

| (a) | Non-income producing security. |

| | *Cost of investments for federal income tax purposes is substantially the same as for financial statement purposes and net unrealized appreciation on investments consists of: |

| Gross Unrealized Appreciation | | $ | 18,844,793 | |

| Gross Unrealized Depreciation | | | (1,689,730 | ) |

| Net Unrealized Appreciation | | $ | 17,155,063 | |

The following is a summary of the inputs used to value the Fund’s investments as of June 30, 2011.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to Note 2 - Security Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs | | Investments in Securities |

| Level 1 - Quoted Prices | | $ | 57,139,869 | |

| Level 2 - Other Significant Observable Inputs | | | - | |

| Level 3 - Significant Unobservable Inputs | | | - | |

| Total Investments | | $ | 57,139,869 | |

The Level 1 inputs displayed in the Investments in Securities column of this table are Common Stock. Refer to the Schedule of Investments for a further breakout of each security by type.

| PORTFOLIO HOLDINGS | | |

| % of Total Investments | | |

| Consumer Discretionary | 11.9 | % |

| Consumer Staples | 6.5 | % |

| Energy | 19.4 | % |

| Financial Services | 9.6 | % |

| Health Care | 8.7 | % |

| Materials & Processing | 2.2 | % |

| Producer Durables | 12.2 | % |

| Technology | 29.5 | % |

| | 100.0 | % |

| | See Notes to Financial Statements | |

| | 6 | |

| LOU HOLLAND |

| GROWTH FUND |

| |

| Statement of Assets and Liabilities |

| June 30, 2011 |

| | | | | | | |

| ASSETS | | | | |

| | Total investments, at value (Cost $39,984,806) | | $ | 57,139,869 | |

| | Cash | | | 2,170,387 | |

| | Receivables: | | | | |

| | | Dividends and interest | | | 26,870 | |

| | Prepaid expenses | | | 12,930 | |

| Total Assets | | | 59,350,056 | |

| LIABILITIES | | | | |

| | Payables: | | | | |

| | | Fund shares redeemed | | | 184,730 | |

| | Accrued Liabilities: | | | | |

| | Investment adviser fees | | | 33,441 | |

| | | Trustees’ fees and expenses | | | 58 | |

| | | Fund service fees | | | 10,483 | |

| | | Compliance services fees | | | 1,167 | |

| | | Other expenses | | | 35,315 | |

| Total Liabilities | | | 265,194 | |

| NET ASSETS | | $ | 59,084,862 | |

| COMPONENTS OF NET ASSETS | | | | |

| | Paid-in capital | | $ | 41,516,658 | |

| | Distributions in excess of net investment income | | | (78,469 | ) |

| | Accumulated net realized gain | | | 491,610 | |

| | Net unrealized appreciation | | | 17,155,063 | |

| NET ASSETS | | $ | 59,084,862 | |

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | | |

| | Investor Shares | | | 2,696,926 | |

| | Institutional Shares | | | 57,197 | |

| | A Shares | | | 618 | |

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE | | | | |

| | Investor Shares (based on net assets of $57,842,166) | | $ | 21.45 | |

| | Institutional Shares (based on net assets of $1,229,445) | | $ | 21.49 | |

| | A Shares (based on net assets of $13,251) | | $ | 21.44 | |

| | A Shares Maximum Public Offering Price Per Share (net asset value per share/(100%-5.75%)) | | $ | 22.75 | |

