UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4984

AMERICAN BEACON FUNDS

(Exact name of registrant as specified in charter)

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Address of principal executive offices)-(Zip code)

GENE L. NEEDLES, JR., PRESIDENT

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817) 391-6100

Date of fiscal year end: December 31, 2016

Date of reporting period: December 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

About American Beacon Advisors

Since 1986, American Beacon Advisors has offered a variety of products and investment advisory services to numerous institutional and retail clients, including a variety of mutual funds, corporate cash management, and separate account management.

Our clients include defined benefit plans, defined contribution plans, foundations, endowments, corporations, financial planners, and other institutional investors. With American Beacon Advisors, you can put the experience of a multi-billion dollar asset management firm to work for your company.

BAHL & GAYNOR SMALL CAP GROWTH FUND

Investing in small-capitalization stocks may involve greater volatility and lower liquidity than larger company stocks. Investing in foreign securities may involve heightened risk due to currency fluctuations and economic and political risks. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. The use of futures contracts for cash management may subject the Fund to losing more money than invested. The Fund may participate in a securities lending program. Please see the prospectus for a complete discussion of the Fund’s risks. There can be no assurances that the investment objectives of this Fund will be met.

HOLLAND LARGE CAP GROWTH FUND

Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. Investing in foreign securities may involve heightened risk due to currency fluctuations and economic and political risks. The use of futures contracts for cash management may subject the Fund to losing more money than invested. Please see the prospectus for a complete discussion of the Fund’s risks. There can be no assurances that the investment objectives of this Fund will be met

Any opinions herein, including forecasts, reflect our judgment as of the end of the reporting period and are subject to change. Each advisor’s strategies and each Fund’s portfolio composition will change depending on economic and market conditions. This report is not a complete analysis of market conditions, and, therefore, should not be relied upon as investment advice. Although economic and market information has been compiled from reliable sources, American Beacon Advisors, Inc. makes no representation as to the completeness or accuracy of the statements contained herein.

| | |

| American Beacon Funds | | December 31, 2016 |

Contents

President’s Message

| | |

| | Dear Shareholders, |

| | During the 12-month period ended December 31, 2016, China’s slowing growth escalated concerns for global markets, and many of the world’s central banks – the Federal Reserve (the “Fed”) included – responded by either continuing or expanding their economic stimulation policies. In the first half of 2016, international stocks declined while U.S. and emerging-market stocks made modest gains. Falling global interest rates supported bond returns during the period. |

| | On June 24, 2016, the U.K. announced that the Brexit referendum to leave the European Union passed with a 52% majority vote, further shaking up global markets. By the end of that month, however, the U.S. stock market and some global markets had rebounded to near pre-Brexit levels as investors took opportunistic risks following the historic vote. After Theresa May’s succession as the U.K.’s prime minister on July 13, 2016, many central banks put their Brexit concerns on hold and turned their attention to their own economies. |

In the weeks ahead of the U.S. presidential election on November 8, 2016, uncertainty about the outcome caused many investors to stay on the sidelines. Some investors questioned whether the election’s result would have negative consequences for their portfolios, but elections rarely have a lasting effect on the market. Historically speaking, from August 1 to October 31 during 19 of the last 22 election years - or approximately 86% of the time - the S&P 500 rallied for an average gain of approximately 6%.

On December 14, 2016, the Fed announced that it increased short-term interest rates by 0.25% to a range of 0.50% and 0.75%, signifying the Federal Open Market Committee’s confidence in an improving economy. It was the second rate increase in a decade; the first rate increase occurred in December 2015.

Although U.S. bonds and international investments largely declined in fourth quarter, domestic stocks reached new highs by the end of 2016. Markets responded positively to aspects of the incoming administration’s proposed plans for economic growth; i.e., repatriating jobs from overseas, relaxing regulations, lowering taxes and increasing infrastructure spending. For the year, the Dow Jones Industrial Average gained 16.50%, the S&P 500 Index gained 11.96%, the Nasdaq Composite gained 7.5% and the Russell 2000 gained 21.31%.

For the 12 months ended December 31, 2016:

| | • | | American Beacon Bahl & Gaynor Small Cap Growth Fund (Investor Class) returned 25.31%. |

| | • | | American Beacon Holland Large Cap Growth Fund (Investor Class) returned 1.87%. |

American Beacon Advisors identifies and partners with experienced asset managers from across all asset classes to help protect our shareholders’ portfolios over the long term. We are proud to offer a variety of funds that allow investors to invest in the asset classes best aligned with their long-term goals.

Thank you for your continued investment in the American Beacon Funds. For additional information about the Funds or to access your account information, please visit www.americanbeaconfunds.com.

Best Regards,

Gene L. Needles, Jr.

President

American Beacon Funds

1

Domestic Equity Market Overview

December 31, 2016 (Unaudited)

Domestic equity markets came back with a roar from 2015’s modestly positive performance and continued the long-running, eight-year bull market. The S&P 500 Index, a broad measure of stock performance, was up 11.96%. The Russell 1000 Index, another largely followed market index, was up 12.05% for the year. Looking at the various Russell-style indexes for the year, small-cap stocks outpaced large- and mid-cap stocks and value stocks far outpaced growth stocks. In 2016, the markets continued to demonstrate that macroeconomic events such as the Brexit vote and uncertainty around the U.S. election can influence performance in the short term.

The first quarter of 2016 was marked by significant domestic equity market volatility with negative performance in January nearly matching positive performance in March (with flat performance in between). The month of January was highlighted by a broad market sell-off because of continued weakness in China’s economy despite a rebound by stocks at the end of the month. Healthier economic indicators in February kept the markets from entering correction territory, with most broad domestic equity markets ending the month close to flat. March was characterized by strong market performance led by job gains, a strengthening labor market, and some stability to oil prices. The Federal Reserve (the “Fed”) took a cautious tone following the Federal Open Market Committee (“FOMC”) meeting in March and held the federal funds rate steady. “Global economic and financial developments” were cited as reasons to keep the rate steady. To wit, the surprise move by the European Central Bank for further quantitative easing underscored weakness in Europe’s economy. The quarter ended with most domestic markets in modestly positive territory - the exceptions being the small-cap core/growth space.

The second quarter’s hot topics - Brexit and the lackluster May jobs report - did little to dampen the period’s positive momentum. The first two months of the quarter had positive returns that initially seemed to be threatened by the underwhelming May jobs report released in the first week of June. The weak report put the prospect of the Fed raising interest rates at the June meeting in doubt, which was later realized. Later in the month came the unexpected vote in the United Kingdom to leave the European Union, or Brexit. However, the domestic equity markets’ short-lived reaction to the Brexit vote was followed by a quick rebound and the month of June was relatively flat across most U.S. indexes. The second quarter ended with U.S. equity markets posting positive numbers across the board.

The third quarter was buoyed initially by lessening fear surrounding the Brexit vote and a significant positive revision to the June jobs report, but the Fed’s discussion of whether (and when) they should raise interest rates remained a key theme. This carried into August as U.S. markets were lifted by continued signs of job creation, wage growth and a lower unemployment rate. Gross domestic product (“GDP”) metrics for the period registered +3.5% annualized - the highest observation in two years. Meanwhile, international markets were mixed, particularly as growth in China continued to slow. Weaker markets in September recovered toward the end of month thanks in part to oil prices rising in the wake of OPEC’s announcement of a tentative agreement on production cutbacks. Despite that and concerns about inflation remaining below its target of 2%, the Fed indicated that the case for raising interest rates before the end of the year had strengthened, though they noted they would wait before doing so and continue monitoring the environment. Once again, U.S. equity markets had a positive quarter across the board and particularly in the small-cap space.

The fourth quarter began weakly in October due to the uncertainty of the fast-approaching U.S. presidential election and despite goods and services indicating an increase to real GDP during the same time period. In November, despite predictions of a sharp, negative response to the election results, the U.S. markets went on to achieve new highs later in the month. Notwithstanding generally positive market conditions, the Fed made no interest rate changes in November given the proximity of the FOMC’s meeting to the election. At that time, Federal Reserve Board Chair Janet Yellen foreshadowed a potential rate increase, saying the timing could be appropriate “relatively soon.” On December 14, the Fed met and voted to increase interest rates by 0.25% - the first time in 2016 and only the second time in the past 12 months. As another positive note, consumer confidence rose during the month of December to its highest level in more than 15 years. The fourth quarter was a good period for the U.S. equity markets - especially small-cap stocks and value stocks, which significantly outpaced their large and growth counterparts - and wrapped a big bow around the end of a year that seemed surprising (i.e., U.S. markets leading globally).

