UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4984

AMERICAN BEACON FUNDS

(Exact name of registrant as specified in charter)

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Address of principal executive offices)-(Zip code)

GENE L. NEEDLES, JR., PRESIDENT

220 East Las Colinas Boulevard, Suite 1200

Irving, Texas 75039

(Name and address of agent for service)

Registrant’s telephone number, including area code: (817) 391-6100

Date of fiscal year end: January 31, 2017

Date of reporting period: January 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

American Beacon(R)

FUNDS

2017 ANNUAL REPORT

January 31, 2017

CRESCENT SHORT DURATION HIGH INCOME FUND

About American Beacon Advisors

Since 1986, American Beacon Advisors has offered a variety of products and investment advisory services to numerous institutional and retail clients, including a variety of mutual funds, corporate cash management, and separate account management.

Our clients include defined benefit plans, defined contribution plans, foundations, endowments, corporations, financial planners, and other institutional investors. With American Beacon Advisors, you can put the experience of a multi-billion dollar asset management firm to work for your company.

CRESCENT SHORT DURATION HIGH INCOME FUND

The Fund’s investments in high yield securities, including loans, restricted securities and floating rate securities are subject to greater levels of credit, interest rate, market and liquidity risks than investment-grade securities. Investing in foreign securities may involve heightened risk due to currency fluctuations and economic and political risks. Please see the prospectus for a complete discussion of the Fund’s risks. There can be no assurances that the investment objectives of this Fund will be met.

Any opinions herein, including forecasts, reflect our judgment as of the end of the reporting period and are subject to change. Each advisor’s strategies and each Fund’s portfolio composition will change depending on economic and market conditions. This report is not a complete analysis of market conditions, and, therefore, should not be relied upon as investment advice. Although economic and market information has been compiled from reliable sources, American Beacon Advisors, Inc. makes no representation as to the completeness or accuracy of the statements contained herein.

| | |

| American Beacon Funds | | January 31, 2017 |

Contents

President’s Message

| | |

| | Dear Shareholders, In the weeks ahead of the U.S. presidential election on November 8, 2016, uncertainty about the outcome caused many investors to stay on the sidelines. Some investors questioned whether the election’s result would have negative consequences for their portfolios, although elections have rarely had a lasting effect on the market. Following the election, the markets responded positively to aspects of the incoming administration’s proposed plans for economic growth; i.e., repatriating jobs from overseas, relaxing regulations, lowering taxes and increasing infrastructure spending. From Election Day 2016 to Inauguration Day 2017, the S&P 500 Index - a broad measure of the performance of large U.S. companies - climbed approximately 6%. |

In December 2016, the Federal Reserve increased short-term interest rates by 0.25% to a range of 0.50% and 0.75%, signifying the Federal Open Market Committee’s confidence in an improving economy. It was the second rate increase in a decade; the first rate increase occurred in December 2015. Economists anticipate more rate increases this year.

For the 12-month period that ended January 31, 2017, the Dow Jones Industrial Average - which follows the performance of 30 significant stocks trading on the New York Stock Exchange and The NASDAQ Stock Market - gained 23.89%. The S&P 500 Index, a domestic equity bellwether, grew 20.04%. The MSCI EAFE Index, which measures the world’s developed markets, increased 12.03%. The BofA Merrill Lynch U.S. High Yield Cash Pay BB-B 1-5 Year Index climbed 14.81%.

For the 12 months ended January 31, 2017:

| • | | American Beacon Crescent Short Duration High Income Fund (Investor Class) returned 11.96%. |

At American Beacon Advisors, we are proud to offer a broad range of global equity and fixed-income funds sub-advised by experienced asset managers who employ distinctive investment processes to manage assets through a variety of economic and market conditions. Together, we work diligently to help our shareholders meet their long-term financial goals.

Thank you for your continued investment in American Beacon Funds. For additional information about the Funds or to access your account information, please visit our website at www.americanbeaconfunds.com.

|

Best Regards, |

|

|

|

Gene L. Needles, Jr. |

President |

American Beacon Funds |

1

High Yield Bond Market Overview

January 31, 2017 (Unaudited)

The global bond market produced mixed results during the period as high-quality government issuers posted low or negative returns and high-yield outperformed. The Bloomberg Barclays Global Treasury Index returned 1.8% while the Bloomberg Barclays Global High Yield Index returned 18.2%.

The period began with a weak economic outlook as equity markets declined, commodity prices softened and interest rates drifted lower. Central banks across the globe emphasized their commitment to economic recovery and followed with a variety of accommodative actions.

In the summer of 2016, the markets were again tested as the U.K.’s Brexit vote to leave the European Union sent shockwaves through the markets. Record amounts of government bonds (primarily in Europe and Japan) traded into negative yields, and safe-haven U.S. Treasury yields dropped below the levels seen during the financial crisis of 2008 and the European debt crisis of 2012. As a result, total returns from government bonds were very strong during the first half of the period.

The volatility was short lived, however, as policy makers remained accommodative and hints of improved economic growth eventually began to surface. Commodity prices stabilized as equity markets regained their footing.

The final months of the year proved most pivotal as Donald Trump’s surprise victory in the U.S. presidential election provoked a risk-on rally into year end. Developed market equities rose sharply in hopes of growth-friendly initiatives from the new president, and government bond prices rolled over (yields rose). Emerging market bonds weakened against criticism of trade and immigration policies, but they still managed to finish the year with solid returns overall. The JPMorgan Emerging Market Bond Indexes (both hard and local currency) returned 12.0%. Mexico was particularly hard hit (down 1.8%) as talk of building walls and limiting trade was most pronounced.

The smaller, frontier economies also produced strong results as their commodity-export economies were viewed as less susceptible to trade sanctions, as compared to manufacturing exporters, and they avoided the mainstream selling in emerging markets. The JPMorgan NEXGEM Index returned 19.2%.

U.S. high-yield bonds outperformed investment-grade bonds as investors sought greater income and protection from rising interest rates. The rising stock markets were also helpful for high-yield bonds as they tend to be positively correlated. The Energy and Materials sectors led with returns of more than 50.0%, according to the Bloomberg Barclays High Yield Index. By comparison, investment-grade corporate bonds returned 6.1%, according to the Bloomberg Barclays Corporate Bond Index.

The period ended with optimism that the U.S. would continue to recover, Europe would pull out of its malaise and the worst of the commodity rout was behind. The Federal Reserve had already begun to reduce its monetary policy accommodation. Investors, however, were also beginning to look cautiously at the upcoming elections in Europe and at central bank actions in Japan and China. Likewise, the non-traditional administration in the U.S. was likely to have a few surprises of its own.

2

American Beacon Crescent Short Duration High Income FundSM

Performance Overview

January 31, 2017 (Unaudited)

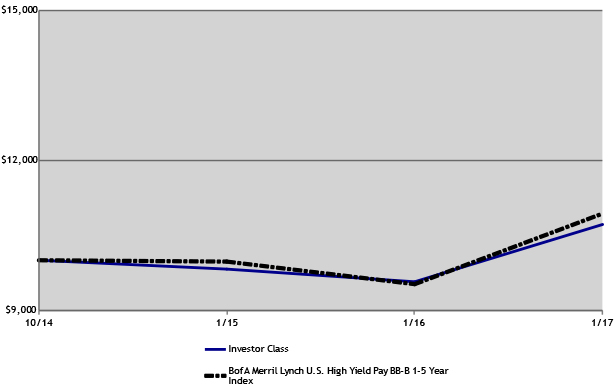

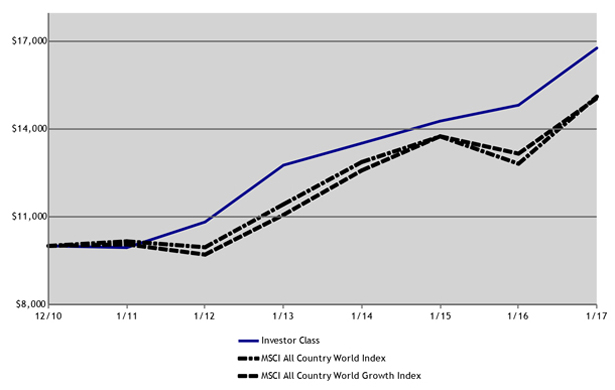

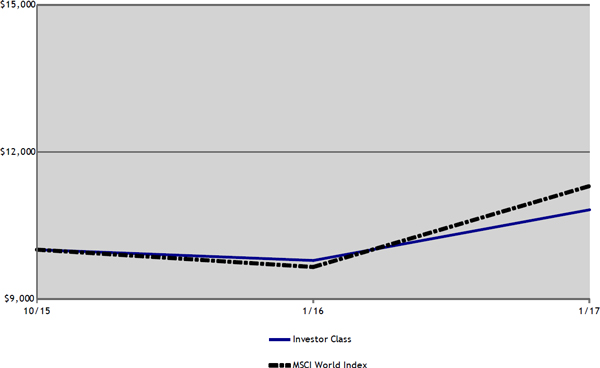

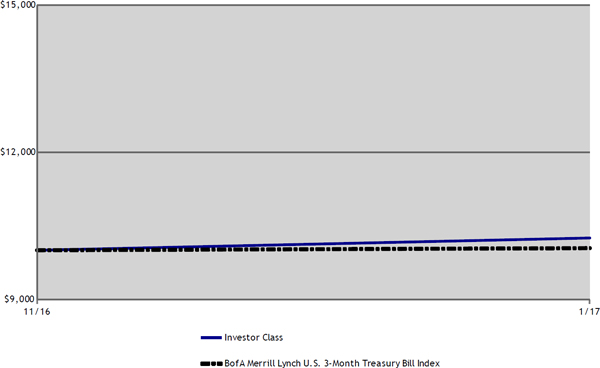

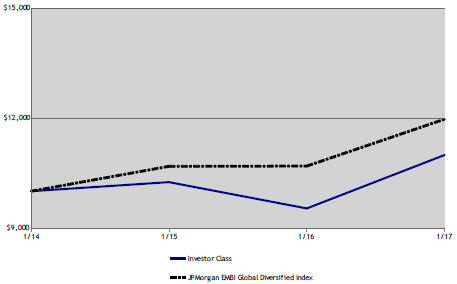

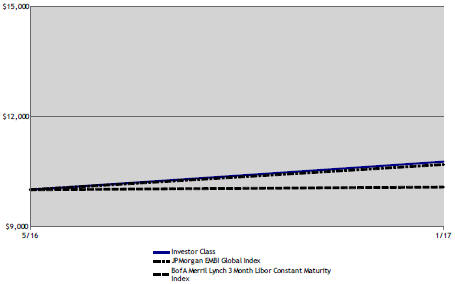

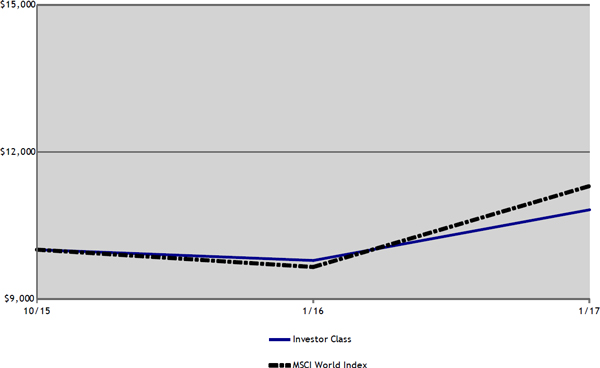

The Investor Class of the American Beacon Crescent Short Duration High Income Fund (the “Fund”) returned 11.96% for the twelve-month period ended January 31, 2017, underperforming the Bank of America Merrill Lynch U.S. High Yield Cash Pay BB-B 1-5 Year Index (the “Index”) return of 14.81%. For further comparison, the Bank of America U.S. High Yield Master II Index returned 20.98% and the Credit Suisse Leveraged Loan Index returned 11.27% during the period.