| | See Notes to Financial Statements | |

| | 7 | |

| LOU HOLLAND |

| GROWTH FUND |

| |

| Statement of Operations |

| For the Six Months Ended June 30, 2011 |

| | | | | | | | |

| INVESTMENT INCOME | | | | | |

| | Dividend income | | $ | 305,513 | | |

| | Interest income | | | 1,226 | | |

| Total Investment Income | | | 306,739 | | |

| | | | | | |

| EXPENSES | | | | | |

| | Investment adviser fees | | | 243,095 | | |

| | Fund service fees | | | 90,501 | | |

| | Transfer Agent fees: | | | | | |

| | Investor Shares | | | 5,647 | | |

| | Institutional Shares | | | 402 | | |

| | A Shares | | | 135 | | |

| | Distribution fees: | | | | | |

| | Investor Shares | | | 70,005 | | |

| | A Shares | | | 16 | | |

| | Custodian fees | | | 3,012 | | |

| | Registration fees: | | | | | |

| | Investor Shares | | | 9,441 | | |

| | Institutional Shares | | | 185 | | |

| | A Shares | | | 2 | | |

| | Professional fees | | | 16,706 | | |

| | Trustees' fees and expenses | | | 927 | | |

| | Compliance services fees | | | 12,363 | | |

| | Miscellaneous expenses | | | 15,918 | | |

| Total Expenses | | | 468,355 | | |

| | Fees waived and expenses reimbursed | | | (83,147 | ) | |

| Net Expenses | | | 385,208 | | |

| | | | | | | | |

| NET INVESTMENT LOSS | | | (78,469 | ) | |

| | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | | |

| | Net realized gain on investments | | | 696,138 | | |

| | Net change in unrealized appreciation (depreciation) on investments | | | 3,454,516 | | |

| NET REALIZED AND UNREALIZED GAIN | | | 4,150,654 | | |

| INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 4,072,185 | | |

| | | | | | | | |

| | See Notes to Financial Statements | |

| | 8 | |

| LOU HOLLAND |

| GROWTH FUND |

| |

| Statements of Changes |

| |

| | | | | For the Six Months Ended June 30, 2011 | | | For the Year Ended December 31, 2010 |

| OPERATIONS | | | | | | | | | |

| | Net investment loss | | $ | (78,469 | ) | | | $ | (109,629 | ) |

| | Net realized gain | | | 696,138 | | | | | 1,268,179 | |

| | Net change in unrealized appreciation (depreciation) | | | 3,454,516 | | | | | 5,678,823 | |

| Increase in Net Assets Resulting from Operations | | | 4,072,185 | | | | | 6,837,373 | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | |

| | Net realized gain: | | | | | | | | | |

| | | Investor Shares | | | - | | | | | (1,269,349 | ) |

| | | Institutional Shares | | | - | | | | | (32,086 | ) |

| | | A Shares | | | - | | | | | (290 | ) |

| Total Distributions to Shareholders | | | - | | | | | (1,301,725 | ) |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | | |

| | Sale of shares: | | | | | | | | | |

| | | Investor Shares | | | 3,172,525 | | | | | 4,822,845 | |

| | | Institutional Shares | | | 18,508 | | | | | 1,294,688 | |

| | | A Shares | | | - | | | | | 10,500 | |

| | Reinvestment of distributions: | | | | | | | | | |

| | | Investor Shares | | | - | | | | | 1,268,874 | |

| | | Institutional Shares | | | - | | | | | 32,086 | |

| | | A Shares | | | - | | | | | 290 | |

| | Redemption of shares: | | | | | | | | | |

| | | Investor Shares | | | (3,444,222 | ) | | | | (7,699,480 | ) |

| | | Institutional Shares | | | - | | | | | (340,732 | ) |

| Decrease in Net Assets from Capital Share Transactions | | | (253,189 | ) | | | | (610,929 | ) |

| Increase in Net Assets | | | 3,818,996 | | | | | 4,924,719 | |

| NET ASSETS | | | | | | | | | |

| | Beginning of Period | | | 55,265,866 | | | | | 50,341,147 | |

| | End of Period (Including line (a)) | | $ | 59,084,862 | | | | $ | 55,265,866 | |

| SHARE TRANSACTIONS | | | | | | | | | |

| | Sale of shares: | | | | | | | | | |

| | | Investor Shares | | | 150,499 | | | | | 261,853 | |

| | | Institutional Shares | | | 893 | | | | | 72,145 | |

| | | A Shares | | | - | | | | | 603 | |

| | Reinvestment of distributions: | | | | | | | | | |

| | | Investor Shares | | | - | | | | | 64,344 | |

| | | Institutional Shares | | | - | | | | | 1,625 | |

| | | A Shares | | | - | | | | | 15 | |

| | Redemption of shares: | | | | | | | | | |

| | | Investor Shares | | | (164,530 | ) | | | | (422,104 | ) |

| | | Institutional Shares | | | - | | | | | (17,466 | ) |

| Decrease in Shares | | | (13,138 | ) | | | | (38,985 | ) |

| (a) | Distributions in excess of net investment income. | | $ | (78,469 | ) | | | $ | - | |