2

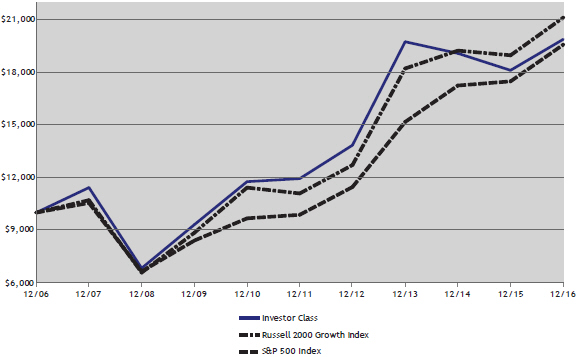

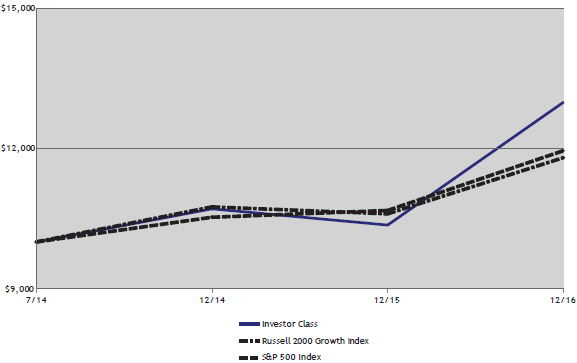

American Beacon Bahl & Gaynor Small Cap Growth FundSM

Performance Overview

December 31, 2016 (Unaudited)

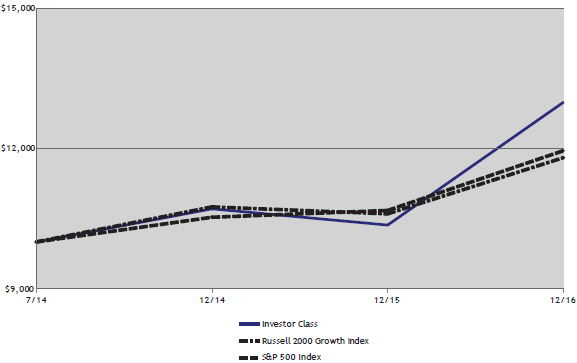

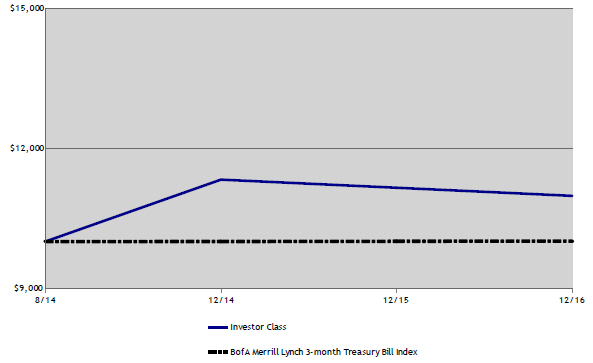

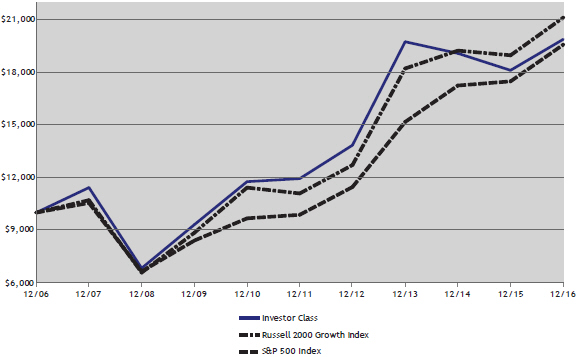

The Investor Class of the Bahl & Gaynor Small Cap Growth Fund (the “Fund”) returned 25.31% for the twelve months ended December 31, 2016. The Fund outperformed the Russell 2000 Growth Index (the “Index”) return of 11.32% for the same period.

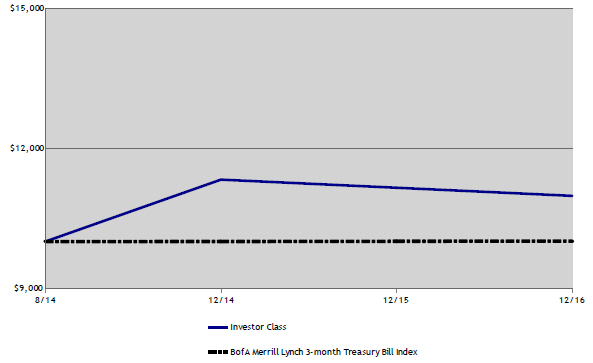

Comparison of Change in Value of a $10,000 Investment for the period from 7/15/2014 through 12/31/2016

Total Returns for the Period Ended December 31, 2016

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Value of $10,000 | |

| | | | | | | | | Since Inception | | | 7/15/2014- | |

| | | Ticker | | | 1 Year | | | (7/15/2014) | | | 12/31/2016 | |

Institutional Class (1,5) | | | GBSIX | | | | 25.88 | % | | | 11.60 | % | | $ | 13,104 | |

Y Class (1,5) | | | GBSYX | | | | 25.80 | % | | | 11.53 | % | | $ | 13,084 | |

Investor Class (1,5) | | | GBSPX | | | | 25.31 | % | | | 11.18 | % | | $ | 12,983 | |

A without Sales Charge (1,2,5) | | | GBSAX | | | | 25.44 | % | | | 11.18 | % | | $ | 12,983 | |

A with Sales Charge (1,2,5) | | | GBSAX | | | | 18.19 | % | | | 8.54 | % | | $ | 12,237 | |

C without Sales Charge (1,3,5) | | | GBSCX | | | | 24.35 | % | | | 10.31 | % | | $ | 12,734 | |

C with Sales Charge (1,3,5) | | | GBSCX | | | | 23.35 | % | | | 10.31 | % | | $ | 12,734 | |

Russell 2000 Growth Index (4) | | | | | | | 11.32 | % | | | 6.95 | % | | $ | 11,801 | |

S&P 500 Index (4) | | | | | | | 11.96 | % | | | 7.52 | % | | $ | 11,950 | |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is calculated based on the published end of day net asset values as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www. americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. A portion of the fees charged to each Class of the Fund has been waived since Fund inception. Performance prior to waiving fees was lower than actual returns shown. |

| 2. | A Class shares have a maximum sales charge of 5.75%. |

| 3. | C Class shares have a maximum contingent deferred sales charge of 1.00% for shares redeemed within one year of the date of purchase. |

3

American Beacon Bahl & Gaynor Small Cap Growth FundSM

Performance Overview

December 31, 2016 (Unaudited)

| 4. | The S&P 500 Index is a market capitalization weighted index of common stocks publicly traded in the United States. The Russell 2000 Growth Index and the Russell 2000 Index are registered trademarks of Frank Russell Company. The Russell 2000 Growth Index is an unmanaged index of those stocks in the Russell 2000 Index with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 Index is an unmanaged index of approximately 2000 smaller-capitalization stocks from various industrial sectors. One cannot directly invest in an index. |

| 5. | The total annual Fund operating expense ratio set forth in the most recent Fund prospectus for the Institutional, Y, Investor, A, and C Class shares was 3.05%, 2.77%, 3.20%, 2.89%, and 3.85%, respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

The Fund outperformed the Index primarily due to superior stock selection relative to the Index. From a stock selection standpoint, the Fund’s holdings in the Health Care, Information Technology and Consumer Discretionary sectors contributed the most to relative performance. In the Health Care sector, positions in West Pharmaceutical Services (up 42.1%), LeMaitre Vascular (up 71.9%) and Cantel Medical Corp (up 25.8%) were the largest contributors. Within the Information Technology sector, holdings in Monolithic Power (up 44.2%), FEI Company (up 36.7%), Synnex Corp (up 50.7%) and Silicon Motion Technol ADR (up 38.8%) were favorable to performance. Companies in the Consumer Discretionary sector that contributed to relative performance were Thor Industries (up 80.7%), Texas Roadhouse (up 38.1%) and Flexsteel (up 40.2%).

Sector allocation also added to relative returns during the period, as the Fund was underweight to Health Care and held an overweight to Financials relative to the benchmark.

The Fund’s basic philosophy remains focused on investing in companies using a fundamental investment approach that seeks price appreciation, capital preservation and income.

| | | | |

Top Ten Holdings (% Net Assets) | | | | |

Evercore Partners, Inc. | | | 3.1 | |

Thor Industries, Inc. | | | 3.0 | |

Monolithic Power Systems, Inc. | | | 2.8 | |

Cantel Medical Corp. | | | 2.7 | |

Texas Roadhouse, Inc. | | | 2.7 | |

West Pharmaceutical Services, Inc. | | | 2.5 | |

Methode Electronics, Inc. | | | 2.4 | |

Watsco, Inc. | | | 2.3 | |

Flexsteel Industries, Inc. | | | 2.2 | |

Pegasystems, Inc. | | | 2.2 | |

Total Fund Holdings 68

| | | | |

Sector Allocation (% Equities) | | | | |

Information Technology | | | 26.4 | |

Consumer Discretionary | | | 17.0 | |

Industrials | | | 16.9 | |

Health Care | | | 15.3 | |

Financials | | | 12.7 | |

Materials | | | 4.3 | |

Consumer Staples | | | 4.2 | |

Real Estate | | | 2.1 | |

Energy | | | 1.1 | |

4

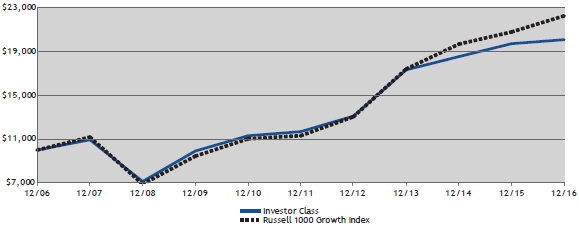

American Beacon Holland Large Cap Growth FundSM

Performance Overview

December 31, 2016 (Unaudited)