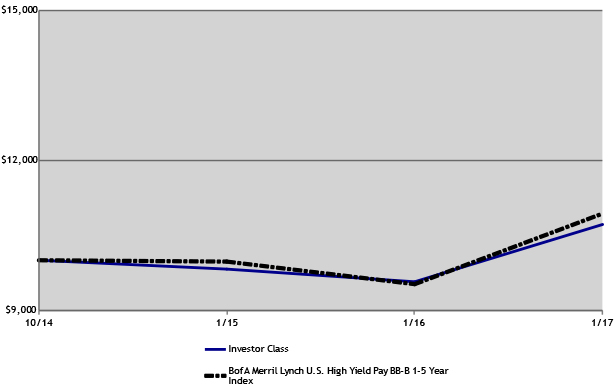

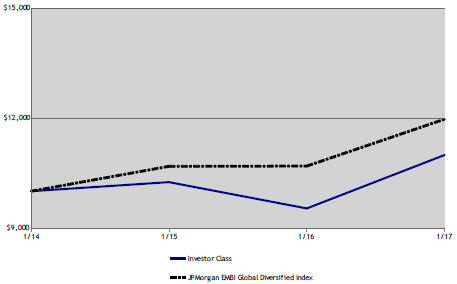

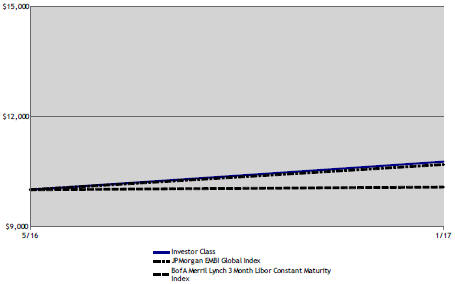

Comparison of Change in Value of a $10,000 Investment for the period from 10/1/2014 through 1/31/2017

Total Returns for the Period ended January 31, 2017

| | | | | | | | | | | | | | | | |

| | | Ticker | | | 1 Year | | | Since Inception

10/1/2014 | | | Value of $10,000

10/1/2014-

1/31/2017 | |

Institutional Class (1,3) | | | ACHIX | | | | 12.38 | % | | | 3.38 | % | | $ | 10,806 | |

Y Class (1,3) | | | ACHYX | | | | 12.27 | % | | | 3.25 | % | | $ | 10,775 | |

Investor Class (1,3) | | | ACHPX | | | | 11.96 | % | | | 3.00 | % | | $ | 10,714 | |

A without Sales Charge (1,3) | | | ACHAX | | | | 11.94 | % | | | 2.93 | % | | $ | 10,697 | |

A with Sales Charge (1,3) | | | ACHAX | | | | 9.15 | % | | | 1.80 | % | | $ | 10,426 | |

C without Sales Charge (1,3) | | | ACHCX | | | | 10.98 | % | | | 2.17 | % | | $ | 10,515 | |

C with Sales Charge (1,3) | | | ACHCX | | | | 9.98 | % | | | 2.17 | % | | $ | 10,515 | |

| | | | |

BofA Merrill Lynch U.S High Yield Cash Pay BB-B 1-5 Year Index (2) | | | | | | | 14.81 | % | | | 3.89 | % | | $ | 10,933 | |

| 1. | Performance shown is historical and is not indicative of future returns. Investment returns and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Performance shown is calculated based on the published end of day net asset values as of the date indicated and current performance may be lower or higher than the performance data quoted. To obtain performance as of the most recent month end, please visit www.americanbeaconfunds.com or call 1-800-967-9009. Fund performance in the table above does not reflect the deduction of taxes a shareholder would pay on distributions or the redemption of shares. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights. A portion of the fees charged to each Class of the Fund has been waived since inception. Performance prior to waiving fees was lower than the actual returns shown since inception. A Class shares have a maximum sales charge of 2.50%. The maximum contingent deferred sales charge for the C Class is 1.00% for shares redeemed within one year of the date of purchase. |

3

American Beacon Crescent Short Duration High Income FundSM

Performance Overview

January 31, 2017 (Unaudited)

| 2. | The BofA Merrill Lynch U.S. High Yield Cash Pay BB-B 1-5 Year Index is an unmanaged index that generally tracks the performance of BB-B rated U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market with maturities of 1 to 5 years. One cannot directly invest in an index. |

| 3. | The Total Annual Fund Operating Expense ratios set forth in the most recent Fund prospectus for the Institutional, Y, Investor, A, and C Class shares was 1.28%, 1.30%, 1.47%, 1.56%, and 2.37%, respectively. The expense ratios above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

The Fund’s sub-advisor actively allocates among traditional high-yield, floating-rate bank loan and private debt sectors of the bond market to seek attractive risk-adjusted returns with lower volatility than that of the high-yield market overall. This flexibility also allows for opportunity to invest in securities outside of the traditional indices. On average during the period, the Fund held approximately 65% of assets in traditional high yield, 25% in floating-rate bank loans and 10% in private debt.

The Fund underperformed the Index due primarily to its exposure to floating-rate bank loans and underweight position in the commodity sectors (including energy and metals). The Fund actively seeks investments in floating-rate bank loans due to their attractive risk-adjusted characteristics, but loans underperformed during the period as interest rates declined and high yield spreads narrowed. Near period end, however, in response to the improving U.S. economy, surprise election results and Fed rate hike, interest rates rose markedly contributing to a strong finish for loans.

The Fund also held underweight positions in the energy and metals sectors, which detracted from results as those were the best performing sectors during the period. Commodity prices stabilized early in the period, and the improving economic outlook encouraged investors to look for opportunity. The Fund, however, has been underweight commodities since 2014 when they began to roll over. As such, the Fund’s two-year returns, which are in line with the index and peer group, are more reflective of its longer-term approach to add value over the cycle.

To a lesser extent, the Fund’s underweight position in financials detracted somewhat from returns as the banking sector posted a strong finish based on expectations of the Trump administration’s easing of the regulatory burden.

Overall, the Fund performed as expected during the period and delivered attractive risk-adjusted returns.

| | | | | | | | |

Top Ten Holdings (% Net Assets) | | | | | | | | |

T-Mobile USA, Inc., 6.625%, Due 4/1/2023 | | | | | | | 1.7 | |

Sprint Corp., 7.25%, Due 9/15/2021 | | | | | | | 1.3 | |

HCA, Inc., 5.875%, Due 5/1/2023 | | | | | | | 0.9 | |

Post Holdings, Inc., 6.00%, Due 12/15/2022, 144A | | | | | | | 0.8 | |

Fly Leasing Ltd., 6.75%, Due 12/15/2020 | | | | | | | 0.8 | |

First Data Corp., 7.00%, Due 12/1/2023, 144A | | | | | | | 0.7 | |

Ally Financial, Inc., 3.75%, Due 11/18/2019 | | | | | | | 0.7 | |

Cott Beverages, Inc., 5.375%, Due 7/1/2022 | | | | | | | 0.7 | |

Block Communications, Inc., 7.25%, Due 2/1/2020, 144A | | | | | | | 0.7 | |

Universal Hospital Services, Inc., 7.625%, Due 8/15/2020 | | | | | | | 0.7 | |

| | |

Total Fund Holdings | | | 346 | | | | | |

| | | | | | | | |

Sector Weightings (% Investments) | | | | | | | | |

Service | | | | | | | 32.8 | |

Manufacturing | | | | | | | 27.3 | |

Energy | | | | | | | 12.8 | |

Finance | | | | | | | 10.0 | |

Telecom | | | | | | | 6.7 | |

Consumer | | | | | | | 6.1 | |

Transportation | | | | | | | 2.2 | |

Utilities | | | | | | | 2.0 | |

4

American Beacon FundsSM

Expense Example

January 31, 2017 (Unaudited)

Fund Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees if applicable, and (2) ongoing costs, including management fees, administrative service fees, distribution (12b-1) fees, and other Fund expenses. The Examples below are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Examples are based on an investment of $1,000 invested at the beginning of the period (or the inception date of the Fund) in each Class and held for the entire period from August 1, 2016 through January 31, 2017.

Actual Expenses

The “Actual” lines of the tables provide information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the “Expenses Paid During Period” for the applicable Fund to estimate the expenses you paid on your account during this period. Shareholders of the Institutional and Investor Classes that invest in the Funds through an IRA or Roth IRA may be subject to a custodial IRA fee of $15 that is typically deducted each December. If your account was subject to a custodial IRA fee during the period, your costs would have been $15 higher.

Hypothetical Example for Comparison Purposes

The “Hypothetical” lines of the table provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the Fund’s actual return). You may compare the ongoing costs of investing in the Fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. Shareholders of the Institutional and Investor Classes that invest in the Fund through an IRA or Roth IRA may be subject to a custodial IRA fee of $15 that is typically deducted each December. If your account was subject to a custodial IRA fee during the period, your costs would have been $15 higher.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs charged by the Fund, such as sales charges (loads). Similarly, the expense examples for other funds do not reflect any transaction costs charged by those funds, such as sales charges (loads), redemption fees or exchange fees. Therefore, the “Hypothetical” lines of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If you were subject to any transaction costs during the period, your costs would have been higher.

5

American Beacon FundsSM

Expense Example

January 31, 2017 (Unaudited)

Crescent Short Duration High Income Fund

| | | | | | | | | | | | |

| | | Beginning Account Value

8/1/2016 | | | Ending Account Value

1/31/2017 | | | Expenses Paid During

Period

8/1/2016-1/31/2017* | |

Institutional Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,046.88 | | | $ | 4.37 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,020.87 | | | $ | 4.32 | |

Y Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,045.28 | | | $ | 4.88 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,020.36 | | | $ | 4.82 | |

Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,043.76 | | | $ | 6.32 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,018.95 | | | $ | 6.24 | |

A Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,043.70 | | | $ | 6.42 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,018.85 | | | $ | 6.34 | |

C Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,039.75 | | | $ | 10.25 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,015.06 | | | $ | 10.13 | |

| * | Expenses are equal to the Fund’s annualized net expense ratios for the six-month period of 0.85%, 0.95%, 1.23%, 1.25% and 2.00% for the Institutional, Y, Investor, A and C Classes, respectively, multiplied by the average account value over the period, multiplied by the number derived by dividing the number of days in the most recent fiscal half-year (184) by days in the year (366) to reflect the half-year period. |

| ** | 5% return before expenses. |

6

American Beacon FundsSM

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of American Beacon Funds and Shareholders of American Beacon Crescent Short Duration High Income Fund

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments as of January 31, 2017, and the related statements of operations and of changes in net assets and the financial highlights for the year then ended present fairly, in all material respects, the financial position of the American Beacon Crescent Short Duration High Income Fund (a series constituting American Beacon Funds, hereafter referred to as the “Fund”), as of January 31, 2017, the results of its operations, the changes in its net assets and its financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities as of January 31, 2017 by correspondence with the custodian, agent banks and brokers or by other appropriate auditing procedures where replies were not received, provide a reasonable basis for our opinion. The financial statements as of and for the year ended January 31, 2016 and the financial highlights for each of the periods ended on or prior to January 31, 2016 (not presented herein, other than the statement of changes in net assets and the financial highlights) were audited by other auditors whose report dated March 31, 2016 expressed an unqualified opinion on those financial statements and financial highlights.