| | See Notes to Financial Statements | |

| | 9 | |

| LOU HOLLAND |

| GROWTH FUND |

| |

| Financial Highlights |

| |

These financial highlights reflect selected data for a share outstanding throughout each period. | | | | | | | | | |

| | | For the Six Months Ended | | For the Years Ended December 31, |

| | June 30, 2011 | | | 2010 | | | | 2009 | | | | 2008 | | | | 2007 | | | | 2006 | |

| INVESTOR SHARES | | | | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Period | $ | 19.97 | | | $ | 17.94 | | | $ | 12.90 | | | $ | 19.81 | | | $ | 18.65 | | | $ | 17.99 | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (a) | | (0.03 | ) | | | (0.04 | ) | | | (0.02 | ) | | | (0.04 | ) | | | (0.04 | ) | | | 0.02 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | |

| | gain (loss) | | 1.51 | | | | 2.55 | | | | 5.06 | | | | (6.86 | ) | | | 1.79 | | | | 0.92 | |

| Total from Investment Operations | | 1.48 | | | | 2.51 | | | | 5.04 | | | | (6.90 | ) | | | 1.75 | | | | 0.94 | |

| DISTRIBUTIONS TO | | | | | | | | | | | | | | | | | | | | | | | |

| SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | — | | | | — | | | | — | | | | — | | | | (0.01 | ) | | | (0.01 | ) |

| Net realized gain | | — | | | | (0.48 | ) | | — | | | | (0.01 | ) | | | (0.58 | ) | | | (0.27 | ) |

| Total Distributions to Shareholders | | — | | | | (0.48 | ) | | | — | | | | (0.01 | ) | | | (0.59 | ) | | | (0.28 | ) |

| NET ASSET VALUE, End of Period | $ | 21.45 | | | $ | 19.97 | | | $ | 17.94 | | | $ | 12.90 | | | $ | 19.81 | | | $ | 18.65 | |

| TOTAL RETURN | | 7.46 | %(b) | 14.03 | % | | 39.07 | % | | (34.83 | )% | | 9.40 | % | | 5.23 | % |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of | | | | | | | | | | | | | | | | | | | | | | | |

| | Period (000's omitted) | $57,842 | | | $54,128 | | | $50,341 | | | $33,766 | | | $55,703 | | | $58,993 | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | (0.28 | )%(c) | (0.22 | )% | | (0.11 | )% | | (0.25 | )% | | (0.19 | )% | | 0.10 | % |

| Net expense | | 1.35 | %(c) | 1.35 | % | | 1.35 | % | | 1.35 | % | | 1.35 | % | | 1.35 | % |

| Gross expense (d) | | 1.64 | %(c) | 1.77 | % | | 1.69 | % | | 1.71 | % | | 1.41 | % | | 1.47 | % |

| PORTFOLIO TURNOVER RATE | | 6 | %(b) | 18 | % | | 11 | % | | 35 | % | | 26 | % | | 32 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Not annualized. |

| (c) | Annualized. |

| (d) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

| | See Notes to Financial Statements | |

| | 10 | |

| LOU HOLLAND |

| GROWTH FUND |

| |

| Financial Highlights |

| |

These financial highlights reflect selected data for a share outstanding throughout each period. |

| | | For the Six Months Ended June 30, 2011 | | March 1, 2010 (a) Through December 31, 2010 | |

| INSTITUTIONAL SHARES | | | | | | | | |

| NET ASSET VALUE, Beginning of Period | $ | 20.00 | | | $ | 17.88 | | |

| INVESTMENT OPERATIONS | | | | | | | | |

| Net investment loss (b) | | (0.01 | ) | | | (0.01 | ) | |

| Net realized and unrealized gain (loss) | | 1.50 | | | | 2.61 | | |

| Total from Investment Operations | | 1.49 | | | | 2.60 | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | |

| Net realized gain | | — | | | | (0.48 | ) | |

| NET ASSET VALUE, End of Period | $ | 21.49 | | | $ | 20.00 | | |

| TOTAL RETURN | | 7.50 | %(c) | 14.58 | %(c) |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | |

| Net Assets at End of Period (000's omitted) | $1,229 | | | $1,126 | | |

| Ratios to Average Net Assets: | | | | | | | | |

| Net investment loss | | (0.13 | )%(d) | (0.06 | )%(d) |

| Net expense | | 1.20 | %(d) | 1.20 | %(d) |

| Gross expense (e) | | 1.52 | %(d) | 1.91 | %(d) |

| PORTFOLIO TURNOVER RATE | | 6 | %(c) | 18 | %(c) |

| | | | | | | | | | |

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Not annualized. |

| (d) | Annualized. |

| (e) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

| | See Notes to Financial Statements | |

| | 11 | |

| LOU HOLLAND |

| GROWTH FUND |

| |

| Financial Highlights |

| |

These financial highlights reflect selected data for a share outstanding throughout each period. |

| | | For the Six Months Ended June 30, 2011 | | February 1, 2010 (a) through December 31, 2010 | |

| A SHARES | | | | | | | | |

| NET ASSET VALUE, Beginning of Period | $ | 19.96 | | | $ | 17.40 | | |

| INVESTMENT OPERATIONS | | | | | | | | |

| Net investment loss (b) | | (0.03 | ) | | | (0.04 | ) | |

| Net realized and unrealized gain (loss) | | 1.51 | | | | 3.08 | | |

| Total from Investment Operations | | 1.48 | | | | 3.04 | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | |

| Net realized gain | | — | | | | (0.48 | ) | |

| NET ASSET VALUE, End of Period | $ | 21.44 | | | $ | 19.96 | | |

TOTAL RETURN (c) | | 7.41 | %(d) | 17.51 | %(d) | |

| RATIOS/SUPPLEMENTARY DATA | | | | | | �� | | |

| Net Assets at End of Period (000's omitted) | $ | 13 | | | $ | 12 | | |

| Ratios to Average Net Assets: | | | | | | | | |

| Net investment loss | | (0.33 | )%(e) | (0.22 | )%(e) | |

| Net expense | | 1.40 | %(e) | 1.40 | %(e) | |

| Gross expense (f) | | 12.49 | %(e) | 42.81 | %(e) | |

| PORTFOLIO TURNOVER RATE | | 6 | %(d) | 18 | %(d) | |

| | | | | | | | | | |

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Total Return does not include the effect of front end sales charge or contingent deferred sales charge. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

| | See Notes to Financial Statements | |

| | 12 | |

| LOU HOLLAND |

| GROWTH FUND |

| |

| Notes to Financial Statements |

| June 30, 2011 |

Note 1. Organization

The Lou Holland Growth Fund (the “Fund”) is a diversified portfolio of Forum Funds (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940 (the “Act”), as amended. Under its Trust Instrument, the Trust is authorized to issue an unlimited number of the Fund’s shares of beneficial interest without par value. The Fund currently offers three classes of shares: Investor Shares, Institutional Shares and A Shares. A Shares are offered at net asset value plus a maximum sales charge of 5.75%. A Shares are also subject to contingent deferred sales charge (“CDSC”) of 1.00% on purchases without an initial sales charge and redeemed less than one year after they are purchased. Investor Shares and Institutional Shares are not subject to a sales charge. Investor Shares commenced operations on April 26, 1996, Institutional Shares commenced operations on March 1, 2010, and A Shares commenced operations on February 1, 2010. The Fund’s investment objective is to seek long term growth of capital, with the receipt of dividend income as a secondary consideration.

Note 2. Summary of Significant Accounting Policies

These financial statements are prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increase and decrease in net assets from operations during the fiscal year. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation – Exchange-traded securities and over-the-counter securities are valued using the last quoted sale or official closing price, provided by independent pricing services as of the close of trading on the market or exchange for which they are primarily traded, on each Fund business day. In the absence of a sale, such securities are valued at the mean of the last bid and ask price provided by independent pricing services. Non-exchange traded securities for which quotations are available are valued using the last quoted sales price, or in the absence of a sale at the mean of the last bid and ask prices provided by independent pricing services. Shares of open-end mutual funds are valued at net asset value (“NAV”). Short-term investments that mature in sixty days or less may be valued at amortized cost.