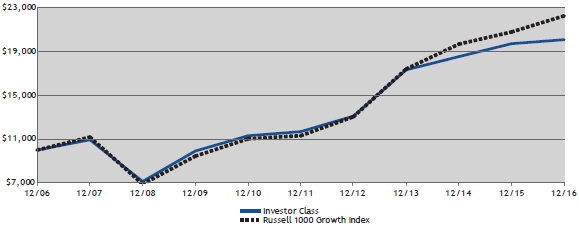

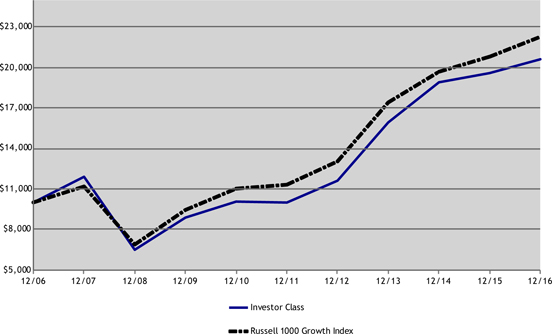

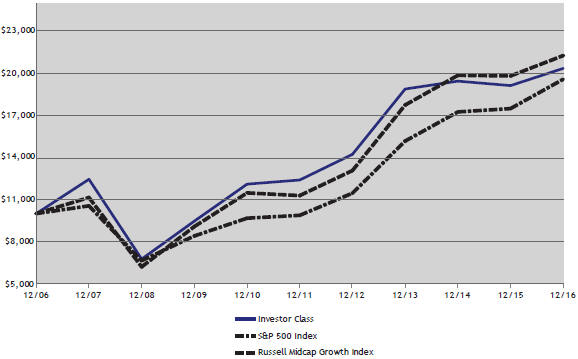

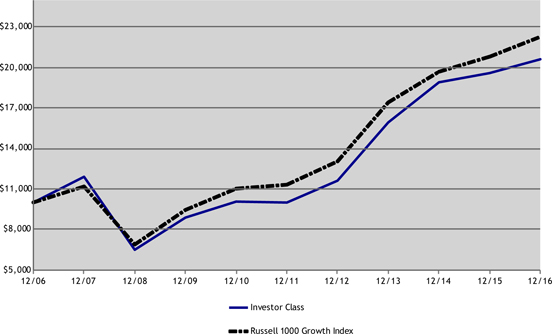

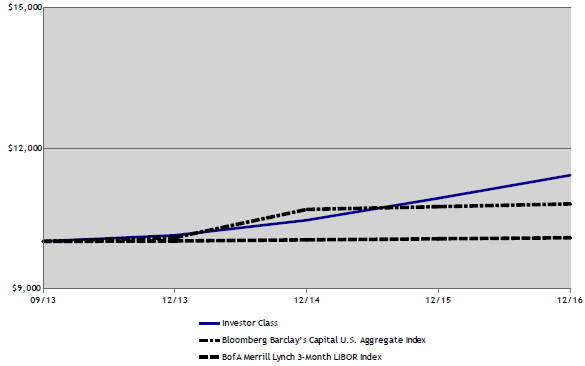

The Investor Class of the American Beacon Holland Large Cap Growth Fund (the “Fund”) returned 1.87% for the twelve months ended December 31, 2016. The Fund underperformed the Russell 1000® Growth Index (the “Index”) return of 7.08%.

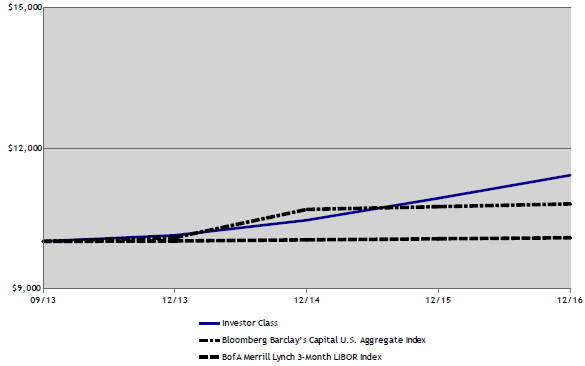

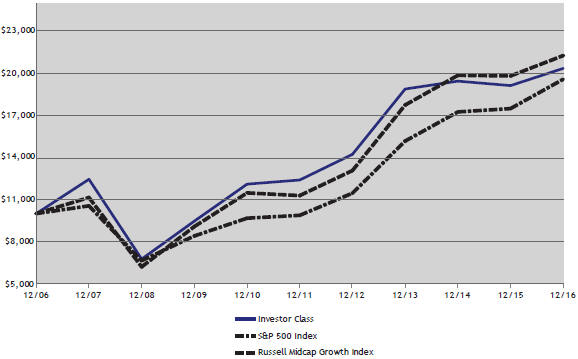

Comparison of Change in Value of a $10,000 Investment for the period from 12/31/2006 through 12/31/2016

Total Returns for the Period Ended December 31, 2016

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Value of $10,000 | |

| | | | | | | | | | | | | | | | | | 12/31/2006- | |

| | | Ticker | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | 12/31/2016 | |

Institutional Class (1,2,7) | | | LHGIX | | | | 2.25 | % | | | 5.41 | % | | | 11.84 | % | | | 7.44 | % | | $ | 20,502 | |

Y Class (1,3,7) | | | LHGYX | | | | 2.22 | % | | | 5.27 | % | | | 11.70 | % | | | 7.37 | % | | $ | 20,371 | |

Investor Class (1,7) | | | LHGFX | | | | 1.87 | % | | | 5.05 | % | | | 11.45 | % | | | 7.22 | % | | $ | 20,085 | |

A without Sales Charge (1,4,7) | | | LHGAX | | | | 1.85 | % | | | 4.98 | % | | | 11.35 | % | | | 7.17 | % | | $ | 18,836 | |

A with Sales Charge (1,4,7) | | | LHGAX | | | | -3.99 | % | | | 2.93 | % | | | 10.04 | % | | | 6.54 | % | | $ | 18,836 | |

C without Sales Charge (1,5,7) | | | LHGCX | | | | 1.10 | % | | | 4.20 | % | | | 10.55 | % | | | 6.79 | % | | $ | 19,281 | |

C with Sales Charge (1,5,7) | | | LHGCX | | | | 0.10 | % | | | 4.20 | % | | | 10.55 | % | | | 6.79 | % | | $ | 19,281 | |

Russell 1000 Growth Index (6) | | | | | | | 7.08 | % | | | 8.55 | % | | | 14.50 | % | | | 8.33 | % | | $ | 22,266 | |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is calculated based on the published end of day net asset values as of date indicated, and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www. americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. A portion of the fees charged to the Investor Class was waived from 2002 through 2012, partially recovered in 2013, and fully recovered in 2014. Performance prior to waiving fees was lower than the actual returns shown from 2002 through 2012. |

| 2. | Fund performance for the ten-year period represents the returns achieved by the Investor Class from 12/31/06 up to 3/1/10, the inception date of the Institutional Class, and the returns of the Institutional Class since its inception. Expenses of the Institutional Class are lower than those of the Investor Class. As a result, total returns shown may be lower than they would have been had the Institutional Class been in existence since 12/31/06. A portion of the fees charged to the Institutional Class was waived from 2010 through 2012 and partially recovered in 2013 and 2015. Performance prior to waiving fees was lower than the actual returns shown from 2010 through 2012. |

| 3. | Fund performance for the five-year and ten-year periods represent the returns achieved by the Investor Class from 12/31/06 up to 3/1/10, the Institutional Class from 3/1/10 to 3/23/12, the inception date of the Y Class, and the returns of the Y Class since its inception. Expenses of the Y Class are lower than those of the Investor Class. As a result, total returns shown may be lower than they would have been had the Y Class been in existence since 12/31/06. A portion of the fees charged to the Y Class was waived in 2012, partially recovered in 2013 and waived in 2014 and 2015. Performance prior to waiving fees was lower than the actual returns shown in 2012, 2014, and 2015. |

| 4. | Fund performance for the ten-year period represents the returns achieved by the Investor Class from 12/31/06 through 2/1/10, the inception date of the A Class, and the returns of the A Class since its inception. Expenses of the A Class are higher than those of the Investor Class. As a result, total returns shown may be higher than they would have been had the A Class been in existence since 12/31/06. A portion of the fees charged to the A Class was waived from |

5

American Beacon Holland Large Cap Growth FundSM

Performance Overview

December 31, 2016 (Unaudited)

| | 2010 through 2014. Performance prior to waiving fees was lower than the actual returns shown from 2010 through 2014. A Class shares have a maximum sales charge of 5.75%. |

| 5. | Fund performance for the five-year and ten-year periods represent the returns achieved by the Investor Class from 12/31/06 through 3/23/12, the inception date of the C Class, and the returns of the C Class since its inception. Expenses of the C Class are higher than those of the Investor Class. As a result, total returns shown may be higher than they would have been had the C Class been in existence since 12/31/06. A portion of the fees charged to the C Class has been waived since 2012. Performance prior to waiving fees was lower than the actual returns shown since 2012. C Class has a maximum contingent deferred sales charge of 1.00% for shares redeemed within one year of the date of purchase. |

| 6. | The Russell 1000 Growth Index is an unmanaged index of those stocks in the Russell 1000 Index with higher price-to-book ratios and higher forecasted growth values. Russell 1000 Growth Index and Russell 1000 Index are registered trademarks of the Frank Russell Company. One cannot directly invest in an index. |

| 7. | The total annual Fund operating expense ratio set forth in the most recent Fund prospectus for the Institutional, Y, Investor, A, and C Class shares was 0.89%, 1.09%, 1.25%, 1.30%, and 2.06%, respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

The Fund lagged the Index primarily due to poor stock selection as sector allocation added minimal value relative to the Index.

From a stock selection perspective, holdings in the Consumer Discretionary, Consumer Staples and Information Technology sectors detracted most from performance. Companies in the Consumer Discretionary sector detracting from the Fund’s return included Under Armour (down 28.9%), Restoration Hardware (down 47.1%) and Nike (down 17.1%). In the Consumer Staples sector, CVS Health (down 18.0%), Monster Beverage (down 11.3%) and Mead Johnson Nutrition (down 9.6%) detracted from performance. Not owning NVIDIA detracted relative value in the Information Technology sector. The Fund’s allocation in Tyler Technologies (down 7.3%) also detracted from performance in the Information Technology sector.

The Fund’s underweight position in Health Care, the worst performing sector in the Index, added relative value through sector allocation. An overweight in the Industrials sector also contributed to performance. The aforementioned good performance was mostly negated by the Fund’s absence from the Telecommunication Services sector and an average overweight in the Consumer Staples sector, which detracted relative value.