PricewaterhouseCoopers

Boston, Massachusetts

March 30, 2017

7

American Beacon Crescent Short Duration High Income FundSM

Schedule of Investments

January 31, 2017

| | | | | | | | |

| | | Shares | | | Fair Value | |

| | |

COMMON STOCKS - 0.01% (Cost $26,255) | | | | | | | | |

ENERGY- 0.00% | | | | | | | | |

Oil & Gas - 0.00% | | | | | | | | |

Energy & Exploration Partners, Inc.A | | | 3 | | | $ | 1,050 | |

| | | | | | | | |

| | |

HEALTH CARE- 0.01% | | | | | | | | |

Pharmaceuticals - 0.01% | | | | | | | | |

Millennium Health, LLCA B | | | 4,651 | | | | 4,944 | |

| | | | | | | | |

Total Common Stocks (Cost $26,255) | | | | | | | 5,994 | |

| | | | | | | | |

| | |

| | | Principal Amount | | | | |

| | |

BANK LOAN OBLIGATIONS - 24.47% | | | | | | | | |

Consumer - 2.38% | | | | | | | | |

Albertsons LLC, 2016 First Lien Term Loan B4, VR, 3.778%, Due 8/22/2021C D | | $ | 94,940 | | | | 95,325 | |

Anchor Glass Container Corp., First Lien Term Loan, VR, 4.25%, Due 12/7/2023C D | | | 170,568 | | | | 172,061 | |

Anchor Glass Container Corp., Second Lien Term Loan, VR, 8.75%, Due 12/7/2024C D | | | 27,185 | | | | 27,547 | |

B & G Foods, Inc., 2015 Term Loan B, VR, 3.771%, Due 11/2/2022C D | | | 114,011 | | | | 115,008 | |

Dell International LLC, Term Loan A2, VR, 3.03%, Due 9/7/2021B C D | | | 54,042 | | | | 54,062 | |

Dell International LLC, Term Loan B, VR, 4.03%, Due 9/7/2023B C D | | | 80,533 | | | | 80,875 | |

JBS USA, LLC, Term Loan B, 3.25%, Due 10/30/2022B D | | | 125,000 | | | | 125,000 | |

Maple Holdings Acquisition Corp., Term Loan B, VR, 5.313%, Due 3/3/2023C D | | | 56,019 | | | | 56,778 | |

NVA Holdings, Inc., First Lien Term Loan, VR, 4.75%, Due 8/14/2021C D | | | 185,135 | | | | 185,946 | |

Pinnacle Foods Finance LLC, 2017 Term Loan B, VR, 2.00%, Due 1/27/2024 B D | | | 23,374 | | | | 23,418 | |

Prestige Brands, Inc., Term Loan B4, VR, 3.50%, Due 1/26/2024 D | | | 30,000 | | | | 30,263 | |

Revlon Consumer Products Corp., New Term Loan, VR, 4.278%, Due 9/7/2023C D | | | 57,841 | | | | 58,296 | |

RSC Acquisition, Inc., Term Loan, VR, 6.25%, Due 11/30/2022D | | | 247,521 | | | | 243,809 | |

Shearers Foods LLC, First Lien Term Loan, VR, 4.938%, Due 6/30/2021 B D | | | 89,845 | | | | 89,958 | |

Shearers Foods, Inc., Incremental Term Loan, VR, 5.25%, Due 6/30/2021C D | | | 9,900 | | | | 9,894 | |

Spectrum Brands, Inc., Term Loan, VR, 3.313%, Due 6/23/2022C D | | | 36,584 | | | | 36,989 | |

Varsity Brands, Inc. First Lien Term Loan, VR, 5.00%, Due 12/11/2021D | | | 77,716 | | | | 78,737 | |

| | | | | | | | |

| | | | | | | 1,483,966 | |

| | | | | | | | |

| | |

Energy - 0.67% | | | | | | | | |

Chief Exploration & Development LLC, 2nd Lien Term Loan, VR, 6.50%, Due 5/16/2021B D | | | 250,000 | | | | 246,875 | |

CITGO Petroleum Corp., Term Loan B, VR, 4.50%, Due 7/29/2021C D | | | 125,000 | | | | 125,039 | |

Energy & Exploration Partners, Inc., 2016 2nd Lien PIK Term Loan, VR, 5.00%, Due 5/13/2022D | | | 6,195 | | | | 2,788 | |

MEG Energy Corp., 2017 Term Loan B, VR, 4.50%, Due 12/31/2023 D | | | 40,499 | | | | 40,626 | |

| | | | | | | | |

| | | | | | | 415,328 | |

| | | | | | | | |

| | |

Finance - 3.24% | | | | | | | | |

Acrisure LLC, 2016 Term Loan B, VR, 5.75%, Due 10/28/2023 B D J | | | 58,451 | | | | 59,123 | |

Americold Realty Operating Partnership, L.P., Term Loan B, 4.75%, Due 12/1/2022C D E | | | 75,064 | | | | 76,284 | |

Ascensus, Inc., Term Loan, VR, 5.50%, Due 12/3/2022C D | | | 45,872 | | | | 45,814 | |

AssuredPartners Inc., First Lien Term Loan, VR, 5.25%, Due 10/21/2022 D | | | 173,255 | | | | 175,248 | |

Asurion LLC, Term Loan B4, VR, 4.25%, Due 8/4/2022B C D | | | 170,406 | | | | 172,182 | |

Capital Automotive LP, Second Lien Term Loan, VR, 6.00%, Due 4/30/2020D E | | | 250,000 | | | | 251,668 | |

Cision US Inc., Term Loan B, VR, 7.00%, Due 6/16/2023D | | | 99,500 | | | | 99,314 | |

DTZ U. S. Borrower LLC, First Lien Term Loan, VR, 4.25%, Due 11/4/2021B C D | | | 246,250 | | | | 247,597 | |

Higginbotham & Associates LLC, Term Loan, VR, 6.00%, Due 11/25/2021B D | | | 208,025 | | | | 208,545 | |

IG Investment Holdings LLC, Term Loan B, VR, 6.00%, Due 10/29/2021B D | | | 244,898 | | | | 246,122 | |

iStar, Inc., 2016 Term Loan B, VR, 5.50%, Due 7/1/2020C D | | | 79,391 | | | | 79,987 | |

iStar, Inc., 2017 Term Loan B, VR, 4.75%, Due 7/1/2020 D | | | 5,649 | | | | 5,649 | |

MPH Acquisition Holdings LLC, 2016 Cov-Lite First Lien Term Loan, VR, 5.00%, Due 6/7/2023B D | | | 105,591 | | | | 107,065 | |

RPI Finance Trust, Term Loan B5, VR, 3.498%, Due 10/14/2022C D | | | 80,491 | | | | 81,114 | |

Travelport Finance Luxembourg Sarl, 2017 Term Loan B, VR, 5.00%, Due 9/2/2021 D | | | 163,376 | | | | 163,580 | |

| | | | | | | | |

| | | | | | | 2,019,292 | |

| | | | | | | | |

| | |

Manufacturing - 7.12% | | | | | | | | |

American Bath Group LLC, 2017 First Lien Add On Term Loan, VR, 6.25%, Due 9/30/2023 B D | | | 226,415 | | | | 227,547 | |

American Bath Group LLC, Delayed Draw Term Loan, VR, 6.25%, Due 9/30/2023 B D | | | 23,585 | | | | 23,762 | |

See accompanying notes

8

American Beacon Crescent Short Duration High Income FundSM

Schedule of Investments

January 31, 2017

| | | | | | | | |

| | | Principal Amount | | | Fair Value | |

| | |

Manufacturing - 7.12% (continued) | | | | | | | | |

Avast Software BV, Initial Dollar Term Loan, VR, 5.00%, Due 9/30/2022C D | | $ | 103,441 | | | $ | 104,863 | |

BMC Software Finance, Inc., US Borrower Term Loan, VR, 5.00%, Due 9/10/2020D | | | 128,569 | | | | 128,208 | |

Builders FirstSource, Inc., First LienTerm Loan B, VR, 4.75%, Due 7/31/2022C D | | | 155,883 | | | | 155,688 | |

Chromaflo Technologies Corp., 2016 First Lien Term Loan, VR, 5.00%, Due 11/18/2023 D | | | 54,340 | | | | 54,680 | |

Chromaflo Technologies Corp., 2016 Term Loan B2, VR, 5.00%, Due 11/18/2023 D | | | 70,660 | | | | 71,101 | |

Computer Sciences Government Services, Inc., Term Loan B, VR, 3.435%, Due 11/28/2022C D | | | 21,758 | | | | 21,894 | |

Compuware Corp., Term Loan B2, VR, 6.25%, Due 12/15/2021C D | | | 108,681 | | | | 108,763 | |

Cortes NP Acquisition Corp. (aka Vertiv Co.), First Lien Term Loan, VR, 6.039%, Due 11/30/2023 D | | | 64,815 | | | | 65,139 | |

CPG Merger Sub LLC, First Lien Term Loan, VR, 4.75%, Due 9/30/2020 D | | | 147,781 | | | | 148,983 | |

Doosan Infracore International, Inc., Term Loan B, VR, 4.50%, Due 5/28/2021D | | | 55,964 | | | | 56,629 | |

Electrical Components International, Inc., First Lien Term Loan B, VR, 5.75%, Due 5/30/2021C D | | | 100,000 | | | | 100,125 | |

Emerald Performance Materials LLC, First Lien Term Loan, VR, 4.50%, Due 8/1/2021 B D | | | 124,960 | | | | 125,467 | |

Engility Corp., Term Loan B2, VR, 5.75%, Due 8/12/2023C D | | | 35,765 | | | | 35,820 | |

Epicor Software Corp., 1st Lien Bridge Loan, VR, 4.75%, Due 6/1/2022C D | | | 233,012 | | | | 233,886 | |

First Data Corp., 2021 C New USD Term Loan, VR, 3.775%, Due 3/24/2021C D | | | 11,173 | | | | 11,238 | |

First Data Corp., 2022C Dollar Term Loan, VR, 3.775%, Due 7/10/2022 D | | | 93,295 | | | | 93,918 | |