The Fund values its investments at fair value pursuant to procedures adopted by the Trust's Board of Trustees (the "Board") if (1) market quotations are insufficient or not readily available or (2) the adviser believes that the values available are unreliable. Fair valuation is based on subjective factors and, as a result, the fair value price of an investment may differ from the security’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different NAV than a NAV determined by using market quotes.

The Fund has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various “inputs” used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical assets

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

| LOU HOLLAND |

| GROWTH FUND |

| |

| Notes to Financial Statements |

| June 30, 2011 |

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The aggregate value by input level, as of June 30, 2011, for the Fund’s investments is included at the end of the Fund’s Schedule of Investments.

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded on an accrual basis. Premium is amortized and discount is accreted in accordance with GAAP. Identified cost of investments sold is used to determine the gain and loss for both financial statement and federal income tax purposes.

Distributions to Shareholders – Distributions to shareholders of net investment income and net capital gains, if any, are declared and paid at least annually. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund.

Federal Taxes – The Fund intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income to shareholders. In addition, by distributing in each calendar year substantially all its net investment income and capital gains, if any, the Fund will not be subject to a federal excise tax. Therefore, no federal income or excise tax provision is required.

As of June 30, 2011, there are no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund’s federal tax returns filed in the three-year period ended December 31, 2010, remain subject to examination by the Internal Revenue Service.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

The Fund’s class specific expenses are charged to the operations of that class of shares. Income and expenses (other than expenses attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on the class’ respective net assets to the total net assets of the Fund.

Commitments and Contingencies – In the normal course of business, the Fund enters into contracts that provide general indemnifications by the Fund to the counterparty to the contract. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

| LOU HOLLAND |

| GROWTH FUND |

| |

| Notes to Financial Statements |

| June 30, 2011 |

Note 3. Advisory Fees, Servicing Fees and Other Transactions

Investment Adviser – Holland Capital Management LLC (the “Adviser”), is the investment adviser to the Fund. Pursuant to an investment advisory agreement, the Adviser receives an advisory fee monthly from the Fund at the following annualized rates of 0.85% of the Fund’s average daily net assets up to $500 million, 0.75% of the Fund’s average daily net assets up to the next $500 million and 0.65% of the Fund’s average daily net assets in excess of $1 billion.

Distribution – Foreside Fund Services, LLC serves as the Fund’s distributor (the “Distributor”). The Distributor is not affiliated with the Adviser or Atlantic Fund Administration, LLC (d/b/a Atlantic Fund Services) (“Atlantic”) or their affiliates. The Fund has adopted a Distribution Plan (the “Plan”) for Investor Shares and A Shares of the Fund in accordance with Rule 12b-1 of the Act. Under the Plan, the Fund pays the Distributor and/or any other entity as authorized by the Board a fee of up to 0.25% of the average daily net assets of Investor Shares and A Shares. The Distributor had no role in determining the investment policies or which securities are to be purchased or sold by the Trust or its Funds.

For the six months ended June 30, 2011, there were no front-end or CDSC sales charges assessed on the sale of A Shares.

Other Service Providers – Atlantic provides fund accounting, fund administration, and transfer agency services to the Fund. Atlantic also provides certain shareholder report production, and EDGAR conversion and filing services. Atlantic provides a Principal Executive Officer, a Principal Financial Officer, a Chief Compliance Officer, and an Anti-Money Laundering Officer to the Fund, as well as certain additional compliance support functions.

Trustees and Officers – The Trust pays each independent Trustee an annual retainer fee of $45,000 for service to the Trust ($66,000 for the Chairman). In addition, the Chairman receives a monthly stipend of $500 to cover certain expenses incurred in connection with his duties to the Trust. The Trustees and Chairman may receive additional fees for special Board meetings. Each Trustee is also reimbursed for all reasonable out-of-pocket expenses incurred in connection with his duties as a Trustee, including travel and related expenses incurred in attending Board meetings. The amount of Trustees’ fees attributable to the Fund is disclosed in the Statement of Operations. Certain officers of the Trust are also officers or employees of the above named service providers, and during their terms of office received no compensation from the Fund.