Looking forward, the Fund’s sub-advisor will continue to maintain a disciplined, long-term approach to equity investing in larger stocks with above-average growth potential.

| | | | |

| Top Ten Holdings (% Net Assets) | | | | |

Alphabet, Inc. | | | 4.6 | |

Apple, Inc. | | | 4.5 | |

Visa, Inc. | | | 4.4 | |

Amazon.com, Inc. | | | 4.3 | |

Microsoft Corp. | | | 3.7 | |

Adobe Systems, Inc. | | | 3.5 | |

Priceline.com, Inc. | | | 3.4 | |

Honeywell International, Inc. | | | 2.9 | |

Southwest Airlines Co. | | | 2.8 | |

United Parcel Service Inc. | | | 2.8 | |

Total Fund Holdings 51

| | | | |

| |

| Sector Allocation (% Equities) | | | | |

Information Technology | | | 34.3 | |

Consumer Discretionary | | | 22.8 | |

Health Care | | | 14.9 | |

Industrials | | | 12.4 | |

Consumer Staples | | | 10.3 | |

Financials | | | 4.1 | |

Materials | | | 1.3 | |

6

American Beacon FundsSM

Expense Examples

December 31, 2016 (Unaudited)

Fund Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees if applicable, and (2) ongoing costs, including management fees, administrative service fees, distribution (12b-1) fees, and other Fund expenses. The Examples are intended to help you understand the ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Examples are based on an investment of $1,000 invested at the beginning of the period in each Class and held for the entire period from July 1, 2016 through December 31, 2016.

Actual Expenses

The “Actual” lines of the tables provide information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the “Expenses Paid During Period” for the applicable Fund to estimate the expenses you paid on your account during this period. Shareholders of the Institutional and Investor Classes that invest in the Funds through an IRA or Roth IRA may be subject to a custodial IRA fee of $15 that is typically deducted each December. If your account was subject to a custodial IRA fee during the period, your costs would have been $15 higher.

Hypothetical Example for Comparison Purposes

The “Hypothetical” lines of the tables provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the Fund’s actual return). You may compare the ongoing costs of investing in the Funds with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. Shareholders of the Institutional and Investor Classes that invest in the Fund through an IRA or Roth IRA may be subject to a custodial IRA fee of $15 that is typically deducted each December. If your account was subject to a custodial IRA fee during the period, your costs would have been $15 higher.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs charged by the Fund, such as sales charges (loads). Similarly, the expense examples for other funds do not reflect any transaction costs charged by those funds, such as sales charges (loads), redemption fees or exchange fees. Therefore, the “Hypothetical” lines of the tables are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If you were subject to any transaction costs during the period, your costs would have been higher.

7

American Beacon FundsSM

Expense Examples

December 31, 2016 (Unaudited)

Bahl & Gaynor Small Cap Growth Fund

| | | | | | | | | | | | |

| | | | | | | | | Expenses Paid During | |

| | | Beginning Account Value | | | Ending Account Value | | | Period | |

| | | 7/1/2016 | | | 12/31/2016 | | | 7/1/2016-12/31/2016* | |

Institutional Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,176.64 | | | $ | 5.36 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,020.21 | | | $ | 4.98 | |

Y Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,176.95 | | | $ | 5.91 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,019.71 | | | $ | 5.48 | |

Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,174.25 | | | $ | 7.43 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,018.30 | | | $ | 6.90 | |

A Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,175.32 | | | $ | 7.55 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,018.19 | | | $ | 7.00 | |

C Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,169.83 | | | $ | 11.62 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,014.41 | | | $ | 10.79 | |

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 0.98%, 1.08%, 1.36%, 1.38% and 2.13% for the Institutional, Y, Investor, A and C Classes respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (366) to reflect the half-year period. |

| ** | 5% return before expenses. |

Holland Large Cap Growth Fund

| | | | | | | | | | | | |

| | | | | | | | | Expenses Paid During | |

| | | Beginning Account Value | | | Ending Account Value | | | Period | |

| | | 7/1/2016 | | | 12/31/2016 | | | 7/1/2016-12/31/2016* | |

Institutional Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,032.00 | | | $ | 4.49 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,020.69 | | | $ | 4.47 | |

Y Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,032.24 | | | $ | 5.01 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,020.22 | | | $ | 4.98 | |

Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,030.16 | | | $ | 6.43 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,018.82 | | | $ | 6.39 | |

A Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,030.01 | | | $ | 6.63 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,018.60 | | | $ | 6.60 | |

C Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,026.46 | | | $ | 10.39 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,014.86 | | | $ | 10.33 | |

| * | Expenses are equal to the Fund’s annualized expense ratios for the six-month period of 0.88%, 0.98%, 1.26%, 1.30% and 2.04% for the Institutional, Y, Investor, A and C Classes respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (366) to reflect the half-year period. |

| ** | 5% return before expenses. |

8

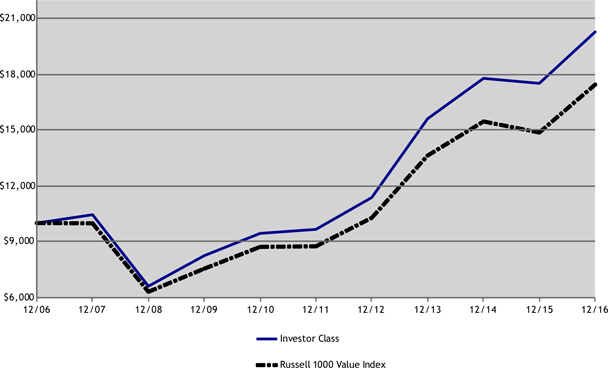

American Beacon FundsSM

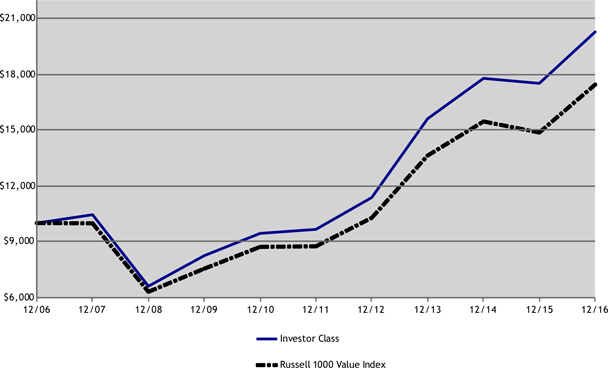

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders of

American Beacon Bahl & Gaynor Small Cap Growth Fund and American Beacon Holland Large Cap Growth Fund

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of American Beacon Bahl & Gaynor Small Cap Growth Fund and American Beacon Holland Large Cap Growth Fund (two of the funds constituting the American Beacon Funds) (collectively, the Funds), as of December 31, 2016, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board

(United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2016, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of American Beacon Bahl & Gaynor Small Cap Growth Fund and American Beacon Holland Large Cap Growth Fund at December 31, 2016, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended and the financial highlights for each of the periods indicated therein in conformity with U.S. generally accepted accounting principles.