Flex Acquisition Co. Inc., First Lien Term Loan, VR, 4.25%, Due 12/29/2023C D | | | 125,000 | | | | 126,016 | |

Global Brass & Copper, Inc., Term Loan B, VR, 5.25%, Due 7/18/2023D | | | 48,260 | | | | 48,743 | |

Huntsman International LLC, First Lien Term Loan B, VR, 3.963%, Due 4/1/2023 B D | | | 99,251 | | | | 100,150 | |

Informatica Corp., Term Loan, VR, 4.50%, Due 8/5/2022C D | | | 70,575 | | | | 70,275 | |

Jeld-Wen, Inc., First Lien Incremental Term Loan B2, VR, 4.75%, Due 7/1/2022 D | | | 94,719 | | | | 95,232 | |

MacDermid, Inc., Term Loan Tranche B4, VR, 5.00%, Due 6/7/2023 D | | | 24,130 | | | | 24,439 | |

MacDermid, Inc., Term Loan Tranche B5, VR, 4.50%, Due 6/7/2020C D | | | 42,813 | | | | 43,337 | |

Magic Newco LLC, Term Loan, VR, 5.00%, Due 12/12/2018B D | | | 239,185 | | | | 239,732 | |

Munters Corp., Term Loan, VR, 6.25%, Due 5/5/2021C D | | | 36,794 | | | | 36,932 | |

Murray Energy Corp., 2015 Term Loan B, VR, 8.25%, Due 4/16/2020C D | | | 96,217 | | | | 91,166 | |

Netsmart Technologies, Inc., 1st Lien Term Loan, VR, 5.75%, Due 4/19/2023C D | | | 40,000 | | | | 40,300 | |

Netsmart Technologies, Inc.,Term Loan C 1, VR, 5.50%, Due 4/19/2023C D | | | 39,900 | | | | 40,049 | |

Omnitracs LLC, First Lien Term Loan, VR, 4.75%, Due 11/25/2020B C D | | | 62,151 | | | | 62,578 | |

PQ Corp., First Lien Term Loan B1, VR, 5.289%, Due 11/4/2022 D | | | 141,788 | | | | 143,591 | |

Press Ganey Holdings, Inc., First Lien Term Loan, VR, 4.25%, Due 10/21/2023C D | | | 37,667 | | | | 37,738 | |

Quickcrete Holdings, Inc., First Lien Term Loan, VR, 4.017%, Due 11/15/2023D | | | 125,000 | | | | 126,476 | |

Reynolds Group Holdings, Inc., Term Loan, VR, 4.25%, Due 2/5/2023C D | | | 109,725 | | | | 109,988 | |

Riverbed Technology, Inc., First Amendment Term Loan, VR, 4.25%, Due 4/24/2022C D | | | 17,558 | | | | 17,677 | |

Road Infrastructure Investment Holdings, Term Loan, VR, 5.00%, Due 6/13/2023C D | | | 77,809 | | | | 78,315 | |

Royal Holdings, Inc., 2015 First Lien Term Loan, VR, 4.50%, Due 6/19/2022C D | | | 88,650 | | | | 89,056 | |

Shoes For Crews, LLC, Term Loan, VR, 6.00%, Due 10/27/2022B D | | | 247,500 | | | | 246,263 | |

SI Organization Vencore, Inc., First Lien Term Loan, VR, 5.75%, Due 11/23/2019C D | | | 74,606 | | | | 75,538 | |

Sophia LP, 2015 First Lien Closing Date Term Loan B, VR, 4.75%, Due 9/30/2022C D E | | | 96,934 | | | | 97,055 | |

SS&C Technologies, Inc., 2015 First LienTerm Loan B1, VR, 4.028%, Due 7/8/2022C D | | | 30,092 | | | | 30,366 | |

SS&C Technologies, Inc., 2015 First LienTerm Loan B2, VR, 4.028%, Due 7/8/2022C D | | | 2,893 | | | | 2,919 | |

Strategic Partners Acquisition Corp., First Lien Term Loan, VR, 6.25%, Due 6/30/2023C D | | | 119,700 | | | | 120,299 | |

Systems Maintenance Services I, First Lien Term Loan, VR, 6.00%, Due 10/11/2023D | | | 35,000 | | | | 34,810 | |

Tank Intermediate Holding Corp., Term Loan A, VR, 5.25%, Due 3/16/2022D | | | 90,217 | | | | 89,451 | |

USIC Holdings, Inc., 2016 First Lien Term Loan, VR, 4.75%, Due 12/8/2023 D | | | 132,021 | | | | 132,956 | |

UTEX Industries, Inc., First Lien Term Loan, VR, 5.00%, Due 5/22/2021D | | | 48,030 | | | | 45,148 | |

Western Digital Corp., Term Loan B1, VR, 4.526%, Due 4/29/2023C D | | | 17,876 | | | | 18,010 | |

Zebra Technologies Corp., Term Loan B, VR, 3.434%, Due 10/27/2021C D | | | 160,928 | | | | 162,226 | |

| | | | | | | | |

| | | | | | | 4,444,542 | |

| | | | | | | | |

| | |

Service - 8.96% | | | | | | | | |

Academy Ltd., 2015 Term Loan B, VR, 5.00%, Due 7/1/2022C D | | | 237,497 | | | | 207,019 | |

Acosta Holdco, Inc., 2015 Term Loan, VR, 4.289%, Due 9/26/2021D | | | 121,812 | | | | 117,548 | |

Affordable Care Holdings Corp., 2015 1st Lien Term Loan, VR, 5.75%, Due 10/22/2022C D | | | 49,500 | | | | 49,500 | |

Amneal Pharmaceuticals LLC, Second Incremental First Lien Term Loan, 4.50%, Due 11/1/2019B C D | | | 65,507 | | | | 65,384 | |

Aspen Dental - ADMI Corp., 2015 Term Loan B, VR, 5.25%, Due 4/30/2022 D | | | 41,560 | | | | 41,854 | |

ATI Holdings Acquisition, Inc., First Lien Iniitial Term Loan, VR, 7.25%, Due 5/10/2023D | | | 100,394 | | | | 101,649 | |

Bass Pro Group LLC, Term Loan B, VR, 5.970%, Due 12/16/2023 B D | | | 51,028 | | | | 49,409 | |

BioClinica, Inc., First Lien Term Loan, VR, 5.25%, Due 10/20/2023D | | | 86,678 | | | | 87,436 | |

BJ’s Wholesale Club, Inc., 2017 First Lien Term Loan, VR, 4.75%, Due 1/26/2024 D | | | 138,292 | | | | 137,904 | |

See accompanying notes

9

American Beacon Crescent Short Duration High Income FundSM

Schedule of Investments

January 31, 2017

| | | | | | | | |

| | | Principal Amount | | | Fair Value | |

| | |

Service - 8.96% (continued) | | | | | | | | |

BJ’s Wholesale Club, Inc., 2017 Second Lien Term Loan, VR, 8.50%, Due 1/26/2025D | | $ | 100,000 | | | $ | 101,000 | |

Brightview Landscapes LLC, Second Lien Term Loan, VR, 7.50%, Due 12/17/2021 B C D | | | 125,000 | | | | 125,521 | |

Burger King - New Red Finance, Inc., 2015 Term Loan B, VR, 3.75%, Due 12/10/2021C D | | | 35,683 | | | | 36,004 | |

California Pizza Kitchen, Inc., 2016 Term Loan, VR, 7.00%, Due 8/23/2022D | | | 249,375 | | | | 248,752 | |

Camelot Finance LP, First Lien Term Loan B, VR, 4.75%, Due 10/3/2023C D E | | | 67,121 | | | | 67,680 | |

Charter Communications Operating LLC, 2016 Term Loan I, VR, 3.026%, Due 1/15/2024 B D | | | 79,400 | | | | 79,653 | |

CHG Healthcare Services, Inc., Term Loan, VR, 4.75%, Due 6/7/2023C D | | | 145,931 | | | | 147,354 | |

CHS/Community Health Systems, Inc., Incremental 2021 First Lien Term Loan H, VR, 4.00%, Due 1/27/2021C D | | | 110,721 | | | | 104,608 | |

CSC Holdings LLC / Neptune Finco Corp., 2016 Term Loan B, VR, 3.767%, Due 10/11/2024B C D | | | 56,987 | | | | 57,343 | |

Curo Health Services LLC, Term Loan, VR, 6.539%, Due 2/7/2022B C D | | | 115,281 | | | | 116,146 | |

ExamWorks Group, Inc., Term Loan, VR, 6.50%, Due 7/27/2023D | | | 62,656 | | | | 62,910 | |

Fort Dearborn Co., 2016 1st Lien Term Loan, VR, 5.00%, Due 10/19/2023D | | | 67,391 | | | | 68,234 | |

Grifols Worldwide Operations USA, Inc., USD Add On Term Loan, VR, 2.25%, Due 12/20/2023 D | | | 30,000 | | | | 30,154 | |

HCA INC., Term Loan B7, VR, 3.528%, Due 2/15/2024D | | | 33,315 | | | | 33,538 | |

inVentiv Health, Inc., 2016 Term Loan B, VR, 4.75%, Due 9/28/2023D | | | 84,045 | | | | 84,746 | |

JC Penney Corp., Inc., Term Loan B, VR, 5.25%, Due 6/23/2023C D | | | 109,628 | | | | 109,457 | |

Jo-Ann Stores LLC, Term Loan B, VR, 6.256%, Due 9/27/2023 B C | | | 51,644 | | | | 50,611 | |

Merrill Communications LLC, Term Loan, VR, 6.289%, Due 6/1/2022B C D | | | 89,684 | | | | 89,497 | |

Mission Broadcasting, Inc., First Lien Term Loan B, VR, 3.00%, Due 1/17/2024C D | | | 2,331 | | | | 2,359 | |

Mister Car Wash Holdings, Inc., Term Loan B, VR, 5.25%, Due 8/20/2021C D | | | 114,872 | | | | 114,968 | |

Mister Car Wash, Inc., Delayed Draw Term Loan, VR, 5.00%, Due 8/20/2021 D J | | | 10,000 | | | | 10,008 | |

MTL Publishing LLC, Term Loan B 4, VR, 2.75%, Due 8/22/2022 B C D | | | 22,740 | | | | 22,800 | |

Neiman Marcus Group Ltd., LLC, Term Loan, VR, 4.25%, Due 10/25/2020B C D | | | 46,940 | | | | 38,798 | |

Nexstar Broadcasting, Inc., First Lien Term Loan B, VR, 3.00%, Due 1/17/2024C D | | | 89,859 | | | | 90,692 | |

NMSC Holdings Inc., 1st Lien Term Loan, VR, 6.00%, Due 4/19/2023D | | | 73,351 | | | | 73,901 | |

Numericable U.S. LLC (SFR Group), Term Loan B7, VR, 5.289%, Due 1/15/2024B C D | | | 124,005 | | | | 125,283 | |

Onex Carestream Health, Inc., First Lien Term Loan, VR, 5.00%, Due 6/7/2019D | | | 122,324 | | | | 117,278 | |