Note 4. Expense Reimbursements and Fees Waived

The Adviser has contractually agreed to waive a portion of its fees and reimburse expenses through May 1, 2013, to the extent necessary to maintain the total operating expenses at 1.35% of average daily net assets of the Investor Shares. The Adviser has contractually agreed to waive a portion of its fees and reimburse expenses through May 1, 2012, to the extent necessary to maintain the total operating expenses at 1.20% and 1.40% of the Institutional Shares and A Shares, respectively. Other fund service providers have voluntarily agreed to waive a portion of their fees. These contractual waivers may be changed or eliminated at any time with consent of the Board and voluntary fee waivers and expense reimbursements may be reduced or eliminated at any time. For the six months ended June 30, 2011, fees waived and reimbursed were as follows:

| LOU HOLLAND |

| GROWTH FUND |

| |

| Notes to Financial Statements |

| June 30, 2011 |

Investment Adviser Fees Waived | | Investment Adviser Expenses Reimbursed | | Other Waivers | | Total Fees Waived and Expenses Reimbursed |

| $40,412 | | $2,678 | | $40,057 | | $83,147 |

| | | | | | | |

Note 5. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments for the six months ended June 30, 2011, were $3,665,023 and $5,114,857, respectively.

Note 6. Federal Income Tax and Investment Transactions

As of December 31, 2010, distributable earnings (accumulated losses) on a tax basis were as follows:

| Unrealized Appreciation | | $ | 13,496,019 | |

The difference between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales.

Note 7. Recent Accounting Pronouncements

In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2010-06 “Improving Disclosures about Fair Value Measurements.” ASU No. 2010-06 clarifies existing disclosure and requires additional disclosures regarding fair value measurements. ASU No. 2010-06 is effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. Management has evaluated ASU No. 2010-06 and has determined that it did not have a significant impact on the reporting of the Fund’s financial statement disclosures.

In May 2011, FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs.” ASU No. 2011-04 establishes common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with U.S. GAAP and International Financial Reporting Standards (“IFRSs”). ASU No. 2011-04 is effective for interim and annual periods beginning after December 15, 2011. Management is currently evaluating the impact ASU No. 2011-04 may have on financial statement disclosures.

Note 8. Subsequent Events

Subsequent events occurring after the date of this report through the date these financial statements were issued have been evaluated for potential impact and the Fund has had no such events.

| LOU HOLLAND |

| GROWTH FUND |

| |

| Additional Information |

| June 30, 2011 |

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund’s portfolio is available, without charge and upon request, by calling (800) 295-9779, on the Fund's website at www.hollandcap.com/lhgf.html and on the SEC’s website at www.sec.gov. The Fund’s proxy voting record for the most recent twelve-month period ended June 30 is available, without charge and upon request, by calling (800) 295-9779 and on the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available, without charge and upon request on the SEC’s website at www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments on certain classes, and (2) ongoing costs, including management fees, 12b-1 fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2011, through June 30, 2011.

Actual Expenses – The first line under each share class in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes – The second line under each share class of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments on certain classes. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs had been included, your costs would have been higher.

| LOU HOLLAND |

| GROWTH FUND |

| |

| Additional Information |

| June 30, 2011 |

| | Beginning | | Ending | | Expenses | | Annualized |

| | Account Value | | Account Value | | Paid During | | Expense |

| | January 1, 2011 | | June 30, 2011 | | Period* | | Ratio* |

| Investor Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,074.65 | | $ | 6.94 | | 1.35 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,018.10 | | $ | 6.76 | | 1.35 | % |

| Institutional Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,075.04 | | $ | 6.17 | | 1.20 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,018.84 | | $ | 6.01 | | 1.20 | % |

| A Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,074.14 | | $ | 7.20 | | 1.40 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,017.85 | | $ | 7.00 | | 1.40 | % |

| | | | | | | | | | | | |

| | *Expenses are equal to the Fund’s annualized expense ratio as indicated above multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 365 to reflect the half-year period. |