Dallas, Texas

February 28, 2017

9

American Beacon Bahl & Gaynor Small Cap Growth FundSM

Schedule of Investments

December 31, 2016

| | | | | | | | |

| | | Shares | | | Fair Value | |

COMMON STOCK - 98.02% | | | | | | | | |

CONSUMER DISCRETIONARY - 16.63% | | | | | | | | |

Auto Components - 2.15% | | | | | | | | |

Gentex Corp. | | | 22,700 | | | $ | 446,963 | |

| | | | | | | | |

Automobiles - 3.75% | | | | | | | | |

Hyster-Yale Materials Handling, Inc. | | | 2,520 | | | | 160,700 | |

Thor Industries, Inc. | | | 6,150 | | | | 615,308 | |

| | | | | | | | |

| | | | | | | 776,008 | |

| | | | | | | | |

Hotels, Restaurants & Leisure - 4.97% | | | | | | | | |

Brinker International, Inc. | | | 2,050 | | | | 101,537 | |

Marriott Vacations Worldwide Corp. | | | 4,265 | | | | 361,885 | |

Texas Roadhouse, Inc. | | | 11,735 | | | | 566,095 | |

| | | | | | | | |

| | | | | | | 1,029,517 | |

| | | | | | | | |

Household Durables - 3.54% | | | | | | | | |

Flexsteel Industries, Inc. | | | 7,565 | | | | 466,534 | |

Matthews International Corp., Class A | | | 3,485 | | | | 267,822 | |

| | | | | | | | |

| | | | | | | 734,356 | |

| | | | | | | | |

Multiline Retail -1.36% | | | | | | | | |

Pricesmart, Inc. | | | 3,395 | | | | 283,483 | |

| | | | | | | | |

Specialty Retail - 0.86% | | | | | | | | |

Monro Muffler Brake, Inc. | | | 3,130 | | | | 179,036 | |

| | | | | | | | |

Total Consumer Discretionary | | | | | | | 3,449,363 | |

| | | | | | | | |

CONSUMER STAPLES - 4.08% | | | | | | | | |

Food & Drug Retailing -0.68% | | | | | | | | |

B&G Foods, Inc. | | | 3,220 | | | | 141,036 | |

| | | | | | | | |

Food Products - 1.96% | | | | | | | | |

J&J Snack Foods Corp. | | | 3,045 | | | | 406,294 | |

| | | | | | | | |

Personal Products - 1.44% | | | | | | | | |

Inter Parfums, Inc. | | | 9,135 | | | | 299,171 | |

| | | | | | | | |

Total Consumer Staples | | | | | | | 846,501 | |

| | | | | | | | |

ENERGY - 1.07% | | | | | | | | |

Oil & Gas - 1.07% | | | | | | | | |

GasLog Ltd. | | | 13,830 | | | | 222,663 | |

| | | | | | | | |

FINANCIALS - 12.47% | | | | | | | | |

Banks - 8.98% | | | | | | | | |

Bank of the Ozarks, Inc. | | | 3,505 | | | | 184,327 | |

Evercore Partners, Inc., Class A | | | 9,220 | | | | 633,414 | |

Glacier Bancorp, Inc. | | | 3,920 | | | | 142,022 | |

MainSource Financial Group, Inc. | | | 4,940 | | | | 169,936 | |

PacWest Bancorp. | | | 5,095 | | | | 277,372 | |

S&T Bancorp, Inc. | | | 6,000 | | | | 234,240 | |

Virtu Financial, Inc., Class A | | | 13,920 | | | | 222,024 | |

| | | | | | | | |

| | | | | | | 1,863,335 | |

| | | | | | | | |

Diversified Financials - 1.78% | | | | | | | | |

MarketAxess Holdings, Inc. | | | 2,520 | | | | 370,238 | |

| | | | | | | | |

Insurance - 1.71% | | | | | | | | |

Horace Mann Educators Corp. | | | 8,270 | | | | 353,956 | |

| | | | | | | | |

Total Financials | | | | | | | 2,587,529 | |

| | | | | | | | |

See accompanying notes

10

American Beacon Bahl & Gaynor Small Cap Growth FundSM

Schedule of Investments

December 31, 2016

| | | | | | | | |

| | | Shares | | | Fair Value | |

HEALTH CARE - 14.99% | | | | | | | | |

Health Care Equipment & Supplies - 9.70% | | | | | | | | |

Abaxis, Inc. | | | 6,520 | | | $ | 344,060 | |

Atrion Corp. | | | 345 | | | | 174,984 | |

Bio-Techne Corp. | | | 1,650 | | | | 169,670 | |

LeMaitre Vascular, Inc. | | | 9,920 | | | | 251,373 | |

Mesa Laboratories, Inc. | | | 2,000 | | | | 245,500 | |

Patterson Cos., Inc. | | | 7,435 | | | | 305,058 | |

West Pharmaceutical Services, Inc. | | | 6,175 | | | | 523,825 | |

| | | | | | | | |

| | | | | | | 2,014,470 | |

| | | | | | | | |

Health Care Providers & Services - 5.29% | | | | | | | | |

Cantel Medical Corp. | | | 7,215 | | | | 568,181 | |

Omnicell, Inc.A | | | 10,175 | | | | 344,933 | |

U.S. Physical Therapy, Inc. | | | 2,615 | | | | 183,573 | |

| | | | | | | | |

| | | | | | | 1,096,687 | |

| | | | | | | | |

Total Health Care | | | | | | | 3,111,157 | |

| | | | | | | | |

INDUSTRIALS - 16.54% | | | | | | | | |

Aerospace & Defense - 0.51% | | | | | | | | |

HEICO Corp. | | | 1,365 | | | | 105,310 | |

| | | | | | | | |

Building Products - 6.02% | | | | | | | | |

Apogee Enterprises, Inc. | | | 6,605 | | | | 353,764 | |

Simpson Manufacturing Co., Inc. | | | 4,870 | | | | 213,063 | |

Universal Forest Products, Inc. | | | 2,000 | | | | 204,360 | |

Watsco, Inc. | | | 3,245 | | | | 480,649 | |

| | | | | | | | |

| | | | | | | 1,251,836 | |

| | | | | | | | |

Commercial Services & Supplies - 4.60% | | | | | | | | |

CSG Systems International, Inc. | | | 3,220 | | | | 155,848 | |

Healthcare Services Group, Inc. | | | 6,695 | | | | 262,243 | |

Monotype Imaging Holdings, Inc. | | | 11,480 | | | | 227,878 | |

MSA Safety, Inc. | | | 4,440 | | | | 307,825 | |

| | | | | | | | |

| | | | | | | 953,794 | |

| | | | | | | | |

Electrical Equipment - 0.96% | | | | | | | | |

II-VI, Inc. | | | 6,695 | | | | 198,507 | |

| | | | | | | | |

Machinery - 4.45% | | | | | | | | |

Applied Industrial Technologies, Inc. | | | 6,085 | | | | 361,449 | |

Raven Industries, Inc. | | | 10,175 | | | | 256,410 | |

Valmont Industries, Inc. | | | 2,170 | | | | 305,753 | |

| | | | | | | | |

| | | | | | | 923,612 | |

| | | | | | | | |

Total Industrials | | | | | | | 3,433,059 | |

| | | | | | | | |

INFORMATION TECHNOLOGY - 25.98% | | | | | | | | |

Electronic Equipment & Instruments - 4.68% | | | | | | | | |

Analogic Corp. | | | 2,170 | | | | 180,002 | |

Littelfuse, Inc. | | | 1,130 | | | | 171,500 | |

Methode Electronics, Inc. | | | 12,175 | | | | 503,436 | |

NVE Corp. | | | 1,625 | | | | 116,074 | |

| | | | | | | | |

| | | | | | | 971,012 | |

| | | | | | | | |

Internet Software & Services - 2.88% | | | | | | | | |

GrubHub, Inc.A | | | 3,850 | | | | 144,837 | |

NIC, Inc. | | | 14,090 | | | | 336,751 | |

Reis, Inc. | | | 5,165 | | | | 114,921 | |

| | | | | | | | |

| | | | | | | 596,509 | |

| | | | | | | | |

See accompanying notes

11

American Beacon Bahl & Gaynor Small Cap Growth FundSM

Schedule of Investments

December 31, 2016

| | | | | | | | |

| | | Shares | | | Fair Value | |

INFORMATION TECHNOLOGY - 25.98% (continued) | | | | | | | | |

IT Consulting & Services - 5.81% | | | | | | | | |

Forrester Research, Inc. | | | 2,480 | | | $ | 106,516 | |

Hackett Group, Inc. | | | 18,445 | | | | 325,739 | |

Ritchie Bros Auctioneers, Inc. | | | 13,135 | | | | 446,590 | |

SYNNEX Corp. | | | 2,700 | | | | 326,754 | |

| | | | | | | | |

| | | | | | | 1,205,599 | |

| | | | | | | | |

Semiconductor Equipment & Products - 7.73% | | | | | | | | |

Cirrus Logic, Inc.A | | | 7,300 | | | | 412,742 | |

Monolithic Power Systems, Inc. | | | 7,045 | | | | 577,197 | |

Power Integrations, Inc. | | | 4,005 | | | | 271,739 | |

Silicon Motion Technology Corp. ADRB | | | 8,090 | | | | 343,663 | |

| | | | | | | | |

| | | | | | | 1,605,341 | |

| | | | | | | | |

Software - 4.88% | | | | | | | | |

Blackbaud, Inc. | | | 4,955 | | | | 317,120 | |

National Instruments Corp. | | | 7,835 | | | | 241,475 | |

Pegasystems, Inc. | | | 12,610 | | | | 453,960 | |

| | | | | | | | |

| | | | | | | 1,012,555 | |

| | | | | | | | |

Total Information Technology | | | | | | | 5,391,016 | |

| | | | | | | | |

MATERIALS - 4.17% | | | | | | | | |

Chemicals - 4.17% | | | | | | | | |

Balchem Corp. | | | 4,090 | | | | 343,233 | |

PolyOne Corp. | | | 11,650 | | | | 373,266 | |

Stepan Co. | | | 1,825 | | | | 148,701 | |

| | | | | | | | |

Total Materials | | | | | | | 865,200 | |

| | | | | | | | |

REAL ESTATE - 2.09% | | | | | | | | |

Real Estate Management & Development - 2.09% | | | | | | | | |

RE/MAX Holdings, Inc., Class A | | | 7,745 | | | | 433,720 | |

| | | | | | | | |

Total Common Stock (Cost $17,406,037) | | | | | | | 20,340,208 | |

| | | | | | | | |

SHORT TERM INVESTMENTS - 3.03% (Cost $628,203) | | | | | | | | |

American Beacon U.S. Government Money Market Select Fund, Select ClassC | | | 628,203 | | | | 628,203 | |

| | | | | | | | |

TOTAL INVESTMENTS - 101.05% (Cost $18,034,240) | | | | | | | 20,968,411 | |

LIABILITIES, NET OF OTHER ASSETS - (1.05%) | | | | | | | (218,394 | ) |

| | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 20,750,017 | |

| | | | | | | | |

| | |

Percentages are stated as a percent of net assets. | | | | | | | | |

| A | Non-income producing security. |

| B | ADR - American Depositary Receipt. |

| C | The Fund is affiliated by having the same investment advisor. |

Futures Contracts Open on December 31, 2016:

| | | | | | | | | | | | | | | | | | | | |

Description | | Type | | | Number of

Contracts | | | Expiration Date | | | Contract Value | | | Unrealized

Appreciation

(Depreciation) | |

Russell 2000 Mini Index Futures | | | Long | | | | 4 | | | | March 2017 | | | $ | 271,380 | | | $ | (2,785 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | 271,380 | | | $ | (2,785 | ) |