Paradigm Acquisition Corp., Term Loan, VR, 6.00%, Due 6/2/2022C D | | | 230,264 | | | | 229,546 | |

Petco Animal Supplies, Inc., 2016 Term Loan, VR, 5.00%, Due 1/26/2023C D | | | 69,768 | | | | 69,063 | |

Playpower, Inc., First Lien Term Loan, VR, 5.75%, Due 6/23/2021D | | | 247,487 | | | | 246,250 | |

Prime Security Services Borrower LLC, First Lien Term Loan, VR, 4.25%, Due 5/2/2022 B D | | | 210,964 | | | | 212,943 | |

Prospect Medical Holdings, Inc., Term Loan B, VR, 7.00%, Due 6/30/2022C D | | | 74,625 | | | | 74,065 | |

Rentpath, Inc., First Lien Term Loan, VR, 6.25%, Due 12/17/2021D | | | 120,635 | | | | 119,830 | |

Scientific Games International, Inc., Term Loan B 2, VR, 6.00%, Due 10/1/2021D | | | 149,626 | | | | 150,655 | |

Serta Simmons Bedding LLC, First Lien Term Loan, VR, 4.50%, Due 11/8/2023 B C D | | | 15,452 | | | | 15,419 | |

Survey Sampling International LLC, First Lien Term Loan B, VR, 6.00%, Due 12/4/2020B C D | | | 122,812 | | | | 122,198 | |

Survey Sampling International LLC, Second Lien Term Loan, VR, 10.00%, Due 12/4/2021B C D | | | 125,000 | | | | 121,250 | |

Team Health, Inc., First Lien Term Loan, VR, 3.75%, Due 1/17/2024 D | | | 130,000 | | | | 129,757 | |

Tribune Media Company, Term Loan C, VR, 3.75%, Due 1/27/2024 D | | | 55,601 | | | | 55,971 | |

Tribune Media Company, Term Loan, VR, 3.77%, Due 12/27/2020D | | | 13,350 | | | | 13,413 | |

Triple Point Technology, Inc., First Lien Terrm Loan, VR, 5.25%, Due 7/10/2020C D | | | 85,019 | | | | 75,454 | |

USAGM Holdco LLC, 2015 Term Loan, VR, 4.75%, Due 7/28/2022B C D | | | 163,350 | | | | 163,912 | |

Valeant Pharmaceuticals International, Inc., Term Loan Series E Tranche B, VR, 5.25%, Due 8/5/2020C D | | | 9,505 | | | | 9,526 | |

Valeant Pharmaceuticals International, Term Loan B, VR, 5.50%, Due 4/1/2022C D | | | 86,182 | | | | 86,516 | |

Vestcom Parent Holdings, Inc., First Lien Term Loan, VR, 5.25%, Due 12/19/2023 D | | | 126,563 | | | | 127,828 | |

Virgin Media Investment Holdings Ltd., USD Term Loan I, VR, 3.517%, Due 1/31/2025 D | | | 107,500 | | | | 108,105 | |

Vistage Worldwide, Inc., Term Loan B, VR, 6.50%, Due 8/19/2021 D | | | 100,000 | | | | 100,250 | |

WEX Inc., Term Loan B, VR, 4.278%, Due 7/1/2023C D | | | 48,231 | | | | 48,774 | |

William Morris Endeavor Entertainment LLC, Term Loan B, VR, 5.25%, Due 5/6/2021B D | | | 121,250 | | | | 121,614 | |

Ziggo Secured Finance Partners, USD Term Loan E, VR, 2.50%, Due 4/23/2025 D | | | 125,000 | | | | 125,248 | |

| | | | | | | | |

| | | | | | | 5,594,585 | |

| | | | | | | | |

| | |

Telecommunications - 0.29% | | | | | | | | |

LTS Buyer LLC, Term Loan B, VR, 4.248%, Due 4/13/2020B C D | | | 24,617 | | | | 24,740 | |

Sprint Communications, Inc., First Lien Term Loan B, VR, 3.25%, Due 1/13/2024 D | | | 125,000 | | | | 125,000 | |

Telesat Canada, Term Loan B, VR, 4.78%, Due 11/17/2023D | | | 32,290 | | | | 32,290 | |

| | | | | | | | |

| | | | | | | 182,030 | |

| | | | | | | | |

See accompanying notes

10

American Beacon Crescent Short Duration High Income FundSM

Schedule of Investments

January 31, 2017

| | | | | | | | |

| | | Principal Amount | | | Fair Value | |

| | |

Transportation - 1.20% | | | | | | | | |

Air Canada, Term Loan B, VR, 3.755%, Due 10/6/2023D | | $ | 60,000 | | | $ | 60,450 | |

American Tire Distributors, Inc., 2015 Term Loan, 5.25%, Due 9/1/2021D | | | 241,900 | | | | 240,541 | |

Avolon Holdings Limited, Term Loan B, VR, 3.50%, Due 1/13/2022 D | | | 179,232 | | | | 181,537 | |

Delta Air Lines, Inc., 2015 Term Loan B, VR, 3.276%, Due 8/24/2022D | | | 49,375 | | | | 49,800 | |

Univar, Inc., 2017 Term Loan B, VR, 4.25%, Due 7/1/2022 D | | | 148,125 | | | | 148,436 | |

XPO Logistics, Inc., Term Loan B, VR, 4.25%, Due 11/1/2021C D | | | 67,530 | | | | 67,952 | |

| | | | | | | | |

| | | | | | | 748,716 | |

| | | | | | | | |

| | |

Utilities - 0.61% | | | | | | | | |

Calpine Corp., First Lien Term Loan B5, VR, 3.75%, Due 1/15/2024C D | | | 59,547 | | | | 59,813 | |

TPF II Power LLC, Syndicated Term Loan B, VR, 5.00%, Due 10/2/2021B D | | | 317,156 | | | | 320,327 | |

| | | | | | | | |

| | | | | | | 380,140 | |

| | | | | | | | |

| | |

Total Bank Loan Obligations (Cost $15,243,561) | | | | | | | 15,268,599 | |

| | | | | | | | |

| | |

CORPORATE OBLIGATIONS - 73.74% | | | | | | | | |

Consumer - 3.79% | | | | | | | | |

Avon International Opera, 7.875%, Due 8/15/2022F | | | 150,000 | | | | 159,795 | |

Central Garden & Pet Co., 6.125%, Due 11/15/2023 | | | 225,000 | | | | 240,750 | |

Cott Beverages, Inc., 5.375%, Due 7/1/2022 | | | 450,000 | | | | 460,800 | |

Dole Food Co., Inc., 7.25%, Due 5/1/2019F | | | 375,000 | | | | 382,725 | |

Post Holdings, Inc., 6.00%, Due 12/15/2022F | | | 500,000 | | | | 525,000 | |

Spectrum Brands, Inc., 5.75%, Due 7/15/2025 | | | 250,000 | | | | 261,250 | |

Vector Group Ltd., 6.125%, Due 2/1/2025F | | | 325,000 | | | | 333,938 | |

| | | | | | | | |

| | | | | | | 2,364,258 | |

| | | | | | | | |

| | |

Energy - 12.17% | | | | | | | | |

Archrock Partners LP / Archrock Partners Finance Corp., 6.00%, Due 4/1/2021E | | | 250,000 | | | | 247,500 | |

Bristow Group, Inc., 6.25%, Due 10/15/2022 | | | 100,000 | | | | 89,375 | |

Calfrac Holdings LP, 7.50%, Due 12/1/2020E F | | | 175,000 | | | | 162,750 | |

California Resources Corp., 8.00%, Due 12/15/2022F | | | 400,000 | | | | 356,000 | |

Callon Petroleum Co., 6.125%, Due 10/1/2024F | | | 50,000 | | | | 52,937 | |

Carrizo Oil & Gas, Inc., 7.50%, Due 9/15/2020 | | | 250,000 | | | | 259,375 | |

Cenovus Energy, Inc., 6.75%, Due 11/15/2039 | | | 100,000 | | | | 112,341 | |

Chesapeake Energy Corp., | | | | | | | | |

6.625%, Due 8/15/2020 | | | 95,000 | | | | 95,475 | |

8.00%, Due 12/15/2022F | | | 50,000 | | | | 53,375 | |

5.75%, Due 3/15/2023 | | | 225,000 | | | | 216,000 | |

Continental Resources, Inc., 4.90%, Due 6/1/2044 | | | 450,000 | | | | 396,000 | |

CSI Compressco LP / Compressco Finance, Inc., 7.25%, Due 8/15/2022E | | | 425,000 | | | | 408,000 | |

Denbury Resources, Inc., 5.50%, Due 5/1/2022 | | | 300,000 | | | | 257,250 | |

Energy Transfer Equity LP, 7.50%, Due 10/15/2020E | | | 100,000 | | | | 112,250 | |

EP Energy LLC / Everest Acquisition Finance, Inc., 9.375%, Due 5/1/2020B | | | 300,000 | | | | 300,000 | |

FTS International, Inc., 8.46%, Due 6/15/2020C F | | | 200,000 | | | | 204,750 | |

Genesis Energy LP / Genesis Energy Finance Corp., 5.625%, Due 6/15/2024E | | | 400,000 | | | | 403,000 | |

Hilcorp Energy, 5.00%, Due 12/1/2024F | | | 250,000 | | | | 246,250 | |

Jones Energy Holdings LLC / Jones Energy Finance Corp., 6.75%, Due 4/1/2022 B | | | 350,000 | | | | 342,125 | |

Laredo Petroleum, Inc., 5.625%, Due 1/15/2022 | | | 250,000 | | | | 253,750 | |

Lonestar Resources America, Inc., 8.75%, Due 4/15/2019F | | | 150,000 | | | | 138,000 | |

Nabors Industries, Inc., 5.50%, Due 1/15/2023F | | | 75,000 | | | | 78,375 | |

Parker Drilling Co., 6.75%, Due 7/15/2022 | | | 150,000 | | | | 129,750 | |

Parsley Energy LLC / Parsley Finance Corp., 5.375%, Due 1/15/2025 B F | | | 200,000 | | | | 205,000 | |

QEP Resources, Inc., 6.875%, Due 3/1/2021 | | | 250,000 | | | | 264,375 | |

Sanchez Energy Corp., 6.125%, Due 1/15/2023 | | | 150,000 | | | | 144,000 | |

SM Energy Co., | | | | | | | | |

5.625%, Due 6/1/2025 | | | 175,000 | | | | 170,625 | |

6.75%, Due 9/15/2026 | | | 200,000 | | | | 208,000 | |

Southwestern Energy Co., 5.80%, Due 1/23/2020 | | | 150,000 | | | | 154,875 | |

Summit Midstream Holdings LLC / Summit Midstream Finance Corp., 5.50%, Due 8/15/2022 B | | | 125,000 | | | | 125,313 | |

Sunoco LP / Sunoco Finance Corp., 6.375%, Due 4/1/2023 | | | 125,000 | | | | 128,313 | |

See accompanying notes

11

American Beacon Crescent Short Duration High Income FundSM

Schedule of Investments

January 31, 2017

| | | | | | | | |

| | | Principal Amount | | | Fair Value | |

| | |

Energy - 12.17% (continued) | | | | | | | | |

Tesoro Logistics LP / Tesoro Logistics Finance Corp., 6.25%, Due 10/15/2022 E | | $ | 200,000 | | | $ | 213,000 | |

Transocean, Inc., 8.125%, Due 12/15/2021 | | | 250,000 | | | | 258,750 | |

Unit Corp., 6.625%, Due 5/15/2021 | | | 300,000 | | | | 297,750 | |

Weatherford Bermuda Company, 5.125%, Due 9/15/2020 | | | 250,000 | | | | 238,750 | |

WPX Energy, Inc., 7.50%, Due 8/1/2020 | | | 250,000 | | | | 271,250 | |

| | | | | | | | |

| | | | | | | 7,594,629 | |

| | | | | | | | |

| | |

Finance - 6.53% | | | | | | | | |

American Equity Investment Life Holding Co., 6.625%, Due 7/15/2021 | | | 250,000 | | | | 261,828 | |

CIT Group, Inc., 5.00%, Due 8/1/2023 | | | 300,000 | | | | 312,750 | |

Communications Sales & Leasing Inc / CSL Capital LLC, 8.25%, Due 10/15/2023 B | | | 300,000 | | | | 325,500 | |

FelCor Lodging LP, 5.625%, Due 3/1/2023E | | | 375,000 | | | | 388,125 | |

Fly Leasing Ltd., 6.75%, Due 12/15/2020 | | | 500,000 | | | | 523,125 | |

Grinding Media Inc / MC Grinding Media Canada, Inc., 7.375%, Due 12/15/2023F | | | 200,000 | | | | 211,250 | |

Icahn Enterprises LP / Icahn Enterprises Finance Corp., | | | | | | | | |

6.00%, Due 8/1/2020E | | | 300,000 | | | | 307,350 | |

6.25%, Due 2/1/2022F | | | 100,000 | | | | 100,750 | |

Ladder Capital Finance Holdings LLLP / Ladder Capital Finance Corp., 5.875%, Due 8/1/2021F H | | | 90,000 | | | | 89,325 | |

OneMain Financial Holdings, Inc., 6.75%, Due 12/15/2019F | | | 400,000 | | | | 415,000 | |

RHP Hotel Properties LP / RHP Finance Corp., 5.00%, Due 4/15/2023E | | | 350,000 | | | | 353,500 | |

Royal Bank of Scotland Group PLC, 4.70%, Due 7/3/2018 G | | | 250,000 | | | | 255,373 | |

Springleaf Finance Corp., 5.25%, Due 12/15/2019 | | | 300,000 | | | | 301,500 | |

Starwood Property Trust, Inc., 5.00%, Due 12/15/2021F | | | 150,000 | | | | 152,438 | |

Tervita Escrow Corp., 7.625%, Due 12/1/2021F | | | 75,000 | | | | 77,813 | |

| | | | | | | | |

| | | | | | | 4,075,627 | |

| | | | | | | | |

| | |

Manufacturing - 19.62% | | | | | | | | |

Advanced Micro Devices, Inc., 7.00%, Due 7/1/2024 | | | 400,000 | | | | 415,500 | |

Alcoa Nederland Holding BV, 7.00%, Due 9/30/2026F | | | 200,000 | | | | 219,000 | |

Allison Transmission, Inc., 5.00%, Due 10/1/2024F | | | 150,000 | | | | 151,125 | |

Ally Financial, Inc., 3.75%, Due 11/18/2019 | | | 450,000 | | | | 457,312 | |

Anixter, Inc., 5.50%, Due 3/1/2023 | | | 175,000 | | | | 182,437 | |

ArcelorMittal, 6.50%, Due 3/1/2021C | | | 250,000 | | | | 273,125 | |

Ardagh Packaging Finance PLC / Ardagh Holdings USA, Inc., 4.625%, Due 5/15/2023F G | | | 50,000 | | | | 50,469 | |

Berry Plastics Corp., 5.125%, Due 7/15/2023 | | | 50,000 | | | | 51,160 | |

BMC Software Finance, Inc., 8.125%, Due 7/15/2021F | | | 250,000 | | | | 241,250 | |

Bombardier, Inc., 6.00%, Due 10/15/2022F | | | 350,000 | | | | 342,125 | |

CF Industries Holdings, Inc., 7.125%, Due 5/1/2020 | | | 150,000 | | | | 165,375 | |

CF Industries, Inc., 5.15%, Due 3/15/2034 | | | 50,000 | | | | 45,875 | |

Chemours Co., | | | | | | | | |

6.625%, Due 5/15/2023 | | | 200,000 | | | | 199,000 | |

7.00%, Due 5/15/2025 | | | 200,000 | | | | 199,300 | |

CONSOL Energy, Inc., 5.875%, Due 4/15/2022 | | | 450,000 | | | | 435,375 | |

Constellium N.V., 5.75%, Due 5/15/2024F | | | 100,000 | | | | 96,250 | |

Credit Acceptance Corp., 6.125%, Due 2/15/2021 | | | 375,000 | | | | 380,625 | |

Entegris, Inc., 6.00%, Due 4/1/2022F | | | 250,000 | | | | 261,250 | |

Equinix, Inc., 5.375%, Due 1/1/2022 | | | 250,000 | | | | 264,375 | |

Fiat Chrysler Automobiles N.V., 5.25%, Due 4/15/2023 | | | 150,000 | | | | 153,750 | |

First Data Corp., 7.00%, Due 12/1/2023F | | | 425,000 | | | | 450,713 | |

First Quantum Minerals Ltd., 6.75%, Due 2/15/2020F | | | 400,000 | | | | 410,252 | |

FMG Resources August 2006 Property Ltd., | | | | | | | | |

9.75%, Due 3/1/2022F | | | 100,000 | | | | 116,000 | |

6.875%, Due 4/1/2022F | | | 100,000 | | | | 103,625 | |

Freeport-McMoRan Copper & Gold, Inc., 3.55%, Due 3/1/2022 | | | 450,000 | | | | 420,750 | |

Gibraltar Industries, Inc., 6.25%, Due 2/1/2021 | | | 250,000 | | | | 258,281 | |

Hexion Inc., 6.625%, Due 4/15/2020 | | | 150,000 | | | | 139,875 | |

HudBay Minerals, Inc., 7.25%, Due 1/15/2023F | | | 400,000 | | | | 423,000 | |

Huntsman International Co., 5.125%, Due 11/15/2022 | | | 250,000 | | | | 258,282 | |

INEOS Group Holdings S.A., 5.625%, Due 8/1/2024F | | | 250,000 | | | | 249,375 | |

Infor Software Parent, Inc., 7.125%, Due 5/1/2021F | | | 300,000 | | | | 308,250 | |

See accompanying notes

12

American Beacon Crescent Short Duration High Income FundSM

Schedule of Investments

January 31, 2017

| | | | | | | | |

| | | Principal Amount | | | Fair Value | |

| | |

Manufacturing - 19.62% (continued) | | | | | | | | |

Lennar Corp., 4.875%, Due 12/15/2023 | | $ | 75,000 | | | $ | 76,312 | |

Micron Technology, Inc., 5.50%, Due 2/1/2025 | | | 125,000 | | | | 125,625 | |

NCI Building Systems, Inc., 8.25%, Due 1/15/2023F | | | 250,000 | | | | 272,500 | |

New Gold, Inc., 6.25%, Due 11/15/2022F | | | 400,000 | | | | 401,000 | |

Novelis Corp., 5.875%, Due 9/30/2026F | | | 125,000 | | | | 126,875 | |

Open Text Corp., 5.875%, Due 6/1/2026F | | | 100,000 | | | | 104,750 | |

Perstorp Holding AB, 8.50%, Due 6/30/2021F | | | 225,000 | | | | 228,656 | |

Platform Specialty Products Corp., 6.50%, Due 2/1/2022F | | | 375,000 | | | | 382,500 | |

PQ Corp., 6.75%, Due 11/15/2022F | | | 100,000 | | | | 108,250 | |

SBA Communications Corp., 4.875%, Due 7/15/2022 | | | 400,000 | | | | 405,500 | |

Solera LLC / Solera Finance, Inc., 10.50%, Due 3/1/2024 B F | | | 300,000 | | | | 341,250 | |

Springs Industries, Inc., 6.25%, Due 6/1/2021 | | | 375,000 | | | | 388,125 | |

Standard Industries, Inc., 5.375%, Due 11/15/2024F | | | 250,000 | | | | 257,812 | |

Teck Resources Ltd., 4.50%, Due 1/15/2021 | | | 150,000 | | | | 152,625 | |

TransDigm, Inc., 6.00%, Due 7/15/2022 | | | 400,000 | | | | 403,000 | |

Tronox Finance LLC, 6.375%, Due 8/15/2020B | | | 250,000 | | | | 240,312 | |

United States Steel Corp., | | | | | | | | |

6.875%, Due 4/1/2021 | | | 21,000 | | | | 21,394 | |

8.375%, Due 7/1/2021F | | | 200,000 | | | | 222,000 | |

7.50%, Due 3/15/2022 | | | 50,000 | | | | 51,626 | |

Wise Metals Group LLC, 8.75%, Due 12/15/2018B F | | | 200,000 | | | | 206,808 | |

| | | | | | | | |

| | | | | | | 12,240,001 | |

| | | | | | | | |

| | |

Service - 23.11% | | | | | | | | |

Ahern Rentals, Inc., 7.375%, Due 5/15/2023F | | | 200,000 | | | | 187,000 | |

Altice Luxembourg S.A., 7.75%, Due 5/15/2022F | | | 400,000 | | | | 424,500 | |

APX Group, Inc., 8.75%, Due 12/1/2020 | | | 400,000 | | | | 415,000 | |

Ashtead Capital, Inc., 5.625%, Due 10/1/2024F | | | 375,000 | | | | 393,750 | |

Block Communications, Inc., 7.25%, Due 2/1/2020F | | | 450,000 | | | | 457,875 | |

Brand Energy and Infrastructure Company, 8.50%, Due 12/1/2021F | | | 100,000 | | | | 103,750 | |

Cable One, Inc., 5.75%, Due 6/15/2022F | | | 75,000 | | | | 78,375 | |

Cablevision Systems Corp., | | | | | | | | |

7.75%, Due 4/15/2018 | | | 250,000 | | | | 263,125 | |

5.875%, Due 9/15/2022 | | | 300,000 | | | | 301,500 | |

Cardtronics, Inc., 5.125%, Due 8/1/2022 | | | 250,000 | | | | 253,750 | |

CEC Entertainment, Inc., 8.00%, Due 2/15/2022 | | | 200,000 | | | | 209,000 | |

Cequel Communications Holdings I LLC / Cequel Capital Corp., 5.125%, Due 12/15/2021B F | | | 150,000 | | | | 152,062 | |

CHS/Community Health Systems, Inc., 5.125%, Due 8/15/2018 | | | 100,000 | | | | 100,312 | |

Community Health Systems, Inc., 8.00%, Due 11/15/2019 | | | 350,000 | | | | 311,500 | |