| | | | | | | | | | | | | | | | | | | | |

See accompanying notes

12

American Beacon Holland Large Cap Growth FundSM

Schedule of Investments

December 31, 2016

| | | | | | | | |

| | | Shares | | | Fair Value | |

COMMON STOCK - 97.25% | | | | | | | | |

CONSUMER DISCRETIONARY - 22.13% | | | | | | | | |

Auto Components - 1.08% | | | | | | | | |

Delphi Automotive PLCA | | | 15,482 | | | $ | 1,042,713 | |

| | | | | | | | |

Home Builders - 0.98% | | | | | | | | |

D.R. Horton, Inc. | | | 34,676 | | | | 947,695 | |

| | | | | | | | |

Hotels, Restaurants &Leisure - 1.69% | | | | | | | | |

Starbucks Corp. | | | 29,522 | | | | 1,639,061 | |

| | | | | | | | |

Internet & Catalog Retail - 7.74% | | | | | | | | |

Amazon.com, Inc.B | | | 5,568 | | | | 4,175,276 | |

priceline.com, Inc.B | | | 2,268 | | | | 3,325,024 | |

| | | | | | | | |

| | | | | | | 7,500,300 | |

| | | | | | | | |

Media - 1.69% | | | | | | | | |

Twenty-First Century Fox, Inc., Class A | | | 58,273 | | | | 1,633,975 | |

| | | | | | | | |

Multiline Retail - 1.40% | | | | | | | | |

Dollar General Corp. | | | 18,253 | | | | 1,352,000 | |

| | | | | | | | |

Specialty Retail - 4.38% | | | | | | | | |

Advance Auto Parts, Inc. | | | 11,475 | | | | 1,940,652 | |

Lowe’s Cos., Inc. | | | 32,274 | | | | 2,295,327 | |

| | | | | | | | |

| | | | | | | 4,235,979 | |

| | | | | | | | |

Textiles & Apparel - 3.17% | | | | | | | | |

NIKE, Inc., Class B | | | 38,696 | | | | 1,966,918 | |

Under Armour, Inc., Class A | | | 37,948 | | | | 1,102,389 | |

| | | | | | | | |

| | | | | | | 3,069,307 | |

| | | | | | | | |

Total Consumer Discretionary | | | | | | | 21,421,030 | |

| | | | | | | | |

CONSUMER STAPLES - 10.03% | | | | | | | | |

Beverages - 2.91% | | | | | | | | |

Monster Beverage Corp.B | | | 42,405 | | | | 1,880,238 | |

PepsiCo, Inc. | | | 8,979 | | | | 939,472 | |

| | | | | | | | |

| | | | | | | 2,819,710 | |

| | | | | | | | |

Food & Drug Retailing - 7.12% | | | | | | | | |

Costco Wholesale Corp. | | | 11,551 | | | | 1,849,431 | |

CVS Caremark Corp. | | | 29,684 | | | | 2,342,364 | |

Mead Johnson Nutrition Co., Class A | | | 16,204 | | | | 1,146,595 | |

Whole Foods Market, Inc. | | | 50,552 | | | | 1,554,980 | |

| | | | | | | | |

| | | | | | | 6,893,370 | |

| | | | | | | | |

Total Consumer Staples | | | | | | | 9,713,080 | |

| | | | | | | | |

FINANCIALS - 3.96% | | | | | | | | |

Diversified Financials - 3.96% | | | | | | | | |

BlackRock, Inc., Class A | | | 5,109 | | | | 1,944,179 | |

TD Ameritrade Holding Corp. | | | 43,443 | | | | 1,894,115 | |

| | | | | | | | |

Total Financials | | | | | | | 3,838,294 | |

| | | | | | | | |

HEALTH CARE - 14.46% | | | | | | | | |

Biotechnology - 4.65% | | | | | | | | |

Biogen Idec, Inc.B | | | 2,173 | | | | 616,219 | |

Gilead Sciences, Inc. | | | 27,238 | | | | 1,950,513 | |

Quintiles IMS Holdings, Inc.B | | | 14,792 | | | | 1,124,932 | |

Vertex Pharmaceuticals, Inc.B | | | 11,000 | | | | 810,370 | |

| | | | | | | | |

| | | | | | | 4,502,034 | |

| | | | | | | | |

See accompanying notes

13

American Beacon Holland Large Cap Growth FundSM

Schedule of Investments

December 31, 2016

| | | | | | | | |

| | | Shares | | | Fair Value | |

HEALTH CARE - 14.46% (continued) | | | | | | | | |

Health Care Equipment & Supplies - 2.54% | | | | | | | | |

Hologic, Inc.B | | | 25,007 | | | $ | 1,003,281 | |

Medtronic PLCA | | | 20,470 | | | | 1,458,078 | |

| | | | | | | | |

| | | | | | | 2,461,359 | |

| | | | | | | | |

Health Care Providers & Services - 4.55% | | | | | | | | |

Cerner Corp.B | | | 25,496 | | | | 1,207,746 | |

DaVita HealthCare Partners, Inc.B | | | 15,234 | | | | 978,023 | |

Envision Healthcare Corp.B | | | 9,951 | | | | 629,799 | |

UnitedHealth Group, Inc. | | | 9,915 | | | | 1,586,796 | |

| | | | | | | | |

| | | | | | | 4,402,364 | |

| | | | | | | | |

Pharmaceuticals - 2.72% | | | | | | | | |

Bristol-Myers Squibb Co. | | | 22,596 | | | | 1,320,510 | |

Zoetis, Inc. | | | 24,466 | | | | 1,309,665 | |

| | | | | | | | |

| | | | | | | 2,630,175 | |

| | | | | | | | |

Total Health Care | | | | | | | 13,995,932 | |

| | | | | | | | |

INDUSTRIALS - 12.02% | | | | | | | | |

Aerospace &Defense - 1.74% | | | | | | | | |

Boeing Co. | | | 10,840 | | | | 1,687,571 | |

| | | | | | | | |

Air Freight & Couriers - 2.80% | | | | | | | | |

United Parcel Service, Inc., Class B | | | 23,676 | | | | 2,714,217 | |

| | | | | | | | |

Airlines - 2.78% | | | | | | | | |

Southwest Airlines Co. | | | 53,920 | | | | 2,687,373 | |

| | | | | | | | |

Electrical Equipment - 1.78% | | | | | | | | |

Roper Industries, Inc. | | | 9,427 | | | | 1,725,895 | |

| | | | | | | | |

Industrial Conglomerates - 2.92% | | | | | | | | |

Honeywell International, Inc. | | | 24,335 | | | | 2,819,210 | |

| | | | | | | | |

Total Industrials | | | | | | | 11,634,266 | |

| | | | | | | | |

INFORMATION TECHNOLOGY - 33.37% | | | | | | | | |

Communications - 1.90% | | | | | | | | |

Facebook, Inc., Class AB | | | 15,969 | | | | 1,837,233 | |

| | | | | | | | |

Communications Equipment - 1.42% | | | | | | | | |

Cisco Systems, Inc. | | | 45,625 | | | | 1,378,788 | |

| | | | | | | | |

Computers & Peripherals - 5.68% | | | | | | | | |

Apple, Inc. | | | 37,782 | | | | 4,375,911 | |

International Business Machines Corp. | | | 6,752 | | | | 1,120,764 | |

| | | | | | | | |

| | | | | | | 5,496,675 | |

| | | | | | | | |

Internet Software & Services - 4.59% | | | | | | | | |

Alphabet, Inc., Class CB | | | 5,760 | | | | 4,445,683 | |

| | | | | | | | |

IT Consulting & Services - 7.18% | | | | | | | | |

Automatic Data Processing, Inc. | | | 15,667 | | | | 1,610,254 | |

Tyler Technologies, Inc. | | | 7,341 | | | | 1,048,075 | |

Visa, Inc., Class A | | | 55,023 | | | | 4,292,894 | |

| | | | | | | | |

| | | | | | | 6,951,223 | |

| | | | | | | | |

Semiconductor Equipment & Products - 1.83% | | | | | | | | |

NXP Semiconductors N.V.B | | | 18,074 | | | | 1,771,433 | |

| | | | | | | | |

Software - 10.77% | | | | | | | | |

Adobe Systems, Inc.B | | | 32,586 | | | | 3,354,729 | |

Check Point Software Technologies Ltd.B | | | 14,574 | | | | 1,230,920 | |

See accompanying notes

14

American Beacon Holland Large Cap Growth FundSM

Schedule of Investments

December 31, 2016

| | | | | | | | |

| | | Shares | | | Fair Value | |

INFORMATION TECHNOLOGY - 33.37% (continued) | | | | | | | | |

Software - 10.77% (continued) | | | | | | | | |

Citrix Systems, Inc.B | | | 10,843 | | | $ | 968,388 | |

Intuit, Inc. | | | 11,111 | | | | 1,273,432 | |

Microsoft Corp. | | | 57,885 | | | | 3,596,974 | |

| | | | | | | | |

| | | | | | | 10,424,443 | |

| | | | | | | | |

Total Information Technology | | | | | | | 32,305,478 | |

| | | | | | | | |

MATERIALS - 1.28% | | | | | | | | |

Chemicals - 1.28% | | | | | | | | |

Ecolab, Inc. | | | 10,551 | | | | 1,236,788 | |

| | | | | | | | |

Total Common Stock (Cost $68,968,529) | | | | | | | 94,144,868 | |

| | | | | | | | |

SHORT-TERM INVESTMENTS - 2.69% (Cost $2,600,481) | | | | | | | | |

American Beacon U.S. Government Money Market Select Fund, Select ClassC | | | 2,600,481 | | | | 2,600,481 | |

| | | | | | | | |

TOTAL INVESTMENTS - 99.94% (Cost $71,569,010) | | | | | | | 96,745,349 | |

OTHER ASSETS, NET OF LIABILITIES - 0.06% | | | | | | | 54,475 | |

| | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 96,799,824 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

| A | PLC - Public Limited Company. |

| B | Non-income producing security. |

| C | The Fund is affiliated by having the same investment advisor. |

Futures Contracts Open on December 31, 2016:

| | | | | | | | | | | | | | | | | | | | |

Description | | Type | | | Number of

Contracts | | | Expiration Date | | | Contract Value | | | Unrealized

Appreciation

(Depreciation) | |

S&P 500 E-Mini Index Futures | | | Long | | | | 22 | | | | March 2017 | | | $ | 2,459,820 | | | $ | (16,479 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | 2,459,820 | | | $ | (16,479 | ) |

| | | | | | | | | | | | | | | | | | | | |

See accompanying notes

15

American Beacon FundsSM

Statements of Assets and Liabilities

December 31, 2016

| | | | | | | | |

| | | Bahl & Gaynor Small | | | Holland Large Cap | |

| | | Cap Growth Fund | | | Growth Fund | |

Assets: | | | | | | | | |

Investments in unaffiliated securities, at fair value A | | $ | 20,340,208 | | | $ | 94,144,868 | |

Investments in affiliated securities, at fair value B | | | 628,203 | | | | 2,600,481 | |

Deposit with brokers for futures contracts | | | 26,565 | | | | 111,138 | |

Dividends and interest receivable | | | 18,453 | | | | 54,996 | |

Receivable for fund shares sold | | | 87,007 | | | | 18,527 | |

Receivable for expense reimbursement (Note 2) | | | 12,182 | | | | 28 | |

Prepaid expenses | | | 16,885 | | | | 12,199 | |

| | | | | | | | |

Total assets | | | 21,129,503 | | | | 96,942,237 | |

| | | | | | | | |

Liabilities: | | | | | | | | |

Payable for investments purchased | | | 322,592 | | | | — | |

Payable for fund shares redeemed | | | 2,387 | | | | 363 | |

Payable for variation margin from open futures contracts (Note 5) | | | 2,780 | | | | 16,430 | |