DaVita, Inc., 5.75%, Due 8/15/2022 | | | 100,000 | | | | 103,875 | |

DISH DBS Corp., 5.125%, Due 5/1/2020 | | | 250,000 | | | | 256,875 | |

Dollar Tree, Inc., 5.75%, Due 3/1/2023 | | | 250,000 | | | | 264,750 | |

EMI Music Publishing Group N. America Holdings, Inc., 7.625%, Due 6/15/2024F | | | 125,000 | | | | 136,563 | |

Endo Ltd / Endo Finance LLC / Endo Finco, Inc., 6.00%, Due 7/15/2023B F | | | 200,000 | | | | 170,500 | |

Guitar Center, Inc., 6.50%, Due 4/15/2019F | | | 250,000 | | | | 224,375 | |

HCA, Inc., | | | | | | | | |

5.875%, Due 5/1/2023 | | | 500,000 | | | | 532,500 | |

5.375%, Due 2/1/2025 | | | 250,000 | | | | 255,000 | |

HealthSouth Corp., 5.75%, Due 11/1/2024 | | | 400,000 | | | | 406,500 | |

Herc Rentals, Inc., 7.50%, Due 6/1/2022F | | | 300,000 | | | | 324,000 | |

Horizon Pharma Financing, Inc., 6.625%, Due 5/1/2023 | | | 40,000 | | | | 38,500 | |

IHS Markit, Ltd., 5.00%, Due 11/1/2022F | | | 325,000 | | | | 336,781 | |

JC Penney Corp, Inc., 5.875%, Due 7/1/2023F | | | 400,000 | | | | 405,600 | |

LifePoint Health, Inc., | | | | | | | | |

5.875%, Due 12/1/2023 | | | 25,000 | | | | 24,875 | |

5.375%, Due 5/1/2024F | | | 150,000 | | | | 143,625 | |

Mallinckrodt International Finance SA / Mallinckrodt CB LLC, 5.625%, Due 10/15/2023B F | | | 350,000 | | | | 310,188 | |

Mednax, Inc., 5.25%, Due 12/1/2023F | | | 225,000 | | | | 232,312 | |

Midas Intermediate Holdco II LLC / Midas Intermediate Holdco II Finance, Inc., 7.875%, Due 10/1/2022 B F | | | 100,000 | | | | 102,750 | |

See accompanying notes

13

American Beacon Crescent Short Duration High Income FundSM

Schedule of Investments

January 31, 2017

| | | | | | | | |

| | | Principal Amount | | | Fair Value | |

| | |

Service - 23.11% (continued) | | | | | | | | |

Monitronics International, Inc., 9.125%, Due 4/1/2020 | | $ | 325,000 | | | $ | 316,062 | |

Natures Bounty Co., 7.625%, Due 5/15/2021F | | | 400,000 | | | | 419,000 | |

Nielsen Finance LLC / Nielsen Finance Co., 5.00%, Due 4/15/2022B F | | | 250,000 | | | | 255,313 | |

Numericable Group S.A., 6.00%, Due 5/15/2022F | | | 350,000 | | | | 360,063 | |

PetSmart, Inc., 7.125%, Due 3/15/2023F | | | 375,000 | | | | 368,437 | |

Pinnacle Entertainment, Inc., 5.625%, Due 5/1/2024F | | | 125,000 | | | | 126,804 | |

Rite Aid Corp., 6.75%, Due 6/15/2021 | | | 250,000 | | | | 260,000 | |

Sabre GLBL, Inc., 5.25%, Due 11/15/2023F | | | 75,000 | | | | 75,938 | |

Scientific Games International, Inc., 10.00%, Due 12/1/2022 | | | 150,000 | | | | 153,693 | |

Silversea Cruise Finance Ltd., 7.25%, Due 2/1/2025F | | | 125,000 | | | | 128,464 | |

Sinclair Television Group, Inc., | | | | | | | | |

5.375%, Due 4/1/2021 | | | 250,000 | | | | 256,875 | |

6.125%, Due 10/1/2022 | | | 150,000 | | | | 156,845 | |

Sirius XM Radio, Inc., 6.00%, Due 7/15/2024F | | | 250,000 | | | | 266,095 | |

Tenet Healthcare Corp., | | | | | | | | |

5.00%, Due 3/1/2019 | | | 250,000 | | | | 245,938 | |

4.75%, Due 6/1/2020 | | | 200,000 | | | | 203,000 | |

6.75%, Due 6/15/2023 | | | 200,000 | | | | 189,000 | |

Tops Holding LLC / Tops Markets II Corp., 8.00%, Due 6/15/2022B F | | | 200,000 | | | | 160,000 | |

United Rentals North America, Inc., 5.50%, Due 5/15/2027 | | | 375,000 | | | | 378,281 | |

Universal Health Services, Inc., 4.75%, Due 8/1/2022F | | | 350,000 | | | | 352,187 | |

Universal Hospital Services, Inc., 7.625%, Due 8/15/2020 | | | 450,000 | | | | 446,625 | |

Univision Communications, Inc., | | | | | | | | |

5.125%, Due 5/15/2023F | | | 175,000 | | | | 173,796 | |

5.125%, Due 2/15/2025F | | | 100,000 | | | | 95,438 | |

Viking Cruises Ltd., 6.25%, Due 5/15/2025F | | | 50,000 | | | | 48,000 | |

Virgin Media Finance PLC, 6.375%, Due 4/15/2023F G | | | 250,000 | | | | 262,500 | |

VTR Finance BV, 6.875%, Due 1/15/2024F | | | 290,000 | | | | 304,500 | |

Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp., 5.50%, Due 3/1/2025 B F | | | 350,000 | | | | 350,875 | |

Ziggo Bond Finance BV, 6.00%, Due 1/15/2027F | | | 150,000 | | | | 148,815 | |

| | | | | | | | |

| | | | | | | 14,423,612 | |

| | | | | | | | |

| | |

Telecommunications - 6.28% | | | | | | | | |

CenturyLink, Inc., | | | | | | | | |

5.80%, Due 3/15/2022 | | | 125,000 | | | | 128,555 | |

7.50%, Due 4/1/2024 | | | 200,000 | | | | 211,750 | |

Frontier Communications Corp., | | | | | | | | |

7.125%, Due 3/15/2019 | | | 250,000 | | | | 266,250 | |

8.875%, Due 9/15/2020 | | | 75,000 | | | | 79,875 | |

11.00%, Due 9/15/2025 | | | 150,000 | | | | 151,687 | |

Hughes Satellite Systems Corp., 5.25%, Due 8/1/2026F | | | 100,000 | | | | 100,000 | |

Level 3 Financing, Inc., 5.375%, Due 1/15/2024 | | | 400,000 | | | | 404,500 | |

Qwest Corp., 6.75%, Due 12/1/2021 | | | 25,000 | | | | 27,483 | |

Sprint Corp., 7.25%, Due 9/15/2021 | | | 750,000 | | | | 803,625 | |

Sprint Nextel Corp., 6.00%, Due 11/15/2022 | | | 425,000 | | | | 431,375 | |

T-Mobile USA, Inc., 6.625%, Due 4/1/2023 | | | 1,000,000 | | | | 1,062,700 | |

Windstream Corp., 6.375%, Due 8/1/2023 | | | 50,000 | | | | 45,250 | |

Windstream Services LLC, 7.75%, Due 10/15/2020B | | | 200,000 | | | | 204,250 | |

| | | | | | | | |

| | | | | | | 3,917,300 | |

| | | | | | | | |

| | |

Transportation - 0.87% | | | | | | | | |

Intrepid Aviation Group Holdings LLC / Intrepid Finance Co., 6.875%, Due 2/15/2019B F | | | 250,000 | | | | 227,500 | |

XPO Logistics, Inc., 6.50%, Due 6/15/2022F | | | 300,000 | | | | 312,750 | |

| | | | | | | | |

| | | | | | | 540,250 | |

| | | | | | | | |

| | |

Utilities - 1.37% | | | | | | | | |

AES Corp., 5.50%, Due 3/15/2024 | | | 250,000 | | | | 253,125 | |

Calpine Corp., 5.375%, Due 1/15/2023 | | | 300,000 | | | | 295,500 | |

See accompanying notes

14

American Beacon Crescent Short Duration High Income FundSM

Schedule of Investments

January 31, 2017

| | | | | | | | |

| | | Principal Amount | | | Fair Value | |

| | |

Utilities - 1.37% (continued) | | | | | | | | |

NRG Energy, Inc., 6.625%, Due 3/15/2023 | | $ | 300,000 | | | $ | 309,000 | |

| | | | | | | | |

| | | | | | | 857,625 | |

| | | | | | | | |

| | |

Total Corporate Obligations (Cost $44,787,678) | | | | | | | 46,013,302 | |

| | | | | | | | |

| | |

| | | Shares | | | | |

| | |

SHORT-TERM INVESTMENTS - 4.00% (Cost $2,498,843) | | | | | | | | |

American Beacon U.S. Government Money Market Select Fund, Select ClassI | | | 2,498,843 | | | | 2,498,843 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS - 102.22% (Cost $62,556,337) | | | | | | | 63,786,738 | |

LIABILITIES, NET OF OTHER ASSETS - (2.22%) | | | | | | | (1,384,127 | ) |

| | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 62,402,611 | |

| | | | | | | | |

| | |

Percentages are stated as a percent of net assets. | | | | | | | | |

| A | Non-income producing security. |

| B | LLC - Limited Liability Company. |

| C | The coupon rate shown on floating or adjustable rate securities represents the rate at period end. The due date on these types of securities reflects the final maturity date. |

| E | LP - Limited Partnership. |

| F | Security exempt from registration under the Securities Act of 1933. These securities may be resold to qualified institutional buyers pursuant to Rule 144A. At the period end, the value of these securities amounted to $18,741,037 or 30.03% of net assets. The Fund has no right to demand registration of these securities. |

| G | PLC - Public Limited Company. |

| H | LLLP - Limited Liability Limited Partnership. |

| I | The Fund is affiliated by having the same investment advisor. |

| J | Unfunded Loan Commitment. At period end, the amount of unfunded loan commitments was $16,773 or 0.03% of net assets. Of this amount, $6,773 and $10,000 relate to Acrisure LLC and Mister Car Wash, Inc, respectively. |