Management and investment advisory fees payable | | | 15,251 | | | | 69,185 | |

Administrative service and service fees payable | | | 2,344 | | | | 15,958 | |

Transfer agent fees payable | | | 412 | | | | 1,660 | |

Custody and fund accounting fees payable | | | 2,019 | | | | 2,740 | |

Professional fees payable | | | 29,397 | | | | 29,960 | |

Trustee fees payable | | | 1 | | | | 11 | |

Payable for prospectus and shareholder reports | | | 1,538 | | | | 1,719 | |

Other liabilities | | | 765 | | | | 4,387 | |

| | | | | | | | |

Total liabilities | | | 379,486 | | | | 142,413 | |

| | | | | | | | |

Net Assets | | $ | 20,750,017 | | | $ | 96,799,824 | |

| | | | | | | | |

Analysis of Net Assets: | | | | | | | | |

Paid-in-capital | | $ | 17,952,792 | | | $ | 71,200,795 | |

Undistributed net investment income | | | — | | | | 5,036 | |

Accumulated net realized gain (loss) | | | (134,162 | ) | | | 434,133 | |

Unrealized appreciation of investments | | | 2,934,172 | | | | 25,176,339 | |

Unrealized (depreciation) of futures contracts | | | (2,785 | ) | | | (16,479 | ) |

| | | | | | | | |

Net assets | | $ | 20,750,017 | | | $ | 96,799,824 | |

| | | | | | | | |

Shares outstanding at no par value (unlimited shares authorized): | | | | | | | | |

Institutional Class | | | 592,267 | | | | 1,043,477 | |

| | | | | | | | |

Y Class | | | 538,005 | | | | 16,497 | |

| | | | | | | | |

Investor Class | | | 284,154 | | | | 2,845,775 | |

| | | | | | | | |

A Class | | | 183,587 | | | | 55,348 | |

| | | | | | | | |

C Class | | | 33,193 | | | | 14,909 | |

| | | | | | | | |

Net assets: | | | | | | | | |

Institutional Class | | $ | 7,563,970 | | | $ | 25,818,864 | |

| | | | | | | | |

Y Class | | $ | 6,856,954 | | | $ | 405,410 | |

| | | | | | | | |

Investor Class | | $ | 3,595,277 | | | $ | 68,905,910 | |

| | | | | | | | |

A Class | | $ | 2,321,426 | | | $ | 1,327,798 | |

| | | | | | | | |

C Class | | $ | 412,390 | | | $ | 341,842 | |

| | | | | | | | |

Net asset value, offering and redemption price per share: | | | | | | | | |

Institutional Class | | $ | 12.77 | | | $ | 24.74 | |

| | | | | | | | |

Y Class | | $ | 12.75 | | | $ | 24.57 | |

| | | | | | | | |

Investor Class | | $ | 12.65 | | | $ | 24.21 | |

| | | | | | | | |

A Class | | $ | 12.64 | | | $ | 23.99 | |

| | | | | | | | |

A Class (offering price) | | $ | 13.41 | | | $ | 25.45 | |

| | | | | | | | |

C Class | | $ | 12.42 | | | $ | 22.93 | |

| | | | | | | | |

A Cost of investments in unaffiliated securities | | $ | 17,406,037 | | | $ | 68,968,529 | |

B Cost of investments in affiliated securities | | $ | 628,203 | | | $ | 2,600,481 | |

See accompanying notes

16

American Beacon FundsSM

Statements of Operations

For the year ended December 31, 2016

| | | | | | | | |

| | | Bahl & Gaynor | | | | |

| | | Small Cap | | | Holland Large | |

| | | Growth Fund | | | Cap Growth Fund | |

Investment income: | | | | | | | | |

Dividend income from unaffiliated securities (net of foreign taxes) A | | $ | 178,586 | | | $ | 1,069,273 | |

Dividend income from affiliated securities | | | 933 | | | | 8,894 | |

| | | | | | | | |

Total investment income | | | 179,519 | | | | 1,078,167 | |

| | | | | | | | |

Expenses: | | | | | | | | |

Management and investment advisory fees (Note 2) | | | 86,130 | | | | 605,211 | |

Administrative service fees (Note 2): | | | | | | | | |

Institutional Class | | | 5,866 | | | | 21,055 | |

Y Class | | | 5,190 | | | | 385 | |

Investor Class | | | 1,550 | | | | 90,164 | |

A Class | | | 1,323 | | | | 1,980 | |

C Class | | | 394 | | | | 741 | |

Transfer agent fees: | | | | | | | | |

Institutional Class | | | 542 | | | | 1,607 | |

Y Class | | | 200 | | | | 18 | |

Investor Class | | | 1,322 | | | | 8,282 | |

A Class | | | 147 | | | | 216 | |

C Class | | | 30 | | | | 46 | |

Custody and fund accounting fees | | | 11,563 | | | | 17,850 | |

Professional fees | | | 26,170 | | | | 29,985 | |

Registration fees and expenses | | | 63,387 | | | | 65,852 | |

Service fees (Note 2): | | | | | | | | |

Y Class | | | 4,183 | | | | 389 | |

Investor Class | | | 3,112 | | | | 255,414 | |

A Class | | | 1,593 | | | | 2,497 | |

C Class | | | 477 | | | | 760 | |

Distribution fees (Note 2): | | | | | | | | |

A Class | | | 2,655 | | | | 4,161 | |

C Class | | | 3,182 | | | | 5,064 | |

Prospectus and shareholder report expenses | | | 5,336 | | | | 6,328 | |

Trustee fees | | | 672 | | | | 6,444 | |

Other expenses | | | 4,668 | | | | 8,132 | |

| | | | | | | | |

Total expenses | | | 229,692 | | | | 1,132,581 | |

| | | | | | | | |

Net fees waived and expenses reimbursed (Note 2) | | | (99,554 | ) | | | (143 | ) |

| | | | | | | | |

Net expenses | | | 130,138 | | | | 1,132,438 | |

| | | | | | | | |

Net investment income (loss) | | | 49,381 | | | | (54,271 | ) |

| | | | | | | | |

Realized and unrealized gain (loss) from investments: | | | | | | | | |

Net realized gain from: | | | | | | | | |

Investments | | | 73,137 | | | | 3,087,628 | |

Commission recapture (Note 1) | | | — | | | | 3,092 | |

Futures contracts | | | 19,965 | | | | 424,669 | |

Change in net unrealized appreciation (depreciation) of: | | | | | | | | |

Investments | | | 2,936,525 | | | | (1,741,977 | ) |

Futures contracts | | | (3,753 | ) | | | (37,112 | ) |

| | | | | | | | |

Net gain from investments | | | 3,025,874 | | | | 1,736,300 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | $ | 3,075,255 | | | $ | 1,682,029 | |

| | | | | | | | |

A Foreign taxes | | $ | 852 | | | $ | — | |

See accompanying notes

17

American Beacon FundsSM

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | | |

| | | Bahl & Gaynor Small Cap Growth | | | | | | | |

| | | Fund | | | Holland Large Cap Growth Fund | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2016 | | | 2015 | | | 2016 | | | 2015 | |

Increase (Decrease) in Net Assets: | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 49,381 | | | $ | 39,587 | | | $ | (54,271 | ) | | $ | (38,964 | ) |

Net realized gain (loss) from investments, commission recapture, and futures contracts | | | 93,102 | | | | (122,070 | ) | | | 3,515,389 | | | | 8,294,079 | |

Change in net unrealized appreciation (depreciation) from investments and futures contracts | | | 2,932,772 | | | | (233,970 | ) | | | (1,779,089 | ) | | | (1,934,166 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 3,075,255 | | | | (316,453 | ) | | | 1,682,029 | | | | 6,320,949 | |

| | | | | | | | | | | | | | | | |

Distributions to Shareholders: | | | | | | | | | | | | | | | | |

Net investment income: | | | | | | | | | | | | | | | | |

Institutional Class | | | (18,862 | ) | | | (17,671 | ) | | | — | | | | — | |

Y Class | | | (16,961 | ) | | | (14,934 | ) | | | — | | | | — | |

Investor Class | | | (8,783 | ) | | | (2,743 | ) | | | — | | | | — | |

A Class | | | (5,812 | ) | | | (3,164 | ) | | | — | | | | — | |

C Class | | | (497 | ) | | | (1,728 | ) | | | — | | | | — | |

Net realized gain from investments: | | | | | | | | | | | | | | | | |

Institutional Class | | | — | | | | (51,523 | ) | | | (646,655 | ) | | | (1,831,892 | ) |

Y Class | | | — | | | | (43,542 | ) | | | (10,980 | ) | | | (34,744 | ) |

Investor Class | | | — | | | | (7,997 | ) | | | (1,766,034 | ) | | | (8,194,511 | ) |

A Class | | | — | | | | (9,223 | ) | | | (34,342 | ) | | | (136,161 | ) |

C Class | | | — | | | | (5,037 | ) | | | (9,316 | ) | | | (83,671 | ) |

| | | | | | | | | | | | | | | | |

Net distributions to shareholders | | | (50,915 | ) | | | (157,562 | ) | | | (2,467,327 | ) | | | (10,280,979 | ) |

| | | | | | | | | | | | | | | | |

Capital Share Transactions: | | | | | | | | | | | | | | | | |

Proceeds from sales of shares | | | 11,394,900 | | | | 5,715,997 | | | | 13,225,448 | | | | 6,242,514 | |

Reinvestment of dividends and distributions | | | 49,550 | | | | 157,455 | | | | 2,467,141 | | | | 10,280,143 | |

Cost of shares redeemed | | | (923,263 | ) | | | (2,230,601 | ) | | | (17,992,253 | ) | | | (13,612,879 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets fromCapital share transactions | | | 10,521,187 | | | | 3,642,851 | | | | (2,299,664 | ) | | | 2,909,778 | |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets | | | 13,545,527 | | | | 3,168,836 | | | | (3,084,962 | ) | | | (1,050,252 | ) |

| | | | | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | | | | | |

Beginning of period | | | 7,204,490 | | | | 4,035,654 | | | | 99,884,786 | | | | 100,935,038 | |

| | | | | | | | | | | | | | | | |

End of Period* | | $ | 20,750,017 | | | $ | 7,204,490 | | | $ | 96,799,824 | | | $ | 99,884,786 | |

| | | | | | | | | | | | | | | | |

*Includes undistributed net investment income | | $ | — | | | $ | — | | | $ | 5,036 | | | $ | — | |

| | | | | | | | | | | | | | | | |

See accompanying notes

18

American Beacon FundsSM

Notes to Financial Statements

December 31, 2016

1. Organization

American Beacon Funds (the “Trust”), is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the “Act”), as a diversified, open-end management investment company. As of December 31, 2016, the Trust consists of twenty-six active series, two of which are presented in this filing (collectively, the “Funds” and each individually a “Fund”): the American Beacon Bahl & Gaynor Small Cap Growth Fund and American Beacon Holland Large Cap Growth Fund. The remaining twenty-four active series are reported in separate filings.