See accompanying notes

15

American Beacon Crescent Short Duration High Income FundSM

Statement of Assets and Liabilities

January 31, 2017

| | | | |

Assets: | | | | |

Investments in unaffiliated securities, at fair value A | | $ | 61,287,895 | |

Investments in affiliated securities, at fair value B | | | 2,498,843 | |

Dividends and interest receivable | | | 850,515 | |

Receivable for investments sold | | | 1,625,270 | |

Receivable for fund shares sold | | | 40,873 | |

Receivable for expense reimbursement (Note 2) | | | 30,815 | |

Prepaid expenses | | | 25,345 | |

| | | | |

Total assets | | | 66,359,556 | |

| | | | |

Liabilities: | | | | |

Payable for investments purchased | | | 3,711,698 | |

Payable for fund shares redeemed | | | 13,511 | |

Dividends payable | | | 4,133 | |

Cash due to custodian | | | 87,297 | |

Unfunded loan commitments | | | 16,773 | |

Management and investment advisory fees payable | | | 38,565 | |

Administrative service and service fees payable | | | 1,939 | |

Transfer agent fees payable | | | 590 | |

Custody and fund accounting fees payable | | | 9,277 | |

Professional fees payable | | | 69,274 | |

Trustee fees payable | | | 711 | |

Payable for prospectus and shareholder reports | | | 2,586 | |

Other liabilities | | | 591 | |

| | | | |

Total liabilities | | | 3,956,945 | |

| | | | |

Net Assets | | $ | 62,402,611 | |

| | | | |

| |

Analysis of Net Assets: | | | | |

Paid-in-capital | | $ | 63,948,636 | |

Undistributed (overdistribution of) net investment income | | | 310 | |

Accumulated net realized (loss) | | | (2,776,736 | ) |

Unrealized appreciation of investments | | | 1,230,401 | |

| | | | |

Net assets | | $ | 62,402,611 | |

| | | | |

| |

Shares outstanding at no par value (unlimited shares authorized): | | | | |

Institutional Class | | | 5,378,958 | |

| | | | |

Y Class | | | 651,797 | |

| | | | |

Investor Class | | | 277,946 | |

| | | | |

A Class | | | 122,895 | |

| | | | |

C Class | | | 44,421 | |

| | | | |

Net assets: | | | | |

Institutional Class | | $ | 51,834,666 | |

| | | | |

Y Class | | $ | 6,277,416 | |

| | | | |

Investor Class | | $ | 2,679,338 | |

| | | | |

A Class | | $ | 1,183,362 | |

| | | | |

C Class | | $ | 427,829 | |

| | | | |

Net asset value, offering and redemption price per share: | | | | |

Institutional Class | | $ | 9.64 | |

| | | | |

Y Class | | $ | 9.63 | |

| | | | |

Investor Class | | $ | 9.64 | |

| | | | |

A Class | | $ | 9.63 | |

| | | | |

A Class (offering price) | | $ | 9.88 | |

| | | | |

C Class | | $ | 9.63 | |

| | | | |

| |

A Cost of investments in unaffiliated securities | | $ | 60,057,494 | |

B Cost of investments in affiliated securities | | $ | 2,498,843 | |

See accompanying notes

16

American Beacon Crescent Short Duration High Income FundSM

Statement of Operations

For the year ended January 31, 2017

| | | | |

Investment income: | | | | |

Dividend income from unaffiliated securities | | $ | 954 | |

Dividend income from affiliated securities | | | 7,120 | |

Interest income | | | 2,861,455 | |

| | | | |

Total investment income | | | 2,869,529 | |

| | | | |

| |

Expenses: | | | | |

Management and investment advisory fees (Note 2) | | | 327,233 | |

Administrative service fees (Note 2): | | | | |

Institutional Class | | | 34,559 | |

Y Class | | | 6,058 | |

Investor Class | | | 3,412 | |

A Class | | | 998 | |

C Class | | | 386 | |

Transfer agent fees: | | | | |

Institutional Class | | | 3,515 | |

Y Class | | | 360 | |

Investor Class | | | 1,716 | |

A Class | | | 63 | |

C Class | | | 45 | |

Custody and fund accounting fees | | | 55,479 | |

Professional fees | | | 98,307 | |

Registration fees and expenses | | | 69,025 | |

Service fees (Note 2): | | | | |

Y Class | | | 6,655 | |

Investor Class | | | 8,137 | |

A Class | | | 1,675 | |

C Class | | | 671 | |

Distribution fees (Note 2): | | | | |

A Class | | | 2,793 | |

C Class | | | 4,473 | |

Prospectus and shareholder report expenses | | | 14,974 | |

Trustee fees | | | 4,192 | |

Other expenses | | | 7,723 | |

| | | | |

Total expenses | | | 652,449 | |

| | | | |

Net fees waived and expenses reimbursed (Note 2) | | | (201,928 | ) |

| | | | |

Net expenses | | | 450,521 | |

| | | | |

Net investment income | | | 2,419,008 | |

| | | | |

| |

Realized and unrealized gain (loss) from investments: | | | | |

Net realized gain (loss) from: | | | | |

Investments | | | (1,100,111 | ) |

Change in net unrealized appreciation (depreciation) of: | | | | |

Investments | | | 4,409,874 | |

| | | | |

Net gain from investments | | | 3,309,763 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 5,728,771 | |

| | | | |

See accompanying notes

17

American Beacon Crescent Short Duration High Income FundSM

Statement of Changes in Net Assets

| | | | | | | | |

| | | Crescent Short Duration High

Income Fund | |

| | | Year Ended

January 31, 2017 | | | Year Ended

January 31, 2016 | |

| | |

Increase (Decrease) in Net Assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 2,419,008 | | | $ | 2,169,994 | |

Net realized gain (loss) from investments | | | (1,100,111 | ) | | | (1,364,082 | ) |

Change in net unrealized appreciation (depreciation) from investments | | | 4,409,874 | | | | (2,381,371 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 5,728,771 | | | | (1,575,459 | ) |

| | | | | | | | |

| | |

Net investment income: | | | | | | | | |

Institutional Class | | | (1,882,382 | ) | | | (1,759,283 | ) |

Y Class | | | (321,091 | ) | | | (271,569 | ) |

Investor Class | | | (147,957 | ) | | | (99,781 | ) |

A Class | | | (50,709 | ) | | | (31,972 | ) |

C Class | | | (16,867 | ) | | | (7,389 | ) |

| | | | | | | | |

Net distributions to shareholders | | | (2,419,006 | ) | | | (2,169,994 | ) |

| | | | | | | | |

| | |

Capital Share Transactions: | | | | | | | | |

Proceeds from sales of shares | | | 19,803,117 | | | | 34,658,888 | |

Reinvestment of dividends and distributions | | | 2,333,667 | | | | 2,130,973 | |

Cost of shares redeemed | | | (13,547,704 | ) | | | (16,928,188 | ) |

| | | | | | | | |

Net increase in net assets from capital share transactions | | | 8,589,080 | | | | 19,861,673 | |

| | | | | | | | |

Net increase in net assets | | | 11,898,845 | | | | 16,116,220 | |

| | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of period | | | 50,503,766 | | | | 34,387,546 | |

| | | | | | | | |

End of Period * | | $ | 62,402,611 | | | $ | 50,503,766 | |

| | | | | | | | |

| | |

* Includes undistributed (overdistribution of) net investment income | | $ | 310 | | | $ | 308 | |

| | | | | | | | |

See accompanying notes

18

American Beacon Crescent Short Duration High Income FundSM

Notes to Financial Statements

January 31, 2017

| 1. | Organization and Significant Accounting Policies |

American Beacon Funds (the “Trust”), is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the “Act”), as a diversified, open-end management investment company. As of January 31, 2017, the Trust consists of twenty-seven active series, one of which is presented in this filing (the “Fund”): American Beacon Crescent Short Duration High Income Fund (“Crescent Short Duration Fund”). The remaining twenty-six active series are reported in separate filings.

American Beacon Advisors, Inc. (the “Manager”) is a wholly-owned subsidiary of Resolute Investment Managers, Inc., which is indirectly owned by investment funds affiliated with Kelso & Company, L.P. and Estancia Capital Management, LLC, and was organized in 1986 to provide business management, advisory, administrative and asset management consulting services to the Trust and other investors.

New Accounting Pronouncements

In October 2016, the SEC adopted amendments to rules under the Investment Company Act of 1940 (“final rules”) intended to modernize the reporting and disclosure of information by registered investment companies.

The final rules amend Regulation S-X and require funds to provide standardized, enhanced derivative disclosure in fund financial statements in a format designed for individual investors. The amendments to Regulation S-X also update the disclosures for other investments and investments in, and advances to affiliates and amend the rules regarding the general form and content of fund financial statements. The compliance date for the amendments to Regulation S-X is August 1, 2017. Management is currently evaluating the amendments and its impact, if any, on the fund’s financial statements.

Class Disclosure

The Fund has multiple classes of shares designed to meet the needs of different groups of investors. The following table sets forth the differences amongst the classes:

| | | | | | |

| Class | | Eligible Investors | | Minimum Initial

Investments | |

Institutional | | Large institutional investors - sold directly or through intermediary channels. | | $ | 250,000 | |

| | |

Y Class | | Large institutional retirement plan investors - sold directly or through intermediary channels. | | $ | 100,000 | |

| | |

Investor | | All investors using intermediary organizations such as broker-dealers or retirement plan sponsors - sold directly through intermediary channels. | | $ | 2,500 | |

| | |

A Class | | All investors who invest through intermediary organizations, such as broker-dealers or third party administrator. Retail investors who invest directly through a financial intermediary such as a broker, bank, or registered investment advisor, which may include a front-end sales charge and a contingent deferred sales charge (“CDSC”). | | $ | 2,500 | |

| | |

C Class | | Retail investors who invest directly through a financial intermediary such as a broker or employee directed benefit plans with applicable sales charges, which may include CDSC. | | $ | 1,000 | |

Each class offered by the Trust has equal rights as to assets and voting privileges. Income and non-class specific expenses are allocated daily to each class on the basis of the relative net assets. Realized and unrealized capital gains and losses of each class are allocated daily based on the relative net assets of each class of the respective Fund. Class specific expenses, where applicable, currently include administrative service fees, service fees, and distribution fees and vary amongst the classes as described more fully in Note 2.

The following is a summary of significant accounting policies, consistently followed by the Fund in the preparation of the financial statements. The Funds are investment companies, and accordingly, follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946, Financial Services - Investment Companies, which is part of U.S. Generally Accepted Accounting Principles (“U.S. GAAP”).

19

American Beacon Crescent Short Duration High Income FundSM

Notes to Financial Statements

January 31, 2017

Security Transactions and Investment Income

Security transactions are recorded on the trade date of the security purchase or sale. The Fund may purchase securities with delivery or payment to occur at a later date. At the time the Fund enters into a commitment to purchase a security, the transaction is recorded, and the value of the security is reflected in the net asset value (“NAV”). The value of the security may vary with market fluctuations.

Dividend income, net of foreign taxes, is recorded on the ex-dividend date, except certain dividends from foreign securities which are recorded as soon as the information is available to the Fund. Interest income is earned from settlement date, recorded on the accrual basis, and adjusted, if necessary, for accretion of discounts and amortization of premiums. For financial and tax reporting purposes, realized gains and losses are determined on the basis of specific lot identification.

Dividends to Shareholders

Dividends from net investment income of the Fund generally will be declared daily and paid monthly. Distributions, if any, of net realized capital gains are generally paid at least annually and recorded on the ex-dividend date. Dividends to shareholders are determined in accordance with federal income tax regulations, which may differ in amount and character from net investment income and realized gains recognized for purposes of U.S. GAAP.

Allocation of Income, Expenses, Gains, and Losses

Income, expenses (other than those attributable to a specific class), gains, and losses are allocated daily to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimated.

Other