American Beacon Advisors, Inc. (the “Manager”) is a wholly-owned subsidiary of Astro AB Borrower, Inc., which is indirectly owned by investment funds affiliated with Kelso & Company, L.P. and Estancia Capital Management, LLC, and was organized in 1986 to provide business management, advisory, administrative and asset management consulting services to the Trust and other investors.

Class Disclosure

The Funds have multiple classes of shares designed to meet the needs of different groups of investors. The following table sets forth the differences amongst the classes:

| | | | | | |

Class | | Eligible Investors | | Minimum Initial

Investments | |

Institutional | | Large institutional investors - sold directly or through intermediary channels. | | $ | 250,000 | |

Y Class | | Large institutional retirement plan investors - sold directly or through intermediary channels. | | $ | 100,000 | |

Investor | | All investors using intermediary organizations such as broker-dealers or retirement plan sponsors - sold directly through intermediary channels. | | $ | 2,500 | |

A Class | | All investors who invest through intermediary organizations, such as broker-dealers or third party administrator. Retail investors who invest directly through a financial intermediary such as a broker, bank, or registered investment advisor, which may include a front-end sales charge and a contingent deferred sales charge (“CDSC”). | | $ | 2,500 | |

C Class | | Retail investors who invest directly through a financial intermediary such as a broker or employee directed benefit plans with applicable sales charges, which may include CDSC. | | $ | 1,000 | |

Each class offered by the Trust has equal rights as to assets and voting privileges. Income and non-class specific expenses are allocated daily to each class on the basis of the relative net assets. Realized and unrealized capital gains and losses of each class are allocated daily based on the relative net assets of each class of the respective Funds. Class specific expenses, where applicable, currently include administrative service fees, service fees, and distribution fees and vary amongst the classes as described more fully in Note 2.

The following is a summary of significant accounting policies, consistently followed by the Funds in preparation of the financial statements. The Funds are considered investment companies and accordingly, follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946, Financial Services - Investment Companies, which is part of U.S. Generally Accepted Accounting Principles (“U.S. GAAP”).

Security Transactions and Investment Income

Security transactions are recorded on the trade date of the security purchase or sale. The Funds may purchase securities with delivery or payment to occur at a later date. At the time the Funds enter into a commitment to purchase a security, the transaction is recorded, and the value of the security is reflected in the net asset value (“NAV”). The value of the security may vary with market fluctuations.

Dividend income, net of foreign taxes, is recorded on the ex-dividend date, except certain dividends from foreign securities which are recorded as soon as the information is available to the Funds. Interest income is earned from settlement date, recorded on the accrual basis, and adjusted, if necessary, for accretion of discounts and amortization of premiums. For financial and tax reporting purposes, realized gains and losses are determined on the basis of specific lot identification.

19

American Beacon FundsSM

Notes to Financial Statements

December 31, 2016

Dividends to Shareholders

Dividends from net investment income of the Funds normally will be declared and paid at least annually. Distributions, if any, of net realized capital gains are generally paid at least annually and recorded on the ex-dividend date. Dividends to shareholders are determined in accordance with federal income tax regulations, which may differ in amount and character from net investment income and realized gains recognized for purposes of U.S. GAAP. To the extent necessary to fully distribute capital gains, the Funds also designates earnings and profits distributed to shareholders on the redemption of shares.

Commission Recapture

The Funds have established brokerage commission recapture arrangements with certain brokers or dealers. If the Funds’ investment advisor chooses to execute a transaction through a participating broker, the broker rebates a portion of the commission back to the Funds. Any collateral benefit received through participation in the commission recapture program is directed exclusively to the Funds. This amount is reported with the net realized gain on the Funds’ Statement of Operations.

Allocation of Income, Expenses, Gains, and Losses

Income, expenses (other than those attributable to a specific class), gains, and losses are allocated daily to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimated.

Other

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. In the normal course of business, the Trust enters into contracts that provide indemnification to the other party or parties against potential costs or liabilities. The Trust’s maximum exposure under these arrangements is dependent on claims that may be made in the future and, therefore, cannot be estimated. The Trust has had no prior claims or losses pursuant to any such agreement.

2. Transactions with Affiliates

Management Agreement

From January 1, 2016 to May 29, 2016, the Trust and the Manager were parties to a Management Agreement that obligated the Manager to provide or oversee the provision of all investment advisory, Funds management, and securities lending services. As compensation for performing the duties required under the Management Agreement, the Manager received from the Funds an annualized fee equal to 0.05% of the average daily net assets. Effective May 29, 2016, the Funds and the Manager entered a Management Agreement that obligates the Manager to provide investment advisory, Funds management, and administrative services to the Funds. As compensation for performing the duties under the Management Agreement, the Manager receives from the Funds an annualized fee at the following annual rates as a percentage of average daily net assets: 0.35% of the first $5 billion, 0.325% of the next $5 billion, 0.30% of the next $10 billion, and 0.275% over $20 billion. The Funds also pay the unaffiliated investment advisors hired to direct investment activities of the Funds an annualized investment advisory fee based on a percentage of the Funds’ average daily assets. Management fees paid by the Funds during the year ended December 31, 2016 were as follows:

20

American Beacon FundsSM

Notes to Financial Statements

December 31, 2016

| | | | | | | | | | | | | | | | |

Fund | | Management

Fee Rate | | | Management

Fee | | | Amounts paid

to Investment

Advisors | | | Amounts

Paid to

Manager | |

Bahl & Gaynor Small Cap Growth | | | 0.86 | % | | $ | 86,130 | | | $ | 60,124 | | | $ | 26,006 | |

Holland Large Cap Growth.. | | | 0.75 | % | | | 605,211 | | | | 382,841 | | | | 222,370 | |

Administration Agreement

From January 1, 2016 to May 29, 2016, the Manager and the Trust were parties to an Administrative Agreement which obligated the Manager to provide or oversee administrative services to the Funds. As compensation for performing the duties required under the Administrative Agreement, the Manager received an annualized fee of 0.30% of the average daily net assets of the Institutional, Y, Investor, A, and C Classes of the Funds.

Distribution Plans

The Funds, except for the A and C Classes, have adopted a “defensive” Distribution Plan (the “Plan”) in accordance with Rule 12b-1 under the Act, pursuant to which no separate fees will be charged to the Funds for distribution purposes. However, the Plan authorizes the management and administrative service fees received by the Manager and the investment advisors hired by the Manager to be used for distribution purposes. Under this Plan, the Funds do not intend to separately compensate the Manager or any other party, either directly or indirectly, for the distribution of Fund shares.

Separate Distribution Plans (the “Distribution Plans”) have been adopted pursuant to Rule 12b-1 under the Act for the A and C Classes of the Funds. Under the Distribution Plans, as compensation for distribution assistance, the Manager receives an annual fee of 0.25% of the average daily net assets of the A Class and 1.00% of the average daily net assets of the C Class. The fee will be payable without regard to whether the amount of the fee is more or less than the actual expenses incurred in a particular month by the Manager for distribution assistance.

Service Plans

The Manager and the Trust entered into Service Plans that obligate the Manager to oversee additional shareholder servicing of the Investor, advisor, A and C Classes of the Funds. As compensation for performing the duties required under the Service Plans, the Manager receives 0.10% of the average daily net assets of the Y Class, 0.15% of the average daily net assets of the A and C Classes, 0.25% of the average daily net assets of the Advisor Class, and up to 0.375% of the average daily net assets of the Investor Class of the Funds.

Sub-Transfer Agent Fees

The Manager has entered into agreements, which include servicing agreements, with financial intermediaries that provide recordkeeping, processing, shareholder communications and other services to customers of the intermediaries that hold positions in the Institutional Class of the Funds and has agreed to compensate the intermediaries for providing these services. Intermediaries transact with the Funds primarily through the use of omnibus accounts on behalf of its customers who hold positions in the Funds. Certain services would have been provided by the Funds’ transfer agent and other service providers if the shareholders’ accounts were maintained directly by the Funds’ transfer agent. Accordingly, the Funds, pursuant to the Trust’s Board of Trustees (the “Board”) approval, have agreed to reimburse the Manager for all or a portion of the servicing fees paid to these intermediaries for the Institutional Class. The reimbursement amounts (sub-transfer agent fees) paid to the Manager are subject to a fee limit of up to 0.10% of an intermediaries average net assets in the Institutional Class on an annual basis.

21

American Beacon FundsSM

Notes to Financial Statements

December 31, 2016

For the year ended December 31, 2016, the sub-transfer agent fees, as included in “Transfer agent fees” in the Statements of Operations, were as follows:

| | | | |

Fund | | Sub-Transfer

Agent Fees | |